The Daily Shot: 26-May-22

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

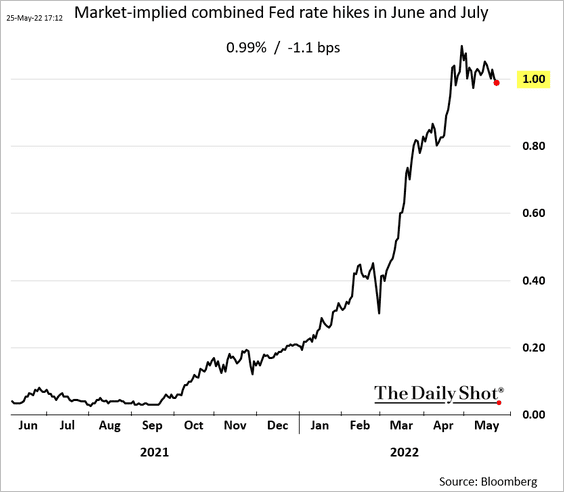

1. The FOMC minutes confirmed the Fed’s goal to frontload rate hikes, which the markets fully expected.

FOMC: – Many participants judged that expediting the removal of policy accommodation would leave the Committee well-positioned later this year to assess the effects of policy firming and the extent to which economic developments warranted policy adjustments.

There was nothing in the report to suggest a 75 bps hike in the months ahead. The market has started pricing in a very small probability that we may not even get the full two 50 bps hikes over the next two months if economic growth hits a wall.

There is also some talk about a pause and “reassessment” in September.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

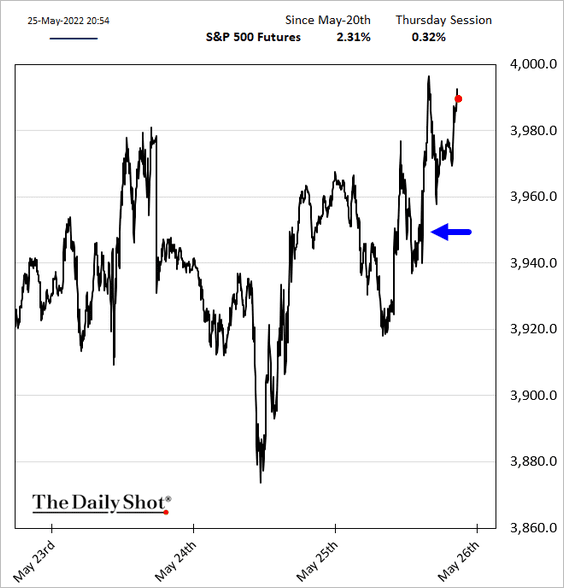

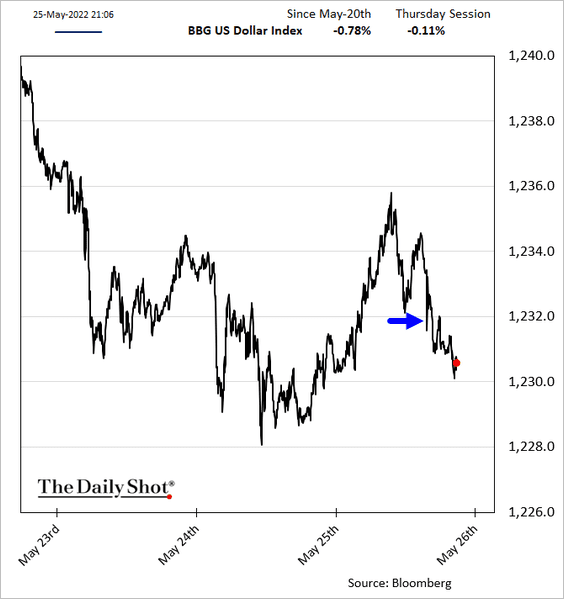

Stocks moved higher, and the dollar declined.

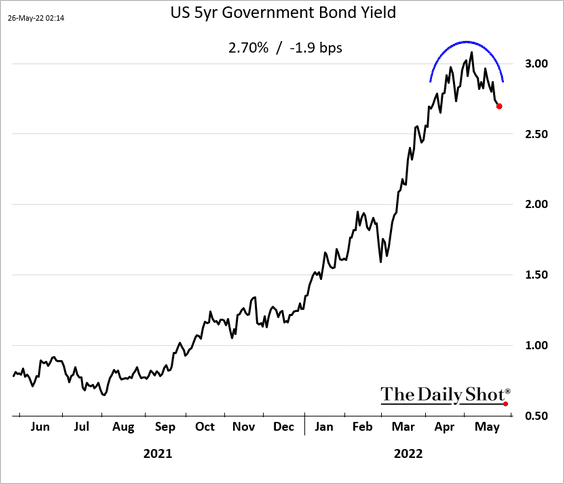

Treasury yields have been drifting lower.

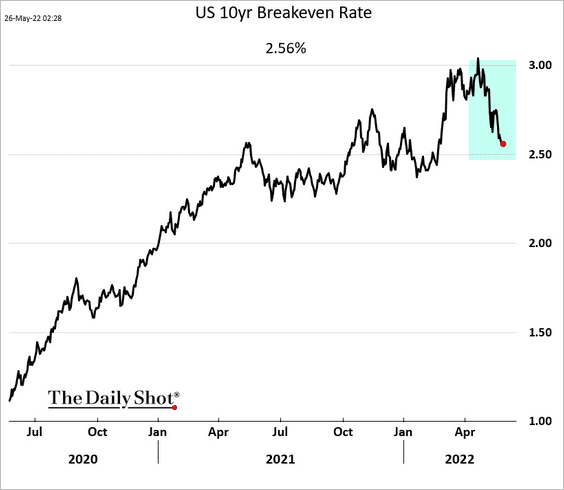

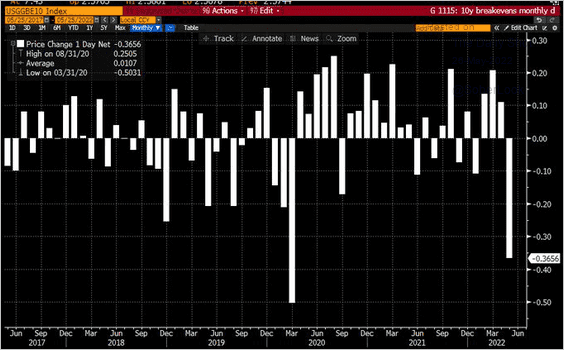

2. Longer-term market-based inflation expectations declined sharply this month amid concerns about economic growth.

Here are the monthly changes in the above index.

Source: @kgreifeld

Source: @kgreifeld

——————–

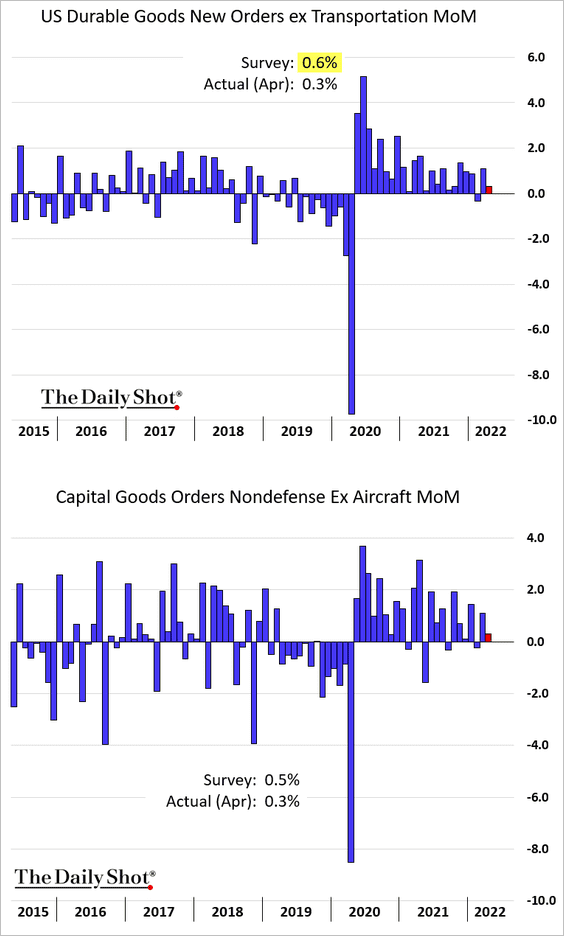

3. Durable goods orders were softer than expected last month.

Source: Reuters Read full article

Source: Reuters Read full article

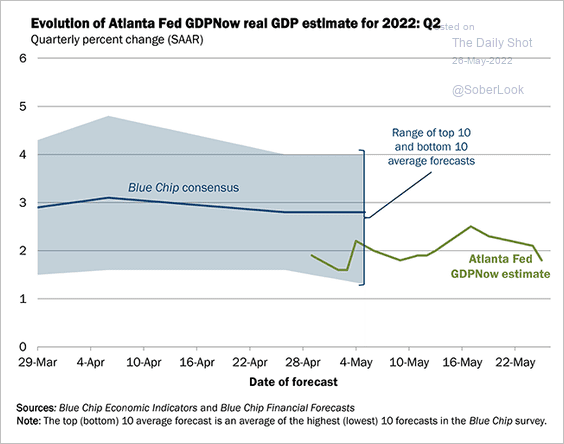

As a result, the Atlanta Fed’s GDPNow Q2 growth model forecast dipped below 2% (annualized).

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

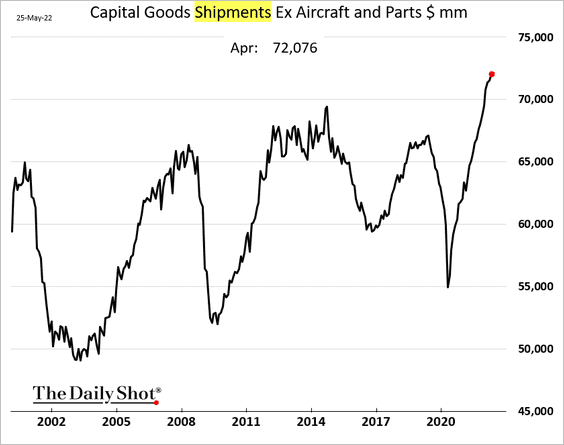

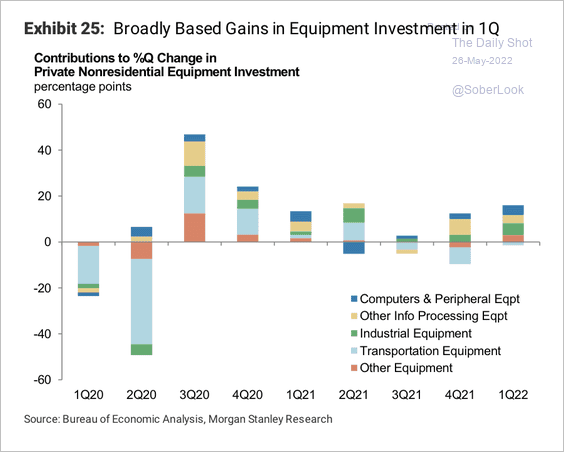

Capital goods shipments have been robust during the COVID-era recovery, …

… indicating strong investment spending.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

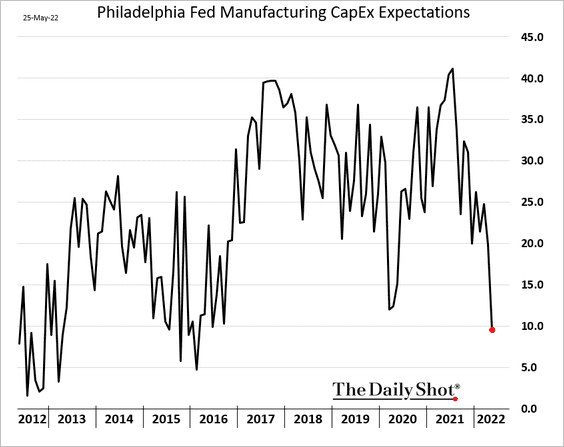

But CapEx expectations point to a slowdown in business investment ahead.

——————–

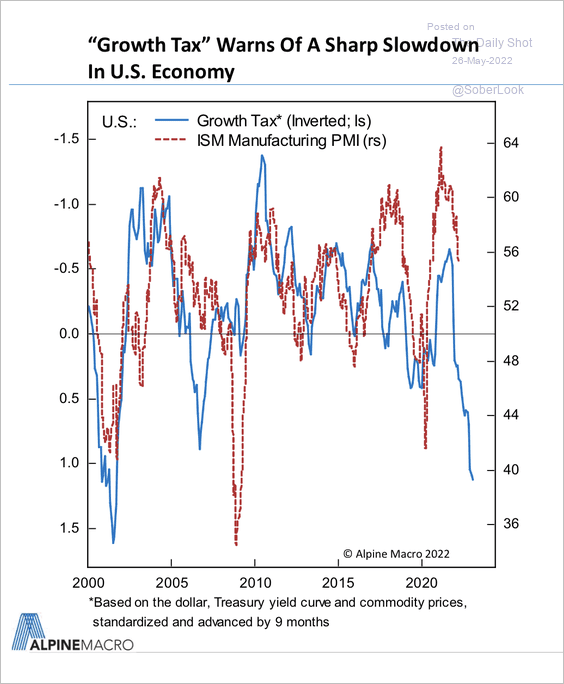

4. The mix of high commodity prices, a strong dollar, and rising rates point to a sharp slowdown in economic growth.

Source: Alpine Macro

Source: Alpine Macro

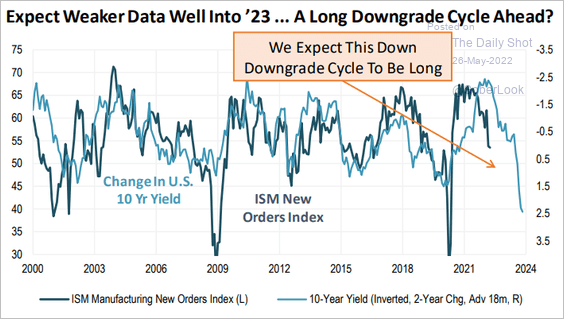

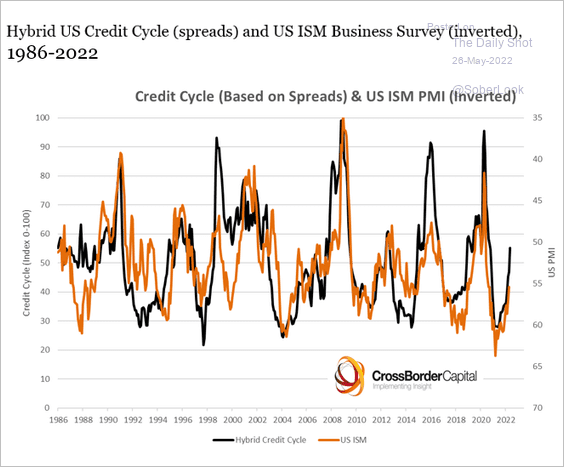

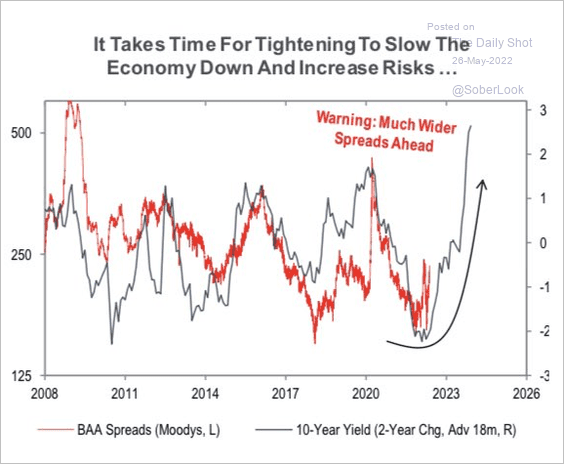

• Higher bond yields and credit spreads also signal a slowdown (2 charts).

Source: Redfin

Source: Redfin

Source: @crossbordercap

Source: @crossbordercap

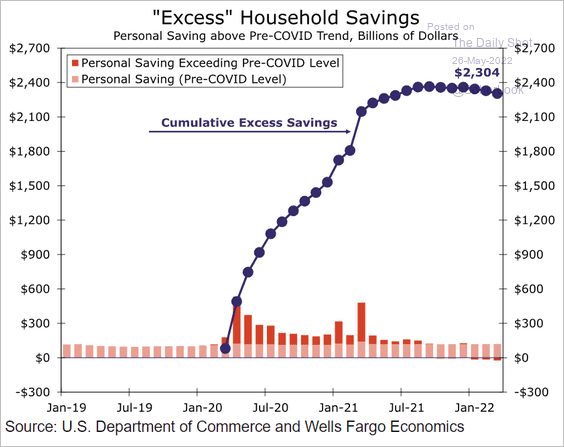

• Most economists don’t see a recession amid lofty household excess savings.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

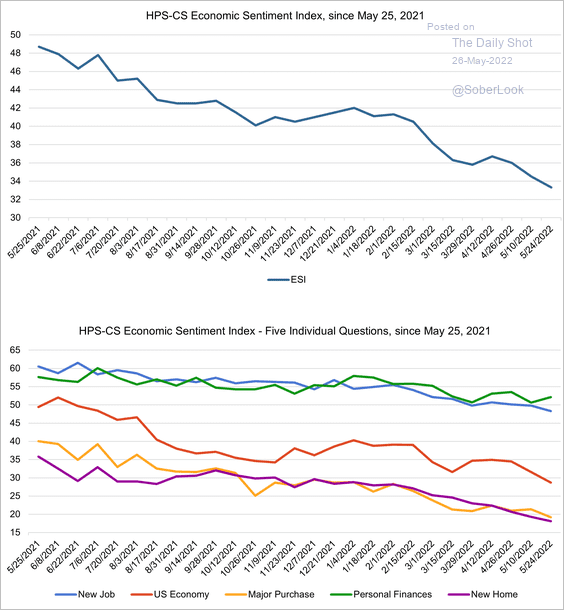

5. Consumer confidence continues to deteriorate.

Source: @HPS_CS, @HPSInsight, @CivicScience

Source: @HPS_CS, @HPSInsight, @CivicScience

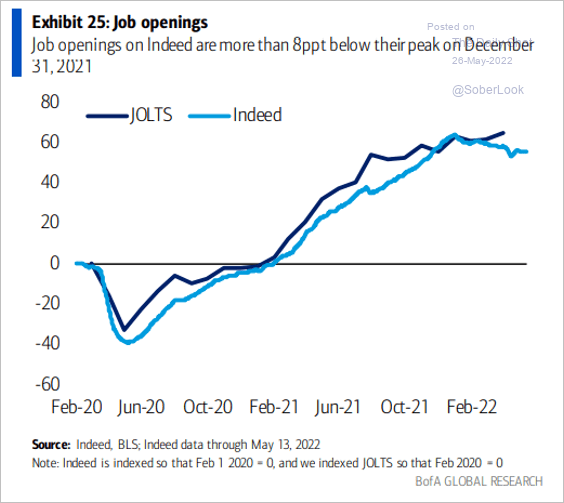

6. Job openings are expected to moderate.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

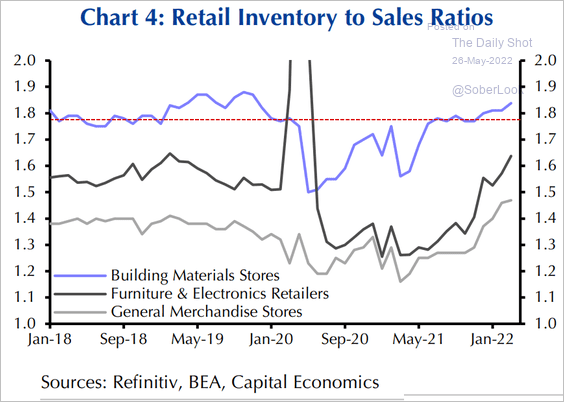

7. Retail inventory-to-sales ratios are above pre-COVID levels. Retailer discounting is coming.

Source: Capital Economics

Source: Capital Economics

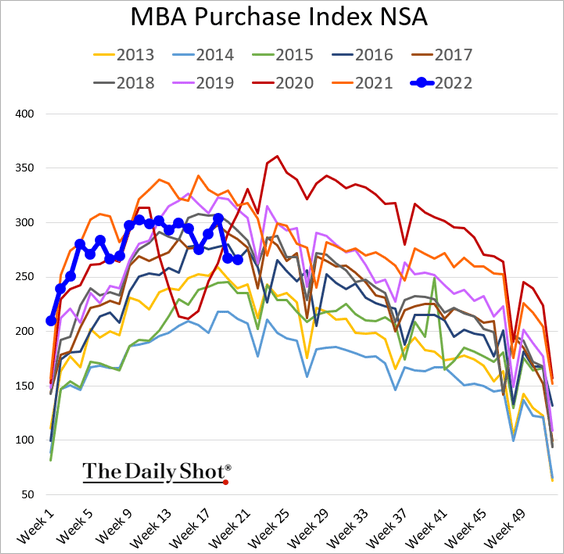

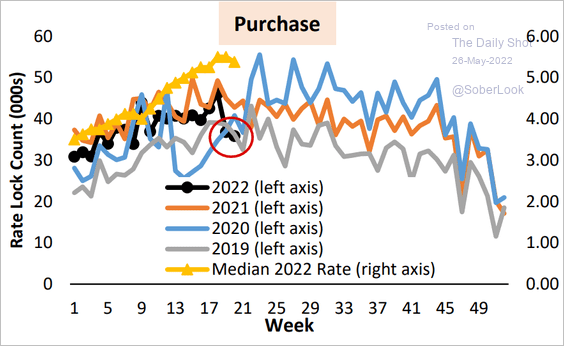

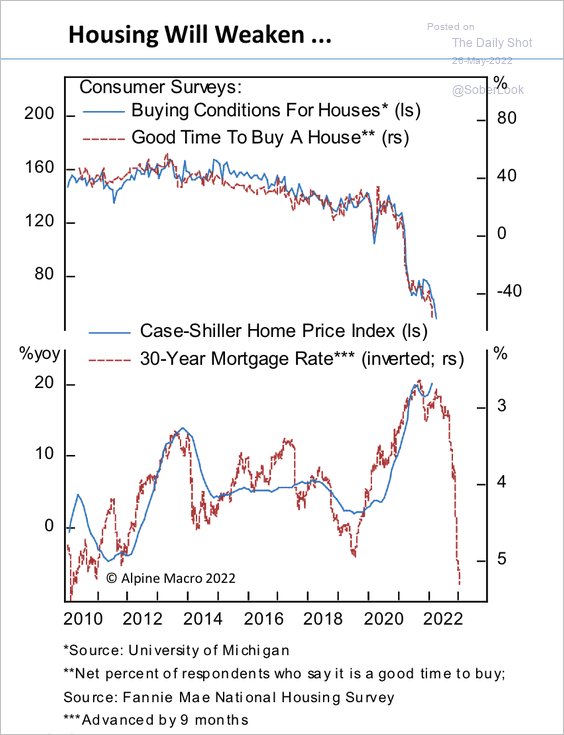

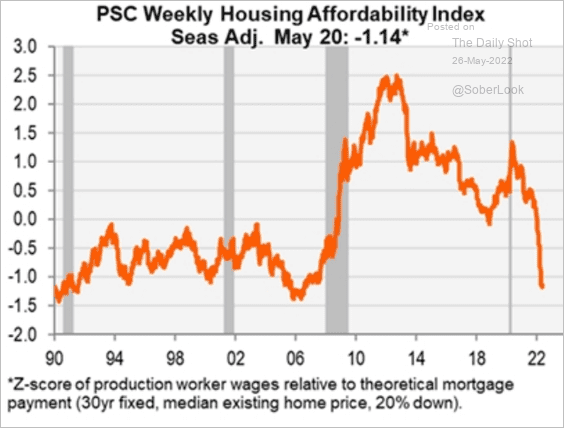

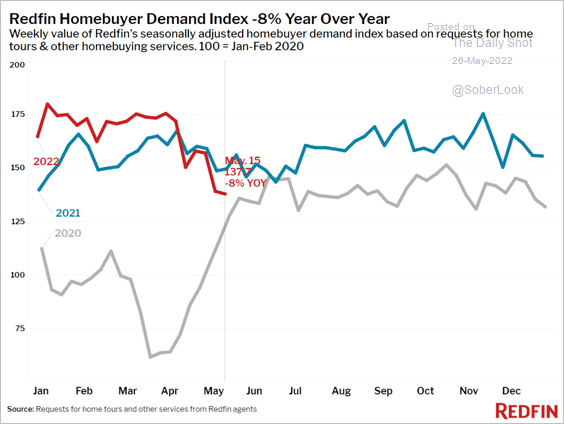

8. Next, we have some updates on the housing market.

• Mortgage applications have declined substantially but are not collapsing.

Here is the number of rate locks.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

• The recent spike in mortgage rates points to a significant decline in home price appreciation, …

Source: Alpine Macro

Source: Alpine Macro

… as affordability deteriorates.

Source: Piper Sandler

Source: Piper Sandler

• Housing demand weakened this month.

Source: Redfin

Source: Redfin

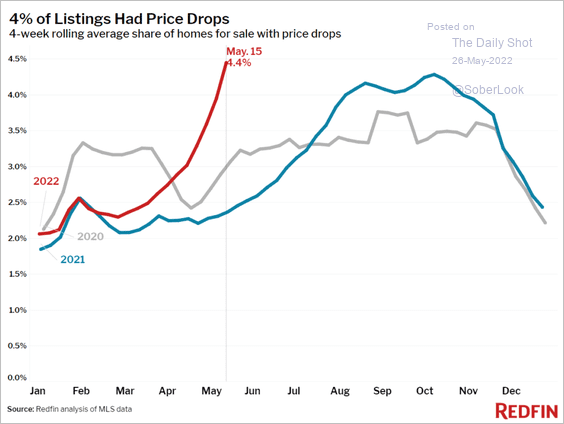

• More sellers are cutting prices.

Source: Redfin

Source: Redfin

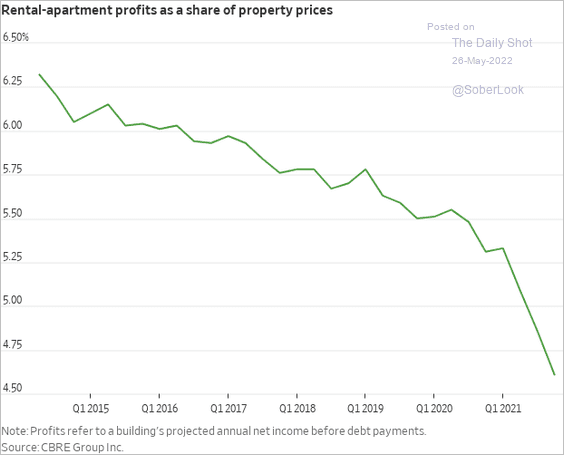

• Apartment rental yields have been tumbling. But with the recent surge in bond yields, this trend should reverse (property prices will decline).

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

The Eurozone

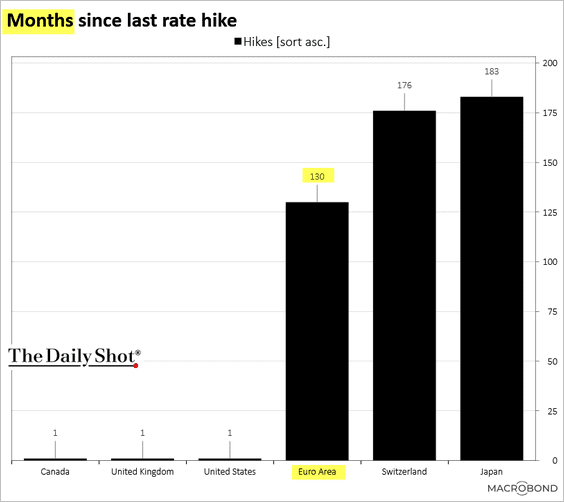

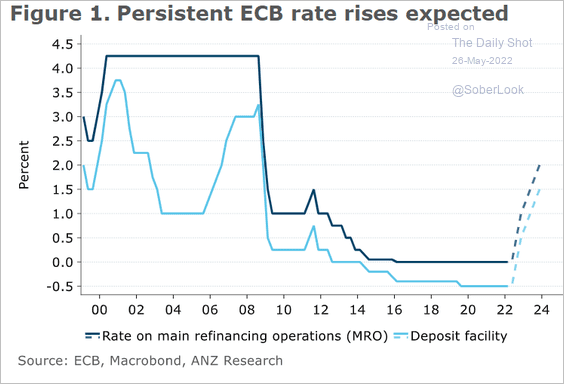

1. The upcoming rate hike is a big deal for the ECB. It hasn’t raised rates since 2011.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

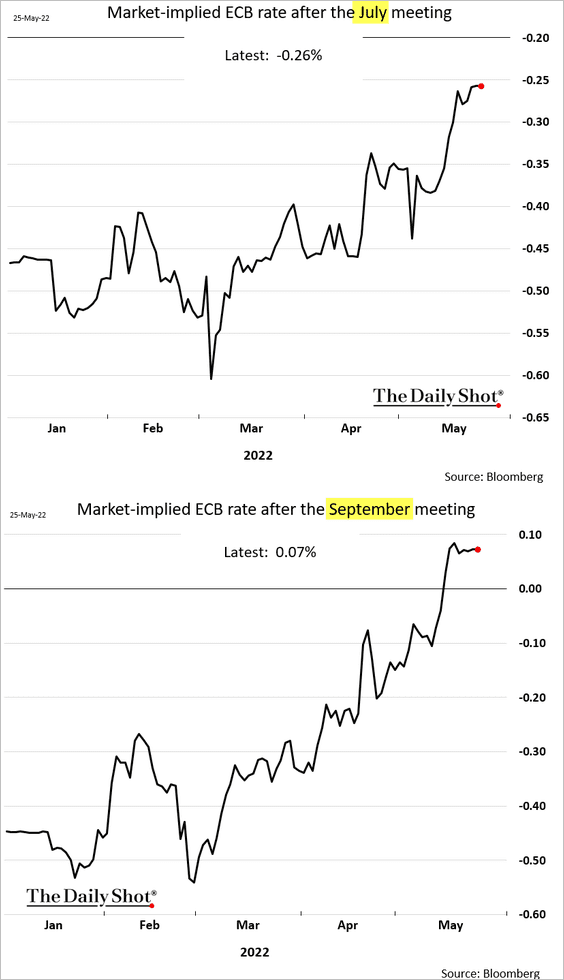

And the market expects 25 bps rate increases, which are large for the ECB. Some central bankers want to leave 50 bps increases on the table.

Here are the rate trajectory forecasts.

• ANZ Research:

Source: @ANZ_Research

Source: @ANZ_Research

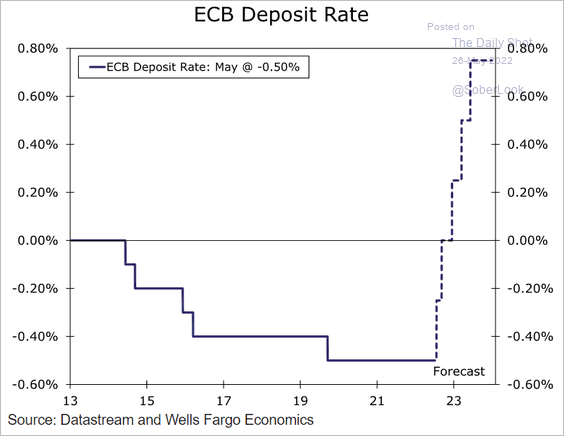

• Wells Fargo:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

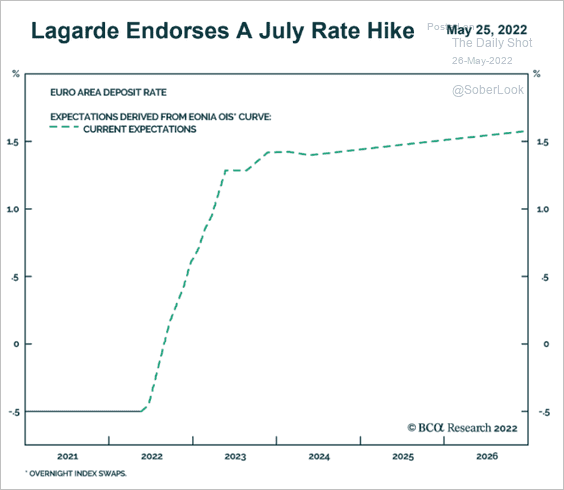

• The market:

Source: BCA Research

Source: BCA Research

——————–

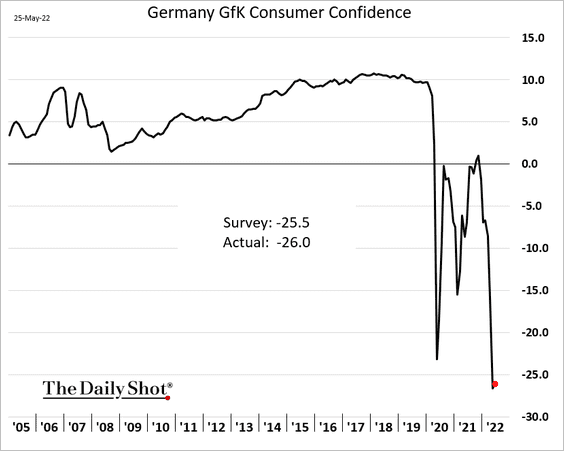

2. German consumer confidence remained depressed in May.

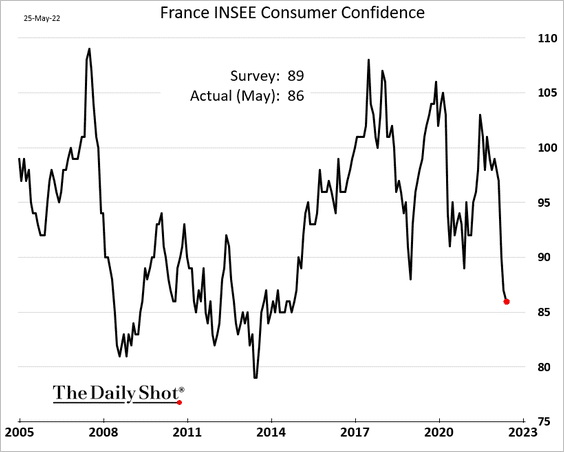

French consumer confidence deteriorated further.

——————–

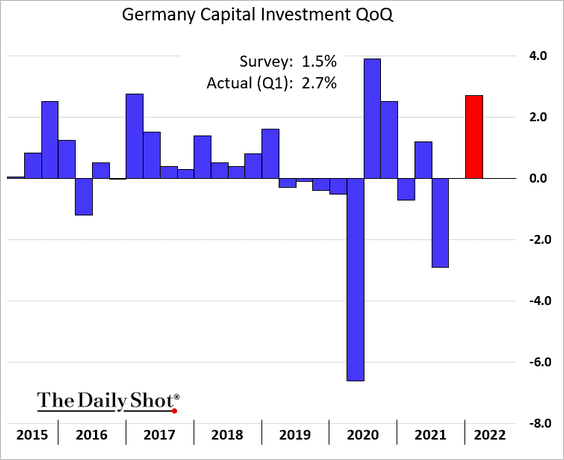

3. Germany’s robust business investment kept the GDP growth in positive territory in Q1.

Back to Index

Europe

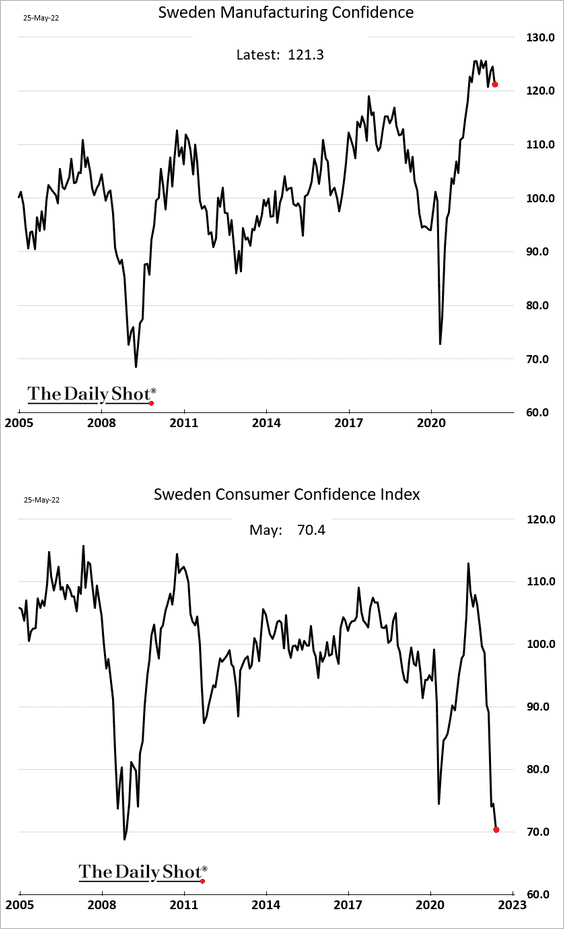

1. Similar to other European economies, Sweden shows a sharp divergence between business and consumer sentiment.

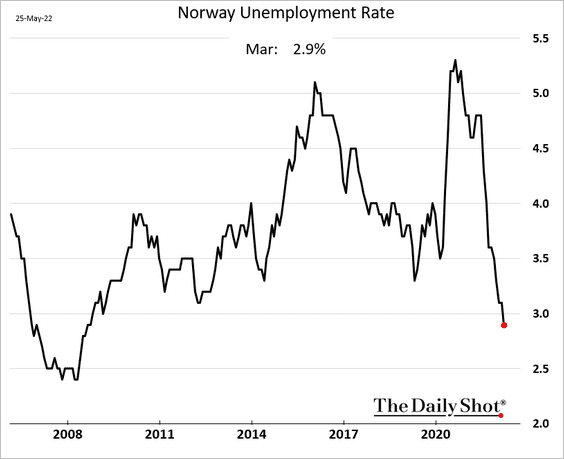

2. Norway’s unemployment rate hit the lowest level since 2008.

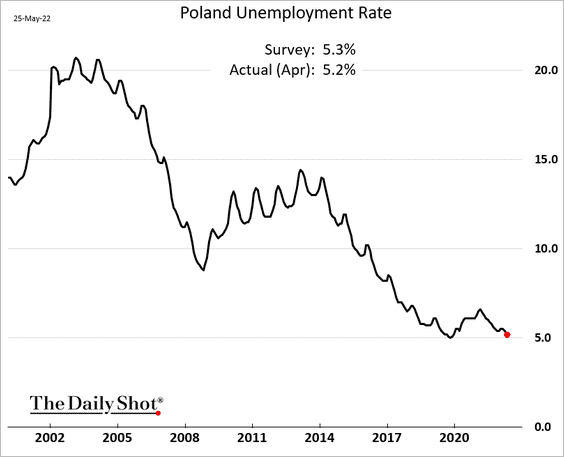

3. Poland’s unemployment rate is also very low.

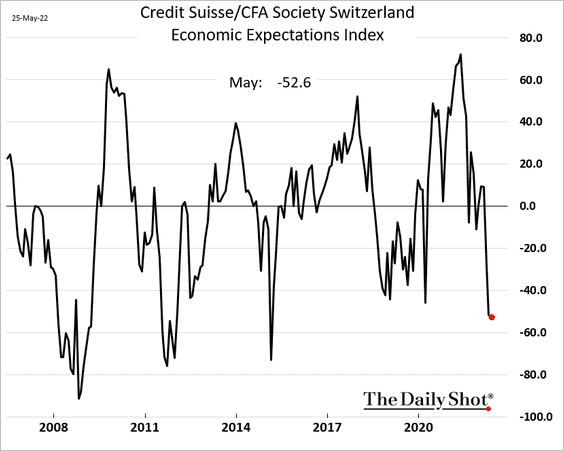

4. The Swiss economic expectations index remained depressed in May.

——————–

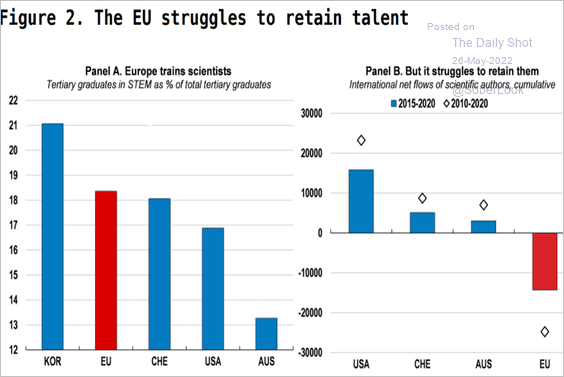

5. The EU struggles to retain STEM professionals.

Source: ECOSCOPE Read full article

Source: ECOSCOPE Read full article

Back to Index

Asia – Pacific

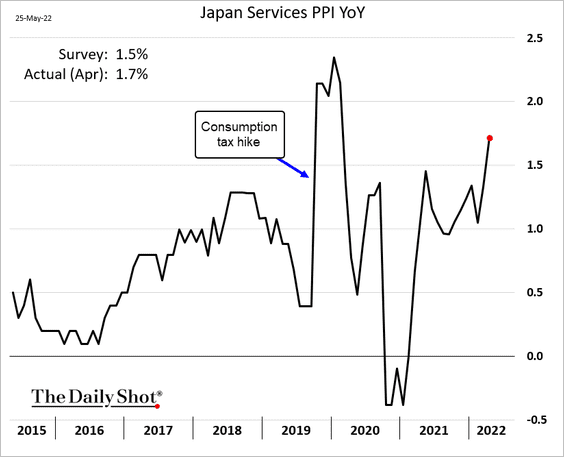

1. Japan’s services PPI surprised to the upside in April.

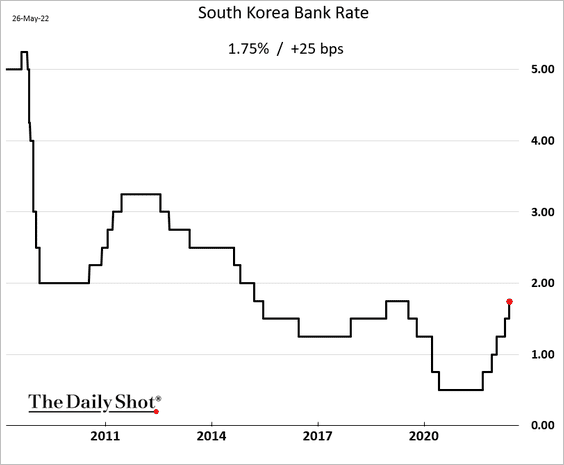

2. South Korea’s central bank hiked rates again.

Back to Index

China

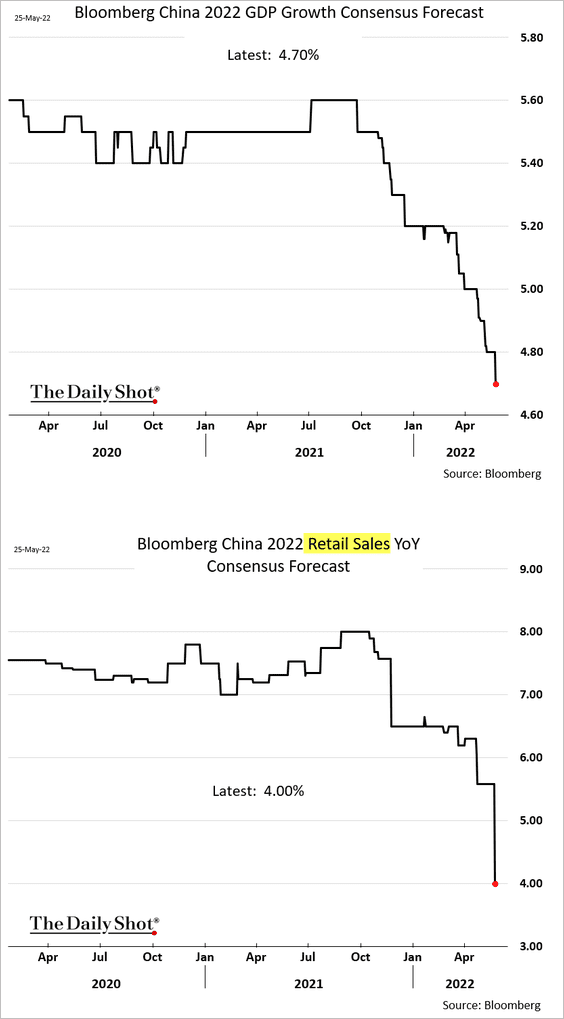

1. Economists continue to downgrade their GDP growth forecasts for China.

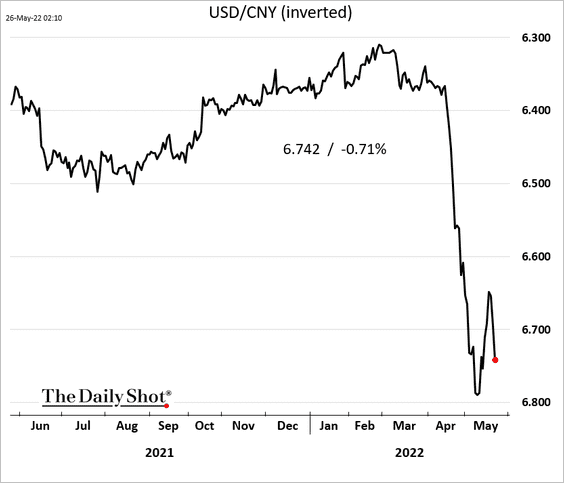

2. The renminbi’s bounce from the lows was short-lived.

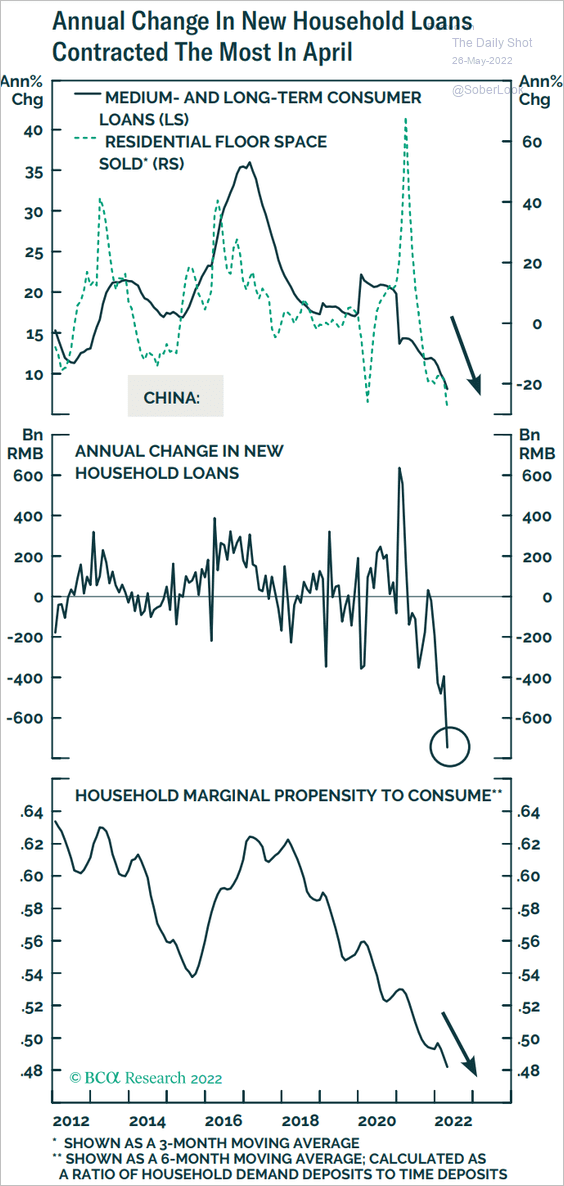

3. Household demand for credit is down sharply.

Source: BCA Research

Source: BCA Research

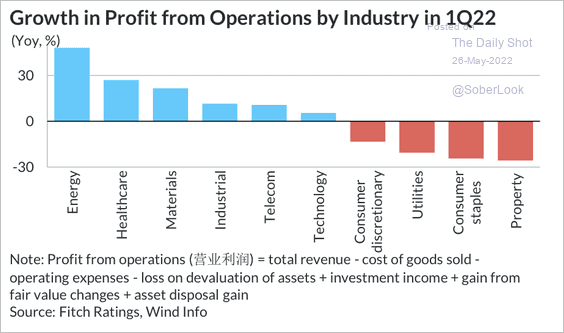

4. Energy, healthcare, and materials companies boosted profits in Q1, while consumer and property firms weakened.

Source: Fitch Ratings

Source: Fitch Ratings

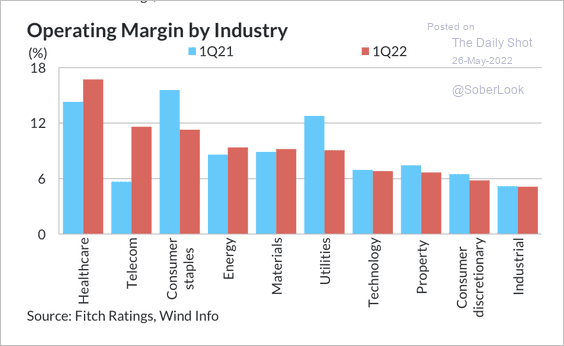

Consumer staples companies saw the biggest margin contraction in Q1, although healthcare and telecom improved.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Emerging Markets

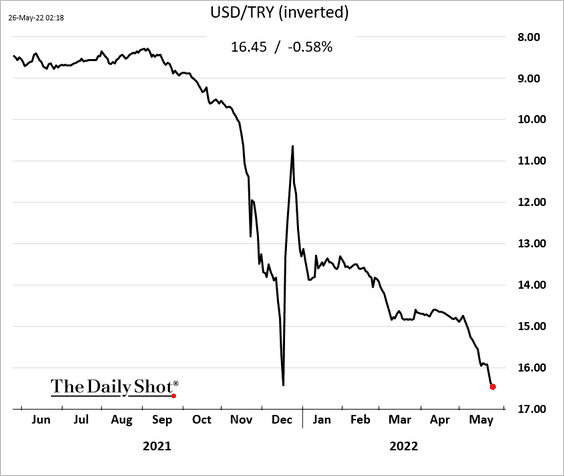

1. The Turkish lira is trading near record lows. This is not going to end well.

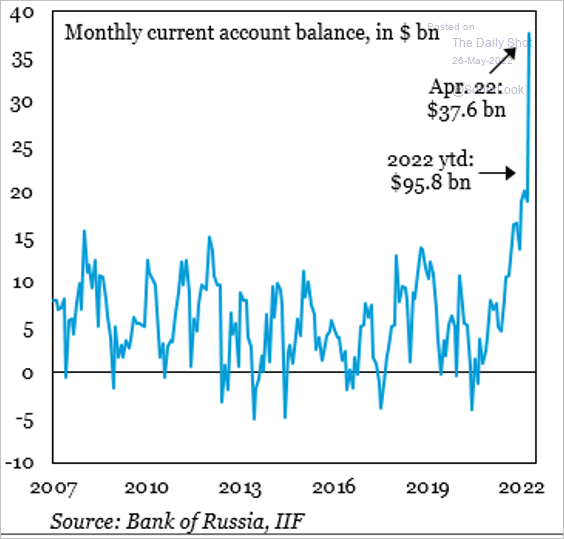

2. Russia’s current account surplus surged last month.

Source: @elinaribakova

Source: @elinaribakova

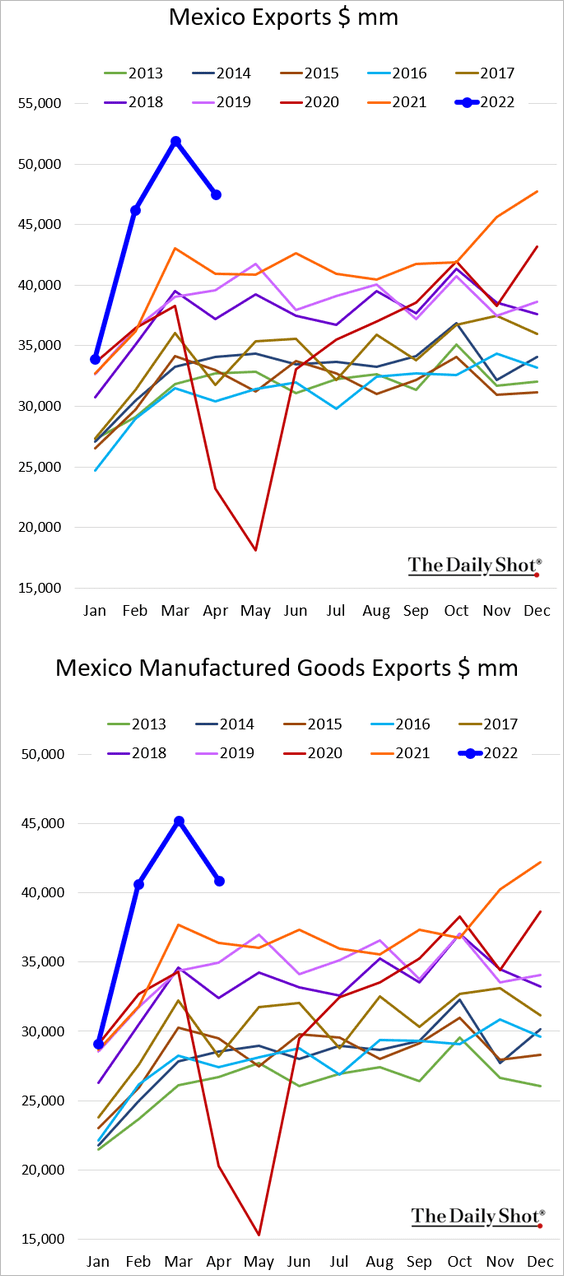

3. Mexican exports declined more than expected in April but are still elevated.

Despite strong exports, Mexico is running a substantial trade deficit.

Back to Index

Commodities

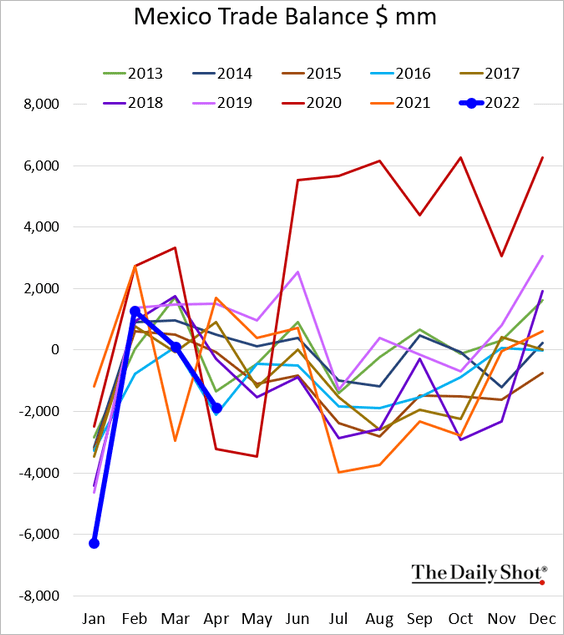

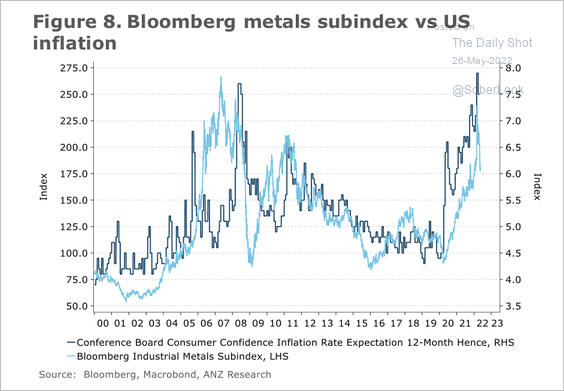

1. Will an increase in China’s credit impulse support demand for base metals?

Source: @ANZ_Research

Source: @ANZ_Research

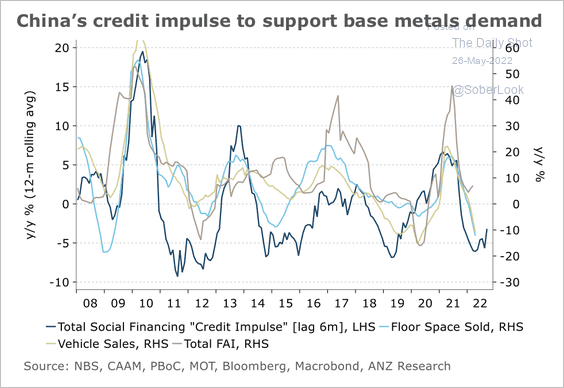

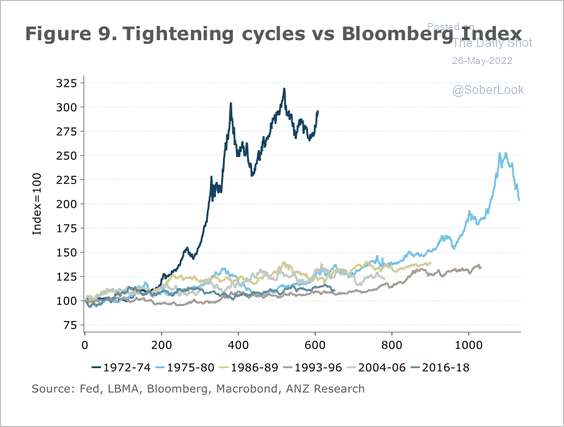

Metals tend to perform well during rising inflation expectations and Fed tightening cycles (2 charts).

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

——————–

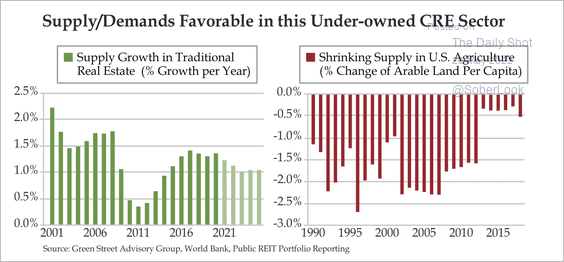

2. The supply of US arable land has declined significantly. That’s partly because of repurposing of what was once farmland into commercial real estate and transport networks, according to Quill Intelligence.

Source: Quill Intelligence

Source: Quill Intelligence

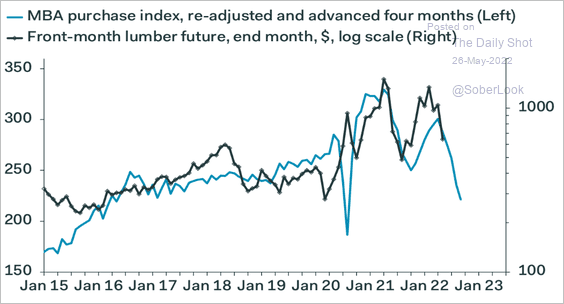

3. More downside for lumber prices ahead?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

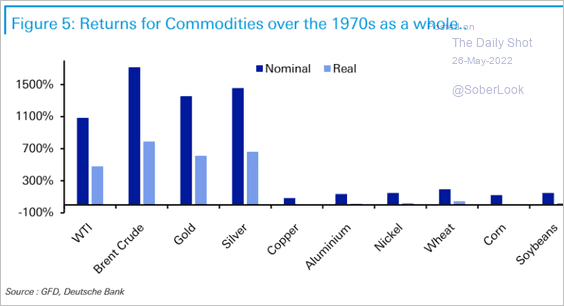

4. How did commodities perform during the 1970s, a period of high inflation.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Energy

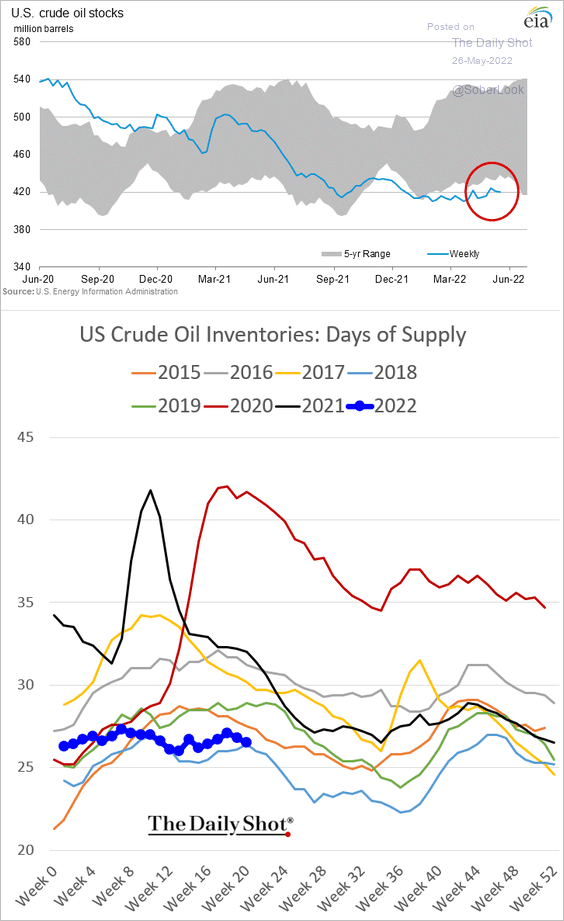

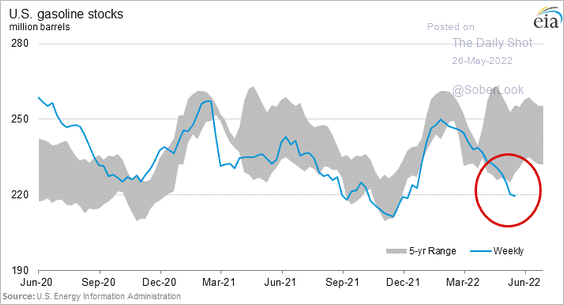

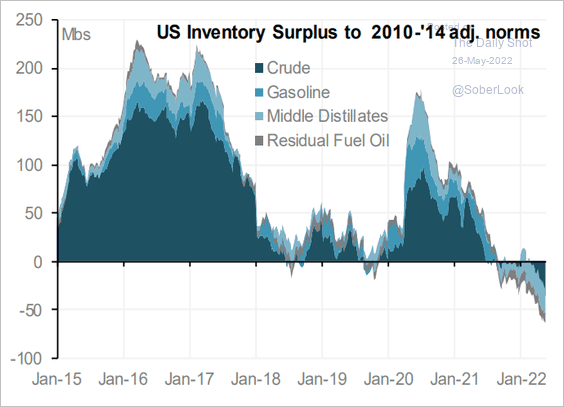

1. US crude oil and refined products inventories remain low for this time of the year (3 charts).

Source: Redfin

Source: Redfin

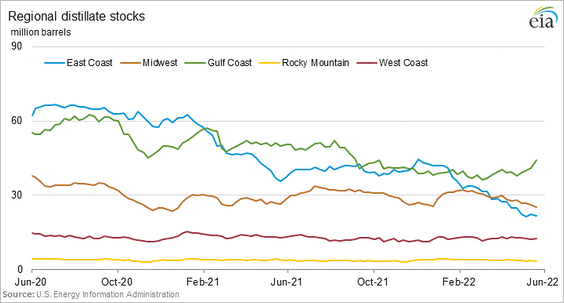

This chart shows US distillates inventories by region.

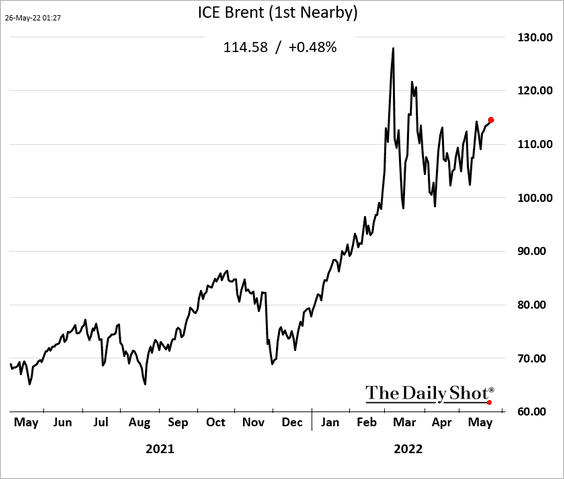

2. Oil prices continue to grind higher.

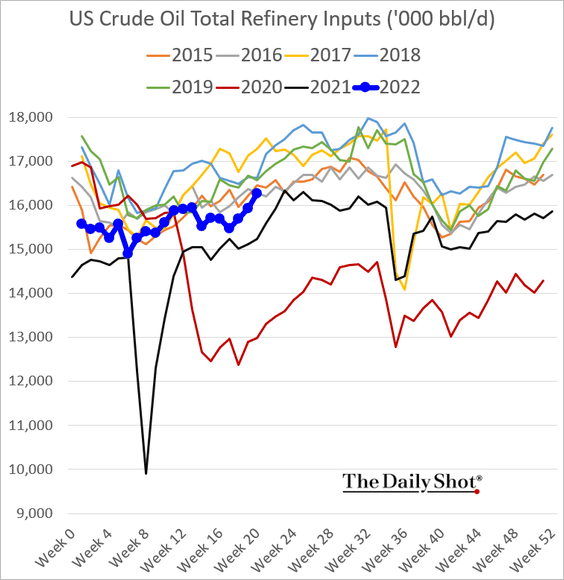

3. US refinery runs jumped in recent weeks.

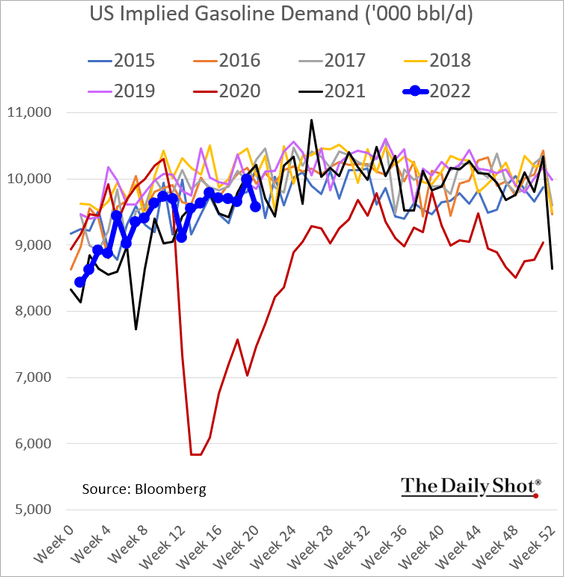

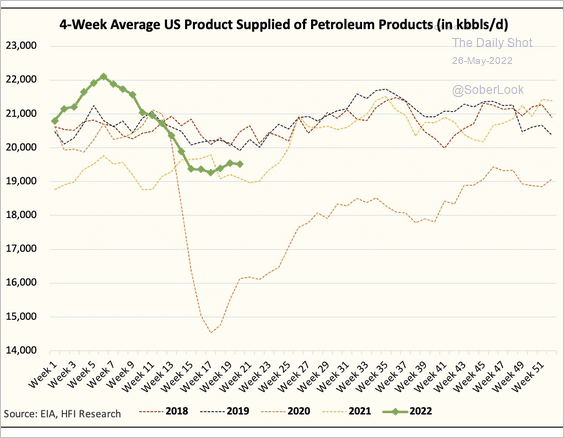

But demand hasn’t been great (2 charts).

Source: @HFI_Research

Source: @HFI_Research

——————–

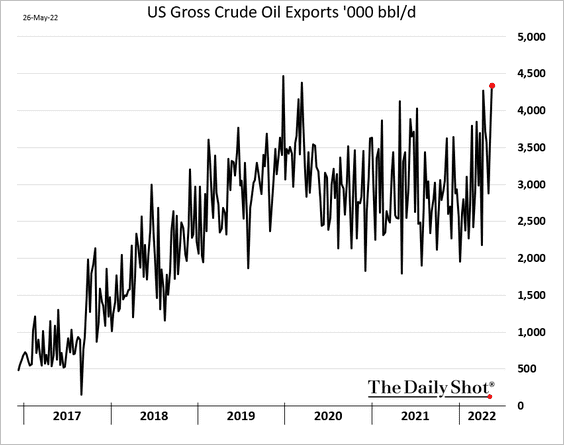

4. US crude oil exports are back at pre-pandemic highs.

Back to Index

Equities

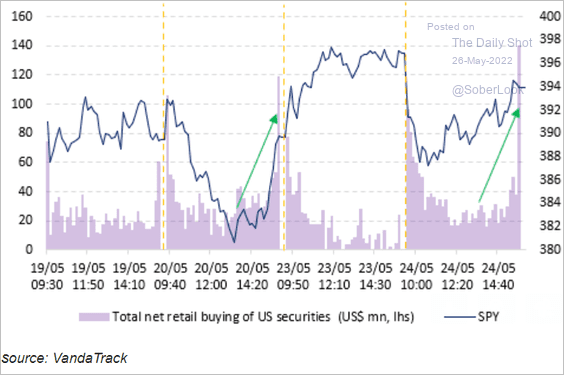

1. Are retail investors responsible for the late afternoon market recoveries we’ve been seeing?

Source: Vanda Research

Source: Vanda Research

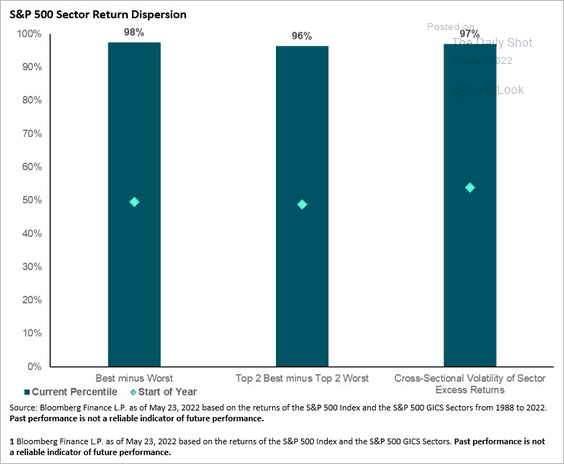

2. S&P 500 sector return dispersion is at an extreme high.

Source: @matthewbartolini; State Street Global Advisors

Source: @matthewbartolini; State Street Global Advisors

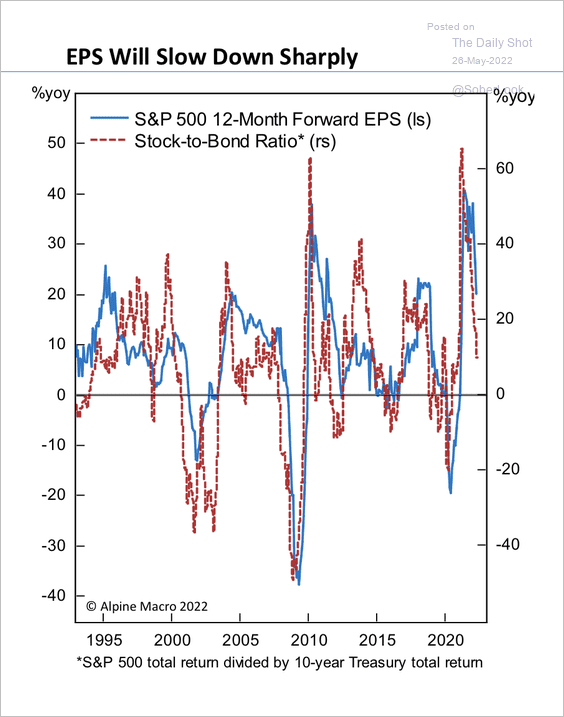

3. The decline in the stock/bond ratio suggests further downside in earnings.

Source: Alpine Macro

Source: Alpine Macro

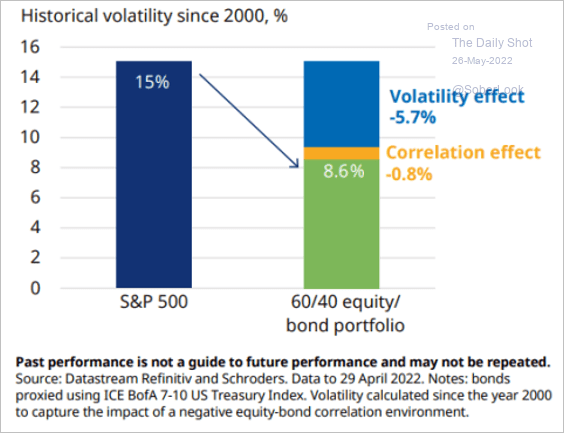

4. Most of the risk reduction in a 60/40 portfolio comes from the lower volatility of bonds.

Source: Sean Markowicz; Schroders

Source: Sean Markowicz; Schroders

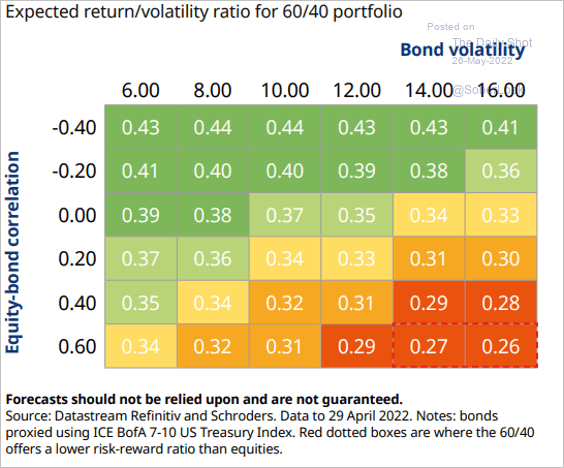

Correlations and bond vol would need to rise a lot to erode the risk/reward of a 60/40 portfolio.

Source: Sean Markowicz; Schroders

Source: Sean Markowicz; Schroders

——————–

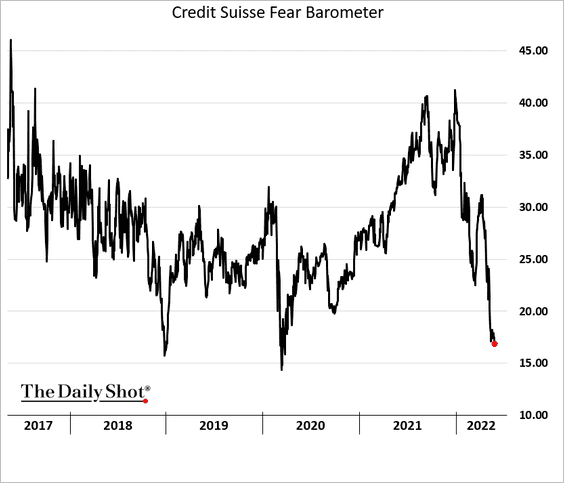

5. The Credit Suisse fear barometer (based on S&P 500 options) continues to move further into “fear territory.”

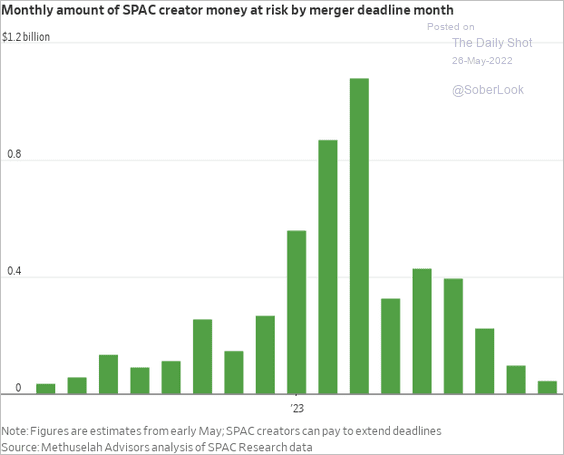

6. SPACs will need to lock in a lot of deals next year to avoid returning capital.

Source: @WSJ Read full article

Source: @WSJ Read full article

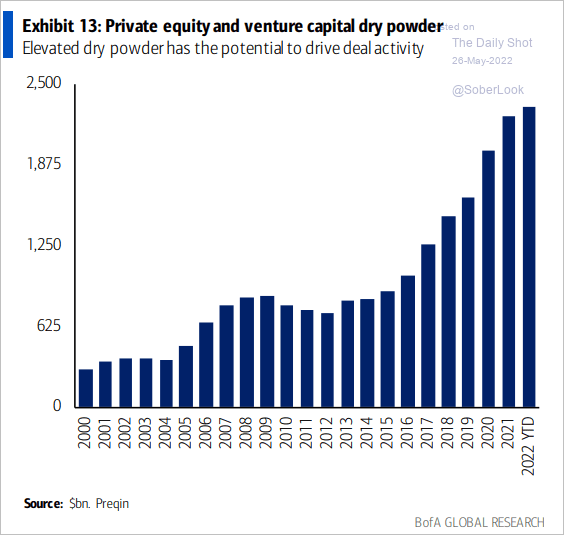

7. Massive amounts of private equity dry powder are a tailwind for the stock market.

Source: BofA Global Research

Source: BofA Global Research

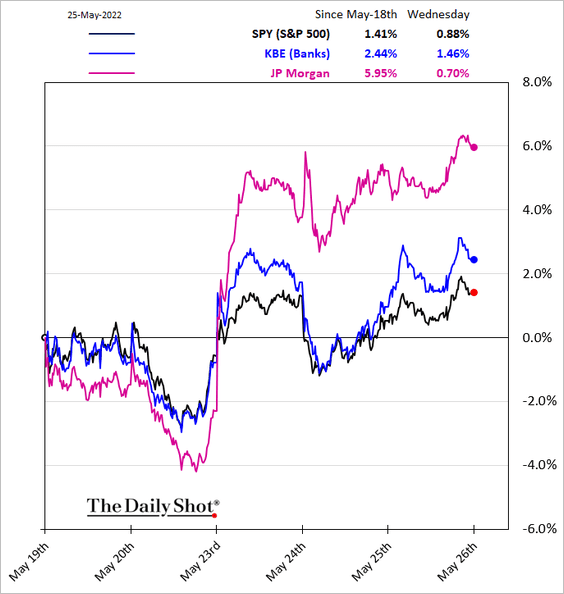

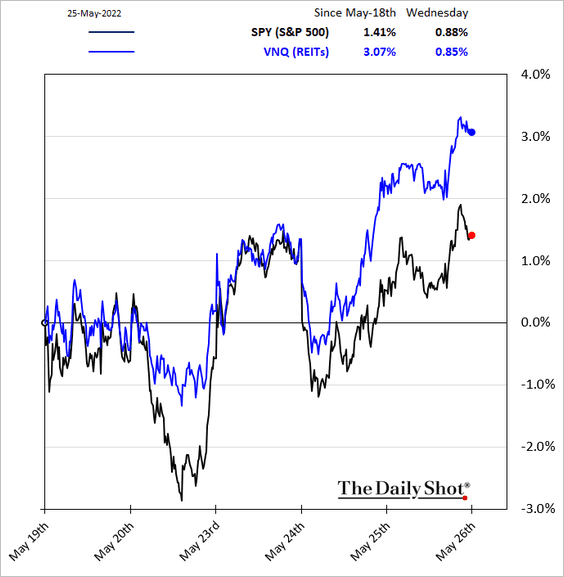

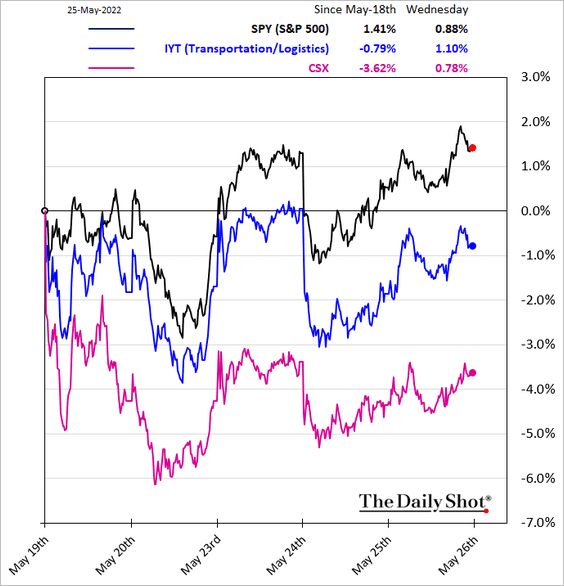

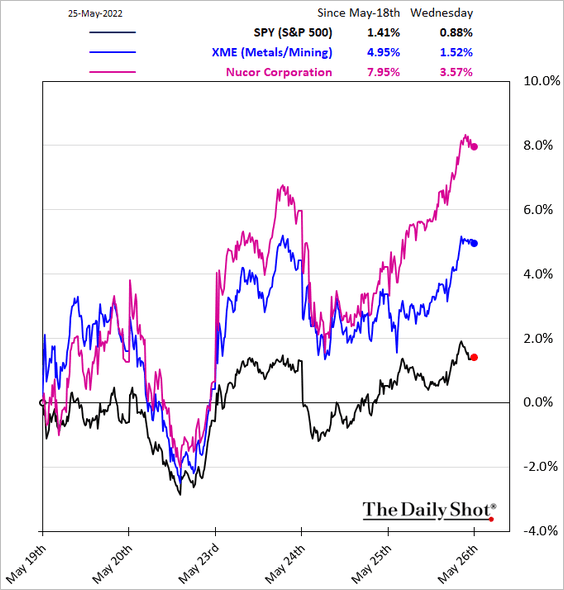

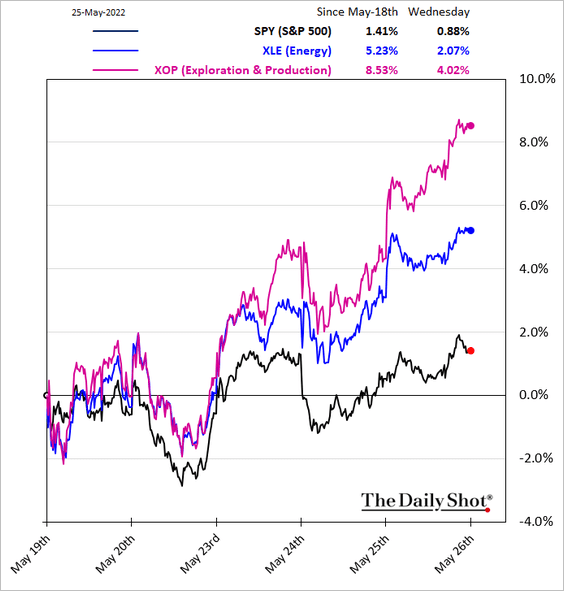

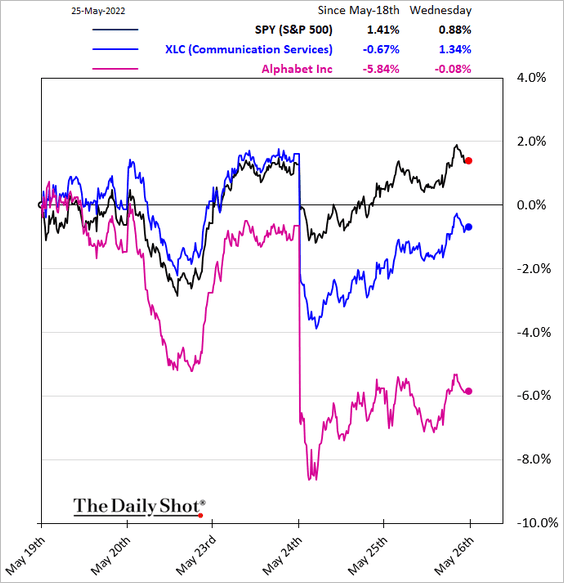

8. Next, we have some sector performance updates over the past five business days.

• Banks:

• Real estate (REITs):

• Transportation:

• Metals & Mining:

• Energy:

• Communication Services:

• Semiconductors:

![]()

The sector got more discouraging news after the close.

Source: Reuters Read full article

Source: Reuters Read full article

![]()

——————–

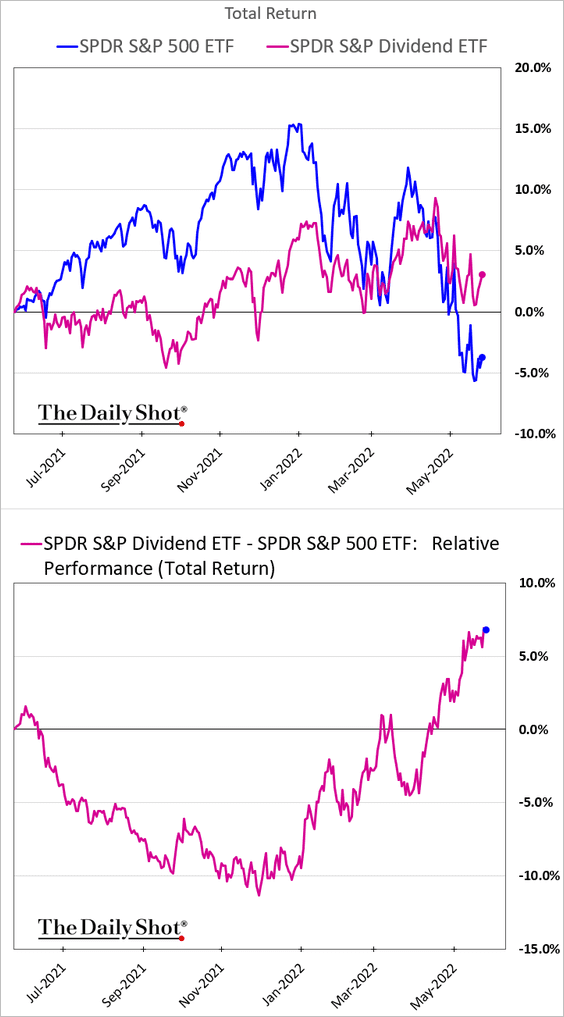

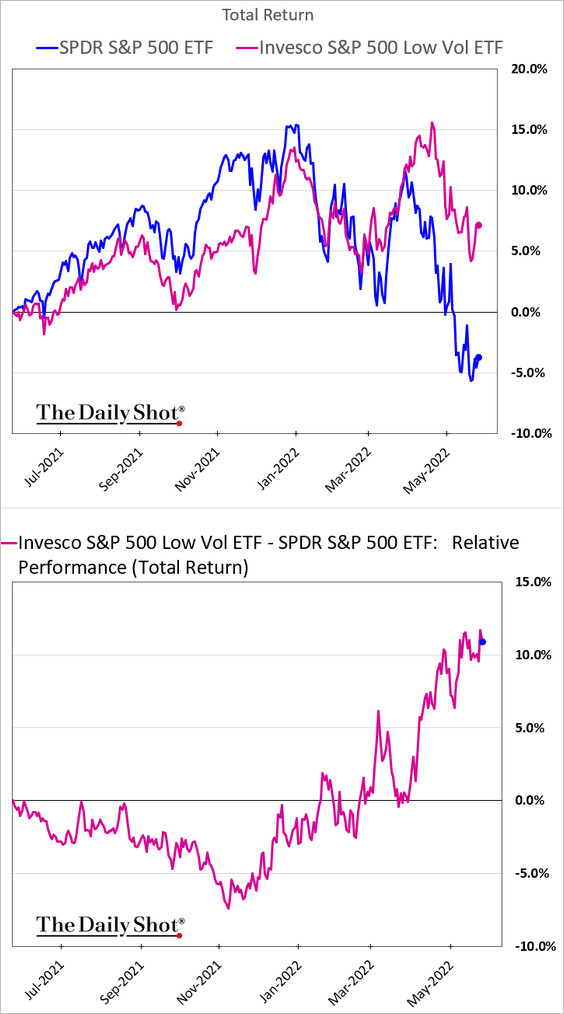

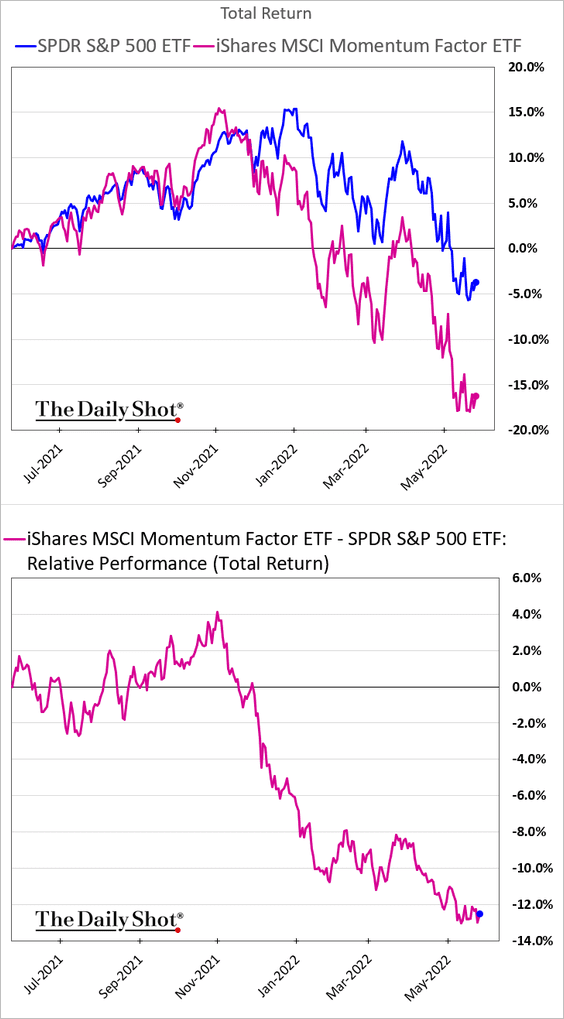

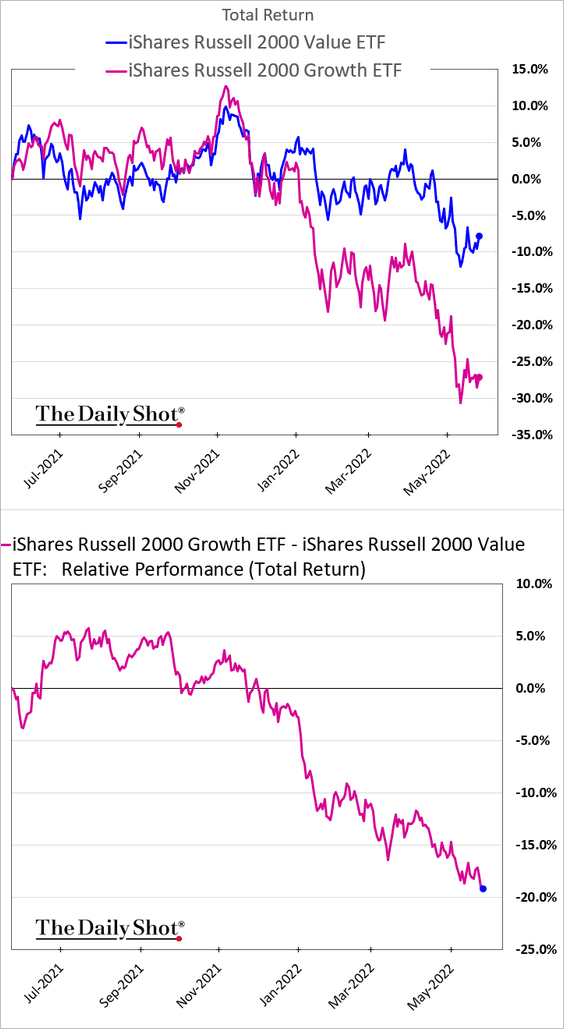

9. Finally, let’s take a look at some equity factor trends over the past 12 months.

• High-dividend:

• Low vol:

• Momentum:

• Small-cap value vs. growth:

Back to Index

Credit

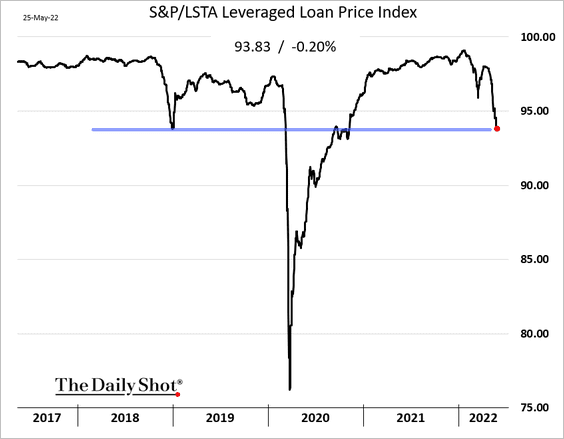

1. Leveraged loans remain under pressure.

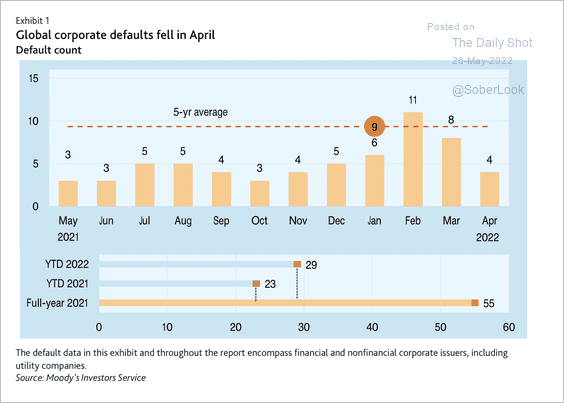

2. Global credit defaults declined in April, but Moody’s expects a modest rise from here (below the five-year average).

Source: Moody’s Investors Service

Source: Moody’s Investors Service

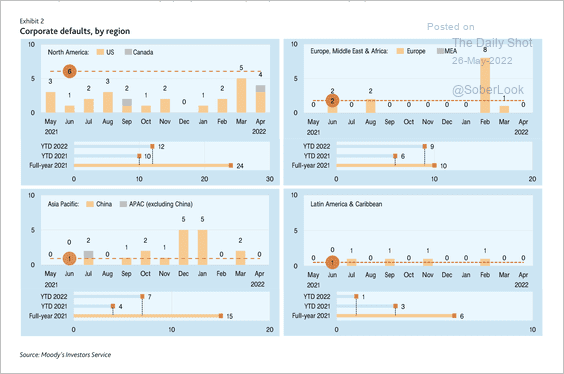

Here is a breakdown of corporate defaults by region.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

——————–

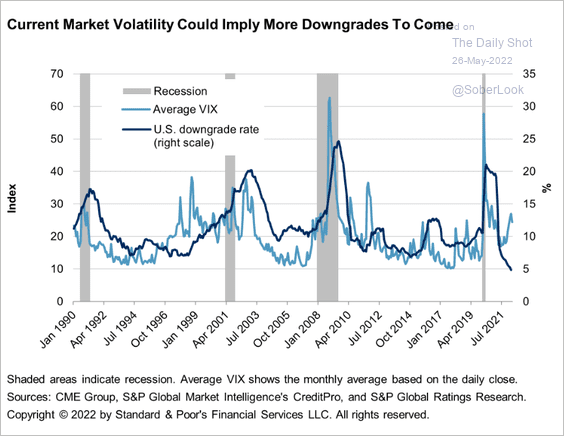

3. More downgrades ahead?

Source: S&P Global Ratings

Source: S&P Global Ratings

4. Higher credit spreads ahead?

Source: @MichaelKantro

Source: @MichaelKantro

Back to Index

Global Developments

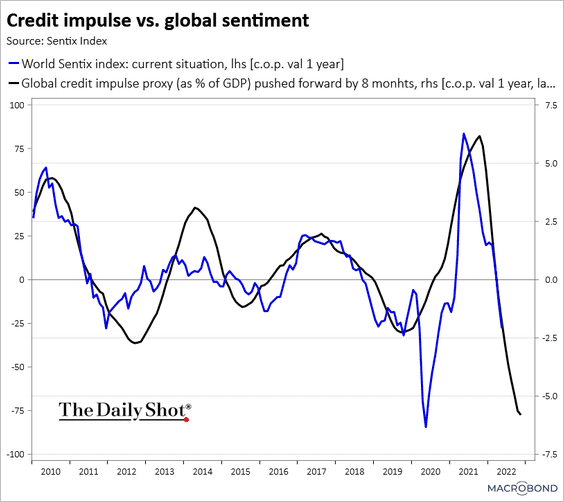

1. The global credit impulse points to further downside risks for economic sentiment.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

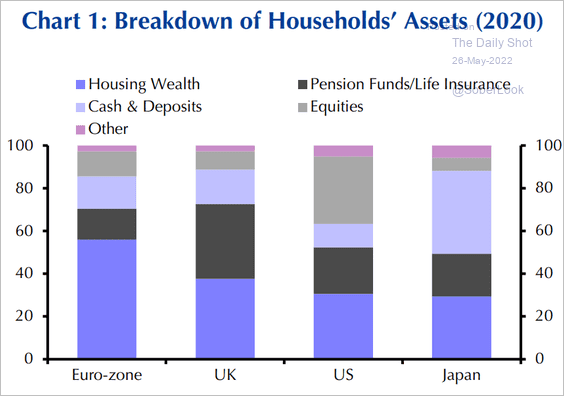

2. This chart shows the breakdown of household assets in the Eurozone, UK, US, and Japan.

Source: Capital Economics

Source: Capital Economics

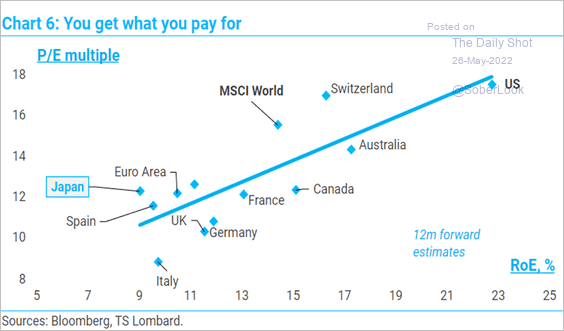

3. This scatterplot shows equity P/E multiples (valuations) vs. returns on equity in advanced economies.

Source: TS Lombard

Source: TS Lombard

——————–

Food for Thought

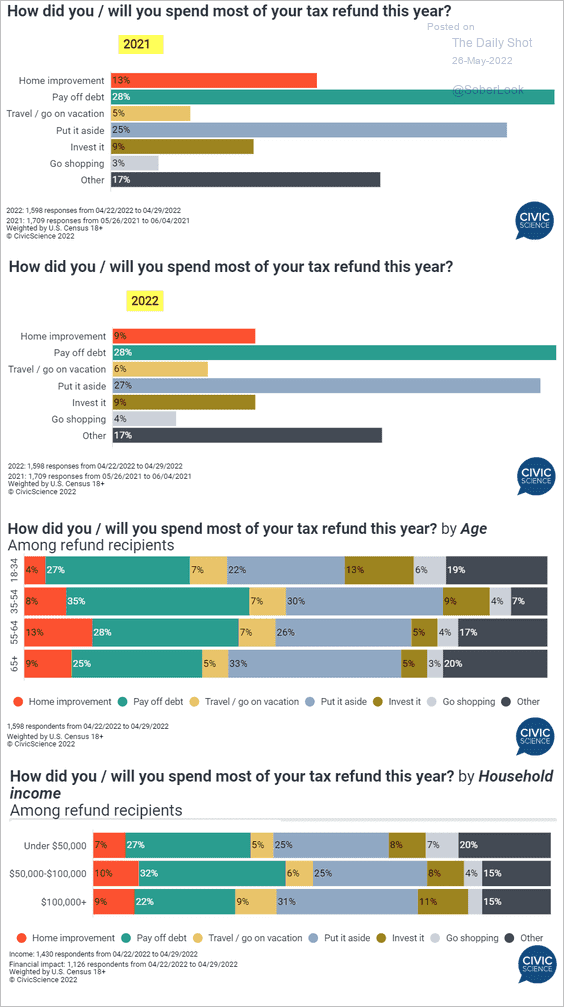

1. Spending the tax refund:

Source: @CivicScience

Source: @CivicScience

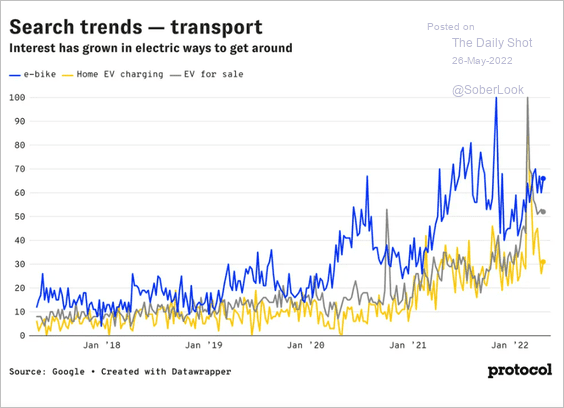

2. EV search trends:

Source: Protocol Read full article

Source: Protocol Read full article

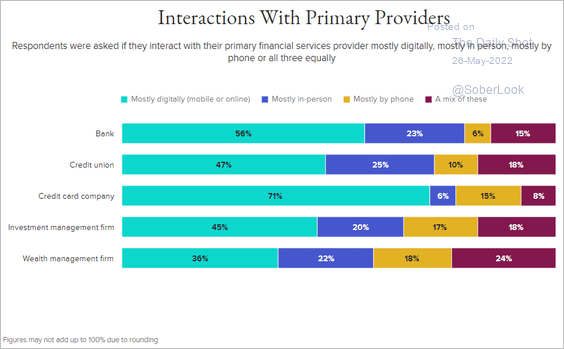

3. Interactions with financial services providers:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

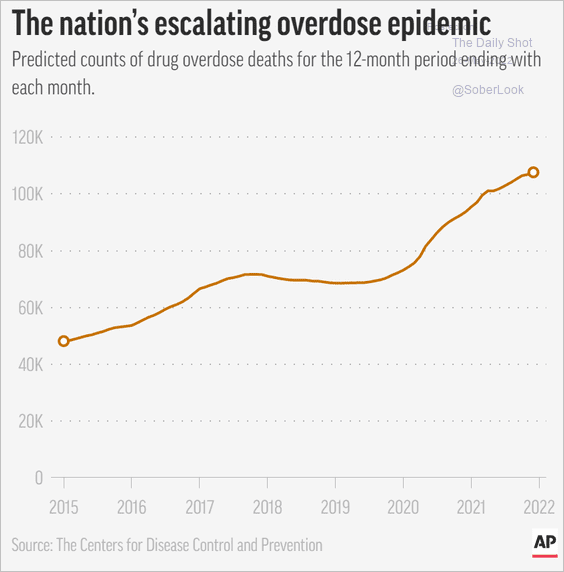

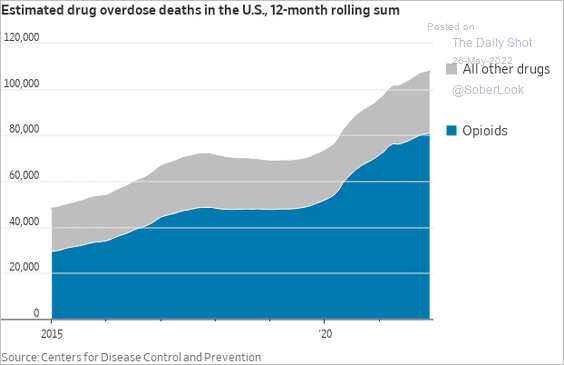

4. US drug overdose deaths (updated):

Source: AP Read full article

Source: AP Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

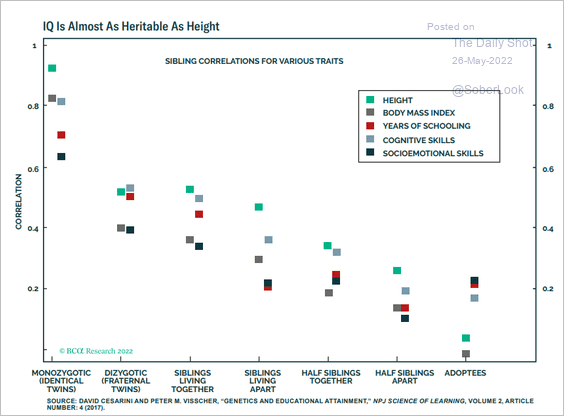

5. Sibling correlations across various traits:

Source: BCA Research

Source: BCA Research

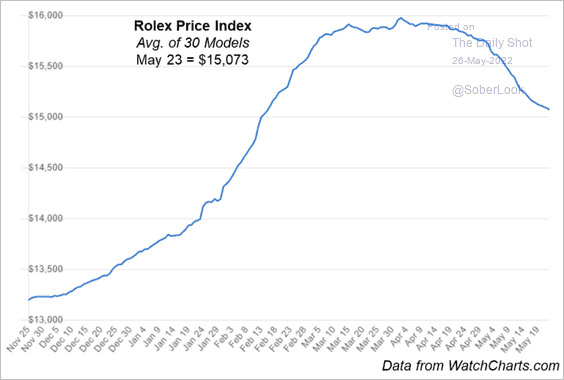

6. The Rolex Price Index since last November:

Source: Evercore ISI Research

Source: Evercore ISI Research

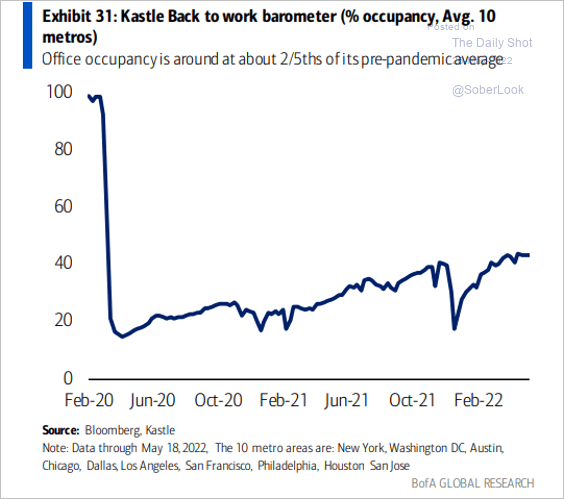

7. US office occupancy:

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

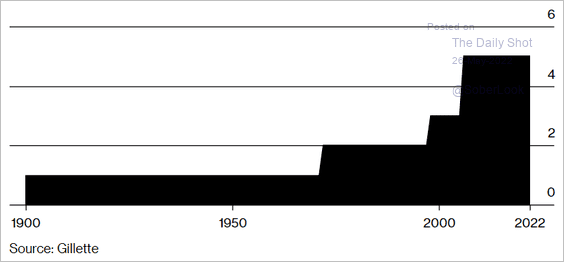

8. The largest number of blades in a Gillette razor:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

Back to Index