The Daily Shot: 29-Mar-22

• Equities

• Credit

• Rates

• Energy

• Commodities

• Cryptocurrency

• China

• Asia – Pacific

• The Eurozone

• Canada

• The United States

• Global Developments

• Food for Thought

Equities

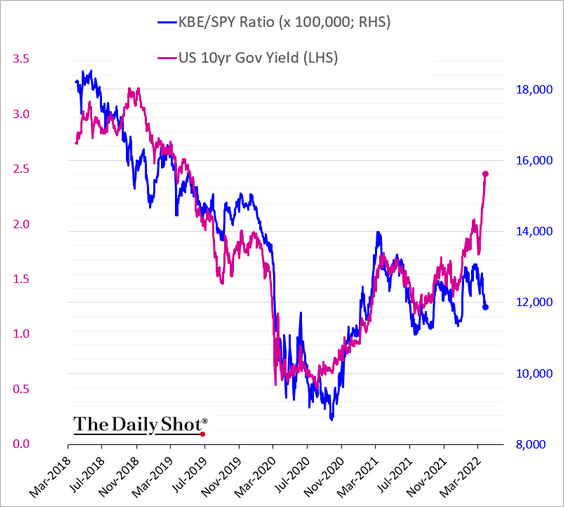

1. Banks have been underperforming despite surging bond yields (KBE = SPDR S&P Bank ETF, SPY = S&P 500 ETF).

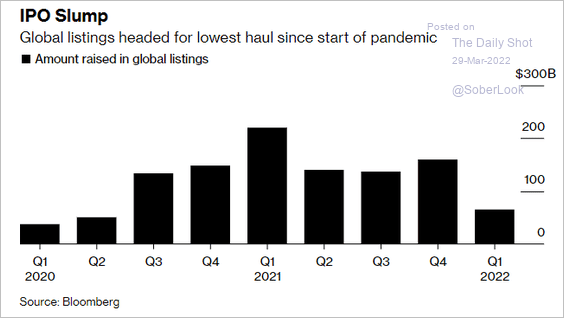

2. Global IPO activity has slowed sharply this quarter.

Source: @julia_fioretti, @Swetha_Gopinath Read full article

Source: @julia_fioretti, @Swetha_Gopinath Read full article

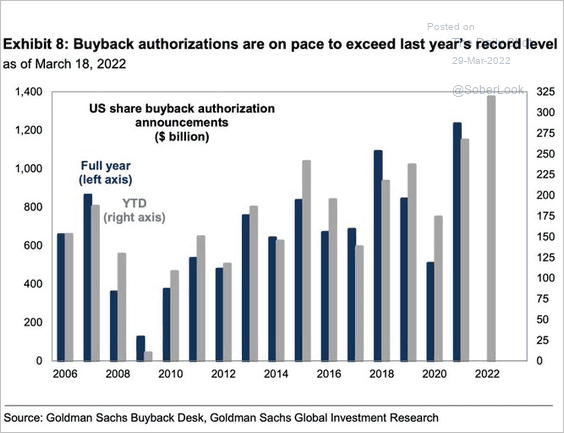

3. Year-to-date share buyback activity hit a new record.

Source: Goldman Sachs

Source: Goldman Sachs

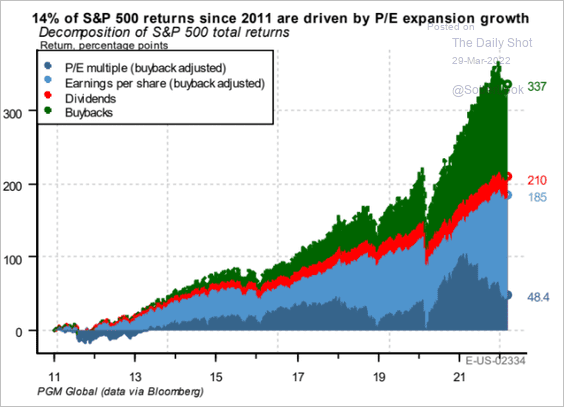

4. Here is the S&P 500 return attribution over the past decade.

Source: PGM Global

Source: PGM Global

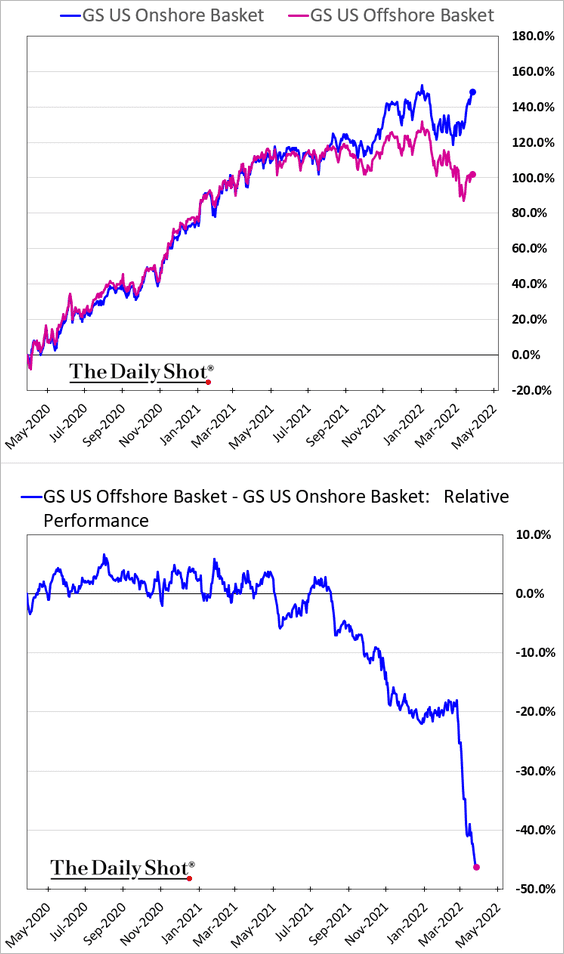

5. The market is punishing US companies that, according to Goldman, “rely on international supply chains or have a high international manufacturing footprint.” Investors want to see more onshoring.

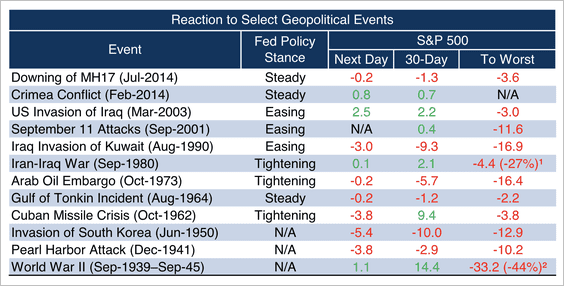

6. Here is another look at historical market returns around geopolitical shocks.

Source: Goldman Sachs Investment Strategy Group

Source: Goldman Sachs Investment Strategy Group

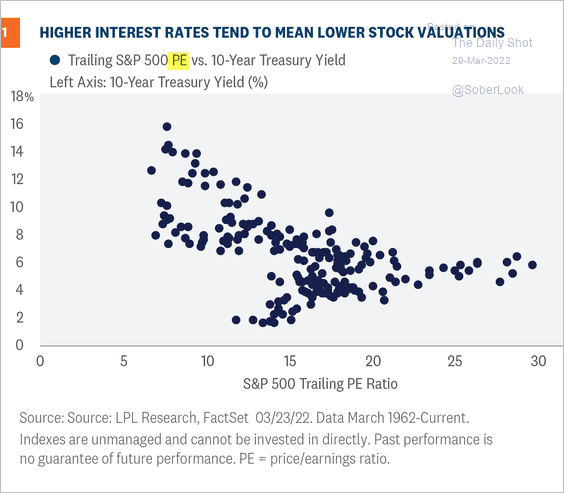

7. Higher bond yields typically mean lower valuations.

Source: Jeff Buchbinder, LPL Research

Source: Jeff Buchbinder, LPL Research

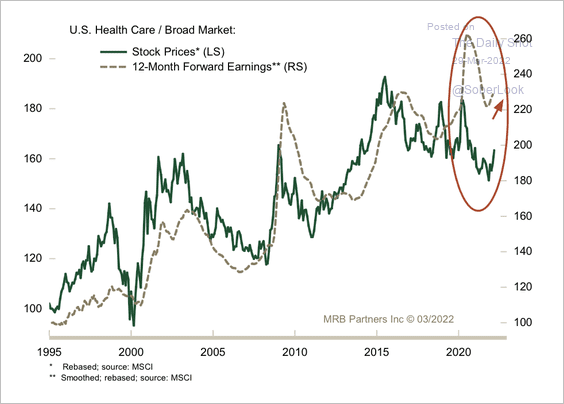

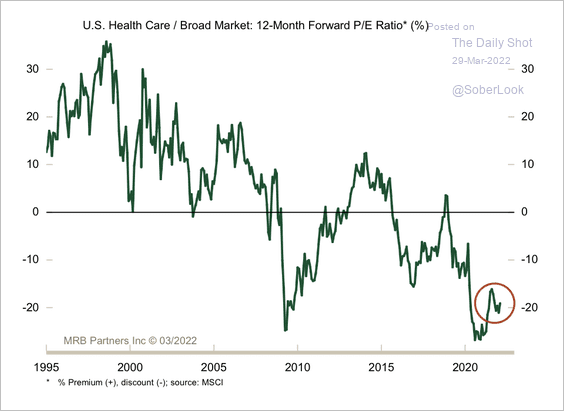

8. Healthcare’s relative share price has lagged underlying relative forward earnings over the past year, …

Source: MRB Partners

Source: MRB Partners

… while relative valuations remain near historic lows.

Source: MRB Partners

Source: MRB Partners

——————–

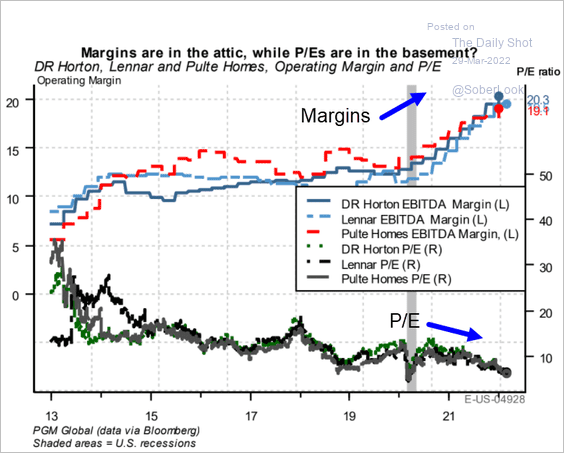

9. Are homebuilders oversold?

Source: PGM Global

Source: PGM Global

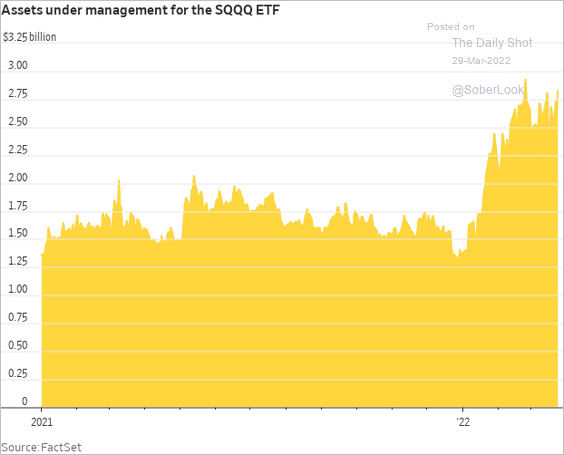

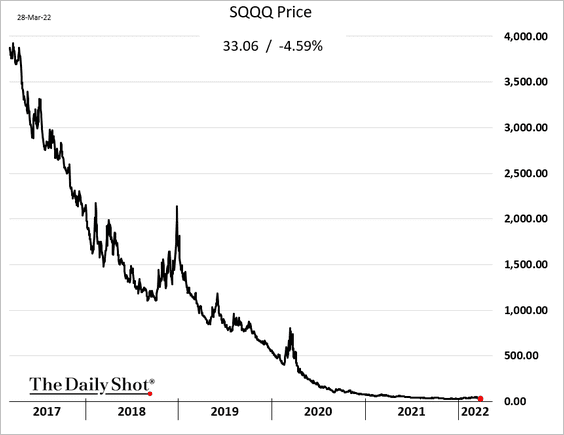

10. The ProShares UltraPro Short QQQ ETF (SQQQ) assets have risen sharply this year as investors bet against Nasdaq 100 stocks.

Source: @WSJ Read full article

Source: @WSJ Read full article

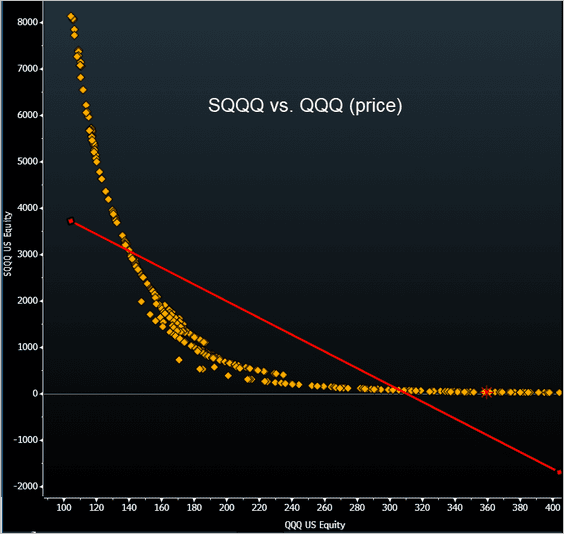

It’s worth noting that a long position in SQQQ is similar to being long a put option.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

But the long gamma position comes with a price: theta decay. The manager’s rebalancing process to keep the leverage constant creates convexity and theta. As a result, holding the trade for longer periods could be painful.

Back to Index

Credit

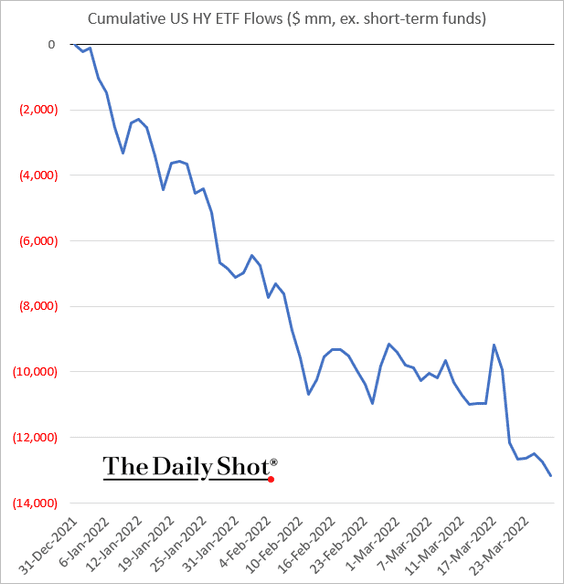

1. High-yield ETFs continue to see outflows.

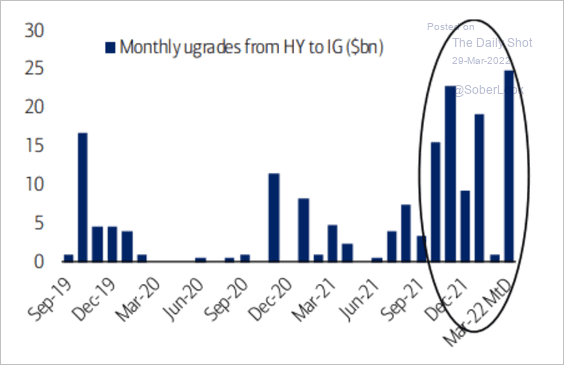

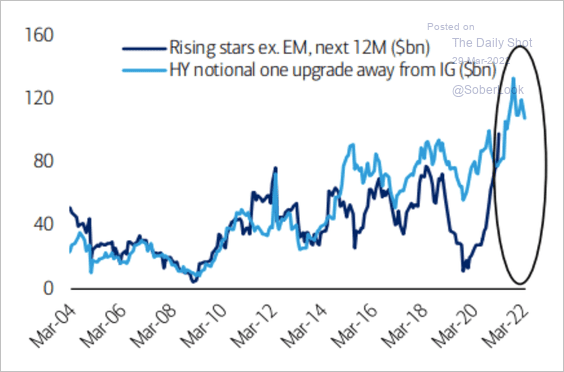

2. More high-yield credit is being upgraded to investment grade (2 charts).

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

Source: BofA Global Research

——————–

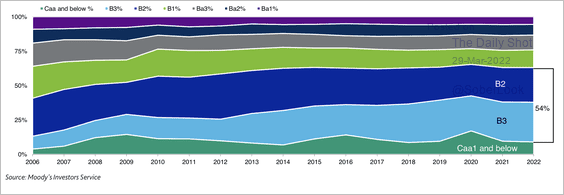

3. The US speculative-grade universe is concentrated in the riskier B2 and B3-rated categories.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

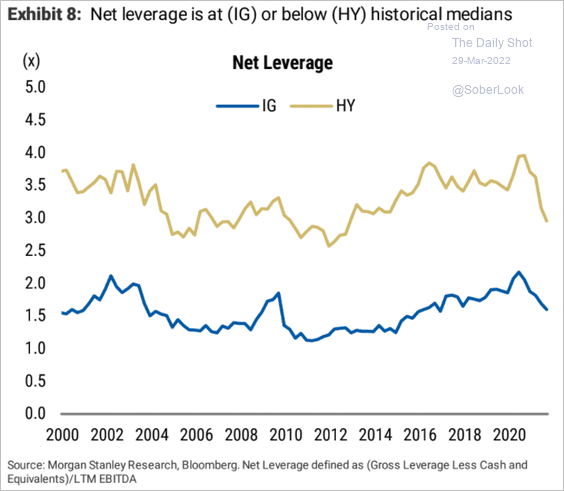

4. Corporate leverage has been moderating.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

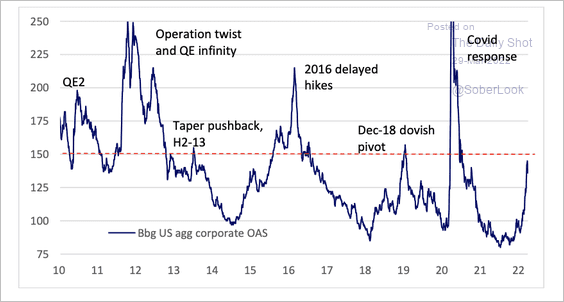

5. US investment-grade spreads have widened to levels that have led to a Fed dovish pivot in the past decade.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

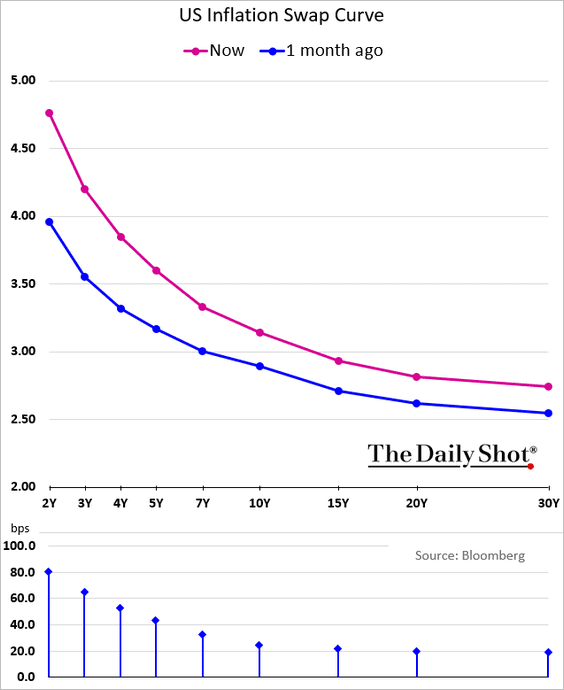

1. The US inflation swap curve (inflation expectations) continues to become more inverted.

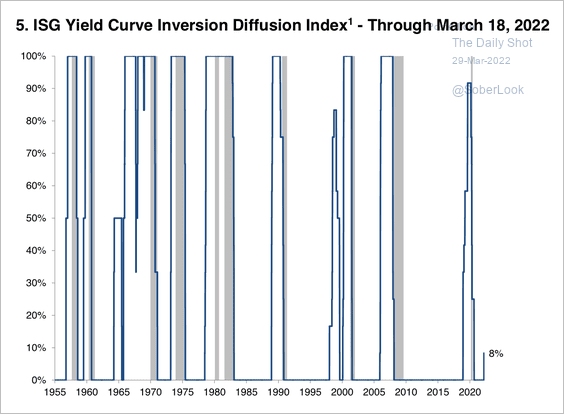

2. Goldman’s yield curve inversion diffusion index, which measures the percentage of yield curves inverted in the previous six months, is very low and does not indicate a coming recession (yet).

Source: Goldman Sachs Investment Strategy Group

Source: Goldman Sachs Investment Strategy Group

Back to Index

Energy

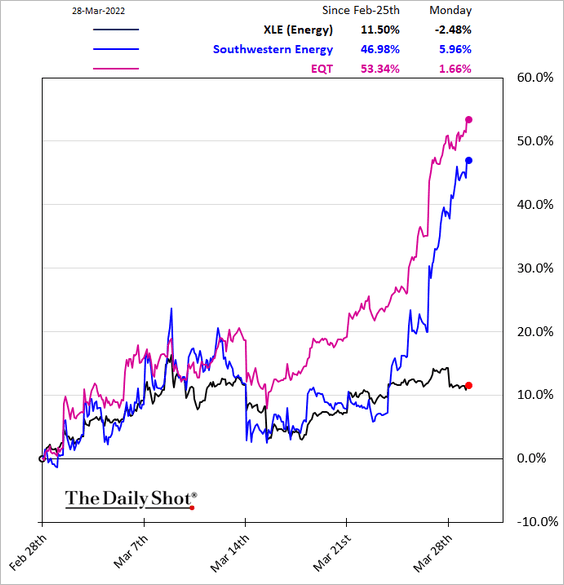

1. Shares of US firms focused on natural gas have been surging.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

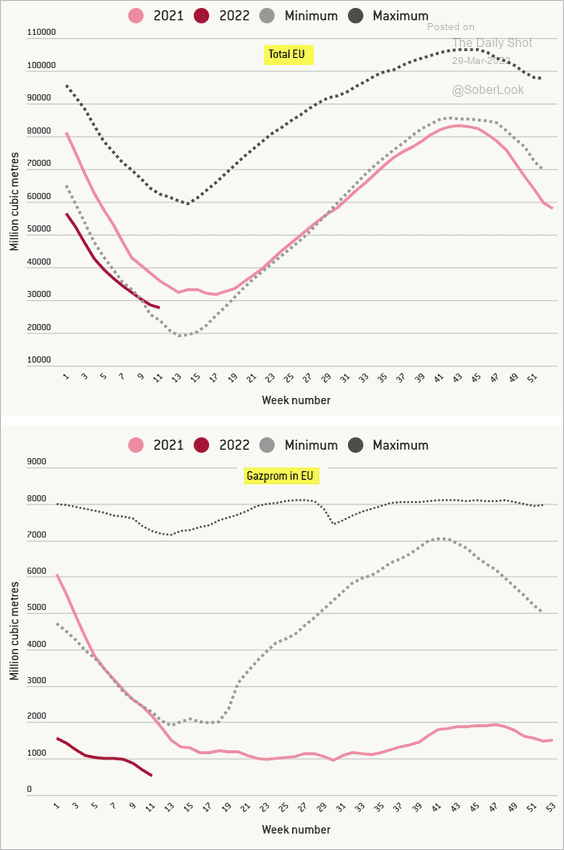

2. Next, we have some updates on the natural gas situation in Europe.

• Natual gas in storage (back within the 5-year range):

Source: Bruegel Read full article

Source: Bruegel Read full article

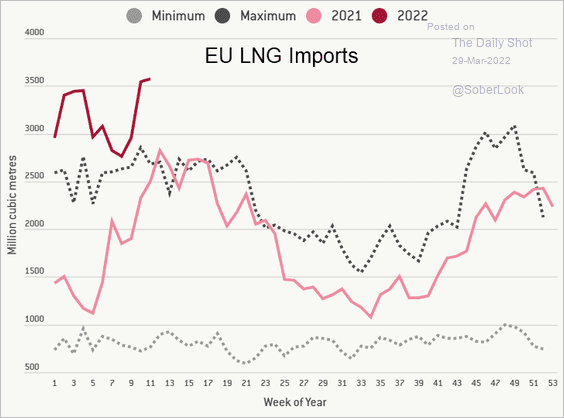

• LNG imports:

Source: Bruegel Read full article

Source: Bruegel Read full article

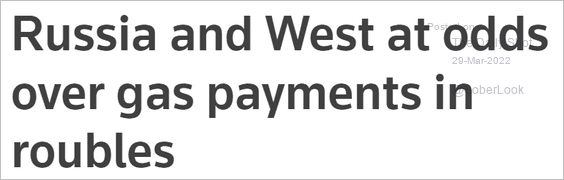

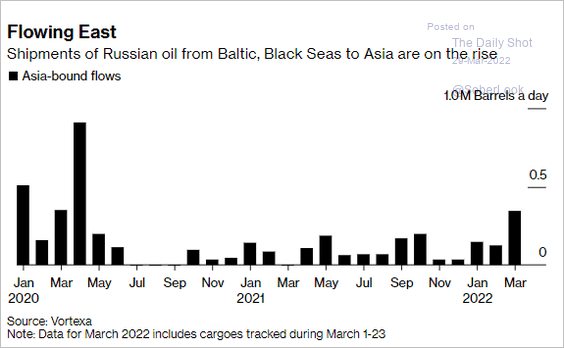

• Gas payments in rubles?

Source: Reuters Read full article

Source: Reuters Read full article

The ruble is rebounding.

——————–

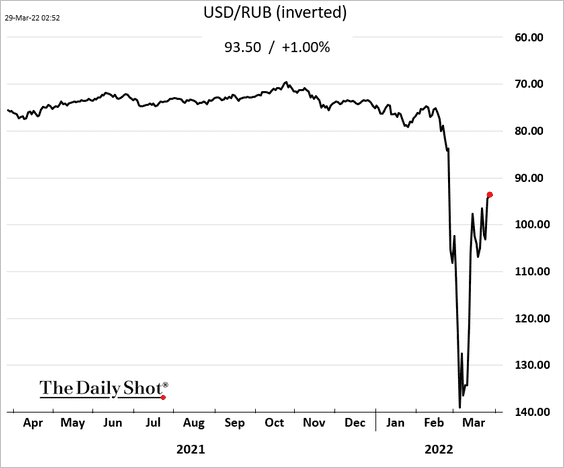

3. European distillate inventories have been declining.

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

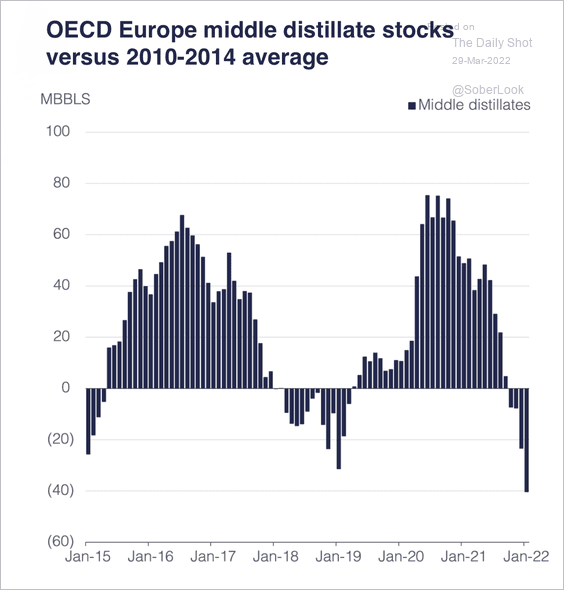

4. Russian oil sales to Asia have picked up.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Commodities

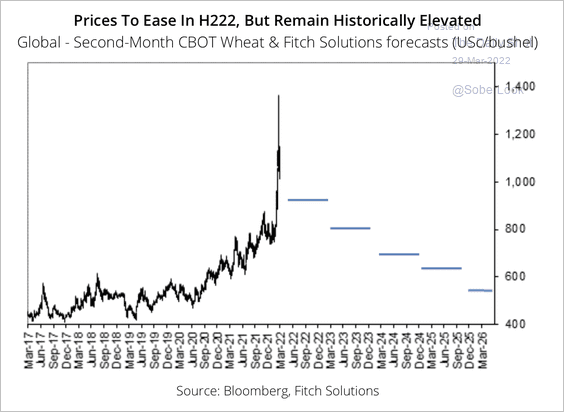

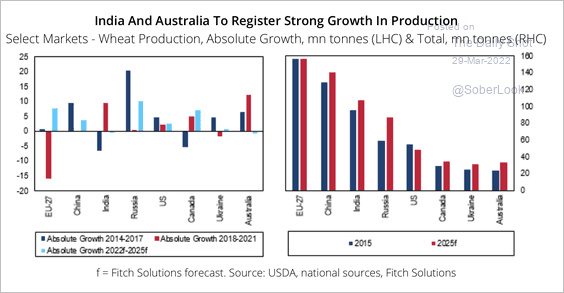

1. Fitch expects the rally in wheat prices to fade later this year ahead of an expected surplus (2 charts).

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

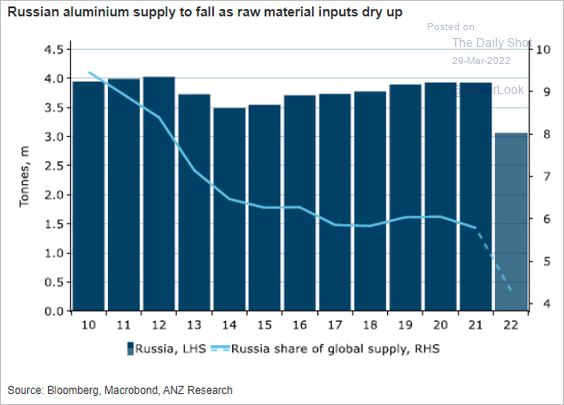

2. According to ANZ, …

… sanctions by market players worldwide have caused constraints on the supply of raw materials to Russia. The country’s largest manufacturer, Rusal, was forced to shut its alumina refinery in Ukraine following the military conflict. In addition, Australia decided to ban alumina exports to Russia, and mining giant Rio Tinto halted bauxite supply to Rusal’s Aughinish refinery in Ireland.

Source: ANZ Research

Source: ANZ Research

Back to Index

Cryptocurrency

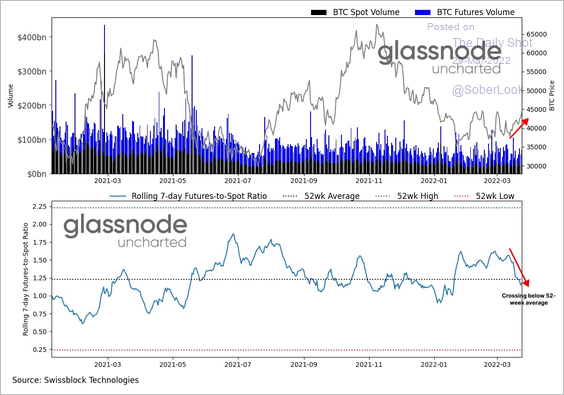

1. Bitcoin’s spot volume is rising more than its futures volume.

Source: @Negentropic_

Source: @Negentropic_

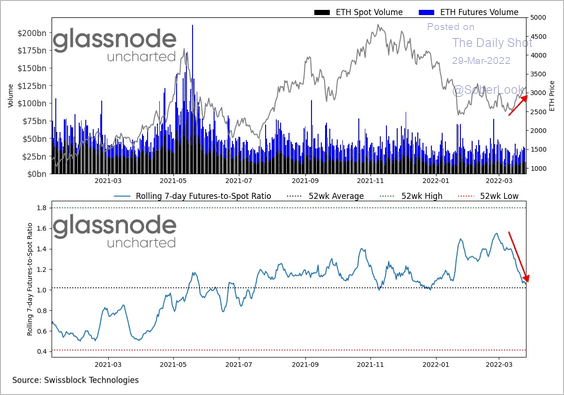

2. The price jump in ether (ETH) was also led by the spot market.

Source: @Negentropic_

Source: @Negentropic_

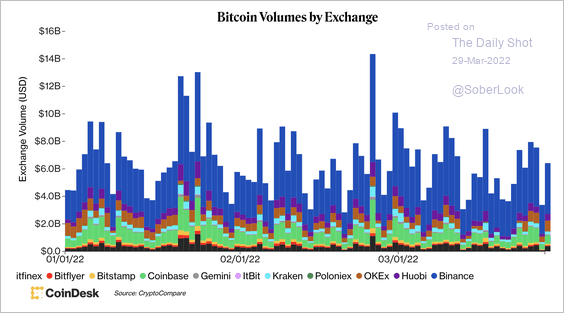

3. Overall, bitcoin’s trading volume across exchanges remains relatively thin.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

China

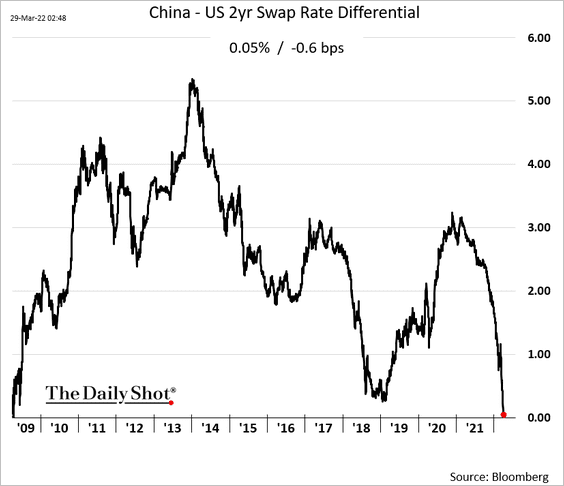

1. China’s 2-year rate is at par with the US for the first time since 2009 as monetary policies diverge.

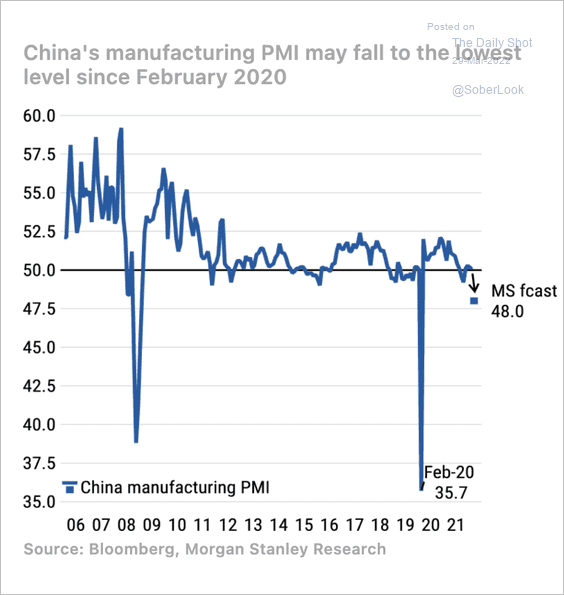

2. Morgan Stanley sees China’s manufacturing activity moving into contraction territory.

Source: @acemaxx, @MorganStanley

Source: @acemaxx, @MorganStanley

Back to Index

Asia – Pacific

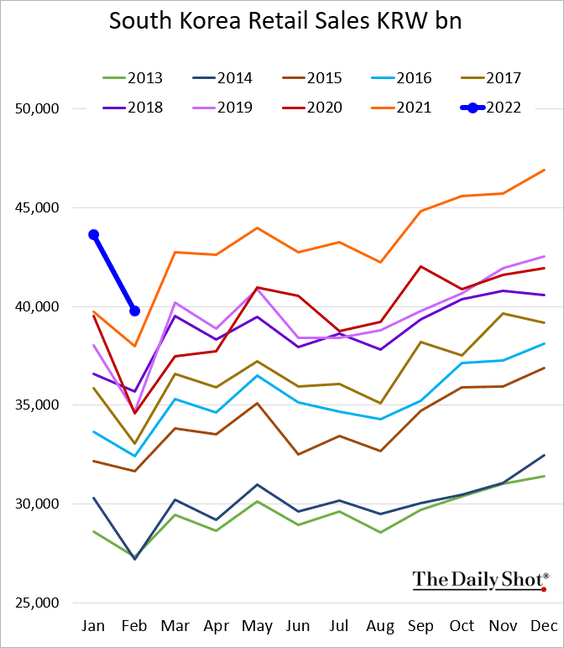

1. South Korea’s retail sales declined more than usual for February but held at multi-year highs for that time of the year.

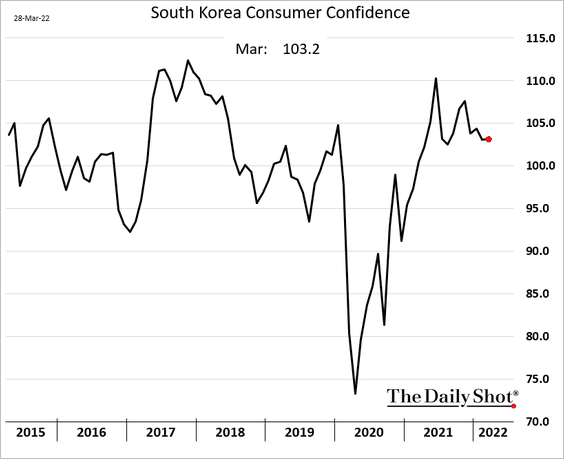

Consumer confidence remains robust.

——————–

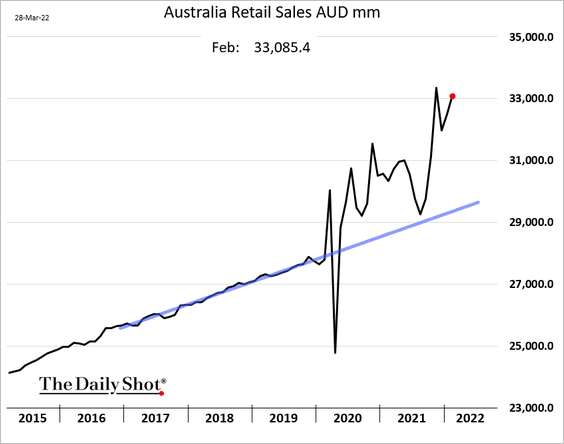

2. Australia’s retail sales were very strong in February.

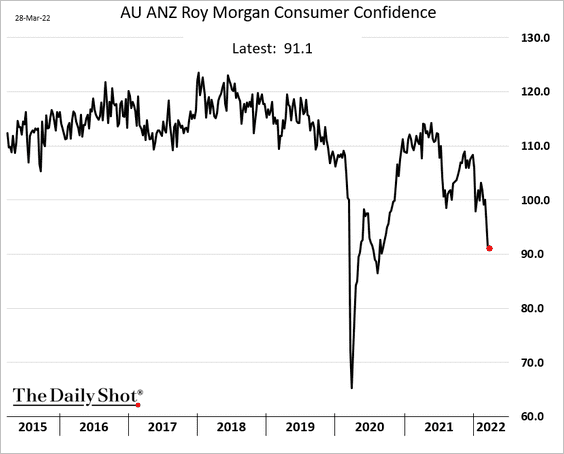

Consumer confidence remains depressed.

——————–

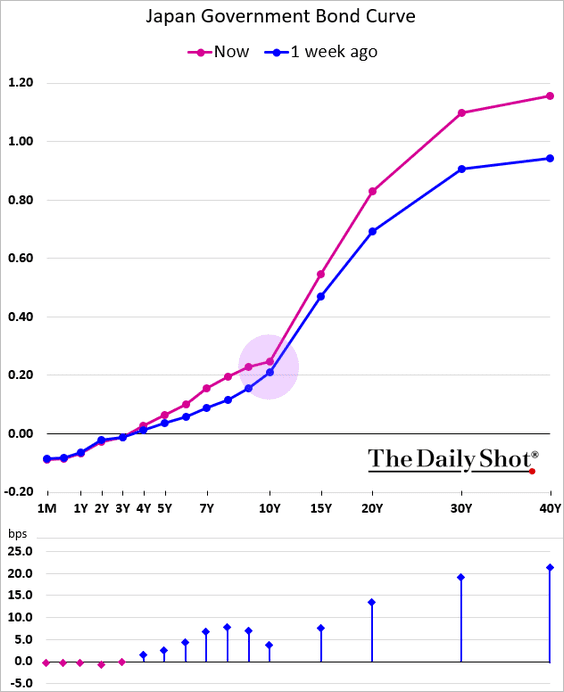

3. The BoJ’s intervention has pinned down the 10-year JGB yield but the rest of the curve is rising.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

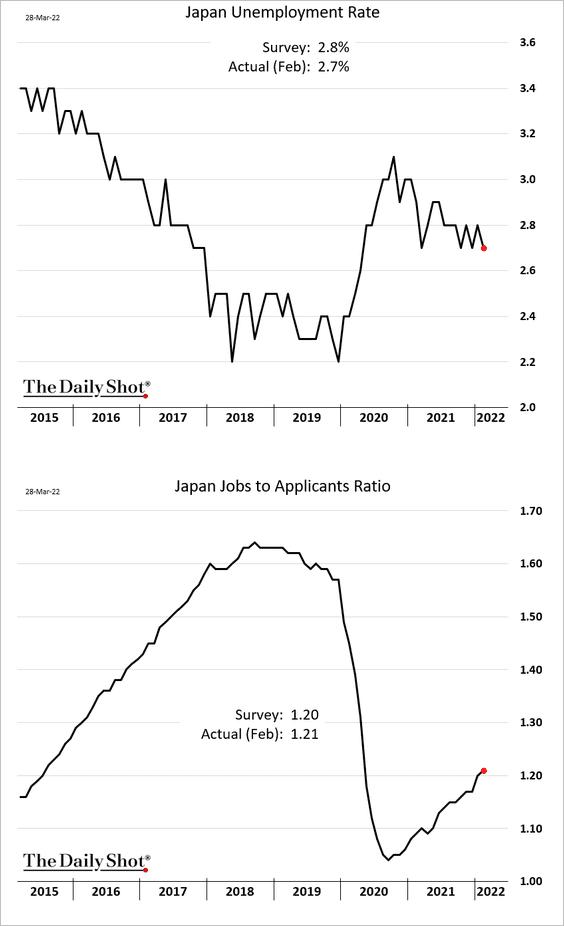

Japan’s labor market indicators were better than expected last month.

Back to Index

The Eurozone

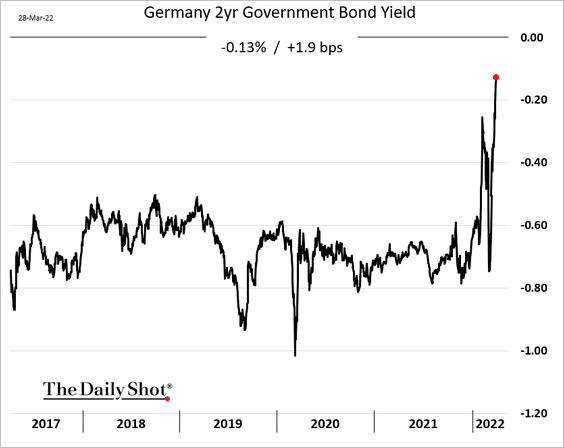

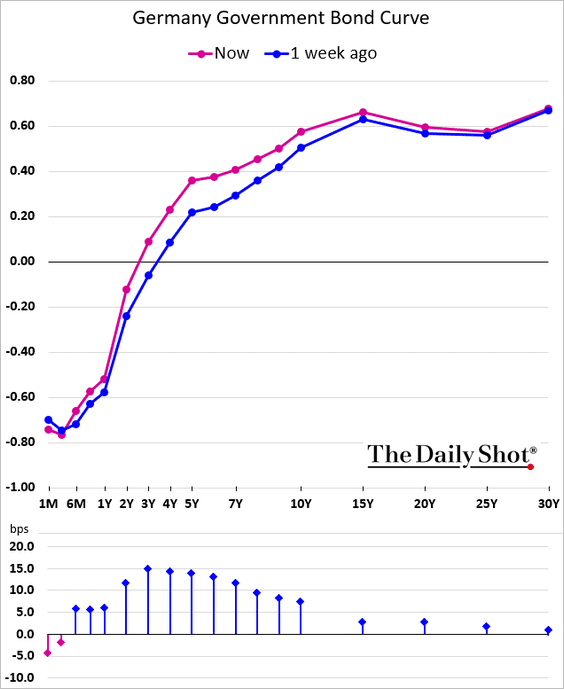

1. Shorter-term Bund yields are surging, …

… as the curve flattens.

——————–

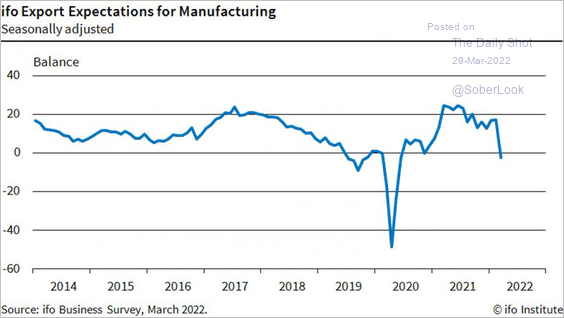

2. Export expectations have deteriorated.

Source: @CESifoGroup, @ifo_Institut, @KlausWohlrabe Read full article

Source: @CESifoGroup, @ifo_Institut, @KlausWohlrabe Read full article

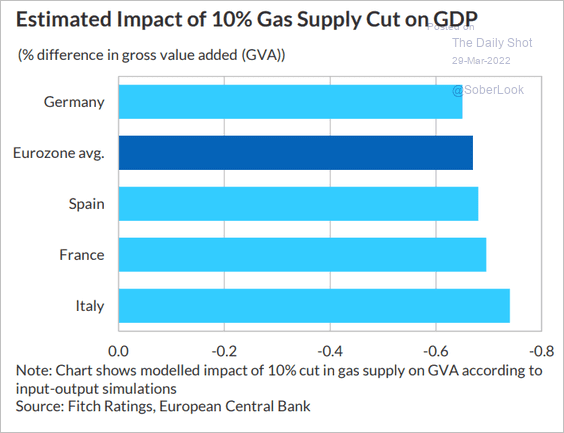

3. What impact will a substantial gas supply cut have on GDP?

Source: Fitch Ratings

Source: Fitch Ratings

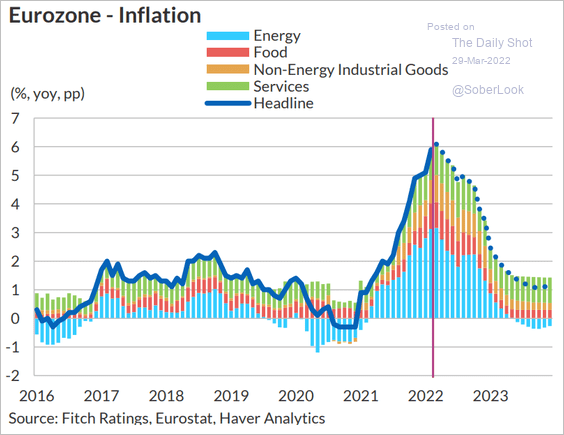

4. Will the Eurozone CPI peak around 6%?

Source: Fitch Ratings

Source: Fitch Ratings

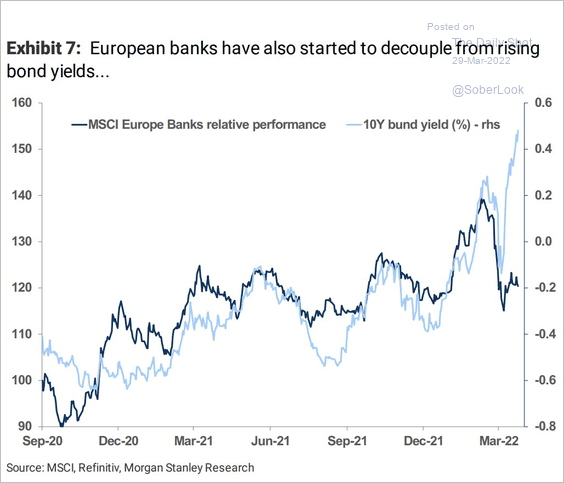

5. European bank shares’ relative performance has decoupled from Bund yields.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

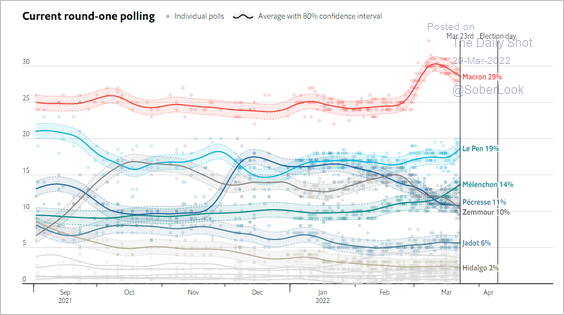

6. Finally, here are the latest French presidential election polls.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Canada

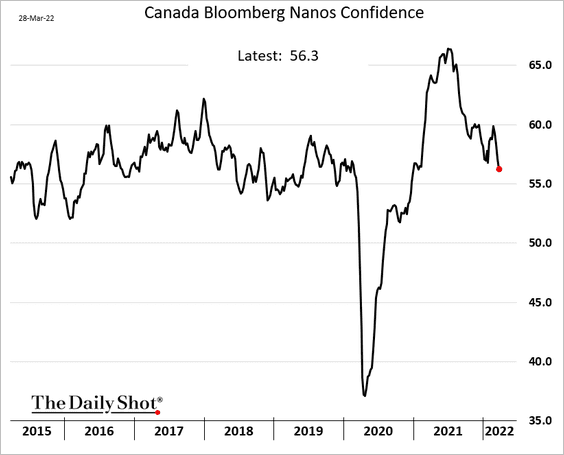

1. Consumer confidence continues to deteriorate.

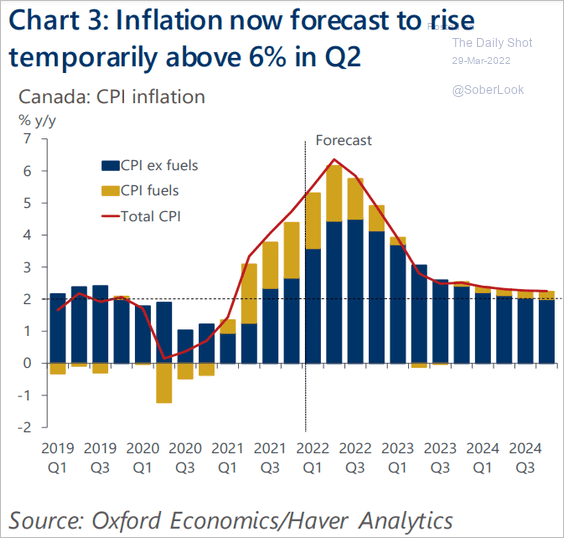

2. Will inflation peak just above 6%?

Source: Oxford Economics

Source: Oxford Economics

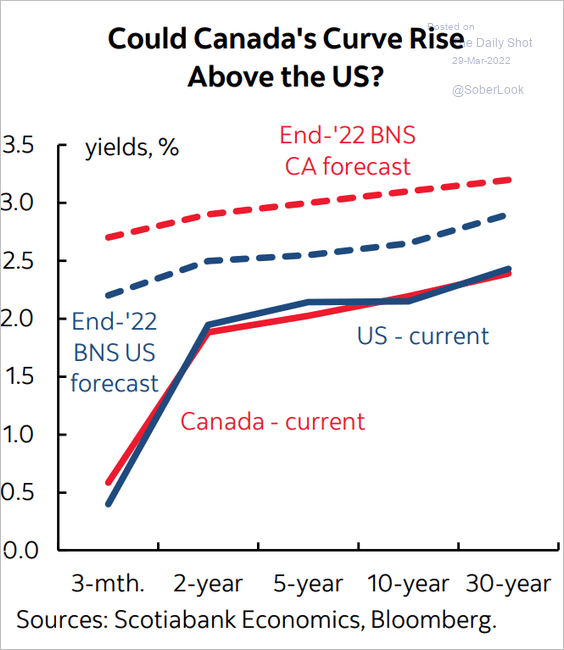

3. Will Canada’s yield curve rise above the US?

Source: Scotiabank Economics

Source: Scotiabank Economics

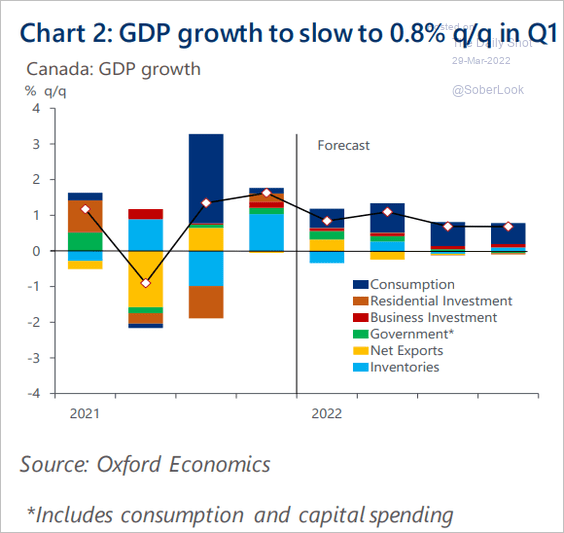

4. Here is the GDP forecast from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

The United States

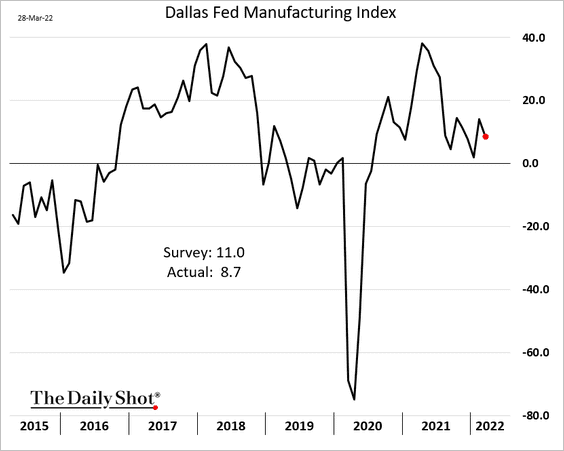

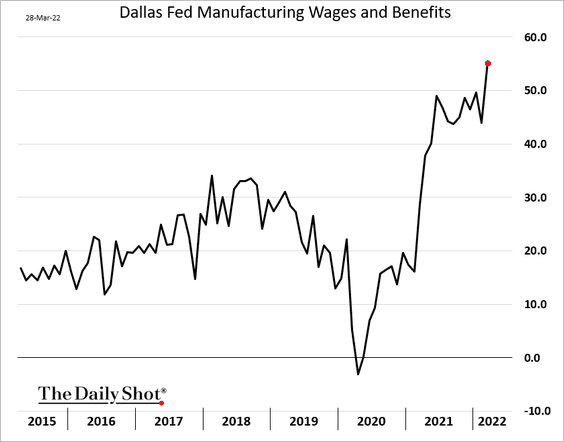

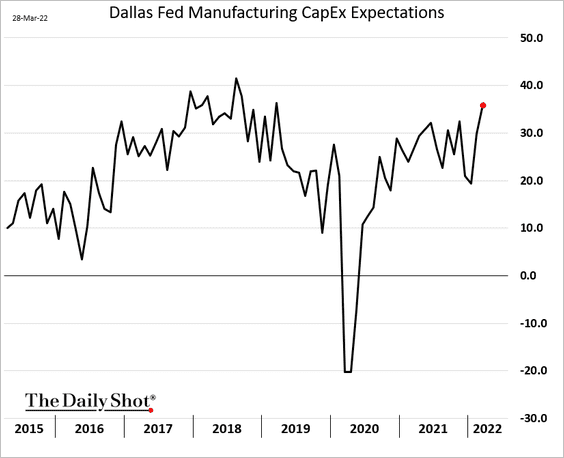

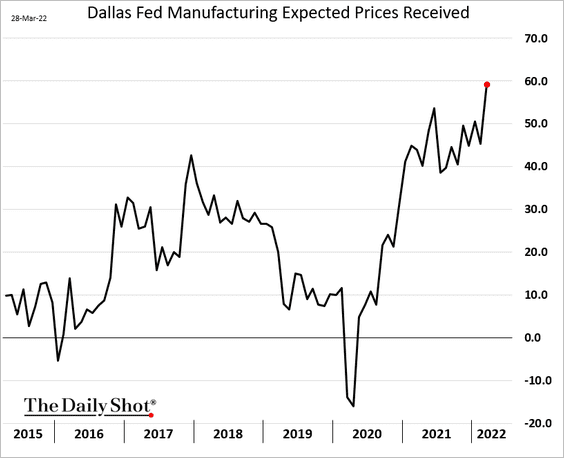

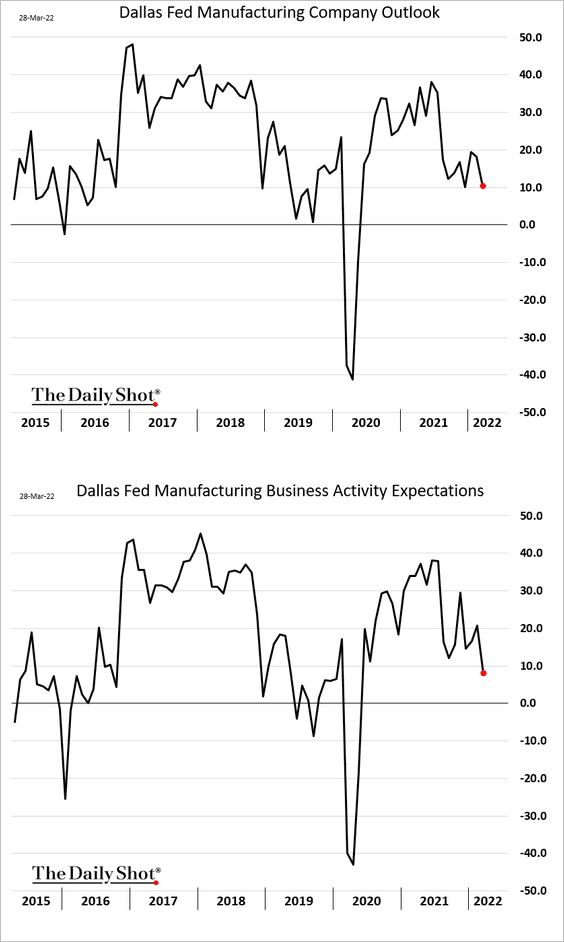

1. The Dallas Fed’s regional manufacturing index eased this month.

• Companies are rapidly boosting wages.

• CapEx expectations continue to improve.

• Factories will keep hiking prices in the months ahead.

• The overall outlook for Texas-area manufacturers has worsened.

——————–

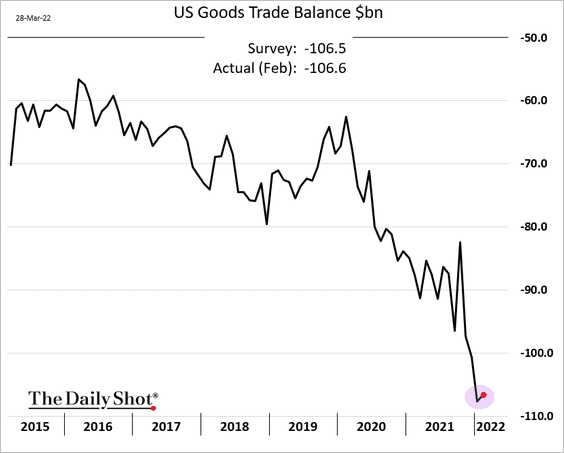

2. The trade deficit in goods eased slightly in February.

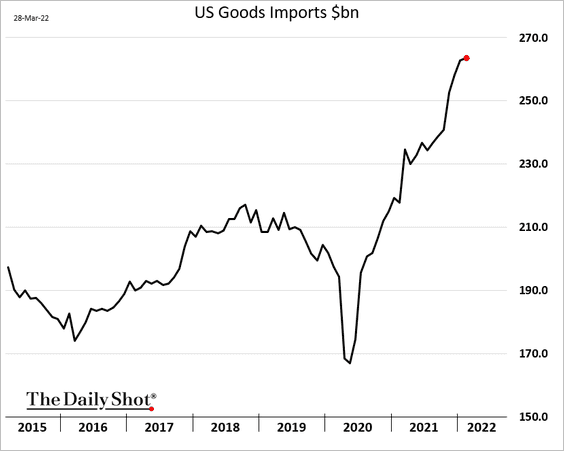

Imports continue to hit record highs.

——————–

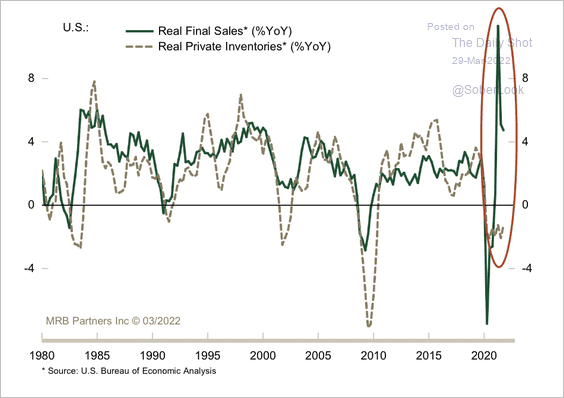

3. Low inventories could bode well for future output.

Source: MRB Partners

Source: MRB Partners

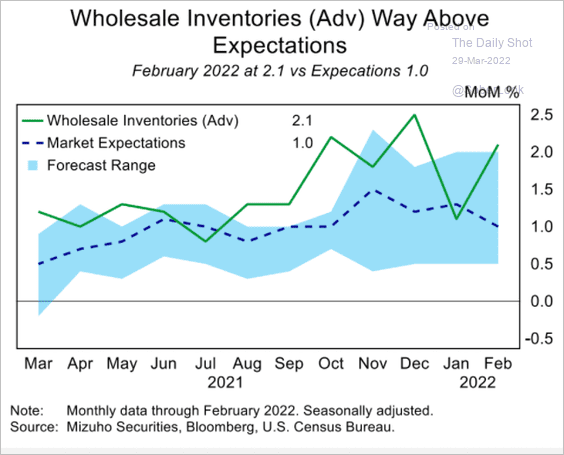

Wholesale inventories increased more than expected last month.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

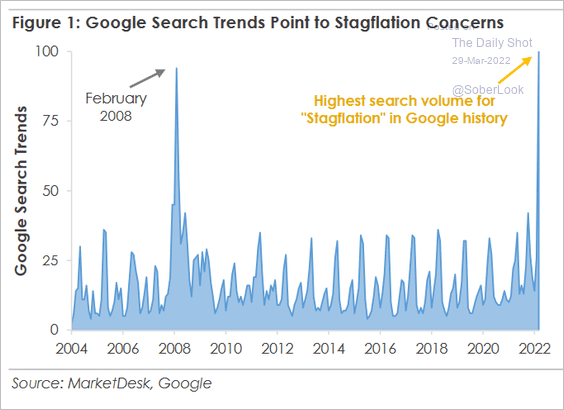

4. Concerns about stagflation have risen sharply.

Source: MarketDesk Research

Source: MarketDesk Research

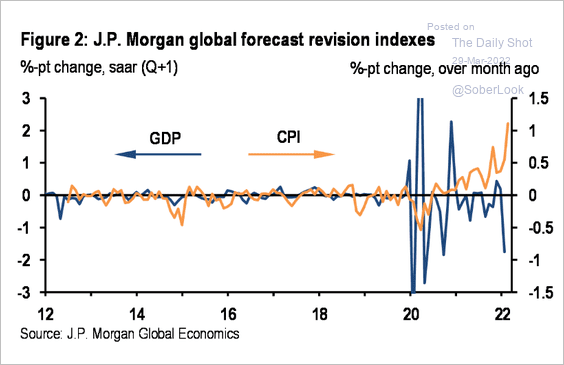

And it’s not limited to the US.

Source: JP Morgan Research; @dlacalle_IA

Source: JP Morgan Research; @dlacalle_IA

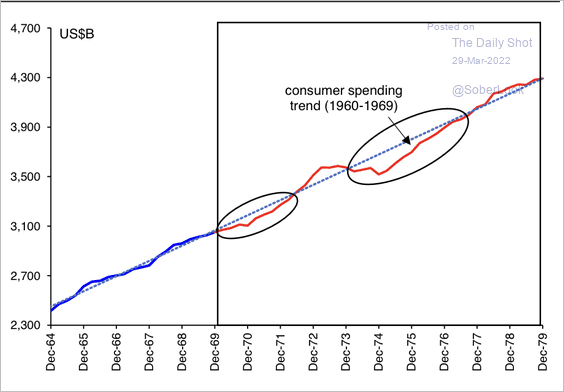

By the way, consumer spending was below trend for most of the 1970s amid slow growth and high inflation.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

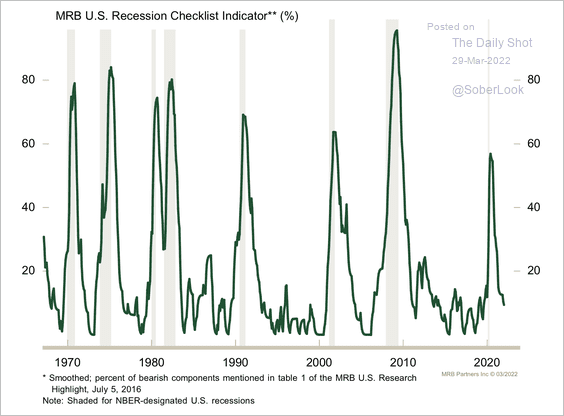

5. Recession risks remain muted, according to MRB’s model.

Source: MRB Partners

Source: MRB Partners

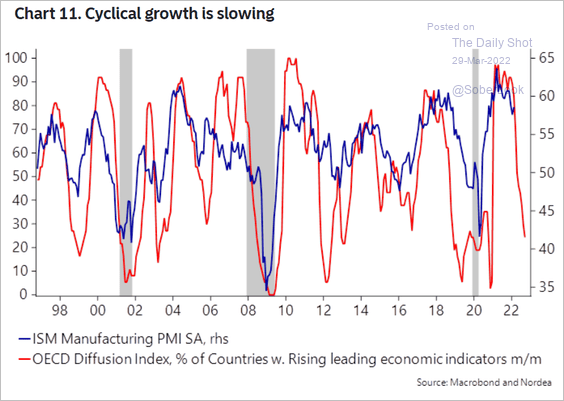

But global headwinds point to slower US business activity ahead.

Source: Nordea Markets

Source: Nordea Markets

——————–

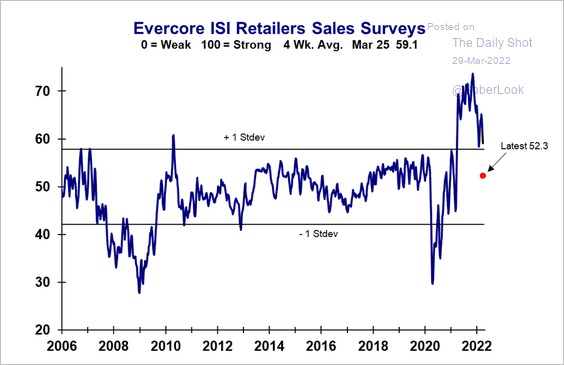

6. The Evercore ISI Retailers Sales index has declined sharply as prices spike.

Source: Evercore ISI Research

Source: Evercore ISI Research

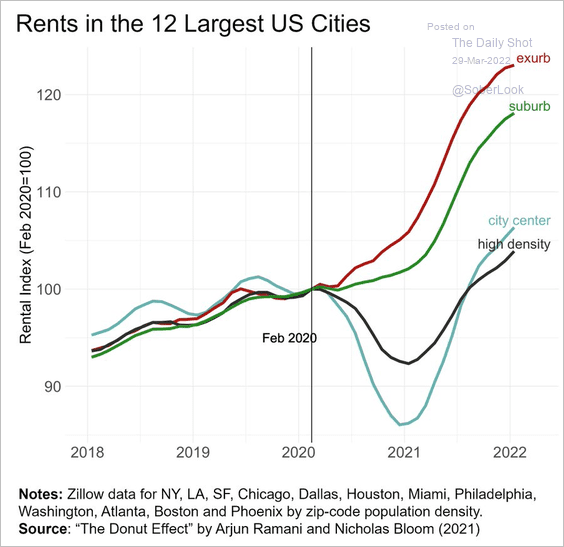

7. City-center rents have returned to their pre-COVID trend. Suburban rents are surging.

Source: @I_Am_NickBloom

Source: @I_Am_NickBloom

Back to Index

Global Developments

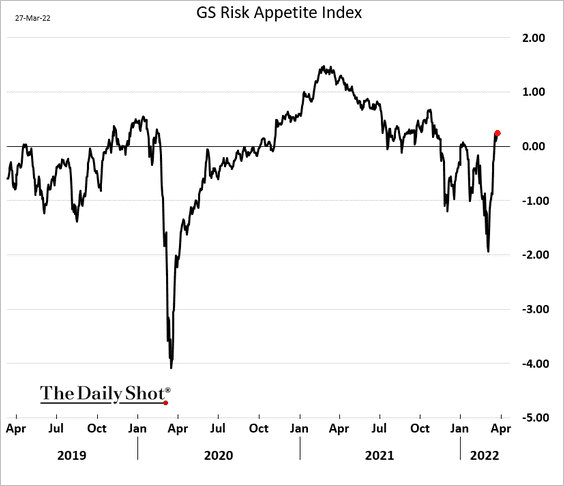

1. Goldman’s risk appetite index has been rebounding.

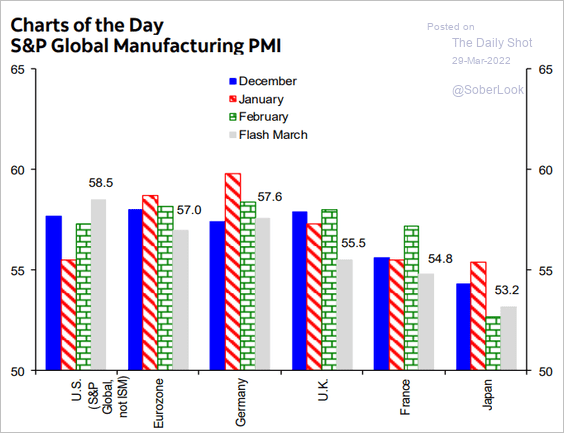

2. March manufacturing PMIs point to resilient factory activity in advanced economies.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

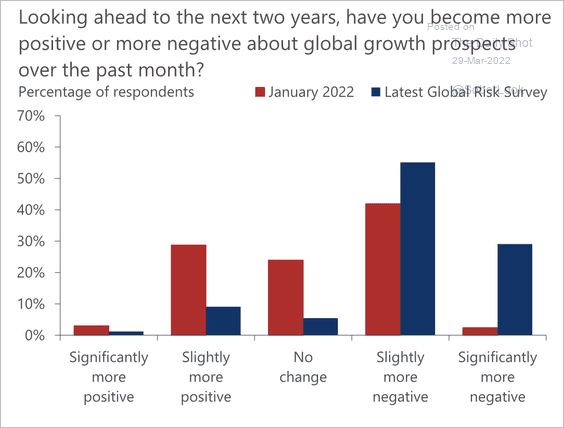

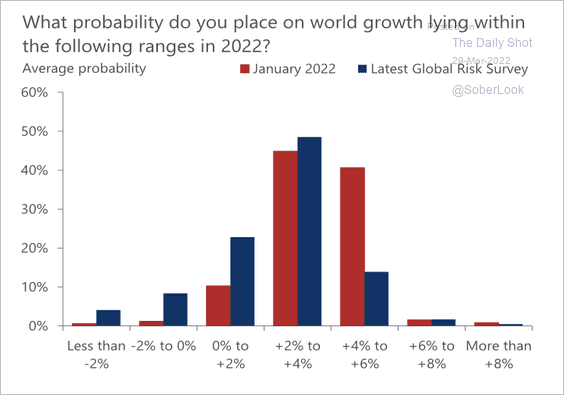

3. A majority of businesses surveyed by Oxford Economics are less positive on global growth (2 charts).

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

——————–

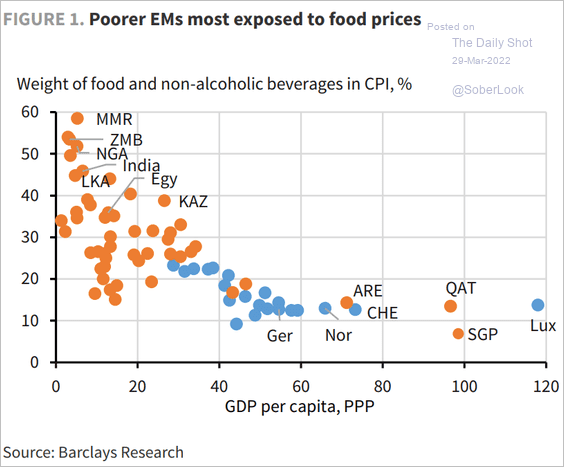

4. Emerging economies have a higher concentration of food items in their CPI baskets.

Source: Barclays Research

Source: Barclays Research

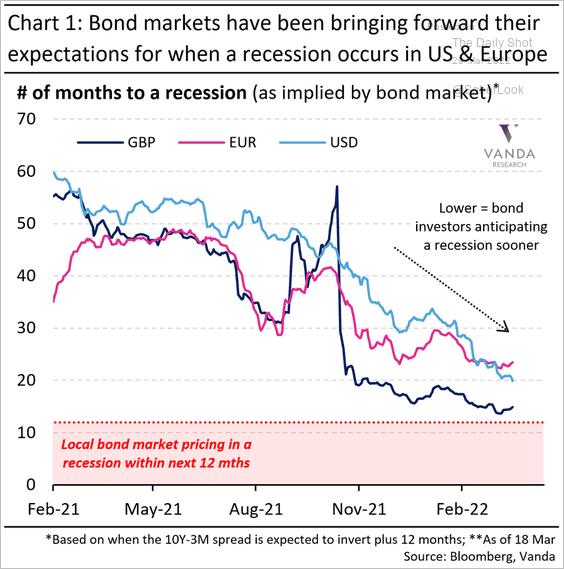

5. What does the bond market tells us about the timing of the next recession?

Source: @VPatelFX

Source: @VPatelFX

——————–

Food for Thought

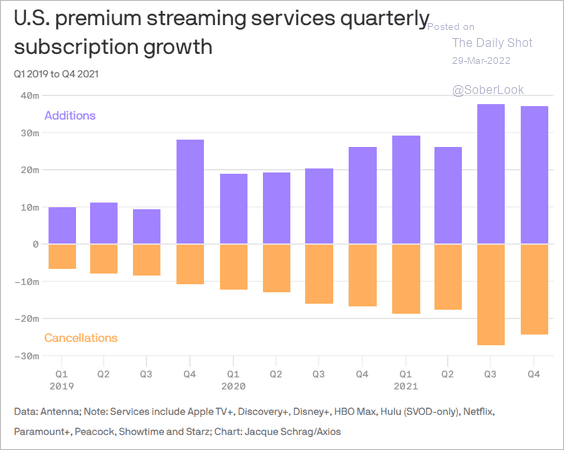

1. New subscriptions and cancellations for streaming video services:

Source: @axios Read full article

Source: @axios Read full article

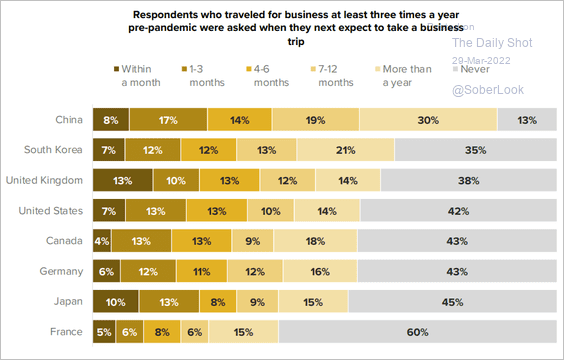

2. Traveling for business:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

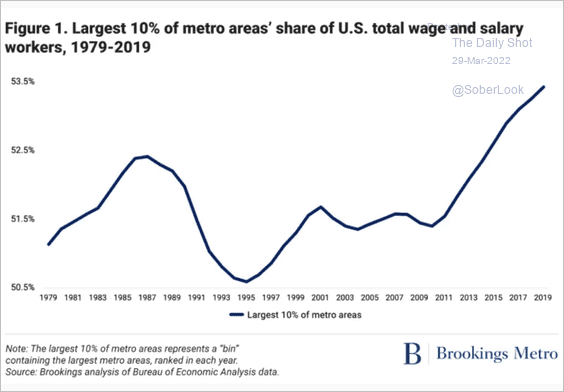

3. Share of US workers in the largest metro areas:

Source: Brookings Read full article

Source: Brookings Read full article

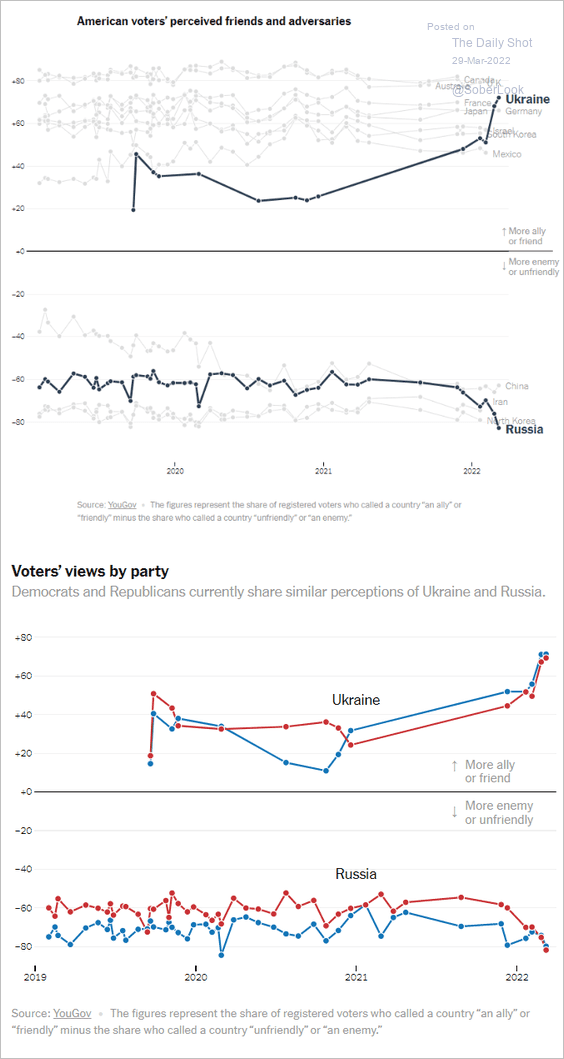

4. Americans’ views on Ukraine and Russia:

Source: The New York Times Read full article

Source: The New York Times Read full article

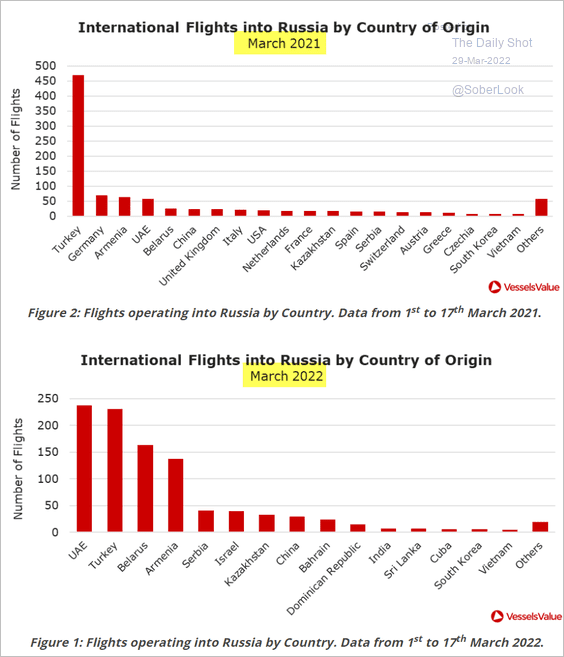

5. International flights into Russia:

Source: VesselsValue Read full article

Source: VesselsValue Read full article

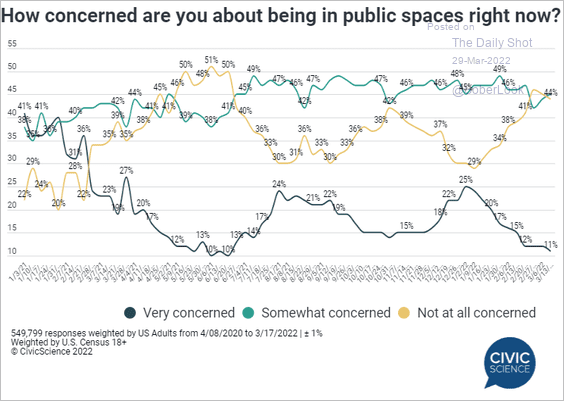

6. Easing concerns about COVID:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

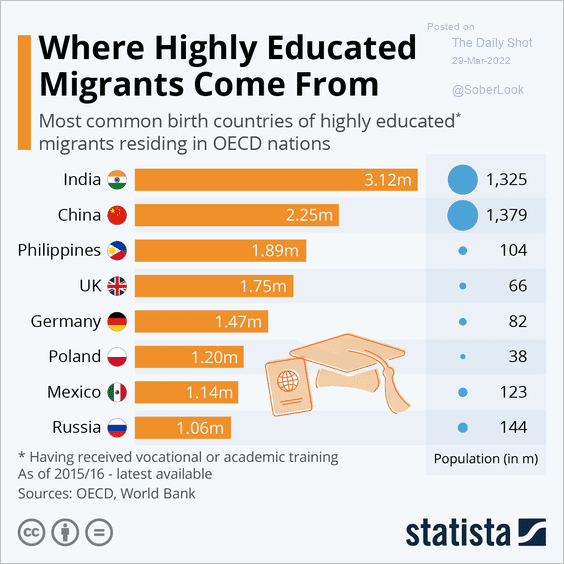

7. Highly-educated immigrants in OECD countries:

Source: Statista

Source: Statista

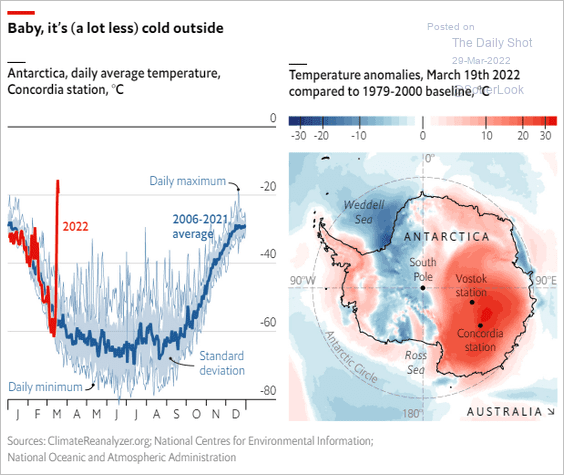

8. Temperature changes in Antarctica:

Source: The Economist Read full article

Source: The Economist Read full article

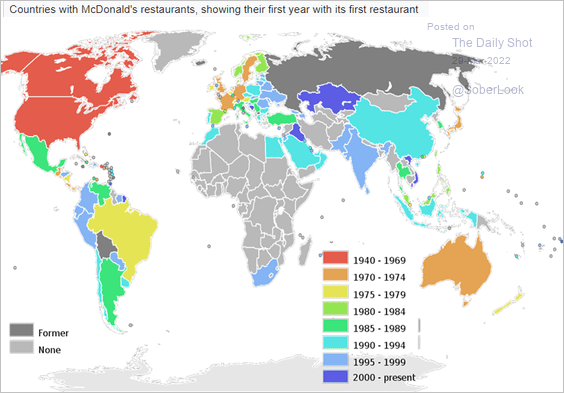

9. Countries with McDonald’s restaurants, showing their first year with its first restaurant:

Source: Wikipedia Read full article

Source: Wikipedia Read full article

——————–

Back to Index