The Daily Shot: 20-May-22

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

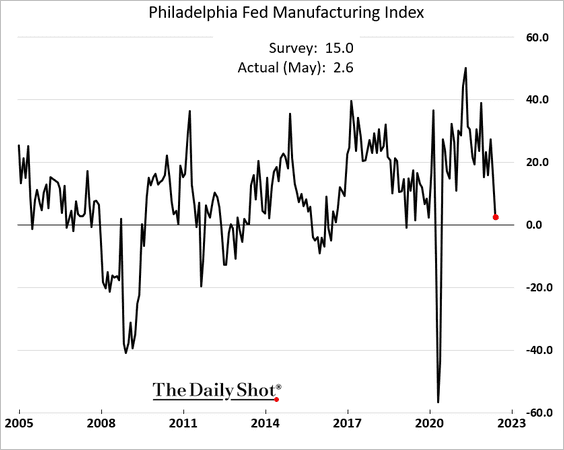

1. Similar to the NY Fed’s manufacturing report, the Philly Fed’s regional factory activity gauge surprised to the downside.

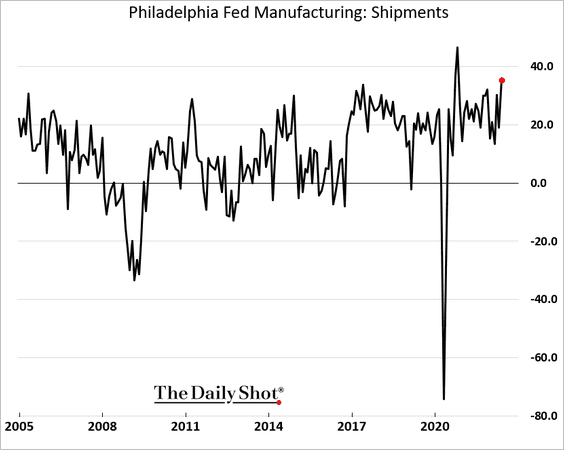

• While current demand appears to be robust, …

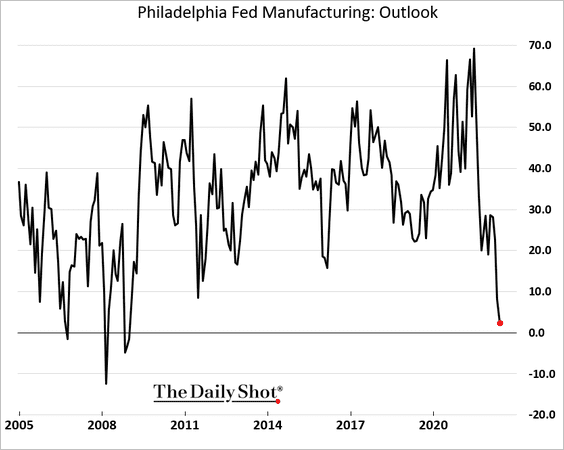

… the business outlook index hit the lowest level since the financial crisis.

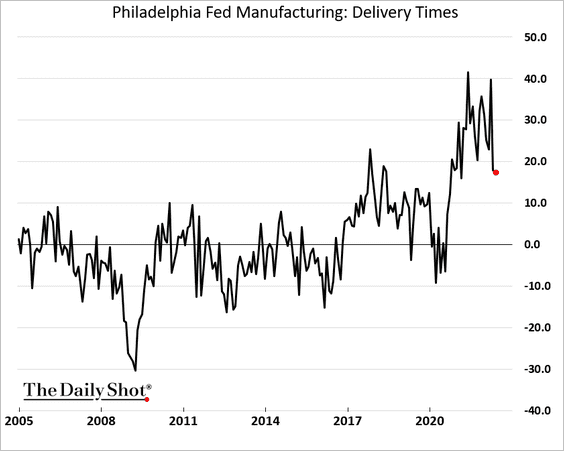

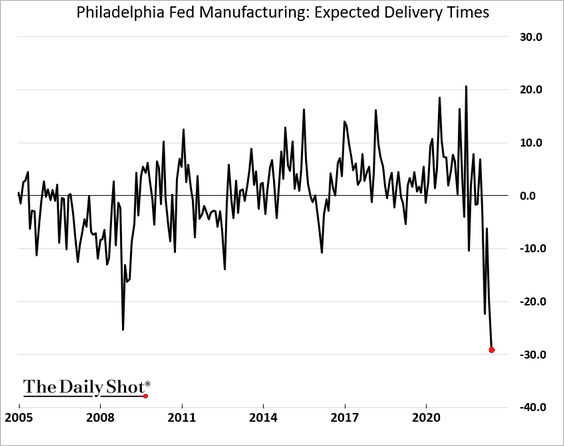

• Supplier delivery times are off the peak but still elevated.

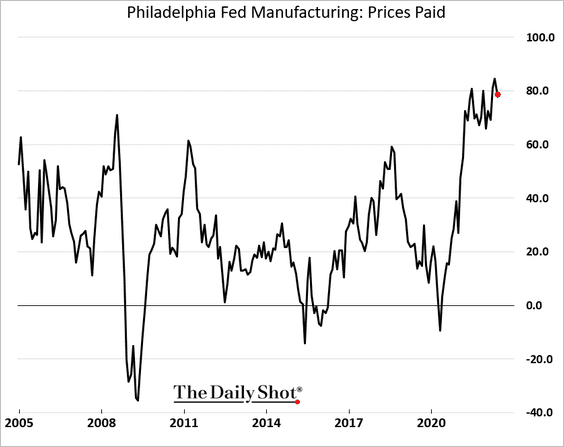

And cost pressures persist.

• However, manufacturers overwhelmingly expect supply bottlenecks to ease over the next six months.

They also see rapid reductions in unfilled orders.

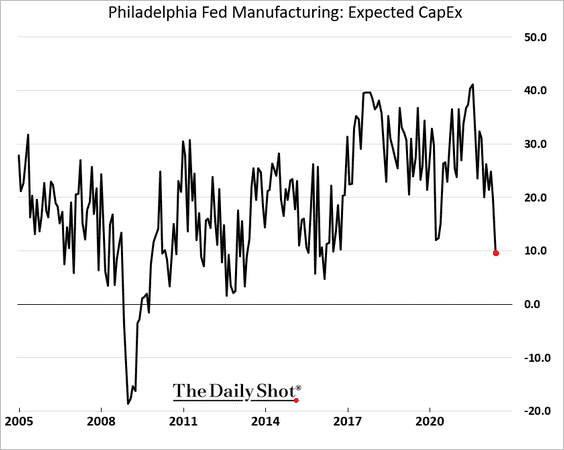

• The CapEx expectations index hit the lowest level since 2016.

——————–

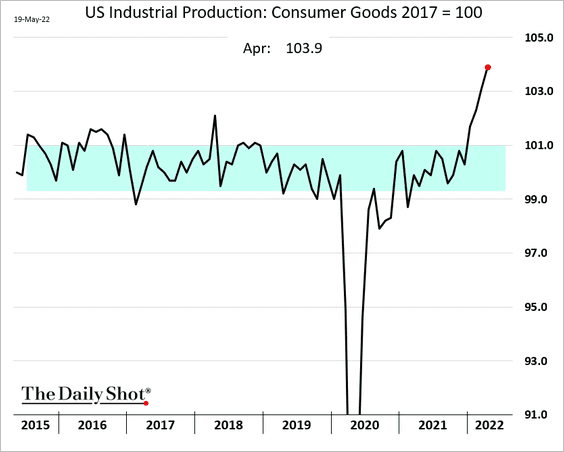

2. US production of consumer goods surged this year.

h/t @RenMacLLC

h/t @RenMacLLC

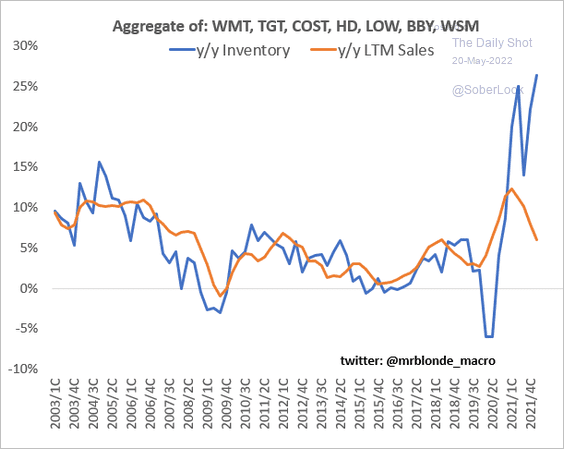

Are we facing an inventory glut? The Philly Fed’s forward-looking indicators (above) suggest that it’s a possibility.

Source: @MrBlonde_macro

Source: @MrBlonde_macro

——————–

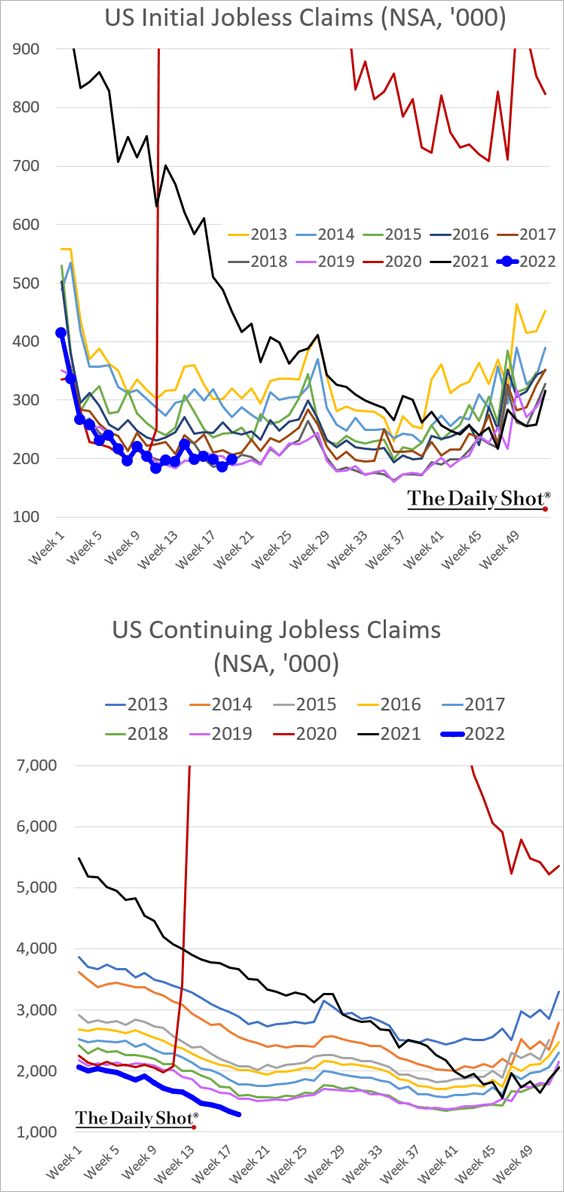

3. Next, we have some updates on the labor market.

• Initial jobless claims ticked up last week but are still very low.

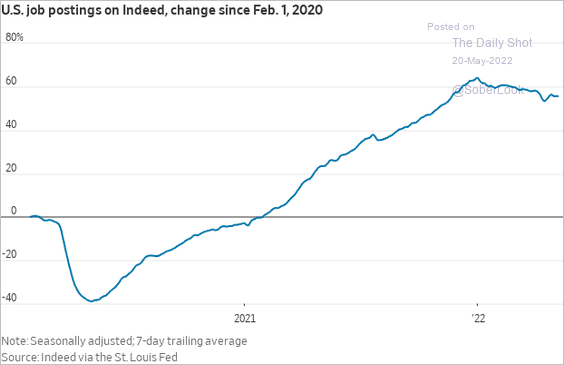

• US job openings have peaked. Job postings on Indeed have been drifting lower.

Source: @WSJecon

Source: @WSJecon

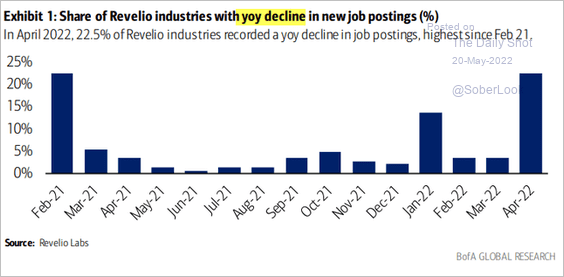

Revelio’s data also points to a decline in job postings.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

——————–

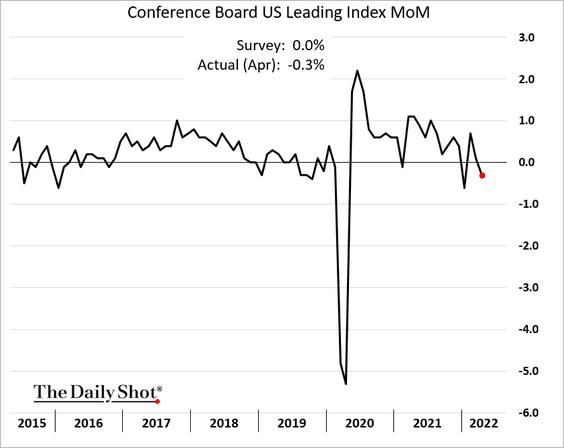

4. Conference Board’s leading indicator unexpectedly declined last month.

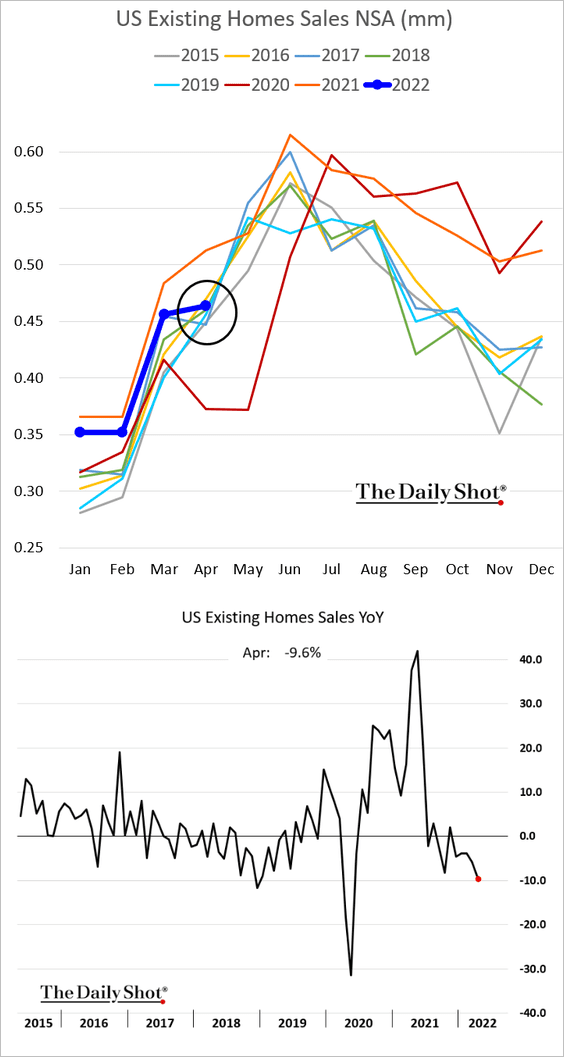

5. Now, let’s revisit the housing market.

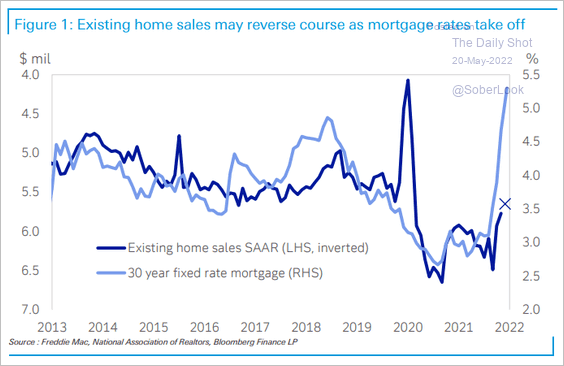

• Existing home sales were soft last month, down almost 10% from 2021.

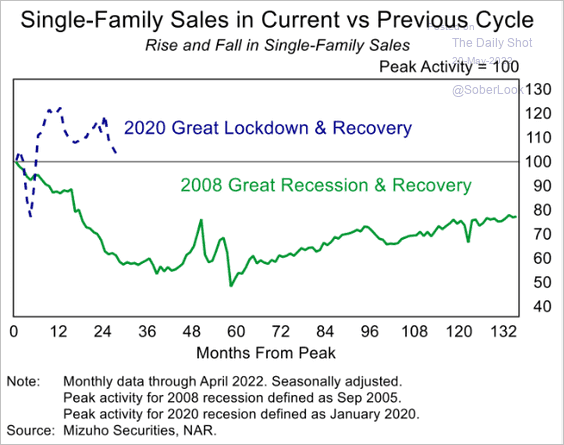

Here is a comparison to the post-2008 recovery.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

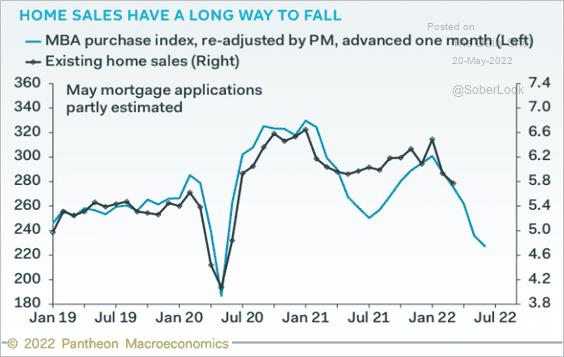

• Weaker mortgage applications and higher mortgage rates point to further weakness in existing home sales (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Deutsche Bank Research

Source: Deutsche Bank Research

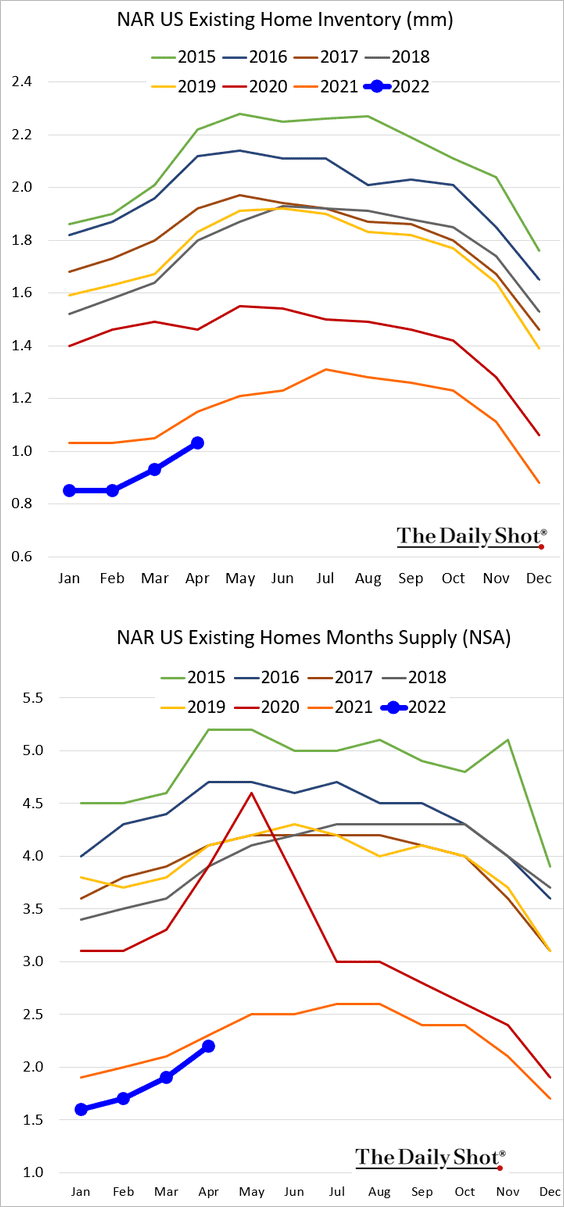

• Existing home inventories are still very low but are rising faster than usual for this time of the year.

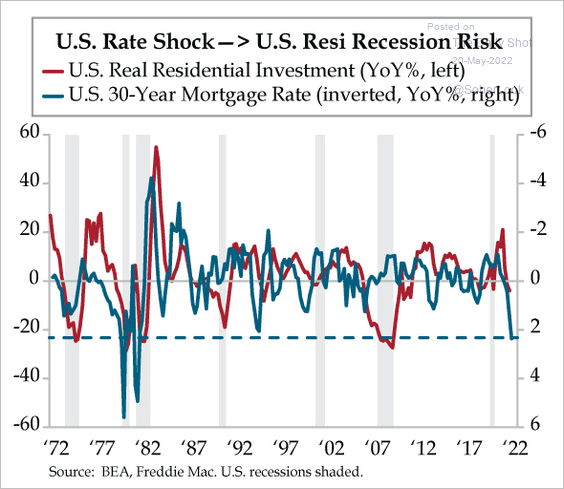

• High mortgage rates will pressure residential investment.

Source: Quill Intelligence

Source: Quill Intelligence

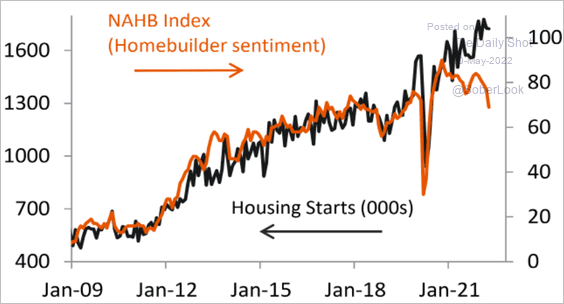

Weak homebuilder sentiment also points to declines in residential construction.

Source: Piper Sandler

Source: Piper Sandler

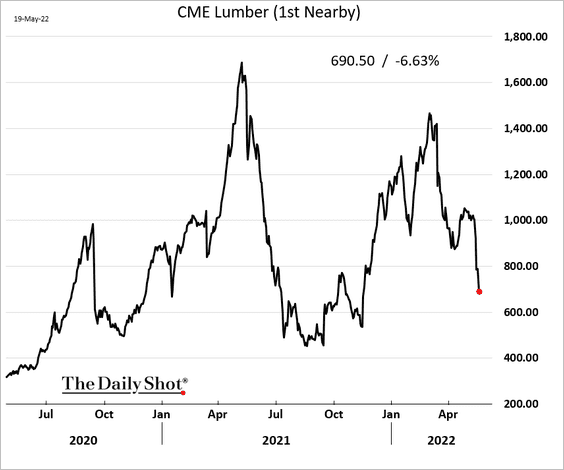

• Lumber prices are sharply lower this month.

——————–

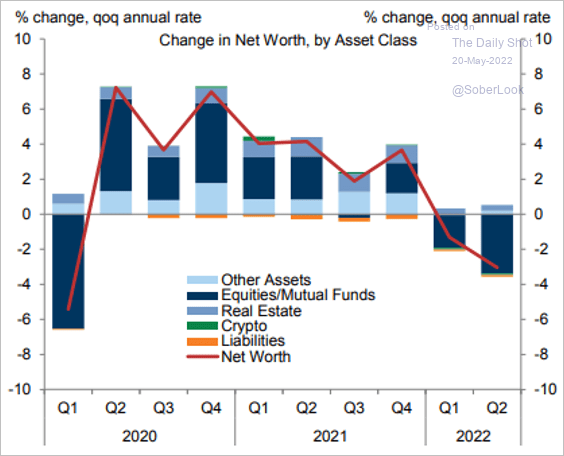

6. How much will the stock market rout impact household wealth?

Source: Goldman Sachs; @tracyalloway

Source: Goldman Sachs; @tracyalloway

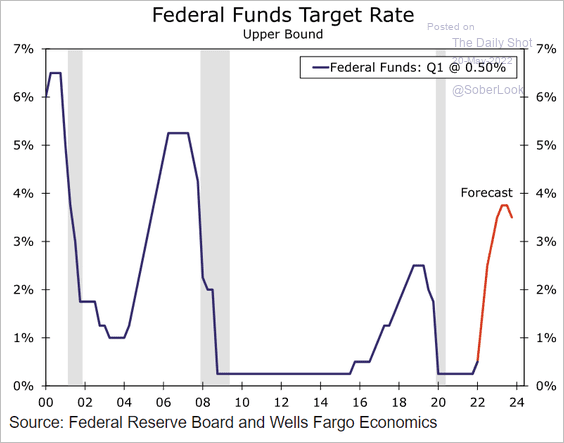

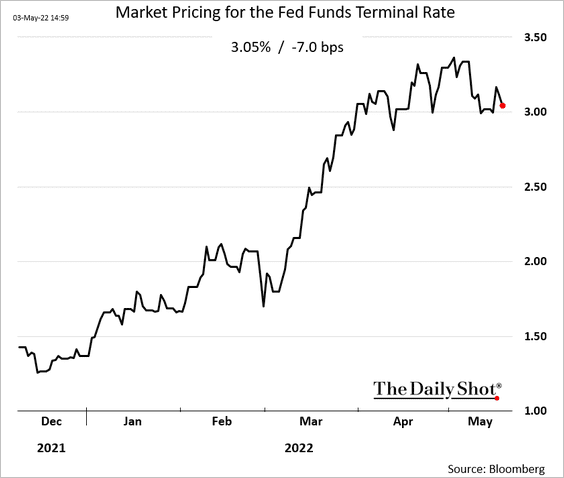

7. How high will the fed funds rate get in the current hiking cycle? A forecast from Wells Fargo suggests we could approach 4%.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

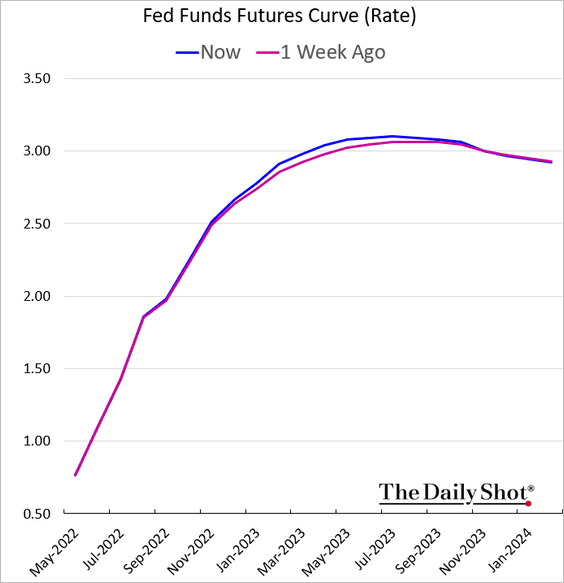

The market, however, is not convinced, pointing to rates peaking just above 3% (2 charts).

Back to Index

The United Kingdom

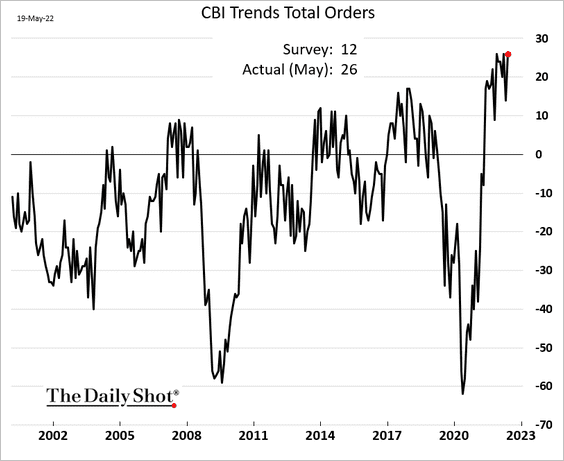

1. Industrial orders surged this month, according to CBI.

Source: Reuters Read full article

Source: Reuters Read full article

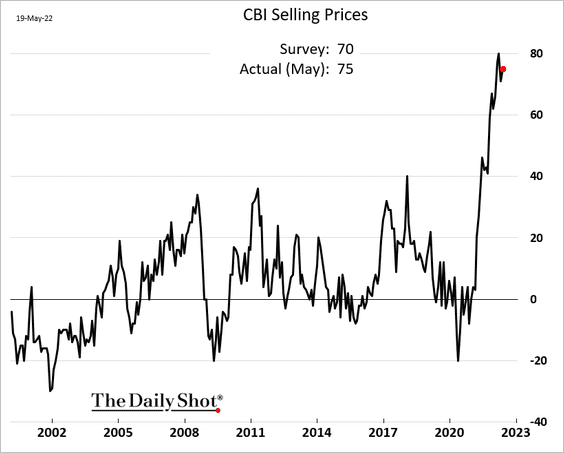

Price pressures persist.

——————–

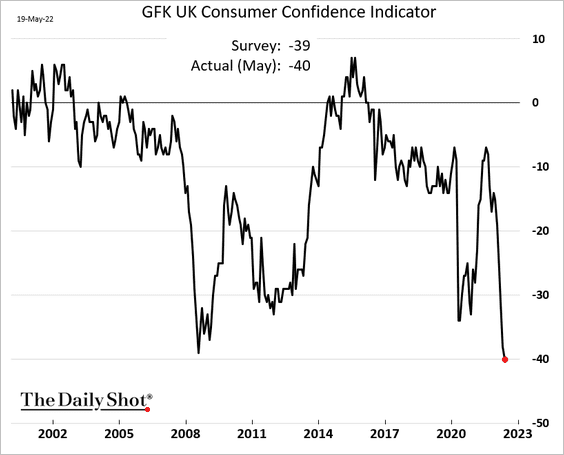

2. Consumer confidence hit a record low.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

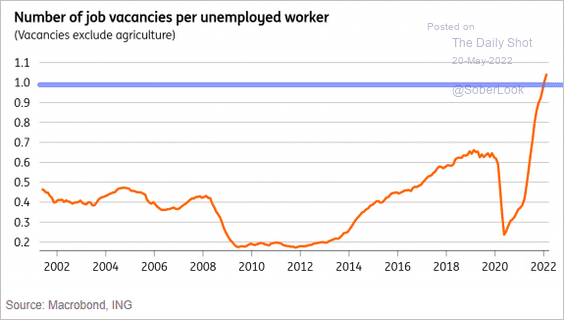

3. There are now more job vacancies than unemployed workers.

Source: ING

Source: ING

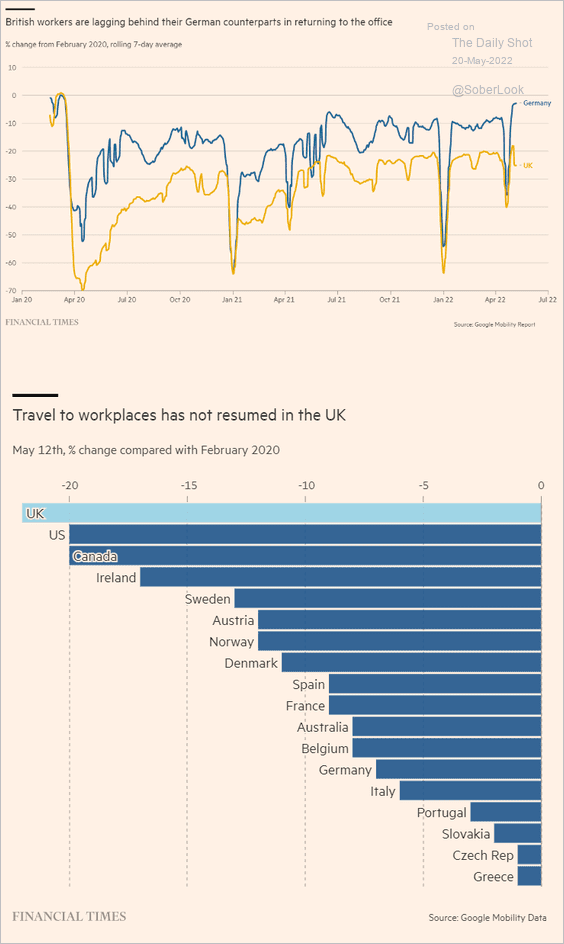

4. Return to the office has been slow.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

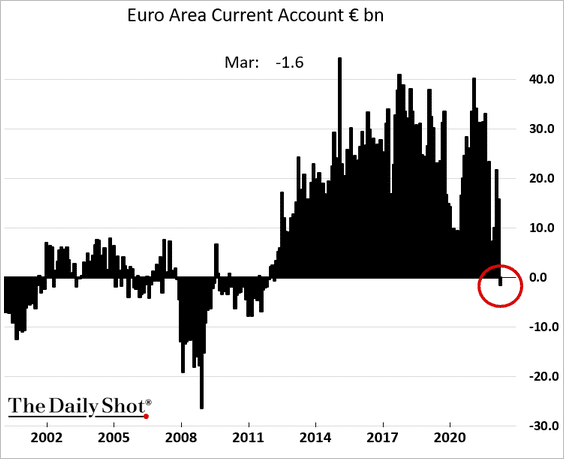

1. The current account swung into deficit for the first time in nearly a decade.

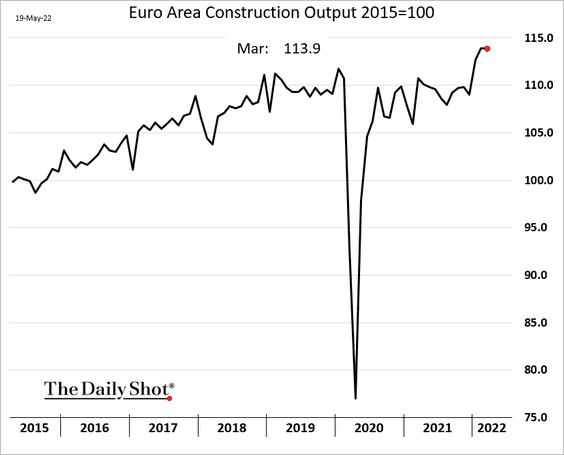

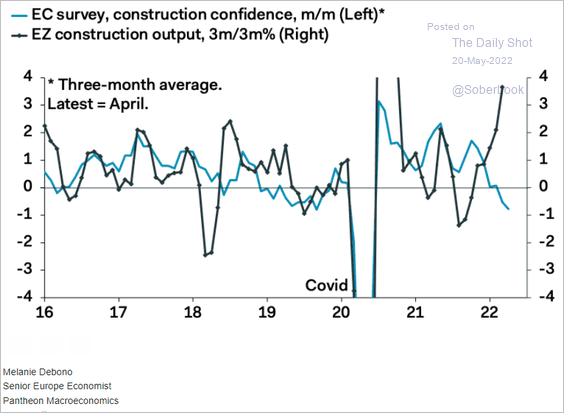

2. Construction output held up well in March.

But weak confidence in the sector points to downside risks.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

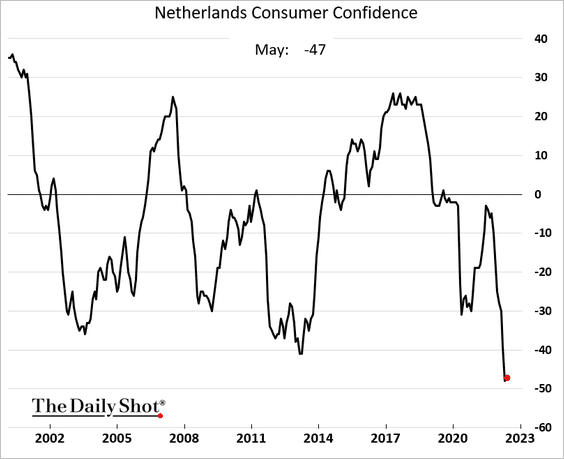

3. Dutch consumer confidence remains near record lows.

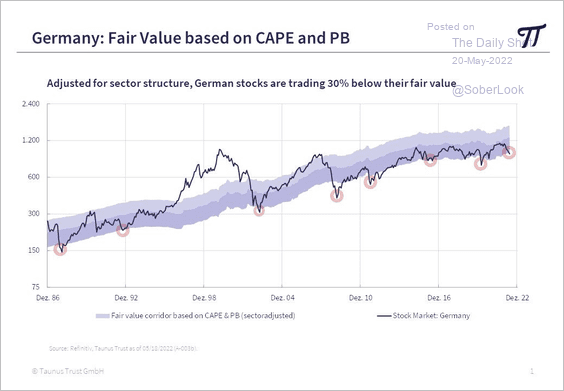

4. German stocks are trading about 30% below fair value.

Source: @NorbertKeimling

Source: @NorbertKeimling

Back to Index

Asia – Pacific

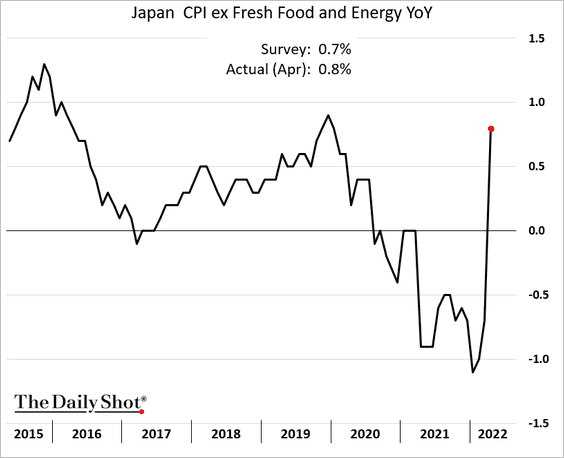

1. Japan’s core CPI accelerated after the telecom price declines fell out of the year-over-year data.

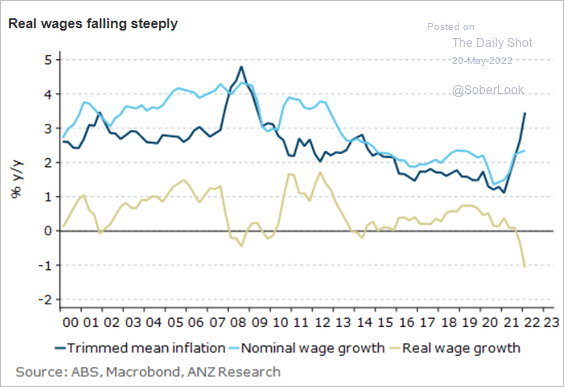

2. Australia’s real wages are tumbling.

Source: @ANZ_Research

Source: @ANZ_Research

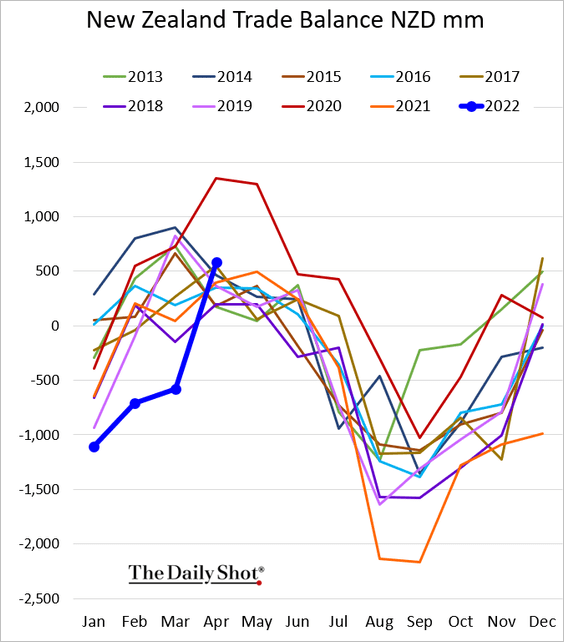

3. New Zealand’s trade balance rebounded last month.

Back to Index

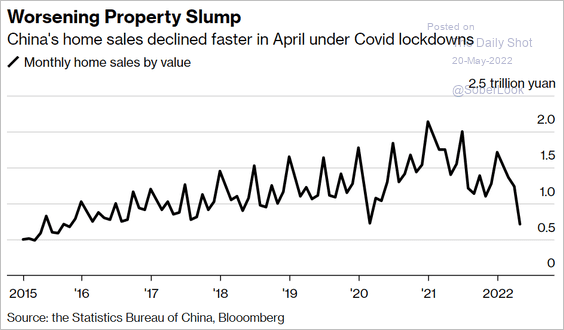

China

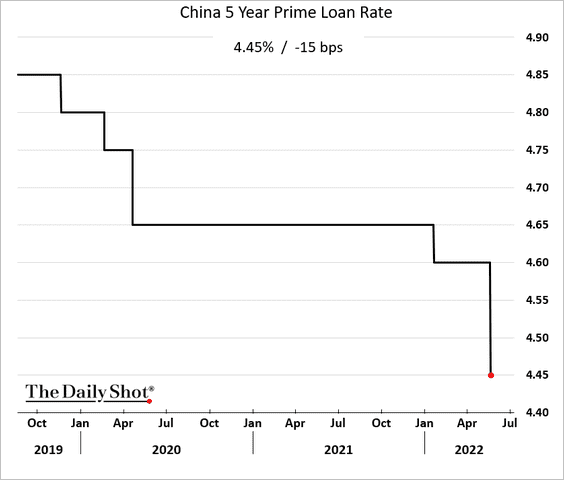

1. The central bank cut the five-year rate to support the struggling housing isector.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

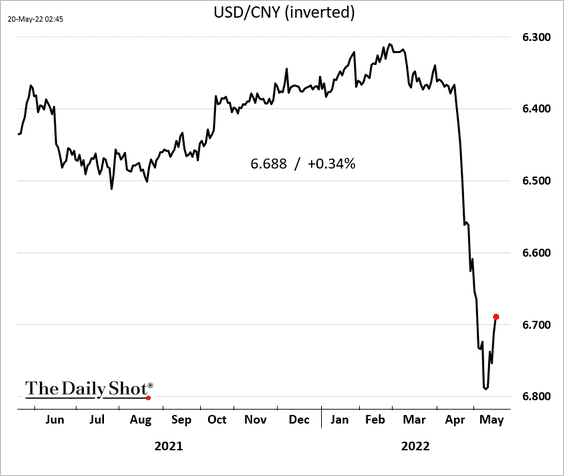

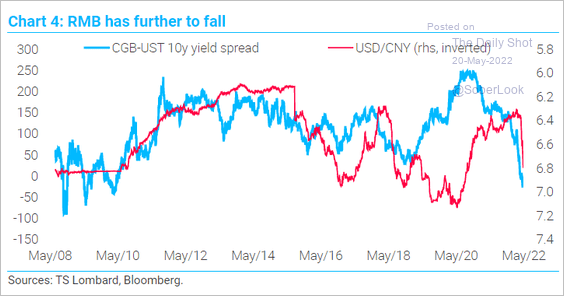

2. The renminbi is rebounding from the recent lows.

But it’s facing more downside risks.

Source: TS Lombard

Source: TS Lombard

——————–

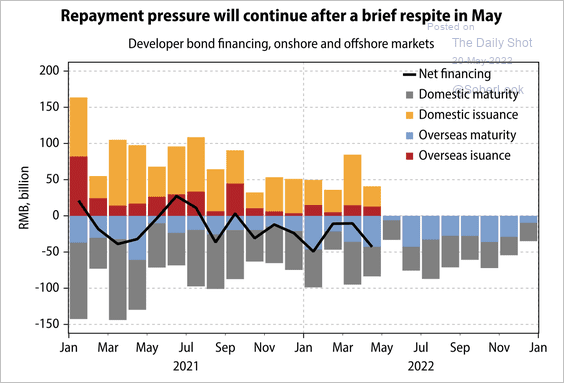

3. Property developers will face another wave of maturing bonds from June to October.

Source: Gavekal Research

Source: Gavekal Research

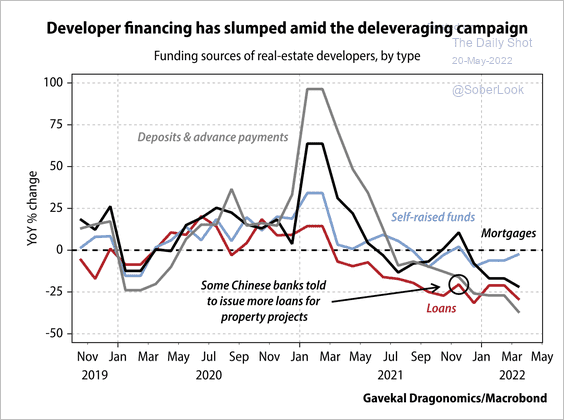

Loans are only a small share of total developer financing. Similar to offshore investors, banks have been risk-averse when lending to property developers, according to Gavekal.

Source: Gavekal Research

Source: Gavekal Research

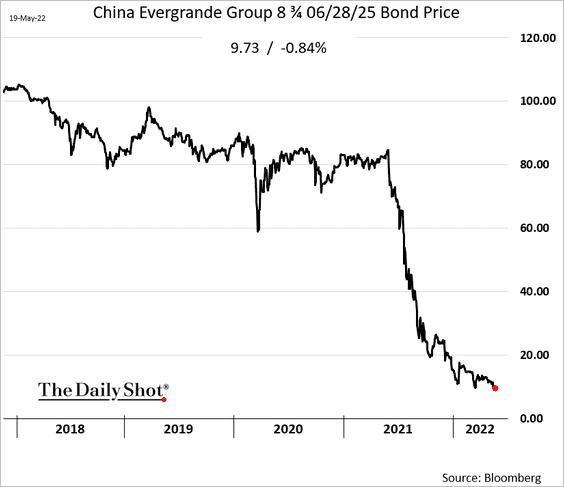

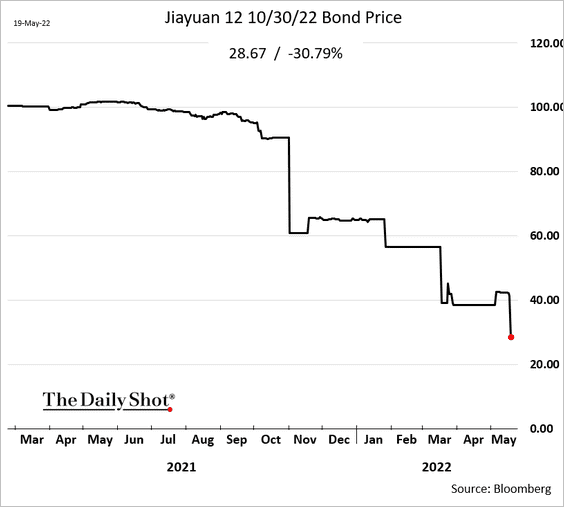

Leveraged developers remain under pressure.

• Evergrande’s USD bonds are trading below 10 cents on the dollar.

• Jiayuan missed an interest payment.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

——————–

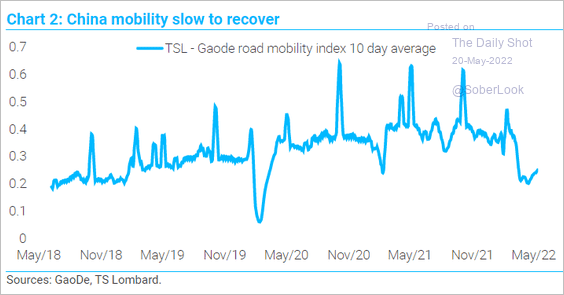

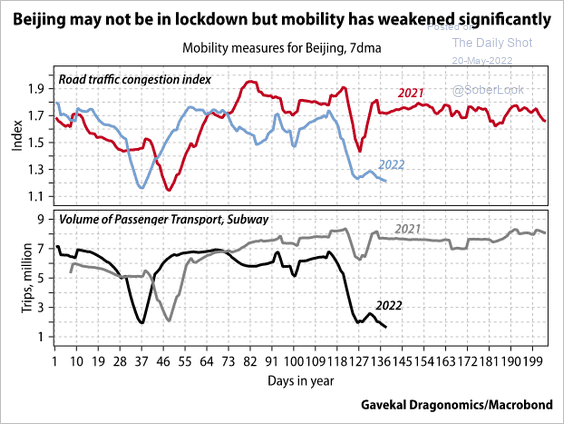

4. Mobility will take time to recover.

Source: TS Lombard

Source: TS Lombard

Source: Gavekal Research

Source: Gavekal Research

——————–

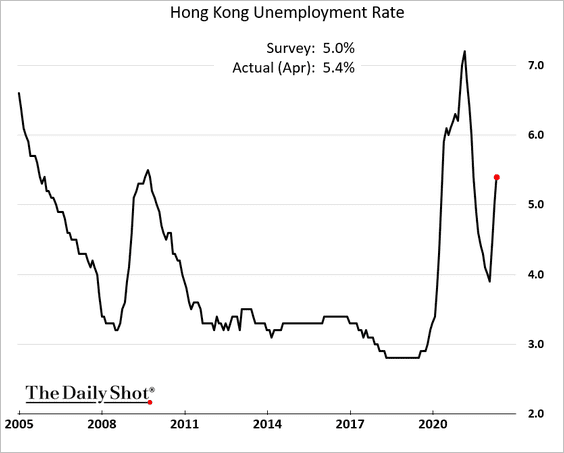

5. Hong Kong’s unemployment rate jumped during the recent COVID wave.

Back to Index

Emerging Markets

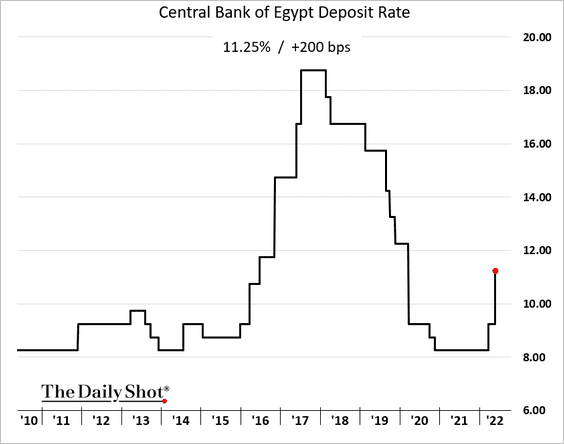

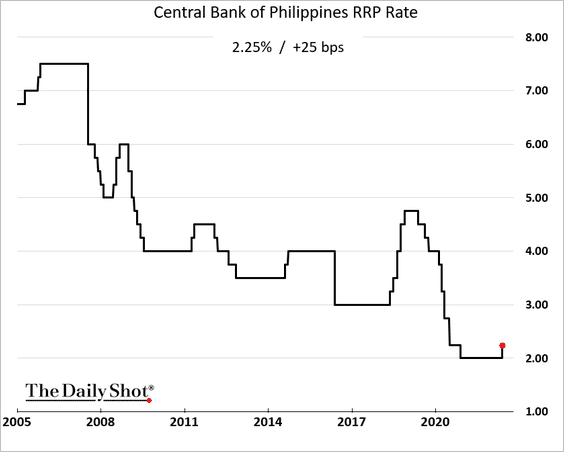

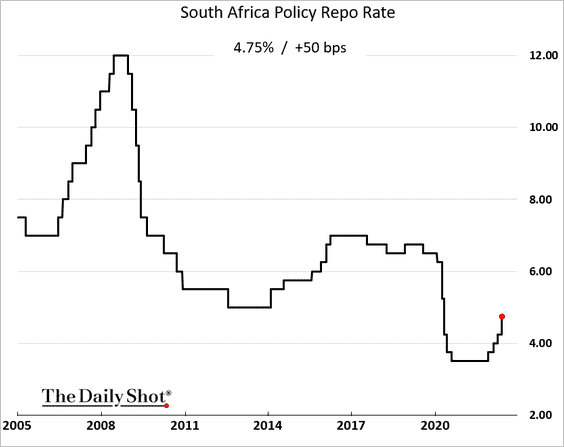

1. Several central banks hiked rates on Thursday as inflation surges.

• Egypt (200 bps!):

• The Philippines:

• South Africa:

——————–

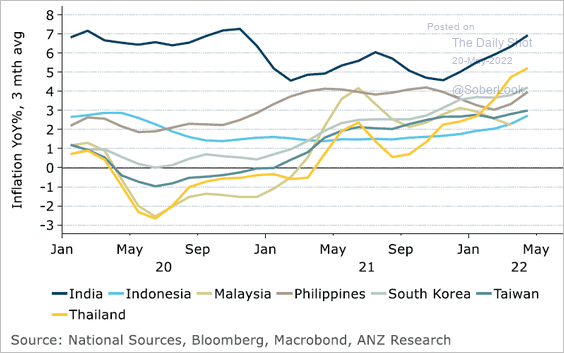

2. Inflationary pressures are rising across Asia.

Source: @ANZ_Research

Source: @ANZ_Research

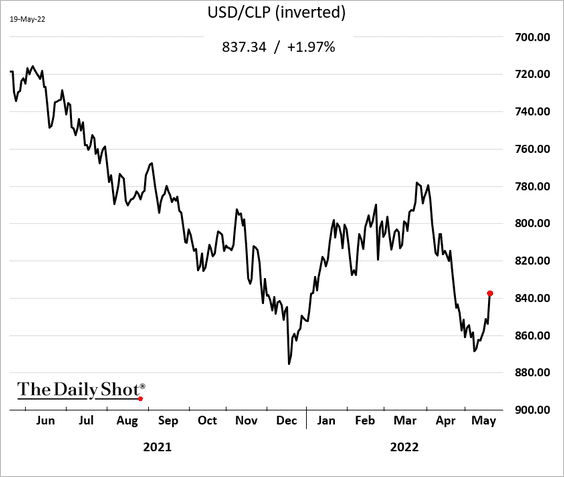

3. The Chilean peso and several other EM currencies have rebounded from the recent lows.

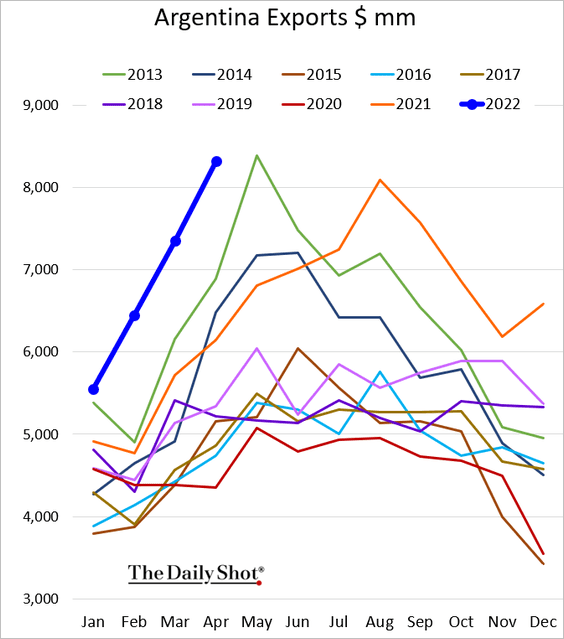

4. Argentina’s exports remain robust, driven by high commodity prices.

5. Next, we have some updates on Russia.

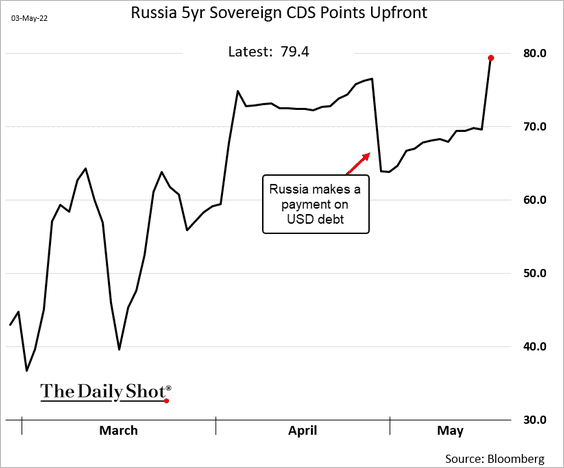

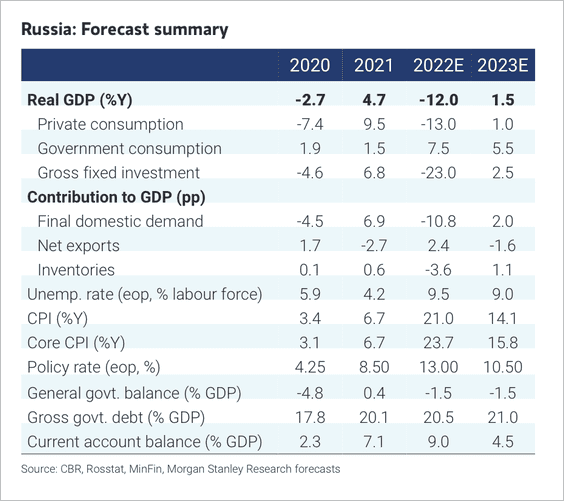

• The sovereign CDS premium climbed this week.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

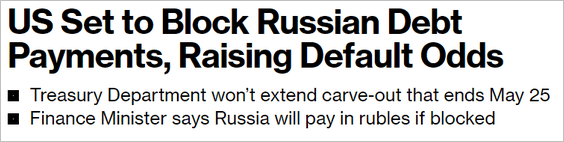

• The nation’s FX reserves continue to move lower.

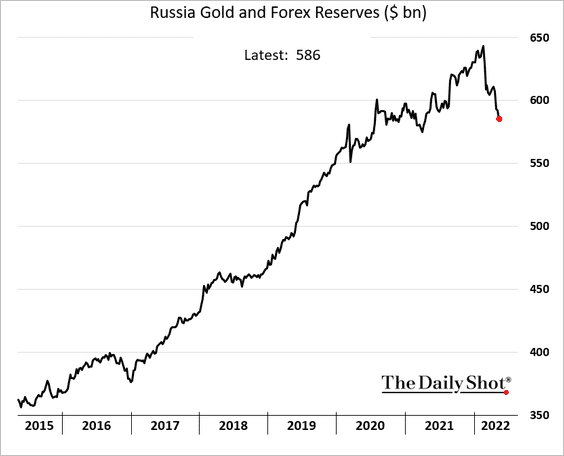

• Morgan Stanley expects a significant GDP contraction in Russia this year, partly because of declining investment (domestic and abroad), business closures, and supply disruptions.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Cryptocurrency

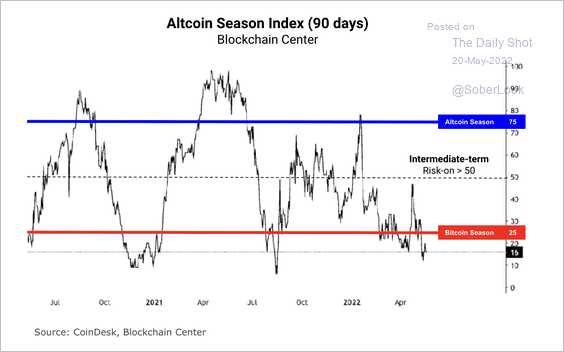

1. Only 15% of the top 50 altcoins have performed better than bitcoin over the past 90 days. That indicates an aversion to risk among crypto traders.

Source: Blockchain Center Read full article

Source: Blockchain Center Read full article

2. Bitcoin’s market cap relative to the total crypto market cap continues to tick higher. Another sign of risk-off.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

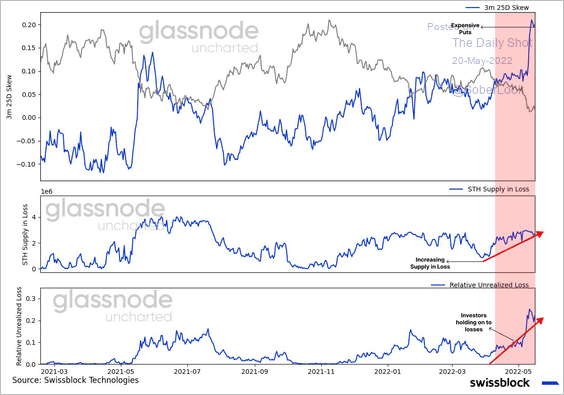

3. As more short-term bitcoin holders are at a loss, the demand for downside protection has driven put prices higher.

Source: @Negentropic_

Source: @Negentropic_

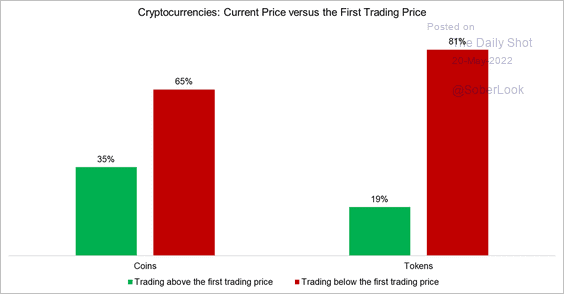

4. A majority of cryptos are trading below their first trading price.

Source: Jackdaw Capital Read full article

Source: Jackdaw Capital Read full article

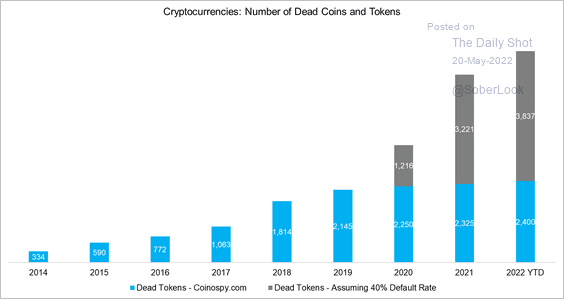

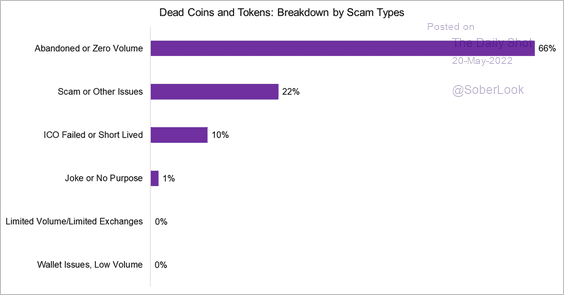

5. This chart shows the estimated rise in dead token projects, …

Source: Jackdaw Capital Read full article

Source: Jackdaw Capital Read full article

…mainly because of zero volume and scams.

Source: Jackdaw Capital Read full article

Source: Jackdaw Capital Read full article

——————–

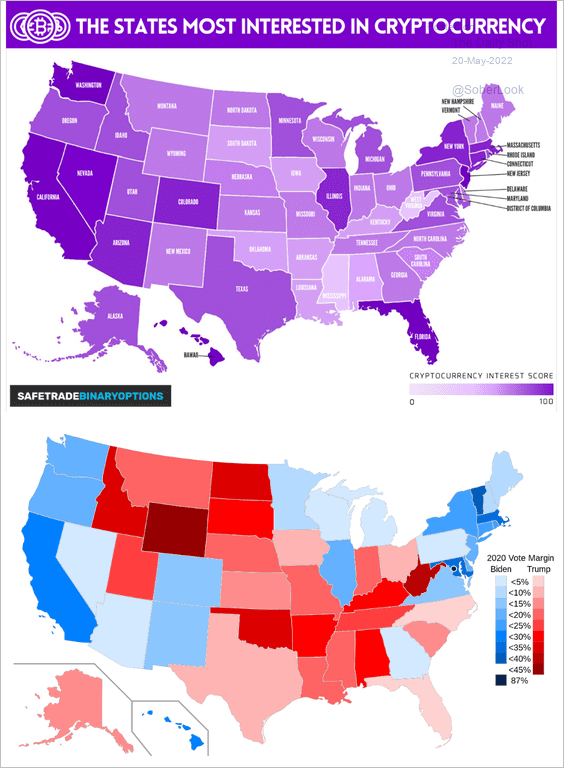

6. This map shows which states are most interested in crypto. The US political leanings map is attached for reference.

Source: Safetradebinaryoptions.com

Source: Safetradebinaryoptions.com

Back to Index

Energy

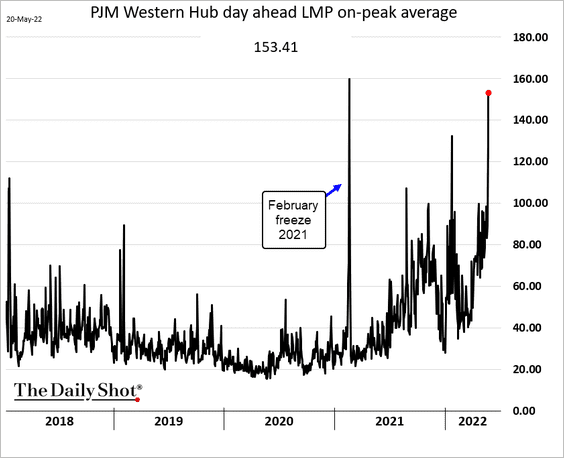

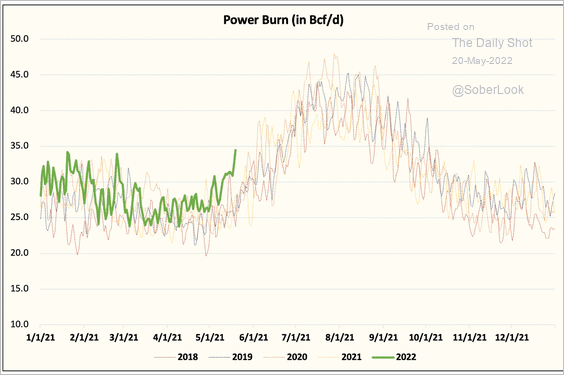

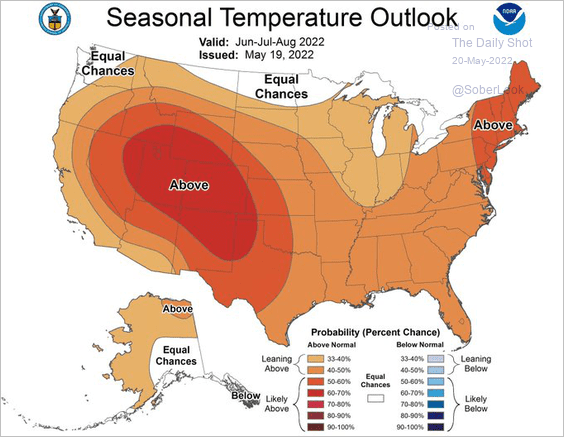

1. US power prices and spot natural gas prices jumped this week, …

… as power demand surged.

Source: @HFI_Research

Source: @HFI_Research

Source: Reuters Read full article

Source: Reuters Read full article

And it’s going to be a hot summer.

Source: @MikeZaccardi, @NOAA

Source: @MikeZaccardi, @NOAA

——————–

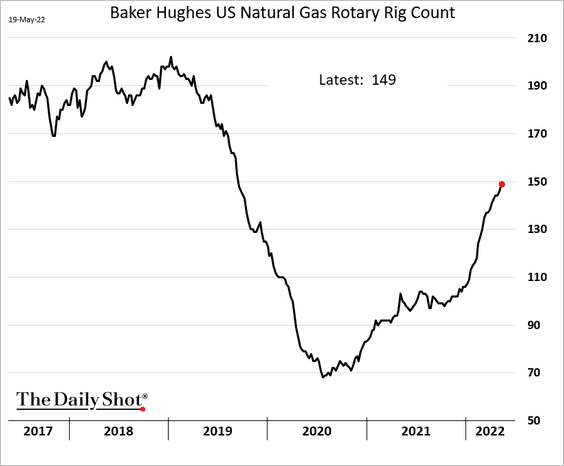

2. US natural gas rigs have been rising quickly.

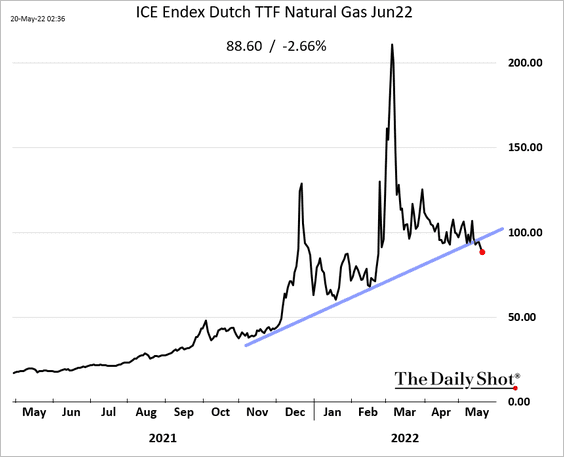

3. European natural gas prices dropped this week.

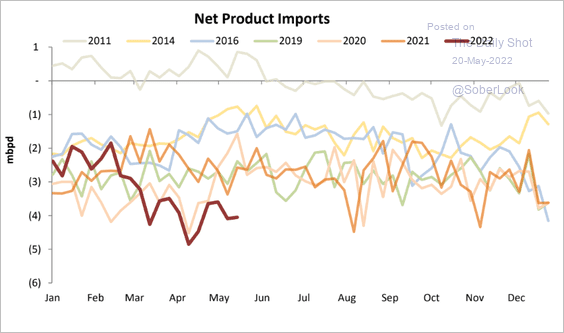

4. The US is exporting a tremendous amount of refined product.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

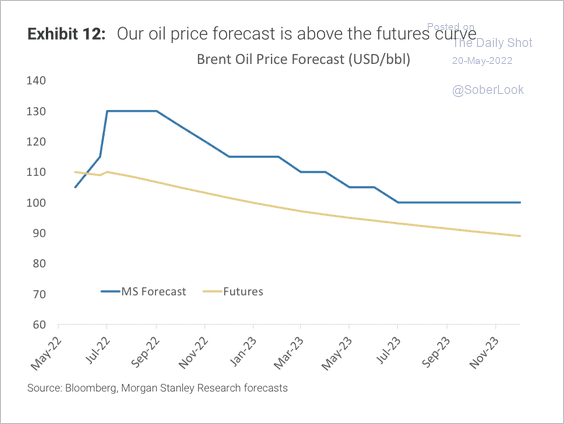

5. Morgan Stanley expects Brent oil prices to remain elevated, with price estimates above the futures curve.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Equities

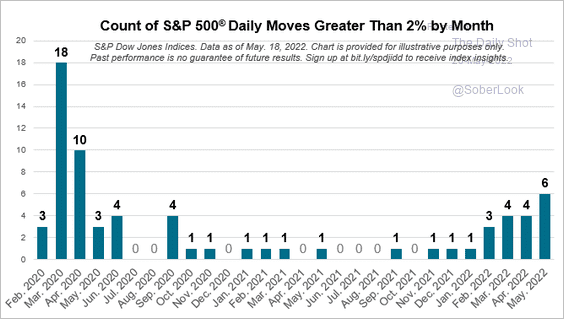

1. It’s been a volatile year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

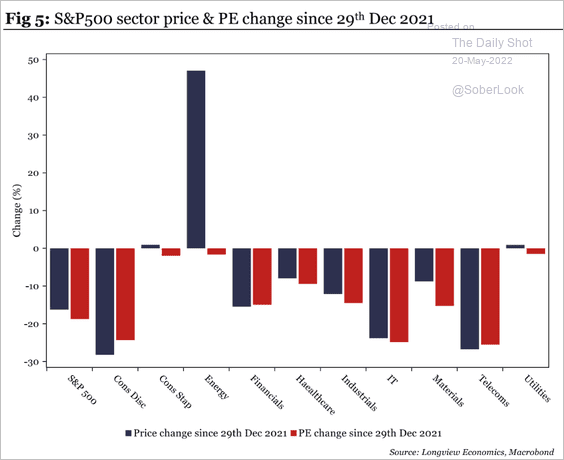

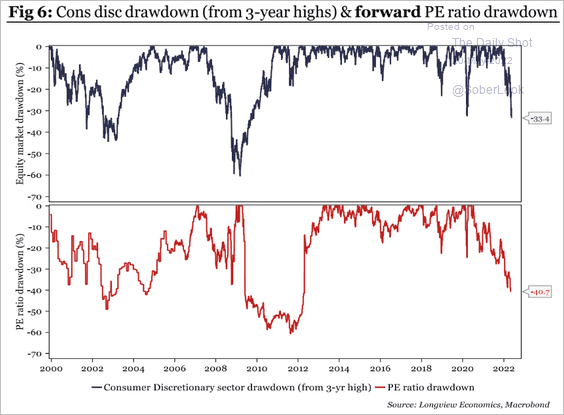

2. This chart shows the year-to-date price changes and P/E contraction by sector.

Source: Longview Economics

Source: Longview Economics

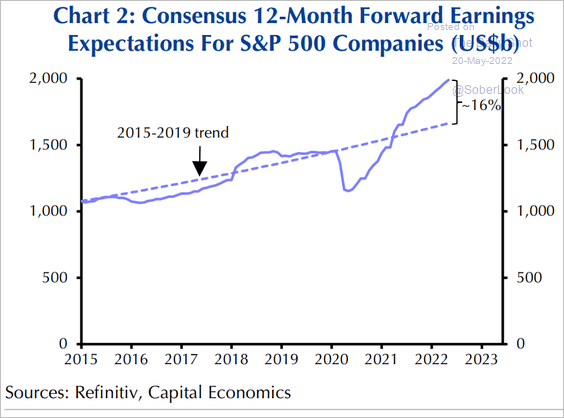

3. Will earnings expectations return to their trend?

Source: Capital Economics

Source: Capital Economics

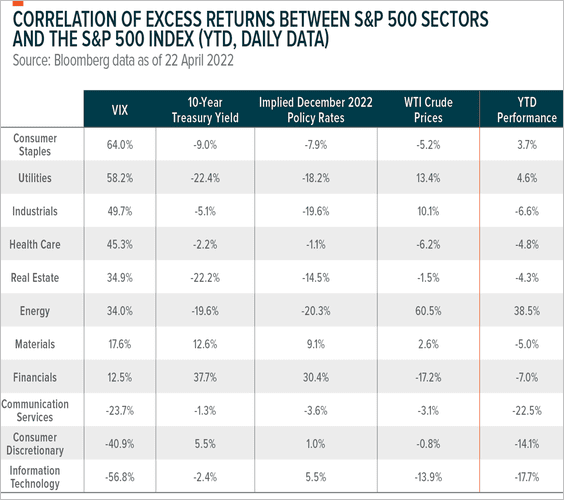

4. This table shows the correlation of excess returns between the S&P 500 index and different sectors. Defensive and energy sectors (late-cycle plays) have taken the lead as volatility returned this year.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

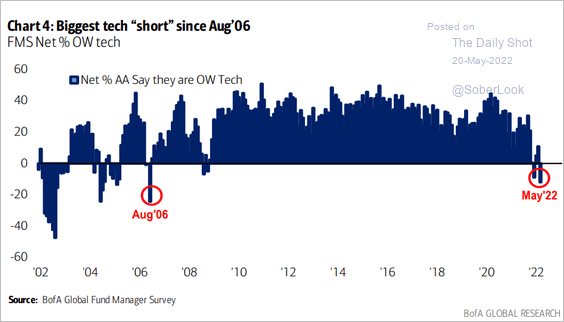

5. Fund managers haven’t been this underweight tech since 2006.

Source: BofA Global Research

Source: BofA Global Research

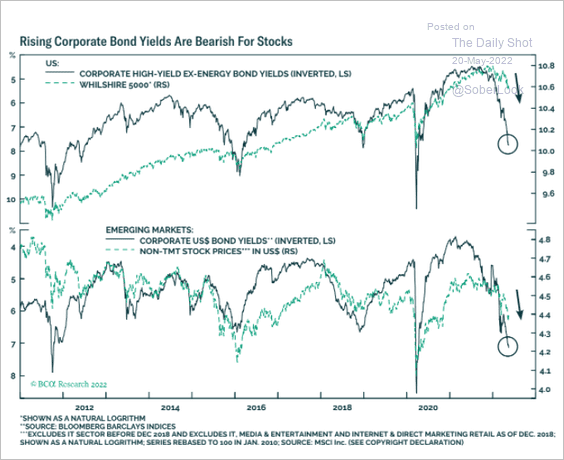

6. Credit markets point to downside risks for stocks.

Source: BCA Research

Source: BCA Research

7. This has been the worst slump in consumer discretionary stocks since the financial crisis.

Source: Longview Economics

Source: Longview Economics

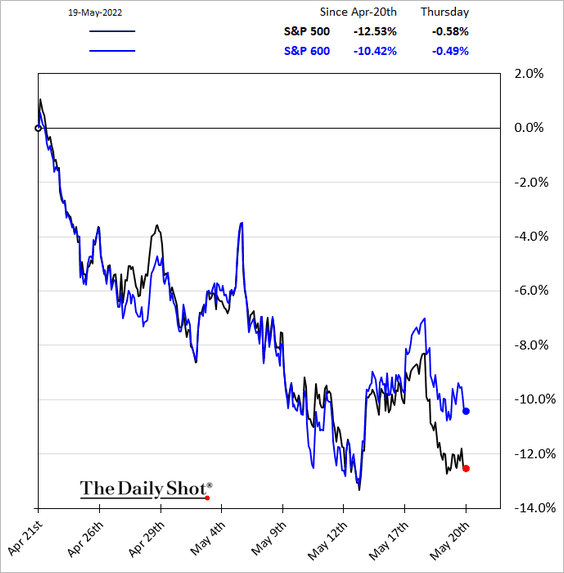

8. Small caps started to outperform this week.

9. Next, we have some updates on retail investor activity.

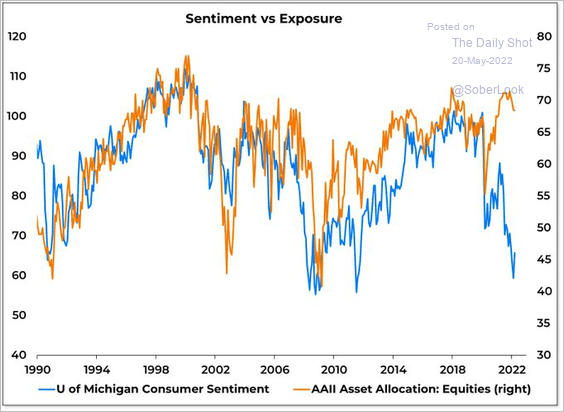

• Positioning doesn’t suggest capitulation even as consumer sentiment collapses.

Source: @WillieDelwiche

Source: @WillieDelwiche

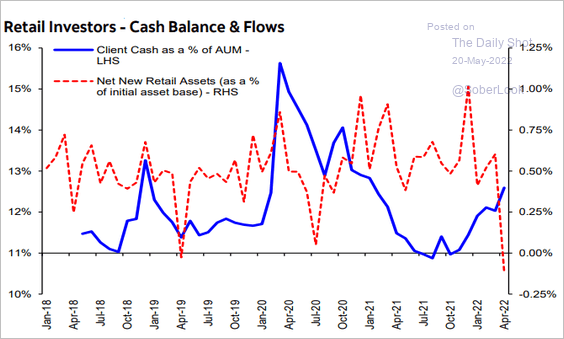

• Retail investors have been raising cash …

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

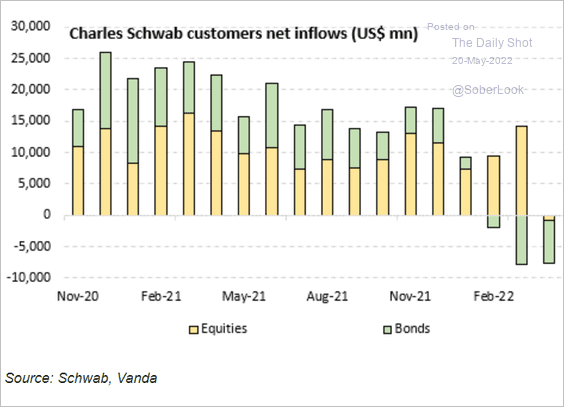

… by selling bonds rather than socks.

Source: Vanda Research

Source: Vanda Research

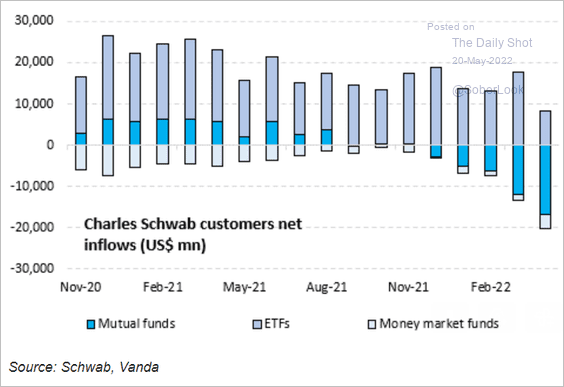

• Retail investors have been selling mutual funds and buying ETFs.

Source: Vanda Research

Source: Vanda Research

——————–

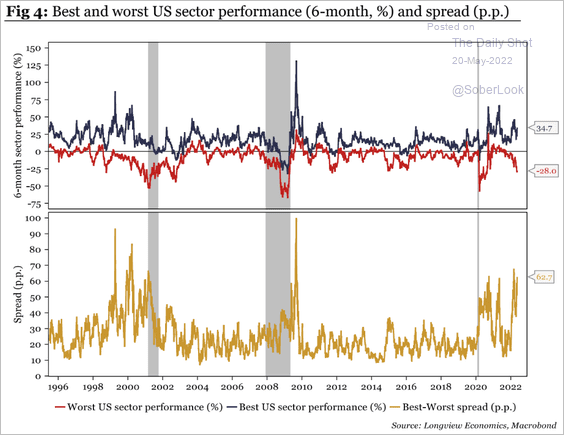

10. Sector performance dispersion had been elevated this year.

Source: Longview Economics

Source: Longview Economics

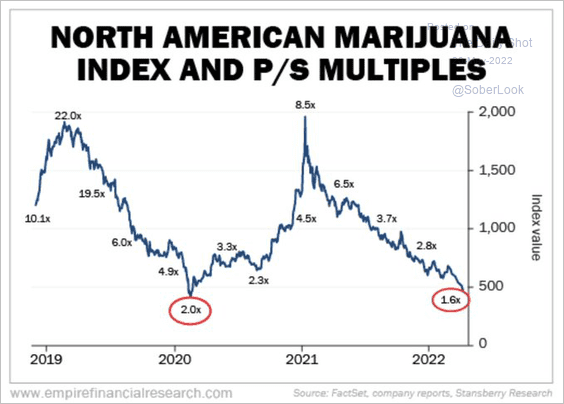

11. Cannabis stocks look cheap.

Source: @jessefelder, @WhitneyTilson Read full article

Source: @jessefelder, @WhitneyTilson Read full article

Back to Index

Credit

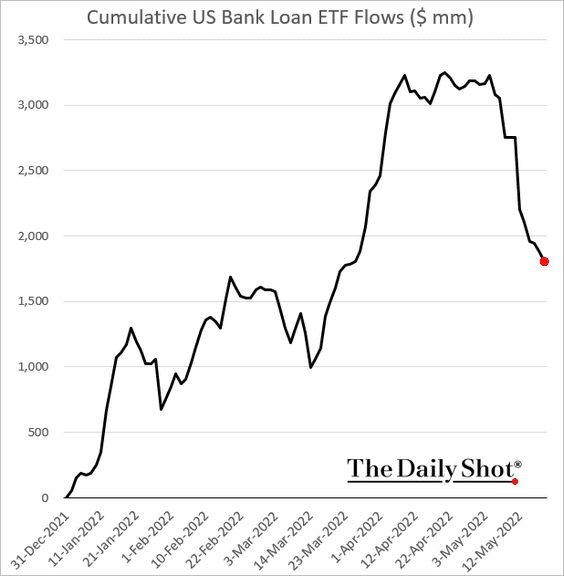

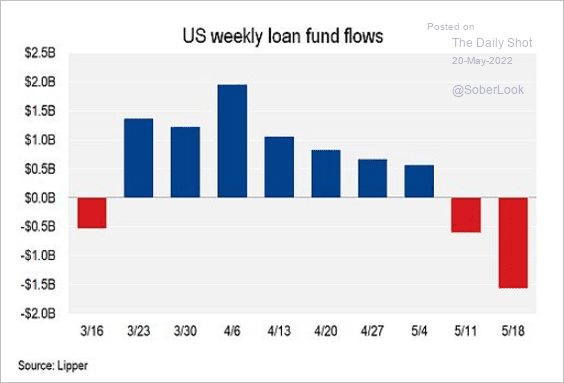

1. Leveraged loans continue to see outflows.

Source: @lcdnews Read full article

Source: @lcdnews Read full article

——————–

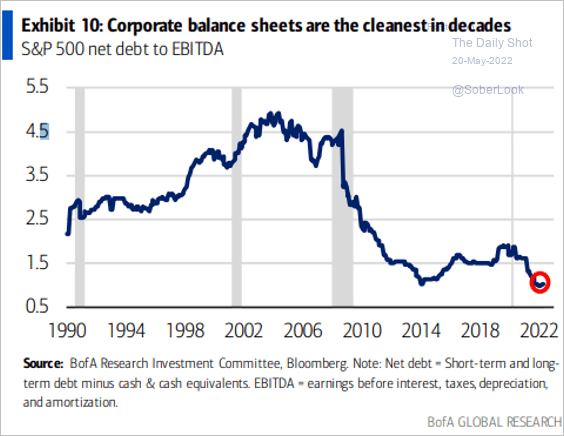

2. Large-cap corporate balance sheets are relatively healthy.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

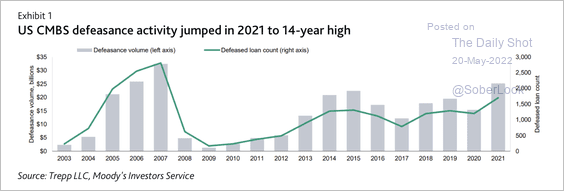

3. US commercial mortgage-backed securities defeasance activity reached a 14-year high.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

Back to Index

Rates

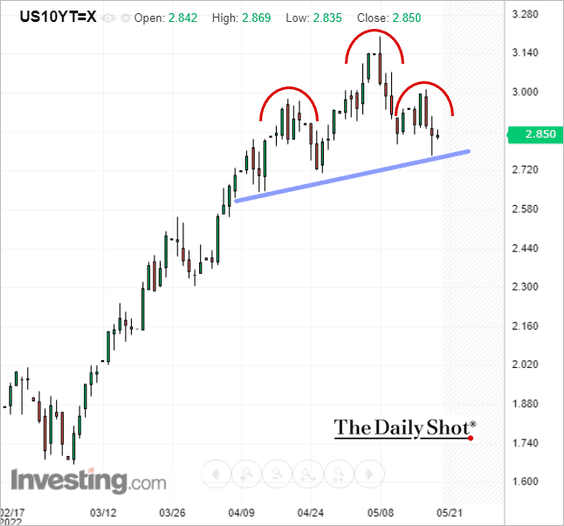

A head-and-shoulders formation in the 10yr Treasury yield?

Back to Index

Global Developments

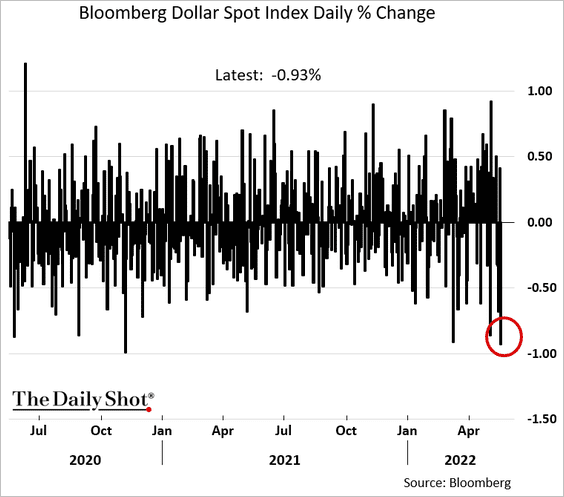

1. The US dollar took a hit on Thursday.

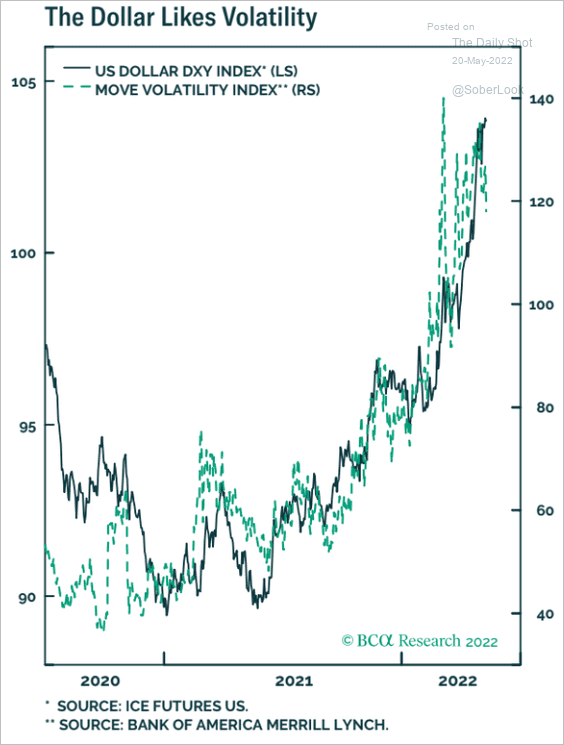

2. Increased global volatility has been a tailwind for the US dollar.

Source: BCA Research

Source: BCA Research

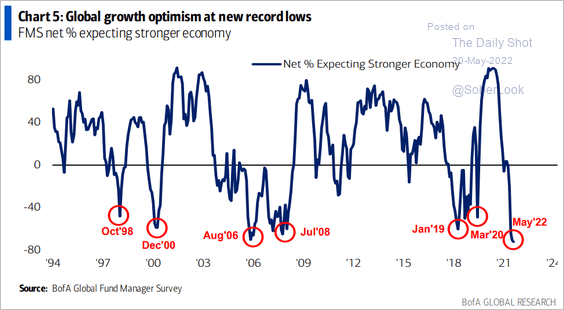

3. Fund managers’ economic pessimism is at extreme levels.

Source: BofA Global Research

Source: BofA Global Research

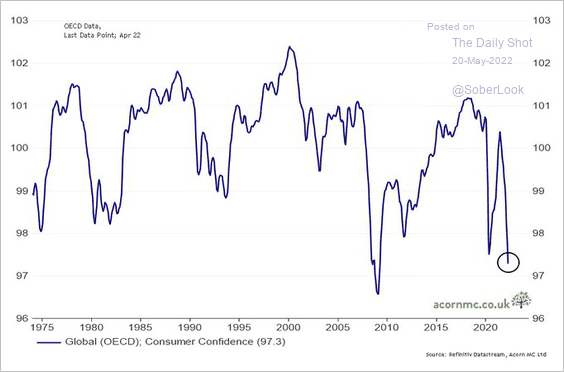

4. The OECD consumer confidence indicator is collapsing.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

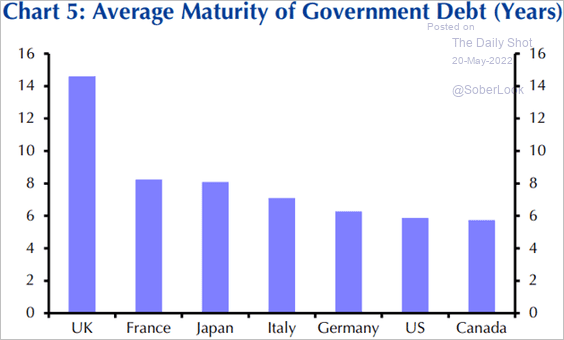

5. The maturity profile of government debt in advanced economies is relatively short-term. If interest rates remain elevated over the coming six years, most government debt will have to be funded at much higher levels.

Source: Capital Economics

Source: Capital Economics

——————–

Food for Thought

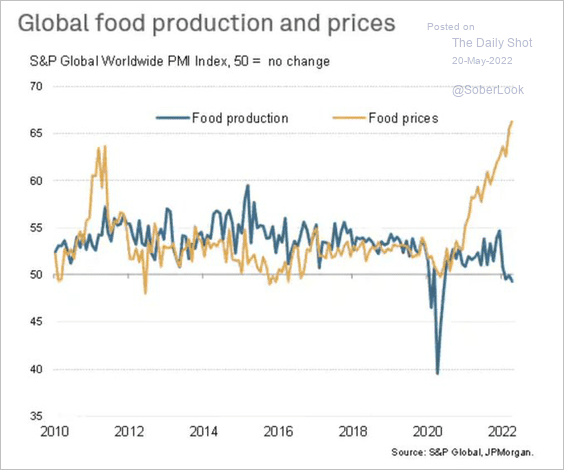

1. Global food production and prices:

Source: @Callum_Thomas

Source: @Callum_Thomas

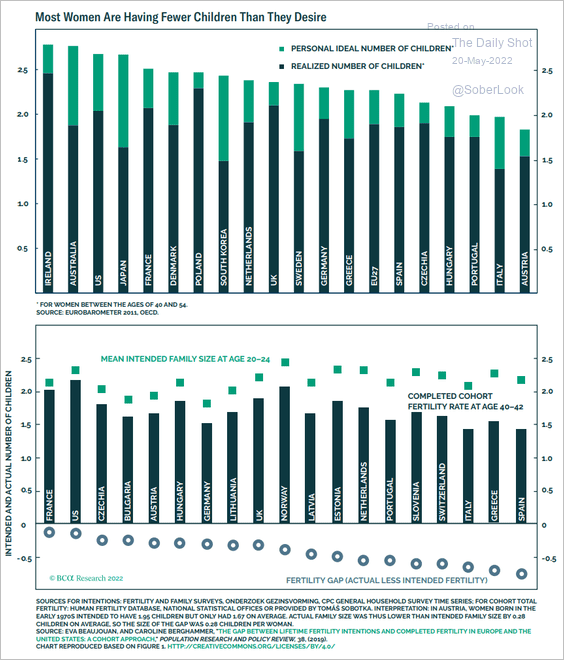

2. Intended vs. actual number of children per family in select economies:

Source: BCA Research

Source: BCA Research

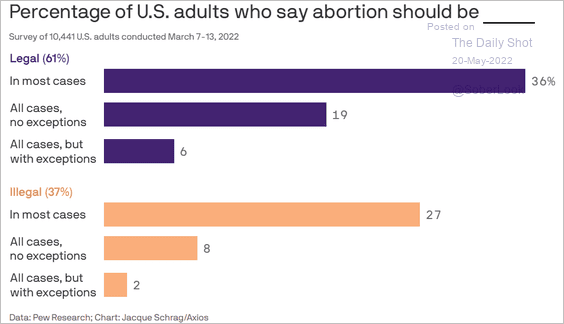

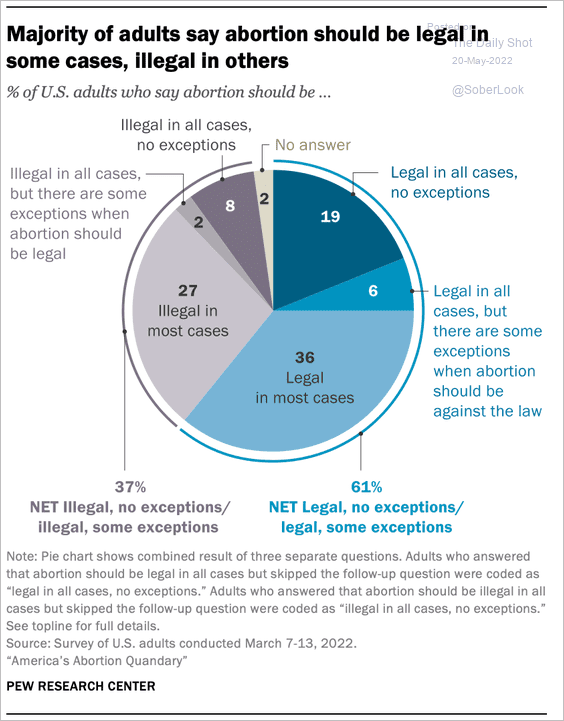

3. Views on abortion in the US:

Source: @axios Read full article

Source: @axios Read full article

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

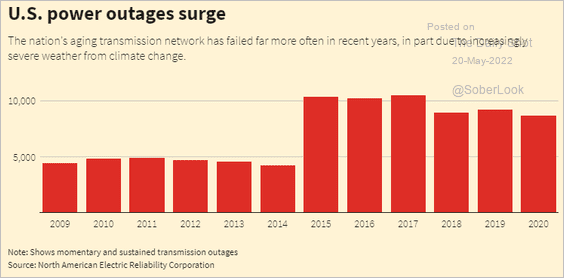

4. US power outages:

Source: Reuters Read full article

Source: Reuters Read full article

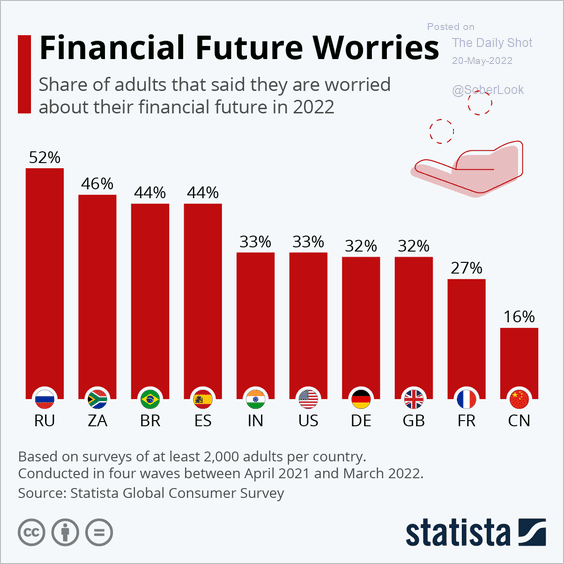

5. Households concerned about their financial future:

Source: Statista

Source: Statista

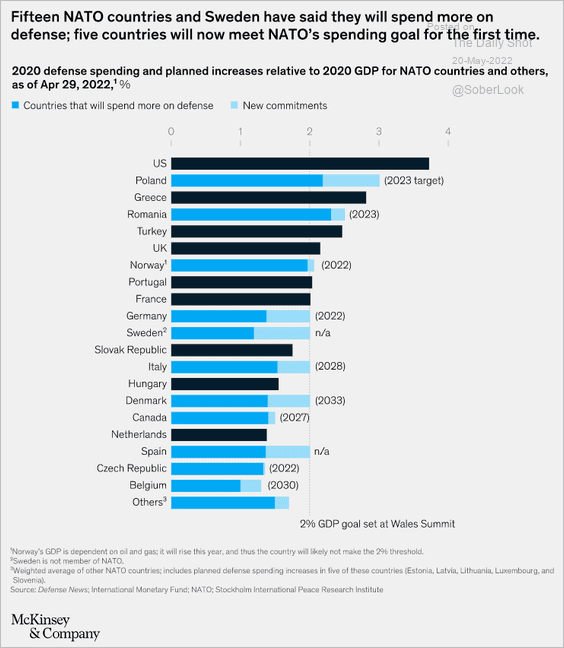

6. Rising defense spending in Europe:

Source: McKinsey & Company

Source: McKinsey & Company

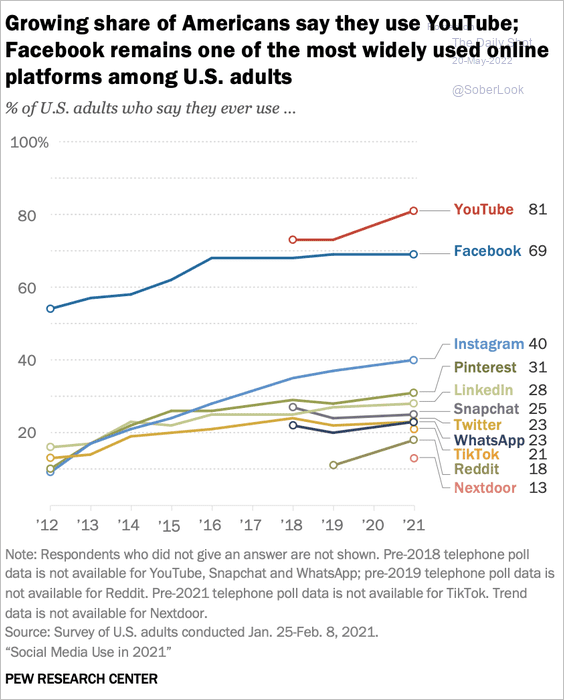

7. Social media platform usage:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

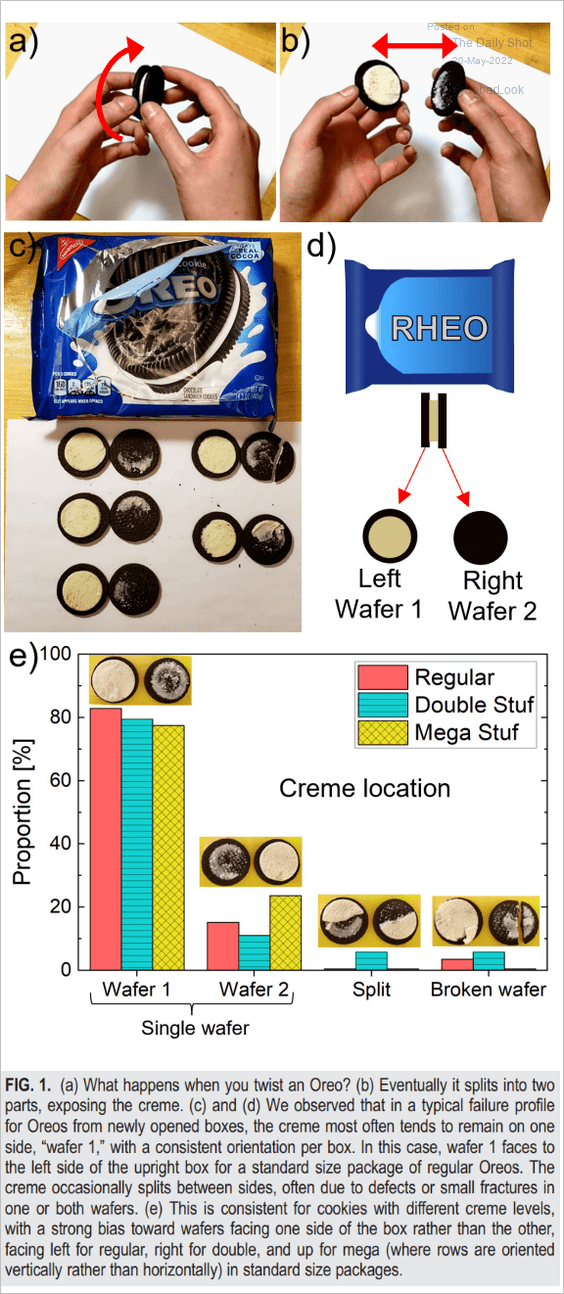

8. What happens when you twist an Oreo?

Source: Owens, Fan, Hart, and McKinley Read full article

Source: Owens, Fan, Hart, and McKinley Read full article

——————–

Have a great weekend.

Back to Index