The Daily Shot: 25-Mar-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

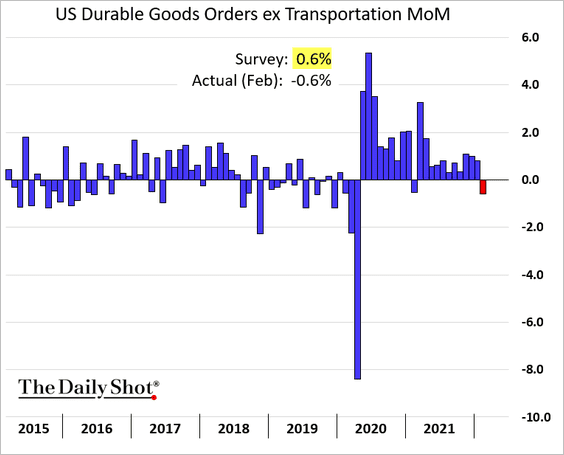

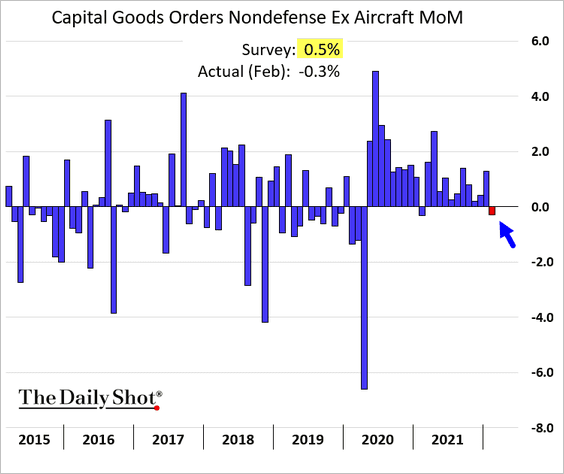

1. Durable goods orders declined in February, with the weakness surprising some economists. Signs of slower growth?

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

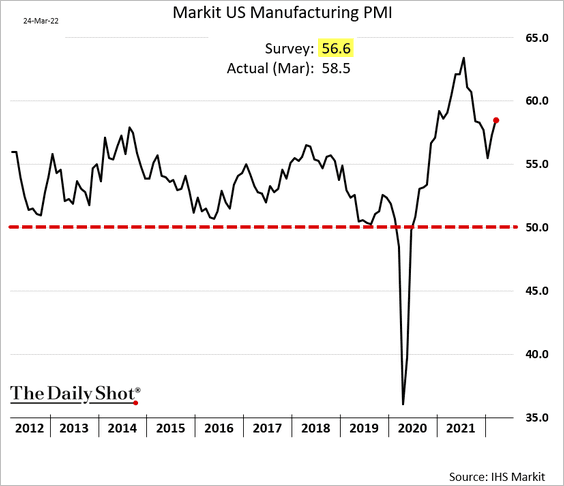

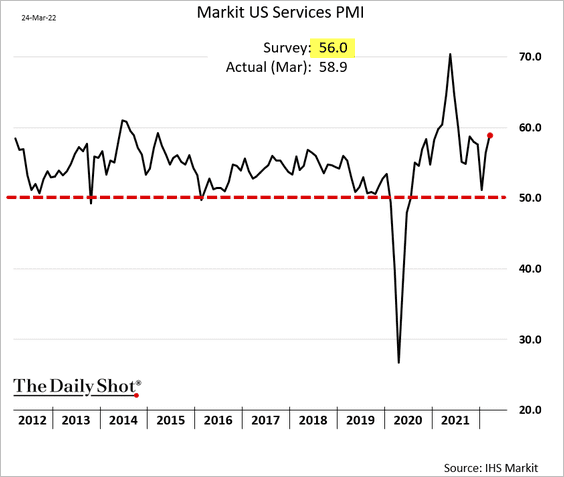

2. However, survey indicators suggest that business activity strengthened this month. The Markit PMI report topped expectations.

• Manufacturing PMI:

• Services PMI:

——————–

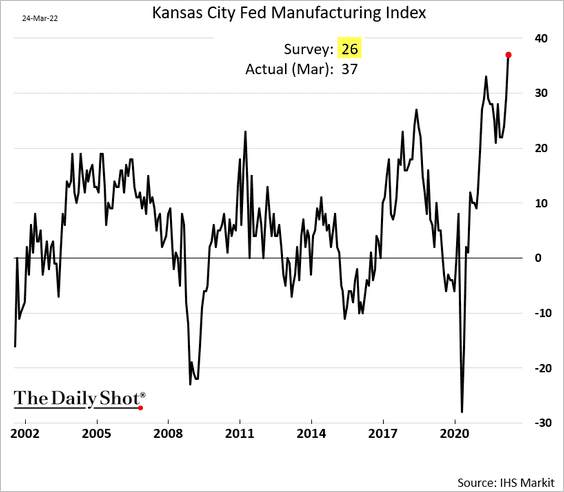

3. The Kansas City Fed’s regional factory activity index hit a record high.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

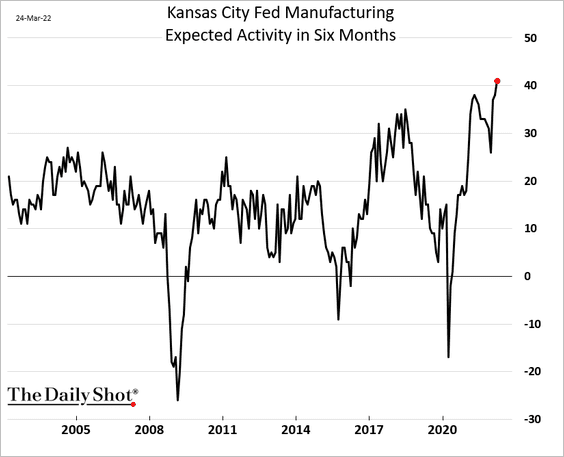

The expectations index was also remarkably strong.

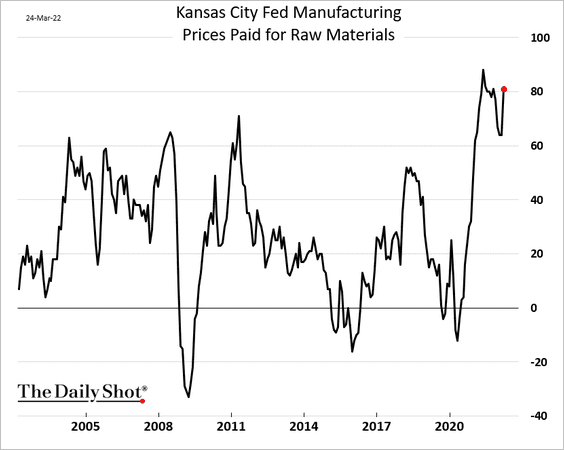

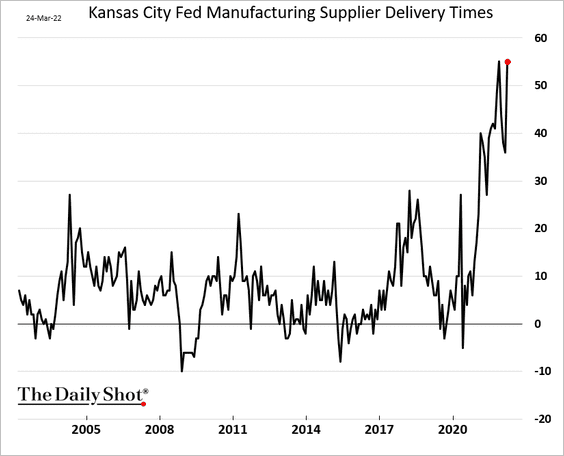

Price pressures and supply bottlenecks worsened this month.

——————–

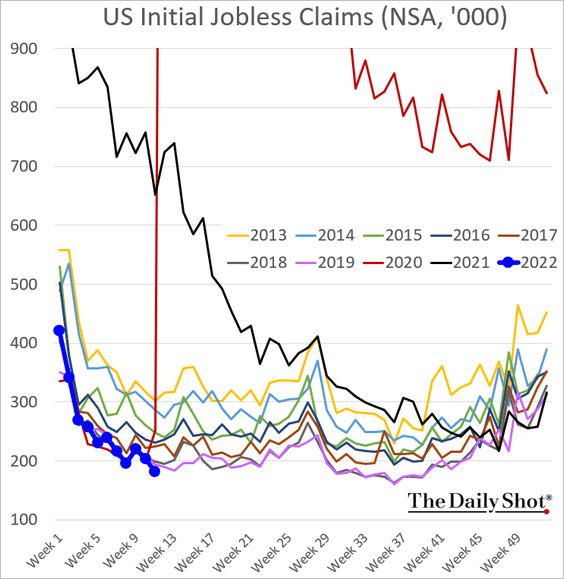

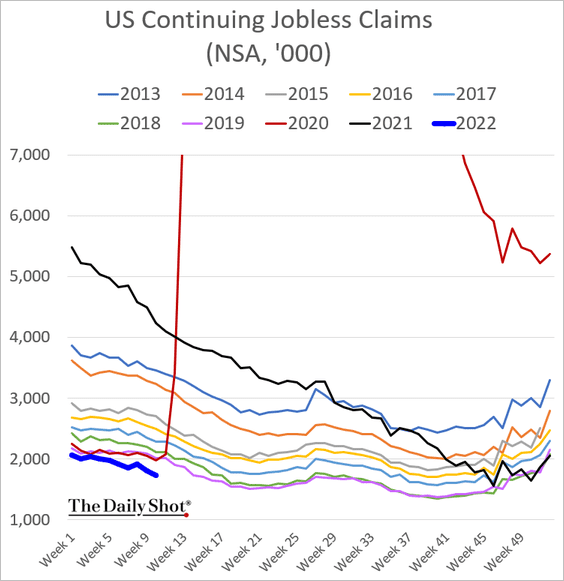

4. Next, we have some updates on the labor market.

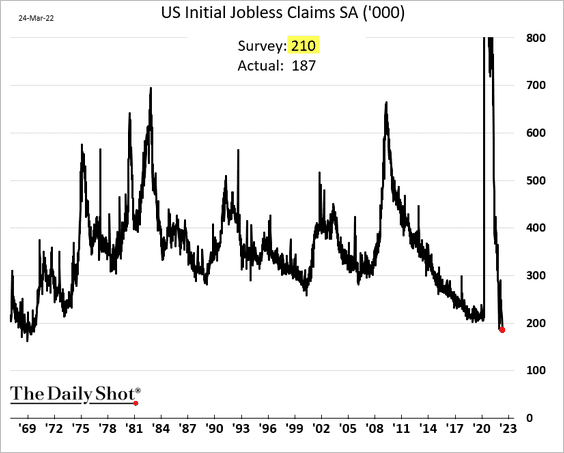

• Initial jobless claims are at multi-decade lows.

Here is the seasonally-adjusted indicator (lowest since 1969, when the US population was much smaller).

Continuing claims have decoupled from the seasonal trends we saw in recent years.

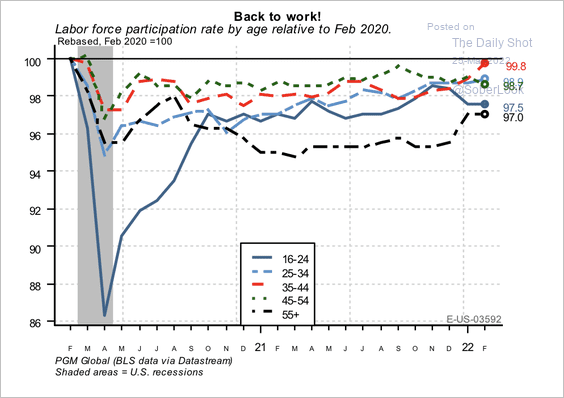

• Labor force participation among workers aged 35-44 has risen over the past few months.

Source: PGM Global

Source: PGM Global

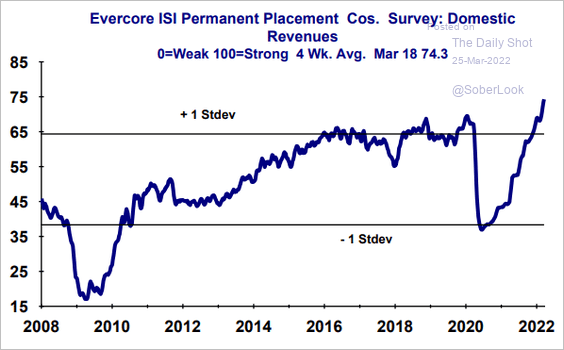

• Placement companies’ revenues are surging.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

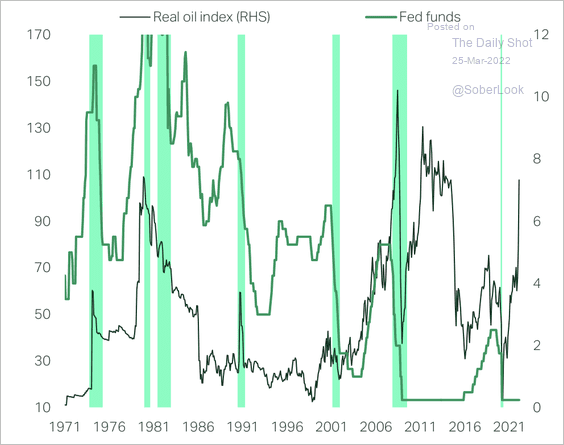

5. Historically, rising oil prices combined with tighter monetary policy have preceded recessions.

Source: TS Lombard

Source: TS Lombard

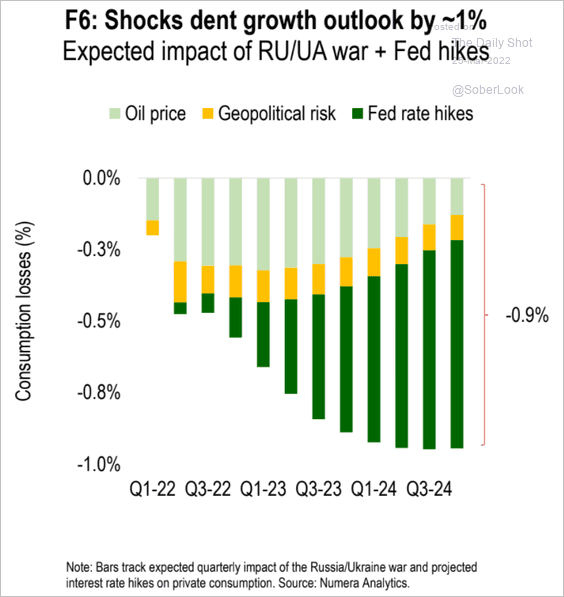

6. This chart shows the cumulative impact on consumption from the spike in oil prices, the geopolitical risk, and rate hikes.

Source: Numera Analytics

Source: Numera Analytics

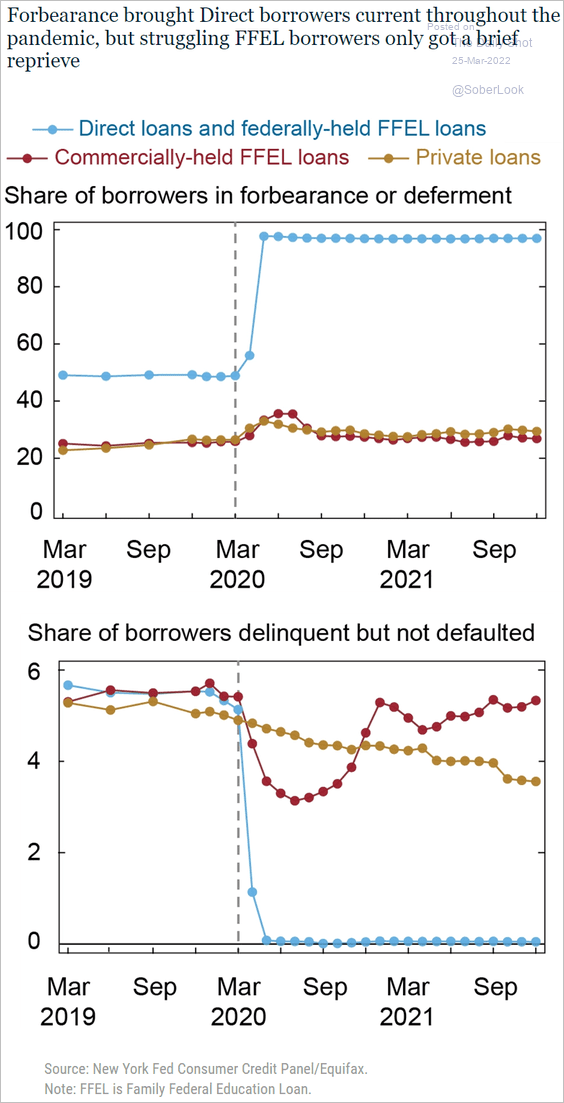

7. Student debt delinquencies could rise sharply when the moratorium is lifted.

Source: Liberty Street Economics Read full article Further reading

Source: Liberty Street Economics Read full article Further reading

Back to Index

The United Kingdom

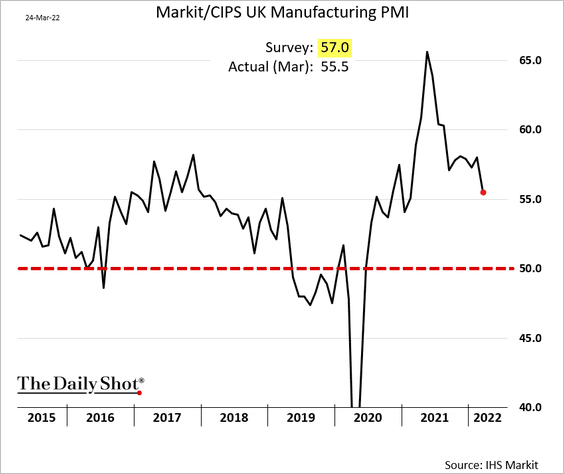

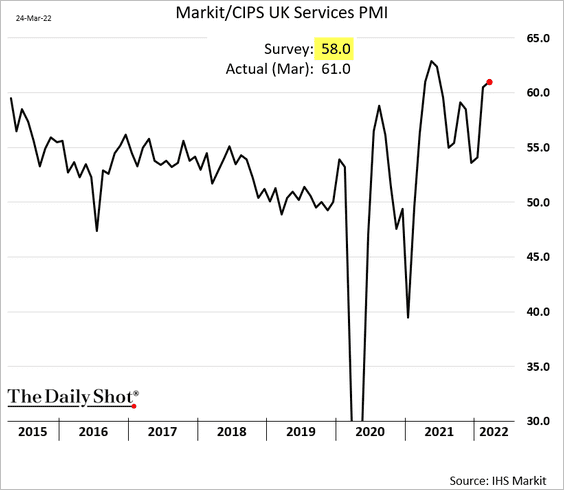

1. The March PMI report was mixed.

• Manufacturing:

• Services (resilient despite the inflationary/geopolitical pressures):

——————–

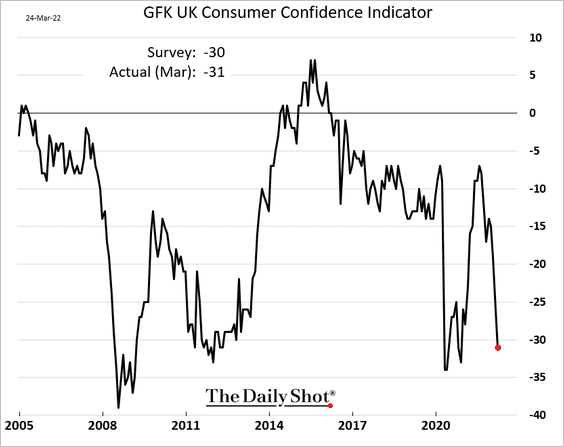

2. Consumer confidence tumbled.

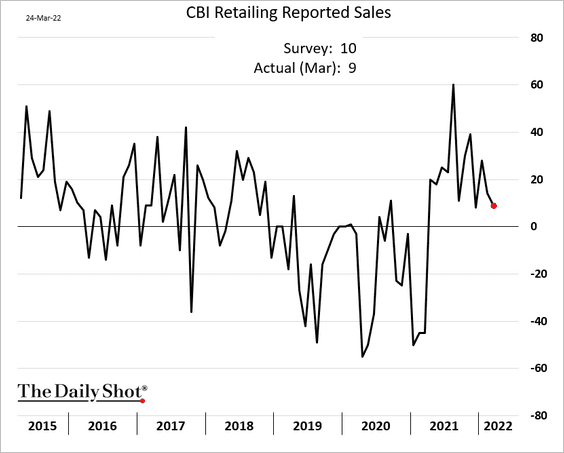

3. Retail sales slowed this month.

Source: Reuters Read full article

Source: Reuters Read full article

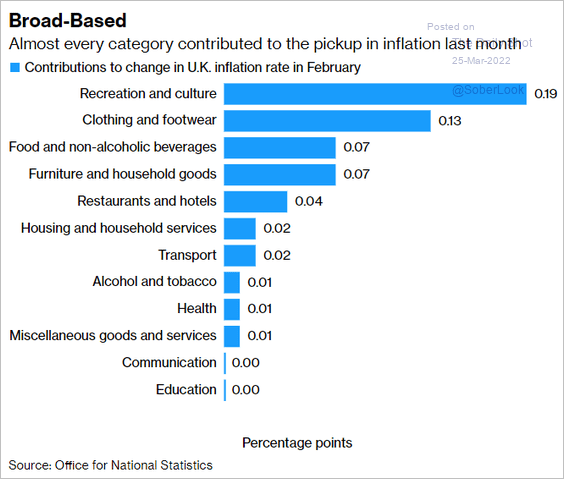

4. Last month’s inflation jump was quite broad. Video game prices drove the increase in recreation CPI.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

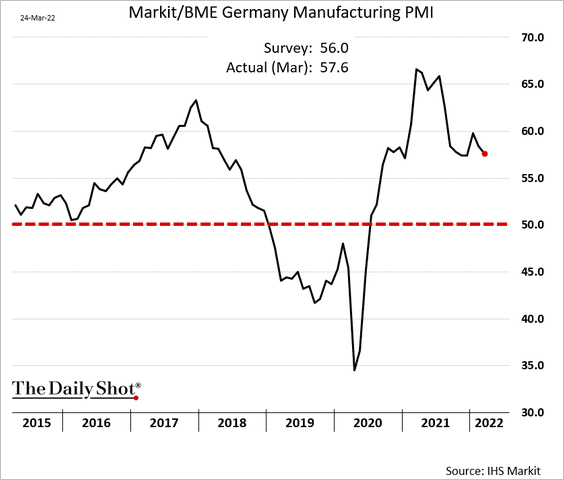

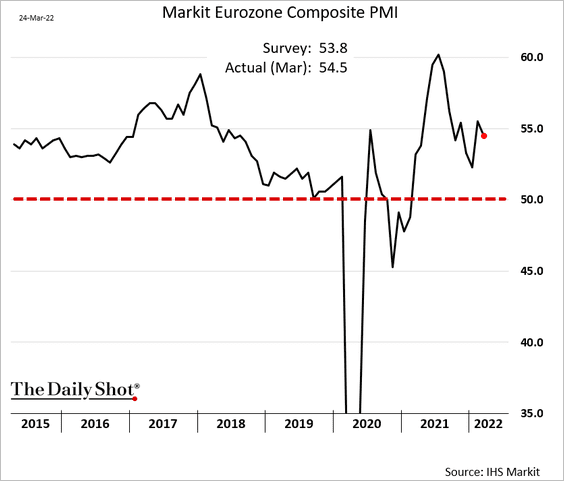

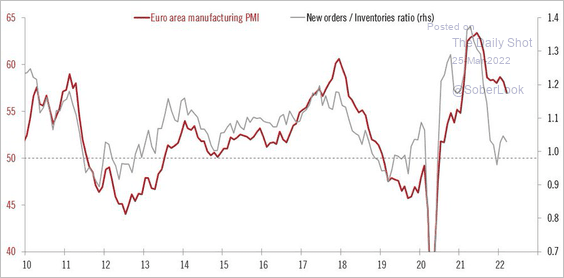

The Eurozone

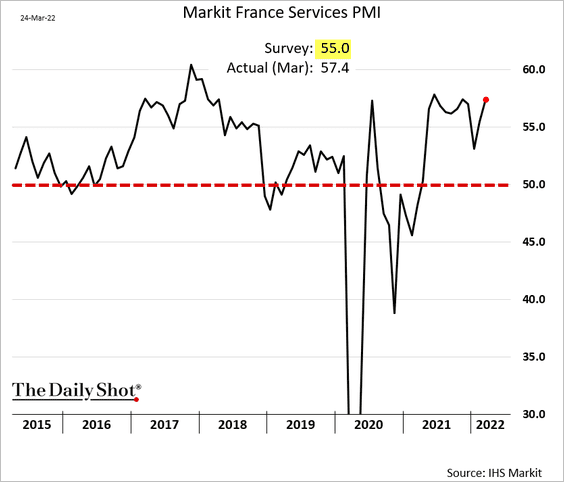

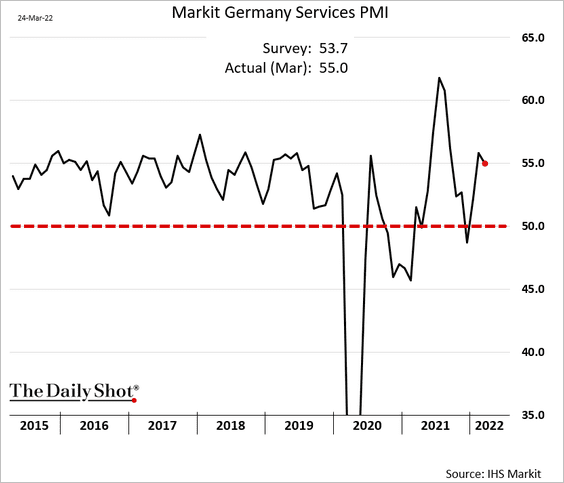

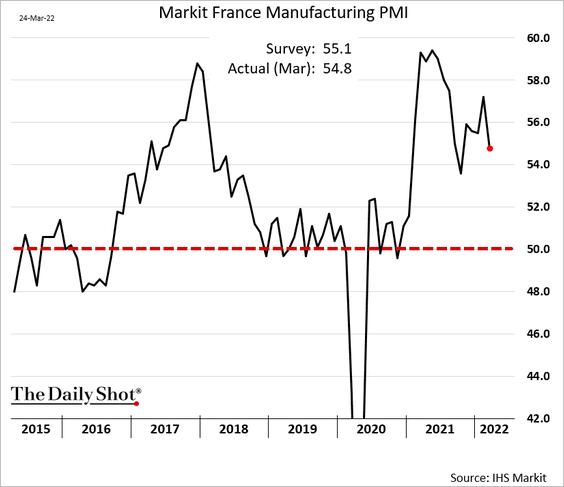

1. Business activity was surprisingly resilient this month, given the geopolitical/inflation backdrop.

• Services:

• Manufacturing:

• Eurozone composite PMI (above consensus):

• Forward-looking measures suggest that factory activity will face some headwinds.

Source: @fwred

Source: @fwred

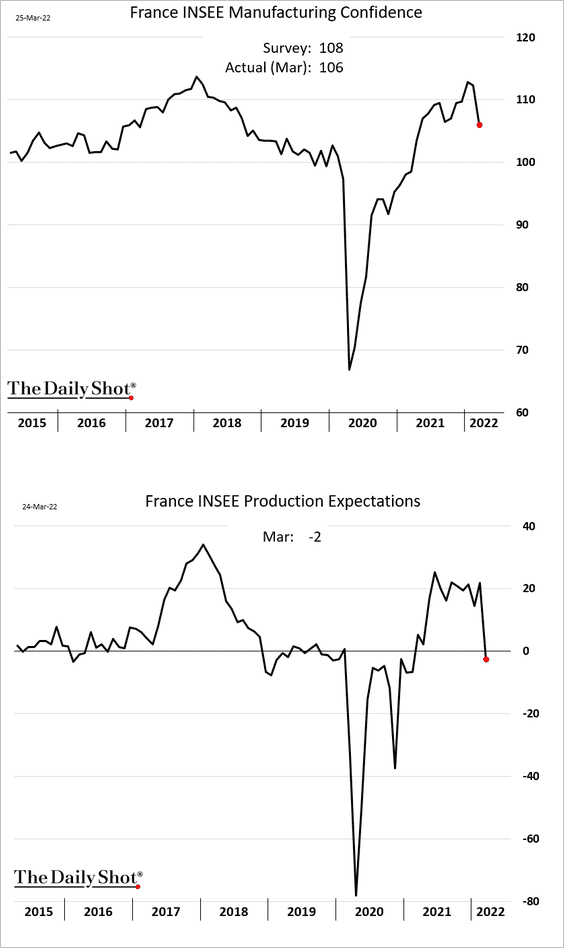

——————–

2. French business confidence deteriorated.

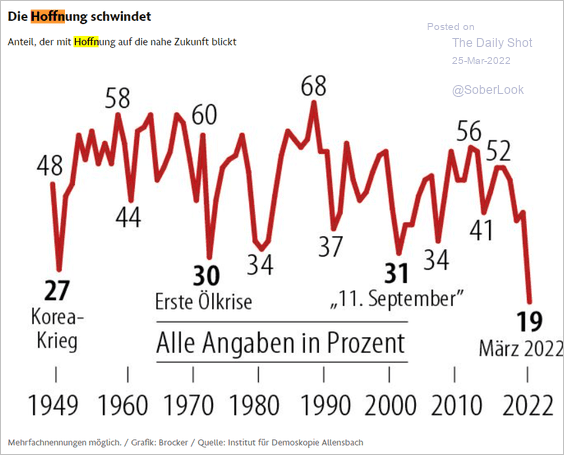

3. Here is German consumer outlook:

Source: @OliverRakau, @FAZ_NET

Source: @OliverRakau, @FAZ_NET

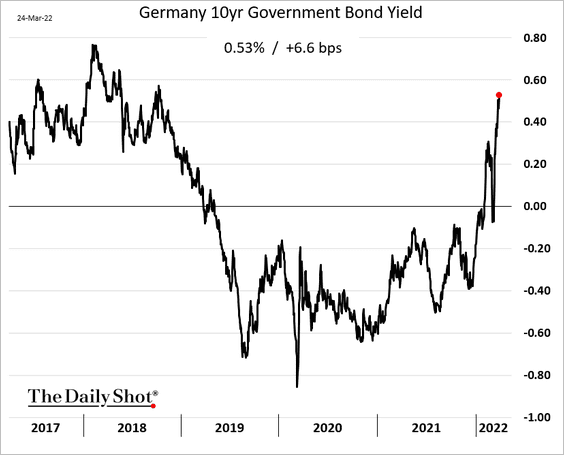

4. Bund yields are surging.

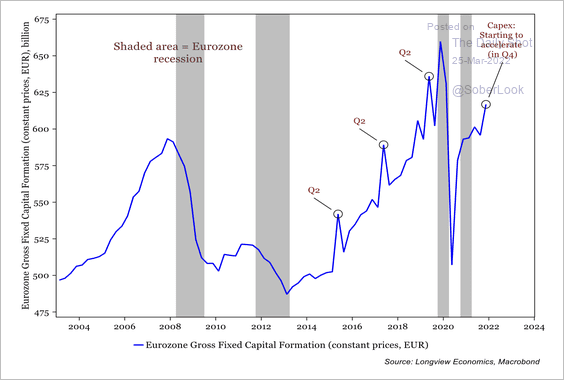

5. Fixed asset investments in the Eurozone are rising.

Source: Longview Economics

Source: Longview Economics

Back to Index

Europe

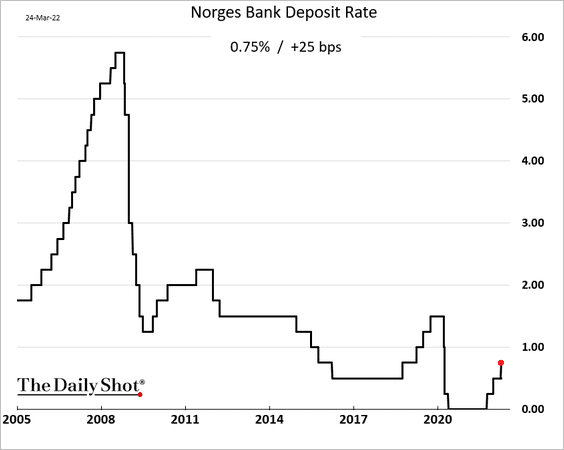

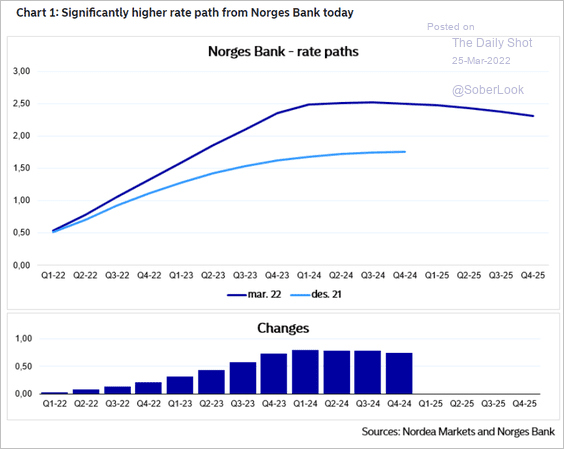

1. Norges Bank hiked rates amid uncertainty around the central bank’s leadership.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

• Norges Bank sharply raised its projected rate hike path.

Source: Nordea Markets

Source: Nordea Markets

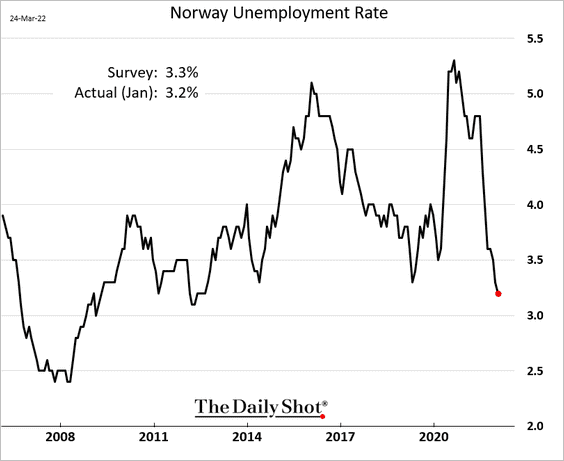

• Norway’s unemployment rate continues to fall.

——————–

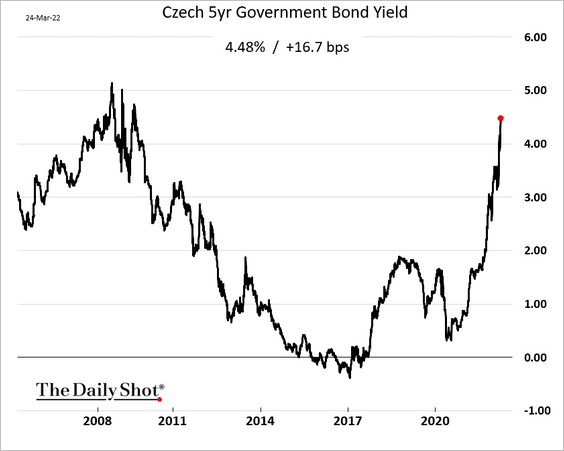

2. Czech bond yields are soaring.

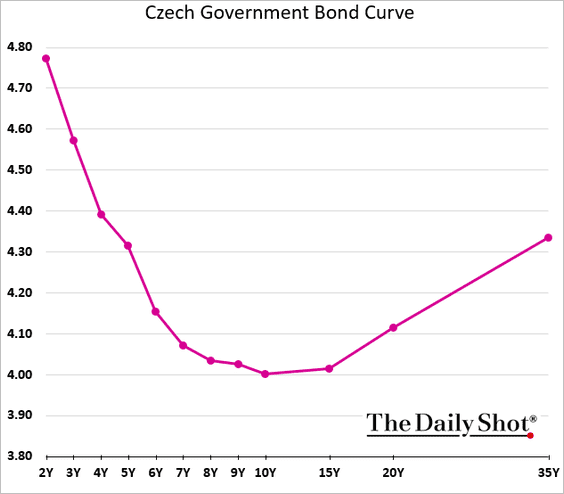

The yield curve is heavily inverted.

——————–

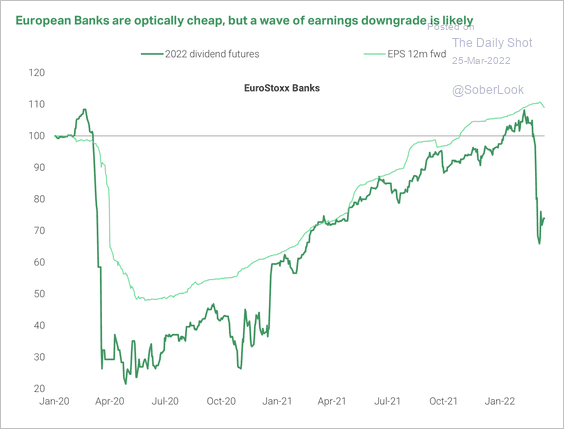

3. The dividend futures market points to a 20%-30% decline in European banks’ earnings.

Source: TS Lombard

Source: TS Lombard

Back to Index

Asia – Pacific

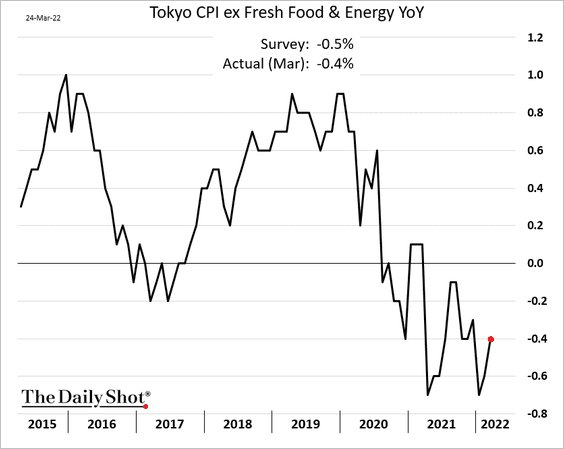

1. Based on the data from Tokyo this month, Japan’s core CPI has bottomed.

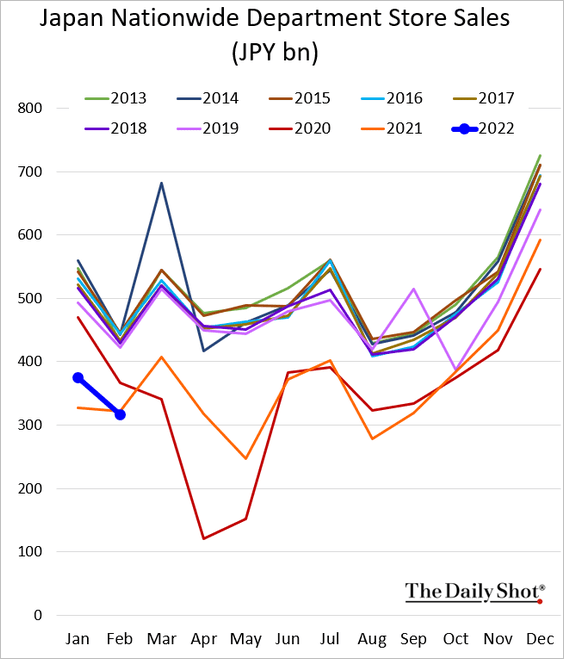

Separately, Japan’s department store sales remain in the doldrums.

——————–

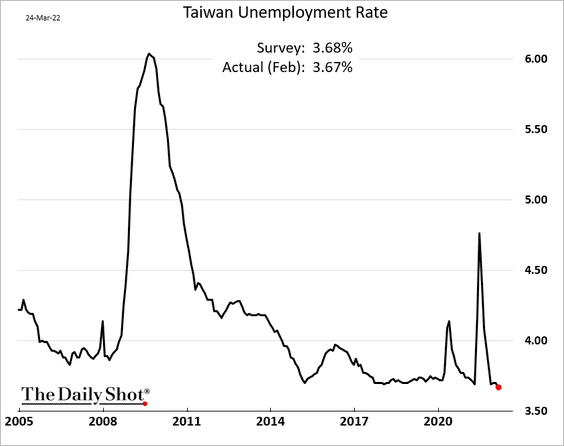

2. Taiwan’s unemployment rate is at multi-year lows.

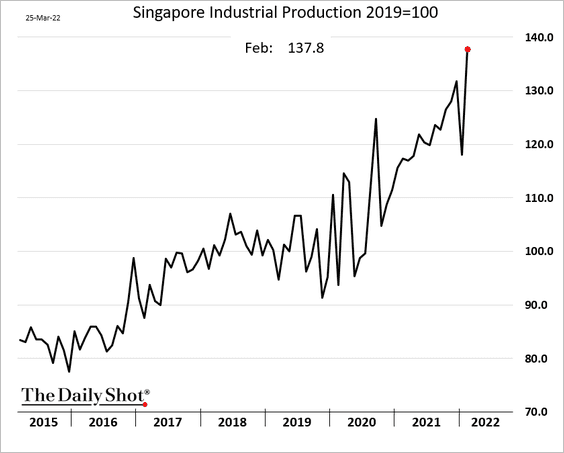

3. Singapore’s industrial production hit a new record.

Back to Index

China

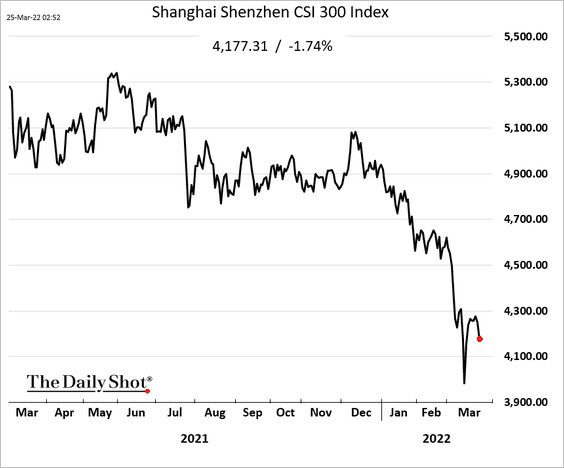

1. The stock market rebound has stalled.

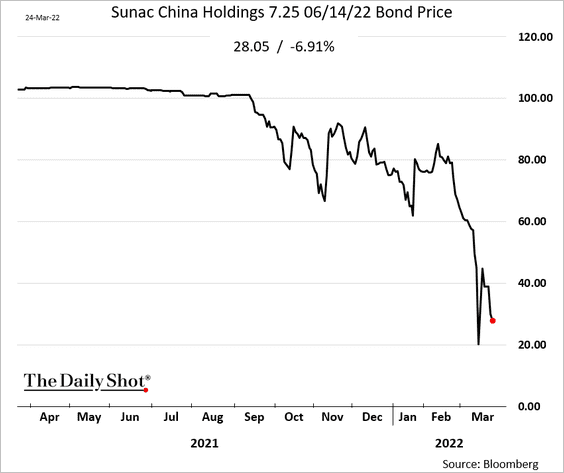

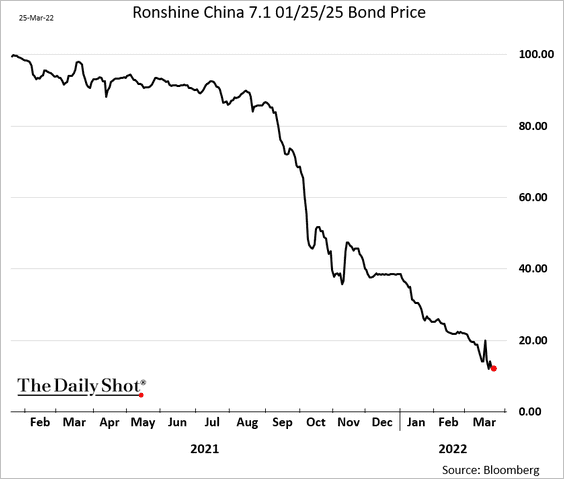

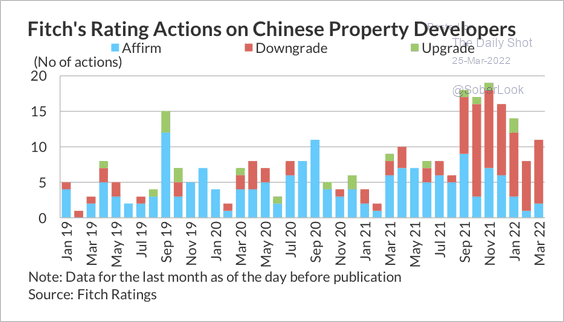

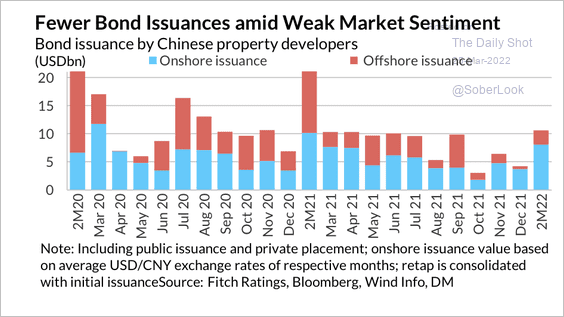

2. China’s leveraged property developers continue to face liquidity risks.

• Sunac:

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

• Ronshine:

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

• Credit downgrades:

Source: Fitch Ratings

Source: Fitch Ratings

• Tepid offshore bond issuance:

Source: Fitch Ratings

Source: Fitch Ratings

——————–

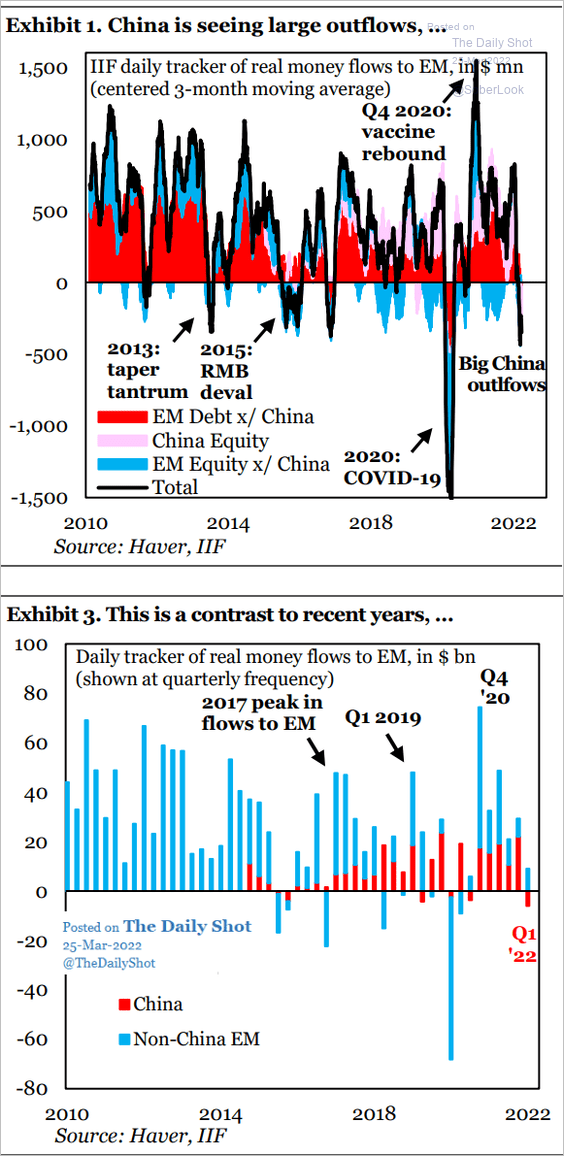

3. In contrast to other EM economies, China’s money flows have turned negative.

Source: IIF

Source: IIF

Back to Index

Emerging Markets

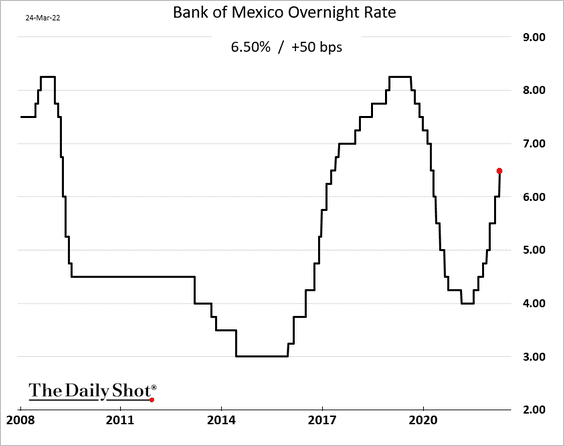

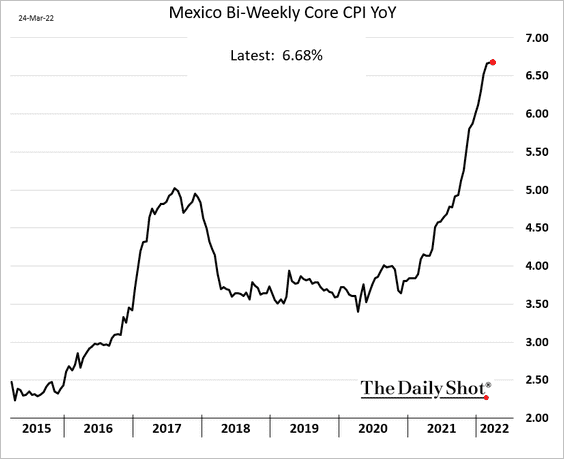

1. Banxico hiked rates by 50 bps despite tighter financial conditions.

• Is inflation peaking or is this just a pause?

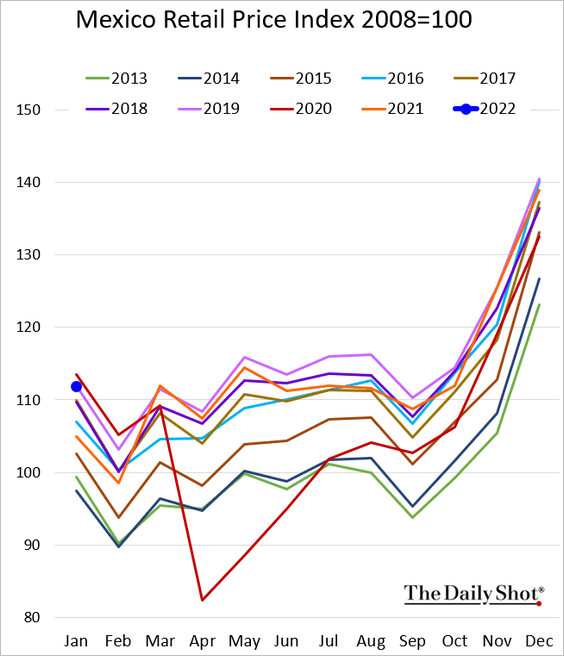

• Retail sales were strong in January.

——————–

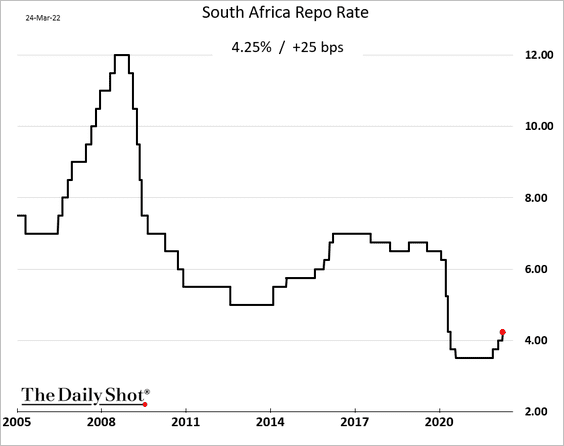

2. South Africa’s central bank also hiked rates.

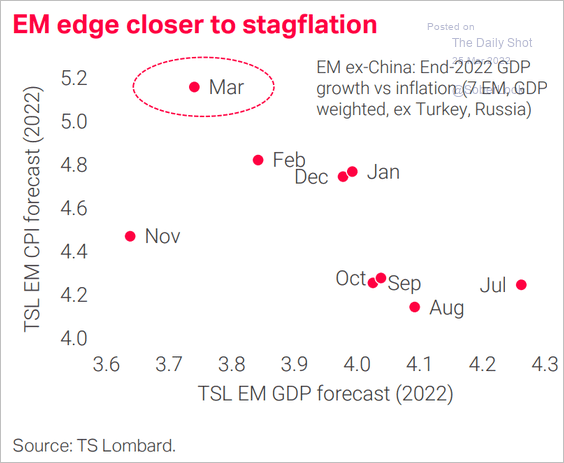

3. Stagflation risks have risen.

Source: TS Lombard

Source: TS Lombard

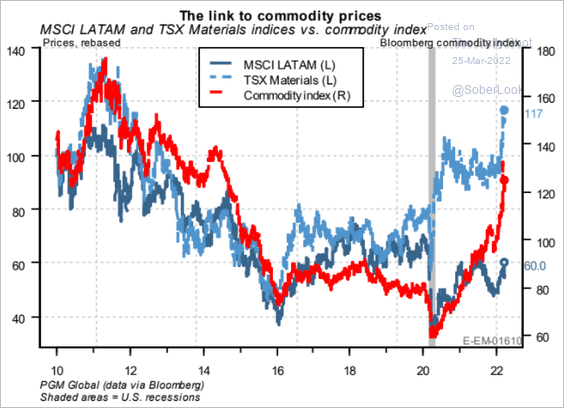

4. More upside for LatAm equities?

Source: PGM Global

Source: PGM Global

Back to Index

Cryptocurrency

1. Bitcoin continues to strengthen and could face resistance at $46K and $51K.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

2. News that Russia could allow countries to pay in “hard currency” or different currencies, including bitcoin, contributed to the rise in cryptos on Thursday.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

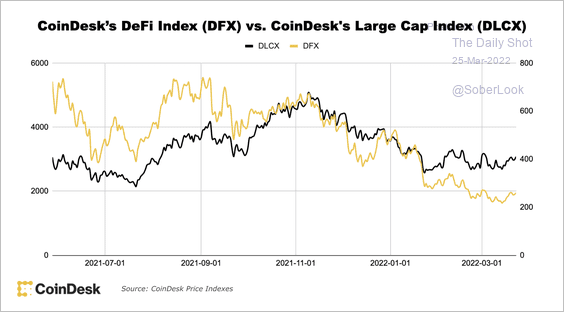

3. Decentralized finance (DeFi) tokens have lagged behind large-cap cryptos, but that could change given recent altcoin rallies.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

4. ANZ Bank has created a stablecoin pegged to the Aussie dollar.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

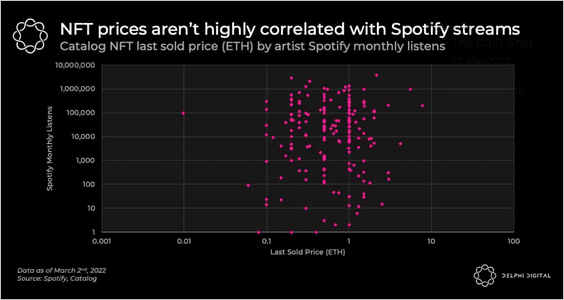

5. There is no correlation between an artist’s popularity on Spotify and their NFT sales.

Source: @Delphi_Digital

Source: @Delphi_Digital

Back to Index

Commodities

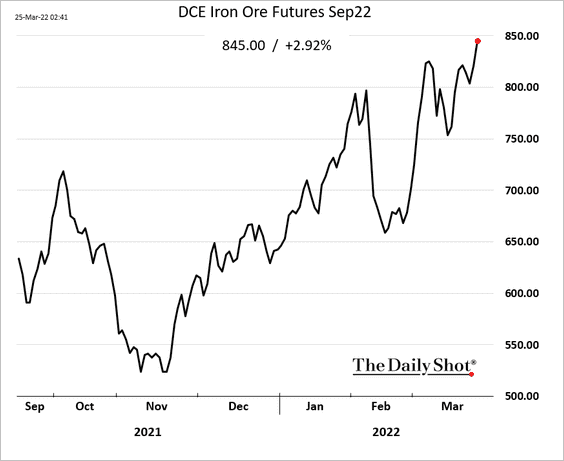

1. Iron ore prices are surging in China.

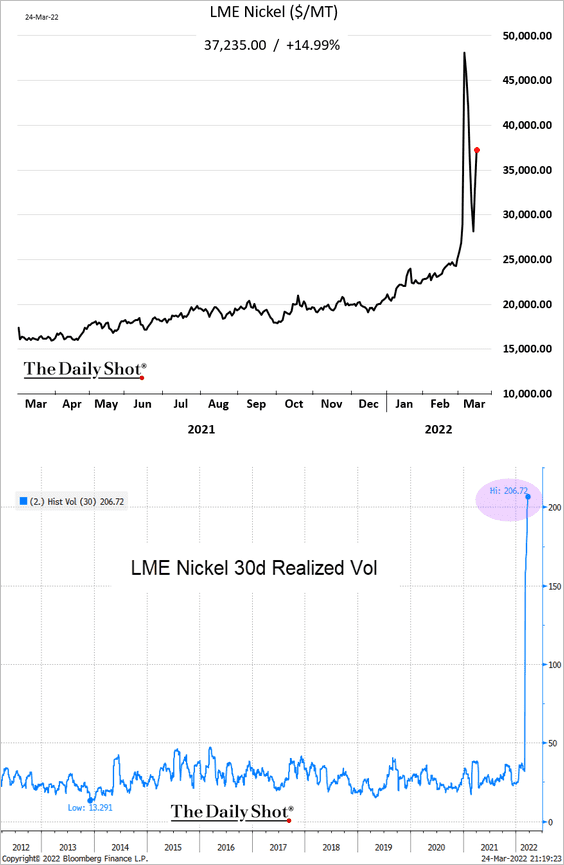

2. Nickel prices spiked 15%, hitting the limit again. Concerns about short-sellers persist.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Was there a “bailout” involved?

Source: @WSJ Read full article

Source: @WSJ Read full article

• The nickel surge is impacting shipyard activities.

Source: TradeWinds Read full article

Source: TradeWinds Read full article

——————–

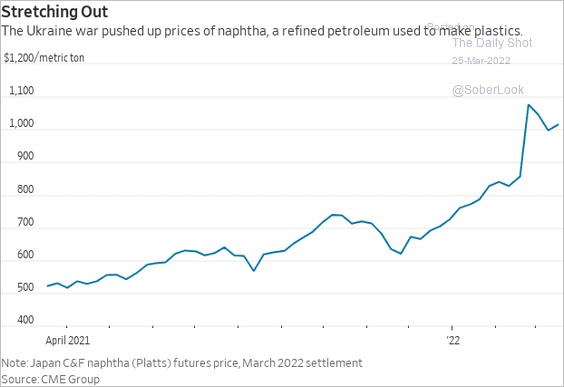

3. Plastics costs are going up with crude oil.

Source: @WSJ Read full article

Source: @WSJ Read full article

4. Is Russia selling some of its gold?

Source: Reuters Read full article

Source: Reuters Read full article

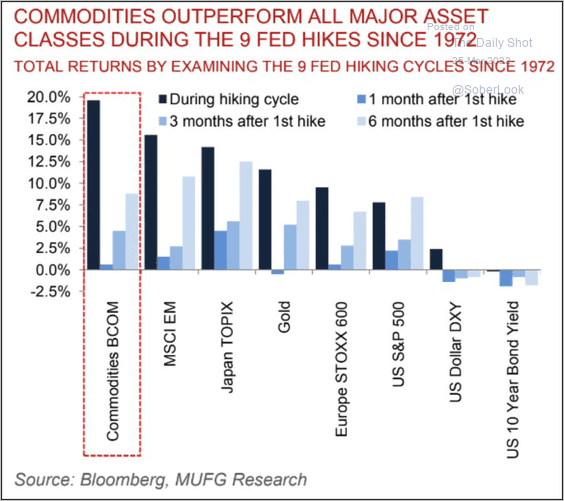

5. Commodities perform well during Fed rate hikes.

Source: MUFG; @giginator_

Source: MUFG; @giginator_

Back to Index

Energy

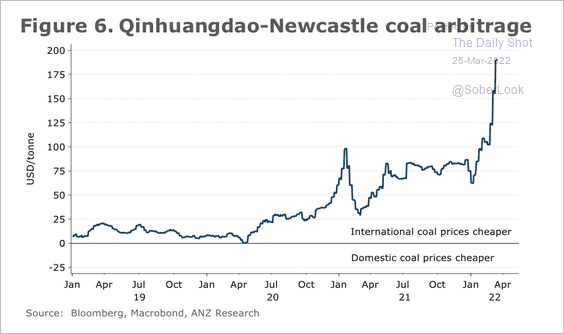

1. The spread between China’s domestic Qinhuangdao coal price and the Asian benchmark coal price (Newcastle) has widened to record highs. That’s partly because Chinese power plants have been reluctant to increase production due to rising raw material costs, according to ANZ.

Source: ANZ Research

Source: ANZ Research

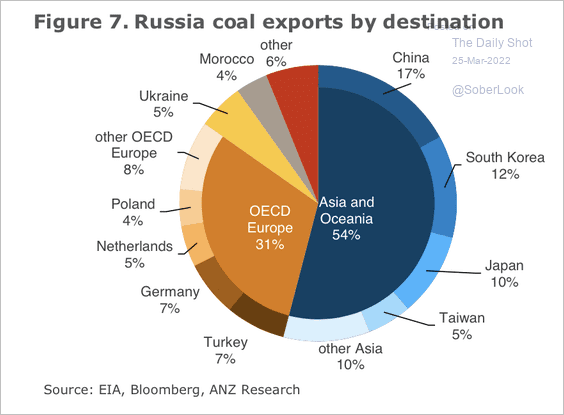

2. Russia supplies a lot of coal to Asia/Pacific and Europe.

Source: ANZ Research

Source: ANZ Research

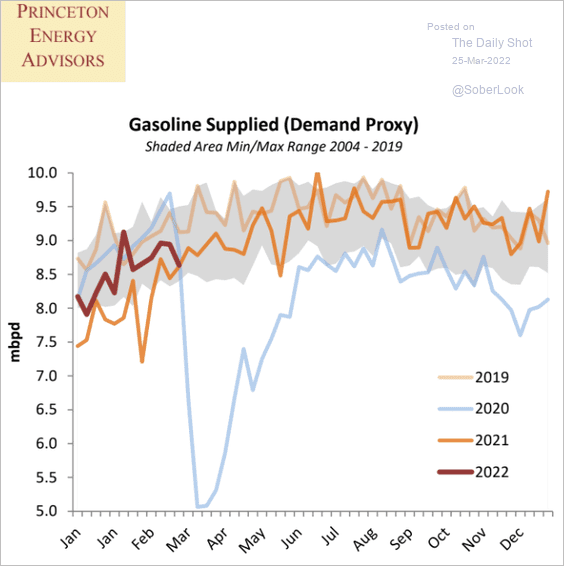

3. Is the gasoline price spike in the US denting demand?

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

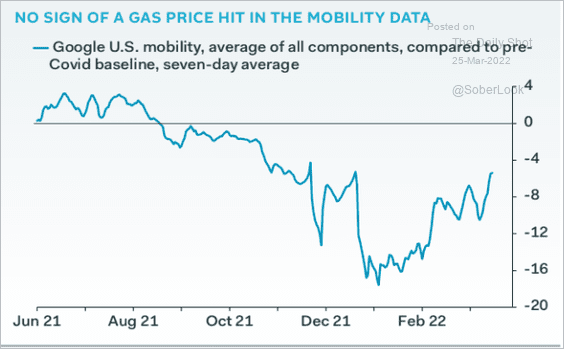

For now, mobility continues to improve.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

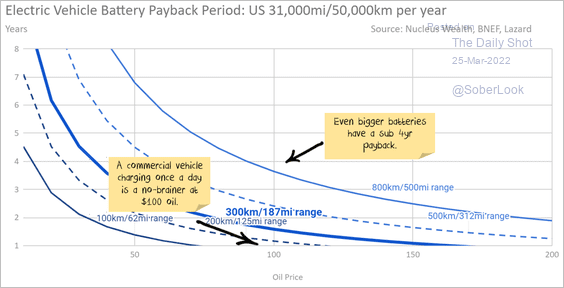

4. This chart shows the estimated payback period of a commercial electric vehicle at various oil prices.

Source: Nucleus Wealth Read full article

Source: Nucleus Wealth Read full article

Back to Index

Equities

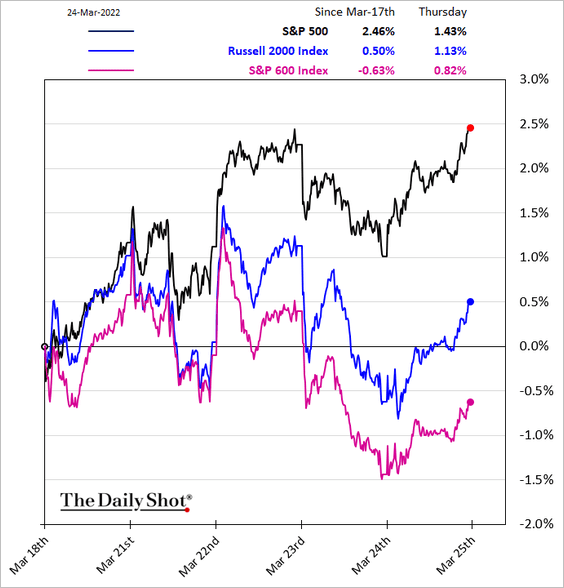

1. Small caps are lagging in this rebound.

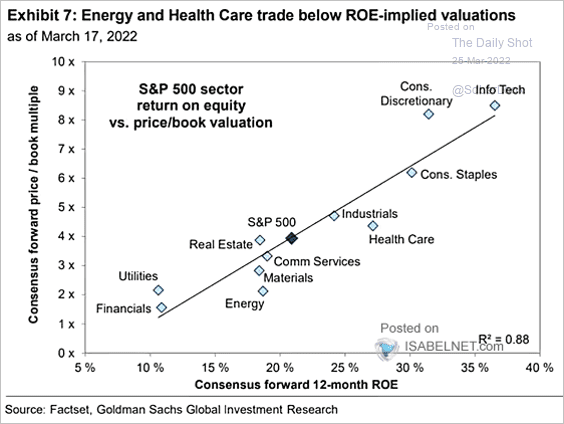

2. Here is the return on equity vs. price-to-book ratio by sector.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

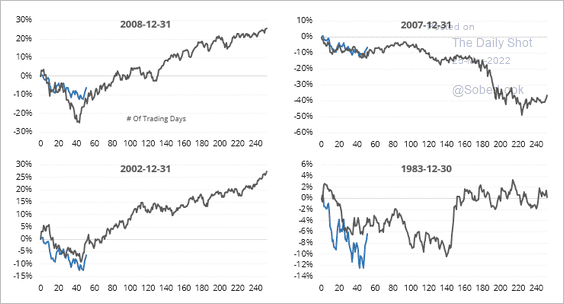

3. These charts show similarities between the latest correction and previous years.

Source: SentimenTrader

Source: SentimenTrader

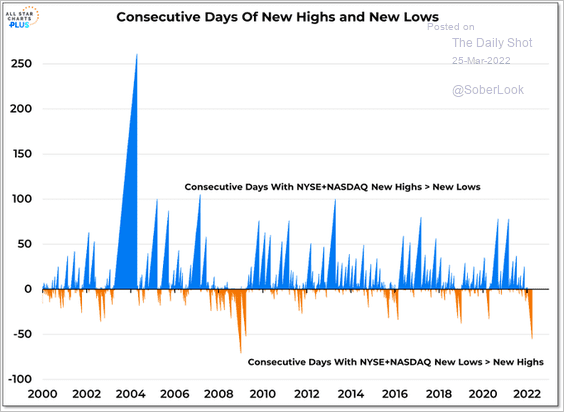

4. The US equity market’s new lows have exceeded new highs for 55 days.

Source: @WillieDelwiche

Source: @WillieDelwiche

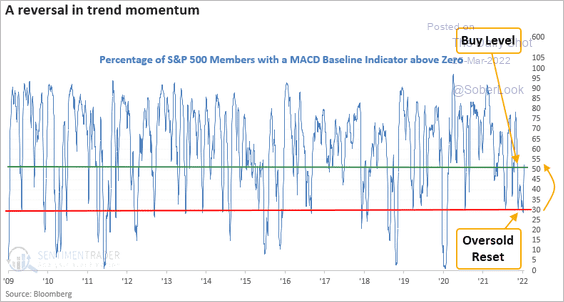

5. The S&P 500 is experiencing an “oversold bounce.”

Source: SentimenTrader

Source: SentimenTrader

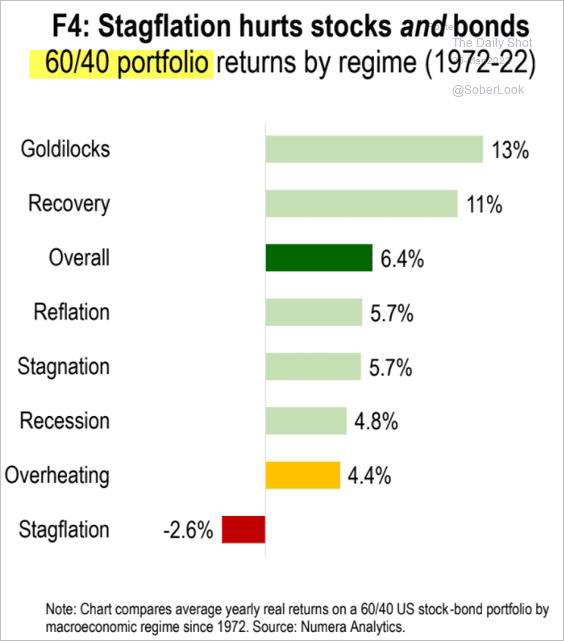

6. Stagflation periods tend to pressure both stocks and bonds.

Source: Numera Analytics

Source: Numera Analytics

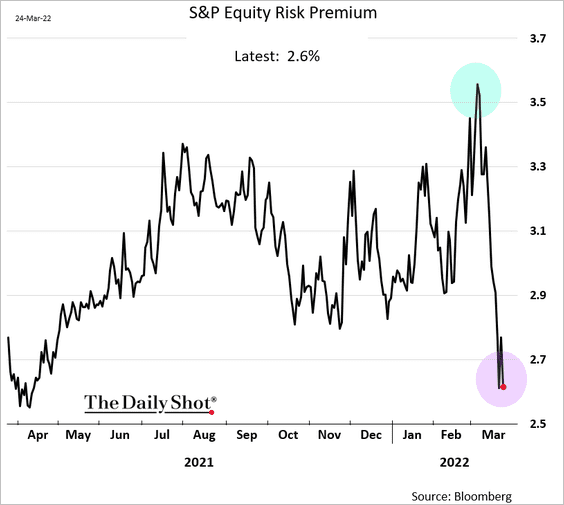

7. Equity risk premium shifted from relatively attractive to expensive levels in a matter of days.

Back to Index

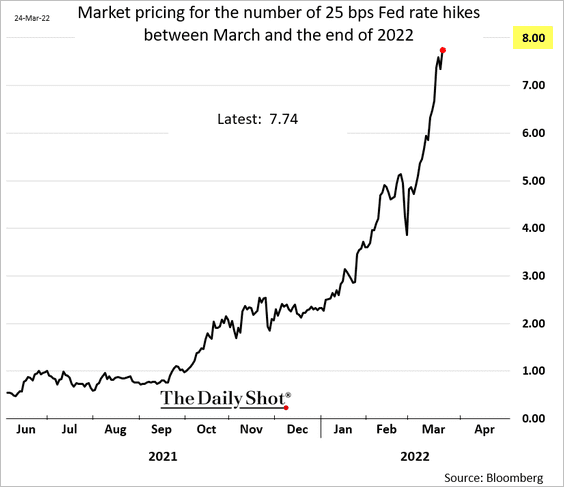

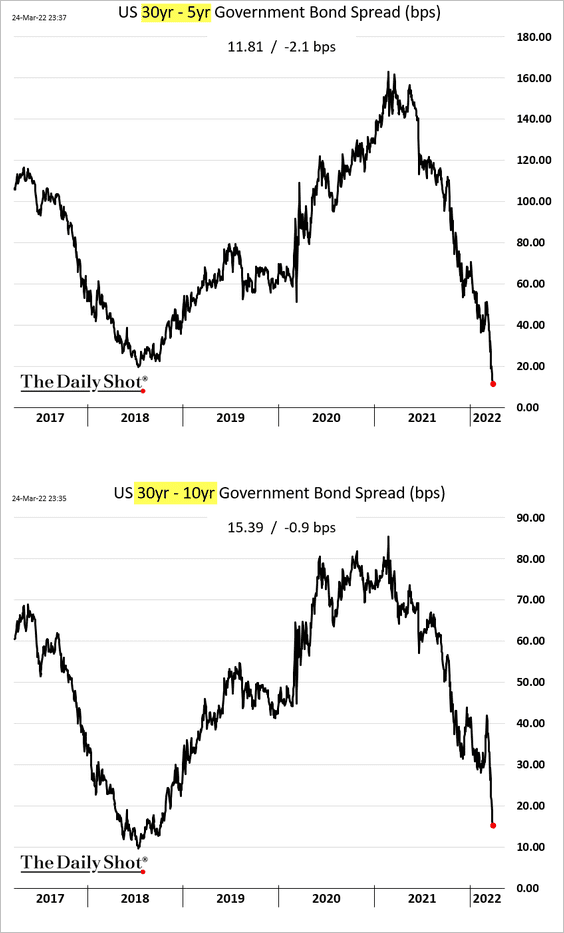

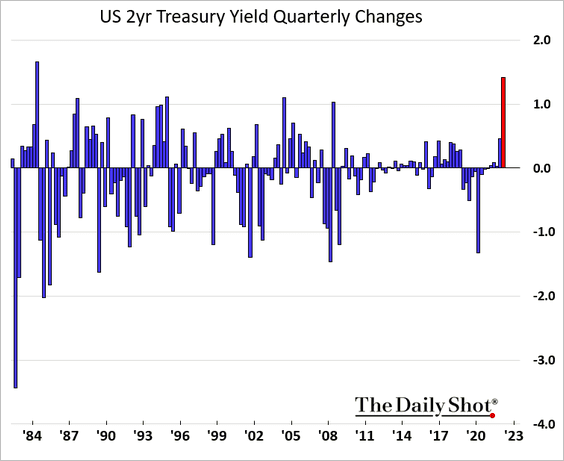

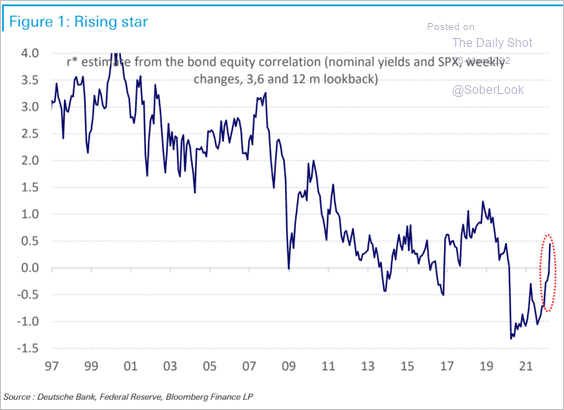

Rates

1. Nine Fed rate hikes this year (8 plus the one we just had) is increasingly likely, according to the futures market.

2. The Treasury curve is flattening rapidly at the longer end.

3. The US 2-year yield increase this quarter has been remarkable.

4. Projections for r-star have risen sharply.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

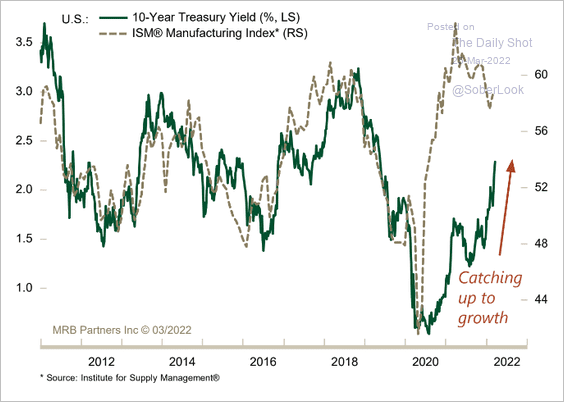

5. Here is the 10yr Treasury yield vs. the ISM Manufacturing PMI.

Source: MRB Partners

Source: MRB Partners

Back to Index

Global Developments

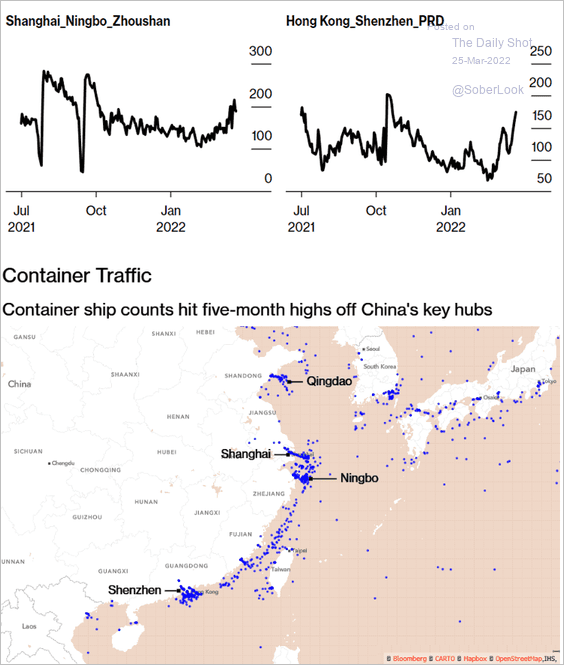

1. Omicron in China is worsening logistics bottlenecks again.

Source: @markets Read full article

Source: @markets Read full article

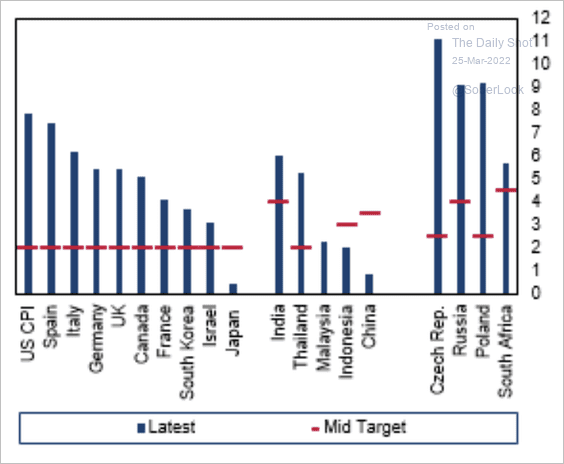

2. Inflation has risen well above the midpoint target of most central banks.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

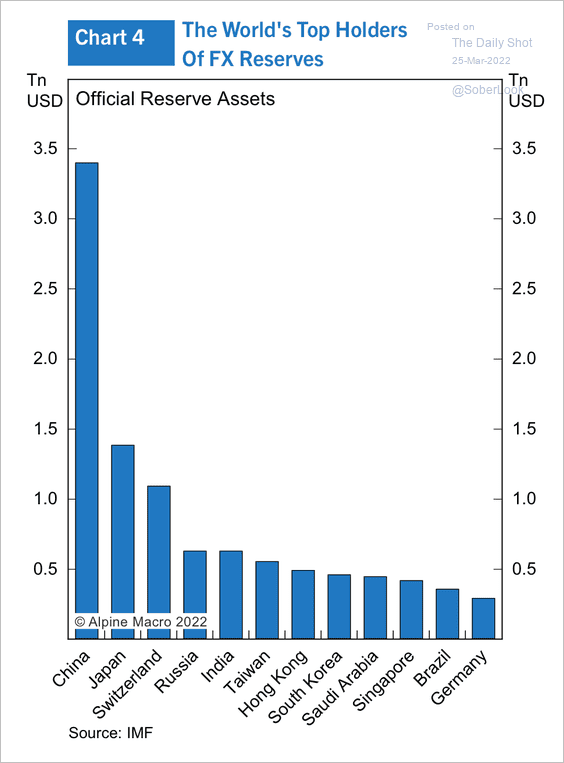

3. Here is a look at the world’s largest currency reserves.

Source: Alpine Macro

Source: Alpine Macro

——————–

Food for Thought

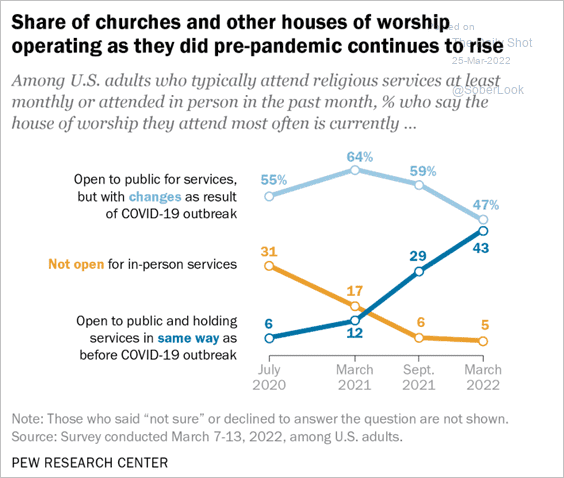

1. In-person religious services:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

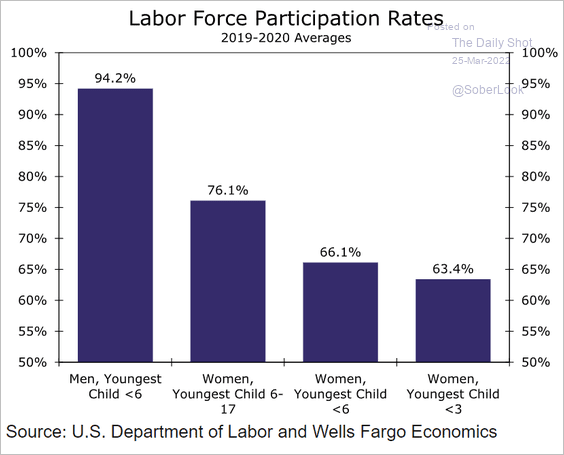

2. US labor force participation rates:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

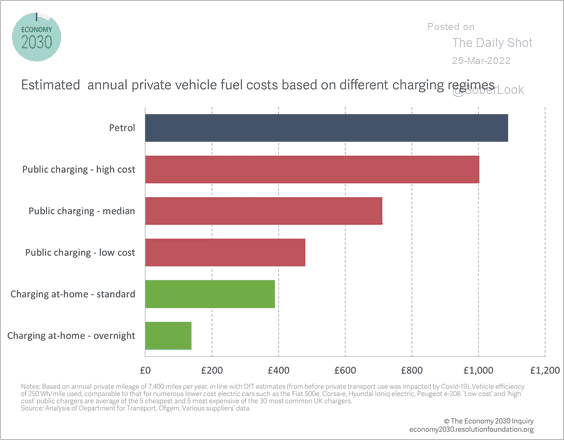

3. Private vehicle charging vs. fuel costs in the UK:

Source: @resfoundation

Source: @resfoundation

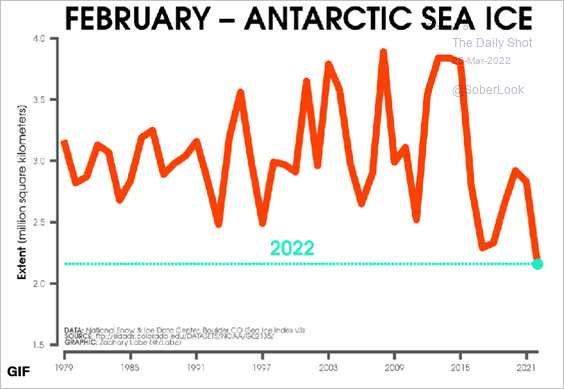

4. Antarctic sea ice:

Source: @ZLabe, @NSIDC

Source: @ZLabe, @NSIDC

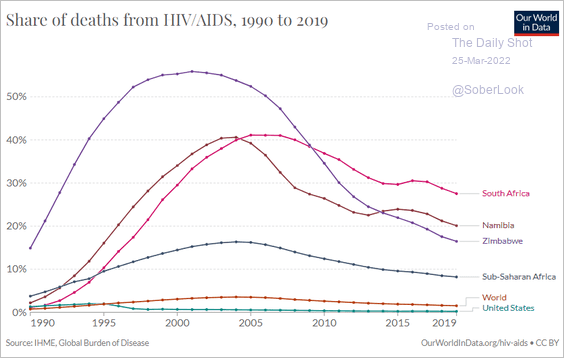

5. HIV deaths over time:

Source: Our World in Data Read full article

Source: Our World in Data Read full article

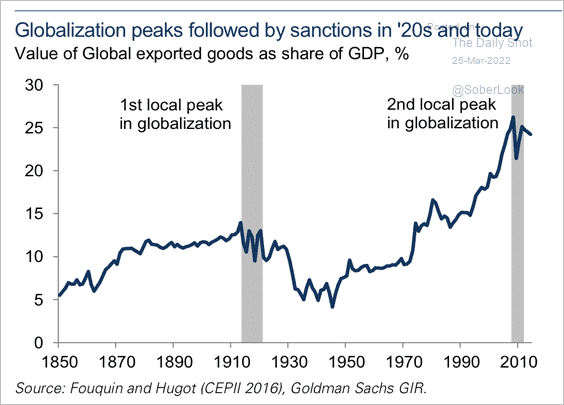

6. Sanctions and de-globalization:

Source: Goldman Sachs

Source: Goldman Sachs

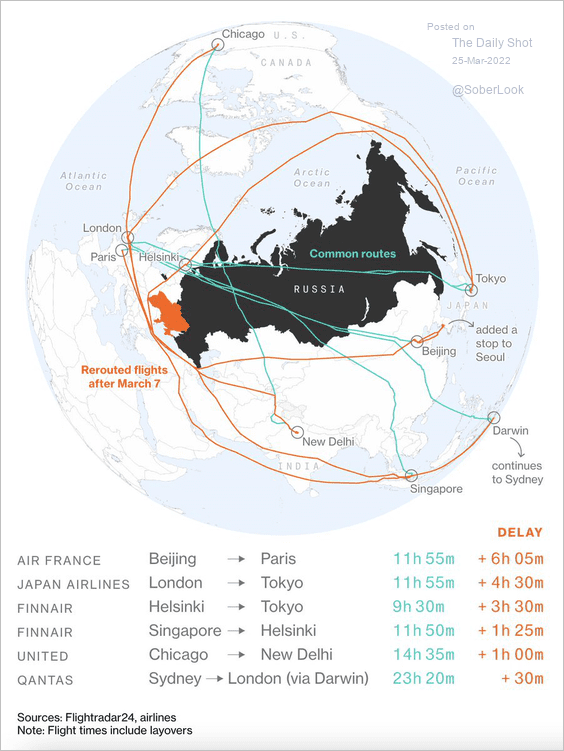

7. Global airlines avoiding Russian airspace:

Source: @BBGVisualData Read full article

Source: @BBGVisualData Read full article

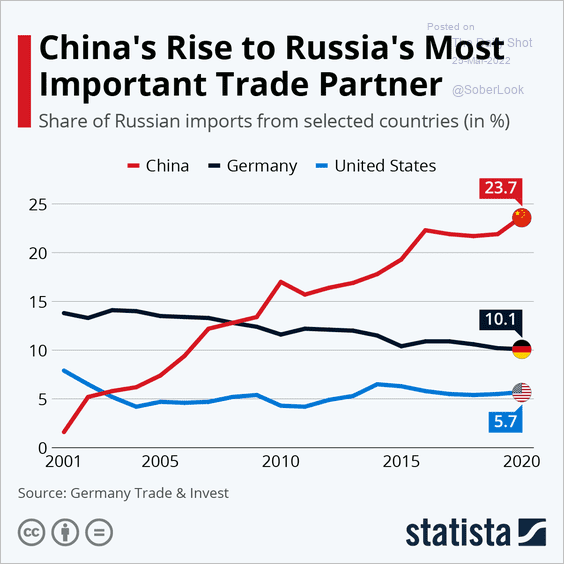

8. China becoming Russia’s largest trade partner:

Source: Statista

Source: Statista

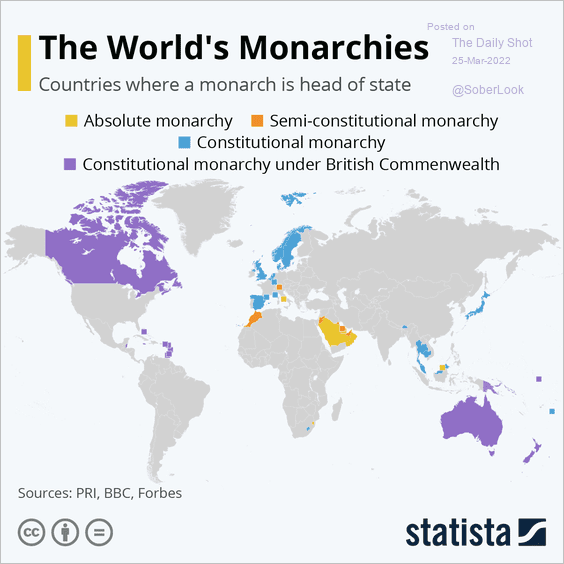

9. The world’s monarchies:

Source: Statista

Source: Statista

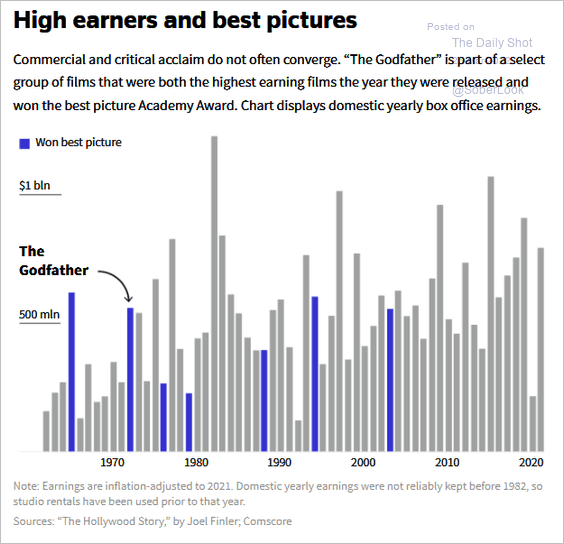

10. The Godfather – Academy Awards and strong box office performance:

Source: Reuters Graphics Read full article

Source: Reuters Graphics Read full article

——————–

Have a great weekend!

Back to Index