The Daily Shot: 04-May-22

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

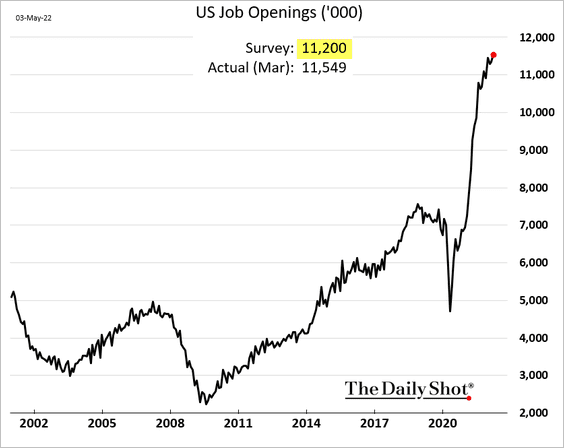

1. The March job openings report topped forecasts as the number of vacancies hits a record high.

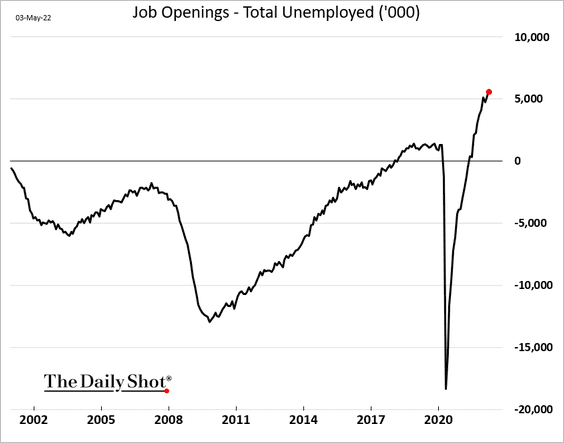

There are now over five million more job openings than unemployed workers. The labor market remains tight, giving the FOMC plenty of room to tighten monetary policy.

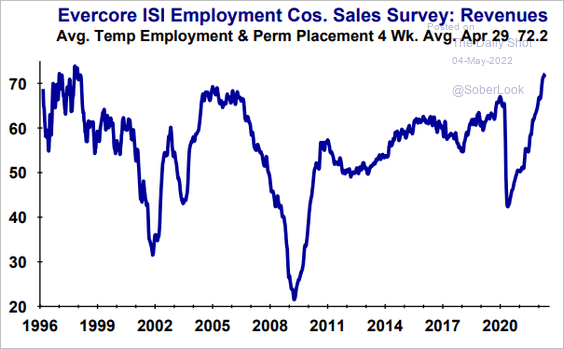

We can also see the robust demand for labor in the Evercore ISI’s employment company survey (both permanent and temp placement firms).

Source: Evercore ISI Research

Source: Evercore ISI Research

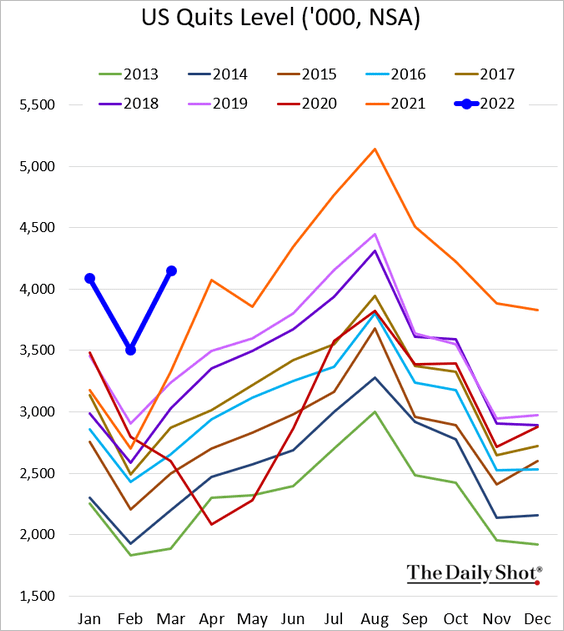

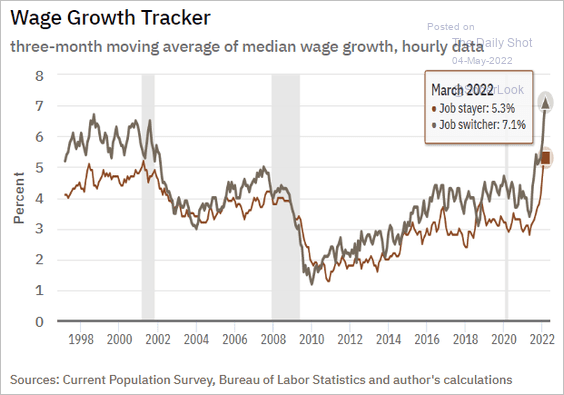

• Voluntary resignations (quits) remain elevated. Job switching has been lucrative (2nd chart).

Source: @AtlantaFed

Source: @AtlantaFed

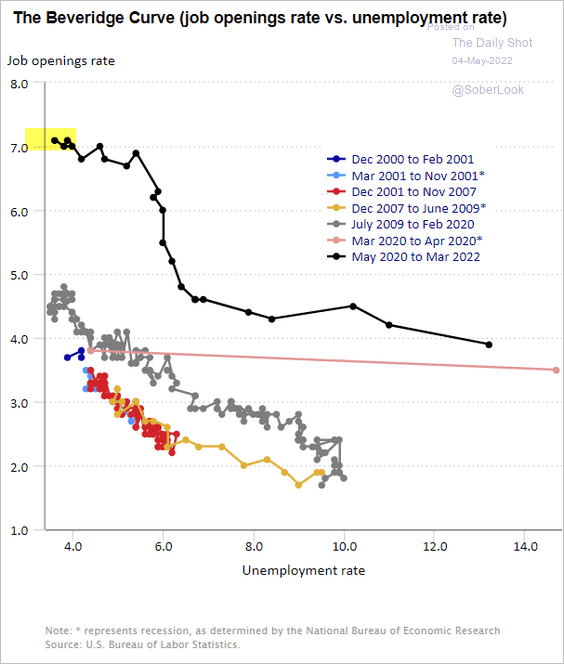

• Here is the Beveridge Curve.

Source: BLS

Source: BLS

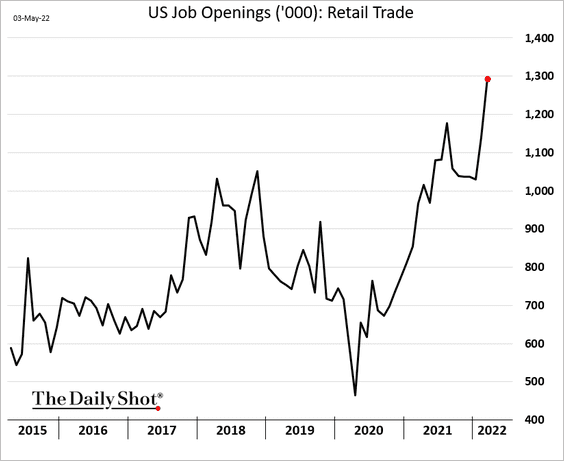

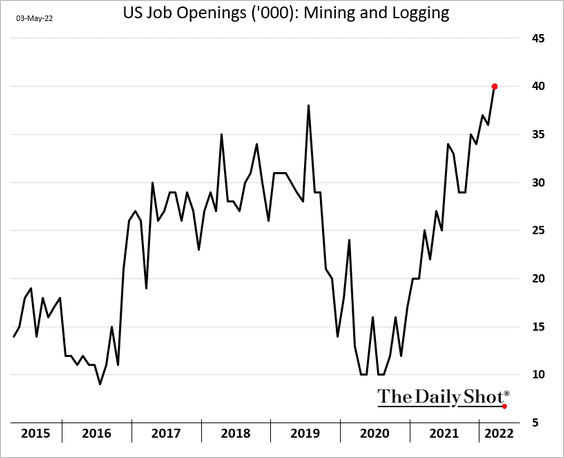

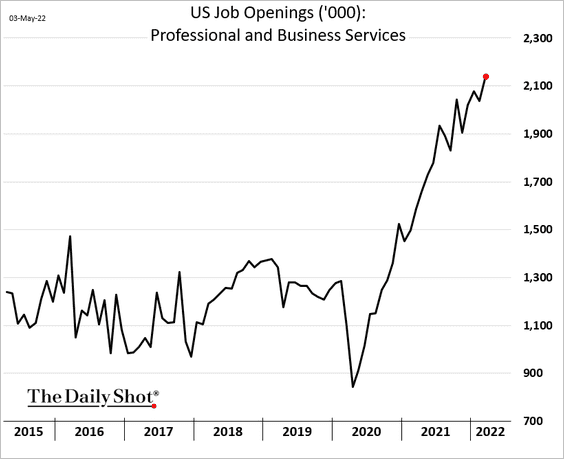

Many sectors saw strong gains in job openings.

– Retail:

– Mining:

– Professional and business services:

——————–

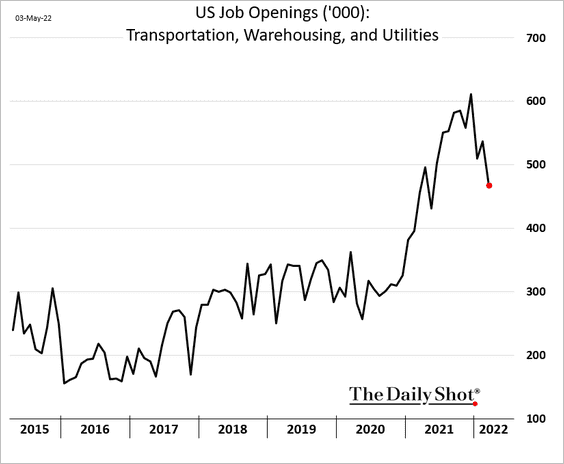

However, we continue to see a pullback in logistics worker demand, suggesting that supply chain issues are starting to ease.

The economic signal from Amazon’s Q1 earnings report was that the firm now has too much warehouse capacity.

Source: Business Insider Read full article

Source: Business Insider Read full article

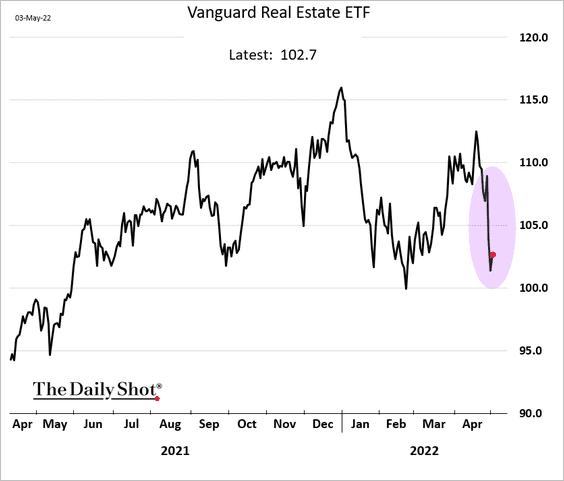

As a result, industrial REITs (warehouse property operators) took a hit in the equity market, pulling down the whole REIT sector. Capacity constraints are easing.

——————–

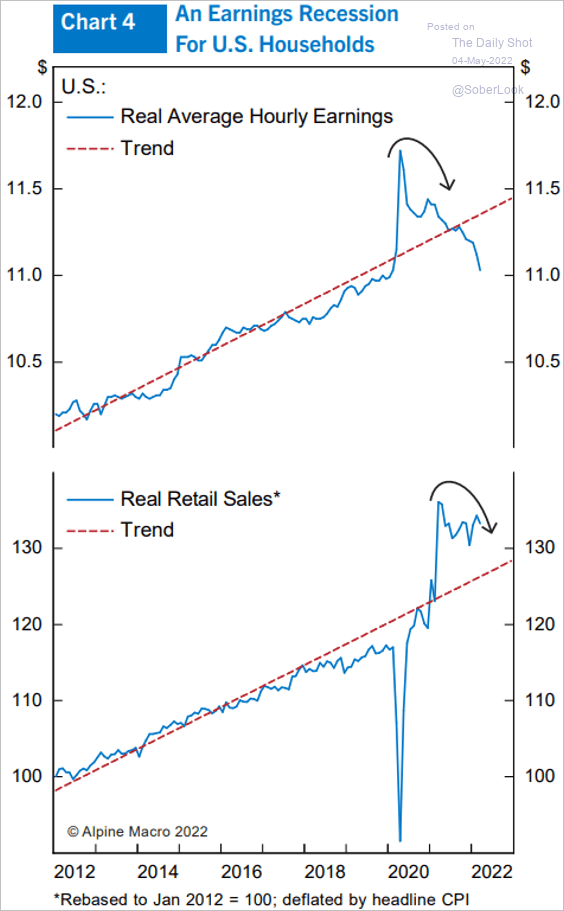

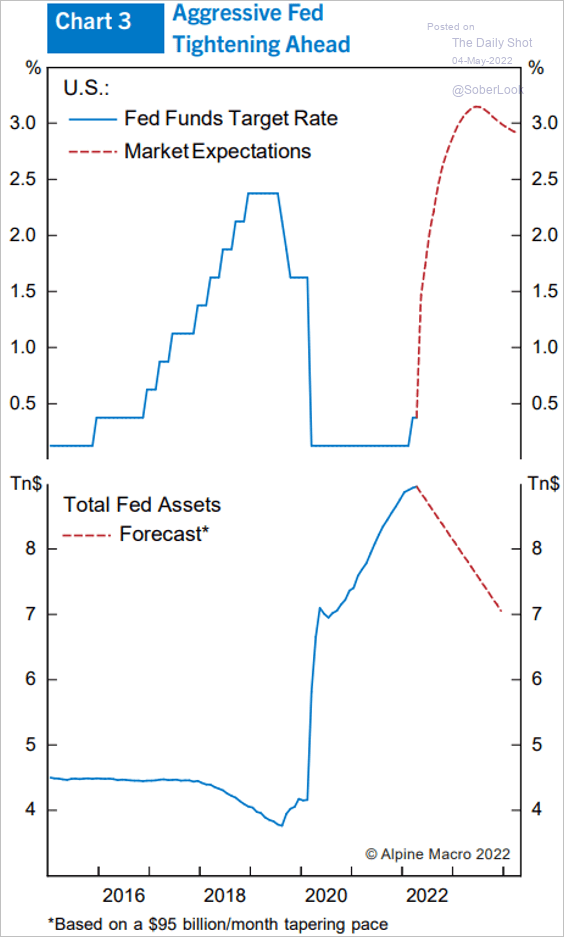

2. The Fed’s aggressive tightening of monetary policy will be accompanied by falling real earnings for US households and in turn, falling real retail sales.

Source: Alpine Macro

Source: Alpine Macro

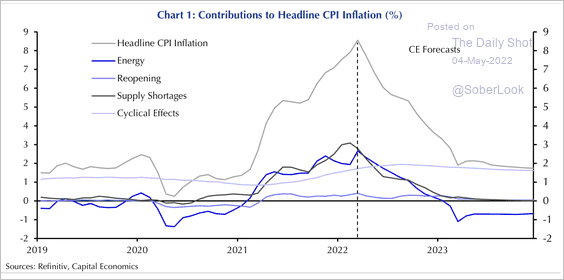

3. Next, we have some updates on inflation

• Capital Economics expects cyclical inflationary pressures to gradually ease, which could encourage the Fed to switch back to 25 basis point rate hikes from September onwards (50 bps is now expected in May and June).

Source: Capital Economics

Source: Capital Economics

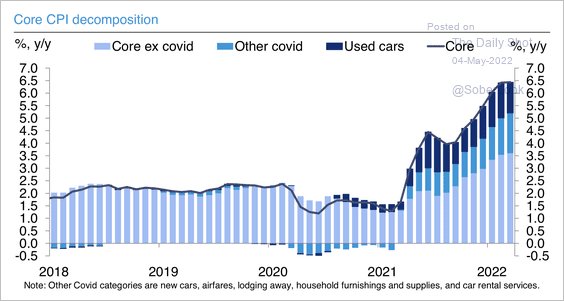

• Used cars and trucks alone are over a percentage point of core CPI, which should begin to unwind.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

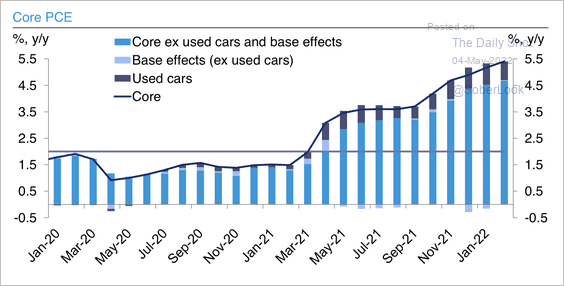

The effect of used cars on core PCE, however, is smaller given the lower weight.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

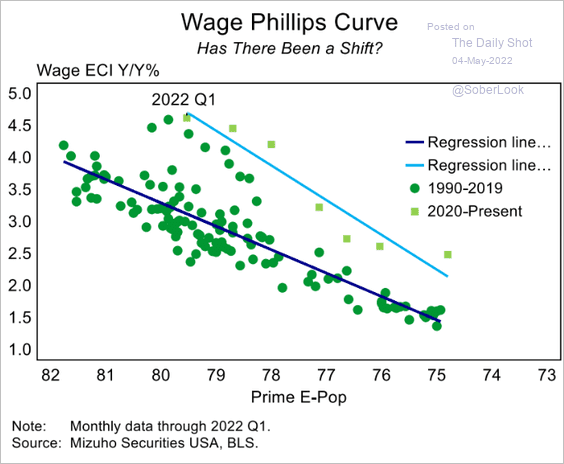

• A steeper Phillips Curve?

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

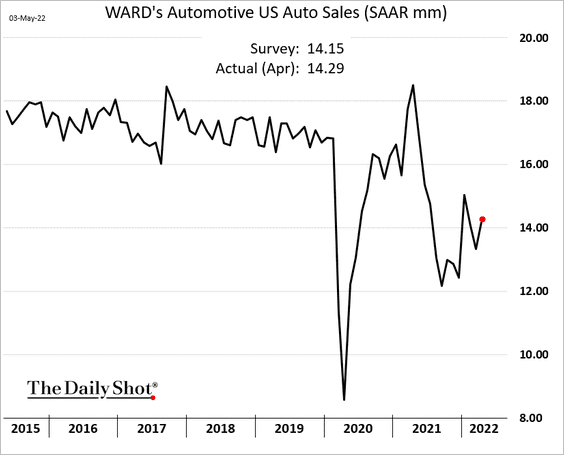

4. Auto sales improved last month.

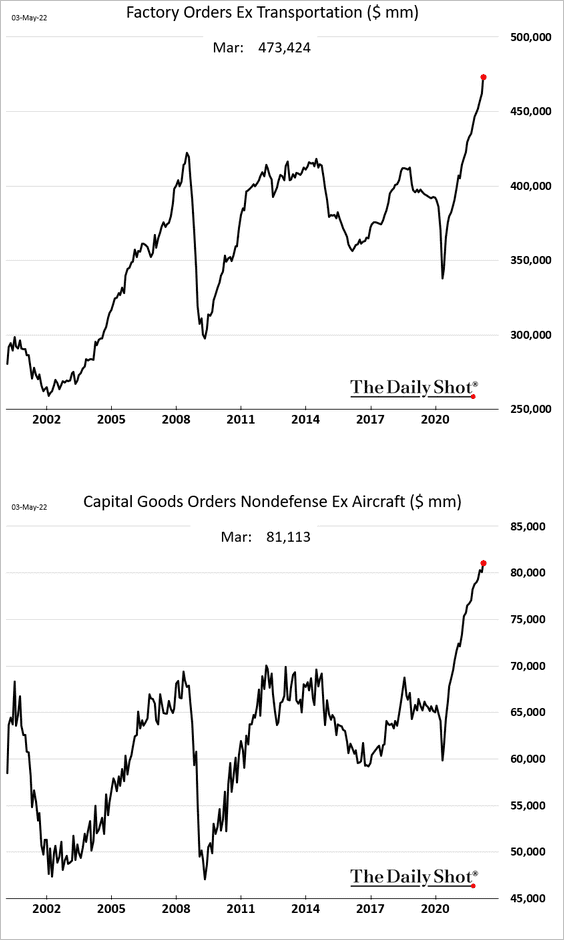

5. Factory orders have been very strong, pointing to robust business investment.

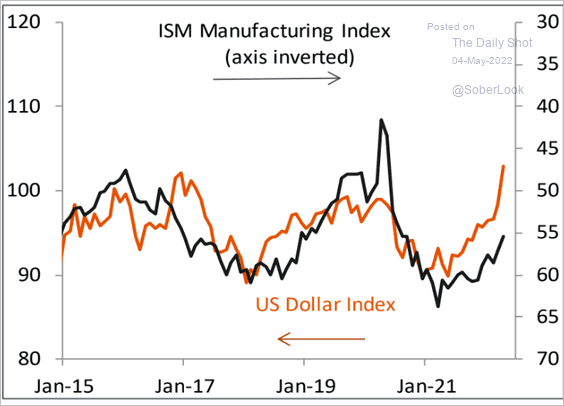

6. The US dollar’s recent strength could put additional pressure on manufacturing activity.

Source: Piper Sandler

Source: Piper Sandler

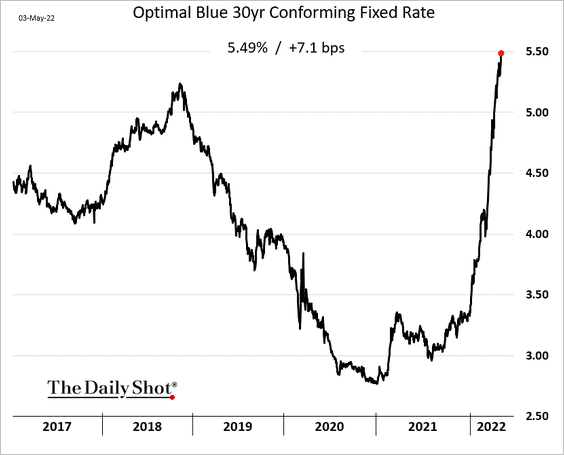

7. The 30-year mortgage rate is approaching 5.5%.

Back to Index

The United Kingdom

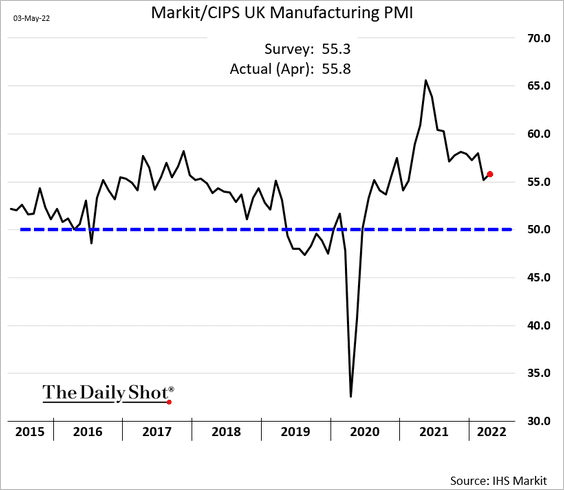

1. The updated April manufacturing PMI figures were stronger than the earlier report.

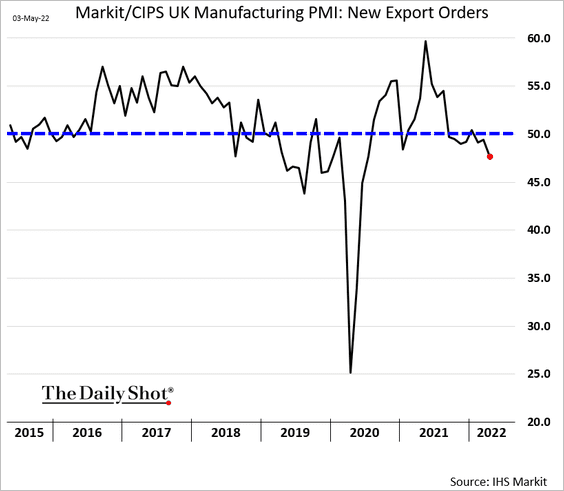

• But export orders are deteriorating, …

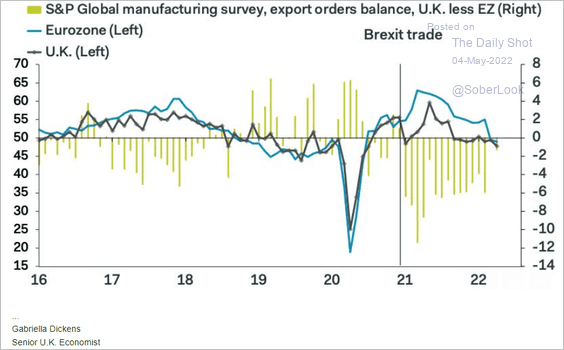

… lagging the Eurozone.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

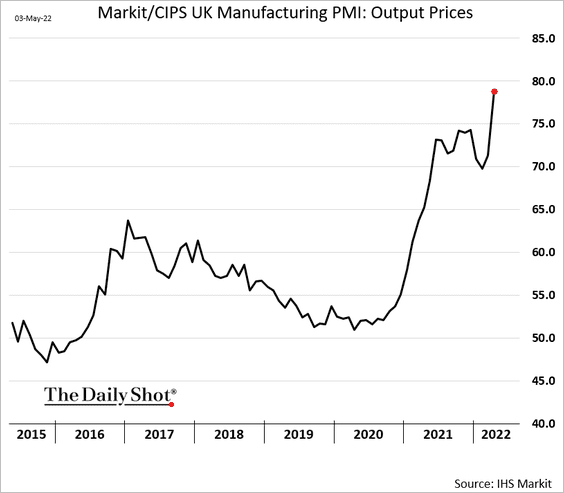

• Factories are rapidly boosting prices.

——————–

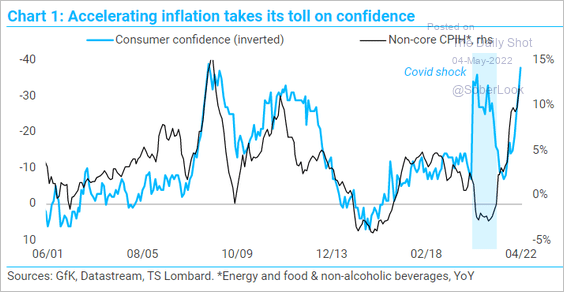

2. Inflation has taken a toll on consumer sentiment.

Source: TS Lombard

Source: TS Lombard

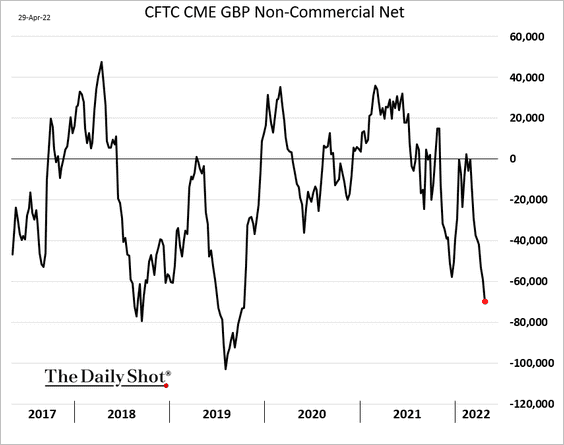

3. Speculative accounts have been boosting their bets against the pound.

Back to Index

The Eurozone

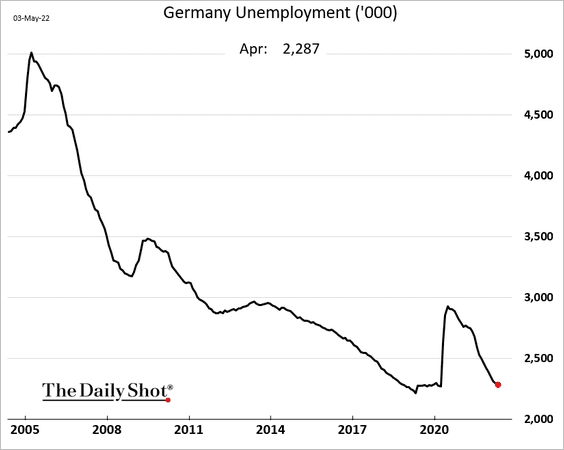

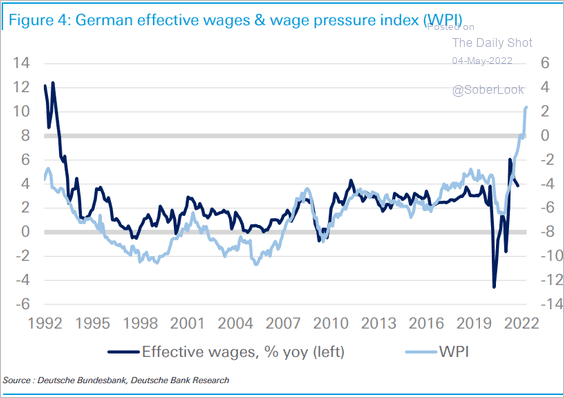

1. German unemployment remains near the lows.

Wage pressures are building.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

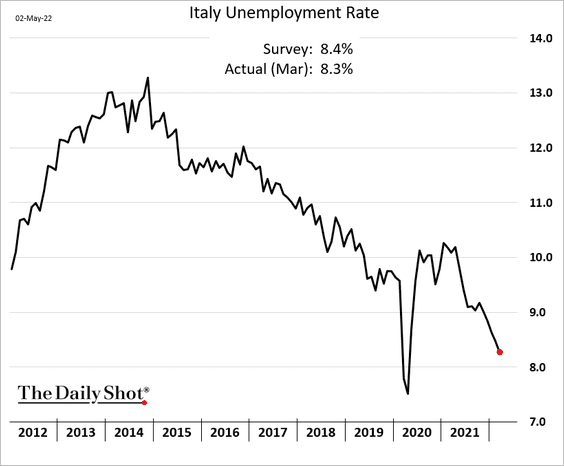

2. Italian unemployment is dropping quickly as well.

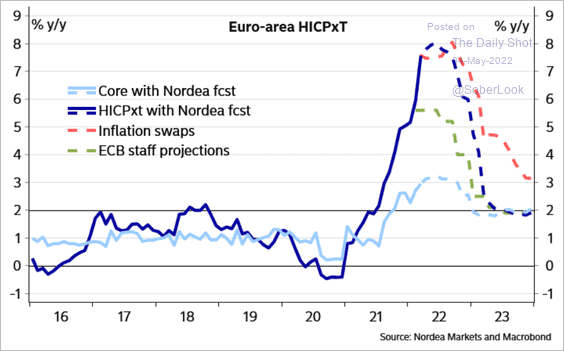

3. Euro-area consumer inflation is nearing a peak.

Source: Nordea Markets

Source: Nordea Markets

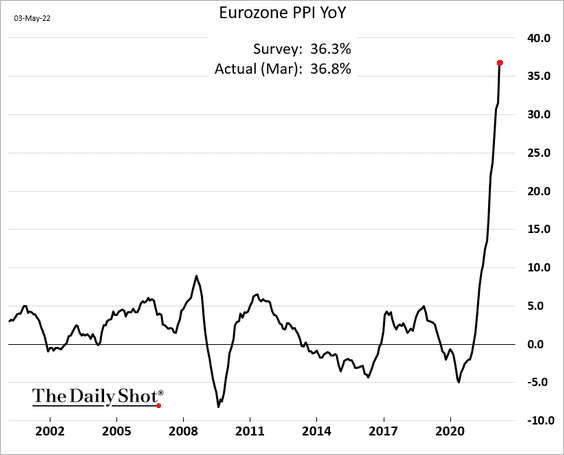

The March PPI broke through 36%.

——————–

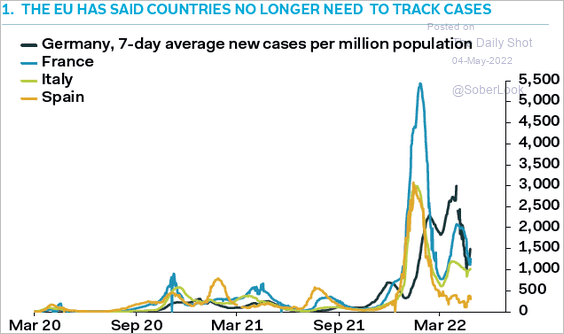

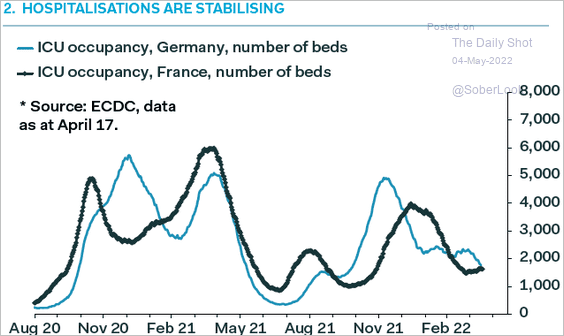

4. Covid19 recovery across the Eurozone proceeds on track, with cases and hospitalizations both trending lower (two charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

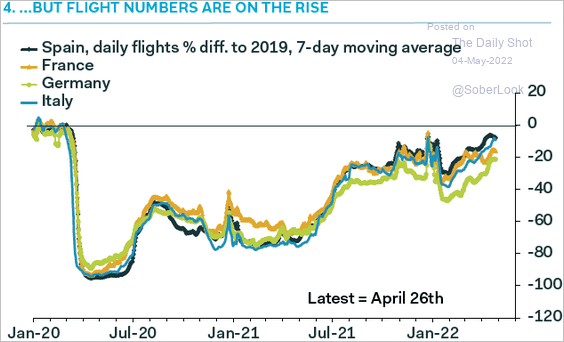

Complementing the falling Covid19 cases, daily flights across the Eurozone are trending back to pre-pandemic levels.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

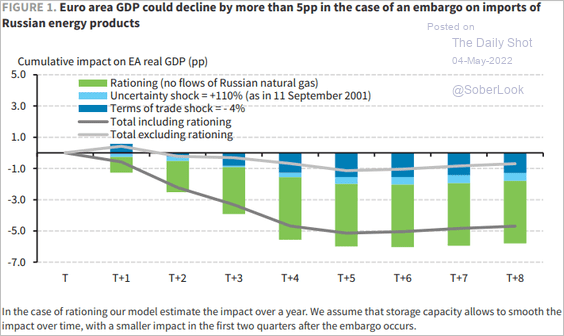

5. As the EU continues to debate sanctions on Russian energy imports, Barclays’ European economists estimate that an embargo of all Russian energy imports could reduce euro area GDP by 5%.

Source: Barclays Research

Source: Barclays Research

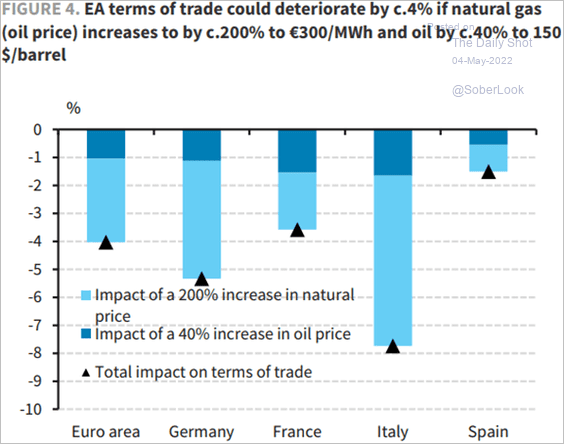

Because the Eurozone imports its natural gas and crude oil requirements, a 200% shock to European natural gas prices and a 40% shock to crude oil prices would result in a 4% deterioration in the Eurozone’s terms of trade.

Source: Barclays Research

Source: Barclays Research

——————–

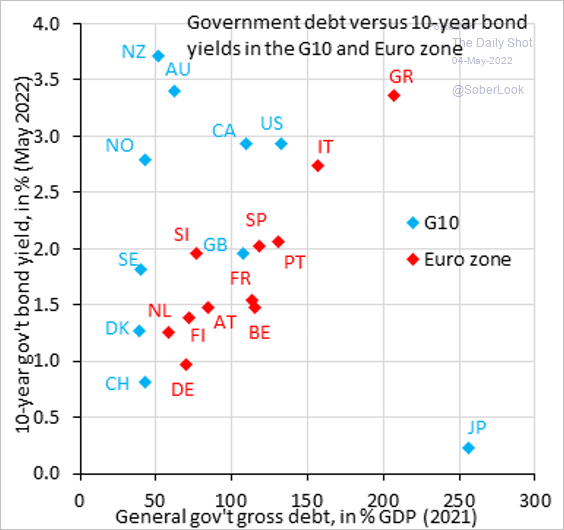

6. Euro-area sovereign bond yields are proportional to the debt-to-GDP ratio.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

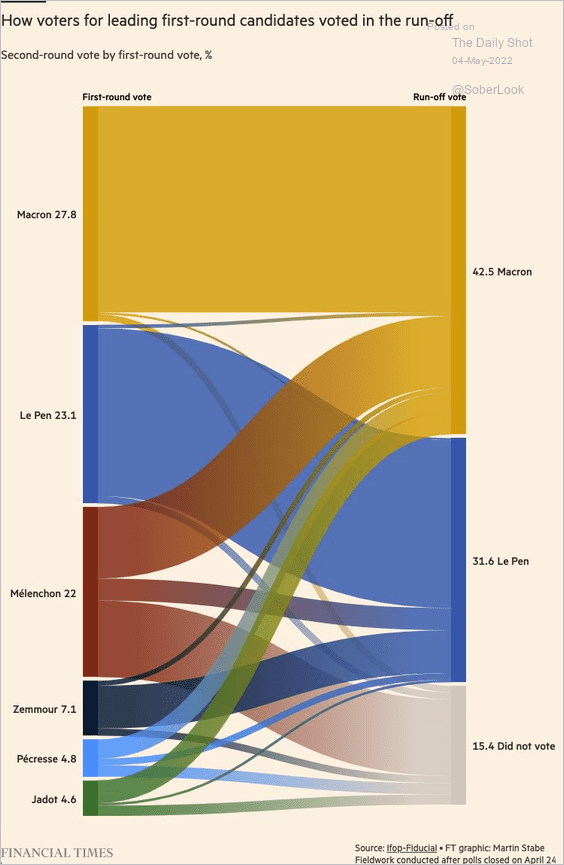

7. Next, we have some data on the French elections.

• Voter flows from the first to the second round:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

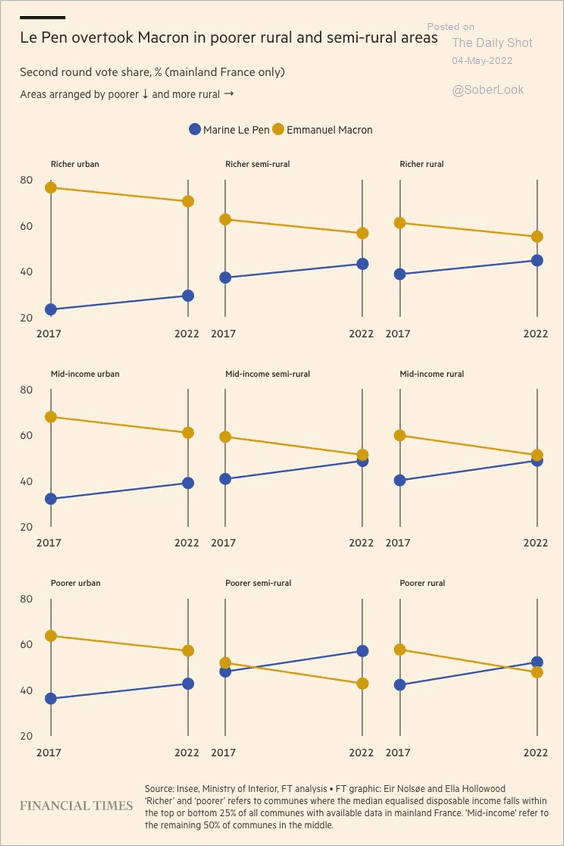

• Le Pen/Macron performance by region:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Asia – Pacific

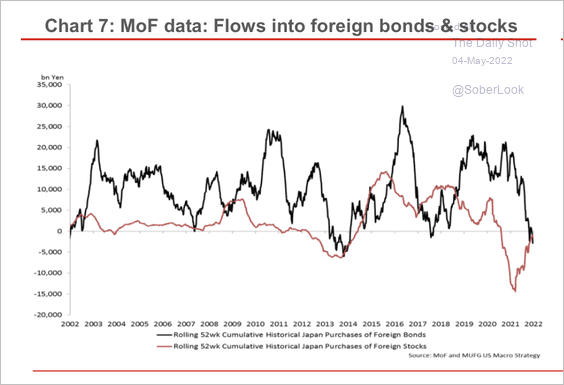

1. This past fiscal year was the first time since 2013 that Japan has been both a net seller of foreign bonds (black) and foreign stocks (red), although there has been less selling of foreign stocks as of late.

Source: MUFG Securities

Source: MUFG Securities

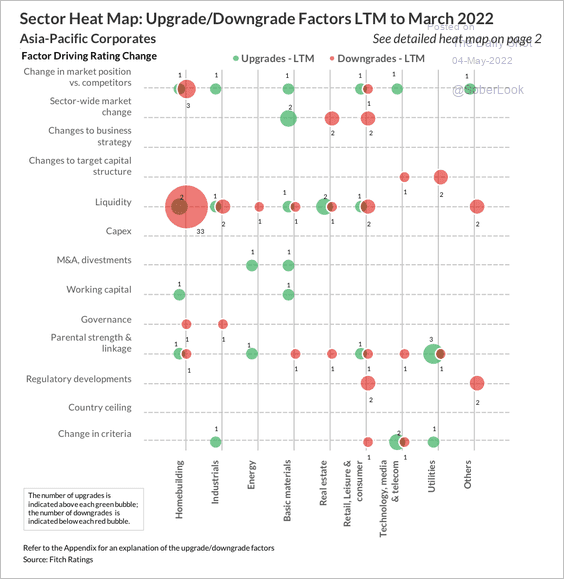

2. Liquidity concerns have triggered downgrades across China and Asia-Pacific homebuilders.

Source: Fitch Ratings

Source: Fitch Ratings

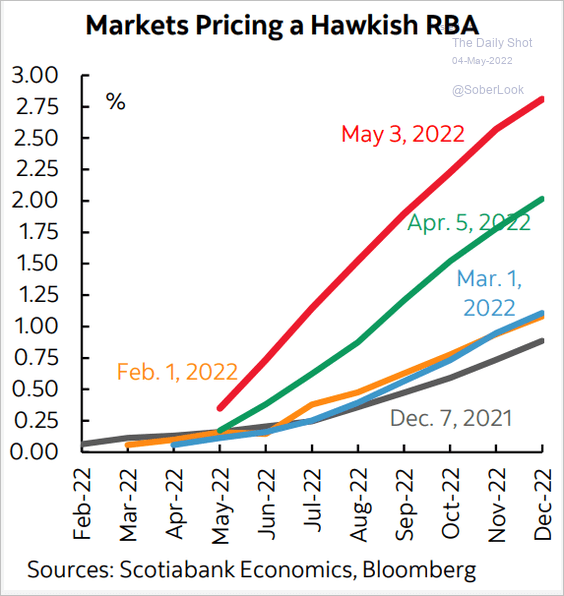

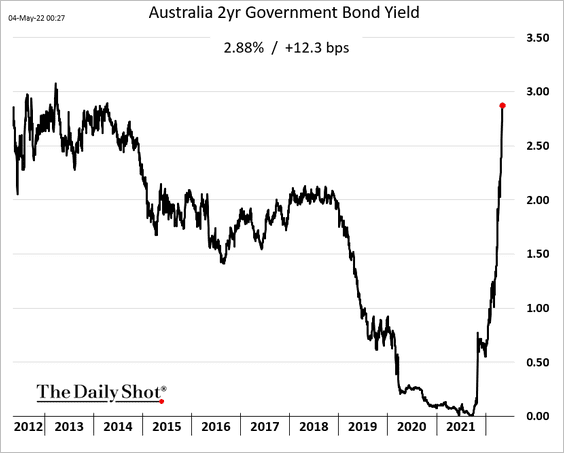

3. Markets repriced the RBA rate trajectory sharply higher.

Source: Scotiabank Economics

Source: Scotiabank Economics

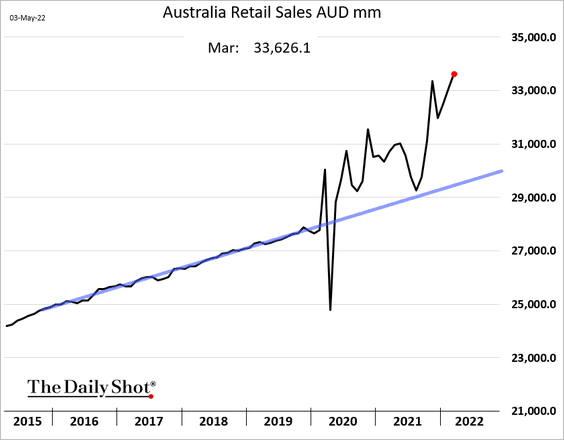

Australian retail sales surged further in March.

——————–

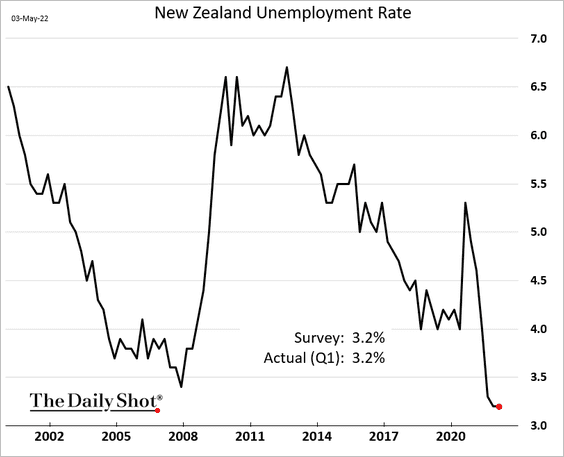

4. New Zealand’s unemployment rate is near record lows.

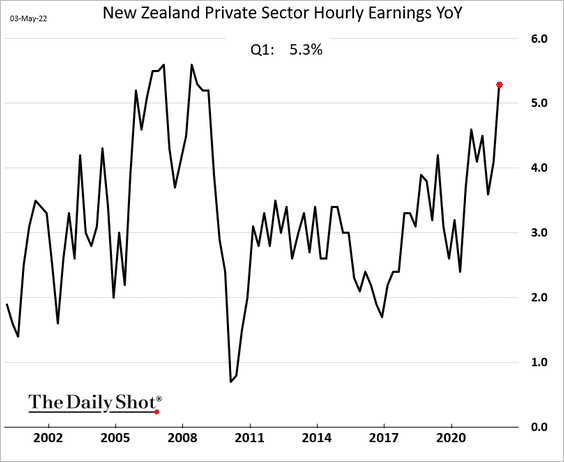

Wage growth is accelerating.

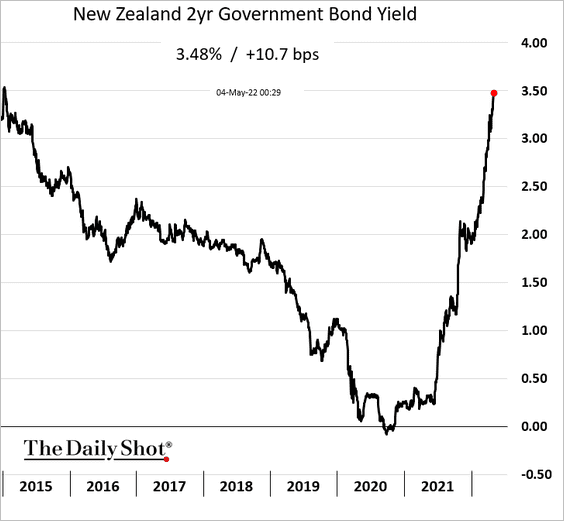

The 2yr yield is nearing the 2015 peak.

Back to Index

China

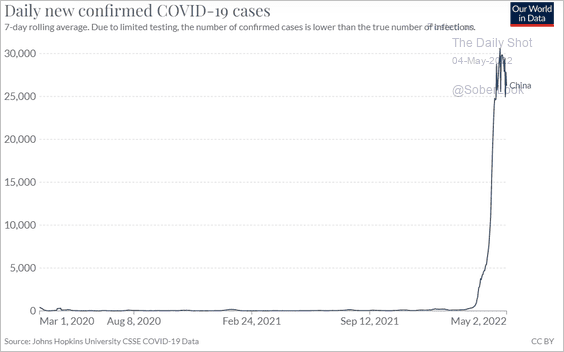

1. The authorities do not appear to be making much progress in mitigating the spread of Covid.

Source: Our World in Data

Source: Our World in Data

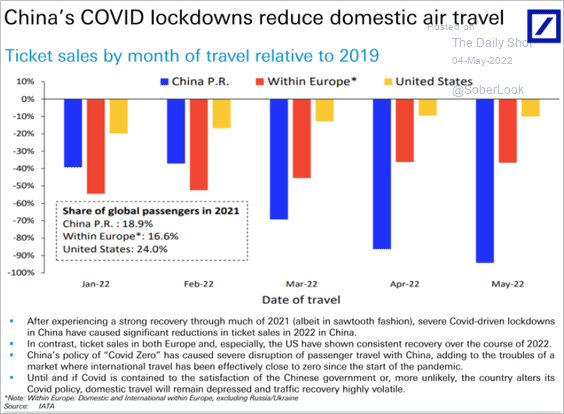

Domestic air travel has collapsed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

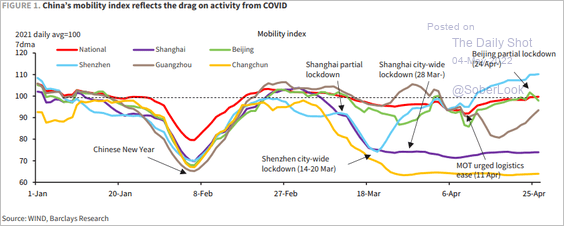

Aggregate mobility indices in some areas have remained depressed.

Source: Barclays Research

Source: Barclays Research

——————–

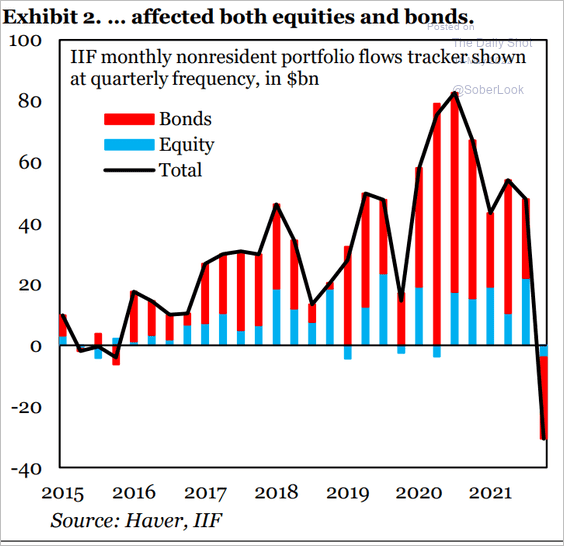

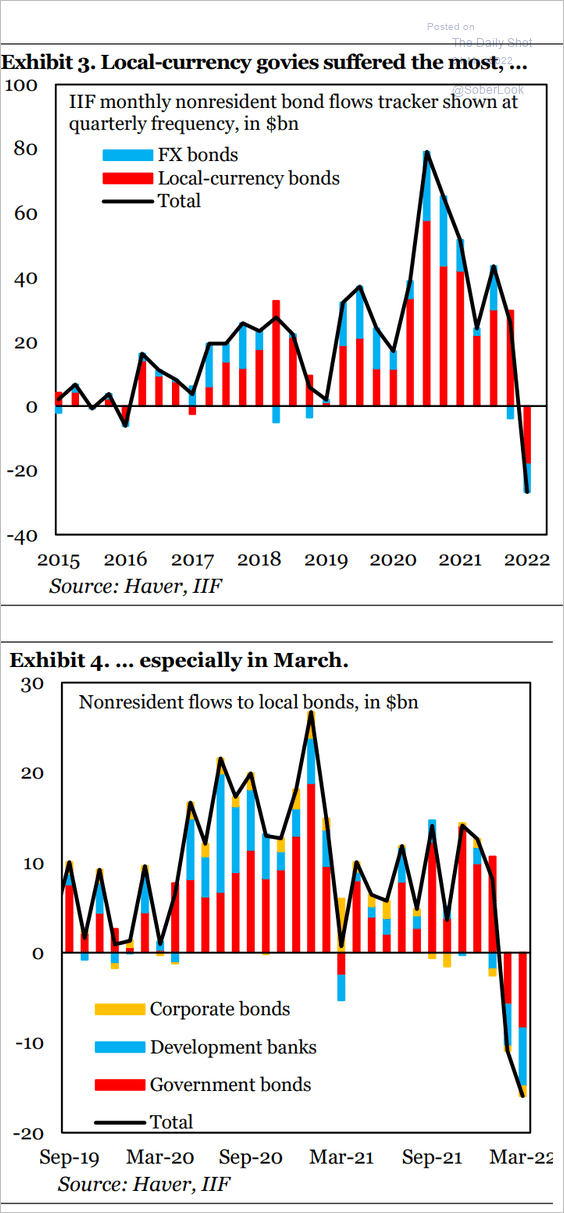

2. Bond outflows were severe last quarter.

Source: IIF

Source: IIF

Source: IIF

Source: IIF

——————–

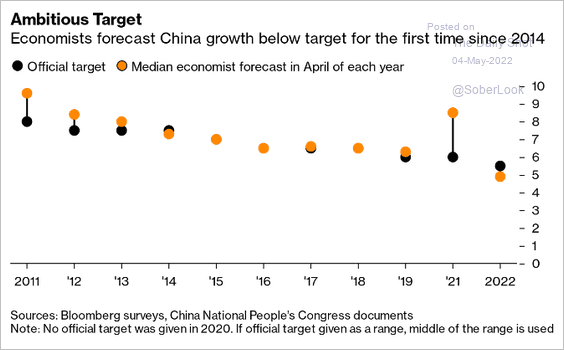

3. Economic forecasts have been weaker than the official target (which is unusual).

Source: @hancocktom Read full article

Source: @hancocktom Read full article

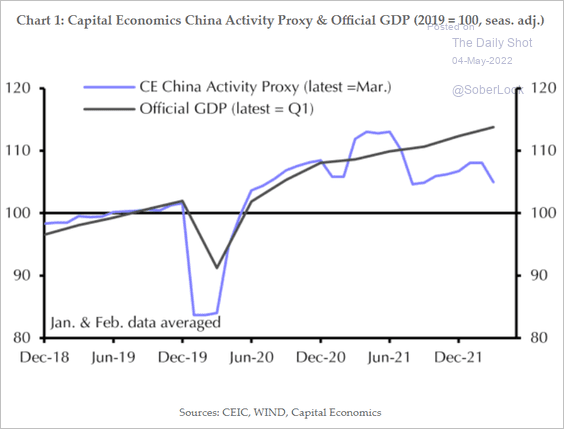

Here is the Capital Economics China Activity Proxy vs. the official GDP.

Source: Capital Economics

Source: Capital Economics

——————–

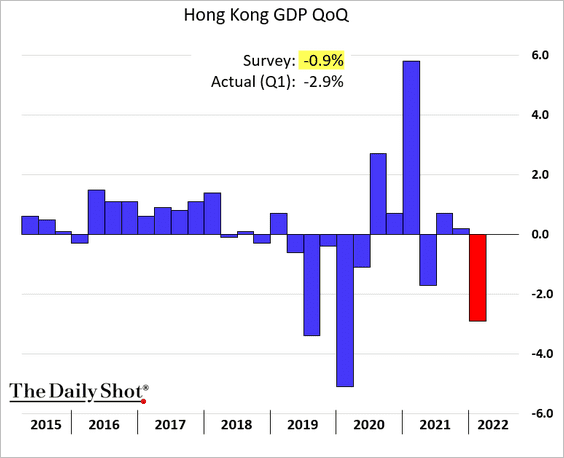

4. Hong Kong’s GDP tumbled last quarter.

Back to Index

Emerging Markets

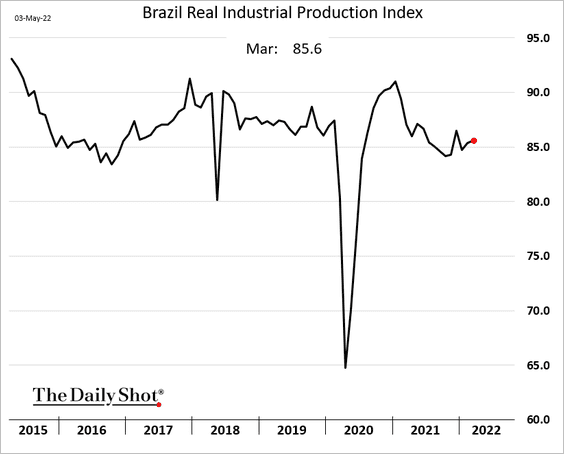

1. Brazil’s industrial production edged higher in March.

Source: Reuters Read full article

Source: Reuters Read full article

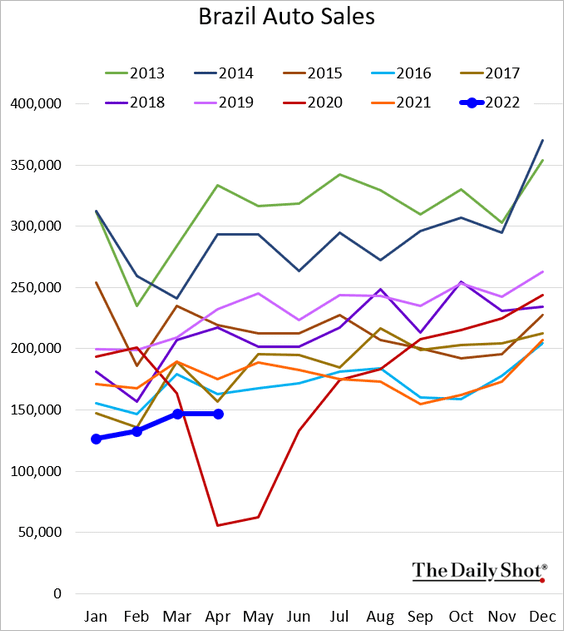

Auto sales remain soft.

——————–

2. Russia’s manufacturing sector continued to contract in April.

Source: IHS Markit

Source: IHS Markit

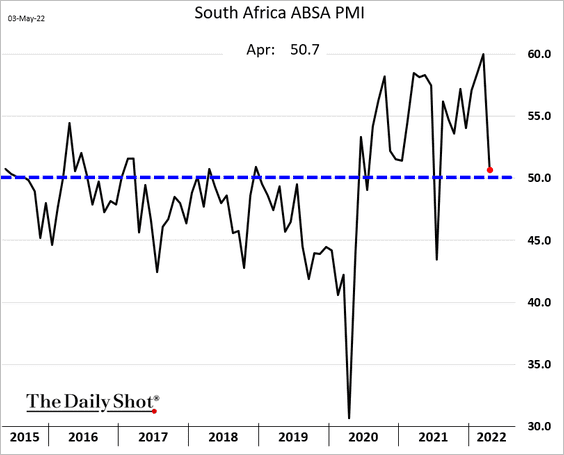

3. South Africa’s manufacturing growth stalled abruptly last month.

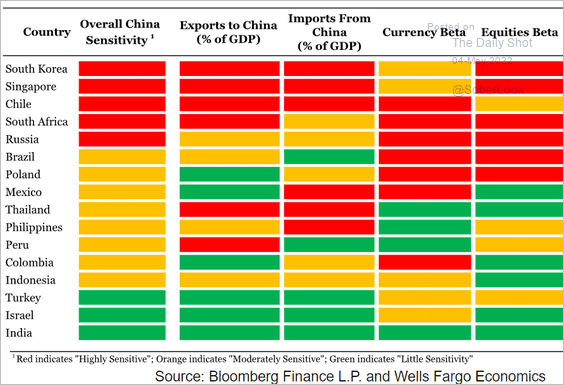

4. Which countries’ economies are most sensitive to China?

Source: Wells Fargo Securities

Source: Wells Fargo Securities

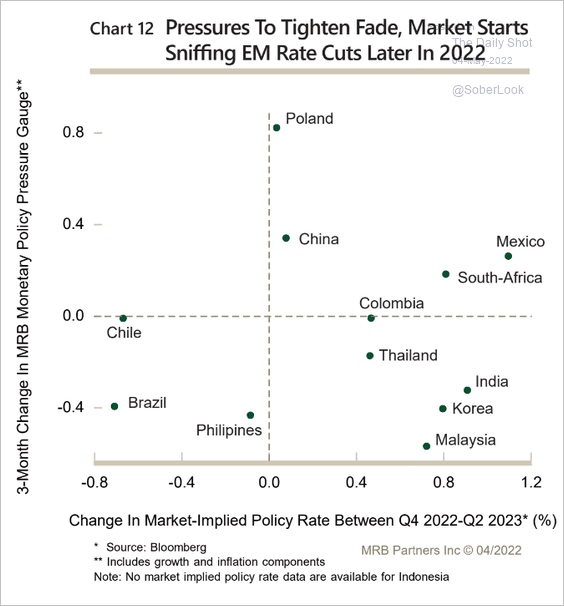

5. We could see rate cuts in some countries later this year.

Source: MRB Partners

Source: MRB Partners

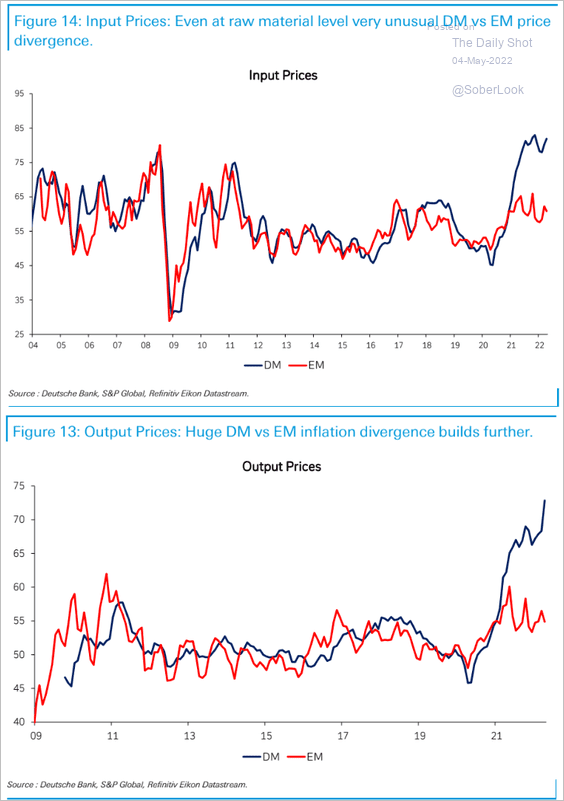

6. EM manufacturing price gains have been much less severe than in advanced economies.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

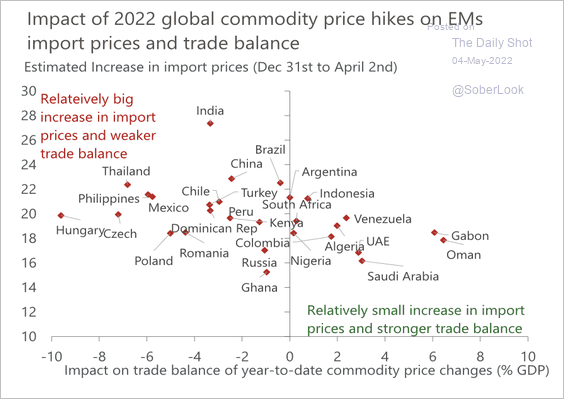

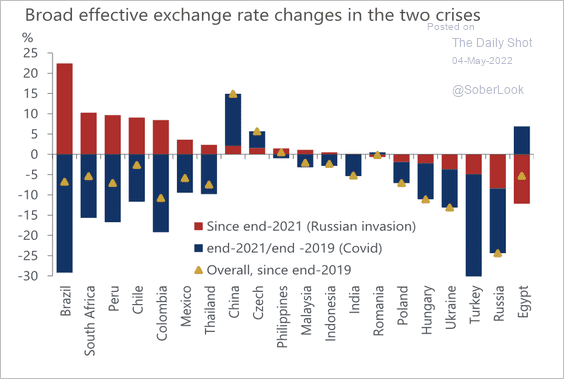

7. Rising commodity prices result in higher import prices and weaker trade balances in some EM Asia and European countries. Meanwhile, GCC countries clearly benefit.

Source: Oxford Economics

Source: Oxford Economics

Commodity importers’ currencies have depreciated the most this year.

Source: Oxford Economics

Source: Oxford Economics

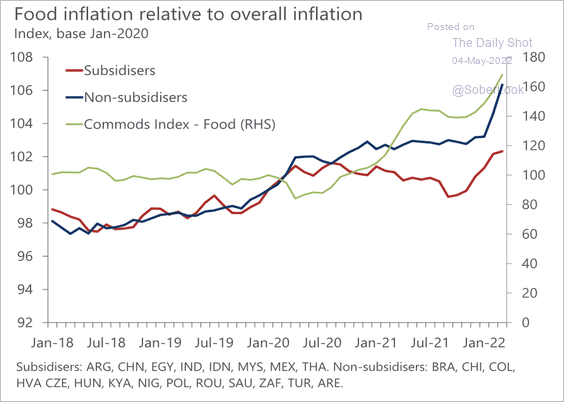

Food subsidies have helped dampen inflationary pressures.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

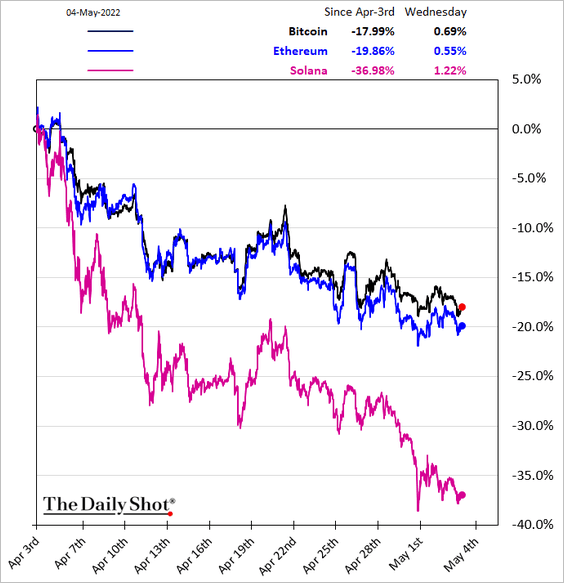

1. Solana has underperformed sharply in recent weeks amid concerns about network stability.

Source: @markets Read full article

Source: @markets Read full article

——————–

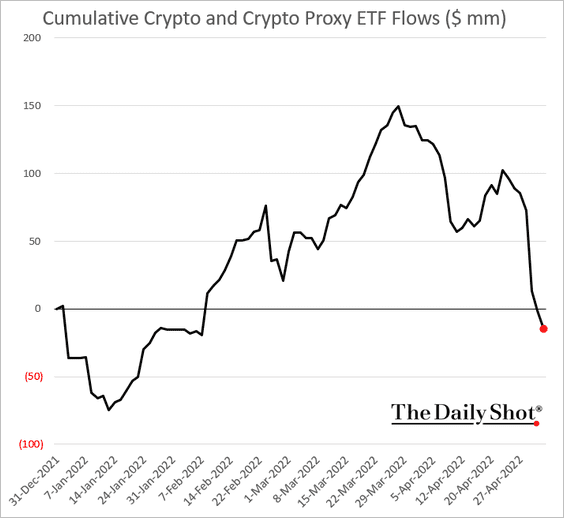

2. Crypto ETF year-to-date flows have turned negative again.

3. A pending reversal in bitcoin’s dominance ratio, or BTC’s market cap relative to the total crypto market cap, could indicate a prolonged risk-off environment.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

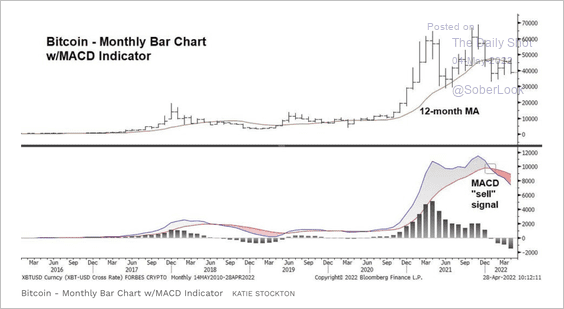

4. Bitcoin has suffered a loss of long-term upside momentum.

Source: @StocktonKatie

Source: @StocktonKatie

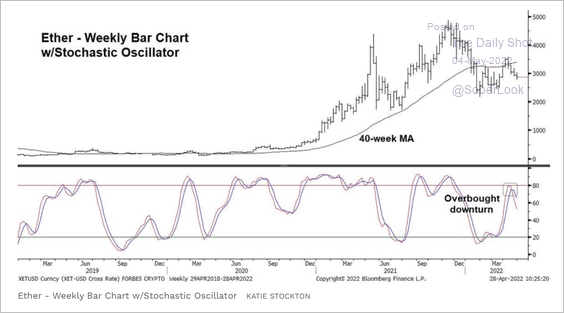

And ether (ETH) appears overbought.

Source: @StocktonKatie

Source: @StocktonKatie

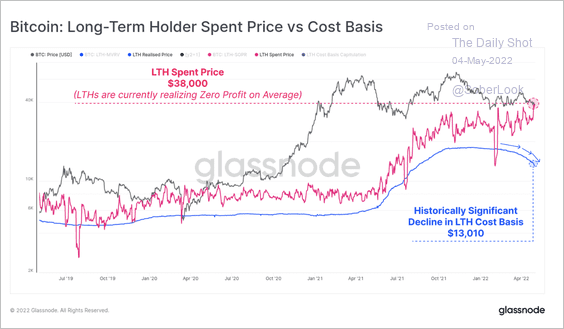

5. Long-term bitcoin holders are starting to take some profits.

Source: Glassnode Read full article

Source: Glassnode Read full article

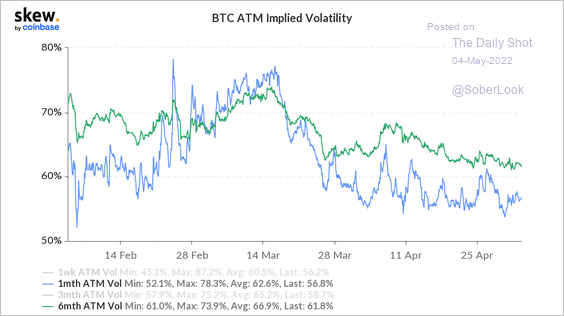

6. Bitcoin’s implied volatility is trending lower, although some traders expect greater price swings ahead of the Fed meeting, which could cause a spike in front-end vol.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

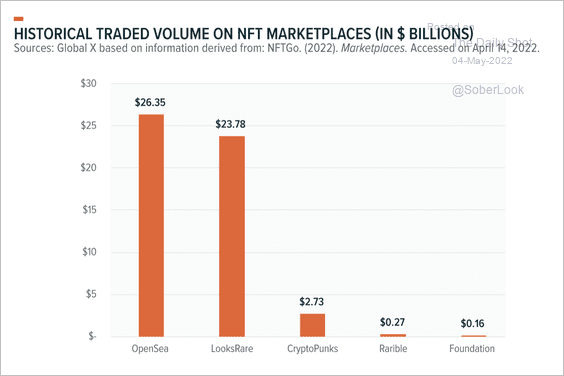

7. OpenSea accounts for a majority of NFT trading volume.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Commodities

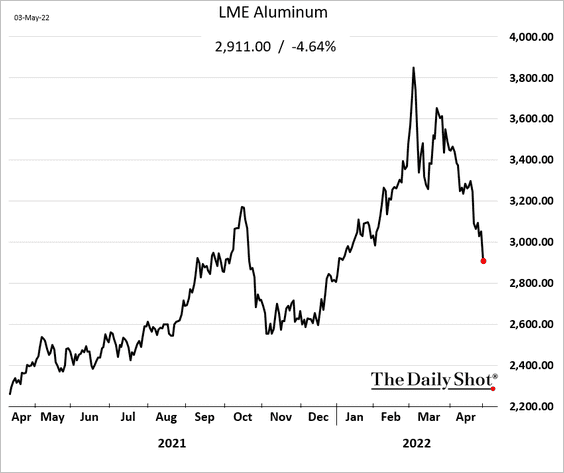

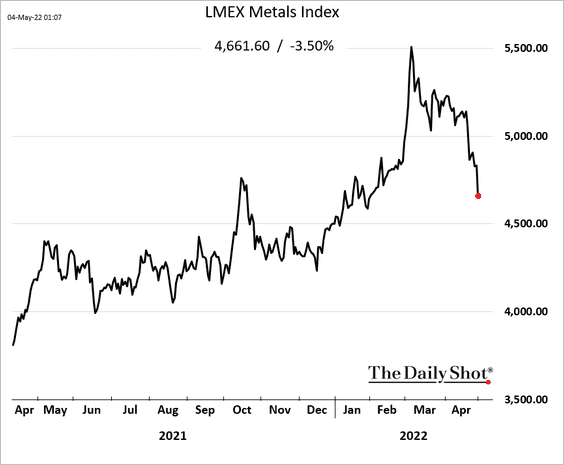

1. Industrial metals have been under pressure due to concerns about softer demand from China.

• Aluminum:

• The LMEX index:

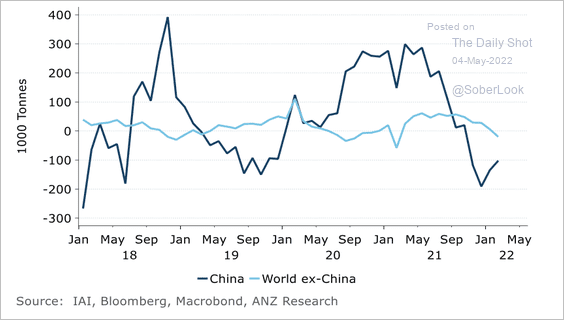

By the way, aluminum production growth is slowing outside of China.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

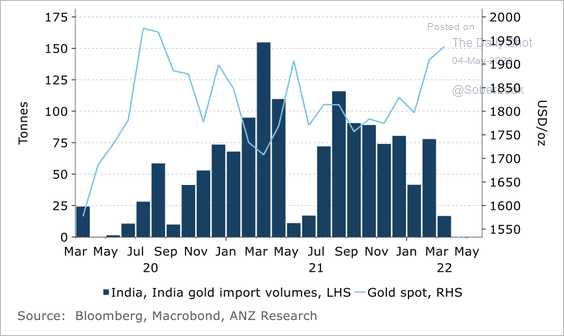

2. India’s gold imports fell sharply in March.

Source: @ANZ_Research

Source: @ANZ_Research

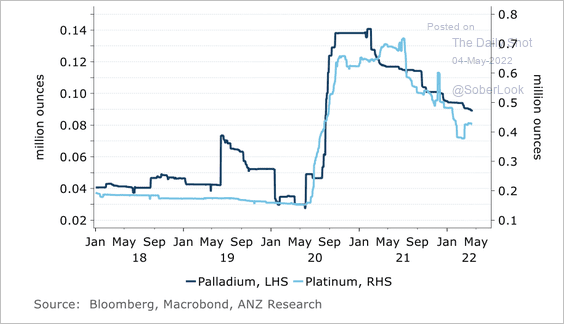

• Platinum and palladium inventories are declining.

Source: @ANZ_Research

Source: @ANZ_Research

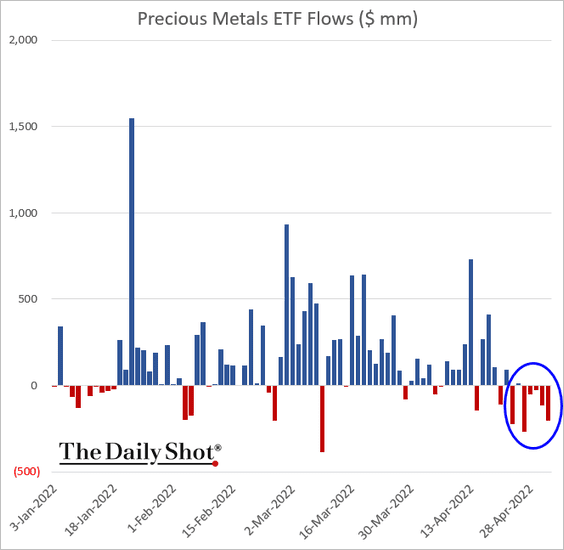

• Precious metals ETFs are experiencing outflows.

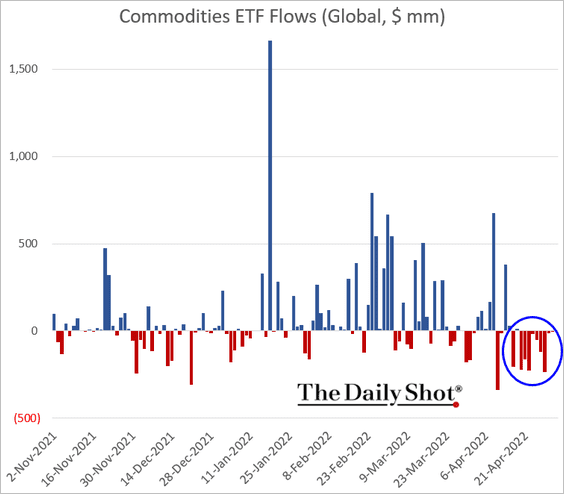

——————–

3. On the whole, commodity ETFs have been bleeding capital in recent days.

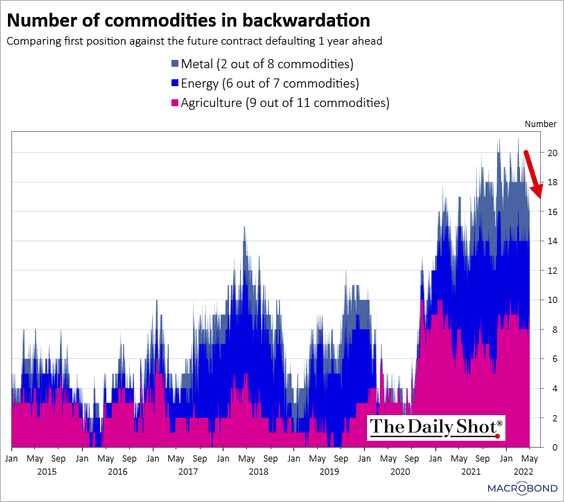

4. Peak backwardation?

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Back to Index

Energy

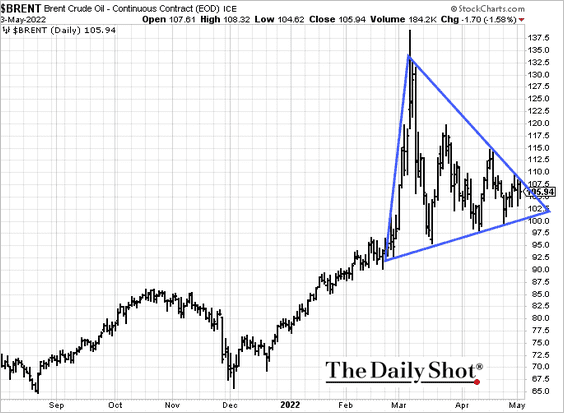

1. The wedge in Brent crude remains intact.

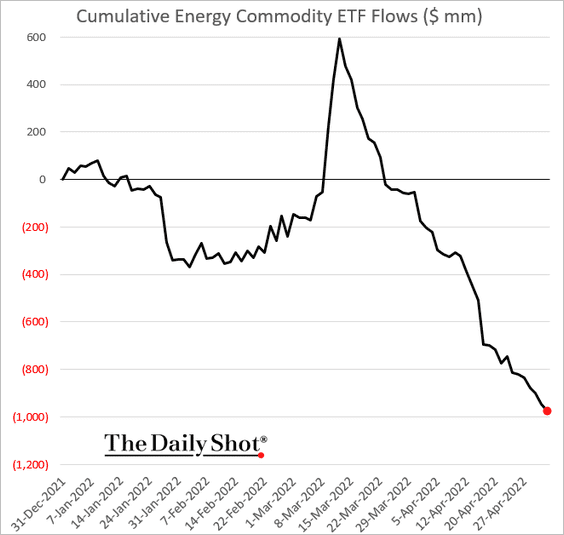

2. Energy commodity ETFs continue to see outflows.

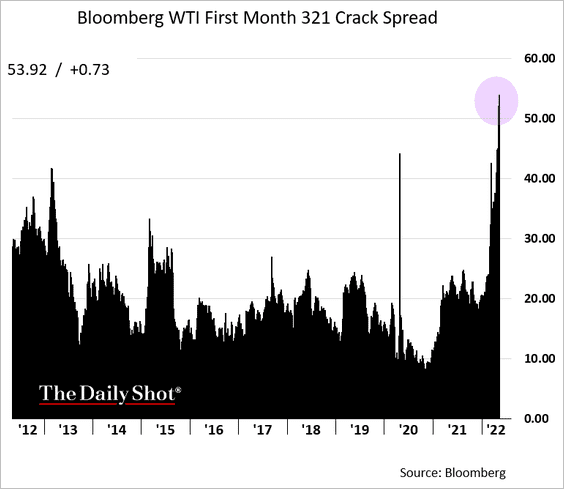

3. US crack spreads are hitting record highs.

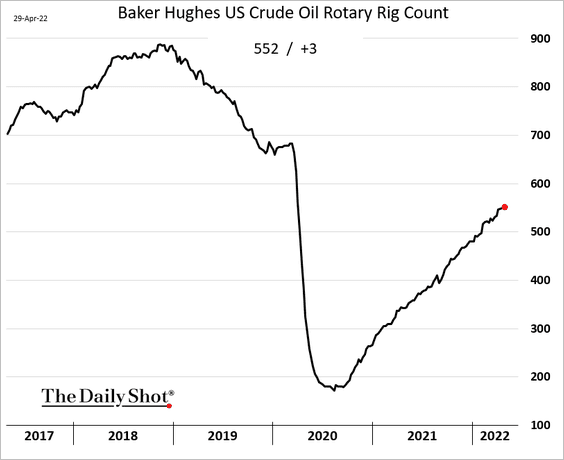

4. The US rig count keeps grinding higher.

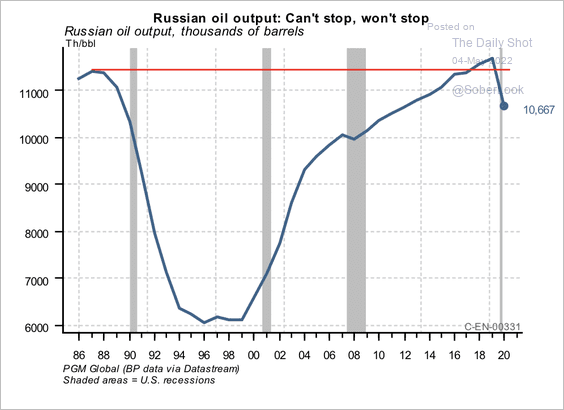

5. Russian oil production reached 1987 levels before the recent drop in output. The country has little storage capacity, which means production could ramp up, according to PGM Global.

Source: PGM Global

Source: PGM Global

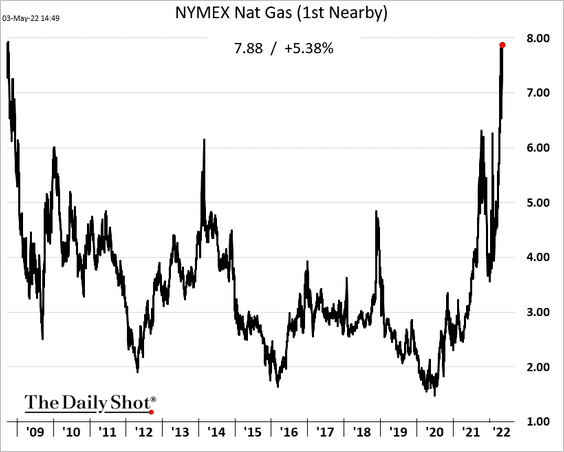

6. US natural gas futures have been surging.

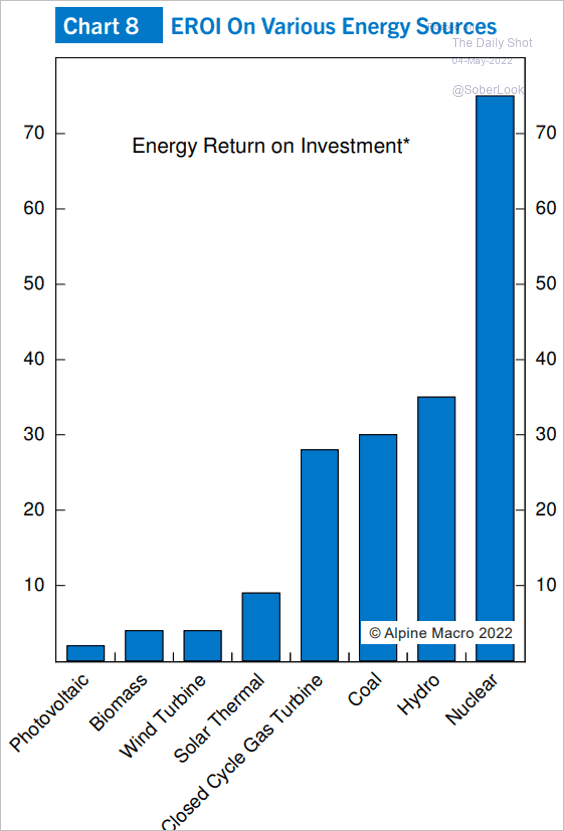

7. Which energy sources provide the best return on investment?

Source: Alpine Macro

Source: Alpine Macro

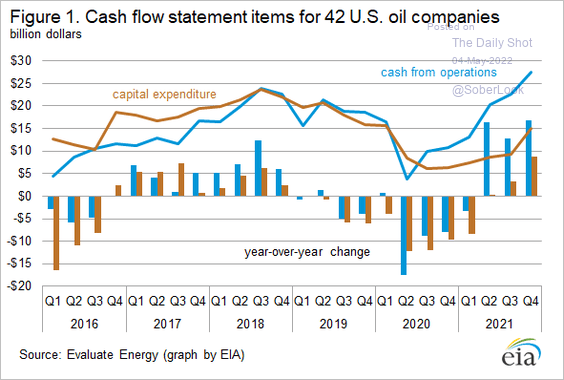

8. US energy companies’ CaPex lags the recent surge in cash flows.

Source: @EIAgov

Source: @EIAgov

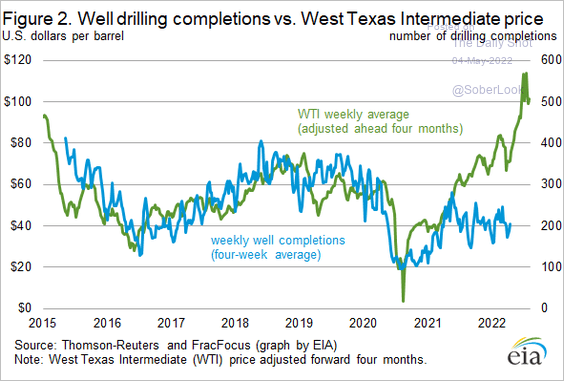

Well completions have been lagging oil prices.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

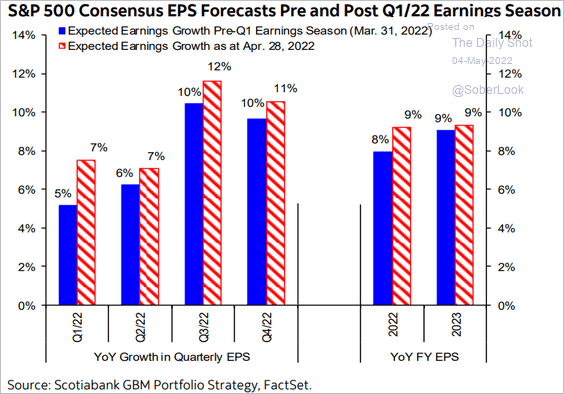

1. Analysts’ earnings forecasts have been rising.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

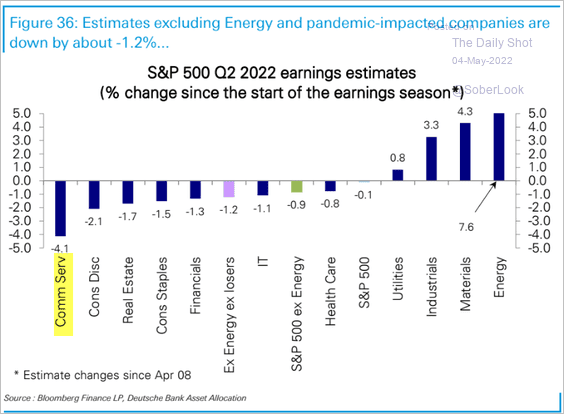

But Q2 estimates excluding energy and pandemic-impacted companies are down.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

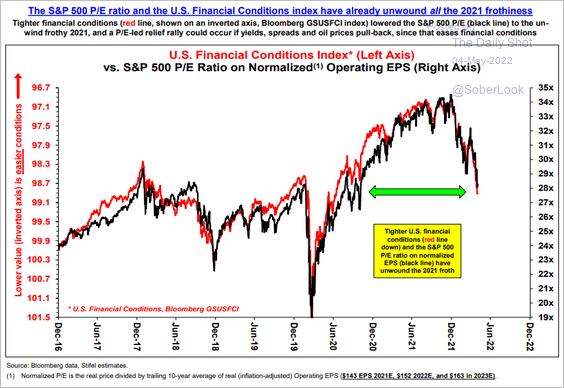

• Tight financial conditions could pressure earnings.

Source: Stifel

Source: Stifel

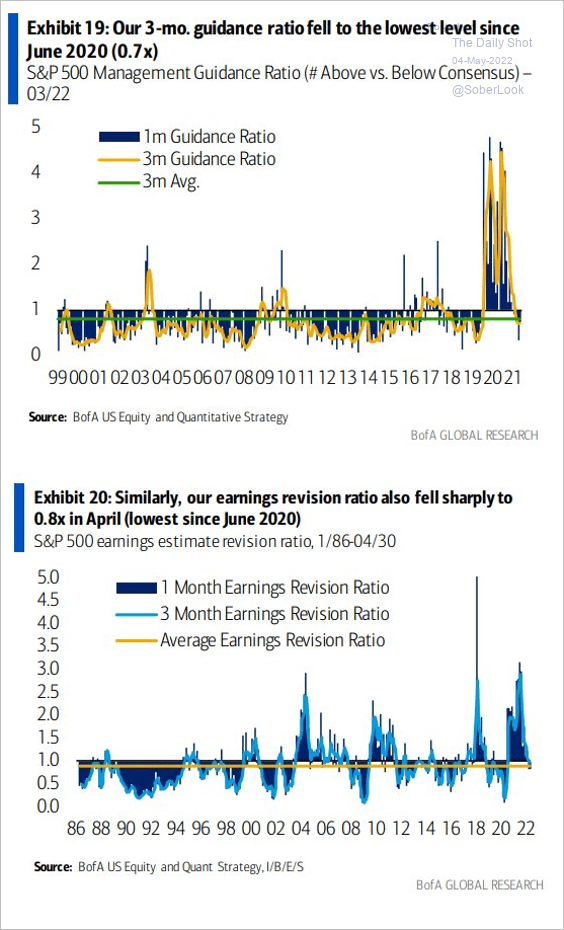

• Management guidance and earnings revisions have been weak.

Source: BofA Global Research

Source: BofA Global Research

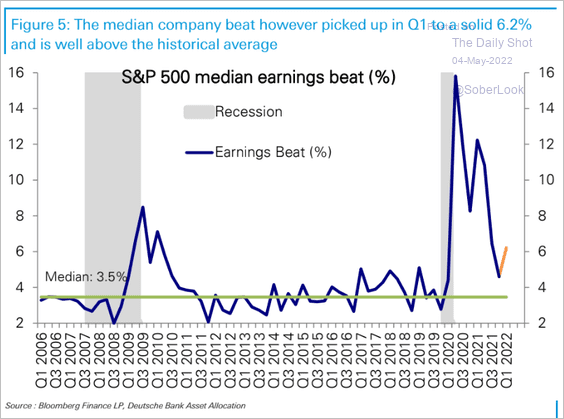

• The median earnings beat improved during this earnings season.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

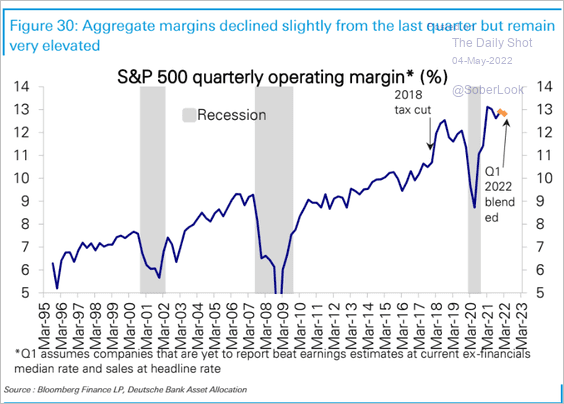

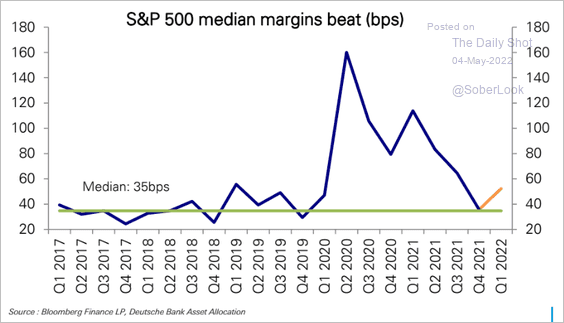

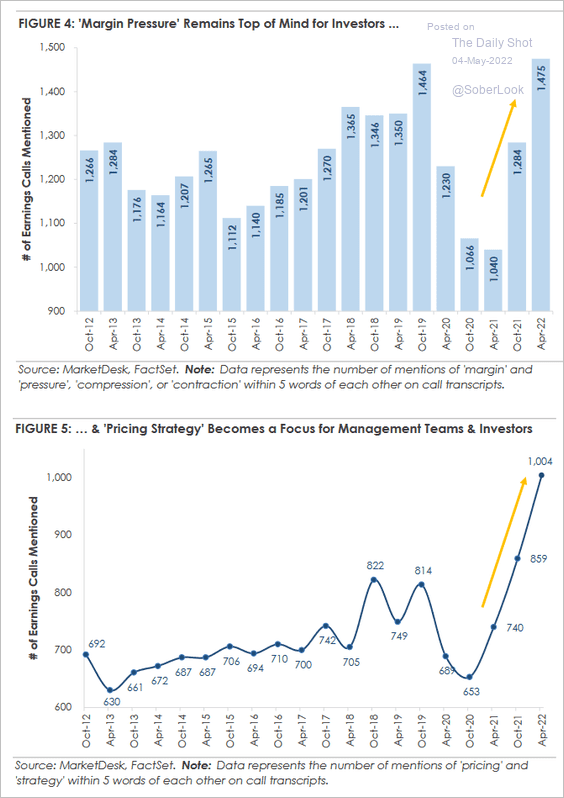

2. Margin levels remain elevated, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

…with the median margin beat improving in this earnings season.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

But companies are facing margin pressures. There is only so much in price increases that firms can pass on to their customers before getting pushback.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

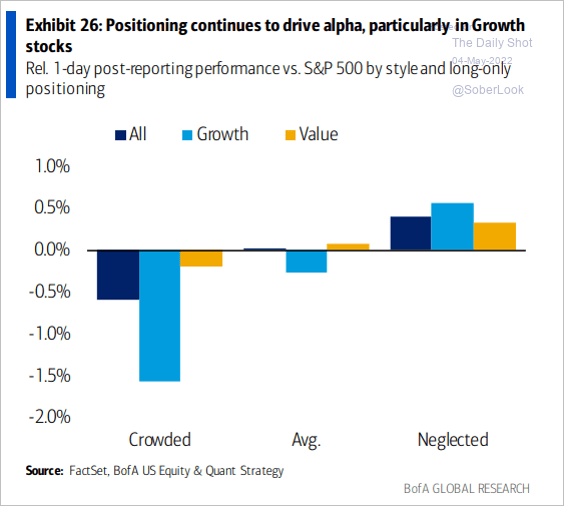

3. Crowded stocks have been hit hard after reporting earnings.

Source: BofA Global Research

Source: BofA Global Research

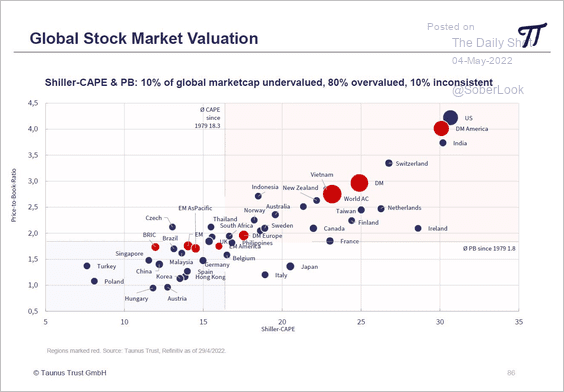

4. Only 10% of global equity markets are trading below their long-term valuation averages.

Source: @NorbertKeimling

Source: @NorbertKeimling

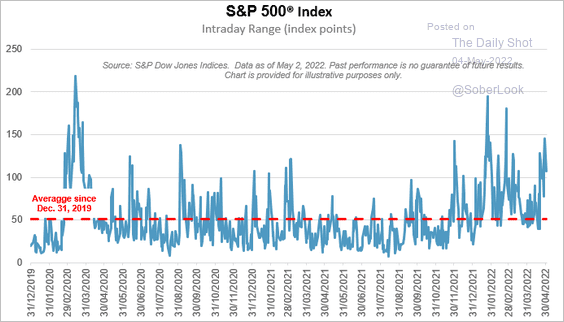

5. The S&P 500 intraday volatility has been elevated.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

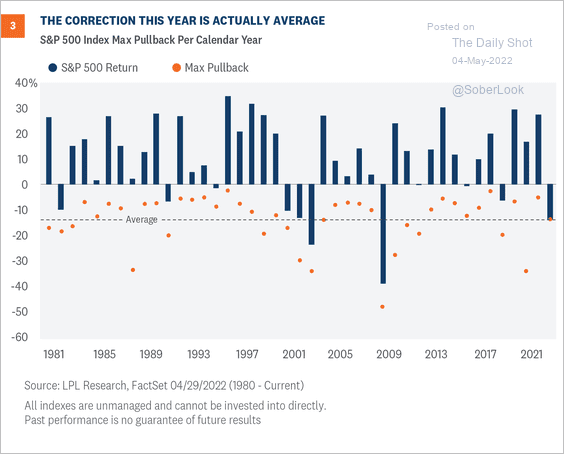

The market pullback this year (so far) has been average.

Source: LPL Research

Source: LPL Research

——————–

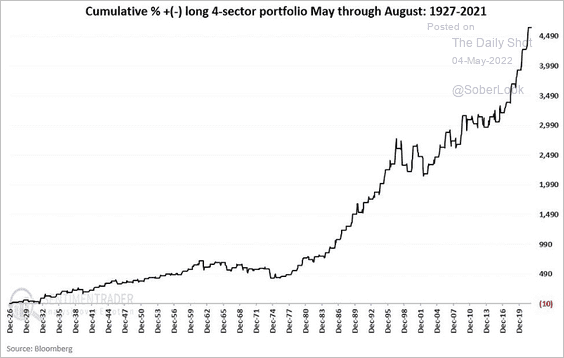

6. Defensive sectors such as consumer staples, utilities, health care, and real estate tend to perform well between May and August.

Source: SentimenTrader

Source: SentimenTrader

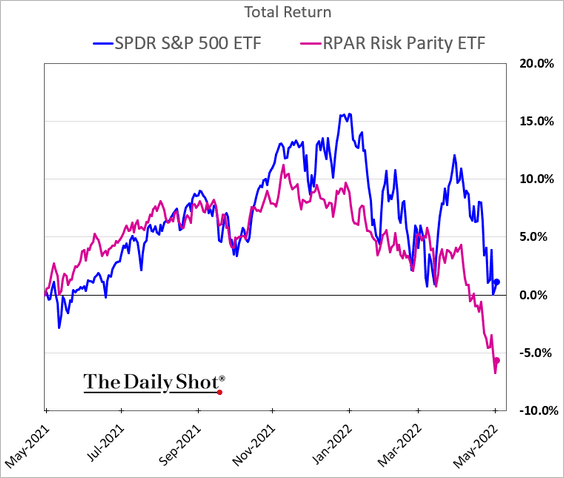

7. Risk parity strategies continue to lag.

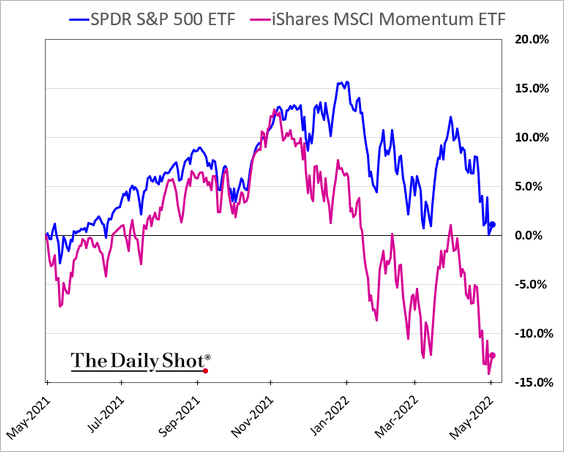

8. Momentum stocks have been underperforming.

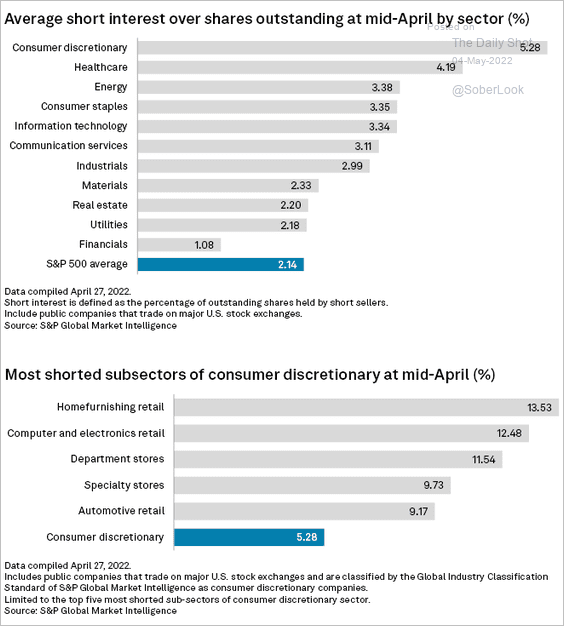

9. Which are the most shorted sectors?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Rates

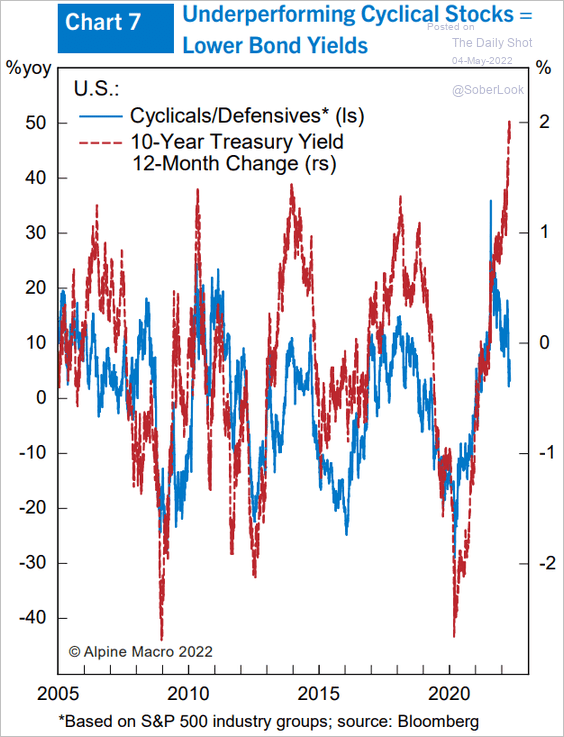

1. If the aggressive Fed tightening continues to weigh on the cyclicals/defensives performance, Treasury yields should move lower, particularly in the 10-year maturities.

Source: Alpine Macro

Source: Alpine Macro

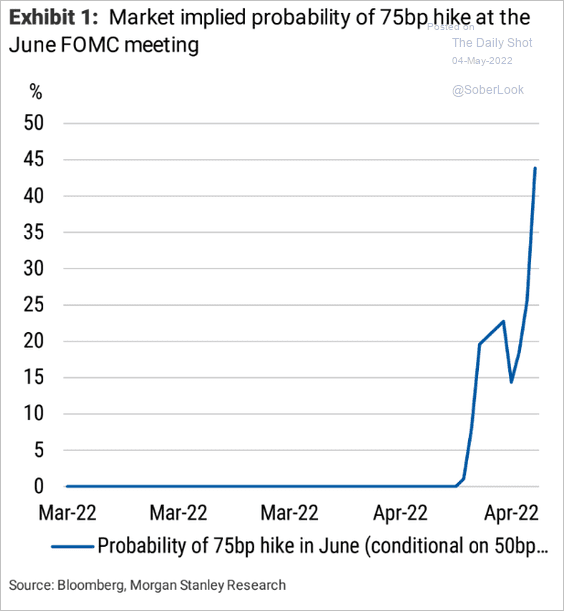

2. Will we get a 75 bps hike in June?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

3. T-bills have been trading at a premium to repo alternatives as investors flooded into cash.

Source: Alpine Macro

Source: Alpine Macro

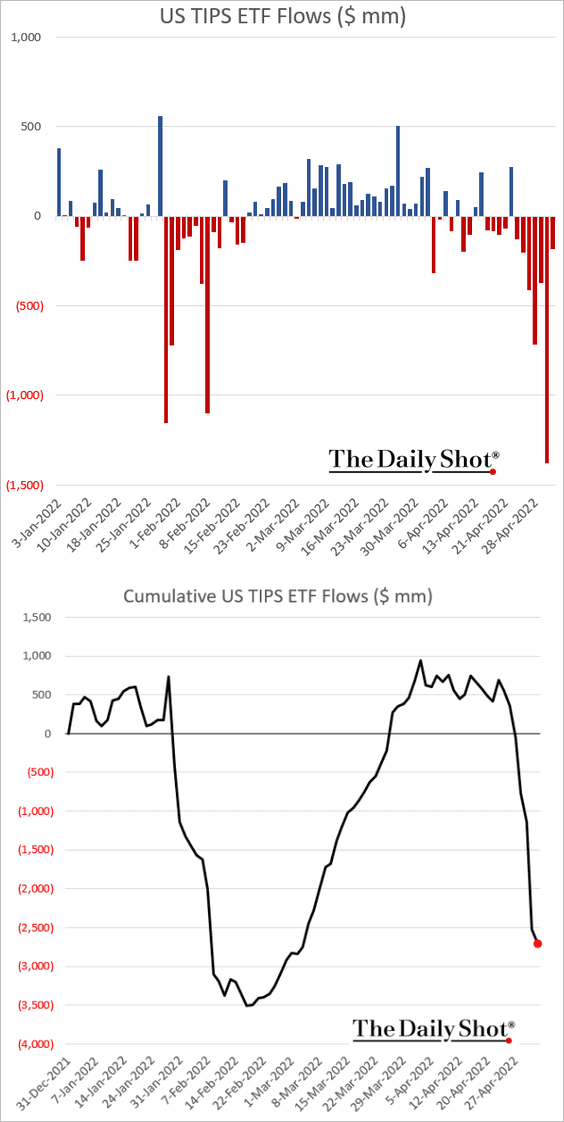

4. TIPS ETFs have been experiencing outflows.

——————–

Food for Thought

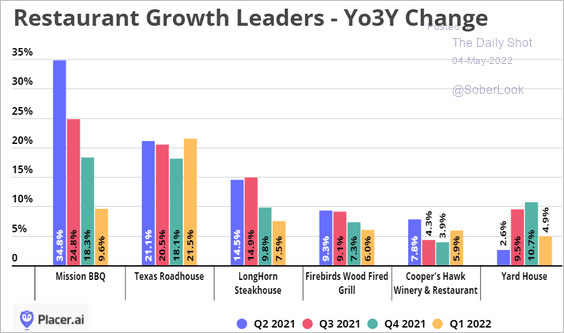

1. Best-performing restaurant chains since 2019:

Source: Placer.ai

Source: Placer.ai

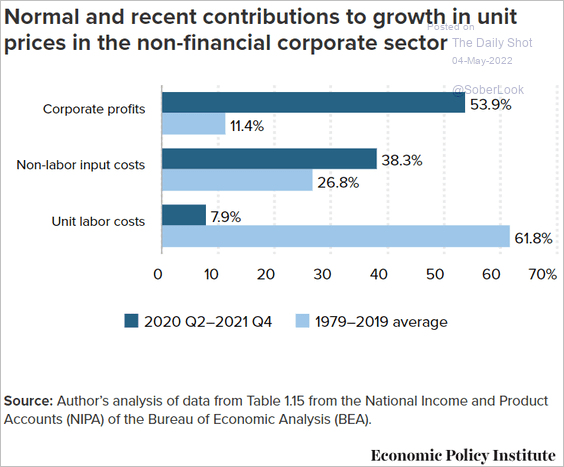

2. How corporate profits, input costs, and labor costs contributed to inflation:

Source: @EconomicPolicy

Source: @EconomicPolicy

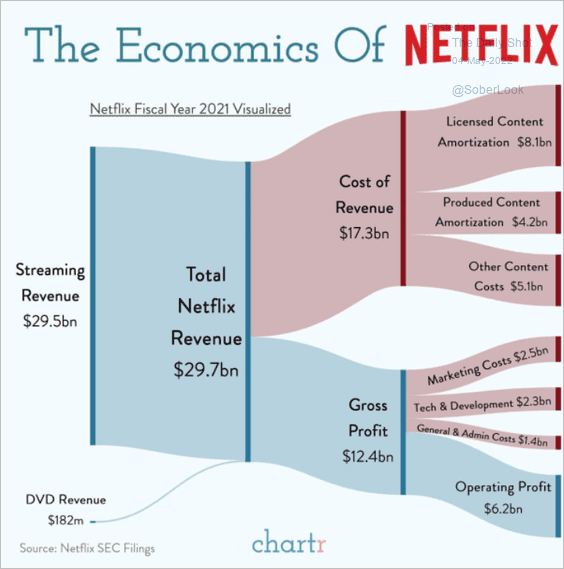

3. The economics of Netflix:

Source: @chartrdaily Read full article

Source: @chartrdaily Read full article

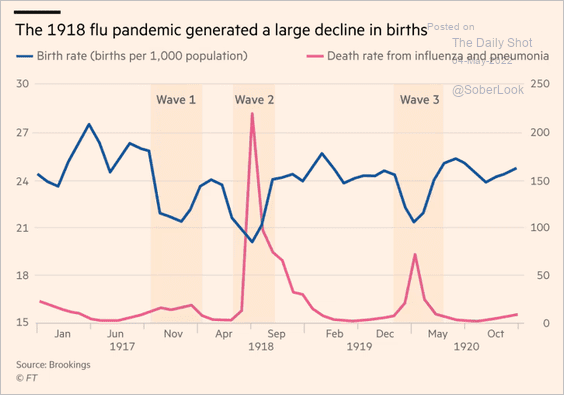

4. The decline in birth rates during the 1918 flu pandemic:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

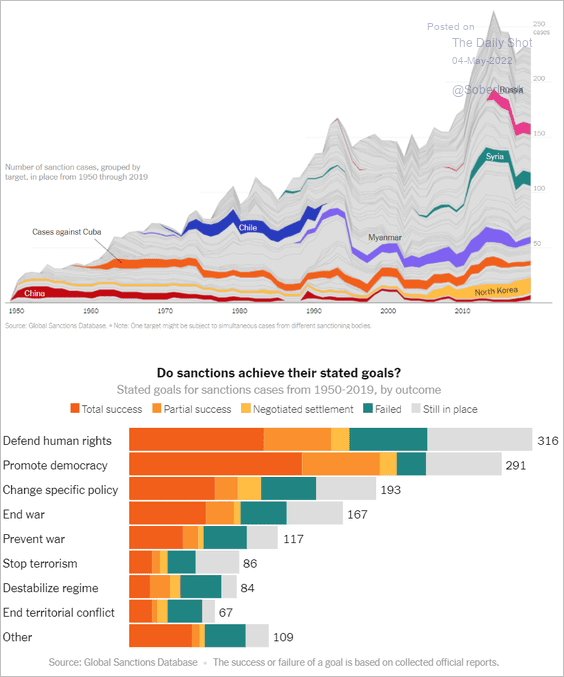

5. Sanctions over time and their success rates:

Source: @WSJ Read full article

Source: @WSJ Read full article

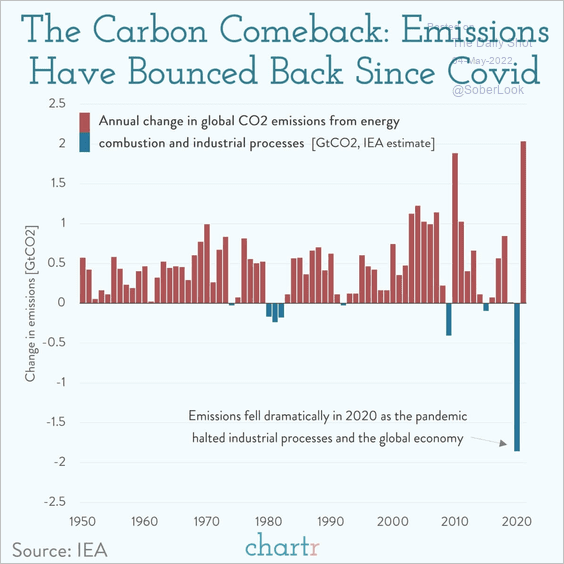

6. The rebound in CO2 emissions:

Source: @chartrdaily

Source: @chartrdaily

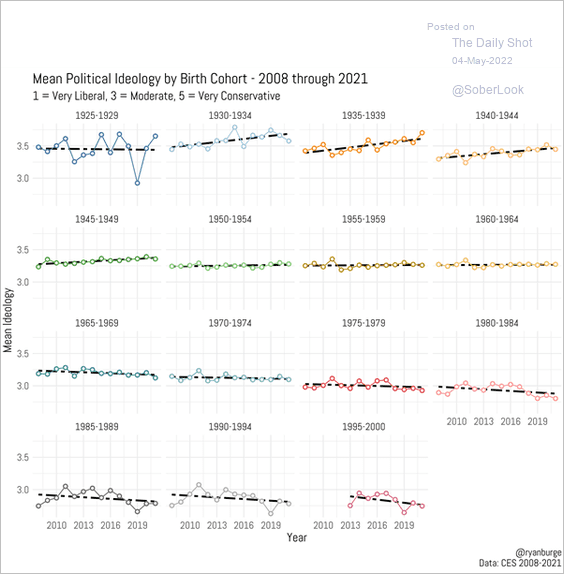

7. Political ideology by birth cohort:

Source: @ryanburge

Source: @ryanburge

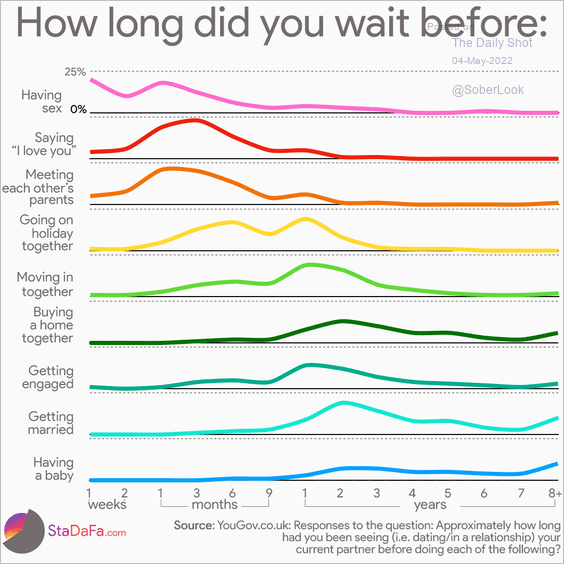

8. How long did you wait?

Source: Statistics_Data_Facts Read full article

Source: Statistics_Data_Facts Read full article

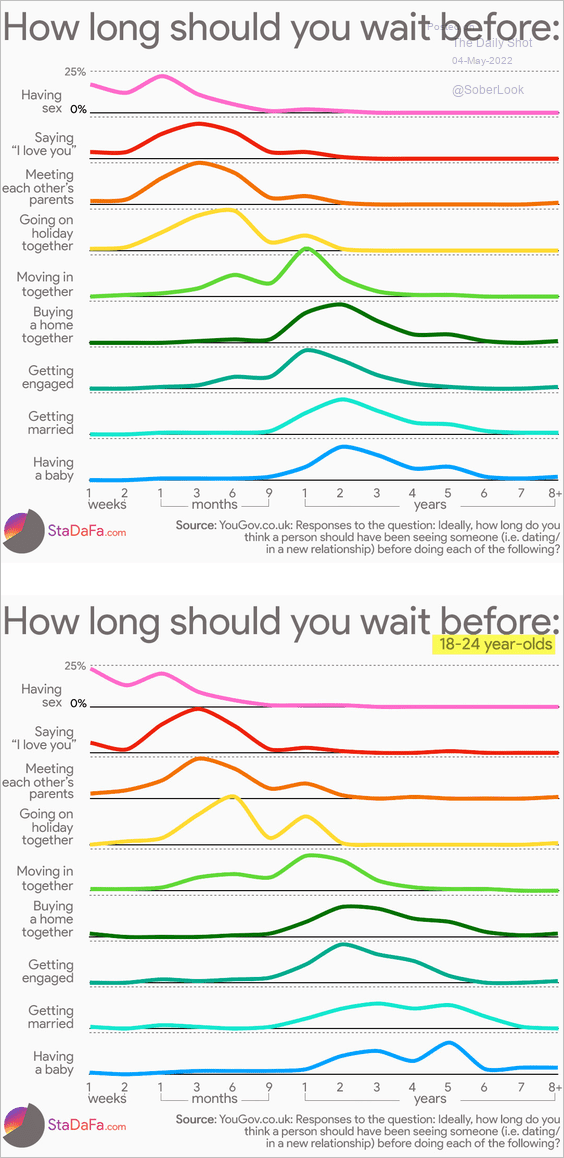

How long should you wait?

Source: Statistics_Data_Facts Read full article

Source: Statistics_Data_Facts Read full article

——————–

Back to Index