The Daily Shot: 22-Apr-22

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Credit

• Global Developments

• Food for Thought

The United States

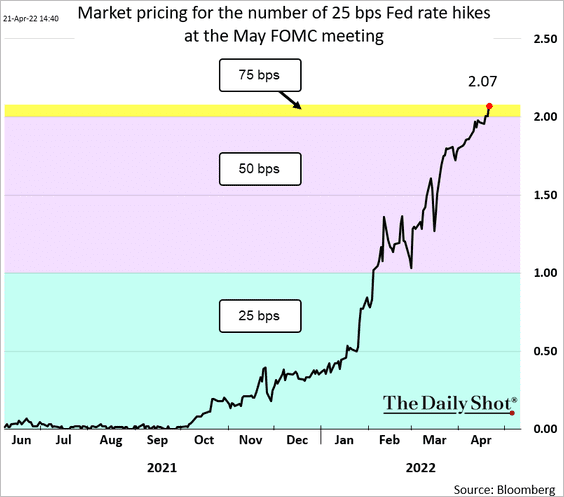

1. A 50 bps rate hike in May has been sealed.

Source: @WSJ Read full article

Source: @WSJ Read full article

But if inflation continues to surprise to the upside, the FOMC may consider a more drastic move. The market is starting to price in the possibility of a 75 bps rate hike in May …

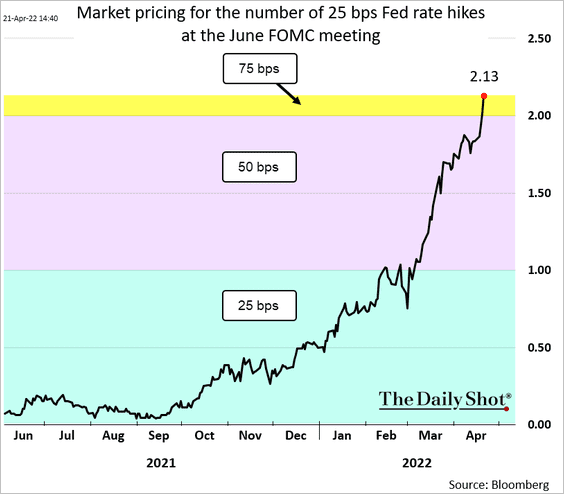

… and in June.

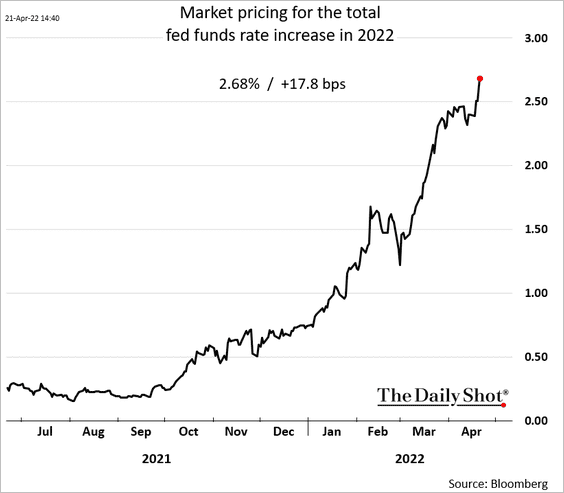

We are now looking at nearly eleven 25 bps hikes this year.

——————–

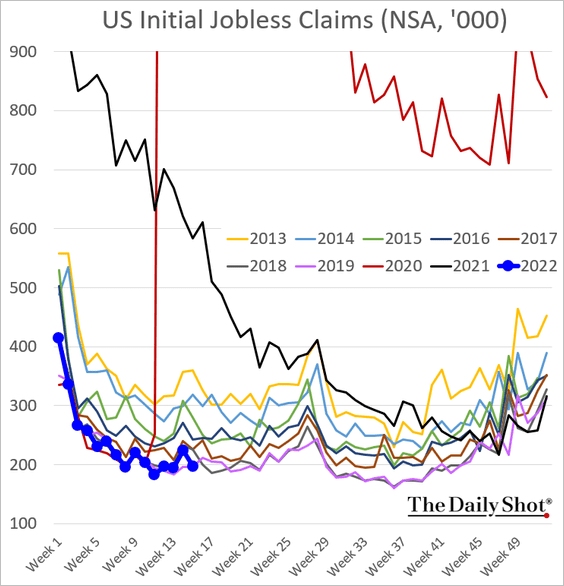

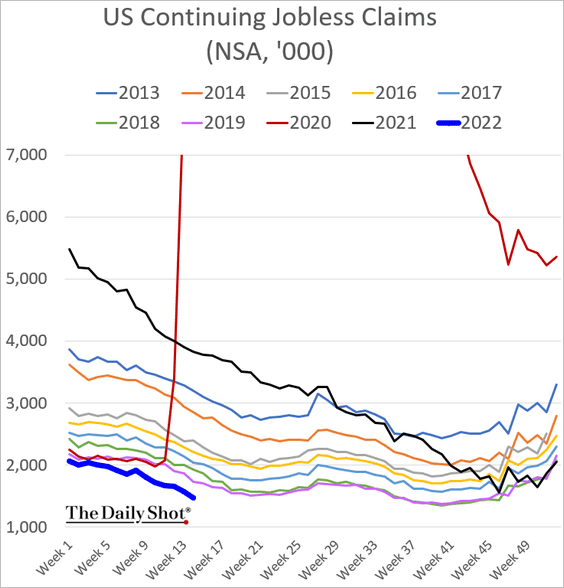

2. Extraordinarily low unemployment applications are giving the Fed the green light to pursue a very hawkish monetary policy.

——————–

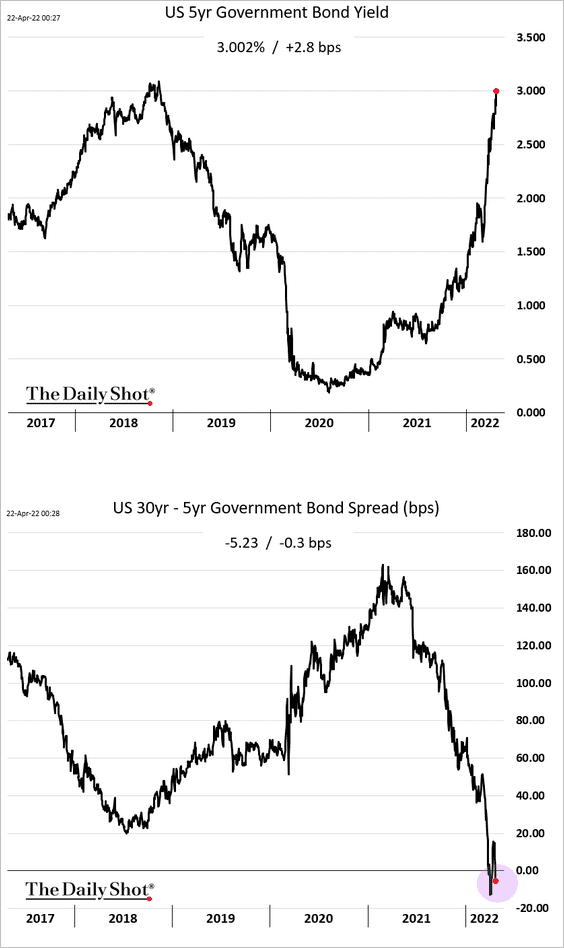

3. The 5-year note yield climbed above 3% for the first time since 2018, and the 30yr-5yr portion of the Treasury curve inverted again.

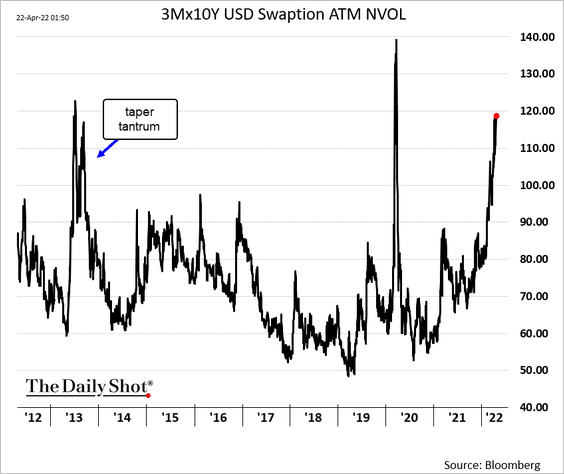

• Implied volatility in rates markets now exceeds taper-tantrum levels.

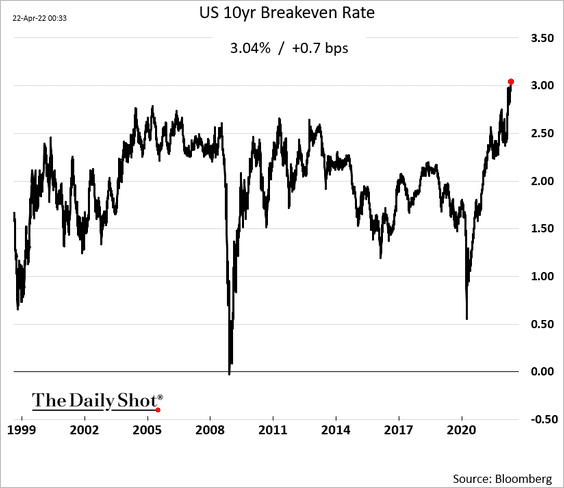

• The 10yr breakeven rate (market-based inflation expectations) surpassed 3% for the first time.

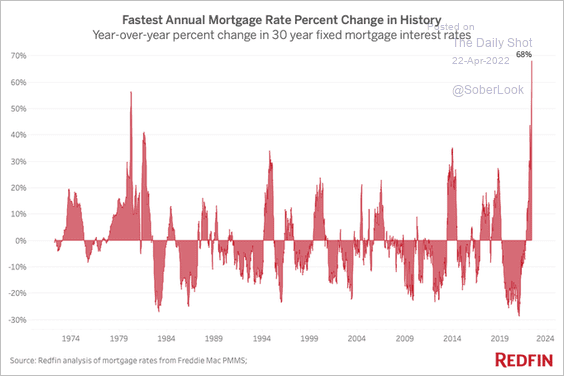

• The year-over-year increase in mortgage rates has been unprecedented.

Source: @TaylorAMarr

Source: @TaylorAMarr

——————–

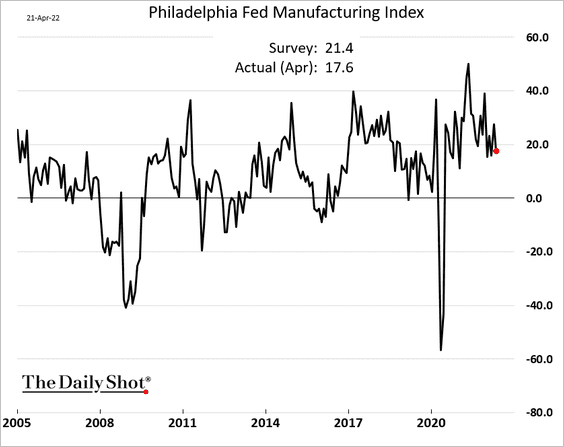

4. The Philly Fed’s regional manufacturing index declined this month.

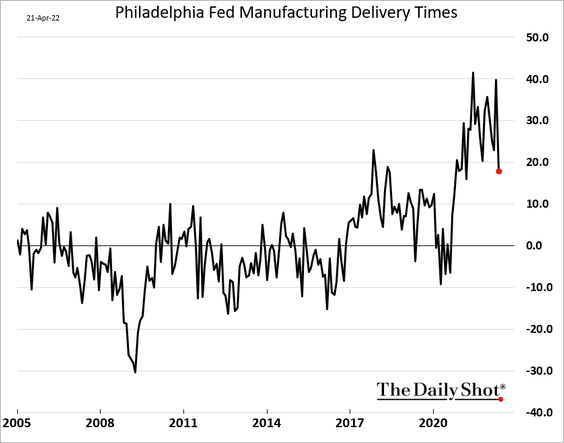

• Supplier delays seem to have peaked.

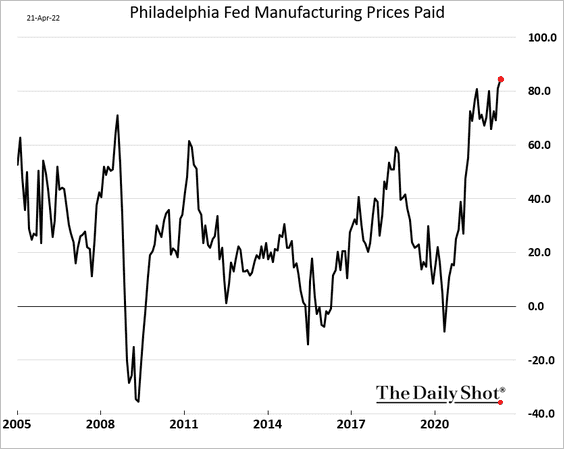

• Price pressures are at extreme levels.

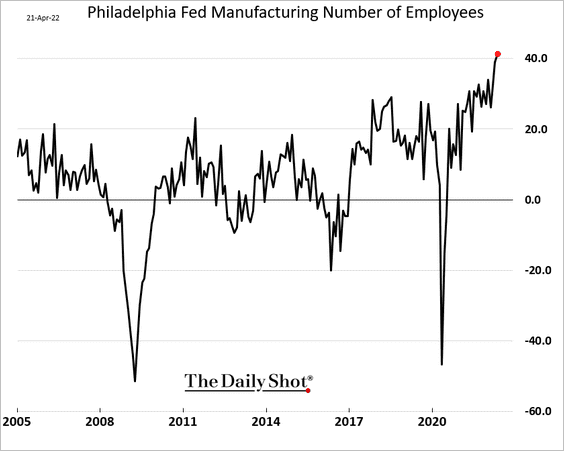

• Hiring in the region has been remarkably strong.

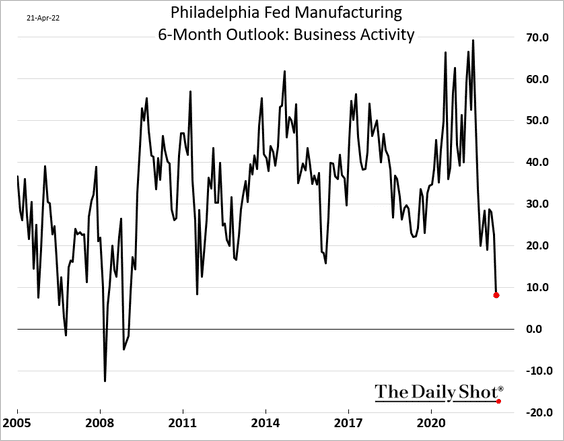

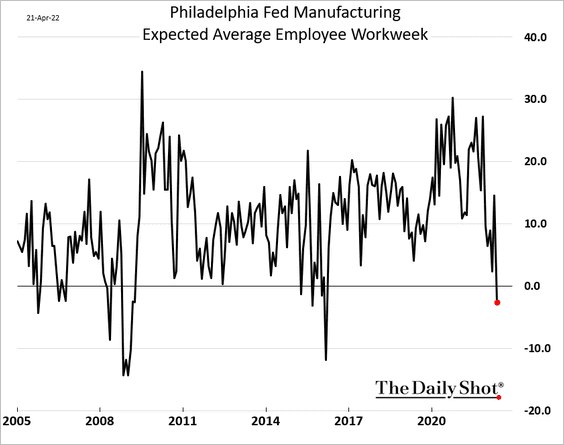

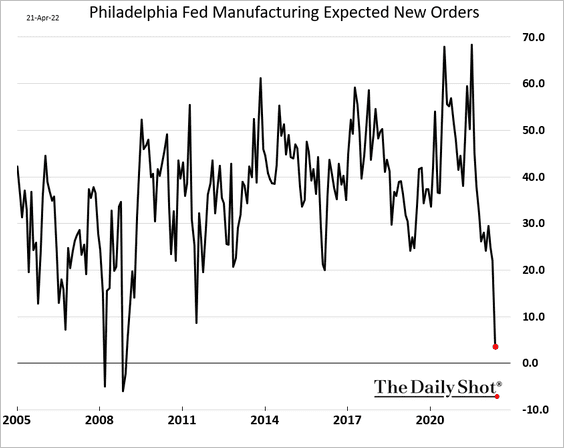

• The surprise was in the Philly Fed’s forward-looking indicators which show collapsing confidence in future activity.

– The overall outlook:

– Expected employee workweek:

– Expected new orders:

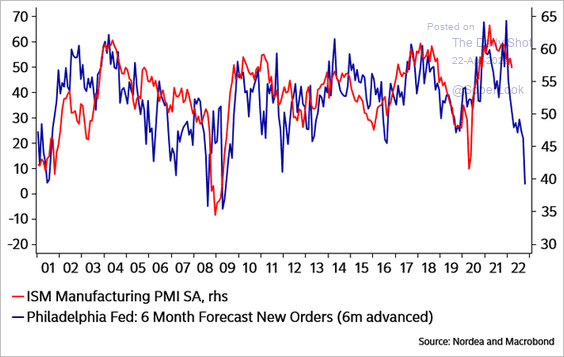

What does this pessimism tell us about factory activity at the national level in the months ahead?

Source: Nordea Markets; @MadsenMaldia

Source: Nordea Markets; @MadsenMaldia

——————–

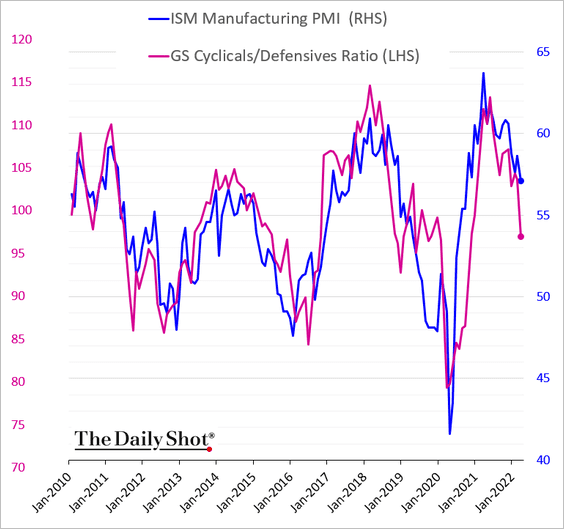

5. The stock market is also signaling weaker manufacturing growth going forward, as cyclical sectors underperform defensives.

h/t @ISABELNET_SA

h/t @ISABELNET_SA

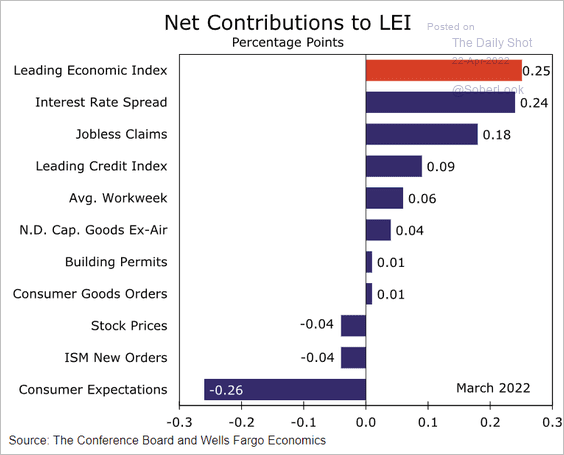

6. Depressed consumer sentiment has been a drag on the Conference Board’s index of leading indicators.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

The United Kingdom

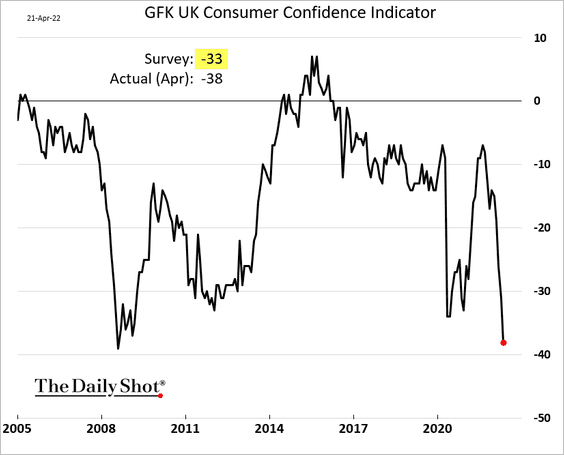

1. Consumer confidence hit the lowest level since 2008.

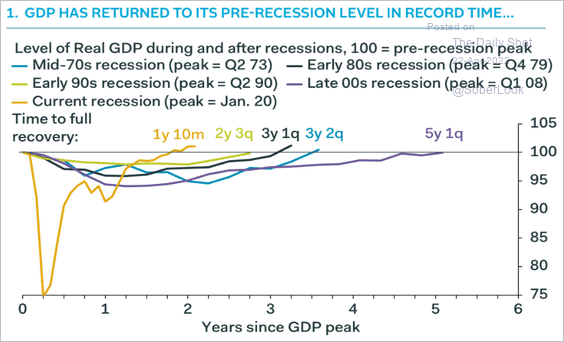

2. The GDP recovery has been unusually rapid.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

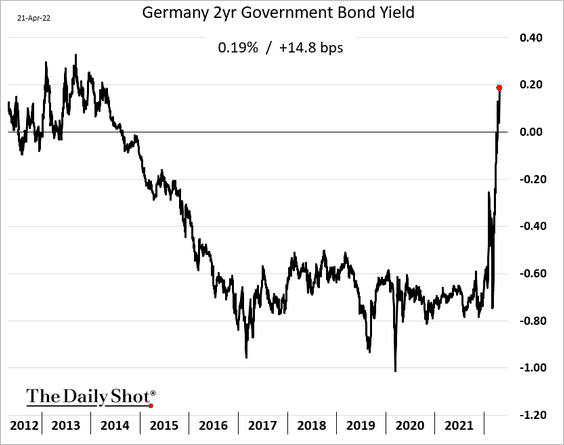

The Eurozone

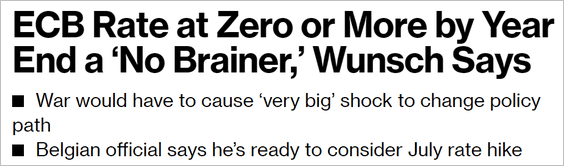

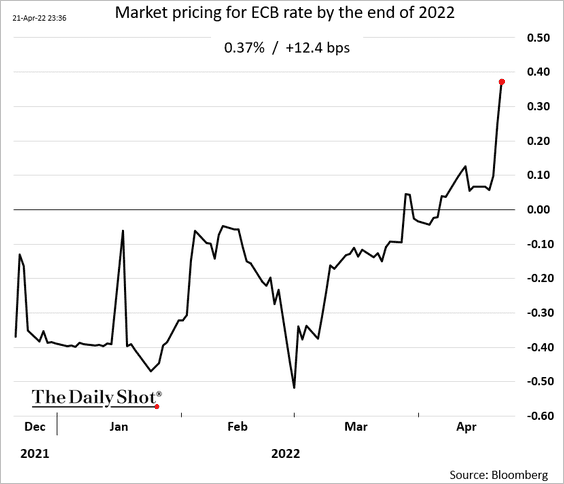

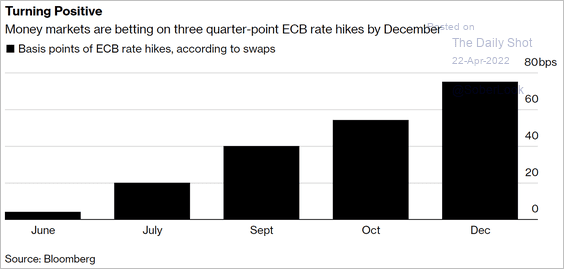

1. We are getting more hawkish signals from the ECB.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

The market now expects the ECB to bring the benchmark rate near 0.4% by the end of the year.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

The 2-year Bund yield has gone vertical.

——————–

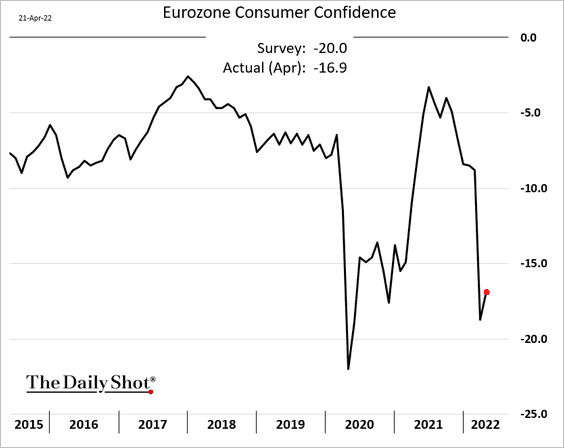

2. Euro-area consumer confidence unexpectedly ticked higher this month.

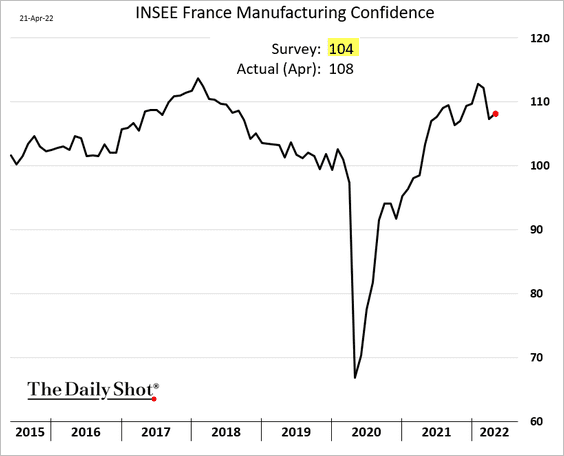

3. French manufacturing confidence surprised to the upside.

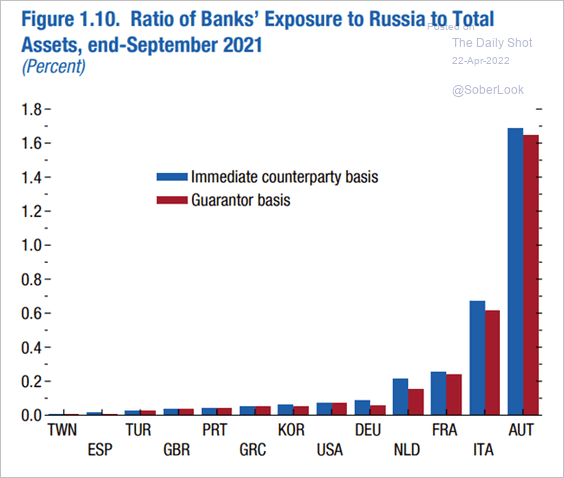

4. The Eurozone’s financial sector exposure to Russia appears to be manageable.

Source: Reuters Read full article

Source: Reuters Read full article

Austrian and Italian banks are most exposed to Russian counterparties.

Source: IMF World Economic Outlook

Source: IMF World Economic Outlook

Back to Index

Asia – Pacific

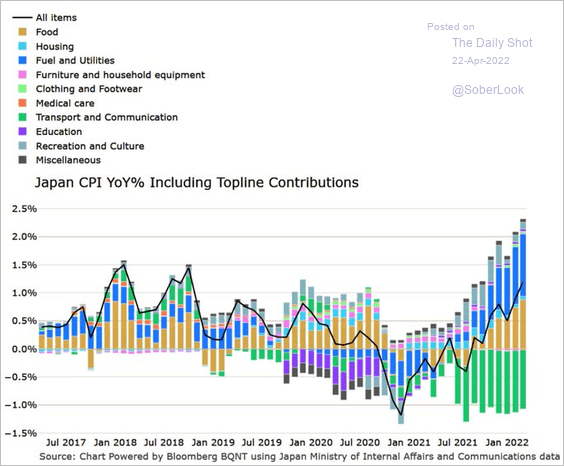

1. Food and energy prices have been boosting Japan’s headline CPI.

Source: @M_McDonough

Source: @M_McDonough

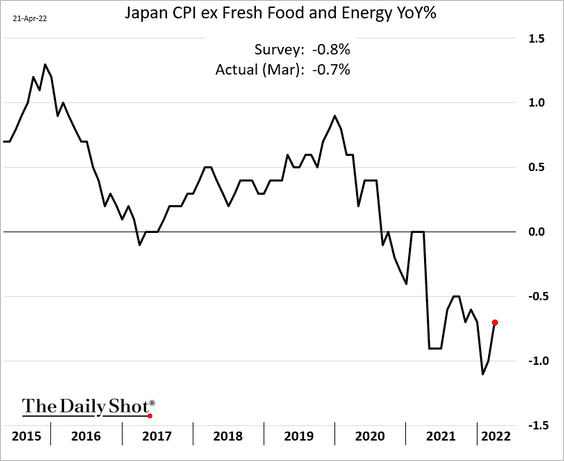

The core CPI, which has been pushed into negative territory by price cuts in mobile services, has bottomed.

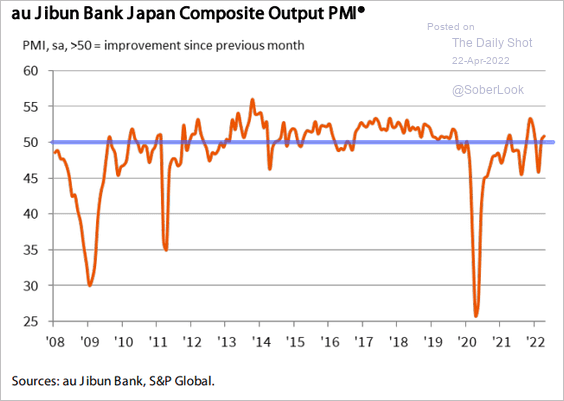

Separately, Japan’s business activity grew modestly this month.

Source: IHS Markit

Source: IHS Markit

——————–

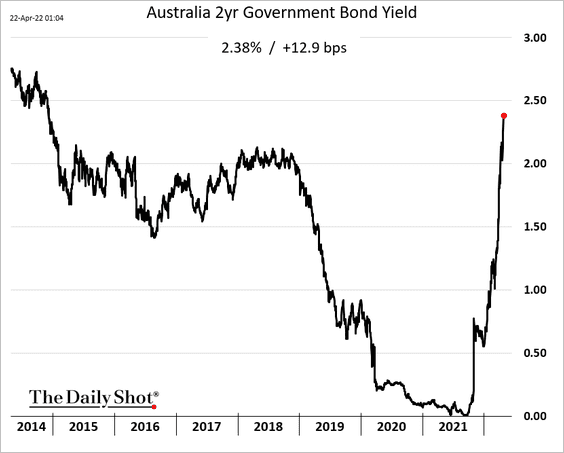

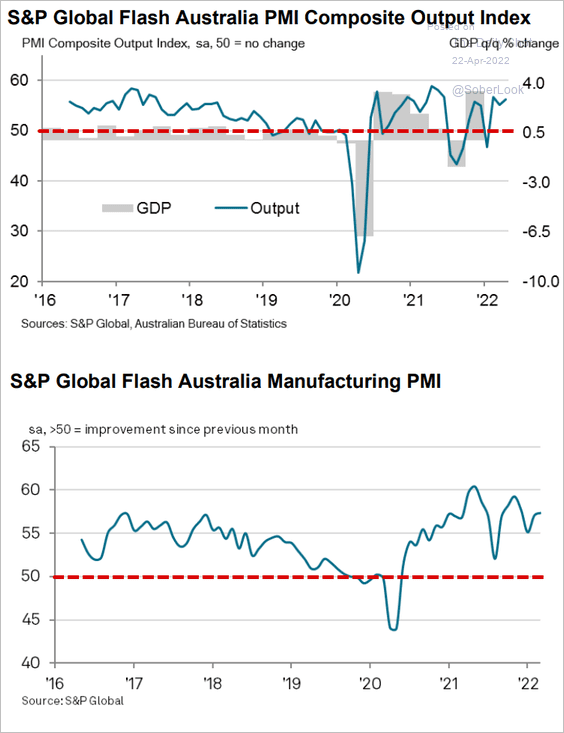

2. Australian 2yr yield hit the highest level since 2014.

Business activity remained robust this month.

Source: IHS Markit

Source: IHS Markit

——————–

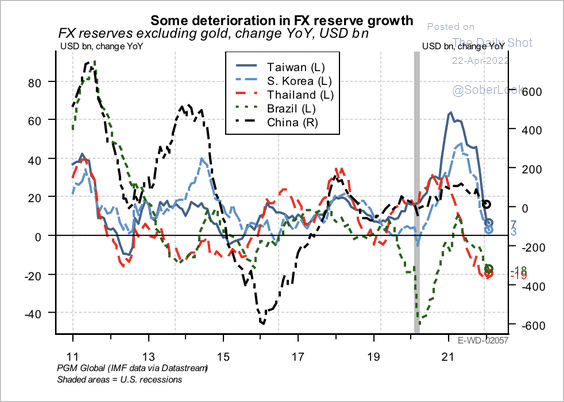

3. Growth in Taiwan’s and South Korea’s FX reserves has stalled.

Source: PGM Global

Source: PGM Global

Back to Index

China

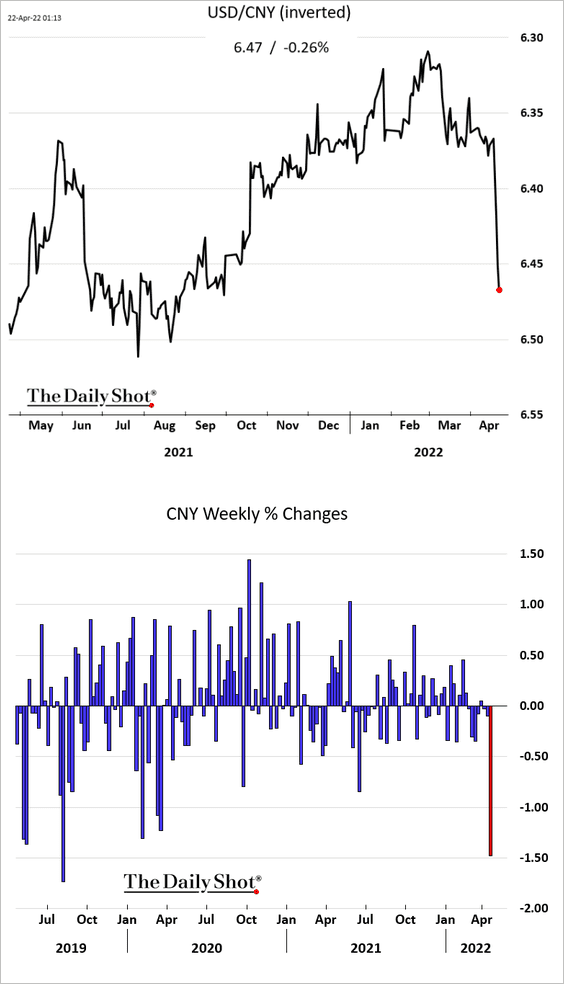

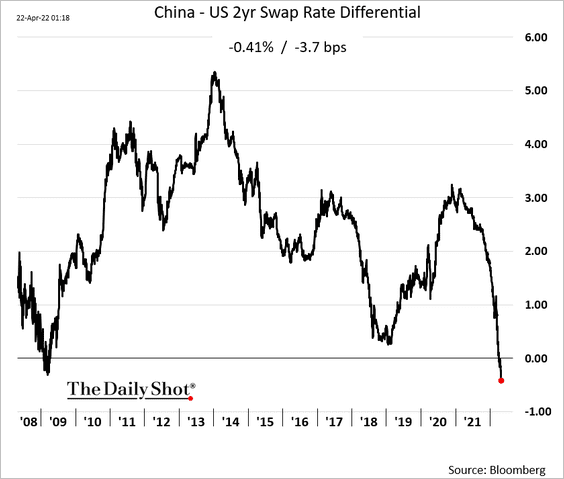

1. China’s currency has declined sharply in recent days, a move that is supported by Beijing.

The rate differential with the US points to further weakness for the RMB.

——————–

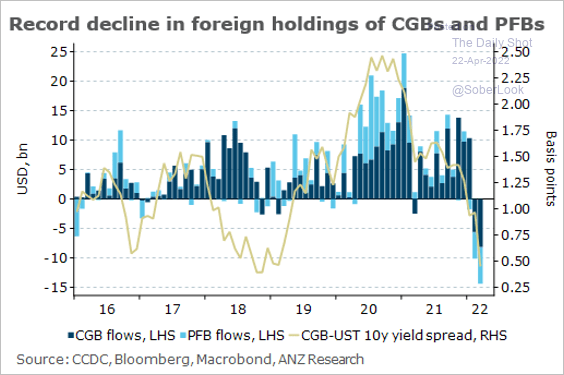

2. Foreign holdings of government and state-bank bonds plunged this year.

Source: @ANZ_Research

Source: @ANZ_Research

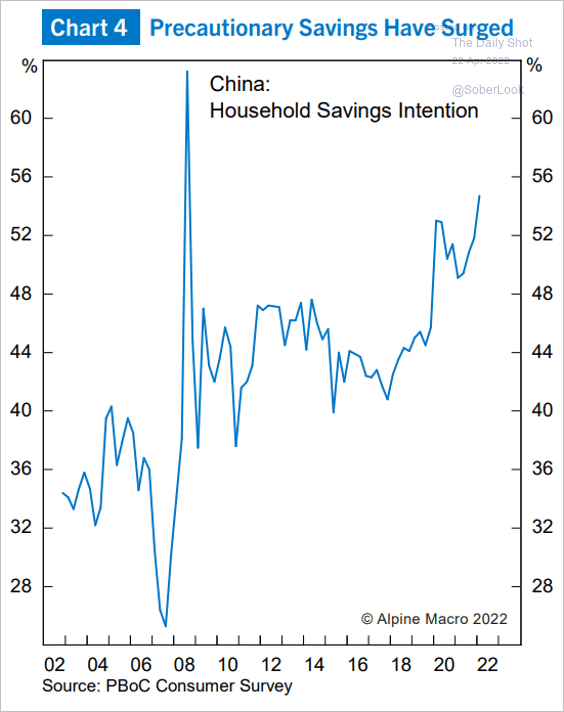

3. Household saving intentions have been rising, which is pressuring consumption.

Source: Alpine Macro

Source: Alpine Macro

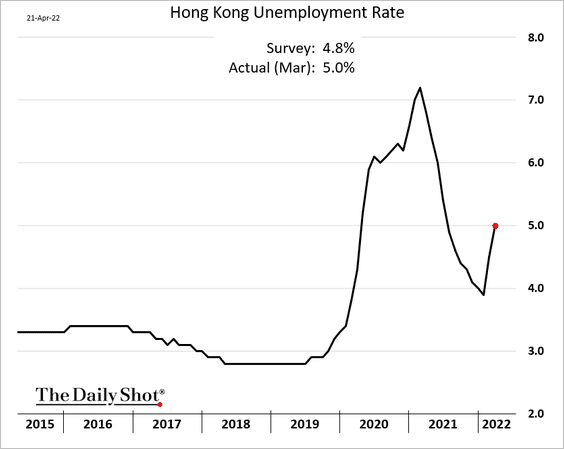

4. Hong Kong’s unemployment rate jumped last month.

Back to Index

Emerging Markets

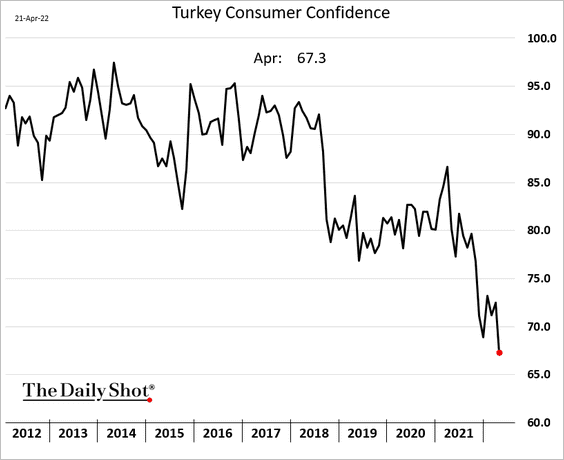

1. Turkey’s consumer confidence continues to deteriorate, exacerbated by the nation’s hyperinflationary trends.

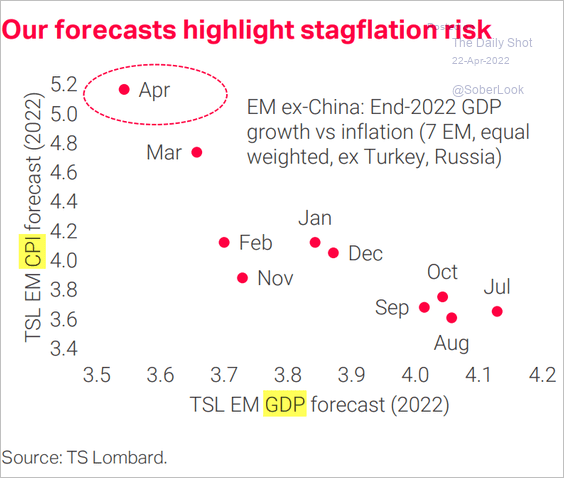

2. Stagflation risks have been rising across EM economies.

Source: TS Lombard

Source: TS Lombard

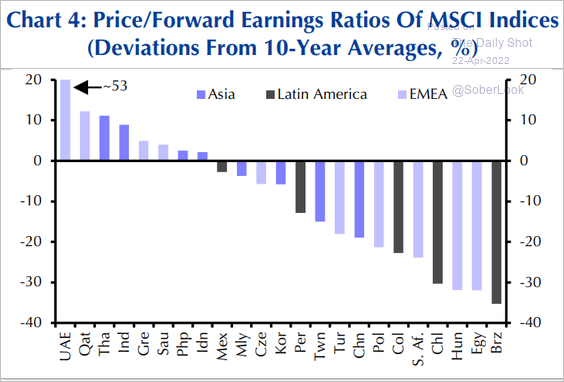

3. Next, we have EM equity market valuations relative to the 10-year averages.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

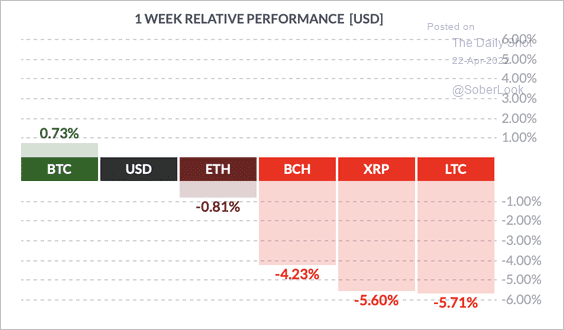

1. So far, bitcoin has outperformed other top cryptos over the past week.

Source: FinViz

Source: FinViz

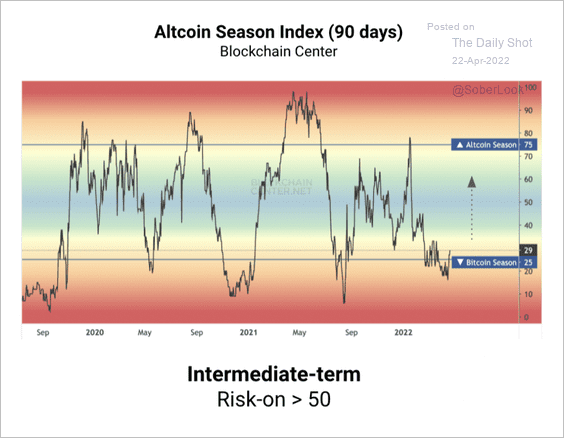

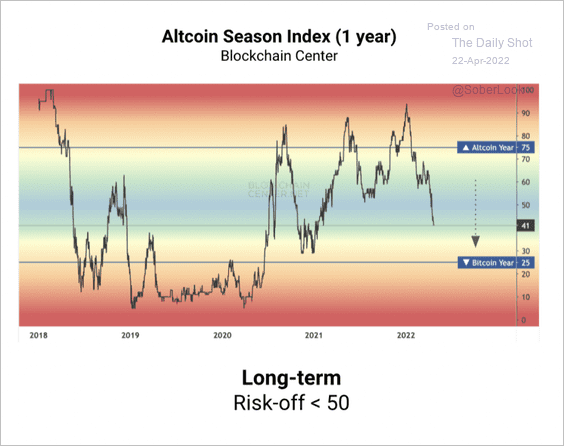

2. Only 29% of the top 50 cryptos have outperformed bitcoin over the past 90 days. Typically, altcoins rise more than bitcoin during risk-on environments.

Source: CoinDesk, Blockchain Center Read full article

Source: CoinDesk, Blockchain Center Read full article

And 41% of the top cryptos have outperformed bitcoin over the past year. Traders have reduced their appetite for risk after an impressive crypto rally in 2020.

Source: CoinDesk, Blockchain Center Read full article

Source: CoinDesk, Blockchain Center Read full article

Back to Index

Commodities

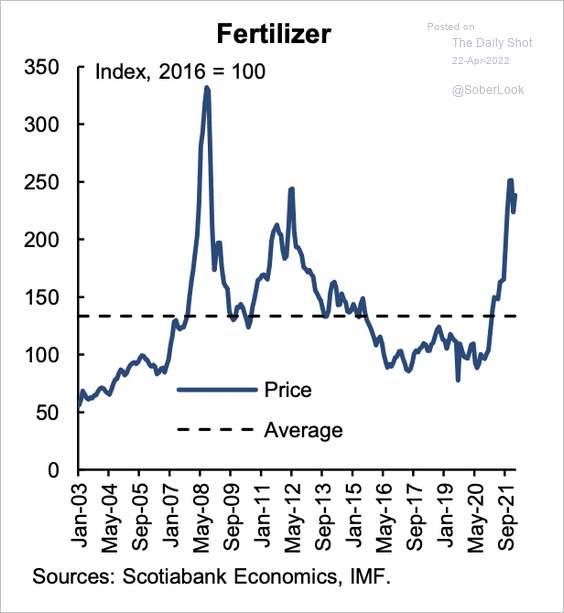

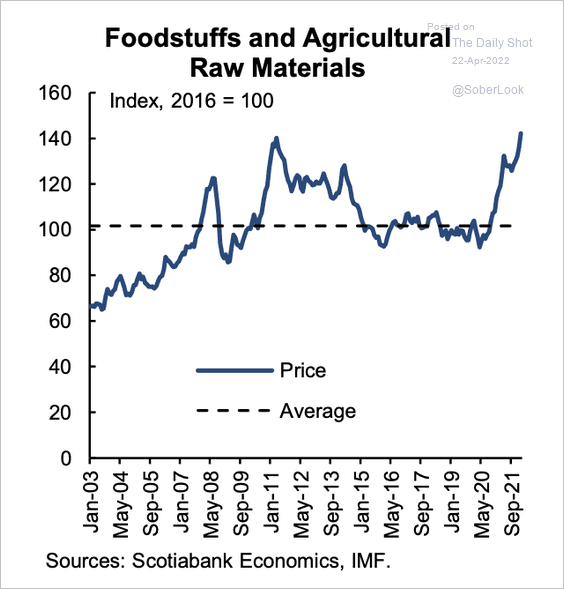

1. The price of fertilizer, foodstuff, and agricultural raw materials are at the highest levels since 2008 (2 charts).

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

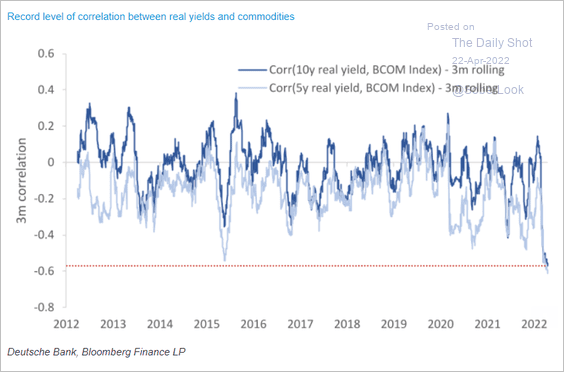

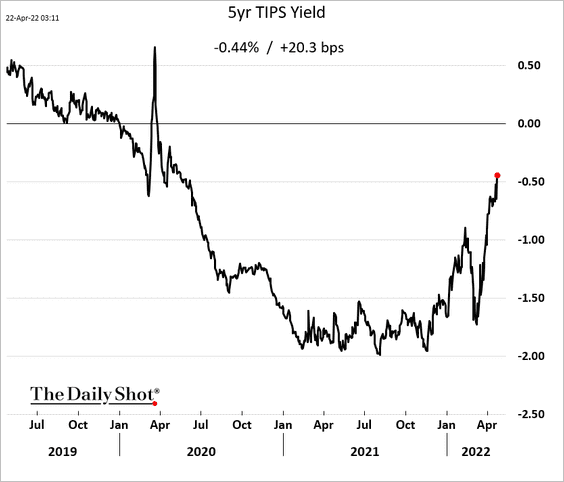

2. Commodities are increasingly vulnerable to rising real yields.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Energy

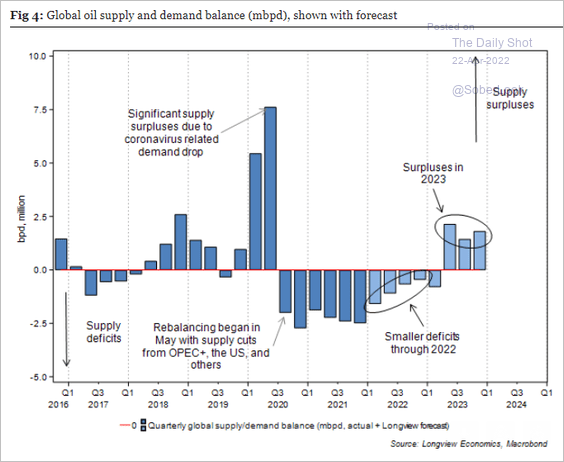

1. Longview Economics is predicting surpluses for the oil markets next year.

Source: Longview Economics

Source: Longview Economics

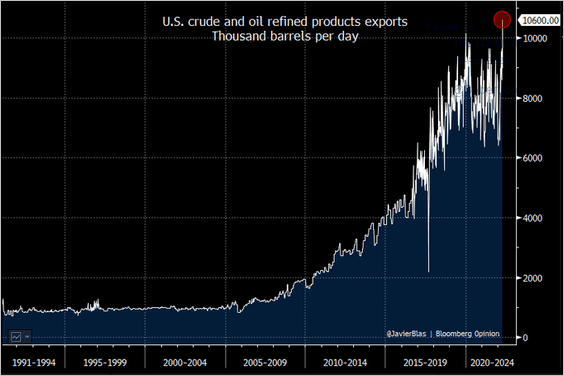

2. US crude oil and refined products exports hit a record high.

Source: @JavierBlas

Source: @JavierBlas

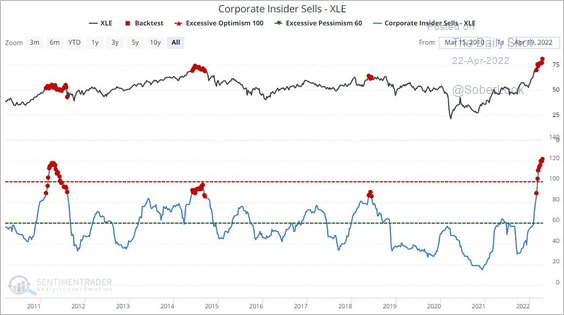

3. Energy sector corporate insiders have been selling stocks, which typically occurs near peak levels.

Source: SentimenTrader

Source: SentimenTrader

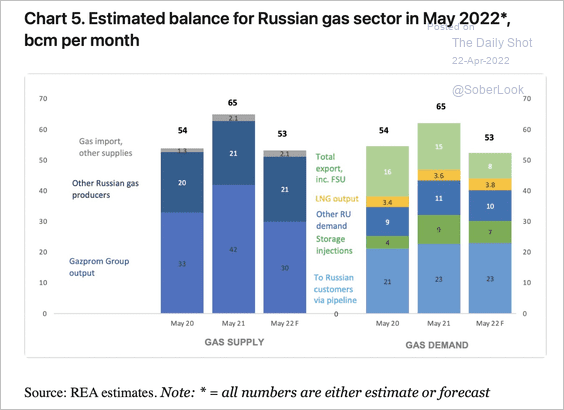

4. Here is an estimate of Russia’s gas supply and demand over the next month. REA anticipates some disruption to gas exports as European buyers could refuse to switch to the new ruble payment system.

Source: Nadia Kazakova; REA

Source: Nadia Kazakova; REA

Back to Index

Equities

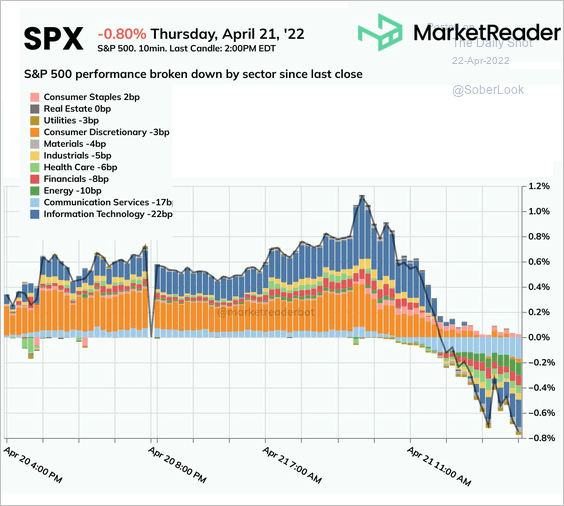

1. Stocks slumped on Thursday as more hawkish signals from the Fed and rising bond yields pressured growth shares.

Source: @marketreaderbot

Source: @marketreaderbot

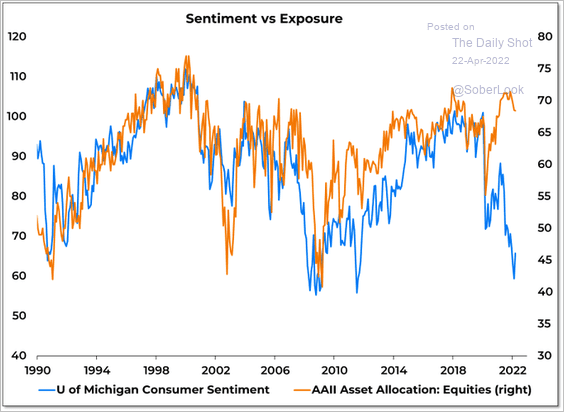

2. There is a considerable disconnect between consumer sentiment and investor allocations to stocks.

Source: @WillieDelwiche

Source: @WillieDelwiche

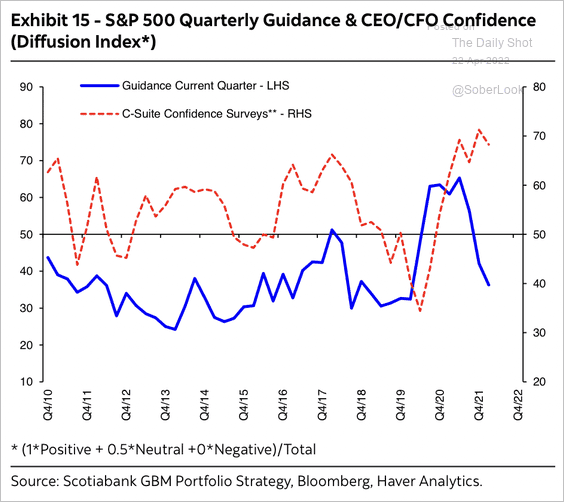

3. Quarterly guidance extended its slide in Q1, suggesting peak optimism among executives.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

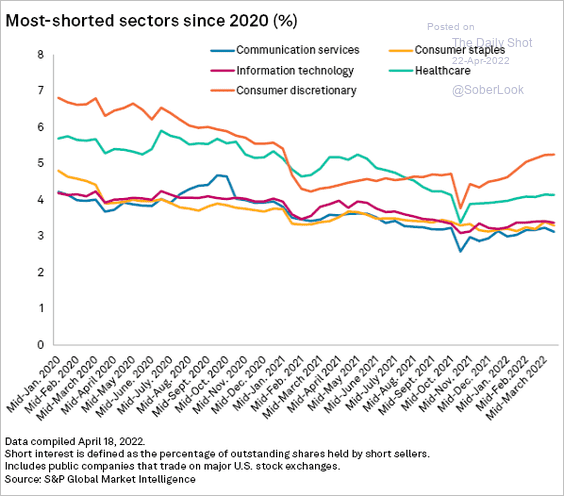

4. This chart shows short interest over time in the most-shorted sectors.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

And these are the most shorted stocks.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

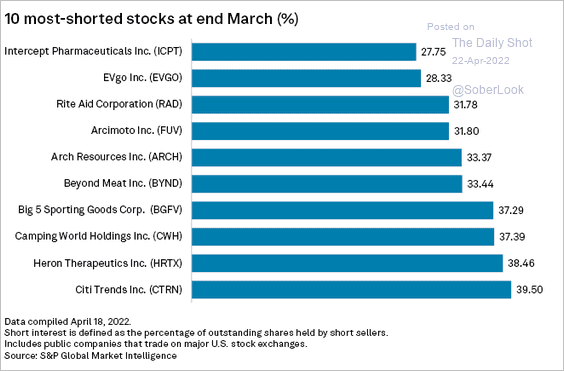

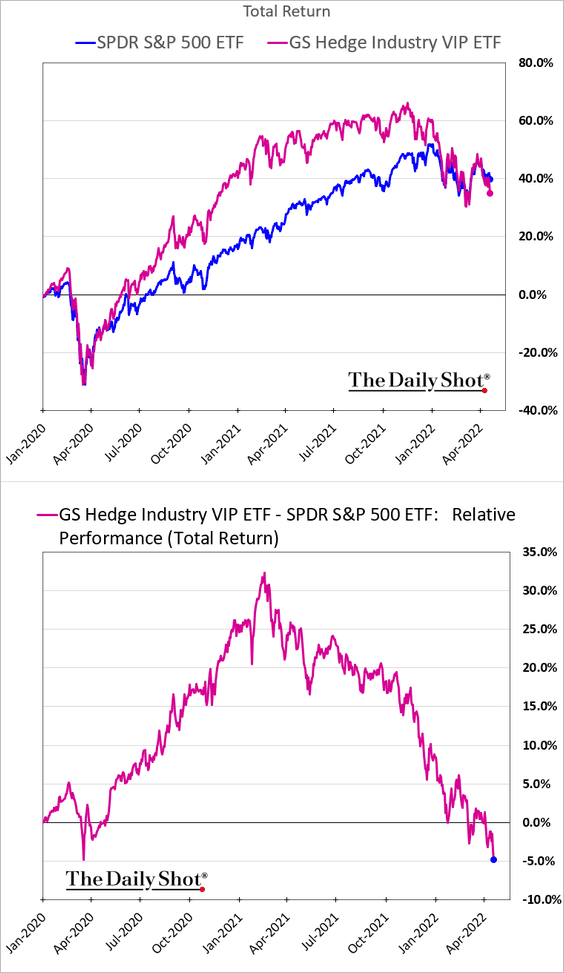

5. Next, we have returns and volatility by sector in a rising rate environment.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

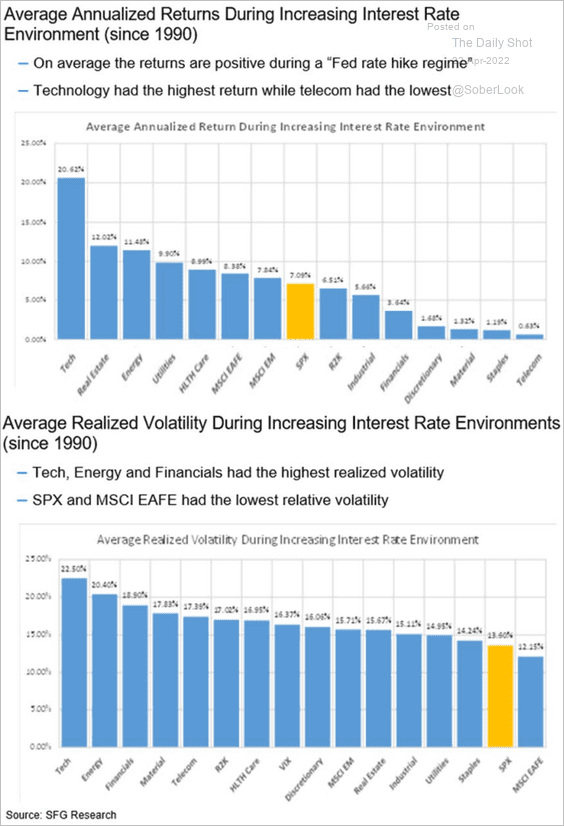

6. Widely-held stocks in the hedge fund industry have given up their post-COVID outperformance.

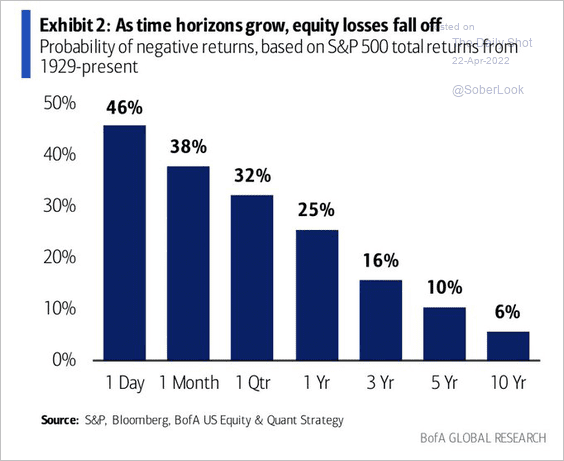

7. What is the relationship between the time horizon and the probability of loss?

Source: BofA Global Research; @carlquintanilla

Source: BofA Global Research; @carlquintanilla

Back to Index

Alternatives

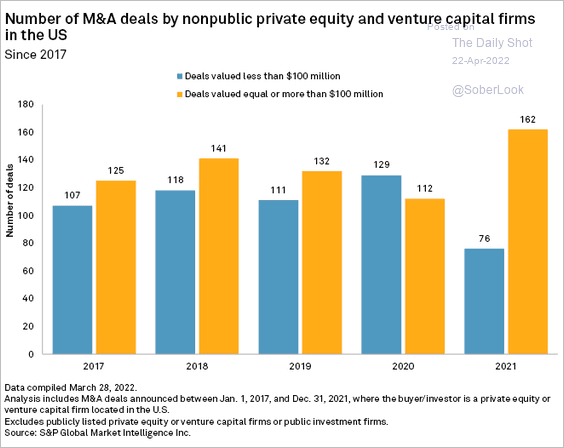

1. Last year, nonpublic private equity firms were focused on larger transactions.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

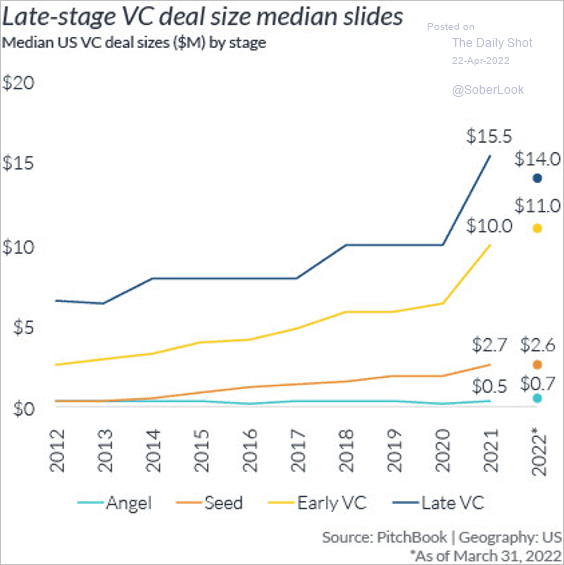

2. The median deal size within late-stage US venture capital is starting to moderate.

Source: PitchBook

Source: PitchBook

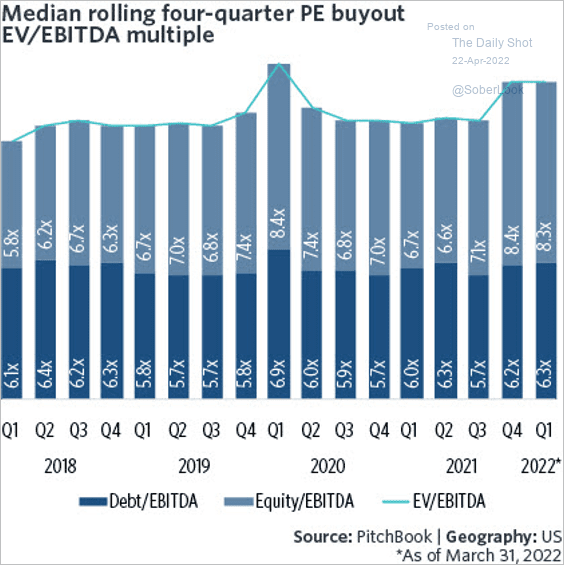

3. US private equity multiples remained steady despite the slowdown in deal-making during the first quarter.

Source: PitchBook

Source: PitchBook

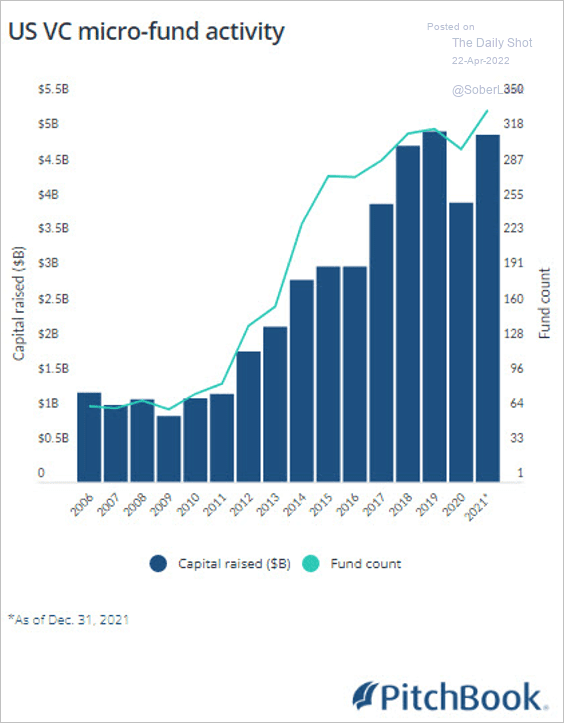

4. The number of US micro-funds (VC funds of under $50 million) has grown over the past decade.

Source: PitchBook

Source: PitchBook

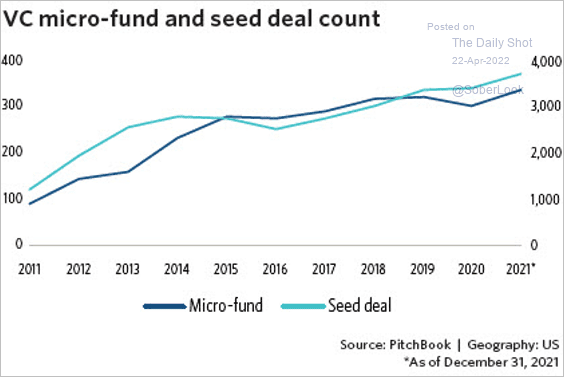

The rise of seed deals and micro-funds is highly correlated.

Source: PitchBook

Source: PitchBook

Back to Index

Credit

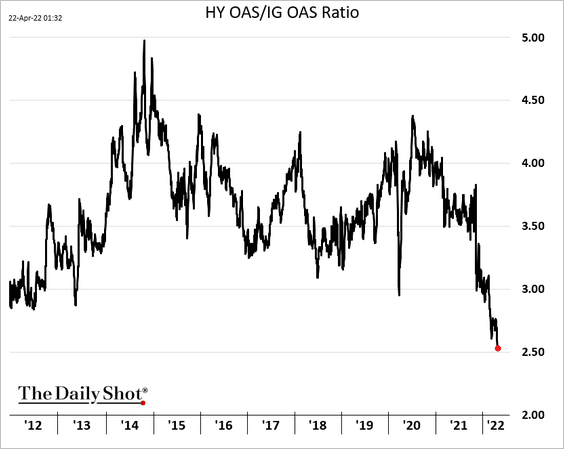

1. High-yield bonds continue to outperform investment-grade debt. Here is the ratio of HY to IG bond spreads.

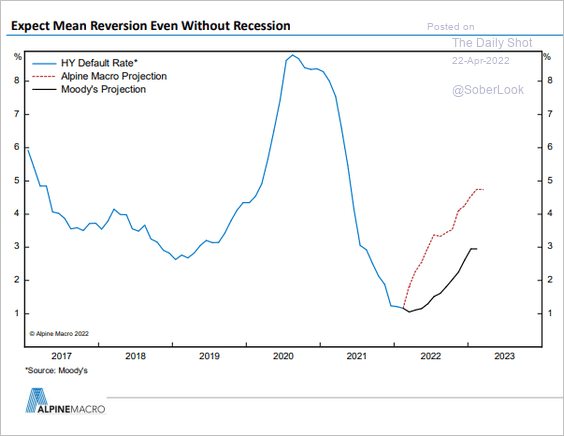

2. High-yield defaults are expected to rise this year.

Source: Alpine Macro

Source: Alpine Macro

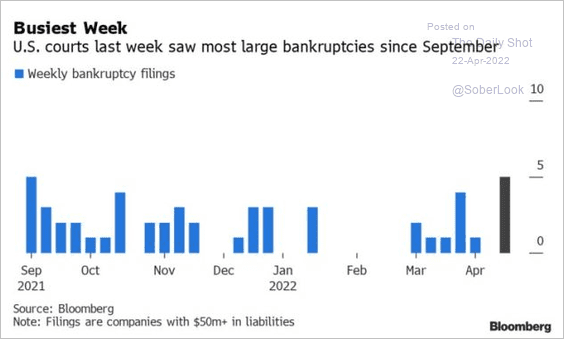

3. US bankruptcy courts have been busy recently.

Source: @bloomberglaw Read full article

Source: @bloomberglaw Read full article

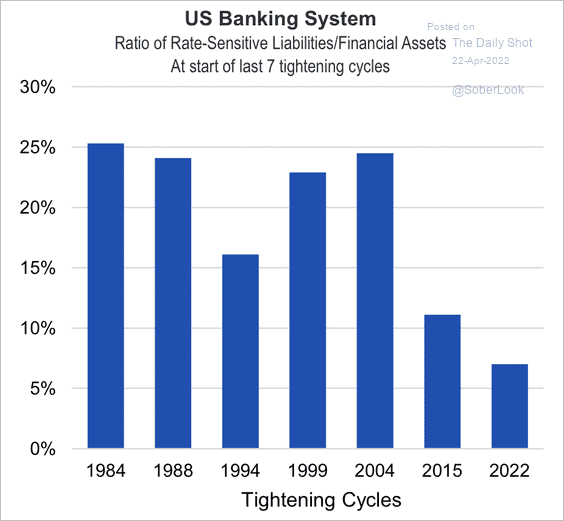

4. US banks have less rate-sensitive liabilities compared with previous tightening cycles.

Source: FHN Financial

Source: FHN Financial

Back to Index

Global Developments

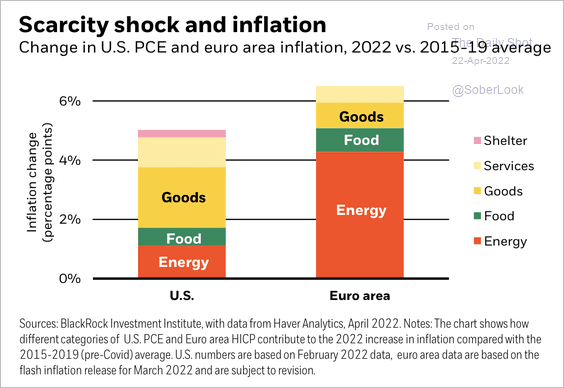

1. Supply shocks have created a shortage of goods, energy, and food that have been driving up prices.

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

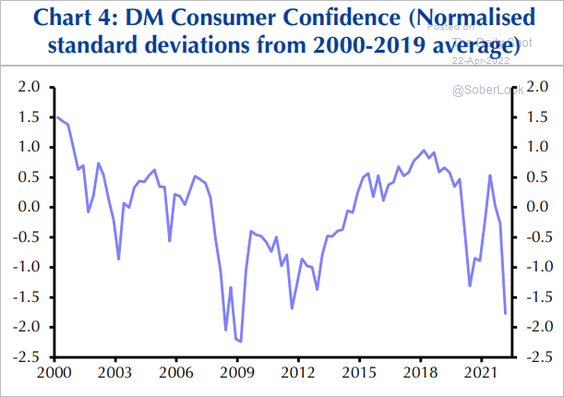

2. Consumer confidence in advanced economies has deteriorated.

Source: Capital Economics

Source: Capital Economics

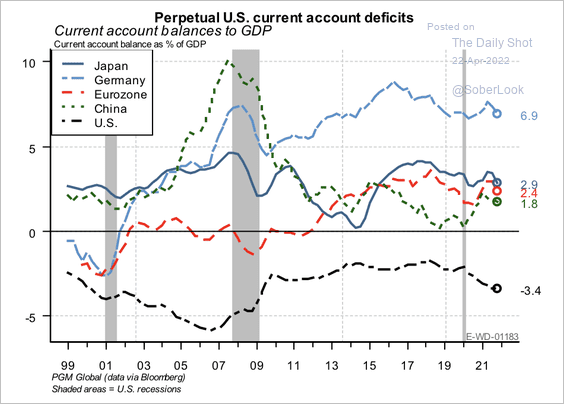

3. Among the major economic powers, only the US has continuously run current account deficits with the rest of the world.

Source: PGM Global

Source: PGM Global

——————–

Food for Thought

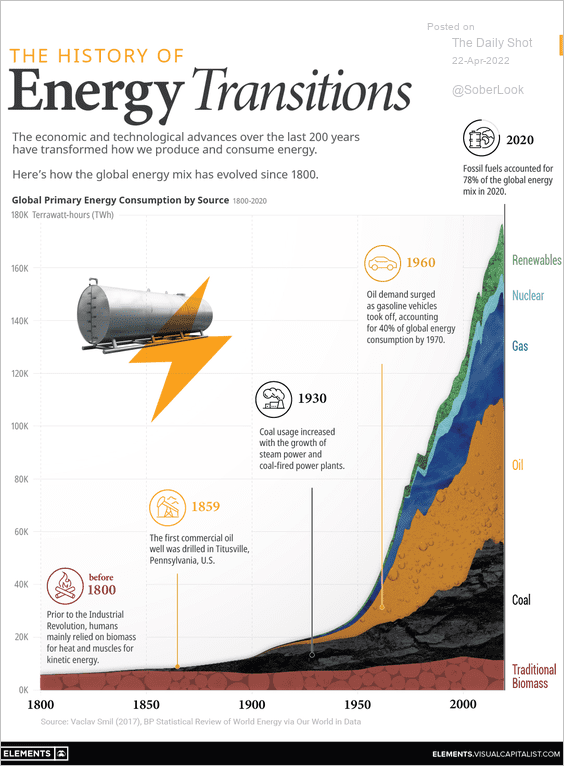

1. The global energy mix since 1800:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

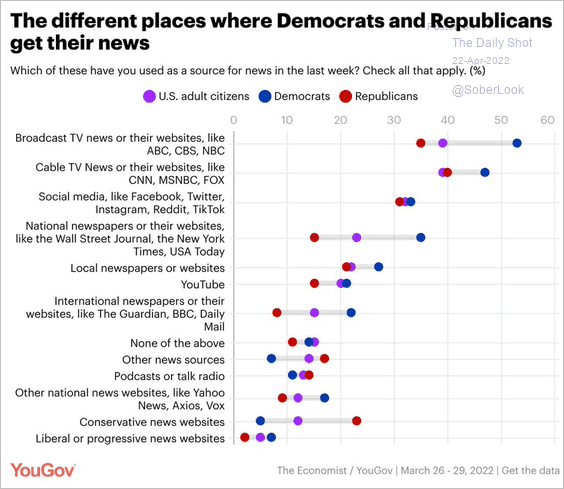

2. Sources of news in the US:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

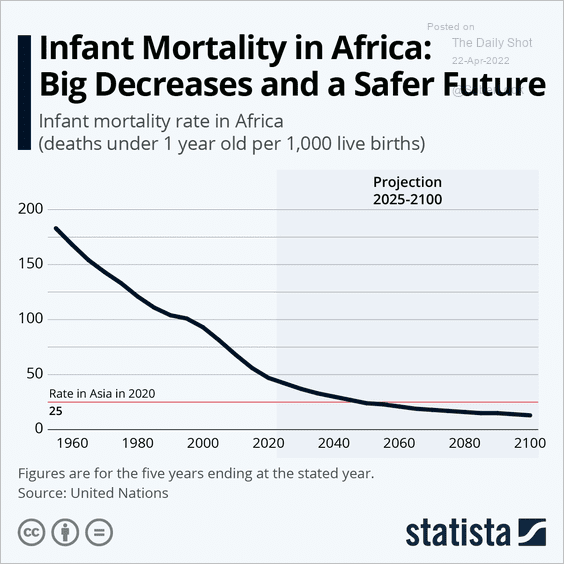

3. Infant mortality in Africa:

Source: Statista

Source: Statista

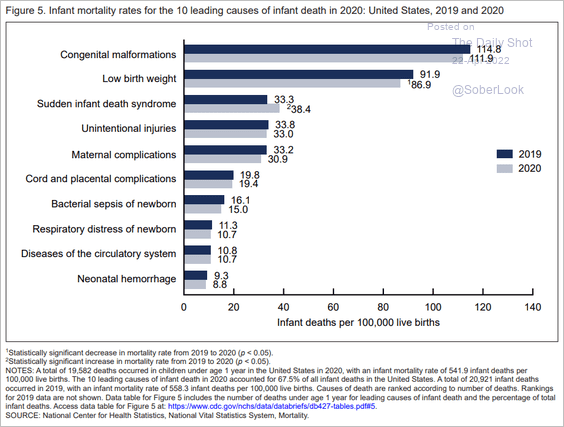

4. US infant mortality rates in 2019 and 2020:

Source: NCHS

Source: NCHS

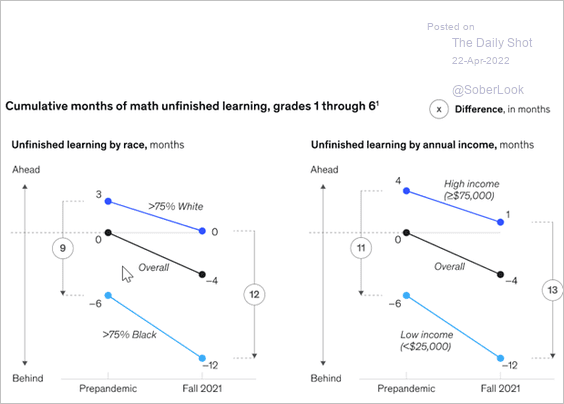

5. The gap between students in majority-Black schools and students in majority-White schools is now three months wider than before the pandemic.

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

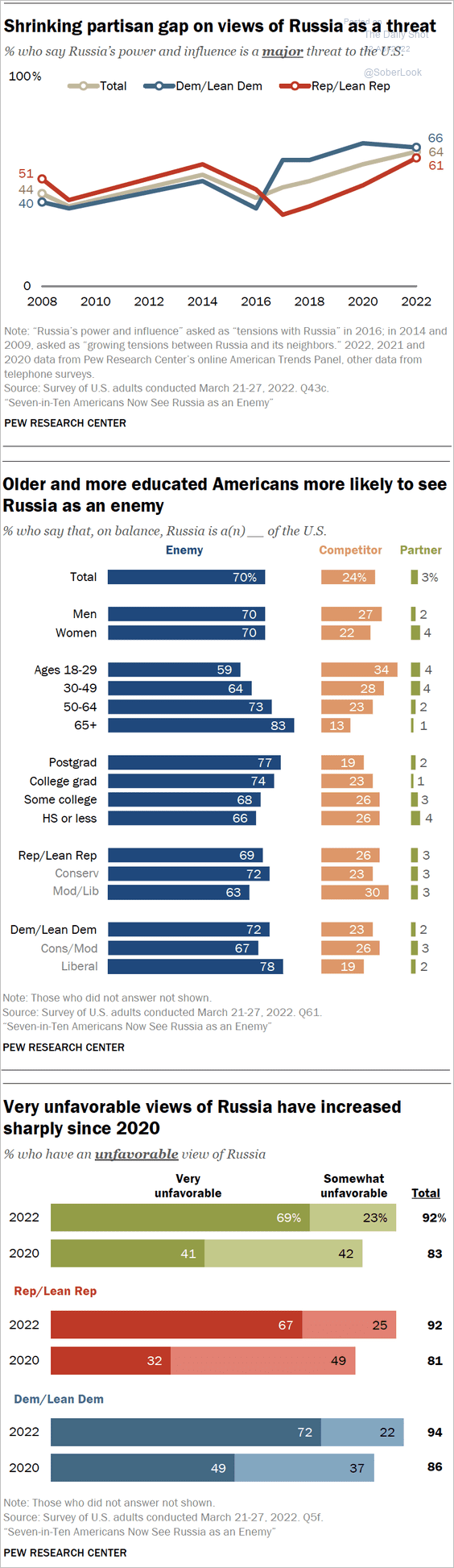

6. Americans viewing Russia as a threat:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

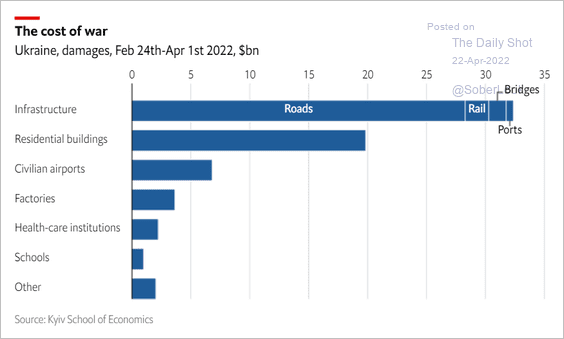

7. Ukraine’s infrastructure damages:

Source: The Economist Read full article

Source: The Economist Read full article

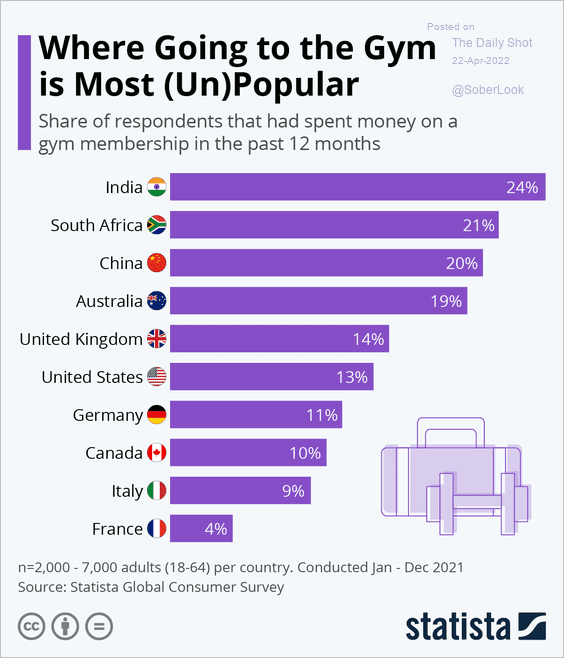

8. Gym membership rates globally:

Source: Statista

Source: Statista

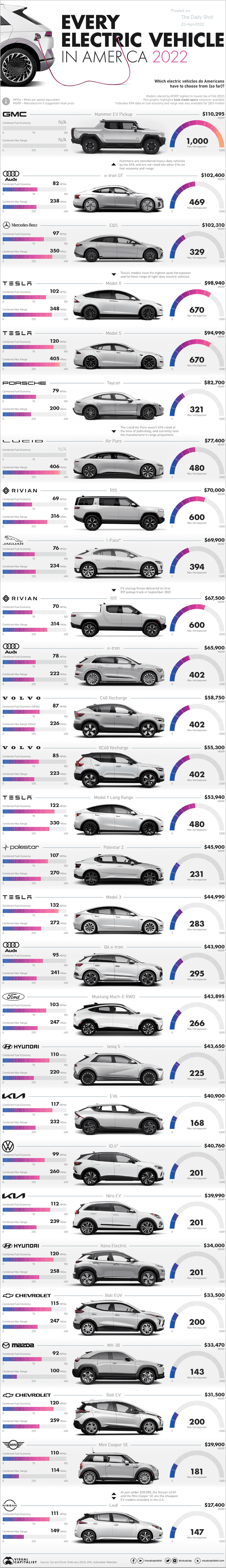

9. The US 2022 electric vehicle lineup:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Have a great weekend!

Back to Index