The Daily Shot: 22-Aug-22

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the housing market.

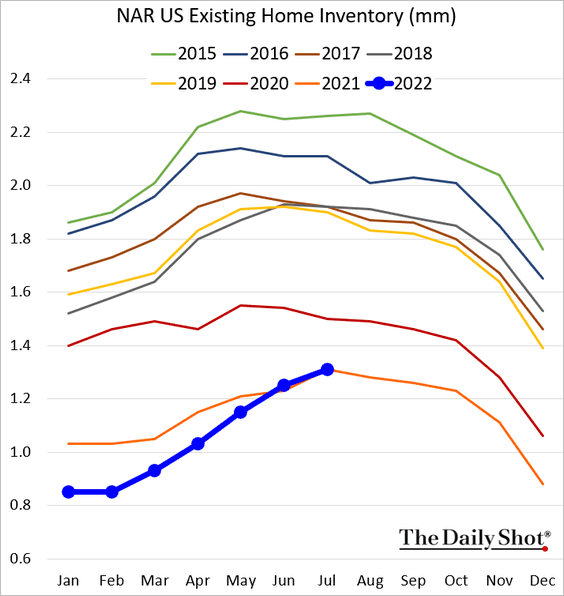

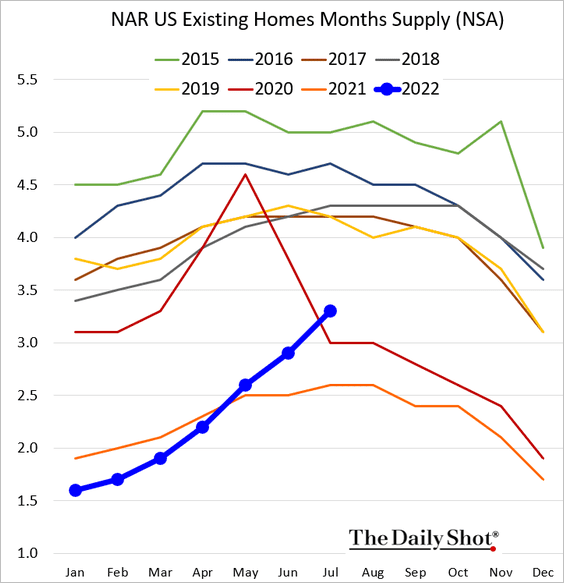

• Housing inventories are running at last year’s levels.

However, the situation is much worse when measured in months of supply (the difference is due to slower home sales).

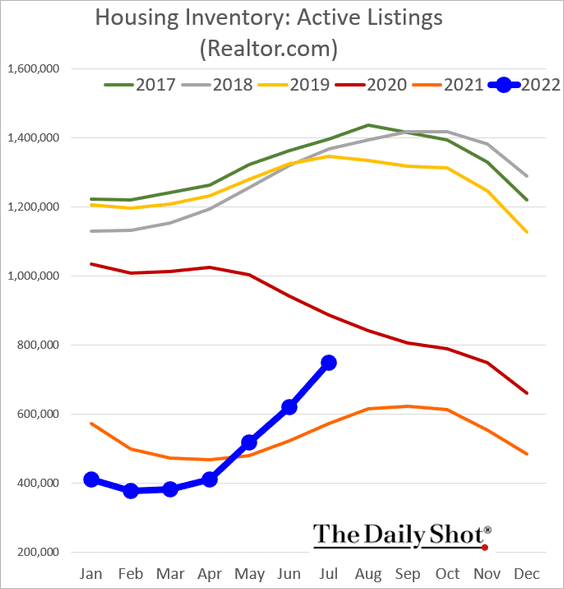

Active listings from Realtor.com are well above last year’s level.

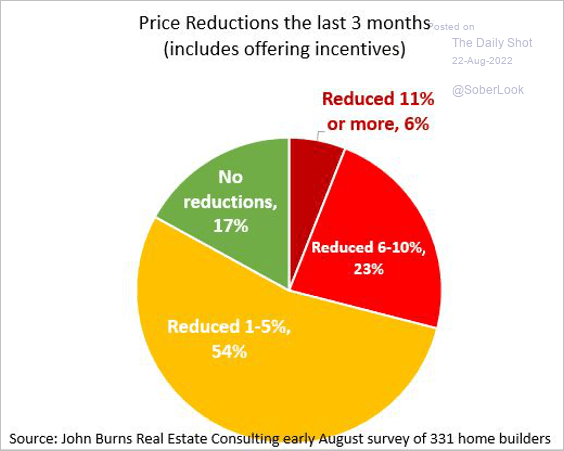

• Builders have been reducing prices.

Source: @johnburnsjbrec

Source: @johnburnsjbrec

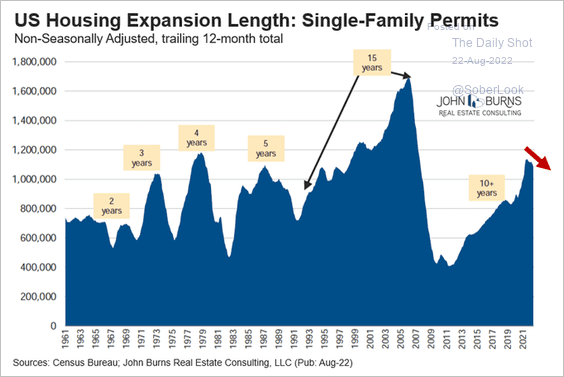

• The end of the housing cycle or just a pause?

Source: @RickPalaciosJr

Source: @RickPalaciosJr

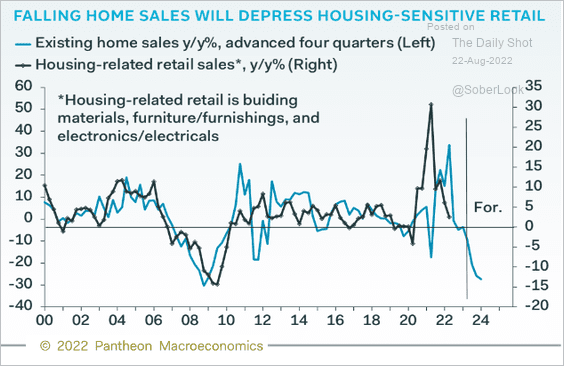

• The housing slump will pressure retail sales in some sectors.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

2. Next, we have some updates on the labor market.

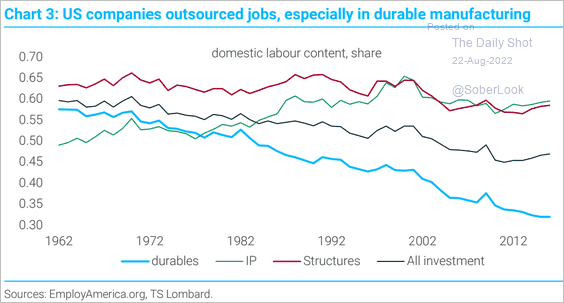

• Job offshoring has been limiting price gains in the US over the past few decades.

Source: TS Lombard

Source: TS Lombard

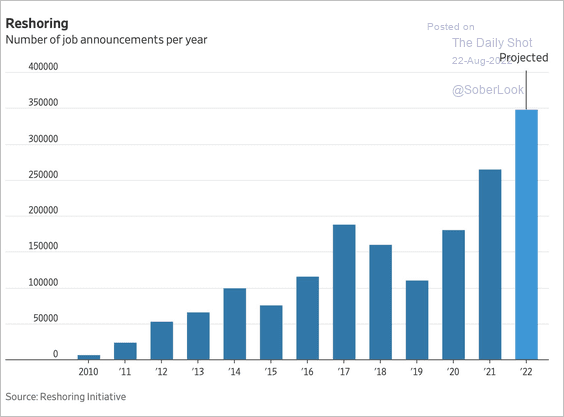

But the offshoring trend is now reversing, which is likely to be inflationary.

Source: @jessefelder, @WSJ Read full article

Source: @jessefelder, @WSJ Read full article

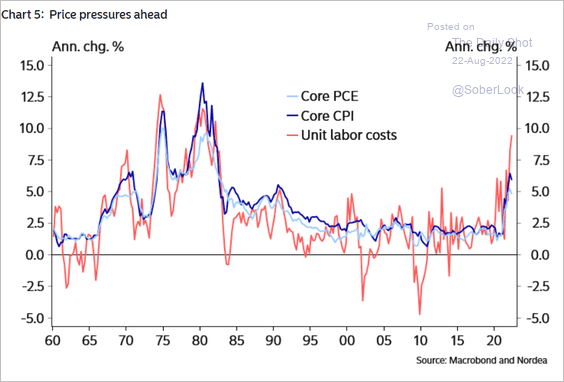

• Labor costs point to persistent price pressures ahead.

Source: Nordea Markets

Source: Nordea Markets

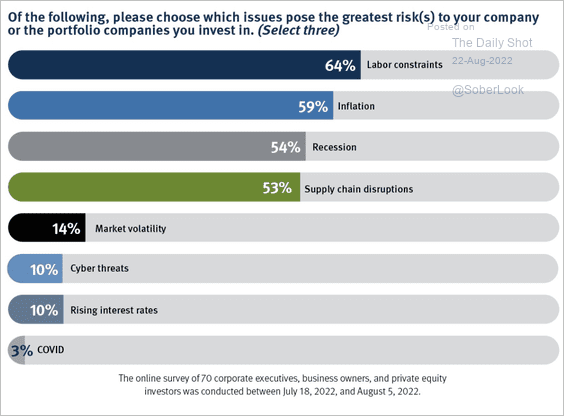

• Labor constraints remain a key concern for companies.

Source: @acemaxx, @ines_ferre, @YahooFinance Read full article

Source: @acemaxx, @ines_ferre, @YahooFinance Read full article

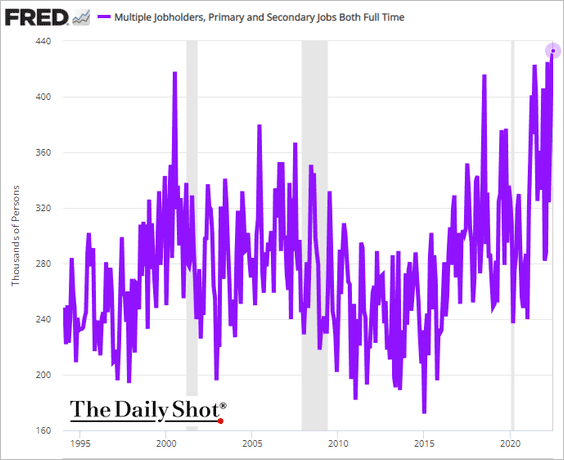

• More Americans hold two or more full-time jobs.

——————–

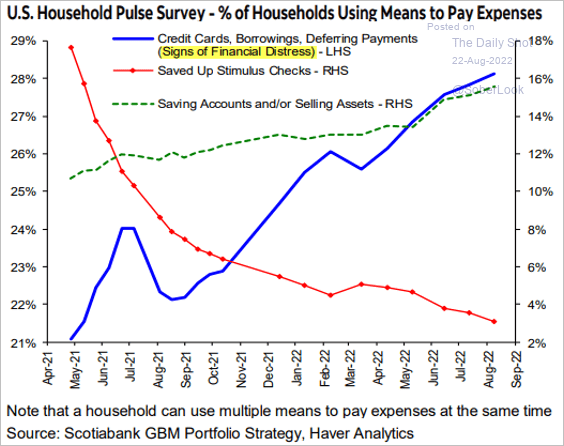

3. There are signs of increasing financial distress among US households.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

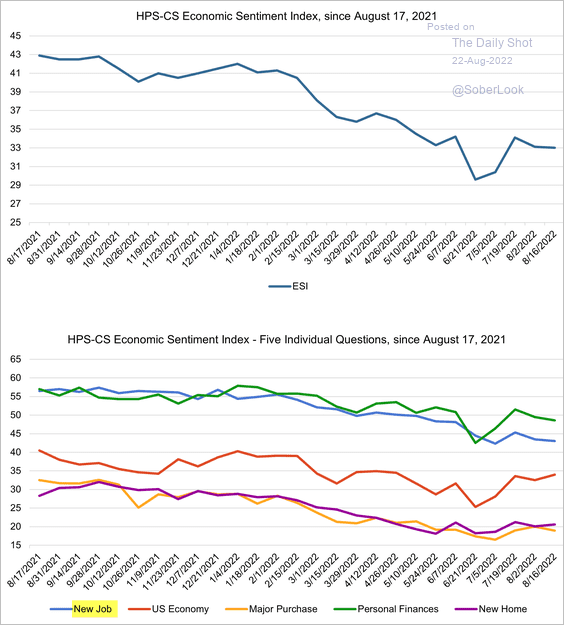

Consumer sentiment resumed its downward trend.

Source: @HPS_CS, @HPSInsight, @CivicScience

Source: @HPS_CS, @HPSInsight, @CivicScience

——————–

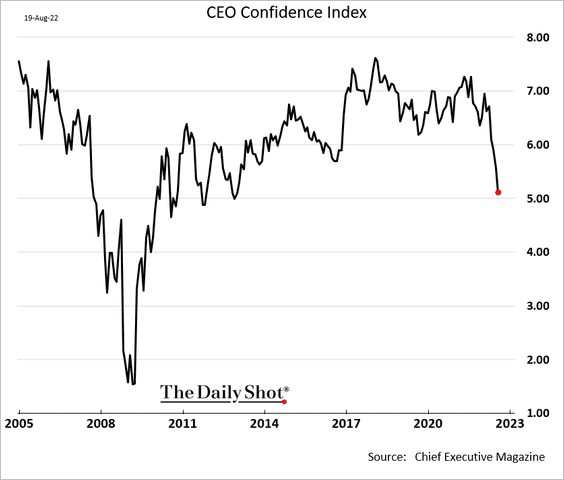

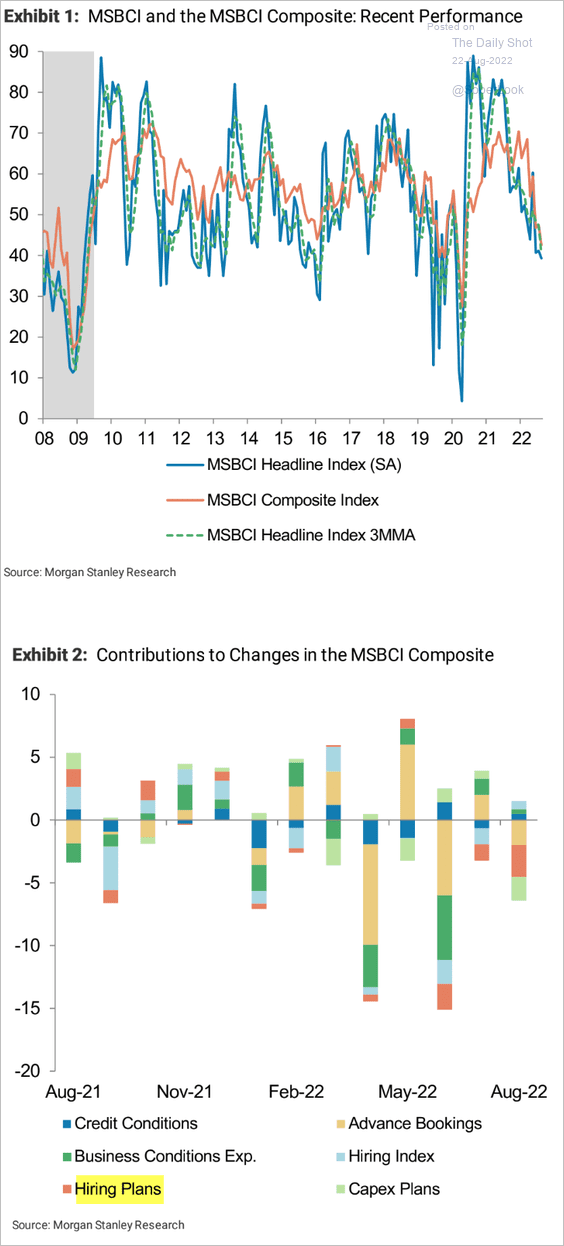

4. CEO confidence has been deteriorating, …

… as business conditions weaken.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

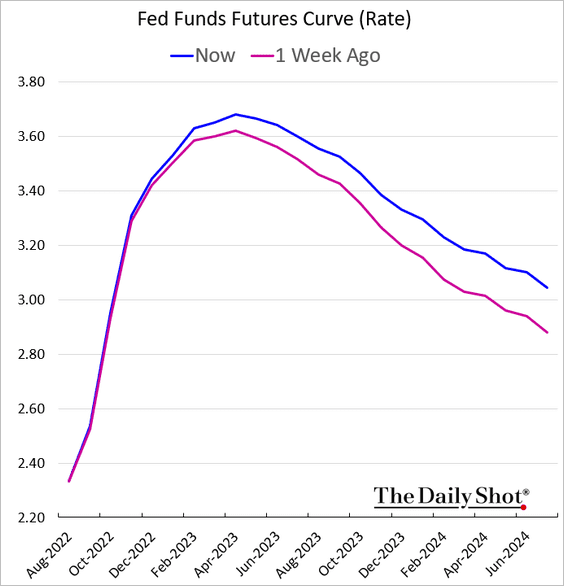

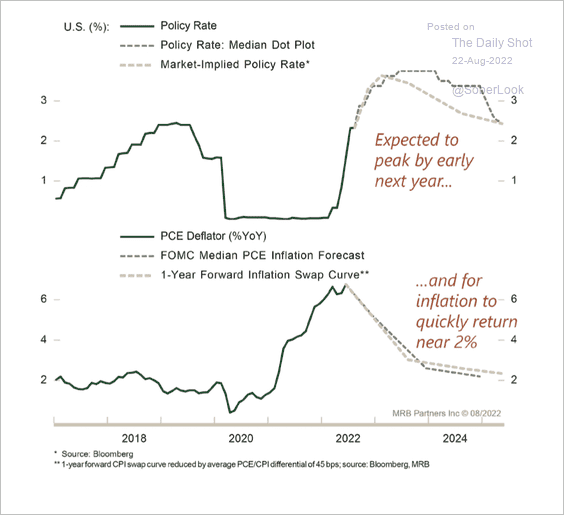

5. Fed officials have been jawboning rate expectations higher.

Source: @WSJ Read full article

Source: @WSJ Read full article

Here is the latest market-implied fed funds rate trajectory.

Even if inflation declines quickly, it may take much longer for the Fed to cut rates than the market currently expects.

Source: MRB Partners

Source: MRB Partners

Back to Index

The United Kingdom

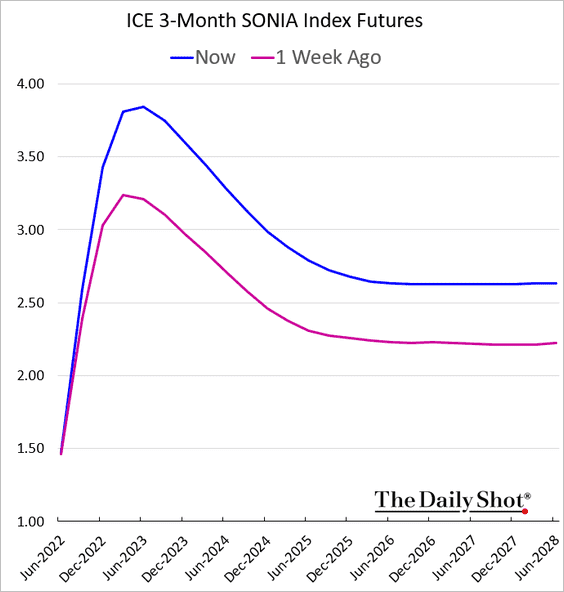

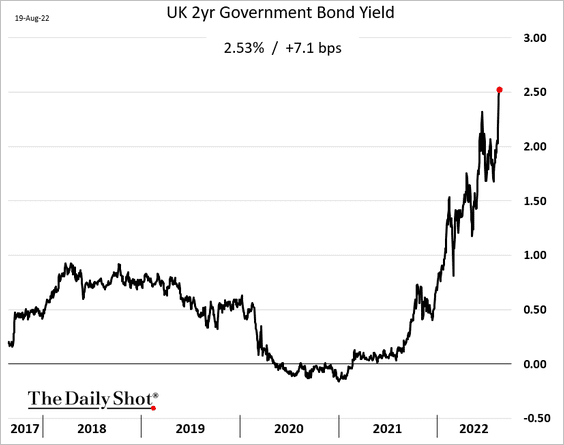

1. Rate hike expectations continue to climb, …

… sending short-term gilt yields to multi-year highs.

——————–

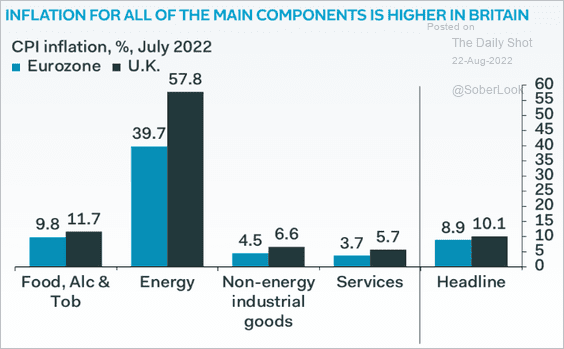

2. UK Inflation is outpacing the Eurozone.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

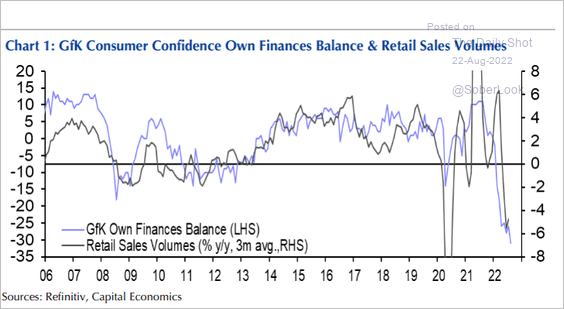

3. New lows in consumer confidence point to further weakness in retail sales.

Source: Capital Economics

Source: Capital Economics

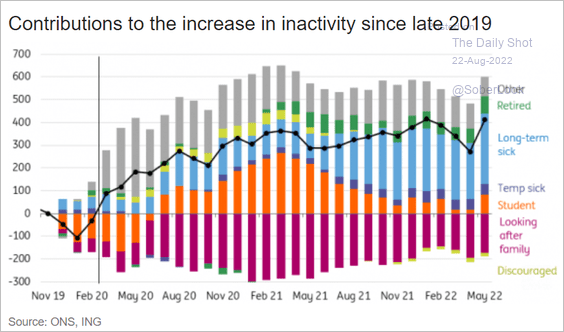

4. Here are the contributions to labor market inactivity.

Source: ING

Source: ING

Back to Index

The Eurozone

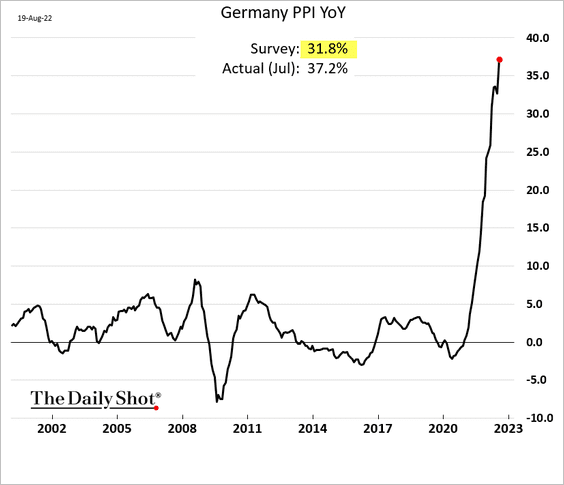

1. Let’s begin with Germany.

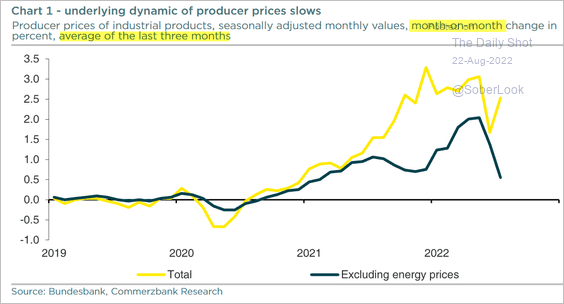

• The PPI hit 37% in July, topping forecasts.

But there are some hopeful signs when energy is excluded.

Source: Commerzbank Research

Source: Commerzbank Research

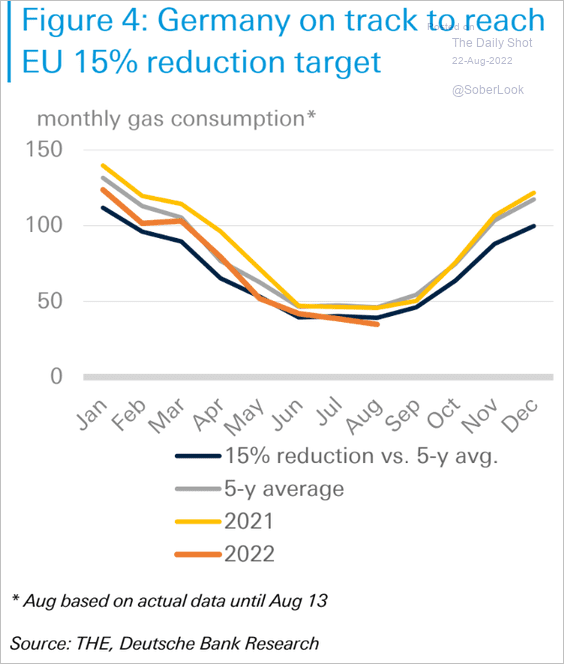

• Monthly natural gas consumption is moving lower.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

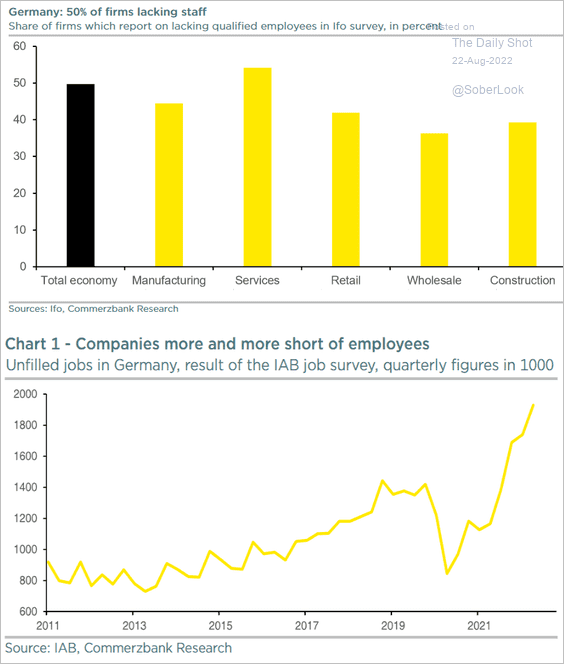

• Companies continue to face labor shortages

Source: Commerzbank Research

Source: Commerzbank Research

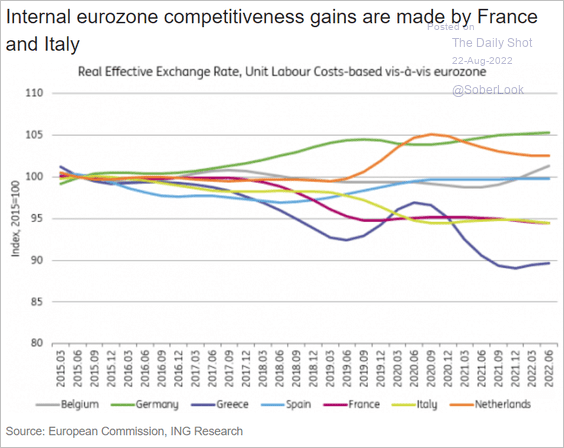

• Germany’s labor costs are reducing competitiveness.

Source: ING

Source: ING

——————–

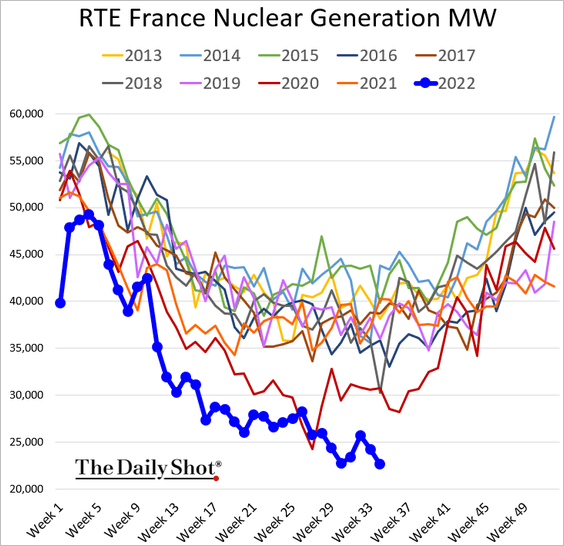

2. French nuclear power output continues to fall.

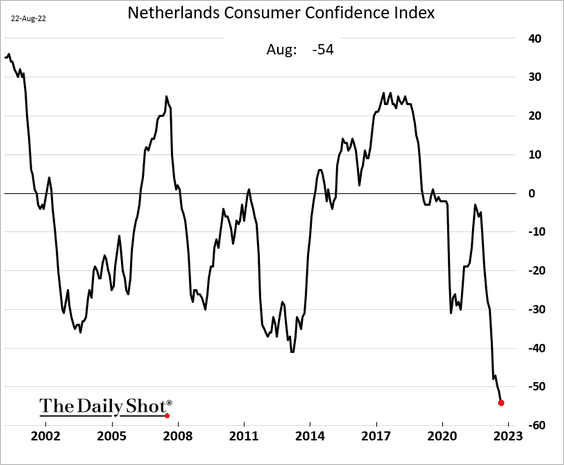

3. Dutch consumer sentiment has collapsed.

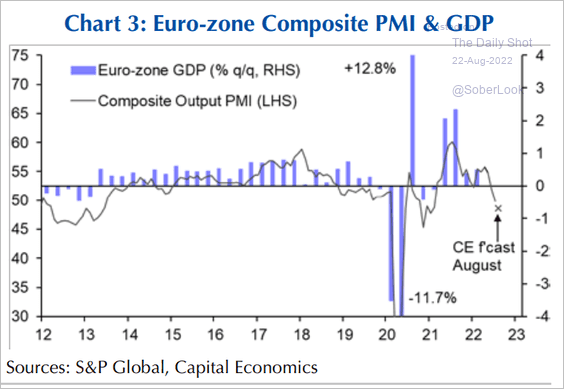

4. Recession ahead?

Source: Capital Economics

Source: Capital Economics

Back to Index

Asia – Pacific

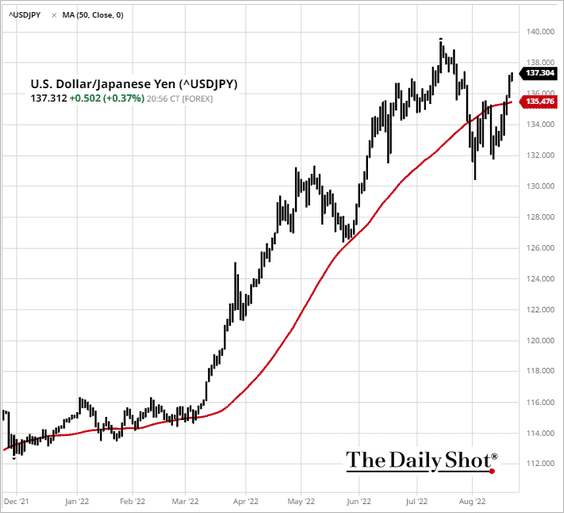

1. Dollar-yen is moving higher after breaking resistance at the 50-day moving average.

Source: barchart.com

Source: barchart.com

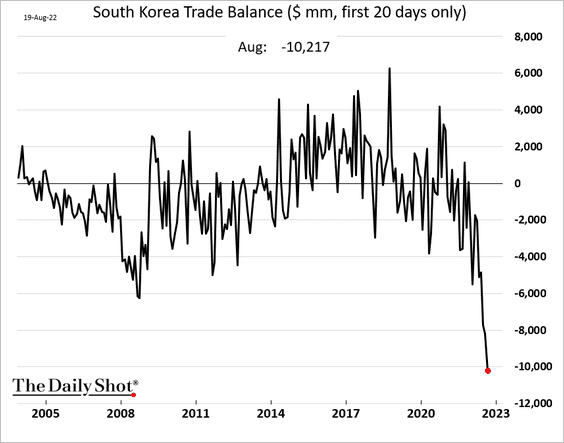

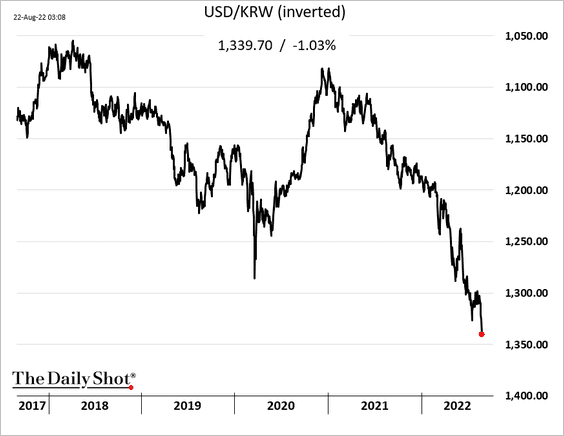

2. South Korea’s trade deficit widened to a new record in August as energy costs take a toll.

The won hit a multi-year low vs. USD.

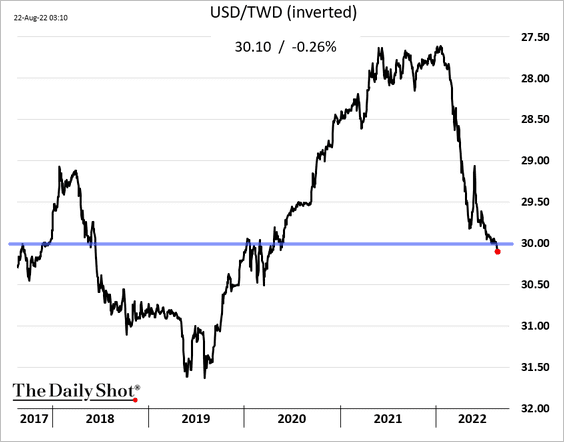

3. The Taiwan dollar is weaker as well.

Back to Index

China

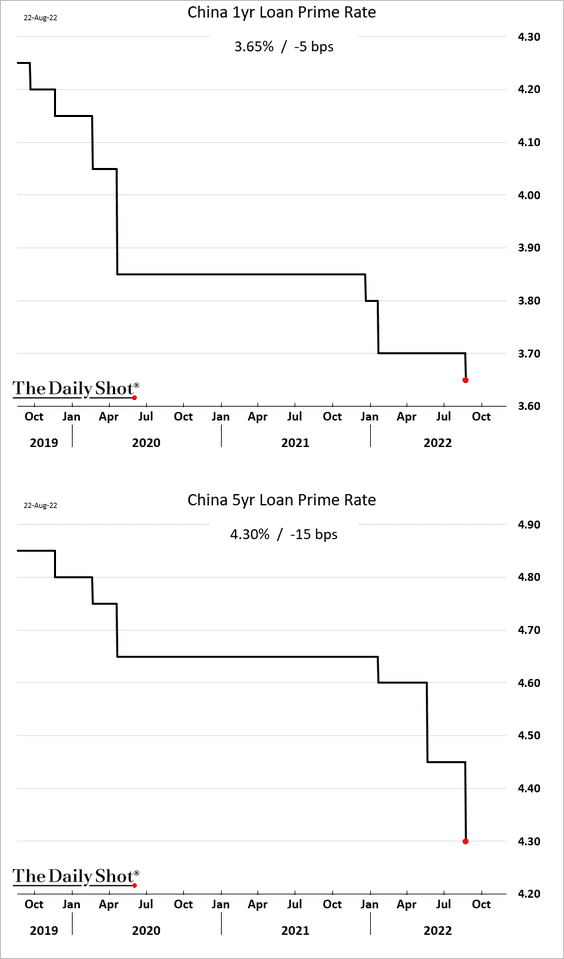

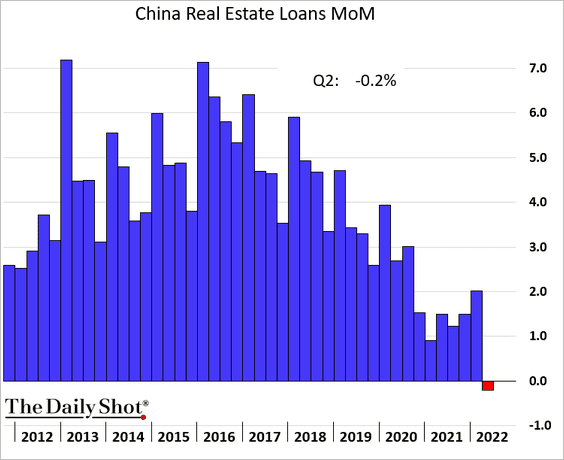

1. The PBoC cut mortgage rates to support the housing market.

Property loans declined last quarter for the first time in years.

h/t @kristyhung122

h/t @kristyhung122

——————–

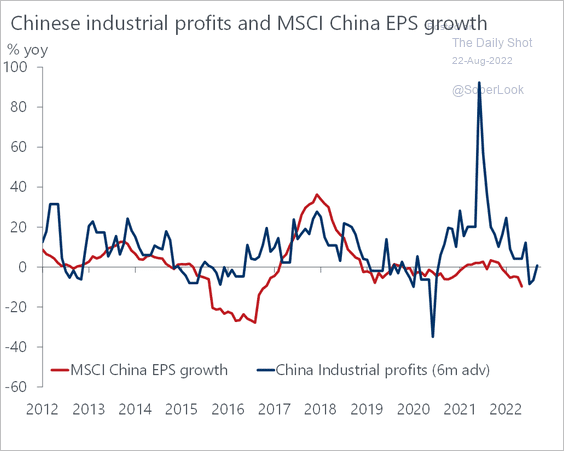

2. Industrial profits are starting to stabilize, which could benefit earnings growth.

Source: Oxford Economics

Source: Oxford Economics

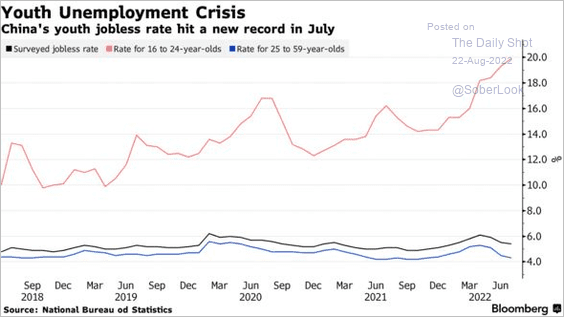

3. Youth unemployment remains elevated.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

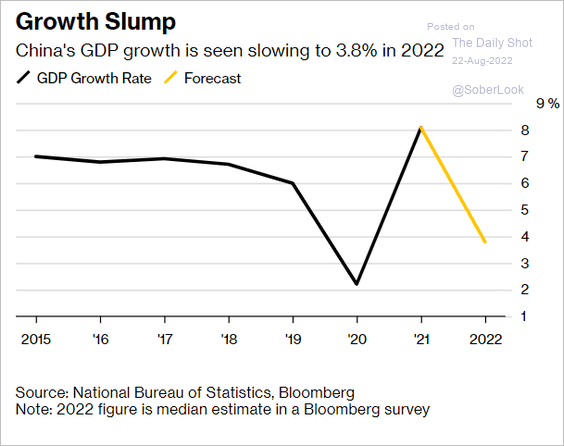

4. How much will China’s growth slow this year?

Source: Bloomberg Read full article

Source: Bloomberg Read full article

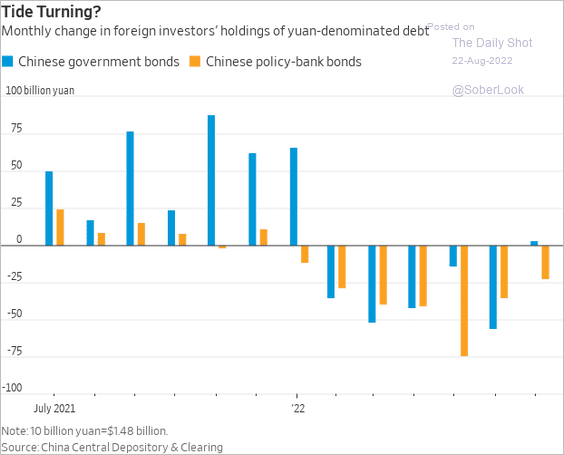

5. Are foreigners returning to China’s debt markets?

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Emerging Markets

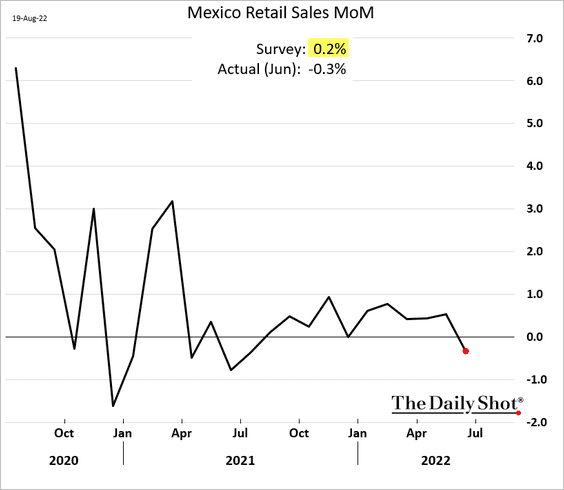

1. Mexico’s retail sales unexpectedly declined in June.

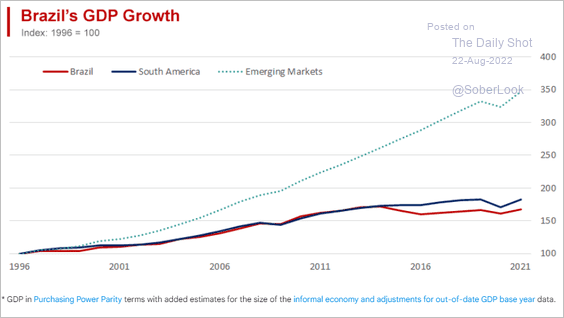

2. Brazil’s economic growth has been underperforming for decades.

Source: World Economics

Source: World Economics

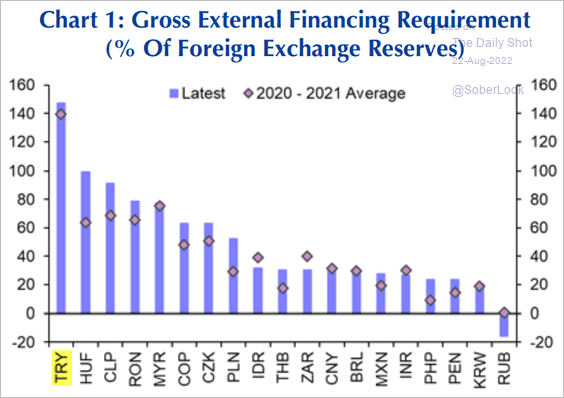

3. Turkey relies heavily on external financing.

Source: Capital Economics

Source: Capital Economics

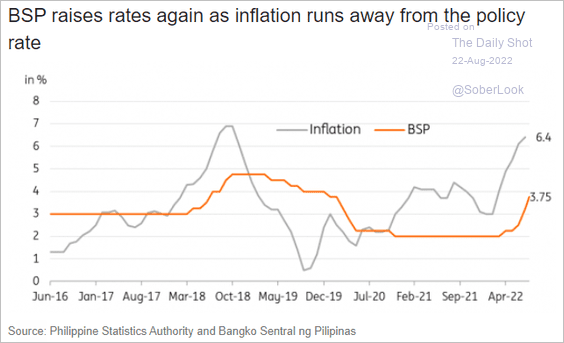

4. The Philippine central bank hiked rates last week as inflation jumped.

Source: ING

Source: ING

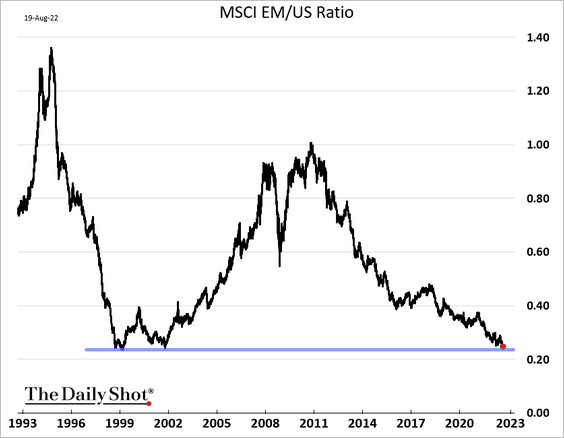

5. EM equities are at support relative to the US.

6. Next, we have some performance data from last week.

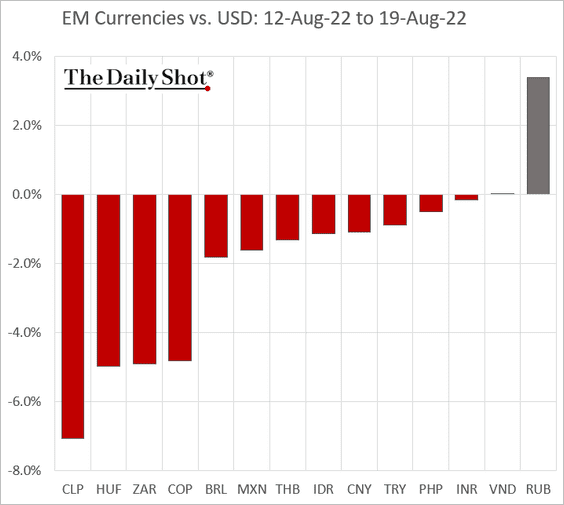

• Currencies:

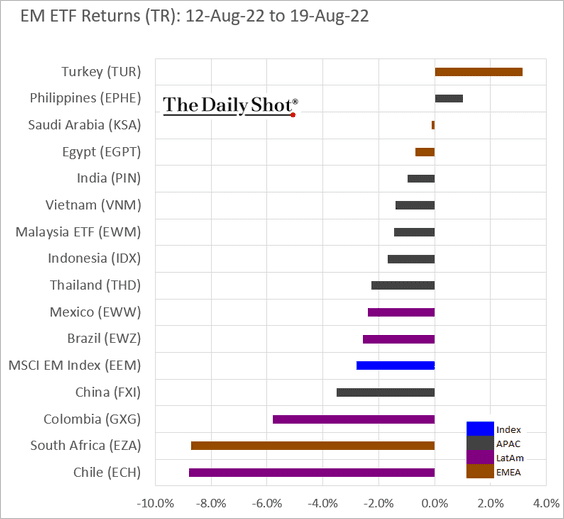

• Equity ETFs:

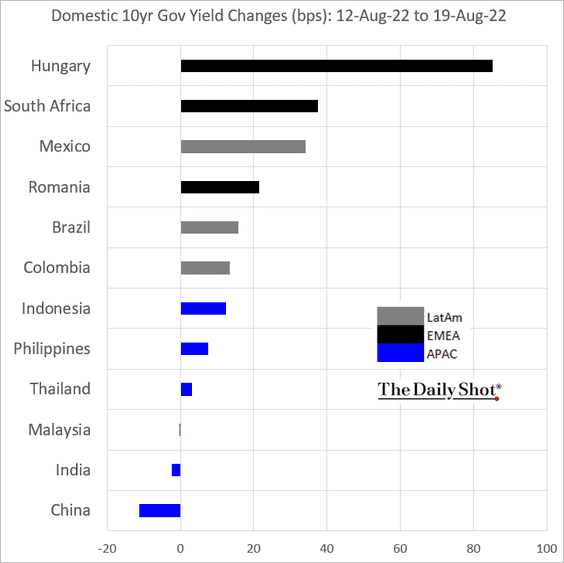

• Local-currency bond yields:

Back to Index

Cryptocurrency

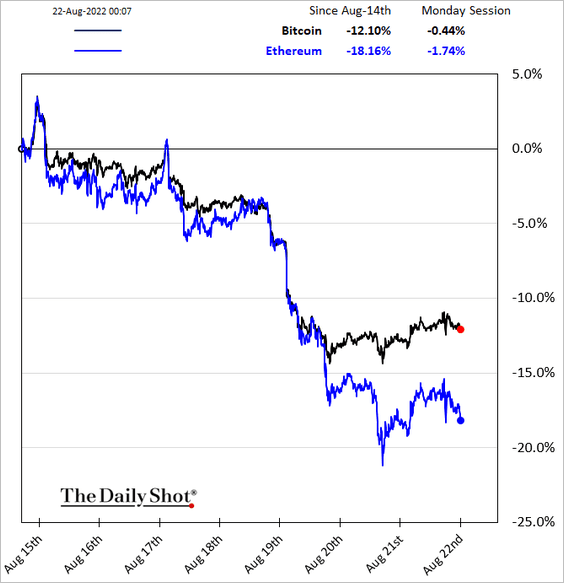

1. Ether underperformed over the weekend.

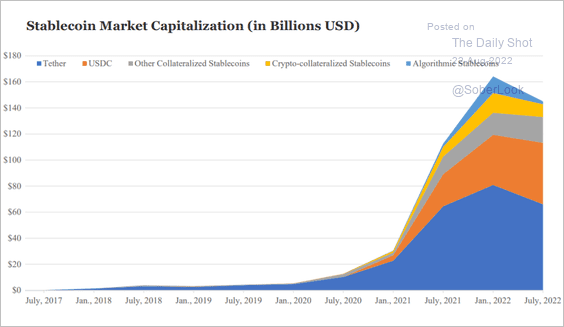

2. The stablecoin market capitalization has peaked for now.

Source: Brookings Read full article

Source: Brookings Read full article

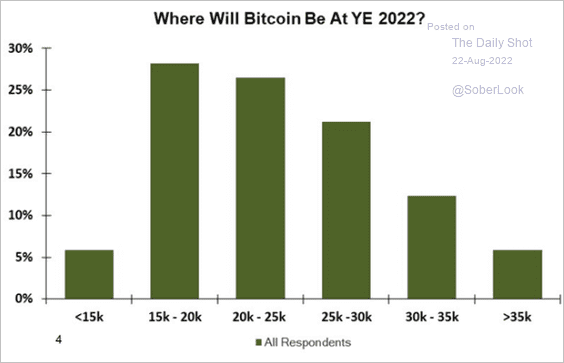

3. Where will bitcoin be at the end of the year? This distribution is based on a survey from Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

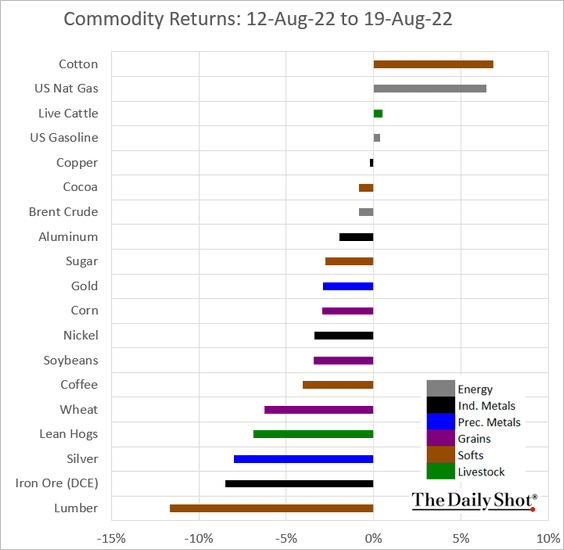

Commodities

Here is last week’s performance across key markets.

Back to Index

Energy

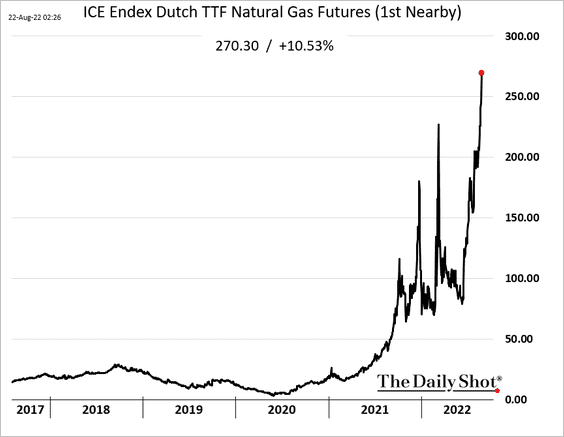

1. Russia completely shut off Nord Stream gas flows to Europe.

Source: @WSJ Read full article

Source: @WSJ Read full article

European natural gas futures are up 10% this morning (a record high).

——————–

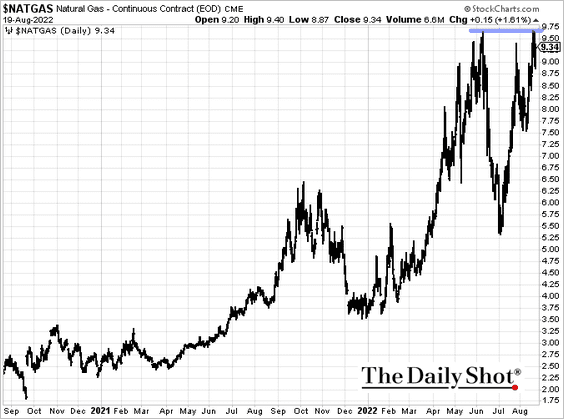

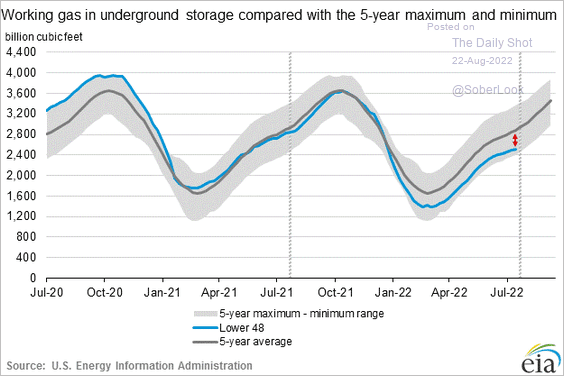

2. US natural gas futures tested resistance last week at the previous peak.

US natural gas inventories have been tightening.

Back to Index

Equities

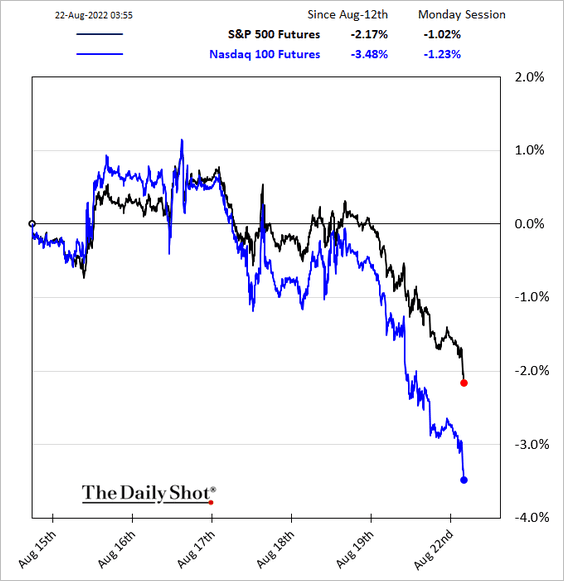

1. Equity futures are heavy this morning on Fed outlook.

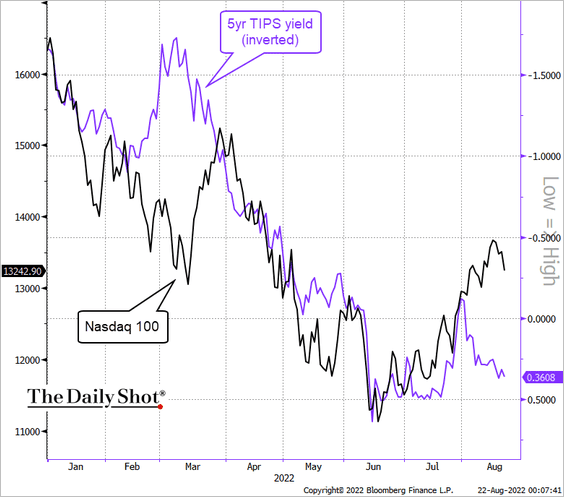

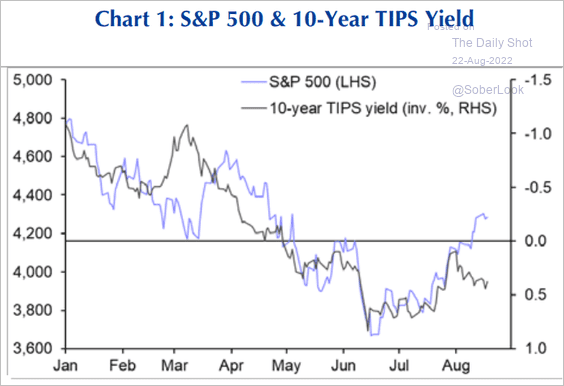

2. Elevated real rates don’t bode well for near-term performance (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Capital Economics

Source: Capital Economics

——————–

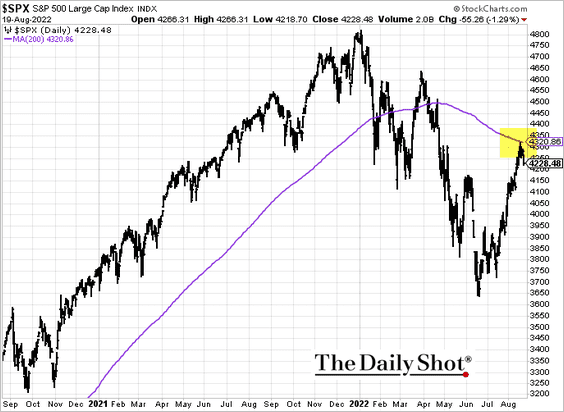

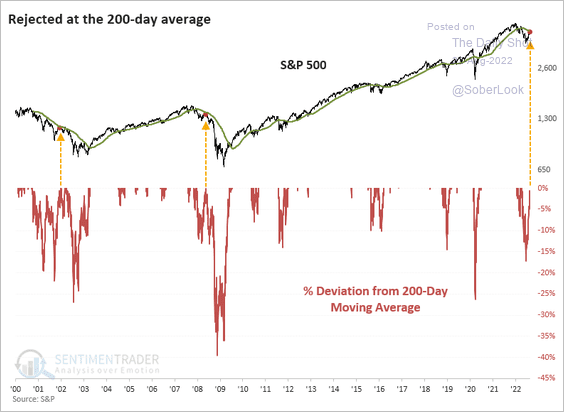

3. A short-term rejection of the 200-day moving average typically precedes market declines.

Source: SentimenTrader

Source: SentimenTrader

——————–

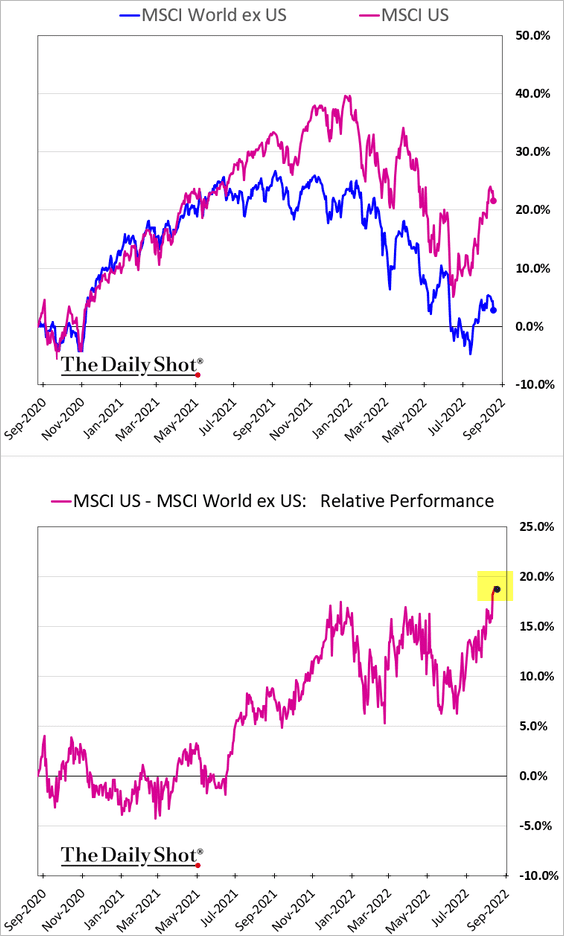

4. US stocks continue to widen their gap with global shares.

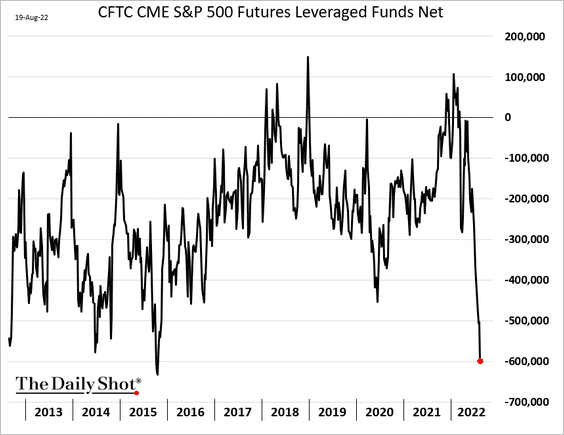

5. Leveraged funds have been rapidly boosting their hedges (cutting exposure).

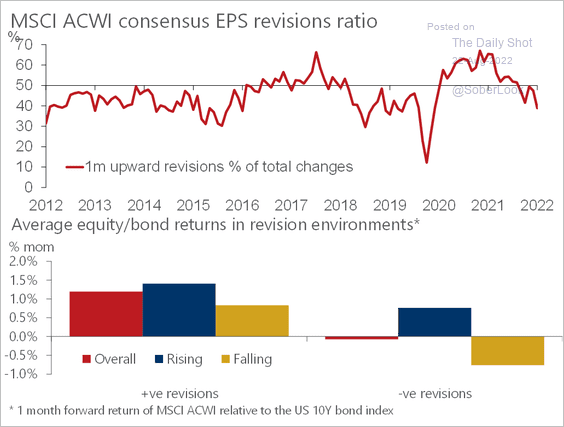

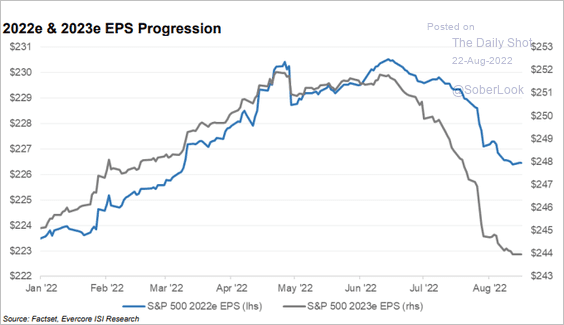

6. Equities tend to struggle when consensus earnings revisions decline.

Source: Oxford Economics

Source: Oxford Economics

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

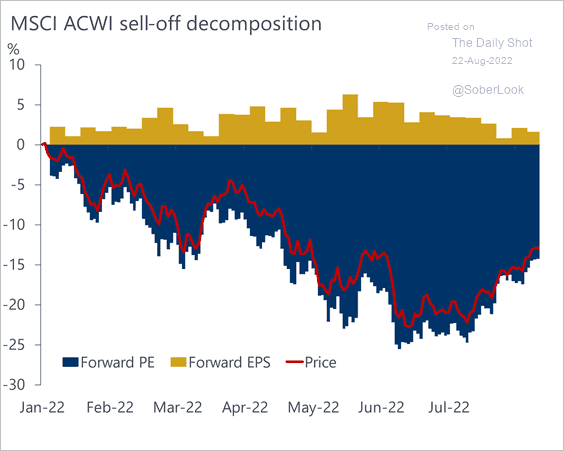

7. Here is the attribution of this year’s global market performance.

Source: Oxford Economics

Source: Oxford Economics

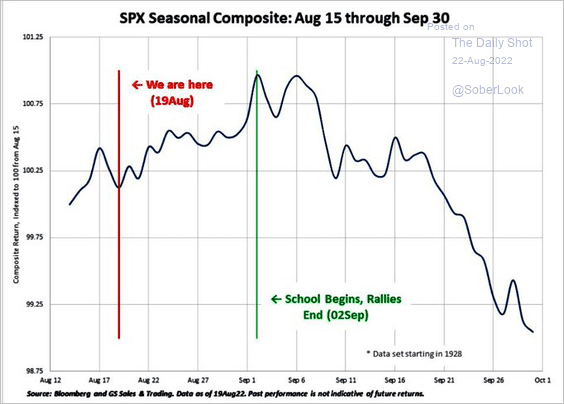

8. Stocks face a challenging seasonal pattern ahead.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

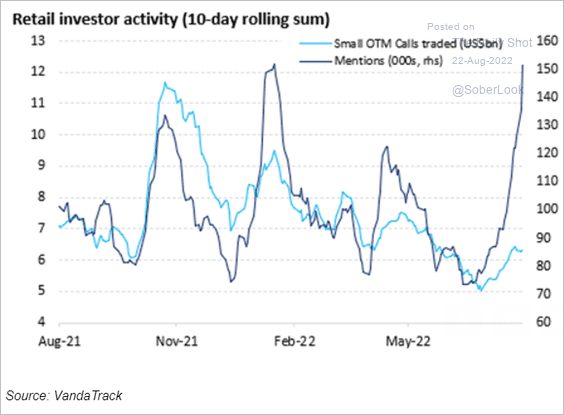

9. The Reddit chatter has been surging.

Source: Vanda Research

Source: Vanda Research

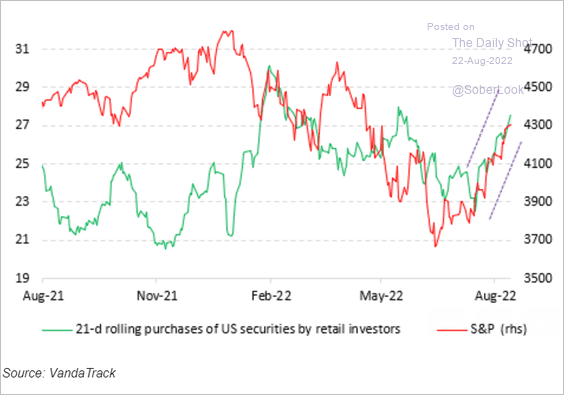

Retail investors continue to buy stocks.

Source: Vanda Research

Source: Vanda Research

——————–

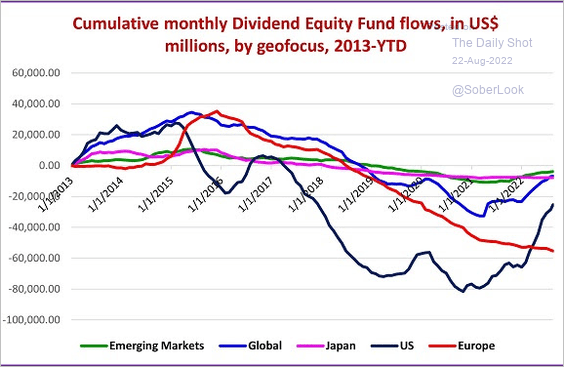

10. US dividend-focused funds registered substantial inflows this year.

Source: EPFR Global Navigator

Source: EPFR Global Navigator

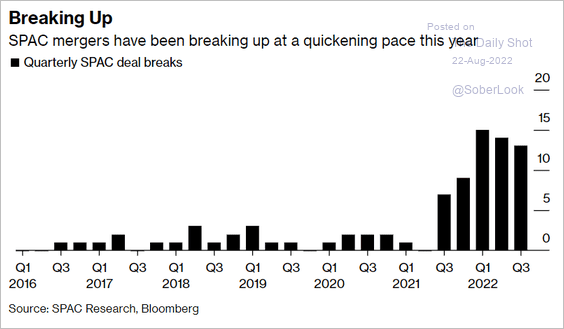

11. Cancelled mergers are forcing more SPACs to return money to investors.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

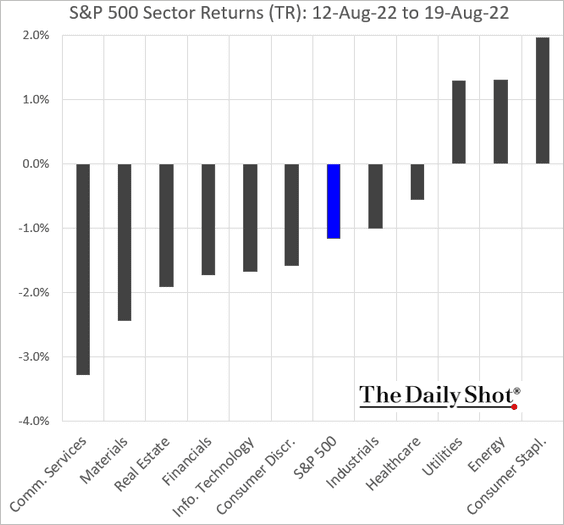

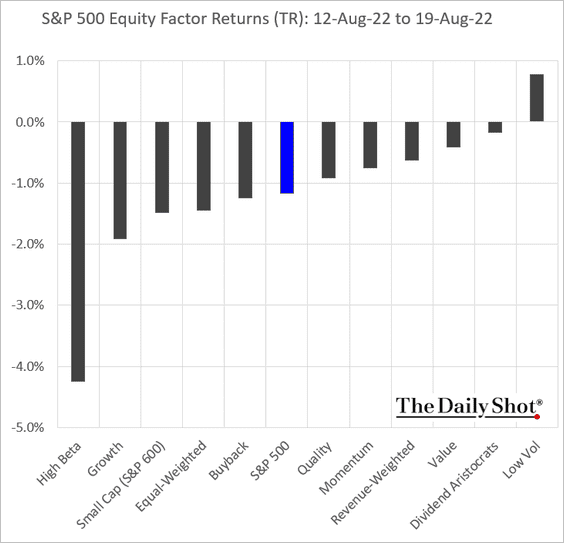

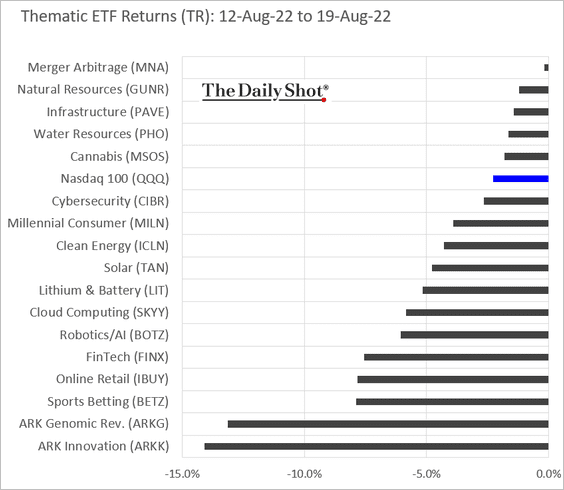

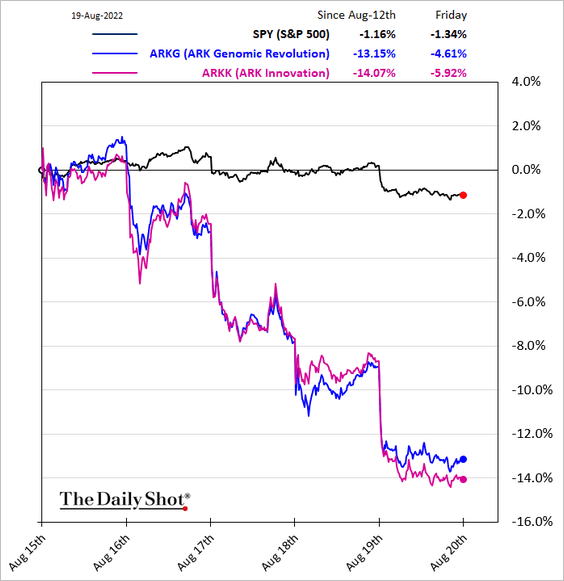

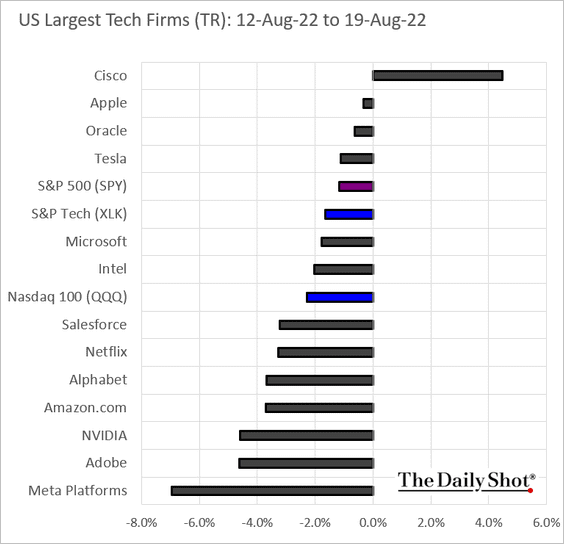

12. Finally, we have some performance data from last week.

• Sectors:

• Factors:

• Thematic ETFs:

• The largest US tech companies:

Back to Index

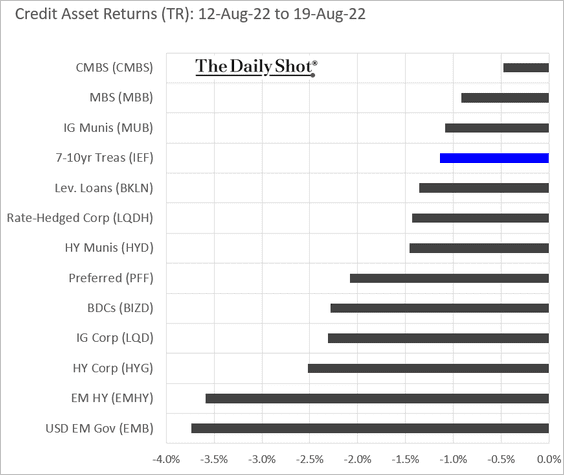

Credit

Credit markets declined across the board last week.

Back to Index

Rates

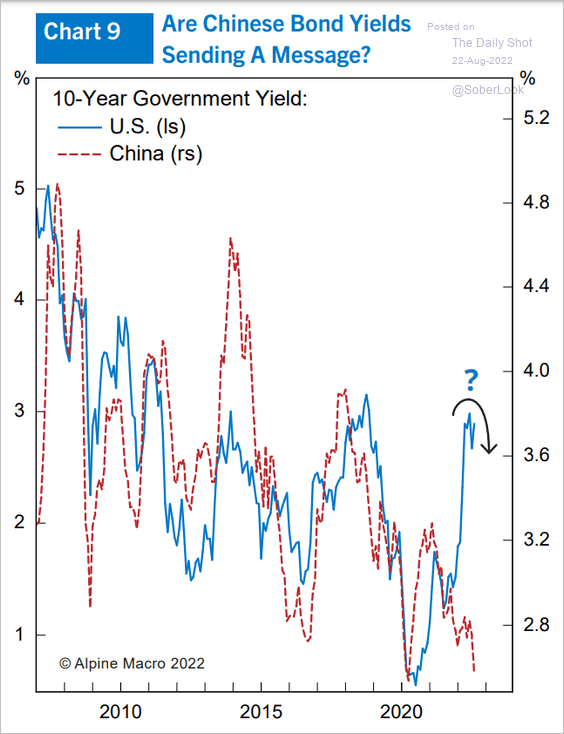

1. Will china’s falling bond yields pull Treasury yields lower?

Source: Alpine Macro

Source: Alpine Macro

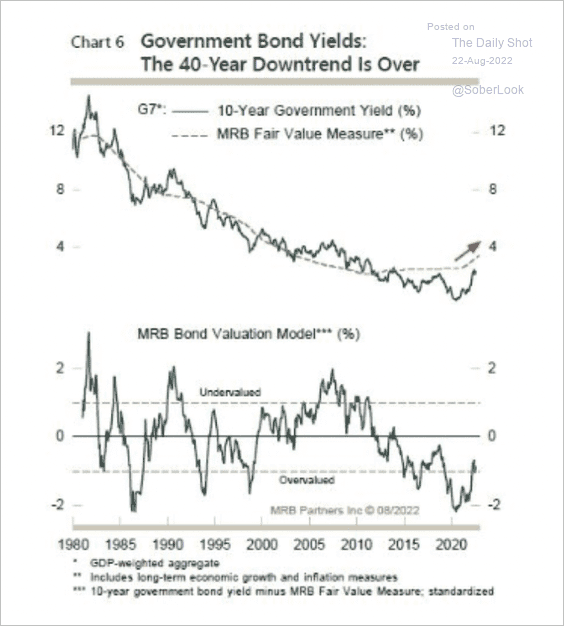

2. Sovereign bond yields have broken above a long-term downtrend.

Source: MRB Partners

Source: MRB Partners

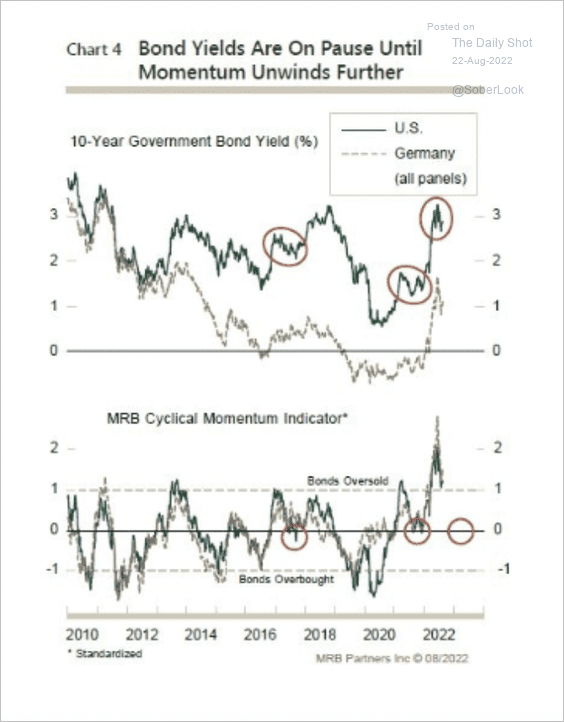

For now, the rally in yields has paused.

Source: MRB Partners

Source: MRB Partners

Back to Index

Global Developments

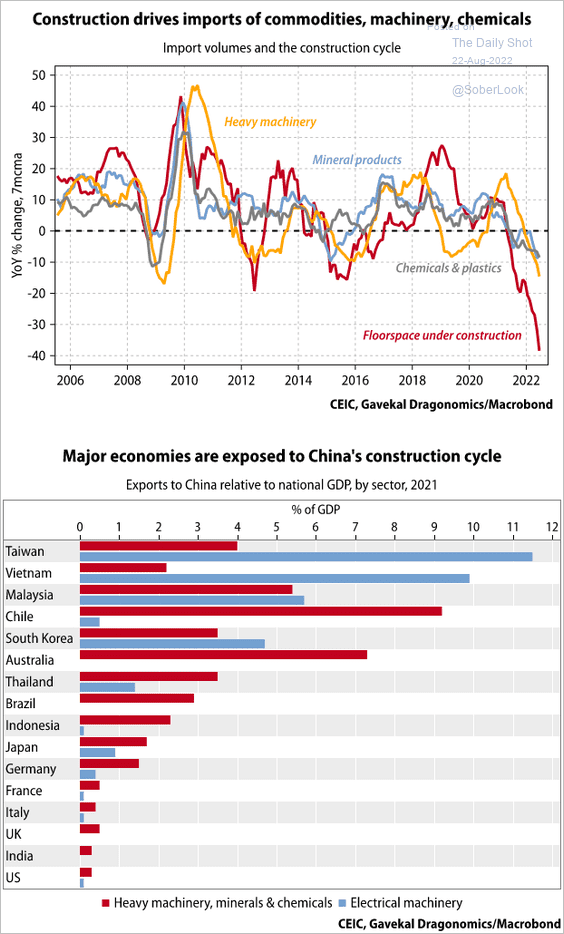

1. China’s construction slump is impacting global industrial demand.

Source: Gavekal Research

Source: Gavekal Research

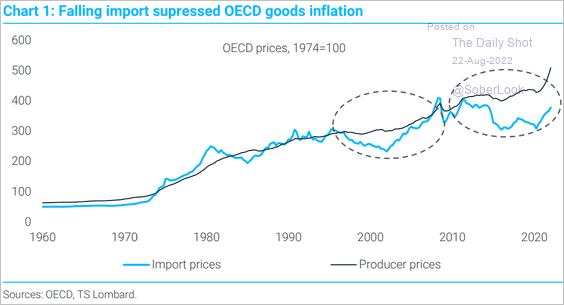

2. Deglobalization will put upward pressure on prices.

Source: TS Lombard

Source: TS Lombard

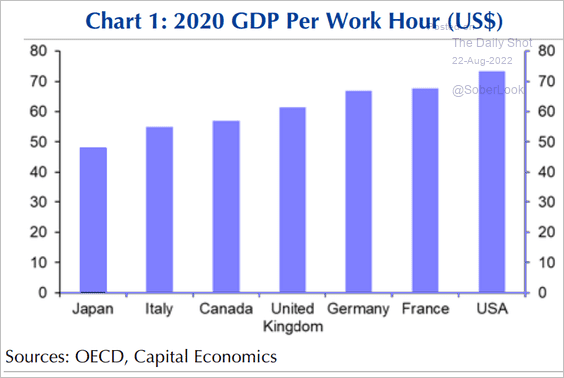

3. This chart shows labor productivity in advanced economies.

Source: Capital Economics

Source: Capital Economics

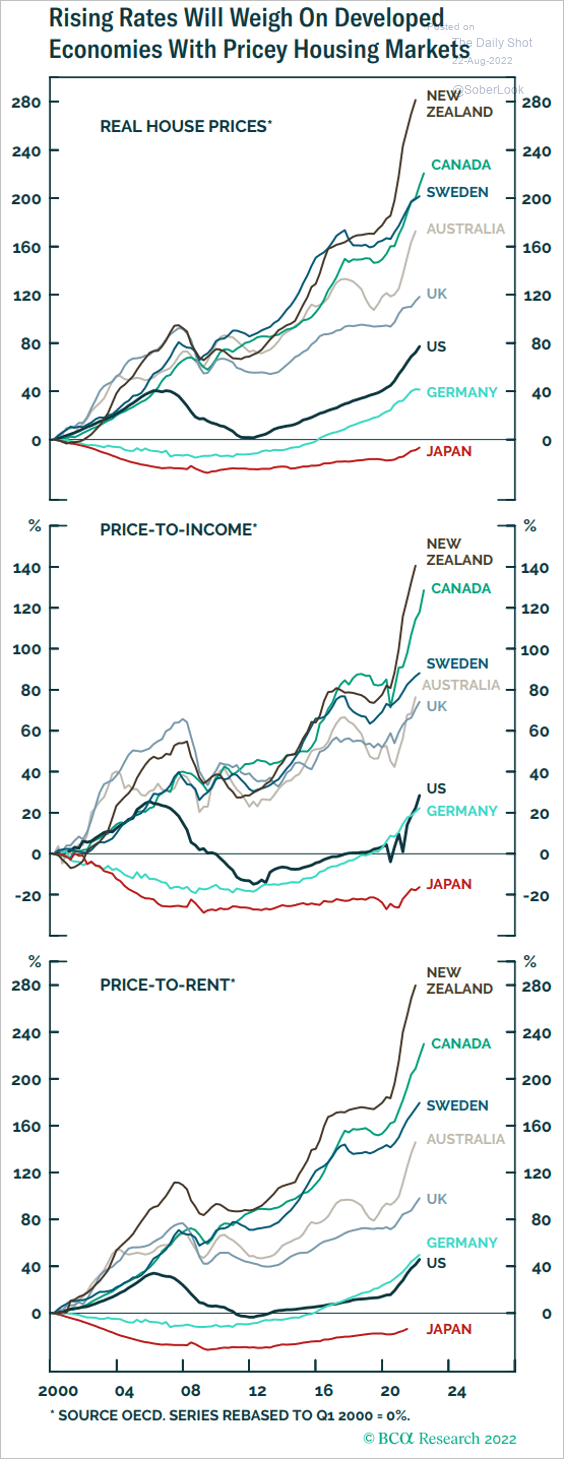

4. Which countries’ housing markets are most vulnerable to rising rates?

Source: BCA Research

Source: BCA Research

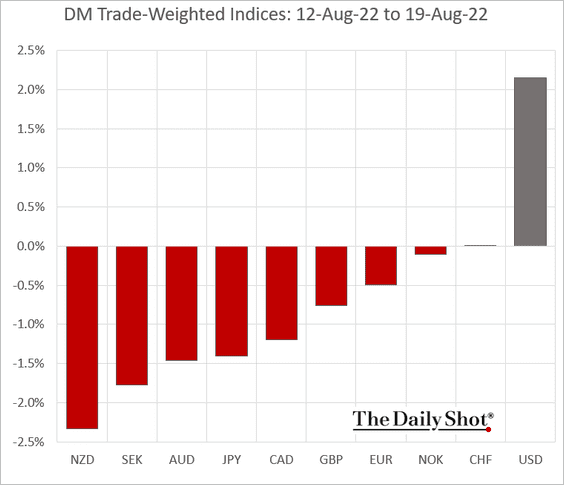

5. Finally, we have some performance data from last week.

• Trade-weighted currency indices:

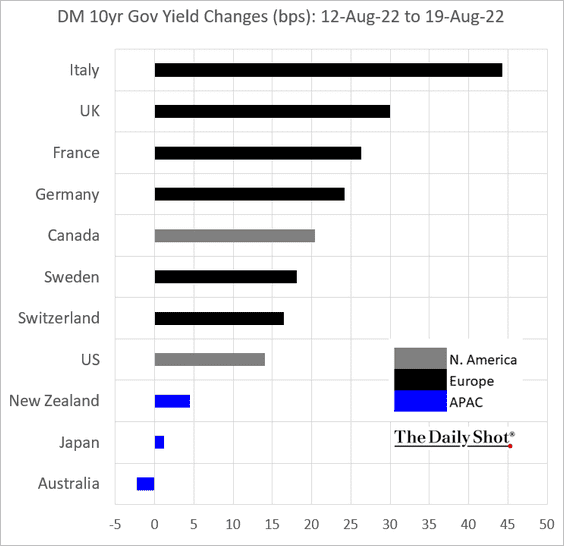

• Bond yields:

——————–

Food for Thought

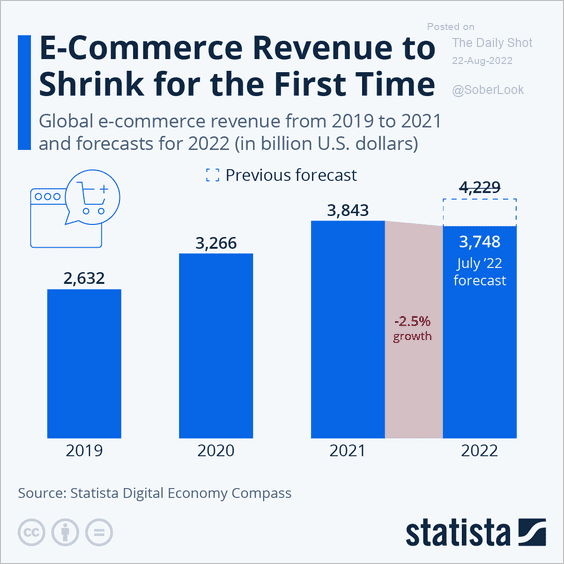

1. Global e-commerce revenue:

Source: Statista

Source: Statista

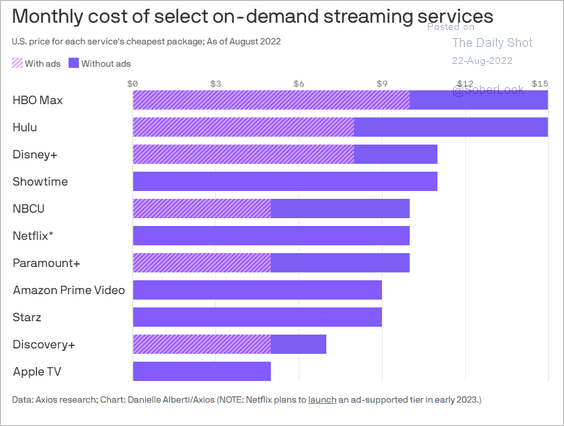

2. On-demand streaming services pricing:

Source: @axios Read full article

Source: @axios Read full article

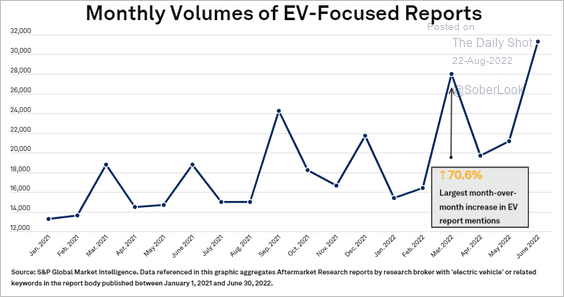

3. Research coverage of the EV sector:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

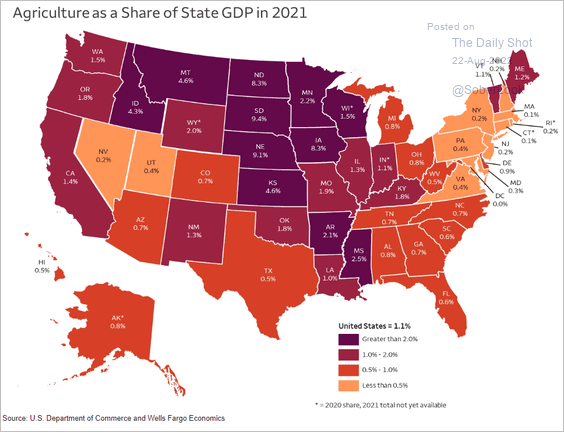

4. Agriculture as a share of state GDP:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

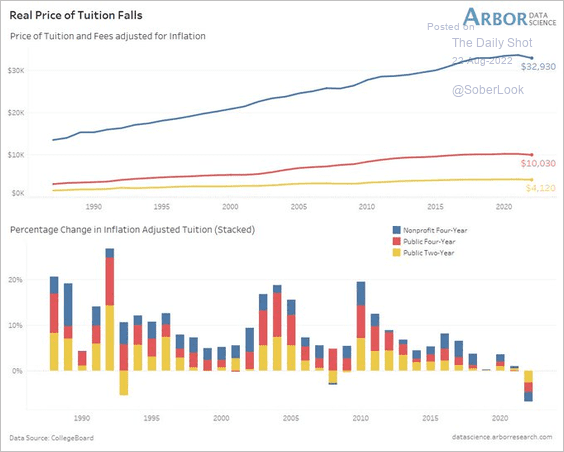

5. Inflation-adjusted college tuition in the US:

Source: @LizAnnSonders, @DataArbor

Source: @LizAnnSonders, @DataArbor

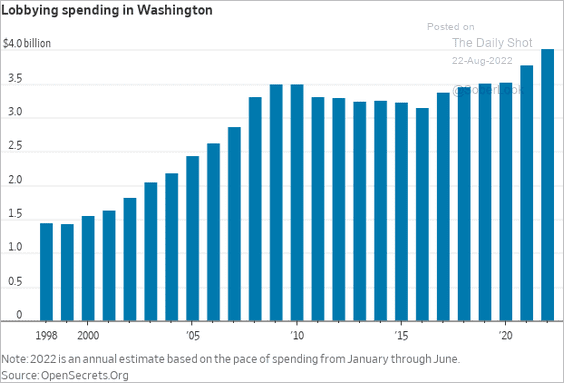

6. Lobbying spending:

Source: @WSJ Read full article

Source: @WSJ Read full article

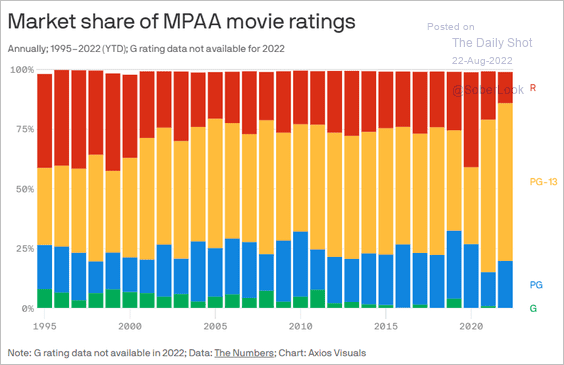

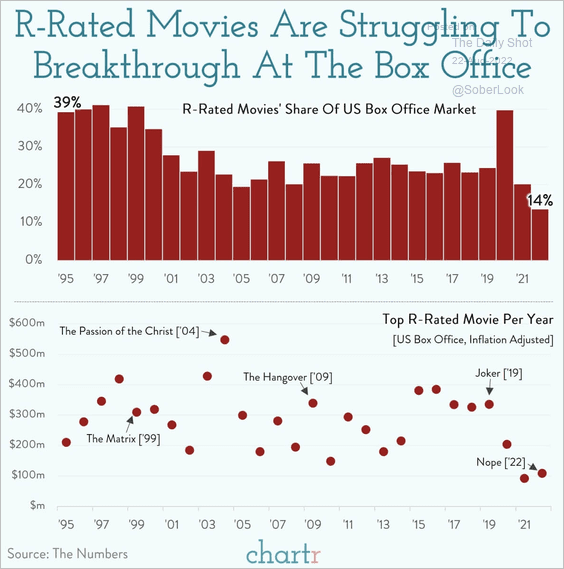

7. Increasing dominance of PG-13 movies …

Source: @axios Read full article

Source: @axios Read full article

… and a slump in R-rated films:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index