The Daily Shot: 13-Apr-22

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

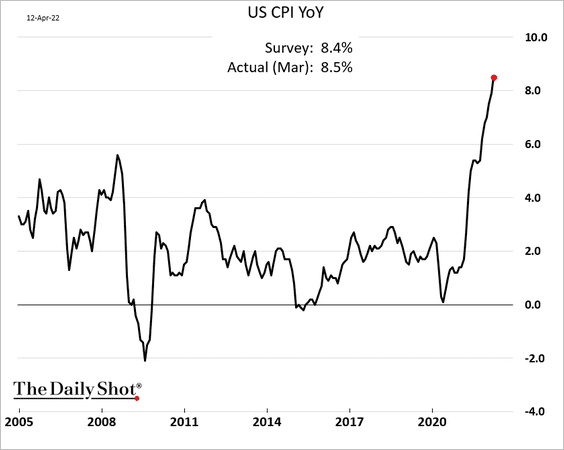

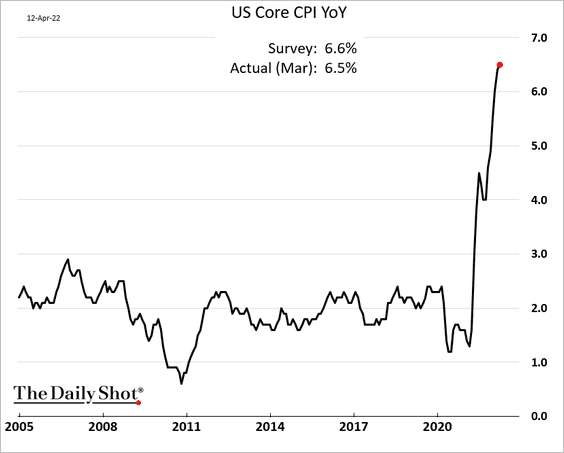

1. Consumer inflation reached a multi-decade high, …

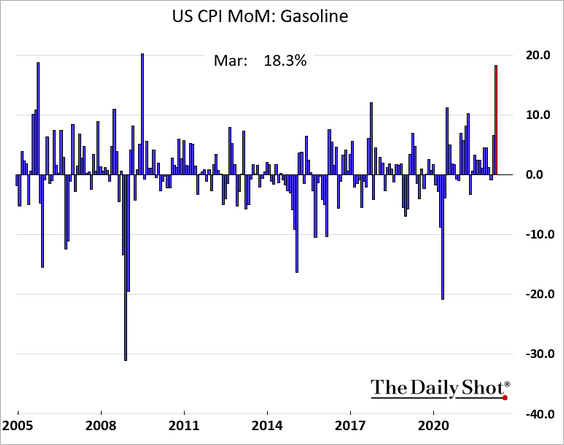

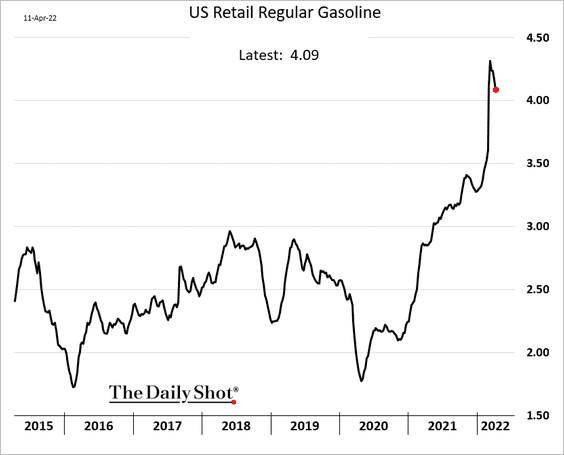

… with the headline CPI boosted by a surge in gasoline prices last month.

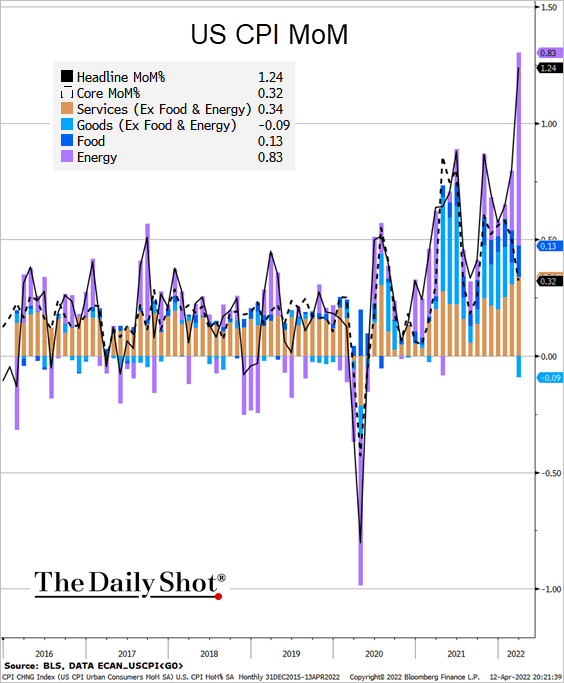

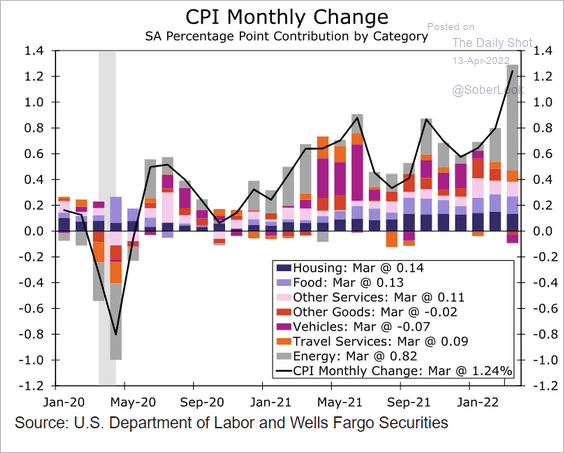

Here are the contributions on a month-over-month basis (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

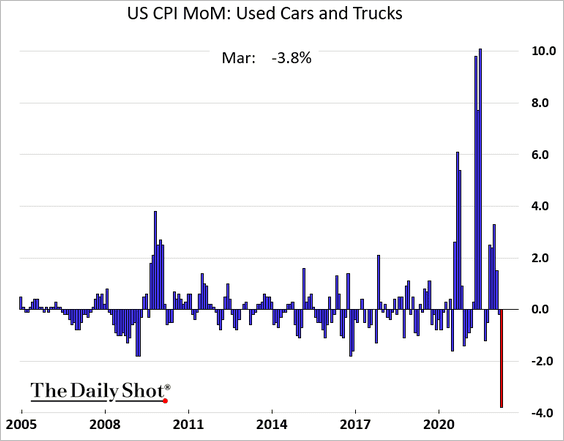

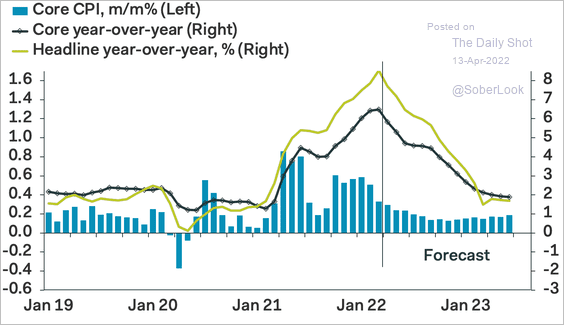

• The core CPI gain was a bit less severe than expected, …

… as used car prices dropped. Used vehicle prices could continue to move lower, becoming a drag on the core CPI in the months ahead.

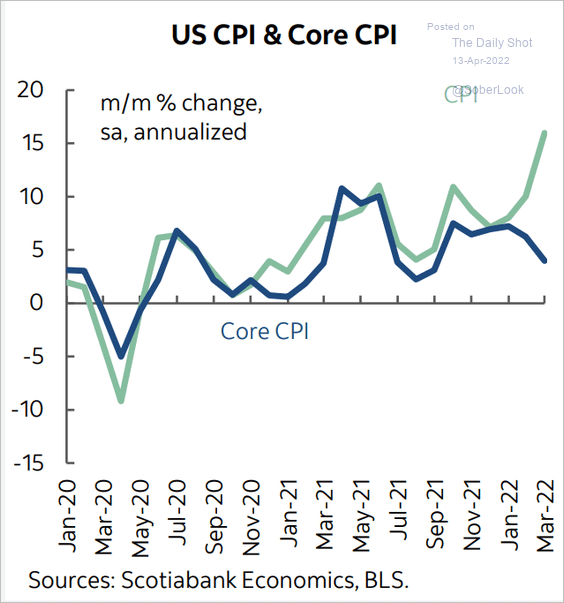

On a month-over-month basis, the core and the headline CPI measures have diverged. The market saw slower core CPI gains as a hopeful sign.

Source: Scotiabank Economics

Source: Scotiabank Economics

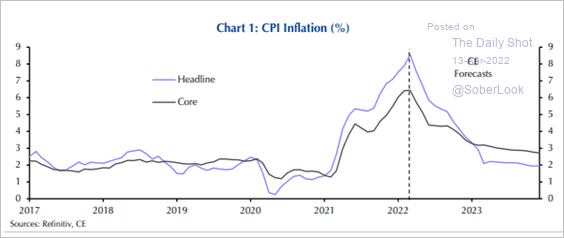

• Assuming gasoline price gains moderate going forward, …

… the year-over-year CPI growth peaked in March. The question is how long will it take for inflation to get back to the Fed’s 2% target. Here are a couple of forecasts.

– Pantheon Macroeconomics:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

– Capital Economics:

Source: Capital Economics

Source: Capital Economics

We will have more on the CPI report later.

——————–

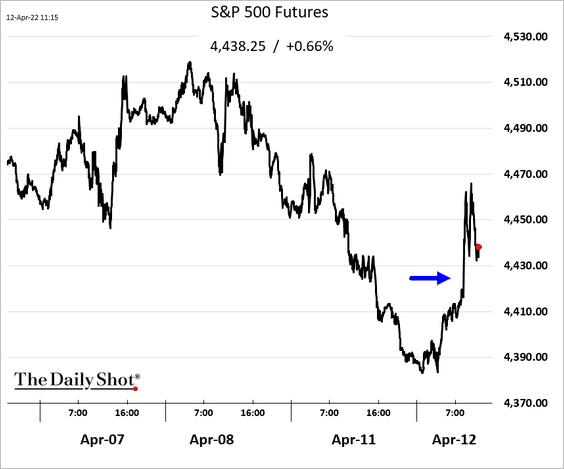

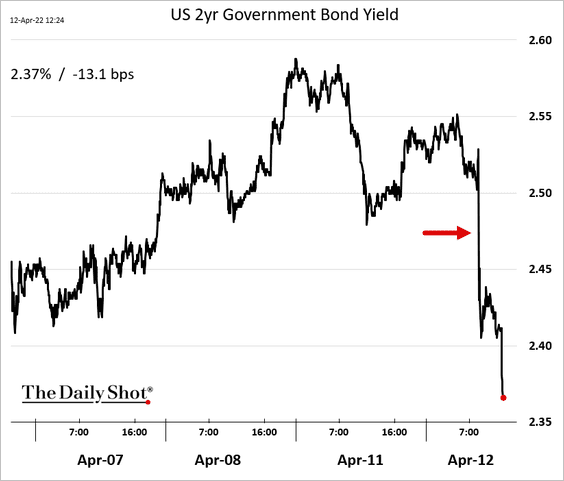

2. The market saw some hopeful signs in the inflation report, as monthly gains in the core CPI slowed.

• Stocks futures climbed, albeit temporarily.

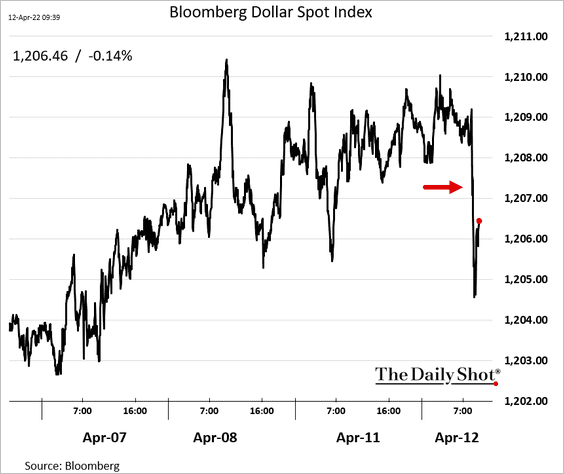

• Treasury yields and the dollar declined, …

… although the dollar resumed its rally this morning. A stronger US dollar should help ease inflationary pressures.

——————–

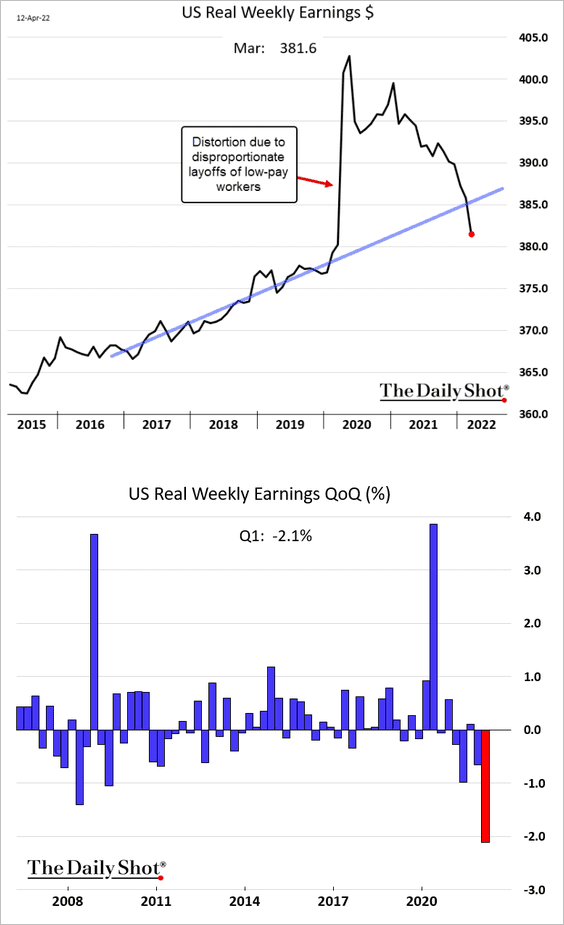

3. Degraded by inflation, real wages were down sharply last quarter.

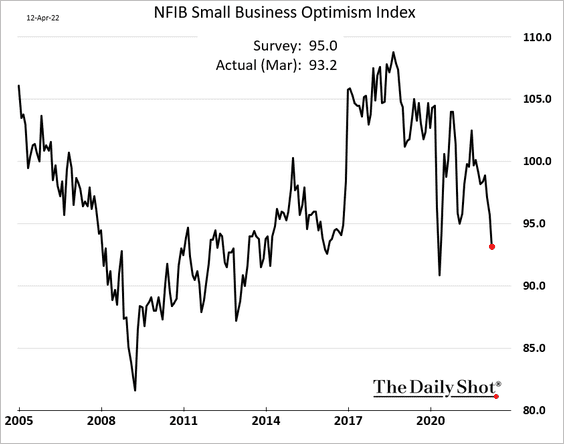

4. The NFIB small business sentiment index showed further deterioration last month.

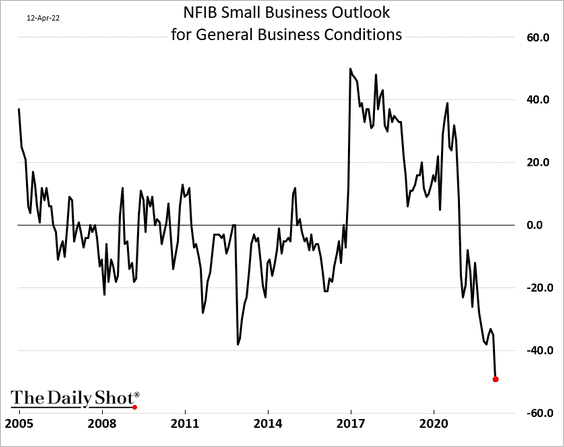

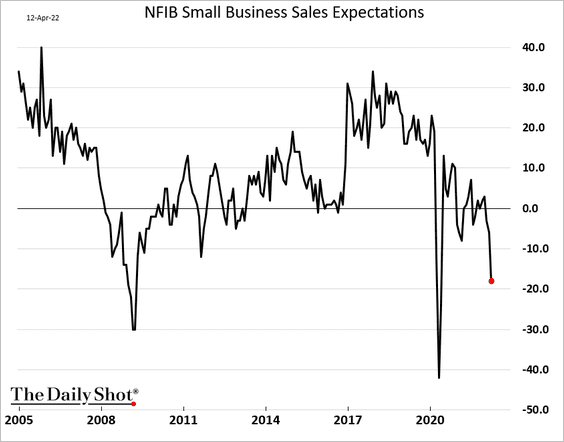

• Outlook indicators plunged.

– Business conditions:

– Sales expectations:

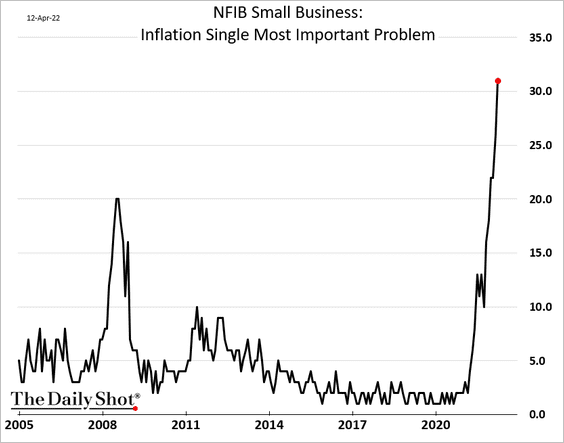

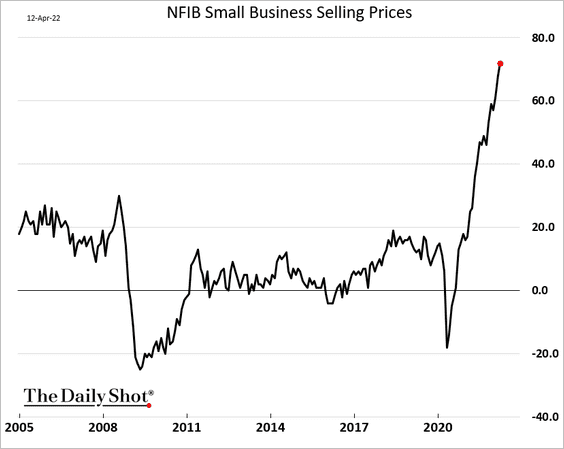

The above trends have been in response to surging inflation.

• The percentage of businesses boosting prices hit another record high.

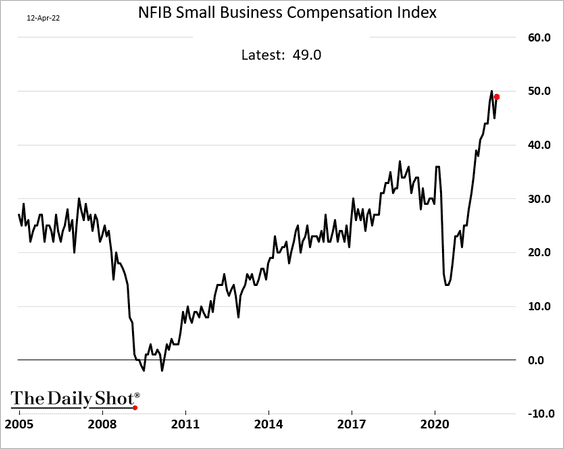

• The compensation index is also near the highs.

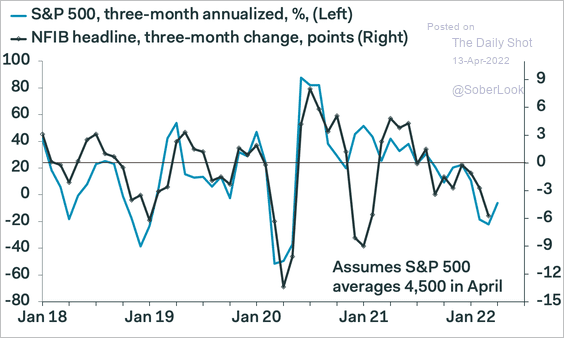

By the way, the NFIB business sentiment index is highly correlated with the stock market.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

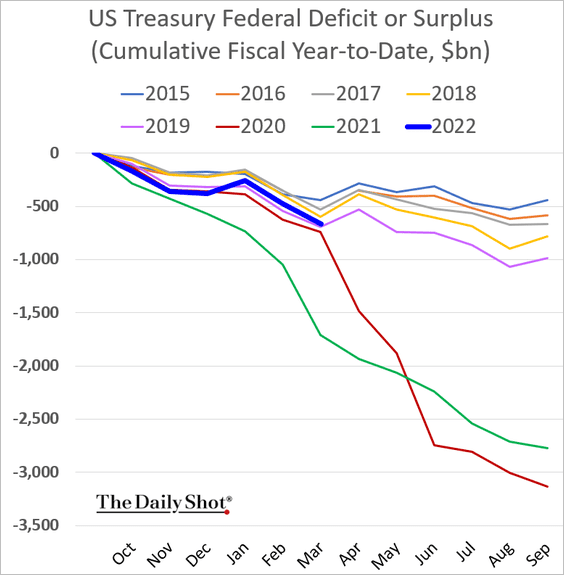

5. The federal deficit is running roughly in line with 2019 levels.

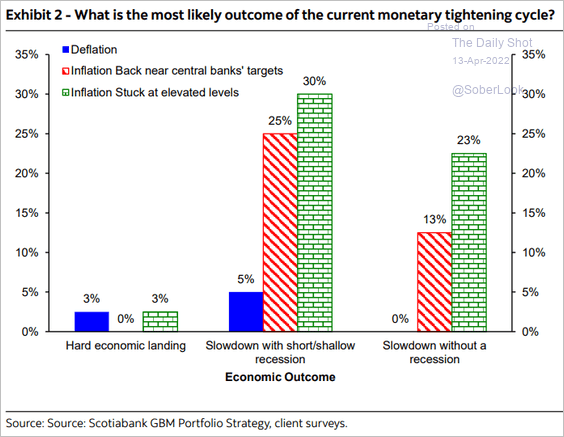

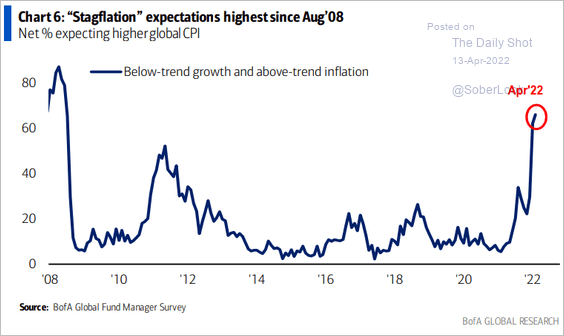

7. Investors increasingly see stagflation as a likely outcome (2 charts).

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: BofA Global Research

Source: BofA Global Research

Back to Index

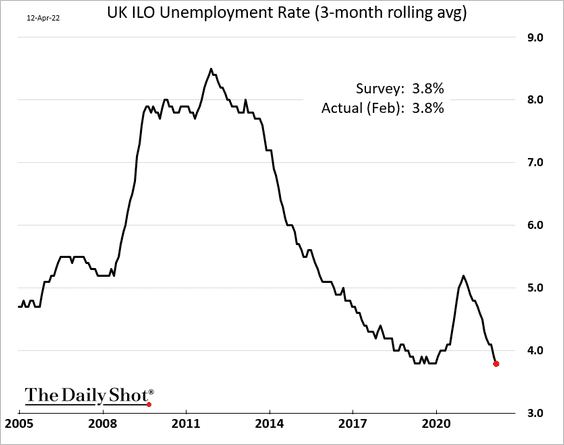

The United Kingdom

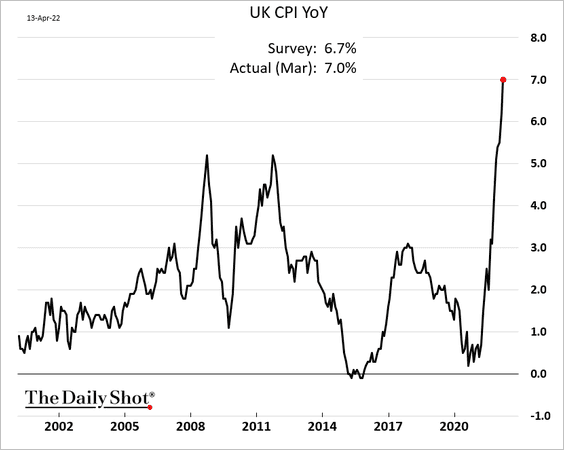

1. The CPI hit 7%, topping forecasts. We will have more on the inflation report tomorrow.

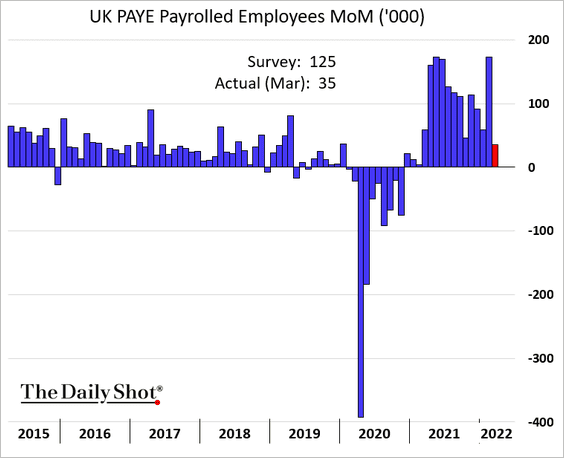

2. Payroll gains were softer than expected in March.

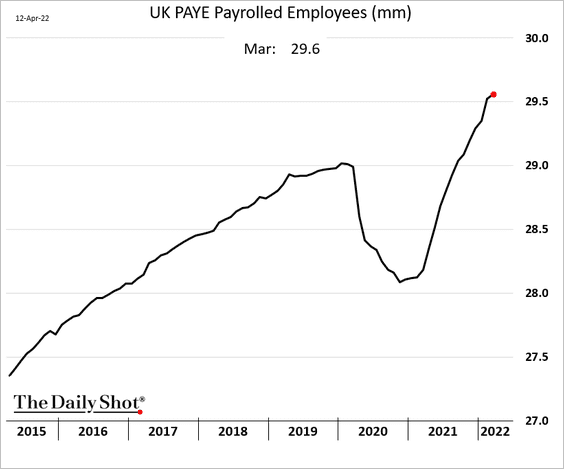

But the trend in job growth remains robust.

Here is the unemployment rate.

——————–

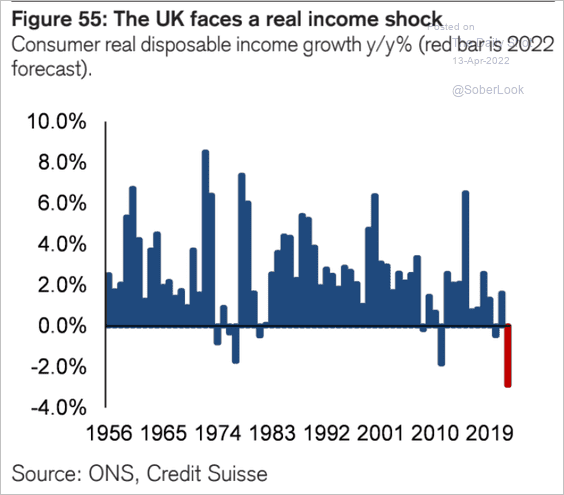

3. Real disposable income is expected to deteriorate sharply this year due to surging prices.

Source: Credit Suisse

Source: Credit Suisse

Back to Index

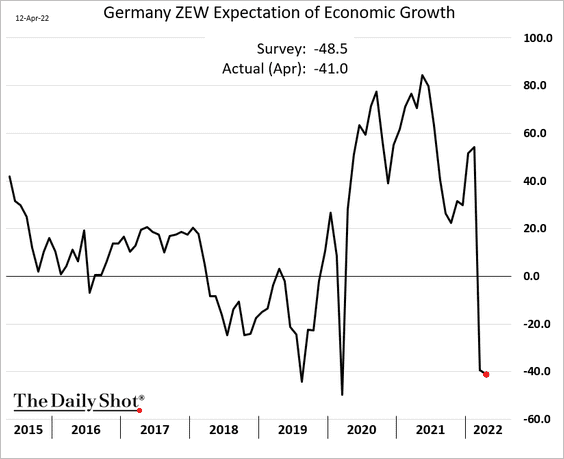

The Eurozone

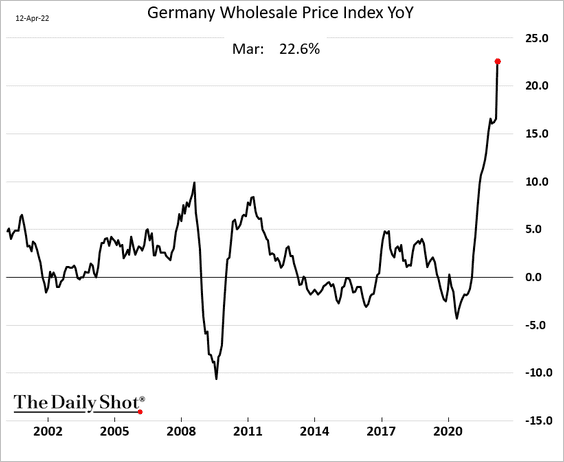

1. Let’s begin with Germany.

• The ZEW expectations index declined less than forecast this month.

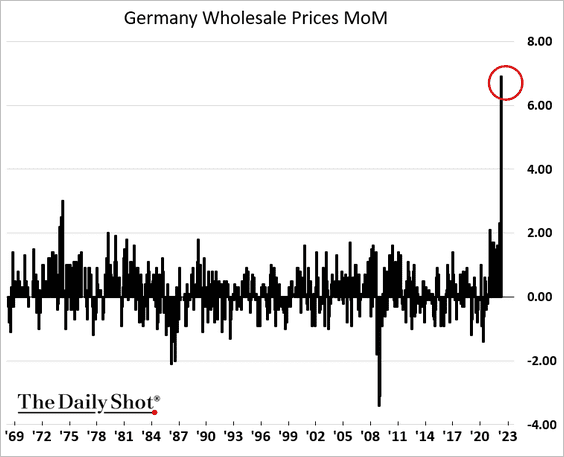

• Wholesale prices are soaring.

Here are the monthly changes.

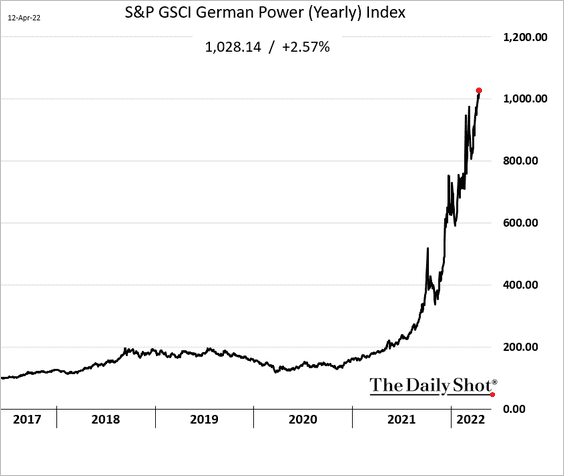

Surging electricity costs will maintain upward pressure on wholesale prices.

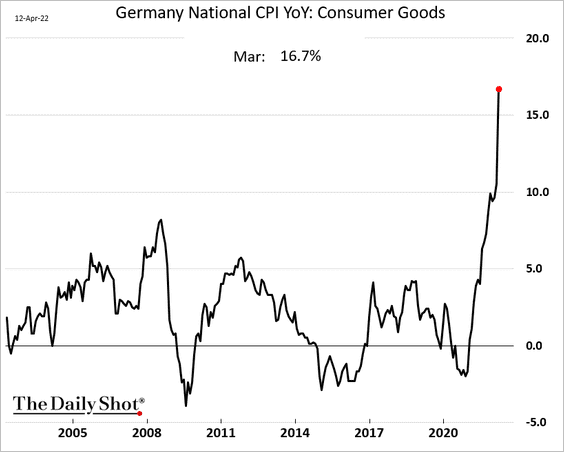

• Consumer goods prices (a component of the CPI) are up almost 17% vs. last year.

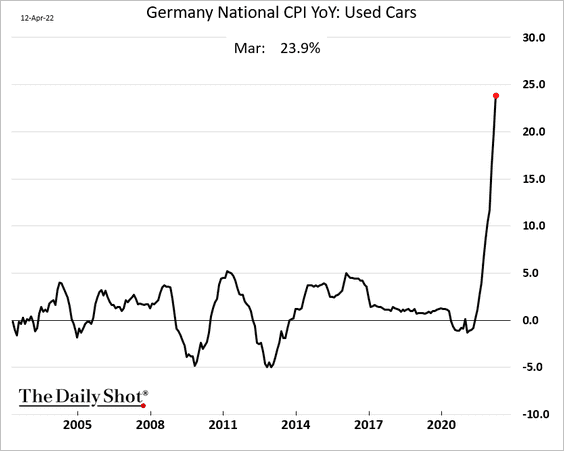

Used car prices are up nearly 24%.

——————–

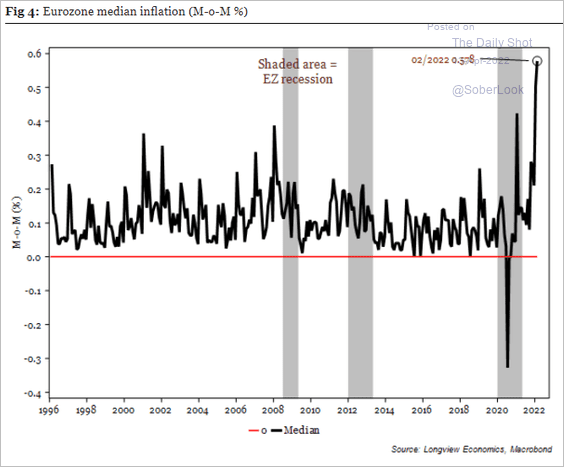

2. Here are the monthly changes in the Eurozone median inflation.

Source: Longview Economics

Source: Longview Economics

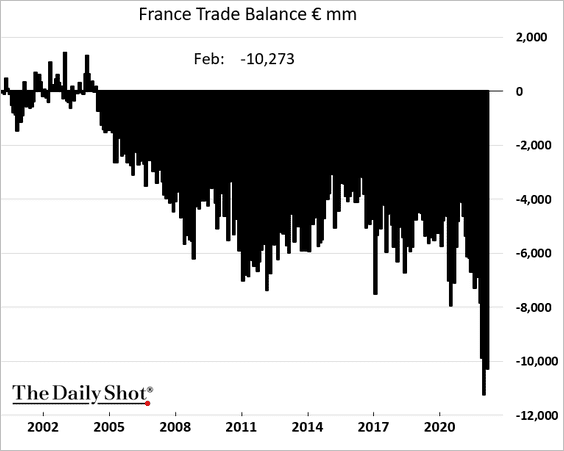

3. The French trade deficit remains near record levels amid surging energy prices.

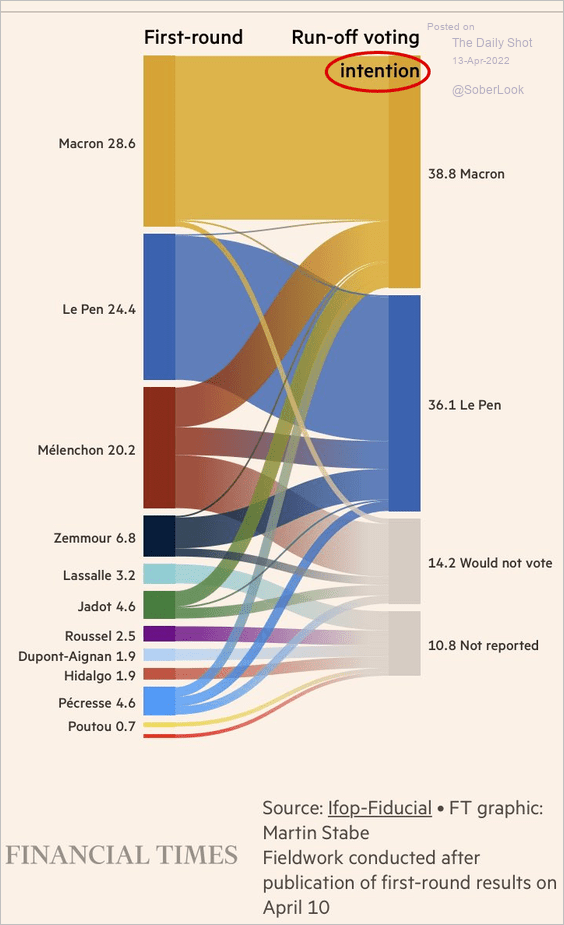

The run-off election in France is going to be tight.

Source: @ChassNews, @FT

Source: @ChassNews, @FT

Back to Index

Asia – Pacific

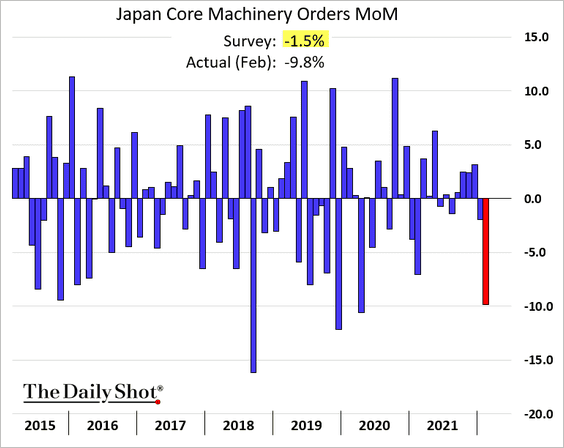

1. Japan’s core machinery orders tumbled in February, clouding the outlook for business investment.

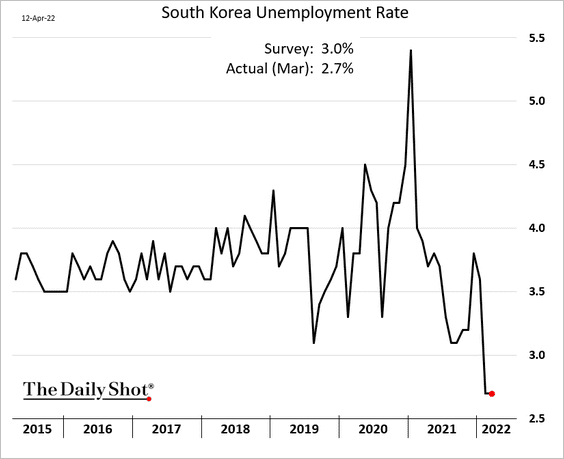

2. South Korea’s unemployment rate remains extremely low.

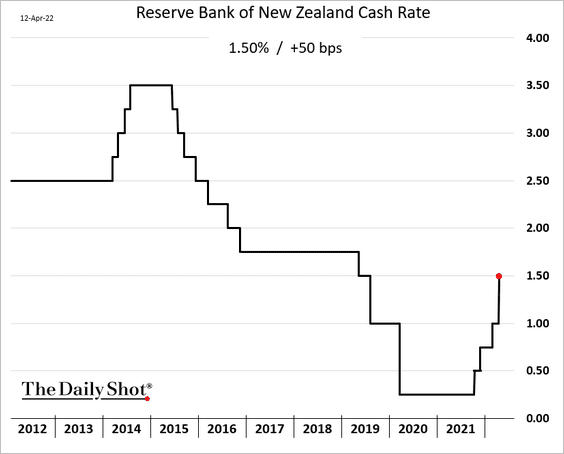

3. The RBNZ hiked rates by 50 bps, surprising the market (which expected 25 bps).

Source: @WSJ Read full article

Source: @WSJ Read full article

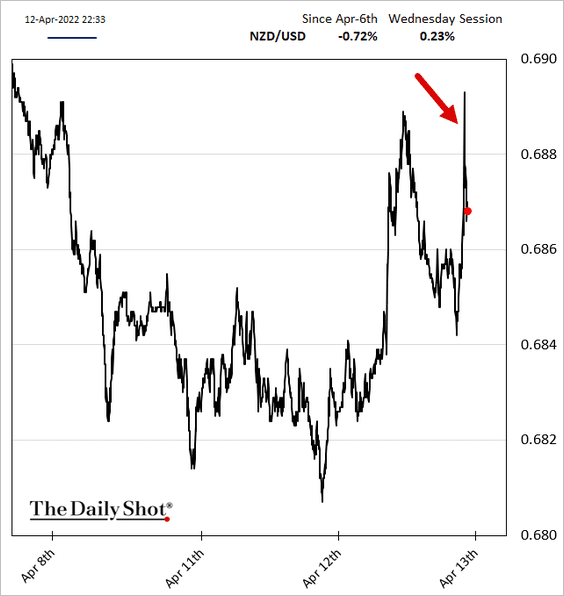

The Kiwi dollar jumped but retreated shortly after.

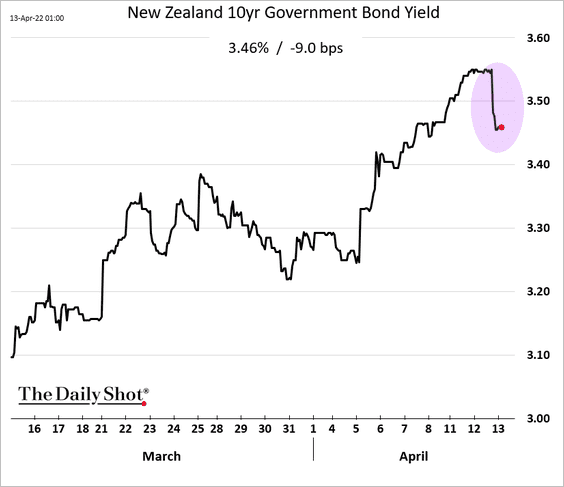

New Zealand’s bond yields dropped.

——————–

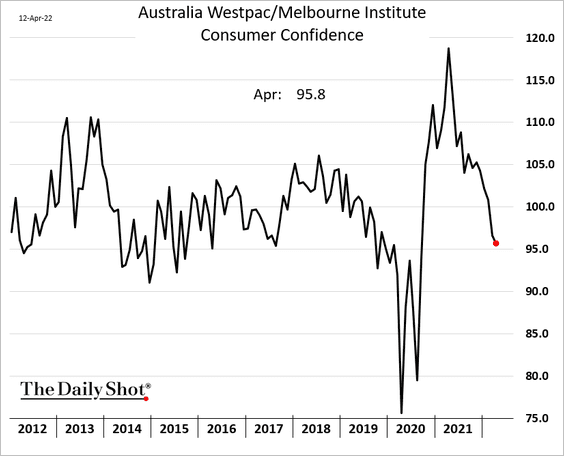

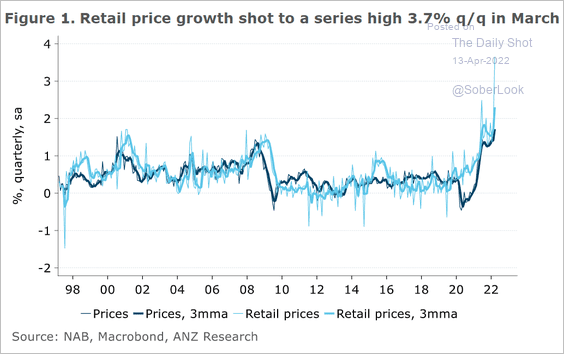

4. Australia’s consumer confidence remains soft, according to Westpac’s index.

Retail price growth hit a multi-decade high in March.

Source: ANZ Research

Source: ANZ Research

Back to Index

China

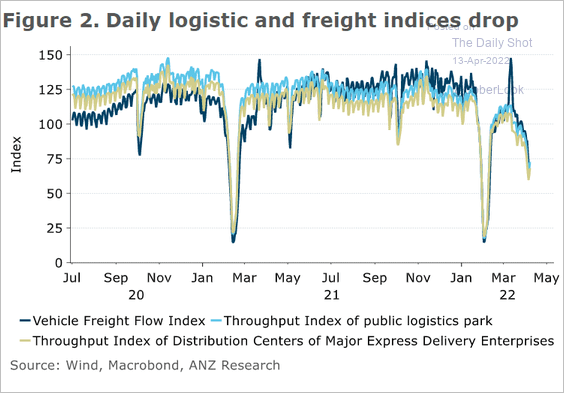

1. Logistics/freight indicators remain depressed due to lockdowns.

Source: ANZ Research

Source: ANZ Research

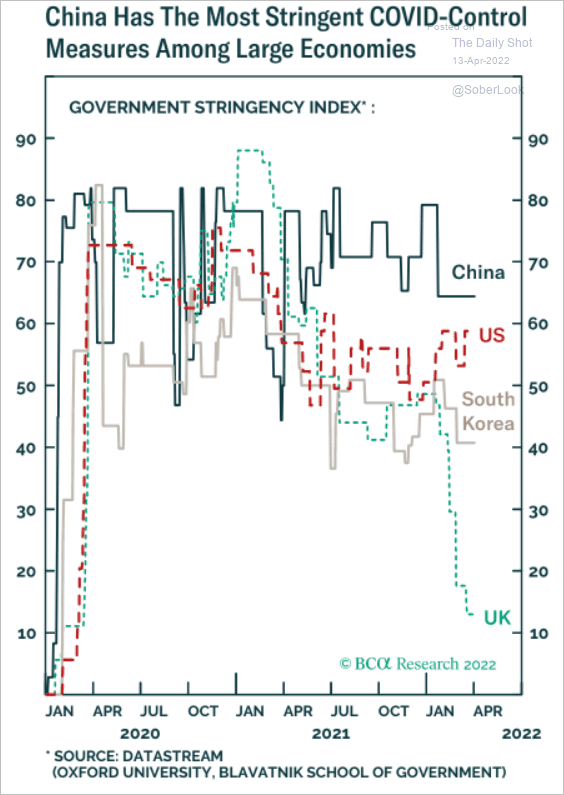

China’s COVID restrictions are more stringent than in other countries.

Source: BCA Research

Source: BCA Research

——————–

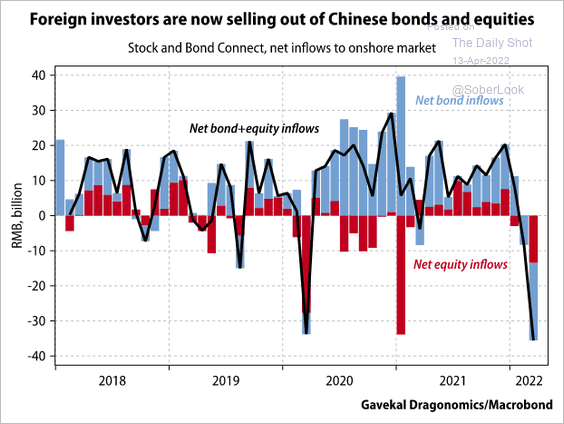

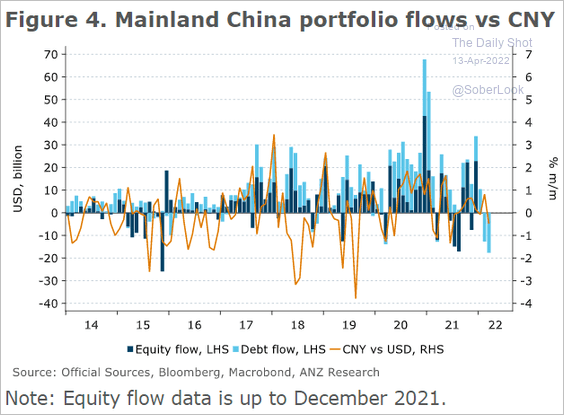

2. Foreign investors have been selling China’s stocks and bonds.

Source: Gavekal Research

Source: Gavekal Research

Source: ANZ Research

Source: ANZ Research

——————–

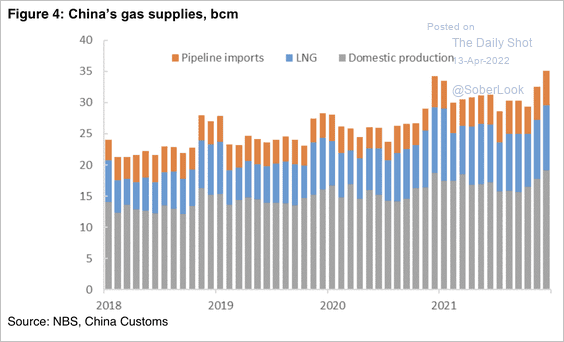

3. LNG imports have risen over the past few years, although pipeline supplies are failing to keep up, according to OIES.

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

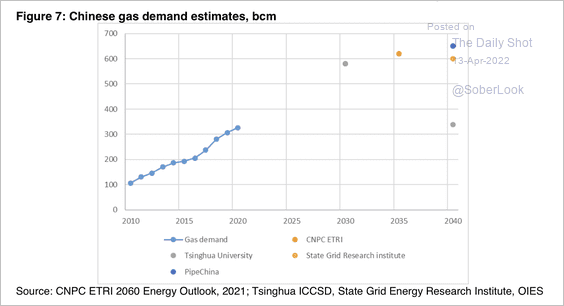

Estimates of China’s future gas demand vary widely.

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

Back to Index

Emerging Markets

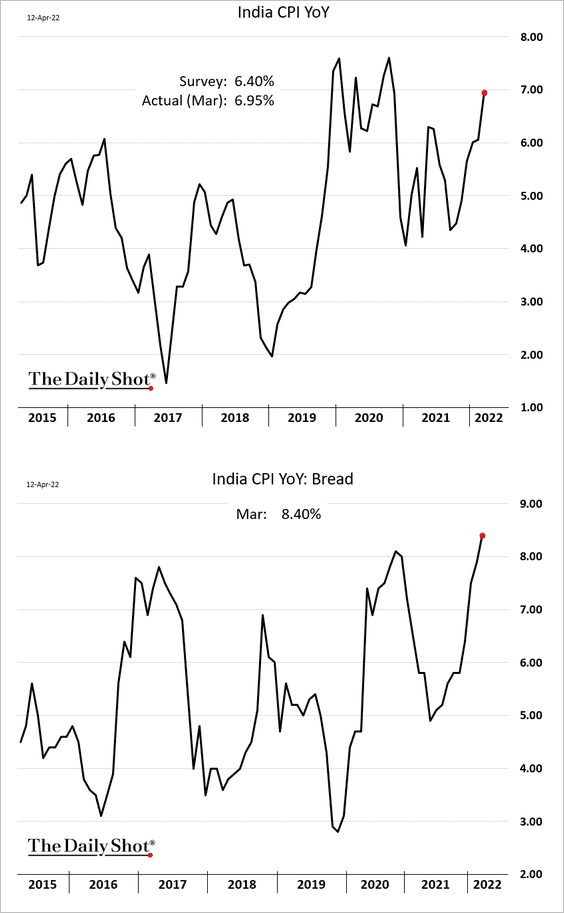

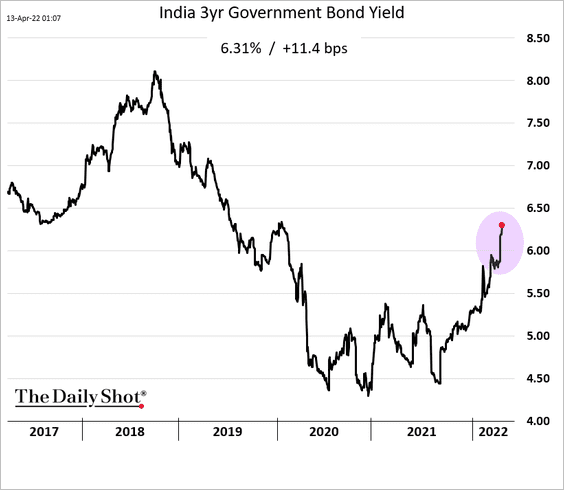

1. India’s CPI surprised to the upside.

Bond yields jumped.

Indian industrial production was softer than expected in February.

——————–

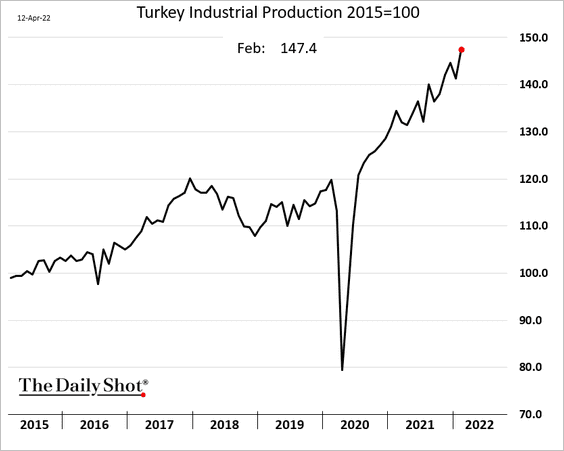

2. Turkey’s industrial output continues to surge.

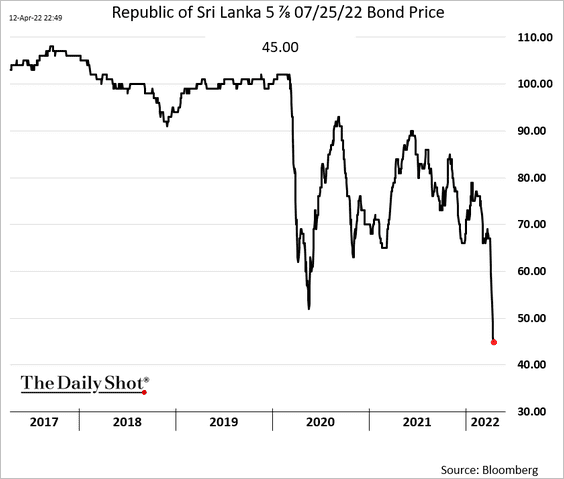

3. Sri Lanka is defaulting on its foreign debt.

Source: NPR Read full article

Source: NPR Read full article

Back to Index

Cryptocurrency

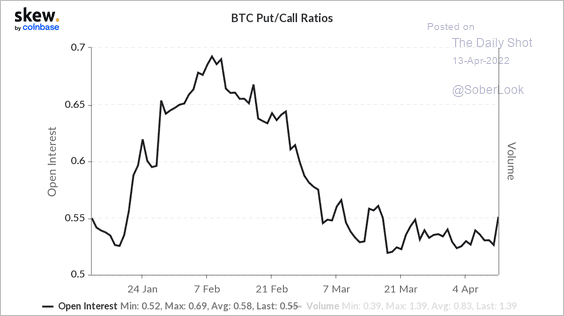

1. Bitcoin’s put/call ratio ticked higher during the recent price dip.

Source: Skew Read full article

Source: Skew Read full article

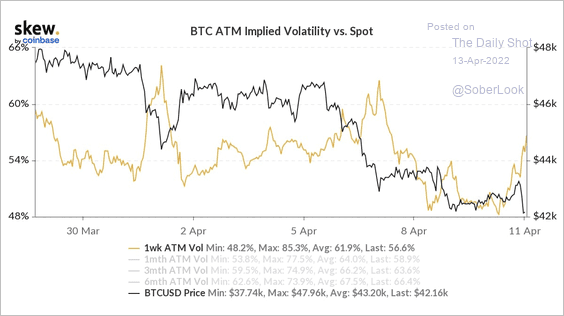

2. Bitcoin’s front-month volatility has been moving inversely with price, which is one reason why traders have demanded downside protection.

Source: Skew Read full article

Source: Skew Read full article

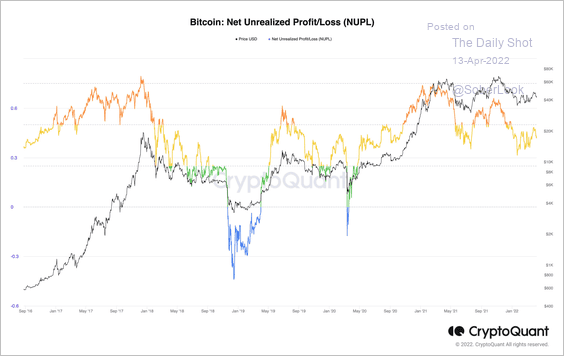

3. This chart shows the difference between unrealized profit and unrealized losses (NUPL) among bitcoin traders, according to data recorded on the blockchain. The indicator is neutral and does not suggest a major cycle low in BTC’s price.

Source: @cryptoquant_com

Source: @cryptoquant_com

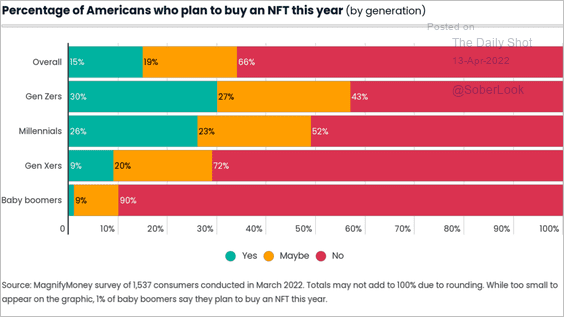

4. The NFT market is slowing down as lawsuits pile up.

Source: VICE Read full article

Source: VICE Read full article

By the way, this chart shows Americans’ interest in NFTs by generation.

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

Back to Index

Energy

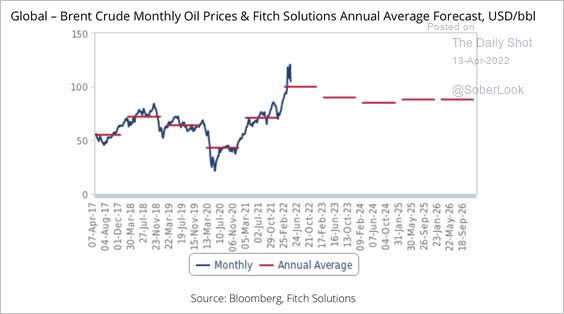

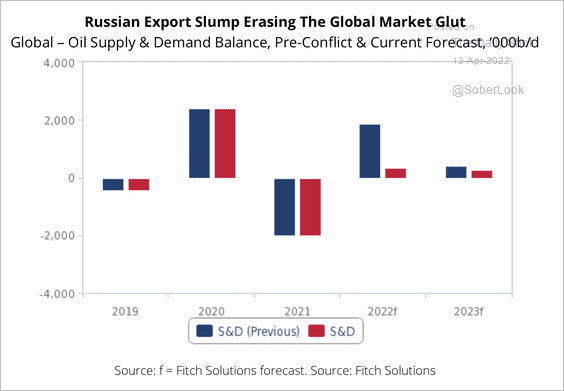

1. Fitch expects oil prices to average around $90-$100/barrel over the next year as lower exports from Russia reduce global supplies (2 charts).

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

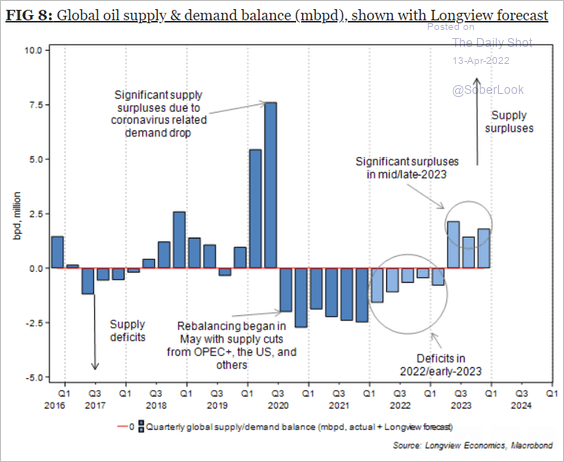

Longview Economics expects the oil market deficit to persist through early next year.

Source: Longview Economics

Source: Longview Economics

——————–

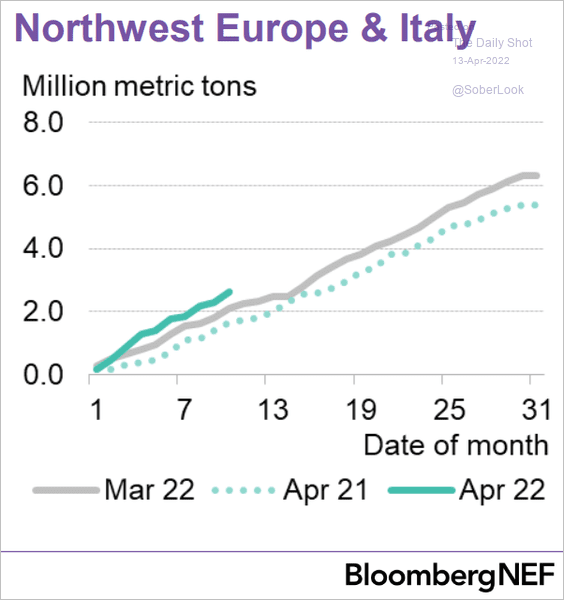

2. European LNG imports remain elevated.

Source: @BloombergNEF Read full article

Source: @BloombergNEF Read full article

Back to Index

Equities

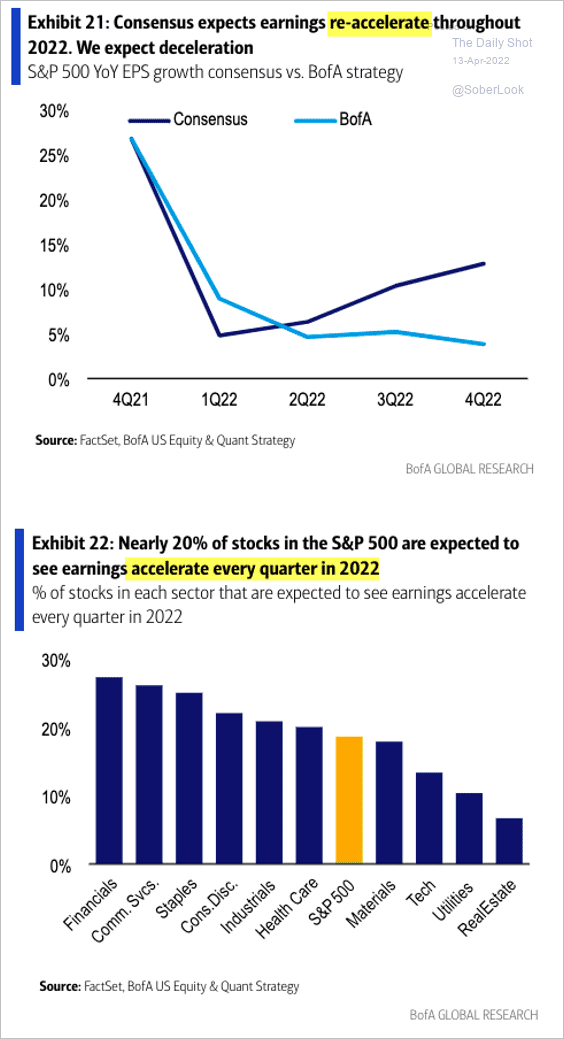

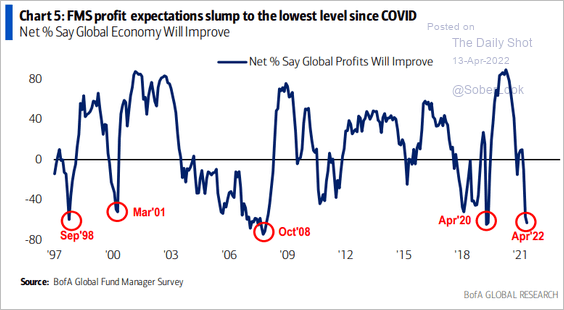

1. Are markets too optimistic about earnings growth?

Source: BofA Global Research; @SamRo

Source: BofA Global Research; @SamRo

Investors increasingly expect a slump in profits.

Source: BofA Global Research

Source: BofA Global Research

——————–

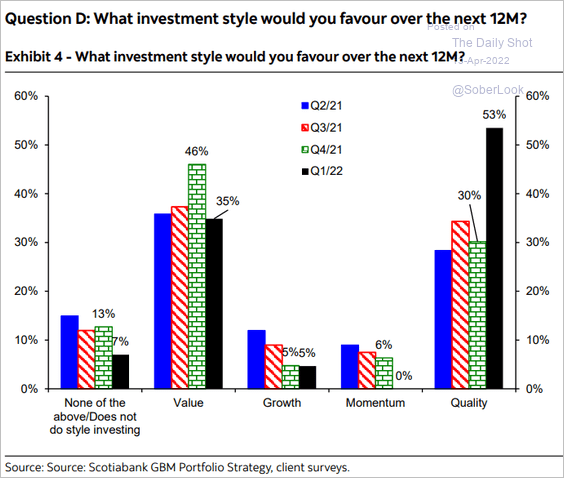

2. Which investment style will outperform over the next 12 months? Here is a survey from Scotia Capital’s Global Equity Research.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

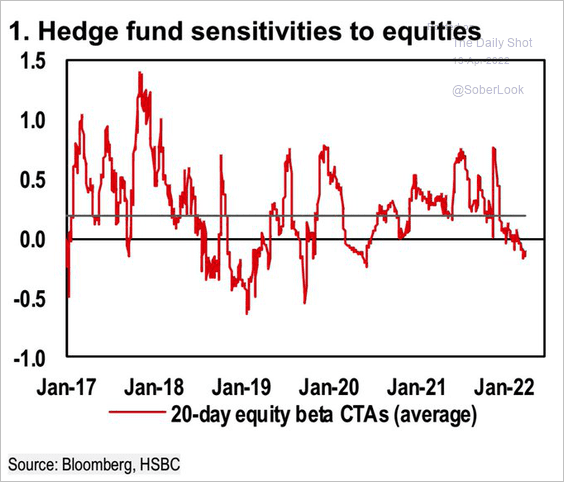

3. Hedge funds are running a negative beta to the stock market.

Source: HSBC; @WallStJesus

Source: HSBC; @WallStJesus

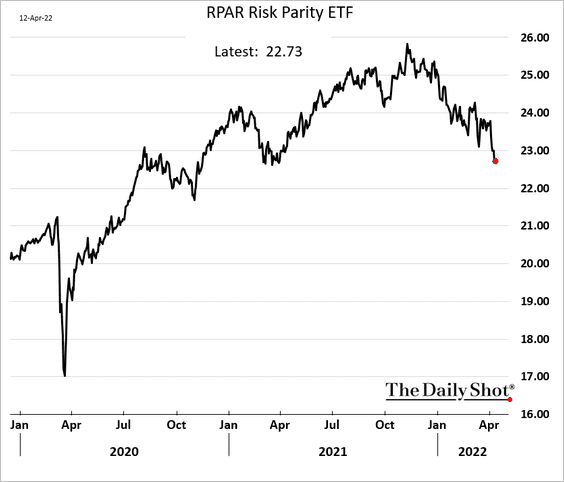

4. Risk parity strategies continue to struggle as both stocks and bonds remain under pressure.

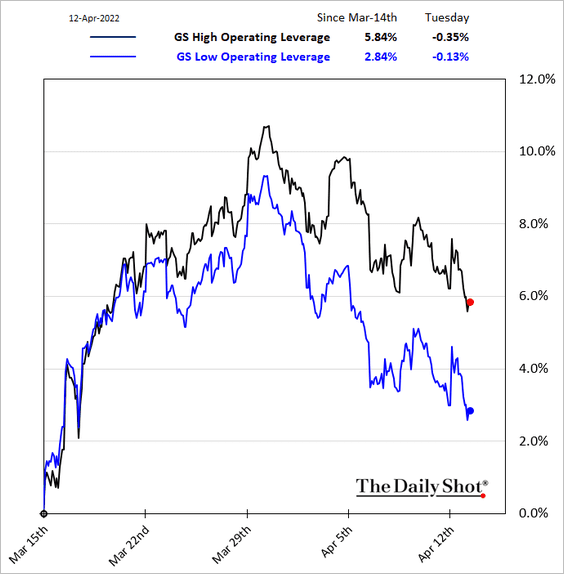

5. Companies with high operating leverage have been outperforming.

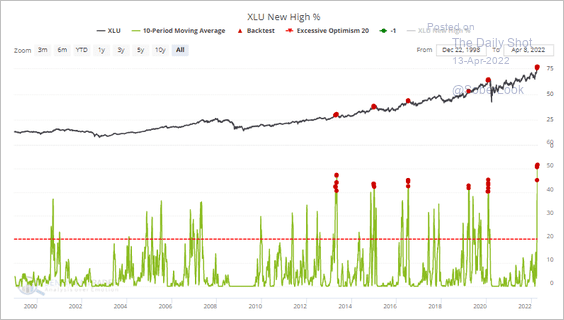

6. More than half of the SPDR Utilities Sector ETF (XLU) stocks reached a new 52-week high over the past 10 sessions – a 23-year record that typically leads to a strong pullback, according to SentimenTrader.

Source: SentimenTrader

Source: SentimenTrader

Back to Index

Credit

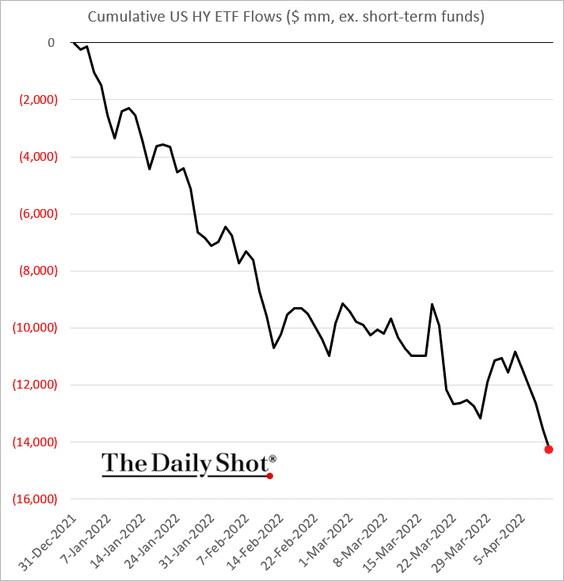

1. US corporate HY ETF outflows have exceeded $14 billion year-to-date.

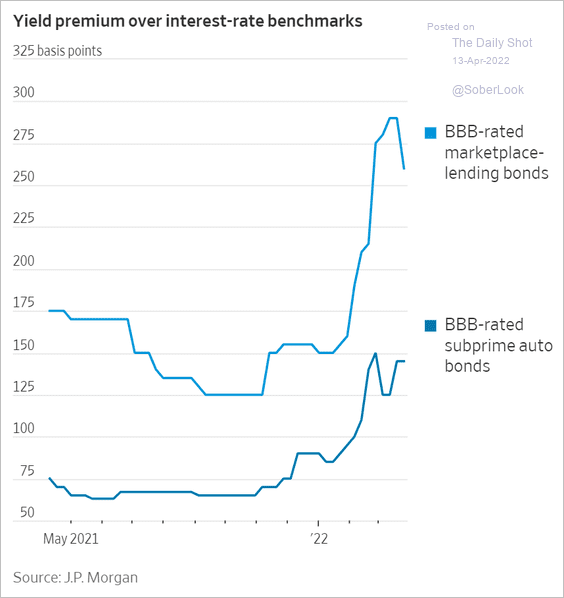

2. Subprime asset-backed bond spreads have widened amid concerns about weaker borrowers being pressured by surging inflation.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

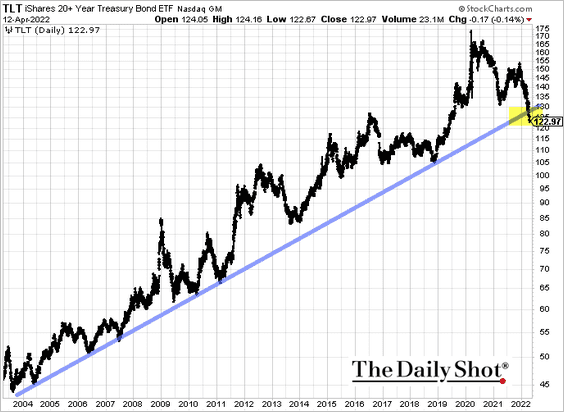

1. Long-term Treasuries breached the uptrend support that has been in place for two decades.

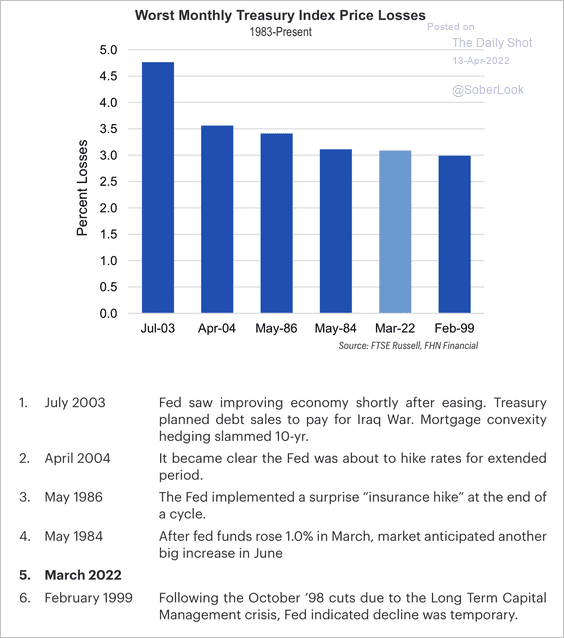

2. Previous Treasury bond price losses were tied to Fed tightening – either real or perceived.

Source: FHN Financial

Source: FHN Financial

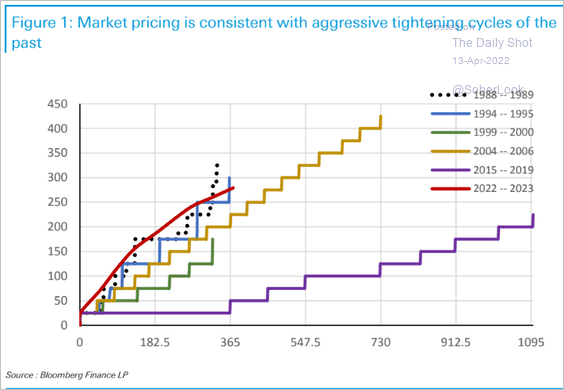

3. The current pricing for the Fed’s rate hikes is consistent with other aggressive tightening cycles.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Related to the above, James Bullard continues to press for a bold response to surging inflation.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

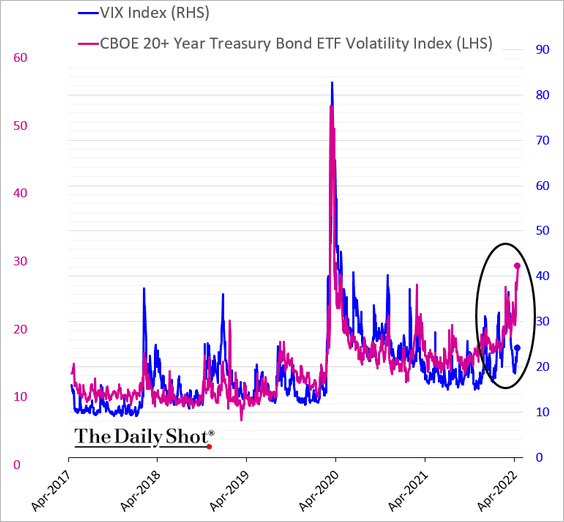

4. Long-term Treasury market implied volatility has widened its gap with equity vol (VIX) as the Fed prepares for quantitative tightening.

Back to Index

Global Developments

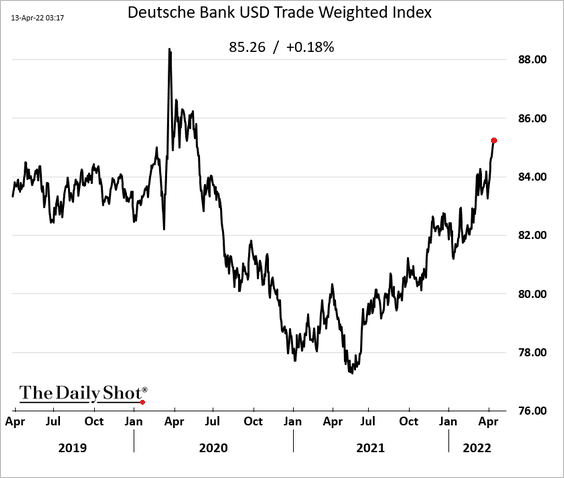

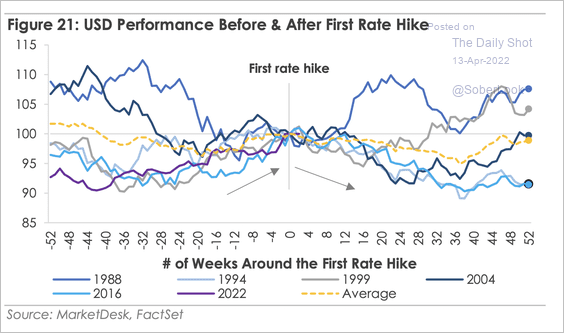

1. The dollar tends to weaken over the next six to nine months following the first Fed rate hike.

Source: MarketDesk Research

Source: MarketDesk Research

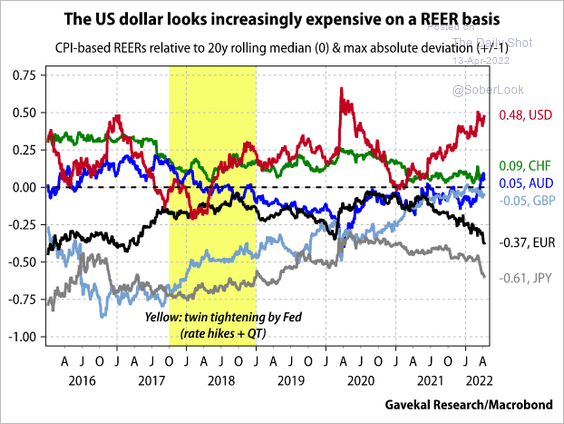

Is the dollar overvalued?

Source: Gavekal Research

Source: Gavekal Research

——————–

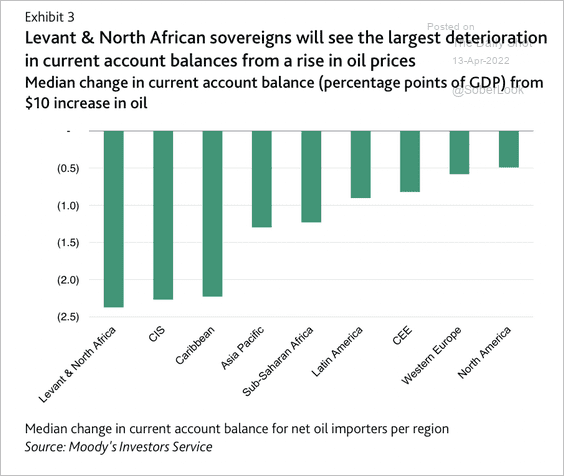

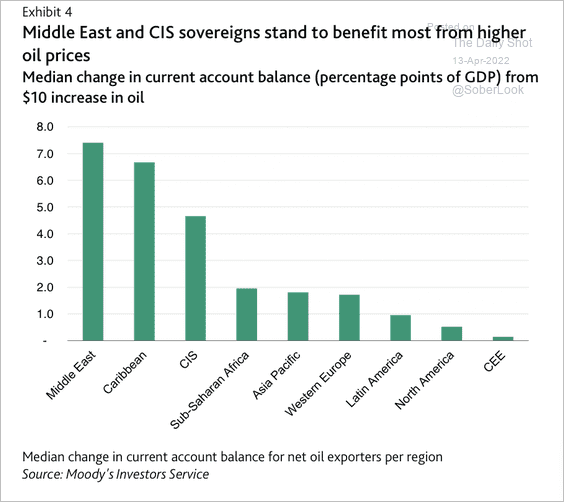

2. Here is a look at the impact of rising oil prices on current account balances (2 charts).

Source: Moody’s Investors Service

Source: Moody’s Investors Service

Source: Moody’s Investors Service

Source: Moody’s Investors Service

——————–

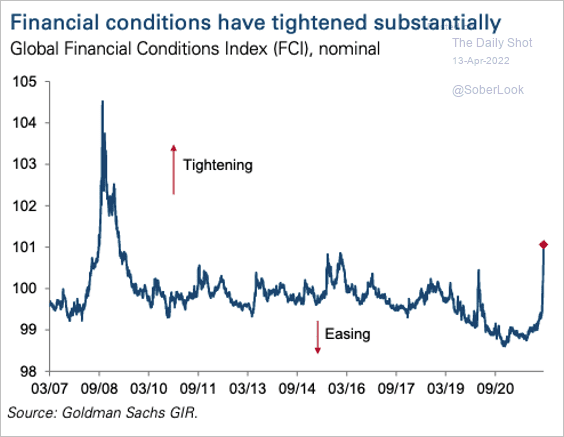

3. Global financial conditions have tightened significantly.

Source: Goldman Sachs; @Mayhem4Markets

Source: Goldman Sachs; @Mayhem4Markets

——————–

Food for Thought

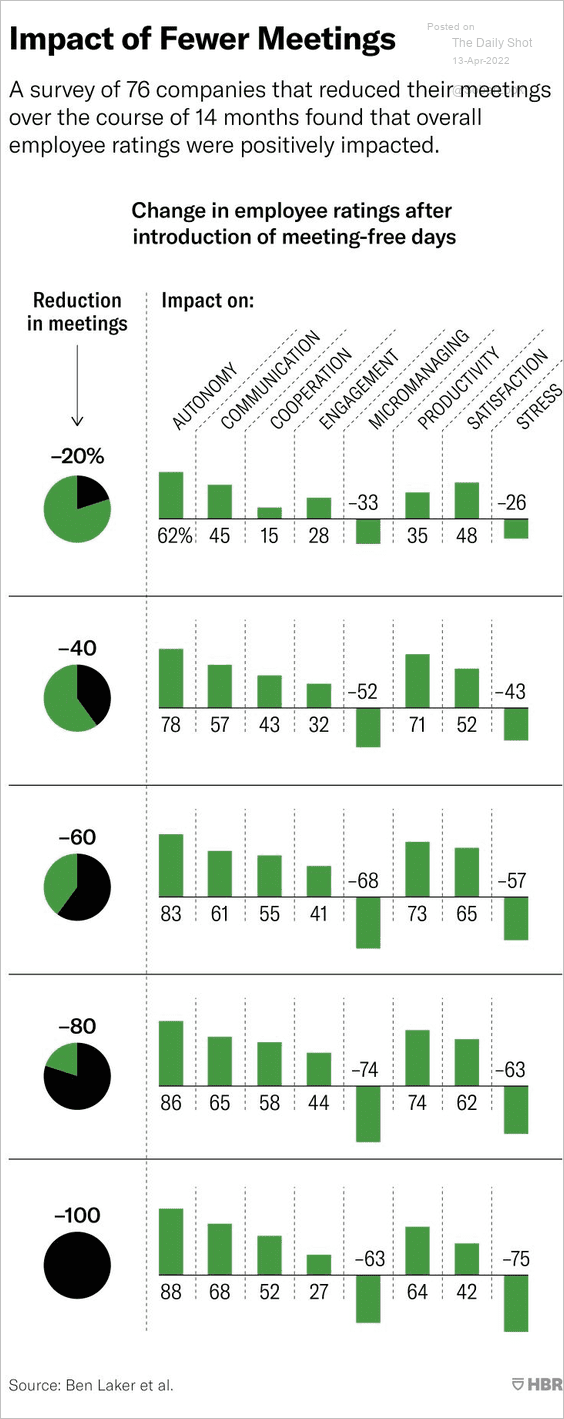

1. Having fewer meetings could boost productivity.

Source: Ben Laker, HBR Read full article

Source: Ben Laker, HBR Read full article

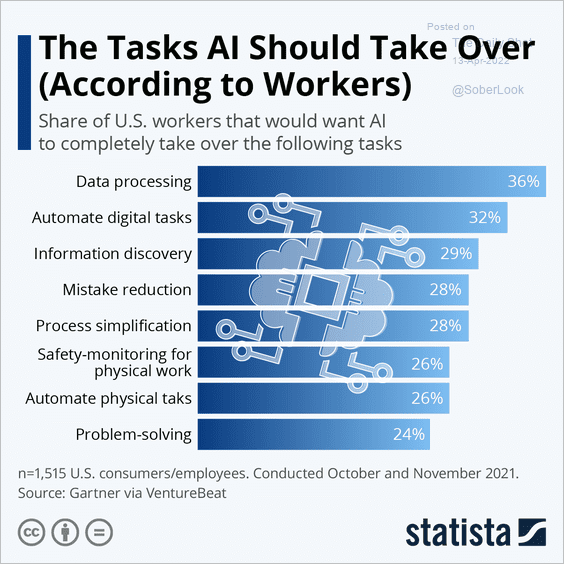

2. Which tasks should AI take over?

Source: Statista

Source: Statista

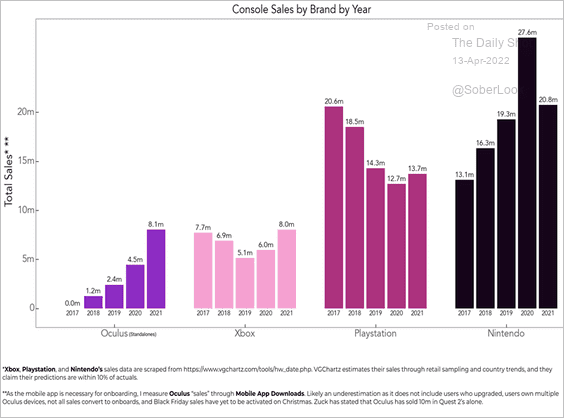

3. VR console sales:

Source: @JackSoslow

Source: @JackSoslow

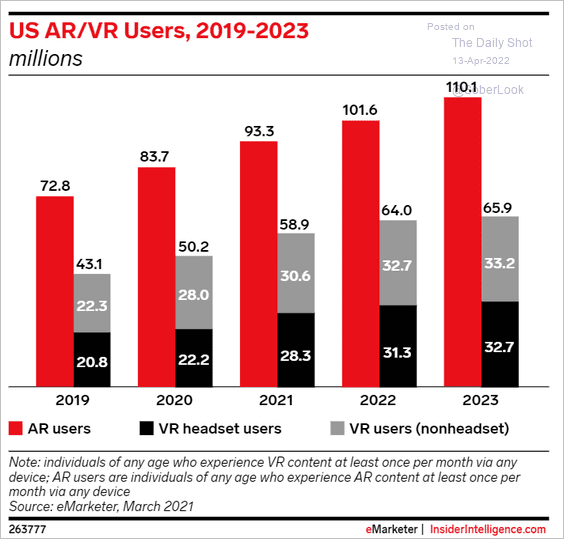

• AR/VR users over time:

Source: eMarketer Read full article

Source: eMarketer Read full article

——————–

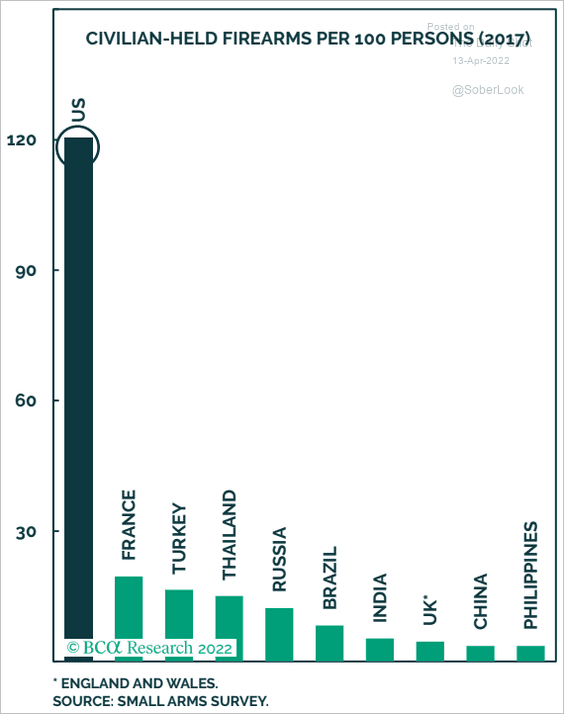

4. Civilian-held firearms per 100 persons:

Source: BCA Research

Source: BCA Research

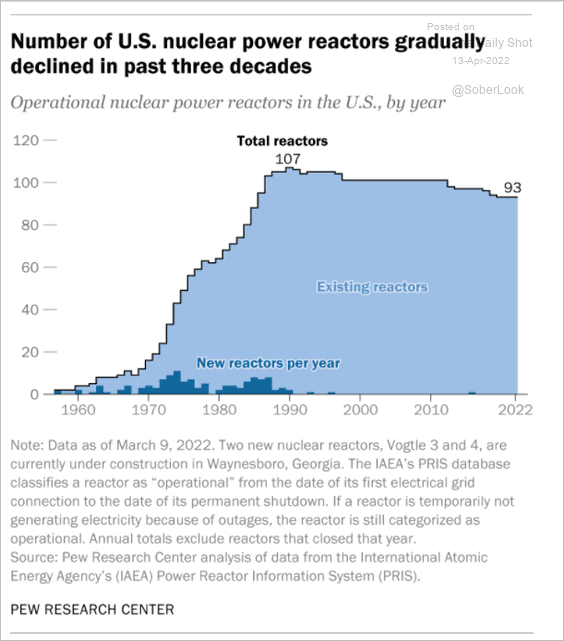

5. US nuclear power reactors:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

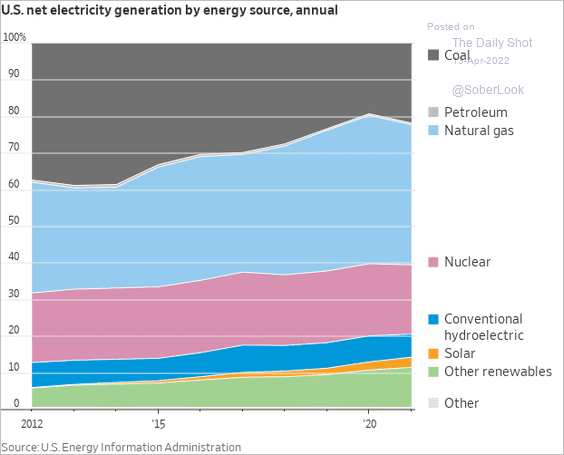

6. US electricity generation by energy source:

Source: @WSJ Read full article

Source: @WSJ Read full article

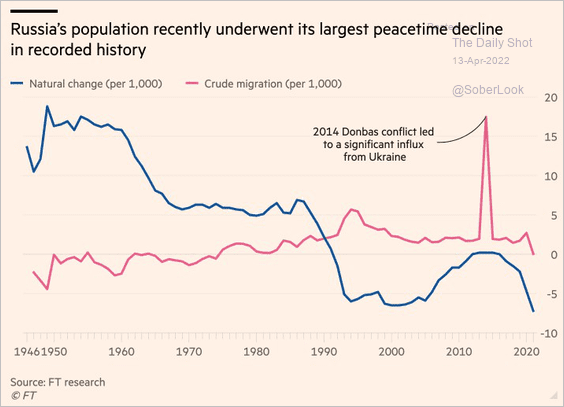

7. Russia’s declining population:

Source: @jessefelder, @FT Read full article

Source: @jessefelder, @FT Read full article

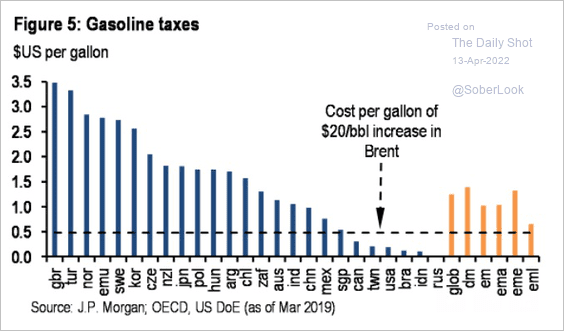

8. Gasoline taxes globally:

Source: JP Morgan Research

Source: JP Morgan Research

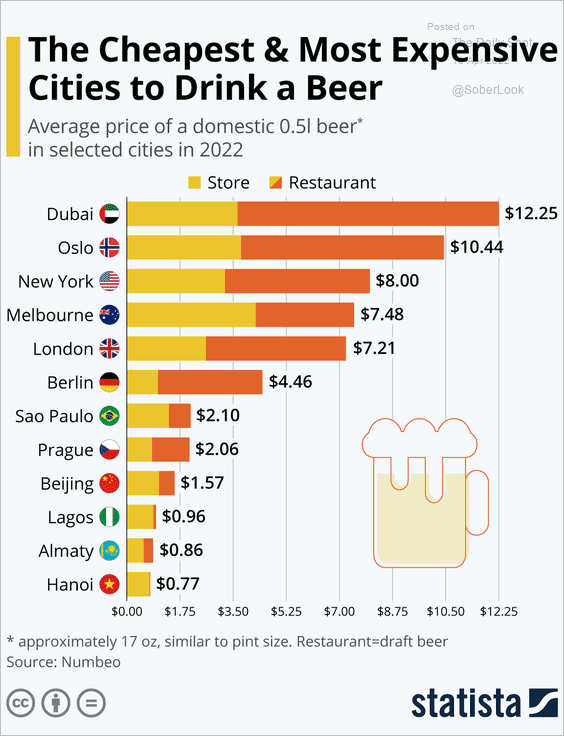

9. Beer prices in select cities:

——————–

Back to Index