The Daily Shot: 10-May-22

• Equities

• Credit

• Rates

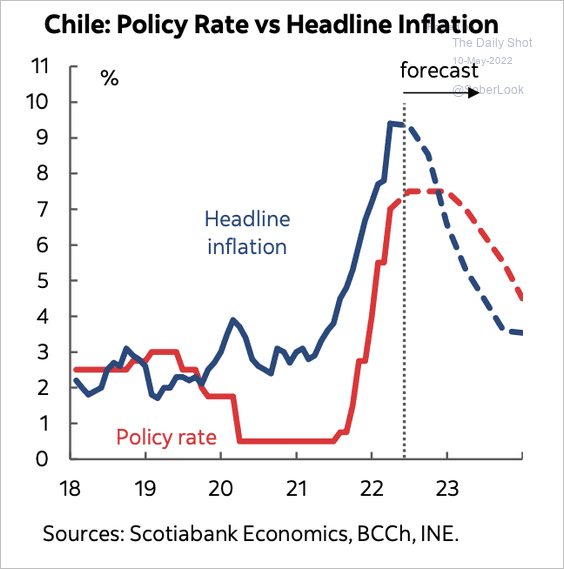

• Commodities

• Energy

• Cryptocurrency

• Emerging Markets

• China

• Australia

• The Eurozone

• Canada

• The United States

• Global Developments

• Food for Thought

Equities

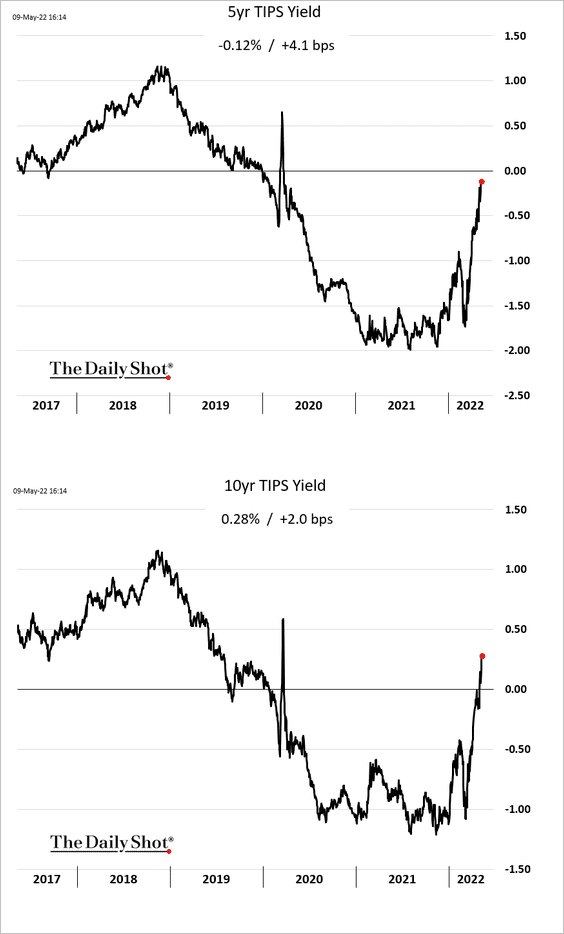

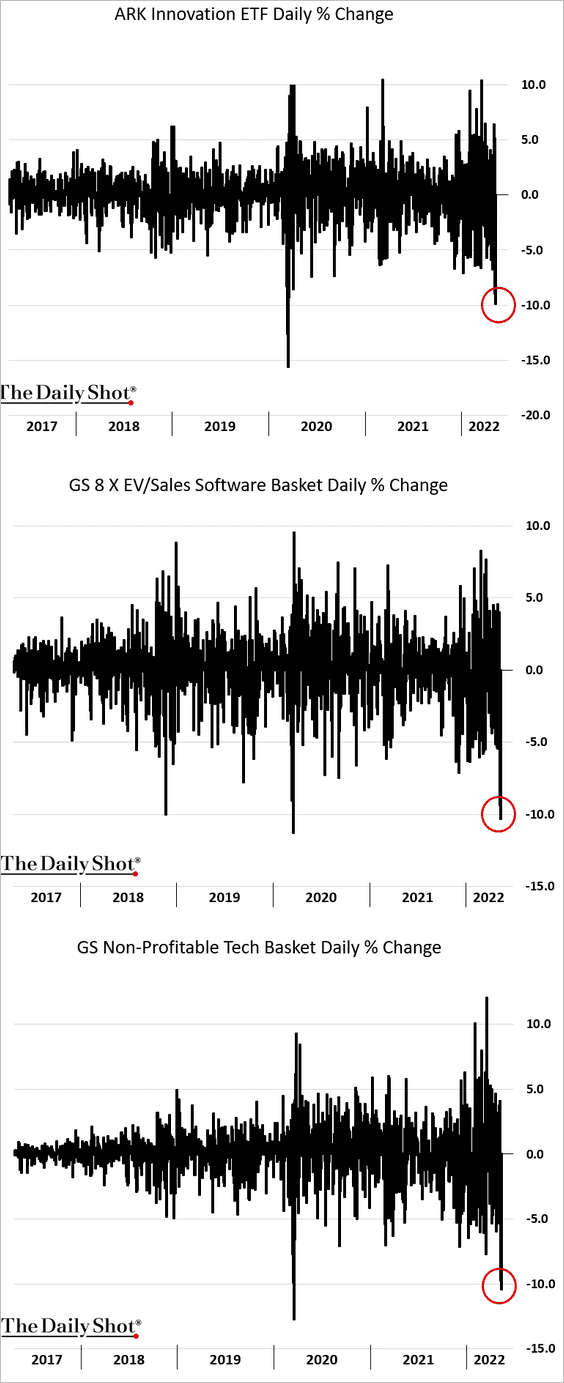

1. Rising real yields continued to put pressure on growth stocks on Monday.

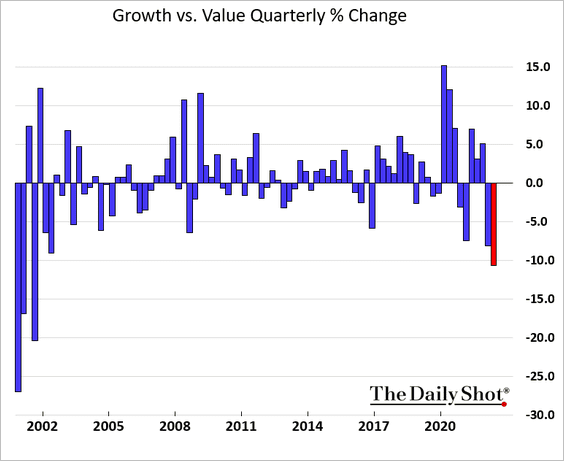

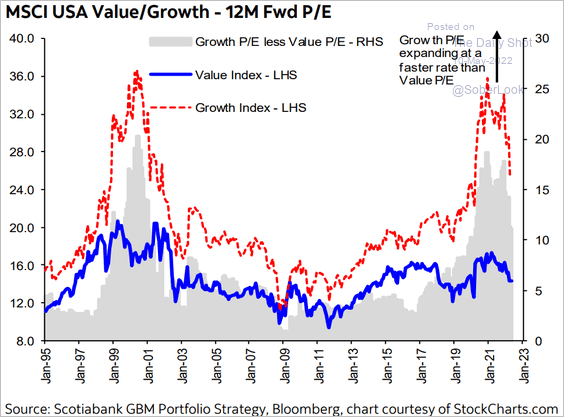

• The current quarter’s underperformance of growth vs. value stocks is the worst since the dot-com bubble.

• More room to go?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

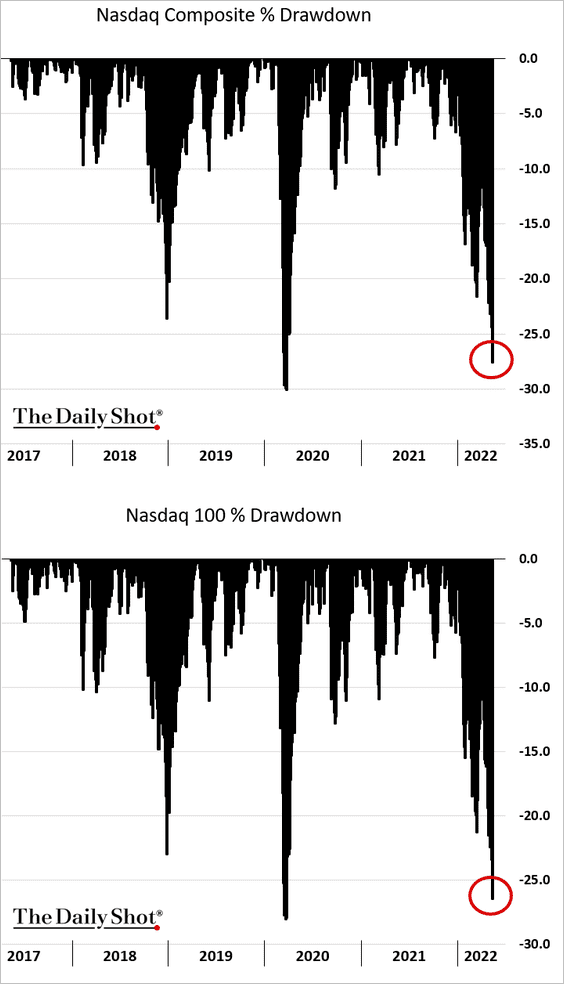

• The current drawdown in the Nasdaq Composite and Nasdaq 100 indices is approaching the COVID shock.

• Speculative growth shares had the worst day since early 2020. It feels like capitulation.

ARK Innovation has given up all of its outperformance.

Source: @markets Read full article

Source: @markets Read full article

——————–

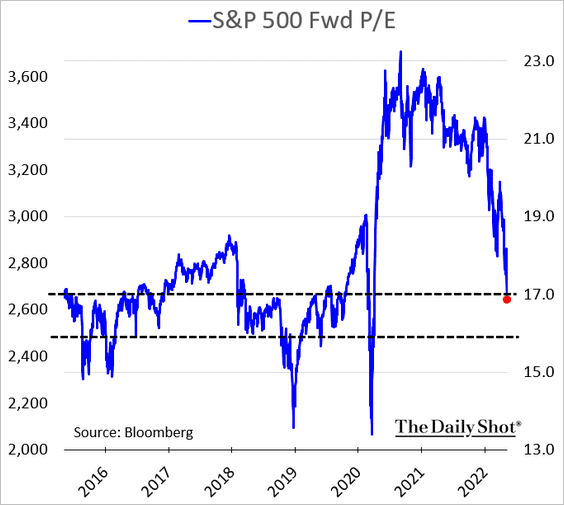

2. The S&P 500 forward P/E ratio went through the 17x support level. Market participants are increasingly skeptical about consensus earnings estimates.

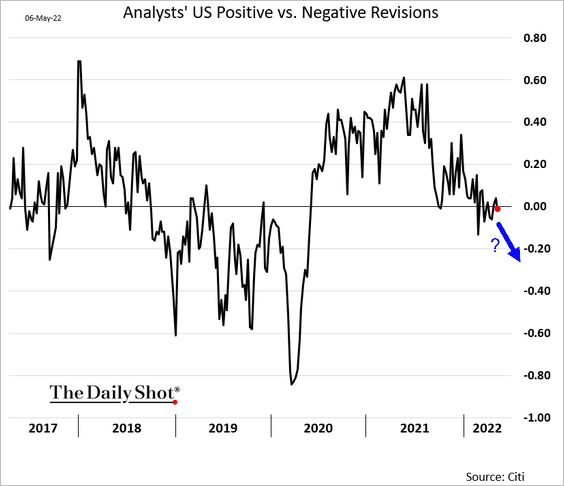

The balance of earnings revisions has been flat lately. Will we see it turn lower?

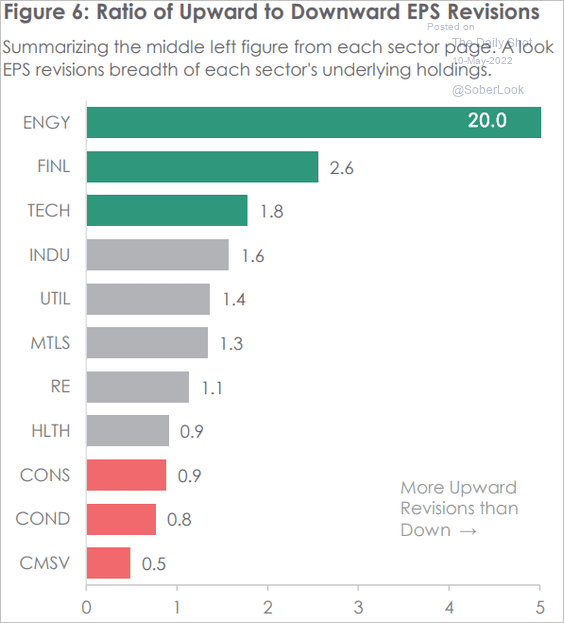

Here is the ratio of upward to downward EPS revisions by sector over the last three months.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

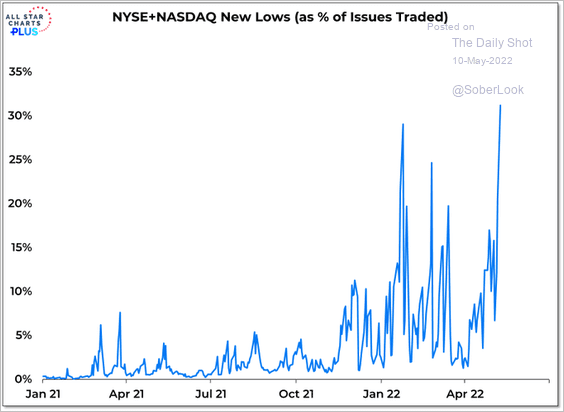

3. There are a lot of new lows.

Source: @WillieDelwiche

Source: @WillieDelwiche

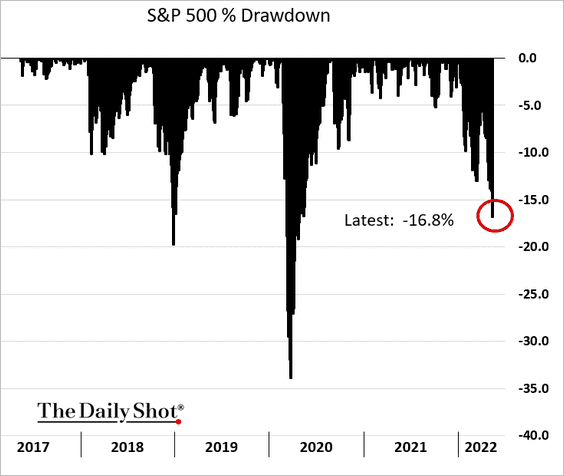

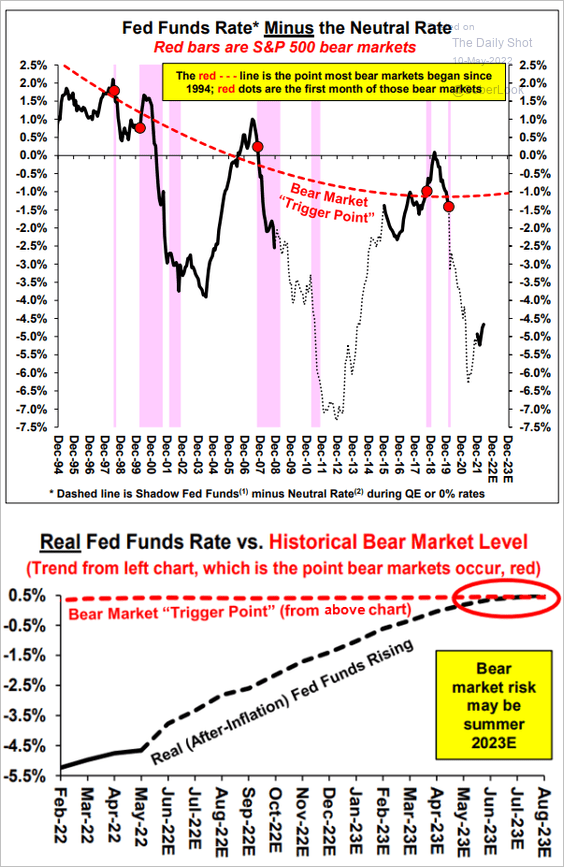

4. The S&P 500 is some 11% below its 200-day moving average.

We are about 3% away from the official bear market label.

Bear market next year (when the fed funds rate moves into restrictive territory)?

Source: Stifel

Source: Stifel

——————–

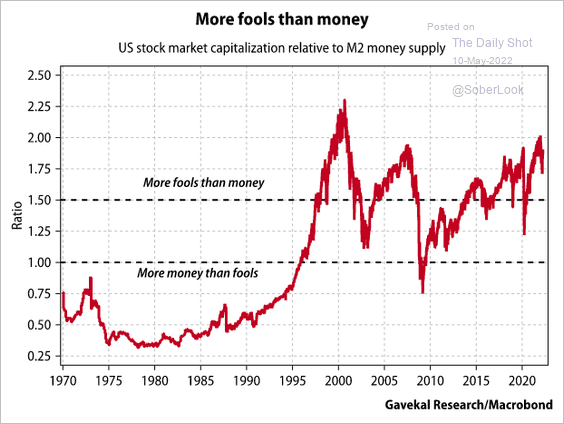

5. More fools than money?

Source: Gavekal Research

Source: Gavekal Research

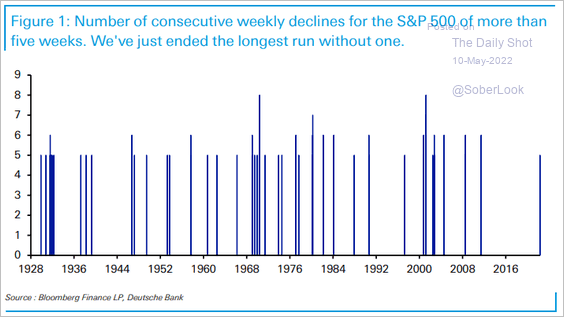

6. Historically, the current volatility represents a more “typical” market behavior.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

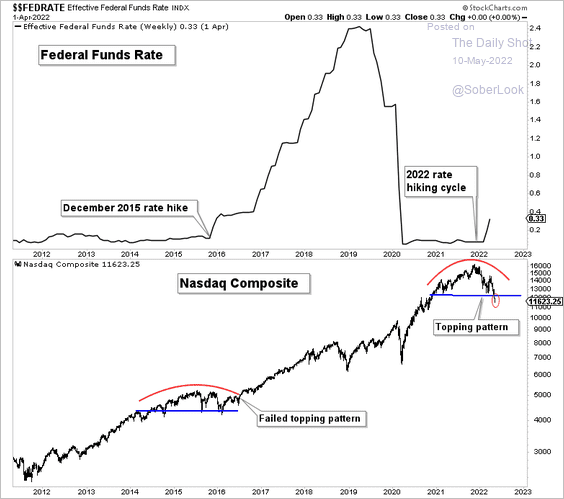

7. The Nasdaq Composite is exhibiting a similar topping pattern to the Dec. 2015 rate hike, which was reversed relatively quickly.

Source: Aazan Habib; Paradigm Capital

Source: Aazan Habib; Paradigm Capital

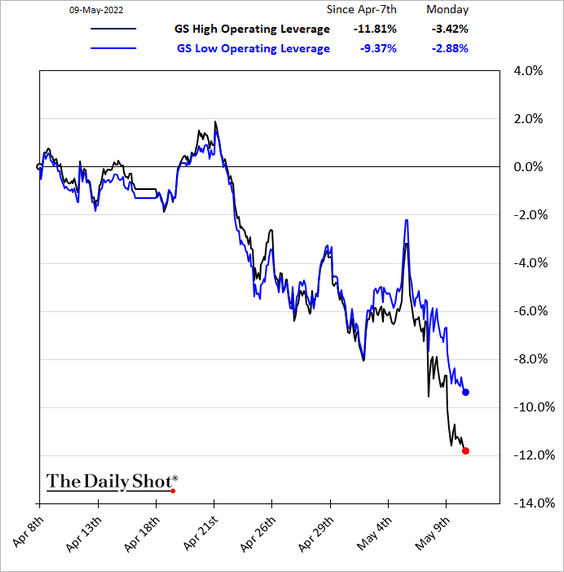

8. Companies with low operating leverage have been outperforming in recent days.

Back to Index

Credit

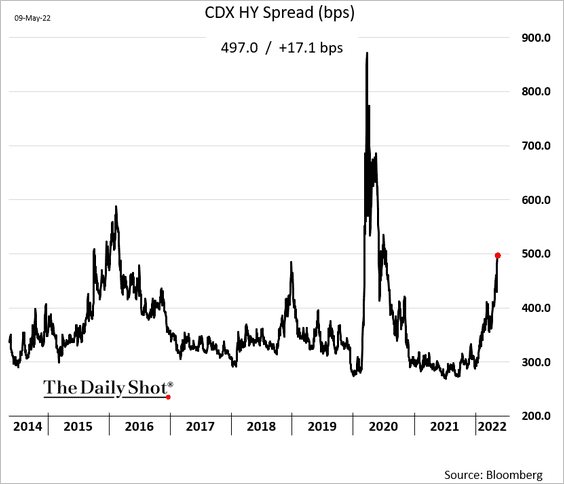

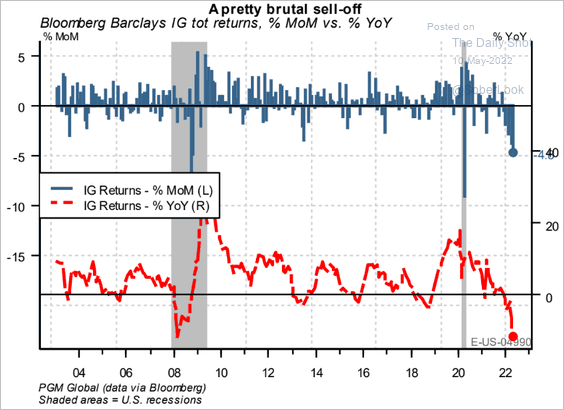

1. Corporate credit markets are under pressure.

• HY CDX spread:

• IG bond selloff:

Source: PGM Global

Source: PGM Global

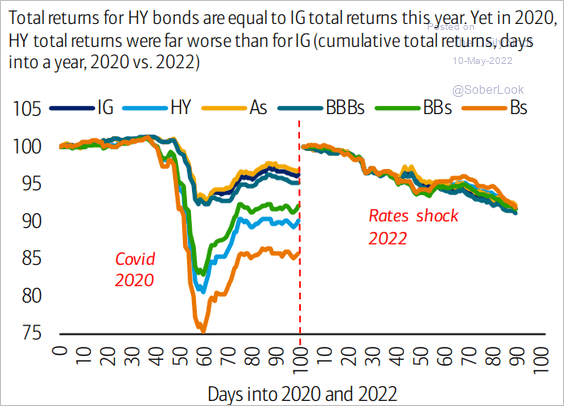

2. Unlike the COVID shock, the current selloff doesn’t discriminate.

Source: @bondvigilantes, @BankofAmerica

Source: @bondvigilantes, @BankofAmerica

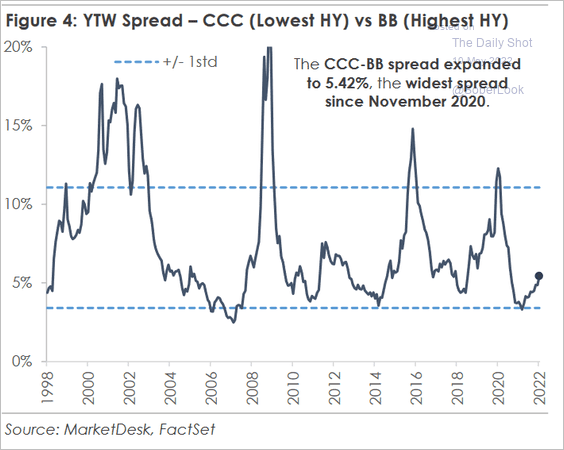

3. More room for the CCC-BB spread to widen?

Source: MarketDesk Research

Source: MarketDesk Research

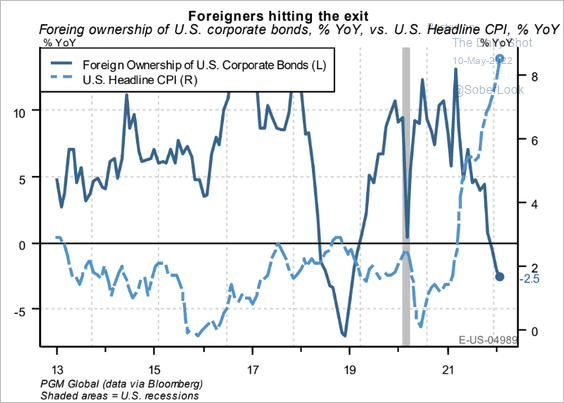

4. Foreign ownership of US corporate bonds has been declining.

Source: PGM Global

Source: PGM Global

Back to Index

Rates

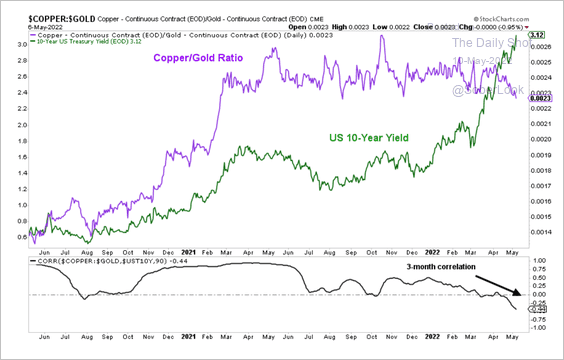

1. The correlation between the copper/gold ratio and the 10-year Treasury yield is breaking down.

Source: Aazan Habib; Paradigm Capital

Source: Aazan Habib; Paradigm Capital

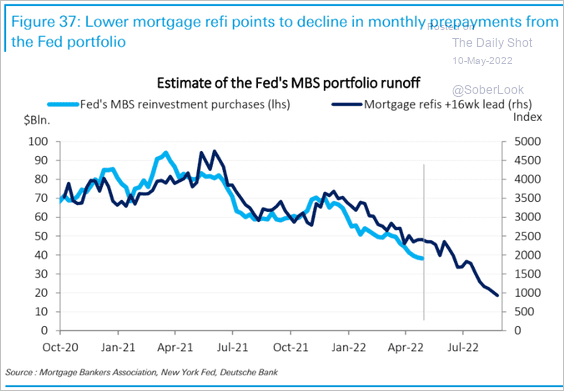

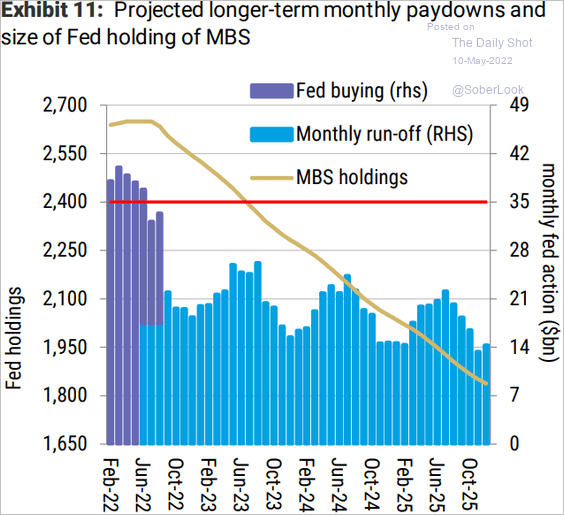

2. With rapidly slowing refi activity, the Fed will be forced to sell MBS debt outright (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

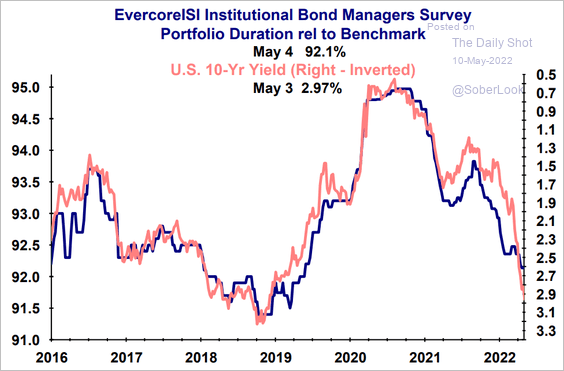

3. Will institutions reduce their portfolio durations further?

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Commodities

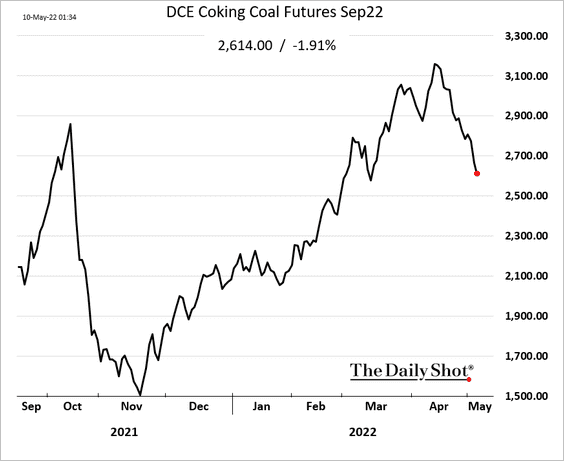

1. Iron ore continues to tumble amid softer demand from China.

Metallurgical coal is following iron ore lower.

——————–

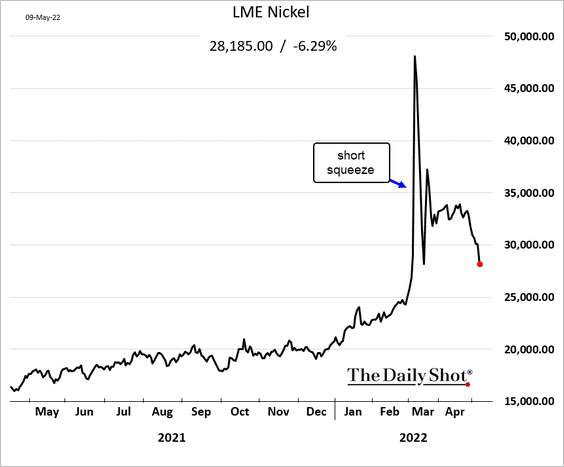

2. Nickel tool a hit in recent days.

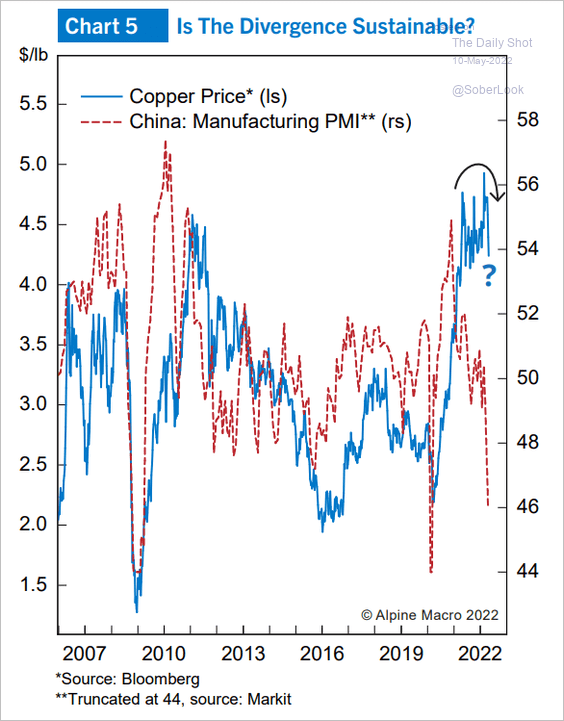

3. More downside risks for copper?

Source: Alpine Macro

Source: Alpine Macro

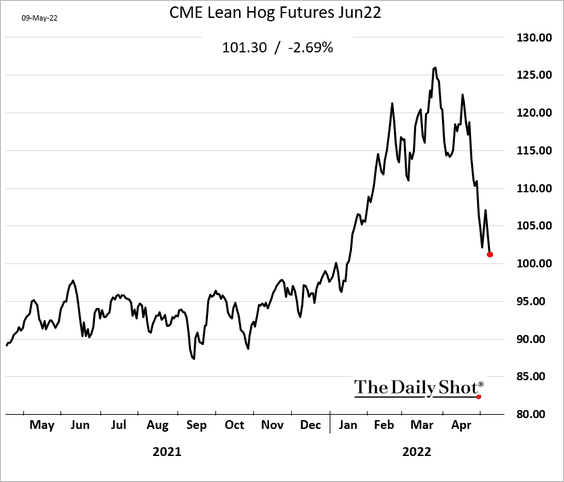

4. Chicago hog futures are tumbling.

Back to Index

Energy

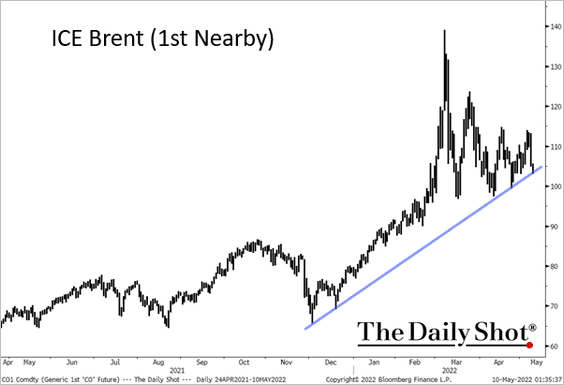

1. Brent crude is holding the uptrend support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

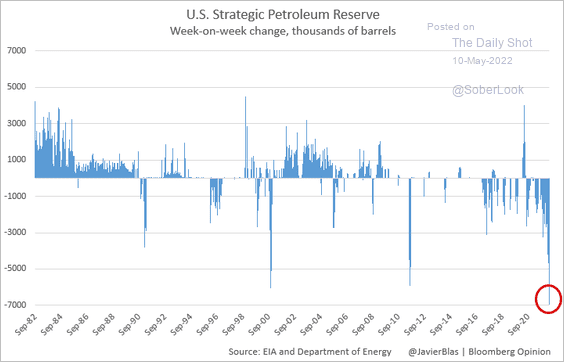

2. The US showed a big draw from the Strategic Petroleum Reserve.

Source: @JavierBlas, @EIAgov

Source: @JavierBlas, @EIAgov

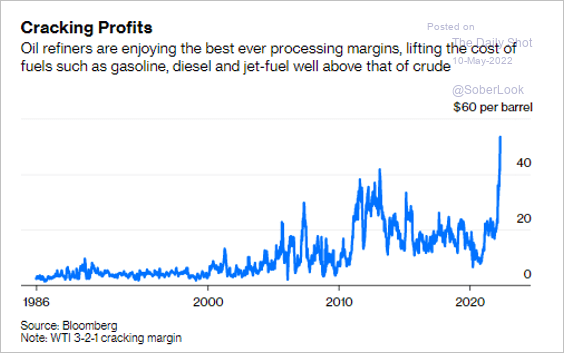

3. Refinery margins are near record levels.

Source: @JavierBlas, @bopinion Read full article

Source: @JavierBlas, @bopinion Read full article

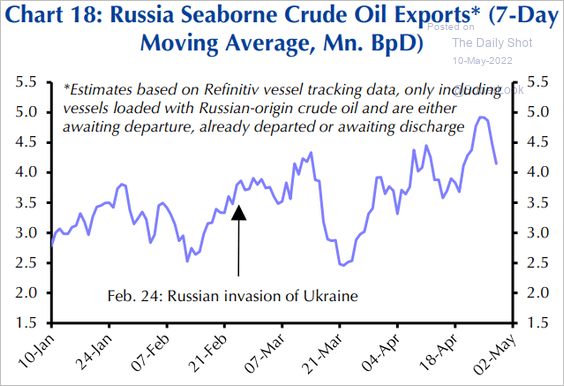

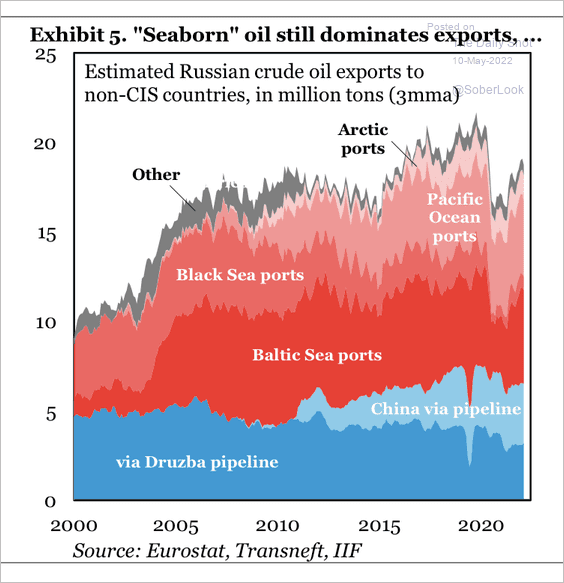

4. Russian crude oil exports are turning lower after the post-invasion spike.

Source: Capital Economics

Source: Capital Economics

Seaborn oil dominates Russia’s exports (which could make sanctions more effective).

Source: IIF

Source: IIF

Back to Index

Cryptocurrency

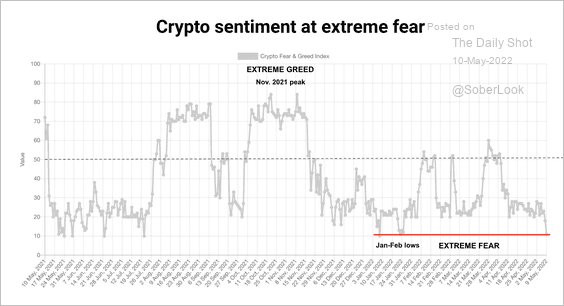

1. Bitcoin’s Fear & Greed Index entered “extreme fear” territory.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

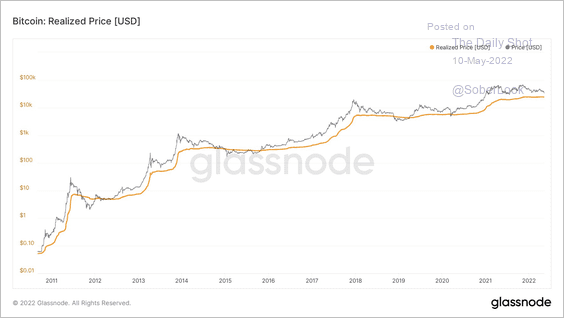

2. Bitcoin’s realized price (average cost basis among traders) is currently at $24,300, which could be an important support level.

Source: @DylanLeClair_

Source: @DylanLeClair_

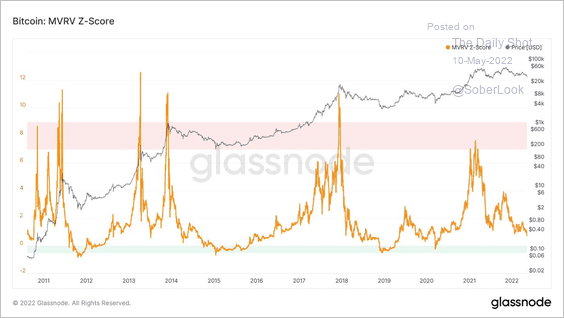

3. This chart shows bitcoin’s market value relative to its realized value (MVRV), which does not appear oversold.

Source: @DylanLeClair_

Source: @DylanLeClair_

4. Once again, El Salvador, the first country to make BTC legal tender last year, bought the dip. So far, the crypto venture has been a bust for the impoverished nation.

Source: @nayibbukele

Source: @nayibbukele

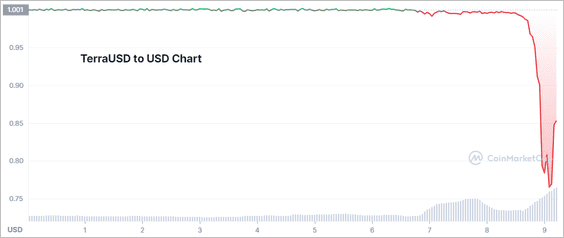

5. The UST stablecoin lost its dollar peg for the second time in three days, increasing the risk of customer redemptions. Welcome to the world of “breaking the buck.”

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

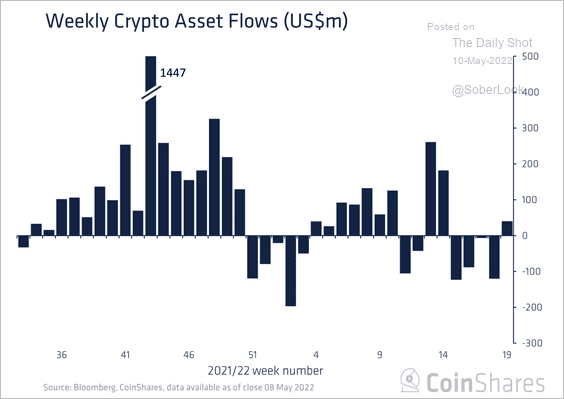

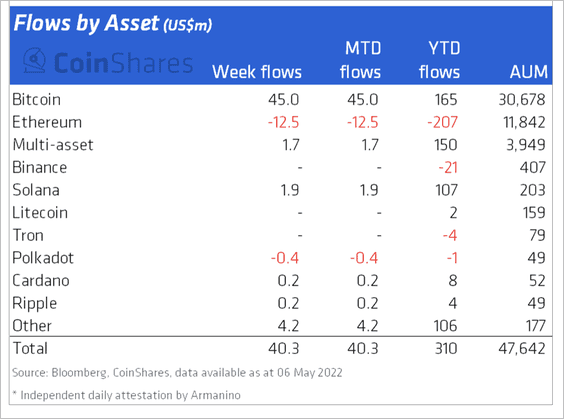

6. Crypto funds saw net inflows over the past week, although short bitcoin funds experienced the second-largest weekly inflows on record over the same period.

Source: CoinShares Read full article

Source: CoinShares Read full article

Ethereum-based funds continue to experience outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Emerging Markets

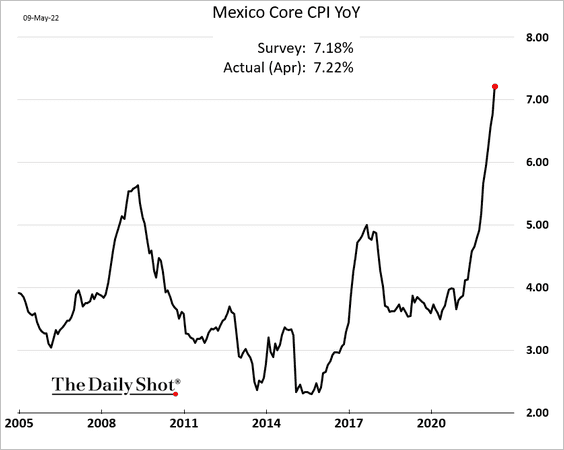

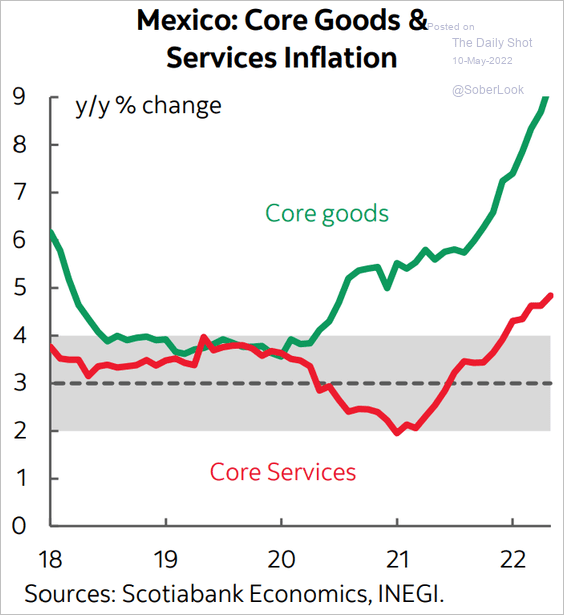

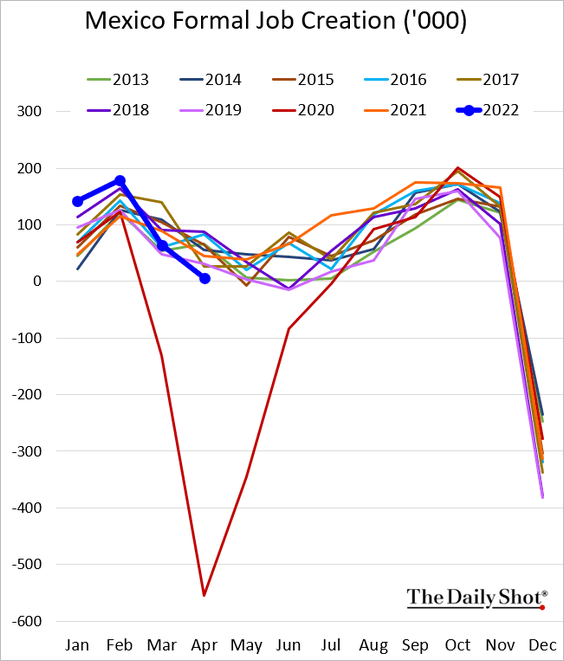

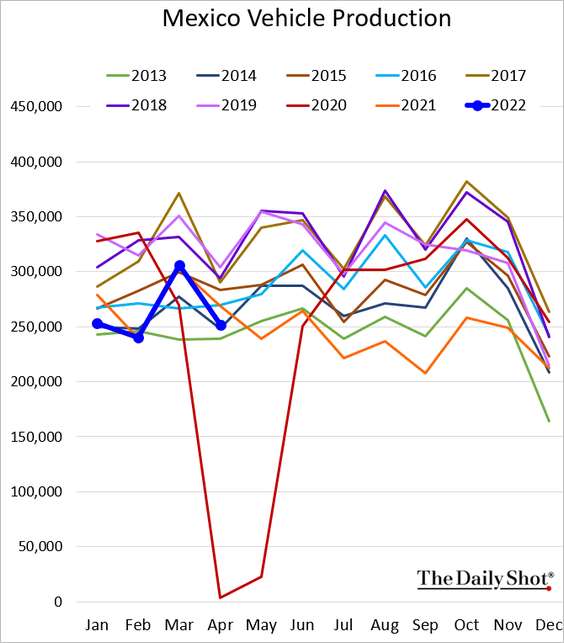

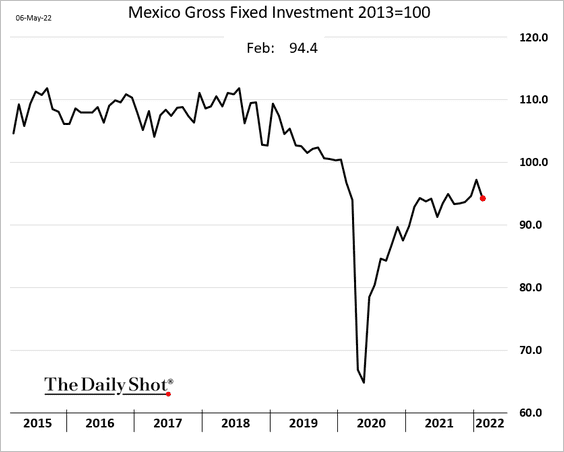

1. Let’s begin with Mexico.

• The core CPI is above 7%.

Source: Scotiabank Economics

Source: Scotiabank Economics

• Formal job creation deteriorated in April.

• Vehicle production is back at 2014 levels.

• Business investment declined in February.

——————–

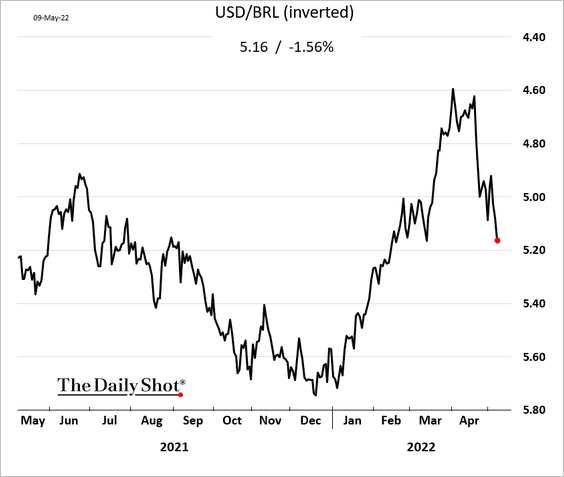

2. The Brazilian real continues to weaken.

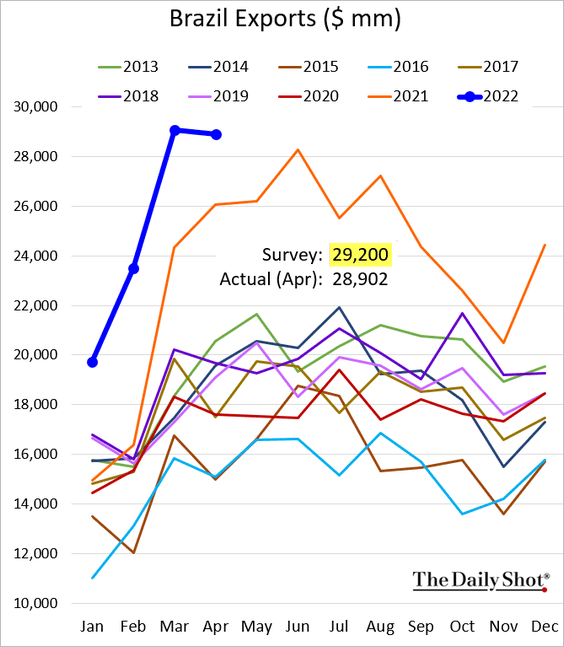

Brazilian exports were softer than expected last month.

——————–

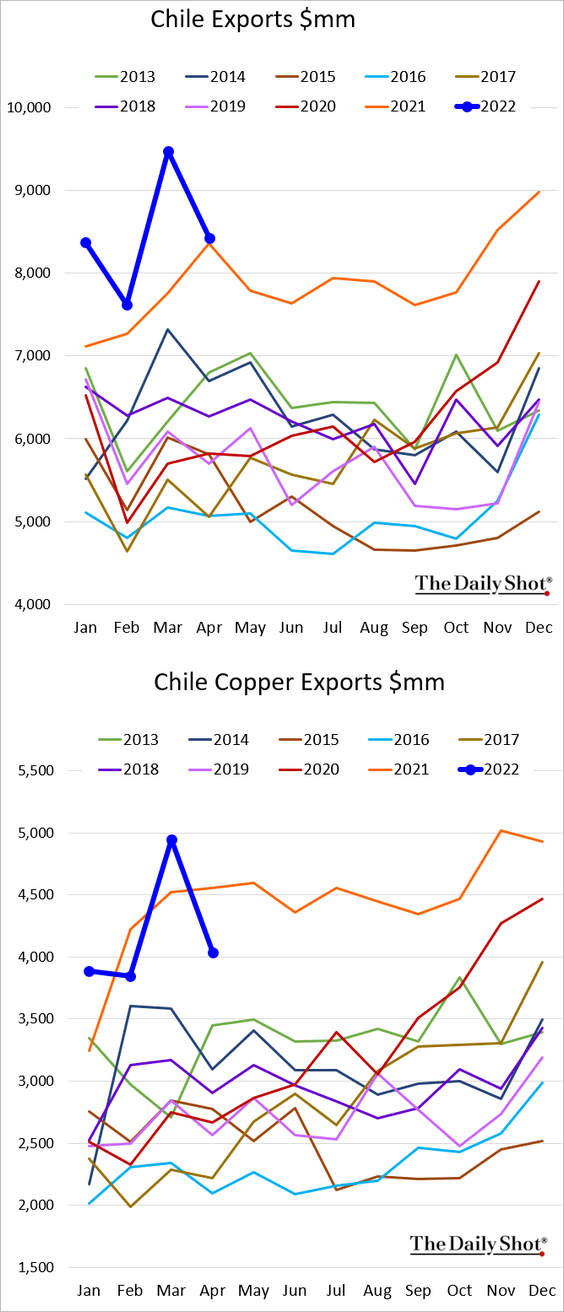

3. Chile’s exports pulled back from the highs.

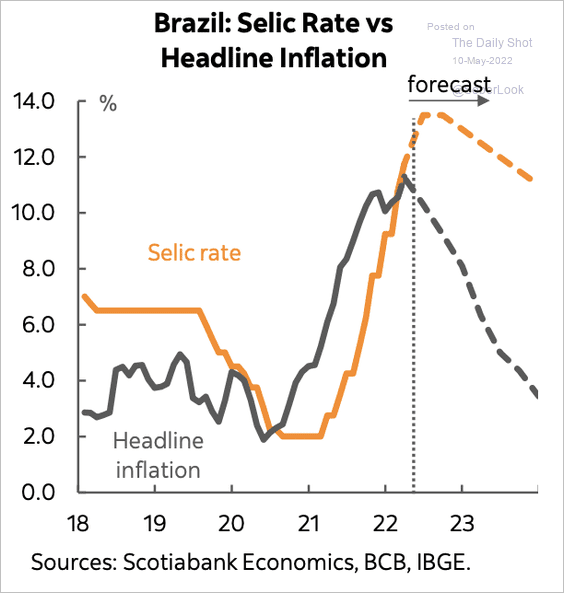

4. Scotiabank expects inflation to moderate in Brazil and Chile, which could trigger a series of rate cuts (2 charts).

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

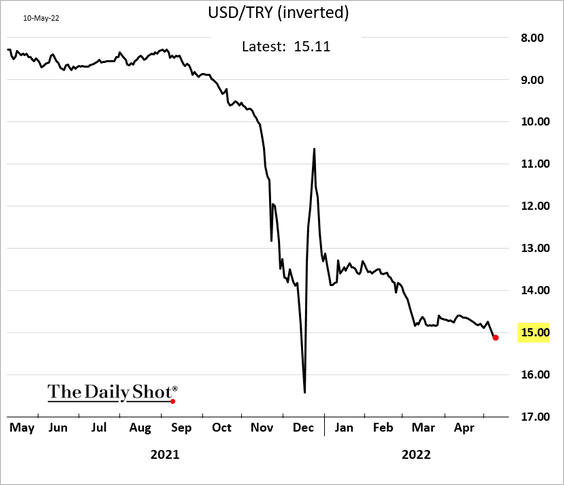

5. The Turkish lira weakened through 15 to the dollar.

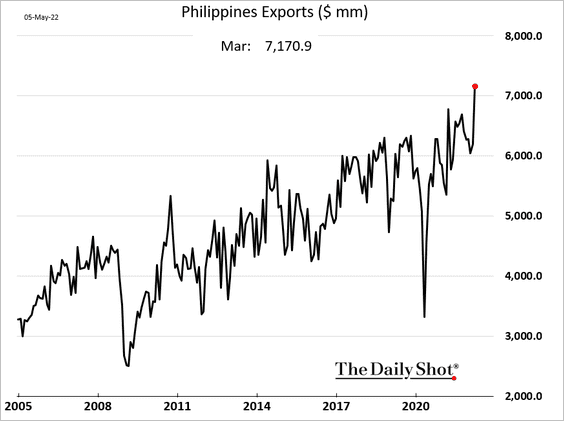

6. Philippine exports hit a record high.

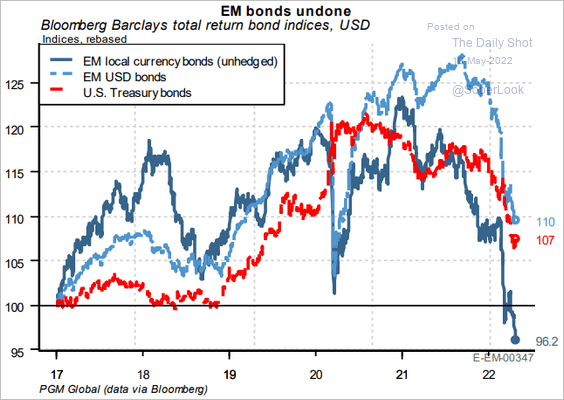

7. With the recent explosion in the US dollar, EM local currency bonds are exhibiting their worst returns since the Global Financial Crisis.

Source: PGM Global

Source: PGM Global

Back to Index

China

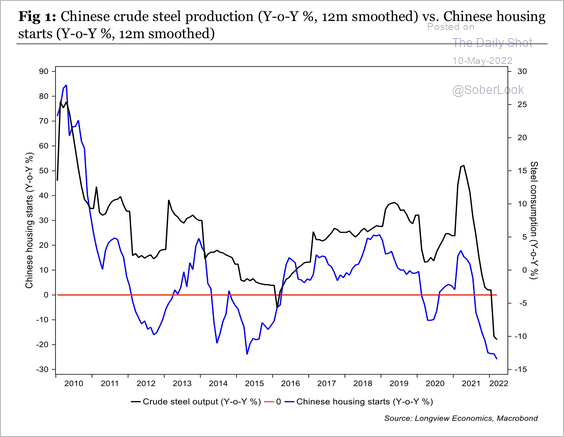

1. The decline in steel production and housing starts show no signs of easing.

Source: Longview Economics

Source: Longview Economics

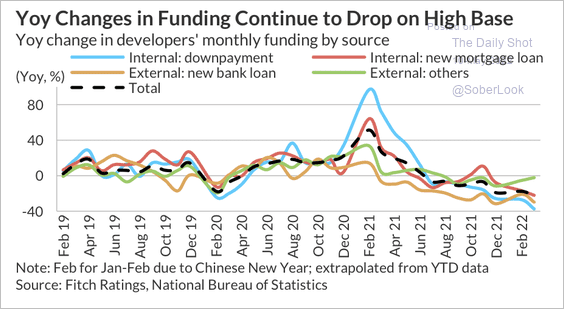

Developer funding continues to drop.

Source: Fitch Ratings

Source: Fitch Ratings

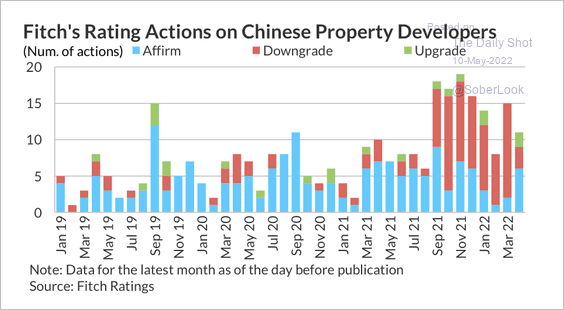

There have been fewer credit downgrades among property developers recently.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

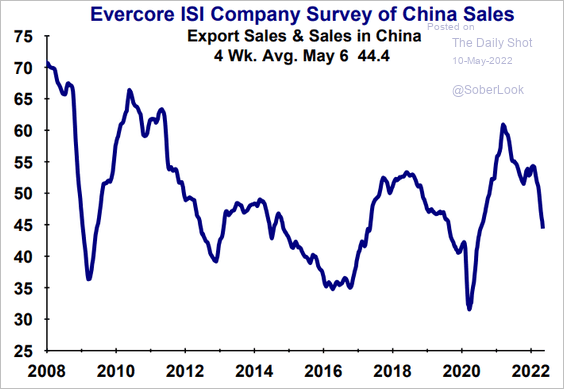

2. International firms see softer sales in China.

Source: Evercore ISI Research

Source: Evercore ISI Research

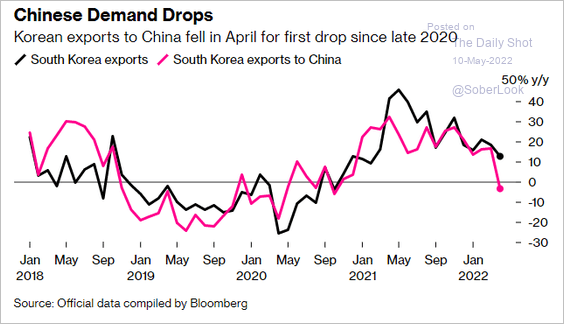

3. South Korea’s exports illustrate deteriorating domestic demand in China.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Australia

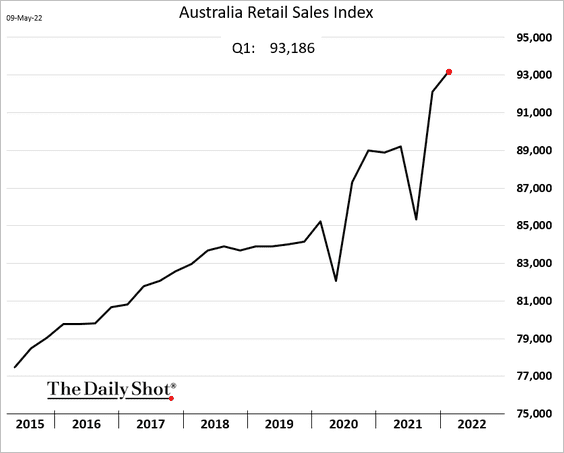

1. Retail sales were robust last quarter.

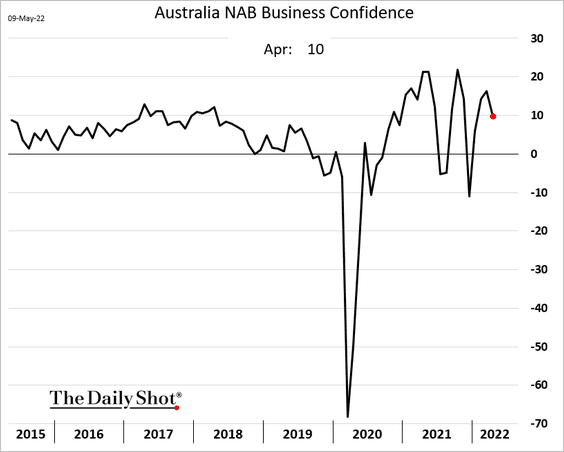

2. Business confidence eased last month.

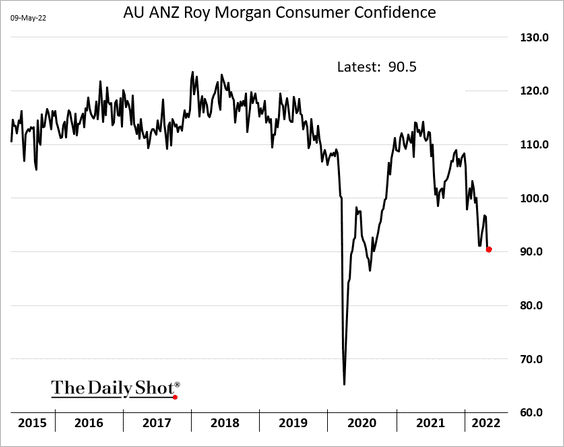

3. Consumer confidence continues to deteriorate.

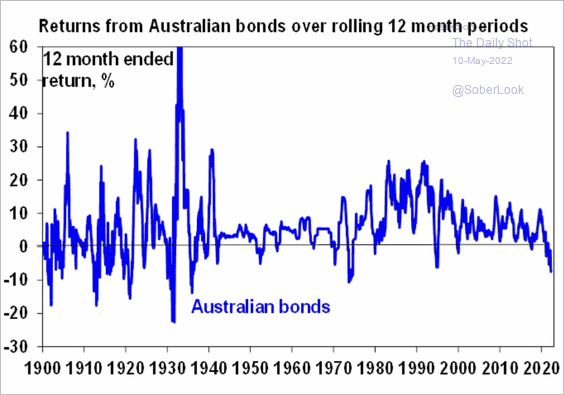

4. This chart shows the Bloomberg Australia Bond Composite Index at its worst rolling 12-month return since August 1974.

Source: @ShaneOliverAMP

Source: @ShaneOliverAMP

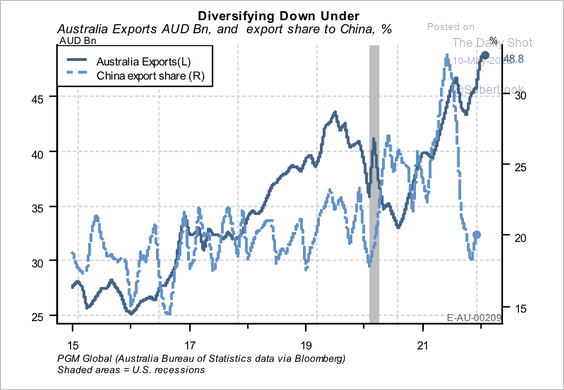

5. China’s share of Australia’s exports has declined over the past year.

Source: PGM Global

Source: PGM Global

Back to Index

The Eurozone

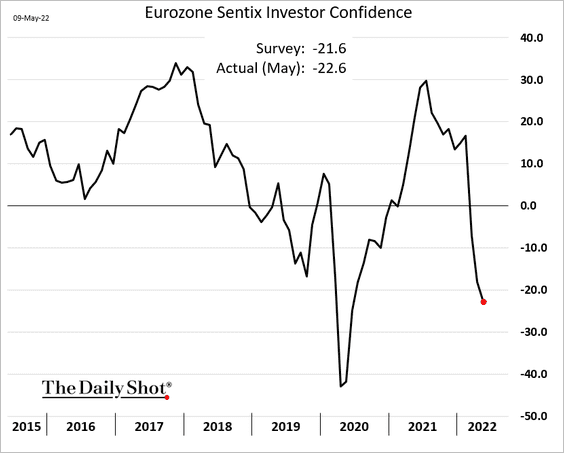

1. Investor confidence deteriorated further this month.

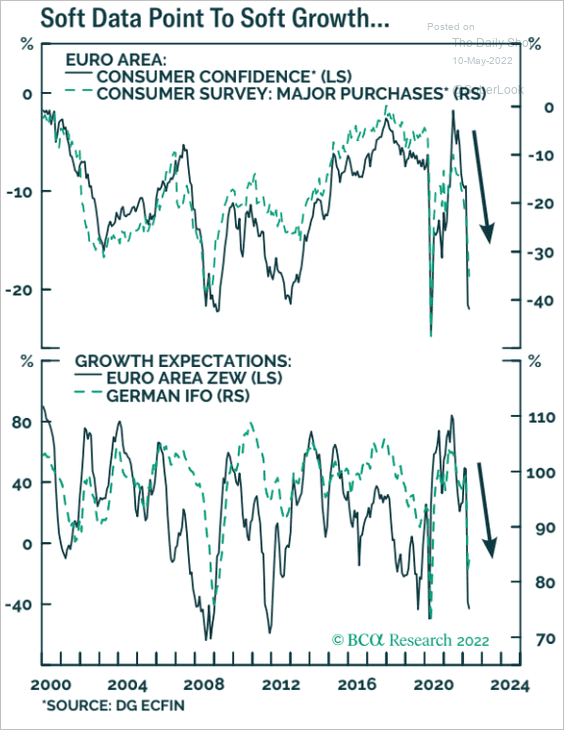

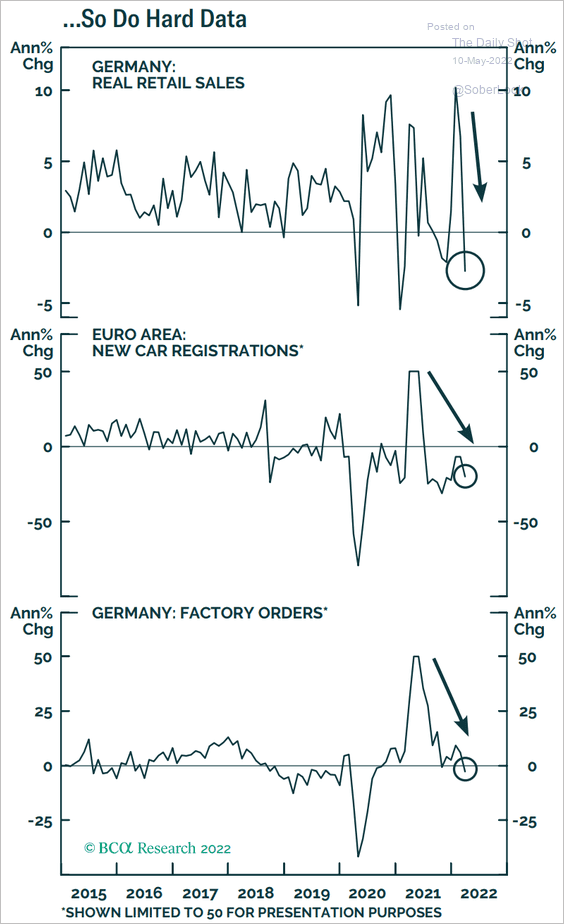

Both soft (chart below) and hard data (2nd chart) point to slower economic growth in the Eurozone.

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

——————–

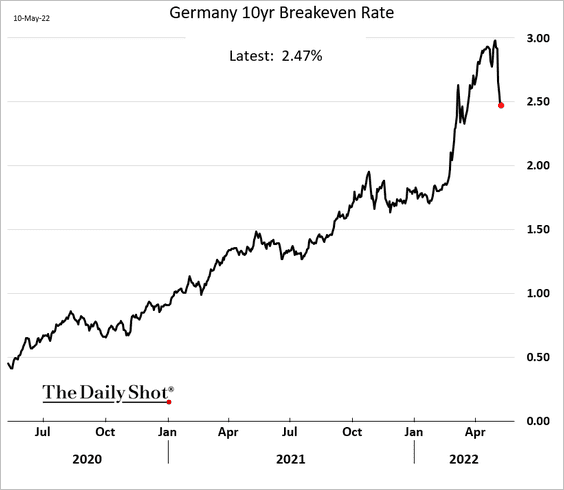

2. German market-based inflation expectations have peaked.

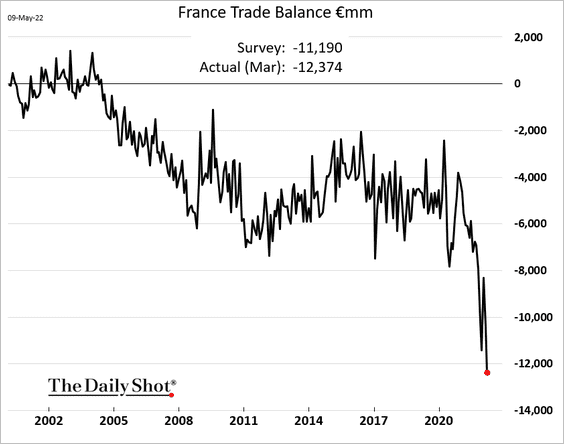

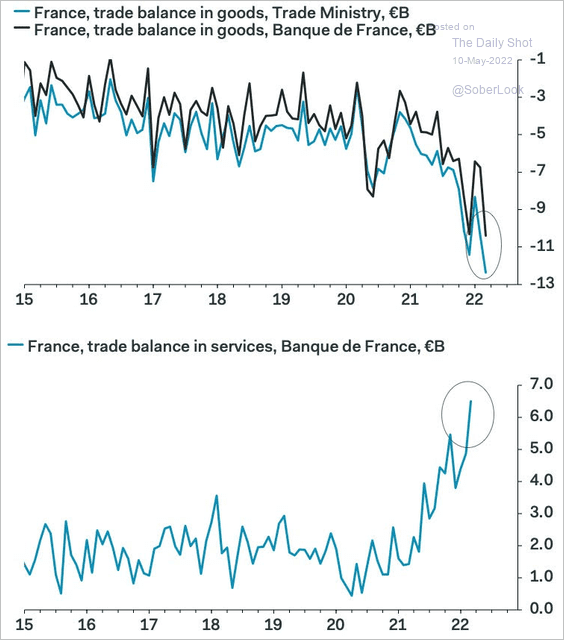

3. The French trade deficit hit a new record as energy prices soared.

But France is running a record surplus in services.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

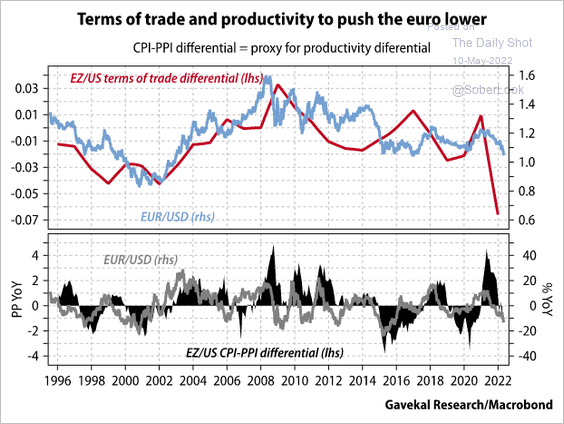

4. The euro faces further downside risks.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Canada

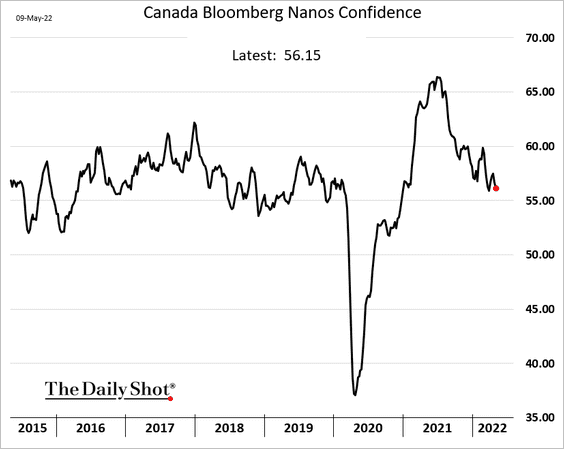

1. Consumer confidence is trending lower.

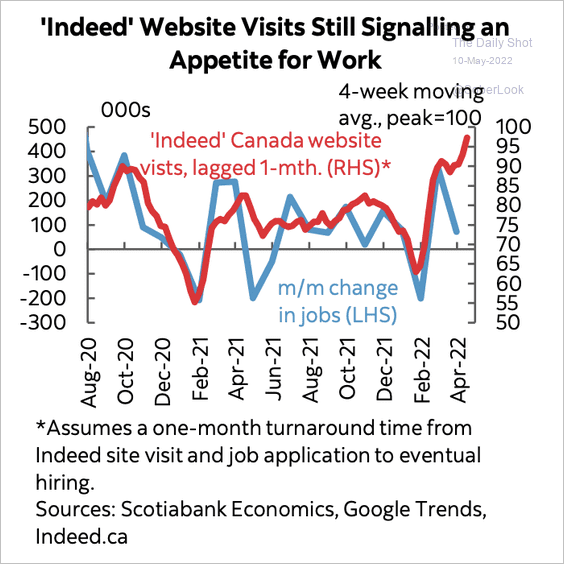

2. Job searches are picking up, …

Source: Scotiabank Economics

Source: Scotiabank Economics

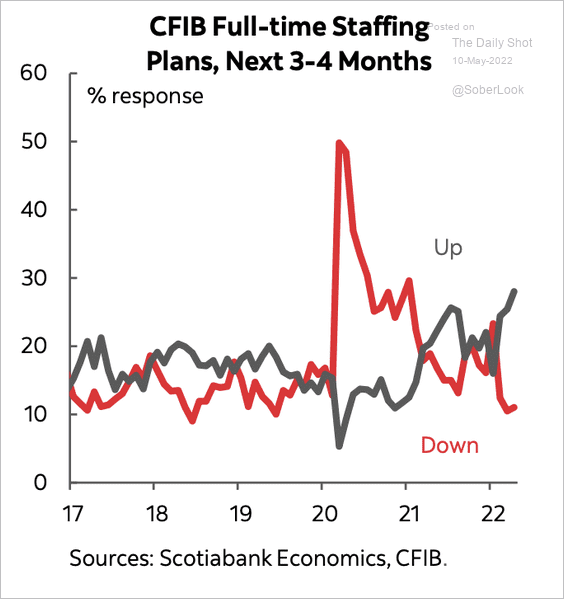

…and so is the appetite for future hiring.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United States

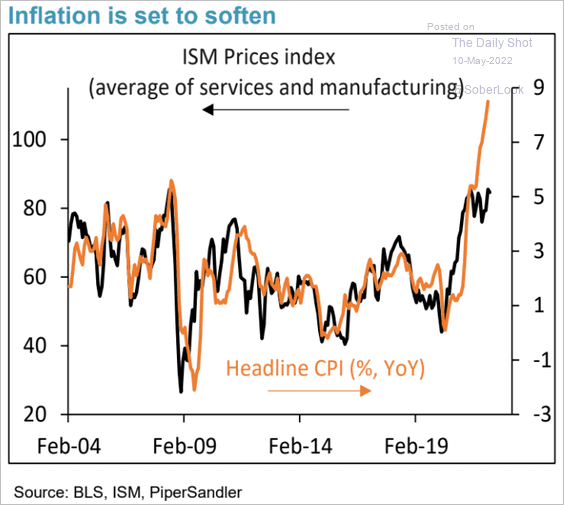

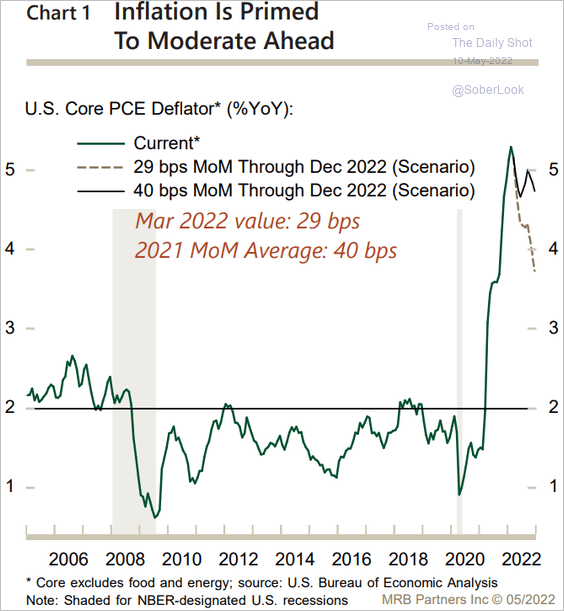

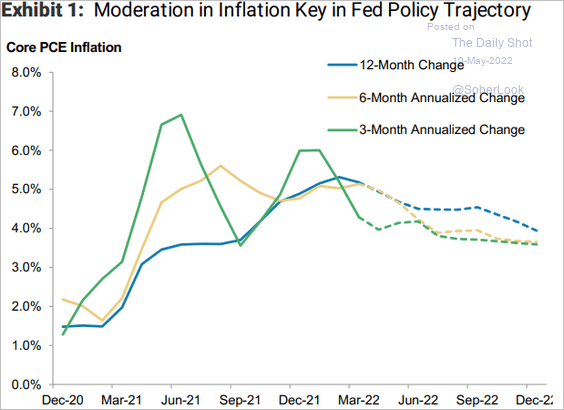

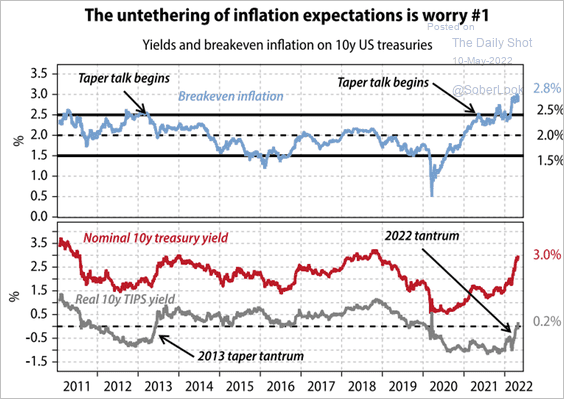

1. Let’s begin with some updates on inflation.

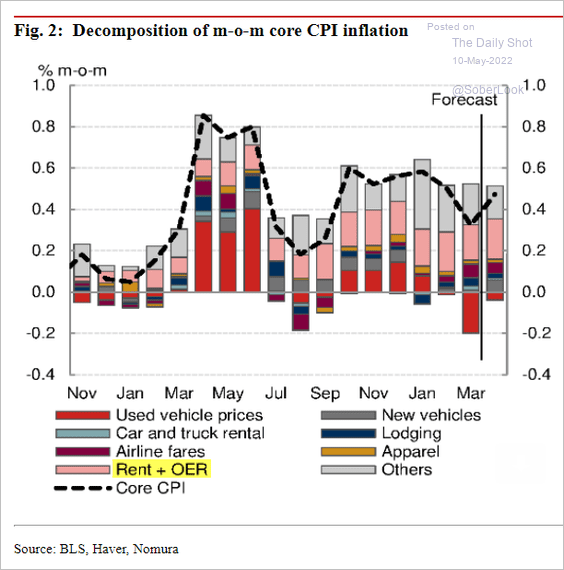

• Nomura expects to see an uptick in the month-over-month CPI change in April, driven by housing.

Source: Nomura Securities

Source: Nomura Securities

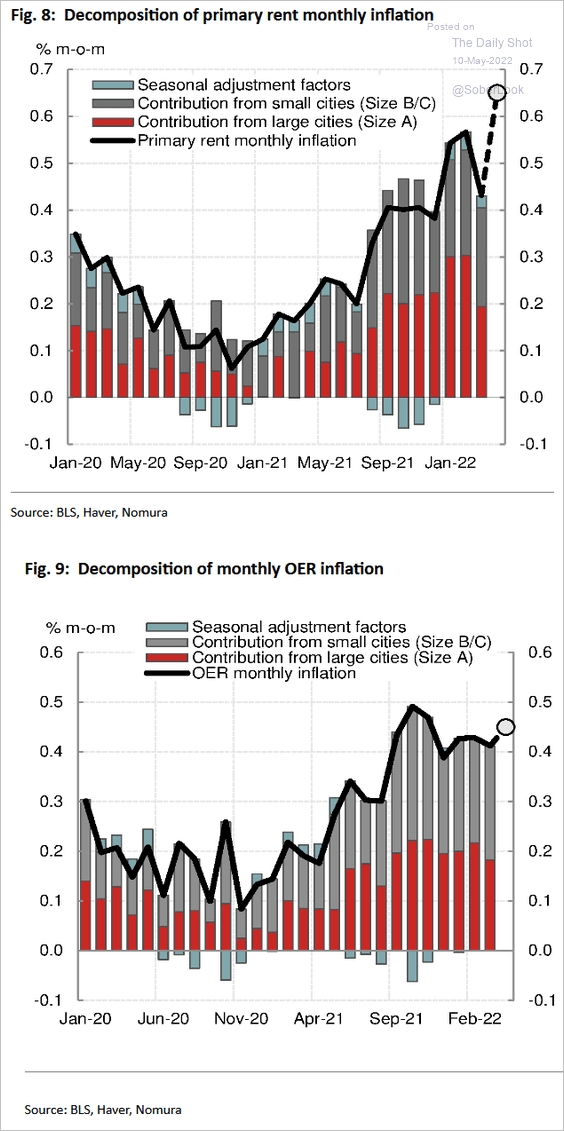

Primary rent is expected to be the key contributor to the CPI gain.

Source: Nomura Securities

Source: Nomura Securities

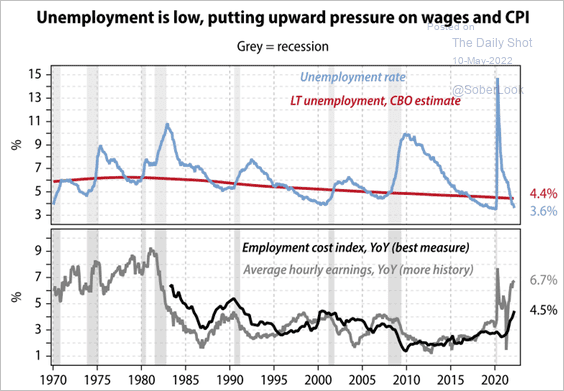

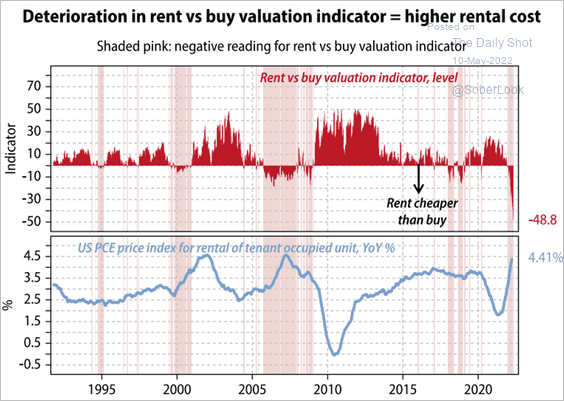

• While supply chain constraints and the global energy crisis are considered less persistent sources of inflation going forward, wage growth and rental prices are two sources that are expected to be more persistent drivers of inflation in 2022 (two charts).

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

• On a year-over-year basis, inflation is expected to soften.

Source: Piper Sandler

Source: Piper Sandler

Source: MRB Partners

Source: MRB Partners

• Markets are likely to exhibit heightened sensitivity to upcoming inflation prints due to the Fed’s new focus.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• The “untethering” of inflation expectations is a key risk for the Fed.

Source: Gavekal Research

Source: Gavekal Research

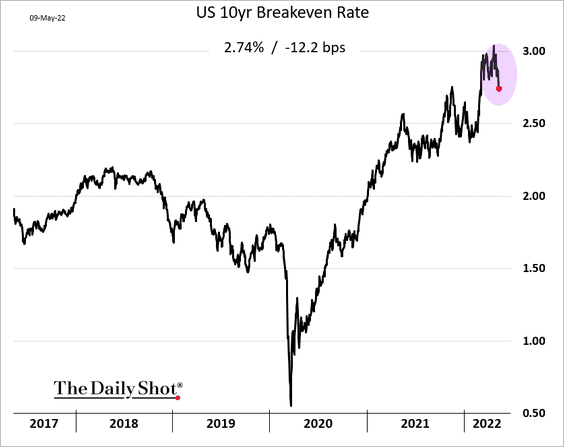

• Market-based inflation expectations moved lower on Monday.

——————–

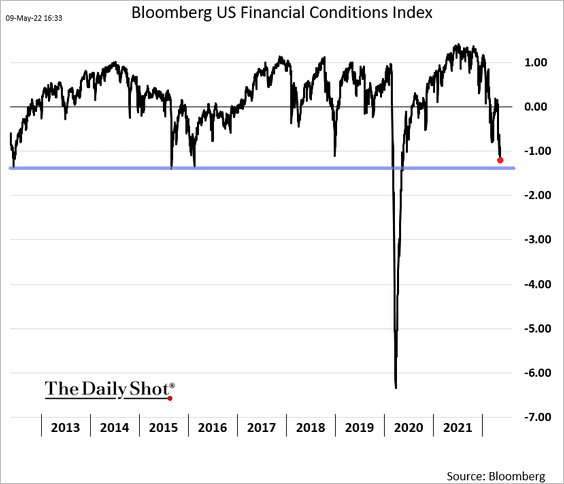

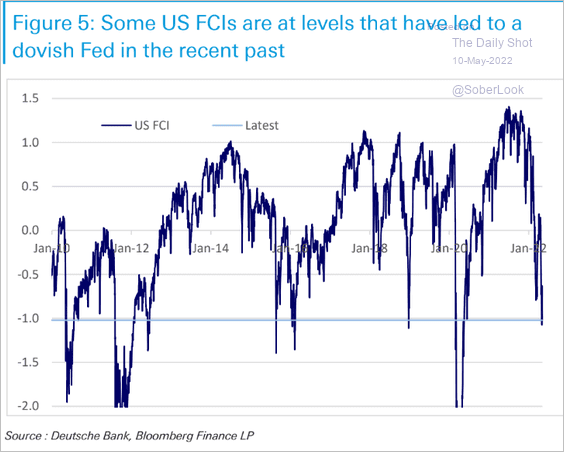

2. The Fed has been successful in tightening US financial conditions through forward guidance.

Was the central bank too successful?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

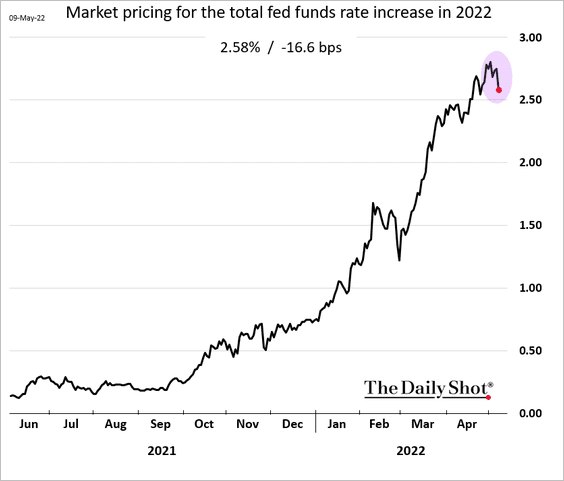

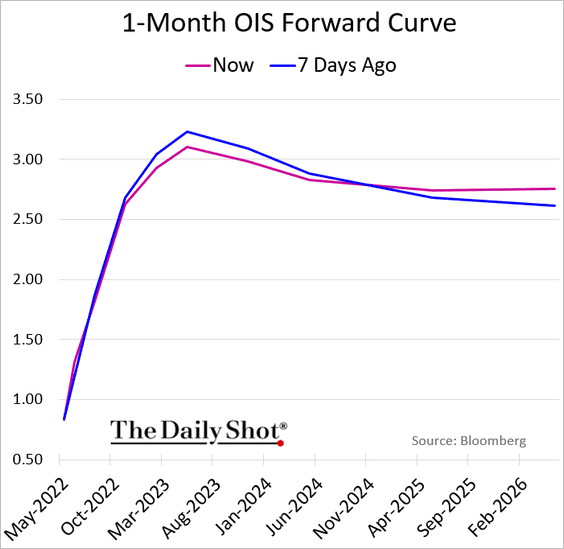

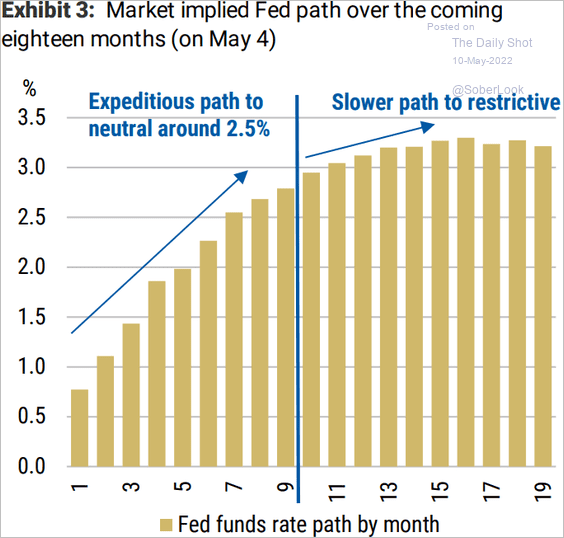

3. Rate hike expectations eased on Monday.

• Here is the market-based trajectory for the fed funds rate.

• The Fed is currently set to “expeditiously” get to neutral by the end of 2022 and move to restrictive monetary conditions in 2023 at a slower pace.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

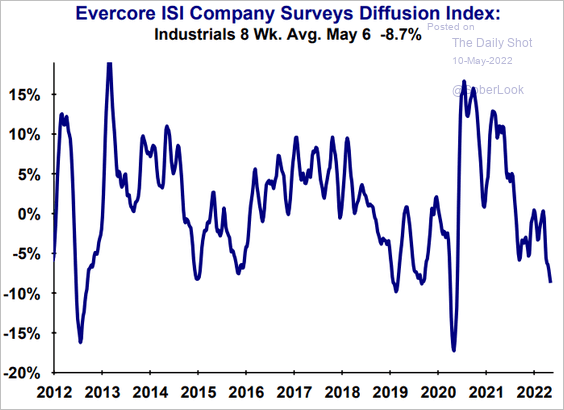

4. The Evercore ISI industrials survey points to downside risks for the ISM Manufacturing PMI.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Global Developments

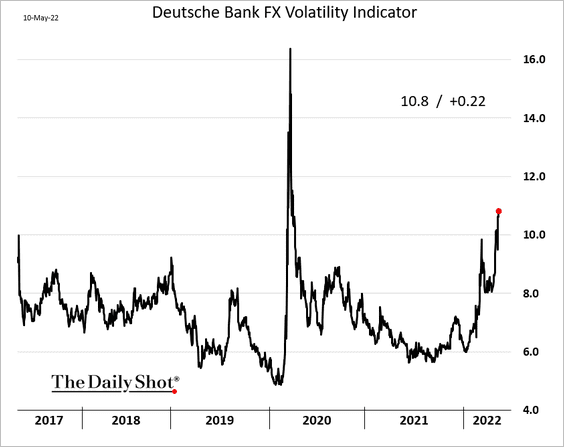

1. Currency market implied volatility is surging.

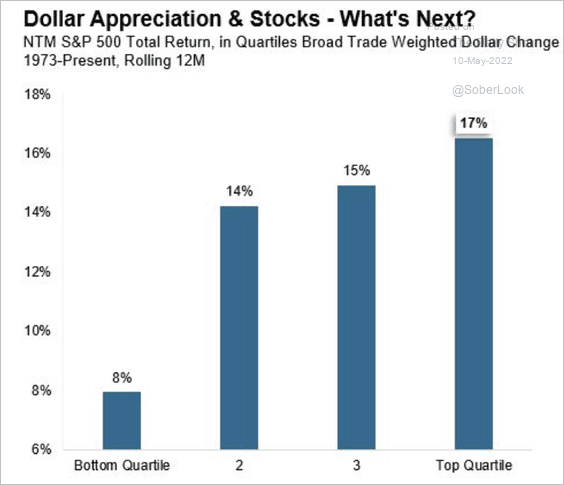

2. The dollar has seen a top quartile move over the past year, which typically signals further upside for the greenback.

Source: Denise Chisholm; Fidelity Investments

Source: Denise Chisholm; Fidelity Investments

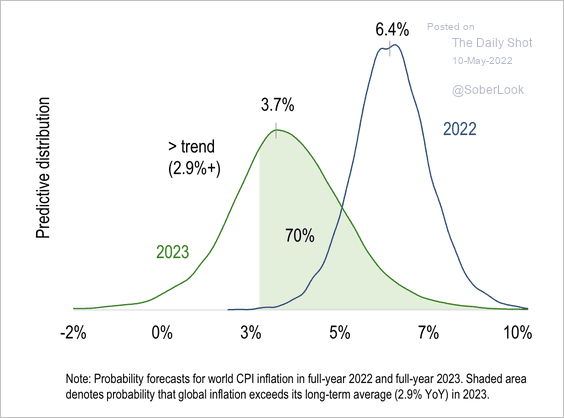

3. Numera Analytics expects global inflation to remain well above trend.

Source: Numera Analytics

Source: Numera Analytics

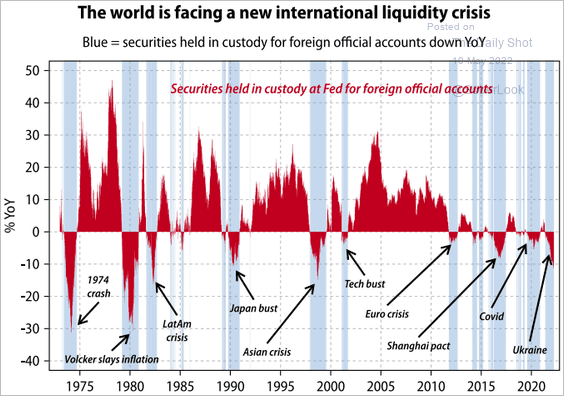

4. Securities held in custody at the Fed on behalf of foreign official accounts have fallen noticeably by 10% over the past year. This reduction in global liquidity has historically coincided with major market adjustments.

Source: Gavekal Research

Source: Gavekal Research

——————–

Food for Thought

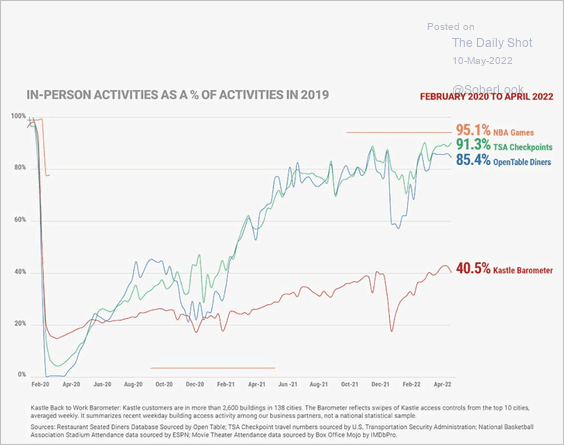

1. The return to normal activity but not to the office:

Source: Kastle Systems, Bain & Company Read full article

Source: Kastle Systems, Bain & Company Read full article

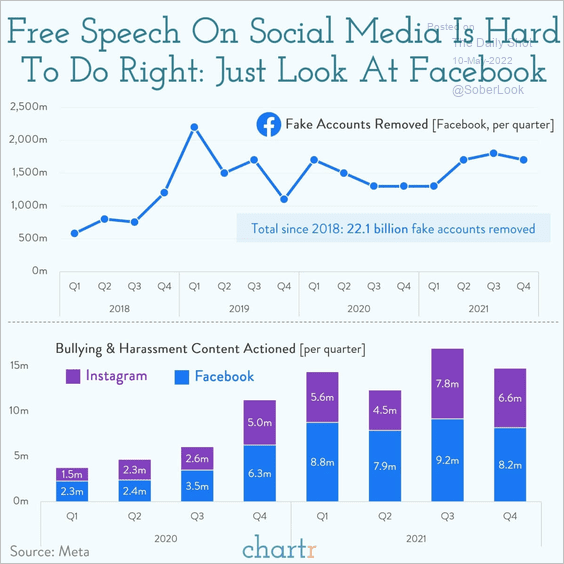

2. Challenges with “free speech” on social media:

Source: @chartrdaily

Source: @chartrdaily

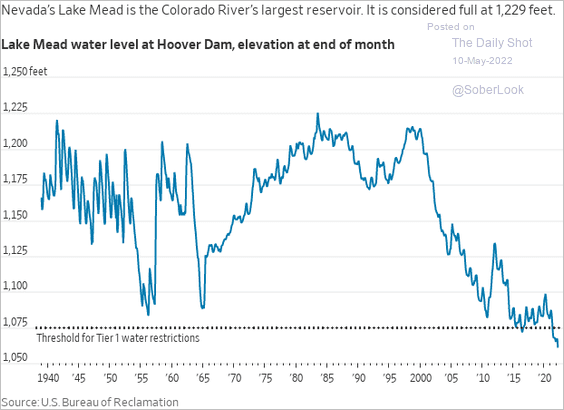

3. Water level at the Hoover Dam:

Source: @WSJ Read full article

Source: @WSJ Read full article

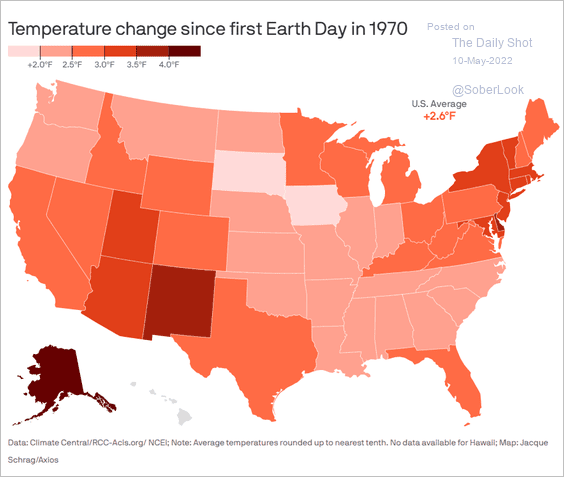

4. Temperature changes since 1970:

Source: @axios Read full article

Source: @axios Read full article

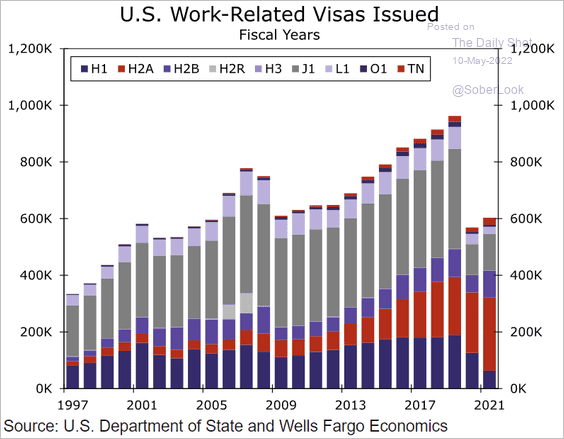

5. US work-related visa issuance:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

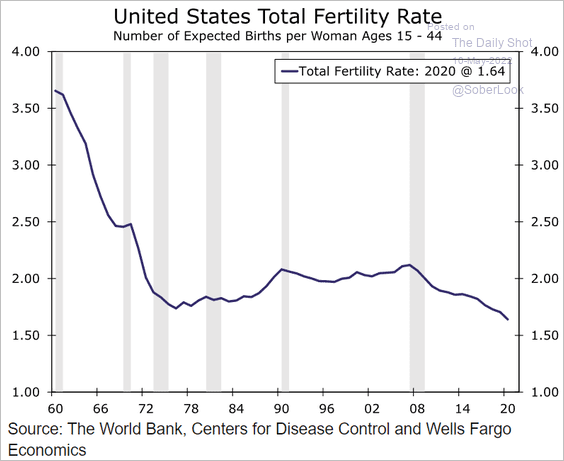

6. The US fertility rate:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

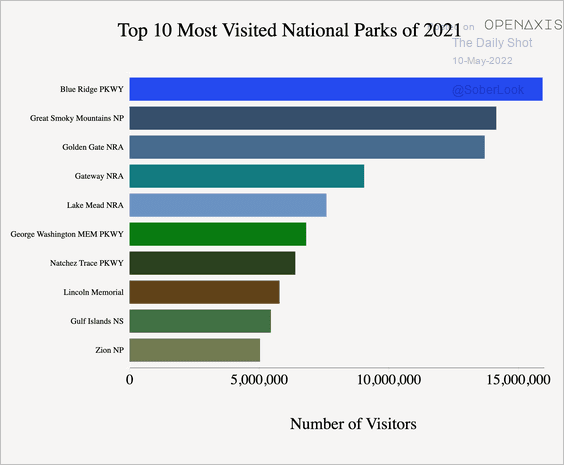

7. Most visited US national parks:

——————–

Back to Index