The Daily Shot: 22-Feb-22

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Food for Thought

Emerging Markets

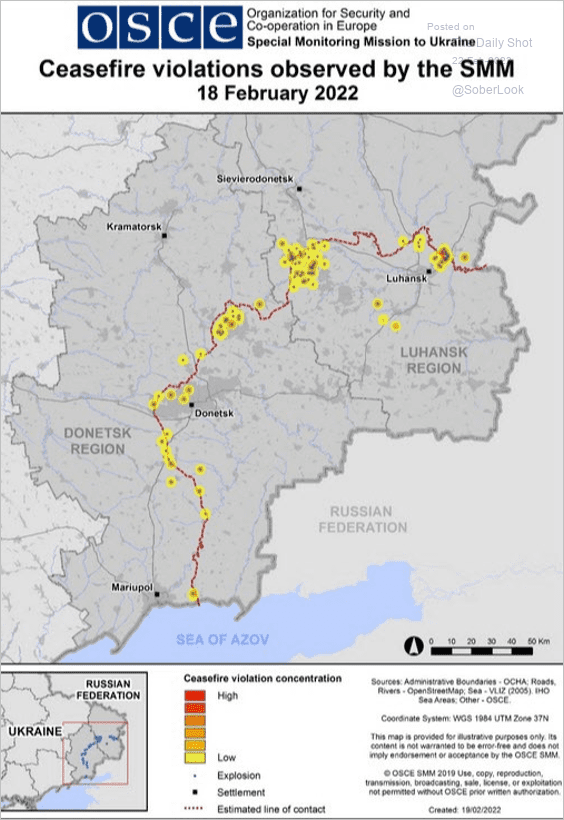

1. The Ukraine/Russia situation has deteriorated further.

Source: Reuters Read full article

Source: Reuters Read full article

Russia-backed separatists currently control less than half of the Luhansk/Donetsk region. Which portion of the region did Putin recognize as “independent”? If it’s the whole area, the act will likely lead to war.

Source: BBC Read full article

Source: BBC Read full article

Will Russian “peacekeepers” push across the Minsk Protocol buffer zone?

Source: OSCE Read full article

Source: OSCE Read full article

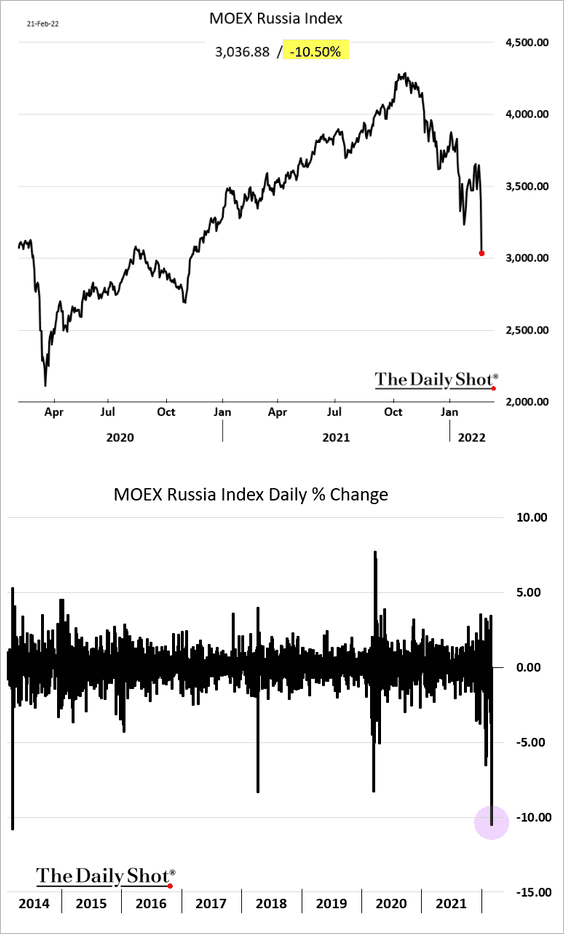

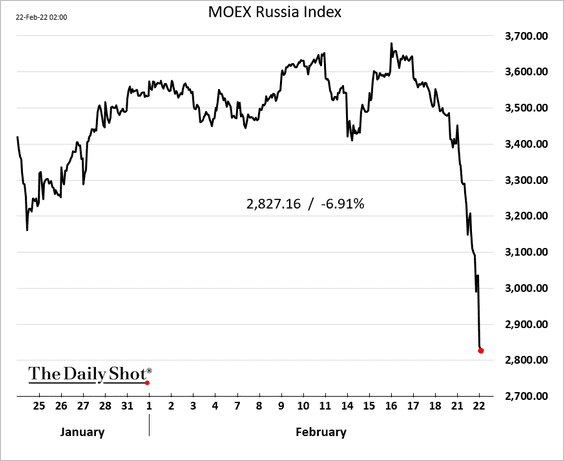

2. Russia’s markets have been under pressure.

• Stocks tumbled yesterday, …

… and are down again this morning.

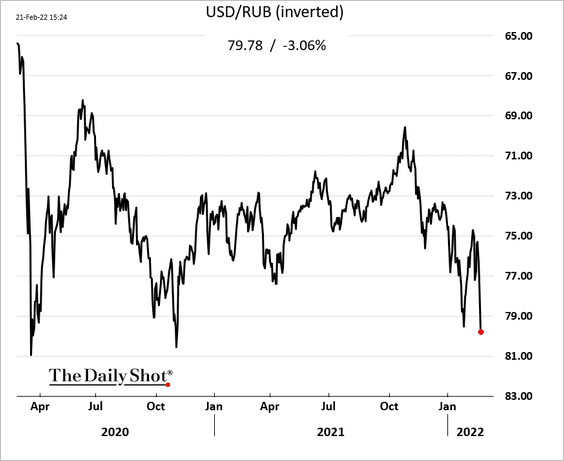

• The ruble was sharply lower.

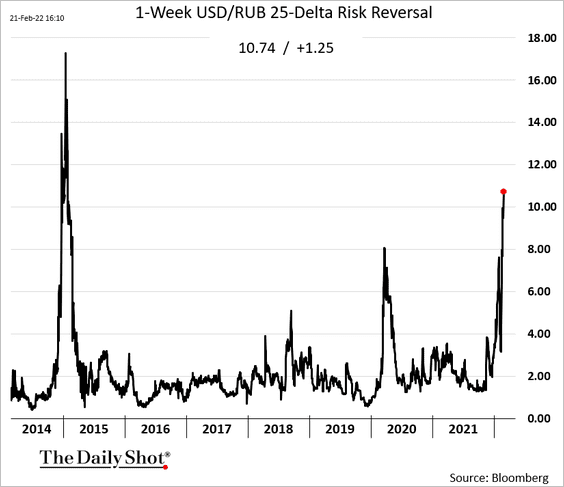

The ruble risk reversals point to surging demand for downside protection.

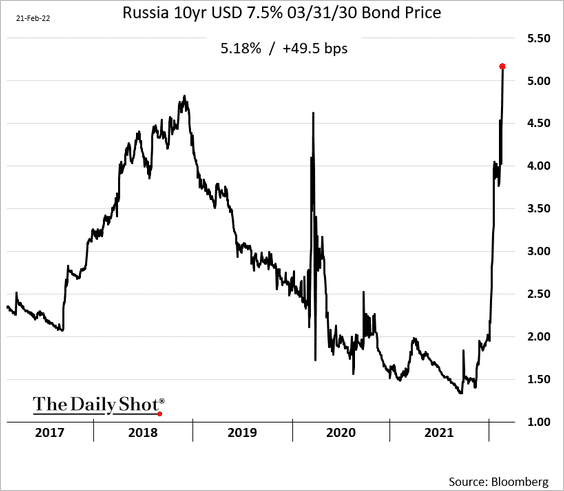

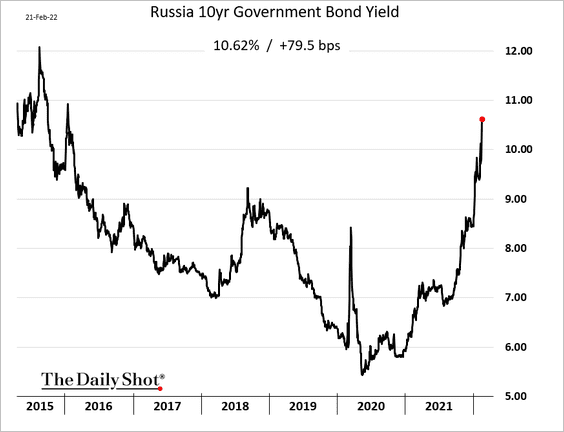

• Russia’s bonds have sold off as well.

– USD-denominated bond yield:

– Domestic bond yield:

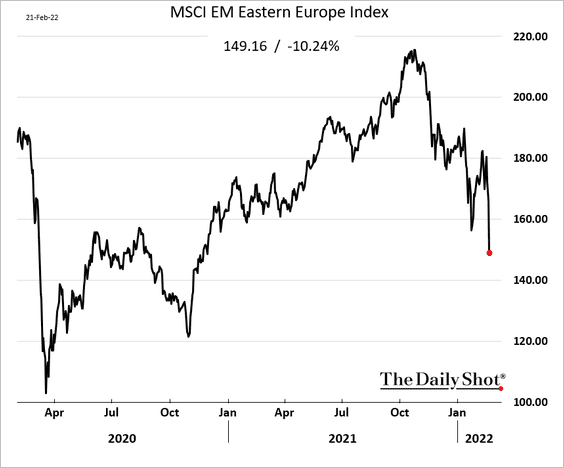

• Stocks tumbled across EM Eastern Europe.

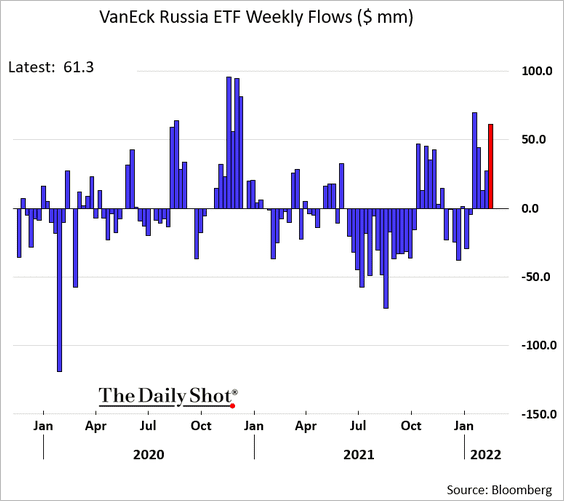

• By the way, the largest US-based Russia equity ETF has been getting some inflows, as investors bet on a speedy resolution to this conflict.

——————–

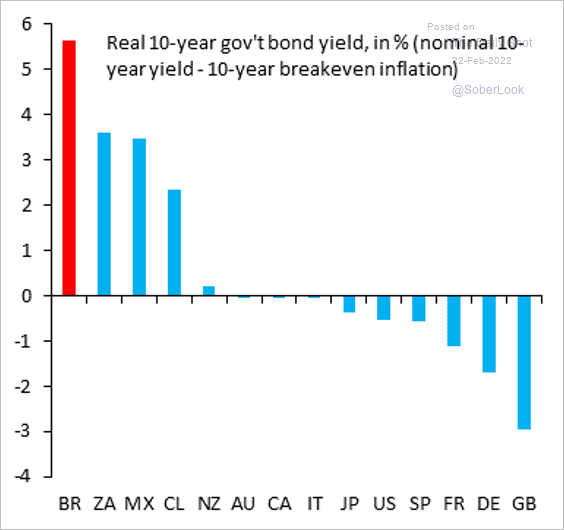

2. Some EM real yields are much higher than what we see in developed economies.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

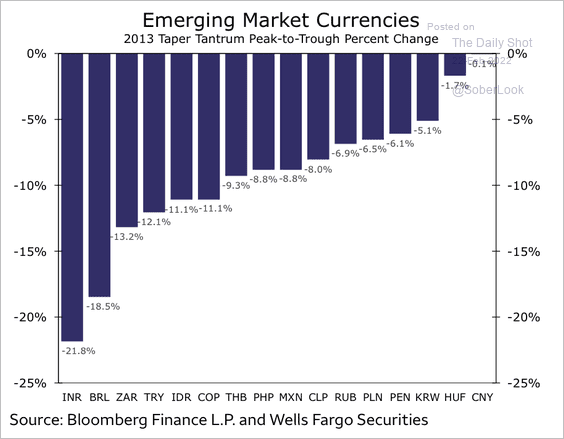

3. Here is how EM currencies performed during the 2013 taper tantrum.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

Cryptocurrency

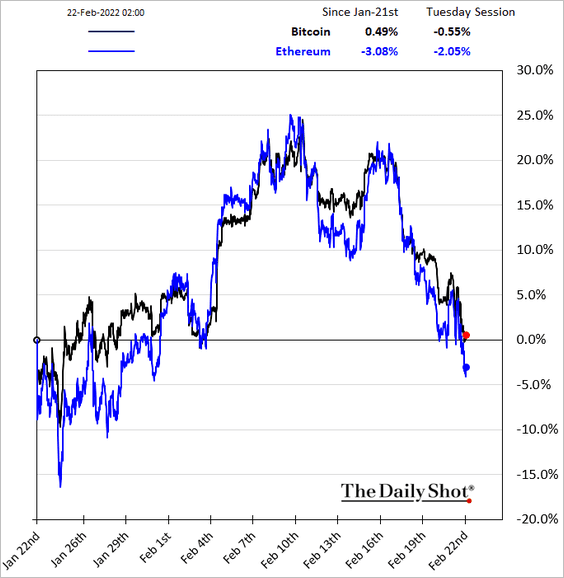

1. Cryptos have given up the February gains.

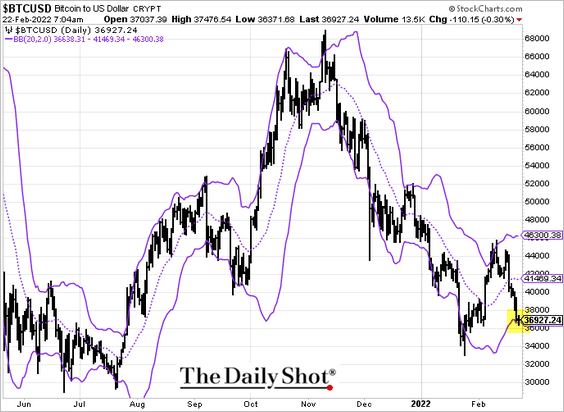

2. Bitcoin is holding support at the lower Bollinger Band.

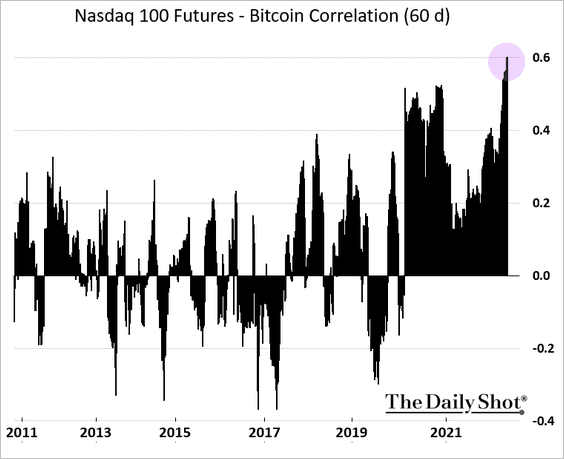

3. Bitcoin’s correlation with stocks continues to climb.

Back to Index

Commodities

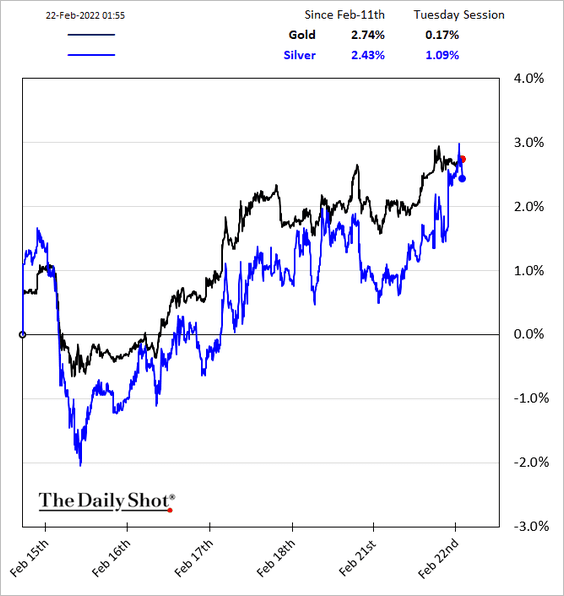

1. Precious metals are higher on the Ukraine/Russia jitters.

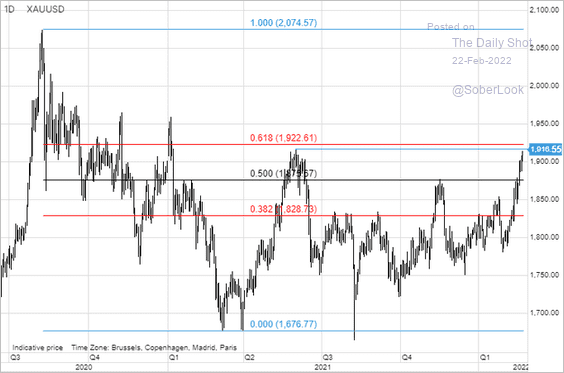

Gold is at resistance.

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

——————–

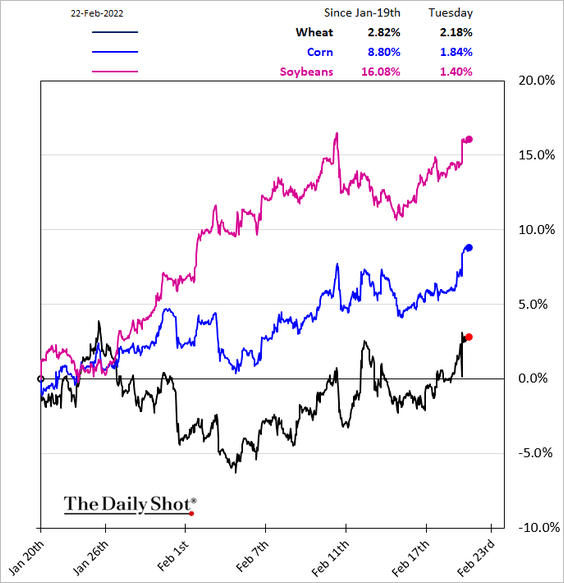

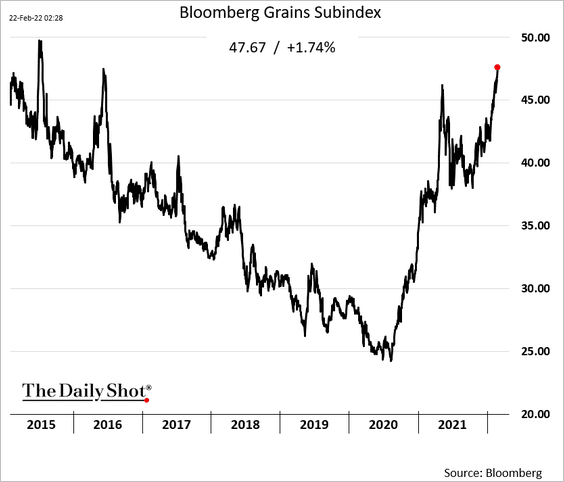

2. Grain prices are surging due to Black Sea supply concerns (potential disruptions from a Ukraine/Russia armed conflict).

Source: Reuters Read full article

Source: Reuters Read full article

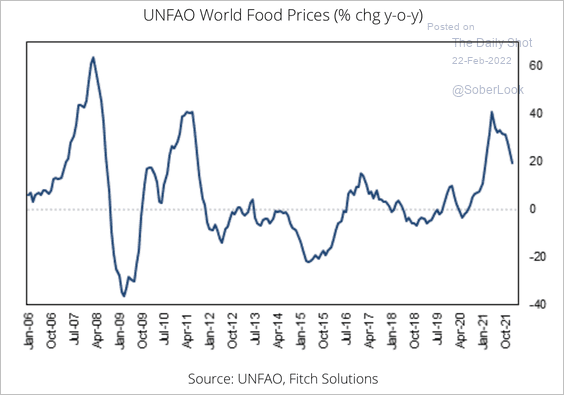

By the way, Fitch Solutions expects lingering supply issues to keep agricultural, and food prices elevated this year.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

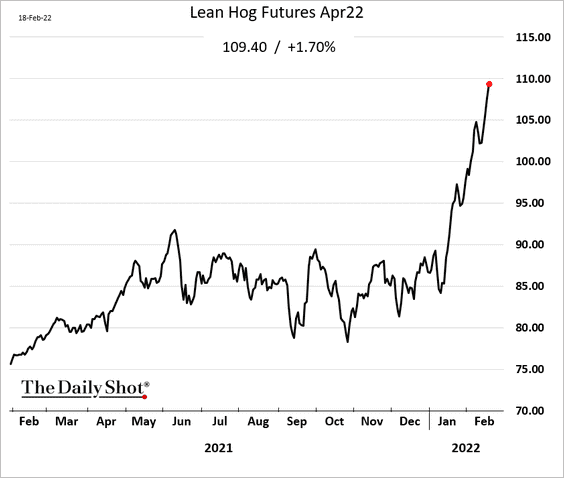

3. US hog futures continue to surge.

Source: The Pig Site Read full article

Source: The Pig Site Read full article

——————–

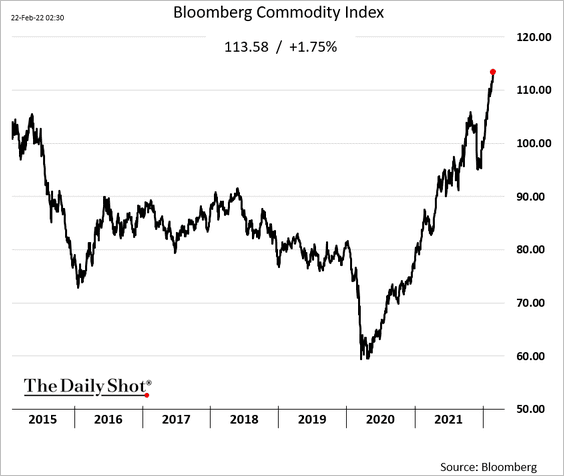

4. Here is Bloomberg’s broad commodity index.

Back to Index

Energy

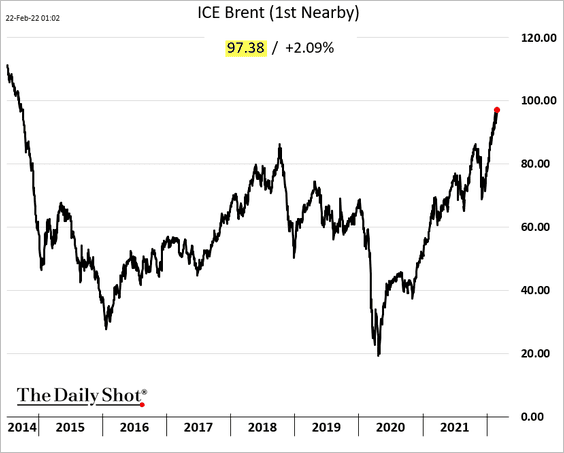

1. Brent crude is trading above $97/bbl for the first time since 2014.

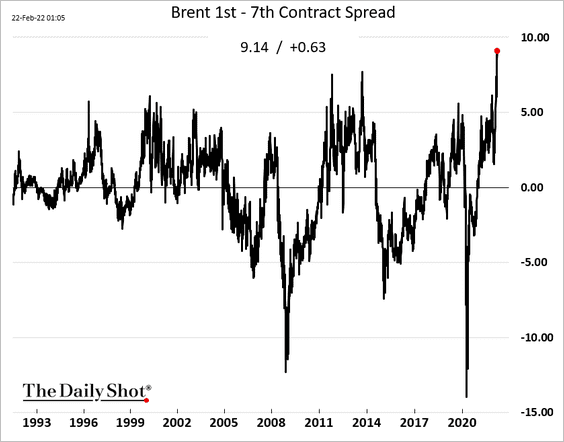

The Brent curve backwardation is now steepest in decades amid worries about supply disruptions.

——————–

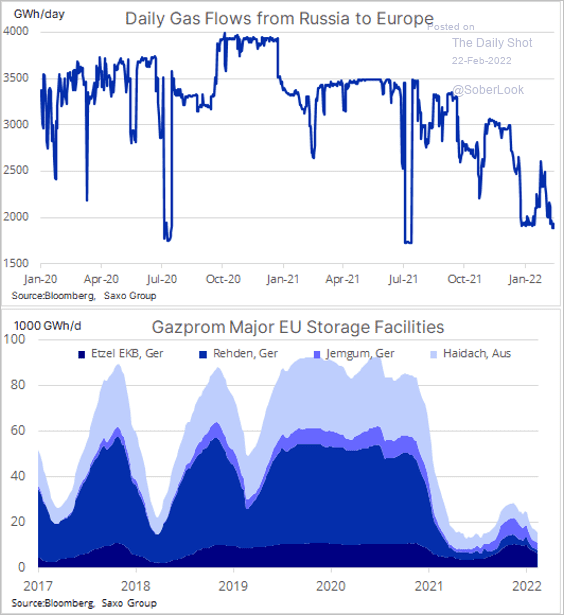

2. This chart shows natural gas flows from Russia to Europe.

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

Back to Index

Equities

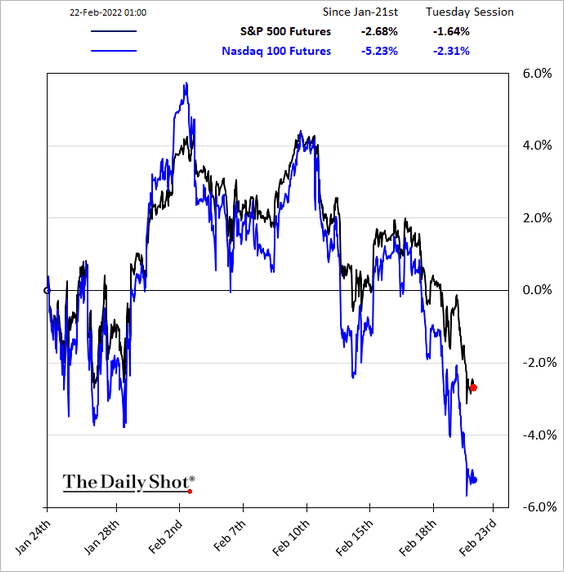

1. Stock futures are heavy this morning as fears of an armed conflict in Eastern Europe spook investors. It’s worth noting that the impact of such a conflict on US corporate earnings would be very limited.

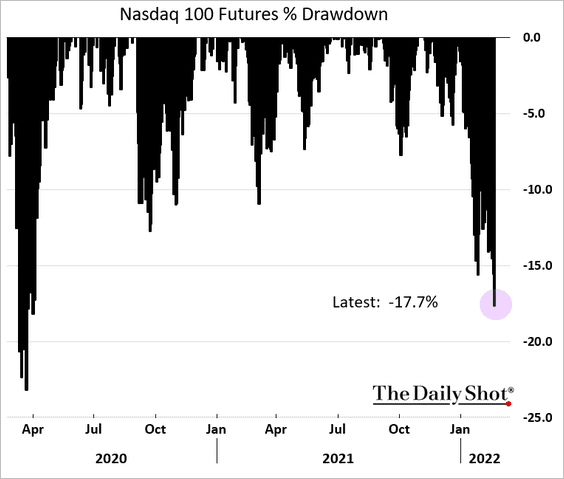

The Nasdaq 100 futures are approaching bear market territory.

——————–

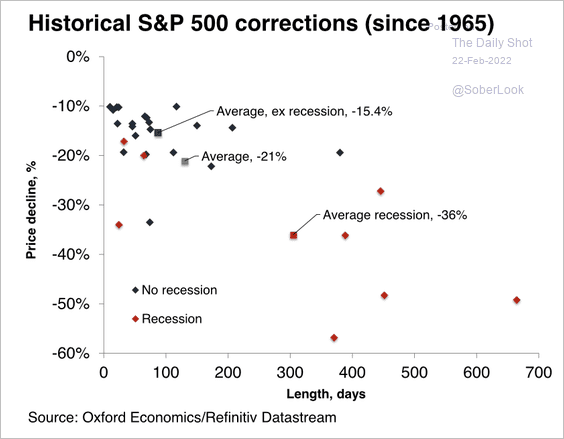

2. Bear markets seldom occur outside of recessions.

Source: Oxford Economics

Source: Oxford Economics

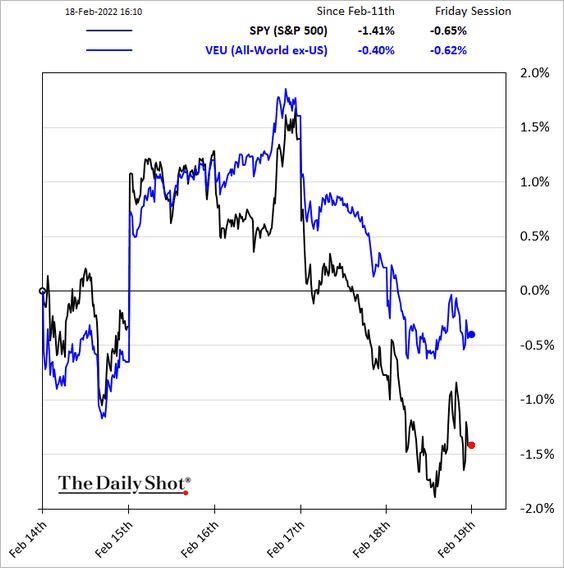

3. US shares have been underperforming the rest of the world in recent days (in dollar terms).

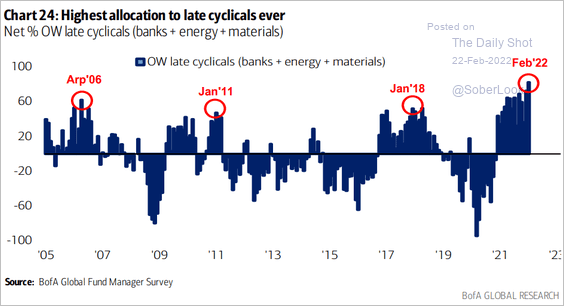

4. Fund managers have been increasingly allocating to “late cyclicals.”

Source: BofA Global Research

Source: BofA Global Research

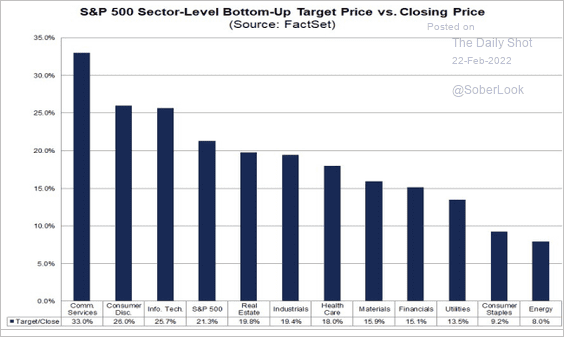

6. Analysts see a great deal of upside in some sectors.

Source: @FactSet

Source: @FactSet

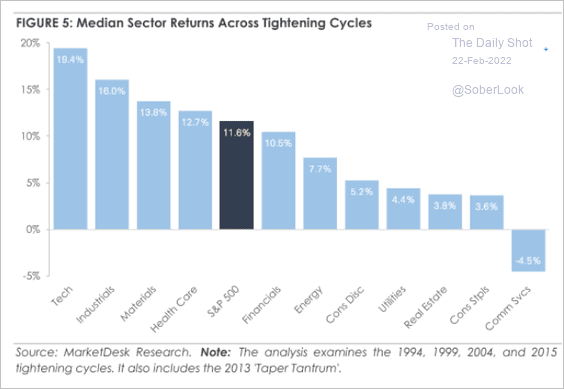

• How did different sectors perform across the tightening cycles?

Source: MarketDesk Research

Source: MarketDesk Research

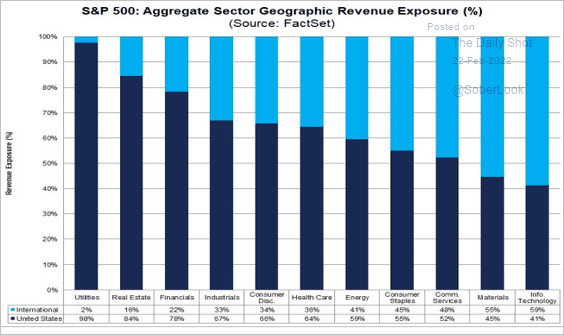

• Which sectors are most exposed to non-US markets?

Source: @FactSet

Source: @FactSet

——————–

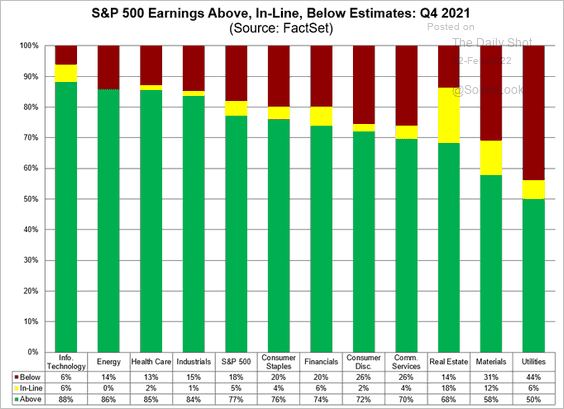

7. Q4 earnings surprises have been roughly in line with the past five years.

Source: @FactSet

Source: @FactSet

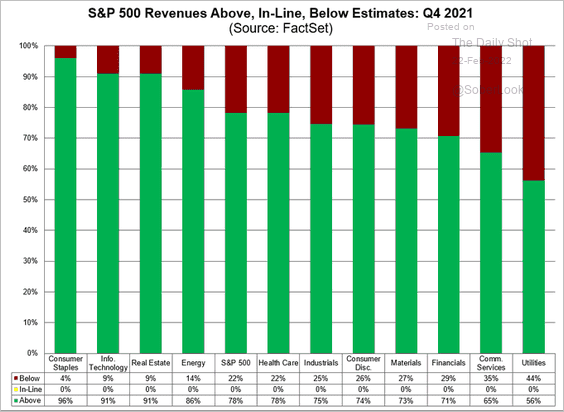

But sales surprises have been among the highest since at least 2008.

Source: @FactSet

Source: @FactSet

——————–

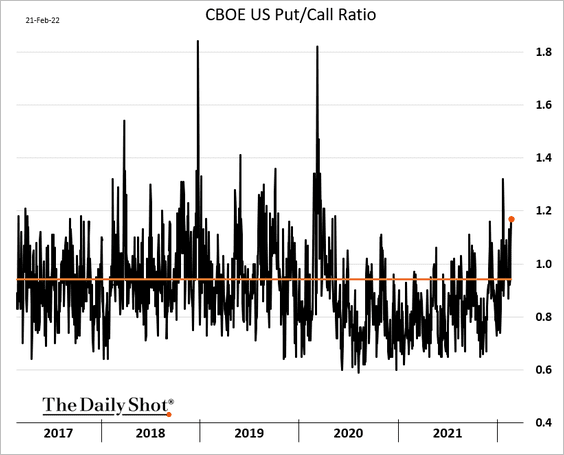

8. The put/call ratio is now well above the pre-COVID average.

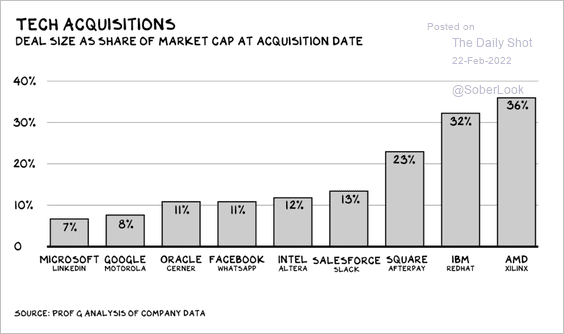

9. Tech companies routinely make acquisitions equal to 10% or more of their total value.

Source: Scott Galloway

Source: Scott Galloway

Back to Index

Credit

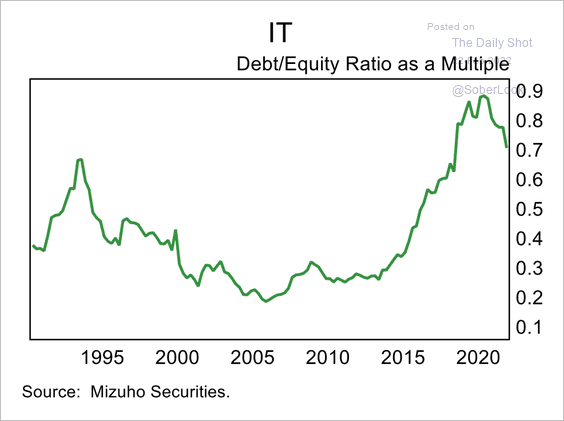

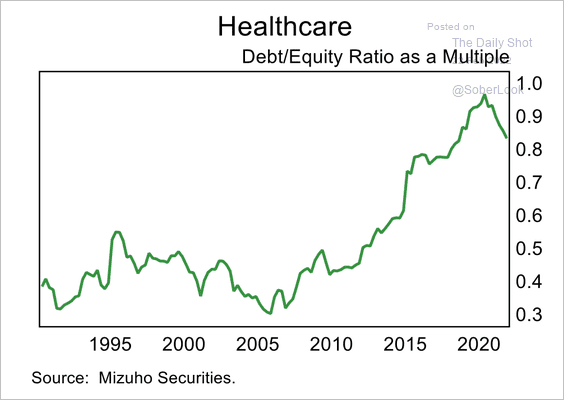

1. Debt/equity ratios are starting to decline from peak levels for IT and healthcare companies (2 charts).

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

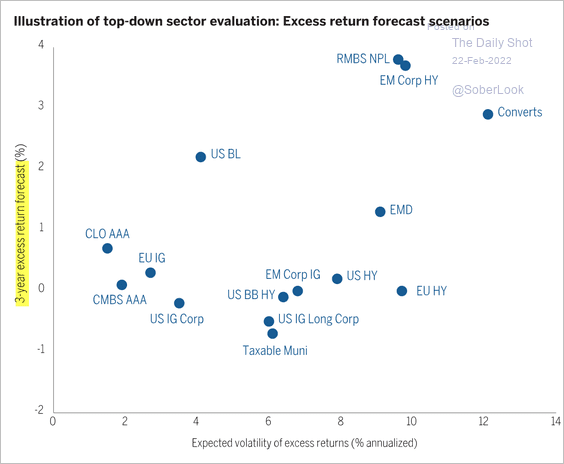

2. This scatterplot shows the IG sector risk/return projections from Mizuho Securities.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Back to Index

Rates

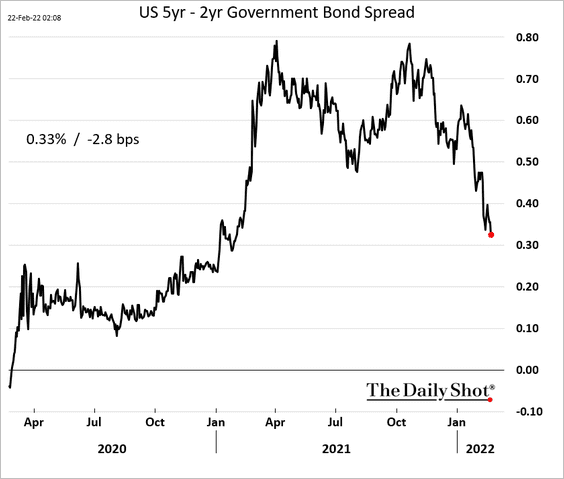

1. The shorter end of the curve has been flattening rapidly.

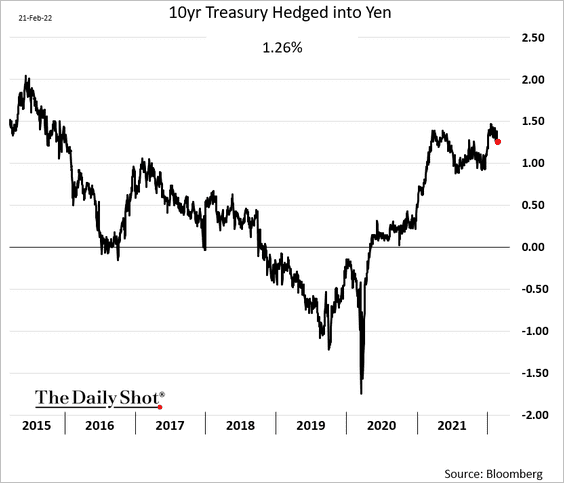

2. Treasury yields remain attractive when hedged into yen (the 10yr JGB yield is less than 20 bps).

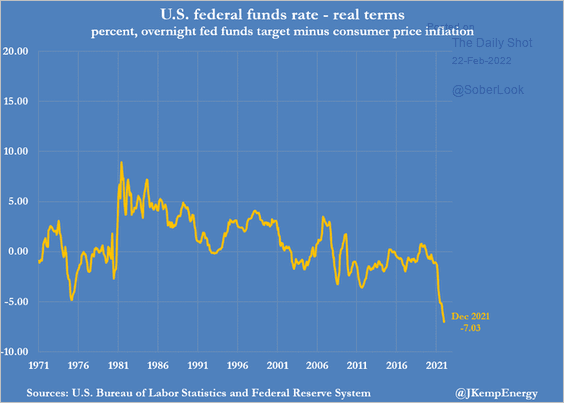

3. The current US monetary policy is excessively accommodative.

Source: @JKempEnergy

Source: @JKempEnergy

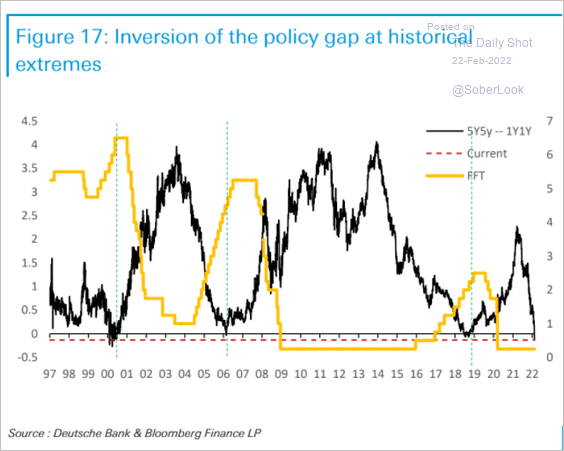

4. Is the market’s projection for Fed rate hikes too steep? The forward curve inversion typically happens at the end of the hiking cycle, not before it starts.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

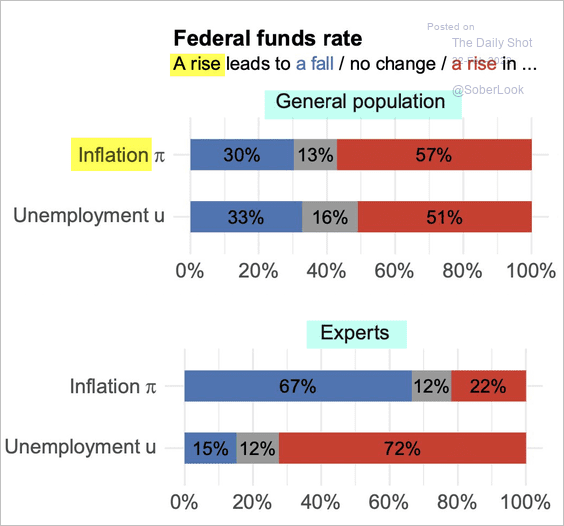

5. What does the public think happens when the fed funds rate rises?

Source: @JWMason1 Read full article

Source: @JWMason1 Read full article

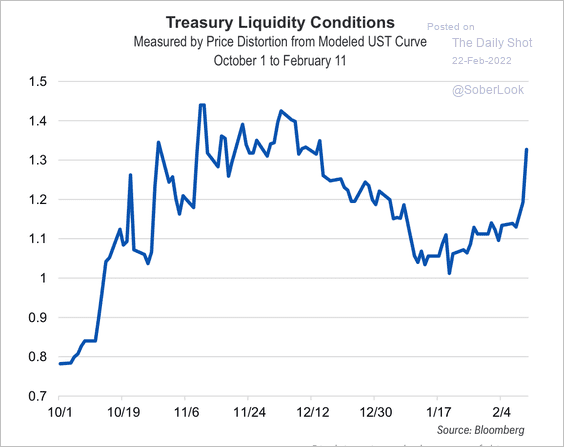

6. This chart shows last week’s disruption in Treasury liquidity. The distortion is back near levels seen in November when there was confusion about Fed policy.

Source: FHN Financial

Source: FHN Financial

Back to Index

The United States

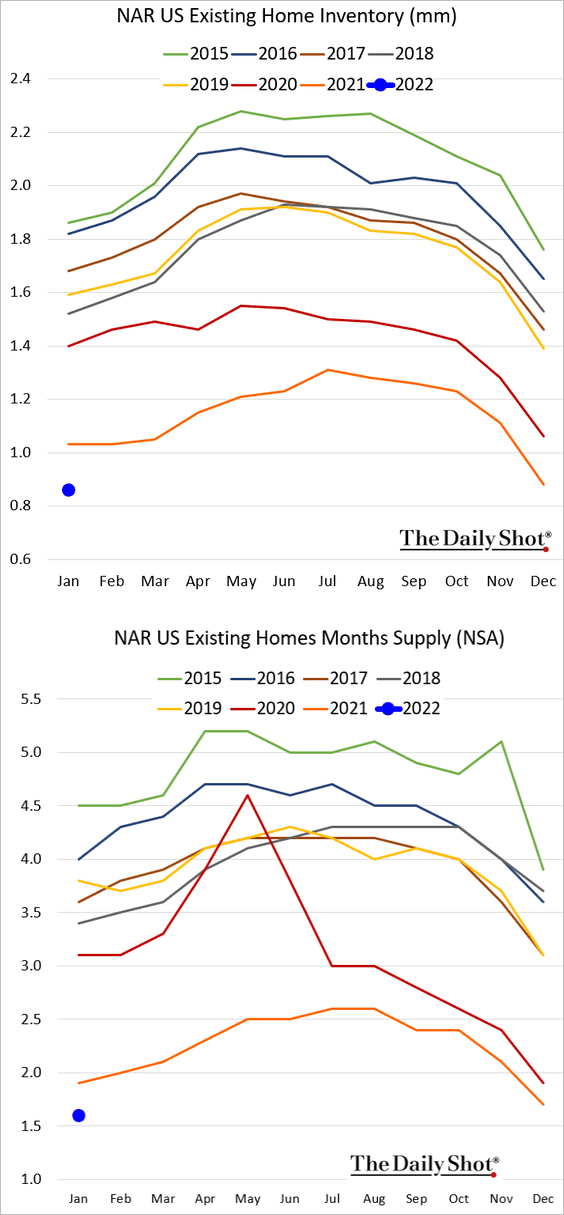

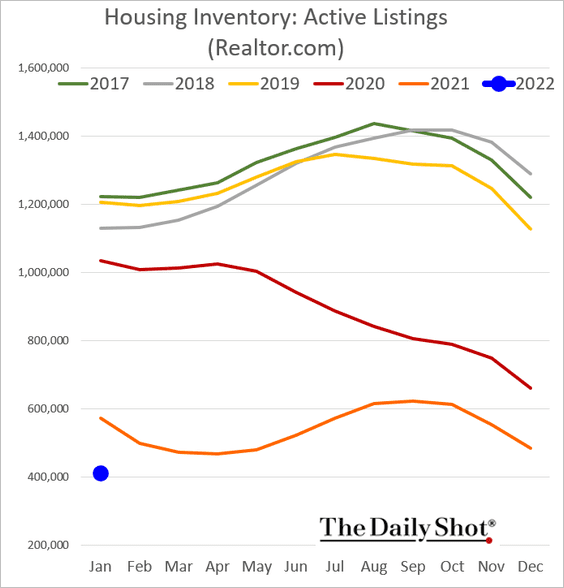

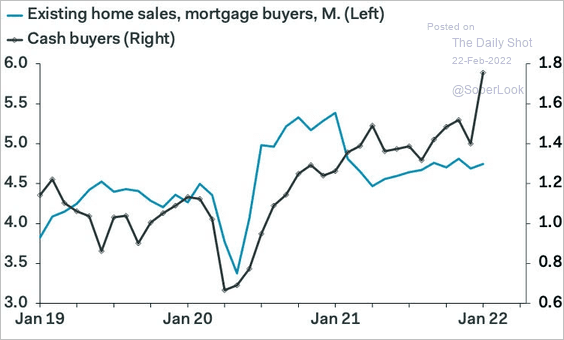

1. Let’s begin with the housing market.

• Existing home inventories are remarkably low.

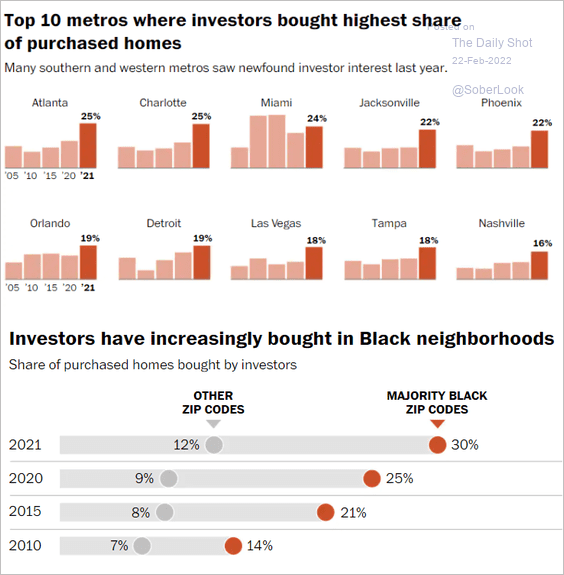

• Investors bought a lot of houses last month (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: The Washington Post Read full article

Source: The Washington Post Read full article

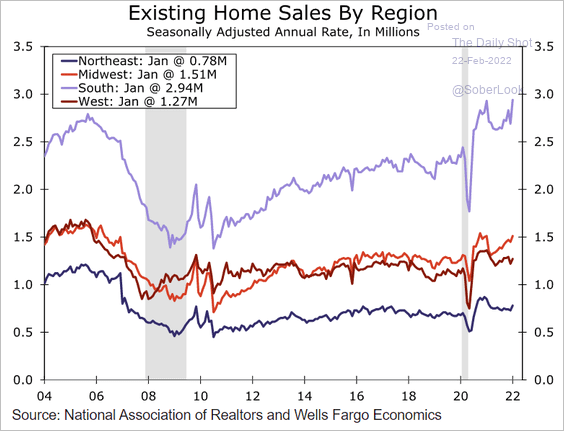

• This chart shows existing home sales by region (seasonally adjusted).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

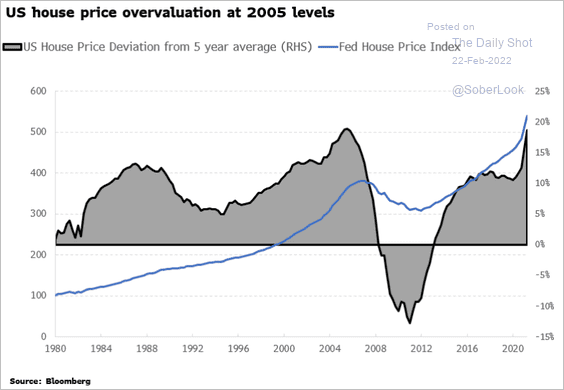

• The COVID-era spike in home prices has been impressive.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

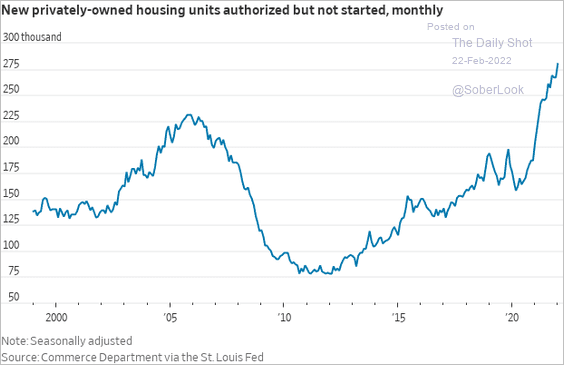

• Here is the backlog of residential building projects with permits that are awaiting construction.

Source: @jeffsparshott

Source: @jeffsparshott

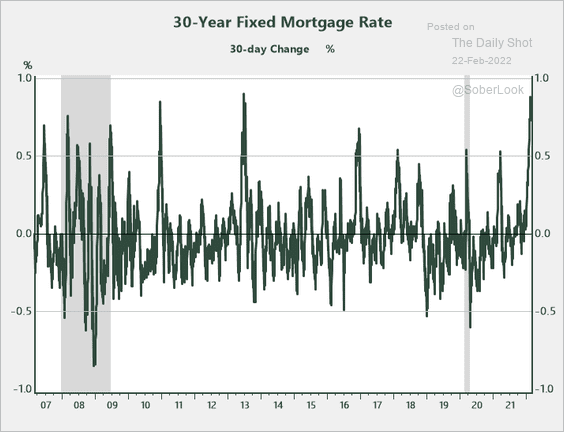

• The recent increase in mortgage rates has been unusually fast, which is likely to weigh on the housing market.

Source: Peter Essele, Portfolio Management for Commonwealth Financial Network

Source: Peter Essele, Portfolio Management for Commonwealth Financial Network

——————–

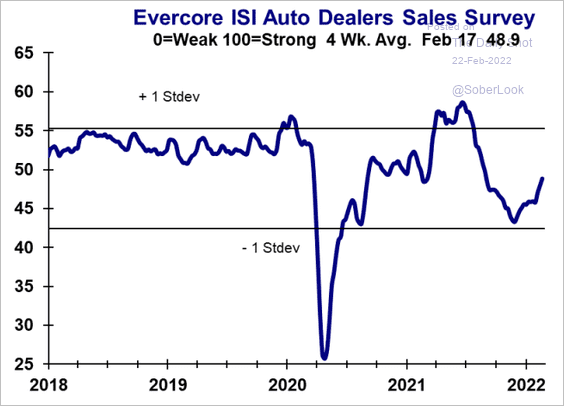

2. The Evercore ISI auto dealers survey shows improvements in sales.

Source: Evercore ISI Research

Source: Evercore ISI Research

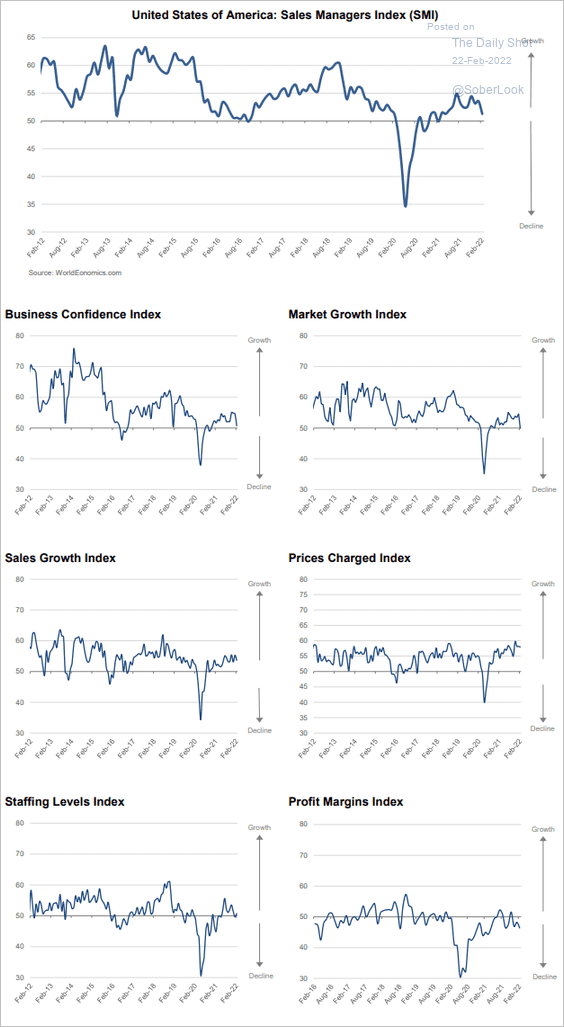

3. Business activity growth slowed this month, according to the World Economics Sales Managers Index. Business confidence is no longer improving.

Source: World Economics

Source: World Economics

Back to Index

The United Kingdom

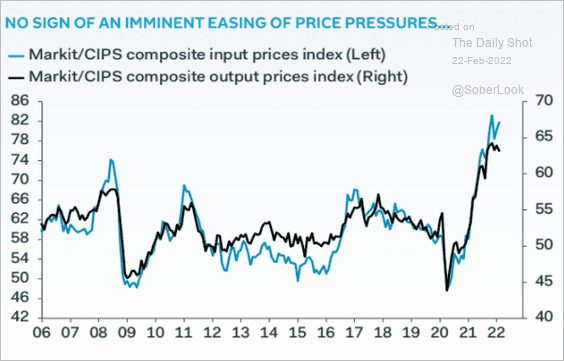

1. The PMI report shows price pressures persisting.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

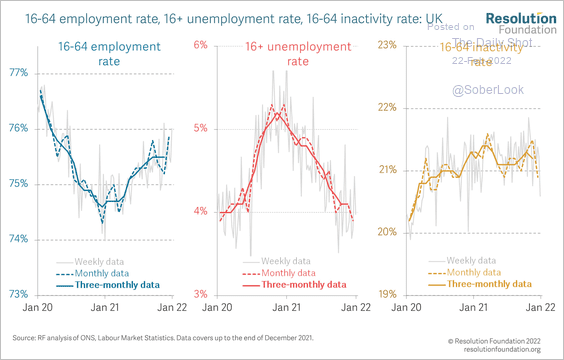

2. The UK labor market dynamics have been encouraging.

Source: @resfoundation

Source: @resfoundation

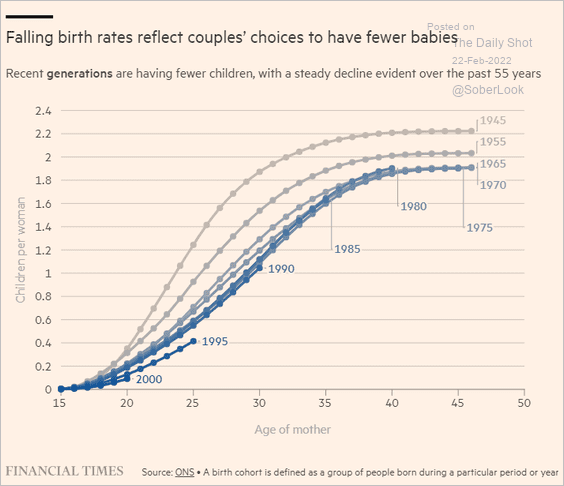

3. UK birth rates continue to decline.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

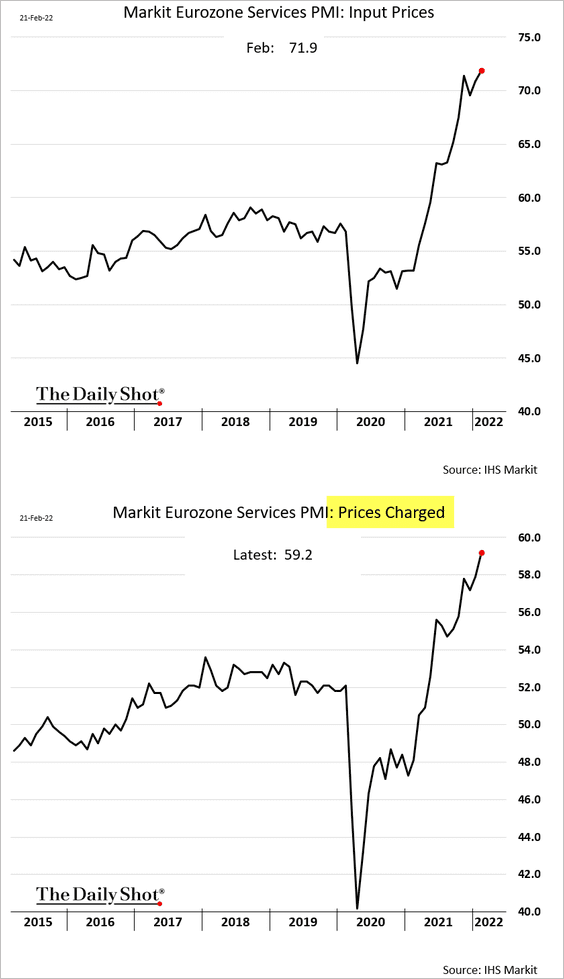

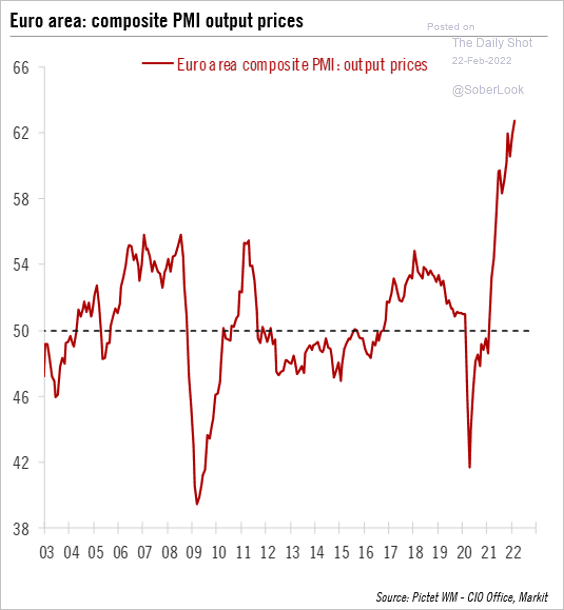

The Eurozone

1. The PMI report revealed intense price pressures, especially in services (2 charts). Once again, it’s a signal for the ECB to change course.

Source: @fwred

Source: @fwred

——————–

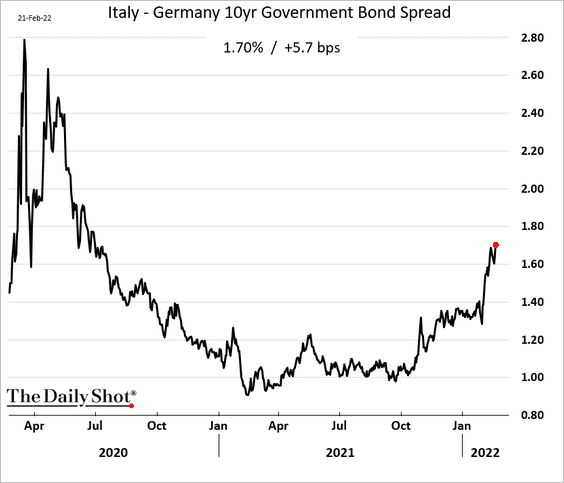

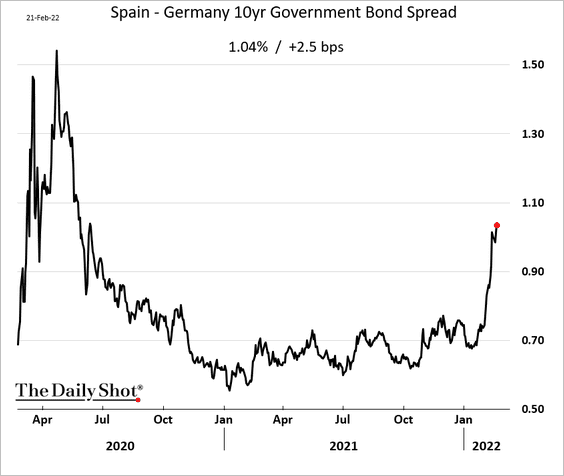

2. Spanish and Italian bond spreads continue to widen.

——————–

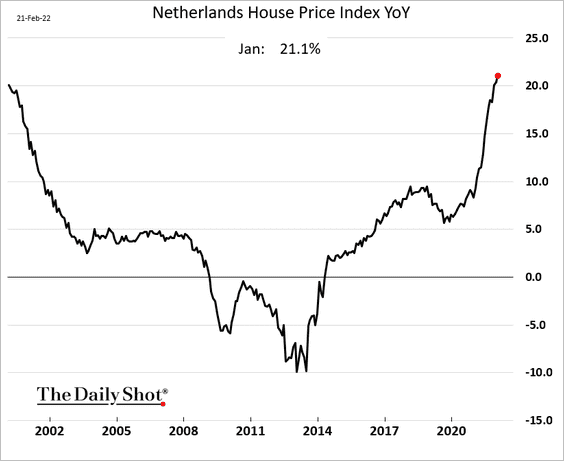

3. Dutch home prices are surging.

Back to Index

Asia – Pacific

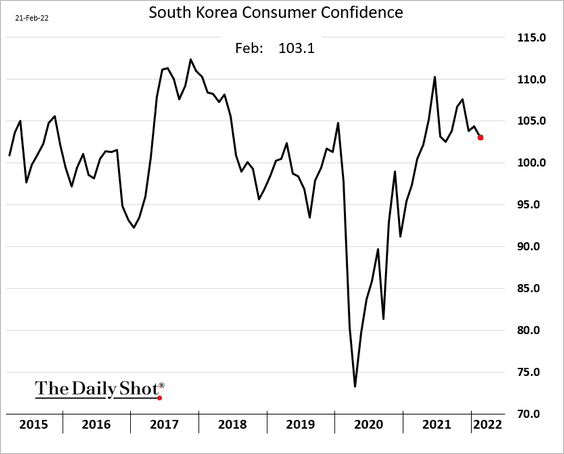

1. South Korea’s consumer confidence is moderating.

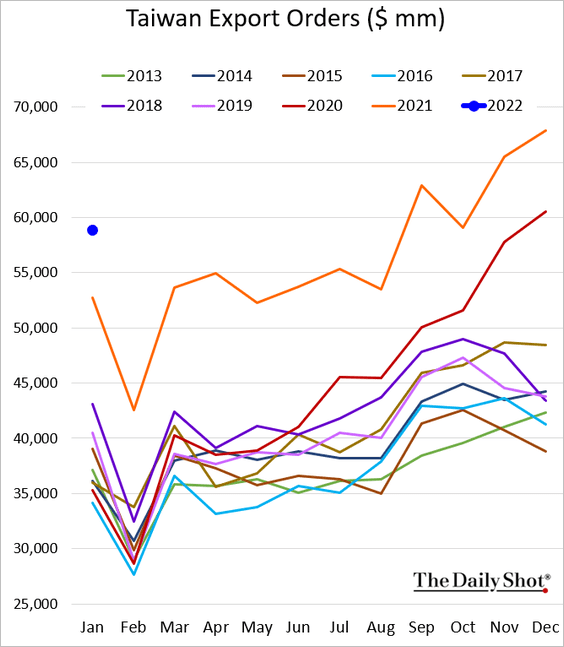

2. Taiwan’s export orders remain exceptionally strong.

Back to Index

China

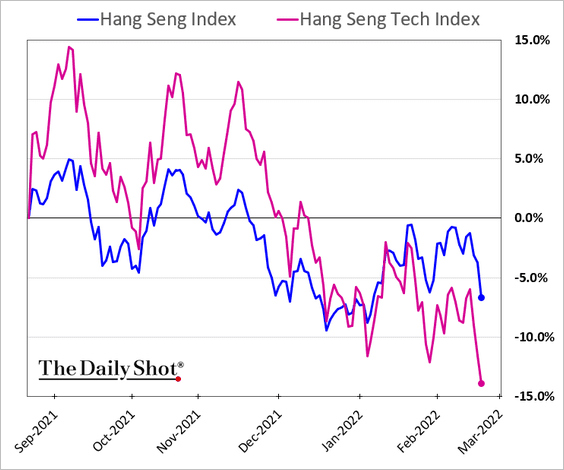

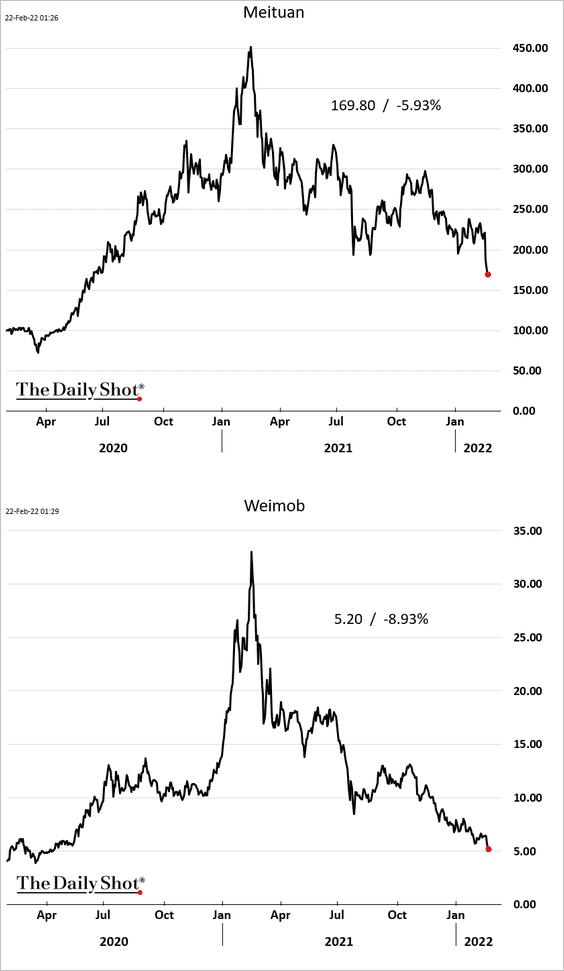

1. Tech shares continue to tumble in Hong Kong amid Beijing’s crackdown (2 charts).

But state-controlled companies are outperforming.

Source: @SofiaHCBBG

Source: @SofiaHCBBG

——————–

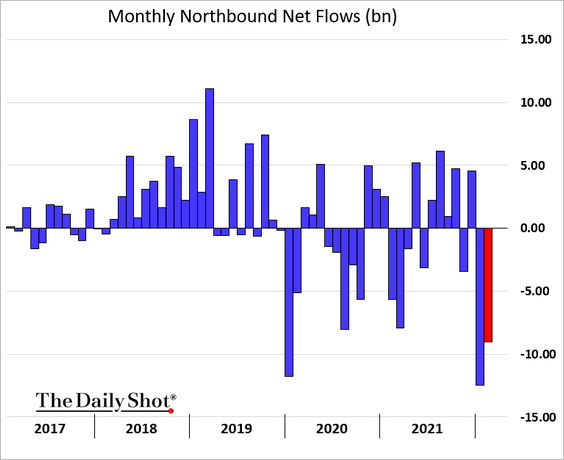

2. Hong Kong-based and foreign investors have been pulling capital out of Mainland stocks.

Source: Bloomberg

Source: Bloomberg

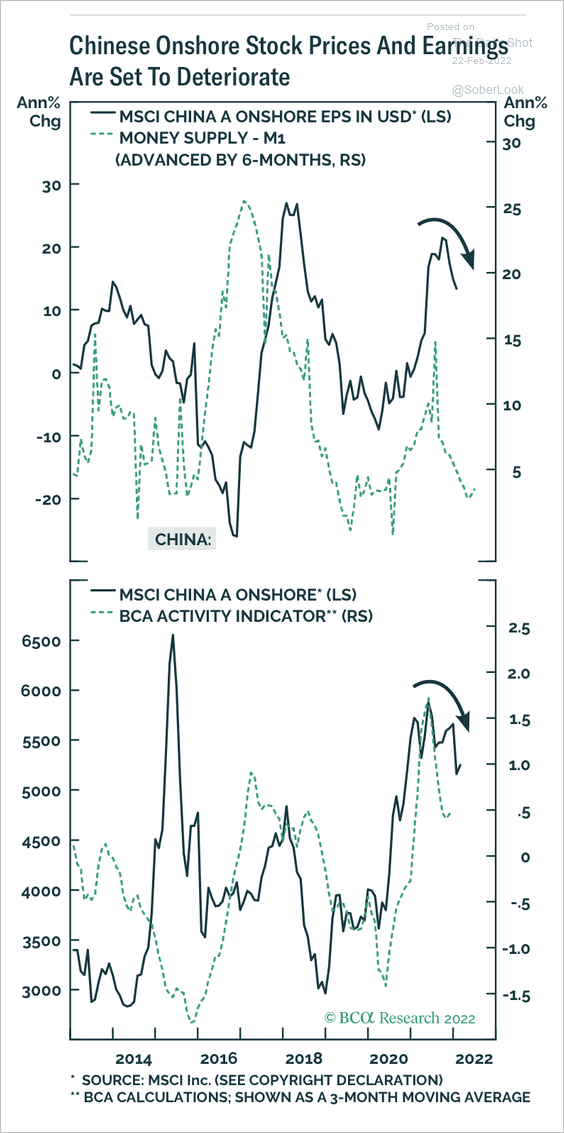

3. The decline in money supply and business activity points to further weakness in stock prices.

Source: BCA Research

Source: BCA Research

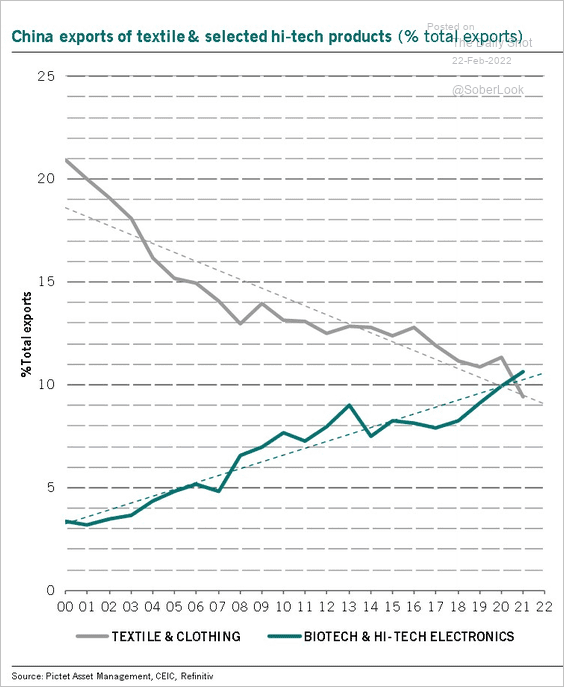

4. This chart shows China’s exports of textiles vs. high-tech products.

Source: @PictetAMFrom, @PkZweifel

Source: @PictetAMFrom, @PkZweifel

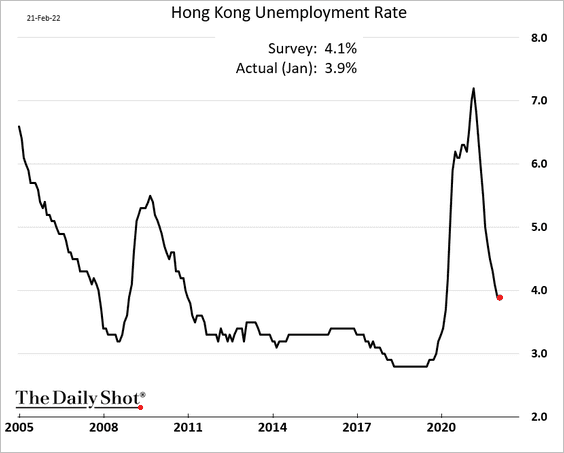

5. Hong Kong’s unemployment rate surprised to the downside.

——————–

Food for Thought

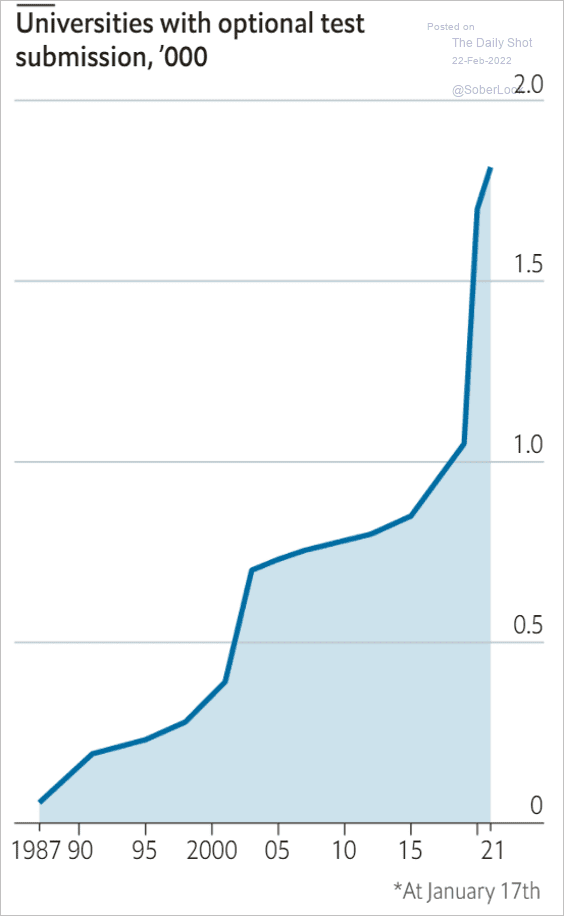

1. Universities with optional SAT and ACT submissions:

Source: The Economist Read full article

Source: The Economist Read full article

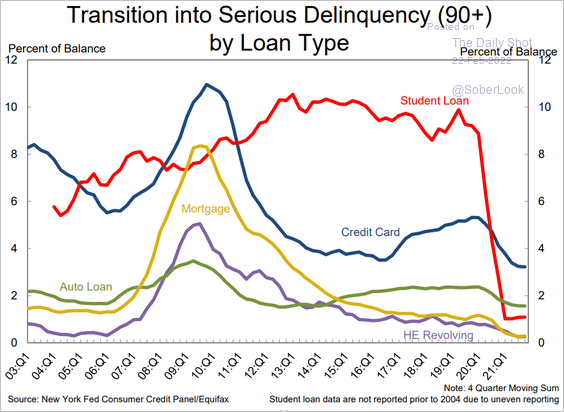

2. Transitions into consumer loan delinquencies:

Source: NY Fed Center for Microeconomic Data

Source: NY Fed Center for Microeconomic Data

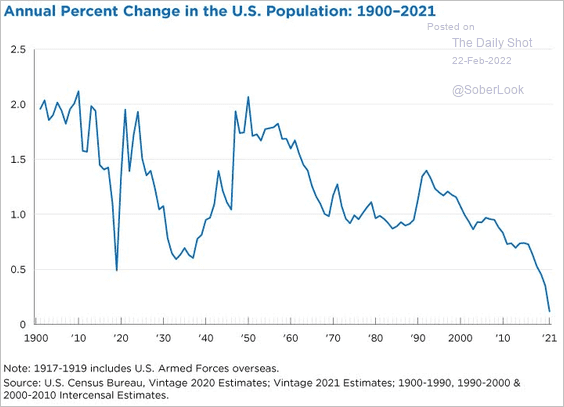

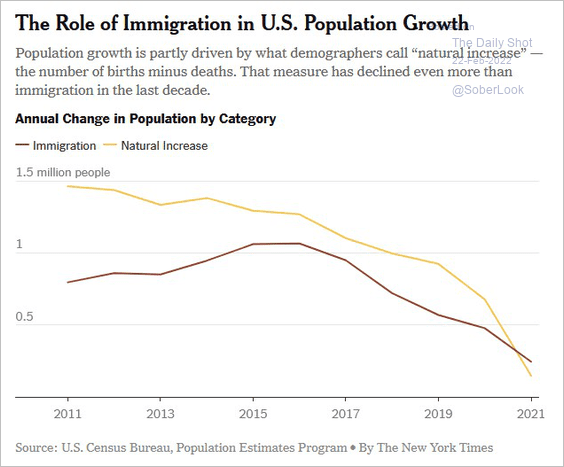

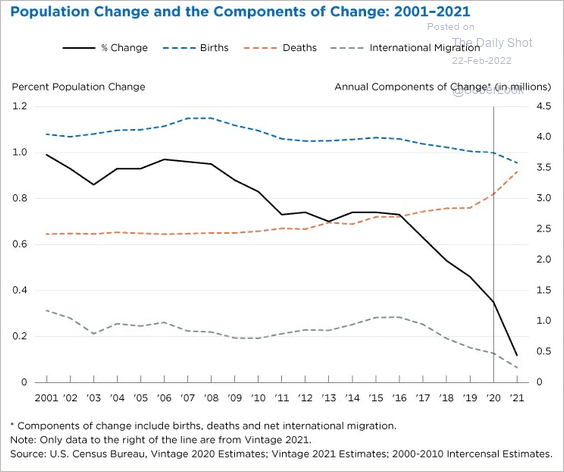

3. Collapsing US population growth (3 charts):

Source: The U.S. Census Bureau

Source: The U.S. Census Bureau

Source: @jessefelder; The New York Times Read full article

Source: @jessefelder; The New York Times Read full article

Source: The U.S. Census Bureau

Source: The U.S. Census Bureau

——————–

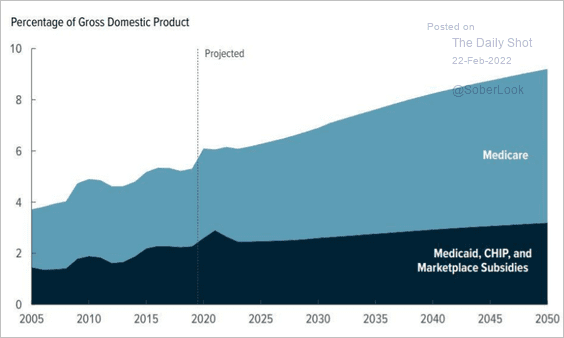

4. US federal health care programs as a share of GDP:

Source: CBO Read full article

Source: CBO Read full article

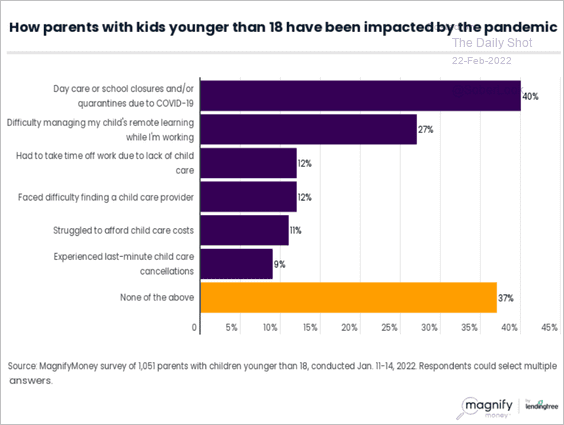

5. How the pandemic has impacted parents:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

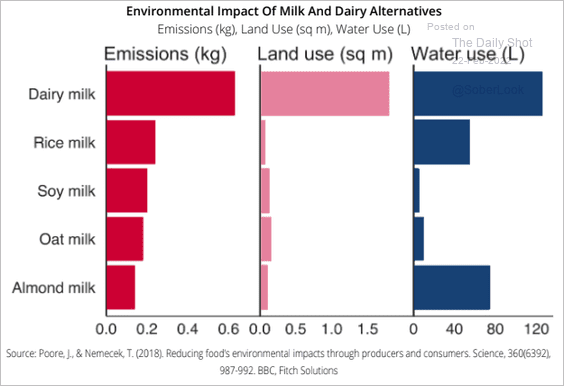

6. The environmental impact of milk and dairy alternatives:

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

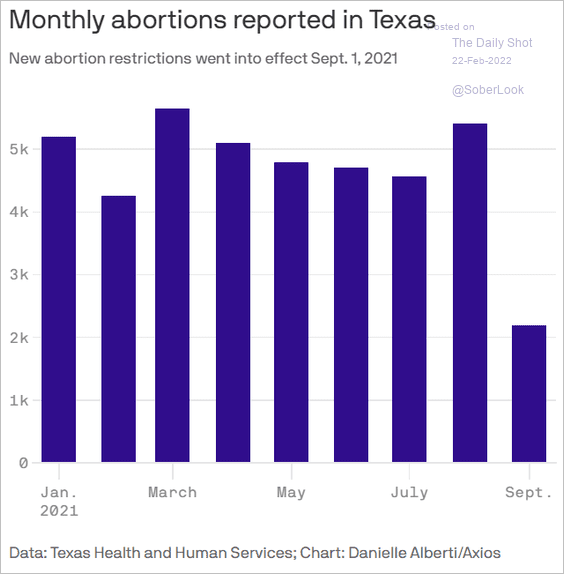

7. Abortions in Texas:

Source: Axios Read full article

Source: Axios Read full article

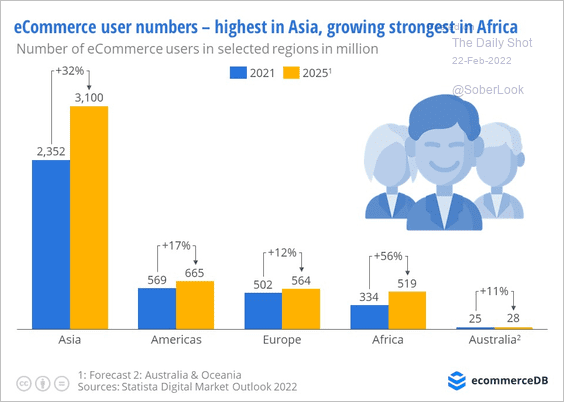

8. Global e-commerce user growth:

Source: EcommerceDB Read full article

Source: EcommerceDB Read full article

9. The market for semiconductors:

![]() Source: Alpine Macro

Source: Alpine Macro

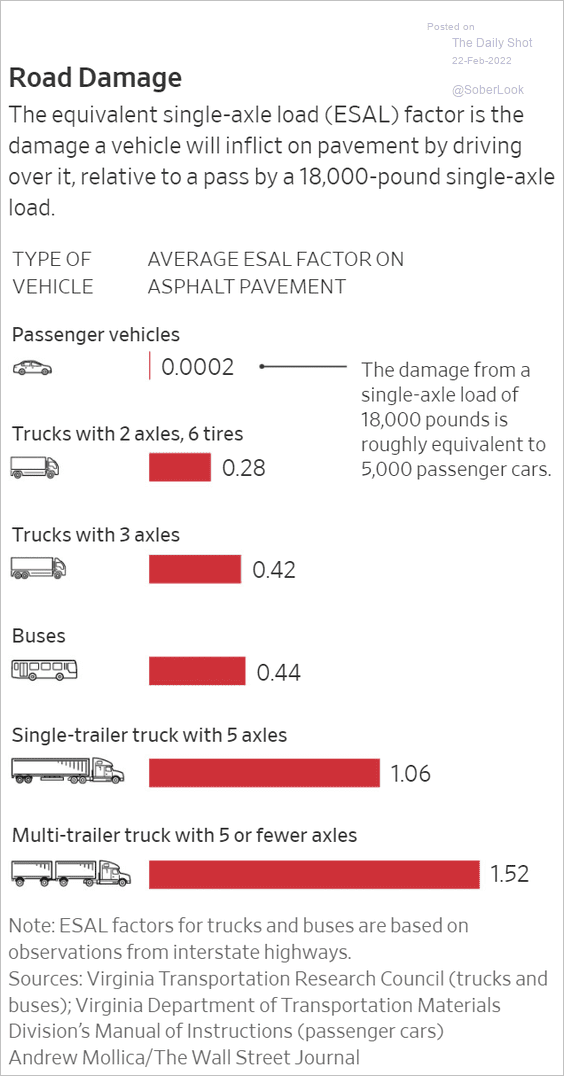

10. Damage inflicted on the pavement:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index