The Daily Shot: 07-Jun-22

• Equities

• Credit

• Rates

• Commodities

• Energy

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• The United Kingdom

• Canada

• The United States

• Food for Thought

Equities

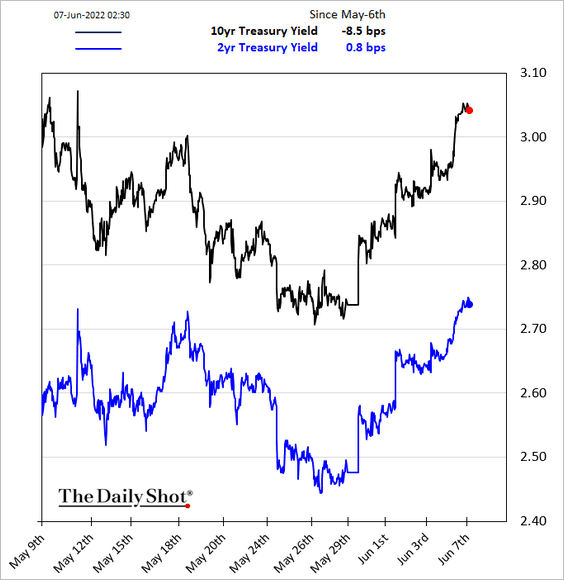

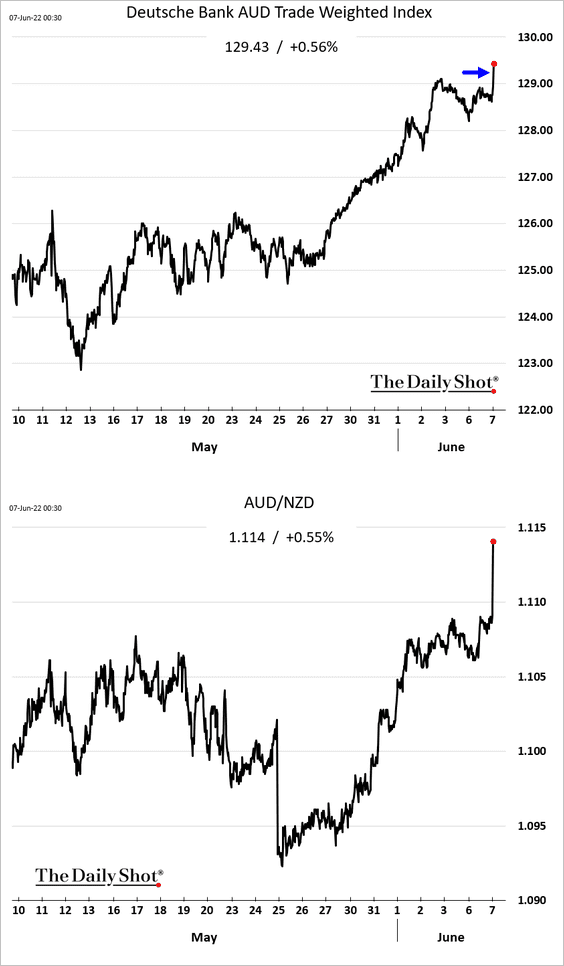

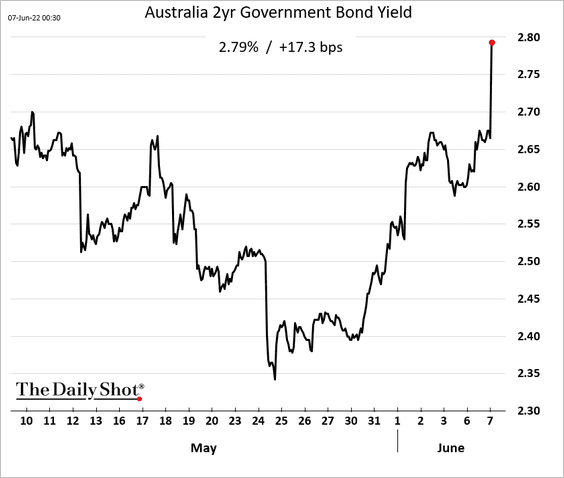

1. Sentiment has shifted to “risk-off” this morning after global bond yields jumped. The RBA’s outsize hike added to concerns about rising rates (see the Asia-Pacific section). The 10-year Treasury yield is back above 3%.

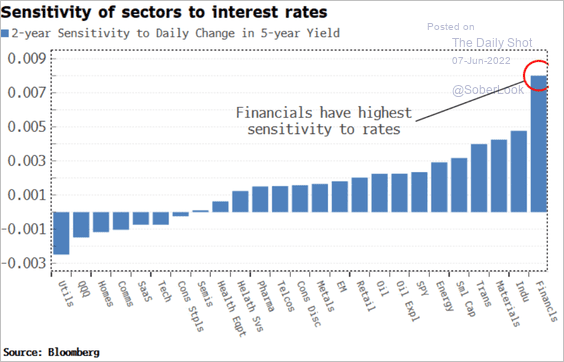

2. Which sectors are most sensitive to interest rates?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

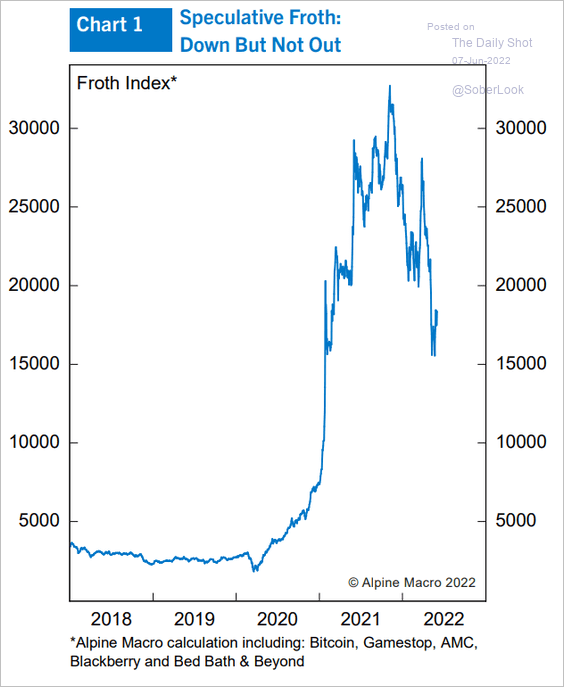

3. Alpine Macro’s “froth” index is still elevated.

Source: Alpine Macro

Source: Alpine Macro

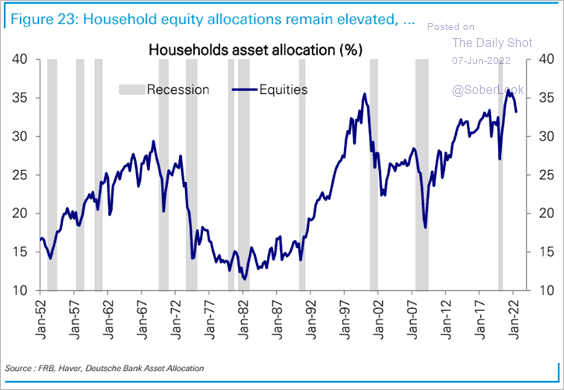

And so are US households’ equity allocations.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

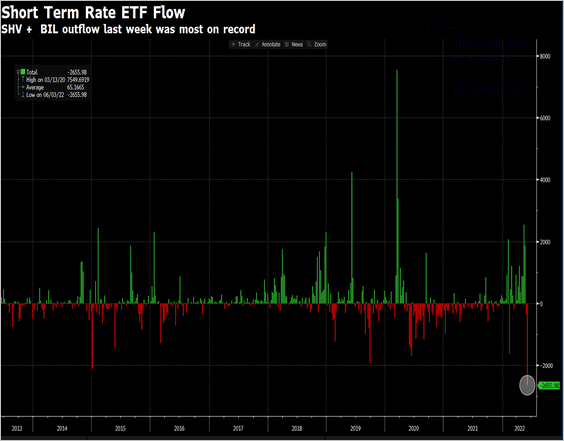

4. Investors dumped cash-equivalent ETFs last week as some move back into risk assets.

Source: @daniburgz

Source: @daniburgz

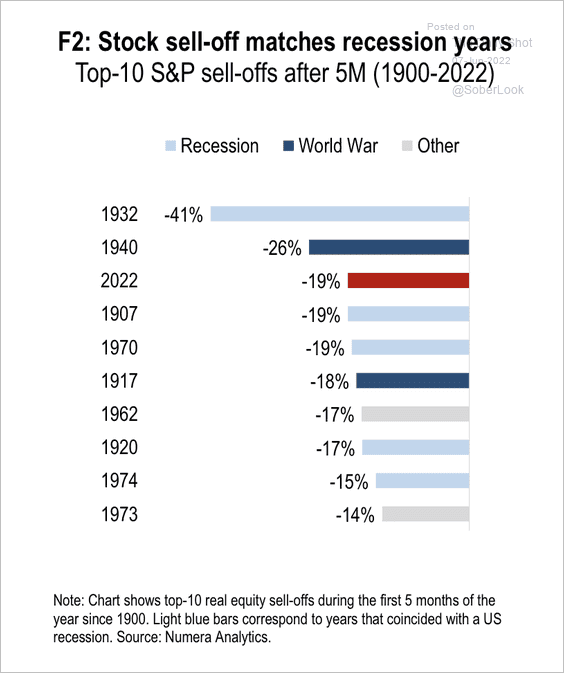

5. So far, the recent sell-off in the S&P 500 is on par with prior recession years.

Source: Numera Analytics

Source: Numera Analytics

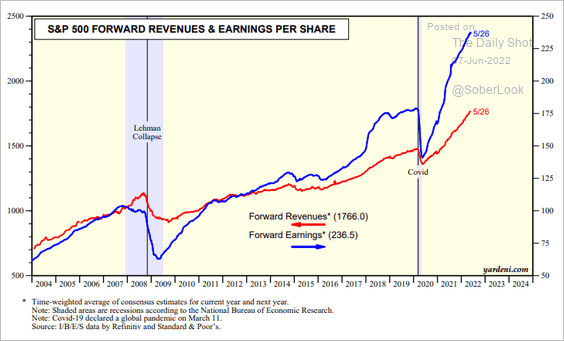

6. Are earnings estimates too optimistic?

Source: Yardeni Research

Source: Yardeni Research

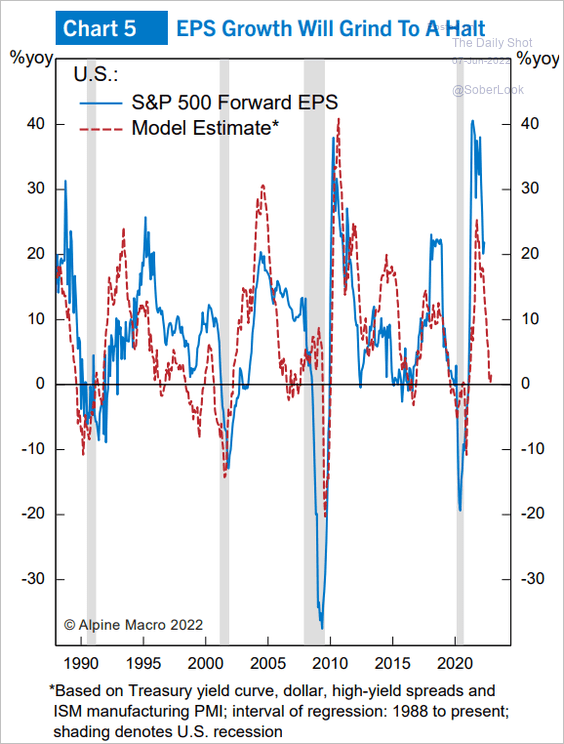

According to Alpine Macro’s model, earnings growth could grind to a halt.

Source: Alpine Macro

Source: Alpine Macro

——————–

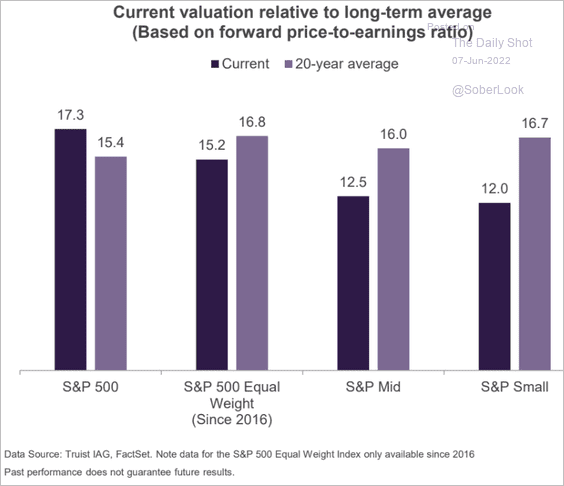

7. Next, we have some valuation-related trends.

• This chart shows current valuations compared to long-term averages.

Source: Truist Advisory Services

Source: Truist Advisory Services

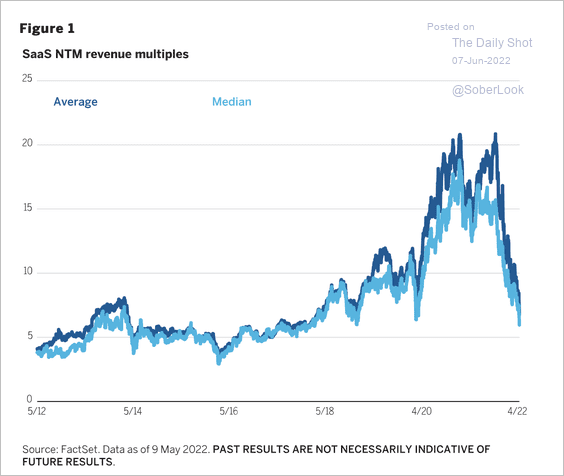

• Valuations for software-as-a-service (SaaS) companies have returned to pre-pandemic levels.

Source: Wellington Management Read full article

Source: Wellington Management Read full article

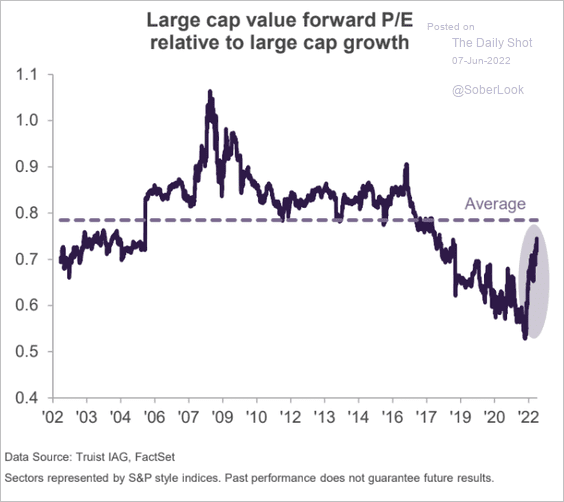

• Value/growth valuation ratio is nearing its long-term average.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

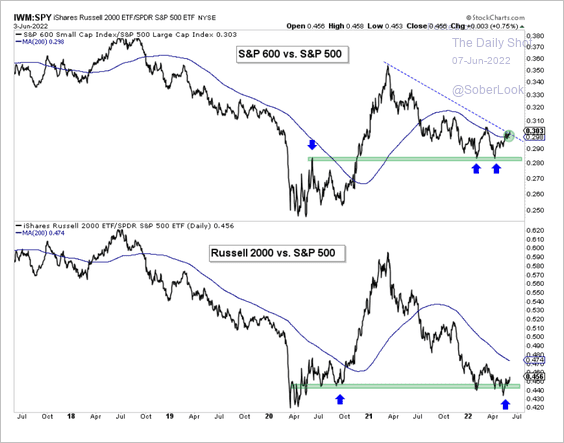

8. US small caps are seeing early signs of improving relative strength as valuations appear attractive on a relative basis (see chart).

Source: Aazan Habib; Paradigm Capital

Source: Aazan Habib; Paradigm Capital

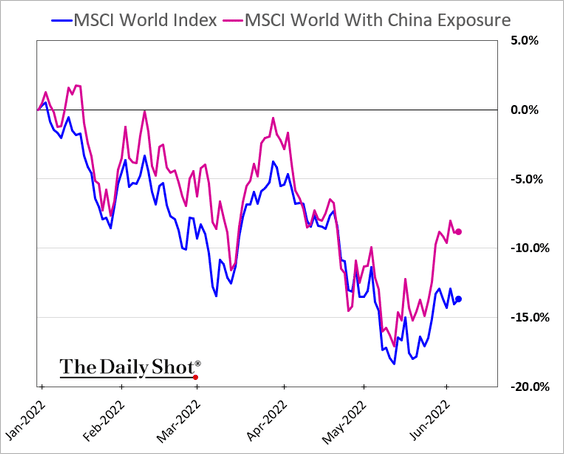

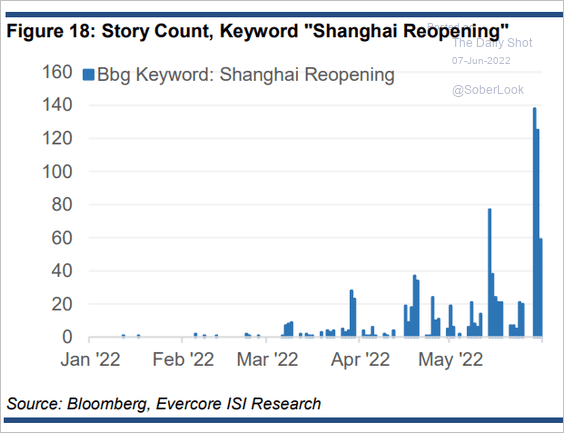

9. Global companies with substantial exposure to China sales have outperformed in recent days, …

… even as their sales in China have deteriorated recently. The market expects demand in China to rebound (see the China section).

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

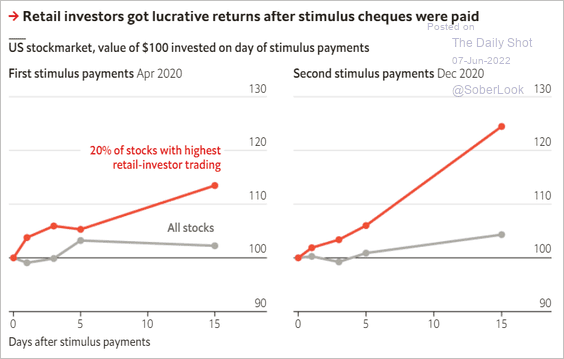

10. Here is an illustration of how stimulus checks pumped up the market in 2020.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Credit

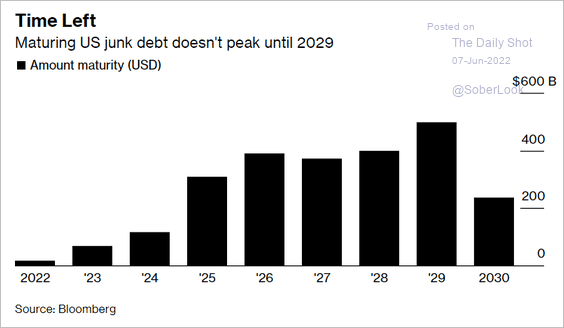

1. The US high-yield debt maturity wall has been pushed out significantly.

Source: @markets Read full article

Source: @markets Read full article

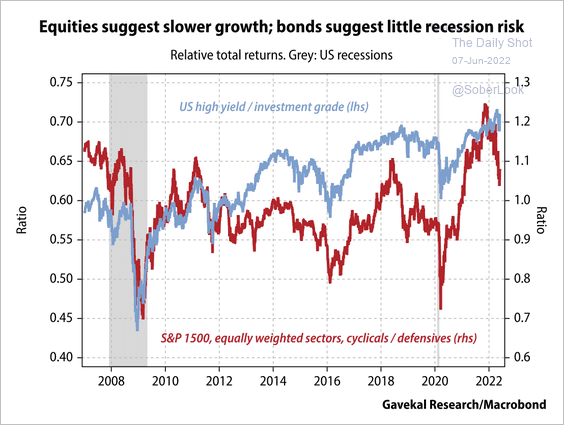

2. The performance of US high-yield versus investment-grade bonds suggests few default fears, while the outperformance of defensive stocks suggests slower economic growth ahead.

Source: Gavekal Research

Source: Gavekal Research

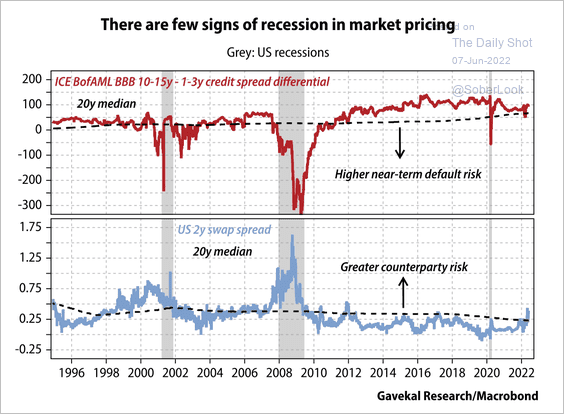

By the way, other bond market indicators show little recession risks, for now.

Source: Gavekal Research

Source: Gavekal Research

——————–

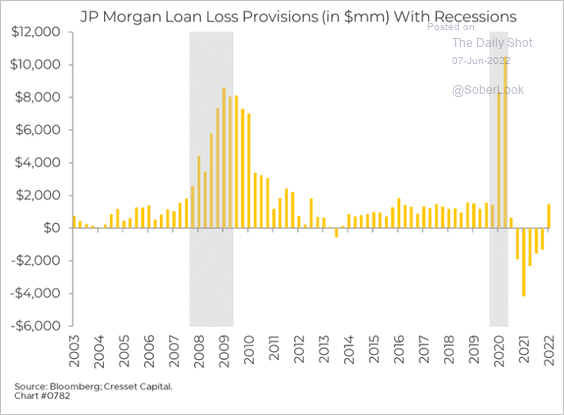

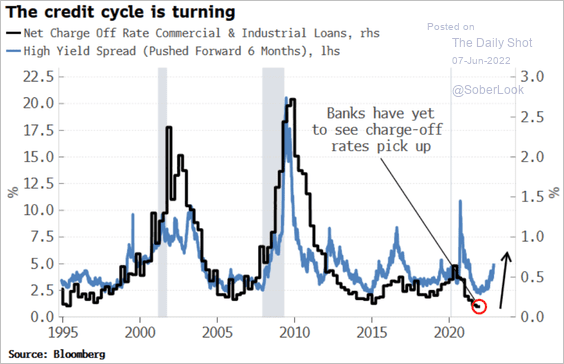

3. Increasing bank charge-off provisions …

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

… point to rising risks for credit.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Back to Index

Rates

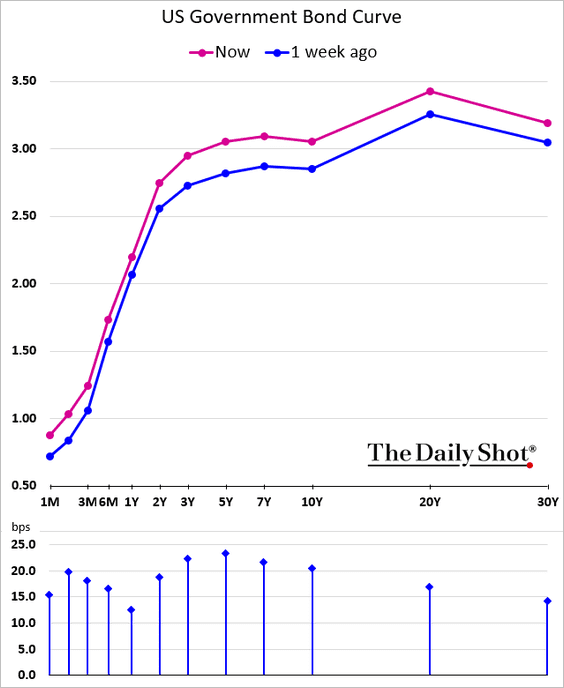

1. US yields climbed across the curve in recent days, with the belly of the curve seeing the largest increases.

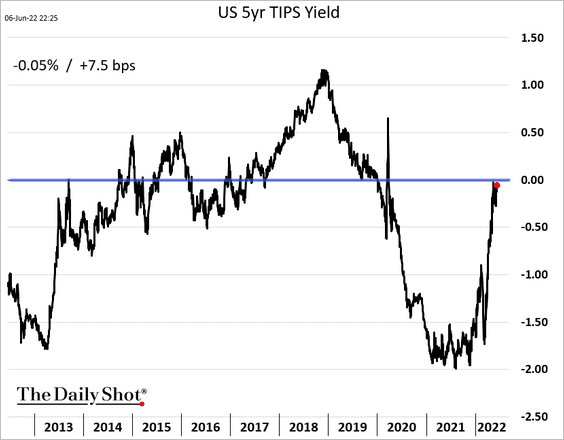

2. The 5-year TIPS yield (real rates) is once again testing resistance at zero. Stocks with high multiples are particularly vulnerable to higher real rates.

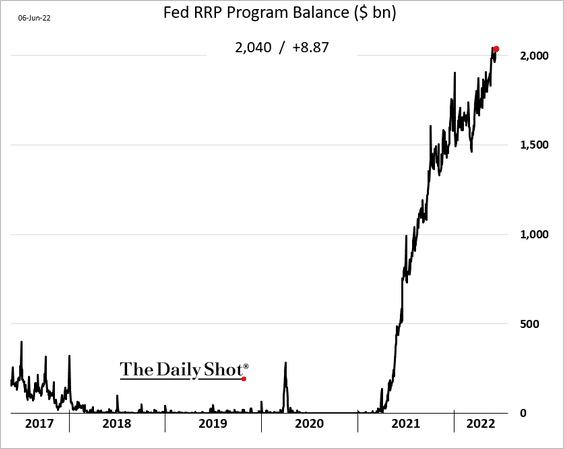

3. The Fed’s reverse repo program balances are near record highs due to tremendous demand for cash-equivalent products (such as money market funds).

Back to Index

Commodities

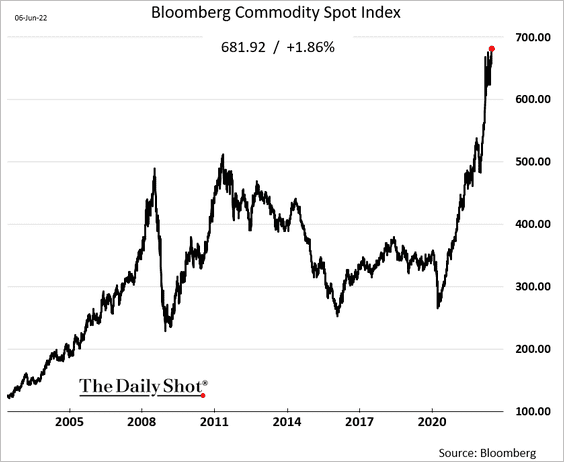

1. Bloomberg’s broad commodity index hit a new high.

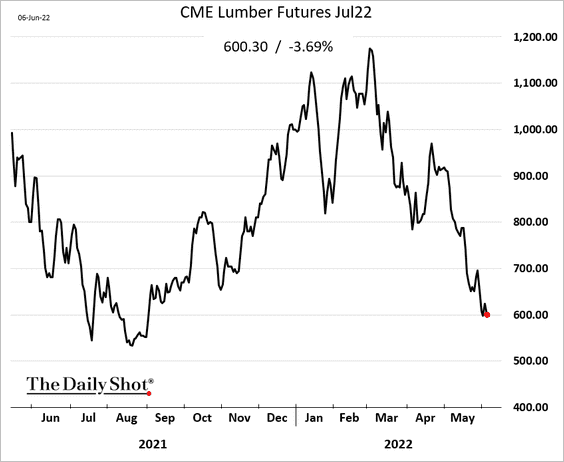

2. Lumber has been bucking the trend amid concerns about the US housing market.

Back to Index

Energy

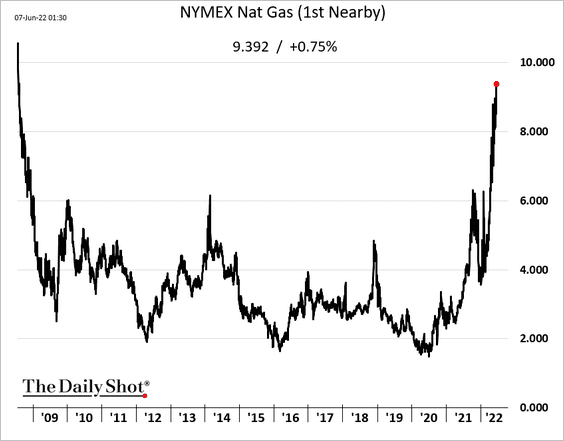

1. US natural gas futures hit the highest level since 2008 as the US prepares for a heatwave.

Source: NOAA

Source: NOAA

——————–

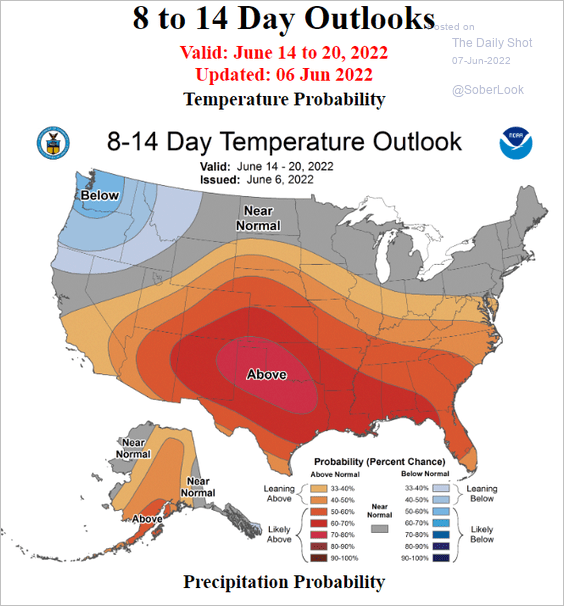

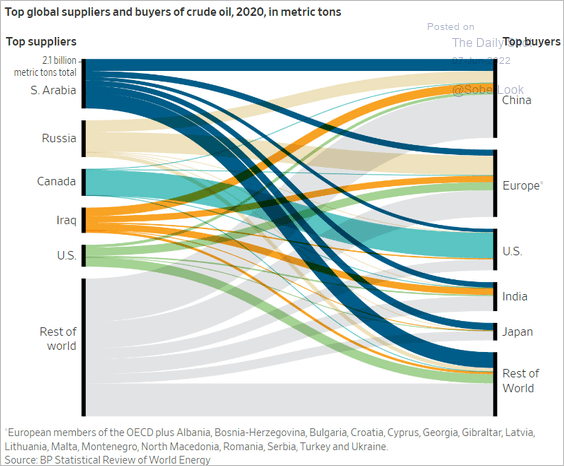

2. US crude oil inventories continue to shrink.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

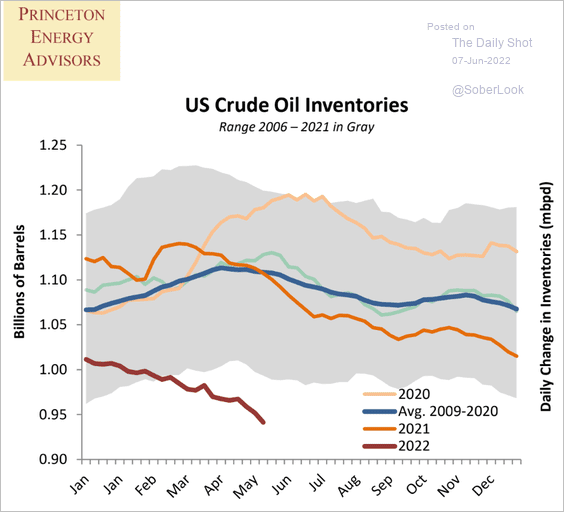

3. Below are the top suppliers and buyers of crude oil.

Source: @WSJ Read full article

Source: @WSJ Read full article

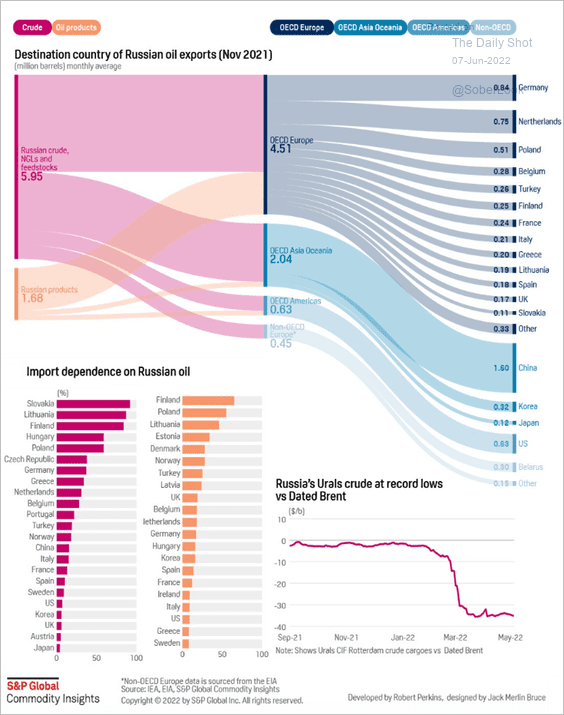

And here are the destinations of Russian oil exports.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

——————–

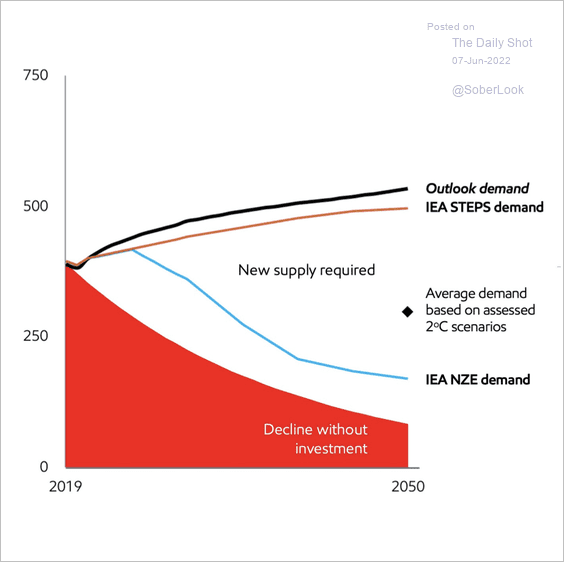

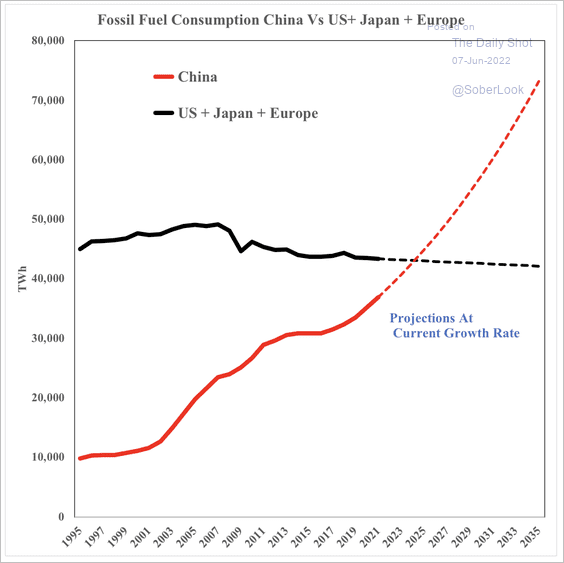

4. Investment in oil and gas supply has declined even as demand from China is expected to grow substantially (2 charts).

Source: IEA; h/t SOM Macro Strategies

Source: IEA; h/t SOM Macro Strategies

Source: IEA; h/t SOM Macro Strategies

Source: IEA; h/t SOM Macro Strategies

Back to Index

Cryptocurrency

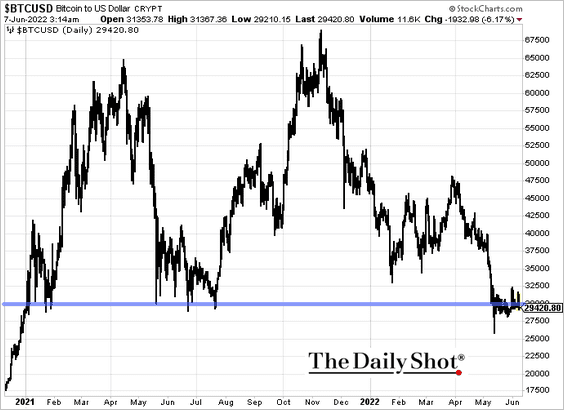

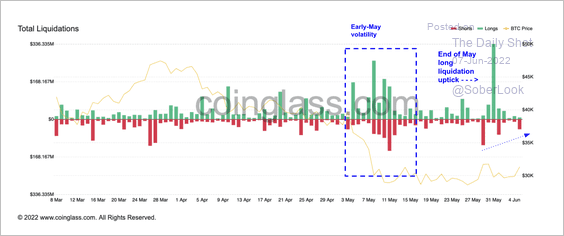

1. Bitcoin hasn’t been able to sustain moves above $30k.

2. There was a slight uptick in short liquidations after BTC rose above $30K. Still, long liquidations have been more severe, reflecting an unwind of bullish positions on each successive price drop.

Source: Coinglass Read full article

Source: Coinglass Read full article

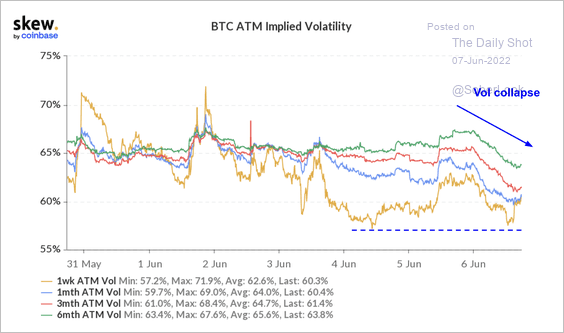

3. Bitcoin’s implied volatility continues to fade, for now.

Source: Skew Read full article

Source: Skew Read full article

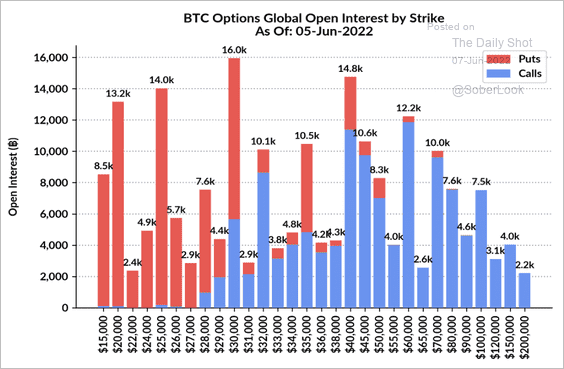

4. The most active BTC strike price is at $30K, where puts outnumber calls.

Source: Skew Read full article

Source: Skew Read full article

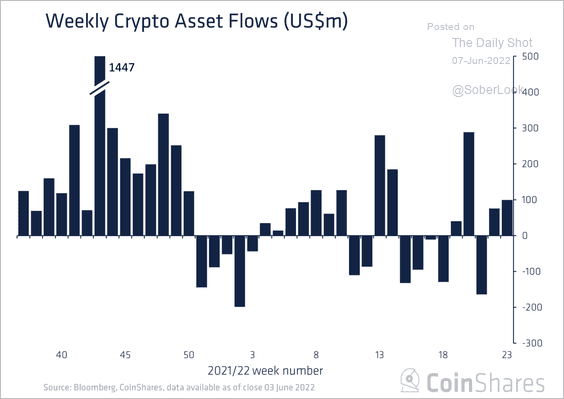

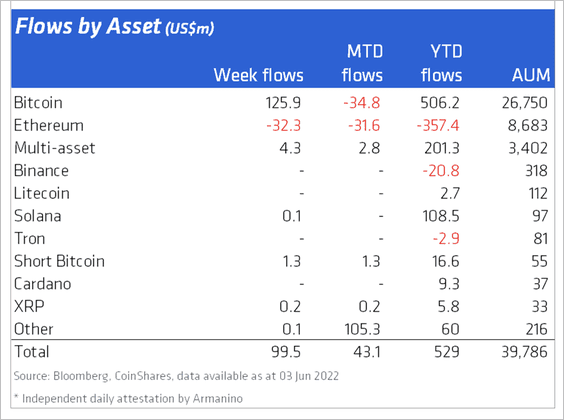

5. Crypto investment products saw inflows totaling $100 million last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Emerging Markets

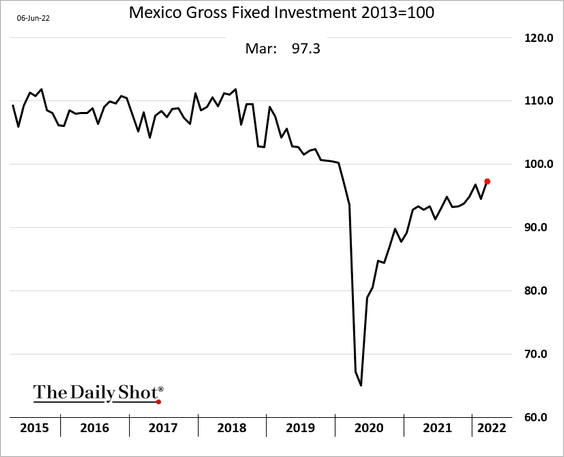

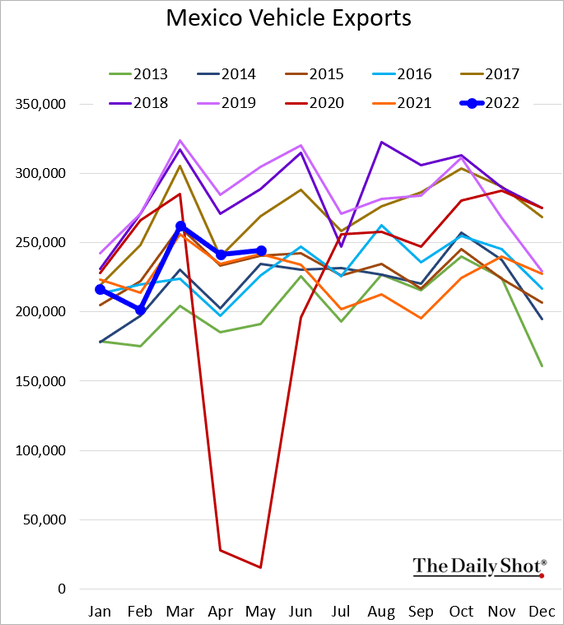

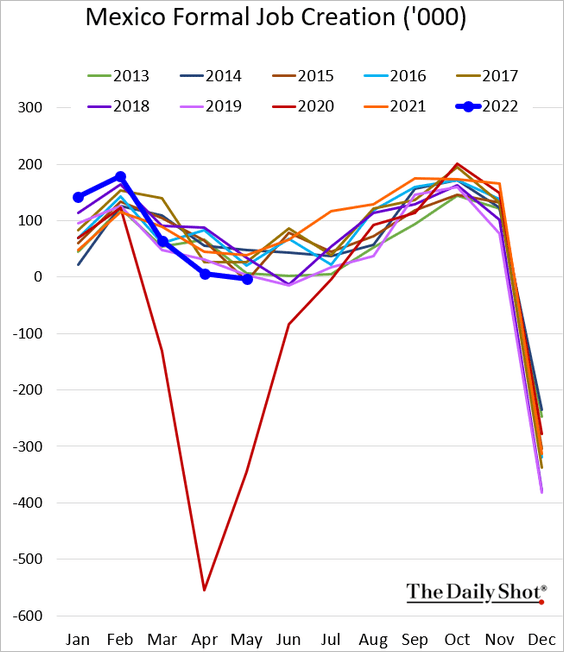

1. Let’s begin with Mexico.

• Business investment continues to recover.

• Vehicle exports are holding near last year’s levels.

• Job creation has been soft relative to last year.

——————–

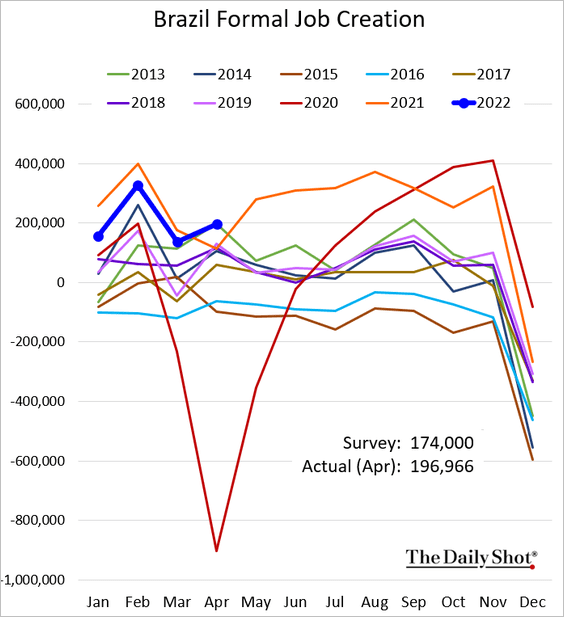

2. Brazil’s formal job creation was well above last year’s levels in April.

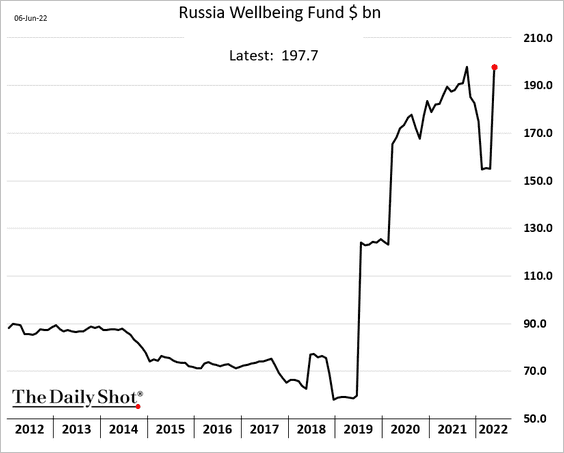

3. The value of Russia’s sovereign wealth fund has rebounded to pre-war levels as “petro-cash” flows in.

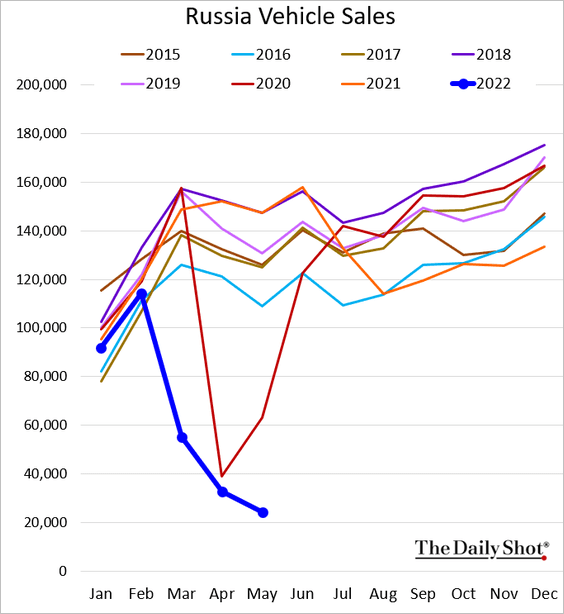

Russia’s vehicle sales have collapsed.

——————–

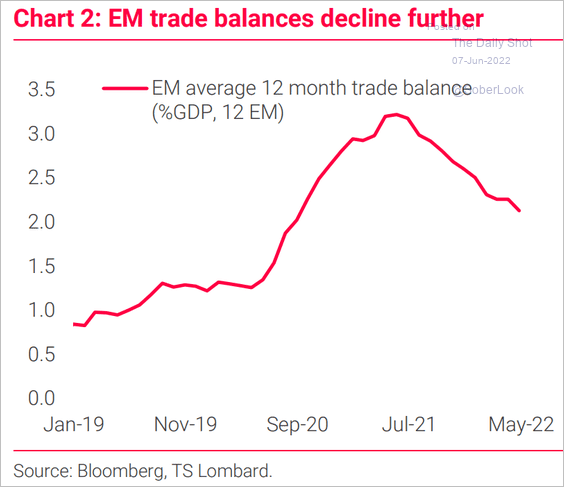

4. EM trade surpluses have been moderating.

Source: TS Lombard

Source: TS Lombard

Back to Index

China

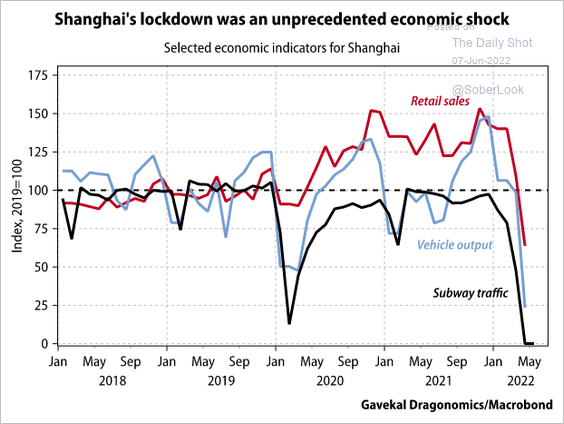

1. The Shanghai lockdown has been a massive economic shock.

Source: Gavekal Research

Source: Gavekal Research

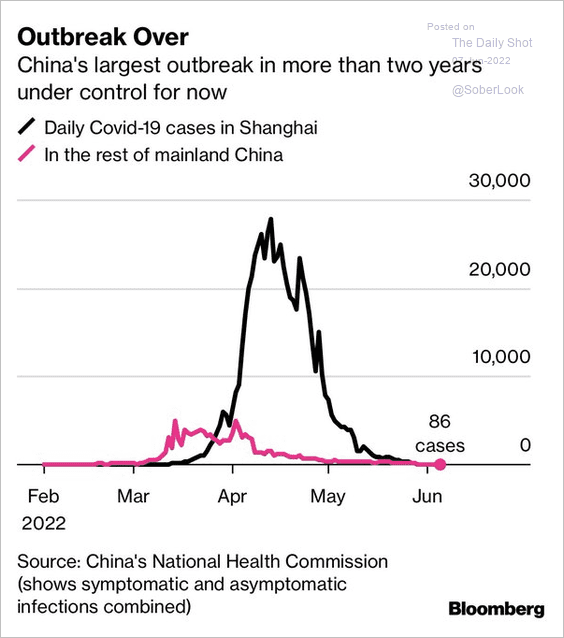

But the virus appears to be under control.

Source: @GregDaco, Bloomberg Read full article

Source: @GregDaco, Bloomberg Read full article

Here is the story count for “Shanghai reopening.”

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

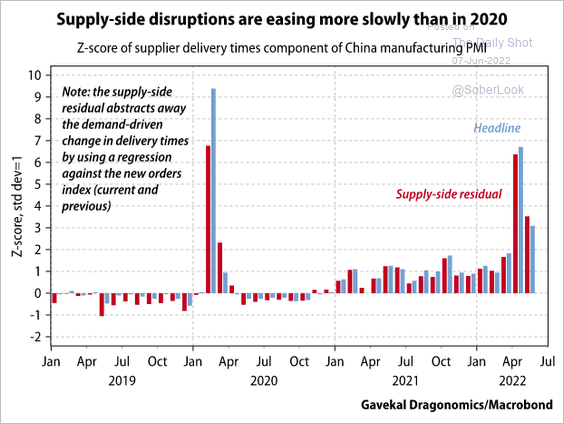

2. The supply chain recovery is taking longer than in 2020.

Source: Gavekal Research

Source: Gavekal Research

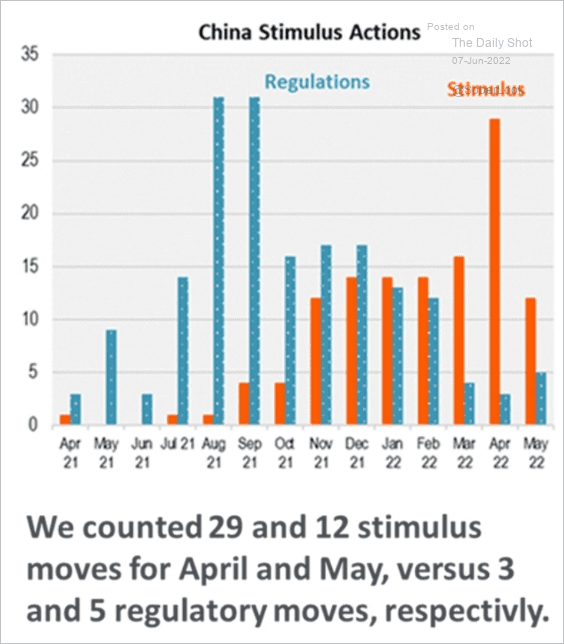

3. The authorities have been shifting from tougher regulation to more stimulus as the economy slumps.

Source: Piper Sandler

Source: Piper Sandler

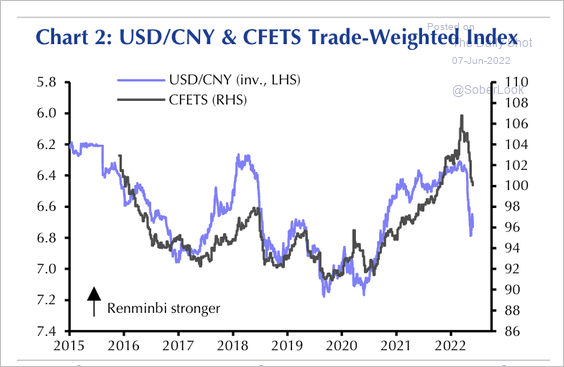

4. The renminbi has weakened substantially in trade-weighted terms.

Source: Capital Economics

Source: Capital Economics

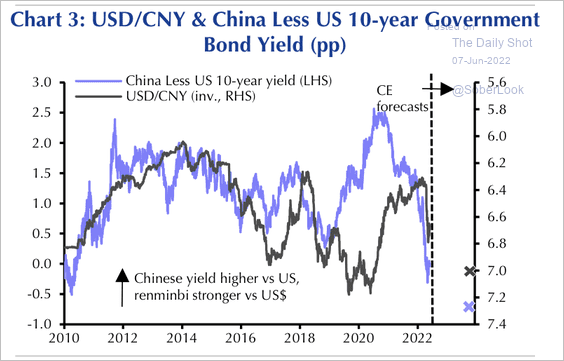

Capital Economics expects further renminbi weakness, partly driven by interest rate differentials.

Source: Capital Economics

Source: Capital Economics

——————–

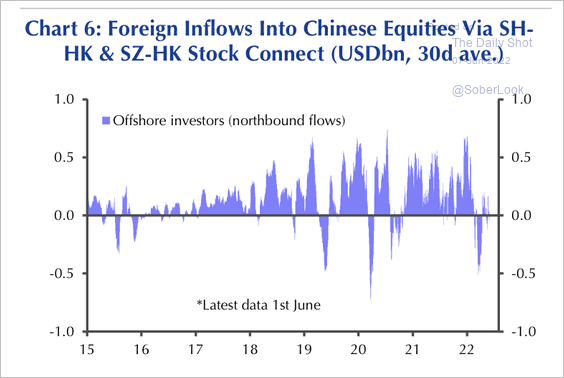

5. Most of the recent foreign outflows from Chinese equities occurred in March, following the onset of the Russia/Ukraine war. Were investors concerned about Western sanctions?

Source: Capital Economics

Source: Capital Economics

Back to Index

Asia – Pacific

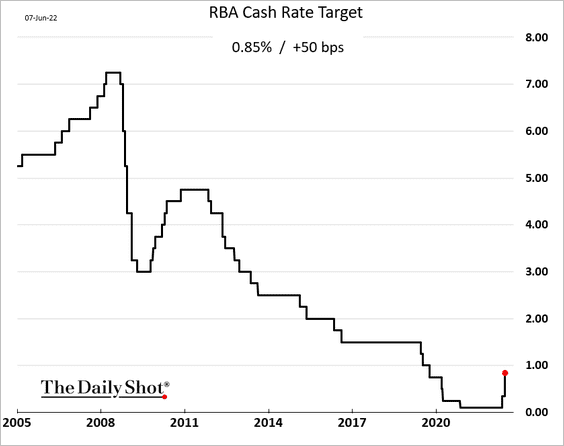

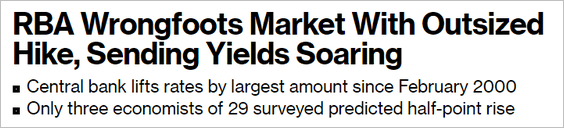

1. The RBA delivered a 50 bps rate hike, spooking the markets.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

• The Aussie dollar and bond yields jumped.

——————–

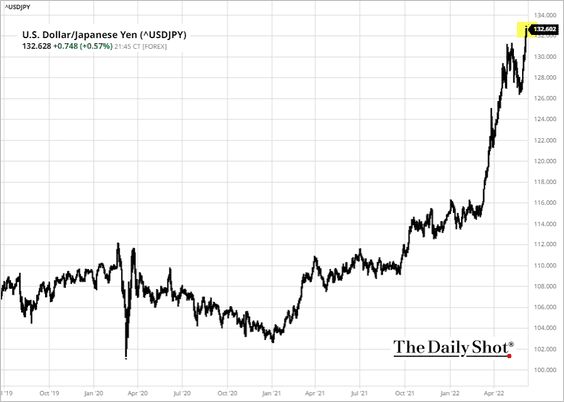

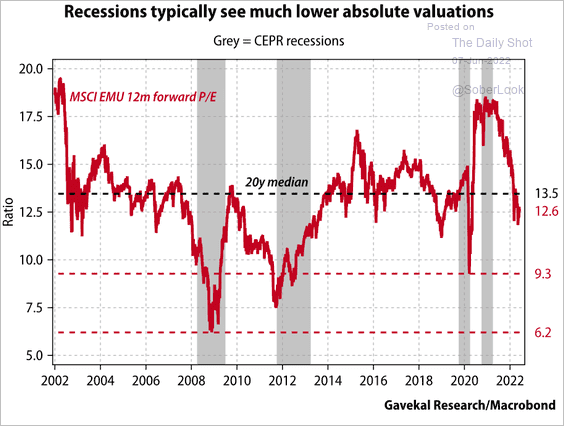

2. The yen hit a two-decade low against the dollar.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

The Eurozone

1. The market now expects the ECB to lift rates by 1.26% this year.

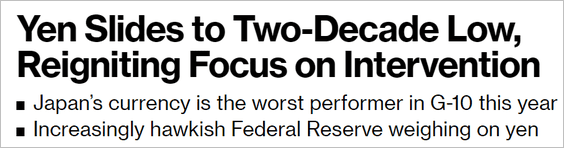

2. Recession risks in the Eurozone are real.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

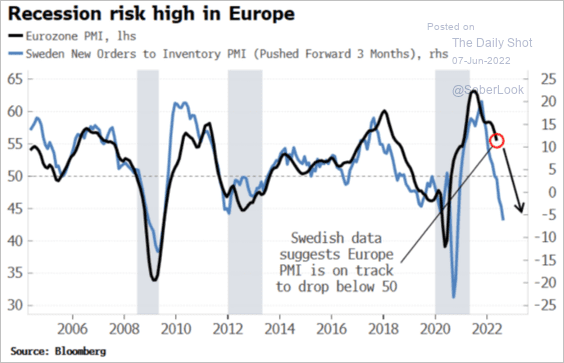

But equity valuations have not fully priced in a recession, pointing to downside risks for stocks.

Source: Gavekal Research

Source: Gavekal Research

——————–

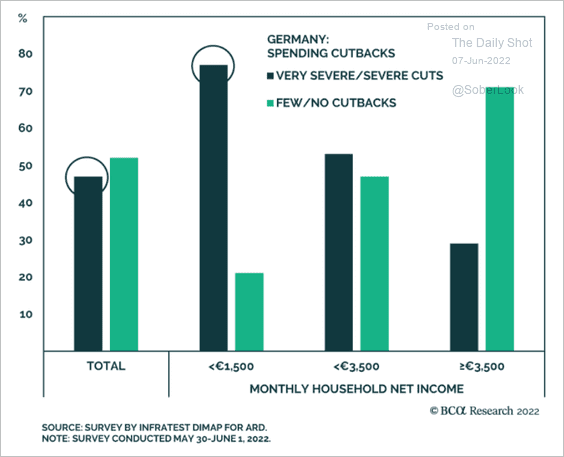

3. German households are cutting spending.

Source: BCA Research

Source: BCA Research

Back to Index

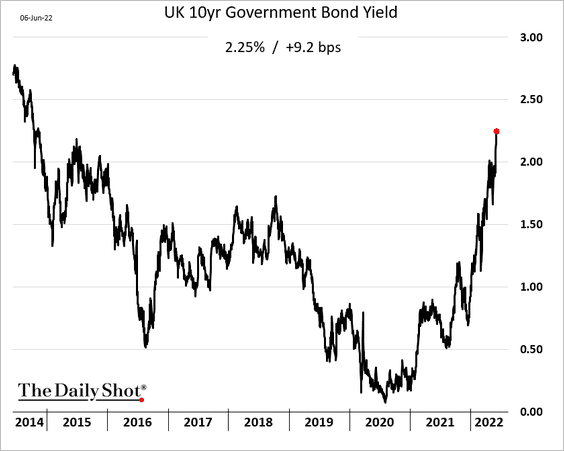

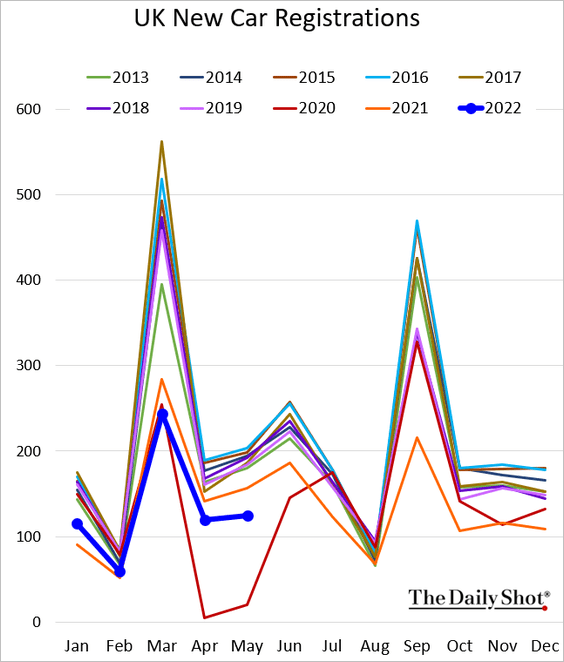

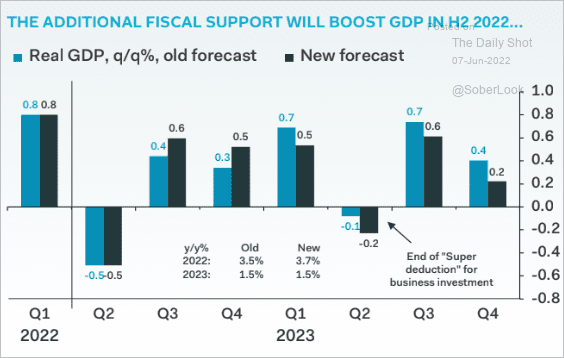

The United Kingdom

1. Gilt yields are surging.

2. Car registrations remain soft.

3. New fiscal support should boost growth in the second half of the year, according to Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Could it also boost inflation?

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

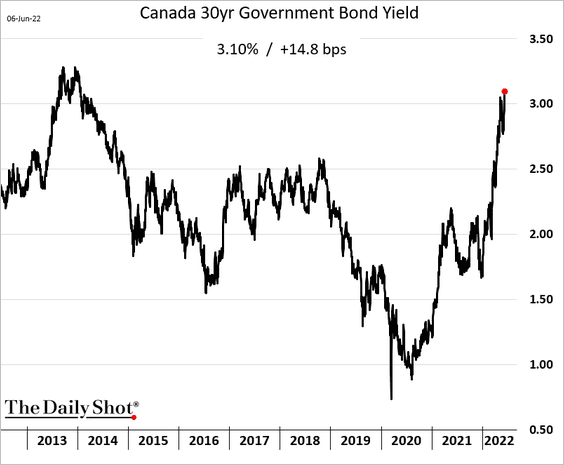

Canada

1. Bond yields keep climbing.

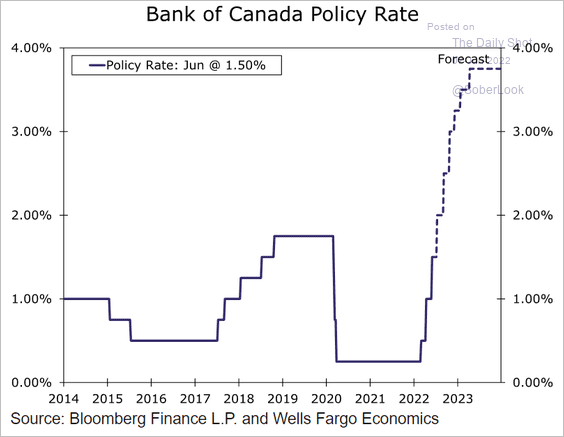

2. Three more 50 bps rate hikes ahead? Here is a forecast from Wells Fargo.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

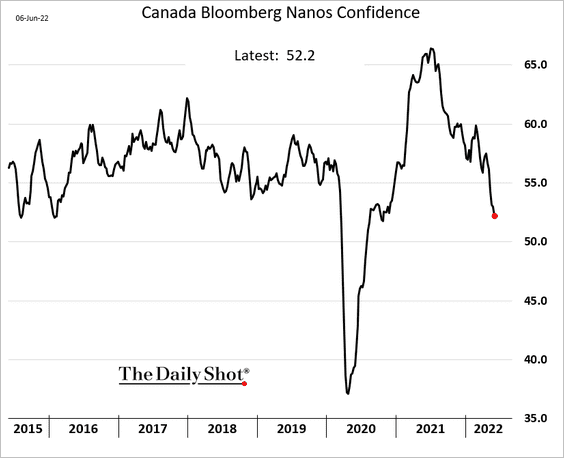

3. Consumer confidence is now well below pre-COVID levels.

Back to Index

The United States

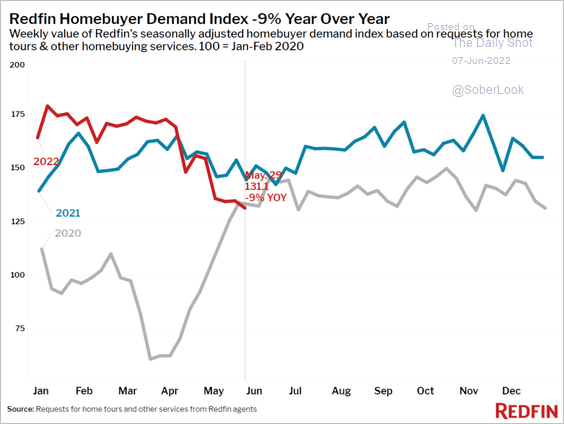

1. Let’s begin with the housing market.

• Housing demand continues to ease.

Source: Redfin

Source: Redfin

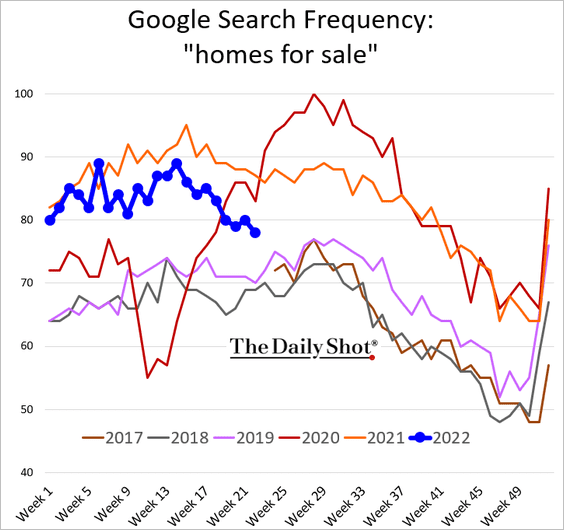

• Google search activity for “homes for sale” has been slowing.

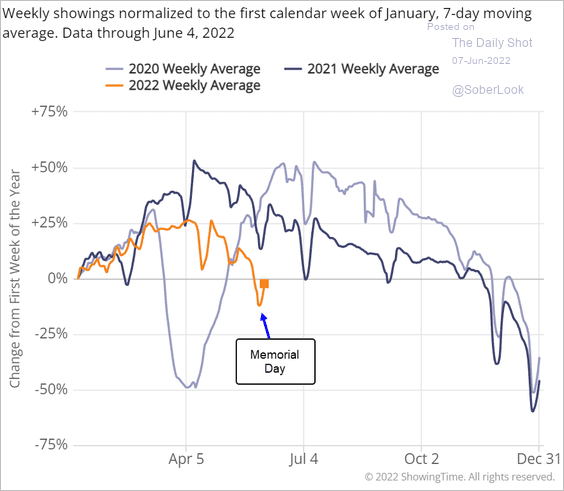

• Real estate showings across North America are well below last year’s levels.

Source: ShowingTime

Source: ShowingTime

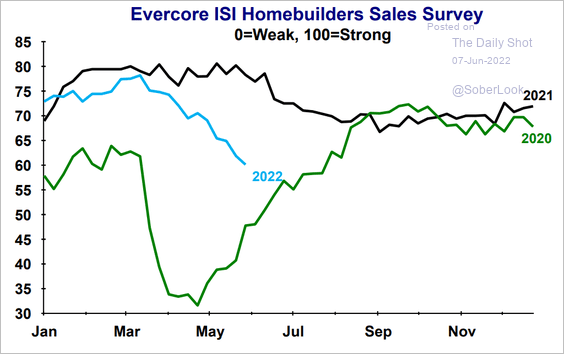

• Homebuilder sales are eroding quickly, according to a survey from Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

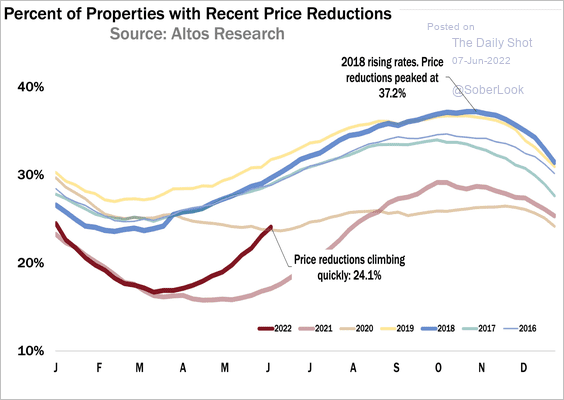

• A higher percentage of sellers have been dropping prices.

Source: @mikesimonsen, @AltosResearch

Source: @mikesimonsen, @AltosResearch

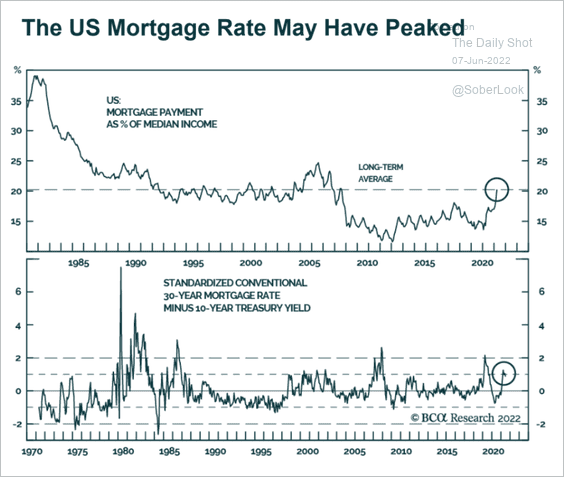

• Have mortgage rates peaked?

Source: BCA Research

Source: BCA Research

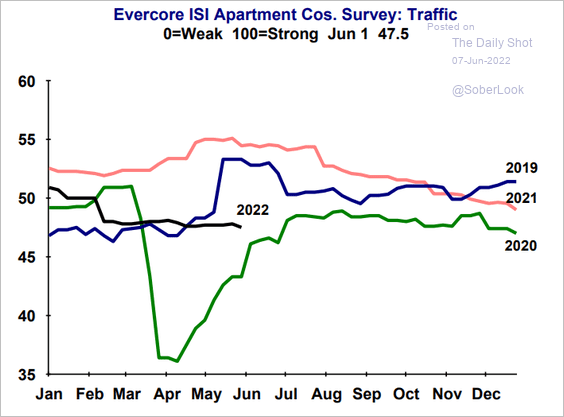

• Apartment traffic is softer than last year’s levels.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

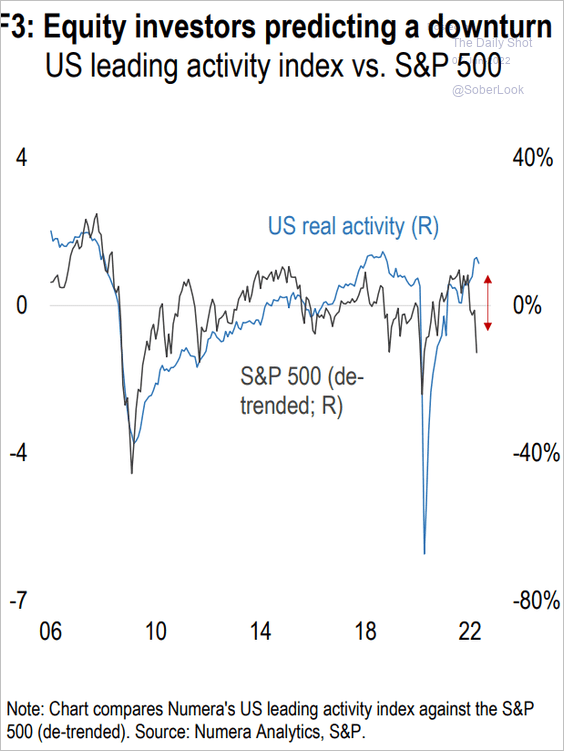

2. Economic growth is expected to slow substantially.

Source: Numera Analytics

Source: Numera Analytics

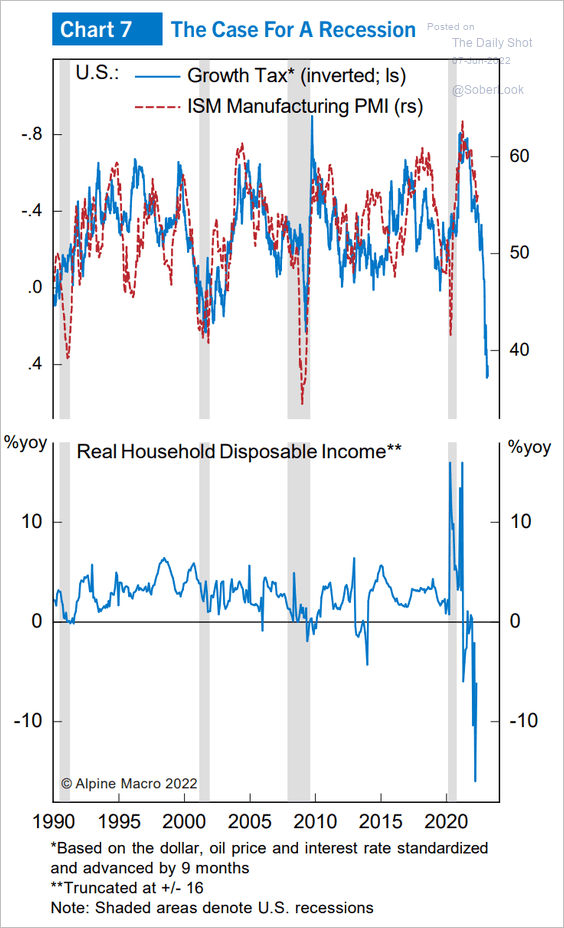

Will we see a recession?

Source: Alpine Macro

Source: Alpine Macro

——————–

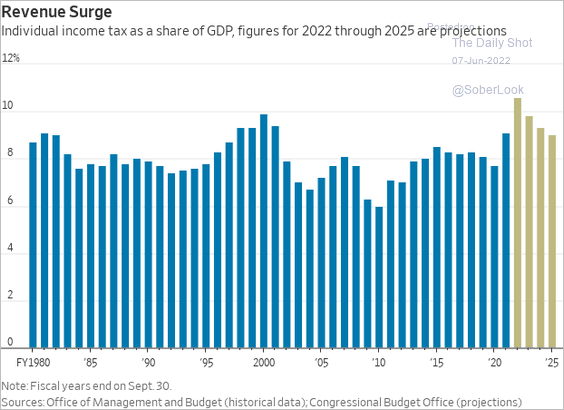

3. The recent surge in income tax receipts surprised economists.

Source: @WSJ Read full article

Source: @WSJ Read full article

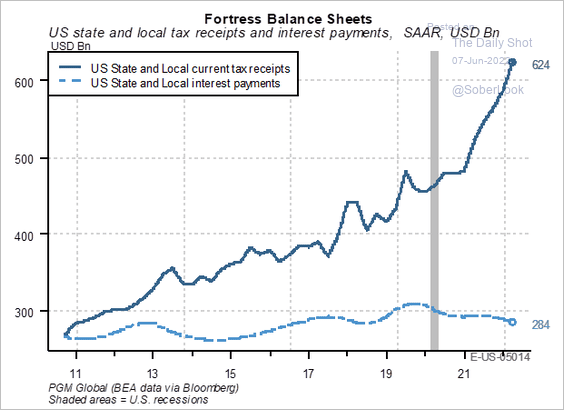

This chart shows state and local governments’ tax receipts and interest payments.

Source: PGM Global

Source: PGM Global

——————–

4. US semiconductor (real) imports have been surging.

![]() Source: Piper Sandler

Source: Piper Sandler

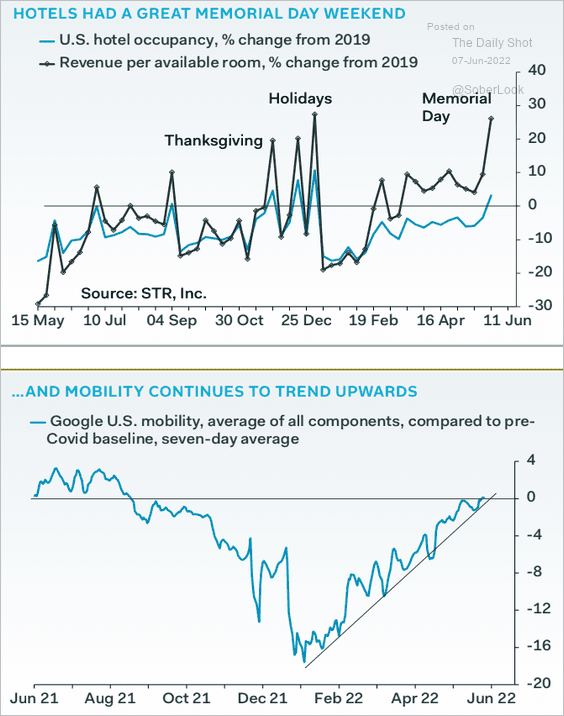

5. Mobility indicators continue to show improvements.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

Food for Thought

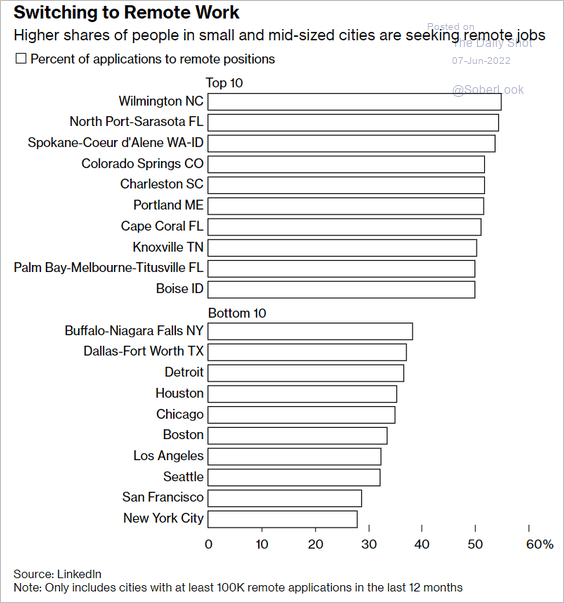

1. Seeking remote work:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

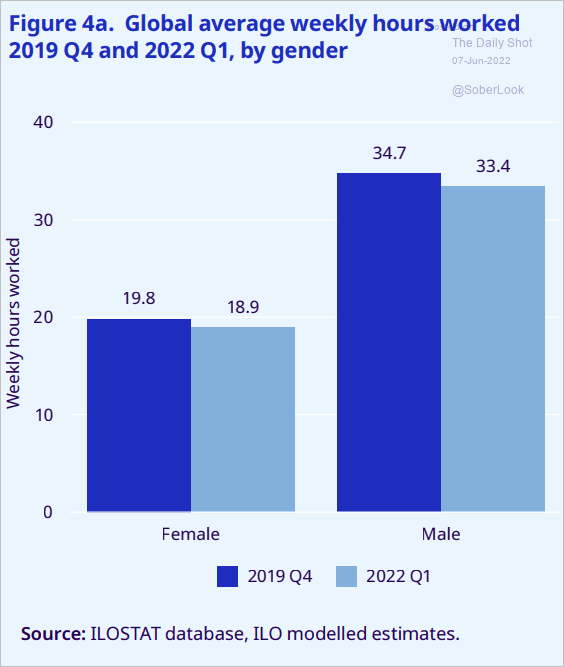

2. Average weekly hours worked (globally):

Source: ILO Read full article

Source: ILO Read full article

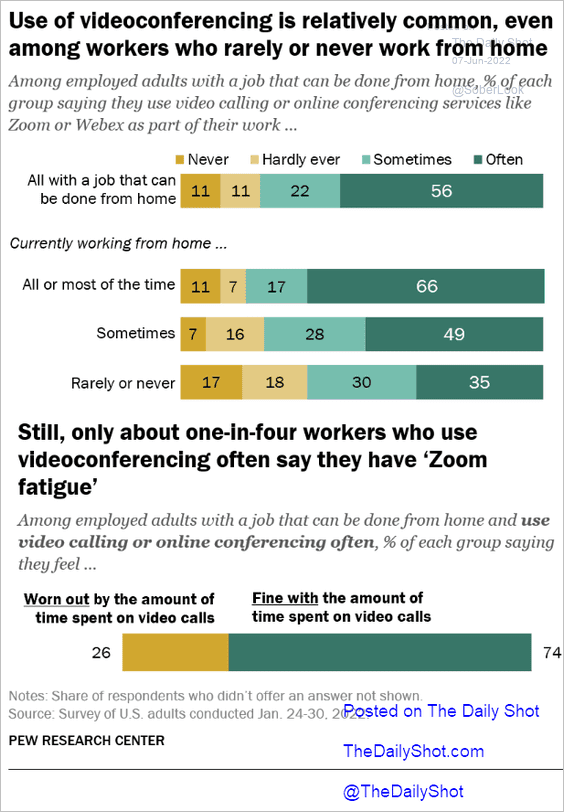

3. Prevalence of videoconferencing:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

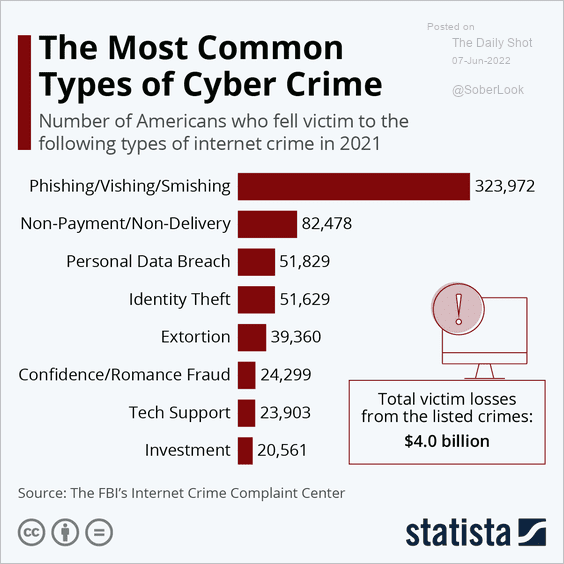

4. Types of internet crime:

Source: Statista

Source: Statista

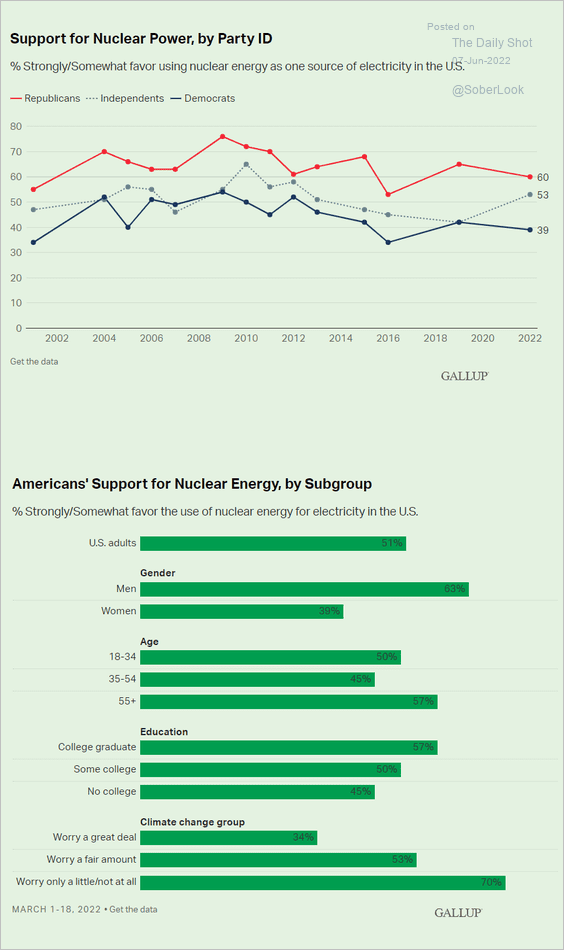

5. Support for nuclear energy in the US:

Source: Gallup Read full article

Source: Gallup Read full article

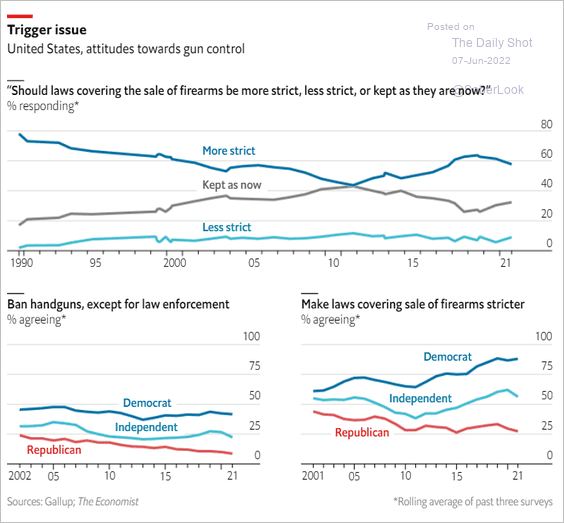

6. Views on gun control over time:

Source: The Economist Read full article

Source: The Economist Read full article

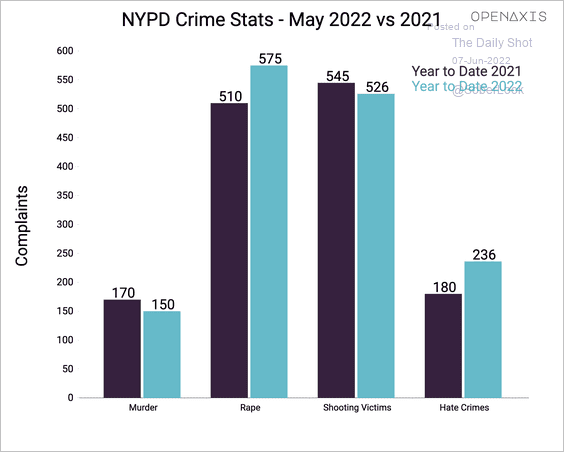

7. NYPD crime stats (2021 and 2022):

Source: OpenAxis

Source: OpenAxis

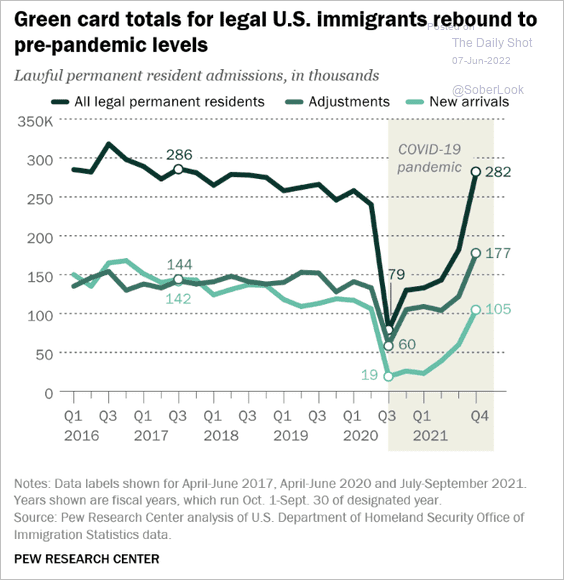

8. US legal immigration:

Source: @GregDaco, @pewresearch Read full article

Source: @GregDaco, @pewresearch Read full article

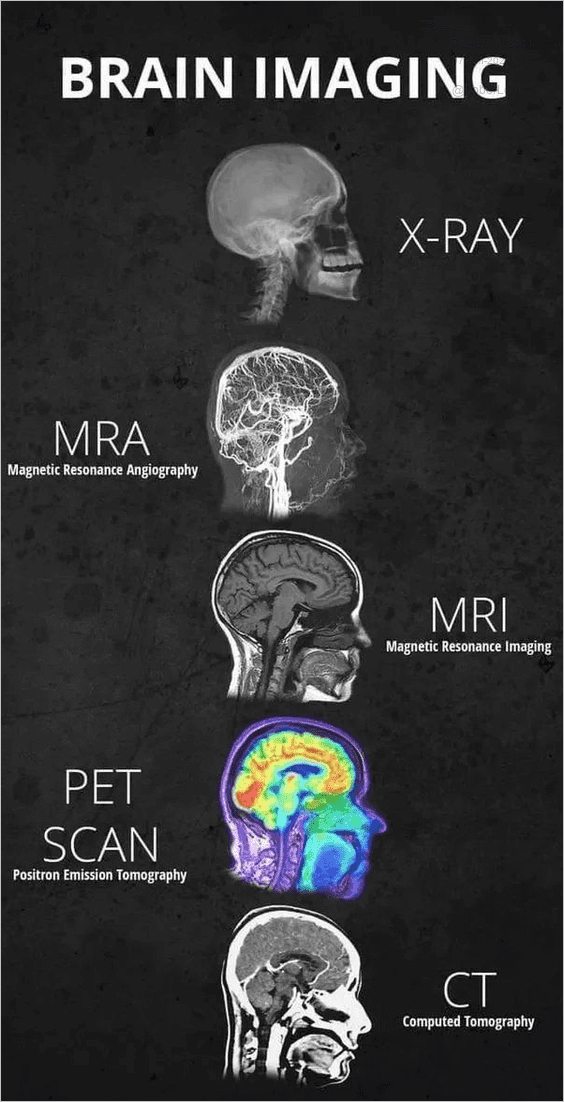

9. Brain imaging:

Source: Slava Bobrov Read full article

Source: Slava Bobrov Read full article

——————–

Back to Index