The Daily Shot: 28-Feb-22

• Energy

• Emerging Markets

• China

• Asia – Pacific

• Japan

• The Eurozone

• Europe

• The United Kingdom

• The United States

• Rates

• Credit

• Equities

• Commodities

• Global Developments

• Food for Thought

Energy

1. Western nations revoked access to SWIFT for major Russian banks. While some efforts were made to carve out energy-related payments, many private entities will refuse to transact with Russian institutions until there is more clarity on the situation. For now, sales of most commodities will be challenging for Russia.

Source: Reuters Read full article

Source: Reuters Read full article

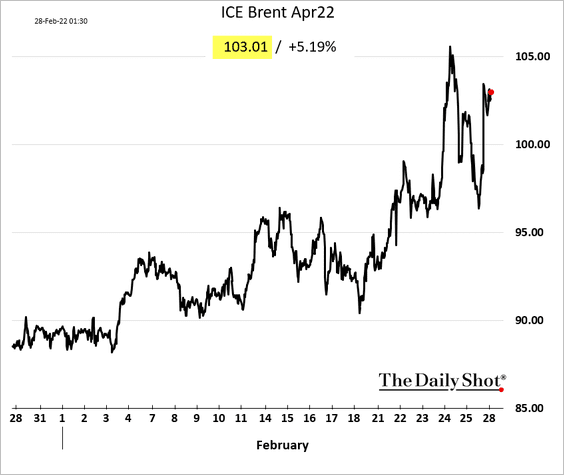

Brent crude surged 5%.

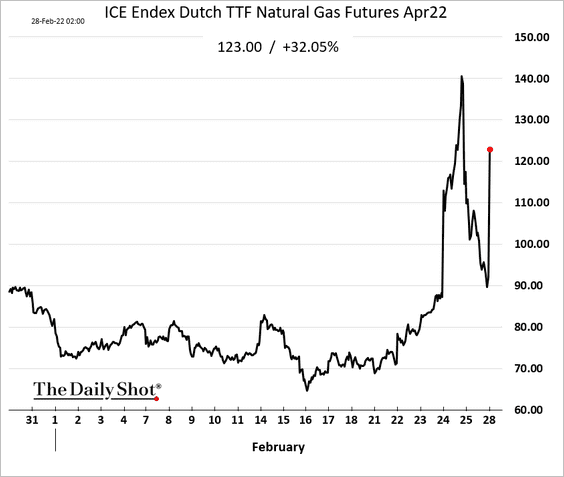

And European natural gas is up over 30%.

• Sanctions also include Russia’s central bank (more on this in the EM section).

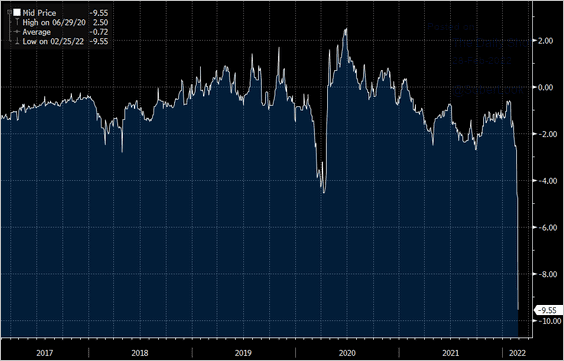

• The Russian crude oil benchmark (Urals) is trading at a deep discount to Brent.

Source: @Ole_S_Hansen, @business

Source: @Ole_S_Hansen, @business

——————–

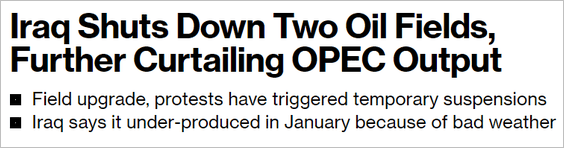

2. Slower output in Iraq is adding to supply concerns.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

The 2022 oil surplus forecasts are starting to look shaky.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

3. Russia’s natural gas proceeds hit a record high before the war.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

——————–

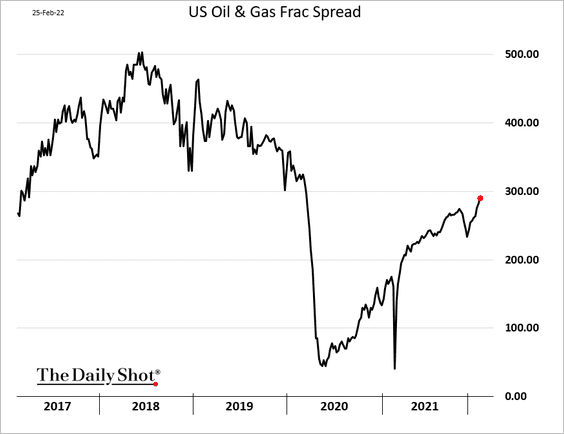

4. Fracking activity in the US has almost rebounded to pre-COVID levels.

But shortages of sand have been hindering fracking output.

Source: Reuters, h/t Walter Read full article

Source: Reuters, h/t Walter Read full article

——————–

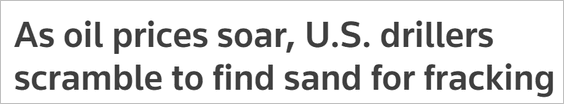

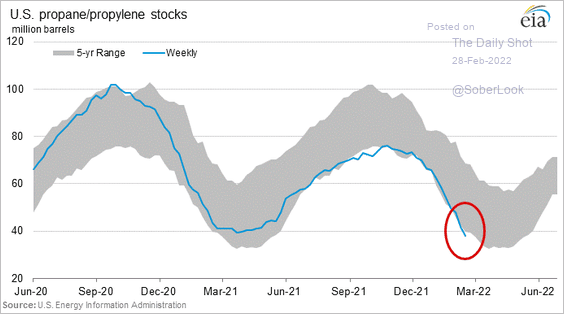

5. At current prices, Gulf oil exporters are running balanced budgets.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

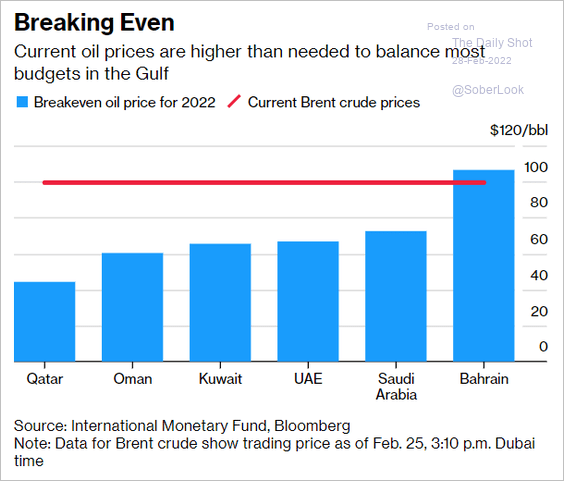

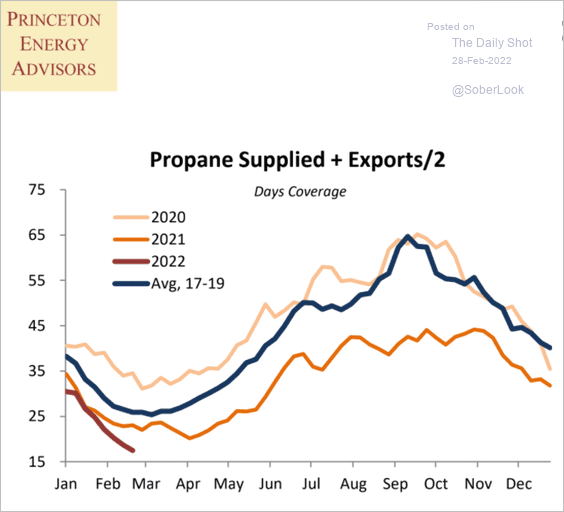

6. US propane inventories are running low, …

… despite warmer-than-usual weather.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

Back to Index

Emerging Markets

1. Let’s begin with Russia.

• Sanctions on Russia’s central bank will put pressure on the nation’s financial system.

Source: @WSJ Read full article

Source: @WSJ Read full article

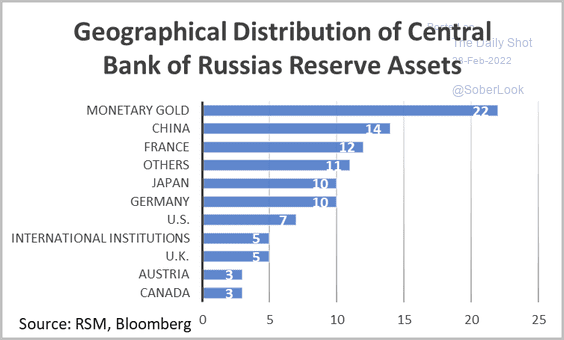

It will be more challenging for the central bank to deploy its record foreign reserves.

• Here is the distribution of Russia’s foreign reserve assets.

Source: @joebrusuelas

Source: @joebrusuelas

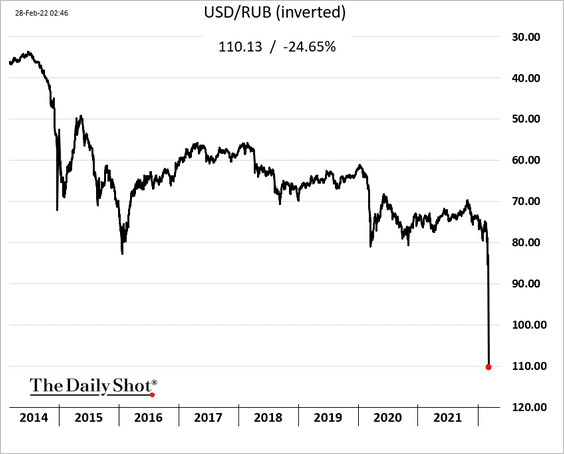

• The ruble plummeted at the open today.

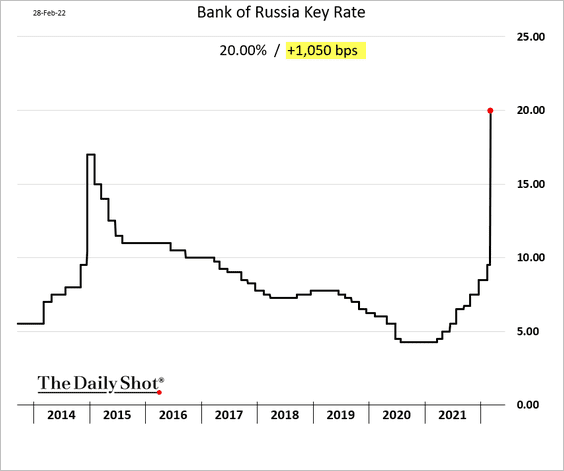

• The central bank hiked rates to 20% (an unprecedented increase) to stem the ruble’s decline. For now, it’s not working.

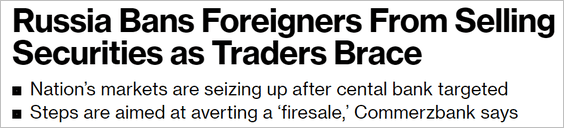

• The central bank implemented exchange controls and is now prohibiting the sales of Russian securities by foreigners to stem the selloff.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

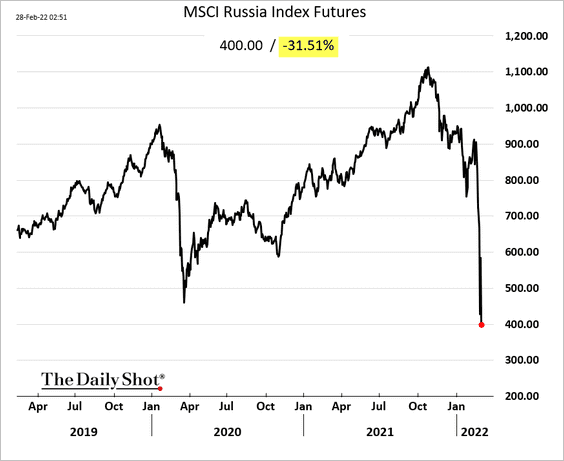

• Futures on the MSCI Russian stock index are down over 30% this morning.

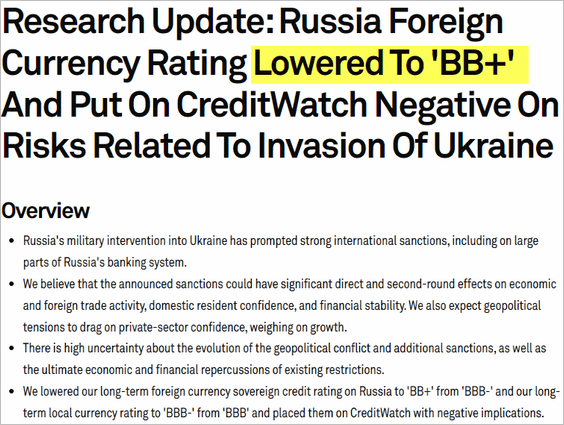

• S&P downgraded Russia into junk territory.

Source: S&P Global Ratings Read full article

Source: S&P Global Ratings Read full article

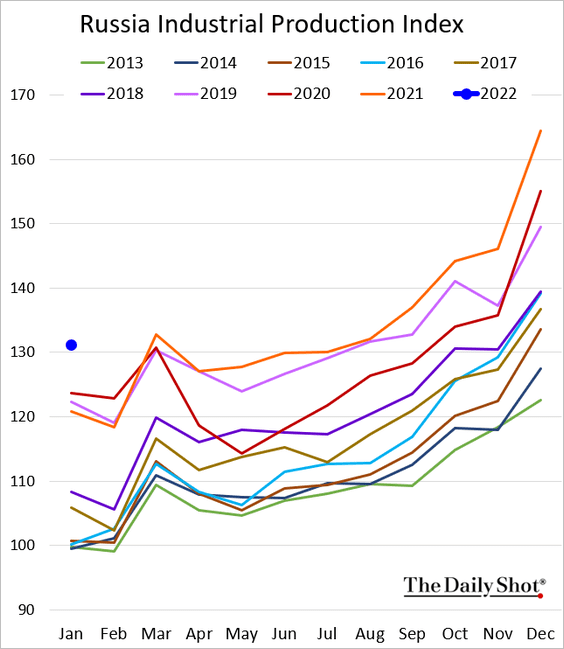

• Before the war, Russia’s industrial production was surging.

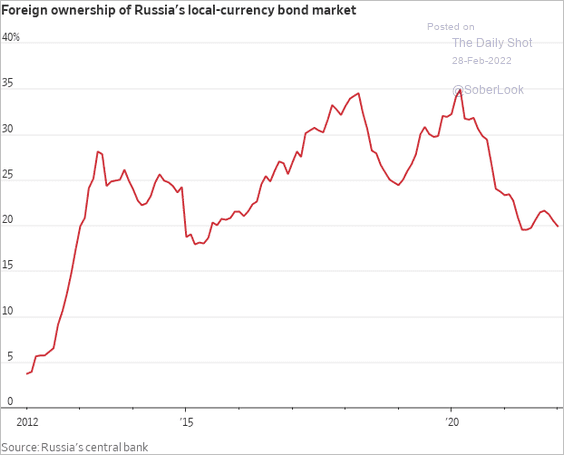

• This chart shows foreign ownership of ruble-denominated bonds.

Source: @WSJ Read full article

Source: @WSJ Read full article

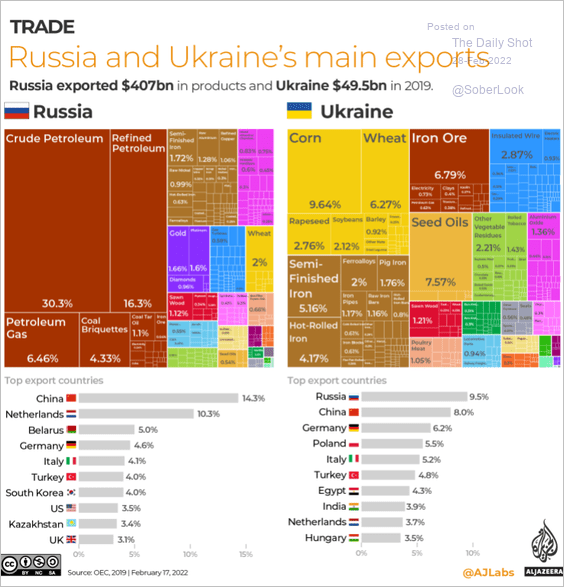

• Finally, this infographic shows Russian and Ukrainian exports.

Source: Al Jazeera Read full article

Source: Al Jazeera Read full article

——————–

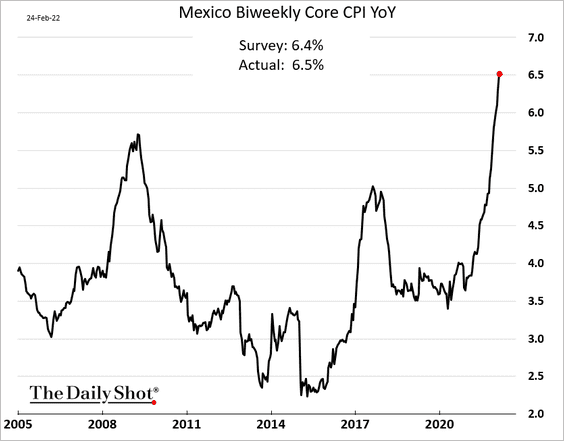

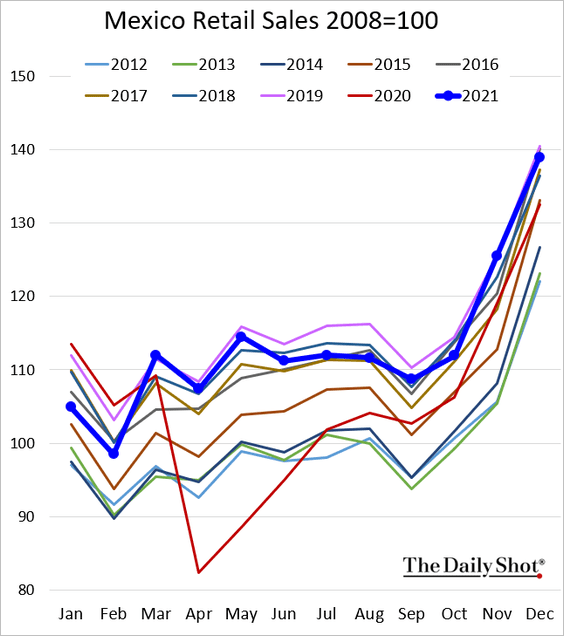

2. Next, we have some updates on Mexico.

• Inflation hit 6.5%.

• Retail sales were relatively soft in December (similar to the US).

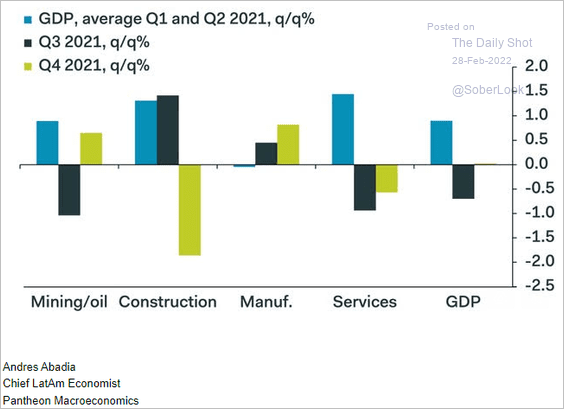

• Construction was a drag on the GDP in Q4.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

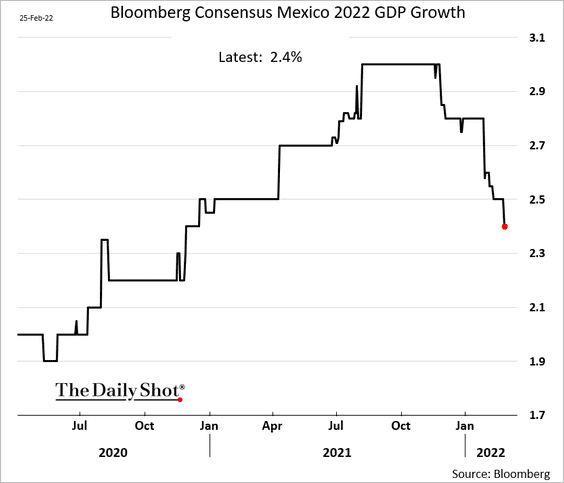

• Economists are downgrading Mexico’s growth for 2022.

——————–

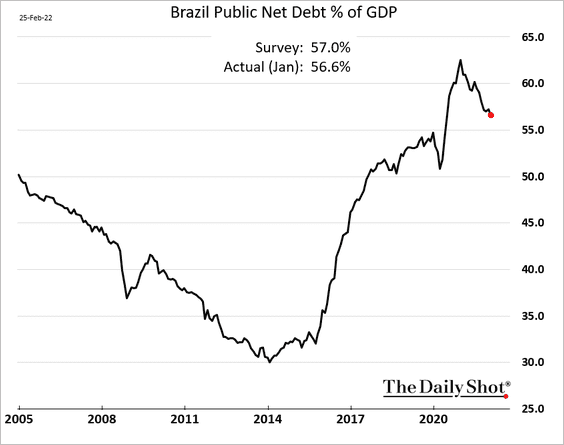

3. Brazil’s debt-to-GDP ratio has been trending lower.

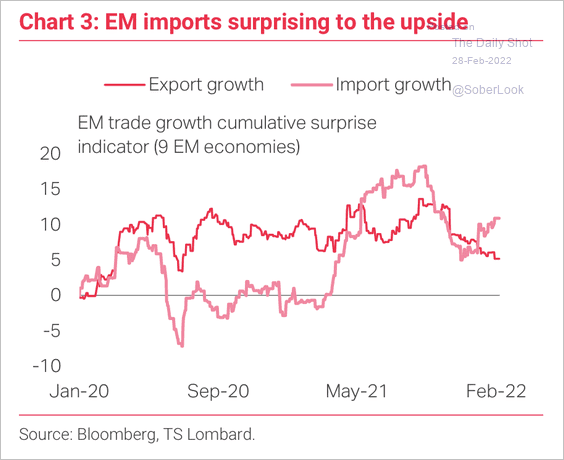

4. EM imports are rising relative to exports.

Source: TS Lombard

Source: TS Lombard

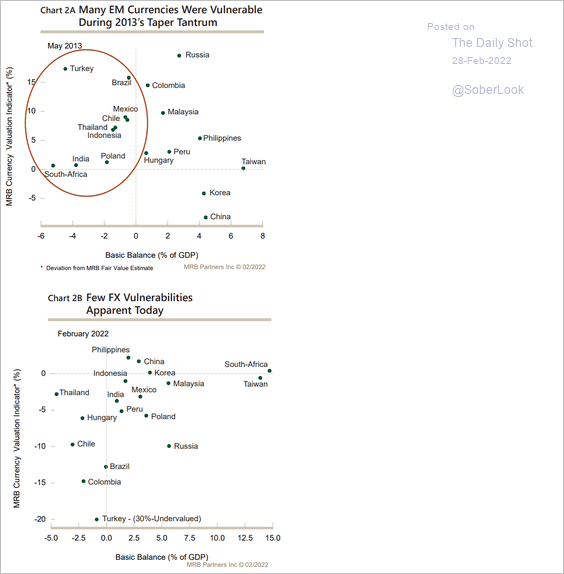

5. The Fed’s taper/QT is less of a concern for EM currencies relative to 2013.

Source: MRB Partners

Source: MRB Partners

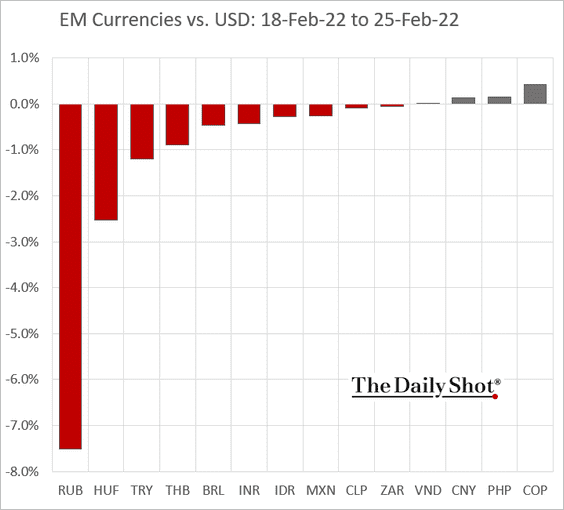

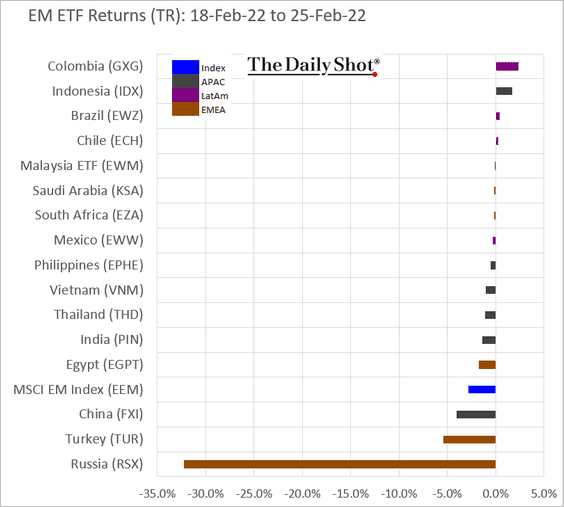

6. Finally, let’s take a look at last week’s performance.

• EM Currencies:

• EM equity ETFs:

Back to Index

China

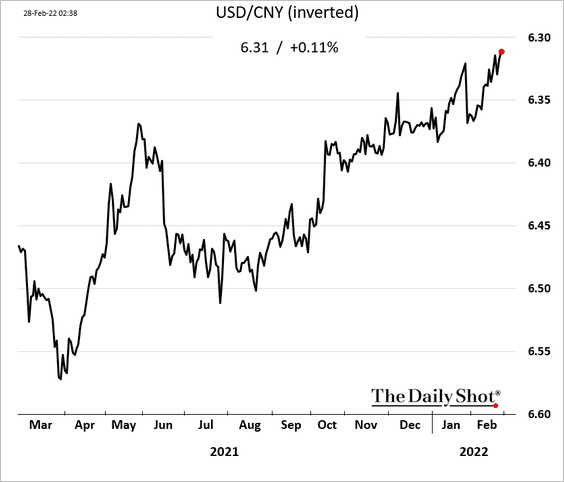

1. Viewed by the market as a safe-haven currency, the renminbi continues to climb.

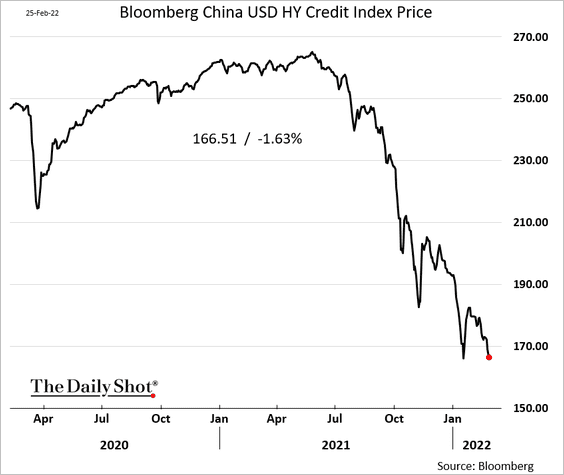

2. USD-denominated HY debt remains under pressure.

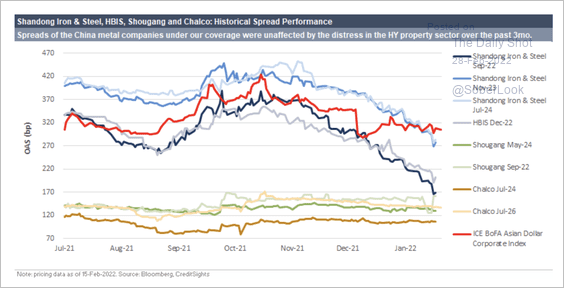

But credit spreads in select Chinese metal companies were unaffected by the distress in the nation’s high-yield property sector over the past few months.

Source: CreditSights

Source: CreditSights

——————–

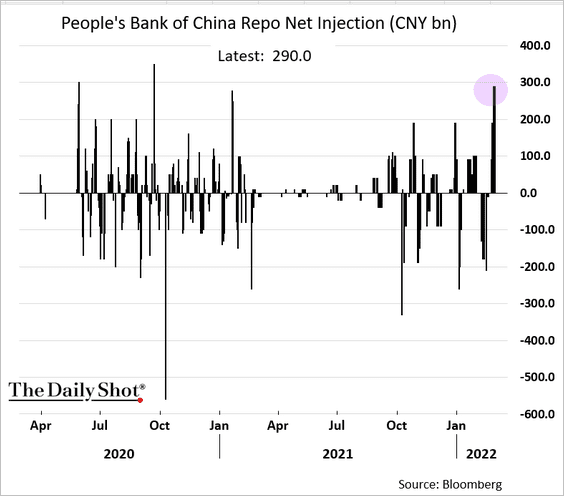

3. The PBoC has been injecting liquidity into the banking system amid rising risk aversion.

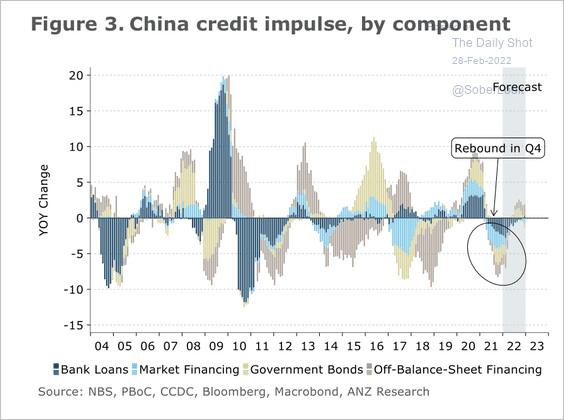

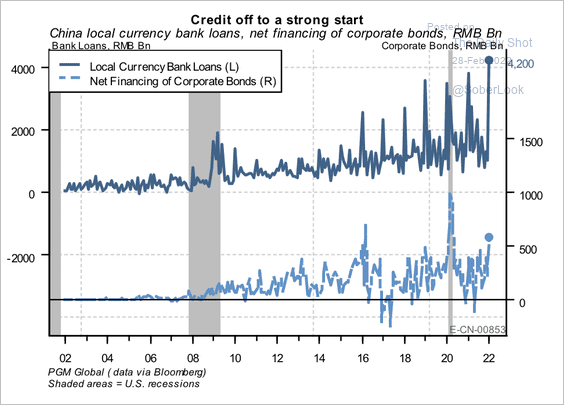

4. The credit impulse bottomed in Q4 2021 as the PBOC began to ease policy.

Source: ANZ Research

Source: ANZ Research

Credit to the non-financial sector has started the year on a strong note.

Source: PGM Global

Source: PGM Global

——————–

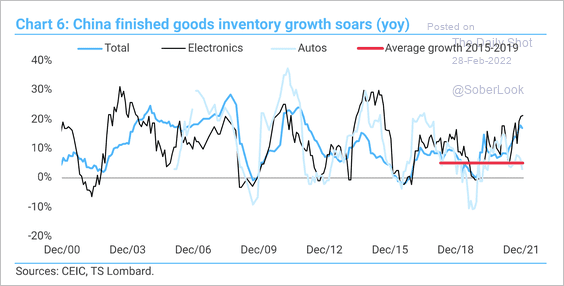

5. Inventories of finished goods are rising rapidly.

Source: TS Lombard

Source: TS Lombard

Back to Index

Asia – Pacific

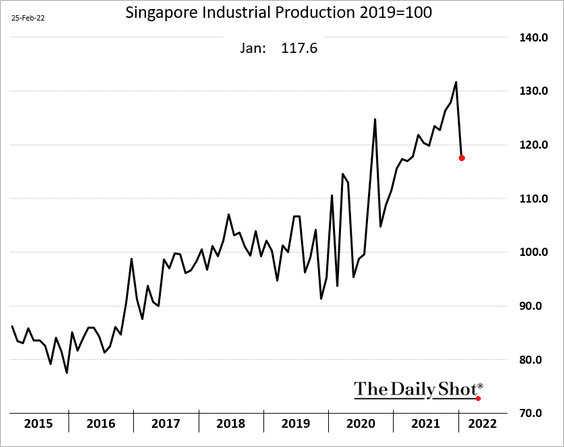

1. Singapore’s industrial production weakened at the start of the year.

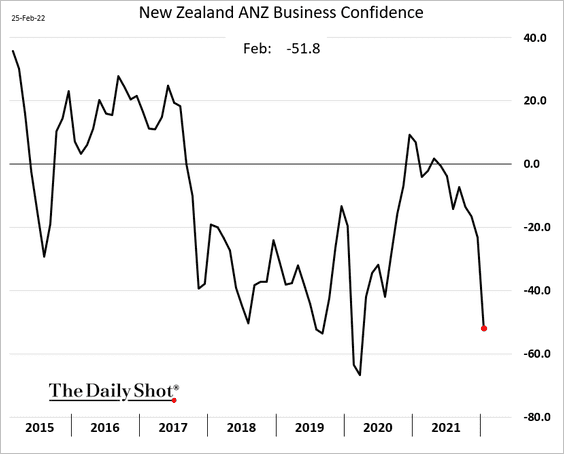

2. New Zealand’s business confidence has been deteriorating.

3. Next, we have some updates on Australia.

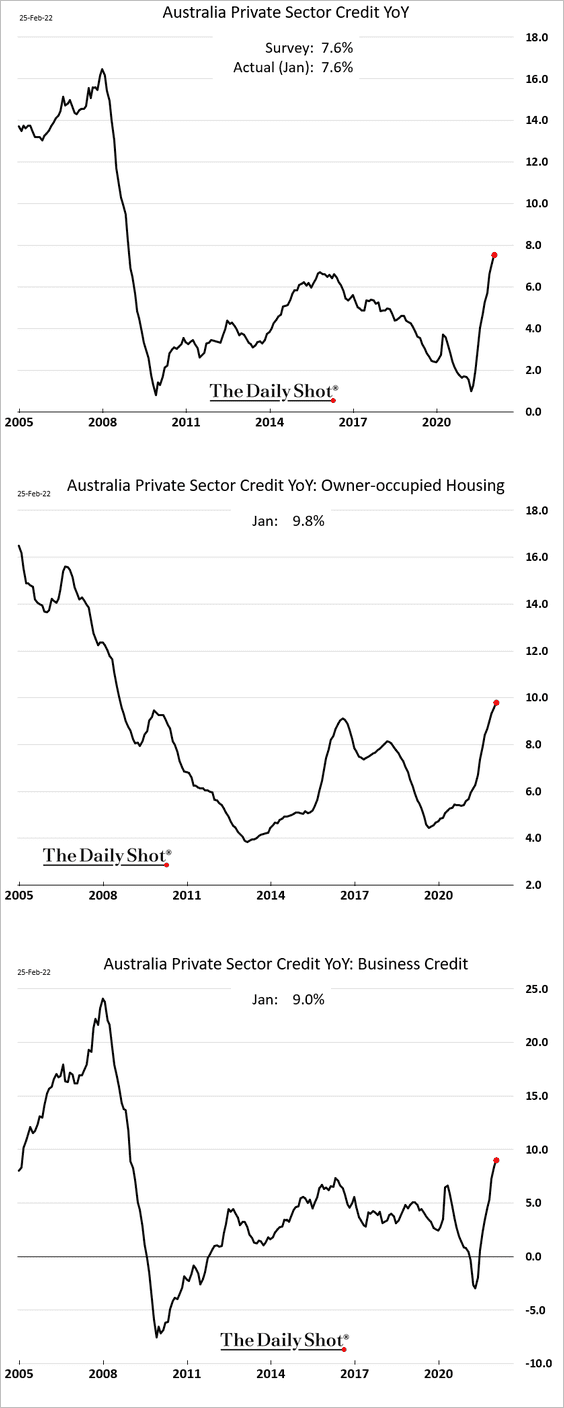

• Private sector credit continues to strengthen.

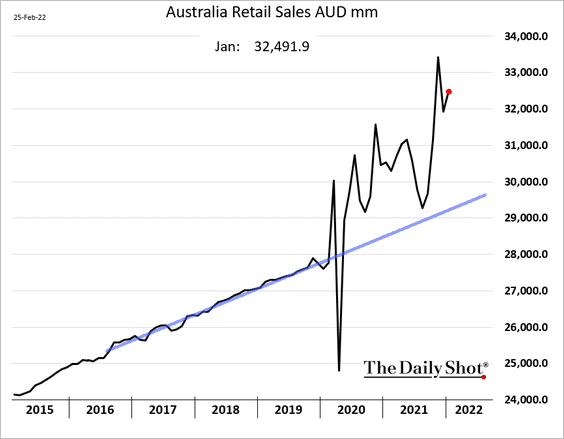

• Retail sales moved up in January.

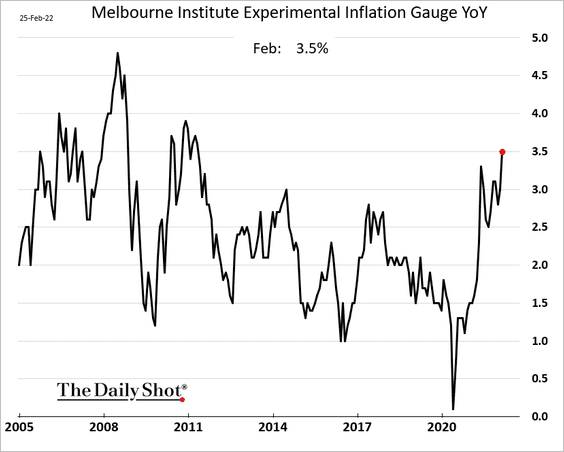

• Inflation is accelerating.

Back to Index

Japan

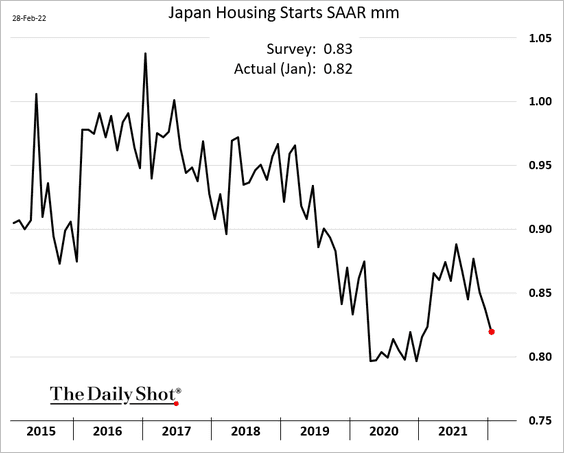

1. Housing starts were weaker last month.

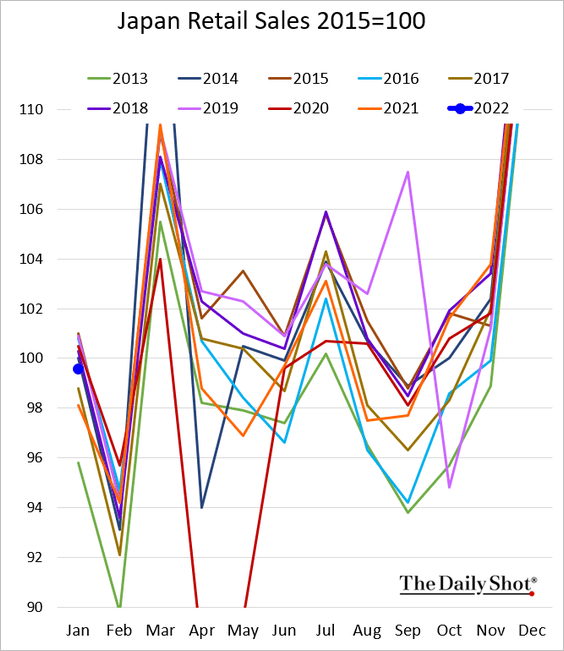

2. Retail sales were well above last year’s level in January.

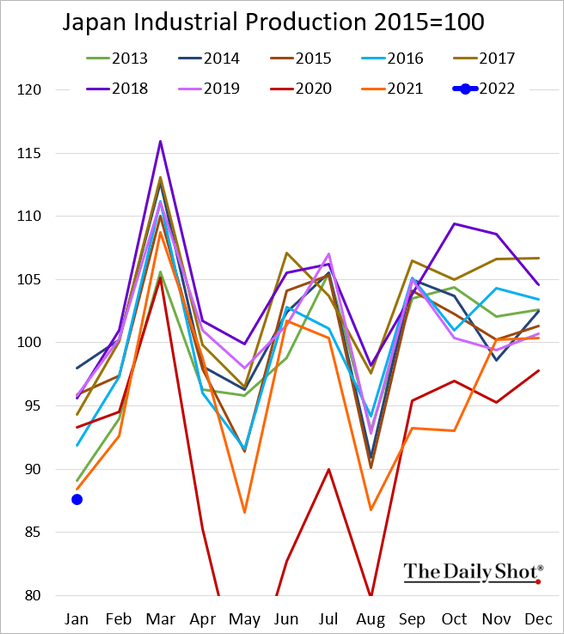

3. Industrial production disappointed.

Back to Index

The Eurozone

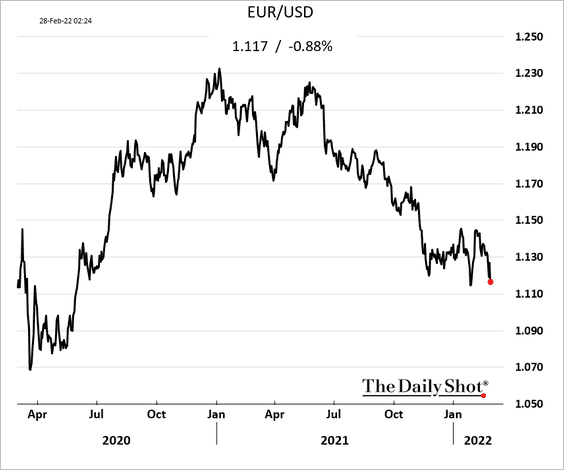

1. The euro is weaker this morning.

2. Next, we have some updates on inflation.

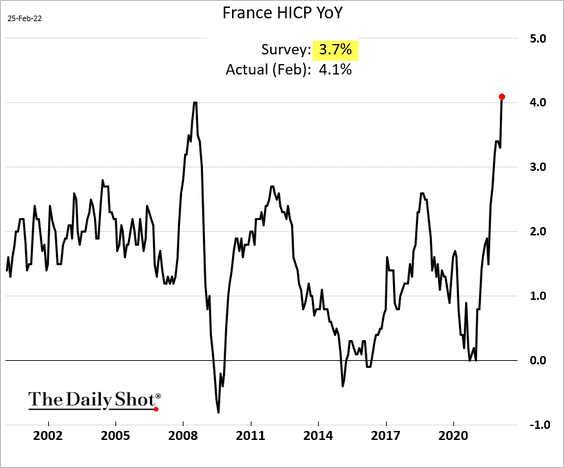

• The French CPI unexpectedly jumped above 4% this month.

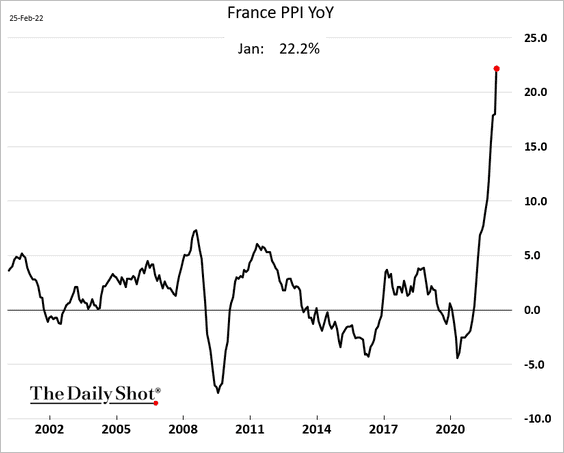

• Here is the French PPI (through January).

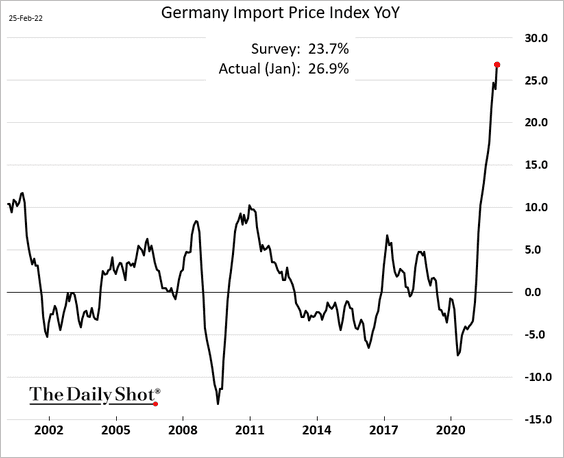

• Germany is importing inflation.

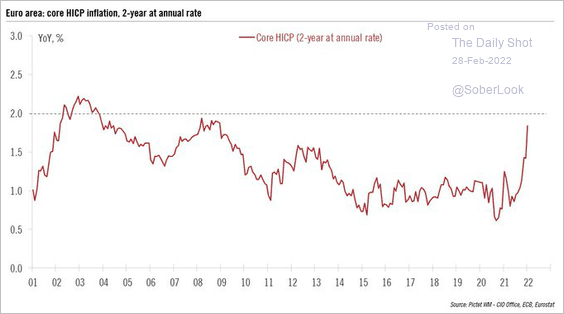

• The surge in euro-area inflation is not about base effects. Here are the 2-year changes in the CPI.

Source: @fwred

Source: @fwred

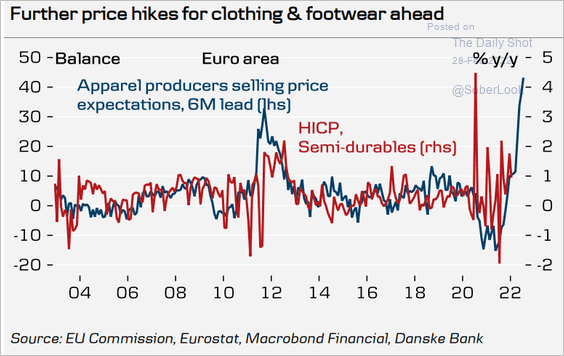

• Clothing and footwear CPI has been soaring.

Source: Danske Bank

Source: Danske Bank

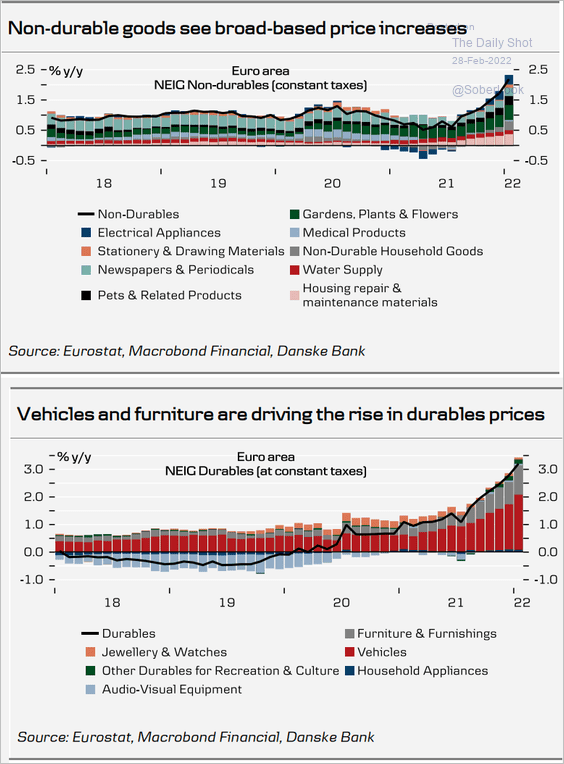

• Goods have been the drivers of inflation.

Source: Danske Bank

Source: Danske Bank

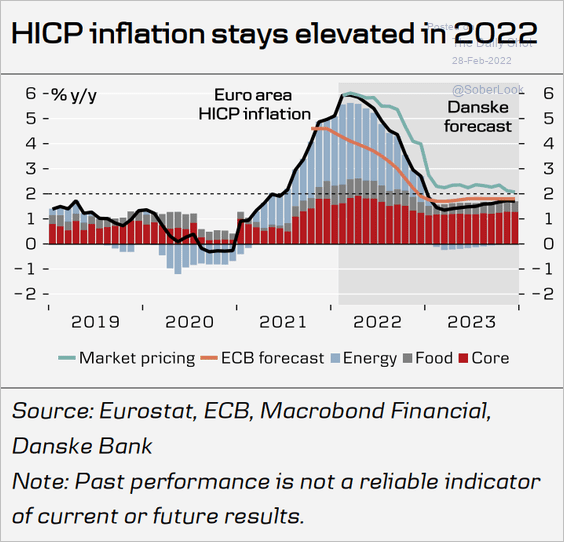

• The CPI is expected to stay elevated.

Source: Danske Bank

Source: Danske Bank

——————–

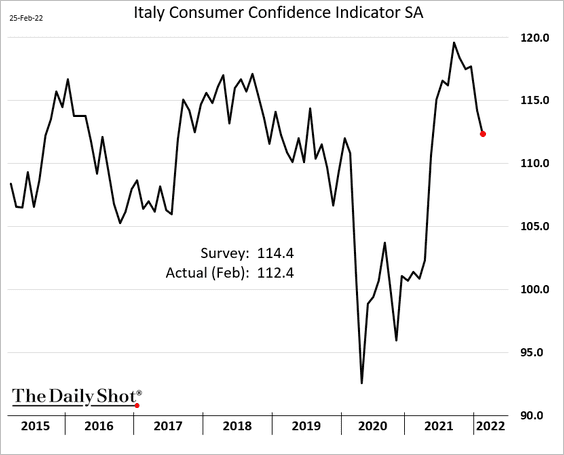

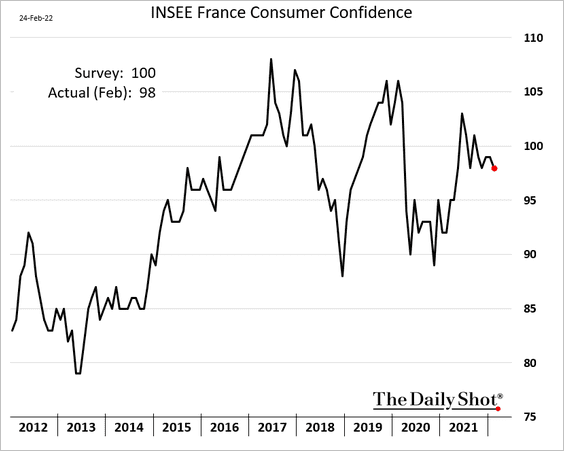

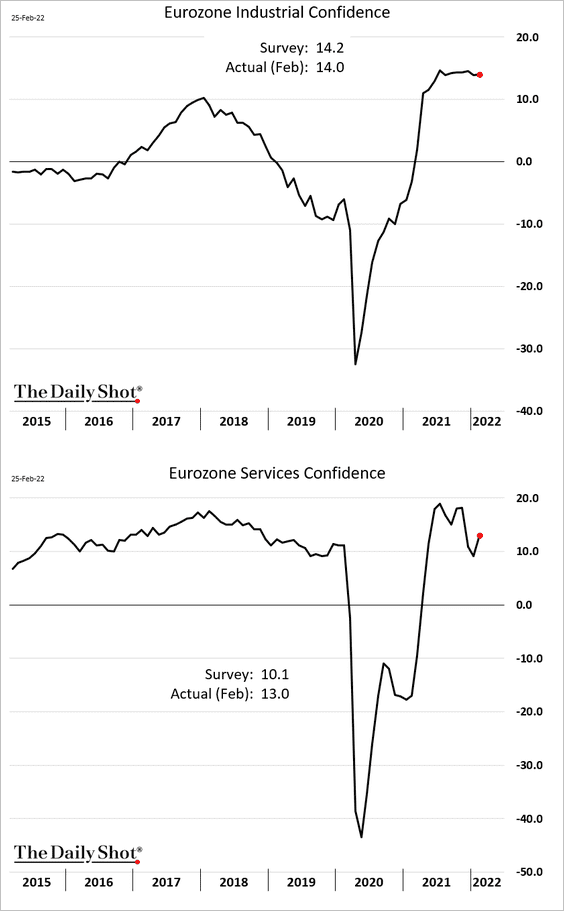

3. Next, let’s run through euro-area sentiment indicators.

• Italian consumer sentiment:

• French consumer confidence:

• Eurozone industrial and service confidence (measured before the war):

Back to Index

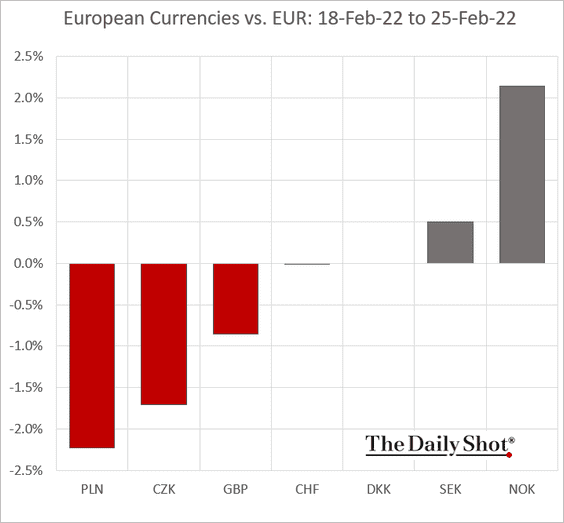

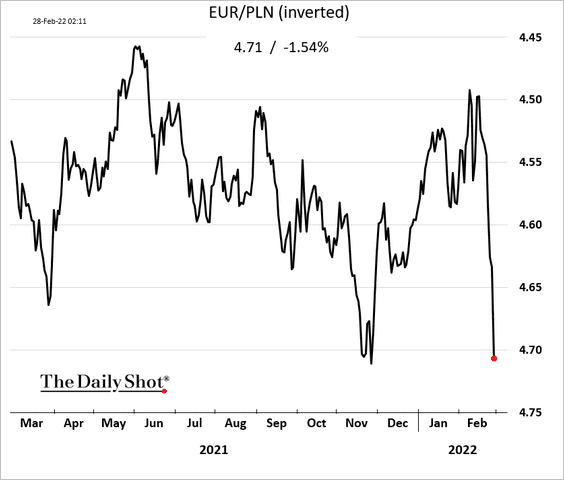

Europe

1. Eastern and Central European currencies are under pressure.

Here is the Polish zloty.

——————–

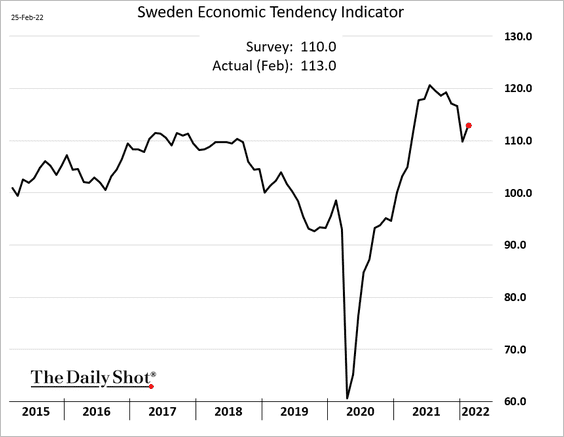

2. Sweden’s economic sentiment (business and consumer) improved this month.

Back to Index

The United Kingdom

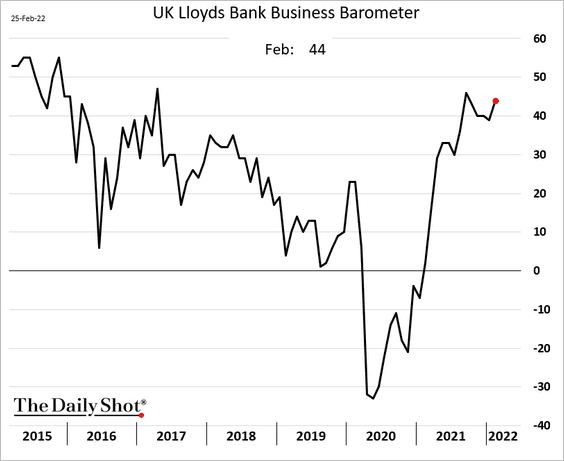

1. Business confidence improved in February. Things will likely be very different next month.

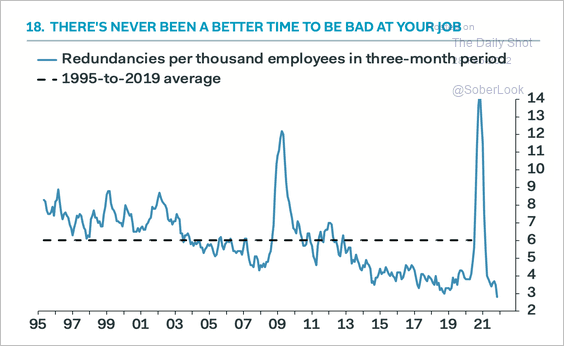

2. Redundancies in the UK have fallen to a new low.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The United States

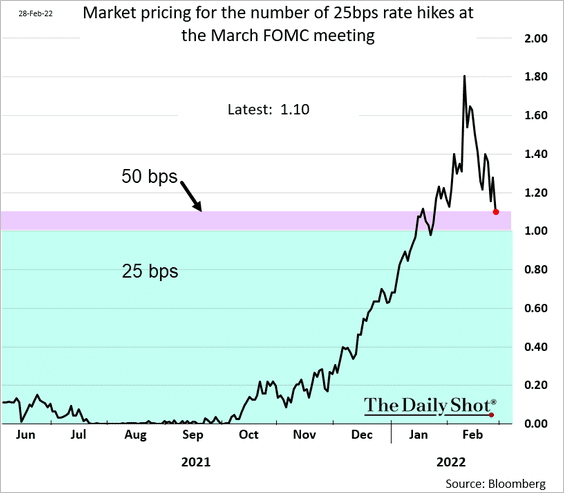

1. A 50 bps rate hike in March appears to be off the table.

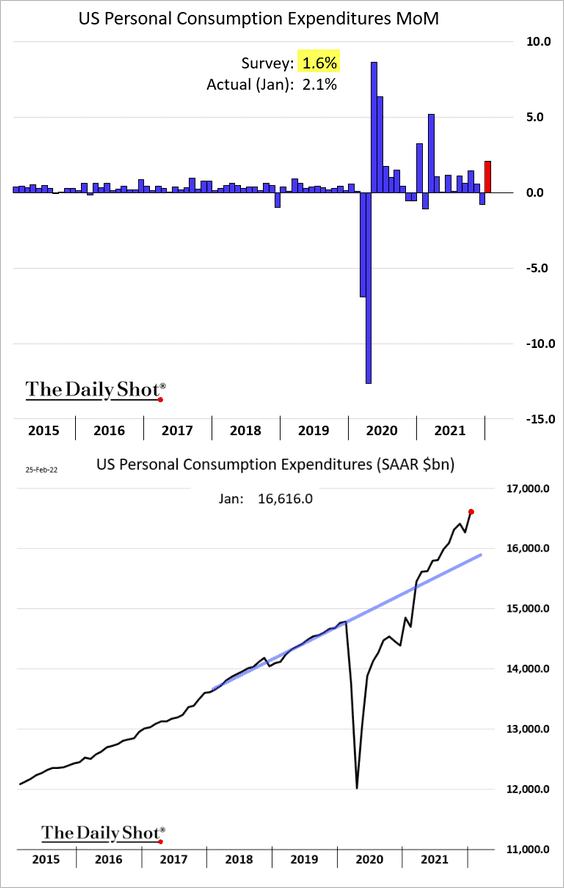

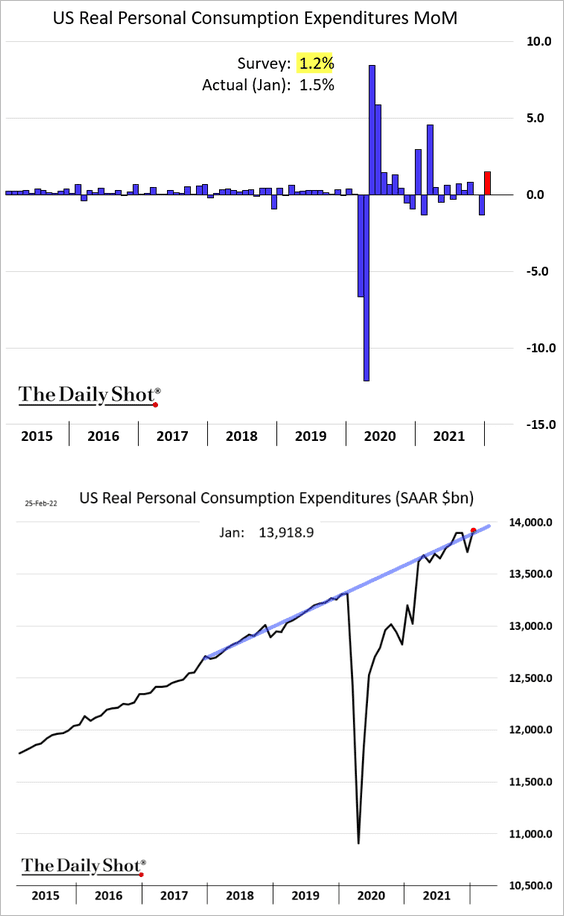

2. Consumer spending surprised to the upside in January.

Real consumer spending is back on the pre-COVID trend.

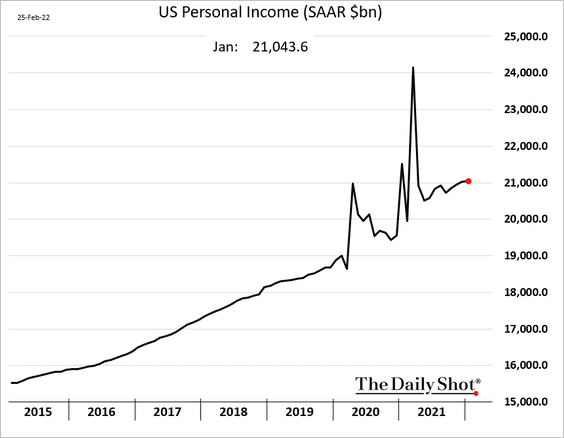

3. Household incomes eased last month.

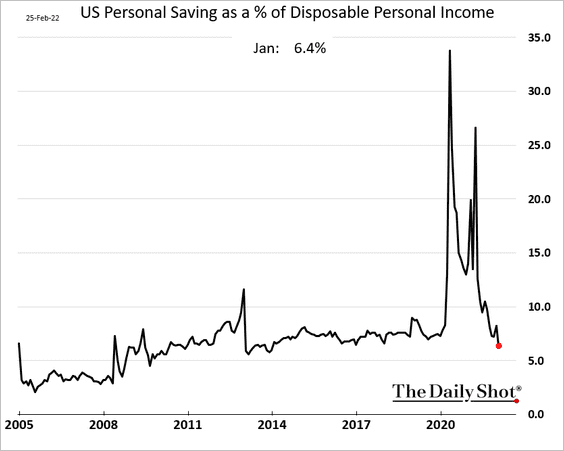

4. Savings as a share of disposable income hit a multi-year low.

——————–

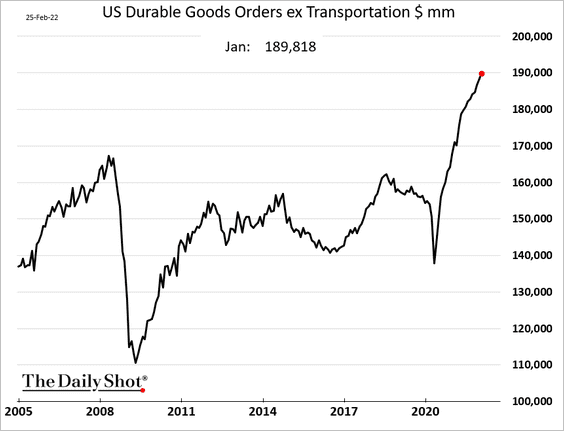

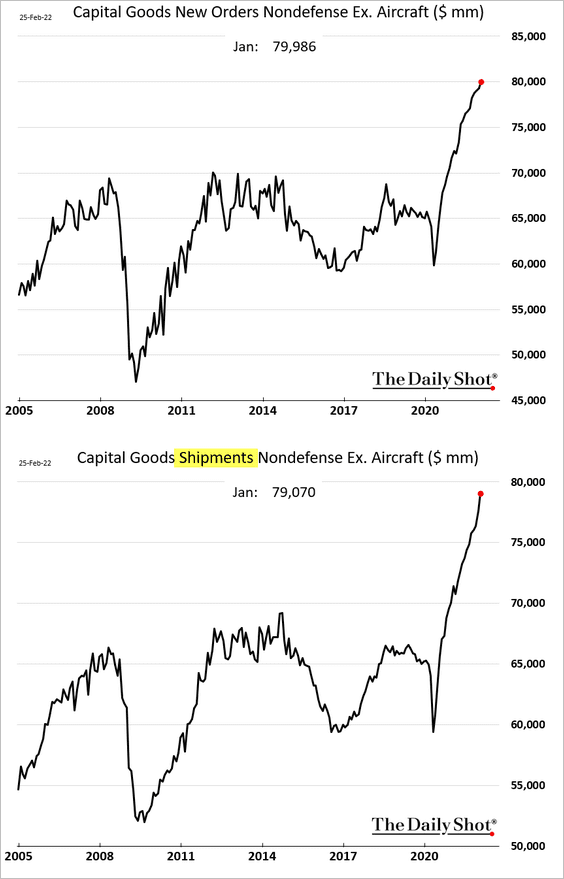

5. Durable goods orders started the year on a solid note.

Orders for capital goods have been particularly strong, pointing to improvements in business investment.

——————–

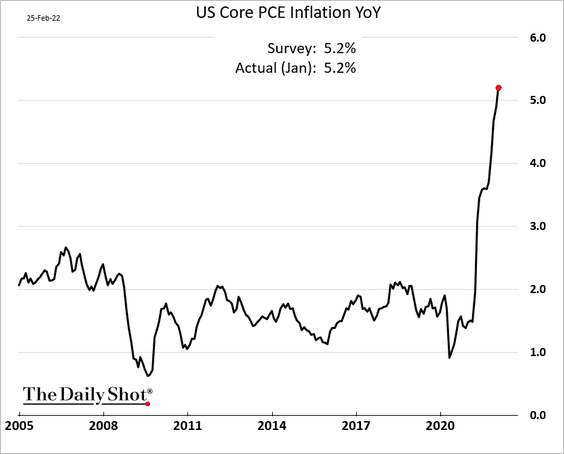

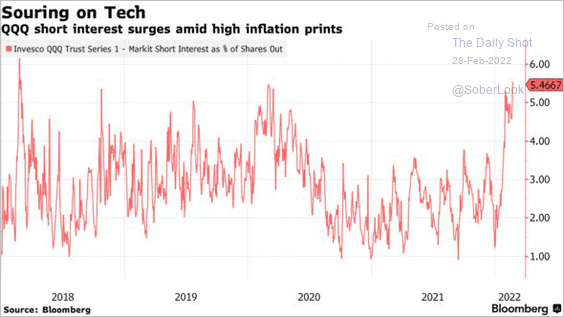

6. The core PCE inflation measure, the Fed’s preferred indicator, is now above 5%.

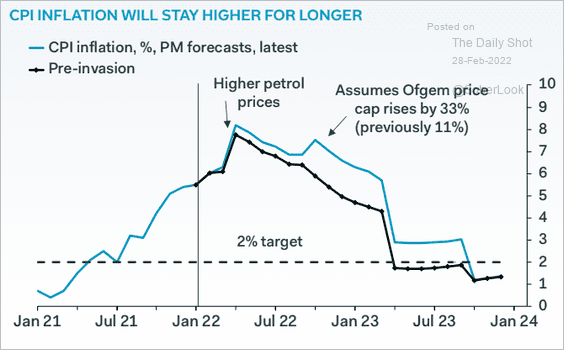

Inflation is expected to stay higher for longer as oil prices surge.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

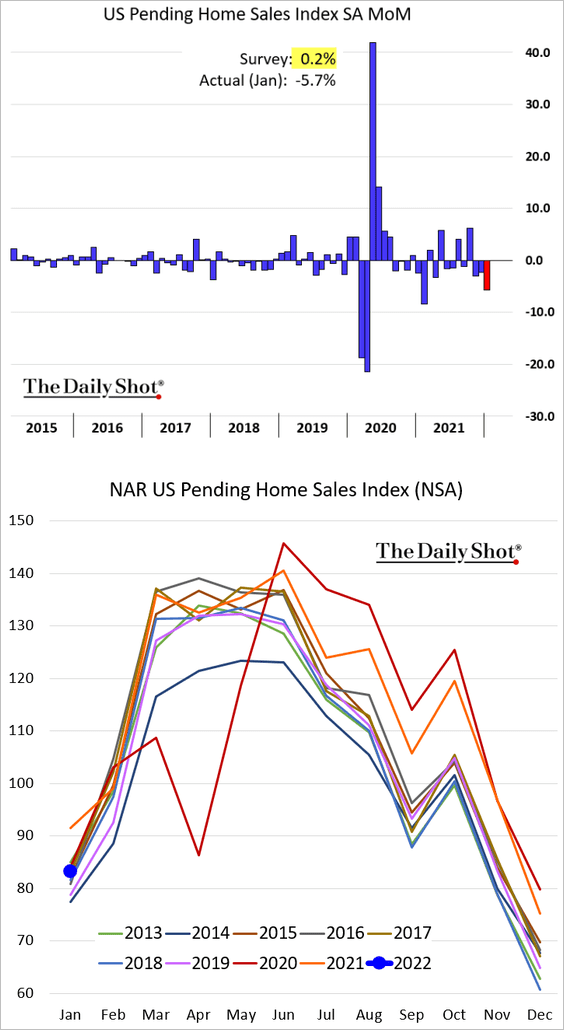

7. Pending home sales were disappointing in January amid tight supplies and surging prices.

Back to Index

Rates

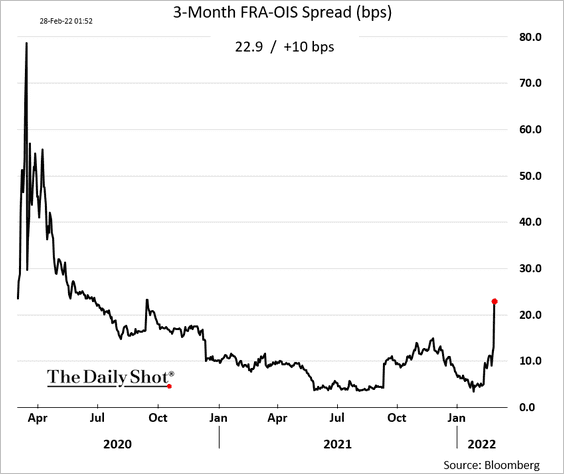

1. We are starting to see some tightening in money markets amid heightened risk aversion.

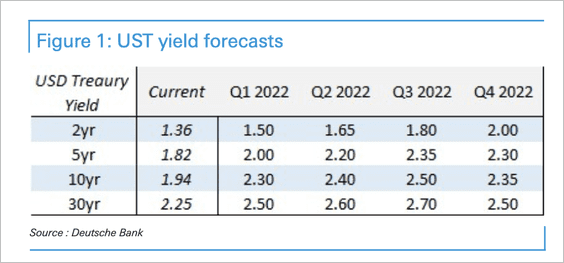

2. Here is Deutsche Bank’s Treasury yield forecast.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

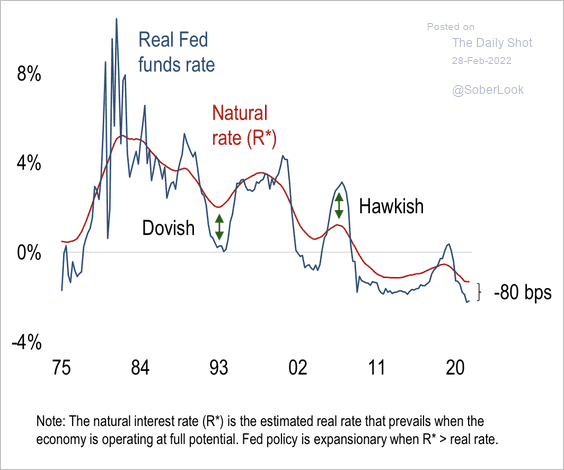

3. Numera Analytics expects the Fed policy to turn “neutral” during the second half of this year.

Source: Numera Analytics

Source: Numera Analytics

Back to Index

Credit

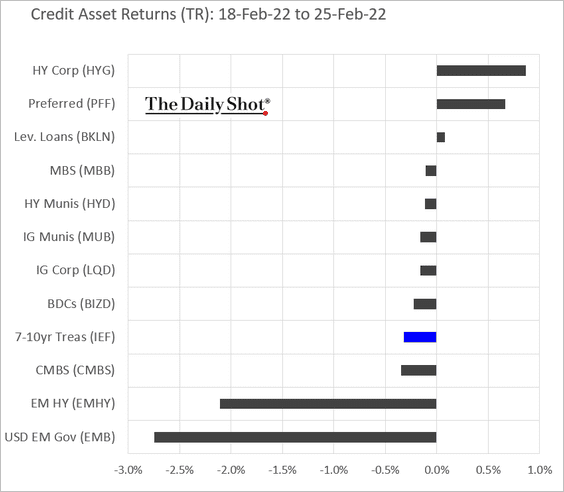

1. EM credit was hit hard last week.

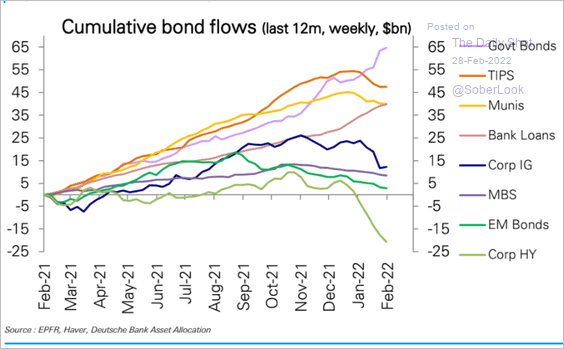

2. High-yield debt took the brunt of the fixed-income outflows this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

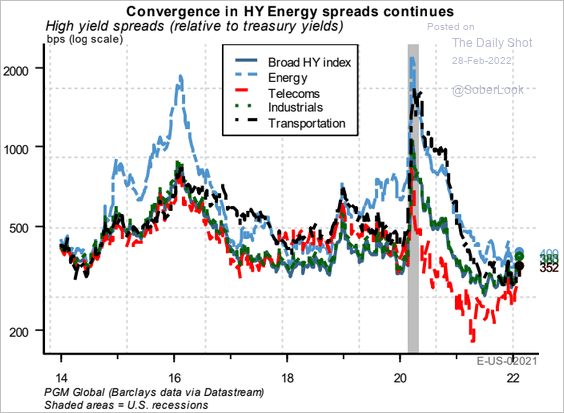

3. High-yield spreads across different sectors have been converging.

Source: PGM Global

Source: PGM Global

Back to Index

Equities

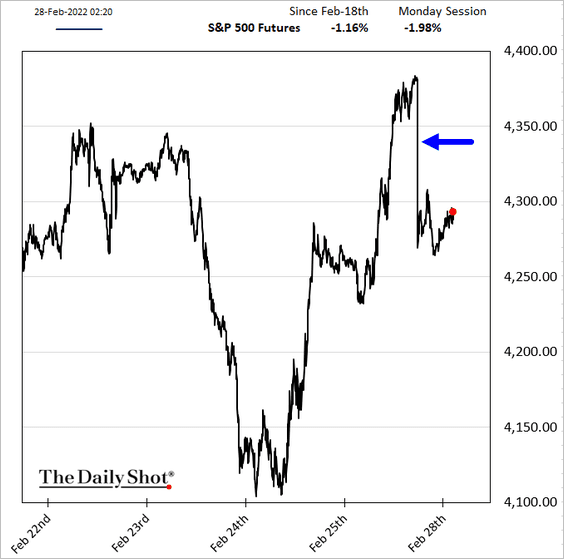

1. Short-covering boosted stock gains on Thursday and Friday.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

But stocks are weaker again this morning.

——————–

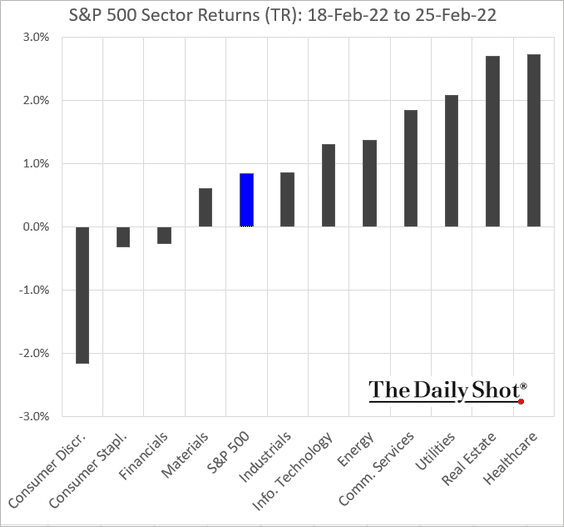

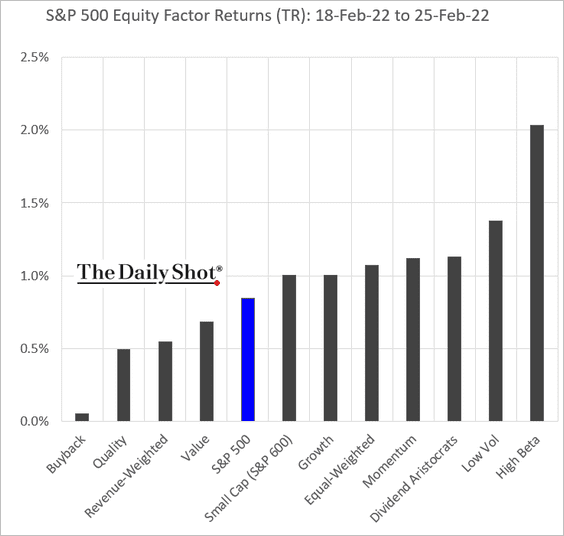

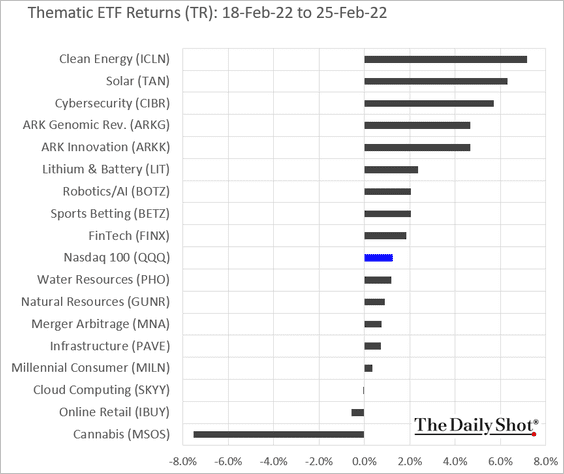

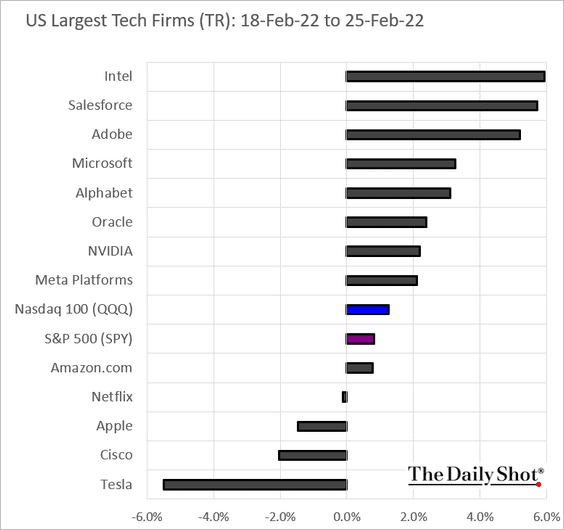

2. Next, let’s look at last week’s performance.

• Sectors:

• Equity factors:

• Thematic ETFs:

• Largest US tech stocks:

——————–

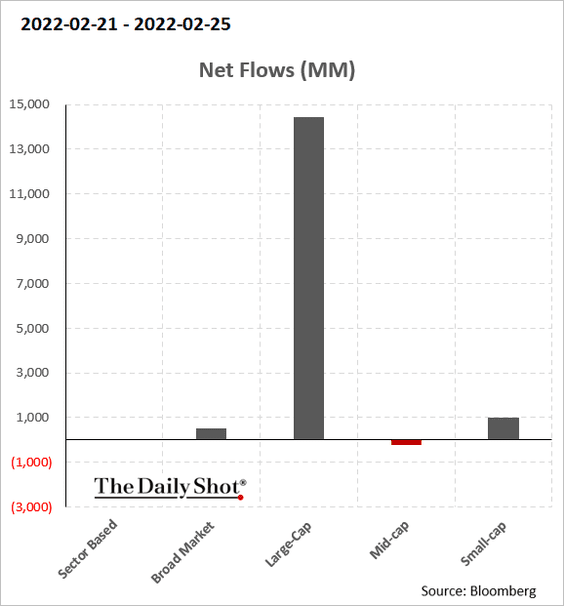

3. Large-cap funds saw substantial inflows last week.

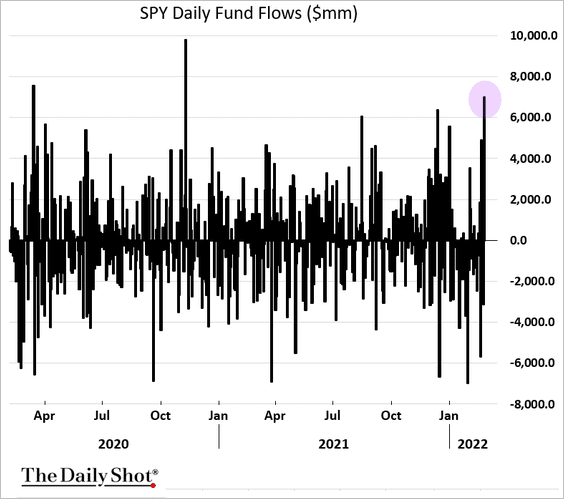

SPDR S&P 500 ETF (SPY) picked up some capital on Friday.

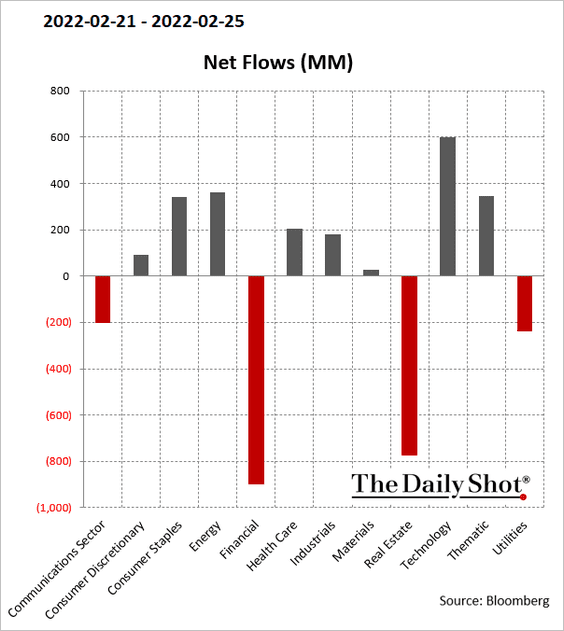

Here is the breakdown of flows by sector.

——————–

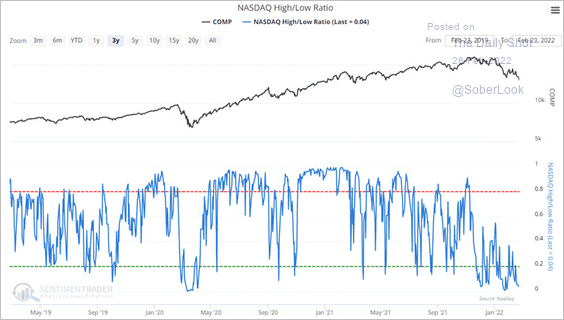

4. More Nasdaq stocks are reaching new 52-week lows, indicating declining breadth.

Source: SentimenTrader

Source: SentimenTrader

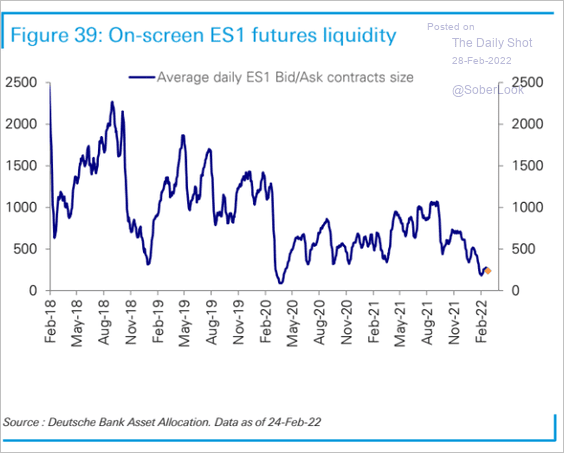

5. S&P 500 futures liquidity has deteriorated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

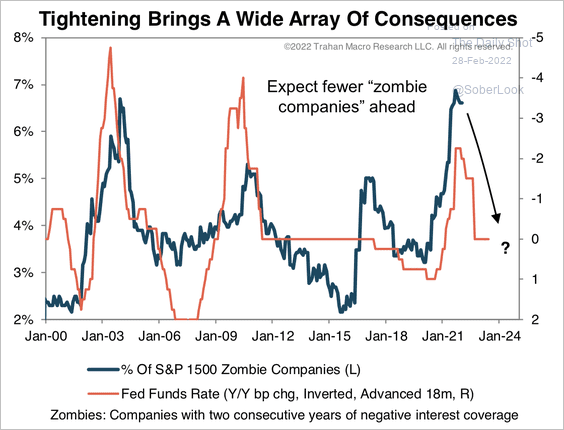

6. Will higher rates reduce the number of “zombie” companies?

Source: Trahan Macro Research

Source: Trahan Macro Research

Back to Index

Commodities

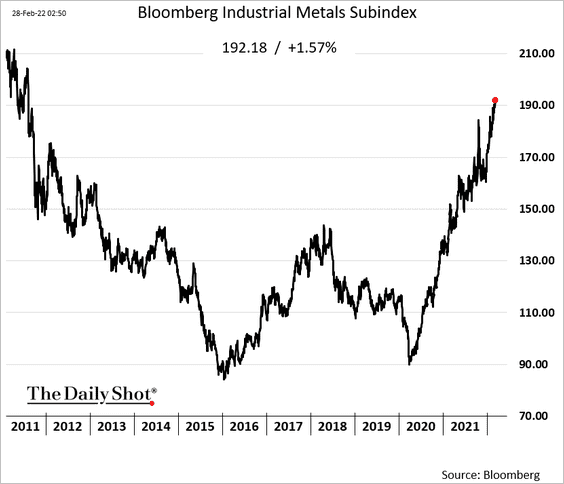

1. Bloomberg’s industrial metals index is hitting decade highs.

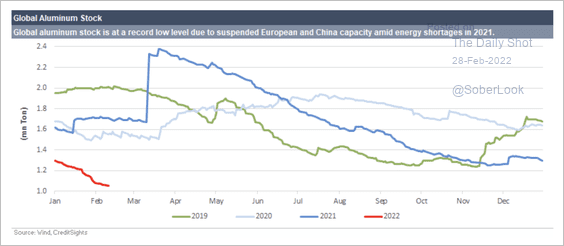

2. The global stock of aluminum is at a record low.

Source: CreditSights

Source: CreditSights

——————–

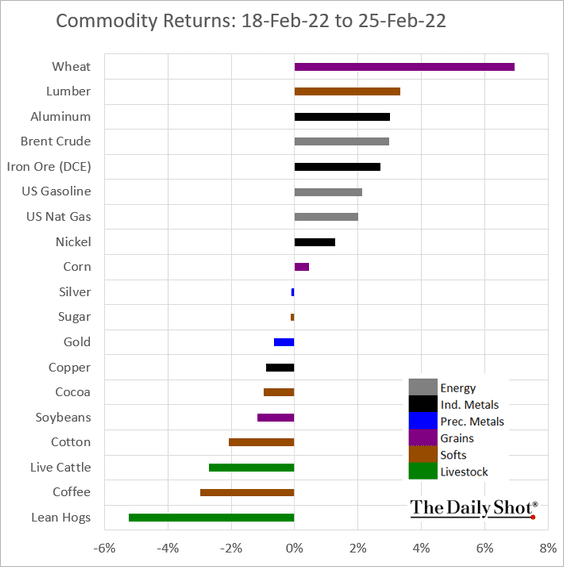

3. Wheat outperformed last week.

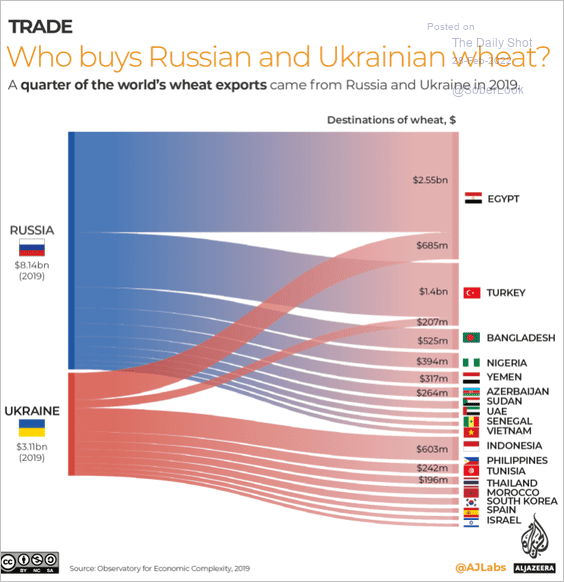

This chart illustrates the flows of Russian and Ukrainian wheat.

Source: Al Jazeera Read full article

Source: Al Jazeera Read full article

——————–

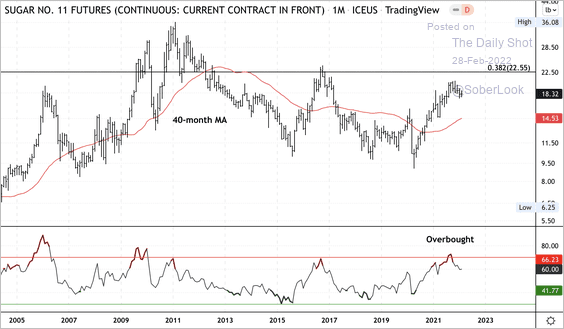

4. The front-month sugar futures contract is testing initial resistance.

Source: Dantes Outlook

Source: Dantes Outlook

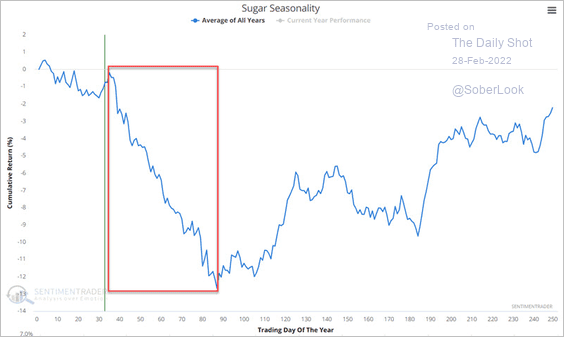

Sugar is entering a seasonally weak period.

Source: SentimenTrader

Source: SentimenTrader

——————–

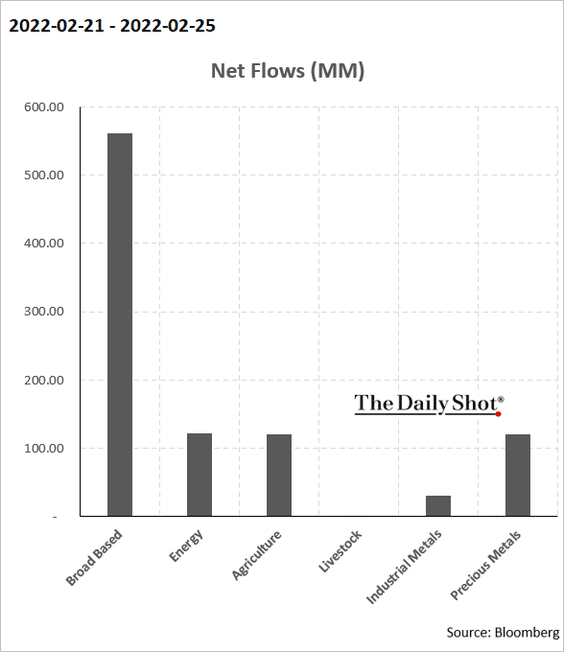

5. Commodities continued to see inflows last week.

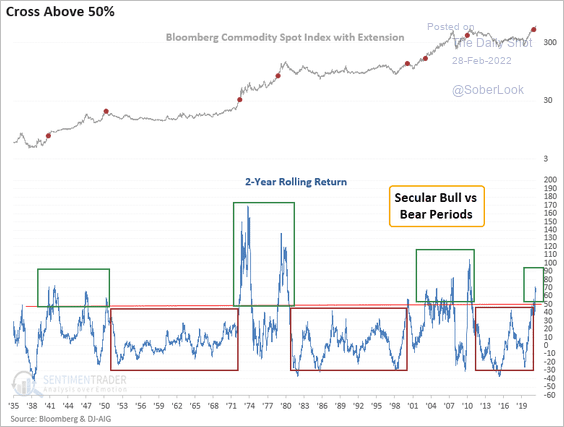

6. The bull run across commodities is not yet extreme compared with previous rallies.

Source: SentimenTrader

Source: SentimenTrader

Back to Index

Global Developments

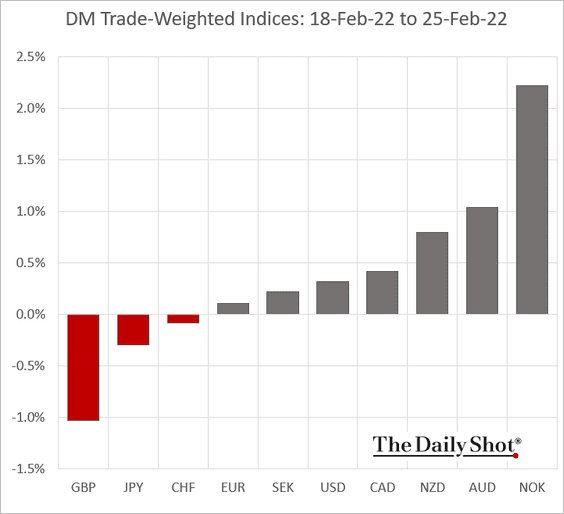

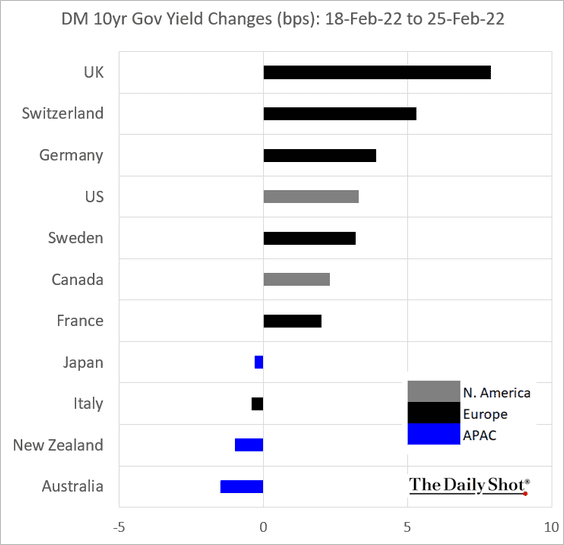

1. Let’s take a look at last week’s performance in select assets.

• DM currencies:

• DM bond yields:

——————–

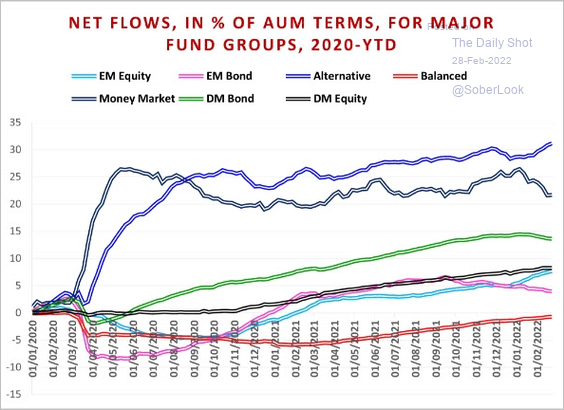

2. Next, we have fund flows across major fund types.

Source: EPFR

Source: EPFR

——————–

Food for Thought

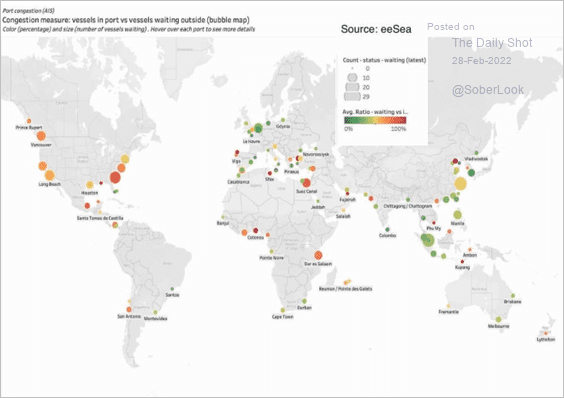

1. Port congestions:

Source: Splash, h/t Walter Read full article

Source: Splash, h/t Walter Read full article

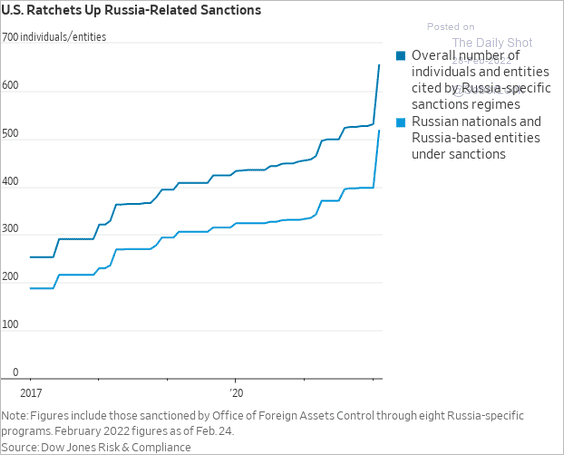

2. Russia-related sanctions:

Source: @WSJ Read full article

Source: @WSJ Read full article

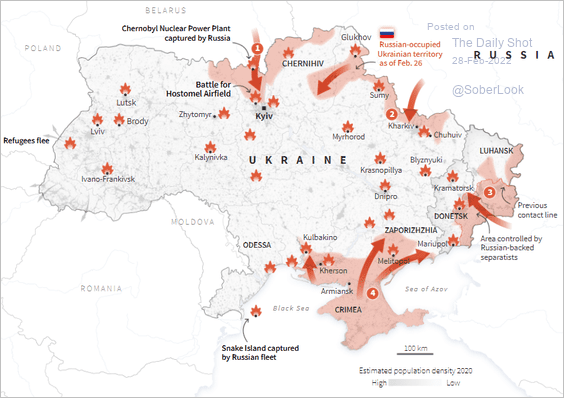

3. Russian-occupied Ukrainian territory:

Source: Reuters Read full article

Source: Reuters Read full article

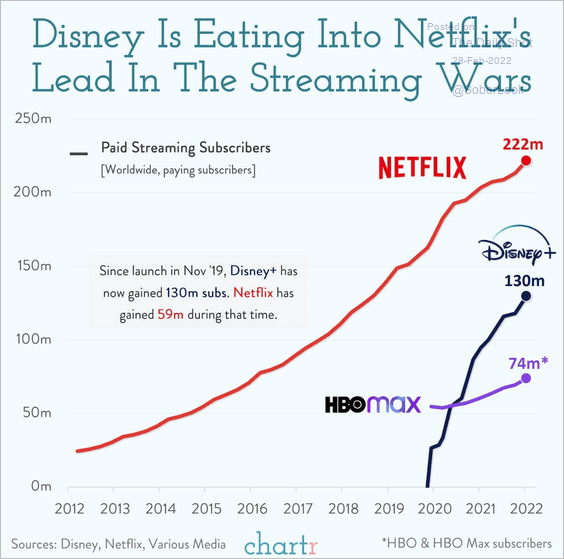

4. Streaming subscribers:

Source: @chartrdaily

Source: @chartrdaily

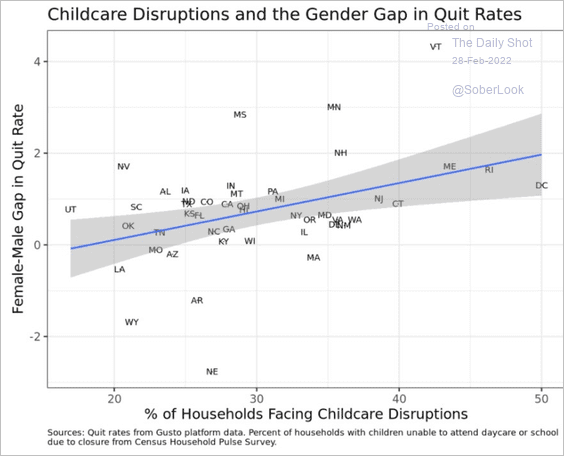

5. Childcare disruptions and the gender gap in quit rates:

Source: Gusto Read full article

Source: Gusto Read full article

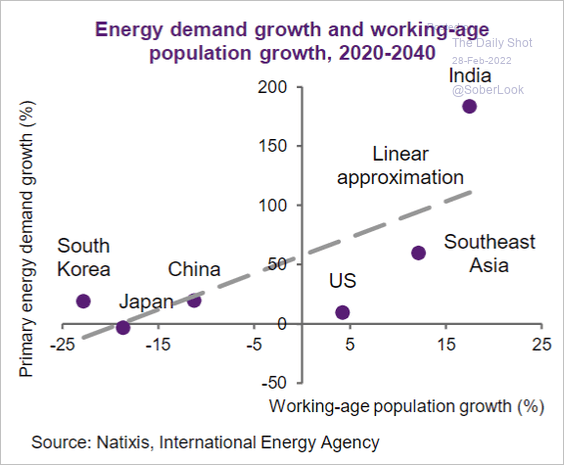

6. Energy demand vs. working-age population growth rates:

Source: Natixis

Source: Natixis

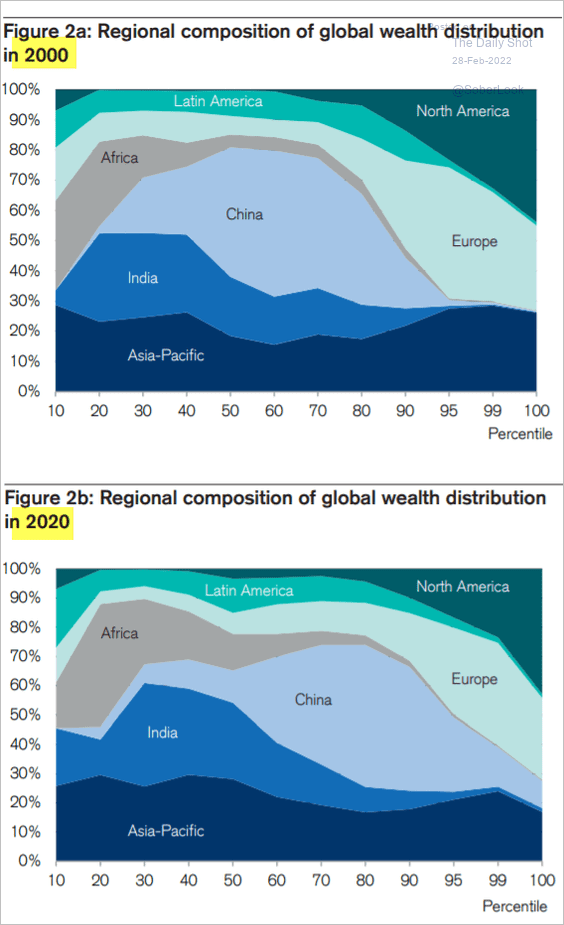

7. The regional composition of global wealth distribution:

Source: Credit Suisse

Source: Credit Suisse

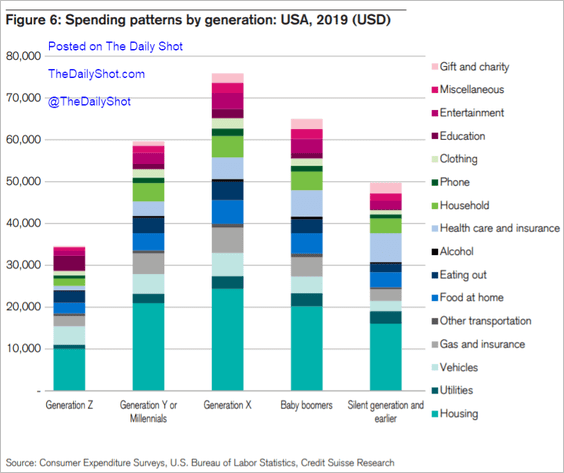

8. Spending patterns by generation:

Source: Credit Suisse

Source: Credit Suisse

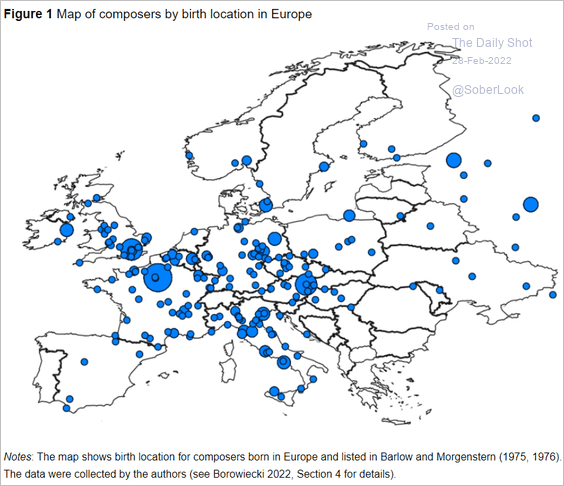

9. Birth locations of European composers:

Source: VOXEU Read full article

Source: VOXEU Read full article

——————–

Back to Index