The Daily Shot: 23-Mar-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

1. Let’s begin with the housing market.

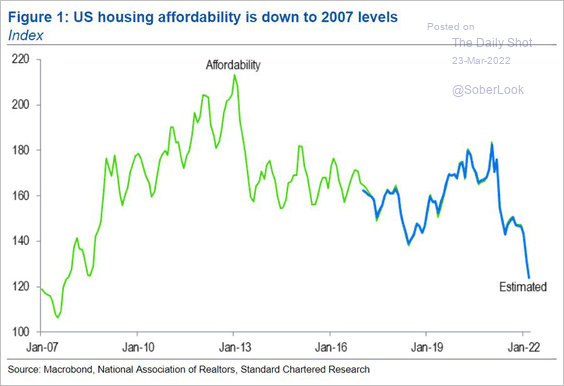

• This estimate of housing affordability from Standard Chartered takes us back to the housing bubble era.

Source: Standard Chartered; @lisaabramowicz1

Source: Standard Chartered; @lisaabramowicz1

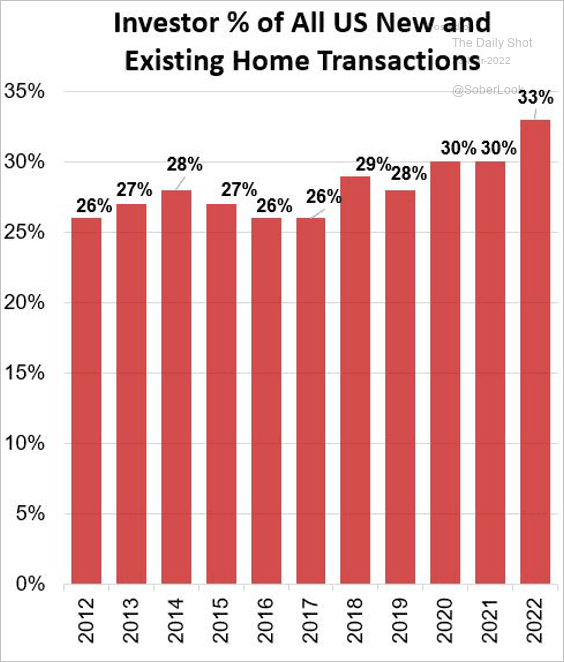

• Investors’ share of the housing market hit a multi-year high.

Source: @johnburnsjbrec

Source: @johnburnsjbrec

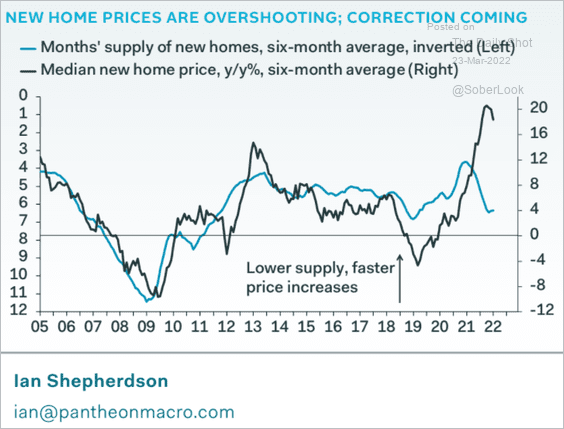

• Are new home prices facing a correction?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

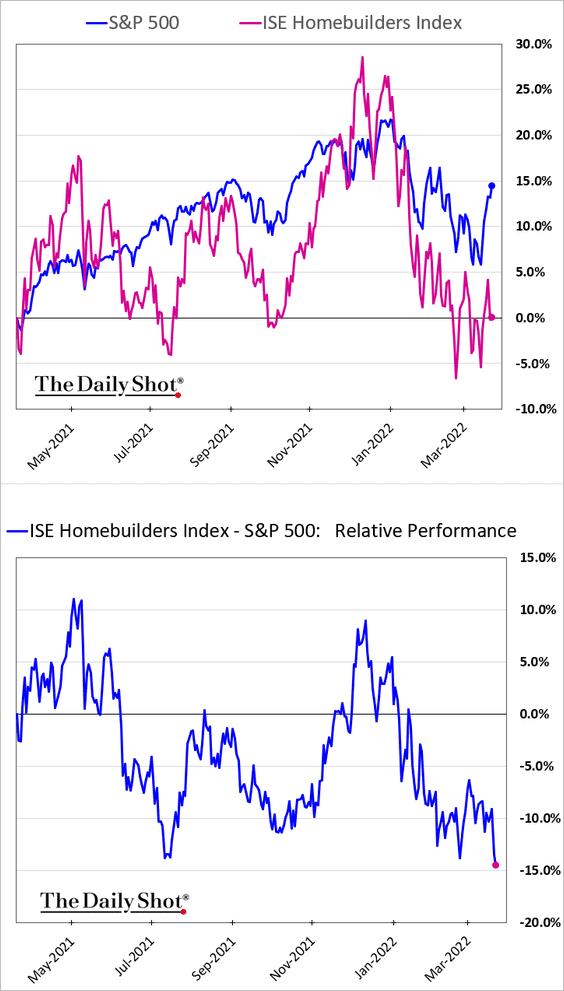

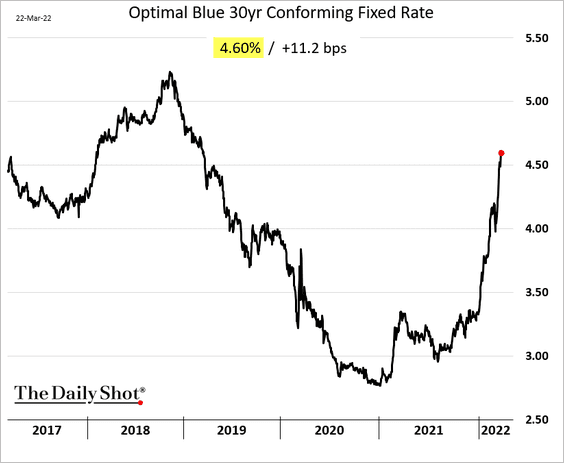

• Homebuilder shares are underperforming, …

… as mortgage rates hit the highest level in three years.

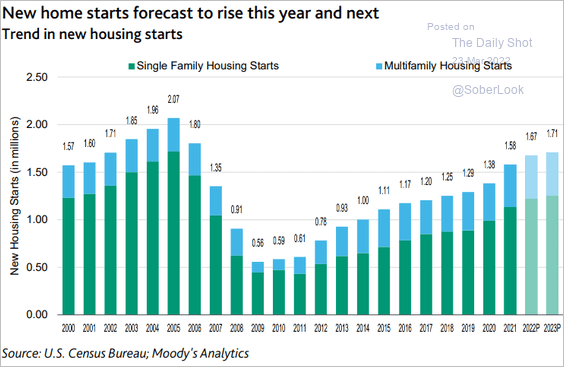

• Despite some of the headwinds, Moody’s expects residential construction activity to keep climbing.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

——————–

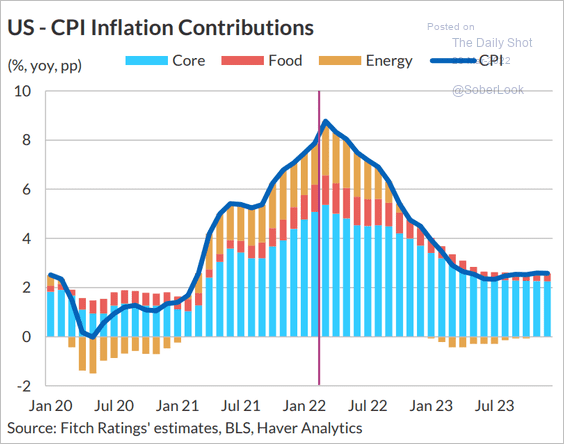

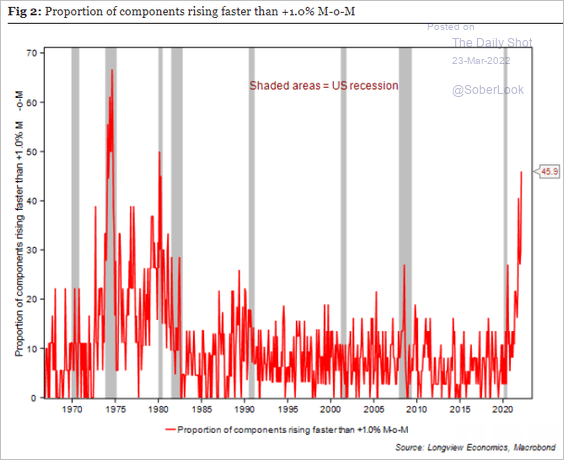

2. Next, we have some updates on inflation.

• Inflation is expected to peak just below 9%, according to Fitch Ratings.

Source: Fitch Ratings

Source: Fitch Ratings

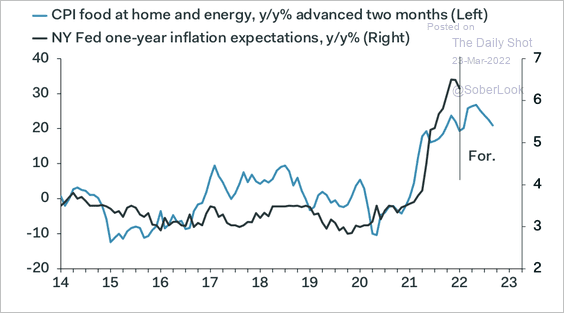

• Consumer inflation expectations could be nearing a peak.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Here is the proportion of CPI components rising faster than 1% month-over-month.

Source: Longview Economics

Source: Longview Economics

——————–

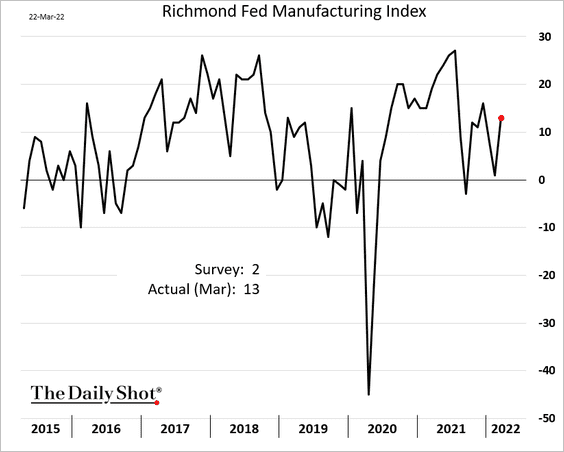

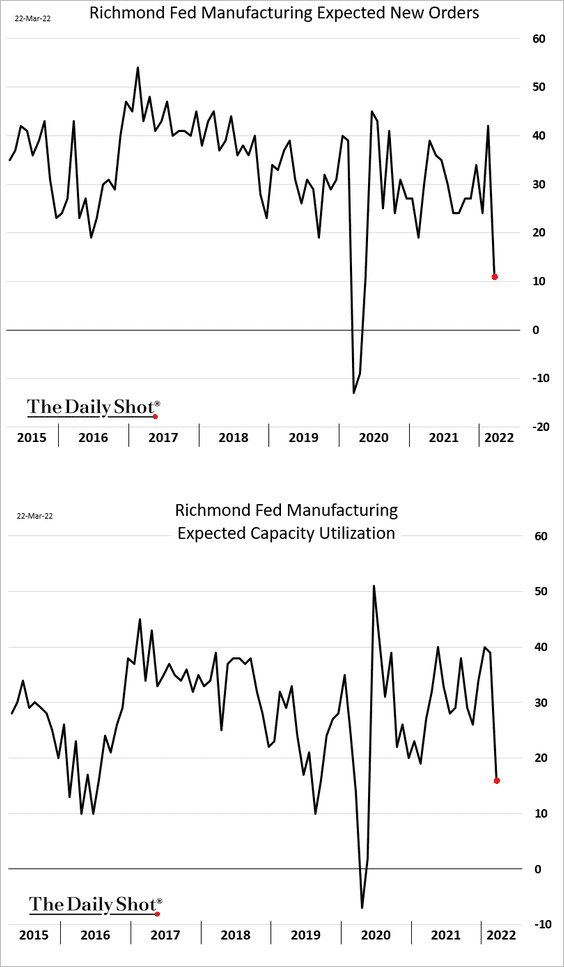

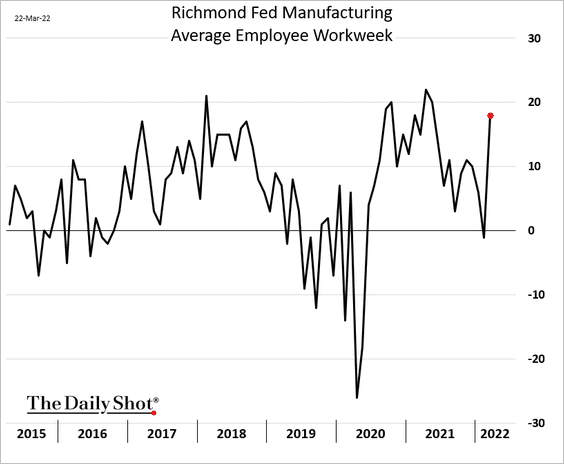

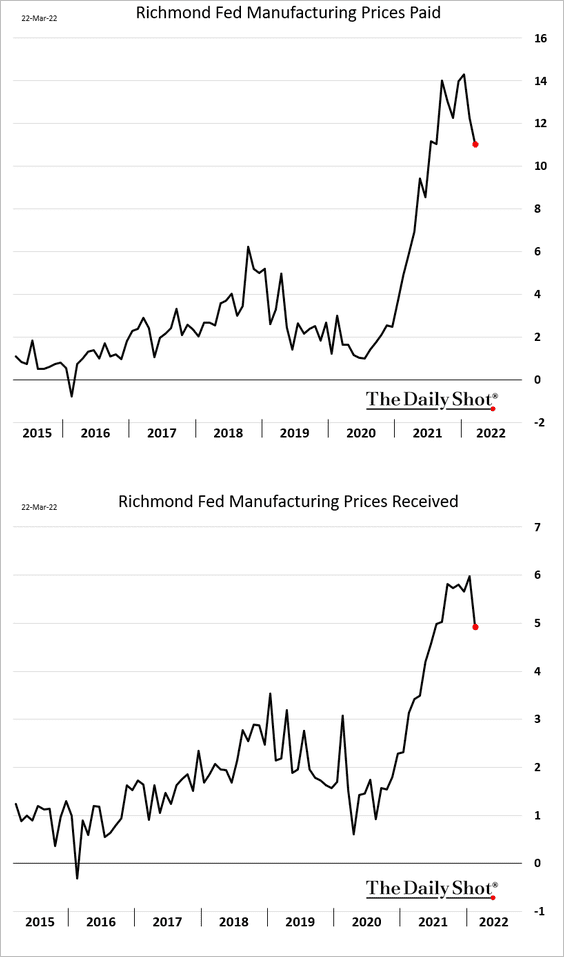

3. The Richmond Fed’s regional manufacturing index improved this month.

But forward-looking indicators deteriorated.

• Employee hours increased.

• Cost pressures remain extreme, but price indicators appear to have peaked.

——————–

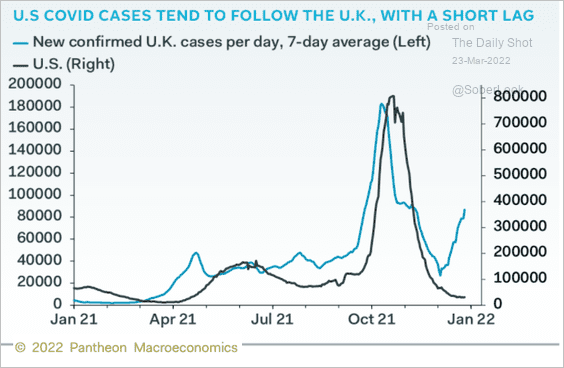

4. Based on the UK data, US COVID cases will be climbing in the days ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

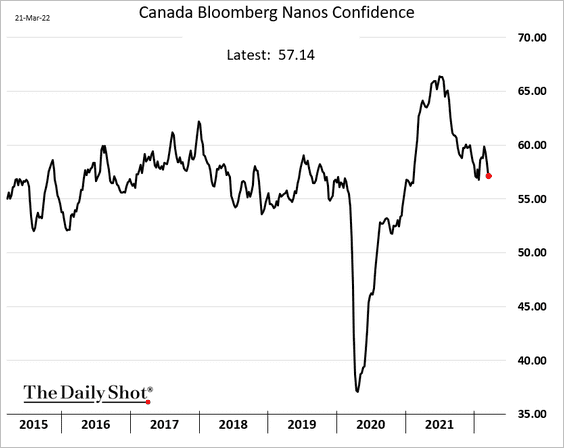

Canada

1. Consumer confidence is dropping again.

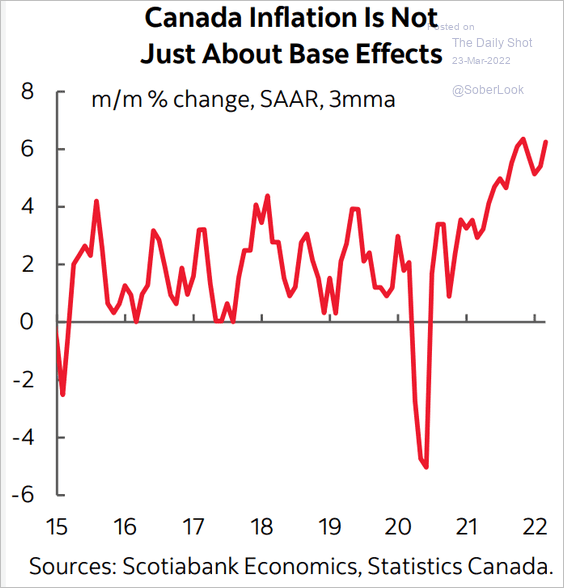

2. The surge in inflation is not just about base effects.

Source: Scotiabank Economics

Source: Scotiabank Economics

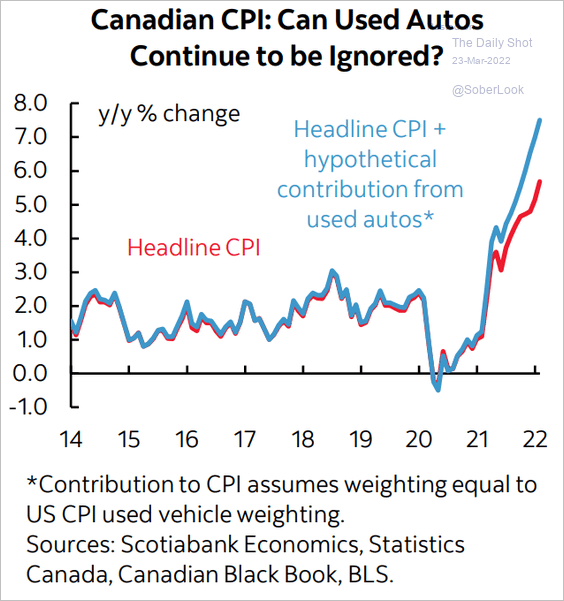

• What happens to Canada’s CPI when we add used vehicles to the index?

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

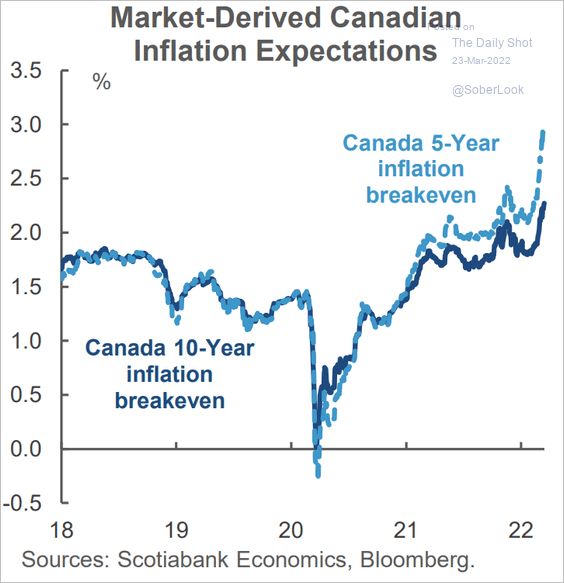

3. Market-based inflation expectations keep climbing, with the front end of the inflation curve rising faster.

Source: Scotiabank Economics

Source: Scotiabank Economics

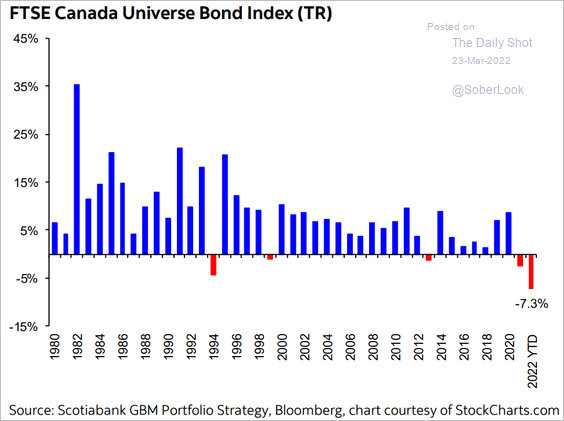

4. Canada’s bonds are having the worst year in decades.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

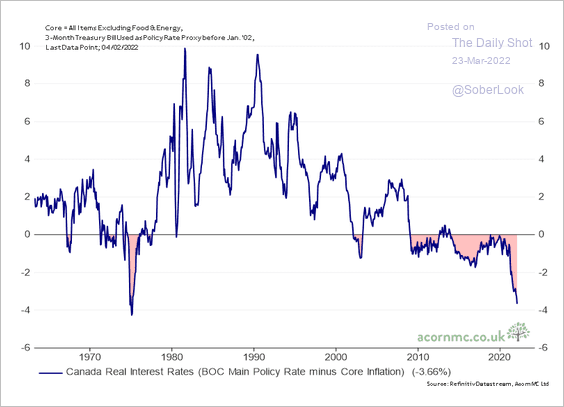

5. This chart shows Canada’s real short-term rates.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

Back to Index

The United Kingdom

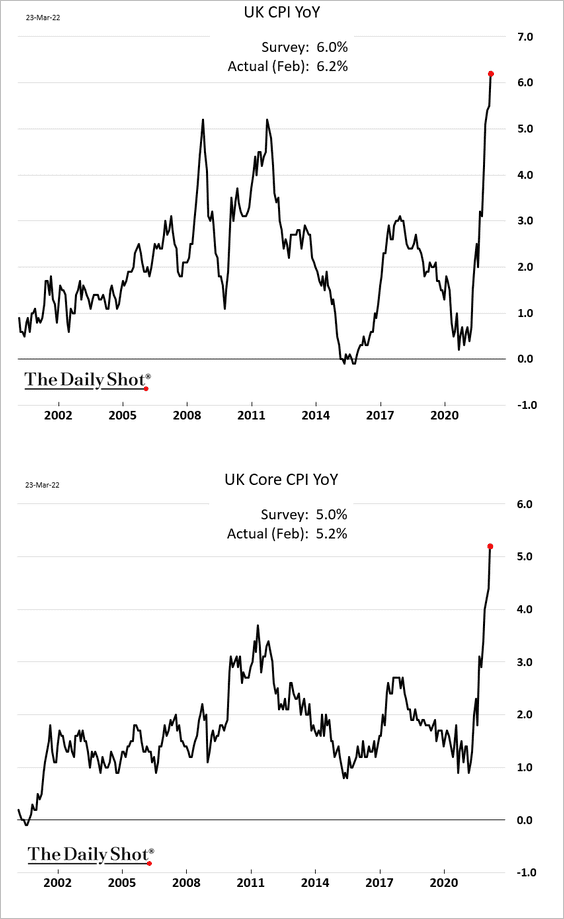

1. The CPI breached 6% for the first time in decades, exceeding forecasts. The core CPI cleared 5% last month.

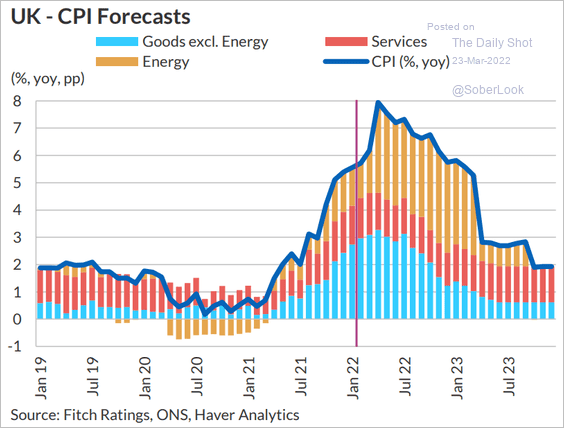

• The CPI is expected to keep climbing in the months ahead, peaking at 8%.

Source: Fitch Ratings

Source: Fitch Ratings

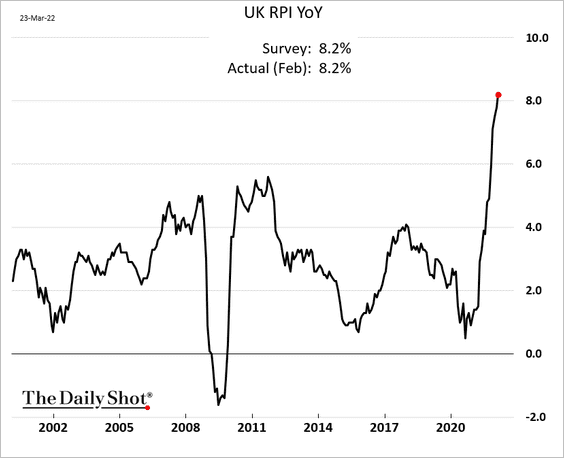

• Retail prices are up over 8%.

——————–

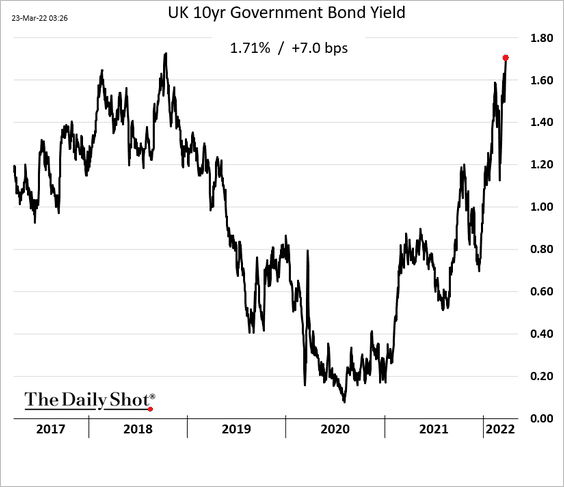

2. The 10yr gilt yield is about to take out the 2018 peak.

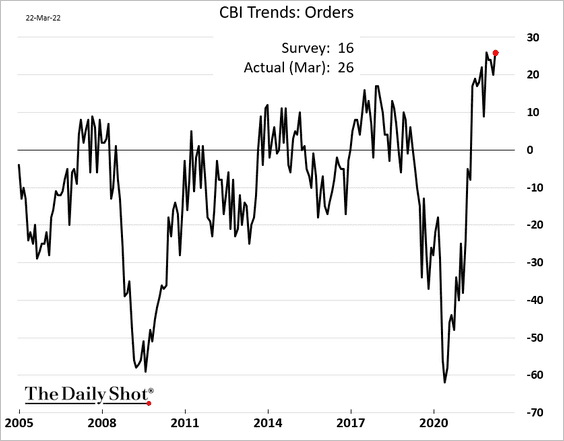

3. Industrial orders surprised to the upside this month.

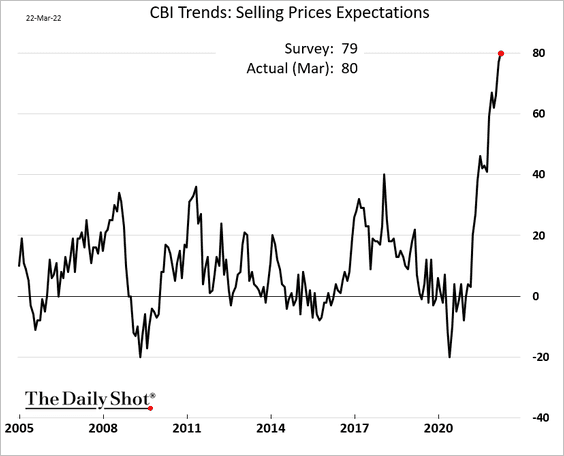

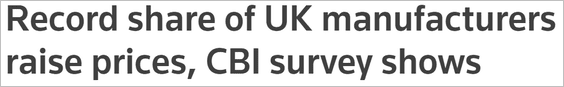

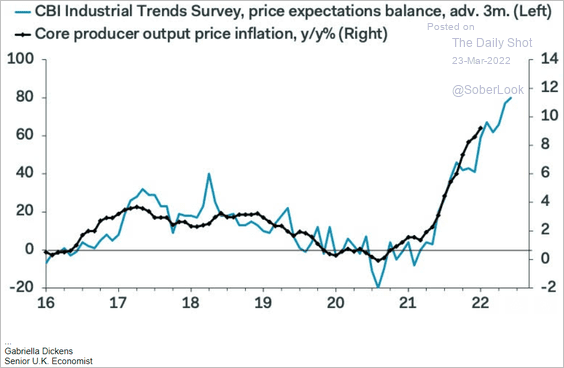

Manufacturers are rapidly boosting prices, …

Source: Reuters Read full article

Source: Reuters Read full article

… which will show up in the PPI in the months ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

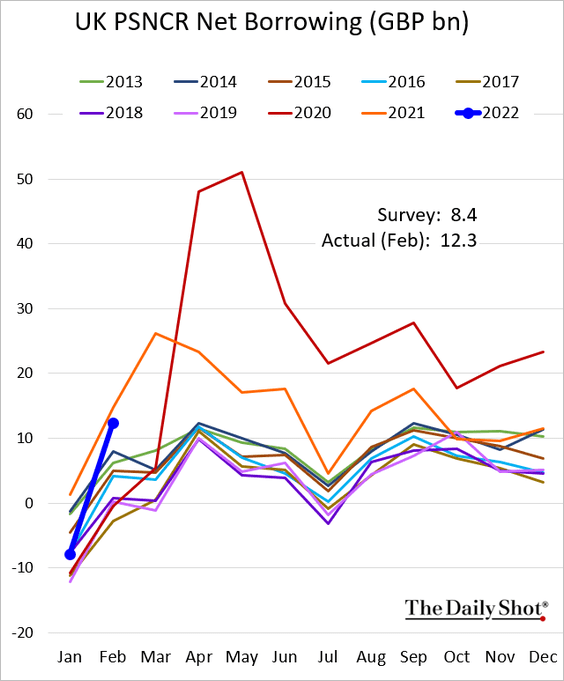

4. The government borrowed more than expected last month.

Back to Index

The Eurozone

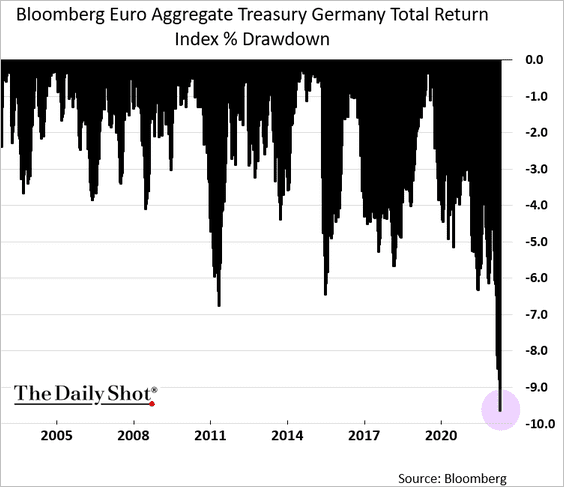

1. The Bund market selloff has been massive.

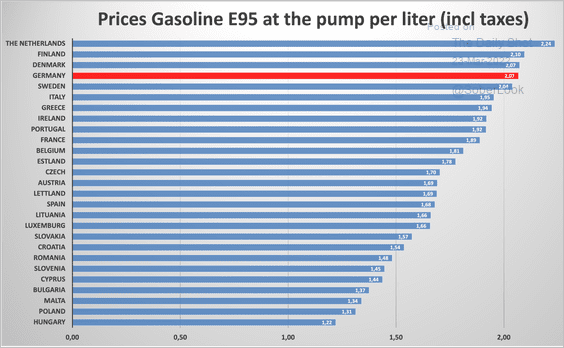

2. The German government wants to bring gasoline prices back toward two euros a liter via subsidies.

Source: @Schuldensuehner, @welt Read full article

Source: @Schuldensuehner, @welt Read full article

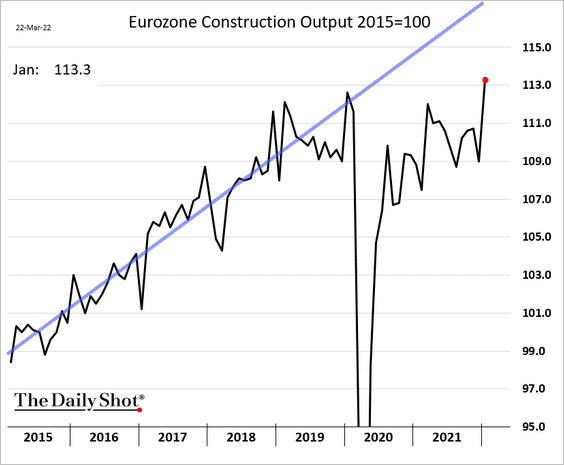

3. Eurozone construction output surged in January.

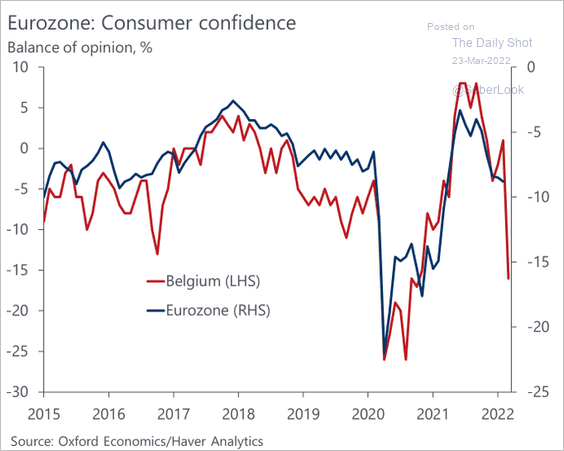

4. Belgium’s March consumer confidence report doesn’t bode well for the Eurozone’s sentiment data.

Source: @OliverRakau

Source: @OliverRakau

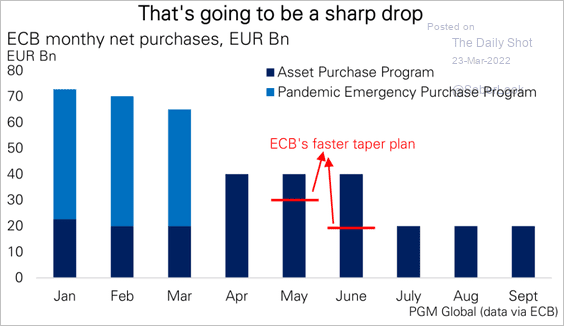

5. Here are the changes in the ECB’s taper plan.

Source: PGM Global

Source: PGM Global

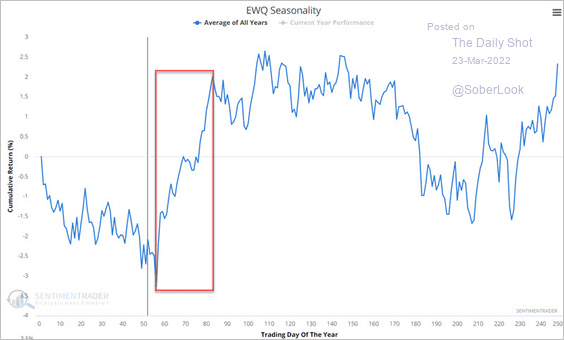

6. The iShares MSCI France ETF (EWQ) is entering a seasonally strong period.

Source: SentimenTrader

Source: SentimenTrader

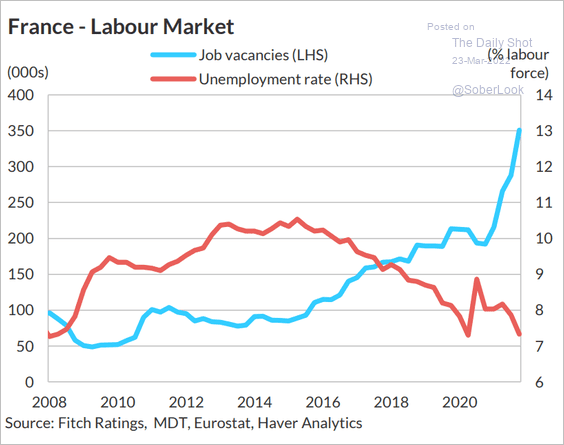

Separately, the labor market is rapidly tightening in France.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

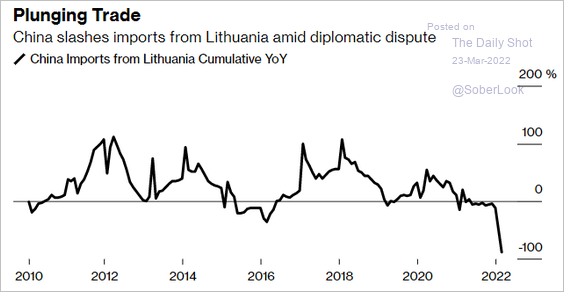

7. China is punishing Lithuania for allowing Taiwan to open a de-facto embassy in Vilnius.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Asia – Pacific

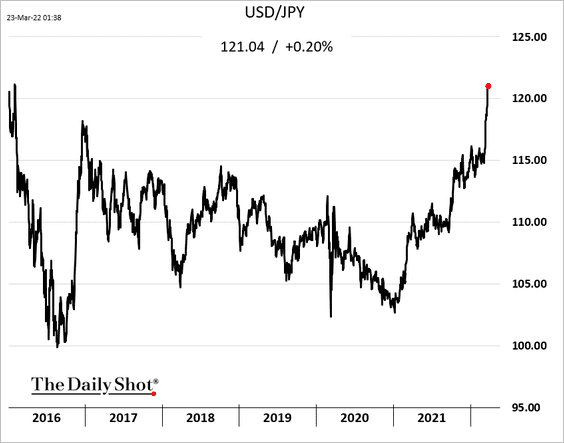

1. Dollar-yen continues to climb.

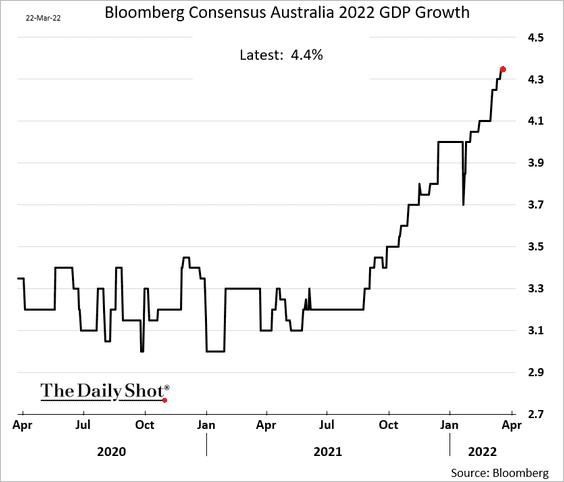

2. Next, we have some updates on Australia.

• Economists continue to boost Australia’s GDP growth forecasts for 2022.

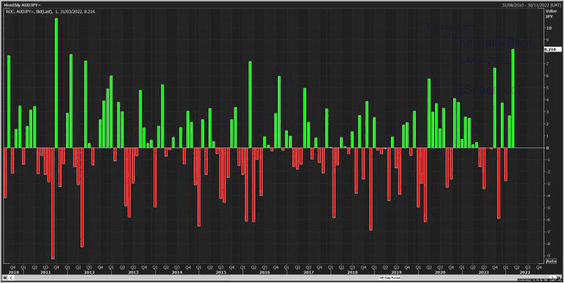

• This month’s Aussie rally has been impressive.

Source: @Scutty

Source: @Scutty

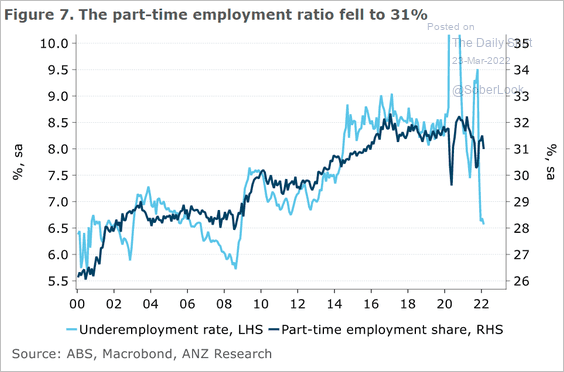

• More Australian workers are shifting to full-time jobs.

Source: ANZ Research

Source: ANZ Research

Back to Index

China

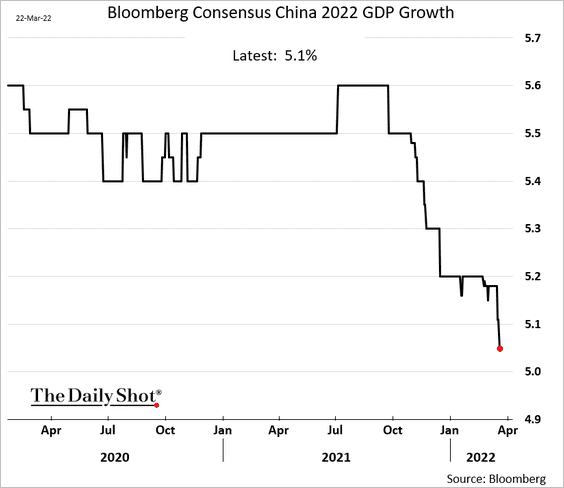

1. Economists keep downgrading China’s GDP growth projections for this year.

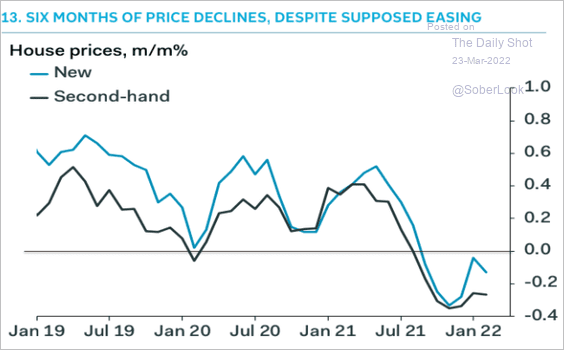

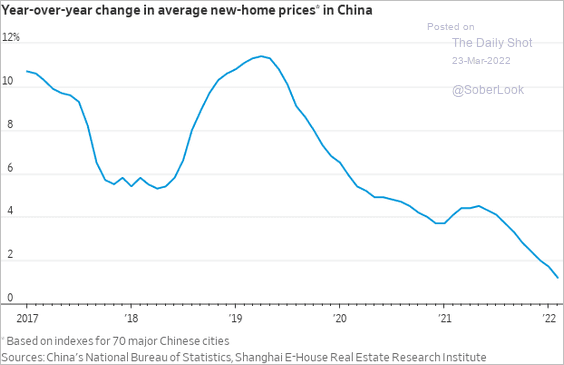

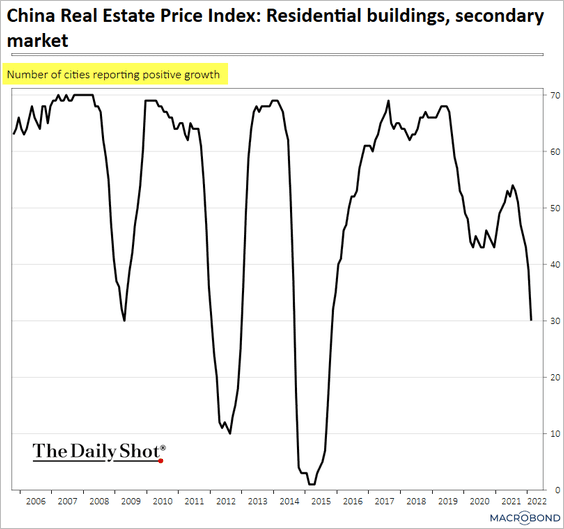

2. Home prices continue to fall (3 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

——————–

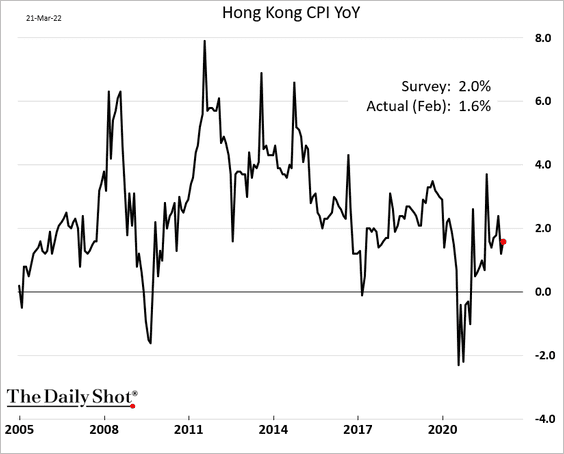

3. Hong Kong’s inflation remains subdued.

Back to Index

Emerging Markets

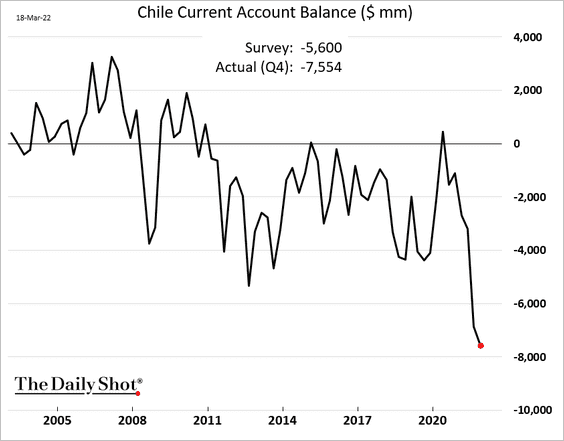

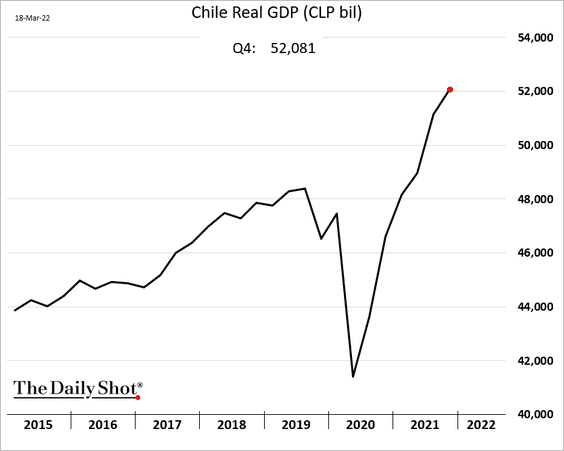

1. Chile’s current account deficit has blown out.

The Q4 GDP growth was a bit below forecasts but still quite strong.

——————–

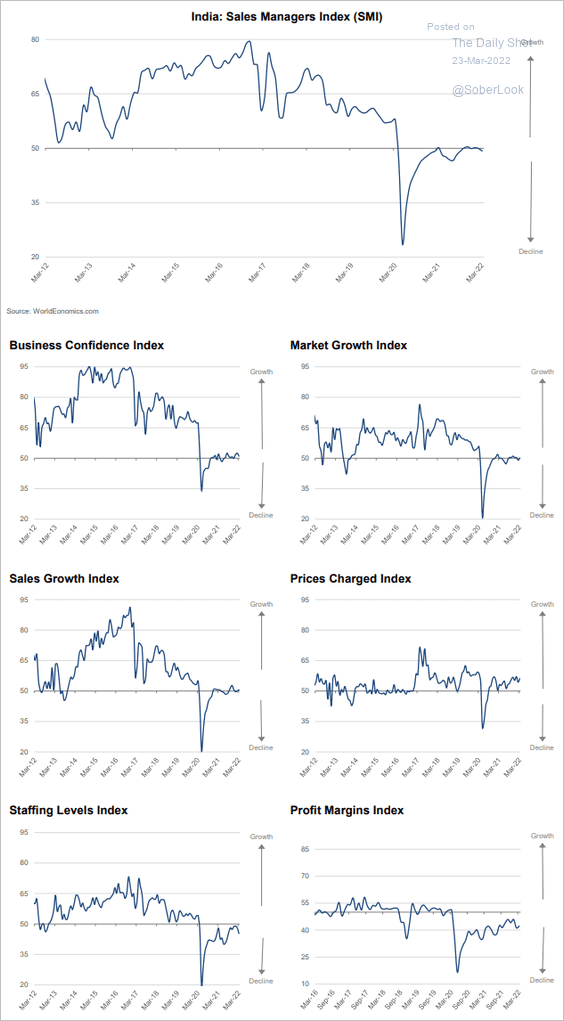

2. According to the World Economics SMI report, India’s business sector is struggling to grow.

Source: World Economics

Source: World Economics

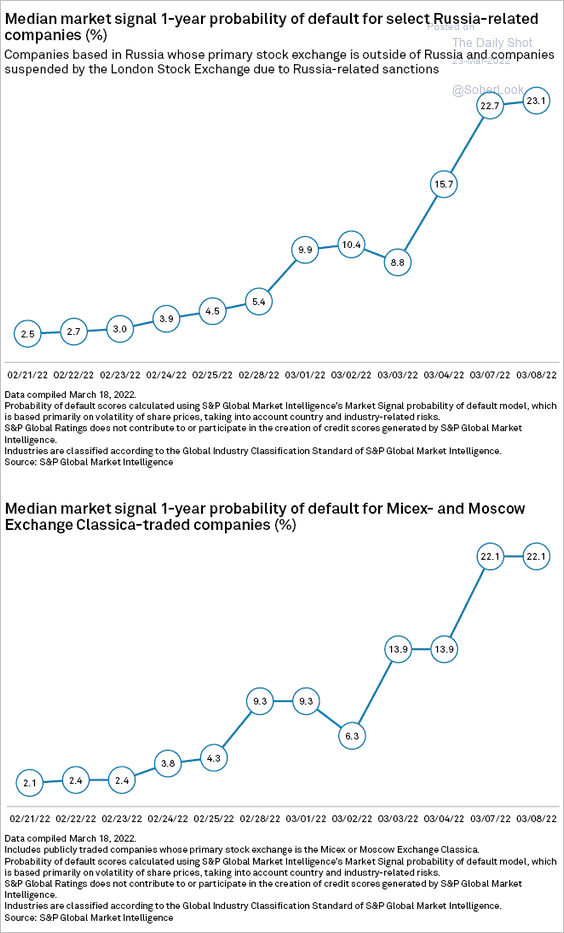

3. The risk of default among Russian companies has risen sharply.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

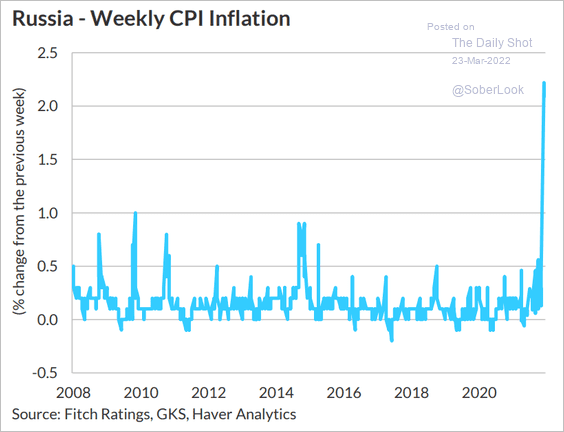

Russia’s inflation is surging.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

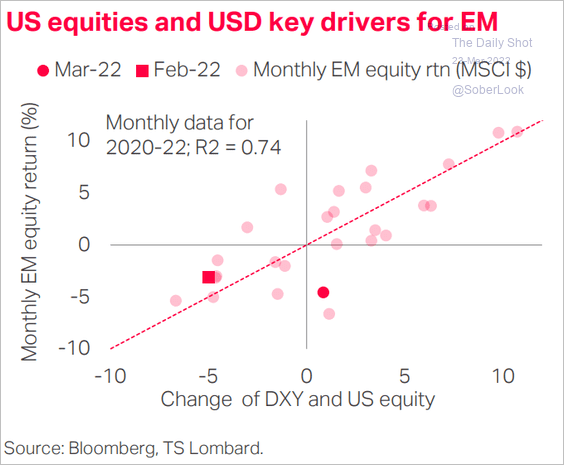

4. US equities and the dollar are the key drivers of EM equity returns.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

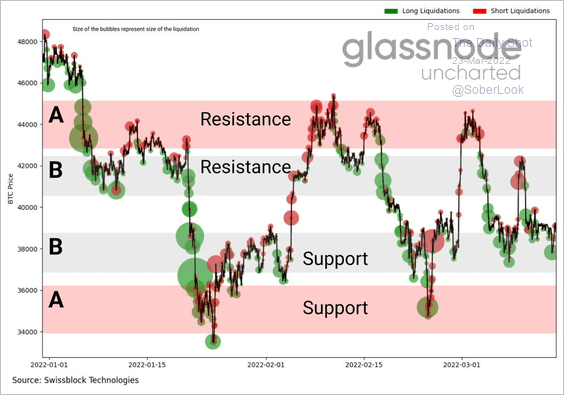

1. This chart shows that BTC long liquidations have dominated so far this year. Will we see an increase in short liquidations around the $44K-$45K resistance zone?

Source: @Negentropic_

Source: @Negentropic_

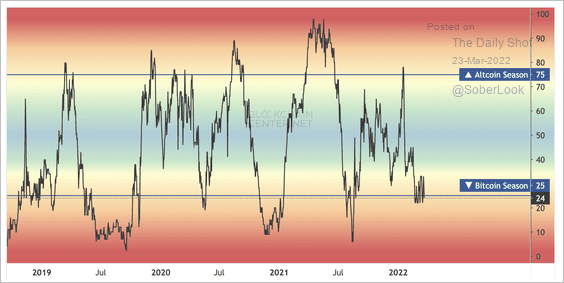

2. Roughly 25% of the top 50 cryptos are performing better than bitcoin over the past 90 days. That does not confirm “altcoin season” just yet.

Source: Blockchain Center Read full article

Source: Blockchain Center Read full article

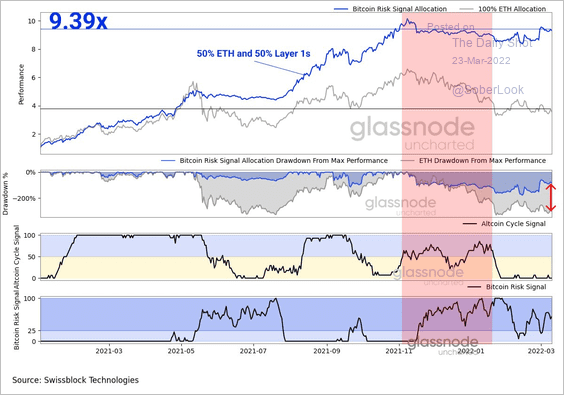

3. This chart shows how a rotation from bitcoin to altcoins can reduce drawdowns during risk-off periods (and vice versa).

Source: @Negentropic_

Source: @Negentropic_

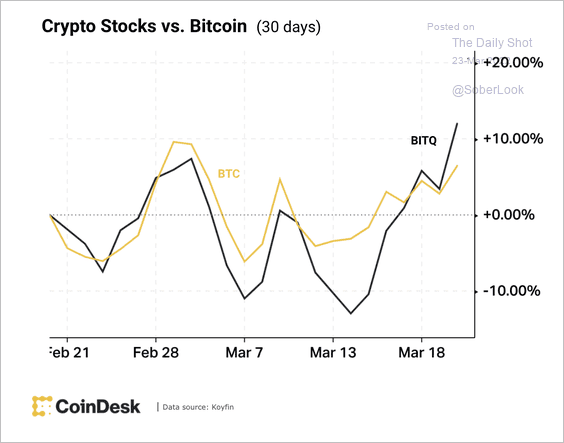

4. The Bitwise Crypto Industry Innovators ETF (BITQ) is now outperforming BTC over the past 30 days.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

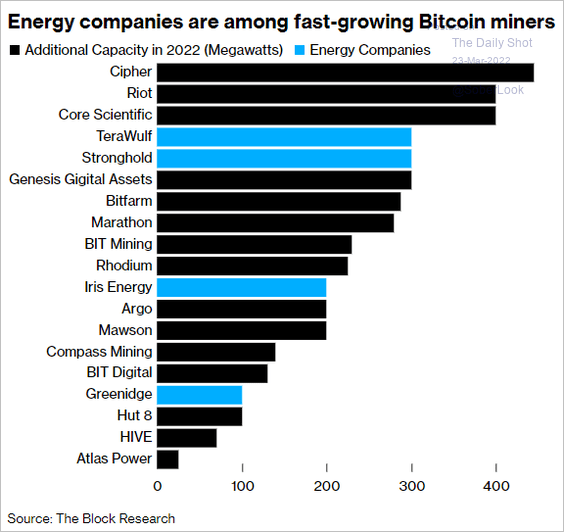

5. Energy companies have been getting into bitcoin mining.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Commodities

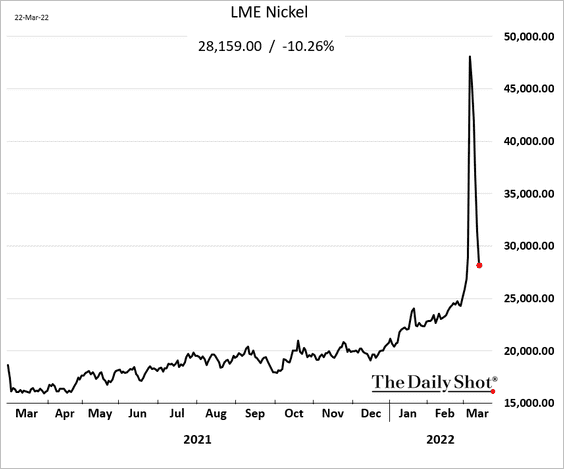

1. LME nickel trading finally stabilized, but prices continue to drop.

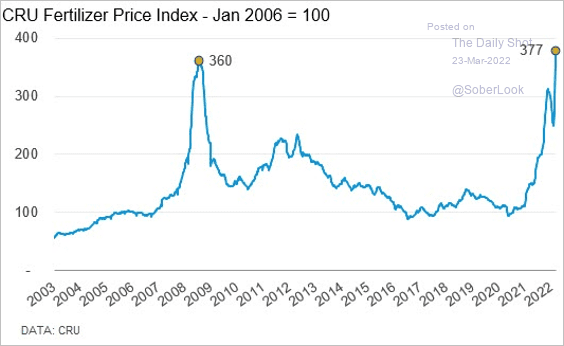

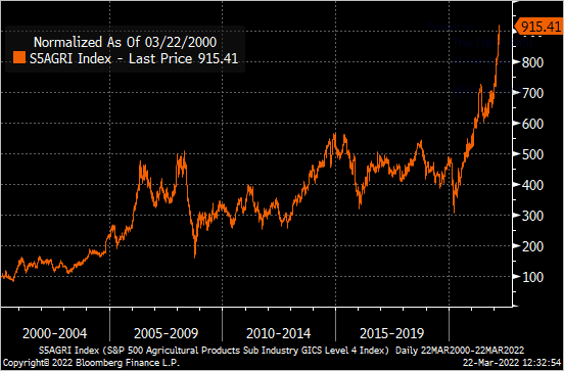

2. Fertilizer prices and shares of companies in that sector have been surging.

Source: @AndreasSteno

Source: @AndreasSteno

Source: @Marcomadness2

Source: @Marcomadness2

——————–

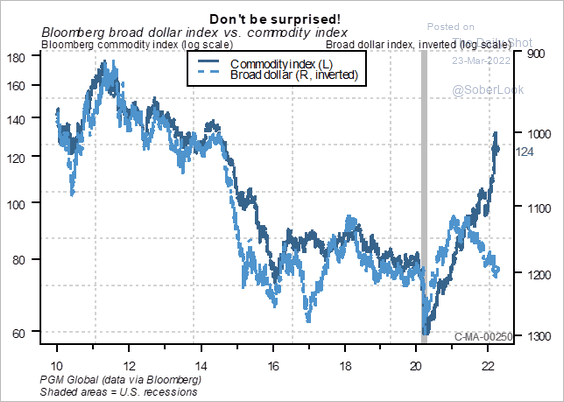

3. The divergence between the dollar and commodities persists.

Source: PGM Global

Source: PGM Global

Back to Index

Energy

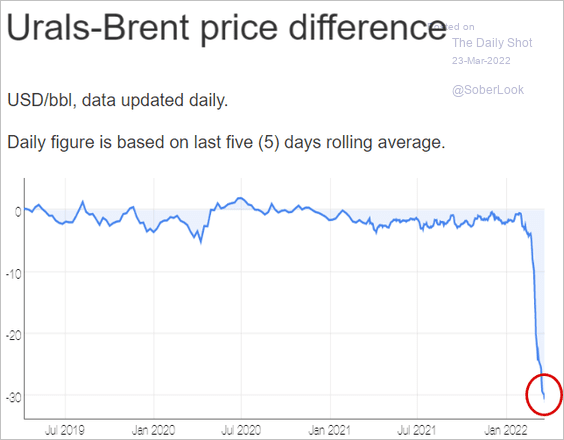

1. Russia’s crude oil discount to Brent has widened further.

Source: Neste

Source: Neste

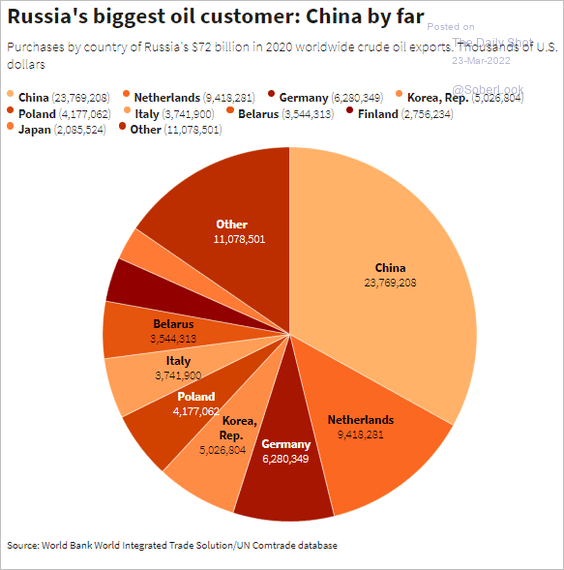

• China and India will be replacing some of the lost sales elsewhere.

Source: Reuters Graphics

Source: Reuters Graphics

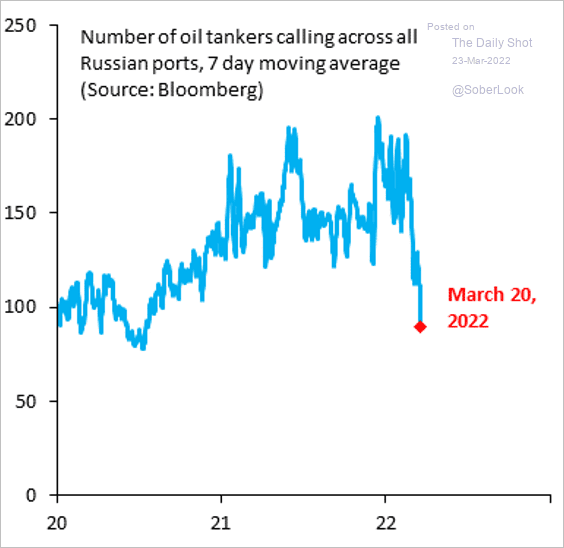

• Oil tanker activity at Russian ports has declined sharply.

Source: @RobinBrooksIIF, @JonathanPingle

Source: @RobinBrooksIIF, @JonathanPingle

• The Dallas Fed sees a global recession without Russian energy supplies.

Source: @WSJ Read full article Further reading

Source: @WSJ Read full article Further reading

——————–

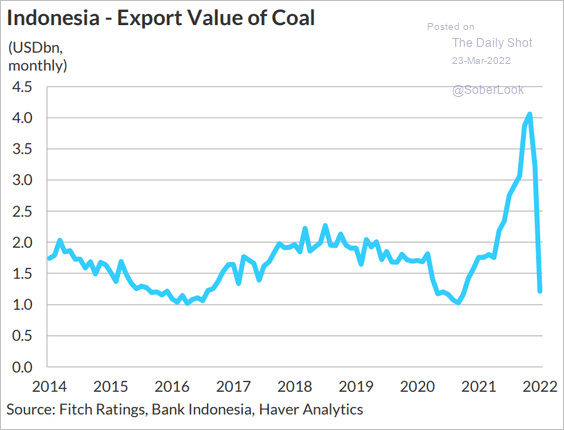

2. Will Indonesia’s coal exports rebound this year to replace some of the lost supply from Russia?

Source: Fitch Ratings

Source: Fitch Ratings

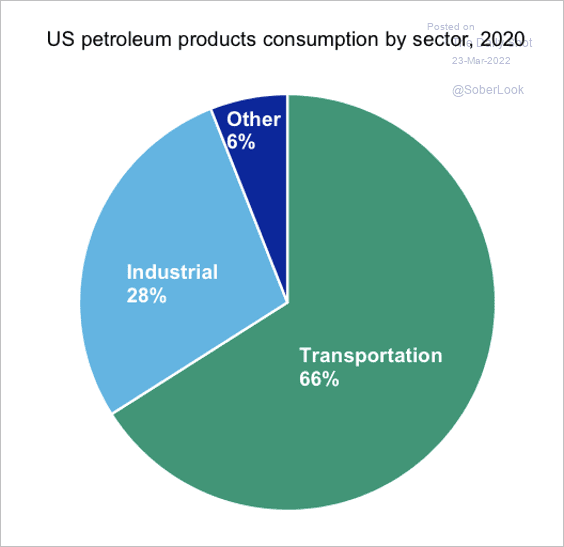

3. About a third of US domestic petroleum consumption is outside of the transportation sector.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

Back to Index

Equities

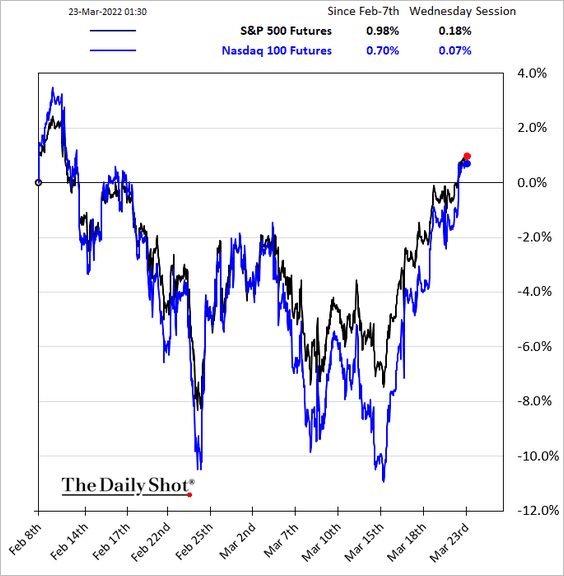

1. Stocks continue to rebound, with some analysts viewing the equity market as a “haven” against inflation.

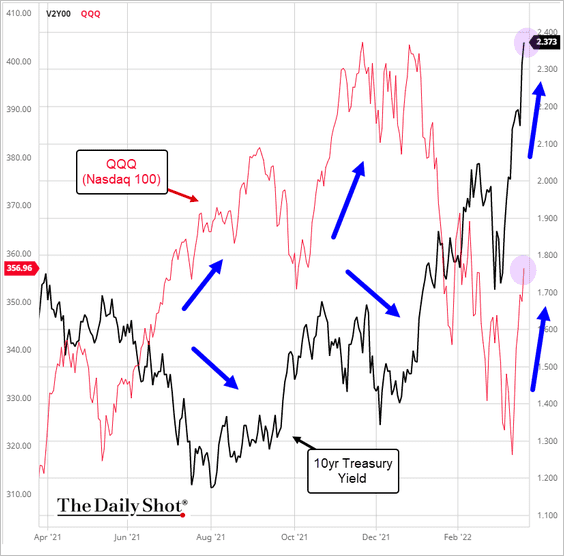

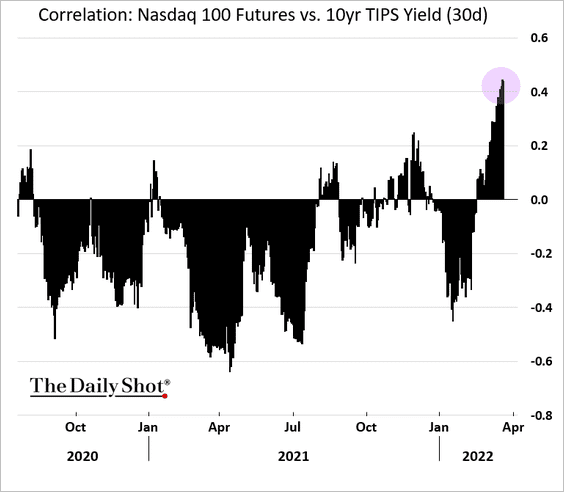

The fear of rising rates we saw in recent months has magically evaporated. The Nasdaq 100 is suddenly correlated with Treasury yields …

Source: barchart.com

Source: barchart.com

… and real rates.

——————–

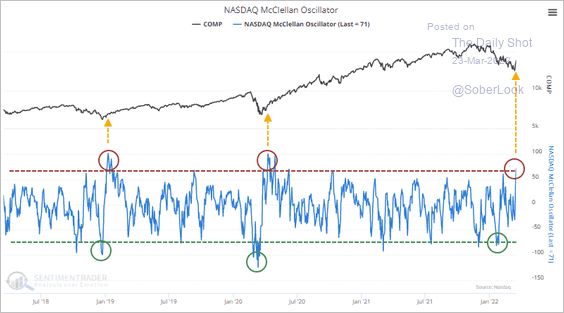

2. The recent surge in the Nasdaq’s momentum looks similar to prior troughs.

Source: SentimenTrader

Source: SentimenTrader

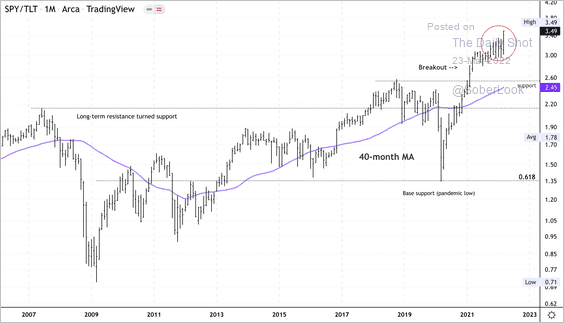

3. The equity/bond ratio (SPY/TLT) continues to strengthen as rates rise.

Source: Dantes Outlook

Source: Dantes Outlook

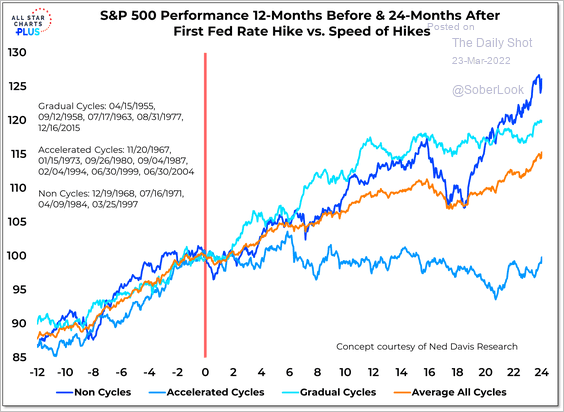

4. Stocks tend to struggle during periods of accelerated rate hikes.

Source: @WillieDelwiche Read full article

Source: @WillieDelwiche Read full article

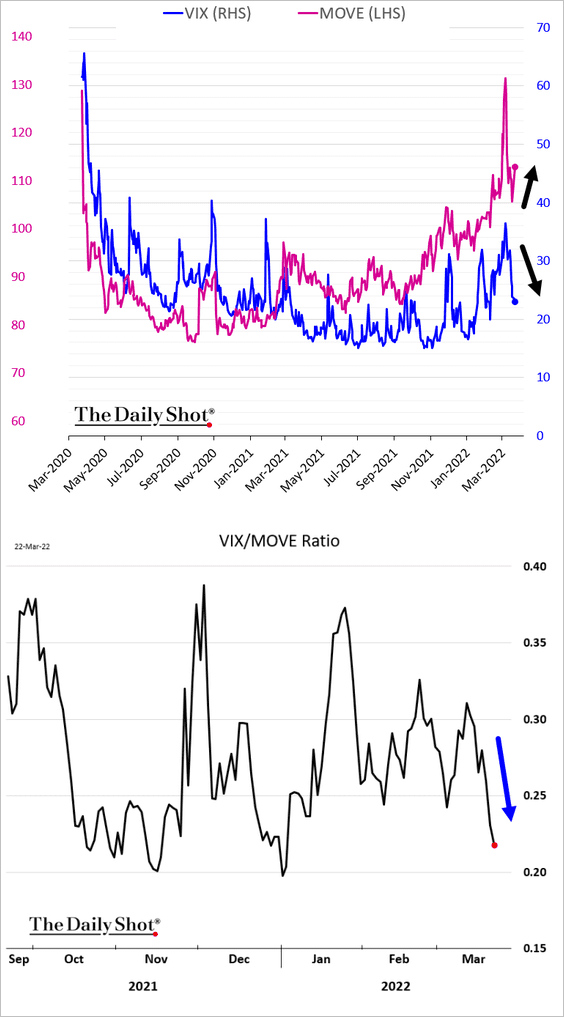

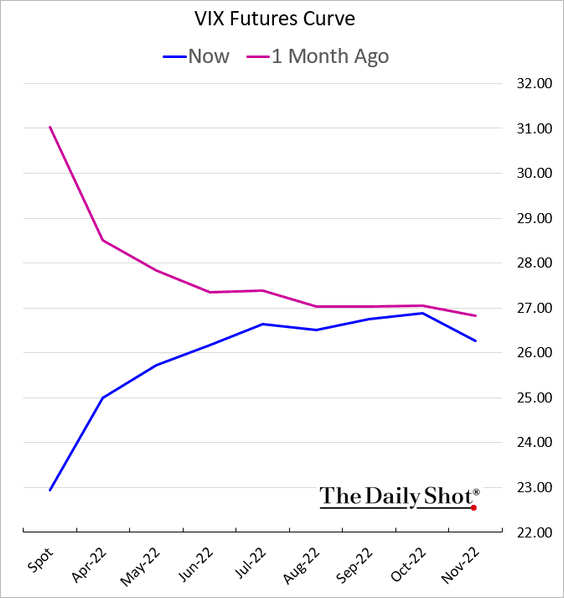

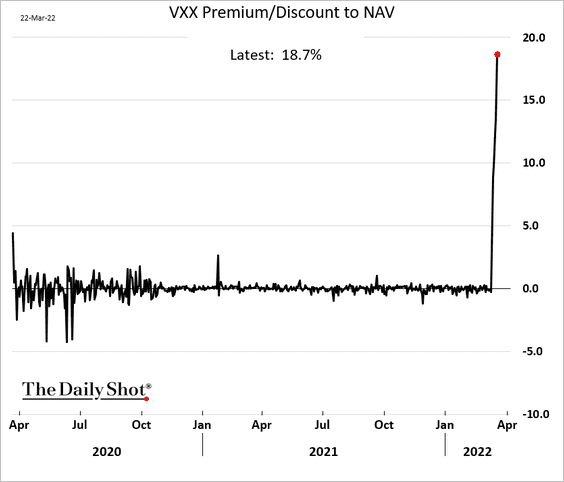

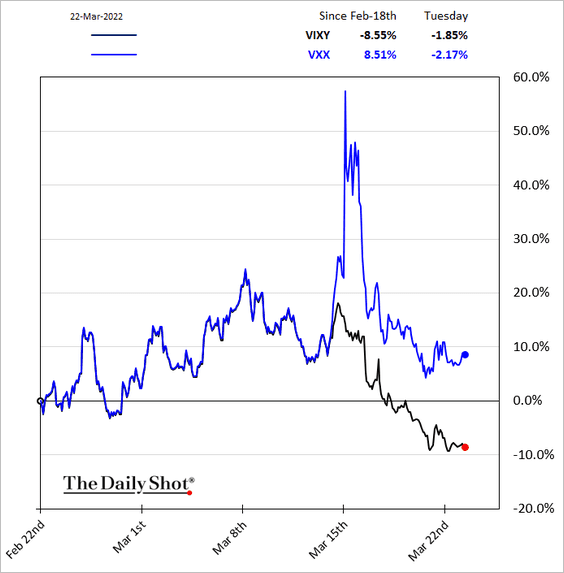

5. Next, we have some updates on the volatility market.

• Indicators of equity vol (VIX) and rate vol (MOVE) have been moving in opposite directions.

• The VIX futures curve is back in contango.

• VXX (a long VIX futures ETN) has decoupled from its NAV after Barclays suspended sales.

These two ETNs are essentially the same product.

Back to Index

Rates

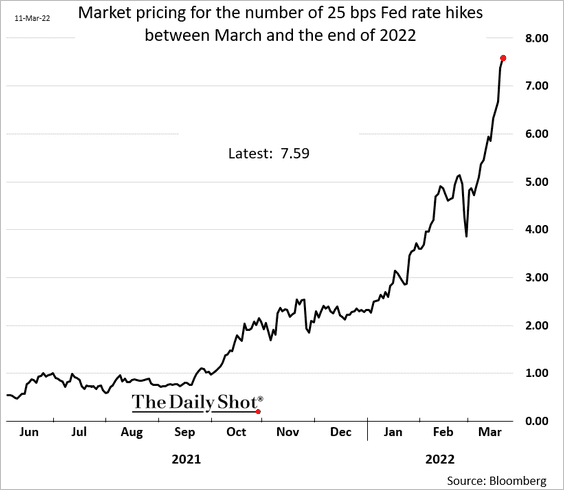

1. Nine 25 bps rate hikes this year are increasingly likely, according to the futures market.

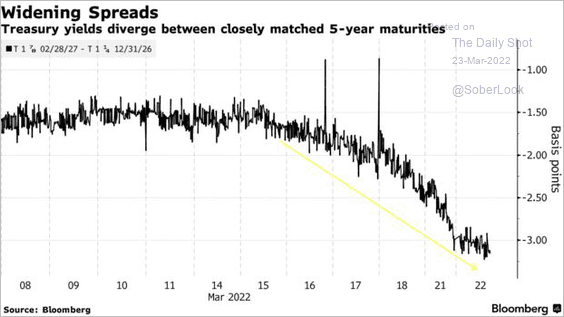

2. Rising liquidity premium in Treasuries has widened the spread between on- and off-the-run 5yr notes.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

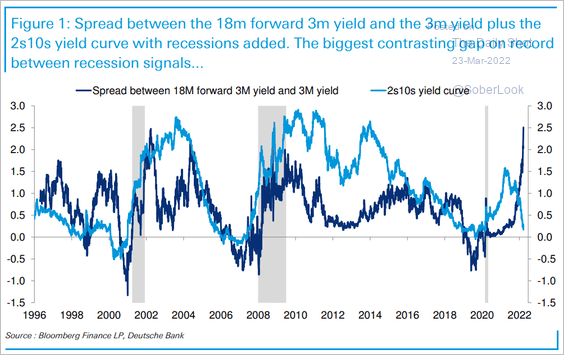

3. Does Powell’s suggestion to focus on the short end of the curve produce a better economic signal?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

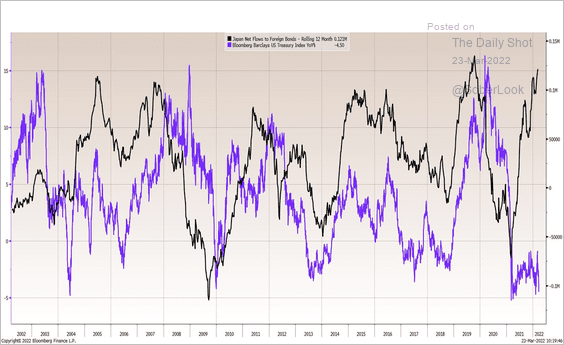

4. Treasuries have been selling off despite inflows from Japan.

Source: @EffMktHype

Source: @EffMktHype

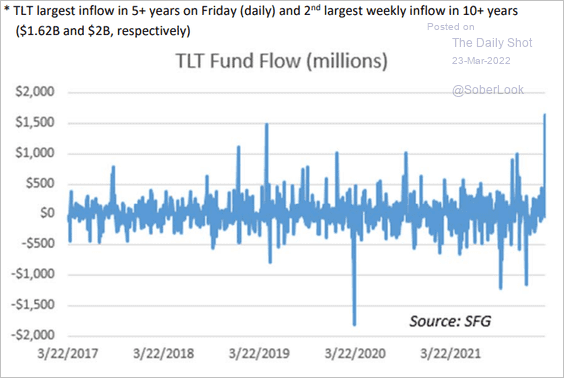

5. Surprisingly, the largest long-term Treasury ETF has been experiencing fund inflows.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

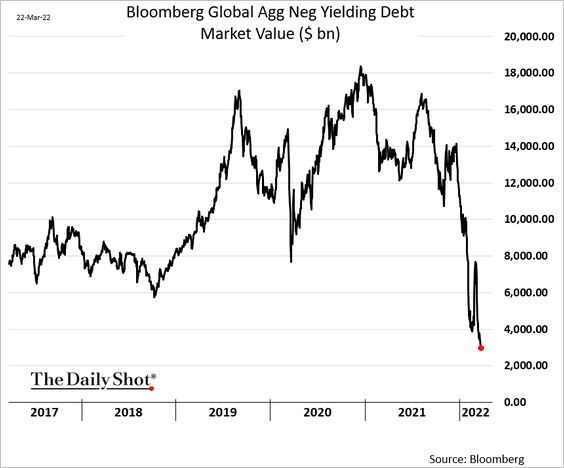

6. There has been a rapid decline in global debt with negative yields.

——————–

Food for Thought

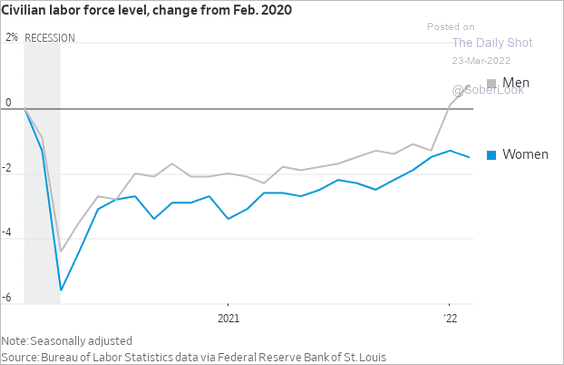

1. US labor force recovery:

Source: @WSJ Read full article

Source: @WSJ Read full article

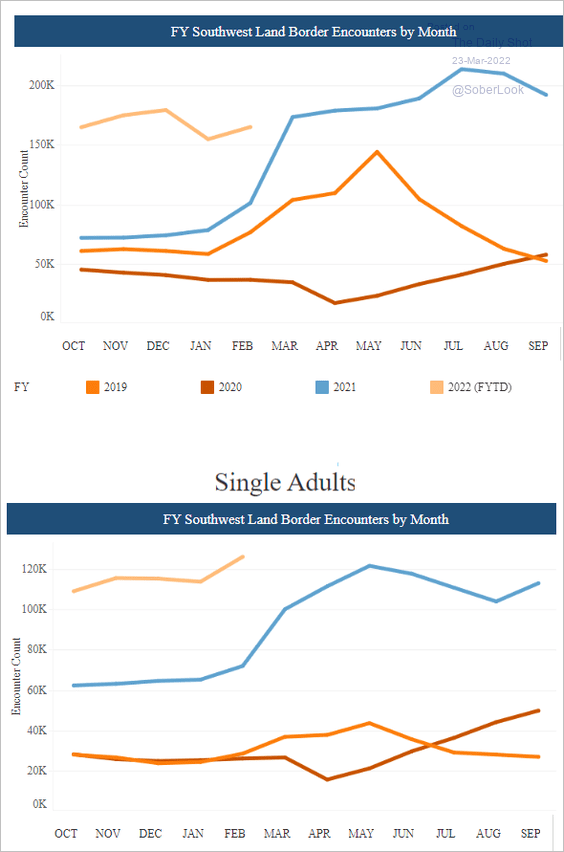

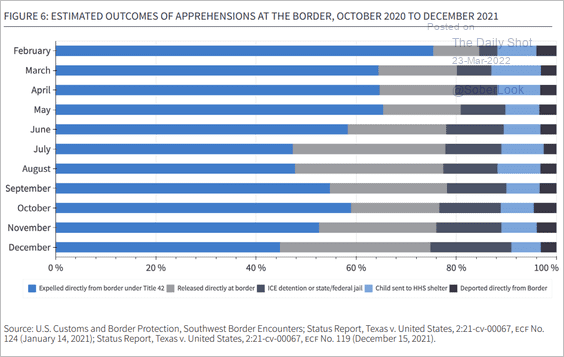

2. US Southwest land border apprehensions:

Source: CBP

Source: CBP

• Outcomes of apprehensions:

Source: American Immigration Council Read full article

Source: American Immigration Council Read full article

——————–

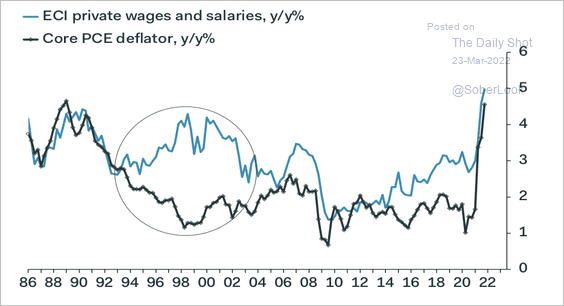

3. In the late 1990’s, rapid wage gains were not inflationary (due in part to robust productivity gains).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

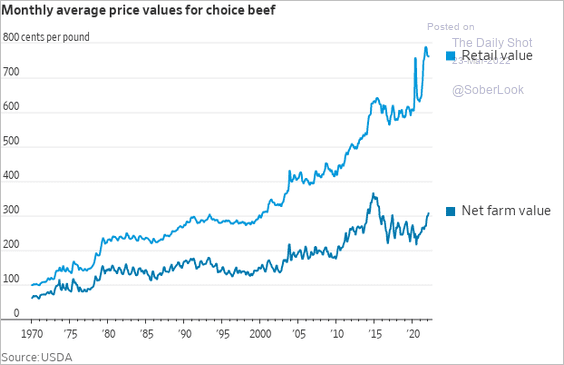

4. Widening meat-processing margins:

Source: @WSJ Read full article

Source: @WSJ Read full article

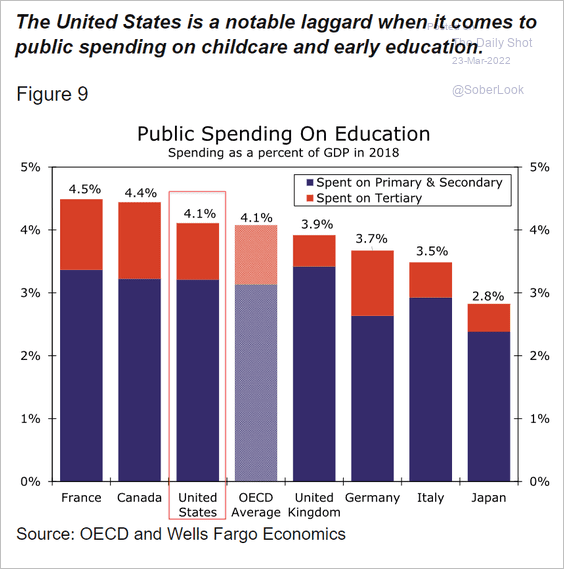

5. Public spending on education:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

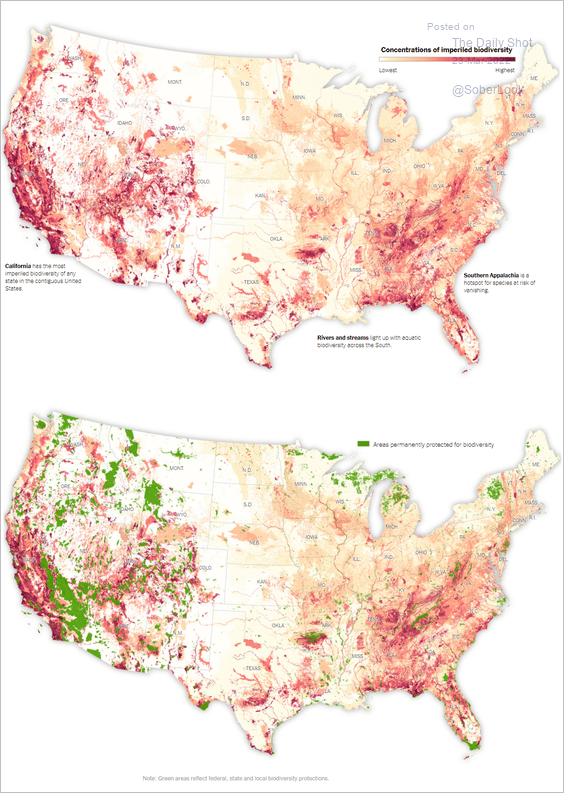

6. Where biodiversity is most at risk in the US:

Source: The NY Times Read full article

Source: The NY Times Read full article

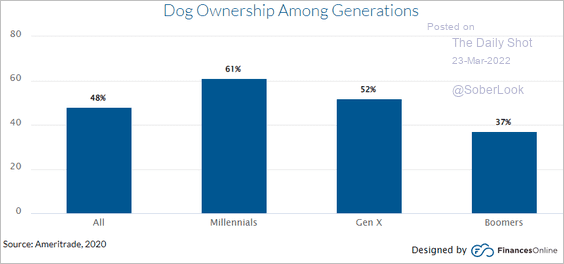

7. US dog ownership by generation:

——————–

Back to Index