The Daily Shot: 11-May-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

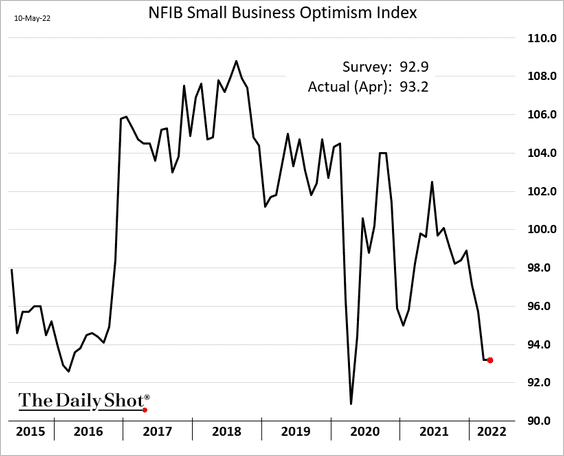

1. The NFIB small business sentiment index held steady last month (at the lowest level since early 2020).

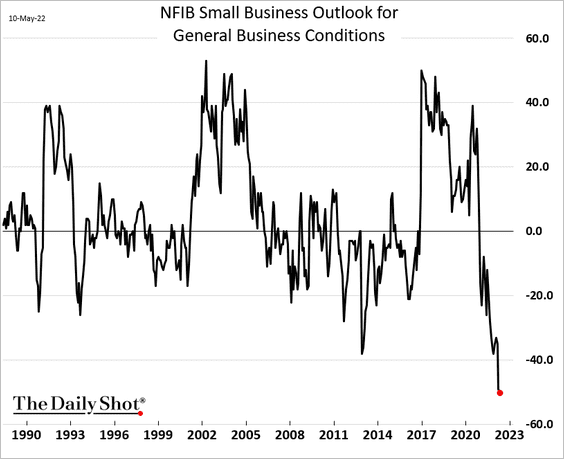

• Outlook is at record lows …

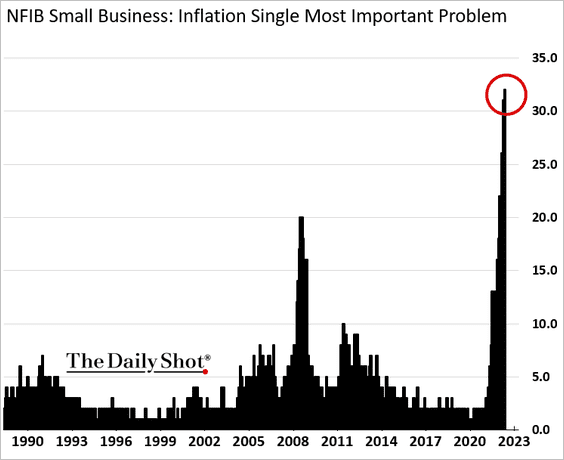

• … due to inflation concerns.

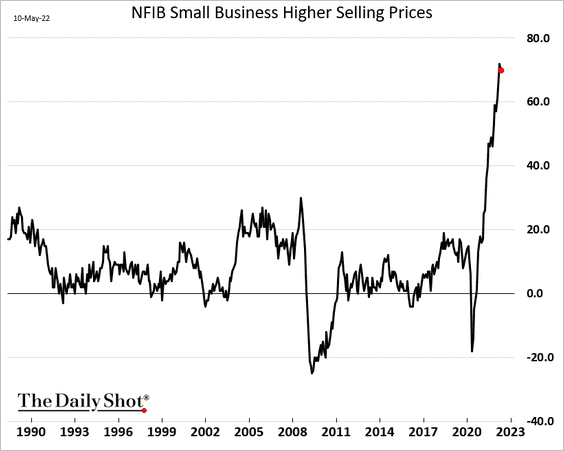

• Near-record percentage of firms have been raising prices.

——————–

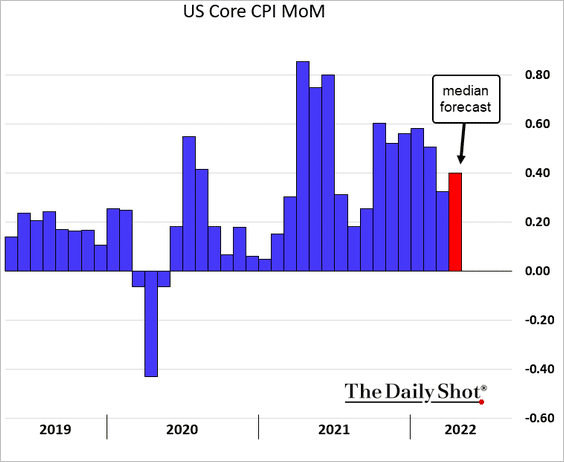

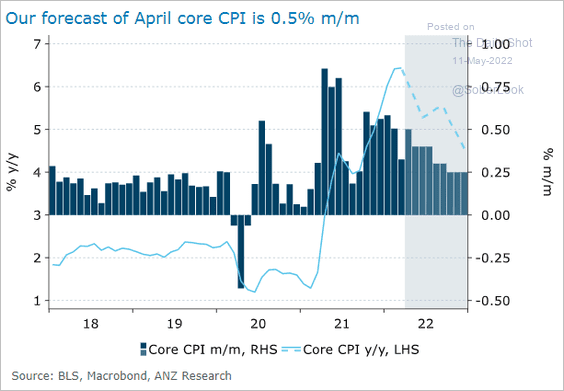

2. Next, we have some updates on inflation.

• The consensus CPI estimate for April is 0.4% month-over-month. This is the most consequential US economic report of the month and will be watched closely around the world.

ANZ’s estimate is 0.5%.

Source: @ANZ_Research

Source: @ANZ_Research

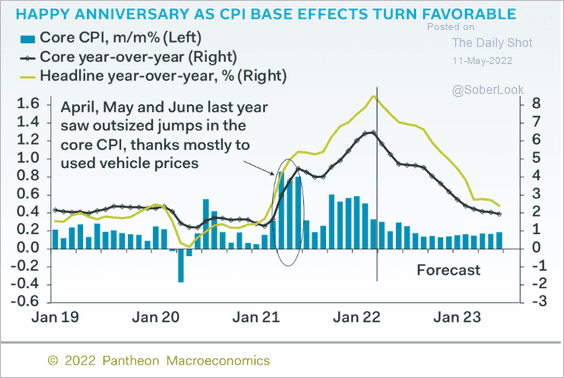

• Base effects tell us that on a year-over-year basis the CPI should decline.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

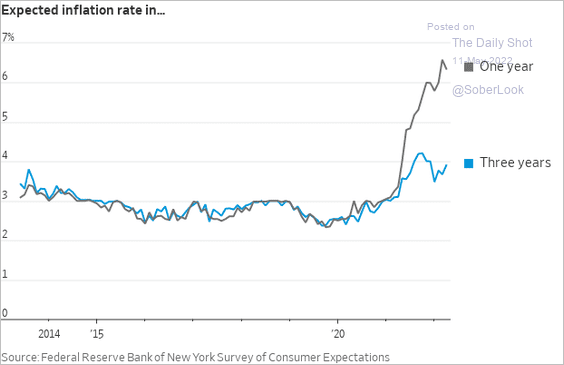

• The Fed’s survey shows a downtick in the one-year consumer inflation expectations and an uptick in the three-year index.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

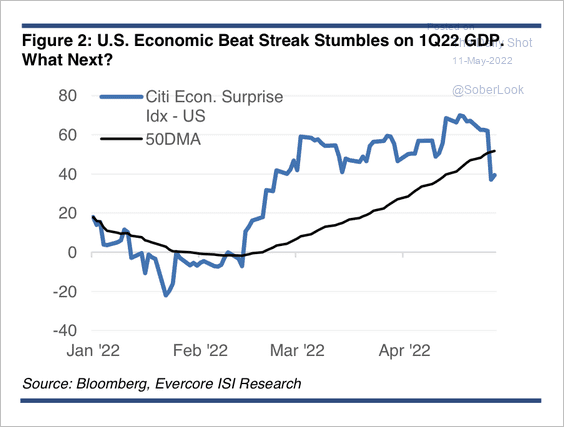

3. Where are we in the business cycle?

Source: BCA Research

Source: BCA Research

The Citi Economic Surprise Index broke below its 50-day moving average, signaling slower growth.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

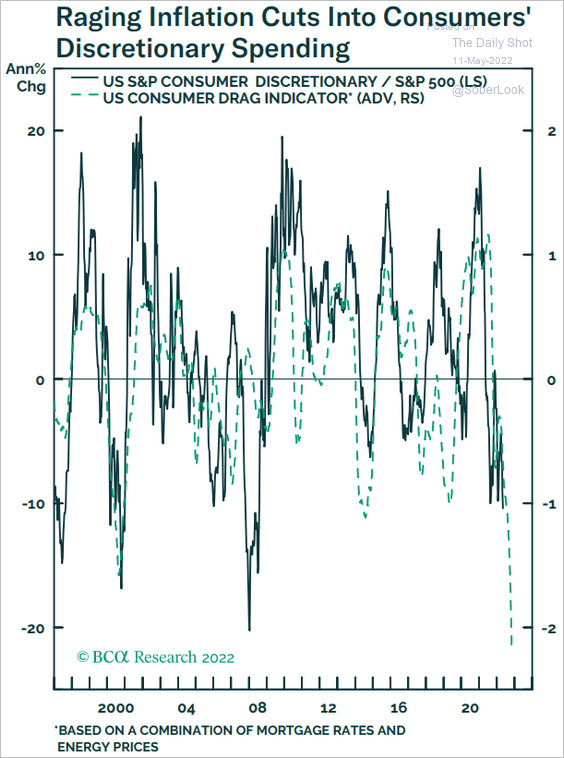

4. High inflation and rising mortgage rates are pressuring discretionary spending.

Source: BCA Research

Source: BCA Research

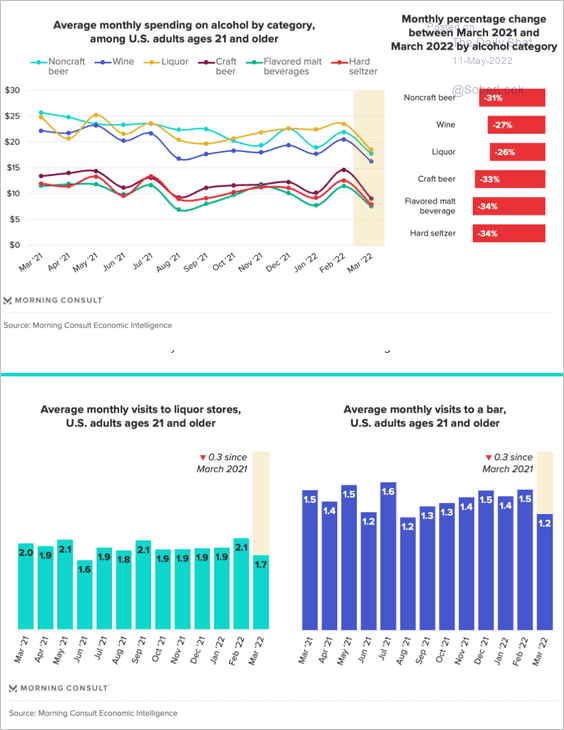

Did the trend start in March when spending on booze declined meaningfully?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

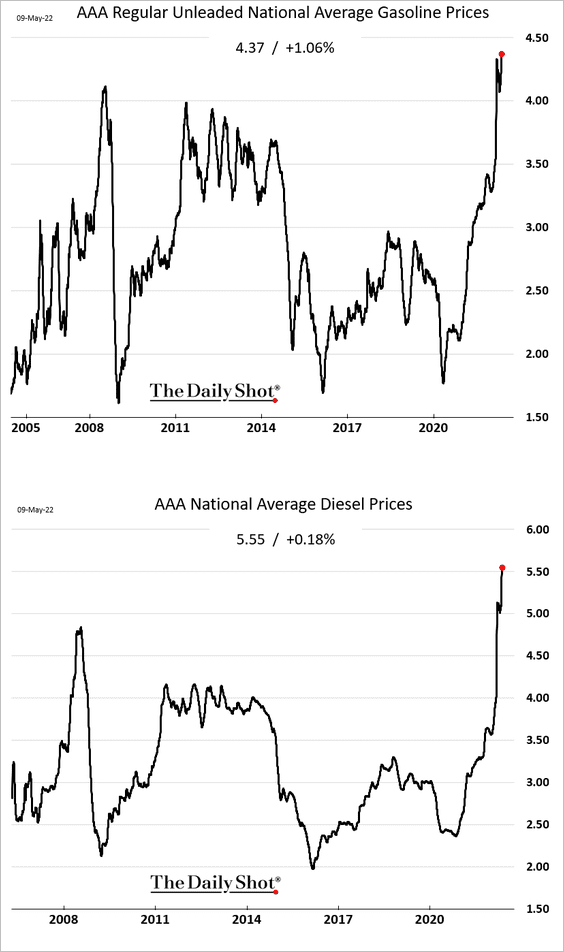

5. Retail gasoline prices hit a record high, which will be a drag on consumer sentiment this month.

Source: @axios Read full article

Source: @axios Read full article

——————–

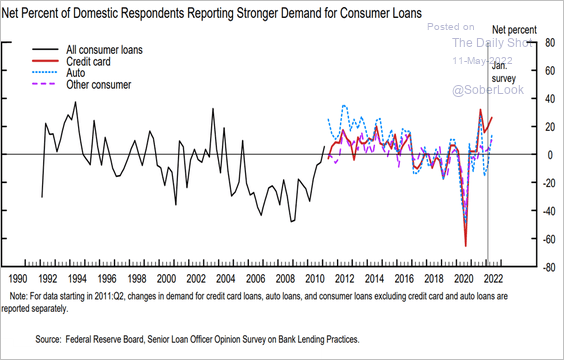

6. Banks see stronger demand for consumer loans.

Source: Federal Reserve Board

Source: Federal Reserve Board

Back to Index

The United Kingdom

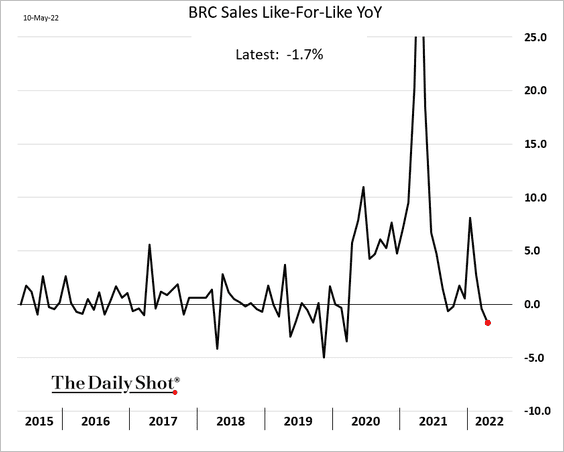

1. The BRC report showed slowing retail sales last month.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

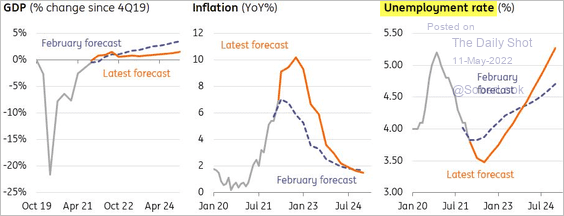

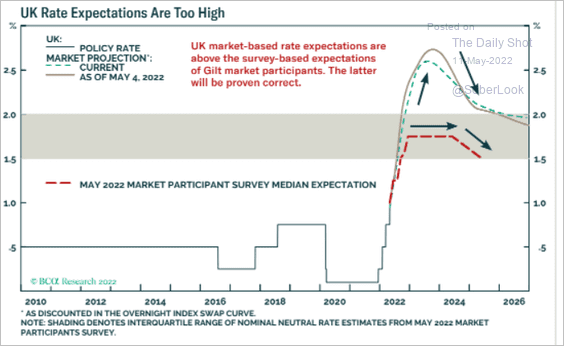

2. The BoE’s latest forecast shows unemployment rising above the COVID peak in 2024.

Source: ING

Source: ING

The central bank may end up being more dovish than markets expect.

Source: BCA Research

Source: BCA Research

——————–

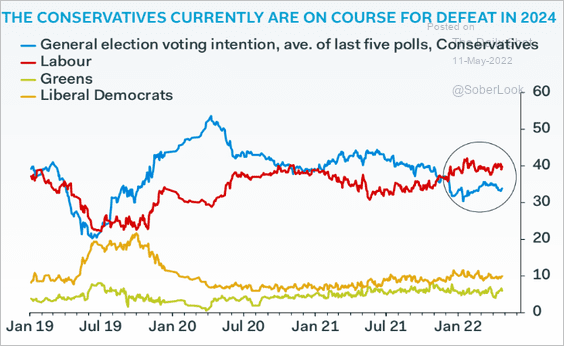

3. Here are the latest general election voting intentions.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

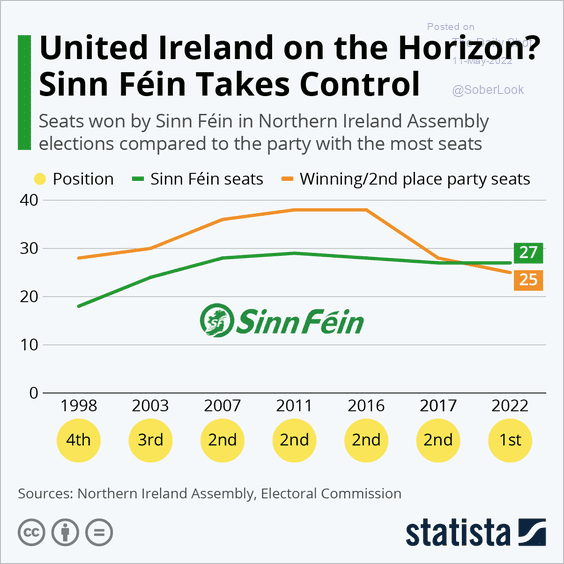

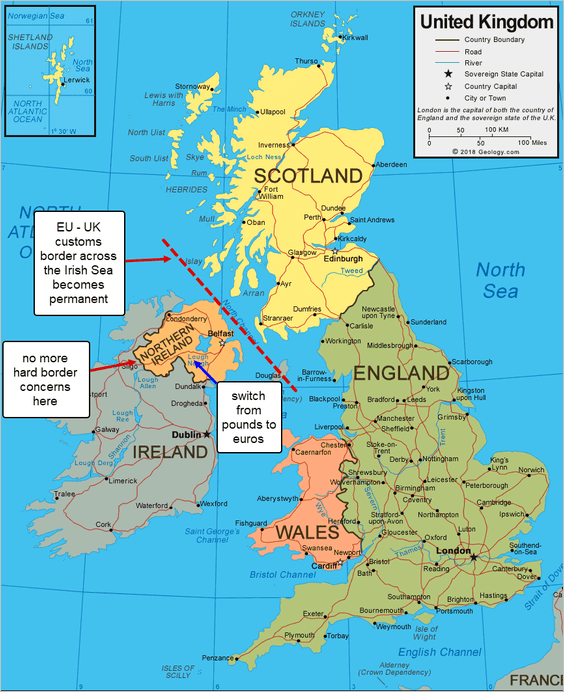

4. Northern Ireland’s trade status remains a thorny issue in the Brexit saga.

Source: Reuters Read full article

Source: Reuters Read full article

While this is still a low-probability event, …

Source: Statista

Source: Statista

… it would “resolve” a good portion of the outstanding trade frictions with the EU.

Back to Index

The Eurozone

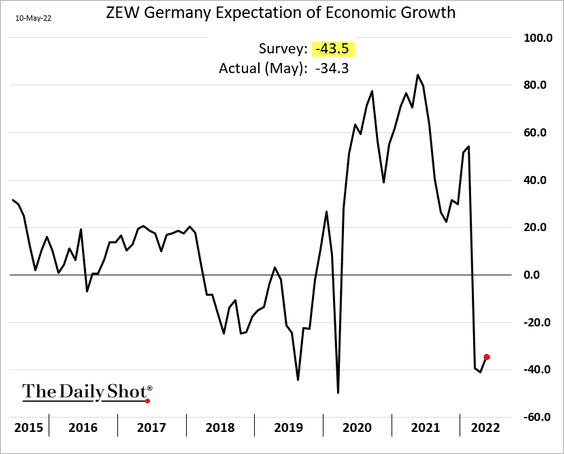

1. Germany’s ZEW economic confidence unexpectedly improved in May.

Source: RTT News Read full article

Source: RTT News Read full article

——————–

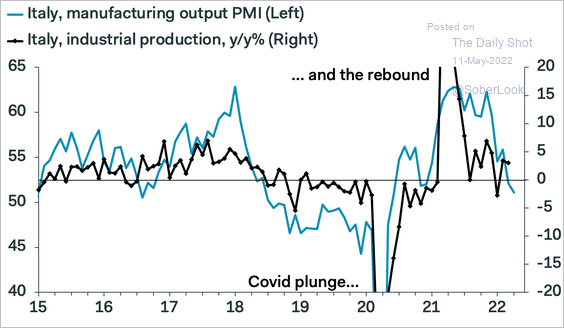

2. Italian industrial production held steady in March.

But the latest PMI report points to downside risks.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

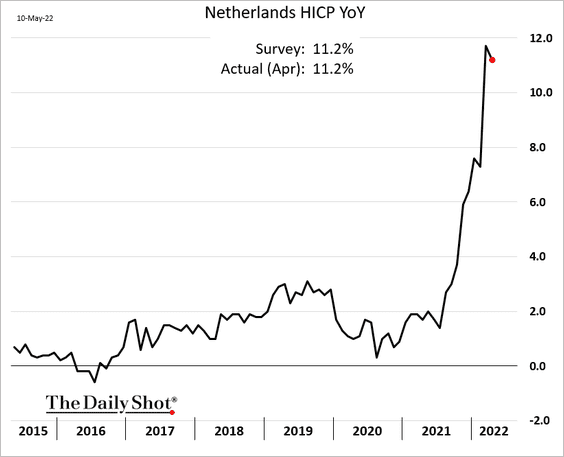

3. The Dutch CPI is off the highs but remains above 11%.

Manufacturing output was softer but still robust in March.

Back to Index

Europe

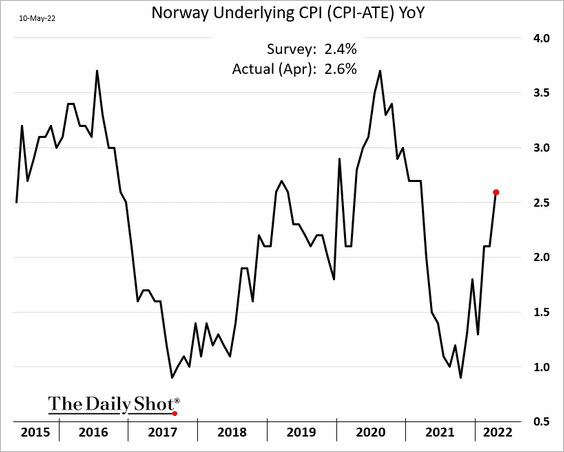

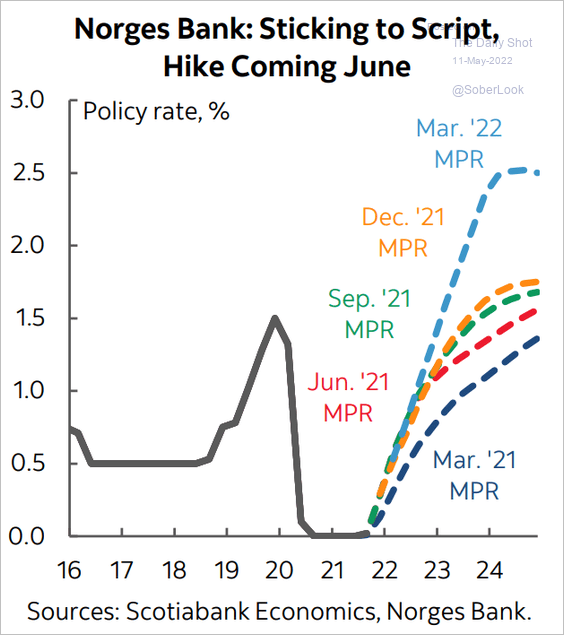

1. Norway’s inflation surprised to the upside.

A rate hike is coming in June.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

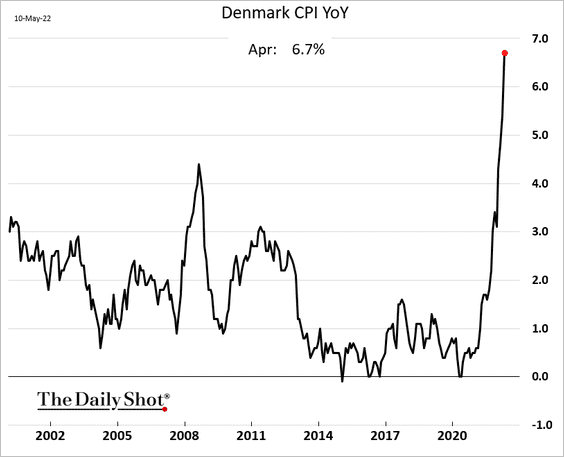

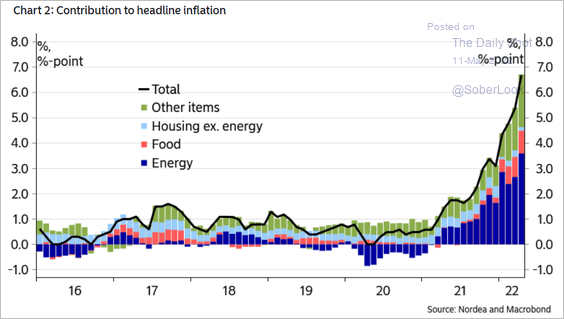

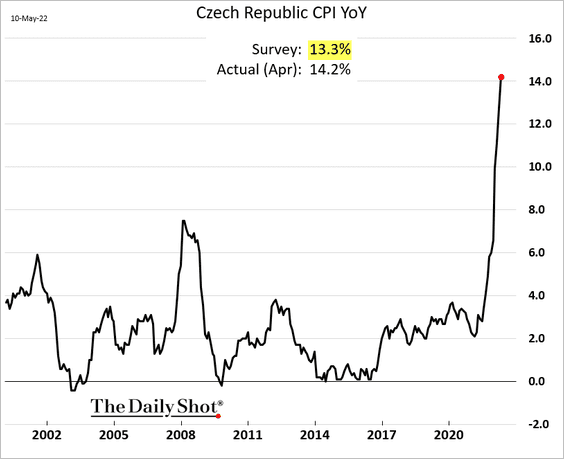

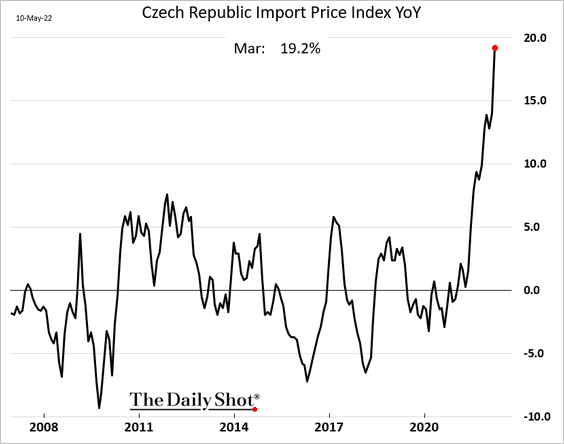

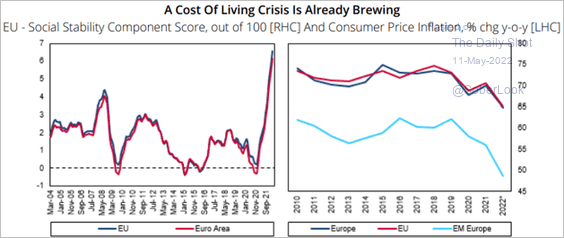

2. Inflation is surging elsewhere in Europe.

• Denmark’s CPI (2 charts):

Source: Nordea Markets

Source: Nordea Markets

• Czech CPI and the import price index:

• The EU is facing a cost-of-living crisis.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

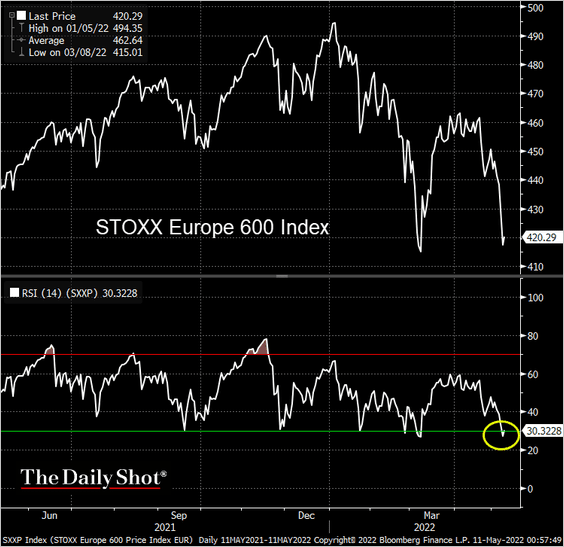

3. European shares bounced from oversold territory.

Source: @TheTerminal, Bloomberg Finance L.P., h/t Sagarika Jaisinghani

Source: @TheTerminal, Bloomberg Finance L.P., h/t Sagarika Jaisinghani

Back to Index

Asia – Pacific

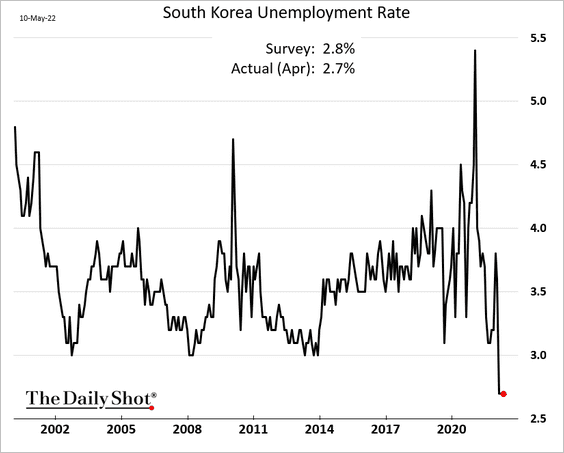

1. South Korea’s unemployment rate is holding at record lows.

Lending to households is slowing.

——————–

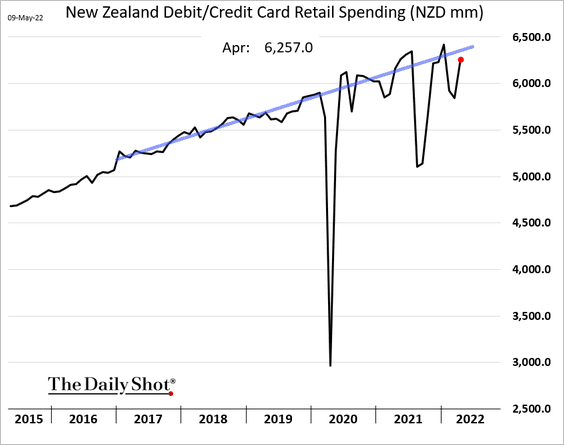

2. New Zealand’s credit card spending rebounded in April.

3. Next, we have some updates on Australia.

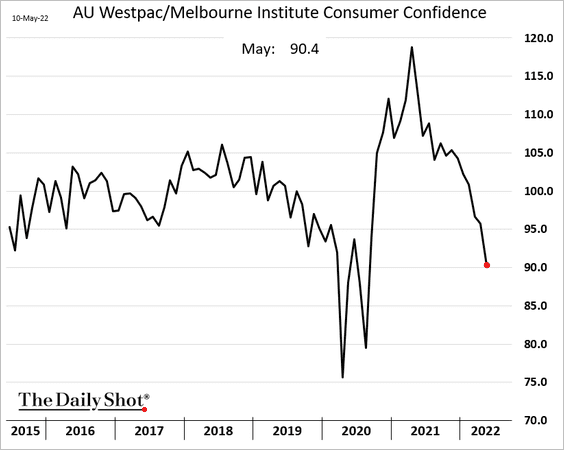

• The Westpac report confirmed consumer sentiment deterioration this month.

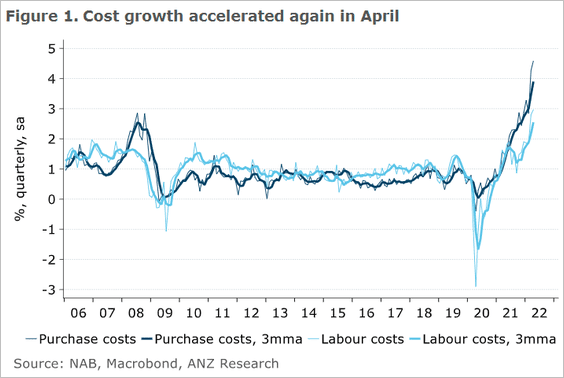

• Costs continue to rise.

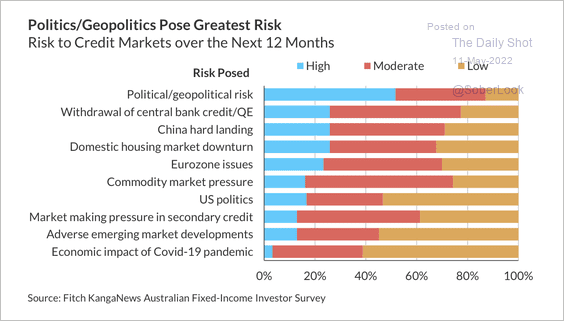

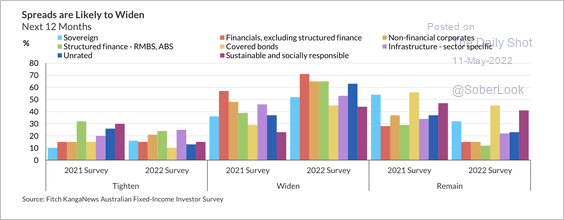

• Political risk and monetary tightening pose the greatest risk to the country’s credit market, according to a survey of fixed income investors.

Source: Fitch Ratings

Source: Fitch Ratings

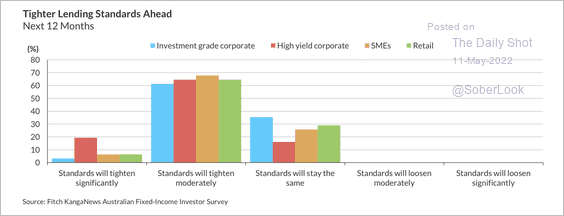

– Investors also expect bank lending standards to tighten over the next 12 months.

Source: Fitch Ratings

Source: Fitch Ratings

– Investors expect credit spreads to widen, especially as macro and property risks re-emerge.

Source: Fitch Ratings

Source: Fitch Ratings

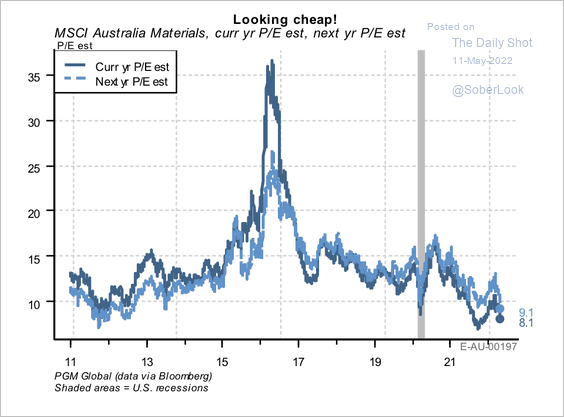

• Australian materials stock valuations are near historical lows.

Source: PGM Global

Source: PGM Global

Back to Index

China

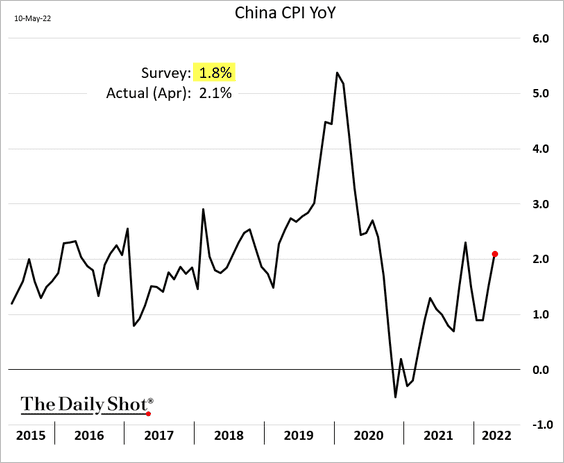

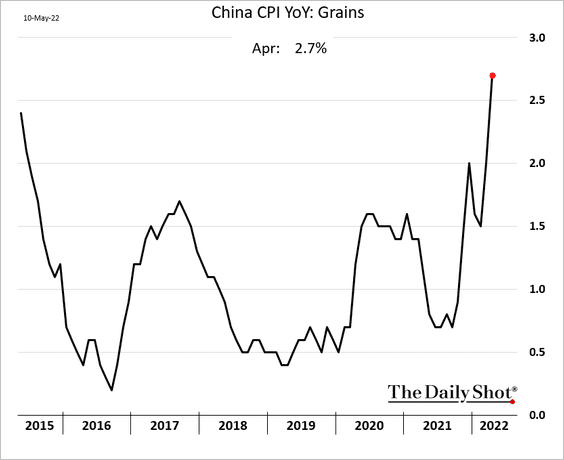

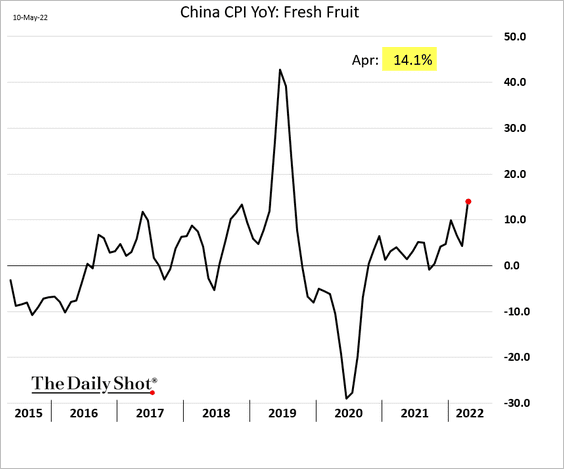

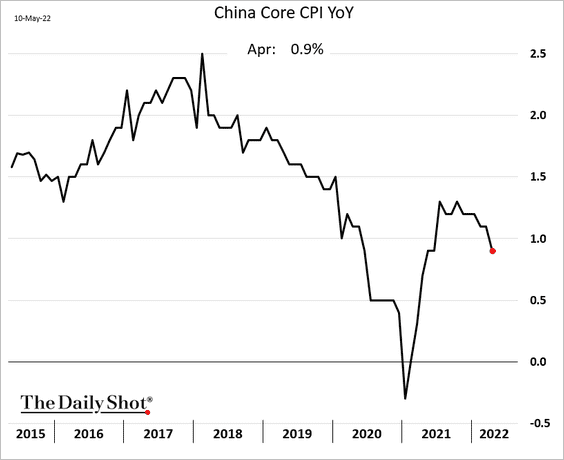

1. Inflation surprise to the upside, …

… driven by food prices (2 charts).

But core inflation is moderating.

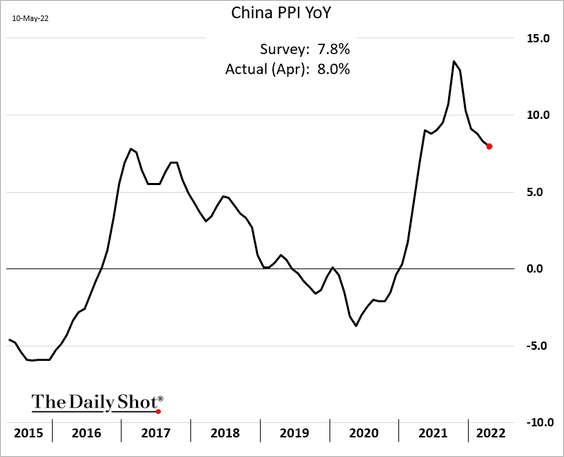

The PPI declined less than expected.

——————–

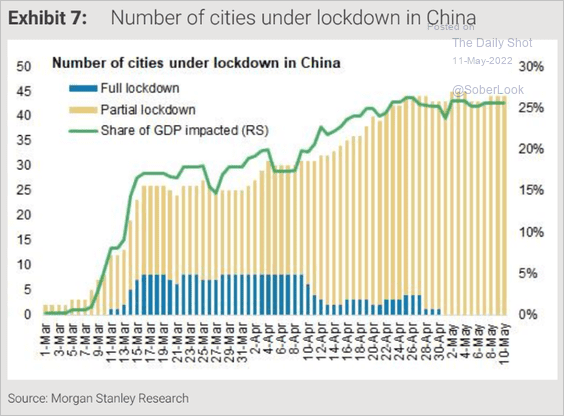

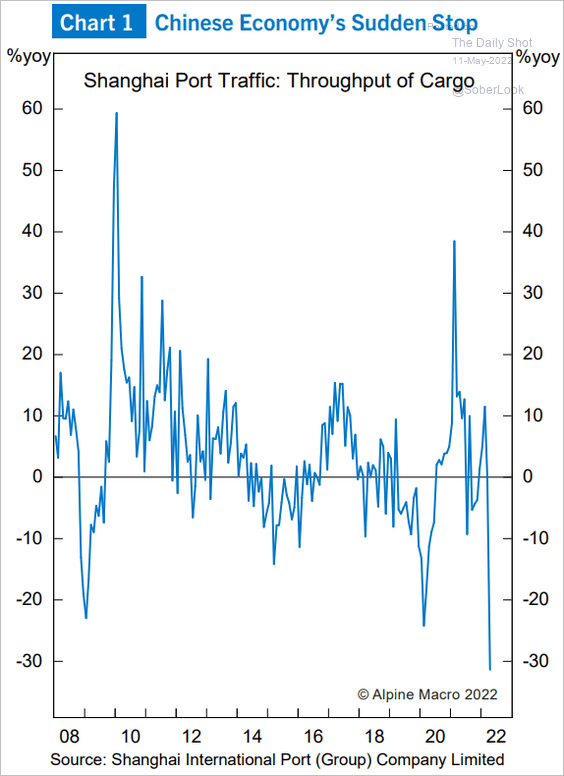

2. Partial lockdowns remain widespread.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Port traffic in Shanghai has taken a hit.

Source: Alpine Macro

Source: Alpine Macro

——————–

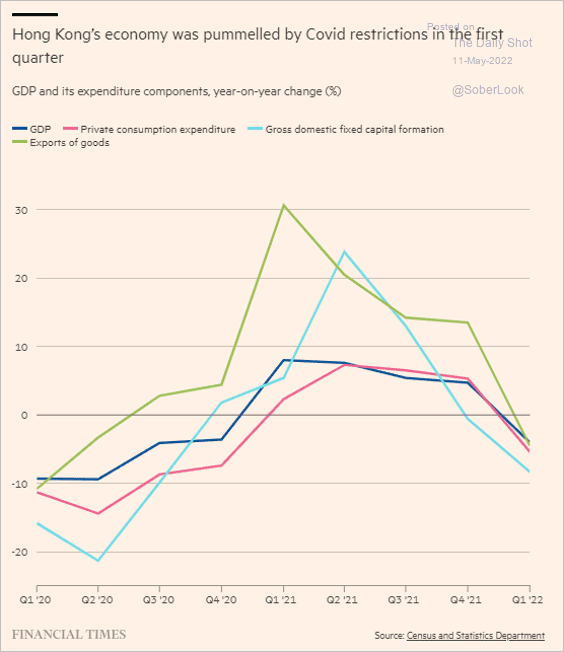

3. The situation in Hong Kong gives an indication of the slowdown we could see in mainland’s economy.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

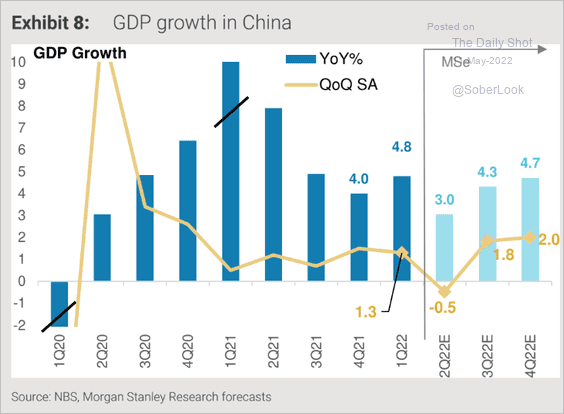

Here is a forecast from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

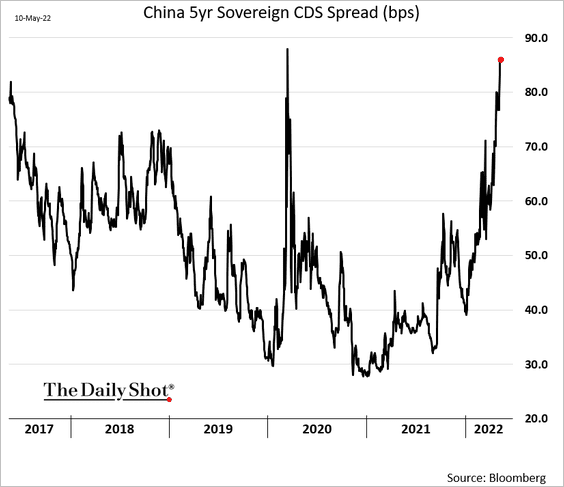

4. The sovereign CDS spread has been elevated.

Back to Index

Emerging Markets

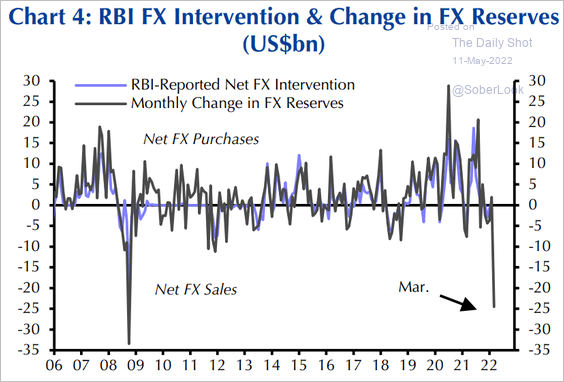

1. Will India’s central bank continue to intervene in the F/X markets to support the rupee?

Source: Capital Economics

Source: Capital Economics

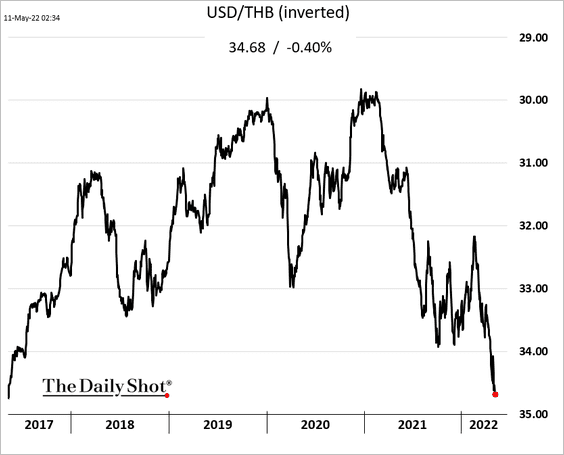

2. The Thai baht hit a 5-year low.

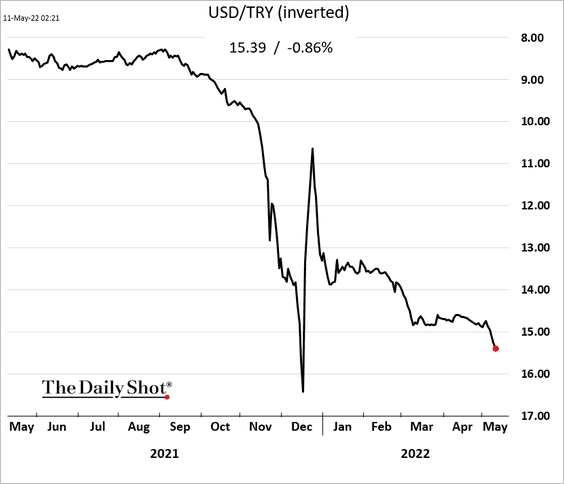

3. The Turkish lira remains under pressure.

Source: Nasdaq Read full article

Source: Nasdaq Read full article

——————–

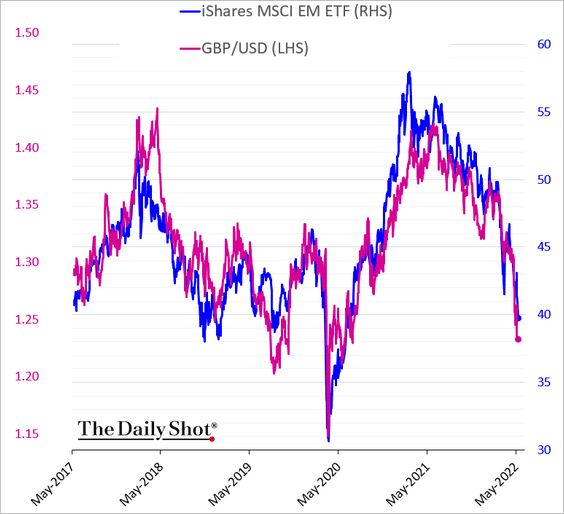

4. EM equity markets (in US dollar terms) are highly correlated to the British pound.

h/t Yvan Berthoux, MNI

h/t Yvan Berthoux, MNI

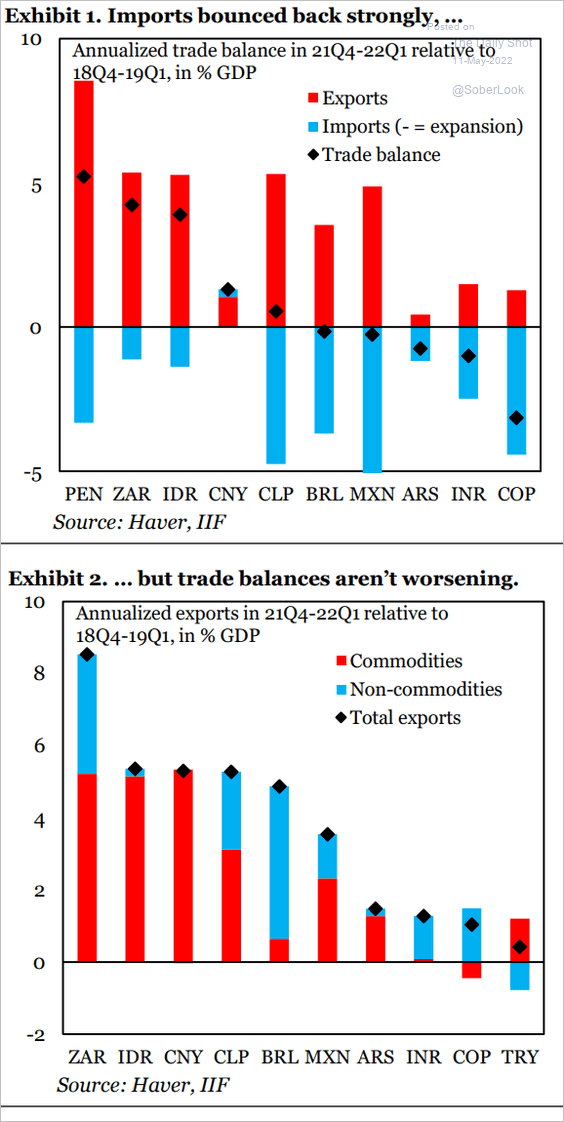

5. Here is a look at EM trade data for Q1 relative to pre-COVID levels.

Source: IIF

Source: IIF

Back to Index

Cryptocurrency

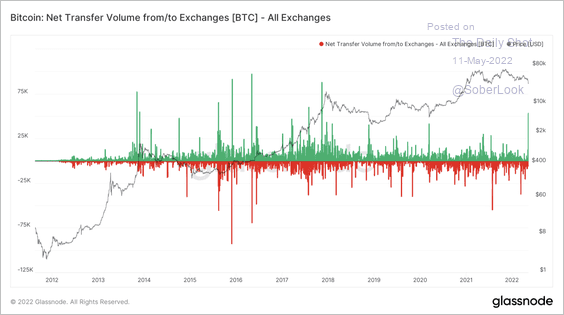

1. There was a spike in the transfer volume of BTC onto exchanges during Monday’s sell-off. That suggests traders are looking to sell their crypto assets instead of moving them to digital wallets.

Source: Glassnode Read full article

Source: Glassnode Read full article

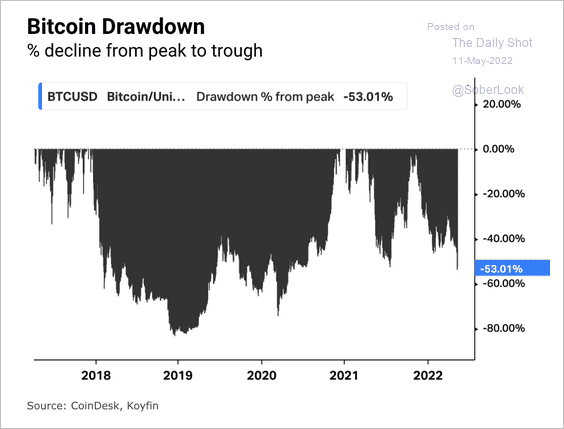

2. Bitcoin is roughly 53% below its all-time high near $69K reached in November of last year.

Source: Koyfin Read full article

Source: Koyfin Read full article

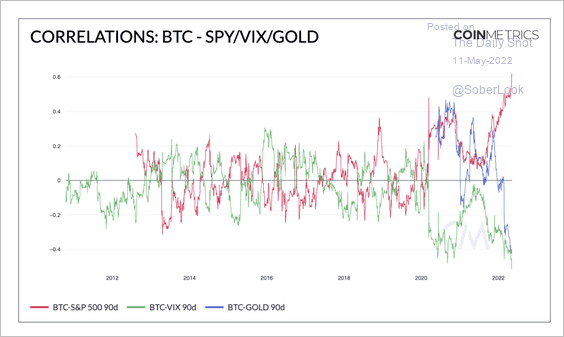

3. As we saw earlier, bitcoin’s correlation with the S&P 500 is at an all-time high amid a broad risk-off environment.

Source: @coinmetrics

Source: @coinmetrics

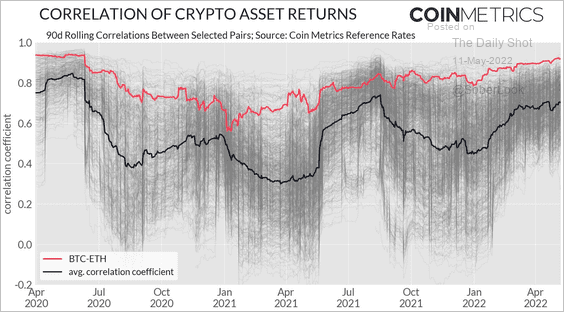

4. Bitcoin (BTC) and ether (ETH) have been increasingly correlated this year.

Source: @coinmetrics

Source: @coinmetrics

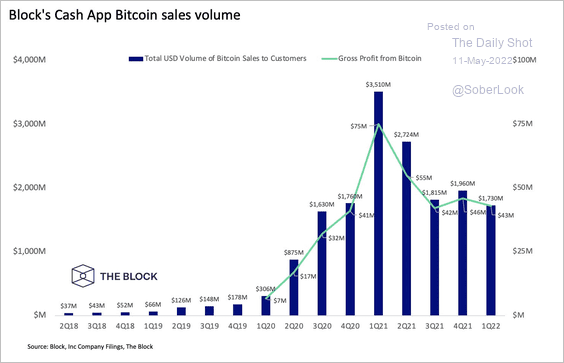

5. Bitcoin’s sales volume on Cash app (owned by Block, formerly Square) has declined over the past year.

Source: @TheBlock_

Source: @TheBlock_

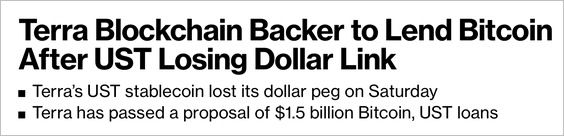

6. Terra’s UST (un)stablecoin is getting propped up by its backers.

Source: @technology Read full article

Source: @technology Read full article

…and its founder is promising a “recovery plan.”

Source: @stablekwon

Source: @stablekwon

Back to Index

Commodities

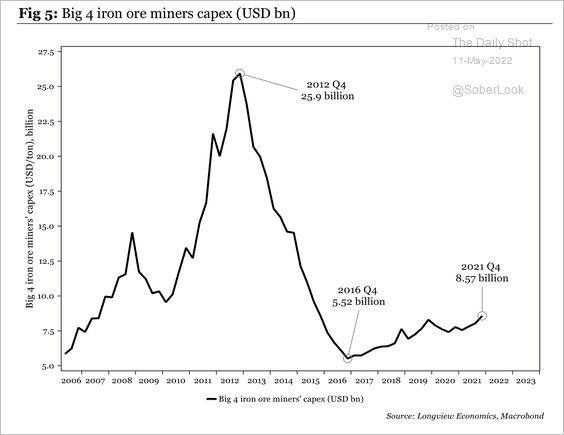

1. Capital spending among iron ore miners has been slow to rise, especially after the resource production boom a decade ago.

Source: Longview Economics

Source: Longview Economics

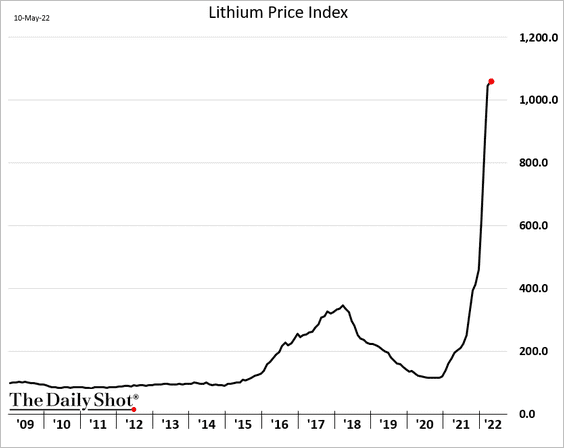

2. Lithium prices continue to hit new highs.

Source: @benchmarkmin Read full article Further reading

Source: @benchmarkmin Read full article Further reading

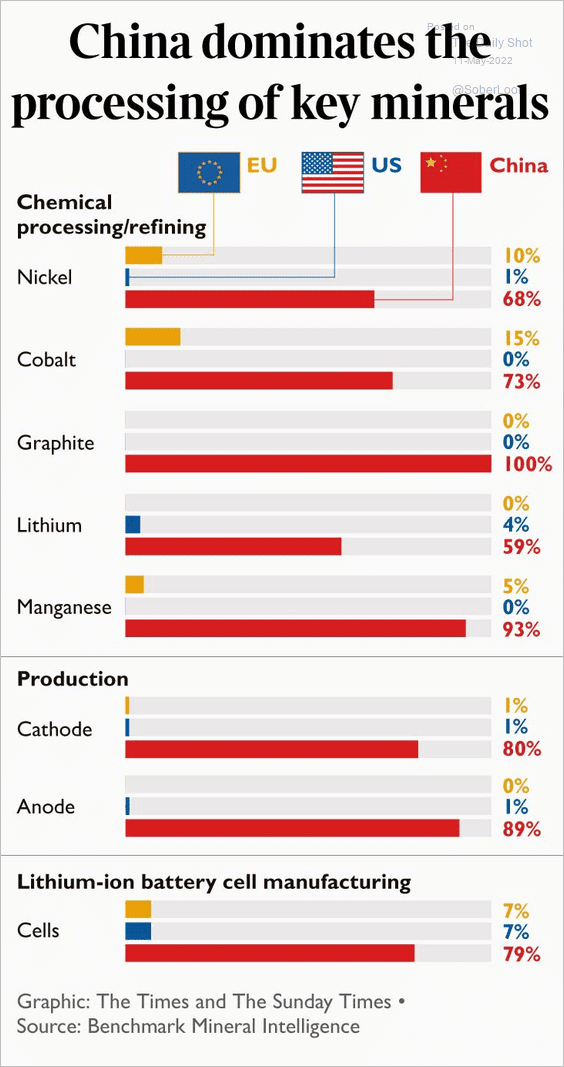

3. Here is a look at China’s dominance in processing key minerals.

Source: @sdmoores, @thetimes, @hjesanderson Read full article

Source: @sdmoores, @thetimes, @hjesanderson Read full article

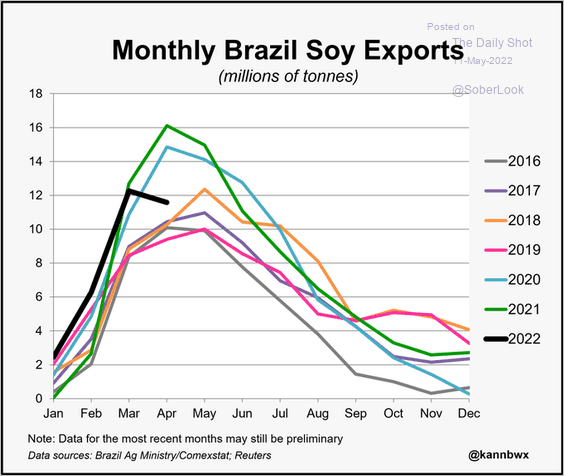

4. Brazil’s soybean exports have taken a hit this year.

Source: @kannbwx

Source: @kannbwx

Back to Index

Energy

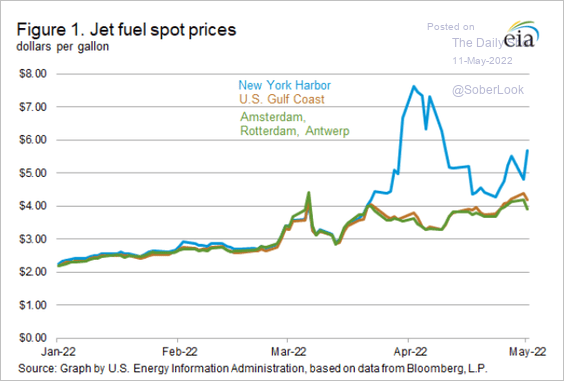

1. The New York Harbor jet fuel remains decoupled from other markets.

Source: @EIAgov

Source: @EIAgov

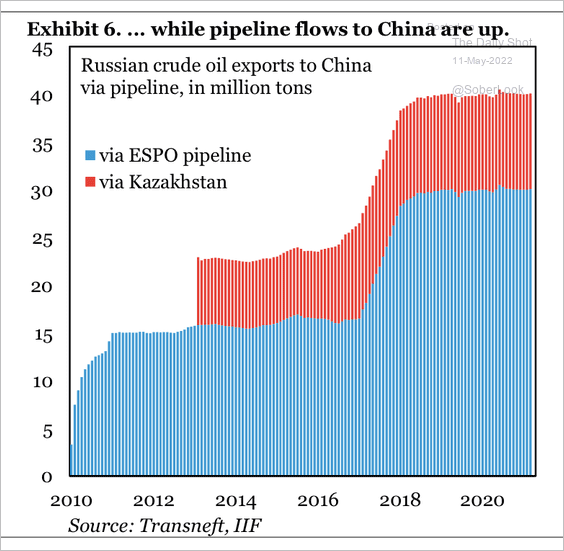

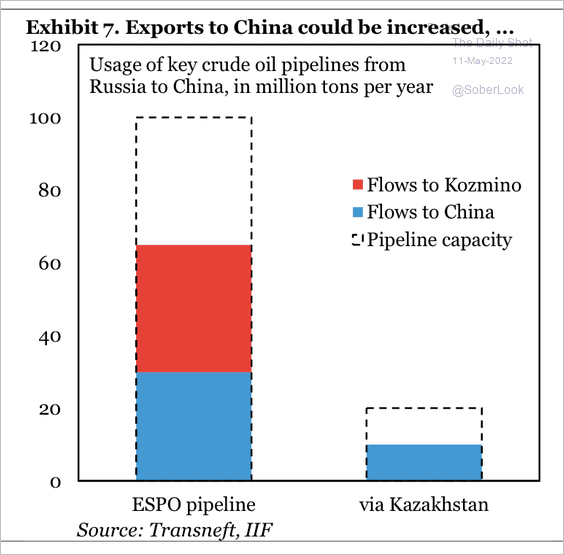

2. Russia’s pipeline flows to China have increased over the past few years, and there is capacity for more flows (2 charts).

Source: IIF

Source: IIF

Source: IIF

Source: IIF

——————–

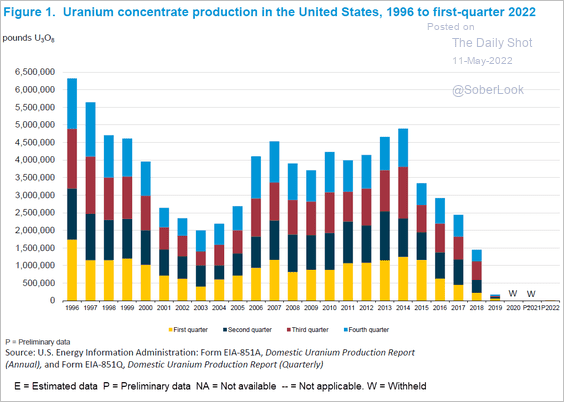

3. US uranium production is down to a trickle.

Source: EIA Read full article

Source: EIA Read full article

Back to Index

Equities

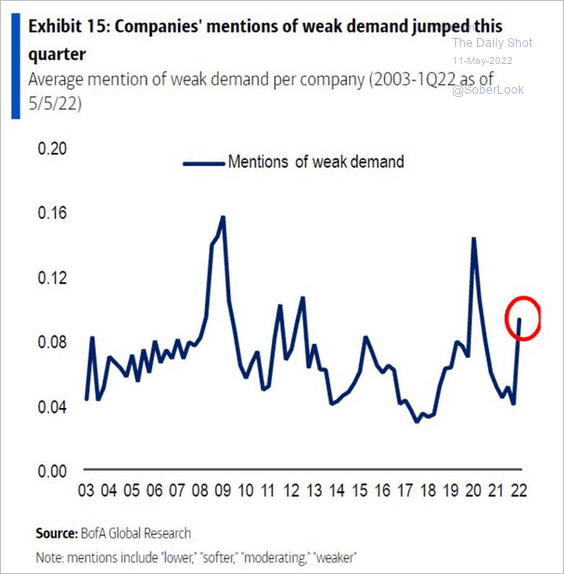

1. More firms are mentioning “weak demand.”

Source: @jessefelder; BofA Global Research Read full article

Source: @jessefelder; BofA Global Research Read full article

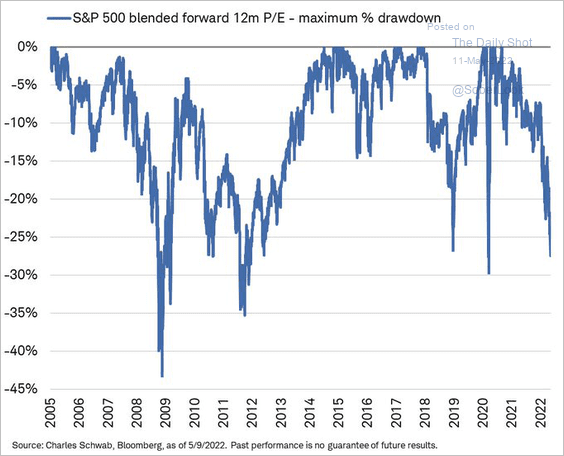

2. The P/E adjustment has been severe in the latest selloff.

Source: @LizAnnSonders

Source: @LizAnnSonders

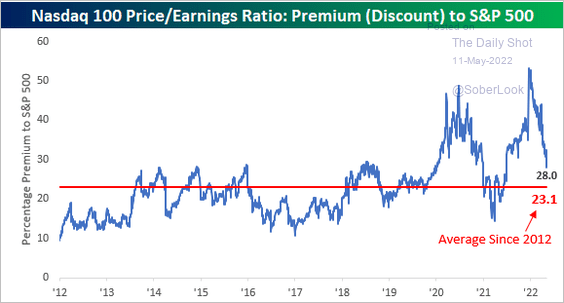

3. The Nasdaq 100 valuation premium to the S&P 500 is nearing its longer-term average.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

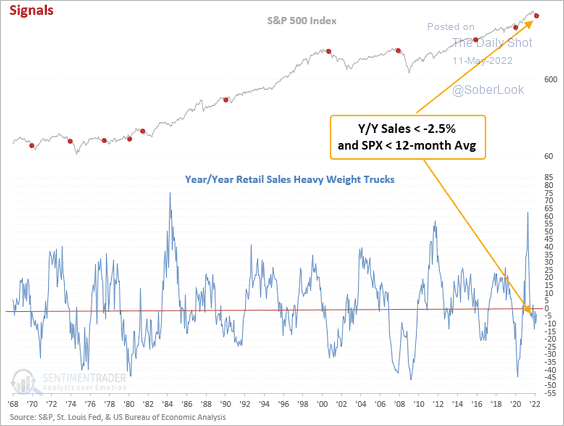

4. The decline in heavy truck sales doesn’t bode well for equity performance.

Source: SentimenTrader

Source: SentimenTrader

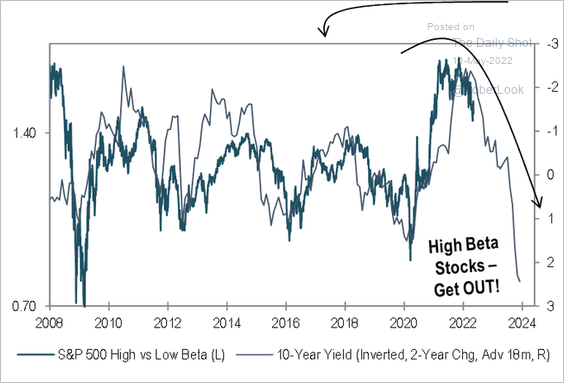

5. Bond yields point to further downside risks for high-beta stocks.

Source: @MichaelKantro

Source: @MichaelKantro

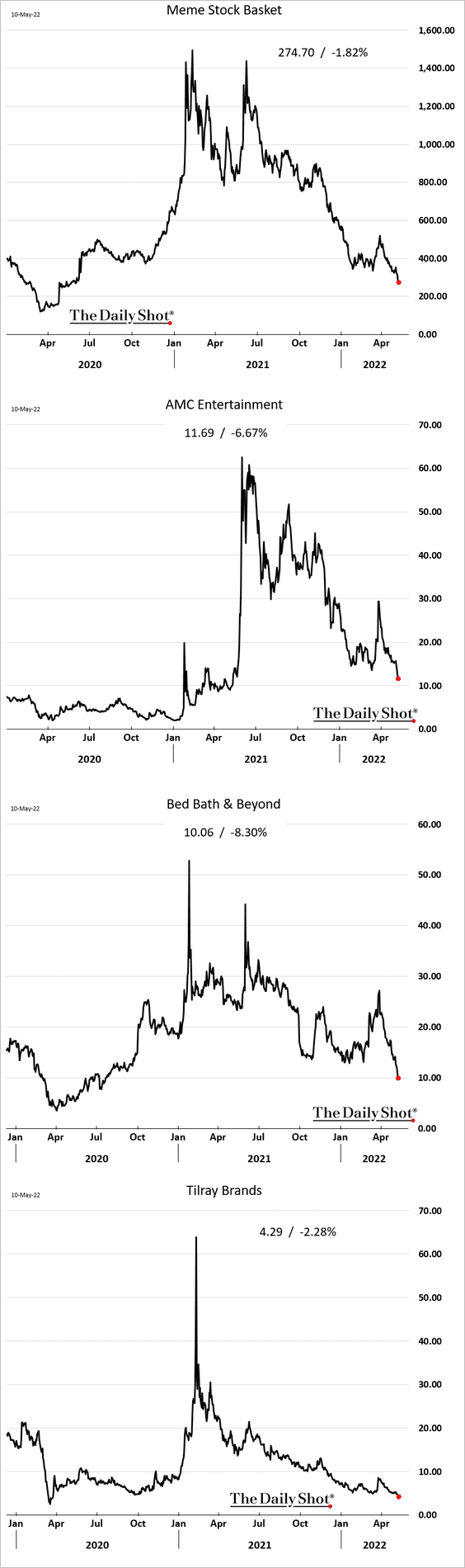

6. The meme bubble continues to deflate.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

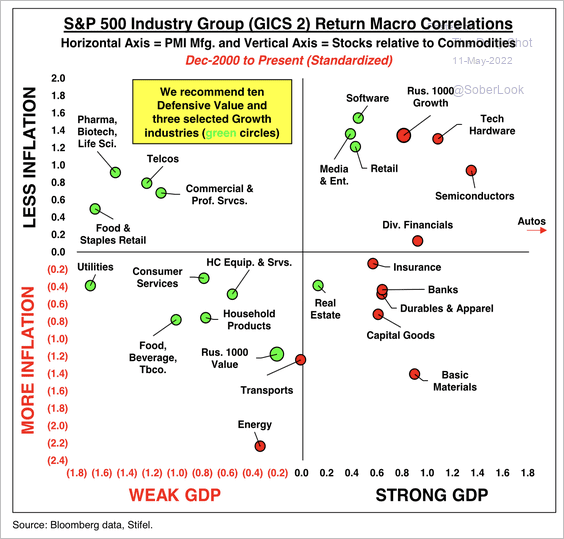

7. Here is a look at macro correlations across S&P 500 industries.

Source: Stifel

Source: Stifel

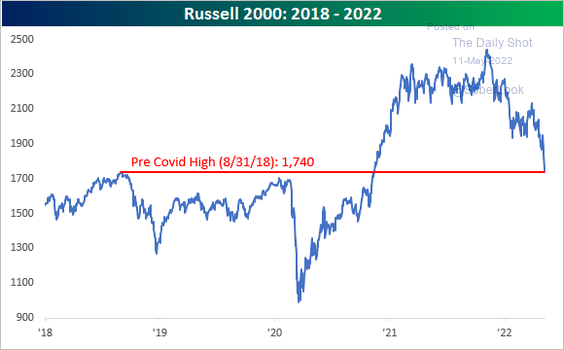

8. The Russell 2000 hit its pre-COVID peak.

Source: @bespokeinvest

Source: @bespokeinvest

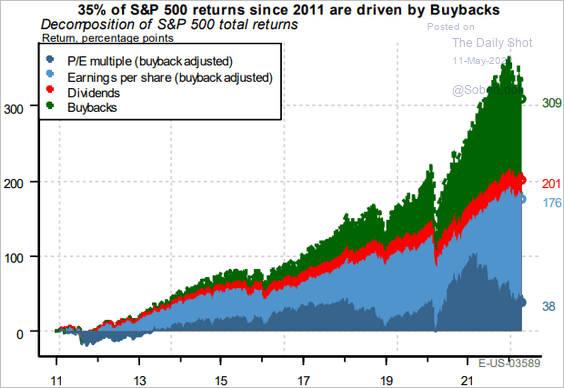

9. Since 2011, over one-third of S&P 500 returns have been driven by buybacks.

Source: PGM Global

Source: PGM Global

Back to Index

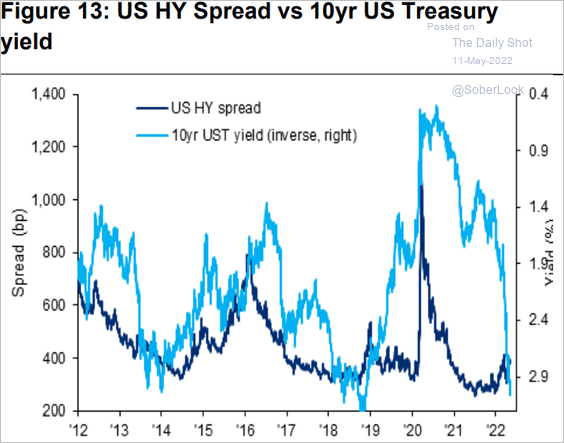

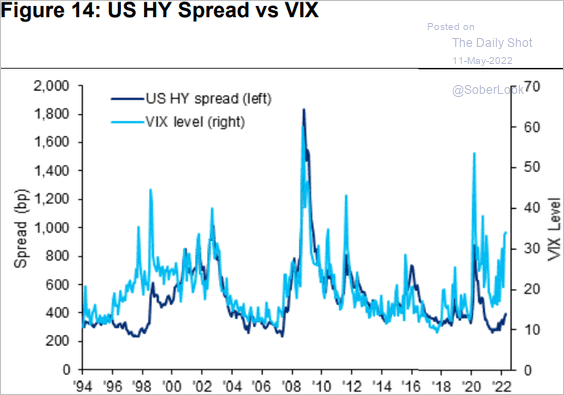

Credit

1. US high-yield spreads could rise further given the 10-year Treasury yield spike and the persistently elevated equity volatility (two charts).

Source: Citi Private Bank

Source: Citi Private Bank

Source: Citi Private Bank

Source: Citi Private Bank

——————–

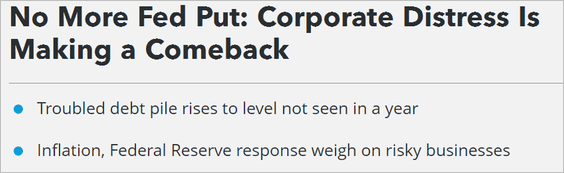

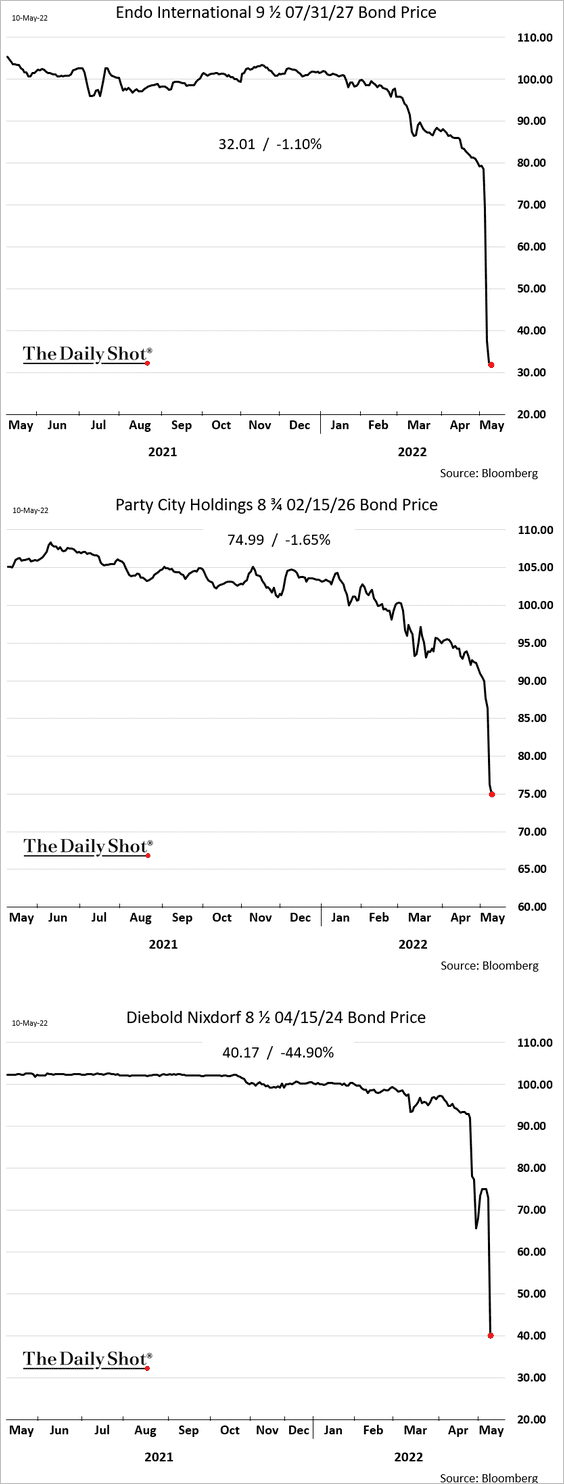

2. The surge in inflation and interest rates is putting stress on weaker credits.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

——————–

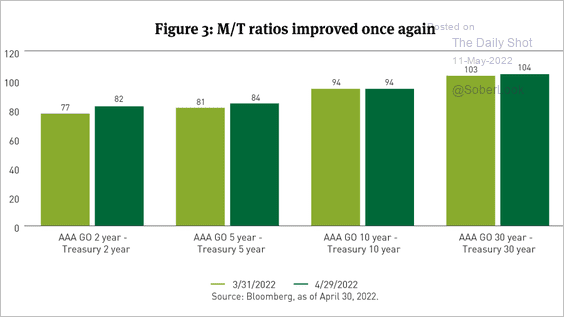

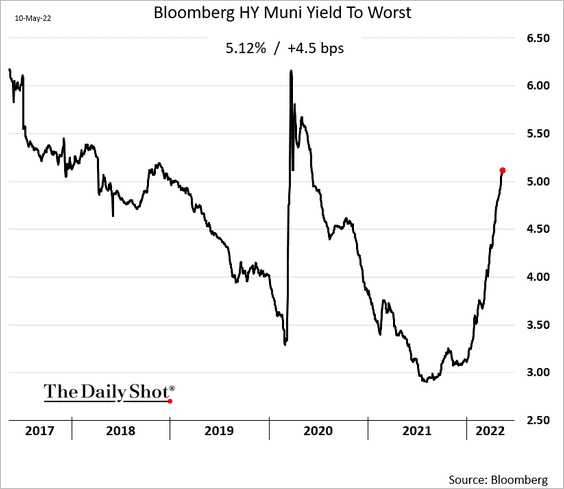

3. Munis underperformed Treasuries last month as ratios increased.

Source: Breckinridge Capital Advisors Read full article

Source: Breckinridge Capital Advisors Read full article

Yields on HY munis keep climbing.

Back to Index

Rates

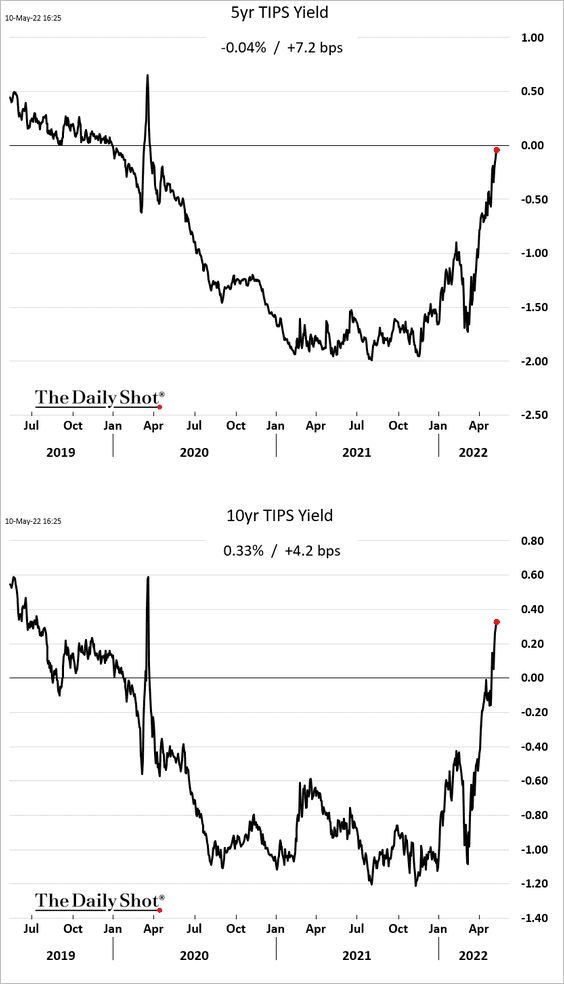

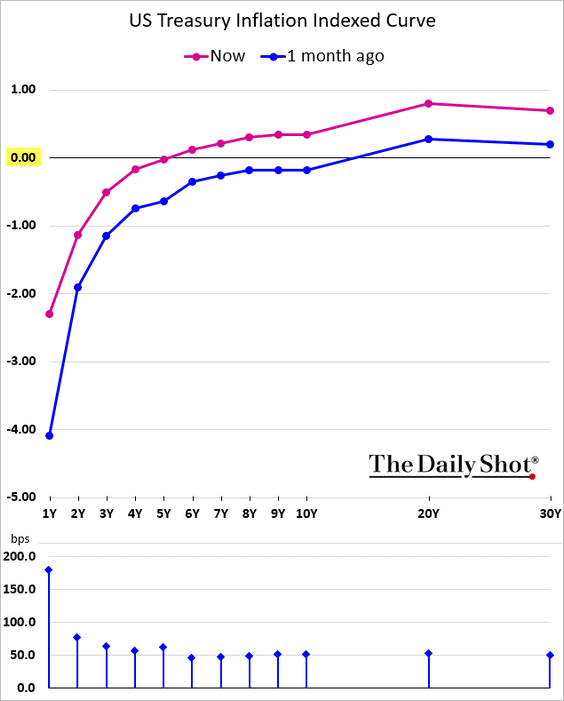

1. Real yields continue to surge, with the 5yr TIPS approaching zero.

Here is the TIPS curve.

——————–

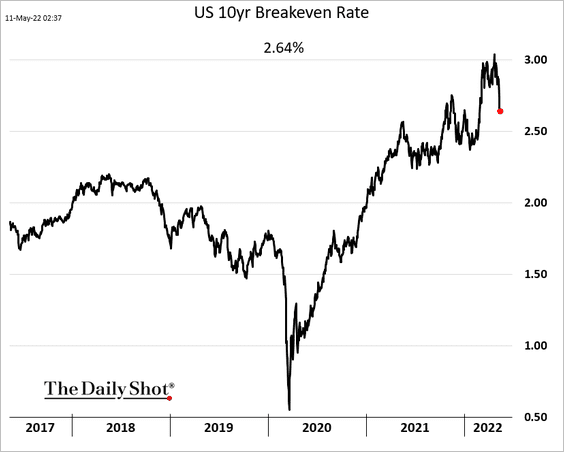

2. The 10yr US breakeven rate (inflation expectations) is off the highs.

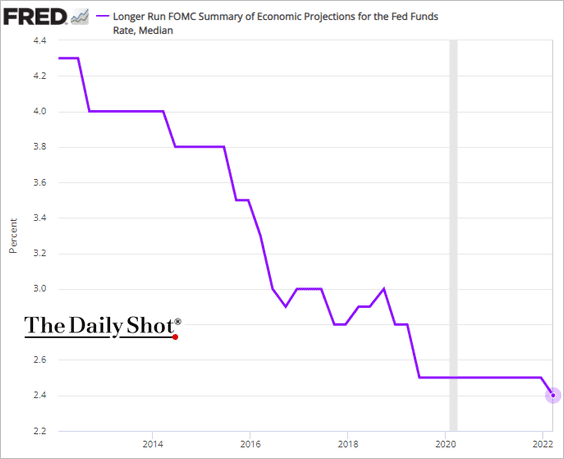

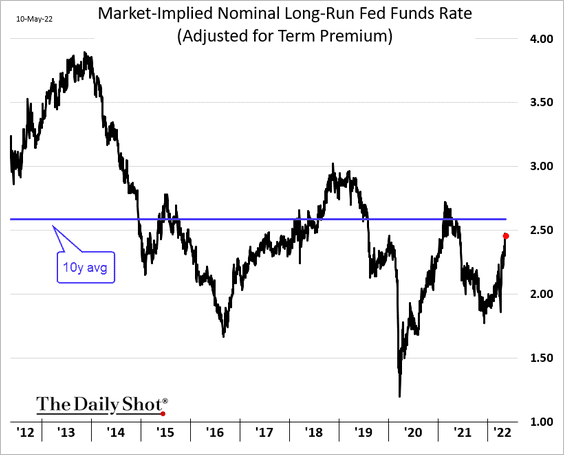

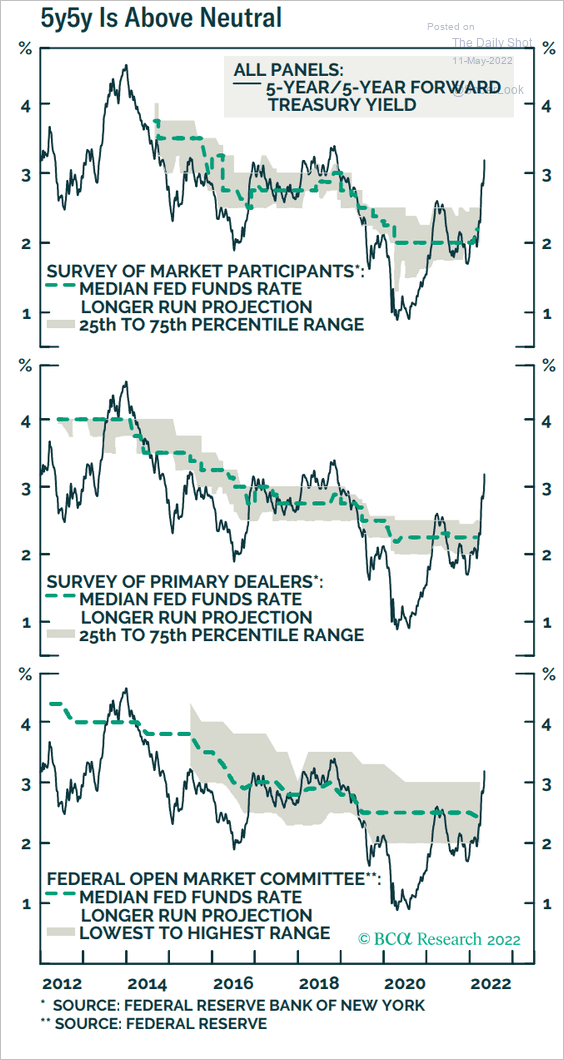

3. Where is the neutral rate currently?

• The FOMC:

• The market:

Forward rates show that the US monetary policy is becoming restrictive.

Source: BCA Research

Source: BCA Research

——————–

Food for Thought

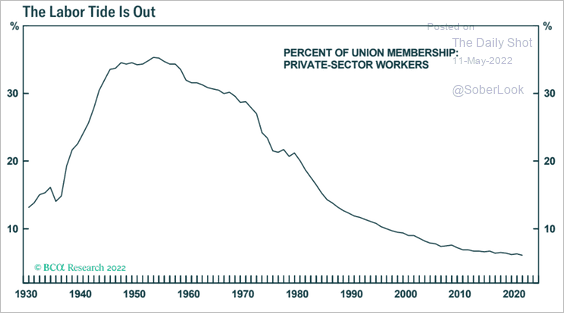

1. Private-sector union membership in the US:

Source: BCA Research

Source: BCA Research

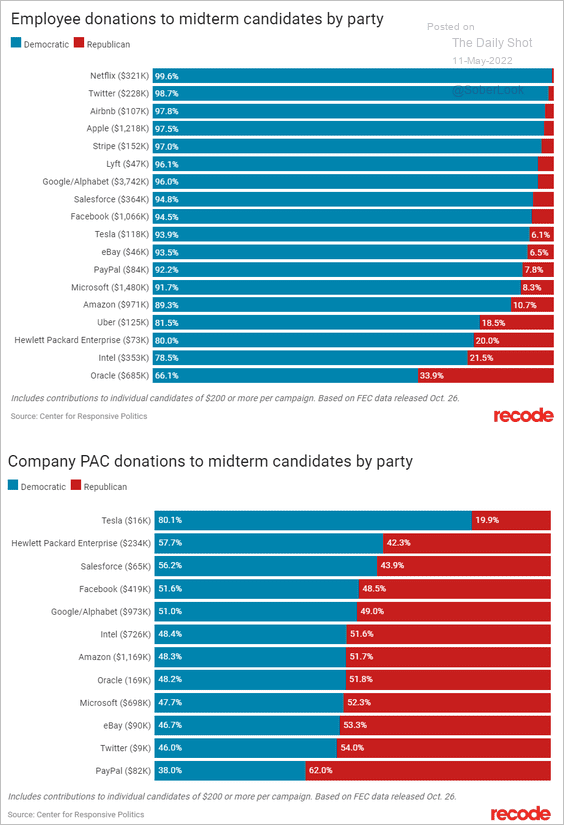

2. Political donations of tech companies and their employees:

Source: Vox Read full article

Source: Vox Read full article

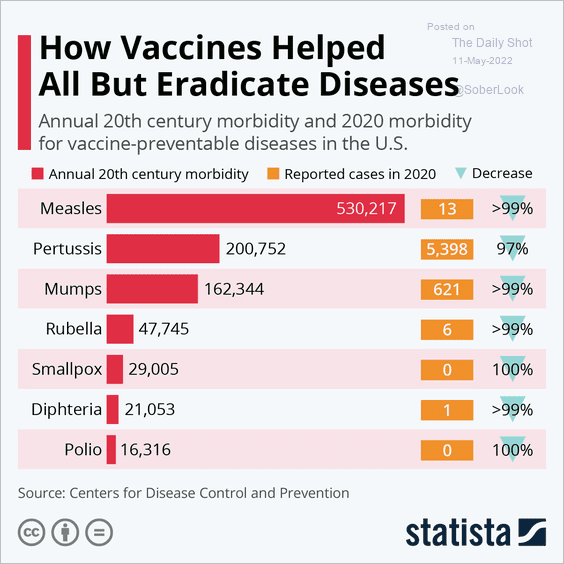

3. Vaccines eradicating diseases:

Source: Statista

Source: Statista

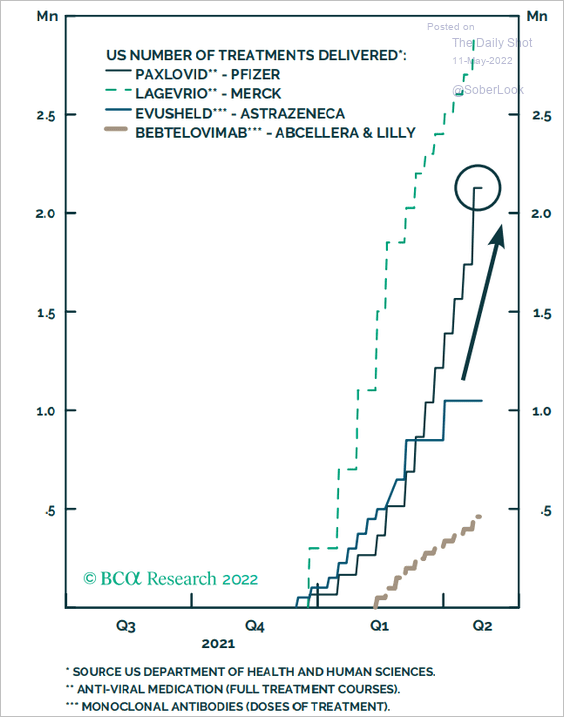

4. COVID treatments delivered:

Source: BCA Research

Source: BCA Research

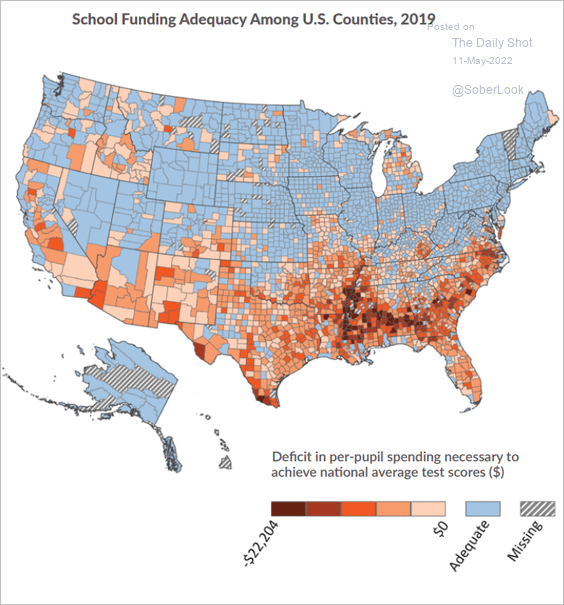

5. School funding adequacy:

Source: County Health Rankings Read full article

Source: County Health Rankings Read full article

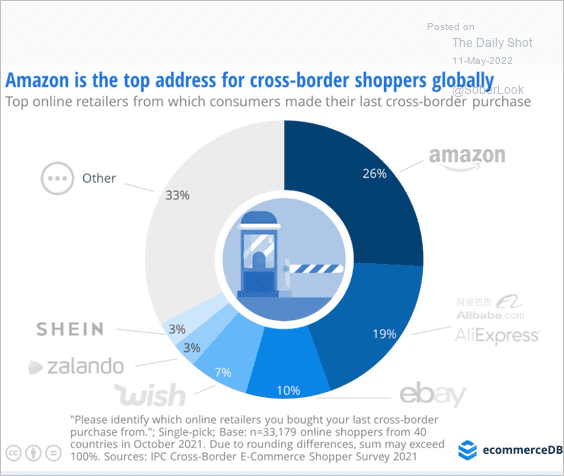

6. Online cross-border shopping:

Source: eCommerceDB Read full article

Source: eCommerceDB Read full article

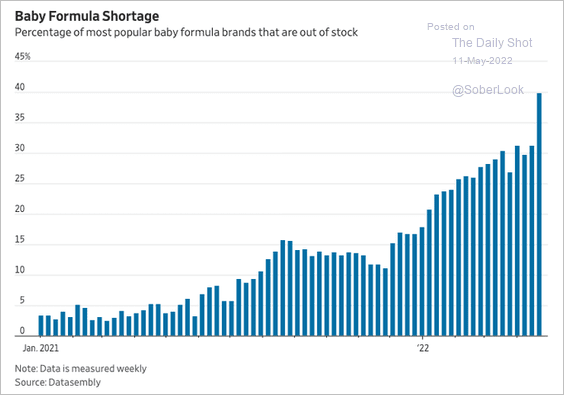

7. Baby formula shortages:

Source: @srussolillo, @josephpisani Read full article

Source: @srussolillo, @josephpisani Read full article

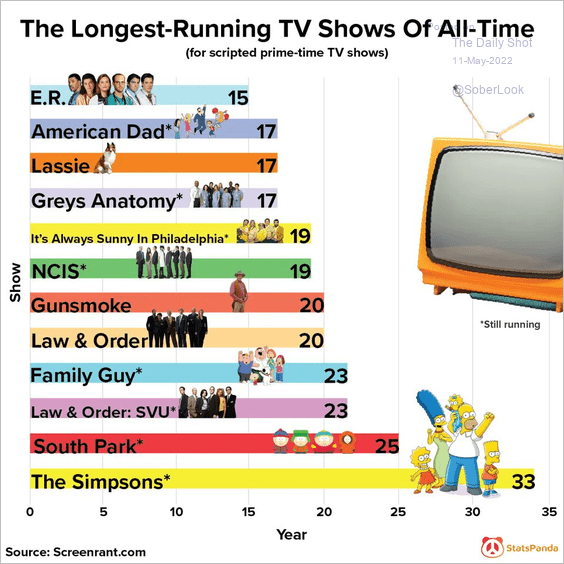

8. The longest-running TV shows:

Source: @statspanda1 Read full article

Source: @statspanda1 Read full article

——————–