The Daily Shot: 01-Mar-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

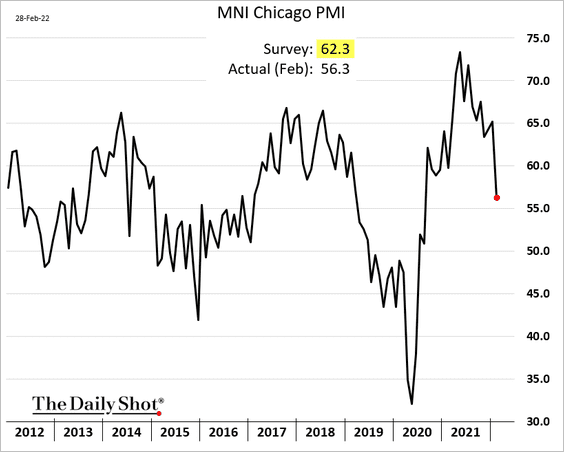

1. The Chicago PMI showed a downshift in the region’s business activity in February

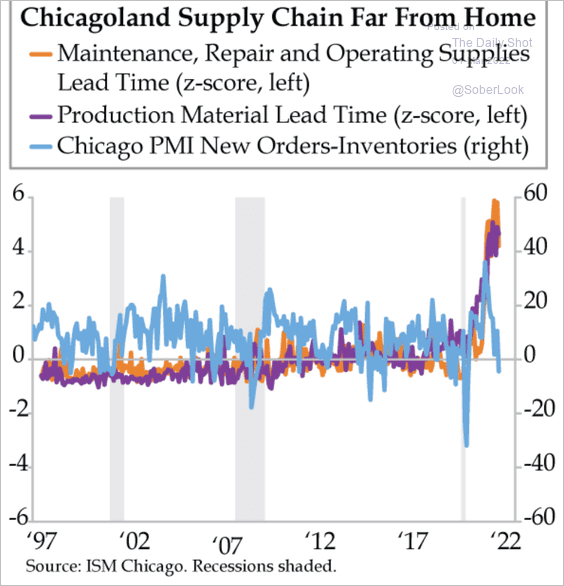

Moreover, the spread between the indices of new orders and inventory dipped below zero, pointing to slower growth ahead. Supply-chain strains remain elevated.

Source: The Daily Feather

Source: The Daily Feather

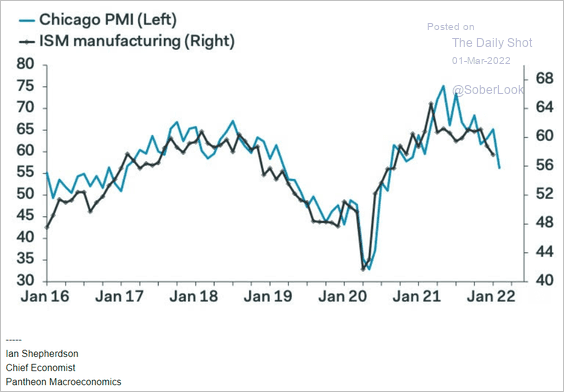

Will we see further declines in the ISM manufacturing PMI at the national level?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

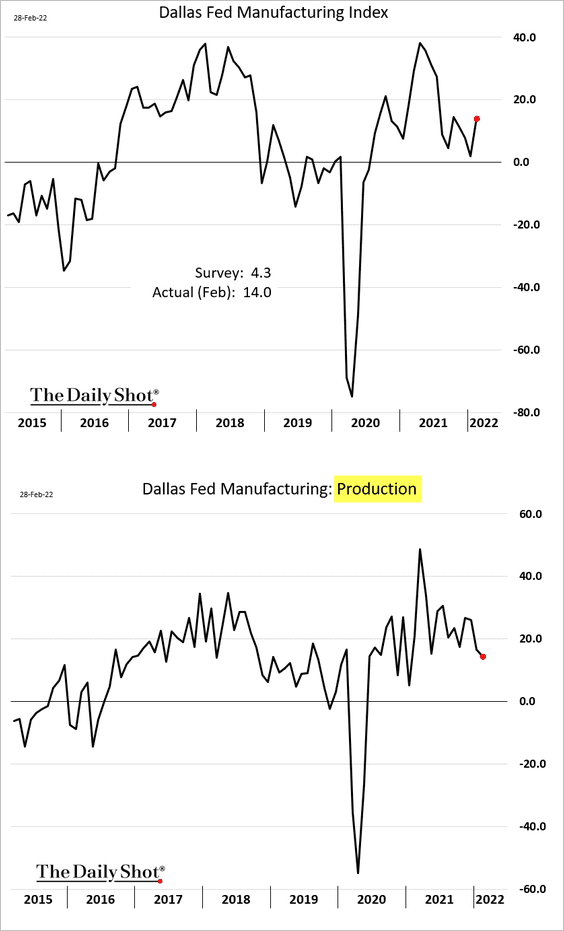

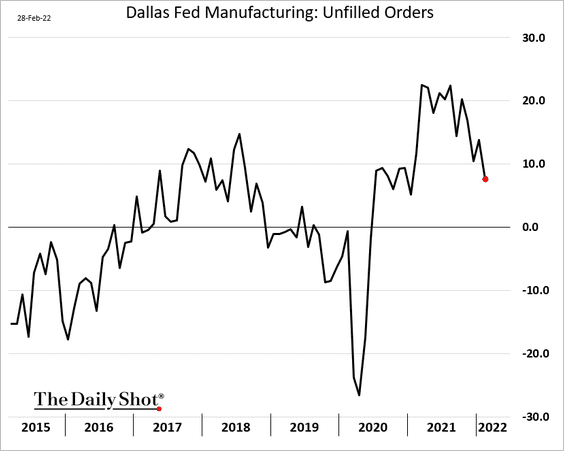

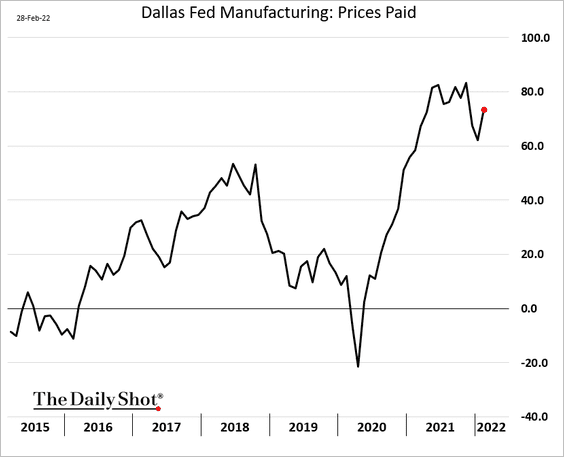

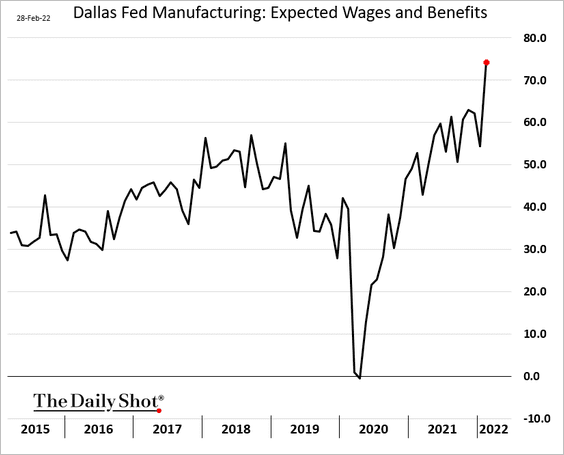

2. The Dallas Fed’s regional manufacturing index jumped last month. However, the sub-index of production eased further (2nd panel).

• Unfilled orders continue to moderate.

• Price pressures persist.

• And most manufacturers now expect to boost wages in the months ahead.

——————–

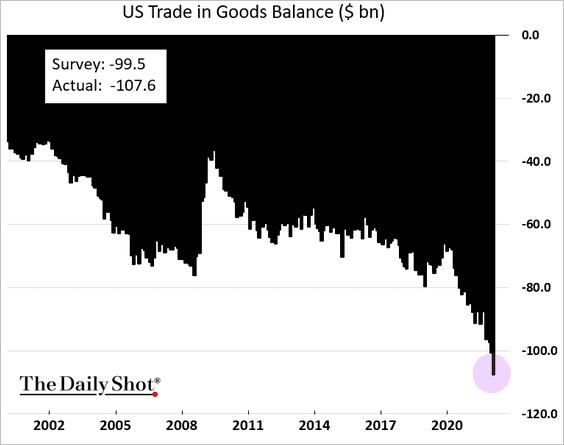

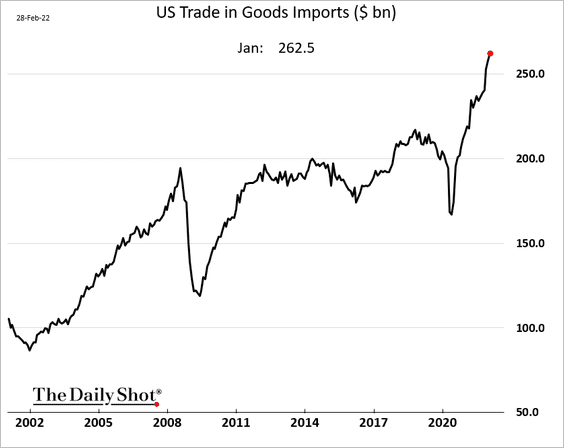

3. The US trade deficit in goods hit another record, …

… as imports surged.

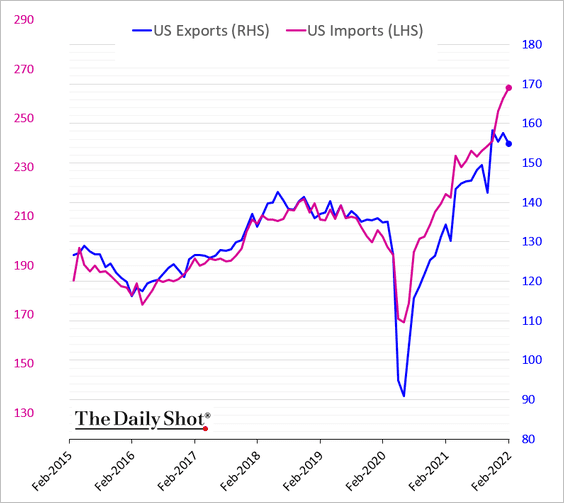

This chart illustrates the divergence between import and export trends in recent months.

——————–

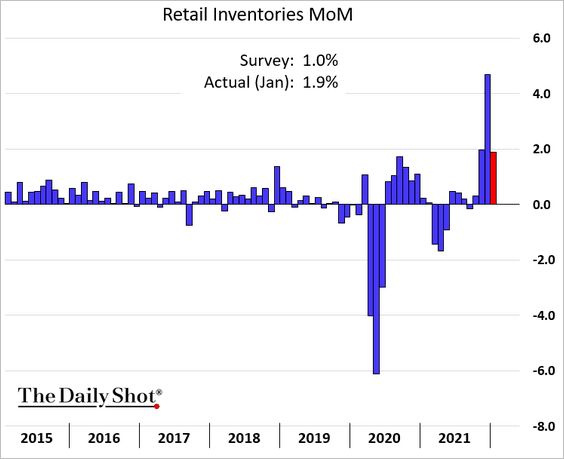

4. Retailers continue to build inventories at a rapid pace. Will we get an inventory overhang if demand slows?

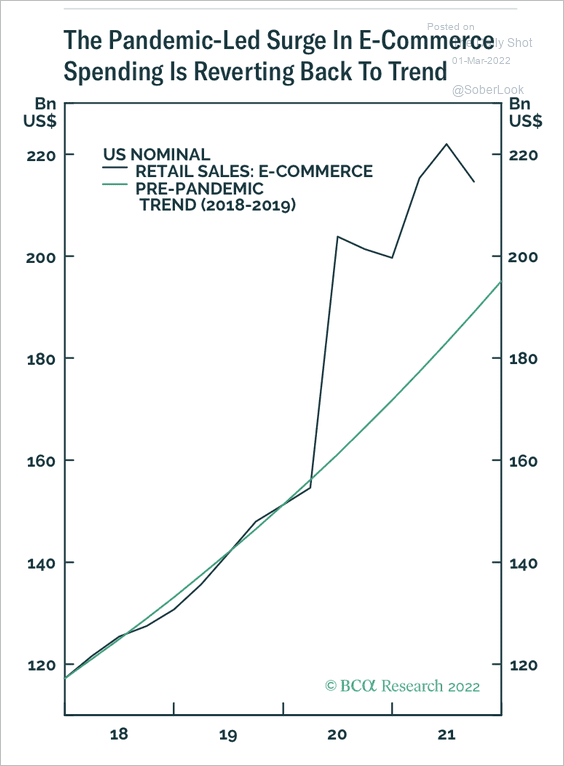

5. Online retail sales are starting to revert to the pre-pandemic trend.

Source: BCA Research

Source: BCA Research

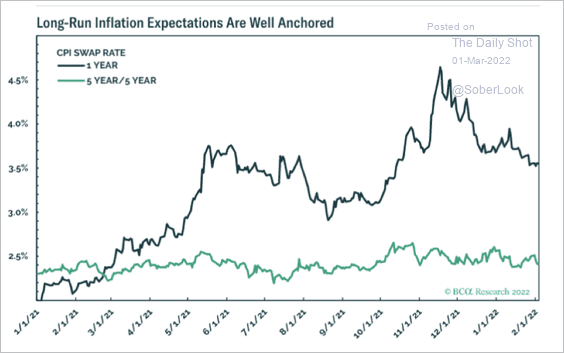

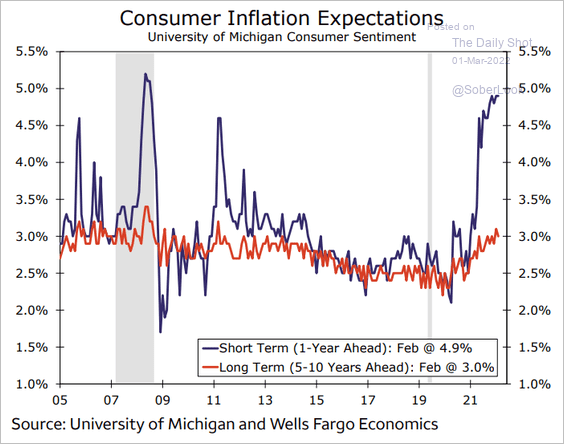

6. Next, we have some updates on inflation.

• Long-run inflation expectations remain relatively moderate despite the recent spike in CPI (2 charts).

Source: BCA Research

Source: BCA Research

Source: Wells Fargo Securities

Source: Wells Fargo Securities

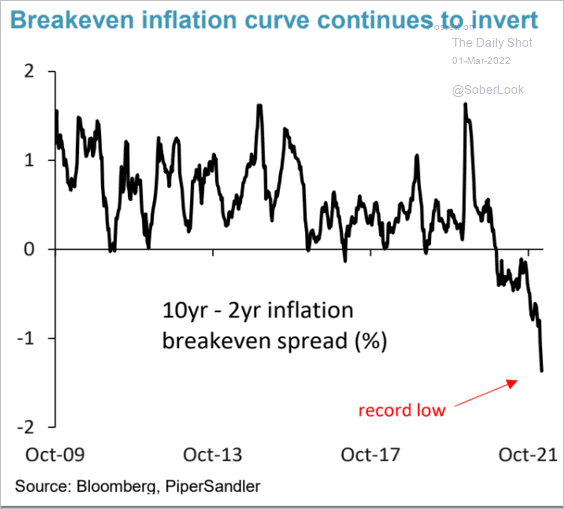

The markets show a sharp divergence between short- and long-term inflation expectations.

Source: Piper Sandler

Source: Piper Sandler

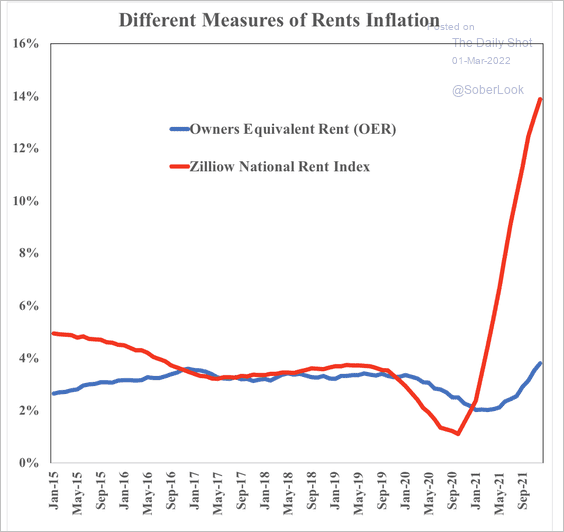

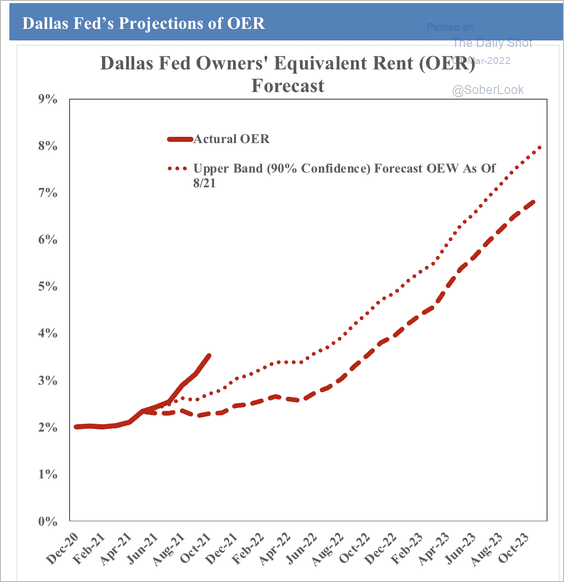

• Rent inflation could have further room to rise (2 charts).

Source: SOM Macro Strategies

Source: SOM Macro Strategies

Source: SOM Macro Strategies

Source: SOM Macro Strategies

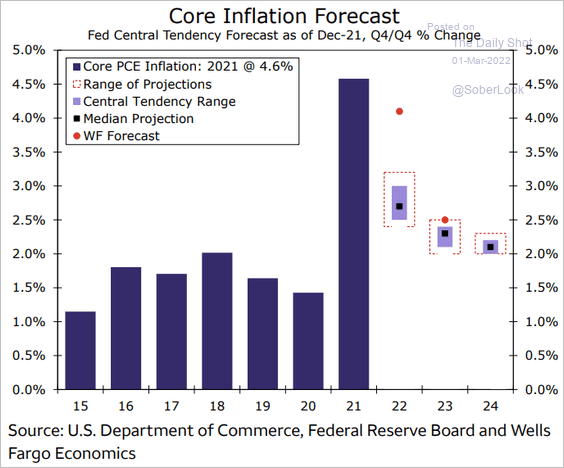

• Here is Wells Fargo’s inflation forecast.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

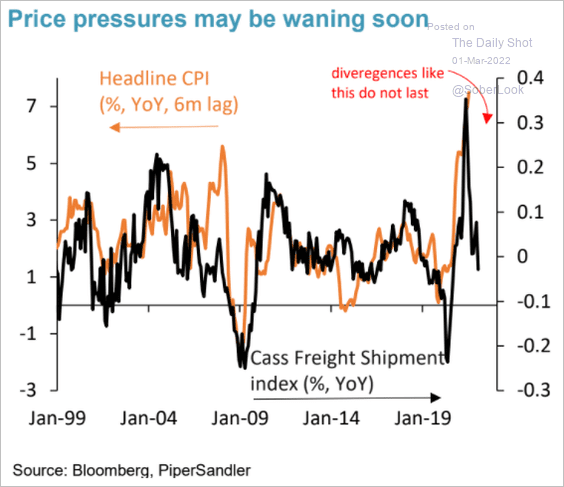

• Slower growth in shipping activity points to moderation in price gains.

Source: Piper Sandler

Source: Piper Sandler

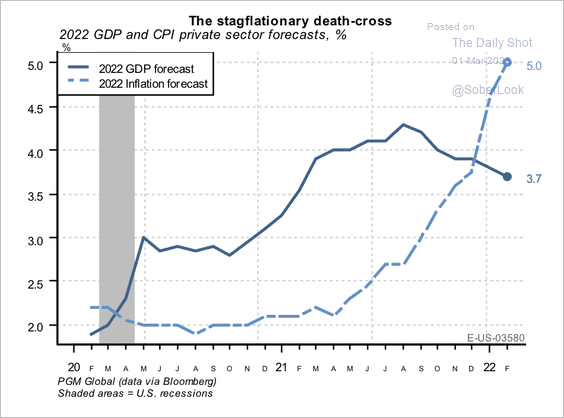

• PGM Global expects a moderate stagflationary event this year.

Source: PGM Global

Source: PGM Global

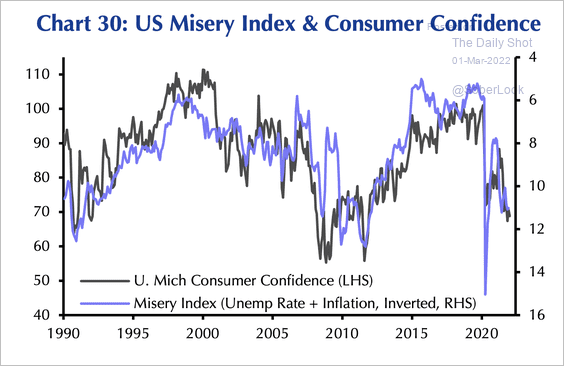

• Consumer confidence follows the Misery index (the sum of the unemployment rate and inflation rate) closely.

Source: Capital Economics

Source: Capital Economics

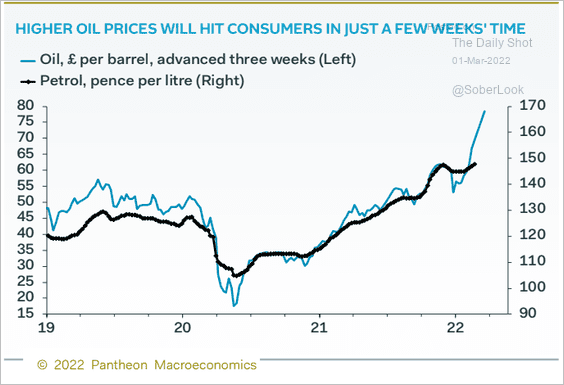

Gasoline prices, in particular, will keep putting downward pressure on sentiment.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

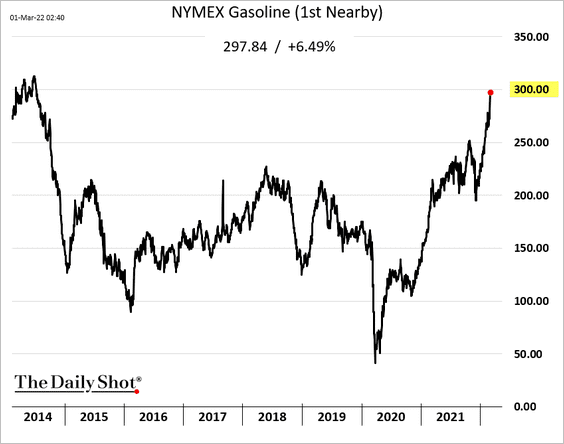

Gasoline futures are surging amid concerns about crude oil supplies (primarily due to sanctions on Russia), which will show up at the pump in the days ahead.

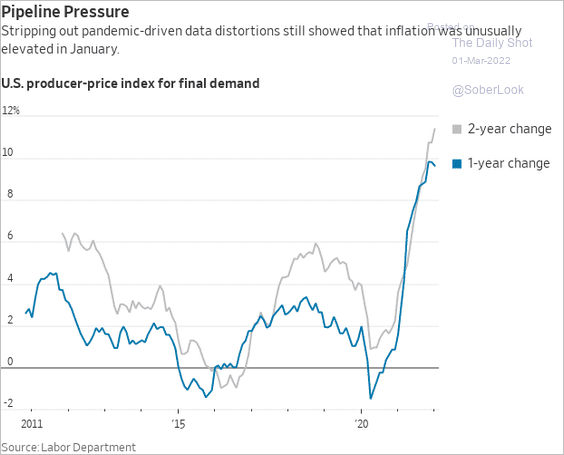

• The 2-year changes in the PPI (removing the base effects) show massive gains in producer prices.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

The United Kingdom

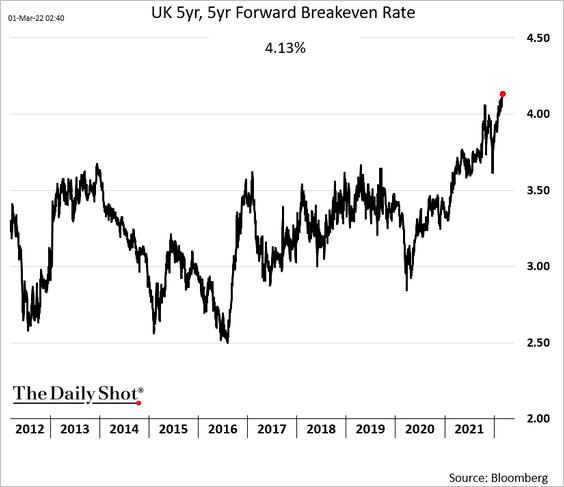

1. Long-term market-based inflation expectations are hitting new highs.

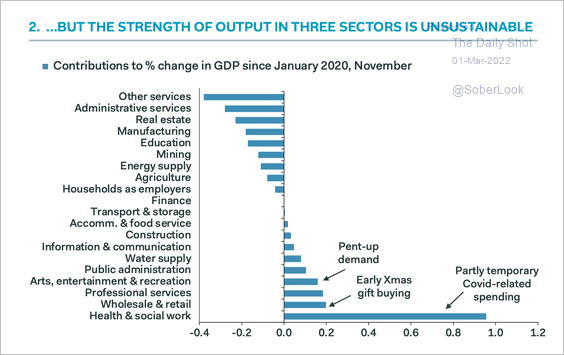

2. UK GDP has been boosted by some sectors where the current pace of growth is unsustainable.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

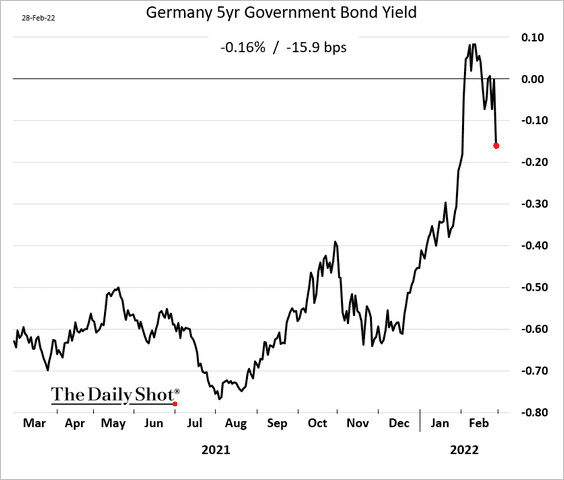

1. Bund yields were down sharply on Monday as traders price in the risk of slower growth ahead (due to the Russia situation and surging energy costs).

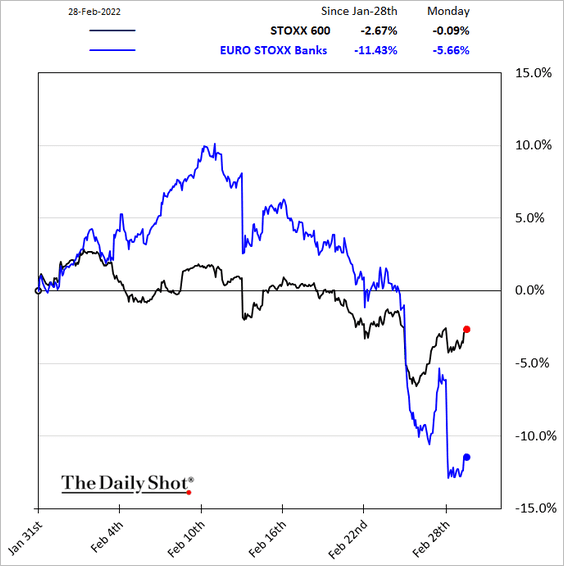

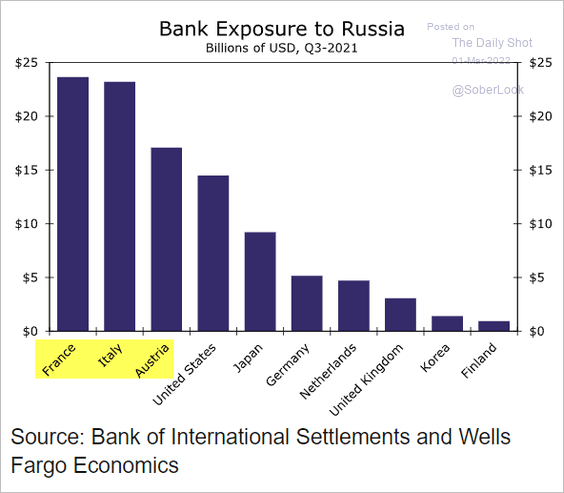

2. European bank shares took a hit due to Russia exposure.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

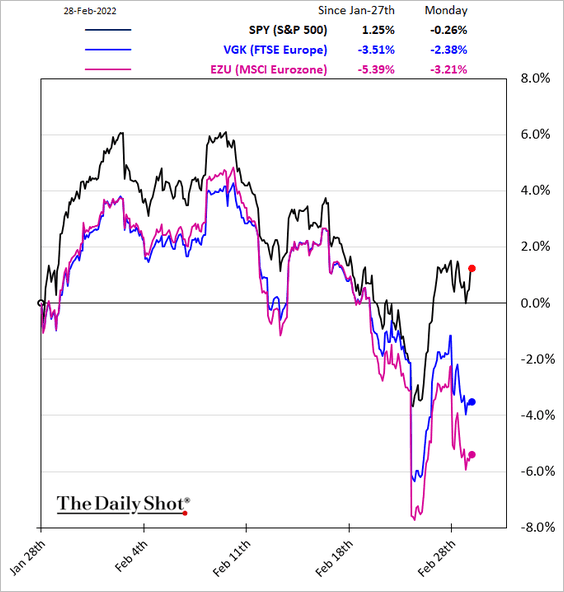

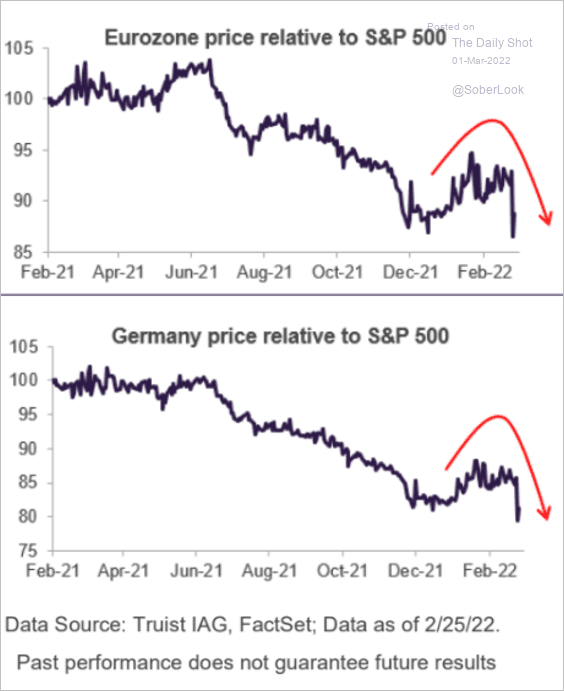

• European markets are underperforming the US.

Source: Truist Advisory Services

Source: Truist Advisory Services

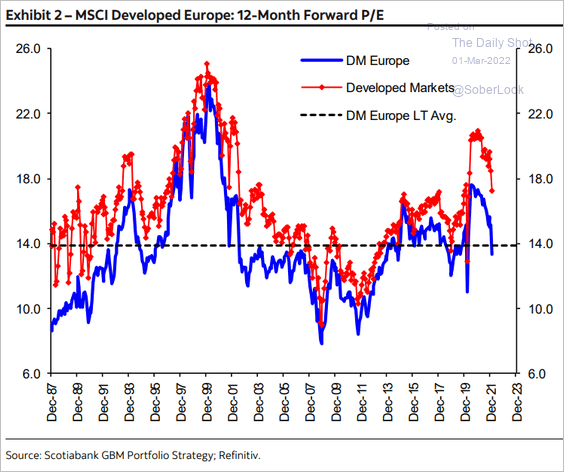

• Valuations look attractive relative to other advanced economies.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

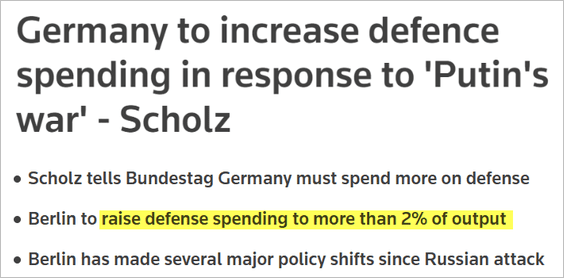

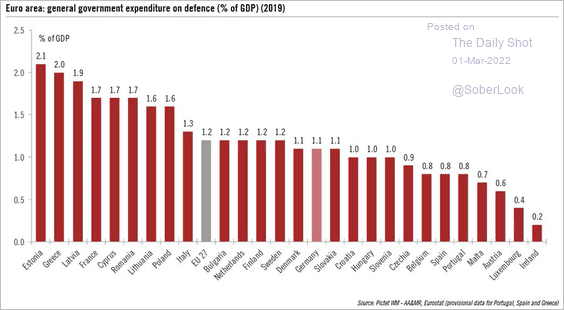

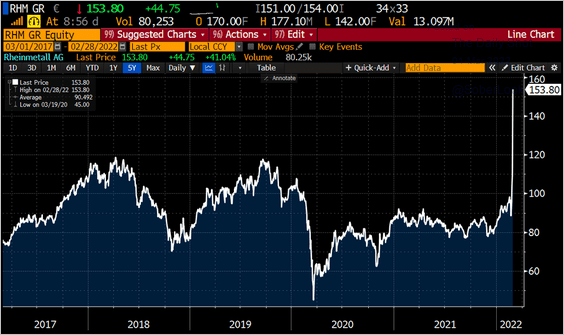

3. Germany announced that it will spend more on defense.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @nghrbi

Source: @nghrbi

Source: @Schuldensuehner

Source: @Schuldensuehner

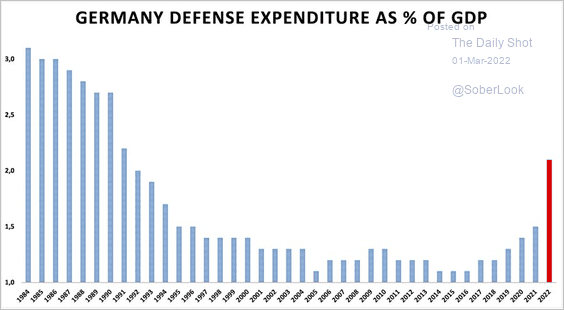

Shares of Germany’s defense contractor Rheinmetall soared.

Source: @Schuldensuehner

Source: @Schuldensuehner

——————–

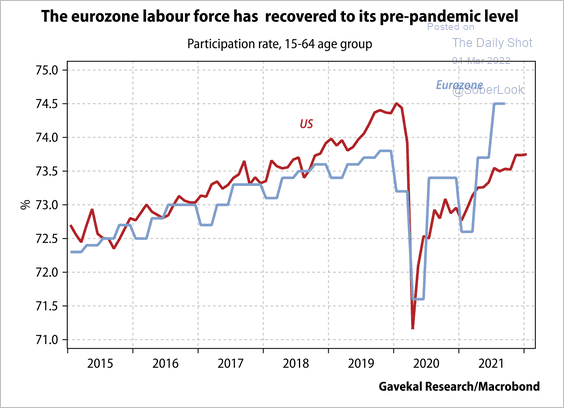

4. Labour force participation is above pre-pandemic levels, in stark contrast to the US.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Europe

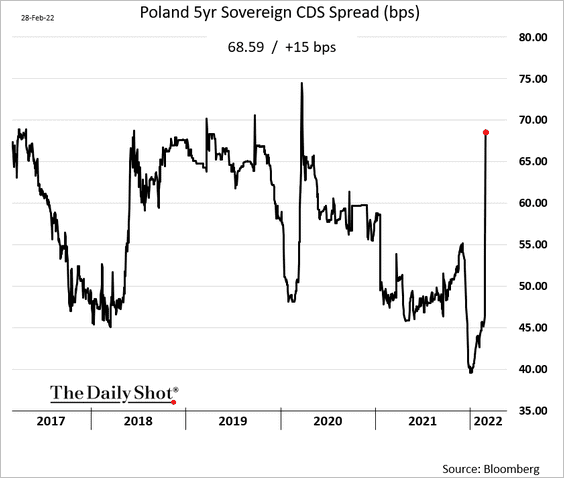

1. Credit default swap spreads in Poland and other Central/Eastern European countries have widened sharply.

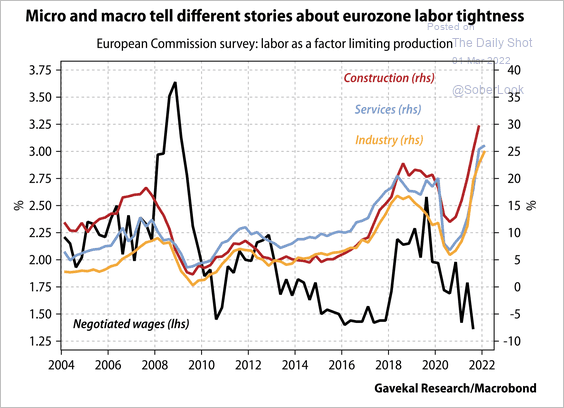

2. European rigid wage system is yet to budge despite labor shortages.

Source: Gavekal Research

Source: Gavekal Research

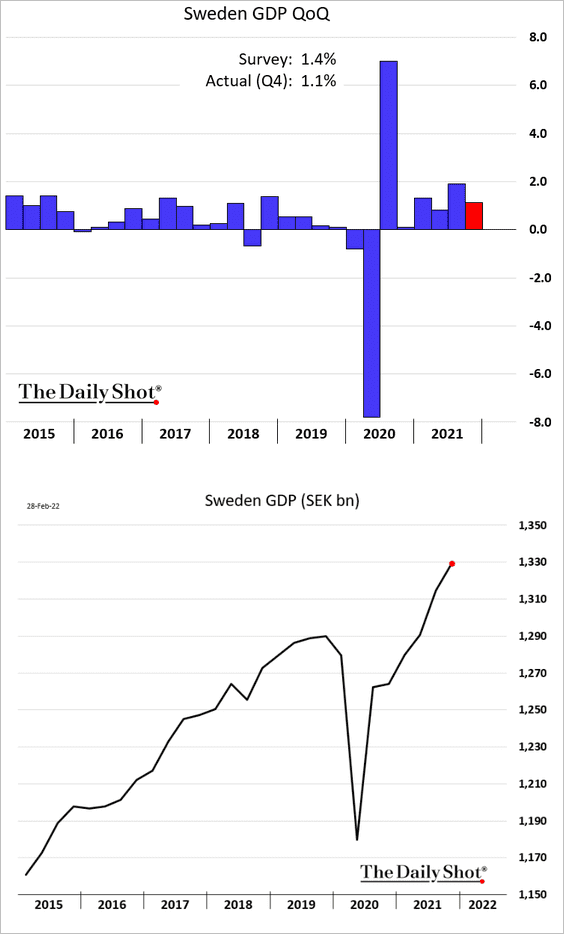

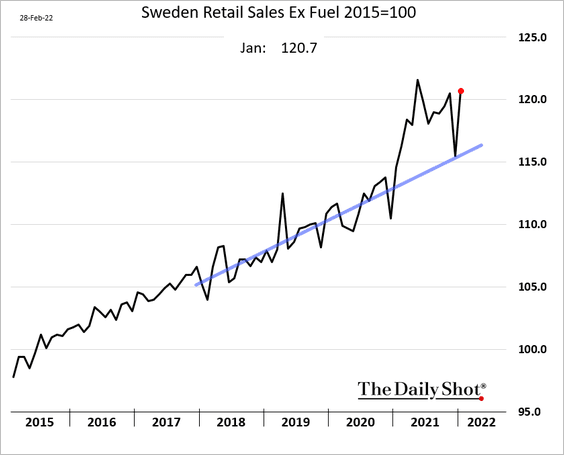

3. Sweden’s Q4 GDP growth was below consensus.

Retail sales rebounded sharply in January.

Back to Index

Asia – Pacific

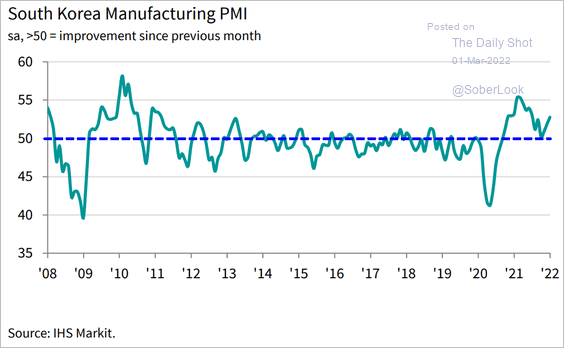

1. South Korea’s manufacturing PMI jumped back into growth mode last month.

Source: IHS Markit

Source: IHS Markit

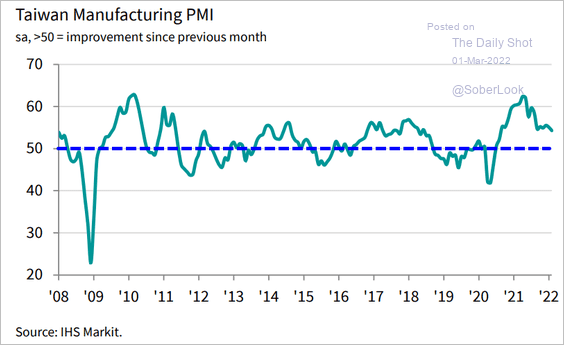

2. Taiwan’s PMI ticked lower.

Source: IHS Markit

Source: IHS Markit

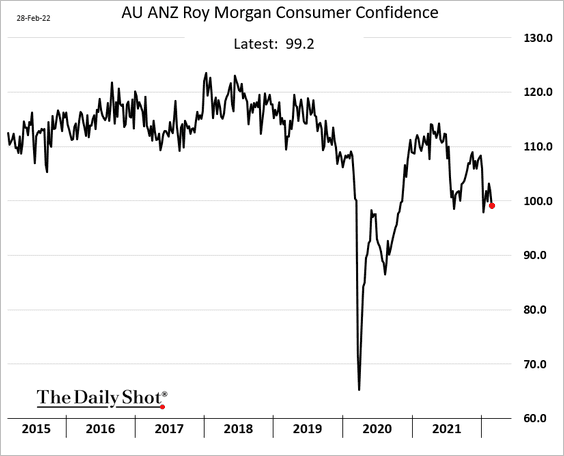

3. Australia’s consumer confidence remains soft.

Back to Index

China

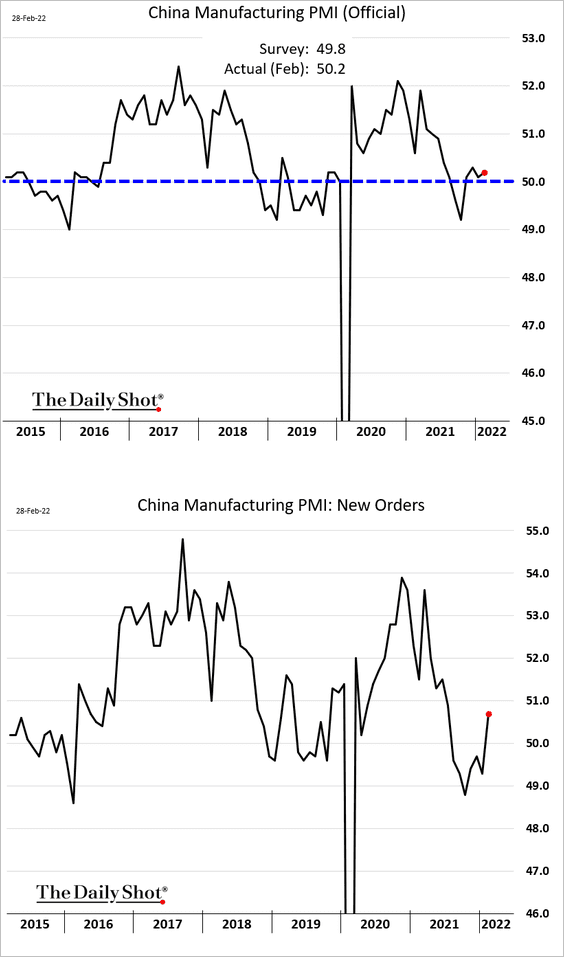

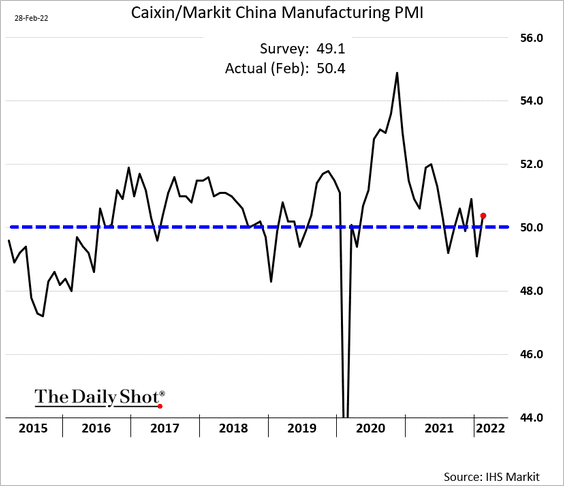

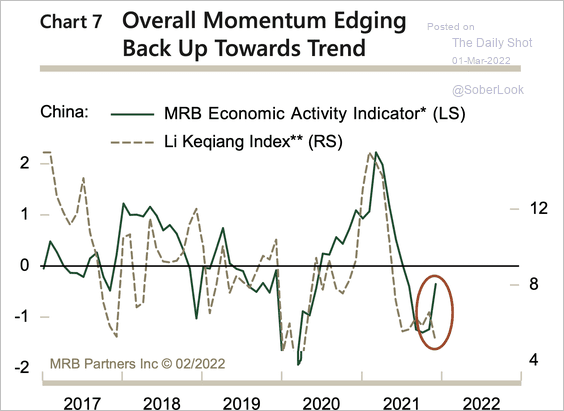

1. Three separate indicators point to an improvement in China’s business activity in February. Price indices increased.

• The official manufacturing PMI:

• Markit PMI:

• The World Economics SMI:

Source: World Economics

Source: World Economics

——————–

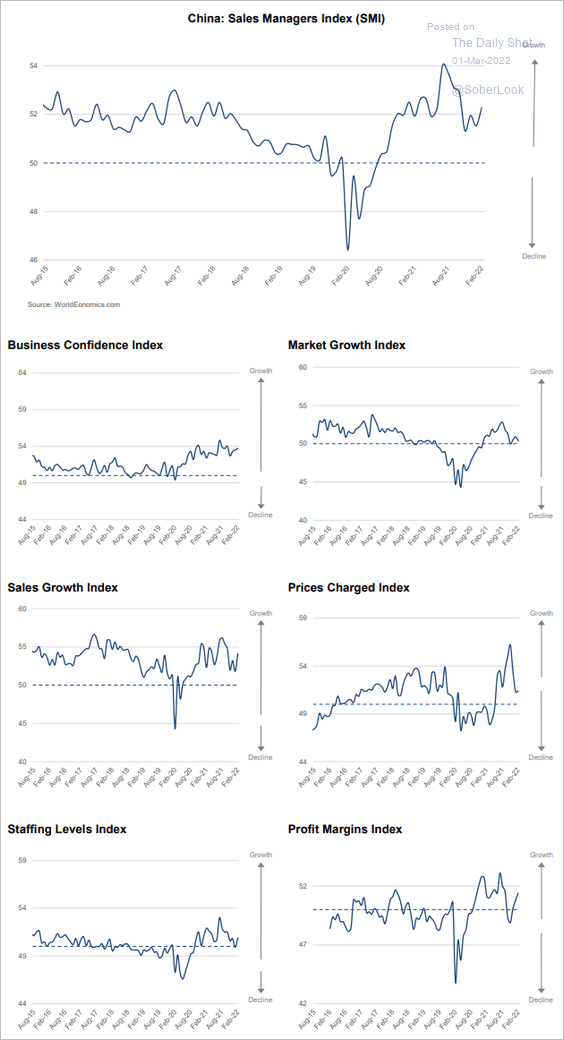

2. The overall economic momentum seems to be turning higher.

Source: MRB Partners

Source: MRB Partners

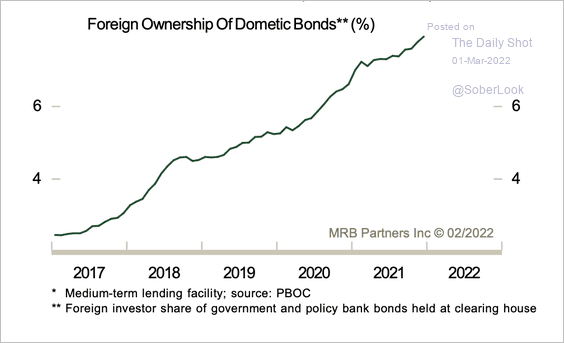

3. Foreign ownership of Chinese bonds keeps rising.

Source: MRB Partners

Source: MRB Partners

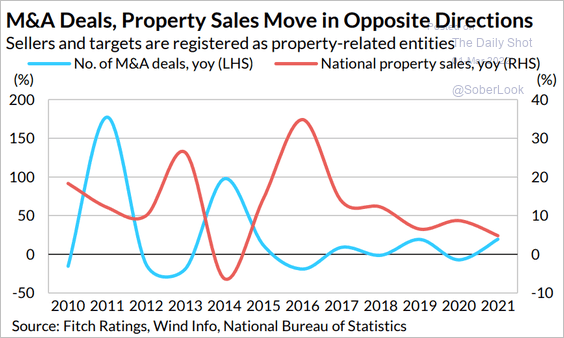

4. Property sales and M&A deals are inversely correlated.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Emerging Markets

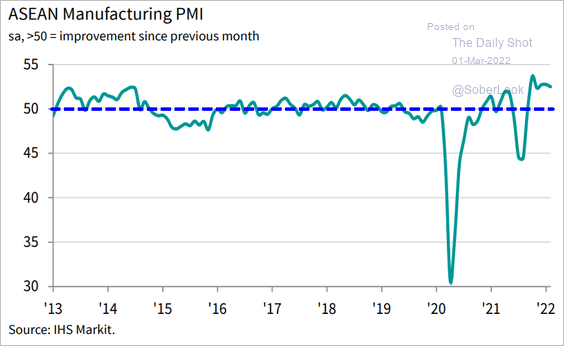

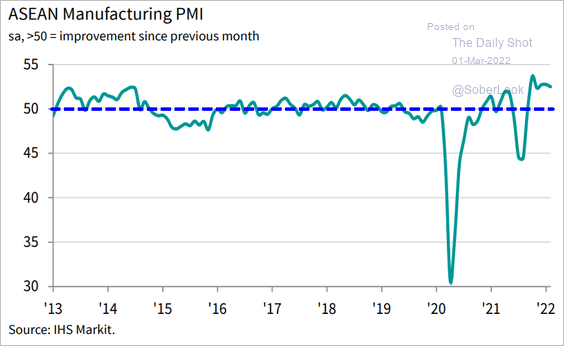

1. The ASEAN manufacturing PMI showed steady growth in February.

Source: IHS Markit

Source: IHS Markit

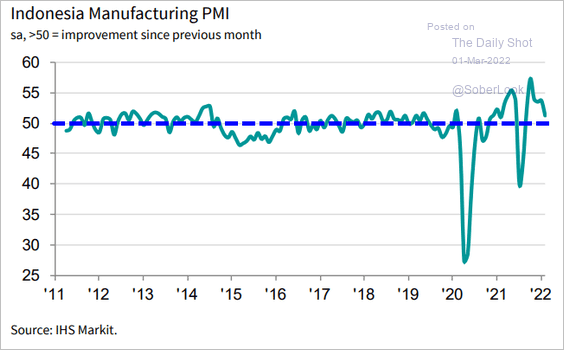

Here are some of the PMI indices.

• Indonesia (slower growth):

Source: IHS Markit

Source: IHS Markit

• The Philippines (steady):

Source: IHS Markit

Source: IHS Markit

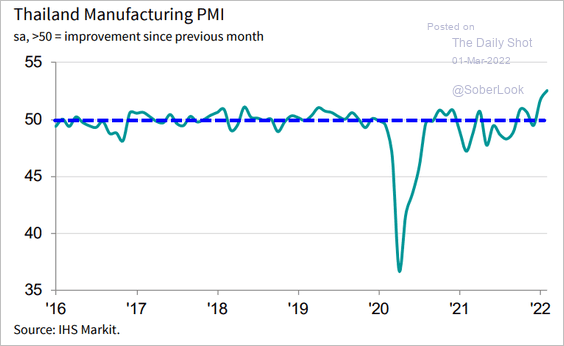

• Thailand (acceleration):

Source: IHS Markit

Source: IHS Markit

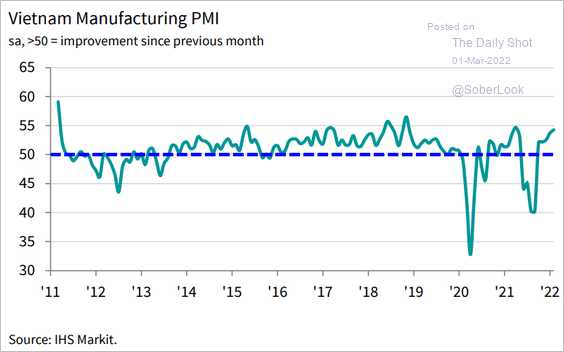

• Vietnam (stronger growth):

Source: IHS Markit

Source: IHS Markit

——————–

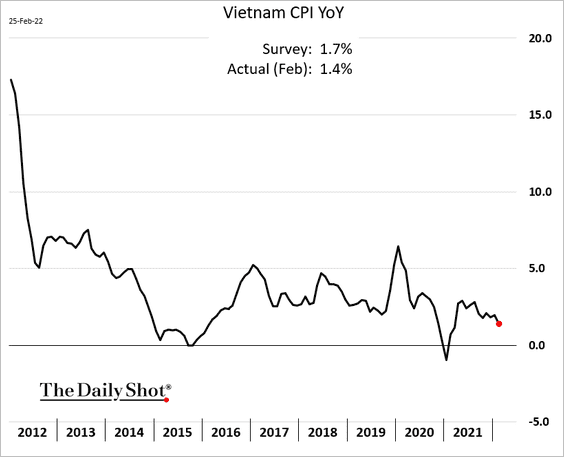

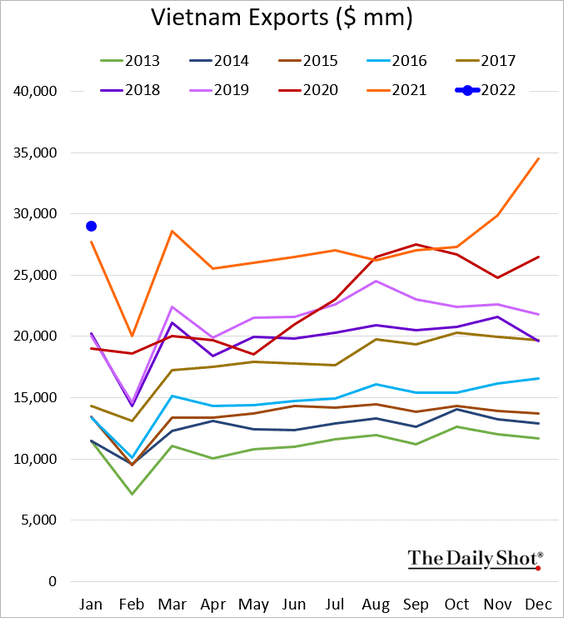

2. Here are some additional updates on Vietnam.

• The CPI (lower than expected):

• Exports:

——————–

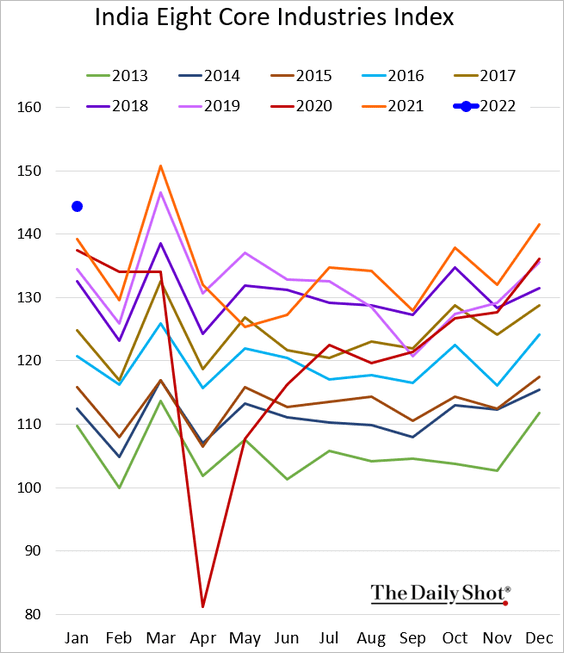

3. India’s industrial activity started the year on a strong note.

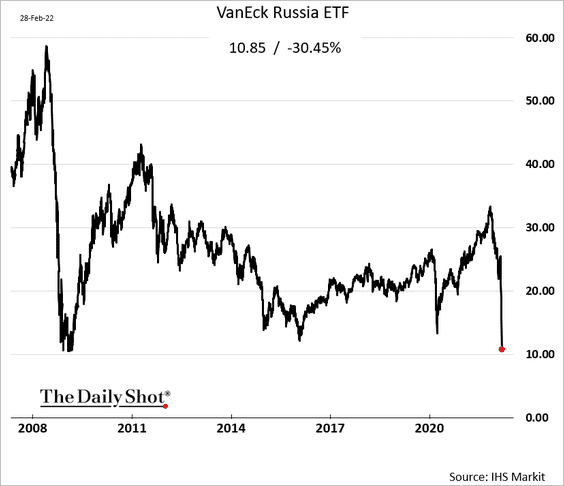

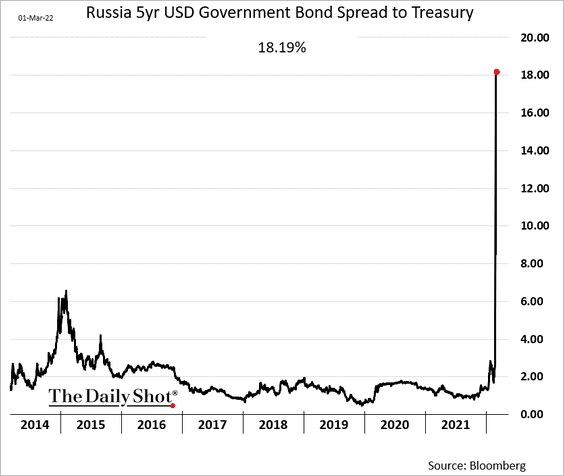

4. Next, we have some updates on Russia.

• Equity futures:

• US-based equity ETF:

• The 5yr spread to Treasuries:

• Sberbank (Russia’s largest bank) CDS spread:

Source: @Lvieweconomics

Source: @Lvieweconomics

Back to Index

Cryptocurrency

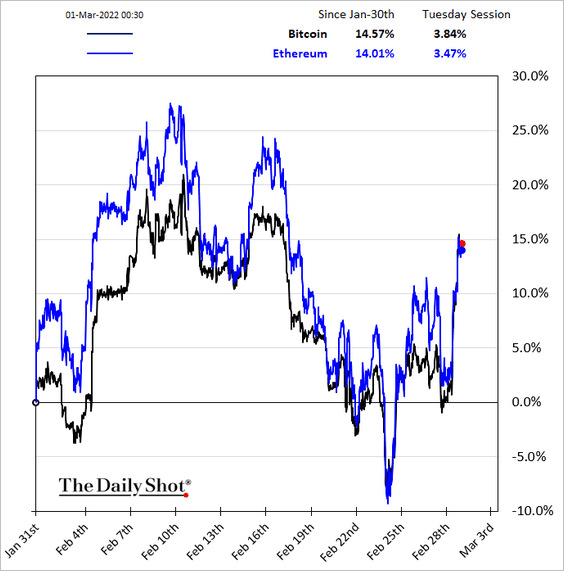

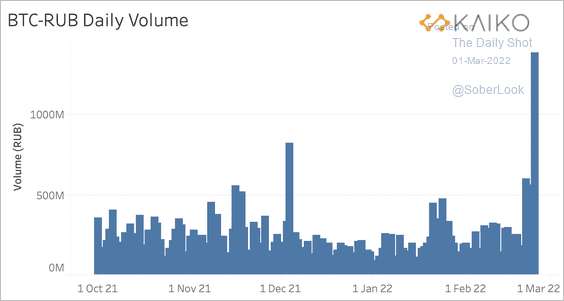

1. Cryptos are sharply higher amid a surge in demand from Russia (as the ruble tumbles).

• Ruble-denominated bitcoin volume swelled to a nine-month high on Sunday.

Source: Kaiko Read full article

Source: Kaiko Read full article

• Ukrainian and other global officials are concerned that crypto could be used to circumvent sanctions.

Source: @FedorovMykhailo

Source: @FedorovMykhailo

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

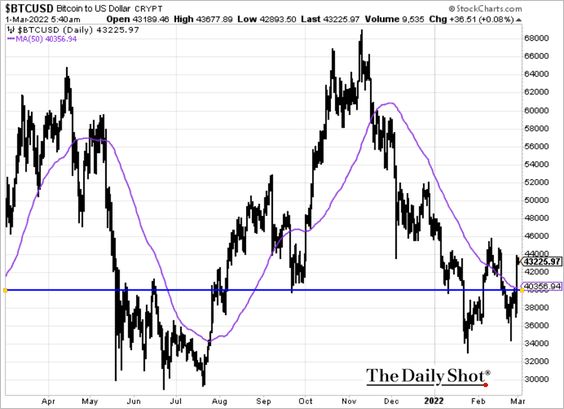

2. Bitcoin is back above the 50-day moving average.

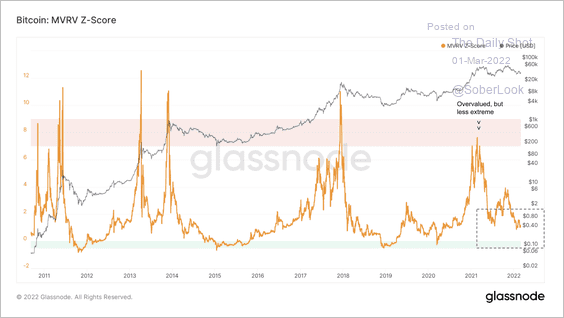

3. The chart below shows that bitcoin’s deviation from “fair value” is not as extreme relative to previous price bottoms.

Source: Glassnode Read full article

Source: Glassnode Read full article

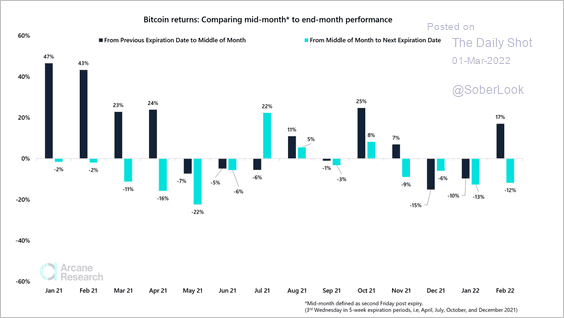

4. There has been a large difference between bitcoin’s performance in the first half of the month versus the second half.

Source: @ArcaneResearch

Source: @ArcaneResearch

Back to Index

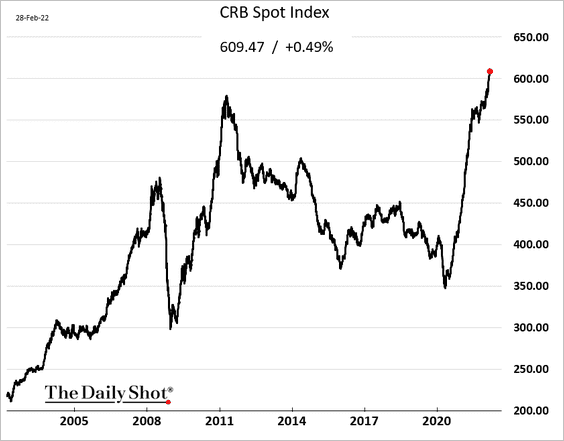

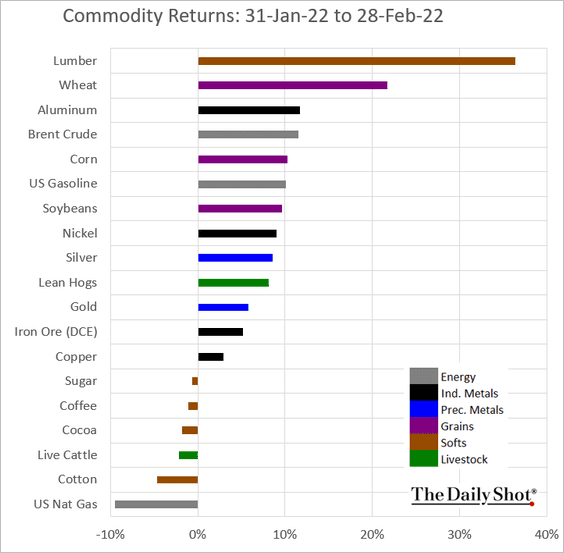

Commodities

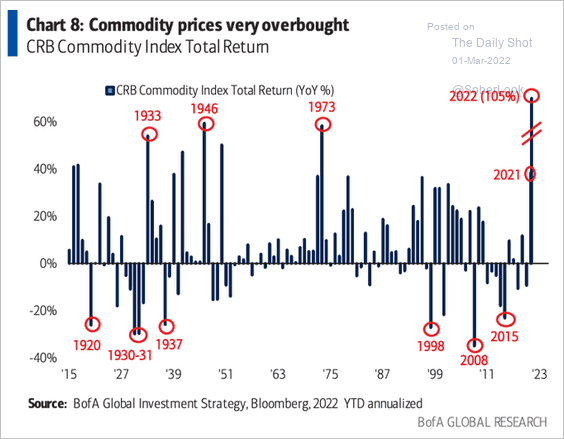

1. The surge in commodity prices this year has been impressive.

Source: BofA; @AndrewThrasher

Source: BofA; @AndrewThrasher

——————–

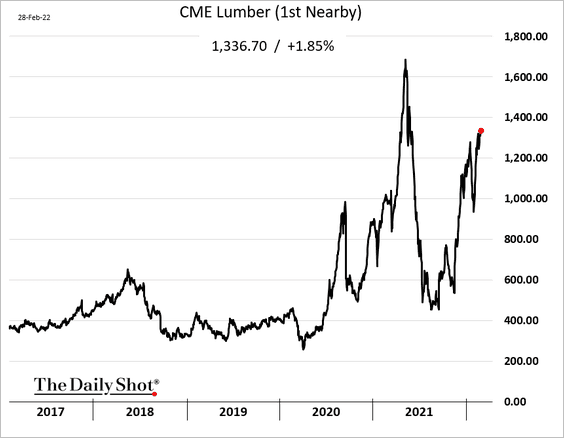

2. February was a good month for US lumber futures (2 charts).

——————–

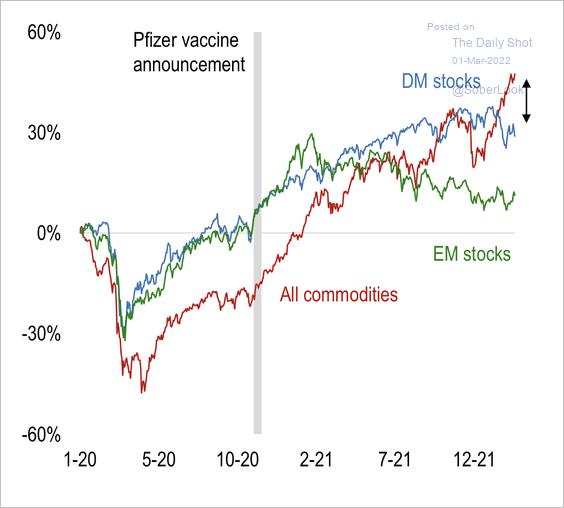

3. Commodities are outperforming developed market stocks after a dismal 2020.

Source: Numera Analytics

Source: Numera Analytics

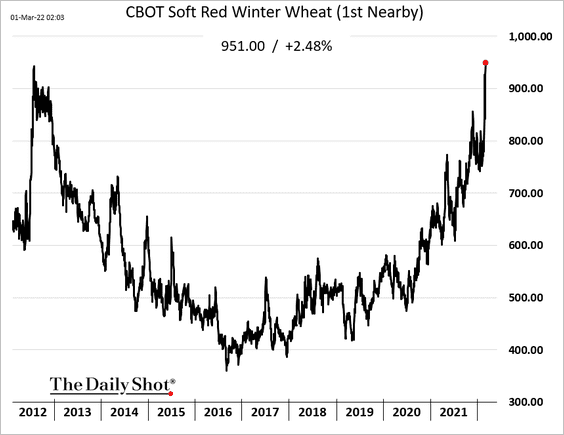

4. Wheat prices continue to soar.

Back to Index

Energy

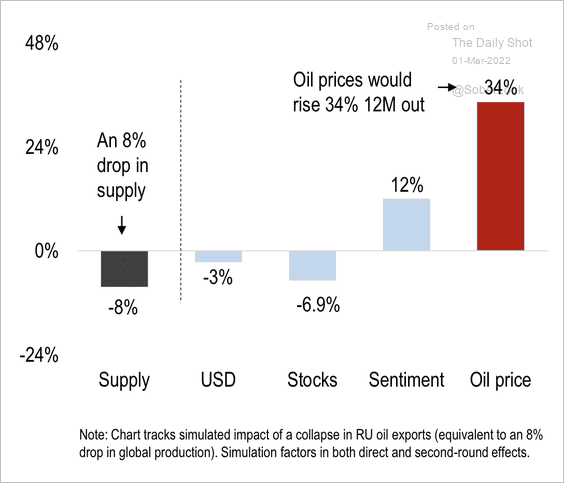

1. This chart shows the expected 12-month change in the Brent spot price if sanctions were to block Russian exports, according to Numera Analytics.

Source: Numera Analytics

Source: Numera Analytics

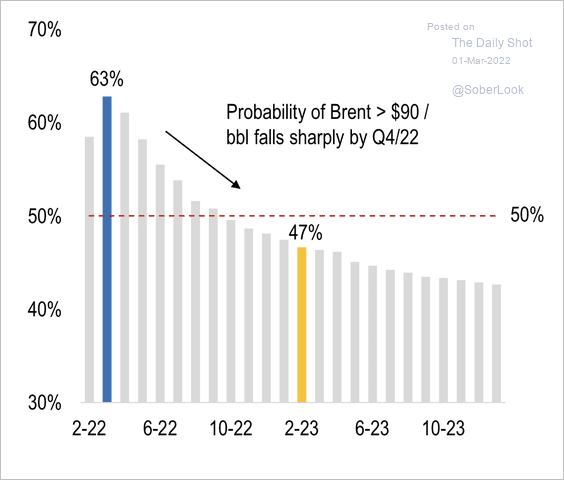

Still, there is a lower probability of oil remaining at high levels over the next few months.

Source: Numera Analytics

Source: Numera Analytics

——————–

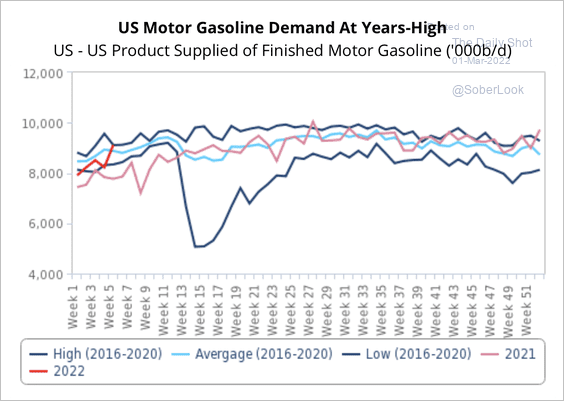

2. US motor gasoline demand is at the high end of its historical range. Fitch expects market tightness to persist over the next quarter, although demand could decline later this year due to seasonal winter effects.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

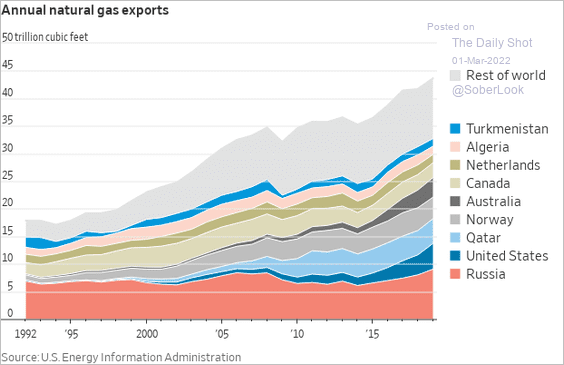

3. This chart shows global natural gas exports.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

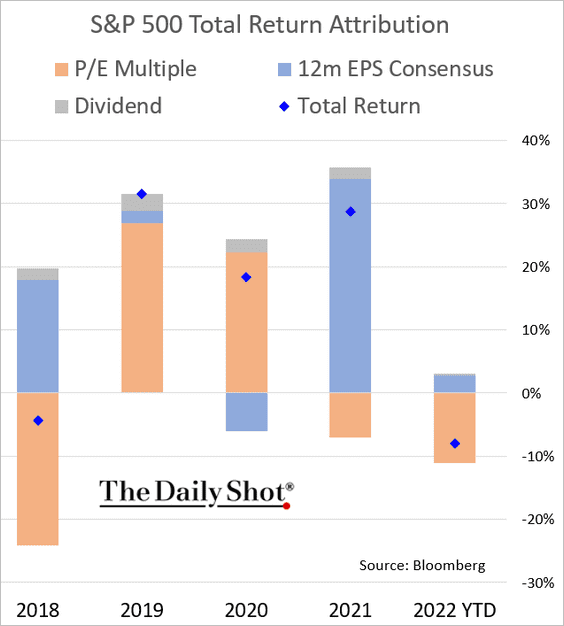

1. Let’s start with the updated year-to-date S&P 500 return attribution.

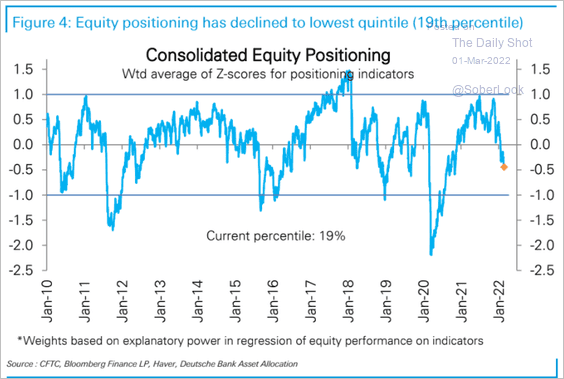

2. Deutsche Bank’s equity positioning indicator has been moving further into negative territory.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

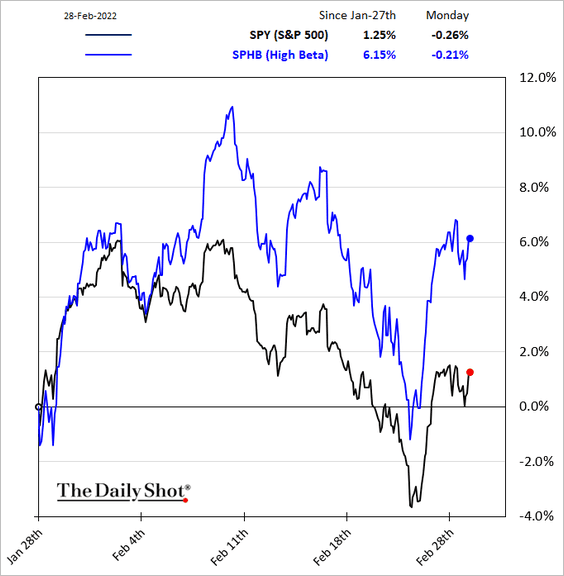

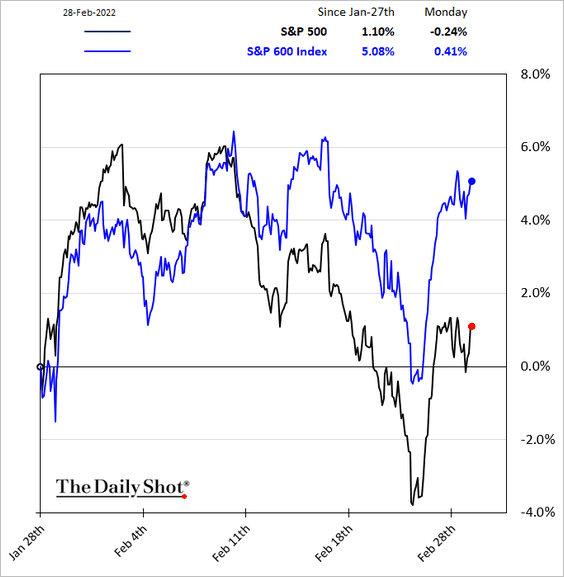

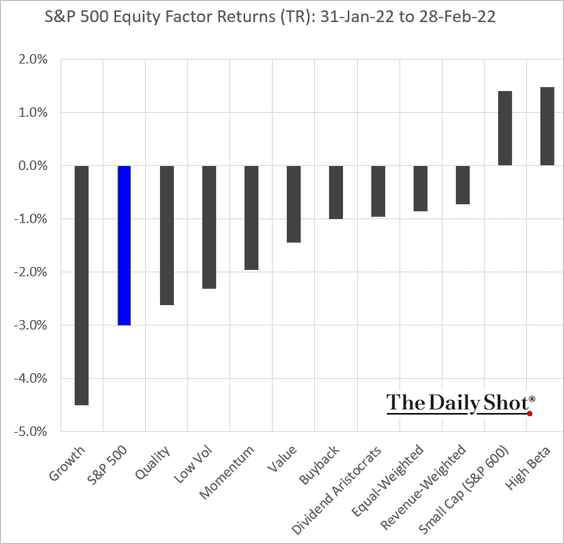

3. High-beta and small-cap stocks outperformed in February, …

… finishing the month in positive territory. Here is the monthly performance across equity factors.

——————–

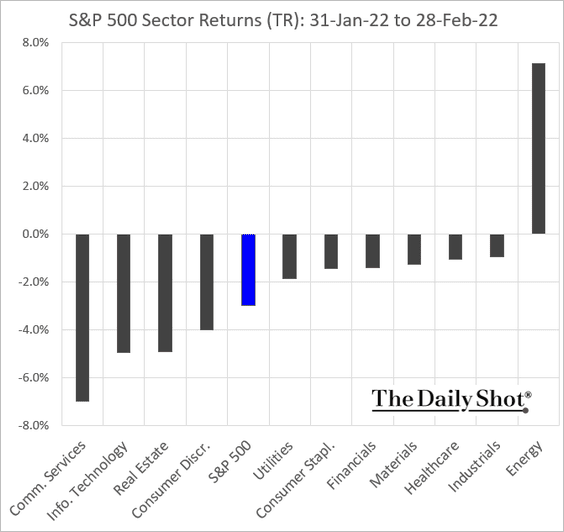

4. Outside of energy, all S&P 500 sectors were down in February.

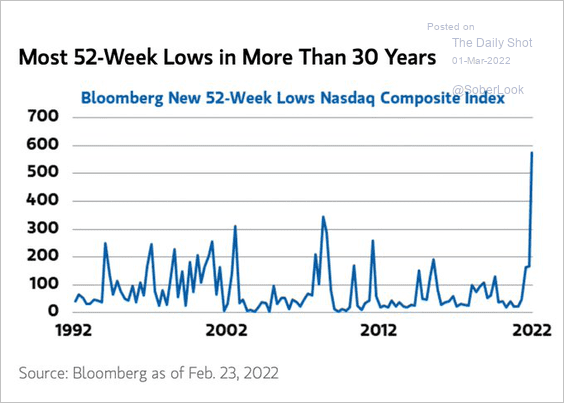

5. Many Nasdaq Composite stocks hit 52-week lows this year.

Source: @acemaxx, @MorganStanley

Source: @acemaxx, @MorganStanley

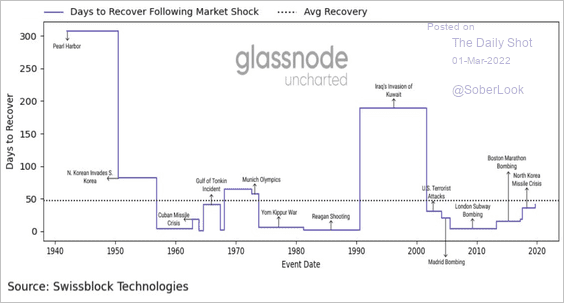

6. On average, it takes about 47 days for the S&P 500 to recover from geopolitical-driven sell-offs. Other studies show that equities continued to advance in three to six months following major global incidents.

Source: @Negentropic_

Source: @Negentropic_

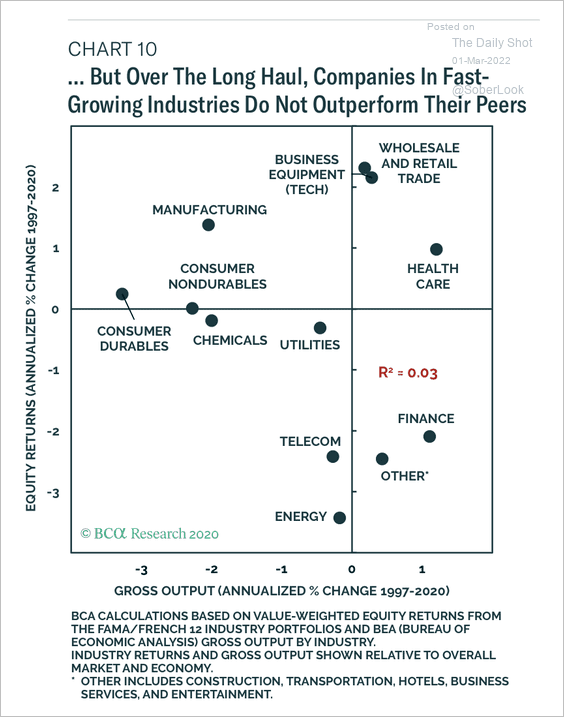

7. Over the long term, the correlation between relative industry growth and relative equity returns evaporates.

Source: BCA Research

Source: BCA Research

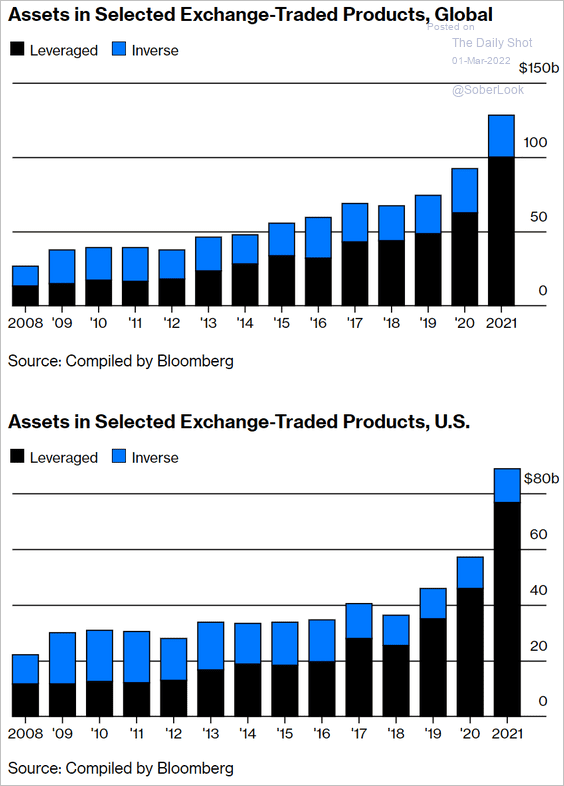

8. Leveraged and inverse ETFs have been very popular.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

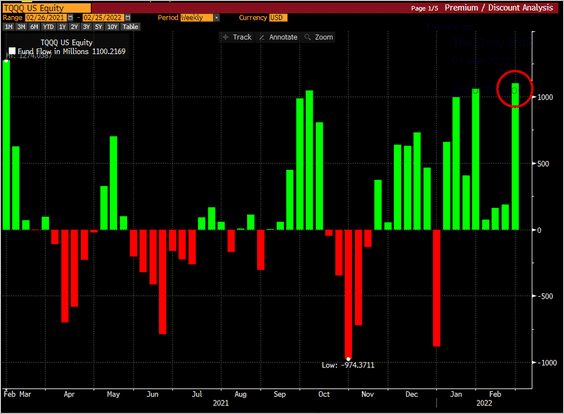

TQQQ (3x Nasdaq 100) got $1.1 billion of inflows last week.

Source: @kgreifeld

Source: @kgreifeld

——————–

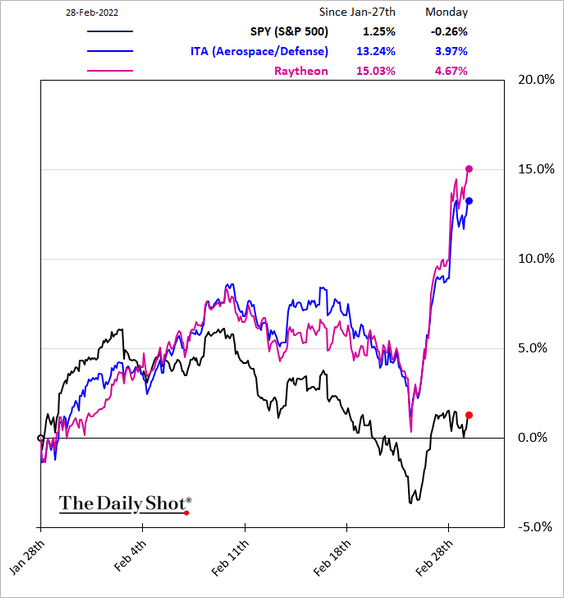

9. Defense stocks had an excellent few days.

Back to Index

Rates

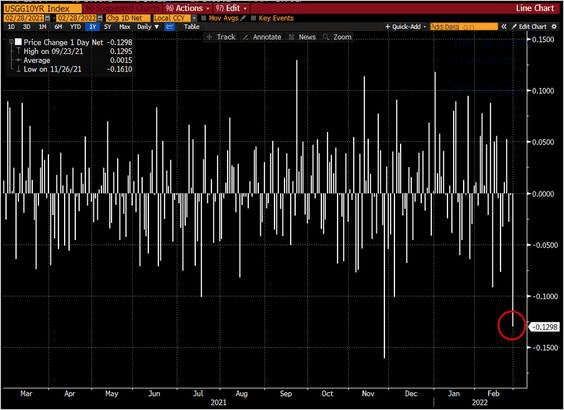

1. Treasury yields declined sharply on Monday.

Source: @kgreifeld

Source: @kgreifeld

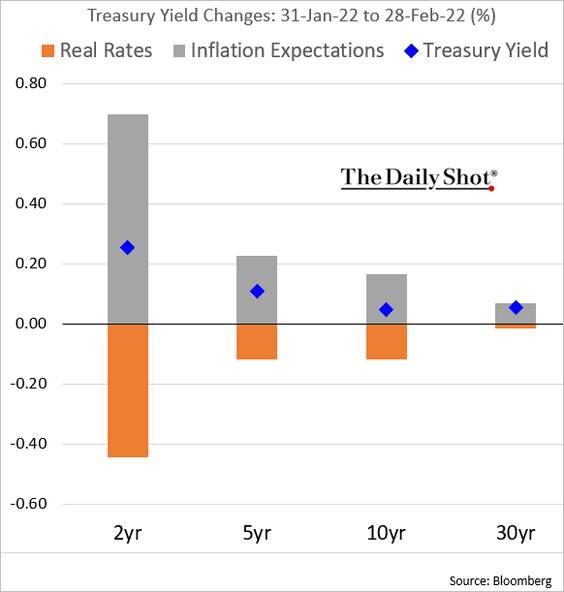

2. Inflation expectations drove Treasury yield increases in February.

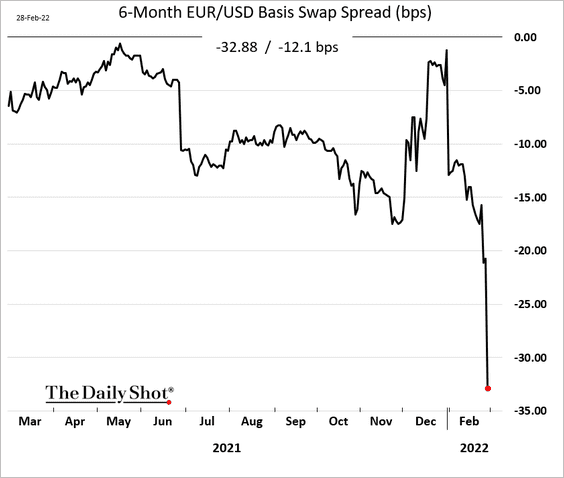

3. Euro basis swaps are showing tighter conditions in the dollar money markets (due to the Russia crisis).

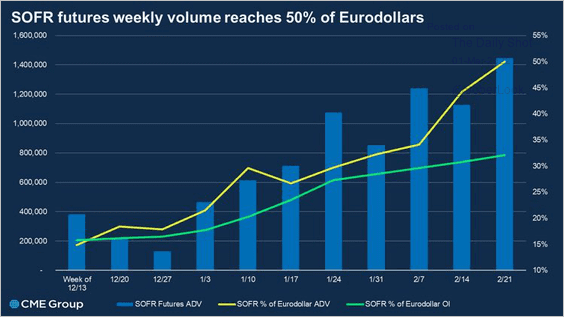

4. SOFR continues to gain in acceptance, with futures volume hitting 50% of the LIBOR-based product.

Source: @BrianGierke

Source: @BrianGierke

——————–

Food for Thought

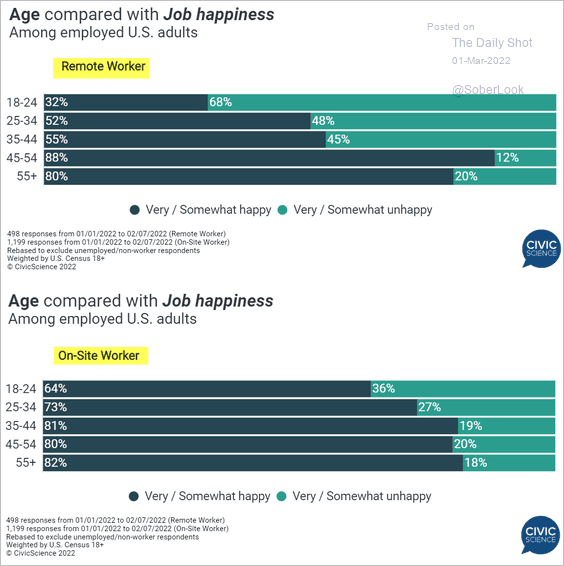

1. Who is happier working on-site rather than remotely:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

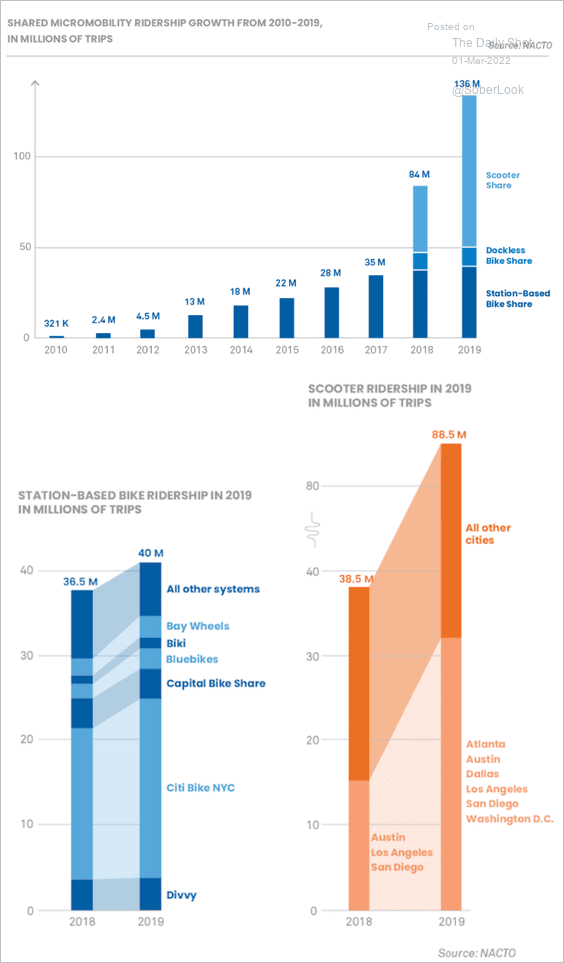

2. Trends in shared micro-mobility:

Source: NACTO Read full article

Source: NACTO Read full article

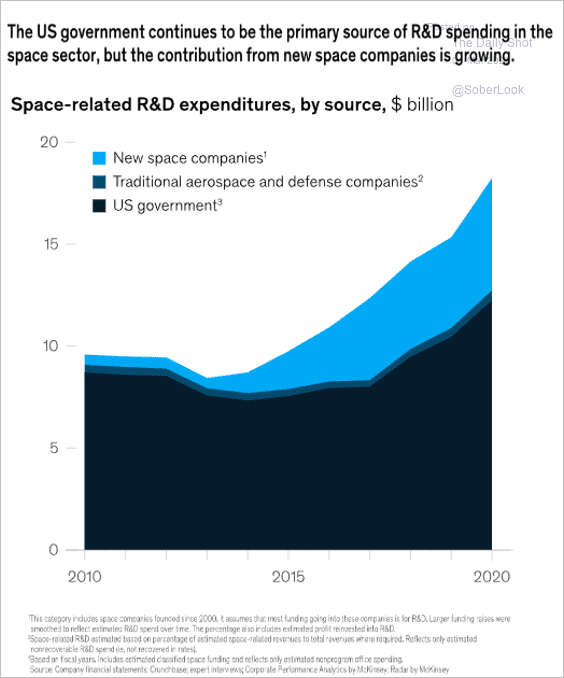

3. Space sector R&D:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

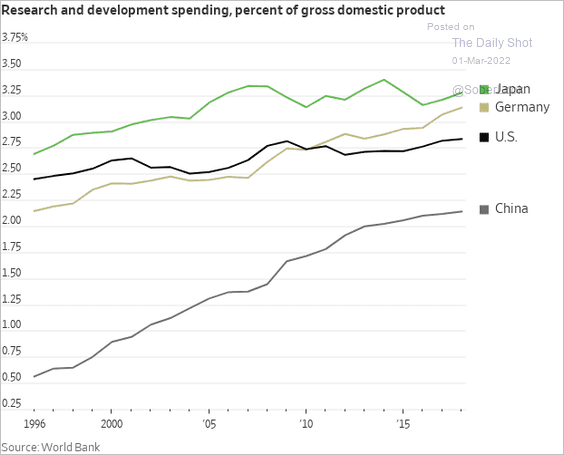

4. R&D spending trends:

Source: @WSJ Read full article

Source: @WSJ Read full article

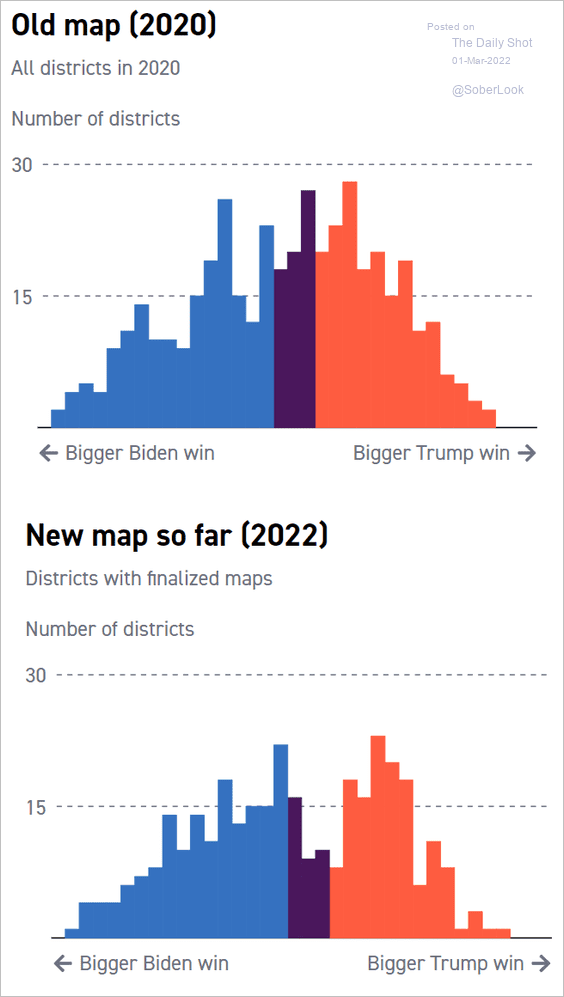

5. More polarization in redrawn US congressional districts:

Source: Politico Read full article

Source: Politico Read full article

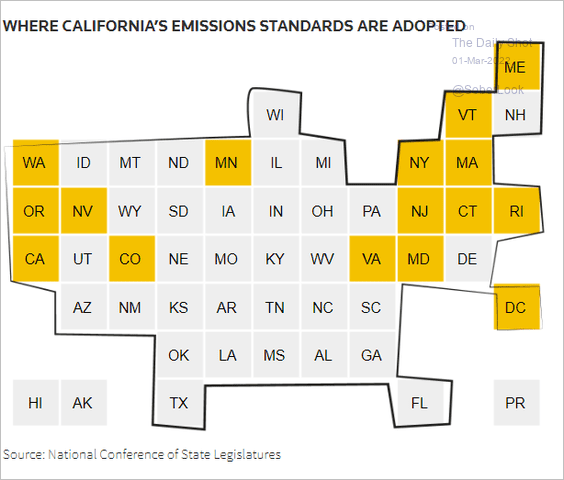

6. Adopting California’s emissions standards:

Source: NYS Read full article

Source: NYS Read full article

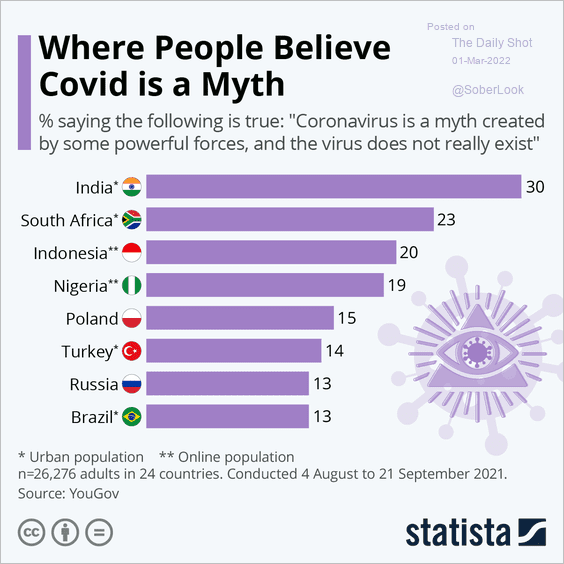

7. COVID skepticism:

Source: Statista

Source: Statista

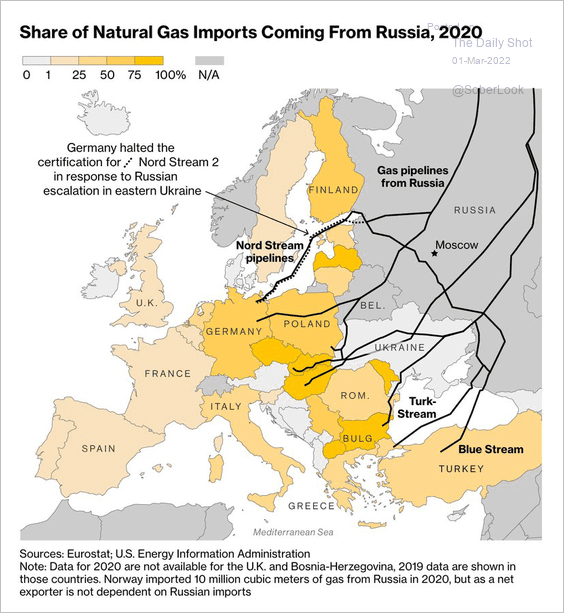

8. Share of natural gas imports coming from Russia:

Source: @BBGVisualData Read full article

Source: @BBGVisualData Read full article

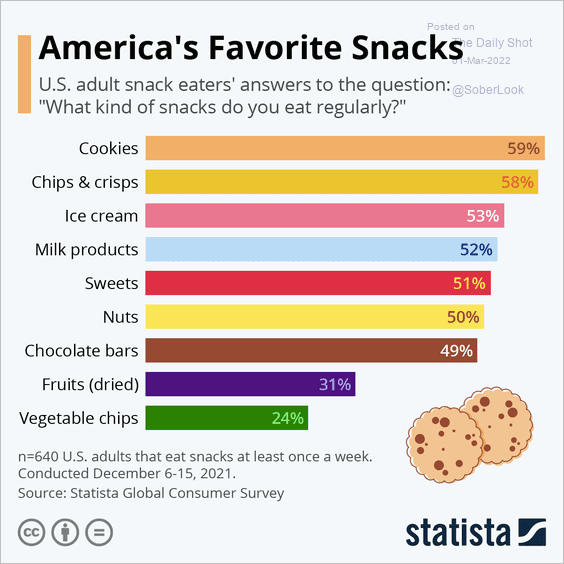

9. Favorite snacks:

Source: Statista

Source: Statista

——————–

Back to Index