The Daily Shot: 01-Jun-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

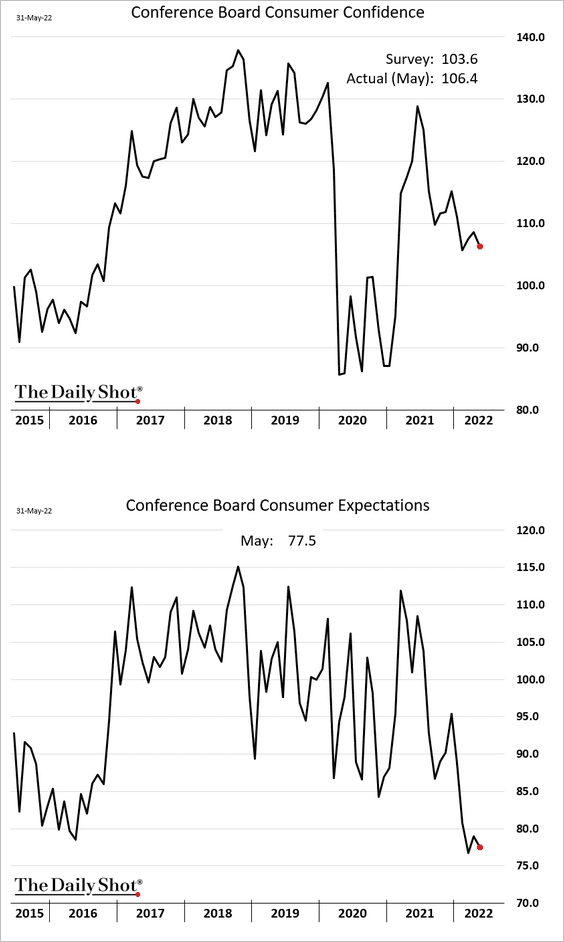

1. The Conference Board’s consumer confidence index was firmer than expected this month.

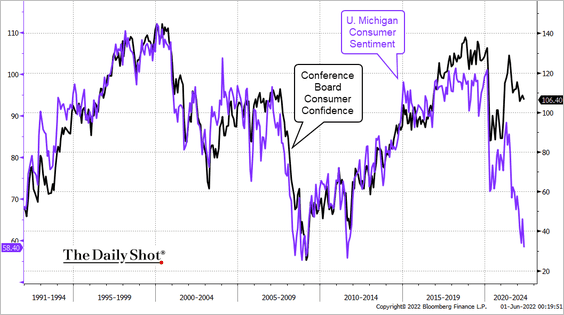

The gap between this index and the one from the University of Michigan continues to widen.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

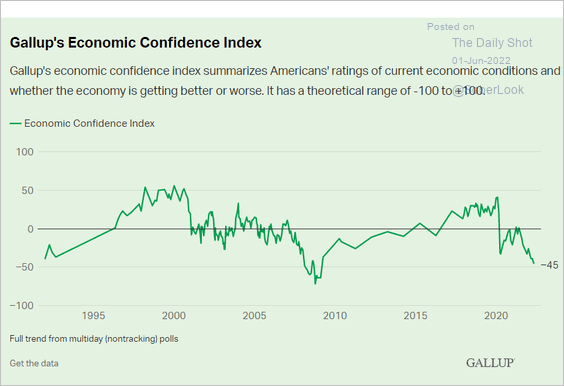

Separately, the economic confidence index from Gallup hit the lowest level since the Financial Crisis.

Source: Gallup

Source: Gallup

——————–

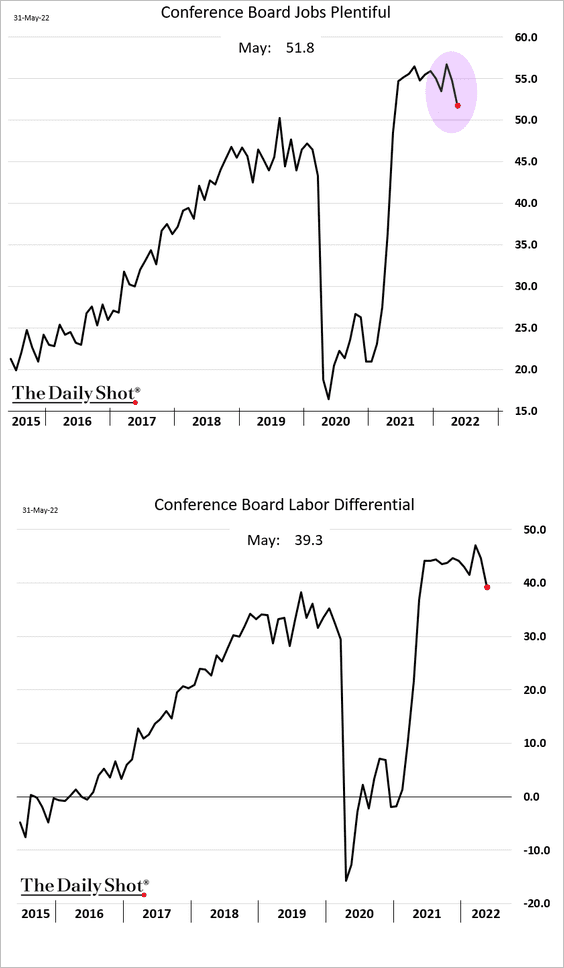

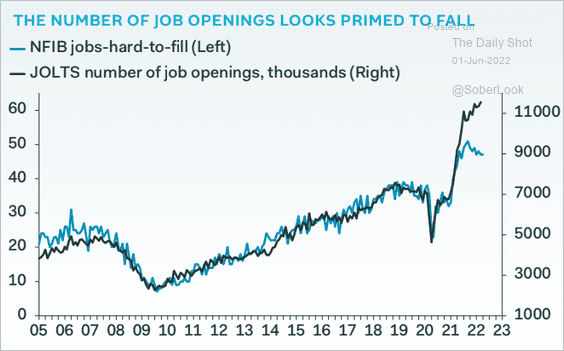

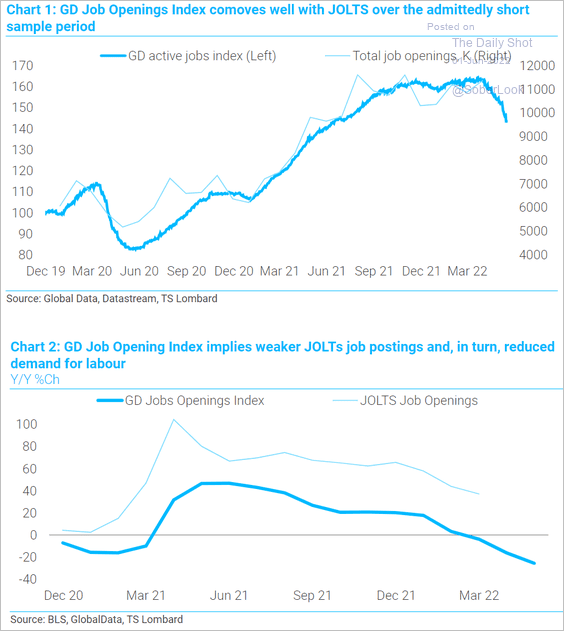

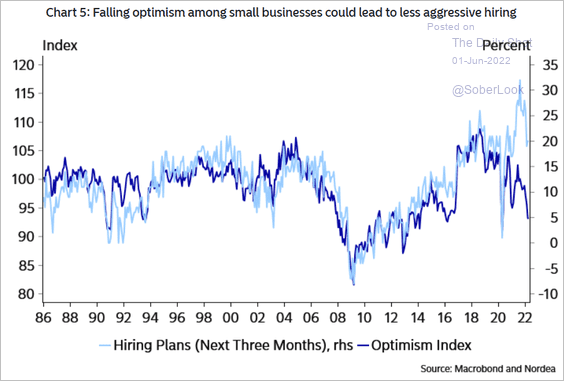

2. Various indicators point to slowing demand for labor.

• The Conference Board’s “jobs plentiful” index and the labor differential (“plentiful” – “hard to get”) hit the lowest level in a year (although both indicators are still very strong).

• Job openings are expected to ebb (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: TS Lombard

Source: TS Lombard

• Deteriorating small business sentiment suggests that hiring will slow.

Source: Nordea Markets

Source: Nordea Markets

——————–

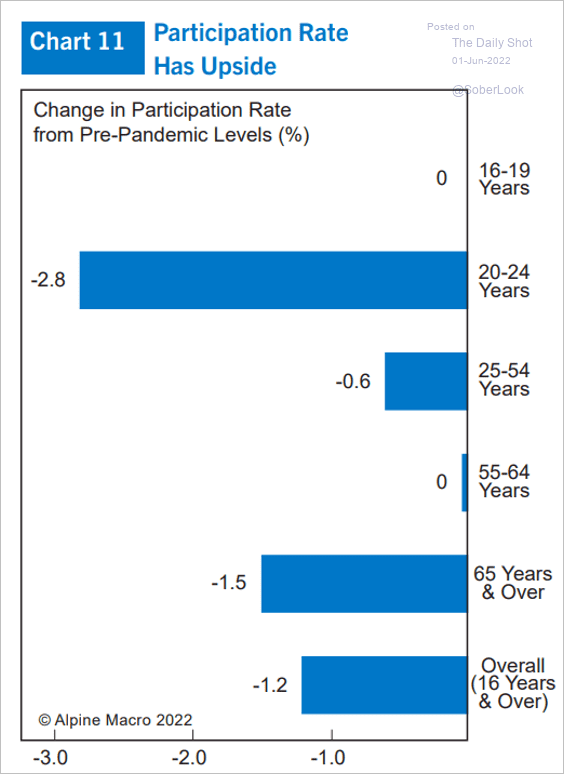

3. This chart shows labor force participation changes by age vs. pre-COVID levels.

Source: Alpine Macro

Source: Alpine Macro

4. Next, we have some updates on the housing market.

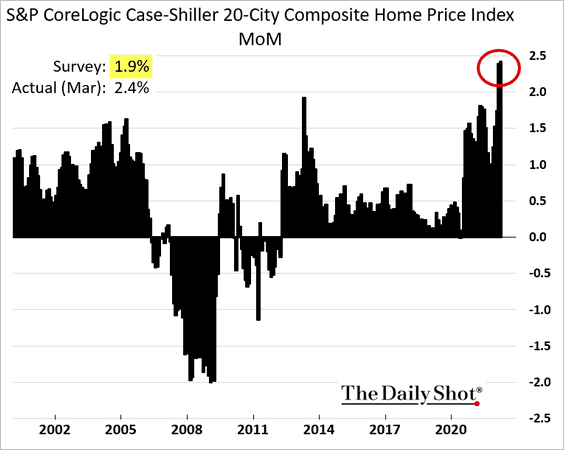

• Home price appreciation hit a record high in March, exceeding 21%. This was likely the peak.

Here are the monthly price gains.

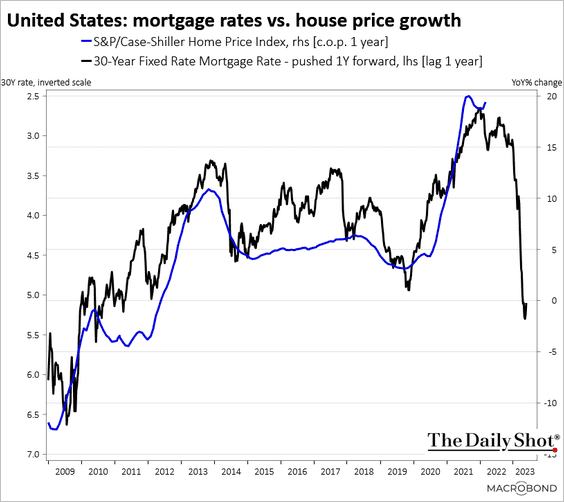

• Higher mortgage rates point to moderating home price appreciation.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

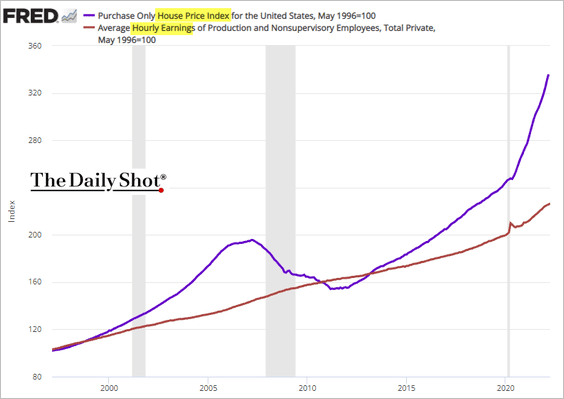

• The gap between home prices and wages continues to widen. This was sustainable when mortgage rates dipped below 3%, but not now.

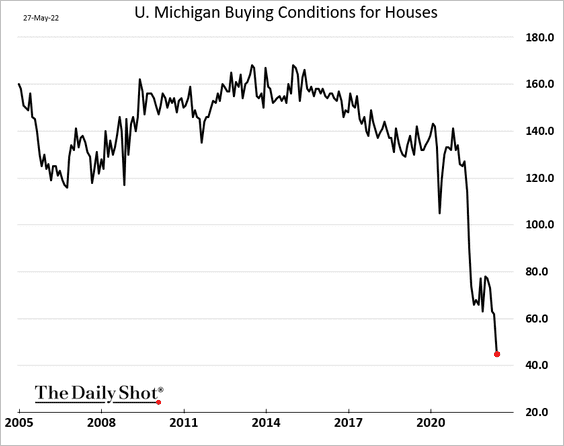

• The U. Michigan index of buying conditions for houses (based on consumer sentiment) has collapsed.

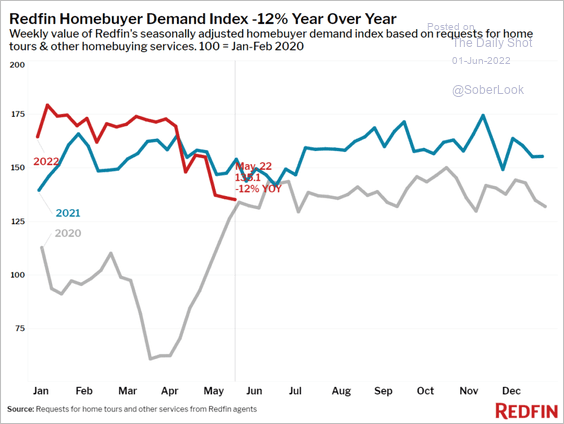

• Housing demand continues to ease, …

Source: Redfin

Source: Redfin

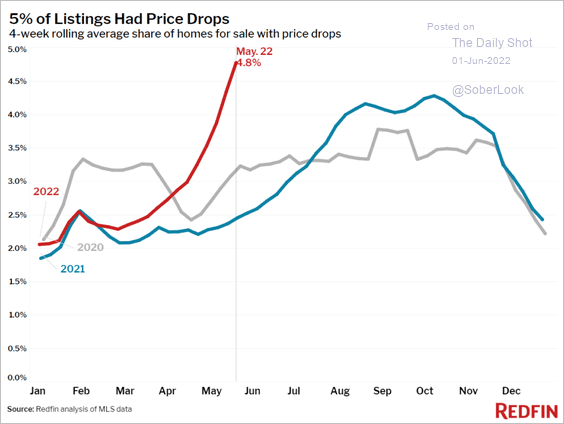

… forcing more sellers to cut prices.

Source: Redfin

Source: Redfin

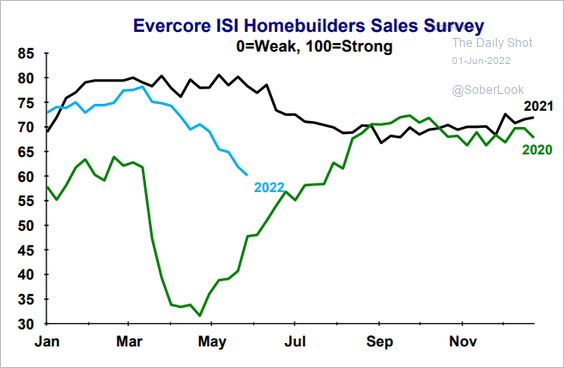

• Homebuilder sales are falling quickly, according to Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

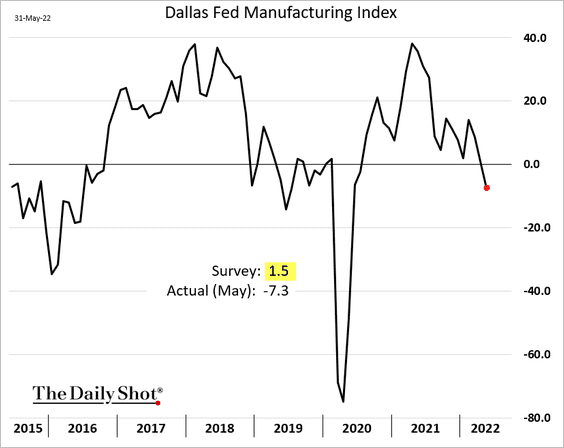

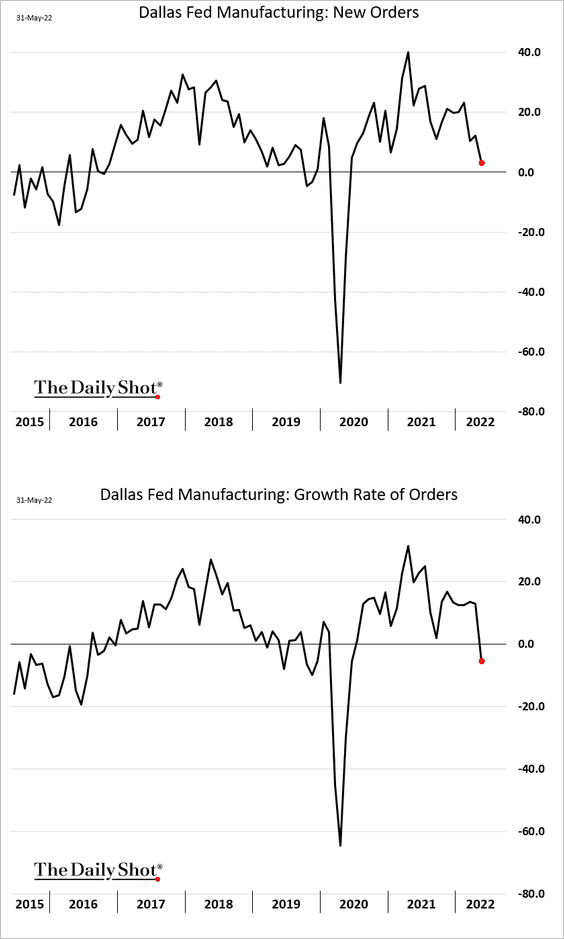

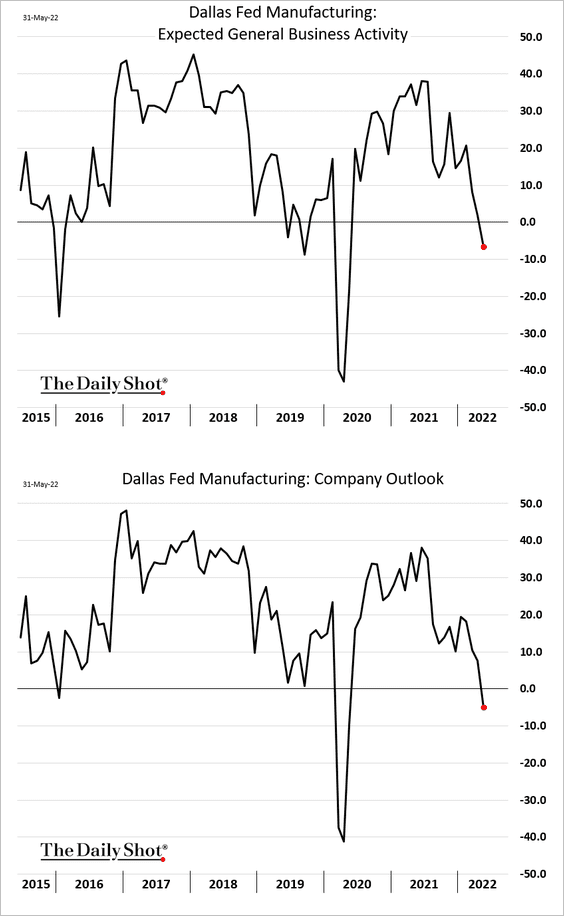

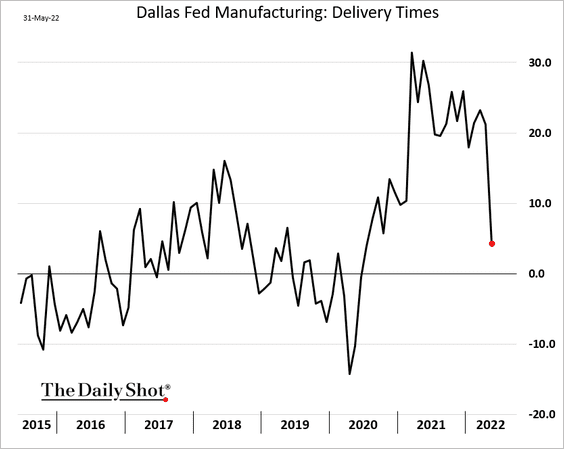

5. The Dallas Fed’s regional manufacturing index showed slowing factory activity in May.

• Demand has been weakening.

• Business outlook has deteriorated.

• Supply bottlenecks are rapidly disappearing.

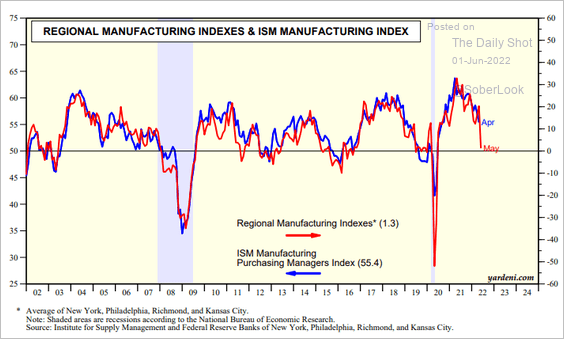

Separately, the regional Fed manufacturing reports point to a substantial decline in the ISM Manufacturing PMI (at the national level).

Source: Yardeni Research

Source: Yardeni Research

——————–

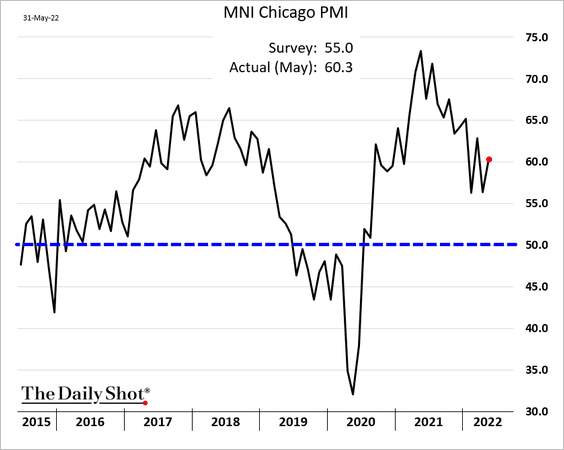

6. The Chicago PMI index was stronger than expected, with Midwest business activity holding up well in May.

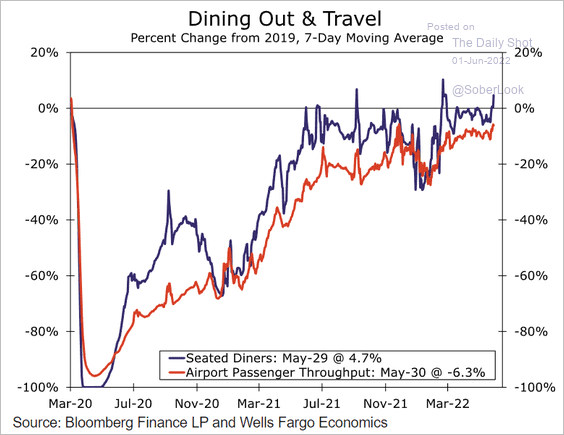

7. Mobility has been improving.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

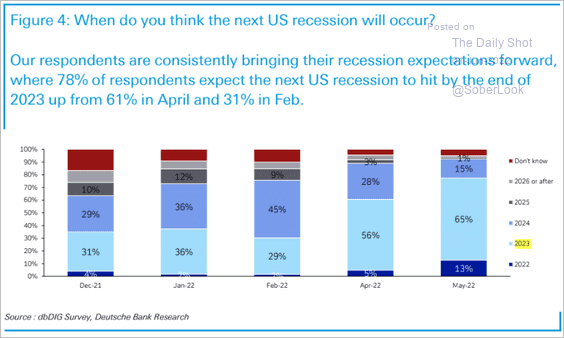

8. When should we expect the next recession? Here is a survey from Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

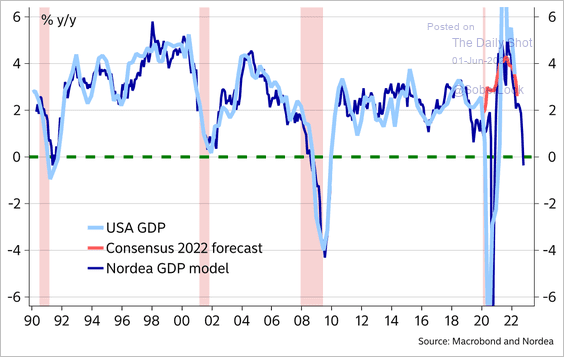

Nordea’s GDP model signals a recession within a year.

Source: @MikaelSarwe

Source: @MikaelSarwe

Back to Index

Canada

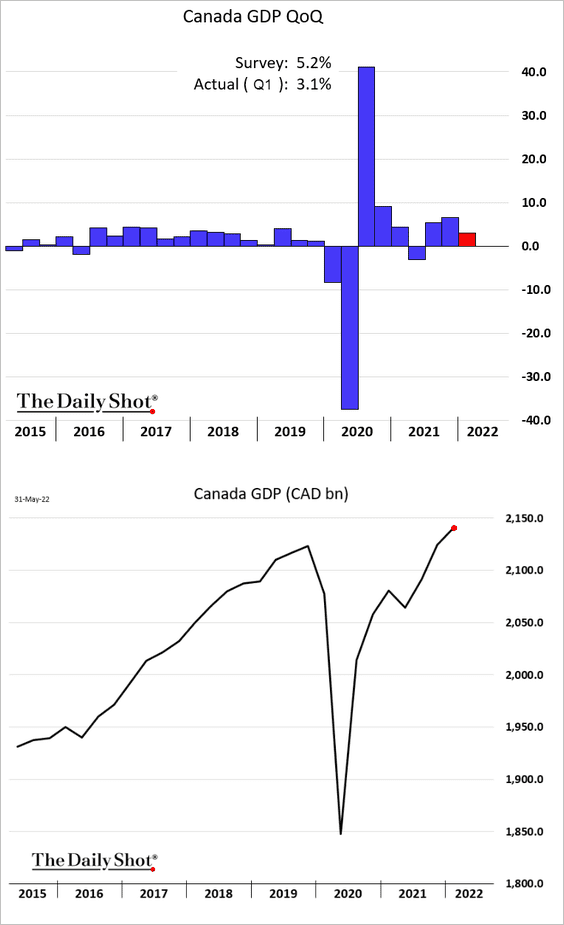

1. The Q1 GDP report was a bit disappointing.

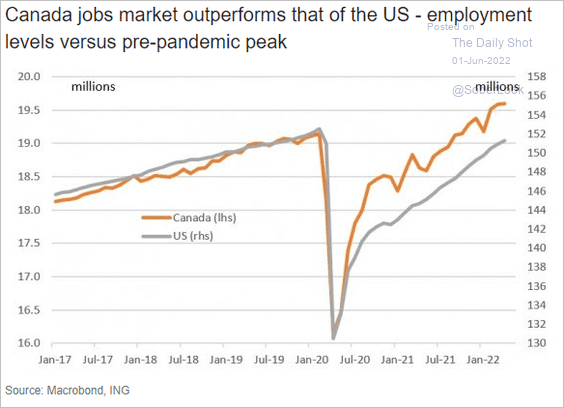

2. Canada’s labor market recovery continues to outpace the US.

Source: ING

Source: ING

Back to Index

The United Kingdom

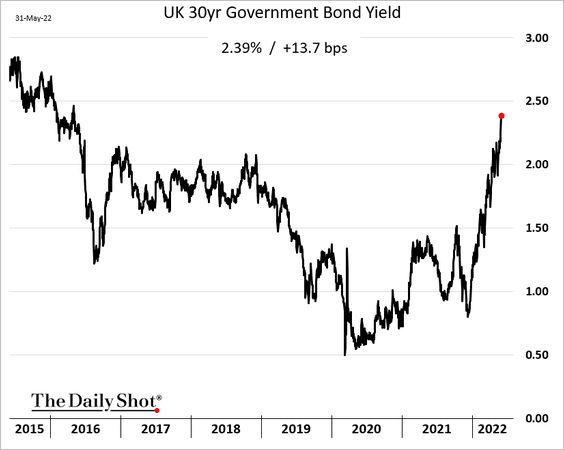

1. Longer-dated gilt yields are surging.

Source: Nasdaq Read full article

Source: Nasdaq Read full article

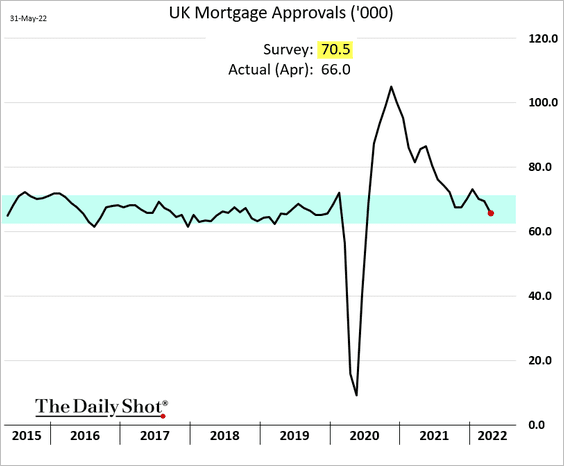

2. Consumer credit growth was firmer than expected in April.

But mortgage approvals continue to ease.

——————–

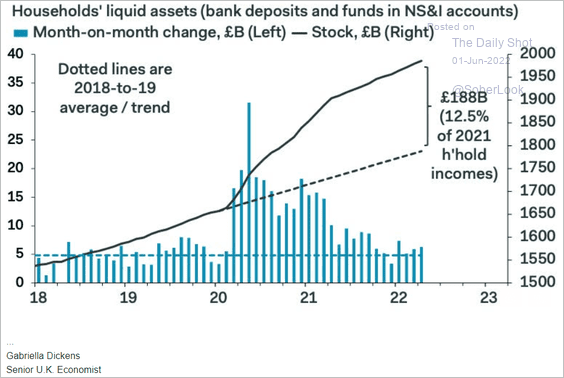

3. Households keep adding to their savings.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

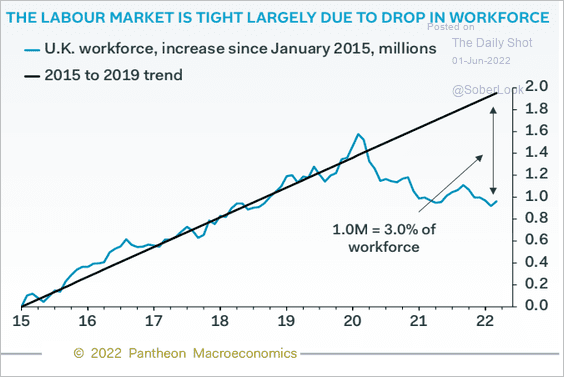

4. Labor market participation remains depressed.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

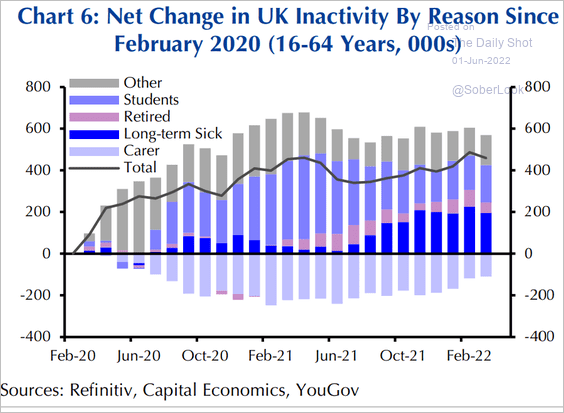

This chart shows the breakdown of inactivity, by reason.

Source: Capital Economics

Source: Capital Economics

Back to Index

The Eurozone

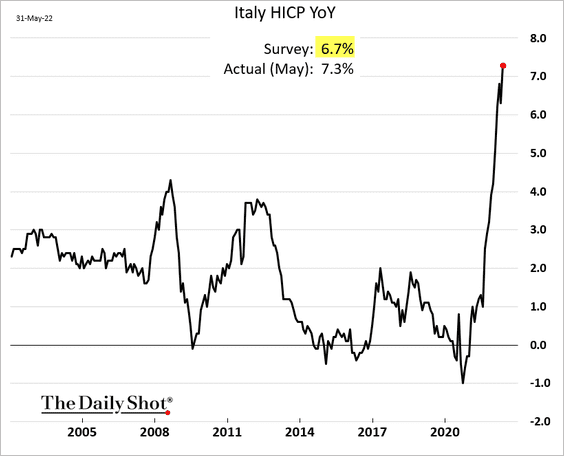

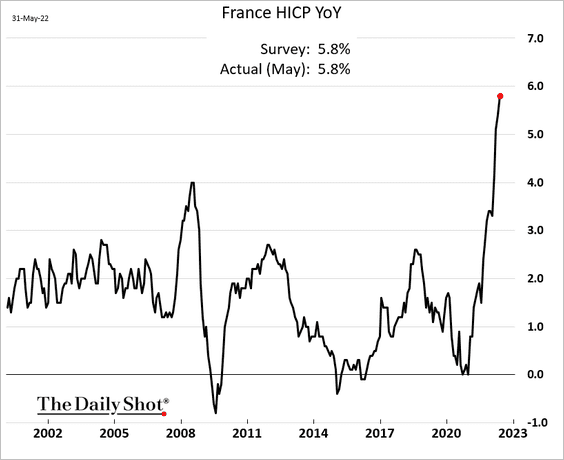

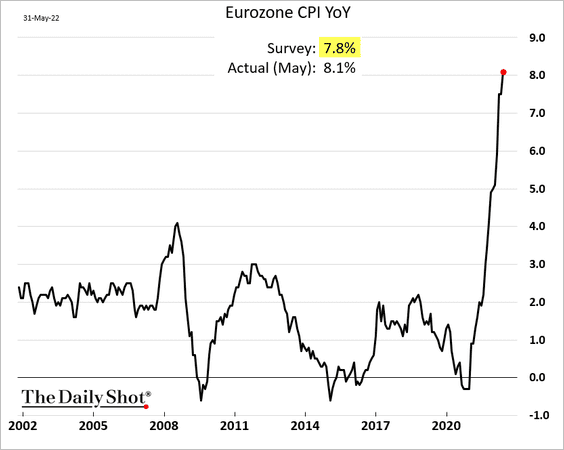

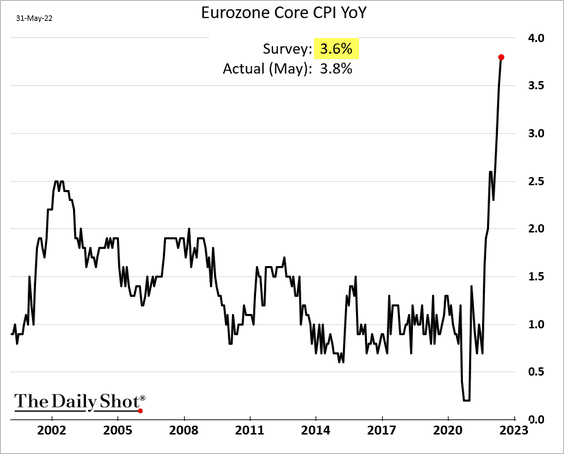

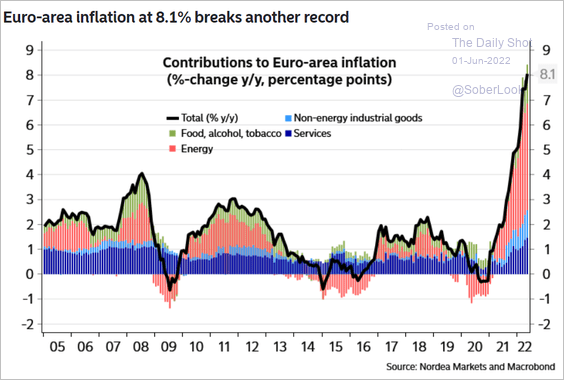

1. Inflation reports continue to show extreme price pressures, with CPI data surprising to the upside.

• Italy:

• France:

• The Eurozone headline CPI:

• The Eurozone core CPI:

Here are the contributions.

Source: Nordea Markets

Source: Nordea Markets

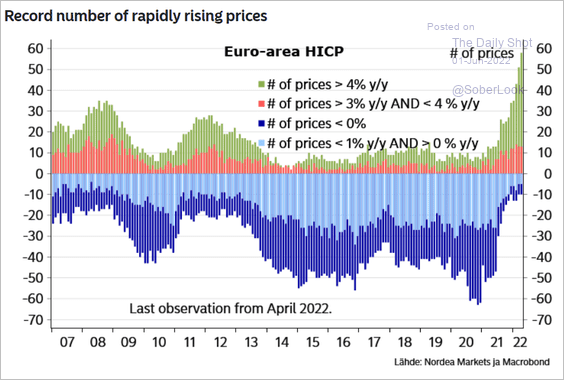

And this chart shows the number of CPI components rising faster than 4%.

Source: Nordea Markets

Source: Nordea Markets

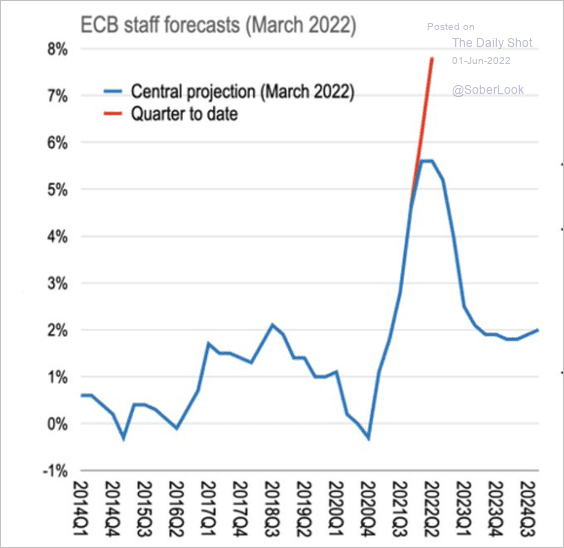

2. The ECB’s inflation forecast is once again way off the mark.

Source: @jnordvig, @ExanteData, @GeneralTheorist

Source: @jnordvig, @ExanteData, @GeneralTheorist

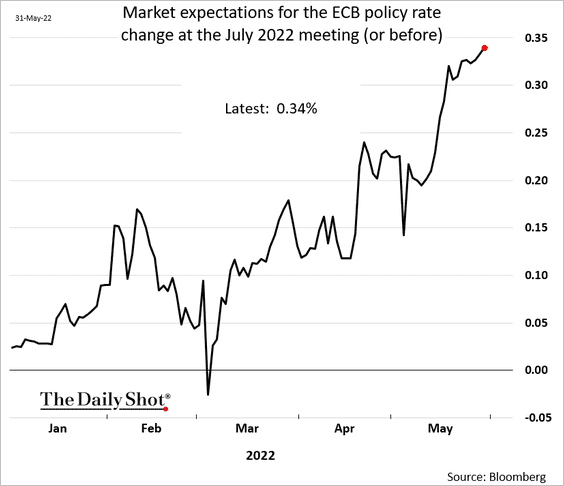

The market is now pricing in a 0.34% rate hike in July (higher probability of a 50 bps hike).

——————–

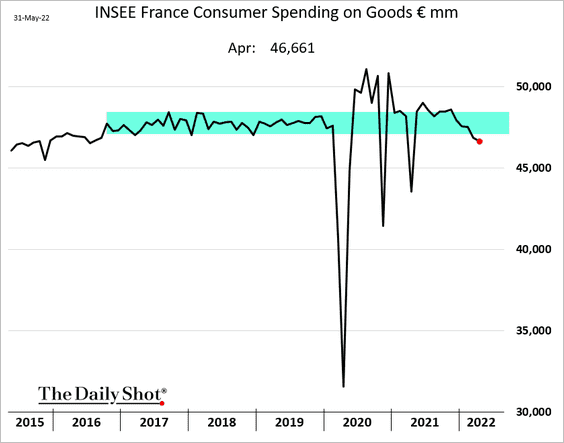

3. French consumer spending on goods continues to deteriorate. Is France in a recession?

Source: ING Read full article

Source: ING Read full article

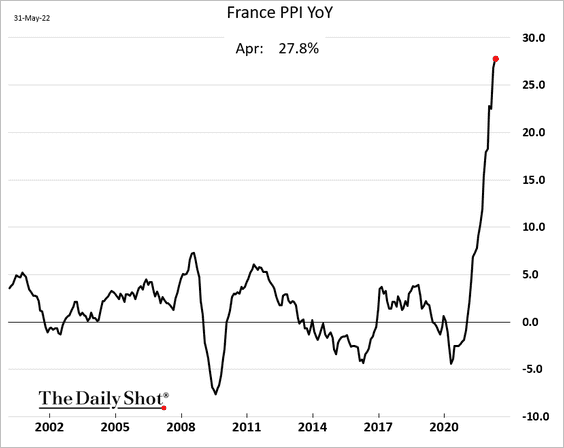

By the way, here is the French PPI.

——————–

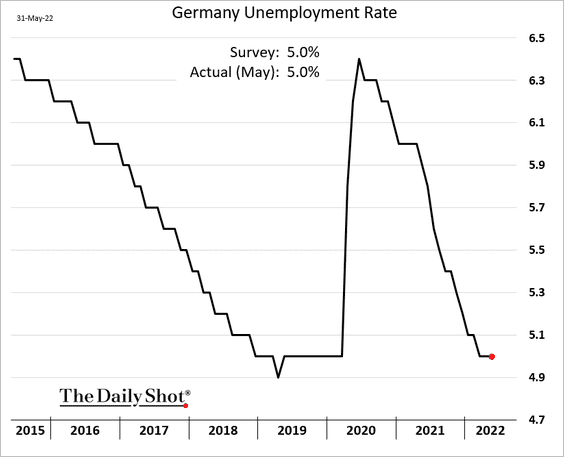

4. Germany’s unemployment rate is holding at 5%.

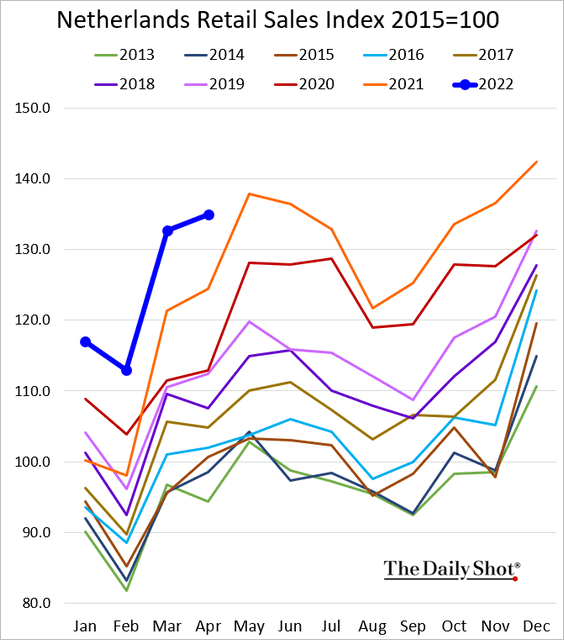

5. Dutch retail sales were strong in April.

Back to Index

Asia – Pacific

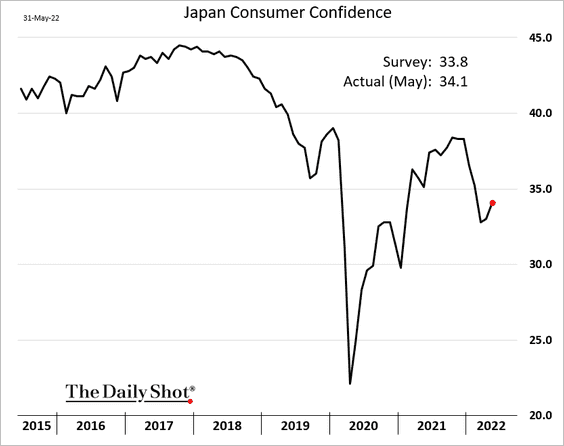

1. Japan’s consumer confidence improved last month.

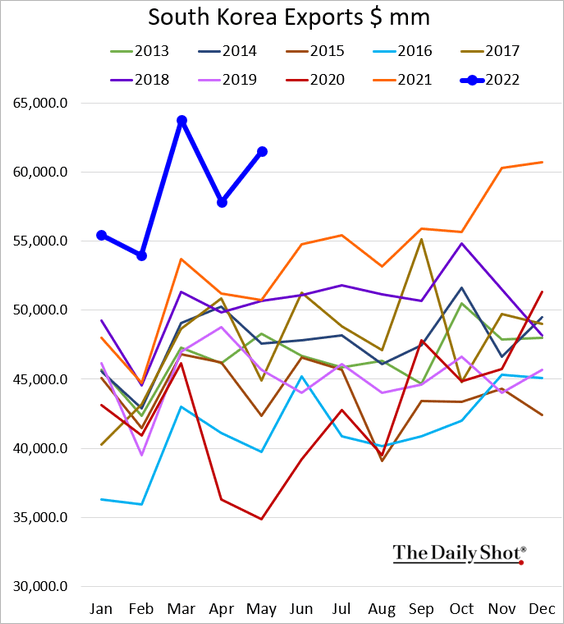

2. South Korea’s exports jumped in May.

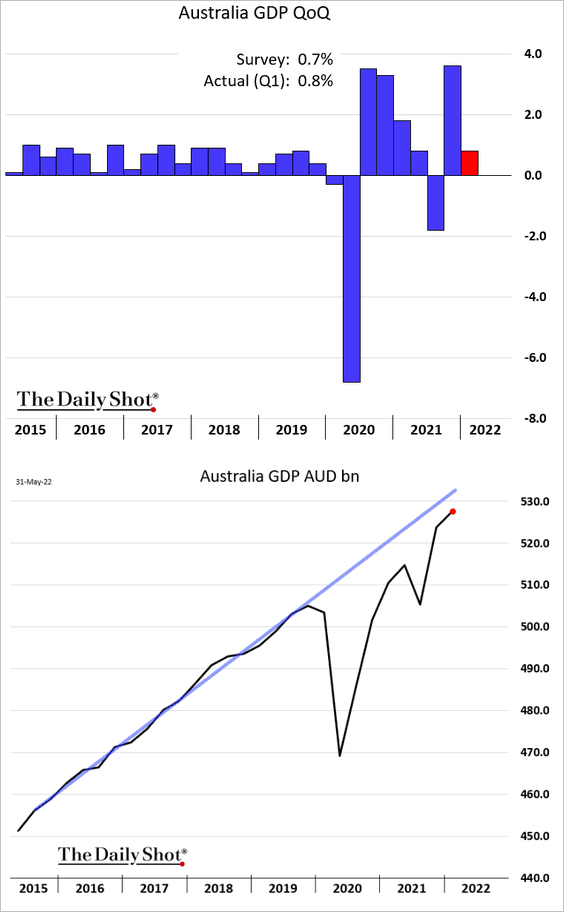

3. Australia’s Q1 GDP growth was a bit firmer than expected.

Back to Index

China

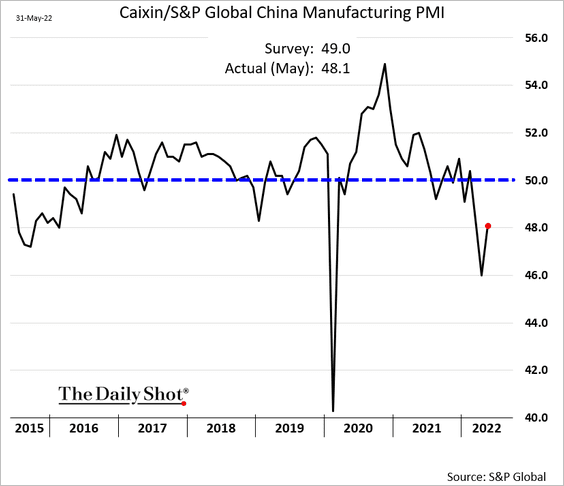

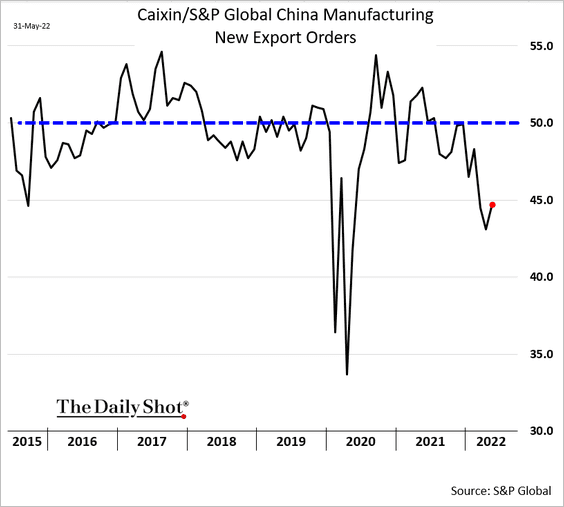

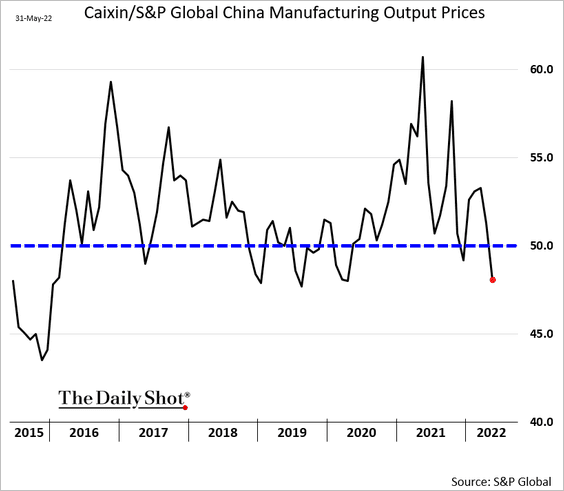

1. Ths Caixin Manufacturing PMI showed that factory activity was still very weak in May (below estimates).

Export orders continue to deteriorate.

Price pressures have dissipated.

——————–

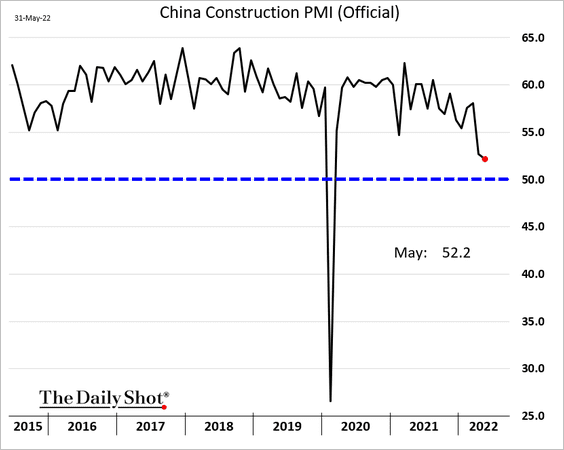

2. Construction activity is still in growth mode, according to official PMI data, but has been slowing rapidly.

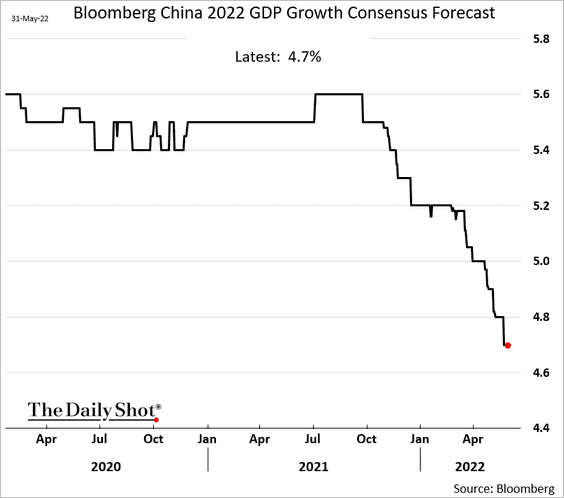

3. Economists continue to downgrade their GDP growth projections for 2022.

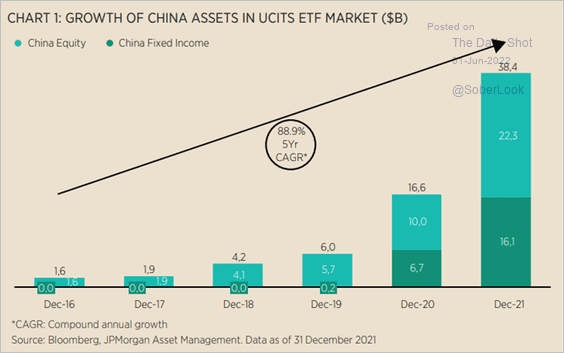

4. Exposure to Chinese assets via UCITS ETFs has grown significantly over the past five years.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

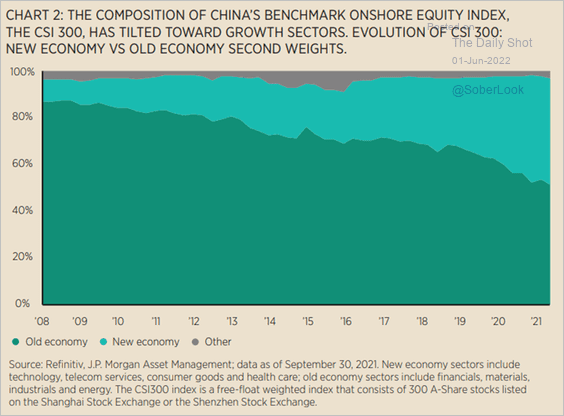

5. The sector composition of China’s benchmark onshore equity index has shifted toward consumption and innovation, and away from export-oriented sectors such as industrial and manufacturing.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

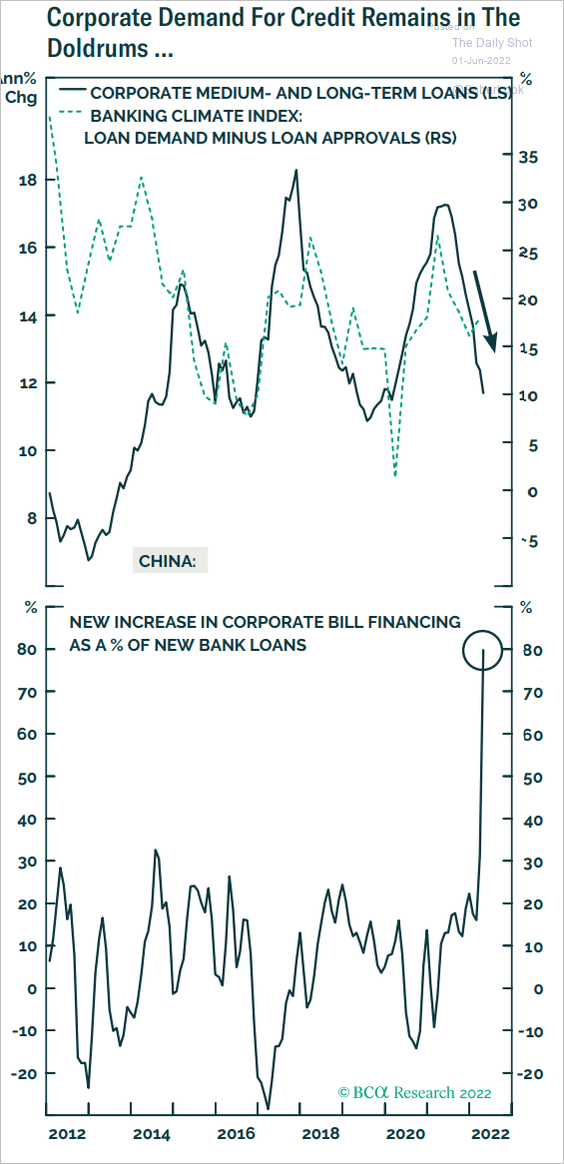

6. With uncertainty elevated, companies shifted to short-term financing.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

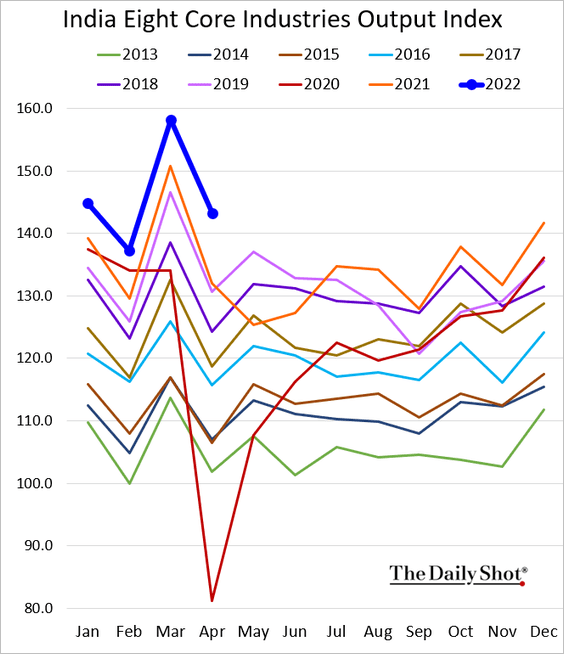

1. India’s core industries’ activity held up well in April.

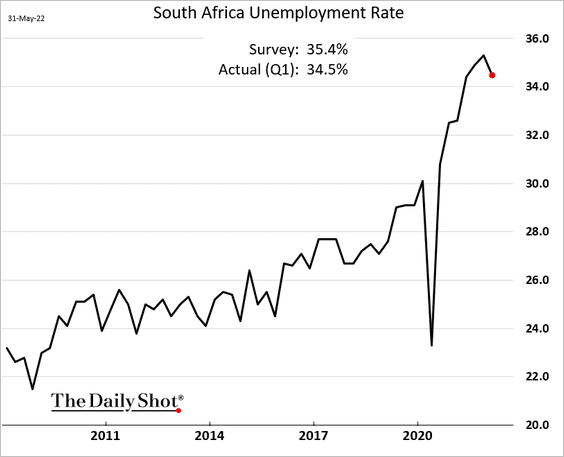

2. South Africa’s unemployment appears to have peaked.

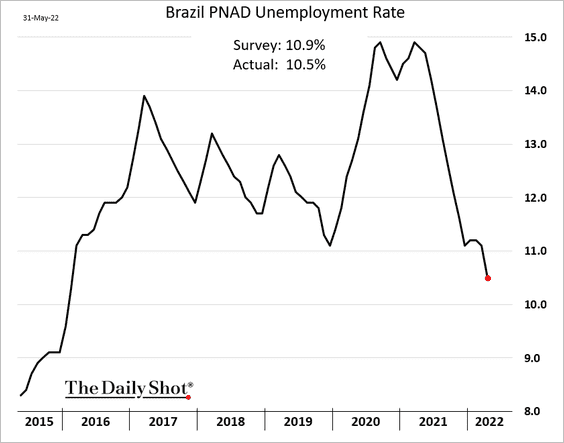

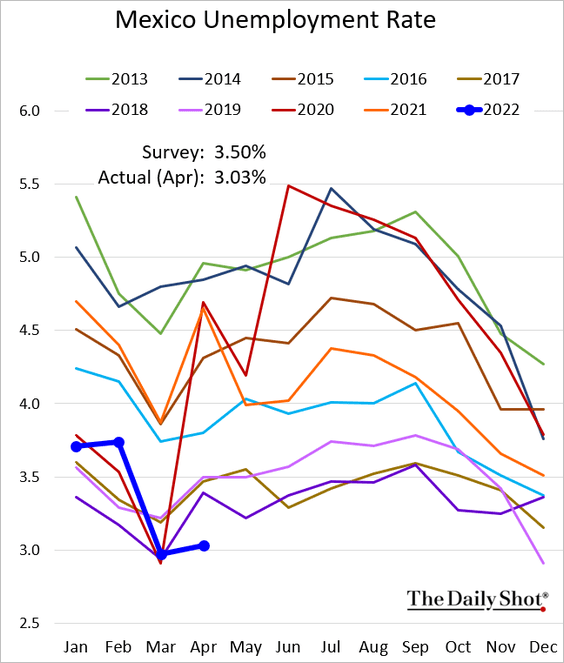

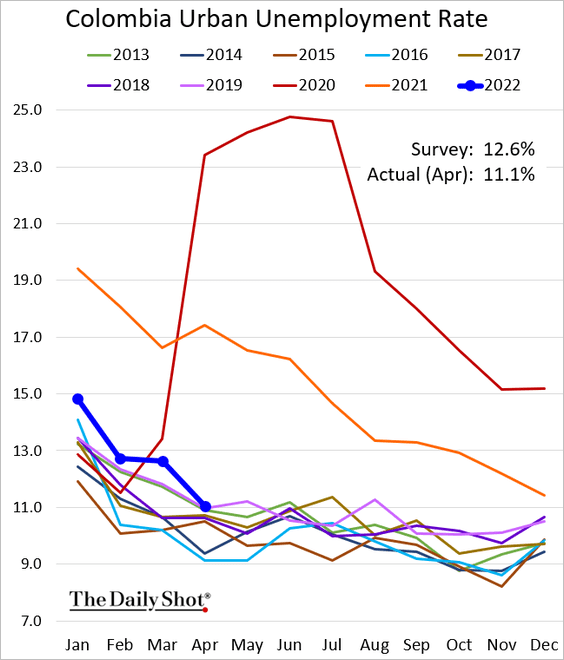

3. LatAm labor markets continue to improve.

• Brazil’s unemployment rate:

• Mexico’s unemployment (very low):

• Colombia’s unemployment rate (back at 2019 levels):

——————–

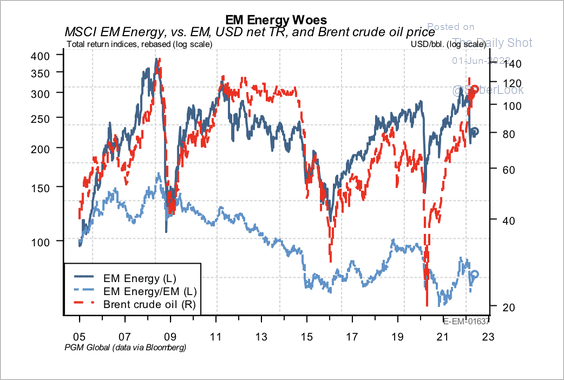

4. EM energy stocks have lagged the upside in oil prices.

Source: PGM Global

Source: PGM Global

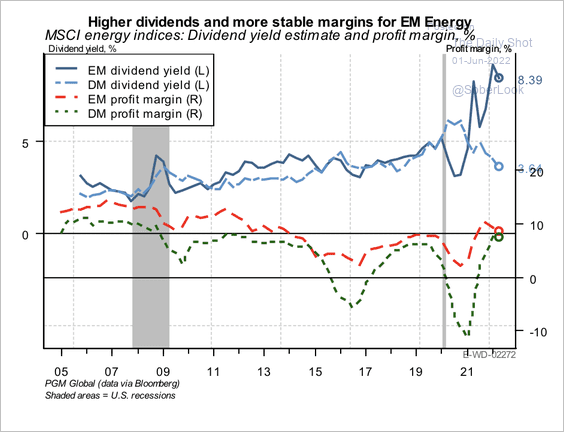

EM energy stocks have higher dividends and more stable margins relative to their developed market peers.

Source: PGM Global

Source: PGM Global

Back to Index

Cryptocurrency

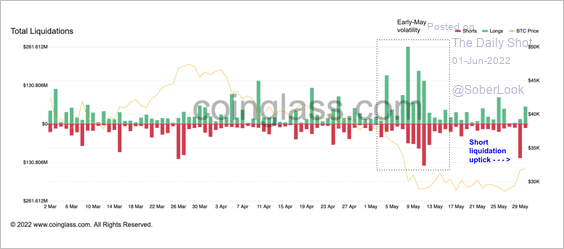

1. Bitcoin’s weekend price bounce above $30K triggered a rise in short liquidations.

Source: Coinglass Read full article

Source: Coinglass Read full article

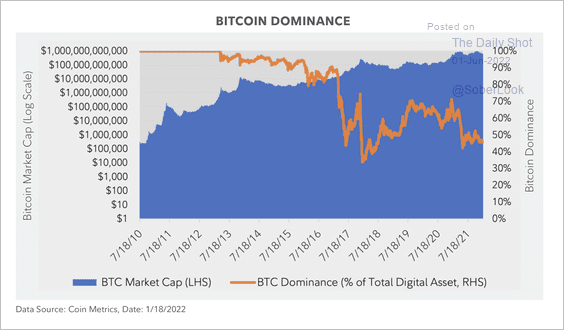

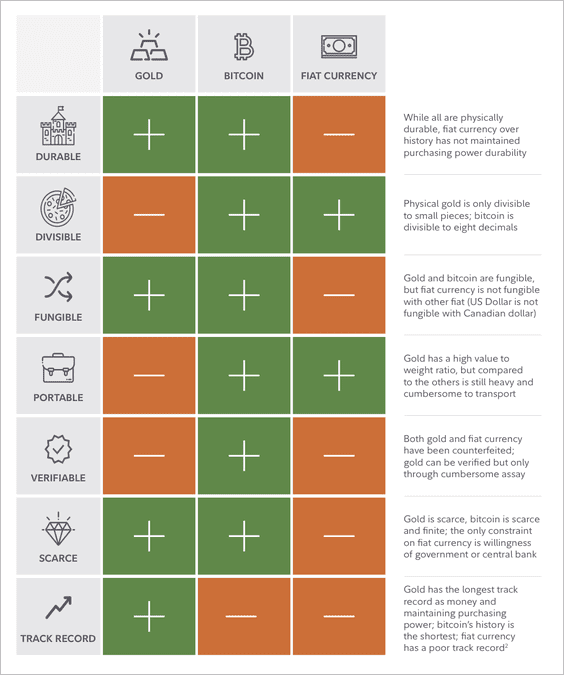

2. Bitcoin’s market cap relative to the total crypto market cap has declined. That’s partly because of the growth of other digital assets over the years.

Source: Fidelity Digital Assets

Source: Fidelity Digital Assets

Fidelity views bitcoin as a monetary good.

Source: Fidelity Digital Assets

Source: Fidelity Digital Assets

Back to Index

Commodities

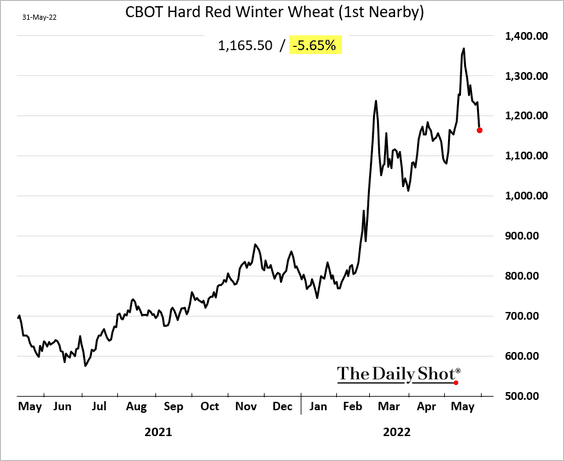

1. Wheat tumbled on news from Russia.

Source: Reuters Read full article

Source: Reuters Read full article

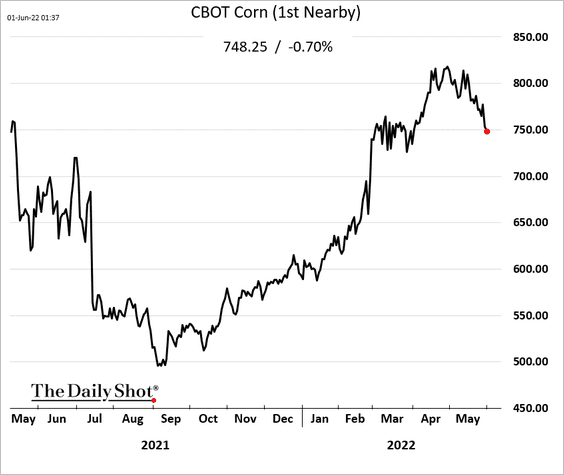

Corn is also rolling over.

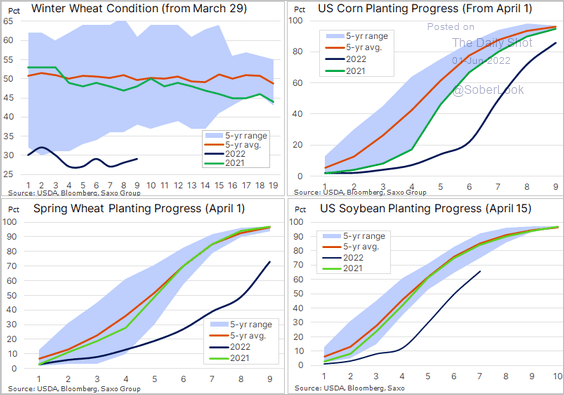

This chart shows the planting conditions for US grains.

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

——————–

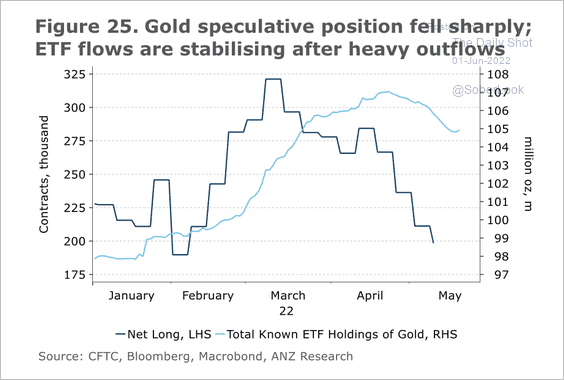

2. Speculators have reduced their net-long positions in gold futures. Meanwhile, gold holdings among ETFs are stabilizing.

Source: @ANZ_Research

Source: @ANZ_Research

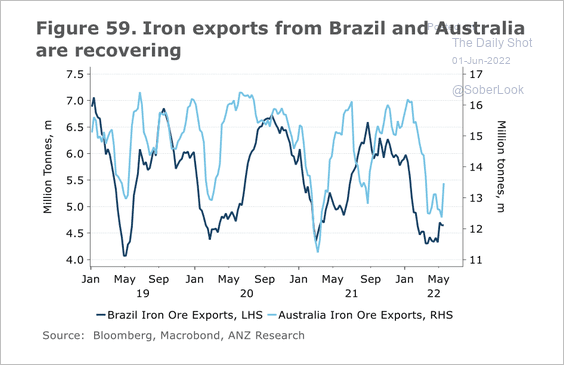

3. Iron ore exports from Brazil and Australia are recovering.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Energy

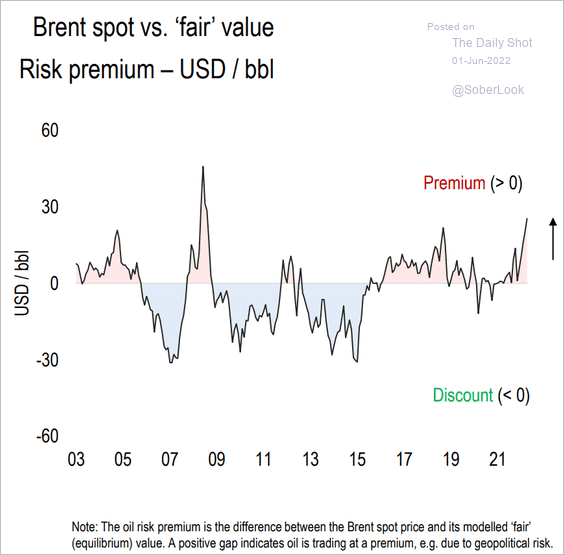

1. Brent held resistance at $125/bbl.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Oil is trading at a substantial premium to “fair value,” according to Numera Analytics.

Source: Numera Analytics

Source: Numera Analytics

——————–

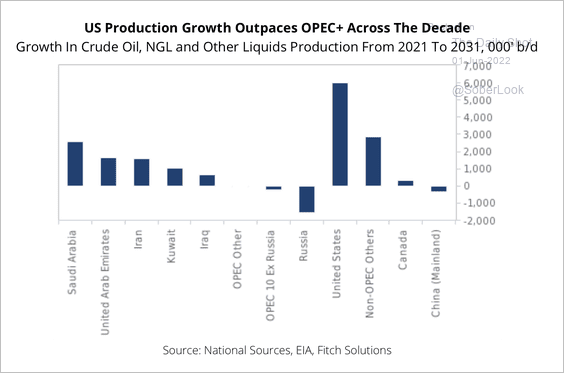

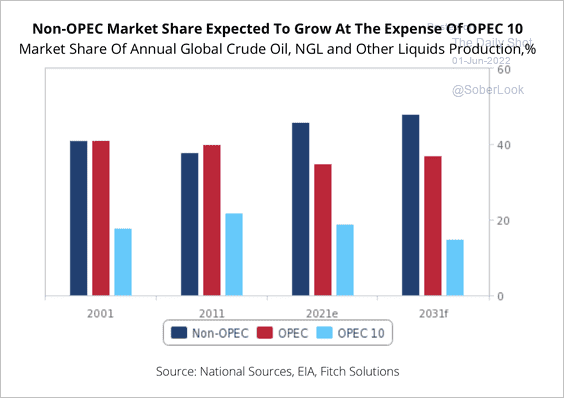

2. US oil production growth is expected to exceed OPEC+ growth over the next decade.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

The 10 non-OPEC producers making up OPEC+ could see their share of global oil production shrink over the next decade.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

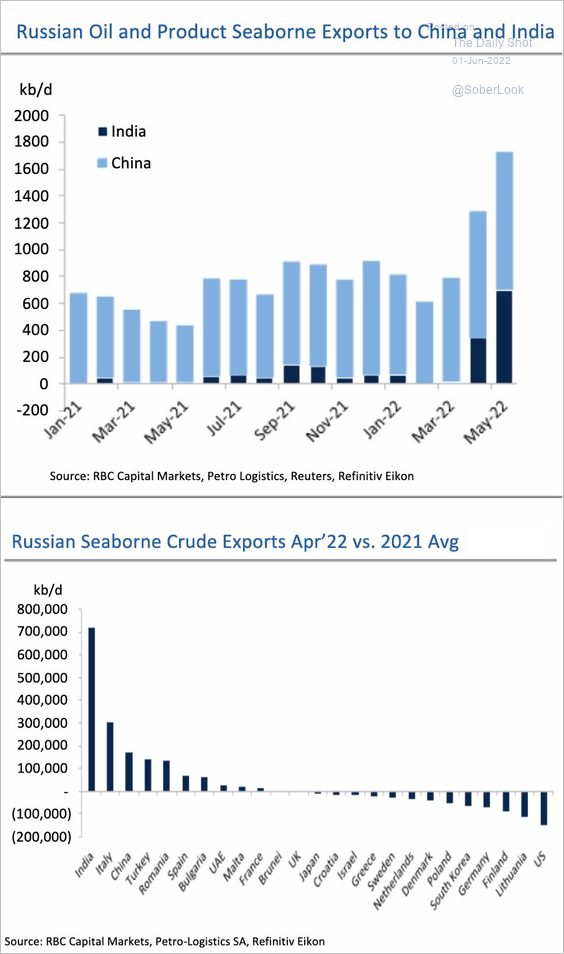

3. Russia has been shifting its oil customer base.

Source: RBC Capital Markets

Source: RBC Capital Markets

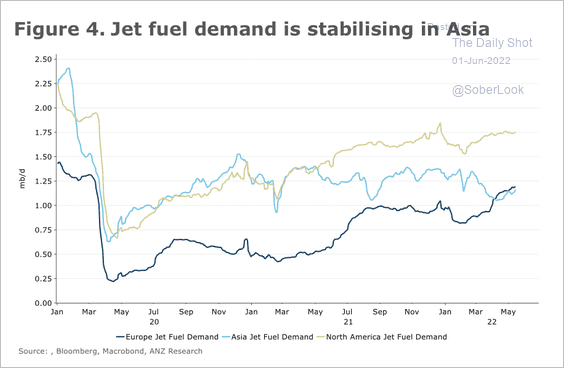

4. Jet fuel demand is stabilizing, albeit still below pre-pandemic levels.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Equities

1. US households haven’t been this gloomy on stocks in about a decade, according to the Conference Board.

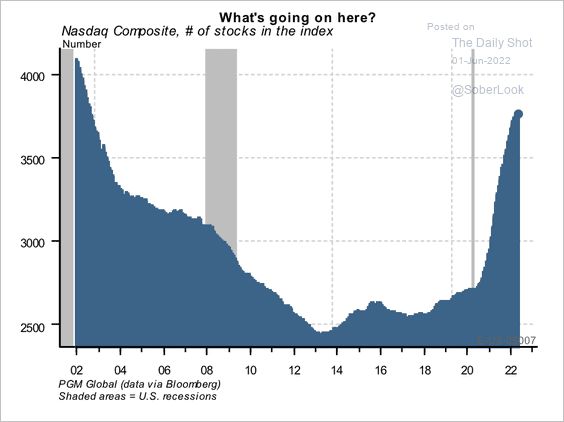

2. The number of firms in the Nasdaq Composite index is nearing levels last seen during the dot-com bust.

Source: PGM Global

Source: PGM Global

Has there been an infiltration of low-quality firms? (2 charts)

Source: PGM Global

Source: PGM Global

Source: PGM Global

Source: PGM Global

——————–

3. Retail investors have sold equity purchases made over the past two years.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Here is the GS retail favorites index.

——————–

4. Tech mega-caps have given up their 2021 gains.

Source: Goldman Sachs; @SamRo

Source: Goldman Sachs; @SamRo

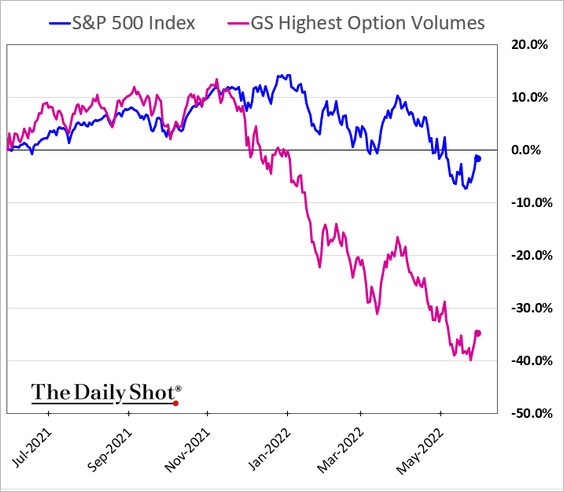

5. Stocks with high option volumes continue to underperform.

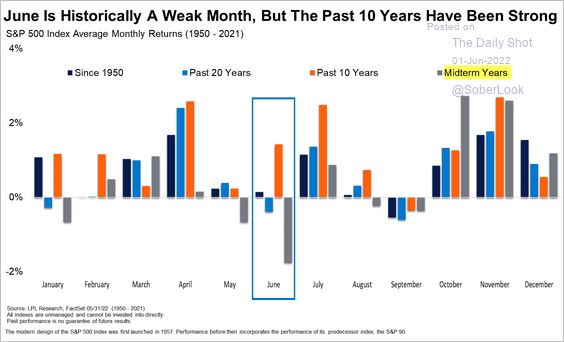

6. June tends to be a weak month during midterm election years.

Source: LPL Research

Source: LPL Research

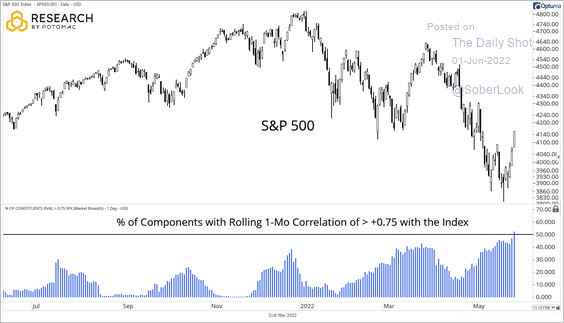

7. More S&P 500 stocks are moving closely with the index.

Source: @DrewTheCharts

Source: @DrewTheCharts

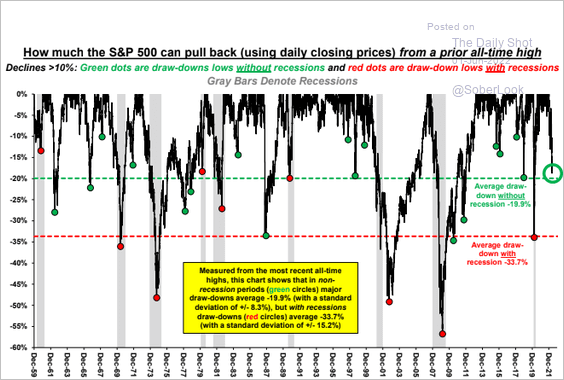

8. The S&P500 has historically exhibited greater than 10% drawdowns quite a few times (16 times since 1959) without the US economy experiencing a recession.

Source: Stifel

Source: Stifel

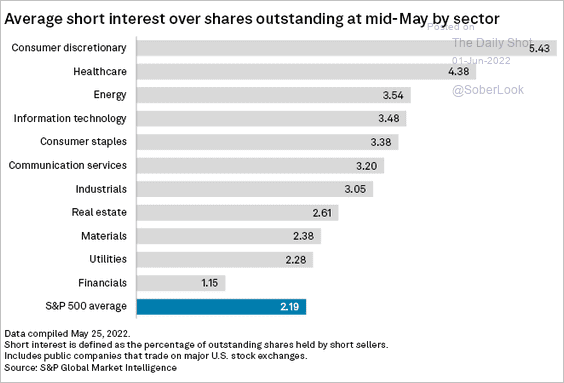

9. Here are the sectors with the highest short interest (as of the 25th of May).

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

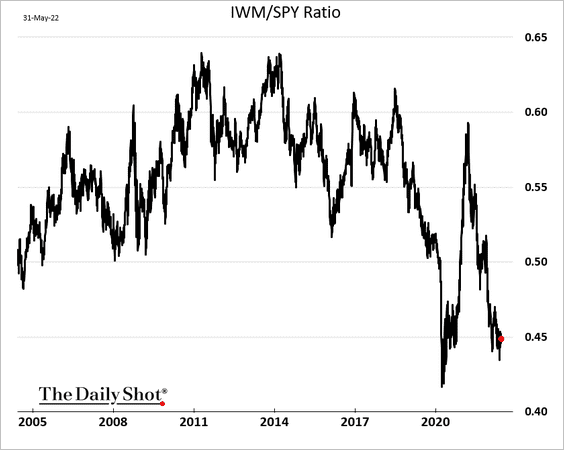

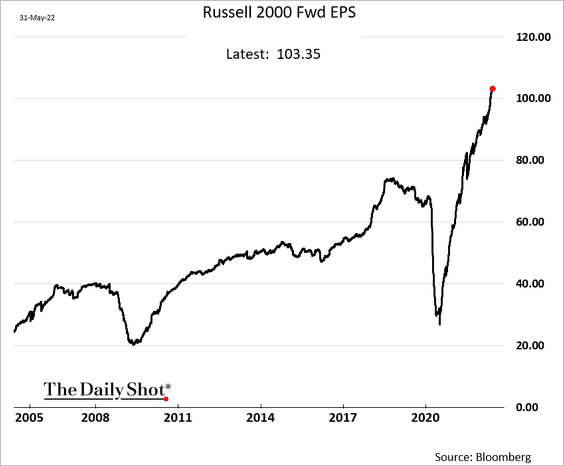

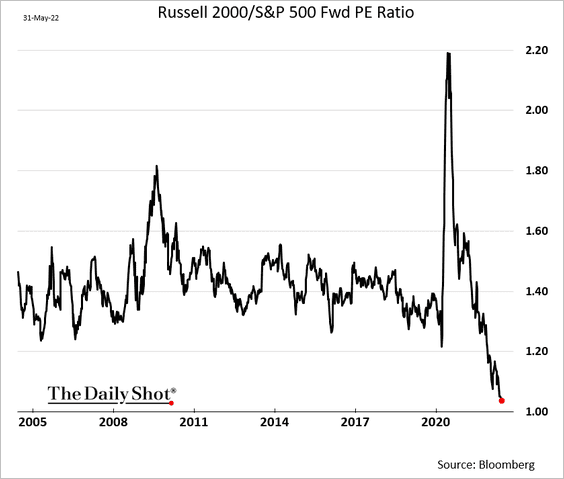

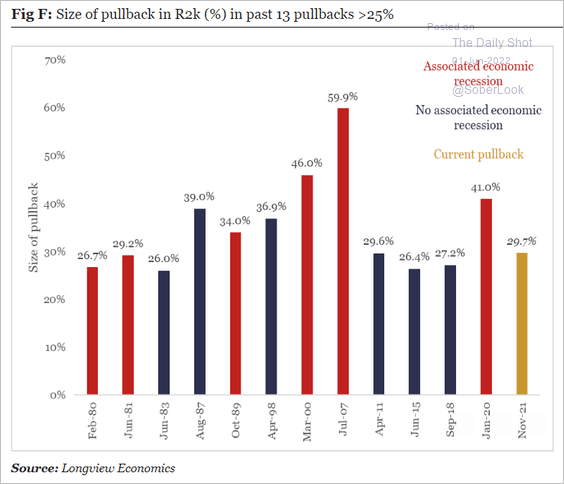

10. Next, we have some updates on US small caps (Russell 2000).

• Russell 2000 (IWM) relative performance vs. S&P 500 (SPY):

• Earnings-per-share expectations:

• Relative forward P/E ratio (small caps look cheap):

• Russell 2000 pullbacks:

Source: Longview Economics

Source: Longview Economics

——————–

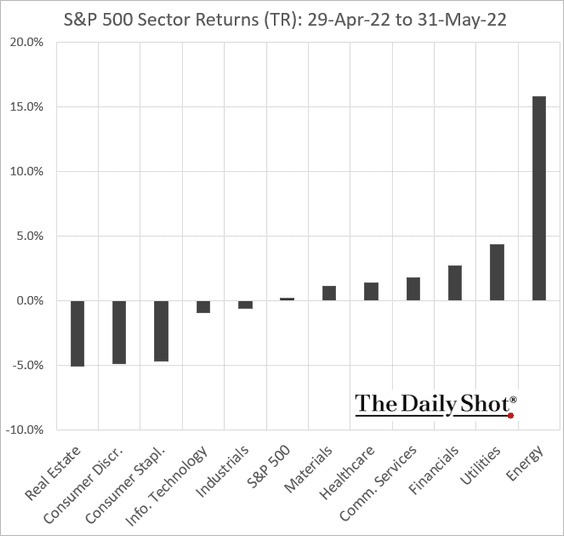

11. Here is the performance by sector in May.

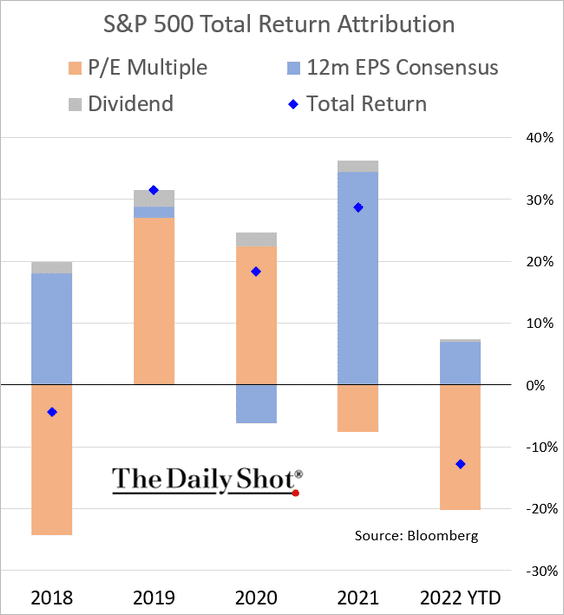

12. Finally, we have the S&P 500 year-to-date performance attribution.

Back to Index

Rates

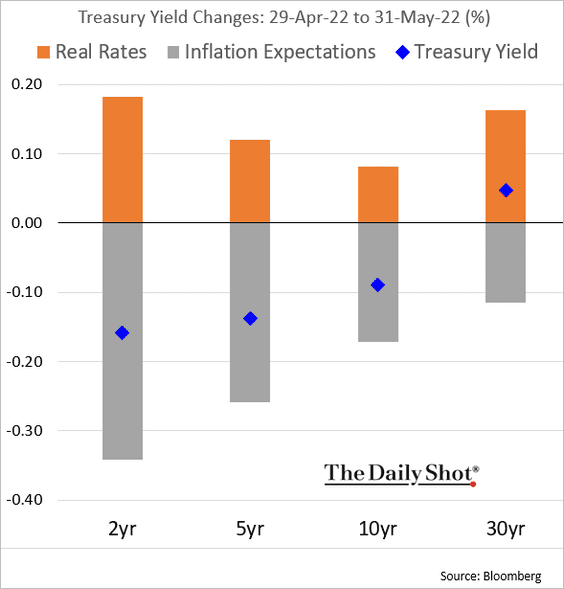

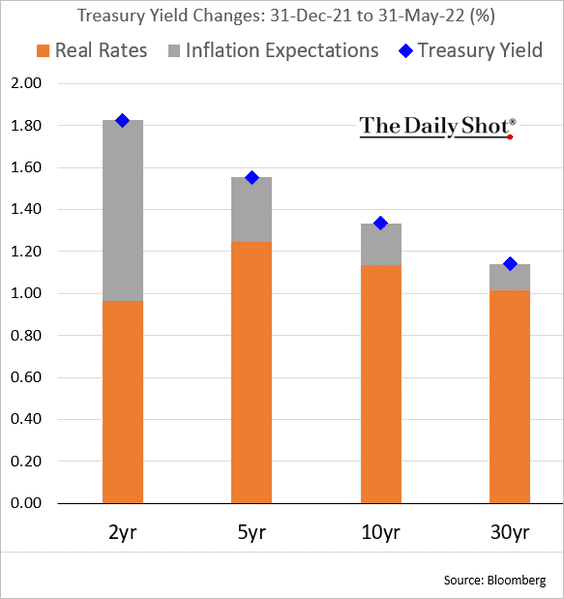

1. Here is a look at the attribution in Treasury yield changes.

• May:

• Year-to-date:

——————–

2. Higher real rates ahead?

Source: MRB Partners

Source: MRB Partners

Back to Index

Global Developments

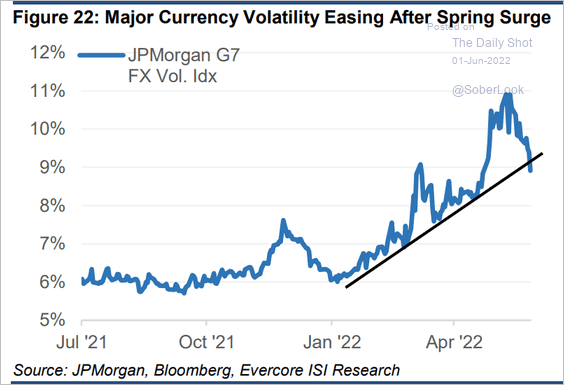

1. DM currency implied volatility has been moderating.

Source: Evercore ISI Research

Source: Evercore ISI Research

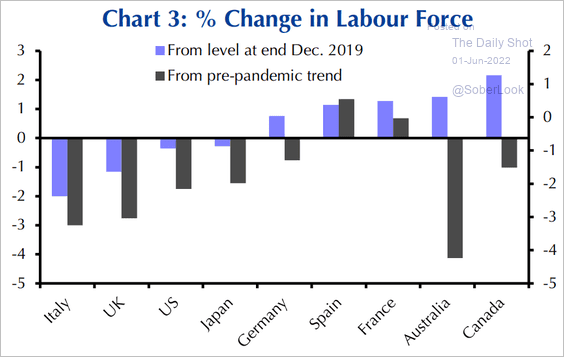

2. How much has the labor force size changed in advanced economies since the start of the pandemic? Relative to the pre-COVID trend?

Source: Capital Economics

Source: Capital Economics

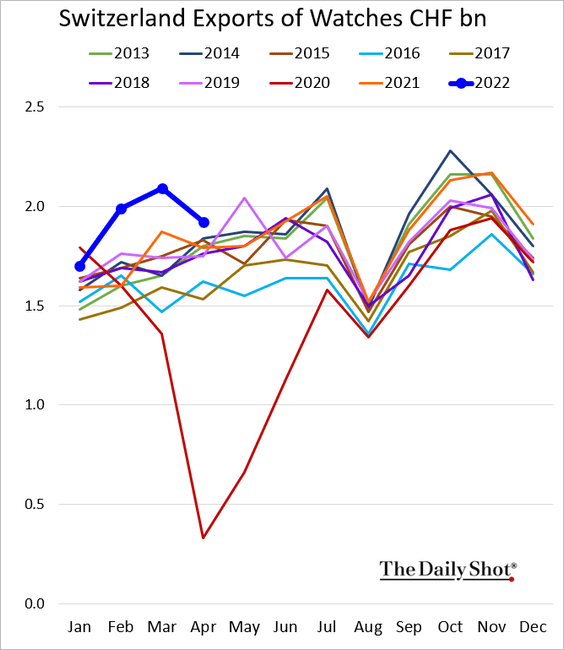

3. The pullback in Swiss watch exports points to softer demand for luxury goods.

——————–

Food for Thought

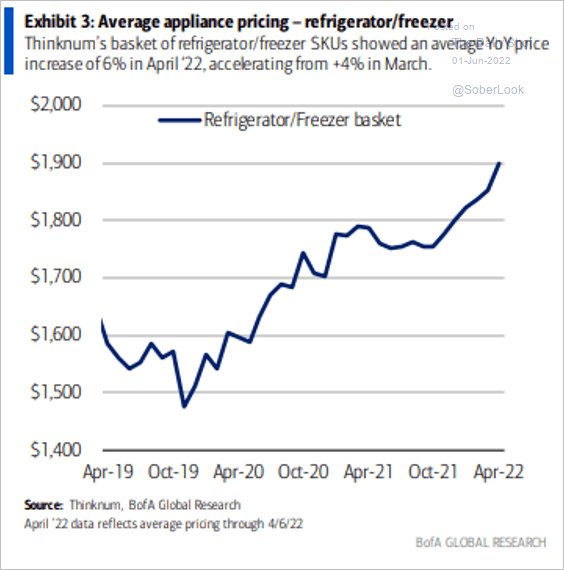

1. Refrigerator prices:

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

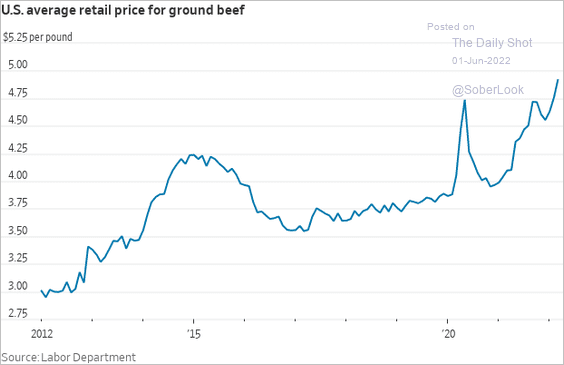

Ground beef prices:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

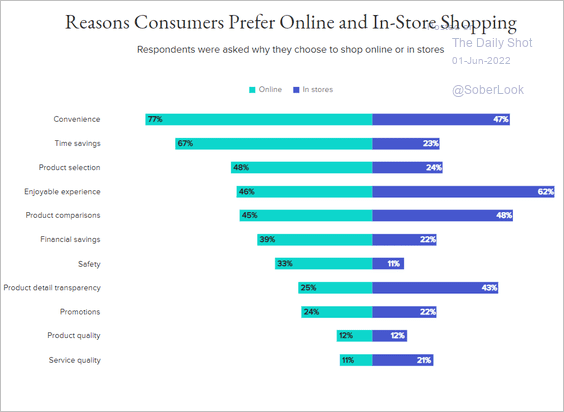

2. Reasons for shopping online or in stores:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

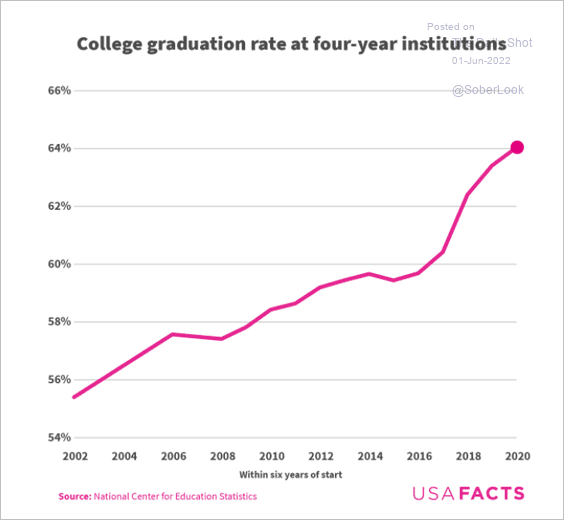

3. US college graduation rates:

Source: USAFacts

Source: USAFacts

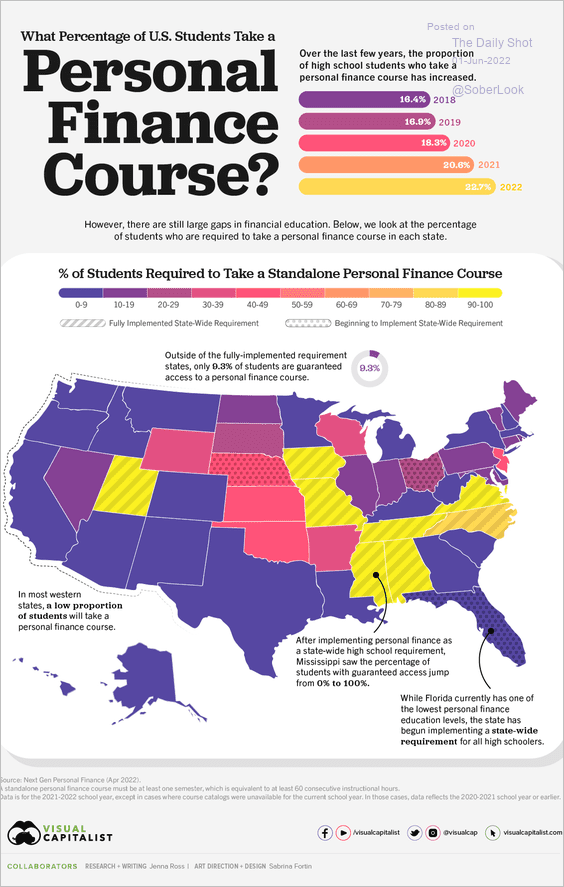

4. Personal finance course requirements:

Source: Visual Capitalist

Source: Visual Capitalist

5. Companies exiting Russia:

Source: The Economist Read full article

Source: The Economist Read full article

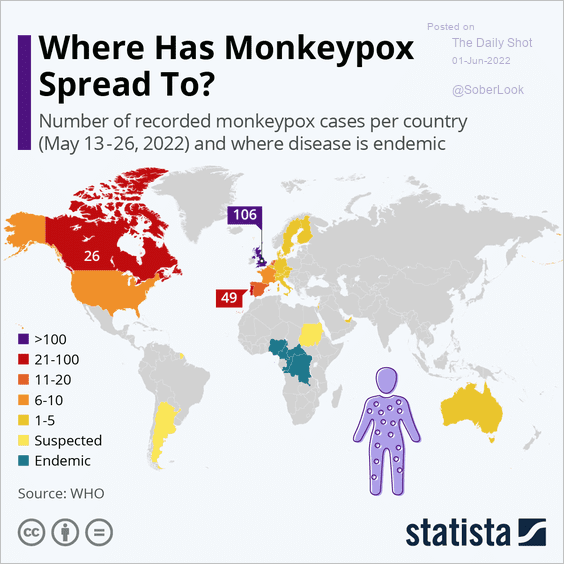

6. Monkeypox cases per country:

Source: Statista

Source: Statista

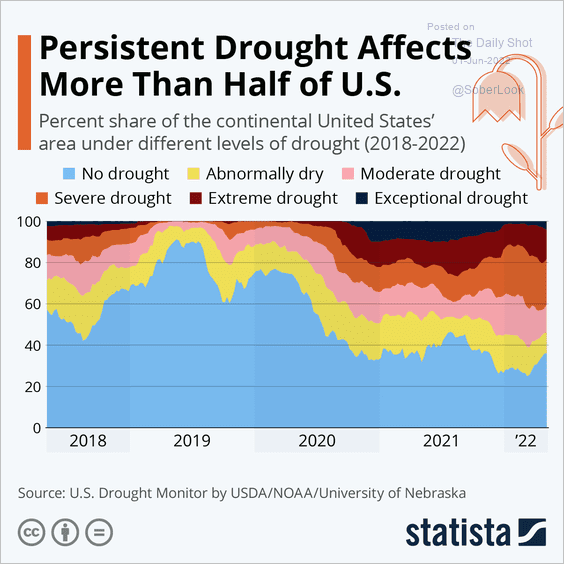

7. Share of the continental US experiencing drought:

Source: Statista

Source: Statista

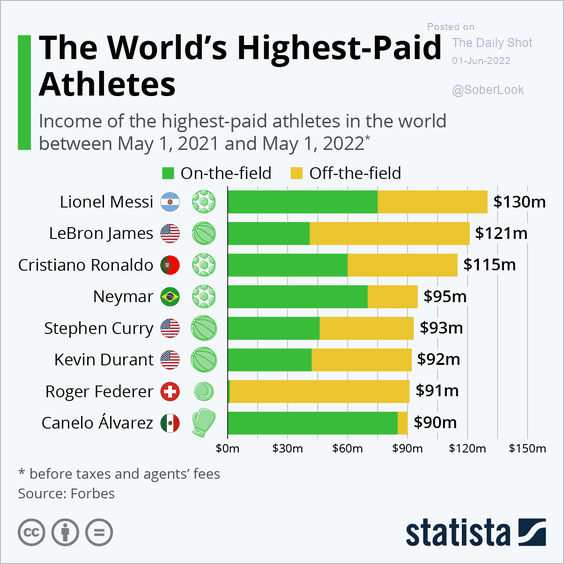

8. The world’s highest-paid athletes:

Source: Statista

Source: Statista

——————–

Back to Index