The Daily Shot: 18-Apr-22

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

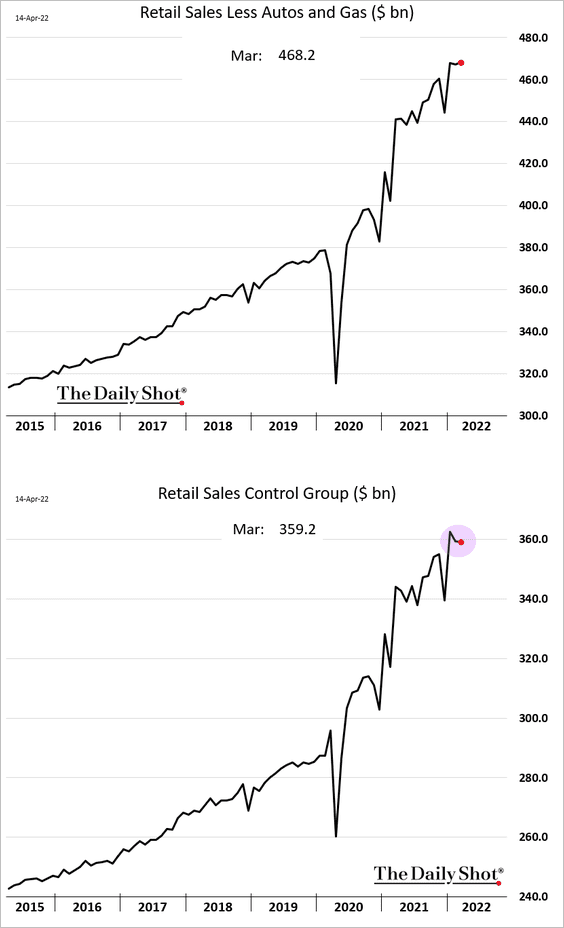

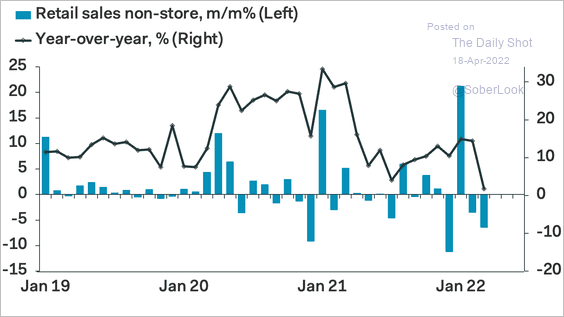

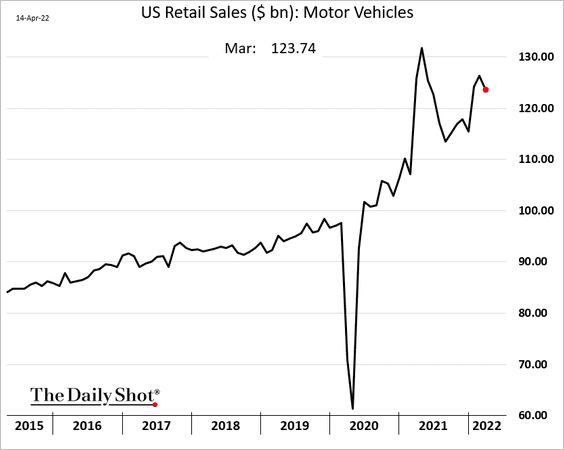

1. The March retail sales report was softer than expected. Excluding volatile items, retail sales were down for the second month in a row.

Online (chart below) and automobile (2nd chart) sales declined.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: @markets Read full article

Source: @markets Read full article

——————–

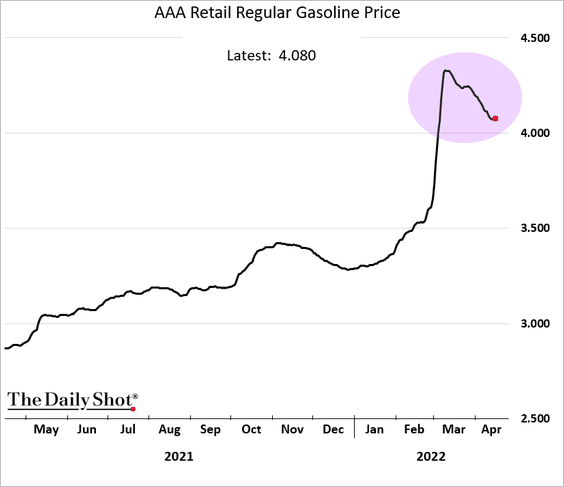

2. Gasoline prices came off the highs in recent days, …

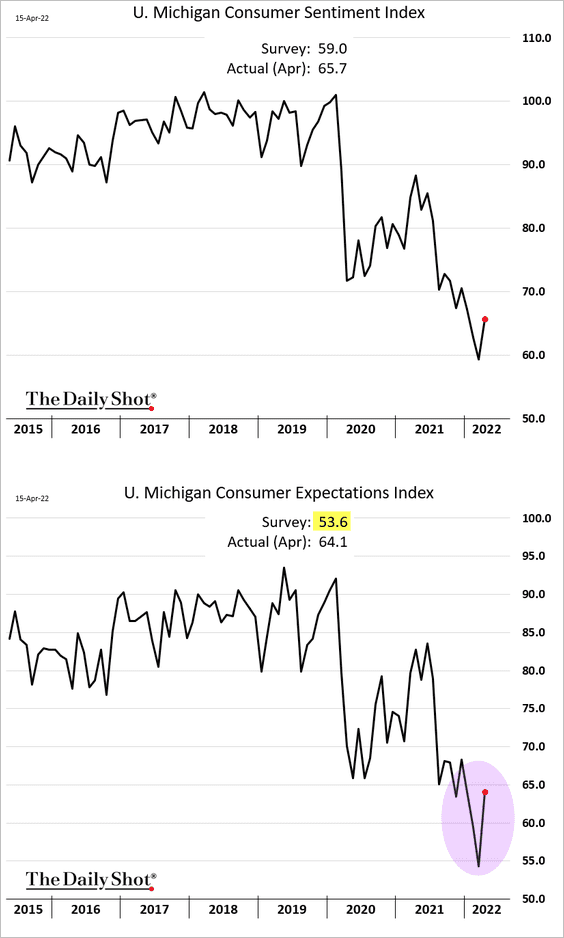

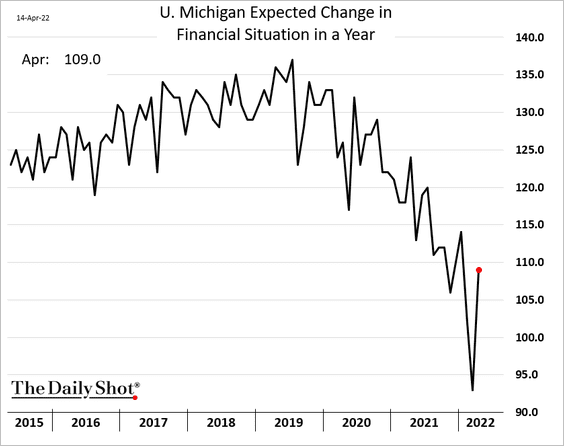

… boosting consumer confidence this month.

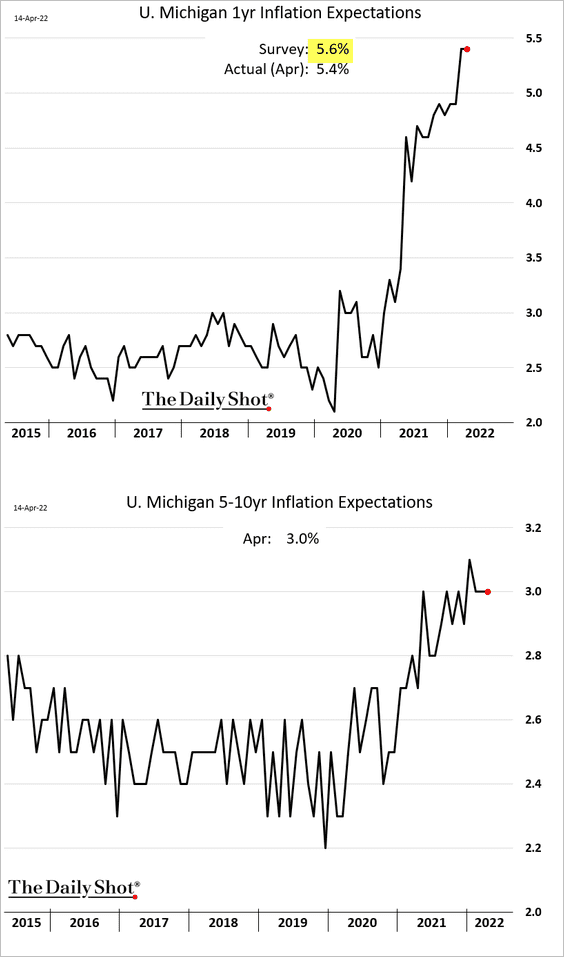

• Inflation expectations held steady.

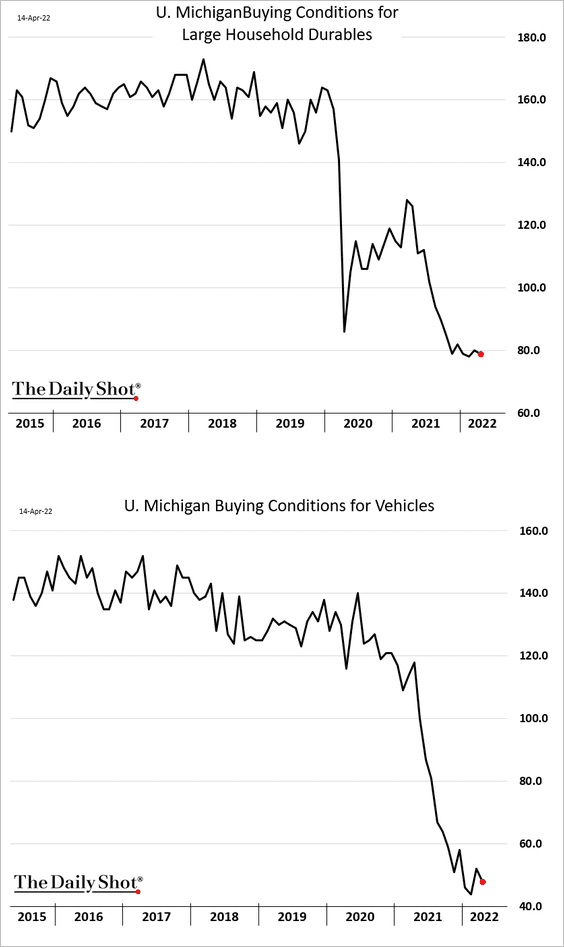

• But buying conditions remain depressed.

——————–

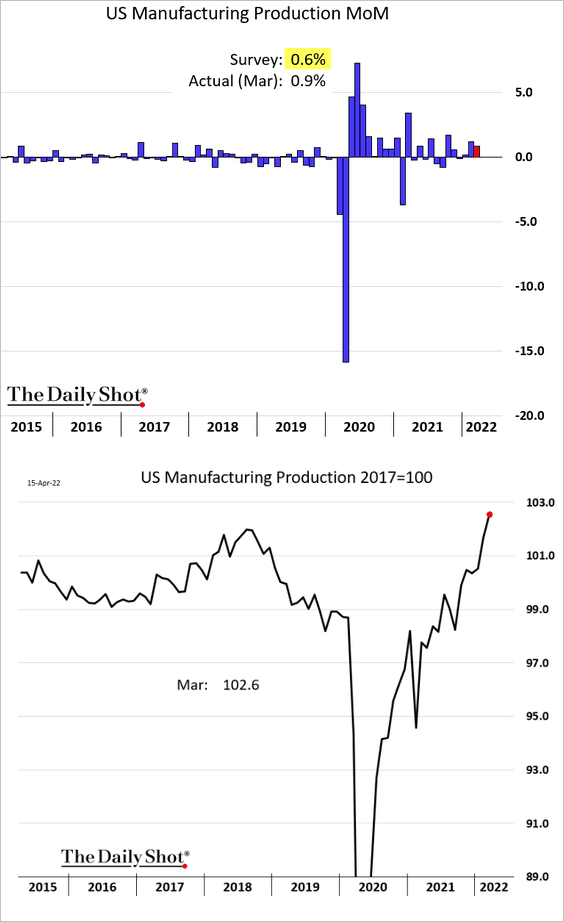

3. March manufacturing output topped forecasts, …

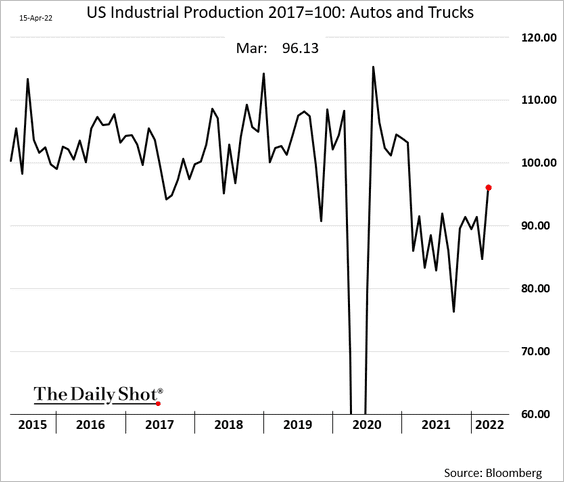

… as automobile production improved. The rebound suggests some easing in supply chain bottlenecks.

Source: Reuters Read full article

Source: Reuters Read full article

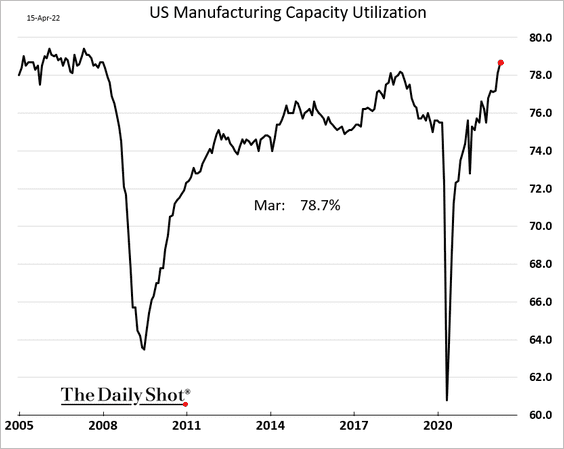

Factory capacity utilization hit the highest level since 2007.

——————–

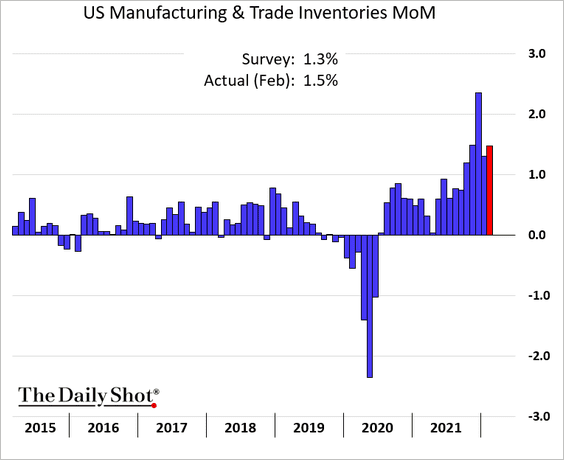

4. The pace of inventory building remained buoyant in February.

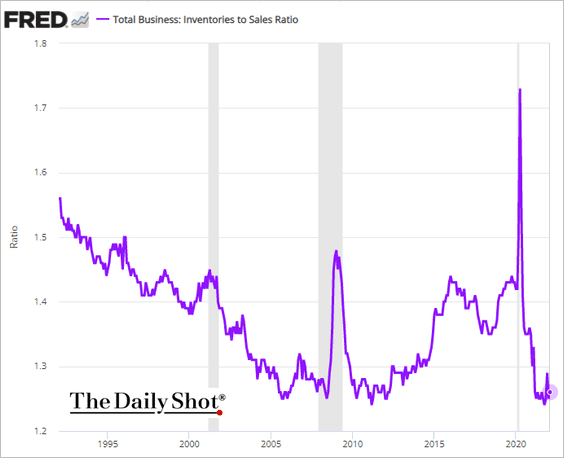

But the inventories-to-sales ratio held near the lows.

——————–

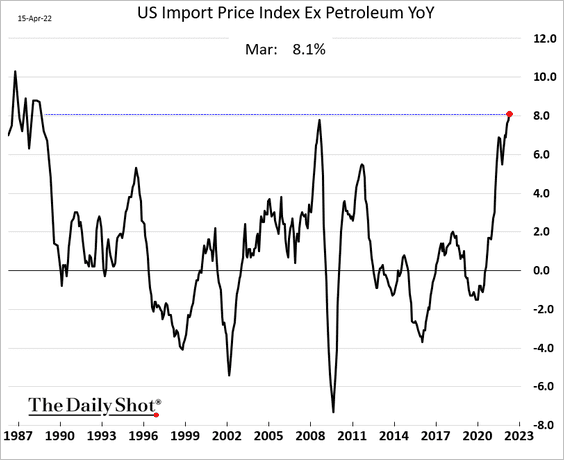

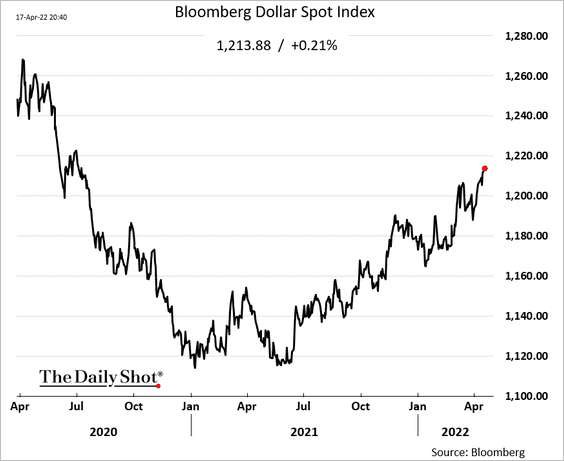

5. Gains in US import prices (excluding petroleum) reached the highest level since the late 1980s.

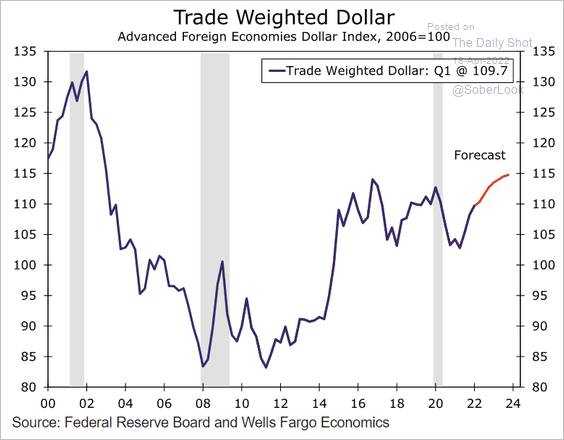

A stronger US dollar should ease import price inflation.

Given the Fed’s hawkish stance, the dollar could continue to rally.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

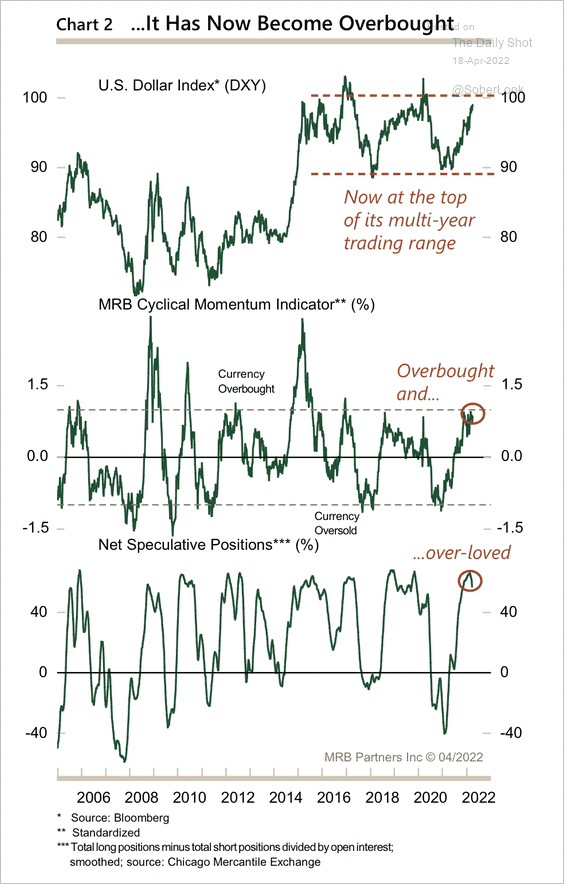

But technical indicators suggest that the dollar is overbought (and approaching resistance).

Source: MRB Partners

Source: MRB Partners

——————–

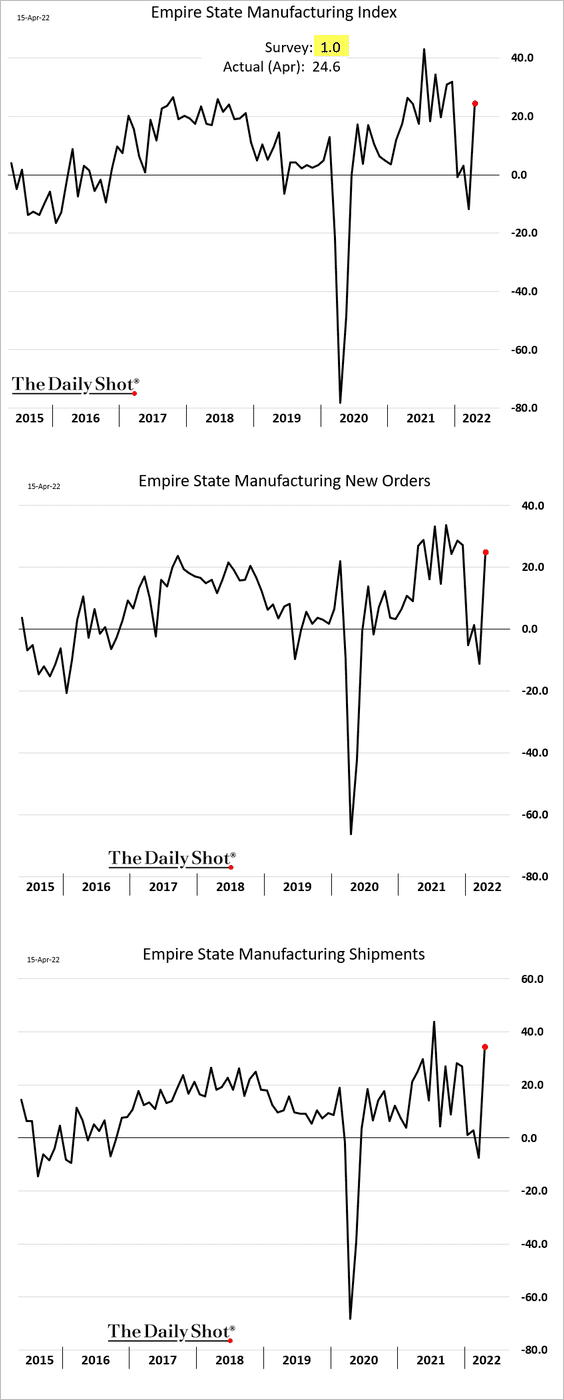

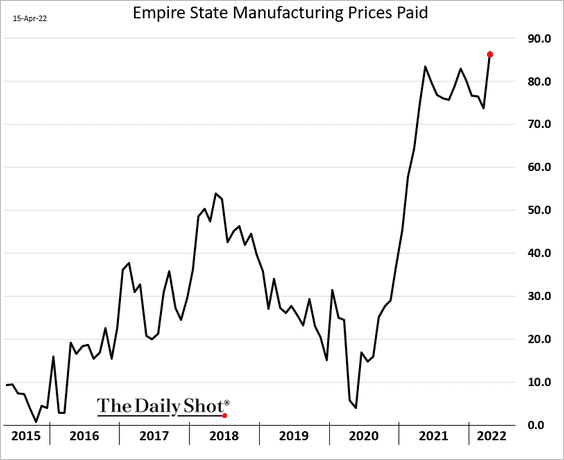

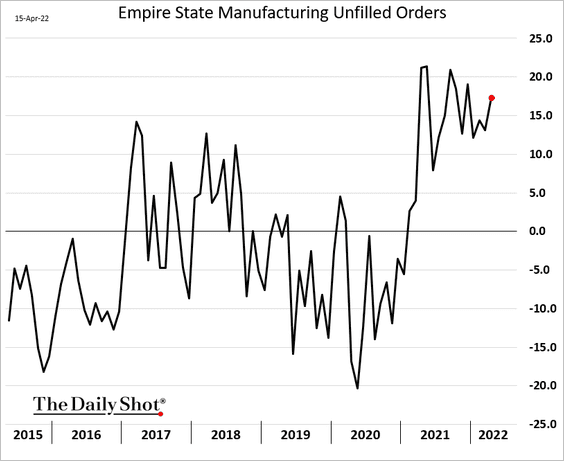

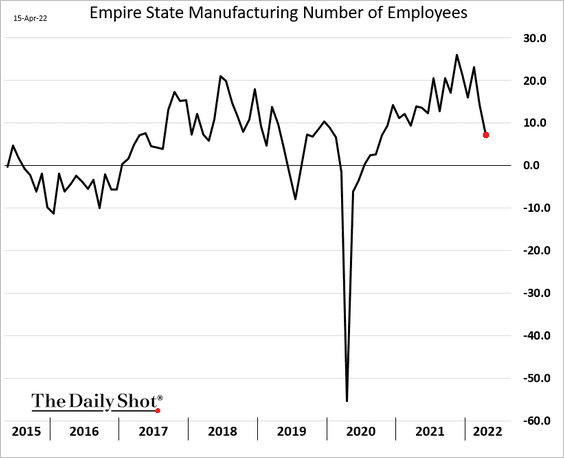

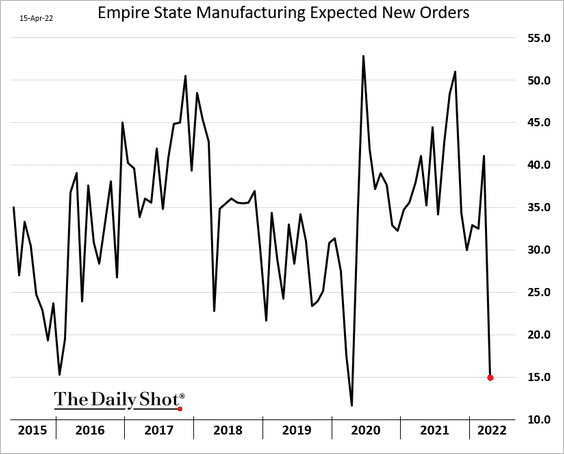

6. The first regional manufacturing report of the month surprised to the upside. The NY Fed’s indices of new orders and shipments rebounded sharply.

• Price pressures continue to worsen, …

… and the index of unfilled orders remains elevated.

• Hiring slowed this month.

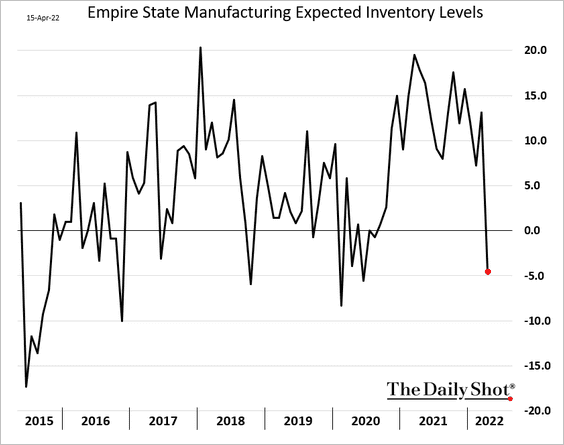

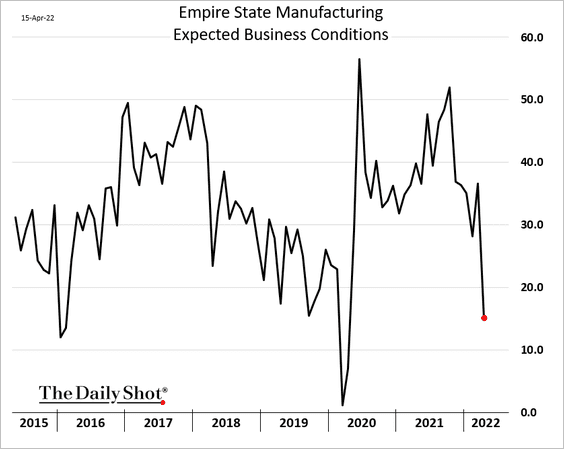

• And forward-looking indicators deteriorated.

– Factories now expect to be cutting inventories in the months ahead.

– Expectations of new orders and shipments tumbled.

– Here is the overall business outlook for the region’s factories.

——————–

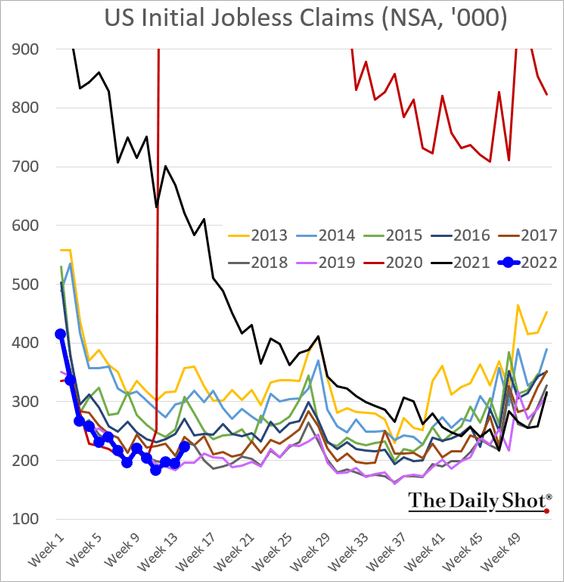

7. US jobless claims are above 2019 levels but remain very low for this time of the year.

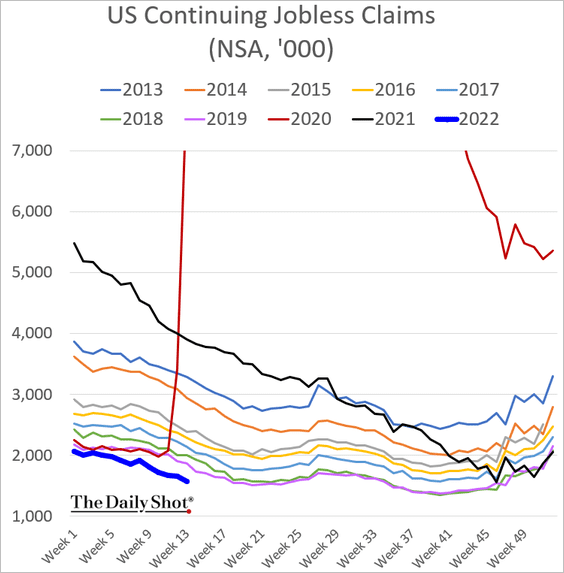

Below are the continuing claims.

——————–

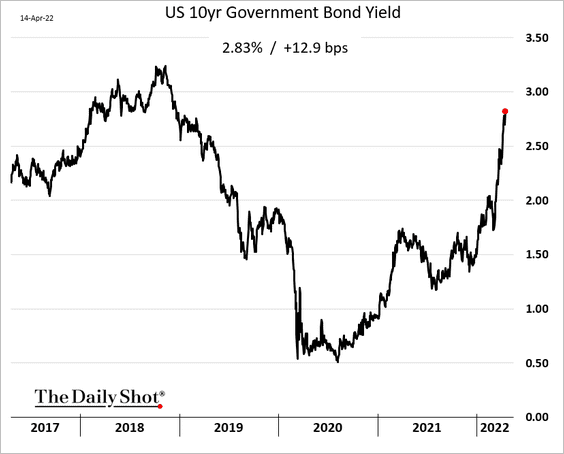

8. Treasury yields keep climbing.

Back to Index

Canada

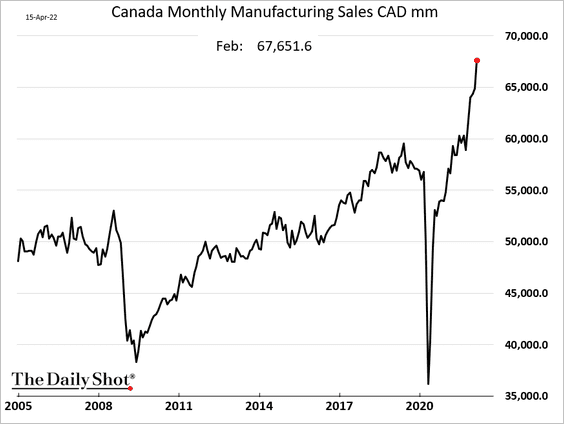

1. Manufacturing sales have been surging.

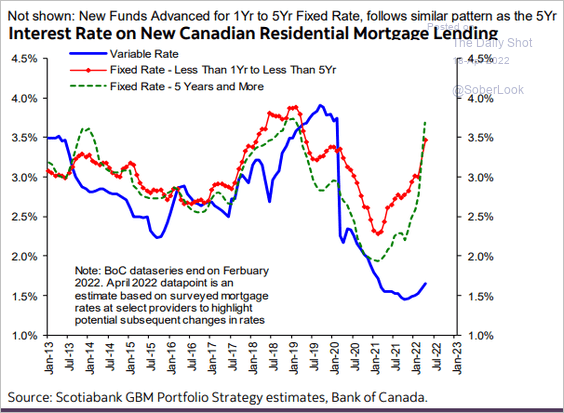

2. Residential mortgage rates are rebounding rapidly.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The Eurozone

1. The ECB’s response to surging inflation remains cautious.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

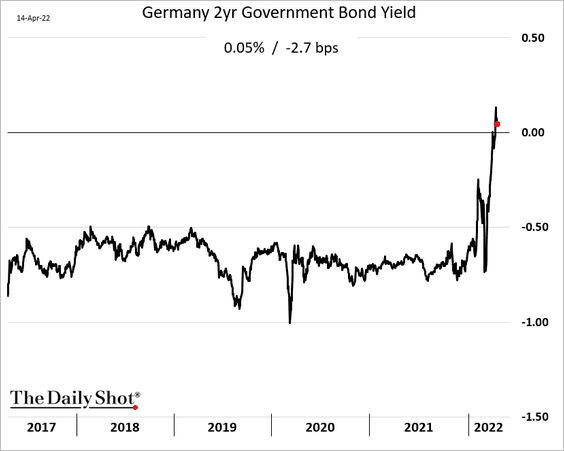

• The central bank’s dovish comments lowered the expected rate hike trajectory, …

… bringing down the 2yr Bund yield.

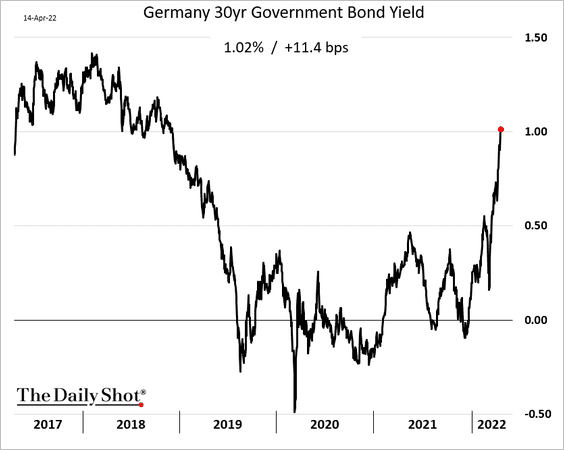

At the same time, inflation concerns sent the 30yr Bund yield above 1%, …

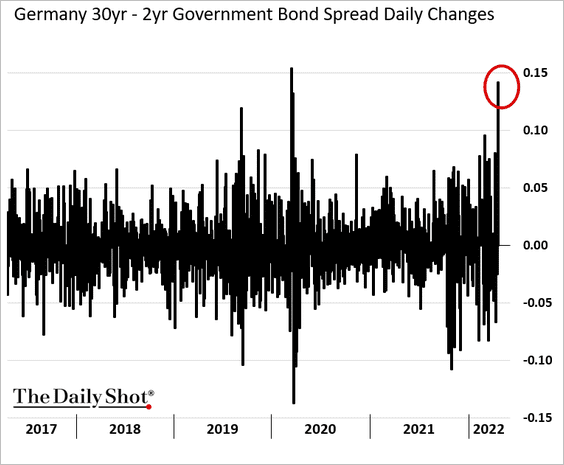

… resulting in a sharp curve steepening on Thursday.

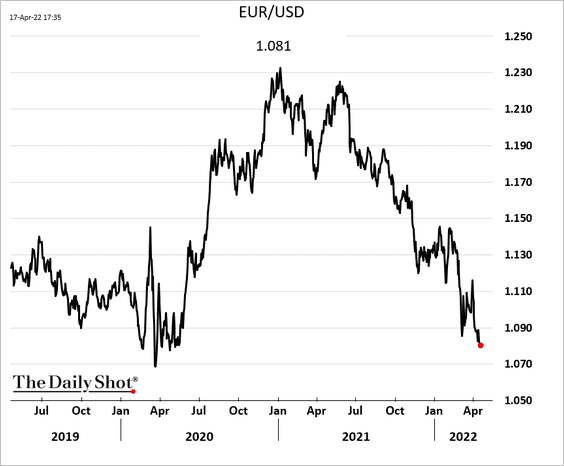

• With the ECB’s policy tightening lagging the Fed’s, …

Source: Alpine Macro

Source: Alpine Macro

… the euro came under pressure.

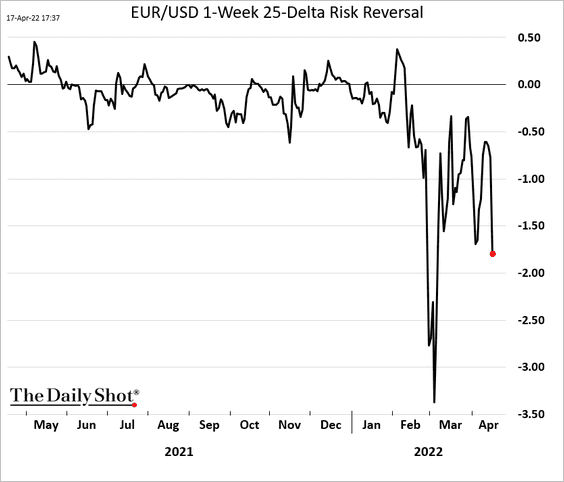

2. The F/X options market is signaling further downside risks for the euro ahead of the French elections (2nd round).

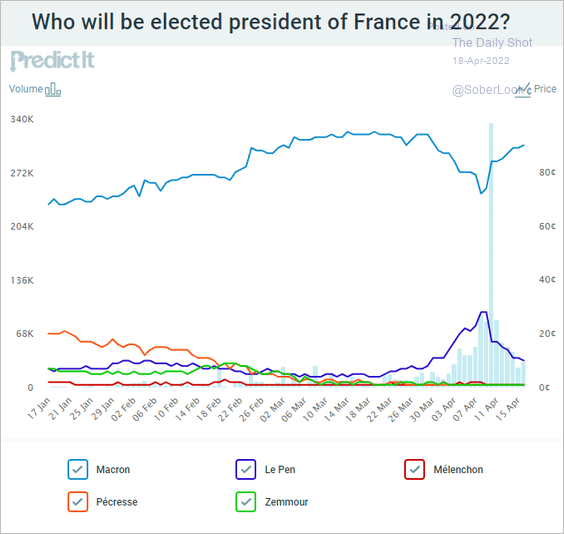

The betting markets see Macron comfortably winning the presidency.

Source: @PredictIt

Source: @PredictIt

——————–

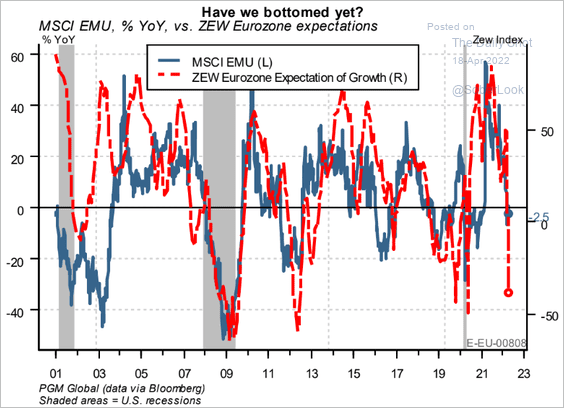

3. Weak sentiment poses downside risks for the Eurozone’s stock market.

Source: PGM Global

Source: PGM Global

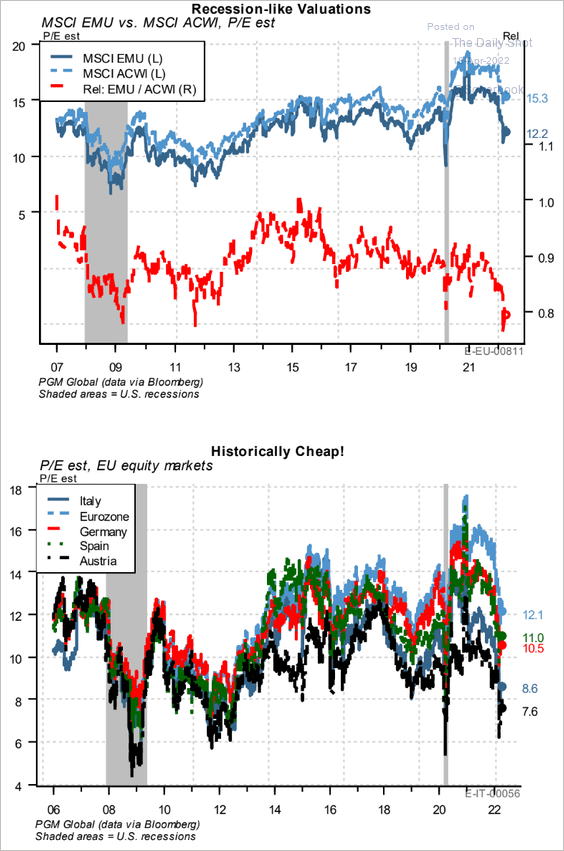

Euro-area stock valuations look attractive relative to the rest of the world.

Source: PGM Global

Source: PGM Global

——————–

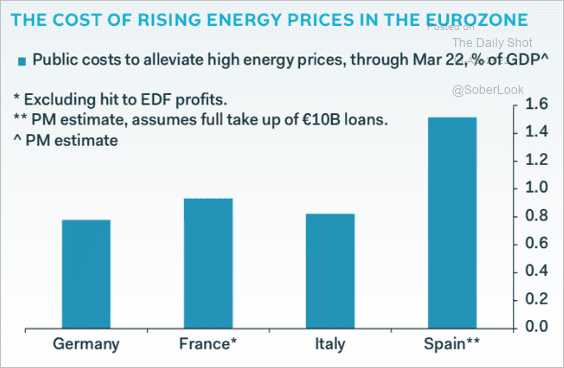

4. This chart shows the cost of public programs to ease consumer energy costs.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

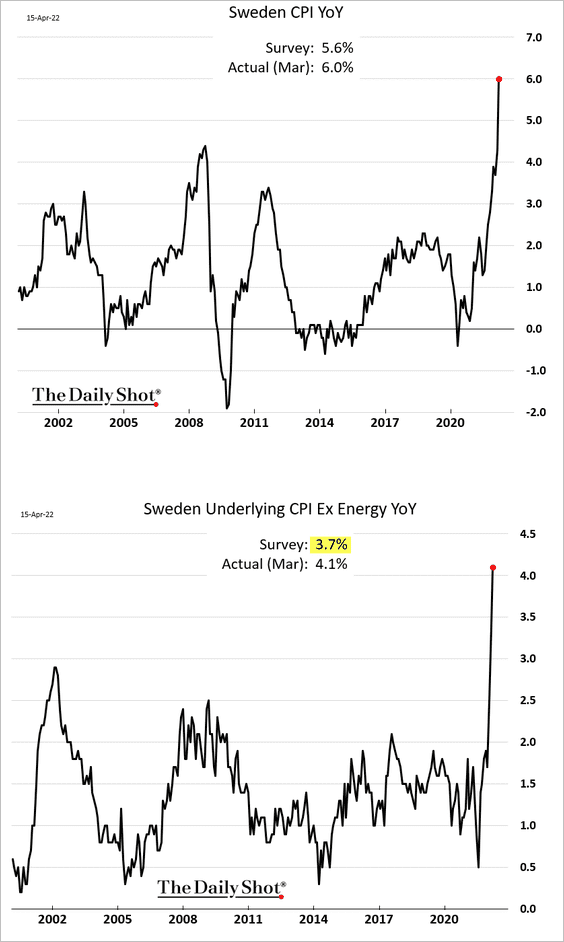

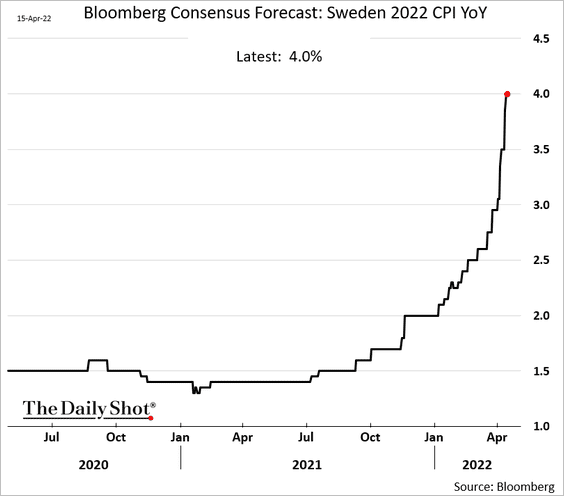

1. Sweden’s CPI report was a shocker.

Economists are rapidly adjusting their 2022 inflation forecasts to keep up with the “situation on the ground.”

——————–

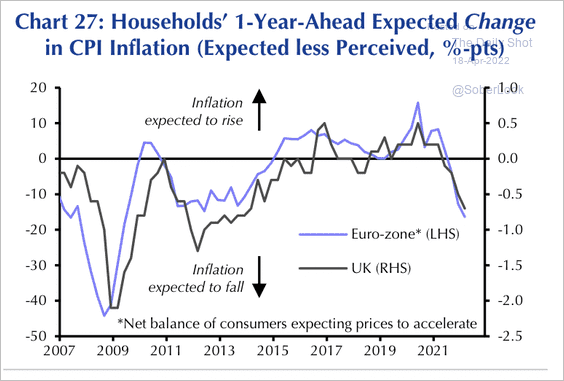

2. Eurozone and UK households expect inflation to fall over the next year.

Source: Capital Economics

Source: Capital Economics

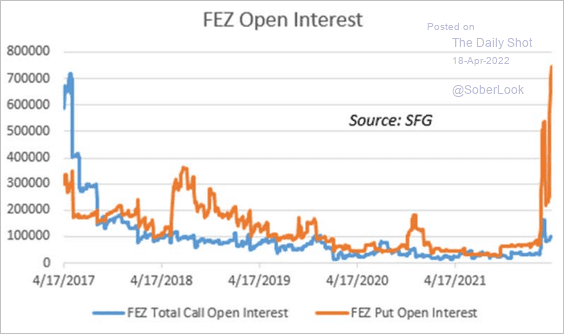

3. Options bets against the SPDR Euro Stoxx 50 ETF have been surging.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

Back to Index

Japan

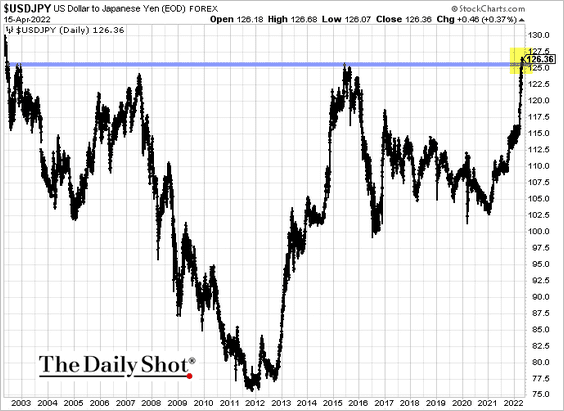

1. Is dollar-yen about break above its long-term resistance?

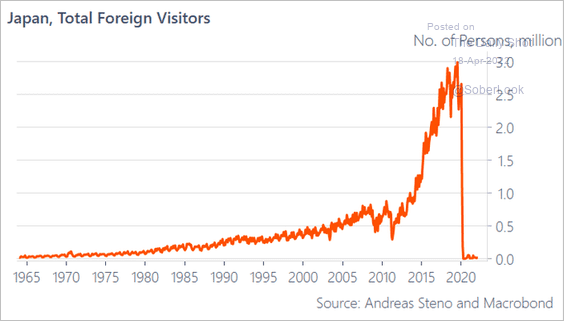

2. Japan isn’t getting many foreign visitors these days.

Source: @AndreasSteno

Source: @AndreasSteno

Back to Index

Asia – Pacific

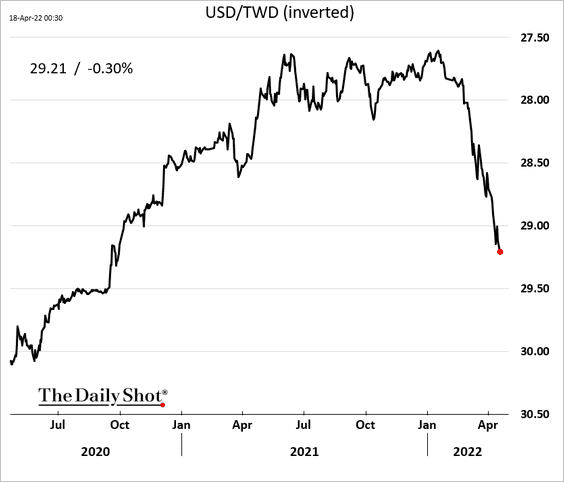

1. The Taiwan dollar has been under pressure.

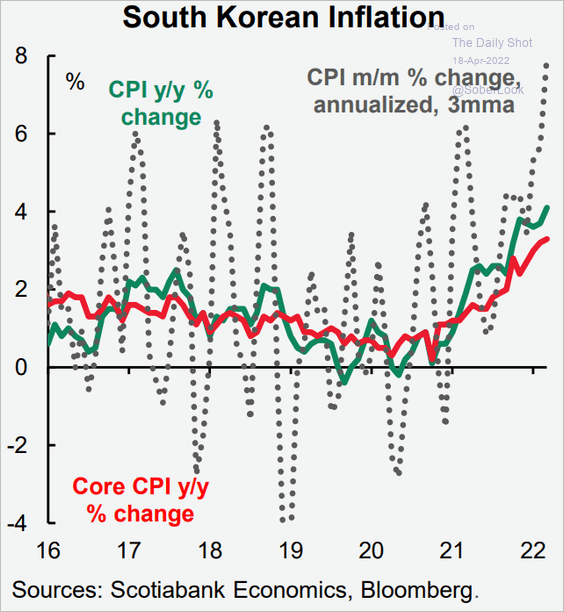

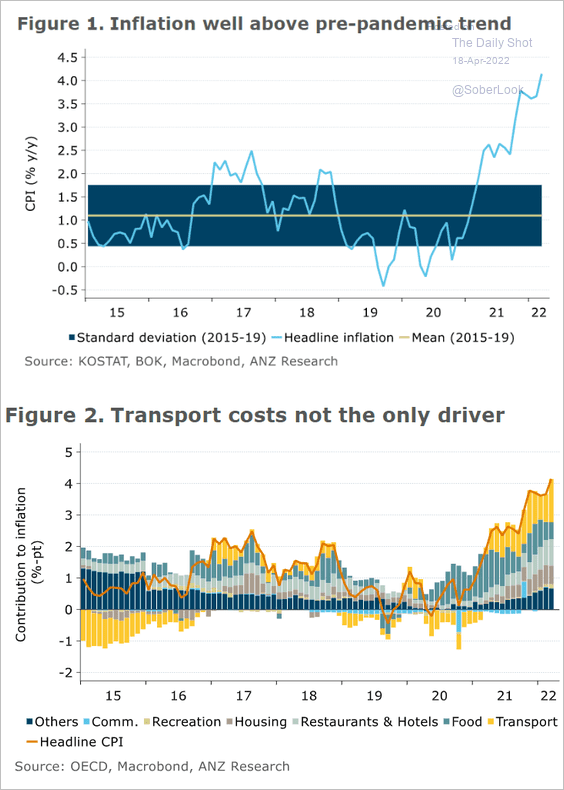

2. South Korea’s consumer inflation has accelerated.

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: @ANZ_Research

Source: @ANZ_Research

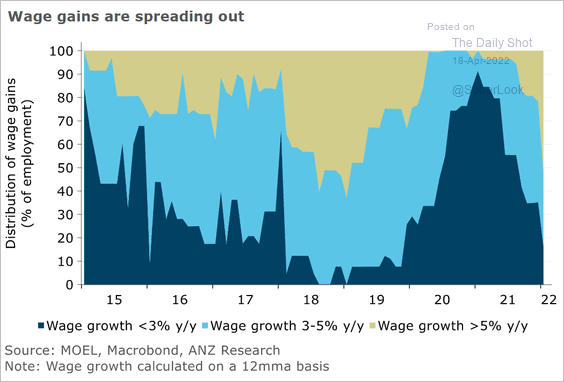

And wage gains have broadened.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

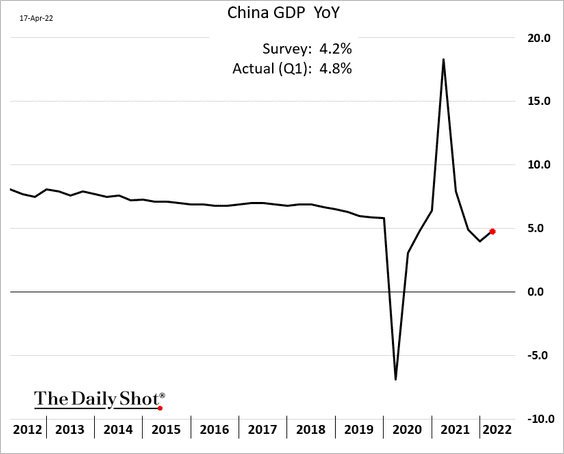

1. The Q1 GDP growth topped expectations (although some economists are skeptical).

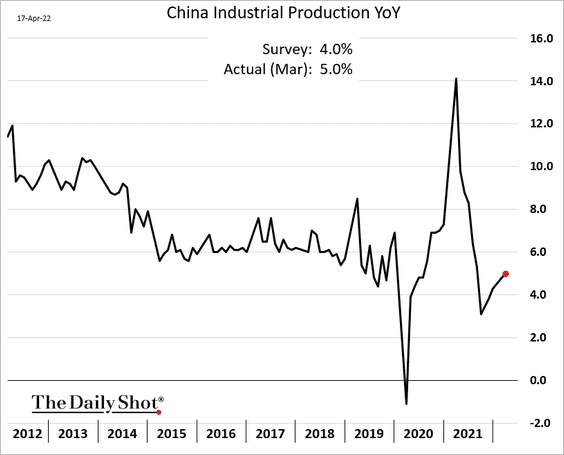

• March industrial production surprised to the upside.

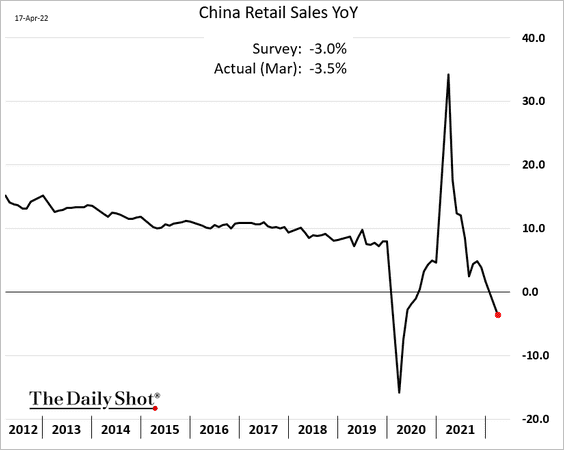

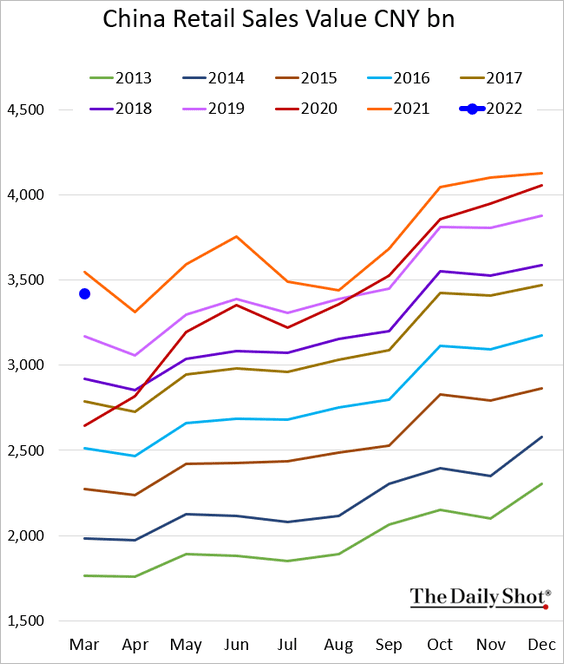

• But retail sales contracted (relative to last year).

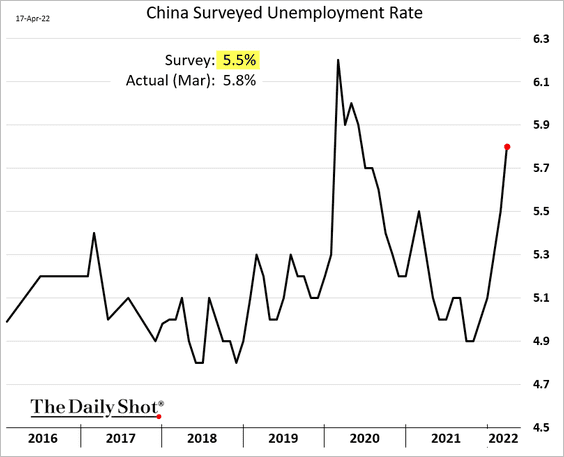

• According to a government survey, the unemployment rate jumped in March.

——————–

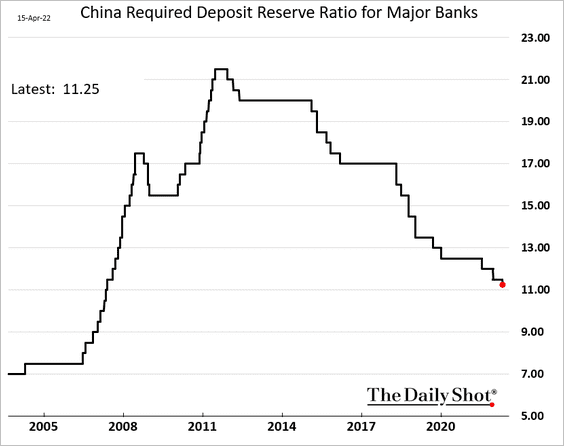

2. The PBoC announced a modest cut to reserve requirements but left rates unchanged. The market was hoping for a more aggressive easing action.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

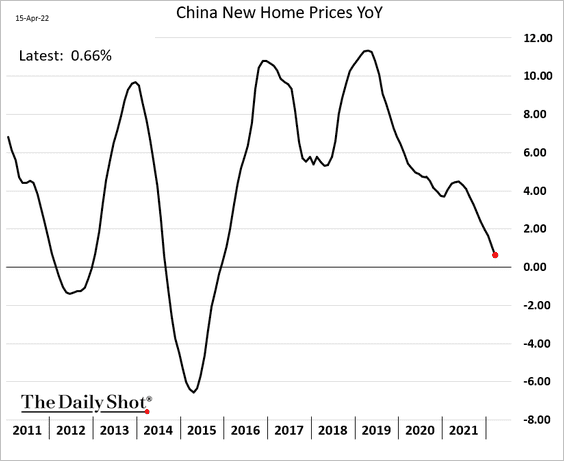

3. On a year-over-year basis, home price appreciation is about to turn negative.

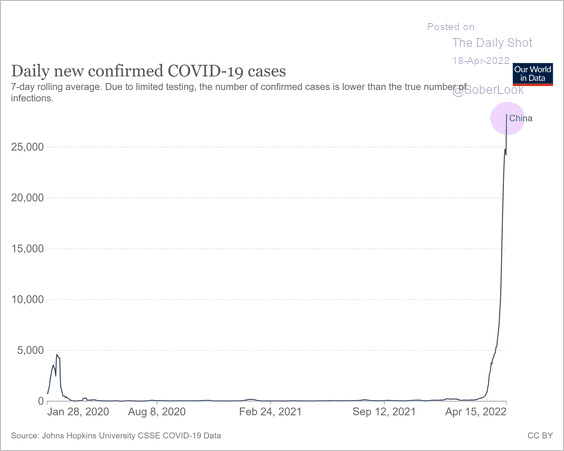

4. The authorities continue to struggle in their quest to contain the omicron surge.

Source: Our World in Data

Source: Our World in Data

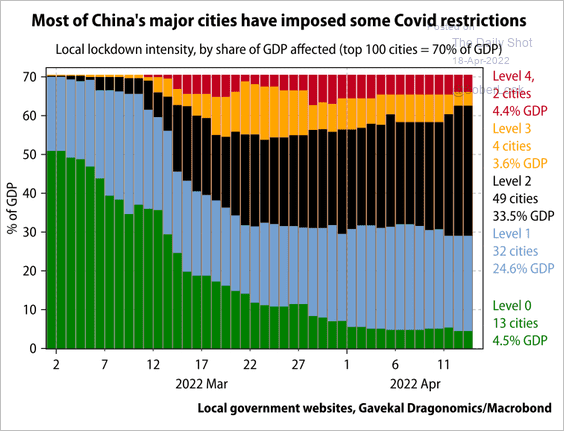

Lockdowns/restrictions are spreading.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Gavekal Research

Source: Gavekal Research

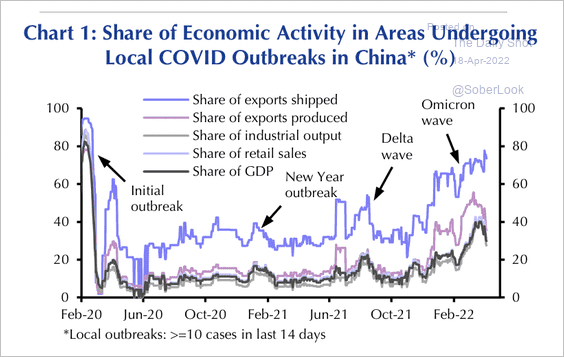

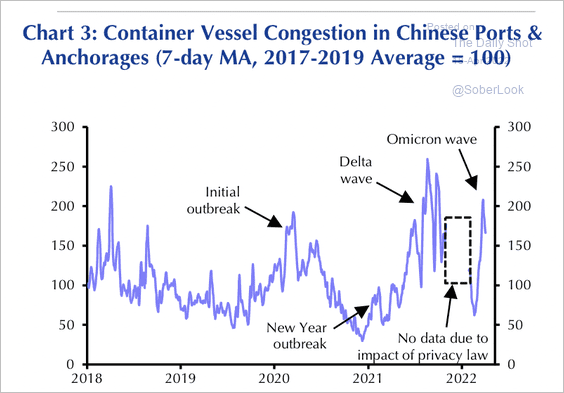

5. Roughly three-quarters of China’s exports are sent by regions experiencing local outbreaks of COVID-19, which has impacted supply chains.

Source: Capital Economics

Source: Capital Economics

Port congestion has increased, albeit still below levels seen during the Delta wave last year.

Source: Capital Economics

Source: Capital Economics

——————–

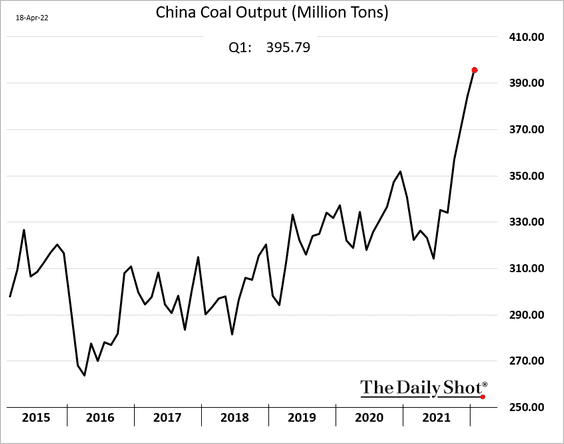

6. China’s coal production has been surging.

Back to Index

Emerging Markets

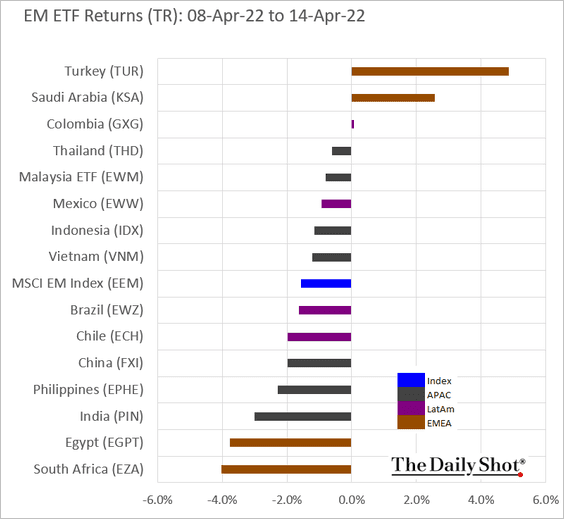

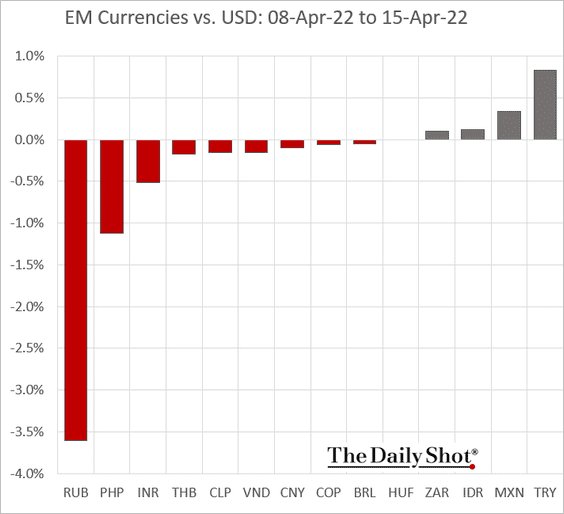

1. Let’s begin with last week’s performance data.

• Equity ETFs:

• EM currencies:

——————–

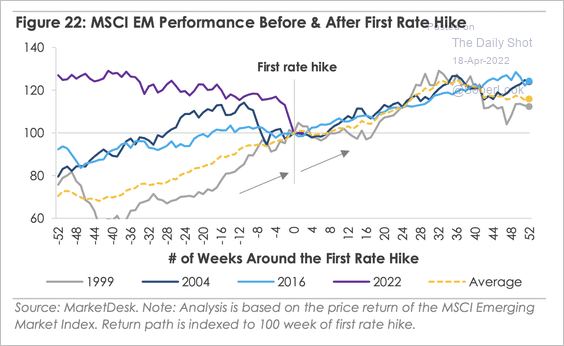

2. EM stocks tend to perform well after the first Fed rate hike.

Source: MarketDesk Research

Source: MarketDesk Research

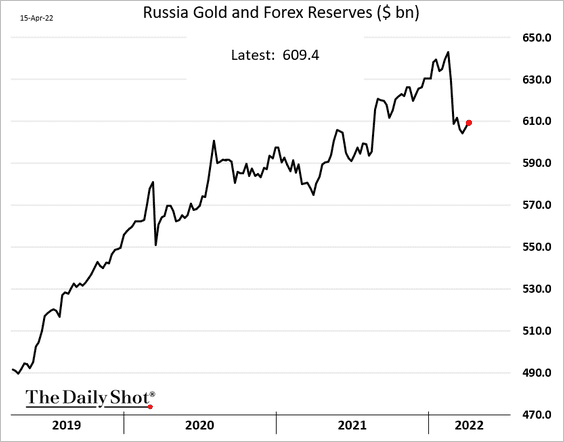

3. Russia’s F/X reserves have stabilized.

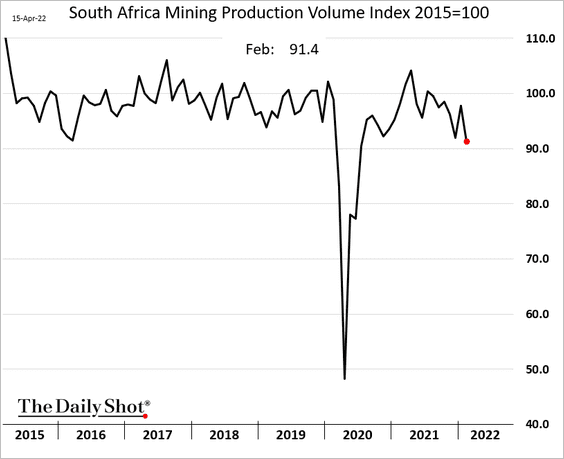

4. South Africa’s mining output has been deteriorating.

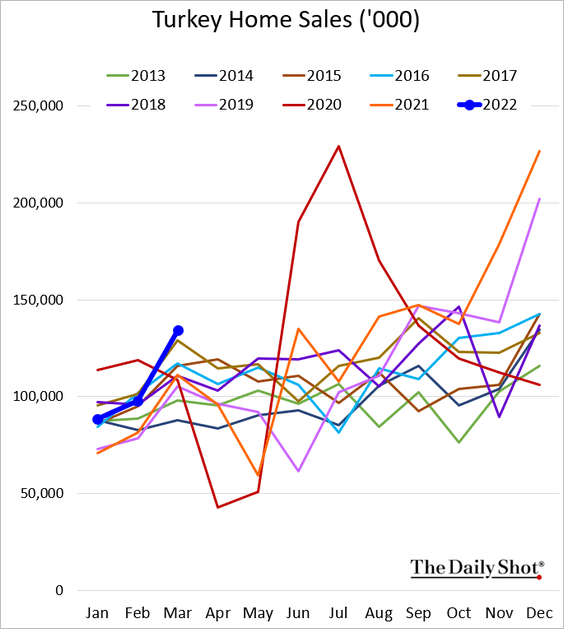

5. Turkey’s home sales hit a multi-year high for this time of the year.

Back to Index

Cryptocurrency

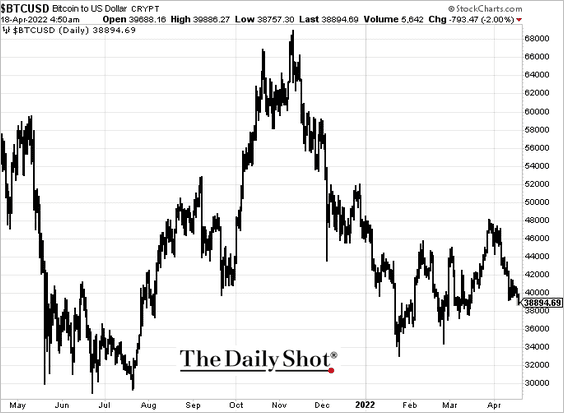

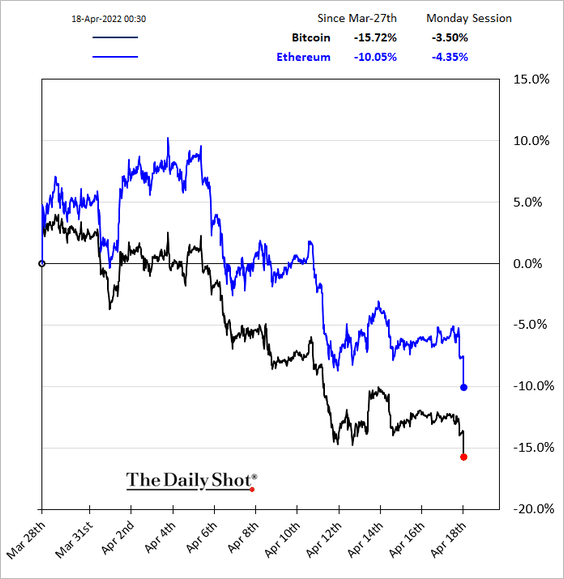

Cryptos are weaker this morning as bitcoin dips below $40k again.

Back to Index

Commodities

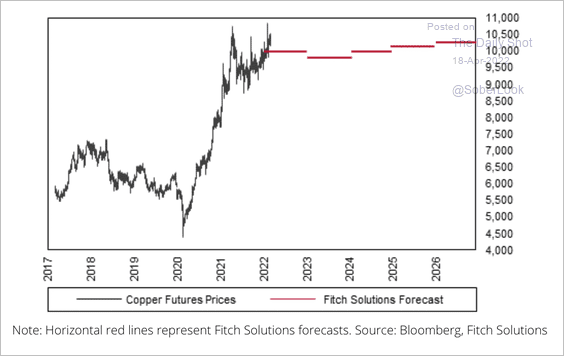

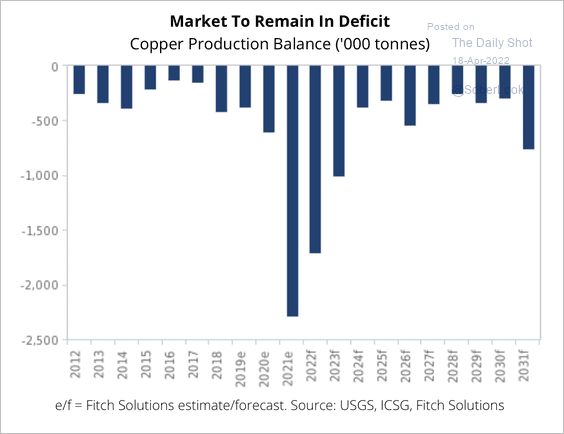

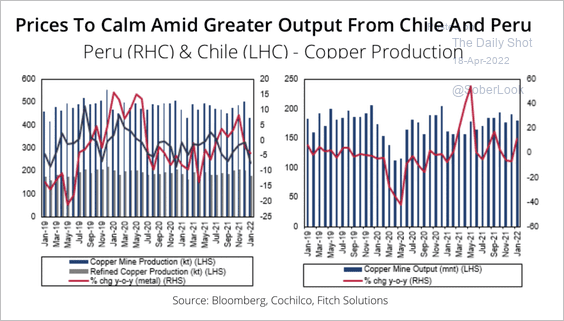

1. Fitch revised its copper price forecast higher as low inventories leave the metal highly sensitive to sentiment and external factors (2 charts).

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Current tightness in copper inventories should ease slightly in the coming months, driven by greater output from Latin America.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

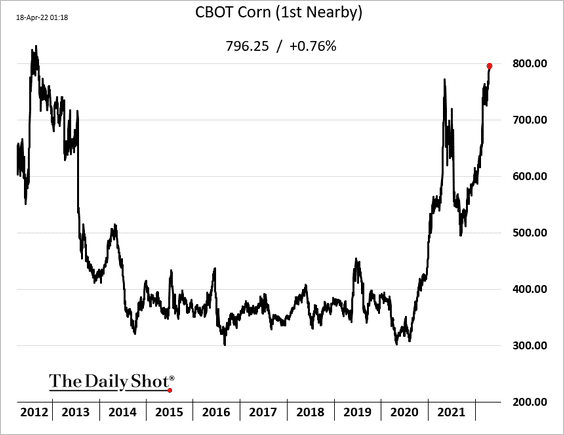

2. Corn futures have been surging.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

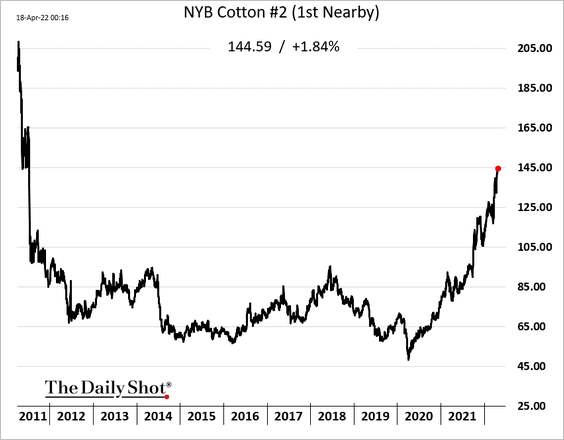

3. US cotton futures are at multi-year highs amid higher demand from India.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

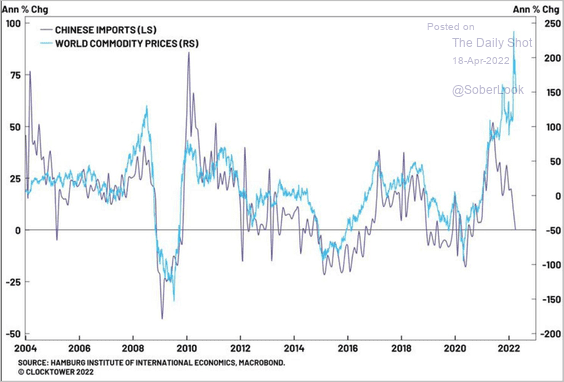

3. Weaker Chinese imports pose downside risks for commodities.

Source: Hamburg Institute of Intl Economics

Source: Hamburg Institute of Intl Economics

Back to Index

Energy

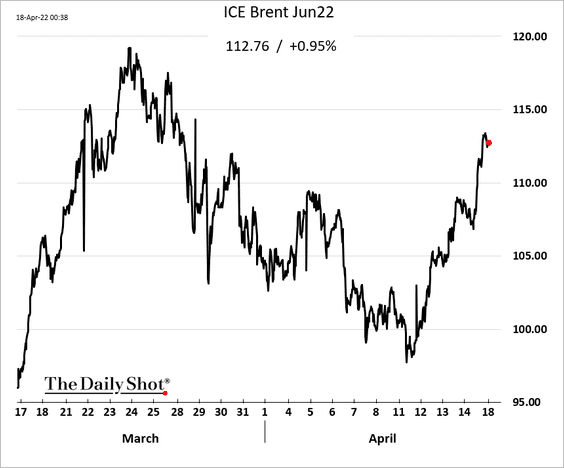

1. Brent crude has rebounded in recent days.

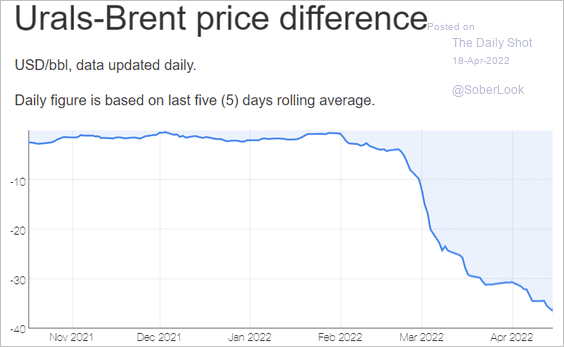

2. Russian oil discount to Brent keeps widening.

Source: Neste

Source: Neste

Source: Yahoo! Read full article

Source: Yahoo! Read full article

——————–

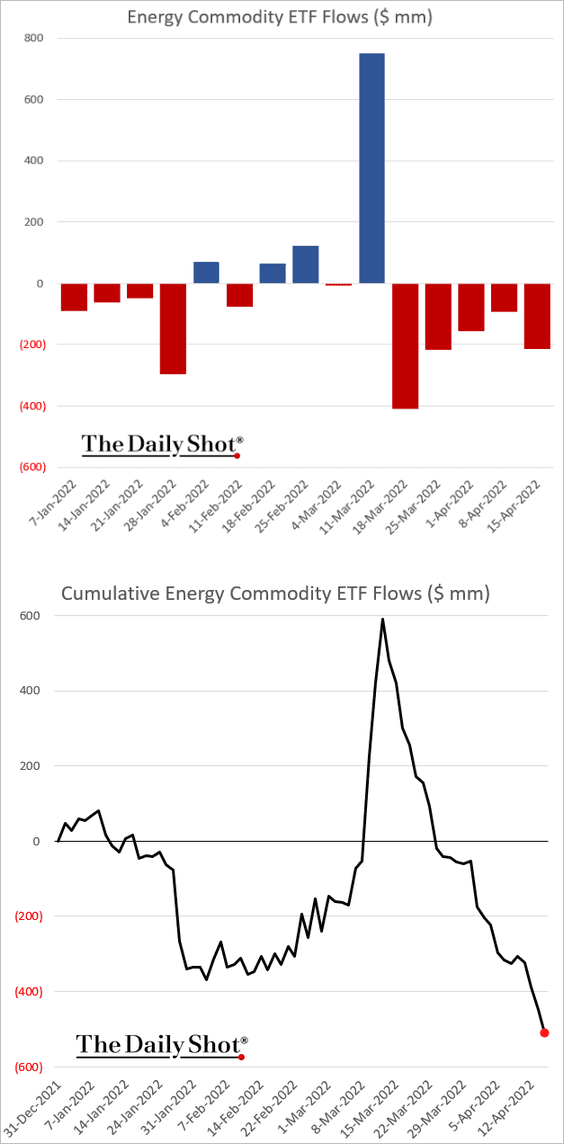

2. Energy (commodity) ETF flows have been negative over the past five weeks.

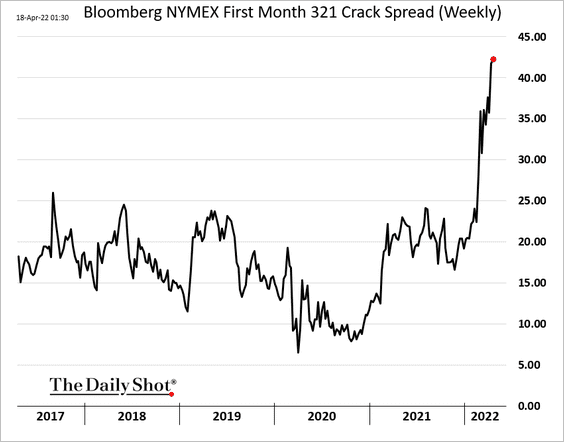

3. Crack spreads remain elevated, supporting refinery margins.

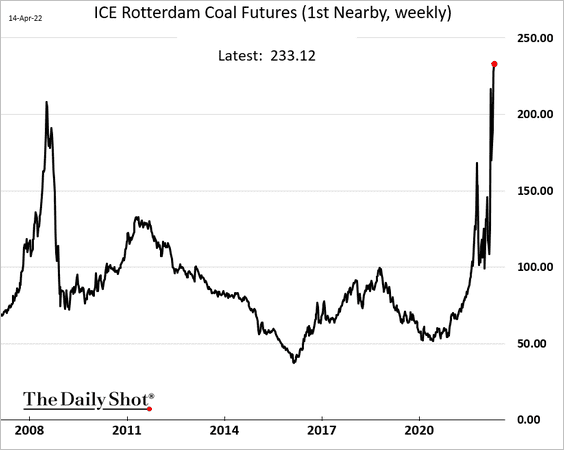

4. Coal prices are holding near multi-year highs.

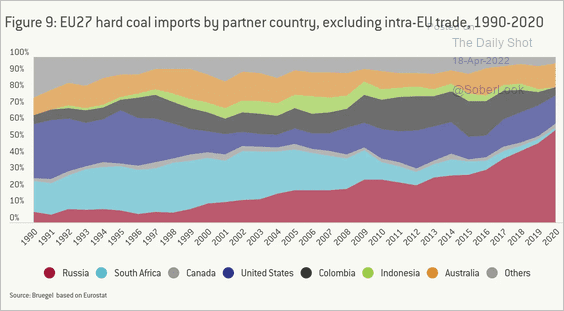

This chart shows the sources of coal imports in the EU.

Source: Bruegel Read full article

Source: Bruegel Read full article

——————–

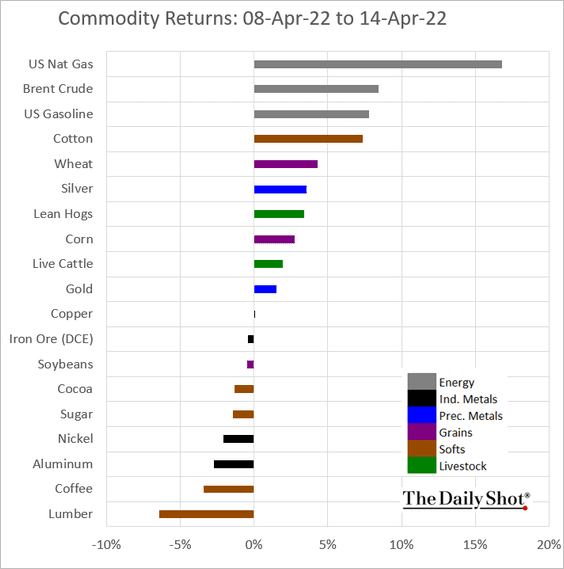

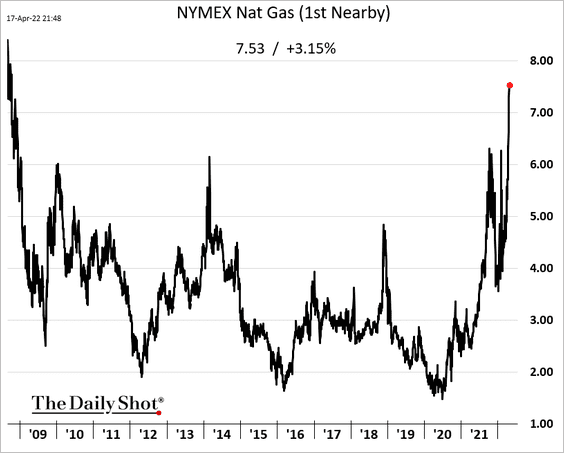

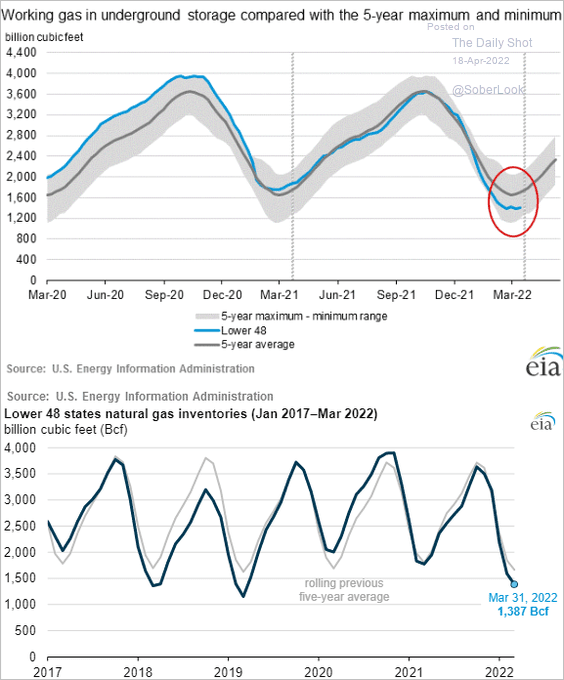

5. The energy complex outperformed other commodities last week, with US natural gas leading the way.

US gas futures hit the highest level since 2008.

Source: Natural Gas Intelligence Read full article

Source: Natural Gas Intelligence Read full article

Here is the natural gas storage situation.

Source: EIA Read full article

Source: EIA Read full article

——————–

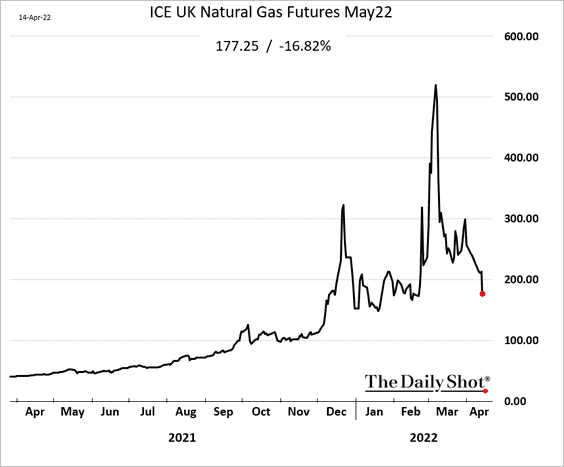

6. UK natural gas was down sharply last week.

Back to Index

Equities

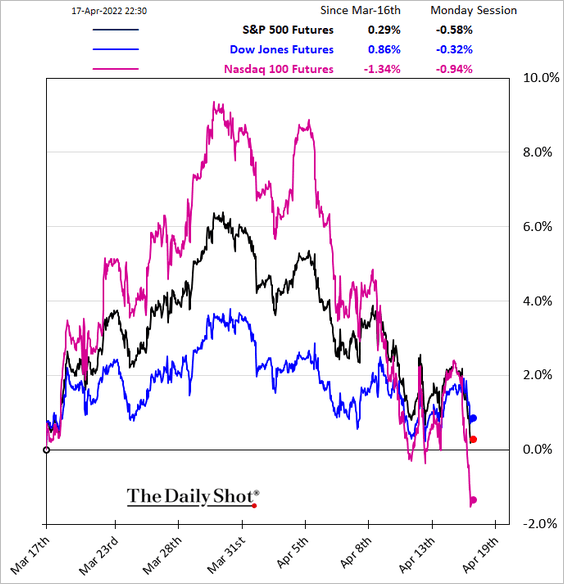

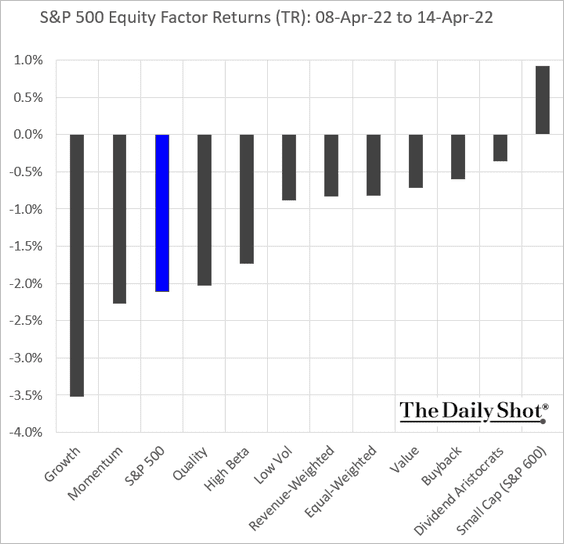

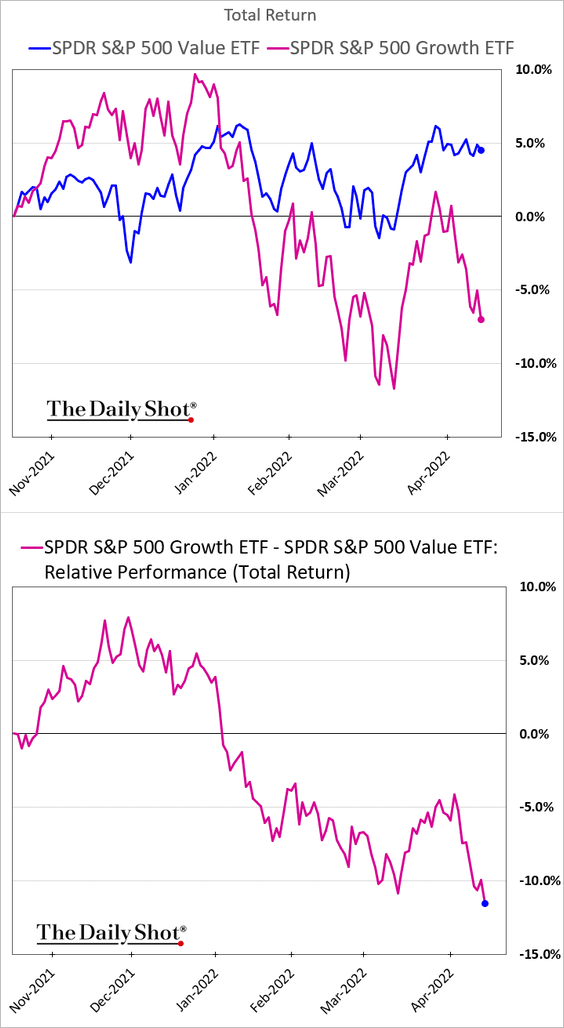

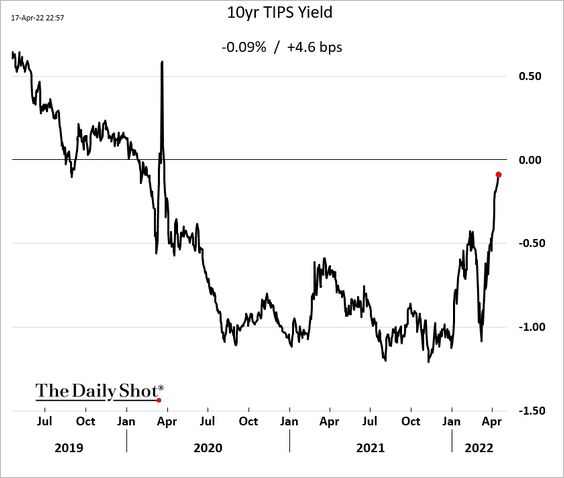

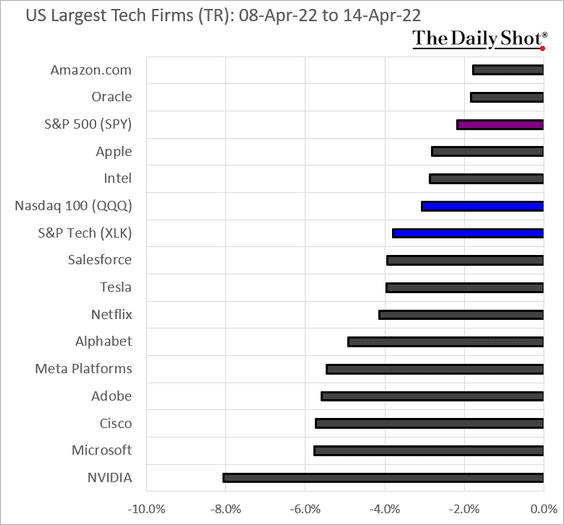

1. Growth stocks continue to lead the market lower (3 charts), …

… as US real rates climb.

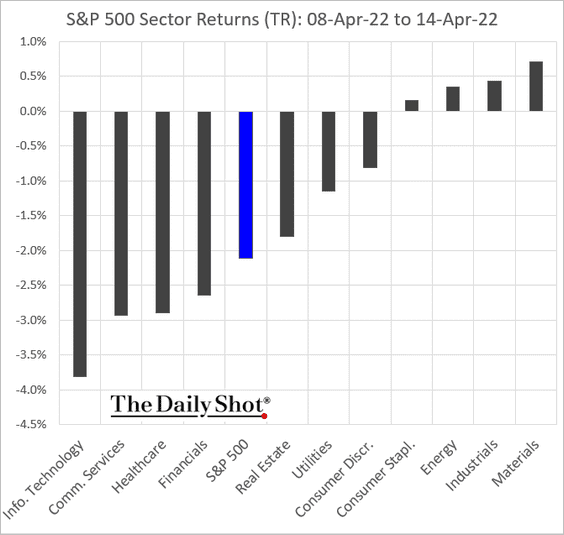

• Tech shares underperformed last week.

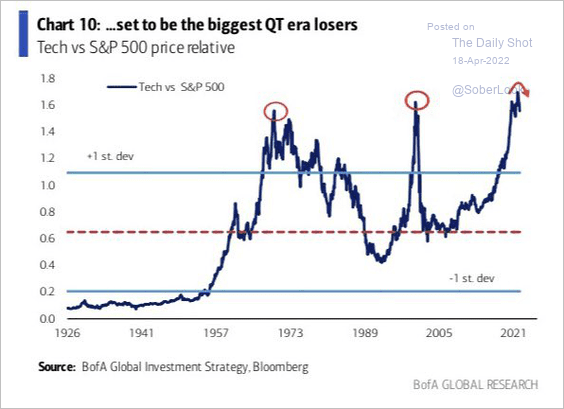

Will further underperformance follow?

Source: BofA Global Research; @Marlin_Capital

Source: BofA Global Research; @Marlin_Capital

Here is last week’s performance of the largest US tech companies.

• Semiconductor stocks have been struggling …

![]()

… despite a rebound in semiconductor prices.

![]()

——————–

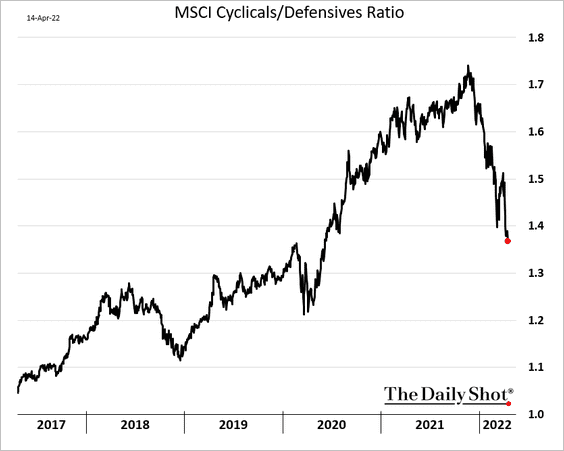

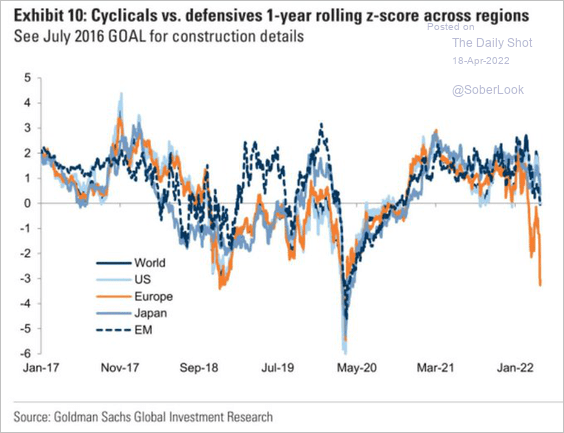

2. Cyclicals continue to underperform defensive sectors.

The trend is particularly acute in Europe.

Source: Goldman Sachs; @Mayhem4Markets

Source: Goldman Sachs; @Mayhem4Markets

——————–

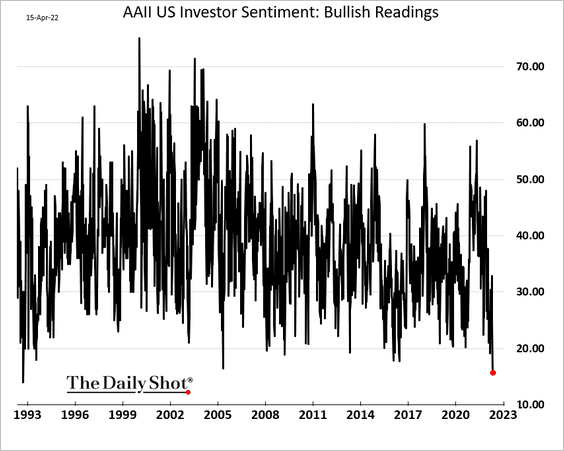

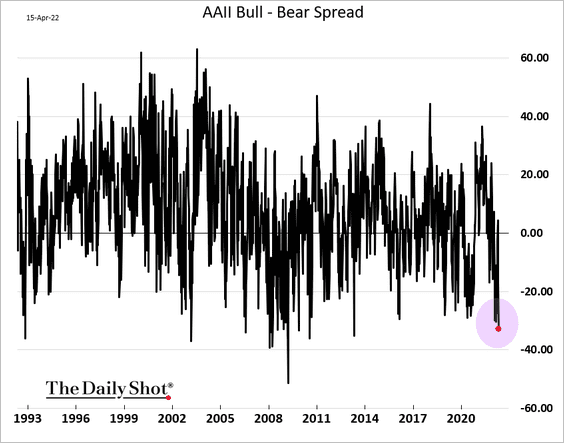

3. According to AAII, the percentage of bullish investors is now the lowest in some 30 years.

Here is the bull-bear spread.

——————–

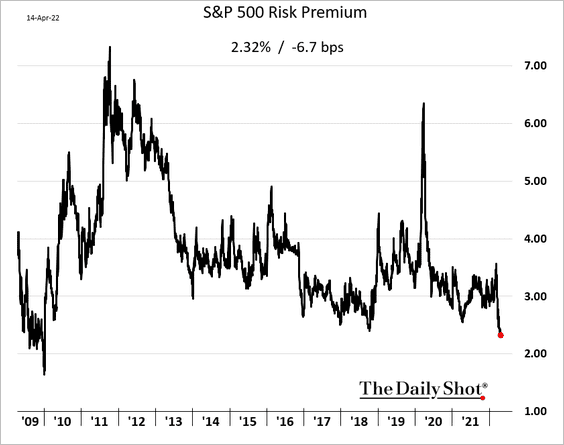

4. S&P 500 equity risk premium keeps drifting lower as Treasury yields climb.

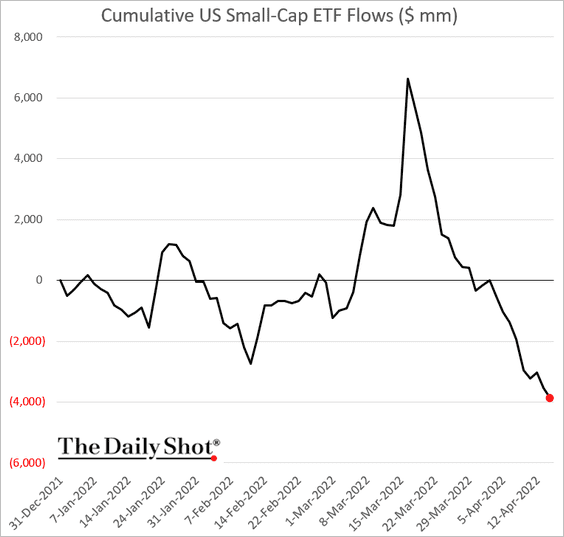

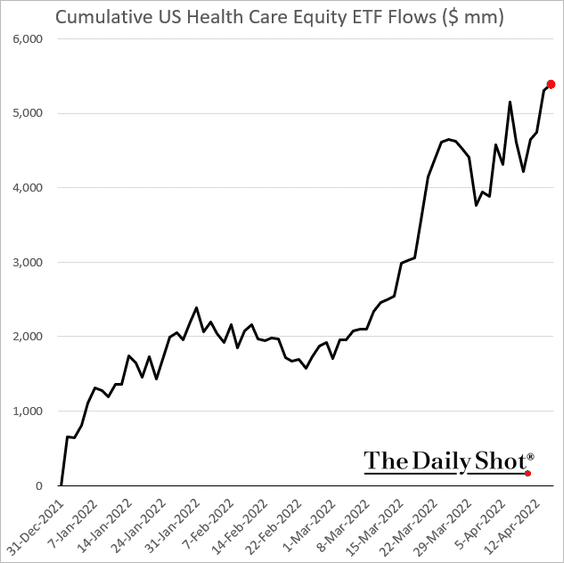

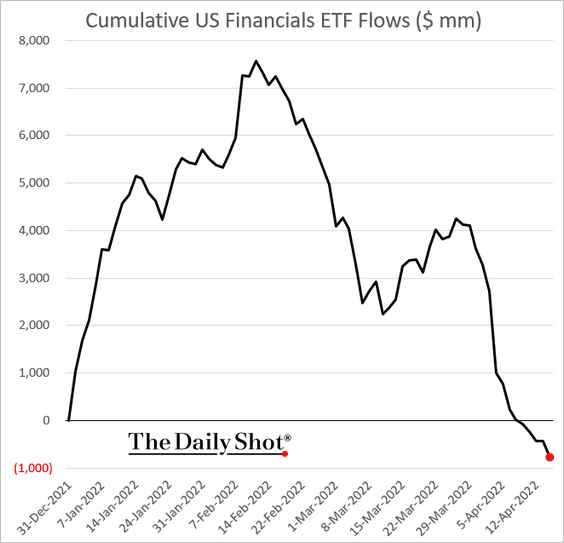

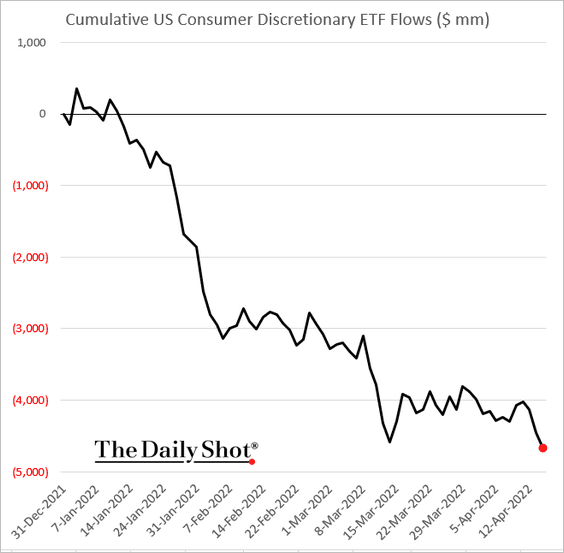

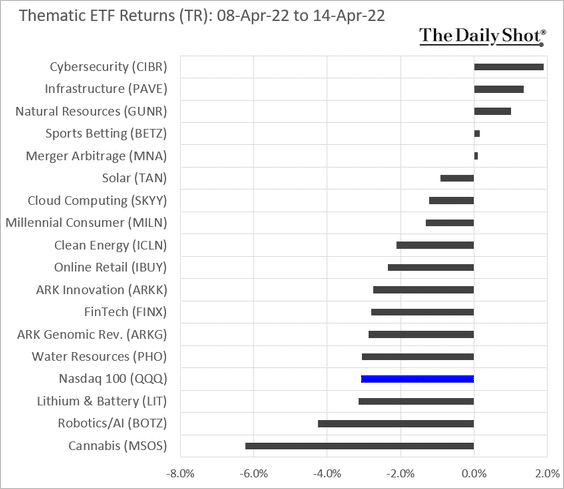

5. Next, we have some ETF flow data.

• Small-caps ($4 billion of outflows this year):

• Healthcare:

• Financials:

• Consumer Discretionary:

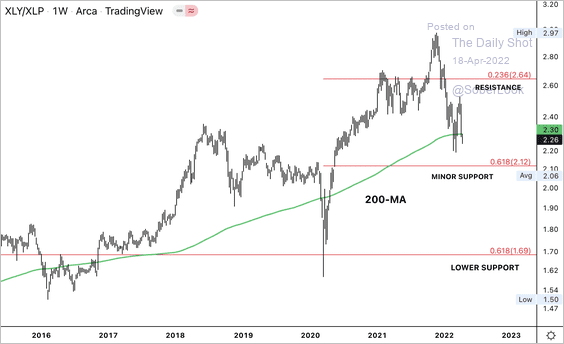

By the way, the SPDR Consumer Discretionary ETF (XLY) is testing support relative to the SPDR Consumer Staples ETF (XLP).

Source: Dantes Outlook

Source: Dantes Outlook

——————–

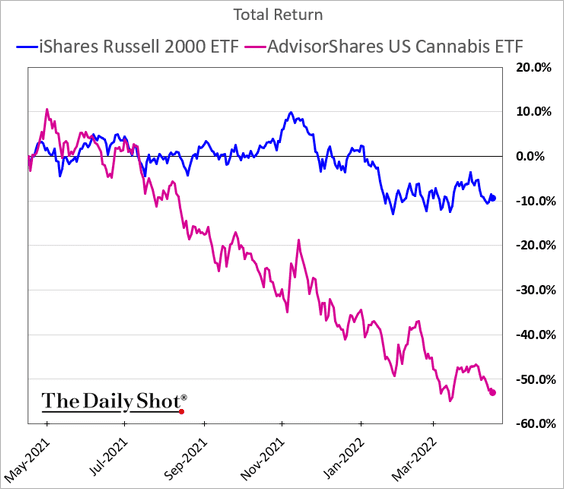

5. Cannabis shares tumbled last week.

It’s been a rough few quarters for the sector.

Back to Index

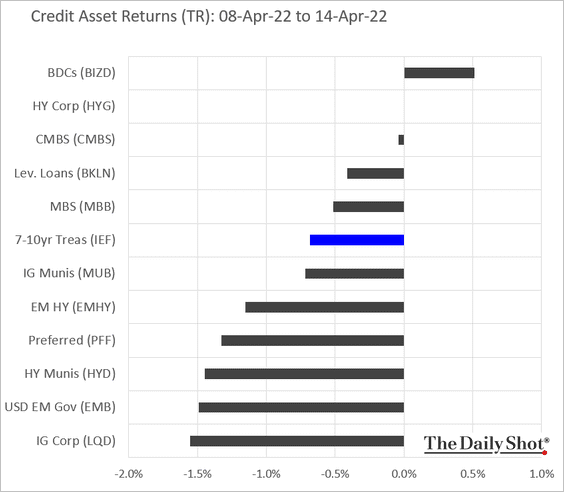

Credit

Here is last week’s performance across credit asset classes.

Back to Index

Rates

1. Foreigners have been buying Treasury notes and bonds.

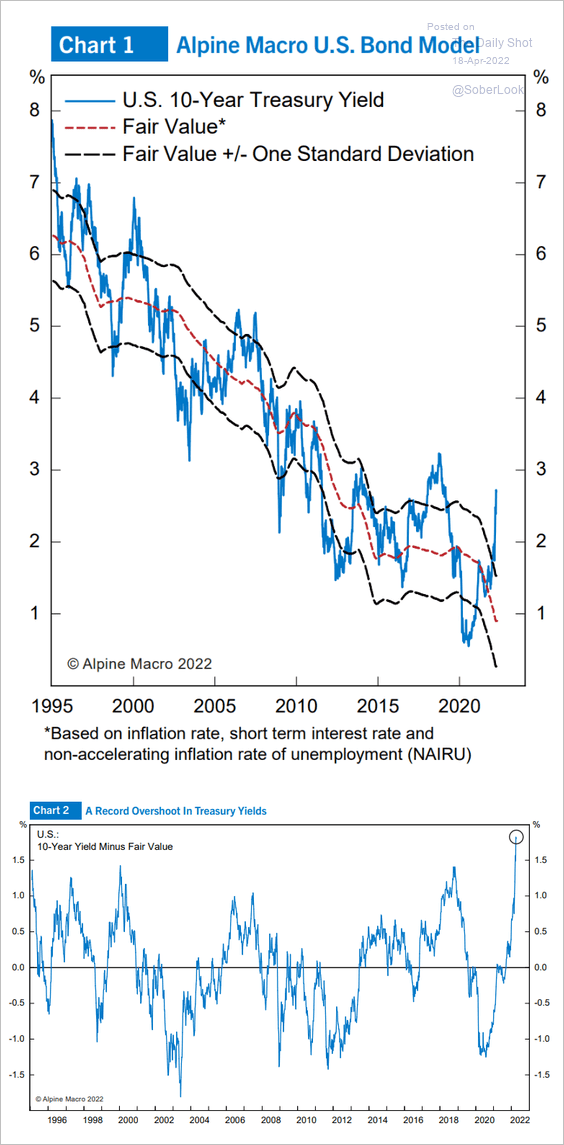

2. According to a model from Alpine Macro, Treasuries are oversold.

Source: Alpine Macro

Source: Alpine Macro

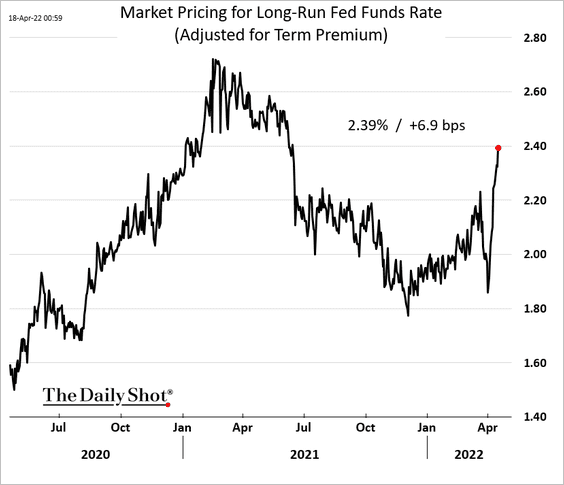

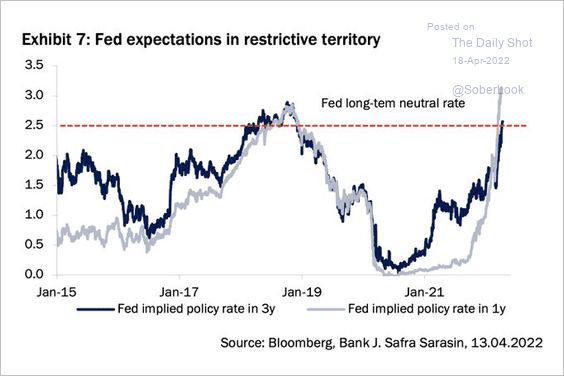

3. Market expectations for the “terminal rate” have been rising.

4. Near-term fed funds rate expectations are in restrictive territory.

Source: @acemaxx, @KarstenJunius

Source: @acemaxx, @KarstenJunius

Back to Index

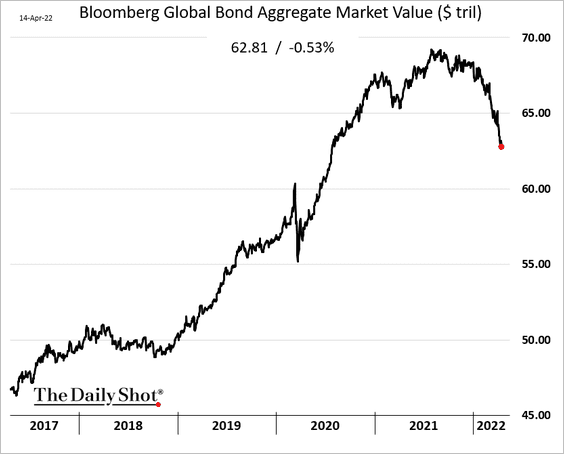

Global Developments

1. The total global bond market value has been tumbling.

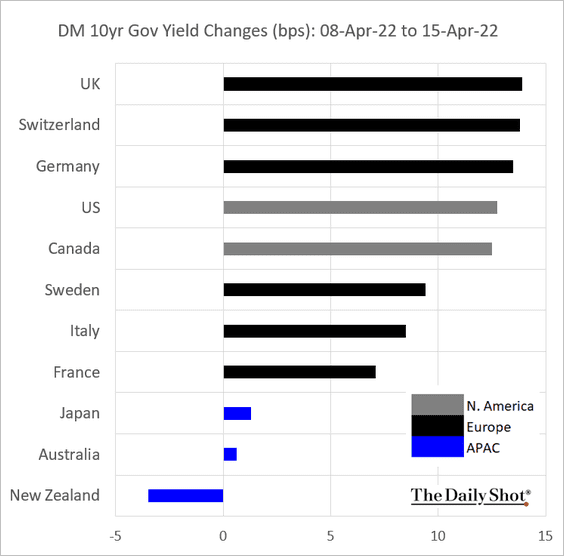

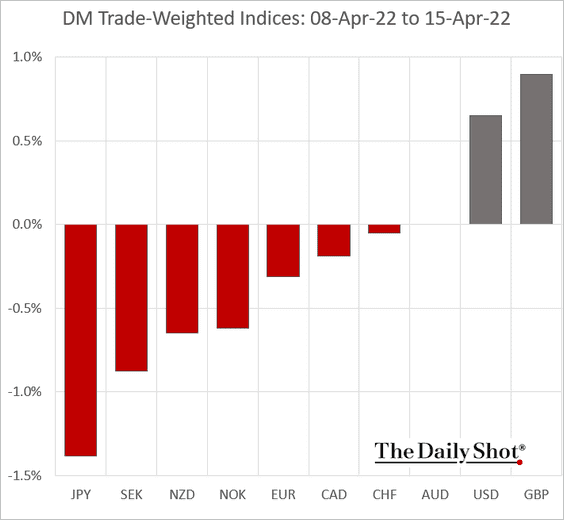

2. Below are a couple of performance charts (for last week).

• DM bond yields:

• Trade-weighted currency indices:

——————–

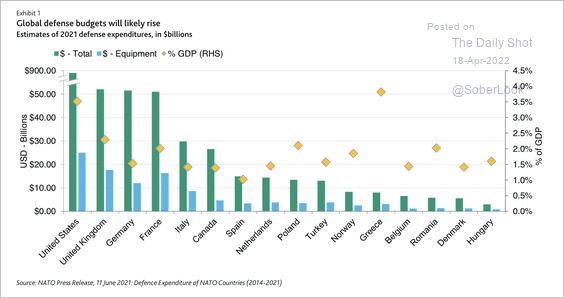

3. Global defense budgets will likely rise.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

——————–

Food for Thought

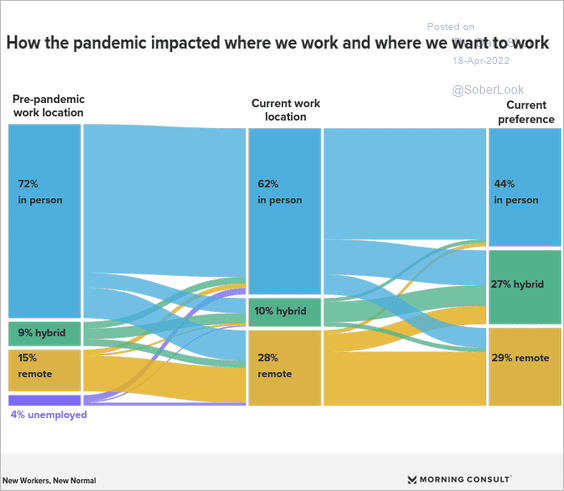

1. Preference for remote and hybrid work:

Source: Morning Consult

Source: Morning Consult

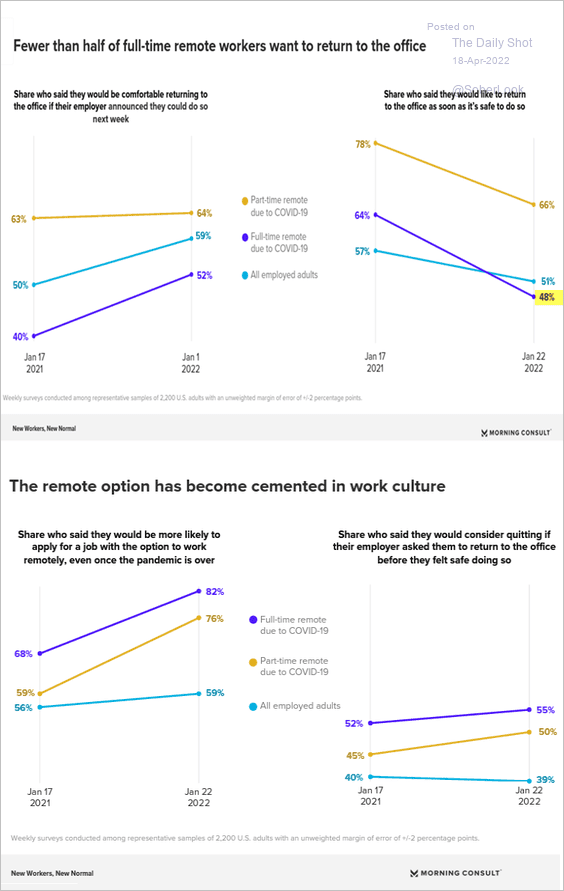

• Decreasing willingness to return to the office:

Source: Morning Consult

Source: Morning Consult

——————–

2. Wage growth vs. inflation:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

3. The global semiconductor market:

![]() Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

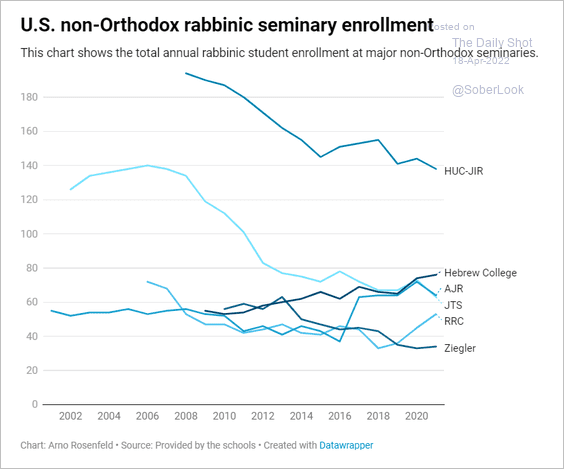

4. US non-Orthodox rabbinic seminary enrollment:

Source: The Forward Read full article

Source: The Forward Read full article

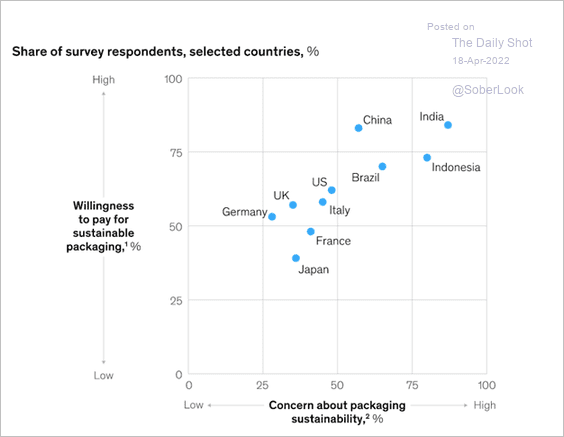

5. Sustainable packaging:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

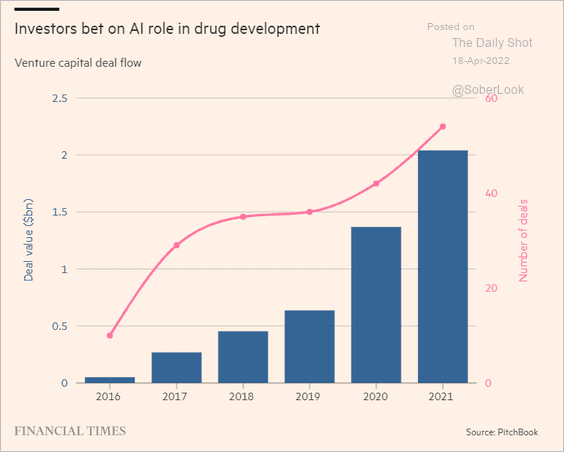

6. Investing in AI for drug development:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

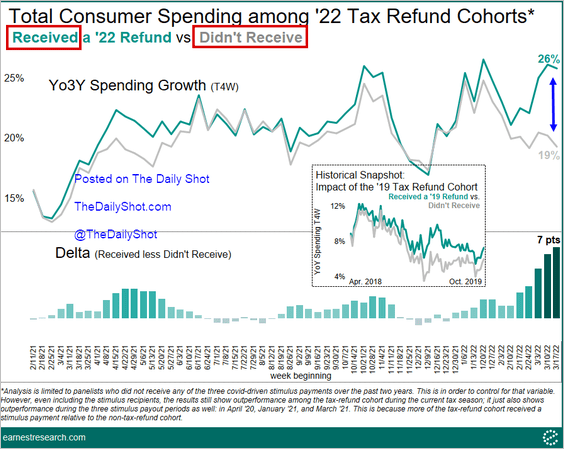

7. Tax refunds and consumer spending:

Source: Earnest Research

Source: Earnest Research

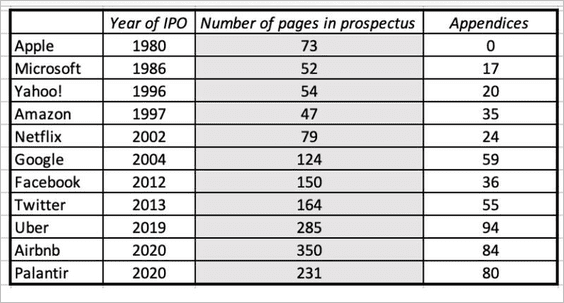

8. Lengthy IPO regulatory disclosures:

Source: Aswath Damodaran Read full article

Source: Aswath Damodaran Read full article

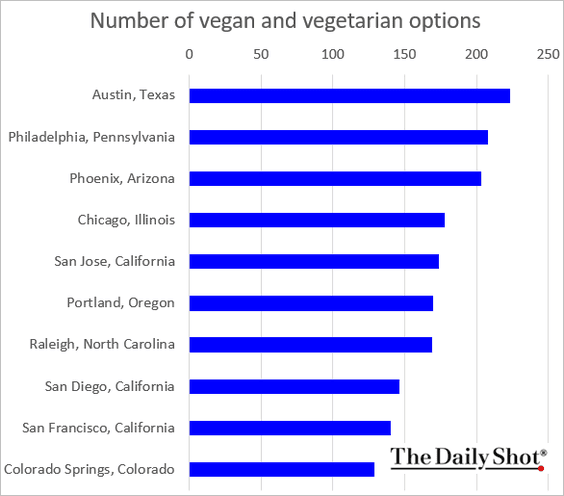

9. The top 10 cities for vegans and vegetarians:

Source: YorkTest Read full article

Source: YorkTest Read full article

——————–

Back to Index