The Daily Shot: 31-Mar-22

• The Eurozone

• The United Kingdom

• Canada

• The United States

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The Eurozone

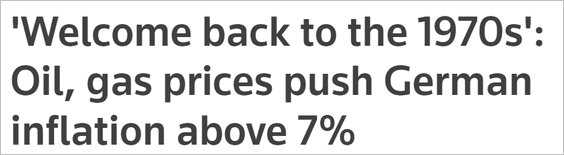

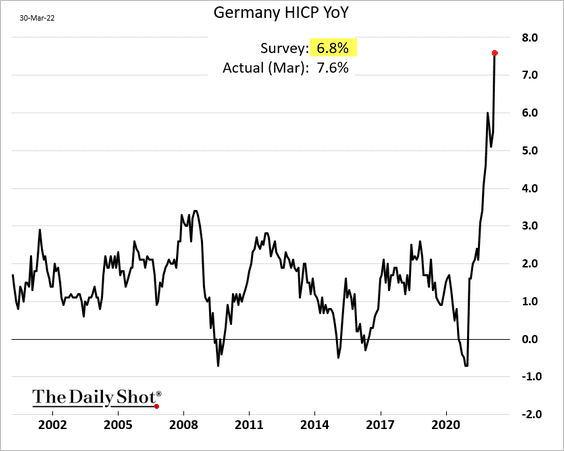

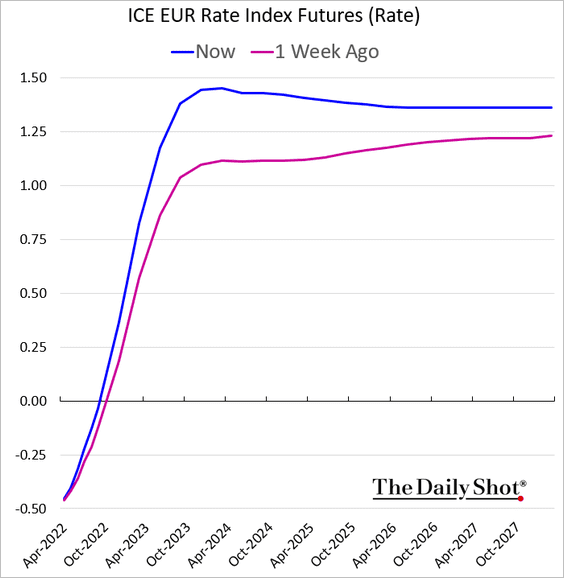

1. German and Spanish consumer inflation is at multi-decade highs and well above consensus forecasts.

Source: Reuters Read full article

Source: Reuters Read full article

Source: MarketWatch Read full article

Source: MarketWatch Read full article

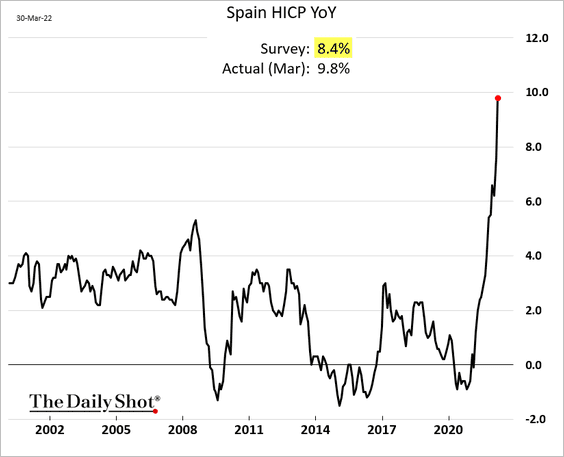

The ECB will be under pressure to act sooner and move faster.

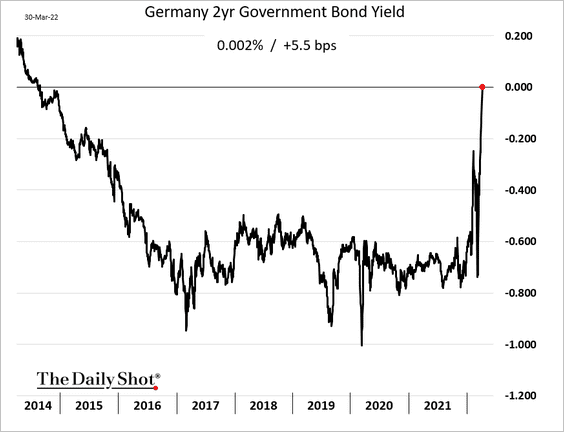

• The market now expects rapid rate hikes.

• The 2yr Bund yield is in positive territory for the first time since 2014.

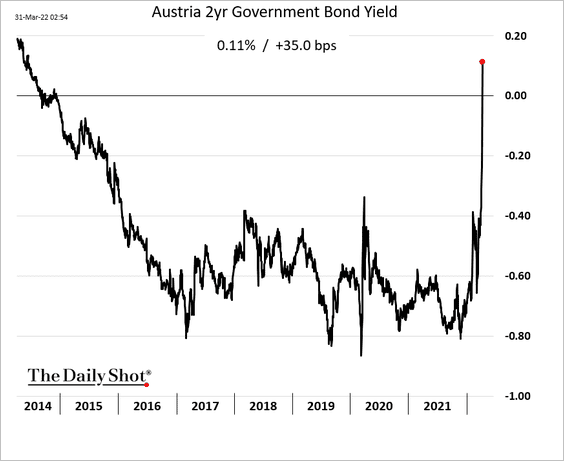

Here is Austria’s 2yr yield.

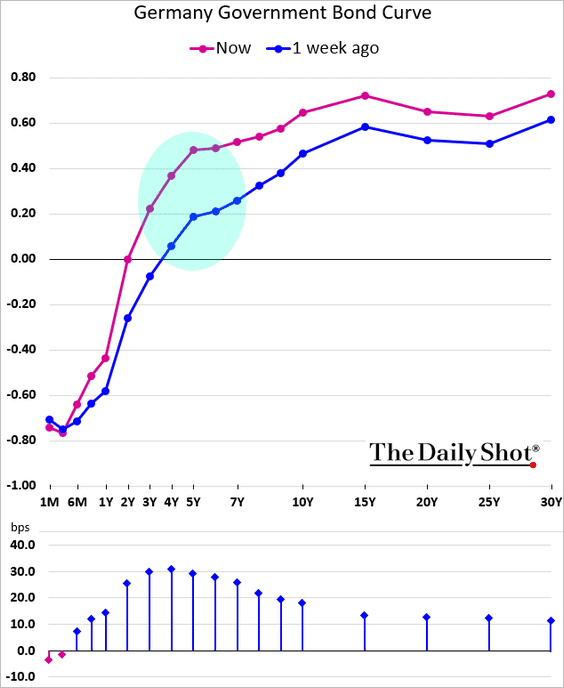

• The Bund curve is flattening.

——————–

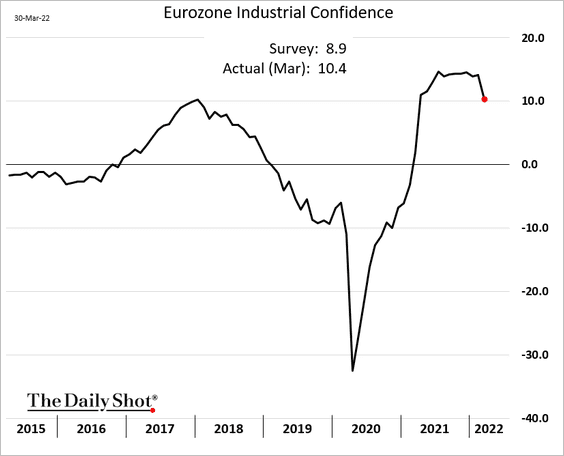

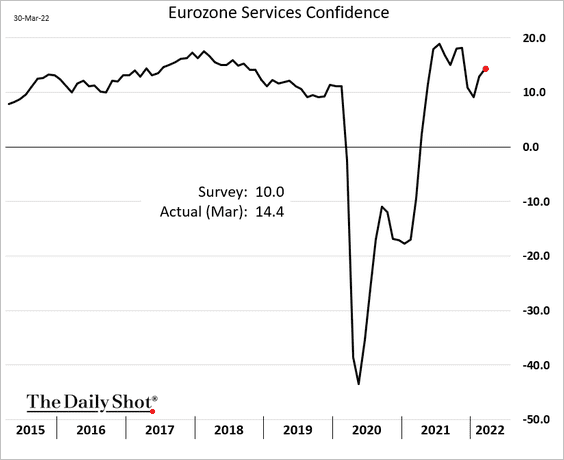

2. Business confidence held up well this month, exceeding forecasts.

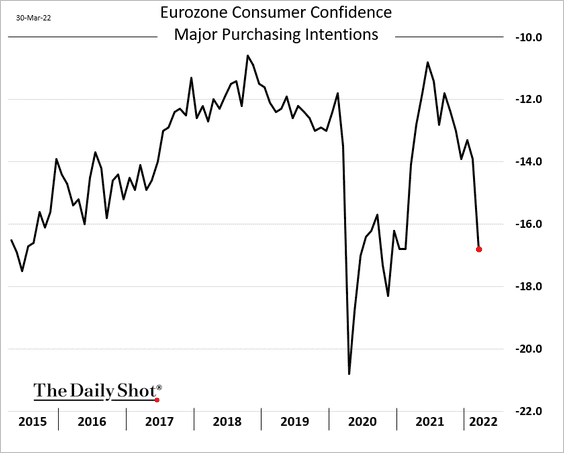

But as we saw earlier, consumer sentiment deteriorated sharply.

• Spending intentions:

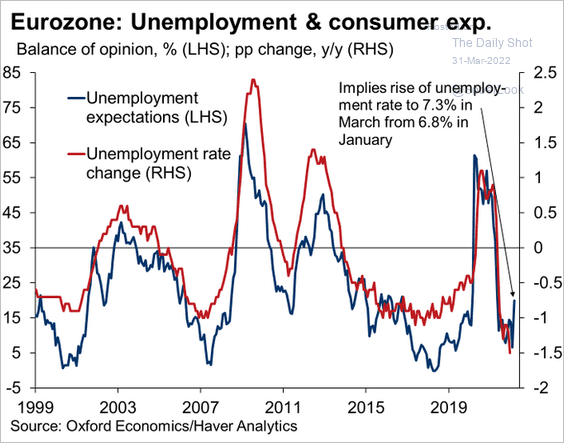

• Concerns about higher unemployment:

Source: @OliverRakau

Source: @OliverRakau

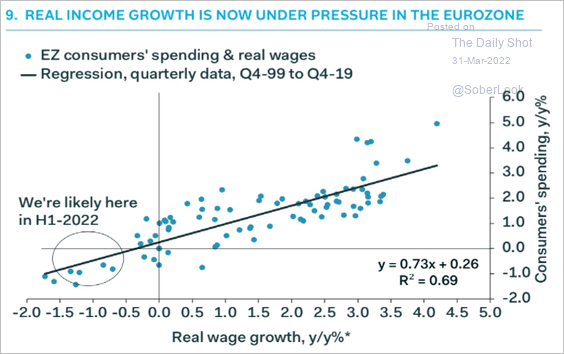

We are going to see a significant downturn in spending as soaring inflation eats into incomes.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

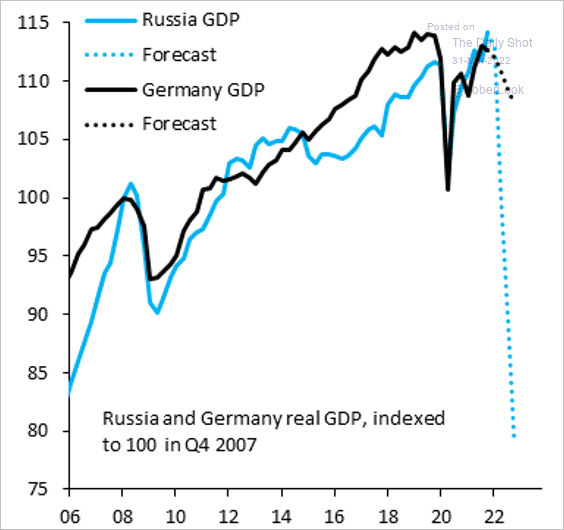

3. German economy will take a substantial hit as a result of the Russian war.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

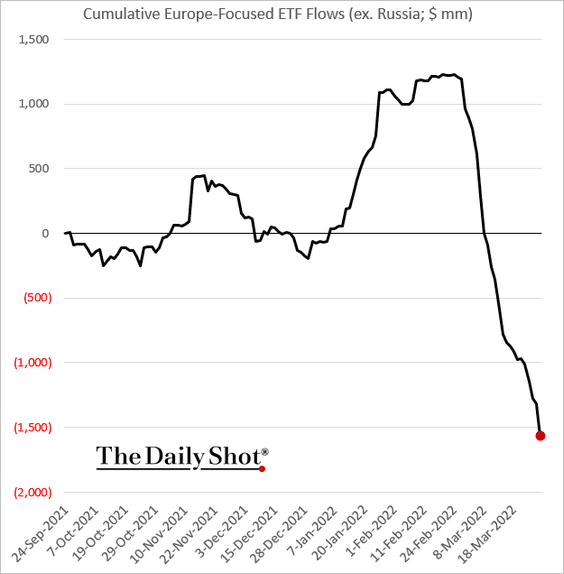

4. Europe-focused ETFs continue to see significant outflows.

Back to Index

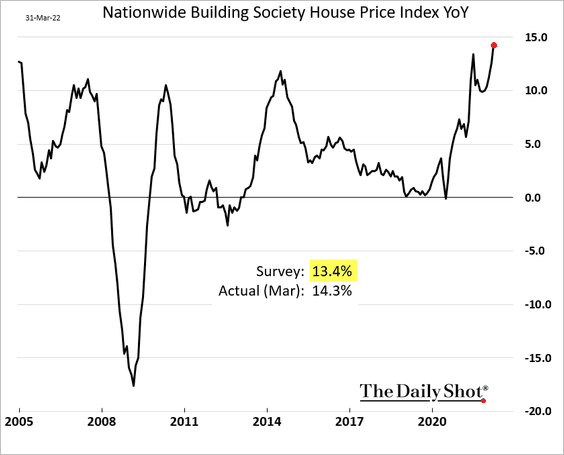

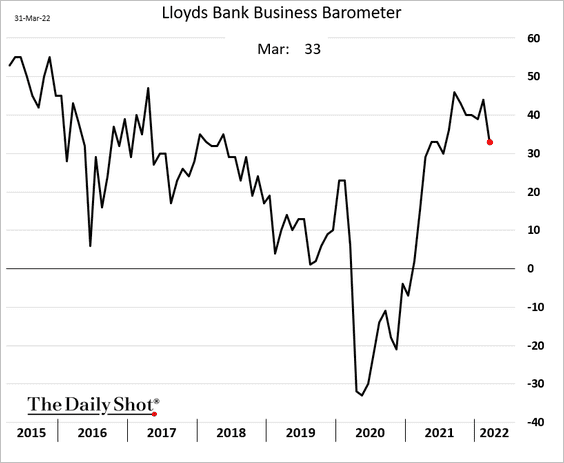

The United Kingdom

1. Home prices are surging.

2. Business sentiment eased in March.

Back to Index

Canada

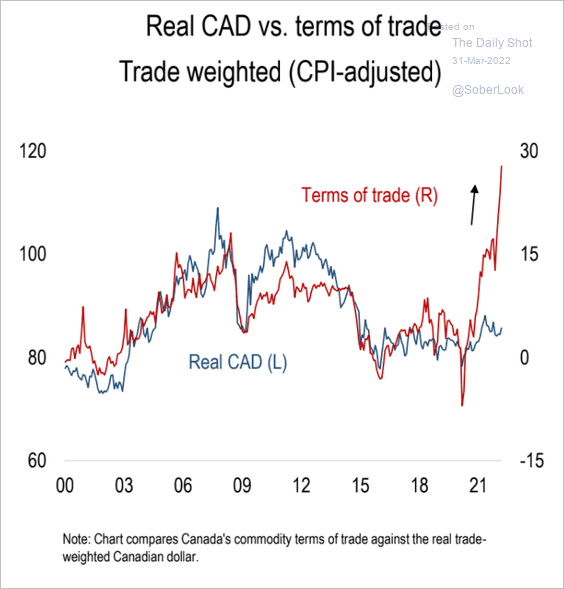

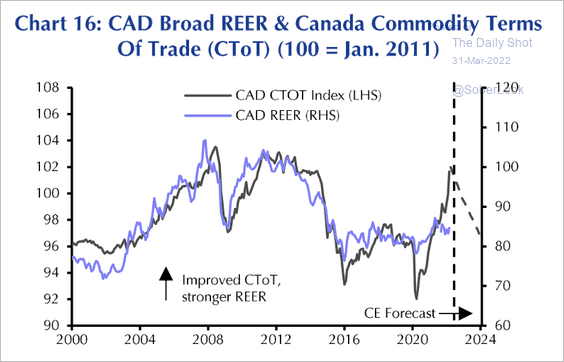

1. The rise in commodity prices is likely to benefit terms of trade, resulting in a higher Canadian dollar exchange rate (2 charts).

Source: Numera Analytics

Source: Numera Analytics

Source: Capital Economics

Source: Capital Economics

——————–

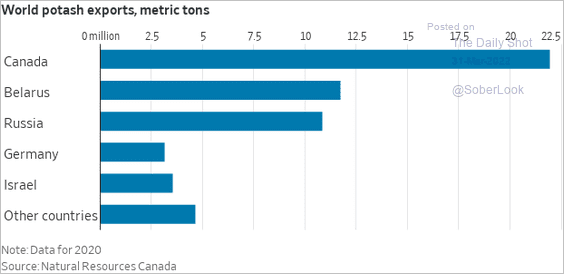

2. Canada has the opportunity to boost its export market share in crude oil, uranium, nickel, potash, and other commodities.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

The United States

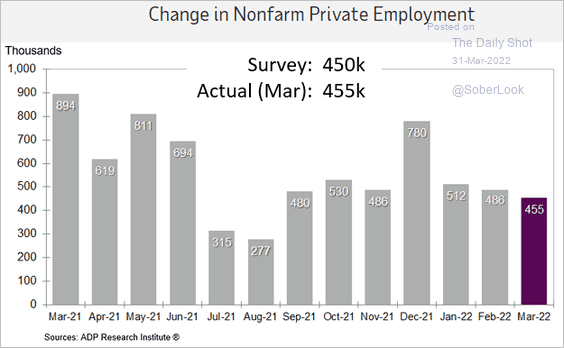

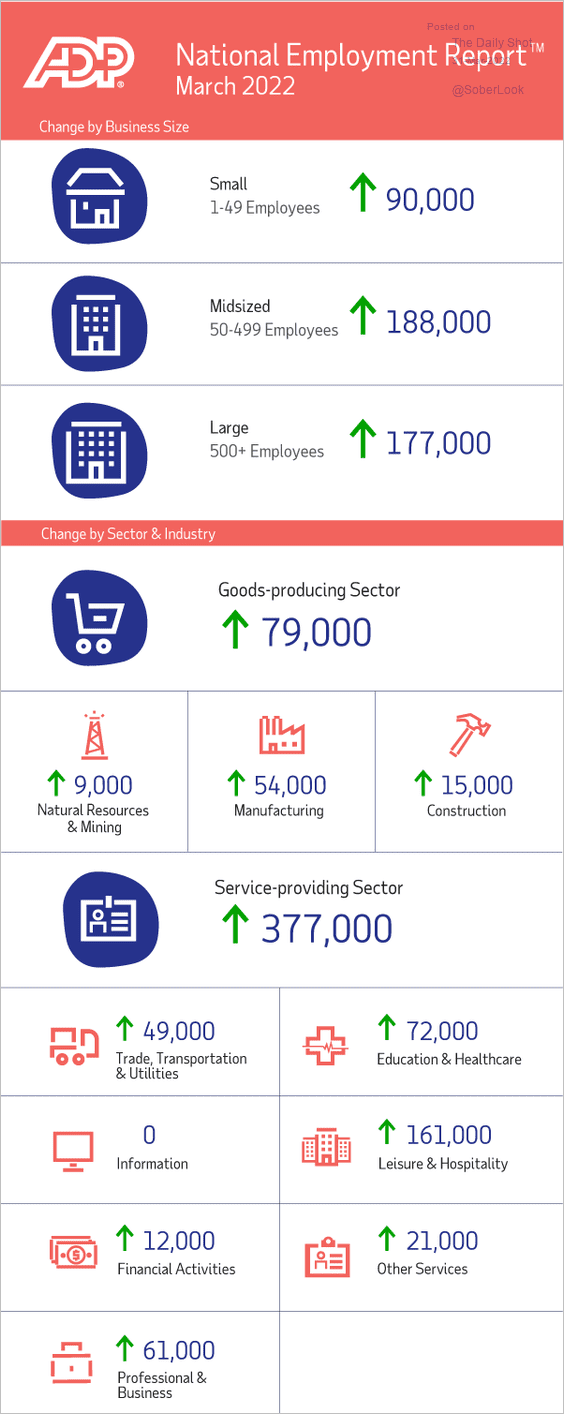

1. The ADP report was in line with expectations, showing robust job gains this month. That doesn’t necessarily translate into a strong payrolls report this Friday.

Source: ADP Research Institute

Source: ADP Research Institute

• Job gains were broad.

Source: ADP Research Institute

Source: ADP Research Institute

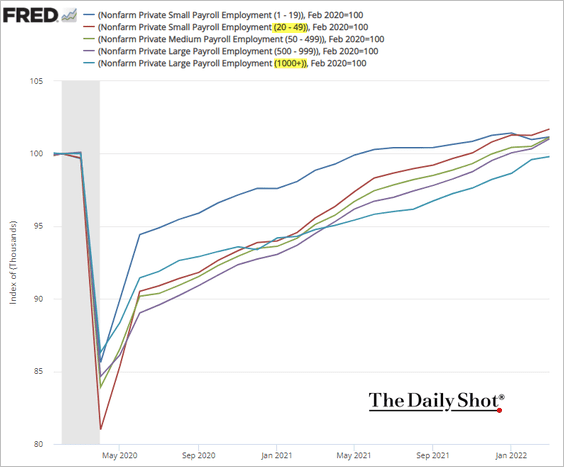

• The jobs recovery at large firms has been lagging smaller companies.

——————–

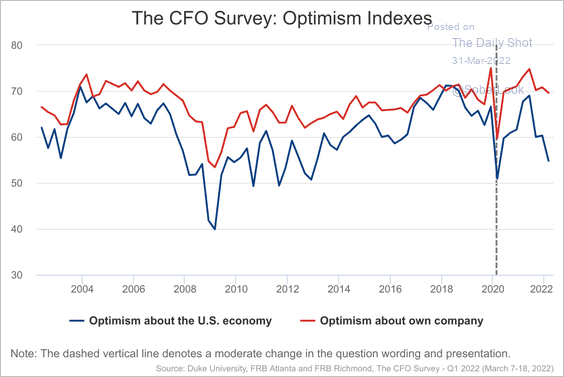

2. The CFO survey shows deterioration in business sentiment amid intense price pressures.

Source: The CFO Survey Read full article

Source: The CFO Survey Read full article

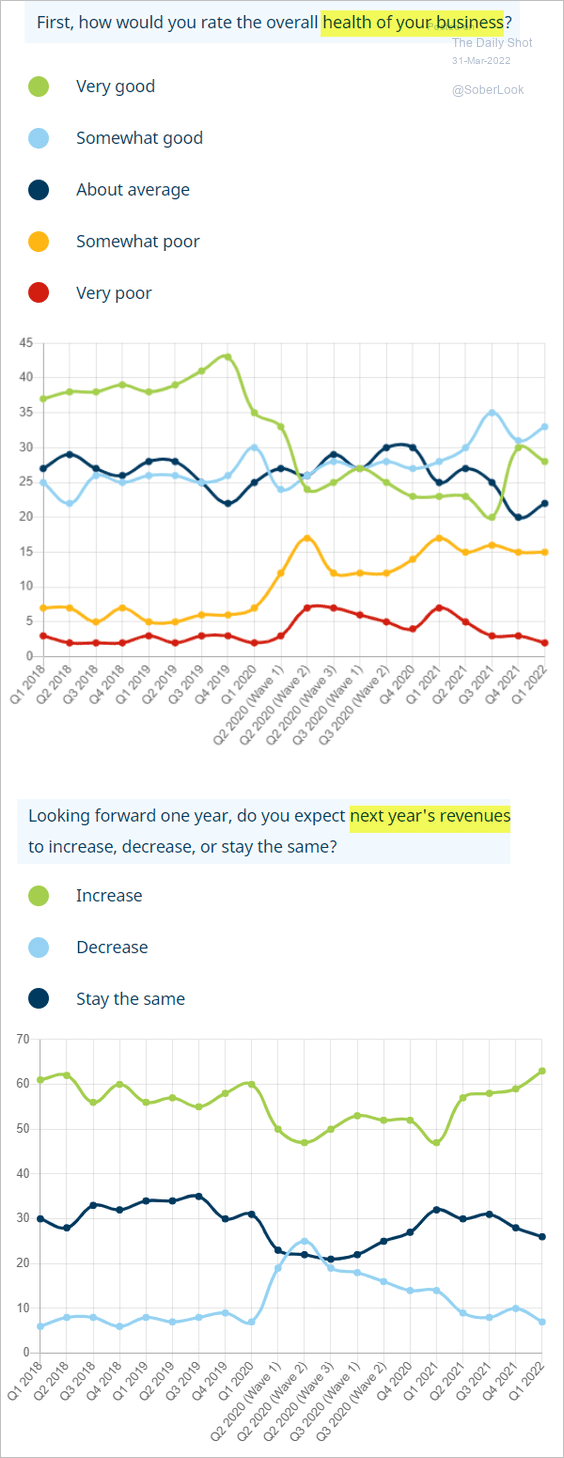

3. US small firms have been relatively upbeat about their business …

Source: MetLife and U.S. Chamber of Commerce Small Business Index. Read full article

Source: MetLife and U.S. Chamber of Commerce Small Business Index. Read full article

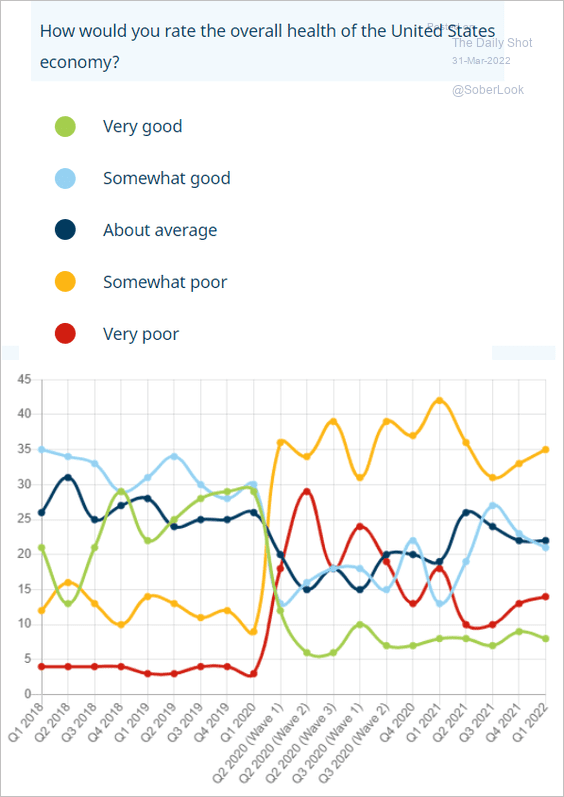

… but are concerned about the US economy.

Source: MetLife and U.S. Chamber of Commerce Small Business Index. Read full article

Source: MetLife and U.S. Chamber of Commerce Small Business Index. Read full article

——————–

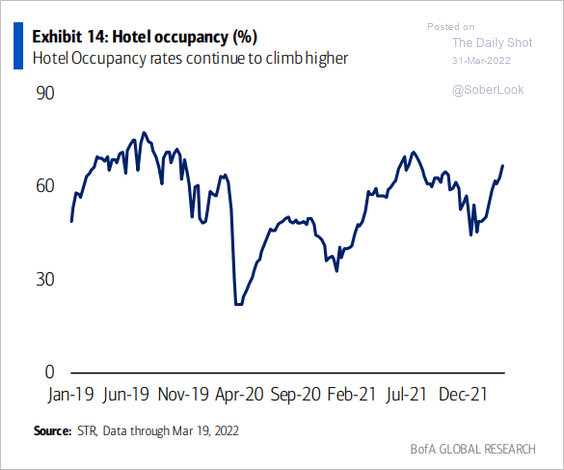

4. Hotel occupancy has been improving.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

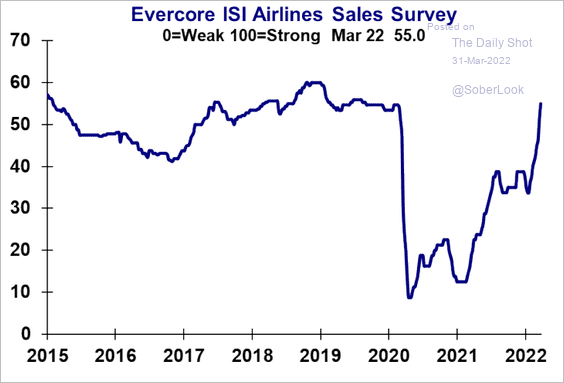

And airline sales are surging.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

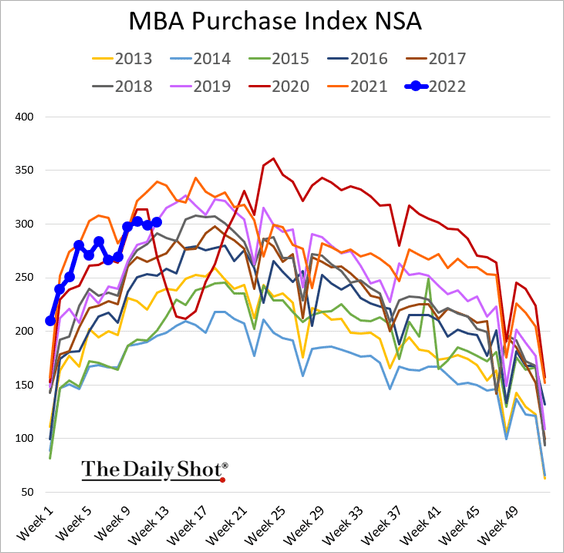

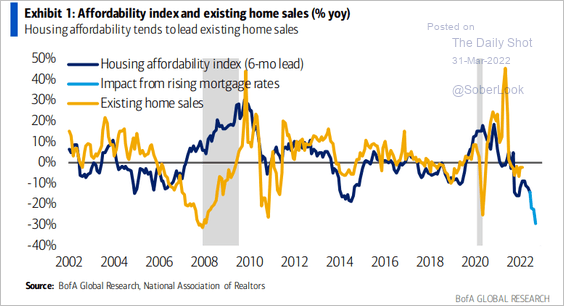

5. Mortgage applications for house purchases are now well below last year’s levels, …

… as affordability deteriorates.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

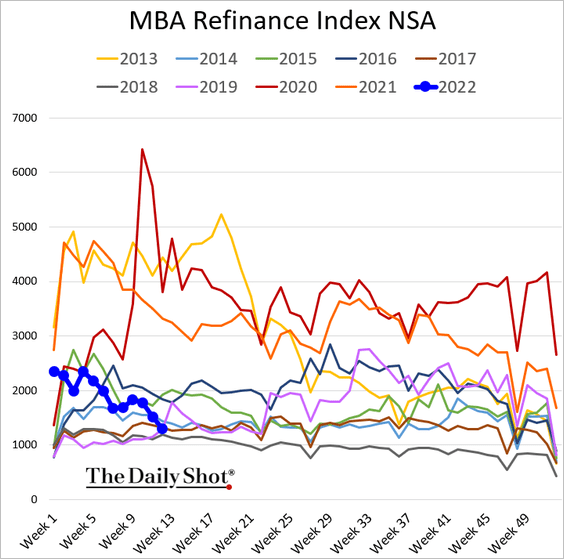

Refi activity is collapsing.

——————–

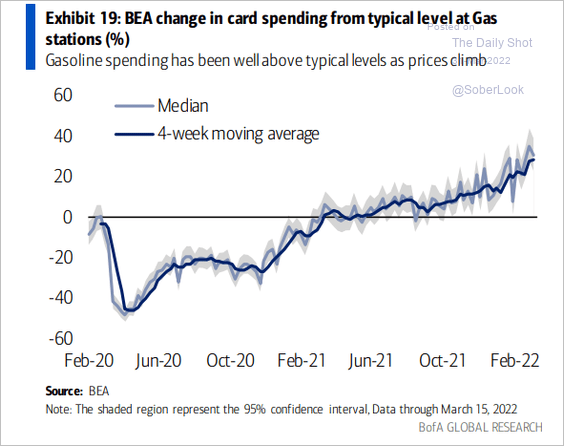

6. Gasoline spending is taking up a larger share of consumer dollars.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

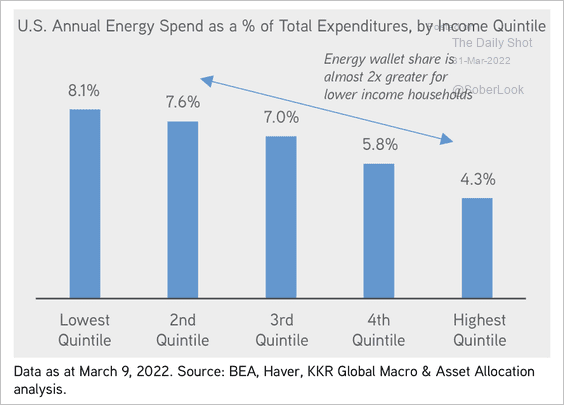

Energy price increases have a disproportionate impact on lower-income households.

Source: KKR Global Institute

Source: KKR Global Institute

——————–

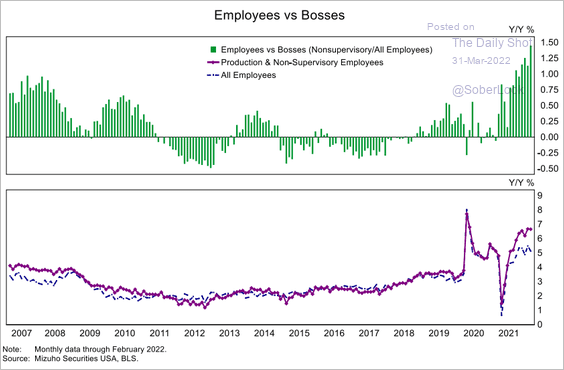

7. Wage growth for non-supervisory employees continues to outpace the overall workforce.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Back to Index

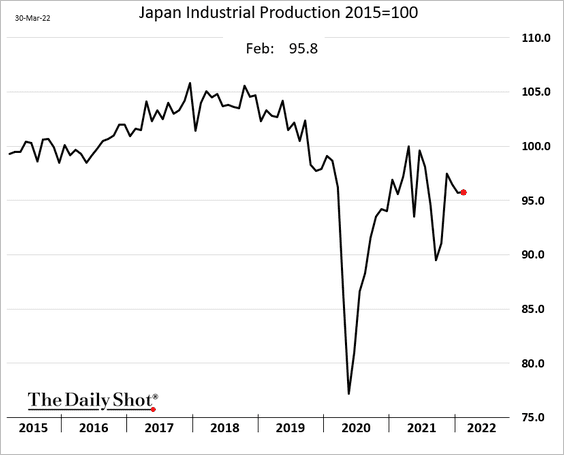

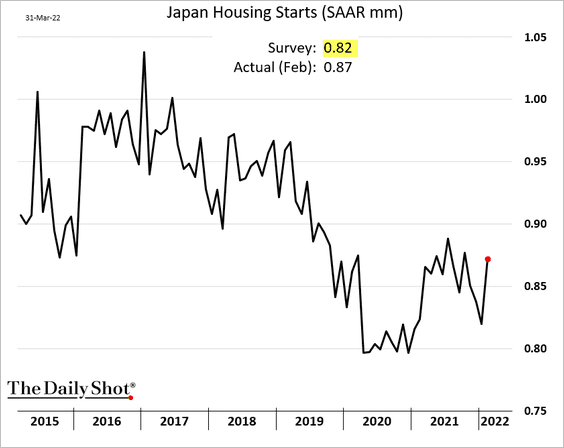

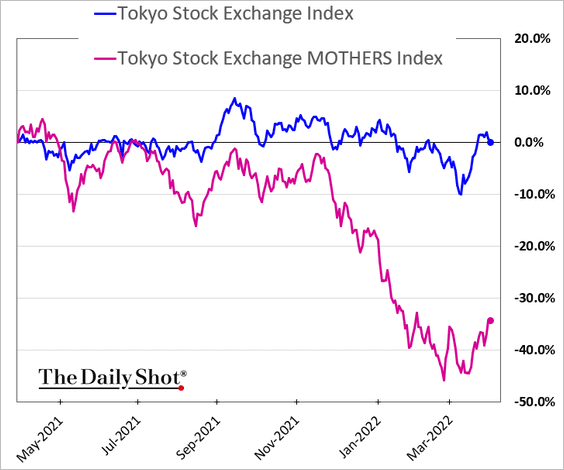

Japan

1. Industrial production held steady in February.

2. Housing starts rebounded.

3. Japan’s start-up equity index (MOTHERS) has underperformed massively in recent months.

h/t Aya Wagatsuma

h/t Aya Wagatsuma

Back to Index

Asia – Pacific

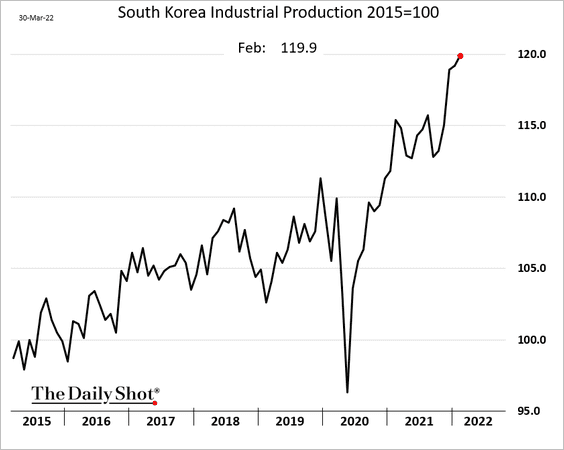

1. South Korea’s industrial production continued to surge in February.

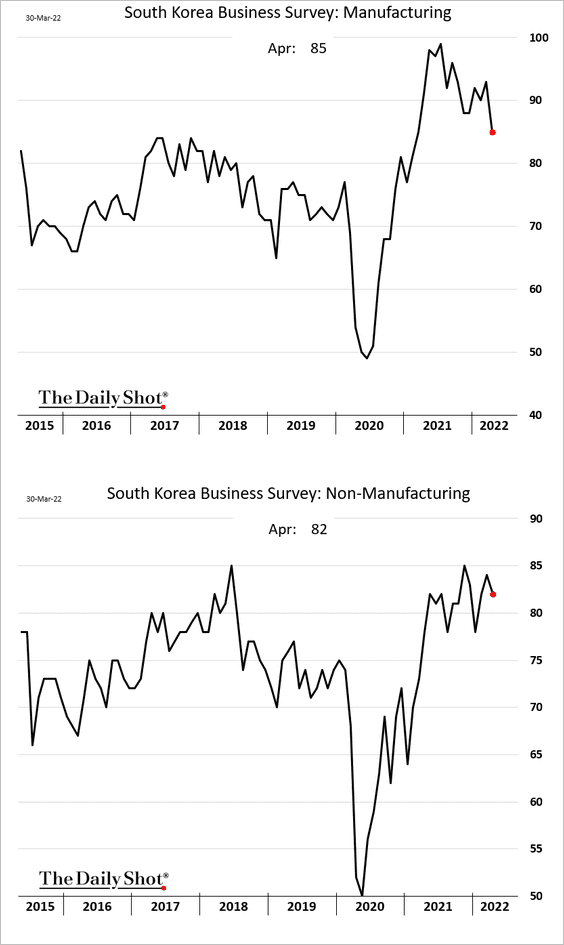

But the monthly manufacturing survey points to a weaker outlook.

——————–

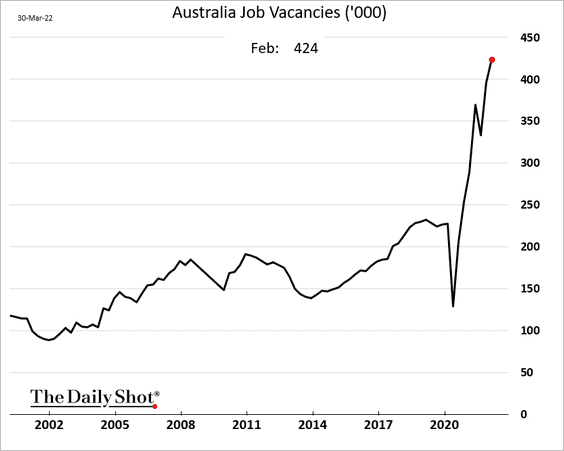

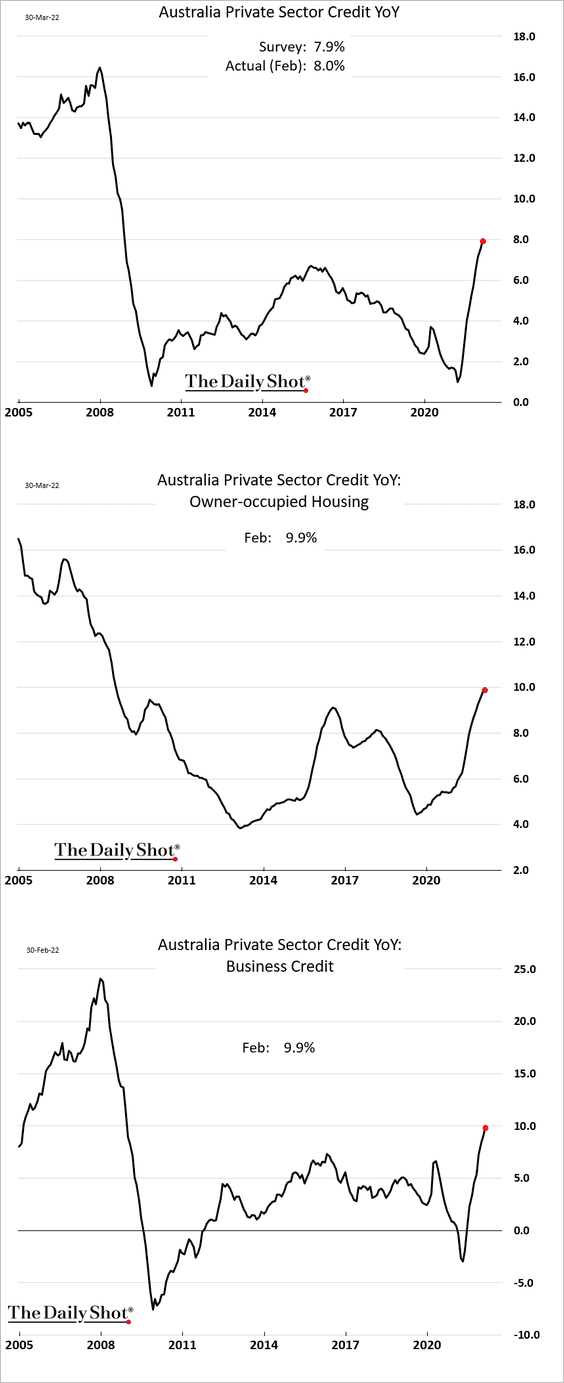

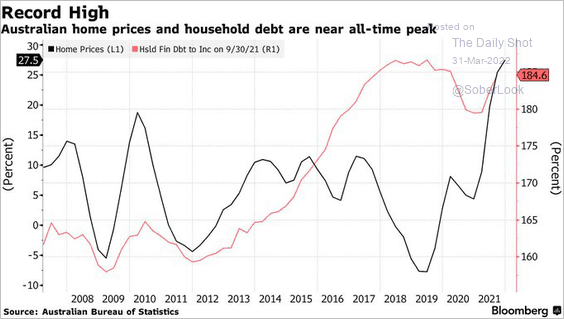

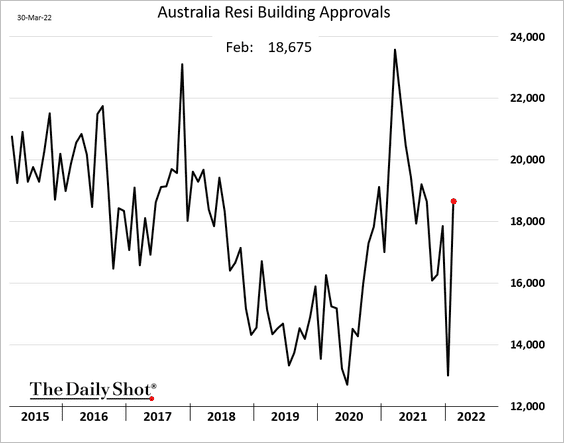

2. Next, we have some updates on Australia.

• Job vacancies have been soaring.

• Credit expansion is accelerating.

• Household leverage is elevated.

Source: @markets Read full article

Source: @markets Read full article

• Building approvals rebounded in February.

Source: ABS Read full article

Source: ABS Read full article

Back to Index

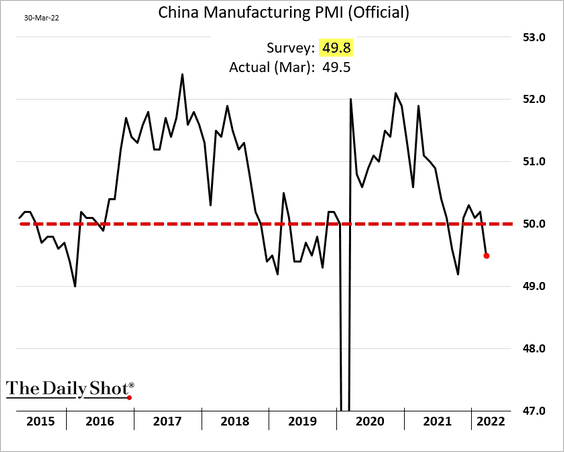

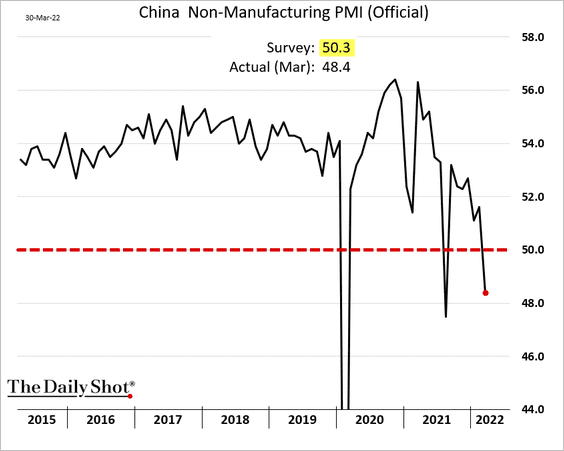

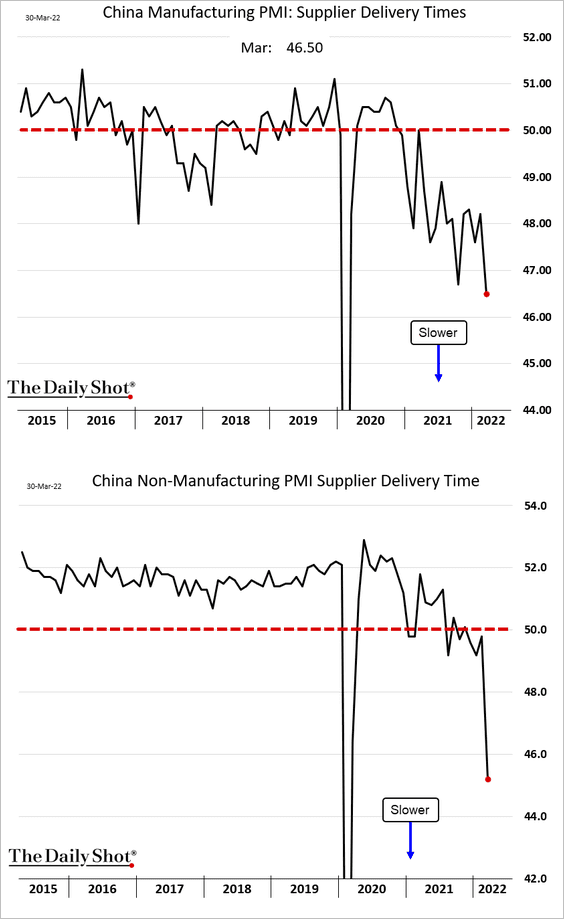

China

1. Omicron and lockdowns took a toll on business activity this month, which is now in contraction territory (PMIs < 50).

• Manufacturing:

• Non-manufacturing:

Supply chain stress levels have worsened sharply due to lockdowns.

——————–

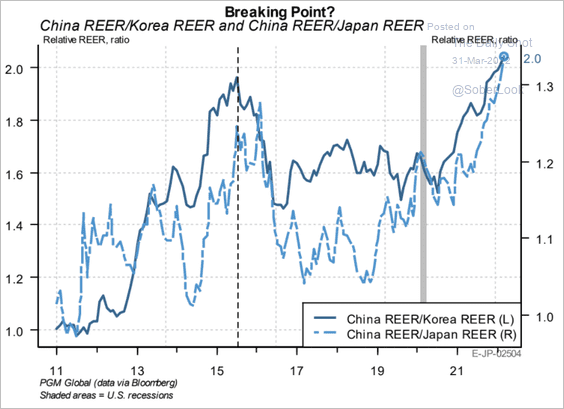

2. Is the renminbi overvalued?

Source: PGM Global

Source: PGM Global

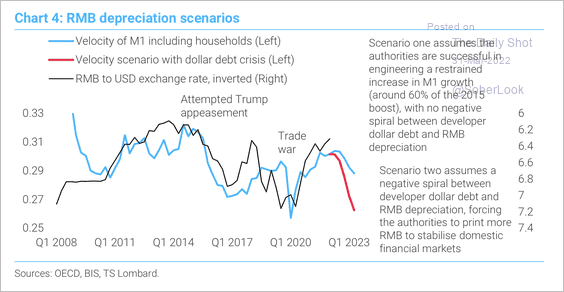

Here are some renminbi depreciation scenarios from TS Lombard.

Source: TS Lombard

Source: TS Lombard

——————–

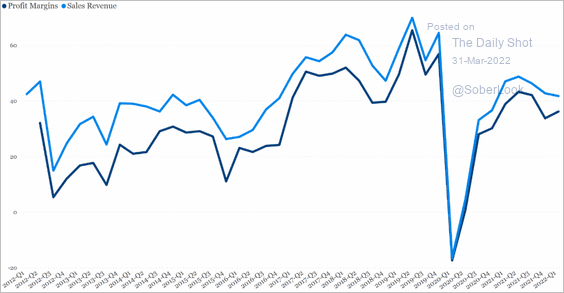

3. Sales revenue and profit margins remain below pre-pandemic levels.

Source: China Beige Book

Source: China Beige Book

Back to Index

Emerging Markets

1. Let’s begin with Russia.

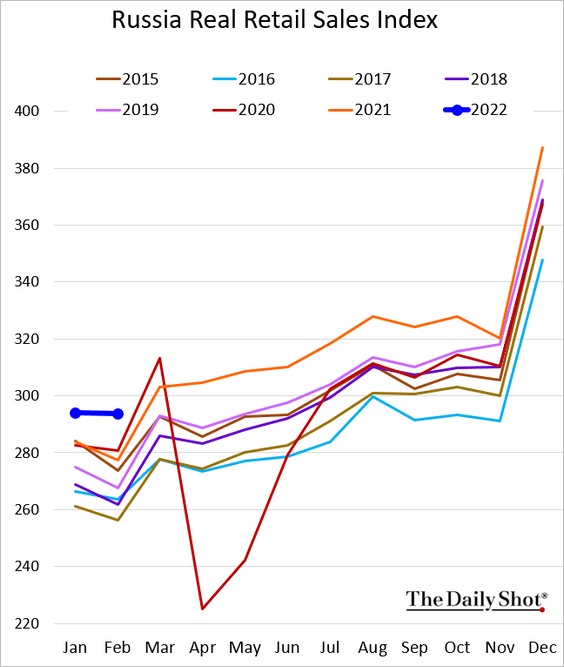

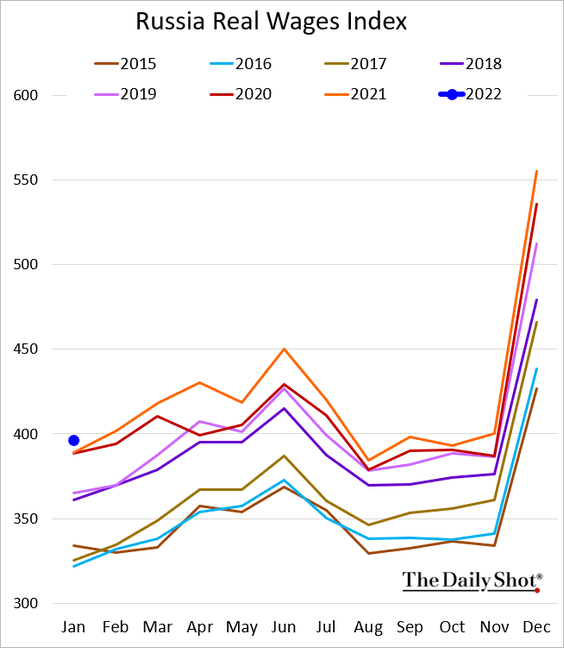

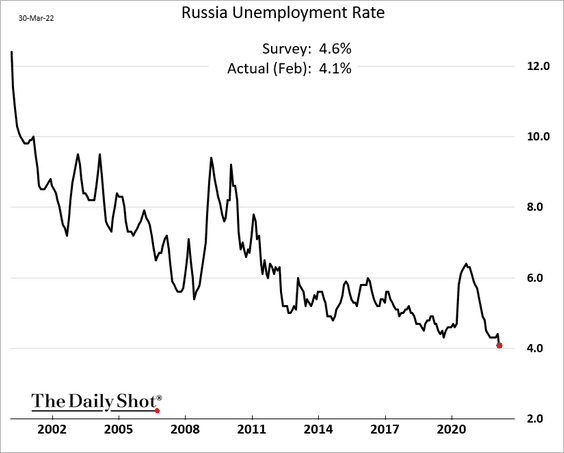

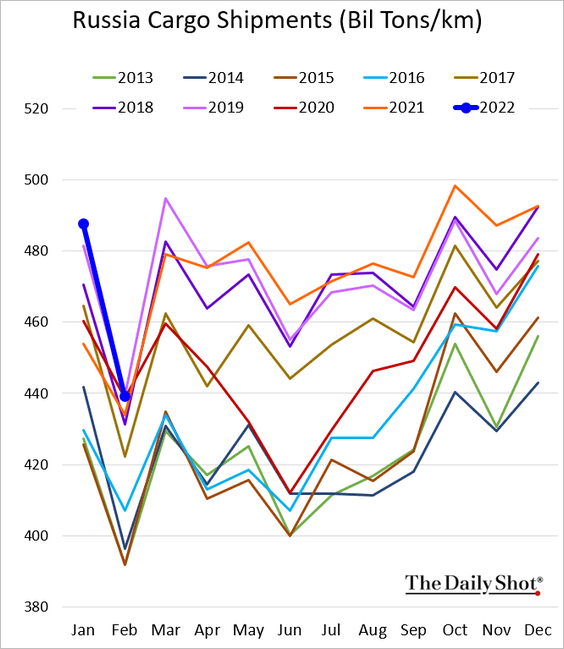

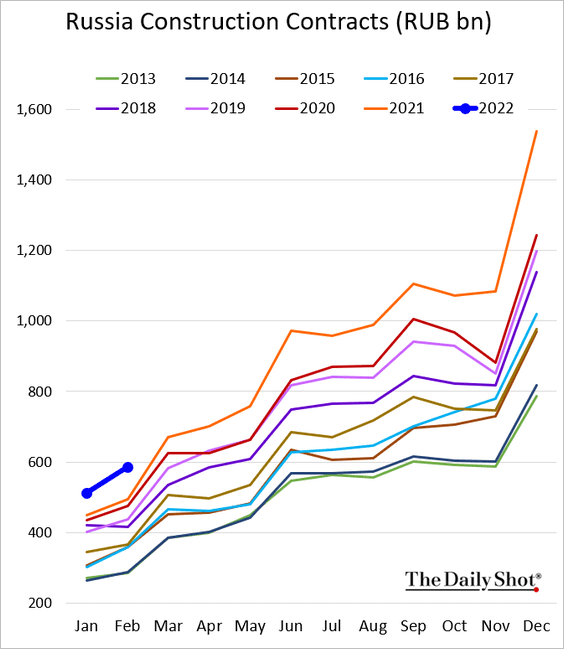

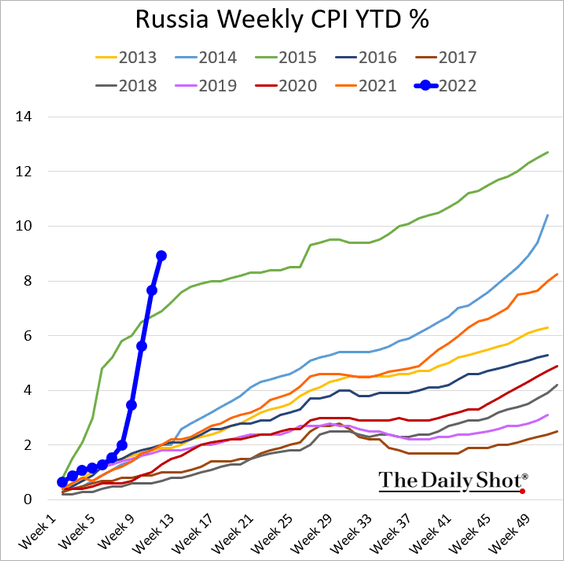

• The economy was improving prior to the war.

– Retail sales (very strong):

– Real wages:

– The unemployment rate (a new low):

– Cargo shipments (a bit softer):

– Construction activity (robust):

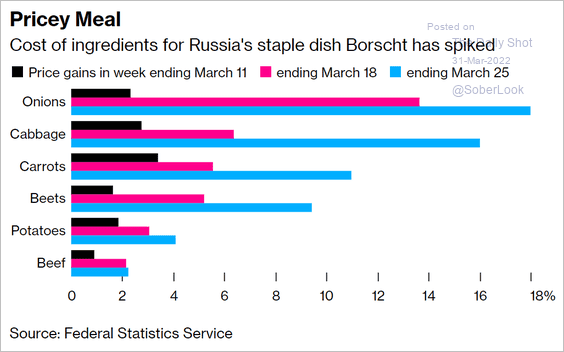

• But now, inflation is soaring (2 charts).

Source: Bloomberg Read full article

Source: Bloomberg Read full article

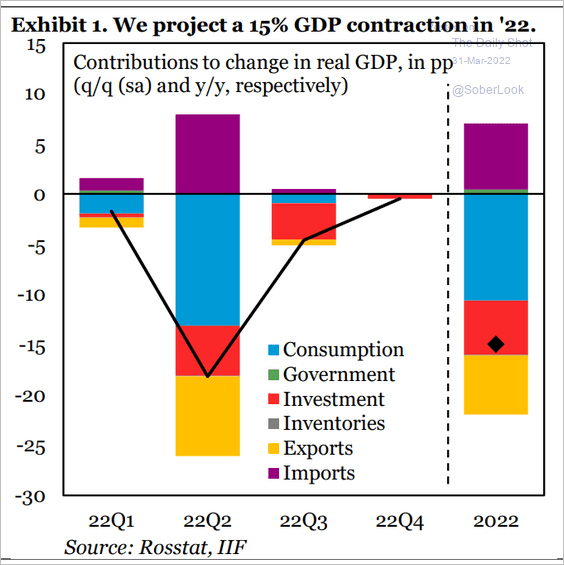

• Here is an economic projection from IIF.

Source: IIF

Source: IIF

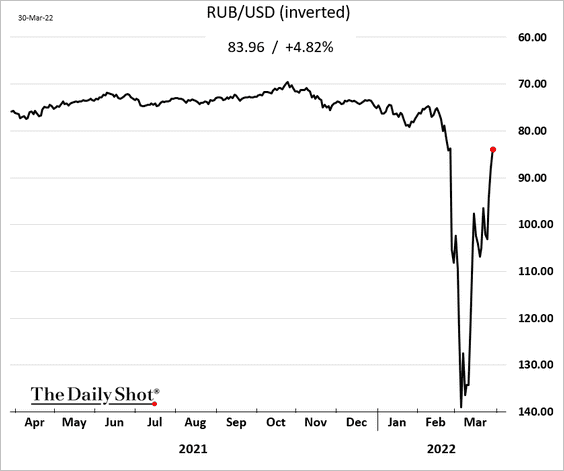

• How do you strengthen the ruble? You require ruble payments for commodities …

Source: Bloomberg Read full article

Source: Bloomberg Read full article

And it’s working.

——————–

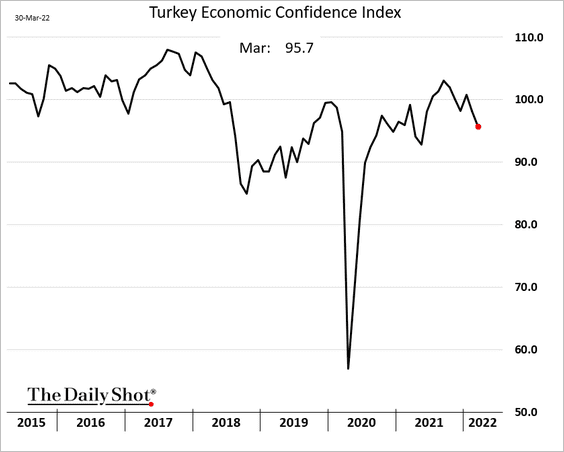

2. Turkey’s economic sentiment eased this month but is still resilient.

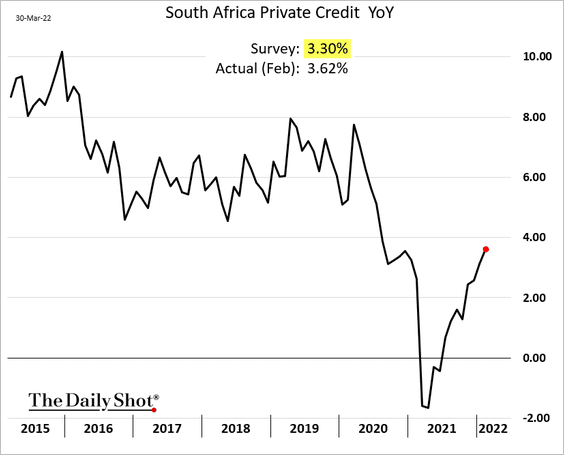

3. South Africa’s credit expansion is picking up momentum.

Back to Index

Cryptocurrency

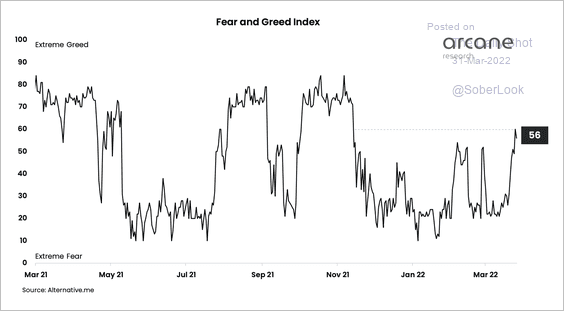

1. Bitcoin’s Fear & Greed Index entered “greed” territory – at its highest level this year, but still below the Nov. 2021 peak.

Source: Arcane Research Read full article

Source: Arcane Research Read full article

2. Bitcoin’s market cap relative to the total crypto market cap continues to fade, which indicates a greater appetite for risk among crypto traders.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

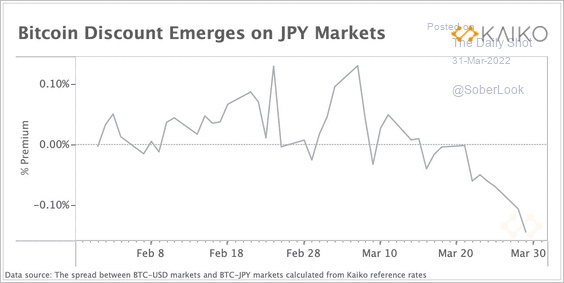

3. The spread between BTC/USD and BTC/JPY flipped negative early this month as the yen started losing ground.

Source: @KaikoData

Source: @KaikoData

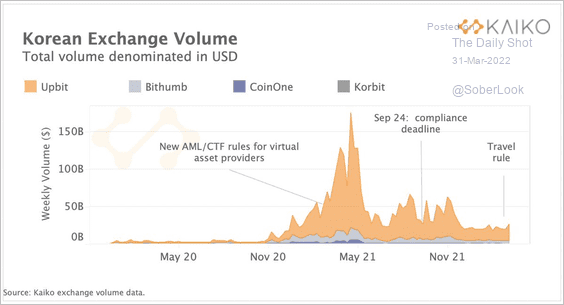

4. South Korean crypto exchange volume plummeted since strict regulatory requirements came into force.

Source: @KaikoData

Source: @KaikoData

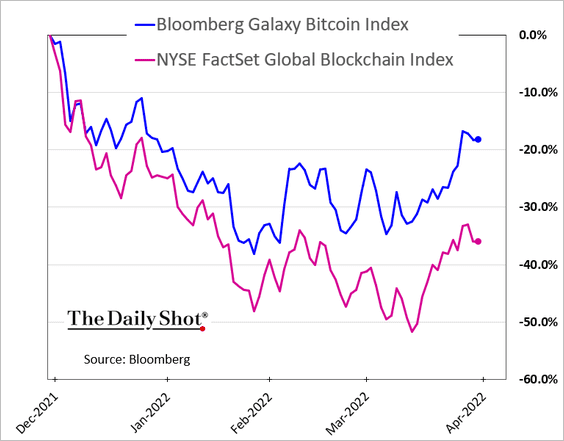

5. Crypto-focused companies are underperforming bitcoin.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

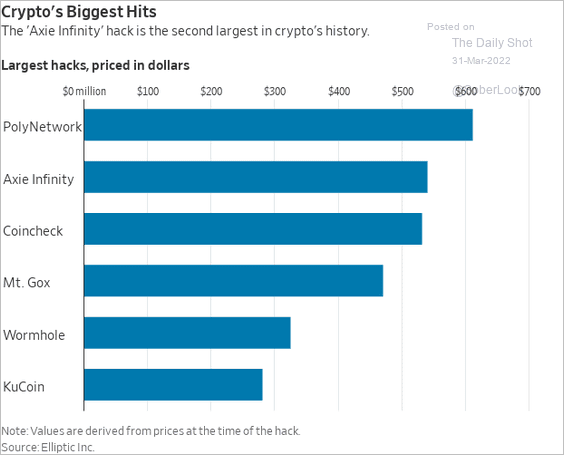

6. Here are the largest crypto hacks.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Commodities

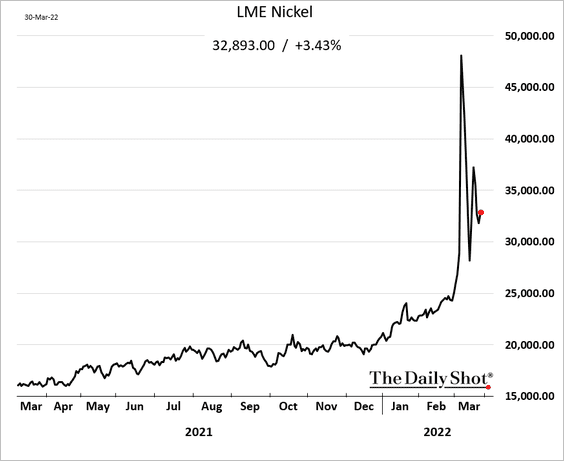

1. LME nickel has “stabilized” at a very high price. This is going to impact a number of industries.

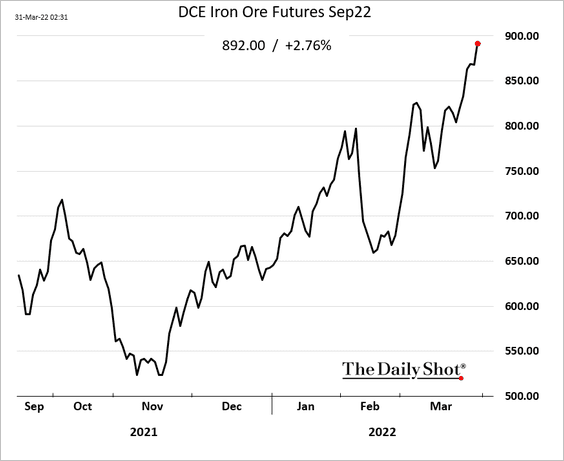

2. Iron ore prices in China continue to surge.

Back to Index

Energy

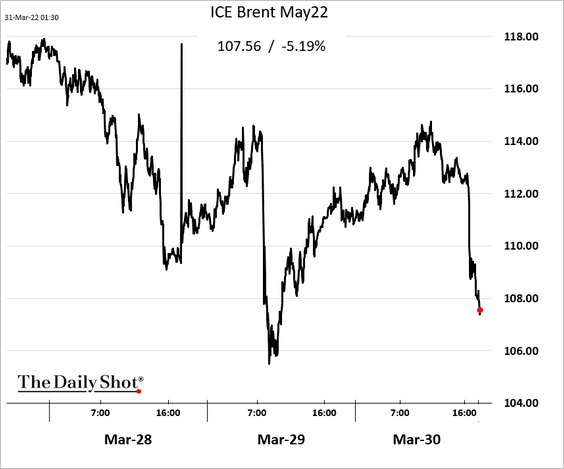

1. Crude oil is lower on the news of planned US (and possibly global) strategic petroleum reserve releases.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

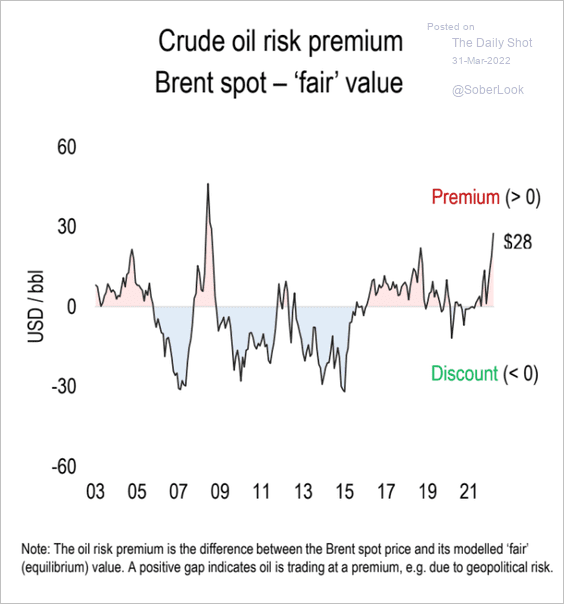

2. Brent is trading at a substantial premium to “fair value” due to geopolitical risks.

Source: Numera Analytics

Source: Numera Analytics

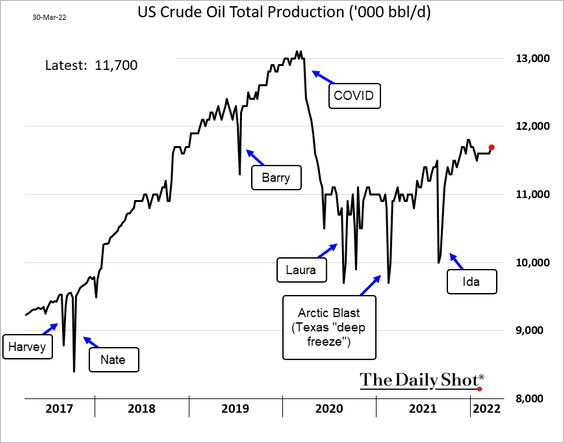

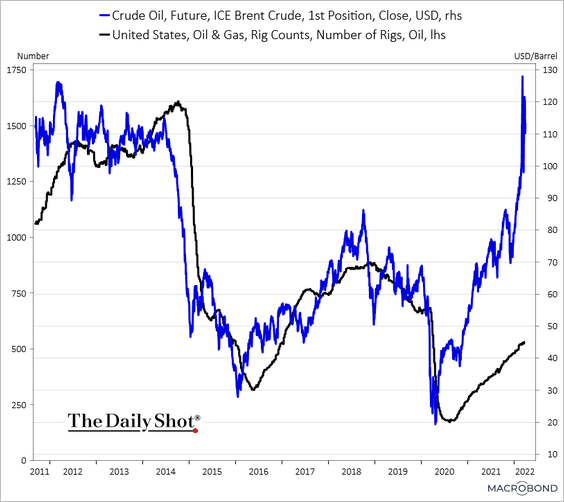

3. US oil production remains well below pre-COVID levels.

The gap between prices in rigs has blown out.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

——————–

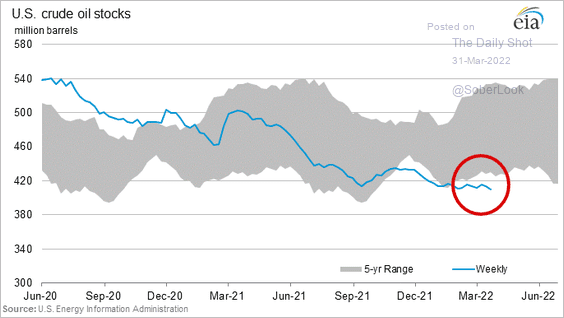

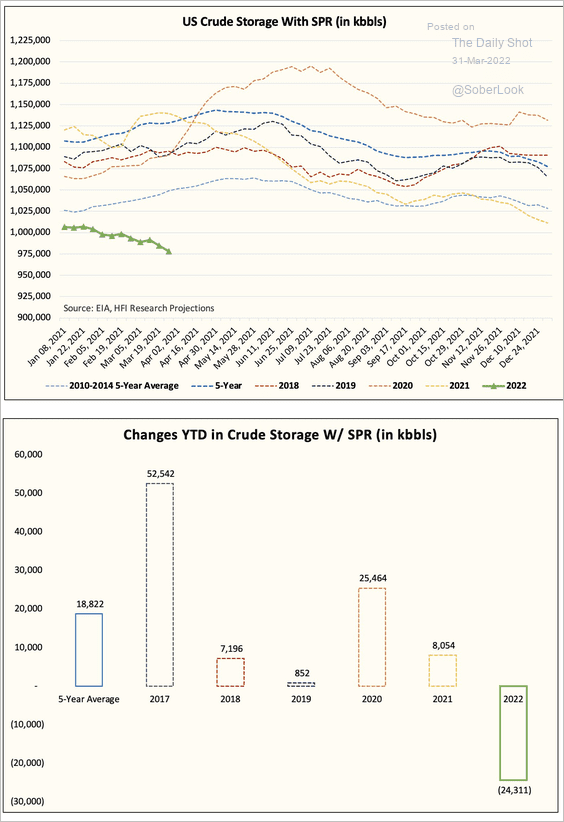

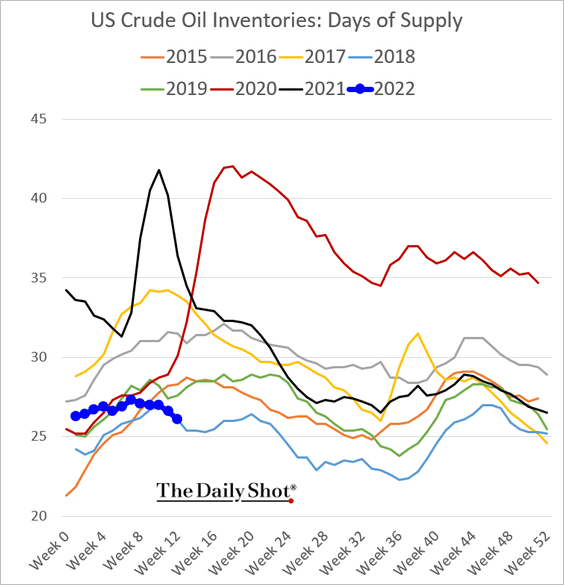

4. US oil inventories continue to fall (3 charts).

Source: @HFI_Research

Source: @HFI_Research

——————–

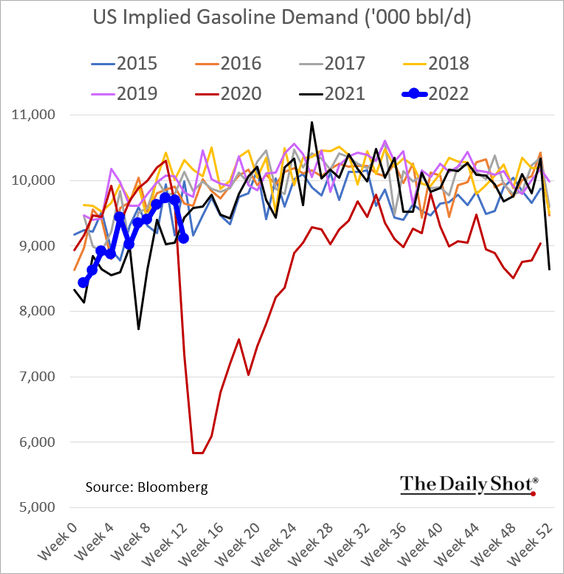

5. Gasoline demand eased last week.

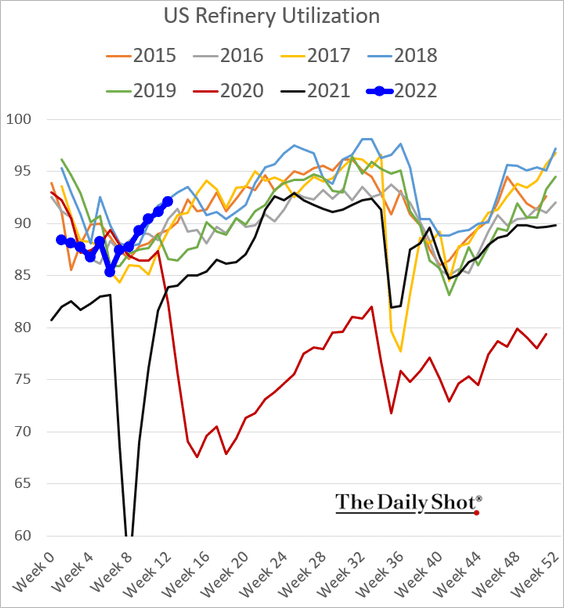

But refinery utilization rates remain elevated.

Back to Index

Equities

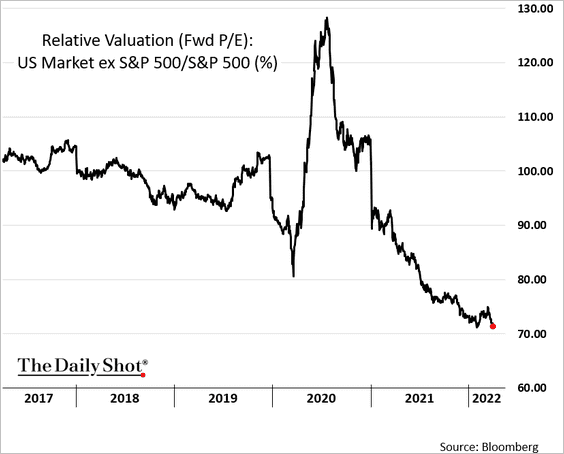

1. The S&P 500 valuation premium to the rest of the US market keeps widening.

2. Are stocks still expensive relative to commodities? The S&P 500 ETF (SPY) is testing initial support relative to the Invesco Commodity ETF (DBC) after a break below a decade-long uptrend.

Source: Dantes Outlook

Source: Dantes Outlook

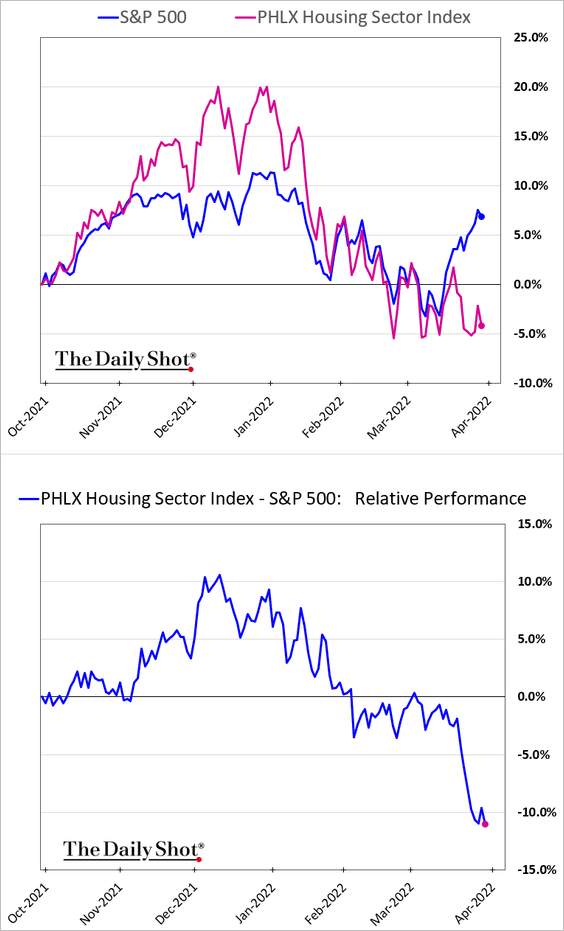

3. Housing stocks remain under pressure as mortgage rates surge.

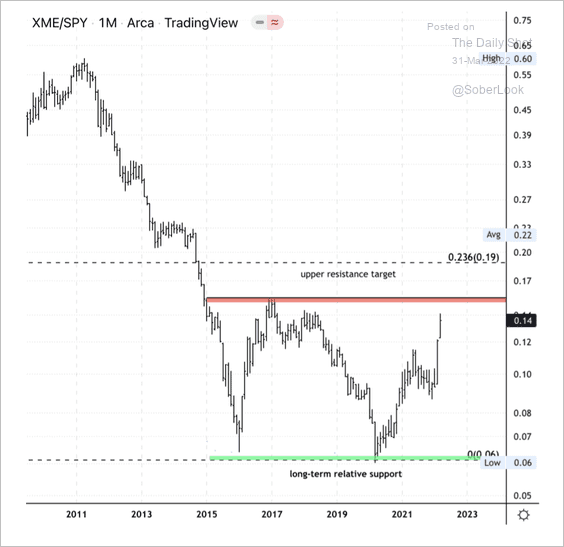

4. The SPDR Metals & Mining ETF is approaching initial resistance relative to the S&P 500 ETF (SPY). Will we see a breakout?

Source: Dantes Outlook

Source: Dantes Outlook

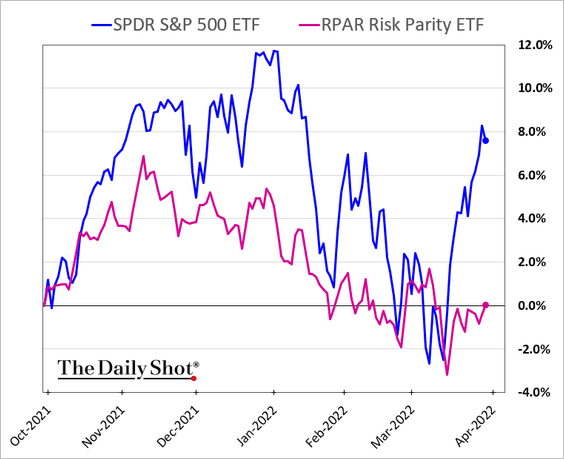

5. Risk-parity strategies (which have “de-risked”) are lagging massively in this rebound.

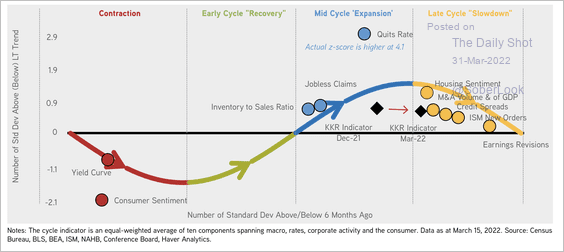

6. The US business cycle has entered a late-cycle slowdown, which typically coincides with below-average equity market performance.

Source: KKR Global Institute

Source: KKR Global Institute

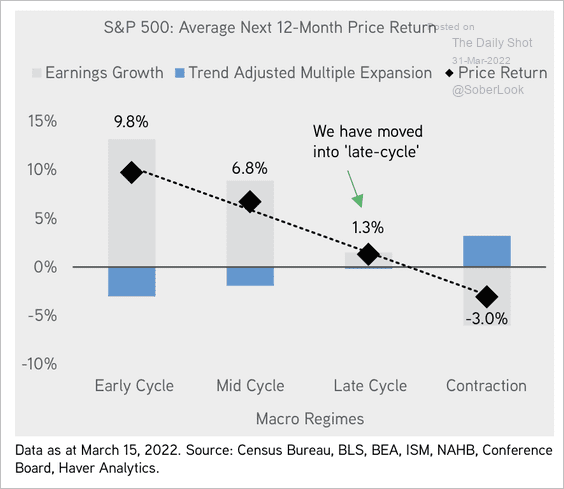

Here is a look at the average next-12-month S&P 500 returns during each phase of the US business cycle.

Source: KKR Global Institute

Source: KKR Global Institute

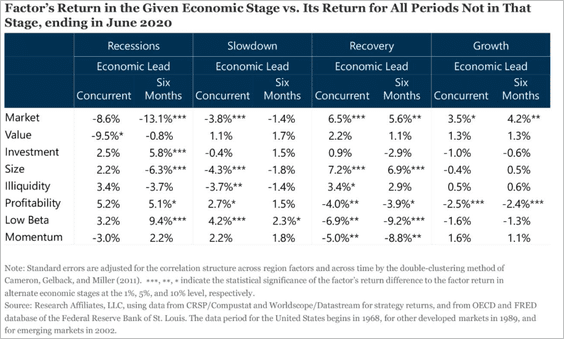

And this table shows equity factor performance at each stage of the business cycle.

Source: Research Affiliates

Source: Research Affiliates

Back to Index

Rates

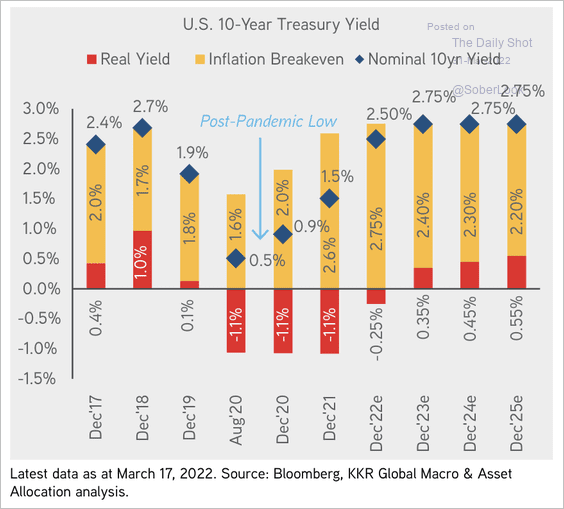

1. KKR expects real rates to remain below pre-pandemic levels, even as nominal rates rise toward 2.75%.

Source: KKR Global Institute

Source: KKR Global Institute

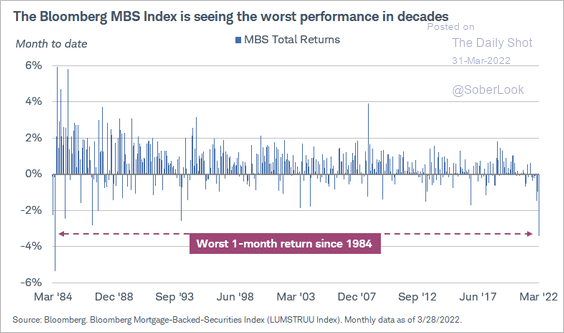

2. The MBS market saw the worst performance in decades this month.

Source: @KathyJones

Source: @KathyJones

Back to Index

Global Developments

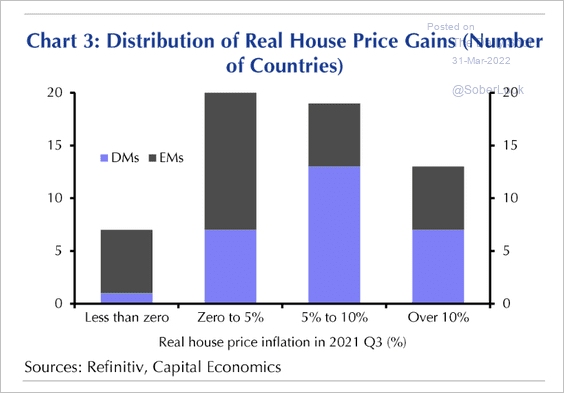

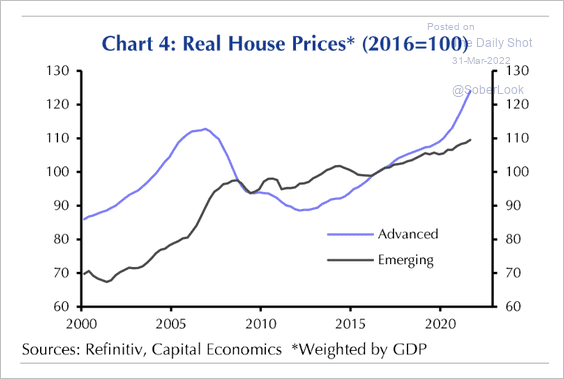

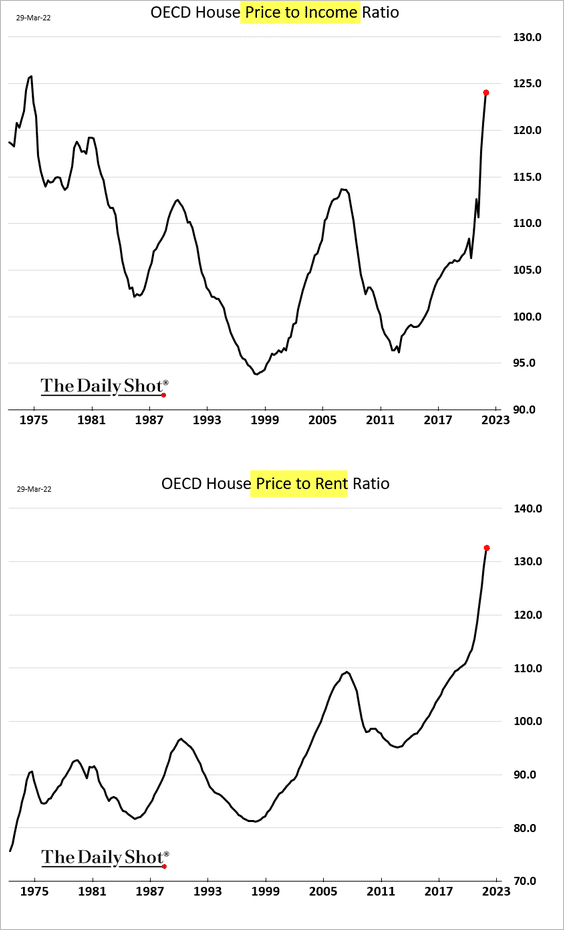

1. Rising house prices have been more extreme in developed markets (2 charts).

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

Home prices across OECD hit the highest level relative to incomes since the early 1970s.

——————–

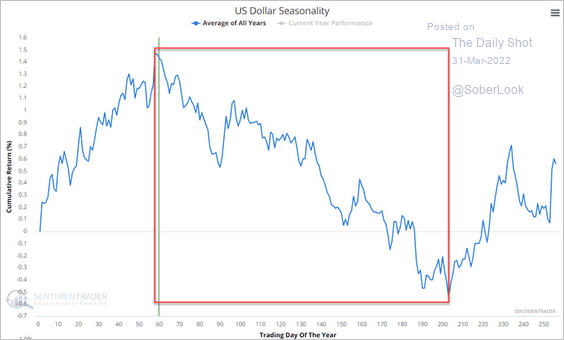

2. The dollar is entering a seasonally weak period.

Source: SentimenTrader

Source: SentimenTrader

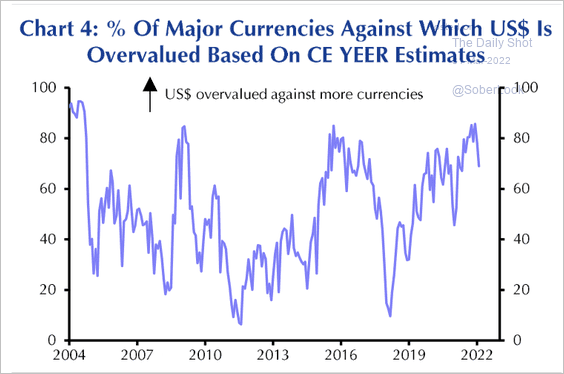

The dollar appears to be less overvalued than last quarter.

Source: Capital Economics

Source: Capital Economics

——————–

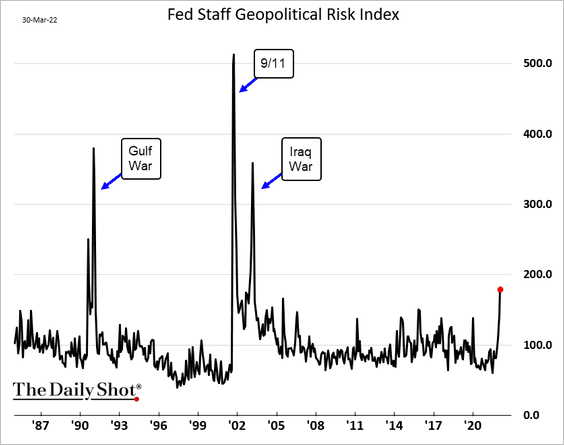

3. Here is the Fed’s geopolitical risk index.

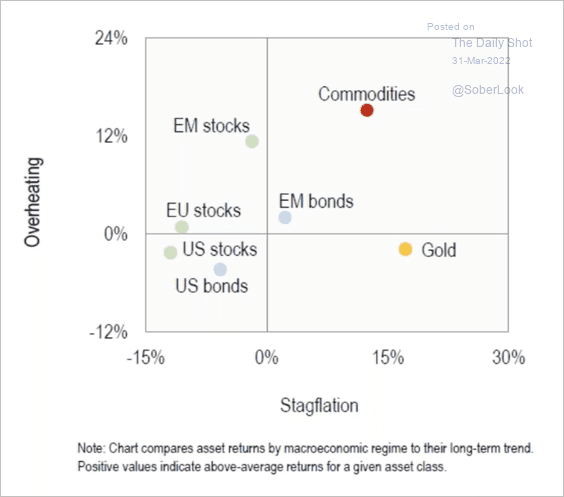

4. This chart shows average yearly returns by asset class in overheating and stagflation periods.

Source: Numera Analytics

Source: Numera Analytics

——————–

Food for Thought

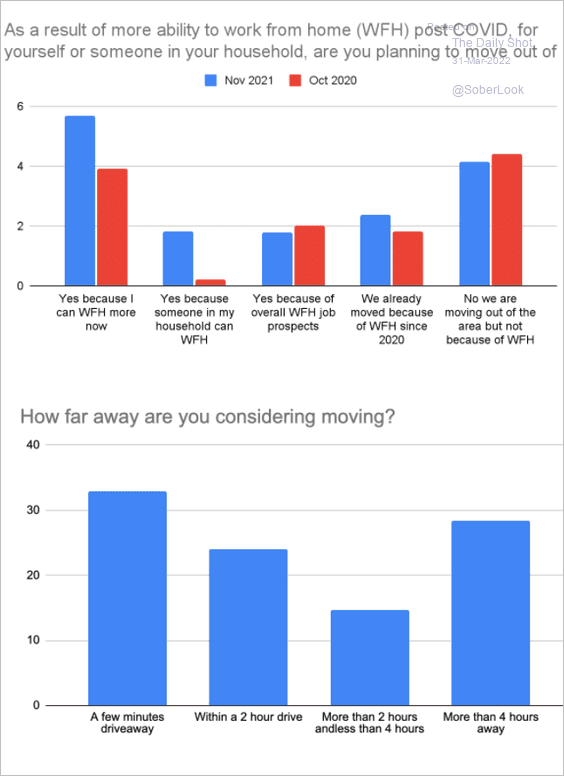

1. Moving because of WFH opportunities:

Source: Upwork Read full article

Source: Upwork Read full article

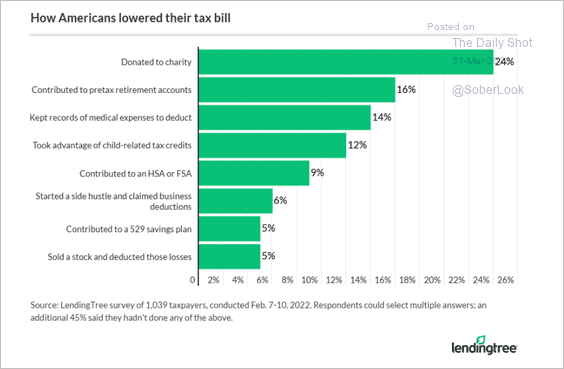

2. Lowering the tax bill:

Source: LendingTree Read full article

Source: LendingTree Read full article

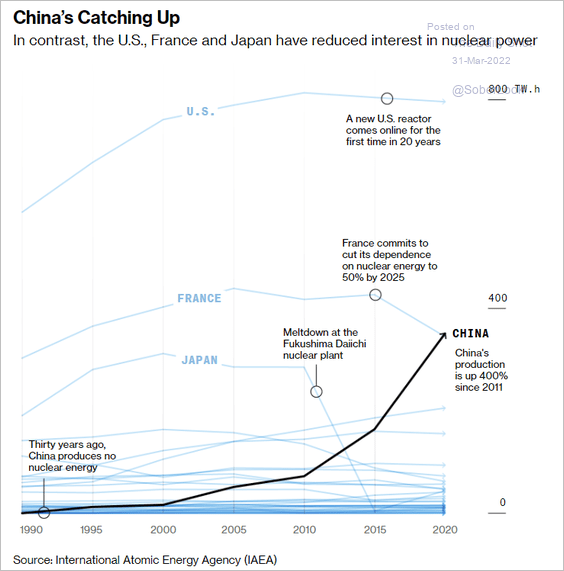

3. Interest in nuclear power:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

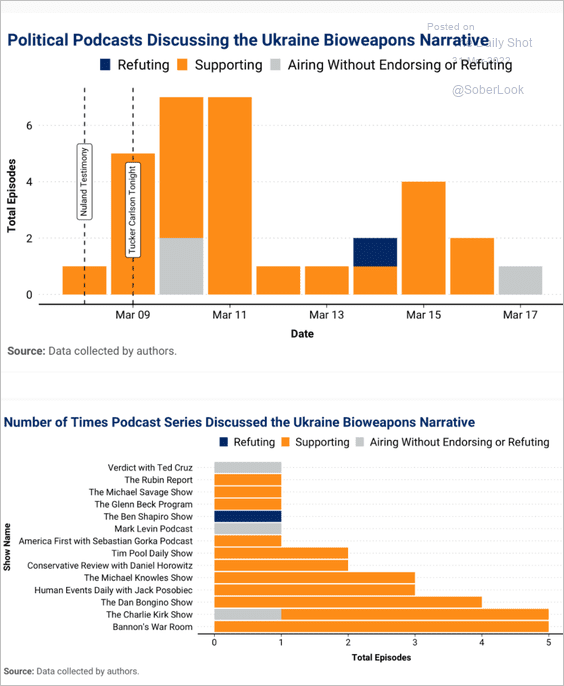

4. Russian disinformation about Ukraine’s “bioweapons”:

Source: Brookings Read full article

Source: Brookings Read full article

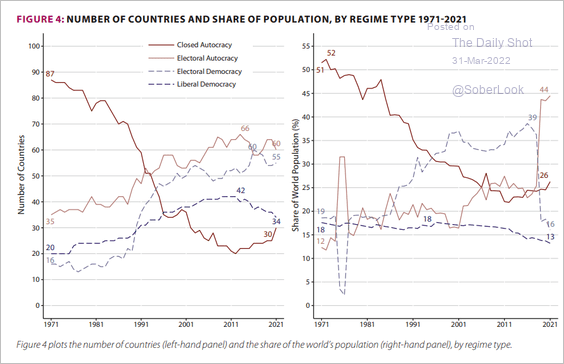

5. Autocracies on the rise:

Source: V-Dem Institute Read full article

Source: V-Dem Institute Read full article

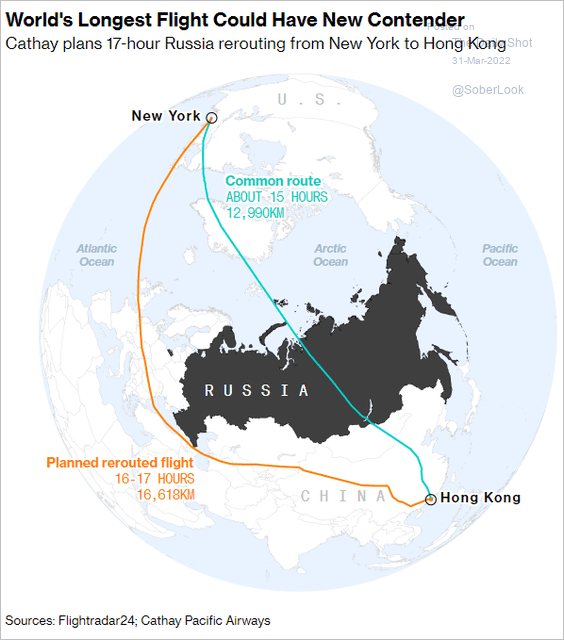

6. Rerouted flight from New York to Hong Kong:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

Back to Index