The Daily Shot: 18-Mar-22

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

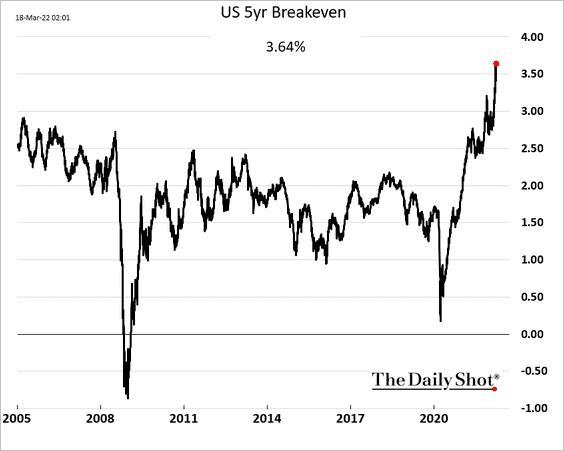

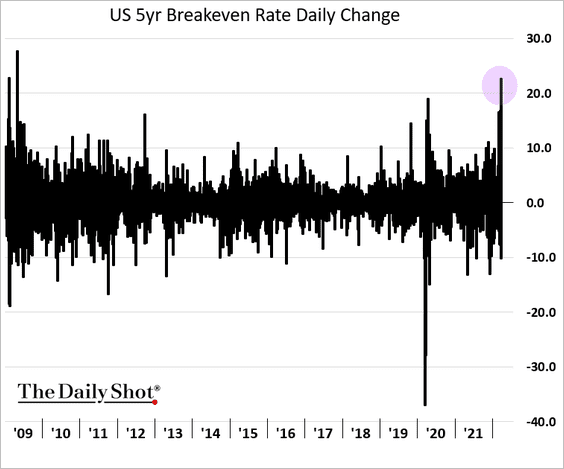

1. The 5-year US breakeven rate (inflation expectations) hit a new high as oil prices rebound.

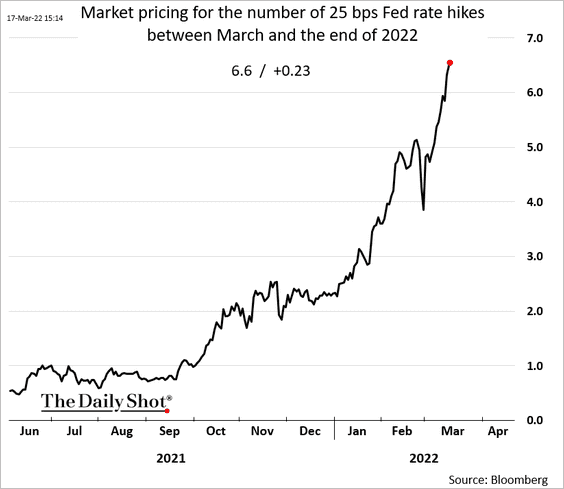

The market is increasingly pricing in the possibility of eight 25 bps Fed rate hikes this year (seven in addition to the one we just had).

——————–

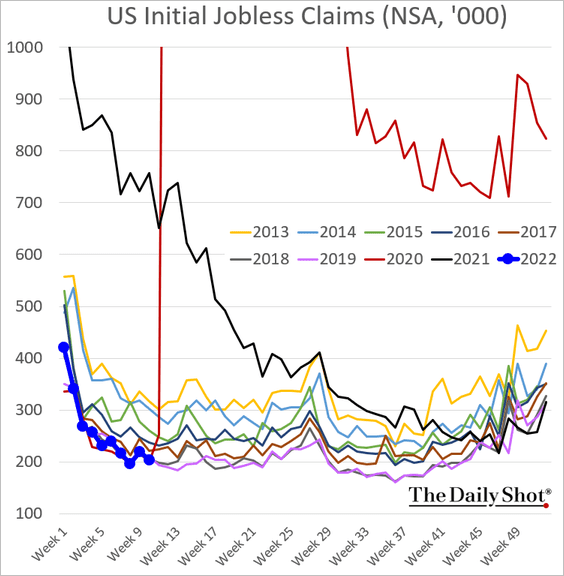

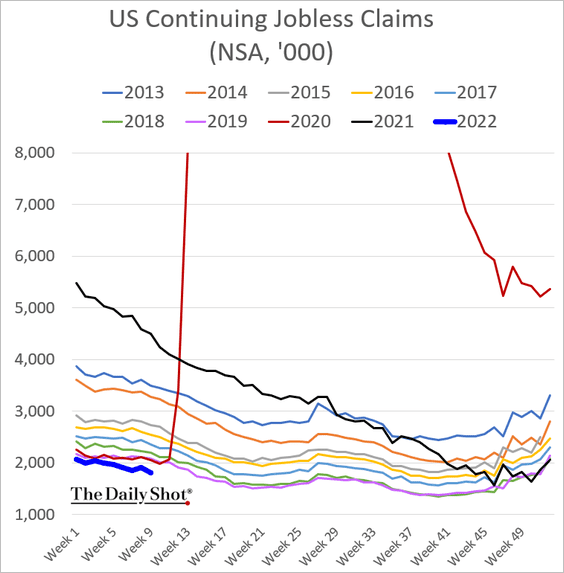

2. The labor market remains robust, with initial jobless claims holding near the lows.

Continuing claims have decoupled from the trends we saw in previous years.

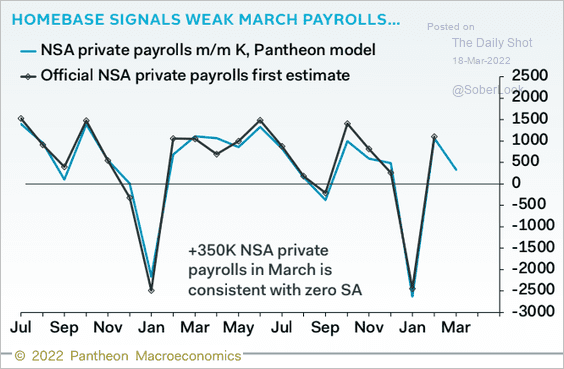

However, based on the data from Homebase, Pantheon Macroeconomics sees soft job gains this month.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

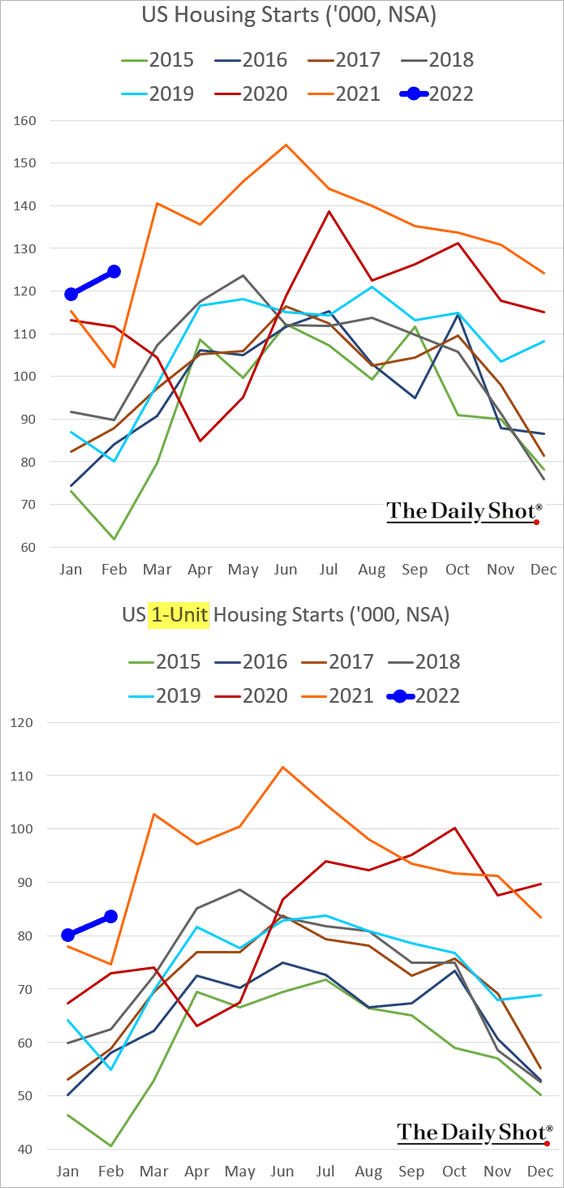

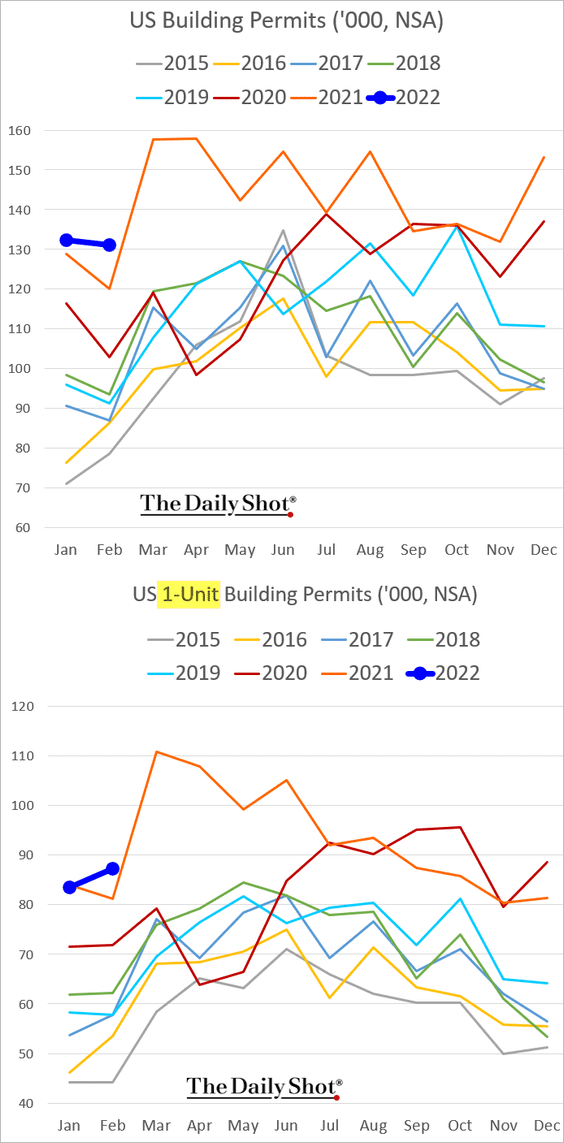

3. Next, we have some updates on the housing market.

• Housing starts were strong last month.

Construction permits also held up well.

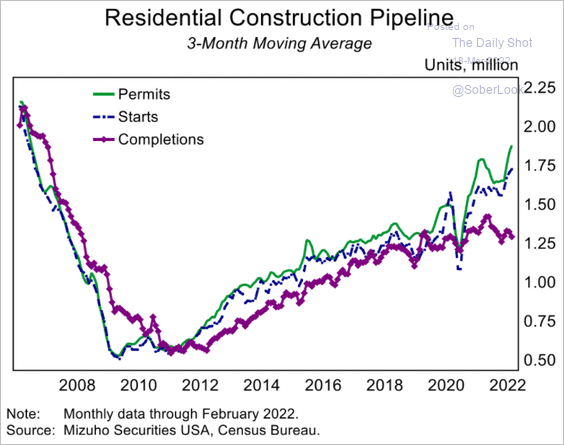

• The gap between residential permits and completions continues to widen, pointing to construction delays.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

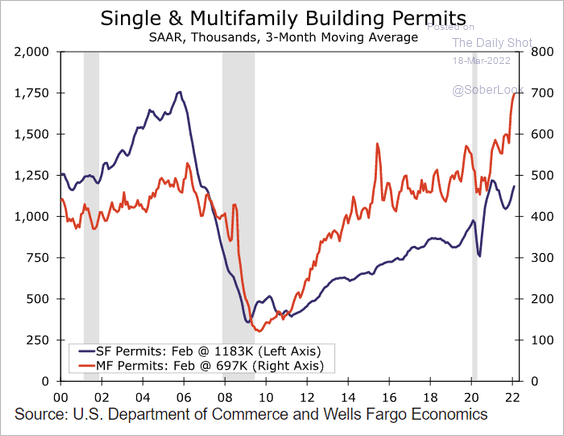

• Multi-family permits hit a record high.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

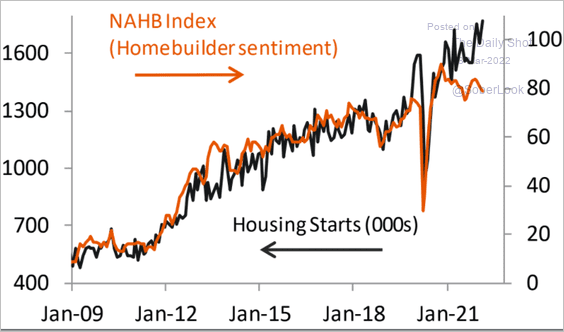

• Homebuilder sentiment (see chart) points to softer residential construction activity ahead.

Source: Piper Sandler

Source: Piper Sandler

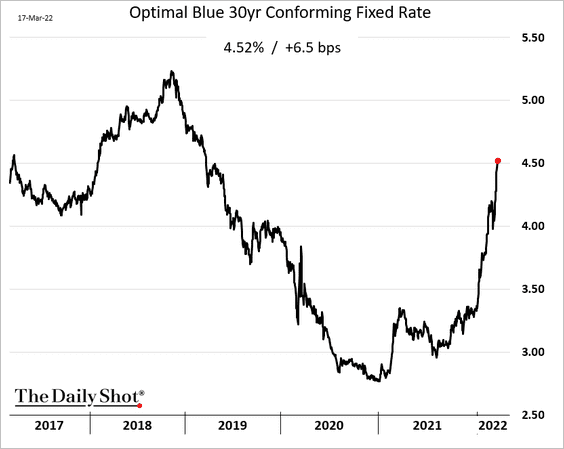

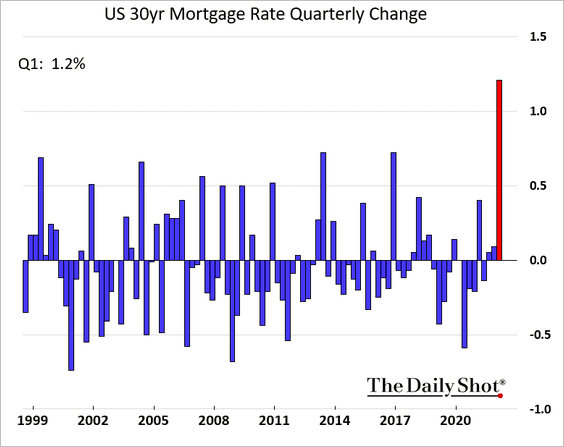

• The 30-year mortgage rate is now above 4.5%

The increase in mortgage rates since the beginning of the year has been massive.

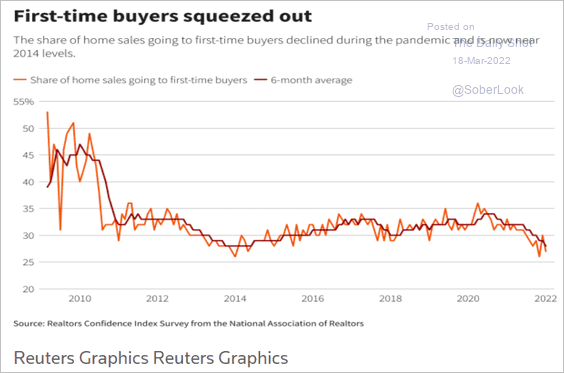

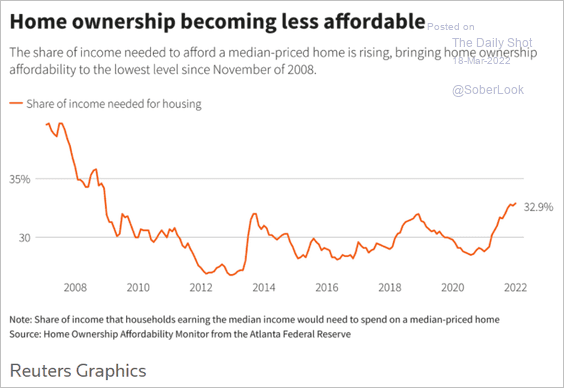

• First-time homebuyers are getting squeezed out of the housing market due to deteriorating affordability.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

——————–

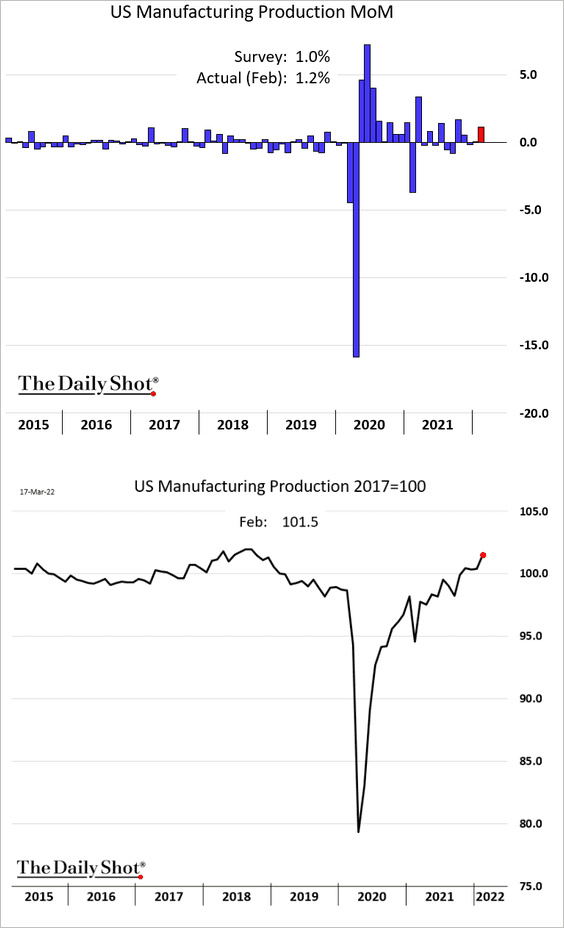

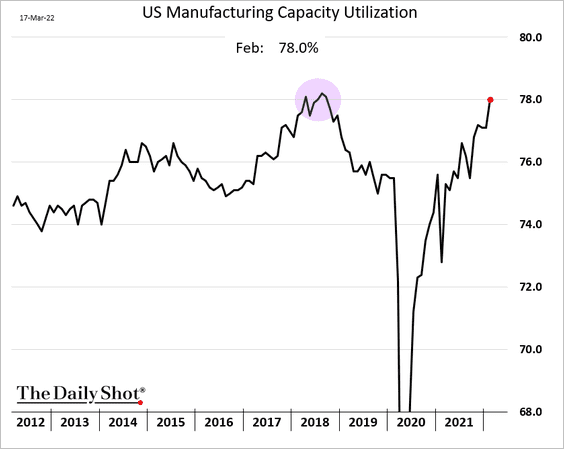

4. US manufacturing output increased last month.

Capacity utilization is nearing the 2018 peak.

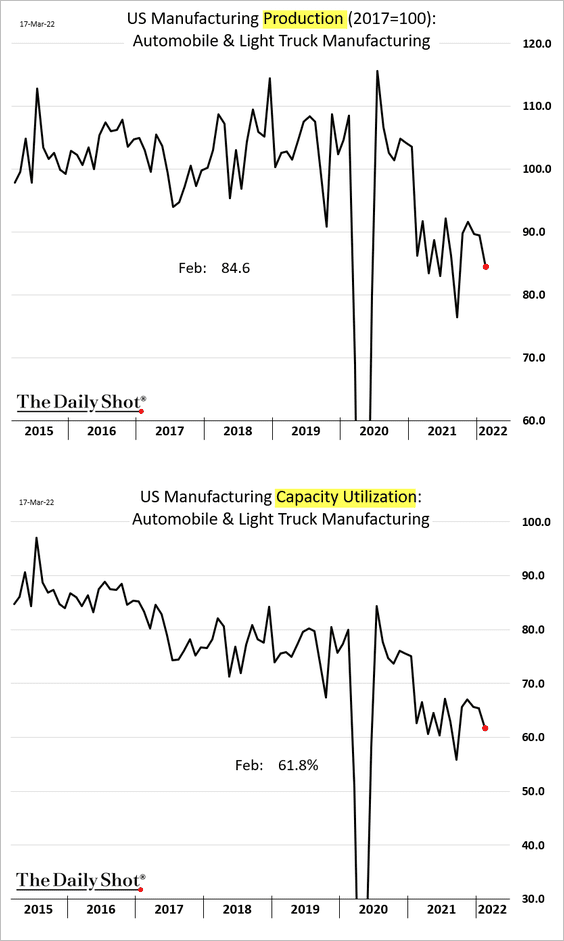

Automobile production deteriorated again last month.

——————–

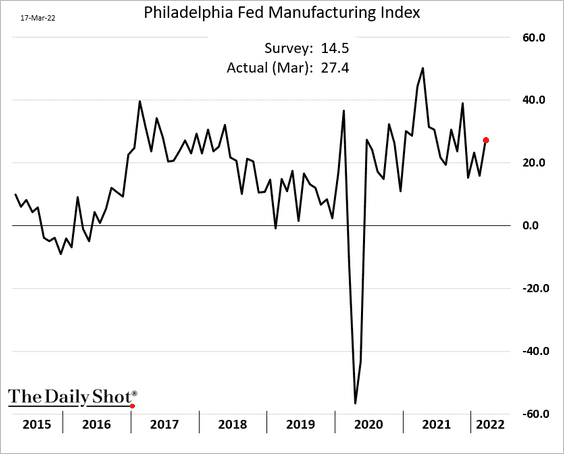

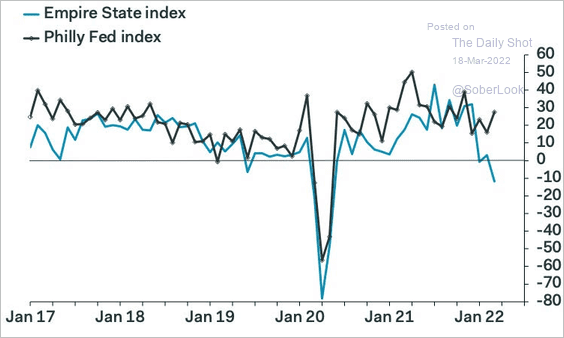

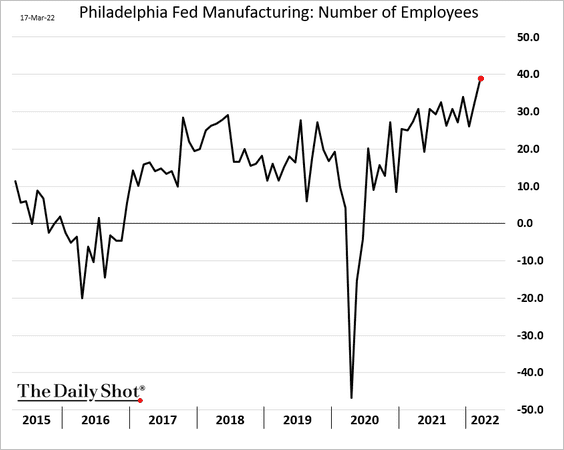

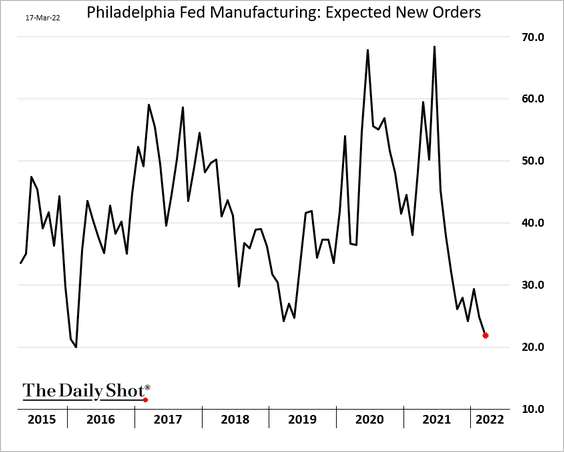

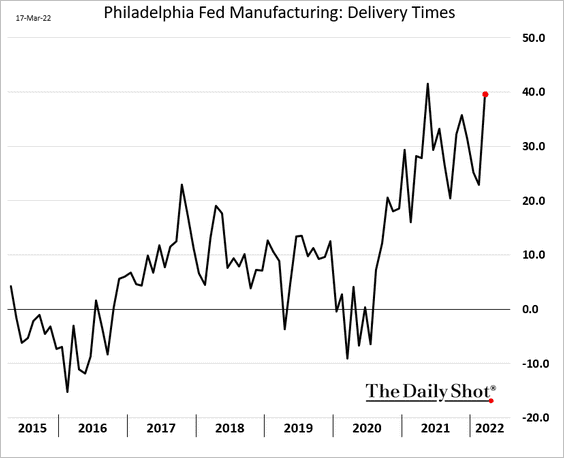

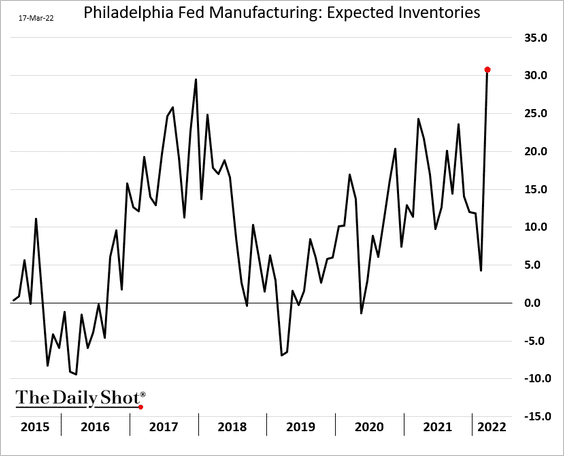

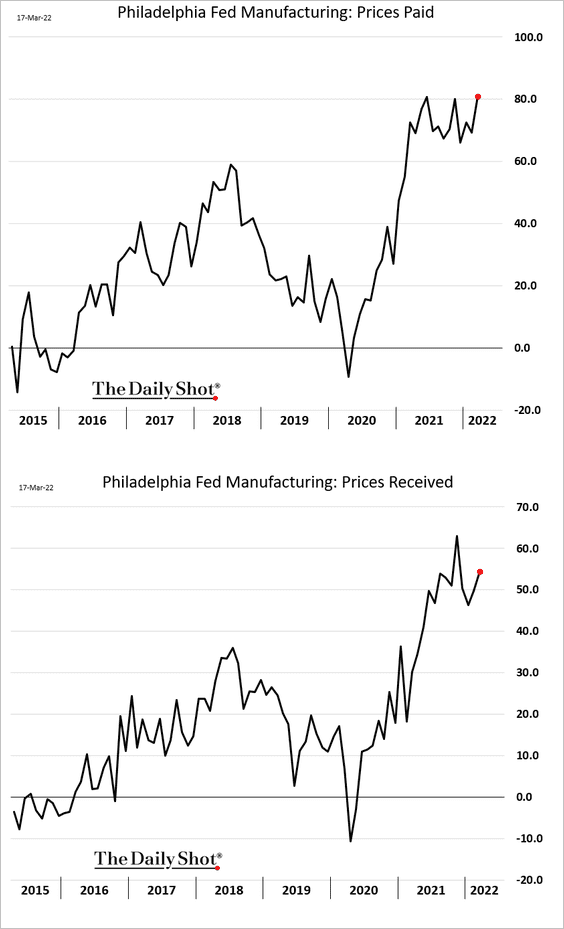

5. The Philly Fed’s manufacturing report showed improvement this month, …

… diverging from the NY Fed’s regional index.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Hiring has been exceptionally strong.

However, forward-looking indicators were less upbeat.

• Supply chain stress persists.

• Factories expect rising inventories ahead.

• Price pressures remain extreme.

——————–

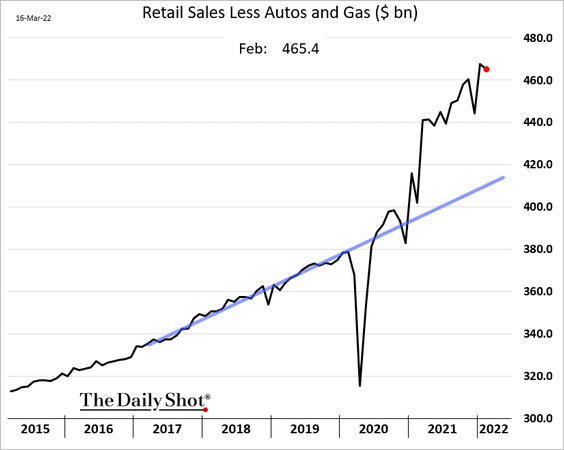

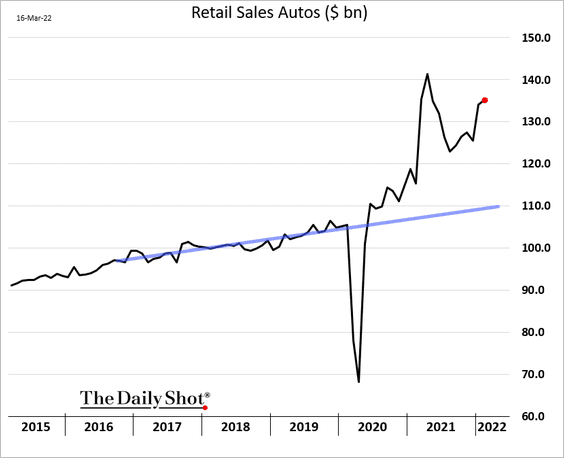

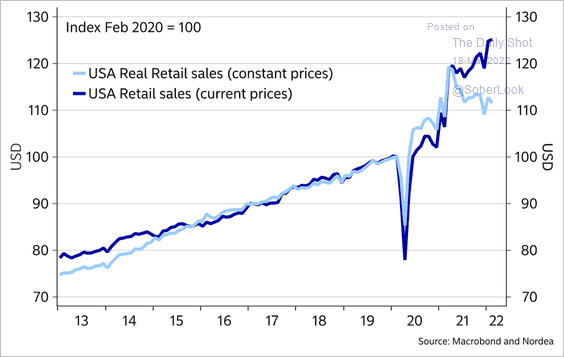

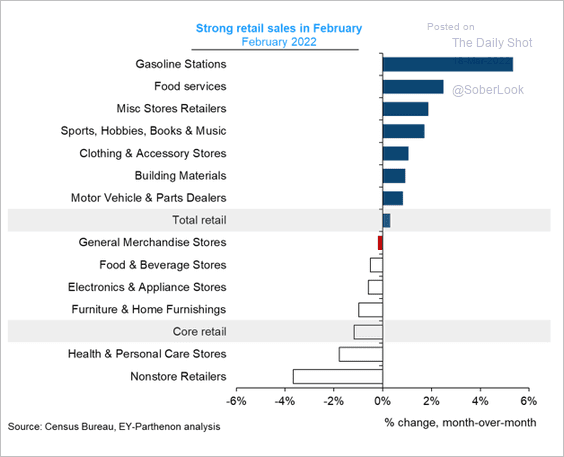

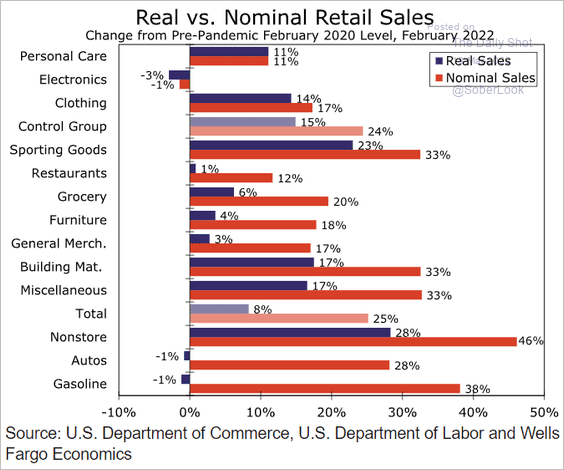

7. Below are some updates on retail sales.

• Retail spending is holding well above the pre-COVID trend.

But the situation is not as upbeat in real terms.

Source: @MikaelSarwe

Source: @MikaelSarwe

• Here are the changes in retail sales by sector.

– February:

Source: @GregDaco

Source: @GregDaco

– Since the start of the pandemic:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

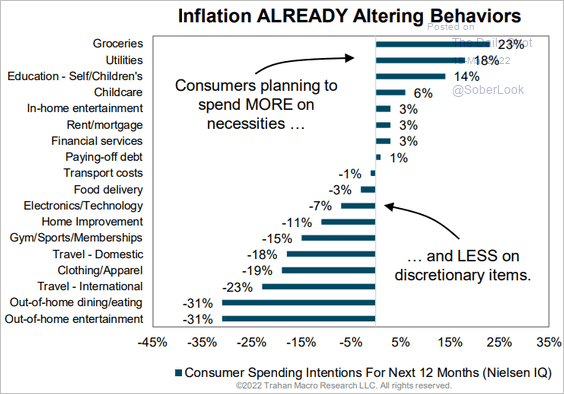

8. Consumers are shifting spending behavior in response to surging prices.

Source: Trahan Macro Research

Source: Trahan Macro Research

Back to Index

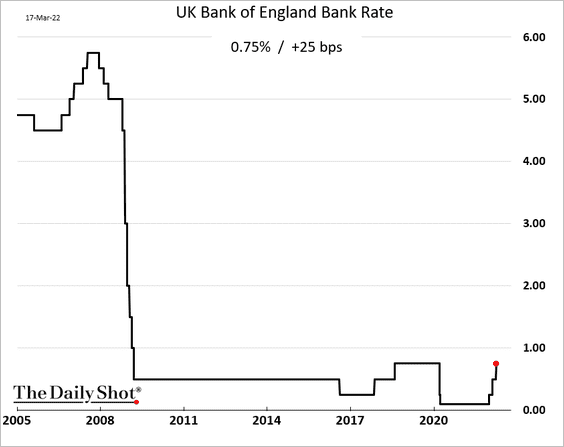

The United Kingdom

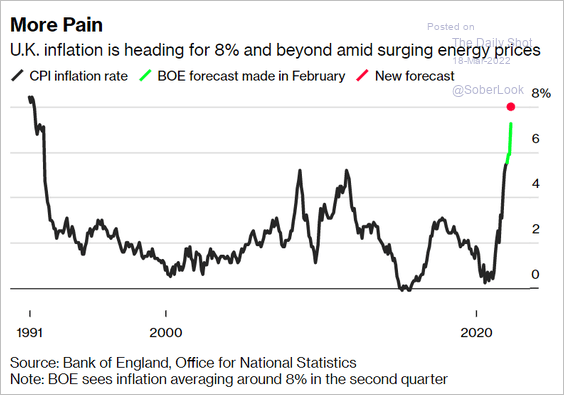

1. The Bank of England hiked rates as expected.

But the statement was dovish. The word used in February was “likely” in reference to further rate increases. This time, the language was “might be.”

Based on its current assessment of the economic situation, the Committee judged that some further modest tightening in monetary policy might be appropriate in the coming months, but there were risks on both sides of that judgement depending on how medium-term prospects for inflation evolved.

The central bank boosted its inflation forecast.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

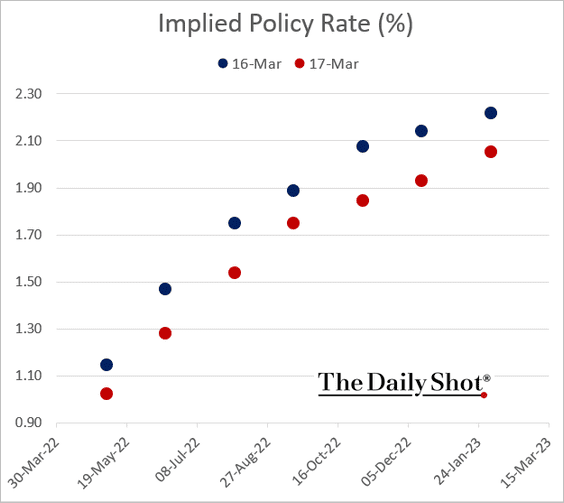

Implied policy rates downshifted.

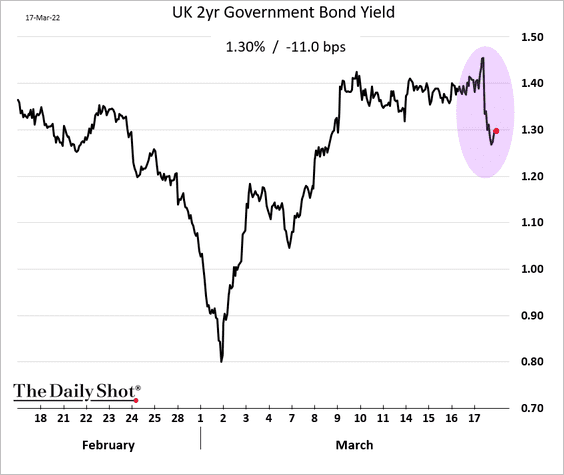

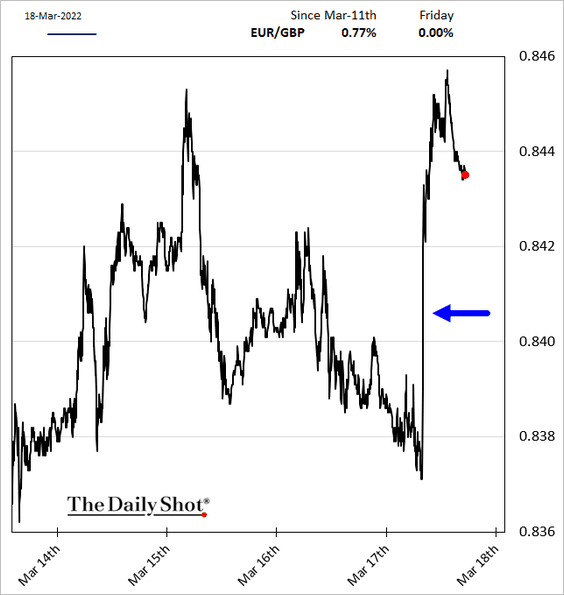

Gilt yields and the pound declined.

——————–

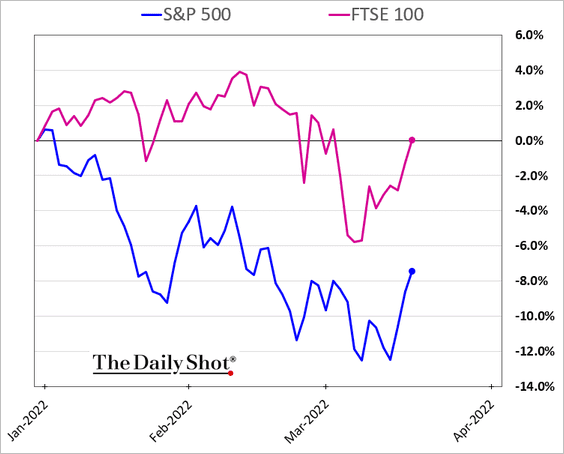

2. UK equities have been outperforming.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

The Eurozone

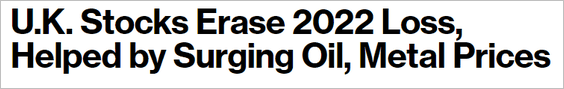

1. New car registrations remained soft in February but did not weaken further. The situation might change this month as consumer sentiment deteriorates.

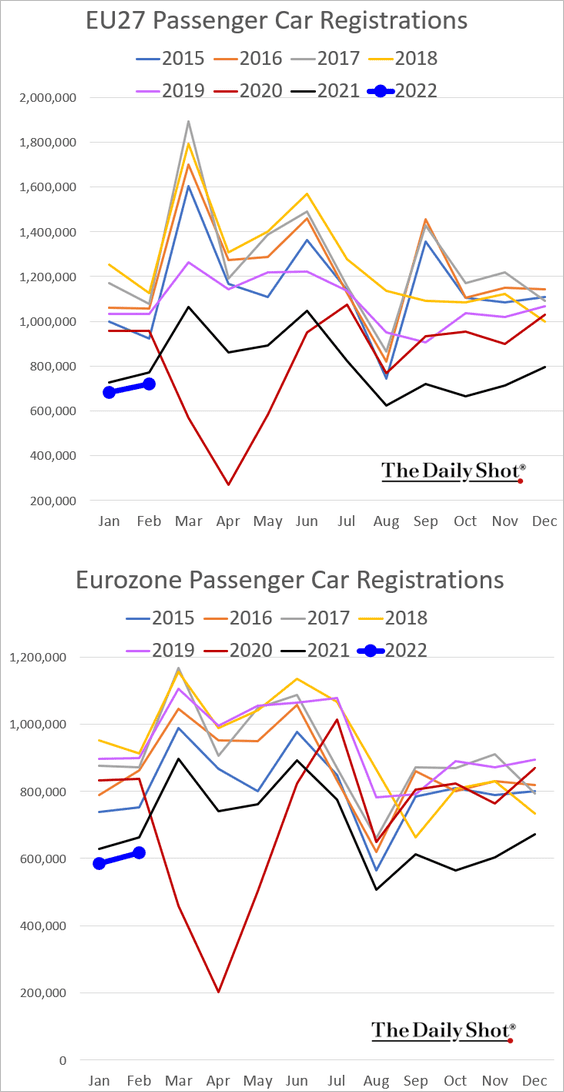

2. Spain’s trade deficit hit a multi-year high as energy prices spiked.

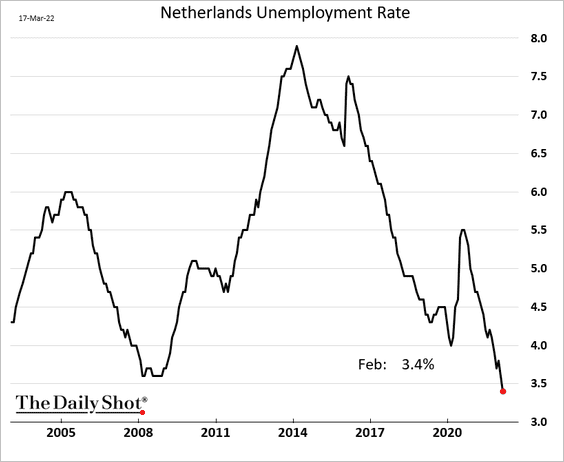

3. Dutch unemployment is at a two-decade low (at least).

Back to Index

Asia – Pacific

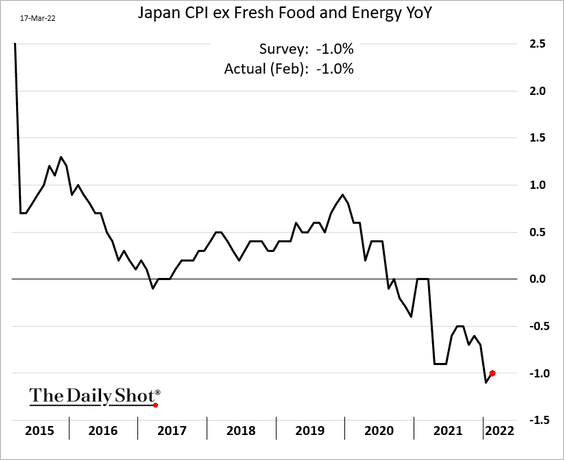

1. Has Japan’s core CPI bottomed?

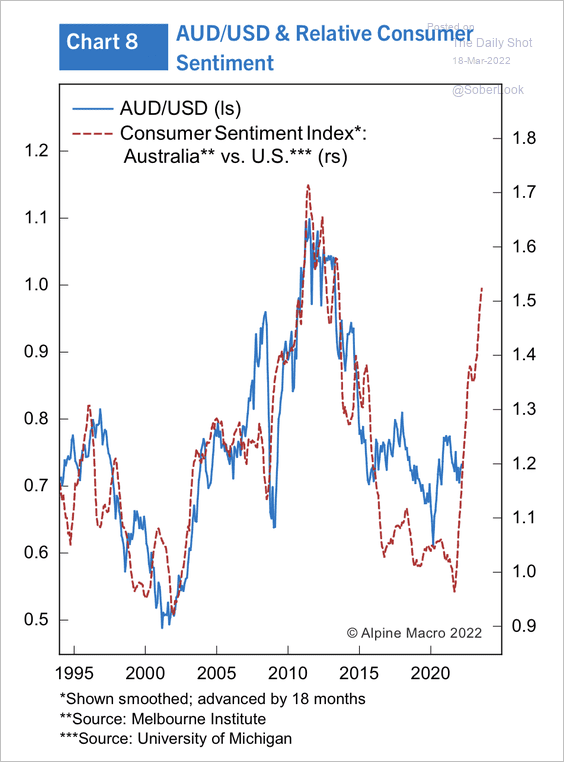

2. The cyclical direction of AUD/USD closely tracks the consumer sentiment differential between Australia and the US.

Source: Alpine Macro

Source: Alpine Macro

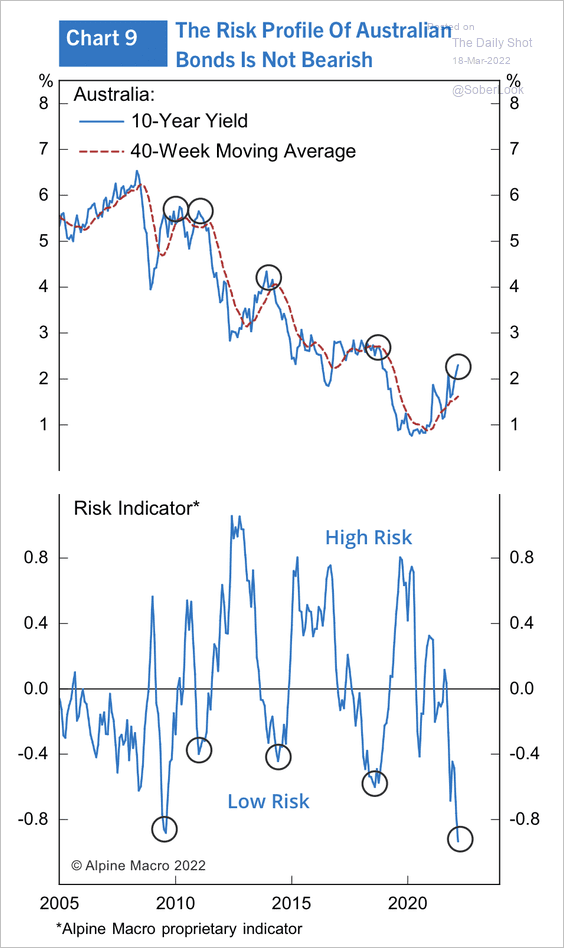

• Aussie bonds have a low-risk profile, especially due to an improving economic outlook, according to Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

China

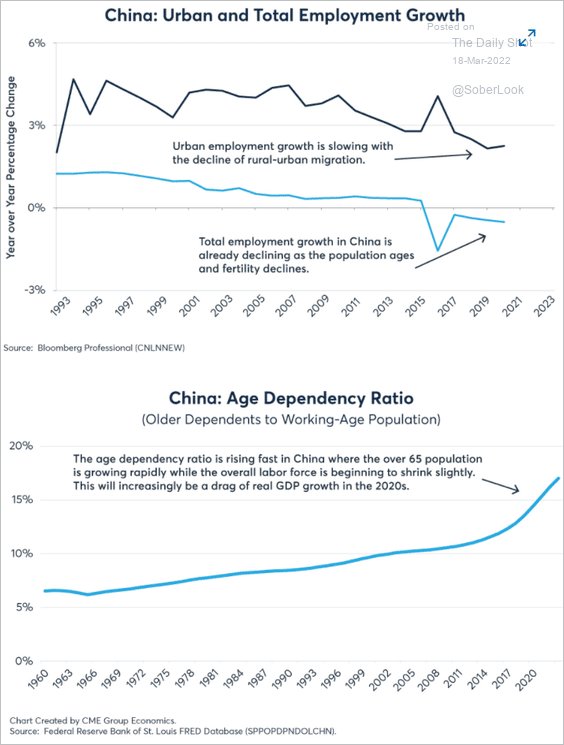

1. This chart shows China’s employment growth and the age dependency ratio.

Source: CME Group Read full article

Source: CME Group Read full article

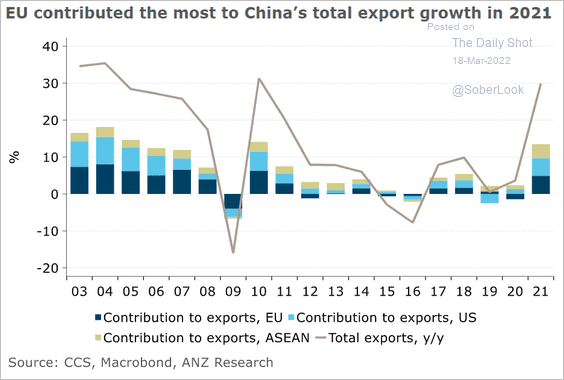

2. What are the drivers of China’s export growth?

Source: ANZ Research

Source: ANZ Research

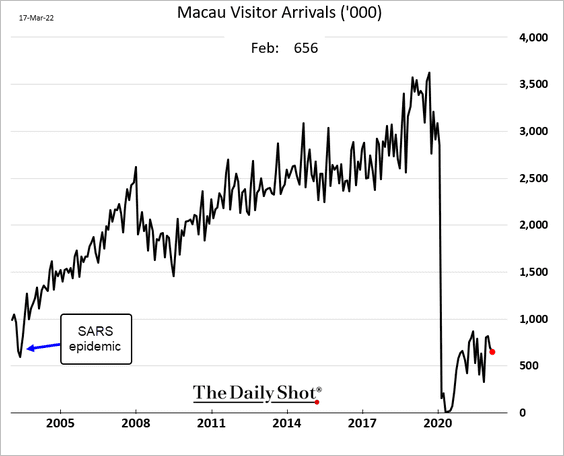

3. Macau visitor activity remains a shadow of its pre-COVID levels.

Back to Index

Emerging Markets

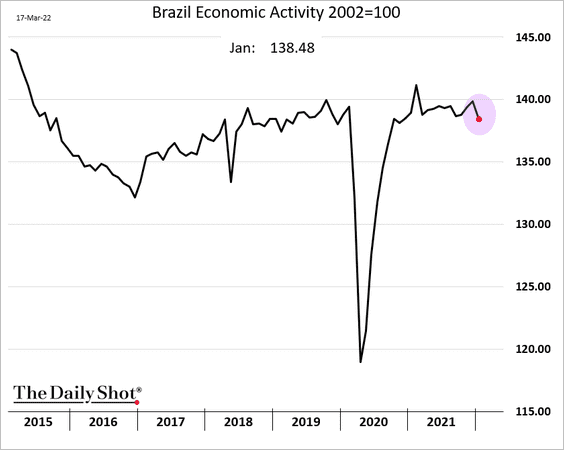

1. Brazil’s economic activity softened in January.

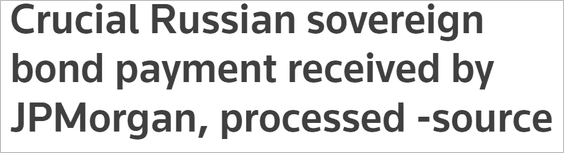

2. Russia made a payment on its dollar bonds.

Source: Reuters Read full article

Source: Reuters Read full article

• Bond prices jumped, albeit from very low levels.

CDS spreads tightened.

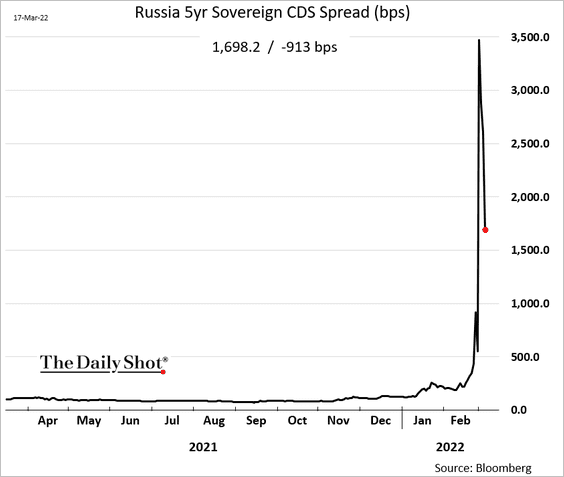

The Russian economy is expected to wipe out nearly two decades of growth.

Source: IIF

Source: IIF

——————–

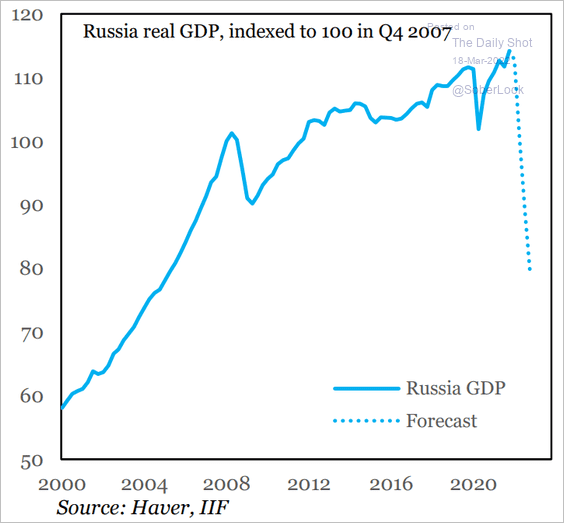

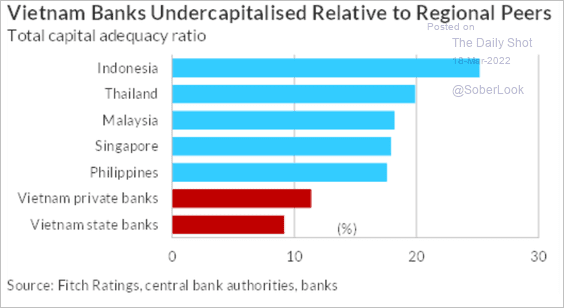

3. Vietnam’s banks are not well capitalized relative to regional peers

Source: Fitch Ratings

Source: Fitch Ratings

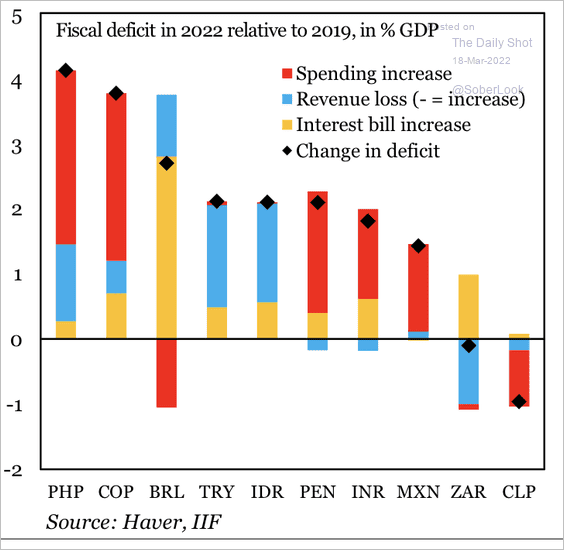

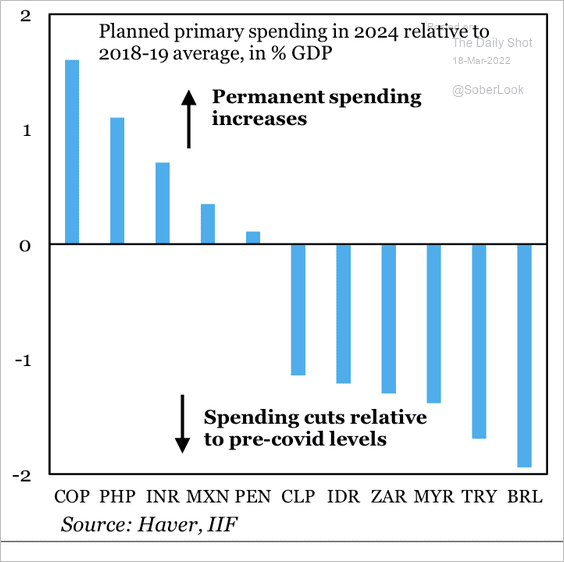

4. Fiscal deficits in some EM countries have not normalized.

Source: IIF

Source: IIF

Some countries are planning to cut spending.

Source: IIF

Source: IIF

Back to Index

Cryptocurrency

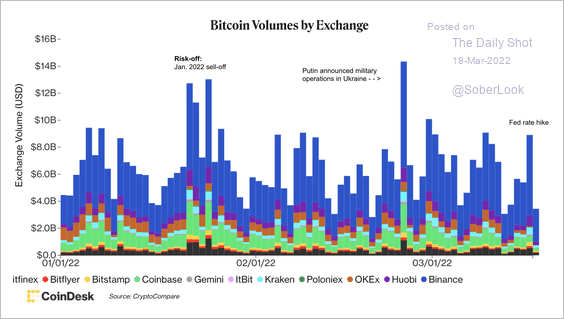

1. Bitcoin’s trading volume spiked on Wednesday after the Fed rate hike but remains low relative to prior highs.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

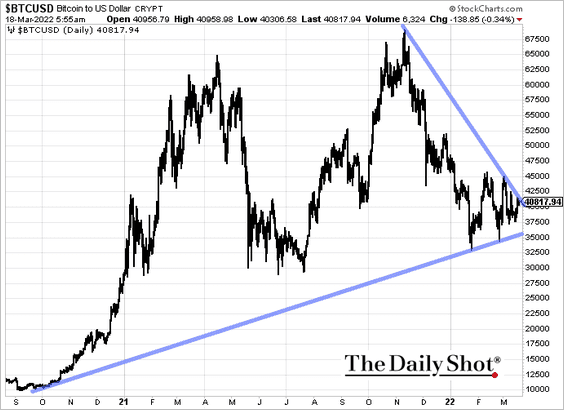

2. A wedge has formed in bitcoin.

3. The rise in bitcoin’s market cap relative to the total crypto market cap has stalled over the past few days as altcoins rallied. Still, the ratio remains elevated this year.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

4. Argentina could discourage the use of crypto as part of a deal signed with the IMF to restructure a $45 billion loan received in 2018.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

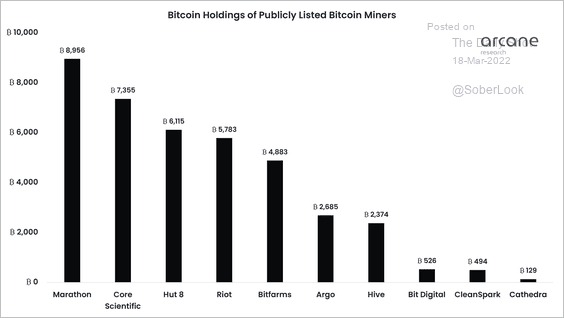

5. This chart shows bitcoin holdings of publicly listed mining companies.

Source: @ArcaneResearch

Source: @ArcaneResearch

Back to Index

Commodities

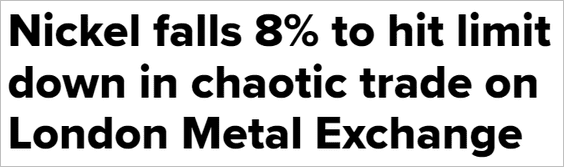

1. Based on the Shanghai futures, LME nickel has further room to fall.

Source: CNBC Read full article

Source: CNBC Read full article

Source: Bloomberg

Source: Bloomberg

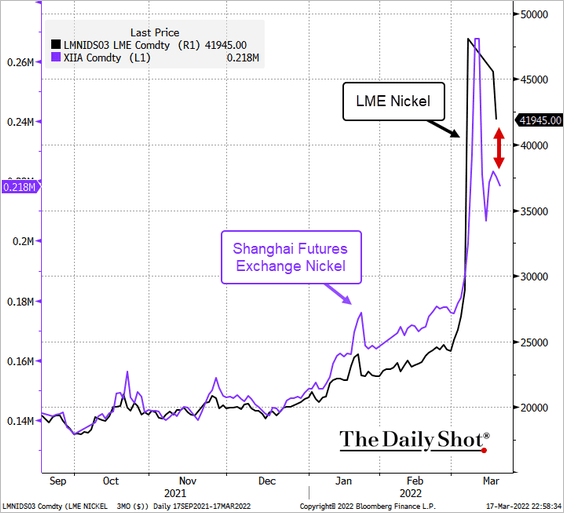

Fitch Solutions expects major nickel producers (mostly Indonesia) to increase production, but it will unlikely compensate for the loss of Russian supplies to the global market.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

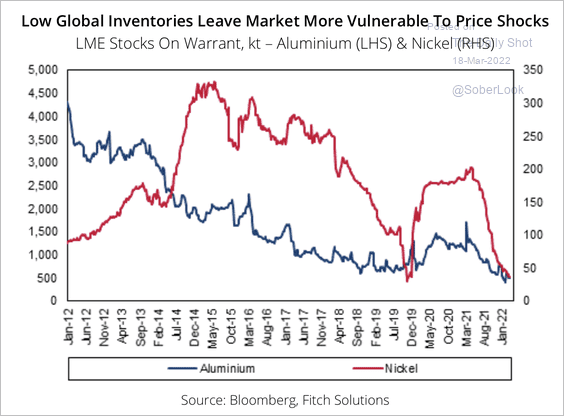

2. Low global stocks of aluminum and nickel have contributed to sharp price rallies.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

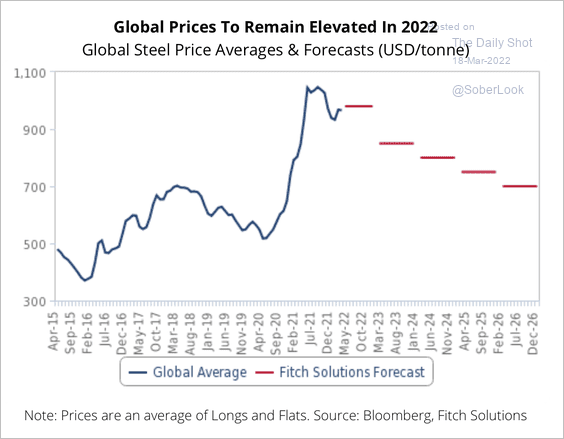

3. Fitch Solutions revised its steel price forecast higher this year ($980/tonne vs. previous $750/tonne) because of the Russia/Ukraine conflict and renewed stimulus for infrastructure in China. Still, prices are expected to fall over the next few years.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

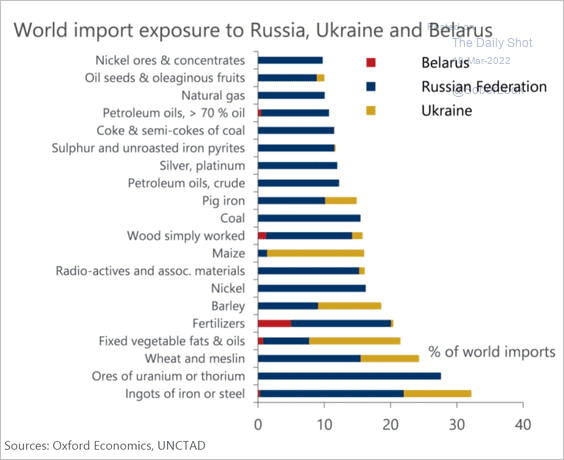

4. Here is the world’s commodity import exposure to Russia, Ukraine, and Belarus.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Energy

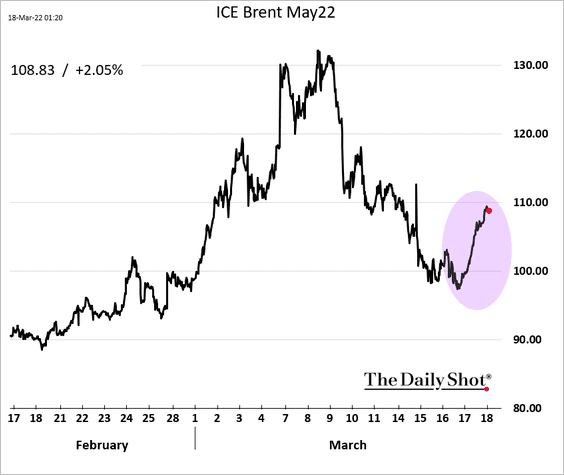

1. Crude oil is rebounding.

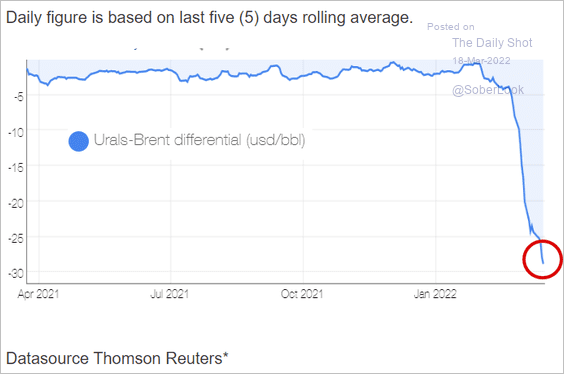

2. The Russian crude oil discount to Brent continues to widen, …

Source: Neste

Source: Neste

… attracting some buyers.

Source: ABC News Read full article

Source: ABC News Read full article

——————–

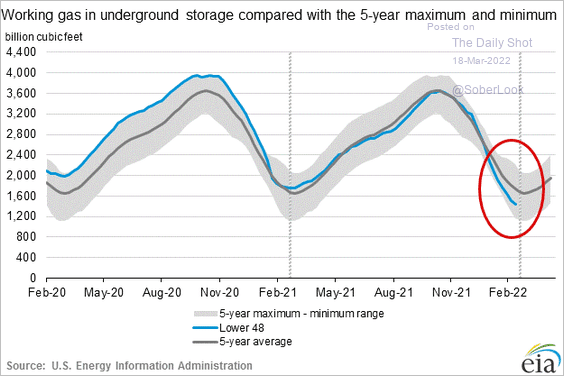

3. US natural gas in storage is low for this time of the year but is still within the five-year range.

Back to Index

Equities

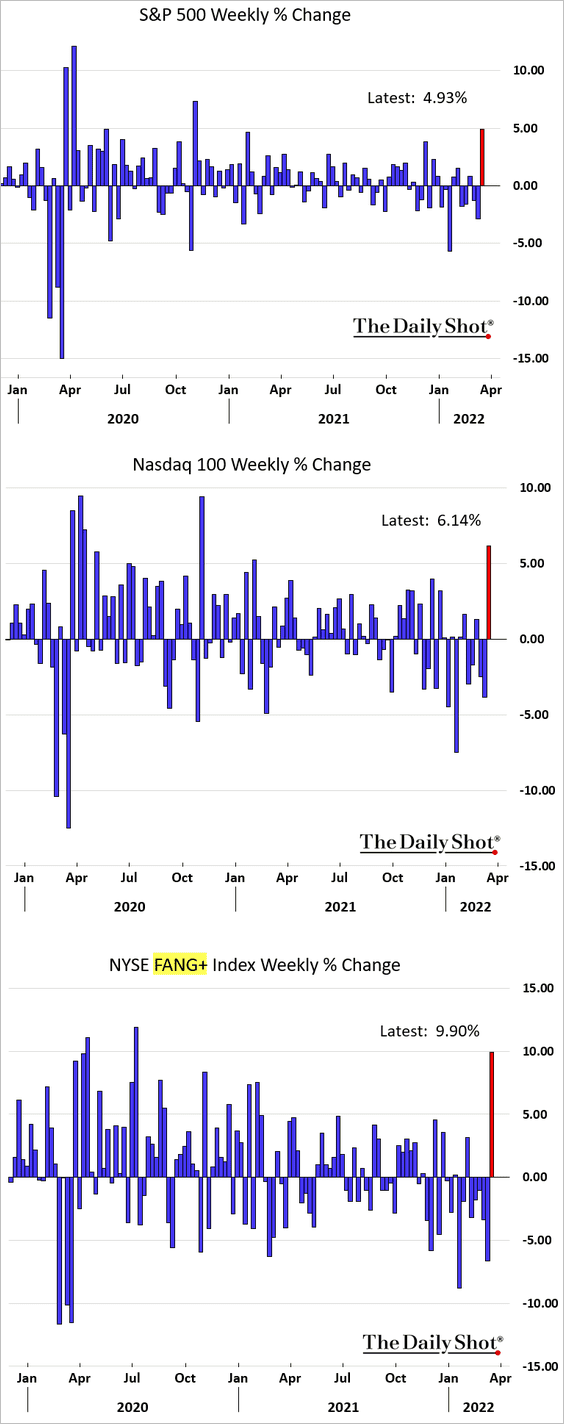

1. It has been a good week for stocks so far.

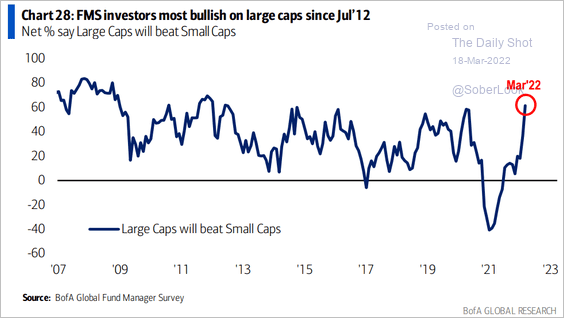

2. Fund managers increasingly prefer large-cap stocks.

Source: BofA Global Research

Source: BofA Global Research

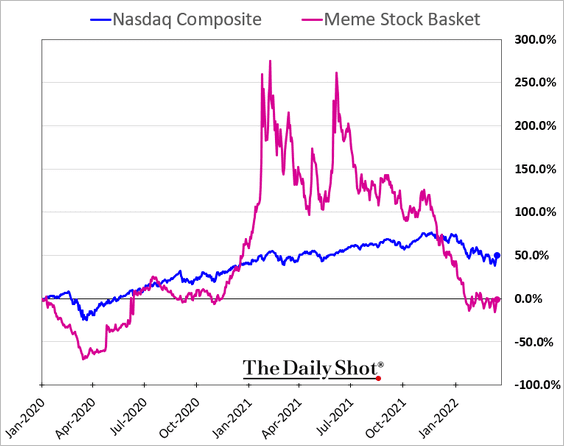

3. A basket of meme stocks is holding near pre-COVID levels.

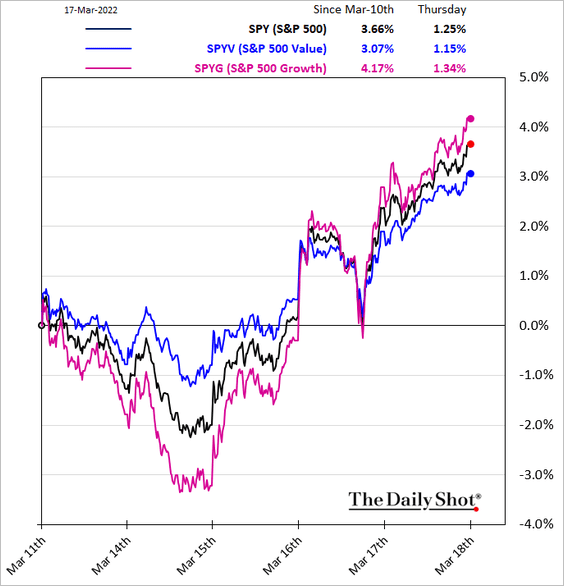

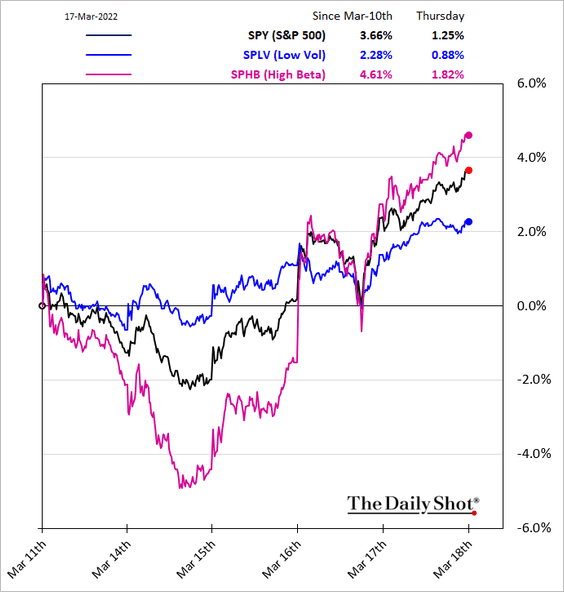

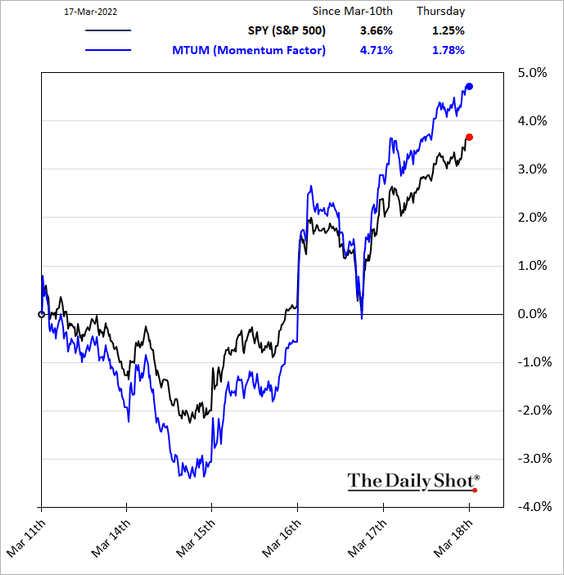

4. Next, let’s take a look at some equity factor trends in recent days.

• Growth and value:

• High-beta and low-vol:

• Momentum:

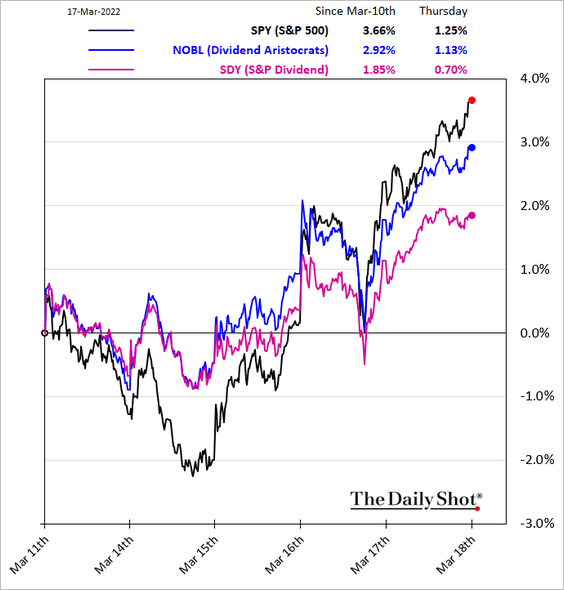

• Dividend yield and dividend growth:

——————–

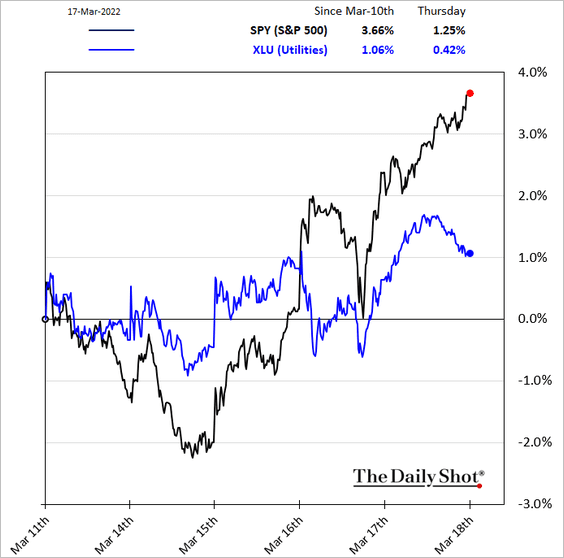

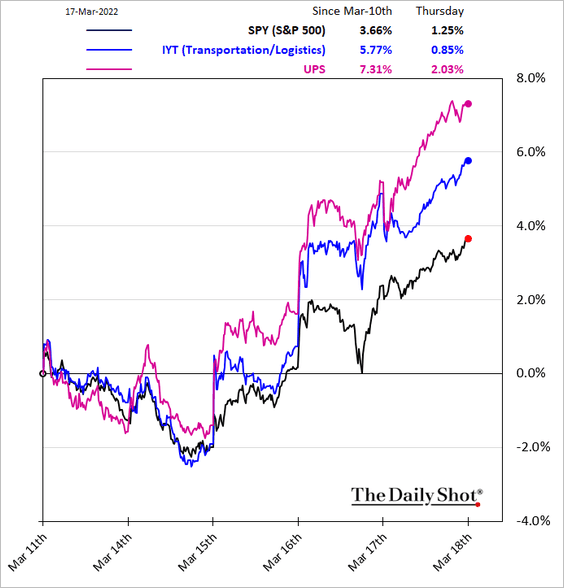

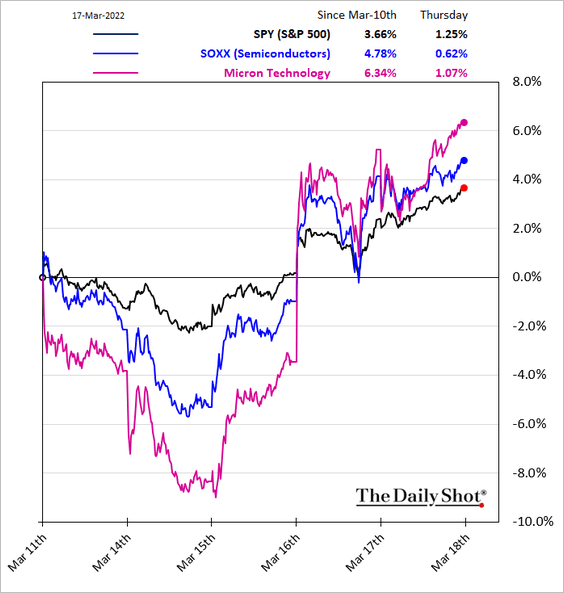

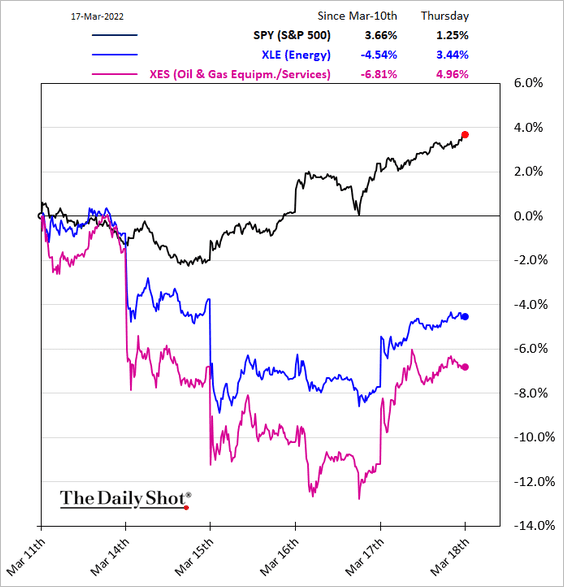

5. Finally, we have some sector trends.

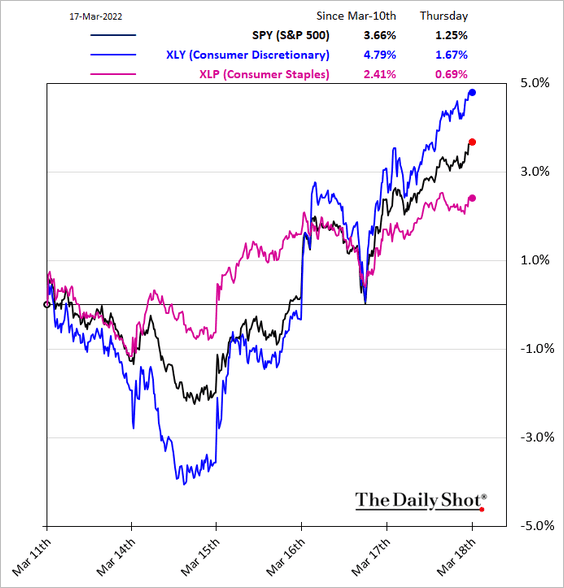

• Consumer discretionary vs. consumer staples:

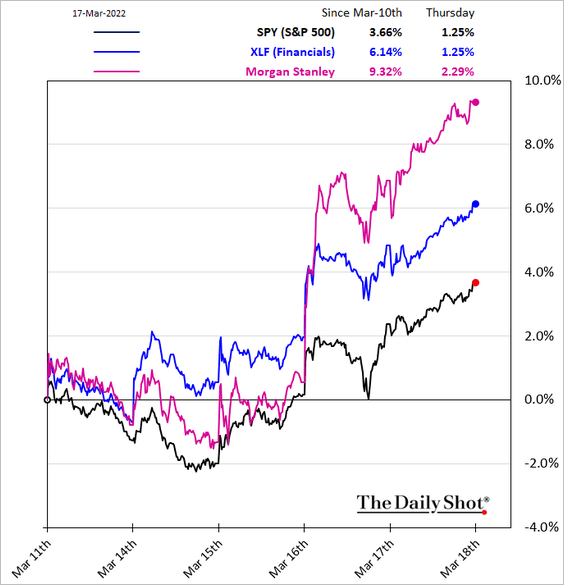

• Financials:

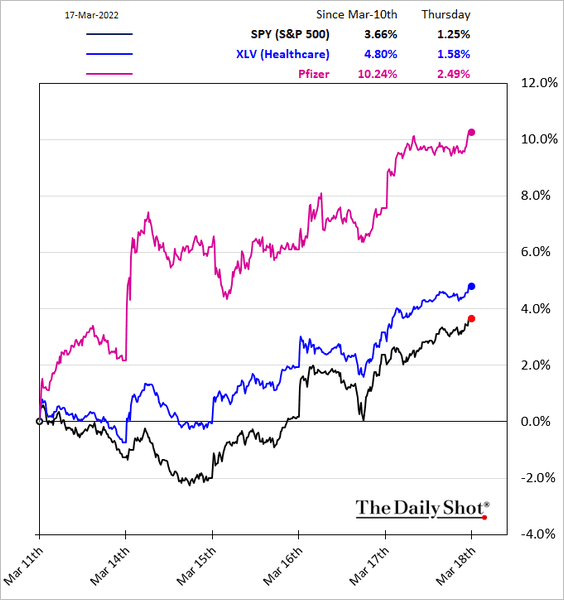

• Healthcare:

• Utilities:

• Transportation/logisitics:

• Semiconductors:

• Energy:

Back to Index

Credit

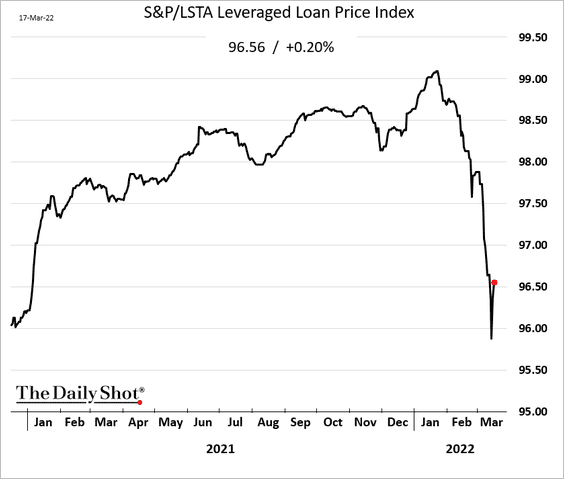

1. Leveraged loan prices appear to have stabilized as equities rebounded.

The market has been nervous.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

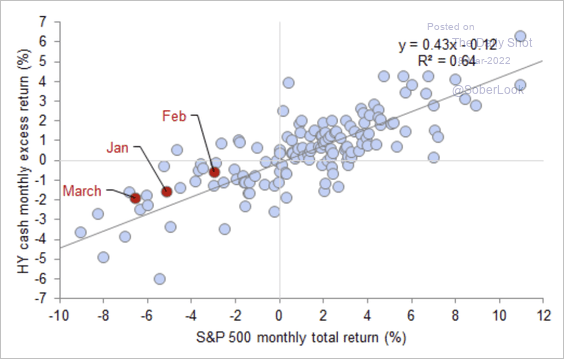

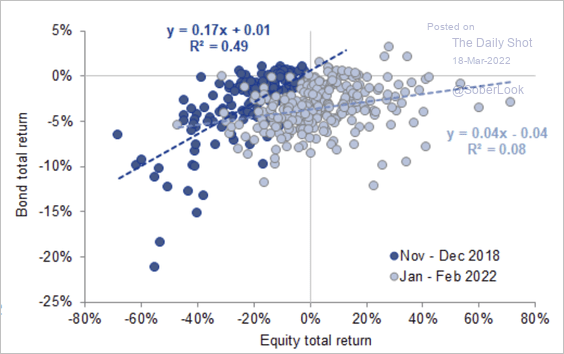

2. High yield has outperformed the S&P 500 over the past three months as compared to its historical beta.

Source: Goldman Sachs, {h/t} III Capital Management

Source: Goldman Sachs, {h/t} III Capital Management

Even at the individual firm level within high-yield credit, the beta over the past three months is still lower than what occurred in the 2018 sell-off.

Source: Goldman Sachs, {h/t} III Capital Management

Source: Goldman Sachs, {h/t} III Capital Management

——————–

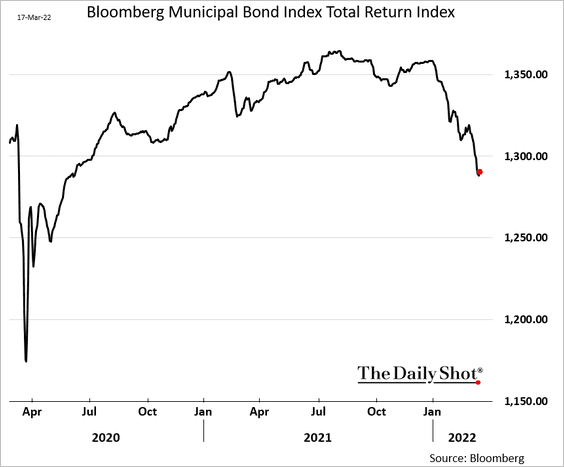

3. Muni bonds have been under pressure.

Back to Index

Rates

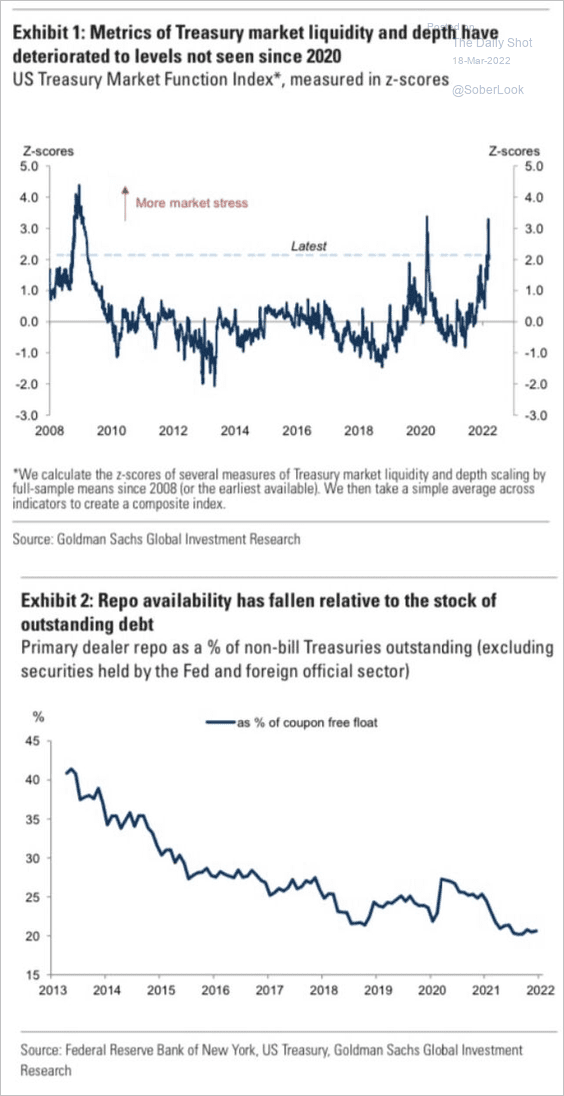

Treasury market liquidity has been worsening.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Global Developments

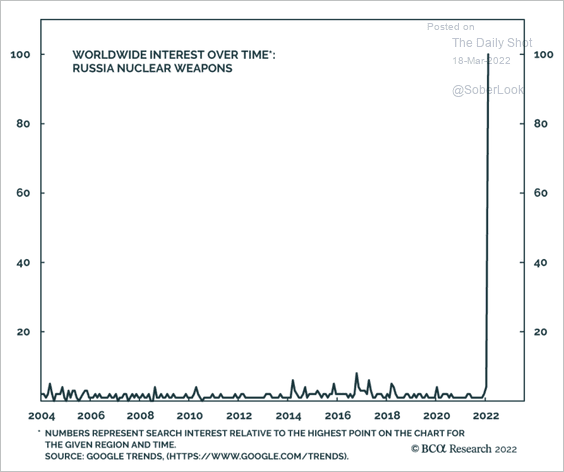

1. Google search activity for “Russia nuclear weapons” spiked.

Source: BCA Research

Source: BCA Research

This concern is not without merit.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

——————–

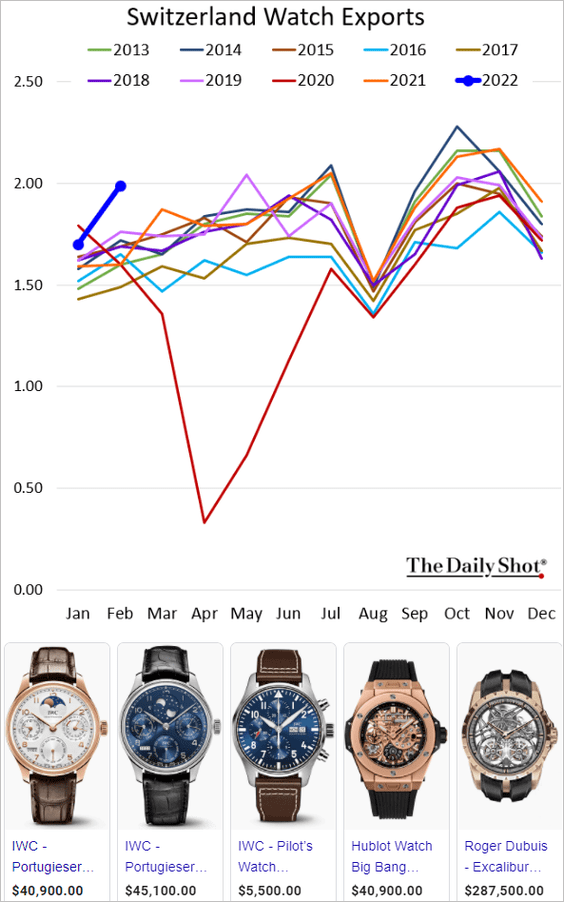

2. Swiss watch exports point to robust demand for luxury goods.

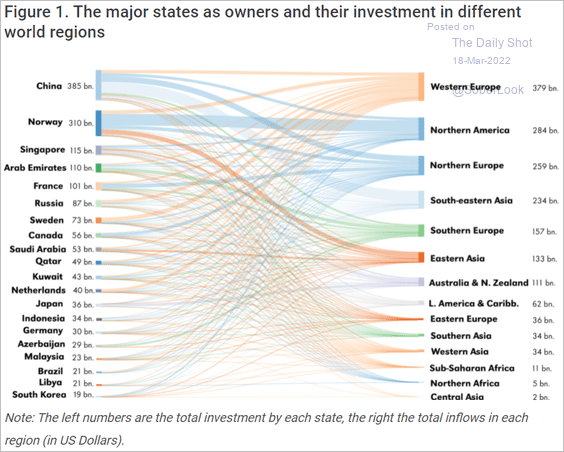

3. This graphic illustrates regional investments by sovereign wealth funds and state-owned enterprises.

Source: LSE Read full article

Source: LSE Read full article

——————–

Food for Thought

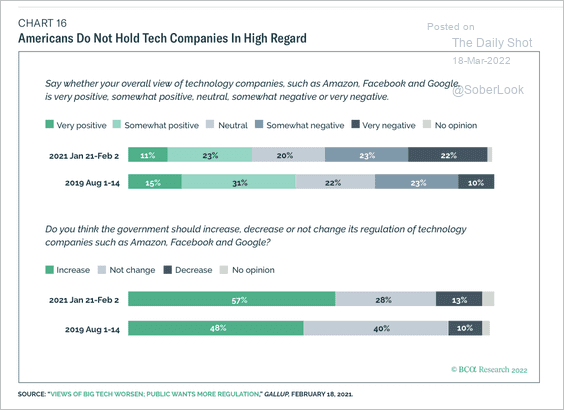

1. Americans’ views on tech companies:

Source: BCA Research

Source: BCA Research

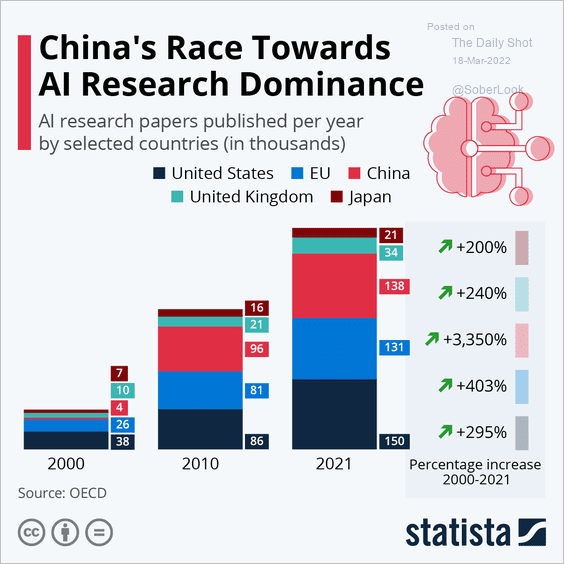

2. AI research papers:

Source: Statista

Source: Statista

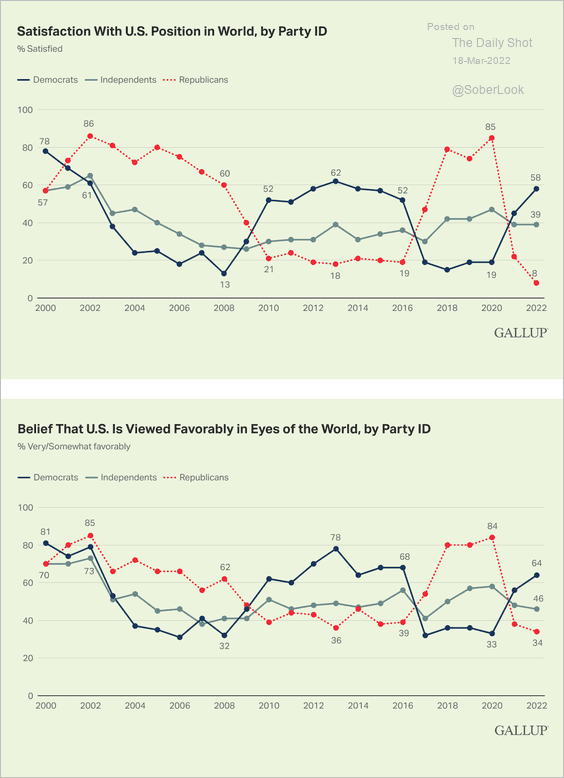

3. In mathematics, these are called “orthogonal” functions.

Source: Gallup Read full article

Source: Gallup Read full article

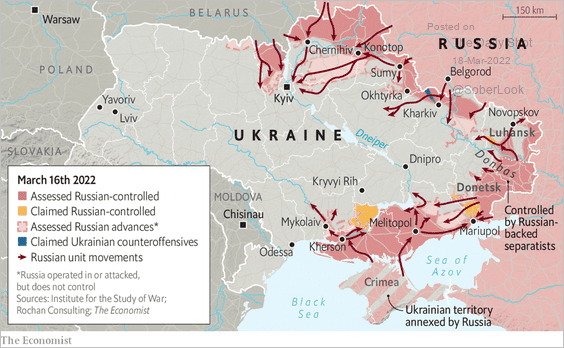

4. The Russian invasion (updated):

Source: The Economist Read full article

Source: The Economist Read full article

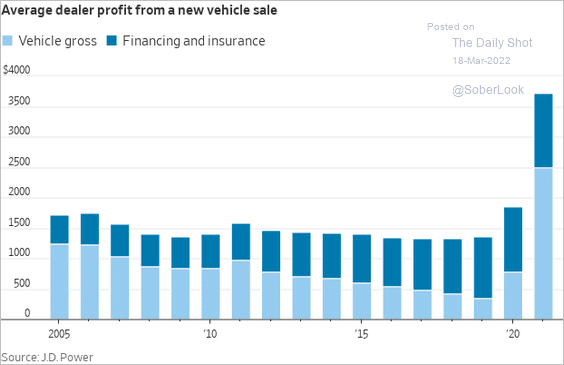

5. Average car dealer profit from a new vehicle sale:

Source: @WSJ Read full article

Source: @WSJ Read full article

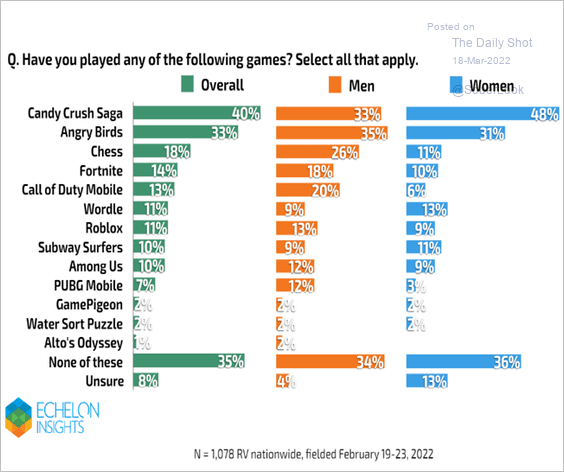

6. Video game popularity:

Source: ECHELON INSIGHTS Read full article

Source: ECHELON INSIGHTS Read full article

——————–

Have a great weekend!

Back to Index