The Daily Shot: 20-Jun-22

• The United States

• Canada

• The United Kingdom

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

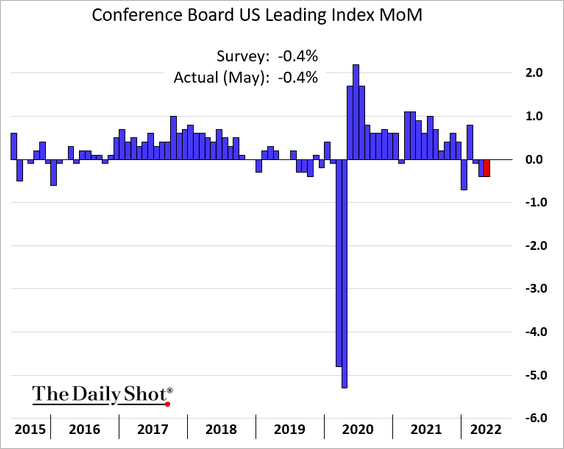

1. We continue to see evidence of slowing economic growth in the US. The Conference Board’s index of leading indicators was down for three months in a row.

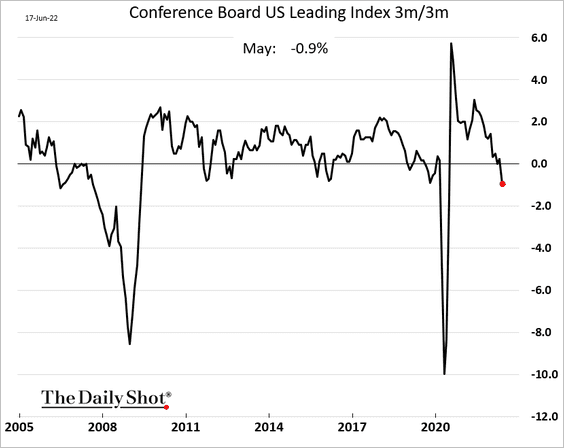

This chart shows the rolling 3-month changes in the Conference Board’s index.

——————–

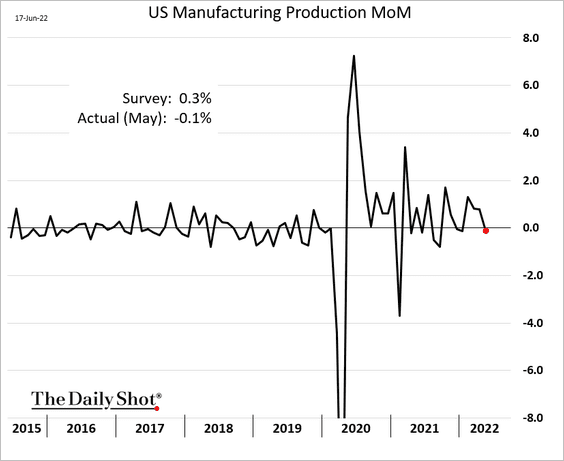

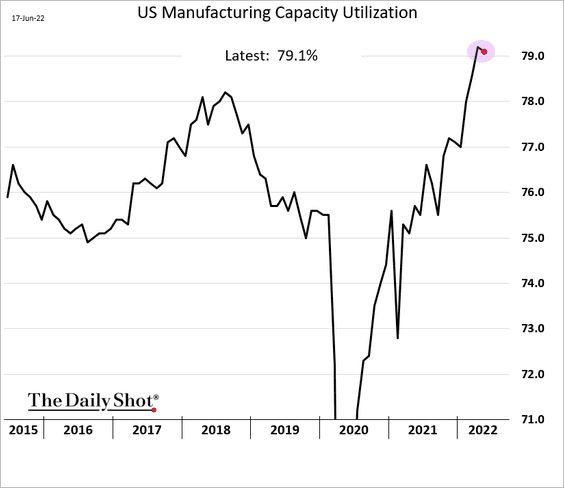

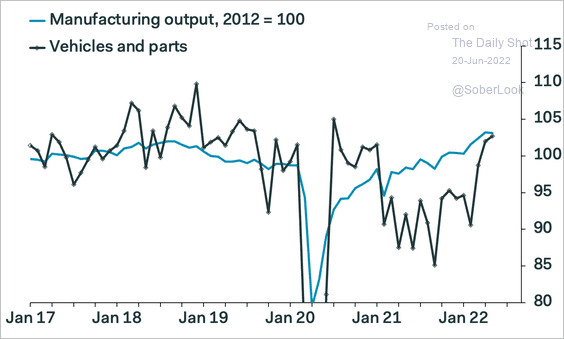

2. US manufacturing output unexpectedly declined last month.

To be sure, factories remained busy in May, but these could be the first “hard data” signs of a slowdown in manufacturing activity.

Vehicle production has been rebounding (replenishing inventories).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

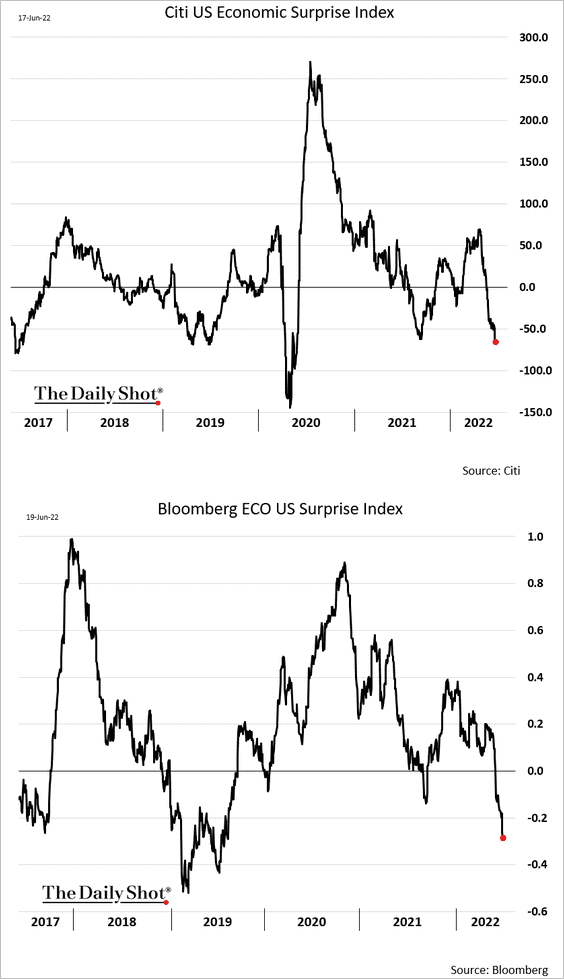

3. Economic surprise indicators are down sharply.

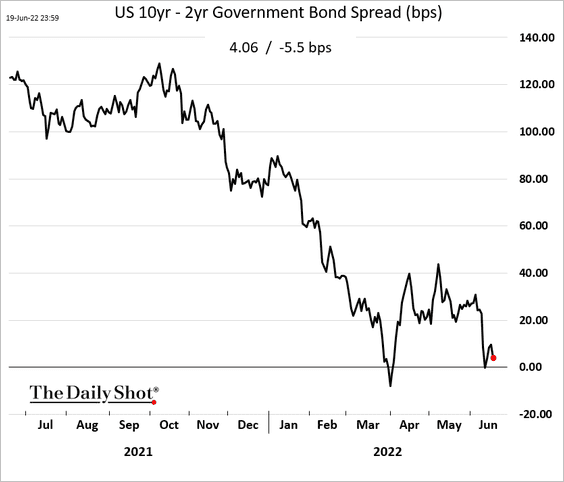

4. The 10yr – 2yr Treasury spread is flirting with inversion.

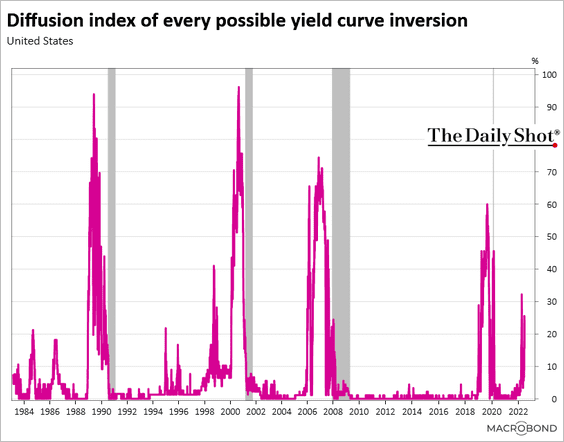

This indicator looks at inversions across the curve. The only reason it’s not higher is that the front end of the curve remains steep as the market prices in Fed rate hikes.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

——————–

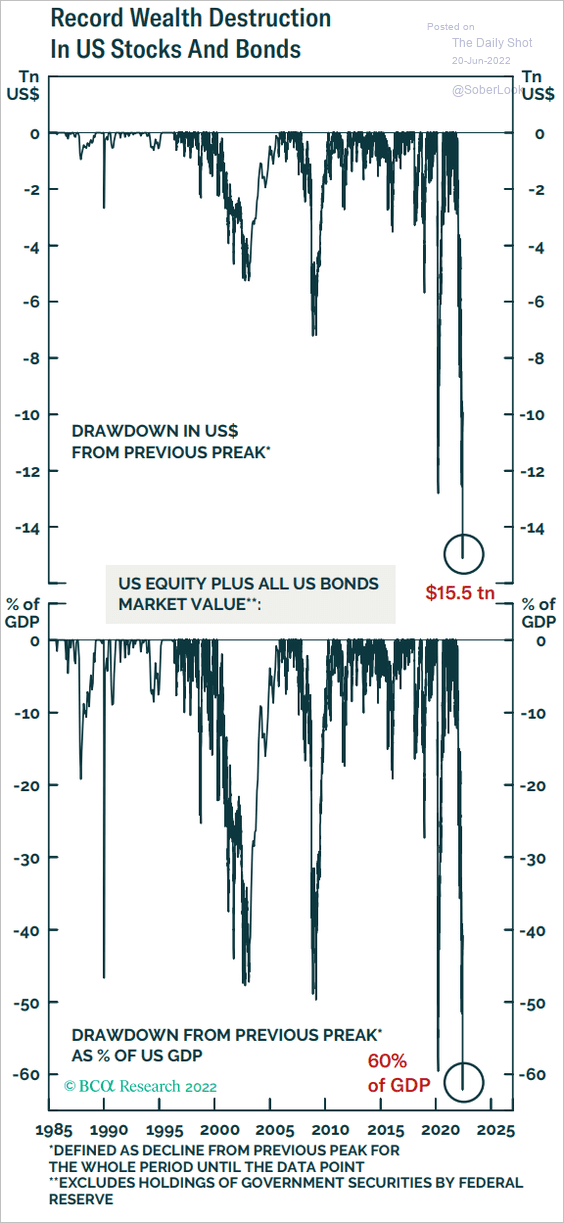

5. Wealth destruction has been massive in this cycle, which is likely to create a drag on consumption.

Source: BCA Research

Source: BCA Research

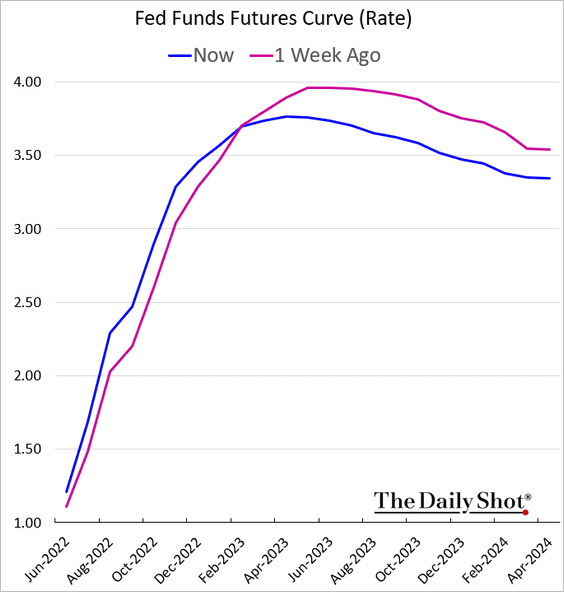

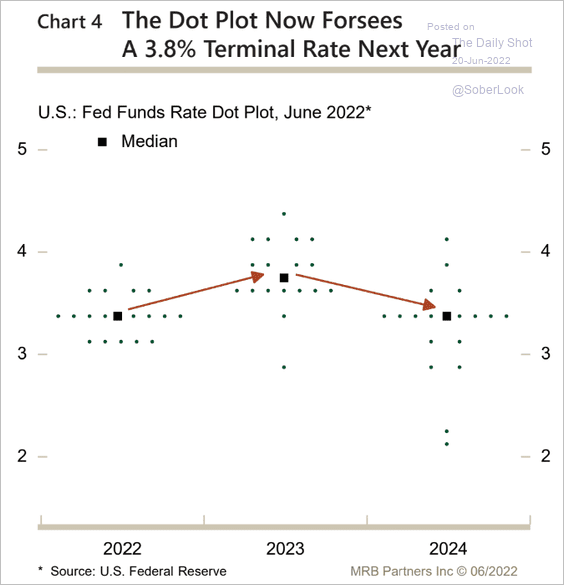

6. The market expects faster rate hikes since the May CPI shock, but the “terminal” (maximum) rate has declined.

Market pricing for the terminal rate is consistent with the dot plot.

Source: MRB Partners

Source: MRB Partners

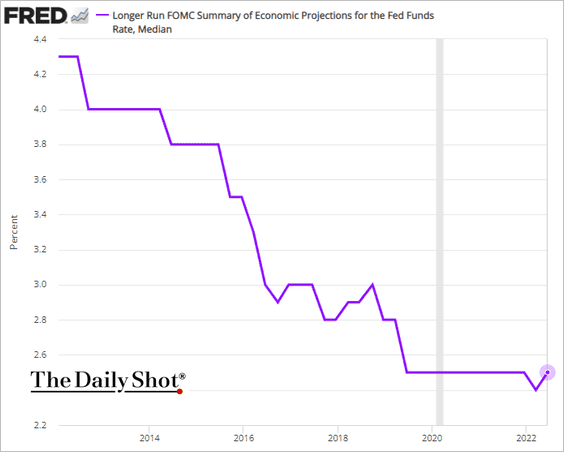

Will the terminal rate be high enough to achieve the Fed’s inflation-fighting goal? We want to compare it to the neutral (or “longer-run”) rate. The Fed’s expectation for the neutral rate (chart below) is roughly in line with the market (2nd chart below).

That puts the spread between the terminal and the neutral rate in the range of 110 – 130 bps. Will that be enough to sufficiently slow demand? What if the neutral rate is actually much higher?

——————–

7. The market expects the headline CPI to peak above 9%.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

8. The US dollar rally in this cycle has been unusually sharp.

Source: MarketDesk Research

Source: MarketDesk Research

Back to Index

Canada

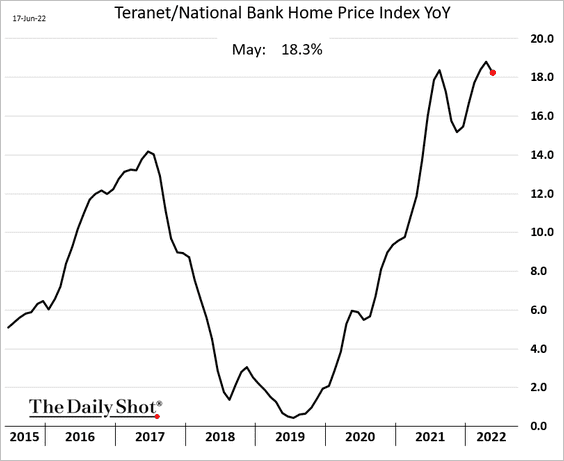

1. Home price appreciation ticked lower but remains near record levels.

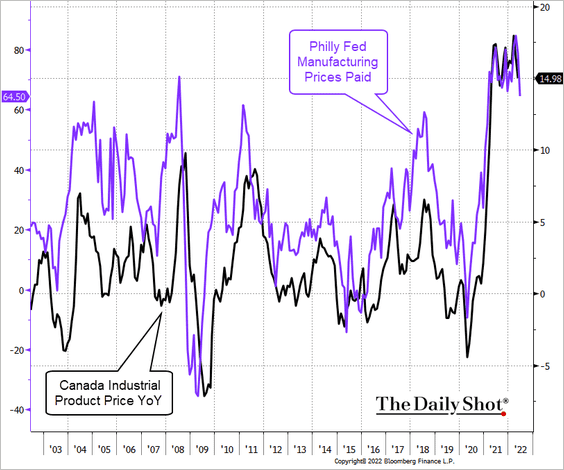

2. The US Philly Fed’s manufacturing “prices paid” indicator leads Canada’s industrial product price index. For now, there are no meaningful signs of relief.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

The United Kingdom

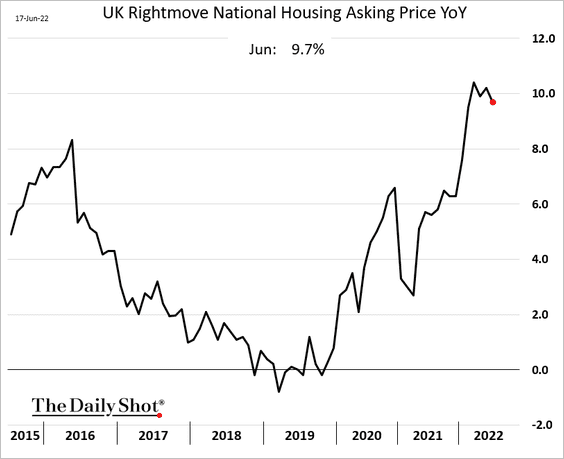

1. Home price appreciation is holding up well despite severe weakness in consumer sentiment.

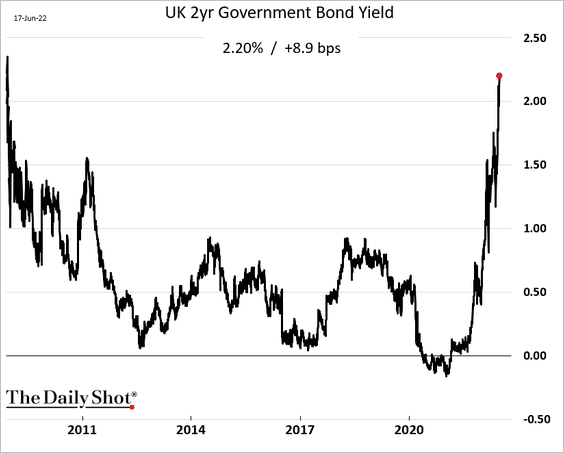

2. The 2yr gilt yield hit the highest level since 2008.

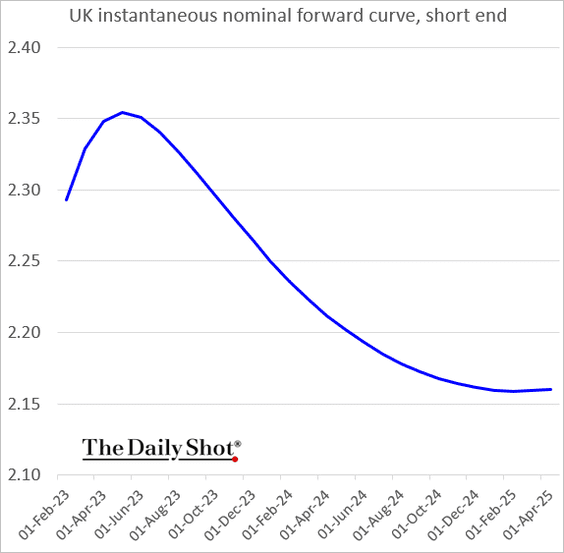

3. The market pricing for the BoE terminal (maximum) rate is slightly above 2.35%. Too low?

Source: BoE

Source: BoE

Back to Index

Europe

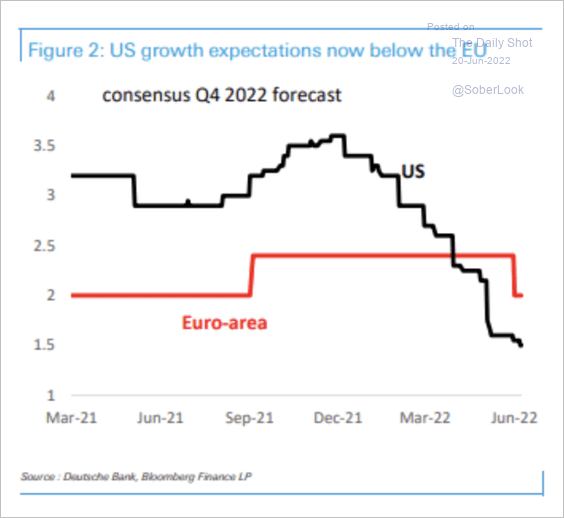

1. Growth expectations for the euro area are now higher than the US.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

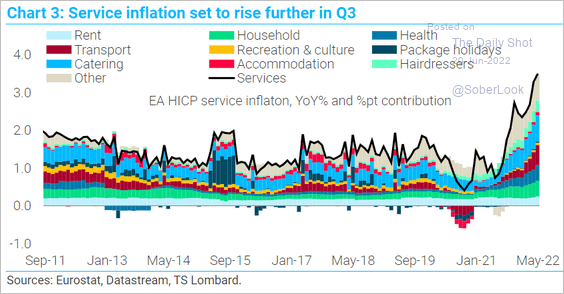

2. Service inflation is expected to keep climbing.

Source: TS Lombard

Source: TS Lombard

3. Germany is taking additional measures to reduce gas consumption as Russia slows supplies to Europe. The nation will restart coal-fired power plants and offer incentives.

Source: Ministry of Economics and Technology, h/t @JavierBlas Read full article

Source: Ministry of Economics and Technology, h/t @JavierBlas Read full article

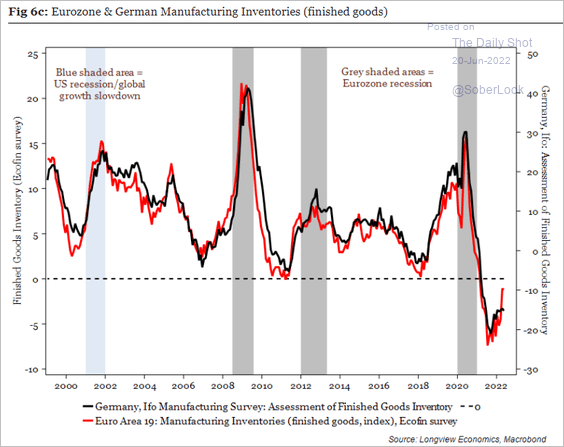

4. Eurozone inventories have started to recover.

Source: Longview Economics

Source: Longview Economics

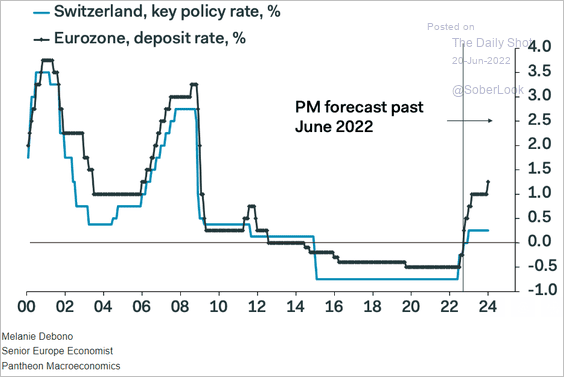

5. Pantheon Macroeconomics expects the SNB rate hikes to outpace the ECB.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

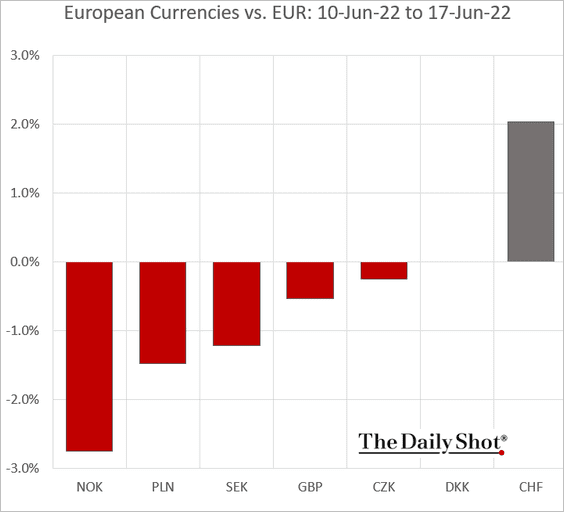

6. Here are last week’s European currency moves vs. the euro.

Back to Index

China

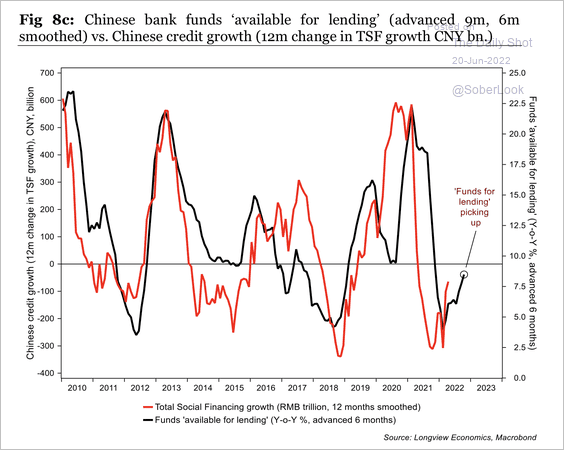

1. Credit growth is picking up.

Source: Longview Economics

Source: Longview Economics

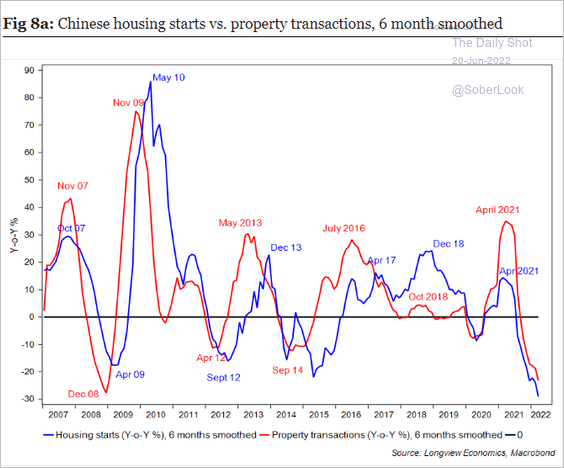

2. Housing starts and property transactions have reached extreme lows. Are we near the bottom?

Source: Longview Economics

Source: Longview Economics

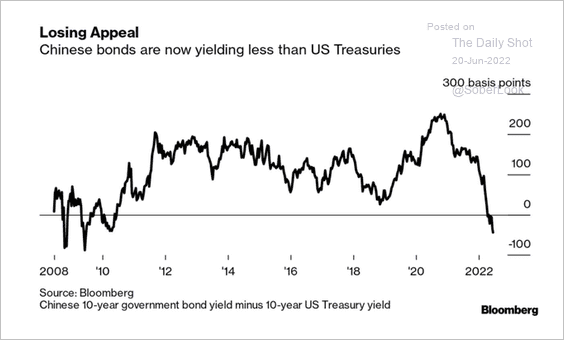

3. Bond yields are now firmly below US Treasuries.

Source: @acemaxx, @markets Read full article

Source: @acemaxx, @markets Read full article

4. Here are the drivers of Goldman’s 2022 GDP growth forecast change.

Source: @acemaxx, @GoldmanSachs

Source: @acemaxx, @GoldmanSachs

Back to Index

Emerging Markets

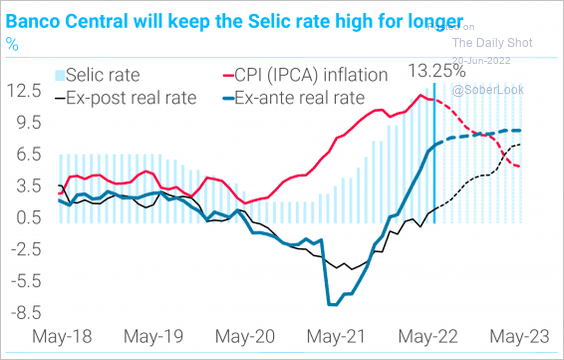

1. Brazil’s central bank is expected to keep rates elevated for some time.

Source: TS Lombard

Source: TS Lombard

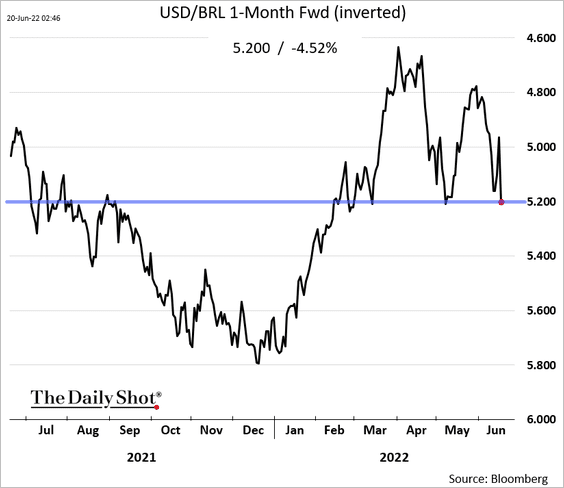

The Brazilian real took a hit on Friday.

——————–

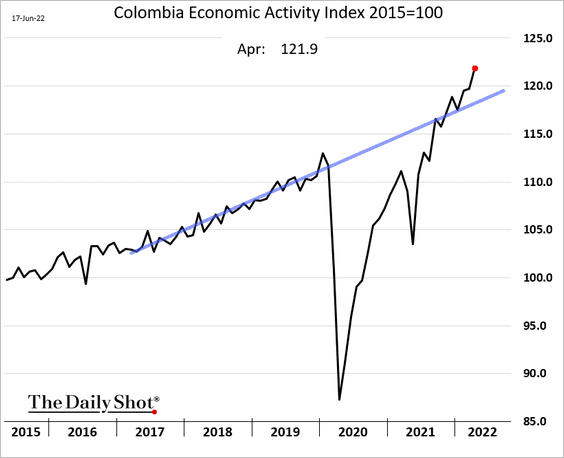

2. Colombia’s economic activity has been moving above the pre-COVID trend.

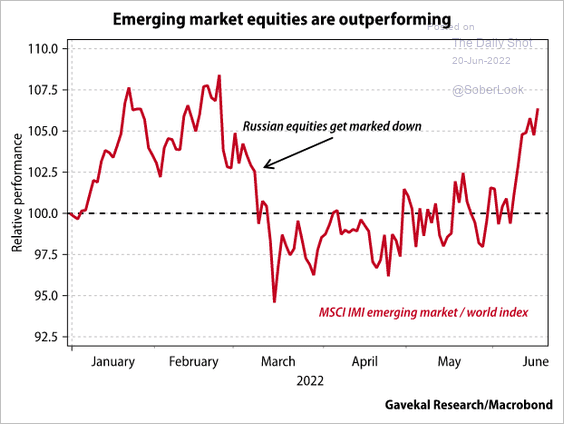

3. EM stocks and bonds have been outperforming DM.

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

Source: Gavekal Research

——————–

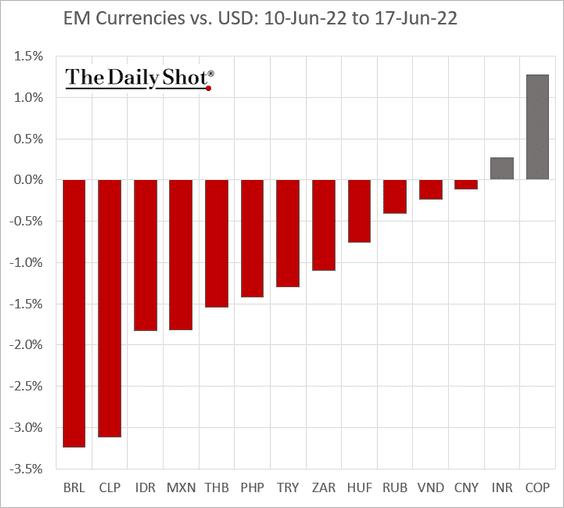

4. Next, we have some performance data from last week.

• Currencies:

• Sovereign yields (European debt sold off sharply as inflation surges).

• Equity ETFs:

Back to Index

Cryptocurrency

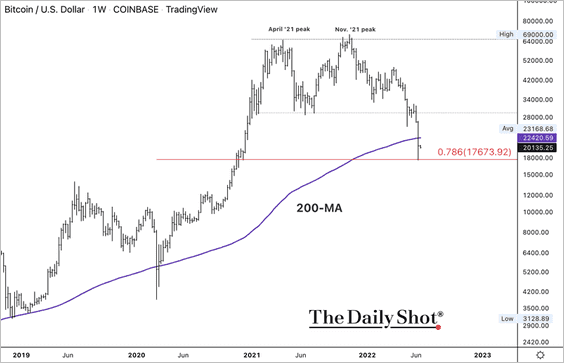

1. There was some panic selling over the weekend. Bitcoin dipped below $18k but rebounded to trade near $20k again.

The cryptocurrency broke below its 200-week moving average but stabilized at the $17,673 support level.

Ether dipped below $900, but is now trading near $1,100

——————–

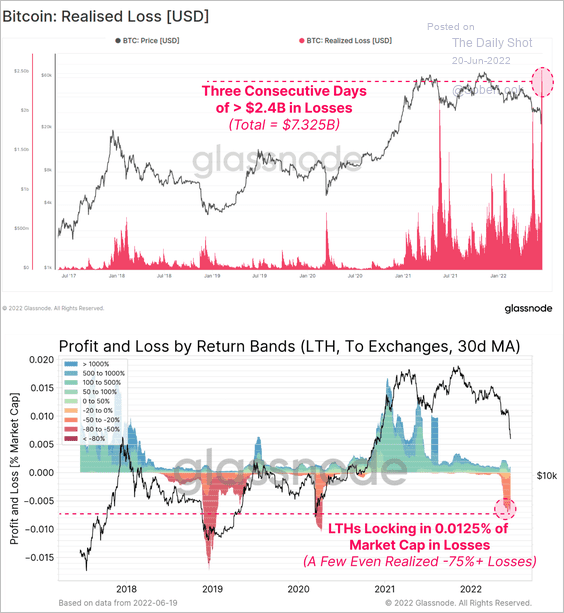

2. The crypto market signaled capitulation as realized losses surged.

Source: @glassnode

Source: @glassnode

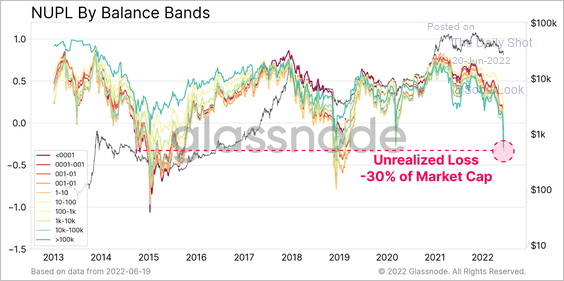

3. Almost all bitcoin wallet cohorts (especially those holding 1-100 BTC) are facing significant unrealized losses, worse than March 2020.

Source: @glassnode

Source: @glassnode

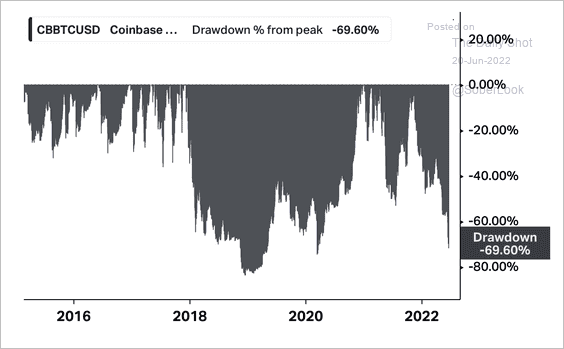

4. Bitcoin’s current drawdown is still less than the March 2020 and December 2018 extremes.

Source: Koyfin

Source: Koyfin

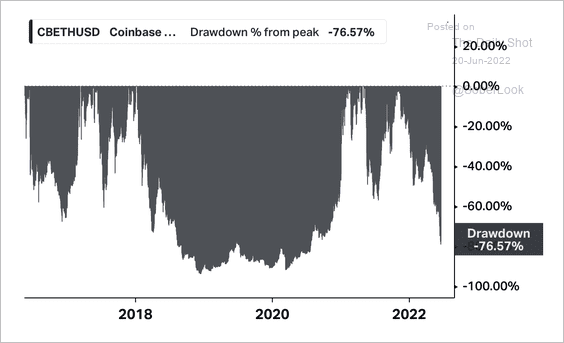

Here is a look at ETH/USD’s drawdown.

Source: Koyfin

Source: Koyfin

Back to Index

Commodities

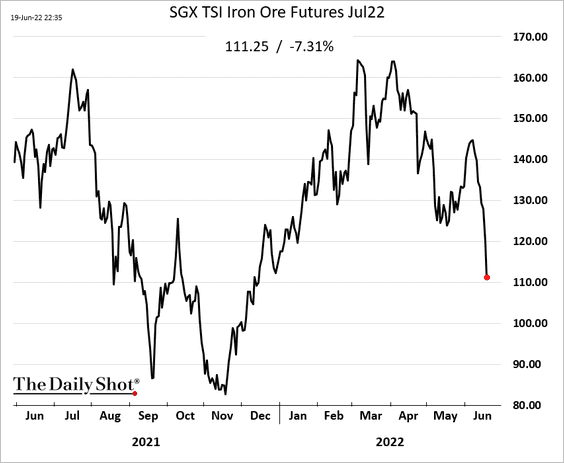

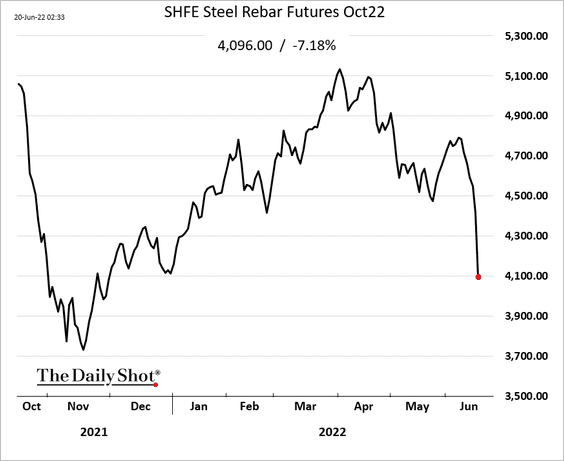

1. Iron ore is now down year-to-date as China’s COVID-related headwinds persist.

The Shanghai steel rebar futures are also down on the year.

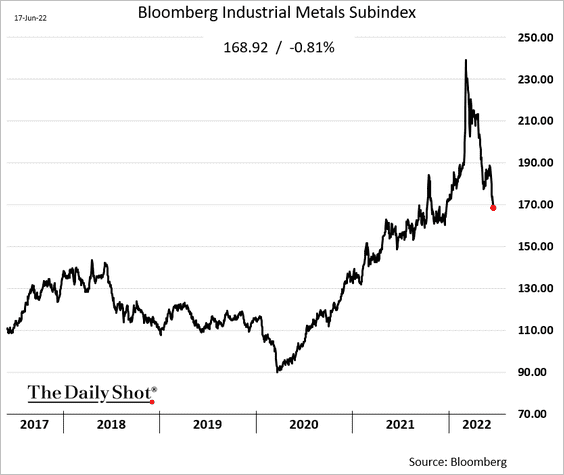

2. Here is Bloomberg’s industrial metals index.

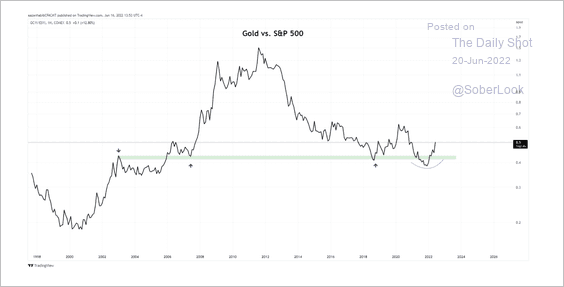

3. Gold is holding support relative to the S&P 500.

Source: Aazan Habib; Paradigm Capital

Source: Aazan Habib; Paradigm Capital

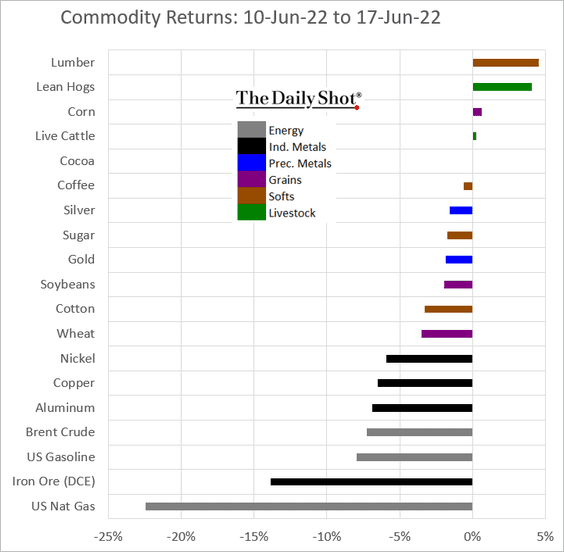

4. Next, we have last week’s performance across key commodity markets.

Back to Index

Energy

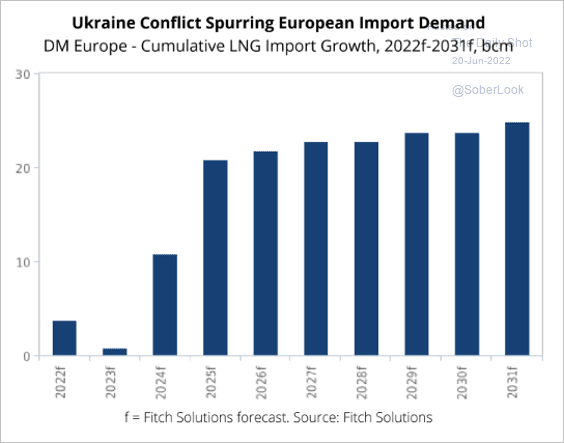

1. Europe’s LNG demand is expected to grow rapidly over the next few years, …

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

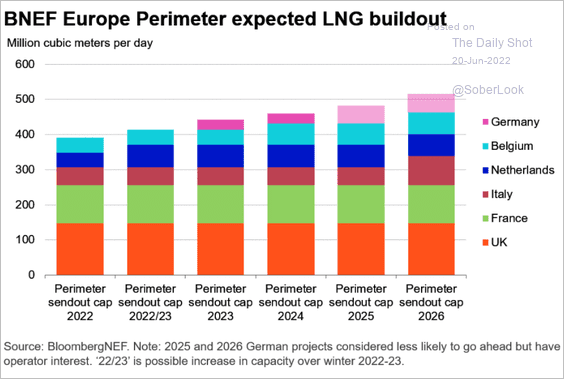

… as it builds out its LNG import capacity.

Source: @BloombergNEF Read full article

Source: @BloombergNEF Read full article

——————–

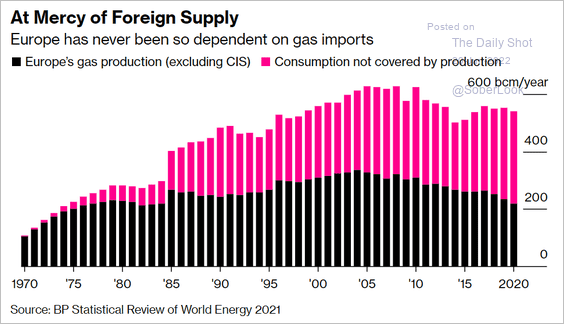

2. This chart shows Europe’s dependence on foreign natural gas suppliers.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

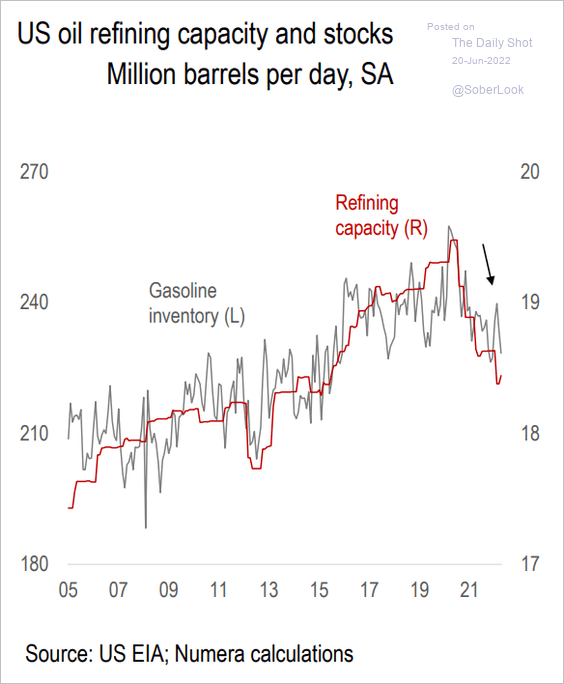

3. US gasoline price surge was exacerbated by shrinking refining capacity.

Source: Numera Analytics

Source: Numera Analytics

Back to Index

Equities

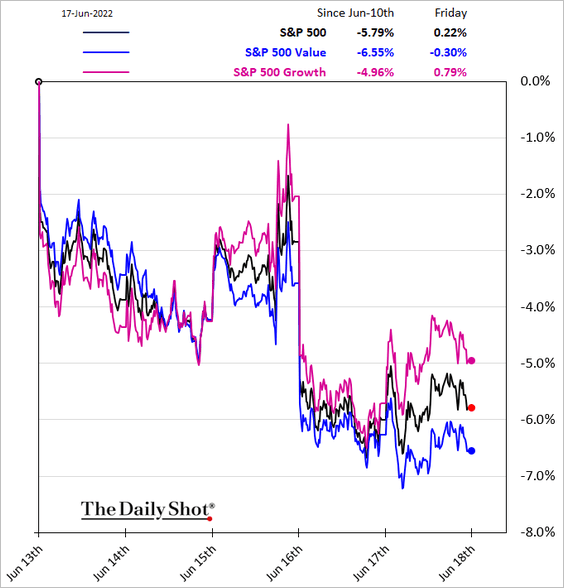

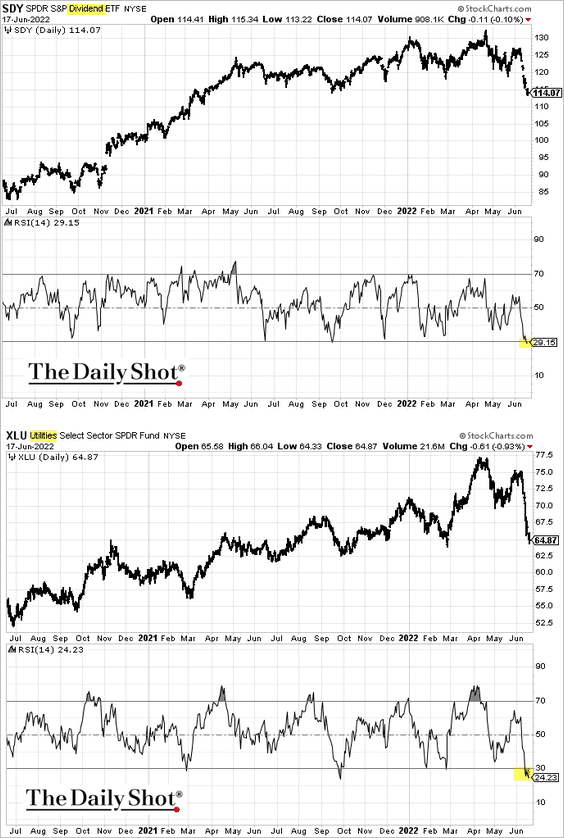

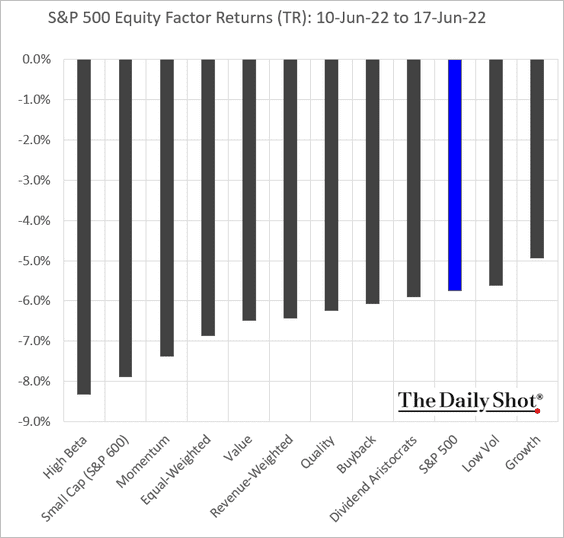

1. Let’s begin with some equity factor updates.

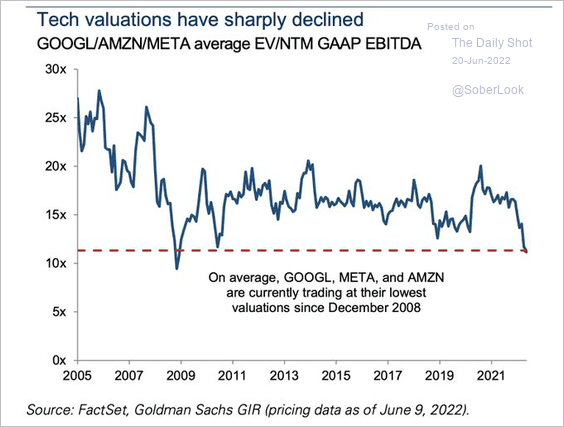

• Growth stocks outperformed on Friday.

By some measures, mega-cap valuations are attractive. This chart shows the ratio of enterprise value to forward earnings (EBITDA) for three of the largest firms.

Source: @acemaxx, @GoldmanSachs

Source: @acemaxx, @GoldmanSachs

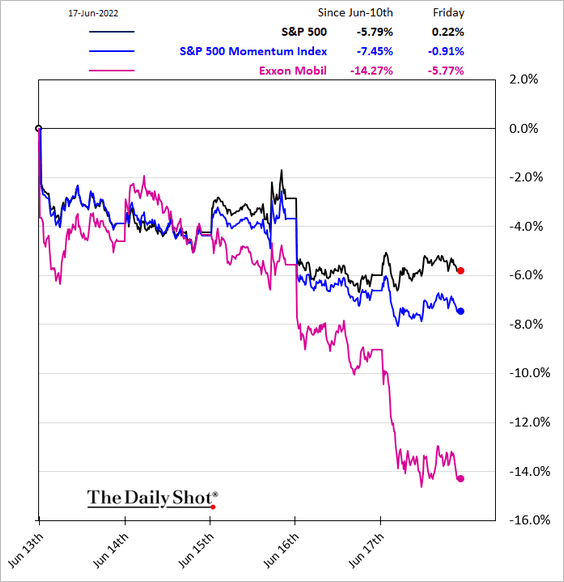

• The momentum factor got whipsawed again as energy shares sold off.

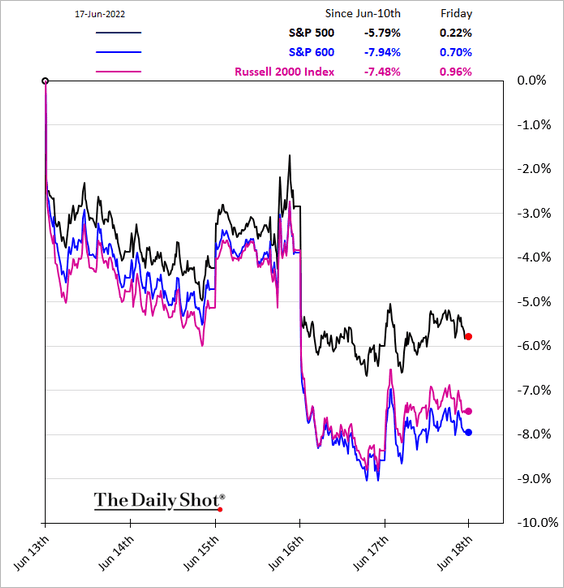

• Small caps underperformed last week.

• Technical indicators suggest that high-dividend shares are oversold.

• Here is last week’s performance across equity factors.

——————–

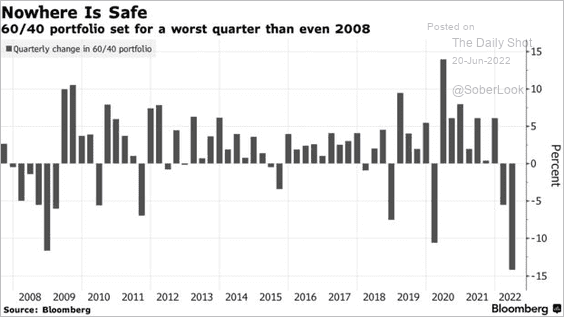

2. The 60/40 portfolio is having the worst quarter in years.

Source: @worrachate, @mccormickliz, @markets Read full article

Source: @worrachate, @mccormickliz, @markets Read full article

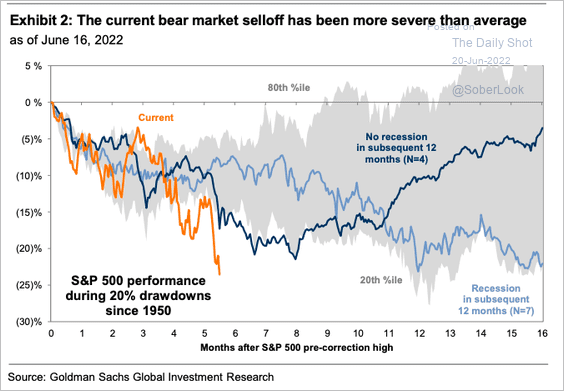

This bear market has been more severe than previous cycles thus far.

Source: Goldman Sachs; @SamRo

Source: Goldman Sachs; @SamRo

——————–

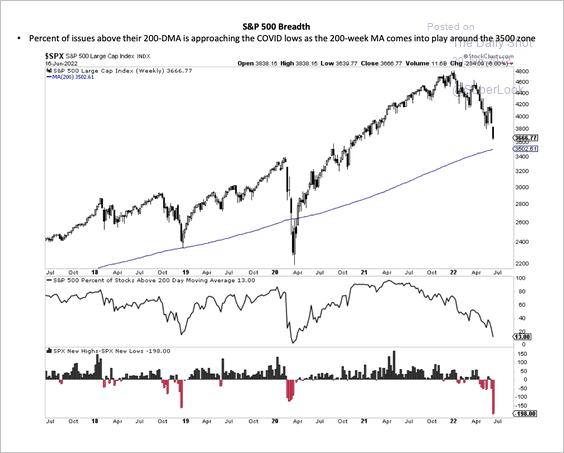

3. The S&P 500 is approaching initial support at its 200-week moving average.

Source: Aazan Habib; Paradigm Capital

Source: Aazan Habib; Paradigm Capital

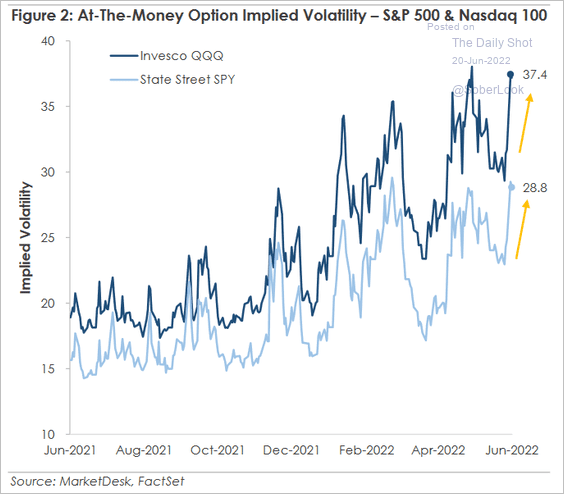

4. Volatility remains elevated.

• Number of 1%+ moves in the S&P 500:

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

• QQQ and SPY implied vol:

Source: MarketDesk Research

Source: MarketDesk Research

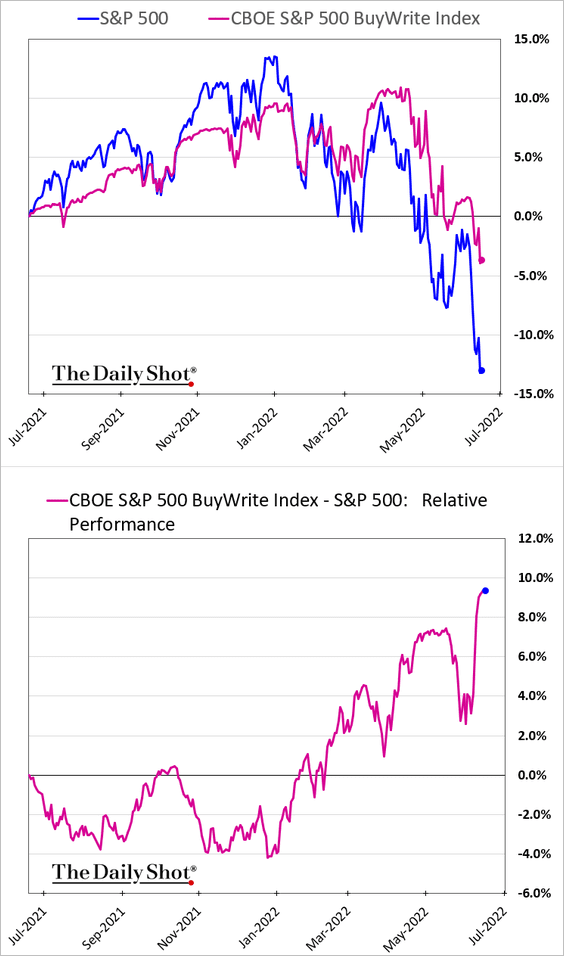

5. The buy-write strategy on the S&P 500 has been outperforming. Selling calls in the high-vol environment has been lucrative (more information here).

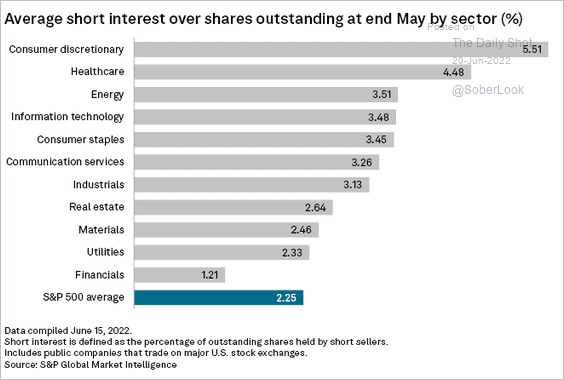

6. Below are the most shorted sectors.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

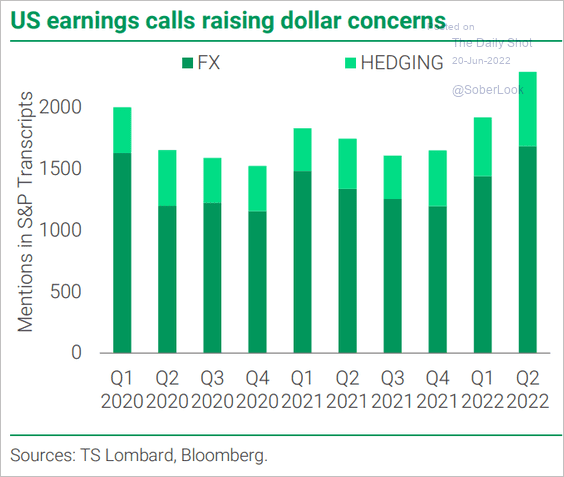

7. The US dollar strength can help offset inflationary pressures, but it’s becoming a headwind for corporate earnings.

Source: TS Lombard

Source: TS Lombard

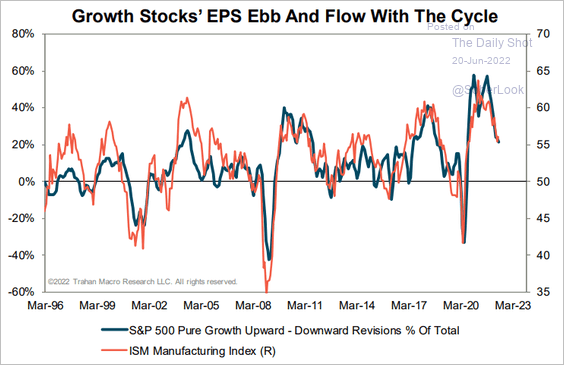

8. Watch the ISM manufacturing PMI for signs of deterioration in corporate earnings.

Source: Trahan Macro Research

Source: Trahan Macro Research

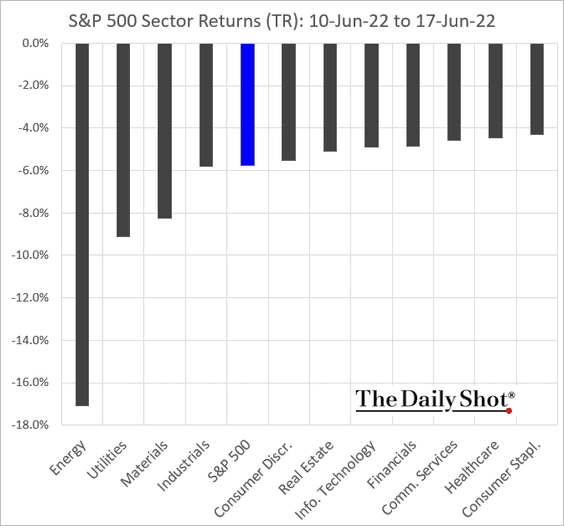

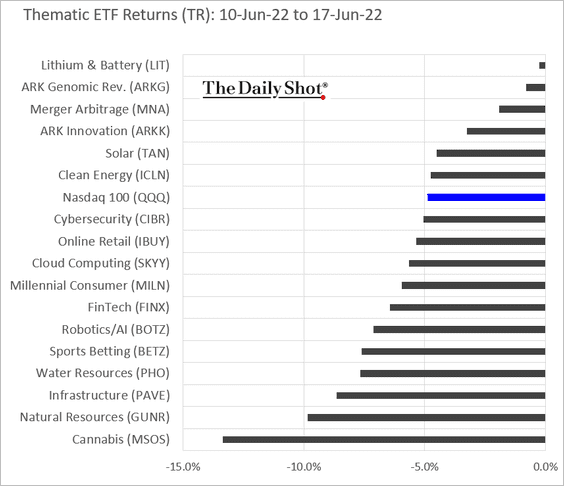

9. Next, we have some additional performance data from last week.

• Sectors:

• Thematic ETFs:

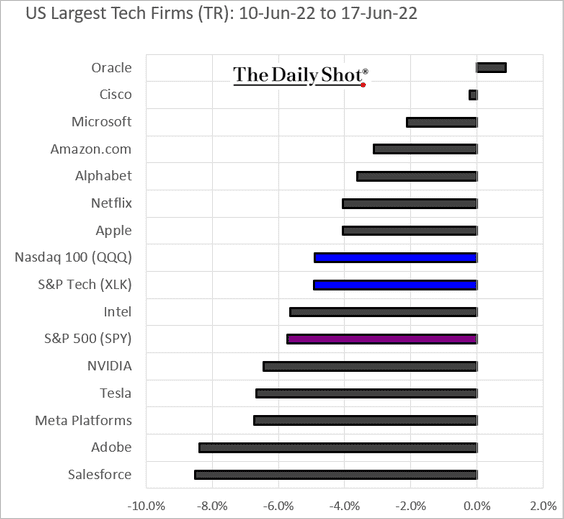

• The largest US tech firms:

Back to Index

Credit

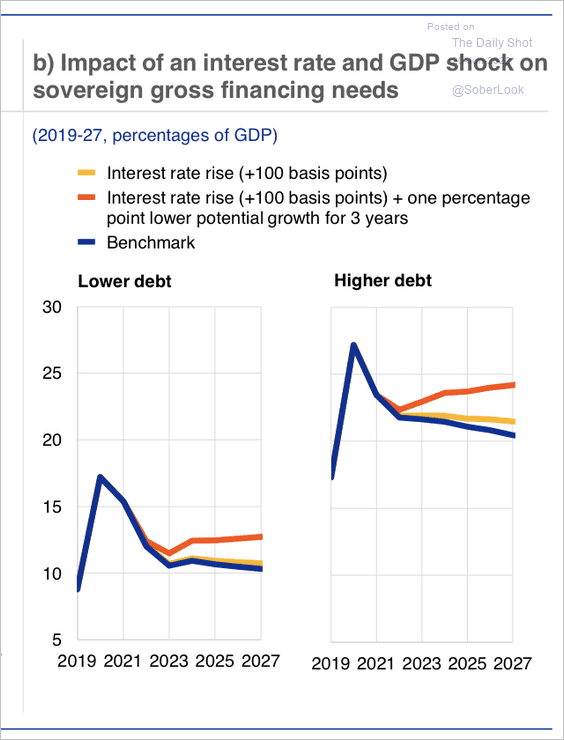

1. Higher interest rates and an economic growth shock could challenge more indebted sovereigns.

Source: ECB

Source: ECB

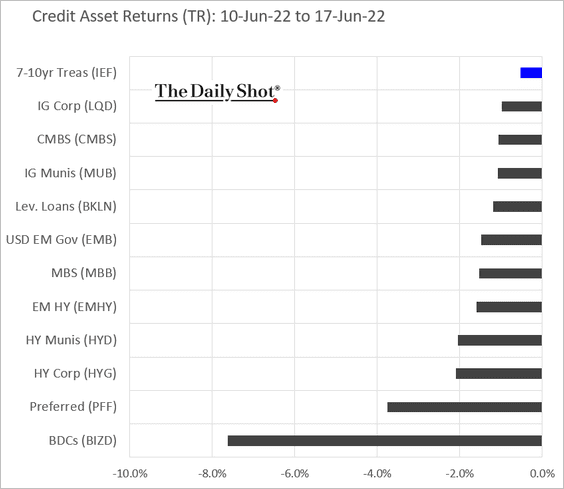

2. This chart shows last week’s returns by asset class.

Back to Index

Global Developments

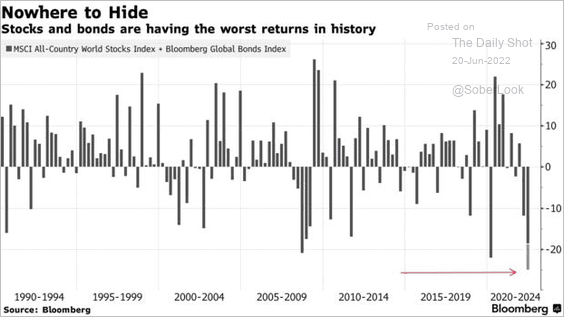

1. It’s been a rough quarter for global stocks and bonds.

Source: @markets Read full article

Source: @markets Read full article

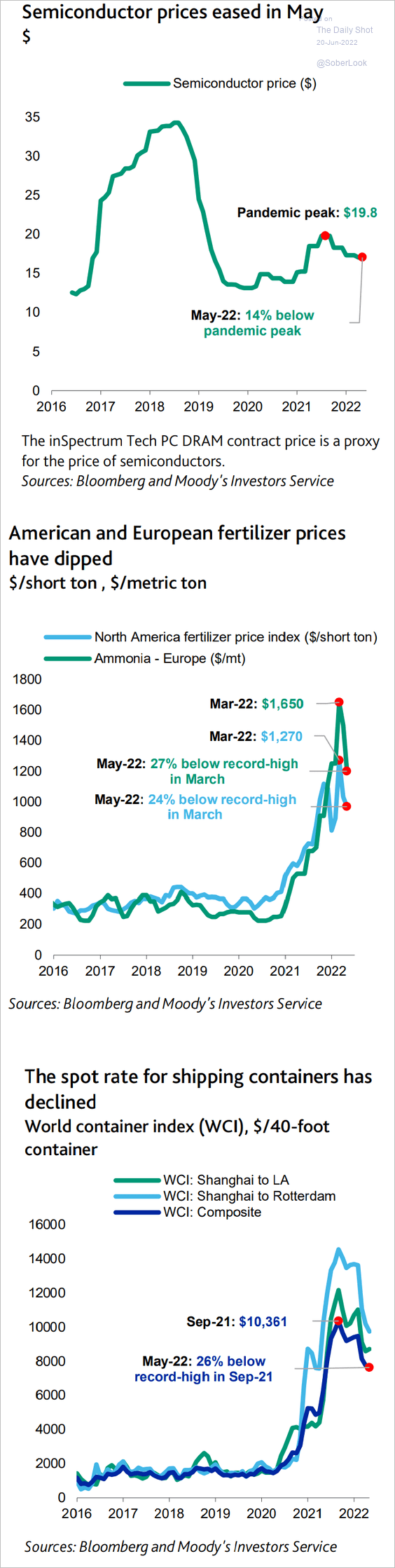

2. Key metrics point to some moderation in supply-chain-driven price pressures.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

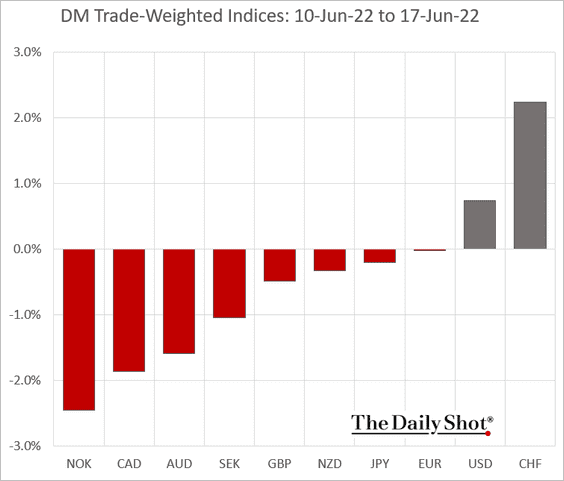

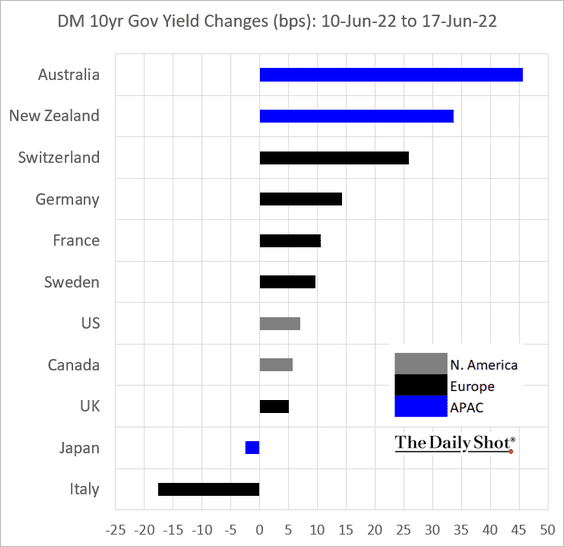

3. Next, we have some performance data from last week.

• DM currencies:

• DM bond yields:

——————–

Food for Thought

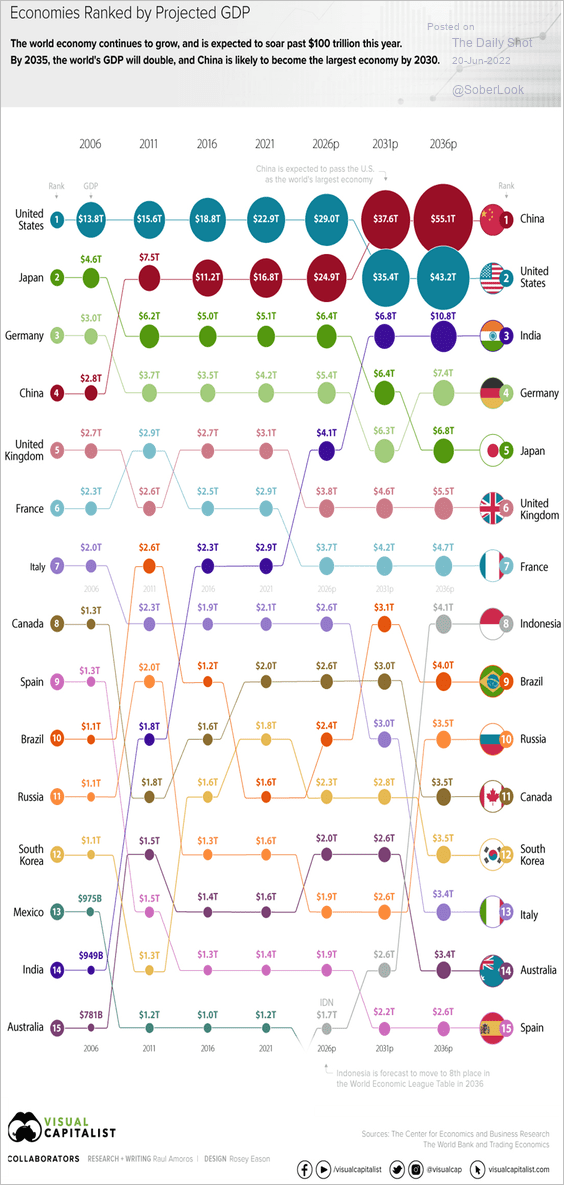

1. Economies ranked by projected GDP:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

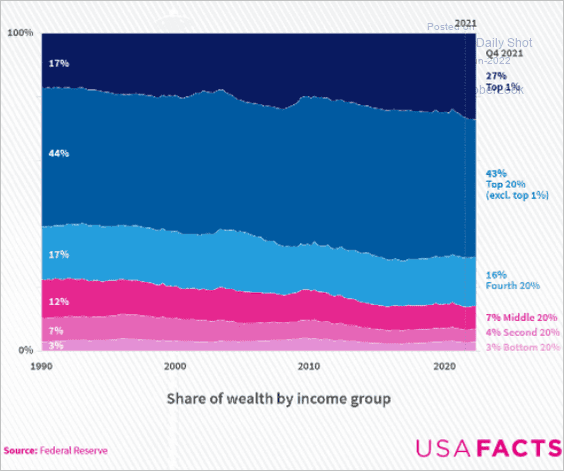

2. Share of wealth ownership by wealth group:

Source: USAFacts

Source: USAFacts

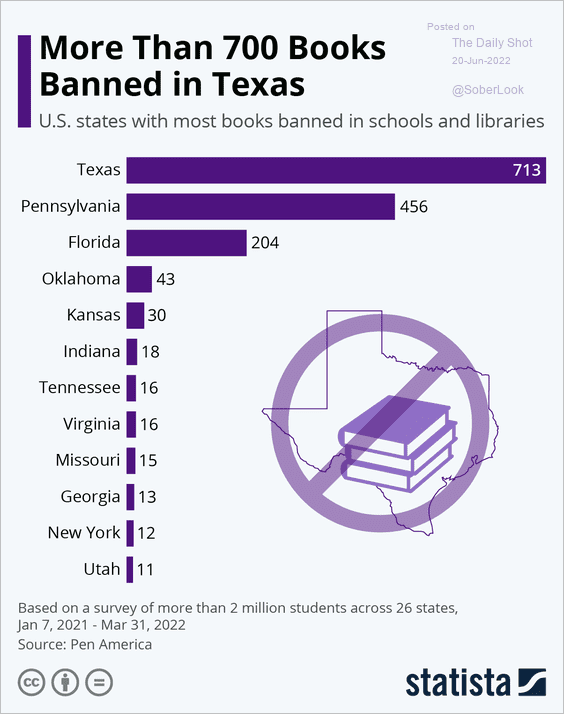

3. Books banned in schools and libraries:

Source: Statista

Source: Statista

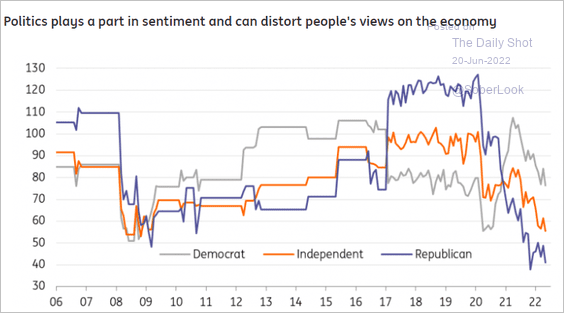

4. US consumer sentiment by political affiliation (the U. Michigan survey):

Source: ING

Source: ING

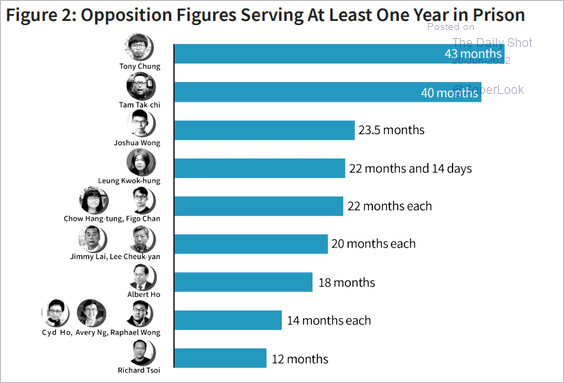

5. Imprisoned Hong Kong opposition leaders:

Source: HKDC Read full article

Source: HKDC Read full article

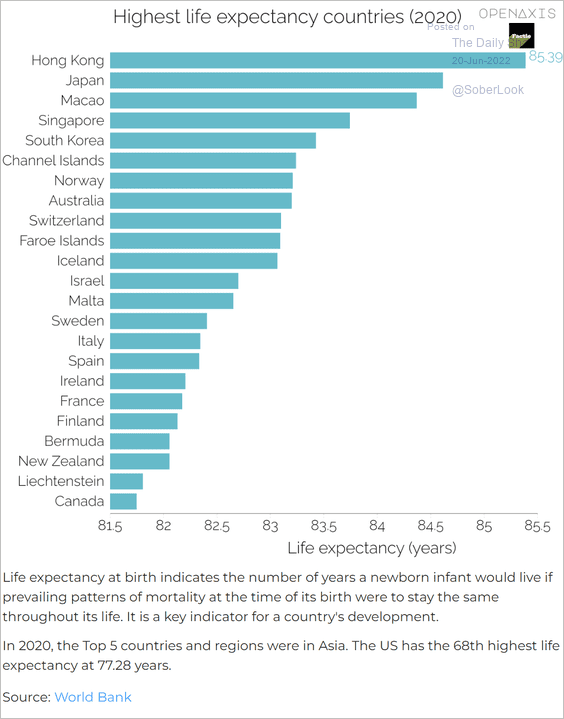

6. Countries with the highest life expectancy:

Source: OpenAxis

Source: OpenAxis

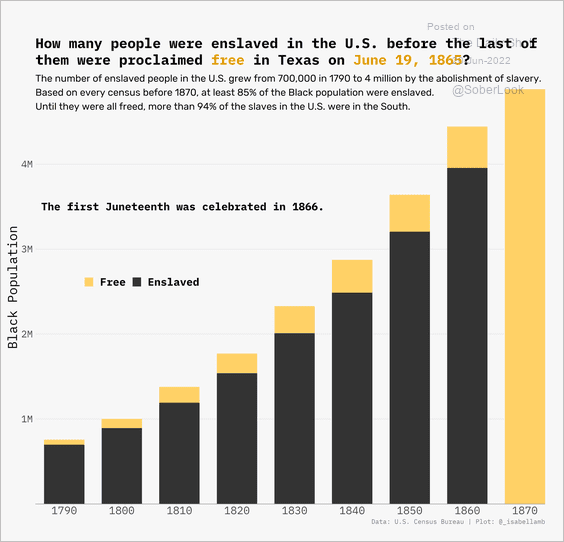

7. Number of enslaved people in the US (1790-1870):

Source: @_isabellamb

Source: @_isabellamb

——————–

Back to Index