The Daily Shot: 28-Jun-22

• The United States

• Canada

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

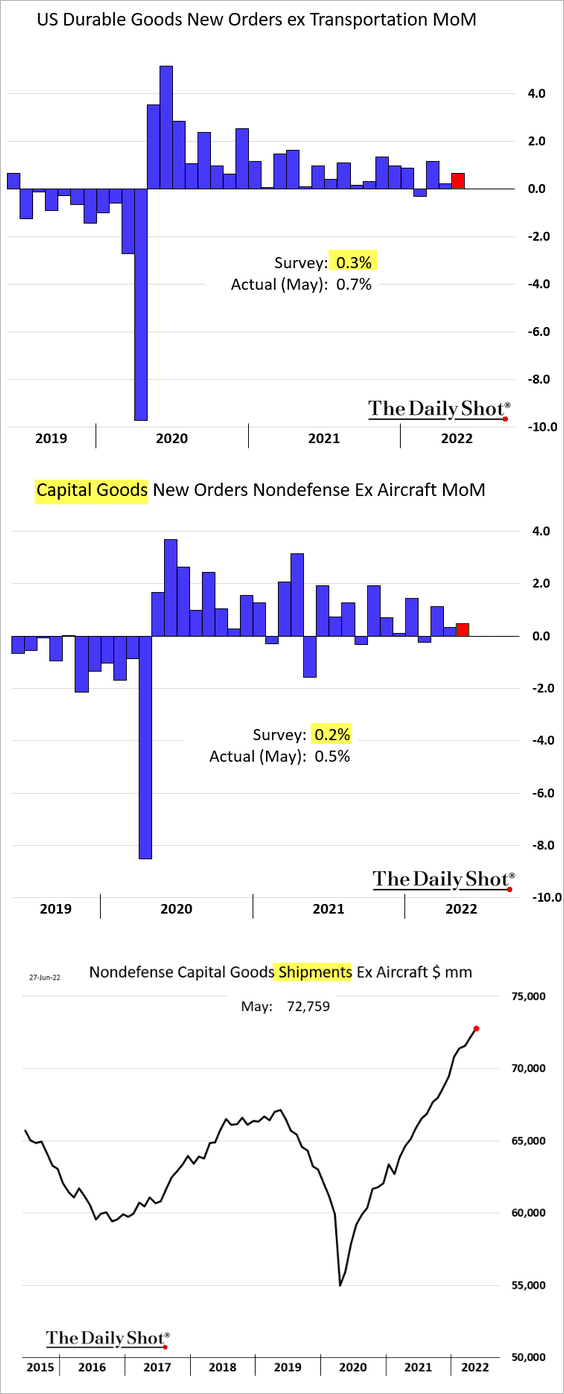

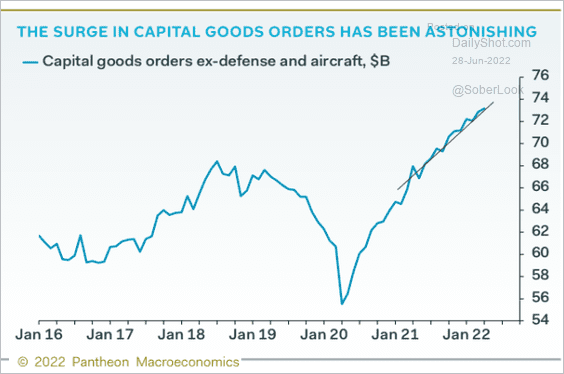

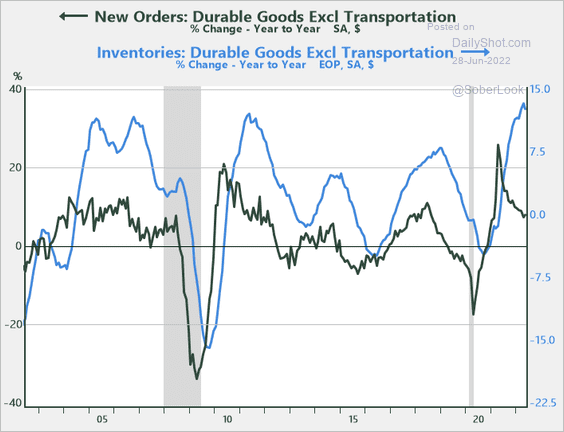

1. US durable goods orders topped expectations, with business investment holding up well despite the headwinds (note that these figures are not adjusted for inflation).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Inventory growth has been outpacing orders.

Source: Peter Essele, Commonwealth Financial Network

Source: Peter Essele, Commonwealth Financial Network

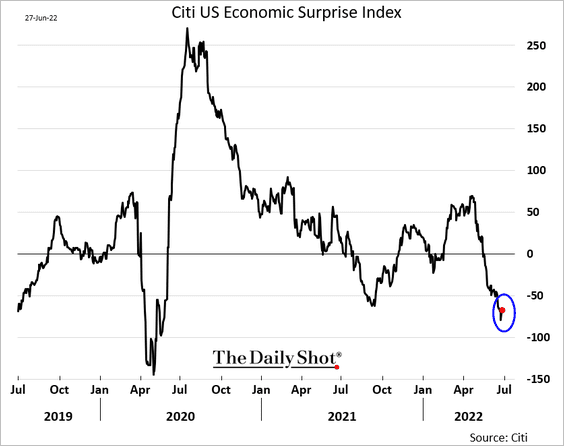

The Citi Economic Surprise Index bounced from the lows after the durable goods orders report.

——————–

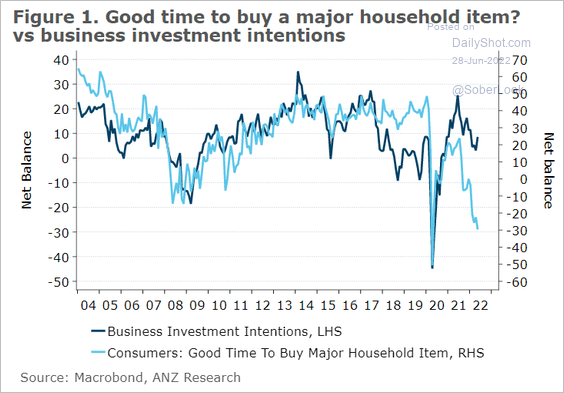

2. Business and consumer spending intentions have diverged.

Source: @ANZ_Research

Source: @ANZ_Research

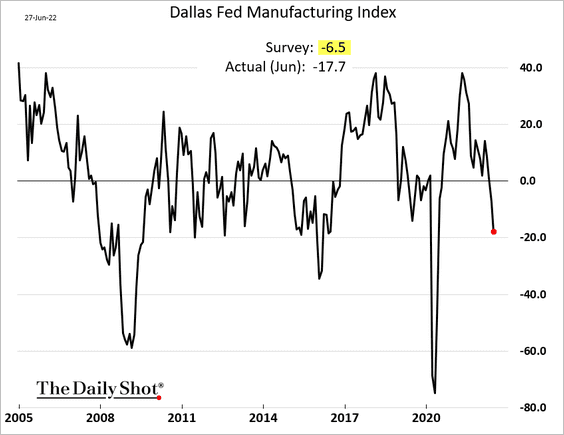

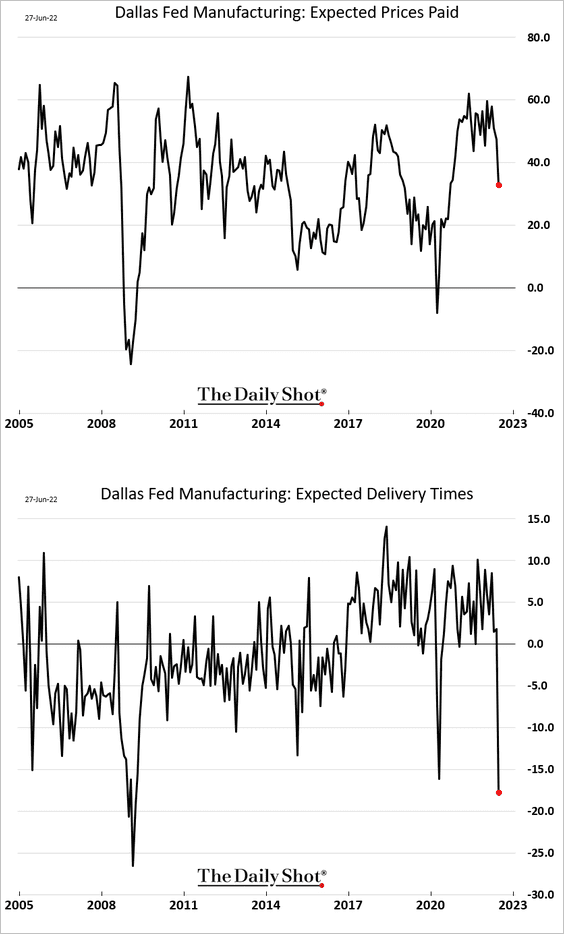

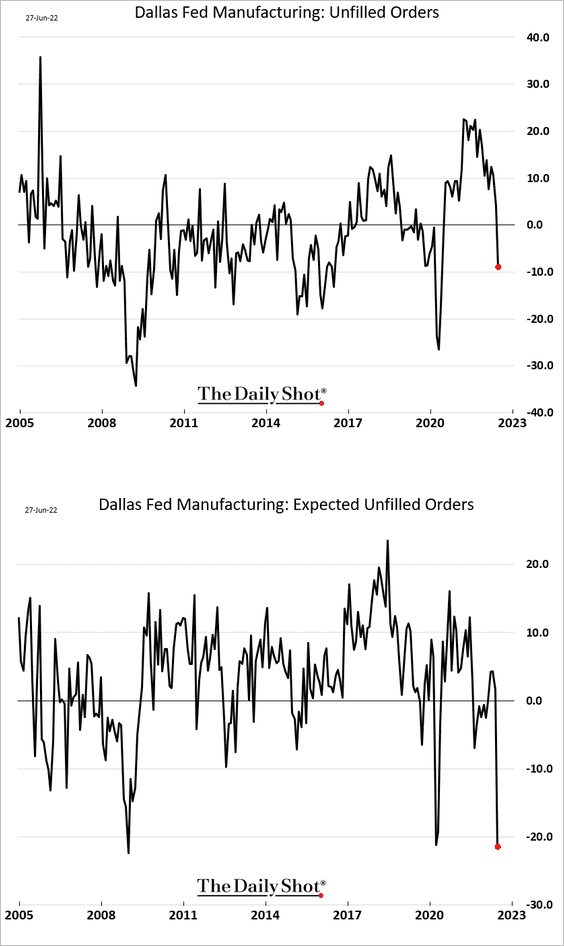

3. The Dallas Fed’s regional manufacturing index tumbled this month, …

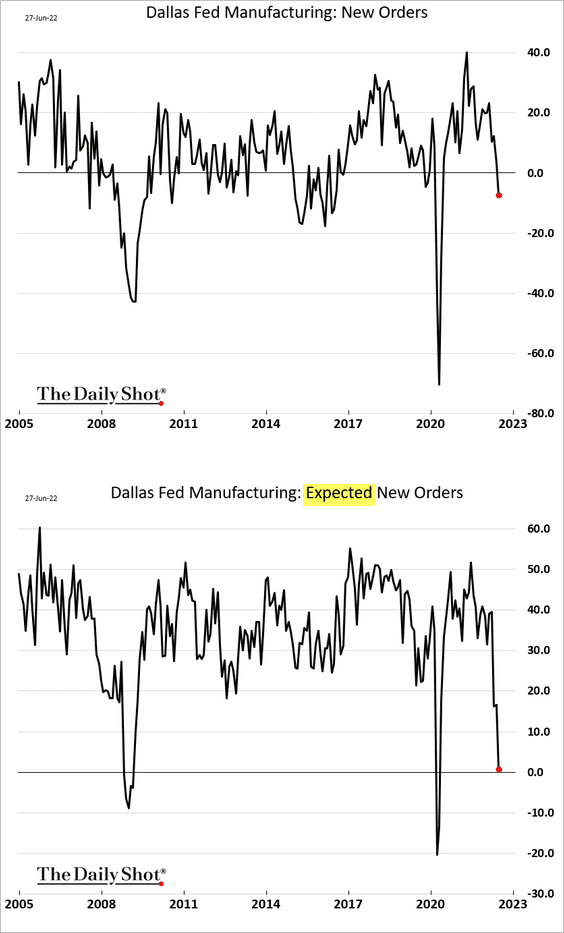

… as demand slumped …

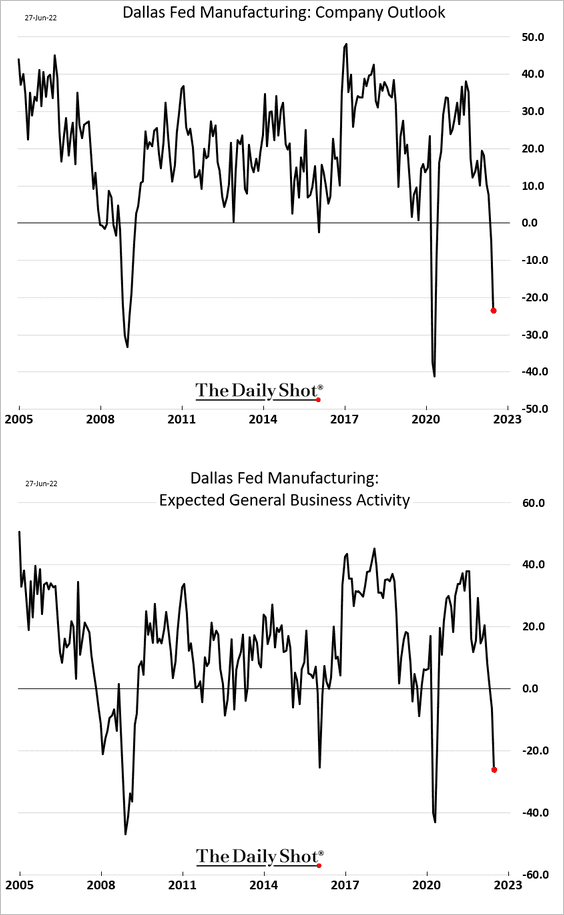

… and outlook collapsed.

Manufacturers expect supply stress to ease with falling demand.

Order backlogs have melted away.

——————–

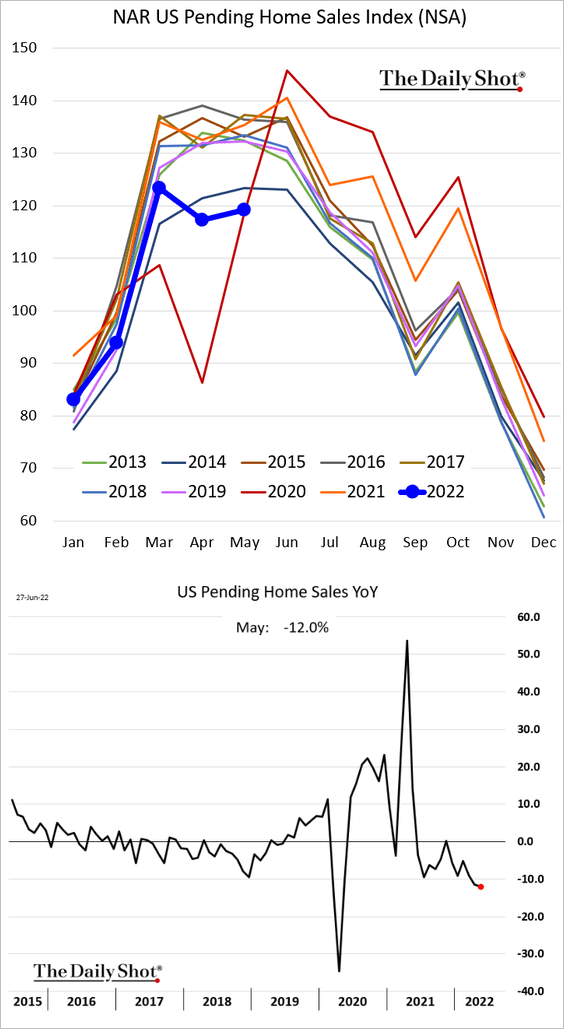

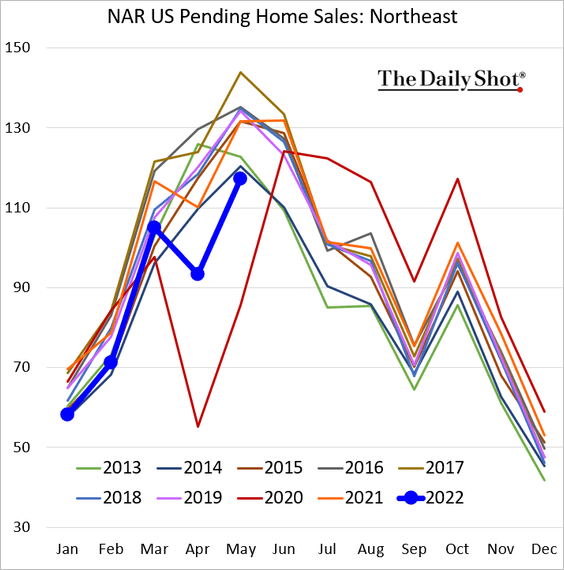

4. Pending home sales were better than expected last month but are still down 12% vs. last year.

The upside surprise was driven by stronger sales in the Northeast.

——————–

5. Next, we have some updates on inflation.

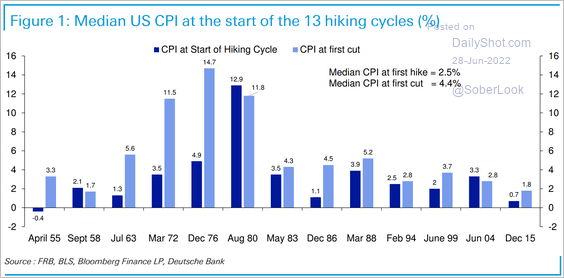

• This chart shows the median CPI at the start of the past 13 hiking cycles (over the past 70 years) and where inflation was at the first rate cut.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

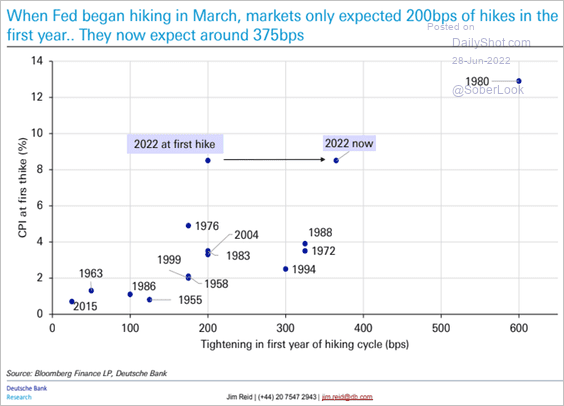

Here is the CPI at the start of the first hike vs. the amount of tightening in the first year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

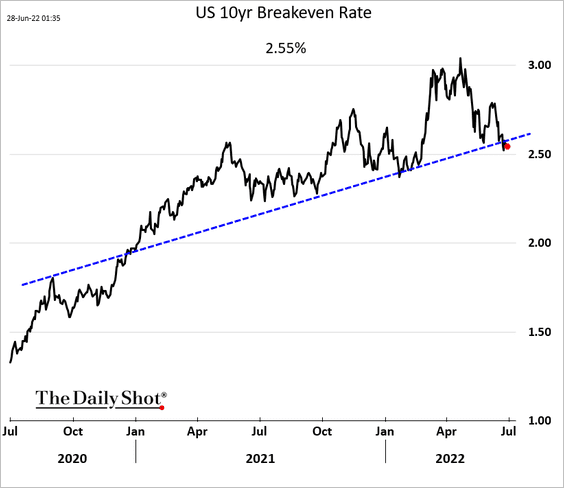

• Market-based inflation expectations have been drifting lower.

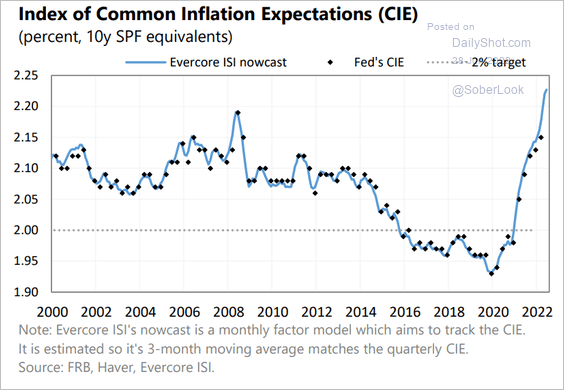

• Here is the Evercore ISI’s estimate of the Fed’s Index of Common Inflation Expectations.

Source: Evercore ISI Research

Source: Evercore ISI Research

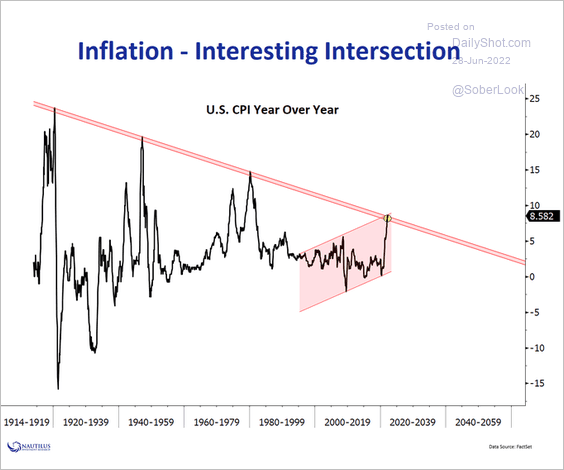

• The CPI is now at its long-term downtrend resistance.

Source: @NautilusCap

Source: @NautilusCap

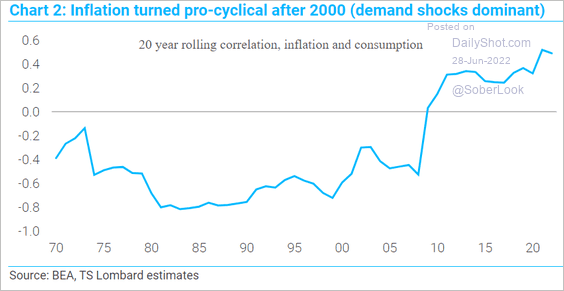

• Inflation has been increasingly correlated to consumption, making price changes more vulnerable to demand shocks.

Source: TS Lombard

Source: TS Lombard

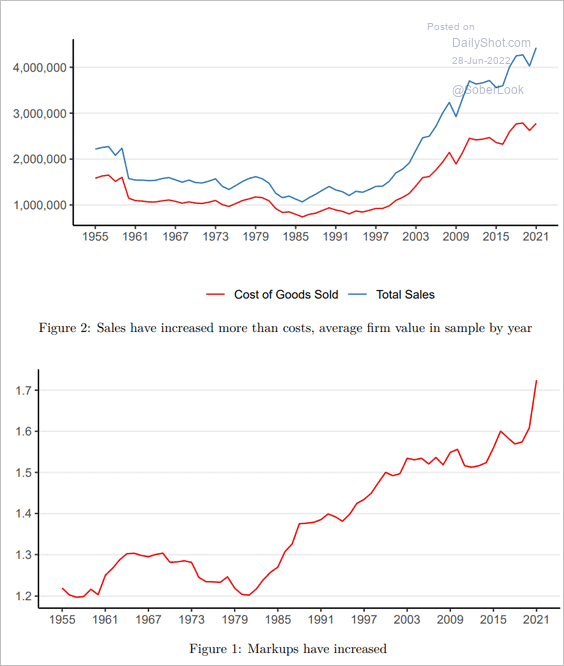

• The surge in US business markups helped fuel inflation.

Source: Mike Konczal, Niko Lusiani Read full article

Source: Mike Konczal, Niko Lusiani Read full article

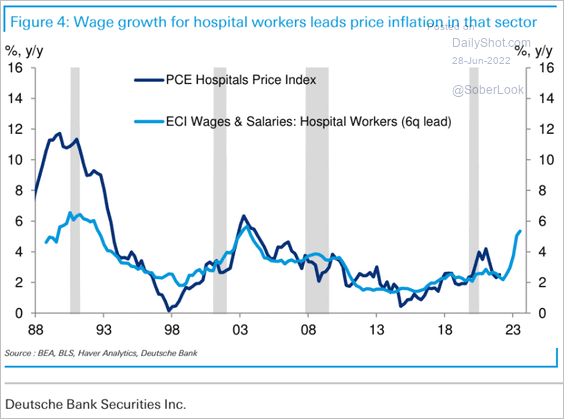

• Hospital inflation could accelerate in the months ahead as labor costs surge.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

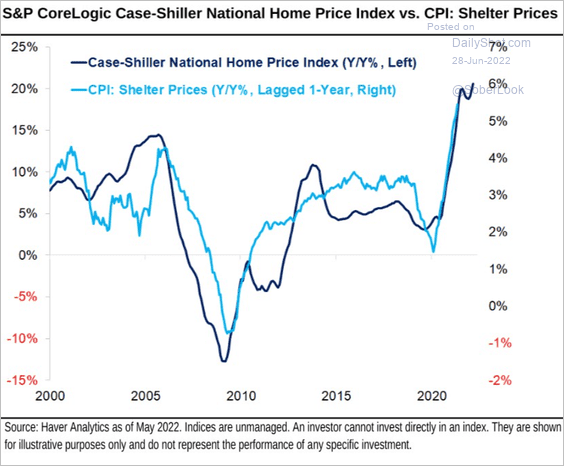

• Shelter CPI has more room to rise.

Source: Citi Private Bank

Source: Citi Private Bank

Back to Index

Canada

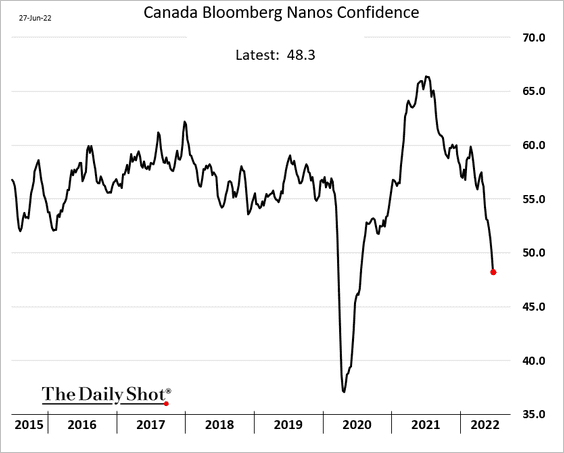

1. Consumer confidence continues to sink.

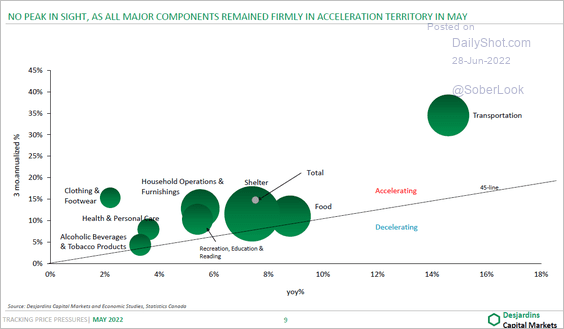

2. Inflation has been accelerating across the board.

Source: Desjardins

Source: Desjardins

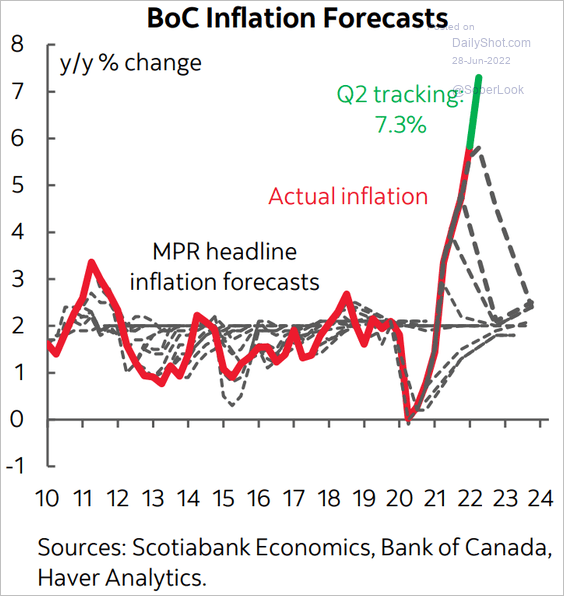

Surging inflation continues to surprise the BoC.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

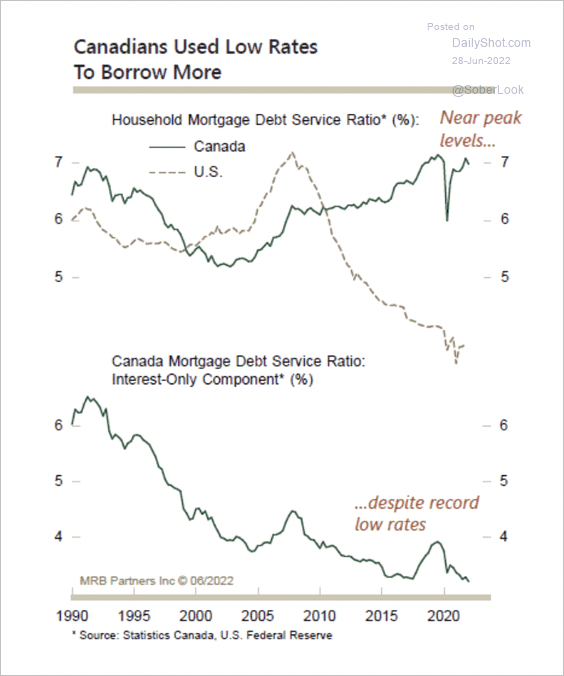

3. The mortgage debt service ratio is near peak levels and sharply higher than the US.

Source: MRB Partners

Source: MRB Partners

Back to Index

The Eurozone

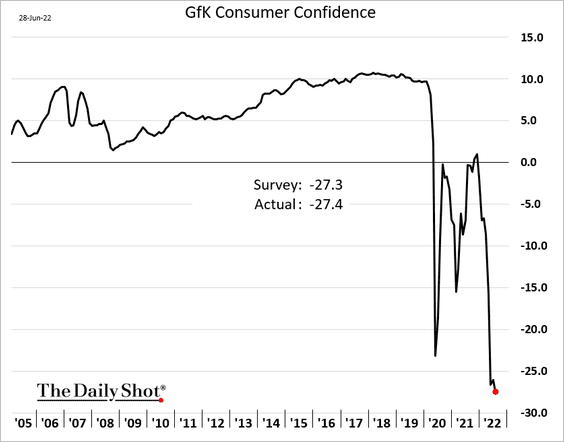

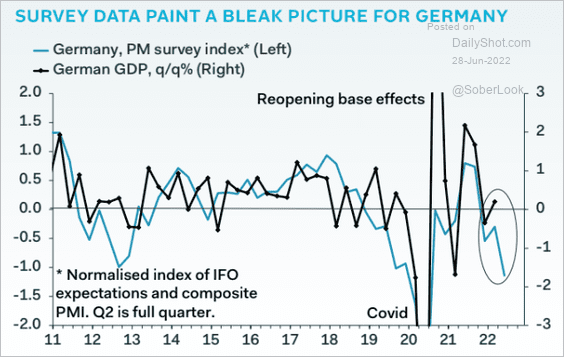

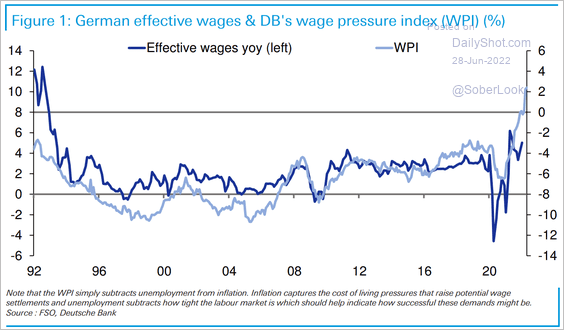

1. Let’s begin with Germany.

• Consumer sentiment hit a record low.

• Survey data weakness signals a GDP contraction in Germany.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Germany is experiencing wage pressures.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

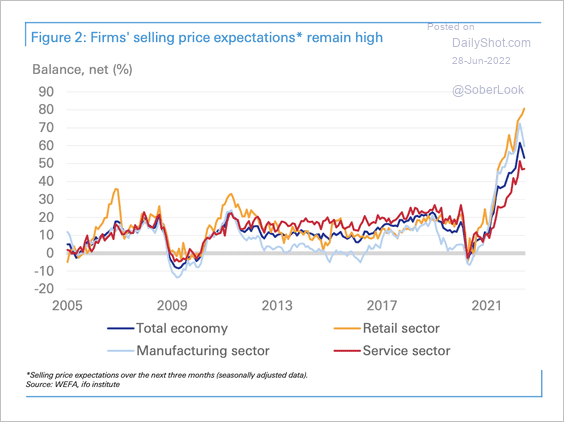

• German firms’ selling price expectations remain high.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

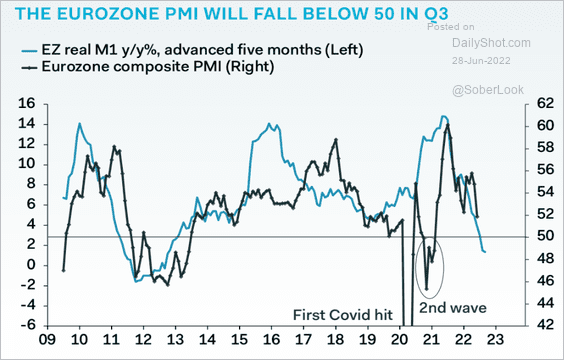

2. Tighter liquidity points to deteriorating business activity in the Eurozone.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

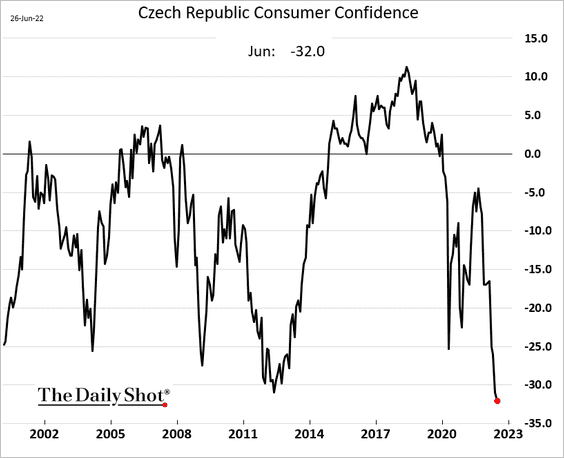

1. Czech consumer confidence hit a record low.

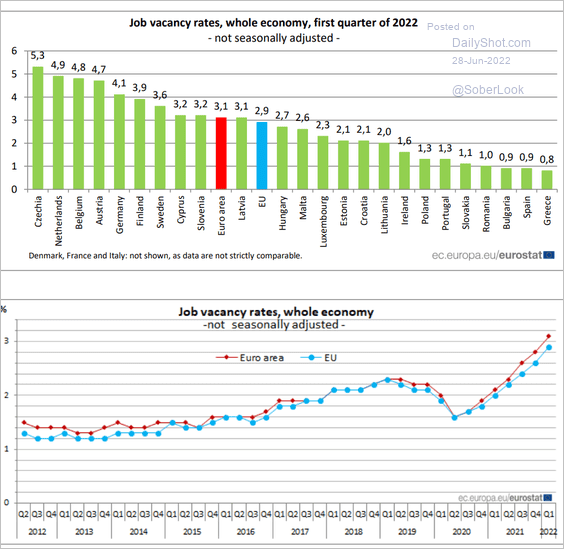

2. Here is a look at job vacancy rates in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

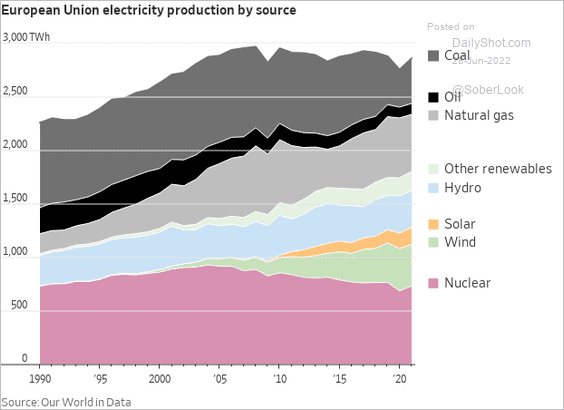

3. And this chart shows EU electricity production by source.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

China

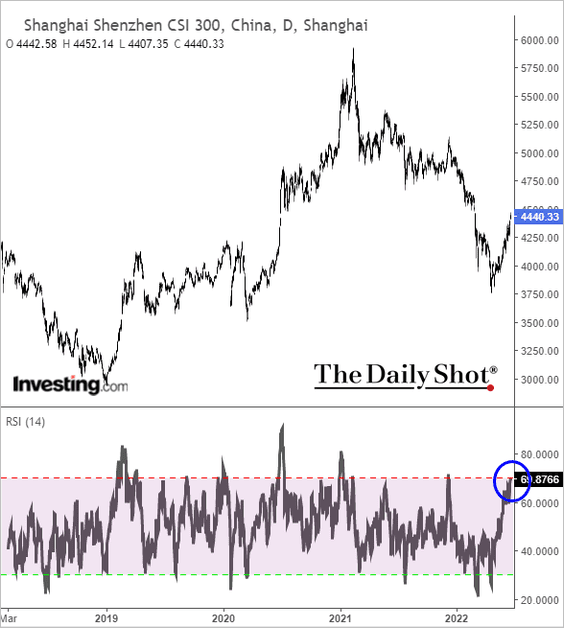

1. The Shanghai Shenzhen CSI 300 Index is entering overbought territory.

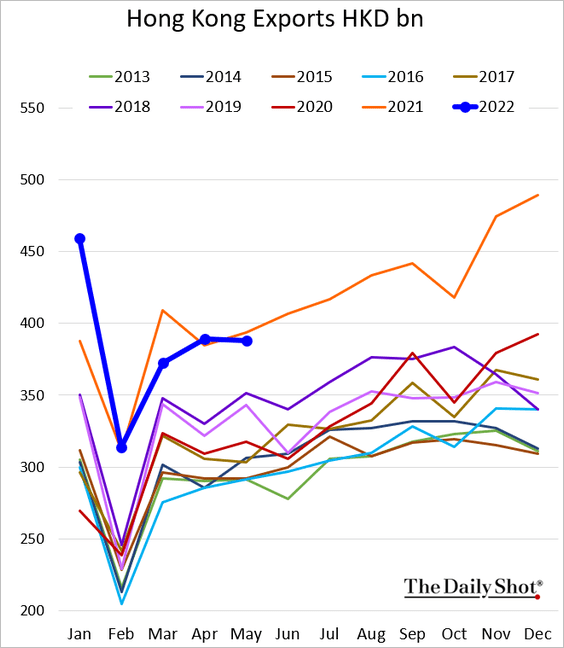

2. Hong Kong’s exports eased in May but remain elevated.

Back to Index

Emerging Markets

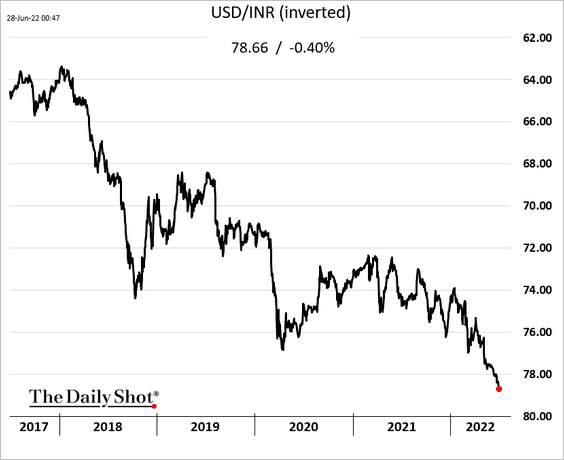

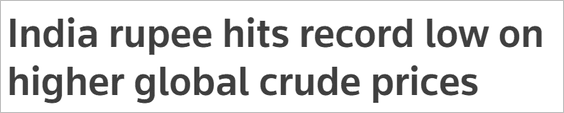

1. The Indian rupee hit a record low as oil prices climb.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

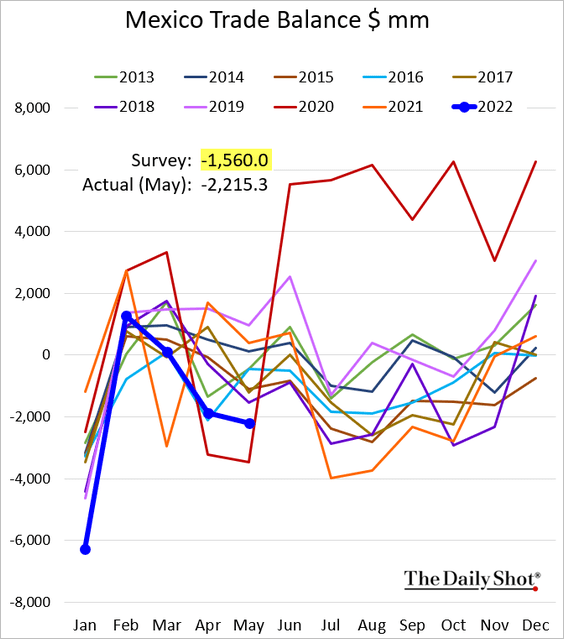

2. Mexico’s trade deficit was wider than expected in May.

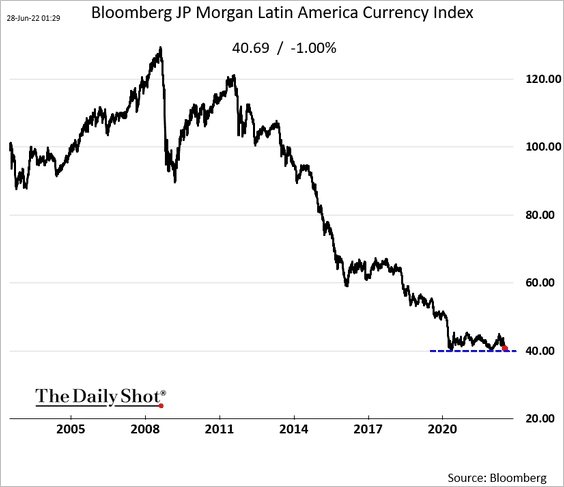

3. JP Morgan’s LatAm currency index is at support.

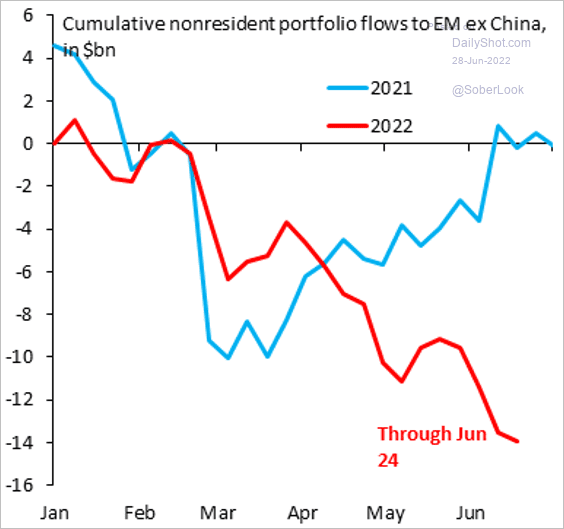

4. EM ex-China economies continue to see non-resident outflows.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

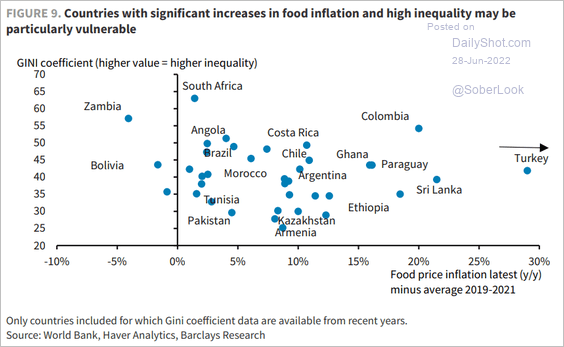

5. Which countries risk social unrest?

Source: Barclays Research

Source: Barclays Research

Back to Index

Cryptocurrency

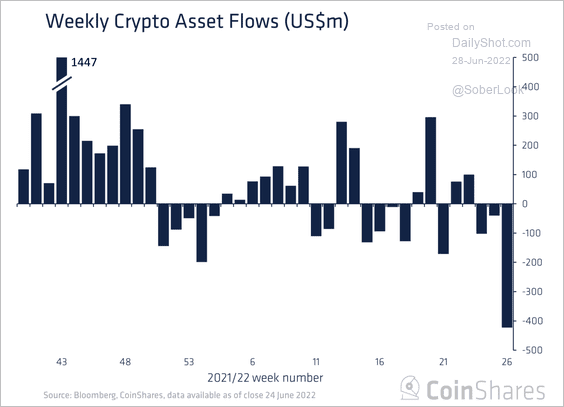

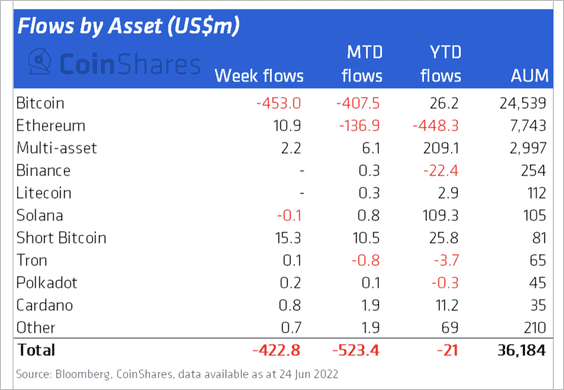

1. Crypto investment products saw massive outflows totaling $423 million last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

Bitcoin-focused products saw the most outflows, while Ethereum-focused funds and short-bitcoin funds saw inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

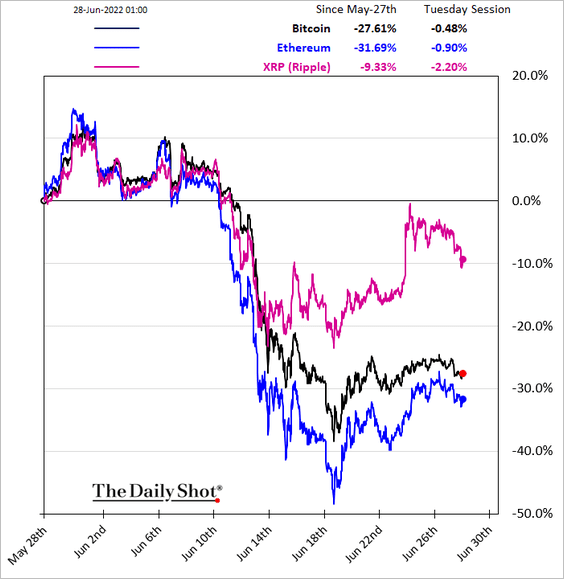

2. XRP has been outperforming.

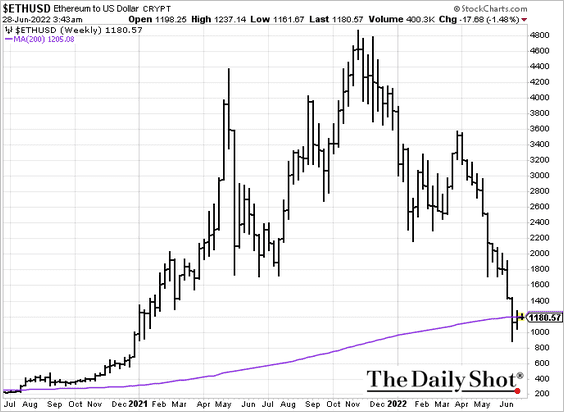

3. Ether has been holding support at the 200-week moving average.

h/t Joanna Ossinger

h/t Joanna Ossinger

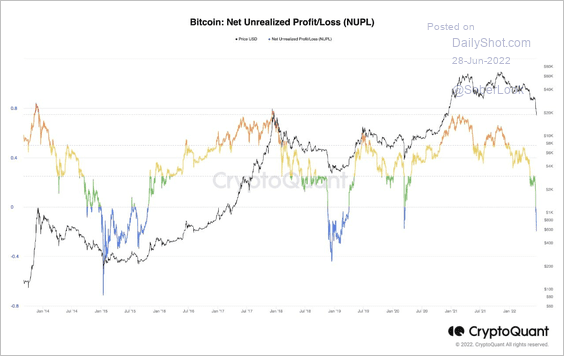

4. A significant number of bitcoin holders are facing unrealized losses, similar to what occurred near previous bear market lows.

Source: @cryptoquant_com

Source: @cryptoquant_com

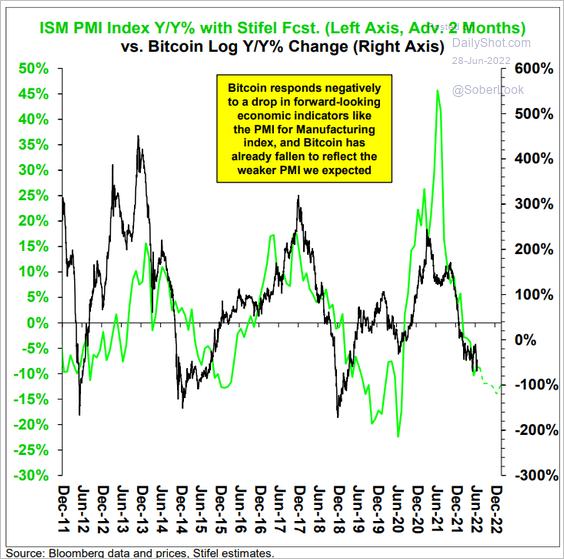

5. Weaker economic indicators pose downside risks for bitcoin.

Source: Stifel

Source: Stifel

Back to Index

Commodities

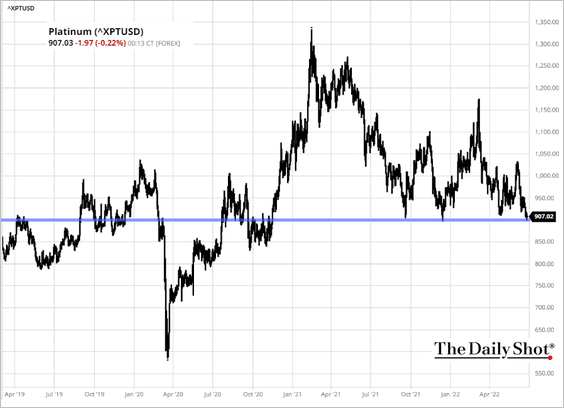

1. Platinum is testing support at $900/oz.

Source: barchart.com

Source: barchart.com

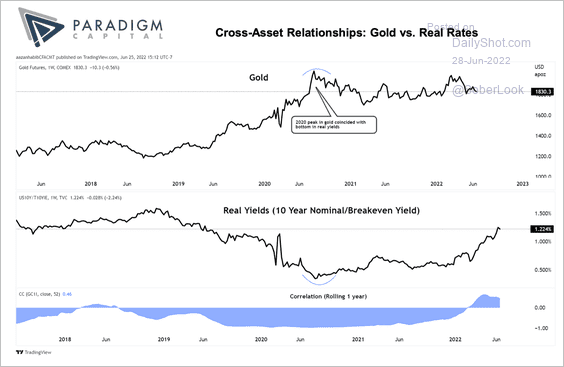

2. The inverse correlation between gold and real yields turned positive in recent months.

Source: Aazan Habib; Paradigm Capital

Source: Aazan Habib; Paradigm Capital

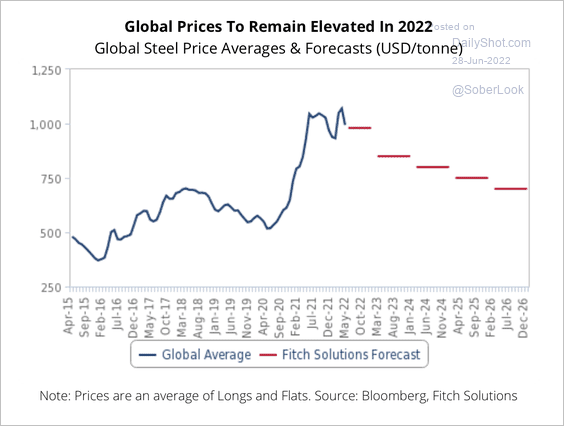

3. Fitch Solutions expects steel prices to remain elevated because of the Russia/Ukraine war and renewed stimulus targeting China’s infrastructure. Still, over the coming decade, demand could slow as China prioritizes services over heavy industry.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

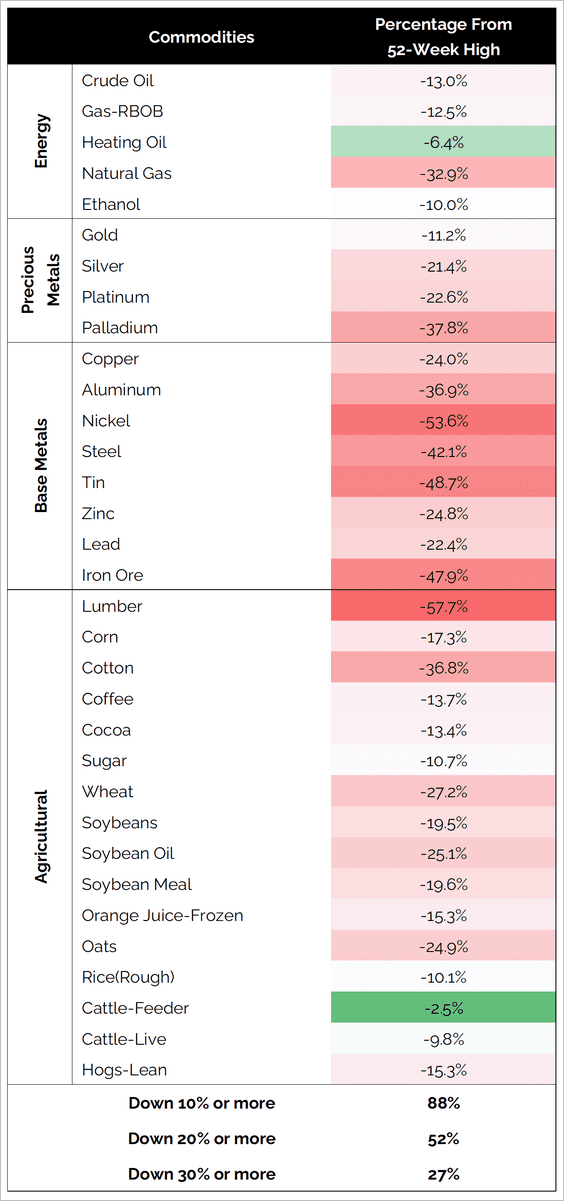

4. Most commodities, especially base metals, are in a bear market.

Source: @granthawkridge

Source: @granthawkridge

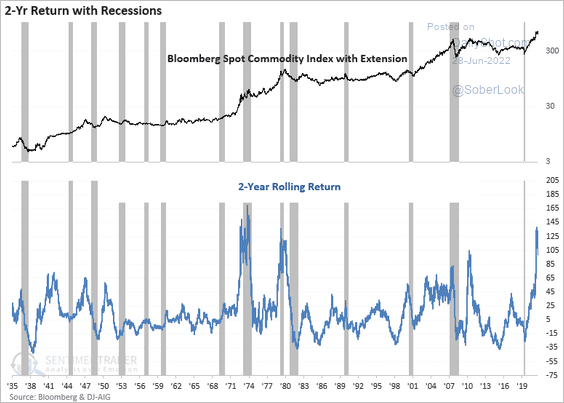

5. Historically, sharp rises in commodity prices have preceded or coincided with recessions. As the momentum surge peaks, however, commodities have struggled over the next few months, according to SentimenTrader.

Source: SentimenTrader

Source: SentimenTrader

Back to Index

Energy

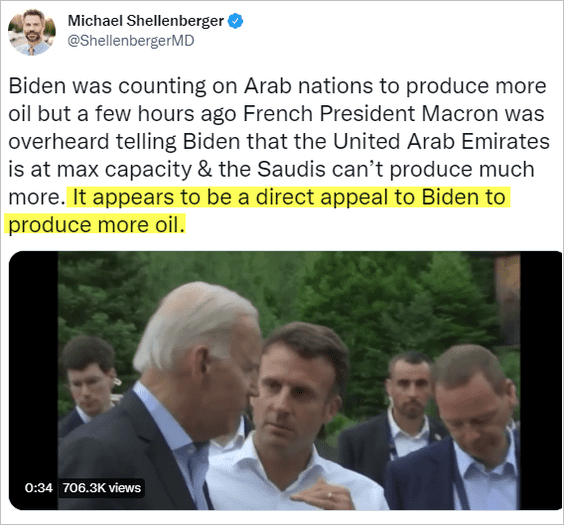

1. OPEC output is near capacity, and Europe is asking the US to step up.

Source: @ShellenbergerMD

Source: @ShellenbergerMD

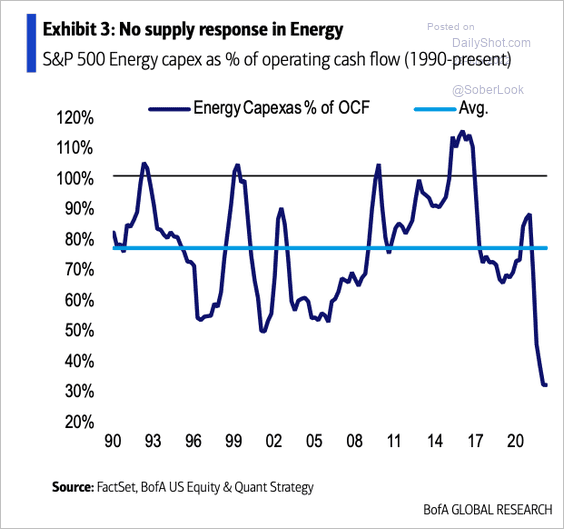

US energy CapEx has been soft.

Source: BofA Global Research; @SamRo

Source: BofA Global Research; @SamRo

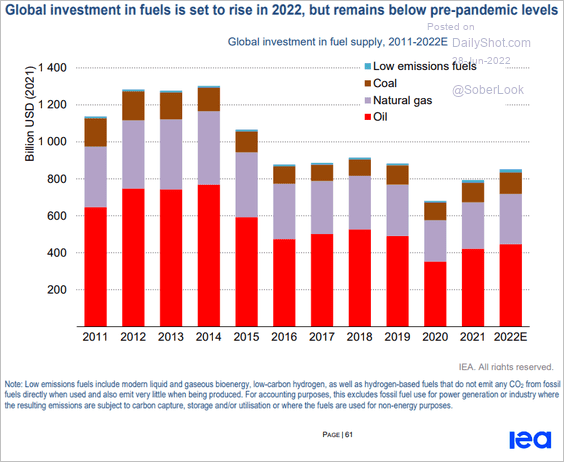

And global investment in fuels is still below pre-COVID levels.

Source: IEA Read full article

Source: IEA Read full article

——————–

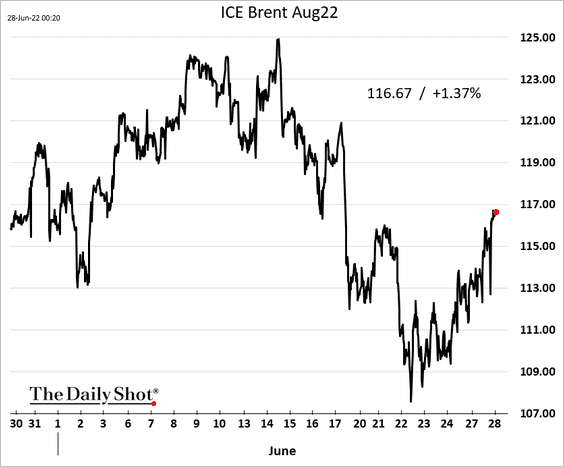

2. Oil is rebounding.

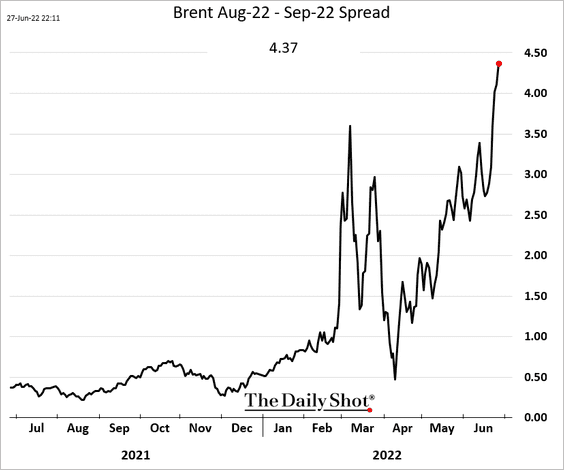

• The market remains very tight. Here is the spread between the August and the September Brent futures (backwardation).

——————–

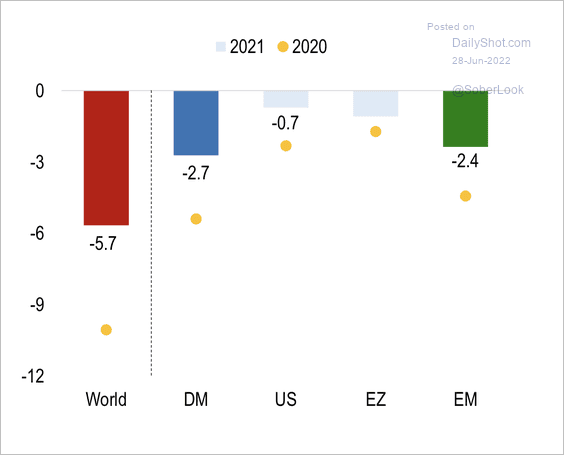

3. This chart shows oil consumption shortfall (deviation from the pre-pandemic path) by region.

Source: Numera Analytics

Source: Numera Analytics

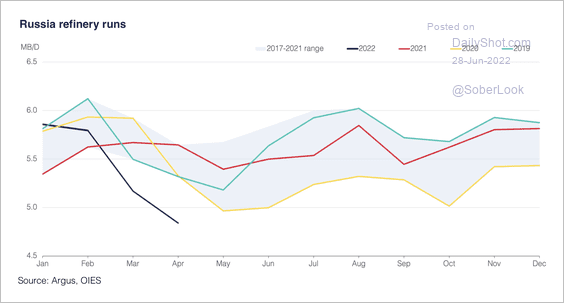

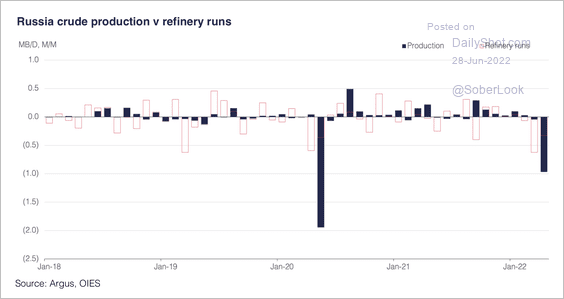

4. Russian refinery inputs are declining as sanctions affected both exports and domestic demand, but also due to maintenance, according to OIES (2 charts).

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

Back to Index

Equities

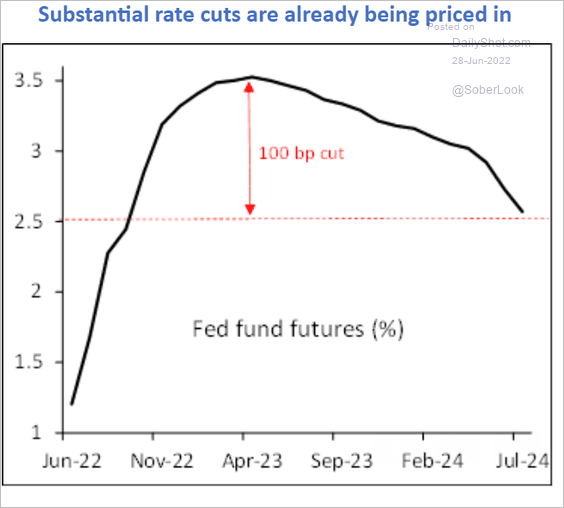

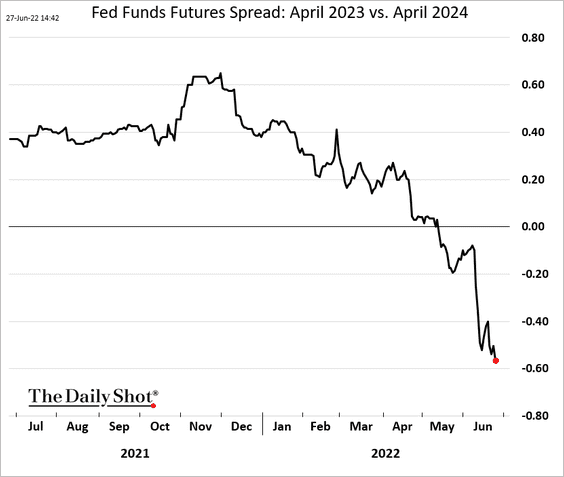

1. Stocks have been firmer in anticipation of rate cuts, which the market expects to start in the first half of next year. The assumption here is that the Fed will be comfortable with its progress in battling inflation by then. Perhaps.

Source: Piper Sandler

Source: Piper Sandler

——————–

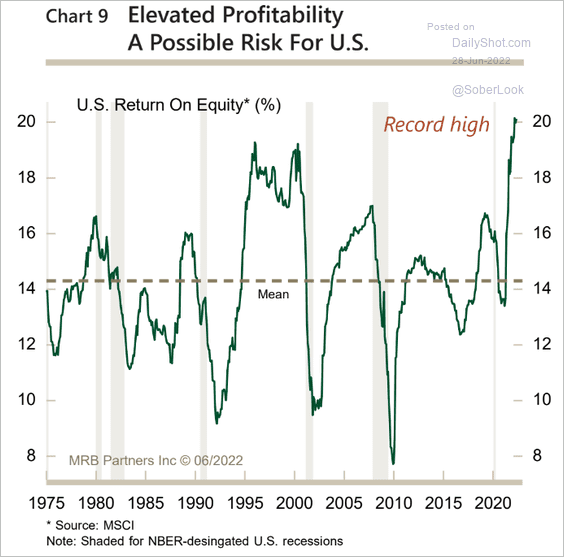

2. Elevated profitability is a risk for stocks.

Source: MRB Partners

Source: MRB Partners

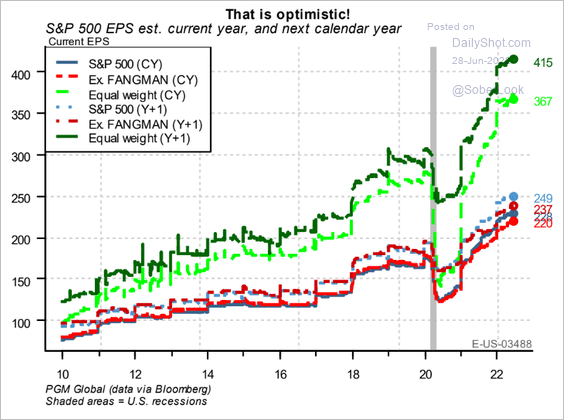

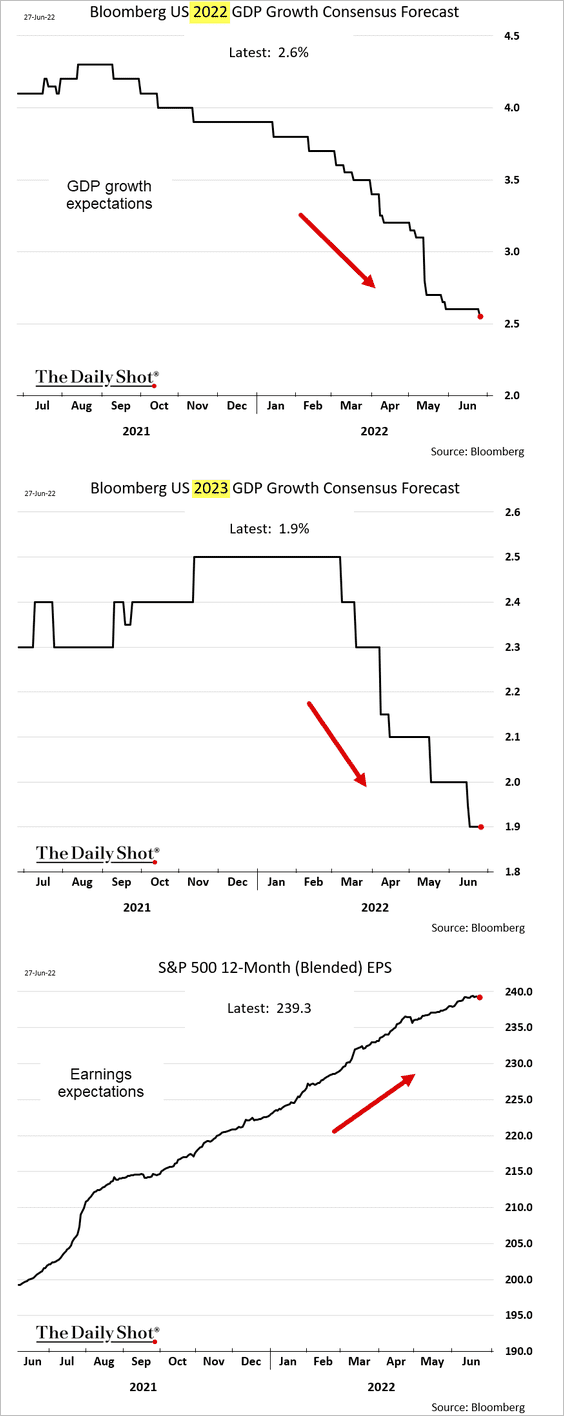

• Earnings forecasts have been trending higher …

Source: PGM Global

Source: PGM Global

… even as economists continue to downgrade GDP growth projections.

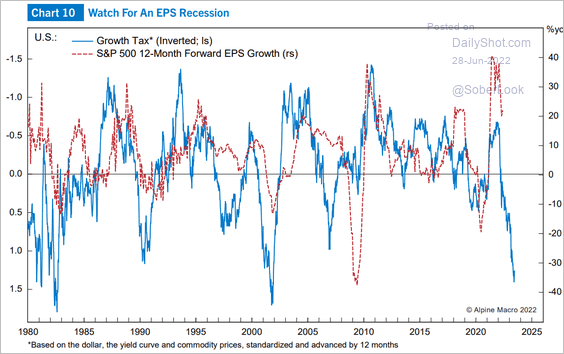

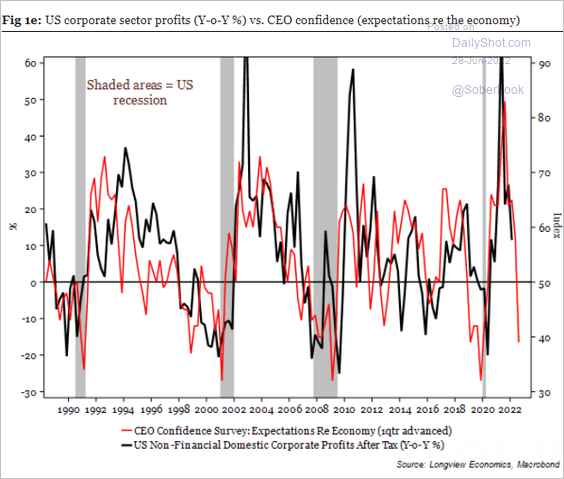

• A number of leading indicators continue to signal a deterioration in earnings growth (2 charts).

Source: Alpine Macro

Source: Alpine Macro

Source: Longview Economics

Source: Longview Economics

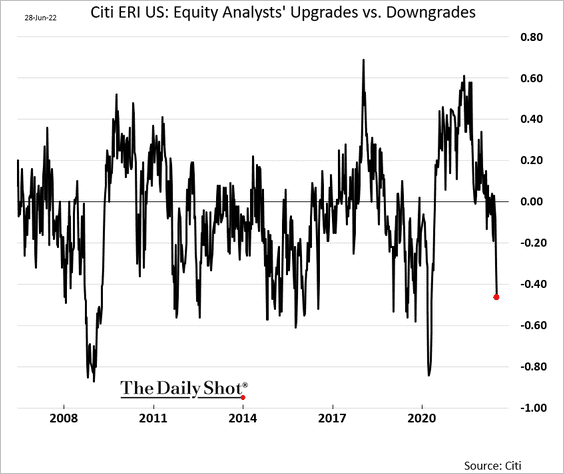

• Equity analysts have been “behind the curve” and are now trying to catch up. Earnings downgrades are increasingly outpacing upgrades.

——————–

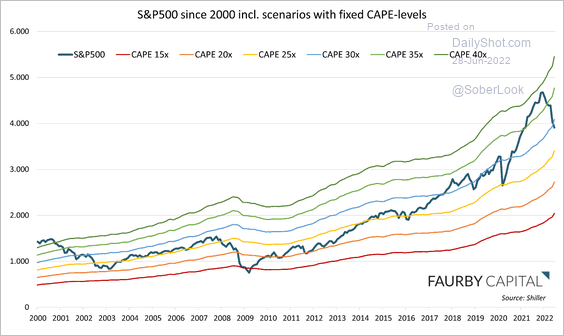

3. There is plenty of room for valuations to adjust lower.

Source: FAURBY CAPITAL

Source: FAURBY CAPITAL

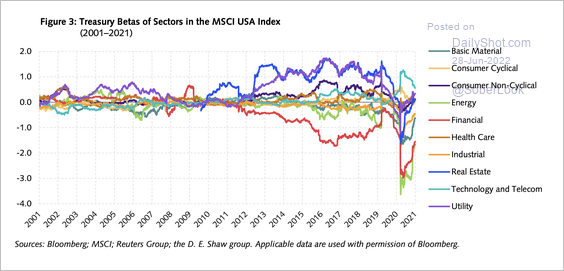

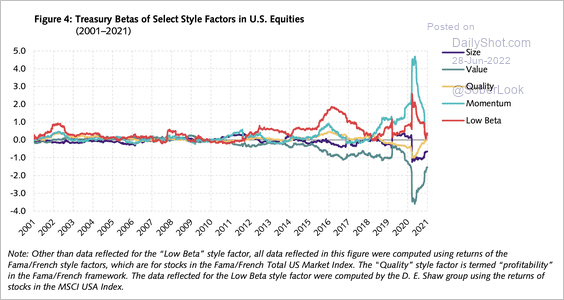

4. The dispersion in interest rate sensitivities across sectors and style factors was muted until about 2012.

Source: D.E. Shaw Group Read full article

Source: D.E. Shaw Group Read full article

Source: D.E. Shaw Group Read full article

Source: D.E. Shaw Group Read full article

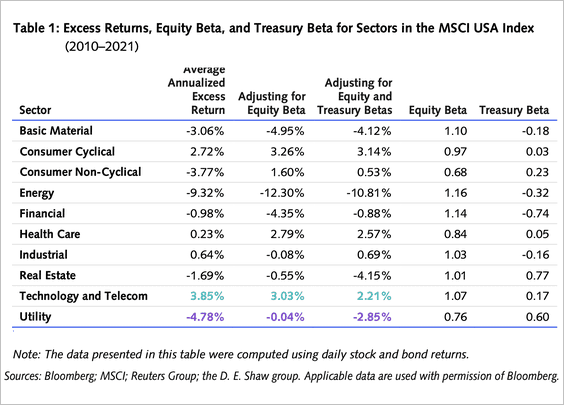

This table shows how sector returns are affected when adjusting for equity and Treasury betas over the past decade.

Source: D.E. Shaw Group Read full article

Source: D.E. Shaw Group Read full article

——————–

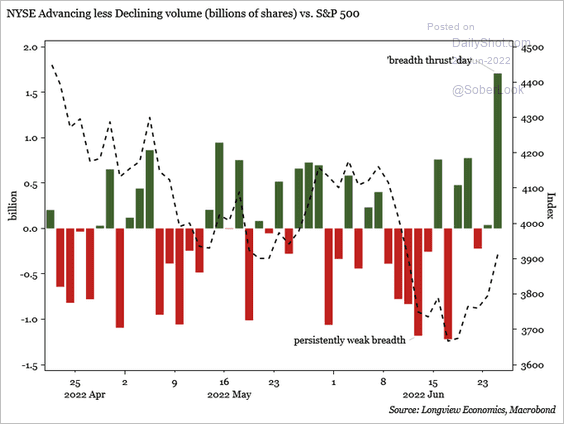

5. Market breadth has improved.

Source: @Lvieweconomics

Source: @Lvieweconomics

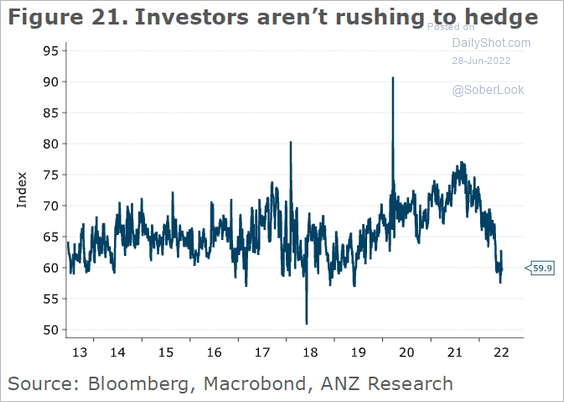

6. Skew indicators point to limited demand for downside protection.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Credit

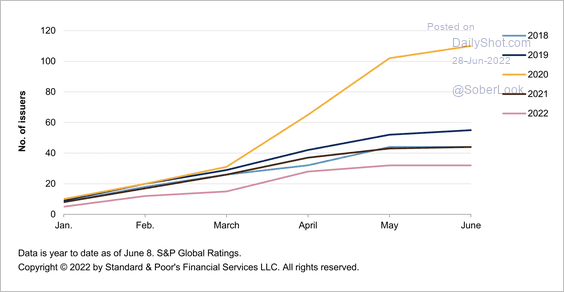

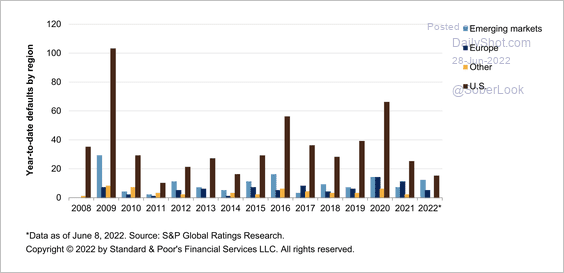

1. The pace of global corporate defaults has slowed so far this year compared to the previous five years.

Source: S&P Global Ratings

Source: S&P Global Ratings

Corporate defaults in the US are currently much lower than in previous years.

Source: S&P Global Ratings

Source: S&P Global Ratings

——————–

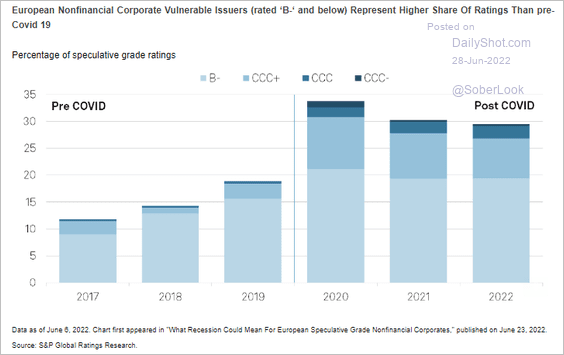

2. The share of stressed EUR HY debt remains well above pre-COVID levels.

Source: S&P Global Ratings Read full article

Source: S&P Global Ratings Read full article

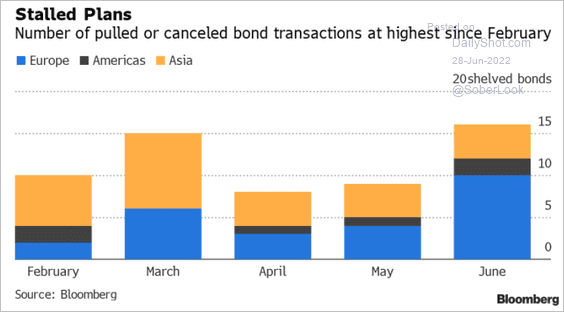

3. A lot of bond deals got pulled this month.

Source: Jacqueline Poh, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: Jacqueline Poh, @TheTerminal, Bloomberg Finance L.P. Read full article

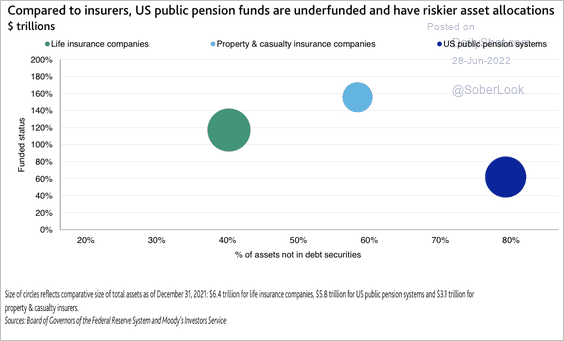

4. The corporate funding strength of US life, property, and casualty insurance companies is substantial relative to public pension systems.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

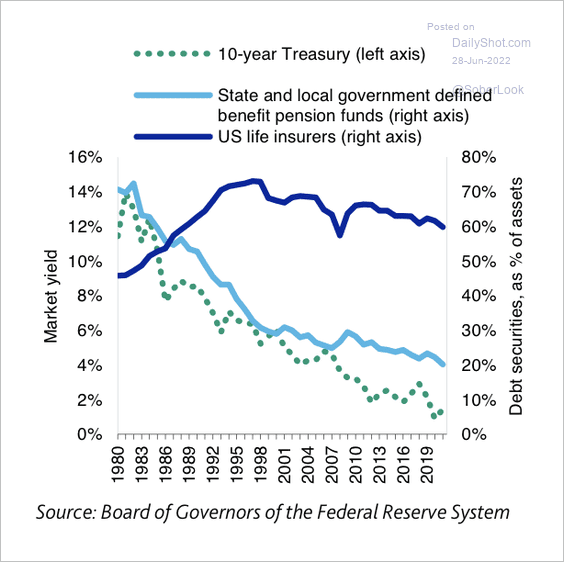

• US public pension systems have shifted away from fixed-income securities as interest rates fell.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

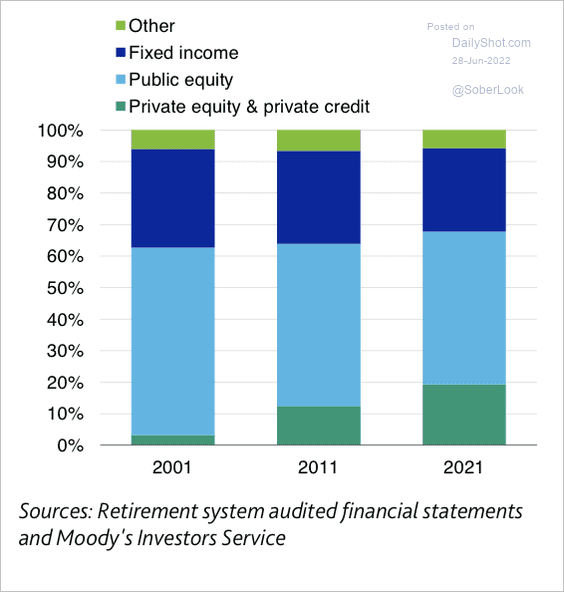

• US public pension systems are increasingly relying on private equity and private credit in pursuit of higher returns (with higher risk). The chart shows aggregated investment allocation of the top 10 largest pension systems.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

Back to Index

Rates

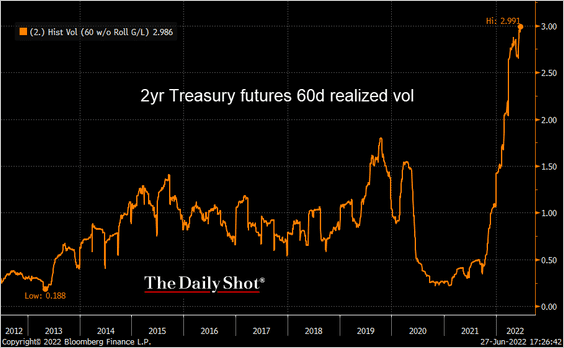

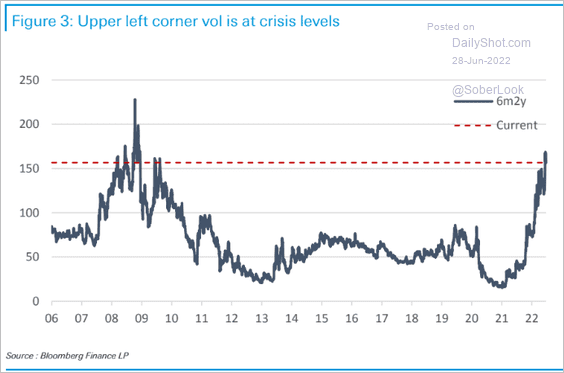

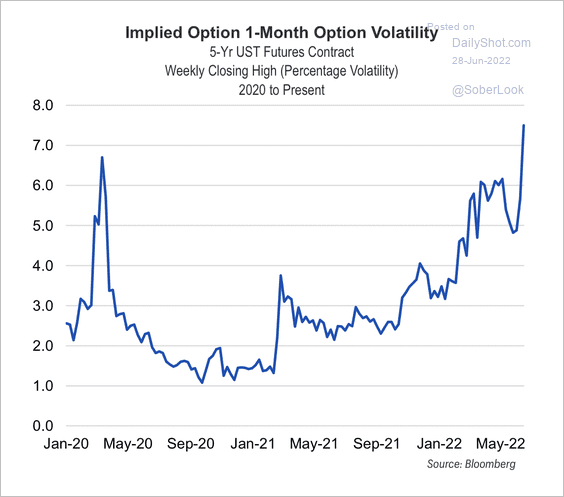

1. Short-term rates volatility has been massive.

• 2yr Treasury futures realized vol:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Implied vol on 2yr rates, 6-months forward:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Implied vol for the one-month option on the 5-year Treasury futures contract:

Source: FHN Financial

Source: FHN Financial

——————–

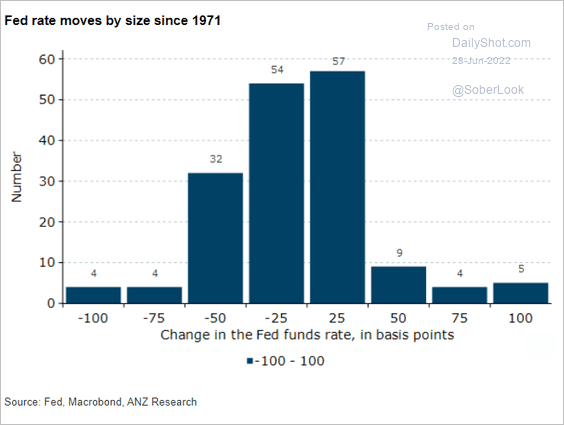

2. Here is the distribution of Fed rate changes since 1971.

Source: @ANZ_Research

Source: @ANZ_Research

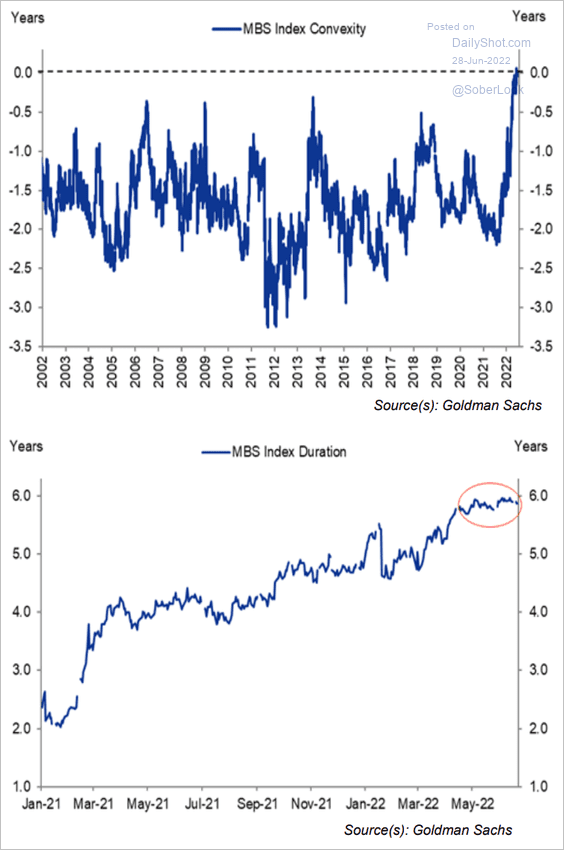

3. MBS convexity is gone as mortgage refi activity grinds to a halt (the prepay option is now too deep out-of-the-money). Durations are higher.

Source: Goldman Sachs; III Capital Management

Source: Goldman Sachs; III Capital Management

Back to Index

Global Developments

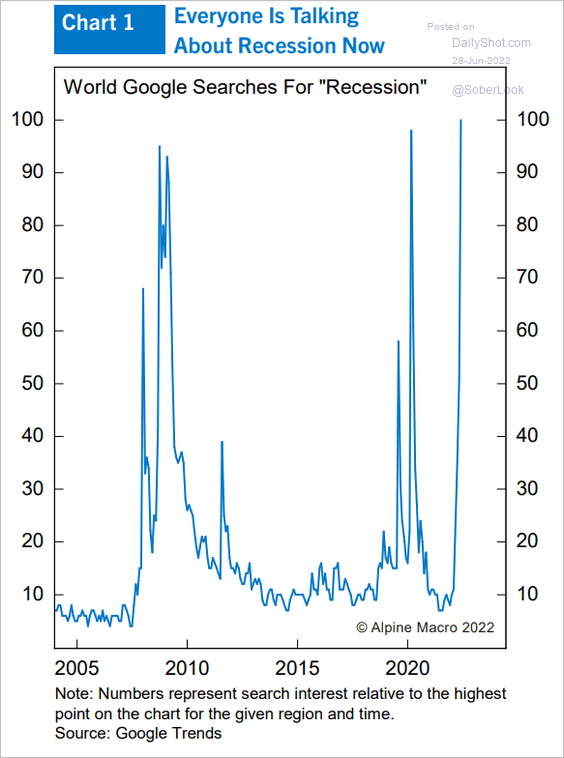

1. Google search activity for “recession” has been surging.

Source: Alpine Macro

Source: Alpine Macro

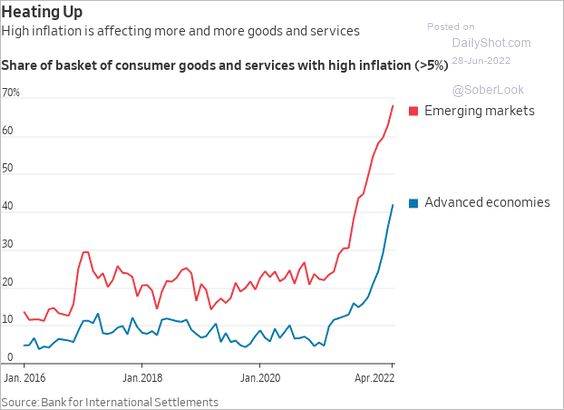

2. Here is the share of inflation components with prices climbing by more than 5%.

Source: @WSJ Read full article

Source: @WSJ Read full article

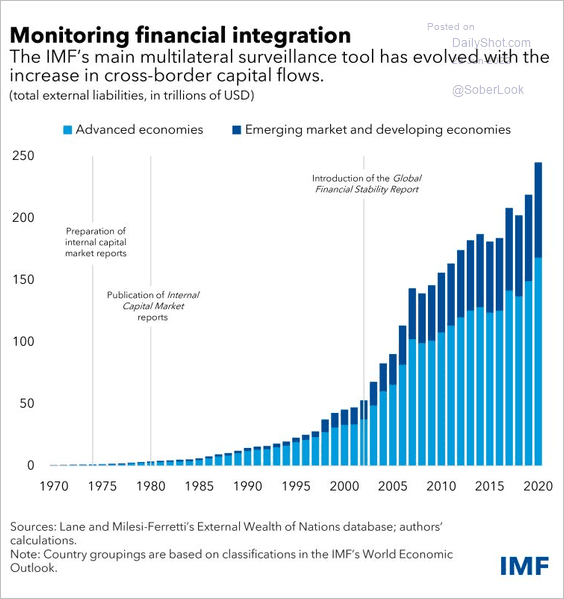

3. Cross-border liabilities continue to rise.

Source: IMF Read full article

Source: IMF Read full article

——————–

Food for Thought

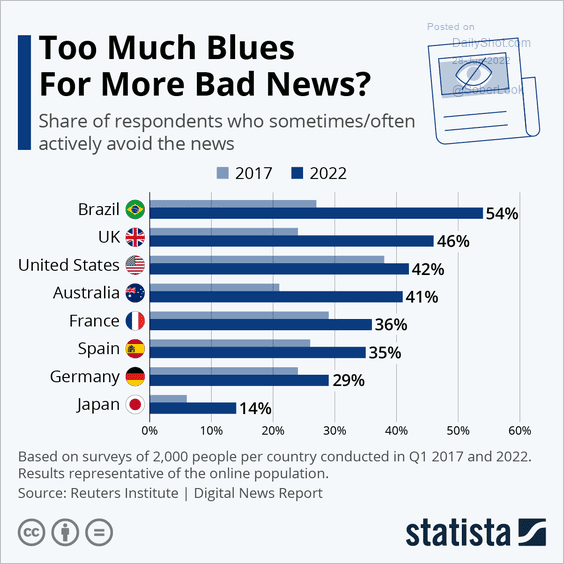

1. Avoiding the news:

Source: Statista

Source: Statista

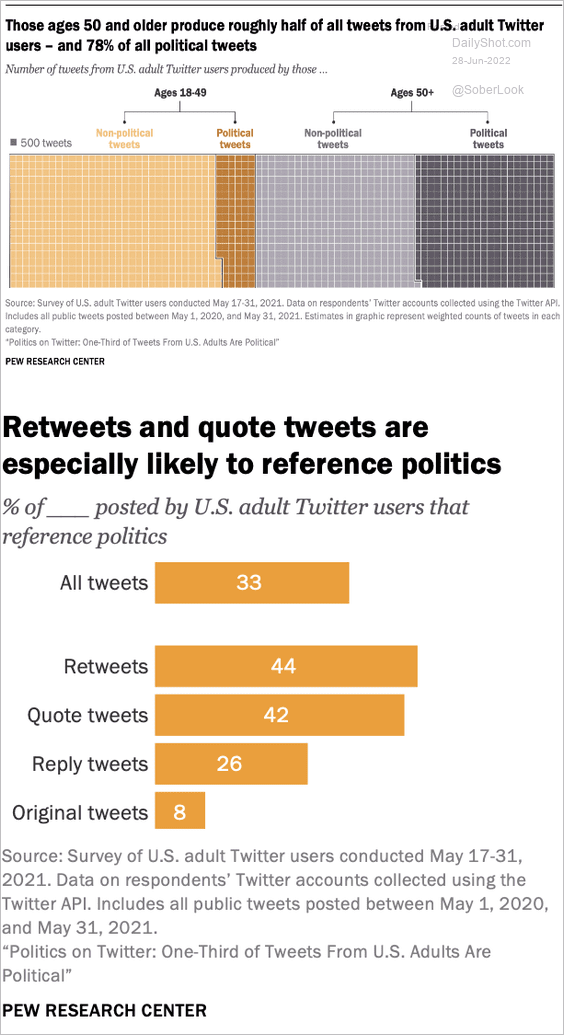

2. Politics on Twitter:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

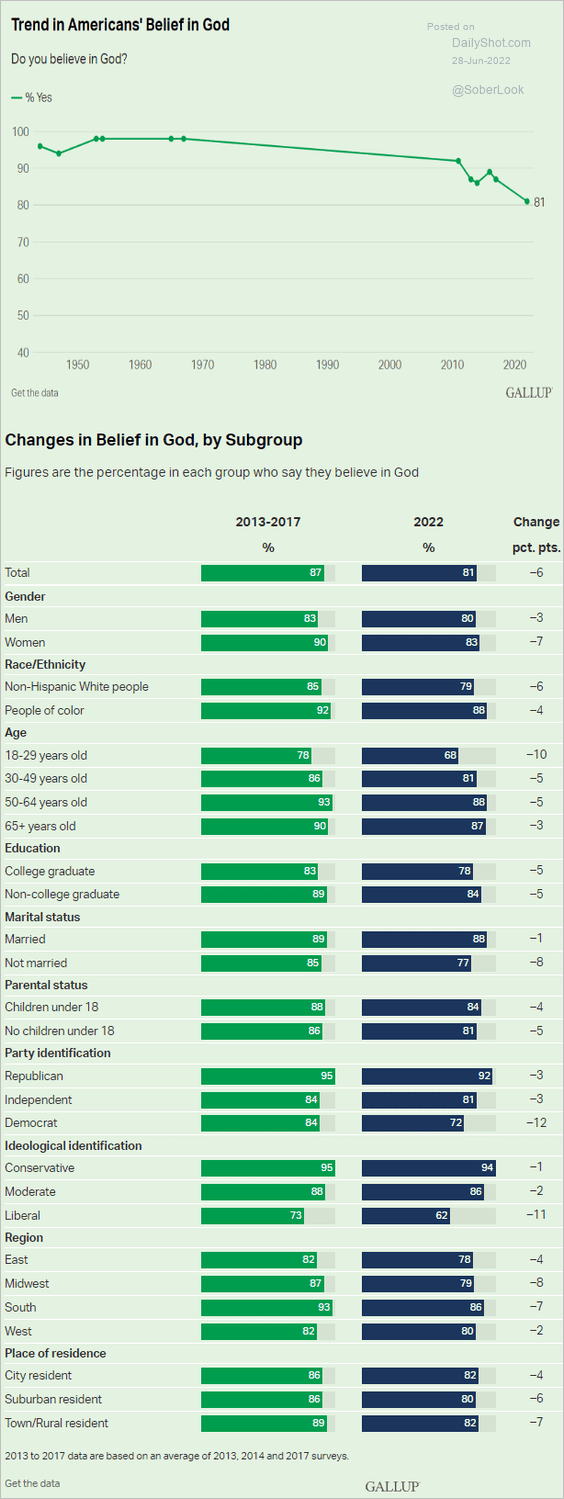

3. Belief in God in the US:

Source: Gallup Read full article

Source: Gallup Read full article

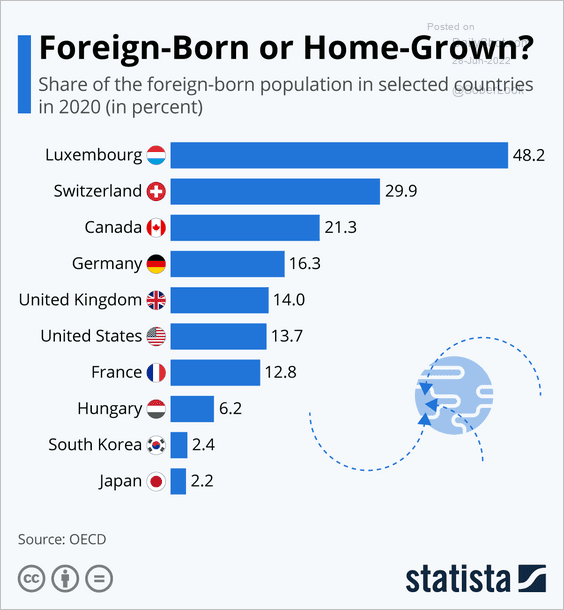

4. Foreign-born population by country:

Source: Statista

Source: Statista

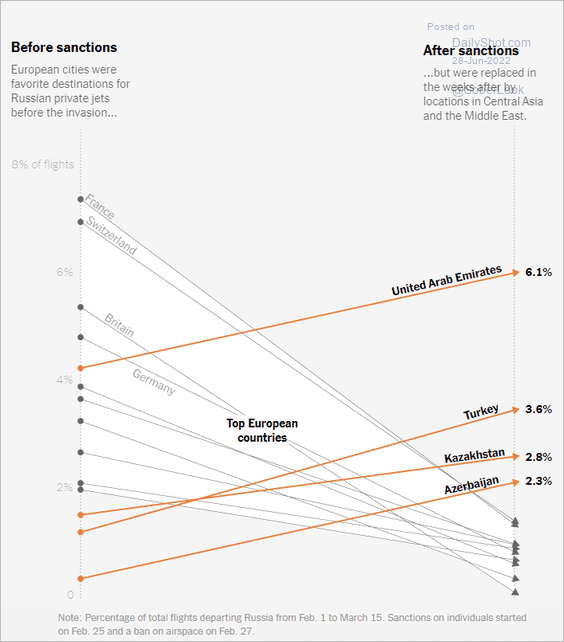

5. Favorite destinations of Russian private jets:

Source: The New York Times Read full article

Source: The New York Times Read full article

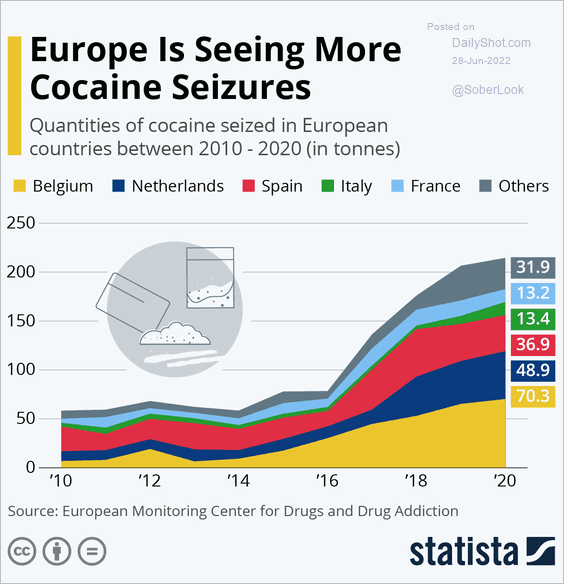

6. Cocaine seizures in Europe

Source: Statista

Source: Statista

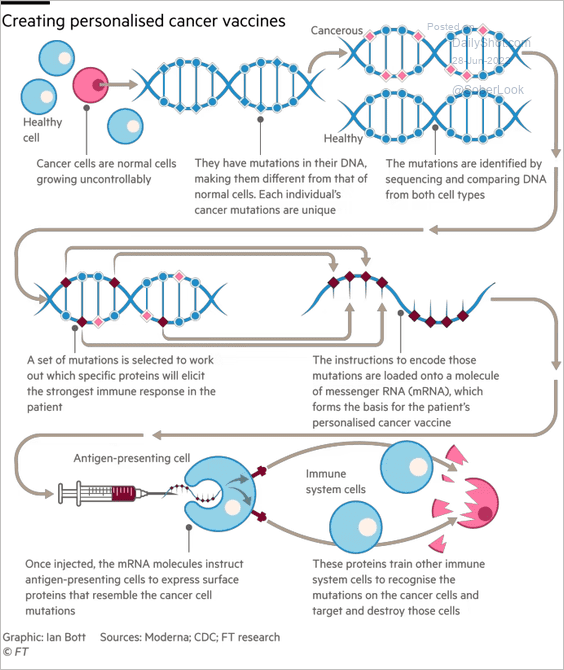

7. Training the immune system to attack cancer cells with personalized vaccines:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

Back to Index