The Daily Shot: 09-May-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

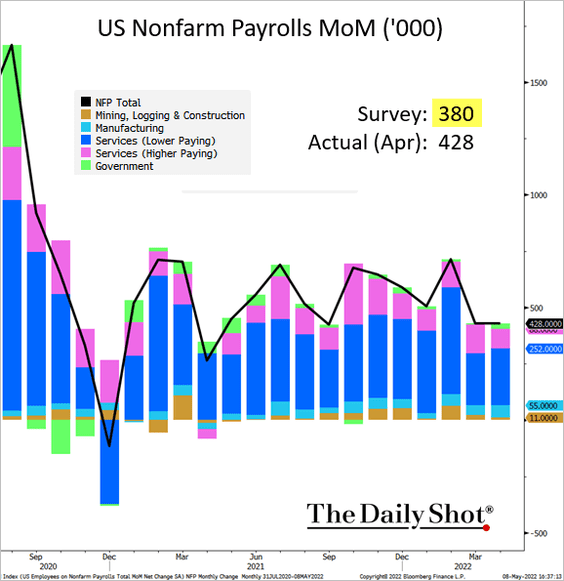

1. The April employment report topped forecasts, but there are hints of stress under the surface.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

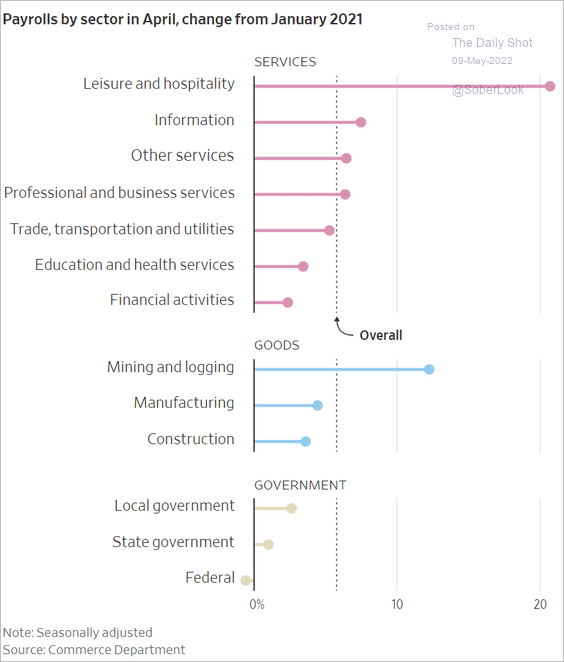

• Here is the breakdown by sector.

Source: @WSJ Read full article

Source: @WSJ Read full article

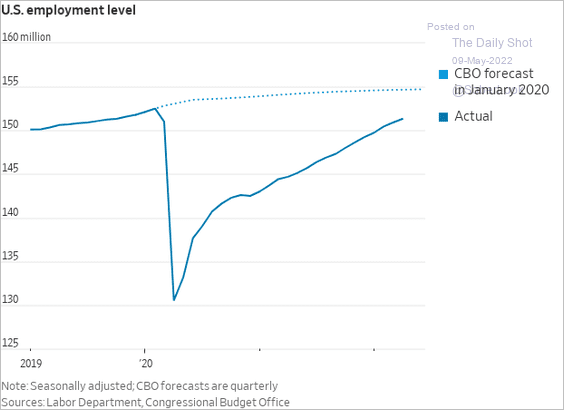

• The labor market has not fully recovered its COVID-era losses.

Source: @WSJ Read full article

Source: @WSJ Read full article

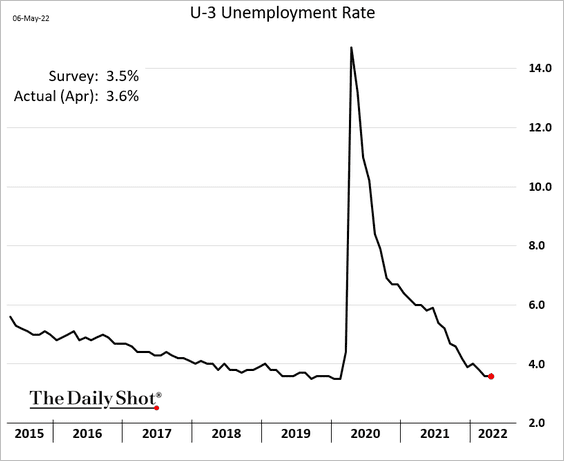

• The unemployment rate held steady last month (the market expected a decline).

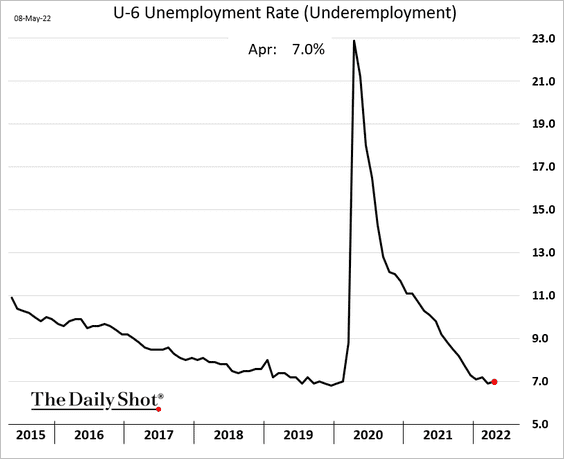

• Underemployment edged higher.

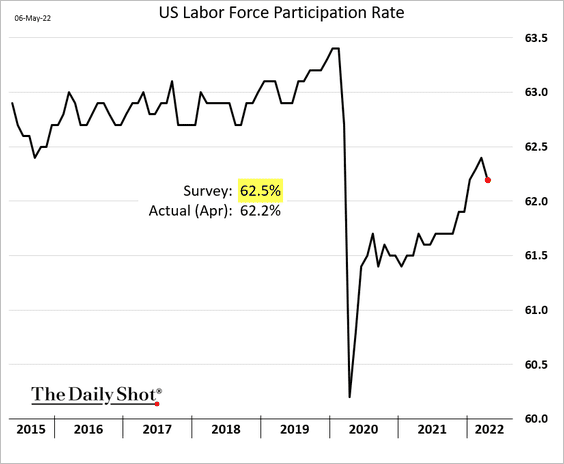

• The participation rate unexpectedly declined.

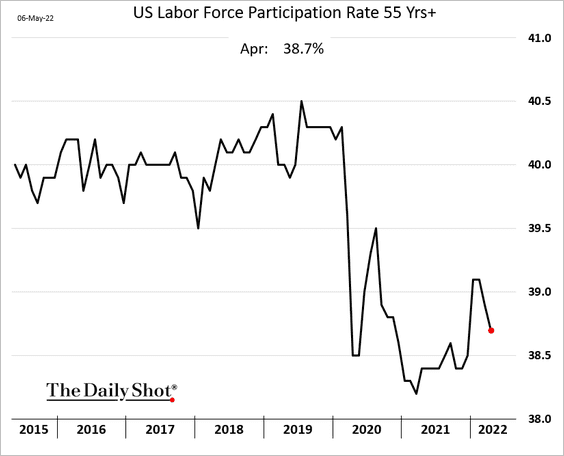

A large number of older workers exited the labor force.

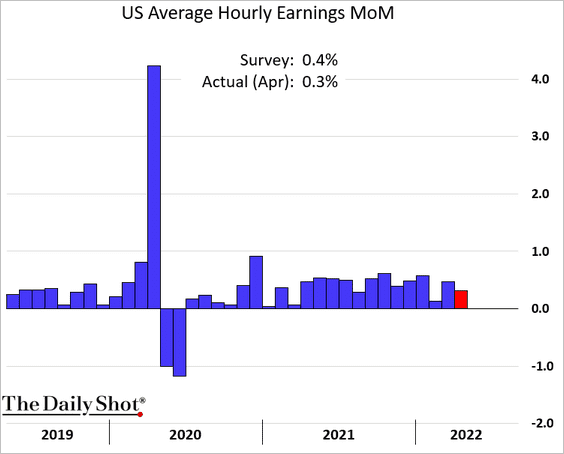

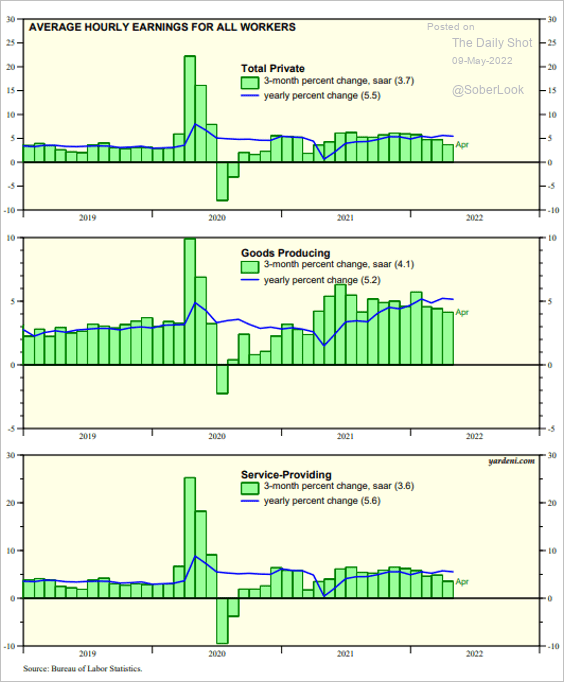

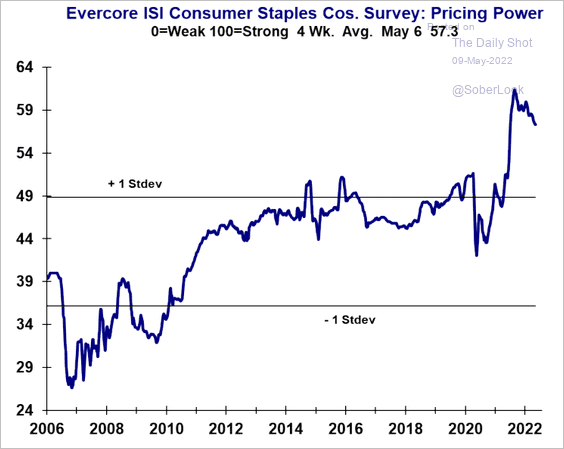

• The biggest surprise was slower wage gains. Are companies hitting the limits of their pricing power?

Source: Yardeni Research

Source: Yardeni Research

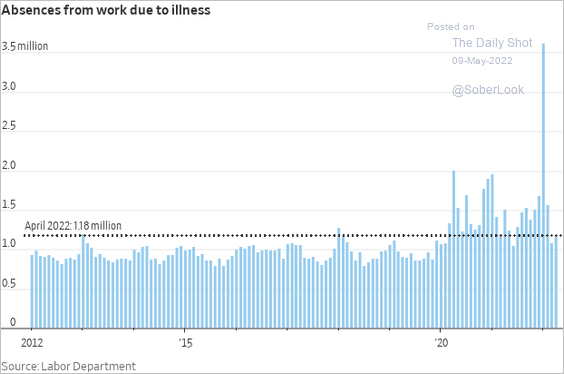

• The number of workers who were out sick remains elevated.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

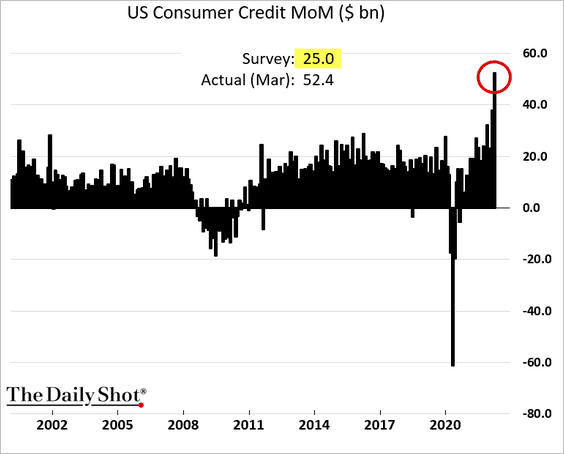

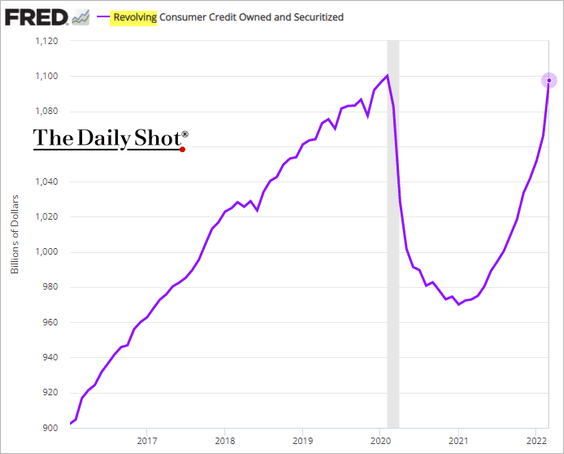

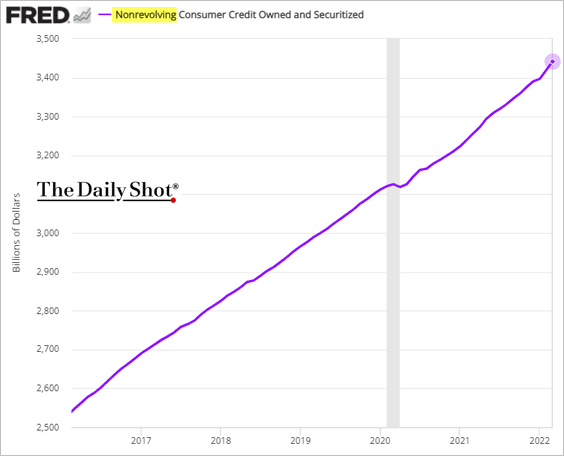

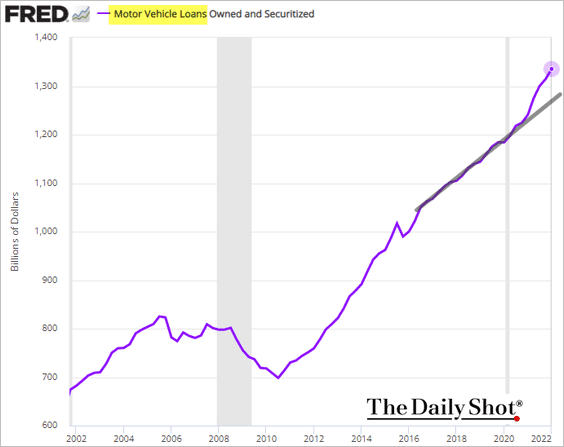

2. Consumer credit surged in March, …

… as Americans accelerated credit card usage (chart below). Declining real disposable income (see chart) is taking a toll.

• Non-revolving credit has also been rising faster, …

… driven by automobile financing.

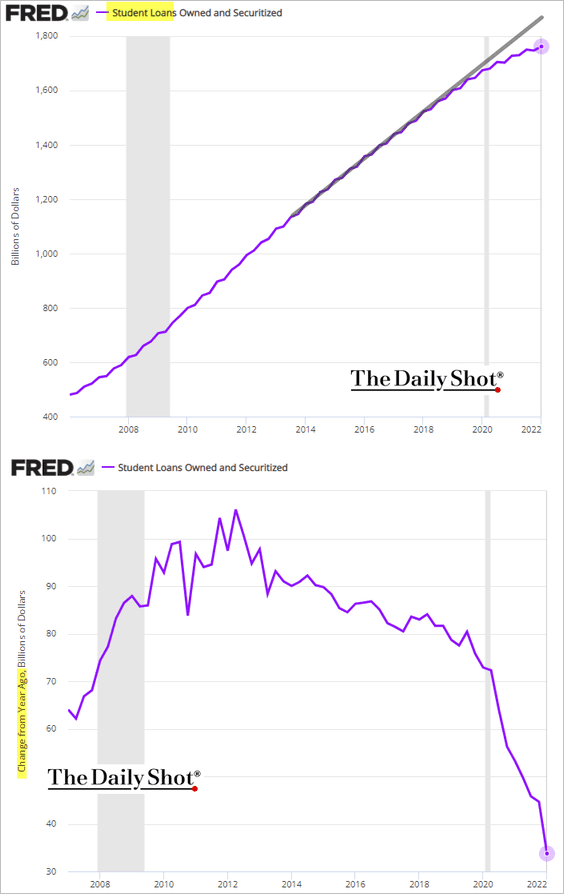

• Growth in student debt continues to slow.

——————–

3. Is corporate pricing power peaking as consumers push back?

Source: Evercore ISI Research

Source: Evercore ISI Research

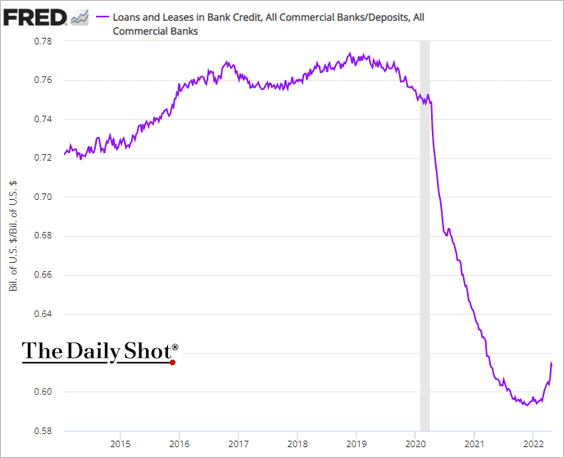

4. The banking system’s loan-to-deposit ratio has been rebounding as the Fed halted liquidity injections.

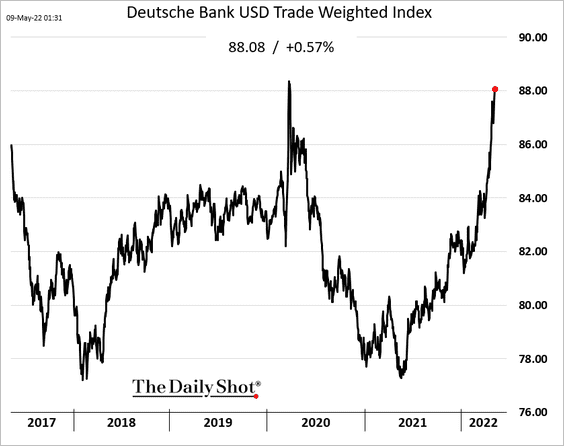

5. The US dollar continues to surge, tightening financial conditions.

Back to Index

Canada

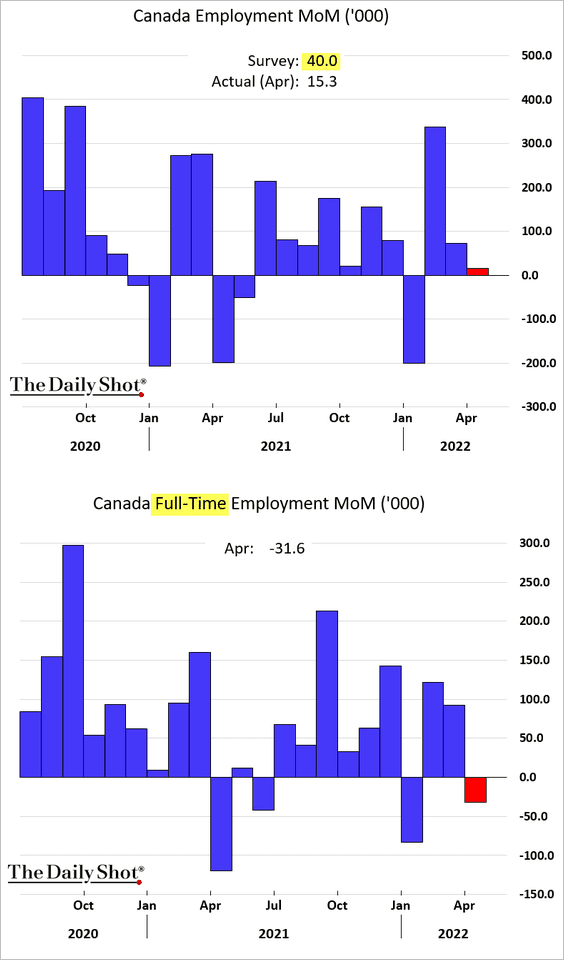

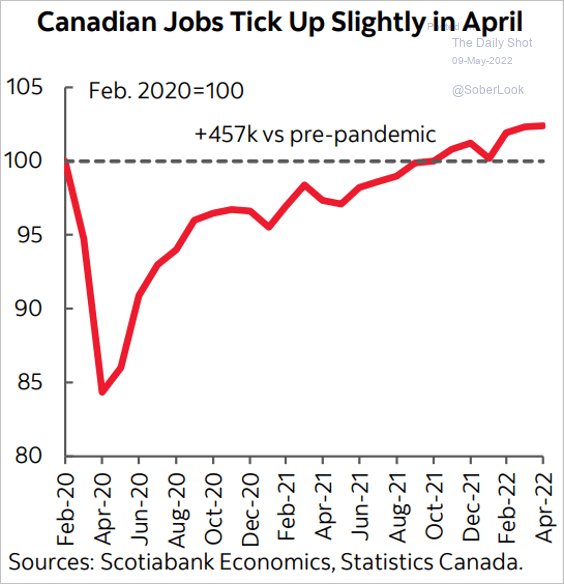

The April employment report was disappointing, showing a loss in full-time jobs.

• Unlike in the US, the total number of jobs is well above pre-COVID levels.

Source: Scotiabank Economics

Source: Scotiabank Economics

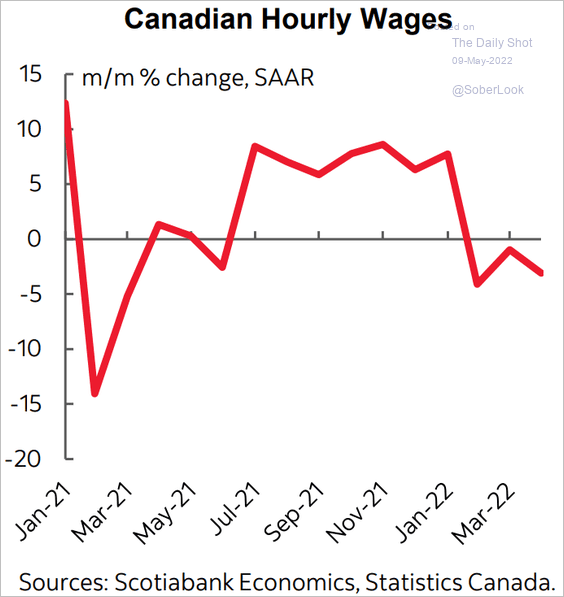

• Wage growth has stalled.

Source: Scotiabank Economics

Source: Scotiabank Economics

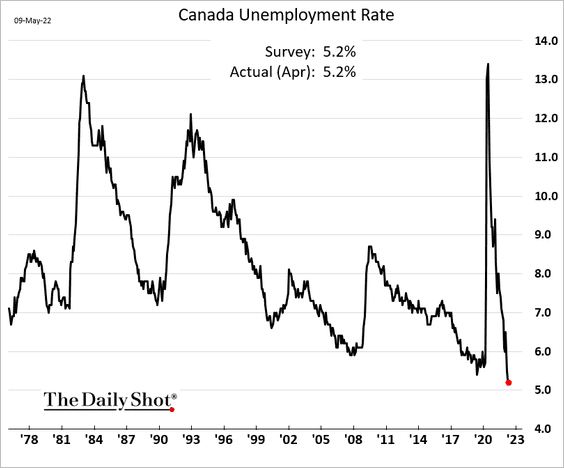

• The unemployment rate is at a new low.

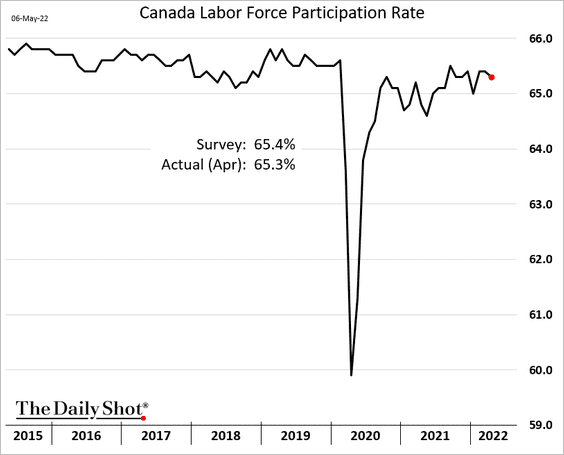

• The participation rate edged down.

Back to Index

The United Kingdom

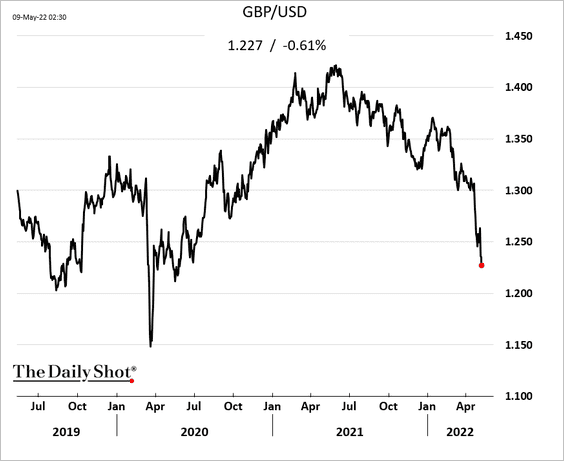

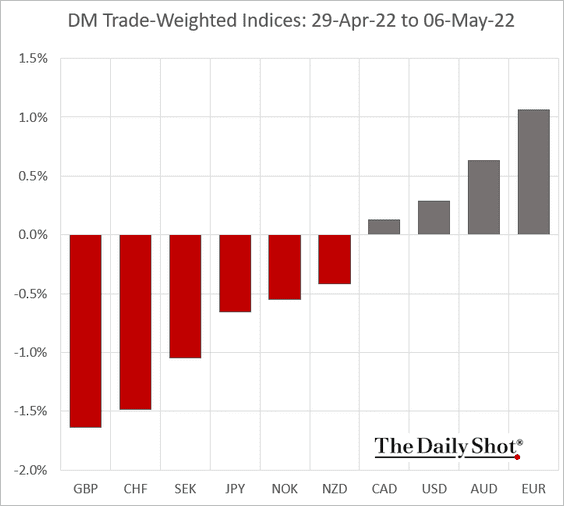

The pound is under pressure, …

… and it’s not just against the dollar. Here are the trade-weighted currency indices.

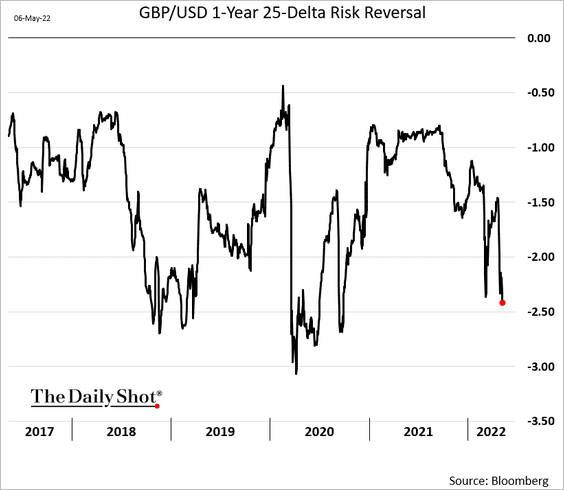

Moreover, traders are gloomy about GBP/USD going forward.

• Risk reversal:

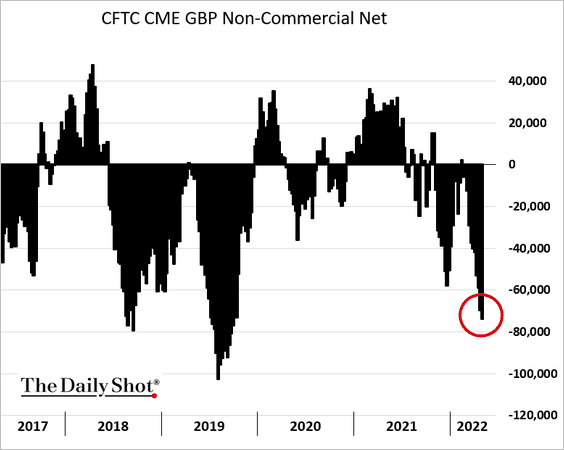

• Speculative positions in GBP futures:

Back to Index

The Eurozone

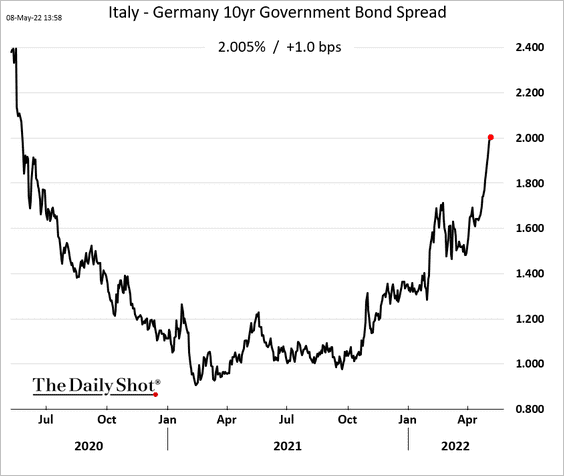

1. The Italy-Germany bond spread continues to widen.

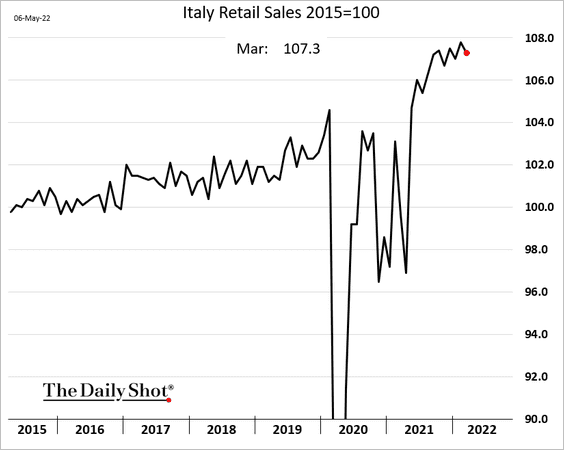

2. Italian retail sales ticked lower in March but remained strong.

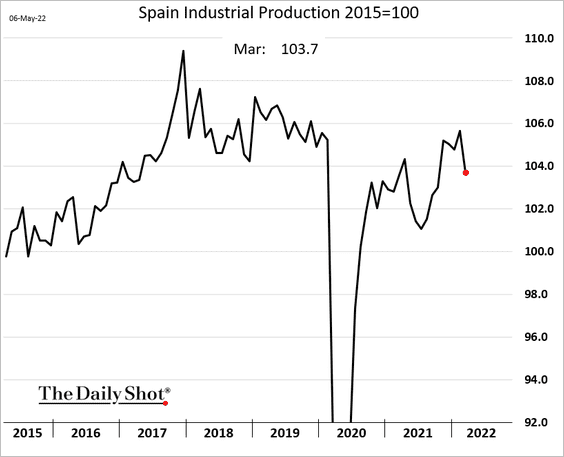

3. Spanish industrial production declined in March.

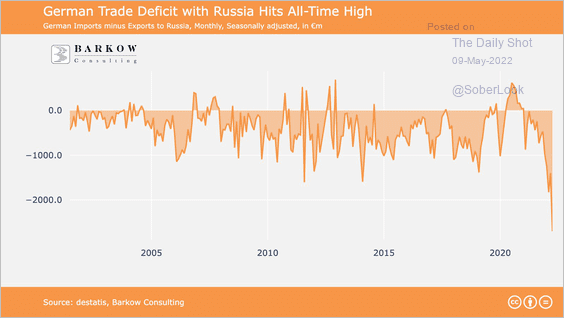

4. Germany’s trade deficit with Russia hit a new record.

Source: @Schuldensuehner Read full article

Source: @Schuldensuehner Read full article

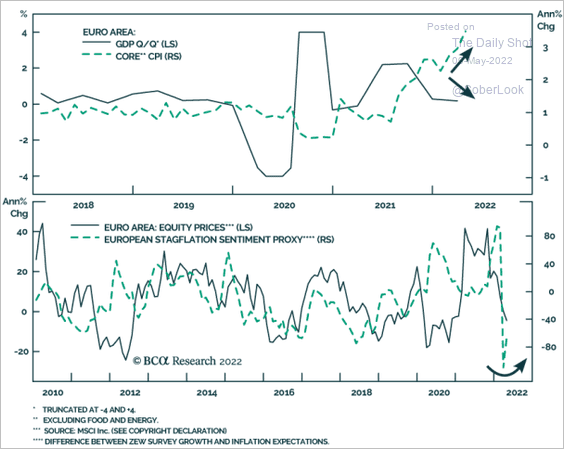

5. The ECB is facing stagflationary pressures as it shifts into a monetary tightening cycle.

Source: BCA Research

Source: BCA Research

Back to Index

Europe

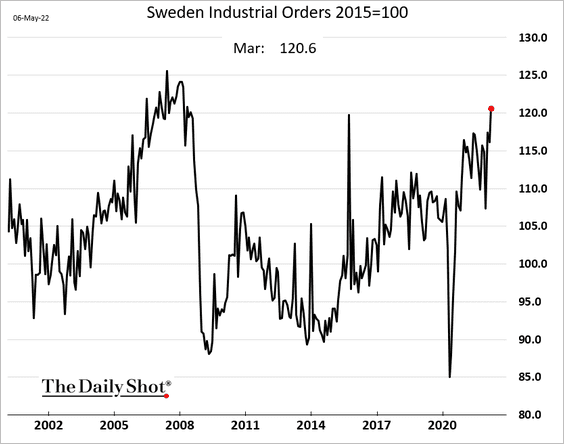

1. Sweden’s industrial orders were very strong in March.

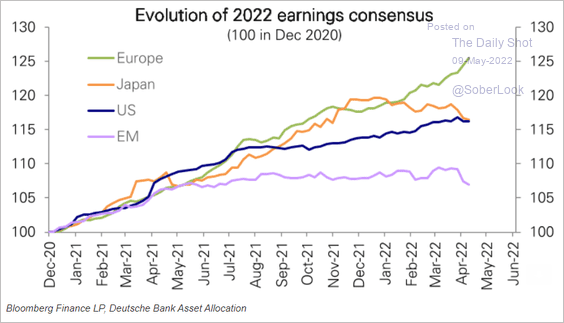

2. The 2022 earnings estimates for European companies are outpacing other markets.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

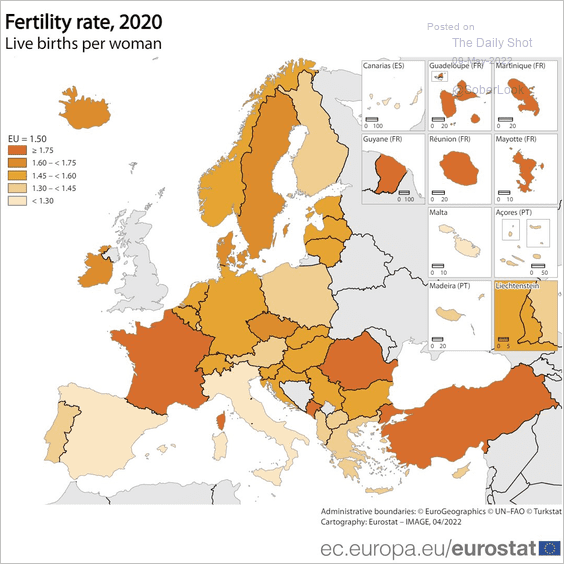

3. This map shows fertility rates across Europe.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

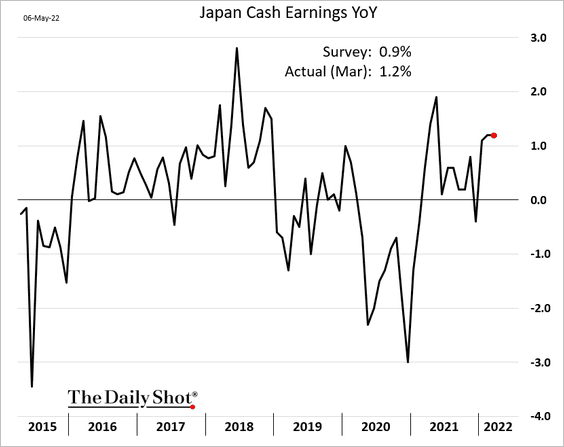

1. Wage growth in Japan topped estimates.

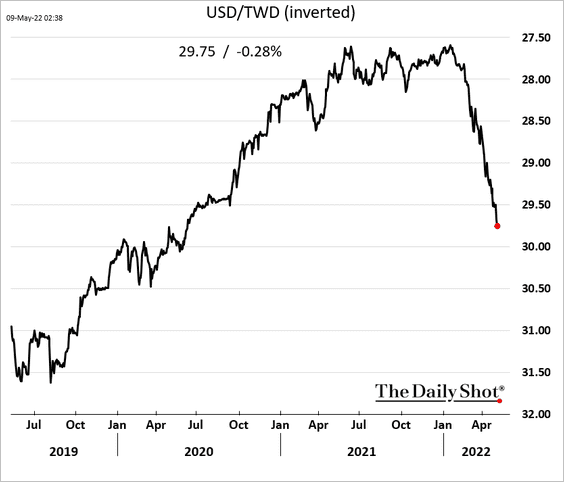

2. The Taiwan dollar continues to sink vs. USD.

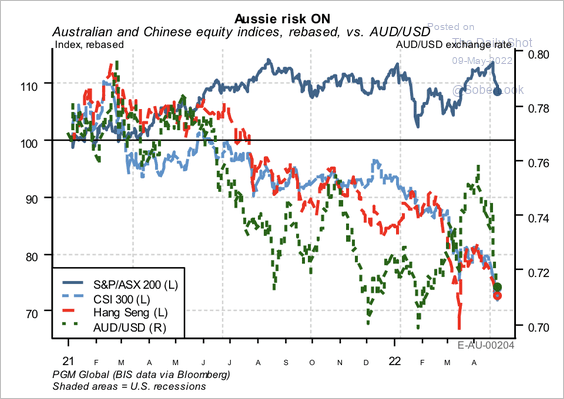

3. The Aussie dollar has been weighed down by regional risk-off conditions, although equities have held up relatively well.

Source: PGM Global

Source: PGM Global

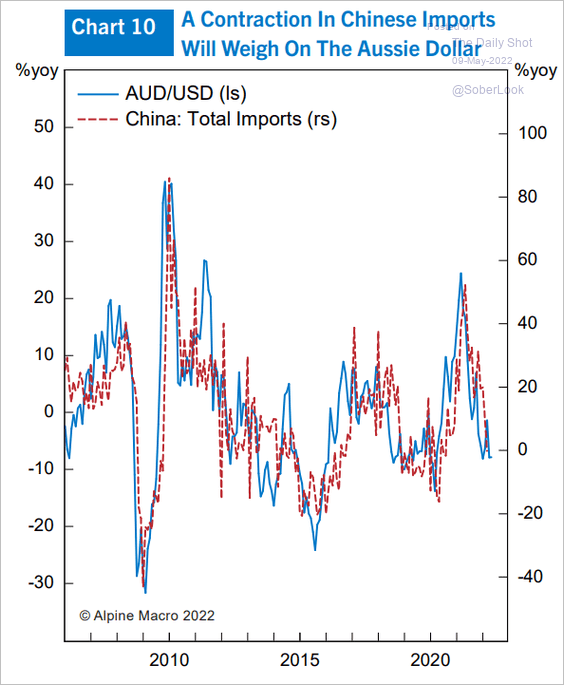

The Aussie dollar is highly correlated to China’s imports. The Shanghai lockdowns are a headwind for the currency.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

China

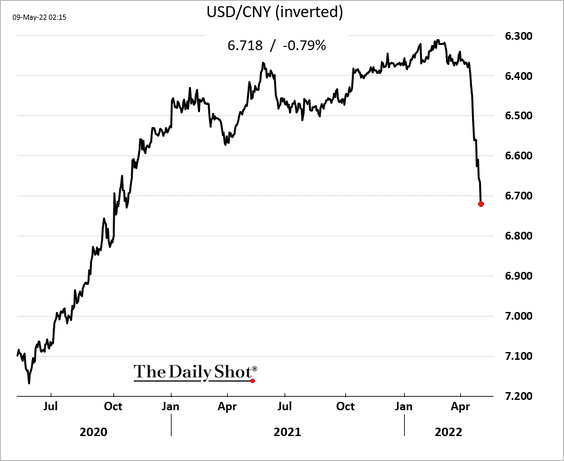

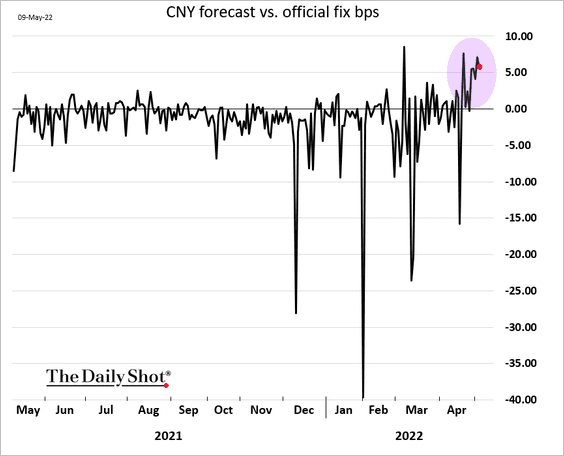

1. The renminbi continues to plunge.

Beijing is now trying to stabilize/support the currency, …

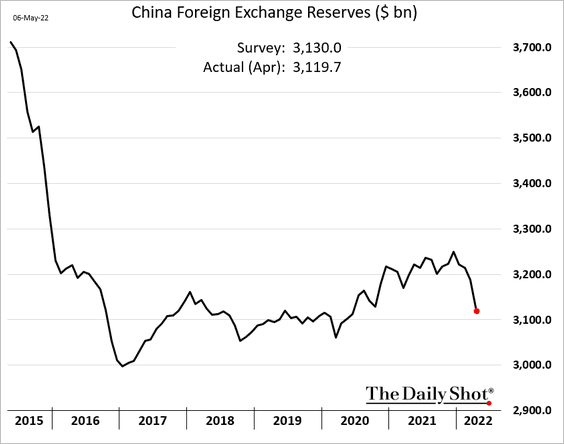

… to make sure there is no 2015-style hit to F/X reserves (which have been declining).

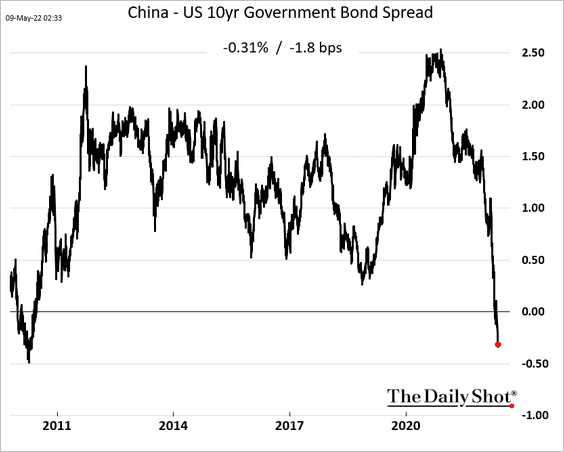

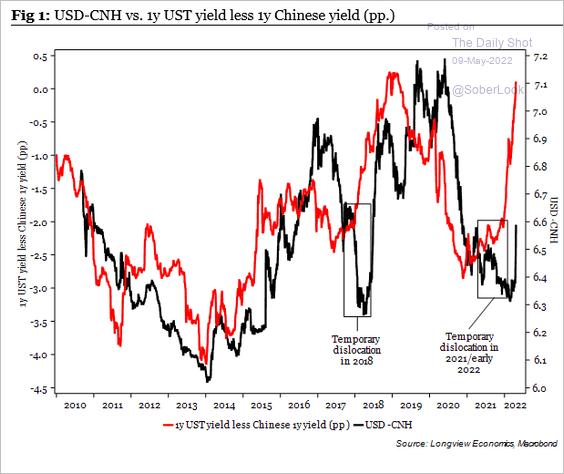

Interest rate differentials with the US don’t bode well for China’s currency going forward (2 charts).

Source: Longview Economics

Source: Longview Economics

——————–

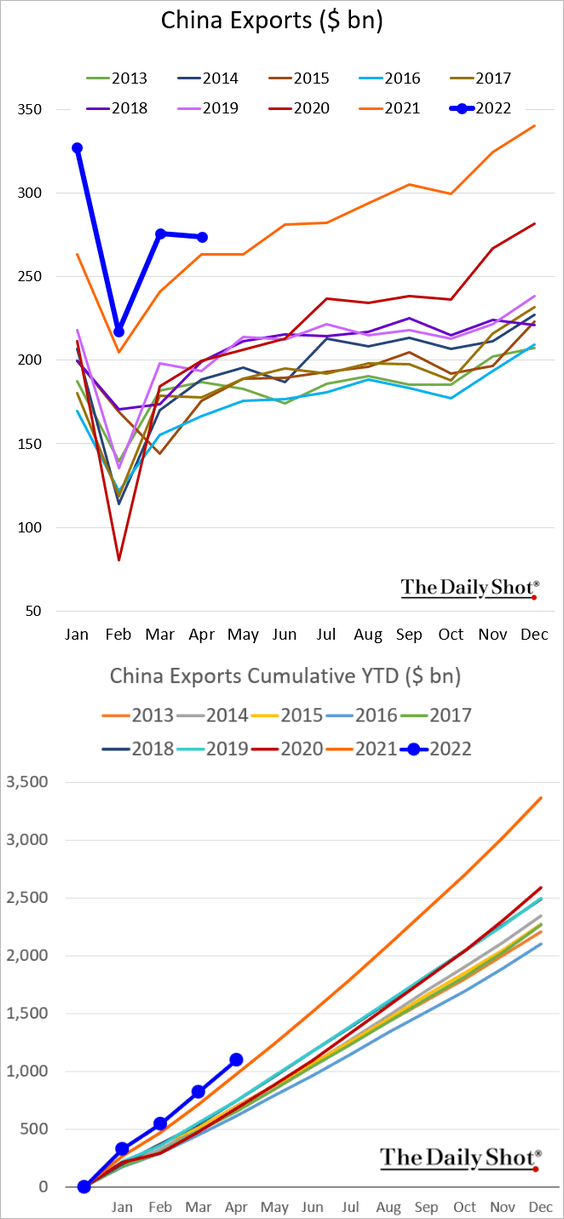

2. The foreign trade report was firmer than expected.

• Exports:

• The trade balance:

——————–

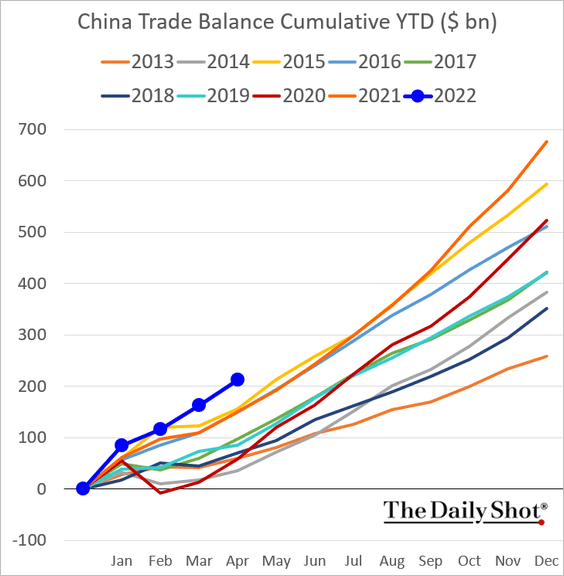

3. Beijing is becoming concerned about China’s labor market weakness.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

h/t Pantheon Macroeconomics

h/t Pantheon Macroeconomics

——————–

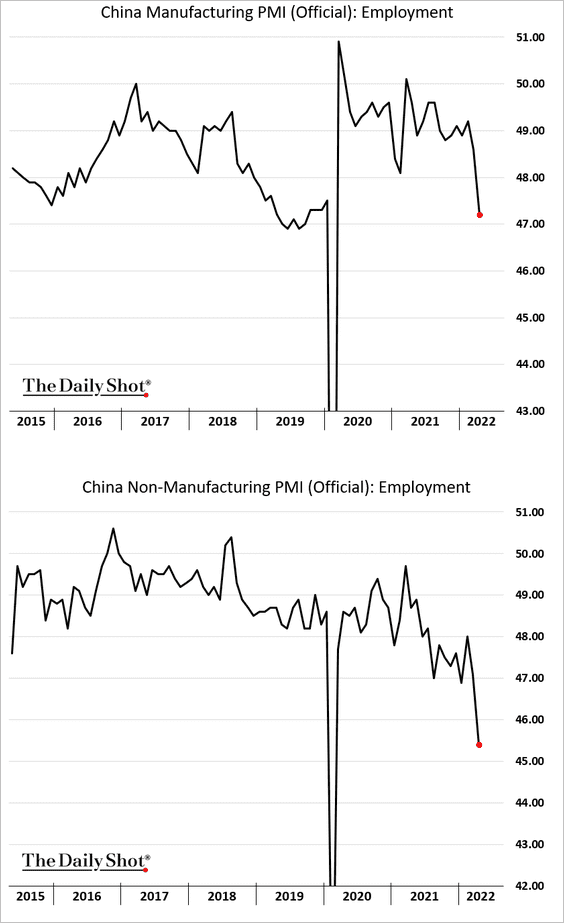

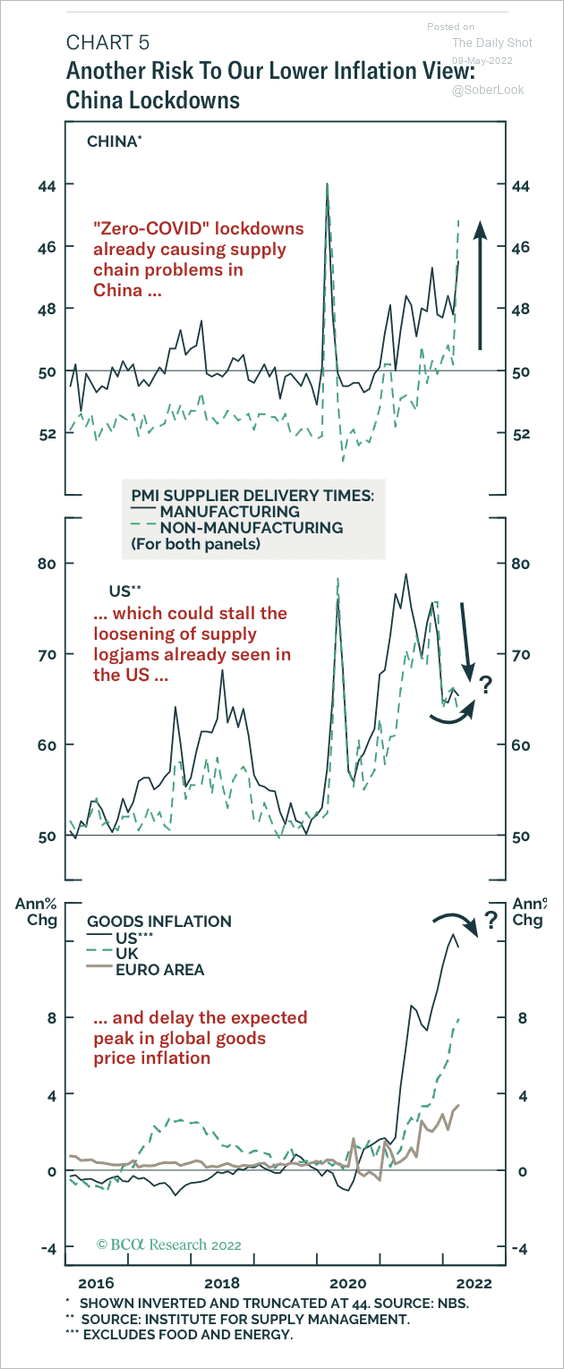

4. China’s lockdowns are holding back the global supply chain recovery and the inflation peak.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

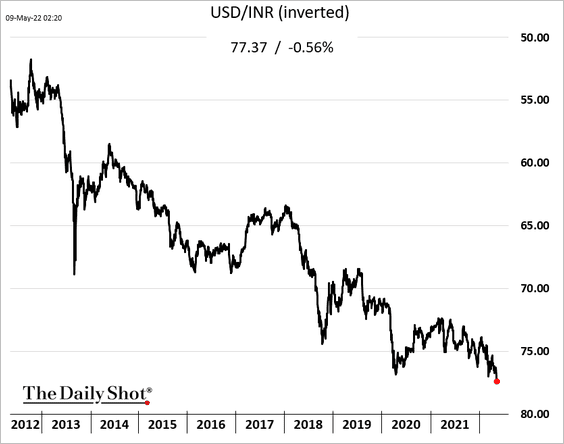

1. The Indian rupee hit a record low amid equity outflows and the US dollar strength.

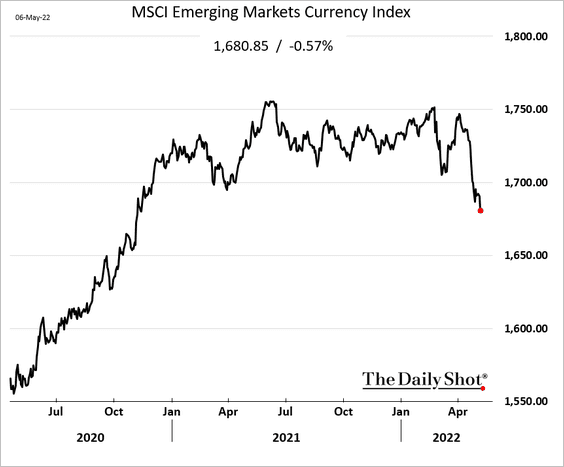

Here is the MSCI EM currency index.

——————–

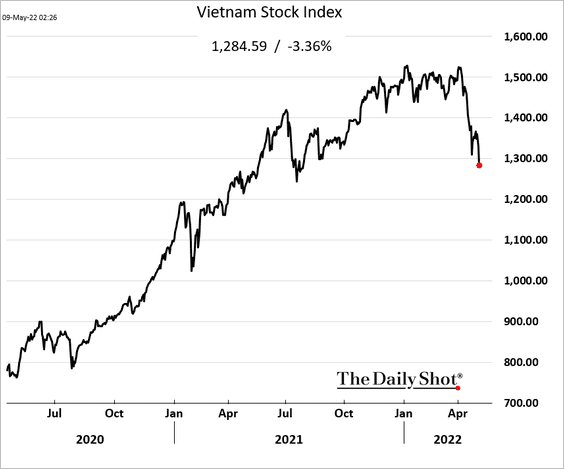

2. Vietnam’s stock market has rolled over.

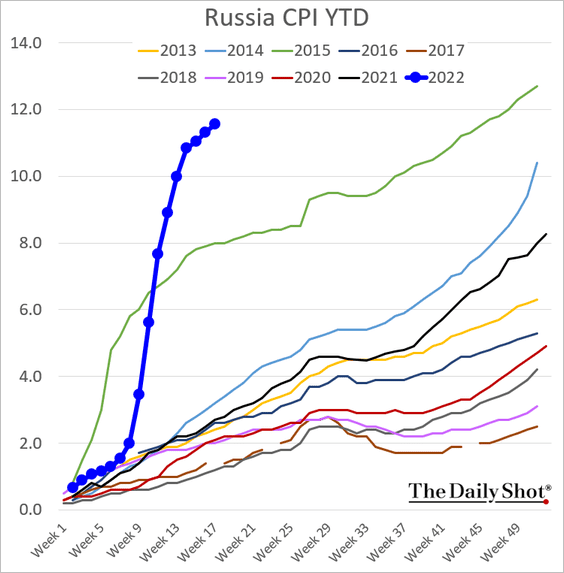

3. Assuming these figures are reliable, Russia’s inflation is moderating.

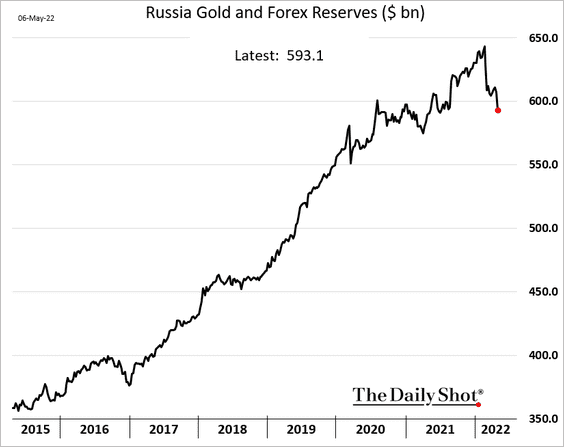

Russia’s F/X reserves continue to fall.

——————–

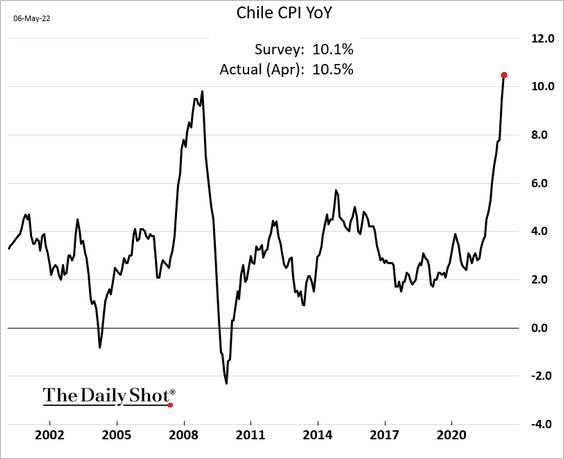

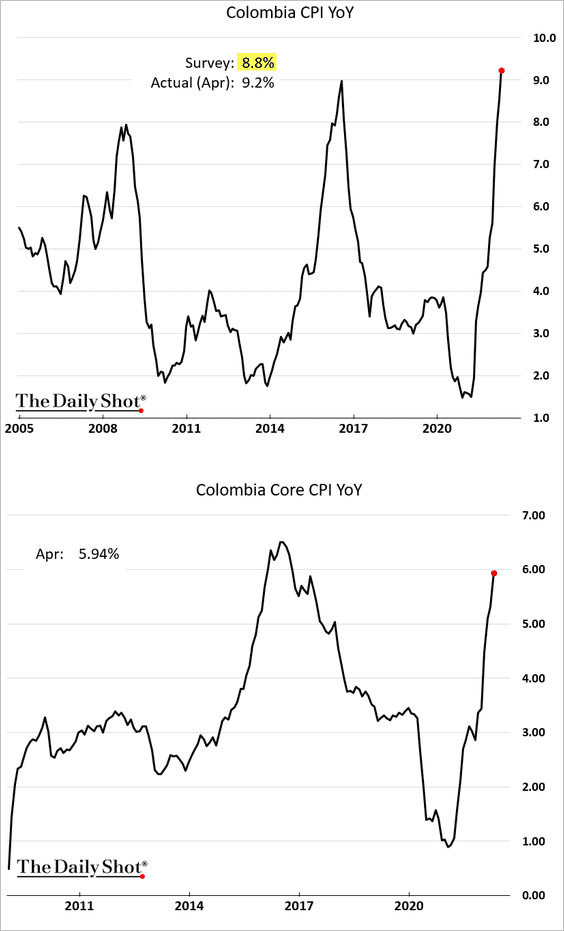

4. Inflation across LatAm economies continues to surge.

• Chile:

• Colombia:

——————–

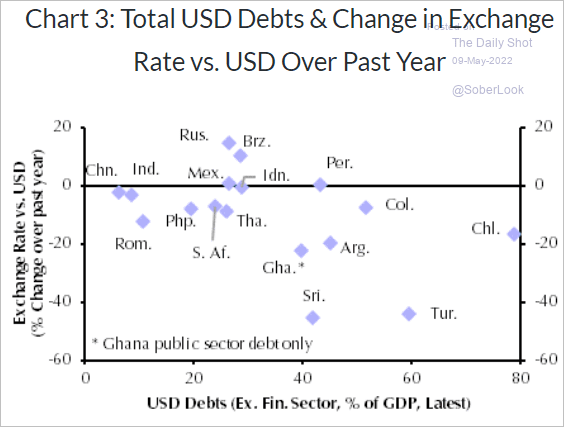

5. This scatterplot shows the change in the currency value vs. each nation’s USD-denominated debt-to-GDP ratio.

Source: Capital Economics

Source: Capital Economics

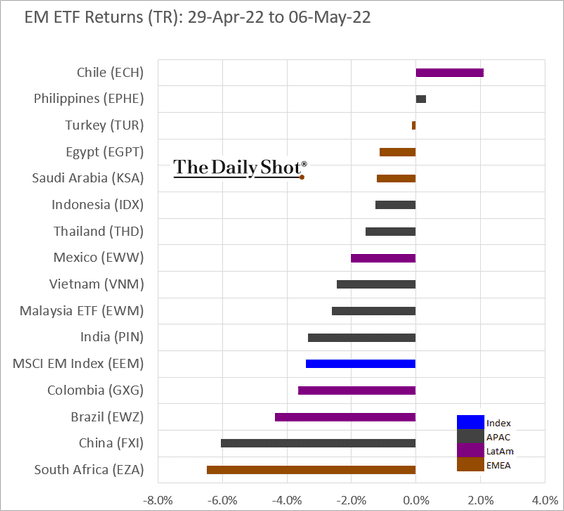

6. Finally, we have last week’s performance data.

• Equity ETFs:

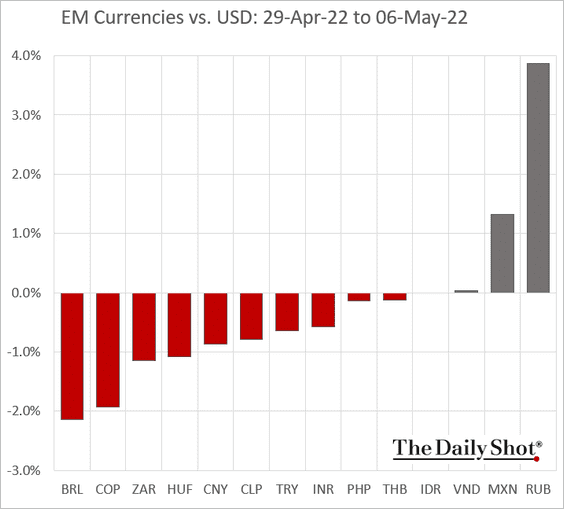

• EM currencies:

Back to Index

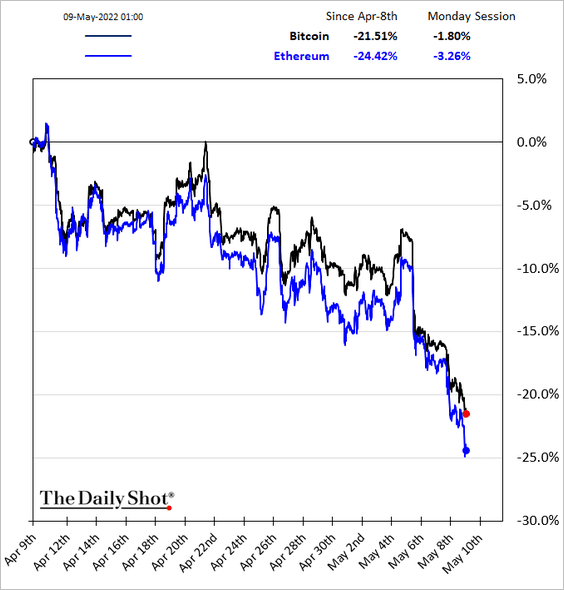

Cryptocurrency

1. Cryptos have been under pressure as equities slump.

2. Bitcoin is approaching oversold territory.

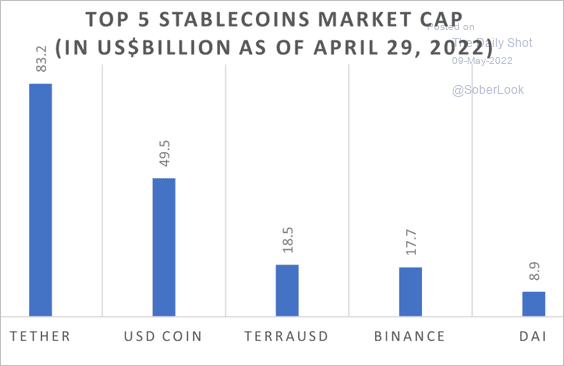

3. This chart shows the updated market cap for the largest stablecoins.

Source: S&P Global Ratings

Source: S&P Global Ratings

Back to Index

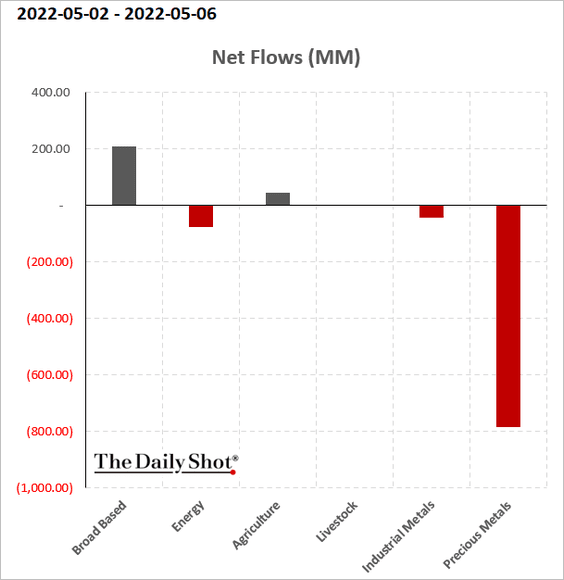

Commodities

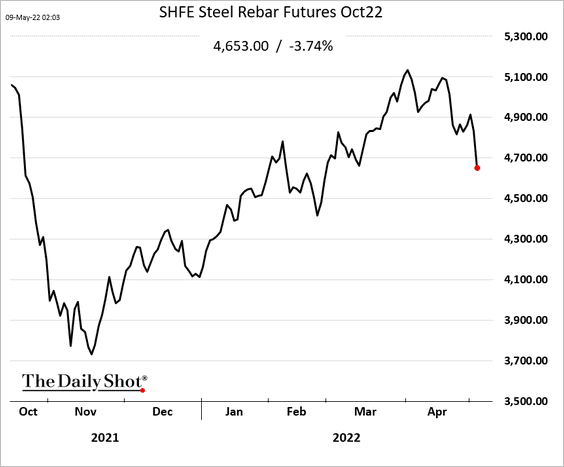

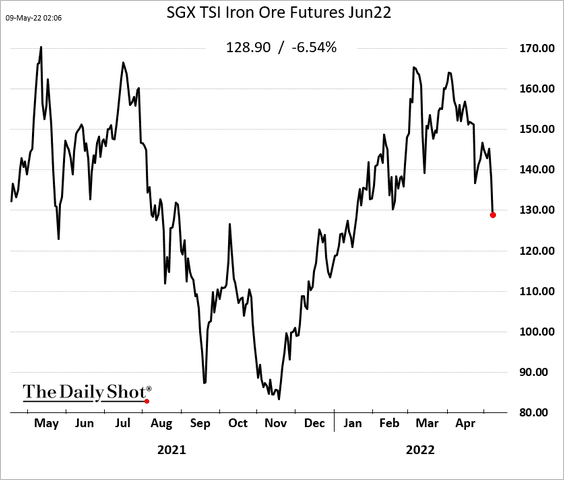

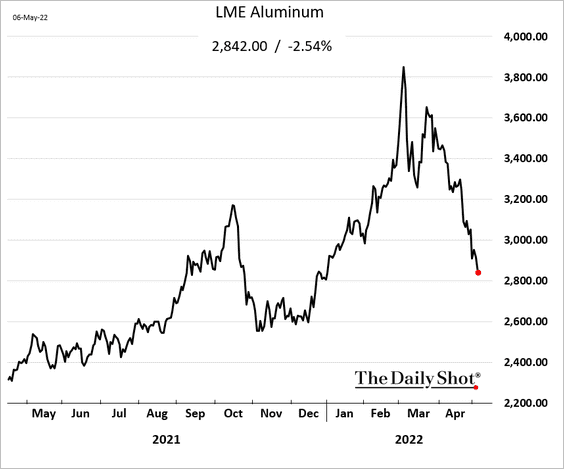

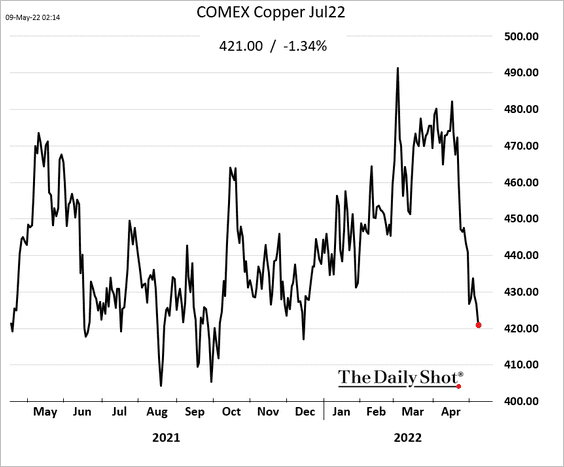

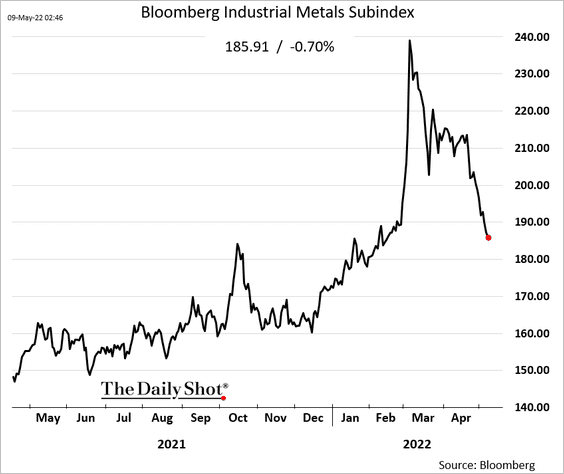

1. Industrial commodities are taking a hit as China’s demand slows.

• Steel rebar in Shangahi:

• Iron ore in Singapore:

• Aluminum in London:

• Copper in NY:

• Bloomberg’s industrial metals index:

——————–

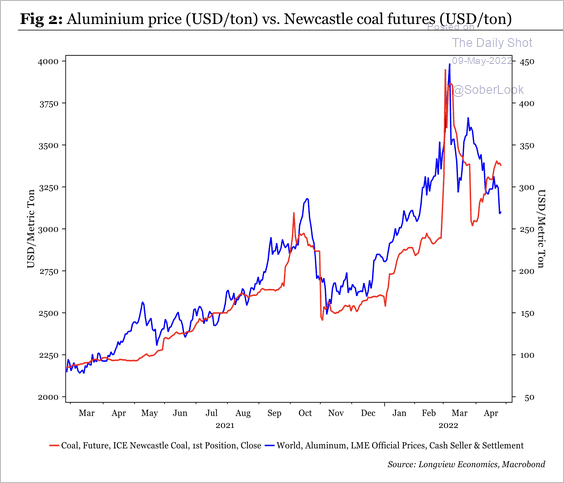

2. The usual correlation between aluminum and coal has broken down recently. That’s partly due to the unwinding of the Russia-related risk premium, according to Longview.

Source: Longview Economics

Source: Longview Economics

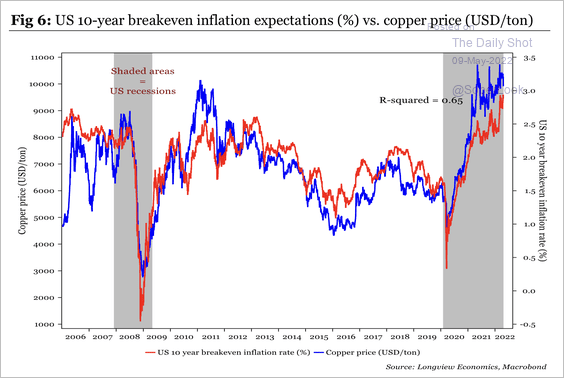

3. The price of copper is correlated with the US 10-year breakeven rate (inflation expectations).

Source: Longview Economics

Source: Longview Economics

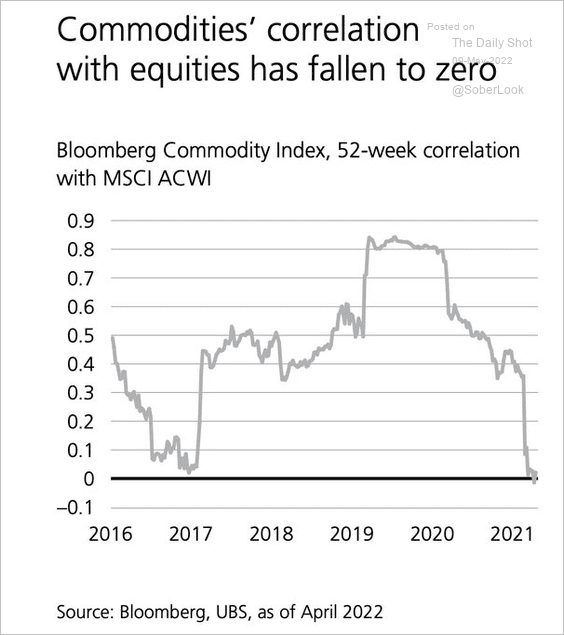

4. The correlation between commodities and equities has collapsed.

Source: @acemaxx, @UBS_CIO

Source: @acemaxx, @UBS_CIO

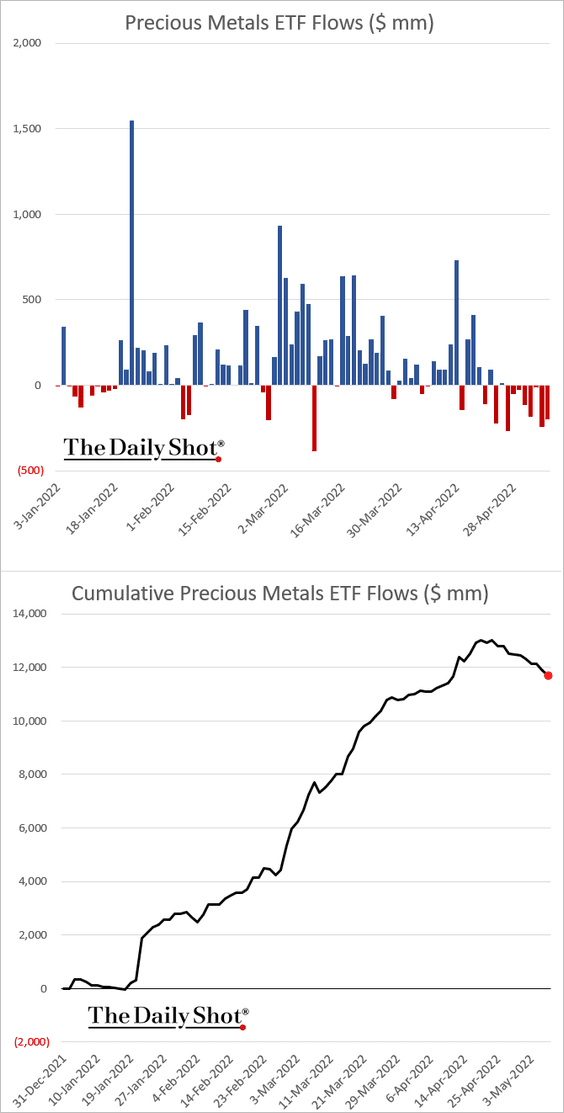

5. Precious metals ETFs are seeing some outflows.

——————–

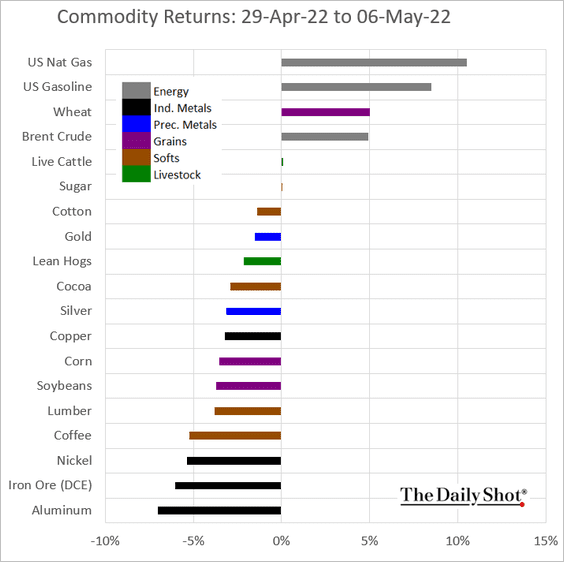

6. Finally, we have last week’s performance across key commodity markets.

Back to Index

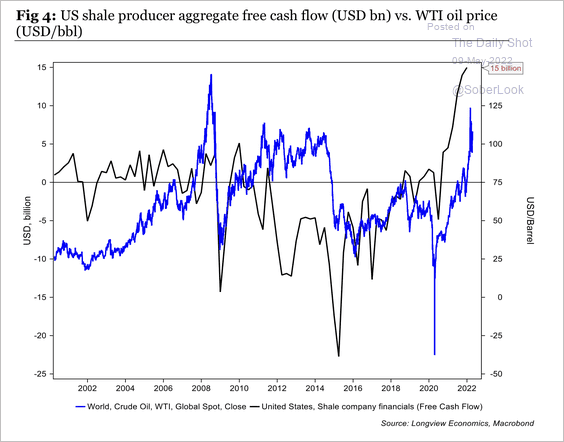

Energy

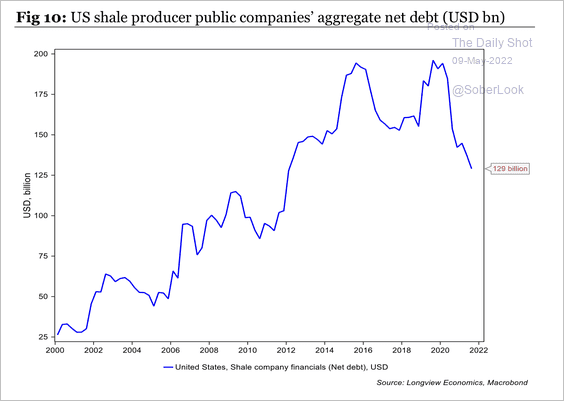

1. US shale producers have significantly increased their free cash flow over the past cycle.

Source: Longview Economics

Source: Longview Economics

Debt levels are moderating.

Source: Longview Economics

Source: Longview Economics

——————–

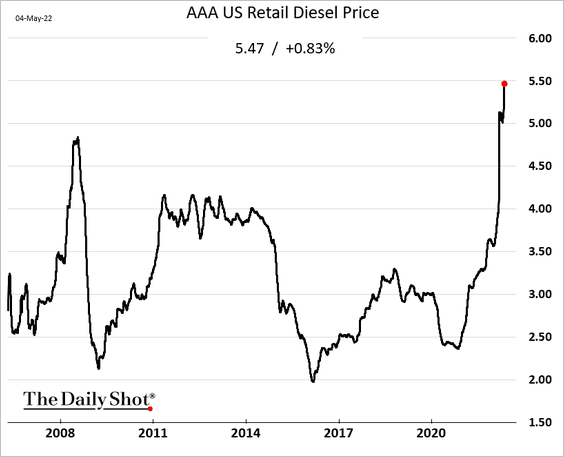

2. US diesel prices continue to surge.

h/t Sophie Caronello

h/t Sophie Caronello

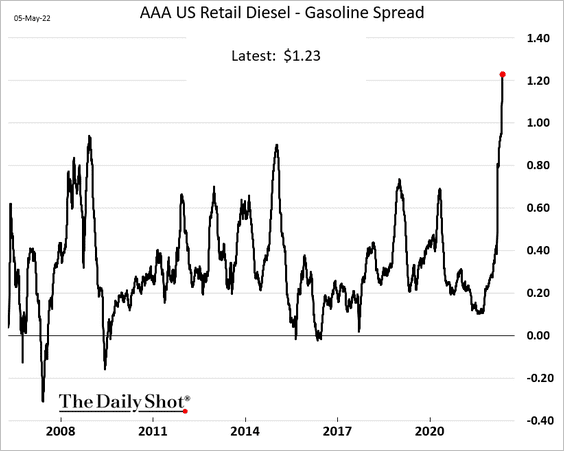

The spread between diesel and gasoline hit a record high.

h/t Chunzi Xu

h/t Chunzi Xu

——————–

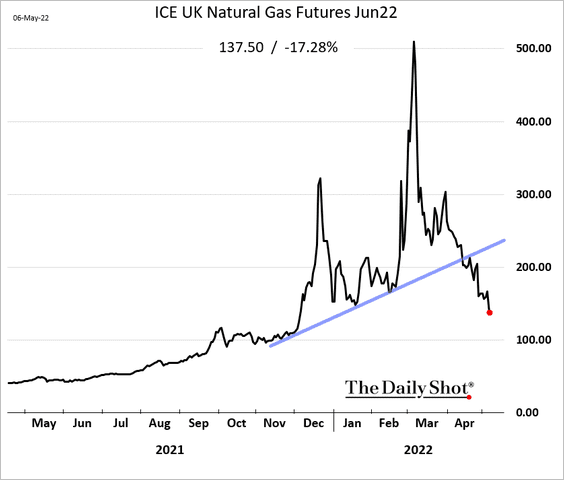

3. UK natural gas prices have been sinking amid robust LNG supplies.

Back to Index

Equities

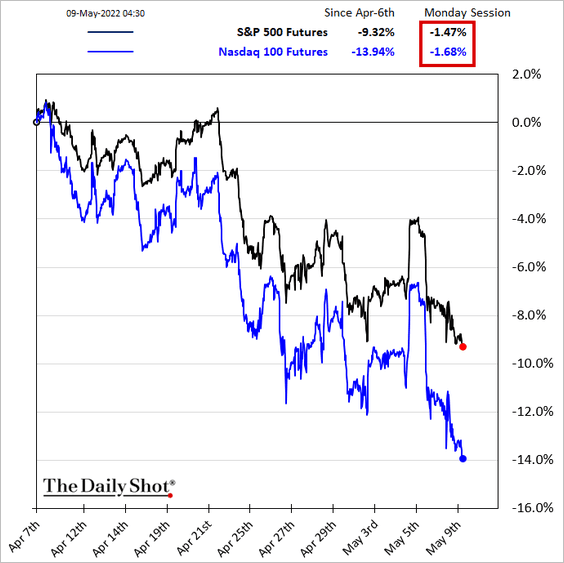

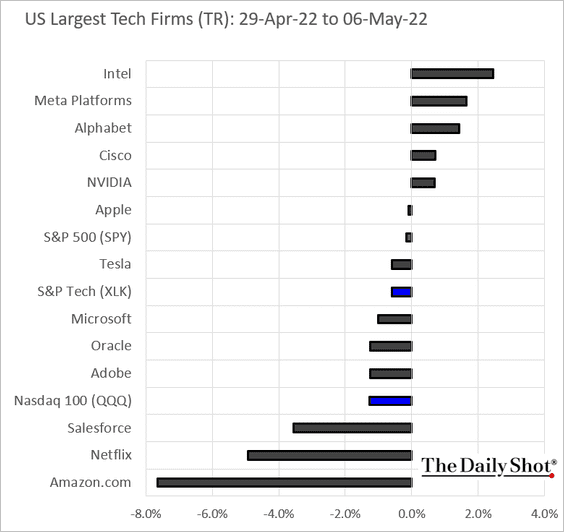

1. After another selloff on Friday, stocks are heavy again this morning.

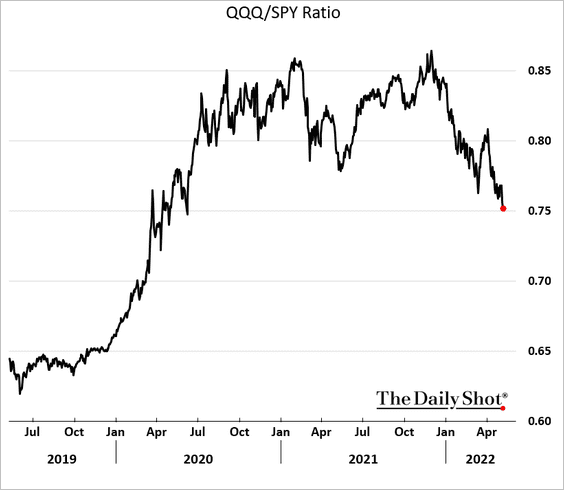

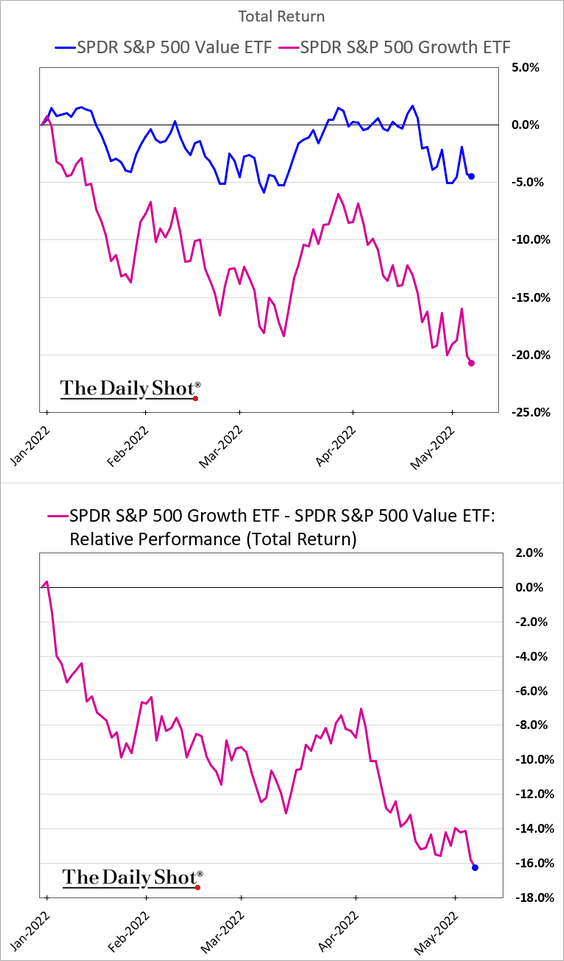

Growth stocks continue to underperform.

——————–

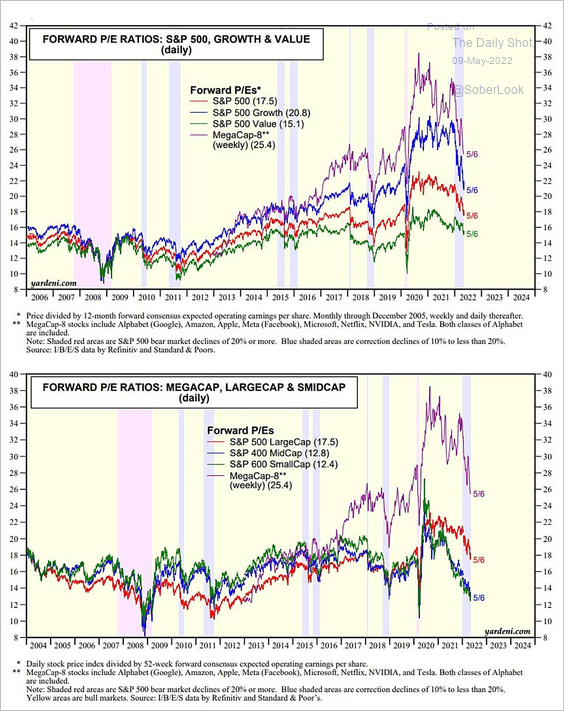

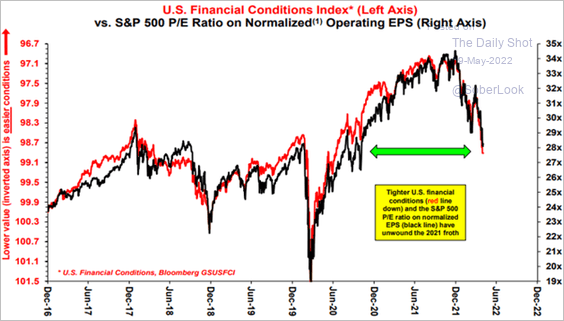

2. COVID-era valuation gains have been reversed, …

Source: Yardeni Research

Source: Yardeni Research

… as financial conditions tighten.

Source: Stifel

Source: Stifel

——————–

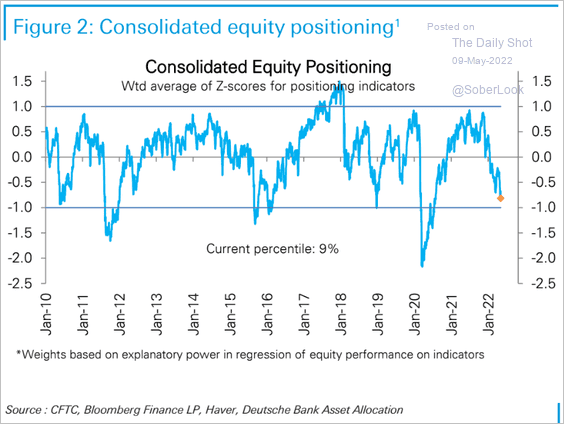

3. Deutsche Bank’s total equity positioning indicator is moving deeper into bearish territory, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

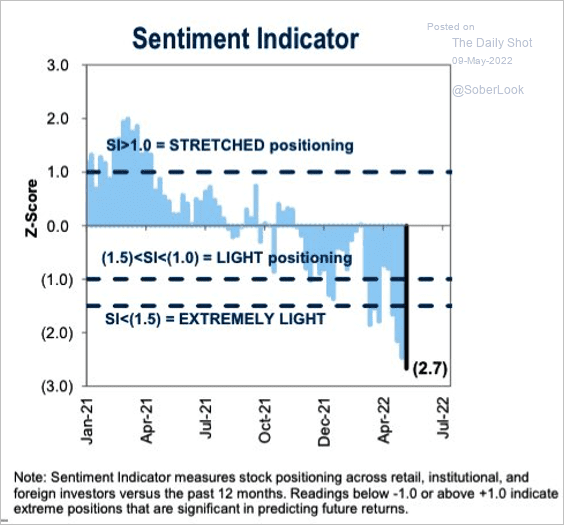

… as sentiment deteriorates further (GS indicator).

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

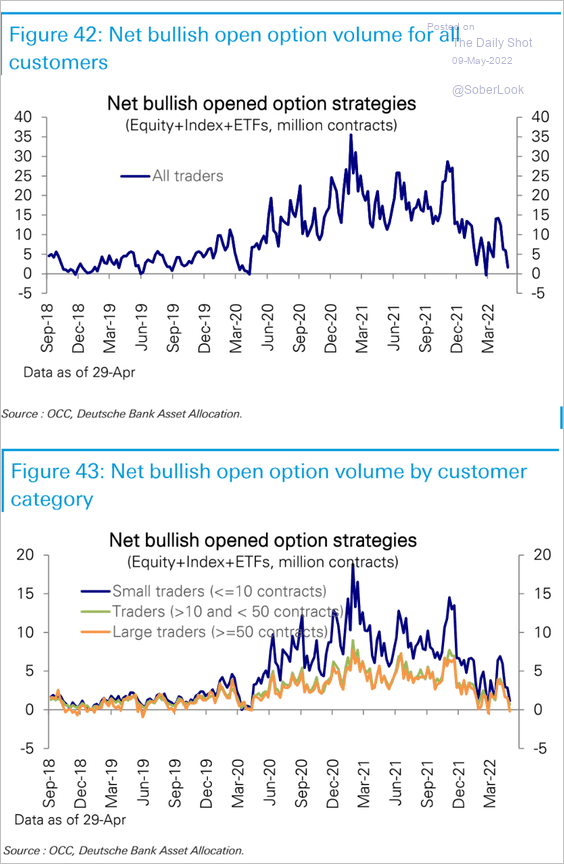

• Retail traders have cut their bullish options positioning to pandemic-era lows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

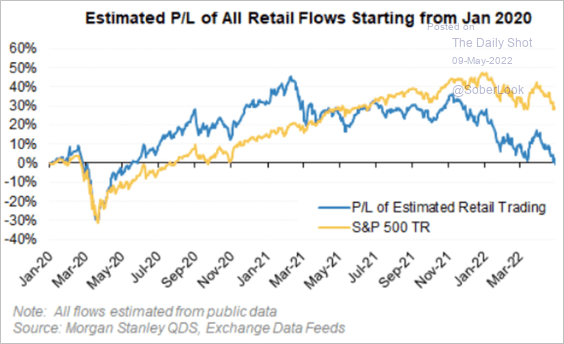

• Gains from retail flows have been reversed.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

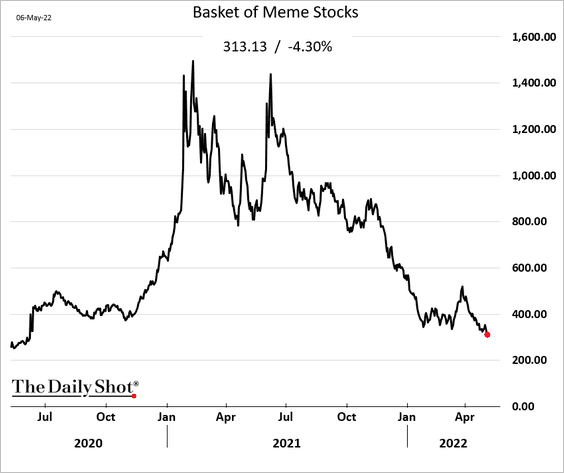

• Here is a basket of meme stocks.

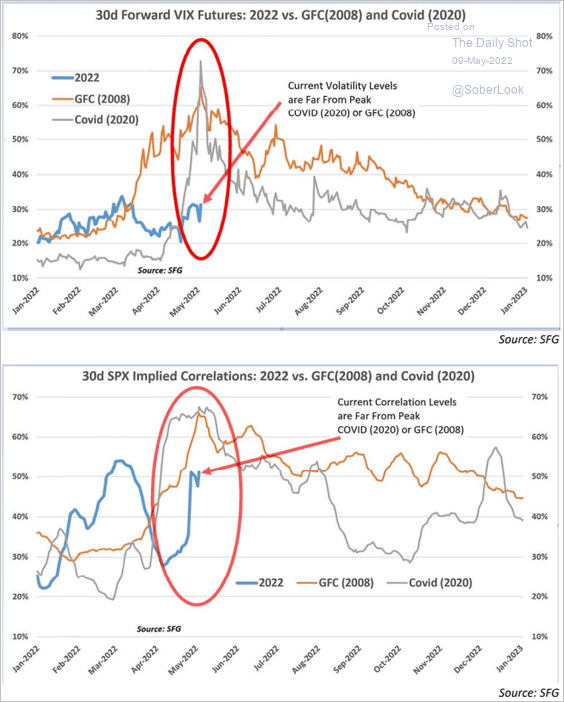

• Have the volatility and correlation indices risen enough to signal full capitulation?

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

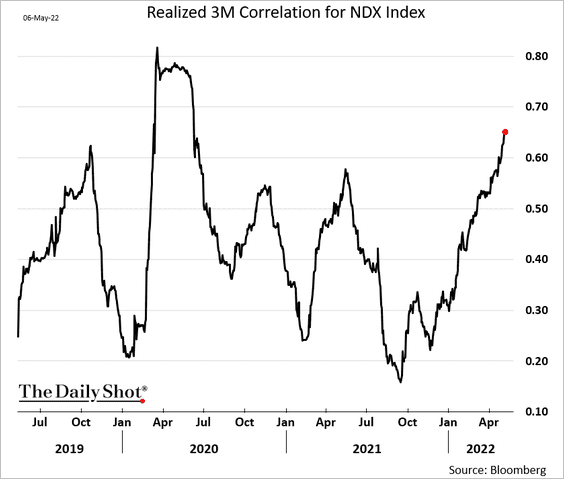

Here is the Nasdaq 100 3-month realized correlation.

——————–

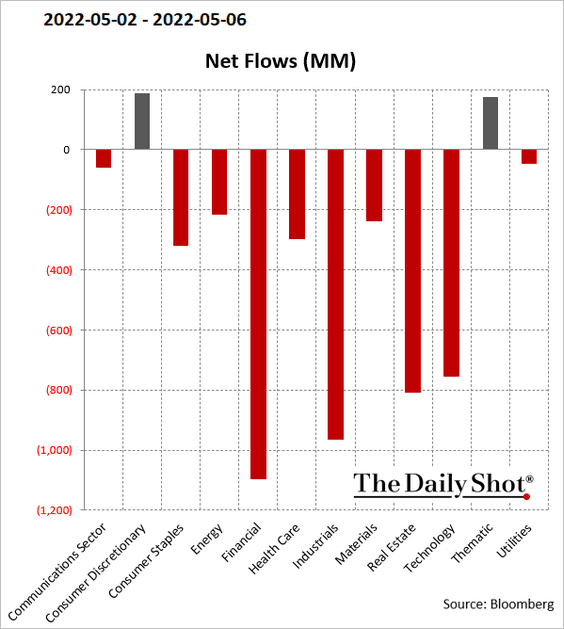

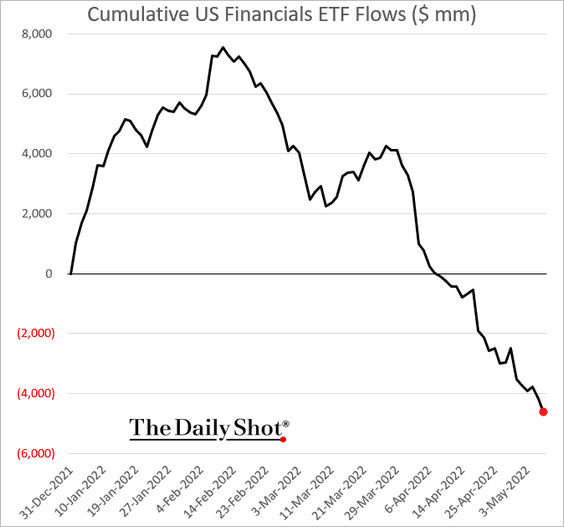

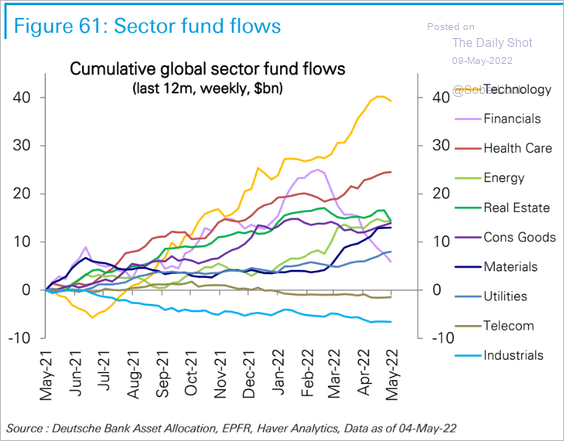

4. While most sector ETFs saw outflows last week, financials have been hit particularly hard.

This chart shows total flows by sector over the past 12 months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

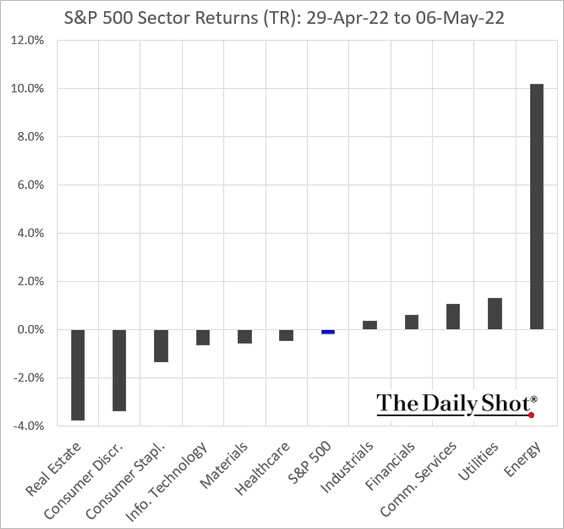

5. Next, we have some performance data.

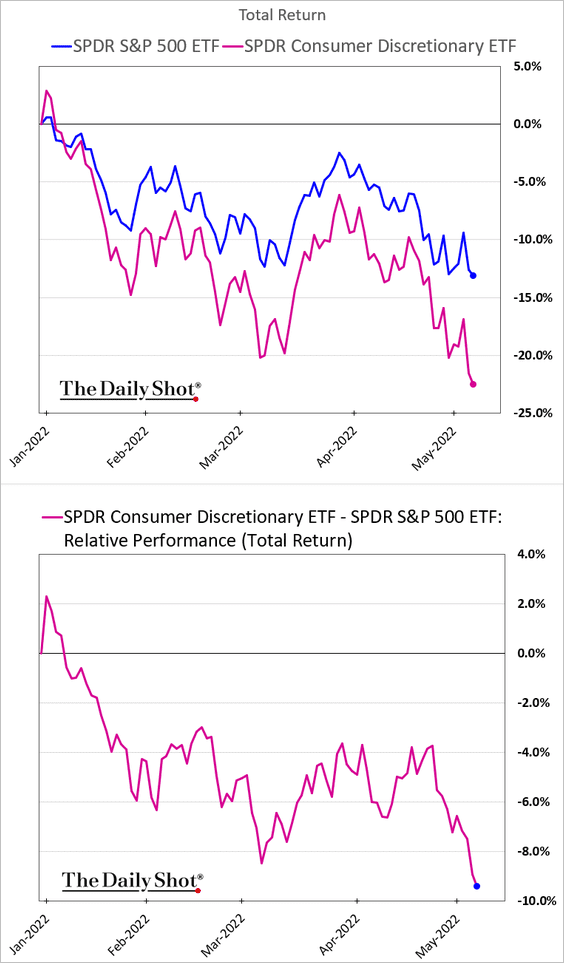

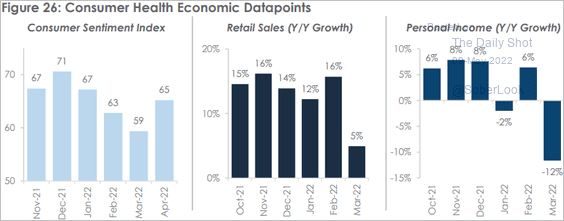

• Consumer Discretionary has been one of the worst-performing sectors, …

… amid concerns about the health of the US consumer.

Source: MarketDesk Research

Source: MarketDesk Research

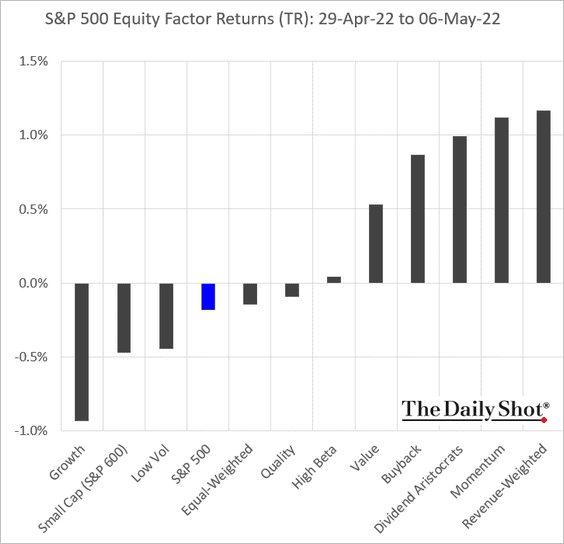

• Growth remains the worst-performing equity factor.

Here is the performance across equity factors over the past three months.

Source: MarketDesk Research

Source: MarketDesk Research

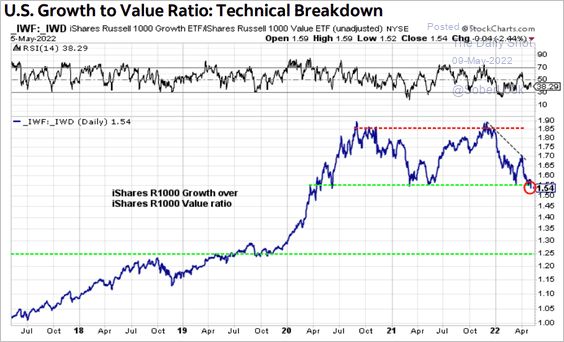

By the way, the growth factor is at support relative to value.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

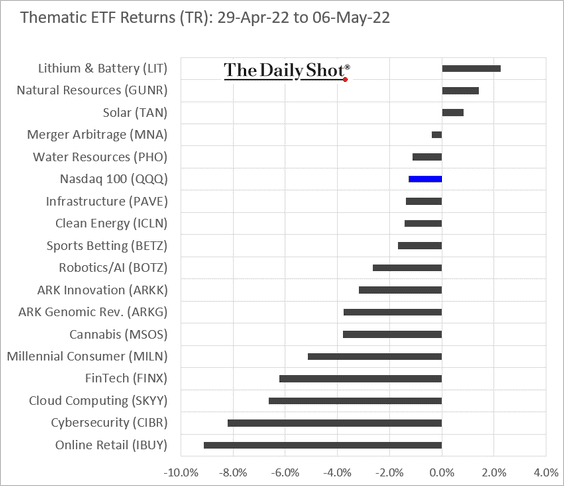

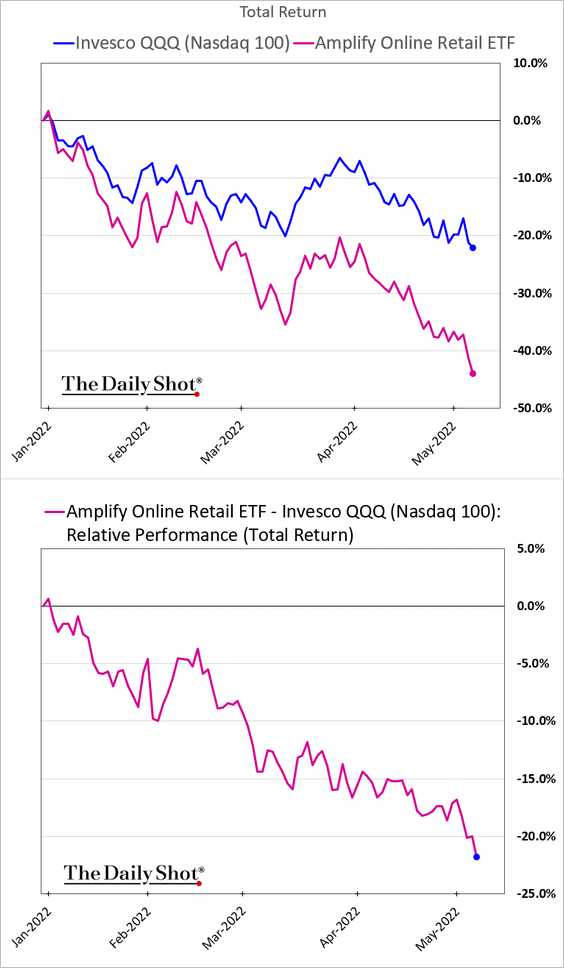

• Online retail was the worst-performing thematic ETF last week, …

… as Amazon got crushed.

——————–

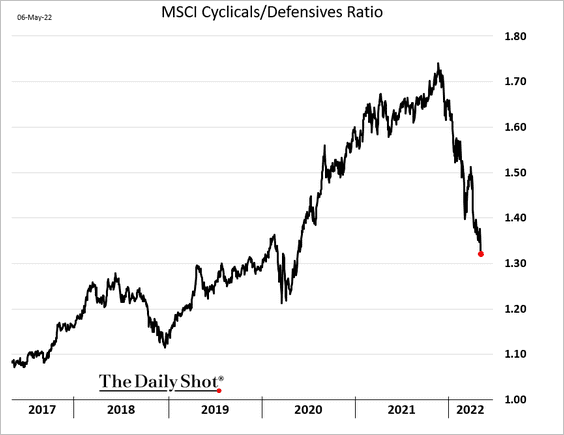

6. Cyclicals continue to lag defensive sectors.

Back to Index

Credit

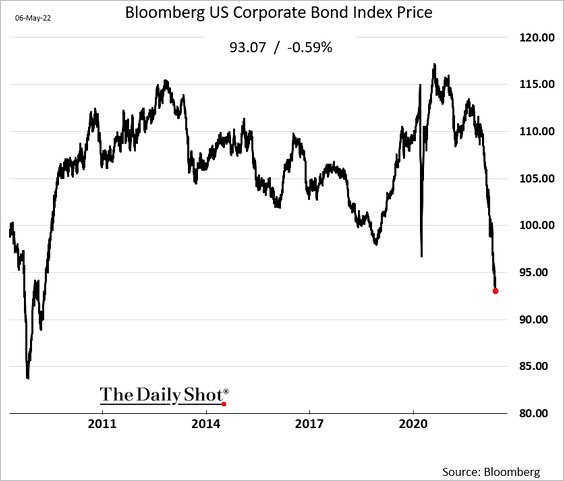

1. Investment-grade bonds remain under pressure.

• Yield:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

• Price:

——————–

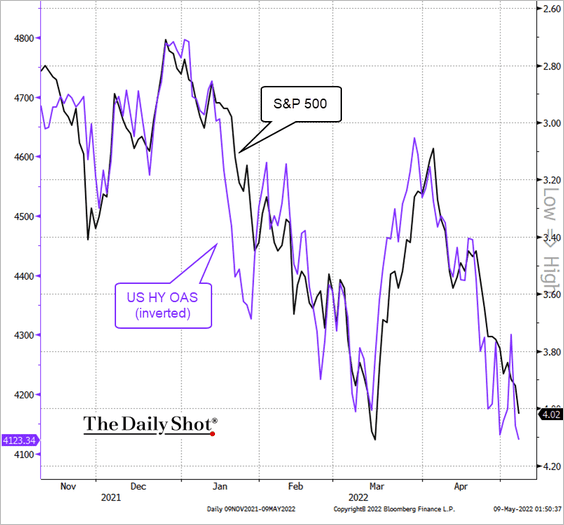

2. High-yield spreads have been trading in line with equities.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

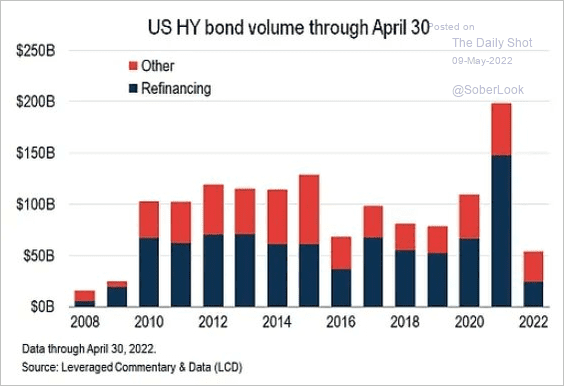

3. High-yield issuance slowed this year.

Source: @lcdnews

Source: @lcdnews

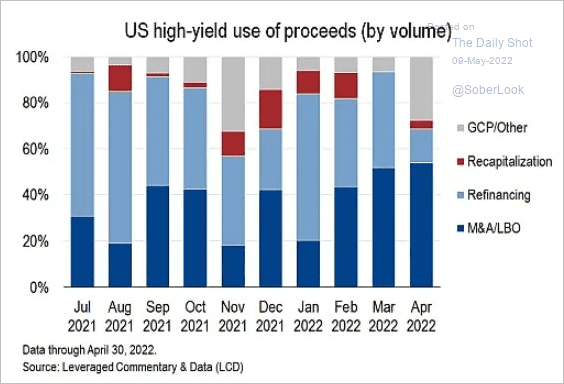

Here is the use of proceeds.

Source: @lcdnews

Source: @lcdnews

——————–

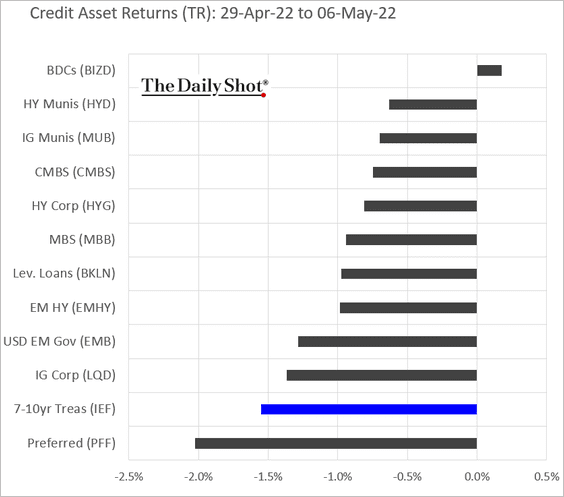

4. Finally, we have last week’s performance by asset class.

Back to Index

Rates

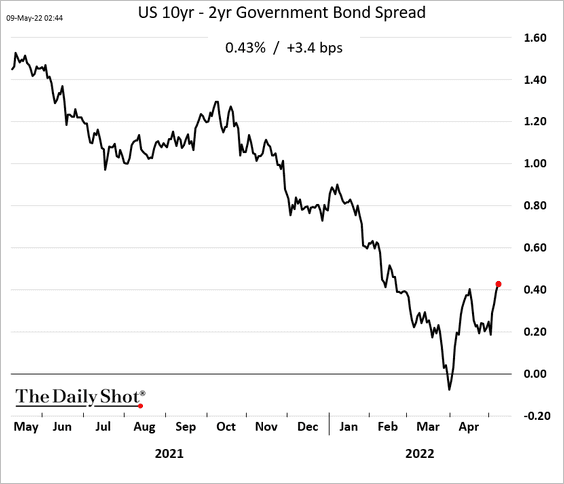

1. The Treasury curve is steepening.

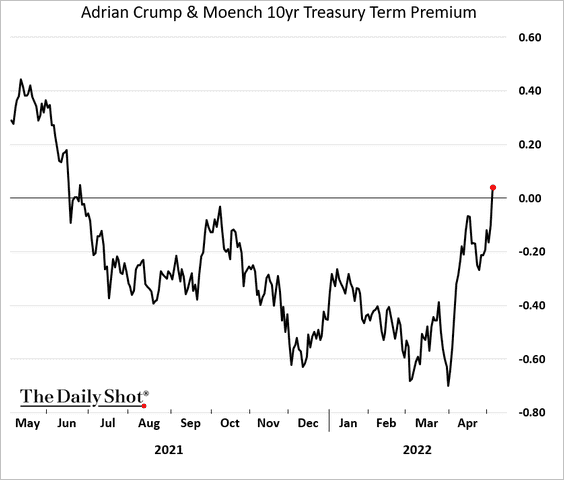

And the term premium has been on the rise.

——————–

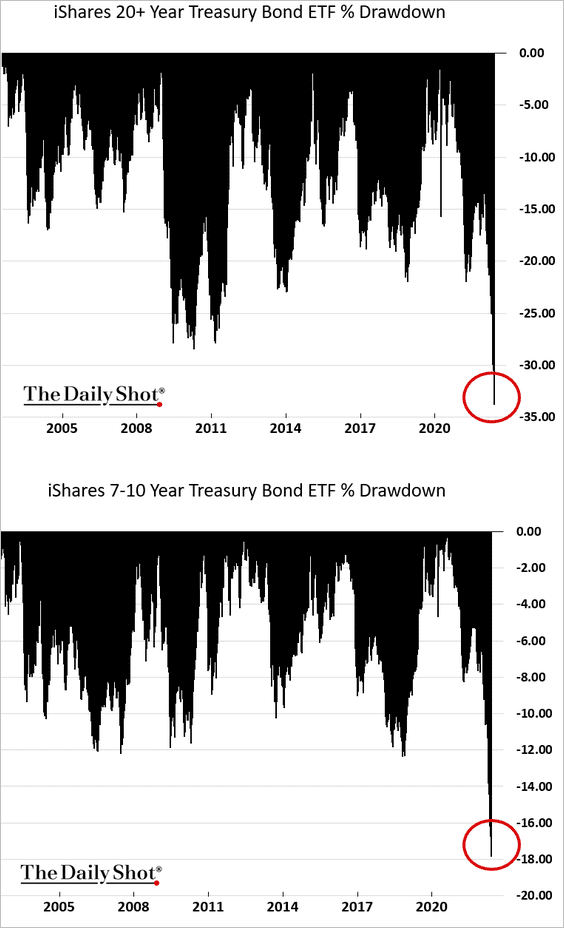

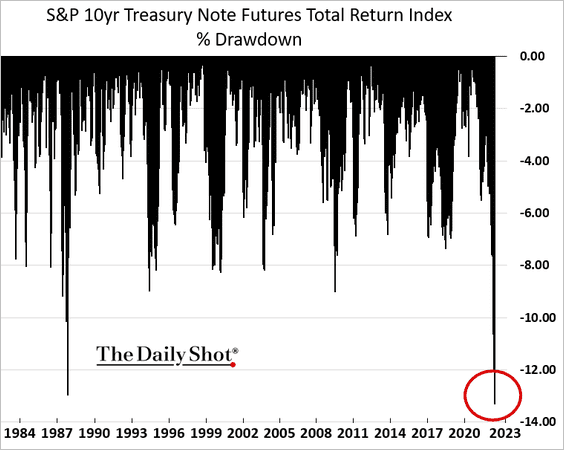

2. The drawdown in Treasuries has been spectacular.

• Treasury ETFs:

• Treasury futures (40 years):

——————–

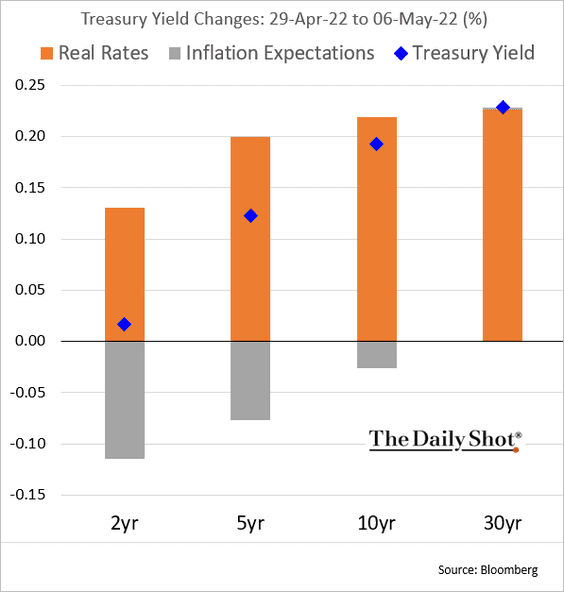

3. This month, Treasury yield gains have been driven by real yields.

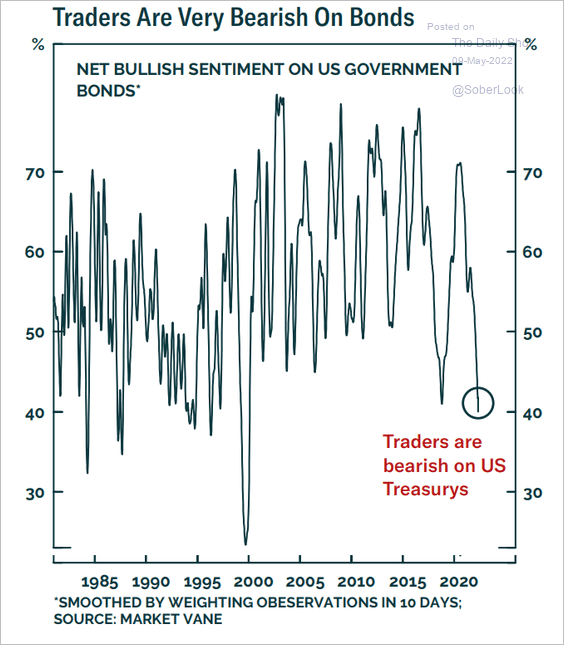

4. Traders remain bearish on bonds.

Source: BCA Research

Source: BCA Research

Back to Index

Global Developments

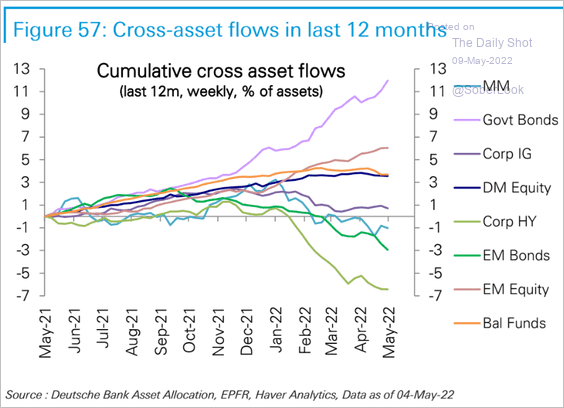

1. Let’s start with fund flows by asset class over the past 12 months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

2. Next, we have some performance data.

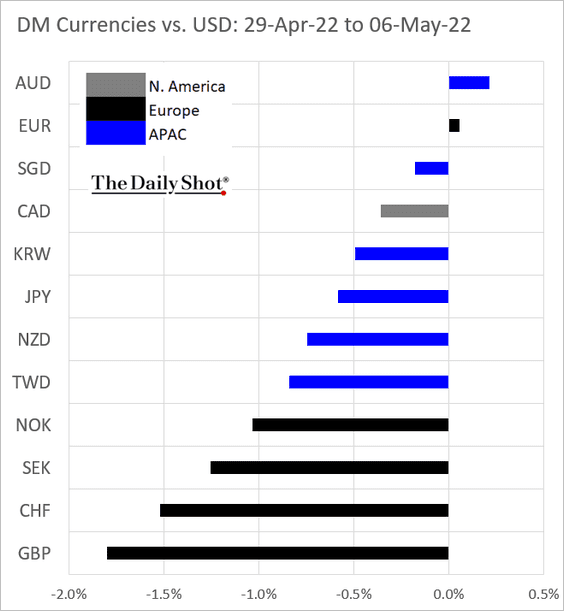

• DM currencies vs. USD (last week):

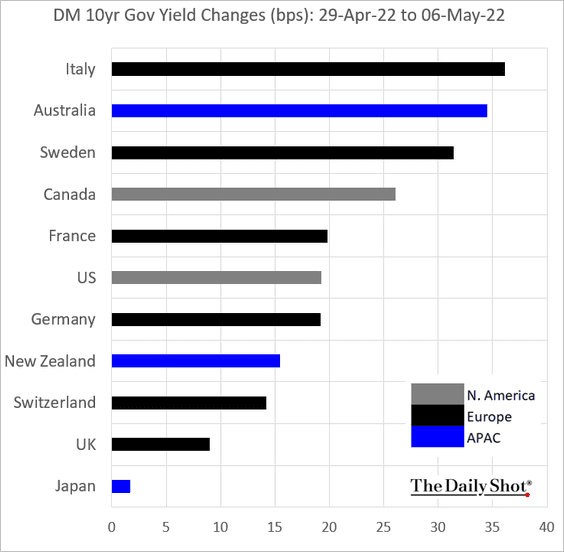

• Government bond yields (last week):

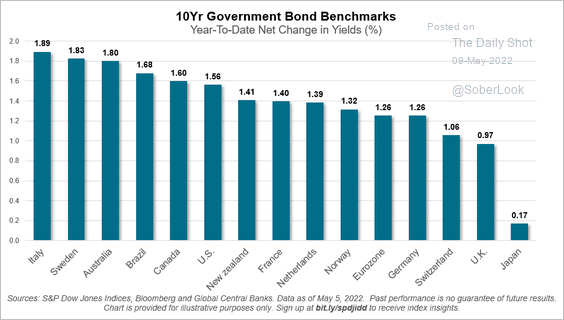

• Government bond yields (year-to-date):

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

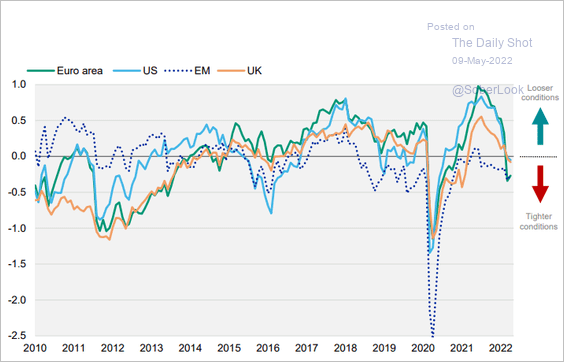

3. Heare are the financial conditions indicators from Moody’s.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

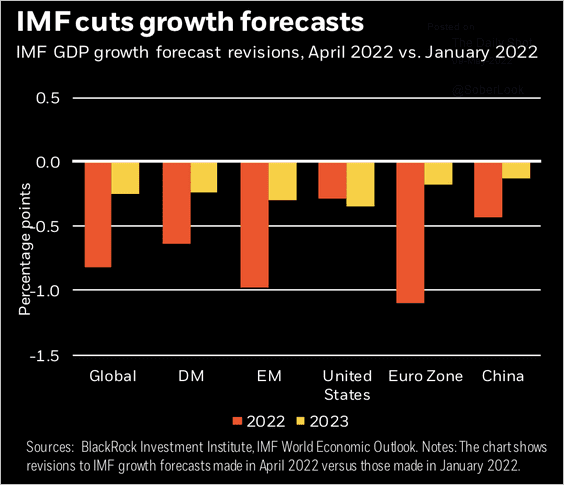

4. The IMF expects weaker economic growth and higher inflation, especially in Europe.

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

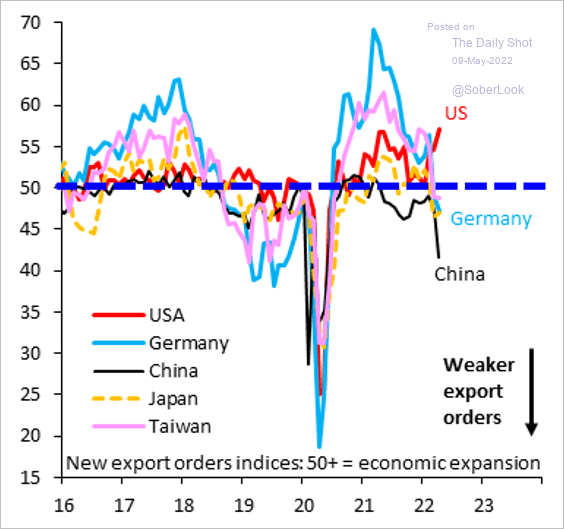

5. Export orders at the largest exporters dropped last month (PMI < 50).

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

——————–

Food for Thought

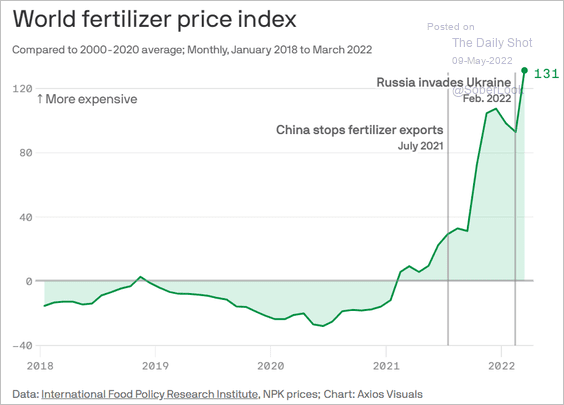

1. Fertilizer prices:

Source: @axios Read full article

Source: @axios Read full article

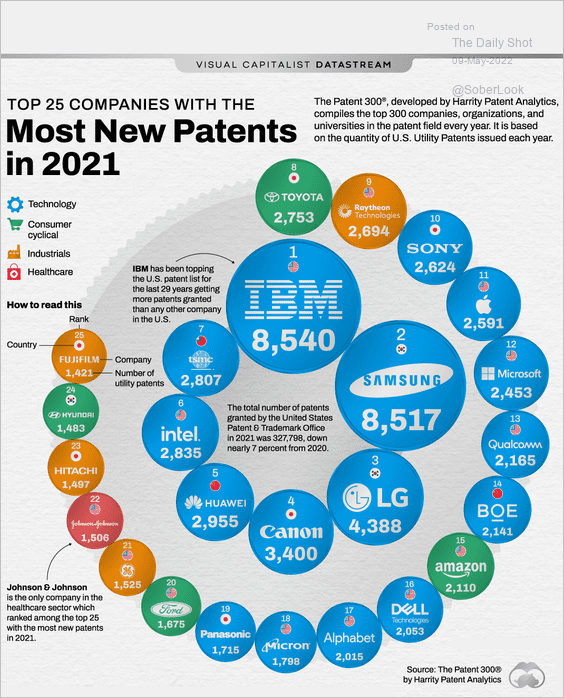

2. Companies with the highest number of new patents:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

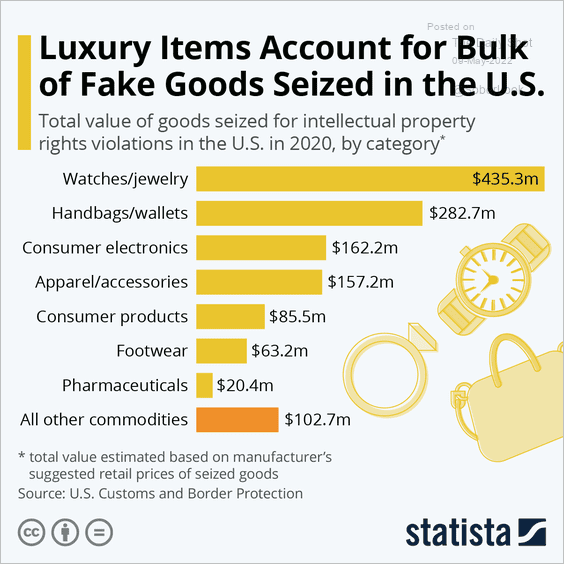

3. Fake goods:

Source: Statista

Source: Statista

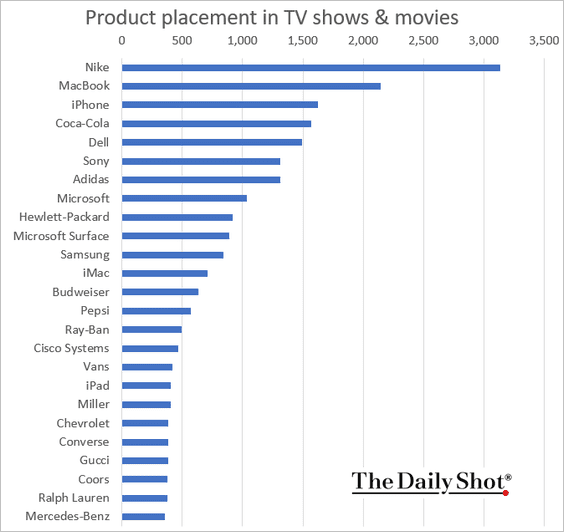

4. Product placement in TV shows & movies from 2020 to 2021:

Source: Sortlist Read full article

Source: Sortlist Read full article

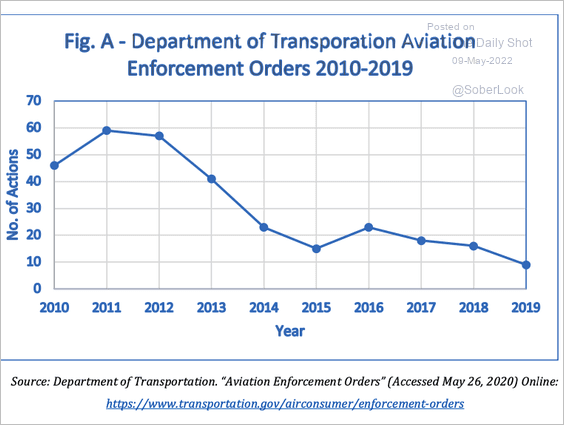

5. The US Department of Transportation aviation enforcement orders:

Source: @matthewstoller Read full article

Source: @matthewstoller Read full article

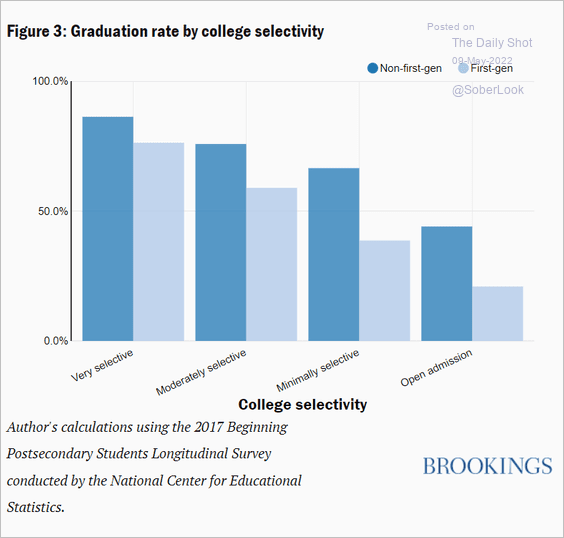

6. Graduation rates for first-generation college students:

Source: Brookings Read full article

Source: Brookings Read full article

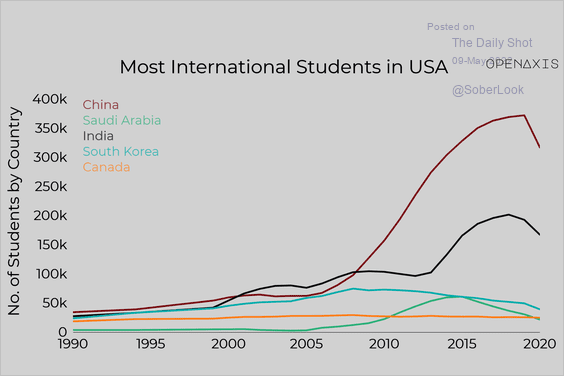

7. International students in the US:

Source: OpenAxis Read full article

Source: OpenAxis Read full article

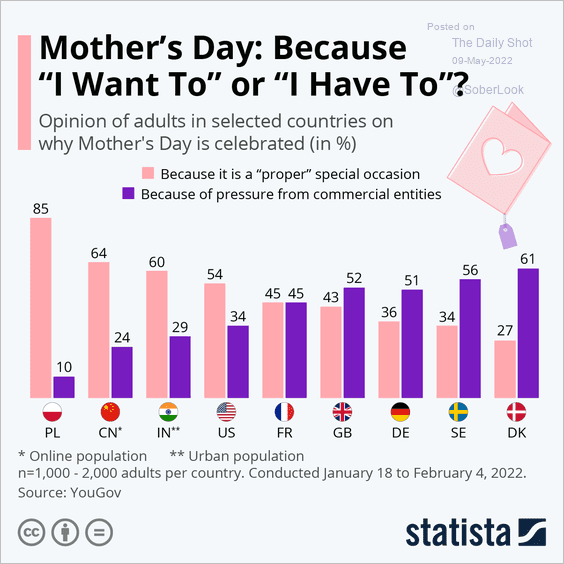

8. Why is Mother’s Day celebrated?

Source: Statista

Source: Statista

——————–

Back to Index