The Daily Shot: 24-Mar-22

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

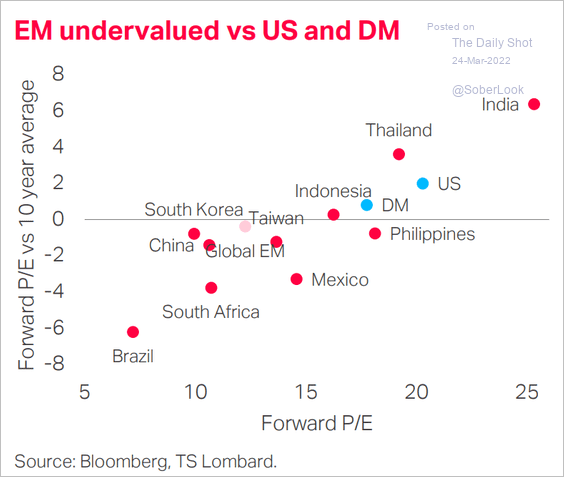

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

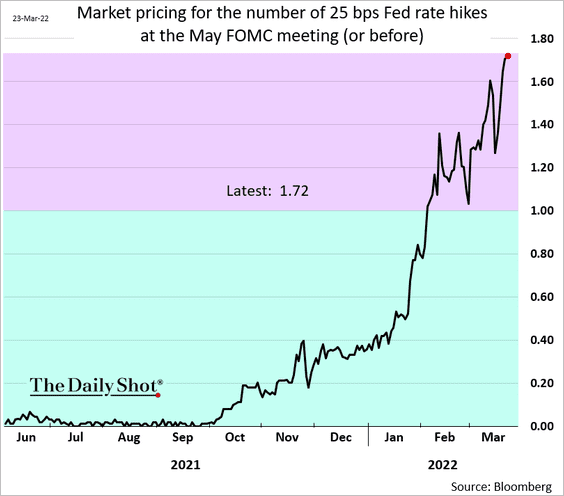

1. Consensus seems to be building for a 50 bps rate hike in May, with the markets giving it a 70%+ probability.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

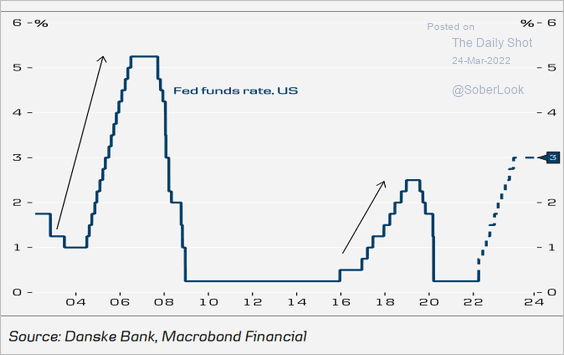

• Danske Bank sees the Fed pushing rates up to 3%.

Source: Danske Bank

Source: Danske Bank

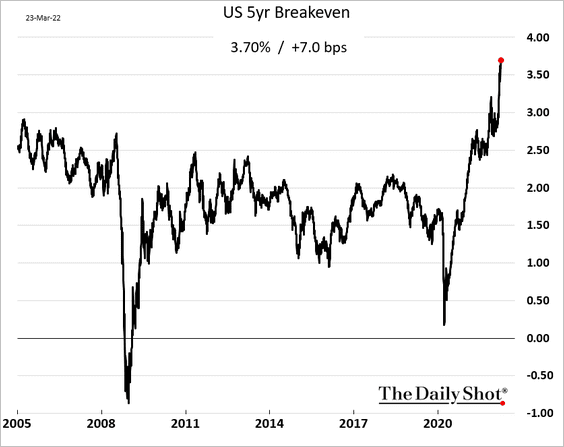

• Market-based inflation expectations keep climbing with oil prices.

——————–

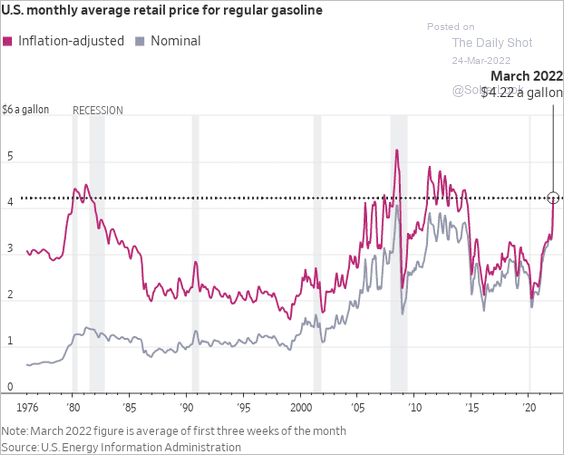

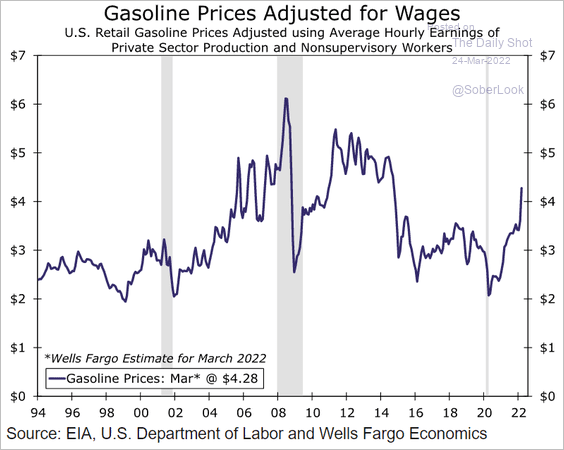

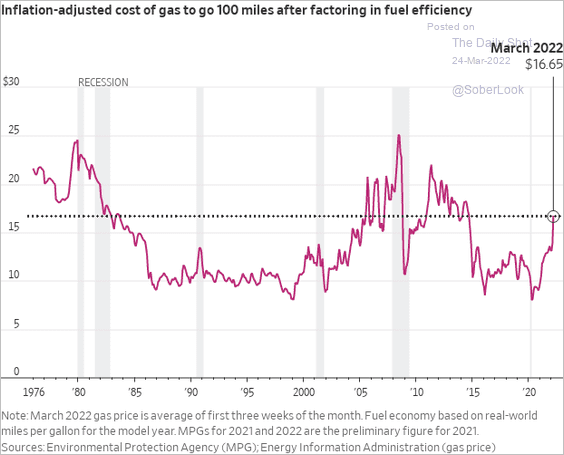

2. US gasoline prices are not extreme when adjusted for …

– Inflation:

Source: @WSJ Read full article

Source: @WSJ Read full article

– Wages:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

– Fuel efficiency:

Source: @WSJ Read full article

Source: @WSJ Read full article

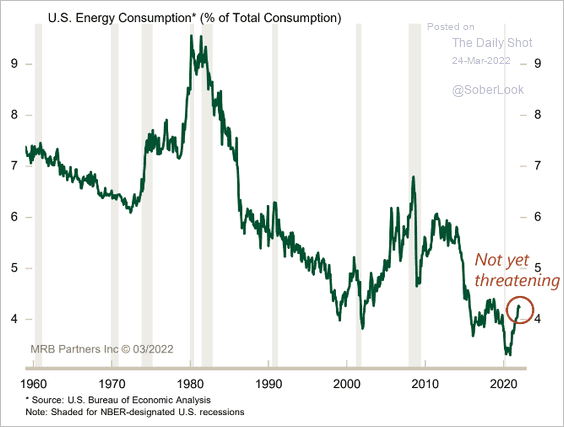

• Energy consumption as a share of total consumer spending is not yet very high.

Source: MRB Partners

Source: MRB Partners

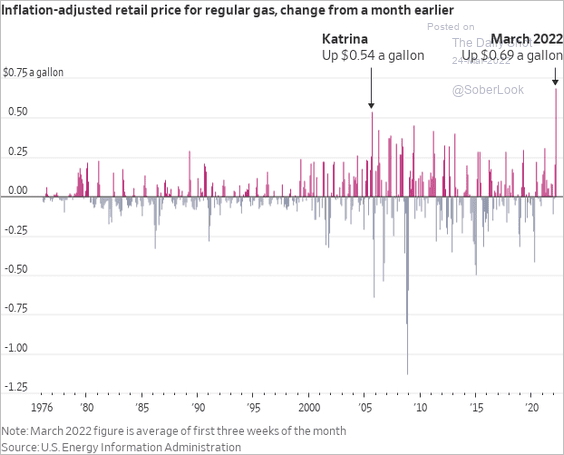

• It’s the speed of the price gains, not the price level that has been a shocker for the consumer.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

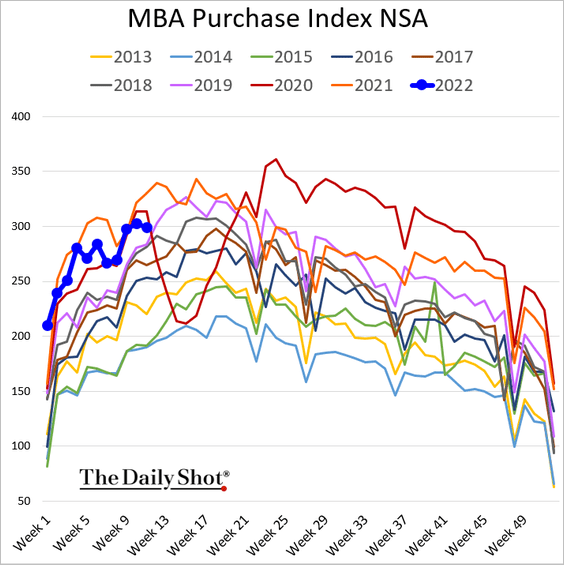

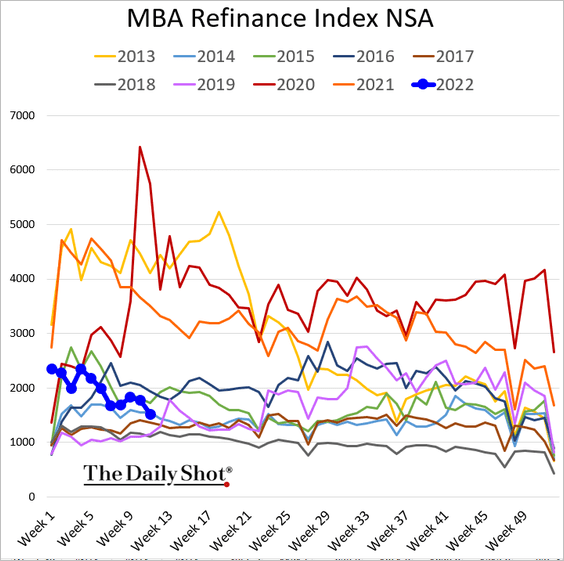

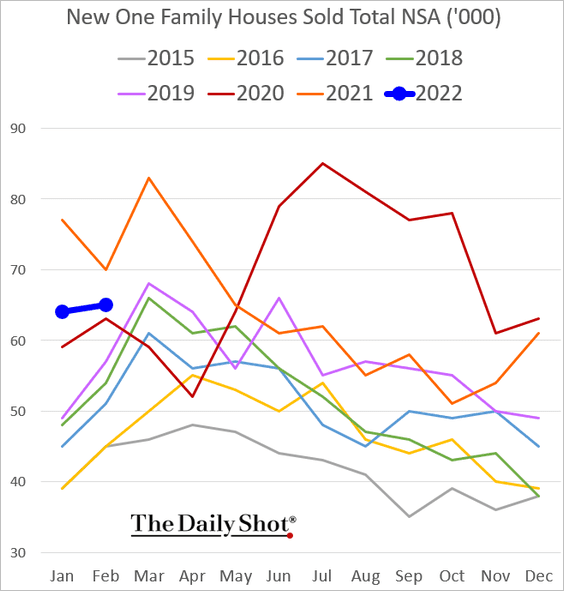

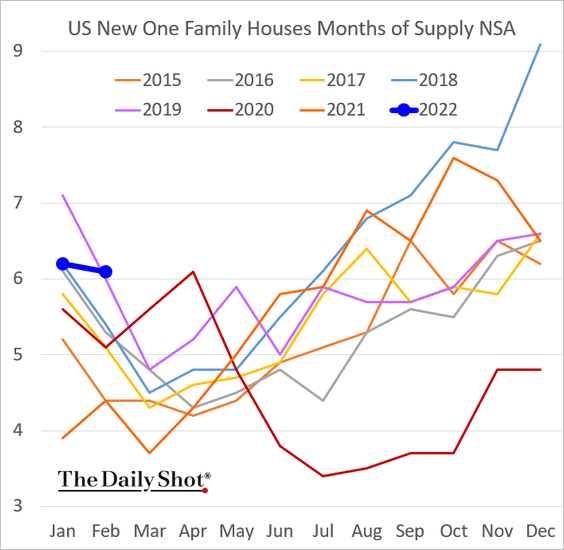

3. Next, we have some updates on the housing market.

• Mortgage applications seem to be slowing.

Refi activity is falling rapidly.

• New home sales were softer than expected last month.

This time of the year, we should see much faster nventory declines.

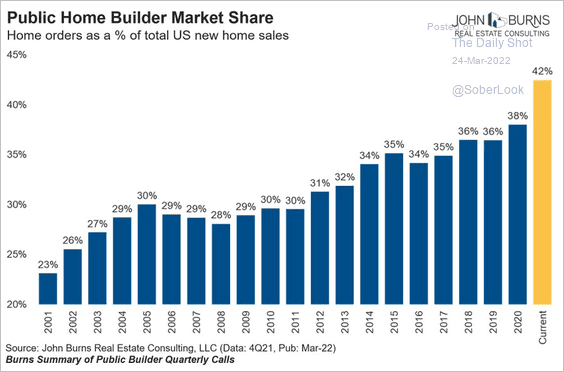

• Big public home builders increasingly dominate the housing market.

Source: @RickPalaciosJr

Source: @RickPalaciosJr

——————–

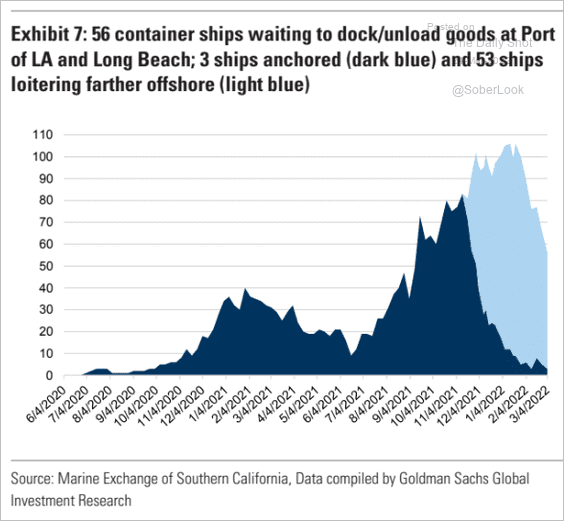

4. The number of container ships waiting at Port of LA and Long Beach has been declining.

Source: Goldman Sachs; @countdraghula

Source: Goldman Sachs; @countdraghula

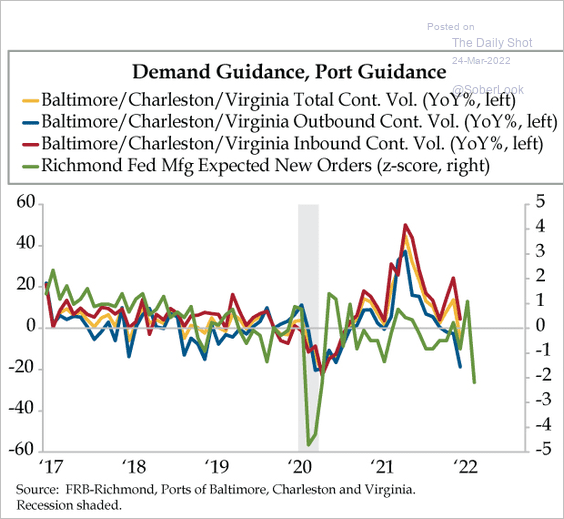

Eastern Seaboard container volumes have been slowing. This trend coincides with deteriorating forward-looking data in the Richmond Fed’s manufacturing survey.

Source: The Daily Feather

Source: The Daily Feather

Back to Index

The Eurozone

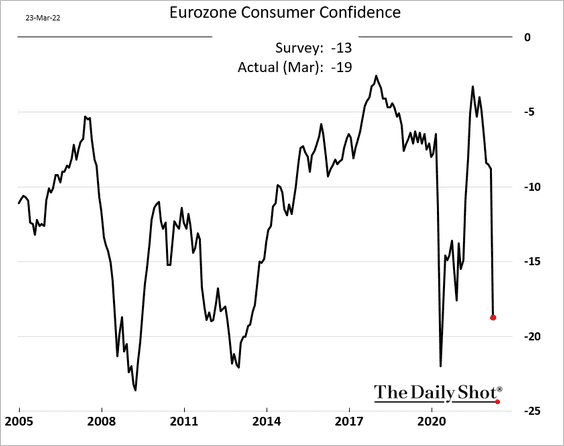

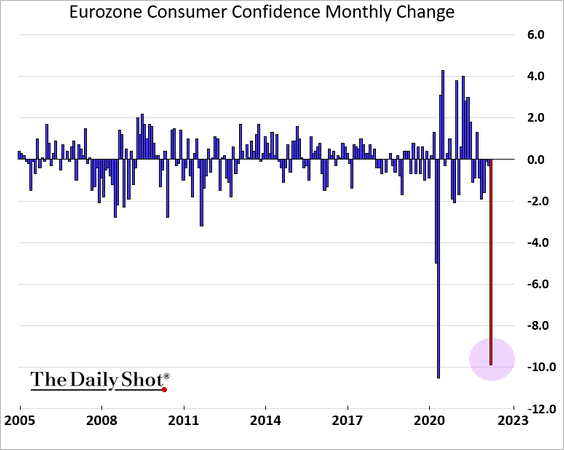

1. Consumer confidence deteriorated sharply this month.

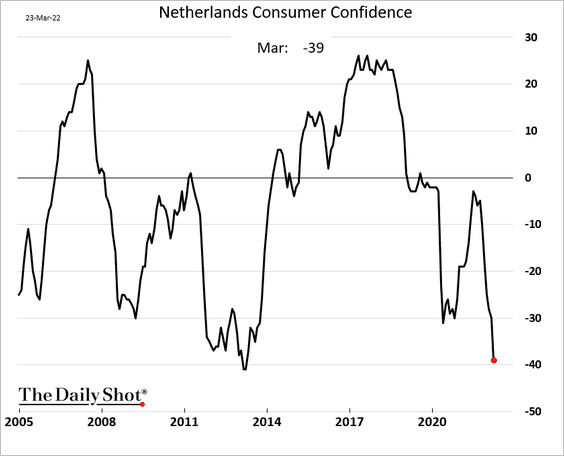

Here is the index for the Netherlands.

——————–

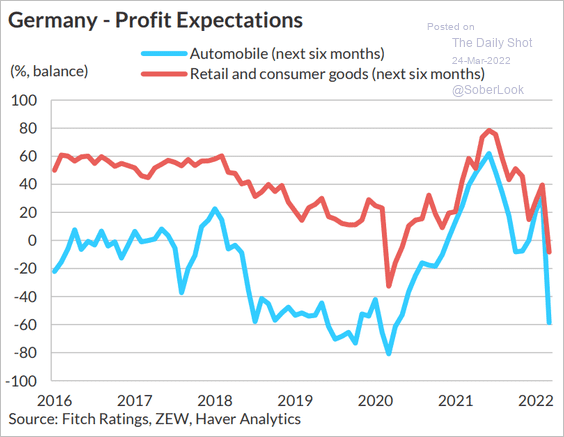

2. Next, we have some updates on Germany.

• Declining profit expectations in key sectors:

Source: Fitch Ratings

Source: Fitch Ratings

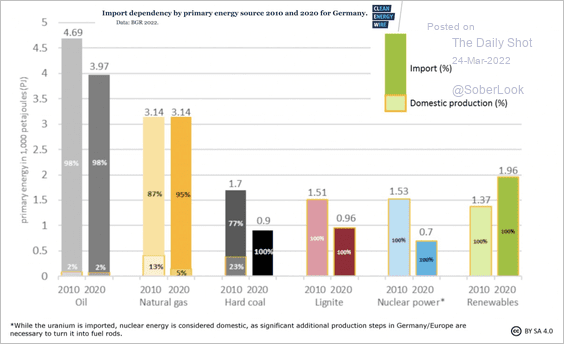

• Germany’s import dependency by energy source:

Source: Clean Energy Wire; {h/t} SOM Macro Strategies

Source: Clean Energy Wire; {h/t} SOM Macro Strategies

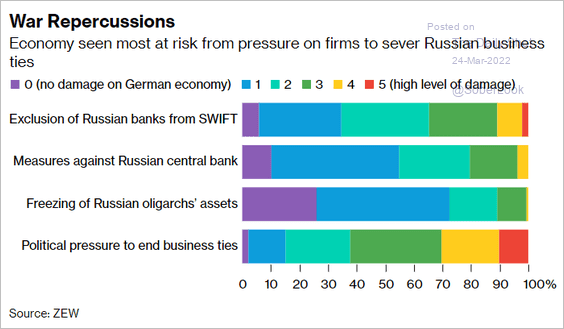

• The impact of severing ties with Russia:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

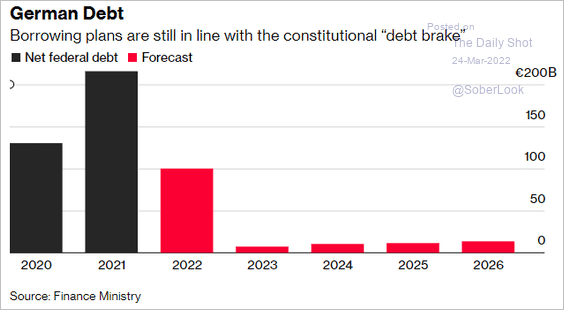

• Funding the defense budget increase:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

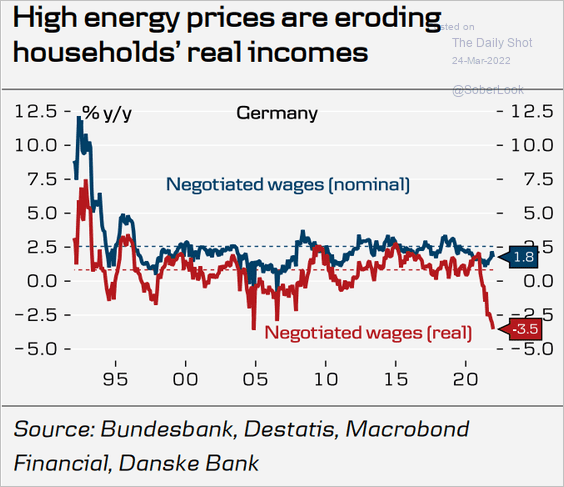

• Plunging real wages:

Source: Danske Bank

Source: Danske Bank

——————–

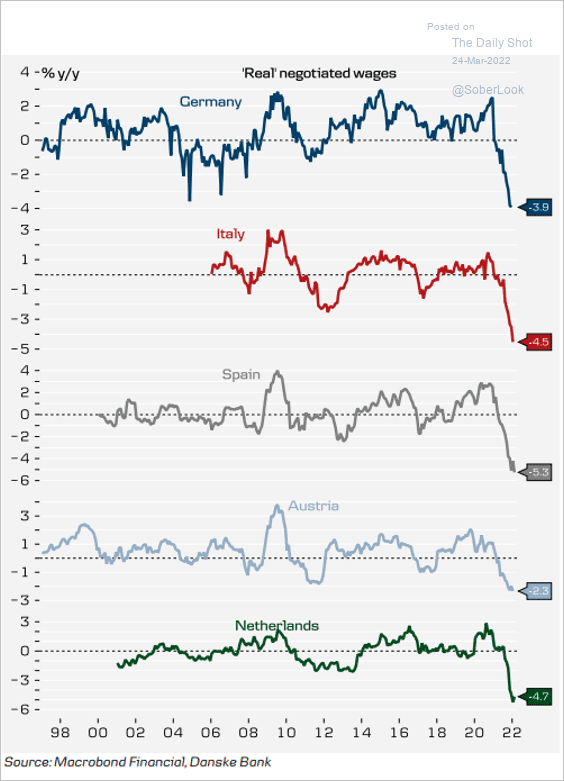

3. Here is the situation with real wages in other economies.

Source: Danske Bank

Source: Danske Bank

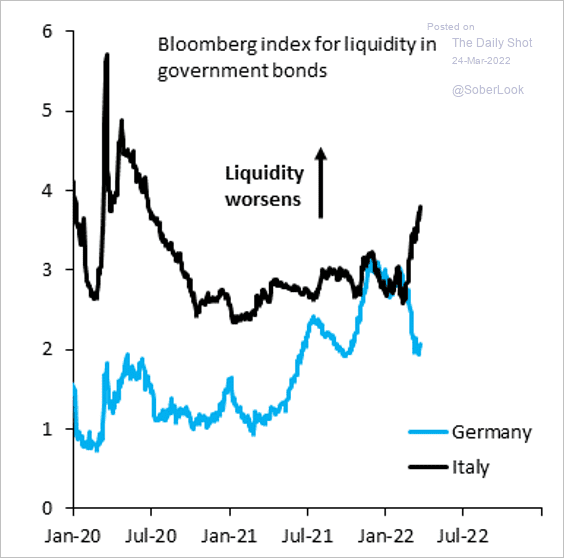

4. Italian bond liquidity has worsened.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

Back to Index

Europe

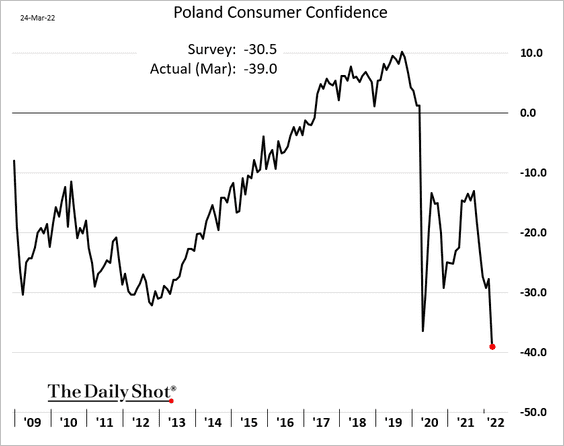

1. Poland’s consumer confidence has collapsed.

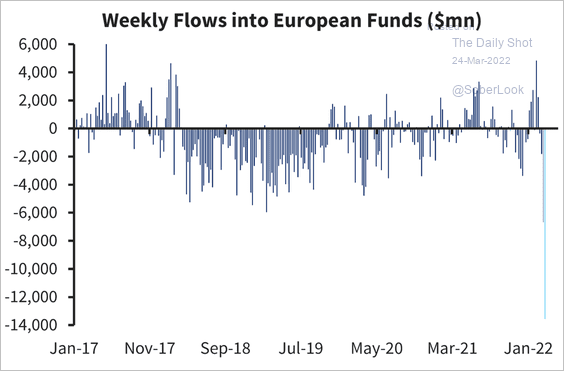

2. Outflows from European equity funds have been extreme.

Source: Barclays Research

Source: Barclays Research

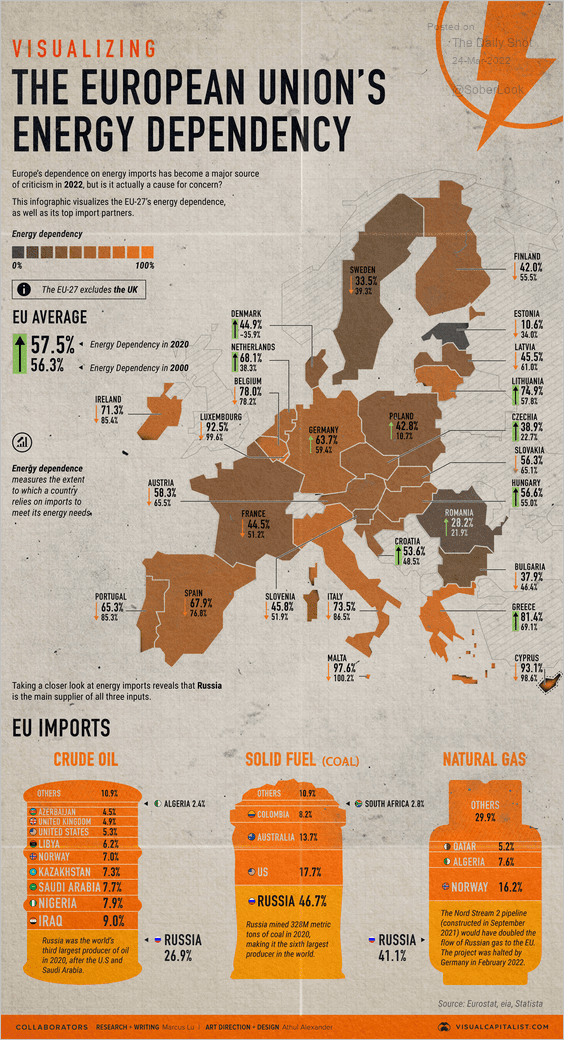

3. Here is a look at the EU’s energy dependency.

Source: Visual Capitalist; h/t Walter Read full article

Source: Visual Capitalist; h/t Walter Read full article

Back to Index

Asia – Pacific

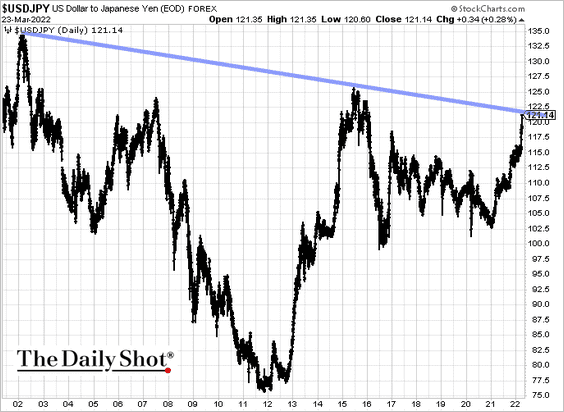

1. Dollar-yen is testing long-term resistance.

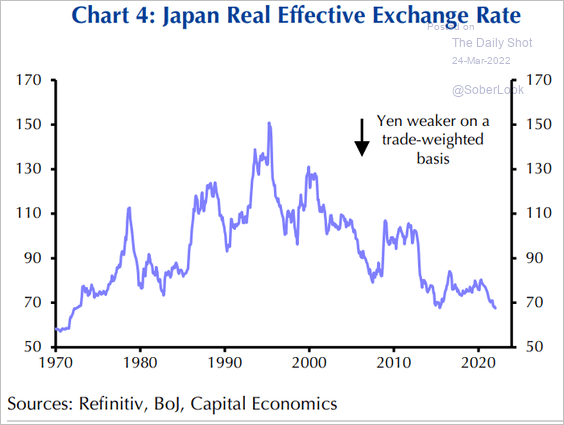

Here is Japan’s real effective exchange rate.

Source: Capital Economics

Source: Capital Economics

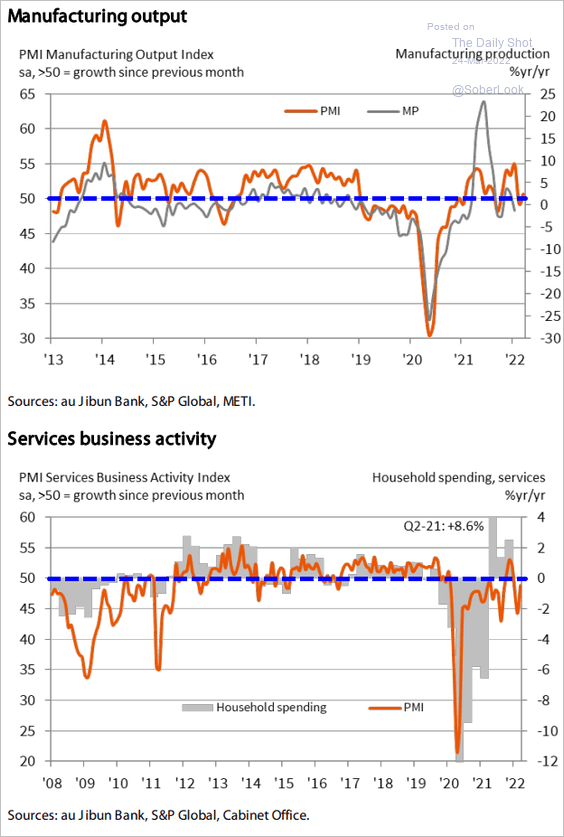

2. Japan’s business activity showed some improvement this month but growth remains elusive.

Source: IHS Markit

Source: IHS Markit

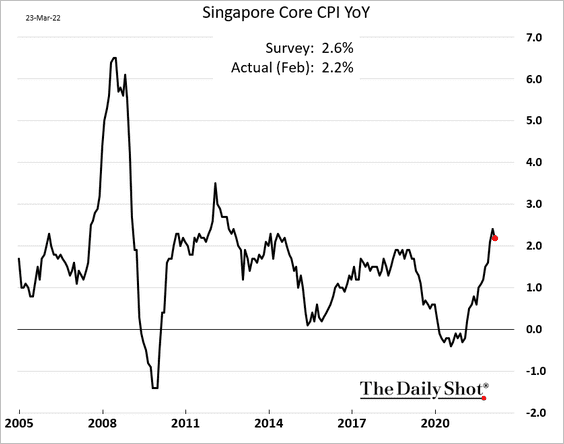

3. Singapore’s CPI unexpectedly declined last month.

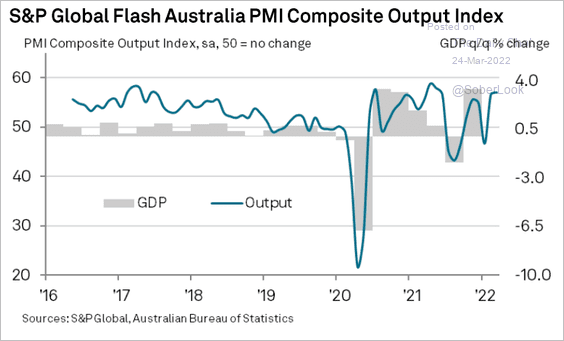

3. Growth in Australia’s business activity remains robust.

Source: IHS Markit

Source: IHS Markit

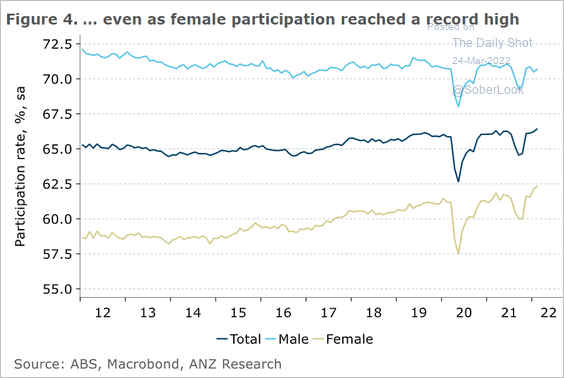

The nation’s labor force participation has been remarkably strong, with gains driven by women entering the workforce.

Source: ANZ Research

Source: ANZ Research

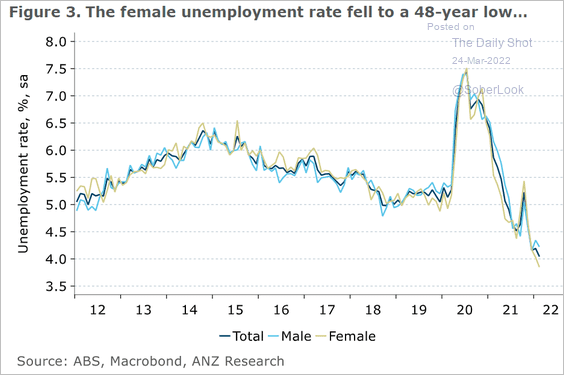

The female unemployment rate is at a 48-year low.

Source: ANZ Research

Source: ANZ Research

Back to Index

China

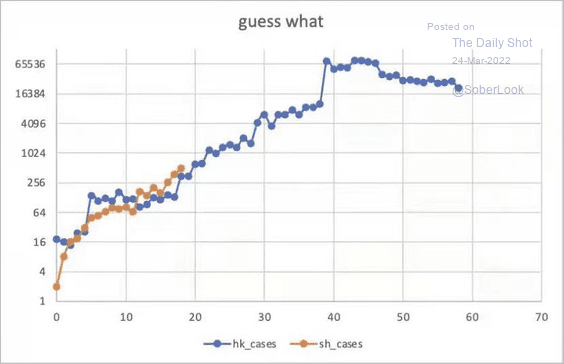

1. Will Shanghai’s COVID cases follow Hong Kong higher?

Source: @HAOHONG_CFA

Source: @HAOHONG_CFA

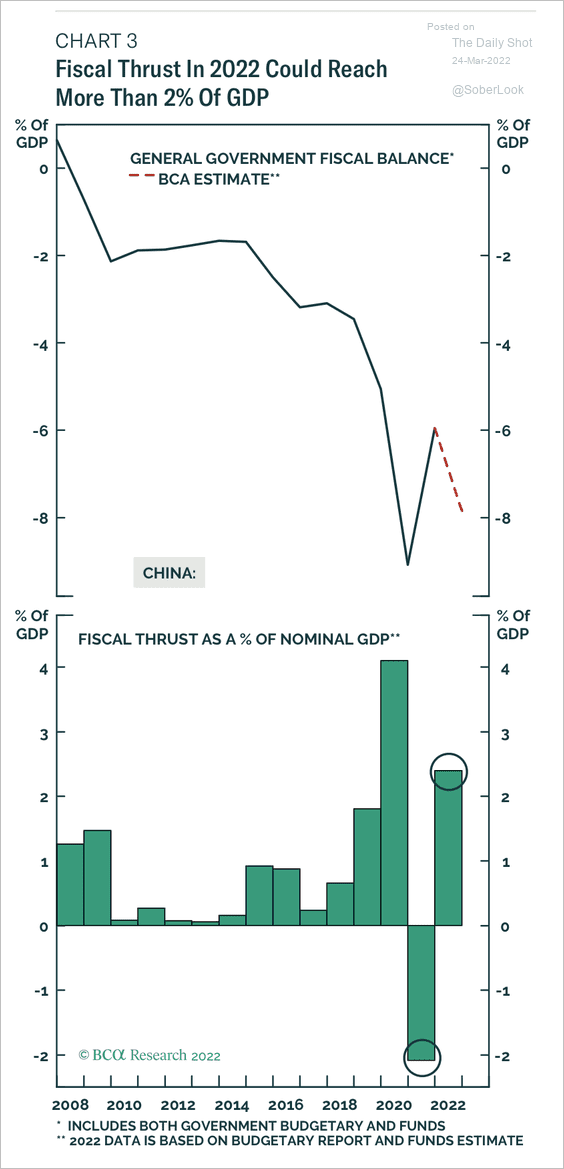

2. BCA Research expects a fresh round of fiscal stimulus that could reverse the current drag.

Source: BCA Research

Source: BCA Research

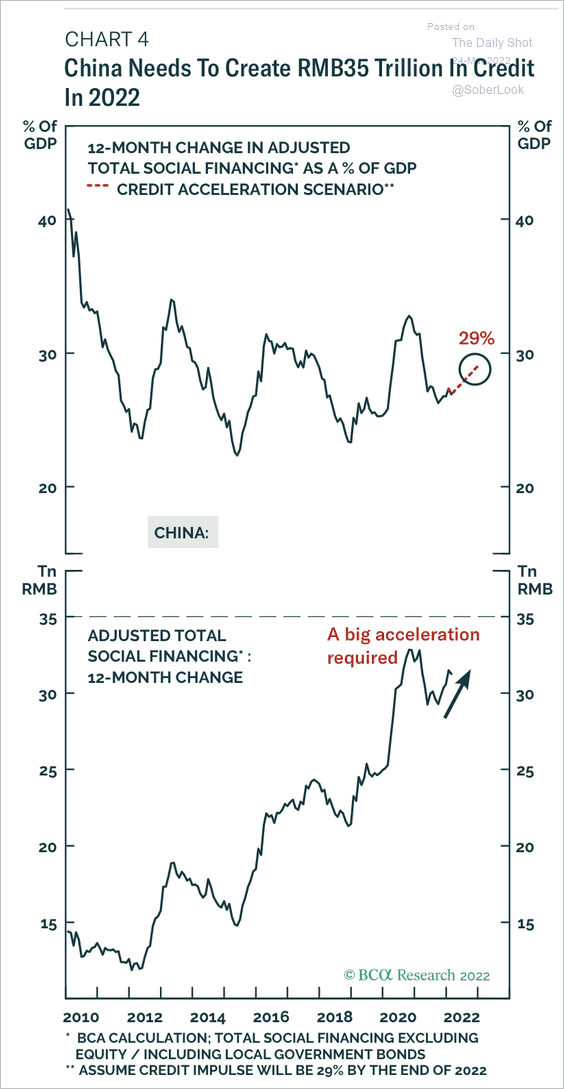

An acceleration in credit growth could also support the economy.

Source: BCA Research

Source: BCA Research

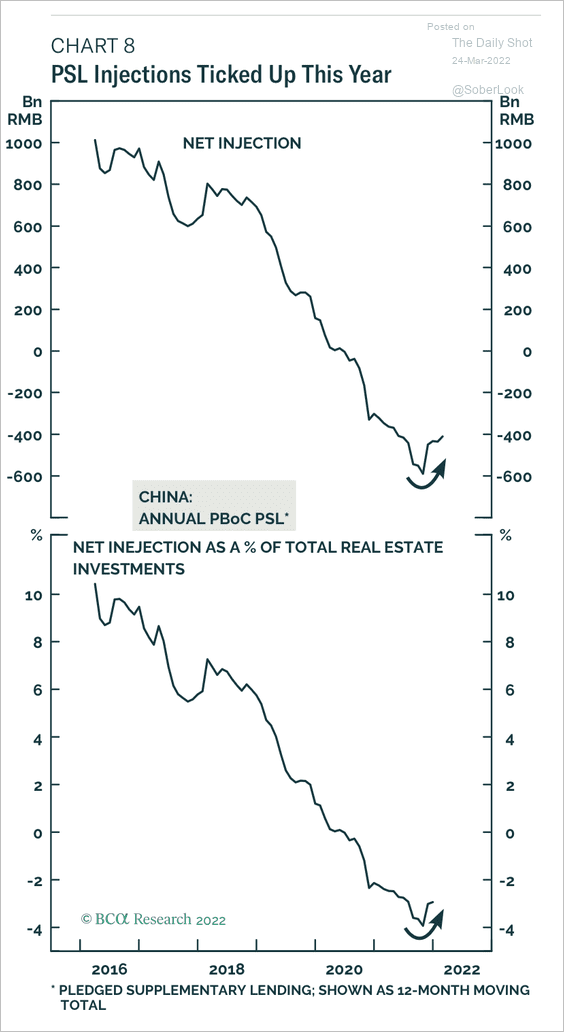

Pledged supplementary lending (PSL), a tool the government utilized to monetize excess inventories in the market in 2015/16, has ticked up.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

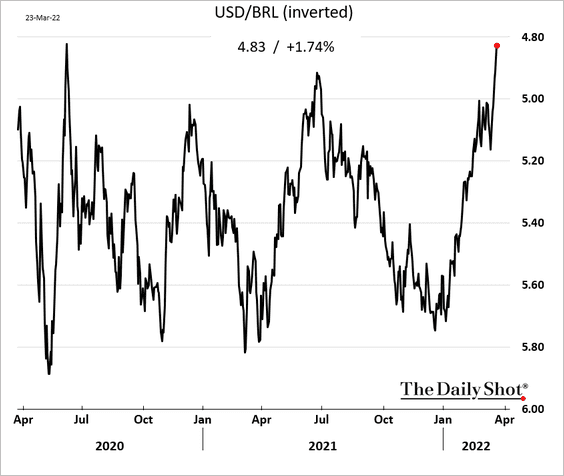

1. The Brazilian real is surging as EM investors rotate to LatAm.

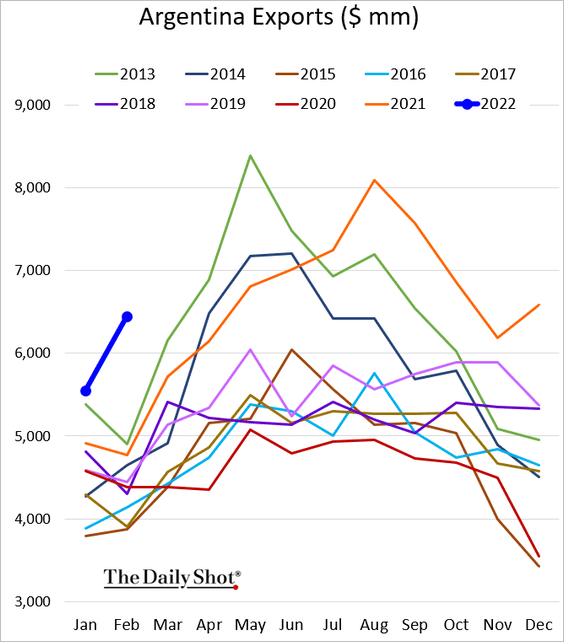

2. Argentina’s exports are at record highs for this time of the year as commodity prices spike.

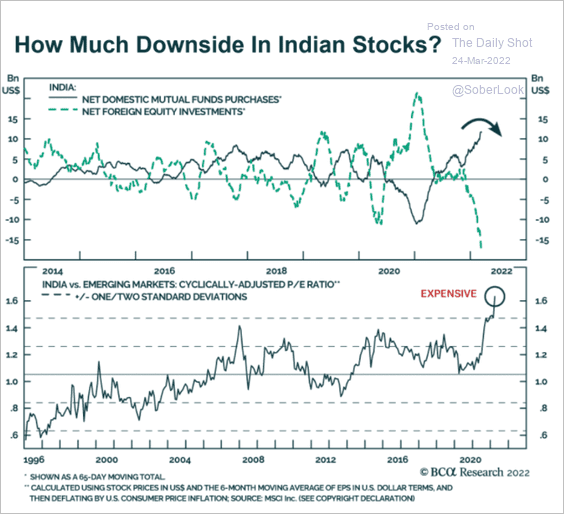

3. Are Indian stocks too expensive?

Source: BCA Research

Source: BCA Research

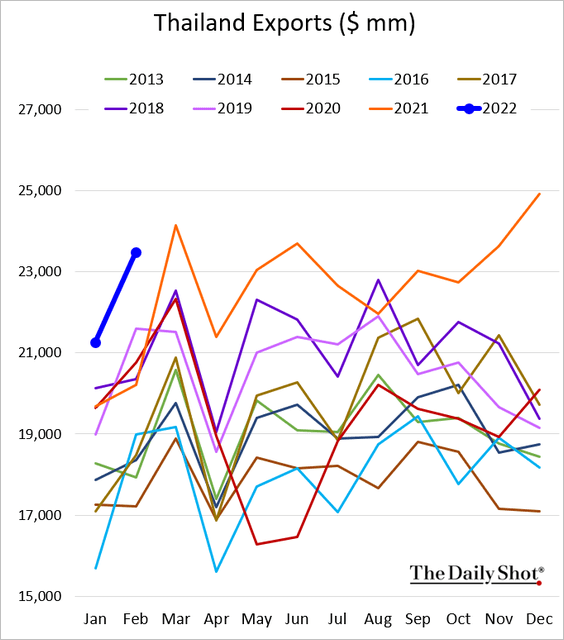

4. Thai exports have been very strong.

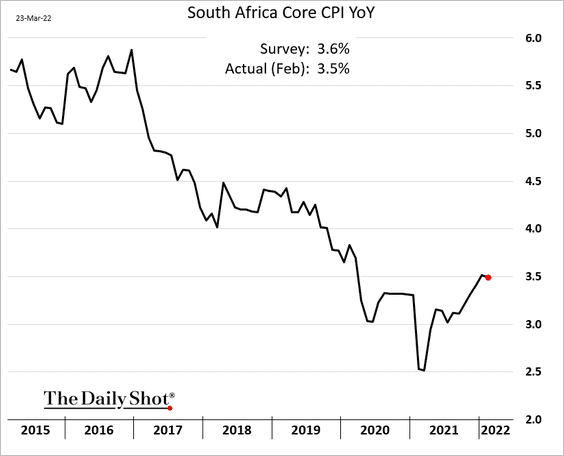

5. South Africa’s inflation slowed last month.

6. EM shares are undervalued relative to DM.

Source: TS Lombard

Source: TS Lombard

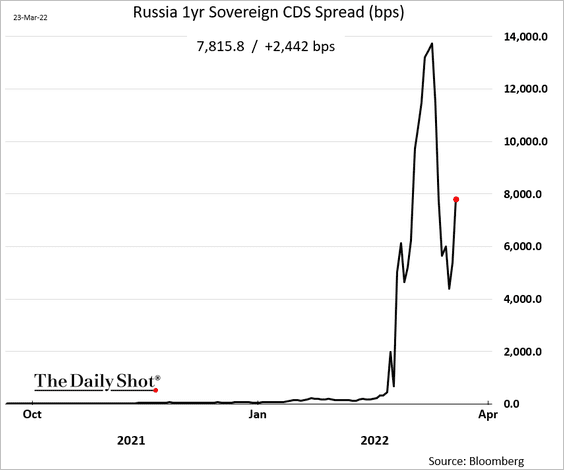

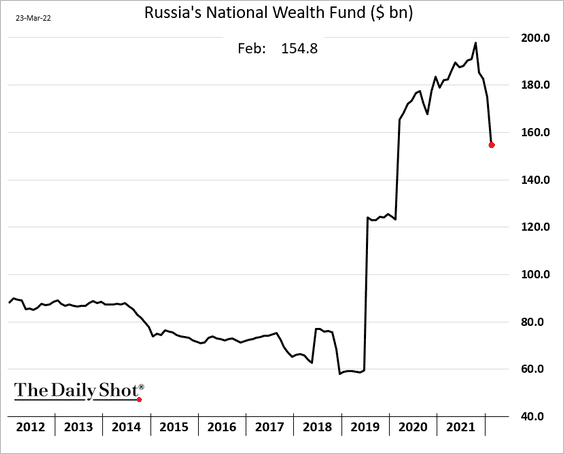

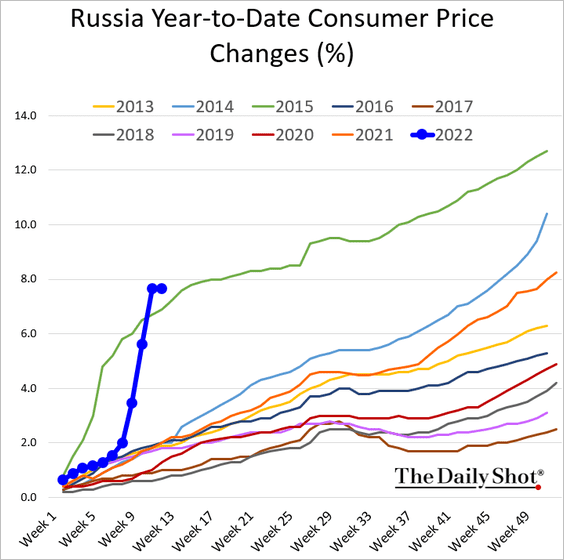

7. Next, We have some updates on Russia.

• Default protection premiums are rising again despite reports that Russia paid its bond coupon.

• Russia’s sovereign wealth fund took a hit in February.

Source: Reuters Read full article

Source: Reuters Read full article

• Inflation has been soaring.

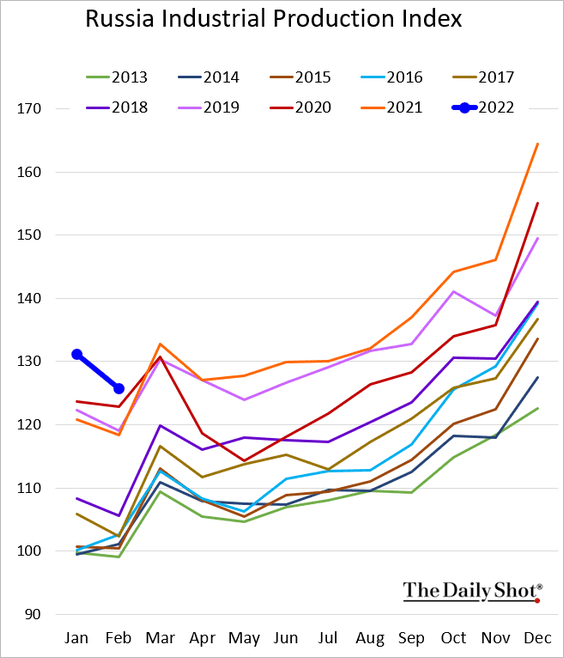

• Industrial production eased in February.

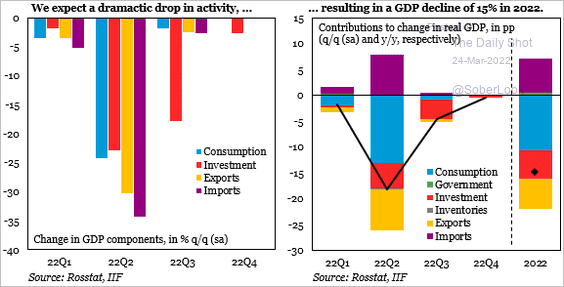

• Here is the anatomy of the GDP shock.

Source: @IIF Read full article

Source: @IIF Read full article

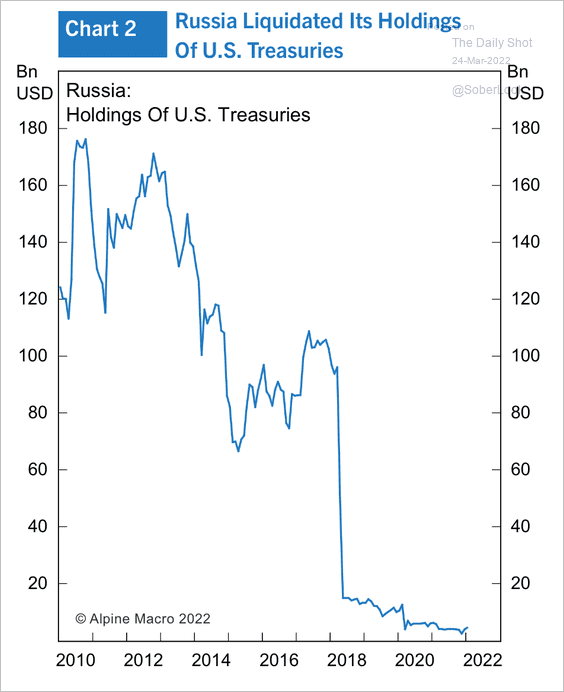

• Cutting out dollar holdings from FX reserves wasn’t particularly helpful as the EU operated in concert with the US on sanctions.

Source: Alpine Macro

Source: Alpine Macro

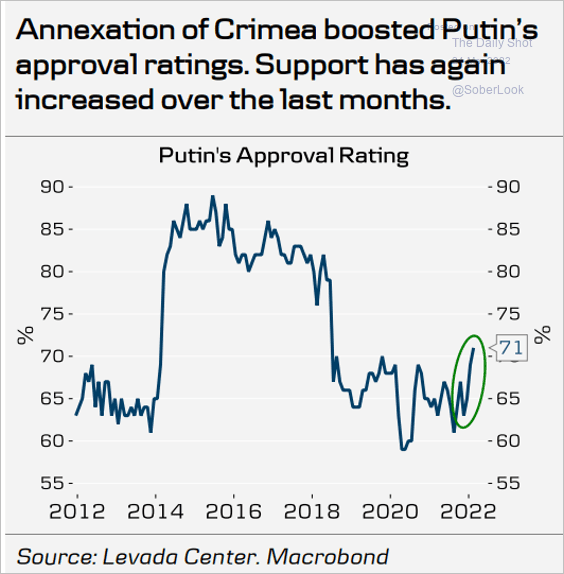

• Putin’s domestic approval ratings have improved.

Source: Danske Bank

Source: Danske Bank

Back to Index

Cryptocurrency

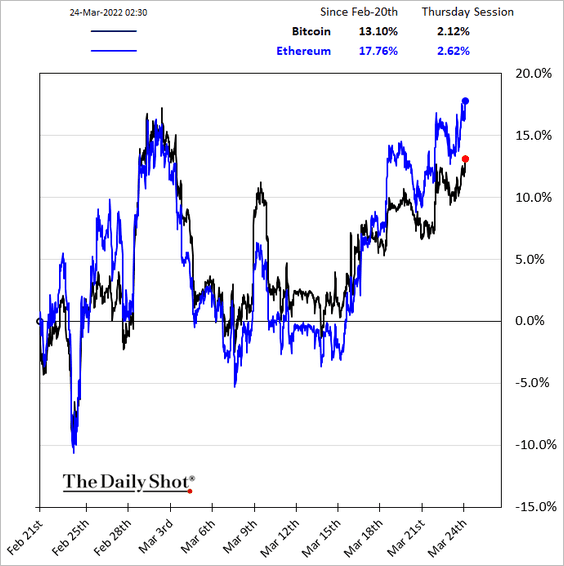

1. Cryptos are rallying, with ether outperforming.

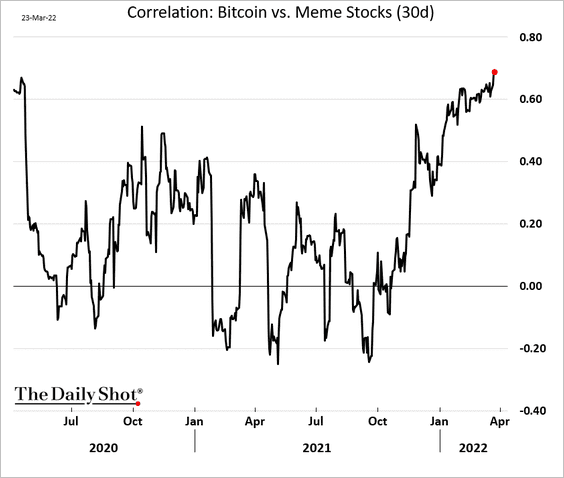

2. Bitcoin is increasingly correlated with meme stocks.

h/t Dantes Outlook

h/t Dantes Outlook

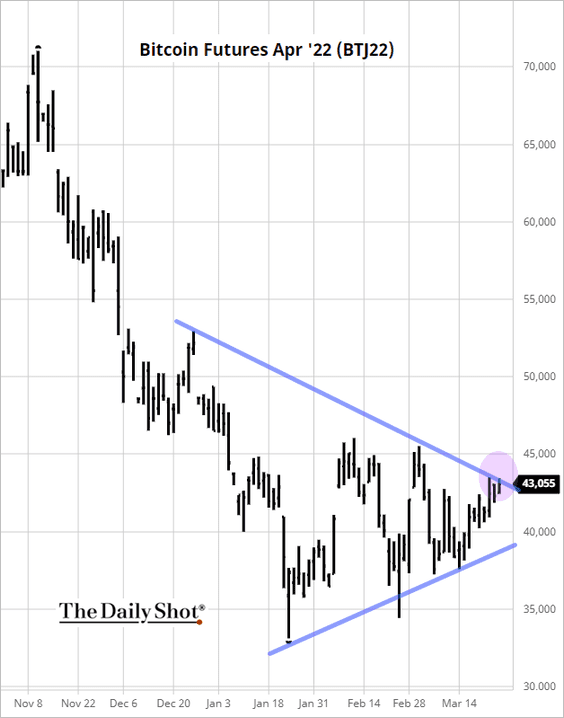

3. Bitcoin futures are at resistance.

Source: barchart.com; h/t @MarkCCranfield

Source: barchart.com; h/t @MarkCCranfield

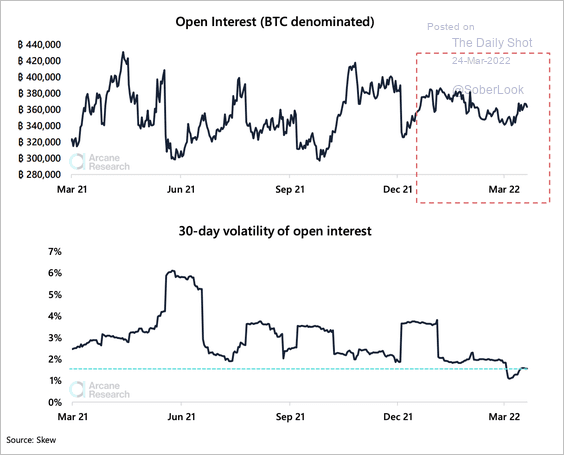

4. Open interest in the bitcoin futures market has stabilized over the past few months, but some analysts expect an uptick in trading activity if BTC pushes higher.

Source: Arcane Research Read full article

Source: Arcane Research Read full article

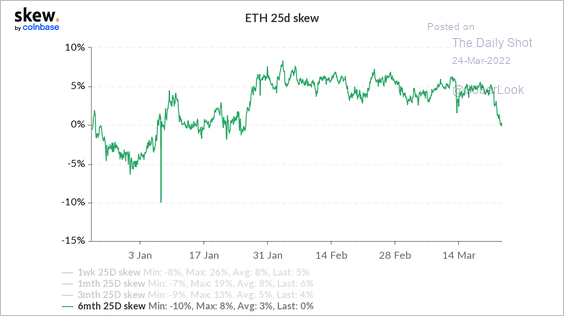

5. The six-month ETH put-call skew is declining, indicating less demand for downside protection among option traders.

Source: Skew Read full article

Source: Skew Read full article

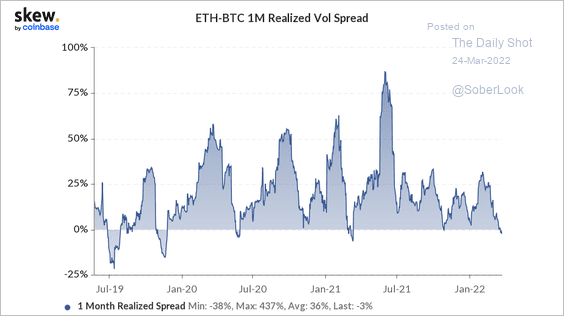

6. The spread between ETH and BTC one-month implied volatility turned negative for the first time since March 2021. We could see a sharp move in the ETH/BTC price ratio.

Source: Skew Read full article

Source: Skew Read full article

Back to Index

Energy

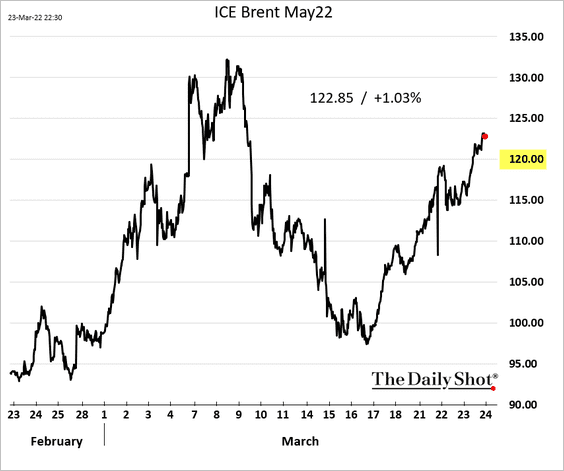

1. Brent passed $120/bbl after the Caspian Sea pipeline news.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

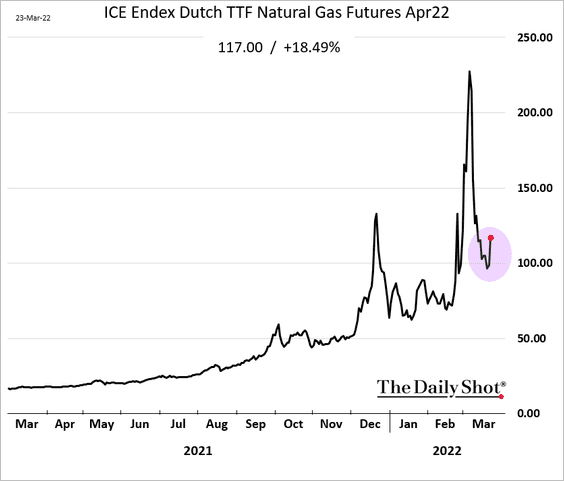

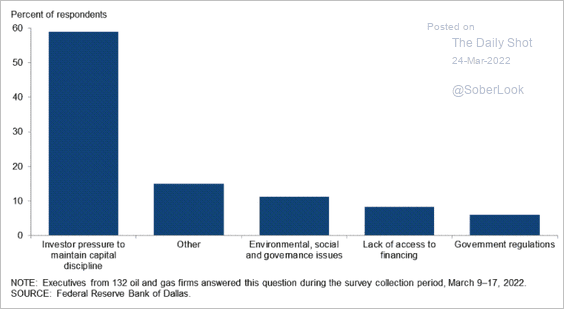

2. European natural gas futures jumped after talk of settling contracts in rubles.

Source: Reuters Read full article

Source: Reuters Read full article

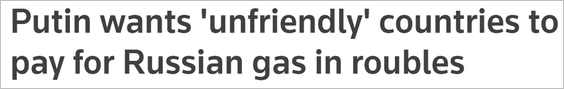

• The biggest natural gas storage facility in Northern Europe is empty.

Source: @AndreasSteno

Source: @AndreasSteno

——————–

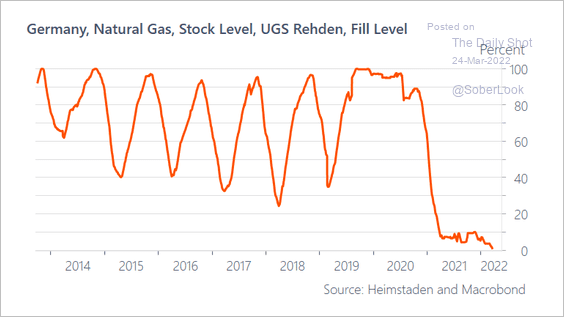

3. European gasoil futures are in massive backwardation.

Source: @JavierBlas

Source: @JavierBlas

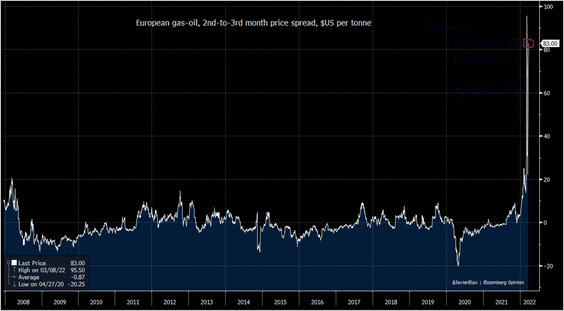

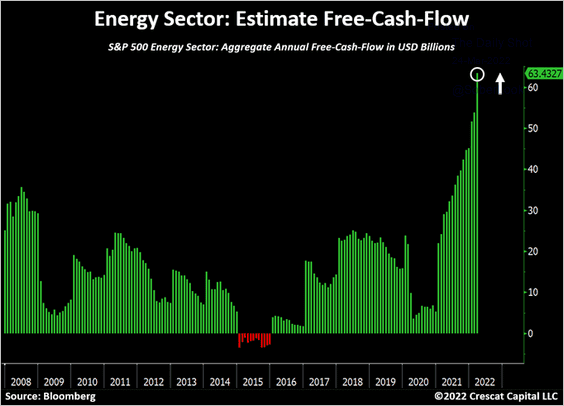

4. A survey from the Dallas Fed shows that US investors still expect strict capital discipline from energy firms.

Source: Federal Reserve Bank of Dallas

Source: Federal Reserve Bank of Dallas

That’s surprising, given the investment opportunity at current prices. Free cash flow has been surging.

Source: @TaviCosta

Source: @TaviCosta

——————–

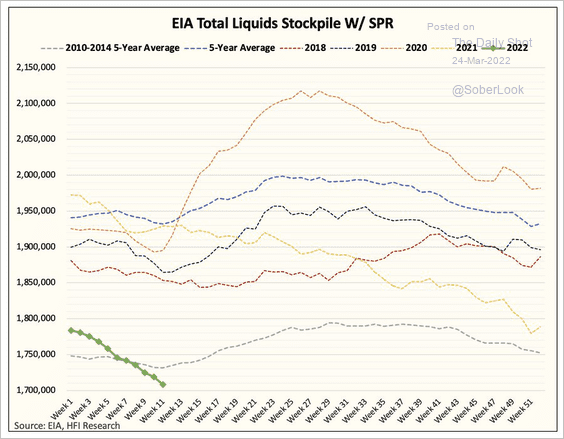

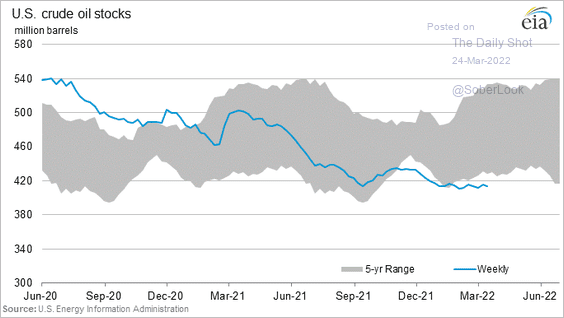

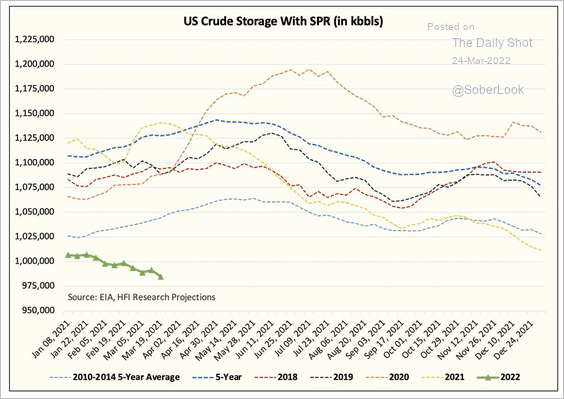

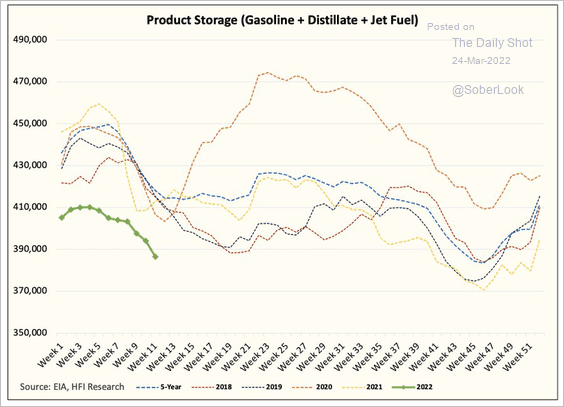

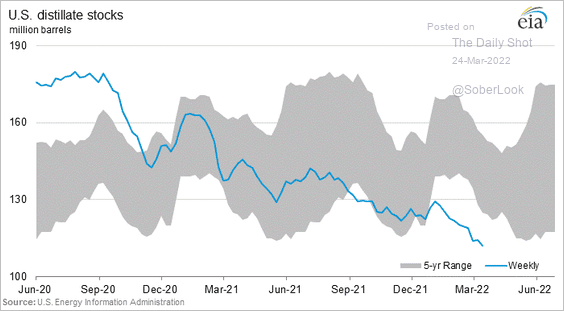

5. US liquids inventories continue to shrink.

Source: @HFI_Research

Source: @HFI_Research

• Crude oil (2 charts):

Source: @HFI_Research

Source: @HFI_Research

• Products (2 charts):

Source: @HFI_Research

Source: @HFI_Research

——————–

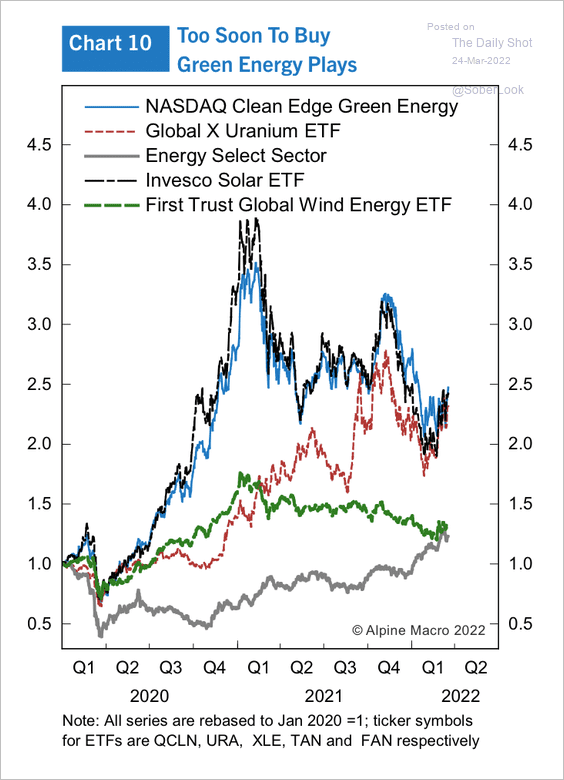

6. Clean energy stocks are attempting a turnaround, although most stocks peaked in the runup to the Nov. 2020 US elections.

Source: Alpine Macro

Source: Alpine Macro

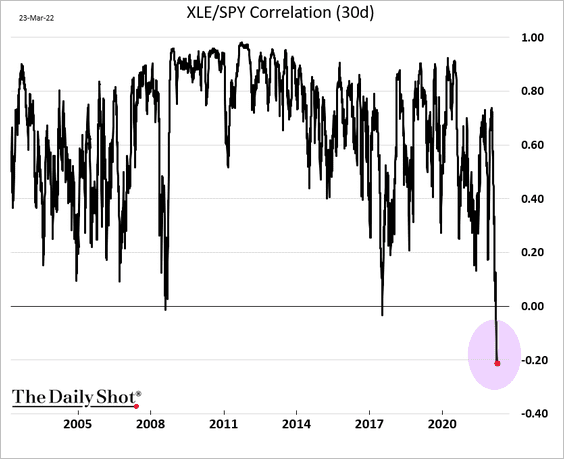

7. Energy shares have been negatively correlated with the rest of the stock market.

Further reading

Further reading

Back to Index

Equities

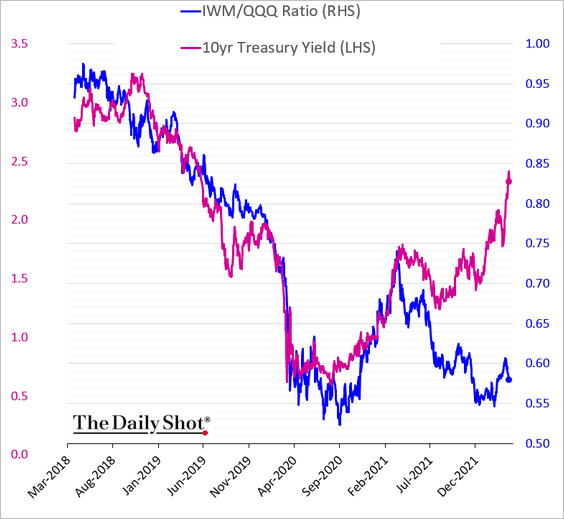

1. Small caps should be outperforming large tech stocks as bond yields climb. That hasn’t been the case.

h/t @mikamsika

h/t @mikamsika

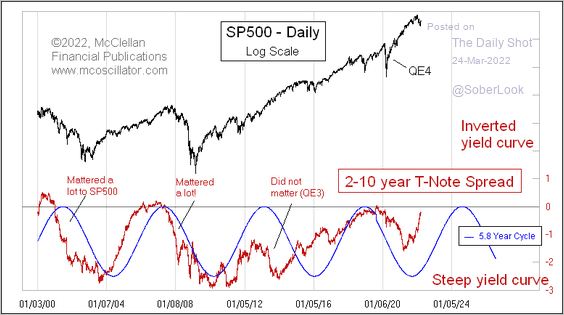

2. Below is a look at the S&P 500 and periods when the 2yr-10yr Treasury slope flattens/inverts.

Source: @McClellanOsc

Source: @McClellanOsc

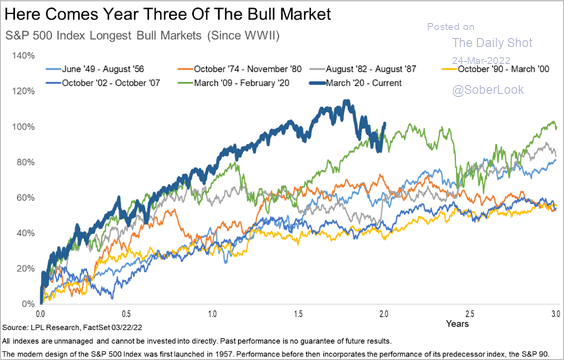

3. Here are the longest bull markets.

Source: Ryan Detrick, LPL Research

Source: Ryan Detrick, LPL Research

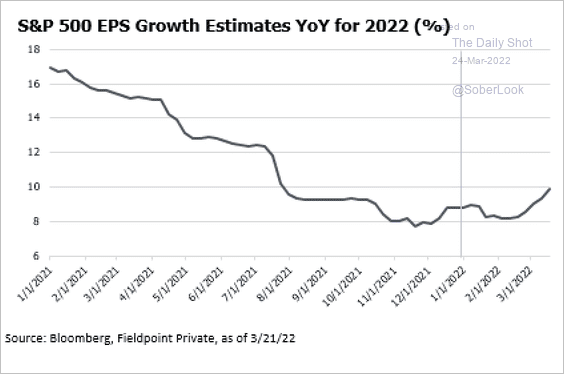

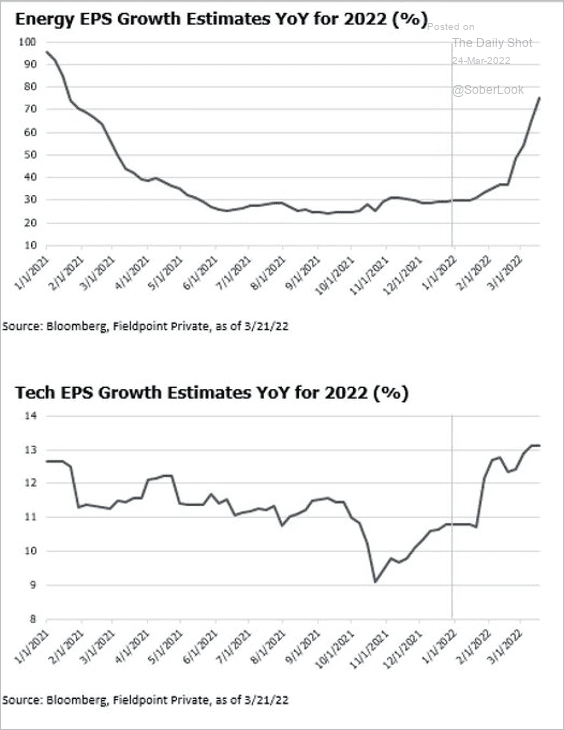

4. EPS growth estimates have improved, …

Source: @CameronDawson

Source: @CameronDawson

… driven by energy and tech.

Source: @CameronDawson

Source: @CameronDawson

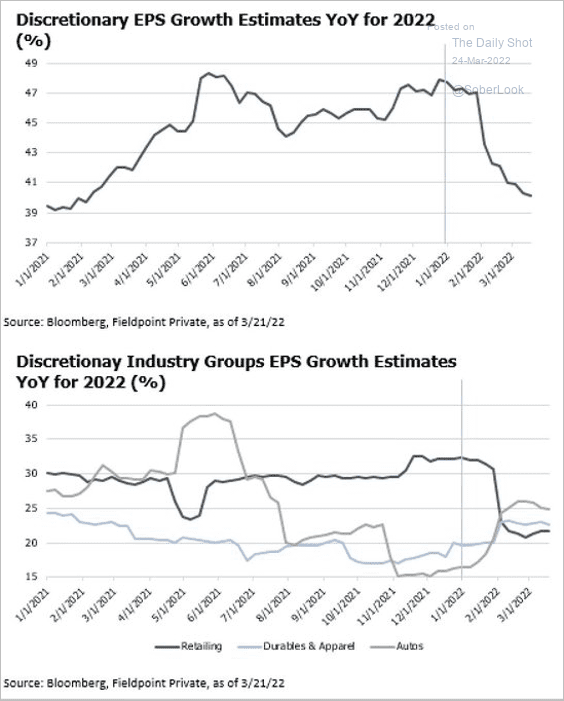

Earnings growth projections for retailing shares have deteriorated.

Source: @CameronDawson

Source: @CameronDawson

——————–

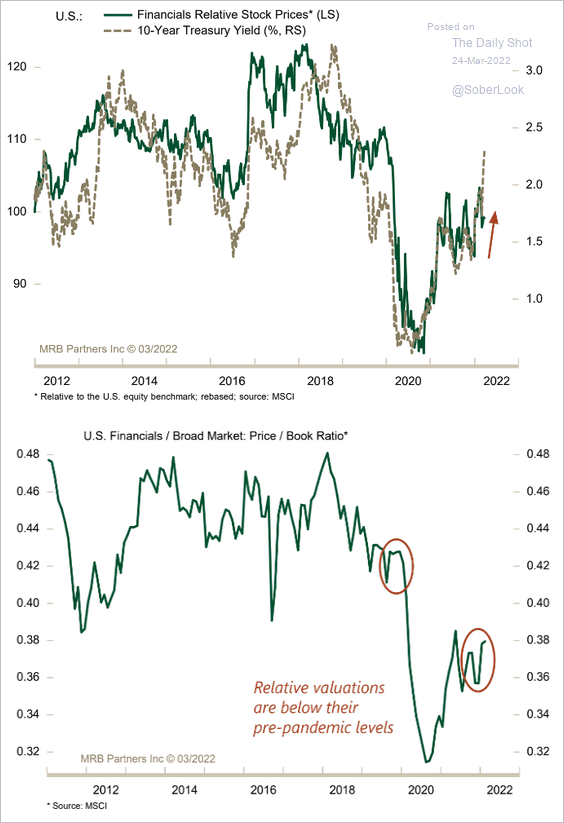

5. More upside for financials?

Source: MRB Partners

Source: MRB Partners

Back to Index

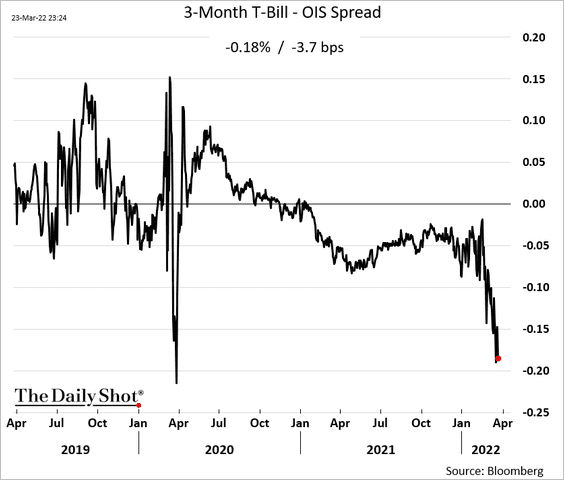

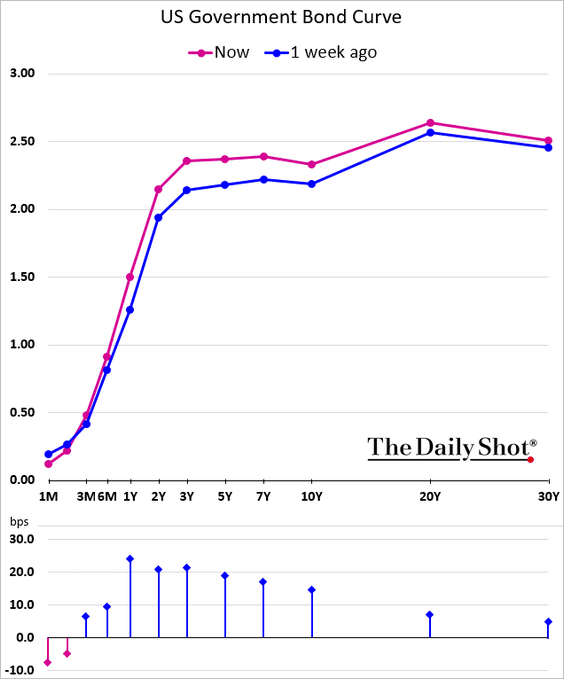

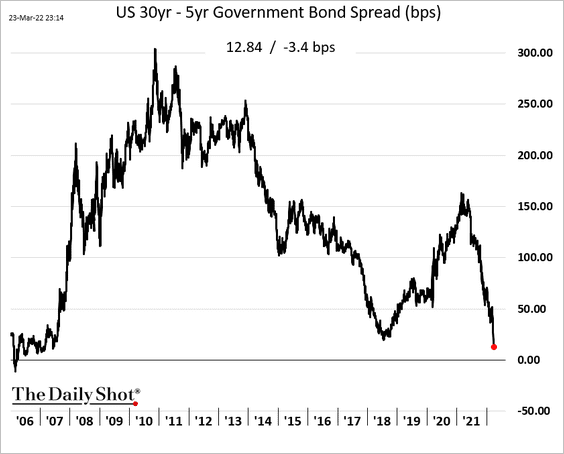

Rates

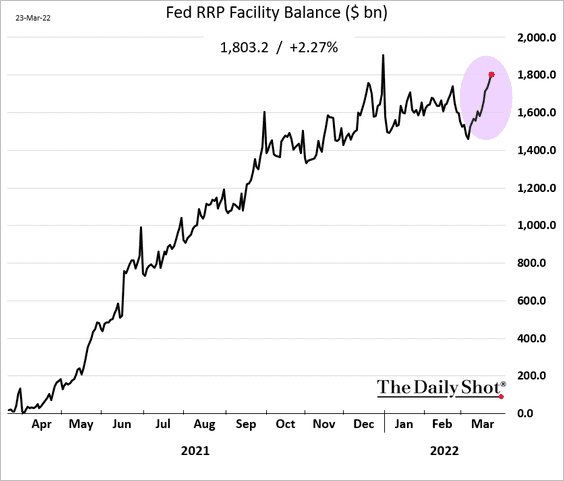

1. Cash is king. Risk-free overnight deposits paying 0.3% at the Fed’s reverse repo facility have been attracting money market funds looking to place massive amounts of cash.

Treasury bills are in huge demand.

——————–

2. The Treasury curve has flattened further amid strong demand for the 20-year paper.

——————–

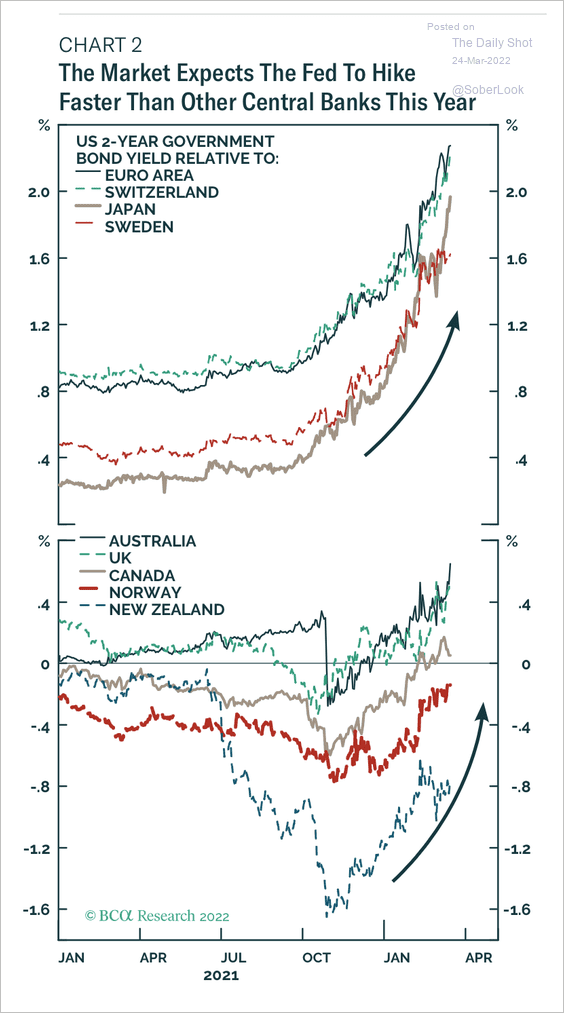

3. The rise in the 2-year Treasury note yield has outpaced most other G10 countries.

Source: BCA Research

Source: BCA Research

Back to Index

Global Developments

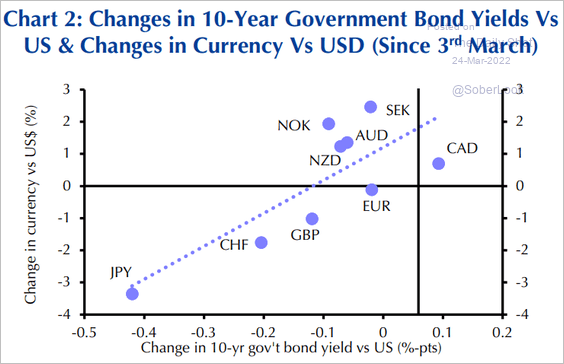

1. DM currency moves vs. USD have been correlated to changes in yield differentials.

Source: Capital Economics

Source: Capital Economics

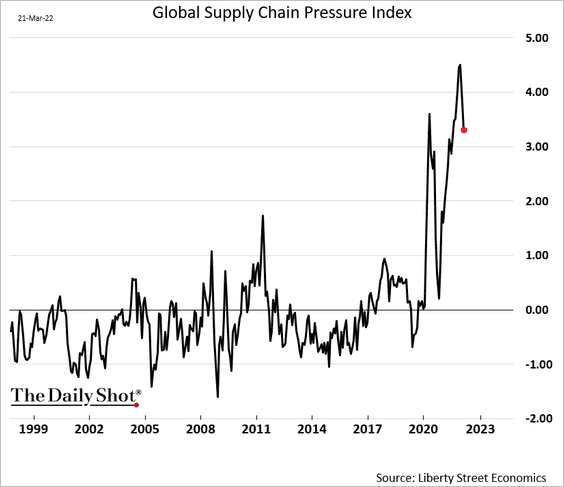

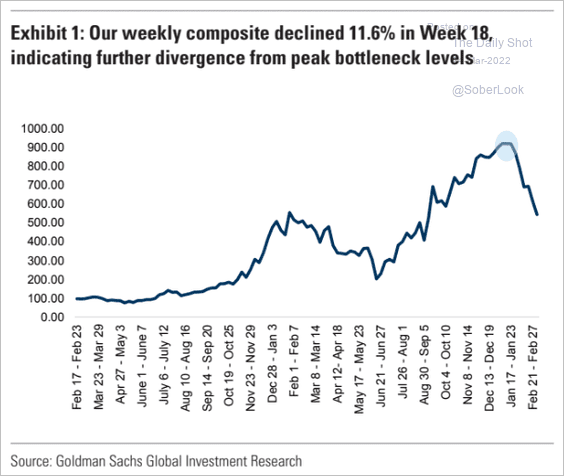

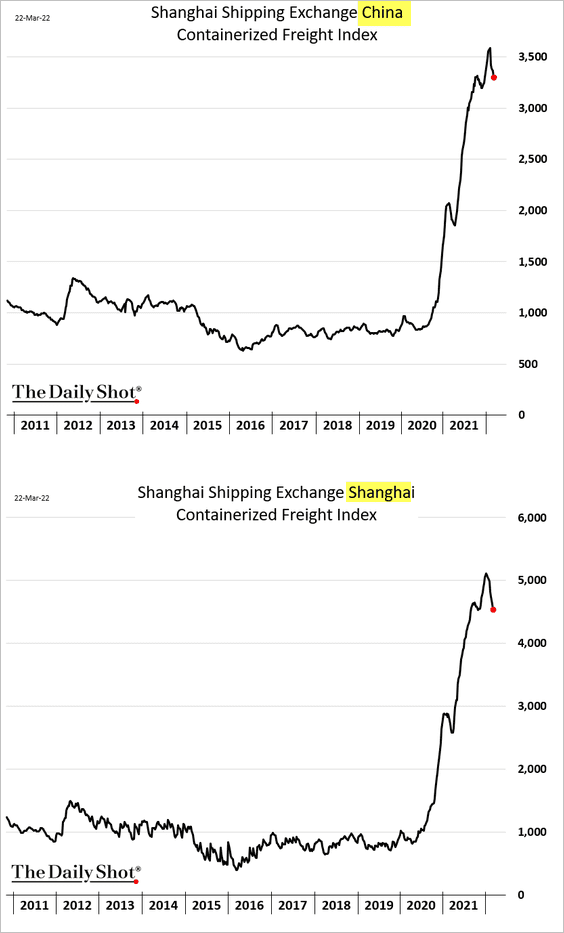

2. Supply-chain bottlenecks have been acute. Have they now peaked (3 charts)?

Source: Goldman Sachs; @countdraghula

Source: Goldman Sachs; @countdraghula

——————–

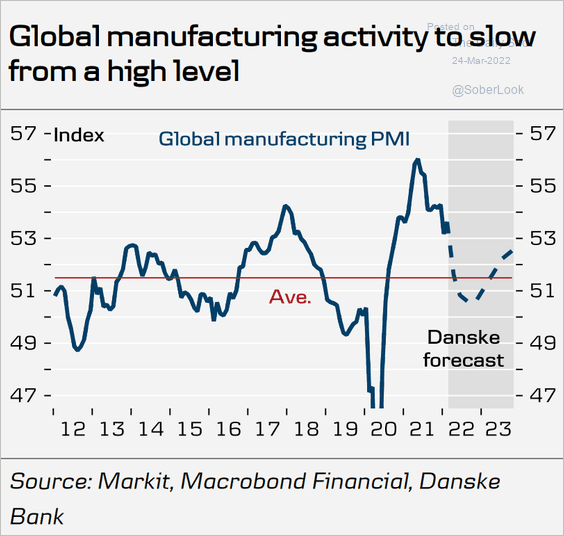

3. Global manufacturing activity is expected to slow.

Source: Danske Bank

Source: Danske Bank

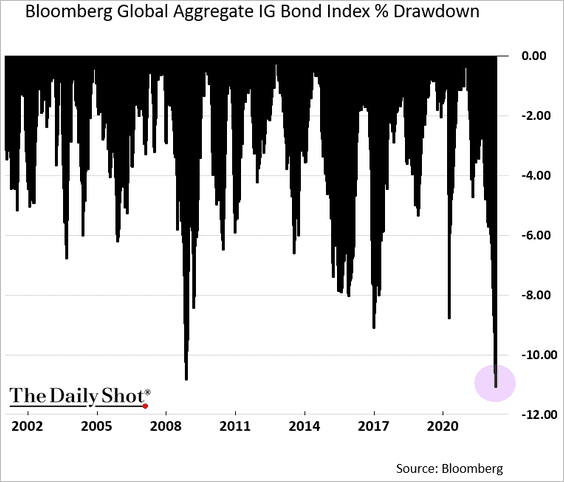

4. The drawdown in global bonds has been massive.

——————–

Food for Thought

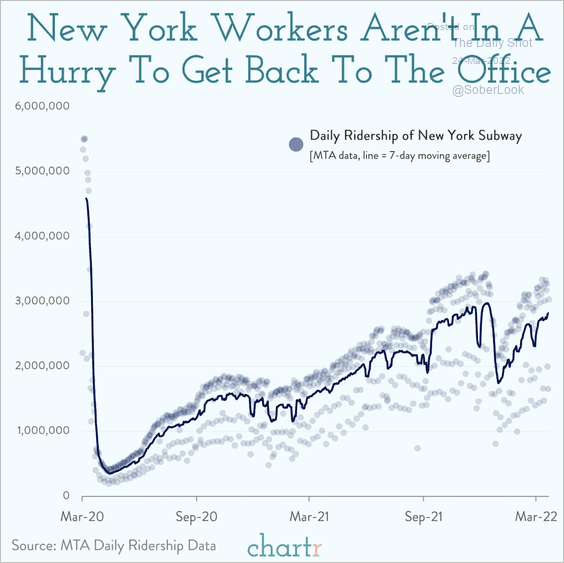

1. NYC subway daily ridership:

Source: @chartrdaily

Source: @chartrdaily

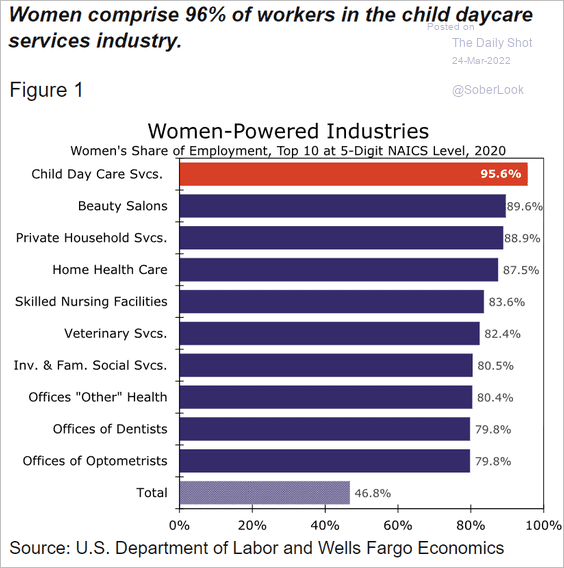

2. Women-powered industries:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

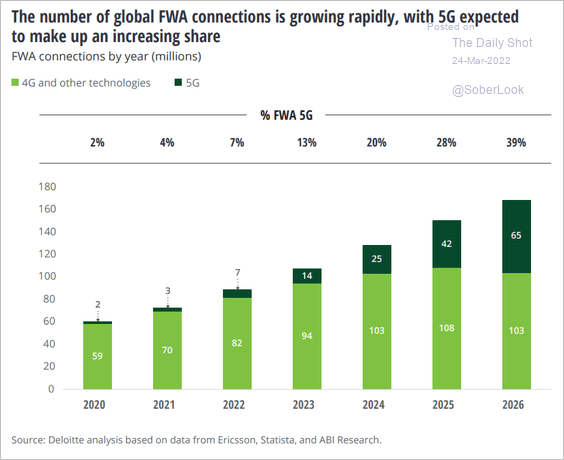

3. Fixed wireless access (FWA) internet services:

Source: Deloitte Read full article

Source: Deloitte Read full article

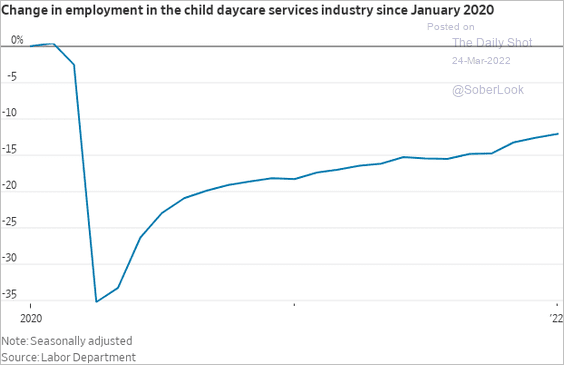

4. Daycare employment:

Source: @WSJ Read full article

Source: @WSJ Read full article

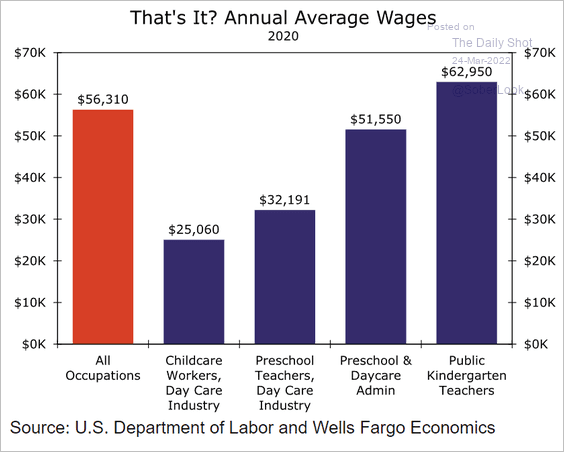

• Daycare wages:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

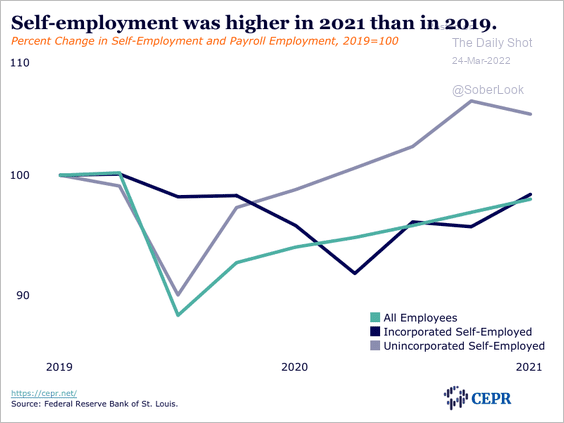

5. Self-employment growth:

Source: @ceprdc Read full article

Source: @ceprdc Read full article

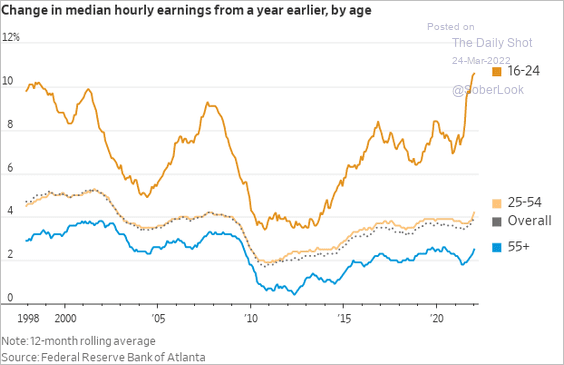

6. Wage growth by age group:

Source: @WSJ Read full article

Source: @WSJ Read full article

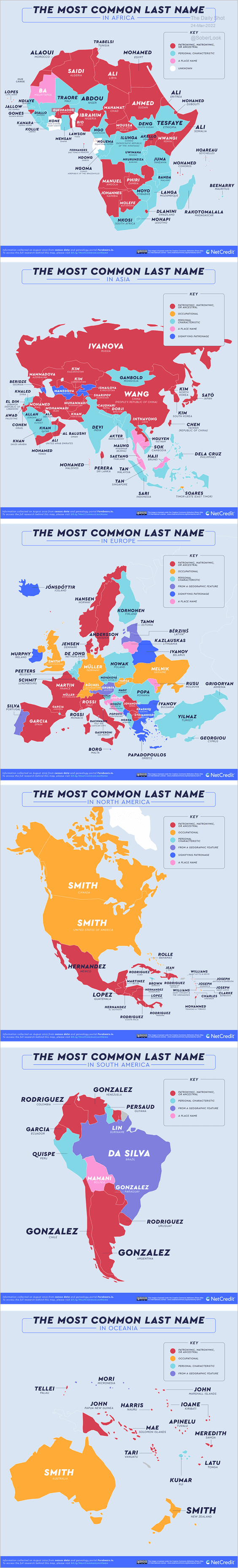

7. The most common last names around the world:

Source: NetCredit Read full article

Source: NetCredit Read full article

——————–

Back to Index