The Daily Shot: 08-Apr-22

• Administrative Update

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

Administrative Update

Please note that The Daily Shot will not be published next Friday, April 15th.

Back to Index

The United States

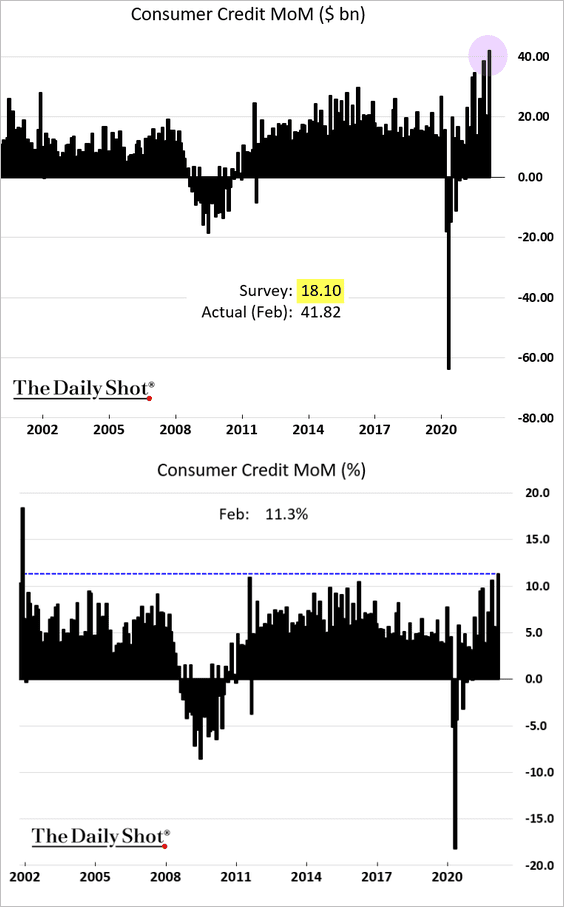

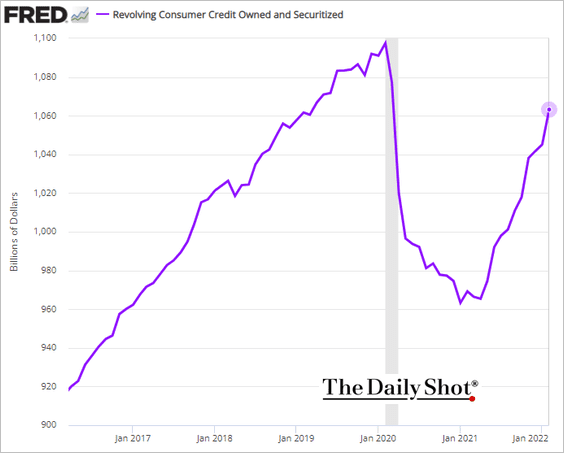

1. US consumer credit surged by nearly $42 billion in February, an 11% gain.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

Faced with rapid price increases, households are tapping their credit cards again.

——————–

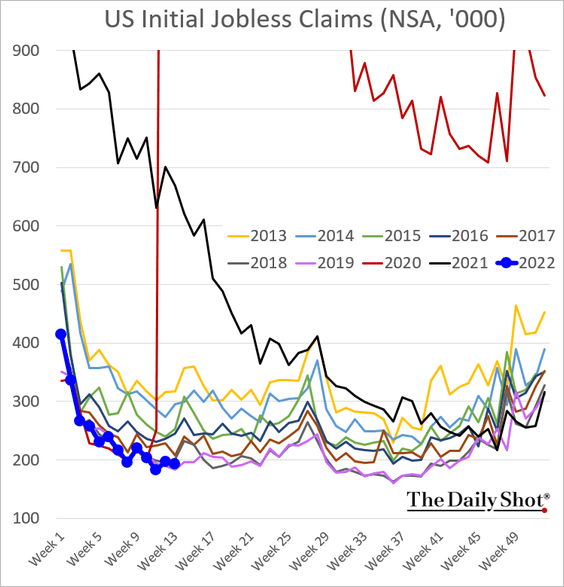

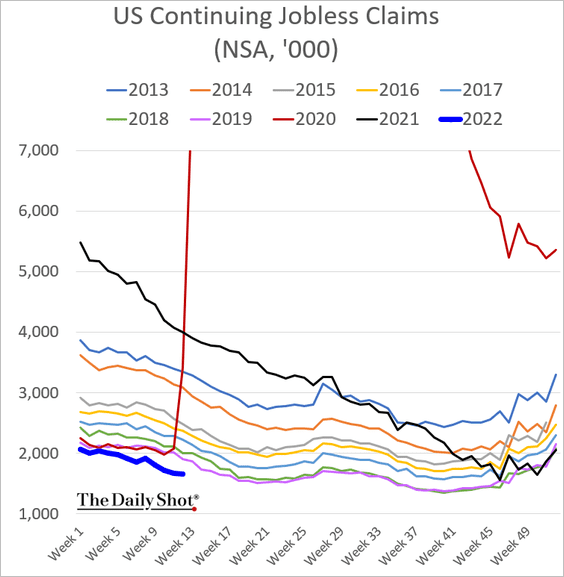

2. Jobless claims remain near multi-year lows.

Here are the continuing jobless claims.

——————–

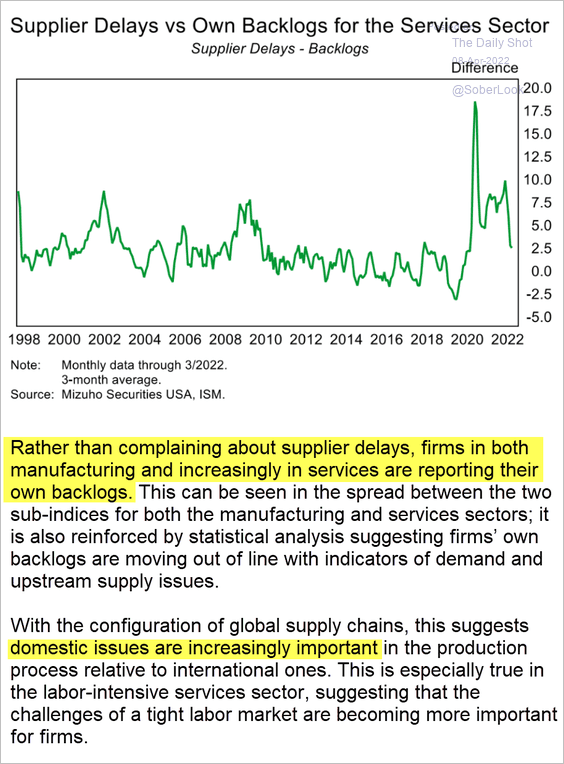

3. Inventory bottlenecks are shifting from supplier delays to companies’ internal backlogs. Below is a comment from Mizuho Securities.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

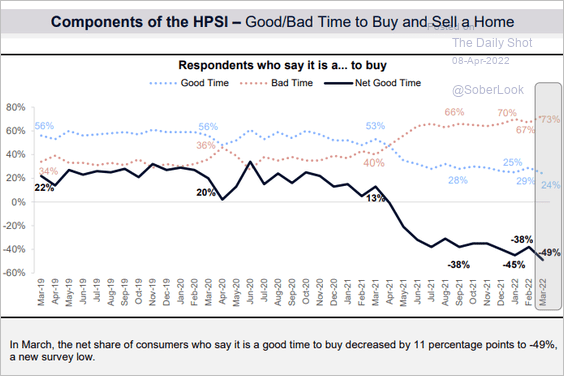

4. Housing market sentiment has deteriorated to multi-year lows, according to Fannie Mae.

Source: Fannie Mae

Source: Fannie Mae

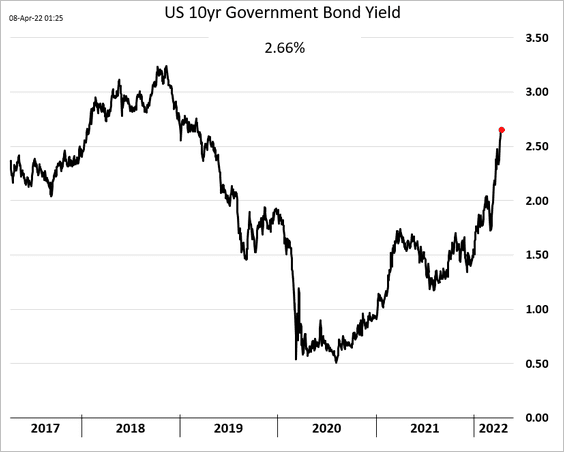

5. Treasury yields keep climbing as the Fed readies its rapid-fire quantitative tightening.

Back to Index

The United Kingdom

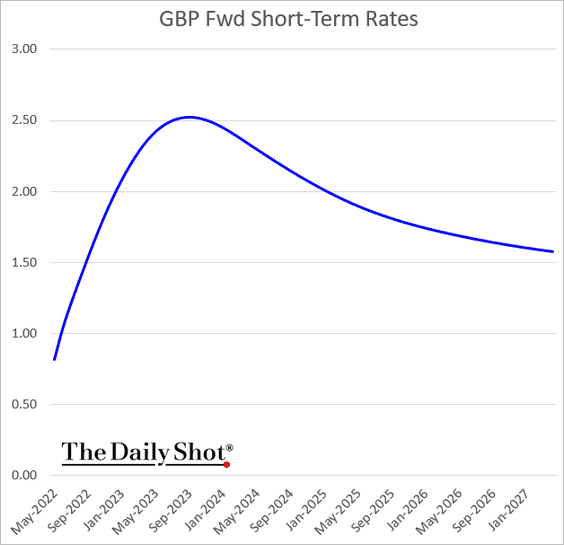

Markets see the BoE pushing the official bank rate above 2.5% before initiating rate cuts late next year.

Back to Index

The Eurozone

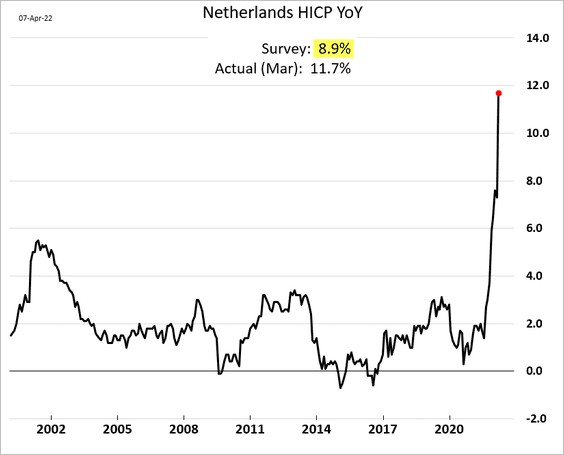

1. The Dutch CPI report was a shocker.

Source: News WWC Media Read full article

Source: News WWC Media Read full article

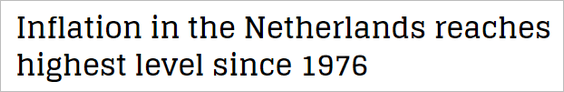

• The ECB continues to get surprised by the euro-area inflation spike.

Source: @fwred

Source: @fwred

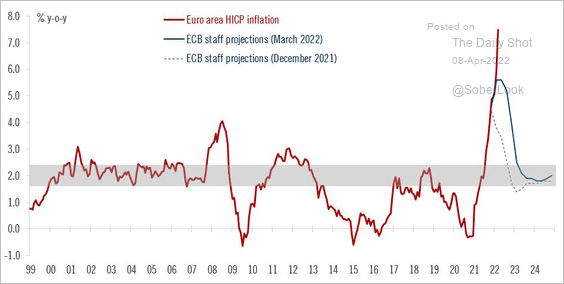

• Here are the market projections for rate hikes.

Source: Danske Bank

Source: Danske Bank

——————–

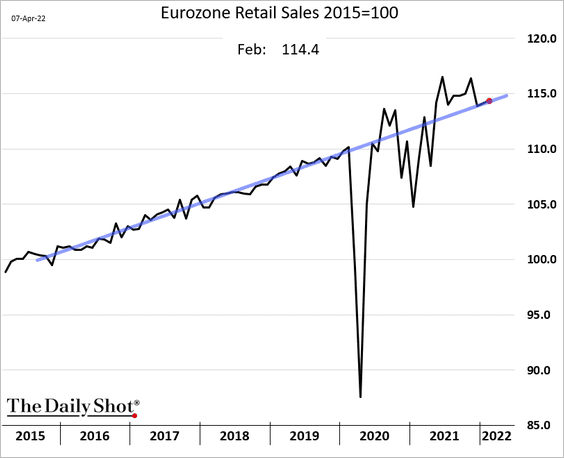

2. Retail sales kept following the pre-COVID trend in February.

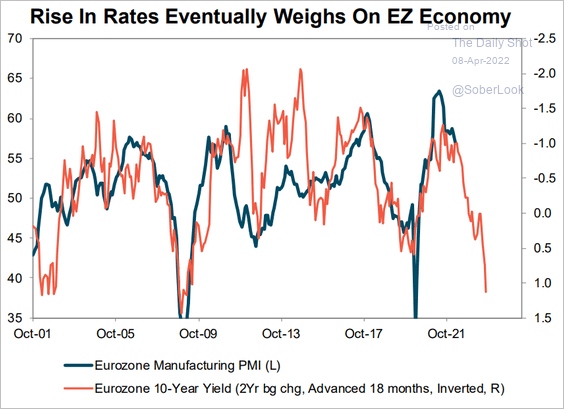

3. Rising rates will put downward pressure on economic activity.

Source: Trahan Macro Research

Source: Trahan Macro Research

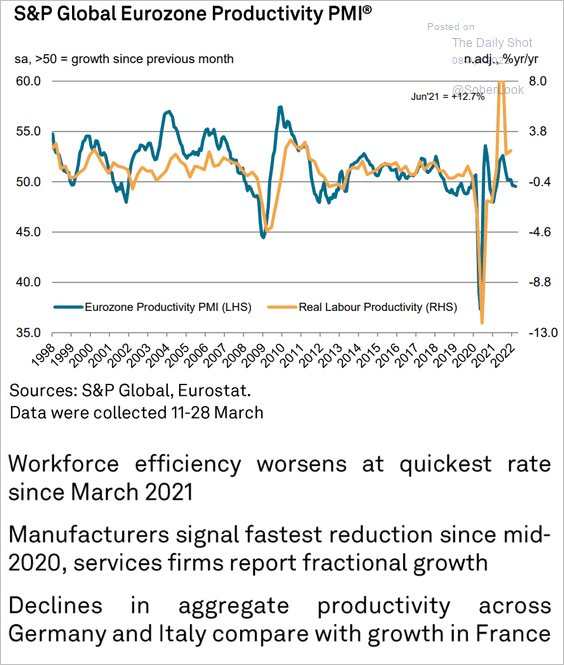

4. Productivity slowed in March.

Source: IHS Markit

Source: IHS Markit

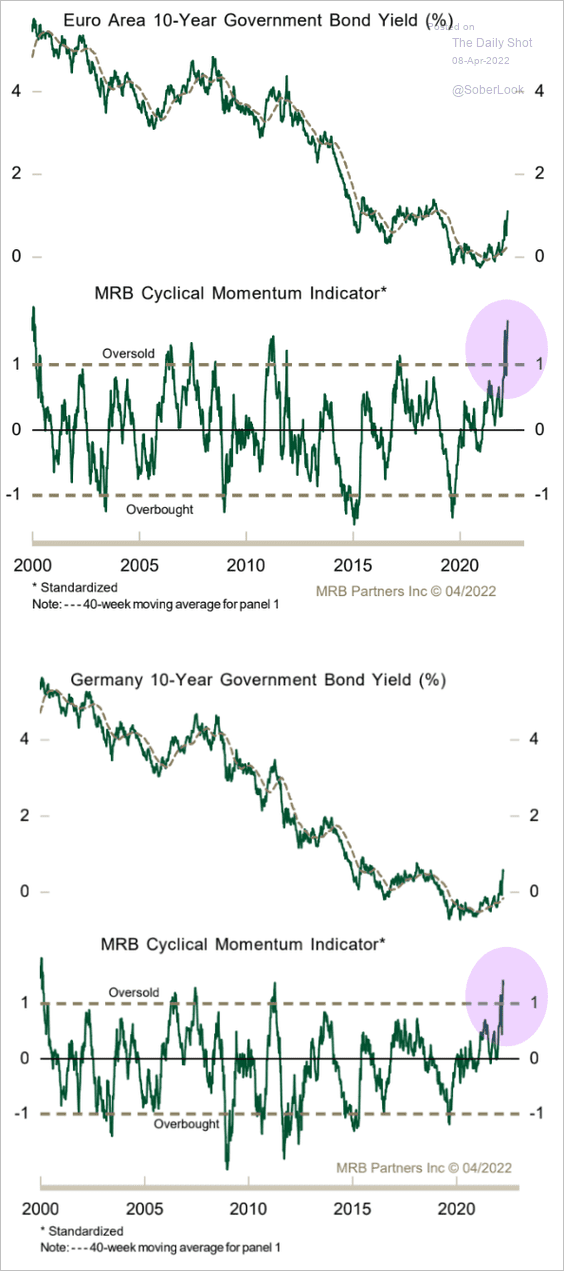

5. Technical indicators suggest that euro-area bonds are oversold.

Source: MRB Partners

Source: MRB Partners

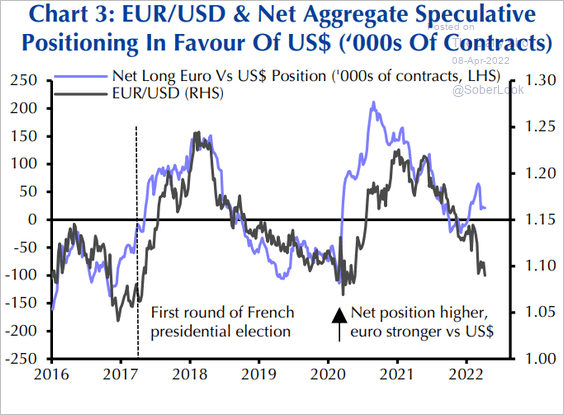

6. Euro futures positioning has decoupled from EUR/USD.

Source: Capital Economics

Source: Capital Economics

Back to Index

Asia – Pacific

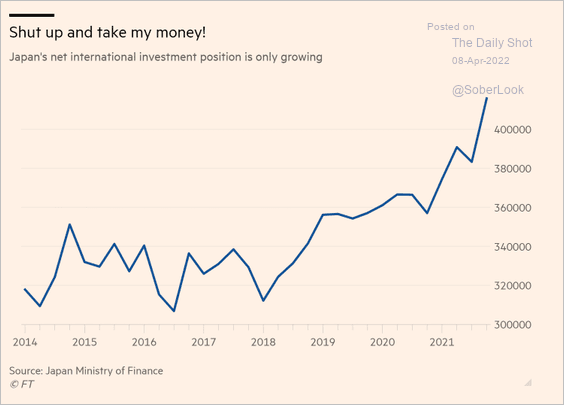

1. Here is Japan’s international investment position.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

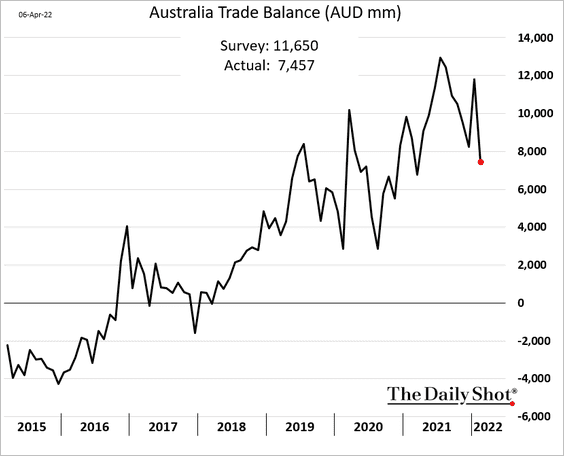

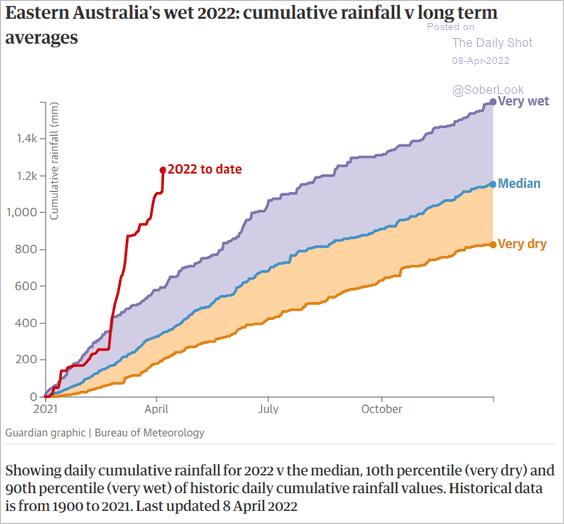

2. Next, we have some updates on Australia.

• The trade balance (below expectations in February):

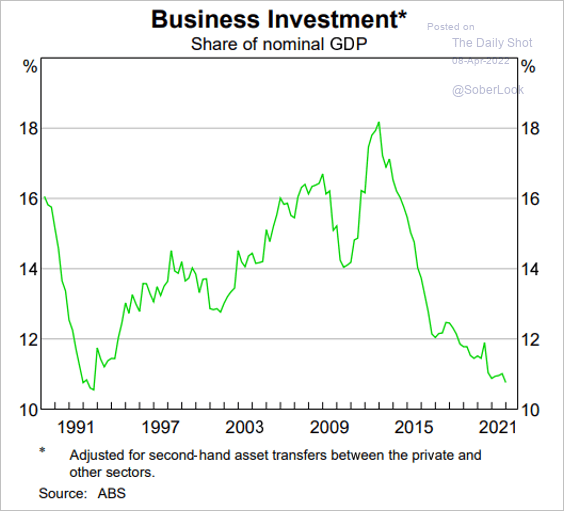

• Business investment:

Source: @AvidCommentator

Source: @AvidCommentator

• Eastern Australia’s rainfall vs. long-term averages:

Source: The Guardian Read full article

Source: The Guardian Read full article

Back to Index

China

1. Beijing hinted at monetary easing …

Source: Bloomberg Read full article

Source: Bloomberg Read full article

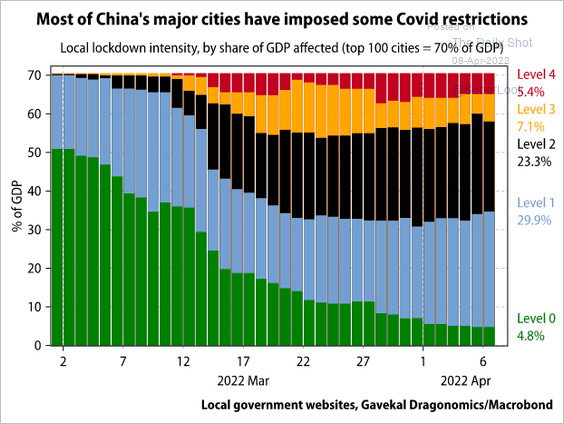

… amid lockdowns.

Source: Ernan Cui, Gavekal Research

Source: Ernan Cui, Gavekal Research

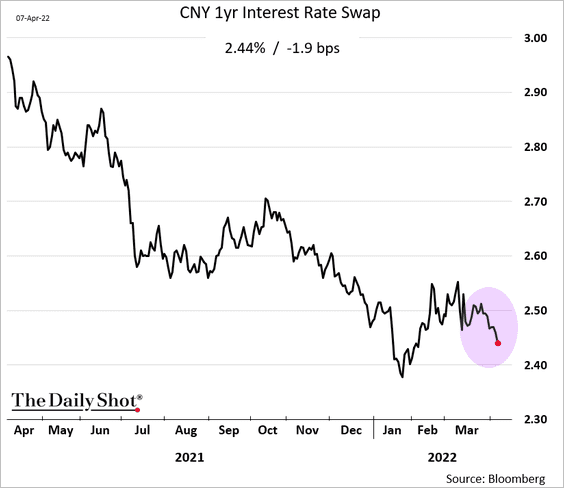

The one-year swap rate is moving lower.

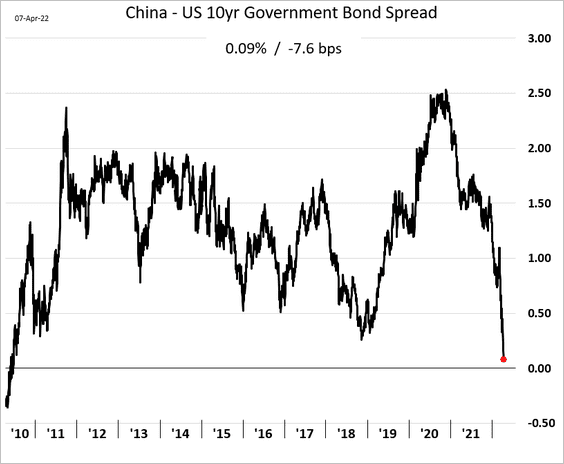

2. The 10-year bond yield differential with the US has collapsed. At some point, this trend has to put downward pressure on the renminbi.

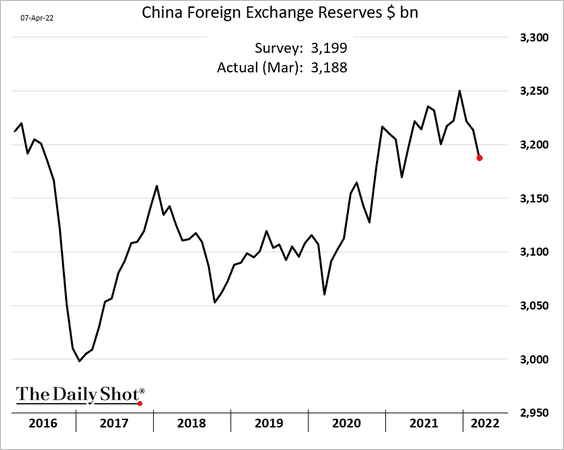

3. China’s F/X reserves have been moving lower in recent months.

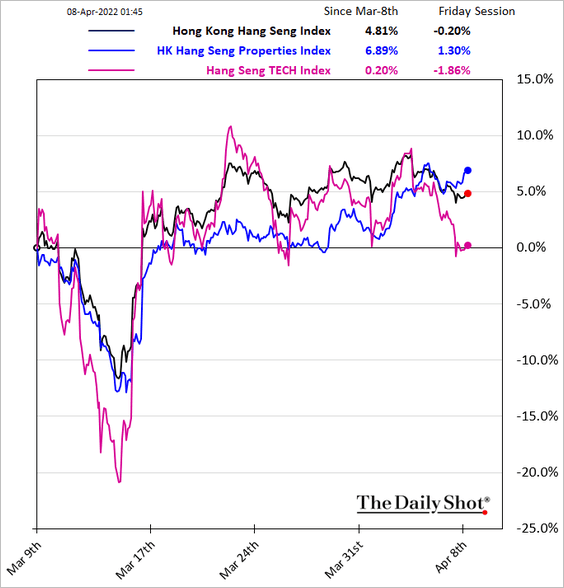

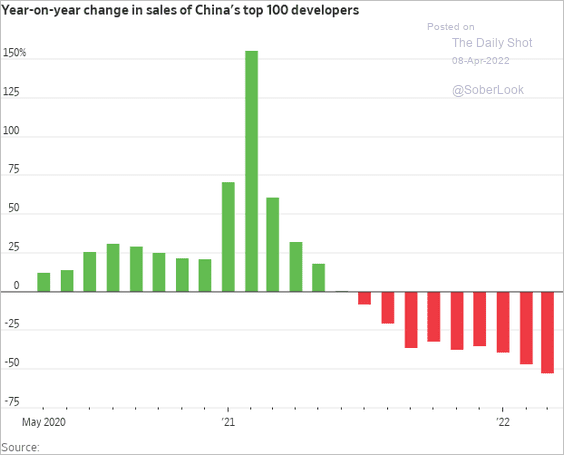

4. Tech stocks are struggling again in Hong Kong, but property developers are outperforming, …

… despite weak sales.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

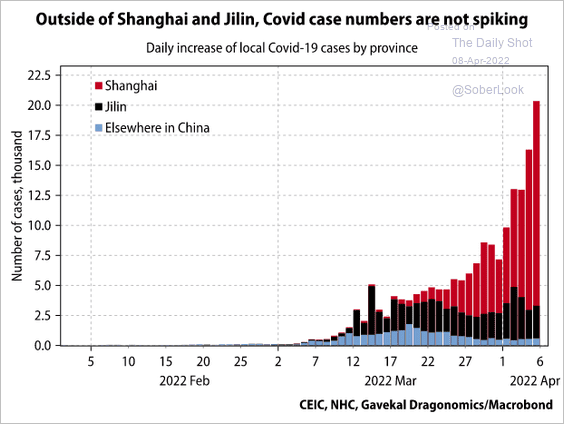

5. The spike in COVID cases seems to be limited to Shanghai and Jilin.

Source: Ernan Cui, Gavekal Research

Source: Ernan Cui, Gavekal Research

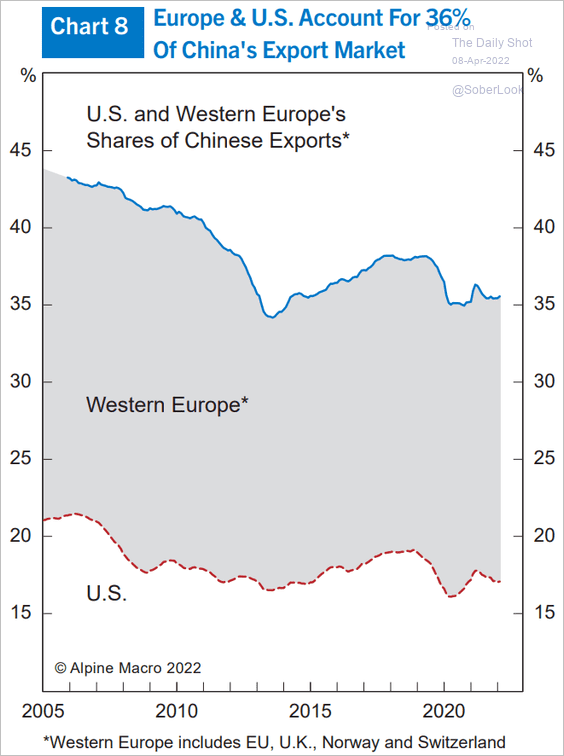

6. This chart shows China’s US and Western Europe export share.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

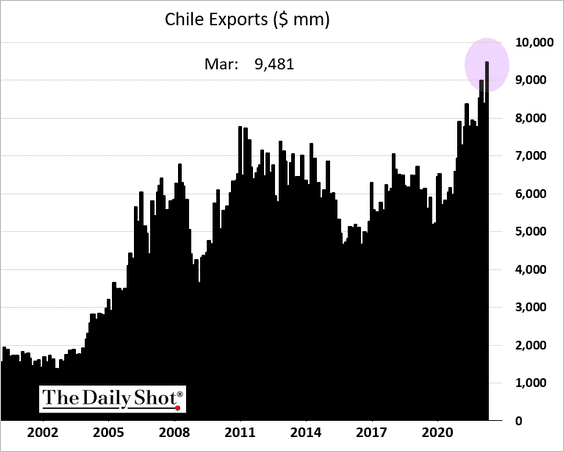

1. Chile’s exports hit a record high.

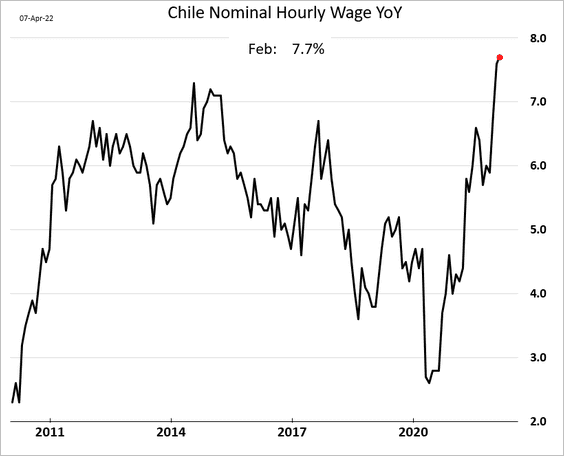

Wage growth accelerated further.

——————–

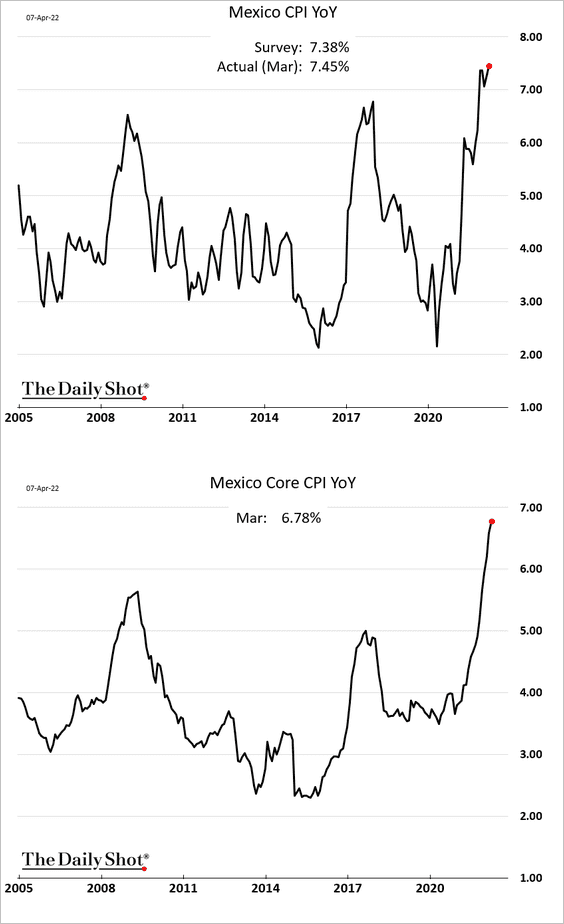

2. Mexico’s March inflation report was ugly.

3. Next, we have some updates on Russia.

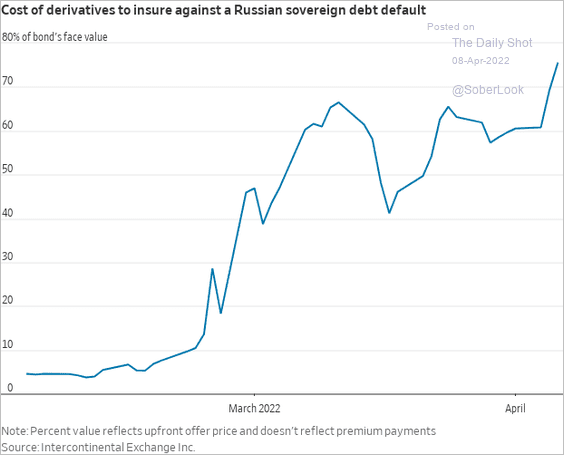

• Sovereign credit default upfront premium (on a 5yr CDS) climbed further after the US Treasury limited Russia’s ability to make payments on its debt.

Source: @WSJ Read full article

Source: @WSJ Read full article

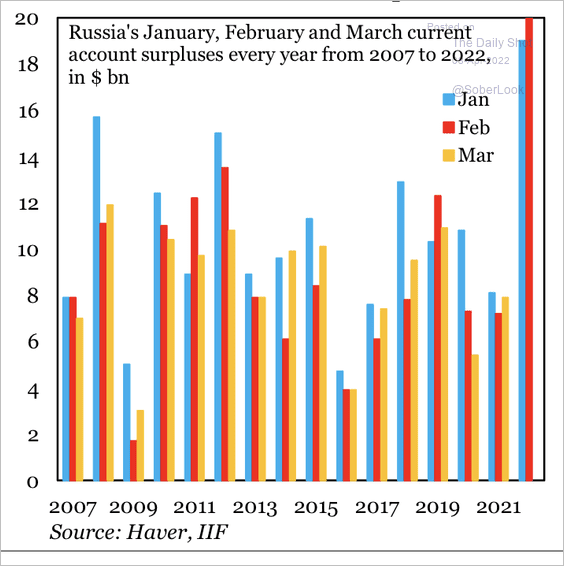

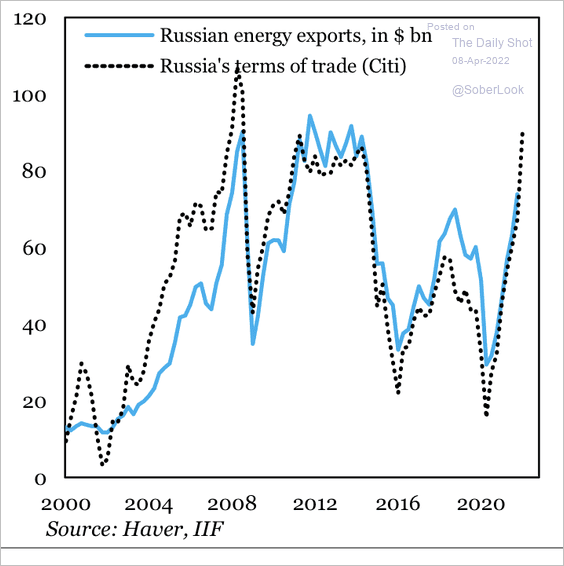

• Russia’s current account surplus surged, driven by rising energy prices that boosted its terms of trade (2 charts).

Source: IIF

Source: IIF

Source: IIF

Source: IIF

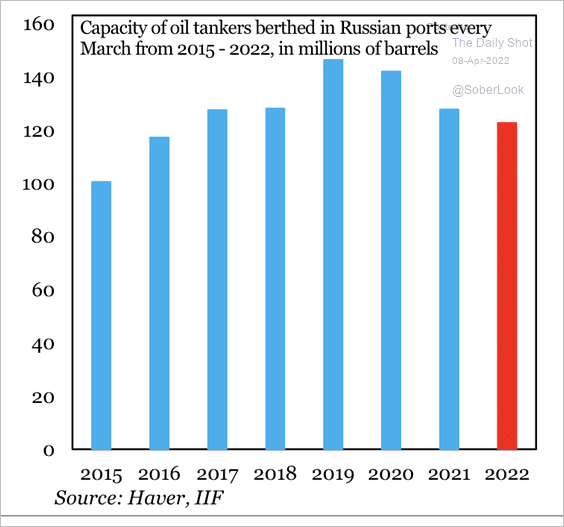

• Sanctions have partly offset gains from higher oil prices, although the capacity of oil tankers in Russian ports has fallen slightly.

Source: IIF

Source: IIF

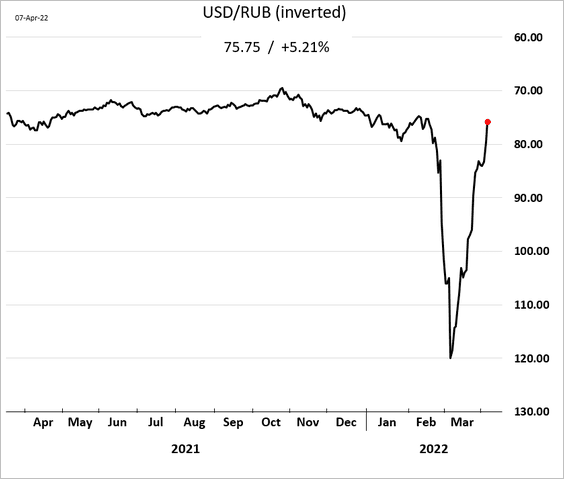

• The ruble has recovered to pre-war levels.

——————–

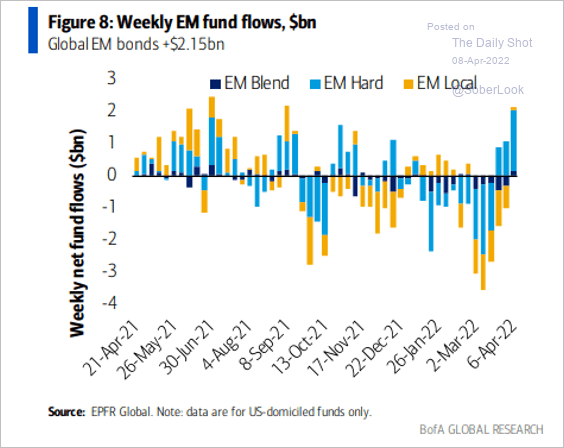

4. EM hard-currency bond fund inflows have accelerated.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

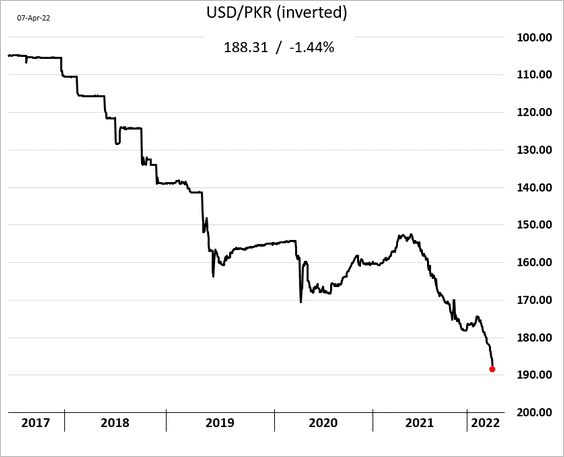

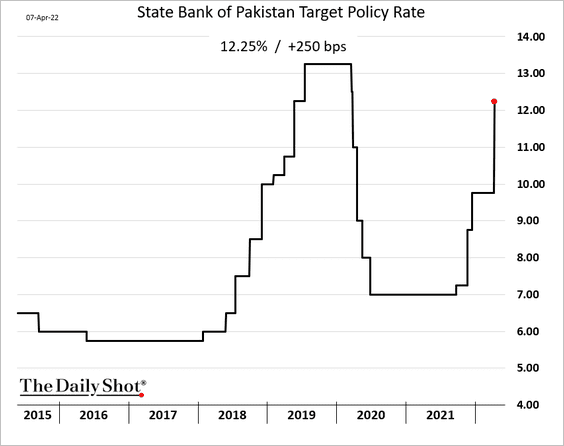

5. If you are scanning for geopolitical risks outside of the Russia-Ukraine war, it’s worth taking a look at Pakistan. Rising political uncertainty and shrinking foreign currency reserves sent the Pakistani rupee to record lows.

Source: Reuters Read full article

Source: Reuters Read full article

The central bank hiked rates by 250 bps to stem the decline.

Back to Index

Energy

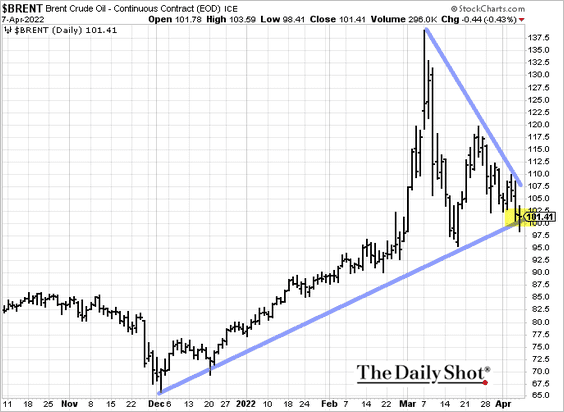

1. Brent crude is testing support.

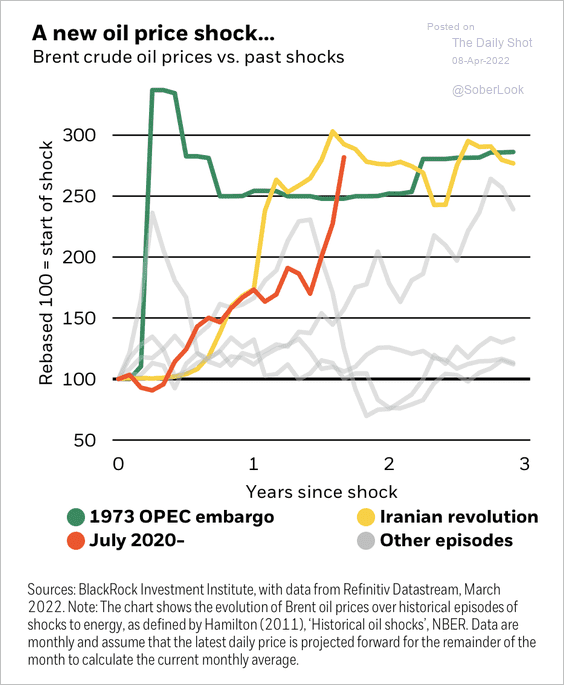

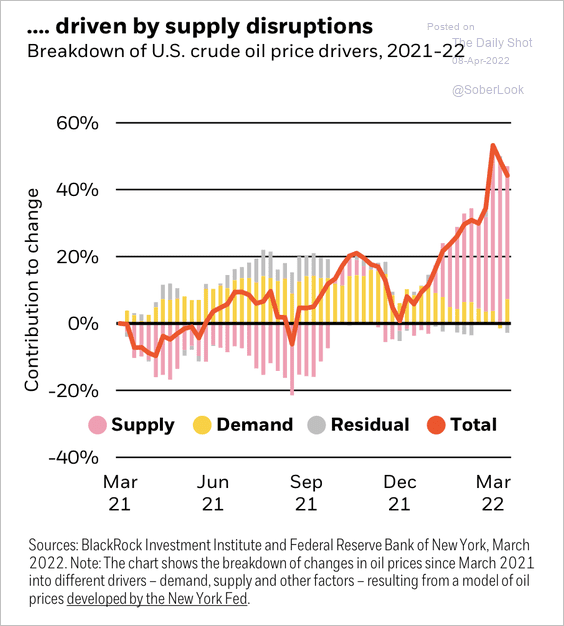

2. Unlike prior spikes, the current oil price shock was driven by a large supply/demand imbalance. By the way, solving for supply-driven inflation comes at the expense of slower economic growth, according to BlackRock (2 charts).

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

——————–

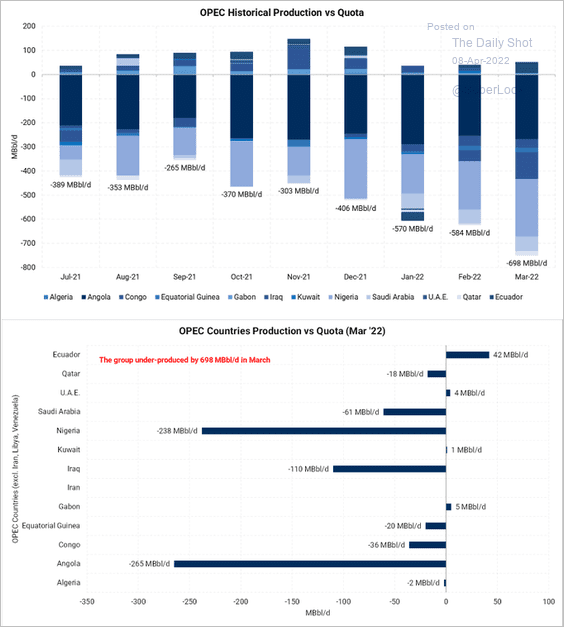

3. OPECs under-production has been worsening.

Source: @nhillman_energy

Source: @nhillman_energy

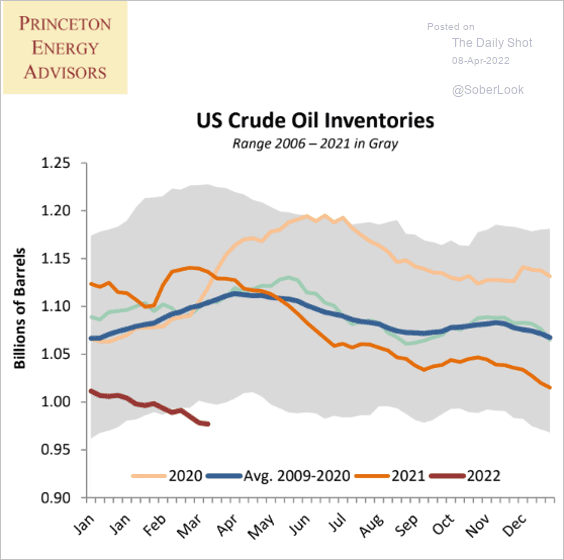

4. US crude oil inventories remain at multi-year lows.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

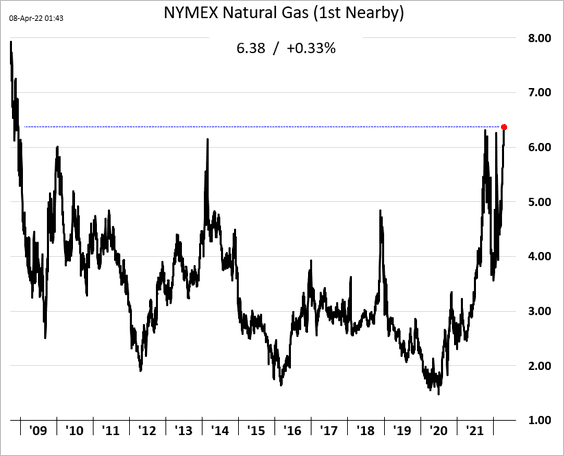

5. US natural gas futures hit the highest level since 2009, …

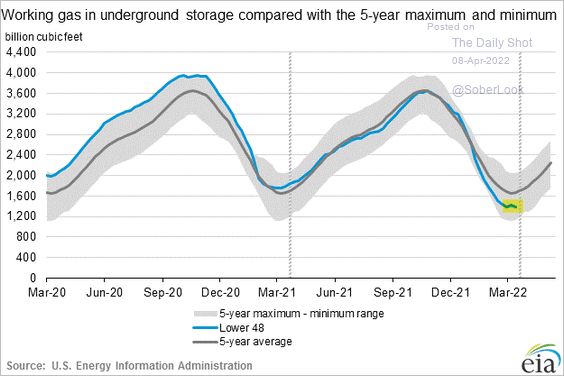

… as inventories surprised to the downside, …

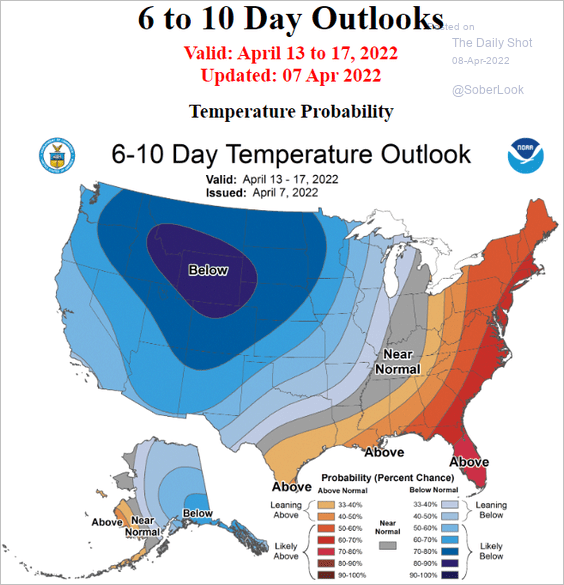

… and the western US is hit with colder-then-normal weather.

Source: NOAA

Source: NOAA

Back to Index

Equities

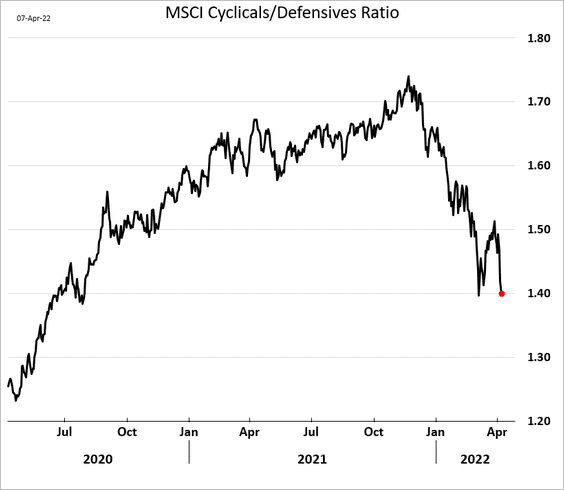

1. The March bounce in cyclical sectors was short-lived.

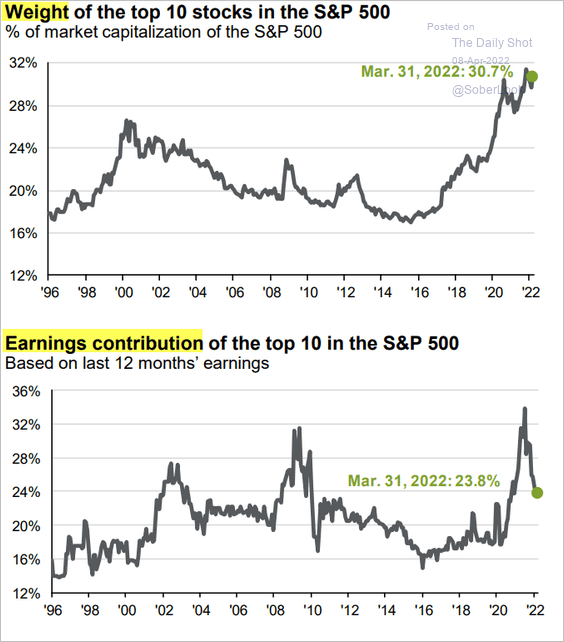

2. The top ten stocks in the S&P 500 remain above 30% of the market value, but the earnings contribution is declining.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

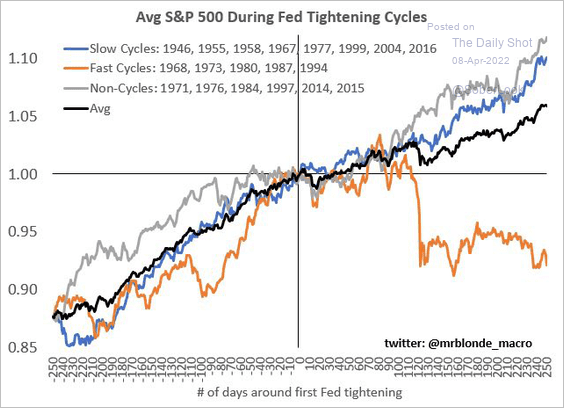

3. Fast Fed tightening cycles are not good for stocks.

Source: @MrBlonde_macro Read full article

Source: @MrBlonde_macro Read full article

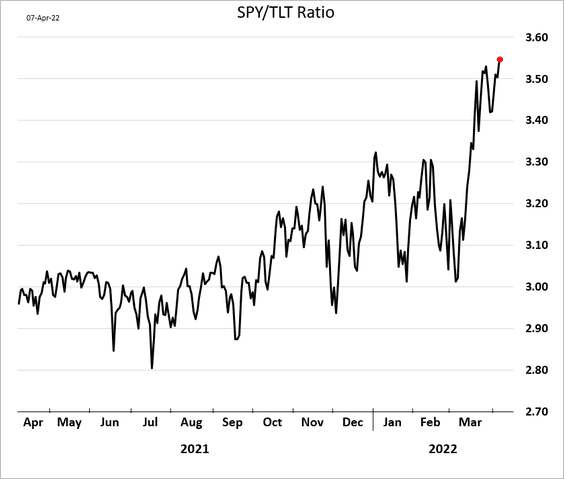

4. The S&P 500 (SPY) ratio to long-term Treasuries (TLT) hit a new high.

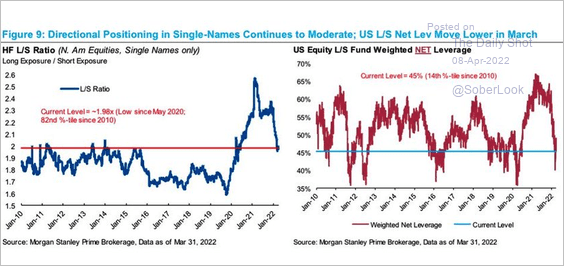

5. Hedge funds have been cutting their exposure to stocks, …

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

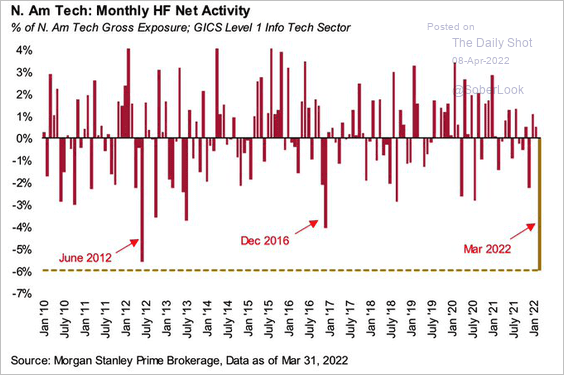

… particularly, tech.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

——————–

6. Next, we have some sector trends.

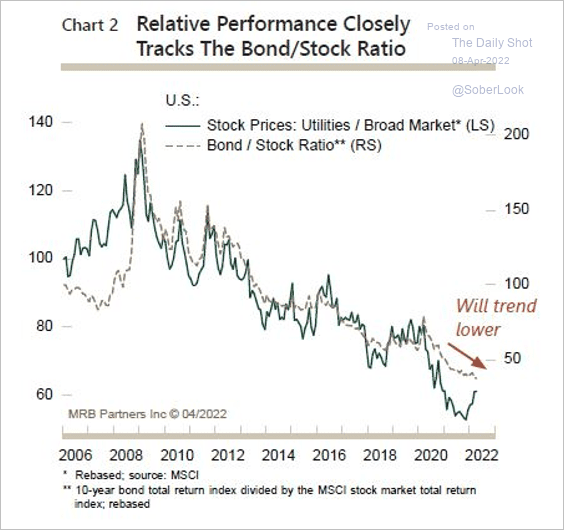

• Over the long run, the relative performance of the US utilities sector has tracked the bond/stock ratio.

Source: MRB Partners

Source: MRB Partners

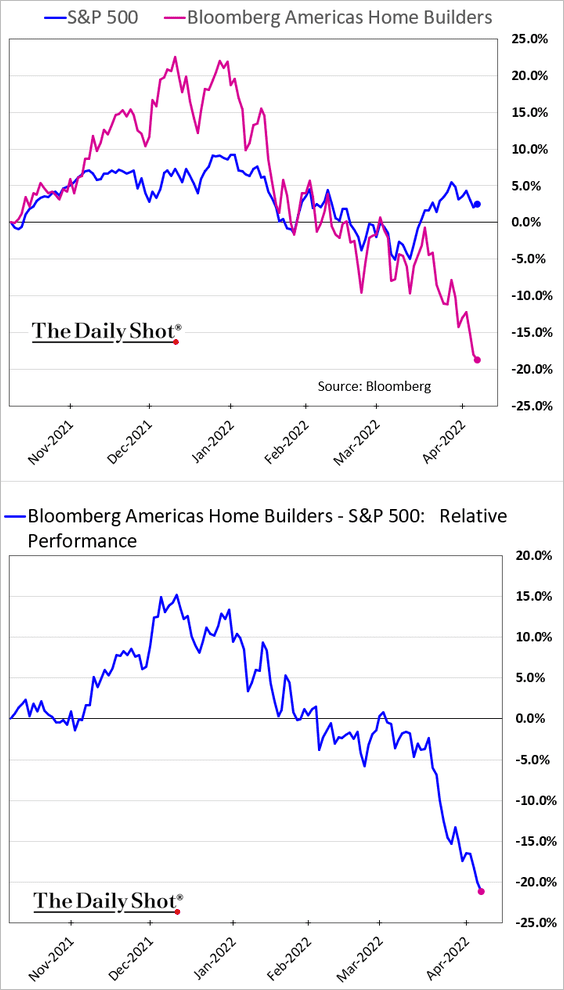

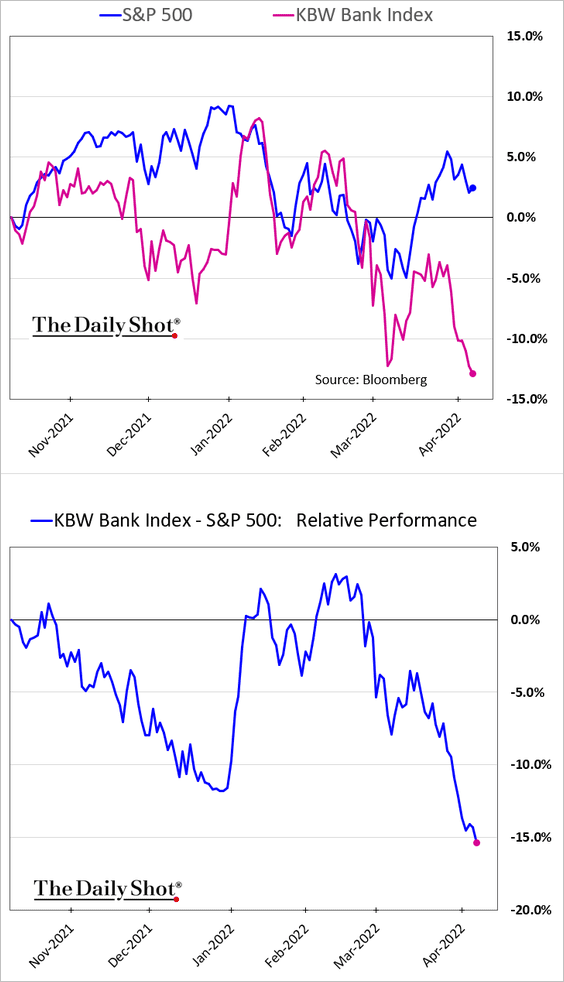

• Homebuilders are now down more than 20% vs. the S&P 500 over the past six months.

• Banks are underperforming the S&P 500 by over 15%.

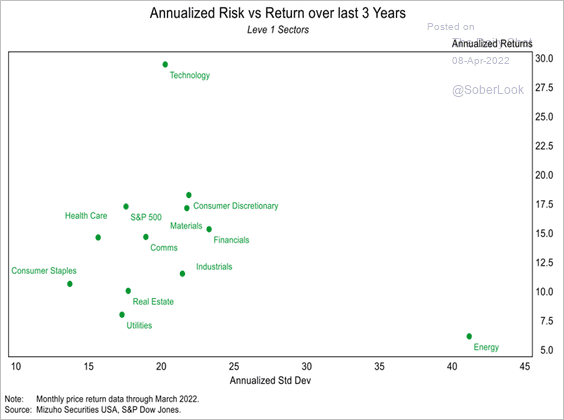

• Here is the risk/return profile across US sectors.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Back to Index

Rates

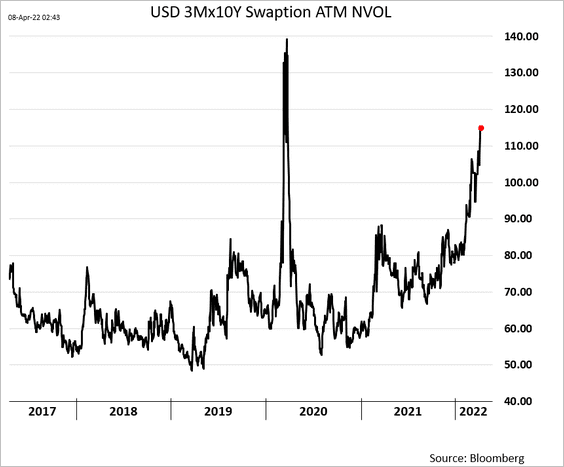

Implied volatility keeps climbing.

Back to Index

Global Developments

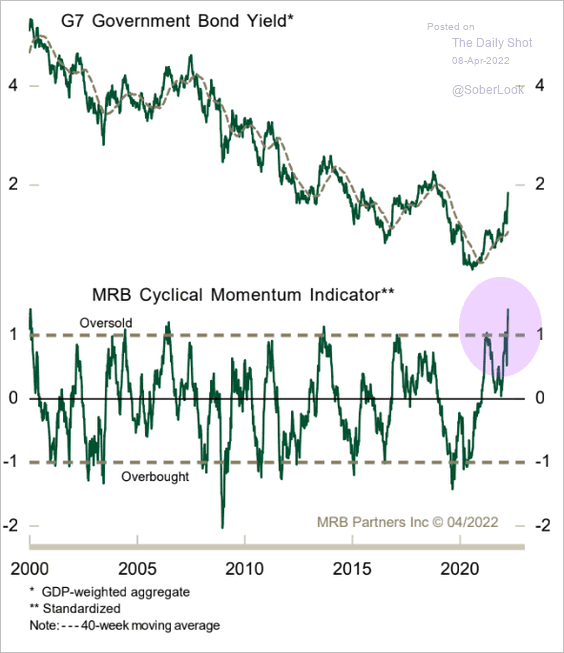

1. Technical indicators suggest that G7 government bonds are oversold.

Source: MRB Partners

Source: MRB Partners

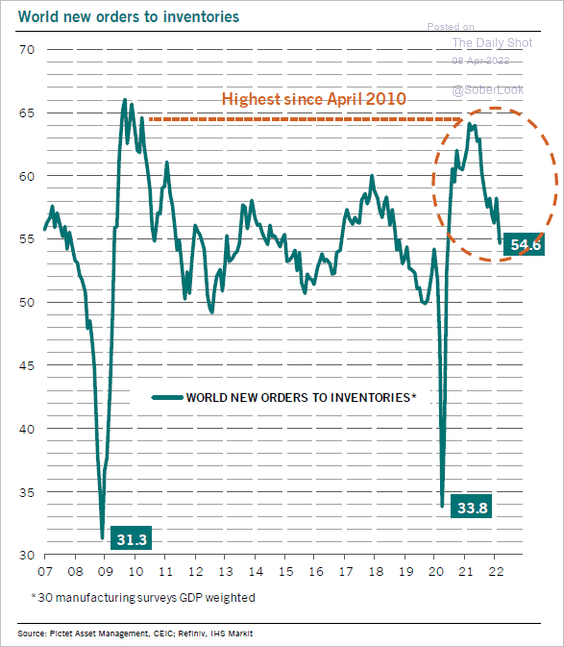

2. The global PMI orders-to-inventories indicator points to a slowdown in economic activity ahead.

Source: @RollinFrederic, @PkZweifel

Source: @RollinFrederic, @PkZweifel

——————–

Food for Thought

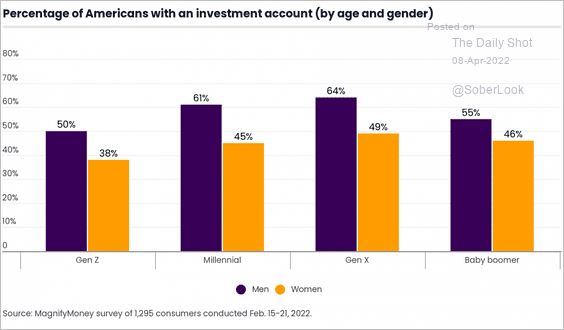

1. Americans with an investment account:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

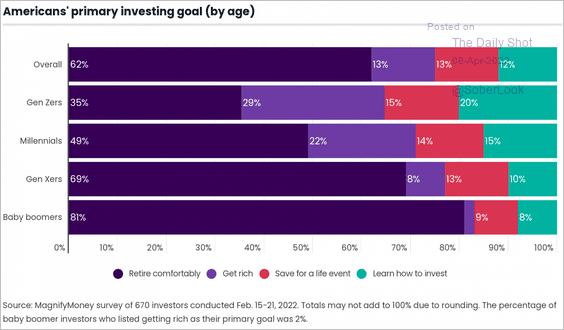

• Primary investing goal:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

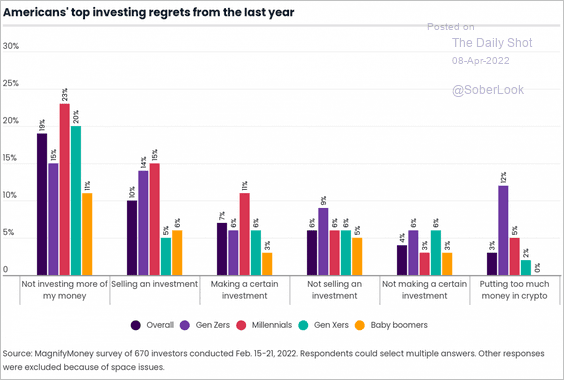

• Americans’ top investing regrets:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

——————–

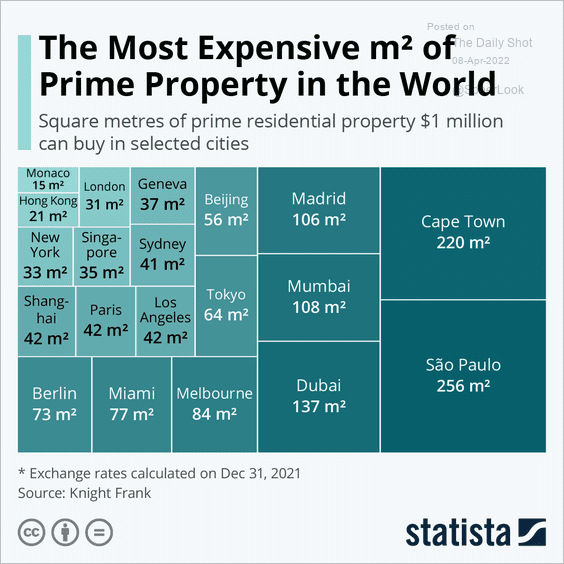

2. Square meters of prime property that can be purchased for $1 million:

Source: Statista

Source: Statista

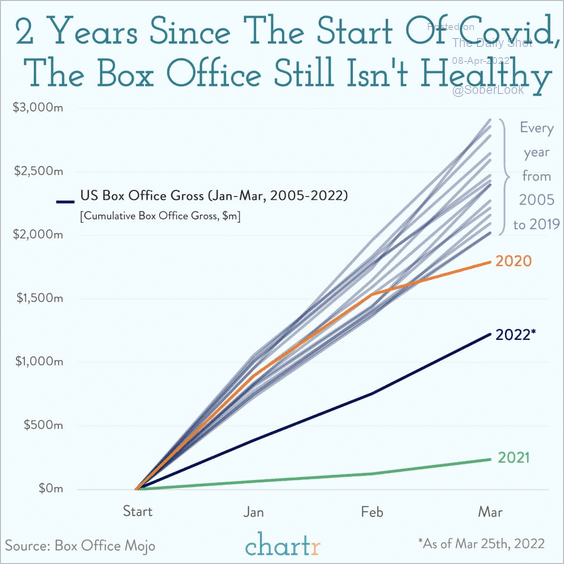

3. US box office proceeds:

Source: @chartrdaily Read full article

Source: @chartrdaily Read full article

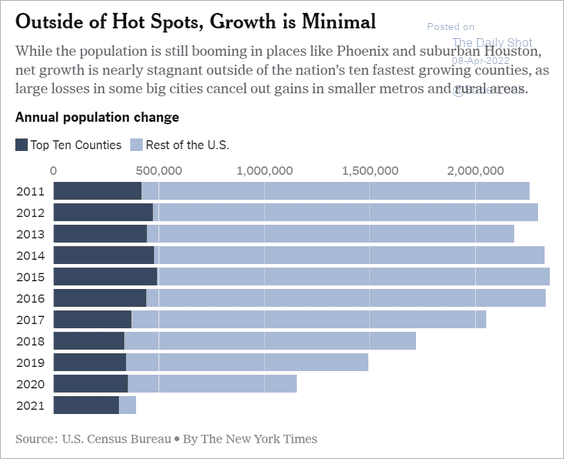

4. US population growth outside of large metro areas:

Source: The New York Times Read full article

Source: The New York Times Read full article

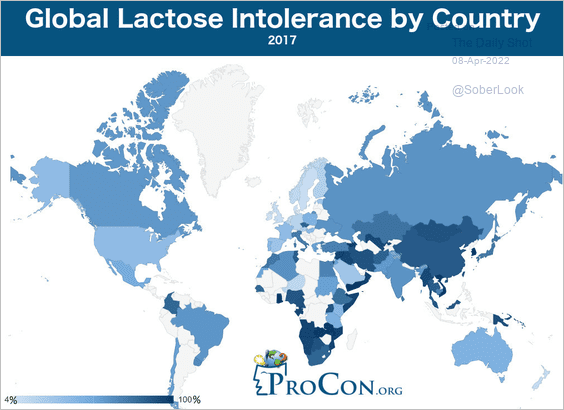

5. Lactose intolerance globally:

Source: ProCon Read full article

Source: ProCon Read full article

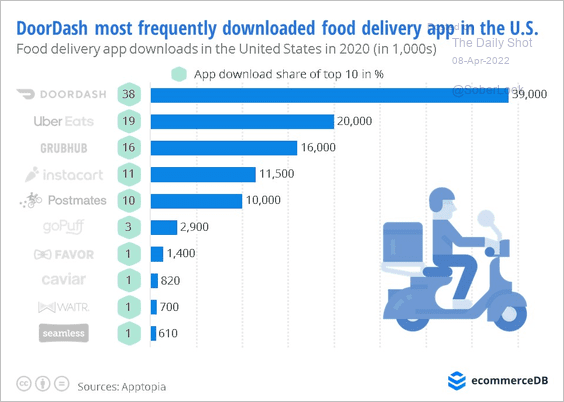

6. Food delivery apps:

Source: EcommerceDB Read full article

Source: EcommerceDB Read full article

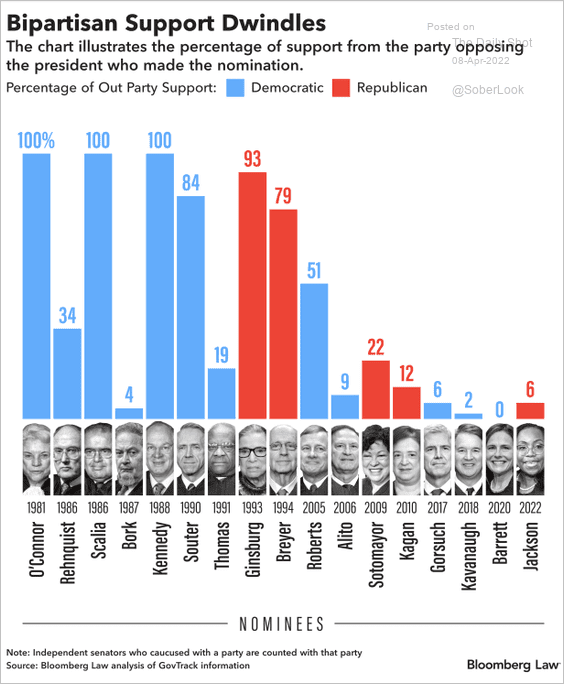

7. Support from the opposing party for Supreme Court nominees:

Source: @madialder Read full article

Source: @madialder Read full article

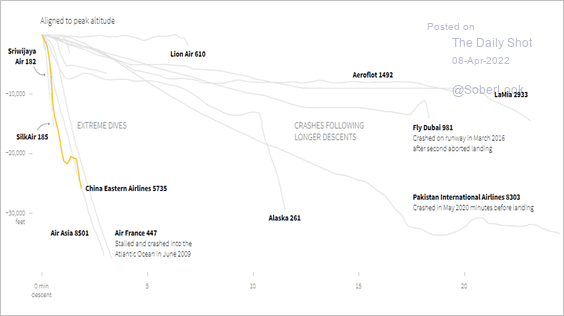

8. China Eastern Airlines flight MU5735 compared to other crash profiles:

Source: Reuters Read full article

Source: Reuters Read full article

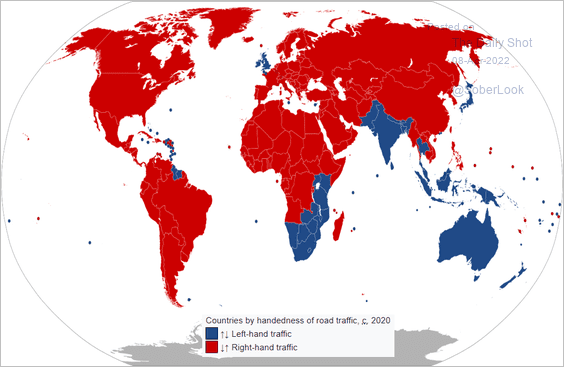

9. Left- and right-hand traffic:

Source: Wikipedia Read full article

Source: Wikipedia Read full article

——————–

Have a great weekend!

Back to Index