The Daily Shot: 03-Jun-22

• The United States

• Canada

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

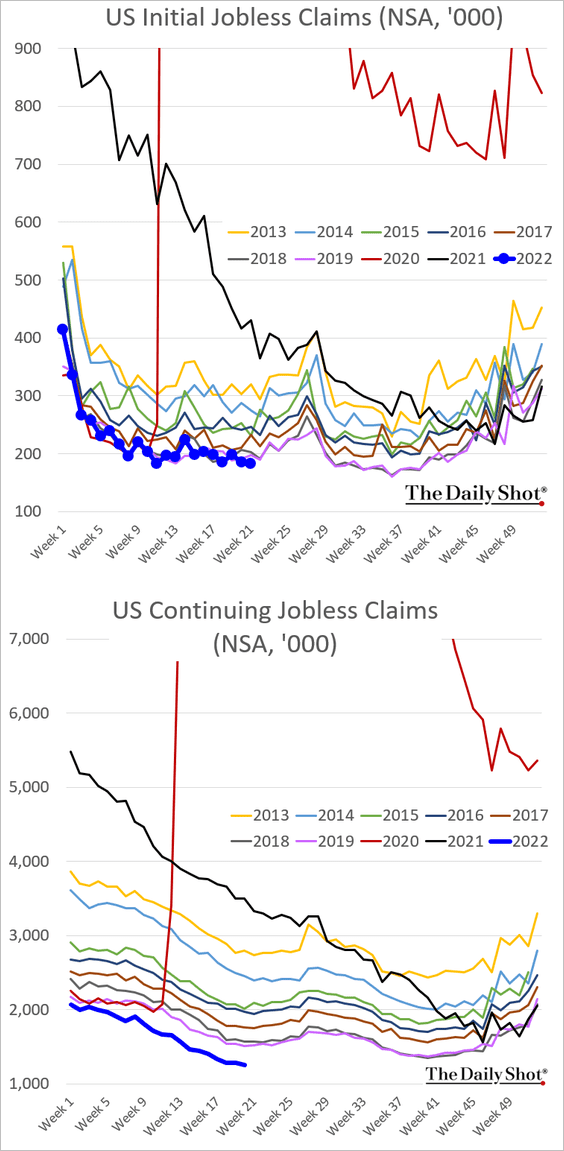

1. Let’s begin with the labor market.

• Unemployment applications remain exceptionally low.

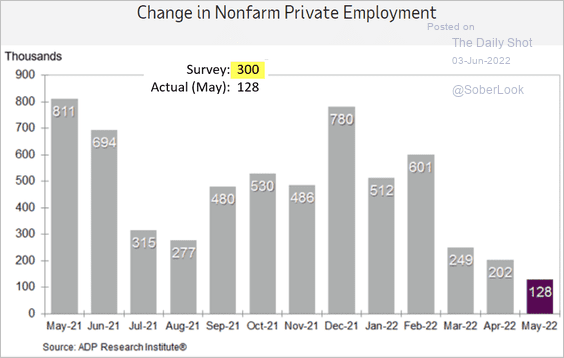

• However, the ADP report showed slower job gains in May, well below forecasts.

Source: ADP Research Institute

Source: ADP Research Institute

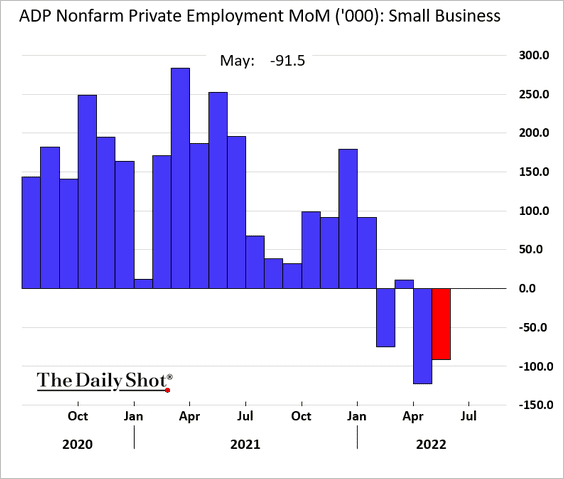

• According to ADP, small businesses have been shedding jobs in recent months.

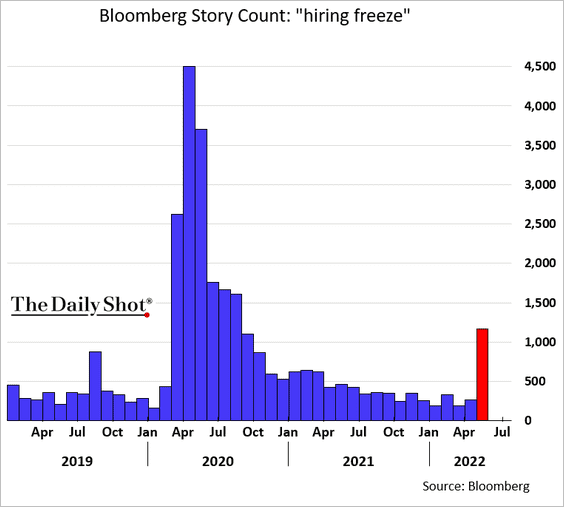

• The number of news articles mentioning “hiring freeze” jumped in May.

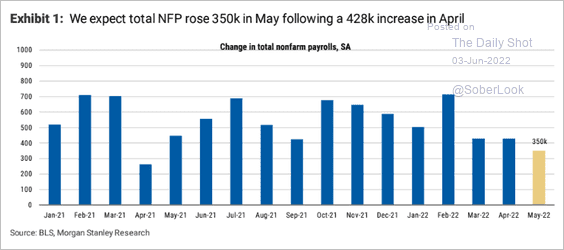

• Morgan Stanley is estimating that the payrolls report will show a gain of 350k jobs in May, …

Source: Morgan Stanley Research

Source: Morgan Stanley Research

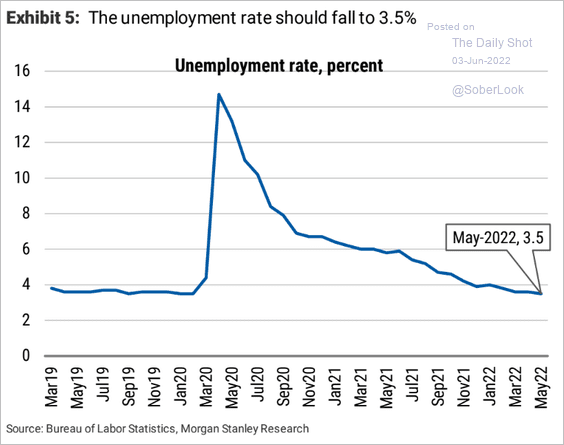

… with the unemployment rate dropping to 3.5%.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

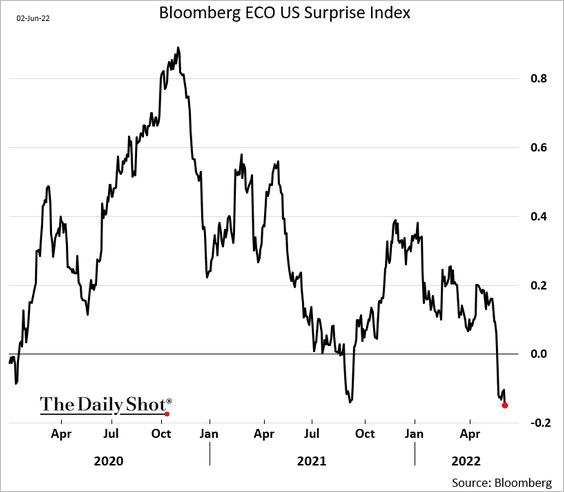

2. On average, economic data continues to surprise to the downside.

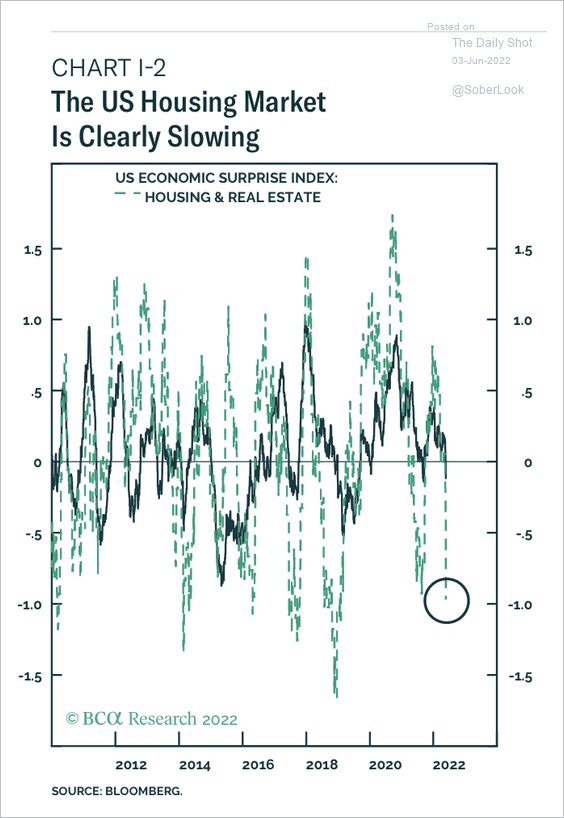

• In particular, housing market data has been very soft.

Source: BCA Research

Source: BCA Research

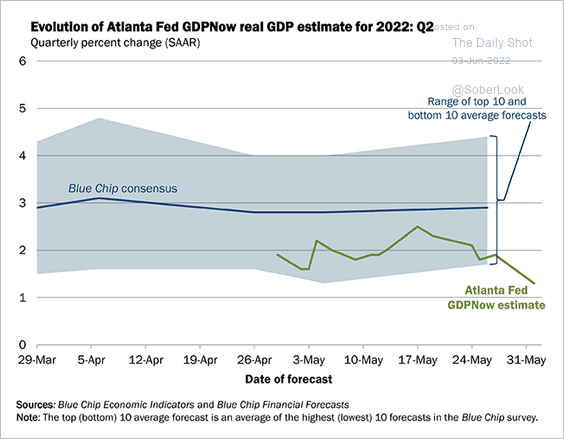

• The Atlanta Fed’s GDPNow estimate has declined to 1.3% growth (annualized) for Q2.

Source: @AtlantaFed

Source: @AtlantaFed

——————–

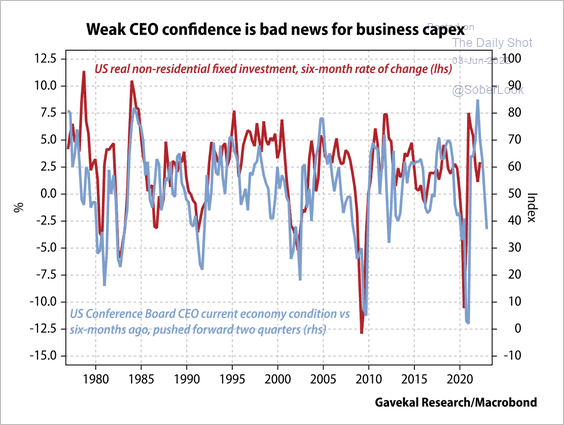

3. The recent decline in CEO confidence does not bode well for capital spending.

Source: Gavekal Research

Source: Gavekal Research

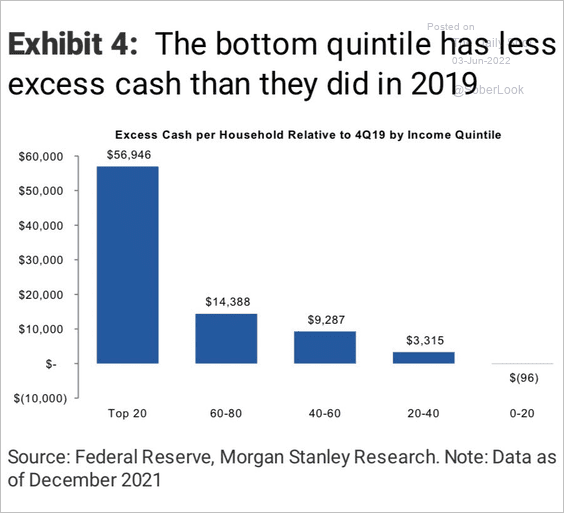

4. The bottom quantile of US households now has less excess savings than in 2019. Note that the top two quantiles represent over 61% of US consumption.

Source: Morgan Stanley Research; @carlquintanilla

Source: Morgan Stanley Research; @carlquintanilla

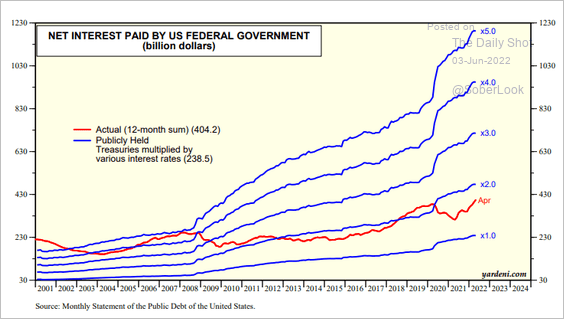

5. This chart shows the federal government’s interest expense under different aggregate interest rate scenarios.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

Canada

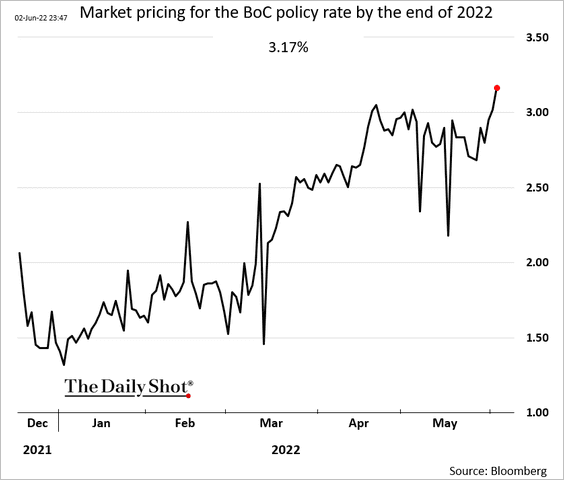

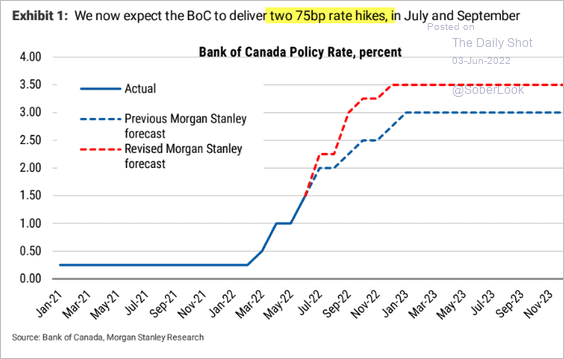

1. The markets now expect the BoC to take rates well above 3% by the end of the year.

• Morgan Stanley sees two 75 bps rate hikes.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

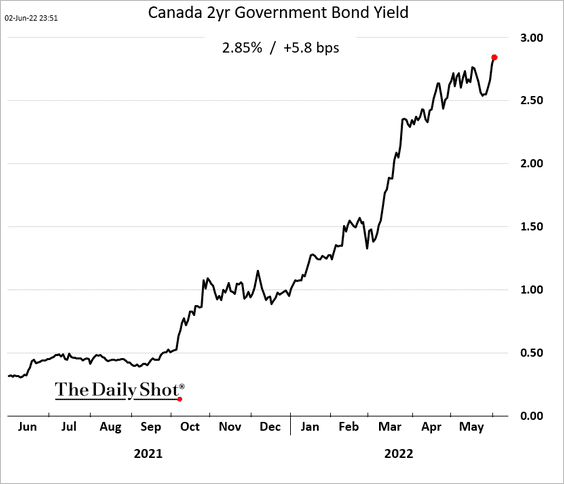

• The 2yr yield keeps climbing.

——————–

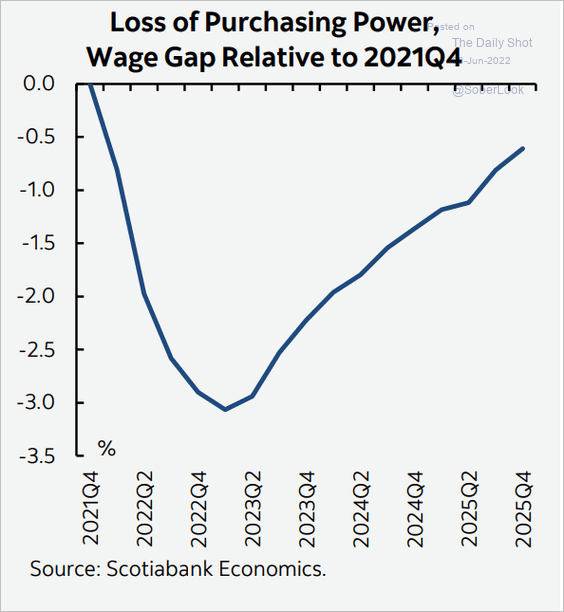

2. Household purchasing power continues to deteriorate, with recovery not expected to start until next year.

Source: Scotiabank Economics

Source: Scotiabank Economics

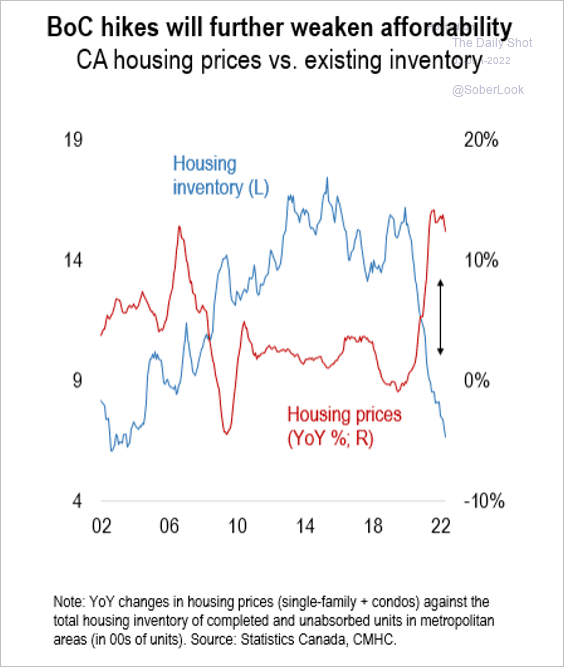

3. Housing inventories are very tight, keeping price appreciation near record levels. How quickly will the BoC’s tightening cool the housing market?

Source: Numera Analytics

Source: Numera Analytics

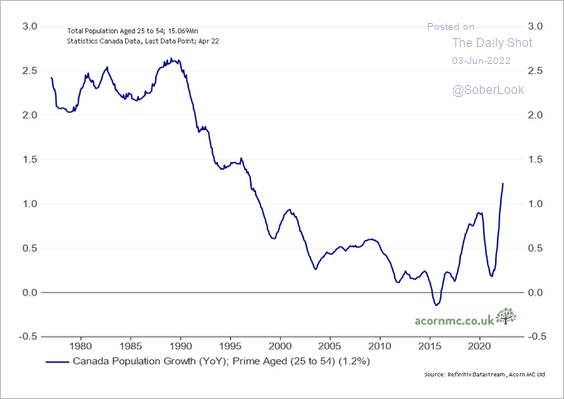

4. Sensible immigration policies helped boost Canada’s prime-age population, which will be a tailwind for GDP growth.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

Back to Index

The Eurozone

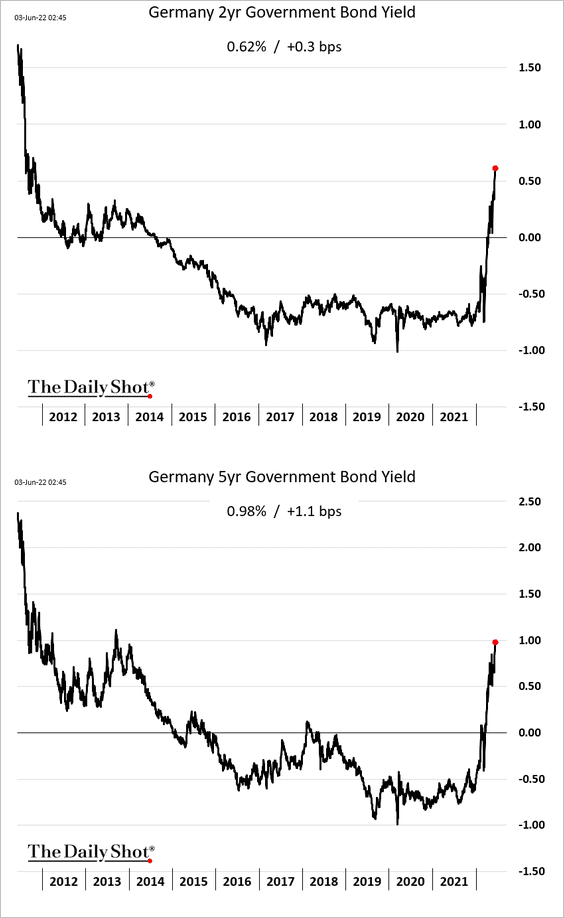

1. Shorter-term Bund yields have been surging as the market prices in a more hawkish ECB.

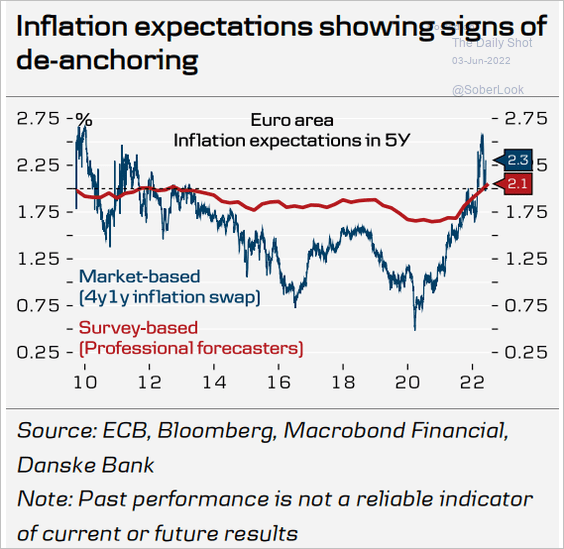

2. Inflation expectations are on the rise.

Source: Danske Bank

Source: Danske Bank

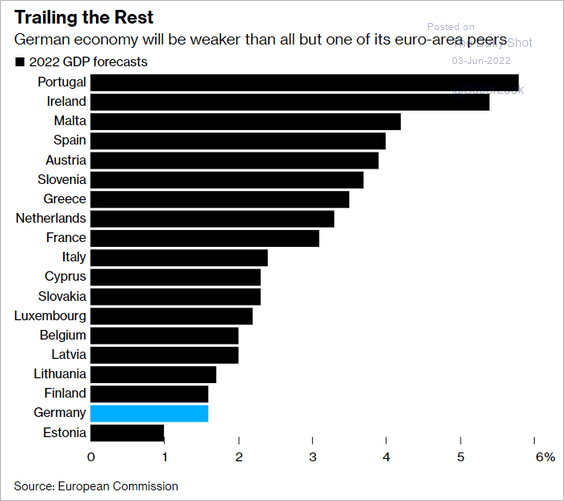

3. Germany’s economy is expected to underperform this year.

Source: @jrandow, @bpolitics Read full article

Source: @jrandow, @bpolitics Read full article

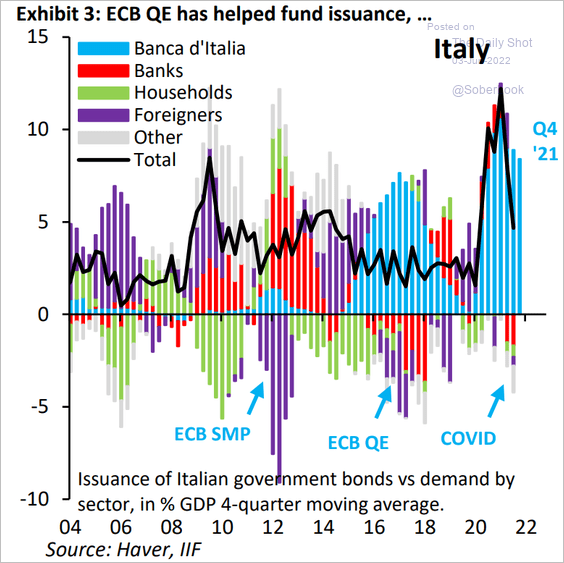

4. The ECB has been financing much of Italy’s bond issuance.

Source: IIF

Source: IIF

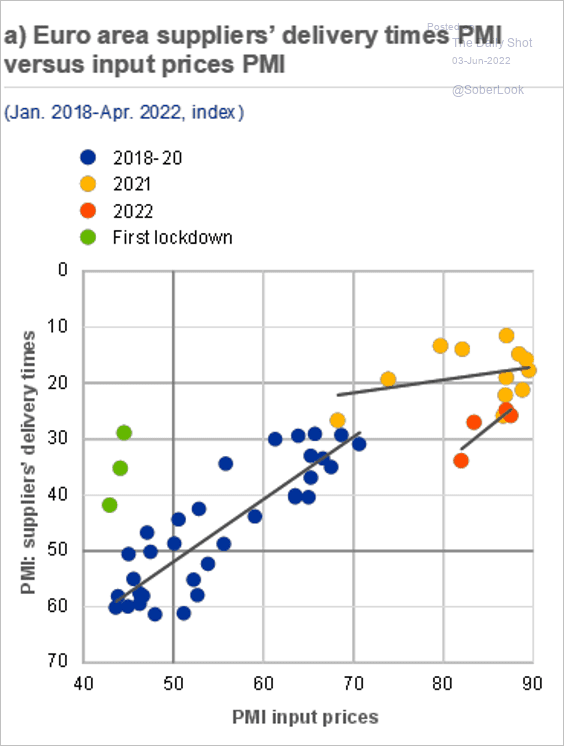

5. What is the relationship between supply strains (delivery times) and input prices?

Source: ECB Read full article

Source: ECB Read full article

Back to Index

Europe

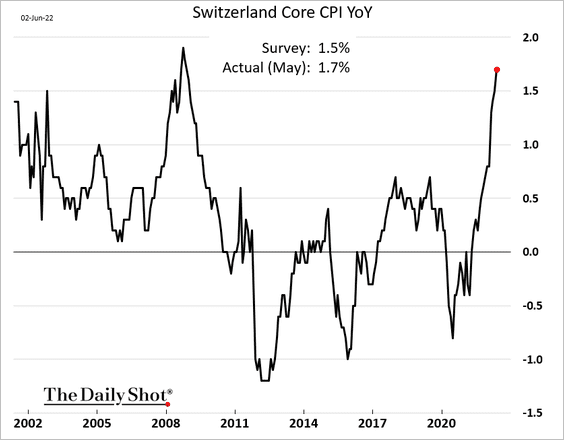

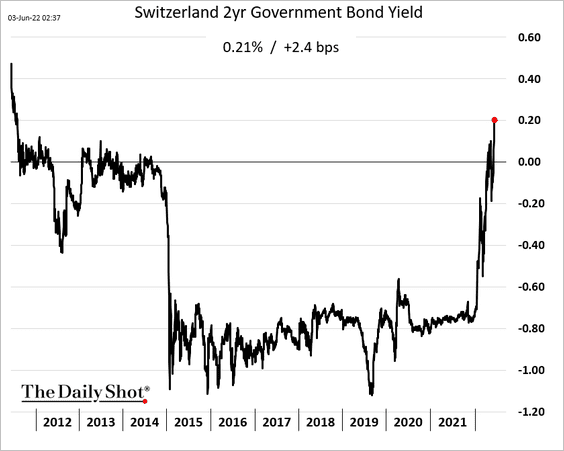

1. Swiss inflation surprised to the upside. A strong Swiss franc has been keeping the CPI well below the levels we see in the Eurozone.

The 2yr Swiss yield hit the highest level since 2011.

——————–

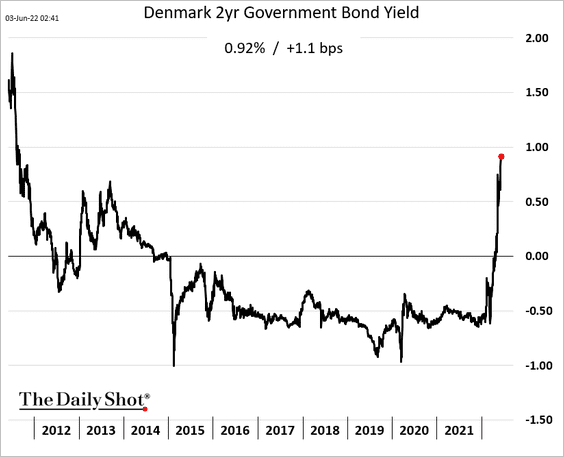

2. Denmark’s short-term yields are surging as well.

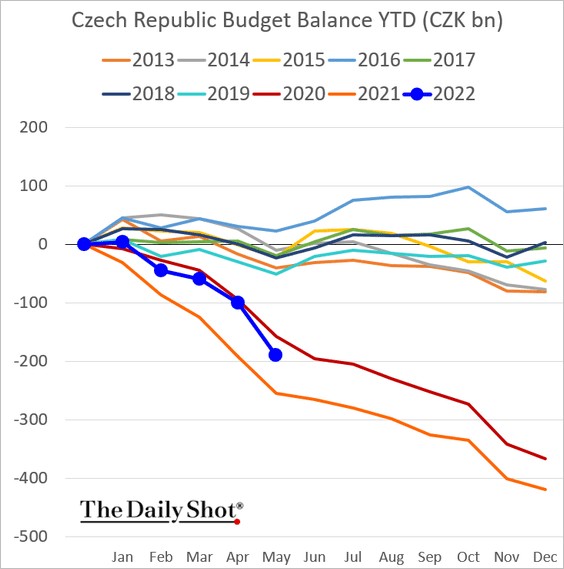

3. The Czech government budget deficit exceeded 2020 levels.

Back to Index

Asia – Pacific

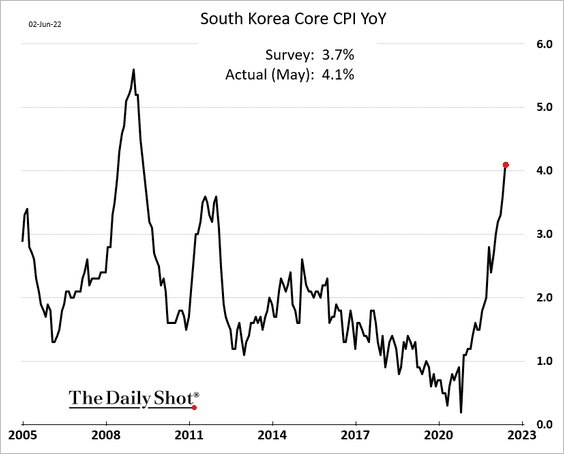

1. South Korea’s inflation topped expectations.

Source: Reuters Read full article

Source: Reuters Read full article

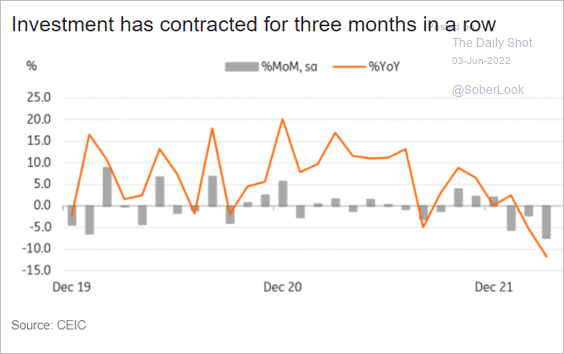

Separately, South Korea’s business investment has been contracting in recent months.

Source: ING

Source: ING

——————–

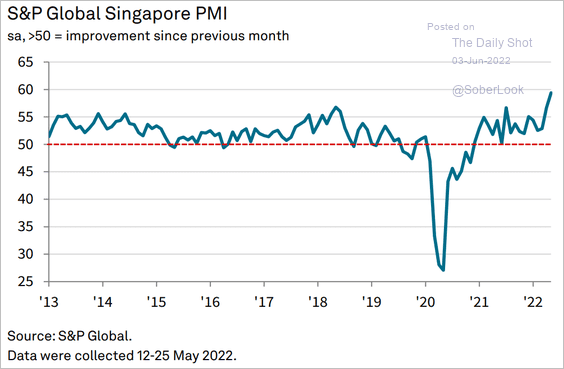

2. Singapore’s business activity surged in May.

Source: S&P Global PMI

Source: S&P Global PMI

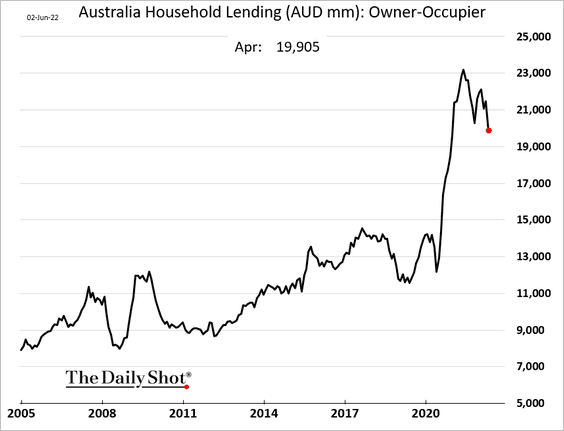

3. Australia’s housing finance is starting to cool.

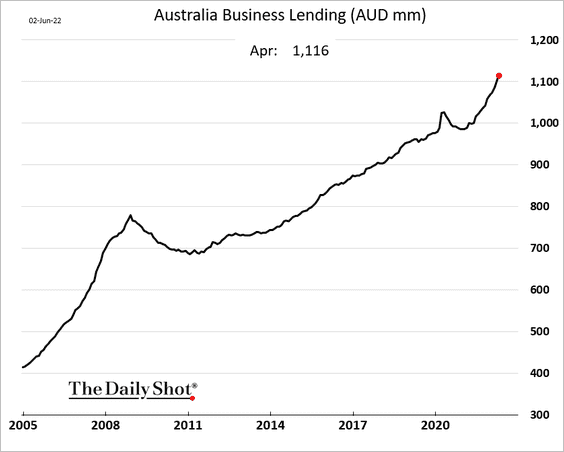

But business lending is accelerating.

Back to Index

China

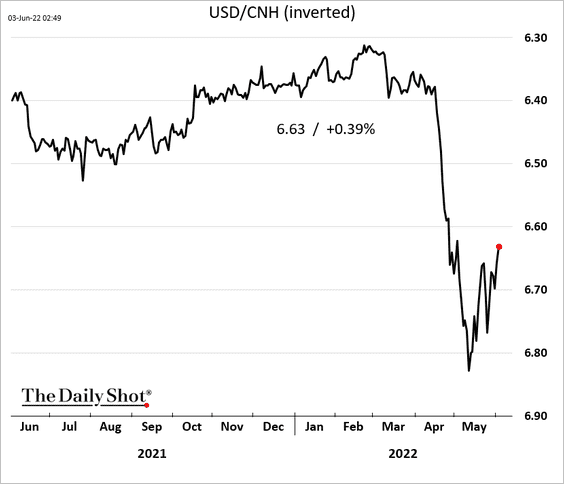

1. The renminbi resumed its rebound as investors return to China.

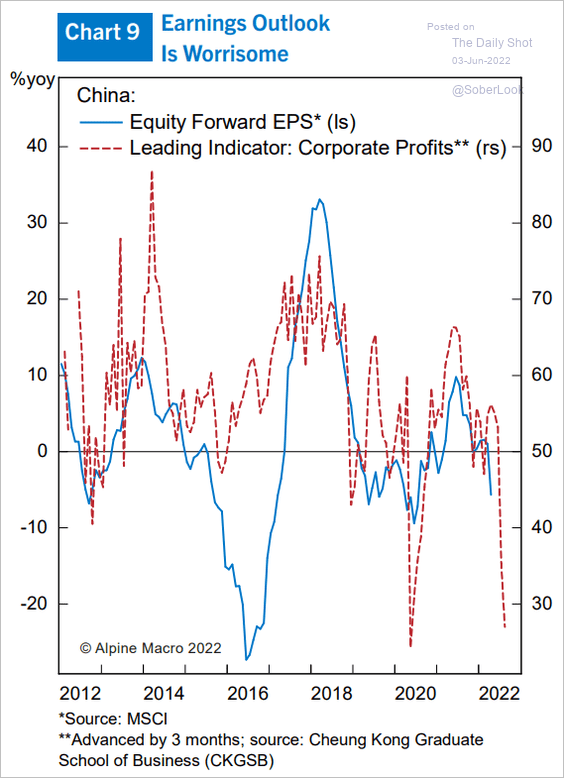

2. Corporate earnings outlook has been weak.

Source: Alpine Macro

Source: Alpine Macro

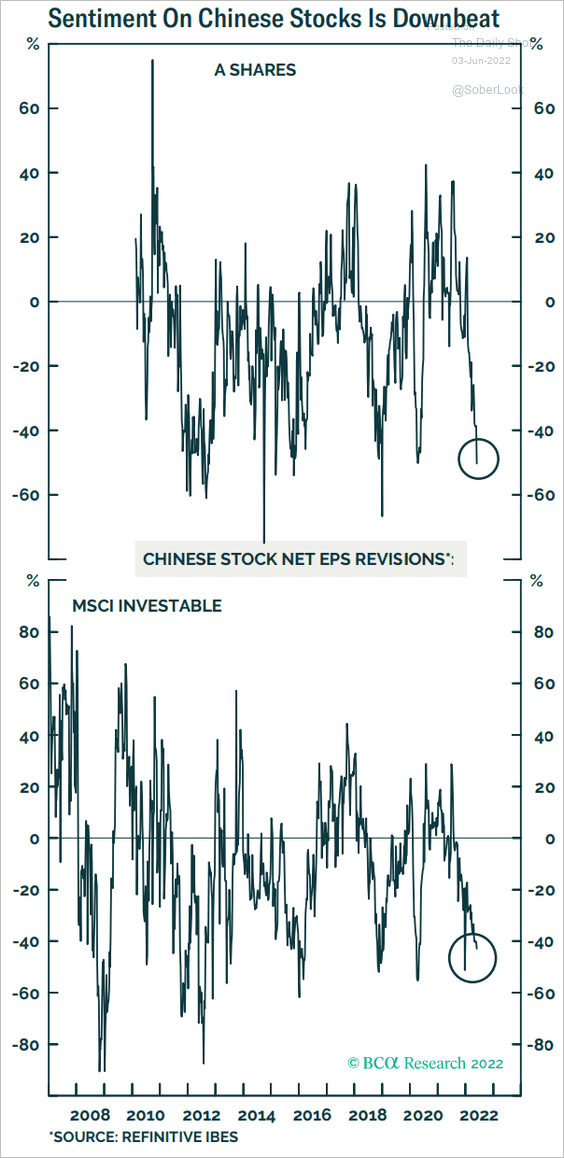

But depressed sentiment on Chinese equities could be a tailwind for the market.

Source: BCA Research

Source: BCA Research

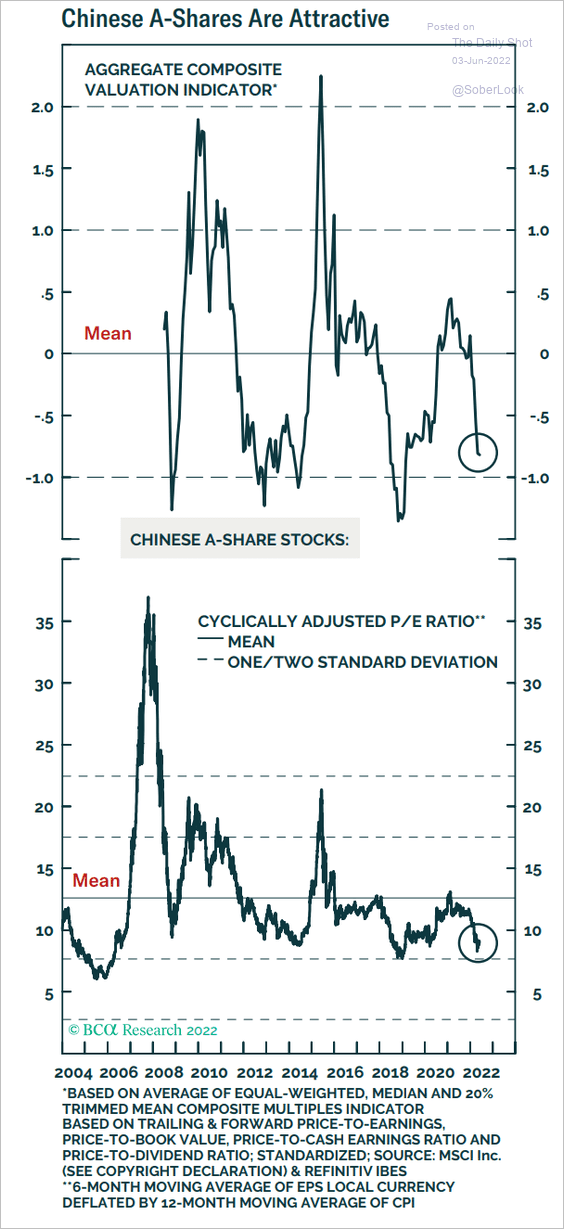

Valuations look attractive.

Source: BCA Research

Source: BCA Research

——————–

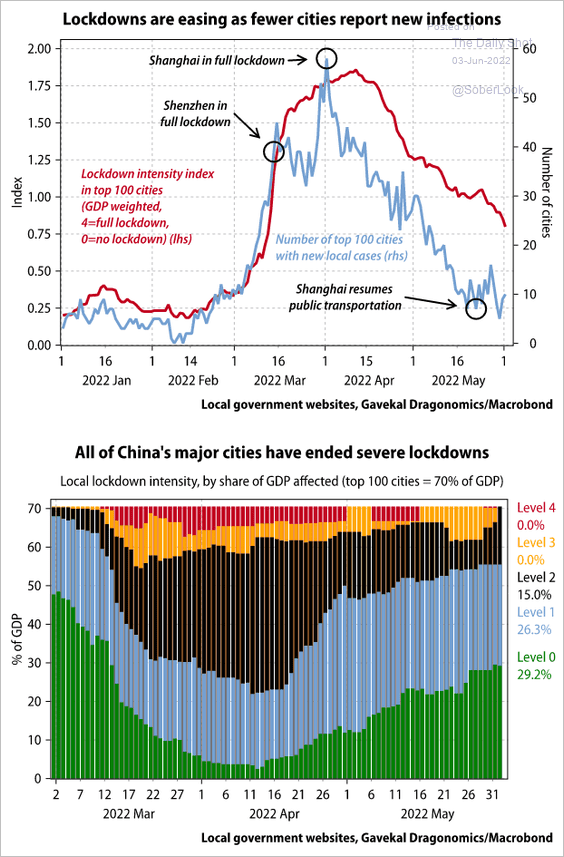

3. Lockdowns are easing.

Source: Gavekal Research

Source: Gavekal Research

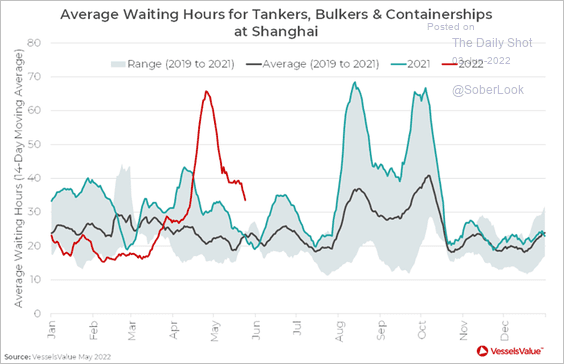

Here are the waiting times for vessels at the Port of Shanghai.

Source: VesselsValue

Source: VesselsValue

——————–

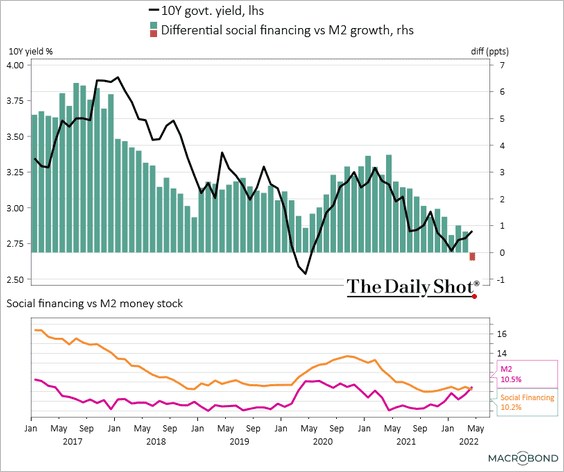

4. China’s total financing is now below the broad money supply growth.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

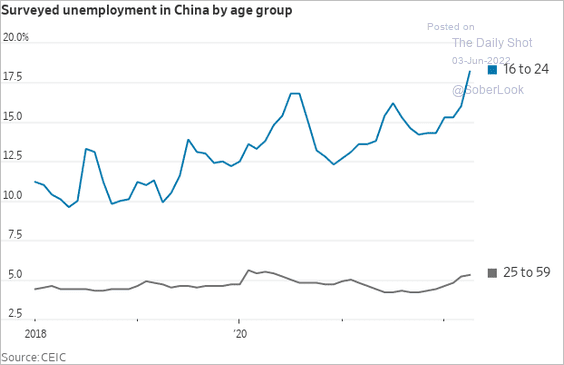

5. The unemployment rate among young people has risen substantially.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

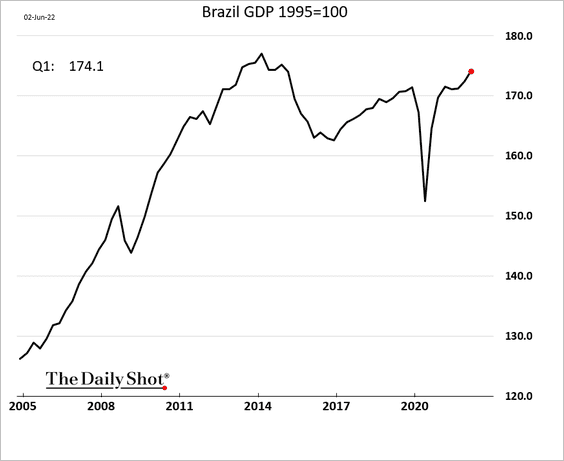

1. Brazil’s economy continued to expand in Q1, although growth was slower than expected. Economists see a tough road ahead for the rest of 2022.

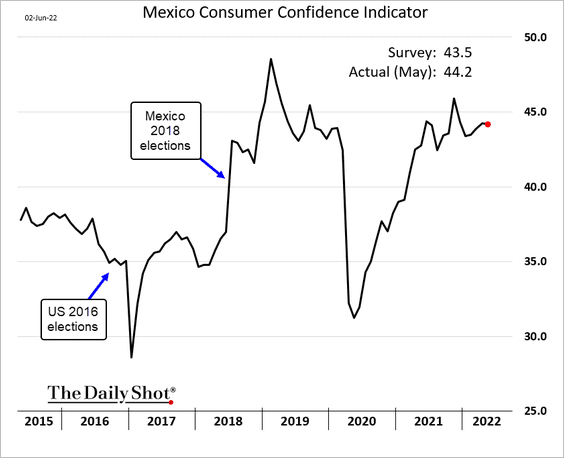

2. Mexican consumer confidence has been resilient.

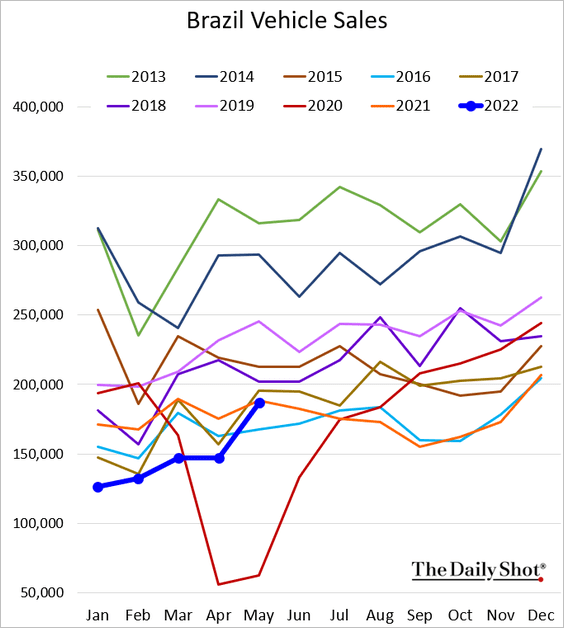

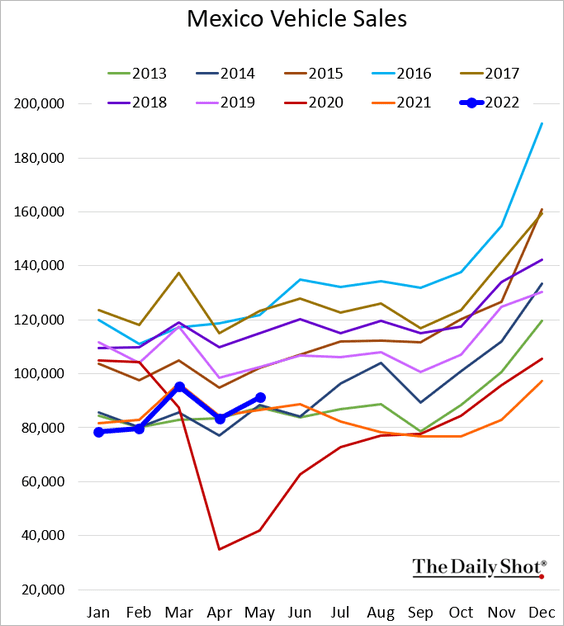

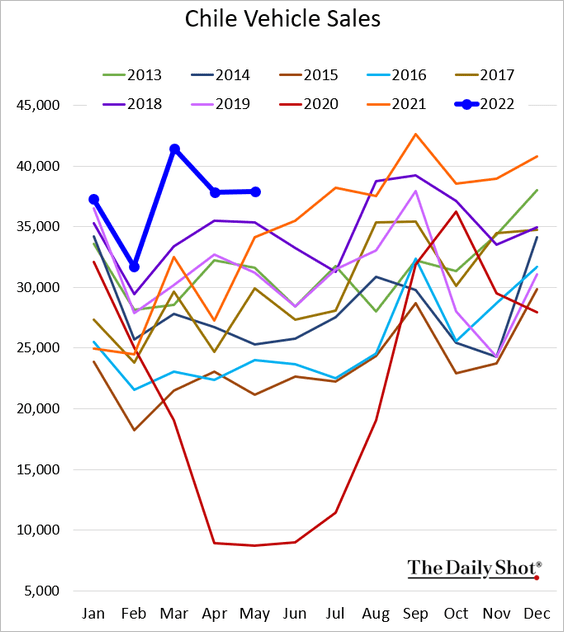

3. Next, we have some vehicle sales data through May.

• Brazil:

• Mexico:

• Chile:

——————–

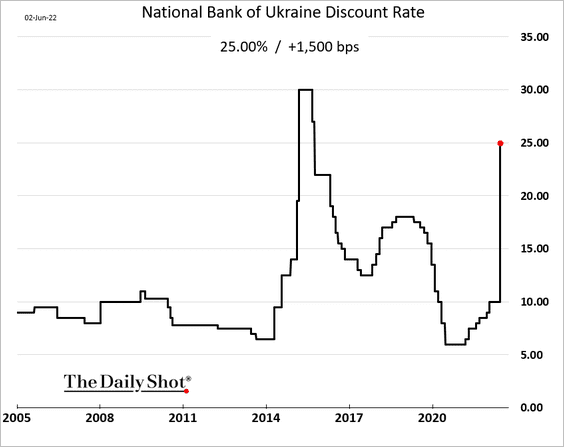

4. Ukraine’s central bank has returned to the business of monetary policy, hiking rates to 25%.

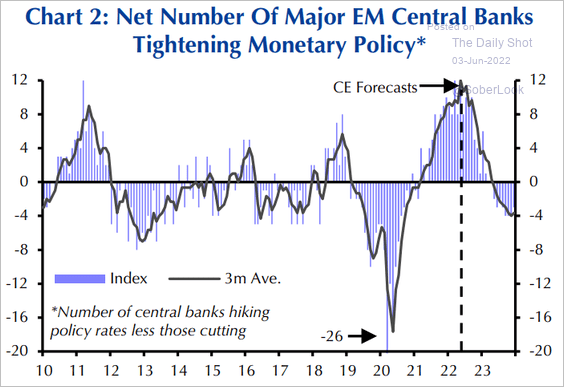

5. EM central banks will begin cutting rates next year, according to Capital Economics.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

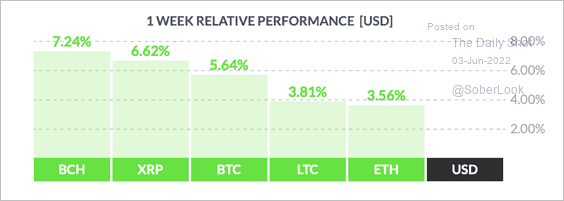

1. Most major cryptos stabilized over the past week.

Source: FinViz

Source: FinViz

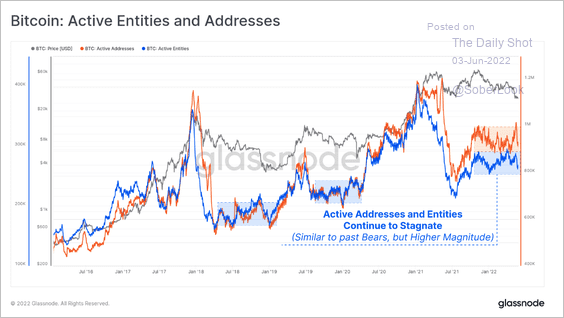

2. There has been a dip in the number of active addresses and entities on the Bitcoin blockchain, similar to what occurred during the 2018 bear market.

Source: Glassnode Read full article

Source: Glassnode Read full article

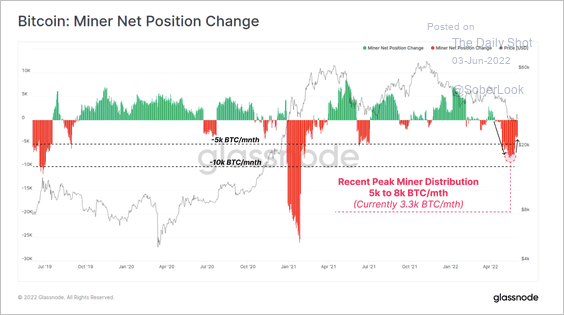

3. Bitcoin miners have distributed less of their BTC holdings over the past few weeks.

Source: Glassnode Read full article

Source: Glassnode Read full article

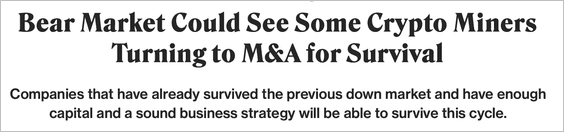

4. Could we see a rise in M&A among crypto miners?

Source: CoinDesk Read full article

Source: CoinDesk Read full article

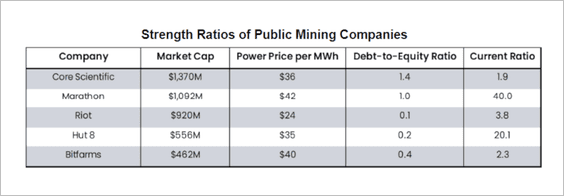

Here is a comparison of fundamental metrics across publicly listed mining companies.

Source: @ArcaneResearch

Source: @ArcaneResearch

——————–

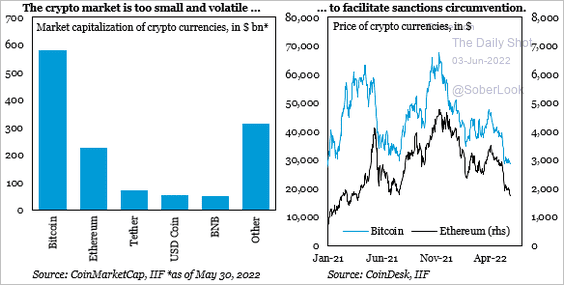

5. It would be challenging for Russia to use crypto for circumventing sanctions.

Source: @IIF Read full article

Source: @IIF Read full article

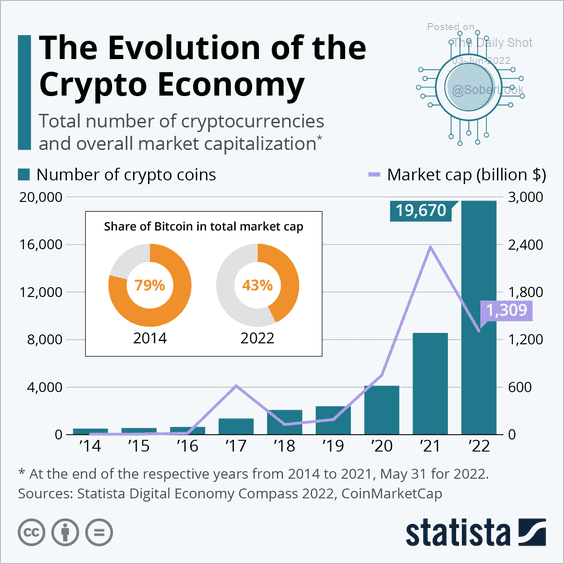

6. The number of cryptocurrencies has exploded.

Source: Statista

Source: Statista

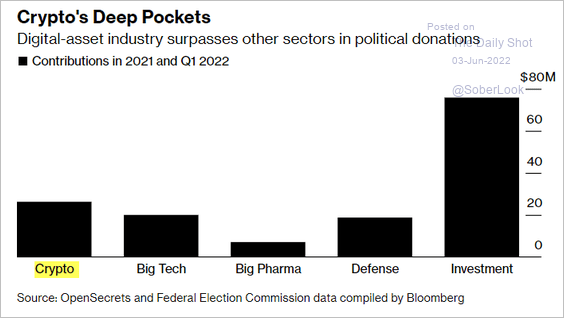

7. Crypto industry political donations surged over the past few quarters.

Source: @allyversprille, @bill_allison, @bpolitics Read full article

Source: @allyversprille, @bill_allison, @bpolitics Read full article

Back to Index

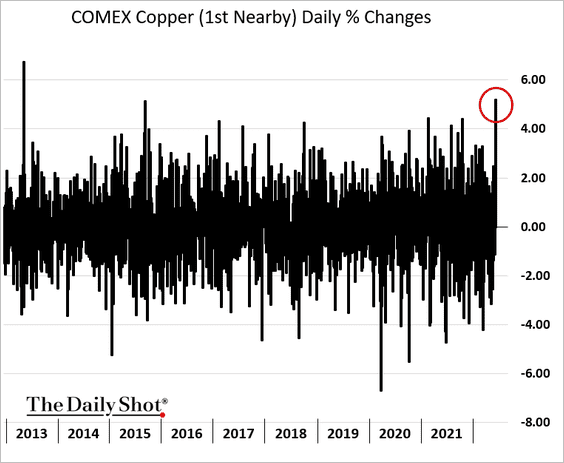

Commodities

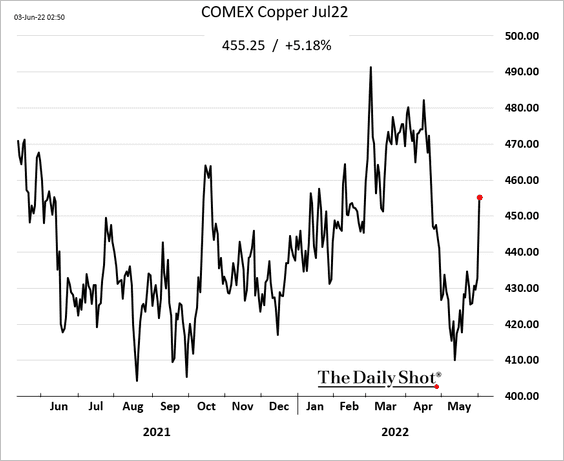

1. Copper soared on Thursday amid improving demand expectations for China.

——————–

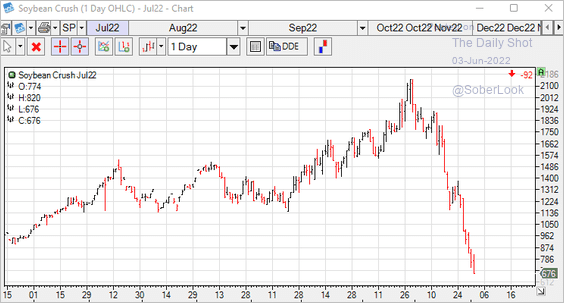

2. Soybean crush has been tumbling as gains in soybeans outpace soybean oil and soybean meal.

h/t Tom

h/t Tom

Back to Index

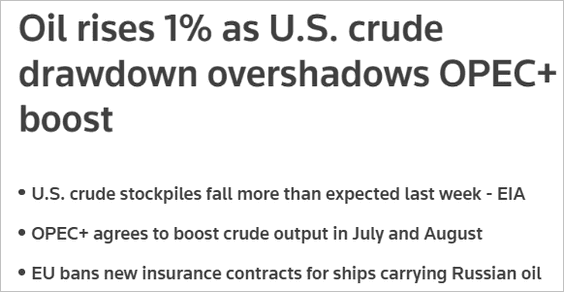

Energy

1. The OPEC+ output “boost” is not very meaningful, because production has been persistently running below quotas.

Source: Reuters Read full article

Source: Reuters Read full article

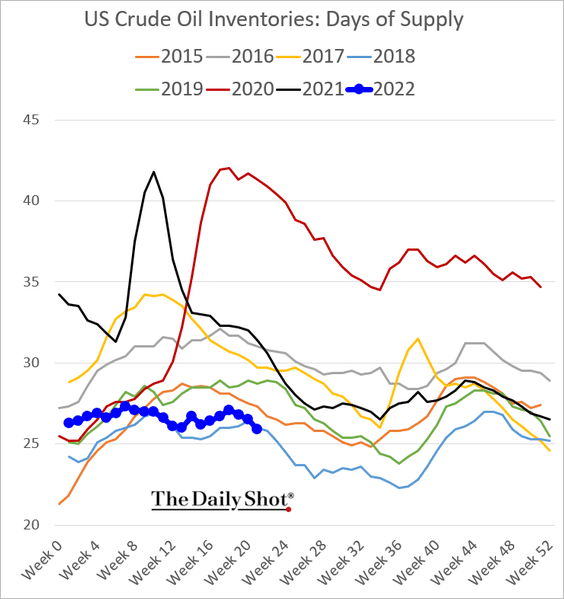

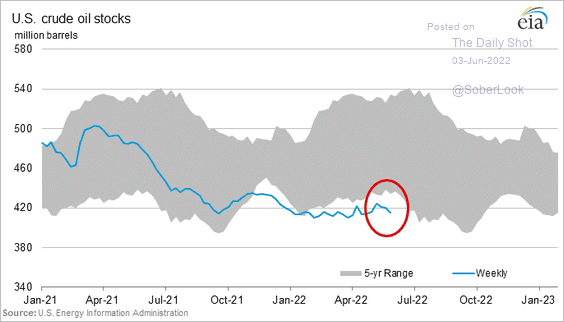

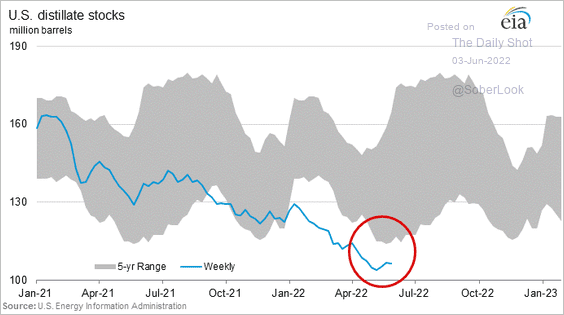

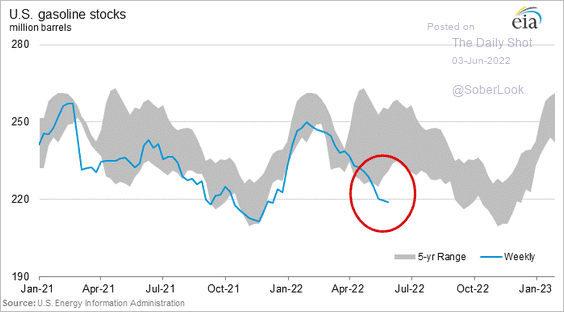

2. US oil inventories surprised to the downside (2 charts).

Refined product inventories are also very tight.

• Distillates:

• Gasoline:

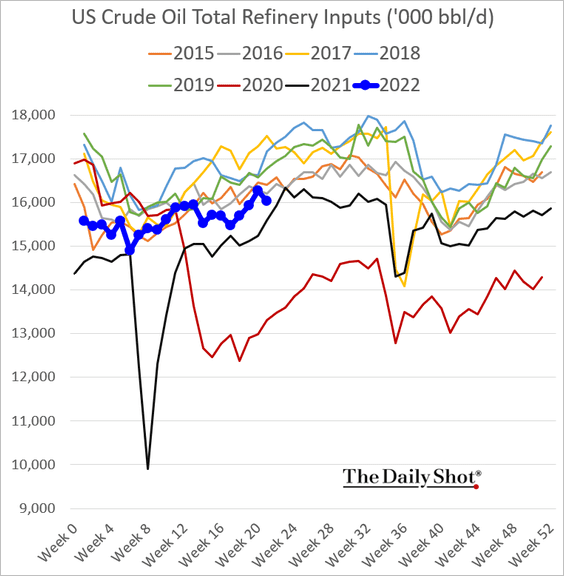

US refinery runs declined last week.

——————–

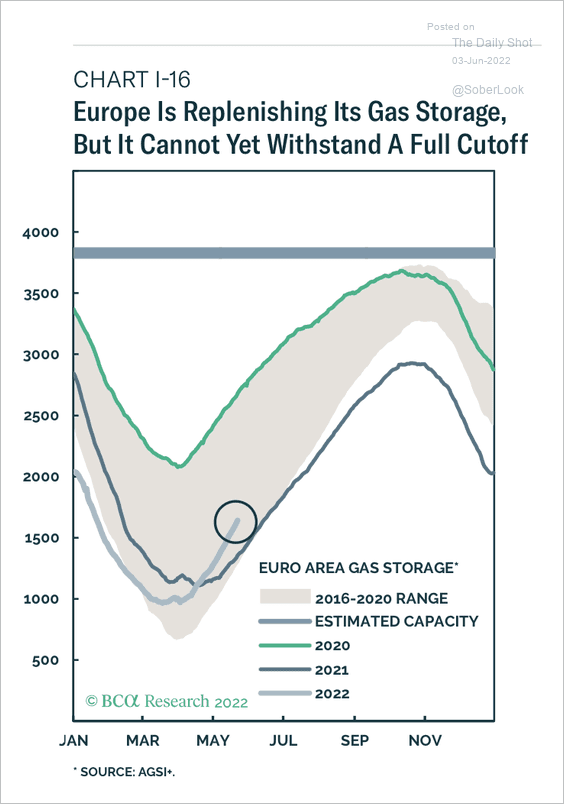

3. Euro area countries have been filling up their gas storage for the upcoming winter, but export cuts from Russia could cause significant setbacks.

Source: BCA Research

Source: BCA Research

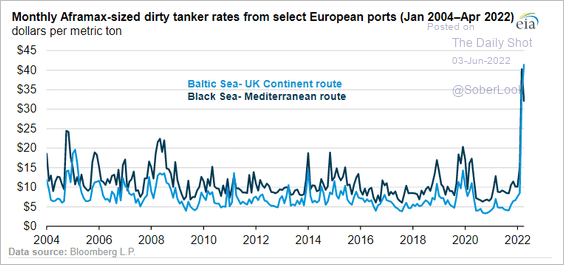

4. European petroleum tanker rates surged this year.

Source: EIA Read full article

Source: EIA Read full article

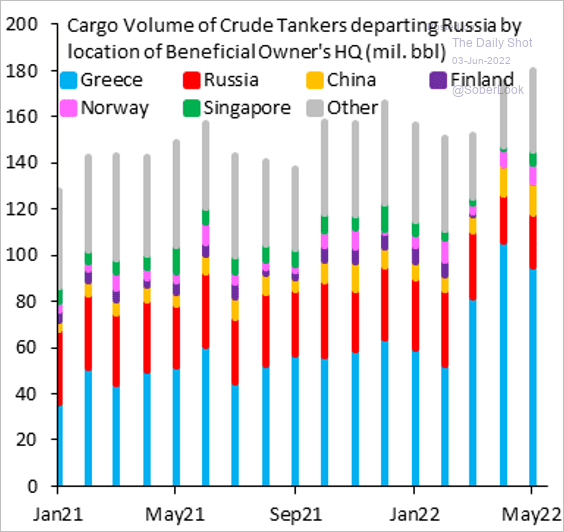

5. Who owns crude tankers moving Russian oil?

Source: @RobinBrooksIIF, @JonathanPingle

Source: @RobinBrooksIIF, @JonathanPingle

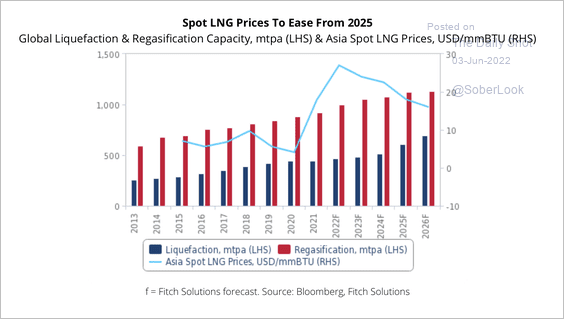

6. Fitch expects Asia spot LNG prices to fade over the next few years.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

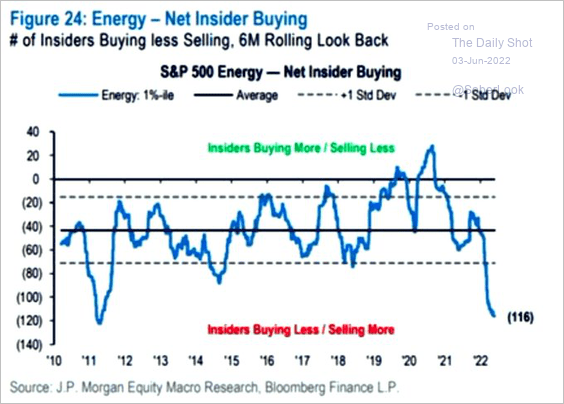

7. Insiders in the energy sector have been selling shares.

Source: JP Morgan Research; @MichaelAArouet

Source: JP Morgan Research; @MichaelAArouet

Back to Index

Equities

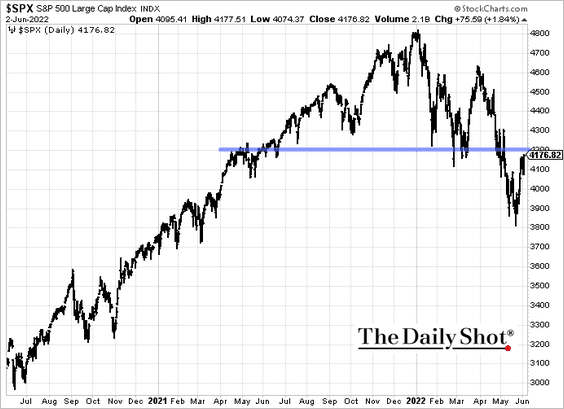

1. Stocks jumped on Thursday, and the S&P 500 now faces resistance at 4,200.

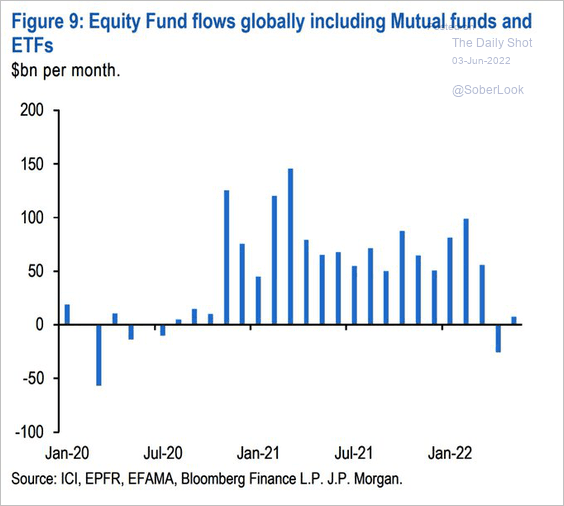

2. Fund flows ended up in the black for May.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

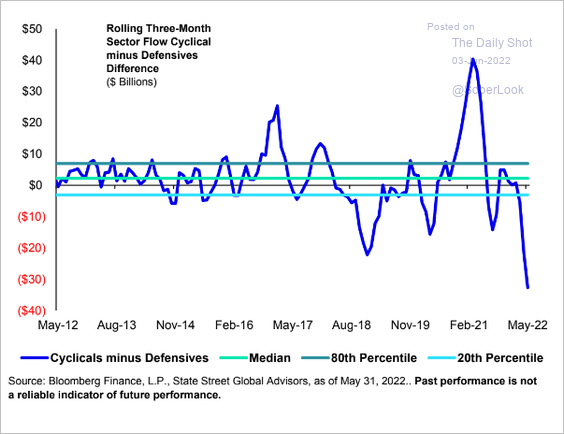

3. The cyclicals-to-defensives rotation has been massive in recent months.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

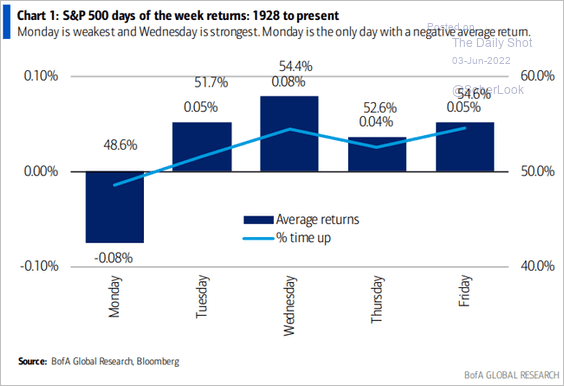

4. This chart shows how stocks performed (on average) each day of the week since 1928.

Source: BofA Global Research

Source: BofA Global Research

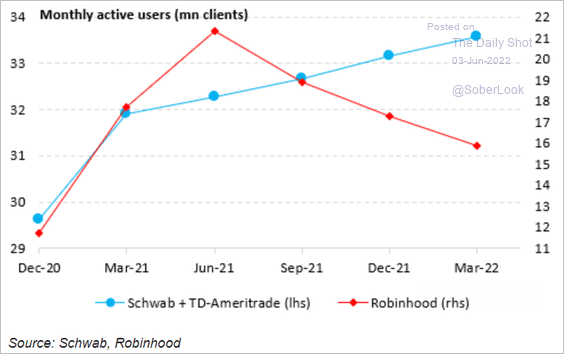

5. Are retail investors migrating to more traditional brokerage platforms?

Source: Vanda Research

Source: Vanda Research

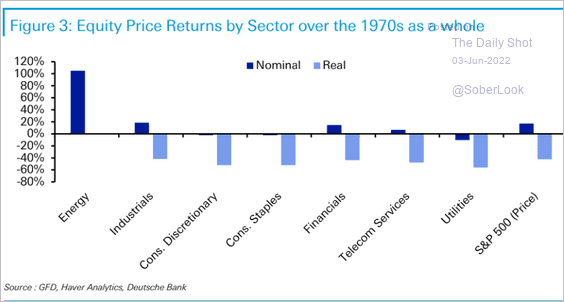

6. Finally, we have returns by sector during the 1970s (when inflation was rampant).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Credit

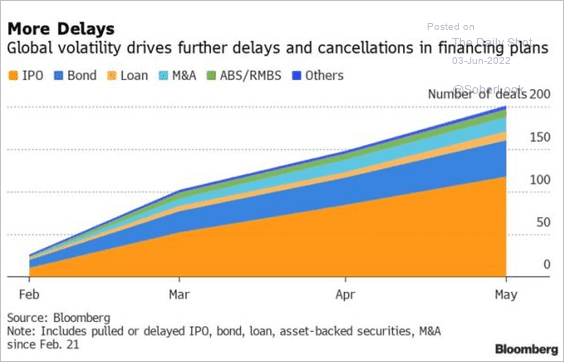

1. Delays and cancellations in financing plans surged this year amid market uncertainty.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

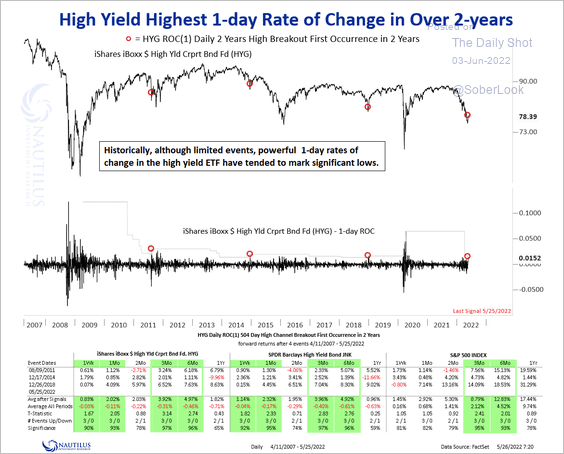

2. The iShares High Yield ETF (HYG) had its largest one-day rate of change in over two years last week, which typically precedes further gains.

Source: @NautilusCap

Source: @NautilusCap

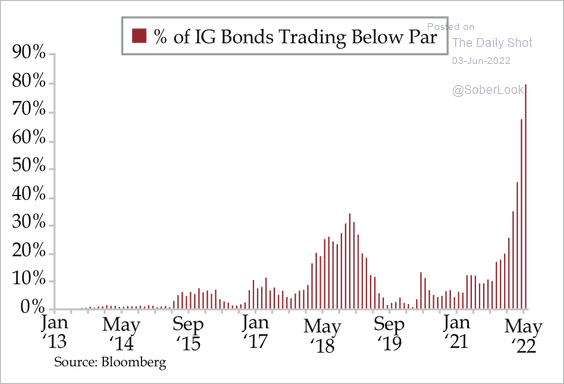

3. A majority of US investment-grade bonds are trading below par.

Source: Quill Intelligence

Source: Quill Intelligence

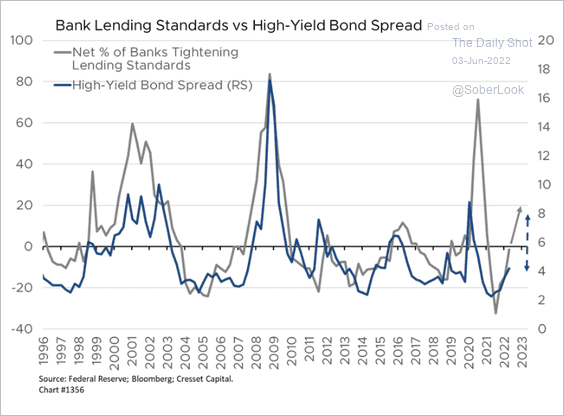

4. Tighter bank lending standards point to wider credit spreads ahead.

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

Back to Index

Rates

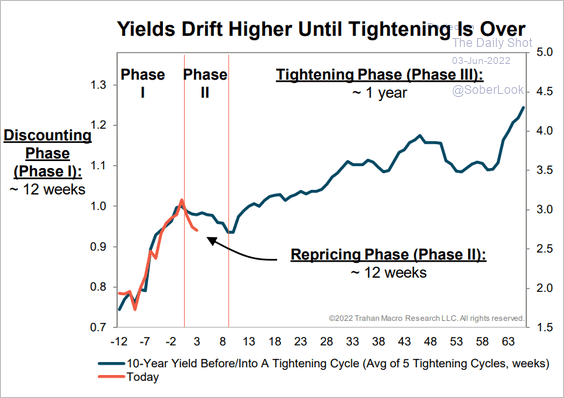

1. Treasury yields have room to rise as the Fed’s tightening cycle progresses.

Source: Trahan Macro Research

Source: Trahan Macro Research

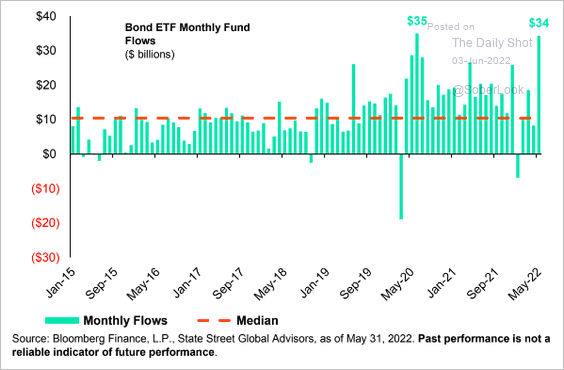

2. Bond ETFs saw substantial inflows in May, …

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

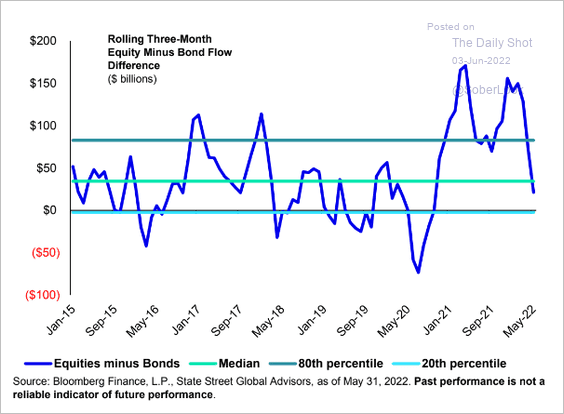

… outpacing equity flows.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

Back to Index

Global Developments

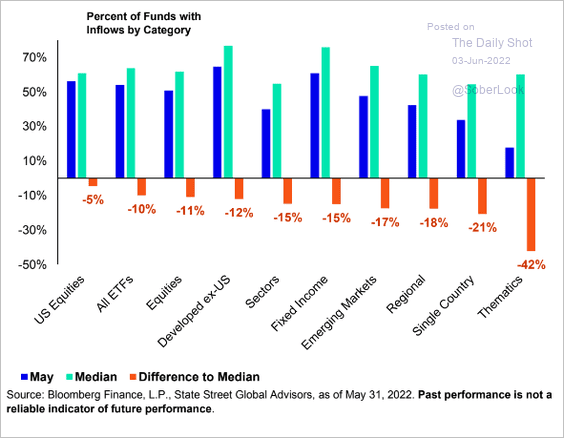

1. This chart shows the percentage of ETFs with inflows in May, compared to historical levels.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

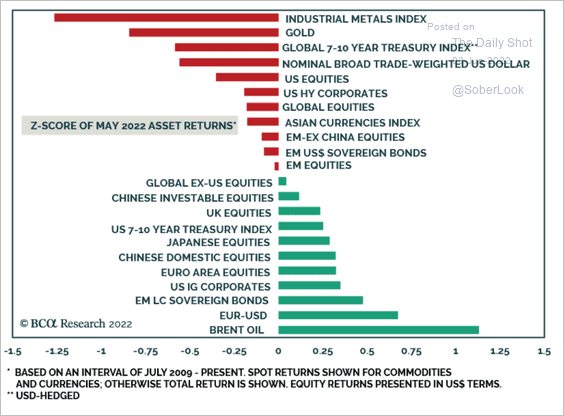

2. Here is a look at May’s performance across asset classes, expressed in standard deviations.

Source: BCA Research

Source: BCA Research

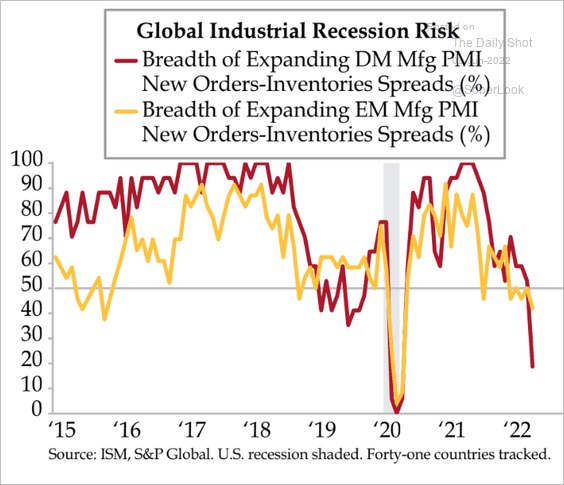

3. The spread between the PMI indices of new orders and inventories has deteriorated, which tends to signal softer manufacturing output going forward.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Food for Thought

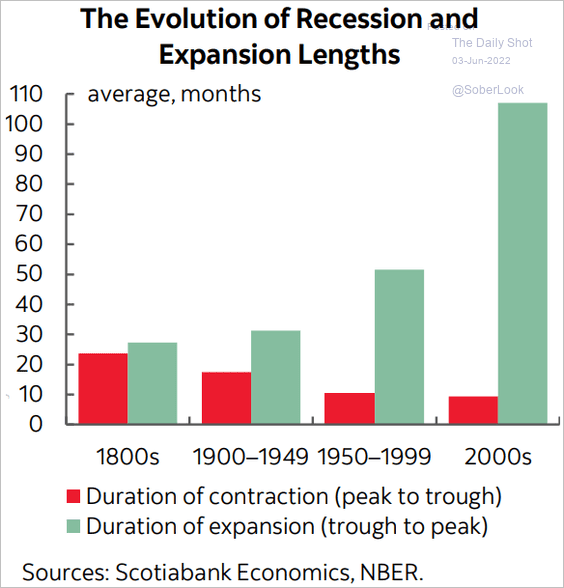

1. US economic recession and expansion lengths:

Source: Scotiabank Economics

Source: Scotiabank Economics

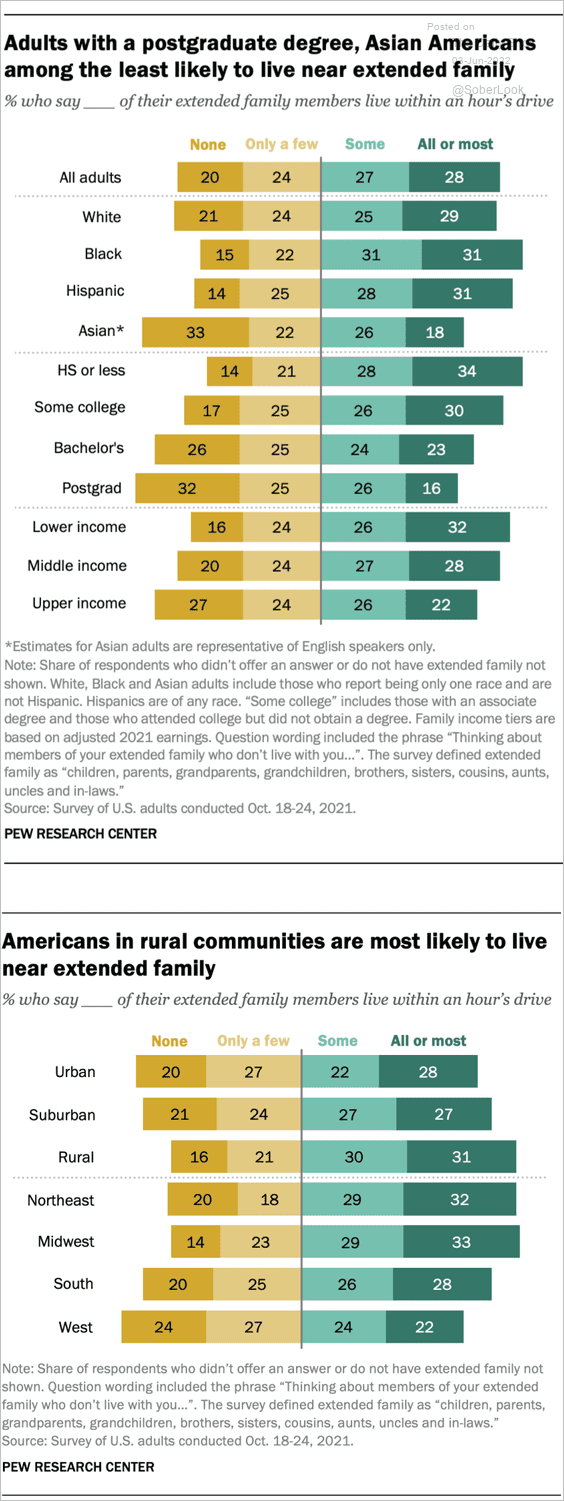

2. Americans living near their extended family:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

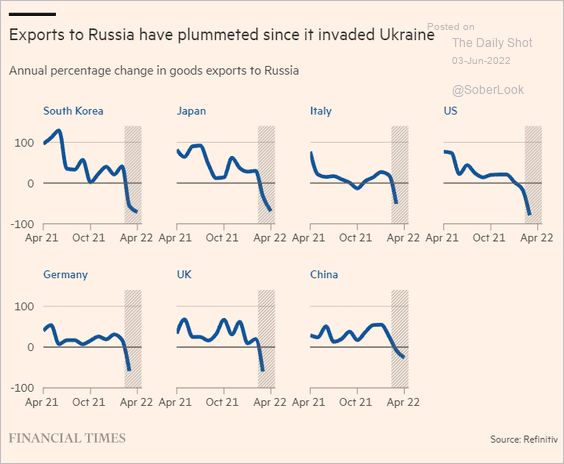

3. Exports to Russia:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

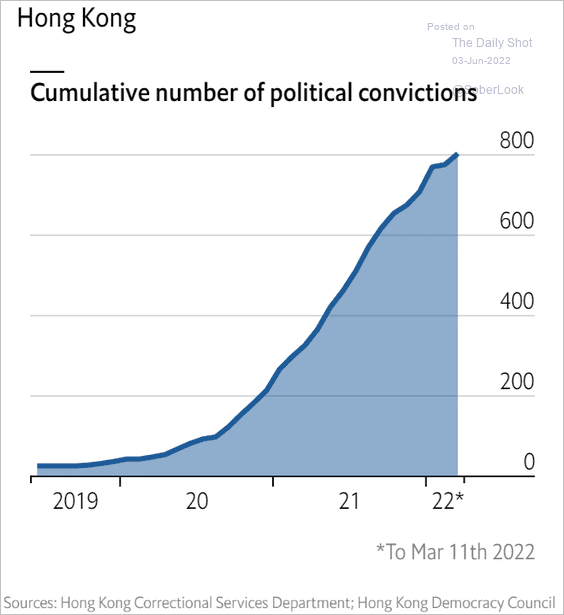

4. Political convictions in Hong Kong:

Source: The Economist Read full article

Source: The Economist Read full article

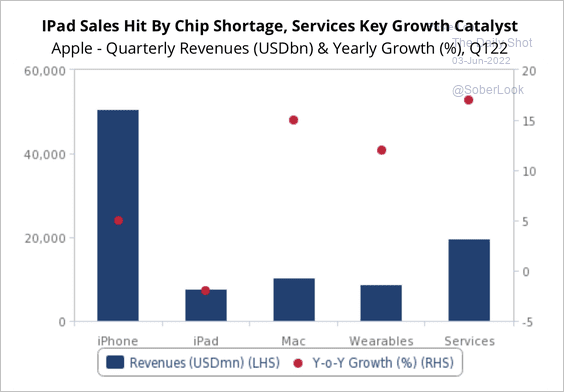

5. Apple’s revenue growth by segment:

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

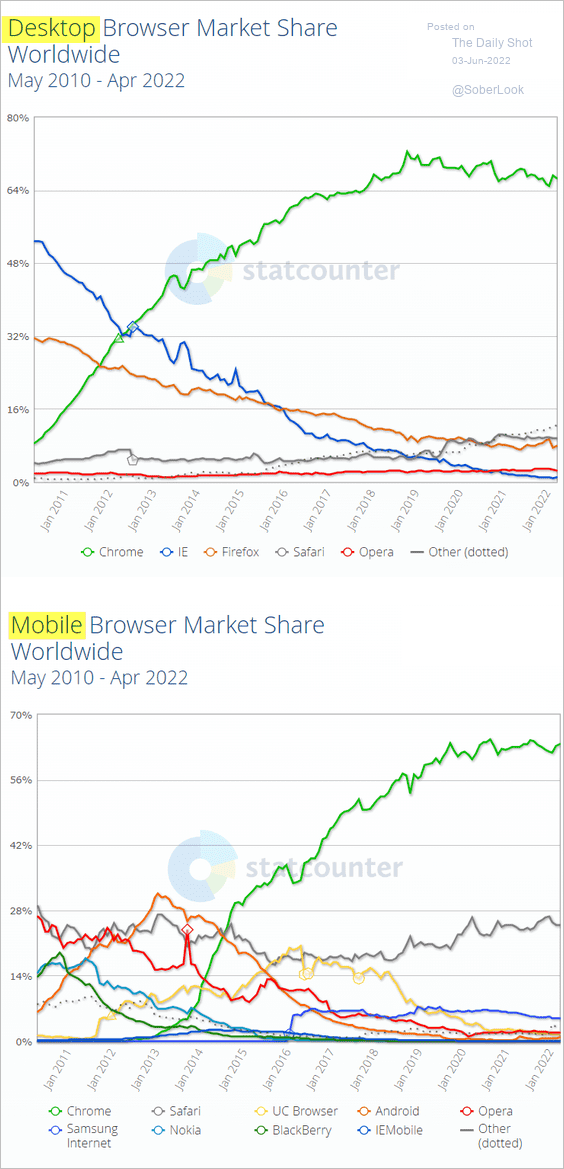

6. Browser market share over time:

Source: Statcounter

Source: Statcounter

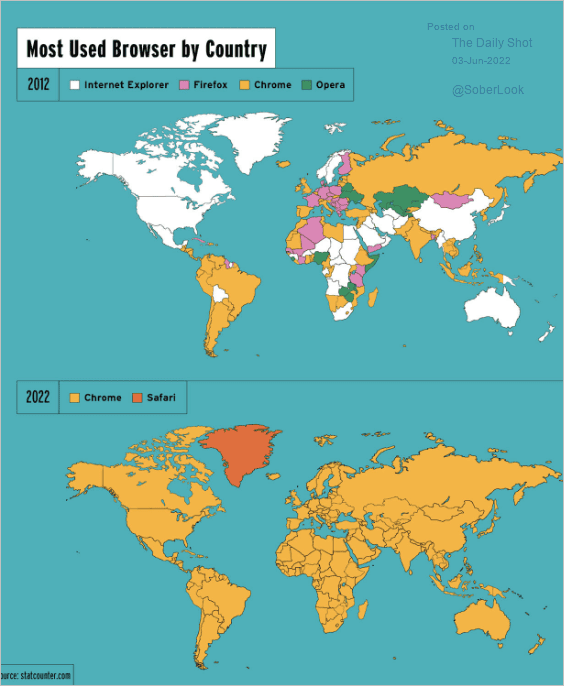

• The most popular browser by country:

Source: Chart of the Week

Source: Chart of the Week

——————–

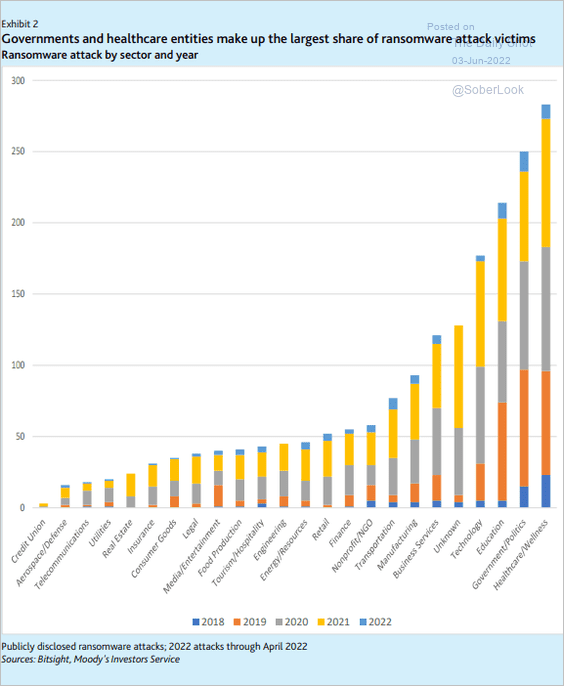

7. Ransomware attacks by sector in the US:

Source: Moody’s Investors Service

Source: Moody’s Investors Service

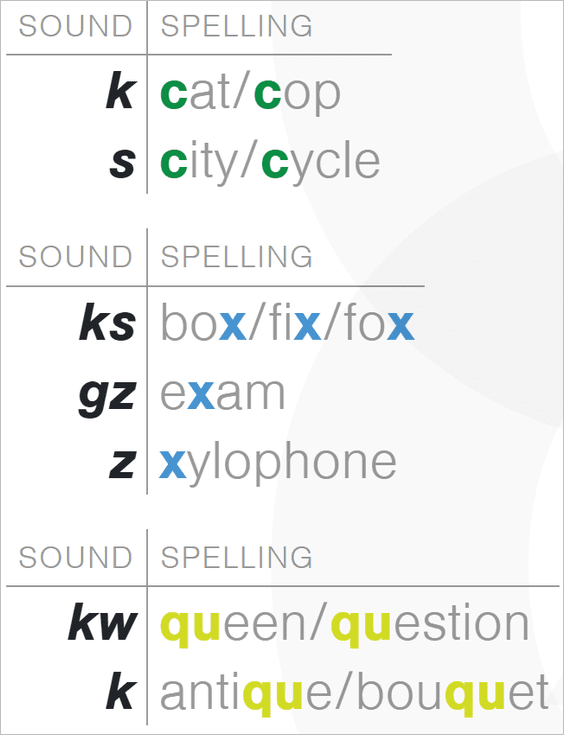

8. Examples of English spelling weirdness:

Source: Reuters Read full article

Source: Reuters Read full article

——————–

Have a great weekend!

Back to Index