The Daily Shot: 08-Jun-22

• The United States

• Canada

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

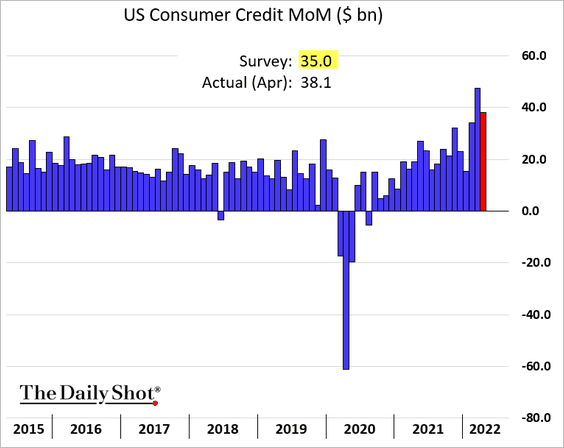

1. US consumer credit growth topped forecasts again.

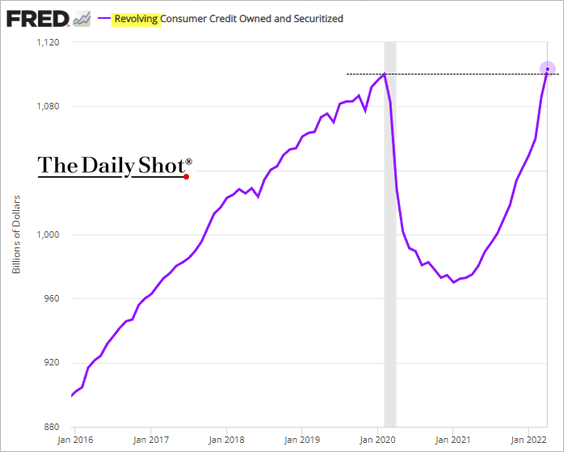

• Revolving credit balances (credit cards) are now above the pre-COVID peak.

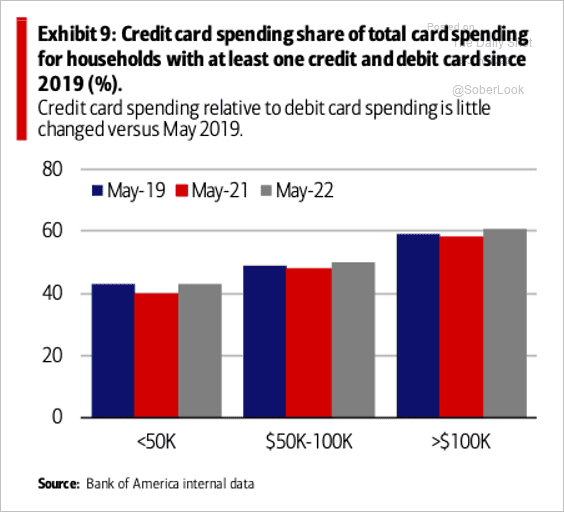

Credit card usage is up sharply, but relative to debit cards, borrowing is not materially different from pre-pandemic levels.

Source: BofA Global Research; @SamRo

Source: BofA Global Research; @SamRo

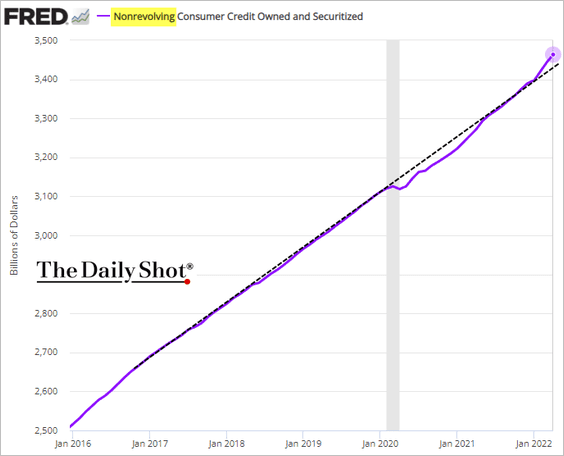

• Non-revolving credit is outpacing the pre-COVID trend (mostly due to automobile debt).

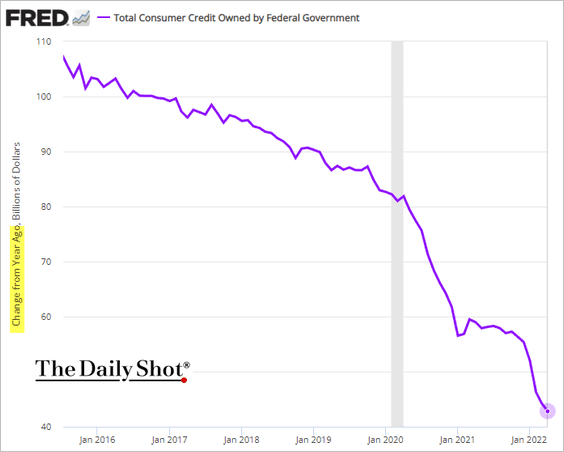

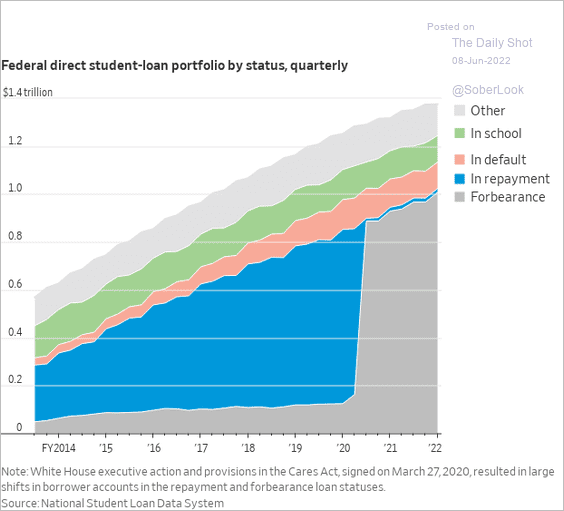

• Growth in student debt continues to slow.

By the way, government-owned student debt in forbearance has now exceeded $1 trillion.

Source: @WSJ Read full article

Source: @WSJ Read full article

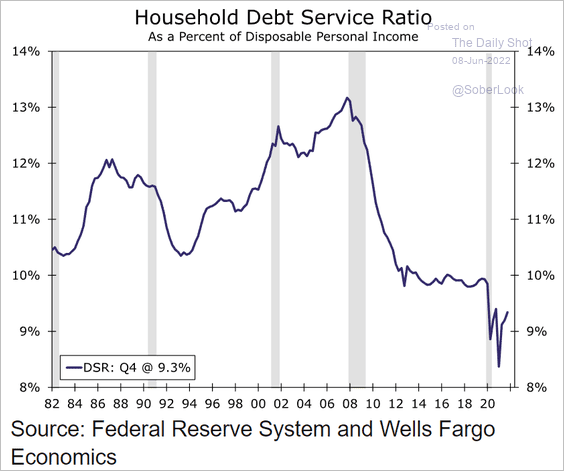

• Household balance sheets remain relatively healthy.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

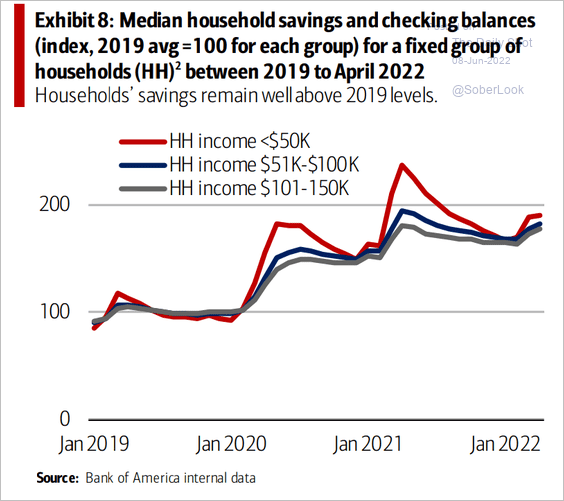

And household cash levels are holding above pre-pandemic levels.

Source: @SamRo, BofA Read full article

Source: @SamRo, BofA Read full article

——————–

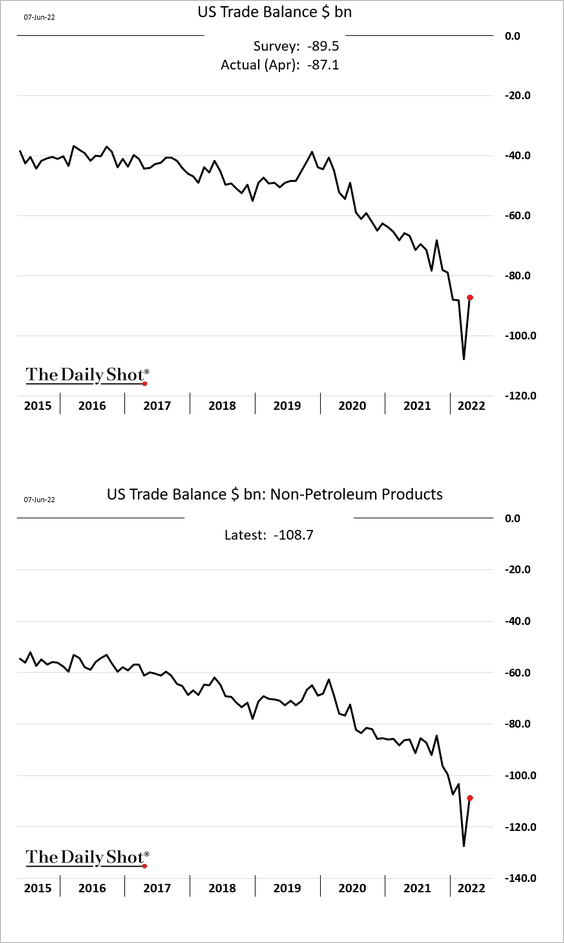

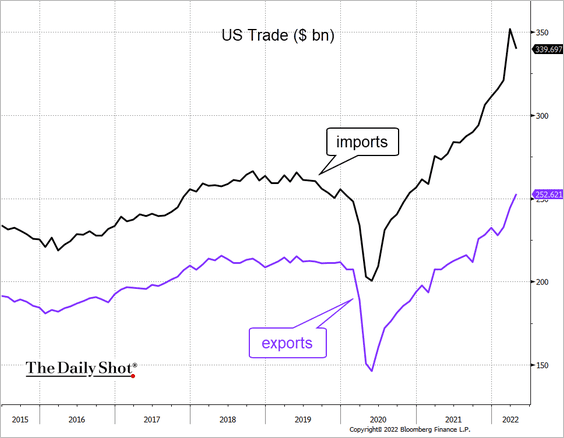

2. The trade deficit shrunk in April (2 charts), which should boost the current quarter’s GDP growth.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Reuters Read full article

Source: Reuters Read full article

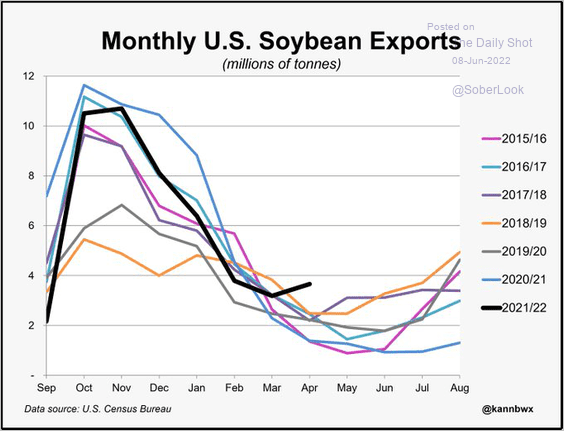

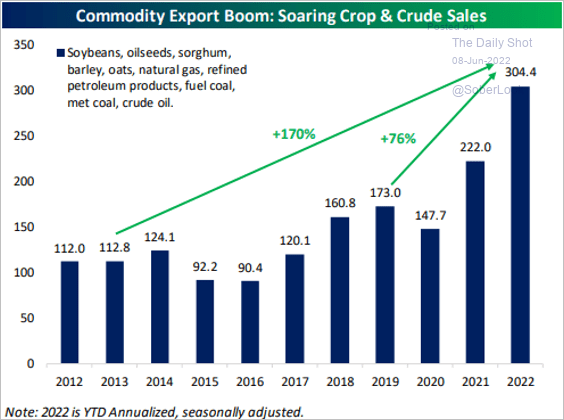

The US has increased exports of energy and agricultural commodities.

Source: @kannbwx

Source: @kannbwx

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

——————–

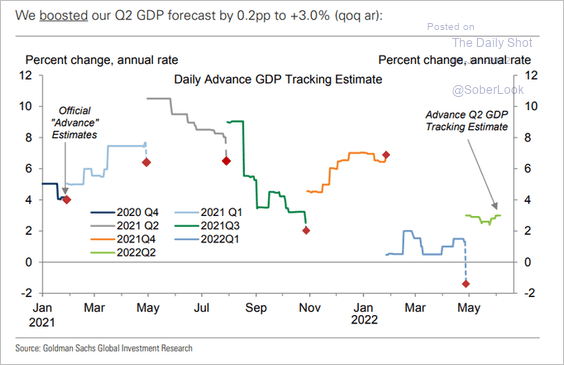

3. Goldman’s Q2 GDP growth tracker moved up to 3%.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

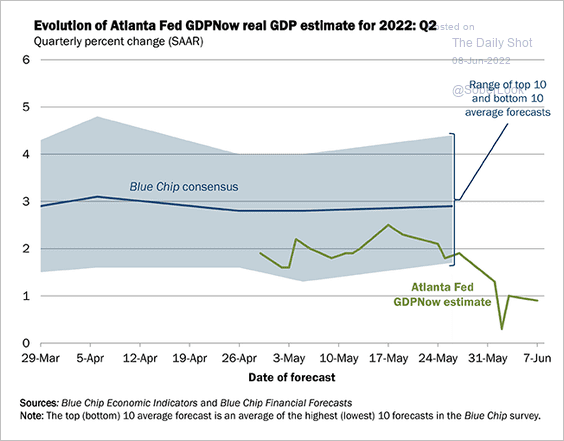

But the Atlanta Fed’s GDP tracker is holding below 1%.

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

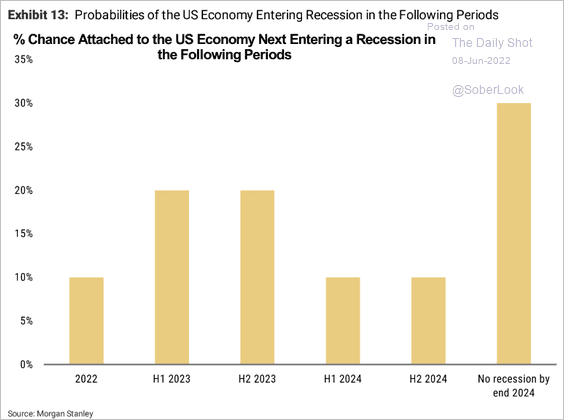

By the way, here are Morgan Stanley’s recession probabilities.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

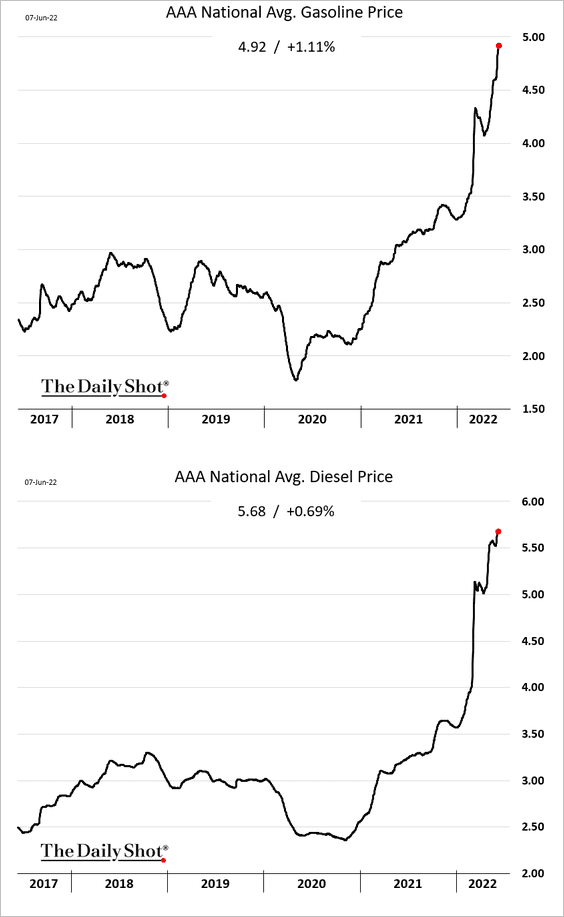

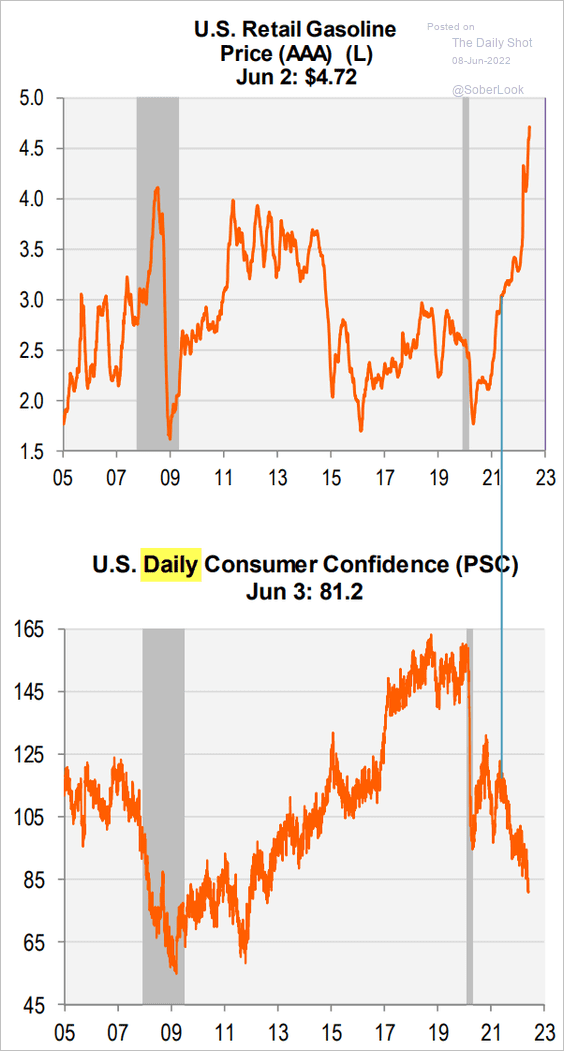

4. Retail gasoline prices continue to surge, …

… depressing consumer confidence.

Source: Piper Sandler

Source: Piper Sandler

——————–

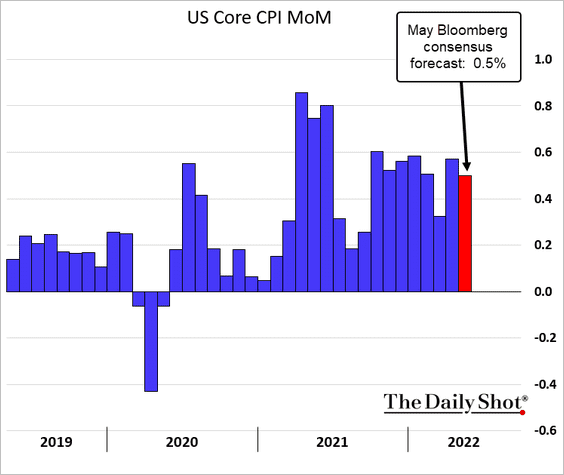

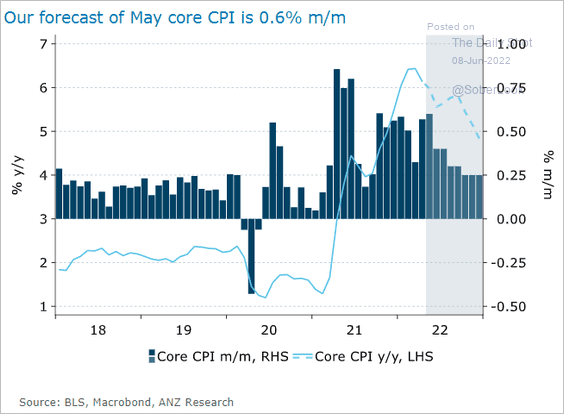

5. Next, we have some updates on inflation.

• The consensus estimate for the May core CPI increase is 0.5%. The markets could react violently if we get an upward surprise, especially if calls for more aggressive Fed rate hikes get louder.

– ANZ expects 0.6% in May.

Source: @ANZ_Research

Source: @ANZ_Research

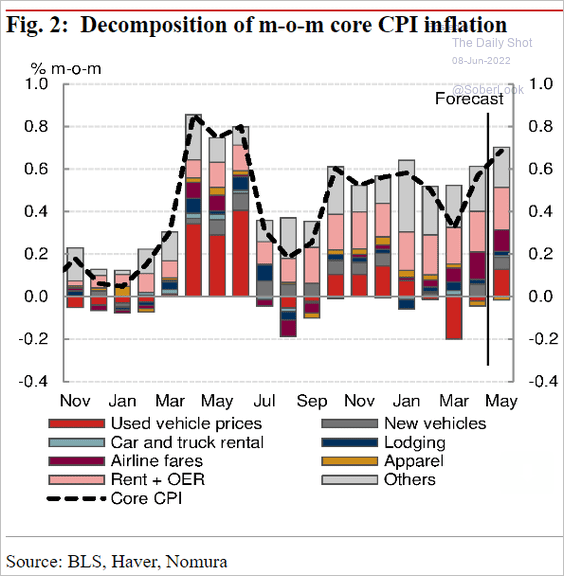

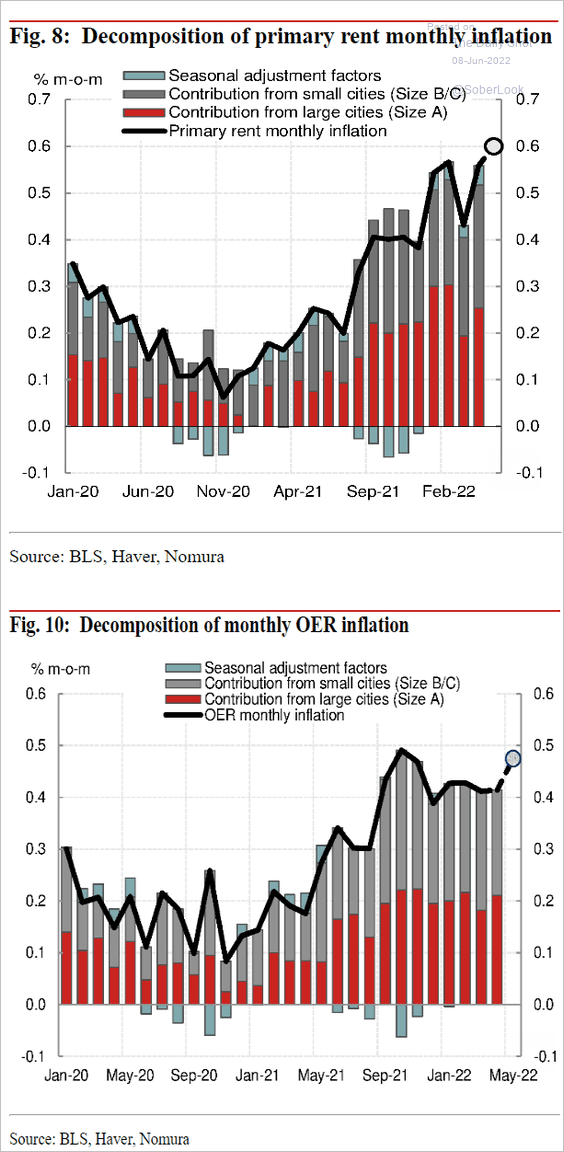

– And Nomura sees an acceleration in the core CPI to 0.7% …

Source: Nomura Securities

Source: Nomura Securities

… as housing-related inflation surges.

Source: Nomura Securities

Source: Nomura Securities

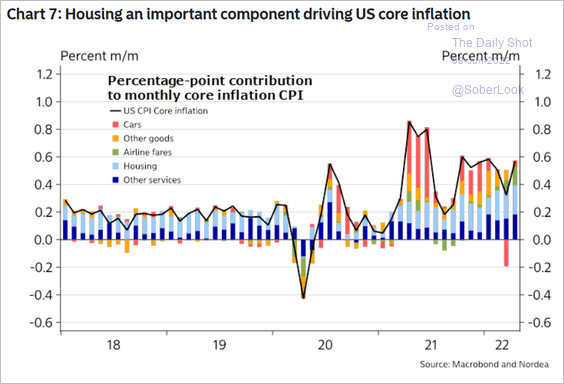

Housing is expected to be a key driver of US core inflation in the months ahead.

Source: Nordea Markets

Source: Nordea Markets

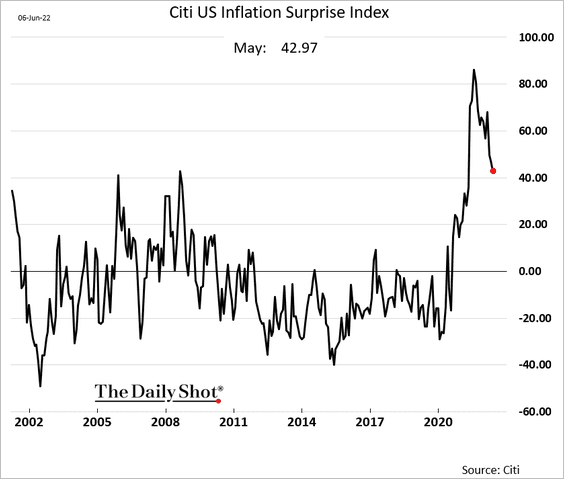

• The Citi inflation surprise index has been moderating.

• Semiconductor prices, shipping costs, and even fertilizer prices appear to be peaking.

![]() Source: @GregDaco, @markets Read full article

Source: @GregDaco, @markets Read full article

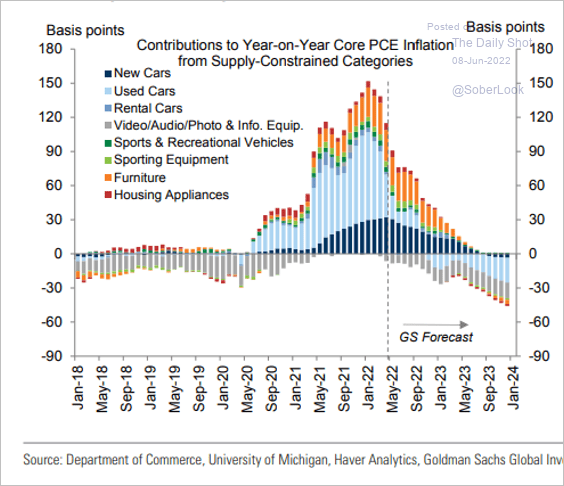

Contributions to the core PCE inflation from supply-constrained items (year-over-year) should become a drag on inflation by the end of 2022.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

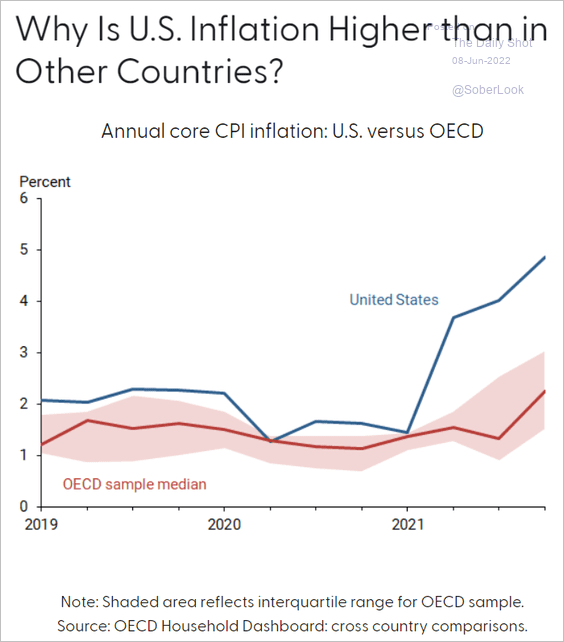

• Why is the US CPI substantially higher than the OECD average?

Source: Federal Reserve Bank of San Francisco Read full article

Source: Federal Reserve Bank of San Francisco Read full article

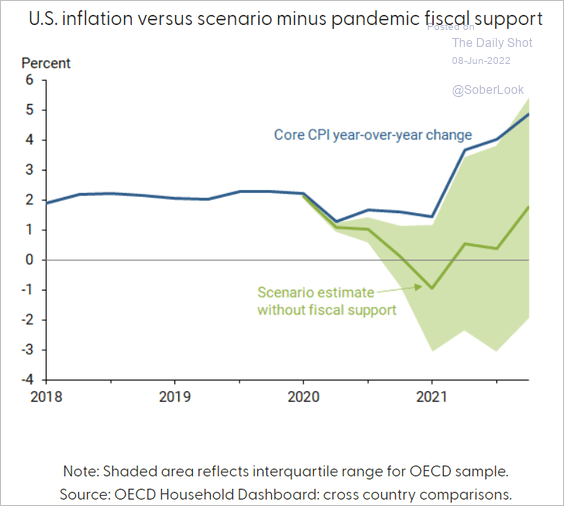

Massive US fiscal support helps explain the above divergence.

Source: Federal Reserve Bank of San Francisco Read full article

Source: Federal Reserve Bank of San Francisco Read full article

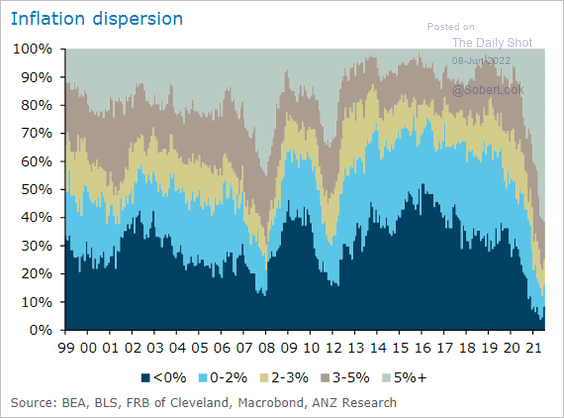

• This chart shows the distribution of inflation components by price gains.

Source: @ANZ_Research

Source: @ANZ_Research

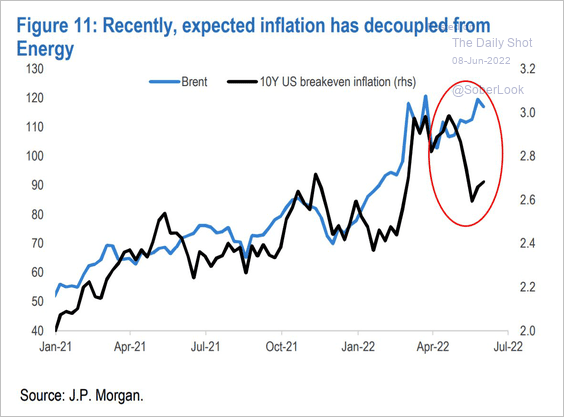

• Market-based inflation expectations have diverged from crude oil.

Source: JP Morgan Research; @WallStJesus

Source: JP Morgan Research; @WallStJesus

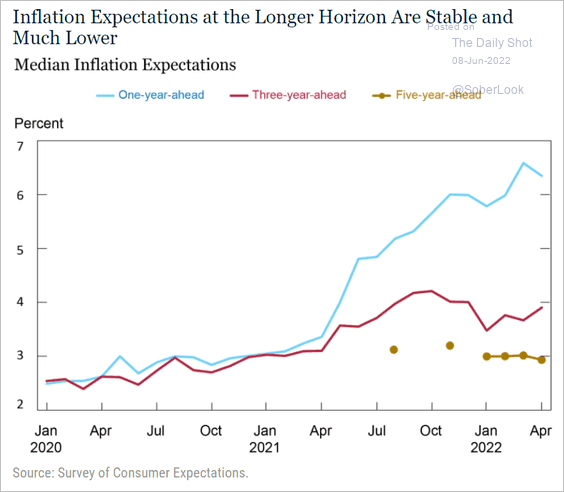

• Longer-term consumer inflation expectations are holding steady for now.

Source: NY Fed; h/t @ANZ_Research

Source: NY Fed; h/t @ANZ_Research

——————–

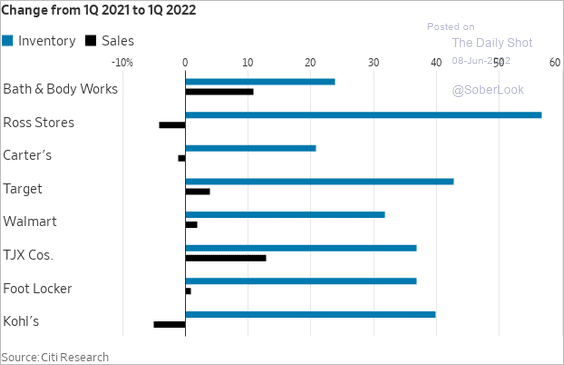

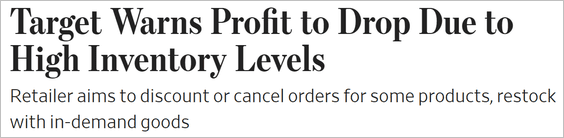

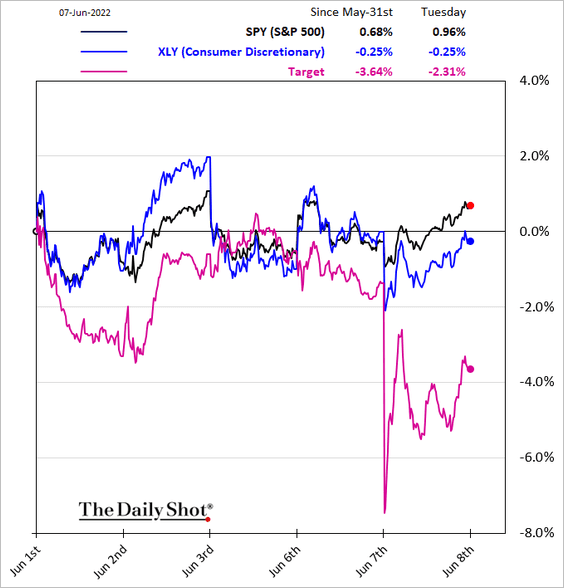

6. Retailers are struggling with bloated inventories.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

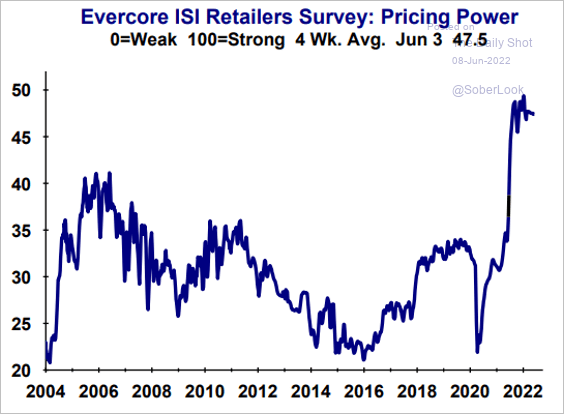

But retailers still feel they have substantial pricing power, according to a survey from Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Canada

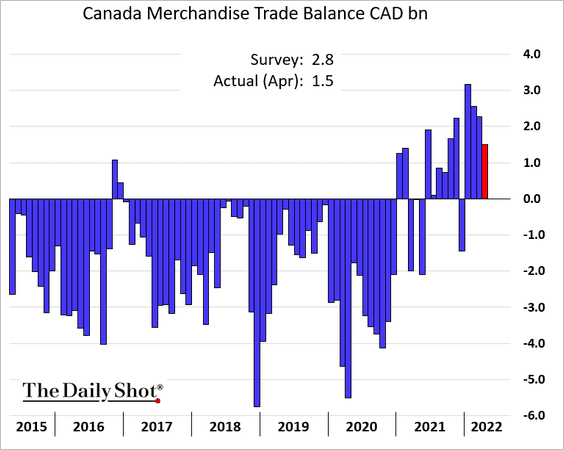

1. The trade surplus was lower than expected in April.

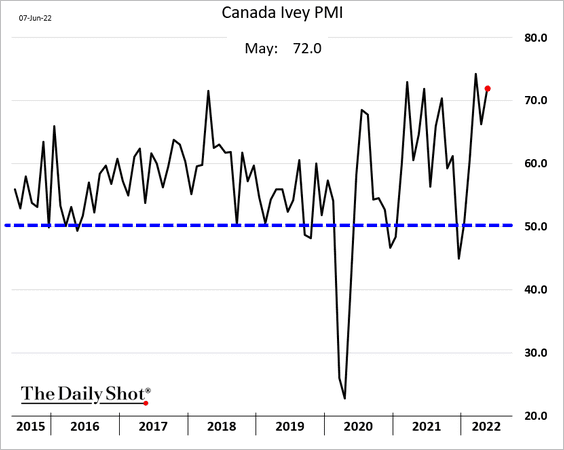

2. Business activity remains robust, according to the Ivey PMI report.

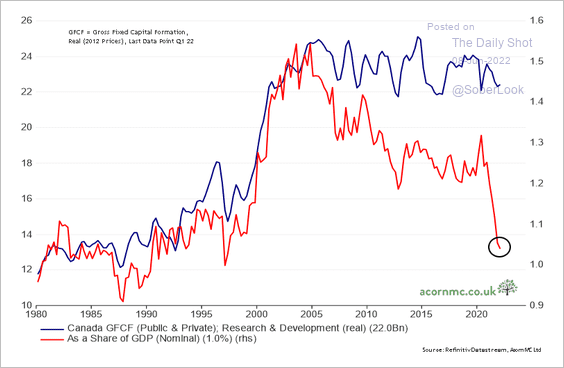

3. Investment as a share of GDP has been slowing.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

Back to Index

The Eurozone

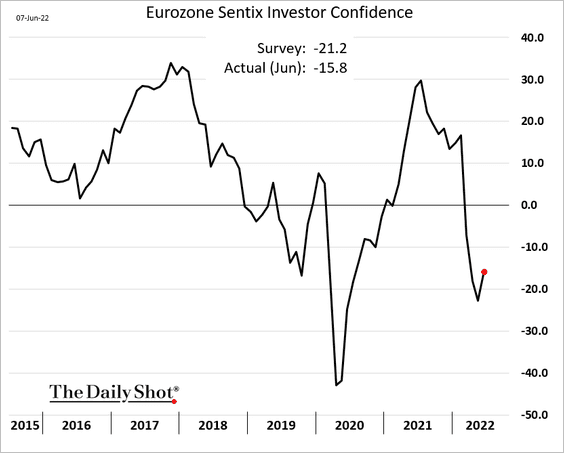

1. Investor confidence edged higher this month.

Source: RTT News Read full article

Source: RTT News Read full article

——————–

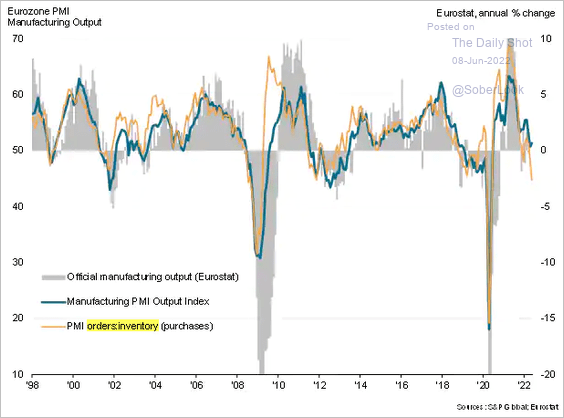

2. The PMI orders-to-inventories ratio points to headwinds for factory activity.

Source: S&P Global PMI

Source: S&P Global PMI

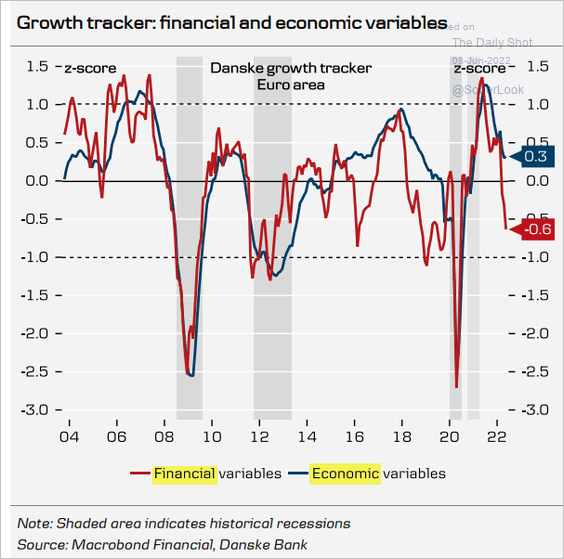

Markets are also signaling an economic slump in the Eurozone.

Source: Danske Bank

Source: Danske Bank

——————–

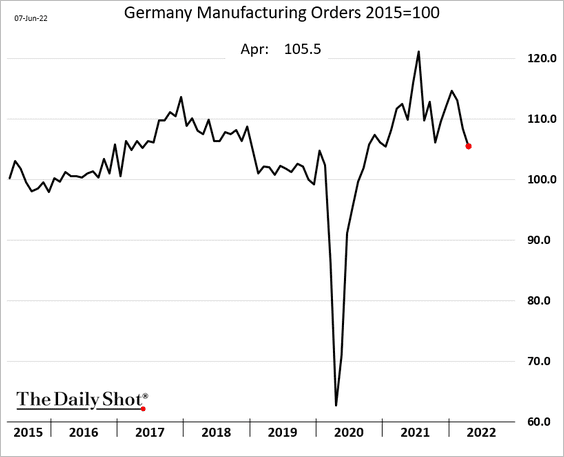

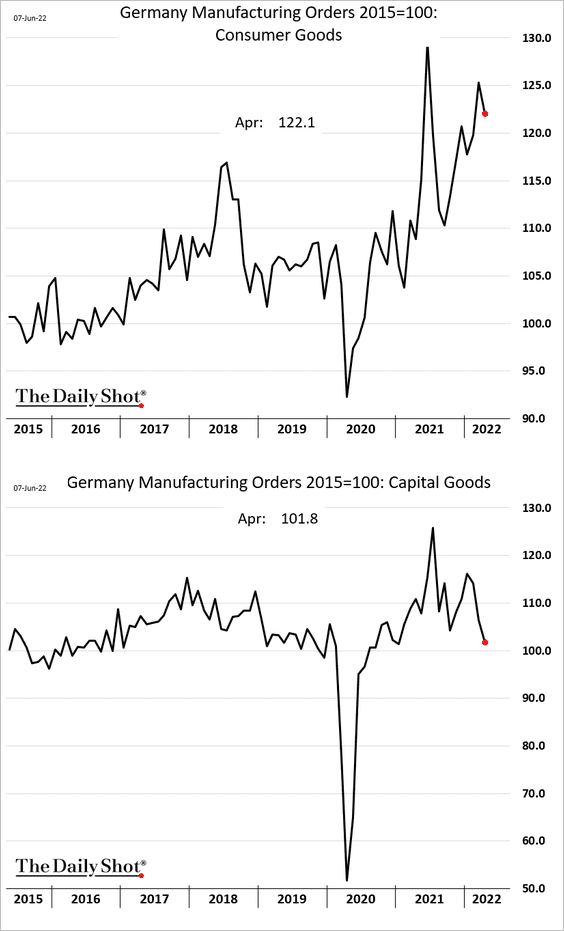

3. Germany’s factory orders continued to decline in April.

Capital goods orders have been particularly soft.

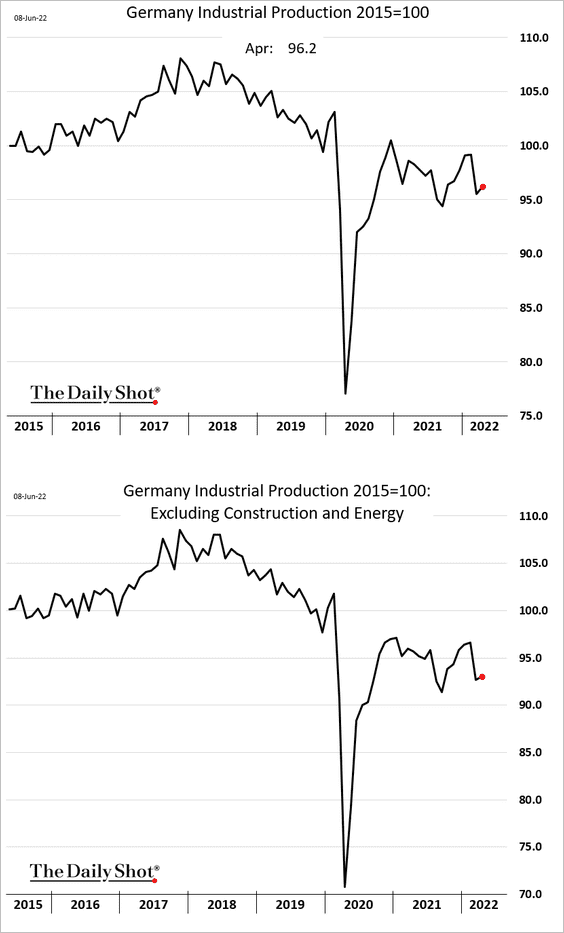

Industrial production edged higher.

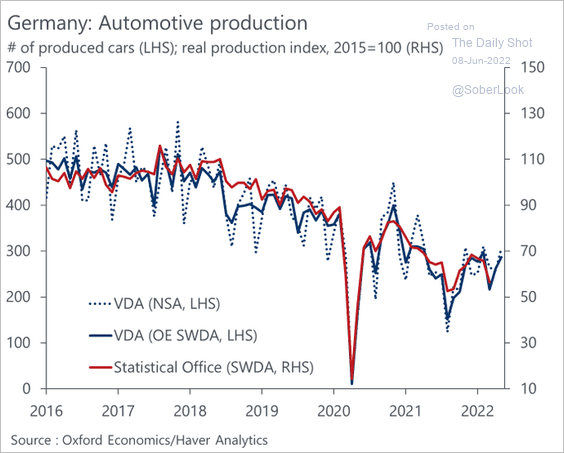

Automobile manufacturing shows signs of improvement, …

Source: @OliverRakau

Source: @OliverRakau

… as semiconductor shortages ease.

![]() Source: @OliverRakau

Source: @OliverRakau

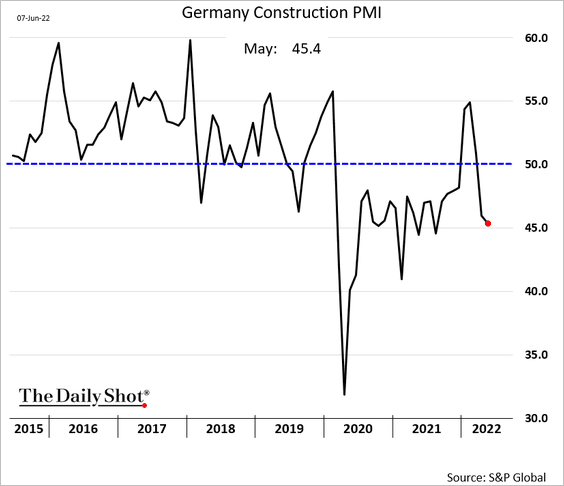

• Construction activity continues to weaken.

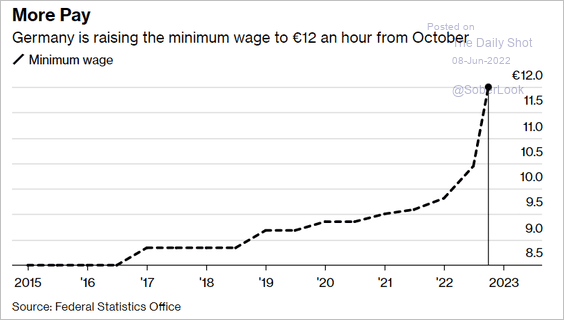

• Germany is boosting the minimum wage to €12.

Source: @bbgequality Read full article

Source: @bbgequality Read full article

——————–

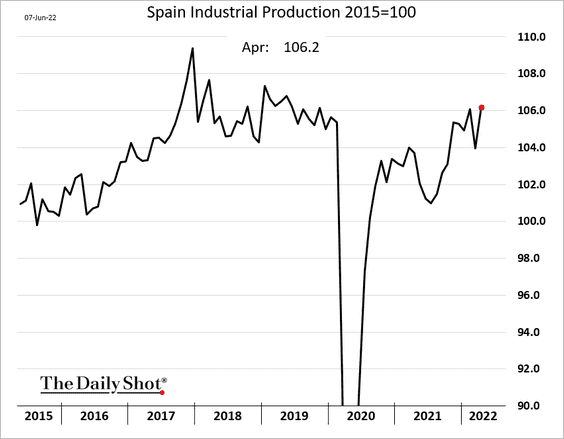

4. Spain’s industrial production is back above pre-COVID levels.

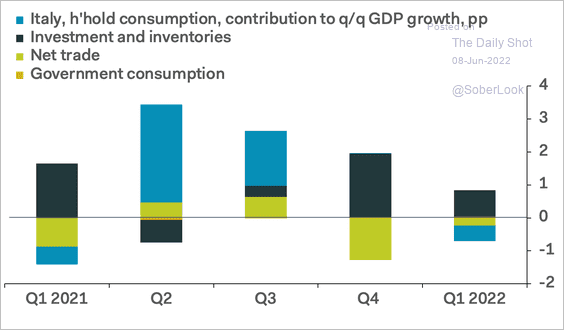

5. Investment rather than consumption drove Italy’s GDP gains in Q4 and Q1.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

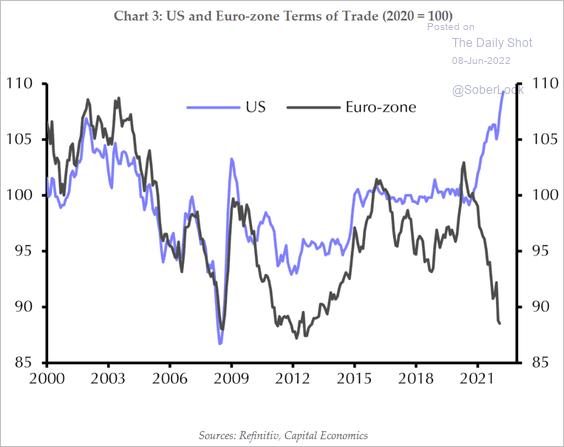

6. The Eurozone terms of trade have decoupled from the US due to European dependence on energy imports.

Source: Capital Economics

Source: Capital Economics

Back to Index

Japan

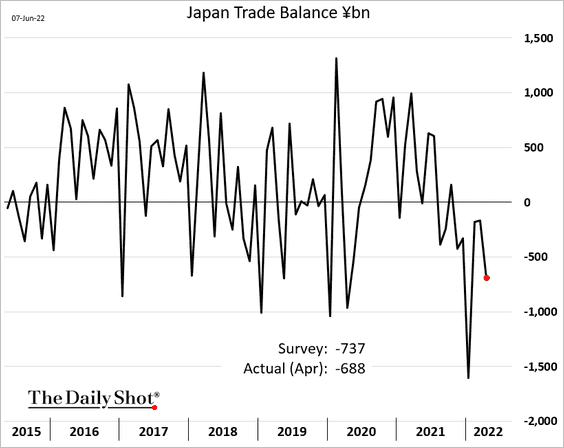

1. The trade gap was narrower than expected.

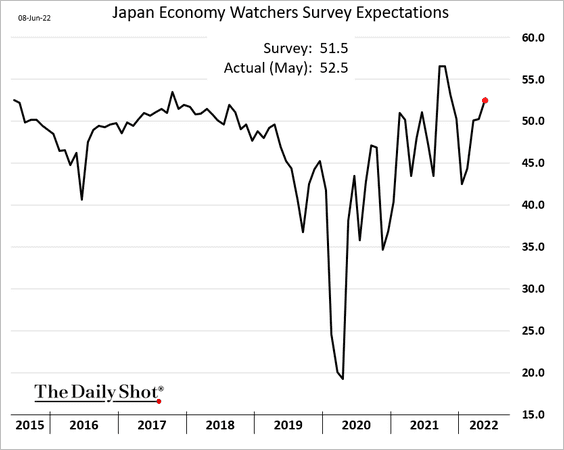

2. The Economy Watchers Survey shows increasing optimism.

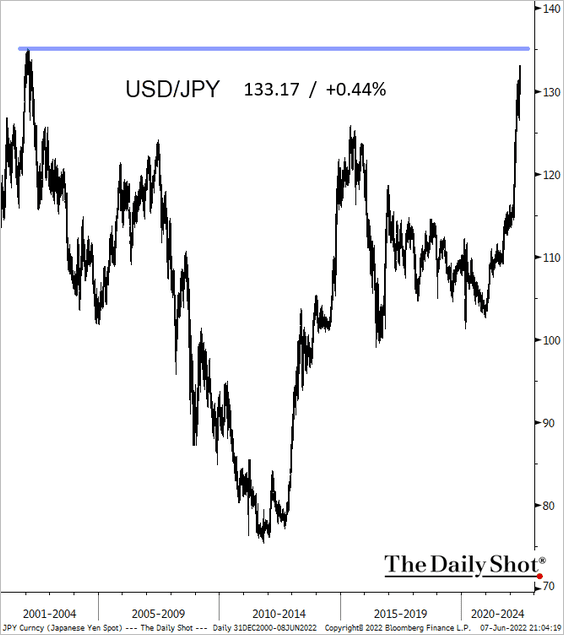

3. The yen continues to weaken, with USD/JPY nearing the peak reached two decades ago. Analysts don’t expect an MoF intervention in the currency markets at this point.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Asia – Pacific

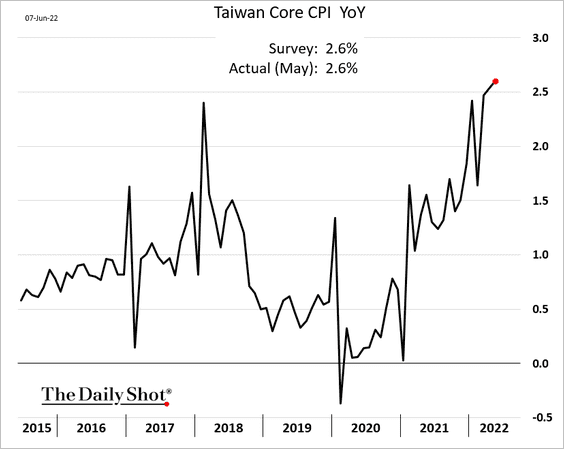

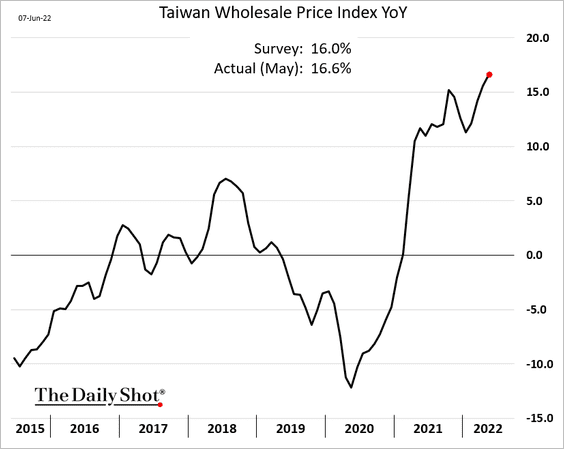

1. Taiwan’s consumer inflation continues to grind higher, …

… as wholesale inflation approaches 17%. Another rate hike is coming.

——————–

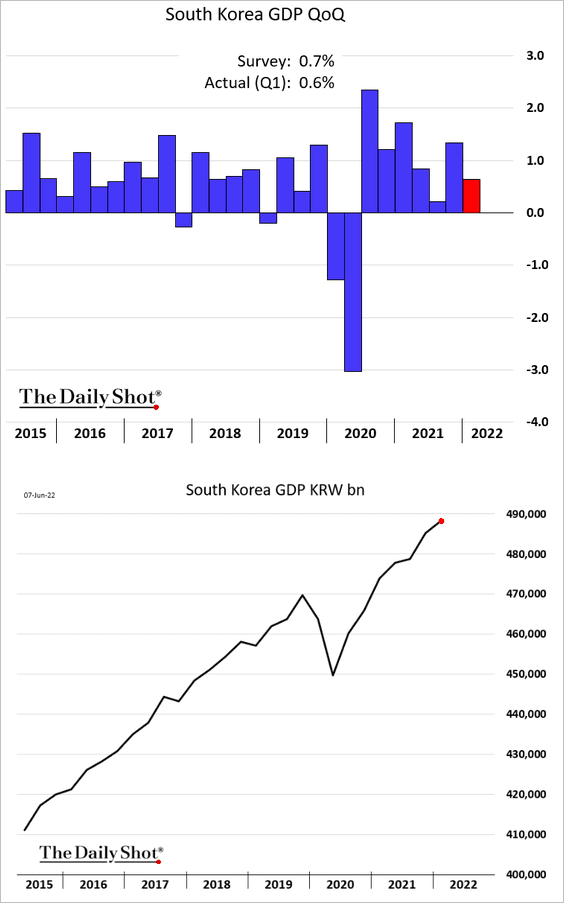

2. South Korea’s economic growth remains robust.

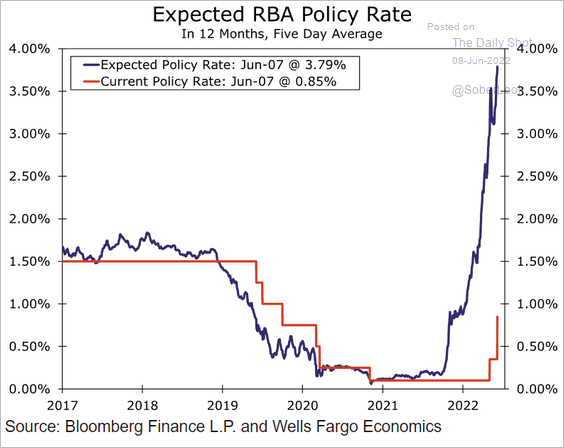

3. The markets expect the RBA’s policy rate to reach 3.79% in 12 months, …

Source: Wells Fargo Securities

Source: Wells Fargo Securities

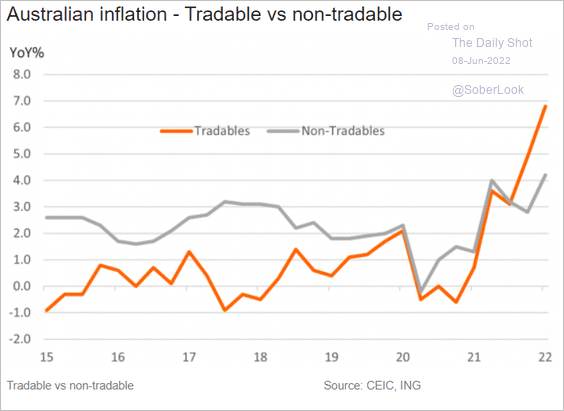

… as inflation gains momentum.

Source: ING

Source: ING

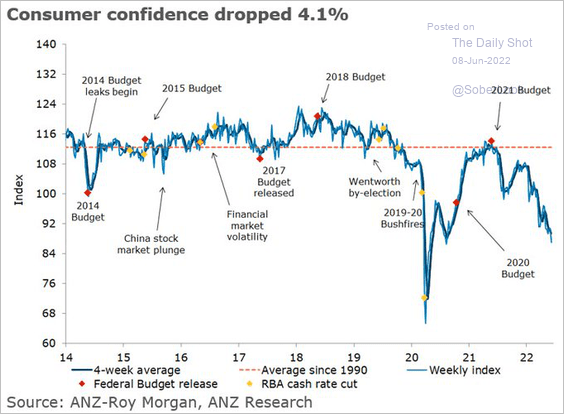

Australian consumer confidence continues to deteriorate due to cost-of-living concerns.

Source: @ANZ_Research, @arindam_chky, @DavidPlank12

Source: @ANZ_Research, @arindam_chky, @DavidPlank12

Back to Index

China

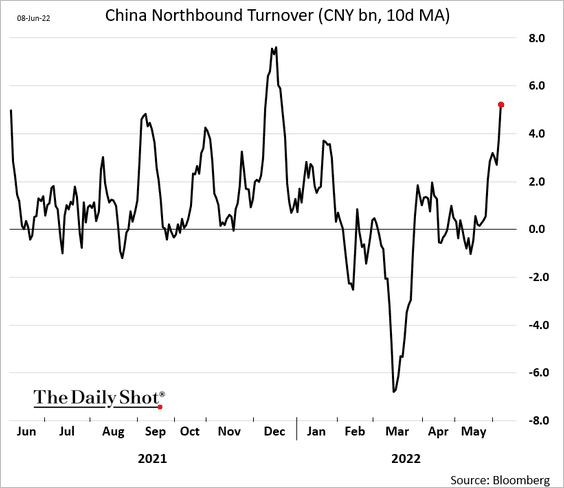

1. Hong Kong-based and foreign investors are returning to mainland equity markets.

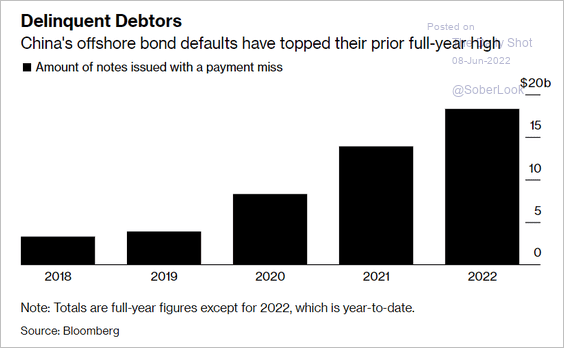

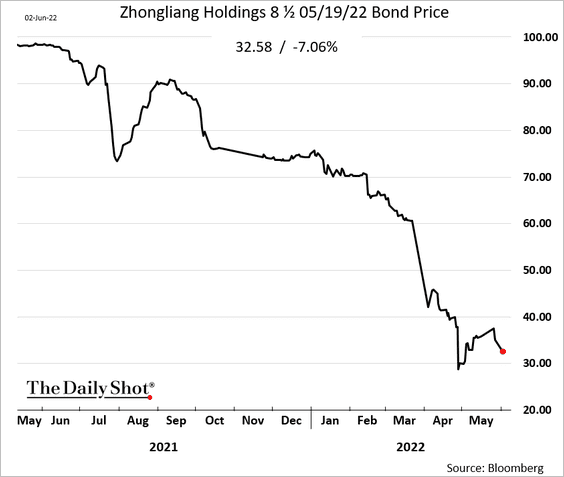

2. Offshore debt defaults have been massive this year.

Source: @business Read full article

Source: @business Read full article

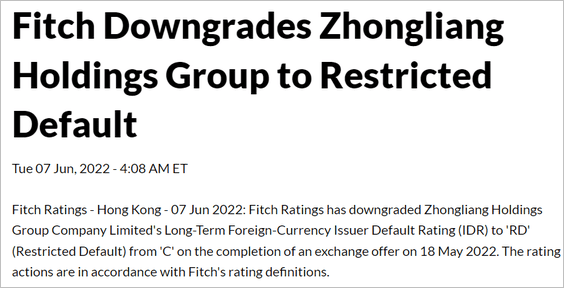

Here is one more.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

——————–

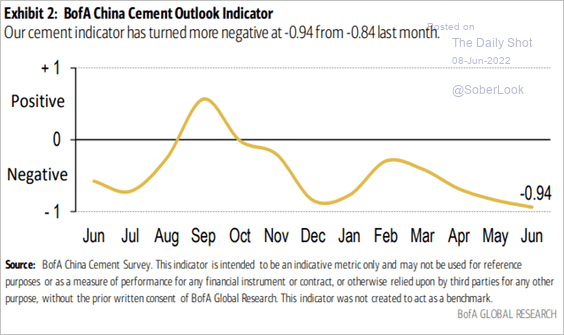

3. Cement produces are not happy.

Source: BofA Global Research

Source: BofA Global Research

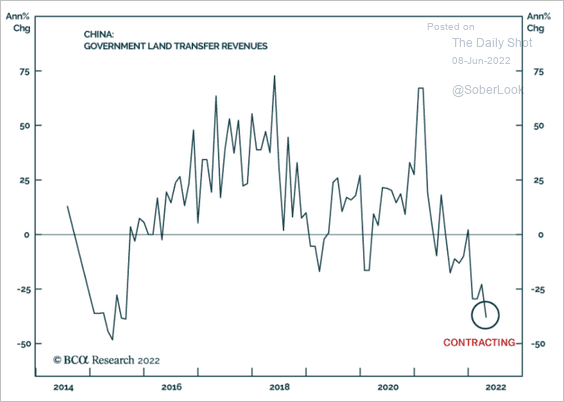

4. Local government’s key source of revenue has been disrupted.

Source: BCA Research

Source: BCA Research

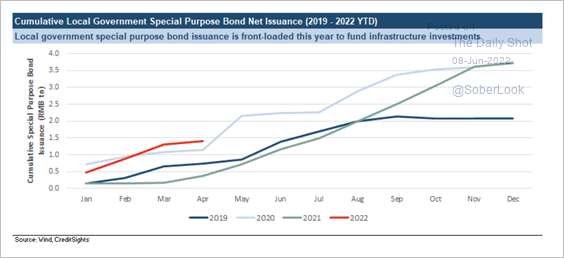

Local government bond issuance has picked up this year to fund infrastructure investments.

Source: CreditSights

Source: CreditSights

——————–

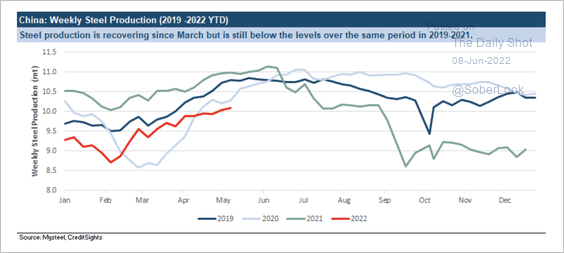

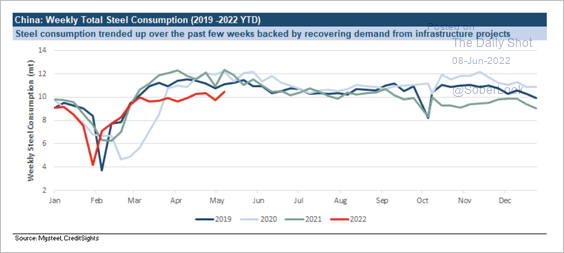

5. Steel production and consumption are recovering because of new infrastructure projects, albeit below pre-pandemic levels (2 charts).

Source: CreditSights

Source: CreditSights

Source: CreditSights

Source: CreditSights

——————–

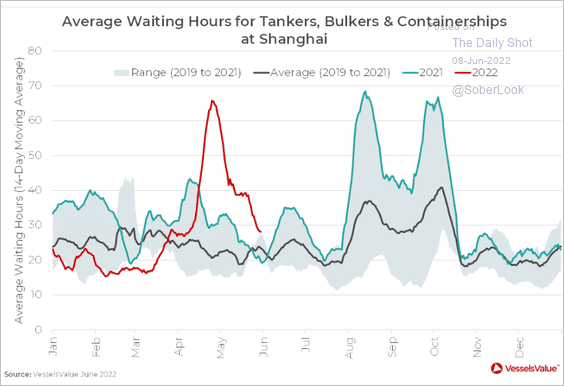

6. The Port of Shanghai is nearly back to normal.

Source: VesselsValue

Source: VesselsValue

Back to Index

Emerging Markets

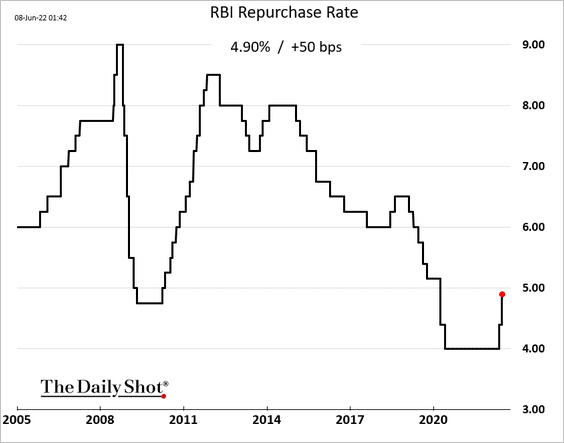

1. India’s central bank hiked rates to address inflationary pressures.

Source: The Economic Times Read full article

Source: The Economic Times Read full article

——————–

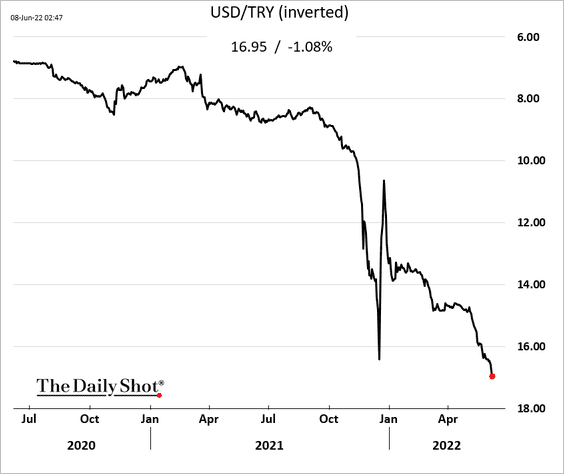

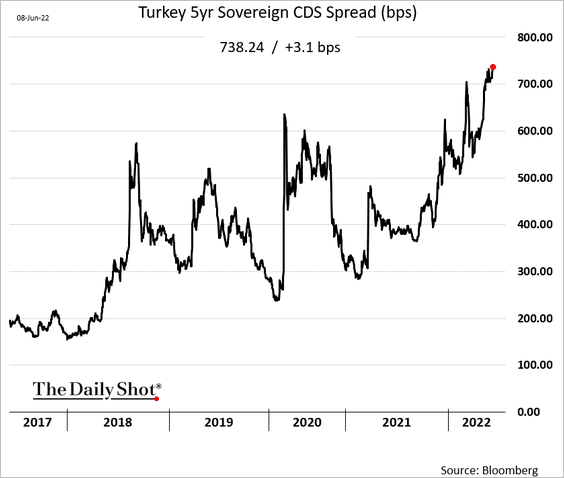

2. The Turkish lira continues to sink, with USD/TRY nearing 17.0.

Sovereign CDS spreads are hitting multi-year highs.

——————–

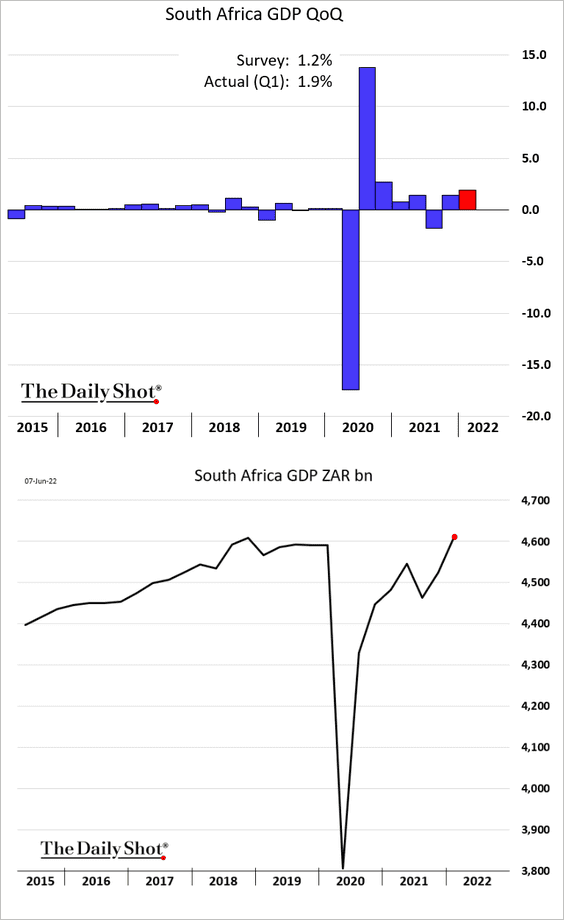

3. South Africa’s Q1 growth surprised to the upside, with the GDP now above pre-COVID levels.

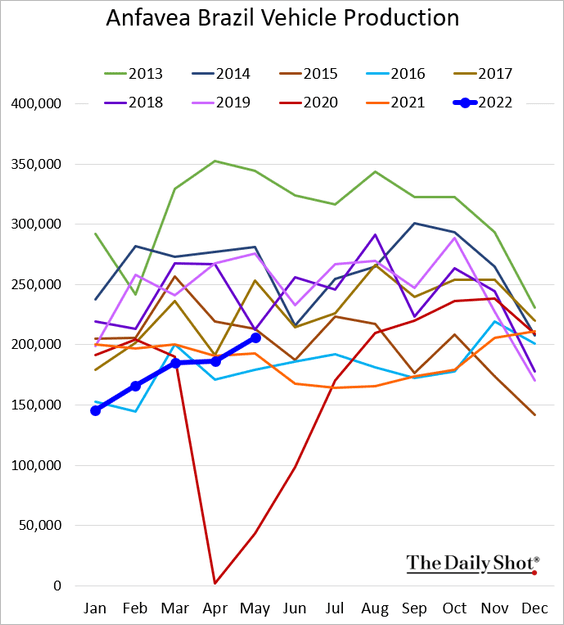

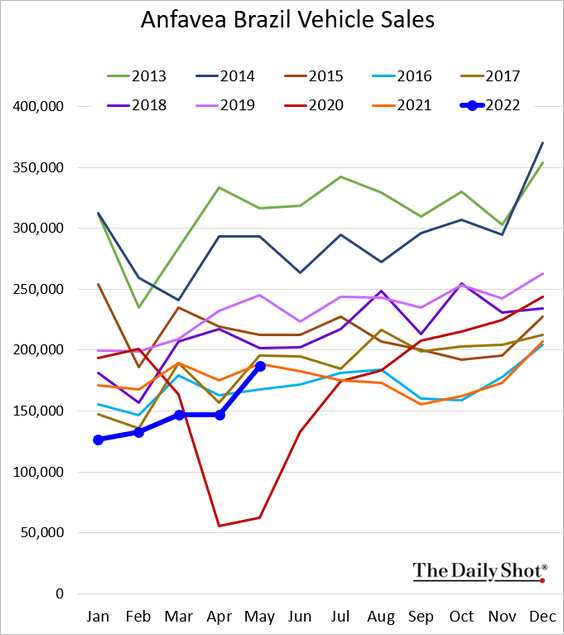

4. Brazil’s vehicle production is accelerating.

Vehicle sales are back to last year’s levels.

——————–

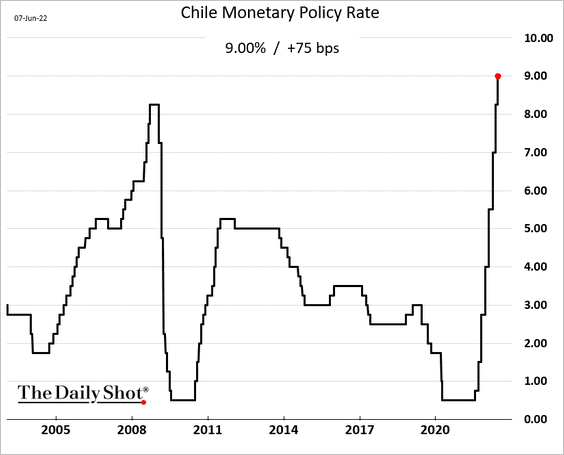

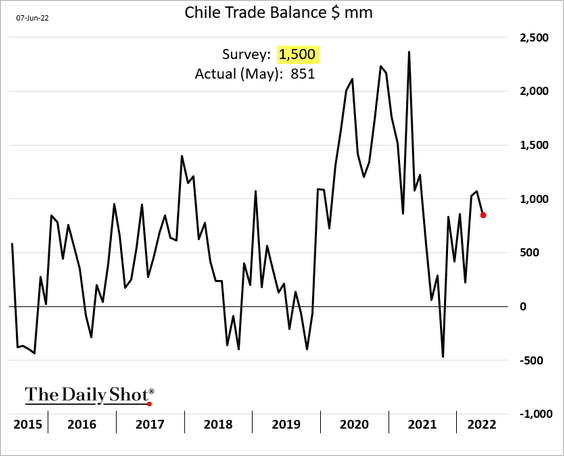

5. Chile’s central bank delivered another aggressive rate hike.

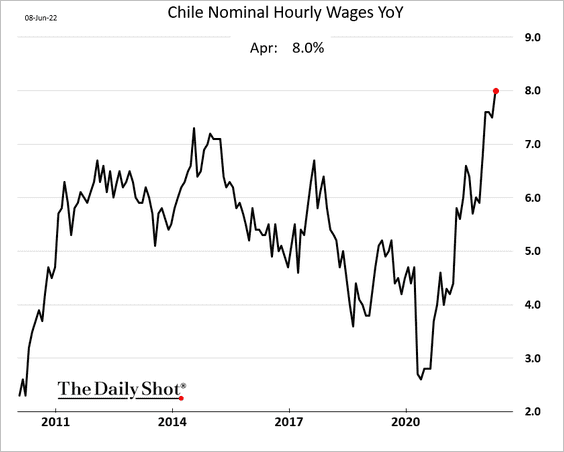

• Wages continue to surge.

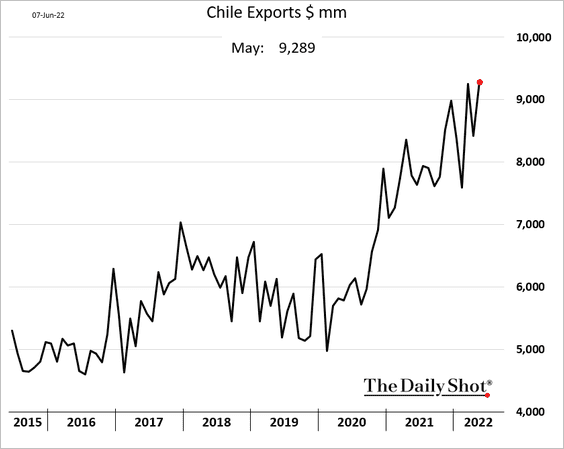

• Chile’s exports keep climbing.

But the trade surplus was lower than expected last month.

Back to Index

Cryptocurrency

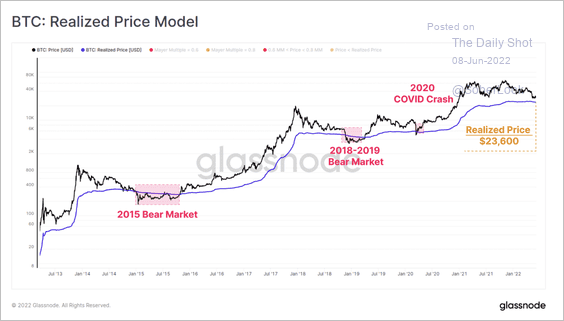

1. Bitcoin’s realized price, or the average cost basis of all BTC in supply, is at $23,600. That could be a key support level.

Source: Glassnode Read full article

Source: Glassnode Read full article

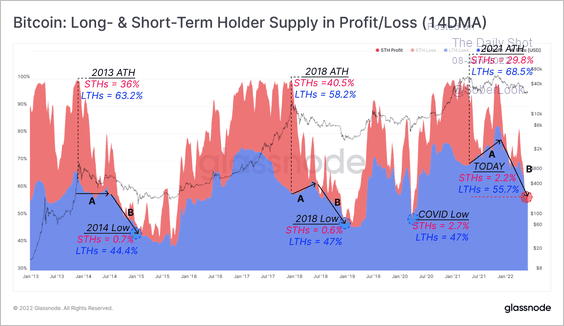

2. Almost all bitcoin investors during this market cycle are holding unrealized losses, according to blockchain data compiled by Glassnode.

Source: @glassnode

Source: @glassnode

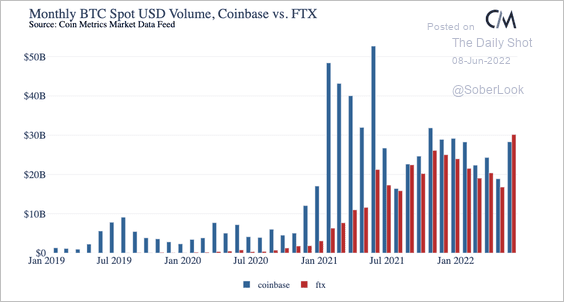

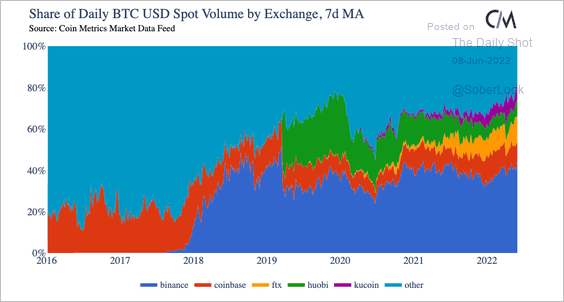

3. May was the first month when total bitcoin spot trading volume was higher on FTX than Coinbase.

Source: @coinmetrics

Source: @coinmetrics

4. Binance has maintained its strong lead on the market as the largest exchange by volume.

Source: @coinmetrics

Source: @coinmetrics

Binance has served as a conduit for laundering billions in illicit funds, according to a Reuters investigation.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

5. Citadel is planning to make markets for various cryptos.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Energy

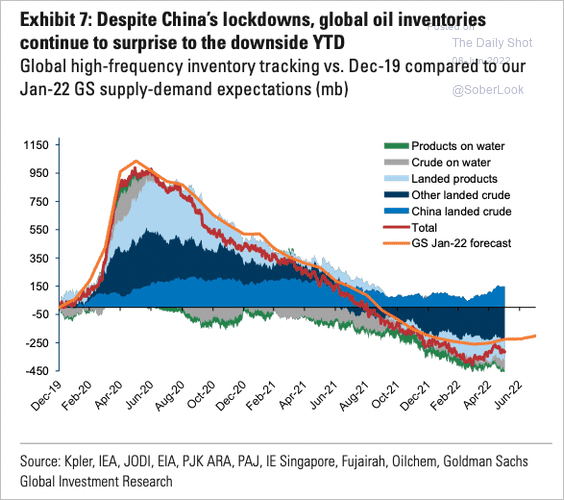

1. Global oil inventories continue to surprise to the downside.

Source: Goldman Sachs; @OpenSquareCap

Source: Goldman Sachs; @OpenSquareCap

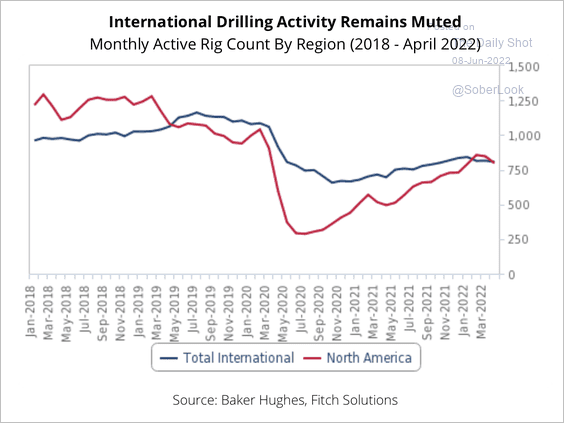

2. The recovery in US drilling activity has been slow.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

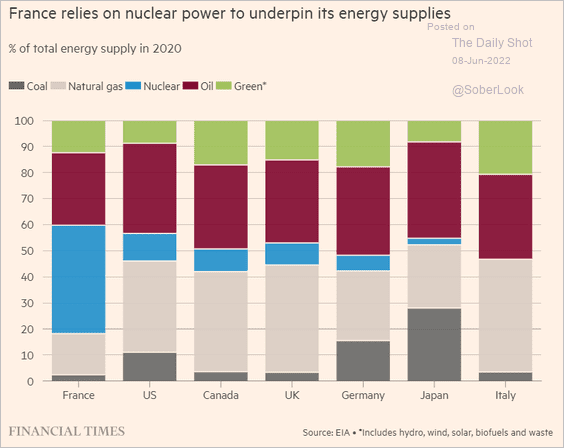

3. Europe could boost investment in nuclear energy to cut its dependence on Russian natural gas.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

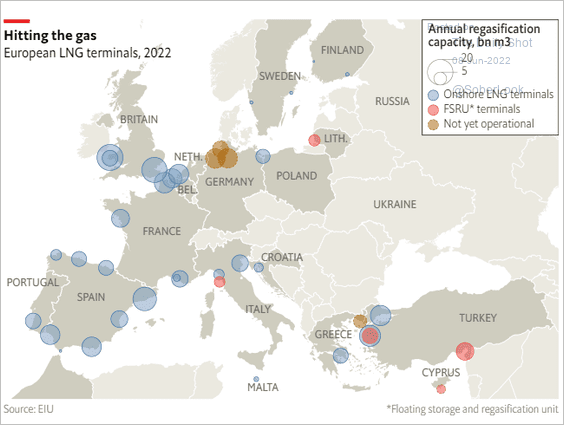

4. Here is a map showing European LNG terminals.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Equities

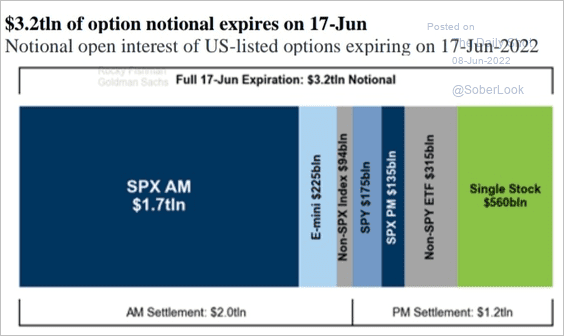

1. $3.2 trillion of equity options expire next week, which could boost volatility.

Source: Goldman Sachs; @MichaelGoodwell

Source: Goldman Sachs; @MichaelGoodwell

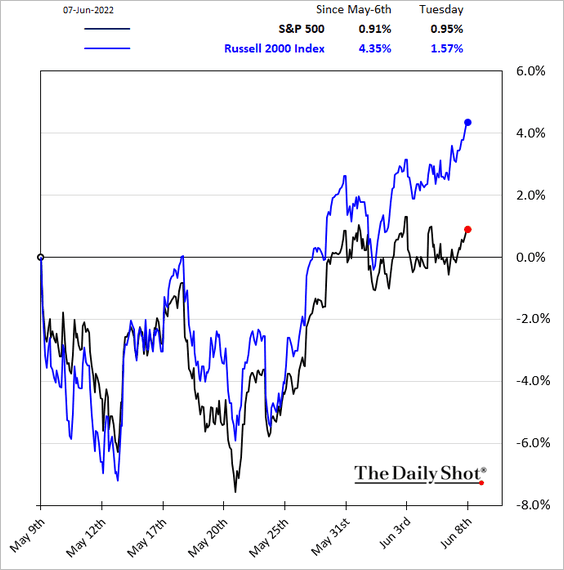

2. Small caps have been outperforming in recent days.

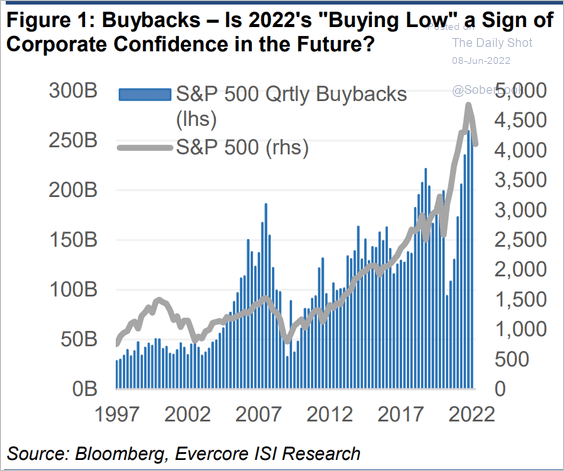

3. Share buybacks remain robust.

Source: Evercore ISI Research

Source: Evercore ISI Research

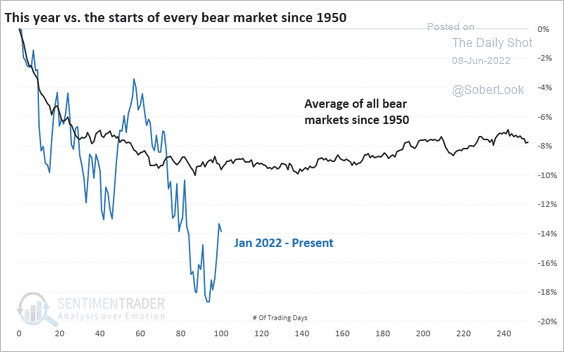

4. Bear markets since 1950 have typically troughed around this point, although there is wide variability.

Source: SentimenTrader

Source: SentimenTrader

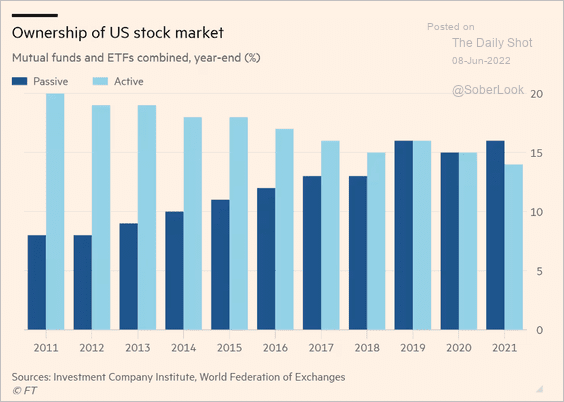

5. According to the FT, “around 16% of US stocks are held by index trackers and ETFs vs. 14% by actively managed funds.”

Source: @financialtimes Read full article

Source: @financialtimes Read full article

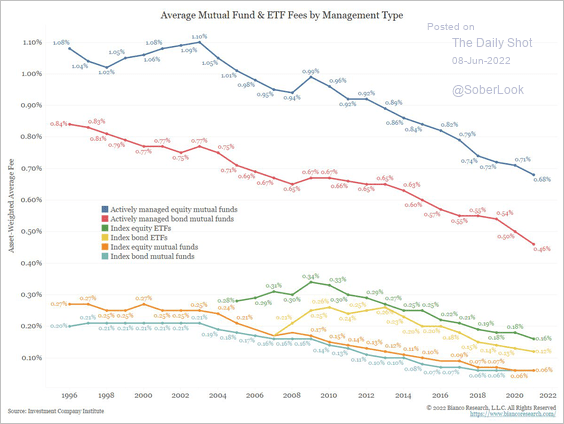

6. Fund fees continue to shrink.

Source: @LizAnnSonders, @biancoresearch

Source: @LizAnnSonders, @biancoresearch

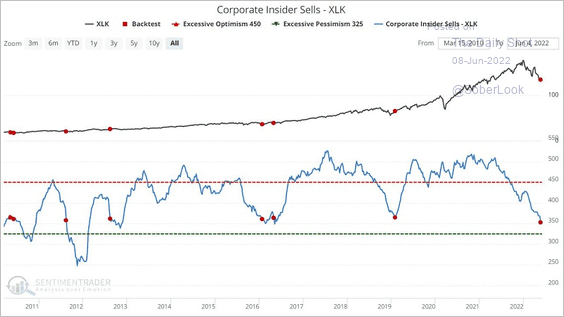

7. Insider selling of tech stocks has steadily declined over the past year.

Source: SentimenTrader

Source: SentimenTrader

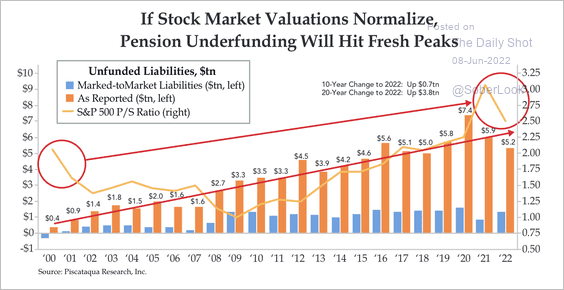

8. Pension underfunding could reach fresh heights if stock valuations “normalize.”

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Credit

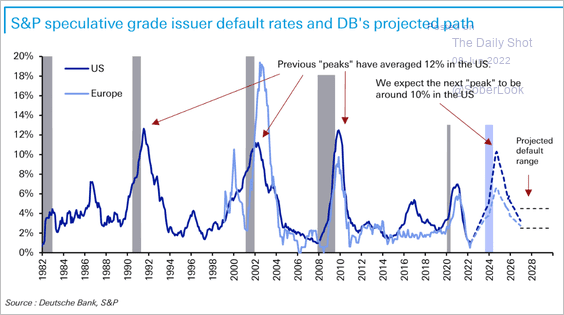

1. In the next few years, high-yield defaults could hit the highest level since the financial crisis, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

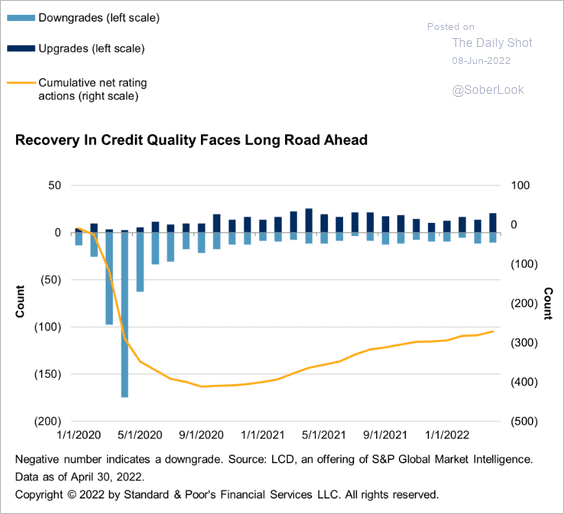

2. The recovery in leveraged loan credit quality has a long way to go.

Source: S&P Global Ratings

Source: S&P Global Ratings

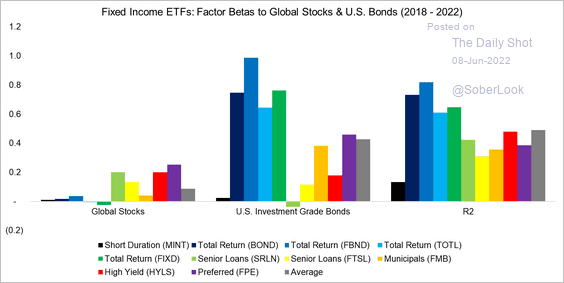

3. This chart shows factor betas of select fixed-income ETFs to global stocks and US bonds.

Source: FactorResearch Read full article

Source: FactorResearch Read full article

Back to Index

Global Developments

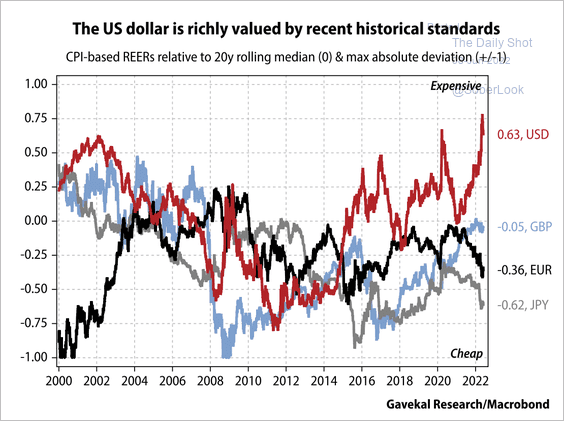

1. The dollar appears richly valued by historical standards.

Source: Gavekal Research

Source: Gavekal Research

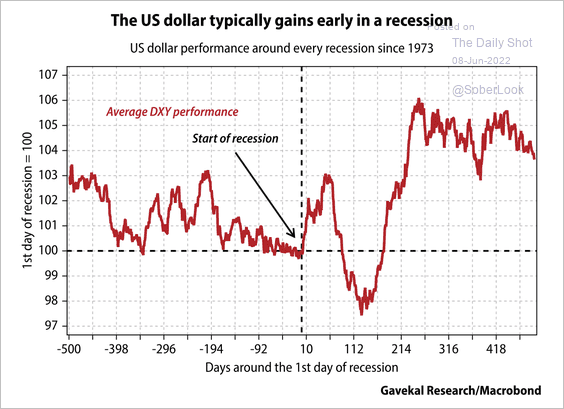

Still, the dollar could see additional “flight to safety” buying if the US falls into a recession.

Source: Gavekal Research

Source: Gavekal Research

——————–

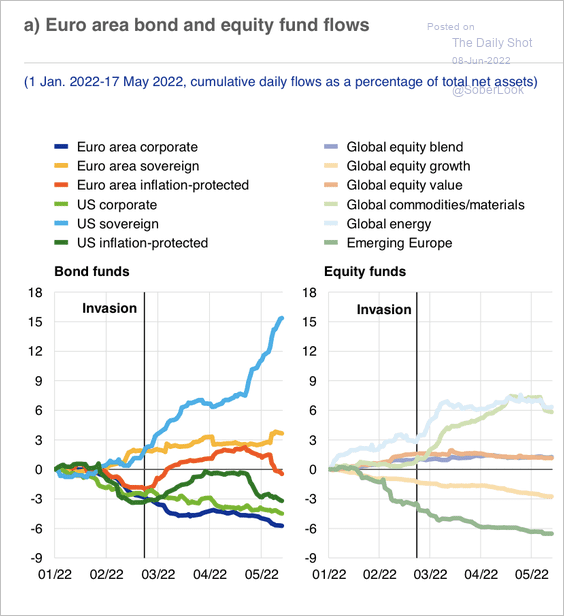

2. Since early this year, there has been a rotation from corporate to sovereign bond funds, as well as from growth to value equity funds.

Source: ECB

Source: ECB

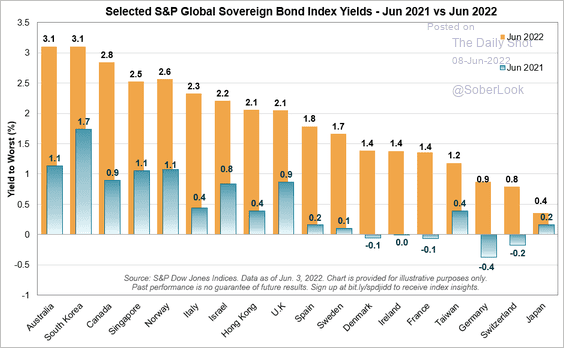

3. It’s been a challenging 12 months for sovereign bonds.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

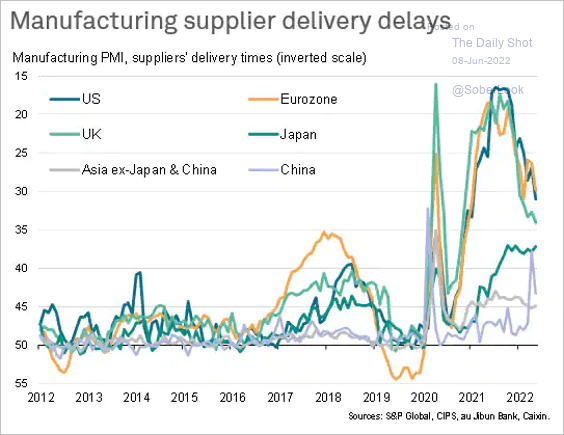

4. Global supply bottlenecks have been easing.

Source: S&P Global PMI

Source: S&P Global PMI

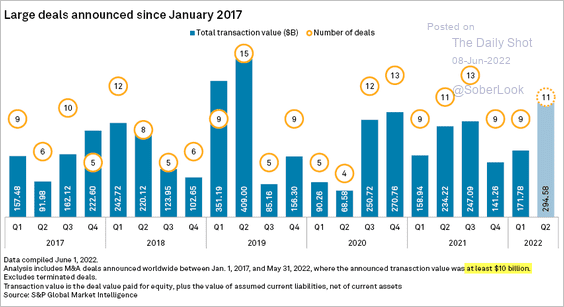

5. Large M&A deal activity has been strong this quarter.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

Food for Thought

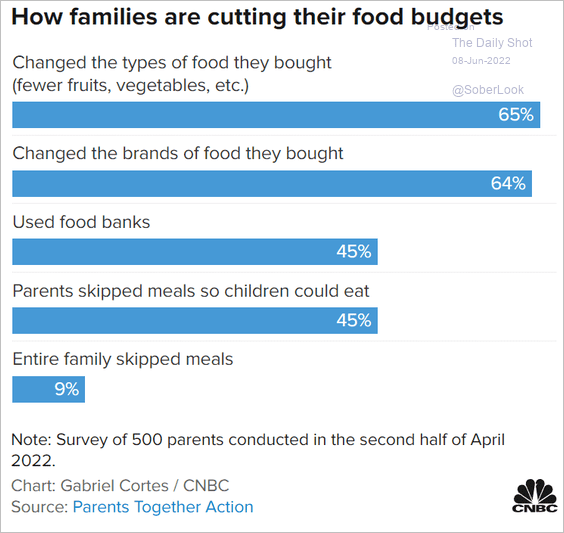

1. Coping with high food prices:

Source: CNBC Read full article

Source: CNBC Read full article

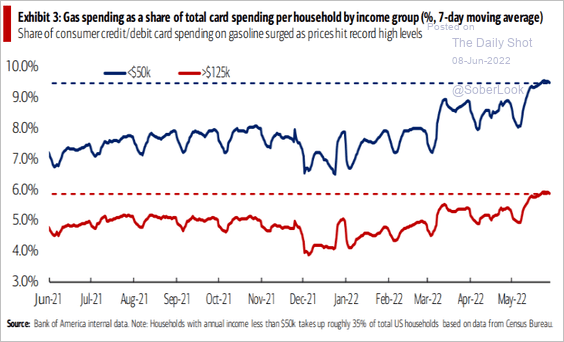

2. Spending on gasoline as a share of total card spending:

Source: @SamRo, BofA Read full article

Source: @SamRo, BofA Read full article

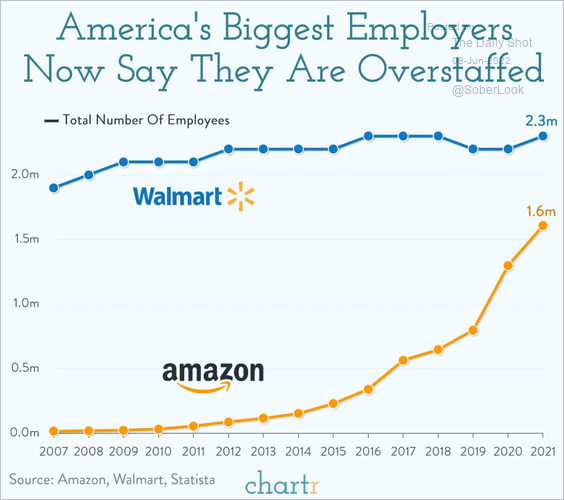

3. The biggest US employers:

Source: @chartrdaily Read full article

Source: @chartrdaily Read full article

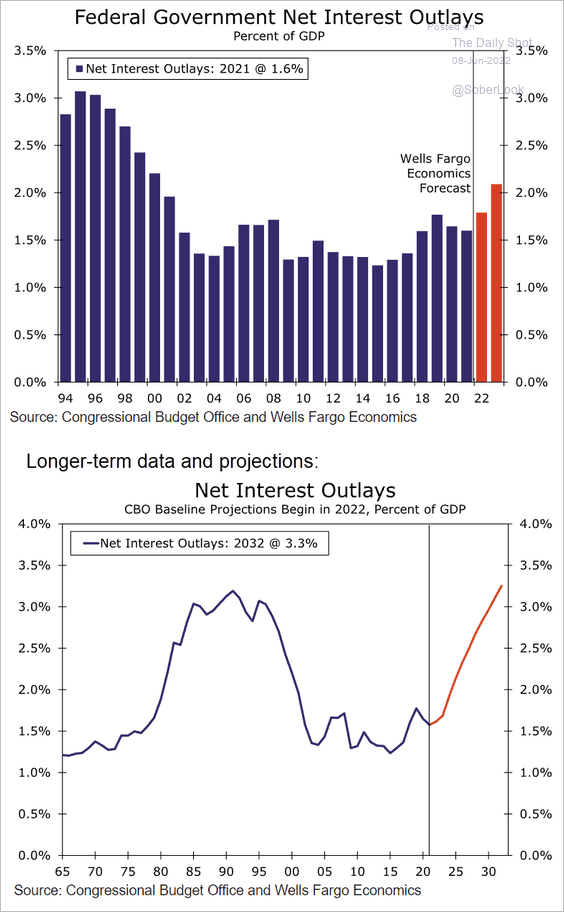

4. US federal government’s interest payments as a percent of GDP:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

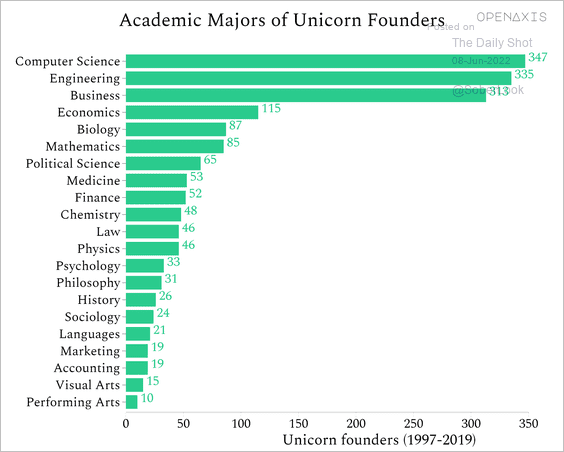

5. Academic majors of unicorn founders:

Source: OpenAxis

Source: OpenAxis

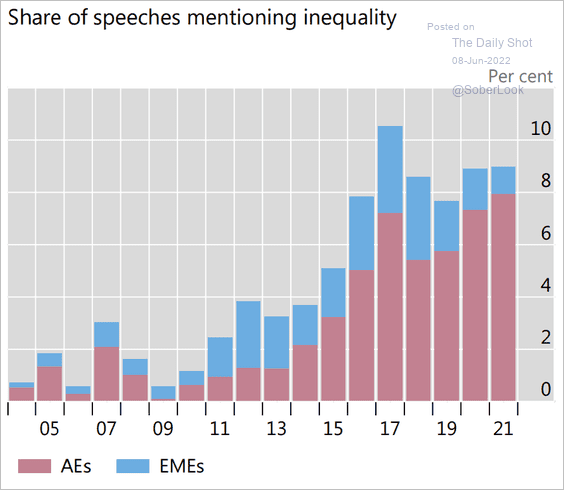

6. Central bankers mentioning “inequality” in their speeches (AE = advanced economies, EME = emerging market economies):

Source: BIS Read full article

Source: BIS Read full article

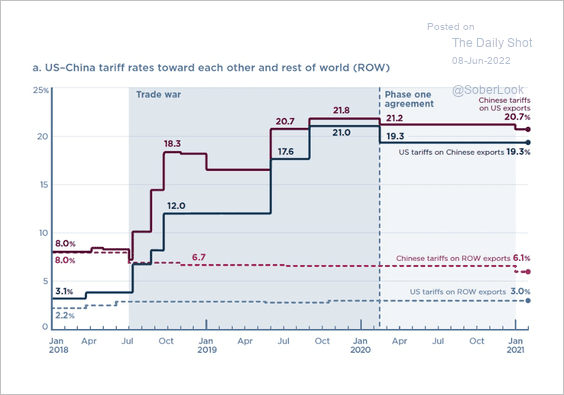

7. US-China tariff rates:

Source: SOM Macro Strategies

Source: SOM Macro Strategies

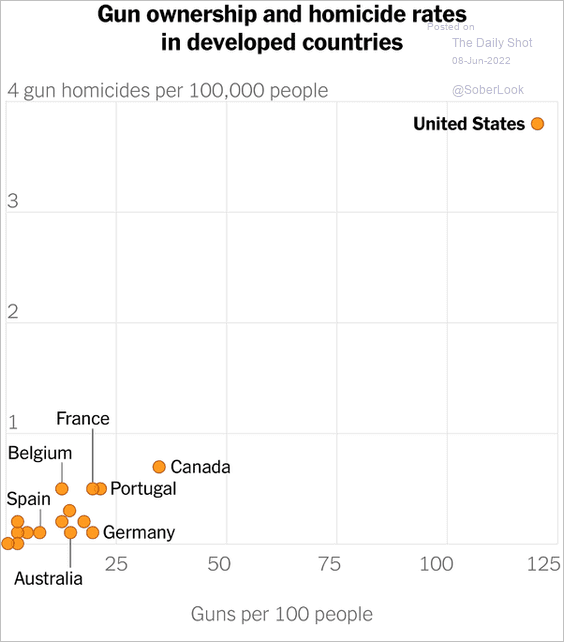

8. Gun ownership and homicide rates:

Source: The New York Times

Source: The New York Times

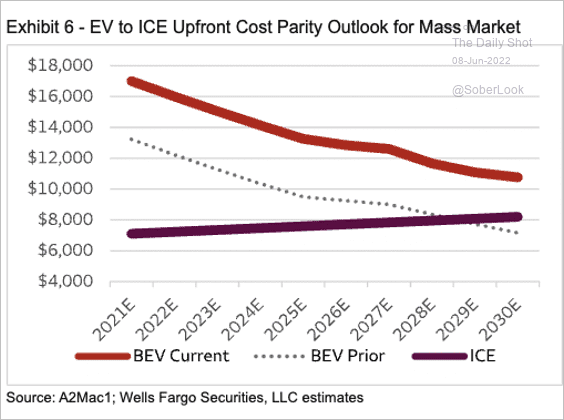

9. The impact of materials costs on EV prices relative to ICE (internal combustion) vehicles:

Source: Wells Fargo Securities; @reillybrennan

Source: Wells Fargo Securities; @reillybrennan

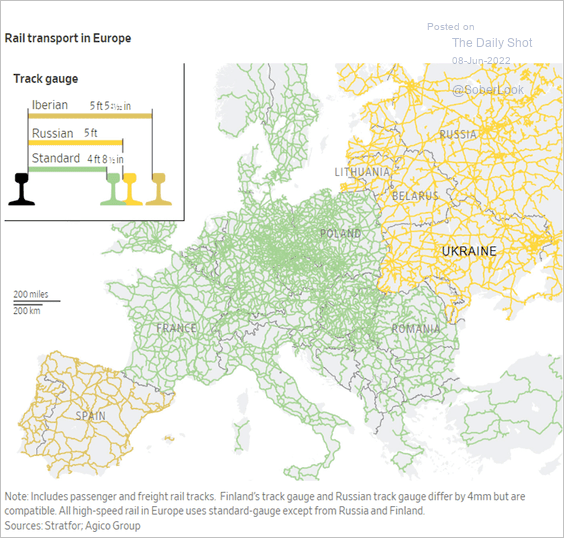

10. Rail track gauge (the distance between the two rails) across Europe:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index