The Daily Shot: 29-Jun-22

• The United States

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

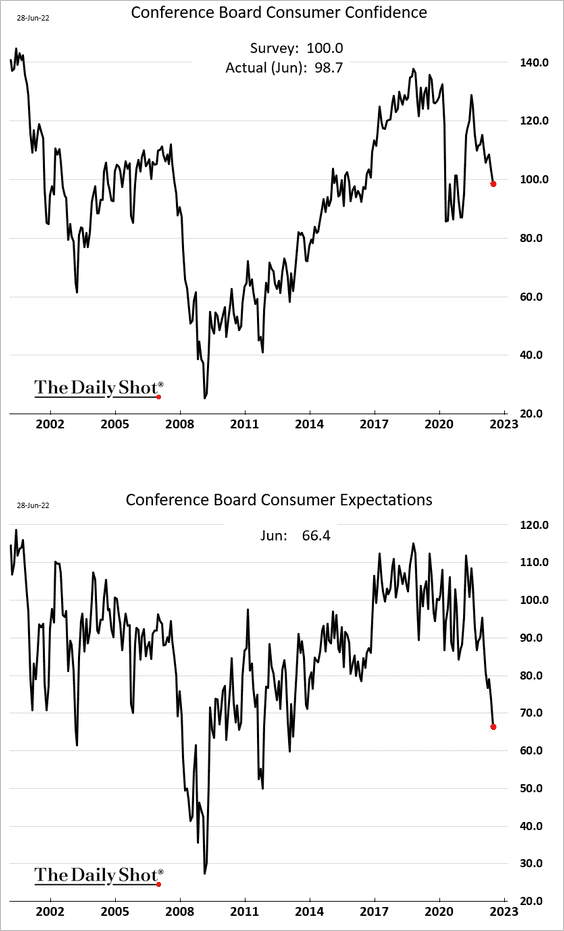

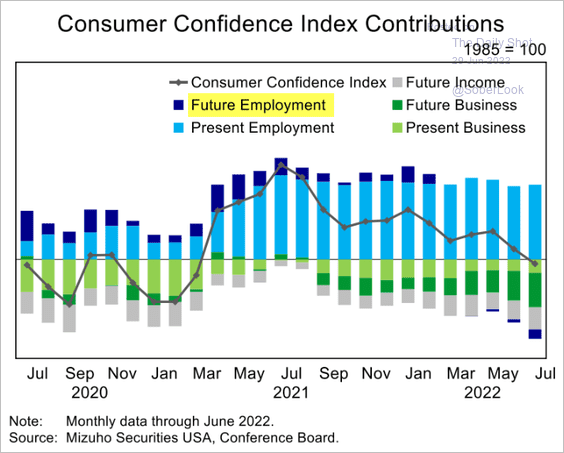

1. The Conference Board’s consumer confidence report came in below forecasts, with the expectations index tumbling to levels not seen in nearly a decade. This was one of the triggers for Tuesday’s 2% drop in the S&P 500, as recession concerns mount.

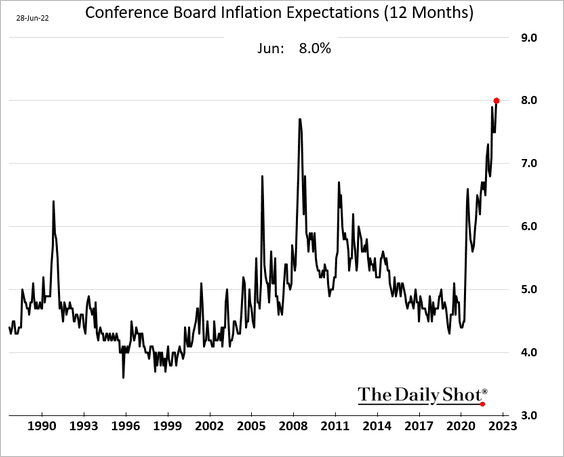

• The Conference Board’s inflation expectations index hit a record high.

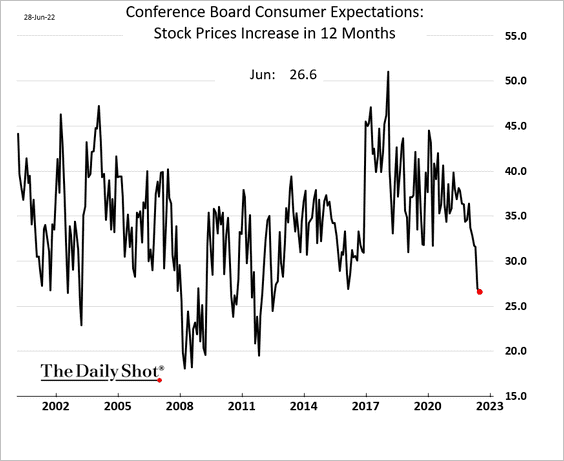

• Consumers are increasingly gloomy about the stock market.

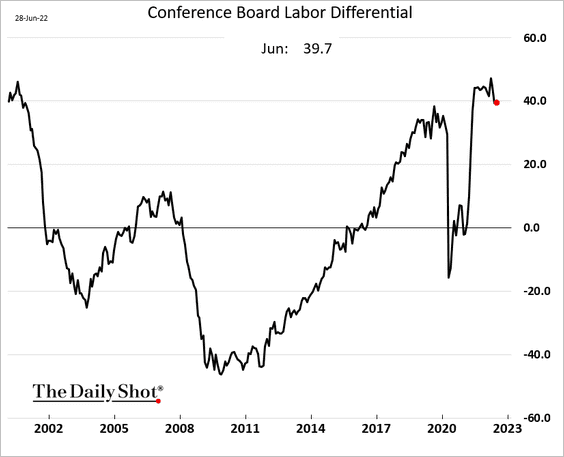

• The labor differential (“jobs plentiful” vs. “jobs hard to get”) remains elevated.

However, consumers are becoming concerned about job prospects going forward. The “future employment” component is now a drag on the overall confidence index.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

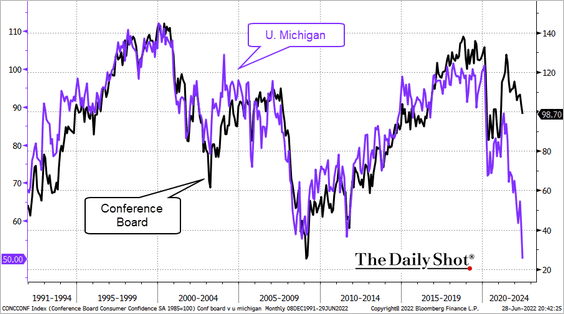

• The Conference Board’s sentiment indicator remains well above the U. Michigan’s survey.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

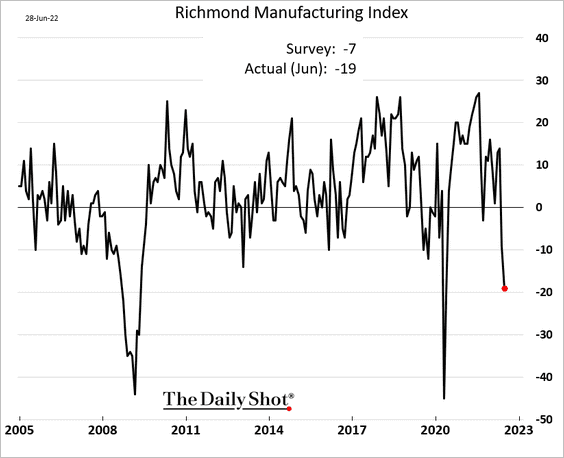

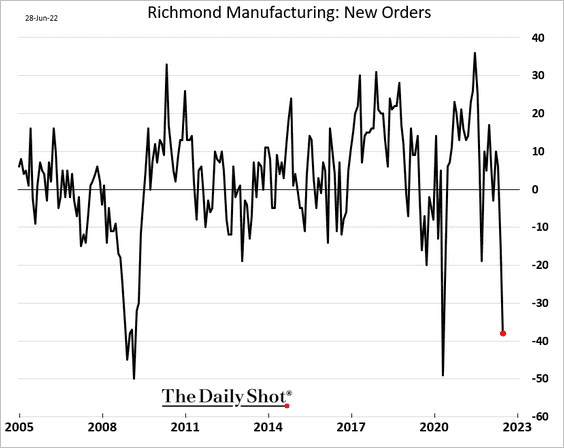

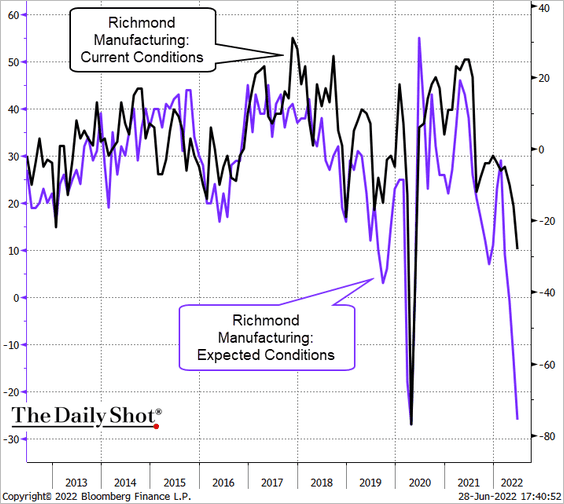

2. The Richmond Fed’s regional manufacturing index plunged this month, …

… as demand deteriorates. Sounds familiar? This trend is playing out across the country.

• Outlook slumped.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

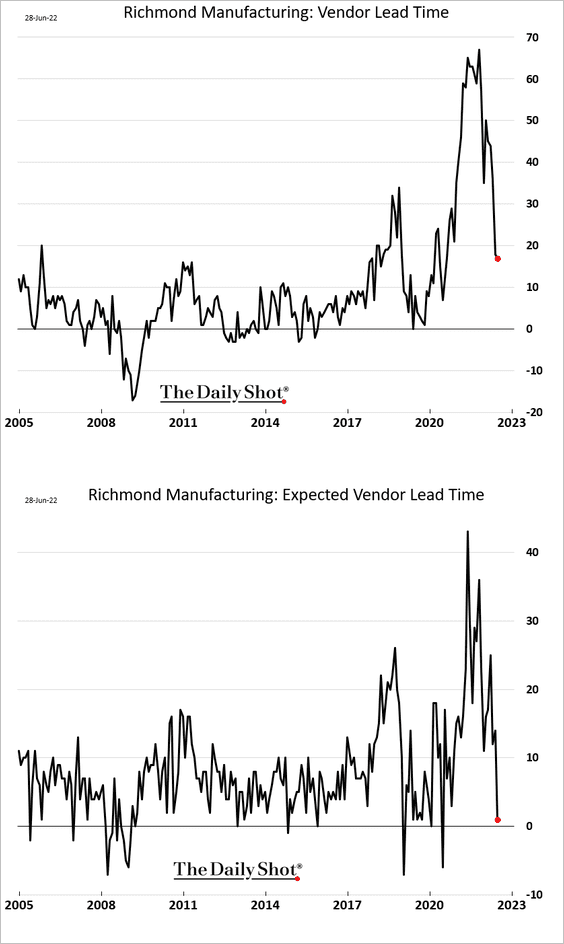

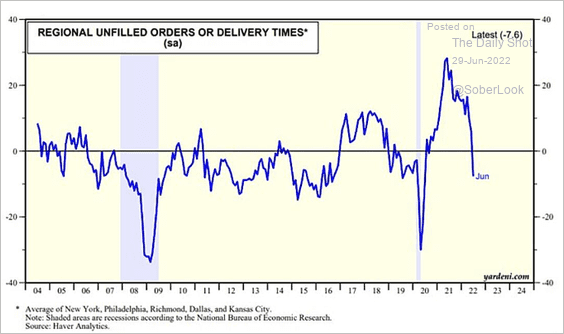

• Supply chain delays are easing, …

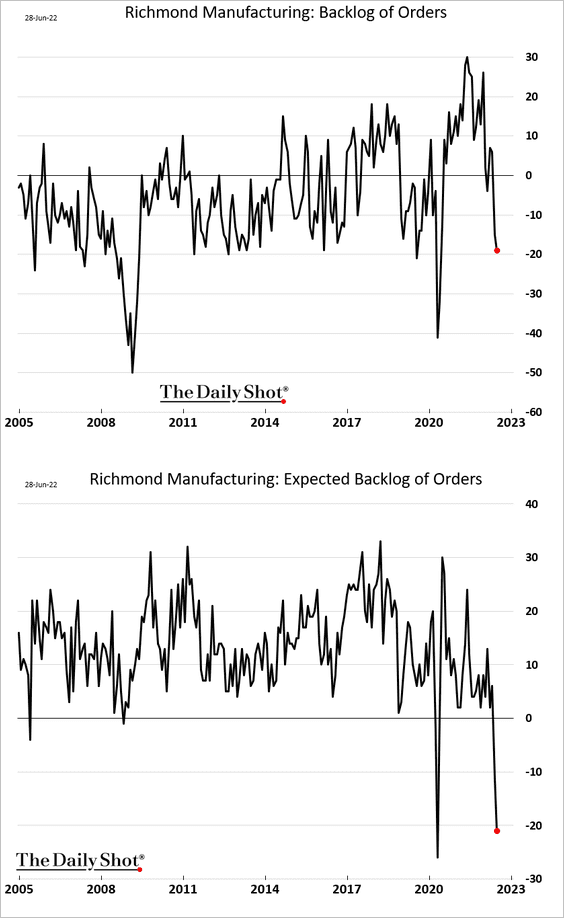

… and order backlogs are depleted, as demand slows.

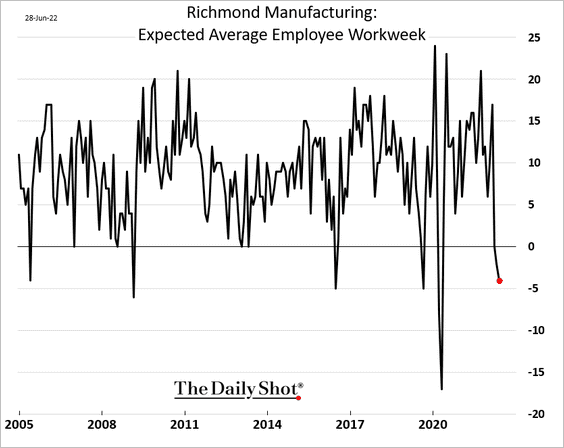

• Factories expect fewer hours for workers in the months ahead.

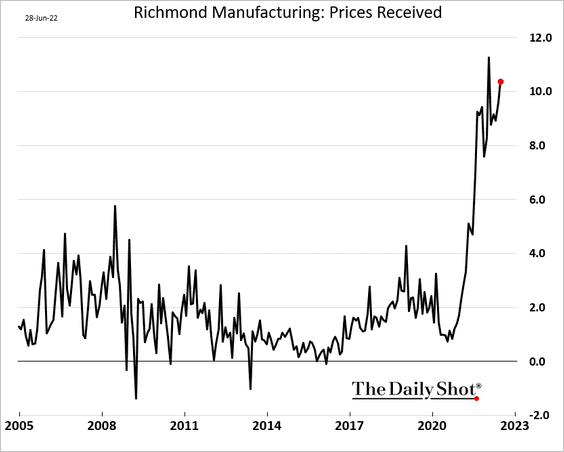

• Despite weaker demand, manufacturers are still boosting prices.

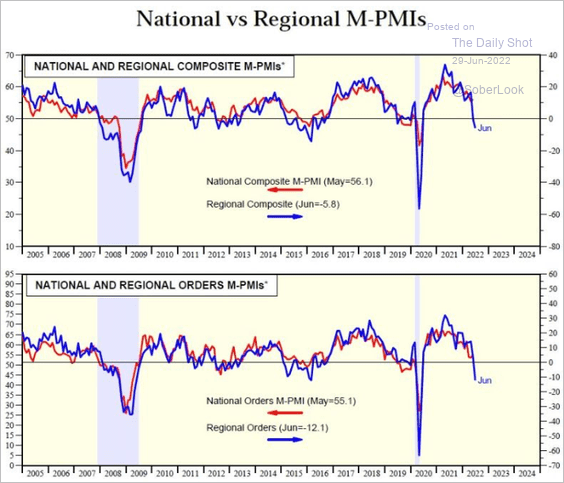

The regional Fed indicators point to manufacturing contraction at the national level this month.

Source: Yardeni Research

Source: Yardeni Research

——————–

2. Supply bottlenecks are now on land.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

But as we saw across the regional manufacturing reports, delivery times are getting shorter as demand stalls.

Source: Yardeni Research

Source: Yardeni Research

——————–

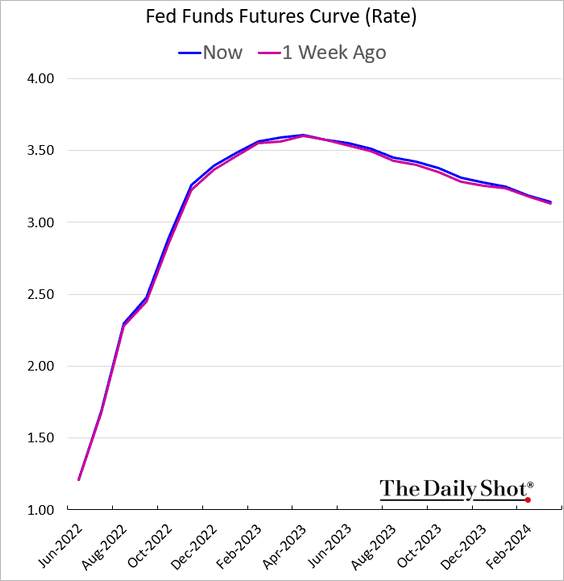

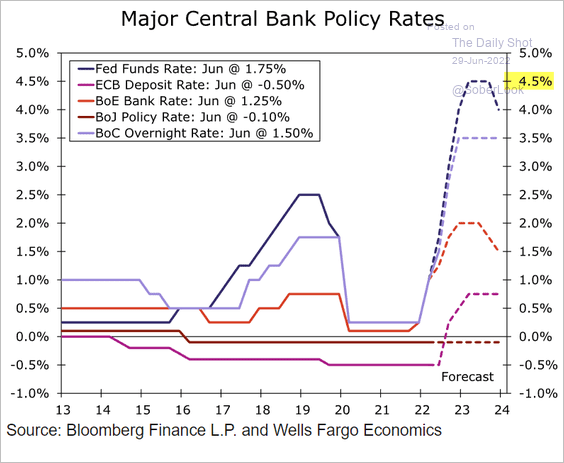

3. The market still doesn’t expect the Fed to raise rates much above 3.5%.

What if these expectations are too dovish? Could the market be off by nearly 100 bps as the Wells Fargo projections show? What would that mean for equity markets?

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

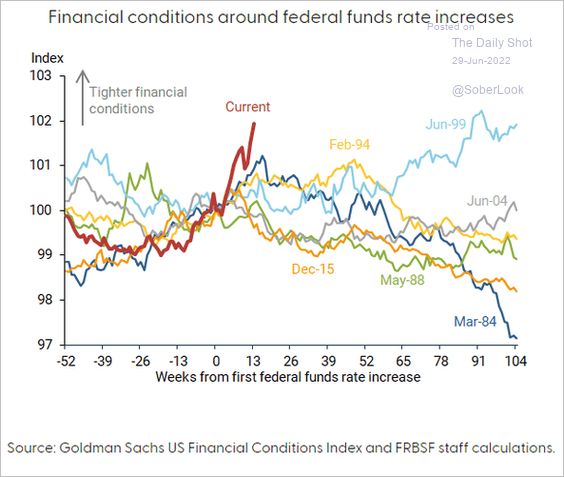

4. Financial conditions tightened faster in this hiking cycle than in previous ones.

Source: @ReutersJamie; FRBSF Read full article

Source: @ReutersJamie; FRBSF Read full article

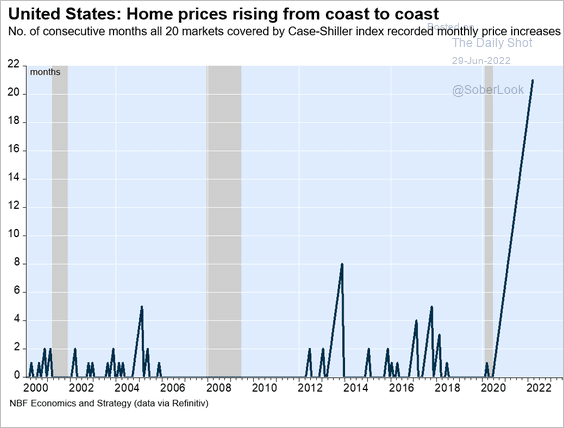

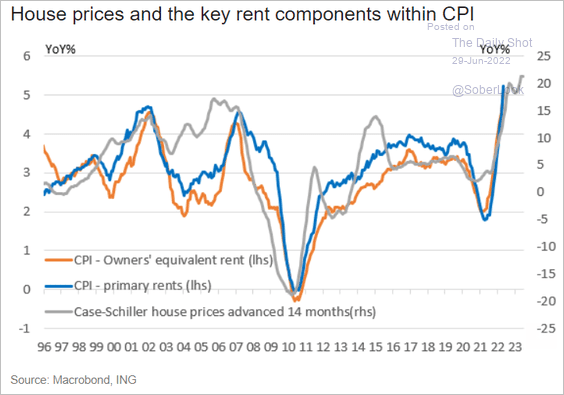

5. Home price appreciation hit a new record in April according to the Case-Shiller housing price index.

• The breadth of the rally in home prices has been unprecedented.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

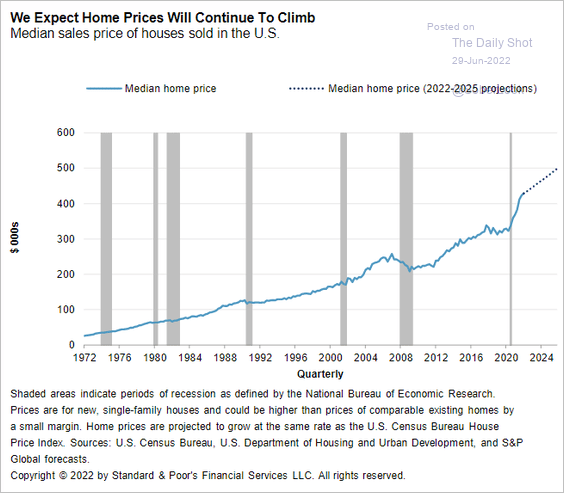

• S&P Global Ratings expects home prices to keep climbing, albeit at a slower rate.

Source: S&P Global Ratings

Source: S&P Global Ratings

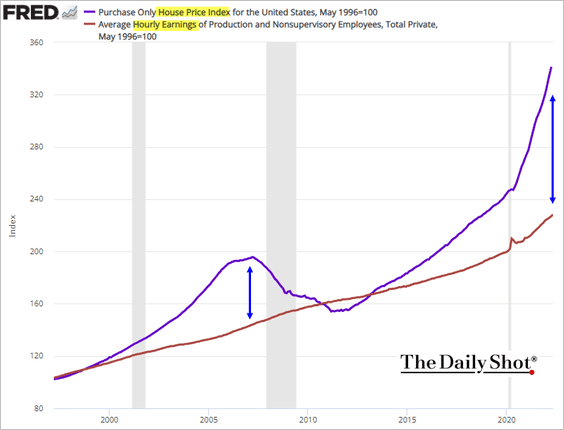

• The divergence between home prices and wages continues to widen.

• What does record-high home price appreciation tell us about housing-related inflation?

Source: ING

Source: ING

——————–

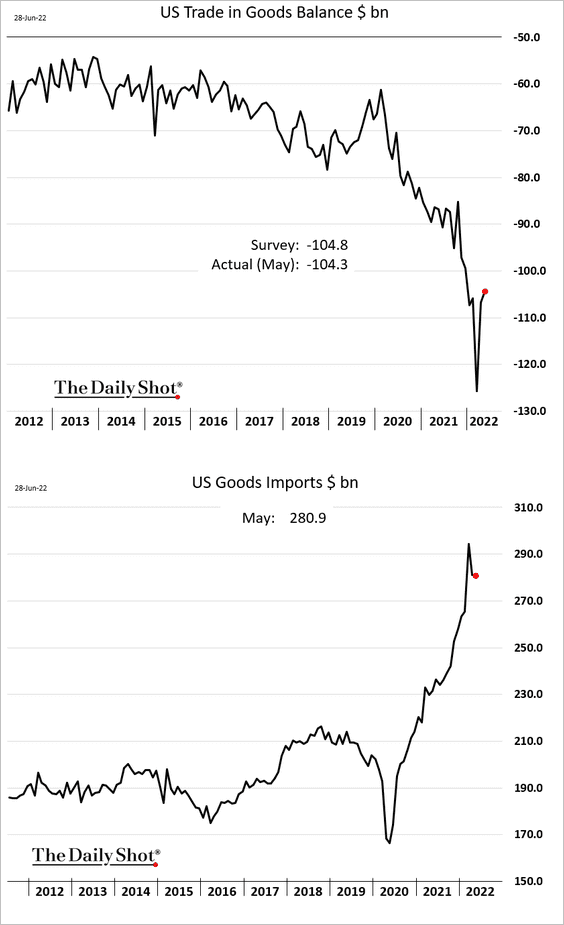

6. The goods trade gap eased further in May, which is a tailwind for Q2 GDP growth.

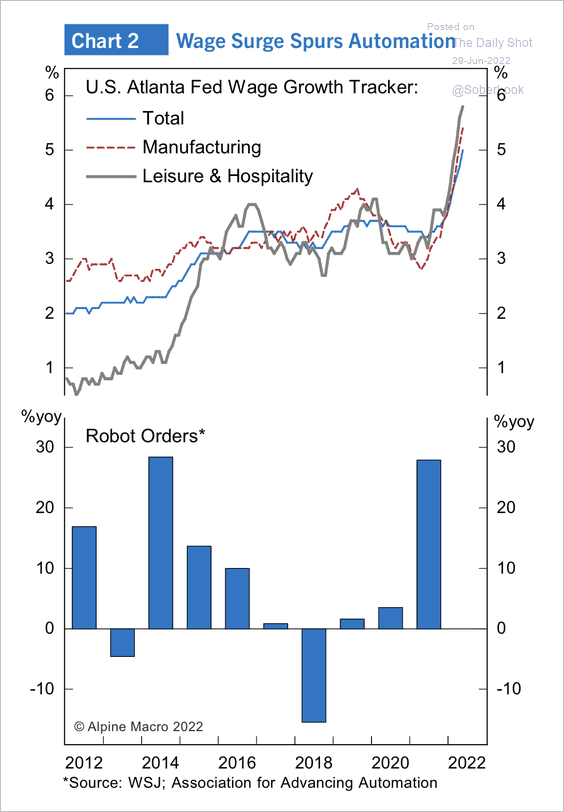

7. Robot orders have increased alongside rising wages.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

The Eurozone

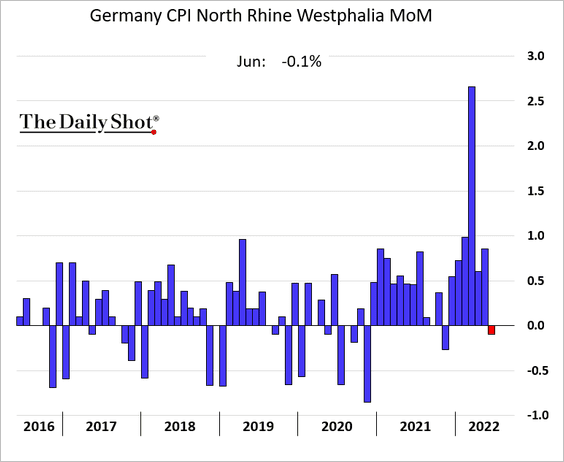

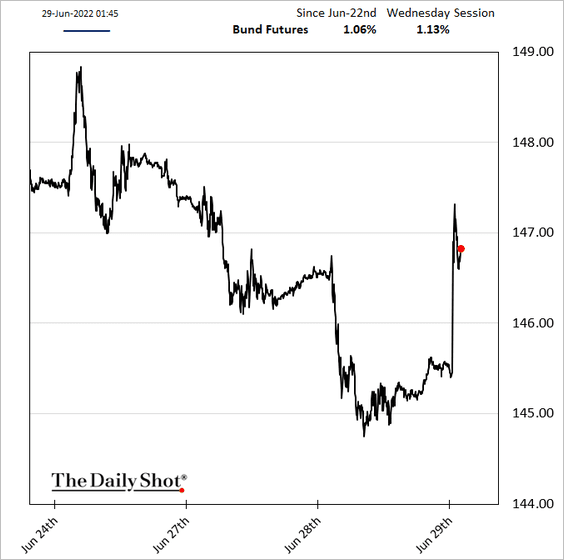

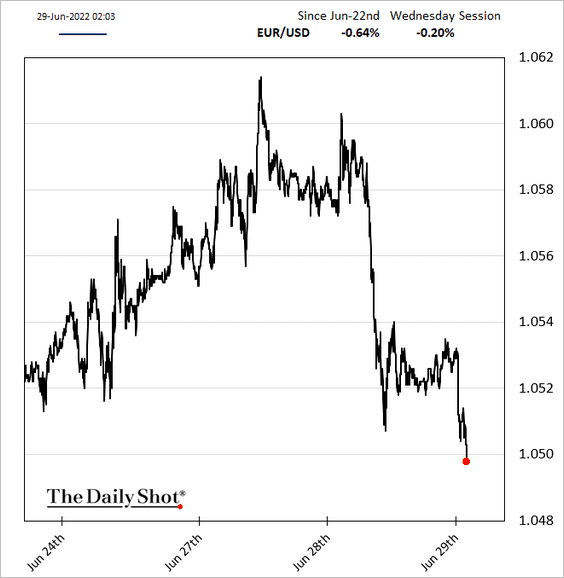

1. There was a hint of slower inflation in Germany.

Bund futures jumped and the euro sold off.

——————–

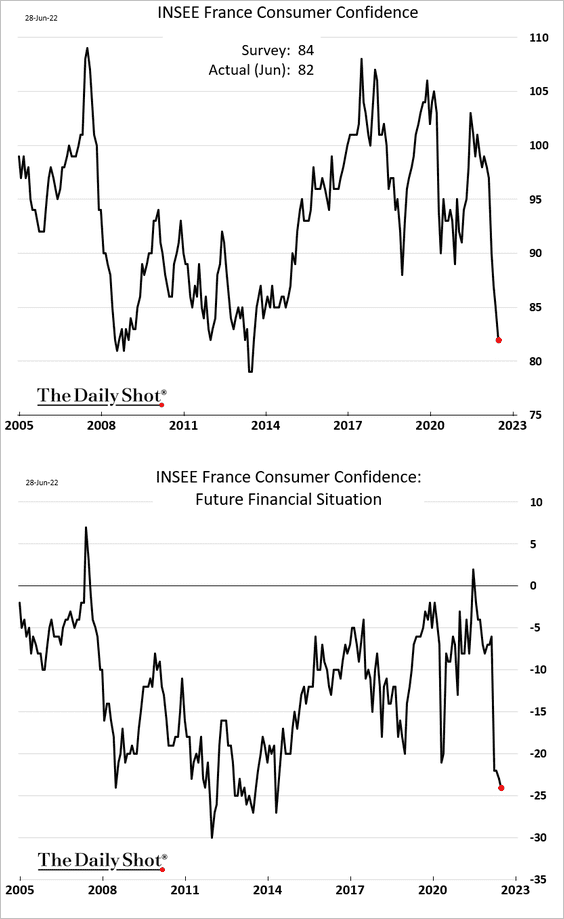

2. French consumer confidence continued to plummet in June (similar to what we see in Germany).

3. Tumbling consumer sentiment will be a drag on retail sales.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

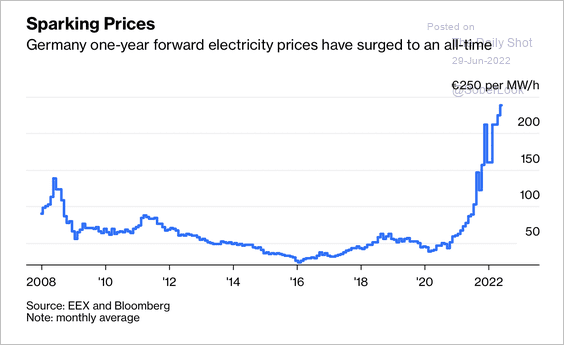

4. German electricity prices have surged to an all-time high. Forward contracts, which lock in energy costs, are getting more expensive by the day.

Source: @JavierBlas Read full article

Source: @JavierBlas Read full article

Back to Index

Asia – Pacific

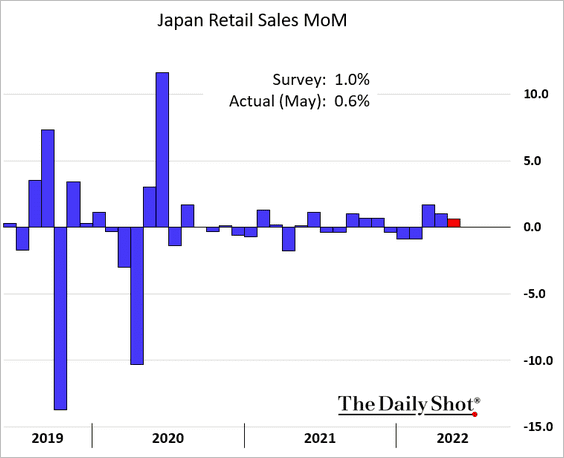

1. Japan’s May retail sales were softer than expected.

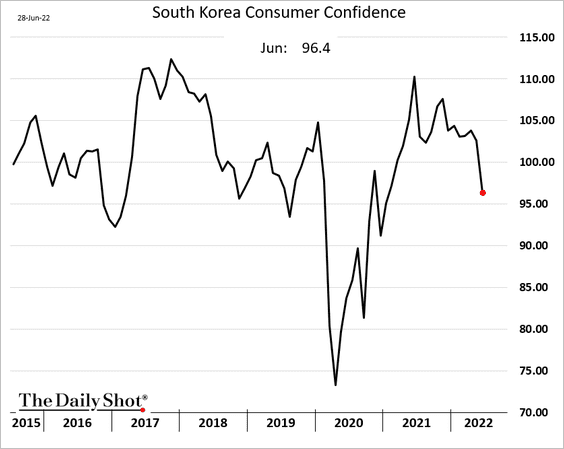

2. South Korea’s consumer confidence is rolling over.

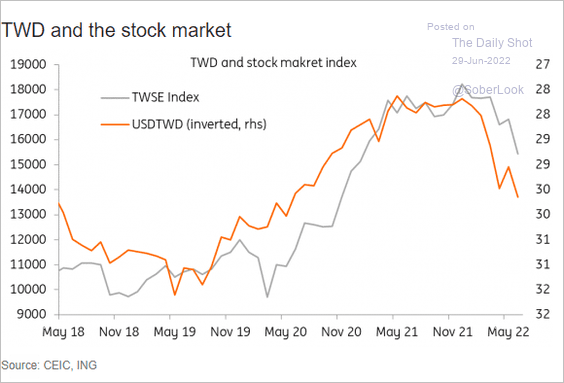

3. Taiwan’s currency and stocks are under pressure amid capital outflows.

Source: ING

Source: ING

4. Australian retail sales have been very strong.

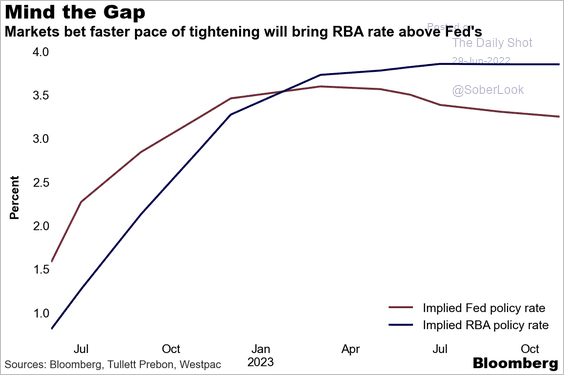

Separately, the market expects the RBA to outpace the Fed’s tightening next year.

Source: Masaki Kondo, @TheTerminal, Bloomberg Finance L.P.

Source: Masaki Kondo, @TheTerminal, Bloomberg Finance L.P.

Back to Index

China

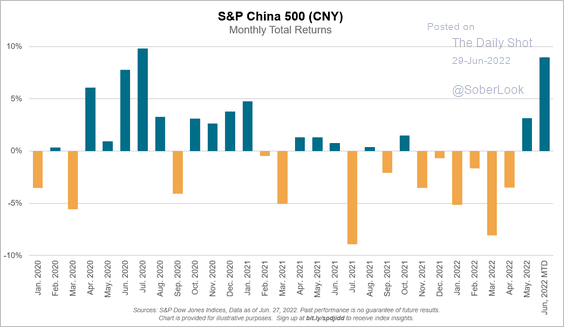

1. It’s been a good month for China’s stocks.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

2. This chart shows Beijing’s regulatory vs. stimulus actions.

Source: Piper Sandler

Source: Piper Sandler

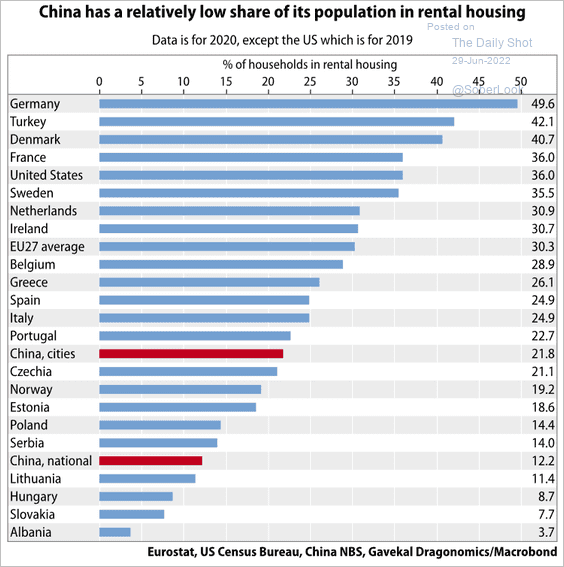

3. China’s rental housing share is relatively low.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

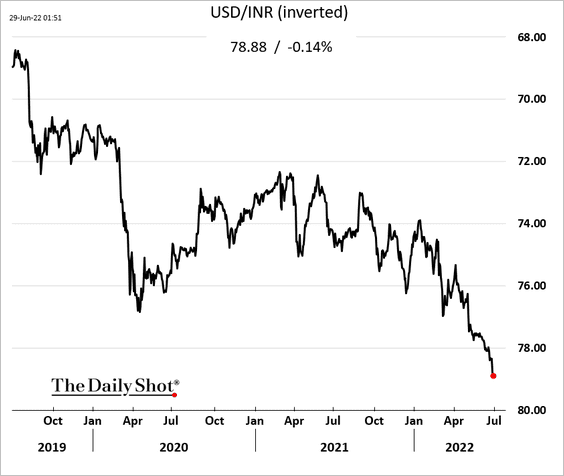

1. The rupee continues to hit record lows, as capital outflows from India accelerate.

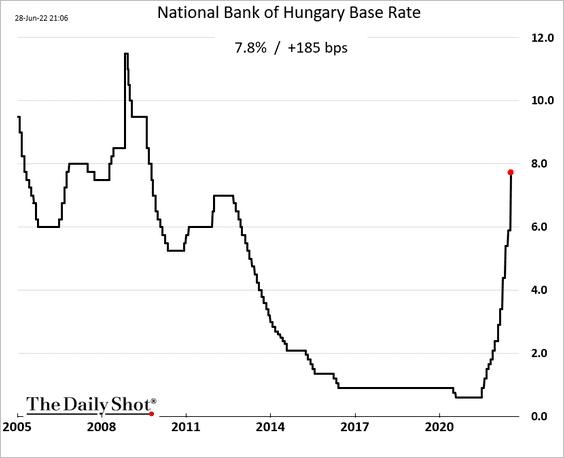

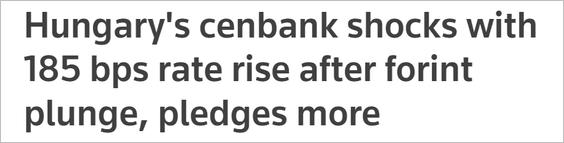

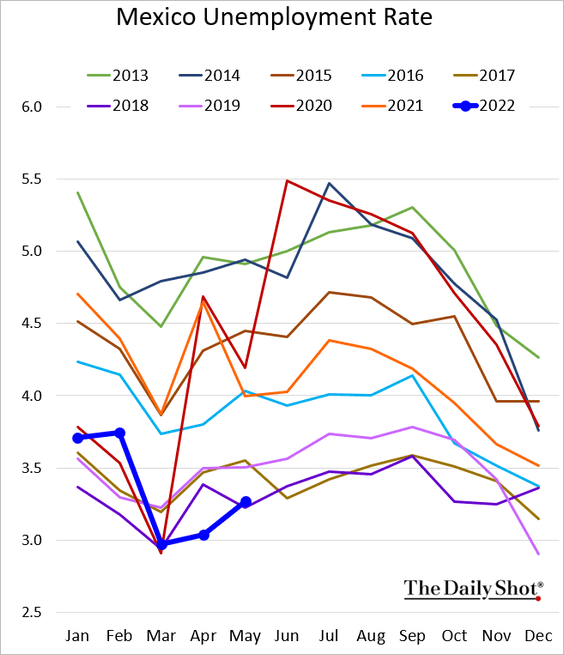

2. The Hungarian central bank shocked the markets with a 185 bps rate hike, …

Source: Reuters Read full article

Source: Reuters Read full article

… as the currency weakens.

——————–

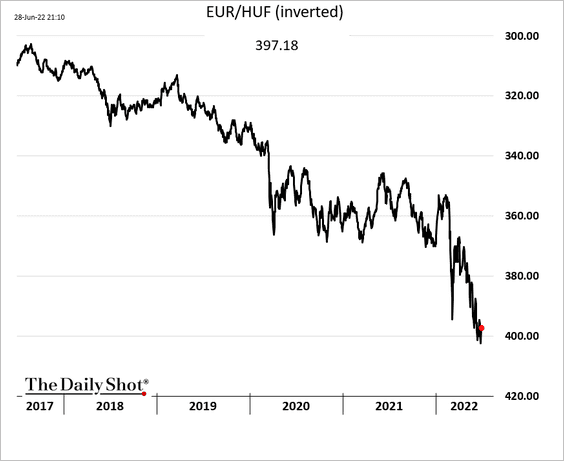

3. Mexican unemployment remains relatively low.

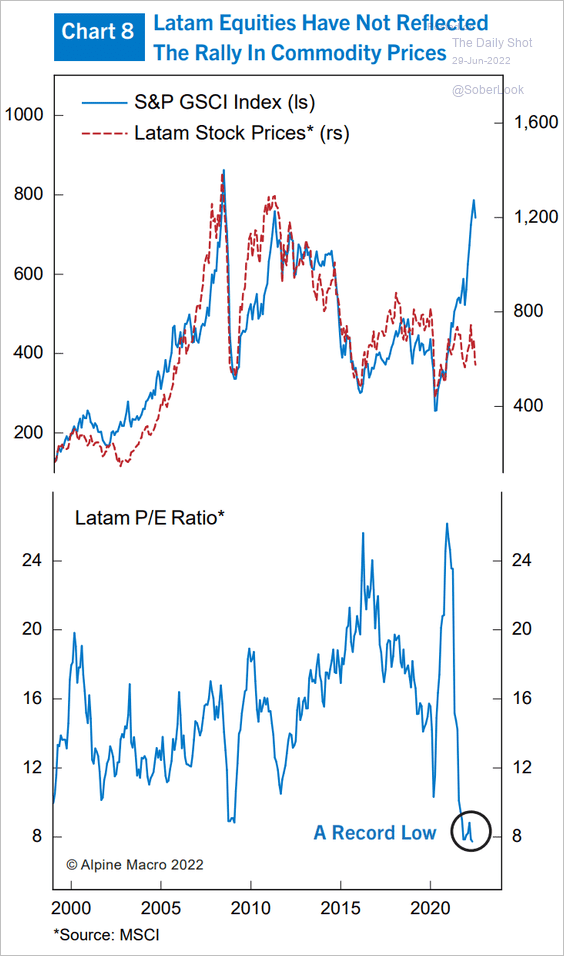

4. LatAm equities have been lagging commodities.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Cryptocurrency

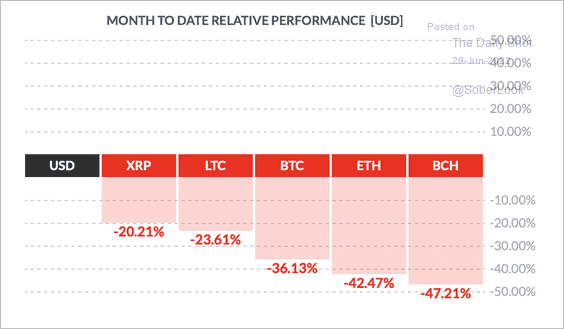

1. It has been a tough month for cryptos.

Source: FinViz

Source: FinViz

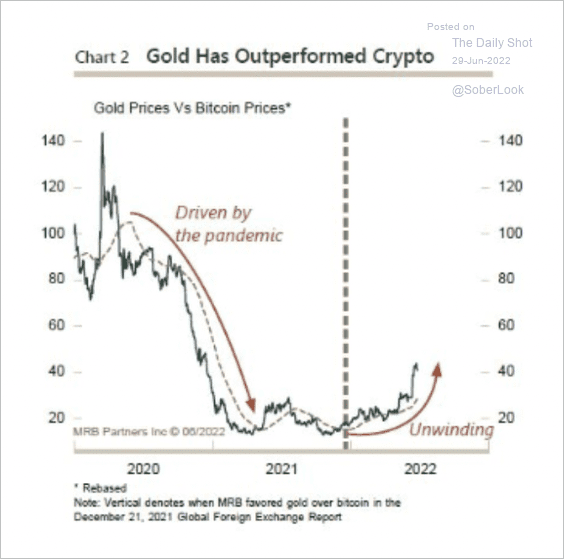

2. Gold has outperformed crypto during the current risk-off environment.

Source: MRB Partners

Source: MRB Partners

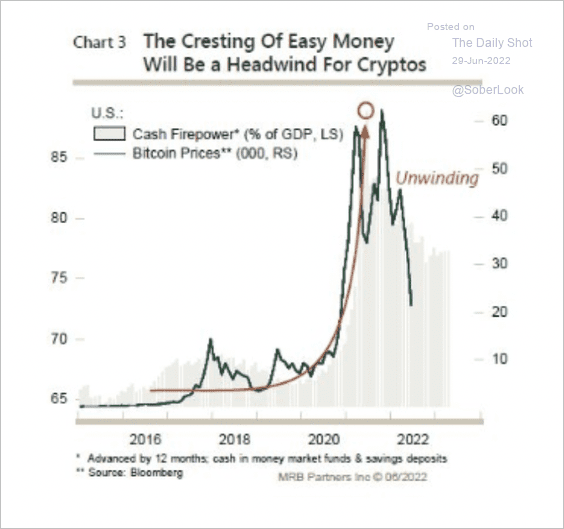

3. Tighter liquidity is a headwind for cryptos.

Source: MRB Partners

Source: MRB Partners

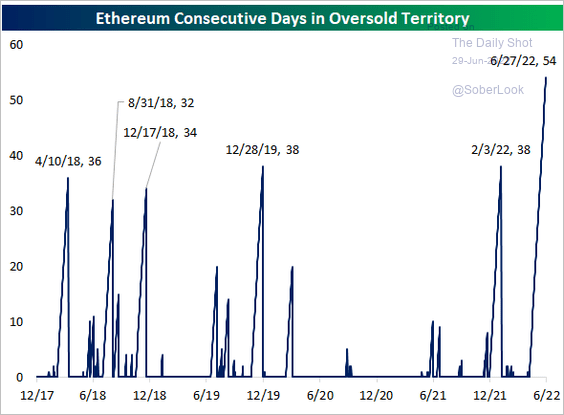

4. Ether has been in oversold territory for 54 days.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

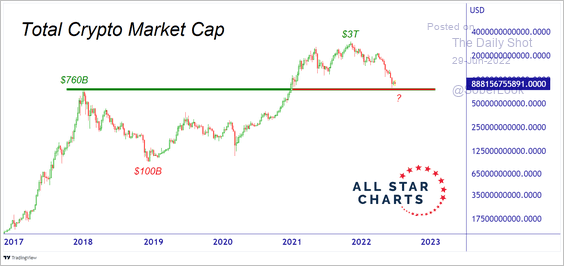

5. The total crypto market cap is at support.

Source: All Star Charts

Source: All Star Charts

Back to Index

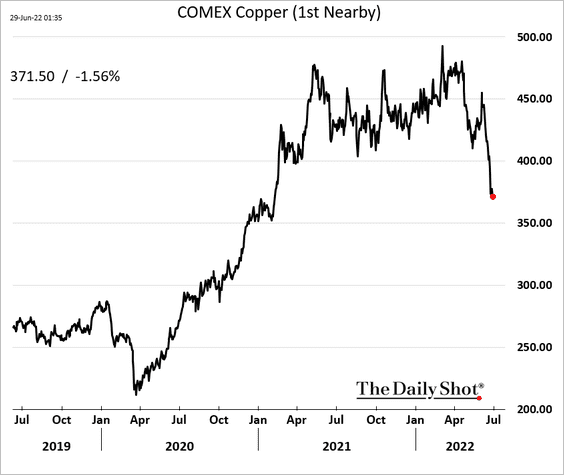

Commodities

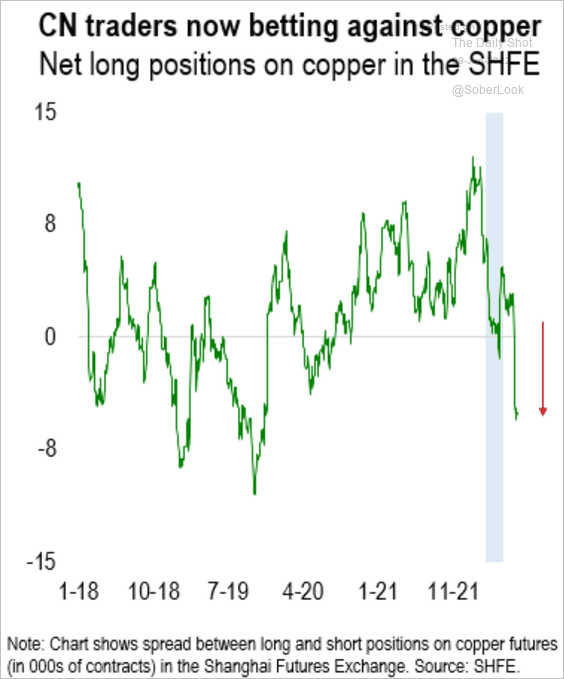

1. Copper is weaker again this morning, …

… and China’s traders are boosting their bets against the metal.

Source: Numera Analytics

Source: Numera Analytics

——————–

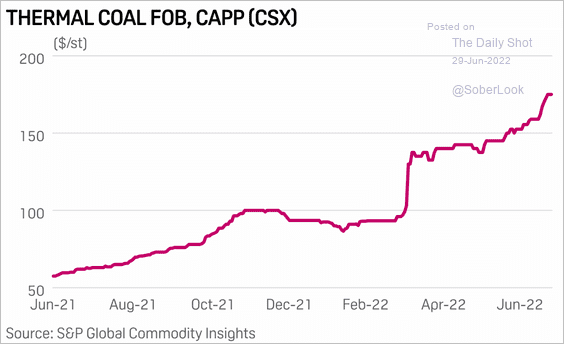

2. Thermal coal prices keep climbing.

Source: S&P Global Commodity Insights

Source: S&P Global Commodity Insights

Back to Index

Equities

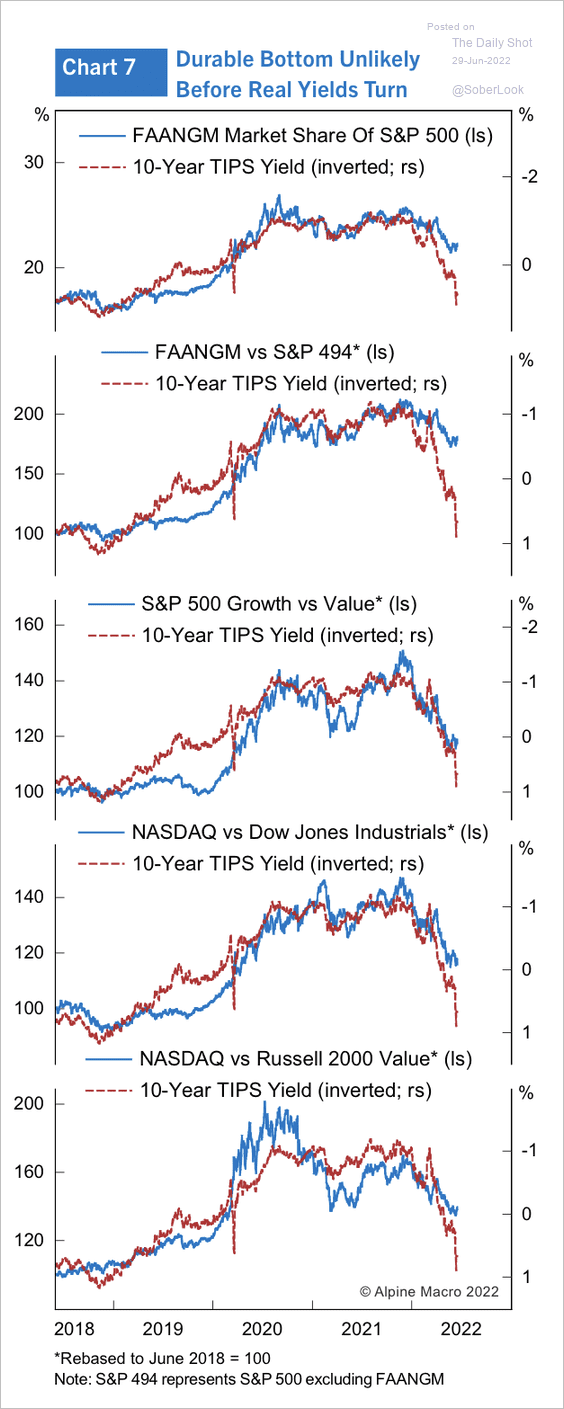

1. A sustained risk-on rally would require a reversal in real yields.

Source: Alpine Macro

Source: Alpine Macro

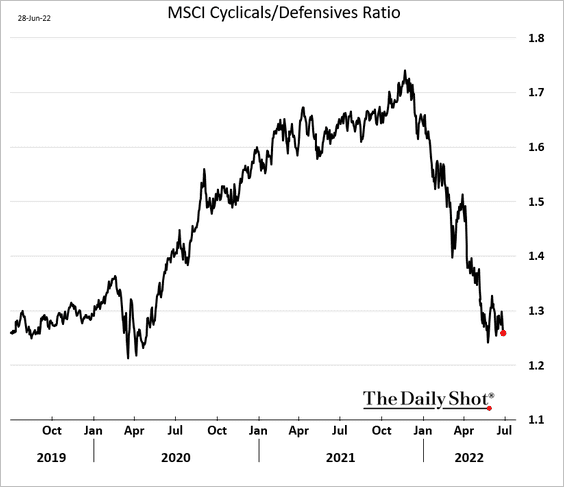

2. The cyclicals/defensives ratio has reversed the COVID-era gains.

3. Profit margin growth consensus estimates are much too optimistic.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

4. Analysts’ earnings forecasts tend to be overly optimistic around recessions.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

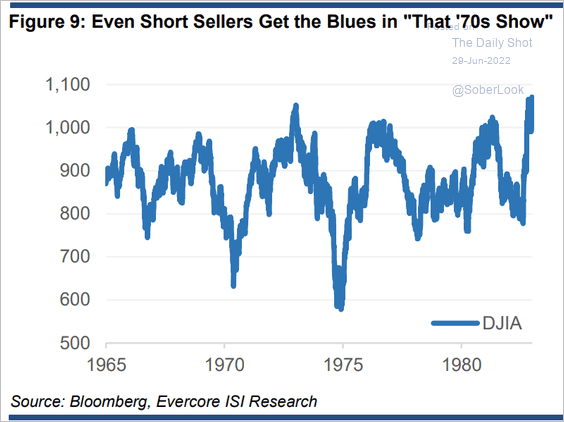

5. Should we expect a 70s-style multi-year sideways market?

Source: Evercore ISI Research

Source: Evercore ISI Research

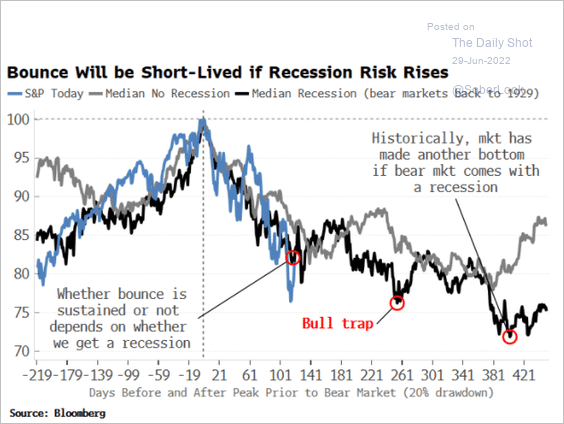

6. This is why investors are so concerned about the current economic downturn becoming a recession.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

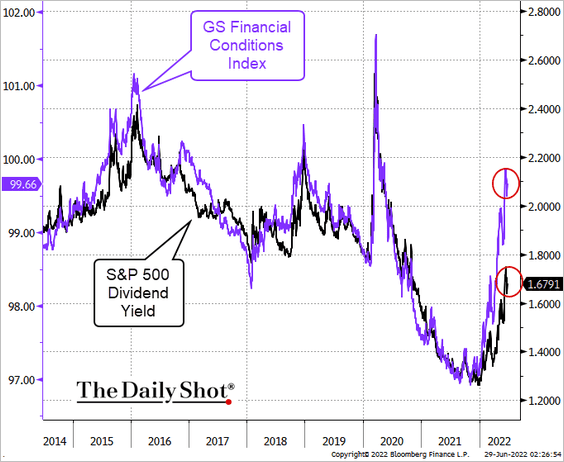

7. Tighter financial conditions require higher compensation for investors to take on risk. The S&P 500 dividend yield is about 40 bps too low. Since companies are not about to boost dividends in this environment, stock prices need to be substantially lower.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

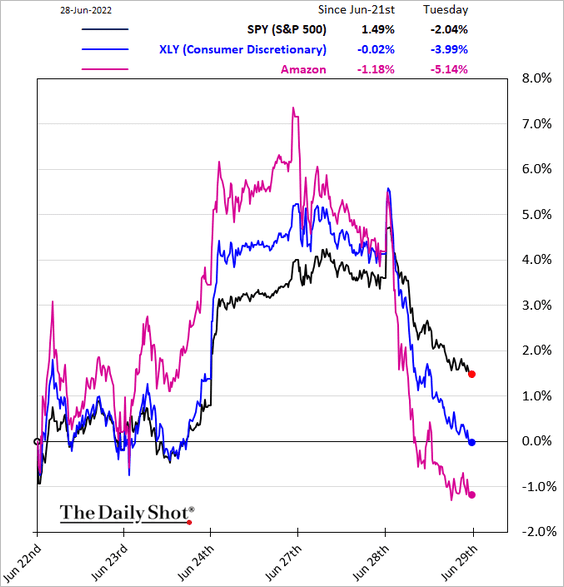

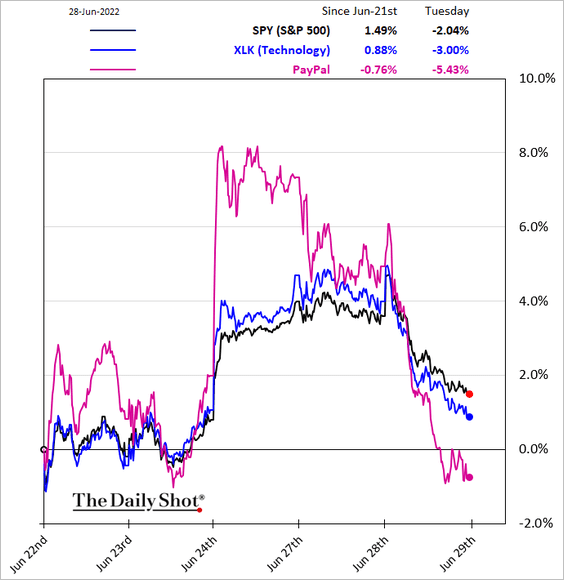

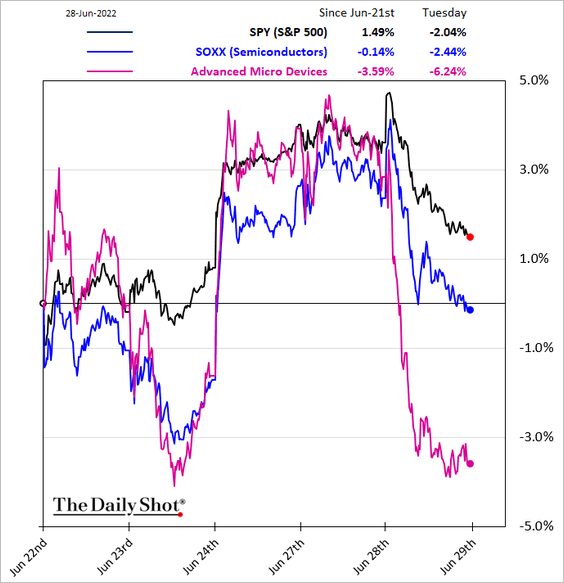

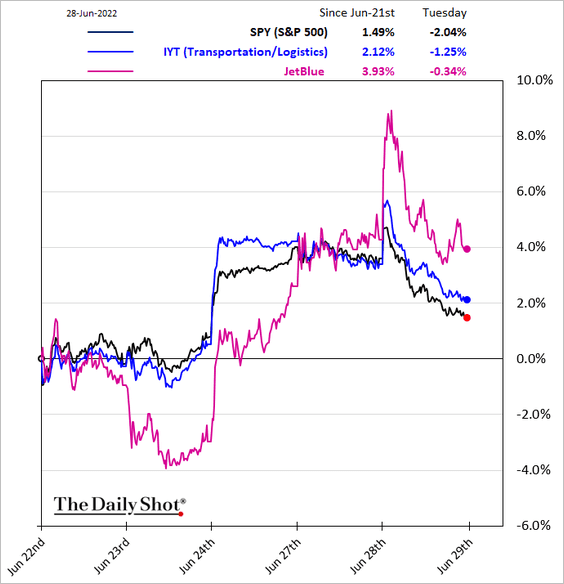

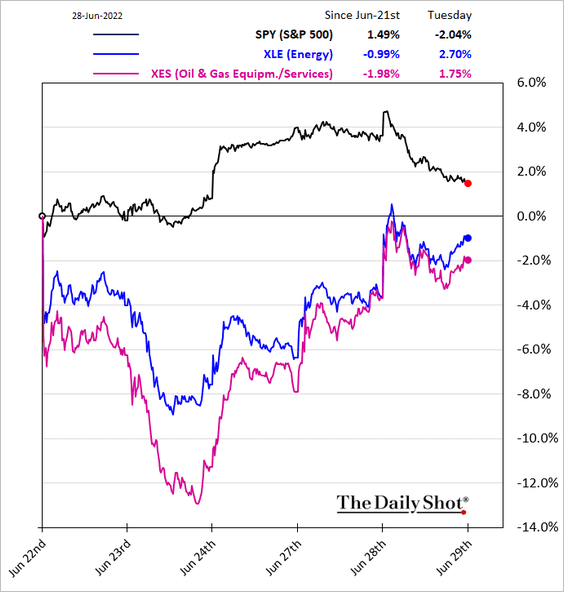

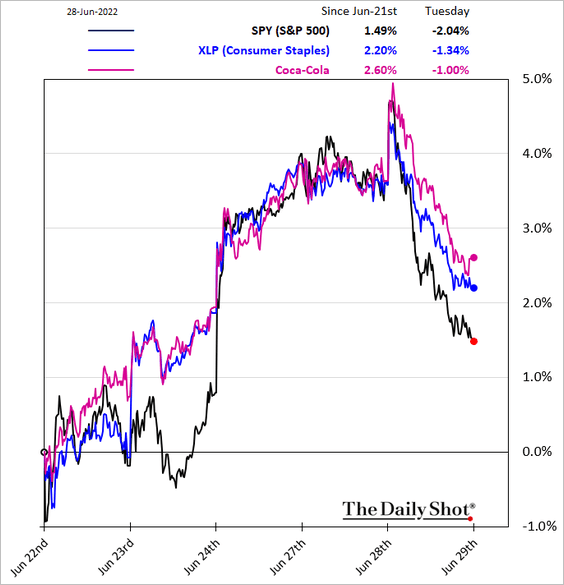

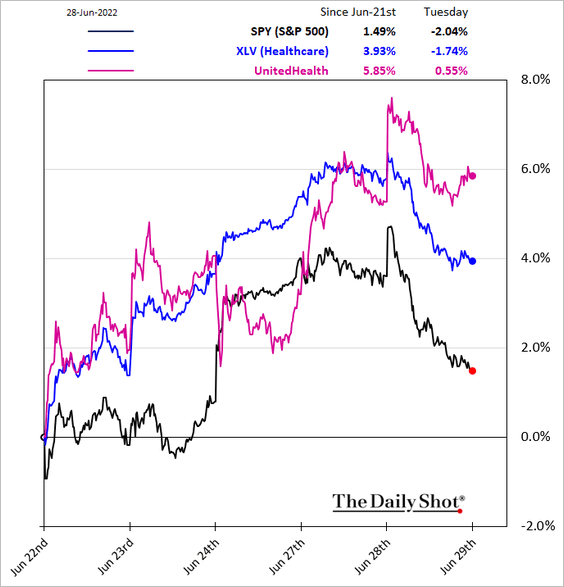

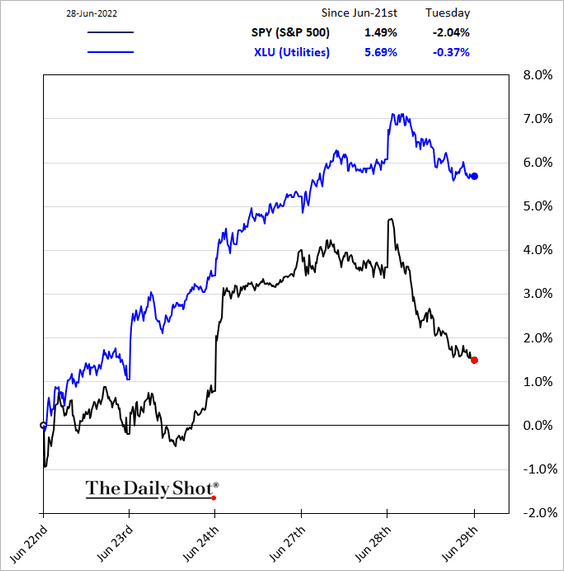

8. Next, we have some sector performance updates.

• Consumer Discretionary:

• Tech/semiconductors:

• Transportation:

• Energy:

• Consumer Staples:

• Healthcare:

• Utilities:

——————–

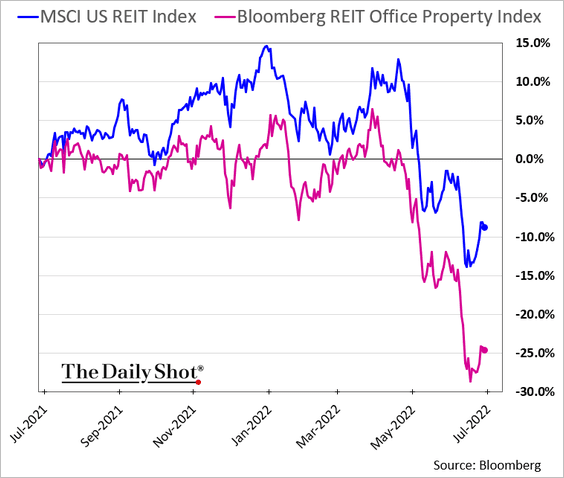

9. Office properties have underperformed sharply in recent weeks.

Back to Index

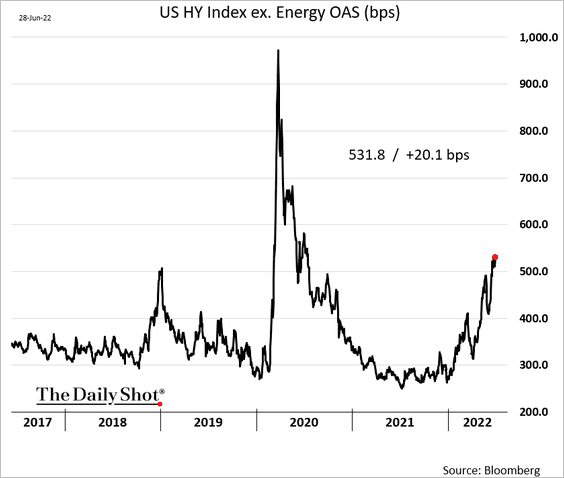

Credit

1. High-yield spreads continue to grind higher.

2. Leveraged finance issuance has been slowing.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

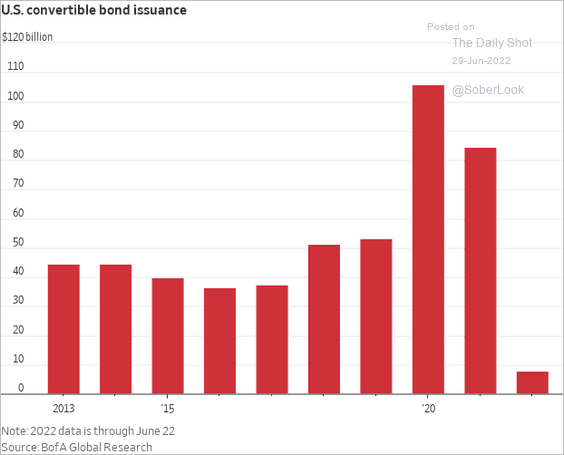

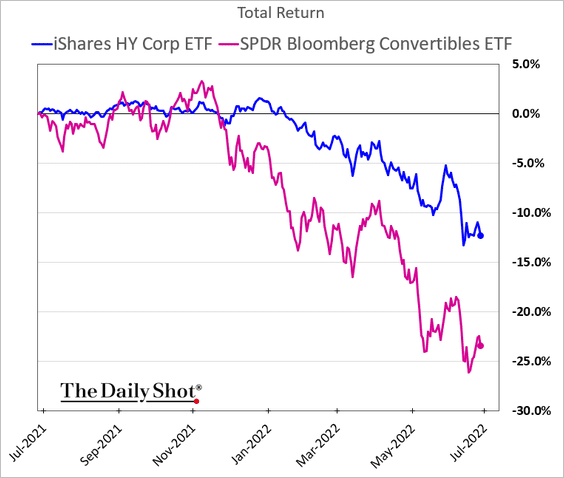

3. Convertibles issuance also slowed sharply as prices slump.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

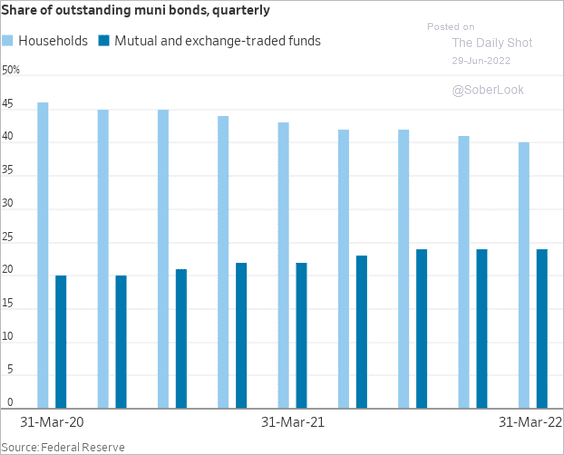

4. Increased fund ownership has exacerbated muni volatility.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

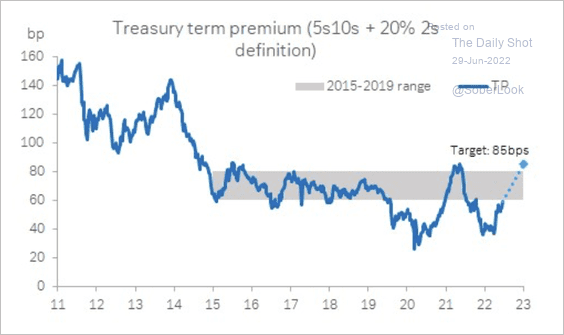

Treasury term premium should rise further with quantitative tightening reaching maximum speed later this year, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

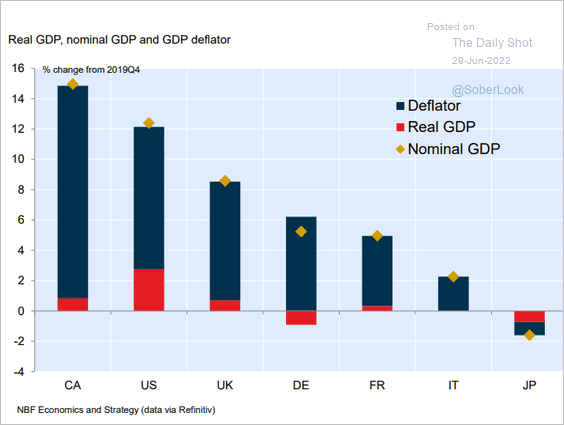

1. Let’s start with COVID-era nominal GDP recovery across G7 economies.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

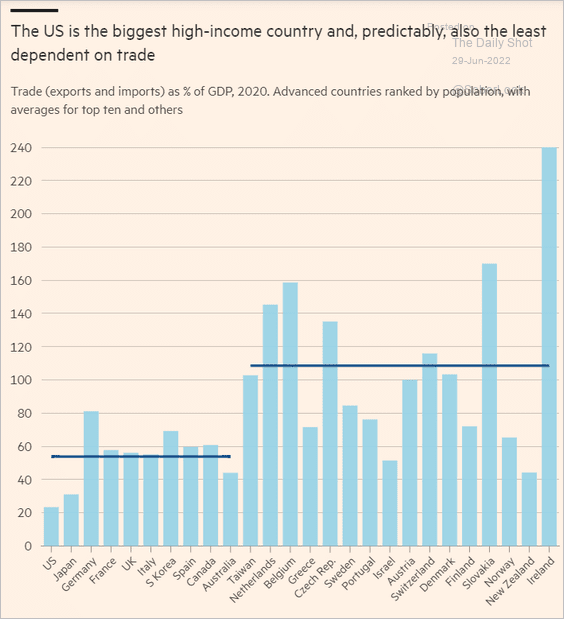

2. How much do different countries rely on international trade?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

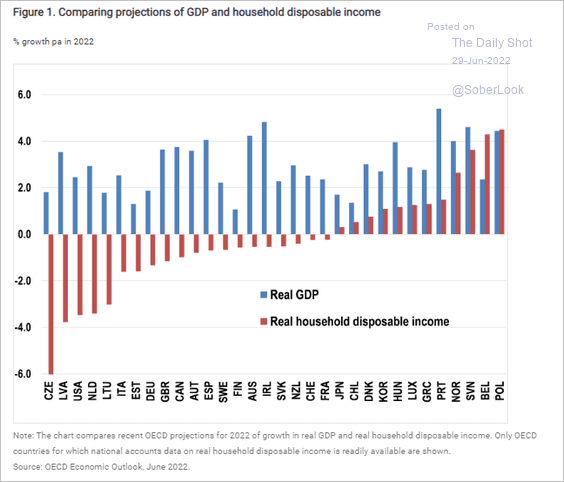

3. This chart compares the 2022 GDP growth with changes in real household disposable incomes?

Source: OECD Read full article

Source: OECD Read full article

——————–

Food for Thought

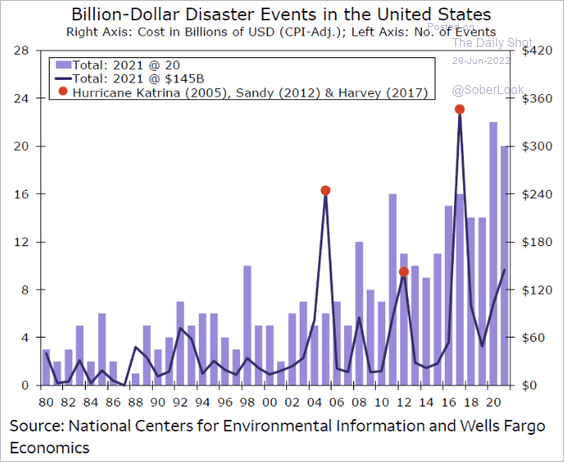

1. Devastating weather disasters in the US have increased in both frequency and size over the past 40 years.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

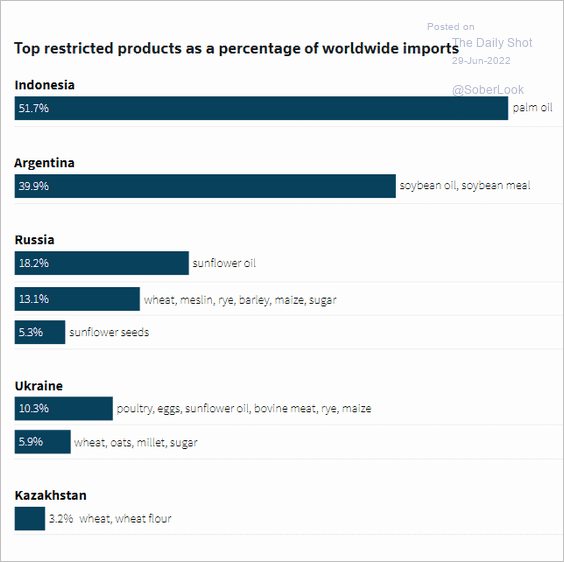

2. Food sales impacted by export restrictions (2 charts):

Source: @SMerler, @IFPRI

Source: @SMerler, @IFPRI

Source: Reuters Read full article

Source: Reuters Read full article

——————–

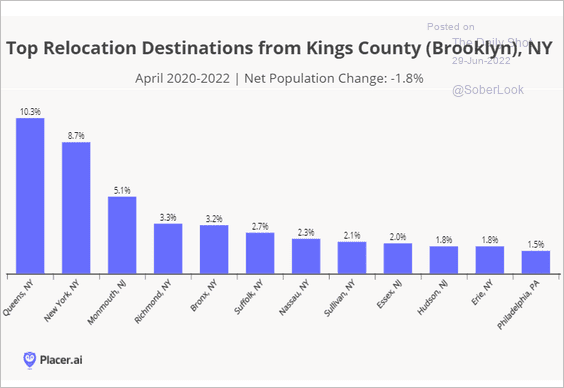

3. Leaving Brooklyn (but mostly staying local):

Source: Placer.ai

Source: Placer.ai

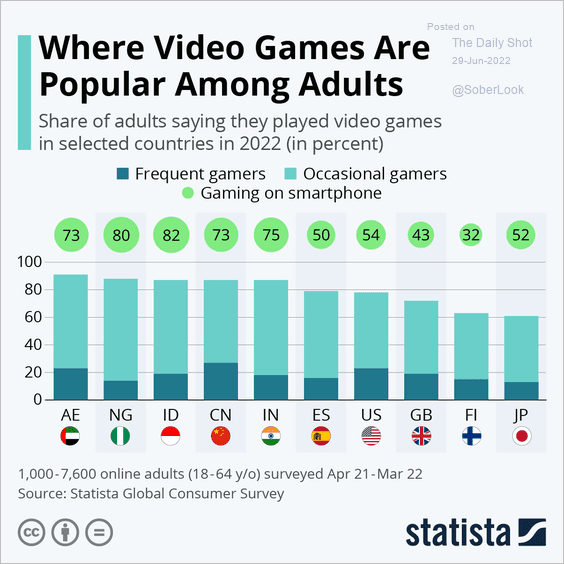

4. Adult gamers:

Source: Statista

Source: Statista

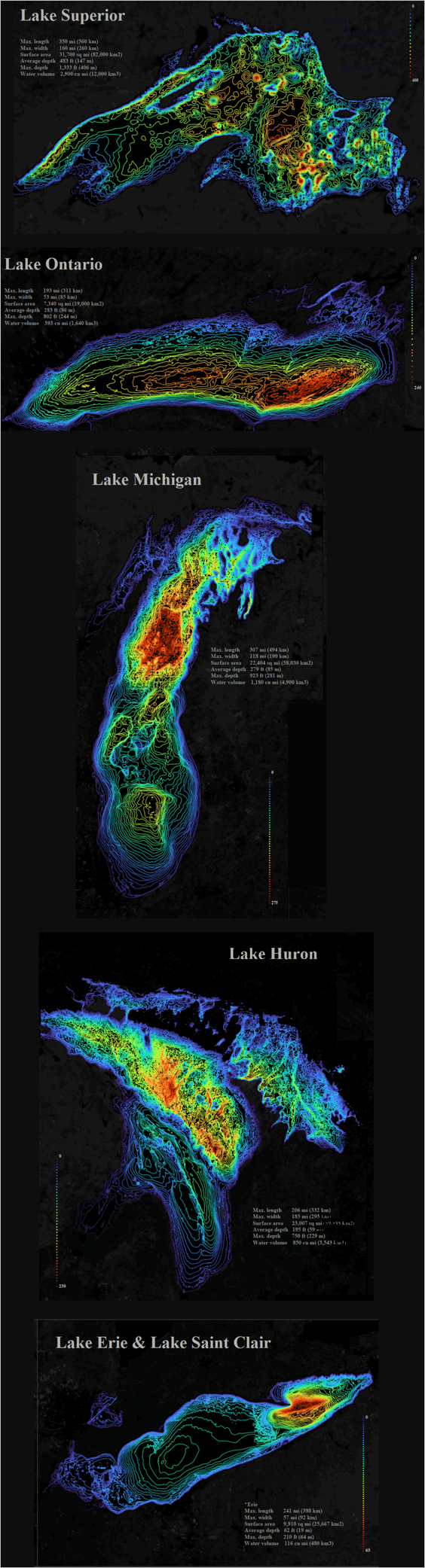

5. How deep are the Great Lakes?

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index