The Daily Shot: 22-Mar-22

• Rates

• Equities

• Credit

• Energy

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• The United States

• Food for Thought

Rates

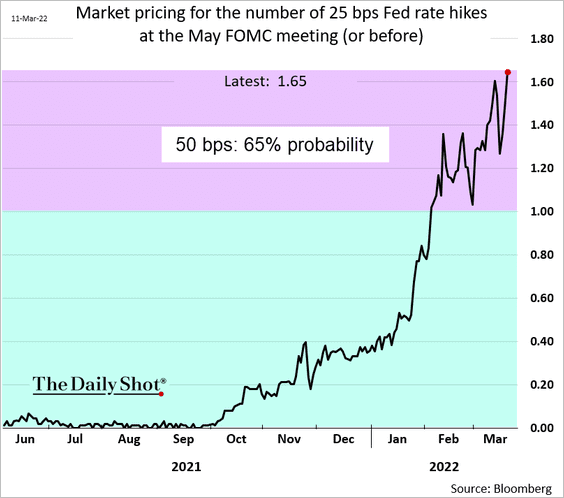

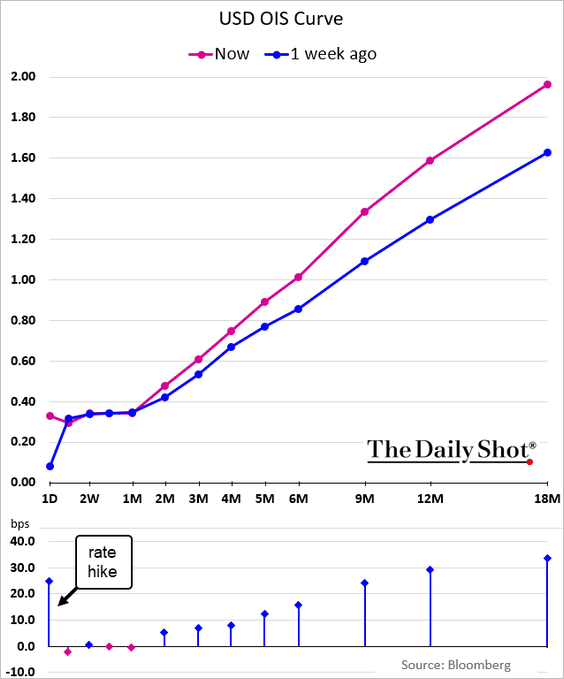

1. There was more hawkish rhetoric from Jerome Powell on Monday, indicating that he is open to one or more 50 bps rate hikes.

We will take the necessary steps to ensure a return to price stability. In particular, if we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so.

The probability of a 50 basis point increase in May (as opposed to 25 bps) climbed above 60%.

Source: Reuters Read full article

Source: Reuters Read full article

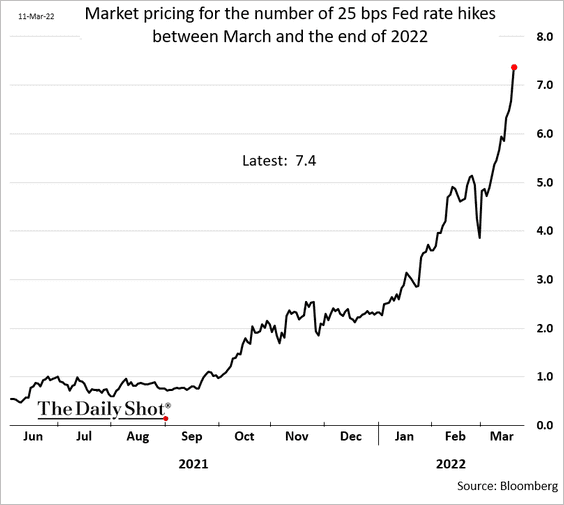

• Eight 25 bps rate hikes (seven in addition to the one we just had) this year have been fully priced in. Could we see nine?

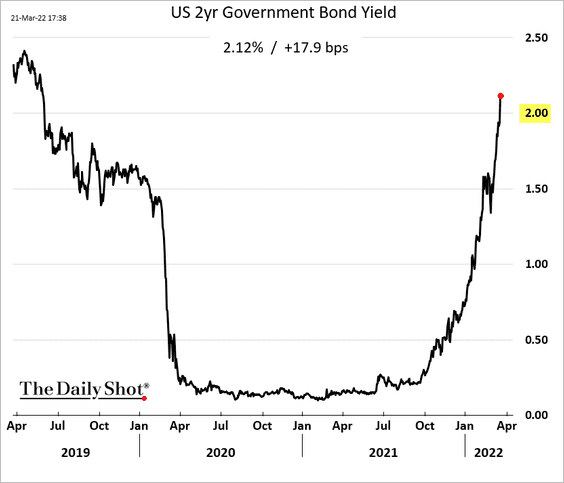

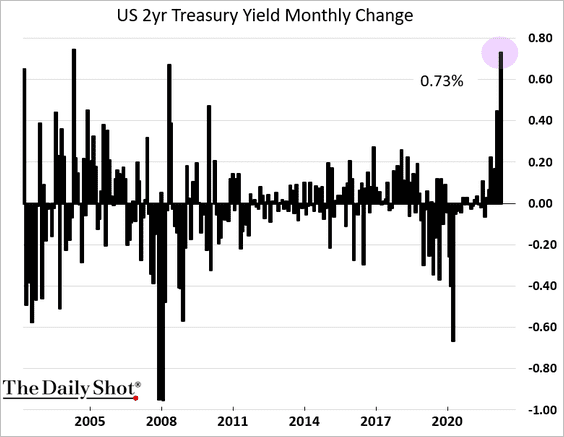

• The 2-year Treasury yield blasted past 2%.

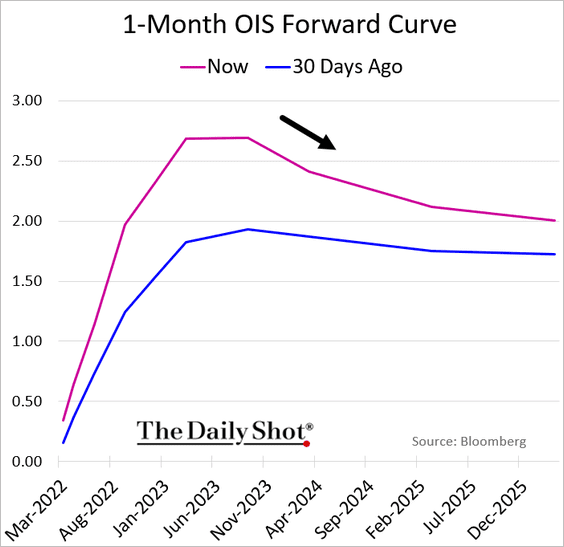

• The market is increasingly confident that the Fed will be cutting rates at the start of 2024.

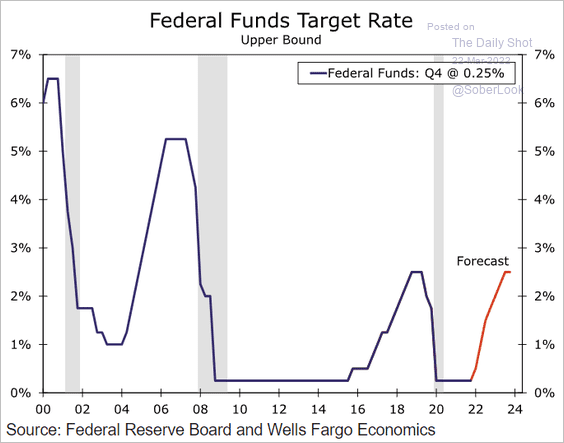

• At what point will the Fed stop raising rates? Here is a forecast from Wells Fargo (consistent with the peak in the chart above).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• The market expectations for the long-run (“terminal”) overnight rate jumped.

——————–

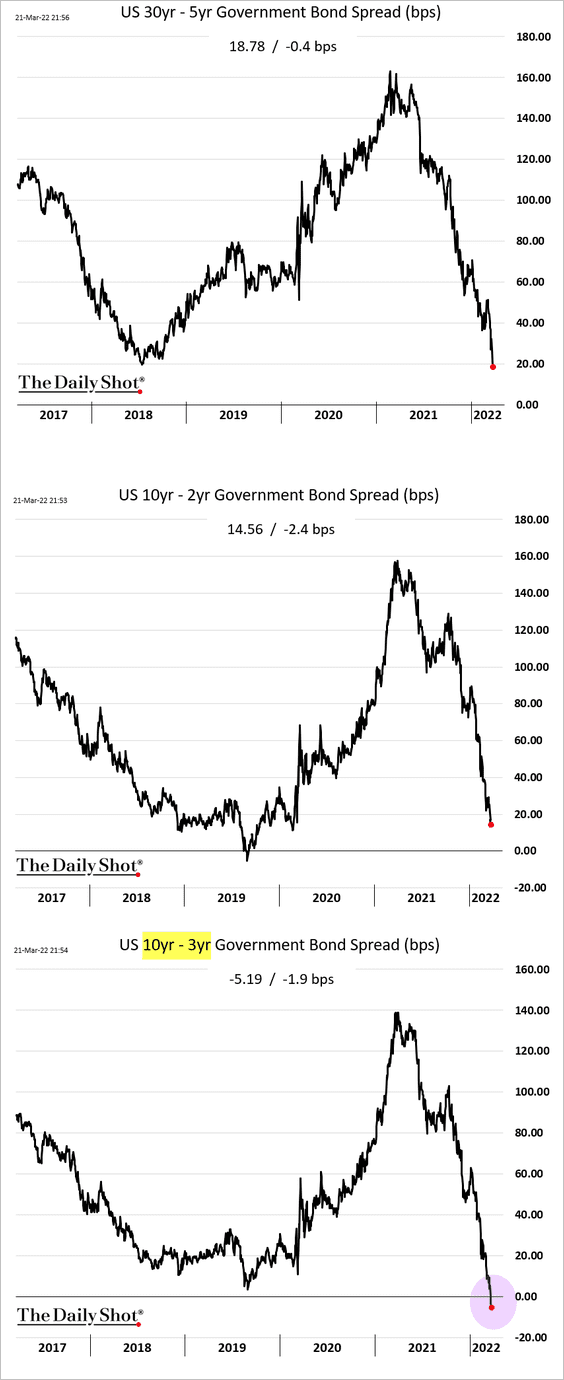

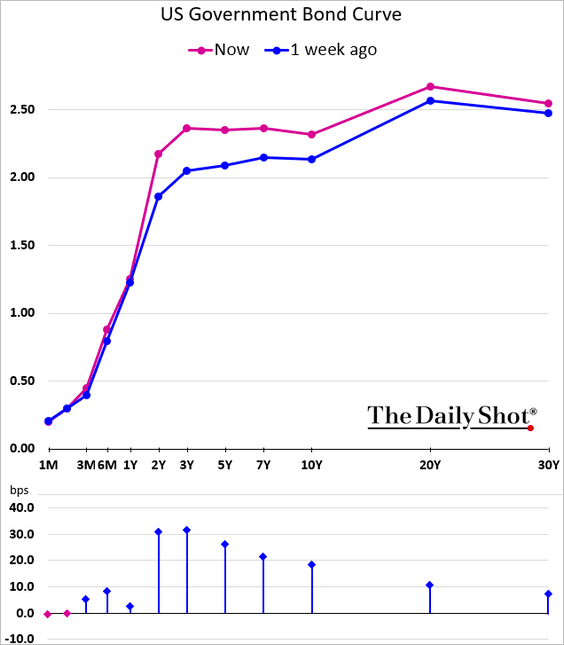

2. The Treasury curve is nearing inversion, with the 10yr – 3yr spread already in negative territory.

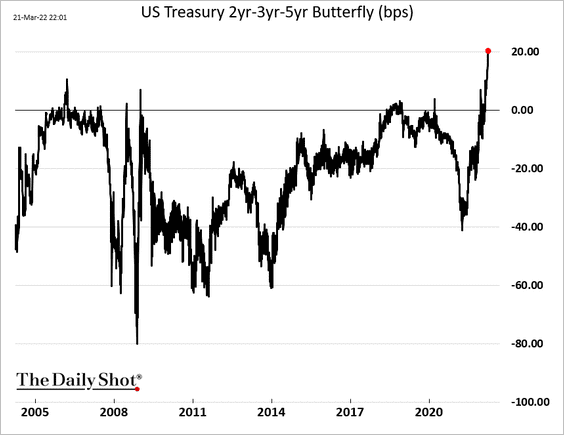

• The 2yr-3yr-5yr butterfly spread hit a multi-year high as the curve kinks around the three-year point.

——————–

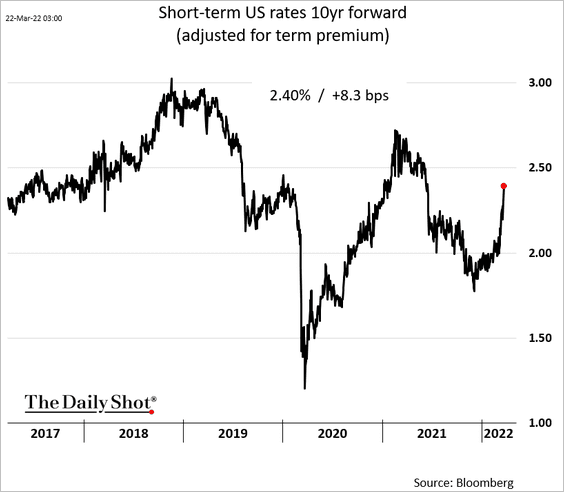

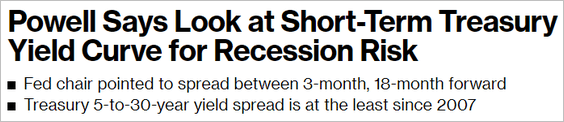

3. Powell suggested that we should be looking at the short end of the curve (which has been steepening) for signals on the economy.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

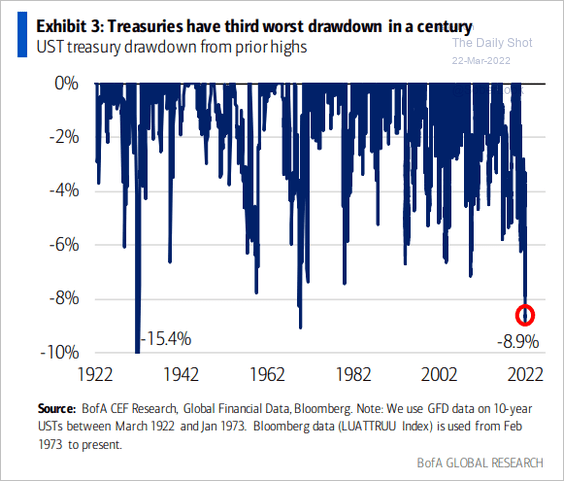

4. The drawdown in the Treasury market has been remarkable.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

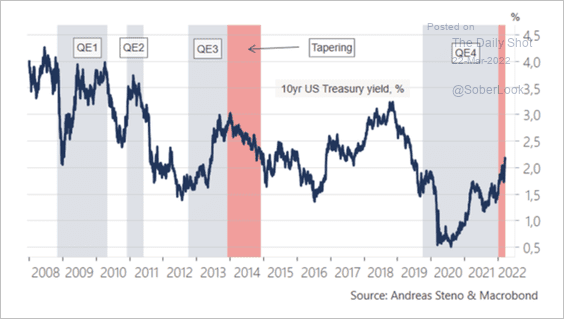

5. It’s worth noting that the 10-year Treasury yield tends to drop after the conclusion of quantitative easing.

Source: Andreas Steno Larsen Read full article

Source: Andreas Steno Larsen Read full article

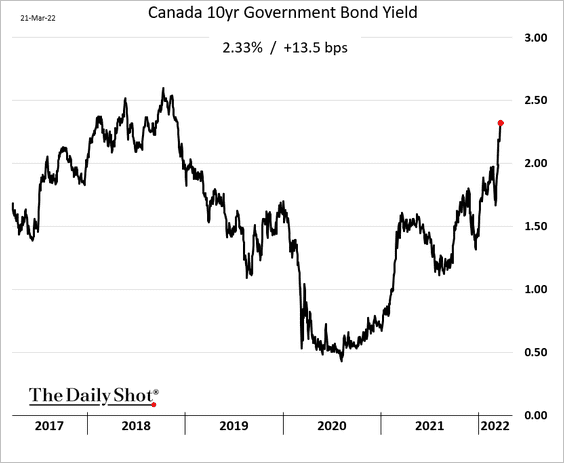

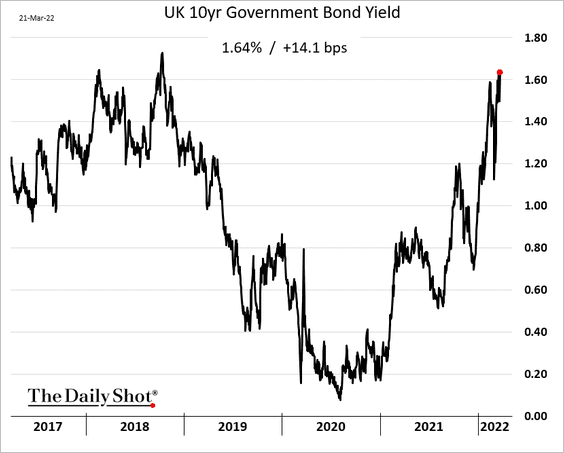

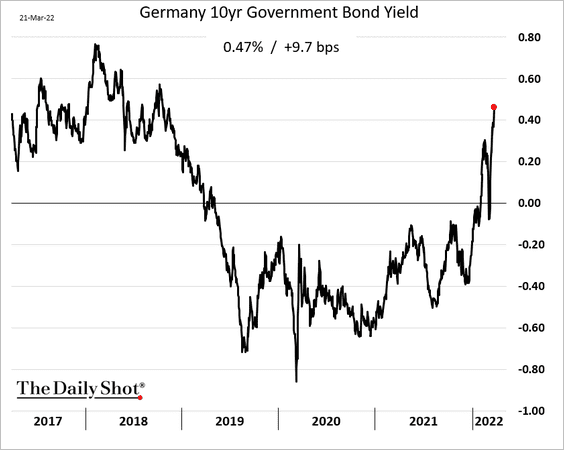

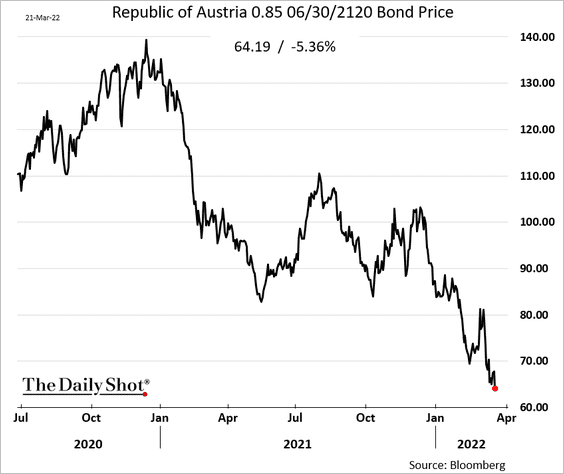

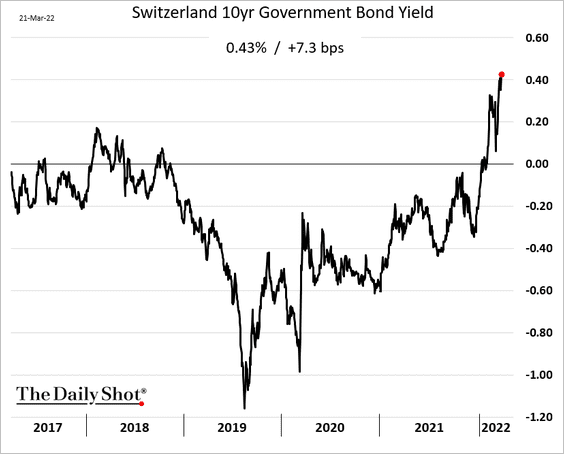

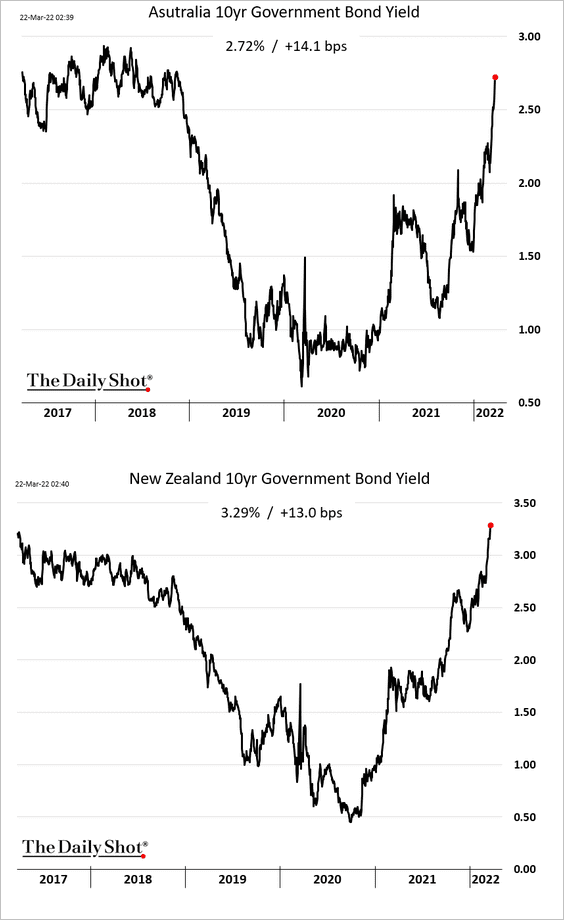

6. Global bond yields are surging.

• Canada:

• The UK:

• Germany:

By the way, here is Austria’s 100-year bond price.

• Switzerland:

• Australia and New Zealand:

Back to Index

Equities

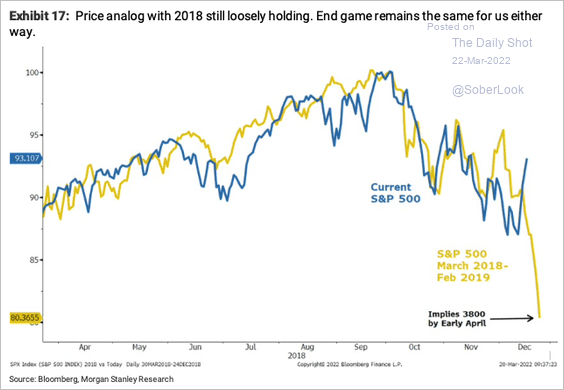

1. Stocks have been resilient in the face of an increasingly hawkish Federal Reserve. But if we follow the 2018-19 trend, there is more pain to come.

Source: Morgan Stanley Research; @SamRo

Source: Morgan Stanley Research; @SamRo

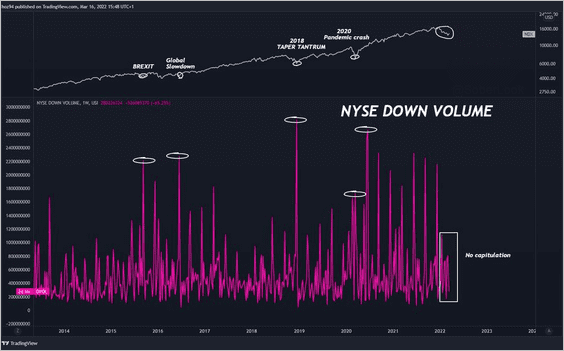

2. The latest selloff did not see the volume spike that tends to accompany investor capitulation.

Source: @MFHoz

Source: @MFHoz

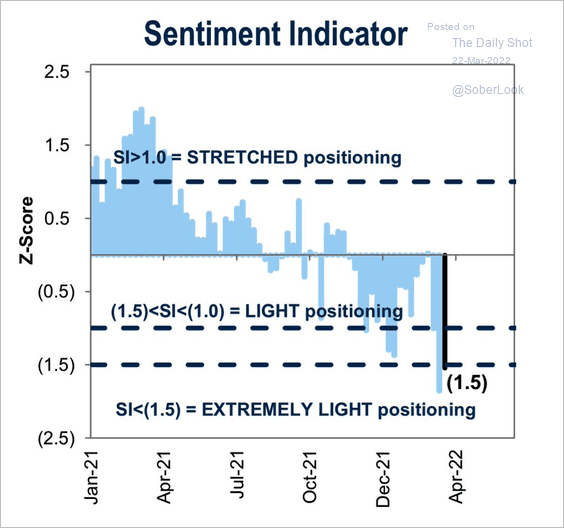

3. Positioning remains bearish.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

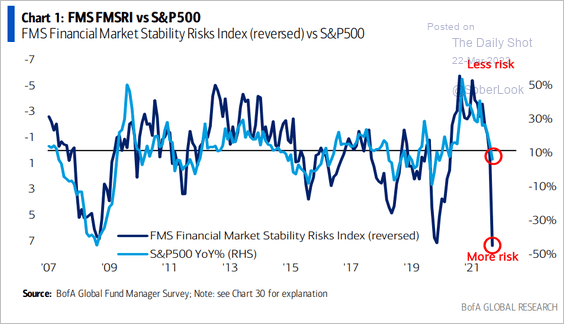

4. BofA’s Financial Stability Risks Index (based on the bank’s fund manager survey) points to downside risks for the market.

Source: BofA Global Research

Source: BofA Global Research

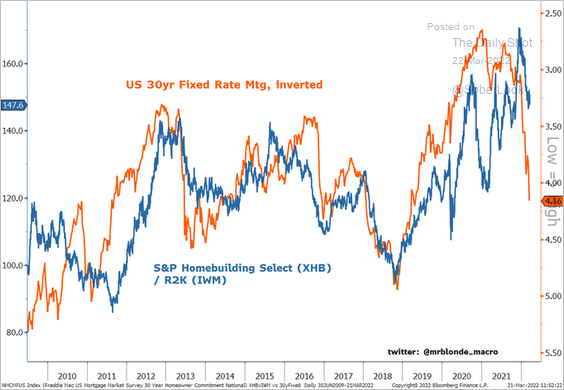

5. Downside risks for housing stocks have risen with bond yields.

Source: @MrBlonde_macro

Source: @MrBlonde_macro

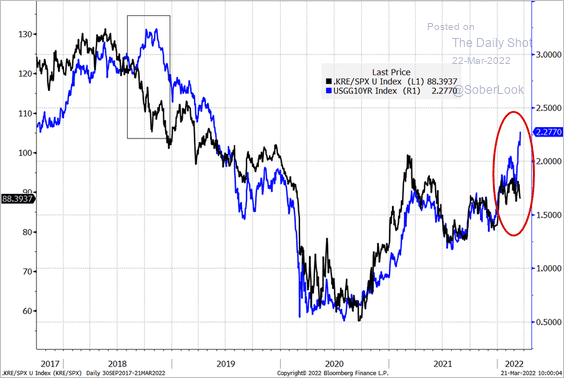

6. Banks are not keeping up with rising bond yields (chart shows the SPDR regional banking ETF relative to the S&P 500 vs. the 10yr yield).

Source: @MrBlonde_macro

Source: @MrBlonde_macro

Back to Index

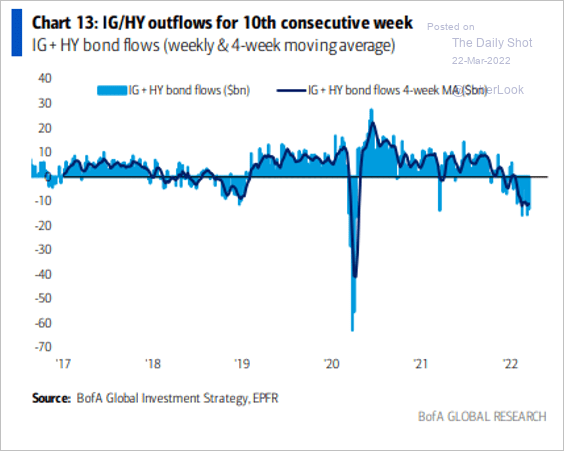

Credit

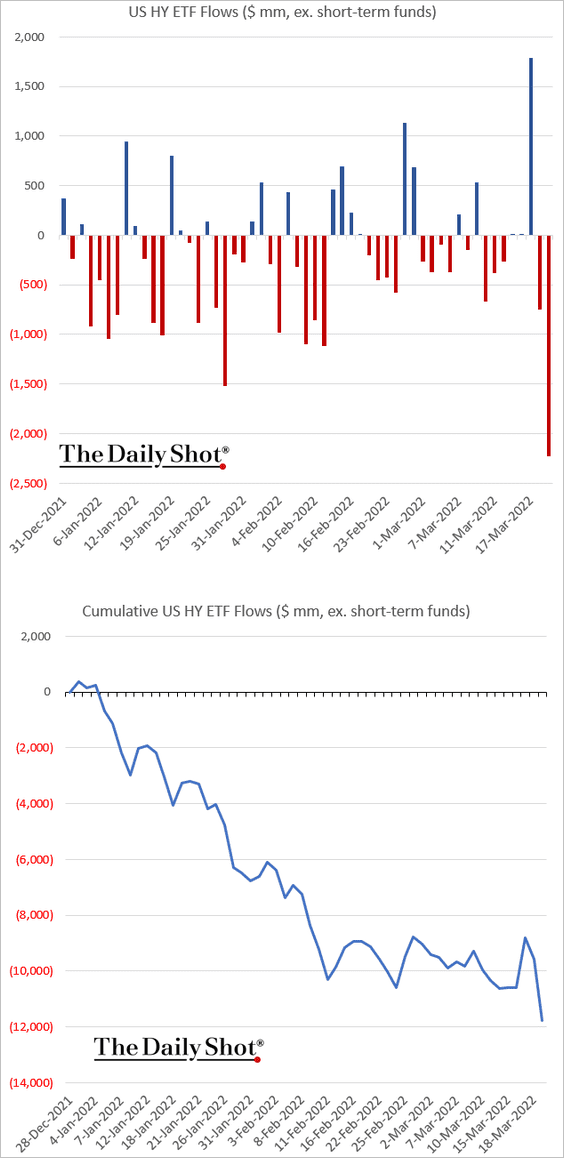

1. High-yield ETFs continue to see outflows.

Here is the situation for corporate credit as a whole.

Source: BofA Global Research; @Mayhem4Markets

Source: BofA Global Research; @Mayhem4Markets

——————–

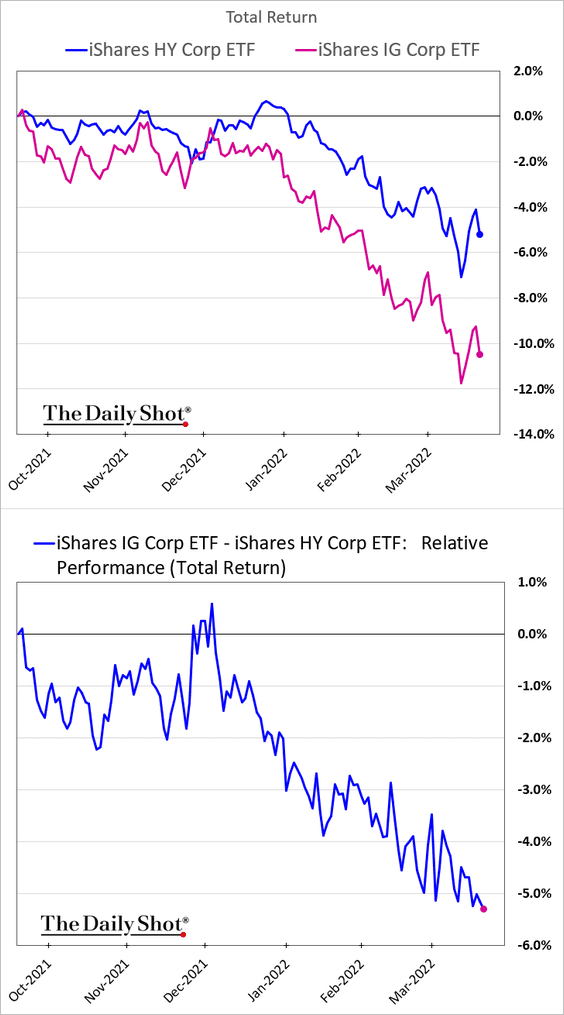

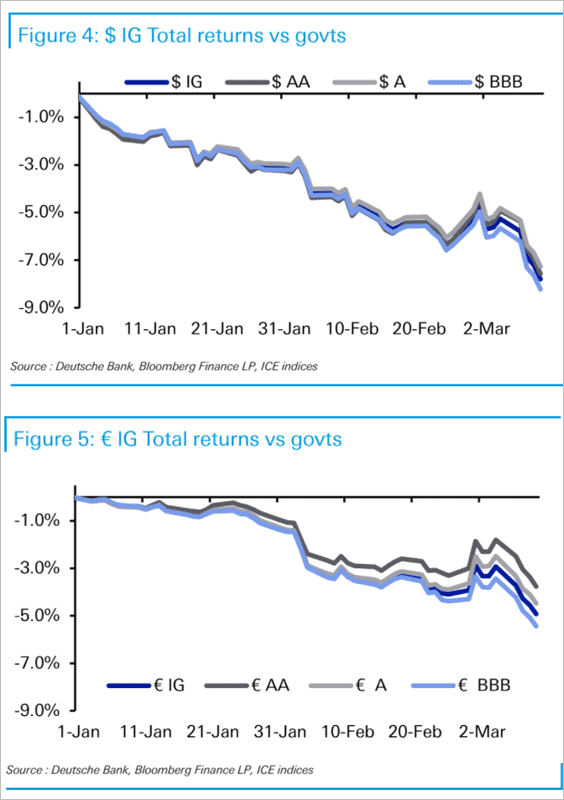

2. Investment-grade debt continues to underperform (2 charts).

Source: Deutsche Bank

Source: Deutsche Bank

Back to Index

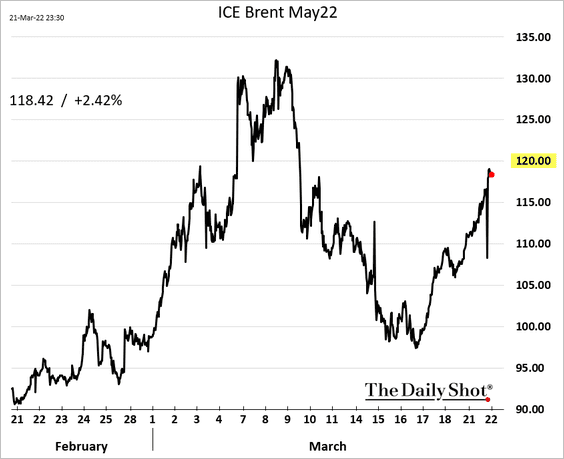

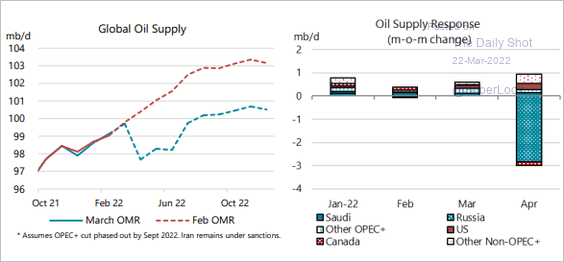

Energy

1. Brent crude is gunning for $120/bbl again.

• The disruption in global oil supplies is expected to be substantial.

Source: @JavierBlas, @IEA

Source: @JavierBlas, @IEA

• Will the EU stop buying Russian oil?

Source: Reuters Read full article

Source: Reuters Read full article

——————–

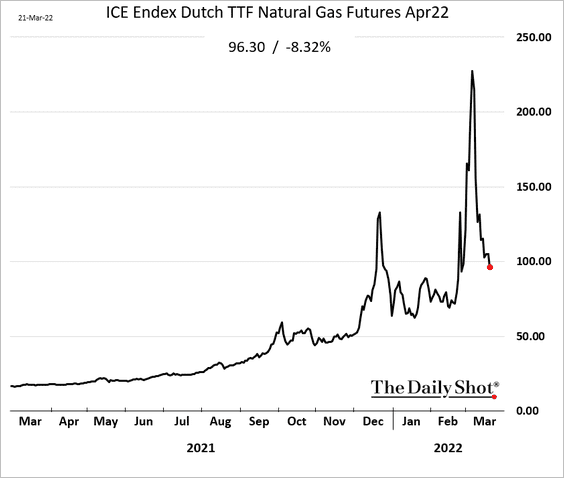

2. European natural gas futures dropped below €100/MWh as Russian gas keeps flowing.

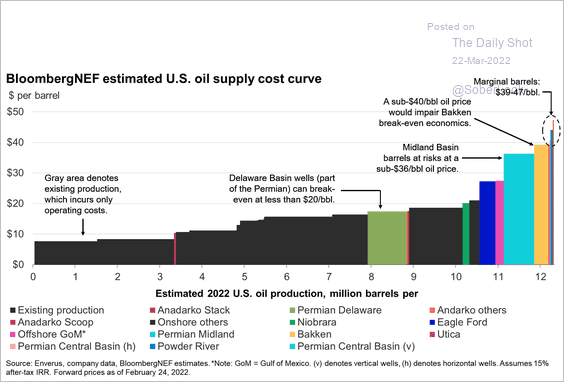

3. This chart shows the US oil supply cost curve.

Source: @BloombergNEF Read full article

Source: @BloombergNEF Read full article

Back to Index

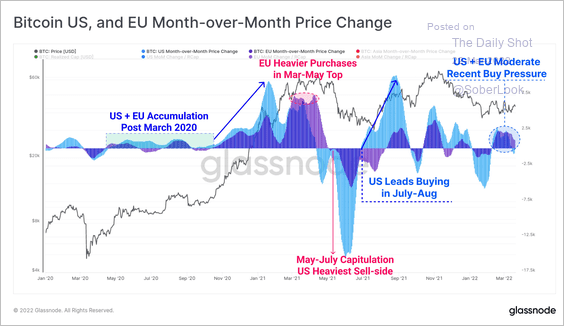

Cryptocurrency

1. Bitcoin’s buying pressure is strongest during US and European trading hours, while a majority of selling pressure occurs during Asia hours.

Source: @glassnode

Source: @glassnode

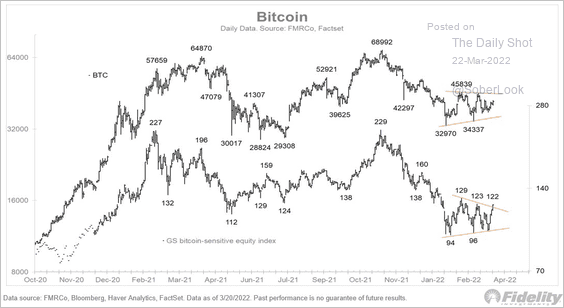

2. Bitcoin-sensitive stocks are starting to outperform BTC.

Source: @TimmerFidelity

Source: @TimmerFidelity

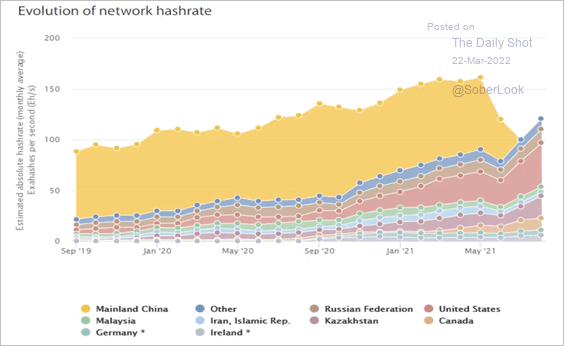

3. The US, Kazakhstan, and Russia have taken the reins of hashrate dominance (computing power) since China’s mining ban took effect.

Source: @Aoyon_A

Source: @Aoyon_A

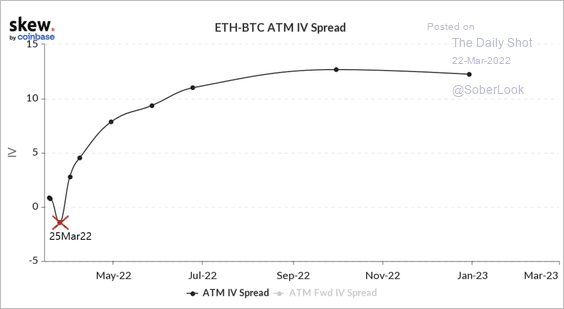

4. Ether’s short-term volatility is trading at a discount relative to bitcoin.

Source: Skew Read full article

Source: Skew Read full article

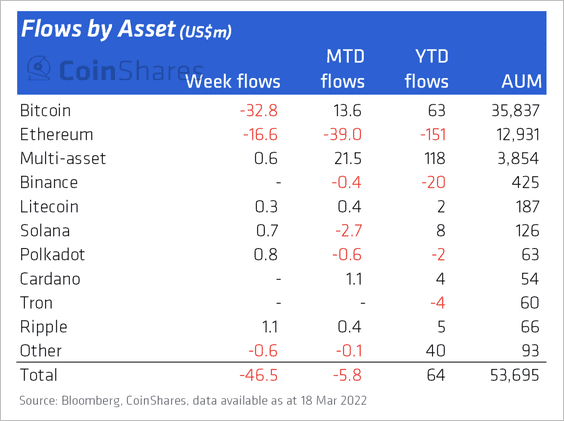

5. Crypto investment products saw the second consecutive week of outflows, led by Bitcoin and Ethereum funds.

Source: CoinShares Read full article

Source: CoinShares Read full article

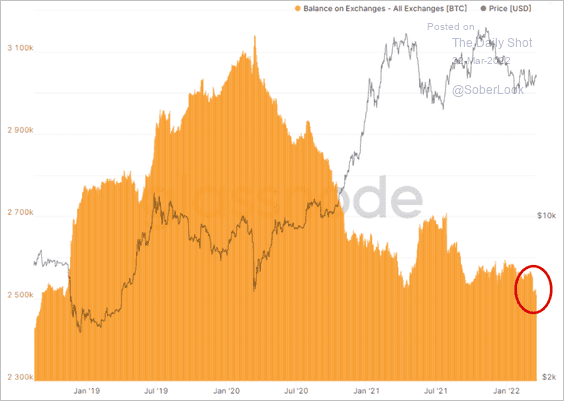

6. Bitcoin balances at crypto exchanges continue to move lower.

Source: Glassnode Read full article

Source: Glassnode Read full article

Back to Index

Emerging Markets

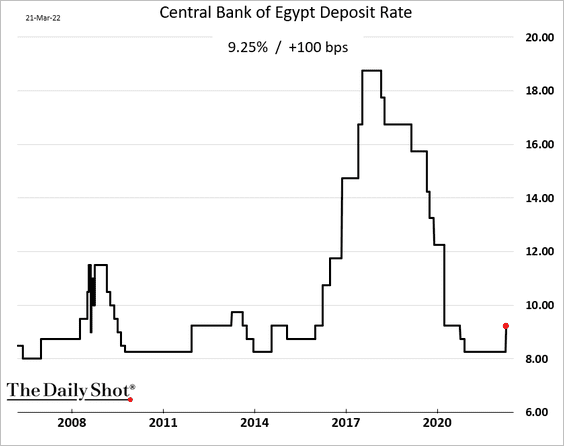

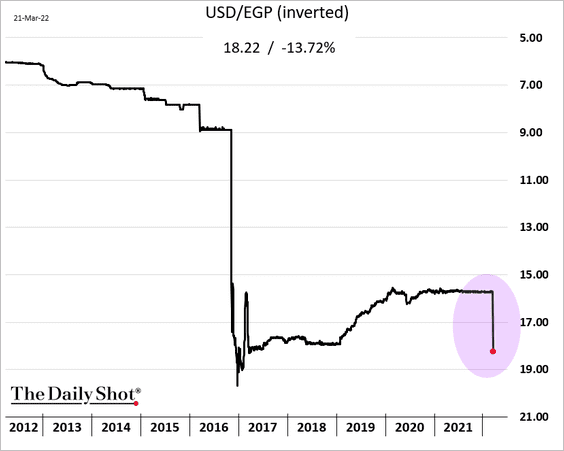

1. Egypt hiked rates, …

… and the Egyptian pound dropped 14% amid deteriorating foreign reserves.

Source: Al Jazeera Read full article

Source: Al Jazeera Read full article

——————–

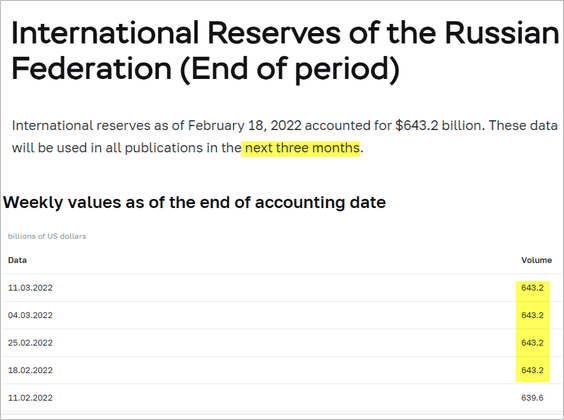

2. Russia is no longer publishing its FX reserves.

Source: Bank of Russia Read full article

Source: Bank of Russia Read full article

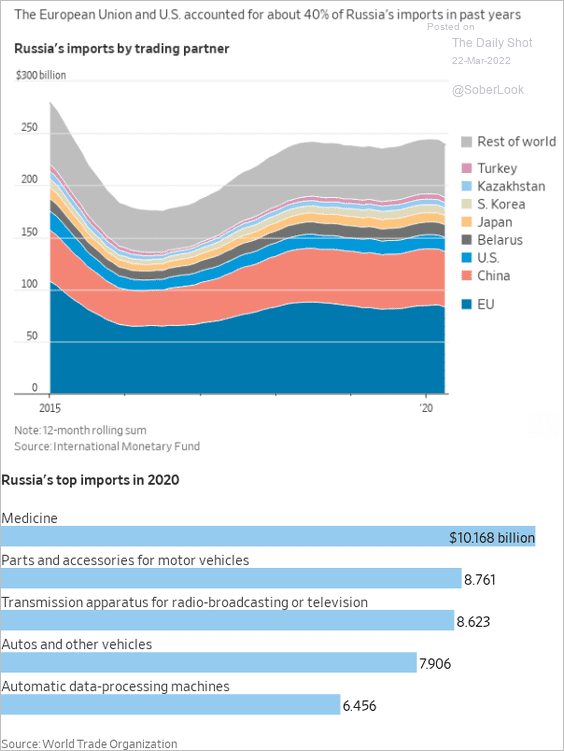

Separately, this chart shows Russia’s imports by source and product.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

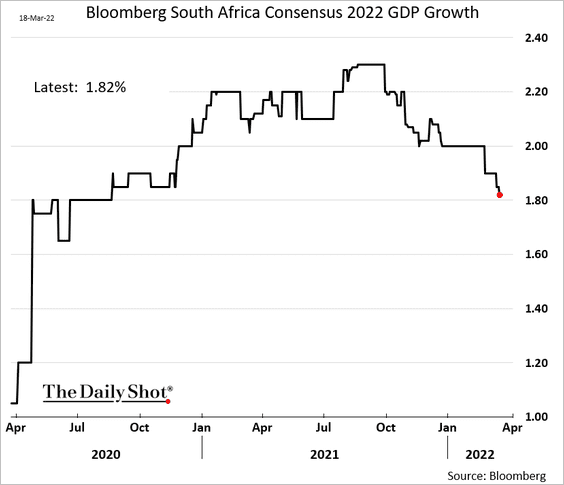

3. Economists are downgrading South Africa’s growth forecasts.

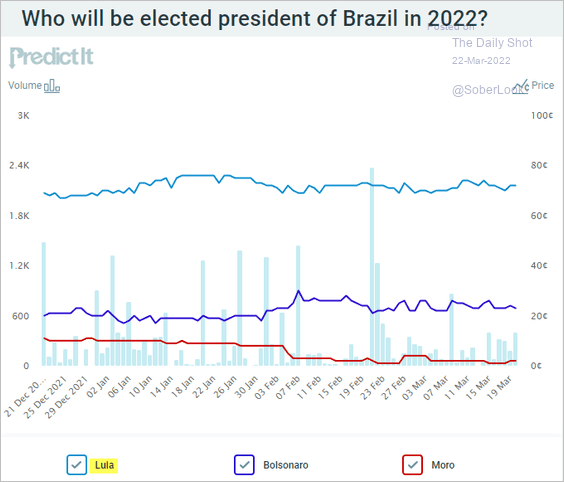

4. Brazil will complete Latin America’s political shift to the left.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @PredictIt

Source: @PredictIt

Back to Index

China

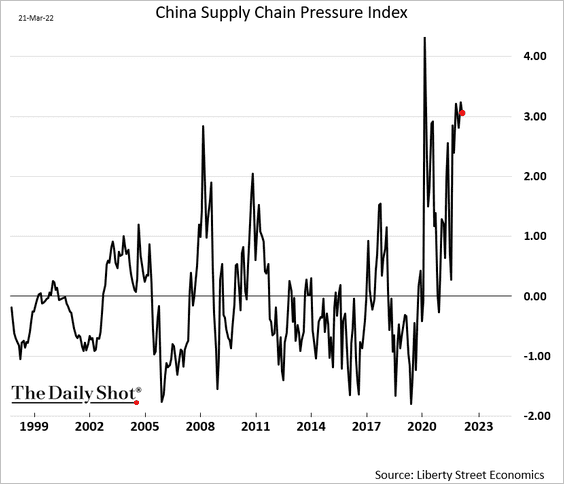

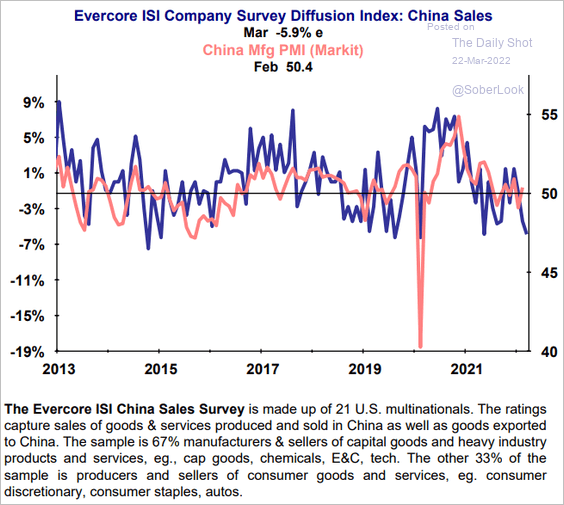

1. Supply stresses remain elevated.

2. The Evercore ISI survey of multinationals points to weakens in business activity ahead.

Source: Evercore ISI Research

Source: Evercore ISI Research

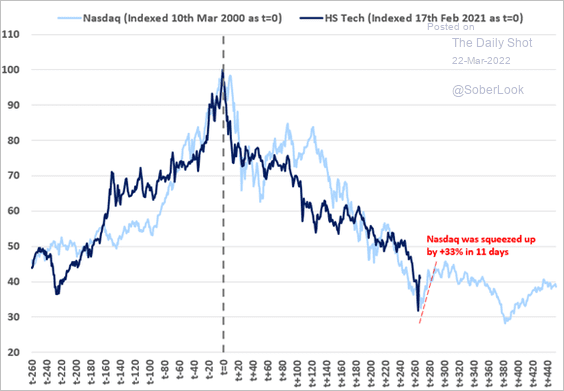

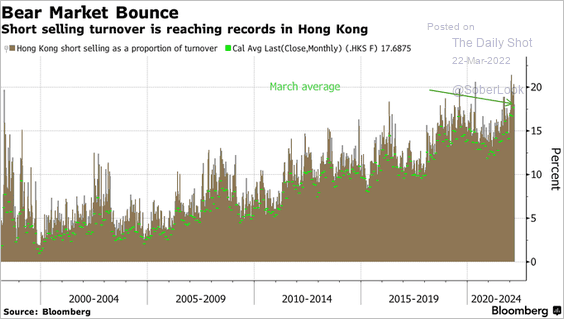

3. More downside risks for Hong Kong stocks?

Source: Morgan Stanley Research; @SofiaHCBBG

Source: Morgan Stanley Research; @SofiaHCBBG

Short-selling turnover has been climbing.

Source: @SofiaHCBBG

Source: @SofiaHCBBG

Back to Index

Asia – Pacific

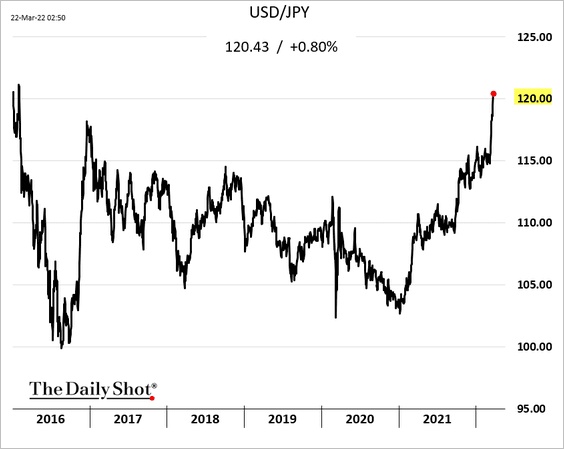

1. Dollar-yen surged above 120 as the monetary policies diverge. The yen no longer trades as a safe-haven currency.

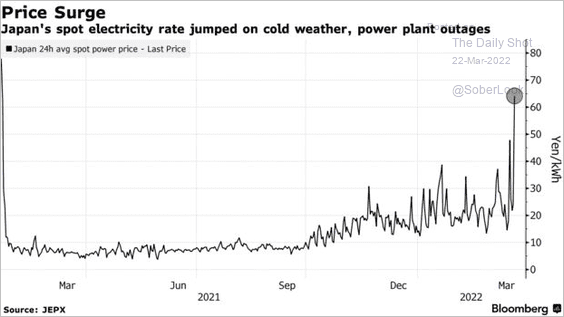

Separately, Tokyo electricity prices soared this week.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

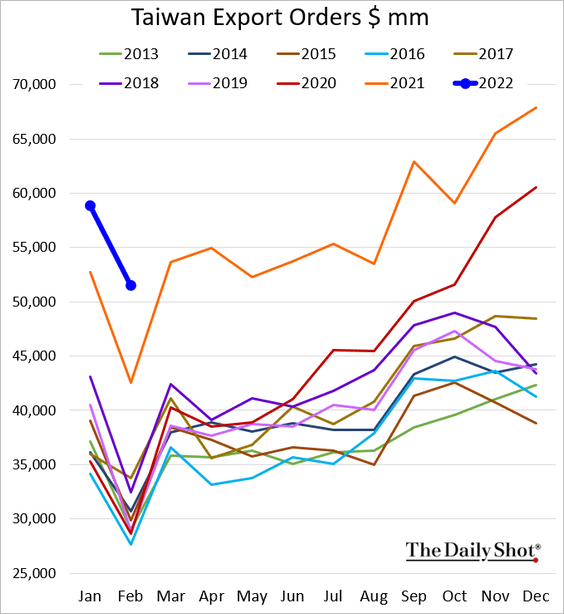

2. Taiwan’s export orders remain very strong, topping forecasts.

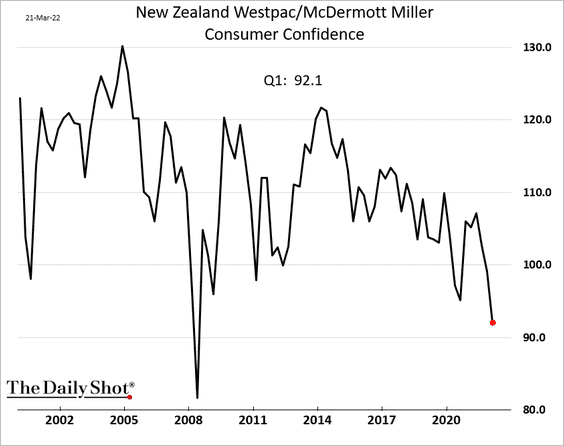

3. Consumer sentiment in New Zealand hit the lowest level since 2008.

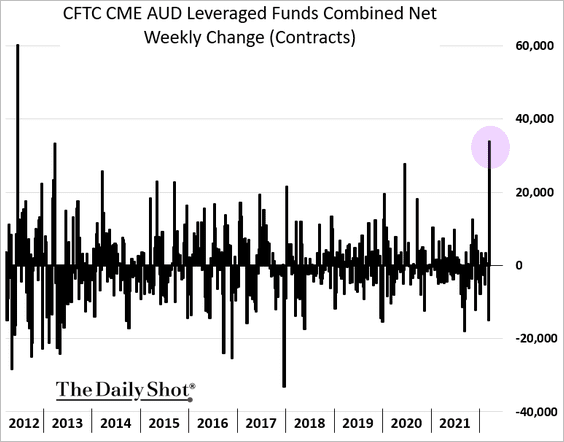

4. Next, we have some updates on Australia.

• Hedge funds covered their AUD shorts last week as Beijing stepped in to support China’s markets.

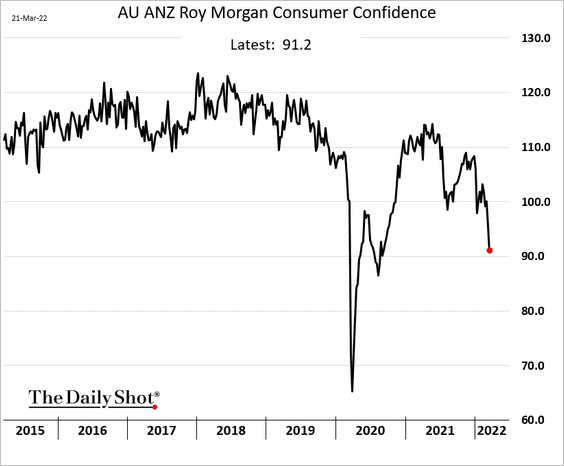

• Consumer confidence keeps deteriorating.

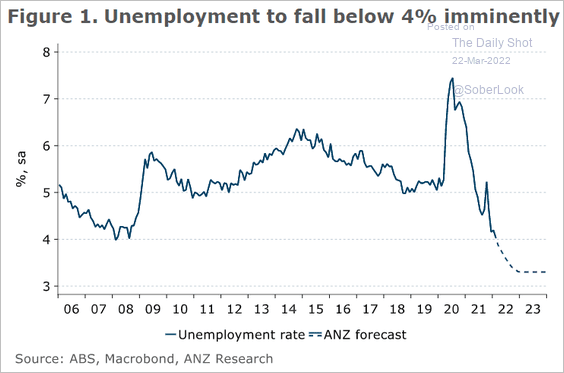

• The labor market is moving into uncharted territory.

Source: ANZ Research

Source: ANZ Research

Back to Index

The Eurozone

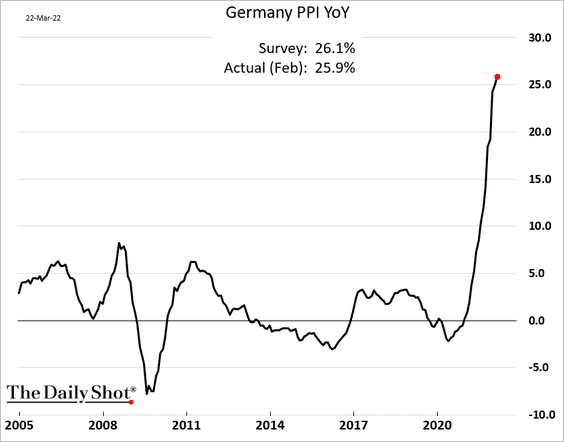

1. Germany’s PPI blasts past 25%.

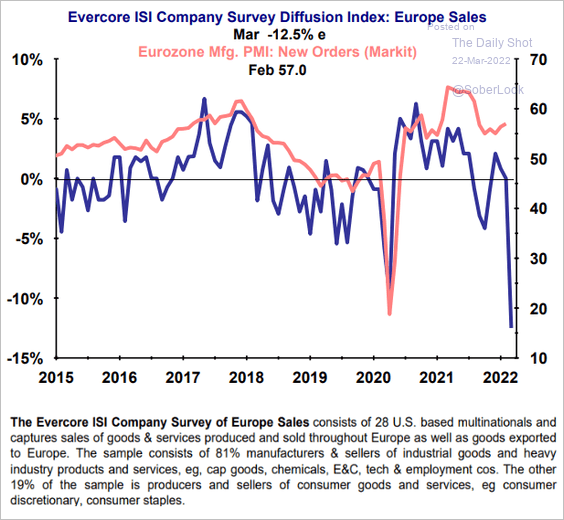

2. The Evercore ISI survey of multinationals points to a weak Eurozone PMI report.

Source: Evercore ISI Research

Source: Evercore ISI Research

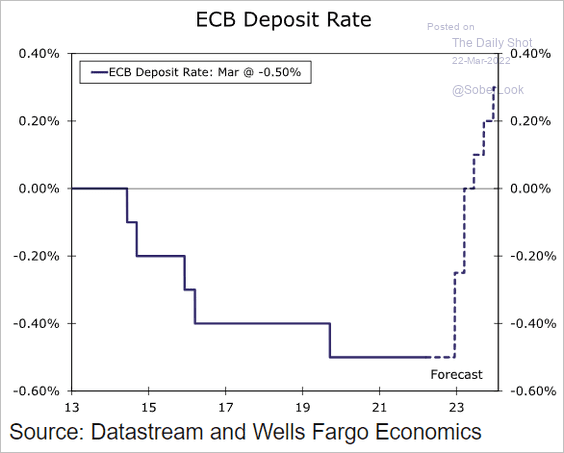

3. Wells Fargo expects “a 25 bps ECB rate increase in December 2022 and another 25 bps rate increase in March 2023”.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

The United States

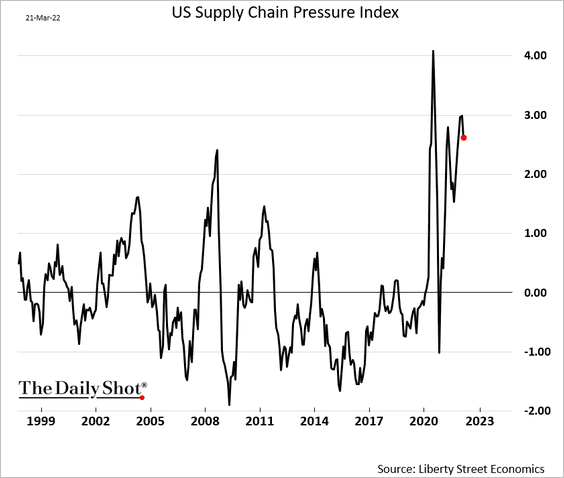

1. Supply chain stress levels remain elevated.

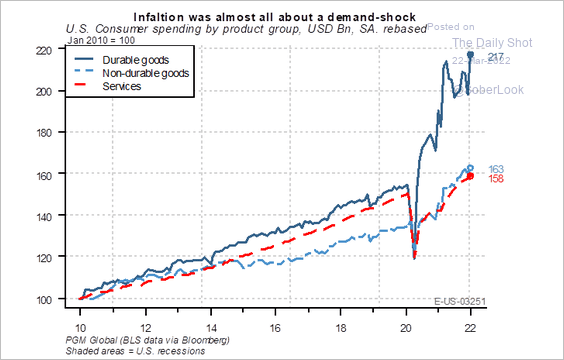

One way to ease supply issues (and therefore inflation) is by slowing consumer demand. Will the Fed’s aggressive rate hikes accomplish this without forcing the economy into recession?

Source: PGM Global

Source: PGM Global

——————–

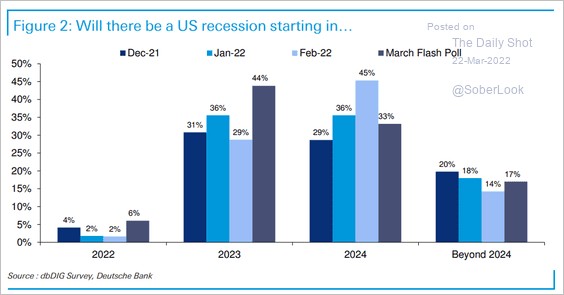

2. When is the start of the next recession? Here is a survey from Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

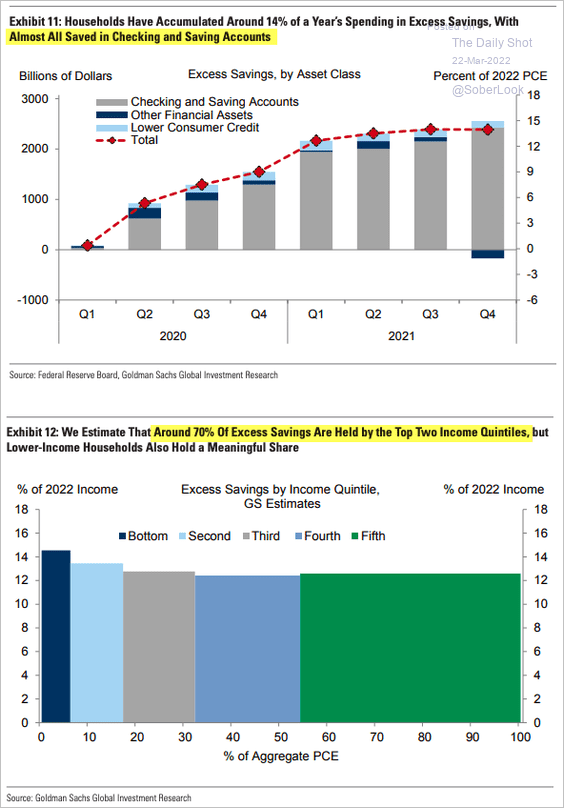

3. Next, we have some data on household excess savings.

Source: Goldman Sachs; @SamRo

Source: Goldman Sachs; @SamRo

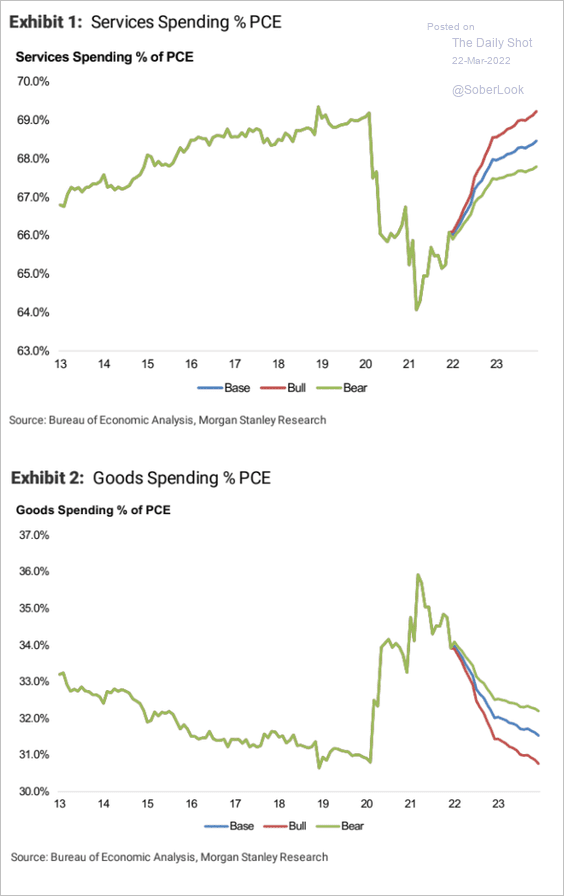

4. How long will it take for goods and services spending to revert to pre-pandemic levels?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

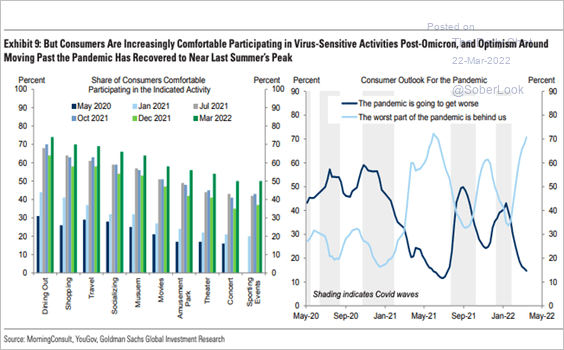

5. COVID concerns among US consumers continue to ease.

Source: Goldman Sachs; @SamRo

Source: Goldman Sachs; @SamRo

——————–

Food for Thought

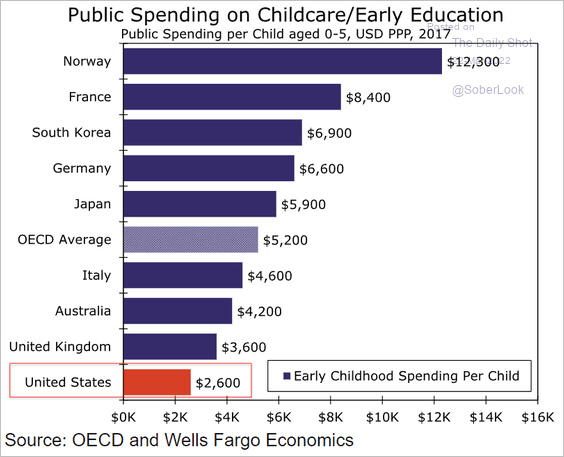

1. Public spending on childcare and early education:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

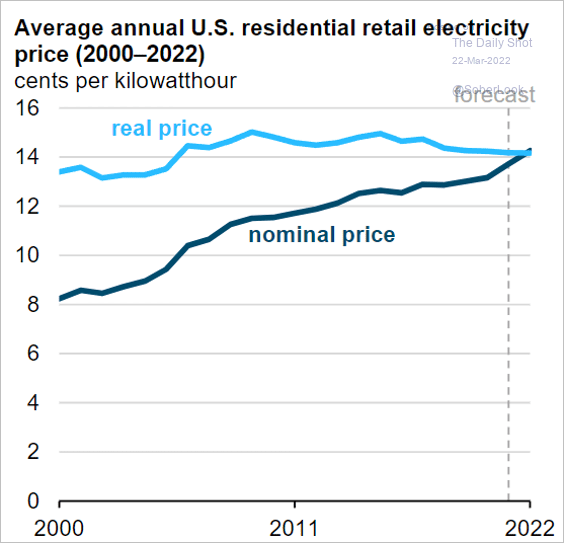

2. US residential retail electricity price:

Source: EIA Read full article

Source: EIA Read full article

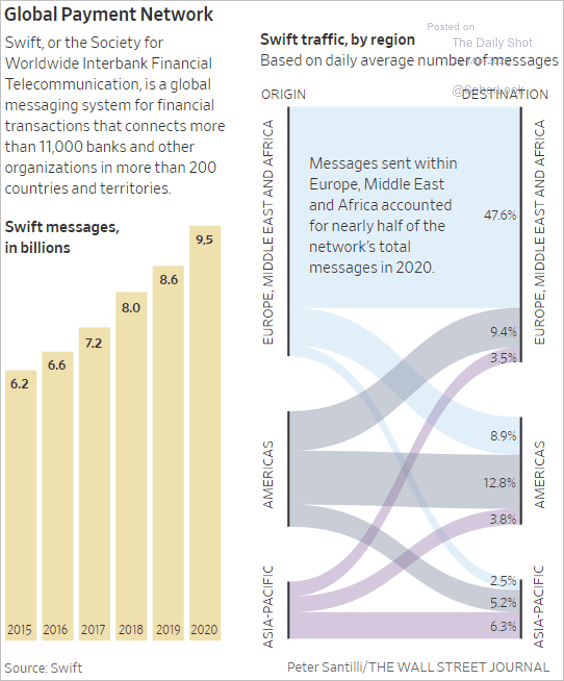

3. The SWIFT payment network

Source: @WSJ Read full article

Source: @WSJ Read full article

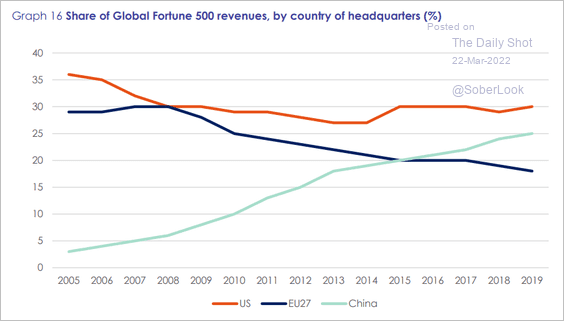

4. Share of global Fortune 500 revenues:

Source: EC Read full article

Source: EC Read full article

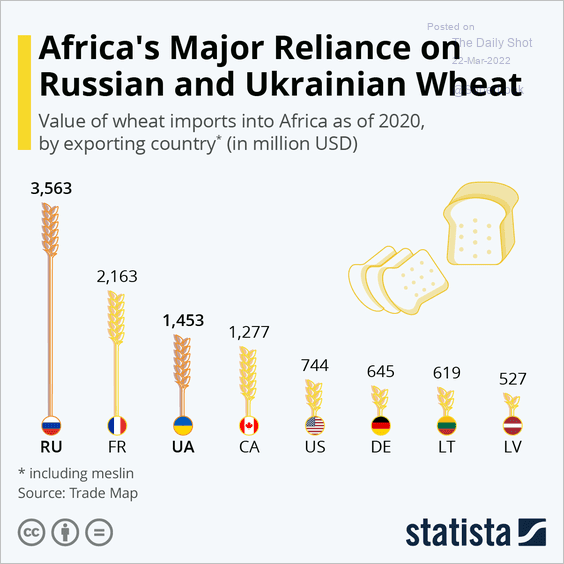

5. African wheat imports by source:

Source: Statista

Source: Statista

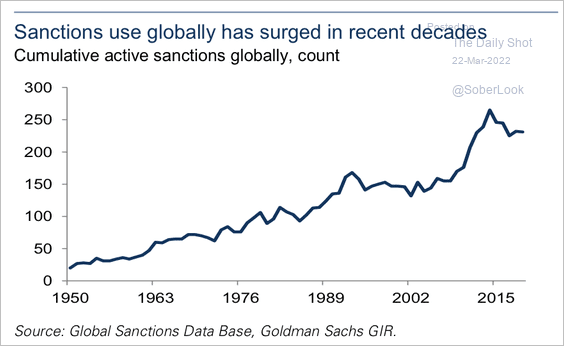

6. Sanctions’ use globally:

Source: Goldman Sachs

Source: Goldman Sachs

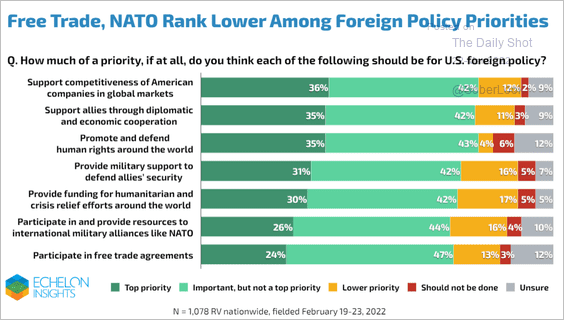

7. Support for US foreign policy initiatives:

Source: Echelon Insights Read full article

Source: Echelon Insights Read full article

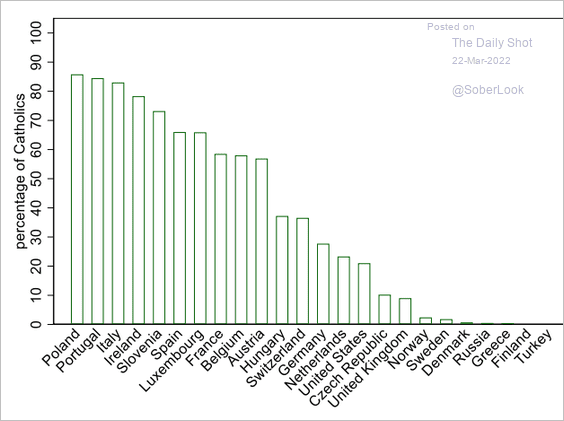

8. The percentage of Catholics by country in Europe:

Source: ECB Read full article

Source: ECB Read full article

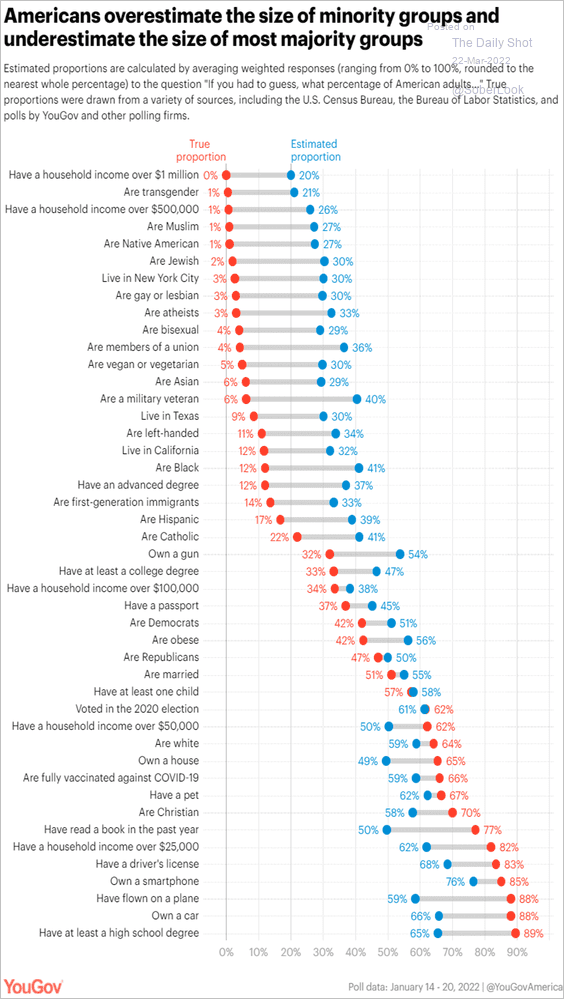

9. Overestimating the size of minority groups:

Source: YouGov Read full article

Source: YouGov Read full article

——————–

Back to Index