The Daily Shot: 23-May-22

• Administrative Update

• Equities

• Credit

• Rates

• Commodities

• Energy

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• The United Kingdom

• The United States

• Global Developments

• Food for Thought

Administrative Update

The Daily Shot will not be published next Monday, May 30th.

Back to Index

Equities

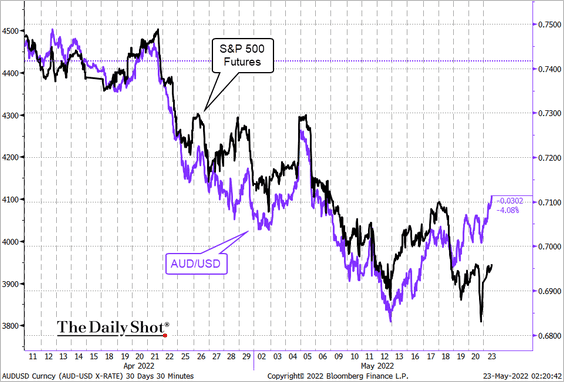

1. Global sentiment shifted to “risk-on” this morning as the Biden administration reviews the current US tariffs against China. The Aussie dollar, which has been correlated with equities is up sharply.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

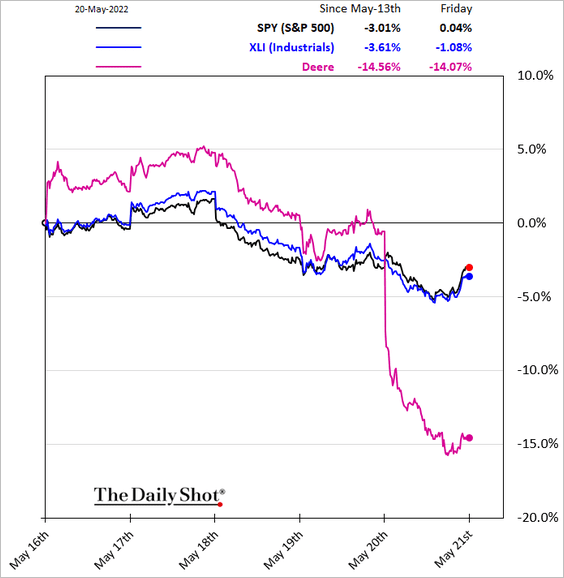

2. The pandemic-era bull market came very close to officially ending on Friday. The earnings report from Deere spooked investors.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

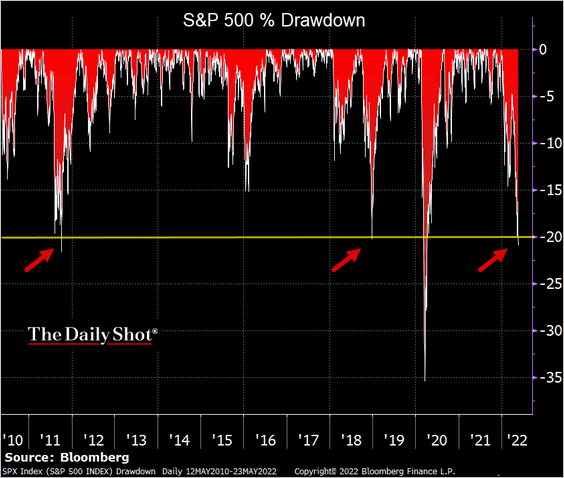

But dip buyers stepped in during the afternoon session. These near-bear-market close calls are not that uncommon.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

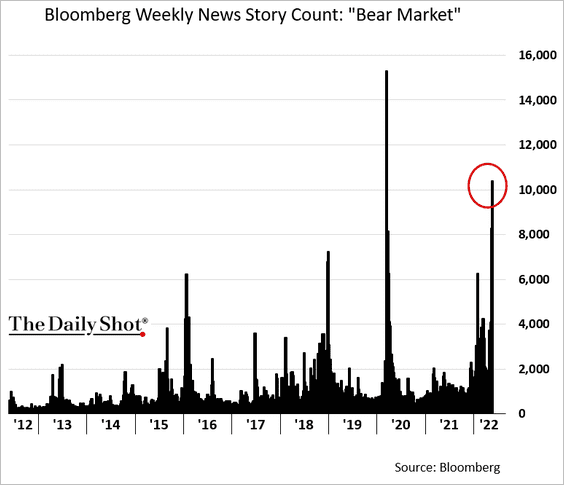

Bear market news stories spiked last week.

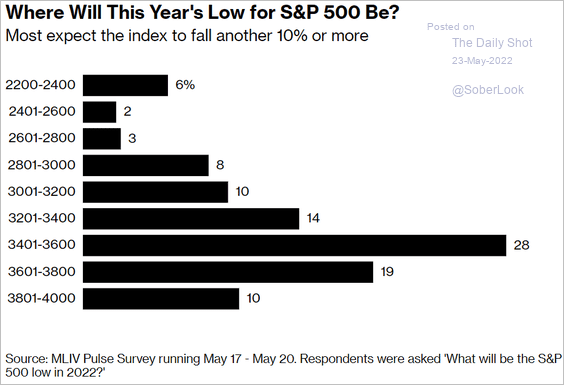

Investors expect more pain ahead.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

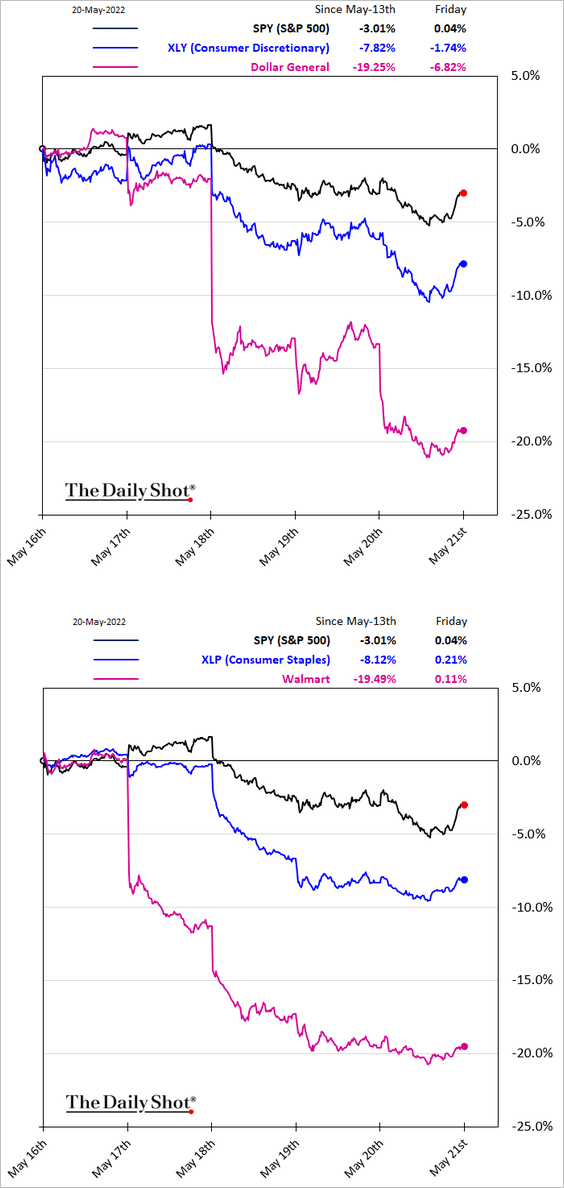

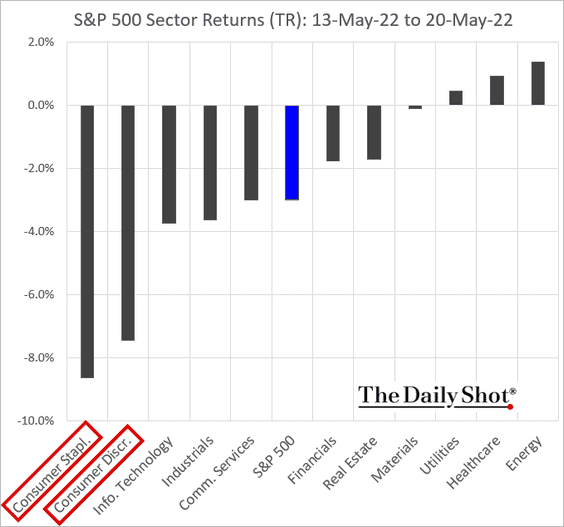

3. Fearing a recession, the market continues to punish consumer shares. Retailers may face some inventory overhang and will be forced to offer discounts. Margins will tighten. We are basically returning to the pre-COVID regime.

——————–

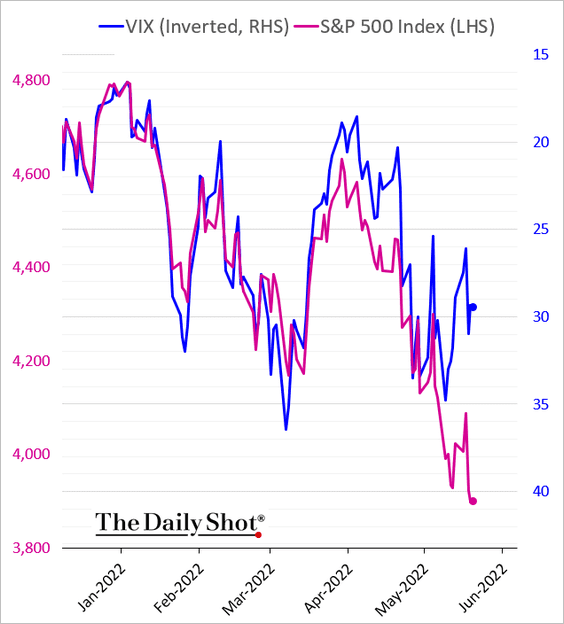

4. The S&P 500 divergence from VIX widened further last week amid limited demand for hedging.

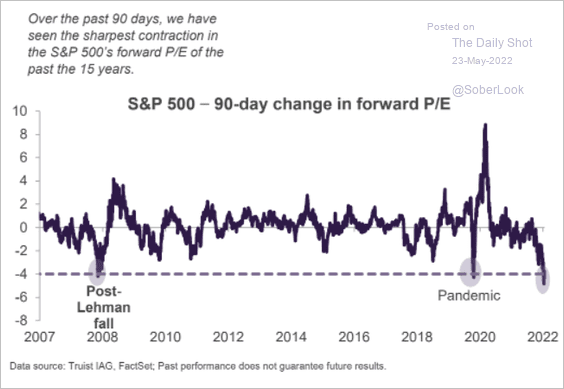

5. The valuation adjustment in the current selloff has been impressive.

Source: Truist Advisory Services

Source: Truist Advisory Services

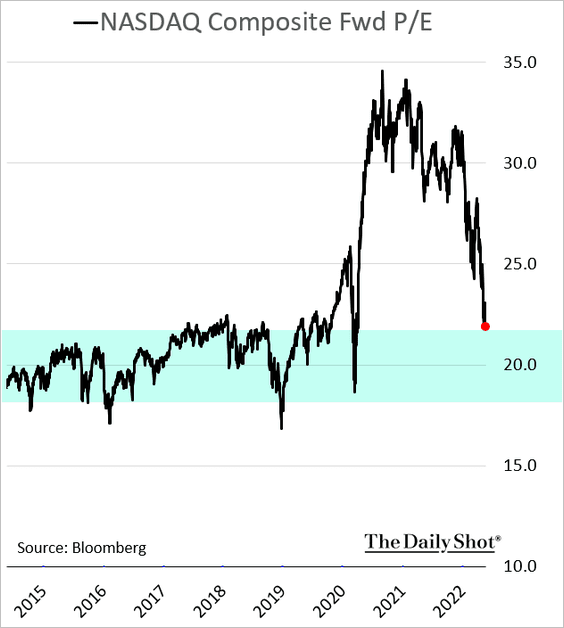

• The Nasdaq Composite forward P/E ratio is nearing the pre-2020 range, but there is plenty of room to move lower.

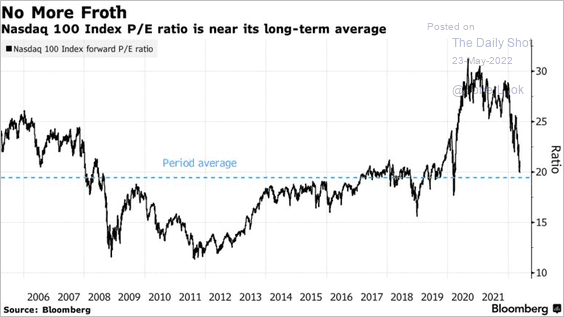

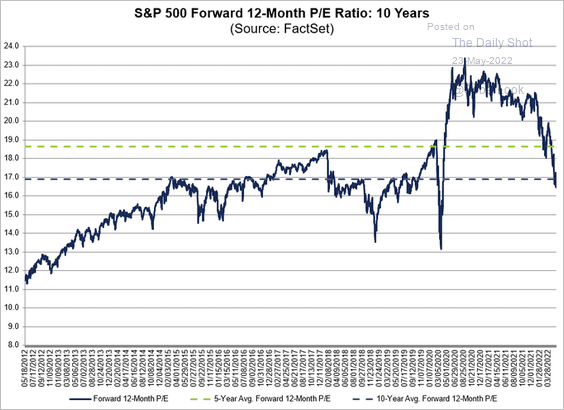

Below are the forward P/E ratios for the Nasdaq 100 and the S&P 500.

Source: @mikamsika, @RyanVlastelica, @markets Read full article

Source: @mikamsika, @RyanVlastelica, @markets Read full article

Source: @FactSet Read full article

Source: @FactSet Read full article

——————–

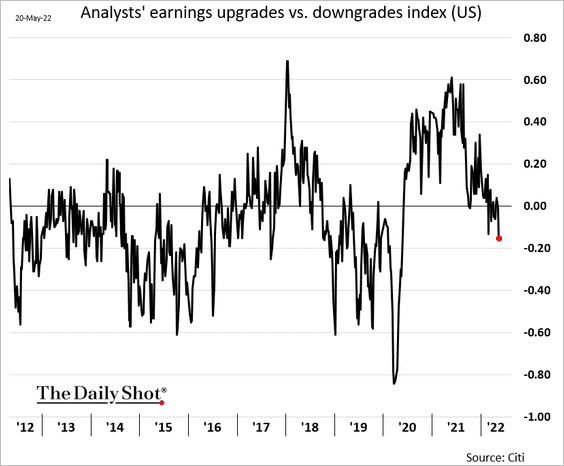

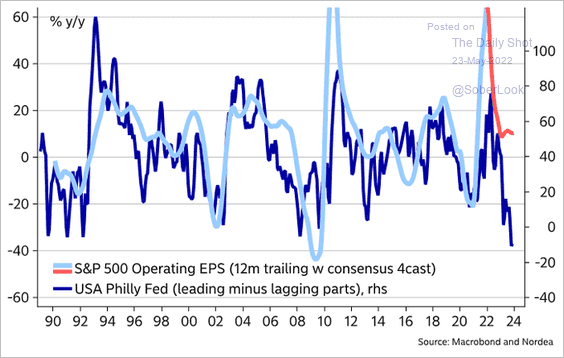

6. More earnings downgrades ahead?

The Philly Fed’s manufacturing report points to substantial downside risks for corporate earnings.

Source: @MikaelSarwe

Source: @MikaelSarwe

——————–

7. The Nasdaq 100 breadth is near the post-2009 lows.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

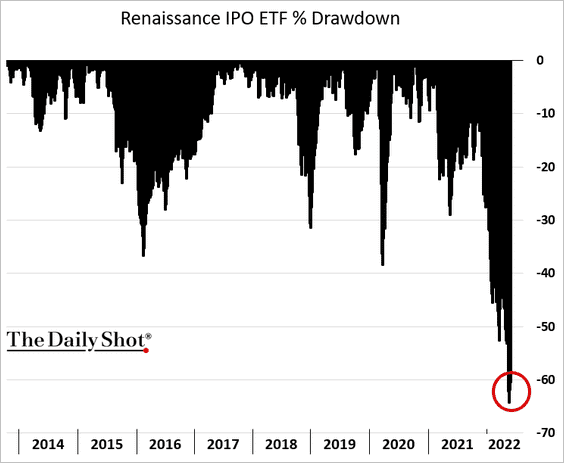

8. It’s been a challenging period for post-IPO stocks.

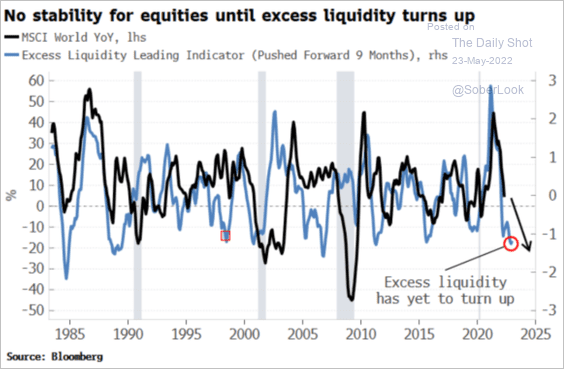

9. The pullback in global liquidity doesn’t bode well for equity markets.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

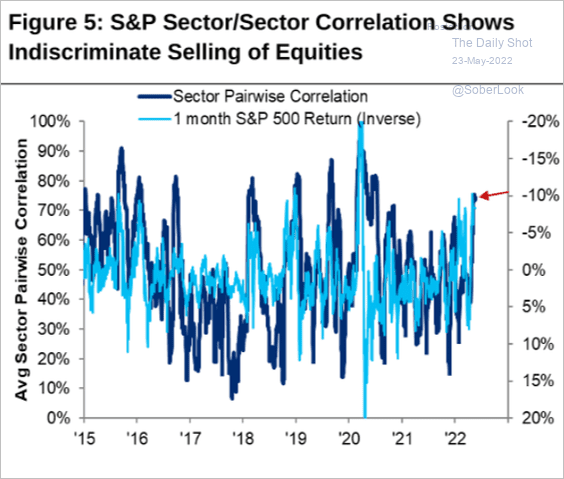

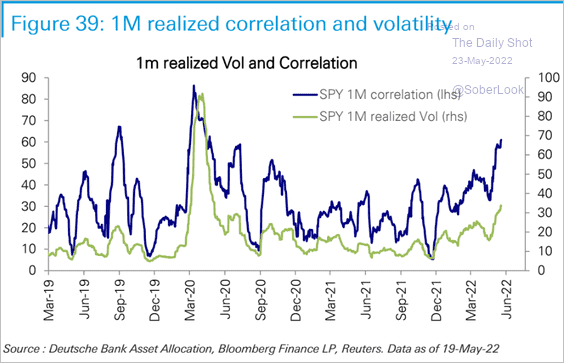

10. Correlations have been elevated (2 charts).

Source: Citi Private Bank

Source: Citi Private Bank

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

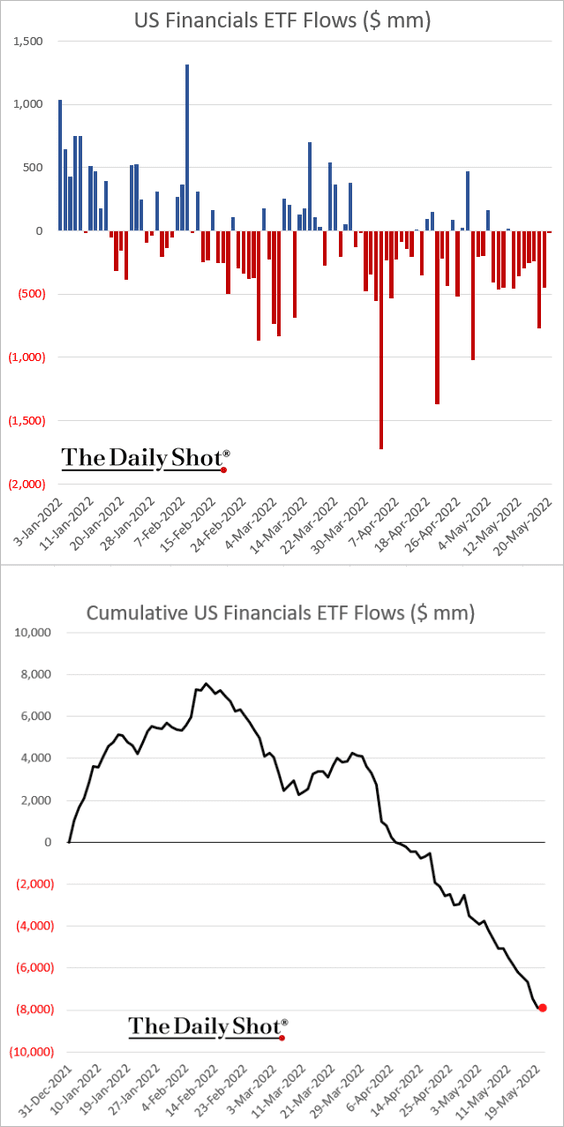

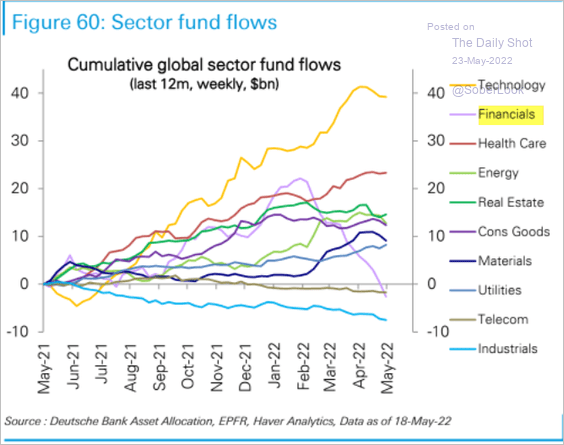

11. Financials continue to see outflows (2 charts)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

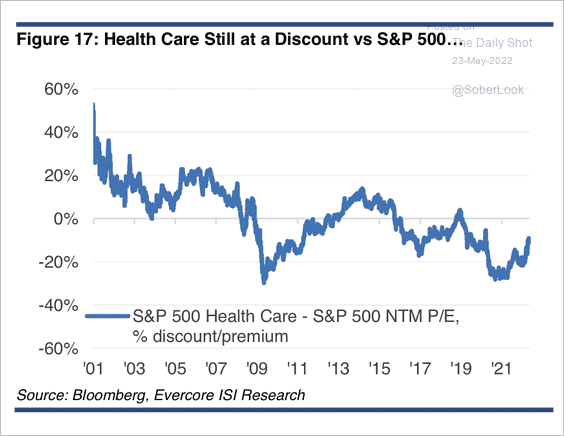

12. The healthcare sector is trading at a discount relative to the S&P 500 …

Source: Evercore ISI Research

Source: Evercore ISI Research

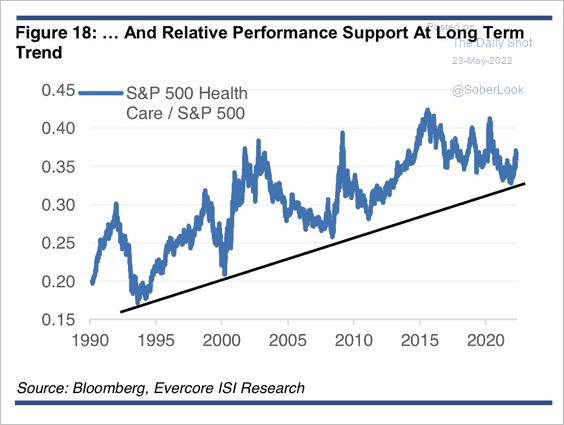

…and is holding long-term relative support.

Source: Evercore ISI Research

Source: Evercore ISI Research

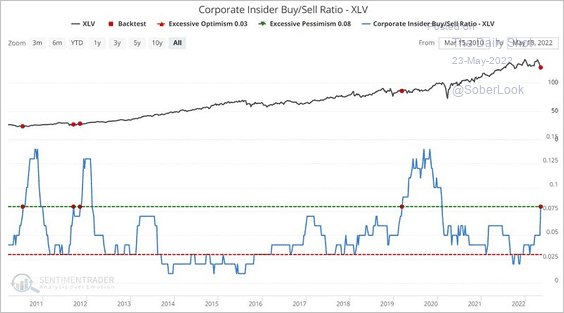

Corporate insiders in healthcare have been busy buying shares.

Source: SentimenTrader

Source: SentimenTrader

——————–

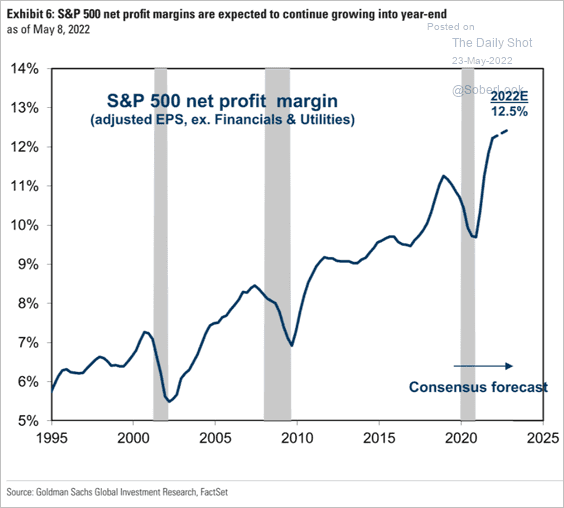

13. Analysts expect profit margins to keep growing. Too much optimism?

Source: Goldman Sachs

Source: Goldman Sachs

14. Next, we have some additional performance data.

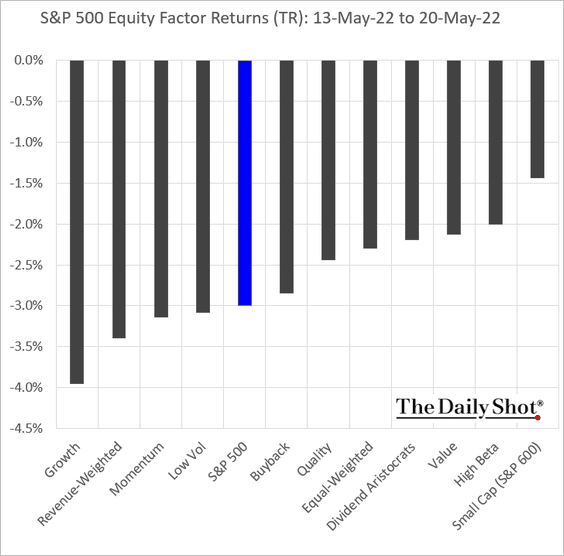

• Here is last week’s factor performance.

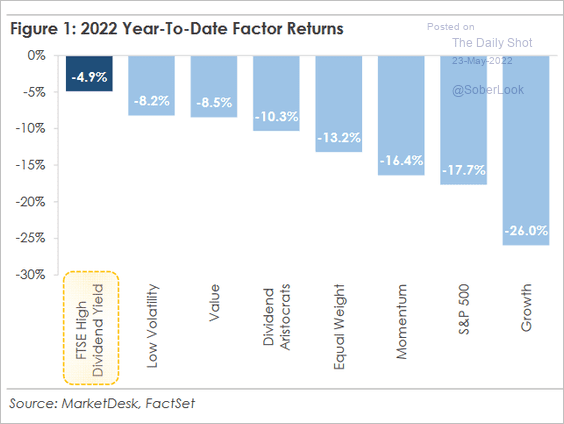

And this chart shows the year-to-date performance.

Source: MarketDesk Research

Source: MarketDesk Research

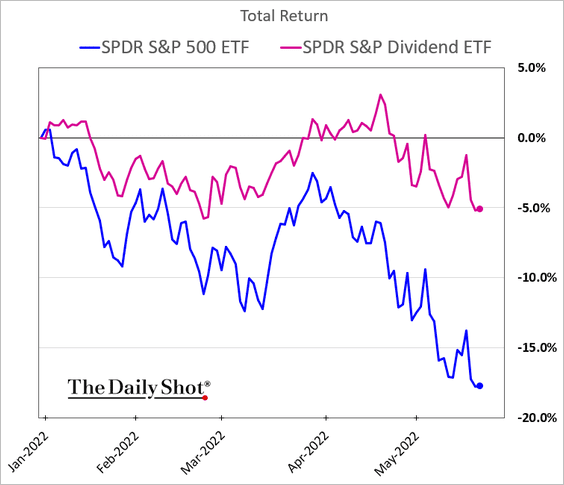

High-dividend stocks continue to outperform.

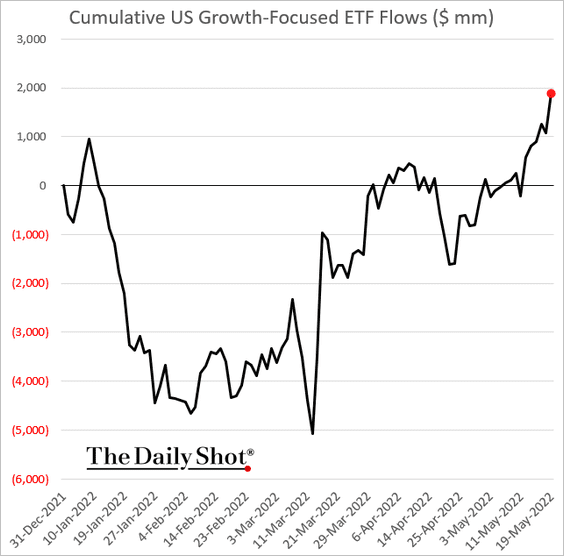

By the way, growth ETFs keep getting capital inflows.

——————–

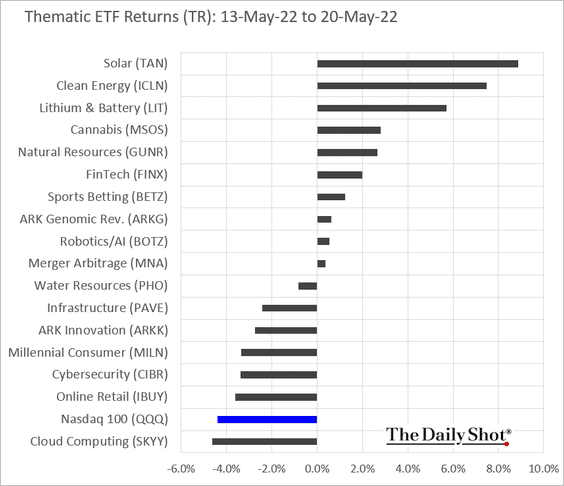

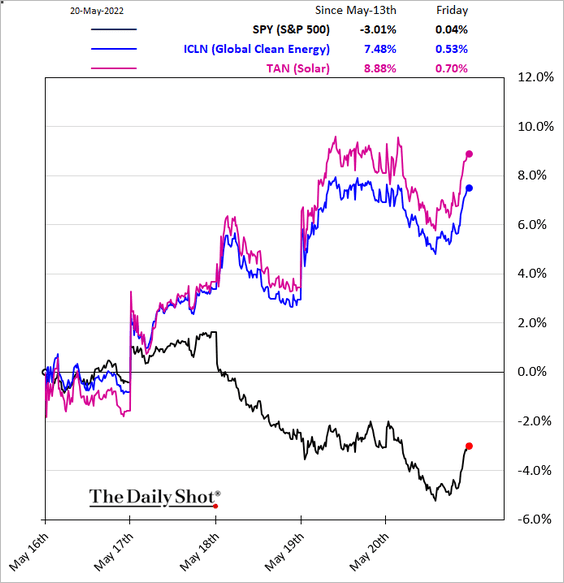

• Clean energy stocks surged last week.

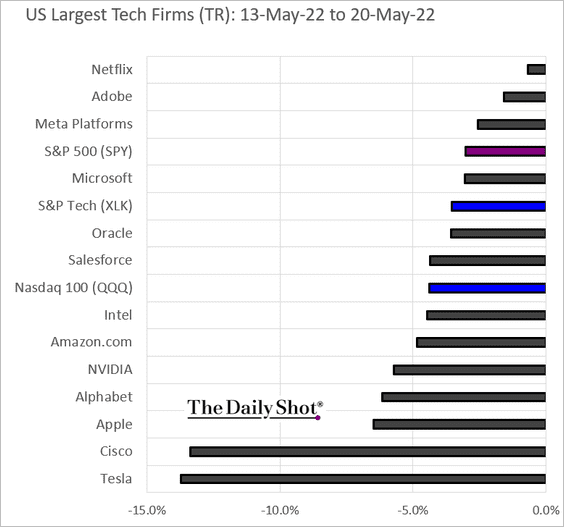

• All large US tech stocks were down last week.

Back to Index

Credit

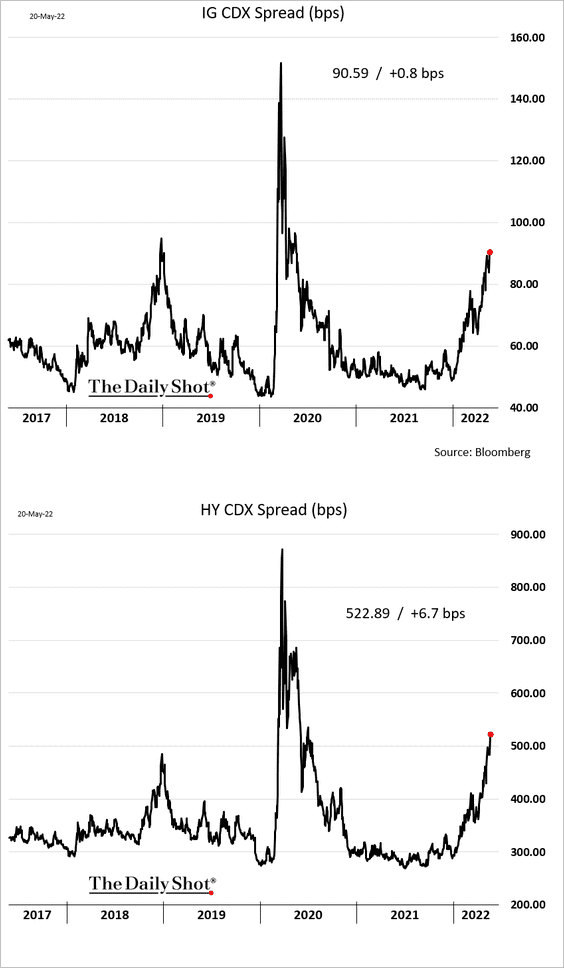

1. Credit spreads kept widening last week.

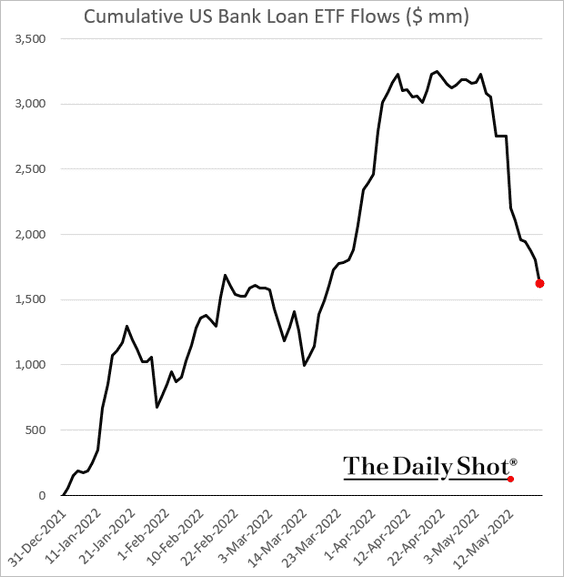

2. Leveraged loans continue to see outflows.

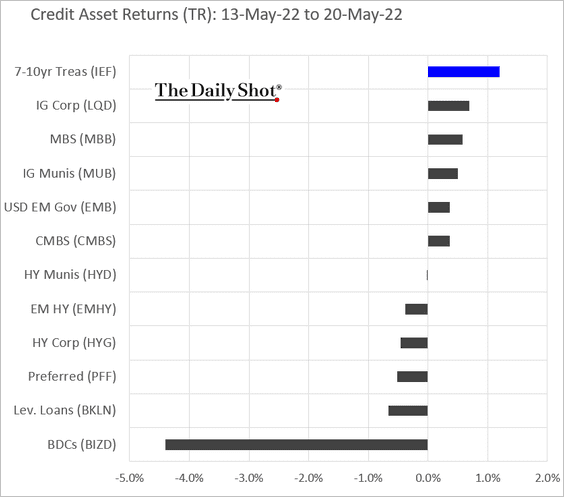

Leveraged loans and BDCs underperformed last week.

——————–

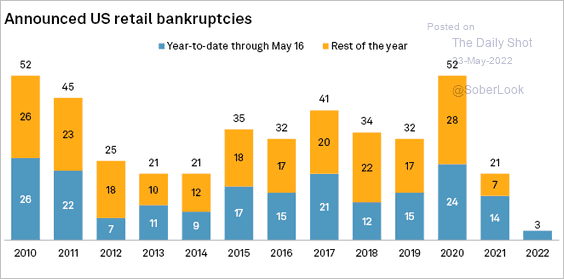

3. We haven’t had too many large retail bankruptcies this year (so far).

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

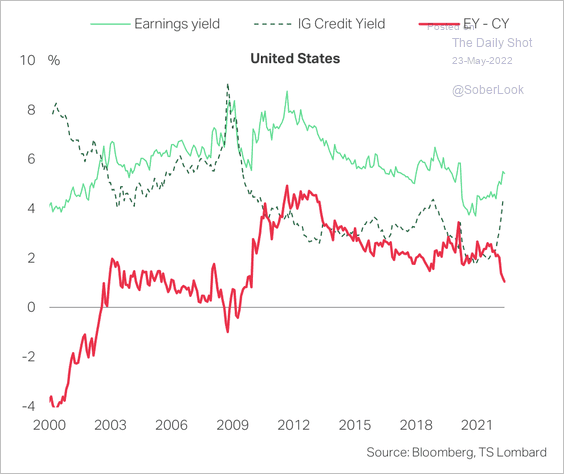

4. In the US, the equity earnings-credit yield gap is the widest since 2010.

Source: TS Lombard

Source: TS Lombard

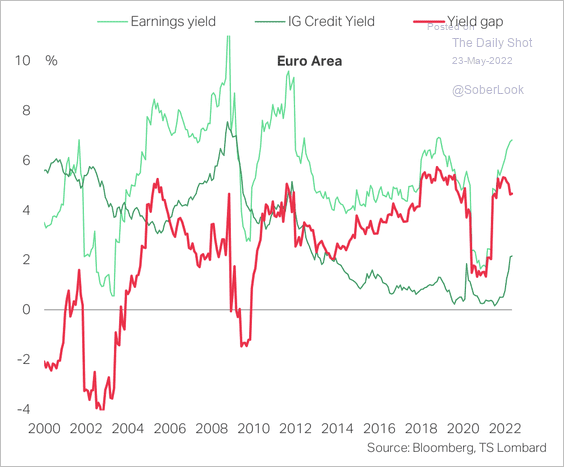

In the Euro Area, however, credit yields are not as appealing as equity earnings yields.

Source: TS Lombard

Source: TS Lombard

Back to Index

Rates

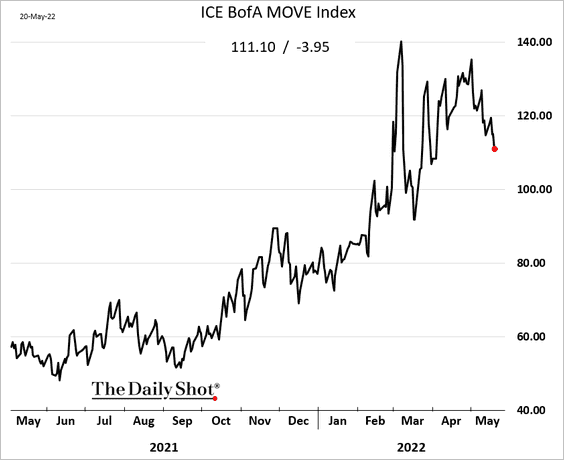

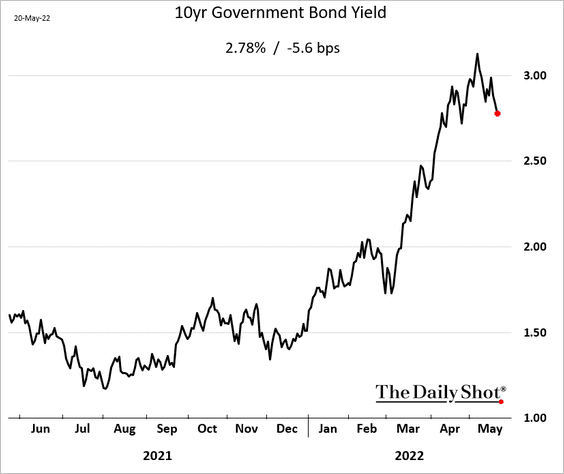

1. Treasury market-implied vol has been rolling over as yields stabilized.

——————–

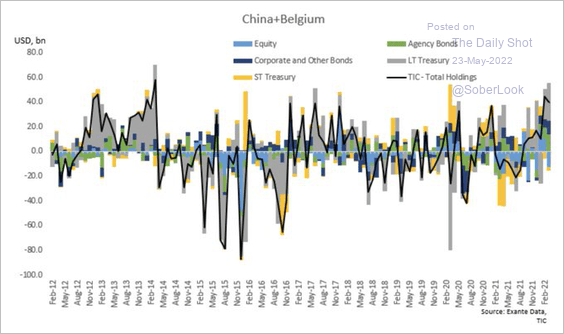

2. China is buying US Treasuries (some of the purchases are through Belgium).

Source: @jnordvig

Source: @jnordvig

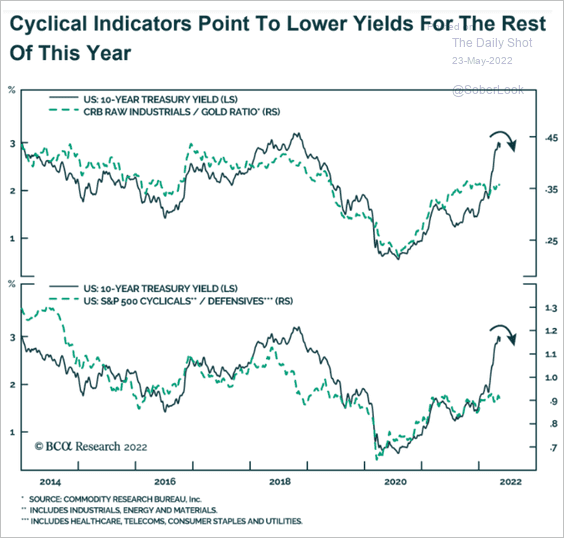

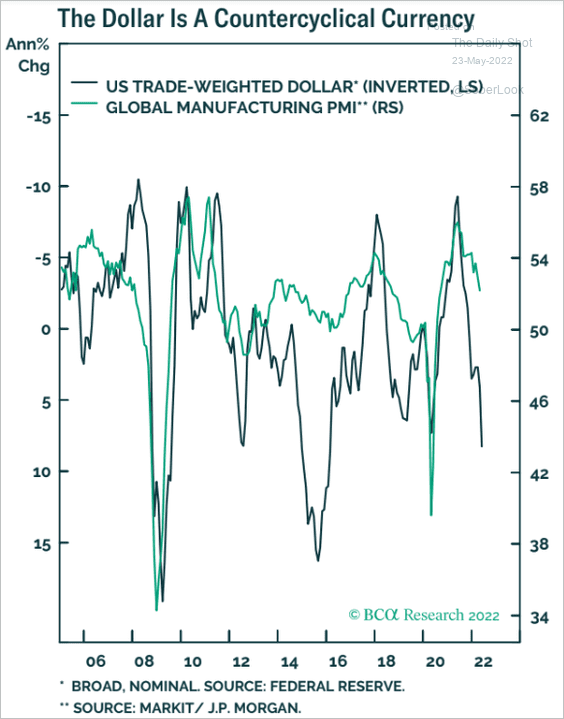

3. Cyclical indicators point to lower yields.

Source: BCA Research

Source: BCA Research

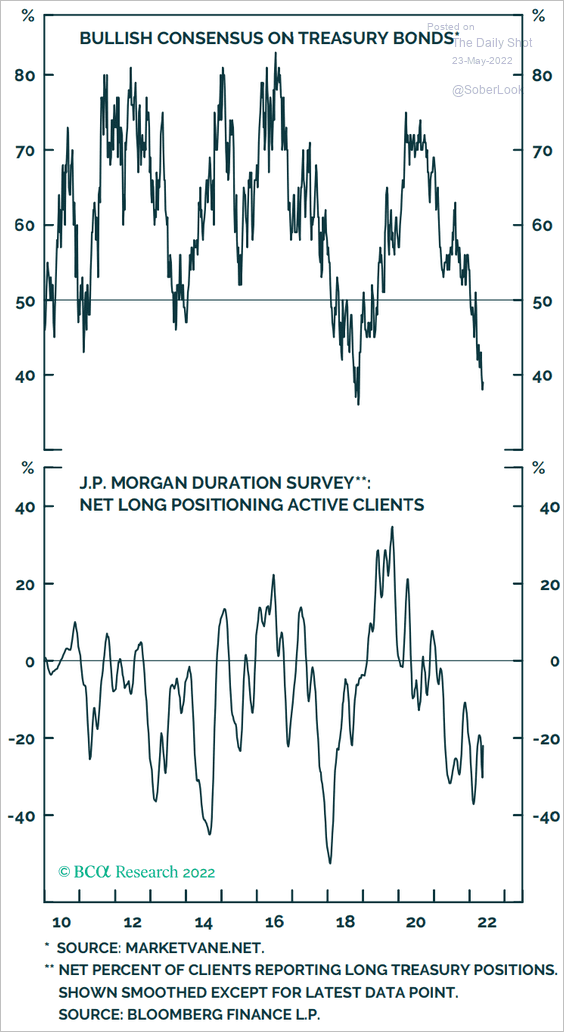

4. Sentiment on bonds has been terrible.

Source: BCA Research

Source: BCA Research

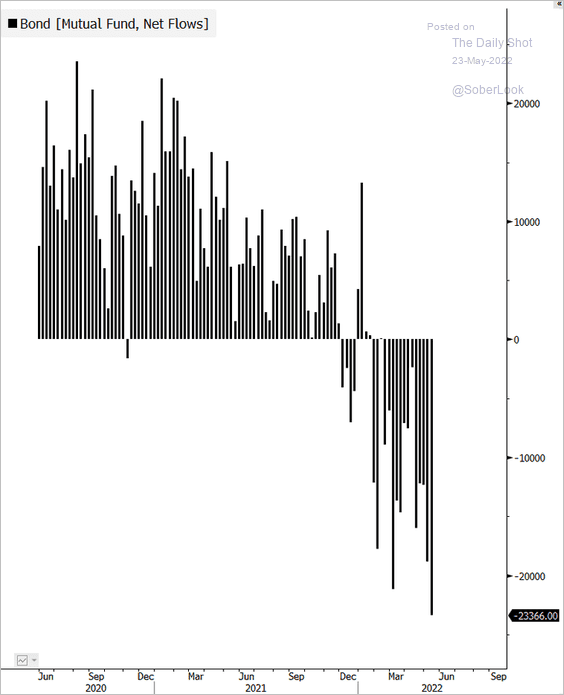

5. Total bond flows have been negative.

Source: @EricBalchunas

Source: @EricBalchunas

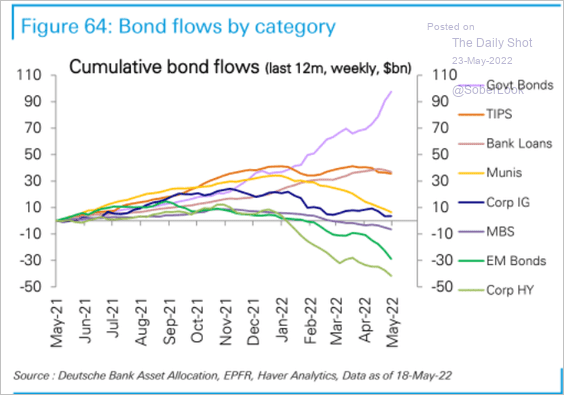

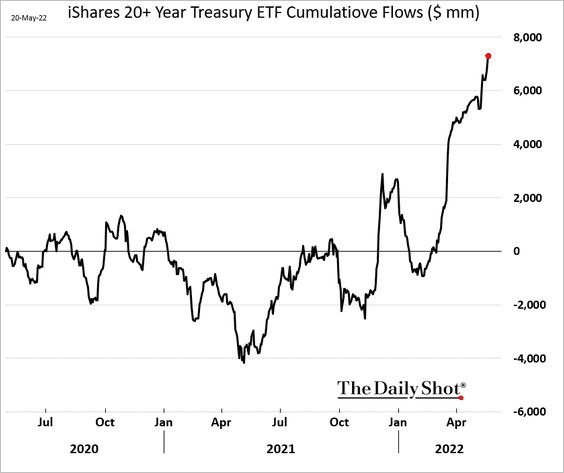

But capital continues to flow into Treasuries.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

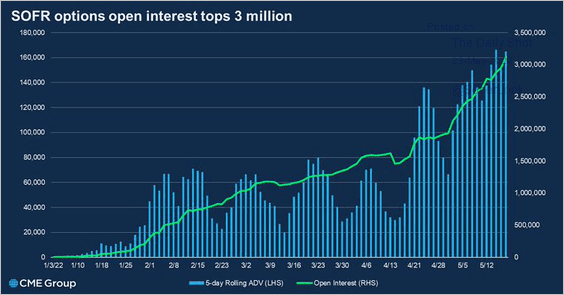

6. SOFR derivatives volume keeps improving (SOFR is the replacement for USD LIBOR).

Source: @CMEGroup

Source: @CMEGroup

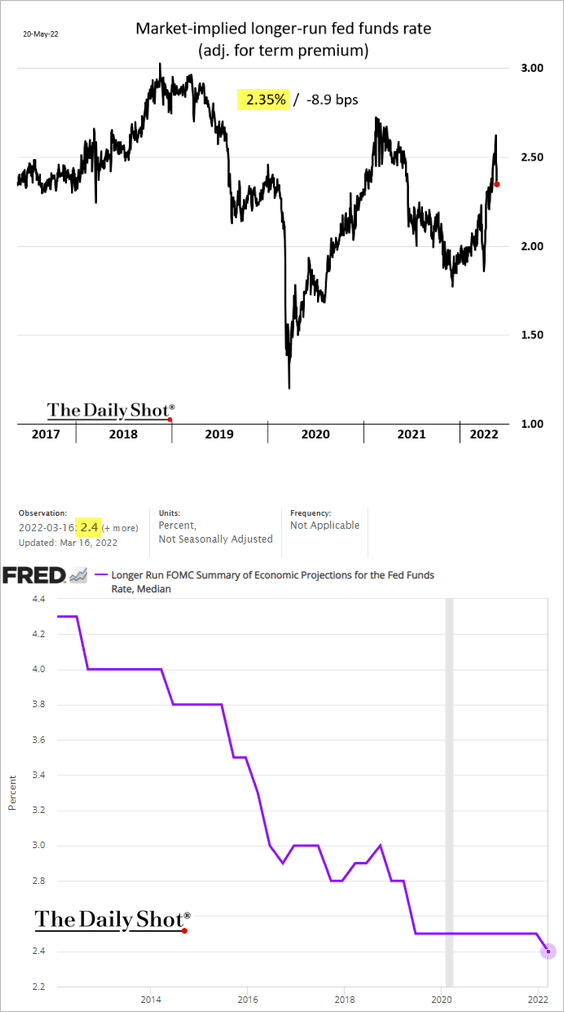

7. Market-based longer-run fed funds expectations are close to the FOMC’s projections. Some would view Fed hikes above these levels as moving monetary policy into “restrictive” territory.

Back to Index

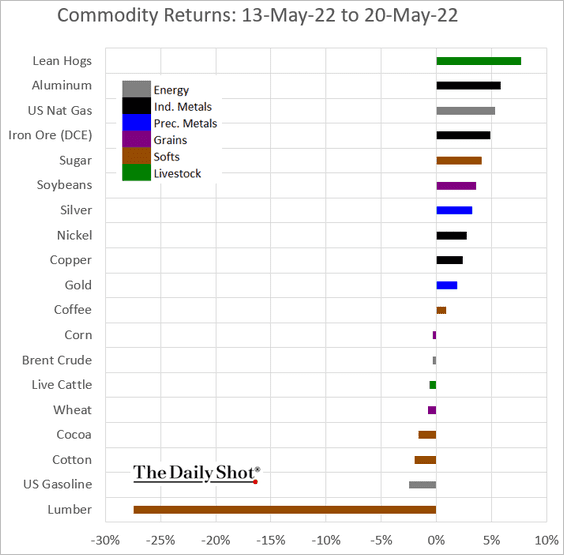

Commodities

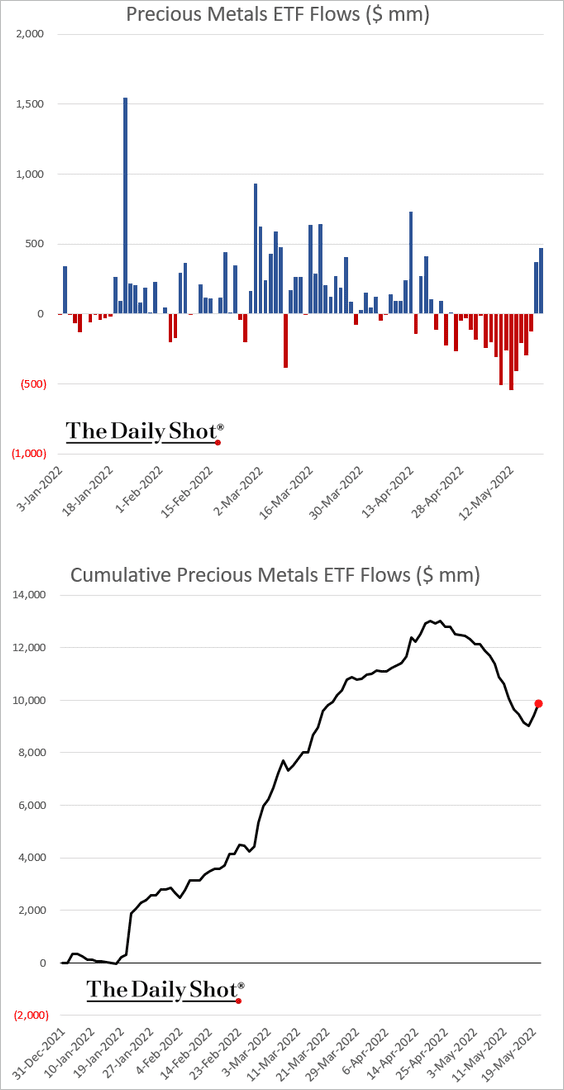

1. Sentiment on silver has been terrible. A buying opportunity?

Source: Sentix; @Callum_Thomas

Source: Sentix; @Callum_Thomas

Precious metals ETF flows have turned positive.

——————–

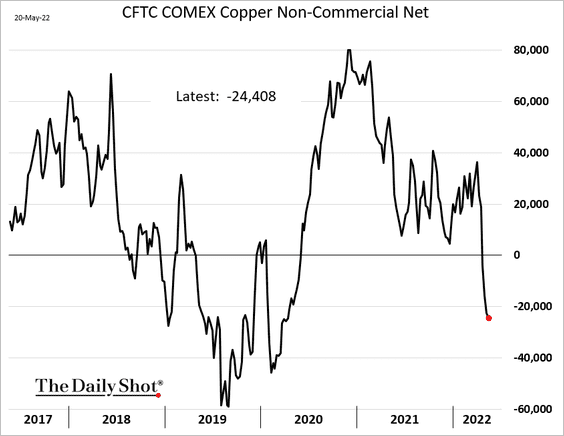

2. Speculative accounts are betting against copper.

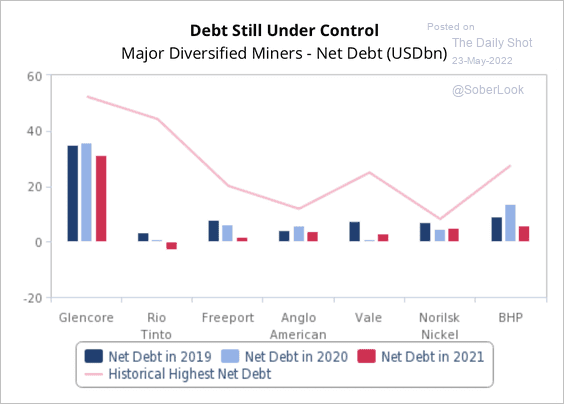

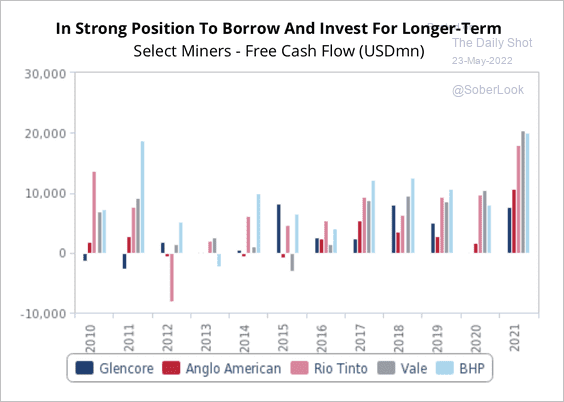

3. Major diversified mining companies have reduced debt and increased cash flow (2 charts).

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

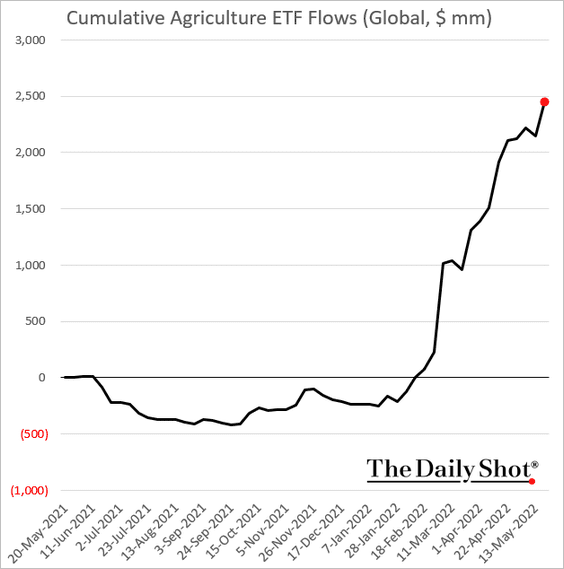

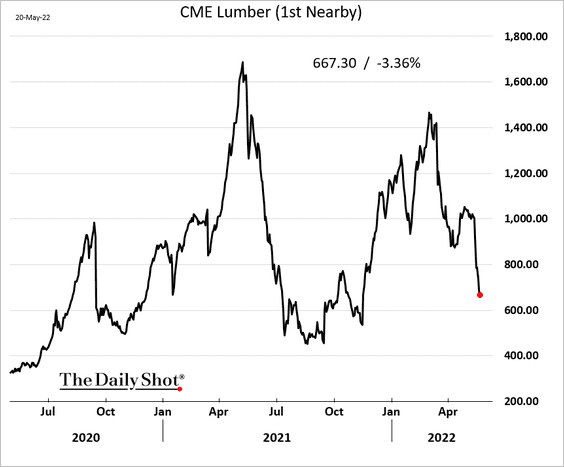

4. Agricultural commodity ETFs continue to see inflows.

5. Lumber tumbled last week amid signs of weakness in the US housing market.

Source: Markets Insider Read full article

Source: Markets Insider Read full article

Back to Index

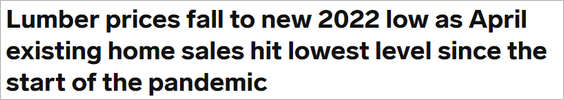

Energy

1. European natural gas prices declined sharply last week.

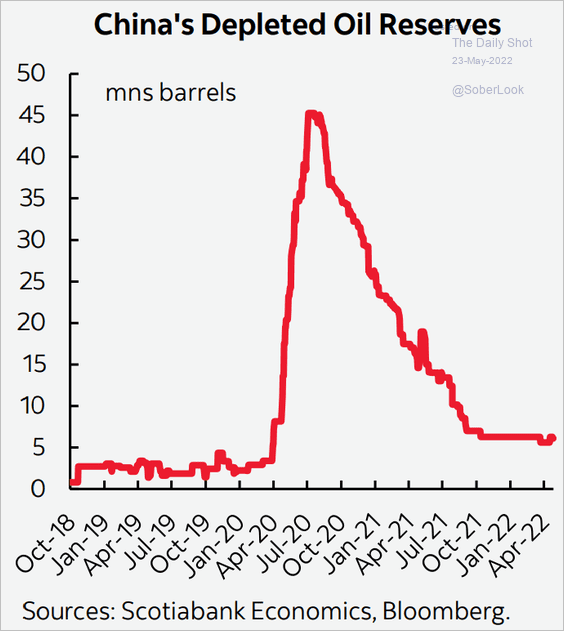

2. This chart shows China’s oil reserves.

Source: Scotiabank Economics

Source: Scotiabank Economics

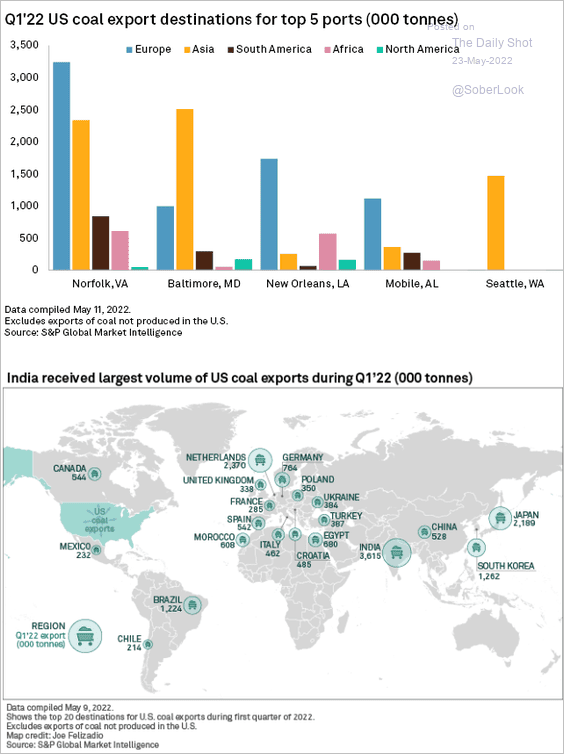

3. Next, we have some data on US coal exports.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Cryptocurrency

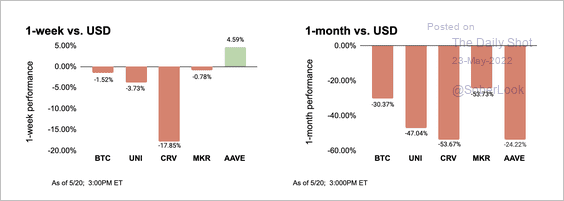

1. The top decentralized finance (DeFi) tokens have underperformed bitcoin over the past month, although some have stabilized last week.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

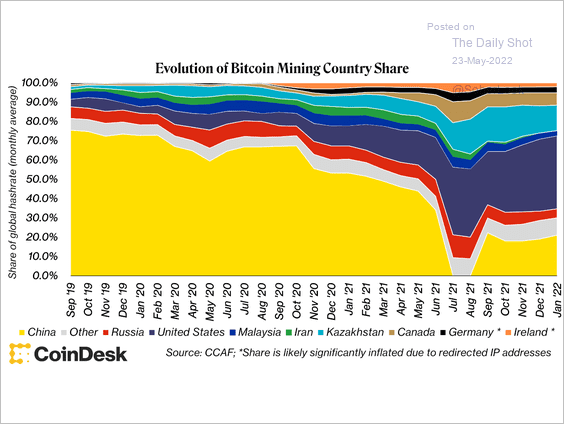

2. China’s bitcoin miners are back online despite the nation’s ban last year.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

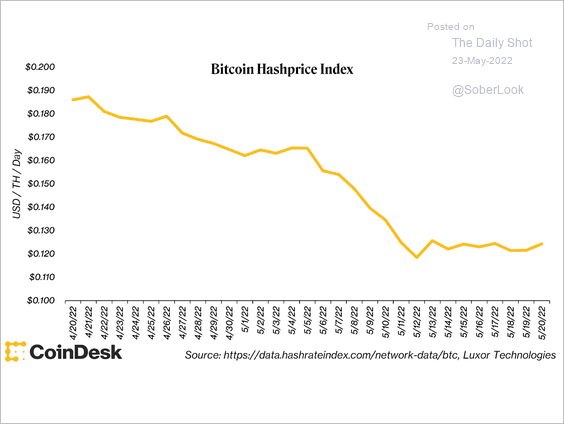

3. The bitcoin hashprice, which represents the expected value of mining, is trending lower. That’s because of the lower price of BTC, more miners coming online, and an increase in network difficulty.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

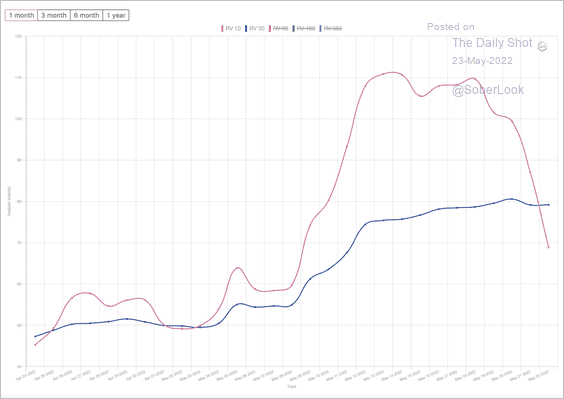

3. Bitcoin’s short-term realized volatility has declined over the past week.

Source: @GenesisVol

Source: @GenesisVol

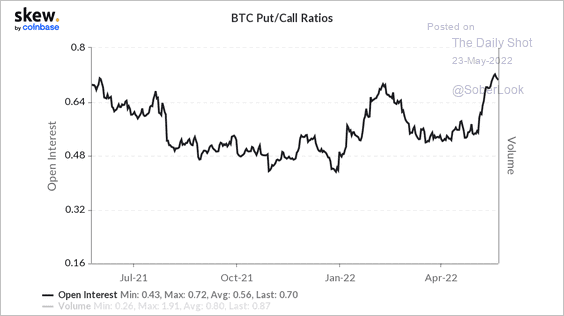

4. Bitcoin’s put/call ratio is starting to tick lower.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

Back to Index

Emerging Markets

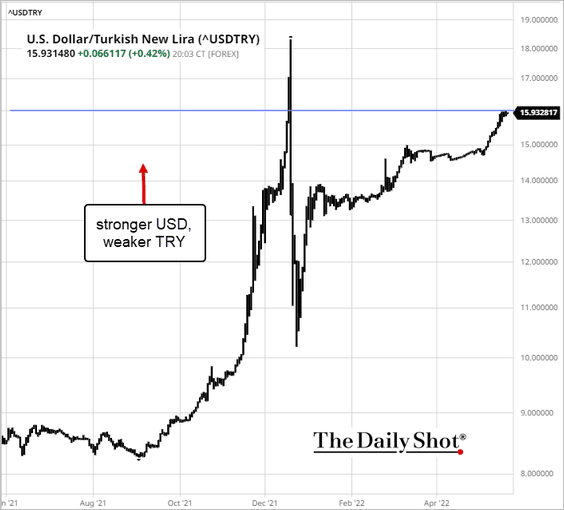

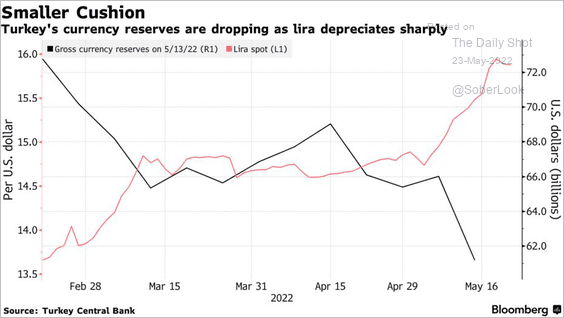

1. The Turkish lira is holding near 16.0 to the dollar.

Source: barchart.com

Source: barchart.com

F/X reserves tumbled in recent weeks, …

Source: Bloomberg Read full article

Source: Bloomberg Read full article

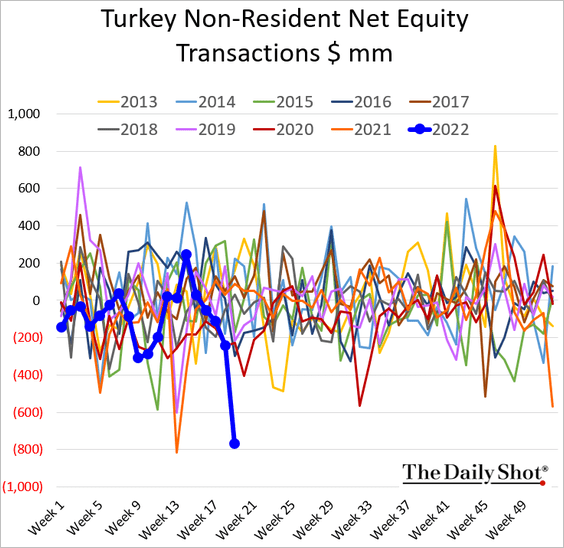

… as foreigners dump Turkish stocks.

——————–

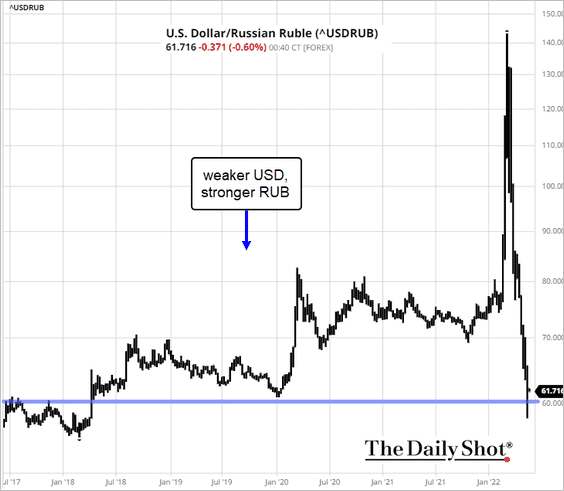

2. USD/RUB is testing support at 60.0 as the ruble continues to strengthen.

Source: barchart.com

Source: barchart.com

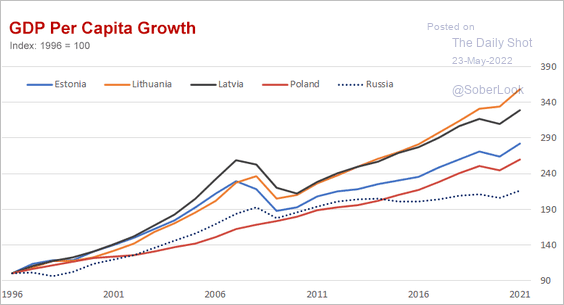

Separately, Russia’s economy has been underperforming for decades.

Source: World Economics

Source: World Economics

——————–

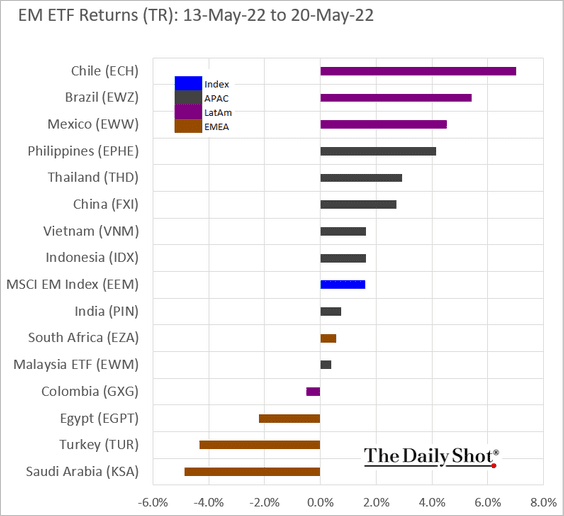

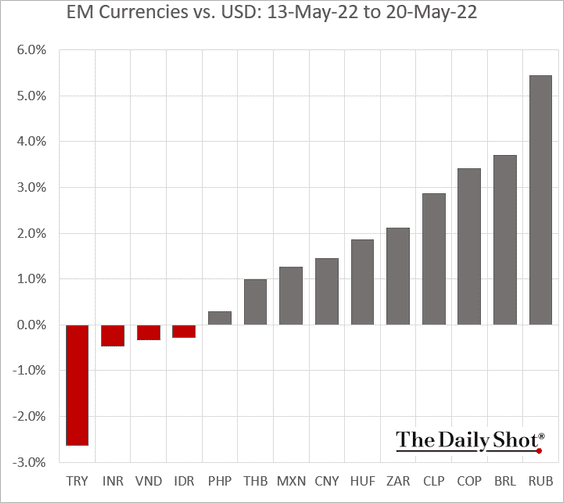

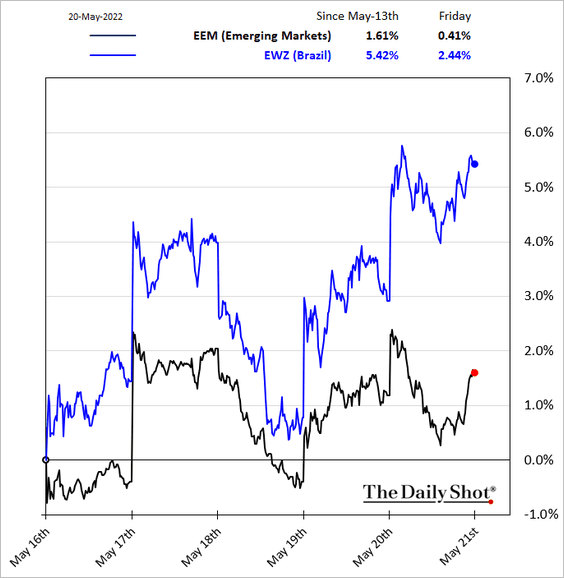

3. LatAm currencies and equity ETFs outperformed last week.

——————–

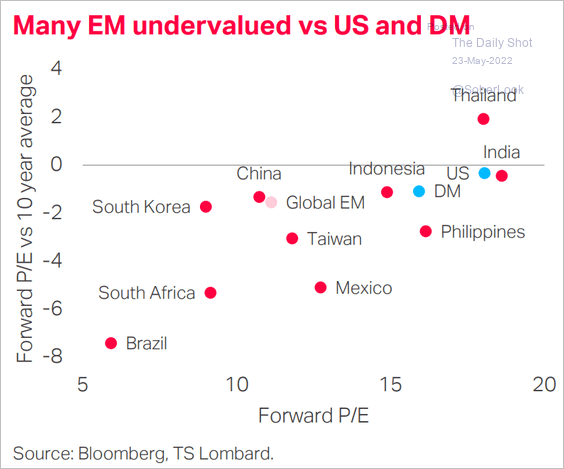

4. Many EM equity markets are undervalued vs. DM.

Source: TS Lombard

Source: TS Lombard

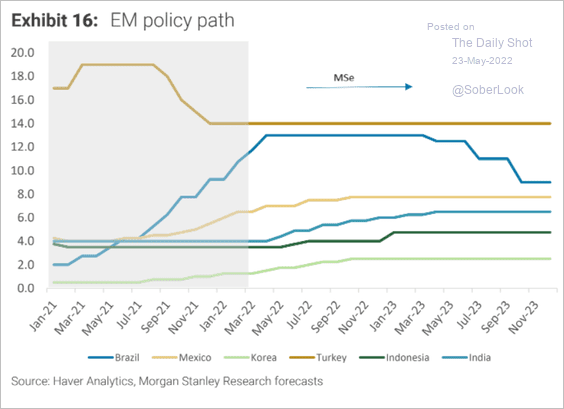

5. Next, we have Morgan Stanley’s projections for policy rates in select economies.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

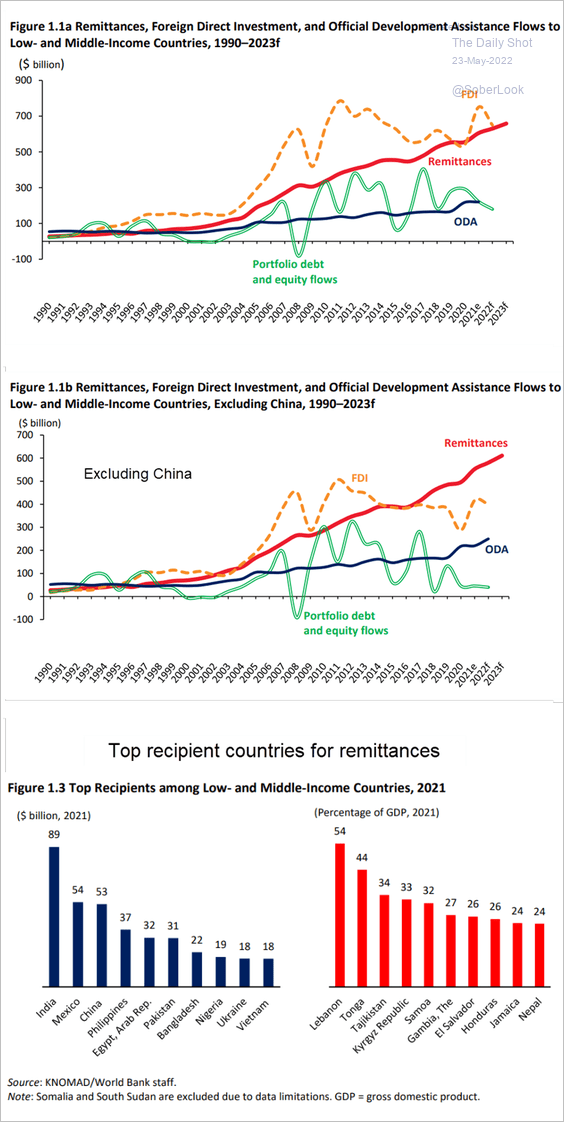

6. Remittances have been overtaking foreign direct investment, official development assistance, and portfolio flows.

Source: KNOMAD Read full article

Source: KNOMAD Read full article

Back to Index

China

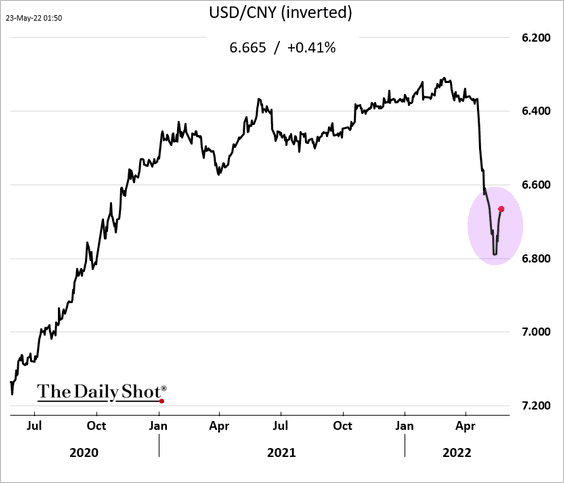

1. The renminbi is rebounding.

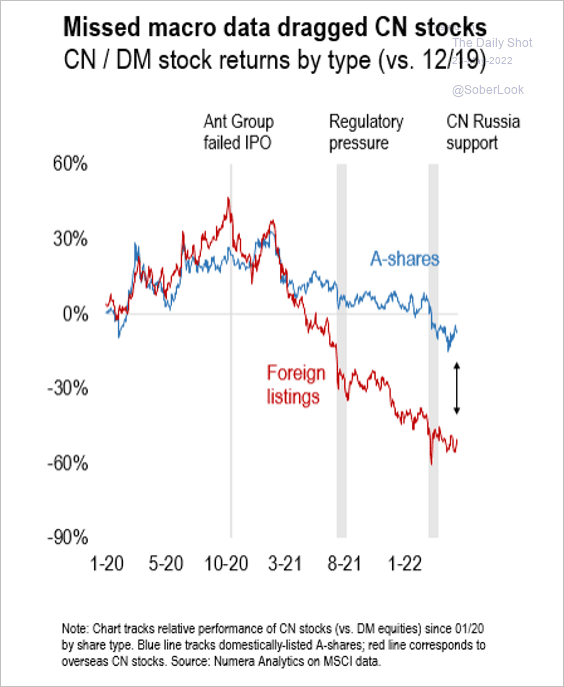

2. Hong Kong listings have sharply underperformed mainland shares.

Source: Numera Analytics

Source: Numera Analytics

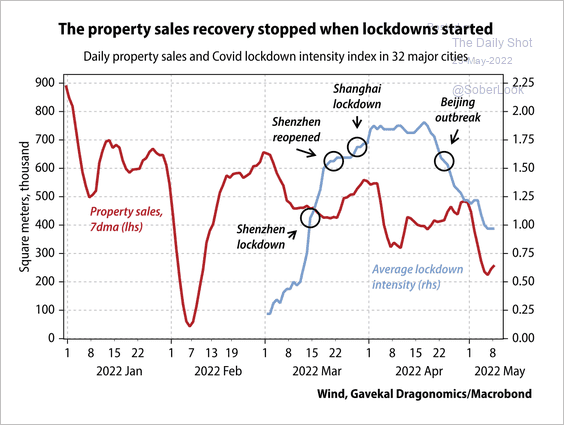

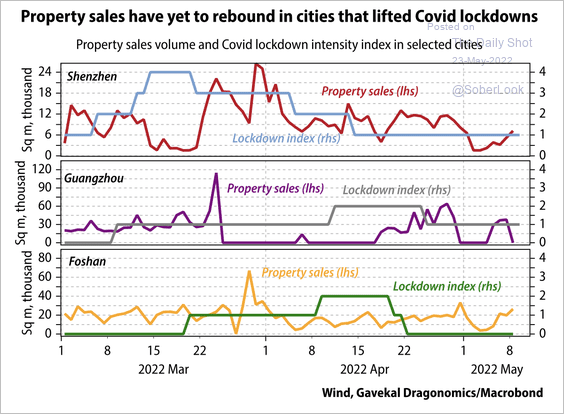

3. Lockdowns have stalled the recovery in property sales (2 charts).

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

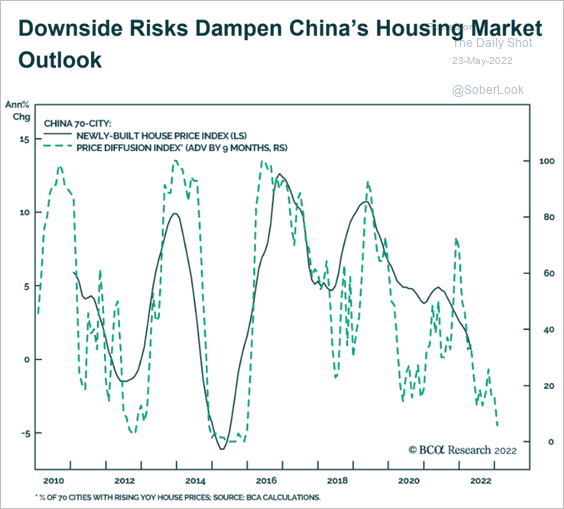

Here is why the PBoC cut the mortgage rate.

Source: BCA Research

Source: BCA Research

——————–

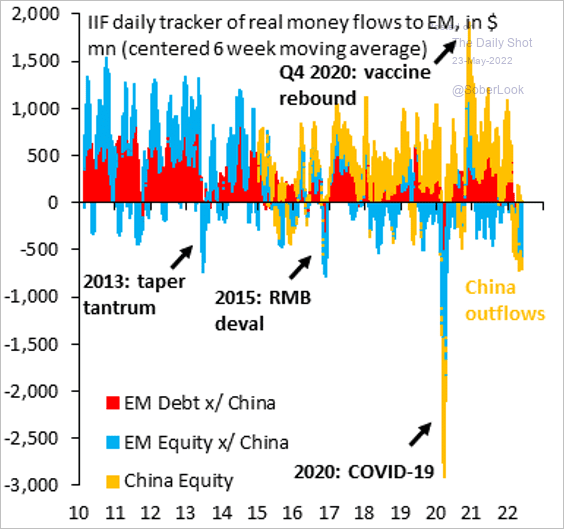

4. Are capital outflows about to end?

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

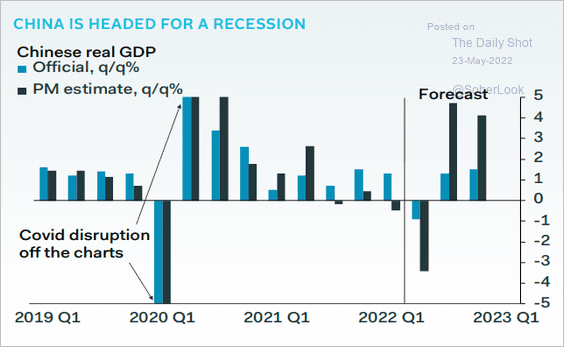

5. China could be experiencing a recession, although the official data won’t show it.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Asia – Pacific

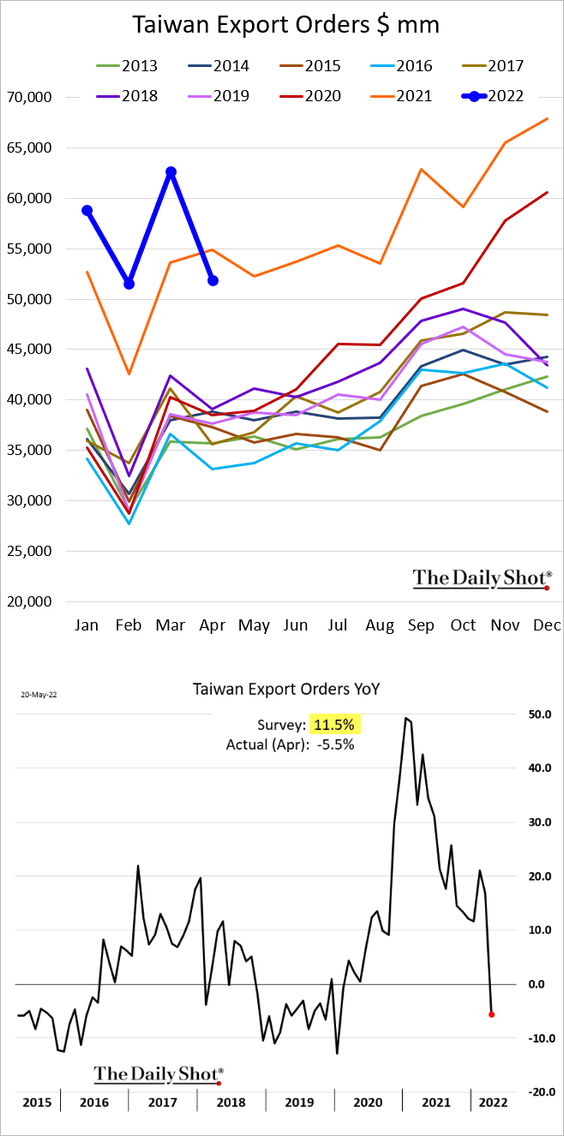

1. Taiwan’s April export orders surprised to the downside.

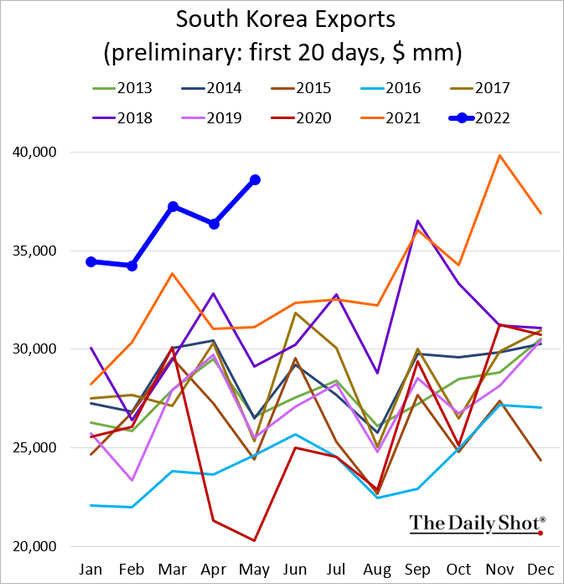

2. South Korea’s exports surged in May.

Back to Index

The Eurozone

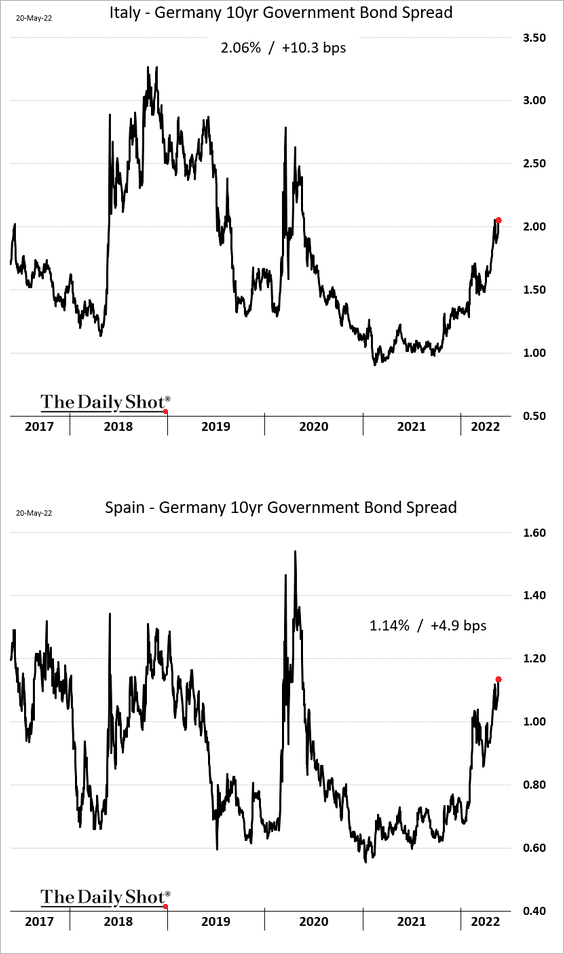

1. Italian and Spanish bond spreads have been widening.

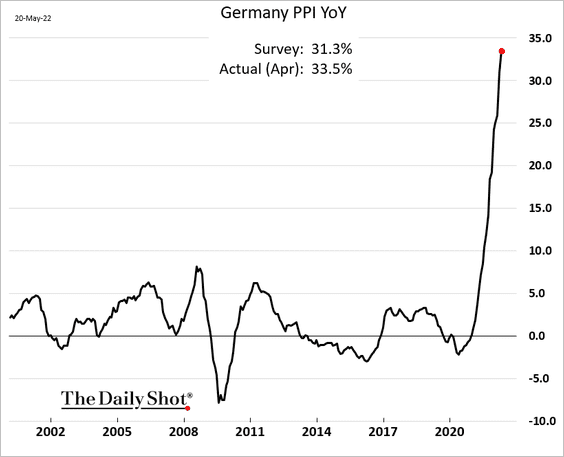

2. Germany’s producer prices are up 33.5% from a year ago.

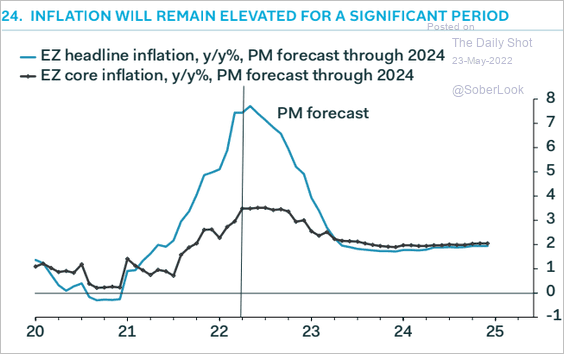

Eurozone’s inflation will remain elevated for some time.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

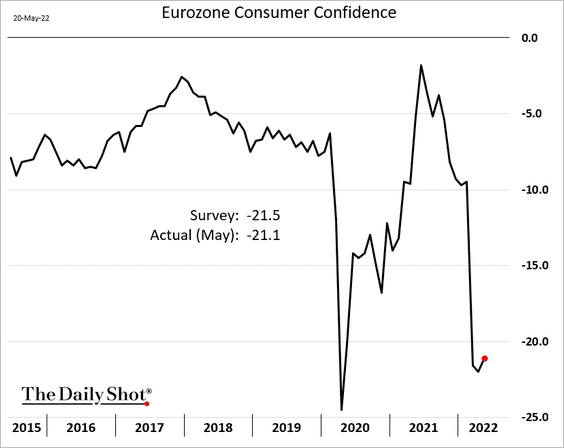

3. Euro-area consumer confidence ticked higher this month.

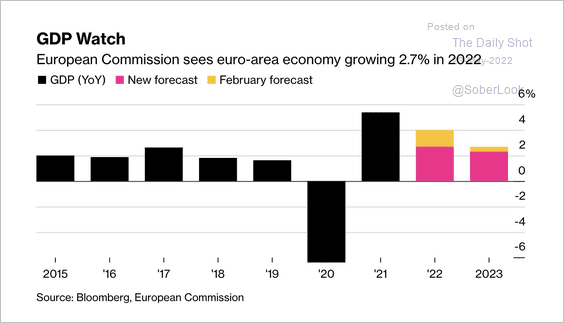

4. Euro-area GDP growth forecasts have been revised lower.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

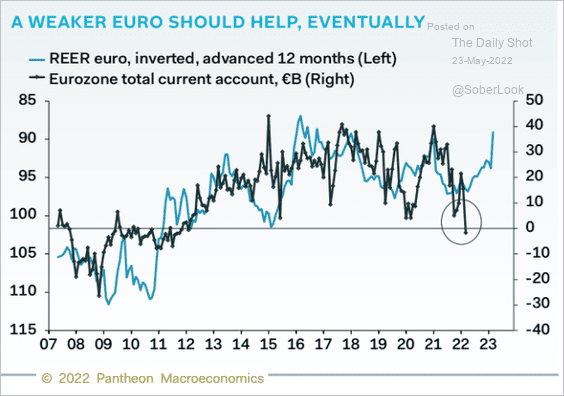

5. Normally, a weaker euro could improve the current account. The problem is that it also makes energy more expensive for Europe.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The United Kingdom

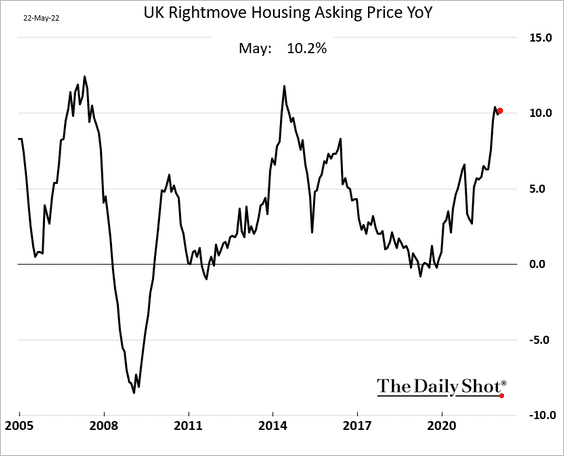

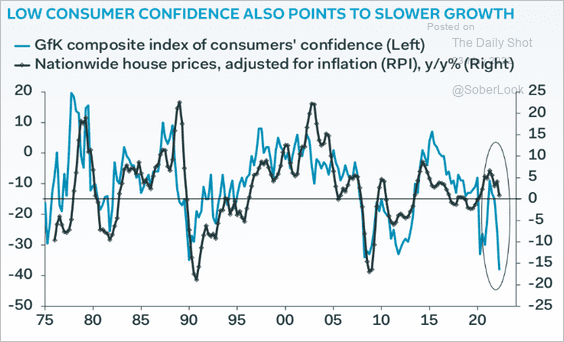

1. The housing market remains robust.

But slumping consumer sentiment will be a headwind for housing going forward.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

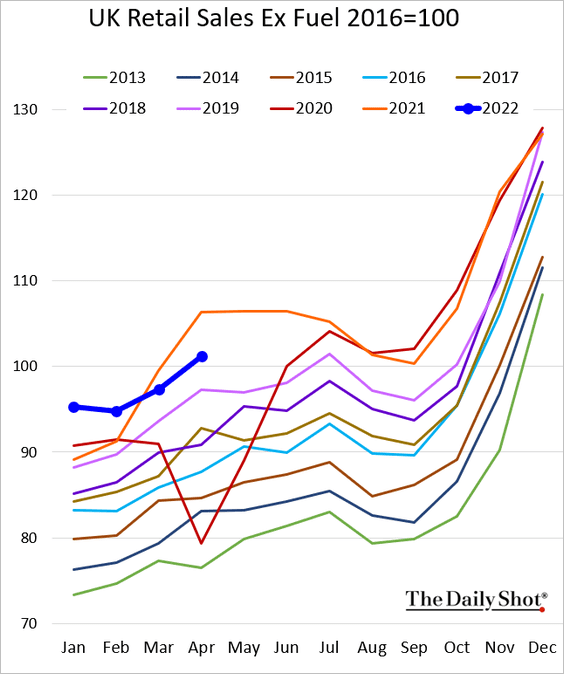

2. Retail sales were stronger than expected last month.

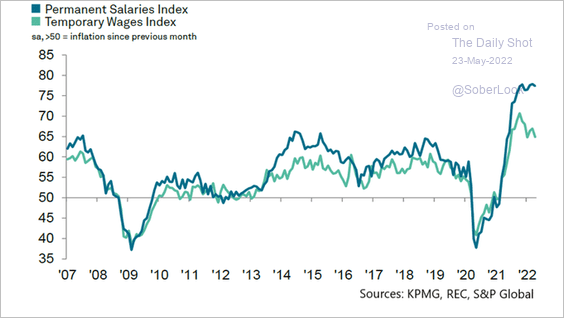

3. Wage indicators remain elevated.

Source: @IHSMarkitPMI

Source: @IHSMarkitPMI

Back to Index

The United States

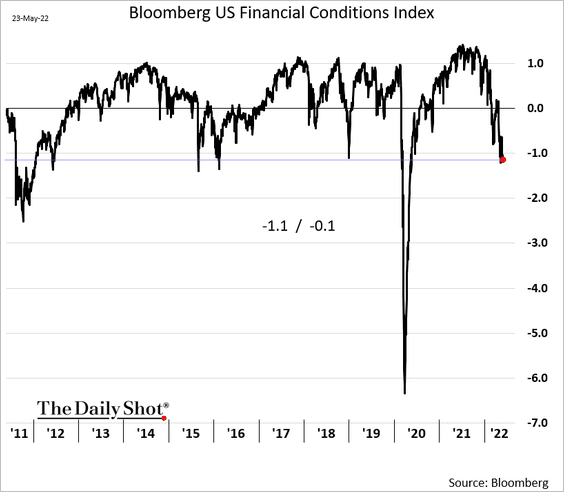

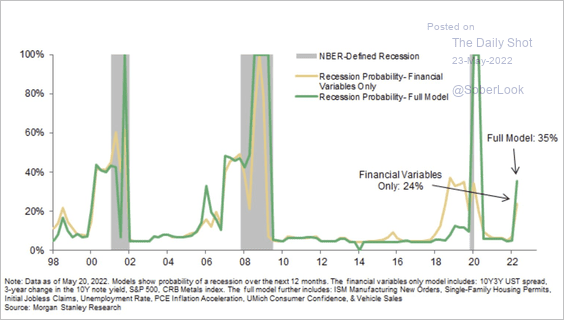

1. Recession fears have reached a feverish pitch, as financial conditions tighten.

• Here is Morgan Stanley’s recession model.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

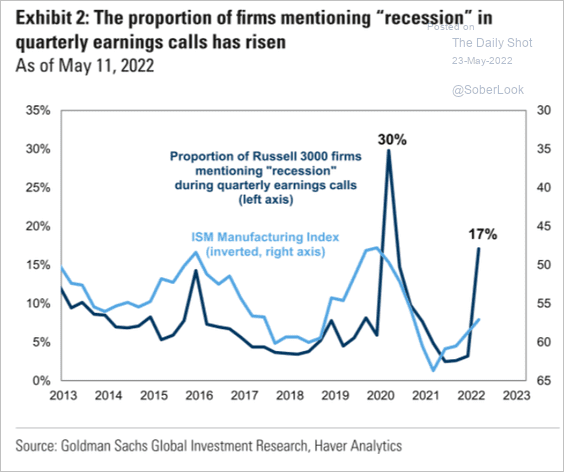

• Companies are increasingly mentioning recession on earnings calls.

Source: Goldman Sachs

Source: Goldman Sachs

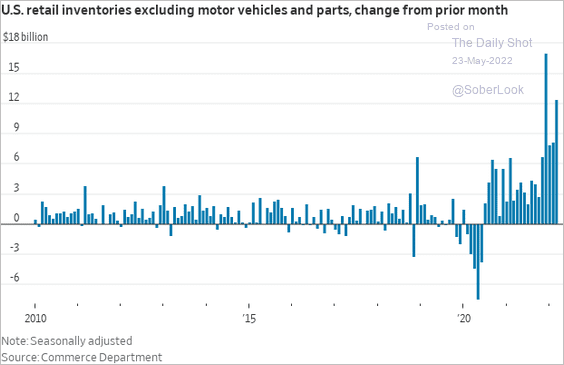

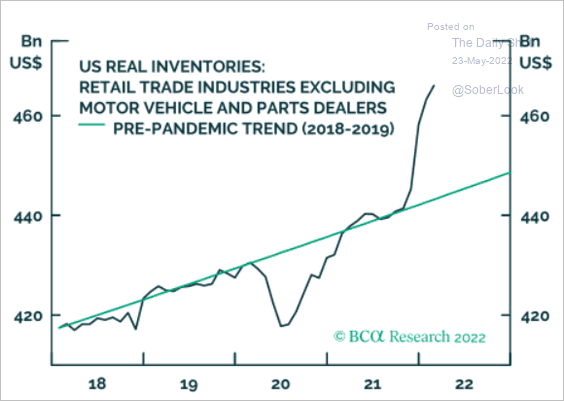

• Retailers are facing an inventory overhang, …

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: BCA Research

Source: BCA Research

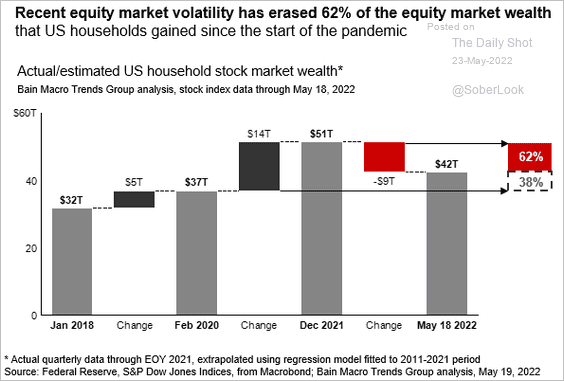

… as the wealth effect becomes a headwind for consumption.

Source: Bain & Company

Source: Bain & Company

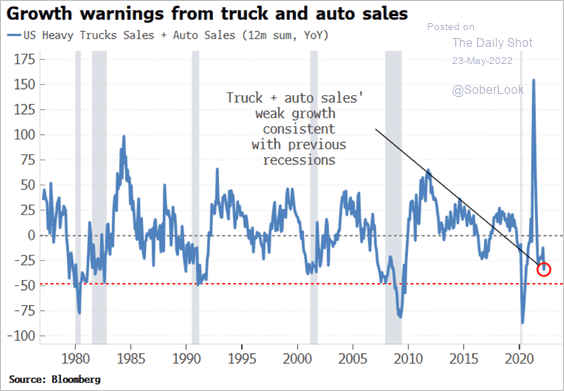

• Heavy truck and auto sales have been soft.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

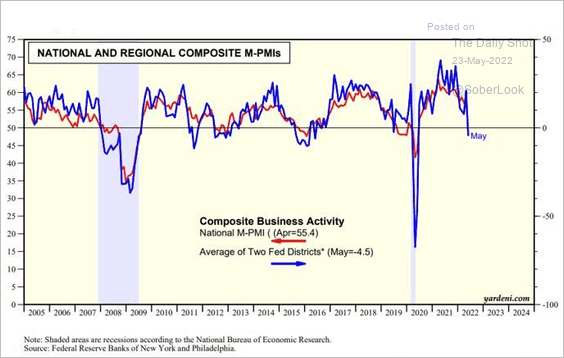

• The NY and Philly Fed manufacturing reports point to a contraction in the nation’s manufacturing sector.

Source: Yardeni Research

Source: Yardeni Research

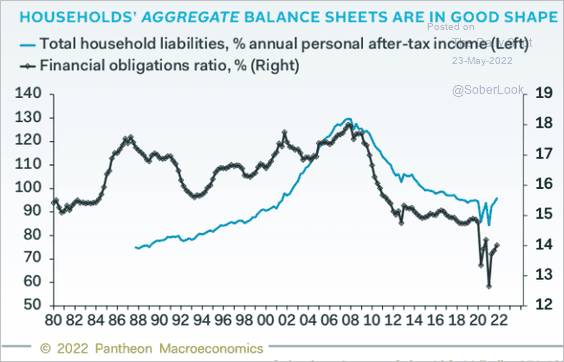

But for now, credit indicators are not signaling a recession.

– Household credit:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

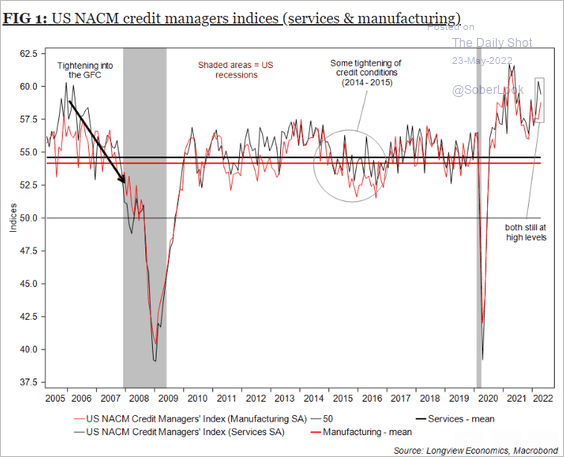

– Corporate credit:

Source: Longview Economics

Source: Longview Economics

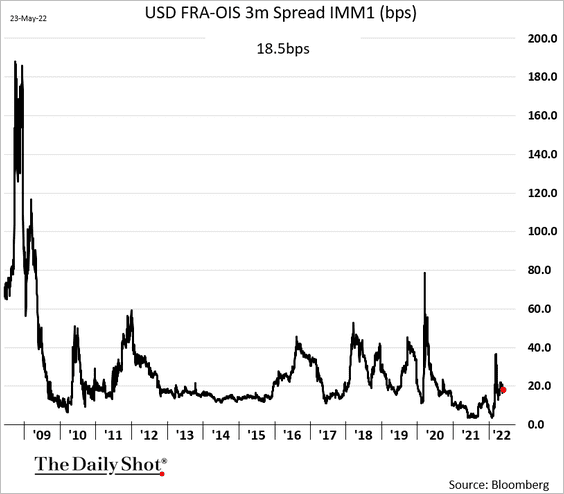

– Money market stress:

——————–

2. Other high-frequency data also suggest a recession is not imminent.

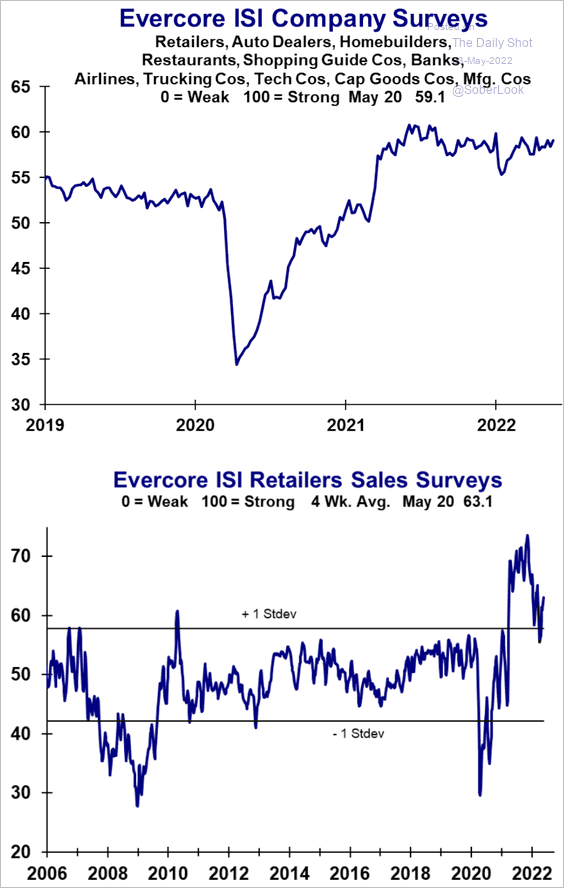

• Evercore ISI business surveys:

Source: Evercore ISI Research

Source: Evercore ISI Research

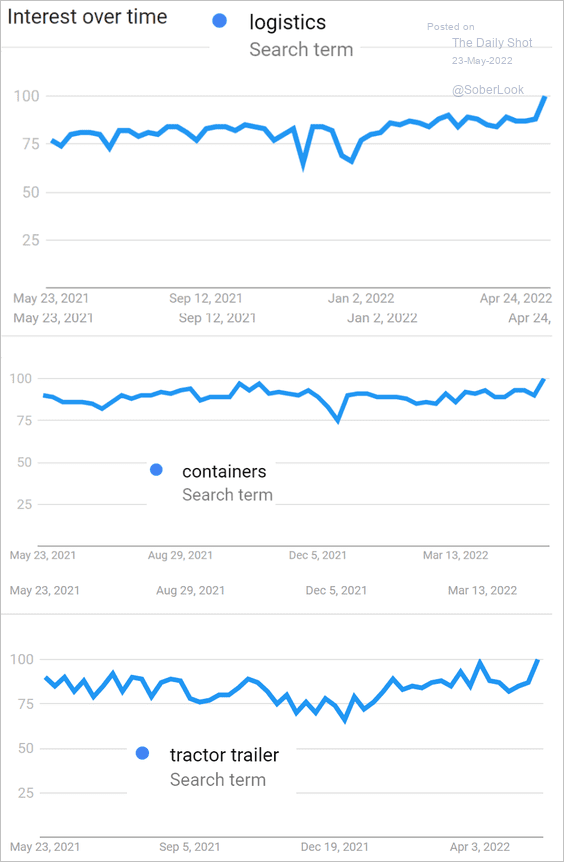

• Search for logistics topics:

Source: Google Trends

Source: Google Trends

——————–

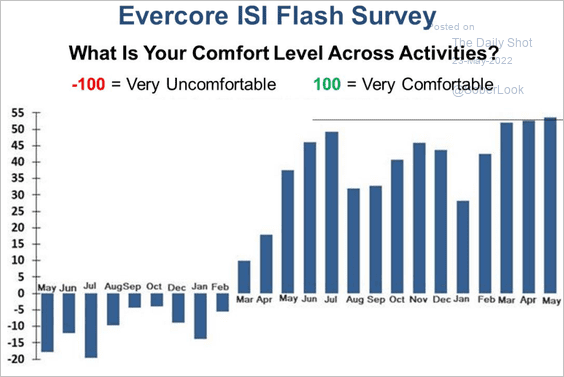

3. Americans’ comfort level with various activities keeps rising.

Source: Evercore ISI Research

Source: Evercore ISI Research

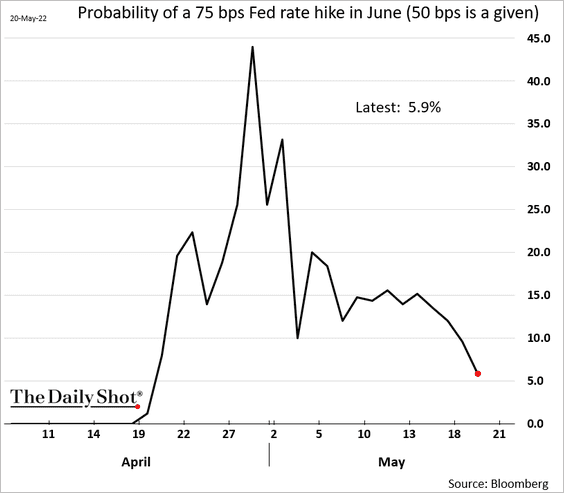

4. The market is increasingly discounting the possibility of a 75 bps rate hike next month.

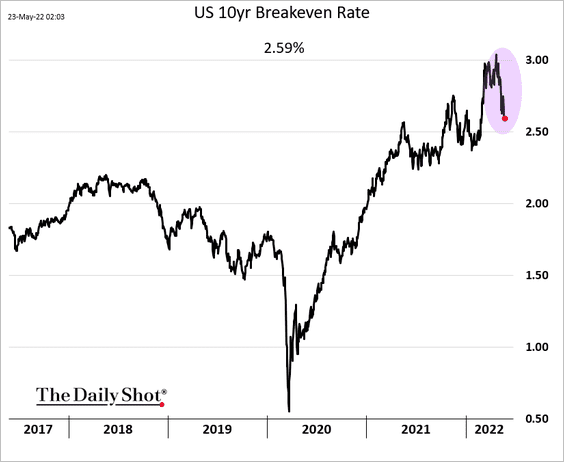

Market-based longer-term inflation expectations are off the highs.

Back to Index

Global Developments

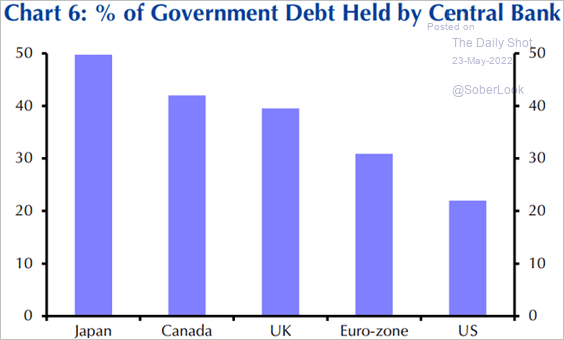

1. What percentage of the G10 government bond debt is owned by central banks?

Source: Capital Economics

Source: Capital Economics

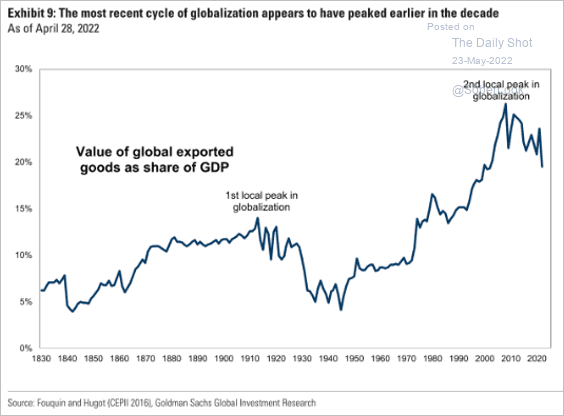

2. Globalization has peaked.

Source: Goldman Sachs

Source: Goldman Sachs

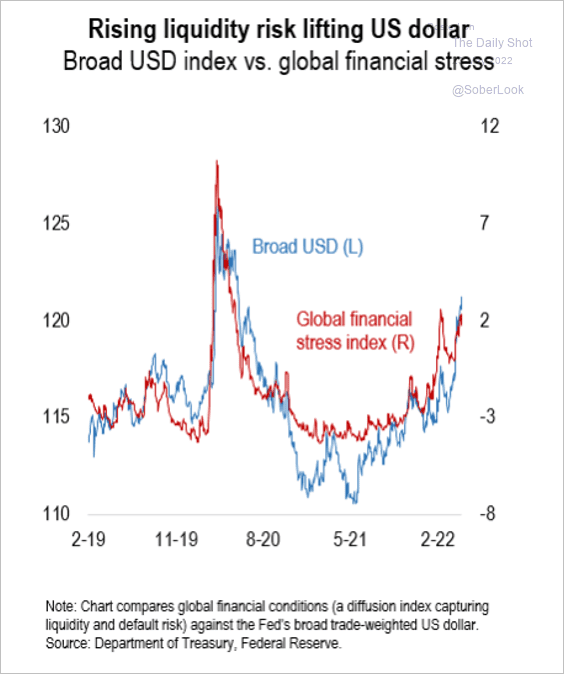

3. Here is why many countries are concerned about the US dollar rally (2 charts).

Source: Numera Analytics

Source: Numera Analytics

Source: BCA Research

Source: BCA Research

——————–

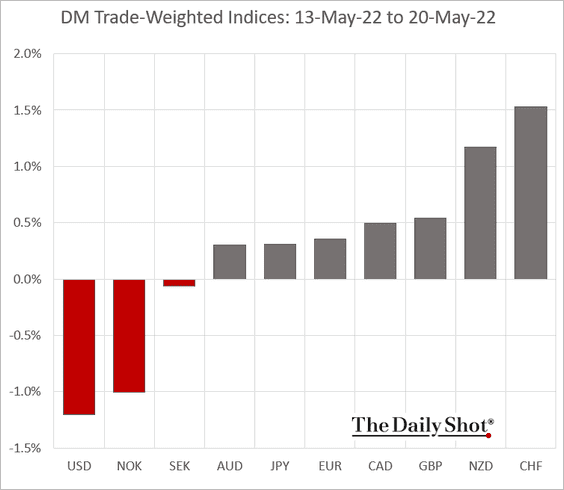

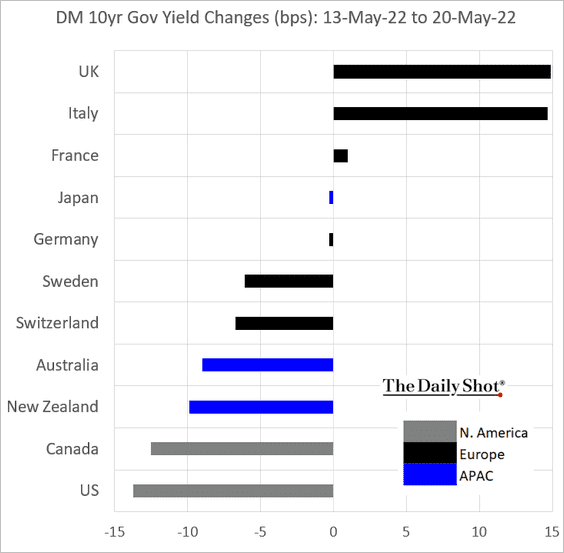

4. Finally, we have some market performance data from last week.

• The trade-weighted currency indices:

• DM sovereign yields:

——————–

Food for Thought

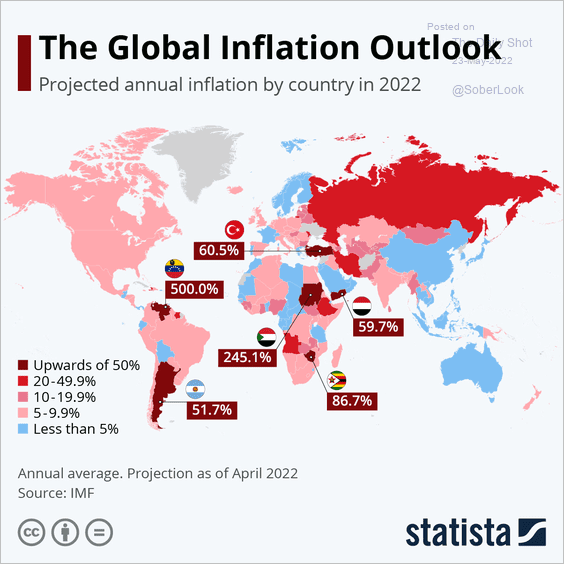

1. Projected inflation rates for 2022:

Source: Statista

Source: Statista

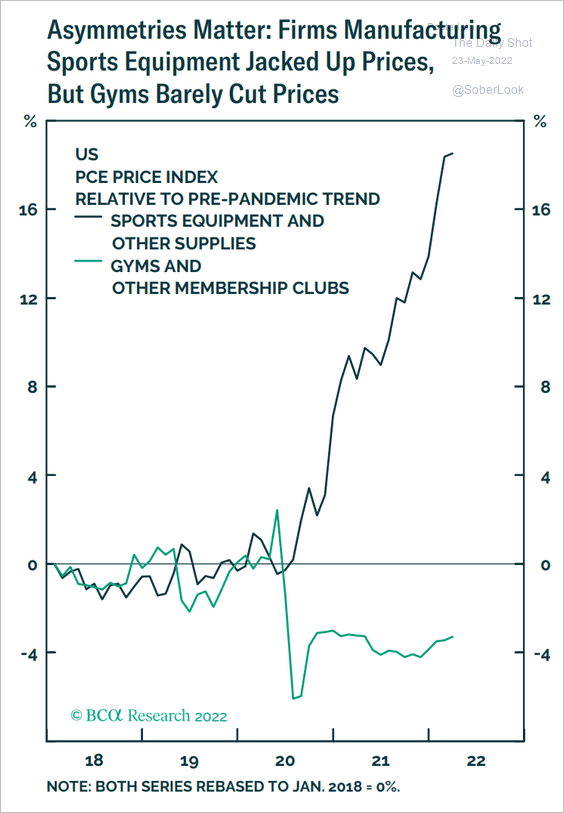

2. US sports equipment vs. gym membership price changes since Jan 2018:

Source: BCA Research

Source: BCA Research

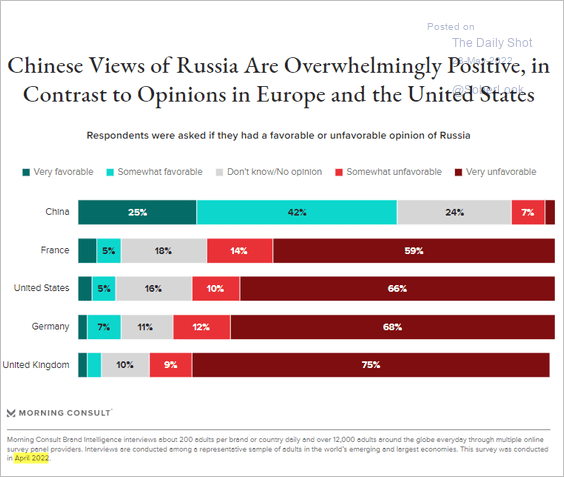

3. Opinion of Russia in select countries:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

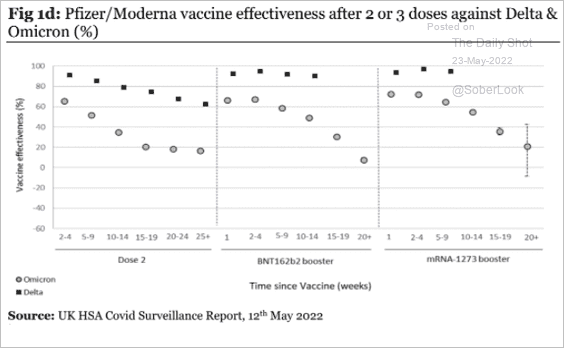

4. Vaccine effectiveness against omicron over time:

Source: Longview Economics

Source: Longview Economics

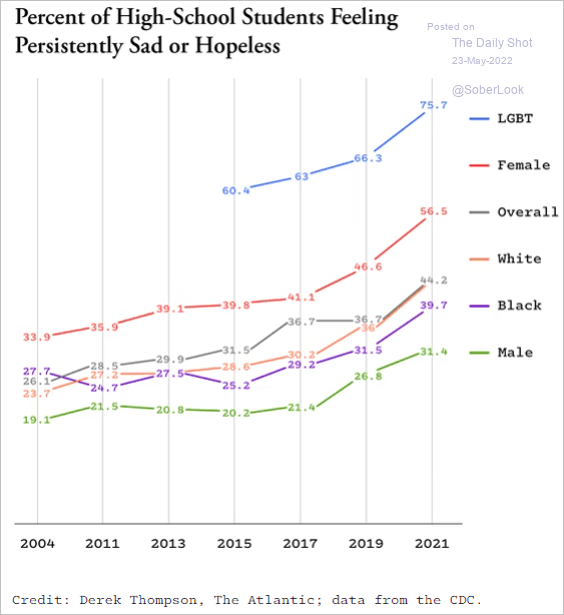

5. High-school students feeling persistently sad or hopeless:

Source: The Atlantic Read full article

Source: The Atlantic Read full article

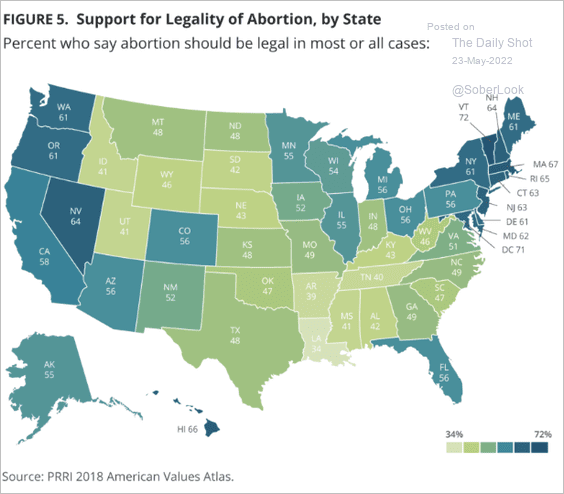

6. Support for legality of abortion by state:

Source: PRRI Read full article

Source: PRRI Read full article

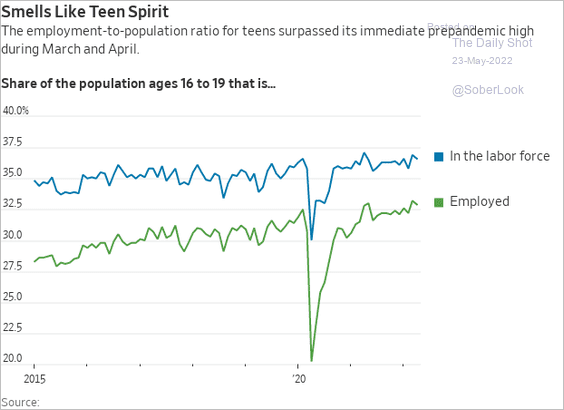

7. Teen employment in the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

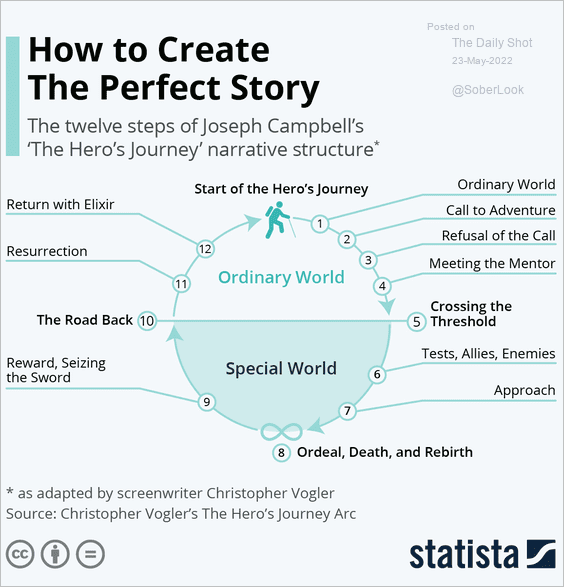

8. Creating the perfect story:

Source: Statista

Source: Statista

——————–

Back to Index