The Daily Shot: 05-May-22

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

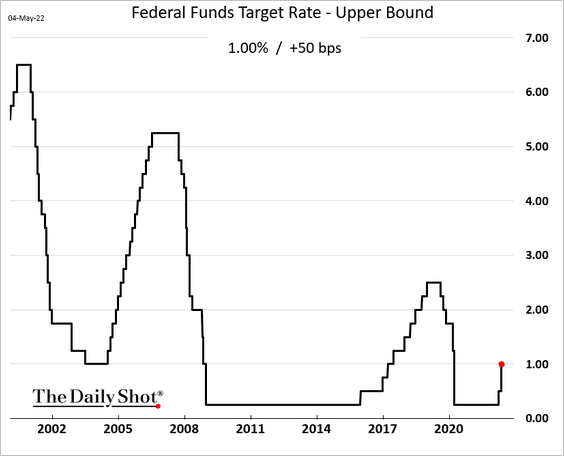

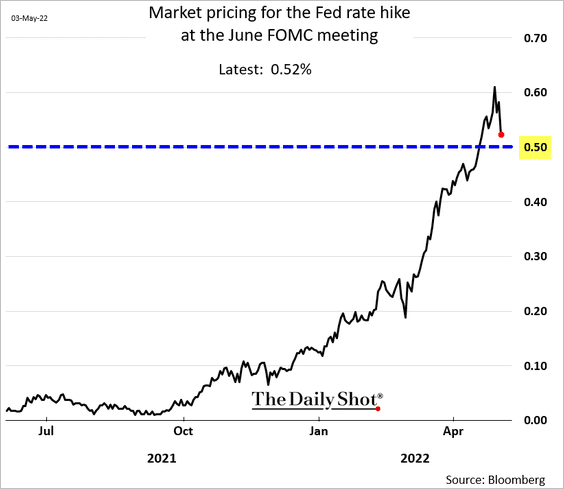

1. The Federal Reserve hiked rates by 50 bps, as expected.

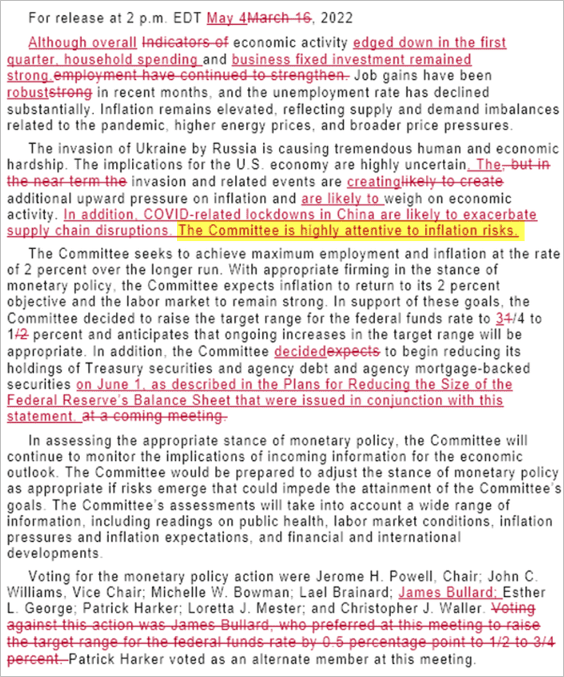

There were no major surprises in the FOMC statement, …

Source: @NickTimiraos

Source: @NickTimiraos

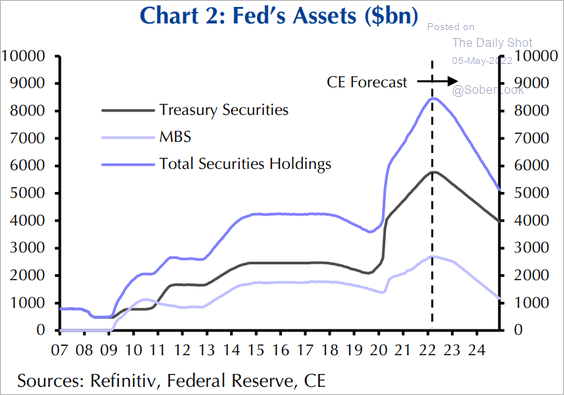

… as the central bank launched quantitative tightening.

Source: Capital Economics

Source: Capital Economics

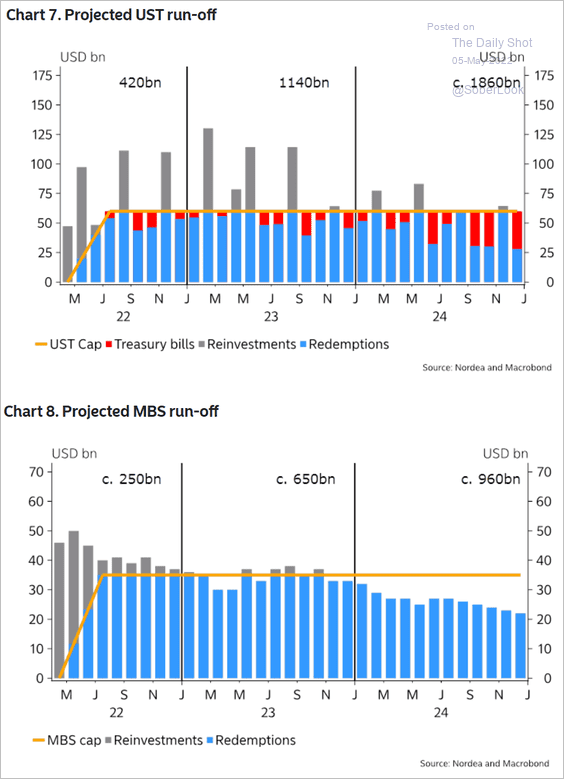

This chart shows the mechanics of the Treasury and MBS securities runoff.

Source: Nordea Markets

Source: Nordea Markets

There was one comment from Chair Powell that got the markets very excited. The “jumbo” rate hikes are off the table for now.

A 75-basis-point increase is not something that the committee is actively considering … I think expectations are that we’ll start to see inflation, you know, flattening out.

The probability of a 75 bps hike in June declined sharply. It’s worth noting that if inflation continues to surprise to the upside, the idea of 75 bps hikes will make a comeback.

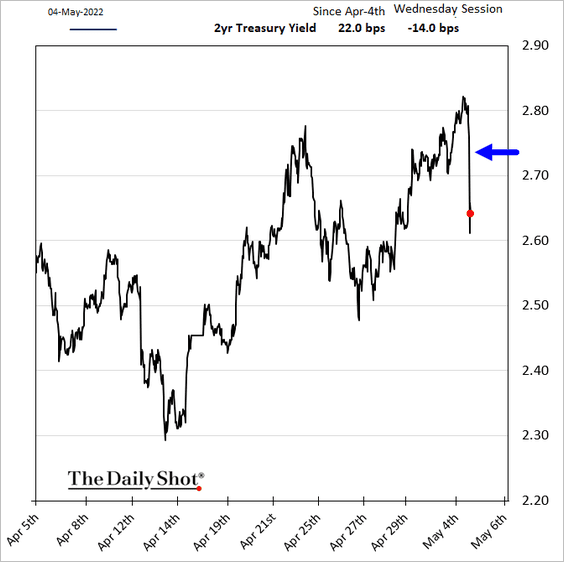

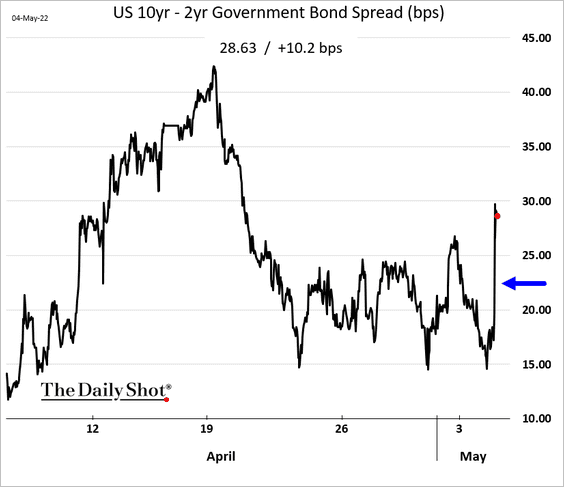

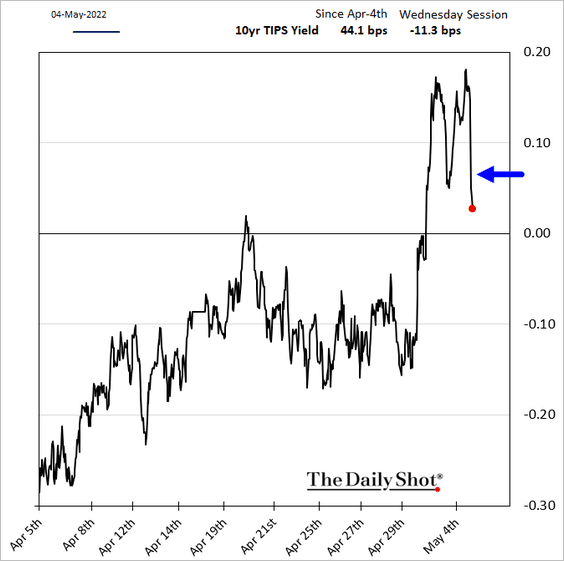

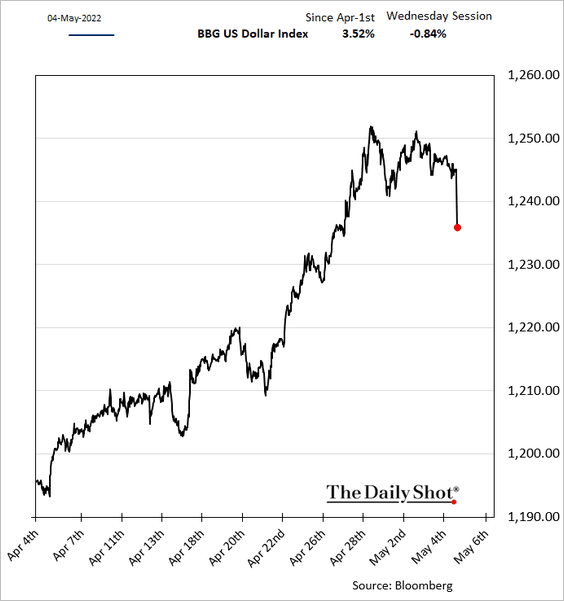

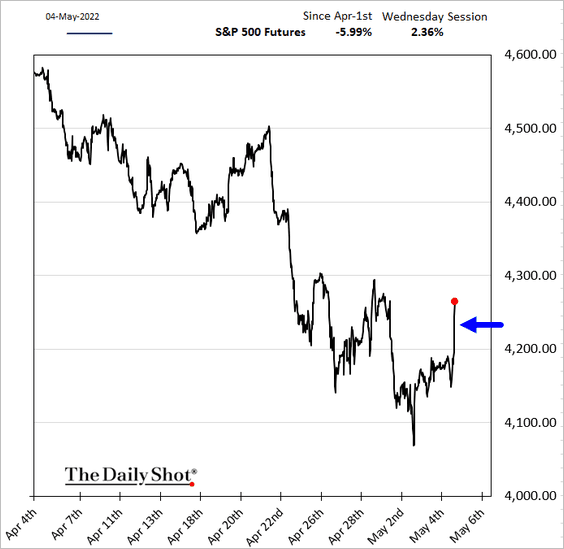

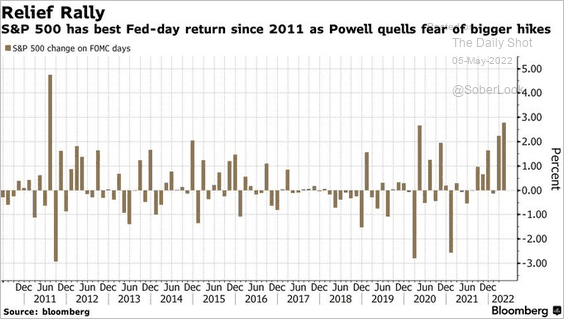

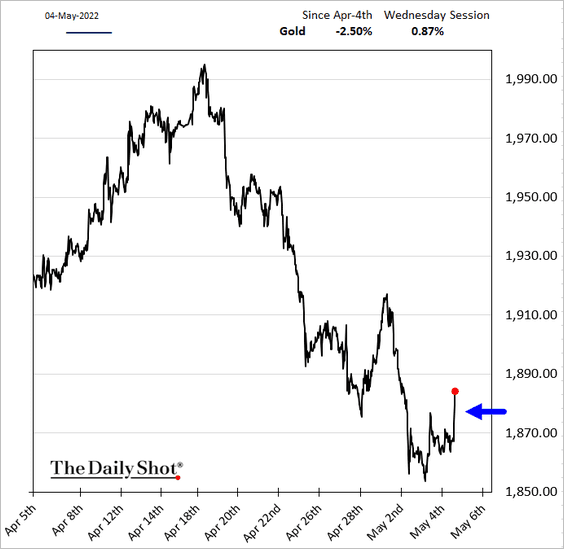

Here is how different markets reacted to Powell’s comment.

• The 2-year Treasury yield:

• The Treasury curve (steeper):

• Real rates (TIPS yield):

• The US dollar:

• Stocks (2 charts):

Source: @kgreifeld, @markets, @VildanaHajric, @luwangnyc Read full article

Source: @kgreifeld, @markets, @VildanaHajric, @luwangnyc Read full article

• Gold:

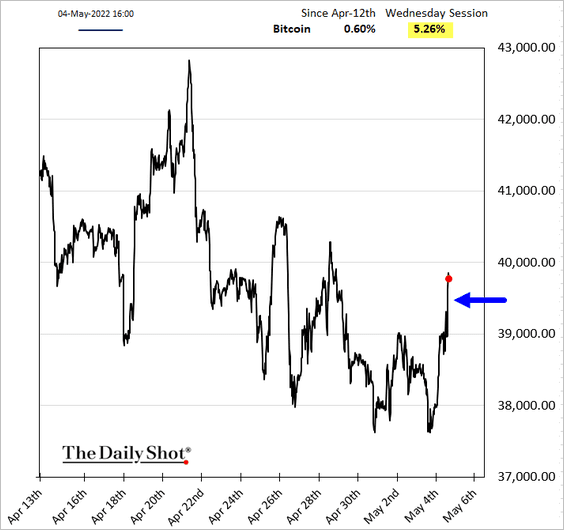

• Bitcoin:

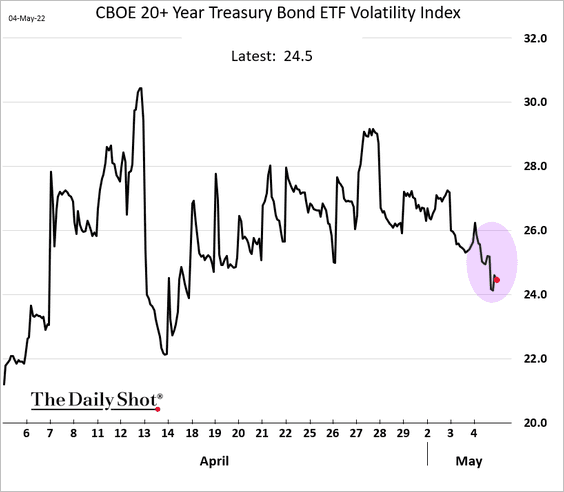

Implied volatility in rates markets eased.

——————–

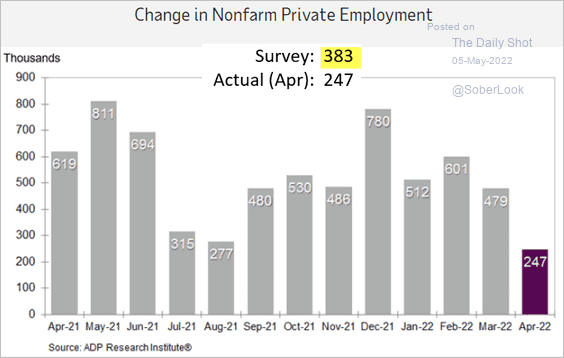

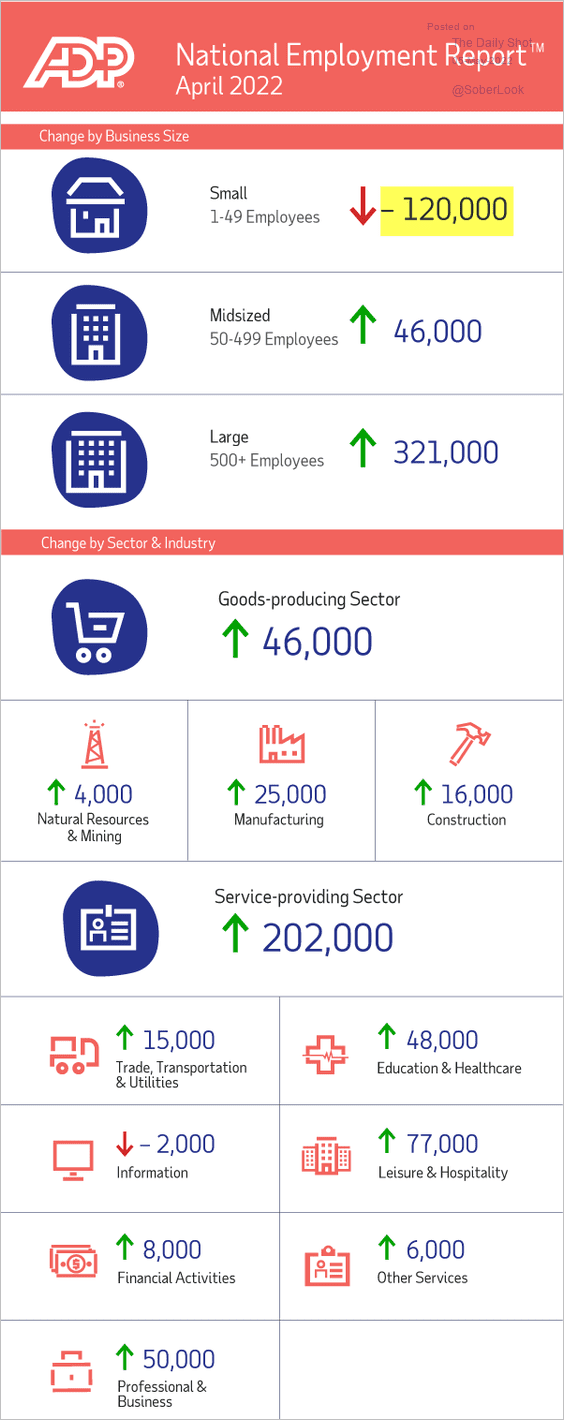

2. The ADP private employment report was softer than expected.

Source: ADP Research Institute

Source: ADP Research Institute

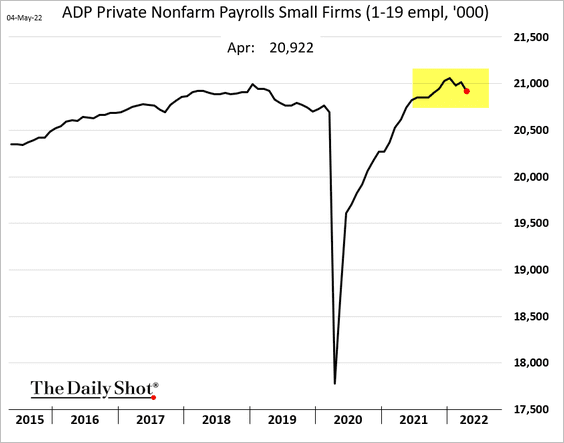

Small businesses shed jobs in April (2 charts).

Source: ADP Research Institute

Source: ADP Research Institute

——————–

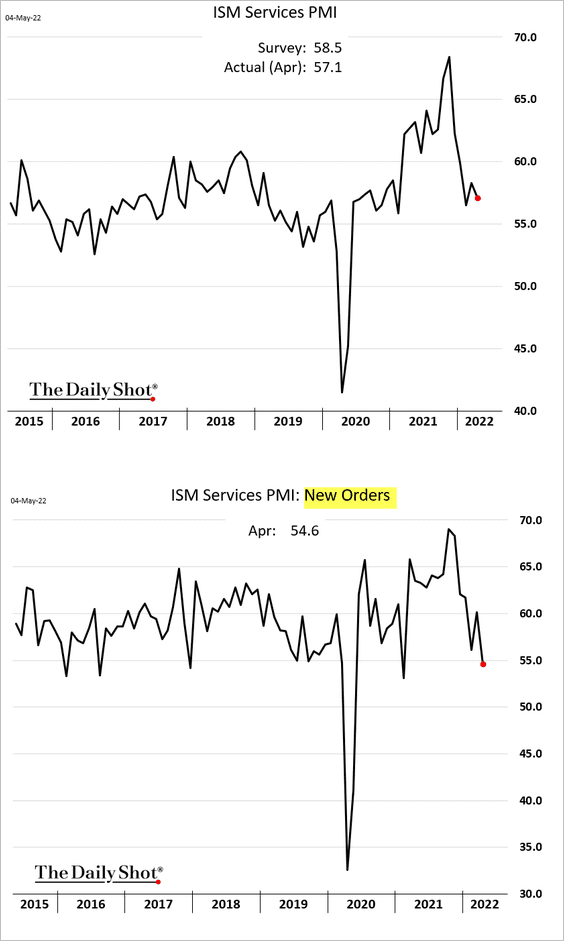

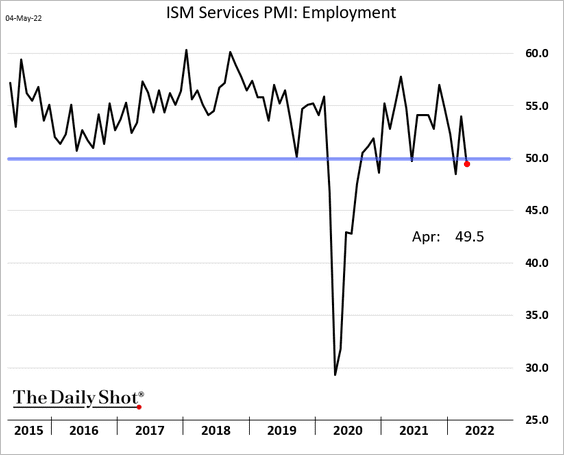

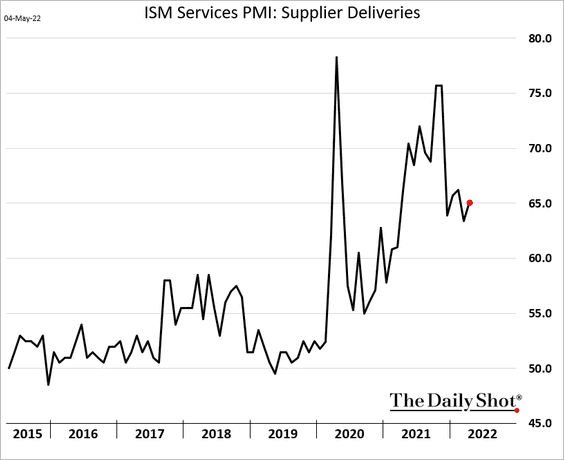

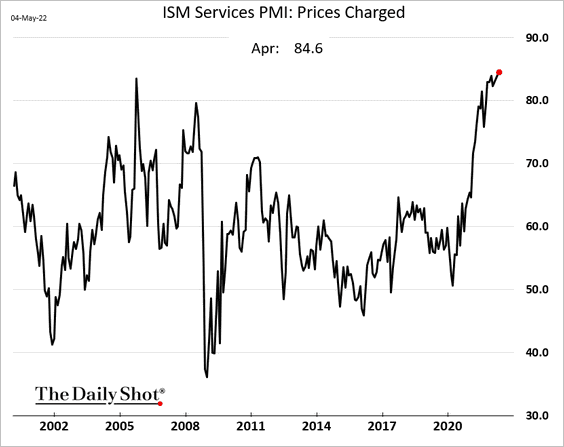

3. The ISM Services PMI declined last month as demand growth weakened (similar to the manufacturing report).

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• Hiring has stalled.

• Supplier delays remain a challenge, although the index is off the highs.

• Companies are rapidly raising prices.

——————–

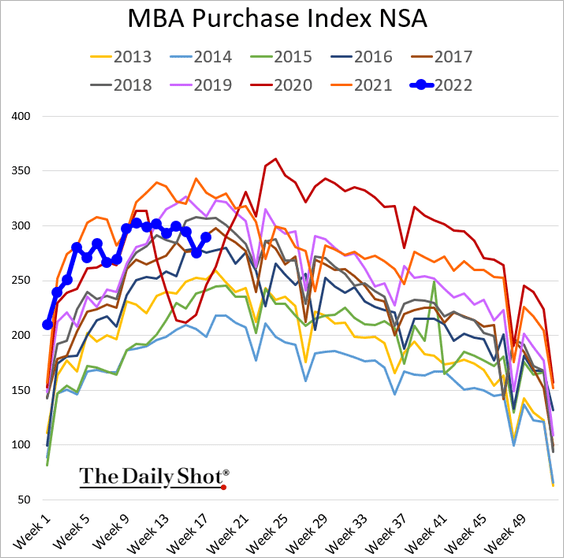

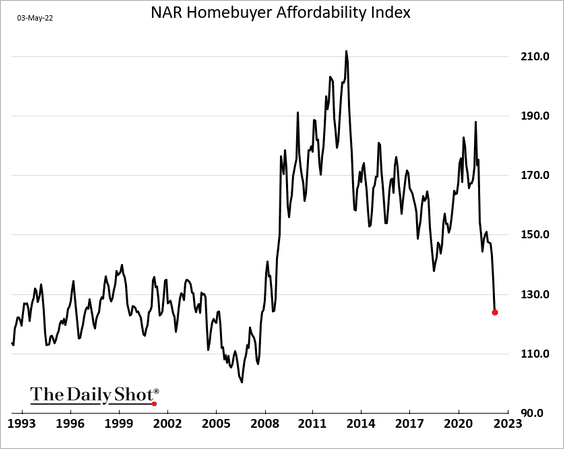

4. Mortgage applications for home purchase are not crashing, …

… despite deteriorating affordability.

——————–

5. Net migration has been boosting inflation in some cities.

Source: @TaylorAMarr Read full article

Source: @TaylorAMarr Read full article

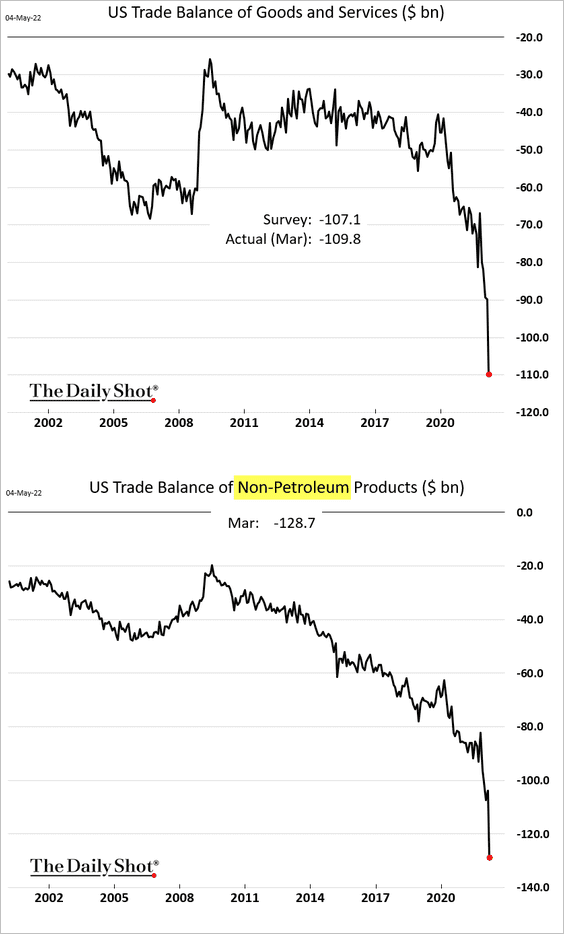

6. The total trade deficit (goods & services) hit a new record, …

… as imports surged. Easing congestion at West Coast ports finally allowed companies to bring in some of the backlogged orders. Going forward, we are likely to see imports easing from record highs.

Source: Capital Economics

Source: Capital Economics

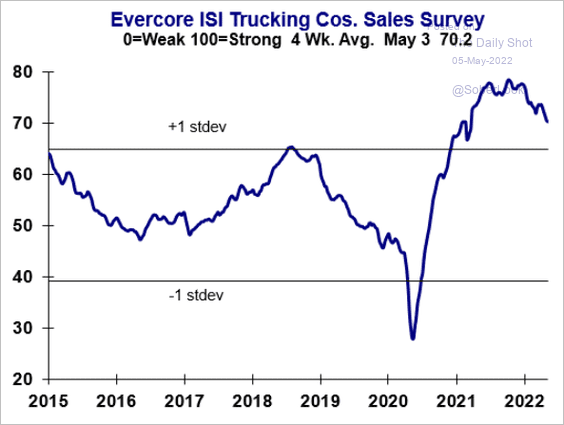

Domestically, we see shipping demand starting to moderate.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

The United Kingdom

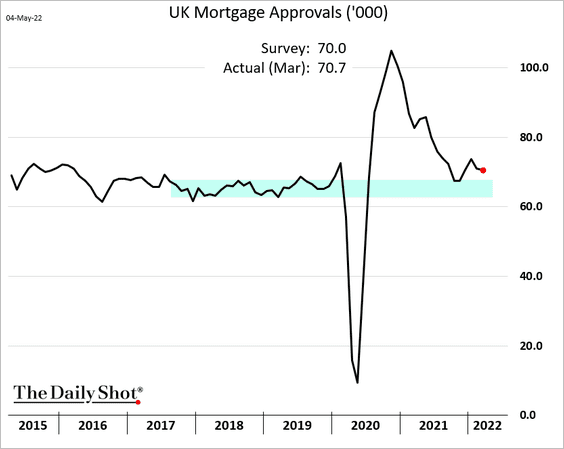

1. Mortgage approvals held steady in March.

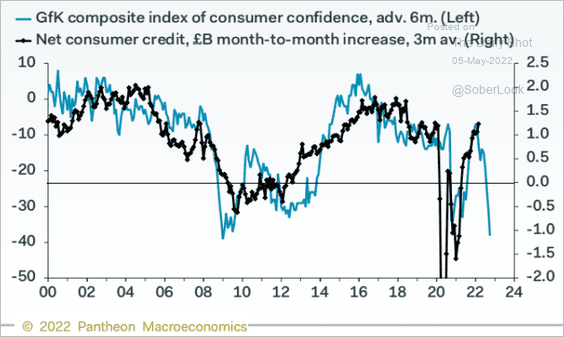

Depressed consumer sentiment will be a drag on credit demand going forward.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

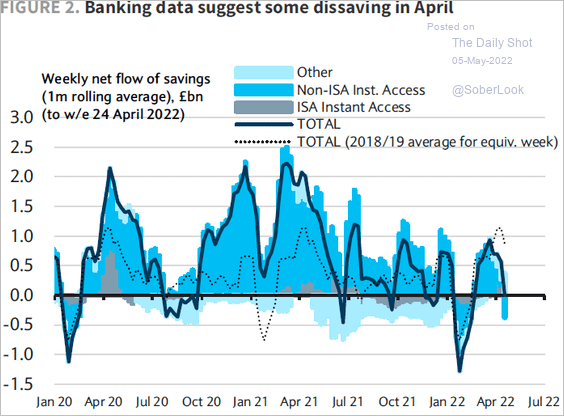

2. The UK is showing signs of dissaving.

Source: Barclays Research

Source: Barclays Research

Back to Index

The Eurozone

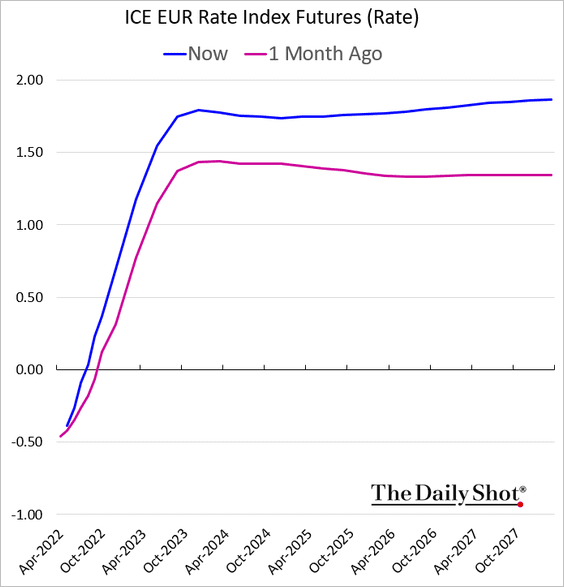

1. The market continues to boost expectations for the ECB rate hikes.

The 2-year swap rate exceeded 1% for the first time in a decade.

——————–

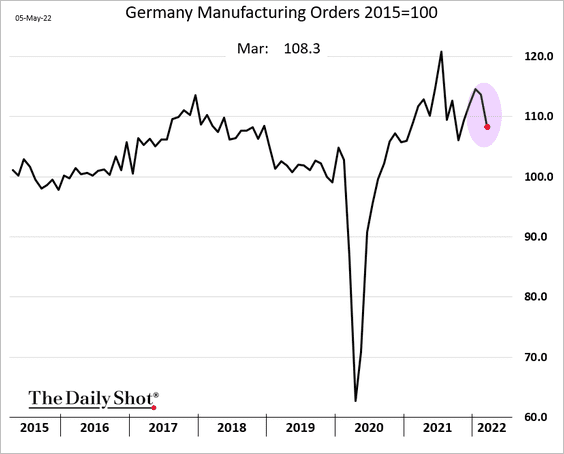

2. German manufacturing orders declined more than expected in March.

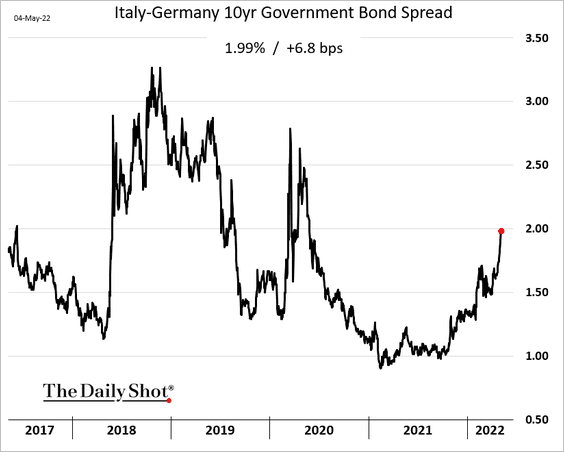

3. The Italian 10yr bond spread to Germany is nearing 2%.

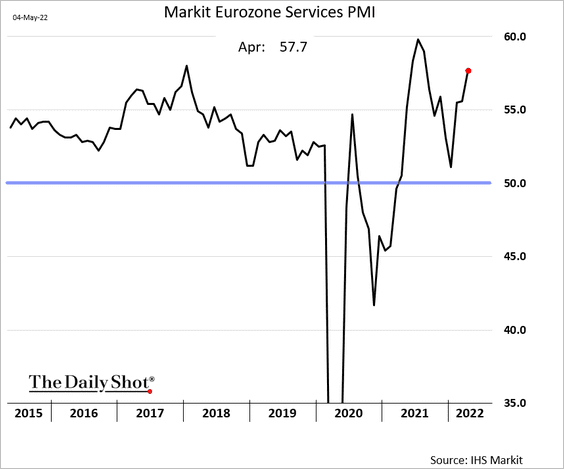

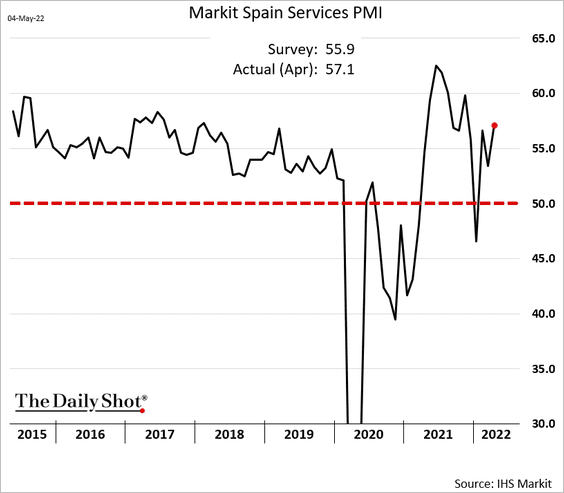

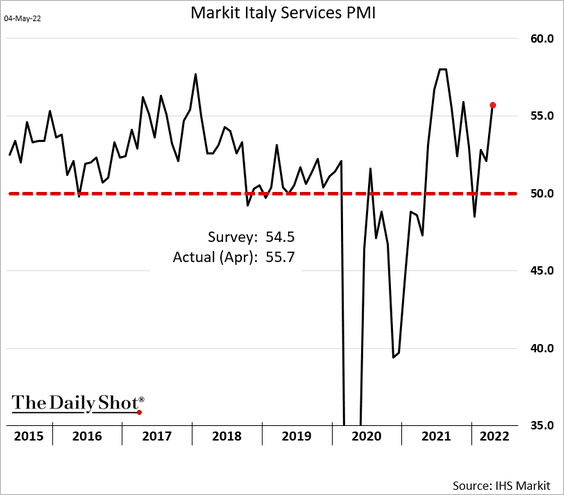

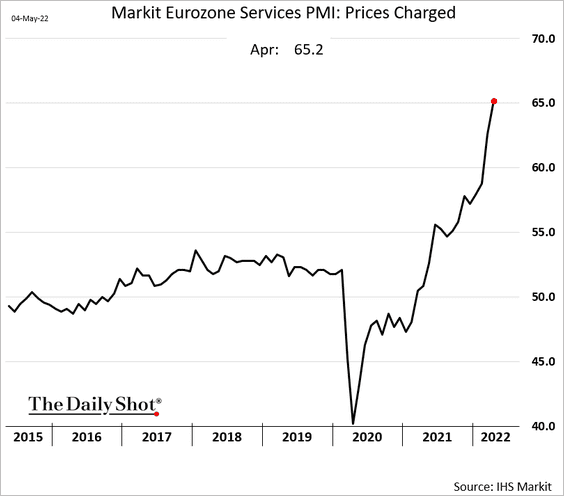

4. The updated services PMI report shows strength in April.

• Spain:

• Italy:

Companies are rapidly boosting prices.

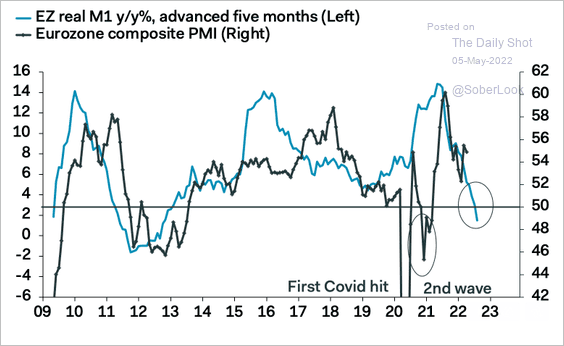

Going forward, shrinking liquidity in the euro area doesn’t bode well for business activity growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

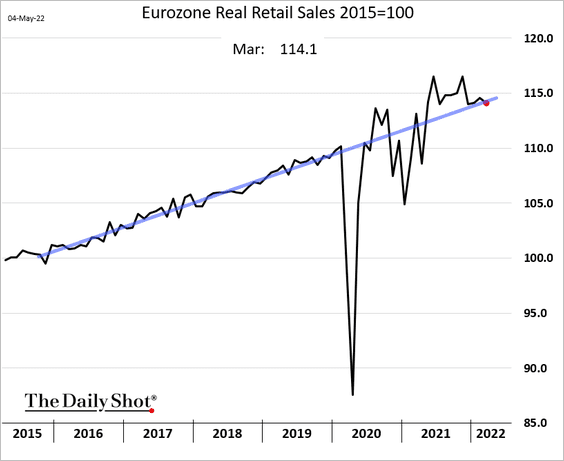

5. Retail sales slowed in March.

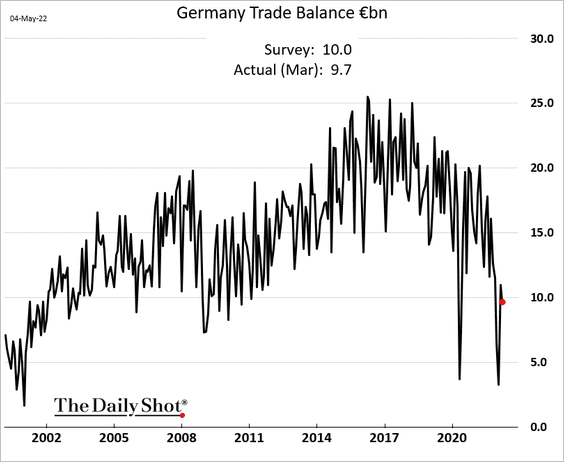

6. Germany’s trade balance remains depressed due to elevated energy costs.

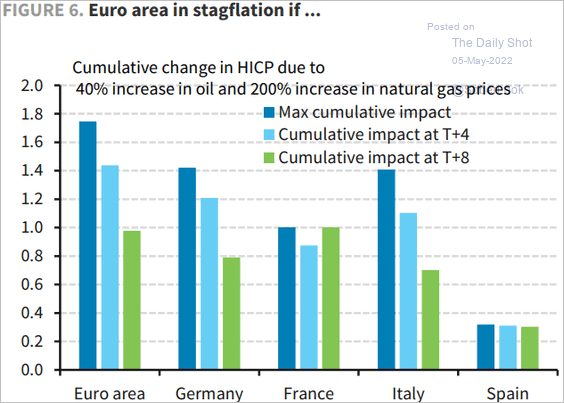

7. The Eurozone would enter severe stagflation as a result of a full embargo on Russian energy.

Source: Barclays Research

Source: Barclays Research

Back to Index

Asia – Pacific

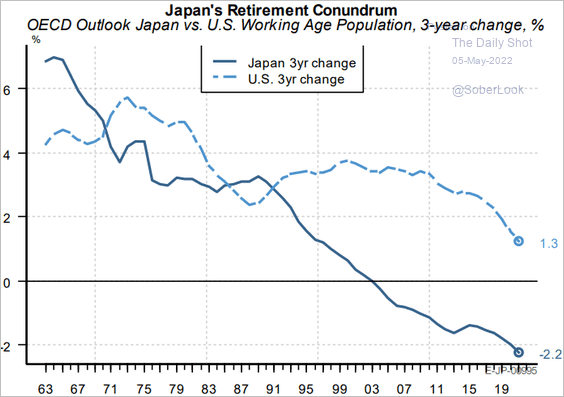

1. One of the big drivers of Japan’s weak inflation outcomes is demographics.

Source: PGM Global

Source: PGM Global

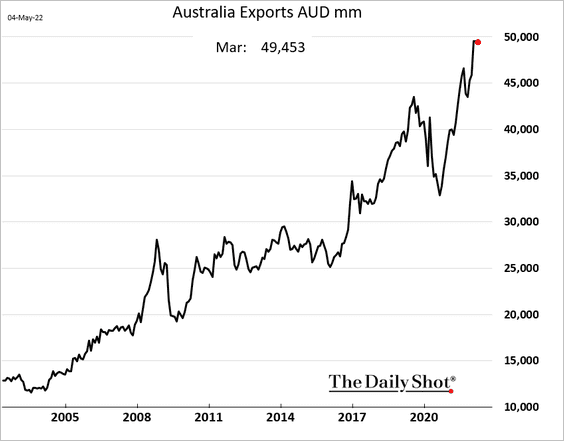

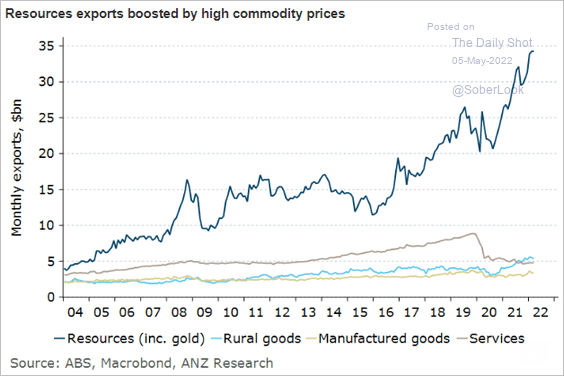

2. Australian exports are holding near record highs, …

… driven by resources.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

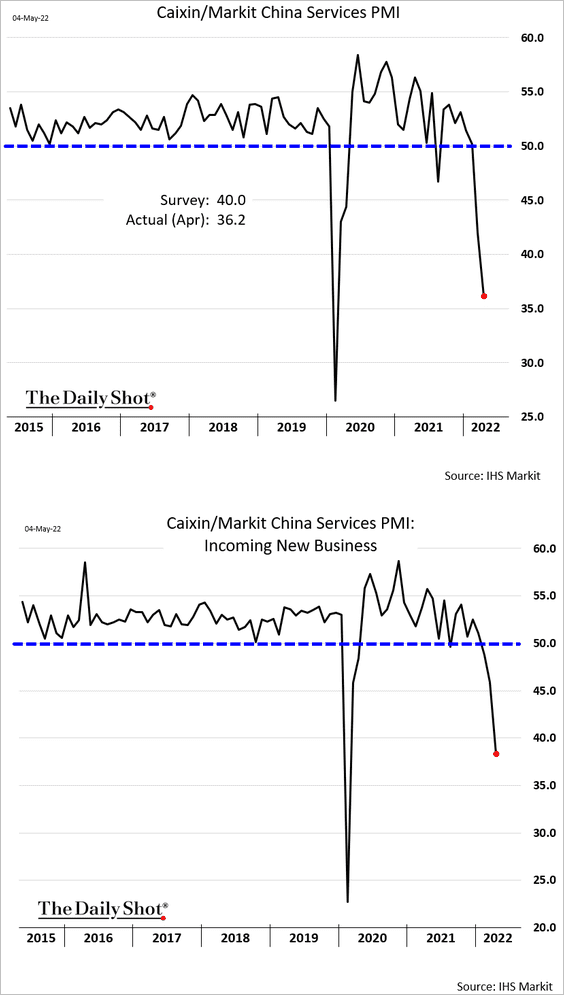

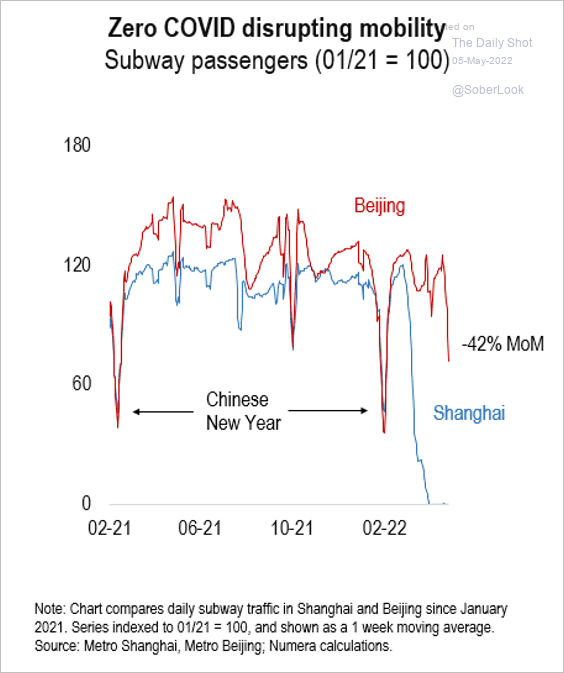

1. The Markit Services PMI showed a collapse in business activity last month due to lockdowns.

Mobility remains depressed.

Source: Numera Analytics

Source: Numera Analytics

——————–

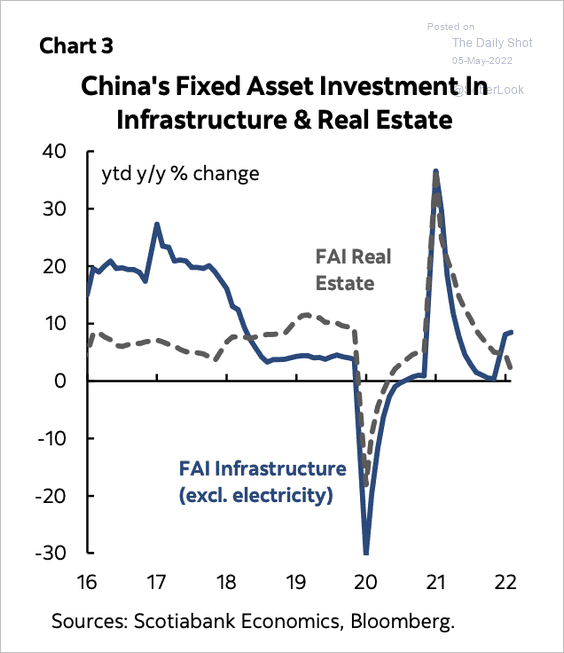

2. New infrastructure development is underway, which could ease downward pressure on the economy.

Source: Scotiabank Economics

Source: Scotiabank Economics

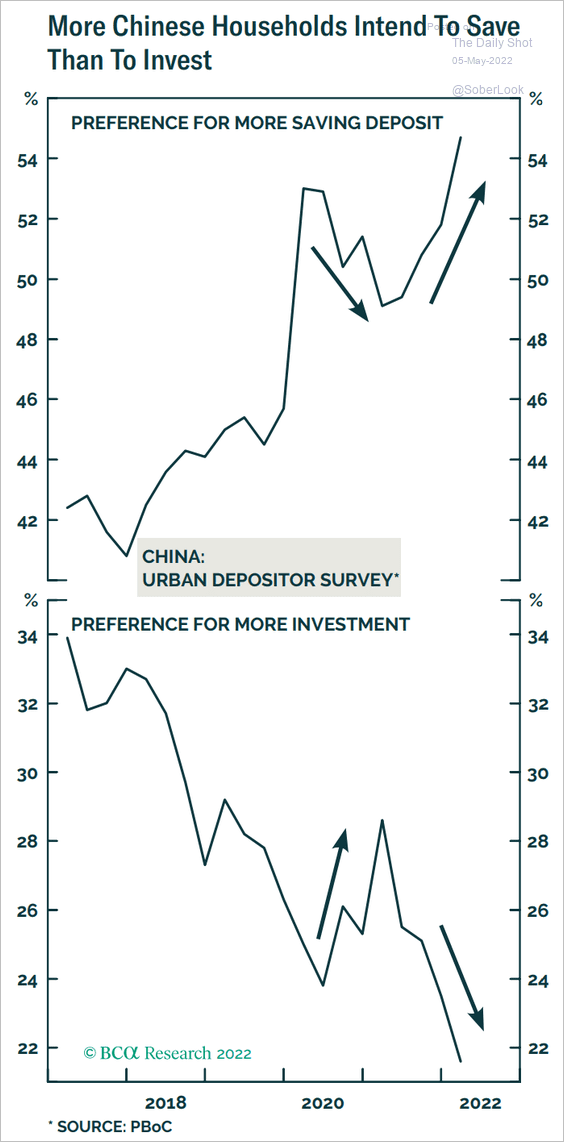

3. Households are not in a hurry to spend …

Source: BCA Research

Source: BCA Research

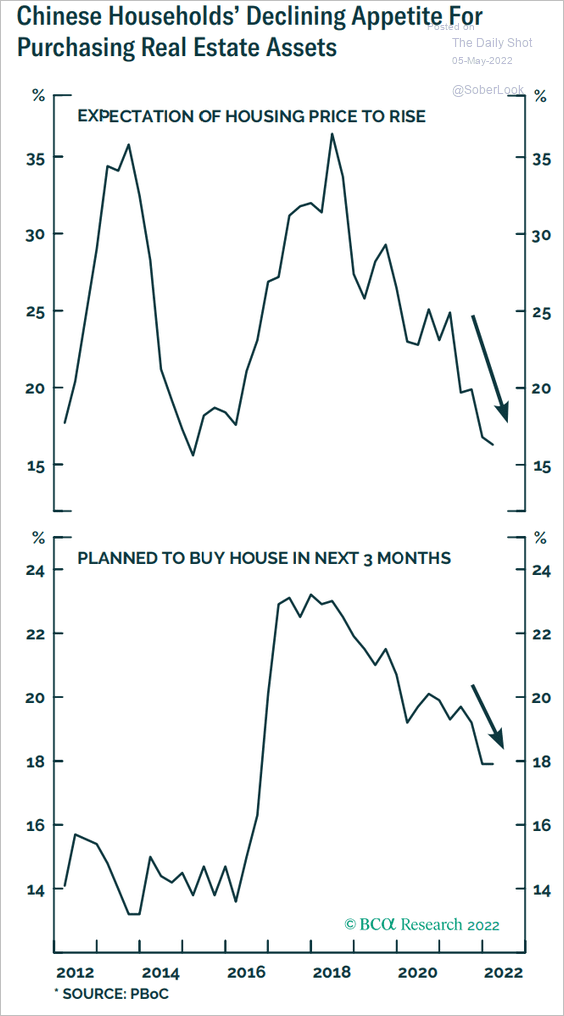

… and are less interested in real estate.

Source: BCA Research

Source: BCA Research

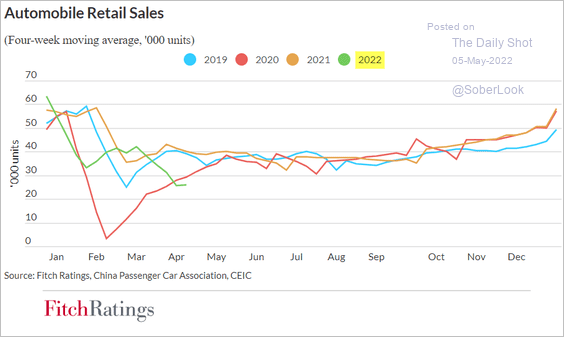

Automobile sales are depressed.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

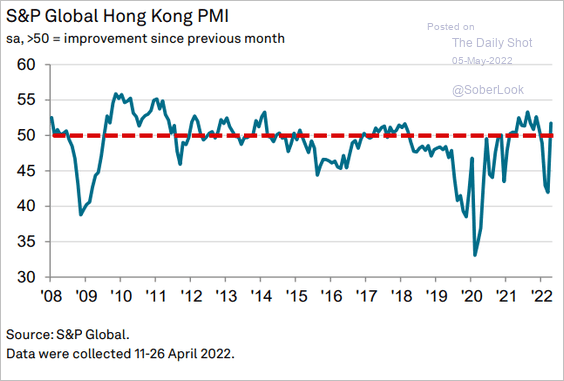

4. Hong Kong’s economic activity was back in growth mode last month.

Source: IHS Markit

Source: IHS Markit

Back to Index

Emerging Markets

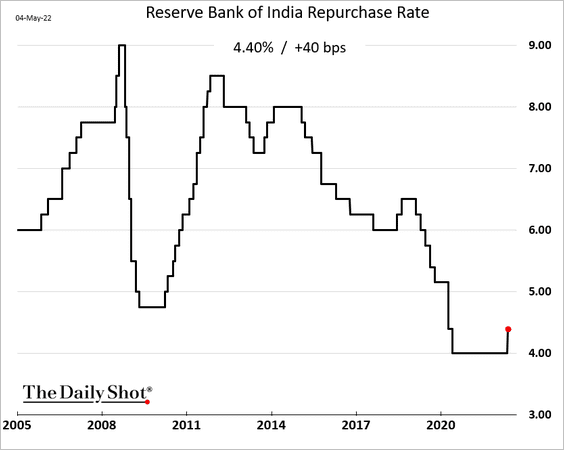

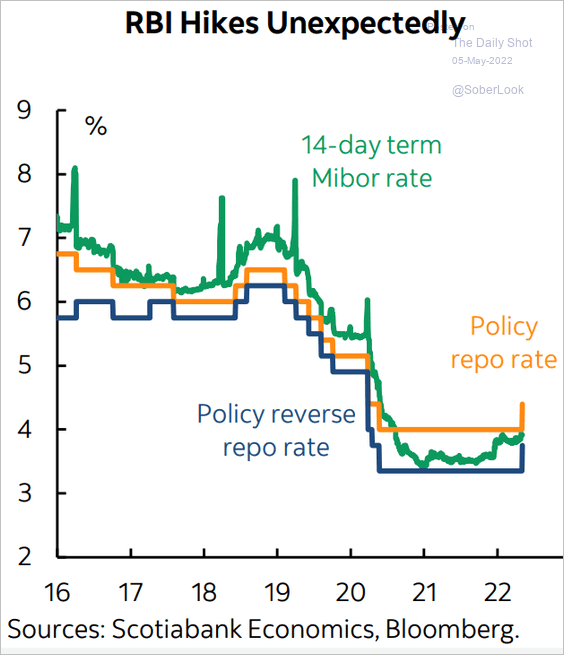

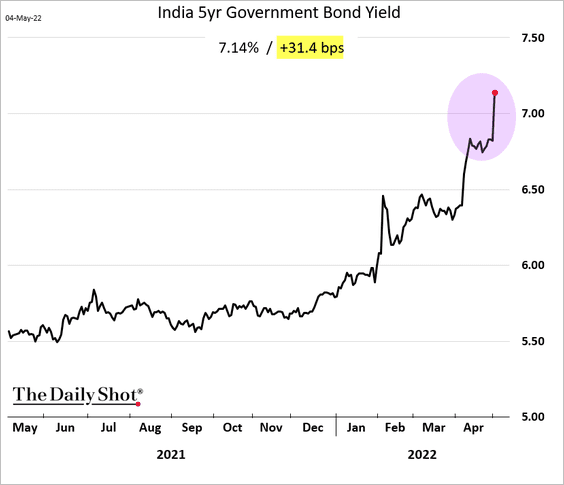

1. India’s RBI unexpectedly hiked rates this week.

Source: Scotiabank Economics

Source: Scotiabank Economics

Bond yields surged.

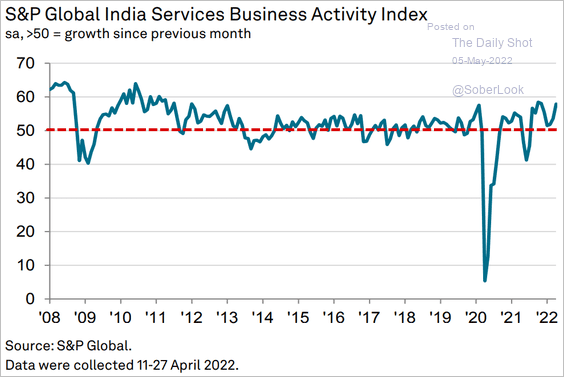

India’s service sector growth accelerated last month.

Source: IHS Markit

Source: IHS Markit

——————–

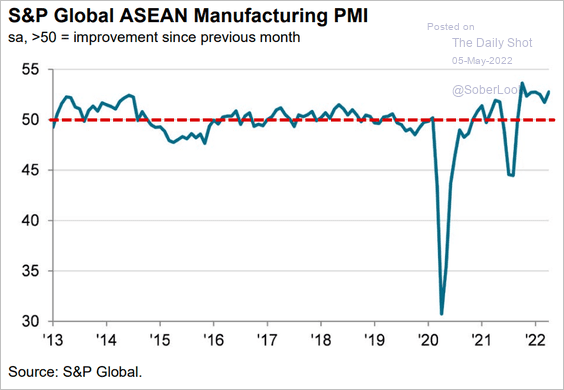

2. ASEAN manufacturing activity gained further momentum in April.

Source: IHS Markit

Source: IHS Markit

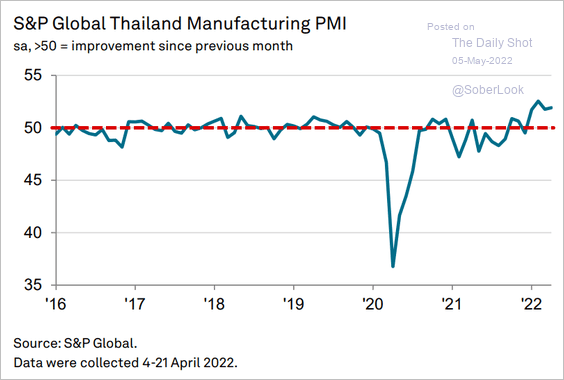

• Thailand:

Source: IHS Markit

Source: IHS Markit

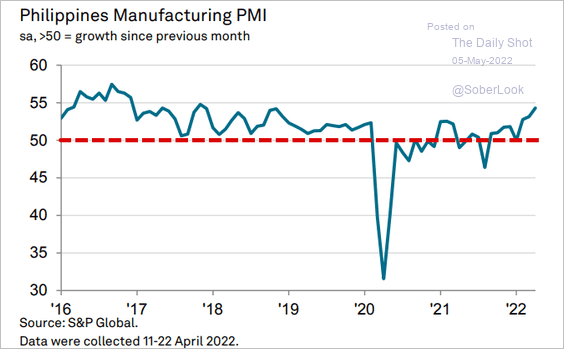

• The Philippines:

Source: IHS Markit

Source: IHS Markit

——————–

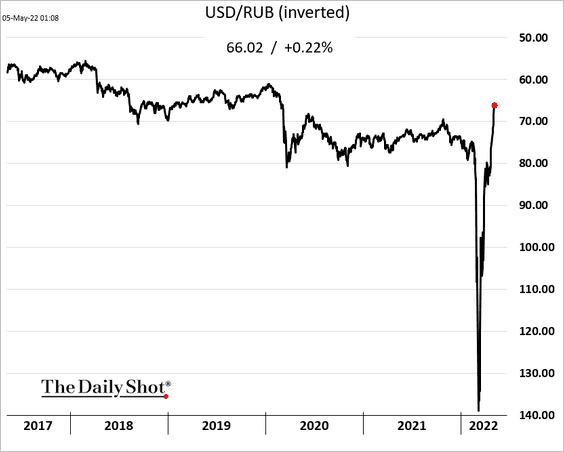

3. The Russian ruble hit the highest level since the initial COVID shock in 2020.

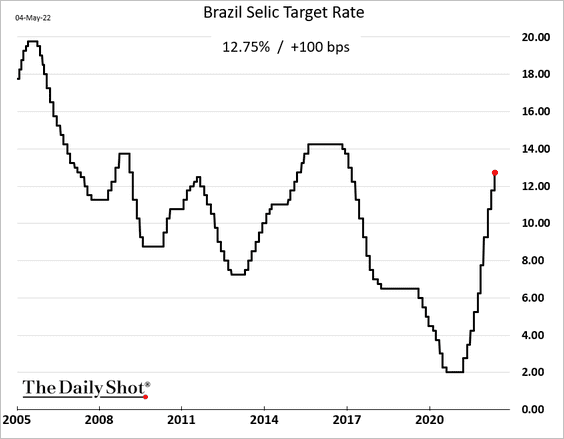

4. Brazil’s central bank hiked the target rate by 100 bps again, signaling that further rate increases may be smaller.

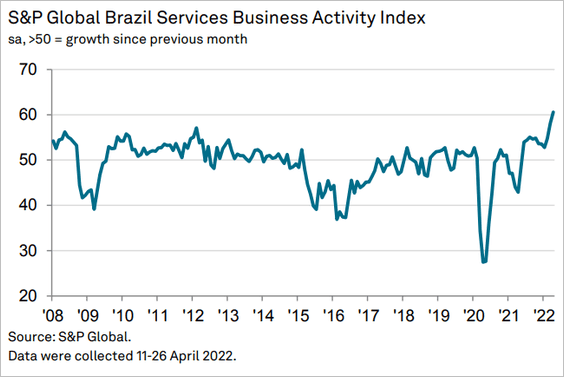

The nation’s service-sector activity is surging.

——————–

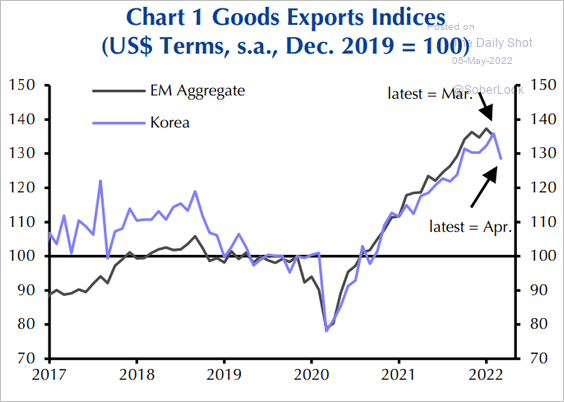

5. Slower South Korean exports are signaling a peak in exports across EM economies (and perhaps globally).

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

1. Bitcoin’s Fear & Greed Index continues to hover around “extreme fear” territory.

Source: @ArcaneResearch

Source: @ArcaneResearch

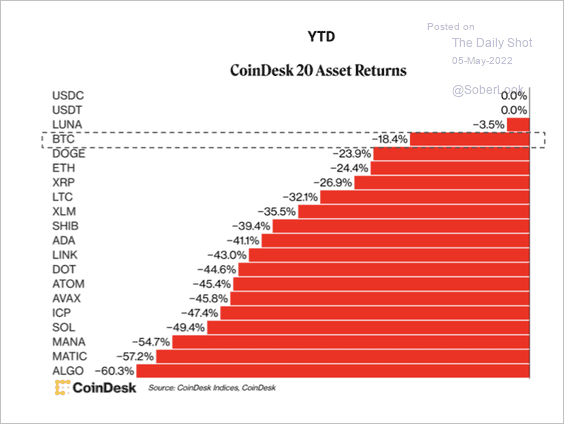

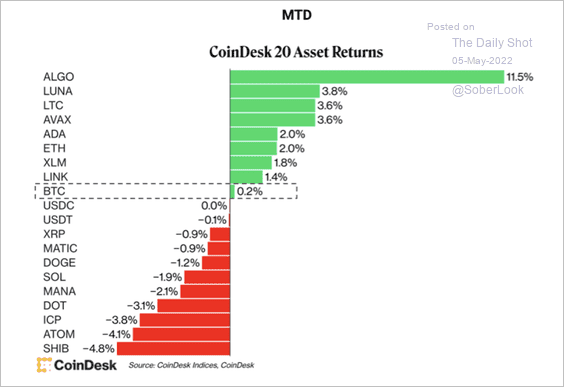

2. Bitcoin is outperforming other large cryptos so far this year but gave up some of its lead over the past few days (2 charts).

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

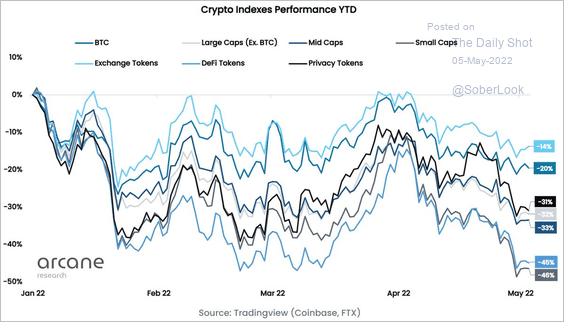

3. Small-cap tokens have underperformed large-cap tokens so far this year, indicating a lower appetite for risk among crypto traders.

Source: @ArcaneResearch

Source: @ArcaneResearch

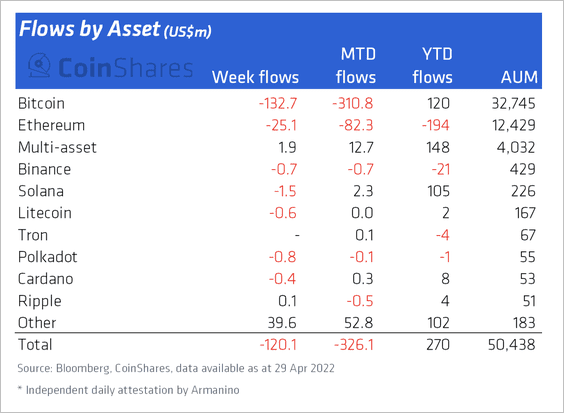

4. Crypto investment products saw outflows last week, led by bitcoin and ethereum-based funds.

Source: CoinShares Read full article

Source: CoinShares Read full article

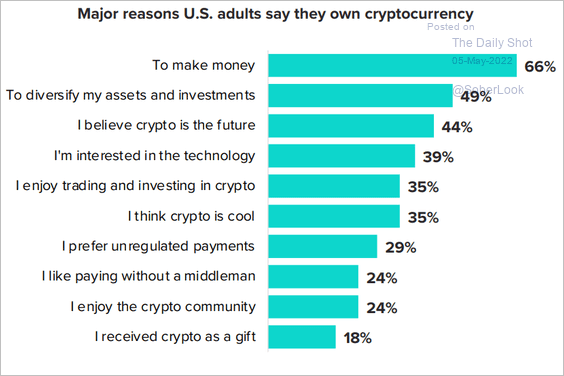

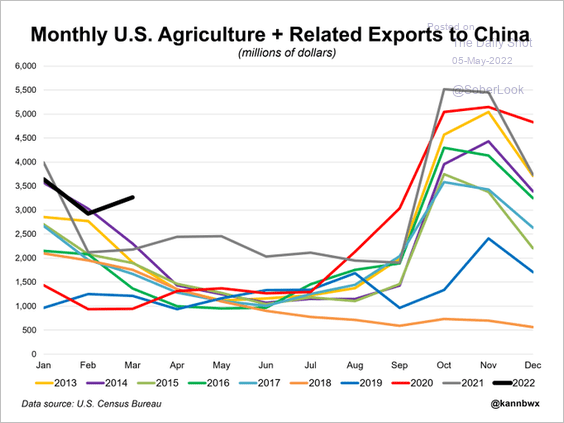

5. Why do some Americans own crypto?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Here are the reasons US adults say they don’t own crypto.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Back to Index

Commodities

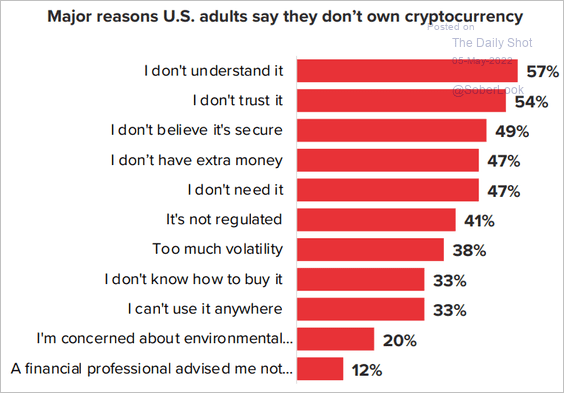

1. Metals and mining, energy, and industrial stocks are still trading near record-low valuations.

Source: PGM Global

Source: PGM Global

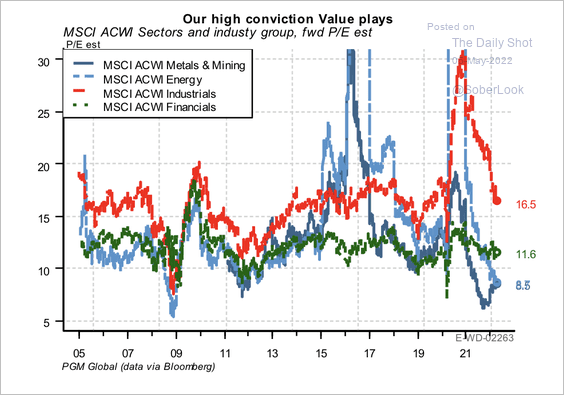

2. US agriculture exports to China are off to a strong start.

Source: @kannbwx

Source: @kannbwx

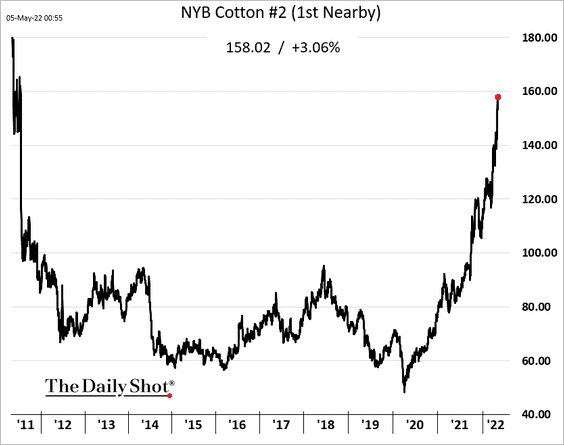

3. New York cotton futures continue to surge due to robust demand from China and US crops negatively impacted by adverse weather conditions.

Back to Index

Energy

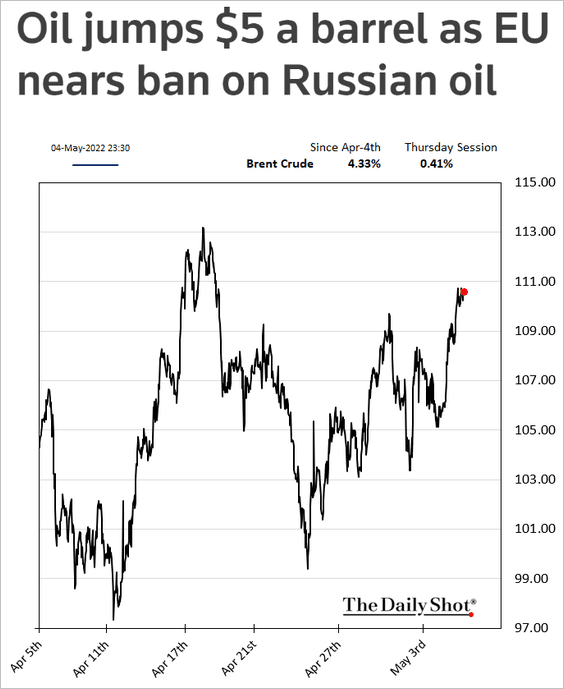

1. Crude prices are firmer as the EU prepares a ban on Russian oil.

Source: Reuters Read full article

Source: Reuters Read full article

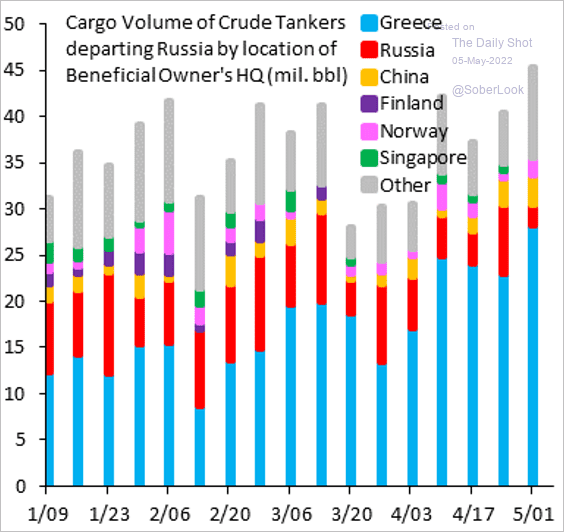

By the way, who owns tankers transporting Russian oil?

Source: @RobinBrooksIIF, @JonathanPingle

Source: @RobinBrooksIIF, @JonathanPingle

——————–

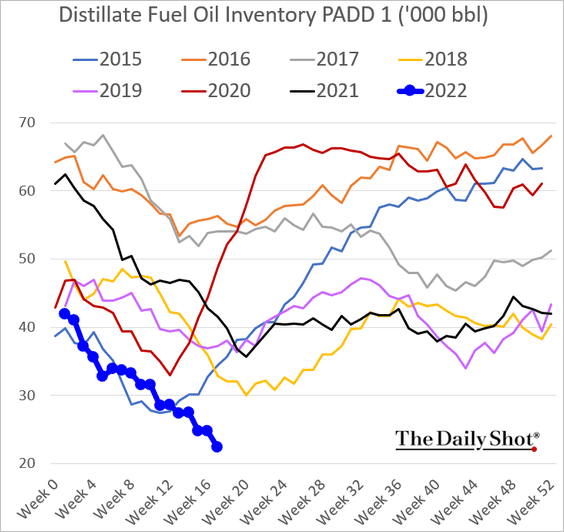

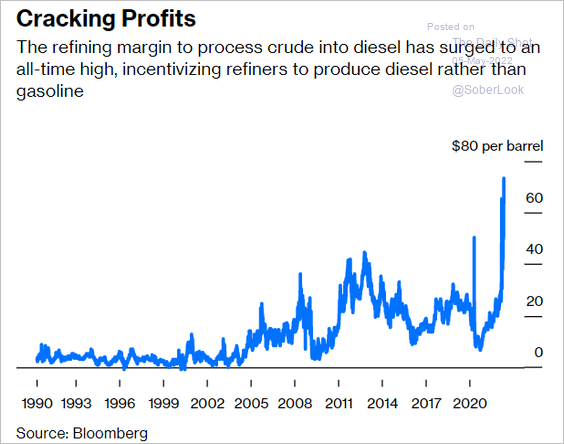

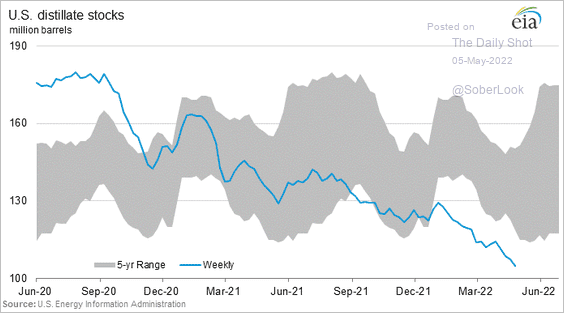

2. The US East Coast is rapidly running out of diesel as inventories tumble.

Diesel crack spreads hit a record high.

Source: @Javier, @bopinion Read full article

Source: @Javier, @bopinion Read full article

——————–

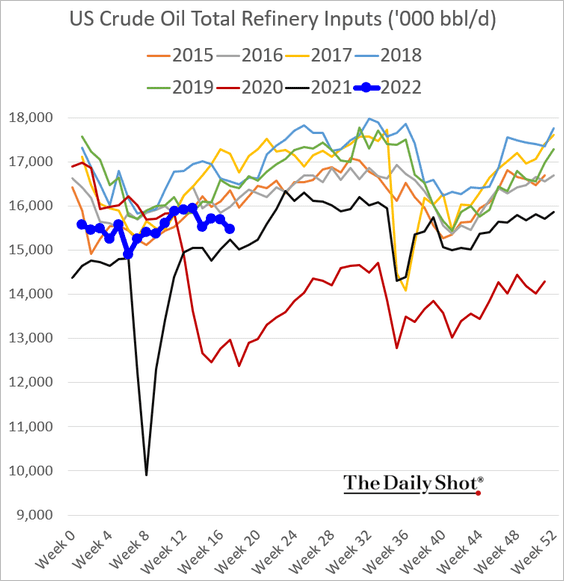

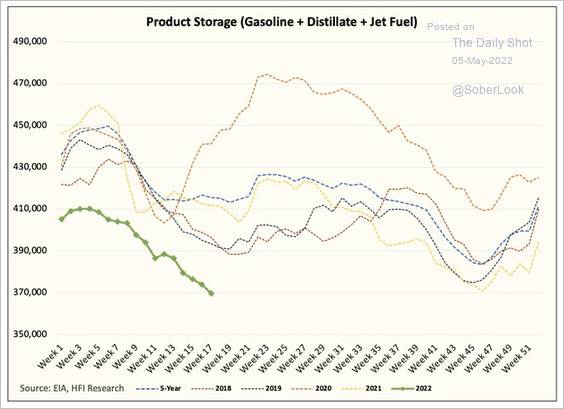

3. US refinery runs have deteriorated, …

… impacting not only distillates …

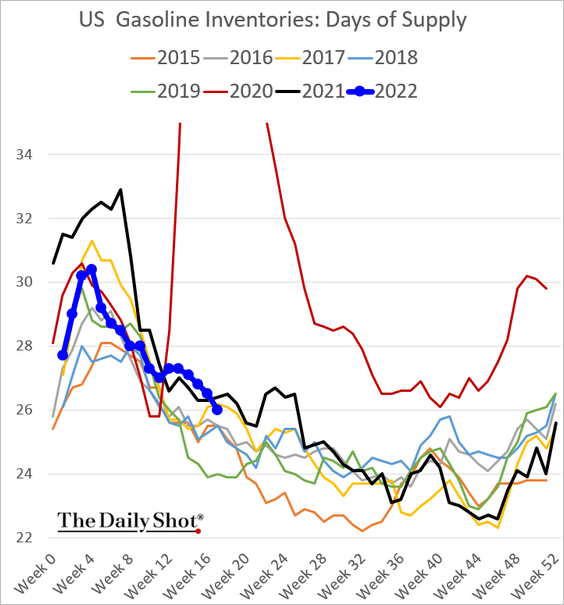

… but gasoline inventories as well.

Total refined product inventories continue to shrink.

Source: @HFI_Research

Source: @HFI_Research

——————–

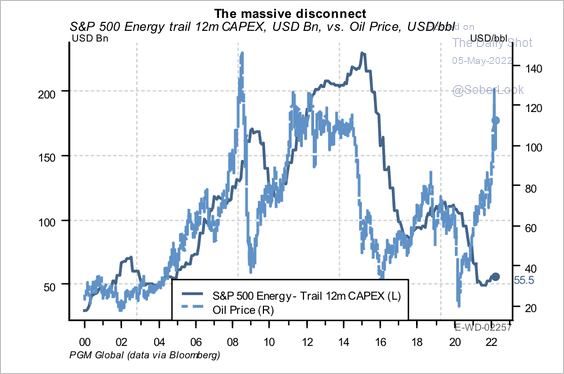

4. As we saw yesterday, CapEx has not kept pace with rising oil prices.

Source: PGM Global

Source: PGM Global

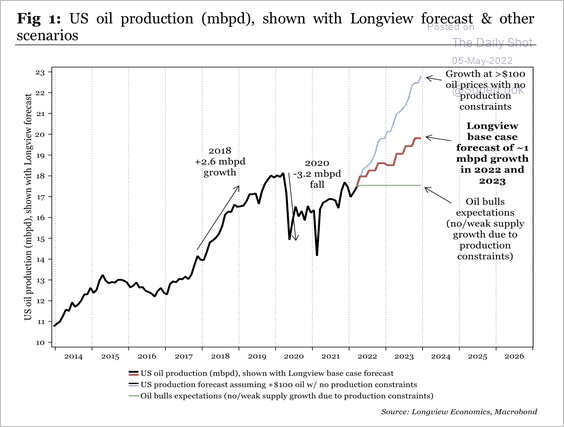

5. Here are some scenarios for US oil production, from Longview.

Source: Longview Economics

Source: Longview Economics

6. German power prices are surging again.

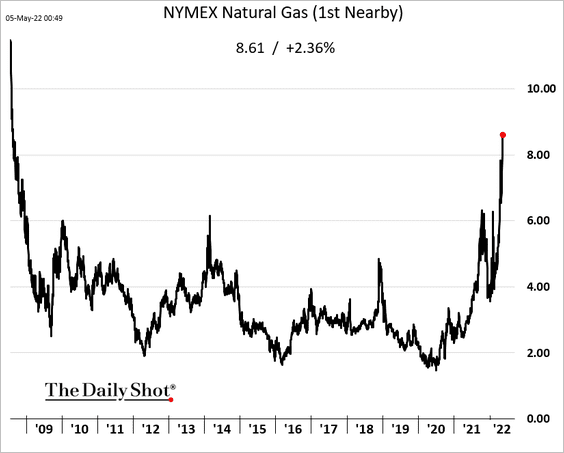

7. US natural gas prices hit the highest level since 2008.

Back to Index

Equities

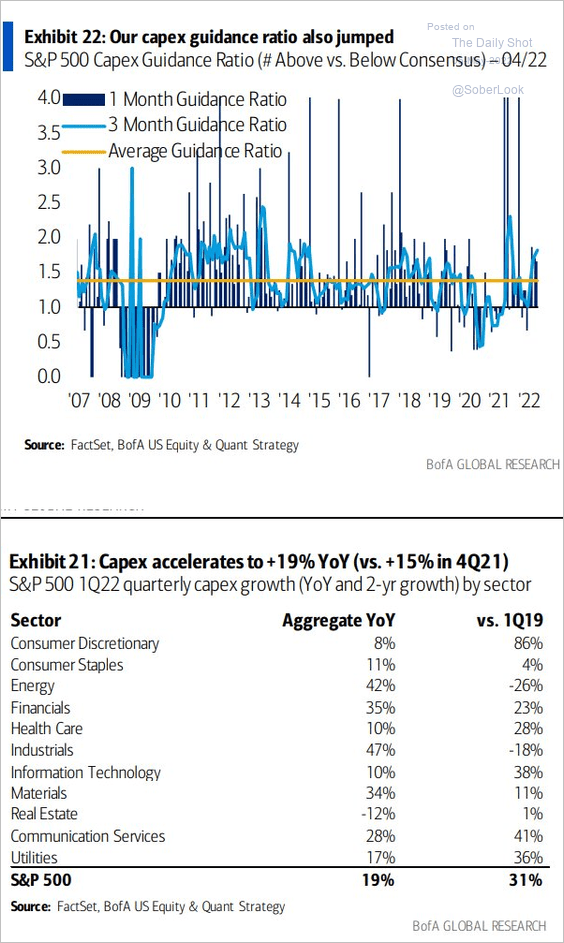

1. Companies are embracing CapEx to gain efficiency as labor costs surge.

Source: BofA Global Research

Source: BofA Global Research

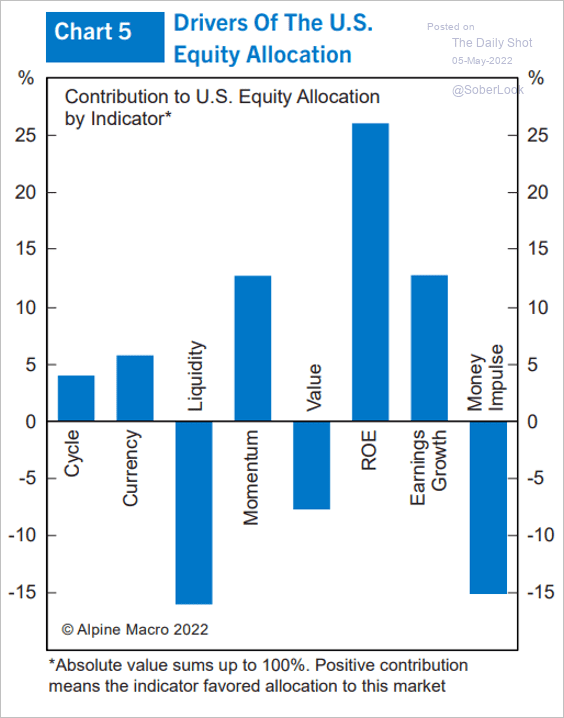

2. This chart shows the drivers of equity allocation based on Alpine Macro’s model.

Source: Alpine Macro

Source: Alpine Macro

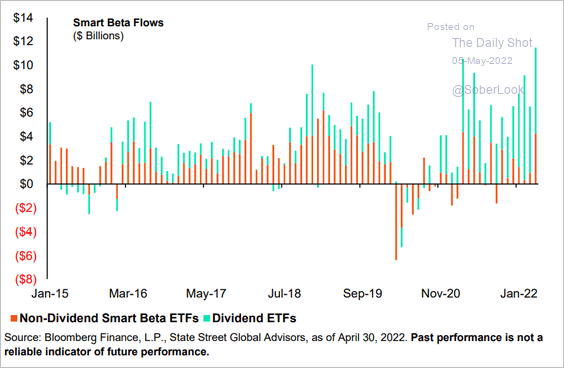

3. Smart beta ETF flows have been strong this year.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

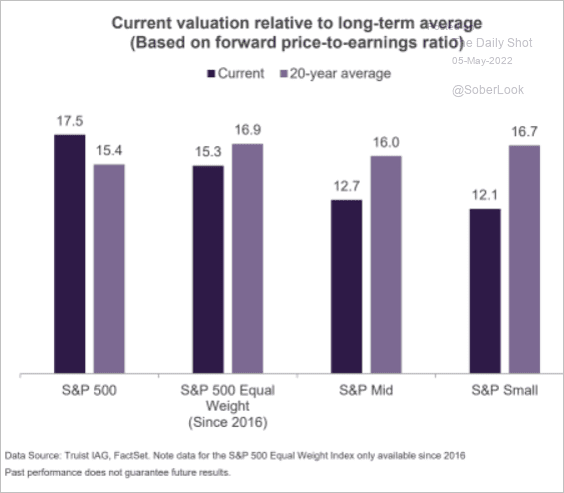

4. Next, we have the forward P/E ratio (valuation measure) by company size, relative to long-term averages.

Source: Truist Advisory Services

Source: Truist Advisory Services

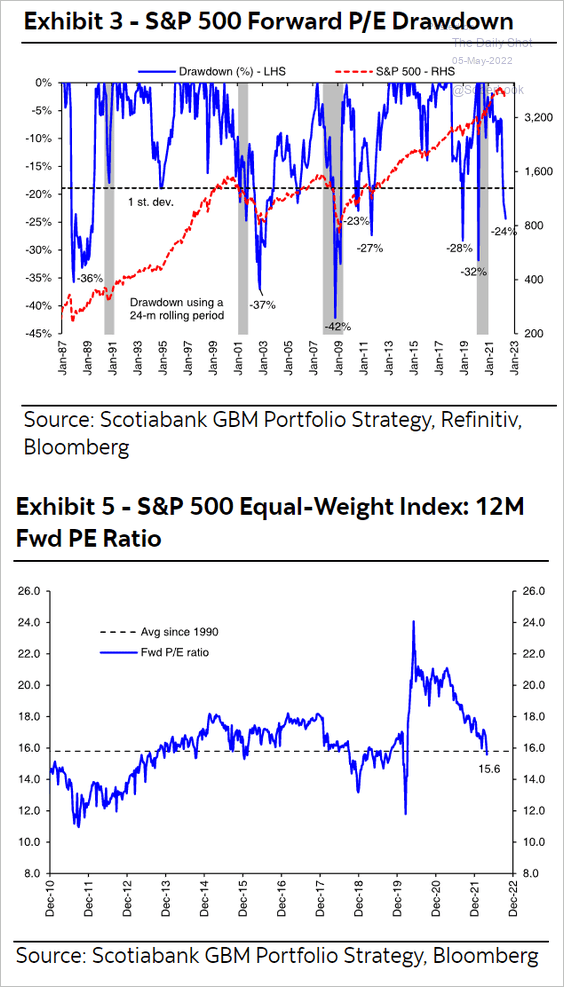

5. The P/E ratio compression has been severe in 2022 (see chart).

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

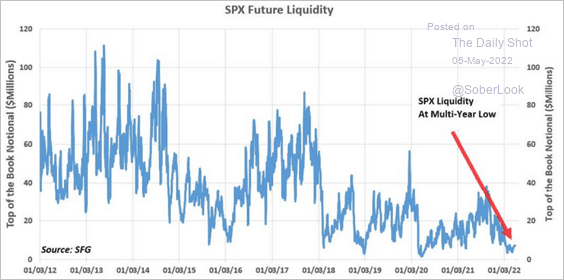

6. S&P 500 futures liquidity has deteriorated.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

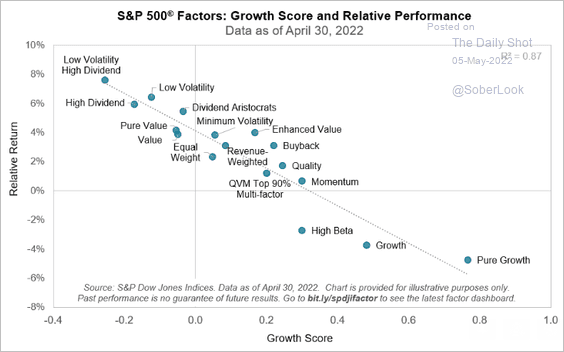

7. Equity factors with high beta to growth were punished last month.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

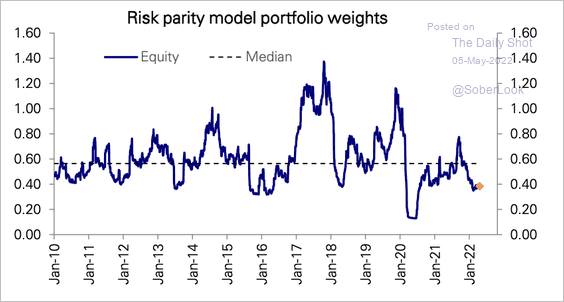

8. Risk-parity portfolios are still significantly underweight stocks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

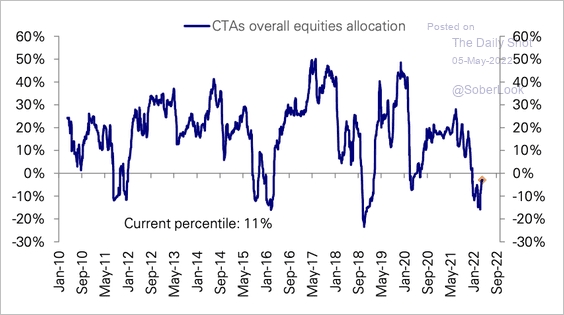

CTAs are starting to increase their exposure to equities.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Credit

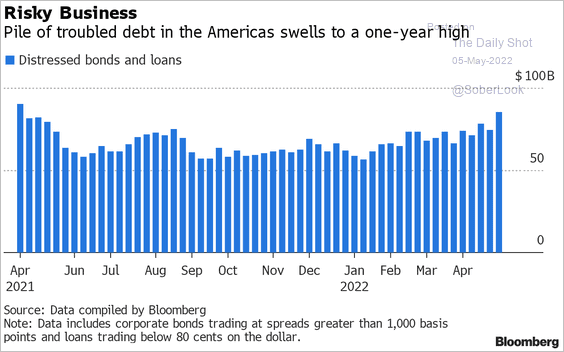

1. The amount of distressed debt has been rising.

Source: @bloomberglaw Read full article

Source: @bloomberglaw Read full article

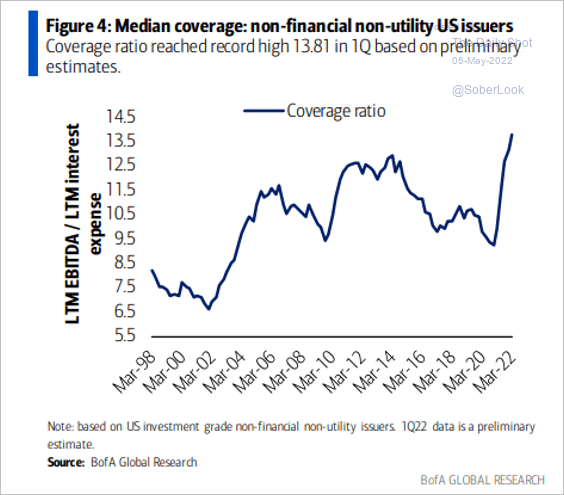

2. Investment-grade borrowers’ coverage ratio hit a record high.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

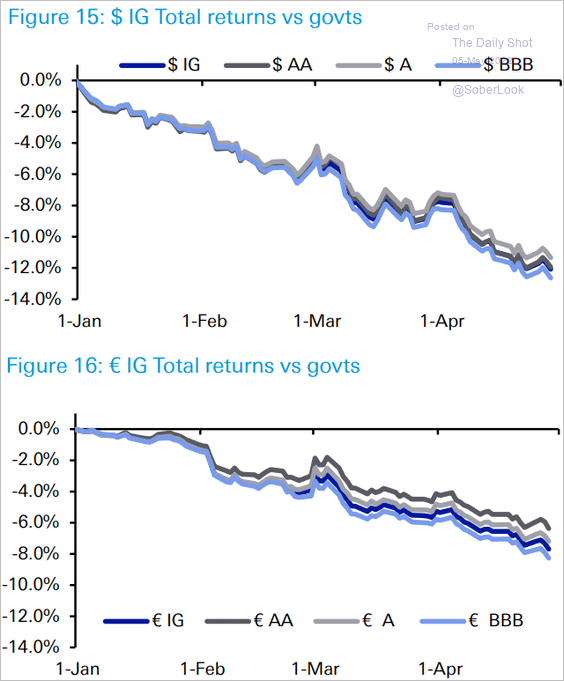

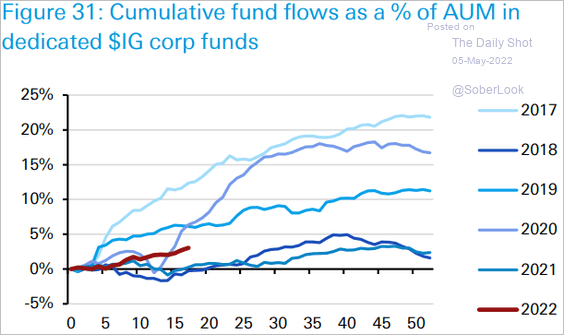

3. Despite poor performance, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

… IG fund flows have been strengthening.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

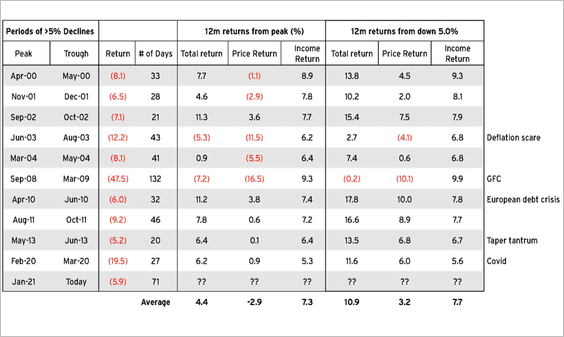

4. When adjusted for credit quality, preferred yields are among the highest across most global fixed income markets.

Source: Citi Private Bank

Source: Citi Private Bank

Historically, preferreds have seen strong total returns following 5%+ drawdowns.

Source: Citi Private Bank

Source: Citi Private Bank

——————–

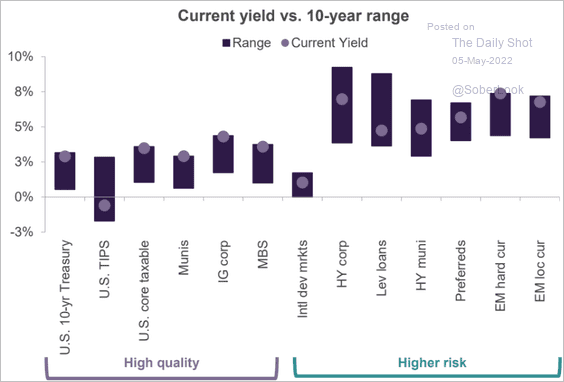

5. Here is a look at yields across credit asset classes relative to historical averages.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

Rates

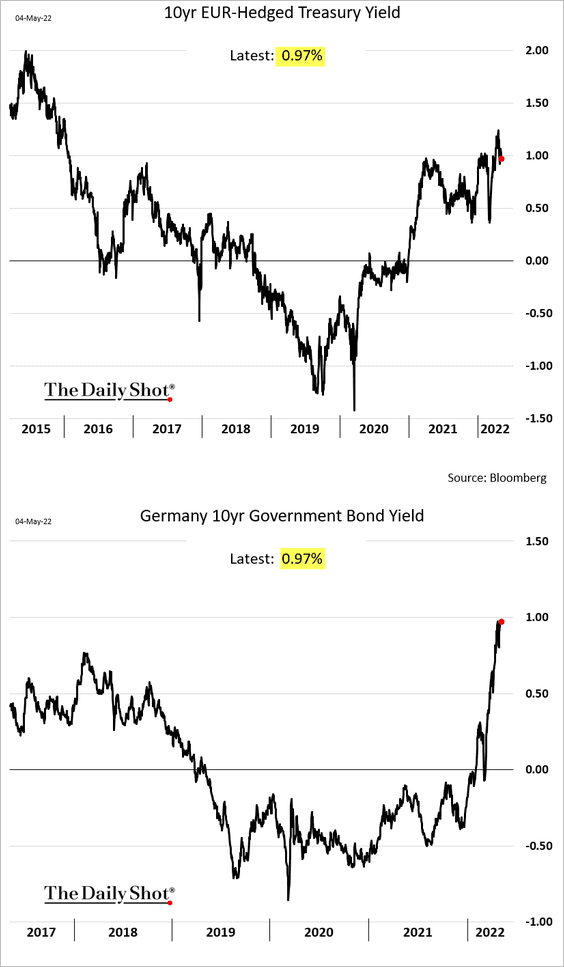

1. Treasuries hedged into euros are no longer attractive relative to Bunds.

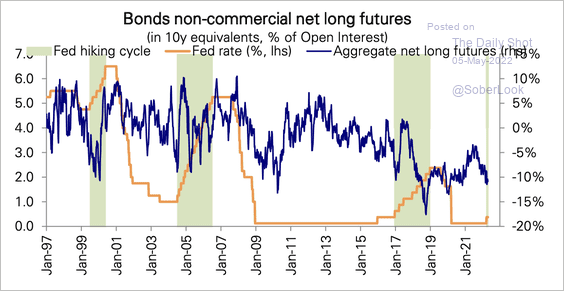

2. Unlike previous hiking cycles, speculators are mostly net short Treasury bond futures (although not as much compared with the 2016-2018 cycle).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

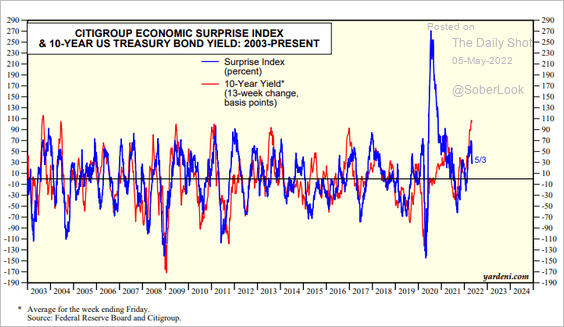

3. Economic indicators suggest that longer-dated Treasury yields should be lower.

• The Citi Economic Surprise Index:

Source: Yardeni Research

Source: Yardeni Research

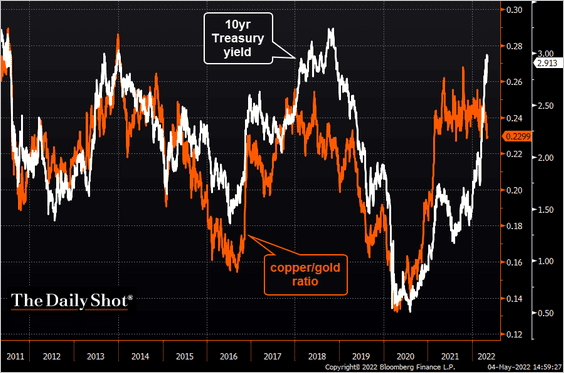

• Copper-to-gold ratio:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Global Developments

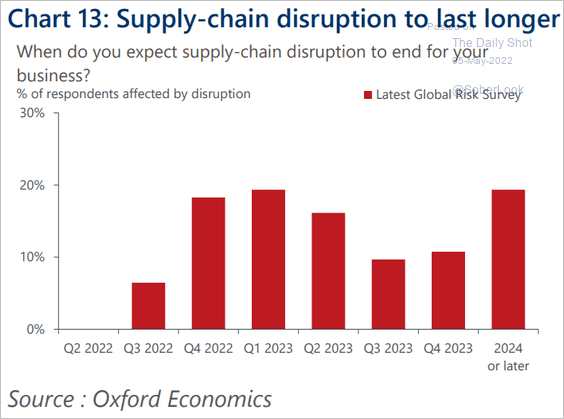

1. How long will supply-chain disruptions last?

Source: Oxford Economics

Source: Oxford Economics

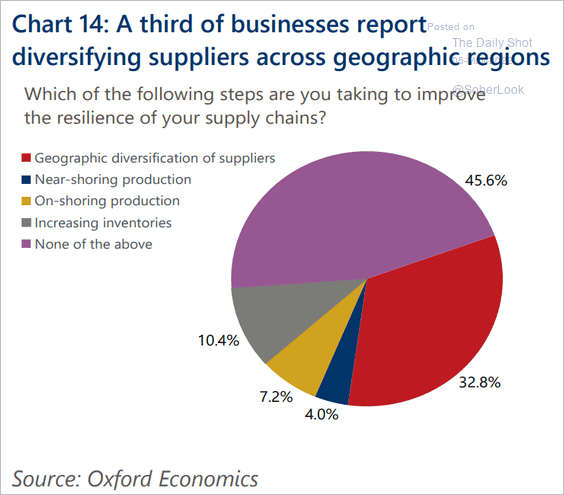

How are businesses addressing supplier risks?

Source: Oxford Economics

Source: Oxford Economics

——————–

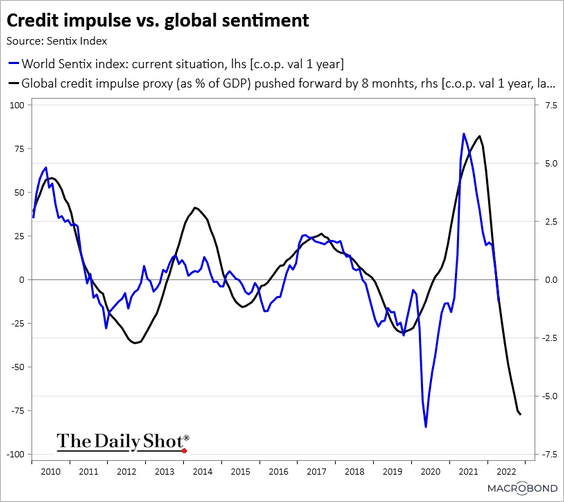

2. The global credit impulse points to further weakness in sentiment.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

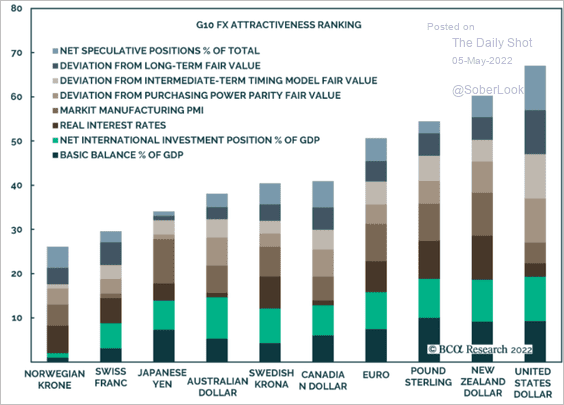

3. This chart shows the G10 currency attractiveness ratings (from BCA Research).

Source: BCA Research

Source: BCA Research

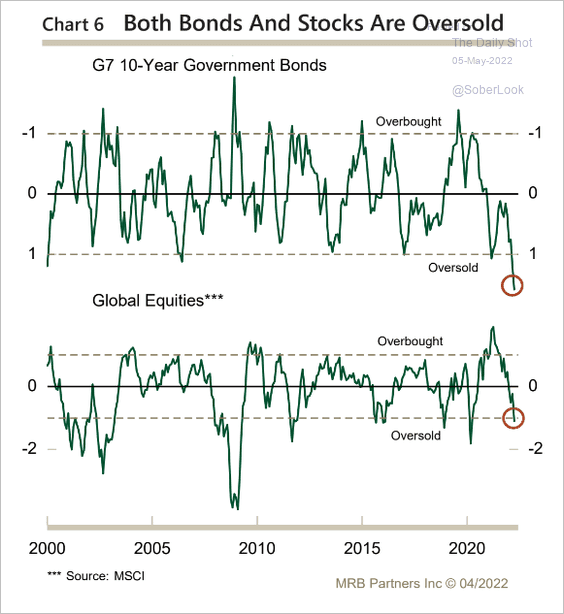

4. Stocks and bonds look oversold.

Source: MRB Partners

Source: MRB Partners

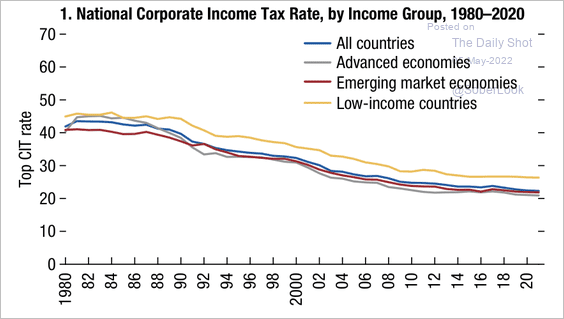

5. Here is the trend in corporate income tax rates.

Source: IMF

Source: IMF

——————–

Food for Thought

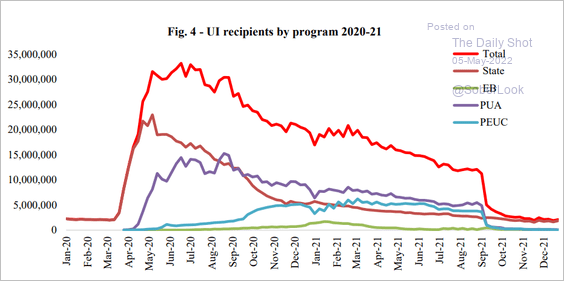

1. US pandemic-era unemployment programs:

Source: BANK OF ITALY Read full article

Source: BANK OF ITALY Read full article

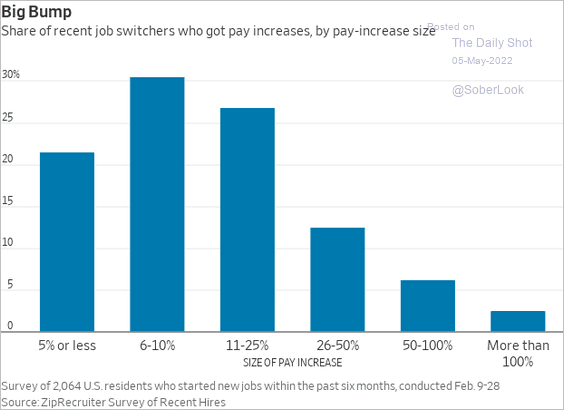

2. Changing jobs for a pay bump:

Source: @WSJ Read full article

Source: @WSJ Read full article

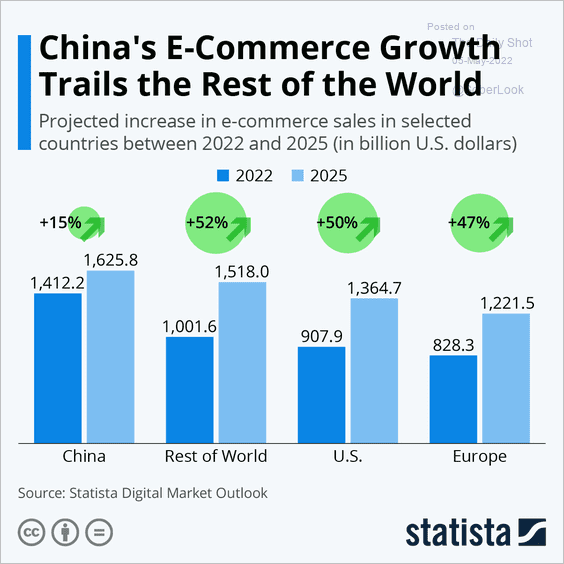

3. Projected growth in e-commerce:

Source: Statista

Source: Statista

4. Domestic violence in the US:

Source: @statspanda1 Read full article

Source: @statspanda1 Read full article

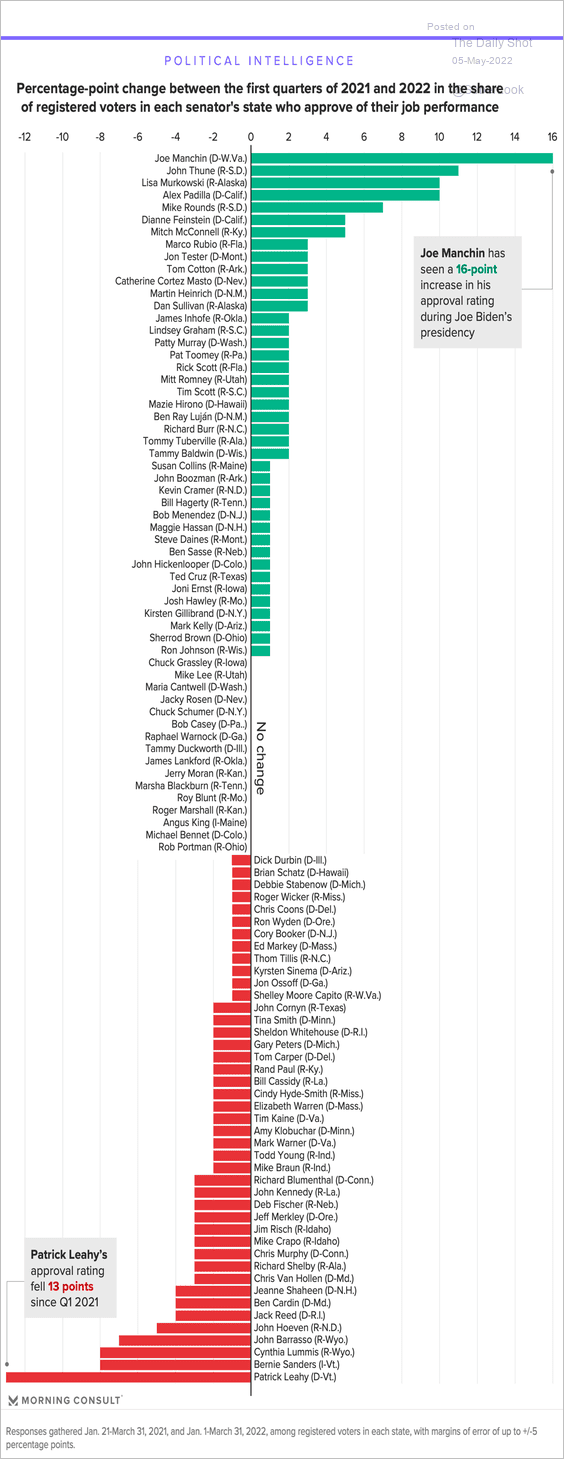

5. Changes in US senators’ approval ratings since Q1:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Most popular and unpopular US senators:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

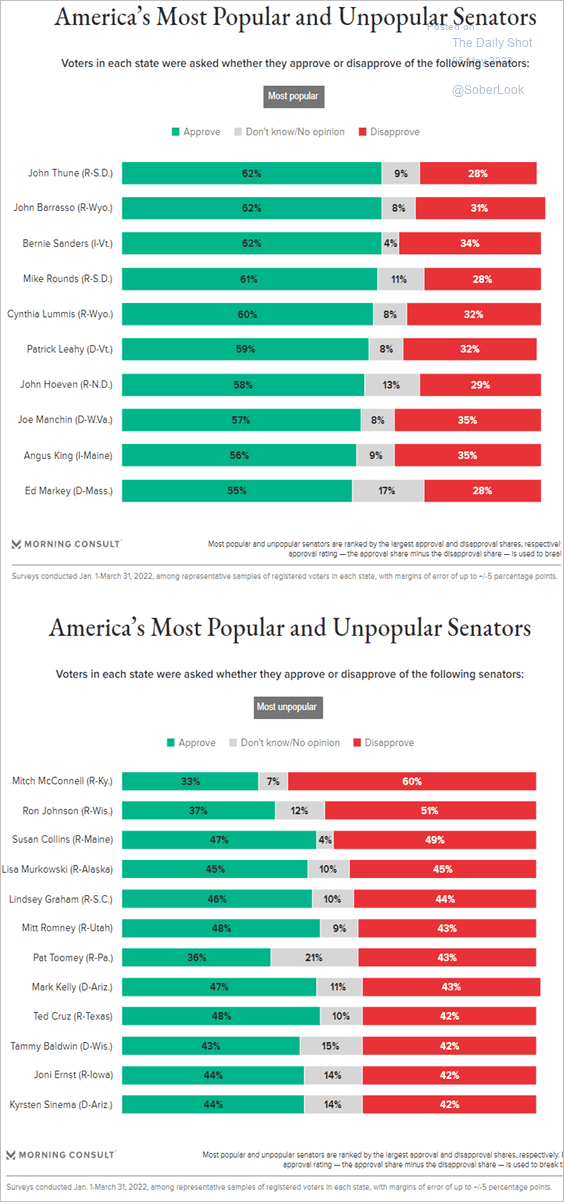

6. Preventable COVID deaths:

Source: Health System Tracker Read full article

Source: Health System Tracker Read full article

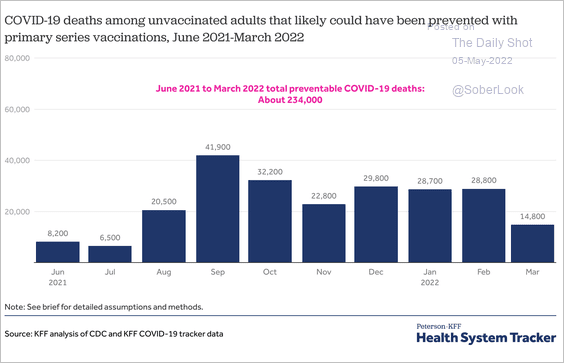

7. Military aid for Ukraine:

Source: Statista

Source: Statista

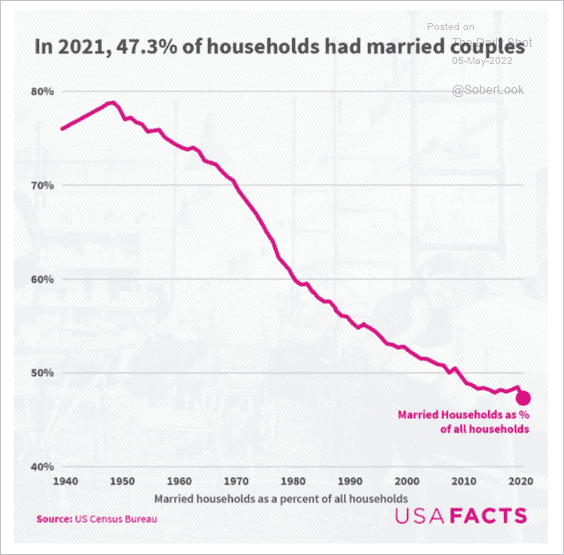

8. Married couples as a share of total US households:

Source: USA Facts

Source: USA Facts

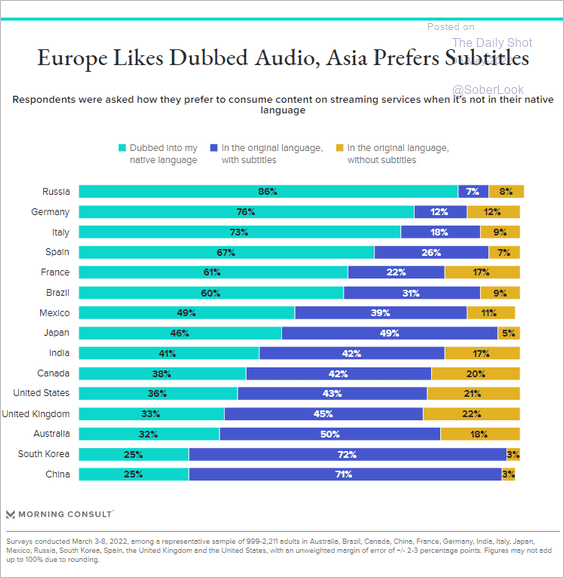

9. Dubbed audio vs. subtitles:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

Back to Index