The Daily Shot: 29-Apr-22

• The United States

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Global Developments

• Food for Thought

The United States

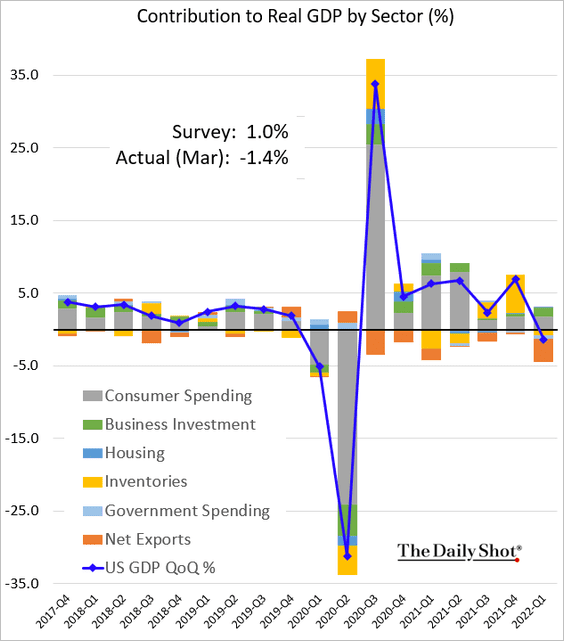

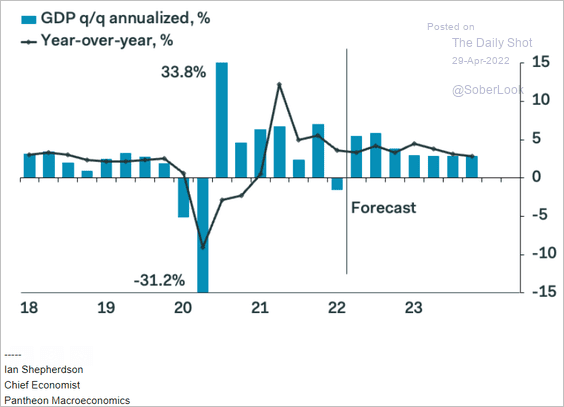

1. The GDP unexpectedly contracted in the first quarter.

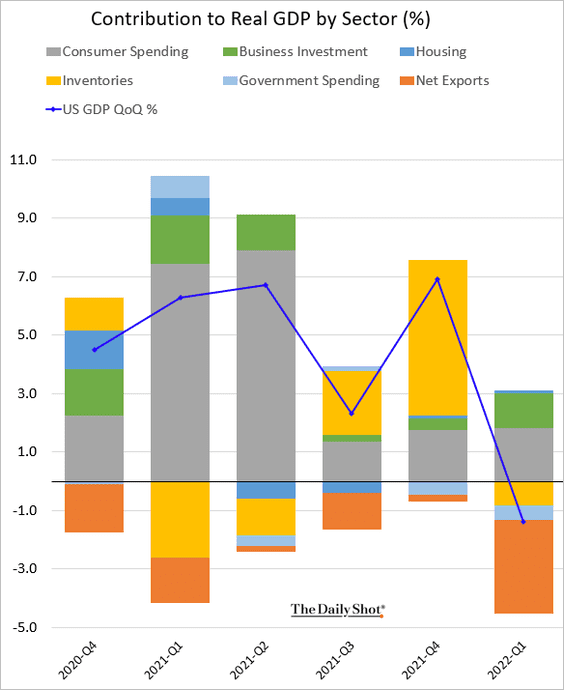

Zooming in, we see that the main driver of the decline was the record trade deficit. Inventories and slower government spending were the other two detracting components.

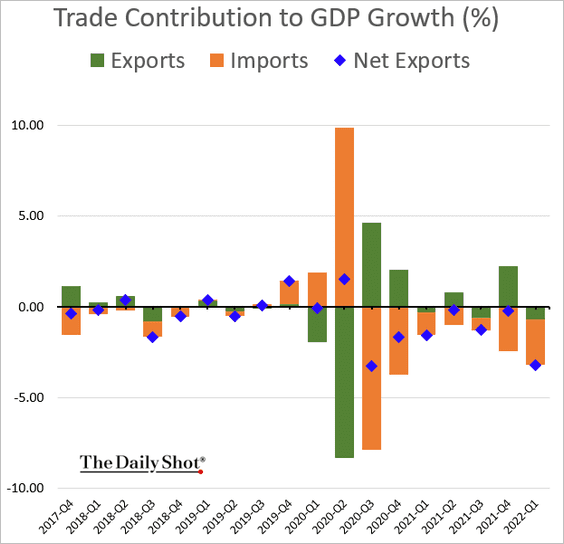

Here is the breakdown of net exports.

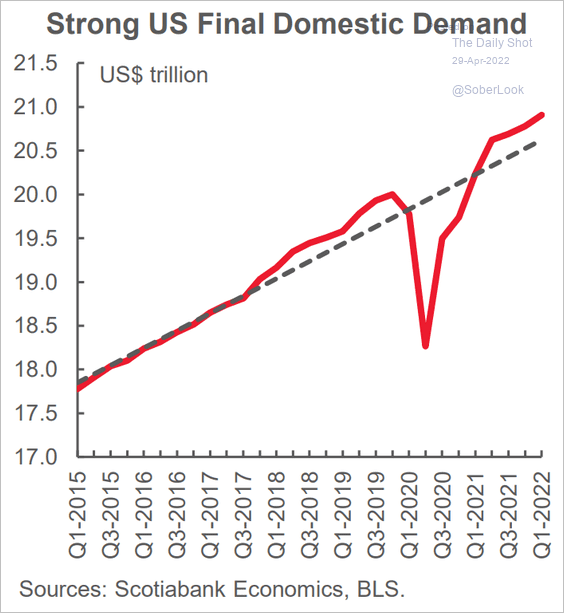

However, real final sales to domestic purchasers climbed 2.6%, suggesting that the core of the economy remains robust.

Source: Scotiabank Economics

Source: Scotiabank Economics

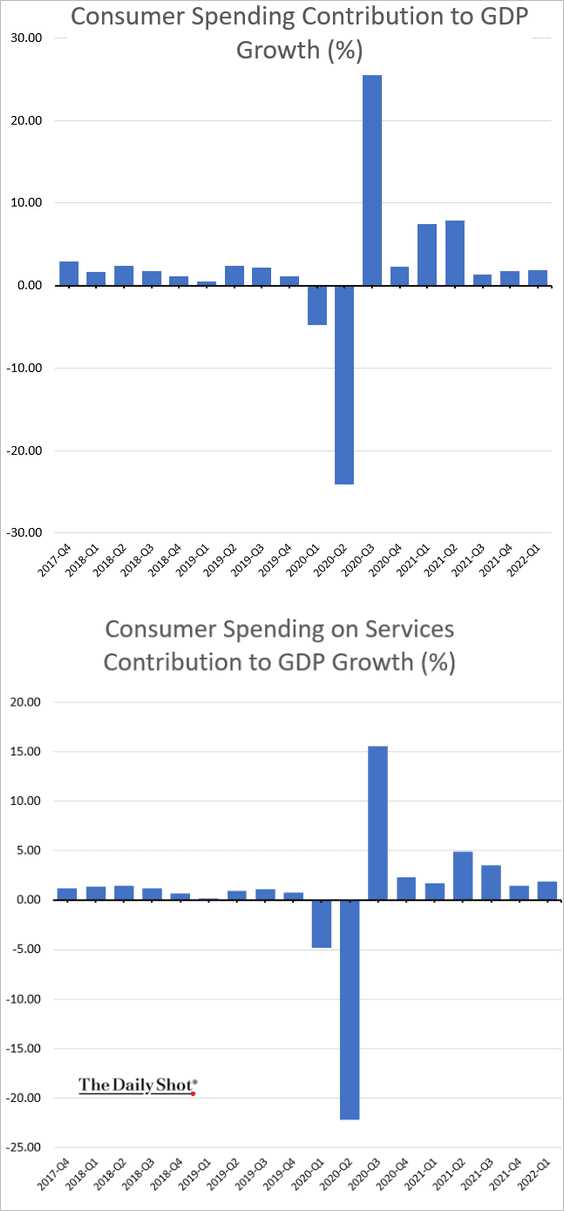

• Consumer spending:

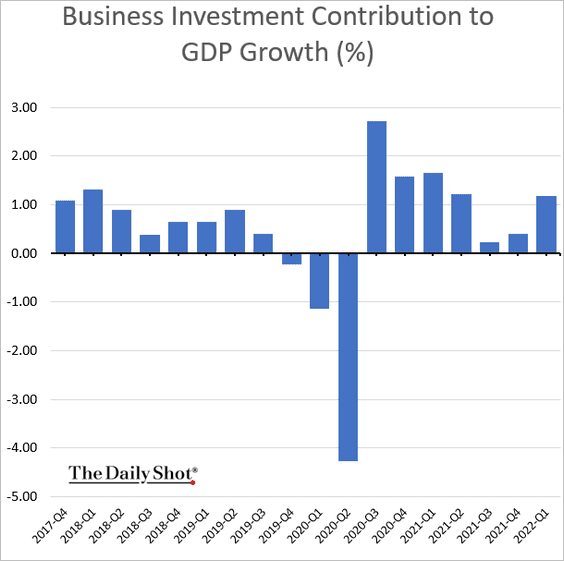

• Business investment:

Economists expect the GDP to swing back into growth this quarter. Here is a forecast from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

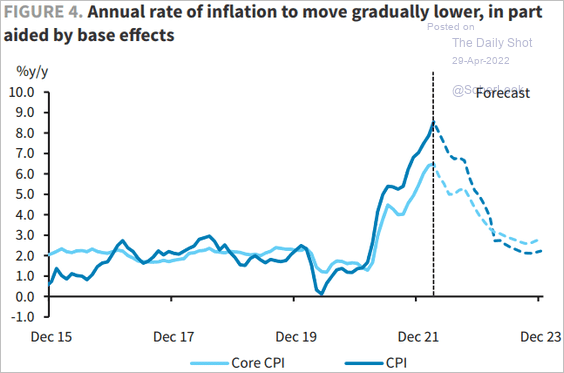

2. Helped by base effects, inflation should moderate throughout this and next year. Here is s forecast from Barclays.

Source: Barclays Research

Source: Barclays Research

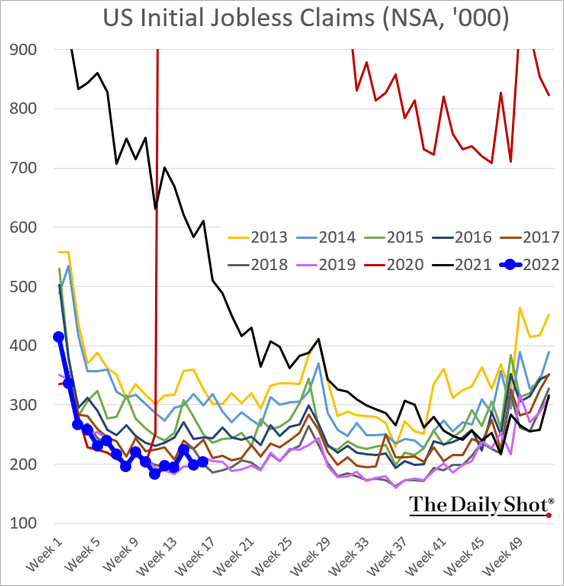

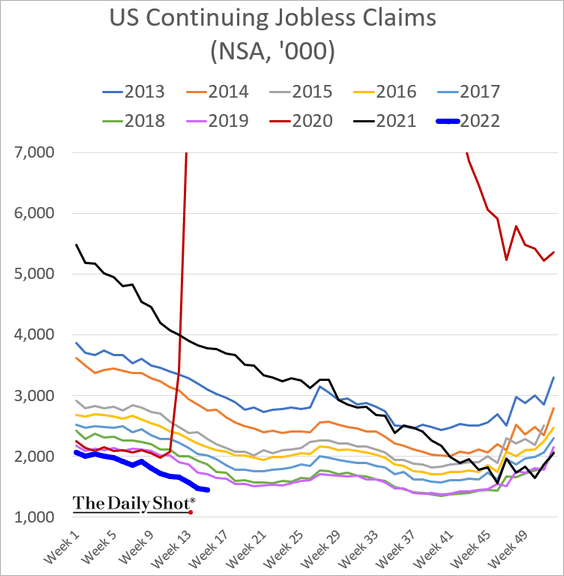

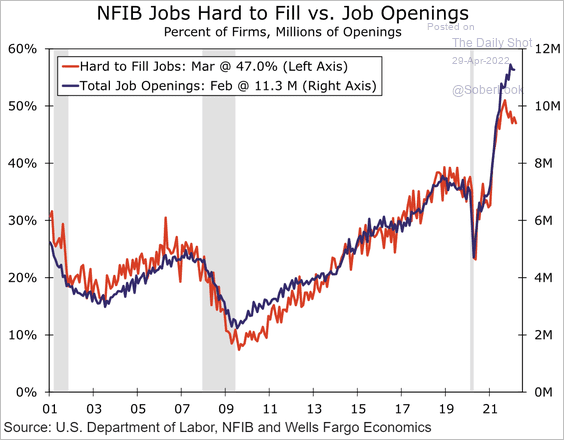

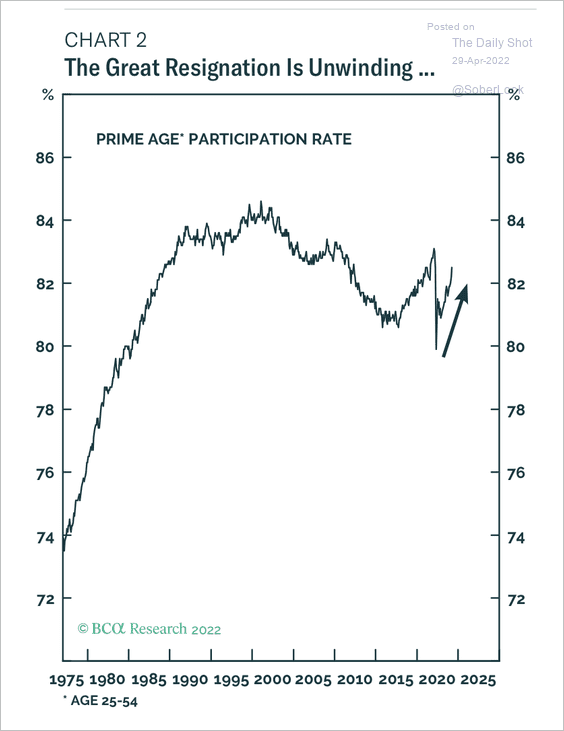

3. Next, we have some updates on the labor market.

• Jobless claims are holding near multi-decade lows.

• Will job openings begin to moderate?

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• The prime-age (25-to-54 year-olds) participation rate is approaching pre-pandemic levels.

Source: BCA Research

Source: BCA Research

——————–

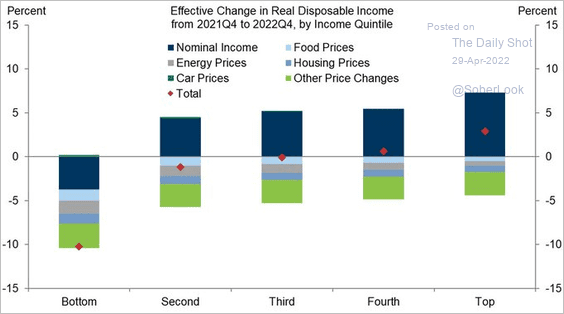

4. This chart shows the expected change in effective real income, by income quintile. Households in the top two quintiles are responsible for over 60% of consumer spending. As a result, consumption growth could persist despite the recent surge in inflation.

Source: @Geo_papic, @GoldmanSachs

Source: @Geo_papic, @GoldmanSachs

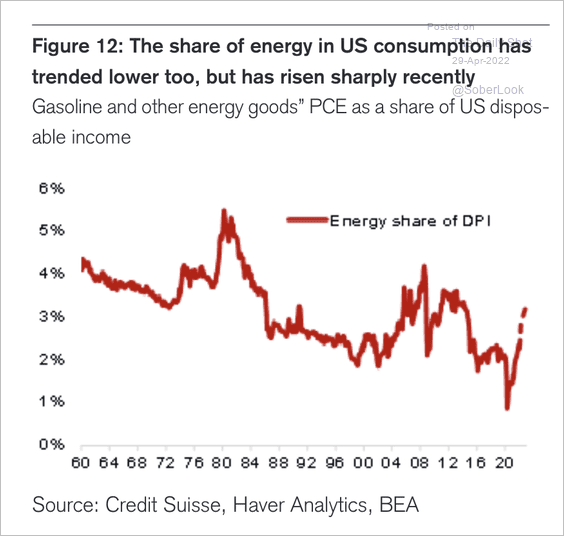

Also, despite the recent increase, energy’s share of consumption remains near historically low levels.

Source: Credit Suisse

Source: Credit Suisse

——————–

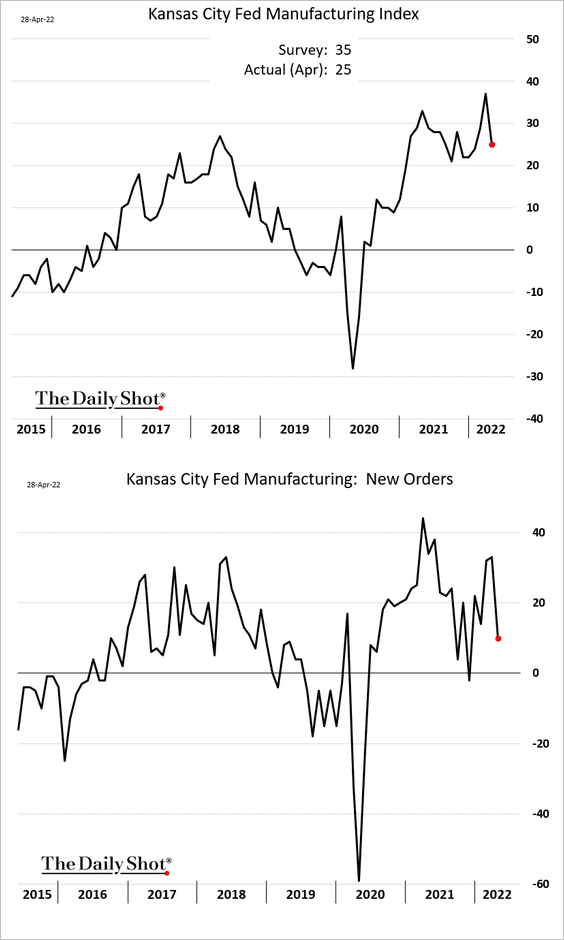

5. The Kansas City Fed manufacturing index pulled back from the highs this month as demand slowed.

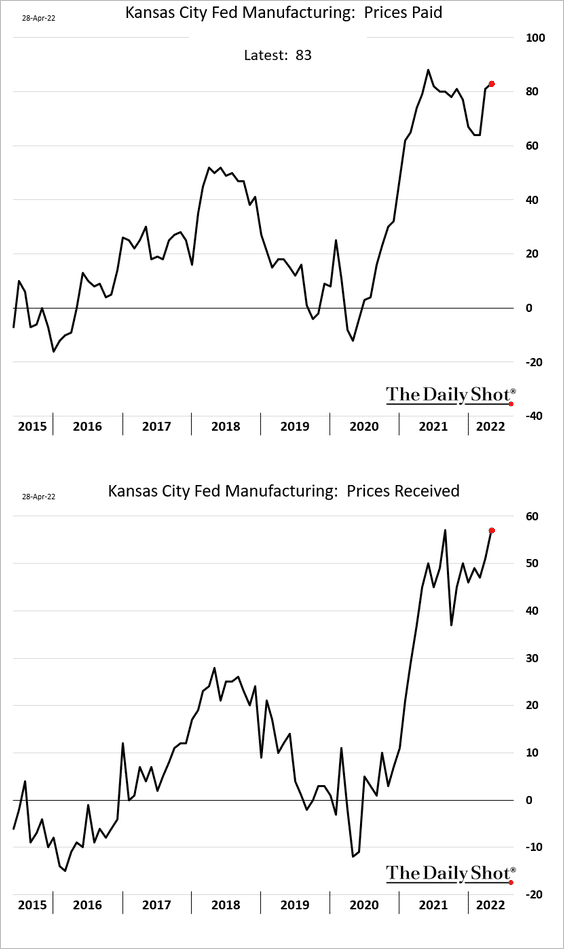

Price pressures are at extreme levels but most factories are able to pass on higher costs to their customers.

——————–

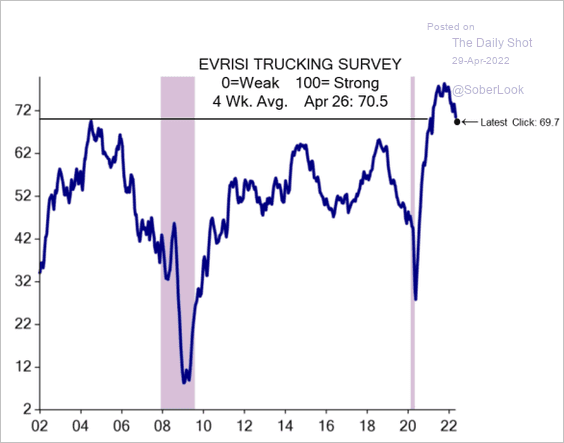

6. The Evercore ISI trucking survey shows some moderation in freight transportation demand. But the index is still near the previous peak reached in 2004.

Source: Evercore ISI Research

Source: Evercore ISI Research

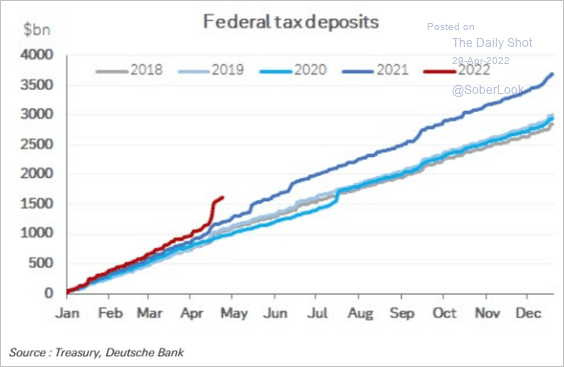

7. Federal tax receipts unexpectedly surged this month.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The Eurozone

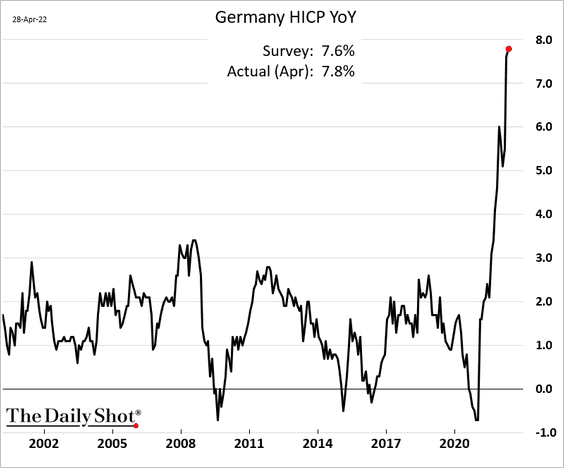

1. Germany’s consumer inflation hit 7.8%.

Source: @markets Read full article

Source: @markets Read full article

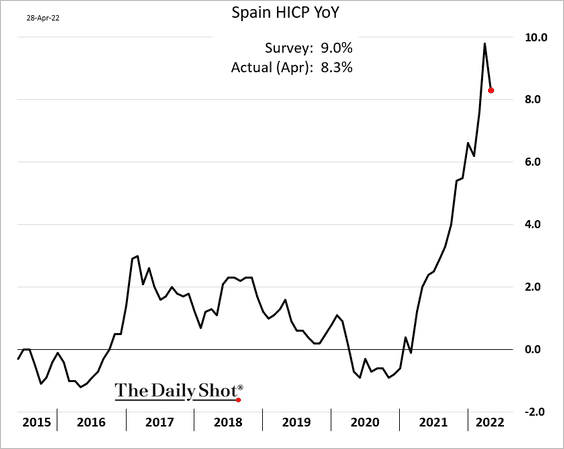

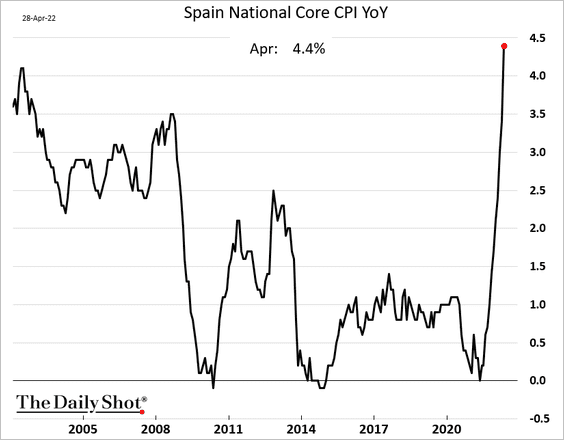

Spain’s headline CPI pulled back from the highs.

But the core CPI (based on the national inflation data) continues to surge.

——————–

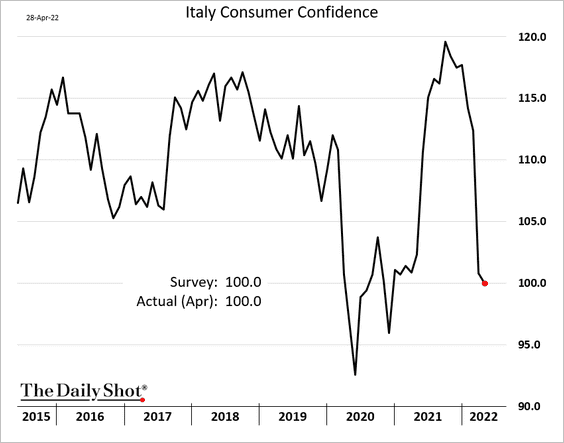

2. Italy’s consumer confidence weakened further this month, in line with expectations.

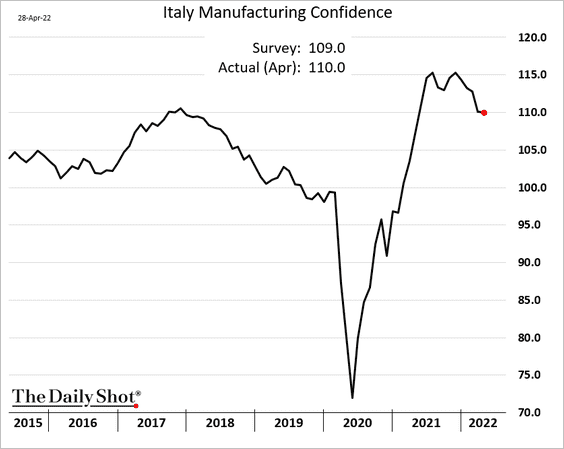

Manufacturing sentiment held steady.

——————–

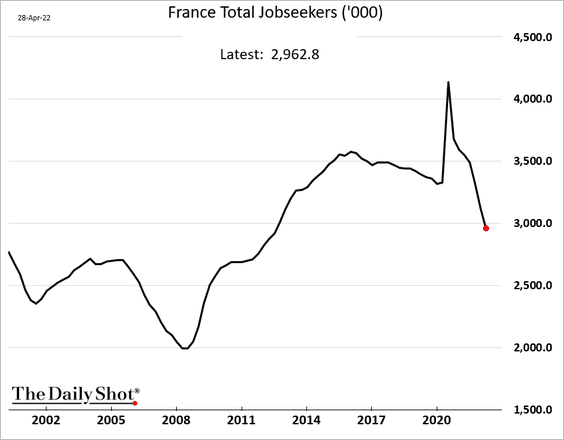

3. The total number of French jobseekers hit the lowest level in a decade.

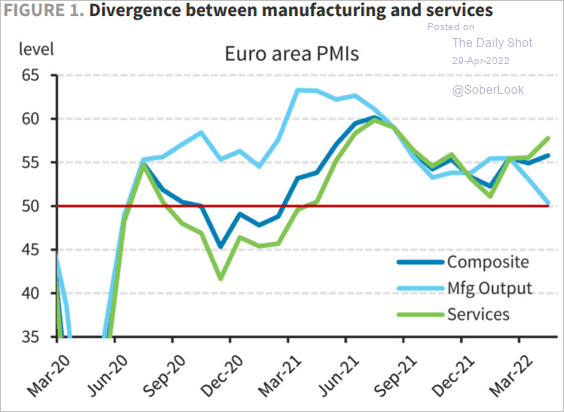

4. Similar to the post-Covid19 recovery in the US, the euro-area services PMIs are projected to improve in 2H’22 relative to weakening manufacturing output.

Source: Barclays Research

Source: Barclays Research

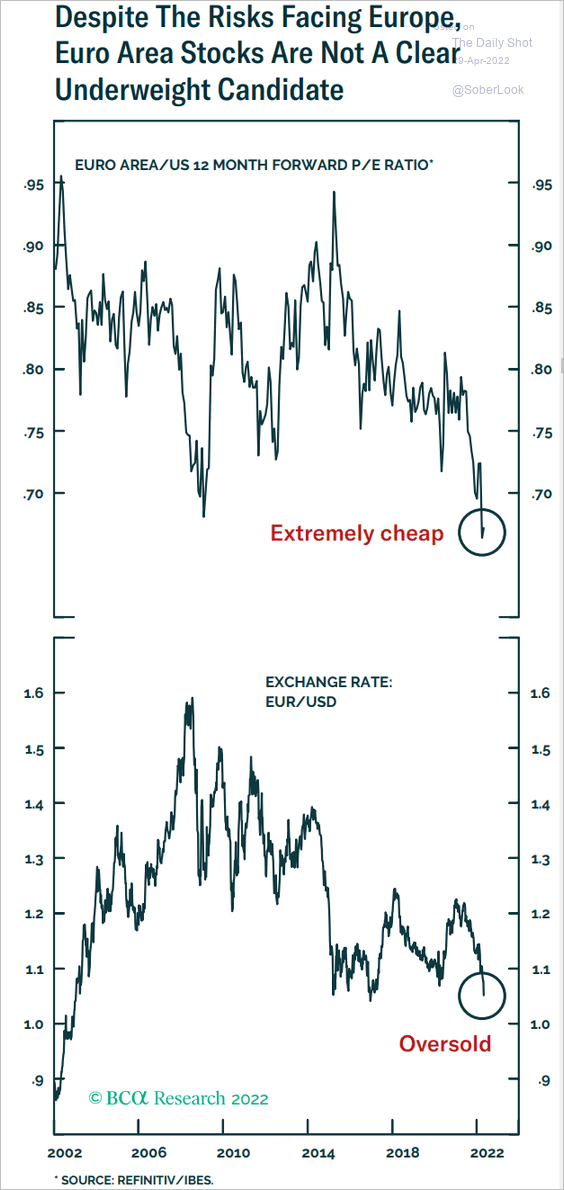

5. Eurozone stocks look very cheap.

Source: BCA Research

Source: BCA Research

Back to Index

Europe

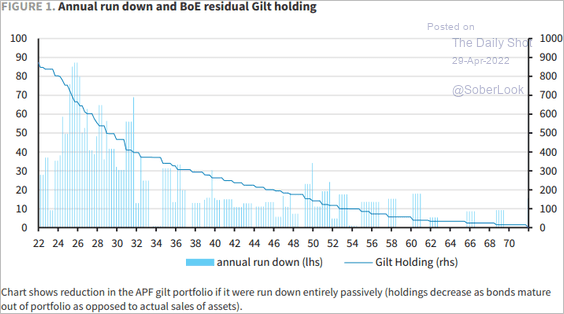

1. Along with the Fed, the Bank of England has been communicating a path towards quantitative tightening (QT). That path will reduce the bank’s balance sheet very gradually over quite a few years.

Source: Barclays Research

Source: Barclays Research

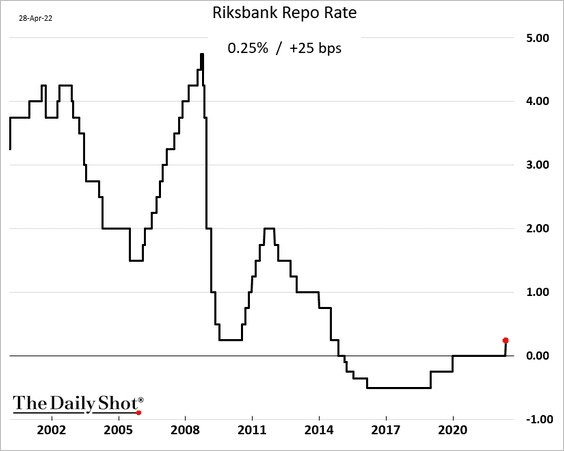

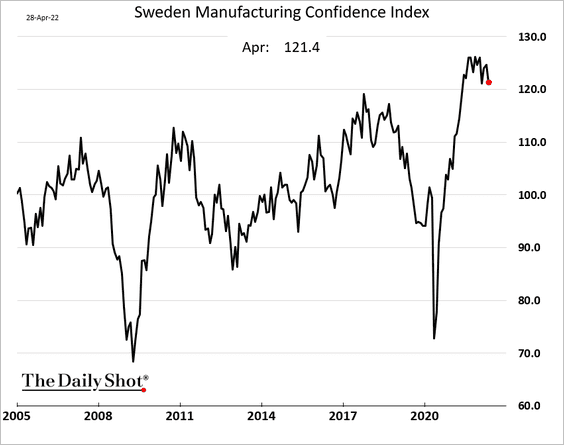

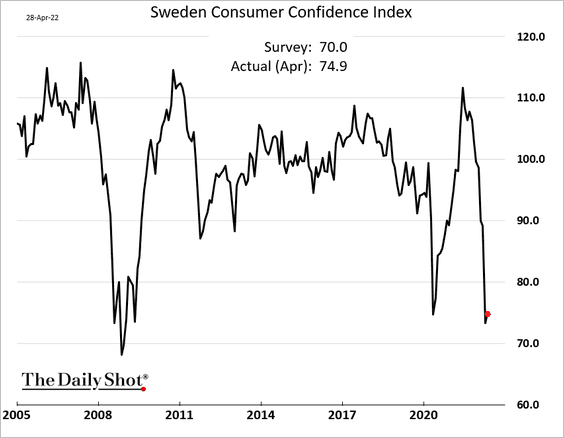

2. Next, we have some updates on Sweden.

• The central bank unexpectedly hiked rates this week in a policy shift, indicating there is more to come.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

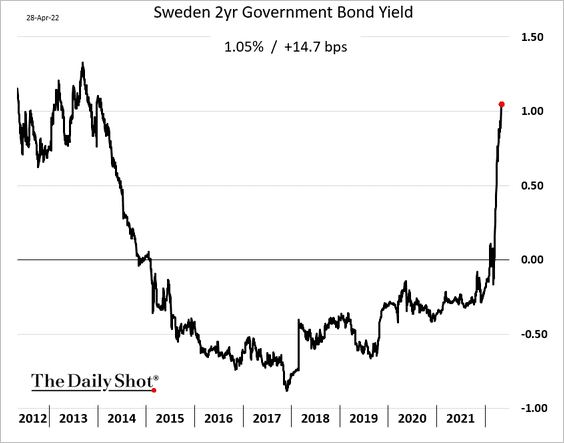

• The 2-year yield blasted past 1% for the first time since 2014.

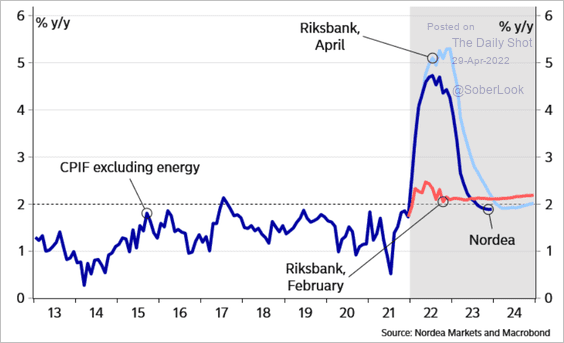

• Riksbank’s CPI projection was boosted sharply.

Source: Nordea Markets

Source: Nordea Markets

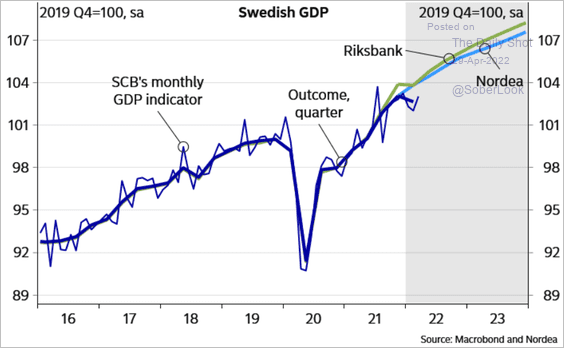

• The GDP estimate was softer than expected.

Source: Nordea Markets

Source: Nordea Markets

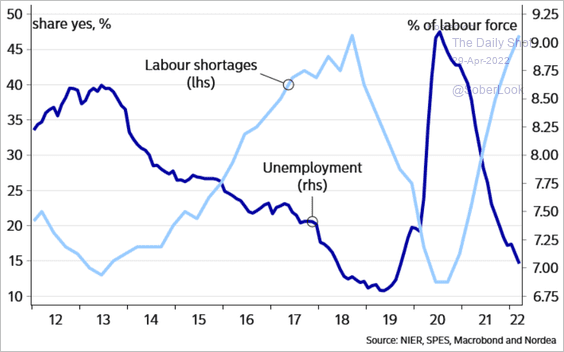

• Labor shortages persist.

Source: Nordea Markets

Source: Nordea Markets

• Consumer and manufacturing confidence indicators remain divergent.

Back to Index

Japan

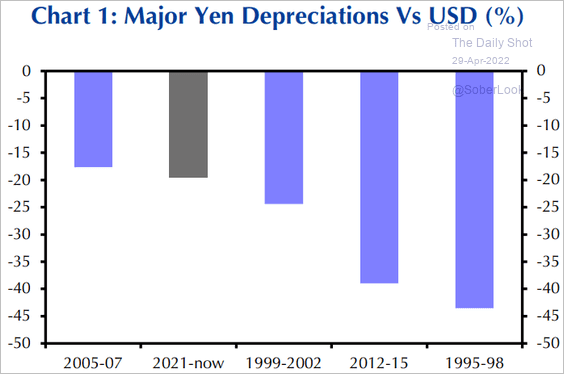

1. While the Japanese yen has depreciated by about 20% vs. the USD this year, there are fundamental reasons why this devaluation could continue towards an exchange rate of 140 yen per dollar, in-line with other major historical depreciations.

Source: Capital Economics

Source: Capital Economics

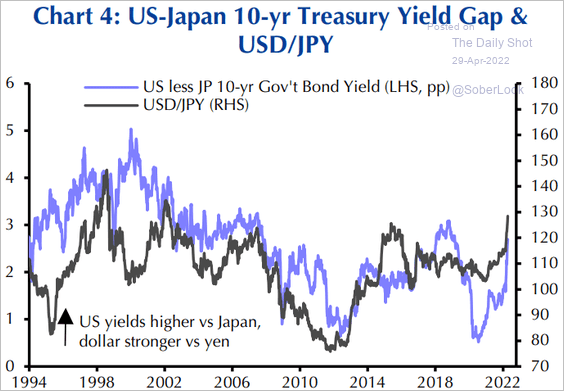

The US-Japan bond yield gap can move higher and also put additional pressure on the yen in the remainder of 2022.

Source: Capital Economics

Source: Capital Economics

——————–

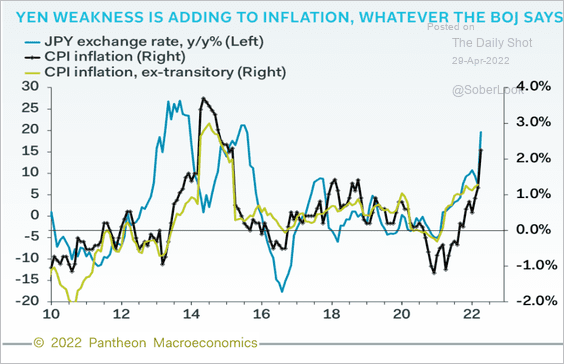

2. The yen’s weakness is accelerating Japan’s inflation.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

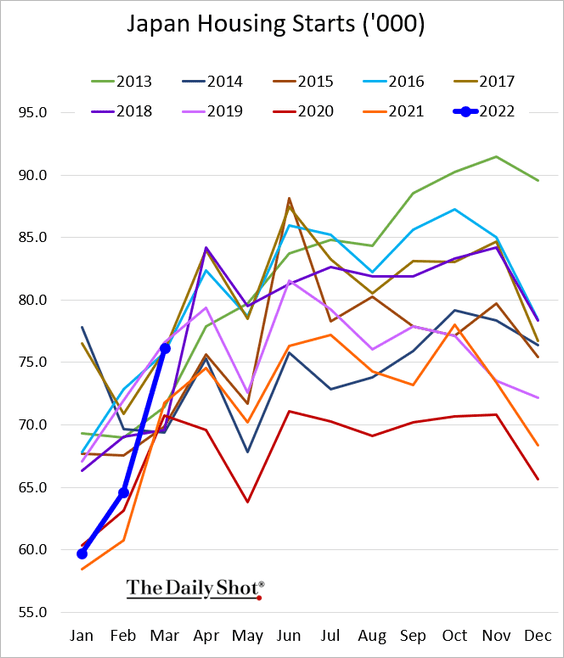

3. Housing starts surprised to the upside in March.

Back to Index

Asia – Pacific

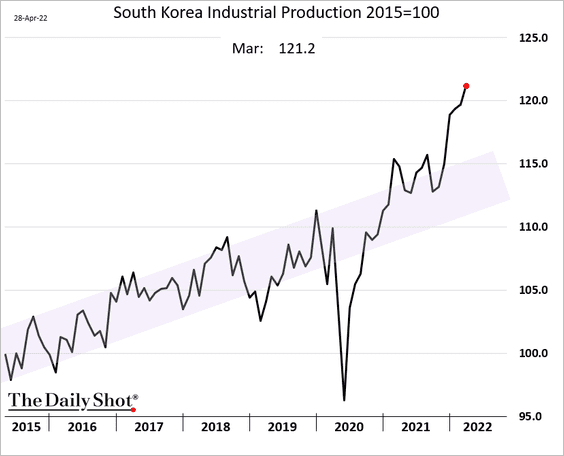

1. South Korea’s industrial production continues to hit record highs, moving well above the pre-COVID trend.

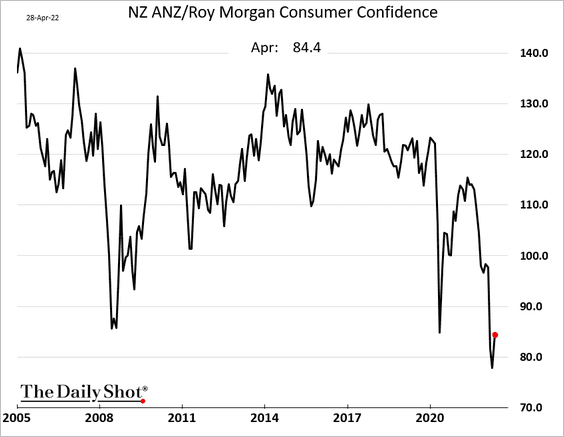

2. New Zealand’s consumer confidence bounced from record weakness but remains under the 2008 lows.

Back to Index

China

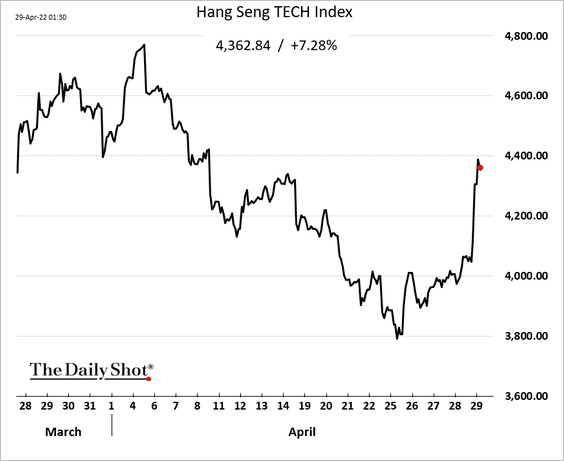

1. Tech stocks are surging in Hong Kong on bets that Beijing will ease up its regulatory campaign.

Source: @markets Read full article

Source: @markets Read full article

——————–

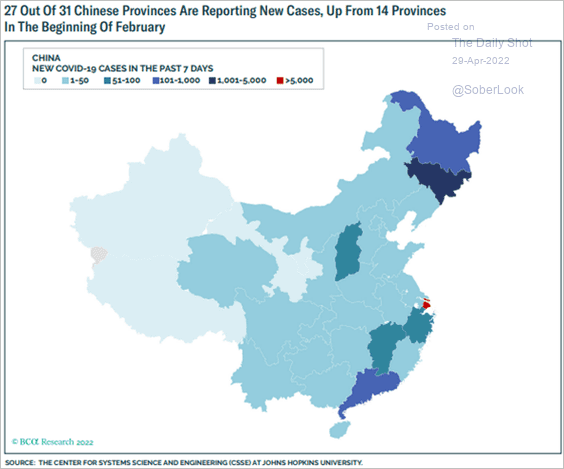

2. The spread of Covid-19 in the heavily populated eastern and southern Chinese provinces remains a challenge.

Source: BCA Research

Source: BCA Research

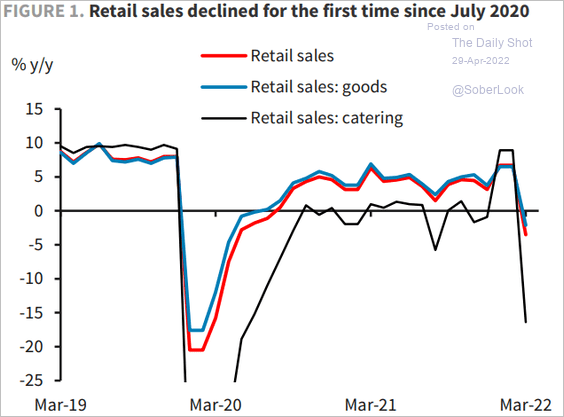

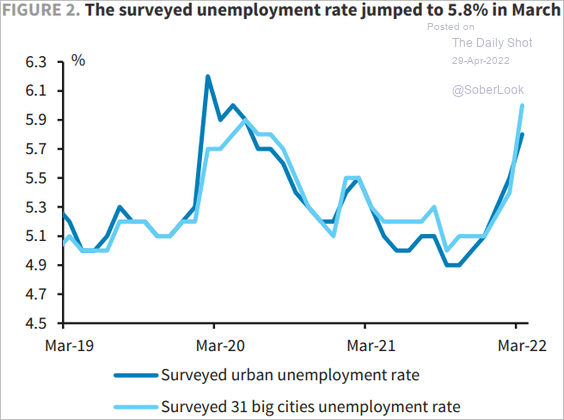

3. The extended lockdowns in China have resulted in deteriorating macroeconomic data. Retail sales have started to decline and unemployment rates have moved noticeably higher (two charts).

Source: Barclays Research

Source: Barclays Research

Source: Barclays Research

Source: Barclays Research

——————–

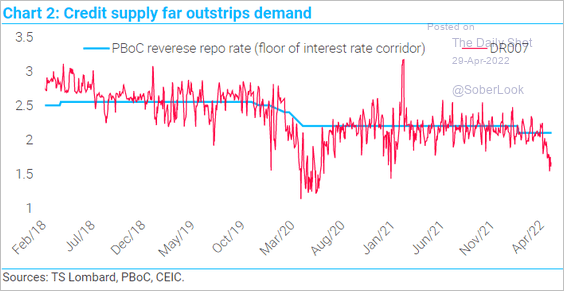

4. Beijing has been providing extra liquidity to deal with the lockdowns’ economic fallout.

Source: TS Lombard

Source: TS Lombard

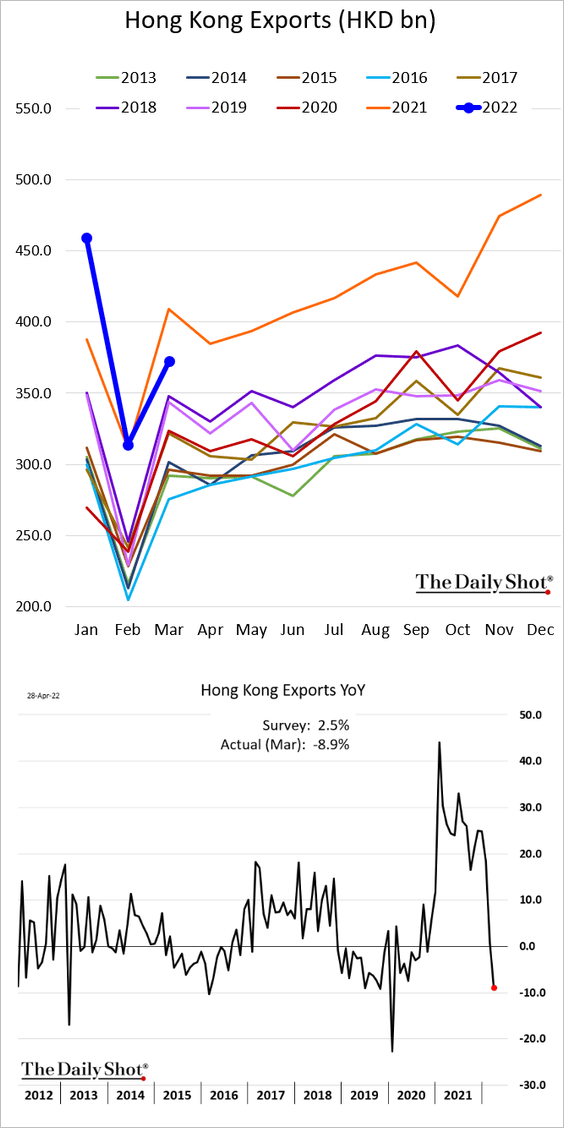

5. Hong Kong’s exports were weaker than expected in March (down 8.9% from a year ago).

Back to Index

Emerging Markets

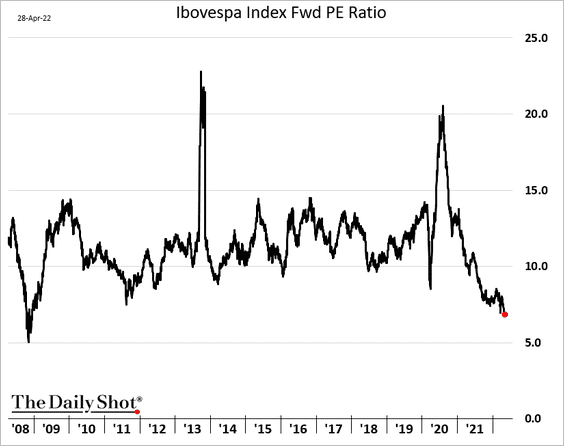

1. Brazil’s shares haven’t been this cheap since the financial crisis.

h/t @andradevini3, @business

h/t @andradevini3, @business

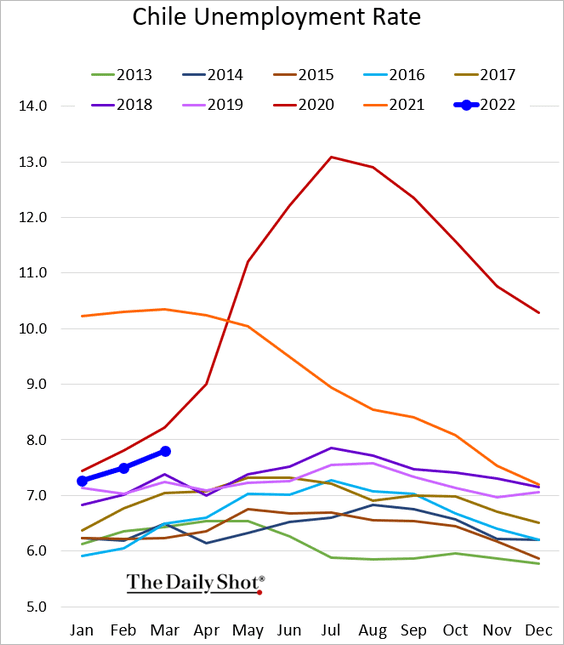

2. Chile’s unemployment rate remains elevated relative to pre-COVID levels.

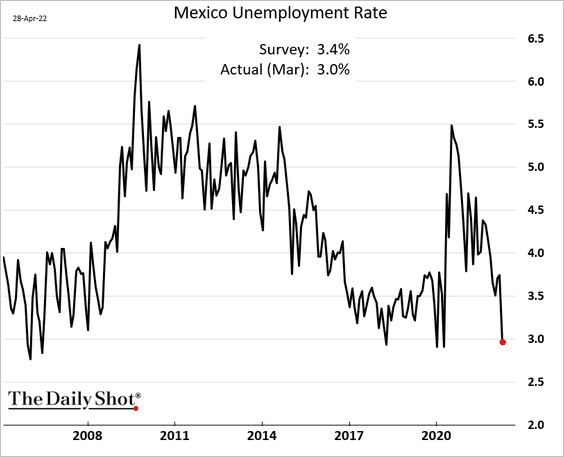

3. Mexico’s unemployment rate is back at 3%.

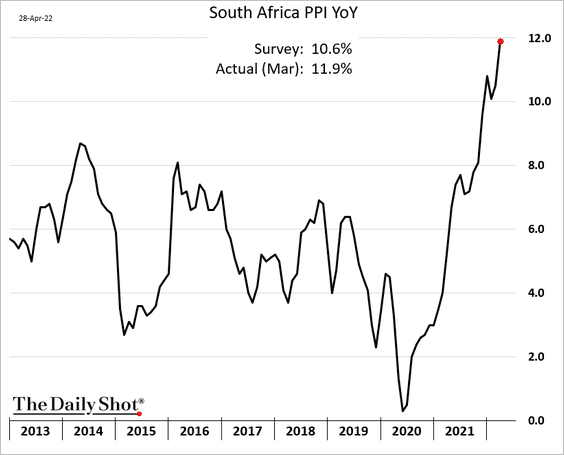

4. South Africa’s producer prices are surging,

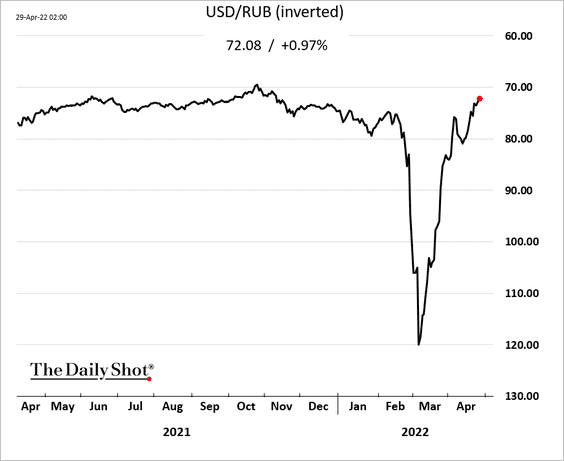

5. The Russian ruble hit the strongest level since November.

Back to Index

Commodities

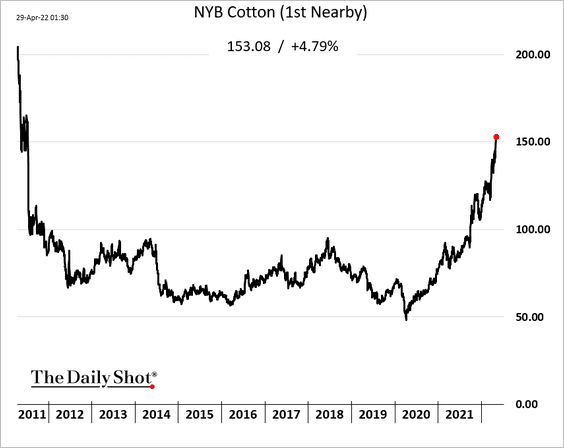

Cotton futures are soaring. Gains are driven by demand from China at a time when the US cotton crop suffers from drought.

Back to Index

Energy

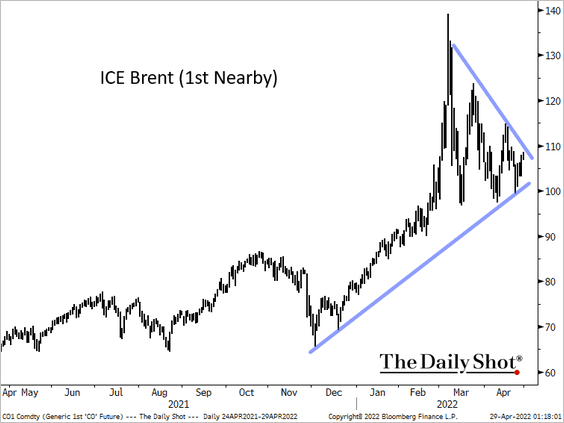

1. Will we see a breakout in Brent crude?

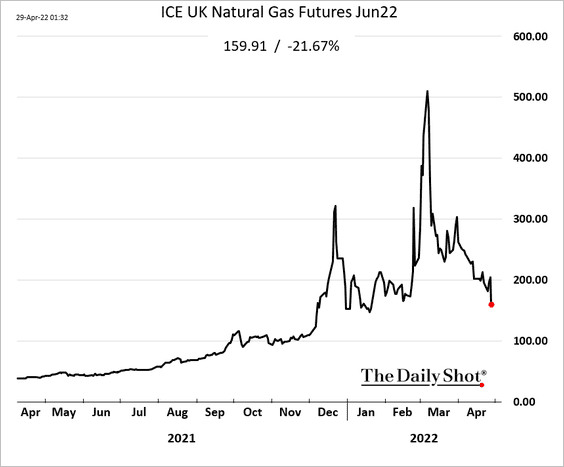

2. UK natural gas prices tumbled 22% on Thursday.

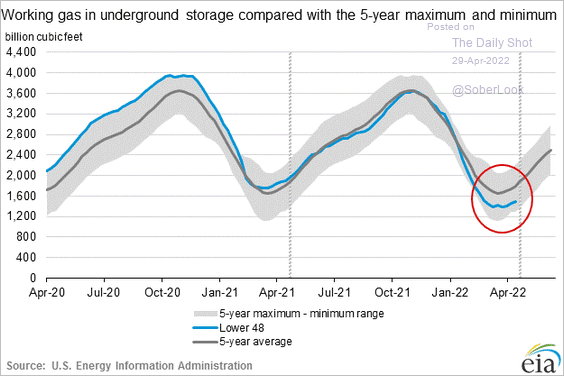

3. US natural gas inventories are low for this time of the year (but within the 5-year range).

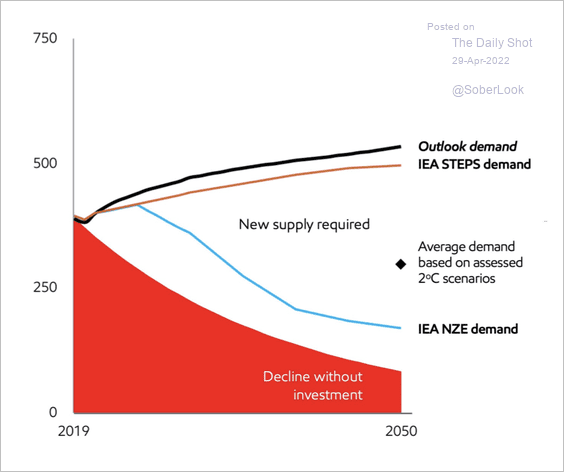

4. Less investment in oil and gas supply will lead to further market imbalances.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

Back to Index

Equities

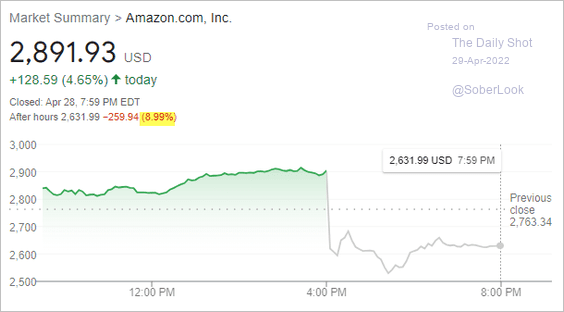

1. Stocks bounced on Thursday, but Amazon is down 9% after the close on a “series of unfortunate events.”

Source: Google.com

Source: Google.com

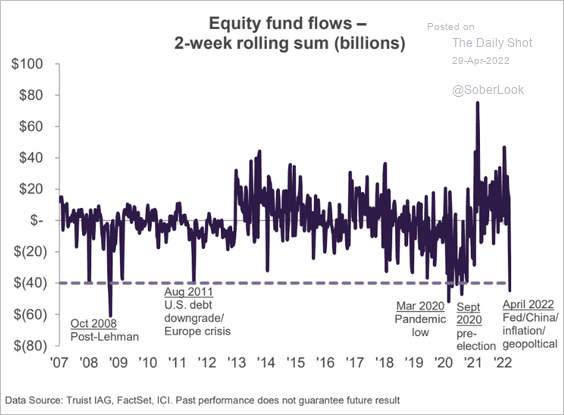

2. This chart shows the two-week rolling sum of equity fund flows.

Source: Truist Advisory Services

Source: Truist Advisory Services

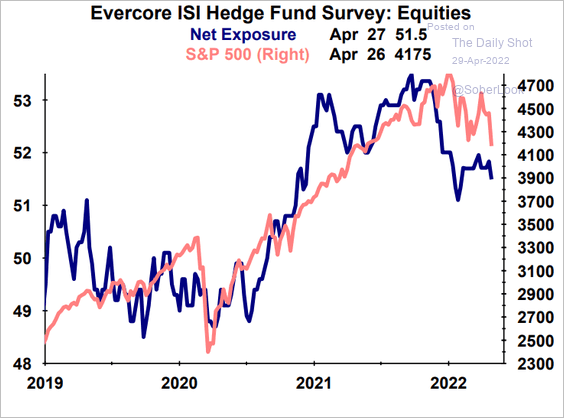

3. Despite the recent volatility, hedge funds’ net equity exposure remains above pre-COVID levels.

Source: Evercore ISI Research

Source: Evercore ISI Research

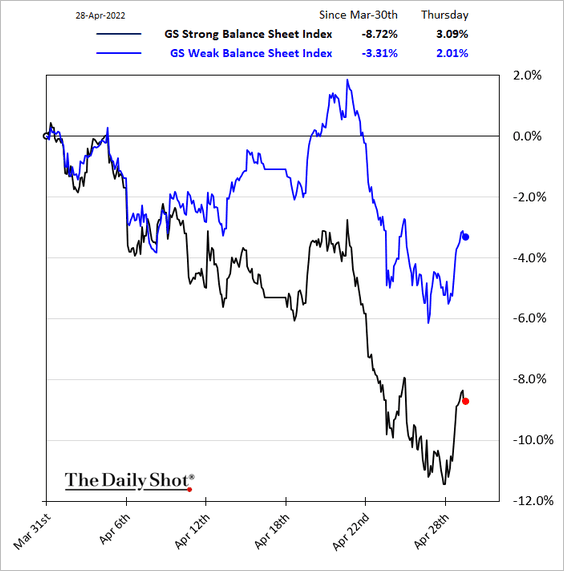

4. Companies with weak balance sheets have been outperforming this month.

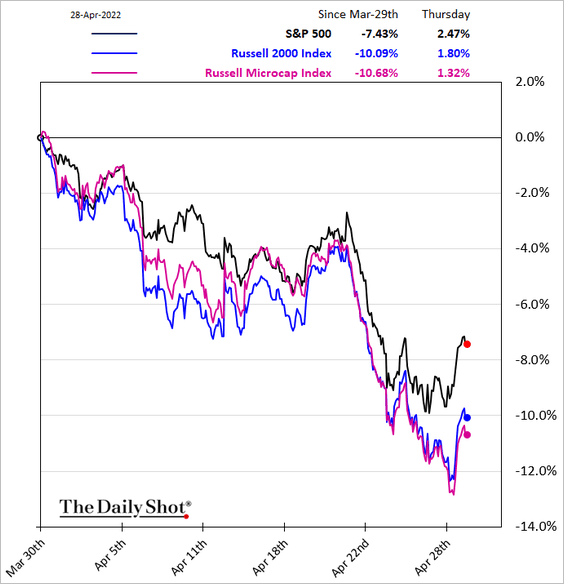

5. The Russell 2000 index underperformed in April, with microcaps lagging even more.

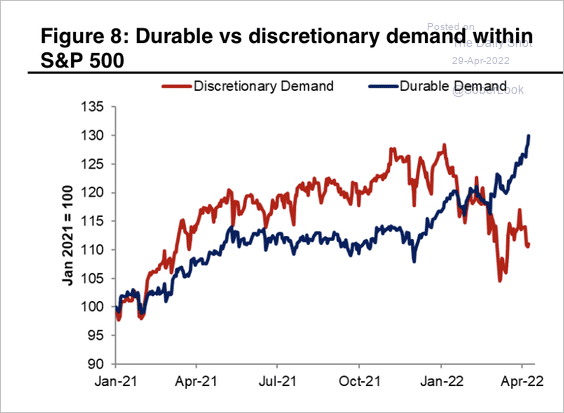

6. In a slowing economic environment, the value of companies with dependable growth (“durable demand”) increases relative to cyclical/discretionary firms, according to Citi Private Bank.

Source: Citi Private Bank

Source: Citi Private Bank

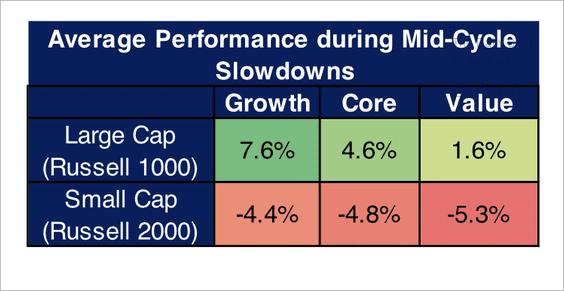

Here is a look at equity style performance when economic growth decelerates.

Source: Citi Private Bank

Source: Citi Private Bank

——————–

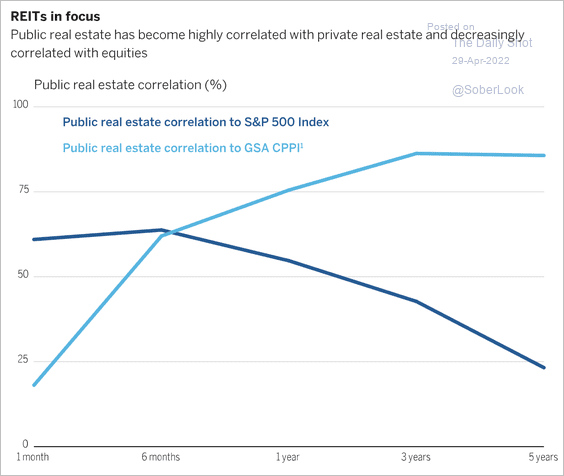

8. Public real estate has witnessed a shift in correlations from the S&P 500 to being more correlated with the private real estate space. That could boost the appeal of REITs as a liquid complement to private market exposure, according to Wellington.

Source: Wellington Management Read full article

Source: Wellington Management Read full article

Back to Index

Global Developments

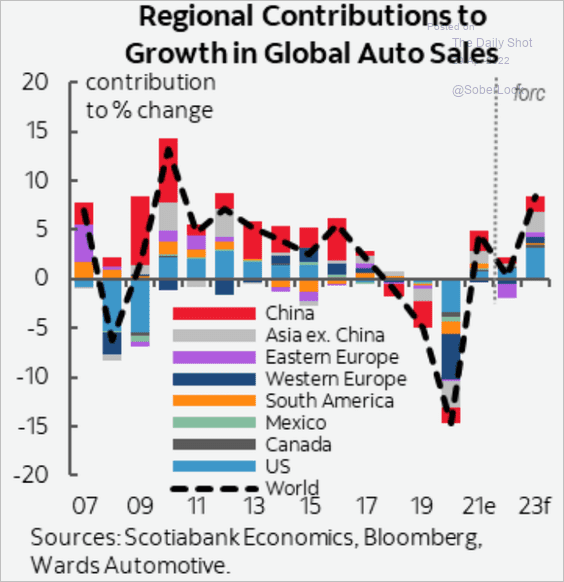

1. Here is Scotiabank’s projection for global automobile sales by region.

Source: Scotiabank Economics

Source: Scotiabank Economics

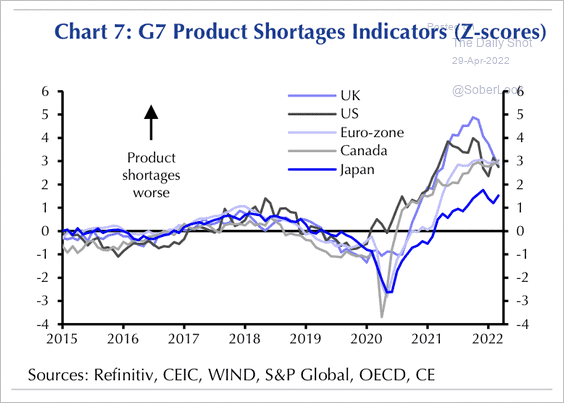

2. Product shortages are starting to ease, at least in the US and UK.

Source: Capital Economics

Source: Capital Economics

——————–

Food for Thought

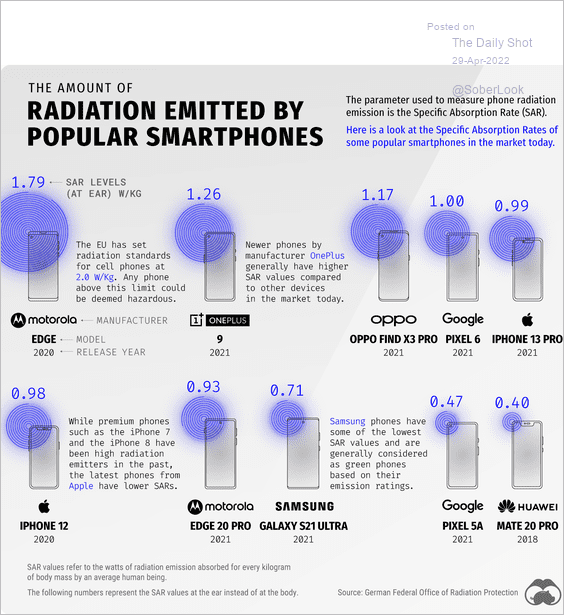

1. Radiation emitted by popular smartphones:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

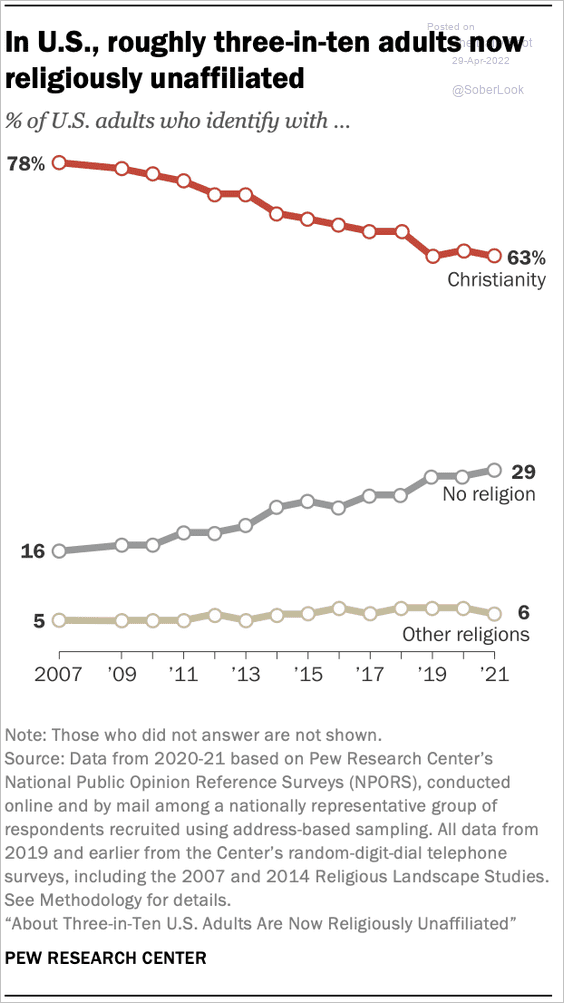

2. Religiously unaffiliated:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

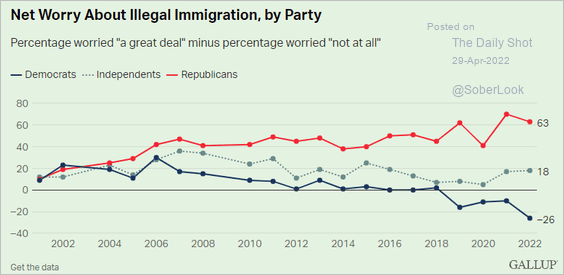

3. Concerns about illegal immigration:

Source: Gallup Read full article

Source: Gallup Read full article

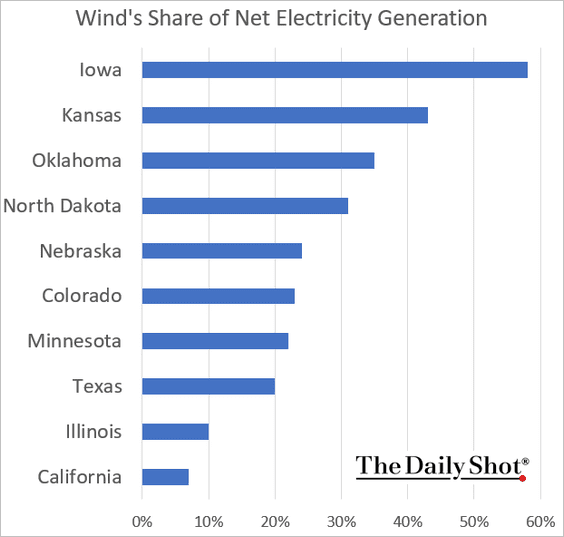

4. Wind’s share of net electricity generation in select states:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

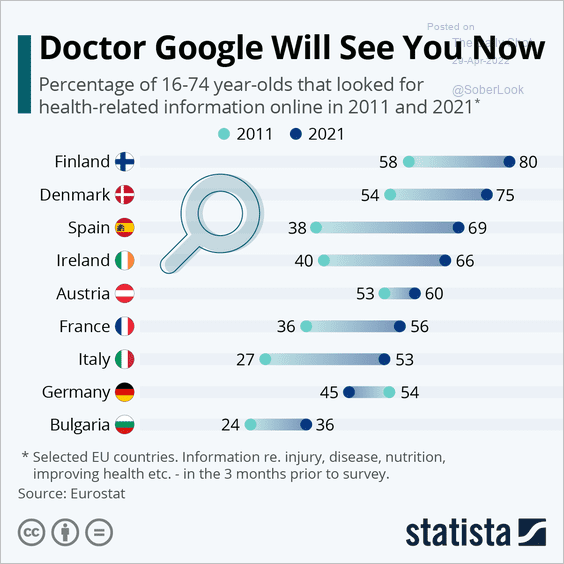

5. Looking up health-related information online:

Source: Statista

Source: Statista

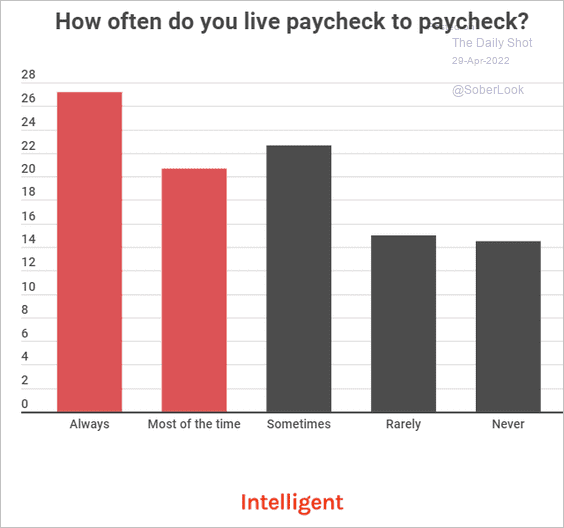

6. US college grads living paycheck to paycheck:

Source: Intelligent.com Read full article

Source: Intelligent.com Read full article

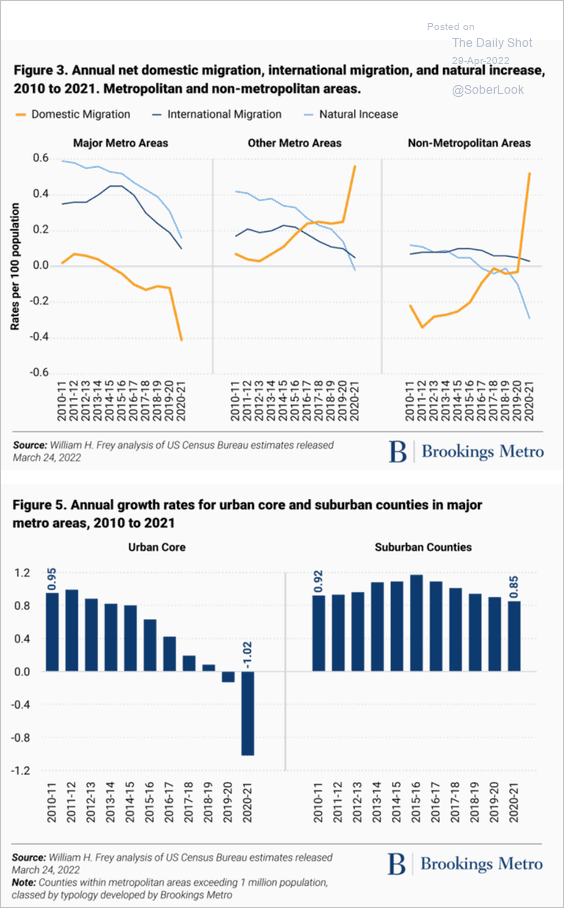

7. US domestic migration trends:

Source: Brookings Read full article

Source: Brookings Read full article

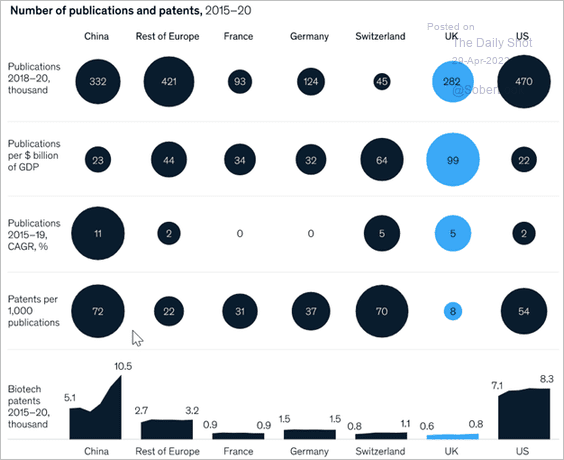

8. The number of biotech patents per category for specific countries:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

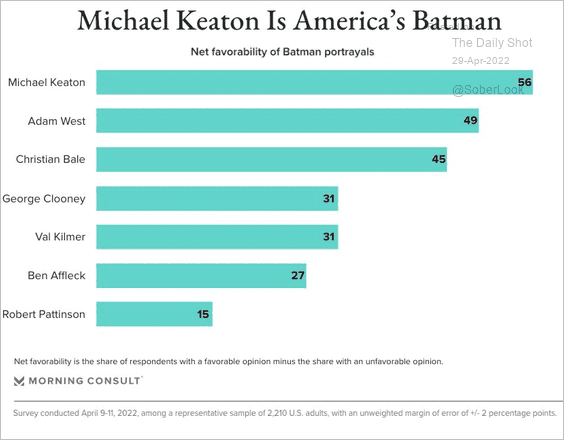

9. America’s favorite batman:

Source: @MorningConsult Read full article

Source: @MorningConsult Read full article

——————–

Have a great weekend!

Back to Index