The Daily Shot: 30-Mar-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Alternatives

• Global Developments

• Food for Thought

The United States

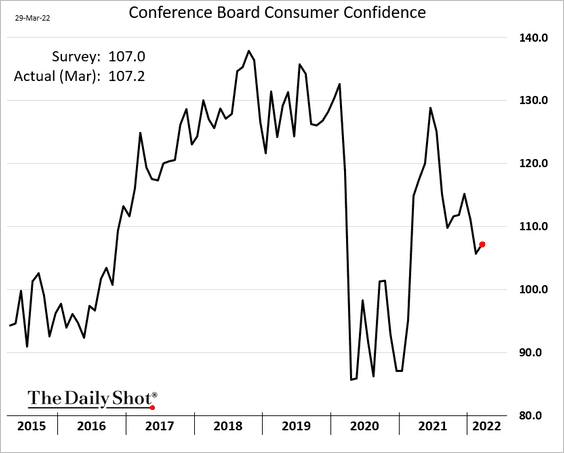

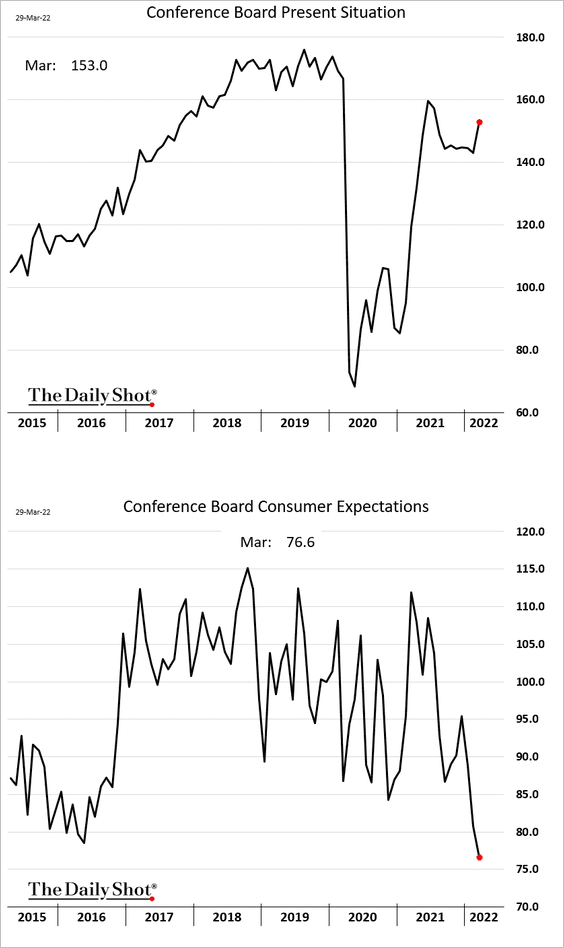

1. The Conference Board’s consumer confidence index ticked higher this month, …

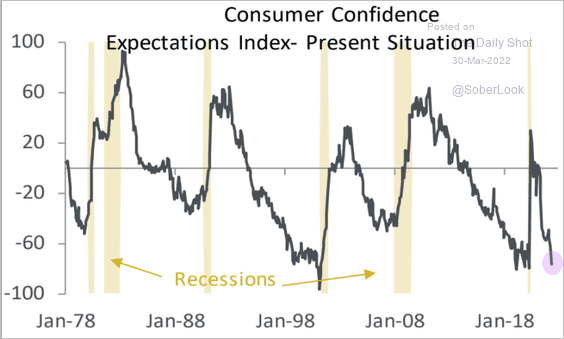

… as the “present situation” and “expectations” subindices diverge.

• This divergence often precedes economic downturns.

Source: Piper Sandler

Source: Piper Sandler

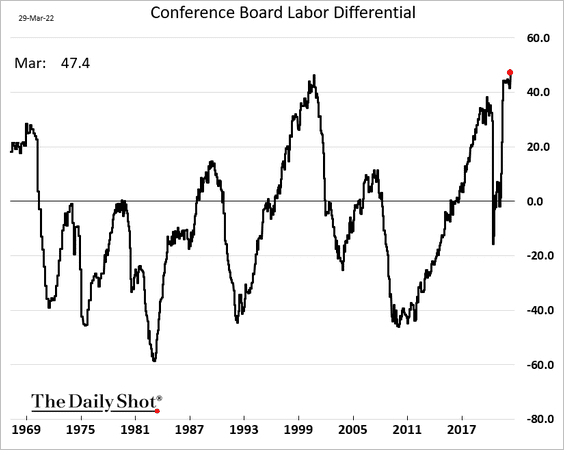

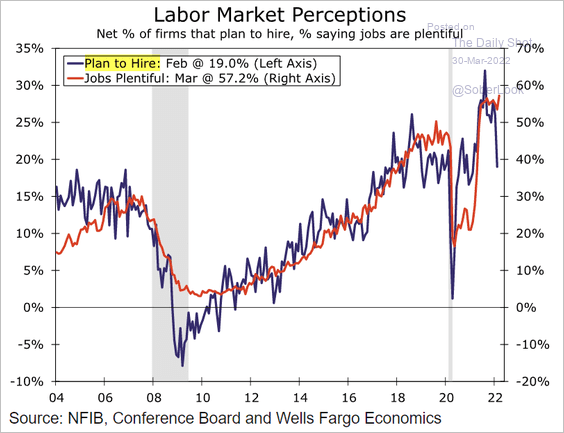

• The labor differential (“jobs plentiful” – “jobs hard to get”) hit a record high, with households increasingly confident in the jobs market.

But small businesses are signaling a potential slowdown in labor demand.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

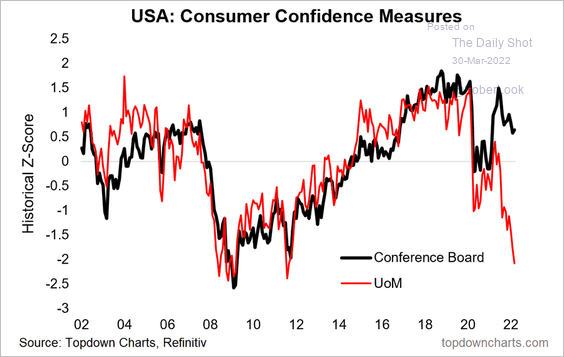

• The gap between the Conference Board’s and the U. Michigan’s sentiment measures has widened further.

Source: @Callum_Thomas

Source: @Callum_Thomas

——————–

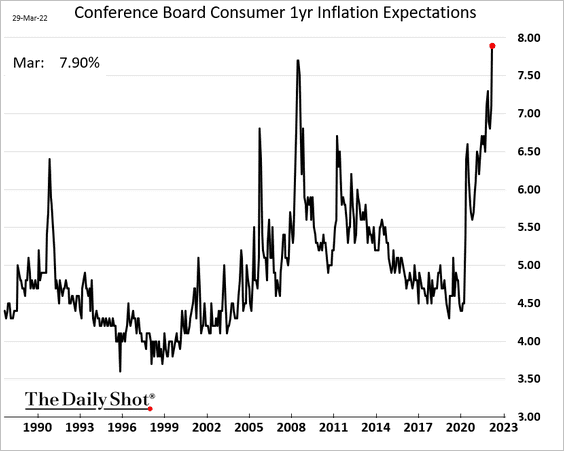

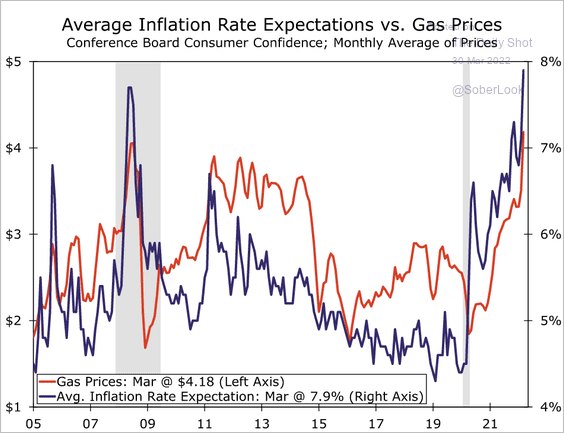

2. Next, we have some updates on inflation.

• The Conference Board’s consumer inflation expectations index hit a new high, …

… boosted by gasoline and food prices.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

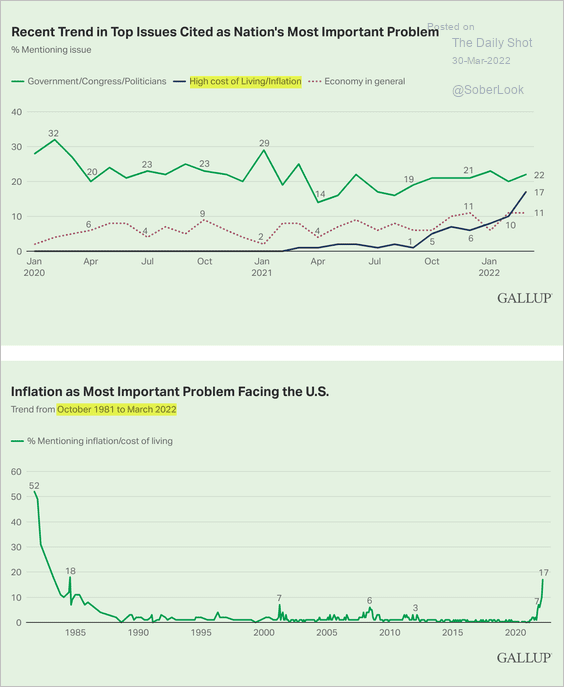

• Households increasingly see inflation as the nation’s most important problem.

Source: Gallup Read full article

Source: Gallup Read full article

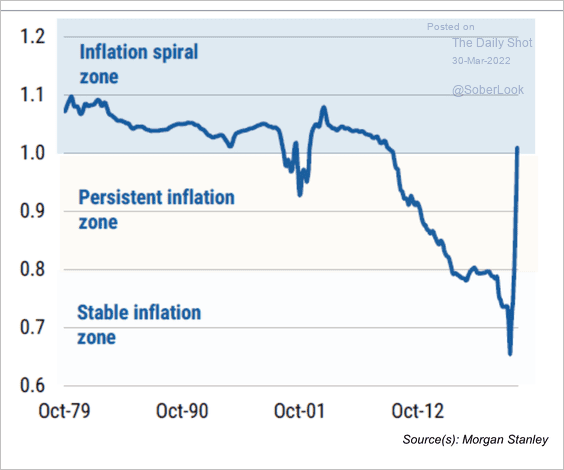

• Inflation persistence is reaching levels last seen in the early 1980s. This trend suggests that broad-based upward price pressures may continue even when demand/supply imbalances subside, according to Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

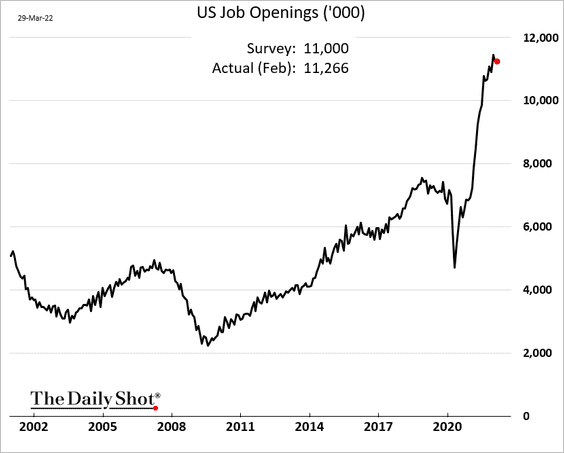

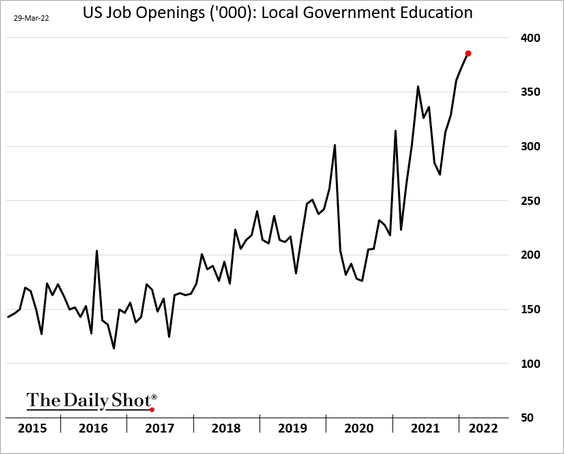

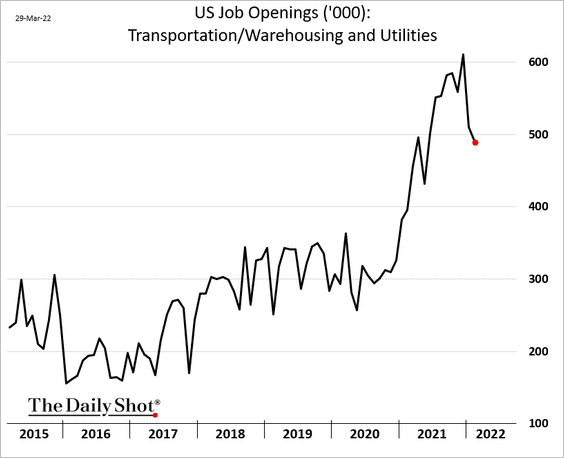

3. Job openings remained near record highs in February.

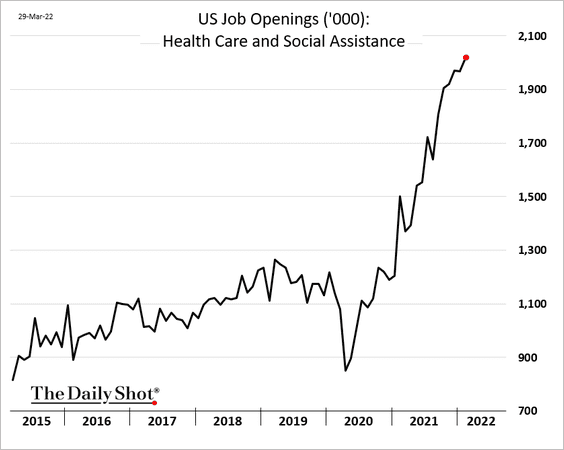

• Some sectors saw record vacancies.

– Healthcare workers:

– Teachers:

But job openings in logistics sectors are slowing amid tentative signs of easing supply bottlenecks.

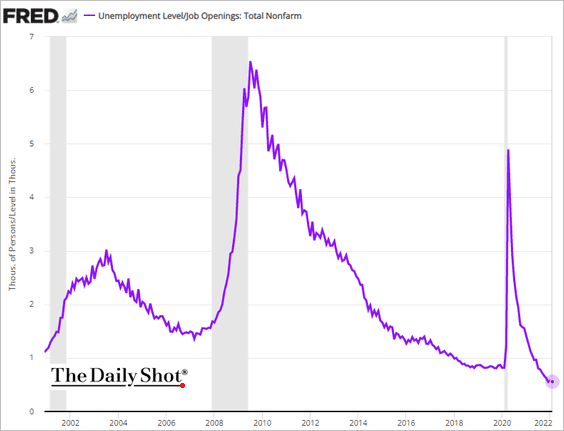

• Here is the ratio of unemployed workers to job openings.

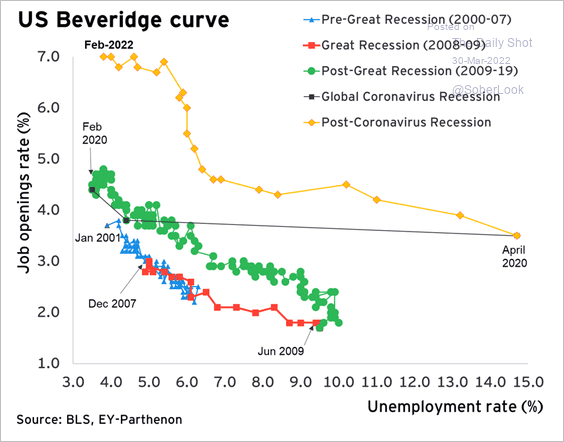

And this chart shows the Beveridge curve.

Source: @GregDaco, @EY_Parthenon

Source: @GregDaco, @EY_Parthenon

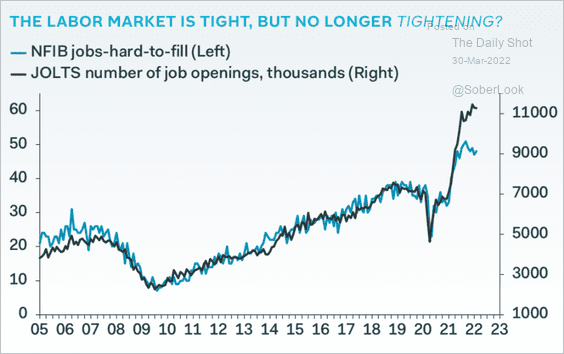

• Small business indicators point to a moderation in job openings ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

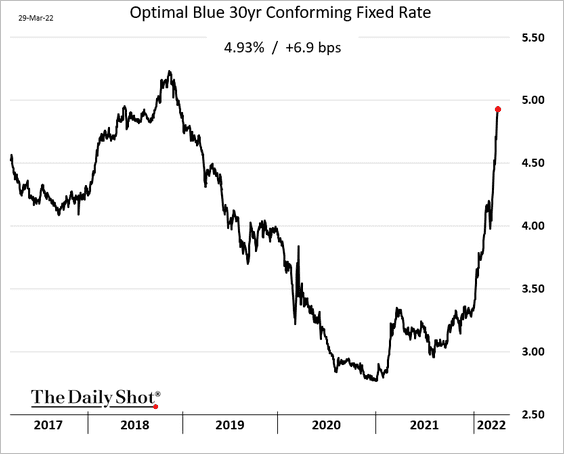

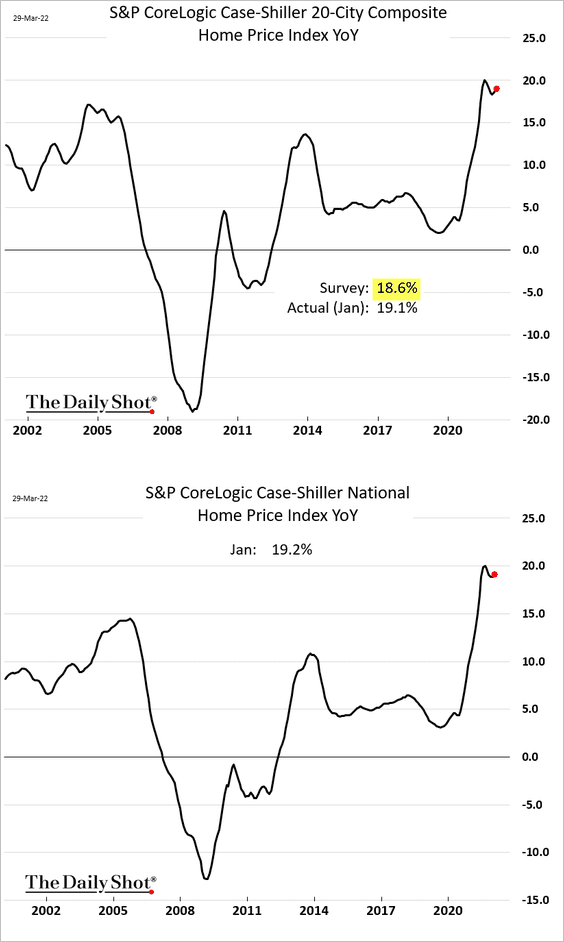

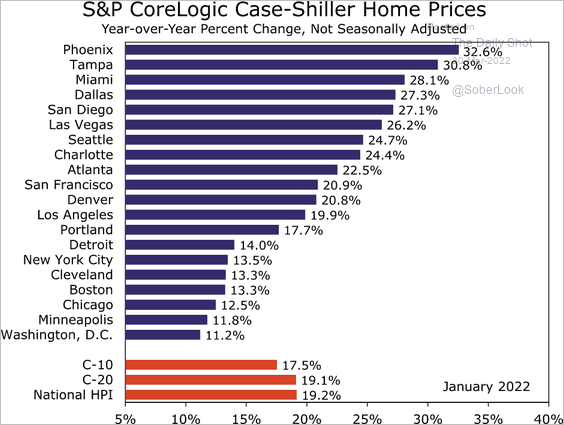

4. Next, we have some updates on the housing market.

• Mortgage rates are approaching 5%.

• Home price appreciation accelerated further in January.

• Here are the price gains by metro area.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

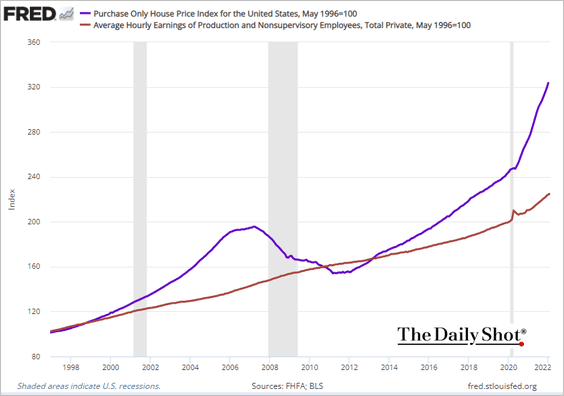

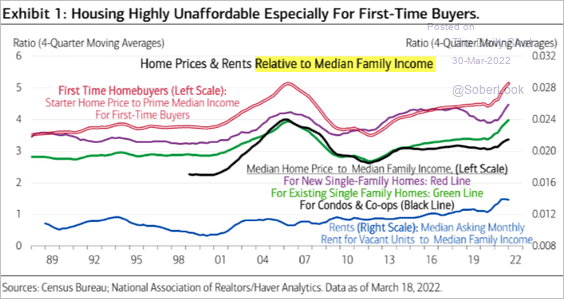

• Home prices continue to outpace wages, …

… with housing becoming highly unaffordable, especially for first-time buyers.

Source: Merrill Lynch

Source: Merrill Lynch

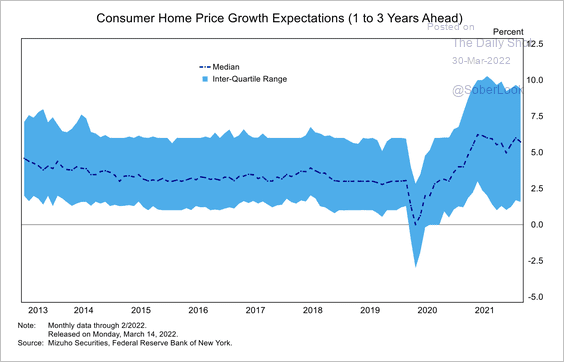

• Consumers expect home price growth to remain high.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

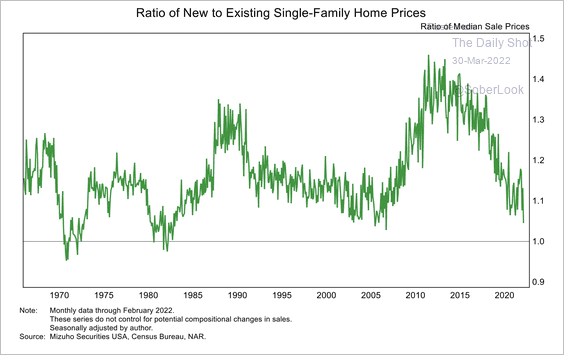

• Existing home prices have been rising faster than new home prices.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

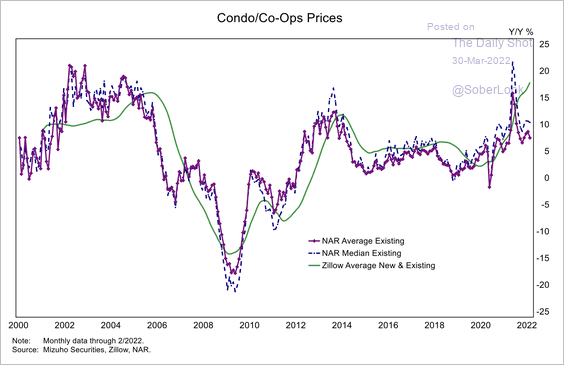

• Condo prices have seen large increases over the past year.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

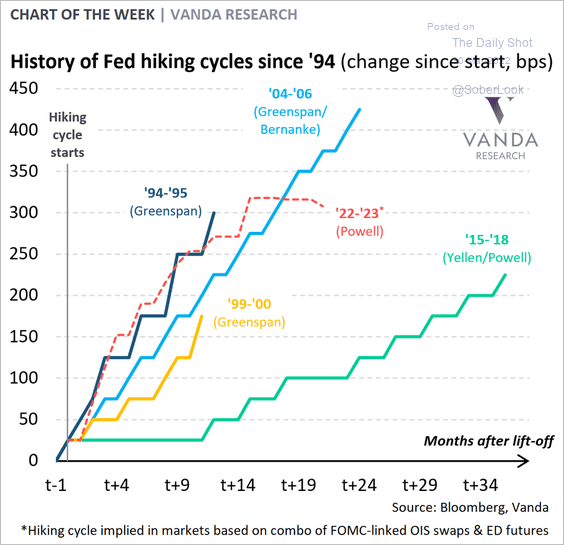

5. The next chart shows previous Fed rate hike cycles.

Source: @VPatelFX

Source: @VPatelFX

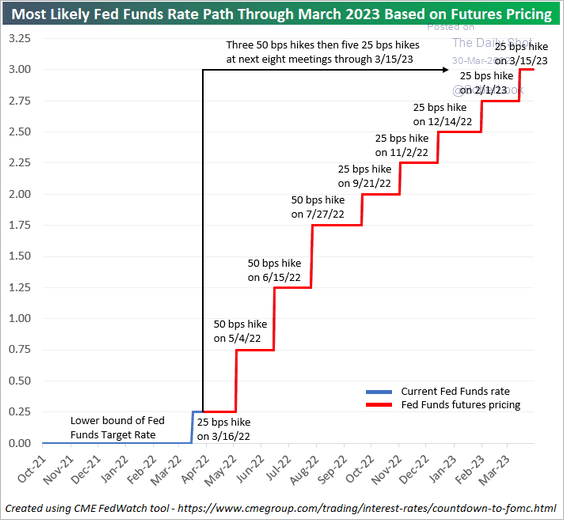

And here is what’s priced into the market for the current cycle.

Source: @bespokeinvest

Source: @bespokeinvest

——————–

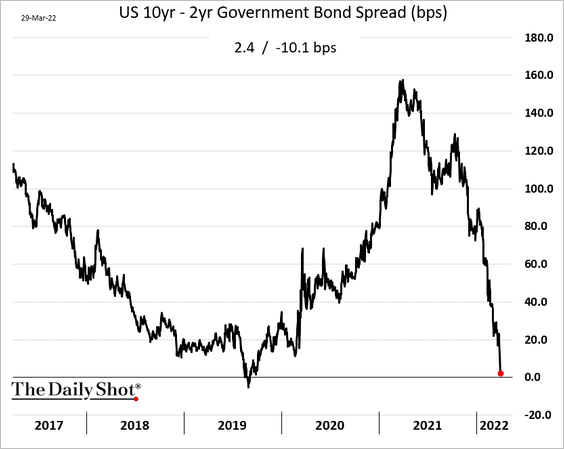

6. The 10-year – 2-year portion of the Treasury curve came close to inversion. Hopes for a positive outcome in the Russia-Ukraine negotiations kept this spread from moving into negative territory.

Back to Index

The United Kingdom

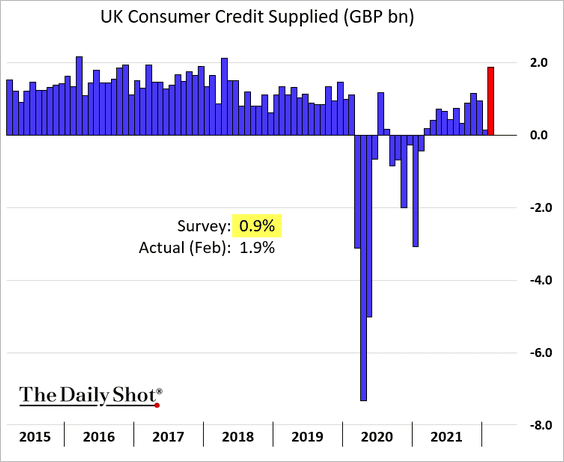

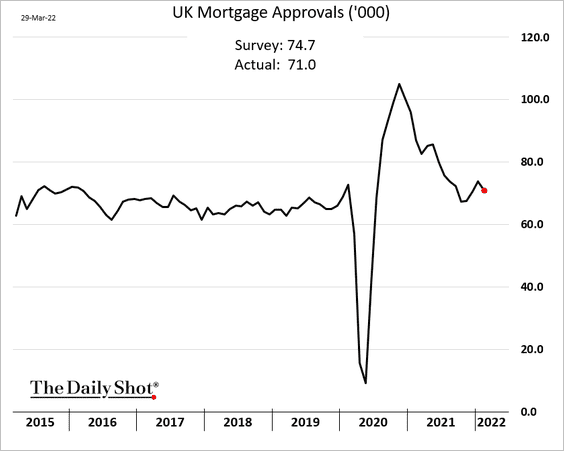

1. Consumer credit surged in February, …

… but mortgage approvals slowed.

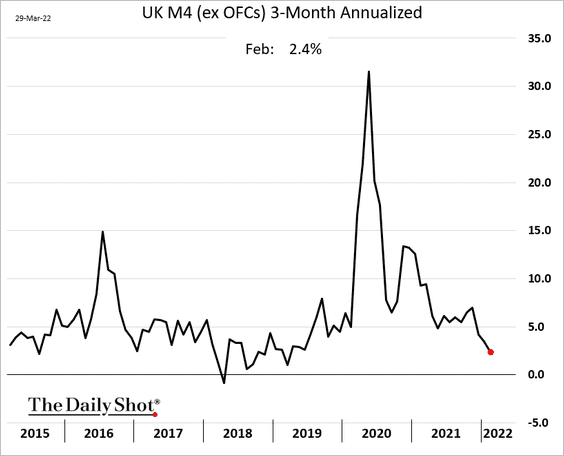

2. The money supply expansion continues to moderate.

Back to Index

The Eurozone

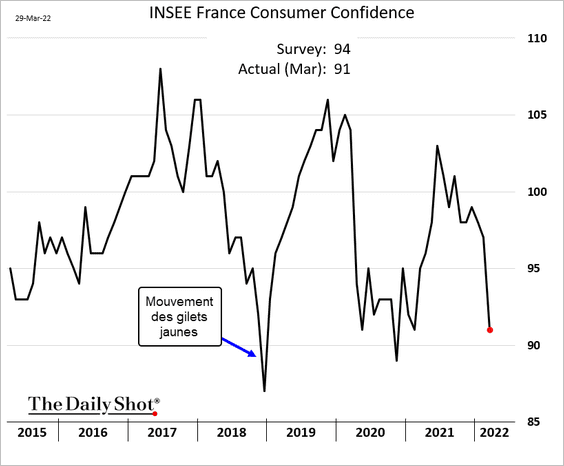

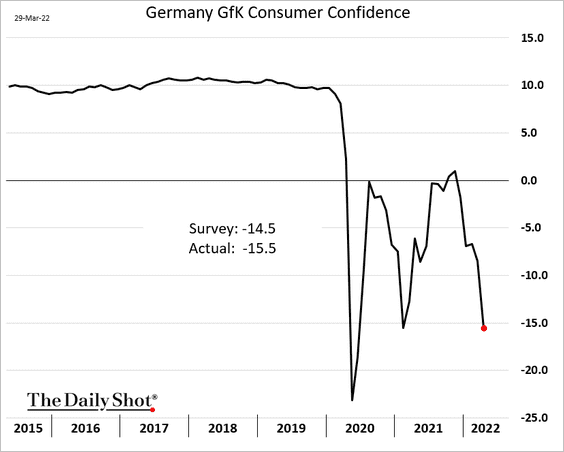

1. As we saw earlier, consumer confidence deteriorated across the euro area this month.

• France:

• Germany:

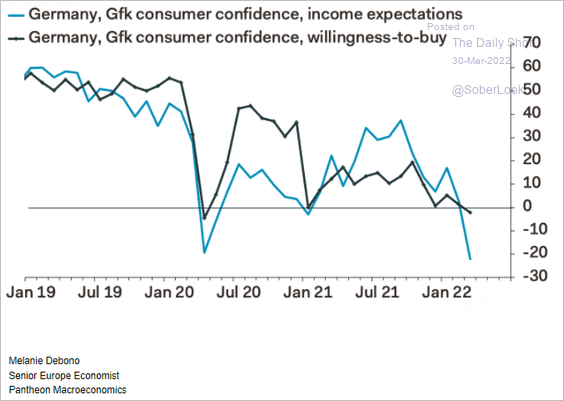

2. Income expectations are falling, which could impact consumer spending.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

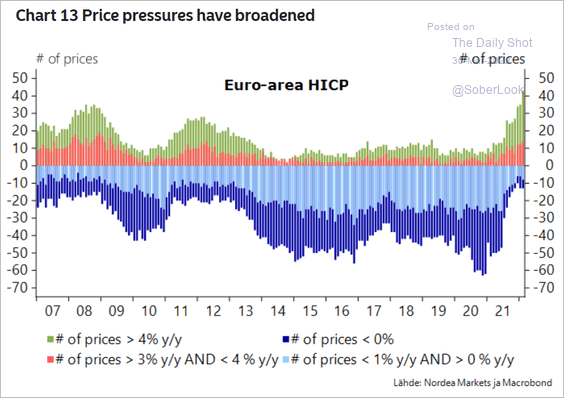

3. Price pressures have been broadening, …

Source: Nordea Markets

Source: Nordea Markets

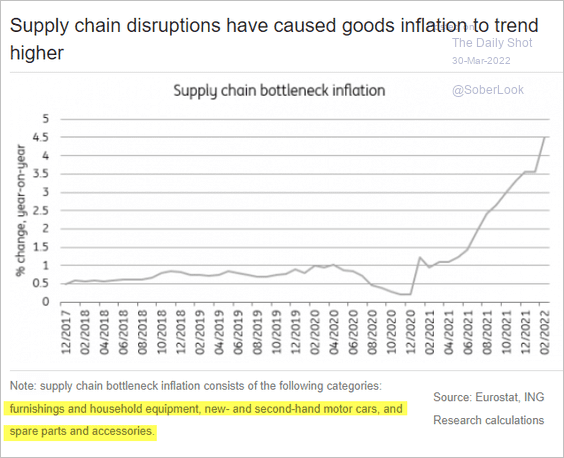

… with gains often driven by supply chain strains.

Source: ING

Source: ING

Back to Index

Europe

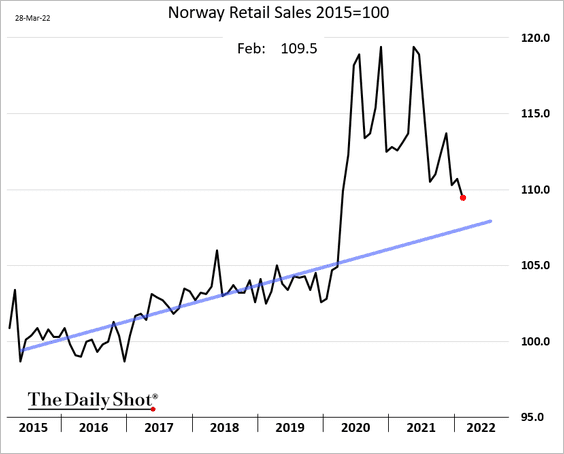

1. Norway’s retail sales continue to slow.

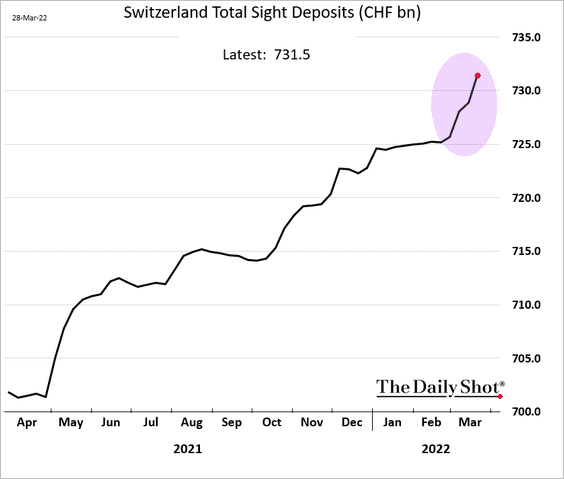

2. Swiss sight deposits point to the SNB’s intervention in the F/X markets to keep the franc from appreciating further.

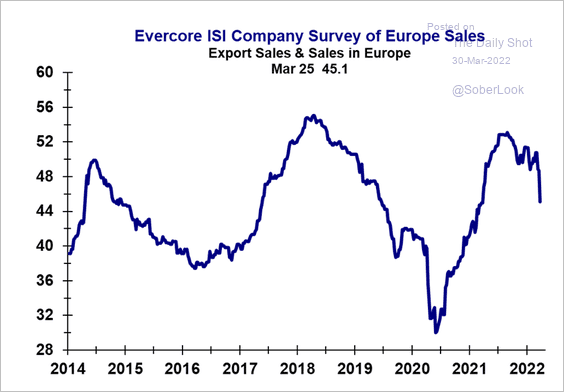

3. Multinationals see slower sales in Europe.

Source: Evercore ISI Research

Source: Evercore ISI Research

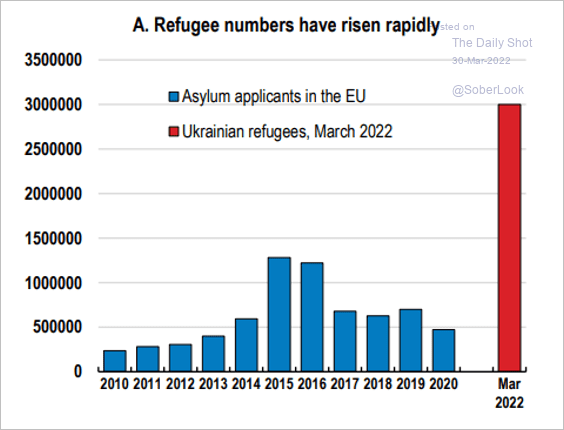

4. EU refugee numbers surge as Russia “depopulates” Ukrainian cities.

Source: OECD Read full article

Source: OECD Read full article

Back to Index

Asia – Pacific

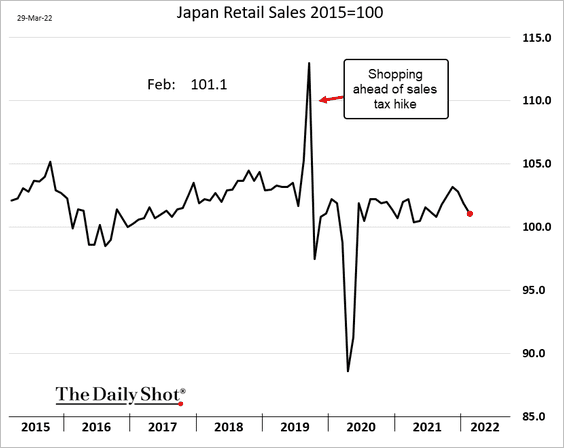

1. Japan’s retail sales slowed again in February.

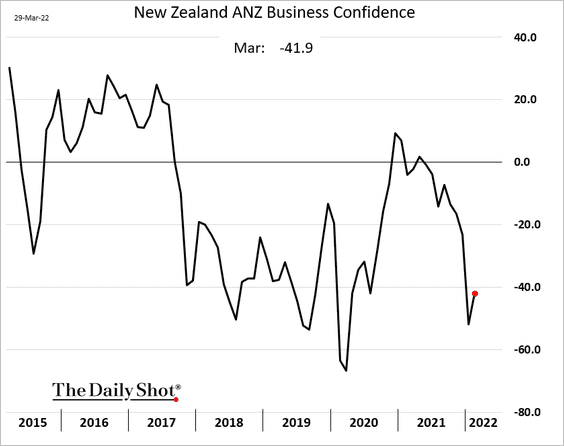

2. New Zealand’s business confidence seems to have bottomed.

Back to Index

China

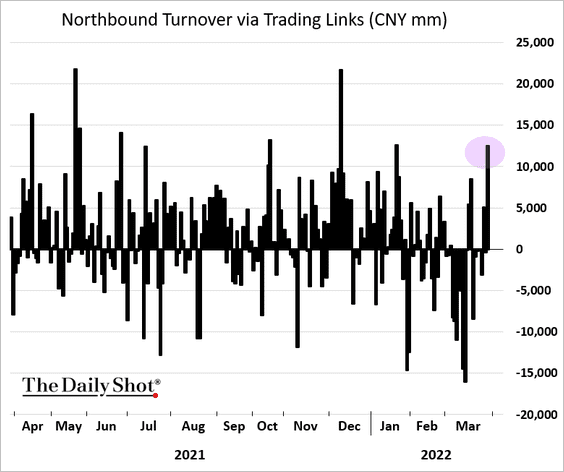

1. Mainland equity markets are finally getting some inflows from foreign/HK investors.

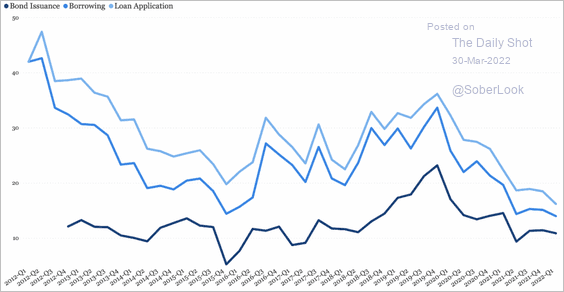

2. Credit demand remains weak. Large firms, however, have faced fewer loan rejections than small firms, according to China Beige Book.

Source: China Beige Book

Source: China Beige Book

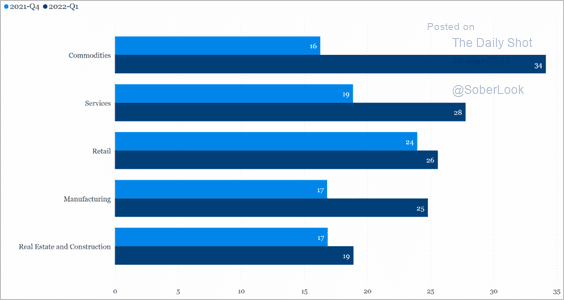

Still, there appears to be pent-up demand for credit, especially in the commodities and service sectors.

Source: China Beige Book

Source: China Beige Book

Back to Index

Emerging Markets

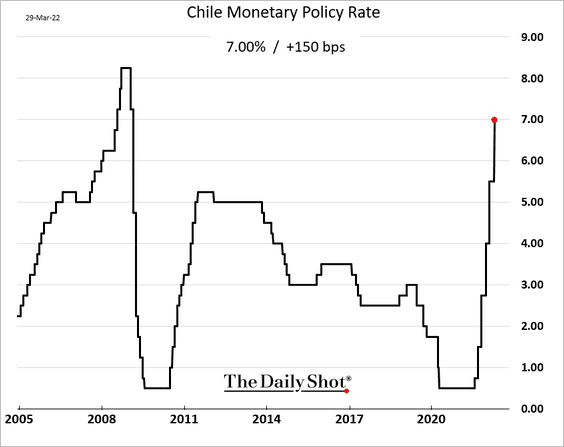

1. Chile’s central bank raised its policy rate by 150 bps as inflation surges (the market expected a 200 bps hike).

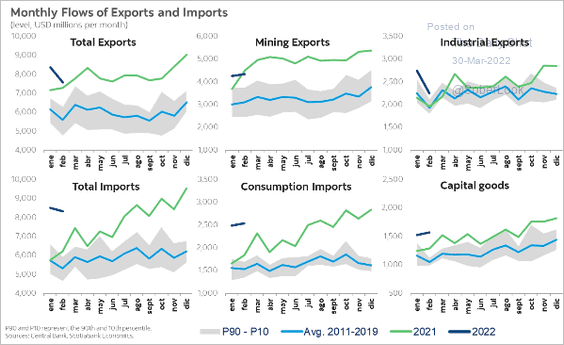

Chile’s foreign trade activity remains robust.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

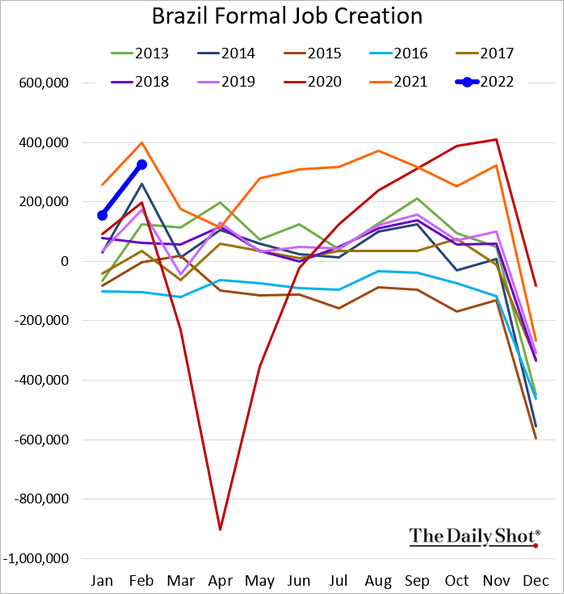

2. Brazil’s formal job creation was strong last month.

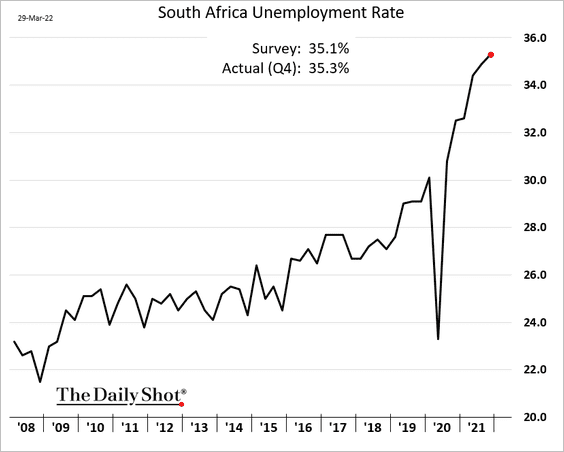

3. South Africa’s unemployment rate is above 35%.

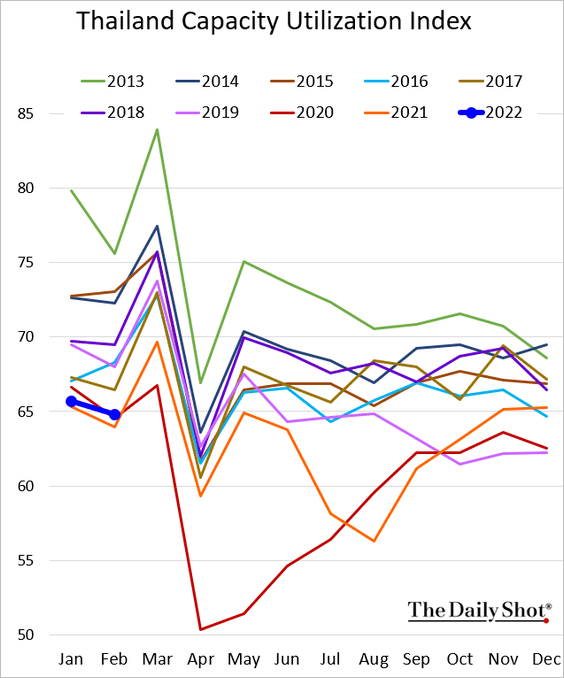

4. Thailand’s industrial capacity utilization remains depressed.

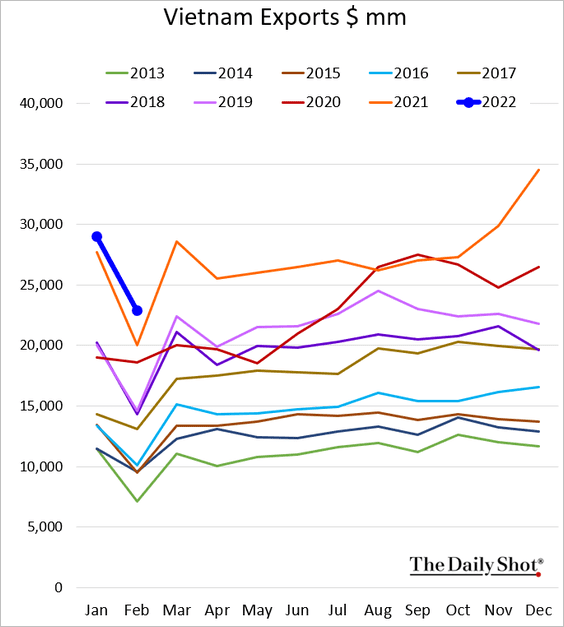

5. Vietnam’s exports have been very strong for this time of the year.

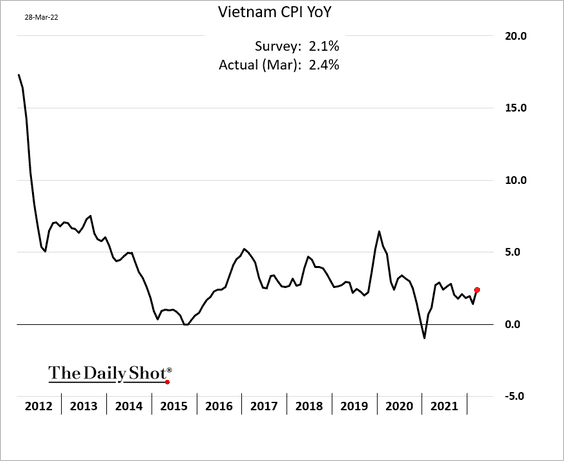

Inflation ticked higher this month.

Back to Index

Commodities

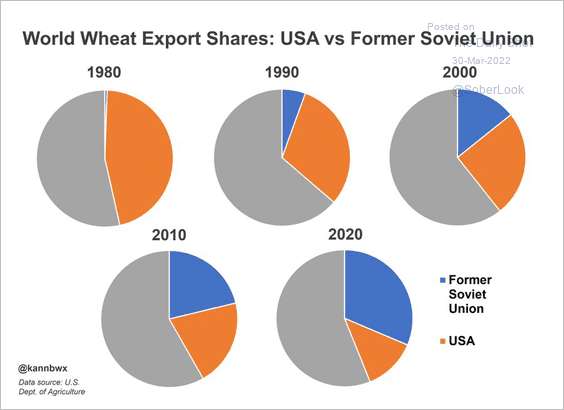

1. Former-USSR nations have been taking market share in global wheat exports over the past few decades.

Source: @kannbwx

Source: @kannbwx

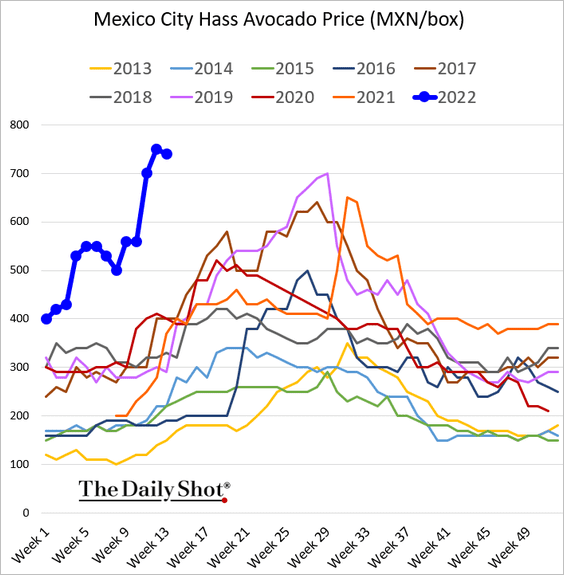

2. Avocado prices have been soaring.

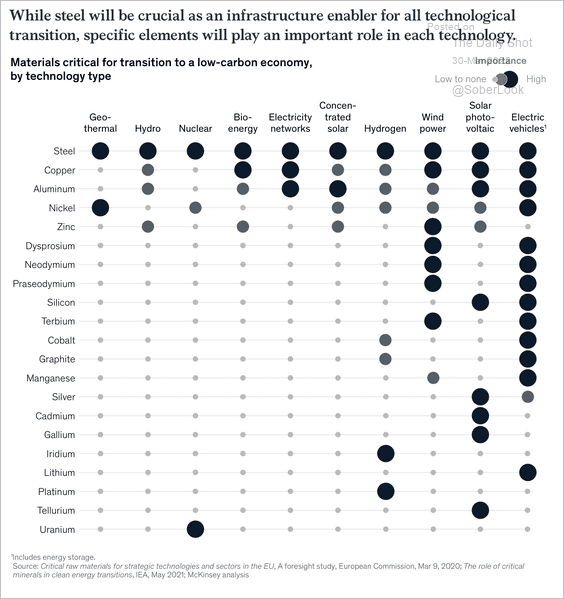

3. Which materials will play a major role in enabling the renewable energy transition?

Source: McKinsey & Company; h/t Walter

Source: McKinsey & Company; h/t Walter

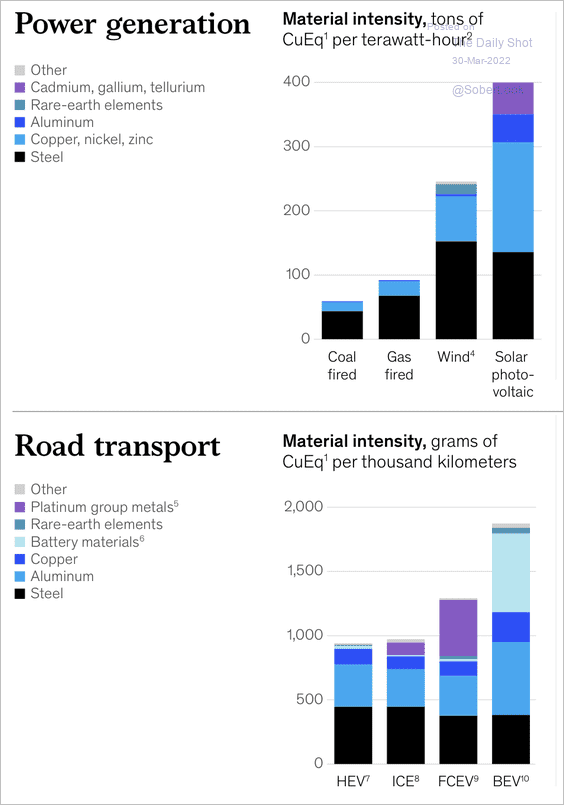

To drastically reduce emissions intensity, low-carbon technologies will require higher material intensity, according to McKinsey.

Source: McKinsey & Company; h/t Walter

Source: McKinsey & Company; h/t Walter

Back to Index

Energy

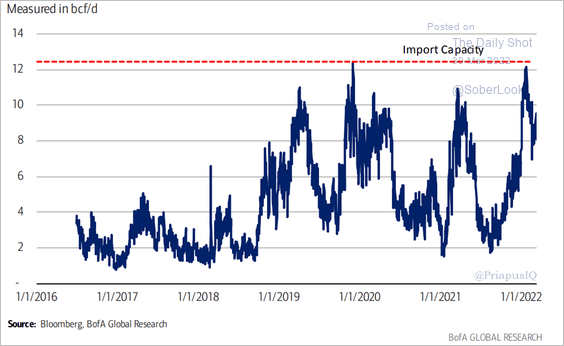

1. Let’s start with the LNG markets.

• The EU needs to boost its LNG import capacity.

Source: BofA Global Research; @PriapusIQ

Source: BofA Global Research; @PriapusIQ

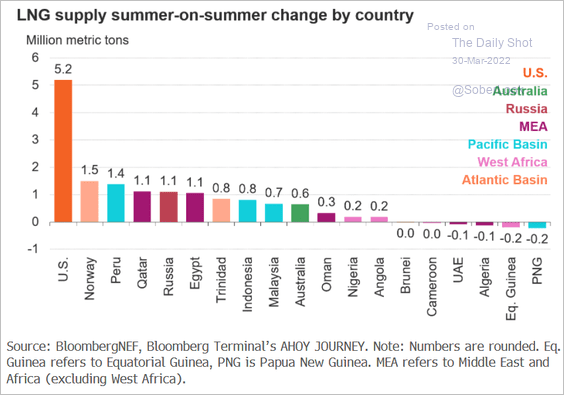

• The US will lead the way in boosting global LNG supplies.

Source: Michael Yip, @BloombergNEF Read full article

Source: Michael Yip, @BloombergNEF Read full article

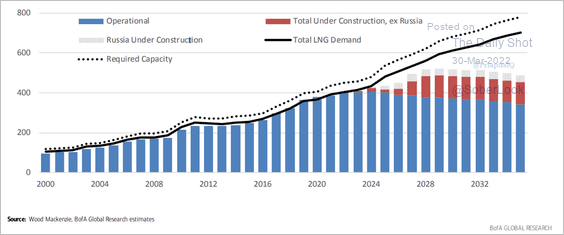

• But it won’t be enough to meet demand.

Source: BofA Global Research; @PriapusIQ

Source: BofA Global Research; @PriapusIQ

——————–

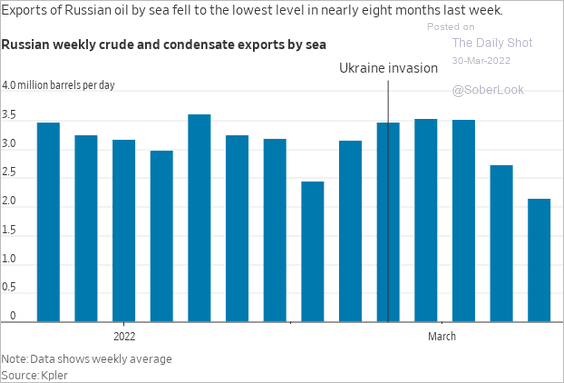

2. Russian crude oil exports have been slowing.

Source: @WSJ Read full article

Source: @WSJ Read full article

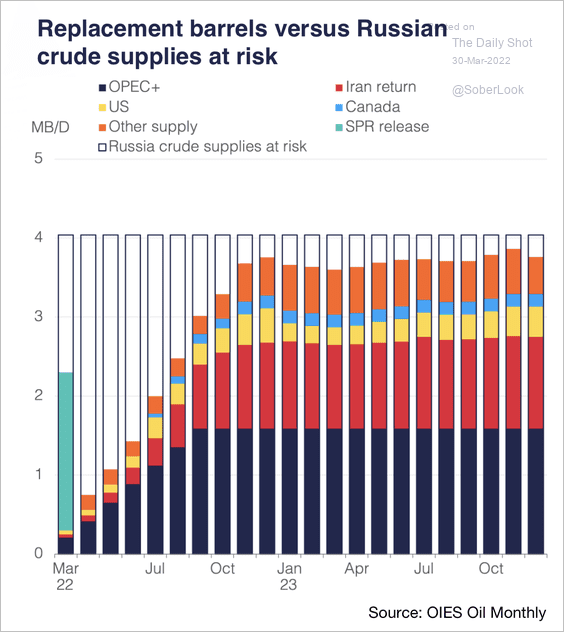

3. This chart shows potential oil supply/demand responses.

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

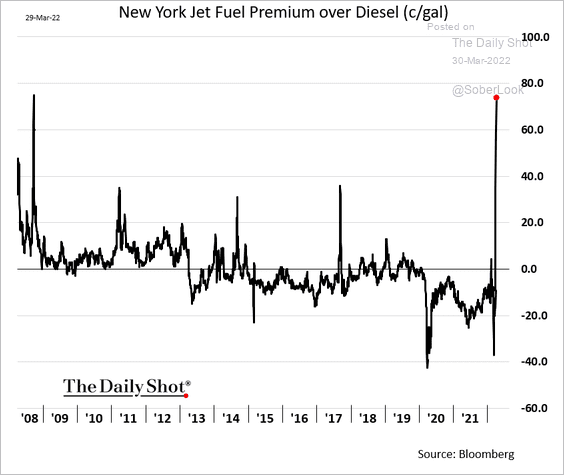

4. US refiners have been focused on boosting diesel production which came at the expense of jet fuel. Low inventories of New York jet fuel sent the premium to diesel to multi-year highs.

h/t Chunzi Xu

h/t Chunzi Xu

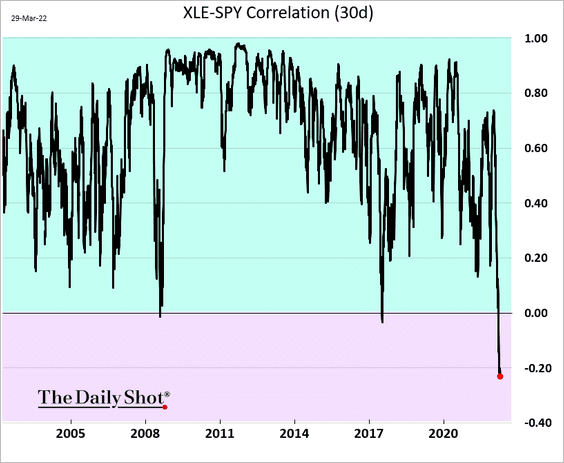

5. The correlation between energy shares and the broader stock market continues to move deeper into negative territory.

Back to Index

Equities

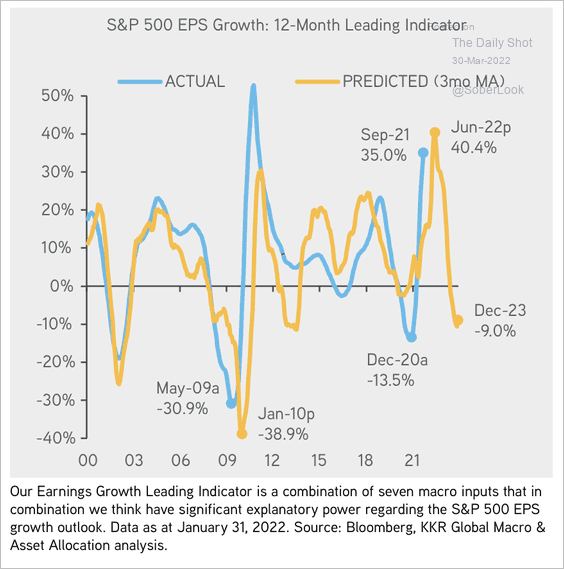

1. KKR expects a significant slowdown in earnings next year, especially if inflation remains elevated.

Source: KKR Global Institute

Source: KKR Global Institute

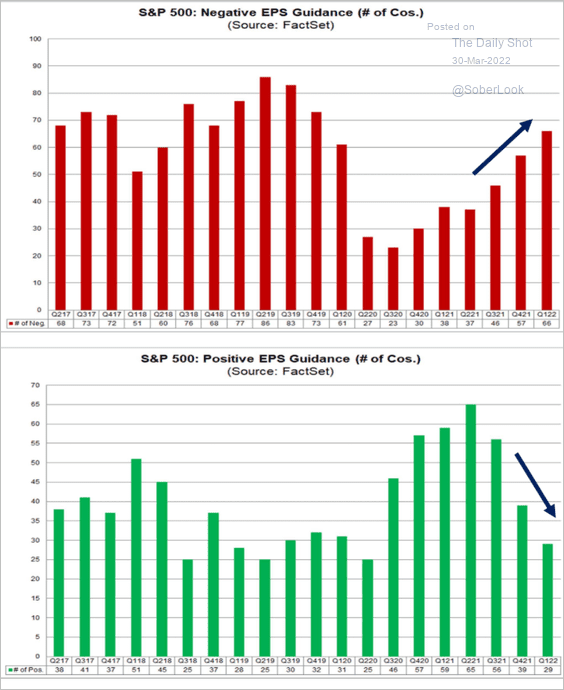

2. Earnings guidance continues to soften.

Source: @FactSet

Source: @FactSet

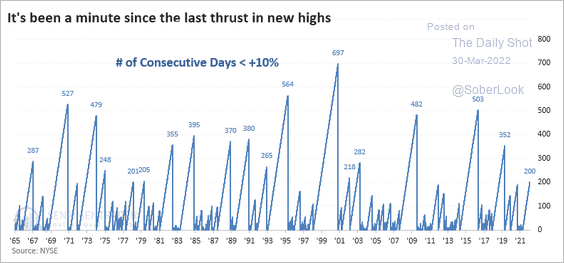

3. The market has gone a while without a thrust to a new high – the longest streak since 2018. That typically leads to mediocre forward returns, according to SentimenTrader.

Source: SentimenTrader

Source: SentimenTrader

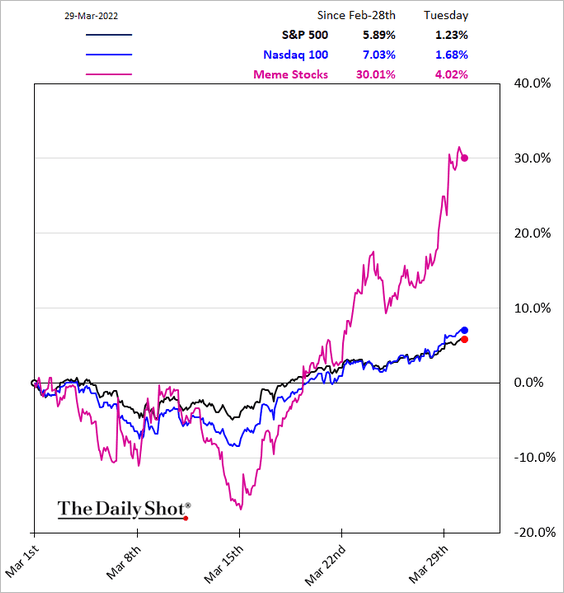

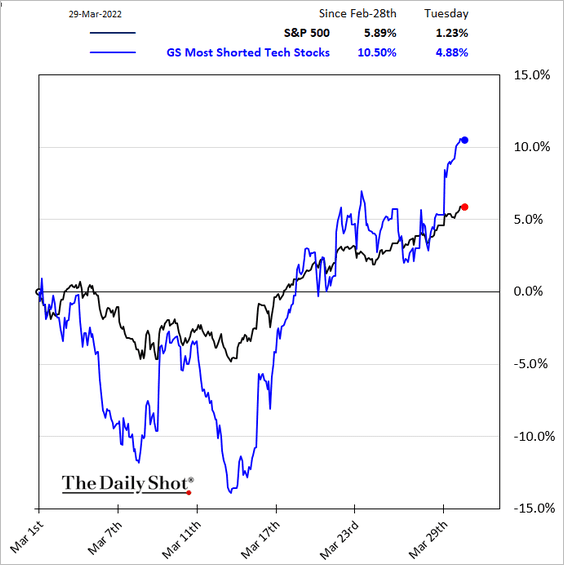

4. Speculative stocks are rebounding.

• Meme stocks:

• Most-shorted tech stocks:

——————–

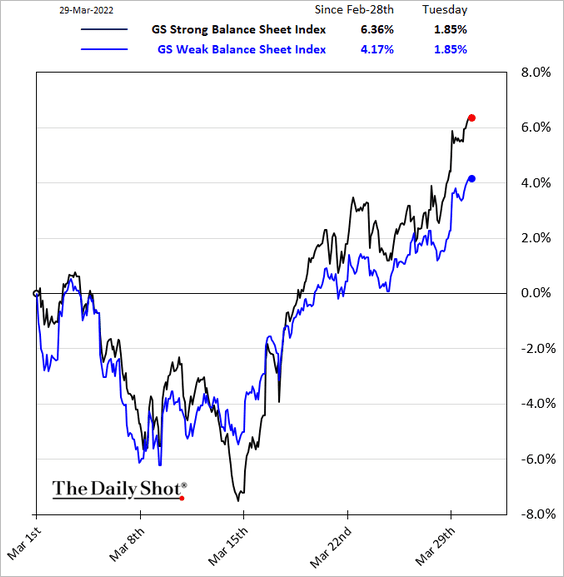

5. Companies with strong balance sheets have been outperforming, boosted by the rebound in tech.

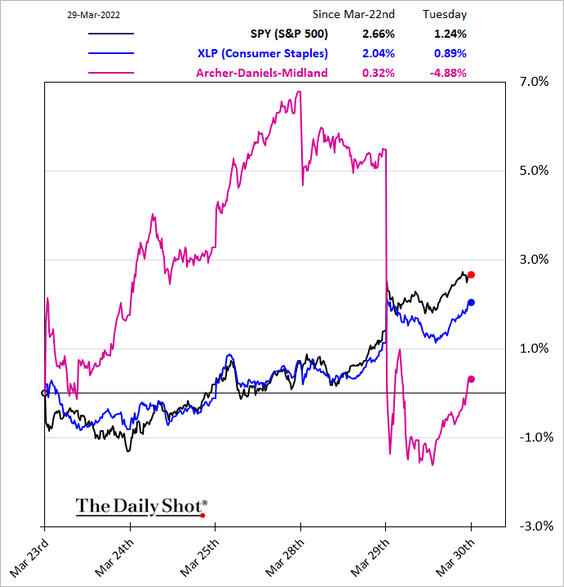

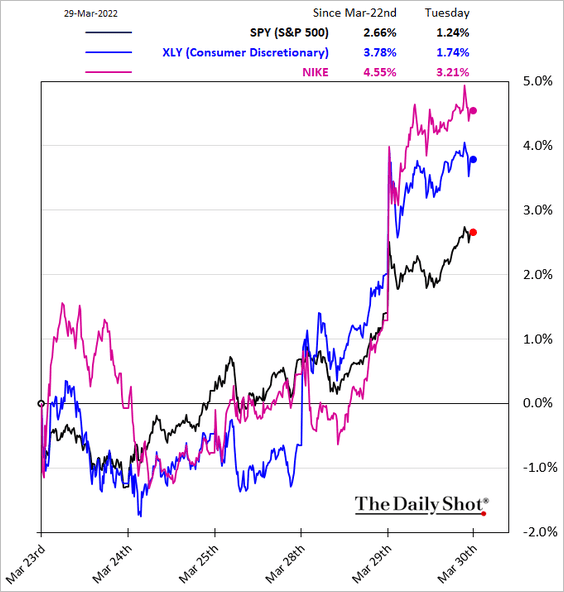

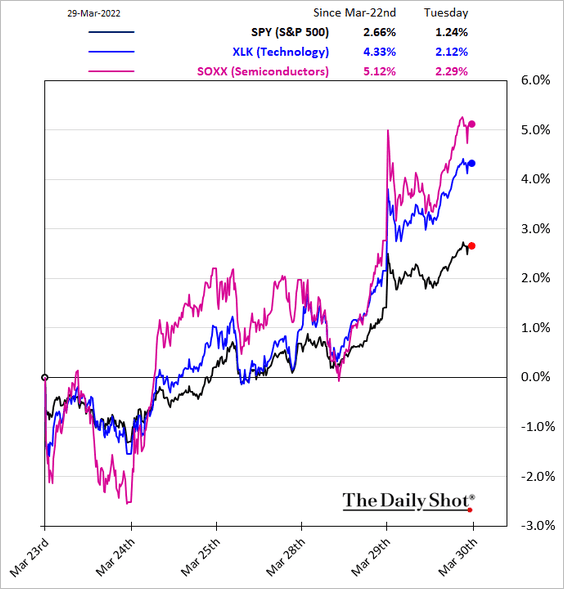

6. Next, we have some sector performance updates.

• Consumer Staples:

• Consumer Discretionary:

• Tech/Semiconductors:

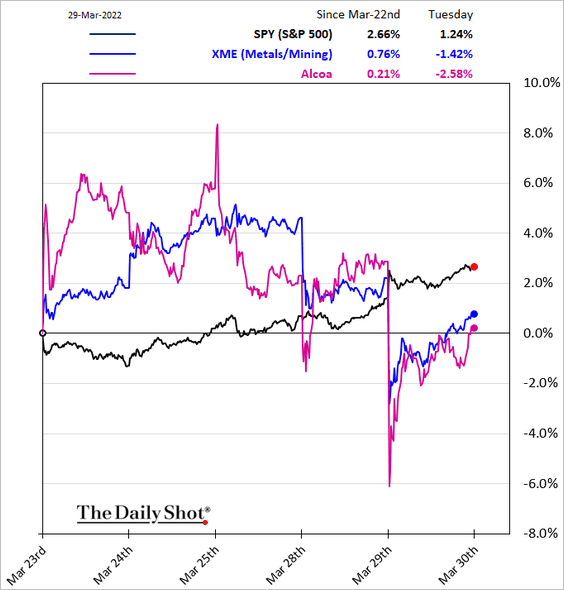

• Metals & Mining:

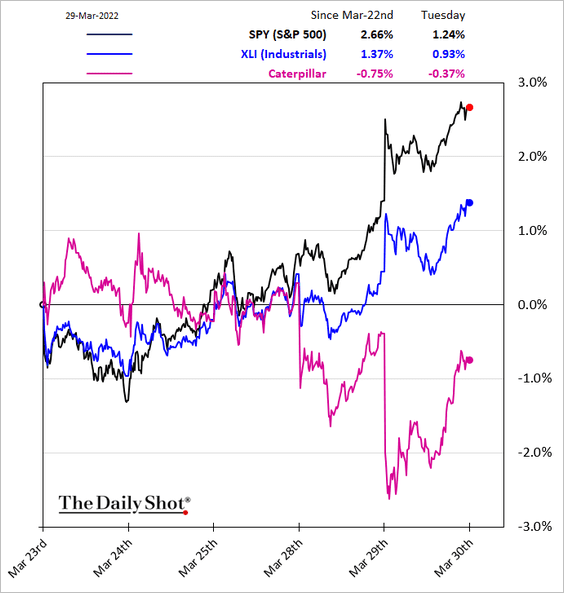

• Industrials:

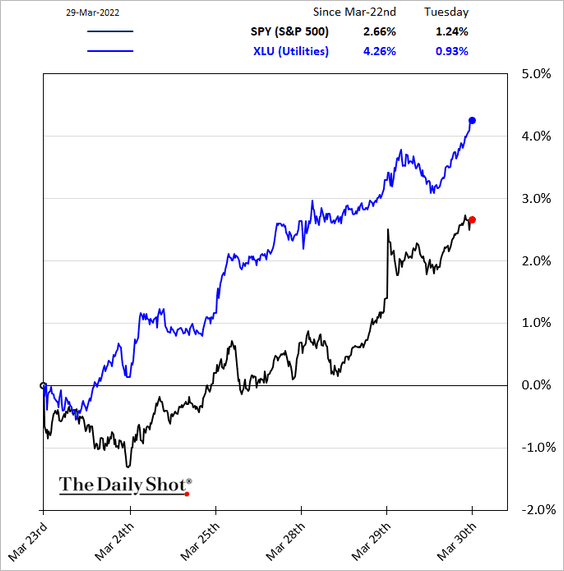

• Utilities:

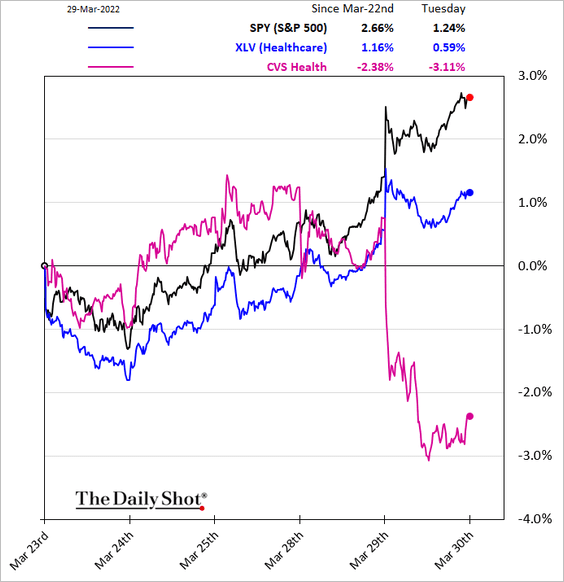

• Healthcare:

Source: Barron’s Read full article

Source: Barron’s Read full article

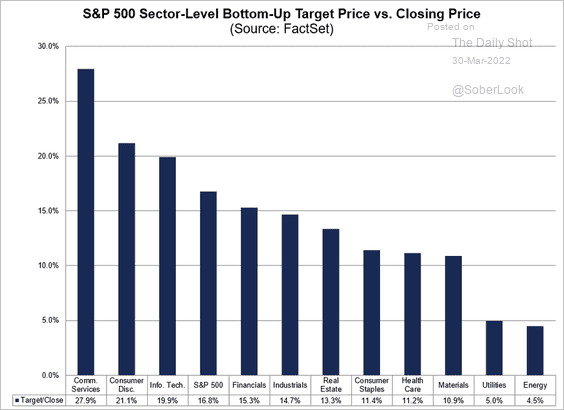

7. In which sectors do industry analysts expect to see the highest gains over the next 12 months?

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

Alternatives

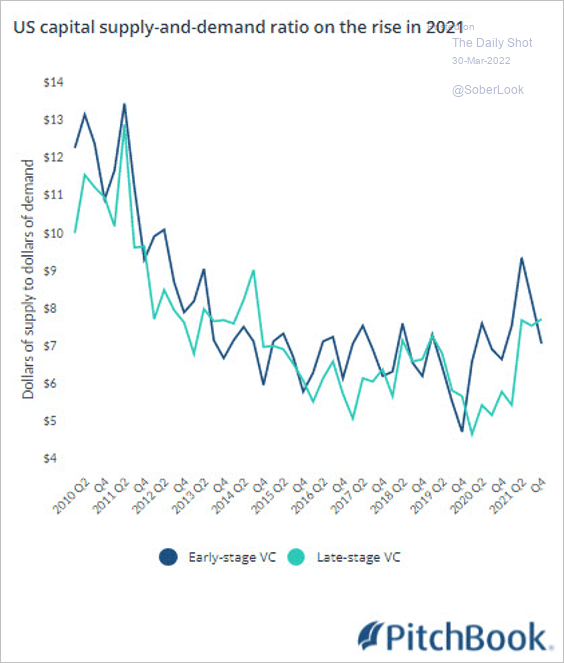

1. The capital supply/demand ratio is starting to rise, which means founders are likely to have more options when searching for capital, according to PitchBook.

Source: PitchBook

Source: PitchBook

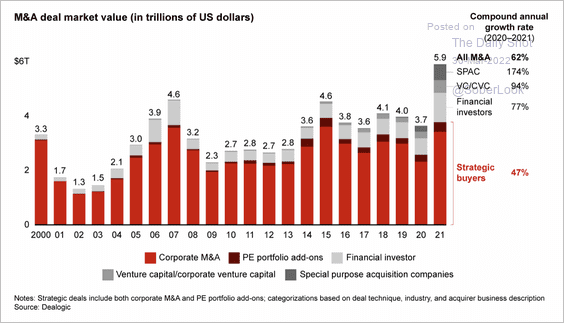

2. Strategic M&A deal value hit a record last year.

Source: Bain & Company Read full article

Source: Bain & Company Read full article

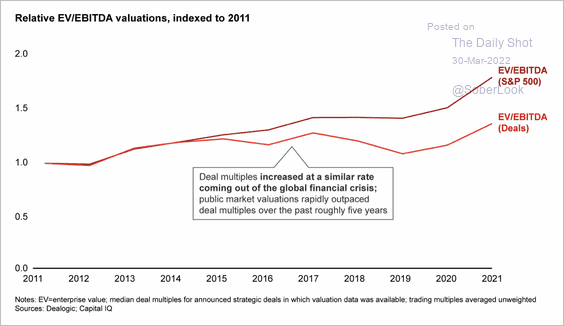

3. Public market valuations have outpaced strategic deal multiples over the past five years.

Source: Bain & Company Read full article

Source: Bain & Company Read full article

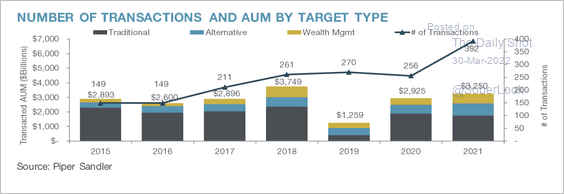

4. Private M&A transactions in the asset management space increased over the past year.

Source: Piper Sandler

Source: Piper Sandler

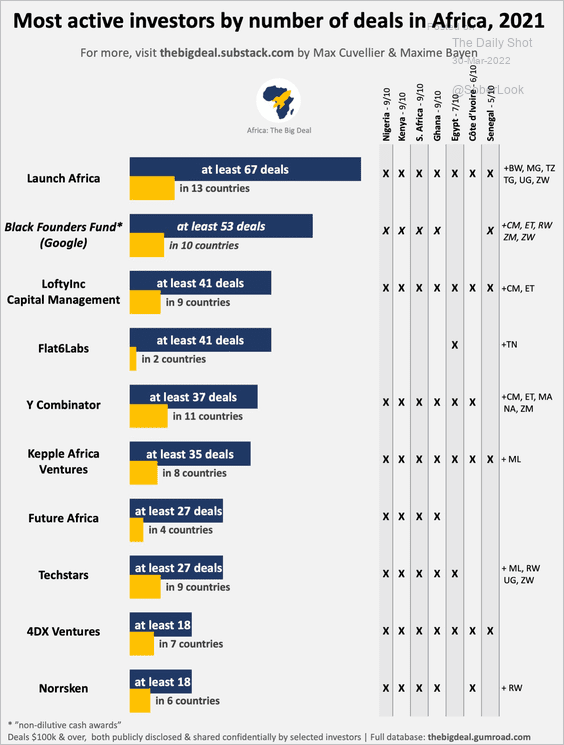

5. Here is a look at Africa’s most active startup investors.

Source: @MaxBayen

Source: @MaxBayen

Back to Index

Global Developments

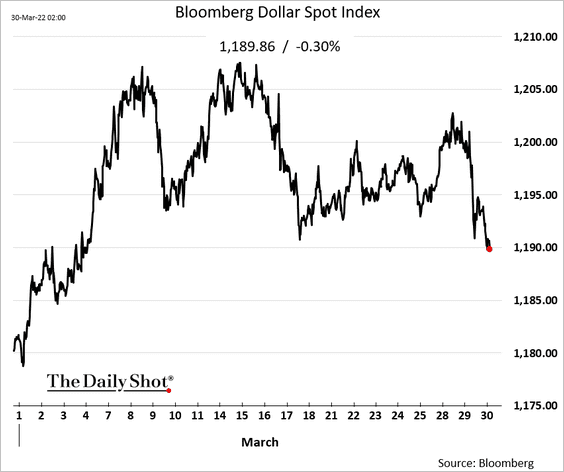

1. The US dollar is under pressure amid hopes for a positive outcome in the Russia-Ukraine negotiations.

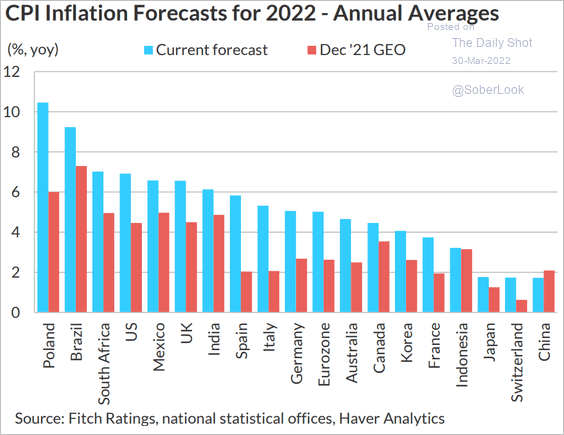

2. This chart shows the latest CPI forecasts for select economies.

Source: Fitch Ratings

Source: Fitch Ratings

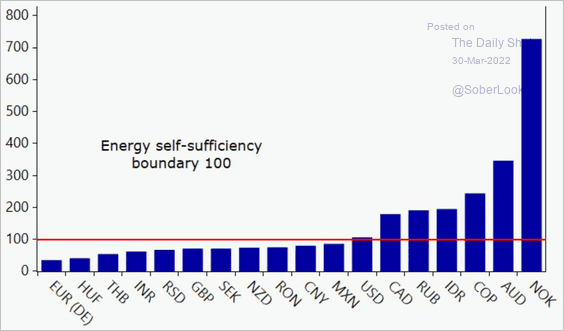

3. Here is a look at energy self-sufficiency.

Source: @AndreasSteno

Source: @AndreasSteno

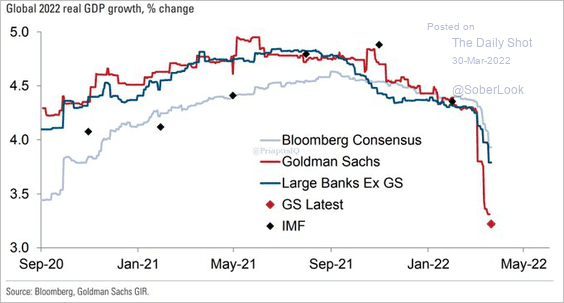

4. Goldman is pessimistic about global growth.

Source: Goldman Sachs; @PriapusIQ

Source: Goldman Sachs; @PriapusIQ

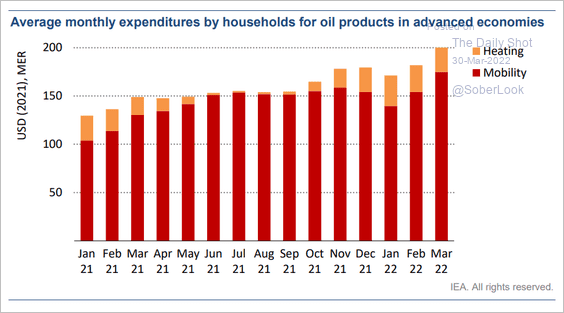

5. Household spending on oil products keeps climbing.

Source: IEA Read full article

Source: IEA Read full article

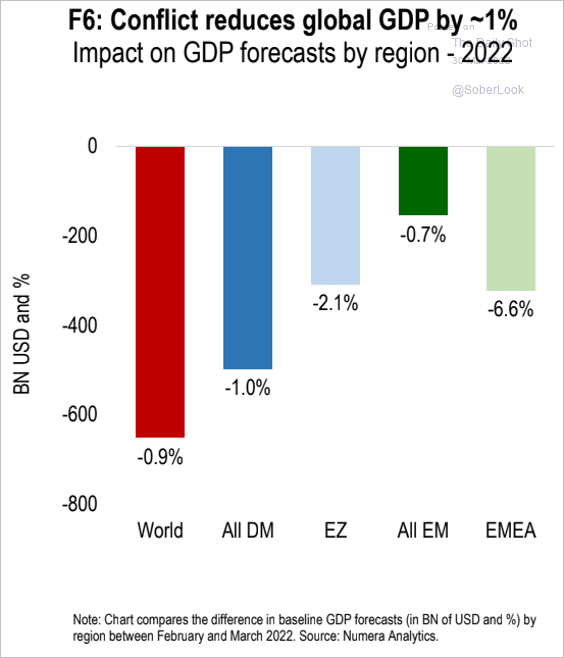

6. How much will the Ukraine/Russia war reduce the global GDP growth?

Source: Numera Analytics

Source: Numera Analytics

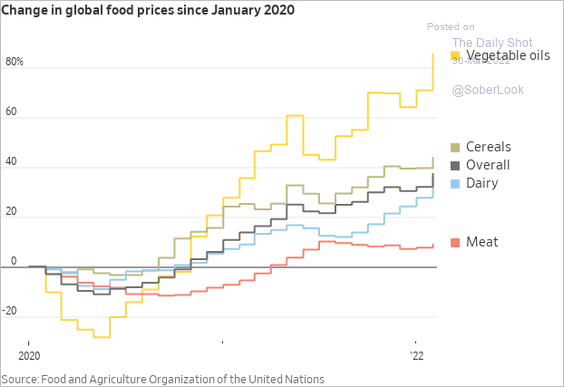

7. Finally, we have food price gains since the start of the pandemic, by category.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Food for Thought

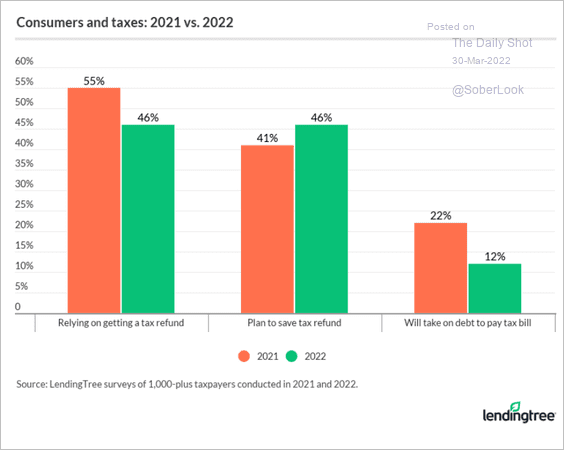

1. Are US consumers relying on their tax refunds?

Source: LendingTree Read full article

Source: LendingTree Read full article

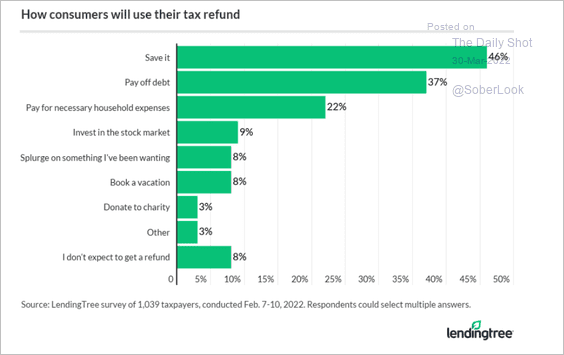

What will consumers do with their tax refunds?

Source: LendingTree Read full article

Source: LendingTree Read full article

——————–

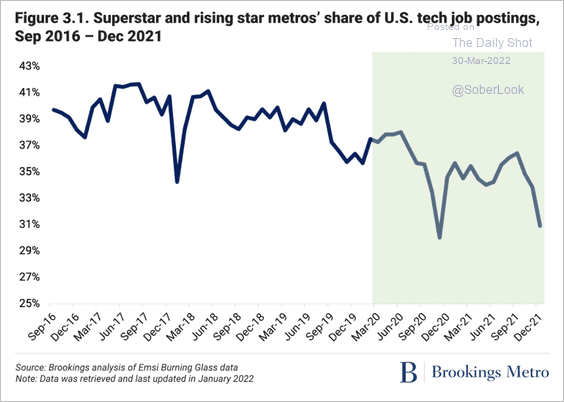

2. Tech-heavy metro areas are losing labor market share due to WFH trends:

Source: Brookings Read full article

Source: Brookings Read full article

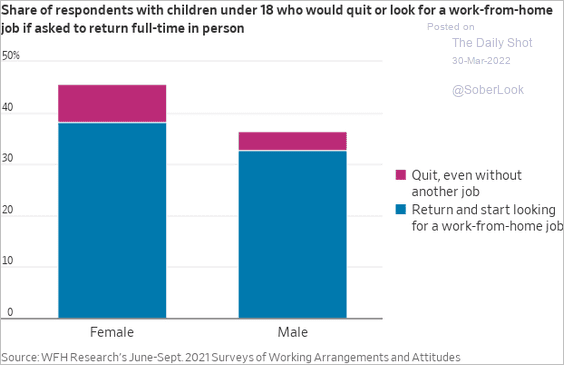

3. Looking for remote work:

Source: @WSJ Read full article

Source: @WSJ Read full article

4. Share of revenue per region across the semiconductor value chain:

![]() Source: McKinsey & Company

Source: McKinsey & Company

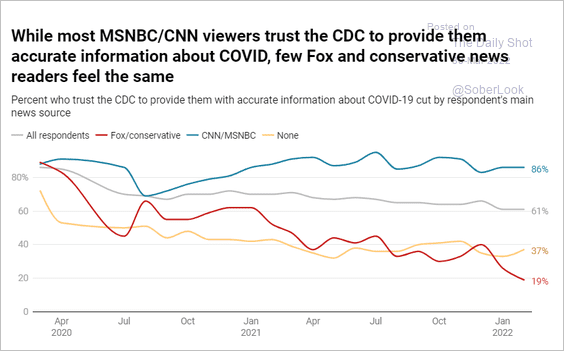

5. Trust in the CDC:

Source: IPSOS Read full article

Source: IPSOS Read full article

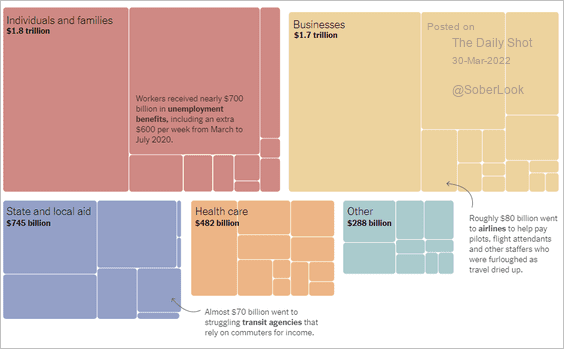

6. Pandemic stimulus funds:

Source: The New York Times Read full article

Source: The New York Times Read full article

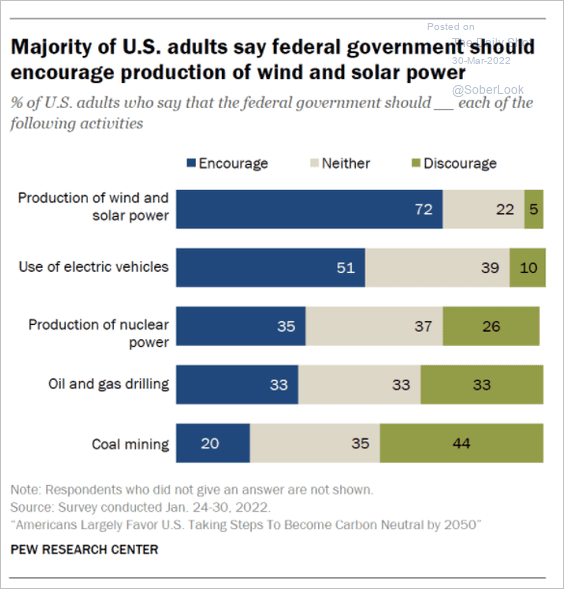

7. Views on the federal government’s energy policies:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

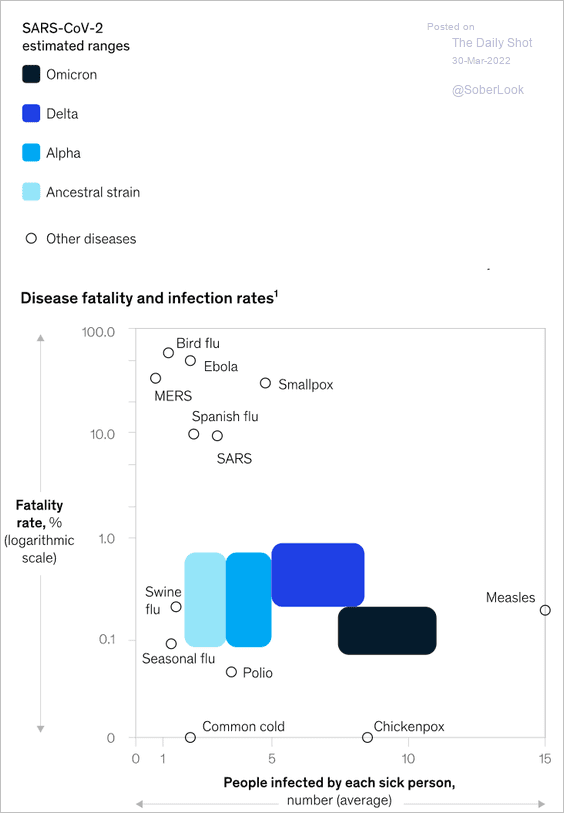

8. Disease fatality and infection rates:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

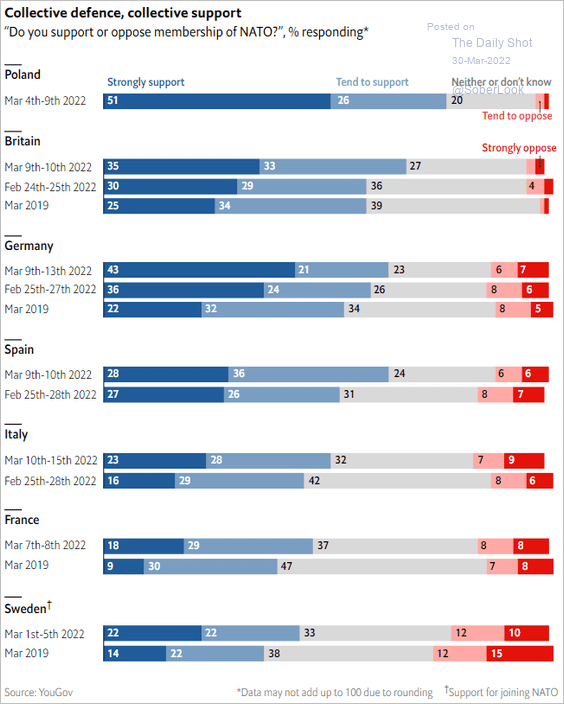

9. Support for NATO membership (joining NATO for Sweden):

Source: The Economist Read full article

Source: The Economist Read full article

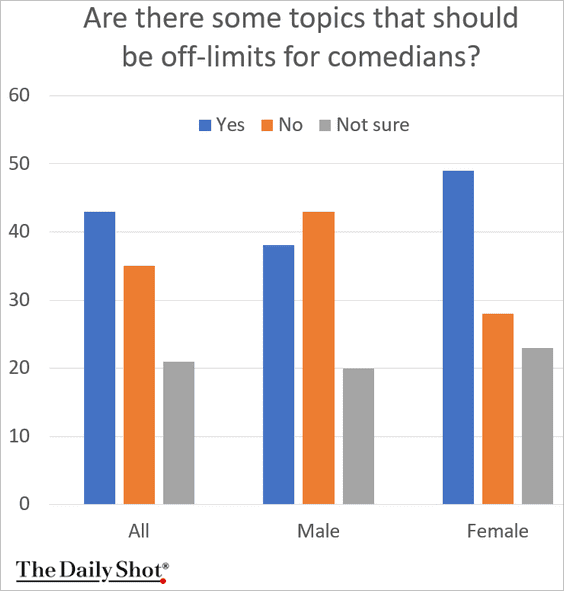

10. Are there topics that should be off-limits for comedians?

Source: @YouGovAmerica

Source: @YouGovAmerica

——————–

Back to Index