The Daily Shot: 21-Jun-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

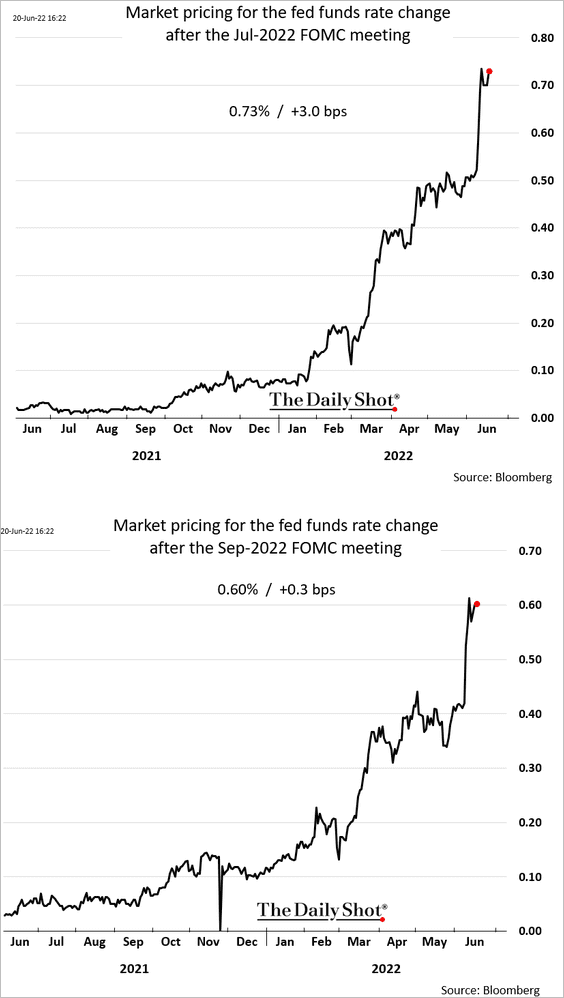

1. The market is still pricing a 75 bps rate hike in July and a strong possibility of one in September as well.

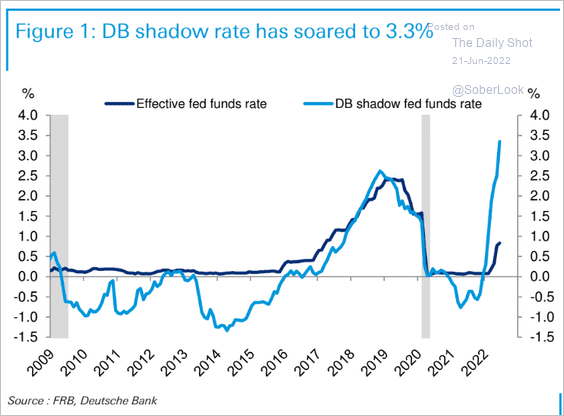

The Fed’s guidance sent the fed funds shadow rate to 3.3%. The US monetary policy has tightened well before the bulk of the upcoming rate hikes.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

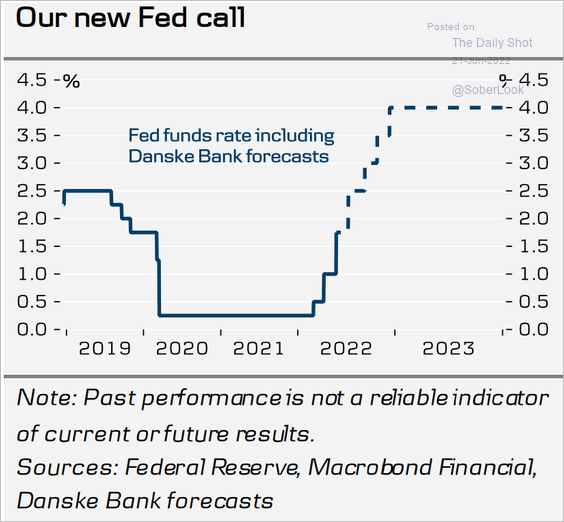

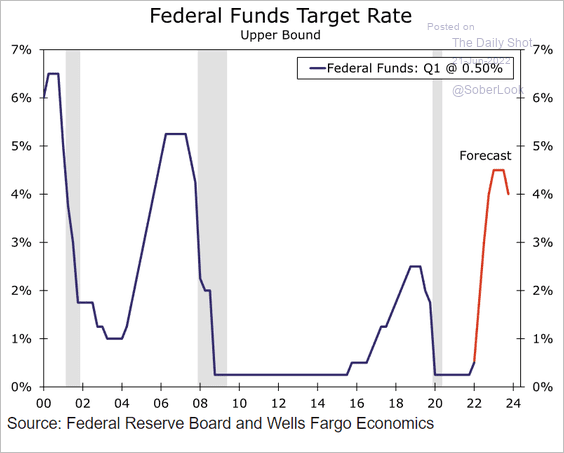

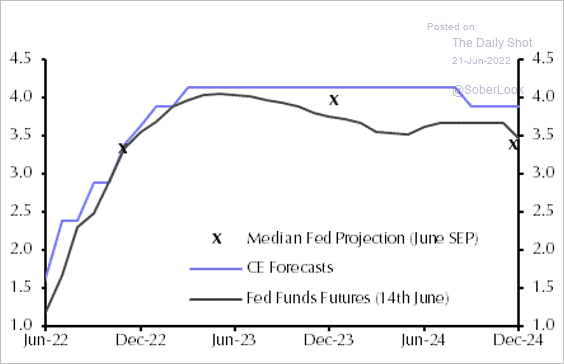

Projections for the terminal rate vary, but most economists expect the target rate to peak at 4% or higher.

• Danske Bank:

Source: Danske Bank

Source: Danske Bank

• Wells Fargo:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Capital Economics:

Source: Capital Economics

Source: Capital Economics

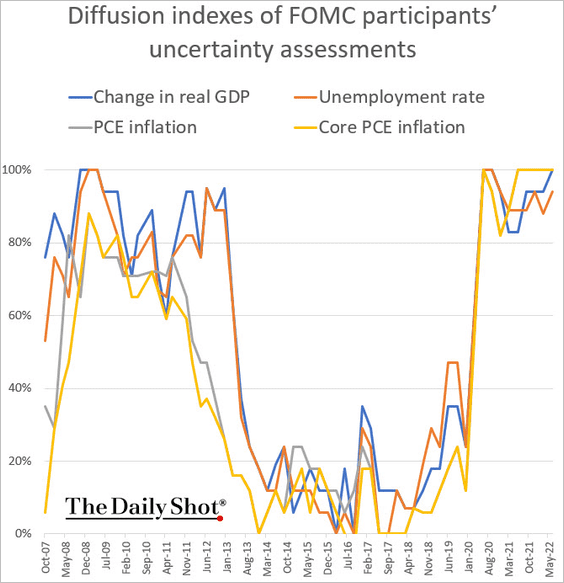

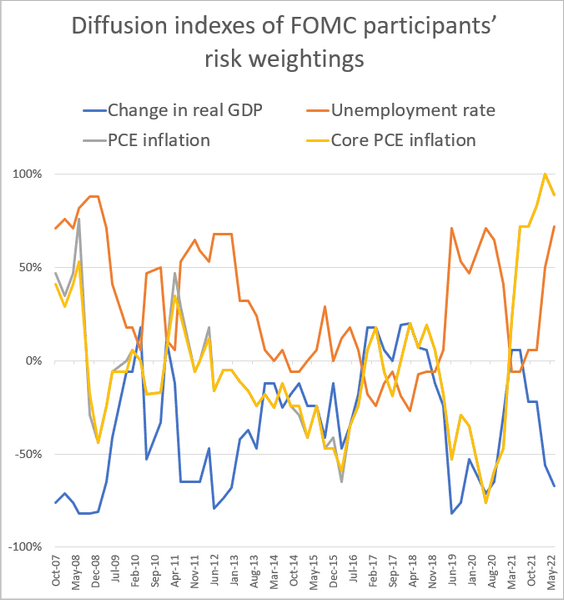

2. The FOMC members are highly uncertain about their economic forecasts …

… and see significant upside risks to inflation and unemployment.

——————–

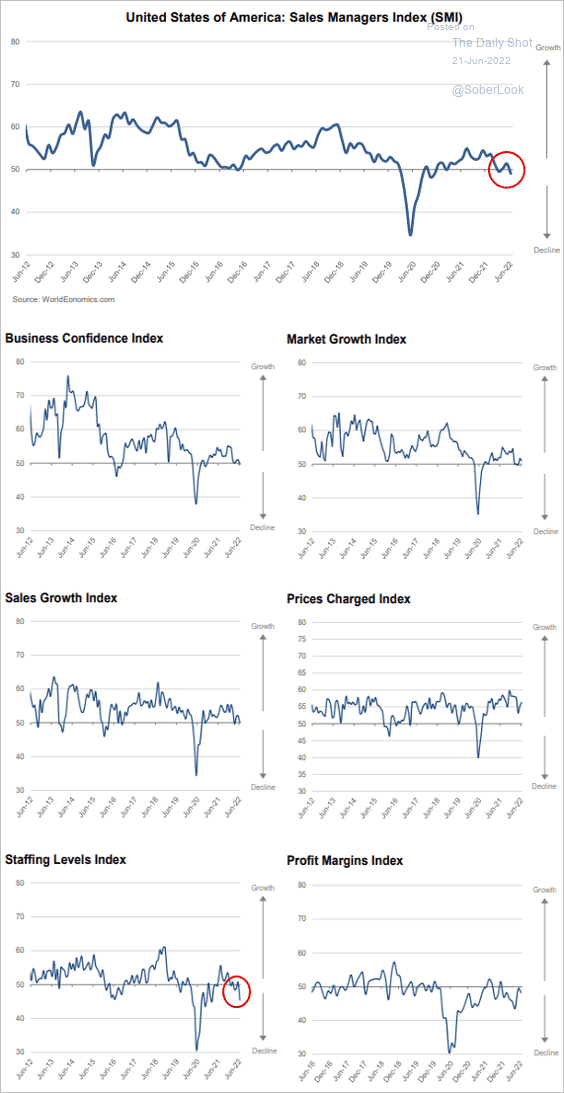

3. The World Economics SMI report indicates that US business activity is already in contraction mode (SMI < 50). It appears that companies are now shedding jobs (lower left panel).

Source: World Economics

Source: World Economics

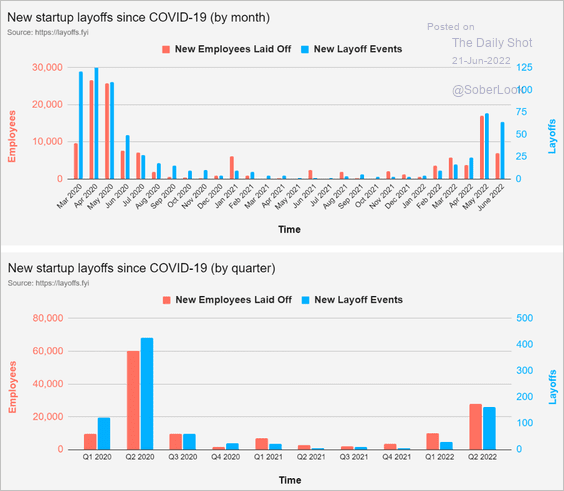

4. Startups continue to lay off workers as VCs warn about the looming “funding winter.”

Source: @Layoffsfyi, @roger_lee

Source: @Layoffsfyi, @roger_lee

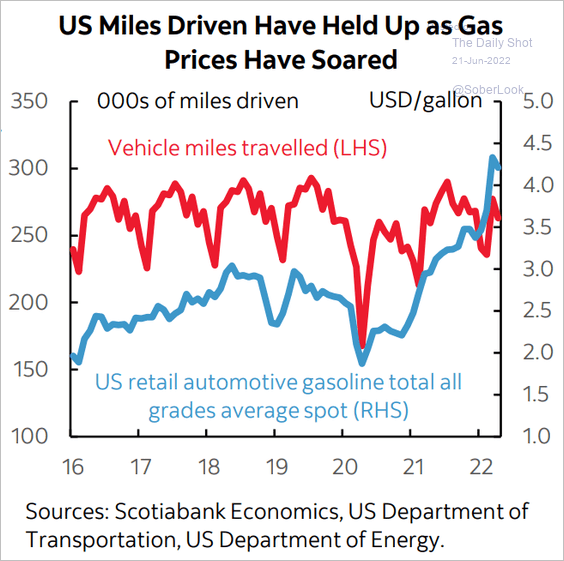

5. Vehicle miles driven are holding up well despite record-high gasoline prices.

Source: Scotiabank Economics

Source: Scotiabank Economics

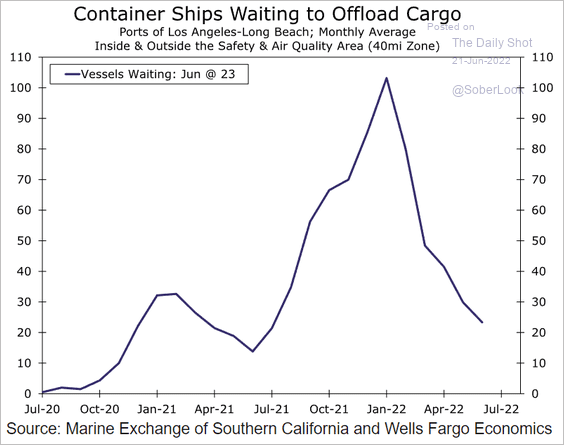

6. West Coast port delays continue to ease, …

Source: Wells Fargo Securities

Source: Wells Fargo Securities

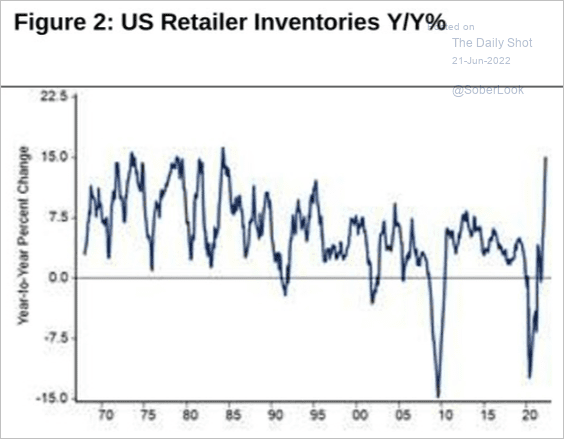

… as inventories surge, slowing demand.

Source: Citi Private Bank

Source: Citi Private Bank

——————–

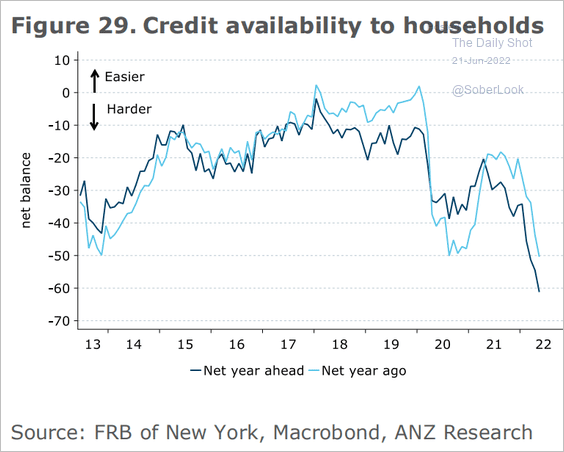

7. The NY Fed’s national consumer survey suggests that household credit availability is worsening.

Source: @ANZ_Research

Source: @ANZ_Research

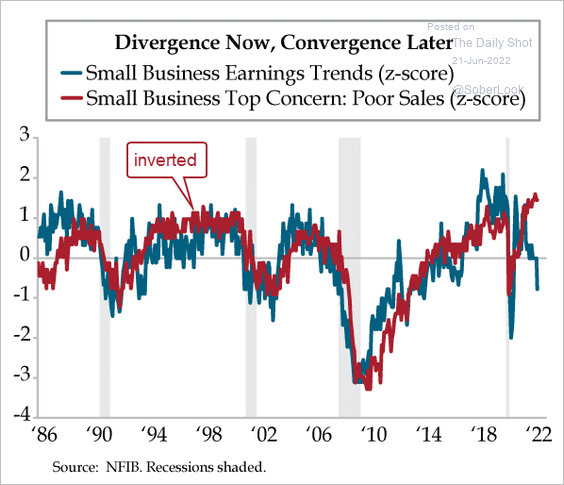

8. The NFIB small business earnings indicator has been deteriorating, but poor sales are not companies’ key concern (the main issue is inflation).

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

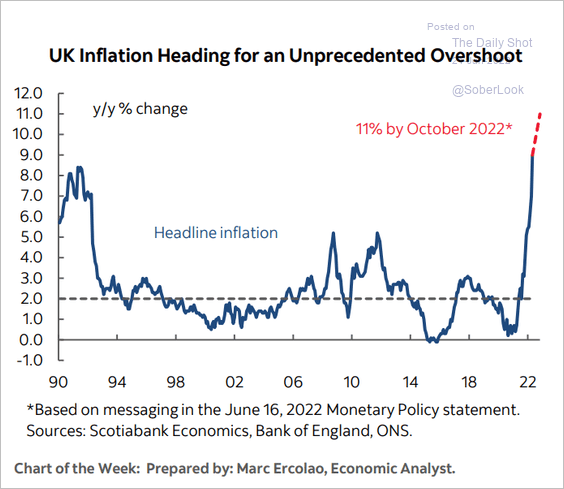

The United Kingdom

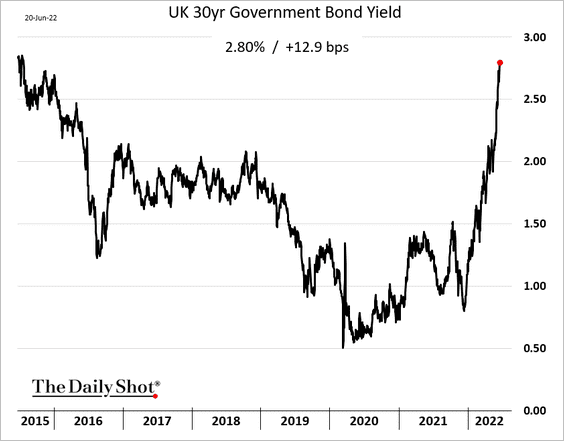

1. The 30-year gilt yield reached the highest level since 2015.

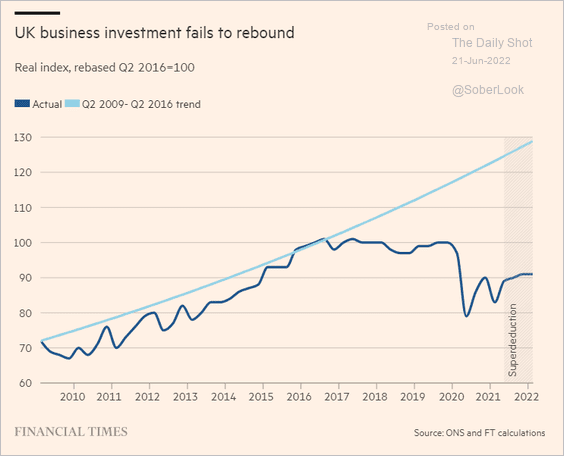

2. Business investment remains depressed.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

3. Here is the UK CPI forecast from Scotiabank Economics.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

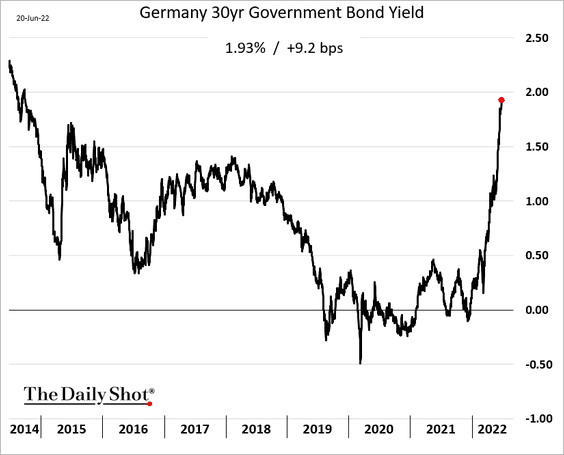

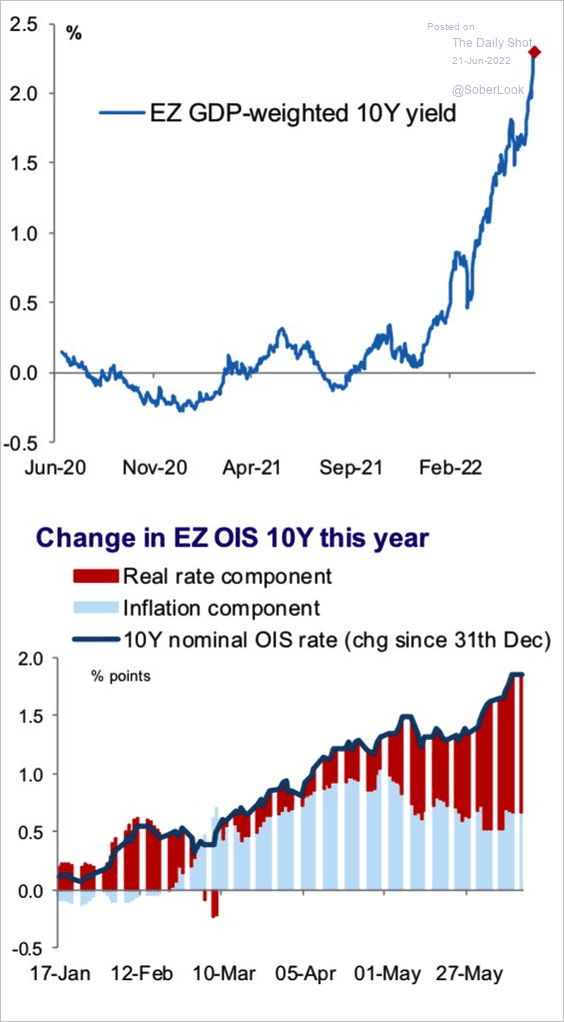

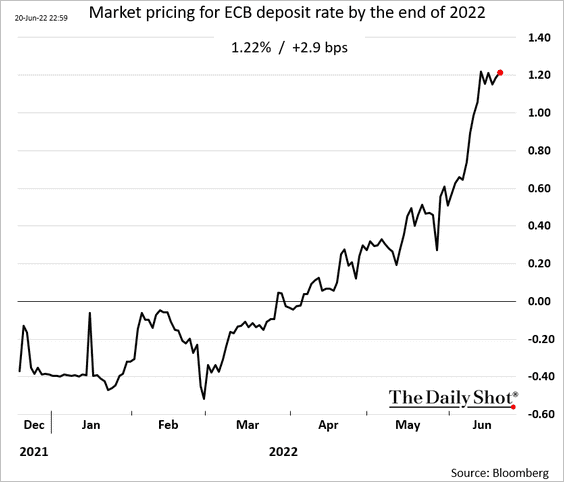

The Eurozone

1. German producer price inflation hit a record high. Is it peaking?

The 30yr Bund yield is approaching 2%.

2. The recent euro-area yield surge has been driven by real rates rather than inflation expectations.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

3. The market expects the ECB to take the deposit rate above 1.2% by the end of the year, despite fragmentation risks.

4. Eurozone construction output came off the highs in April.

5. Euro-area investment has been lagging the US.

Source: The European Money and Finance Forum Read full article

Source: The European Money and Finance Forum Read full article

Back to Index

Europe

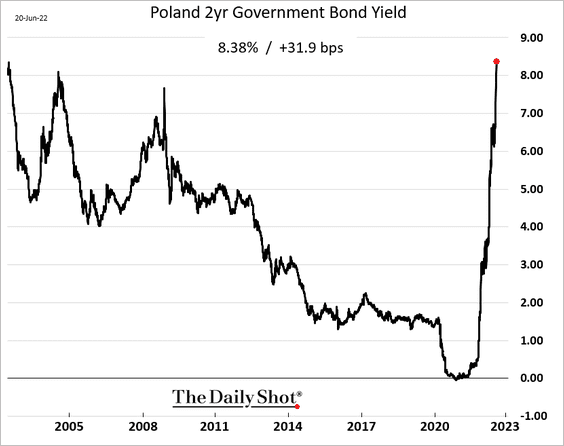

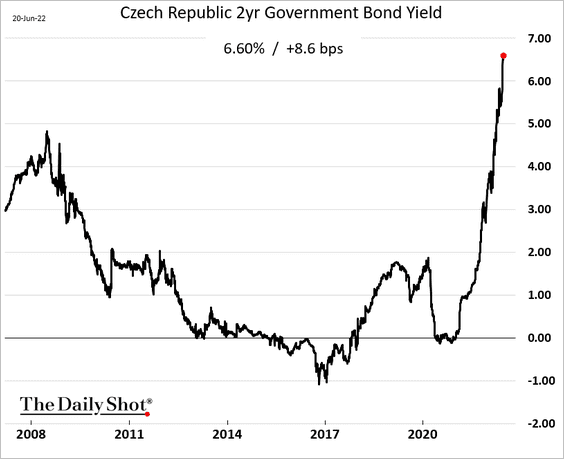

1. Central European yields continue to surge with inflation.

• Poland:

• The Czech Republic:

——————–

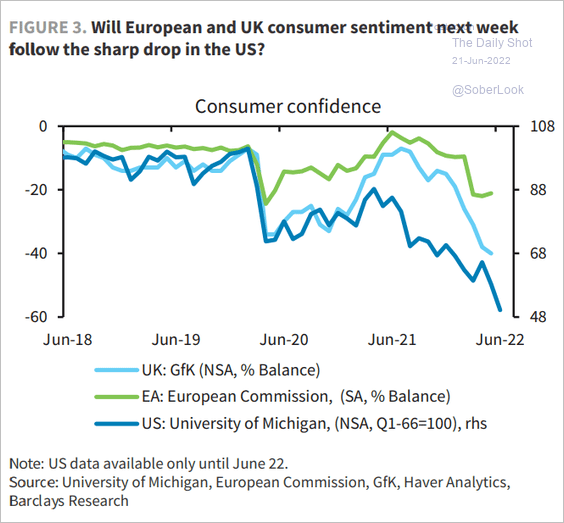

2. Will European sentiment indicators follow the US lower?

Source: Barclays Research

Source: Barclays Research

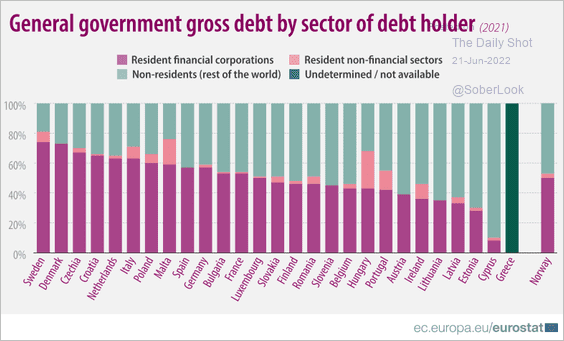

3. Who holds EU government debt?

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

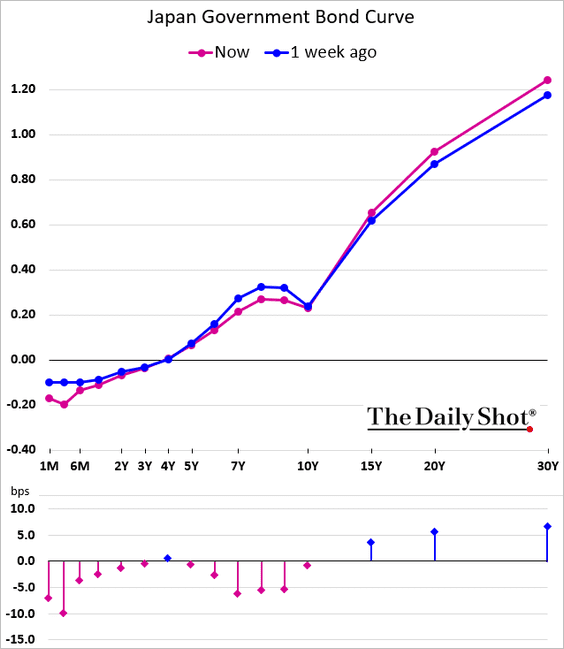

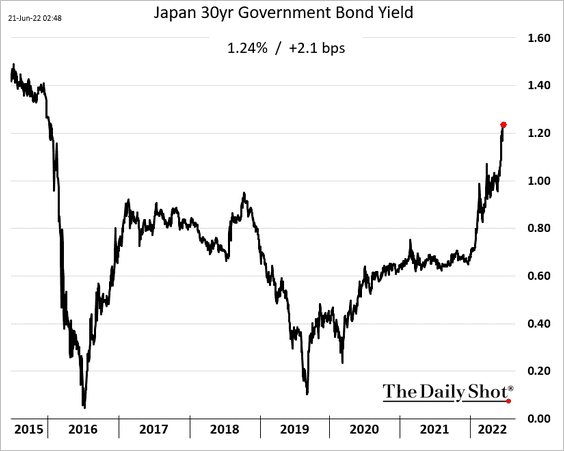

1. The BoJ continues to distort the JGB curve …

… as the market tries to take yields higher.

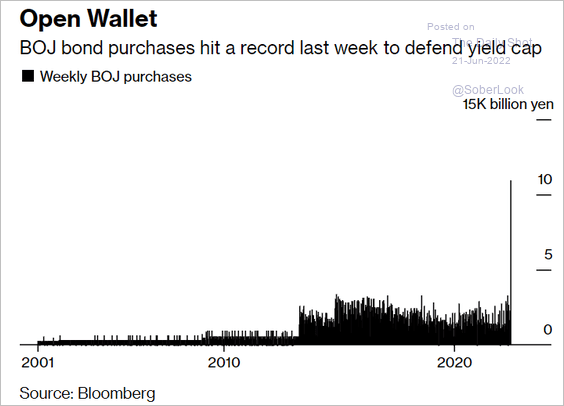

This endeavor is becoming extremely expensive for the central bank, forcing it to buy massive amounts of debt to keep the 10yr yield pinned down.

Source: @markets Read full article

Source: @markets Read full article

——————–

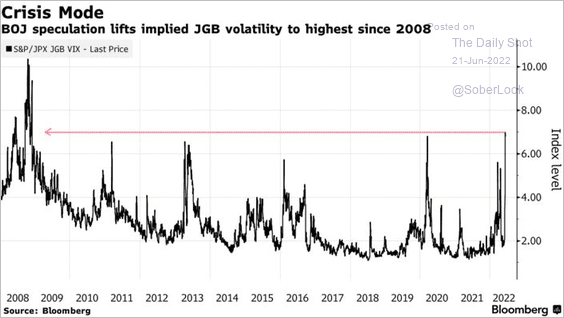

2. The JGB market implied vol surged to the highest level since the financial crisis.

Source: @markets Read full article

Source: @markets Read full article

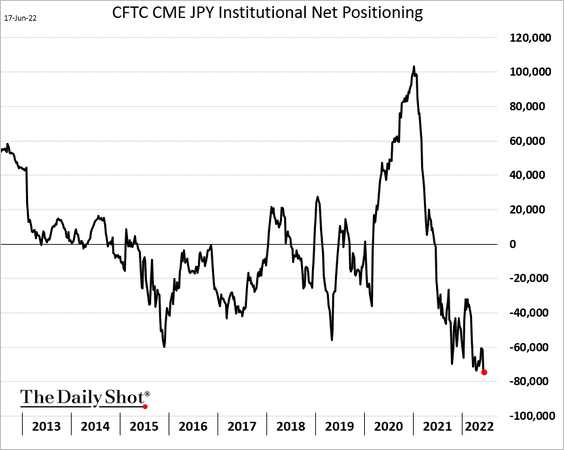

3. Institutions are boosting their bets against the yen.

Back to Index

Asia – Pacific

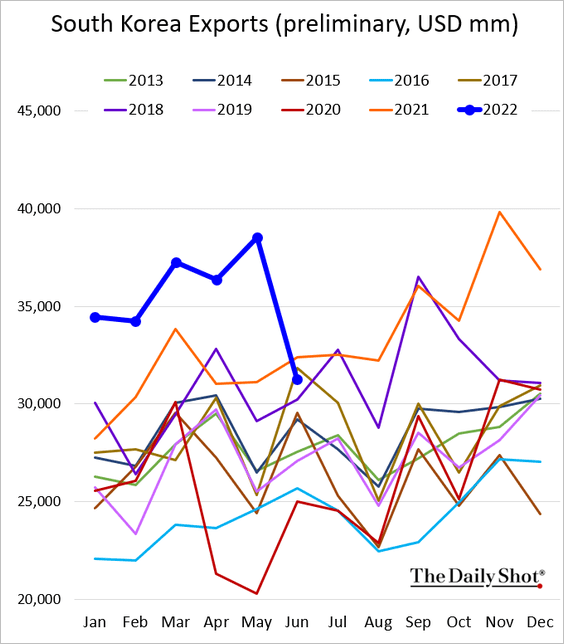

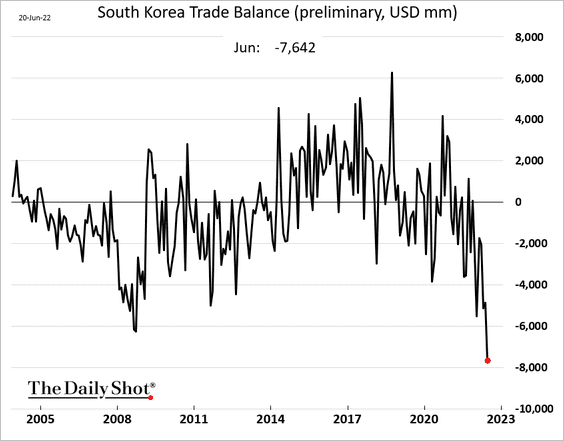

1. South Korea’s exports tumbled this month, …

…sending the trade deficit to a new record.

——————–

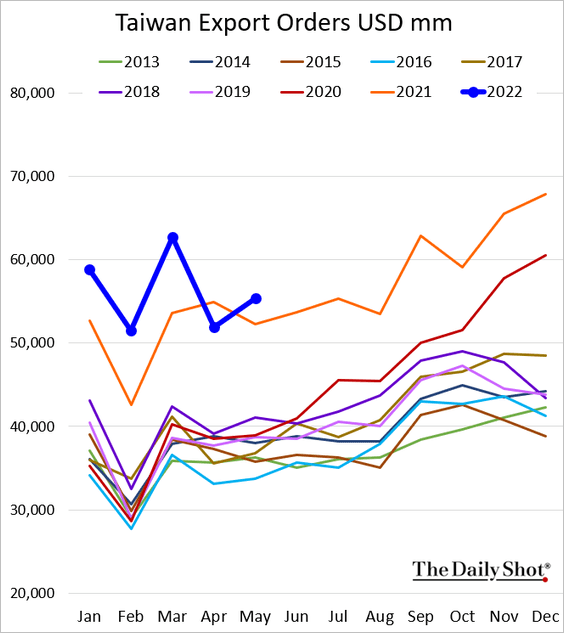

2. Taiwan’s export orders picked up in May.

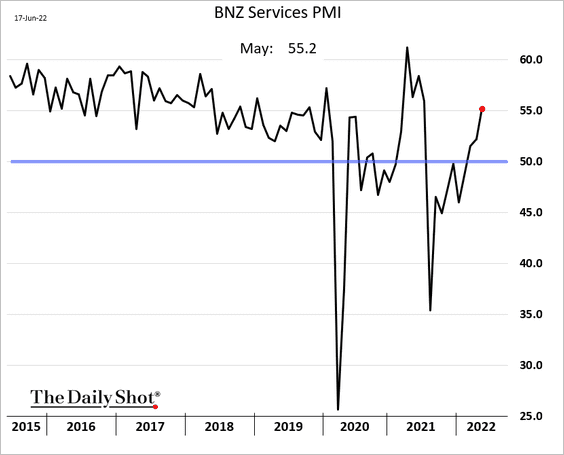

3. New Zealand’s service sector activity strengthened in May.

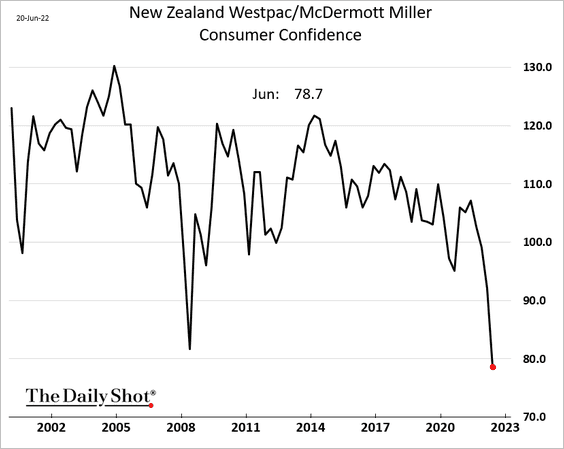

But consumer confidence hit another record low this month.

Back to Index

Emerging Markets

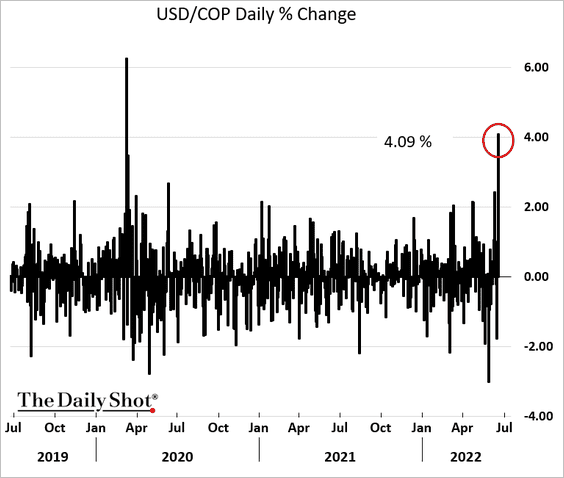

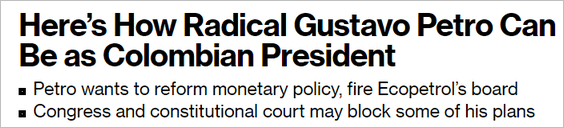

1. The Colombian peso tanked in response to the election outcome (chart shows the US dollar surging against the peso).

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

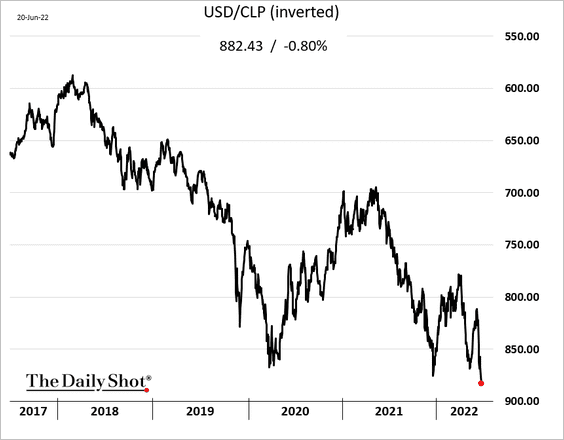

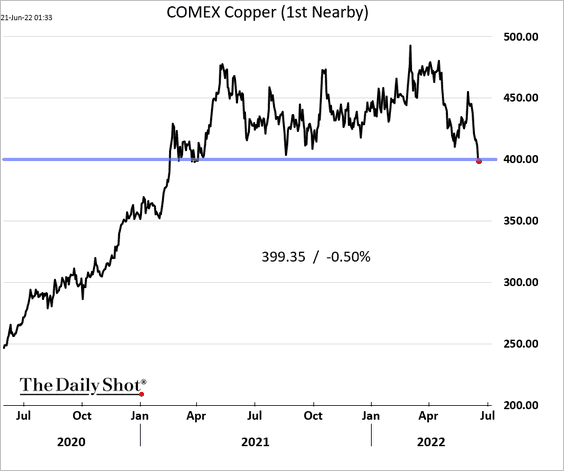

2. The Chilean peso hit a new low vs. USD as copper comes under pressure.

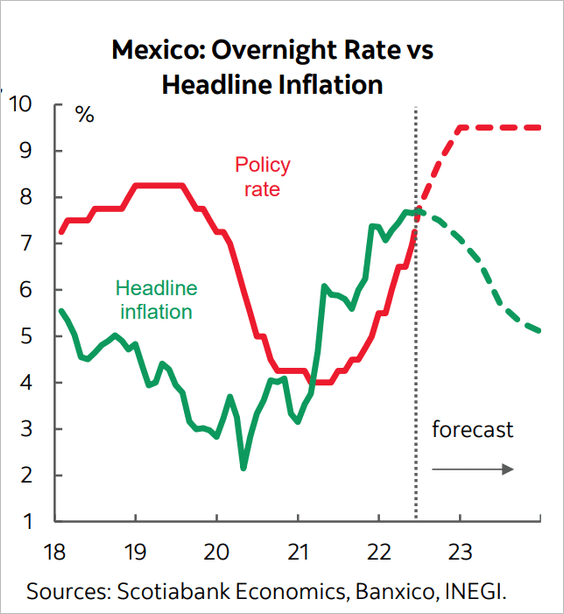

3. Banxico will continue to hike rates for the rest of the year, according to Scotiabank Economics.

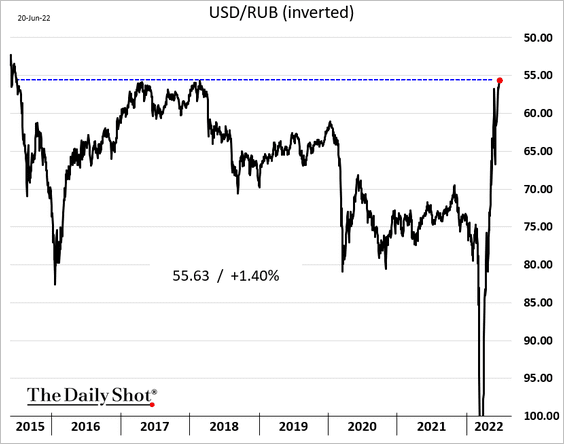

4. The ruble hit this highest level vs. USD since 2015, driven by capital controls and Russia’s lack of imports (due to sanctions). Forcing Europeans to pay in rubles for energy was also a tailwind for Russia’s currency.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

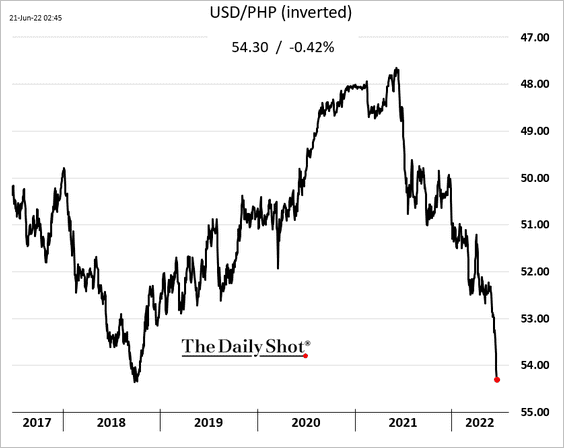

5. The Philippine peso is testing the 2018 lows vs. the dollar as the central bank signals a relatively easy monetary policy.

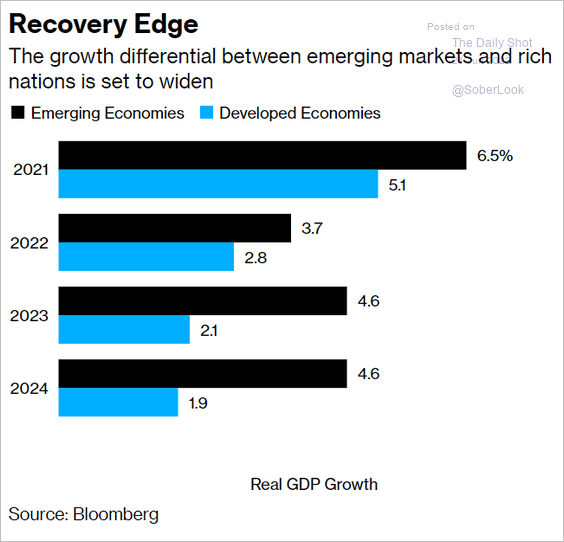

6. EM economies are expected to outperform DM over the next few years.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Cryptocurrency

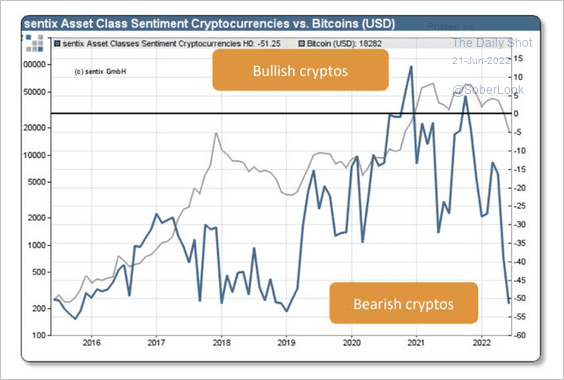

Crypto sentiment has collapsed.

Source: @Callum_Thomas

Source: @Callum_Thomas

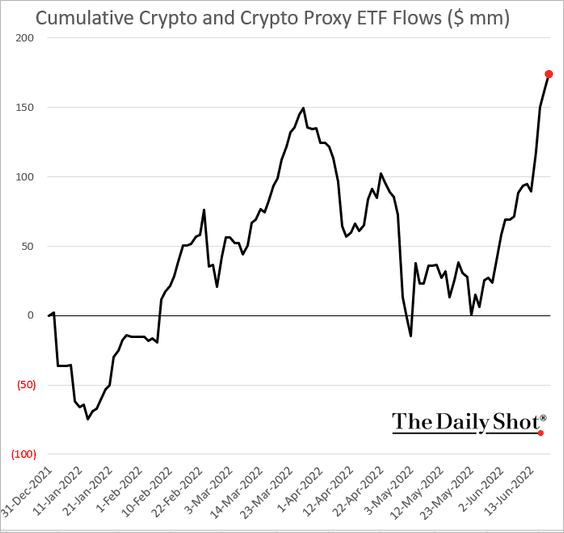

But crypto ETF flows have been positive.

Back to Index

Commodities

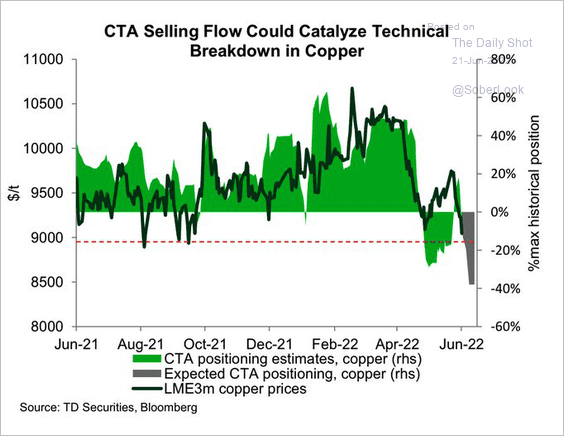

1. Copper has been selling off …

… as CTAs sell.

Source: TD Securities; @WallStJesus

Source: TD Securities; @WallStJesus

——————–

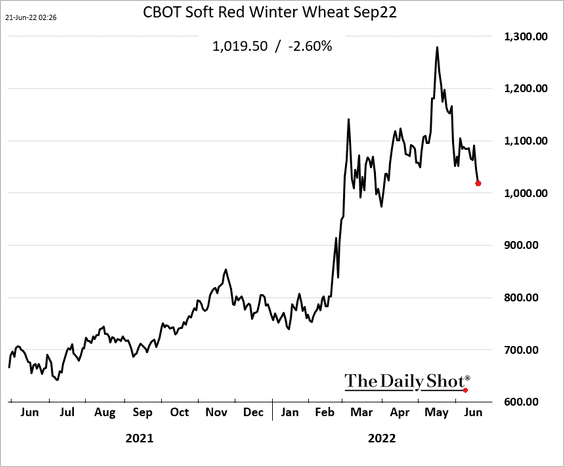

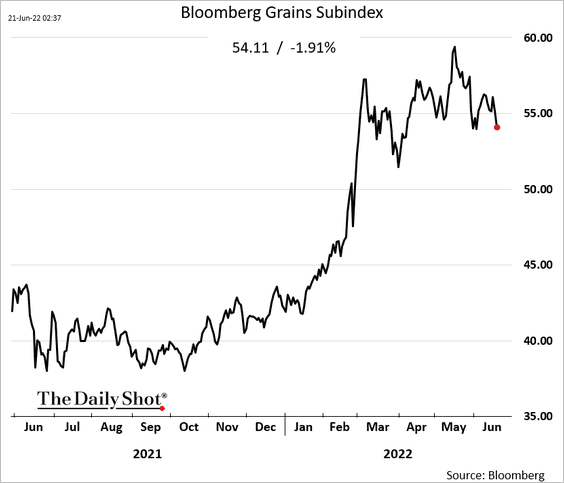

2. Grains are coming off the peak.

——————–

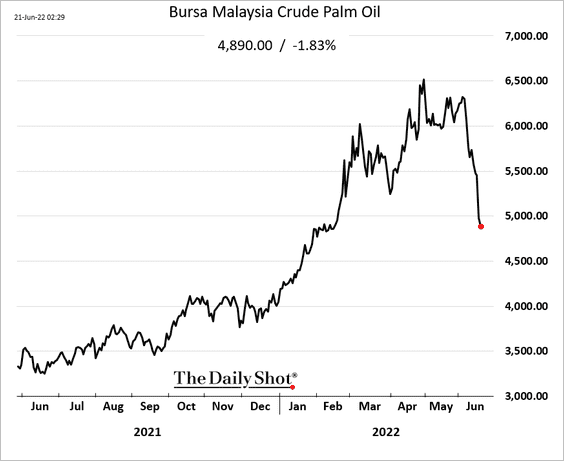

3. Palm oil is in bear market as Indonesia boosts exports to reduce growing domestic inventories.

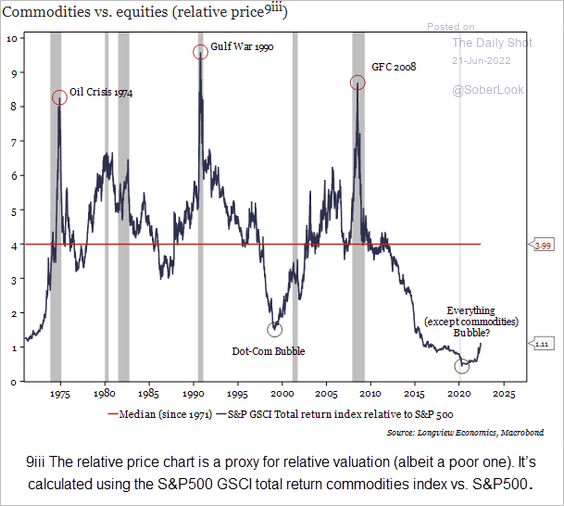

4. Commodities are still depressed relative to equities.

Source: Longview Economics

Source: Longview Economics

Back to Index

Energy

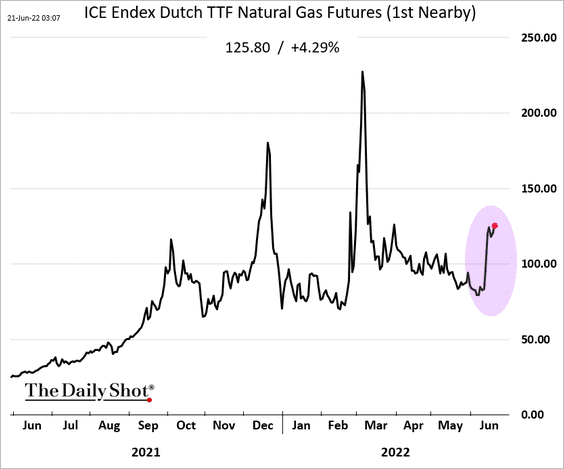

1. European natural gas futures continue to climb as Russia tightens deliveries to take advantage of the US LNG disruption.

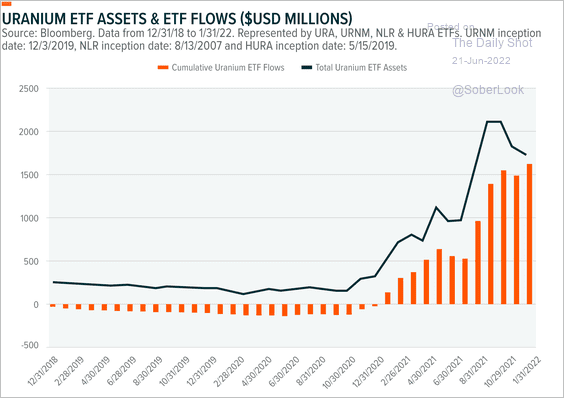

2. Uranium ETF assets and flows have surged over the past year.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

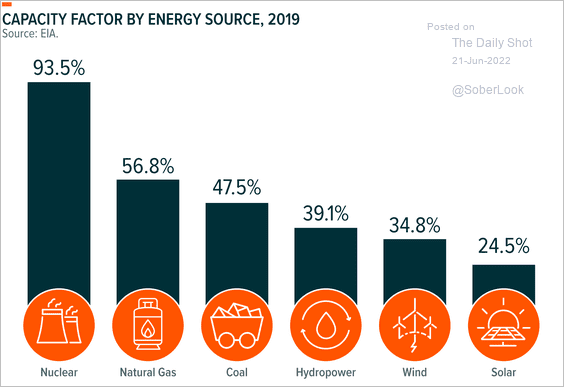

3. Nuclear facilities operate at full capacity 93% of the time.

Source: Global X ETFs Read full article

Source: Global X ETFs Read full article

Back to Index

Equities

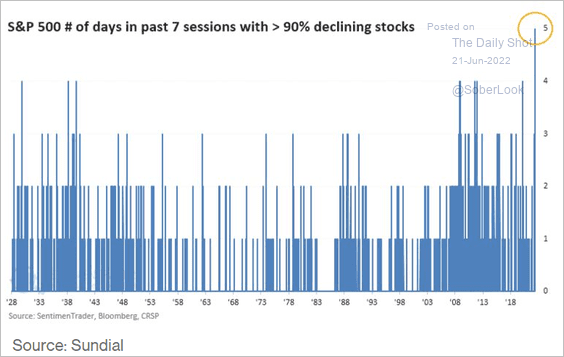

1. The breadth of the recent selloff has been unparalleled.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

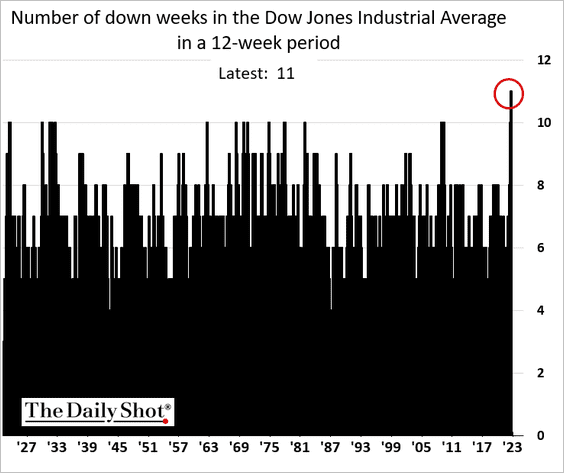

The Dow has been in the red in 11 out of 12 past weeks (a record).

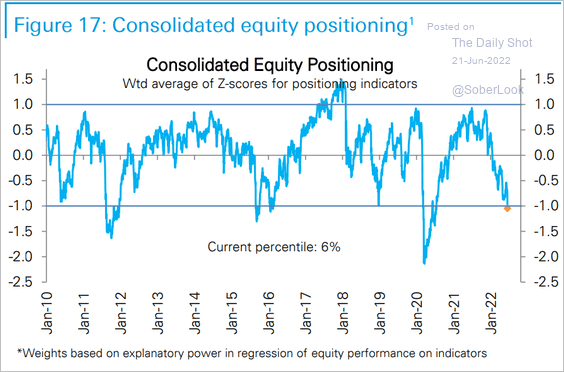

2. Market participants are extremely gloomy. The Deutsche Bank positioning index is below negative one standard deviation.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

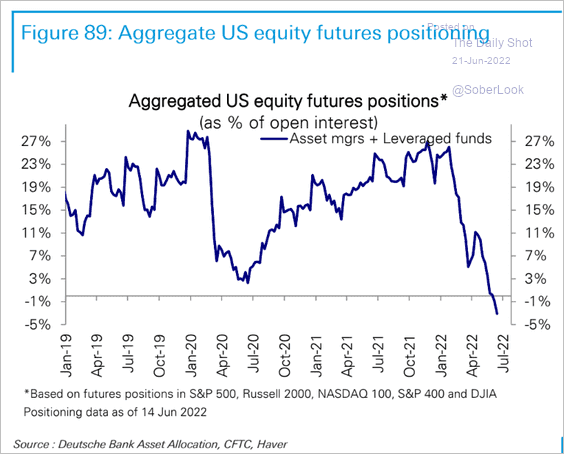

Here is the aggregate equity futures positioning.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

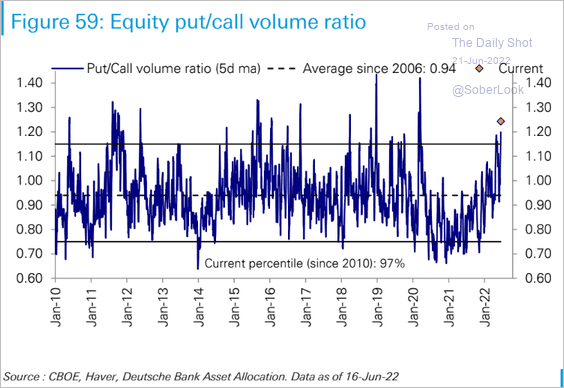

And the put/call ratio remains elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

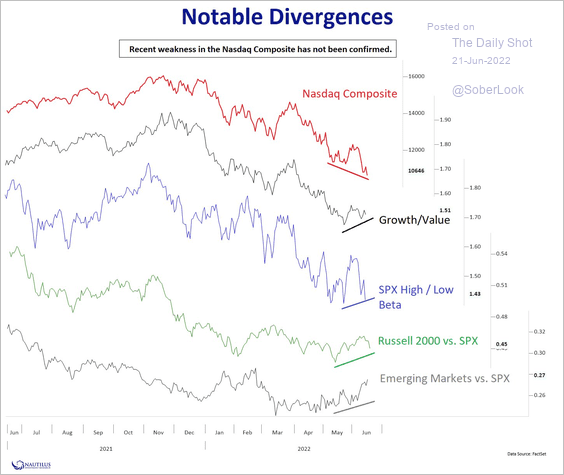

3. There has been a pickup in risk-on areas of the market lately.

Source: @NautilusCap

Source: @NautilusCap

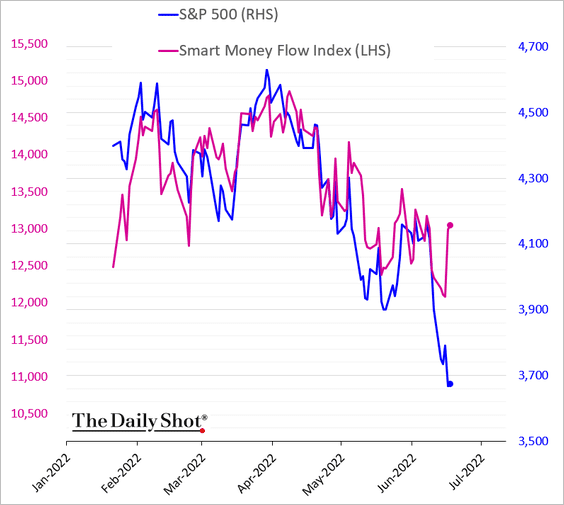

4. Smart money is positioning for a melt-up.

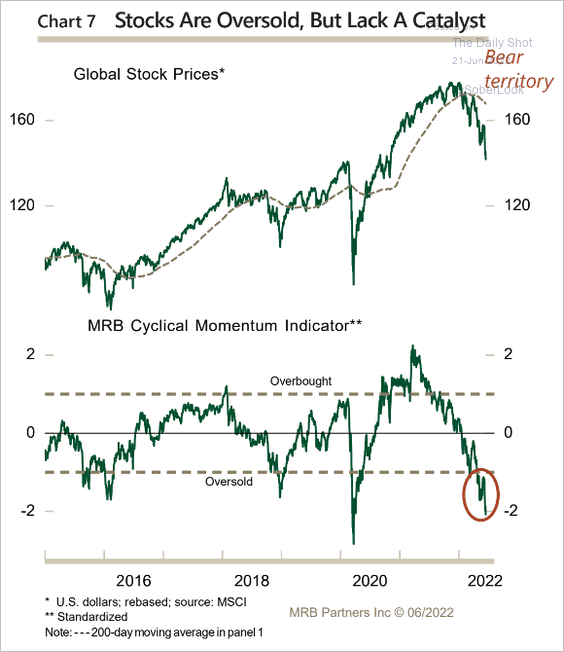

But stocks don’t have a catalyst for a rebound.

Source: MRB Partners

Source: MRB Partners

——————–

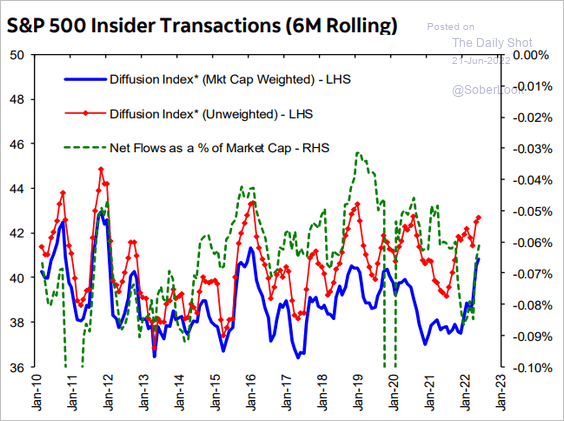

5. Insiders have been buying.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

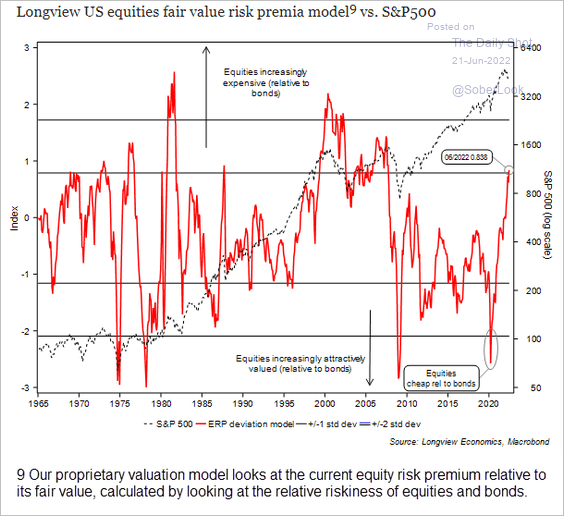

6. Stocks are expensive relative to bonds.

Source: Longview Economics

Source: Longview Economics

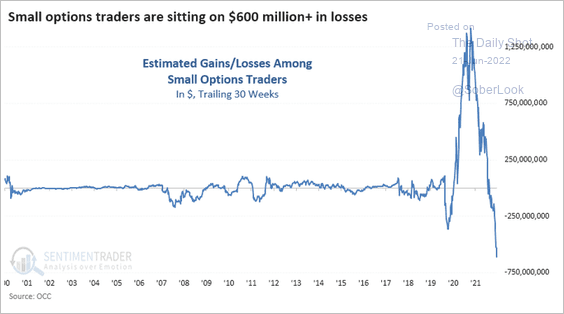

7. Retail options traders are deeply in the red.

Source: @sentimentrader, @jasongoepfert Read full article

Source: @sentimentrader, @jasongoepfert Read full article

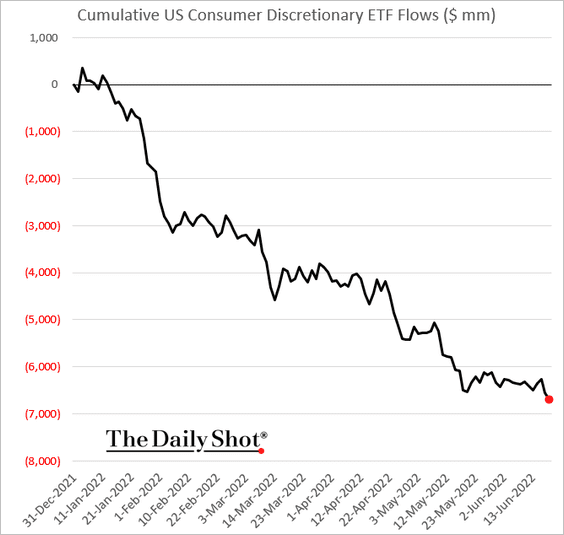

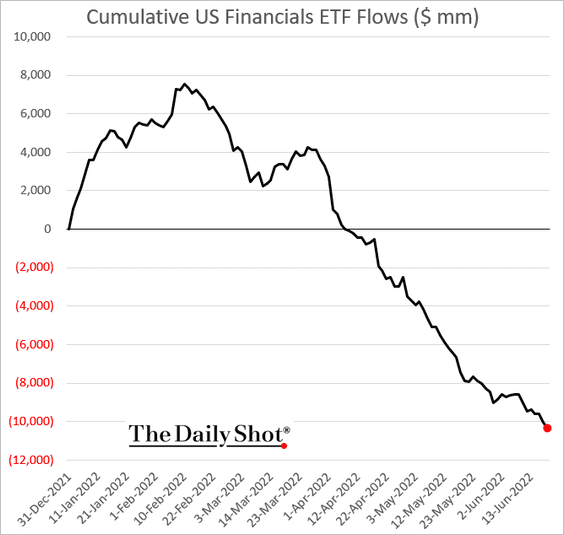

8. Financials and consumer discretionary ETFs continue to see net outflows.

——————–

9. The Nasdaq 100 has been inversely correlated with crude oil.

Source: Evercore ISI Research

Source: Evercore ISI Research

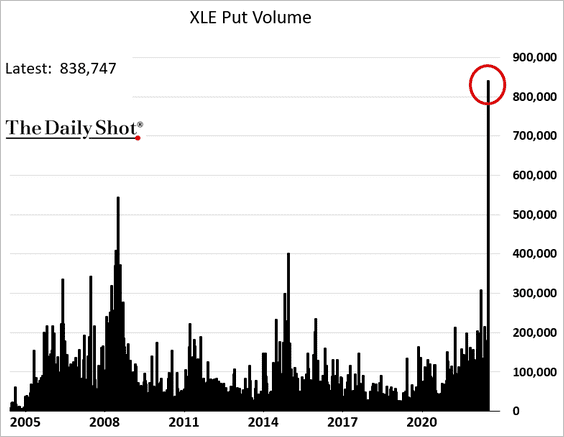

10. XLE, the SPDR energy sector ETF, saw record put option activity last week.

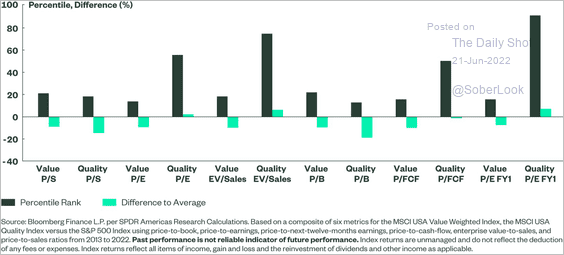

11. Value stocks are trading at a significant discount relative to historical levels.

Source: SPDR Americas Research, @mattbartolini Read full article

Source: SPDR Americas Research, @mattbartolini Read full article

Back to Index

Credit

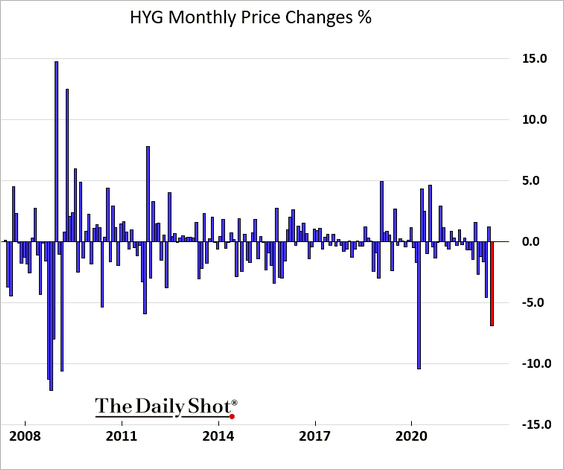

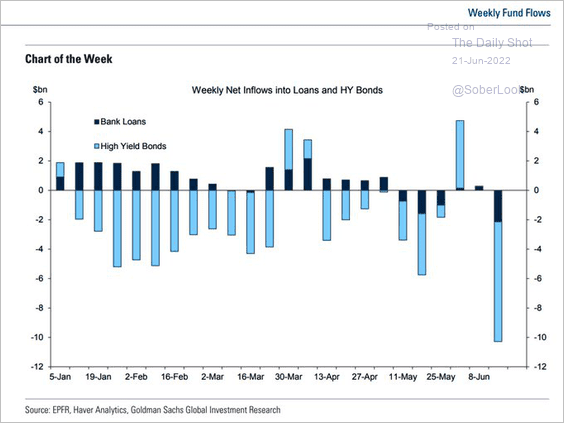

1. It’s been a rough month for high-yield bonds so far (2 charts).

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

——————–

2. EM corporates have been outperforming US high-yield.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

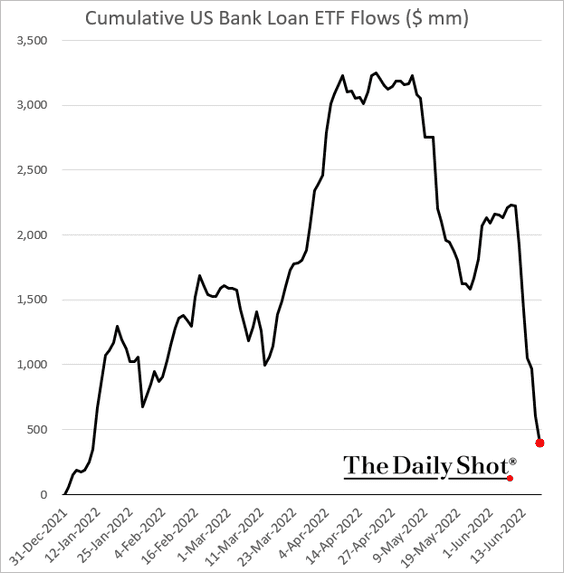

3. Leveraged loan ETFs continue to see outflows.

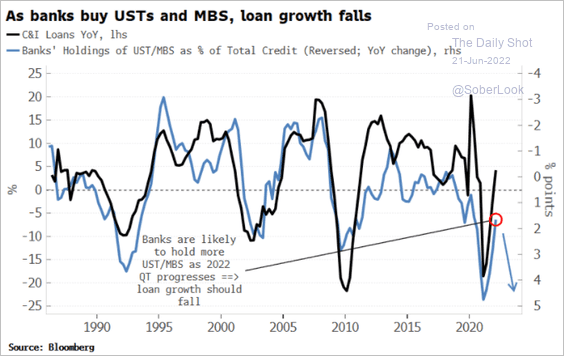

4. Much higher yields will incentivize banks to hold more bonds at the expense of loans.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

5. Muni yields look interesting.

Source: Citi Private Bank

Source: Citi Private Bank

Back to Index

Rates

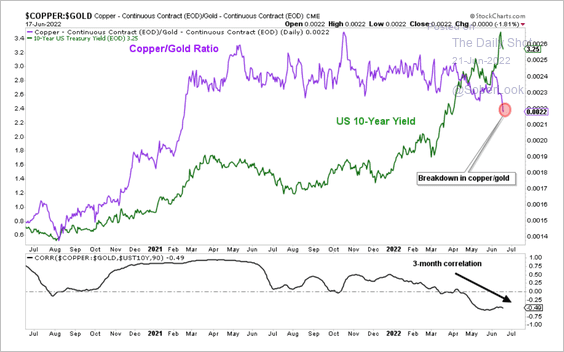

1. The copper/gold ratio is breaking down, which could point to a drop in the 10-year Treasury yield.

Source: Aazan Habib; Paradigm Capital

Source: Aazan Habib; Paradigm Capital

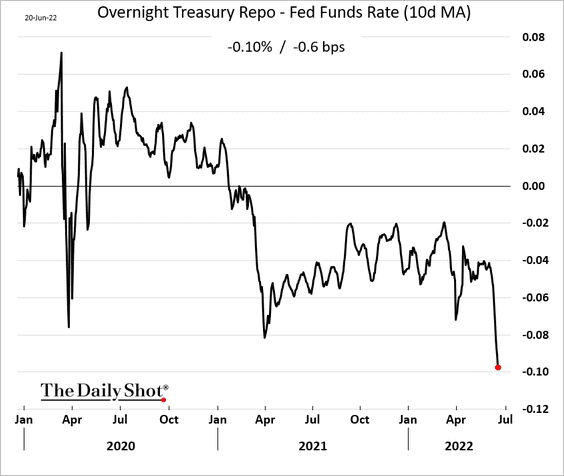

2. Overnight repo rates are now well below the fed funds rate amid strong demand for cash instruments (due to extreme risk aversion).

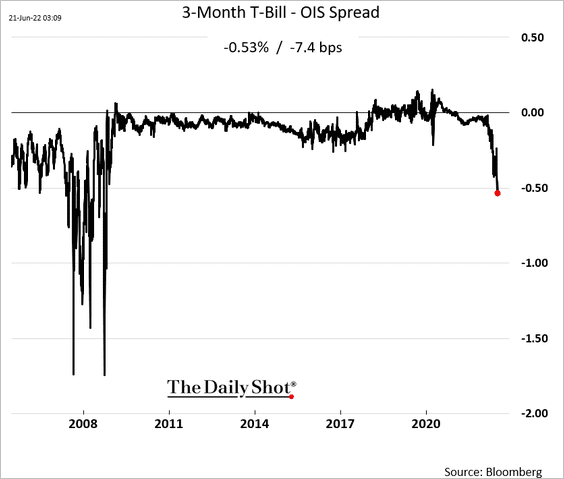

Demand for safe money market instruments (as well as tight supplies) is also sending the 3-month T-Bill – OIS spread to the lowest level since the financial crisis.

Back to Index

Global Developments

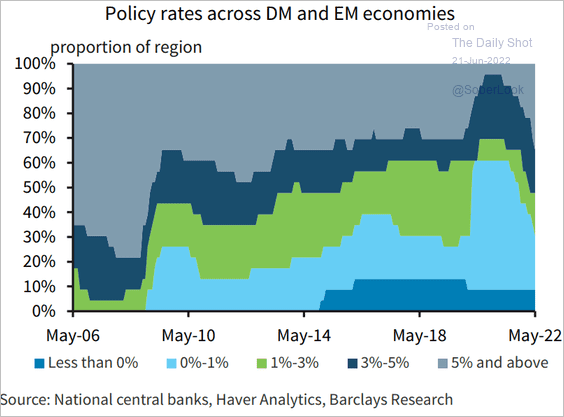

1. This chart shows the distribution of global central bank policy rates.

Source: Barclays Research

Source: Barclays Research

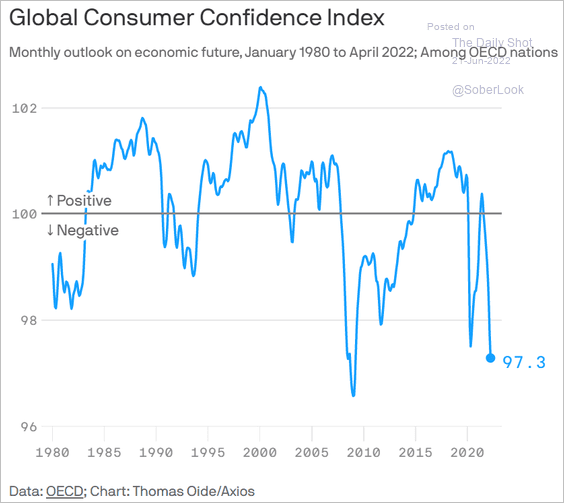

2. Global consumer sentiment hit the lowest level since the financial crisis.

Source: @axios Read full article

Source: @axios Read full article

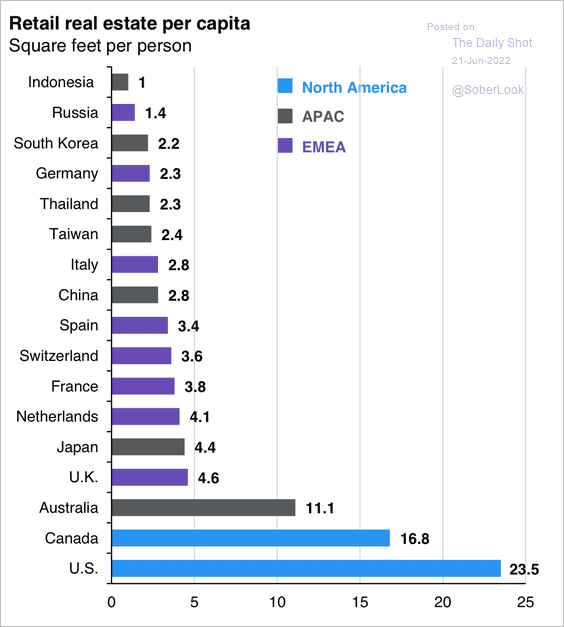

3. The US and Canada have the highest retail space per capita.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

——————–

Food for Thought

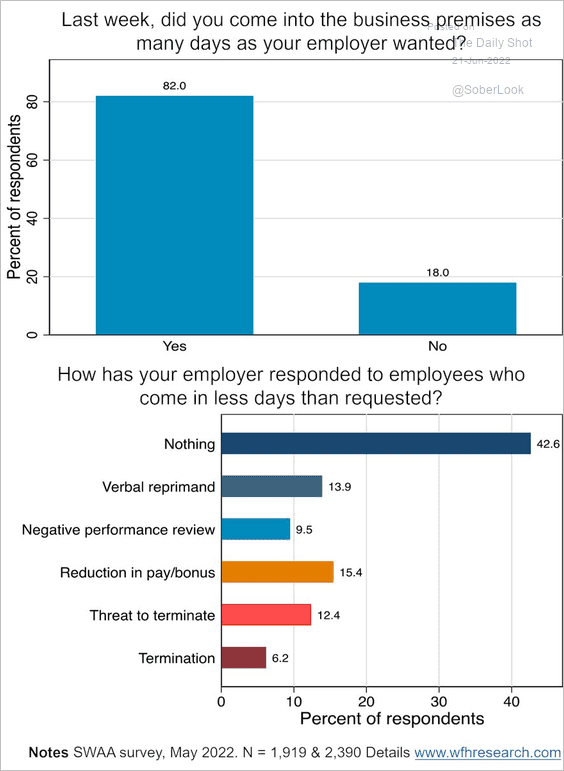

1. Employees are refusing to return to the office as frequently as the boss wants.

Source: @I_Am_NickBloom

Source: @I_Am_NickBloom

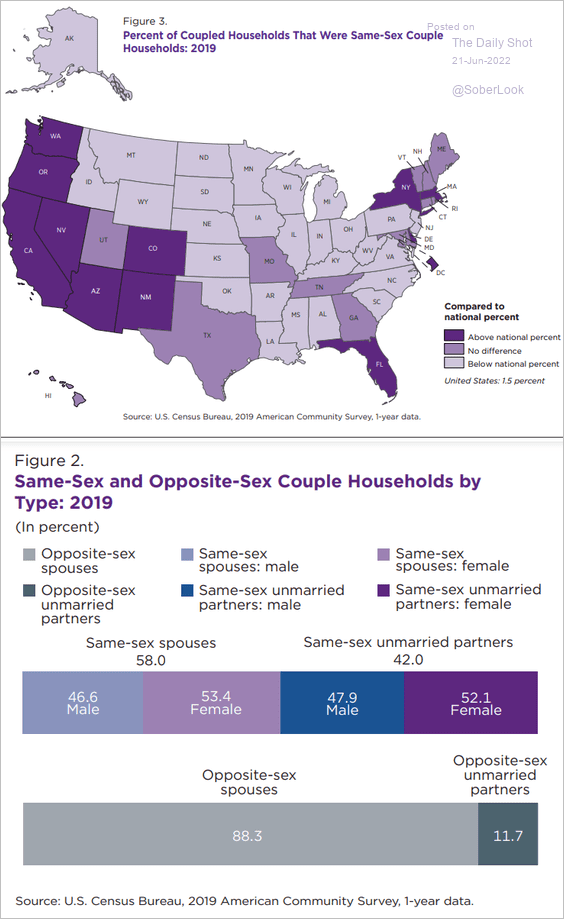

2. Same-sex couples in the US:

Source: US Census Read full article

Source: US Census Read full article

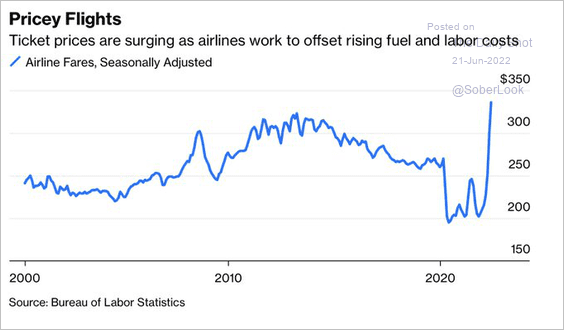

3. US airline fares:

Source: @opinion Read full article

Source: @opinion Read full article

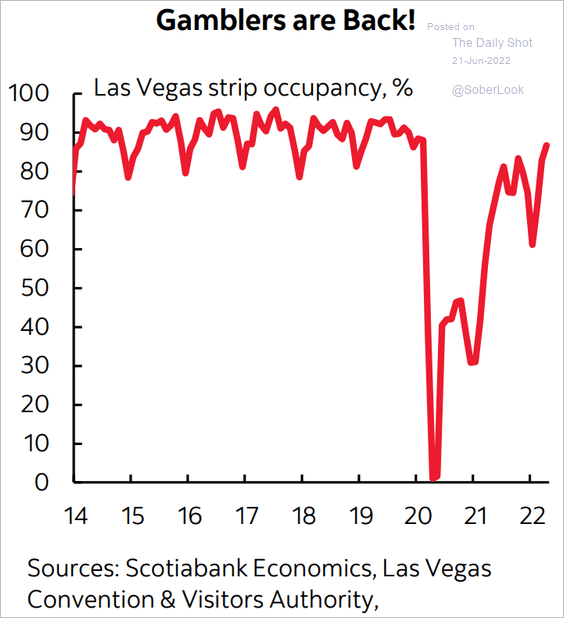

4. Gamblers are back:

Source: Scotiabank Economics

Source: Scotiabank Economics

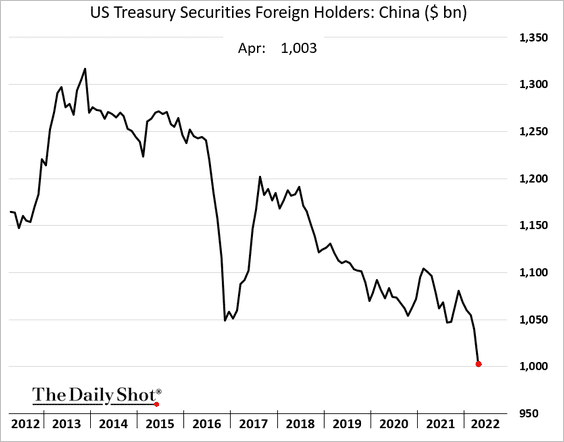

5. China’s holdings of US Treasuries:

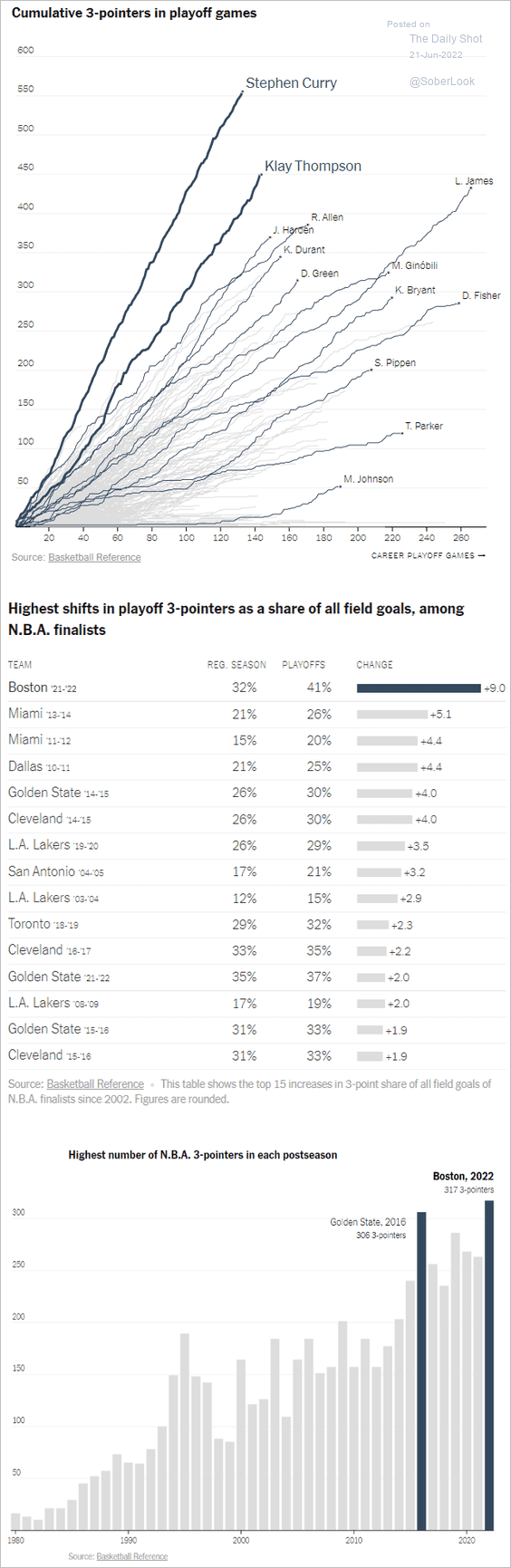

6. NBA 3-pointers:

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

Back to Index