The Daily Shot: 27-May-22

• The United States

• Canada

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Alternatives

• Rates

• Global Developments

• Food for Thought

As a reminder, The Daily Shot will not be published on Monday.

The United States

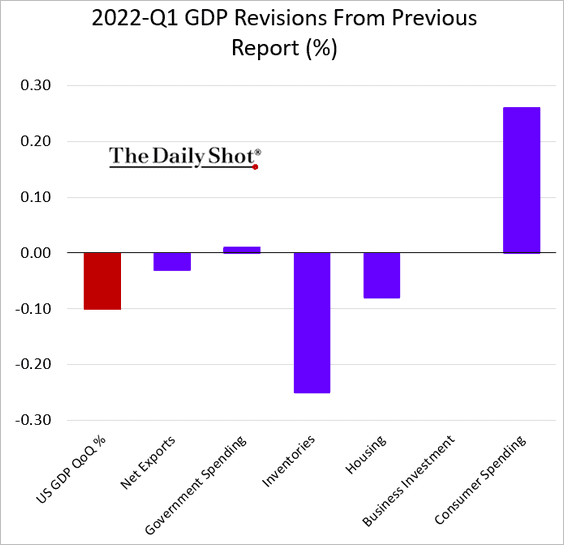

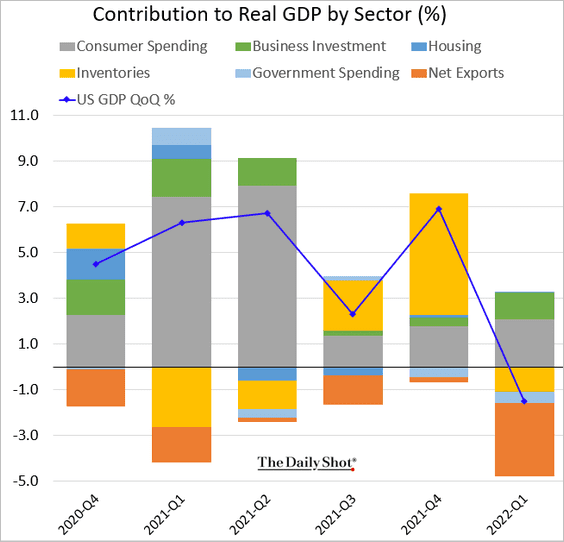

1. The Q1 GDP revision showed a larger negative impact from inventories but a stronger increase in consumption.

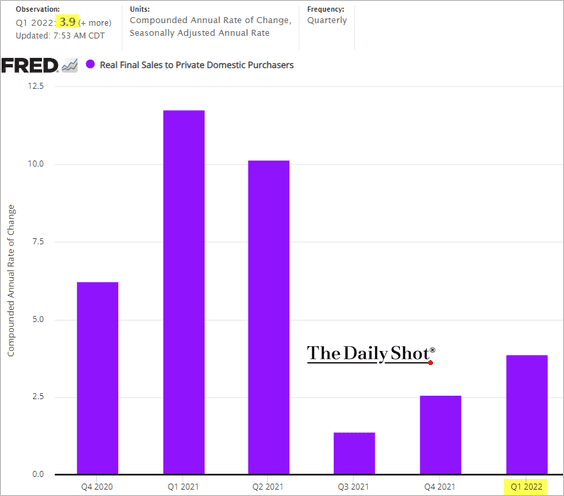

• Outside of net exports, growth was robust, with real final sales to private domestic purchasers rising 3.9% (annualized).

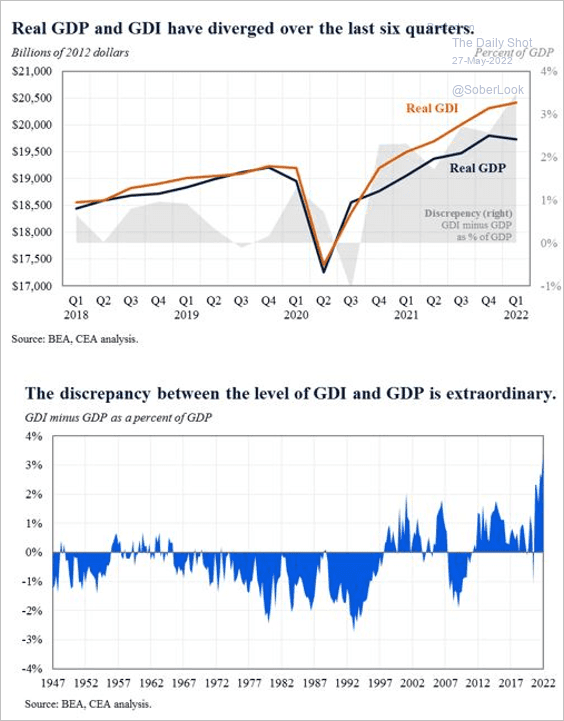

• The GDP has diverged sharply from the GDI.

Source: @WhiteHouseCEA

Source: @WhiteHouseCEA

——————–

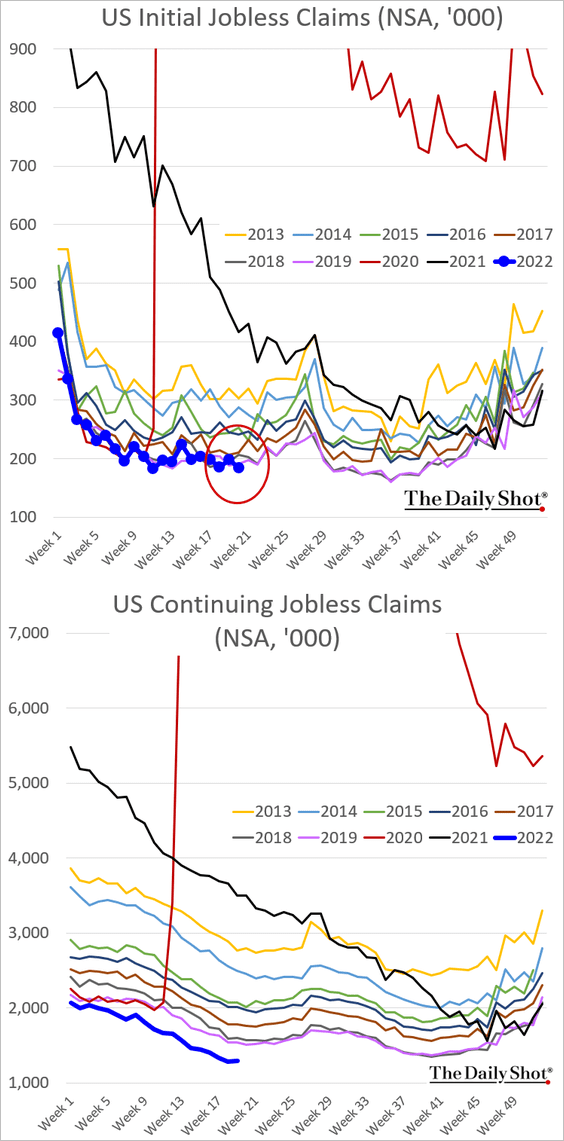

2. Initial jobless claims hit a multi-year low for this time of the year. But economists expect unemployment applications to move up from here.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

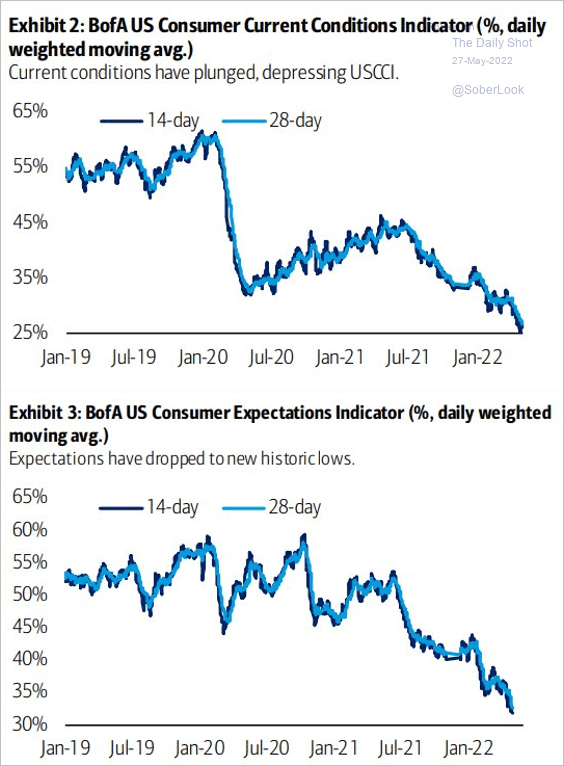

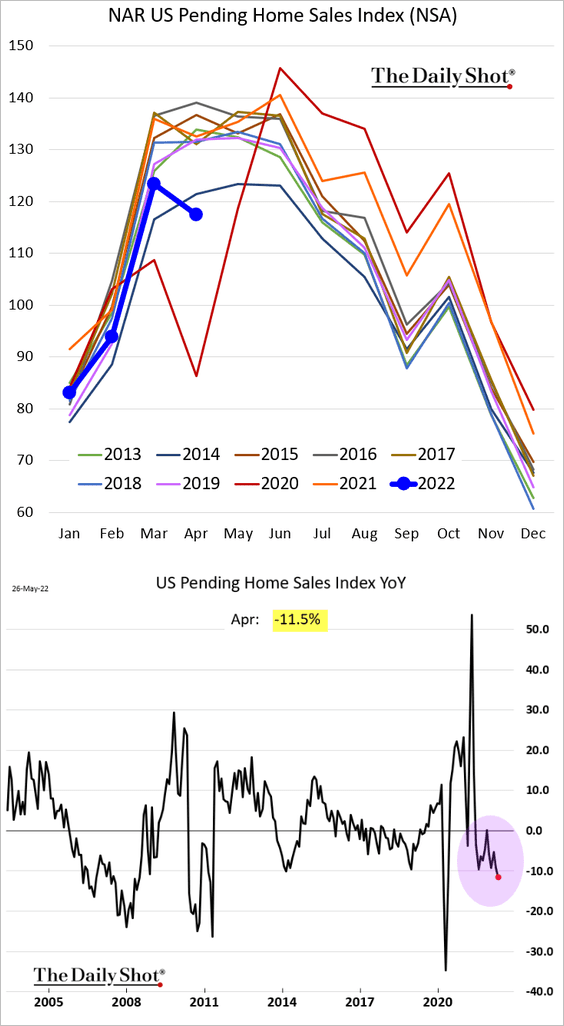

3. As we saw yesterday, high-frequency indicators point to ongoing deterioration in consumer sentiment. Record gasoline prices and the stock market rout are some of the drivers.

Source: BofA Global Research

Source: BofA Global Research

Consumers increasingly think the economy is already in a recession.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

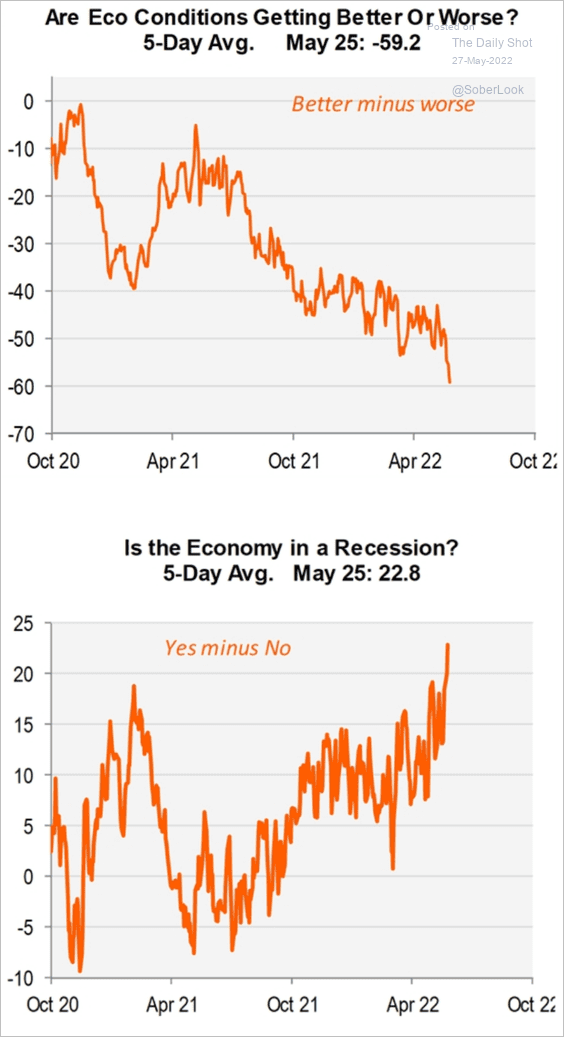

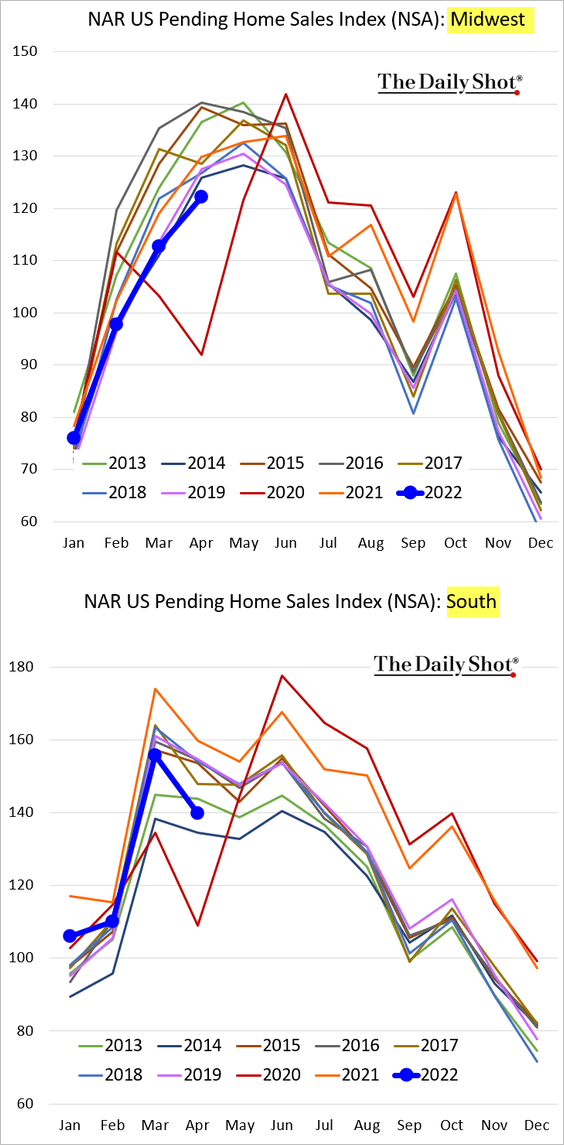

4. Next, we have some updates on the housing market.

• Pending home sales declined more than expected last month, down 11.5% from a year ago.

Here are some regional trends.

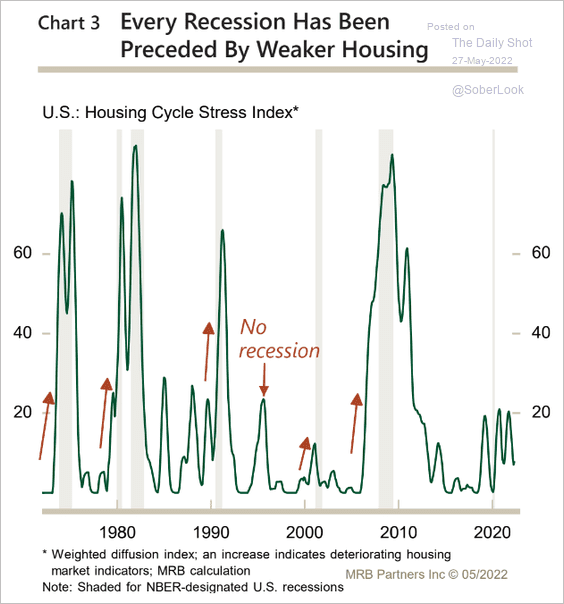

• A key ingredient of a recession start is weakness in the housing market.

Source: MRB Partners

Source: MRB Partners

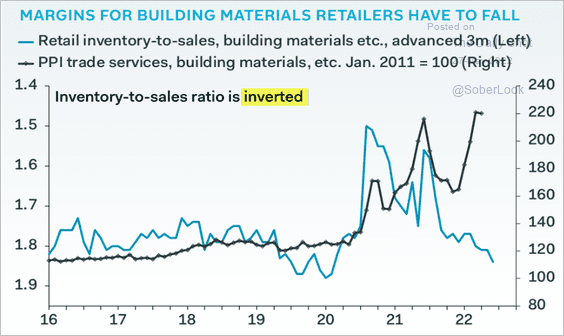

• Building materials inflation should begin to moderate as the retail inventories-to-sales ratio rebounds to pre-COVID levels. We may see an inventory overhang in the sector.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

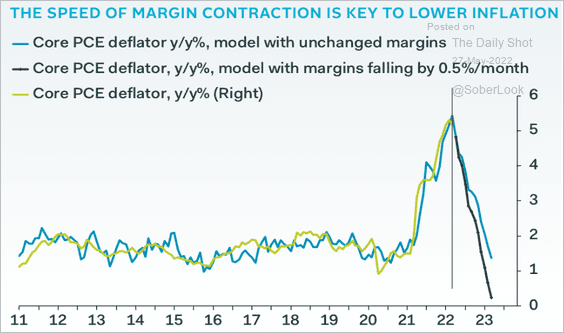

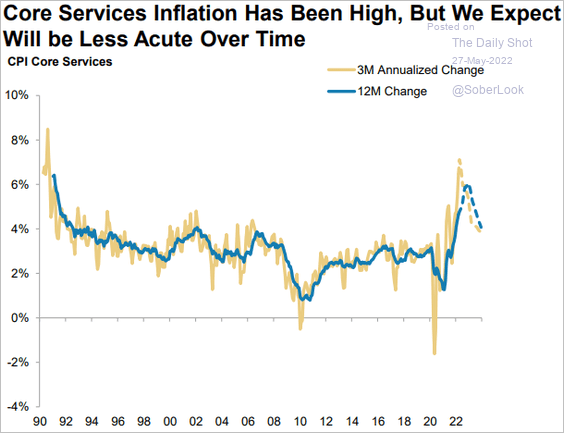

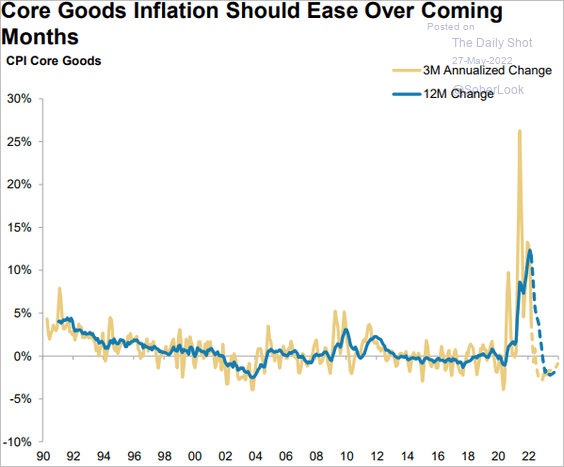

5. Next, we have some additional trends on inflation.

• The pace of moderation in core inflation will depend on corporate margins.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Morgan Stanley sees inflation moderating later this year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

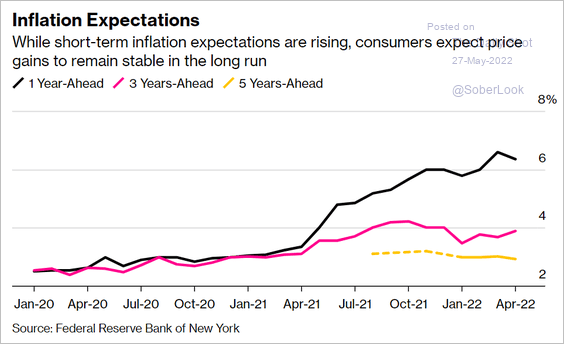

• Longer-term consumer inflation expectations remain “anchored.”

Source: Bloomberg Read full article

Source: Bloomberg Read full article

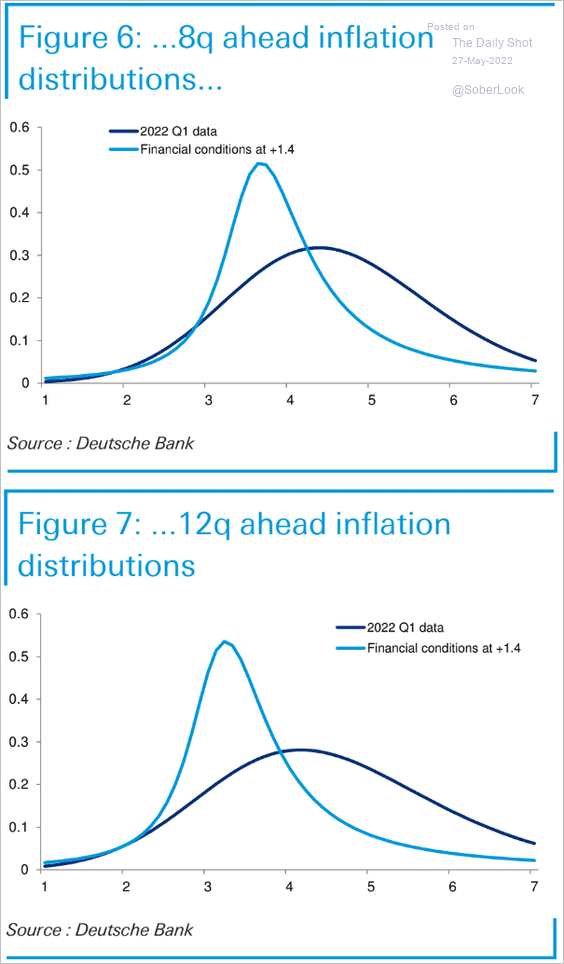

• Financial conditions need to tighten further to limit inflation risks, according to Deutsche Bank. Is the Fed moving too slowly?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

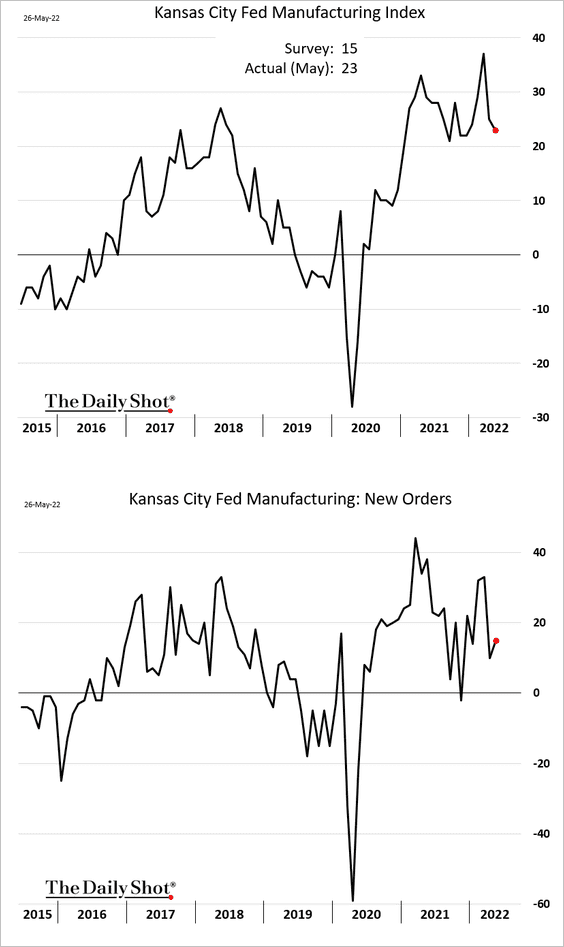

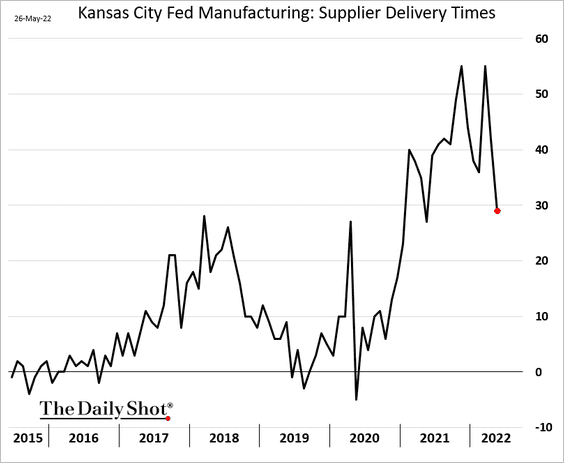

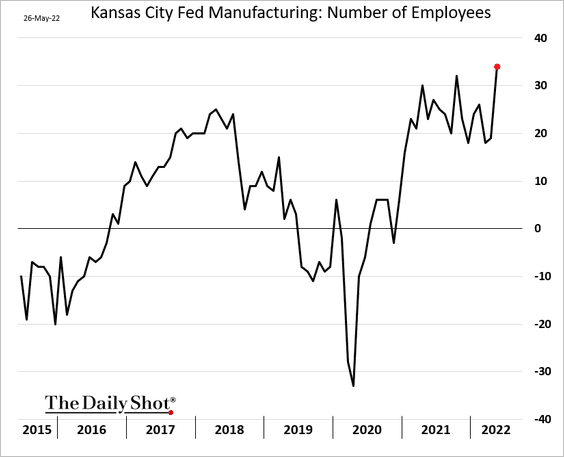

6. The Kansas City Fed’s regional manufacturing report showed factory activity holding up well this month.

• Supply pressures are still extreme but are starting to moderate.

• Hiring has accelerated.

——————–

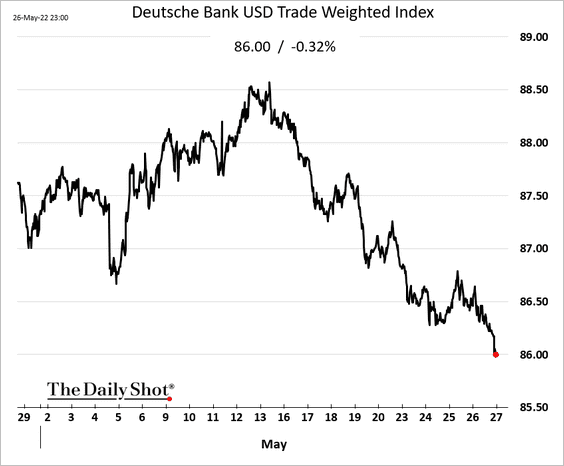

7. It’s been a tough couple of weeks for the US dollar.

Back to Index

Canada

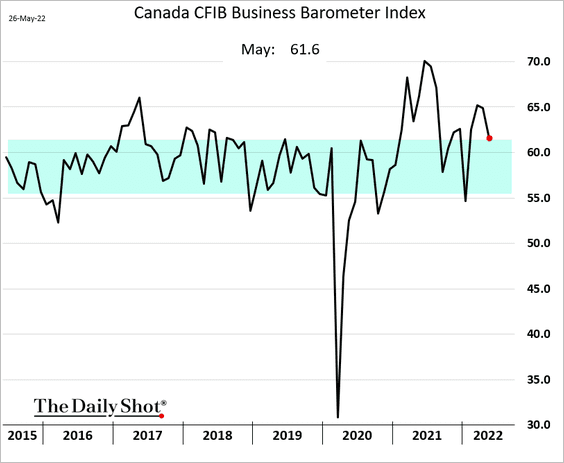

1. The CFIB small/medium-size business indicator softened this month but held above the pre-COVID range.

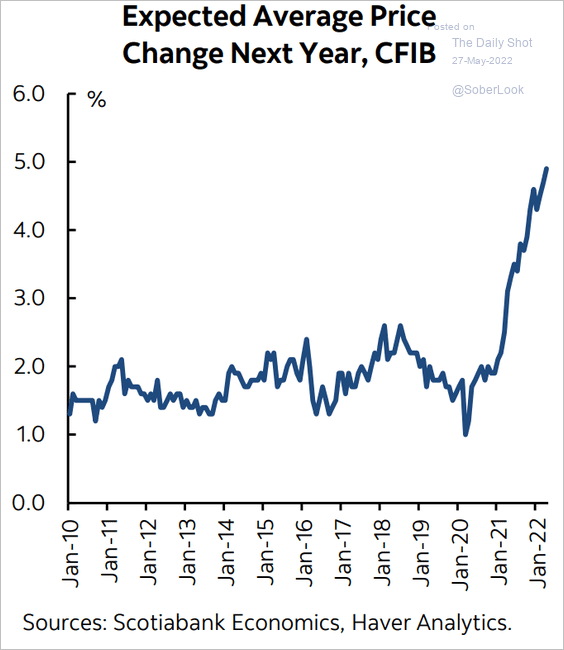

Companies see higher price increases ahead.

Source: Scotiabank Economics

Source: Scotiabank Economics

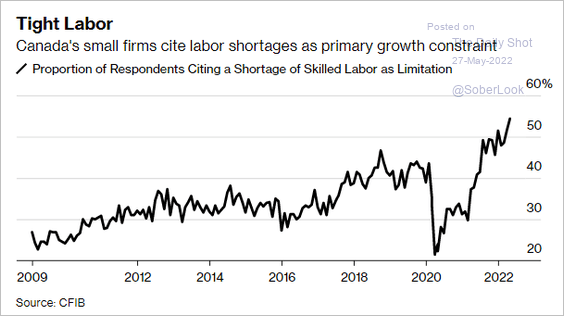

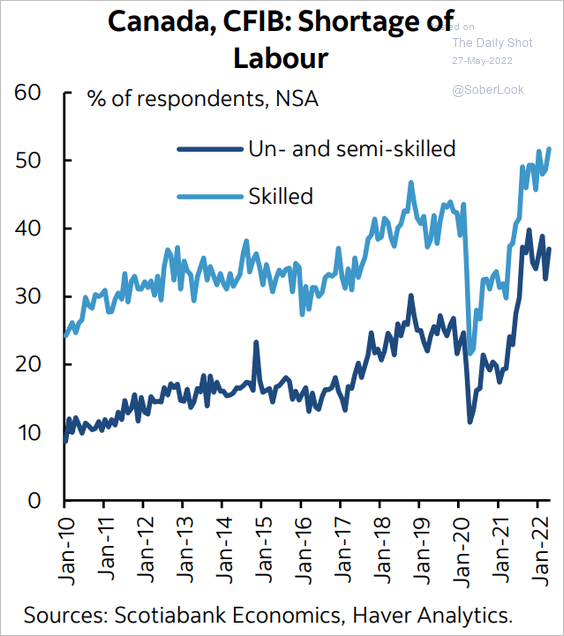

Labor shortages have been worsening (2 charts).

Source: @C_Barraud Read full article

Source: @C_Barraud Read full article

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

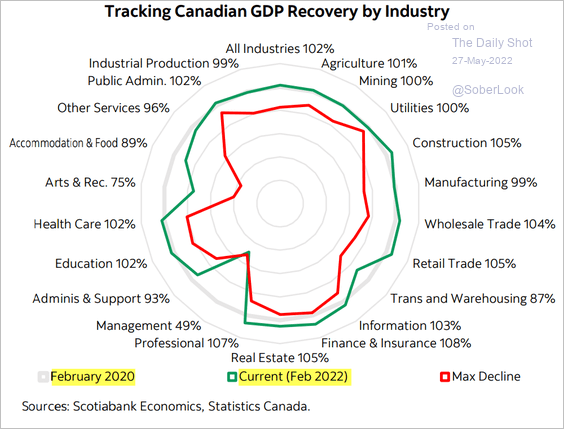

2. This spider chart shows Canada’s post-COVID recovery by industry.

Source: Scotiabank Economics

Source: Scotiabank Economics

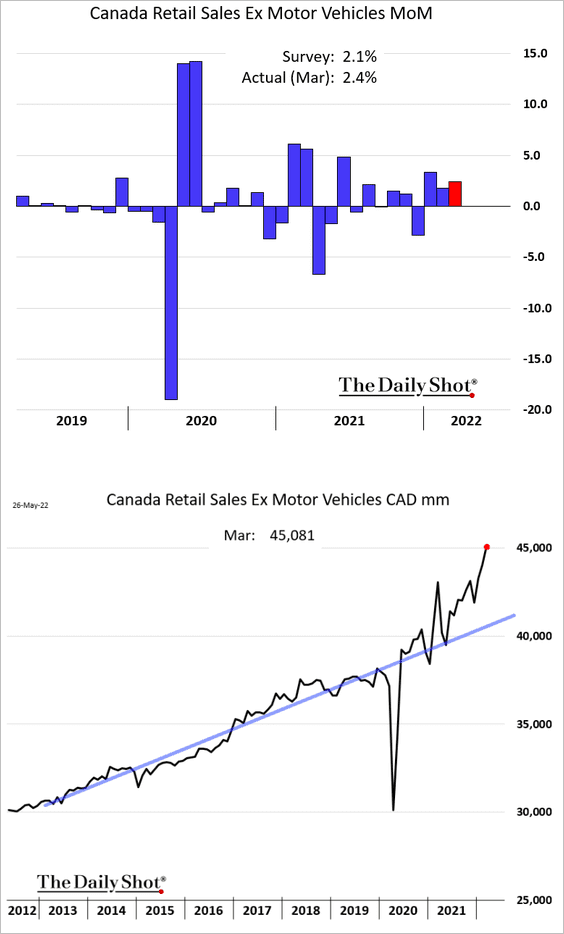

3. Retail sales were firmer than expected in March.

Back to Index

The Eurozone

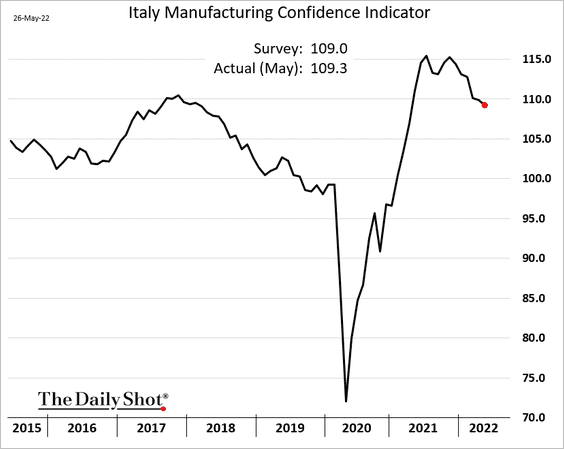

1. Italian manufacturing confidence has been trending lower but remains well above pre-COVID levels.

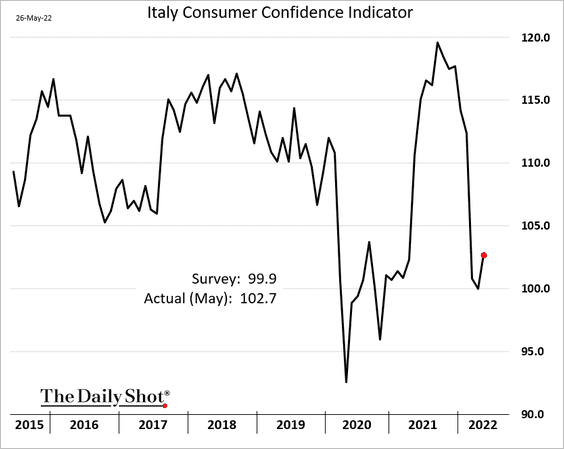

Consumer confidence bounced from the lows.

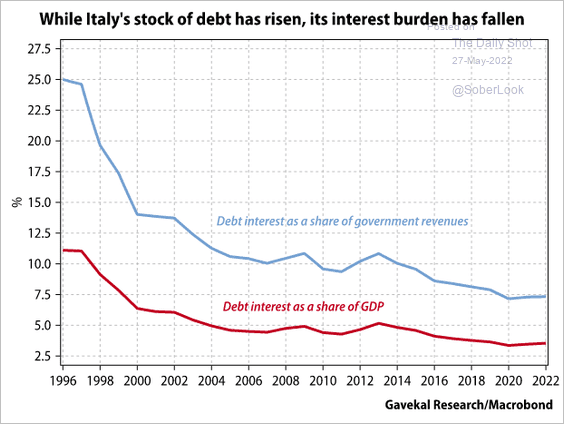

Separately, Italy’s government interest burden decreased dramatically in recent decades.

Source: Gavekal Research

Source: Gavekal Research

——————–

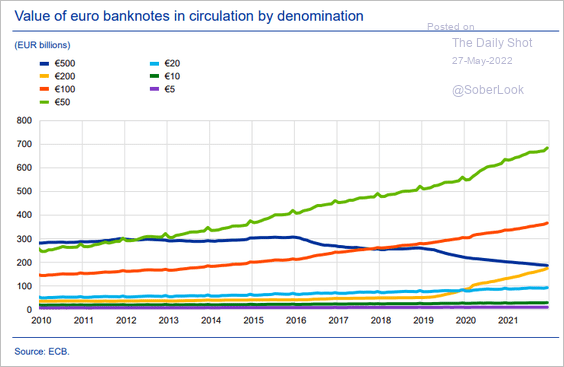

2. Next, we have some data on euro-area cash in circulation.

• Euro banknotes by denomination:

Source: ECB Read full article

Source: ECB Read full article

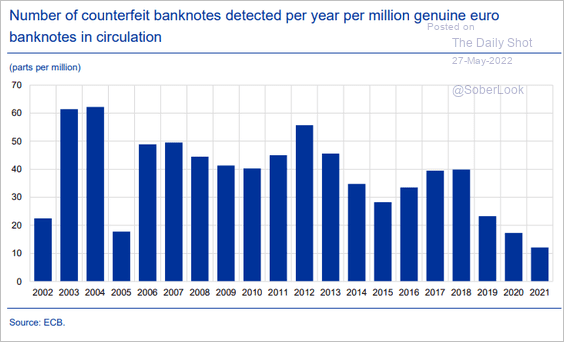

• Counterfit banknotes:

Source: ECB Read full article

Source: ECB Read full article

Back to Index

Asia – Pacific

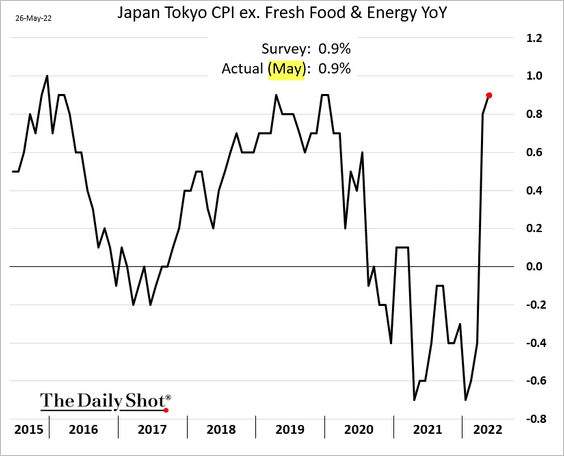

1. The Tokyo core inflation climbed further this month but held below 1%.

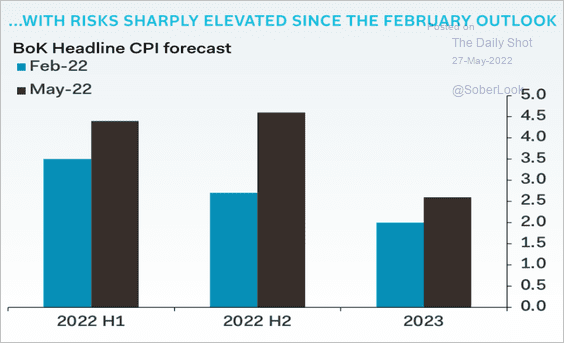

2. South Korea’s central bank sharply increased its CPI projections.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

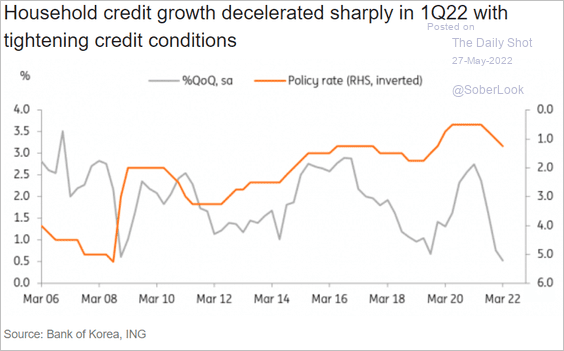

South Korea’s household credit growth decelerated sharply in Q1.

Source: ING

Source: ING

——————–

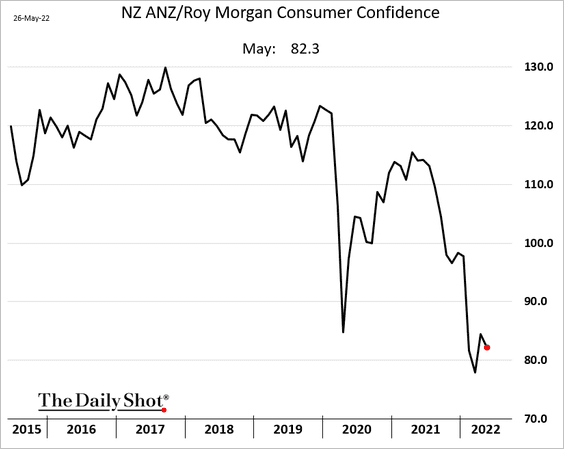

3. New Zealand’s consumer sentiment remains depressed.

Back to Index

China

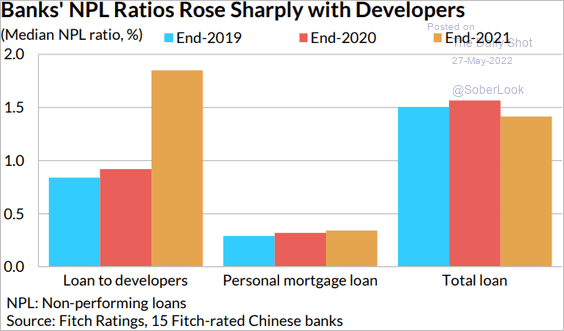

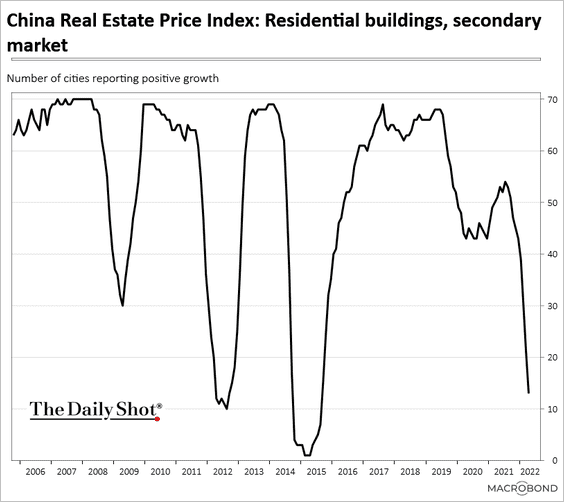

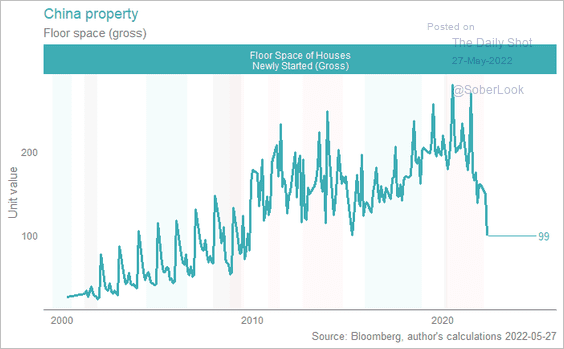

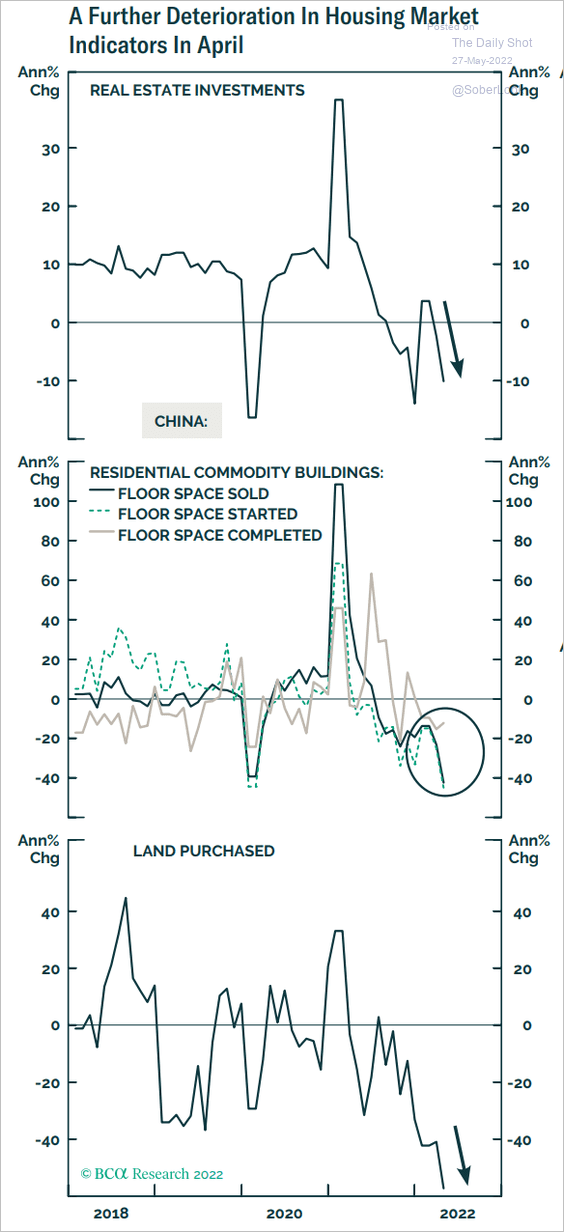

1. China announced an easing of lending requirements for homebuyers. Due to a sharp rise in banks’ NPL ratios with developer loans, however, this may not translate into an effective stimulus for the Chinese economy.

Source: Fitch Ratings

Source: Fitch Ratings

• The housing market remains under pressure (3 charts).

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Source: @berthon_jones

Source: @berthon_jones

Source: BCA Research

Source: BCA Research

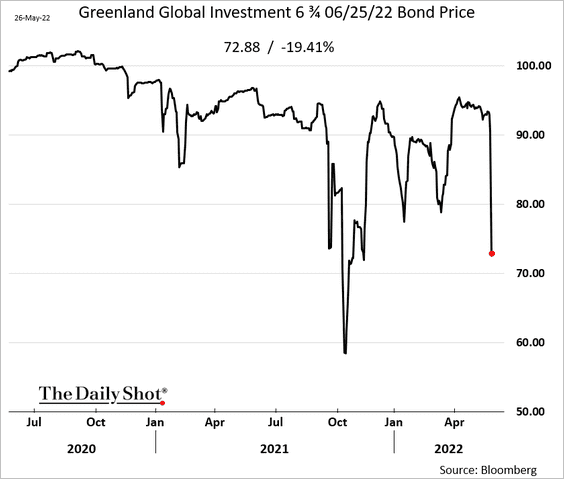

• We continue to see developer debt market stress. Here is Greenland Global’s bond maturing in a month (price).

——————–

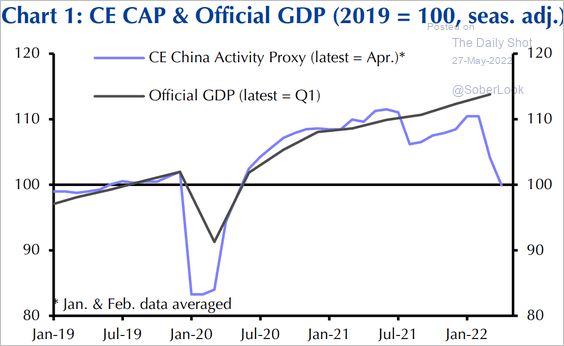

2. This chart shows the Capital Economics Activity Proxy index vs. China’s official GDP.

Source: Capital Economics

Source: Capital Economics

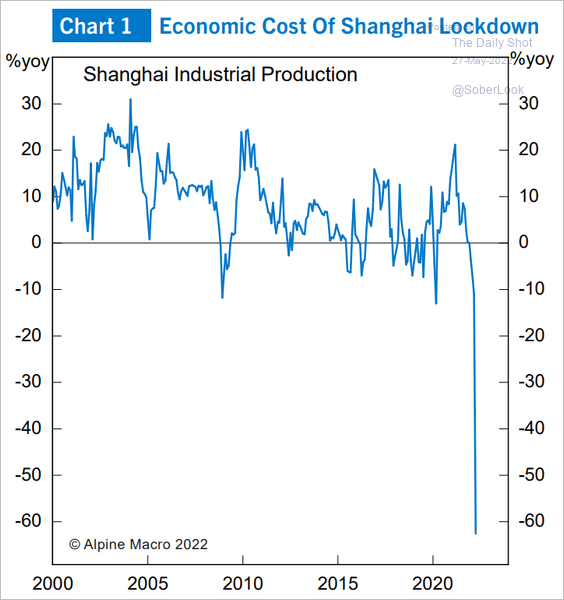

And this is Shanghai’s industrial production.

Source: Alpine Macro

Source: Alpine Macro

——————–

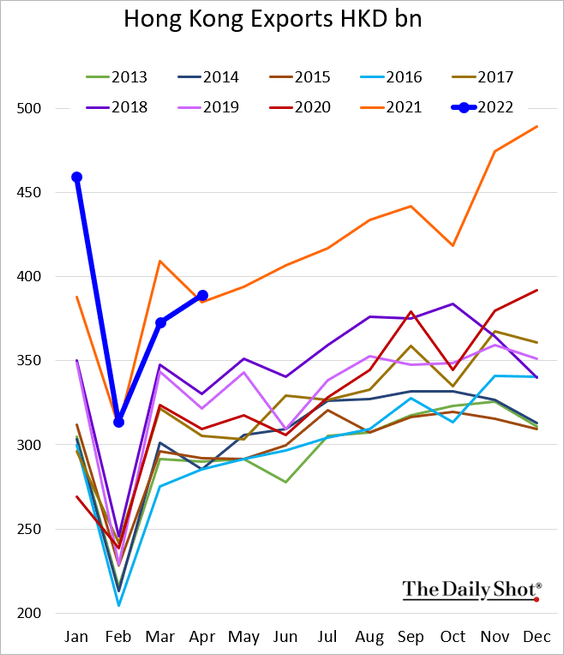

3. Hong Kong’s April exports surprised to the upside.

Back to Index

Emerging Markets

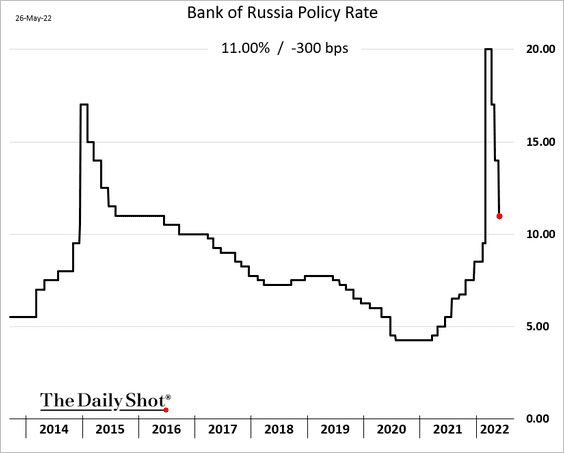

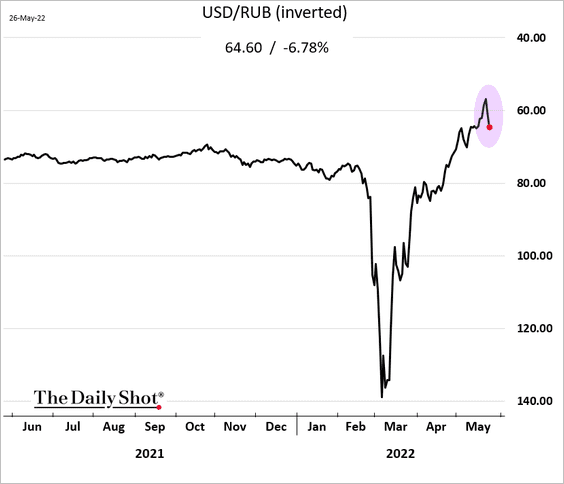

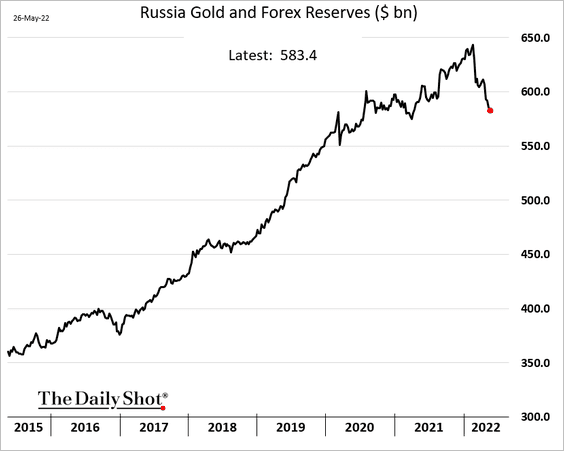

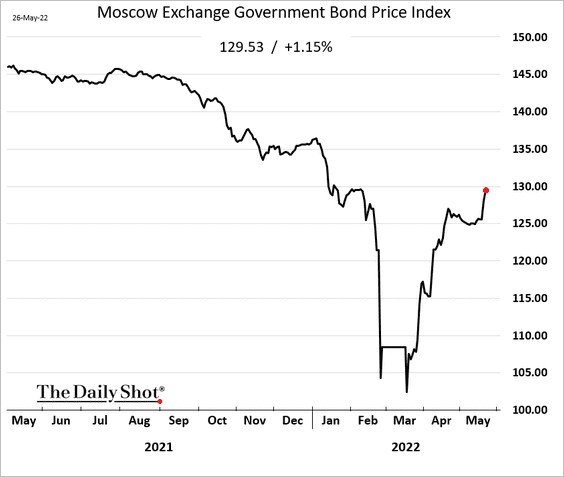

1. Let’s begin with Russia.

• The central bank cut rates by 300 bps, …

… pulling the ruble lower.

• F/X reserves continue to decrease.

• Domestic bond prices have recovered to pre-war levels.

——————–

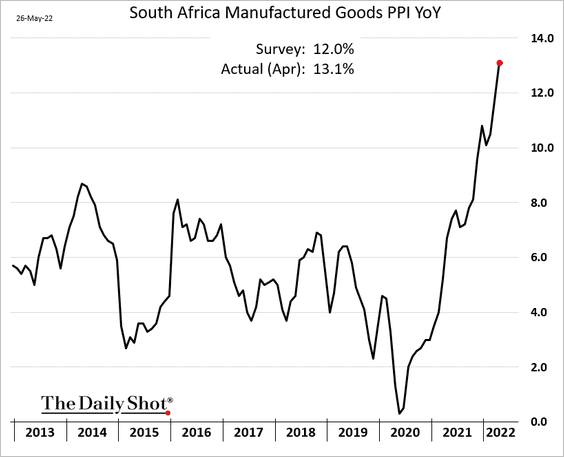

2. South Africa’s PPI breached 13%.

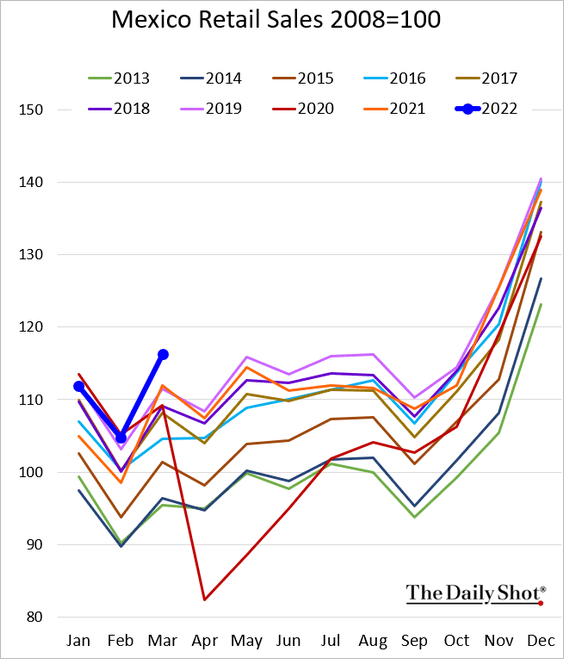

3. Mexican retail sales held up well in March.

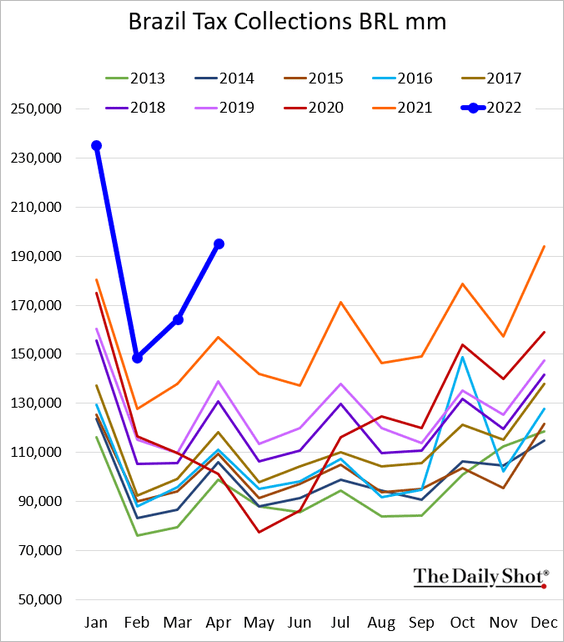

4. Brazil’s government revenues have been robust.

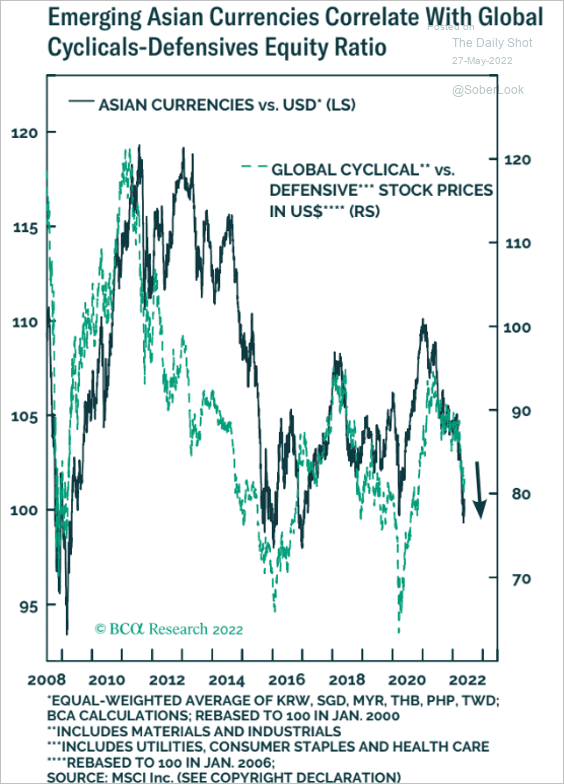

5. EM Asia currencies are correlated with the global cyclicals/defensives equity ratio.

Source: BCA Research

Source: BCA Research

Back to Index

Cryptocurrency

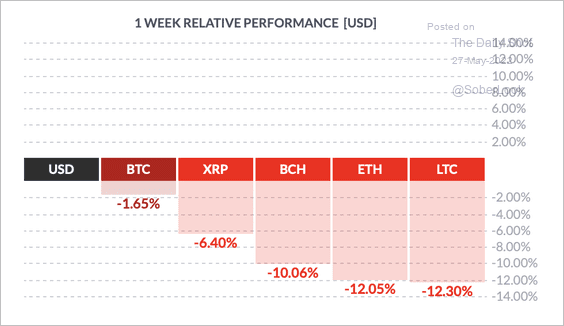

1. It’s been a tough week for cryptos, especially altcoins, as the Terra DeFi crisis deepens.

Source: FinViz

Source: FinViz

Source: @markets Read full article

Source: @markets Read full article

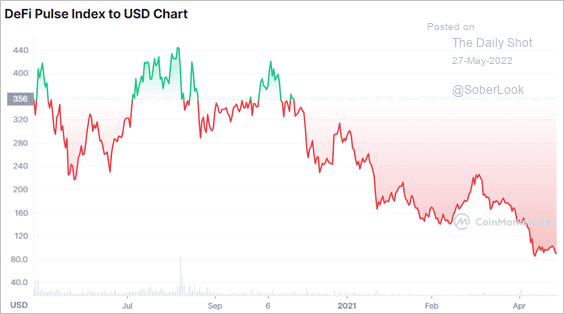

Here is the DeFi Pulse Index.

Source: CoinMarketCap

Source: CoinMarketCap

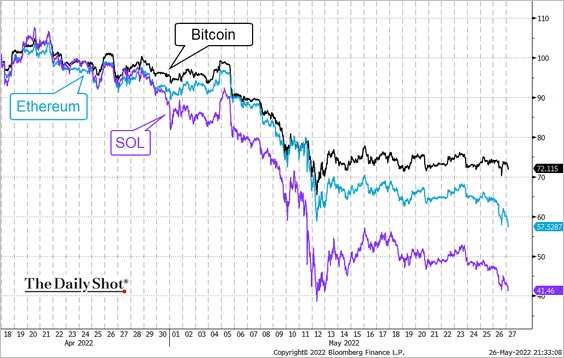

Tokens driving DeFi platforms, such as Solana, have been underperforming.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

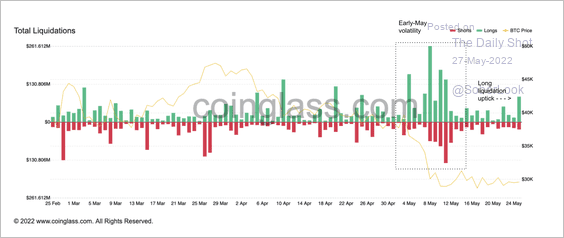

2. There was a slight uptick in BTC long liquidations on Thursday after the cryptocurrency experienced a brief dip toward $28K early in the New York trading day.

Source: Coinglass Read full article

Source: Coinglass Read full article

3. Bitcoin’s market cap relative to the total crypto market cap continues to rise, signaling risk-off conditions.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

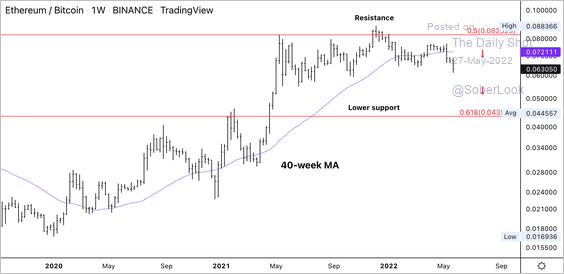

4. The ETH/BTC price ratio extended its decline on Thursday – another risk-off sign.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

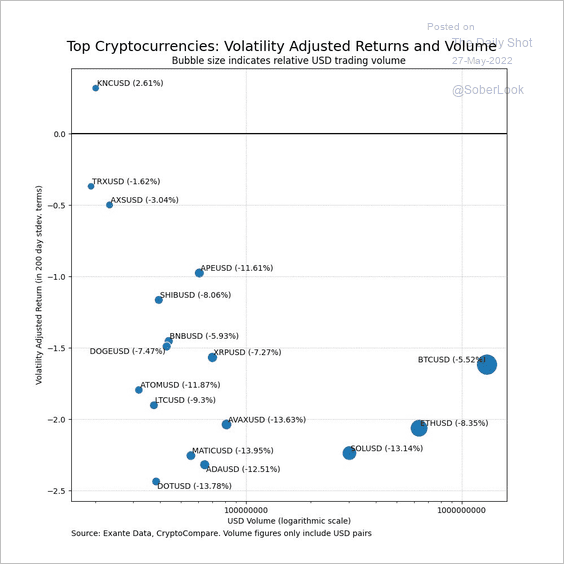

5. This chart shows some of the largest cryptos in terms of volatility-adjusted returns and trading volume.

Source: @ExanteData

Source: @ExanteData

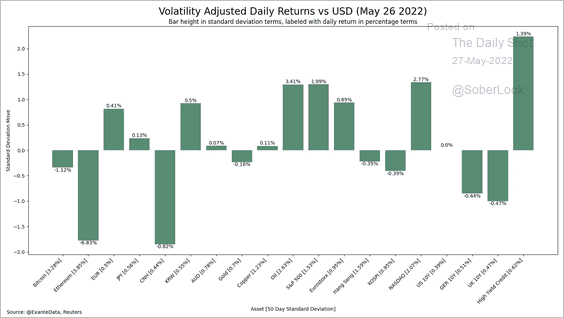

6. Here is a look at volatility-adjusted returns of BTC and ETH versus major global assets on Thursday.

Source: @ExanteData

Source: @ExanteData

Back to Index

Commodities

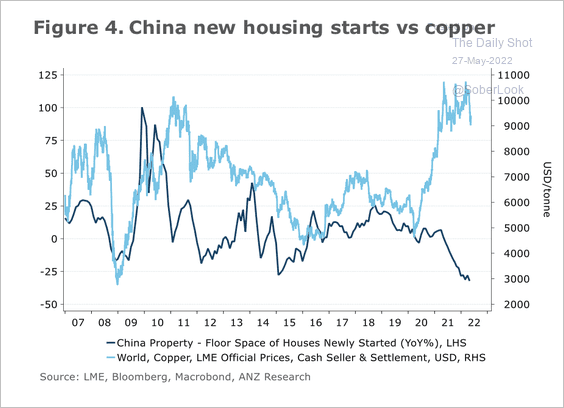

1. The price of copper has sharply diverged from the slowdown in China’s property sector over the past two years.

Source: @ANZ_Research

Source: @ANZ_Research

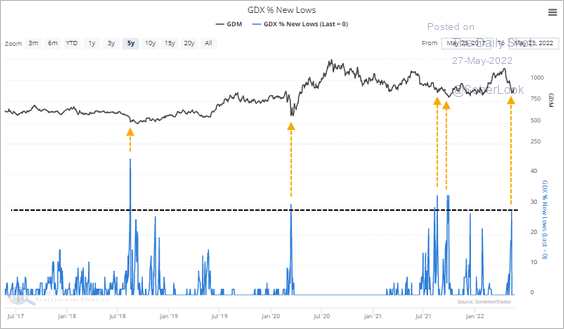

2. More gold mining stocks are making new lows, which could signal a short-term bottom in prices.

Source: SentimenTrader

Source: SentimenTrader

Back to Index

Energy

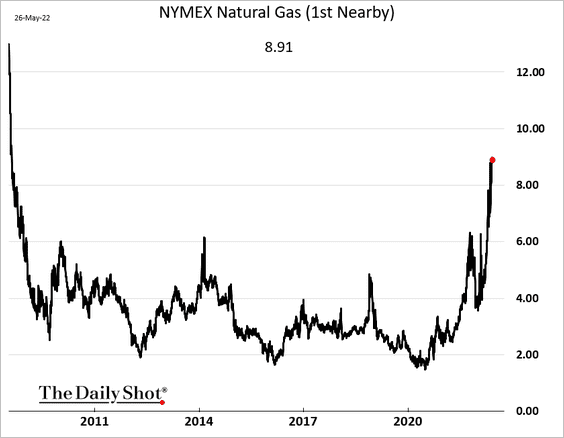

1. US natural gas prices have been strengthening, …

Source: @WSJ Read full article

Source: @WSJ Read full article

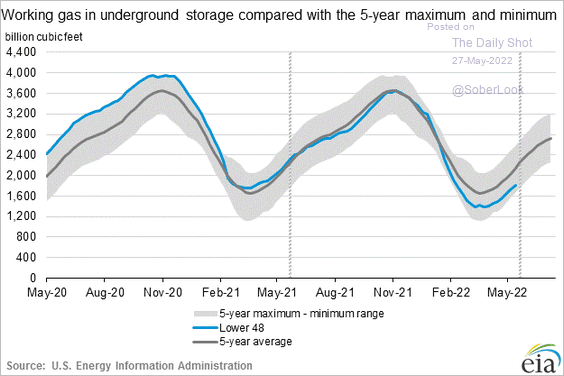

… with inventories holding near the low end of the 5-year range …

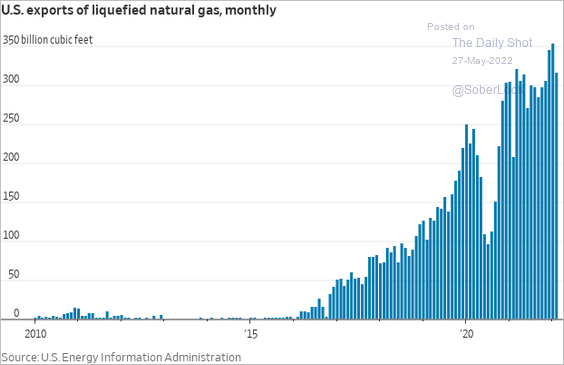

… and LNG exports surging.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

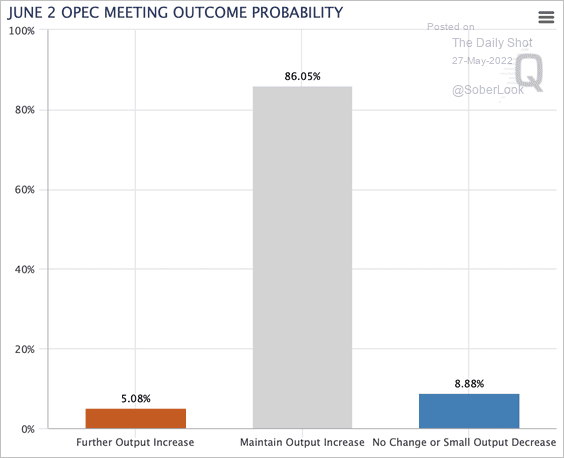

2. The market expects OPEC to maintain its output increase at the June meeting.

Source: CME Group

Source: CME Group

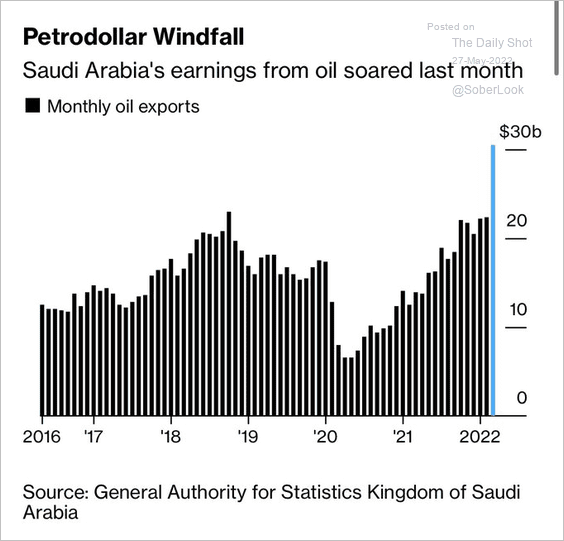

With OPEC oil revenues surging, there is limited incentive to boost production (OPEC tends to have procyclical incentives).

Source: @JavierBlas Read full article

Source: @JavierBlas Read full article

——————–

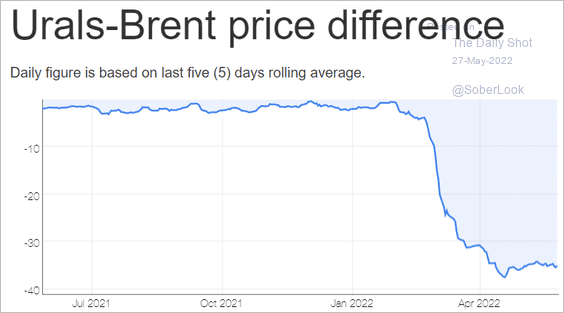

3. Russian oil continues to trade at a massive discount to Brent.

Source: Neste

Source: Neste

Back to Index

Equities

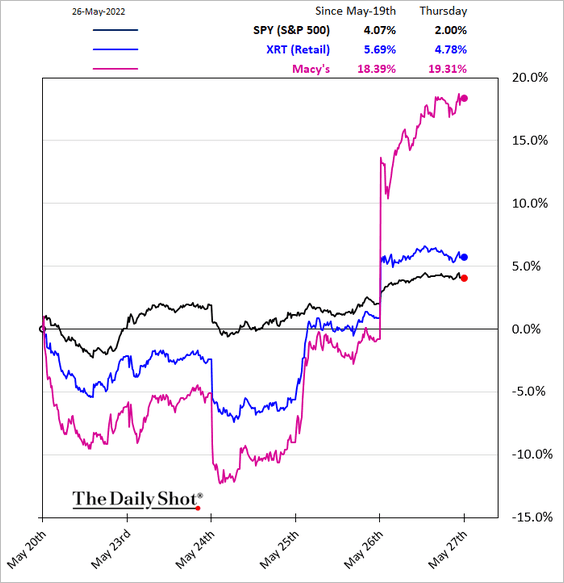

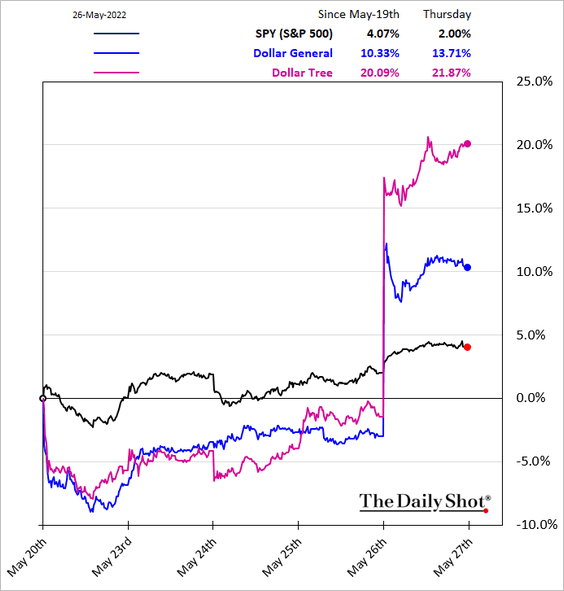

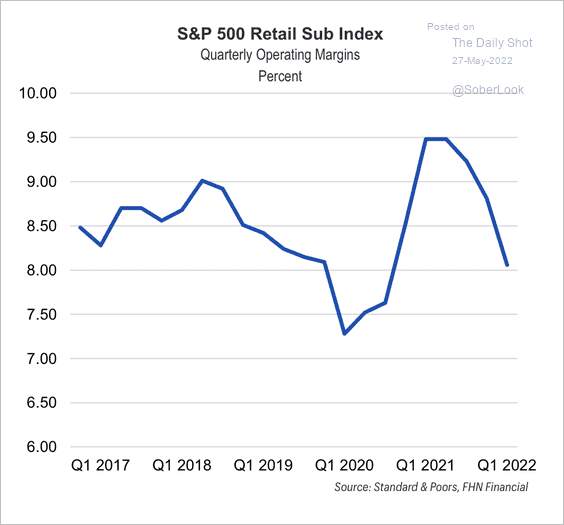

1. US retailers are down but not out.

Source: CNBC Read full article

Source: CNBC Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

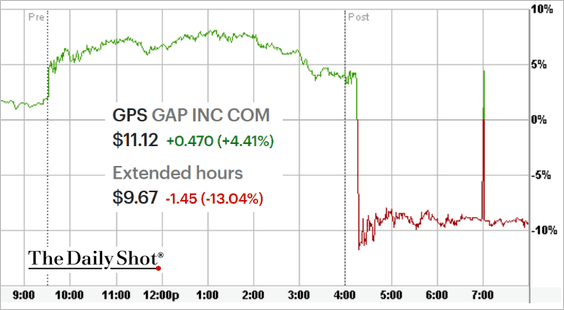

• However, the sector got some unwelcome news after hours from Gap.

Source: CNBC Read full article

Source: CNBC Read full article

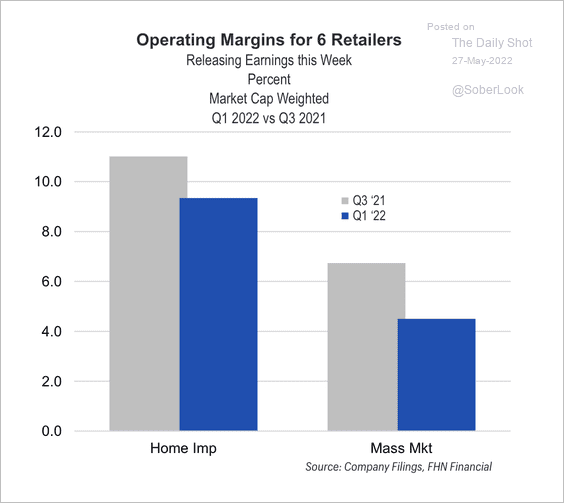

• Q1 further reset operating margins for US retailers compared with last summer (2 charts).

Source: FHN Financial

Source: FHN Financial

Source: FHN Financial

Source: FHN Financial

——————–

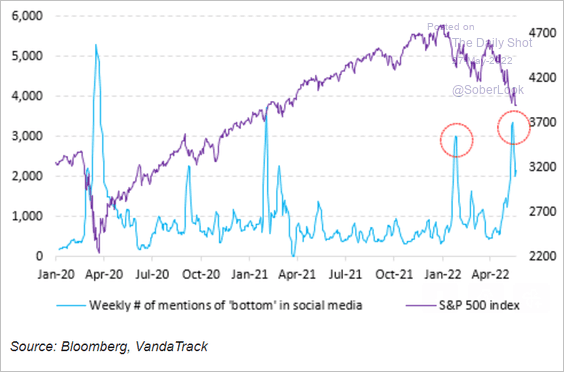

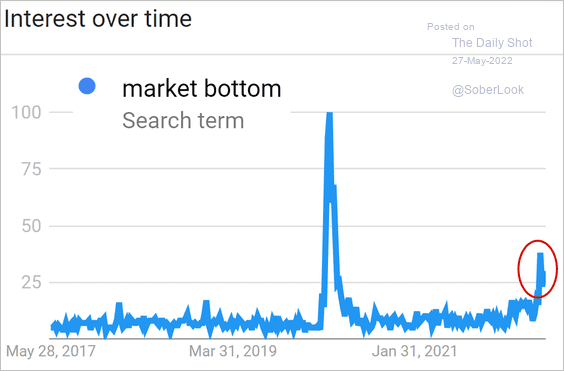

2. Social media has been buzzing about “market bottom.”

Source: Vanda Research

Source: Vanda Research

Here is the Google search activity.

Source: Google Trends

Source: Google Trends

——————–

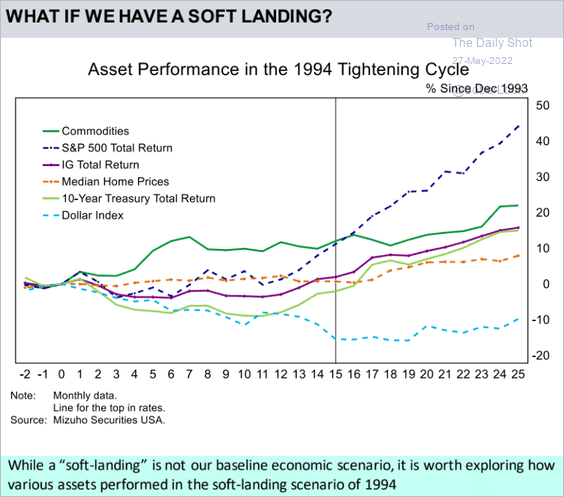

3. A soft landing could boost share prices.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

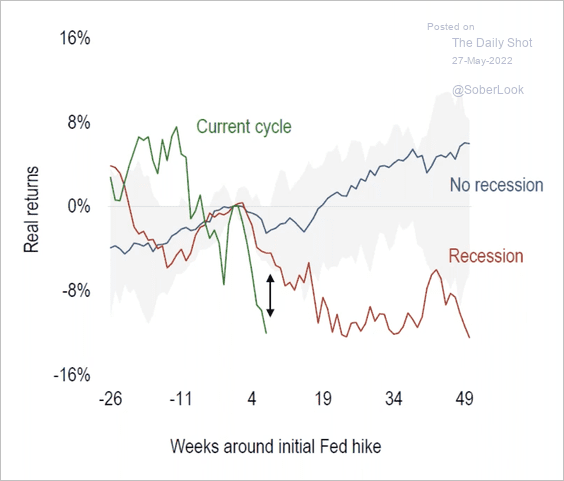

This chart shows the real returns of US stocks around Fed hikes.

Source: Numera Analytics

Source: Numera Analytics

——————–

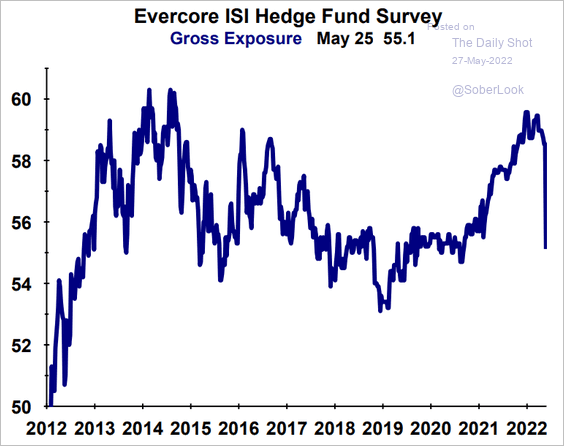

4. Equity hedge funds have significantly trimmed their balance sheets.

Source: Evercore ISI Research

Source: Evercore ISI Research

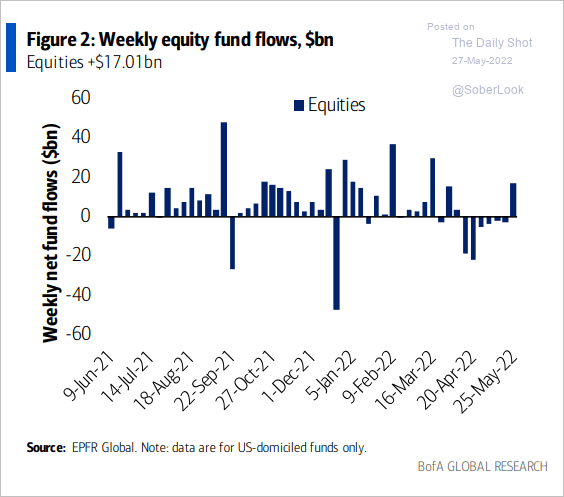

5. Equity mutual funds and ETFs finally got some inflows.

Source: BofA Global Research

Source: BofA Global Research

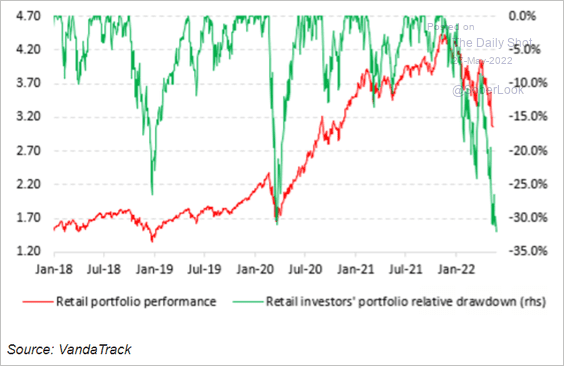

6. Retail investors’ portfolios are deep under water.

Source: Vanda Research

Source: Vanda Research

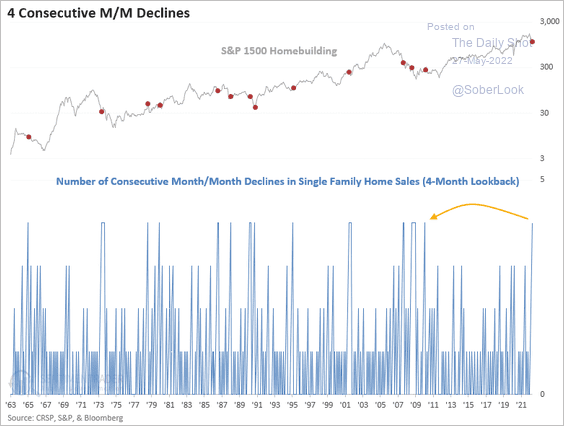

7. The recent slowdown in housing points to further declines in homebuilding stocks.

Source: SentimenTrader

Source: SentimenTrader

Back to Index

Alternatives

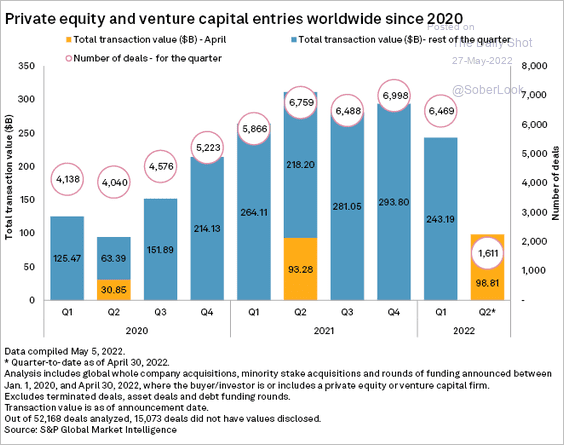

1. Private equity activity has been relatively strong so far this year, despite the headwinds.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

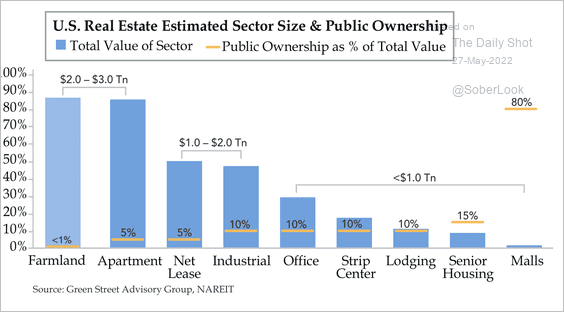

2. Very few institutions own farmland.

Source: Quill Intelligence

Source: Quill Intelligence

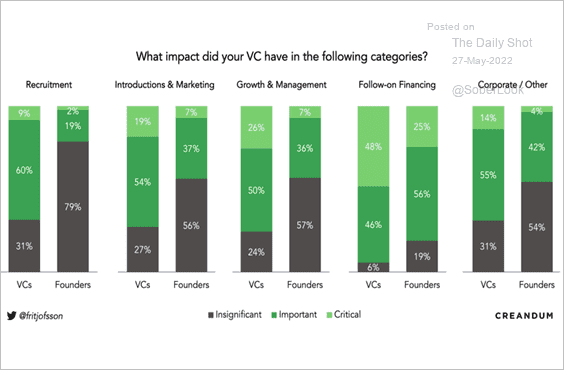

3. VCs tend to overstate their impact on portfolio companies.

Source: Carl Fritjofsson Read full article

Source: Carl Fritjofsson Read full article

Back to Index

Rates

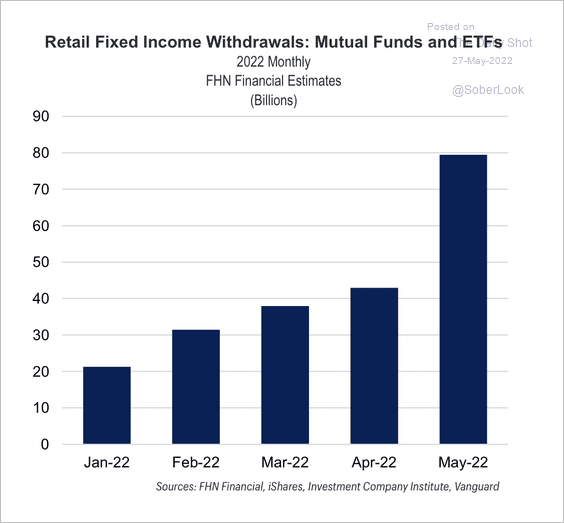

1. Retail investors accelerated their exit from fixed-income mutual funds this month.

Source: FHN Financial

Source: FHN Financial

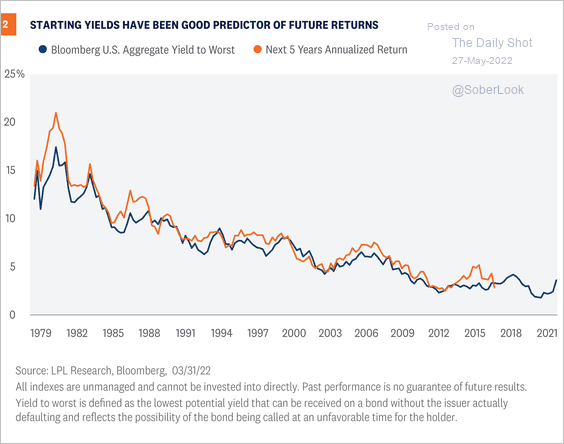

2. Starting yields tend to be a good predictor of future total returns.

Source: LPL Research

Source: LPL Research

Back to Index

Global Developments

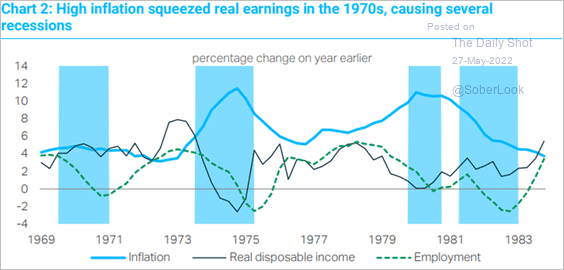

1. The squeeze in real earnings in the 1970s resulted in multiple recessions during that decade.

Source: TS Lombard

Source: TS Lombard

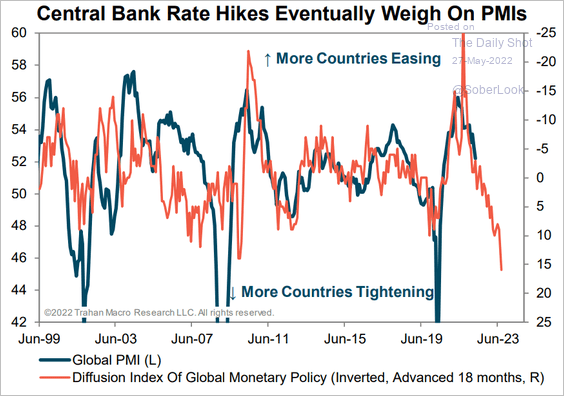

2. Central banks’ policy tightening is expected to take a toll on global economic activity.

Source: Trahan Macro Research

Source: Trahan Macro Research

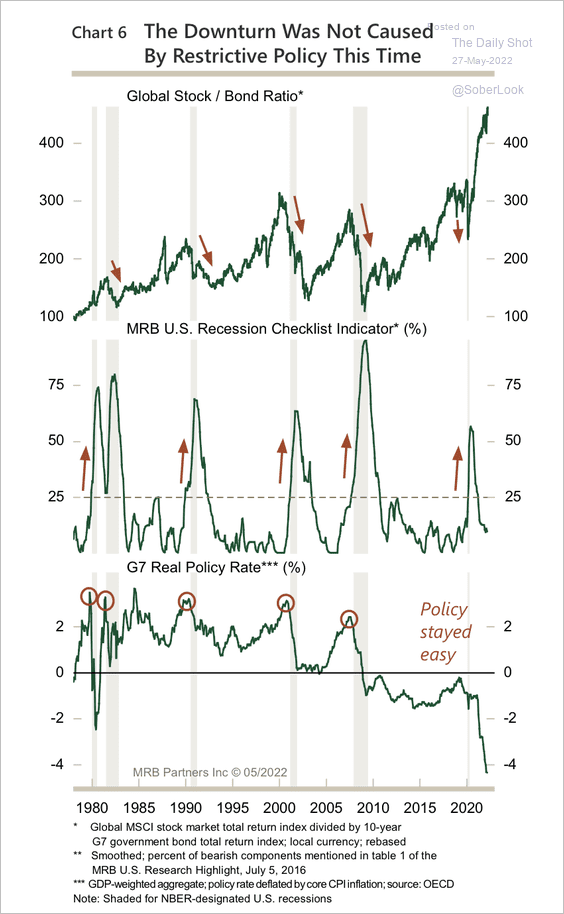

The recent economic downturn was not caused by restrictive monetary policy. Rather, officials have tolerated rising asset prices as long as inflation was perceived to be in hibernation, according to BCA Research.

Source: BCA Research

Source: BCA Research

——————–

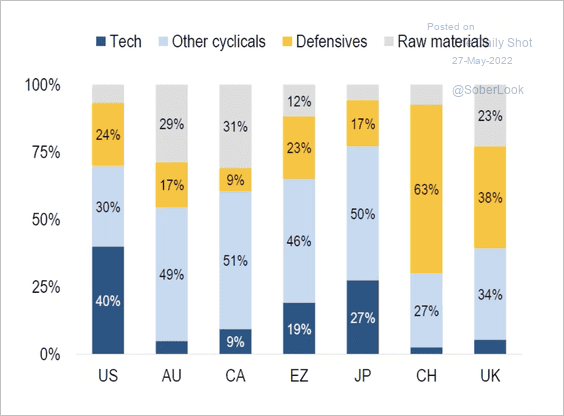

3. Developed-market non-US stocks have higher defensive/low-tech weights as a share of market cap.

Source: Numera Analytics

Source: Numera Analytics

——————–

Food for Thought

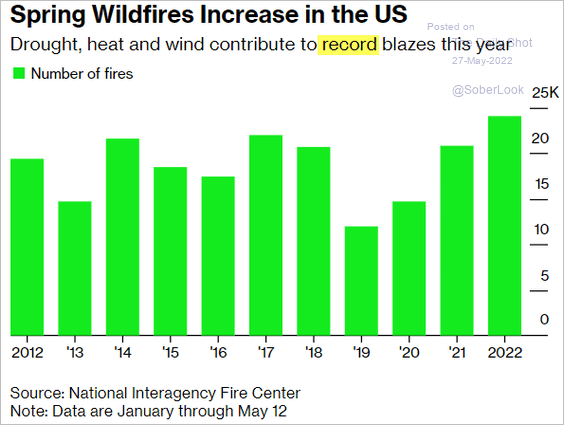

1. US wildfires:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

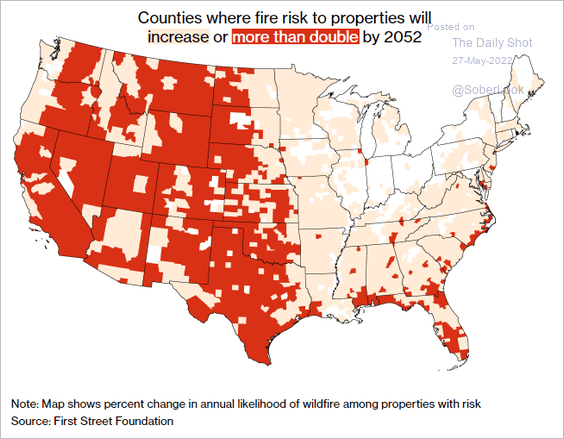

Increasing wildfire risks:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

——————–

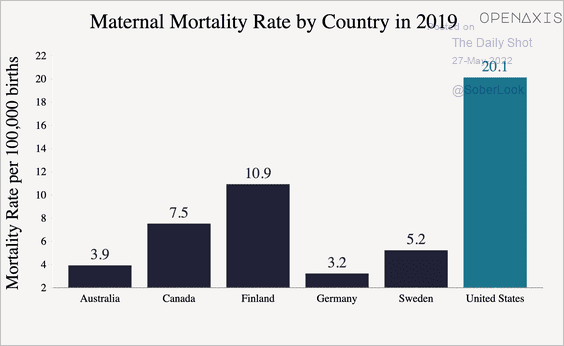

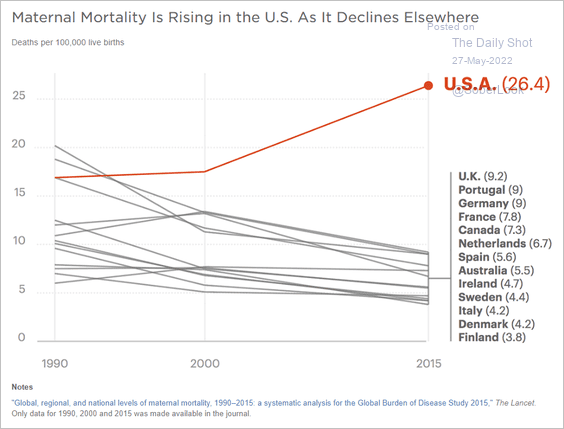

2. Maternal mortality rates:

Source: OpenAxis

Source: OpenAxis

Source: NPR Read full article

Source: NPR Read full article

——————–

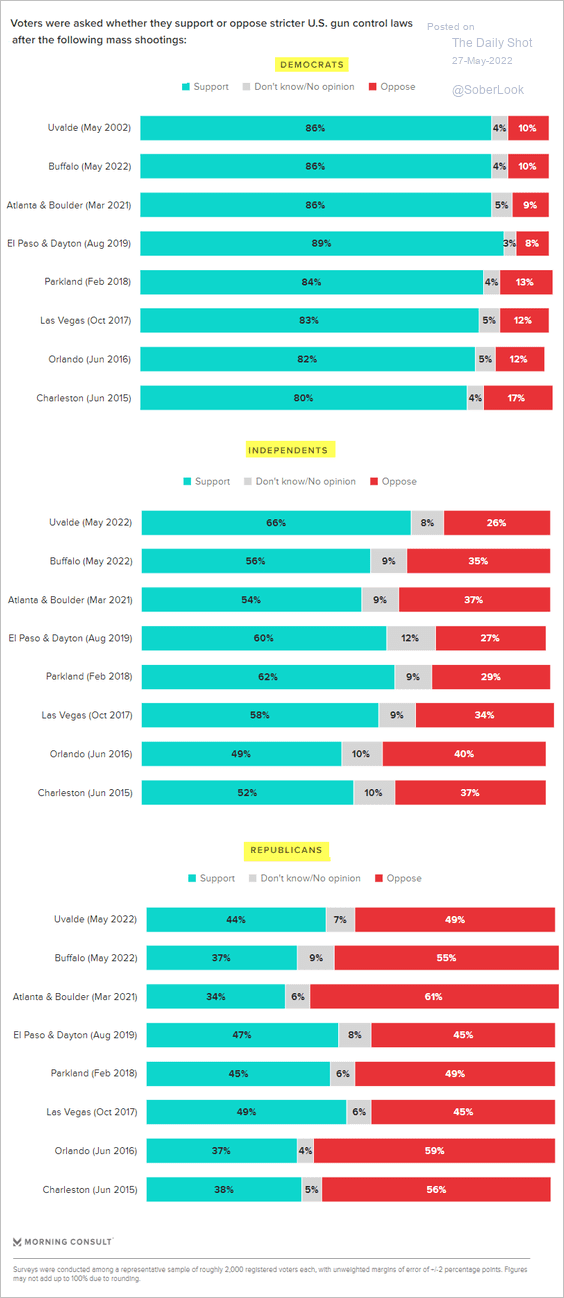

3. Views on stricter US gun control laws after the following mass shootings:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

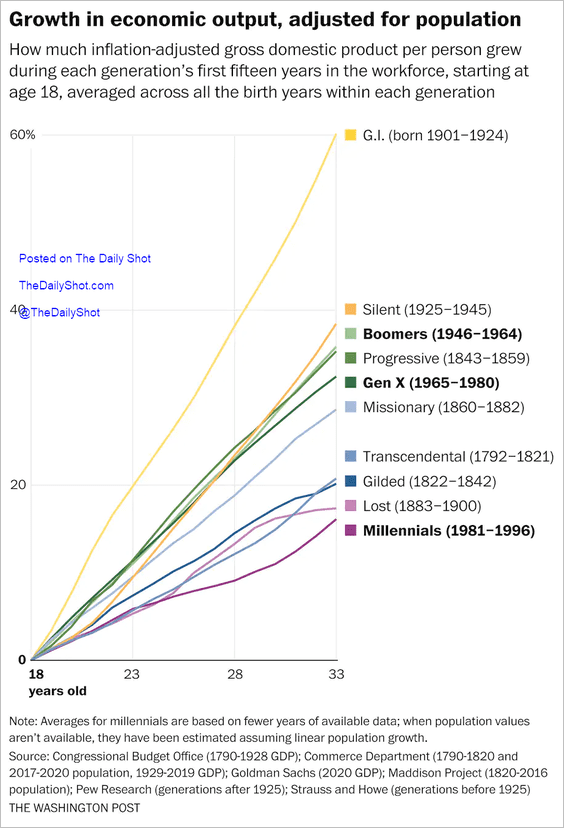

4. Growth in economic output by generation:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

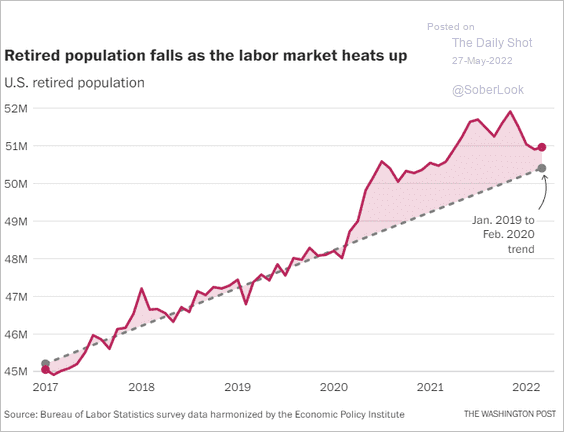

5. Retired population in the US.

Source: The Washington Post Read full article

Source: The Washington Post Read full article

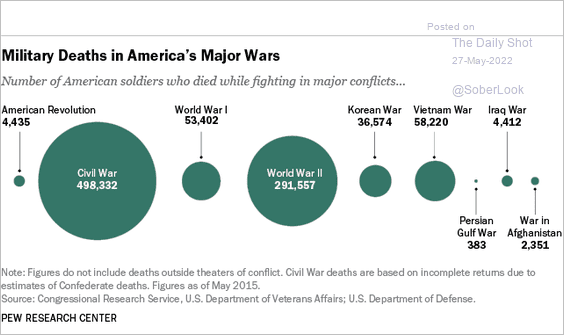

6. Military deaths in US major wars:

Source: Pew Research Center

Source: Pew Research Center

——————–

Have a great weekend and a safe Memorial Day.

Back to Index