The Daily Shot: 05-Jul-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

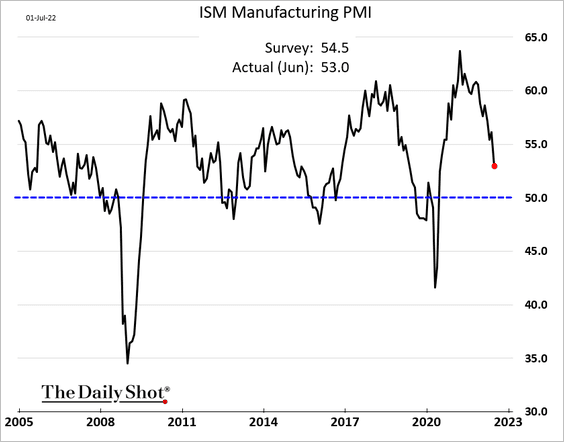

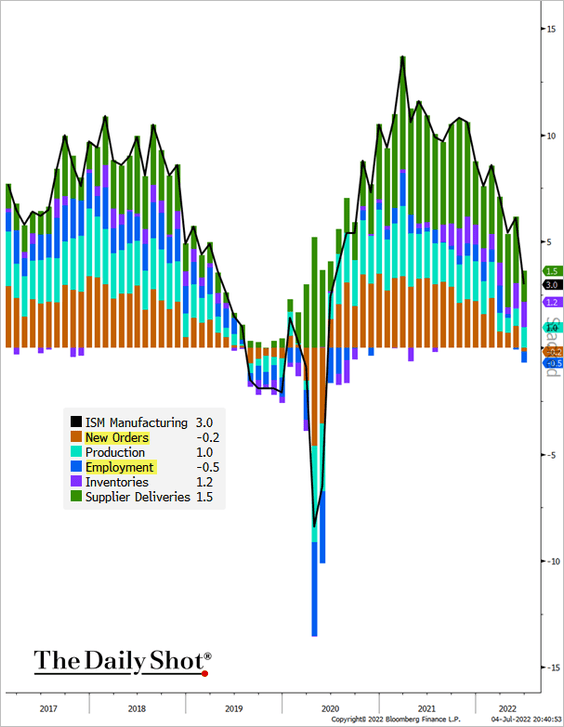

1. According to the ISM PMI report, US manufacturing growth slowed in June but held in positive territory (PMI > 50).

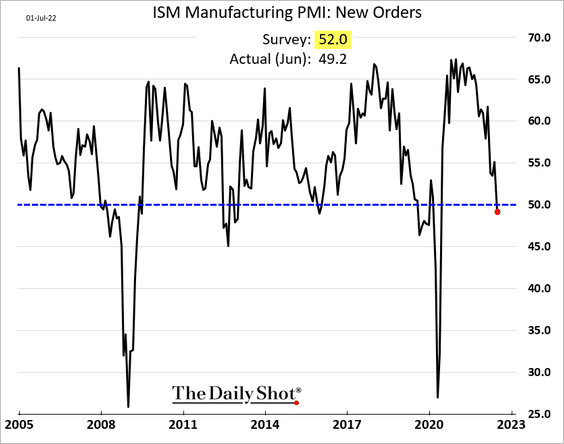

• However, demand deteriorated, with new orders declining for the first time since 2020.

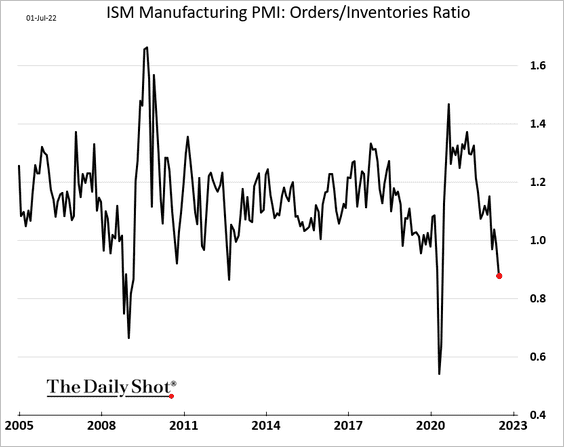

Manufacturers see new orders as being low relative to inventories.

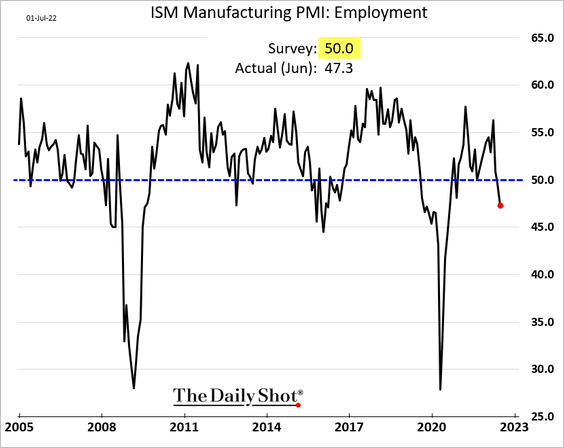

• Factories reported a drop in their workforce.

Employment and new orders are now a drag on the ISM PMI index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

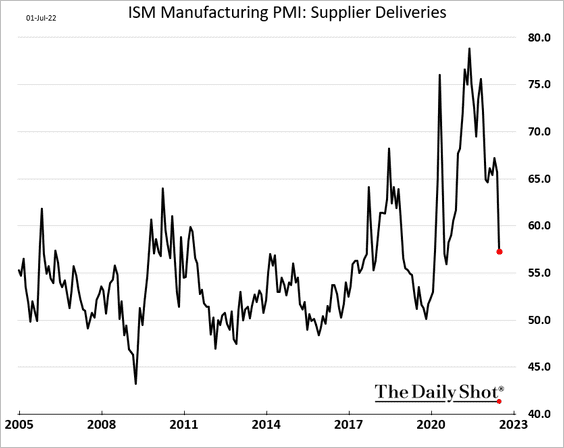

• Supplier bottlenecks are easing.

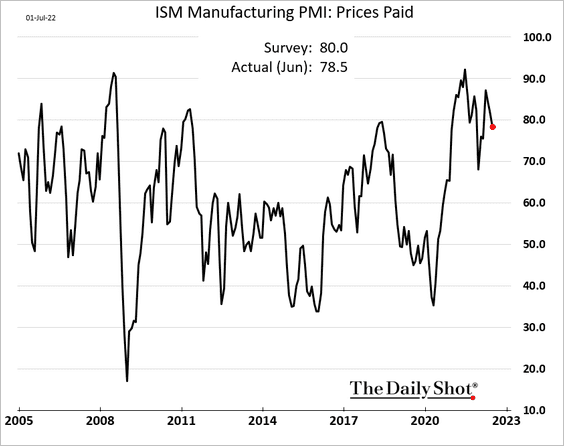

But price pressures persist.

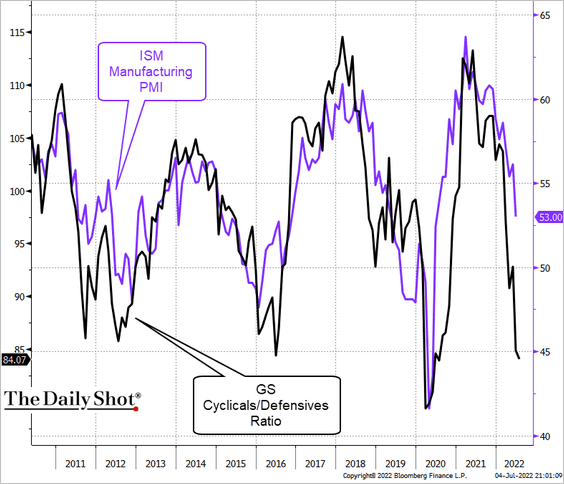

• Forward-looking indicators point to weakness in US factory activity in the months ahead. Here is the ratio of cyclical to defensive equities.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

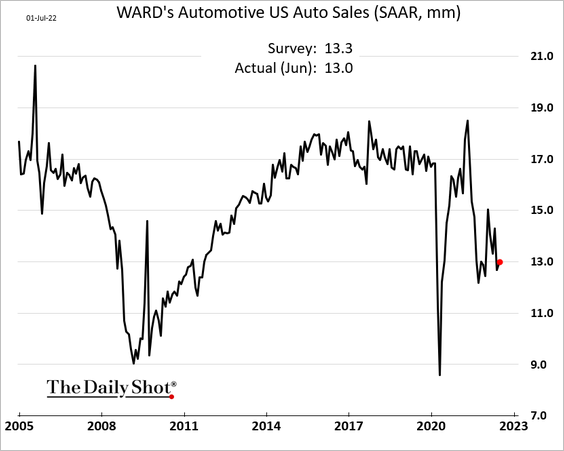

2. US automobile sales remain depressed.

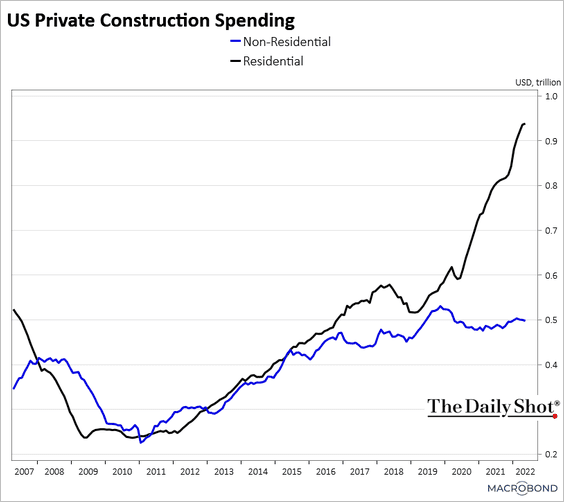

3. Private residential and non-residential construction spending trends continue to diverge.

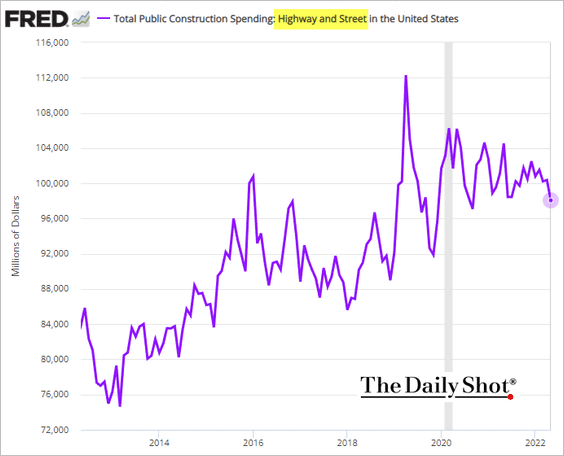

Public construction spending eased as road construction expenditures slumped in recent months.

——————–

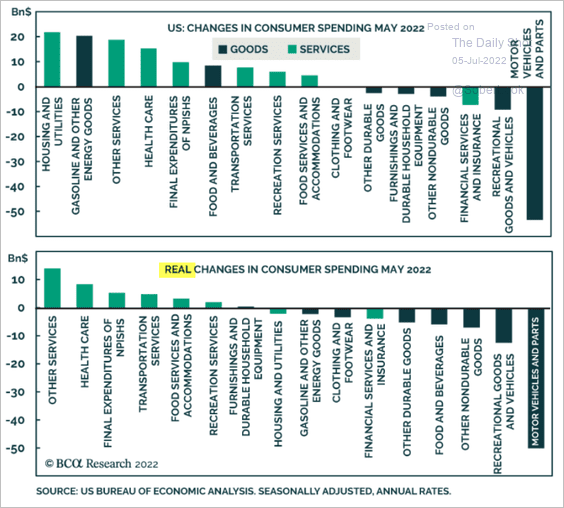

4. This chart illustrates the divergence between goods and services consumer spending in May.

Source: BCA Research

Source: BCA Research

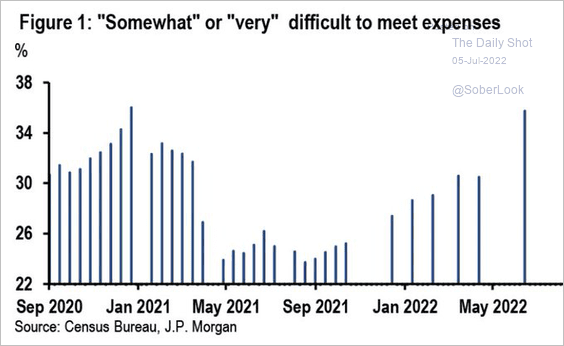

The percentage of consumers struggling to meet expenses increased sharply in recent weeks.

Source: @carlquintanilla, @uscensusbureau, @pattidomm

Source: @carlquintanilla, @uscensusbureau, @pattidomm

——————–

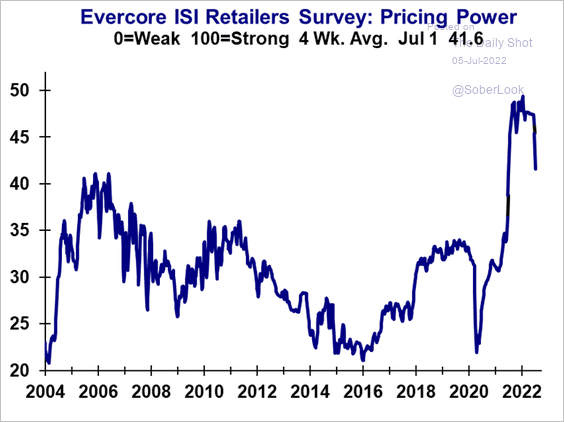

5. Retailers still think they have substantial pricing power, but the Evercore ISI index is now well off the highs.

Source: Evercore ISI Research

Source: Evercore ISI Research

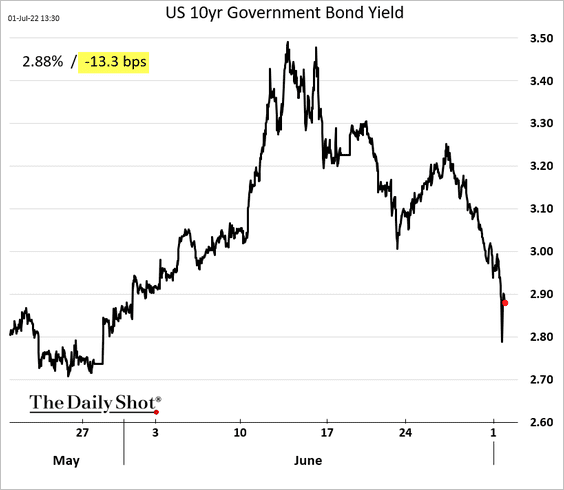

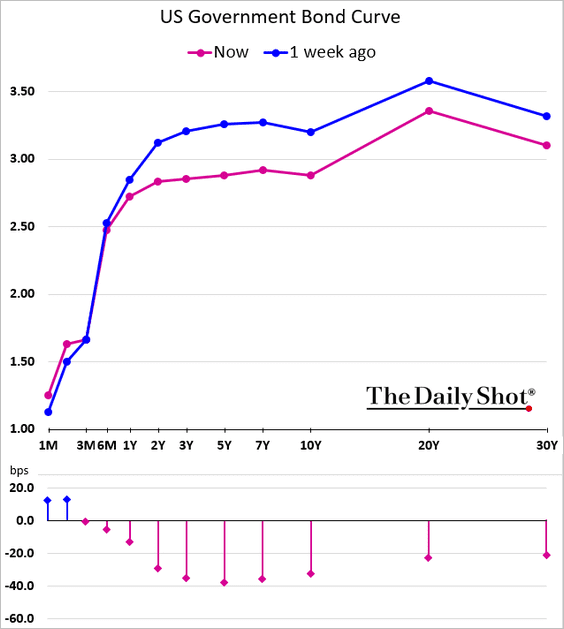

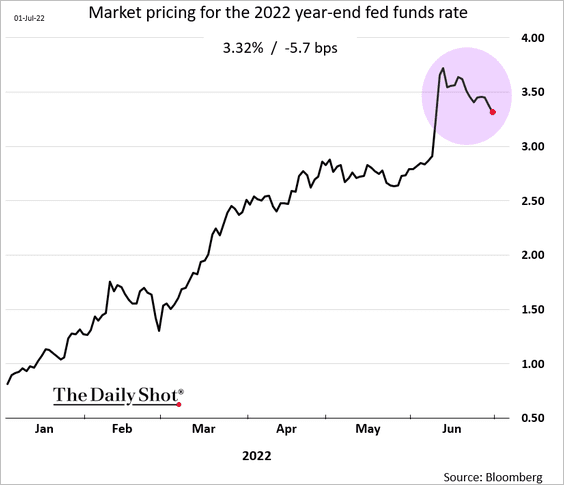

6. Treasury yields declined sharply over the past couple of weeks.

Expectations for the year-end fed funds rate have been drifting lower.

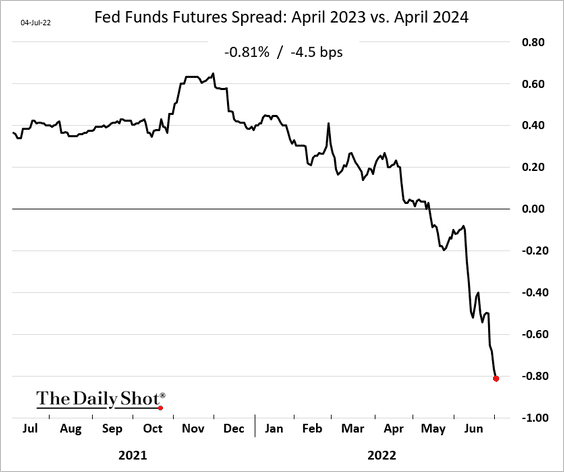

And the market is expecting bigger Fed rate cuts (starting in the first half of next year).

Back to Index

Canada

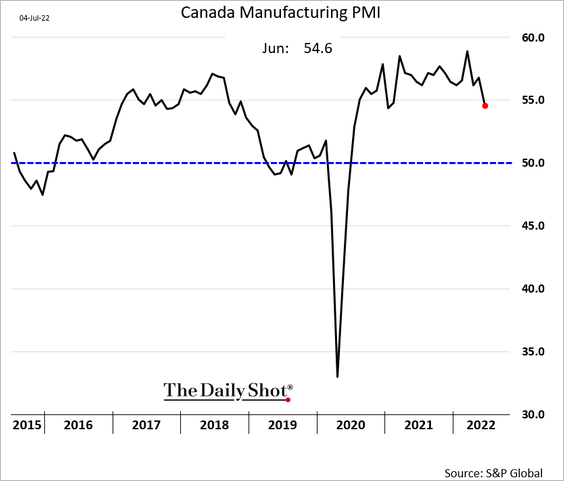

1. Factory activity is holding up well.

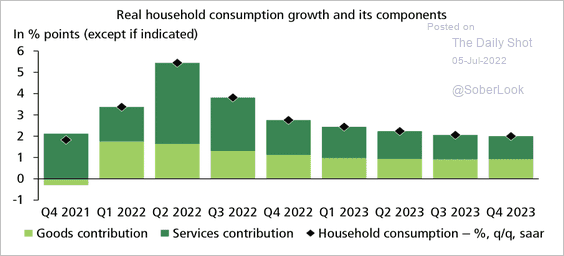

2. Services could keep consumption growth elevated in the near term, according to Desjardins.

Source: Desjardins

Source: Desjardins

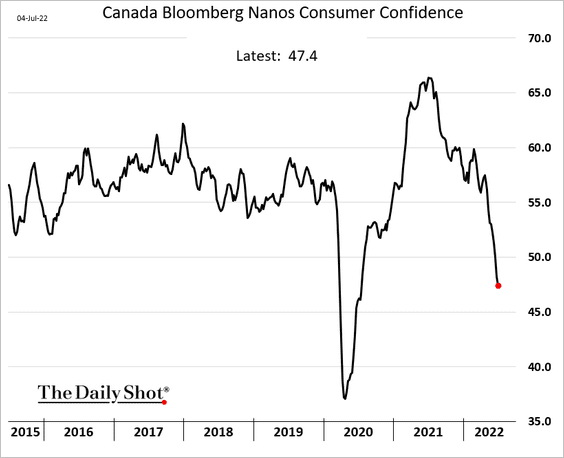

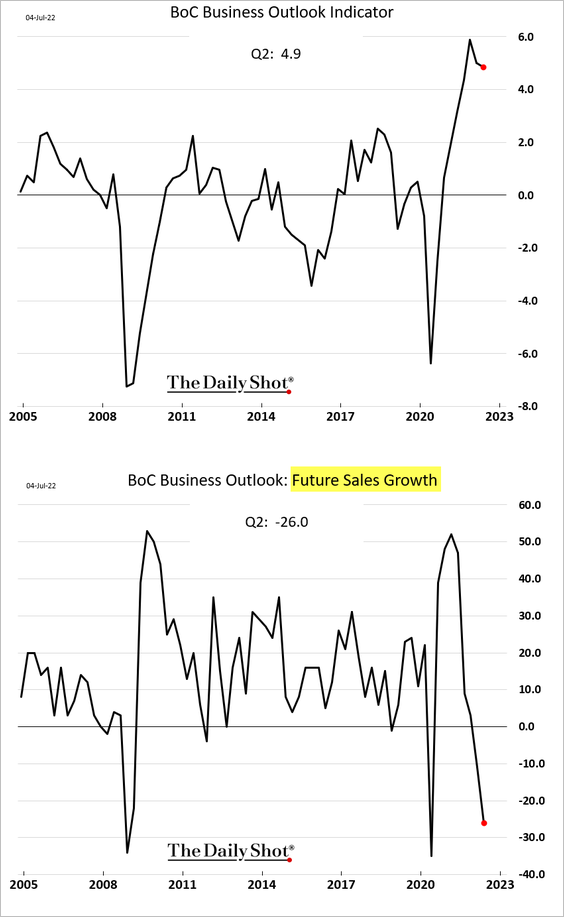

3. The deterioration in consumer confidence has been relentless.

Business outlook is still strong, but companies are becoming concerned about sales growth.

——————–

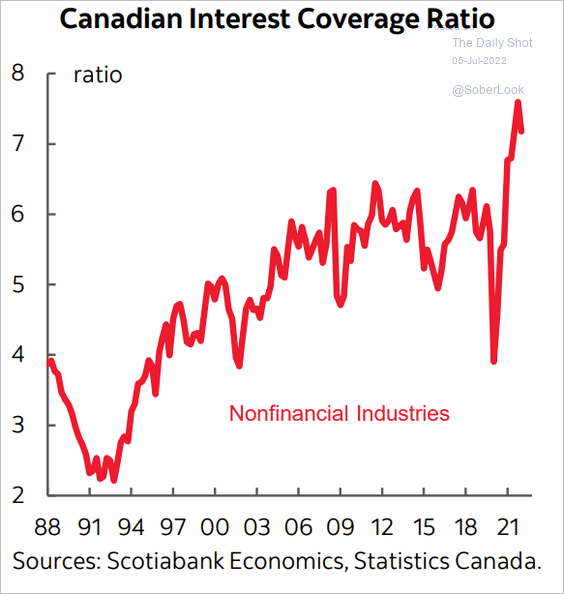

4. The corporate interest coverage ratio remains elevated, suggesting that the business sector can withstand an economic slowdown.

Source: Scotiabank Economics

Source: Scotiabank Economics

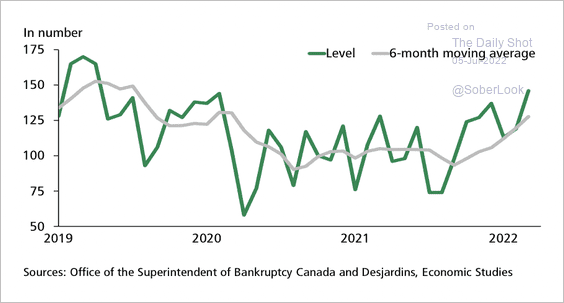

5. Business bankruptcies have been rising for a few months in Quebec.

Source: Desjardins

Source: Desjardins

Back to Index

The United Kingdom

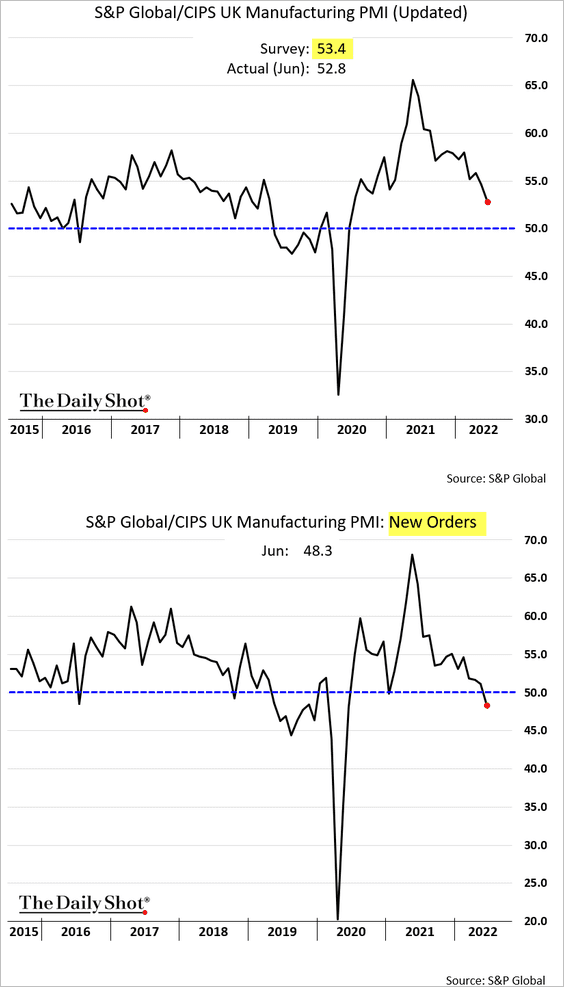

1. The updated June manufacturing PMI report was weaker than the earlier release. Demand is shrinking.

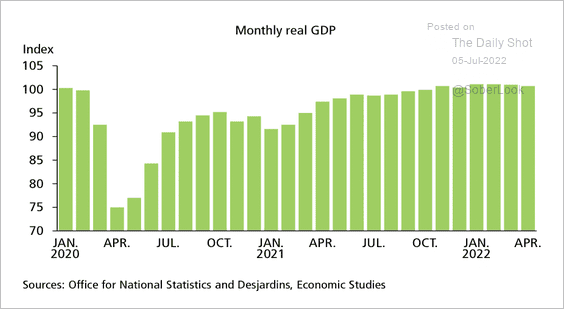

2. Real GDP has not risen since January.

Source: Desjardins

Source: Desjardins

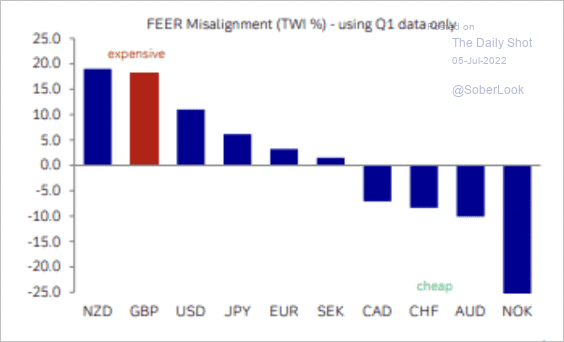

3. The pound appears to be overvalued, according to some metrics.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

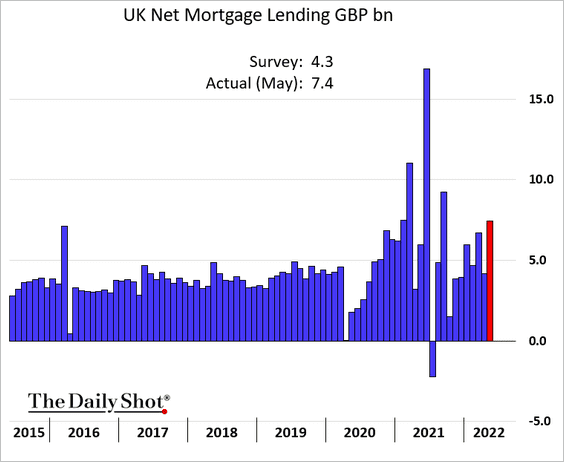

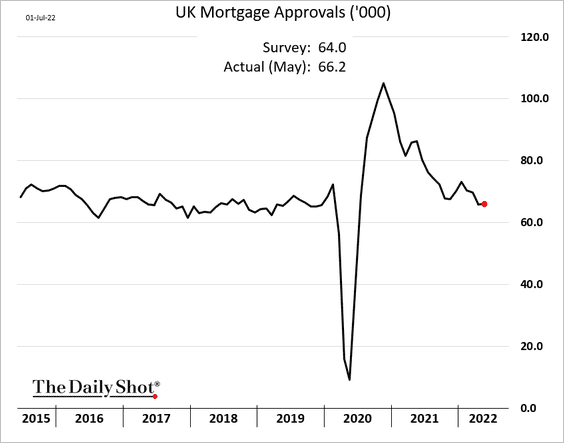

4. Housing finance activity remains robust.

——————–

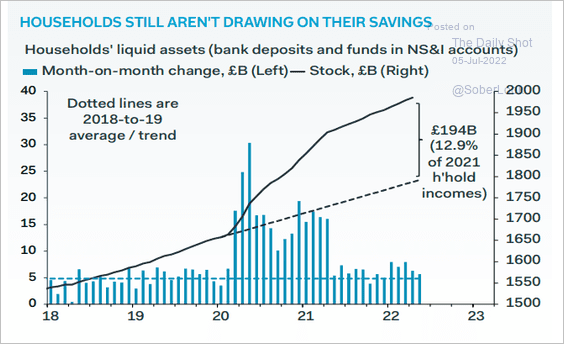

5. Households are yet to draw on their excess savings.

Source: @PantheonMacro, @samueltombs Read full article

Source: @PantheonMacro, @samueltombs Read full article

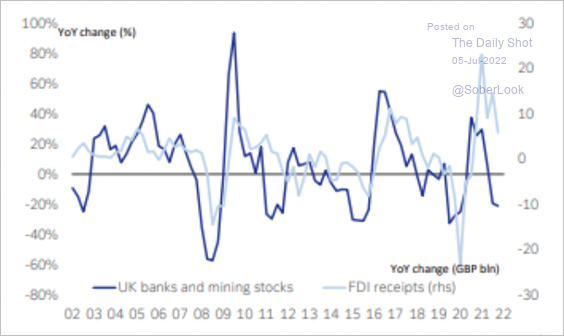

6. Stock prices are pointing to further declines in foreign direct investment.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

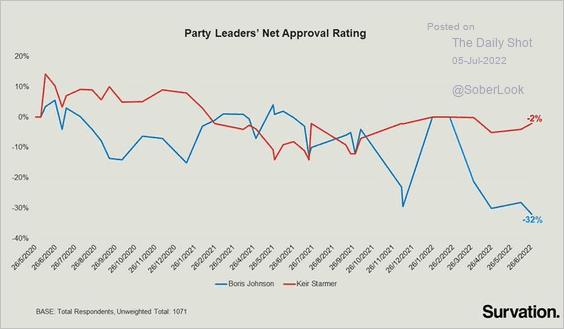

7. Finally, we have party leaders’ approval ratings.

Source: @Survation

Source: @Survation

Back to Index

The Eurozone

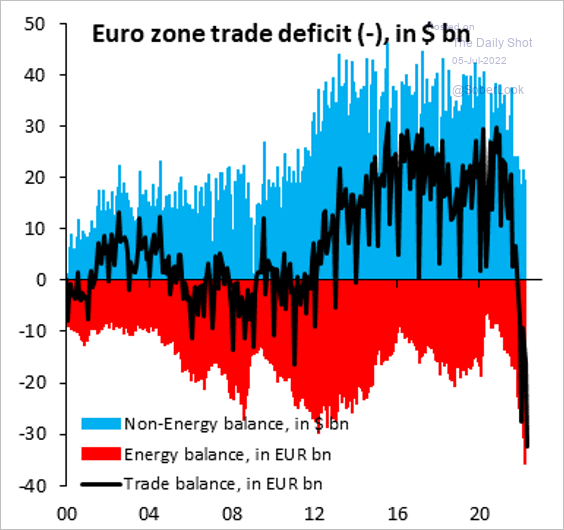

1. Germany’s international trade is in deficit for the first time since 1991 …

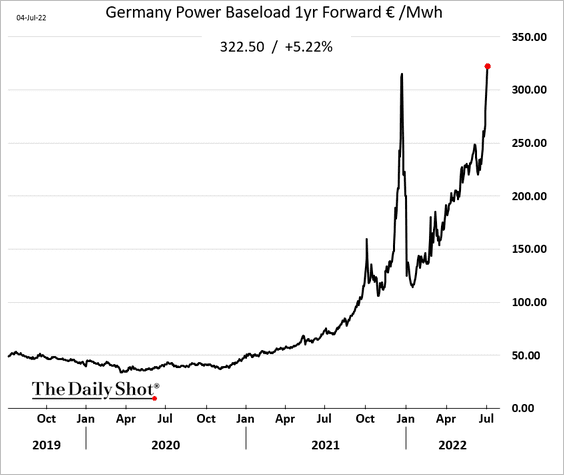

… due to energy costs. The era of powering manufacturing growth with cheap Russian natural gas is over.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

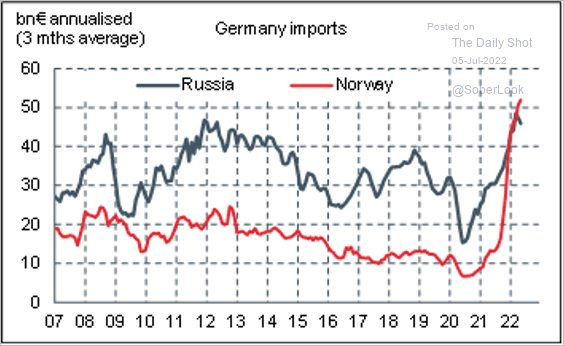

Who are the beneficiaries?

Source: @FabienBossy

Source: @FabienBossy

——————–

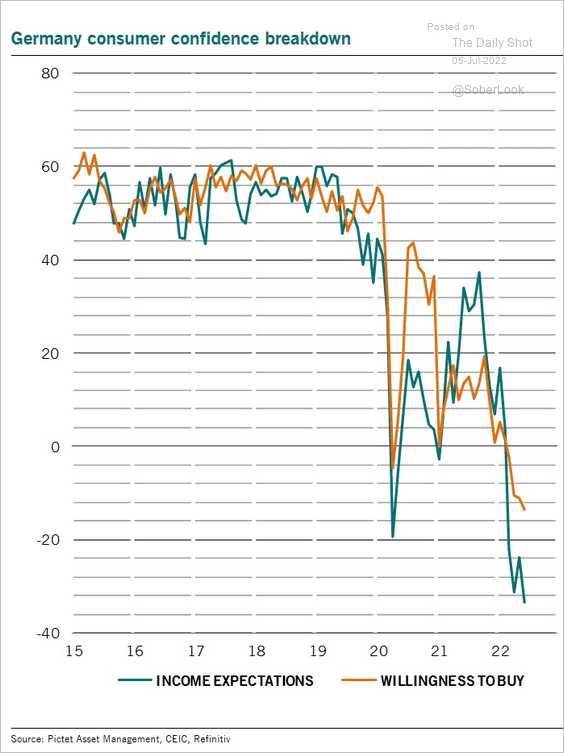

2. Here are a couple of components of Germany’s consumer confidence index.

Source: @skhanniche

Source: @skhanniche

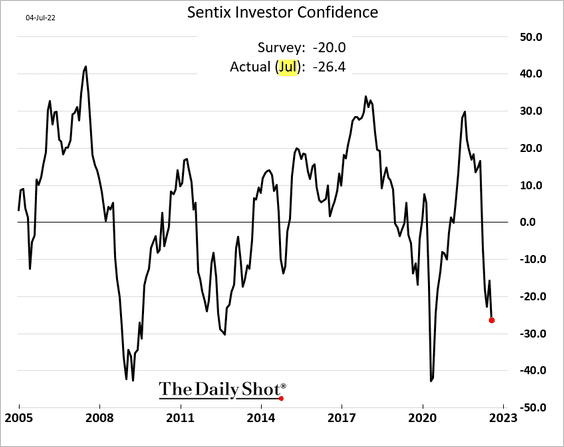

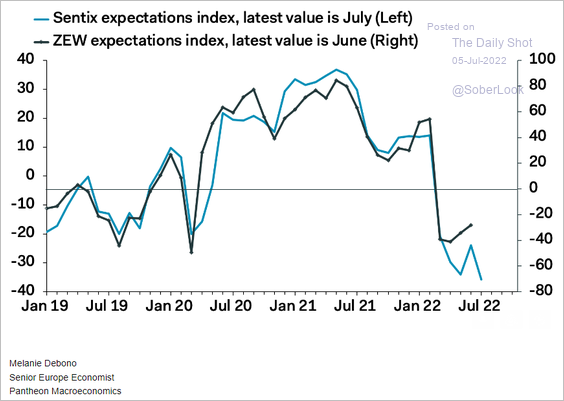

3. Investor confidence slumped at the Eurozone level, …

… which points to substantial weakness in the ZEW index in July.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

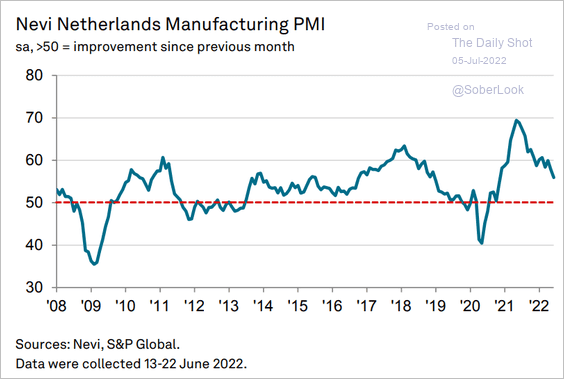

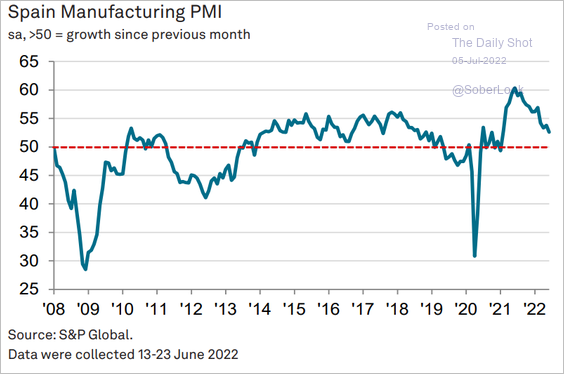

4. Here are some manufacturing PMI indicators.

• The Netherlands (still strong):

Source: S&P Global PMI

Source: S&P Global PMI

• Spain (slowing):

Source: S&P Global PMI

Source: S&P Global PMI

• Italy (growth stalling):

Source: S&P Global PMI

Source: S&P Global PMI

——————–

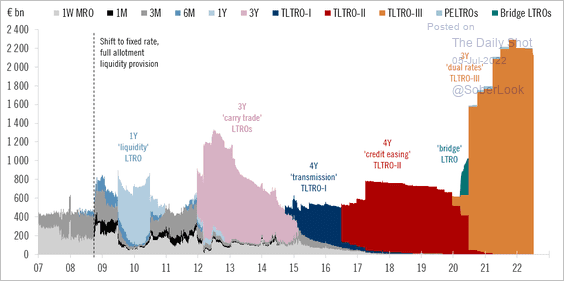

5. Will the ECB change the terms on the TLTRO loans as it hikes rates?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

This chart shows the estimated benefits of the LTRO program for banks.

Source: @fwred

Source: @fwred

——————–

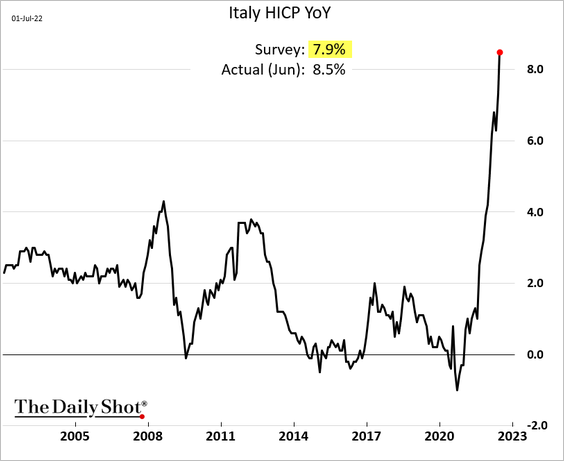

6. The Italian CPI surprised to the upside.

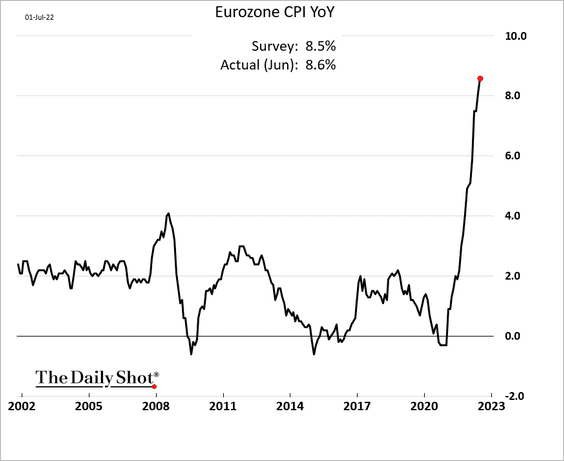

The headline CPI at the Eurozone level hit a new high.

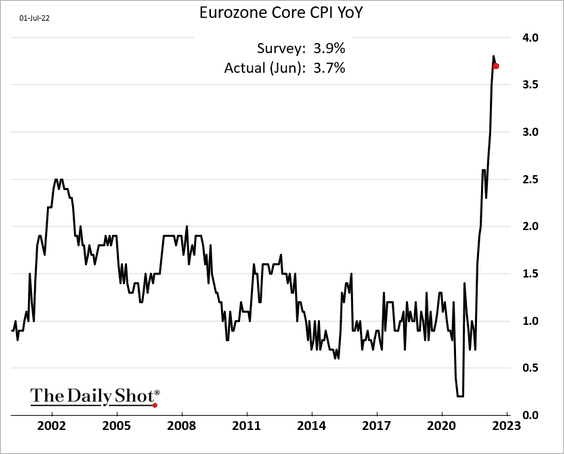

But the core CPI came off the peak.

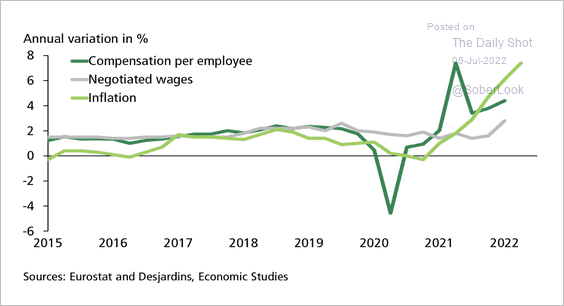

Inflation has far outpaced wage growth.

Source: Desjardins

Source: Desjardins

——————–

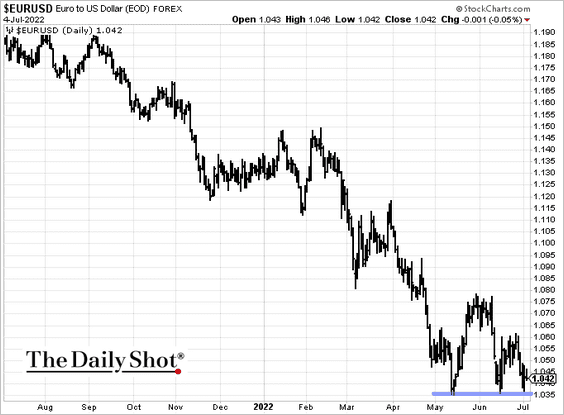

7. The euro is holding support for now.

Back to Index

Europe

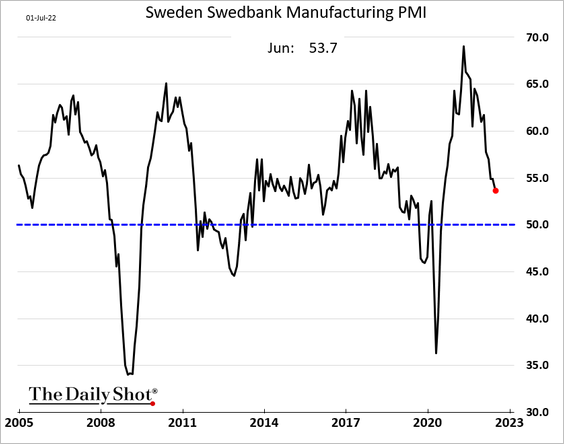

1. Sweden’s manufacturing growth is slowing.

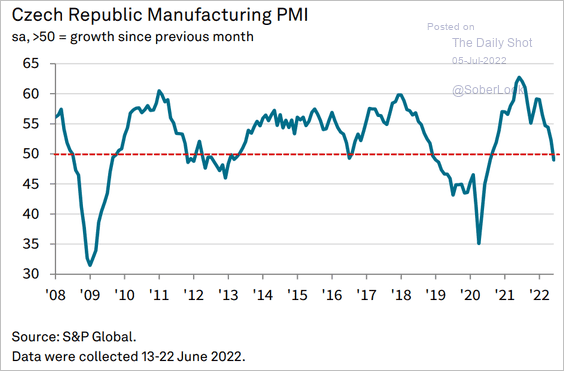

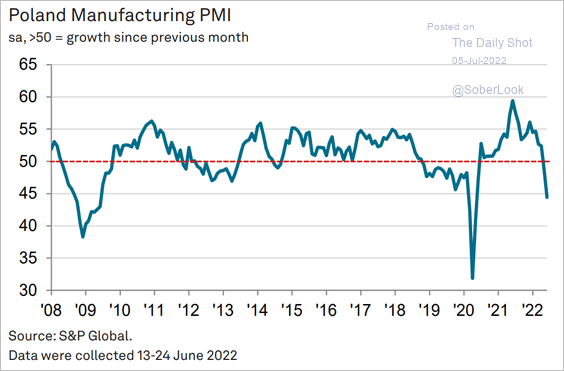

2. Central European factory activity is increasingly looking recessionary.

• Czech Republic:

Source: S&P Global PMI

Source: S&P Global PMI

• Poland:

Source: S&P Global PMI

Source: S&P Global PMI

——————–

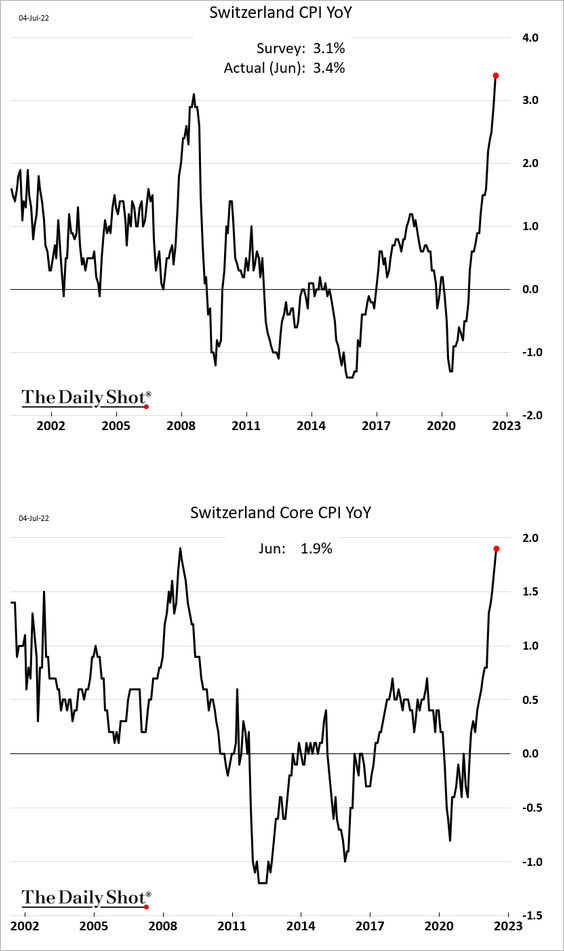

3. Swiss inflation surprised to the upside.

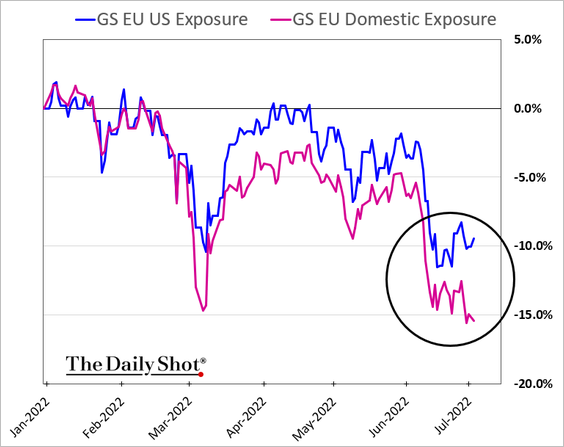

4. European domestically-focused firms are underperforming companies that sell to the US.

Back to Index

Asia – Pacific

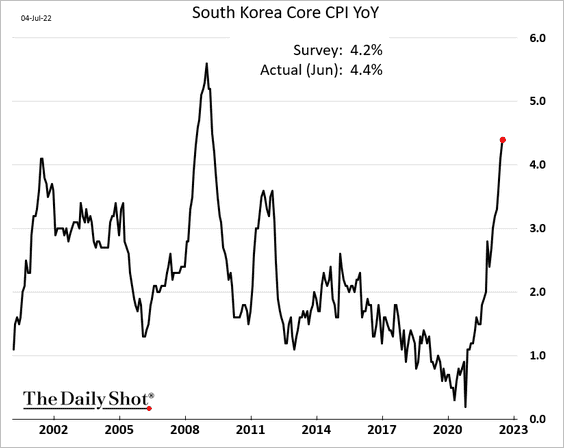

1. South Korea’s inflation is surging.

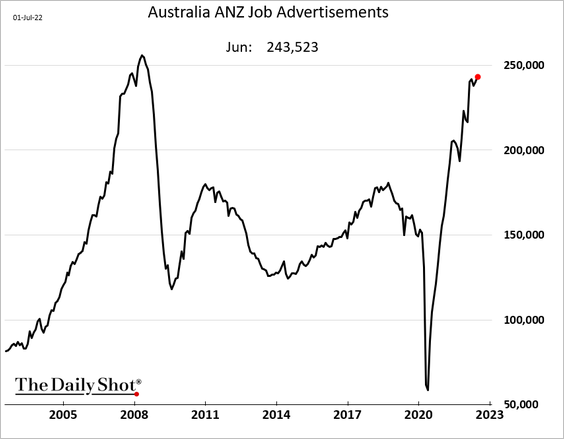

2. Australian job ads hit a multi-year high.

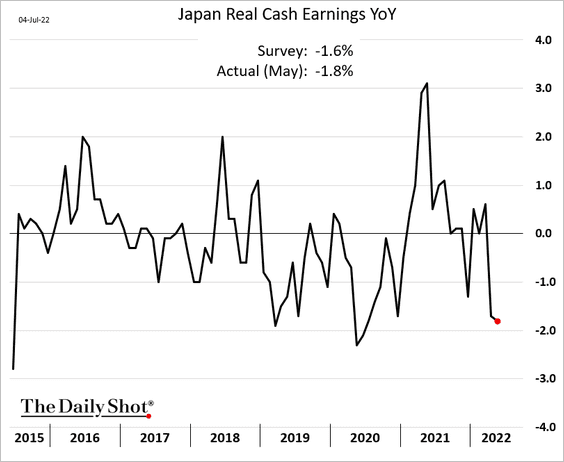

3. Japan’s real household earnings continue to decline.

Back to Index

China

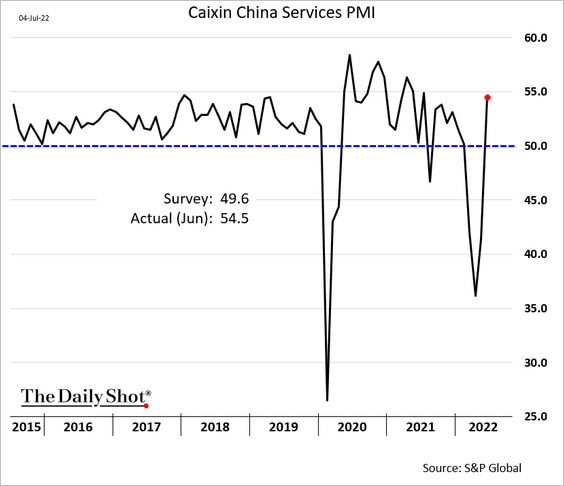

1. Service-sector business activity rebounded faster than expected last month.

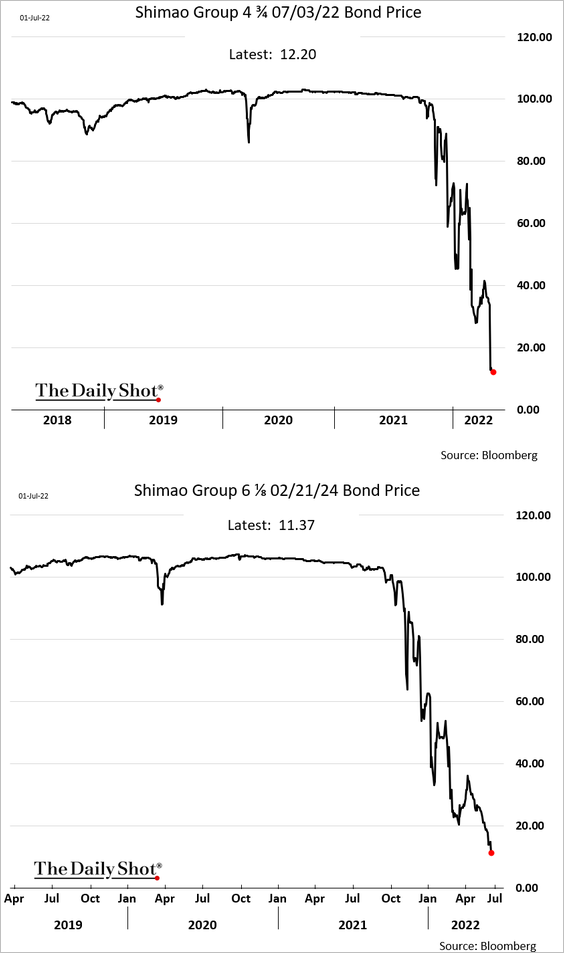

2. Leveraged developers remain under pressure.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

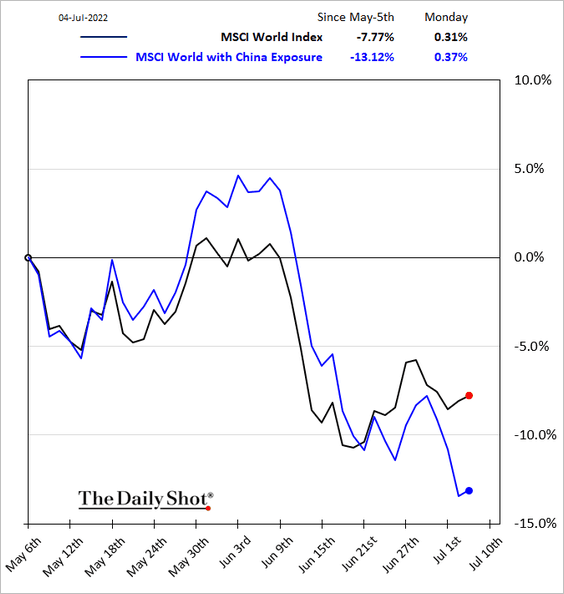

3. Global companies with China sales exposure have been underperforming.

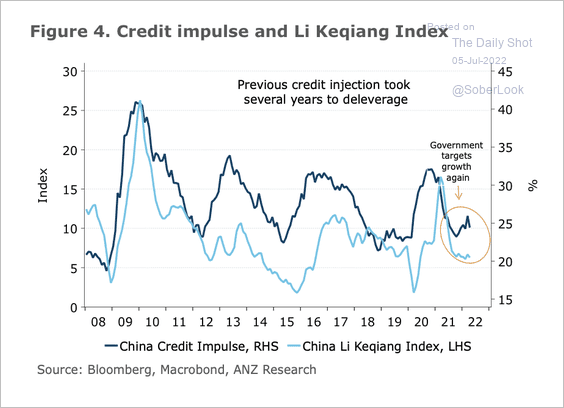

4. The credit impulse has been relatively weak and could take some time to turn around.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Commodities

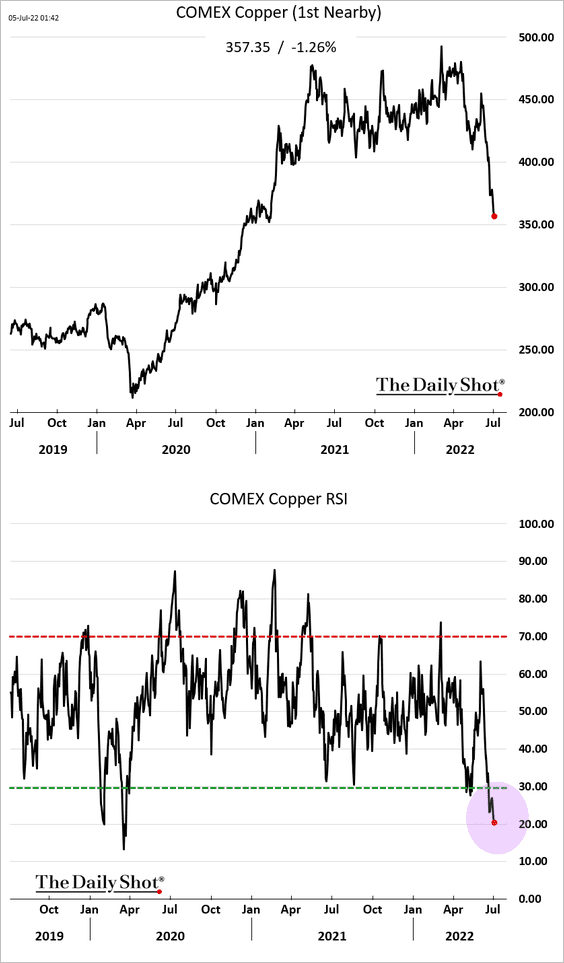

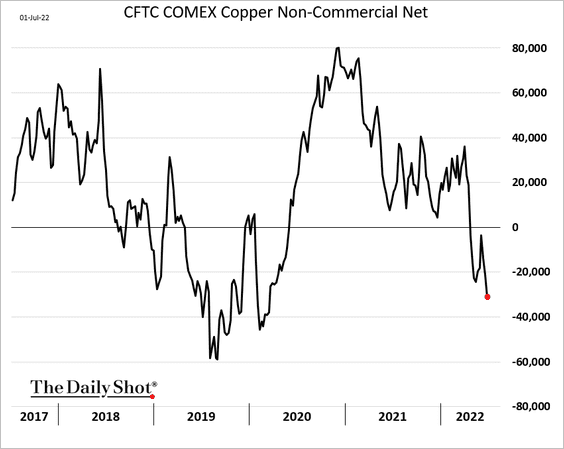

1. Copper is in oversold territory, …

… and speculative accounts continue to boost their bets against the metal.

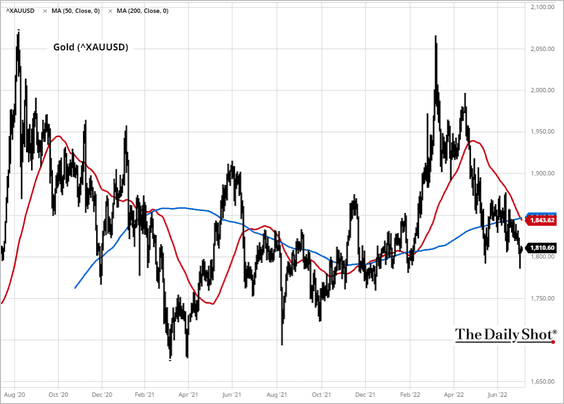

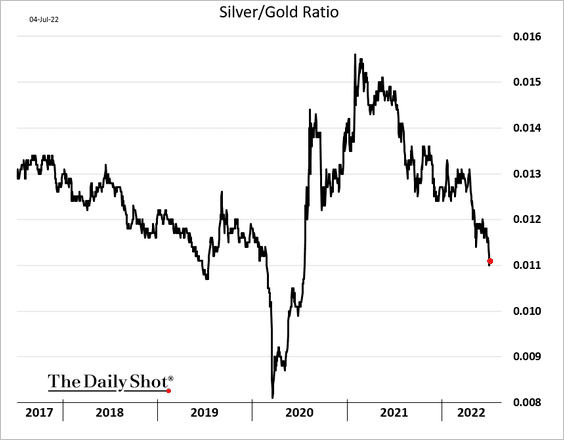

2. Gold hit a death cross.

Source: barchart.com

Source: barchart.com

• The silver-to-gold ratio continues to trend lower on recession concerns.

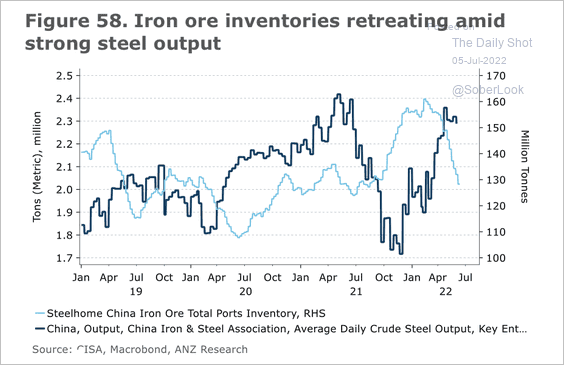

3. Chinese iron ore inventories have declined as steel output rebounded over the past year.

Source: @ANZ_Research

Source: @ANZ_Research

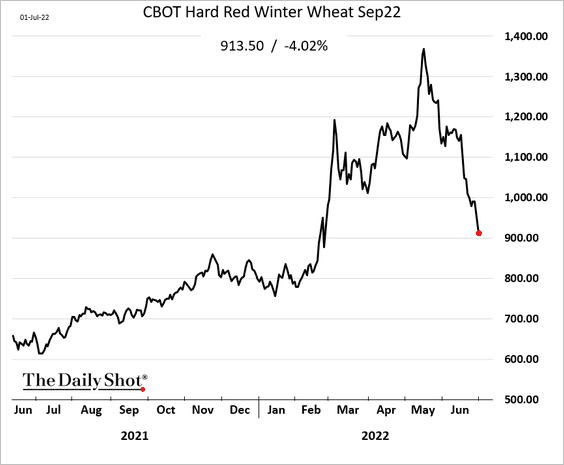

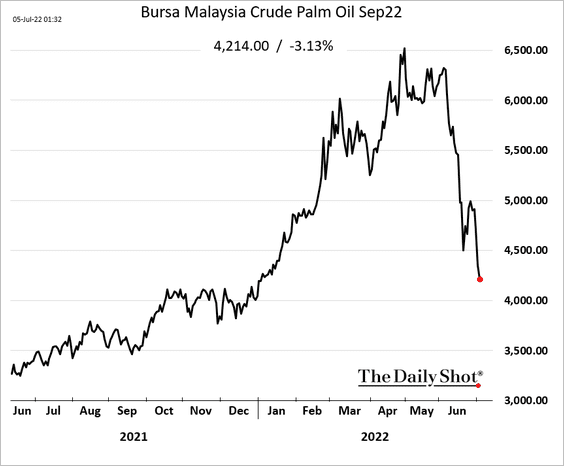

4. The Invesco DB Agriculture Fund (DBA) is declining from long-term resistance.

• Wheat futures continue to fall.

• Here is palm oil:

Back to Index

Energy

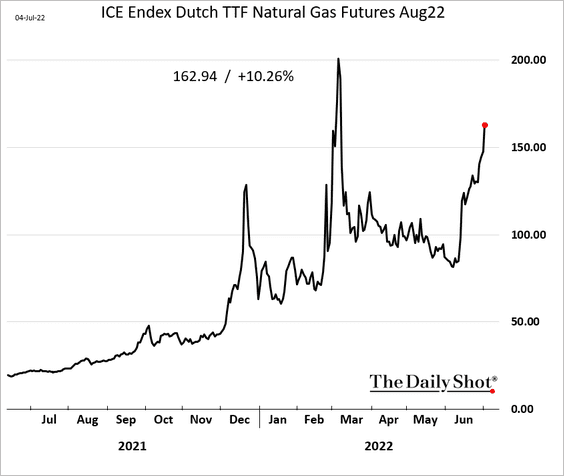

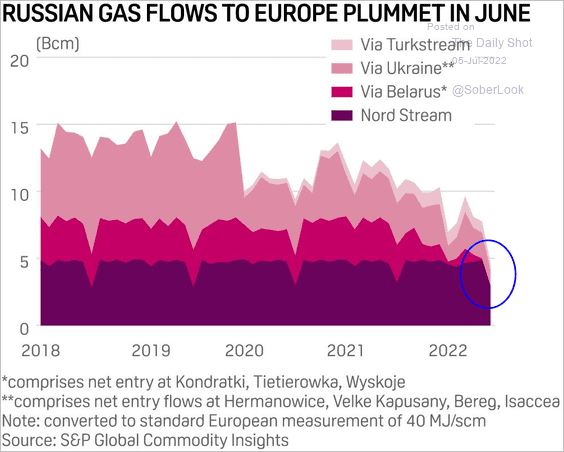

1. European natural gas prices have been surging due to lower US LNG exports and Russia’s gas “squeeze.”

• Russian gas flows plummeted in June.

Source: S&P Global Commodity Insights

Source: S&P Global Commodity Insights

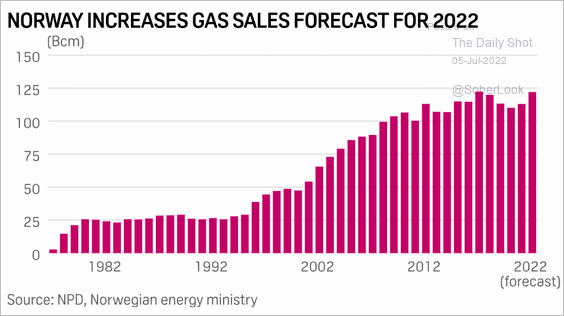

• Norway is boosting output.

Source: S&P Global Commodity Insights

Source: S&P Global Commodity Insights

• Germany’s one-year forward power contract hit a record high.

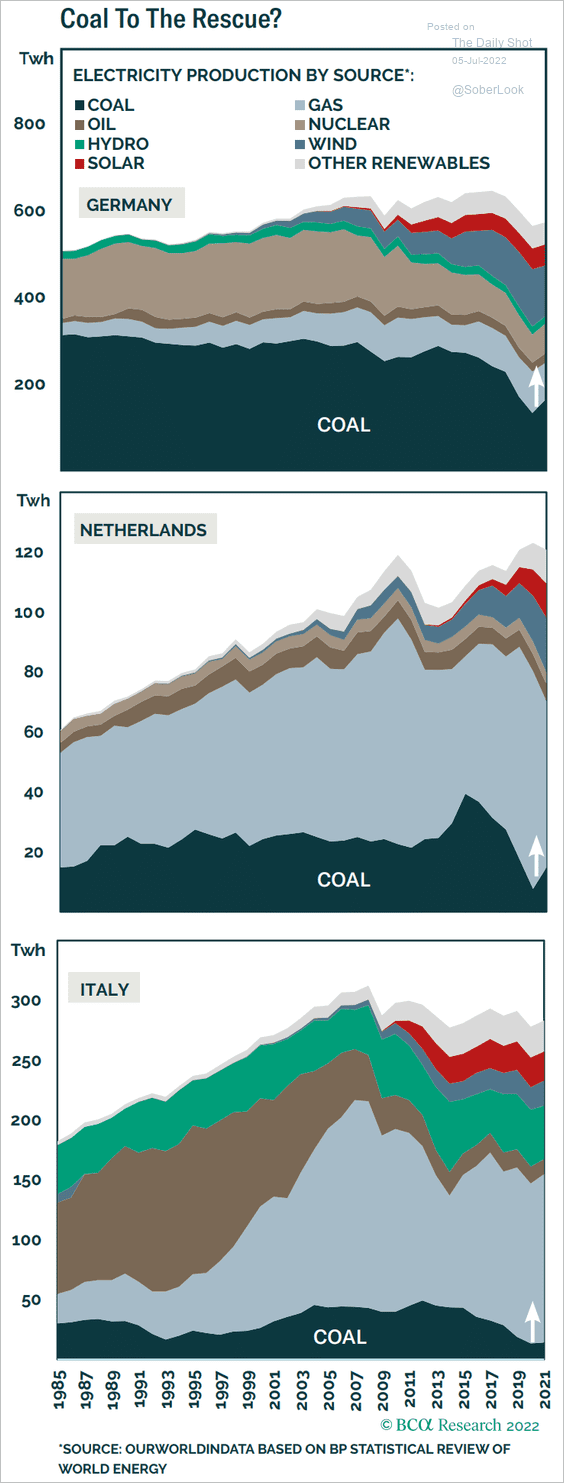

• Coal usage is up.

Source: BCA Research

Source: BCA Research

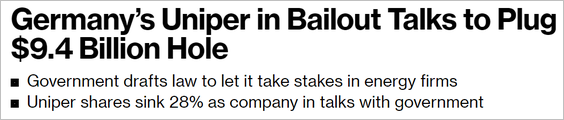

• Europe is forced to bail out its power/energy firms.

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

——————–

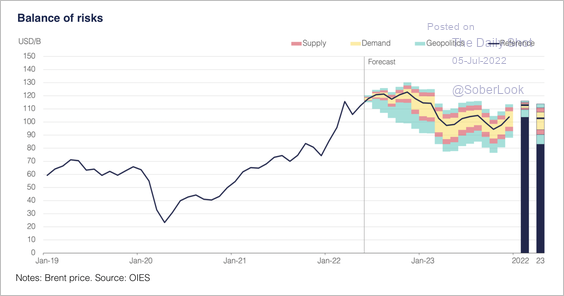

2. OIES expects the Brent oil price to decline next year on lower realization of Russian disruptions followed by negative demand pressures.

Source: Oxford Institute for Energy Studies

Source: Oxford Institute for Energy Studies

This chart shows the change in oil demand during US recessions.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Equities

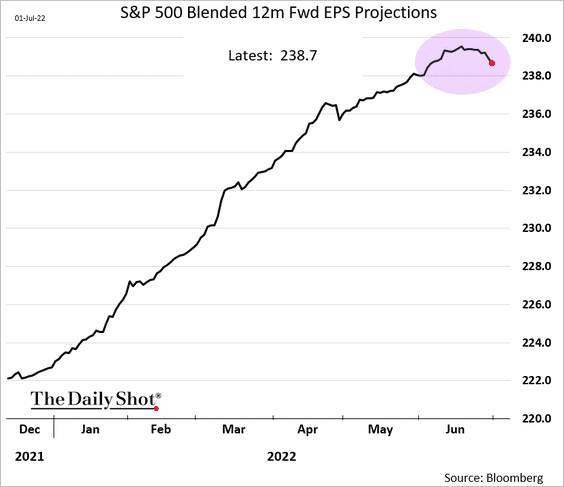

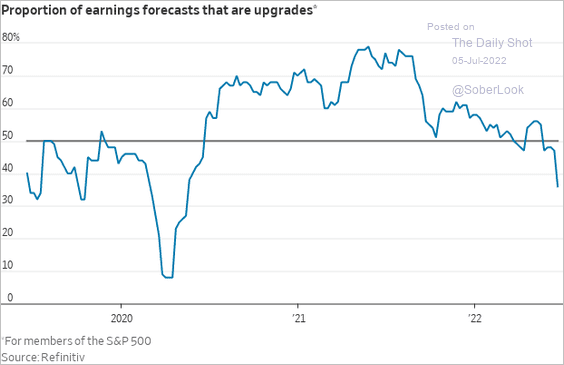

1. Earnings expectations are rolling over, …

… as equity analysts become more skeptical (more in line with the market).

Source: @WSJ Read full article

Source: @WSJ Read full article

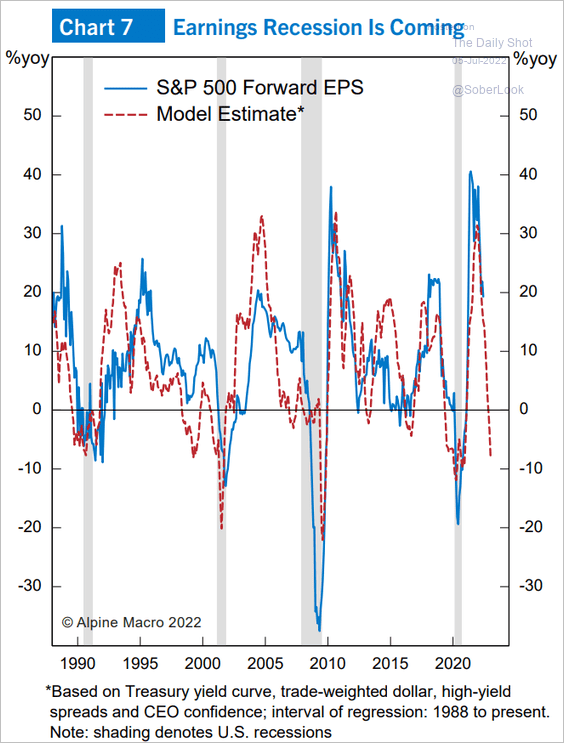

Leading indicators point to ongoing earnings pressures.

Source: Alpine Macro

Source: Alpine Macro

——————–

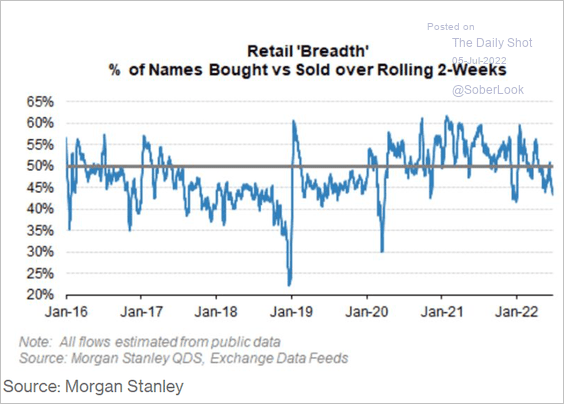

2. More selling ahead for retail investors?

Source: Morgan Stanley Research; @markets Read full article

Source: Morgan Stanley Research; @markets Read full article

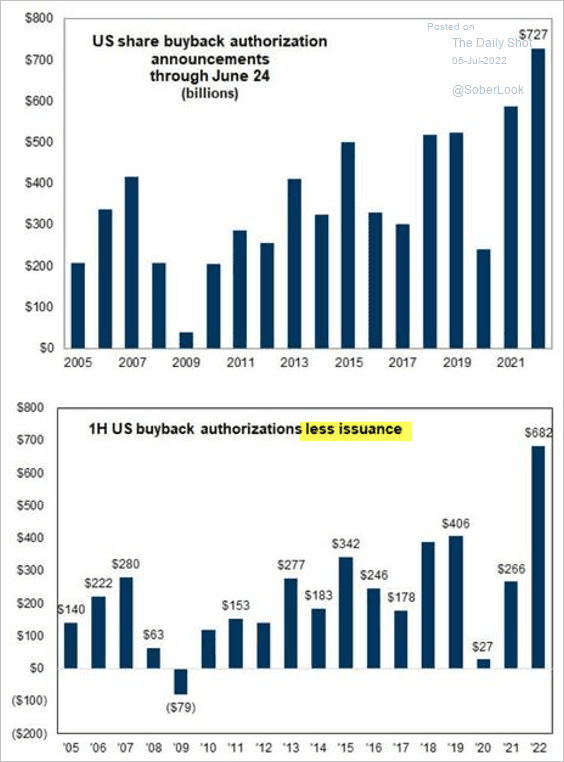

3. Share buyback activity accelerated this year.

Source: Goldman Sachs; @MichaelGoodwell

Source: Goldman Sachs; @MichaelGoodwell

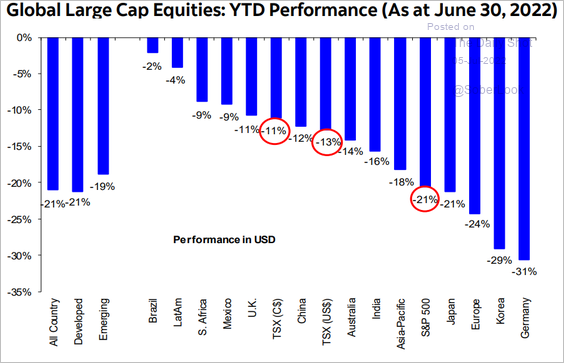

4. This chart shows the year-to-date returns globally.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

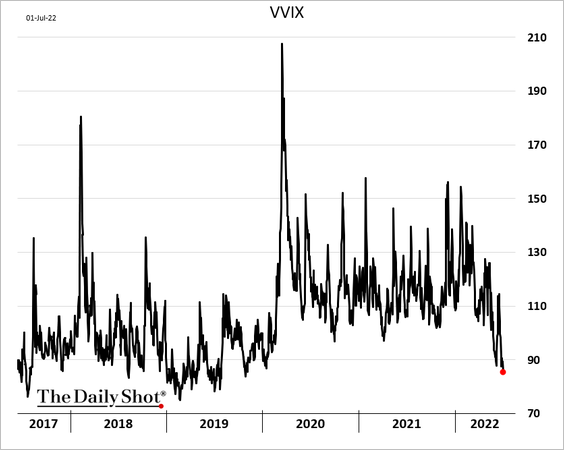

5. The vol of vol index (VVIX) hit the lowest level since 2019 as demand for VIX call options (often used for hedging) eased.

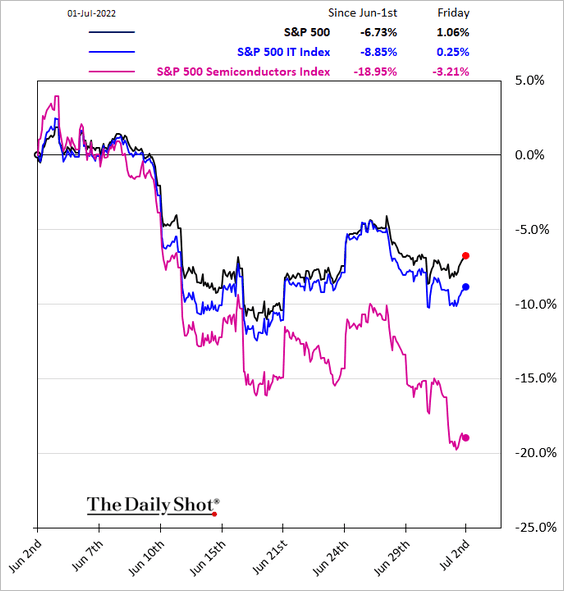

6. Semiconductor stocks have been under pressure.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

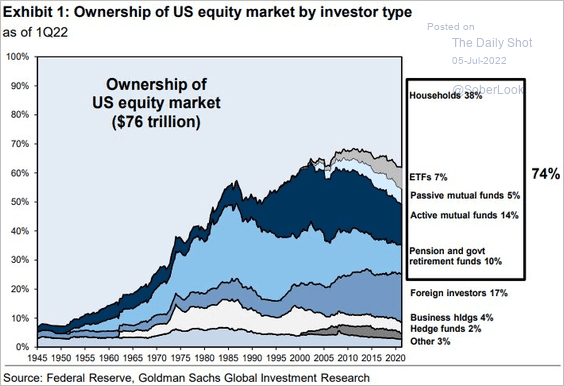

7. Who owns the US equity market?

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Credit

1. US corporate bond spreads continue to widen.

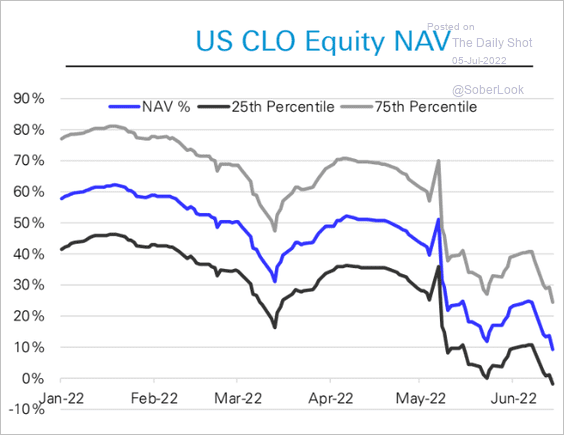

2. Some CLOs saw their equity tranches wiped out.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

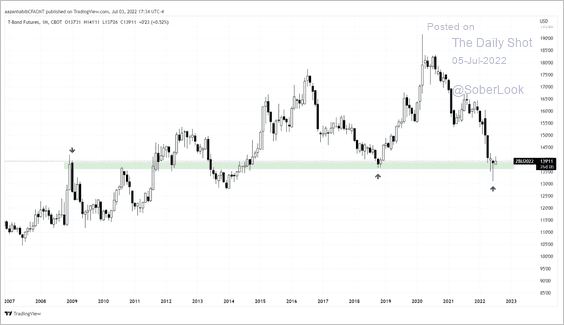

1. The long-duration Treasury futures contract is testing support.

Source: Aazan Habib; Paradigm Capital

Source: Aazan Habib; Paradigm Capital

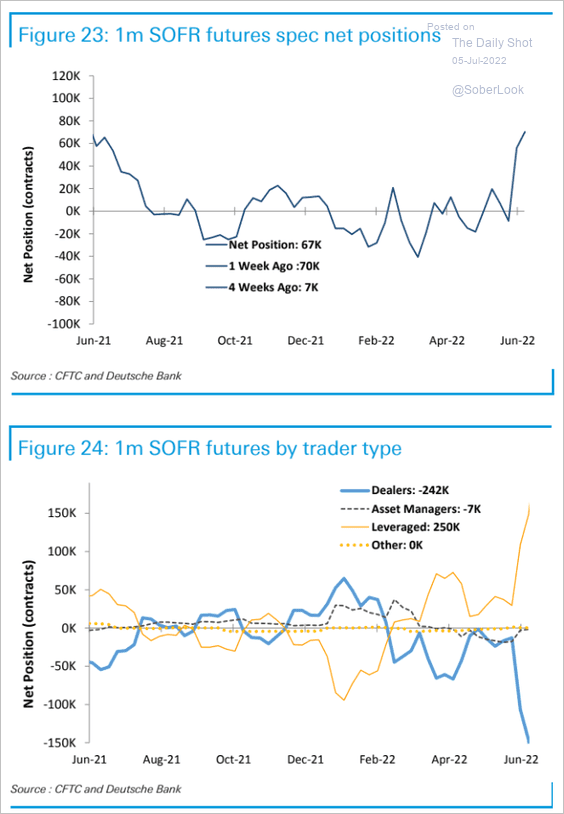

2. Hedge funds are betting on more aggressive Fed rate cuts.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

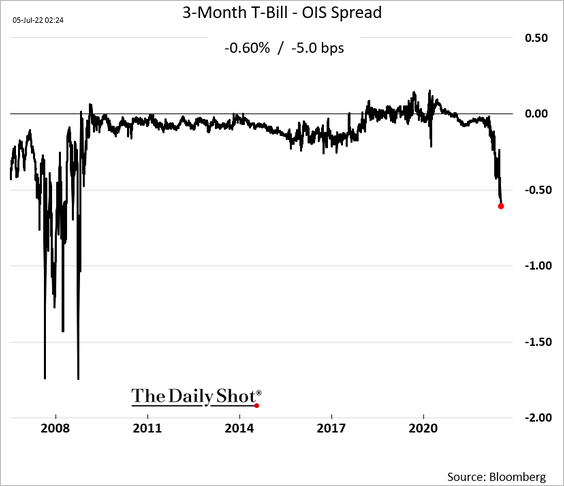

3. T-bills continue to trade at a substantial premium to OIS (the expected fed funds rate).

Back to Index

Food for Thought

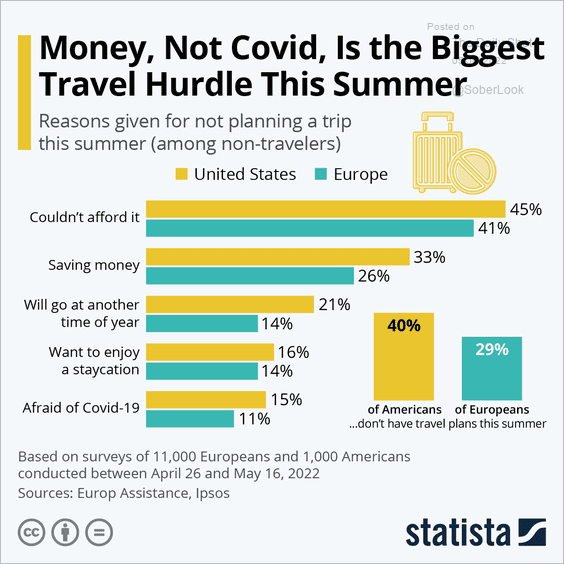

1. Reasons for not traveling this summer:

Source: Statista

Source: Statista

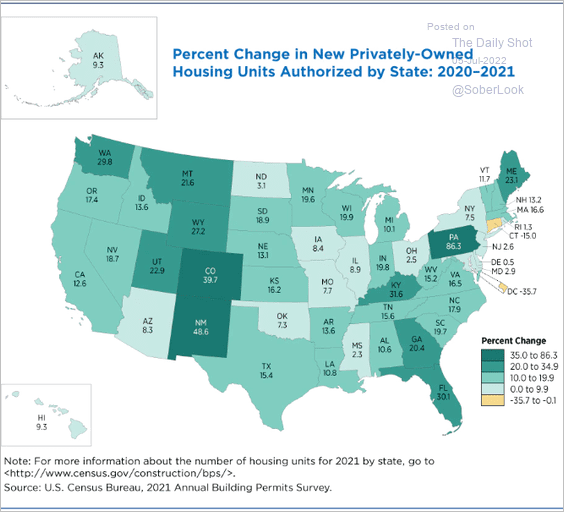

2. The pandemic-era residential construction boom:

Source: Census Bureau Read full article

Source: Census Bureau Read full article

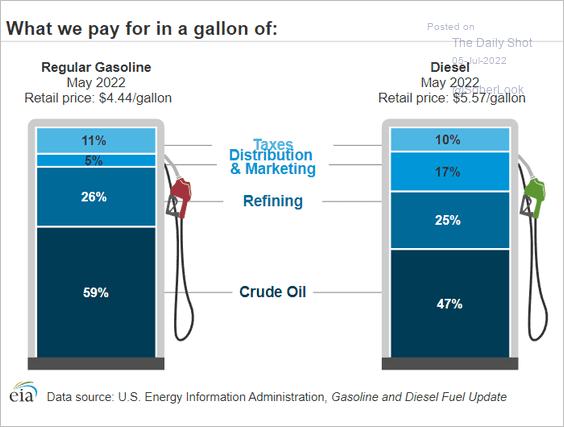

3. The breakdown of US motor fuel costs:

Source: @EIAgov Read full article

Source: @EIAgov Read full article

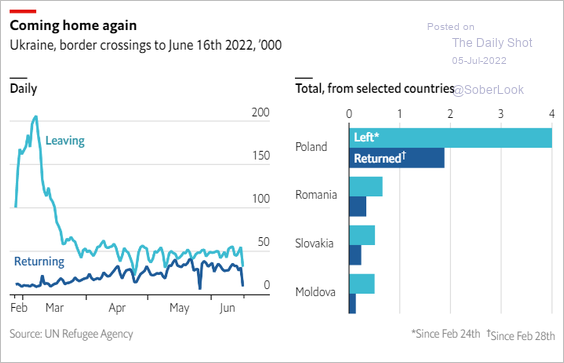

4. Returning Ukrainian refugees:

Source: The Economist Read full article

Source: The Economist Read full article

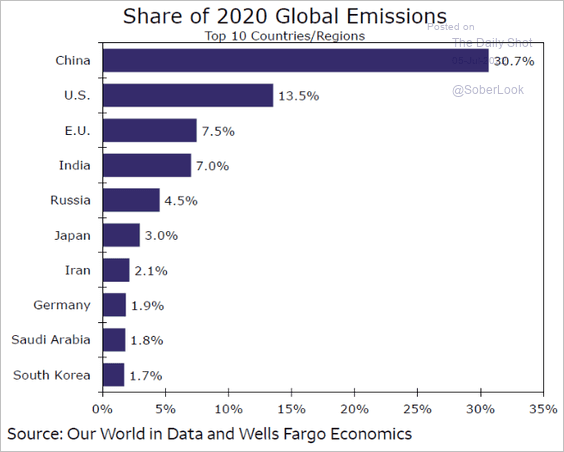

5. Share of global emissions:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

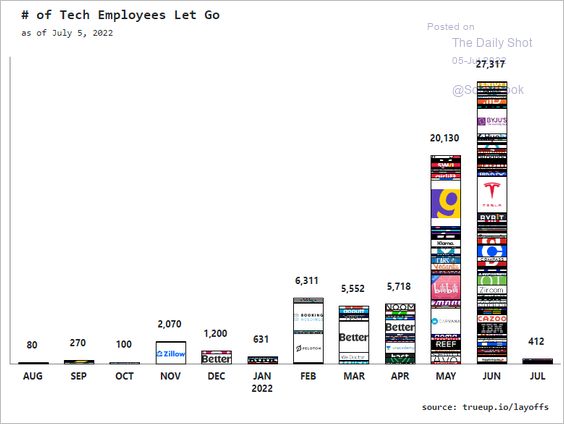

6. Tech layoffs:

Source: TrueUp

Source: TrueUp

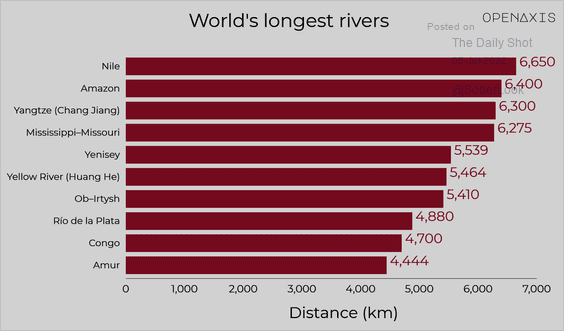

7. The world’s longest rivers:

Source: OpenAxis Read full article

Source: OpenAxis Read full article

——————–

Back to Index