The Daily Shot: 21-Apr-22

• The United States

• Canada

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the housing market.

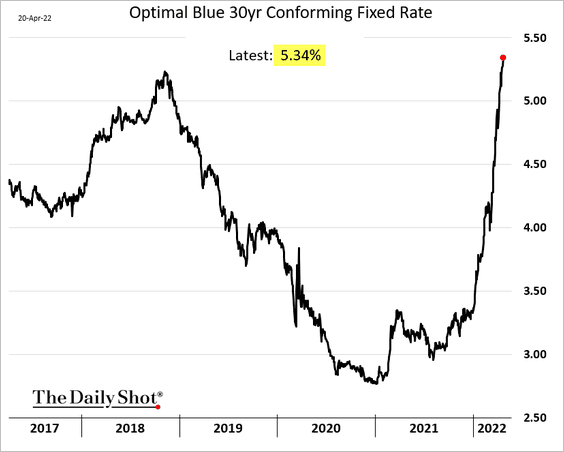

• Mortgage rates continue to surge, …

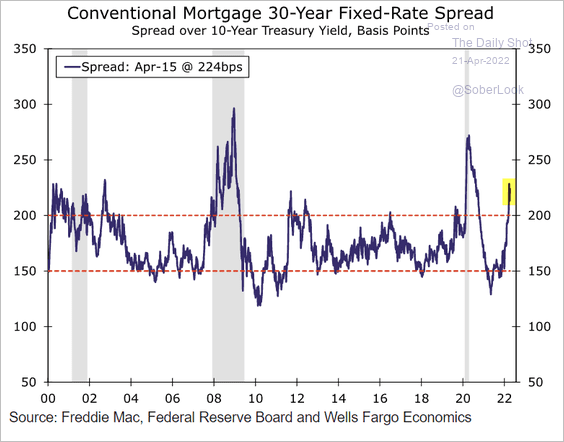

… outpacing the 10-year Treasury yield.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

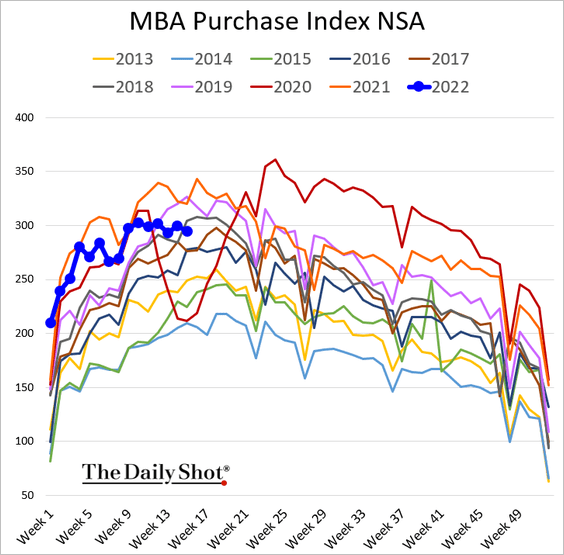

• Mortgage applications to purchase a home dipped below 2018 levels.

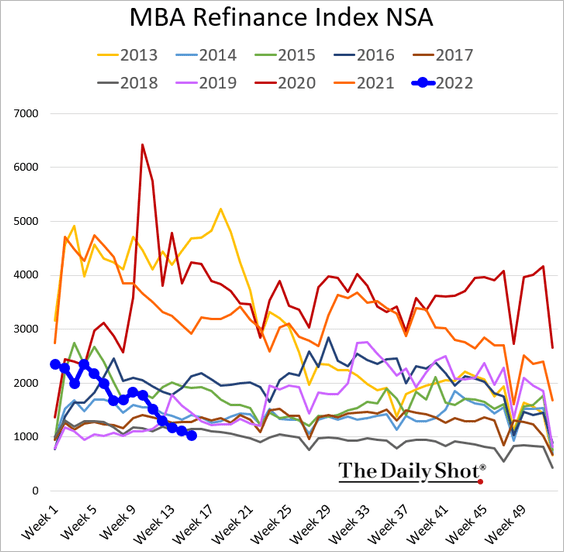

Refi activity is collapsing.

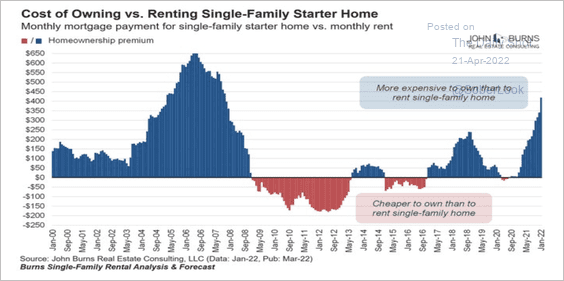

• The home price/rent ratio, a measure of housing valuation, is at the highest level since 2006.

Source: John Burns Real Estate Consulting

Source: John Burns Real Estate Consulting

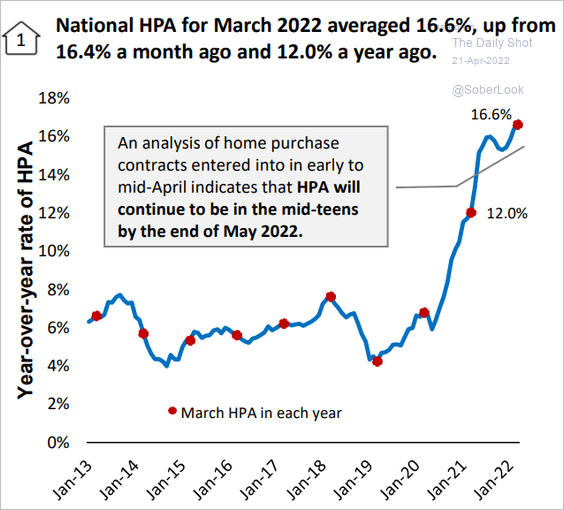

• Home price appreciation is holding up despite the spike in mortgage rates.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

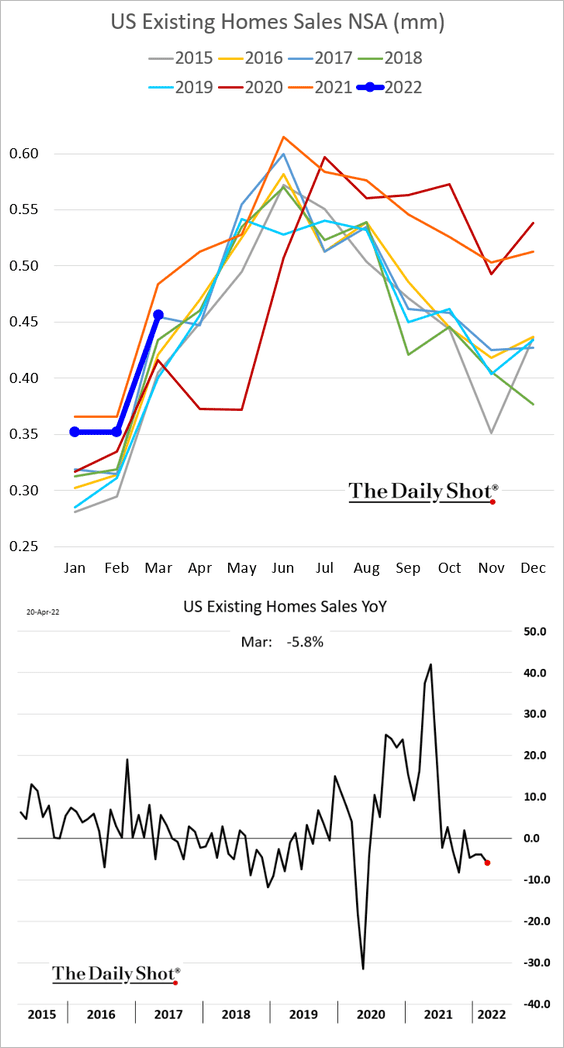

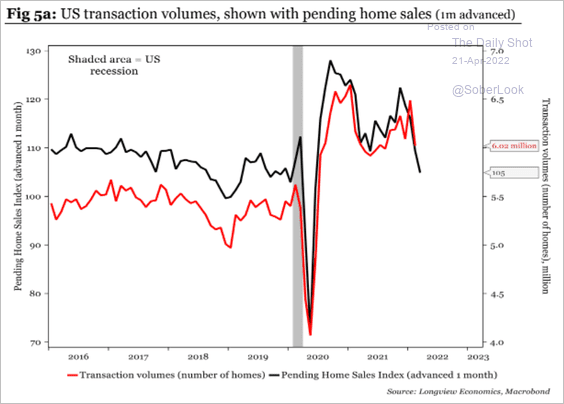

• Existing home sales were relatively soft in March. The second panel shows the year-over-year changes.

Analysts expect further weakness in home sales ahead.

Source: Longview Economics

Source: Longview Economics

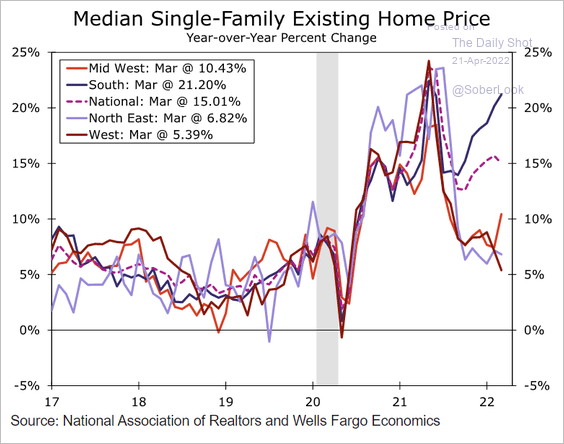

• Home price gains are diverging across US regions.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

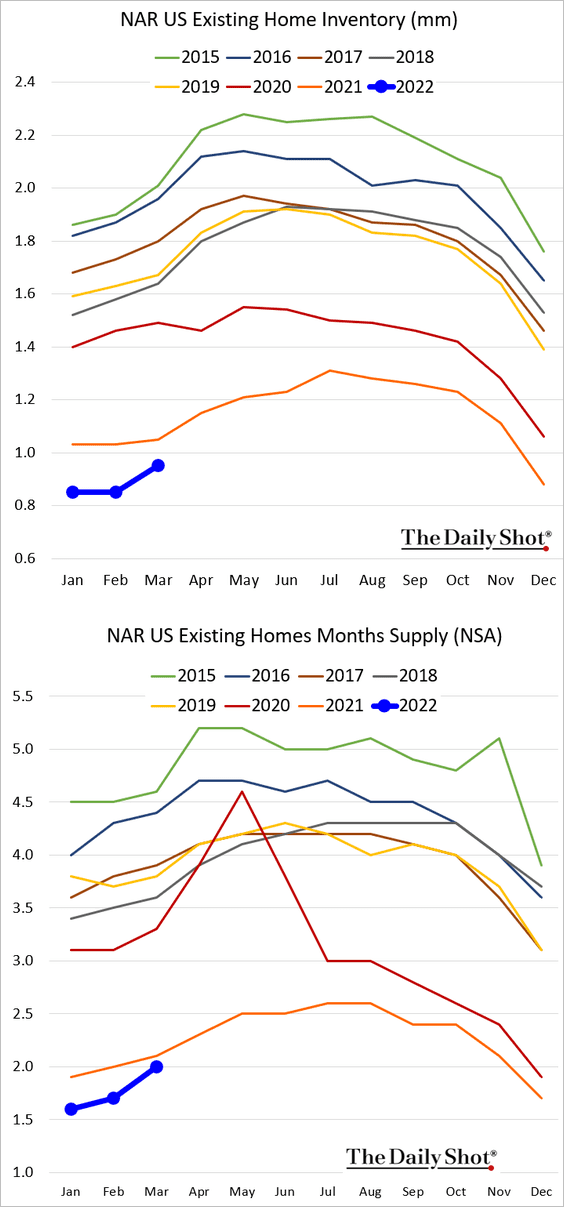

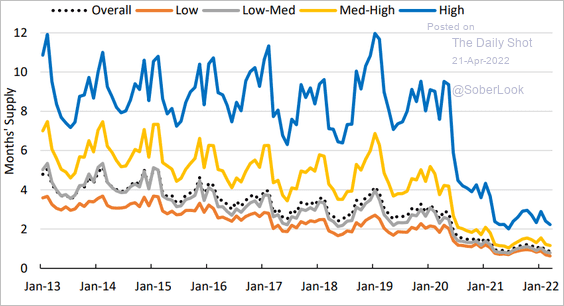

• Inventories remain depressed …

… across price tiers.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

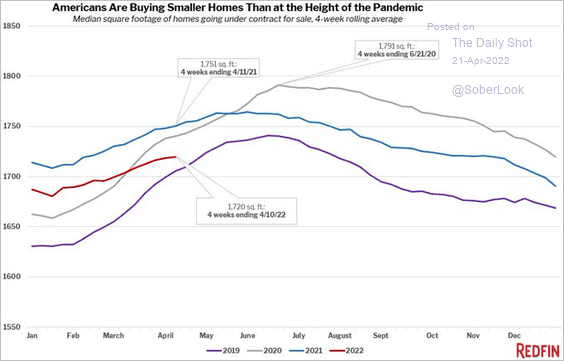

• Americans are buying smaller homes relative to what we saw at the height of the pandemic.

Source: @TaylorAMarr

Source: @TaylorAMarr

——————–

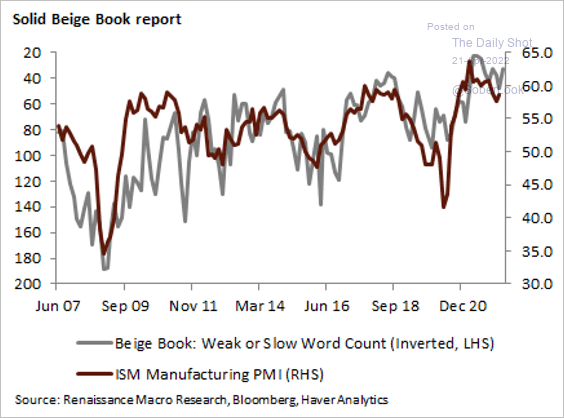

2. The Fed’s Beige Book report was relatively upbeat. But businesses continue to struggle with surging prices, supply bottlenecks, and tight labor markets.

Source: @RenMacLLC

Source: @RenMacLLC

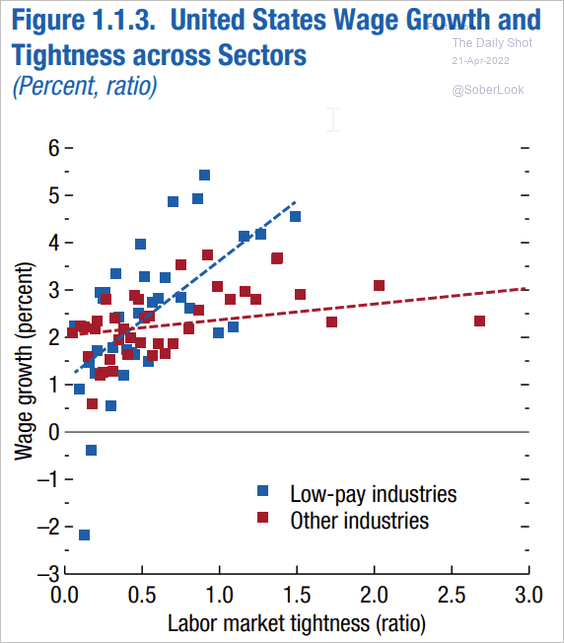

3. Low-pay industries saw a stronger wage response to the tightening labor market.

Source: IMF World Economic Outlook

Source: IMF World Economic Outlook

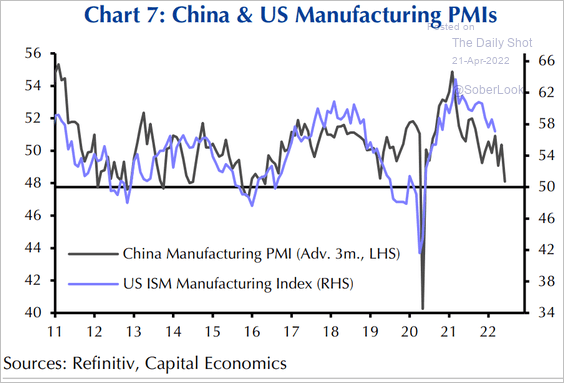

4. Will US manufacturing activity hold up despite the weakness in China?

Source: Capital Economics

Source: Capital Economics

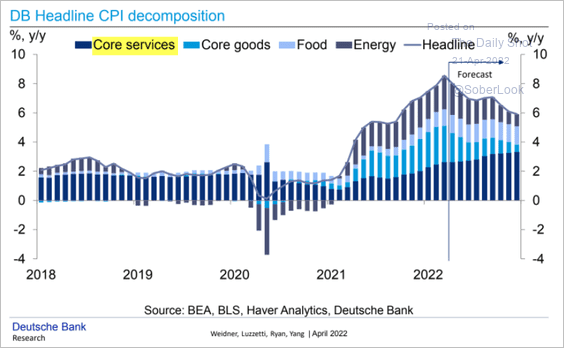

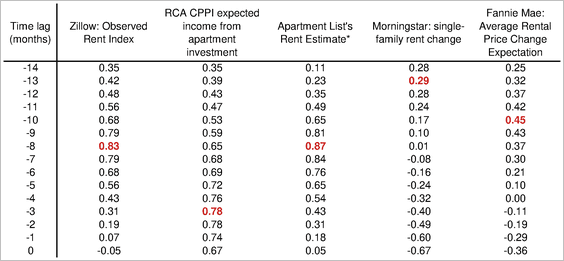

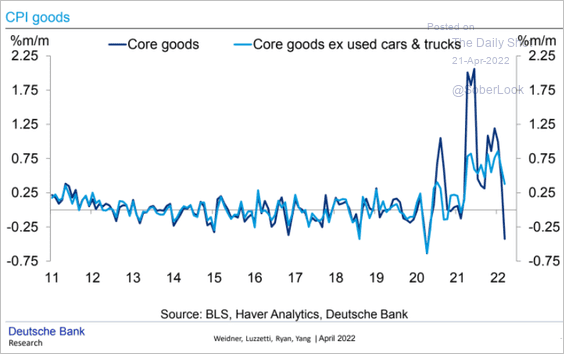

5. Next, we have some updates on inflation.

• Goods inflation is expected to moderate going forward, even as services CPI continues to climb (driven by shelter).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

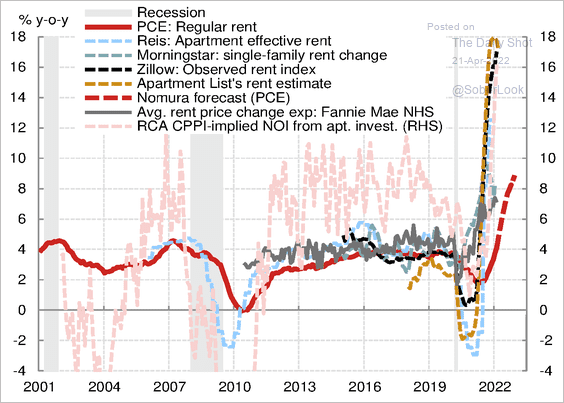

• Rent inflation indicators accelerated in recent months and could continue in the coming quarters, according to Nomura.

Source: Nomura Securities

Source: Nomura Securities

Official BLS rent inflation tends to lag private inflation data by a few quarters.

Source: Nomura Securities

Source: Nomura Securities

• Here are the month-over-month CPI changes and their broad components.

Source: TS Lombard

Source: TS Lombard

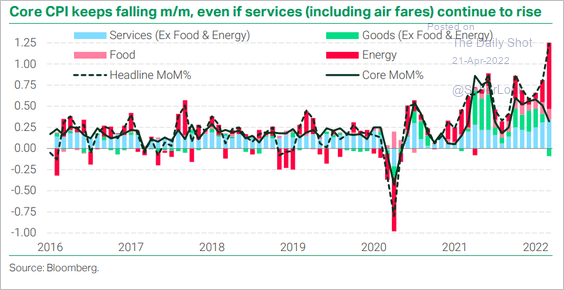

• What does the core goods CPI look like without used vehicles?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

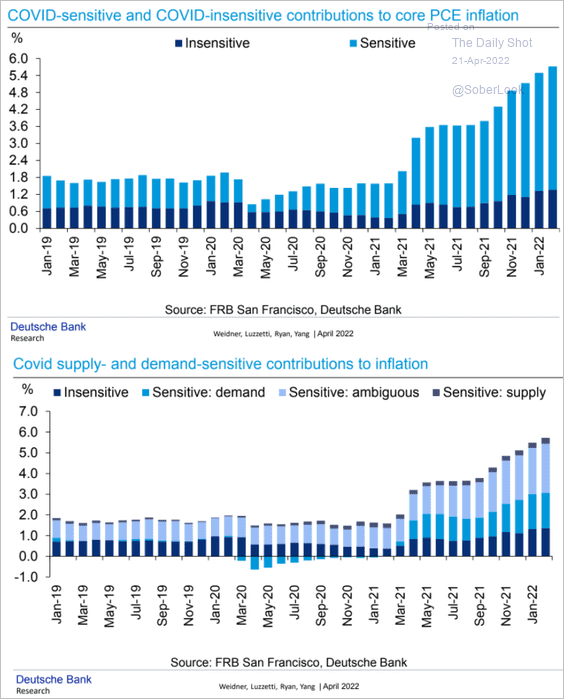

• What portion of the CPI is “COVID-sensitive”?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

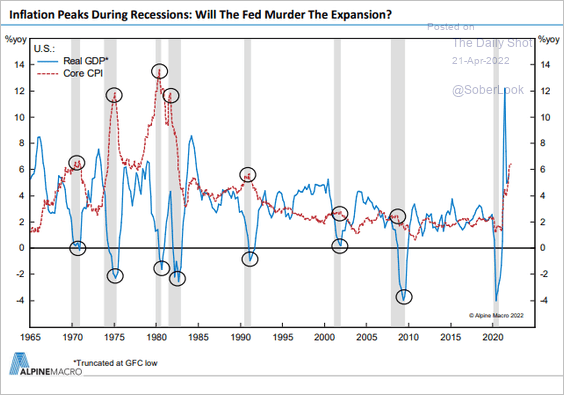

• Inflation tends to peak during recessions.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

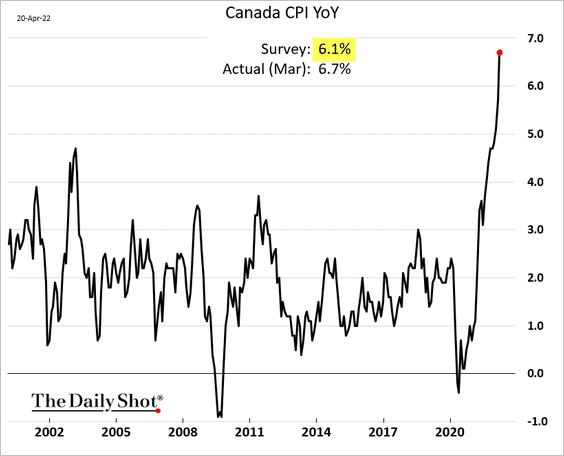

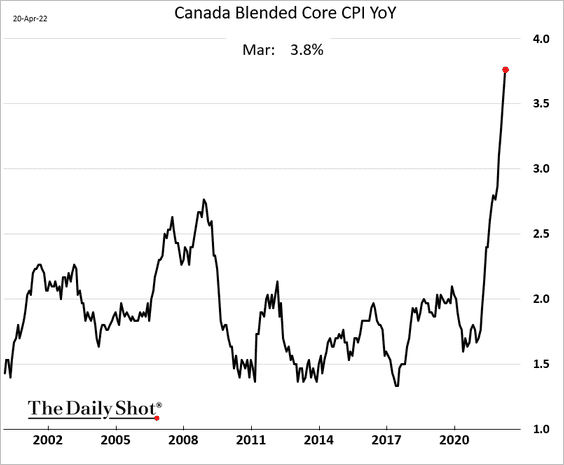

Canada

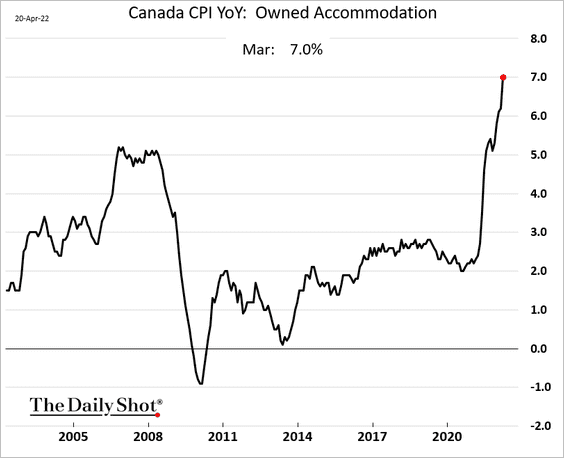

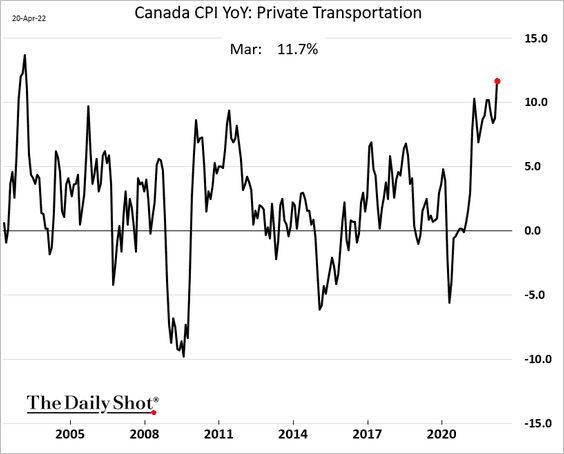

1. The March CPI report topped economists’ forecasts.

• Blended core CPI:

• Shelter:

• Transportation:

——————–

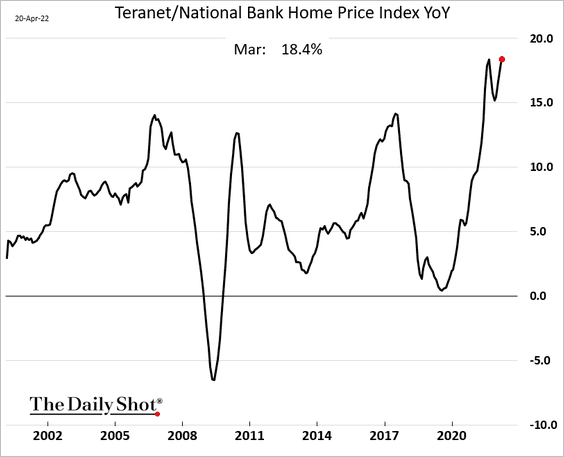

2. Home price appreciation hit a new high.

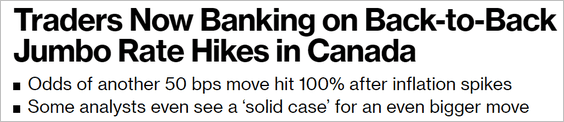

3. The combination of inflation surprises and surging housing prices suggests that the BoC will remain very hawkish. Another 50 bps rate hike is expected at the next meeting. Could we get an even bigger increase?

Source: Bloomberg Read full article

Source: Bloomberg Read full article

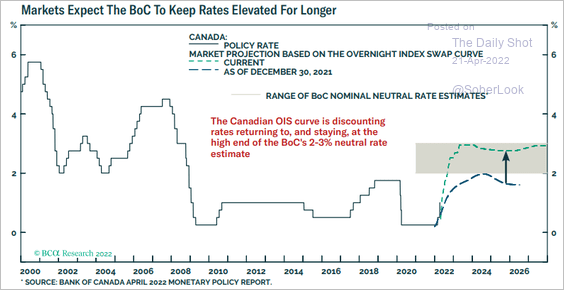

• Markets expect the BoC to keep rates elevated for years.

Source: BCA Research

Source: BCA Research

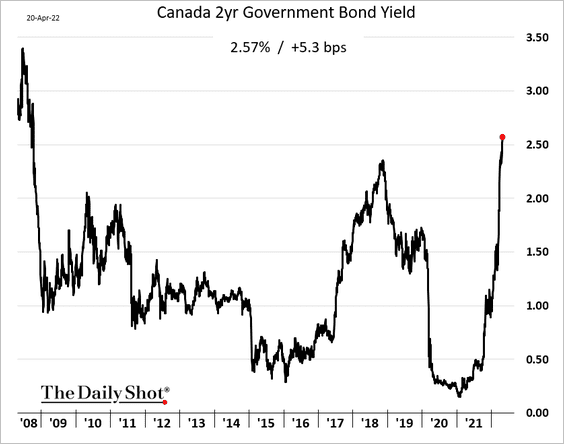

• The 2-year bond yield is above 2.5% for the first time since 2008.

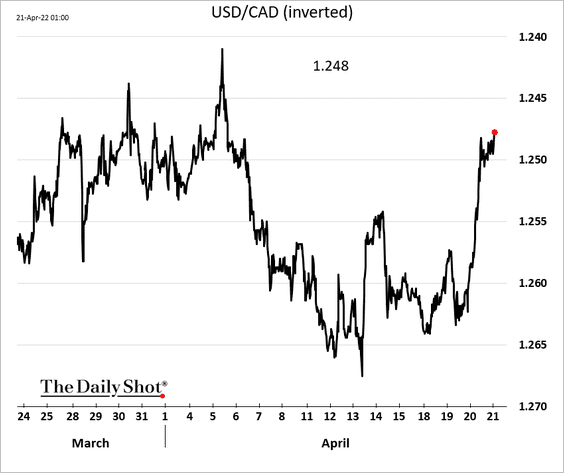

• The loonie got a boost from the CPI report beat.

Back to Index

The Eurozone

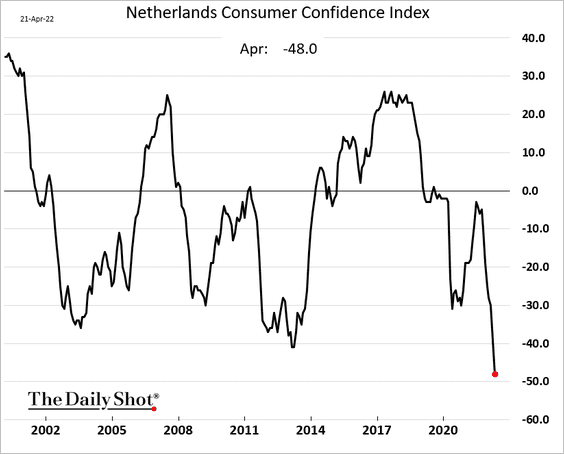

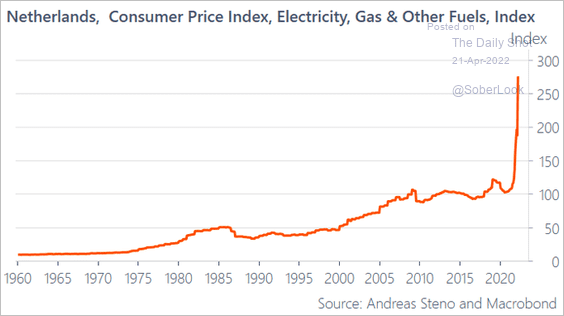

1. Let’s begin with the Netherlands.

• Consumer confidence has collapsed, …

… as consumer energy costs soar.

Source: @AndreasSteno

Source: @AndreasSteno

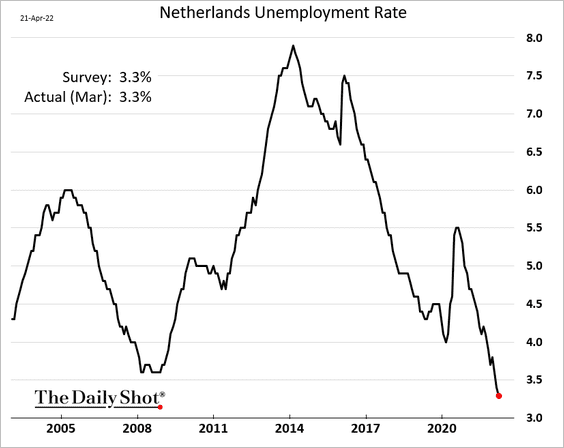

• The unemployment rate hit another low.

——————–

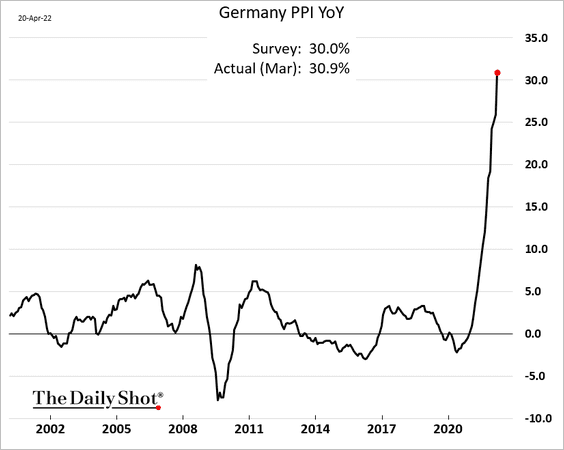

2. Germany’s PPI climbed above 30% in March.

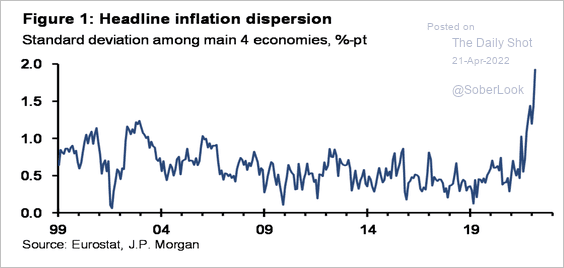

3. Dispersion in headline inflation in the euro area is at a record high.

Source: JP Morgan Research

Source: JP Morgan Research

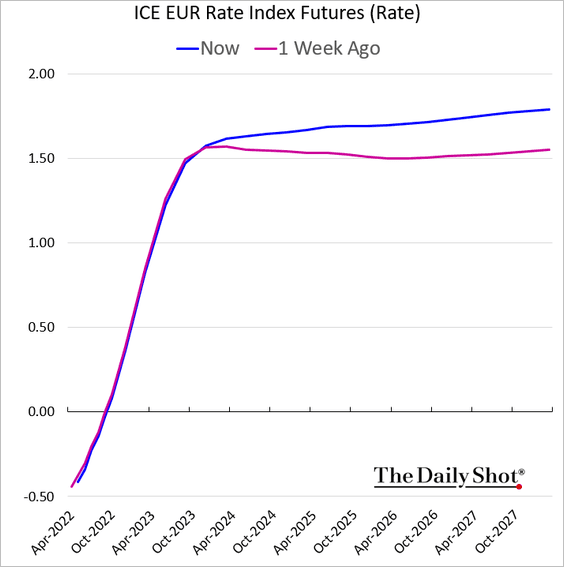

4. The markets expect the ECB to keep rates “higher for longer.”

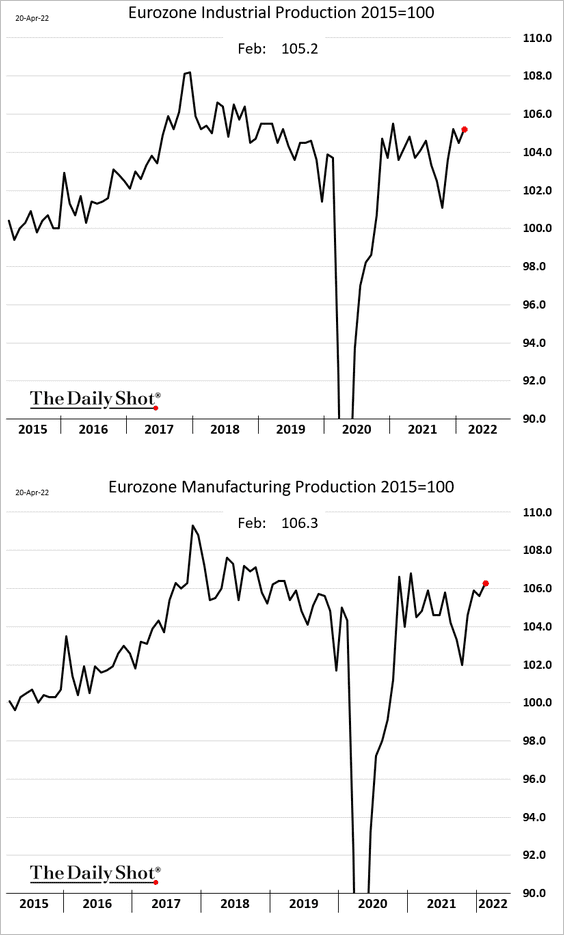

5. Eurozone manufacturing output strengthened in February.

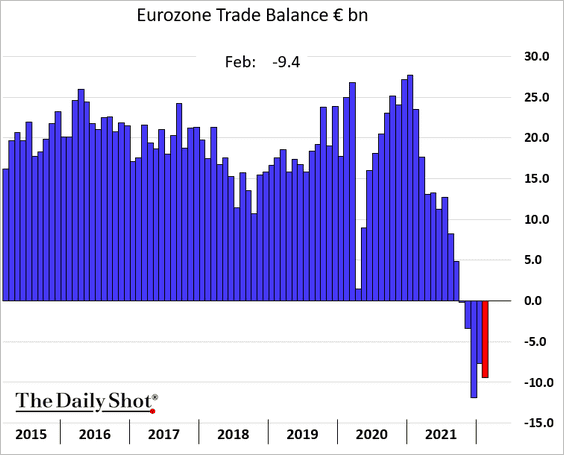

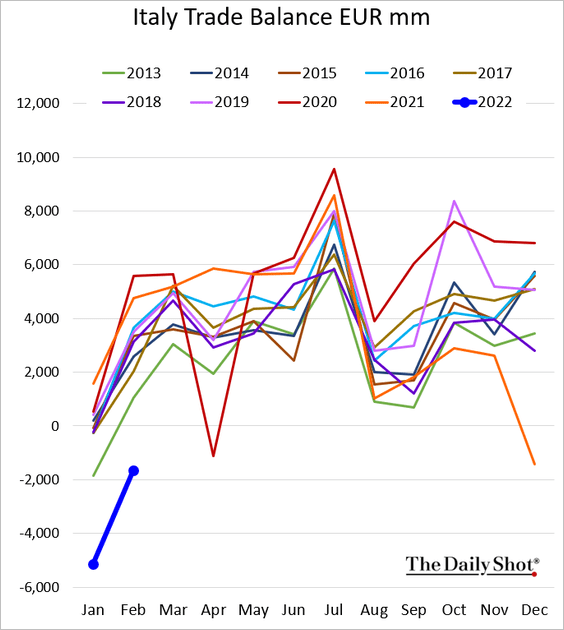

6. The trade deficit has been elevated by surging energy costs.

——————–

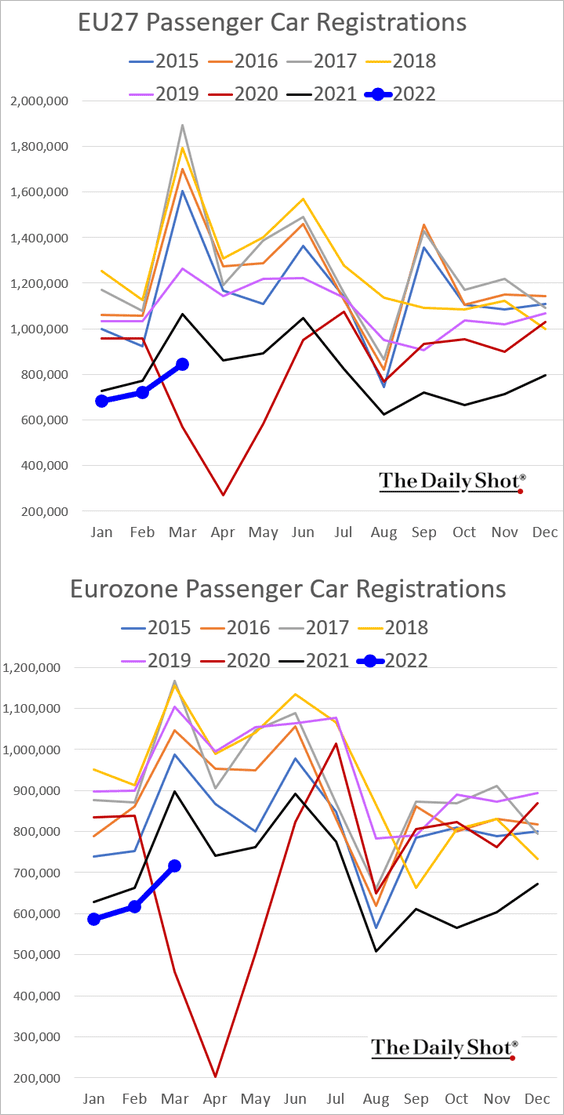

7. New car registrations remain depressed (March is supposed to be the peak buying month).

8. The euro is rebounding from the recent lows.

Source: @markets

Source: @markets

Back to Index

Asia – Pacific

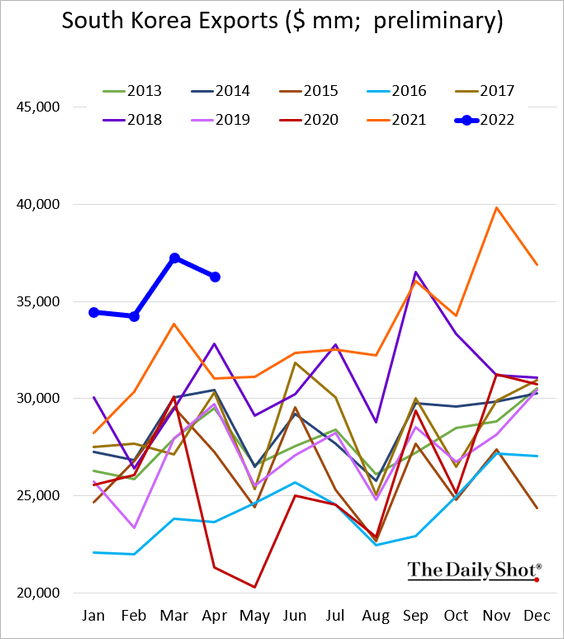

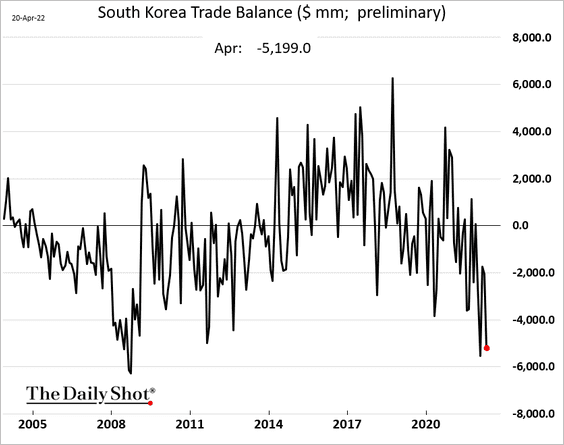

1. South Korea’s exports held up well this month.

But the trade deficit worsened due to lofty energy prices.

——————–

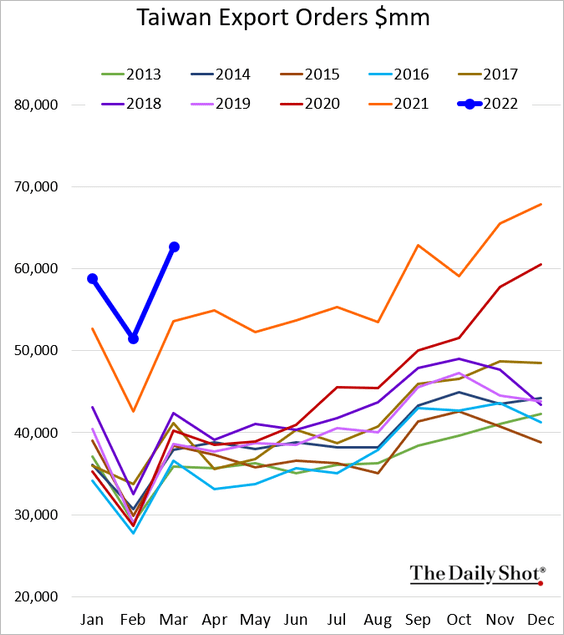

2. Taiwan’s export orders were very strong last month.

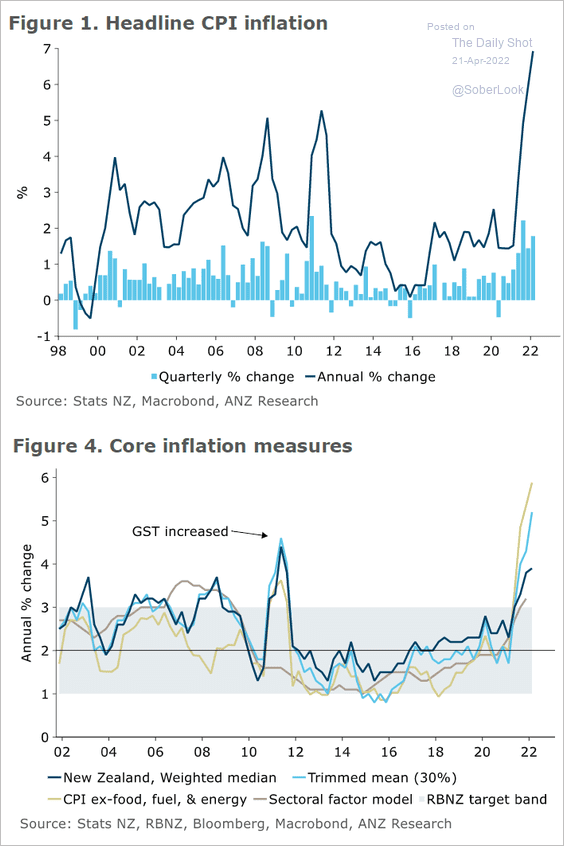

3. New Zealand’s inflation jumped in the first quarter.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

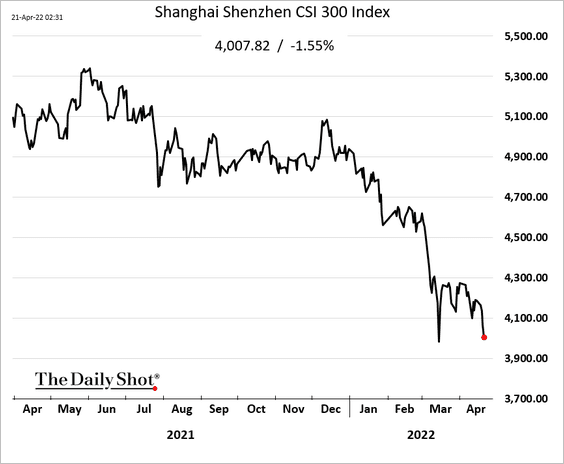

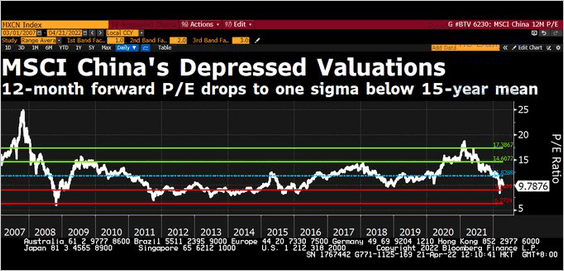

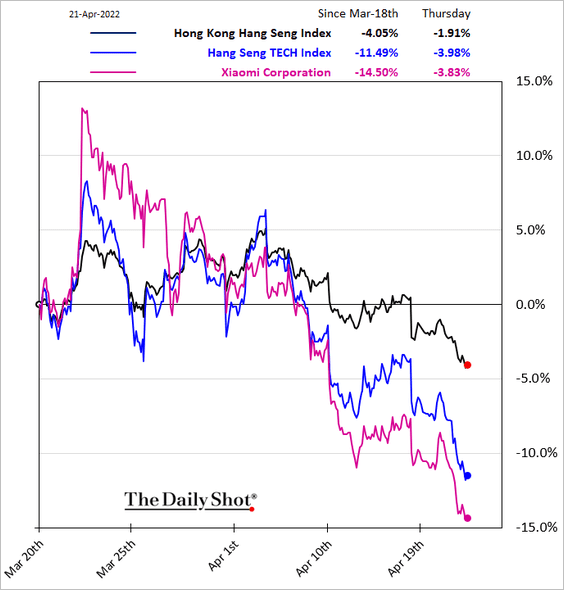

1. The stock market remains under pressure, …

… as valuations look increasingly attractive.

Source: @DavidInglesTV

Source: @DavidInglesTV

Tech shares are tumbling in Hong Kong.

——————–

2. Beijing wants to see a weaker renminbi.

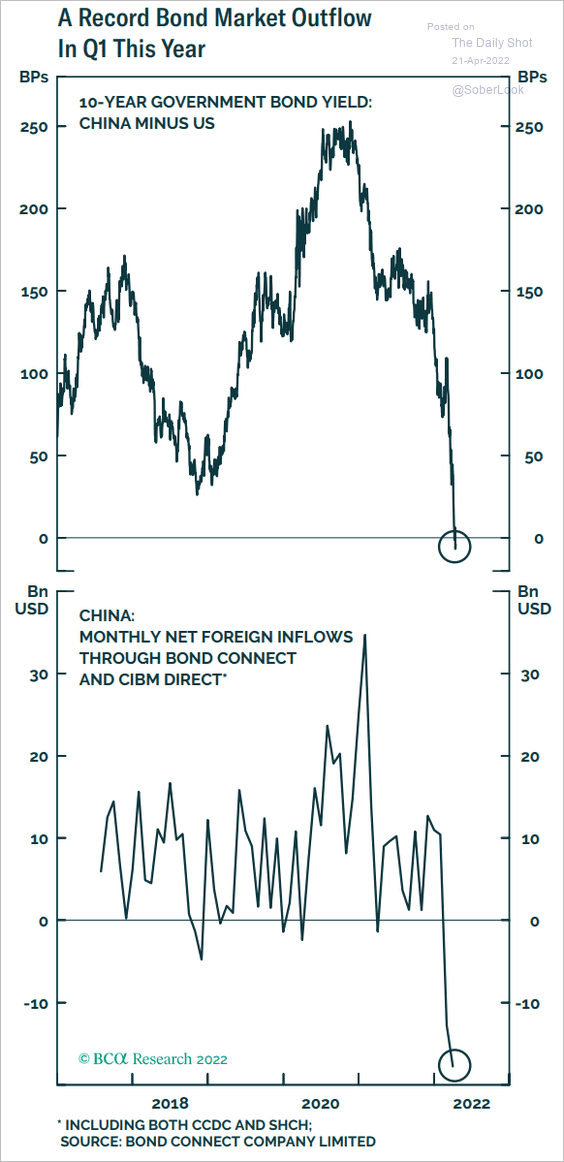

3. The collapse in the China-US yield differential resulted in bond market outflows.

Source: BCA Research

Source: BCA Research

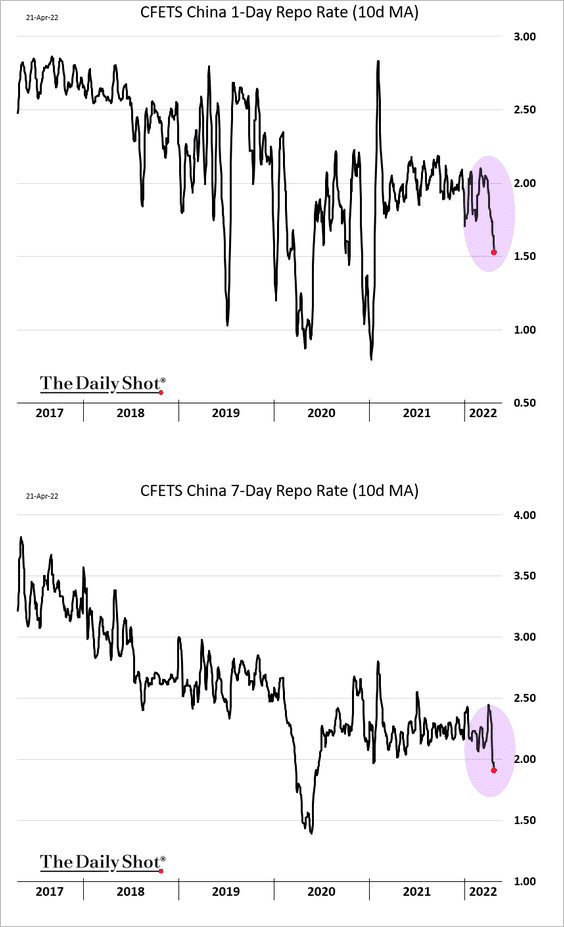

4. Short-term rates are falling.

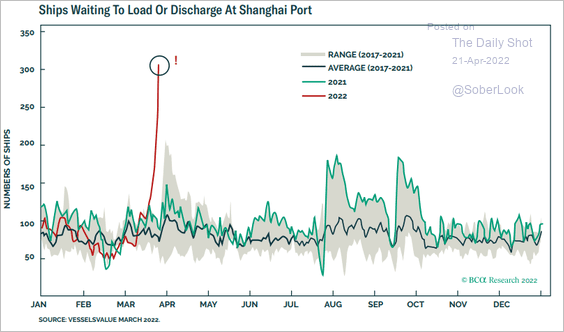

5. The Shanghai port congestion is unprecedented.

Source: BCA Research

Source: BCA Research

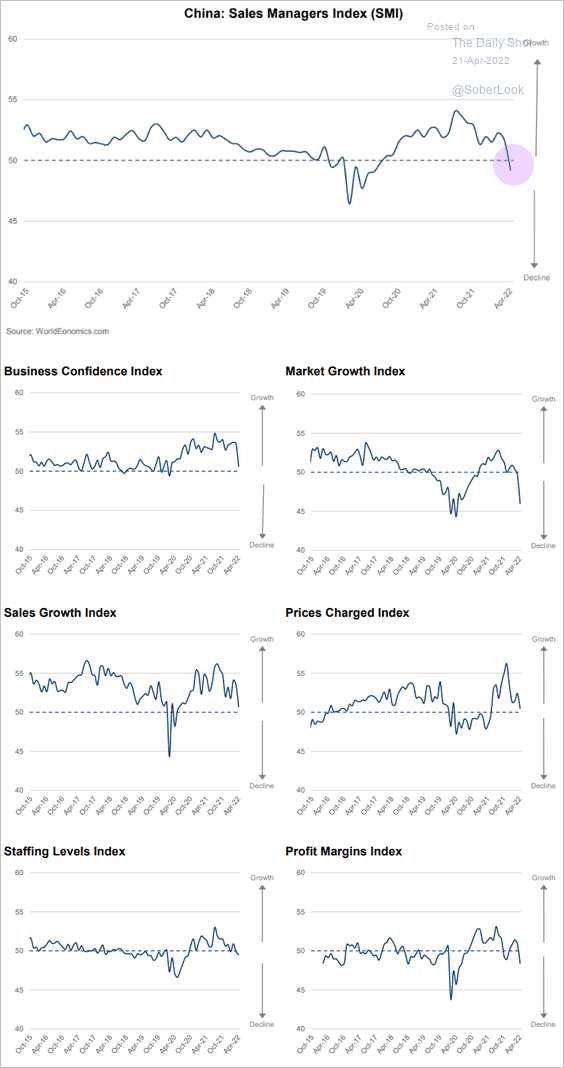

6. The World Economics SMI report shows business activity in contraction territory this month, as outlook worsens.

Source: World Economics

Source: World Economics

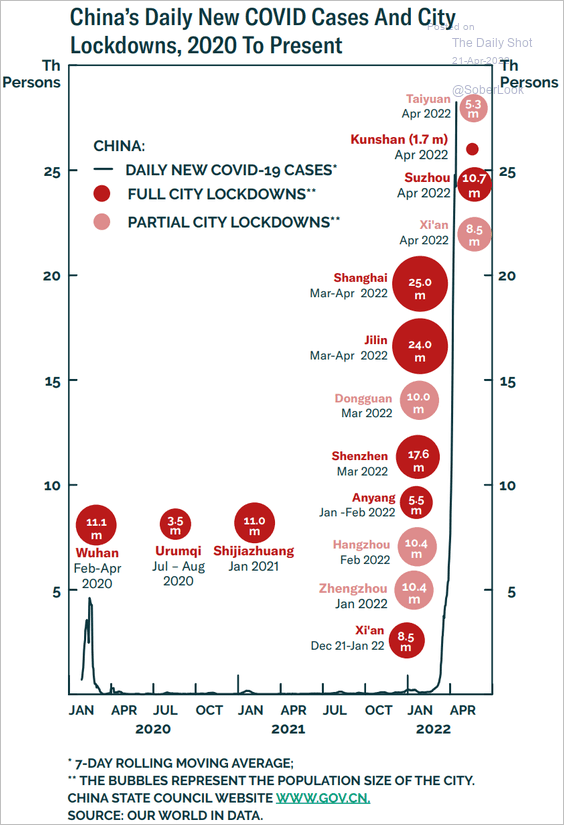

7. Here is the history of China’s COVID lockdowns.

Source: BCA Research

Source: BCA Research

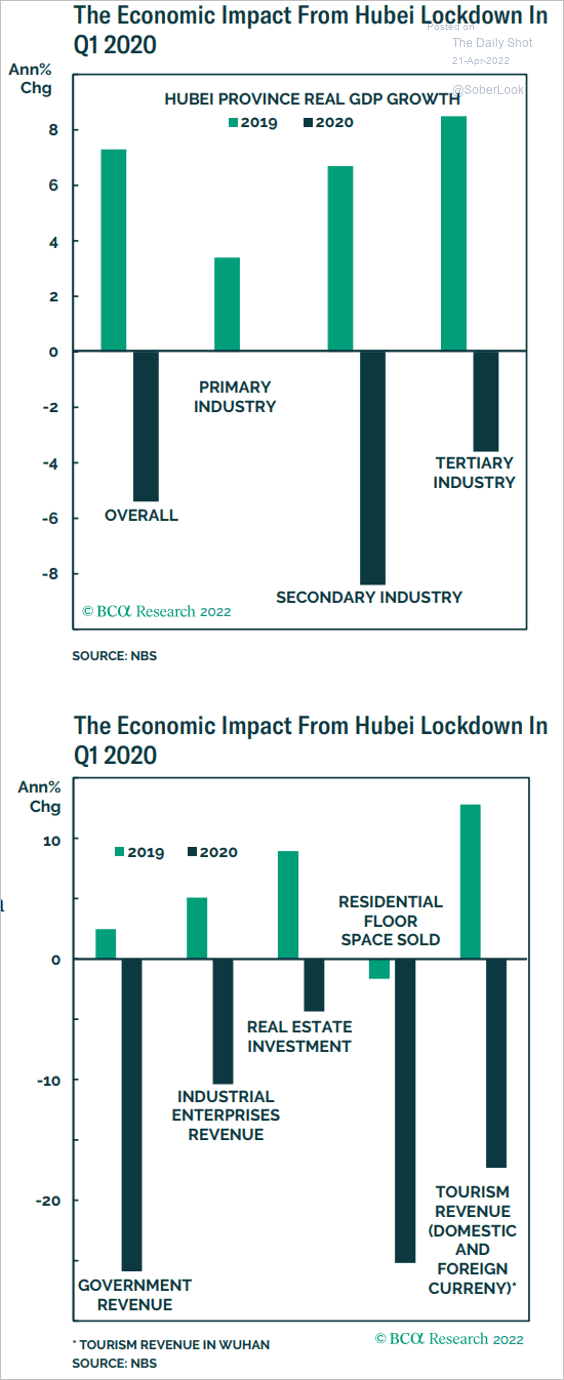

What was the economic impact of the initial Hubei lockdown in early 2020?

Source: BCA Research

Source: BCA Research

——————–

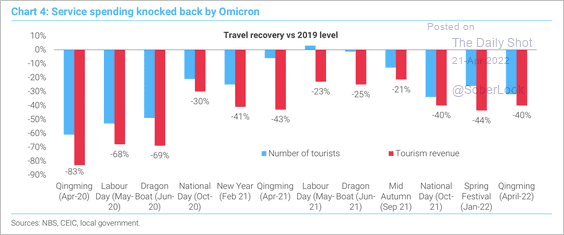

8. Tourism growth remains tepid during the pandemic recovery.

Source: TS Lombard

Source: TS Lombard

Back to Index

Emerging Markets

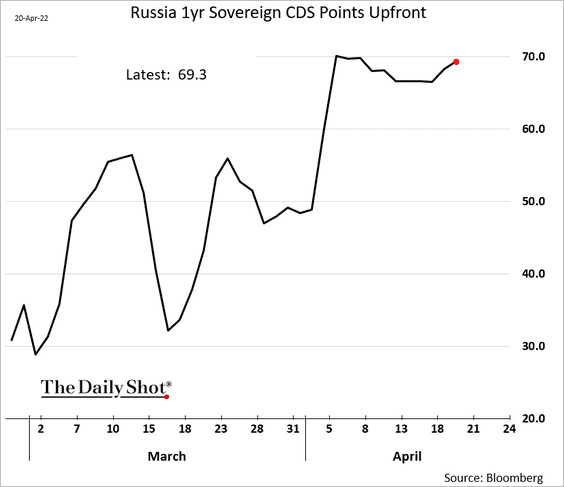

1. Russian sovereign credit default swaps have been pricing in a roughly 30% recovery rate on USD-denominated debt.

Source: Reuters Read full article

Source: Reuters Read full article

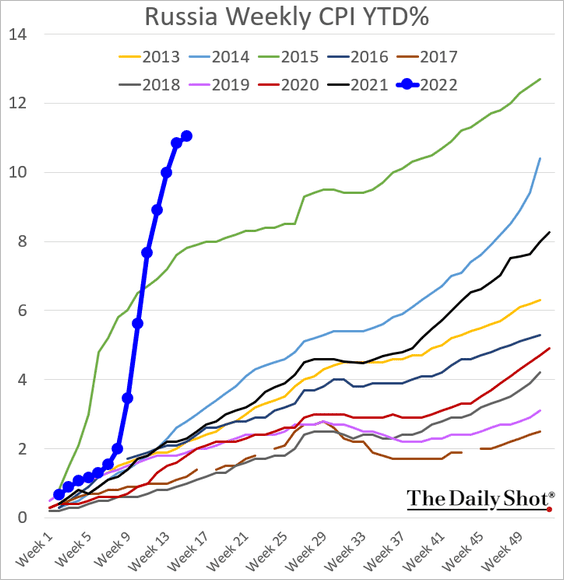

Russia’s weekly inflation appears to be moderating.

——————–

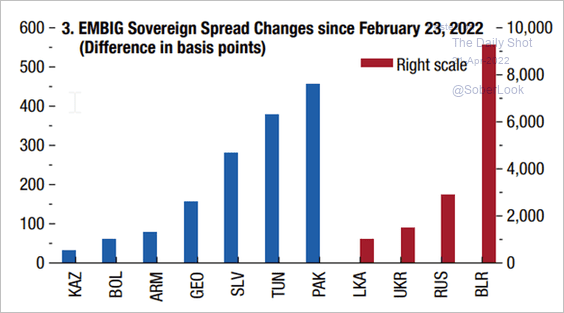

2. This chart from IMF shows sovereign CDS spread changes since February 23rd.

Source: IMF World Economic Outlook

Source: IMF World Economic Outlook

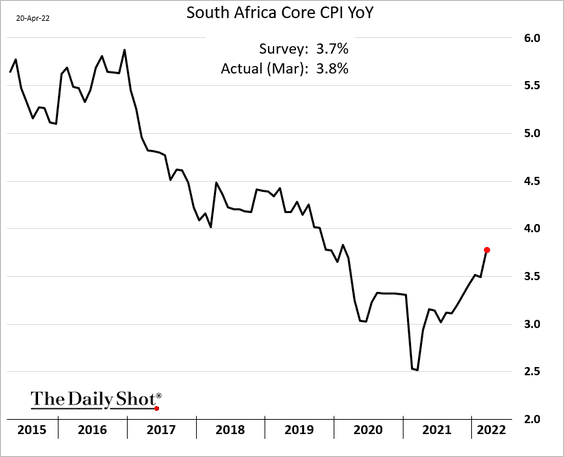

3. South Africa’s inflation keeps strengthening.

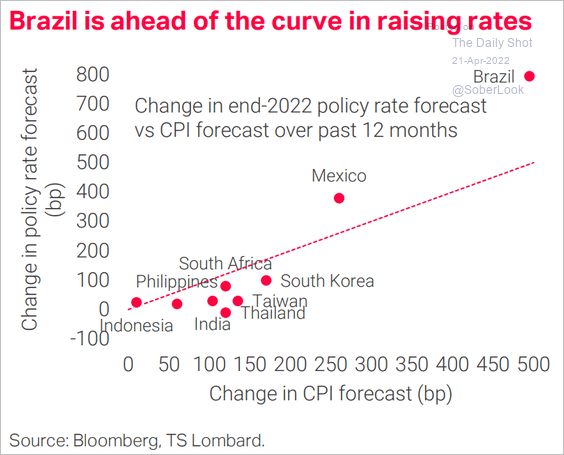

4. Brazil’s central bank has been ahead of the curve in hiking rates.

Source: TS Lombard

Source: TS Lombard

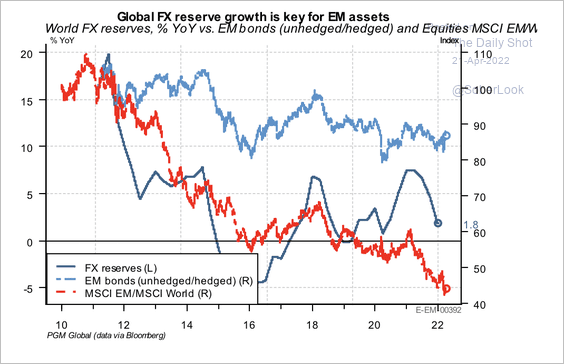

5. A slowdown in global trade could spill over into EM local currency asset price declines.

Source: PGM Global

Source: PGM Global

Back to Index

Cryptocurrency

1. Bitcoin has made a series of higher trading lows since Jan. 24, indicating a loss of downside momentum.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

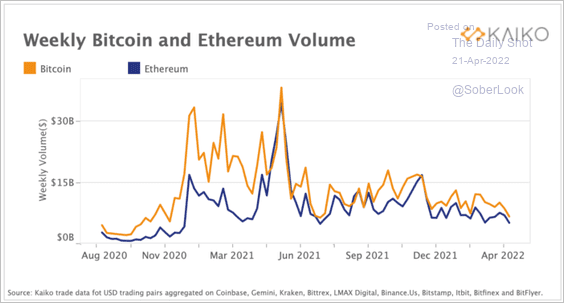

2. Bitcoin and ether’s weekly trade volume fell to its lowest level since the summer of last year.

Source: @KaikoData

Source: @KaikoData

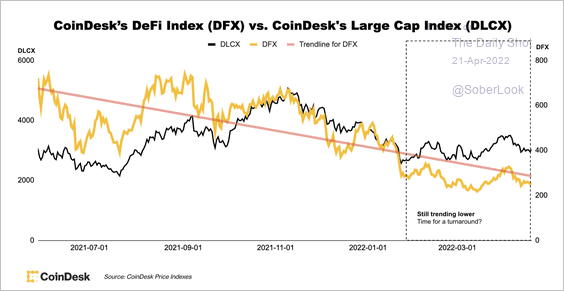

3. Decentralized finance (DeFi) tokens continue to lag large-cap tokens, although the downtrend appears to be slowing.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

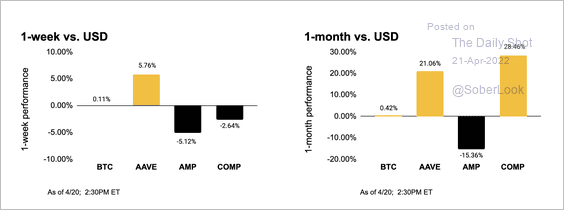

4. This chart shows mixed performance among top DeFi tokens relative to BTC.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Energy

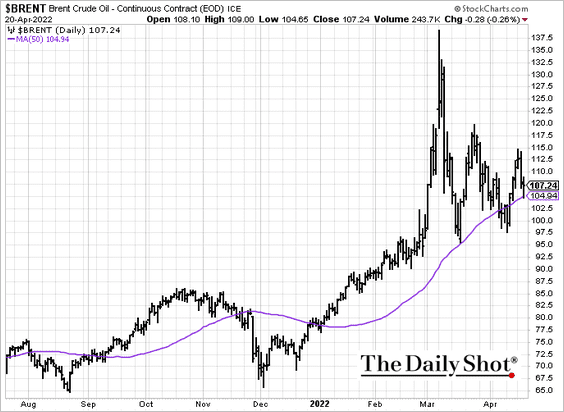

1. Brent crude held support at the 50-day moving average.

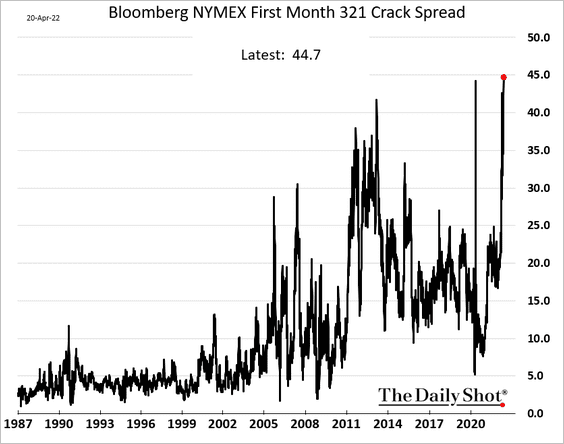

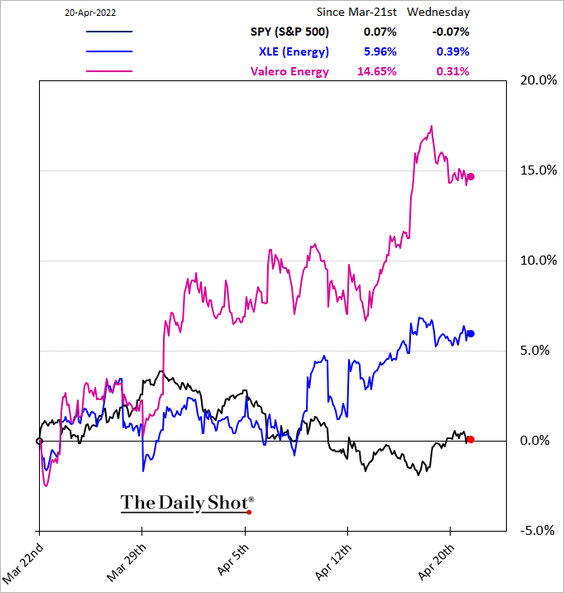

2. Crack spreads are hitting record highs, …

h/t Chunzi Xu

h/t Chunzi Xu

… boosting the profitability of refining businesses such as Valero.

——————–

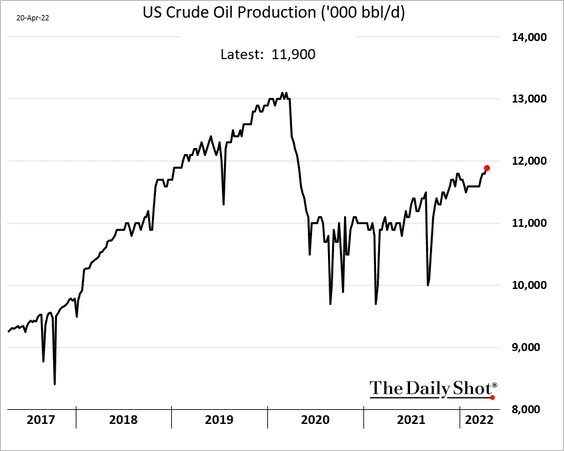

3. US crude oil production is nearing 12 million barrels per day.

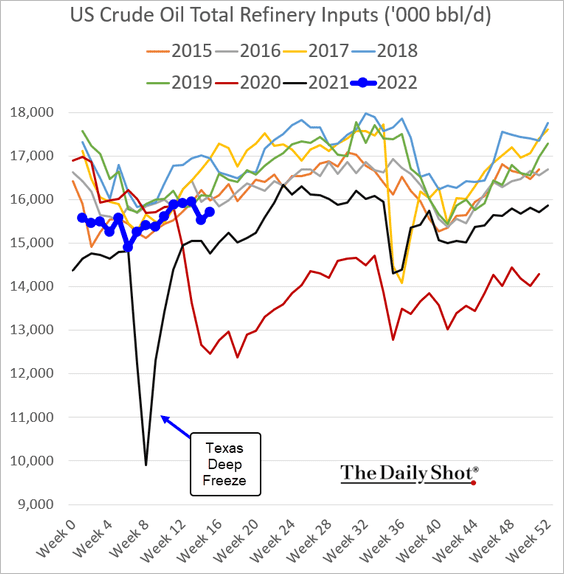

4. Refinery inputs are still soft for this time of the year.

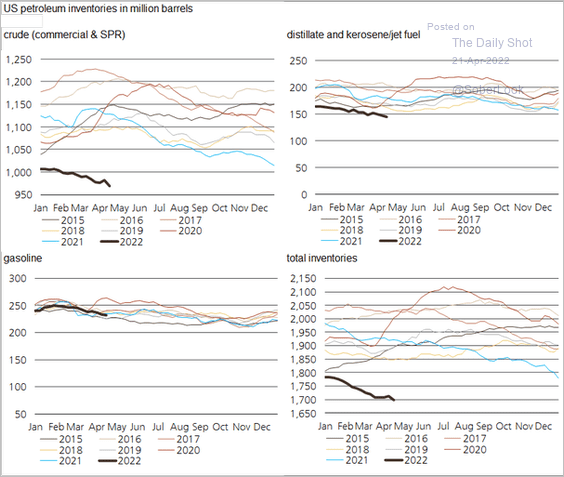

5. US total liquids inventories remain tight.

Source: @staunovo

Source: @staunovo

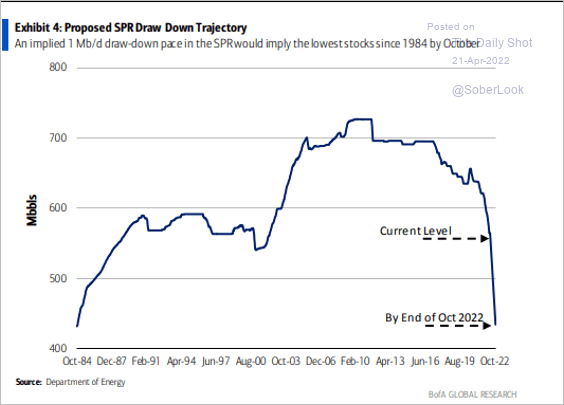

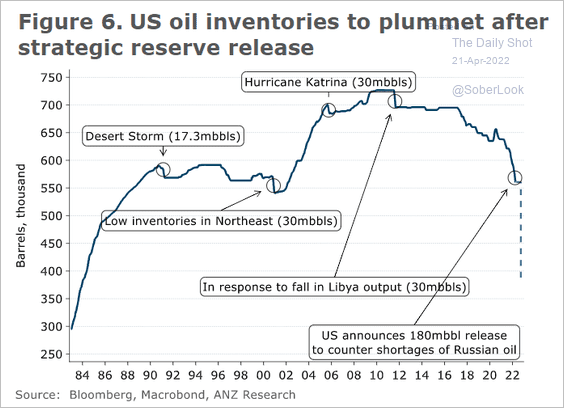

6. The US Strategic Petroleum Reserve is expected to tumble in the months ahead (2 charts).

Source: BofA Global Research; @chigrl

Source: BofA Global Research; @chigrl

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Equities

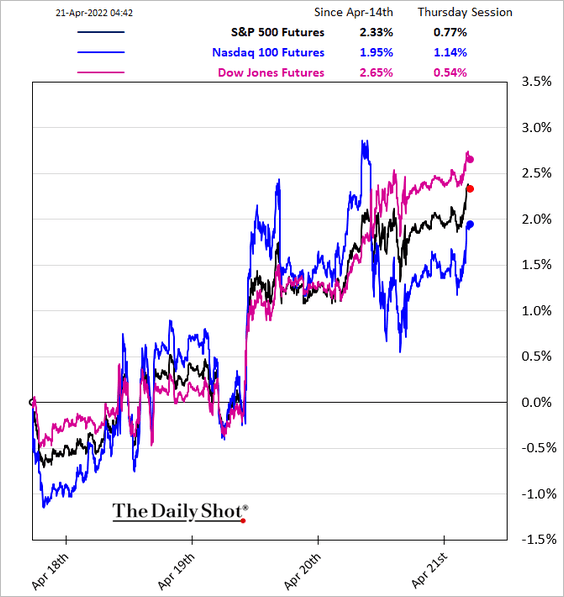

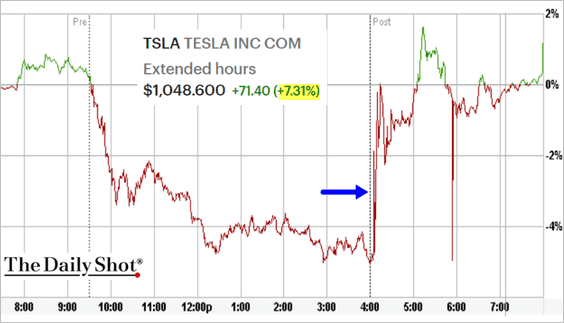

1. Stock futures are higher this morning.

Despite the challenges, the market likes what it heard from Tesla.

——————–

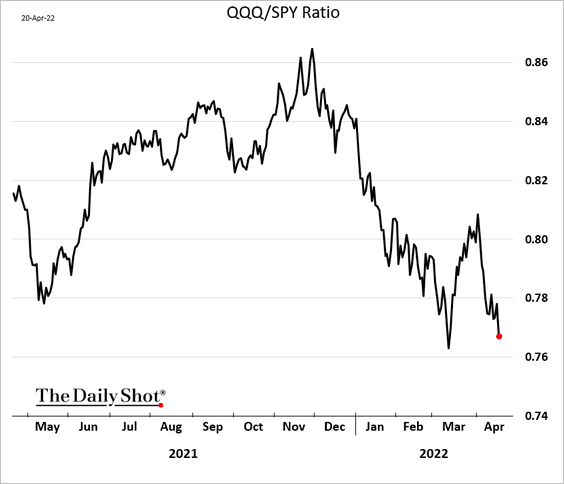

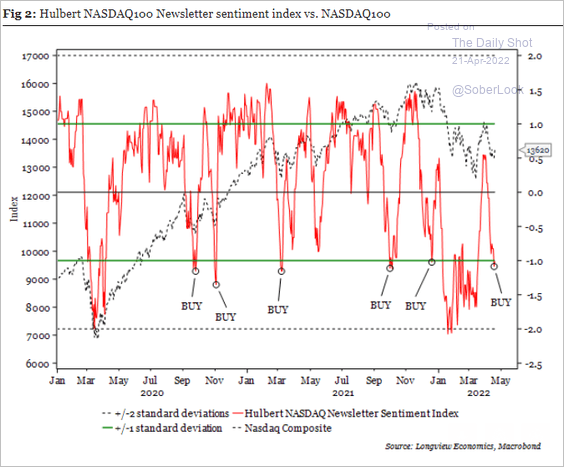

2. The Nasdaq 100 underperformance is near the levels we saw in early March.

• Sentiment has been very bearish. Will we see a rebound?

Source: Longview Economics

Source: Longview Economics

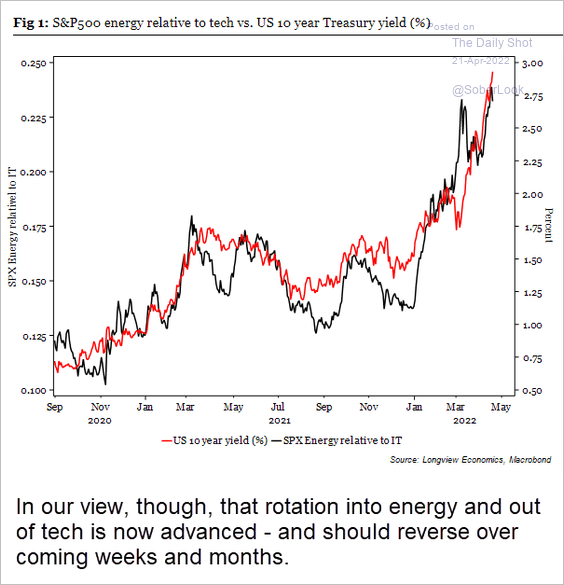

• Is the tech-to-energy rotation about to reverse?

Source: Longview Economics

Source: Longview Economics

——————–

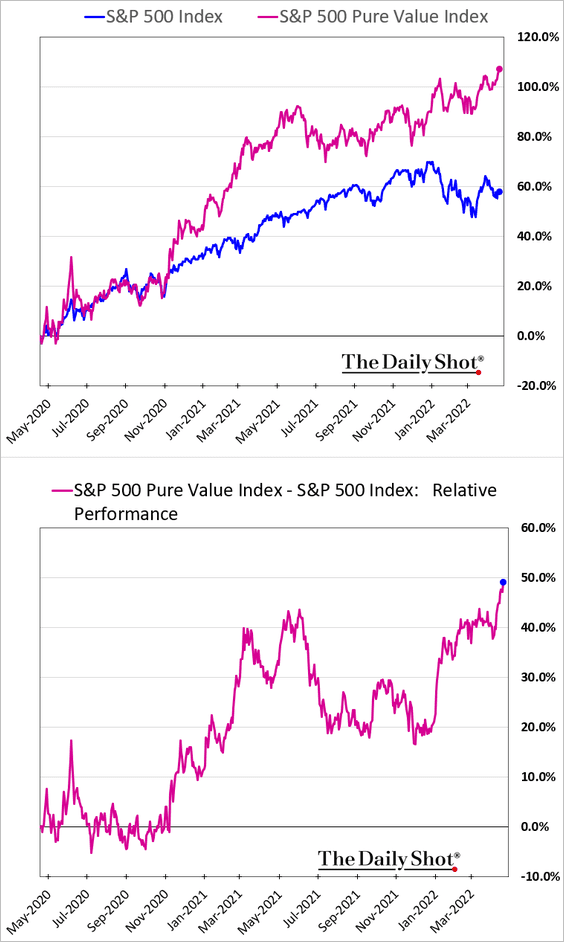

3. The S&P 500 Pure Value Index reached an all-time high, sharply outperforming the S&P 500 this year.

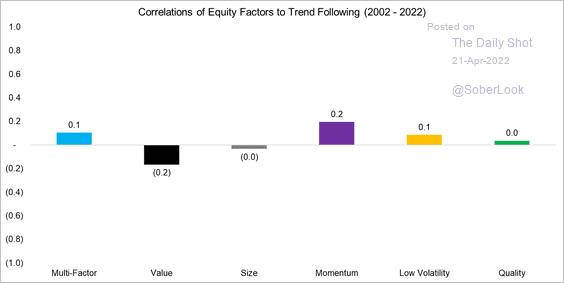

4. Value and size factors have a slight negative correlation to trend following strategies.

Source: FactorResearch Read full article

Source: FactorResearch Read full article

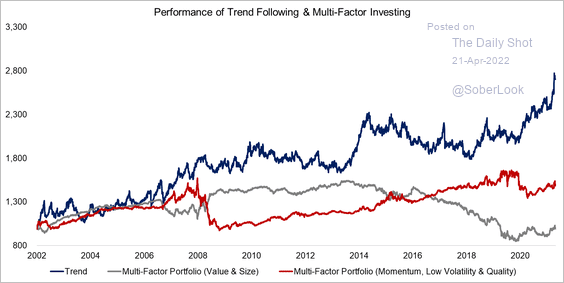

5. Despite having a positive correlation, the performance of trend following portfolios has been more volatile than multi-factor portfolios over the past 20 years.

Source: FactorResearch Read full article

Source: FactorResearch Read full article

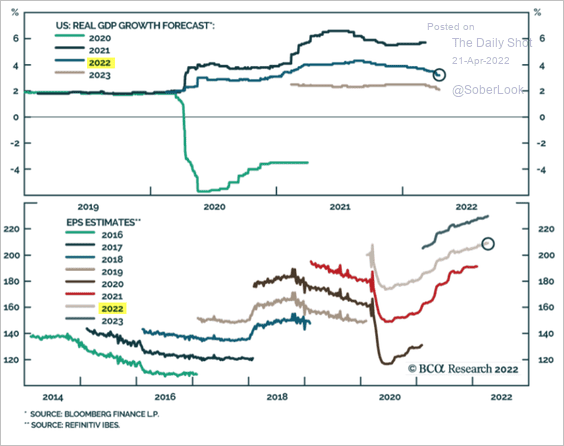

6. Earnings estimates have been strengthening despite projections for slower GDP growth.

Source: BCA Research

Source: BCA Research

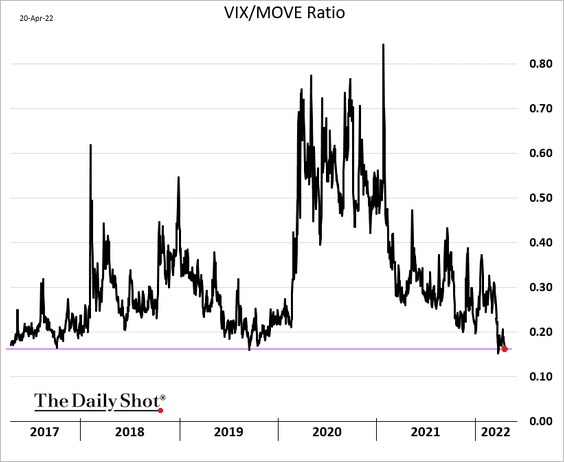

7. The ratio of VIX (equity vol) to MOVE (Treasury market vol) is near extreme lows amid the unprecedented bond market selloff. Has the ratio bottomed?

Back to Index

Rates

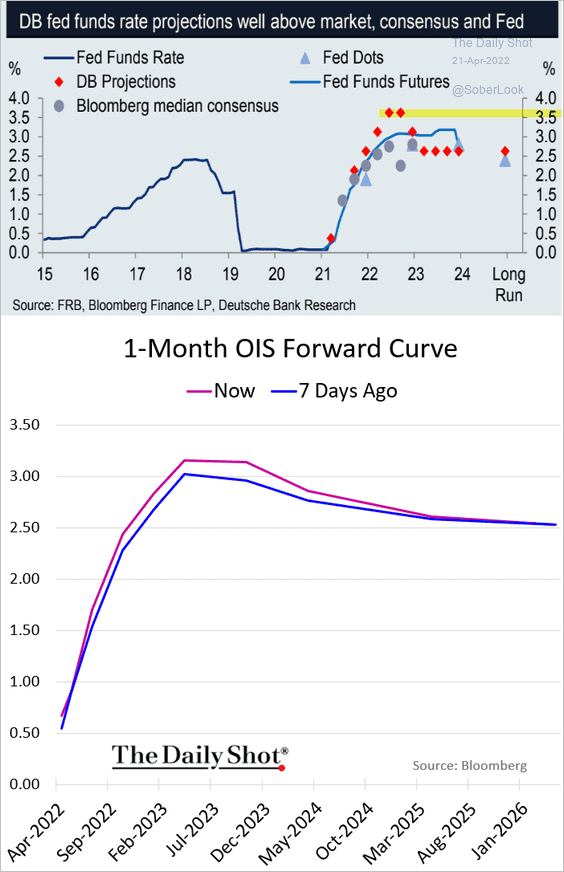

1. Will the Fed take its target rate above 3.5%? The markets are not quite there yet.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

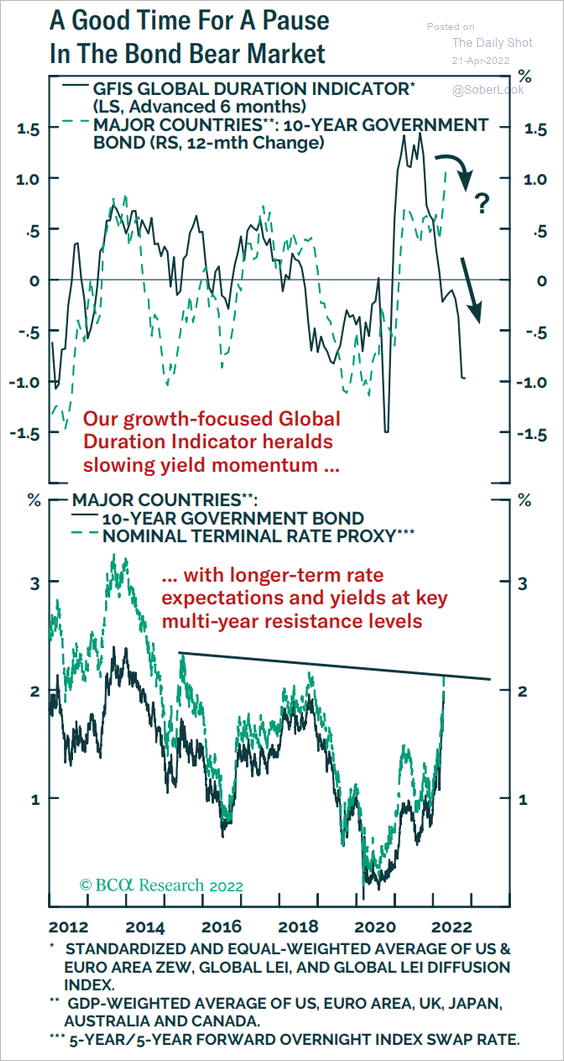

2. Time for a pause in the bond marklet selloff?

Source: BCA Research

Source: BCA Research

Back to Index

Global Developments

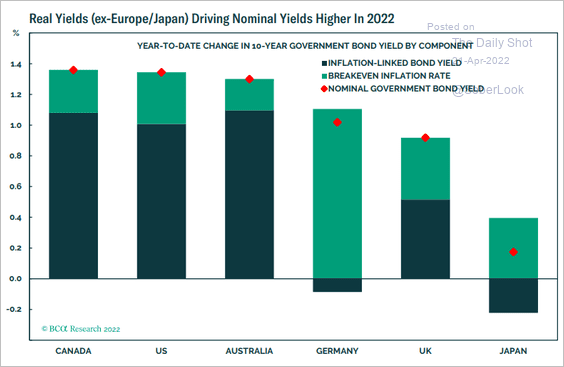

1. Nominal yield increases have been mostly driven by real yields.

Source: BCA Research

Source: BCA Research

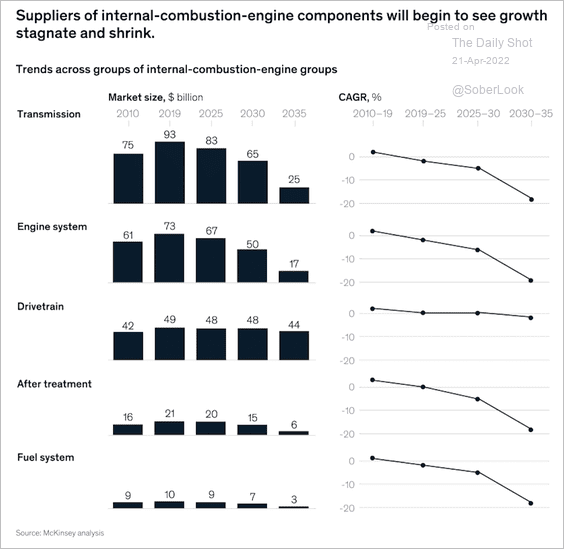

2. As the auto sector shifts toward electric vehicles, the growth of internal combustion product lines could see double-digit declines, according to McKinsey.

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

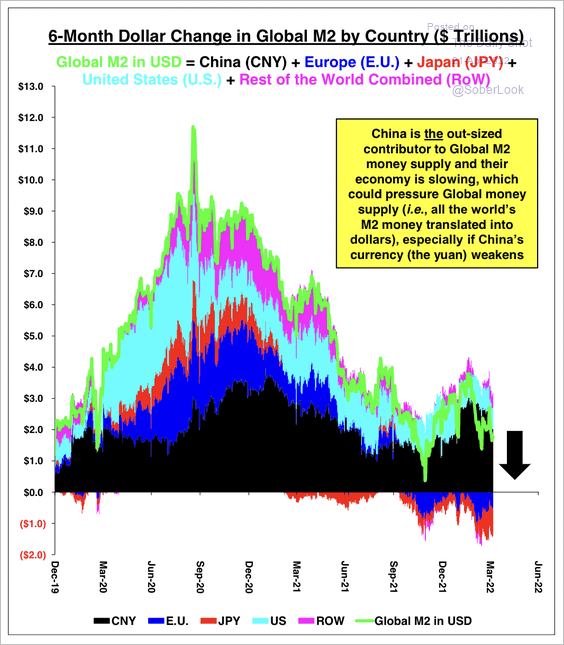

3. A slowdown in China could pressure the global money supply and reduce liquidity, especially if the Chinese yuan falls relative to the dollar, according to Stifel.

Source: Stifel

Source: Stifel

——————–

Food for Thought

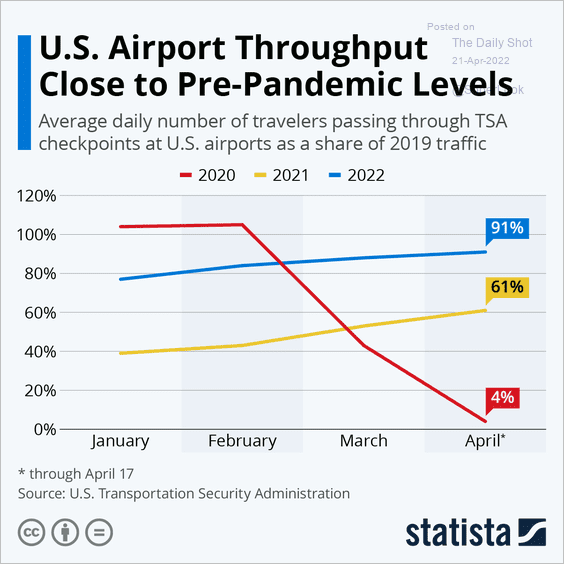

1. US air travel relative to 2019 levels:

Source: Statista

Source: Statista

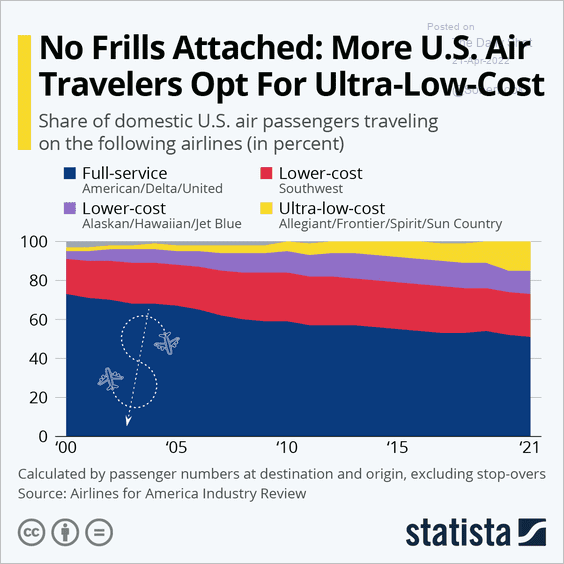

2. A growing preference for low-cost airlines:

Source: Statista

Source: Statista

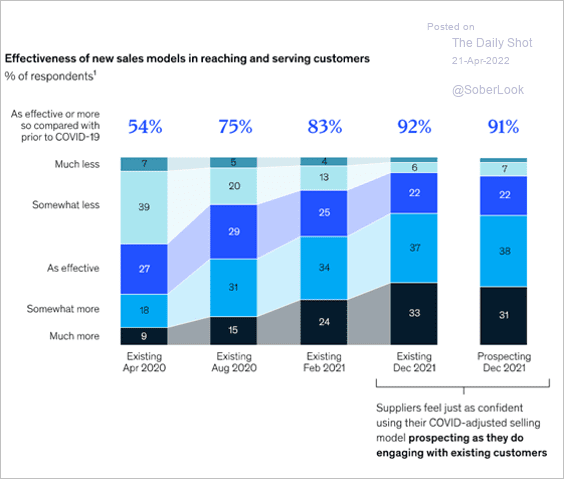

3. Companies are nearly unanimous that their current sales model is as or more effective than their pre-pandemic model.

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

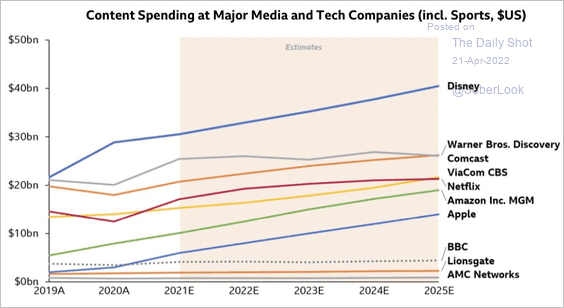

4. Tech and Communication Services companies’ content spending:

Source: @scottygb Read full article

Source: @scottygb Read full article

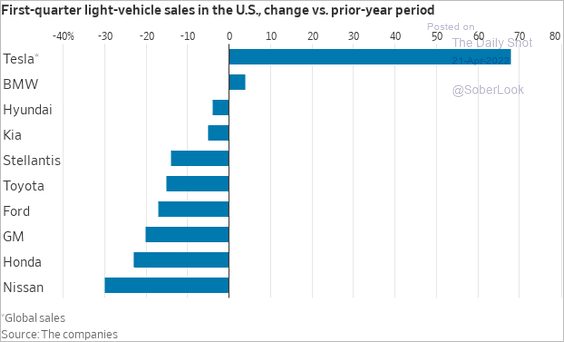

5. Year-over-year changes in vehicle sales:

Source: @WSJ Read full article

Source: @WSJ Read full article

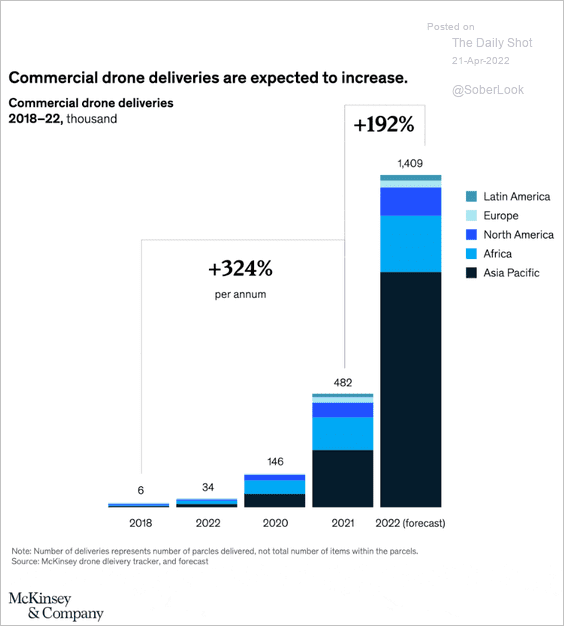

6. Commercial drone deliveries:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

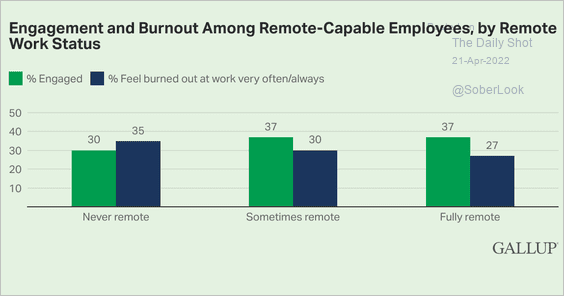

7. Employee burnout rates:

Source: Gallup Read full article

Source: Gallup Read full article

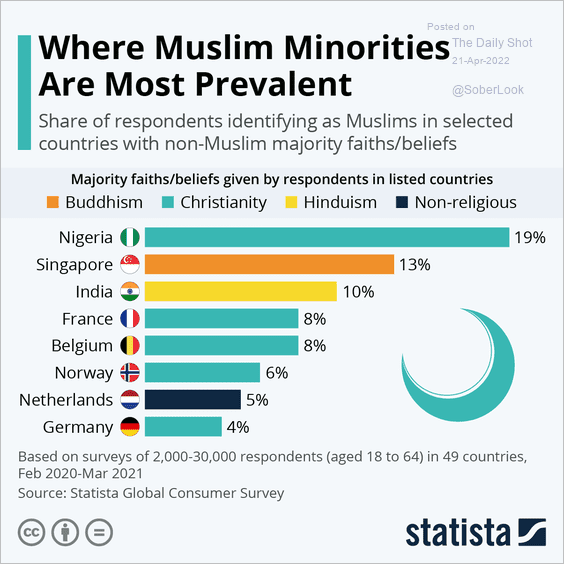

8. Muslim minorities:

Source: Statista

Source: Statista

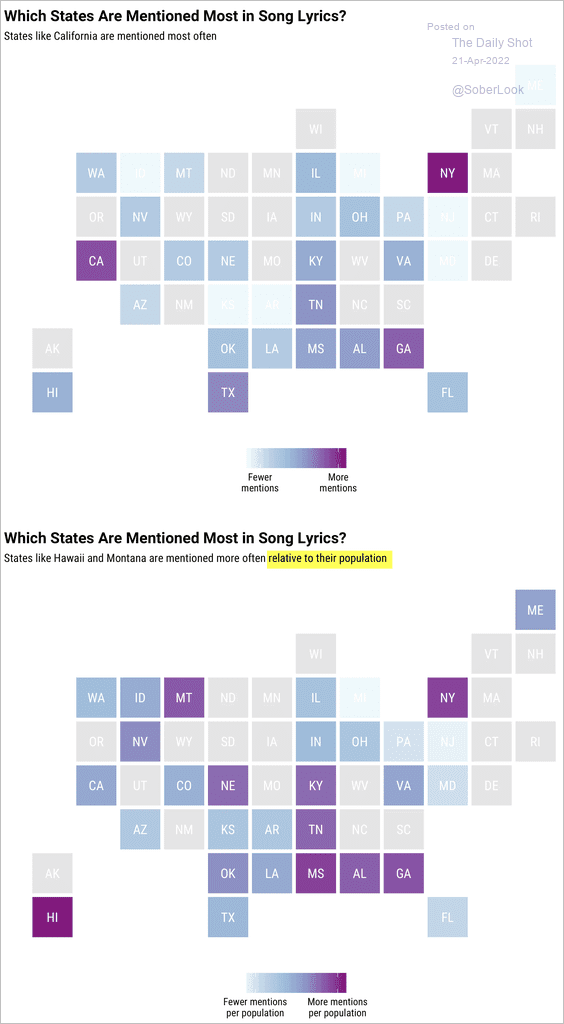

9. States most mentioned in song lyrics:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

——————–

Back to Index