The Daily Shot: 23-Aug-22

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

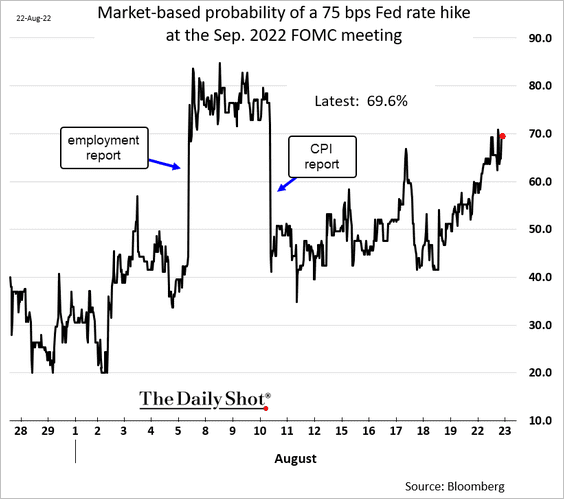

1. The probability of a 75 bps rate hike in September is near 70% as Fed officials strike a hawkish tone.

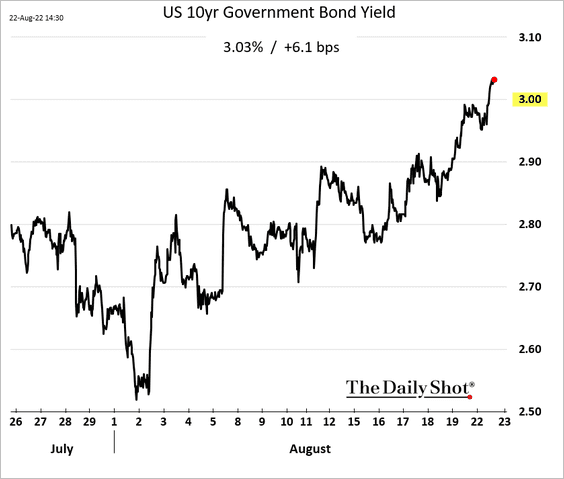

The 10-year Treasury yield is back above 3%.

——————–

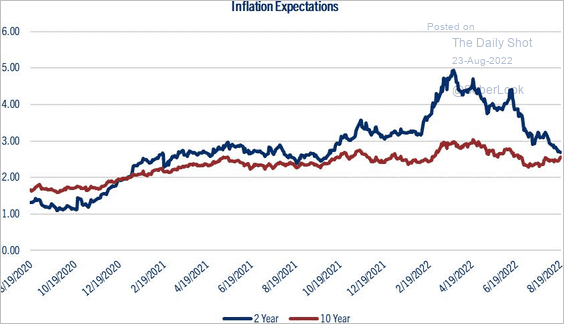

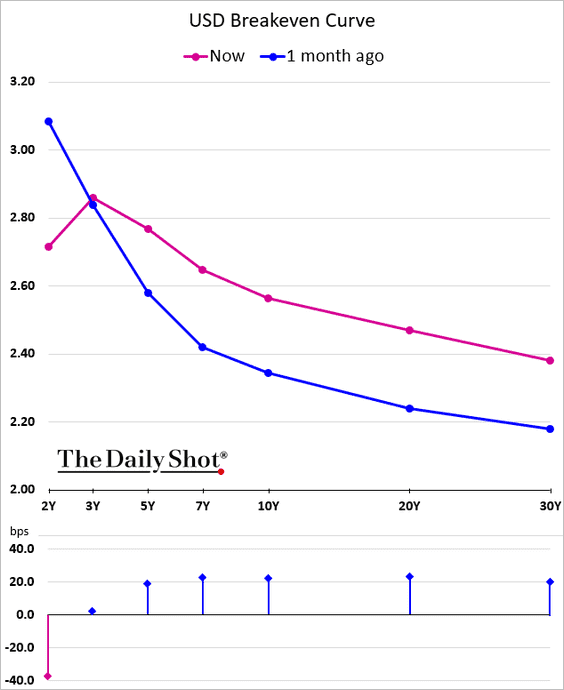

2. Next, we have some updates on inflation.

• The inflation expectations curve has flattened as oil prices moved lower.

Source: John Lynch, Comerica Wealth Management

Source: John Lynch, Comerica Wealth Management

The market expects inflation to moderate in the short term but remain “higher for longer.”

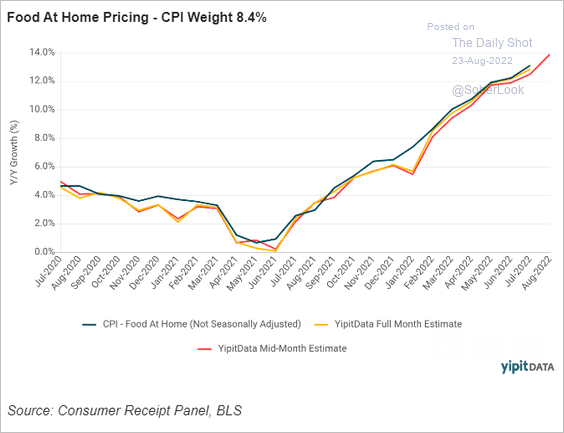

• Groceries’ inflation is nearing 14% this month, according to YipitData.

Source: YipitData

Source: YipitData

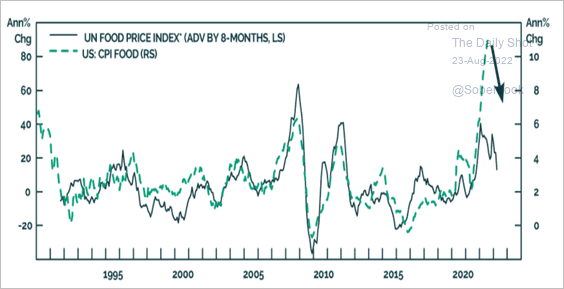

But food inflation should be on the way down in the months ahead.

Source: BCA Research

Source: BCA Research

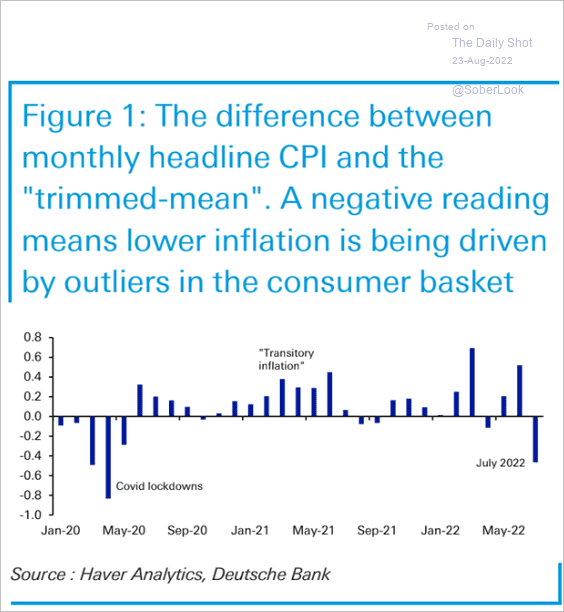

• Outliers drove the recent slowdown in the CPI. Inflation remains sticky.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

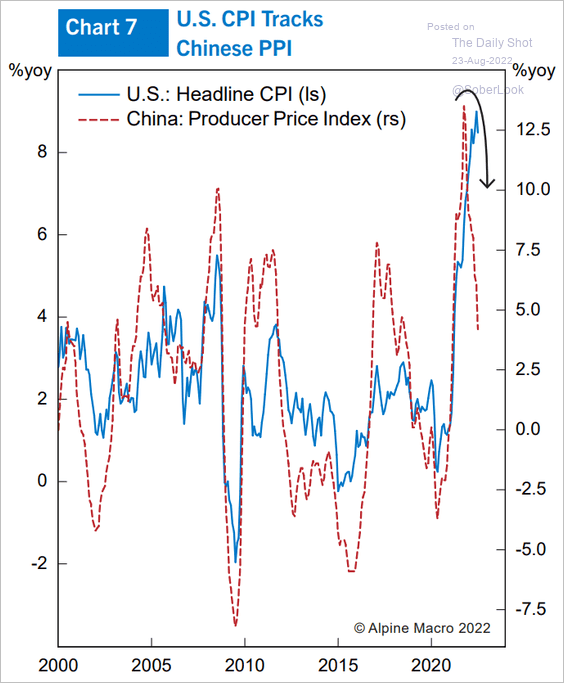

• Slower gains in China’s producer prices should help ease US consumer inflation.

Source: Alpine Macro

Source: Alpine Macro

——————–

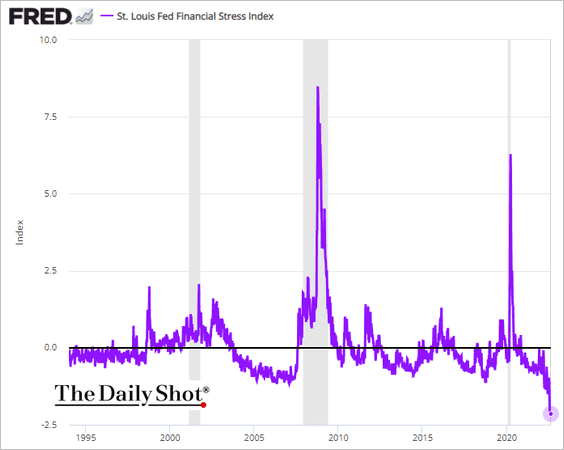

3. The St. Louis Fed’s financial stress index shows “no stress,” giving the Federal Reserve plenty of room to keep hiking rates.

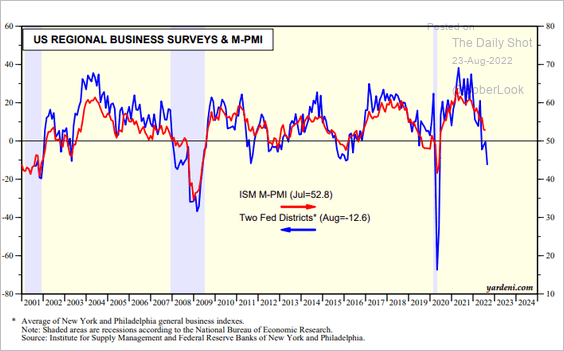

4. Regional Fed manufacturing gauges point to factory activity weakness at the national level.

Source: Yardeni Research

Source: Yardeni Research

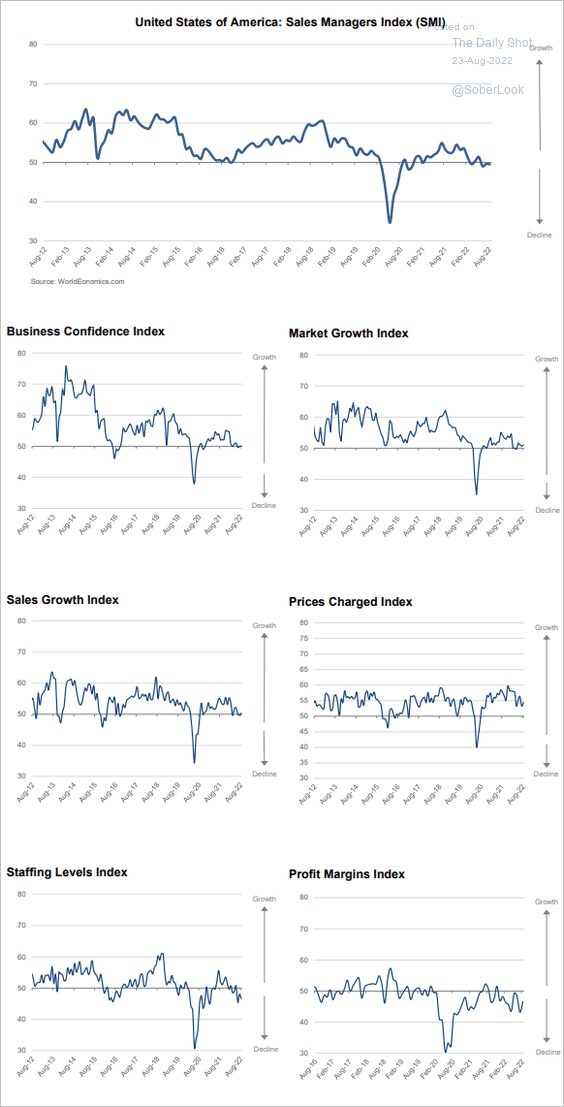

The World Economics SMI report suggests that business activity growth has stalled but is not crashing.

Source: World Economics

Source: World Economics

——————–

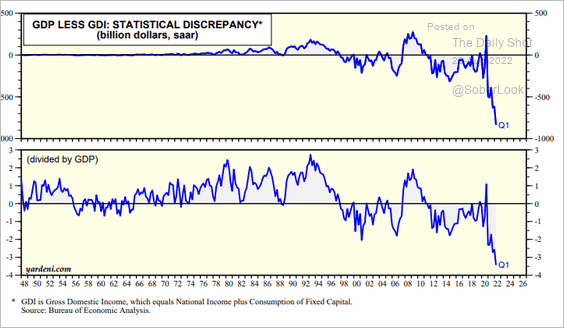

5. The GDP-GDI divergence may indicate an upward GDP revision for Q2.

Source: Yardeni Research Read full article Further reading

Source: Yardeni Research Read full article Further reading

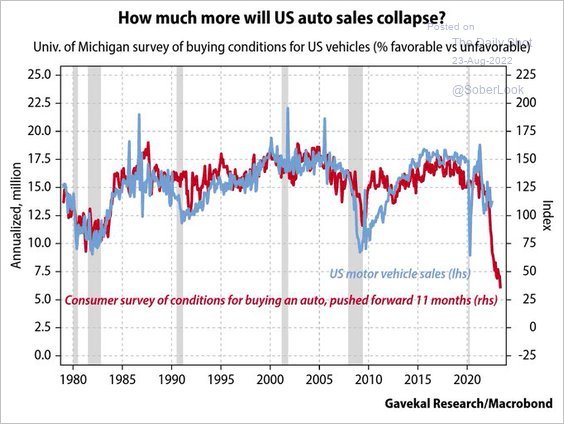

6. Will we see further declines in vehicle sales?

Source: @Gavekal

Source: @Gavekal

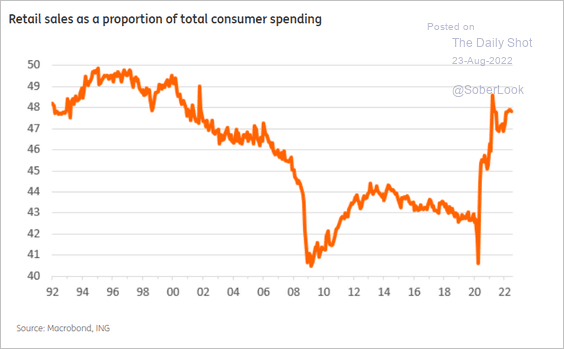

7. Retail sales as a share of total consumer spending remain elevated.

Source: ING

Source: ING

Back to Index

The United Kingdom

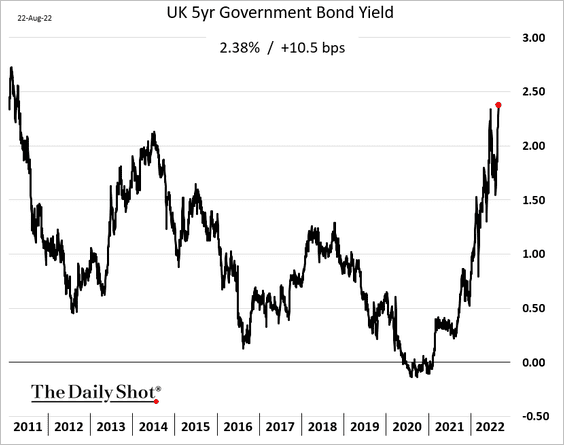

1. The 5-year gilt yield hit the highest level since 2011.

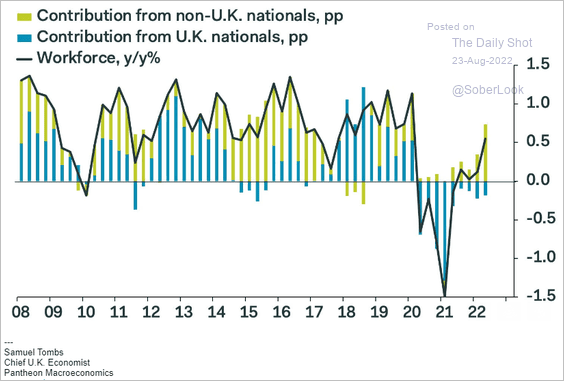

2. This chart shows the contributions to the UK workforce changes.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

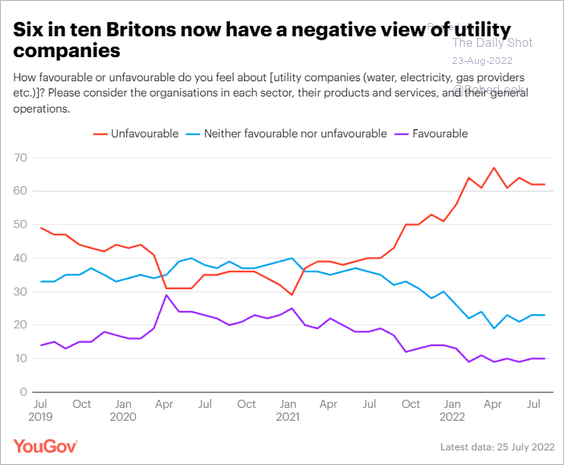

3. Utility companies have become very unpopular lately.

Source: YouGov Read full article

Source: YouGov Read full article

Back to Index

The Eurozone

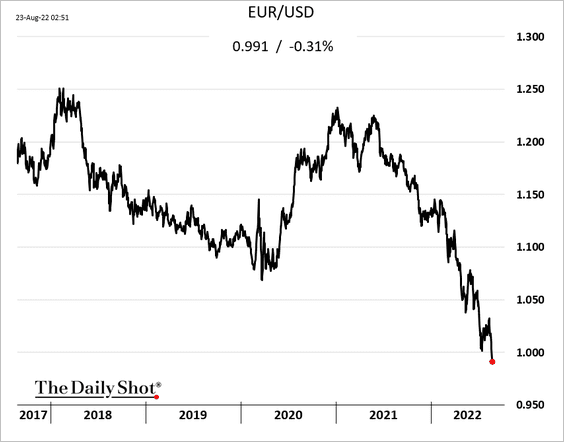

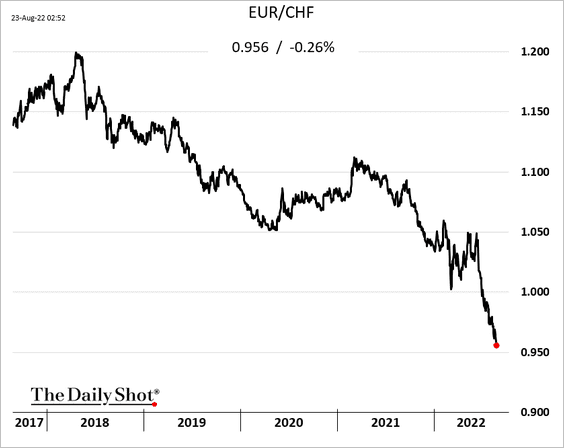

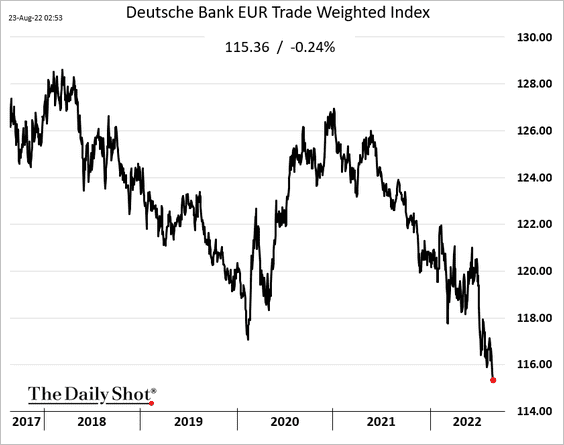

1. The euro is back below parity vs. USD …

… in a broad decline.

——————–

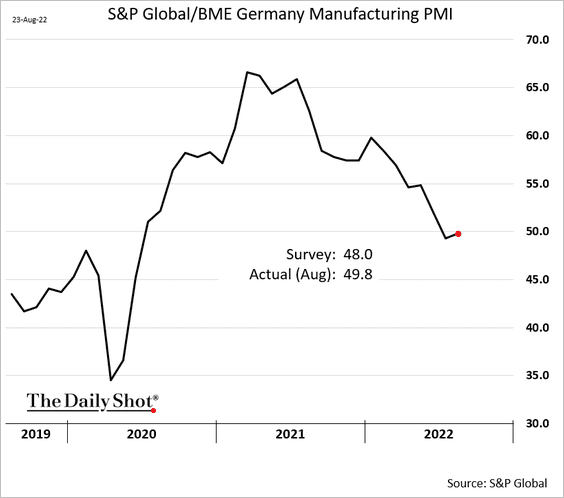

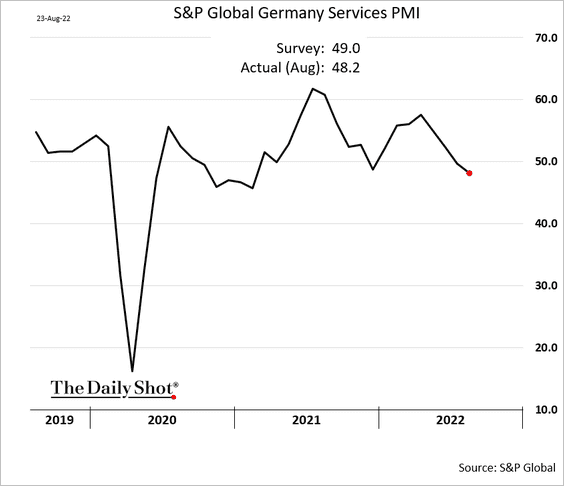

2. Germany’s manufacturing PMI surprised to the upside.

But service-sector activity is moving deeper into contraction. We’ll have more on the Eurozone PMI report tomorrow.

——————–

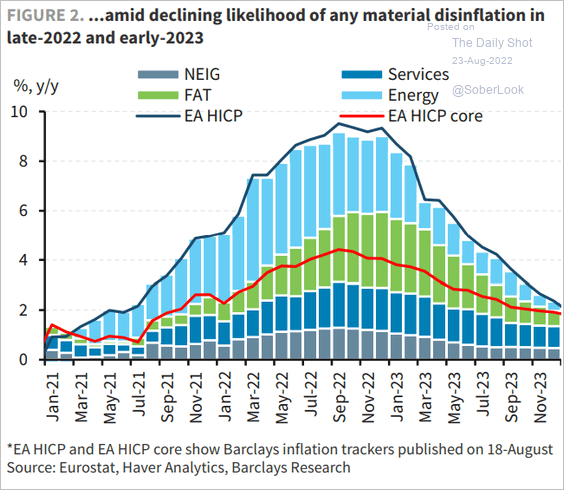

3. Euro-area inflation will remain elevated for some time.

Source: Barclays Research

Source: Barclays Research

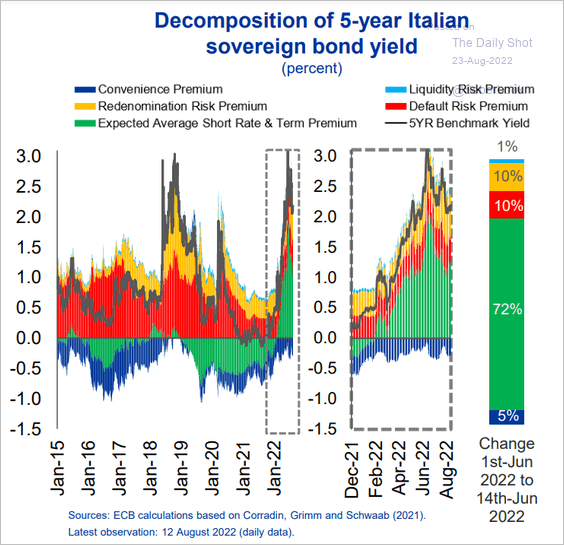

4. This chart shows the decomposition of Italian bond yields.

Source: ECB Read full article

Source: ECB Read full article

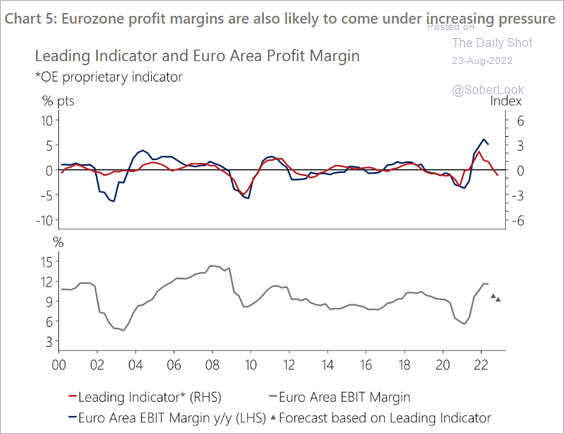

5. Corporate margins are headed lower.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Japan

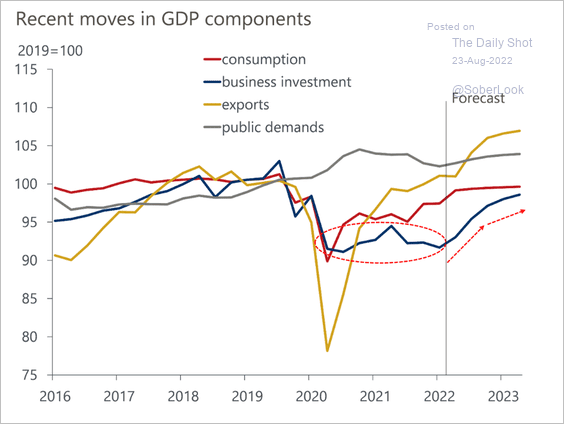

1. Oxford Economics expects a rebound in business investment driven by easy credit conditions and higher domestic consumption.

Source: Oxford Economics

Source: Oxford Economics

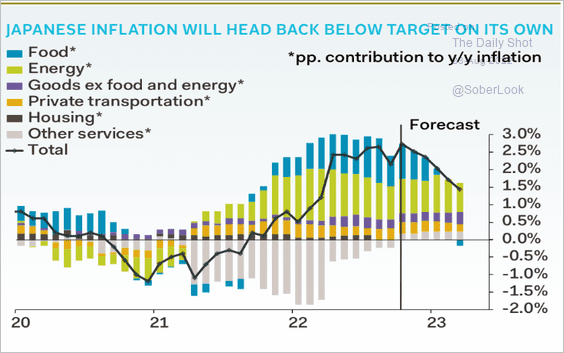

2. Inflation will moderate without the BoJ’s intervention.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

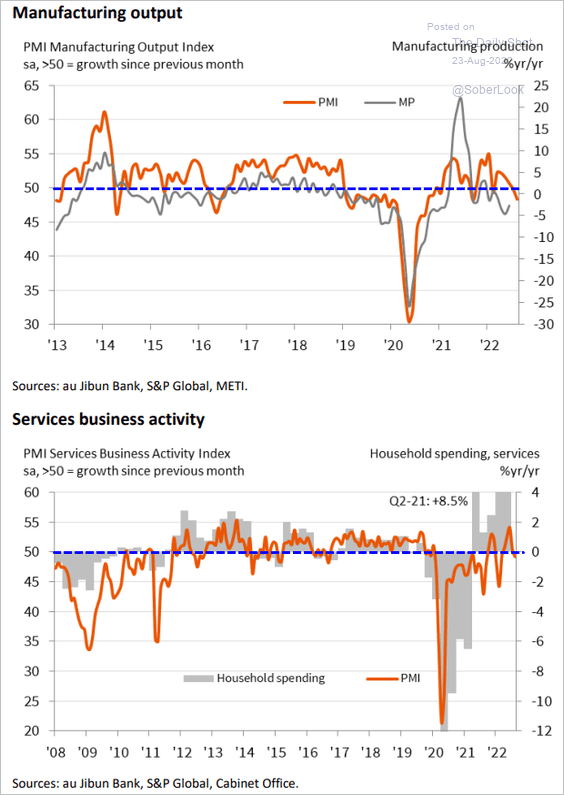

3. Business activity is in contraction territory, according to the S&P Global PMI.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

Asia – Pacific

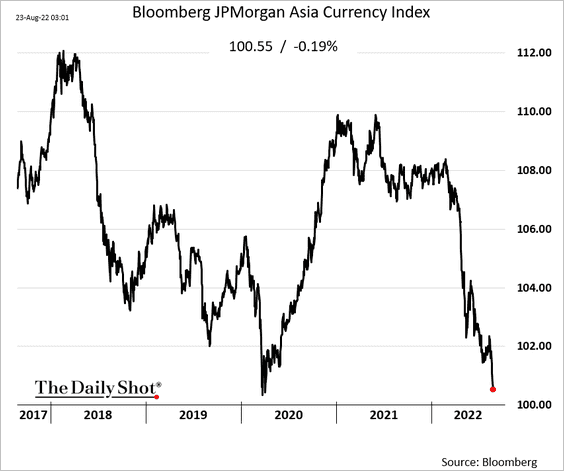

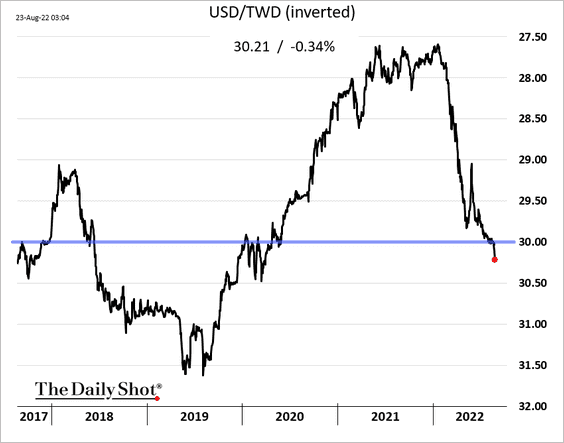

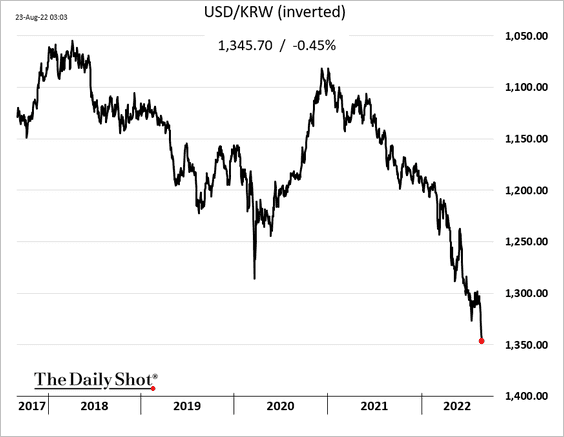

1. Asian currencies remain under pressure vs. USD.

• Currency index:

• The Taiwan dollar:

• The South Korean won:

——————–

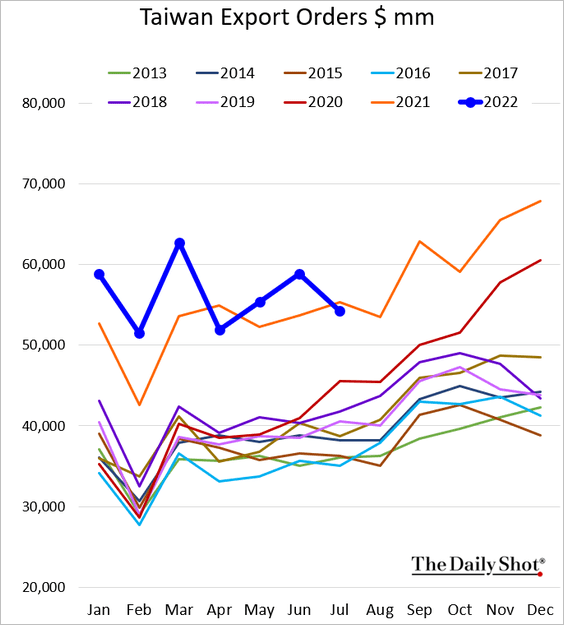

2. Taiwan’s export orders softened in July.

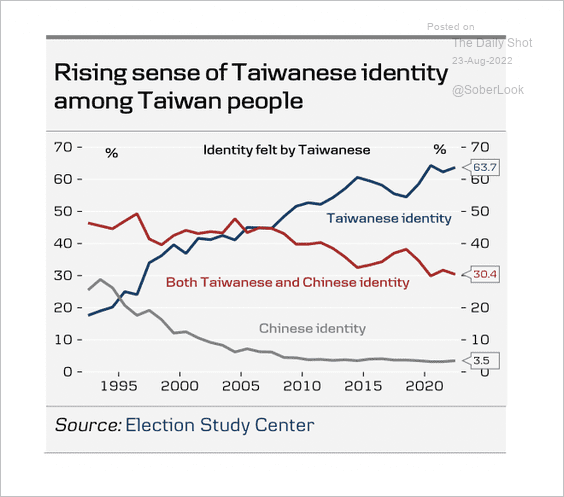

Separately, more residents have identified as Taiwanese over the past decade.

Source: Danske Bank

Source: Danske Bank

——————–

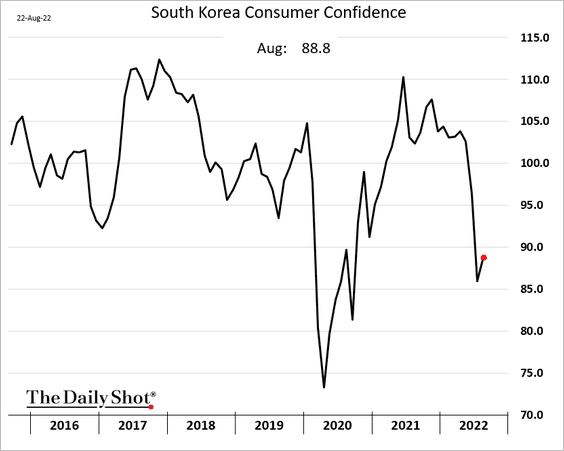

3. South Korea’s consumer confidence has stabilized.

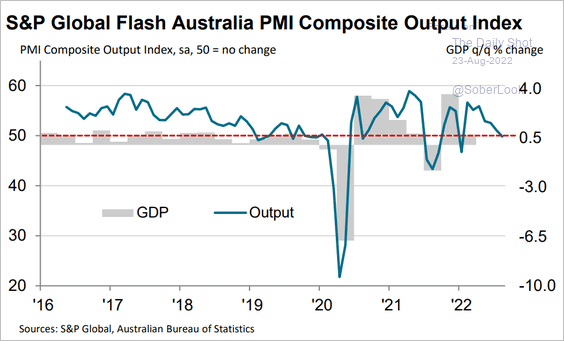

4. Growth in Australian business activity stalled this month.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

China

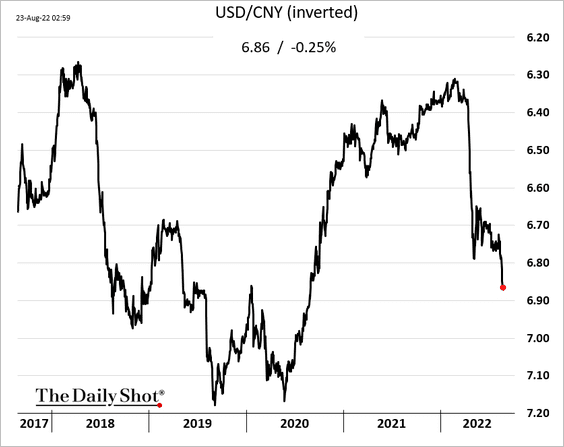

1. The renminbi remains under pressure vs. USD.

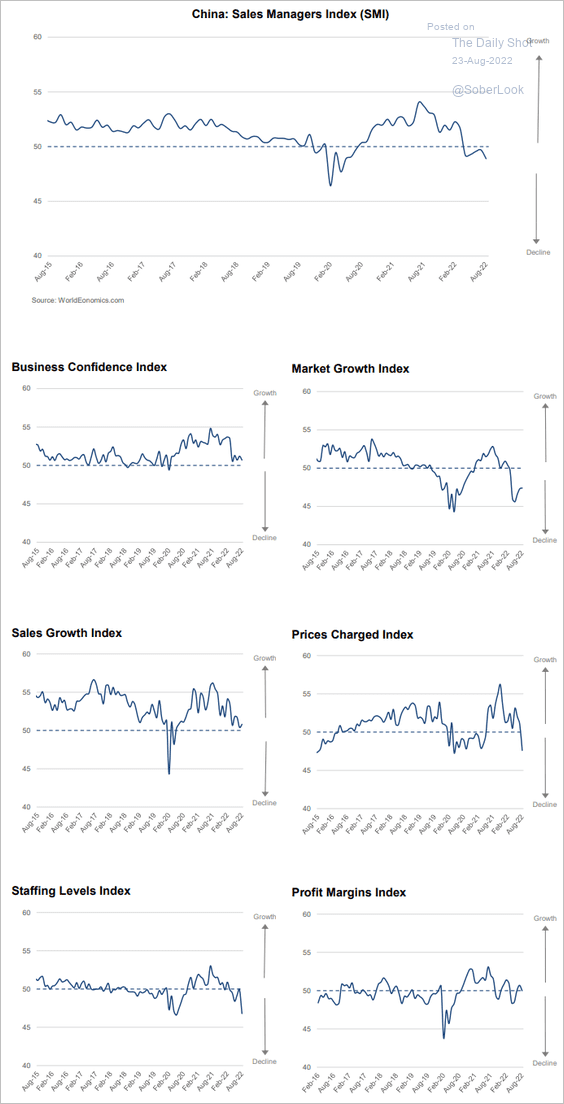

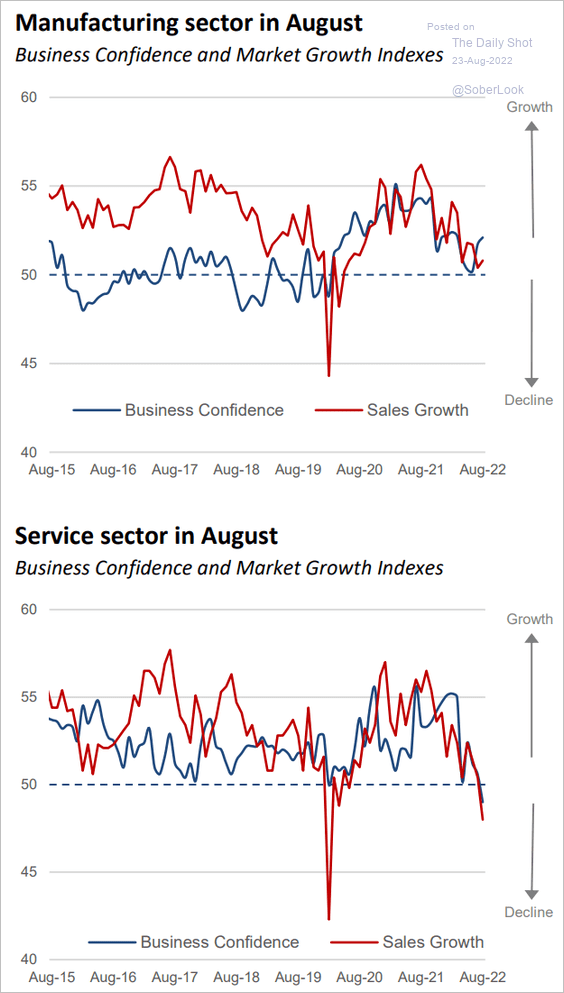

2. Business activity is still in contraction according to the August World Economics SMI report.

Source: World Economics

Source: World Economics

Service companies are struggling.

Source: World Economics

Source: World Economics

——————–

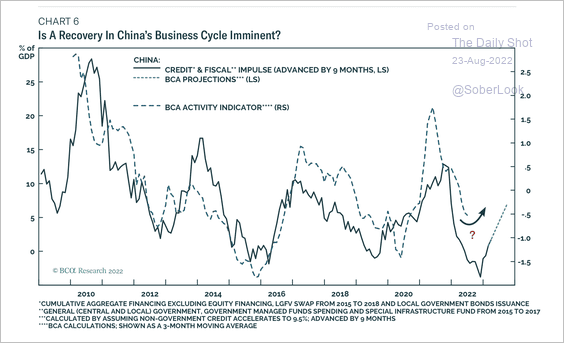

3. Some indicators point to a trough in China’s business cycle.

Source: BCA Research

Source: BCA Research

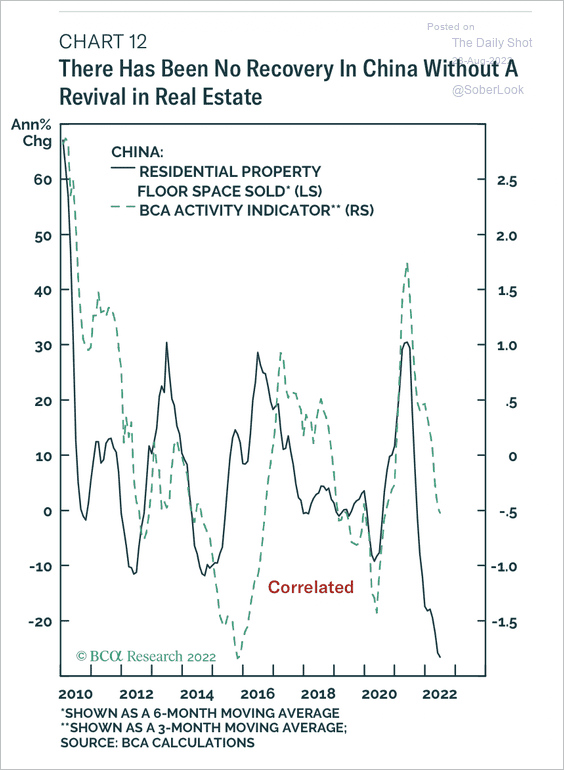

Still, without improvement in the housing market, a meaningful business cycle recovery is unlikely.

Source: BCA Research

Source: BCA Research

——————–

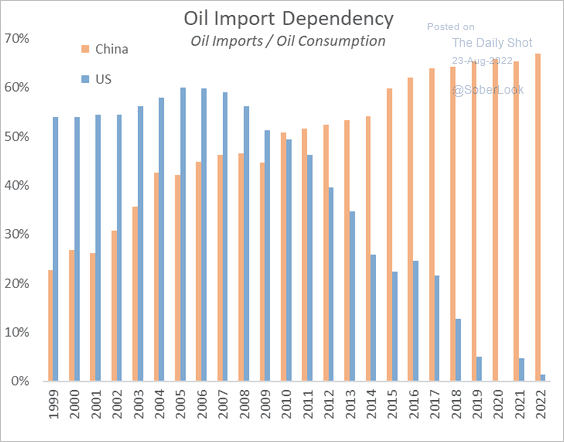

4. China remains heavily dependent on oil imports.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

Back to Index

Emerging Markets

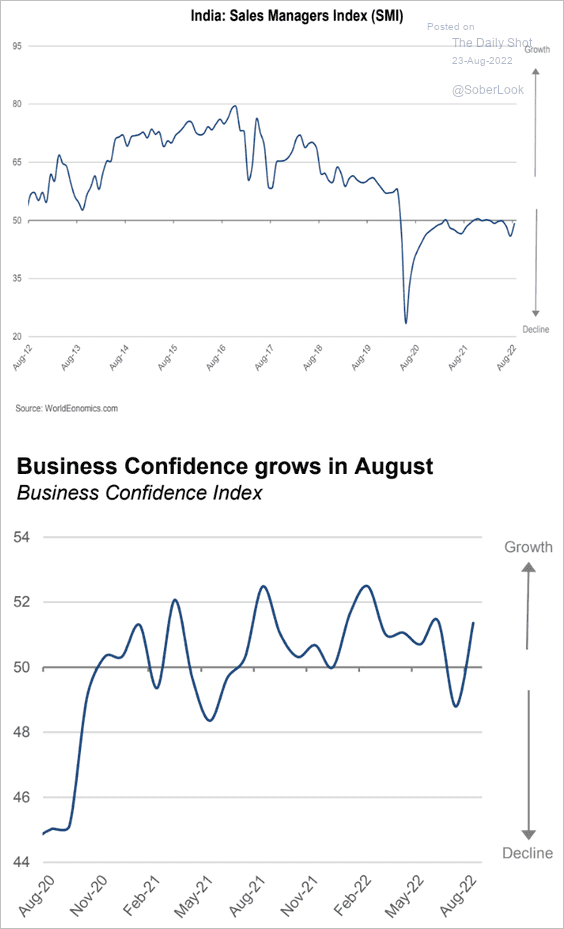

1. India’s business activity has stabilized, according to the World Economics SMI report.

Source: World Economics

Source: World Economics

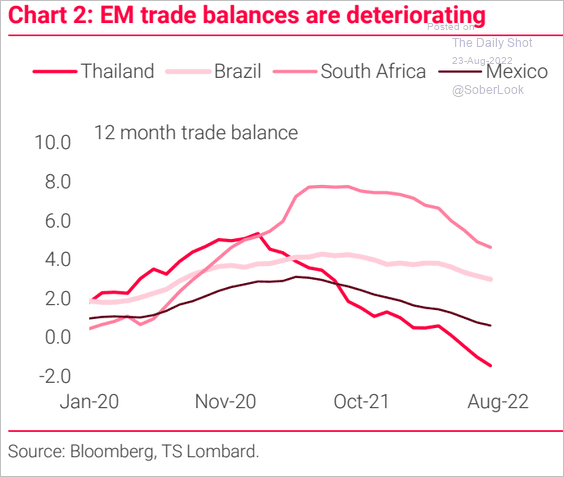

2. EM trade balances are headed lower.

Source: TS Lombard

Source: TS Lombard

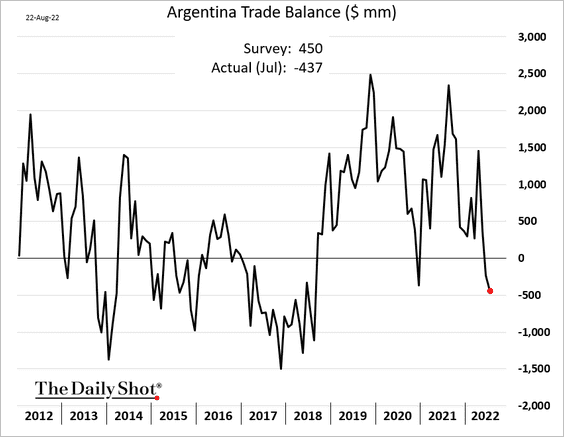

For example, Argentina’s trade balance unexpectedly shifted into deficit.

Back to Index

Cryptocurrency

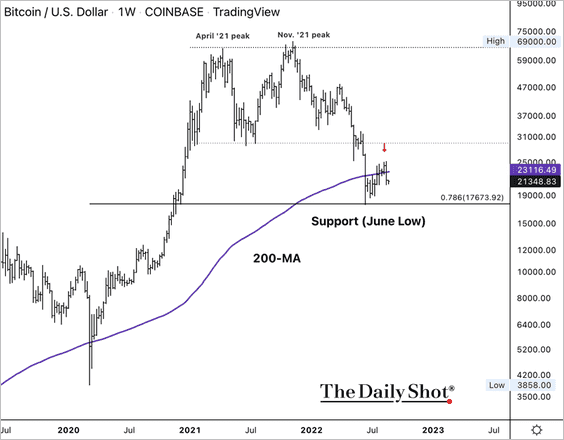

1. Bitcoin is back below its 200-week moving average. The next major support level is at $17,673, which is near the June low.

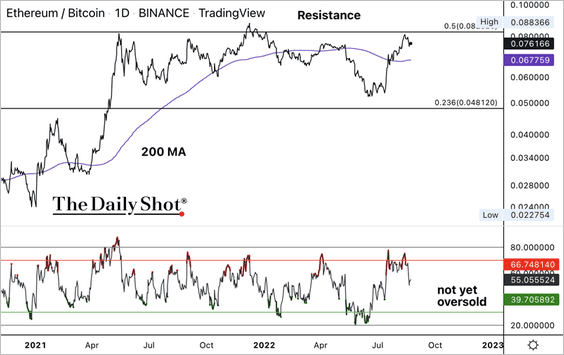

2. The ETH/BTC price ratio declined from long-term resistance and is not yet oversold.

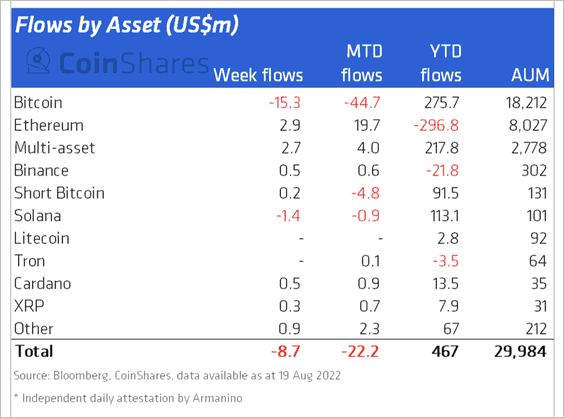

3. Crypto investment funds saw minor outflows last week, driven by bitcoin-focused products.

Source: CoinShares Read full article

Source: CoinShares Read full article

4. A bank run drained BendDAO’s reserves on Sunday.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Back to Index

Commodities

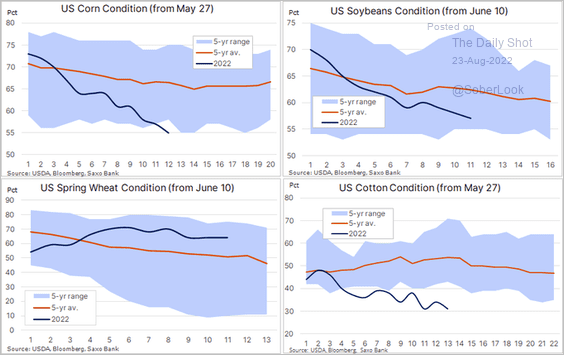

1. US crop conditions for corn, soybeans, and cotton have been deteriorating.

Source: @Ole_S_Hansen

Source: @Ole_S_Hansen

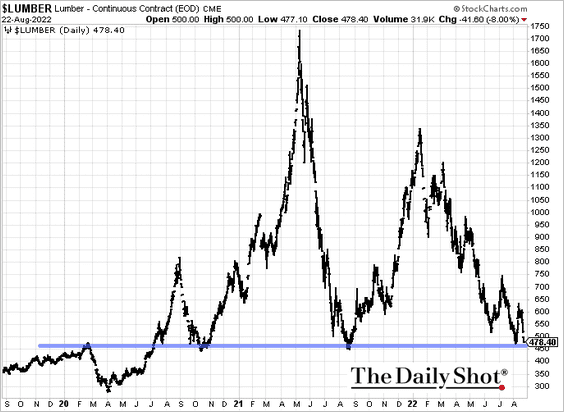

3. Lumber is at support, pressured by US housing market weakness.

Back to Index

Energy

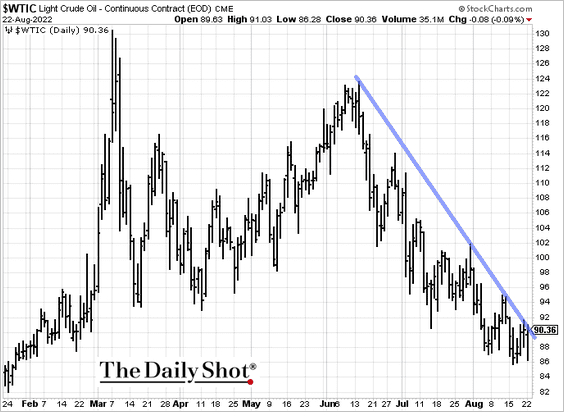

1. WTI crude is about to break above downtrend resistance.

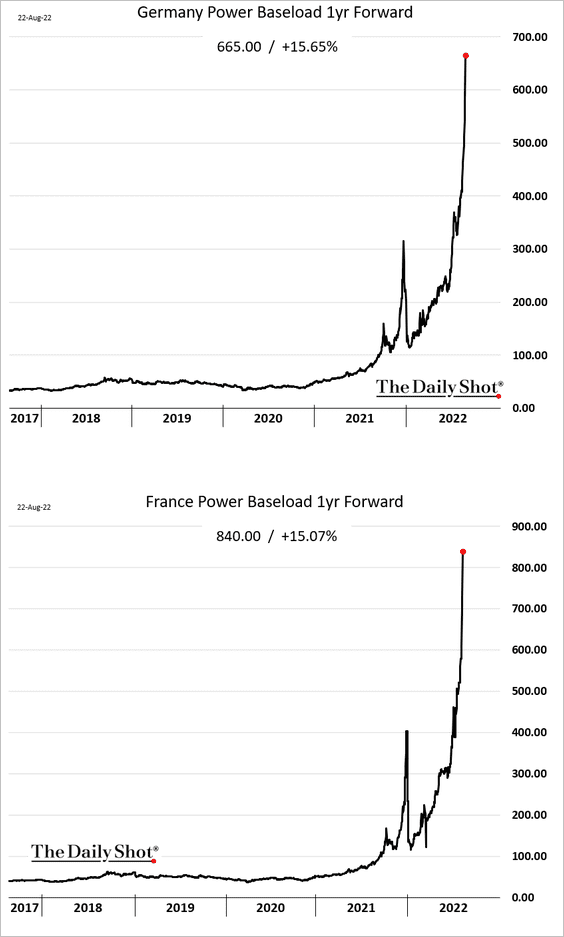

2. European electricity prices have gone vertical.

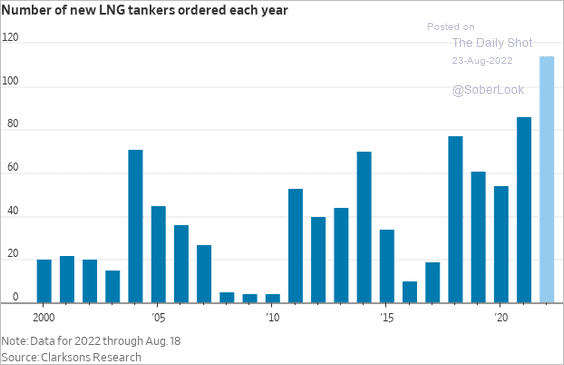

3. LNG shipping activity surged this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

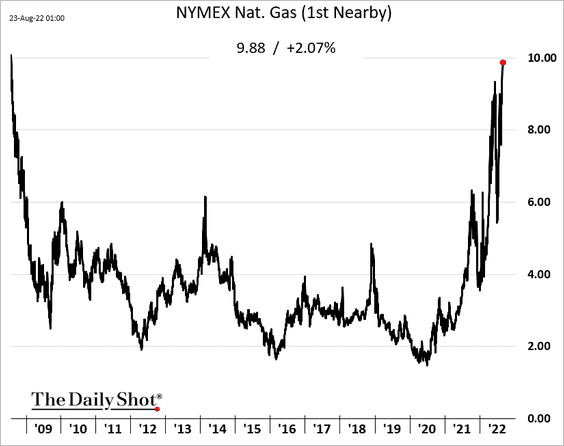

4. US natural gas futures are nearing $10/mmbtu for the first time since 2008, supported by the surge in Europe.

Back to Index

Equities

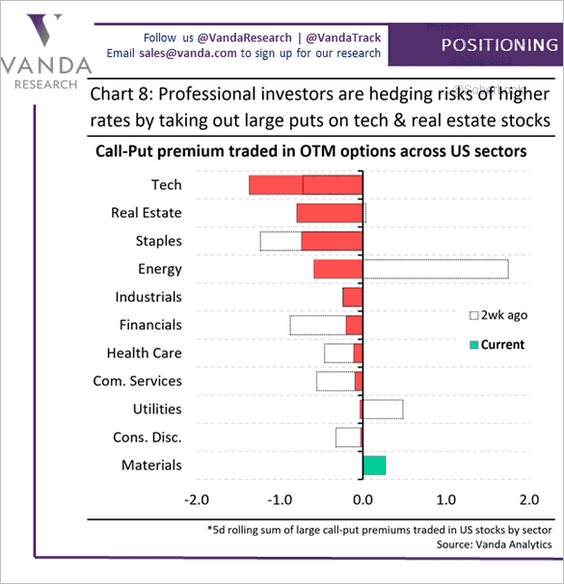

1. Professional investors remain concerned about rates, buying puts on interest-rate-sensitive names over the past two weeks.

Source: @vandaresearch

Source: @vandaresearch

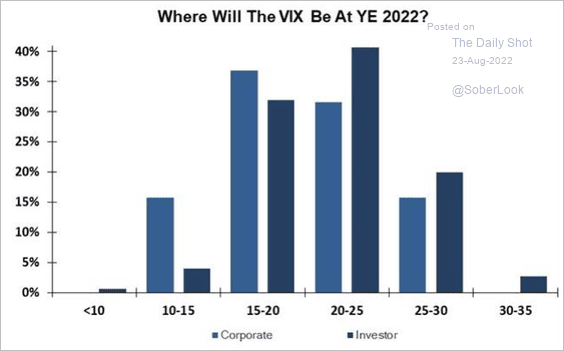

2. Where will VIX be at the end of the year? (from Evercore ISI survey)

Source: Evercore ISI Research

Source: Evercore ISI Research

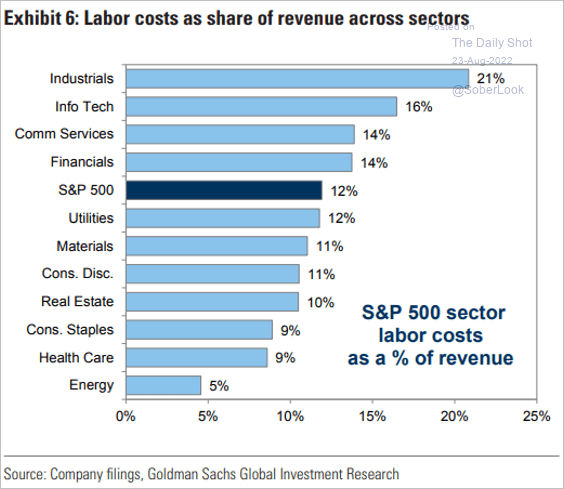

3. This chart illustrates the exposure to labor costs by sector.

Source: Goldman Sachs; @patrick_saner

Source: Goldman Sachs; @patrick_saner

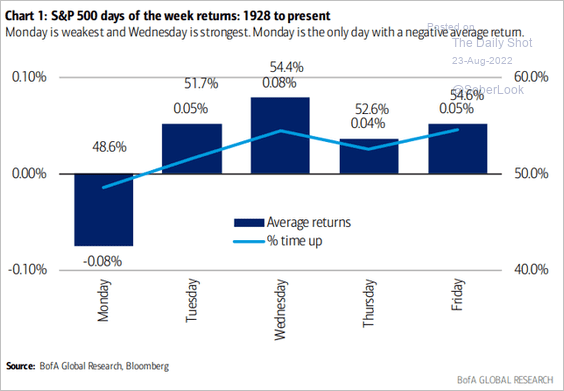

4. Will we see a market bounce today?

Source: BofA Global Research

Source: BofA Global Research

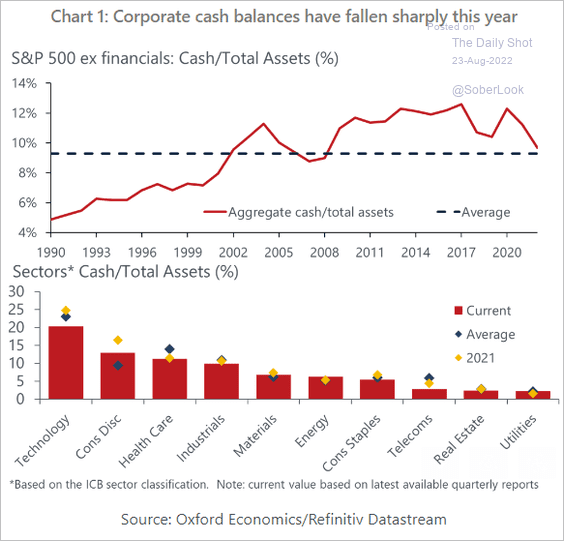

5. Corporate cash balances have been falling.

• Cash holdings:

Source: Oxford Economics

Source: Oxford Economics

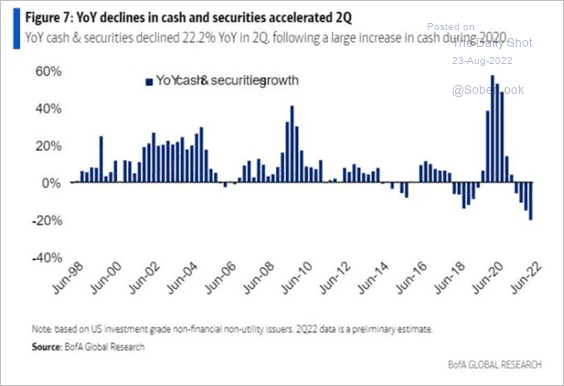

• Year-over-year changes:

Source: @jessefelder, @FT, BofA Global Research Read full article

Source: @jessefelder, @FT, BofA Global Research Read full article

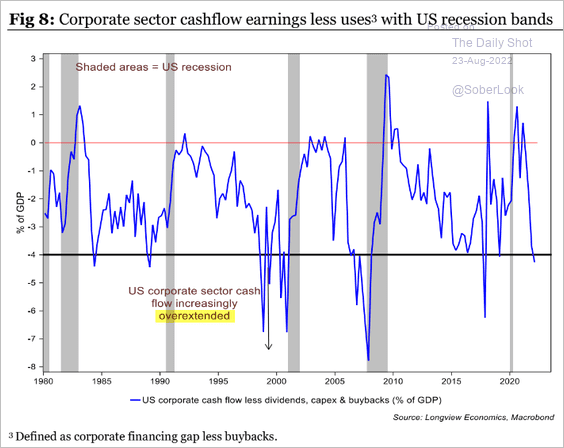

• Corporate cashflow earnings less uses:

Source: Longview Economics

Source: Longview Economics

——————–

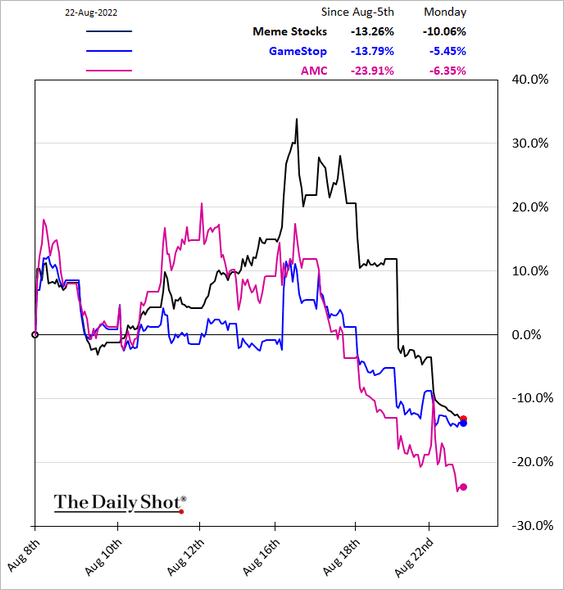

6. Meme stocks are back from the Moon.

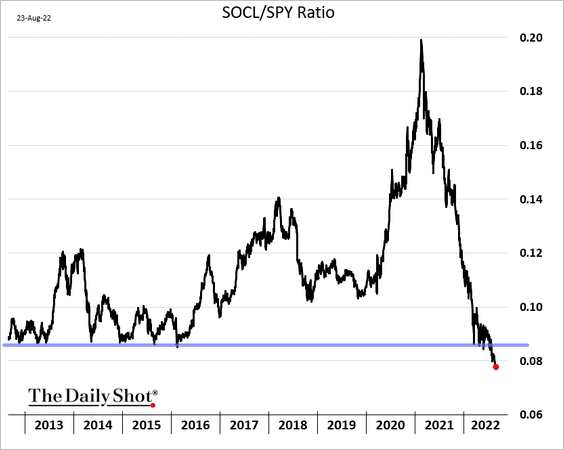

7. Social-media stocks broke below long-term support vs. S&P 500.

h/t @adaptiv, @Callum_Thomas

h/t @adaptiv, @Callum_Thomas

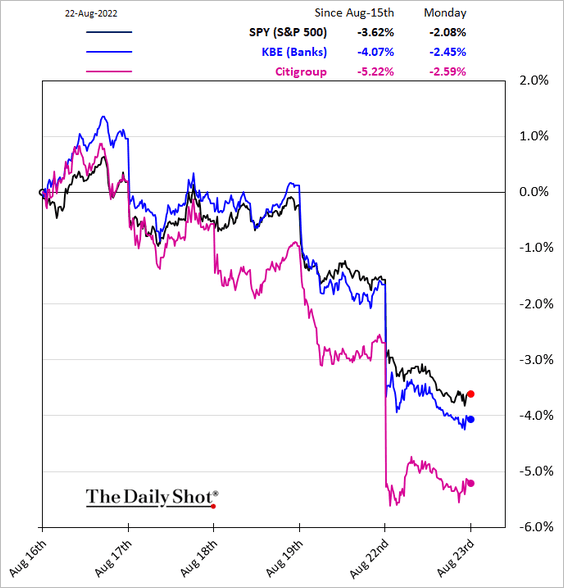

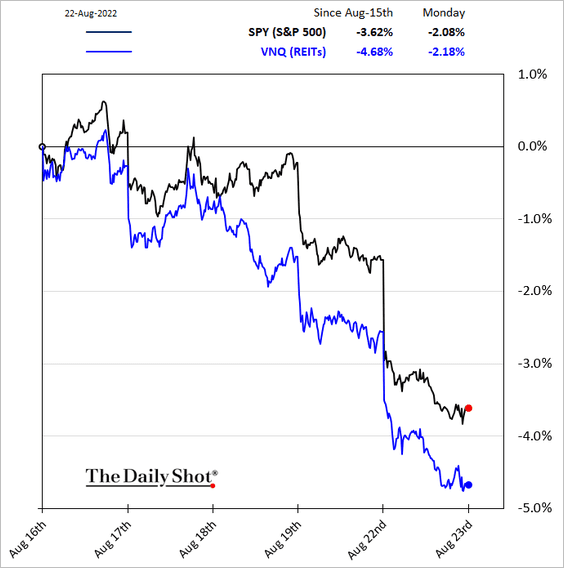

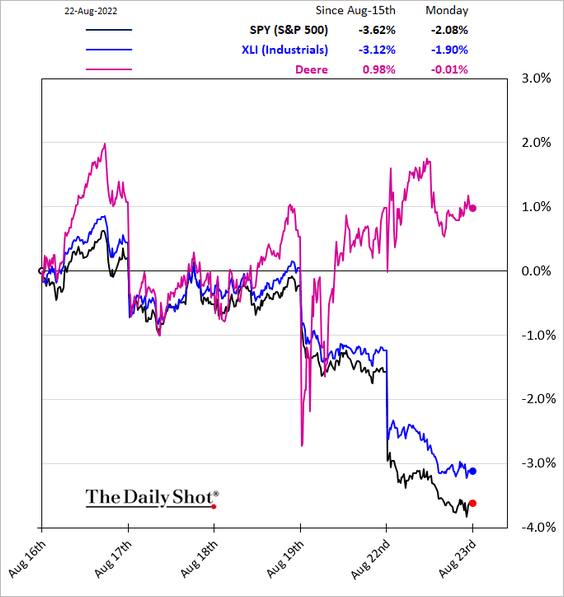

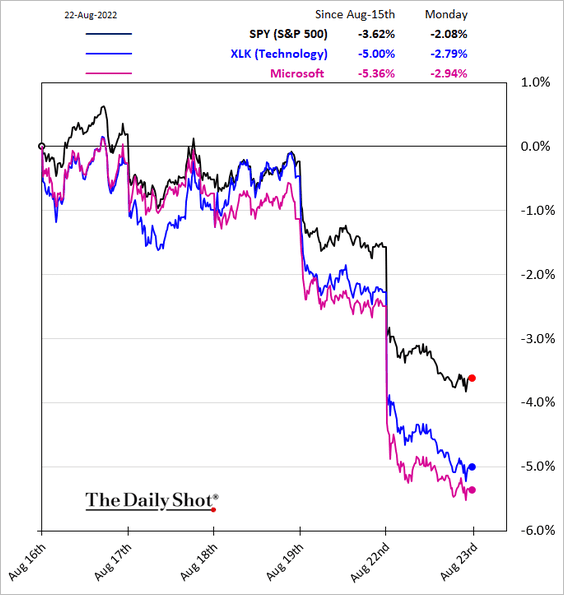

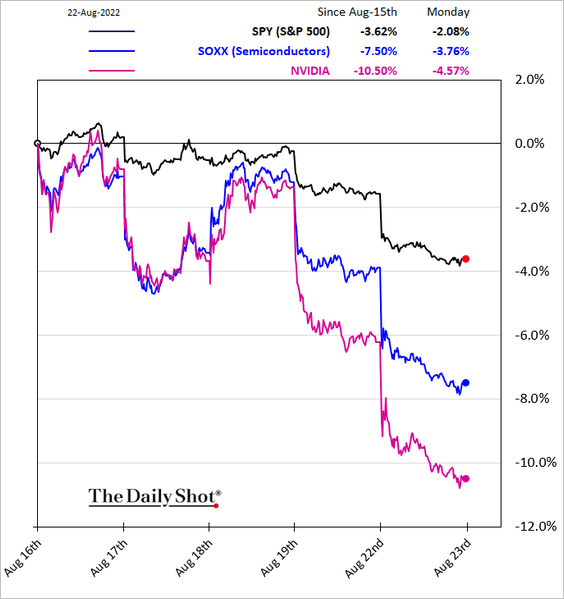

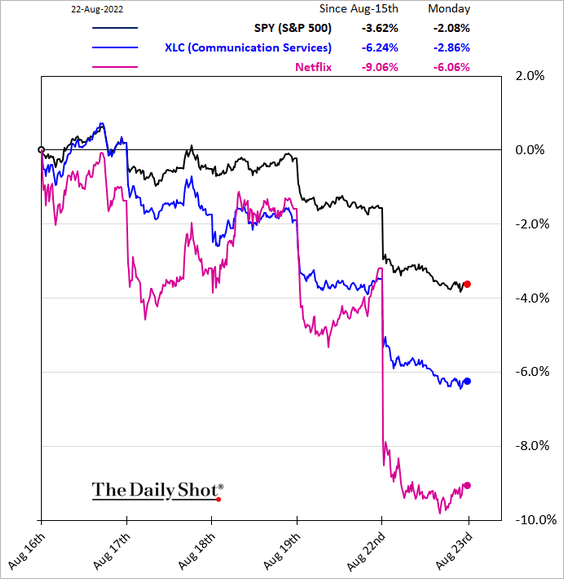

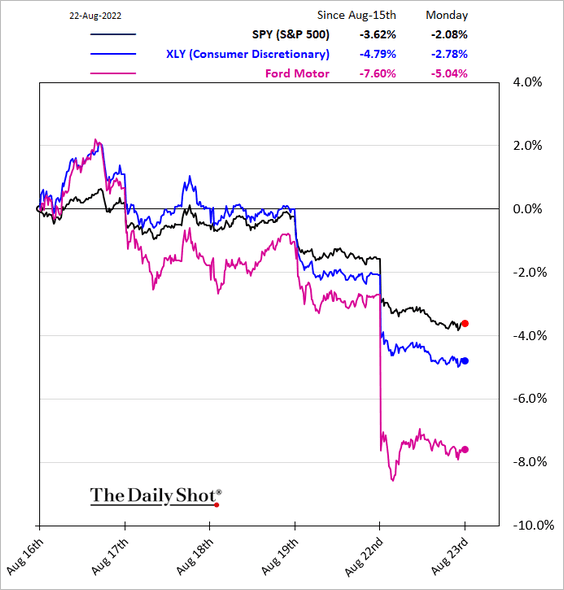

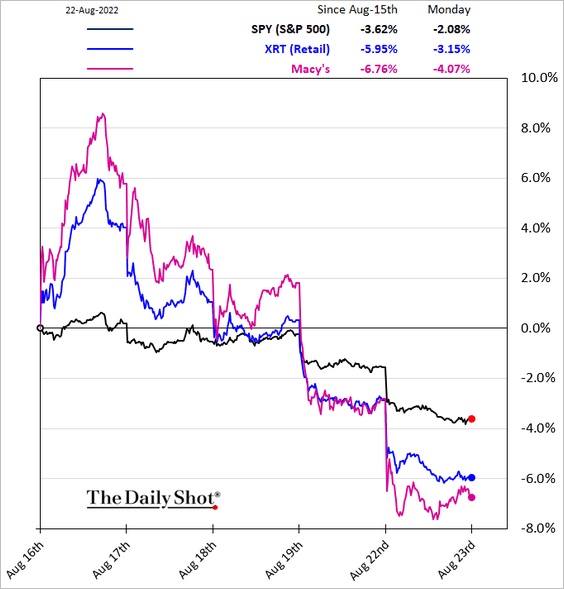

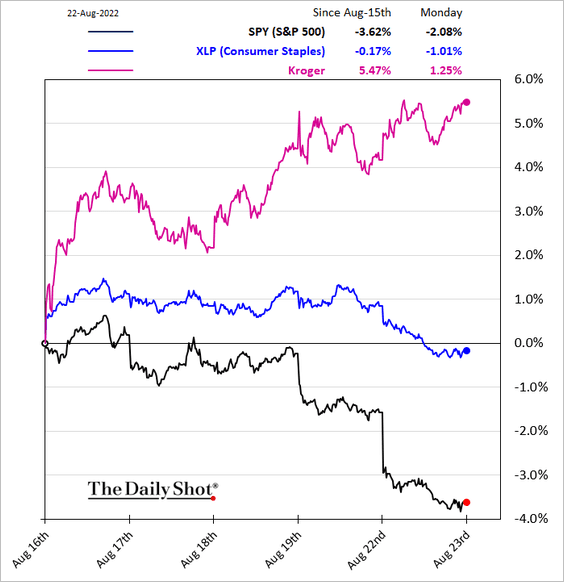

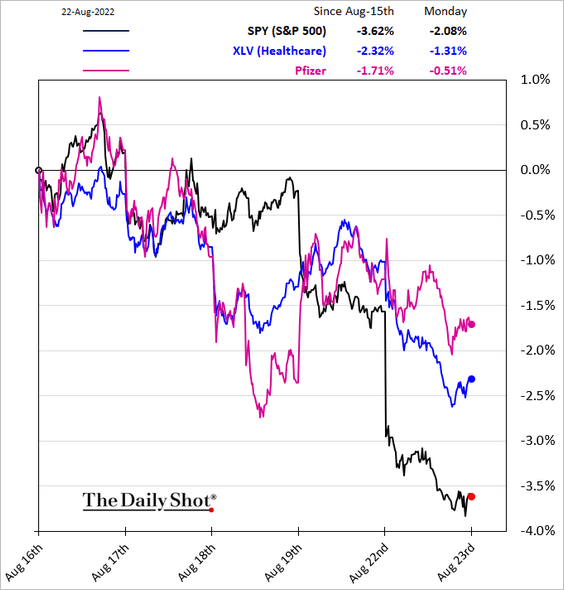

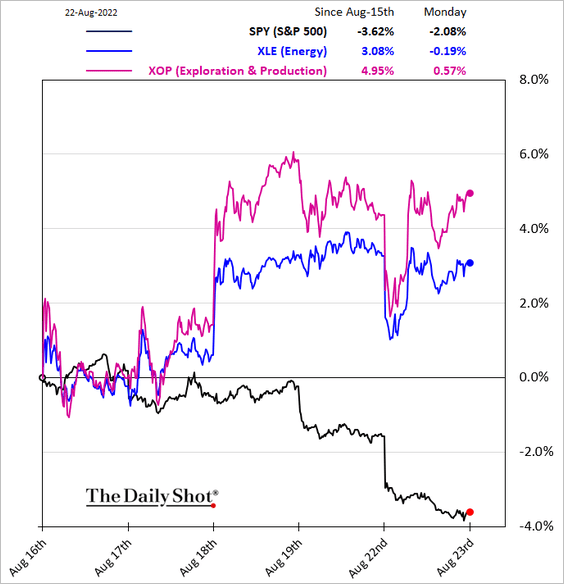

8. Next, we have some sector performance data over the past five business days.

• Banks:

• REITs:

• Industrials:

• Tech and semiconductors:

• Communication Services:

• Consumer Discretionary and Retail:

• Consumer Staples:

• Healthcare:

• Energy:

——————–

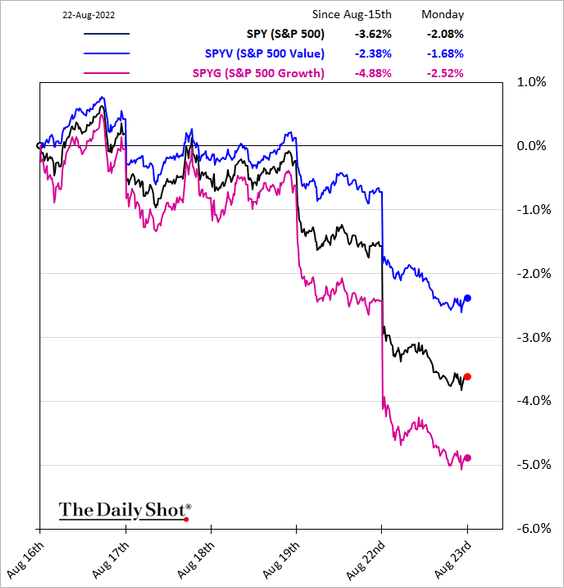

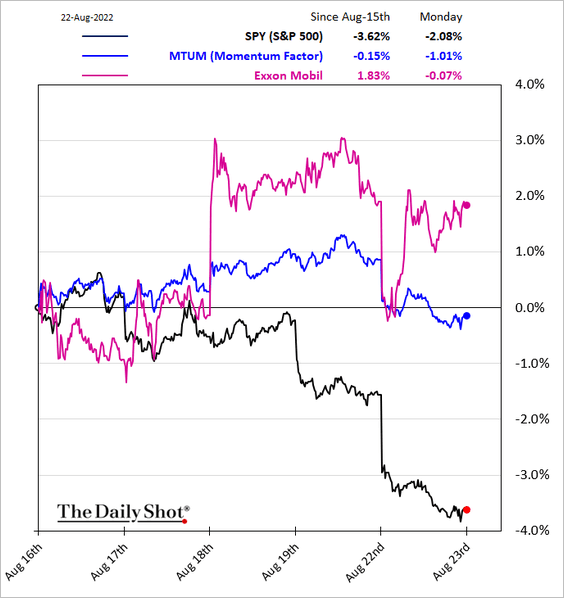

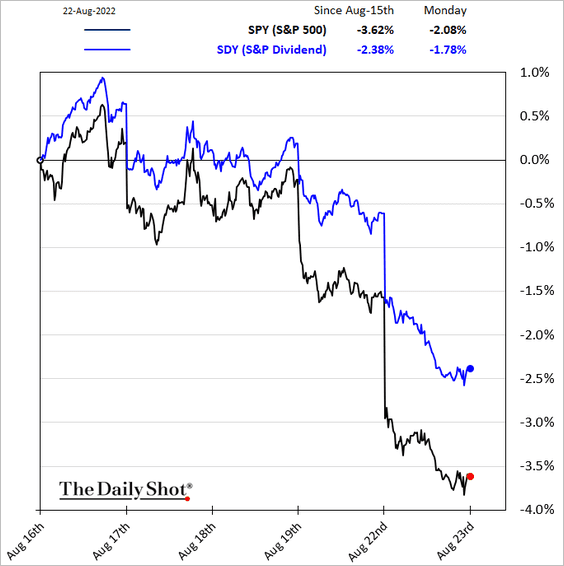

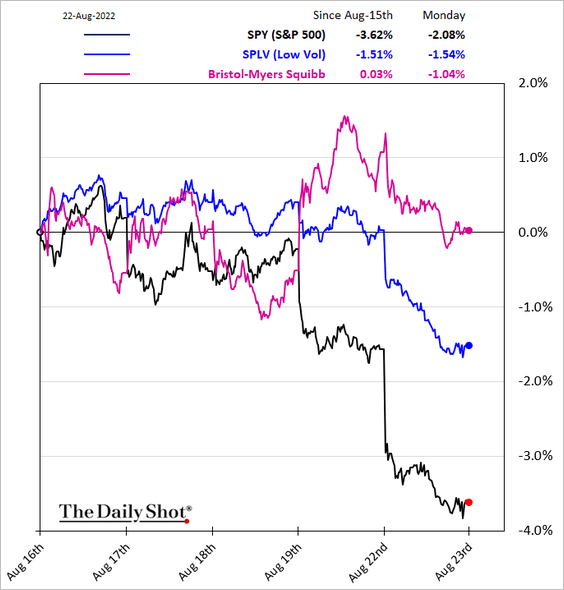

9. Finally, we have some equity factor charts:

• Value vs. growth:

• Momentum:

• High-dividend:

• Low-vol:

Back to Index

Rates

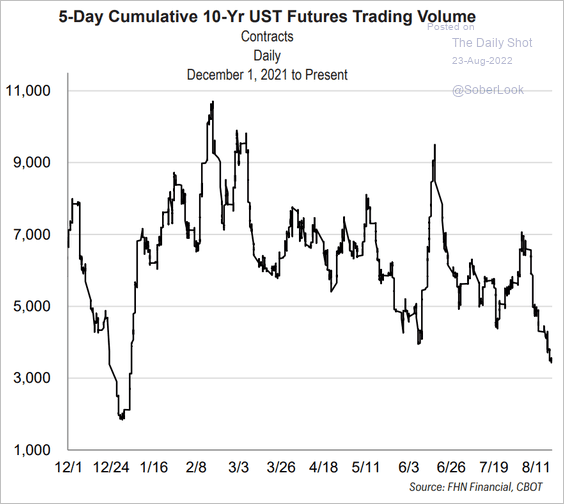

1. Trading volume on the 10-year Treasury futures has been falling.

Source: FHN Financial

Source: FHN Financial

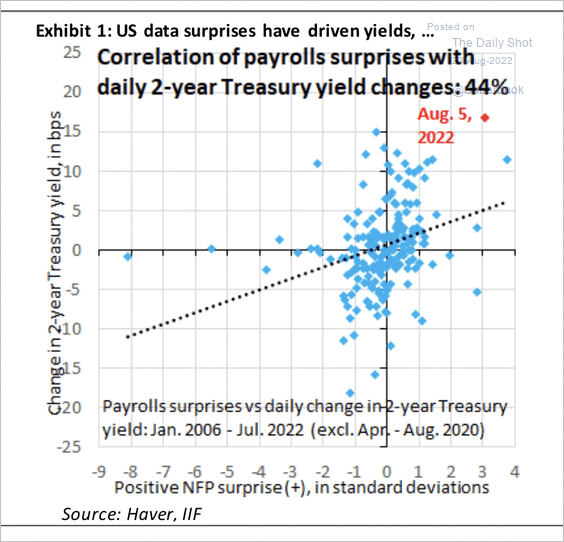

2. The 2-year Treasury yield has been sensitive to payroll surprises.

Source: IIF

Source: IIF

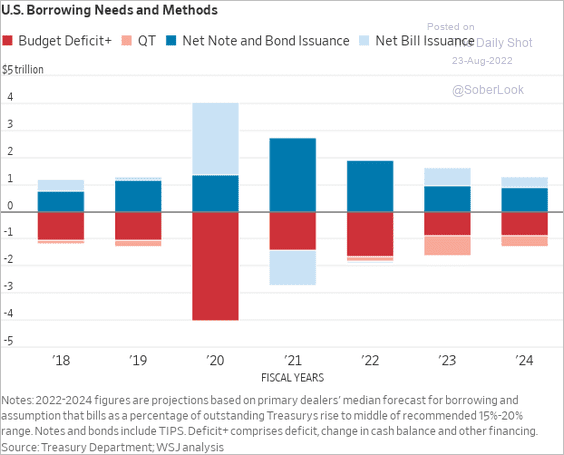

3. Slower Treasury issuance has been offsetting QT.

Source: @WSJ Read full article

Source: @WSJ Read full article

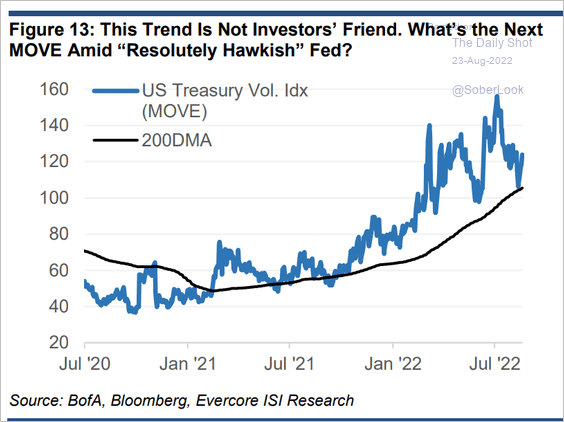

4. Treasury vol is rebounding.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Global Developments

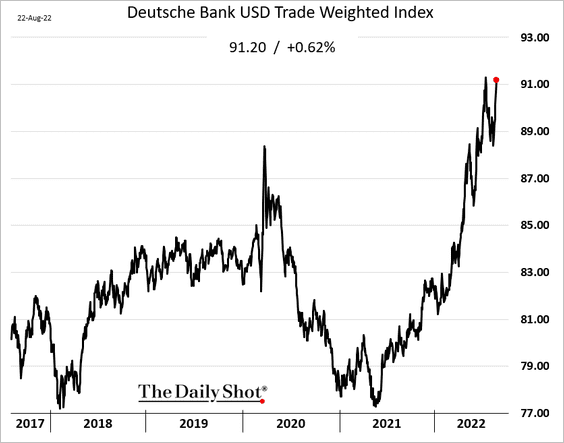

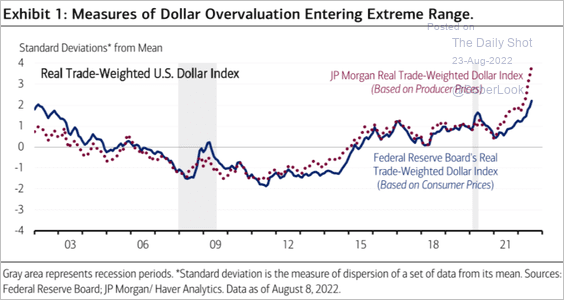

1. The dollar is nearing the multi-year high reached in July.

Is the dollar overvalued?

Source: Merrill Lynch

Source: Merrill Lynch

——————–

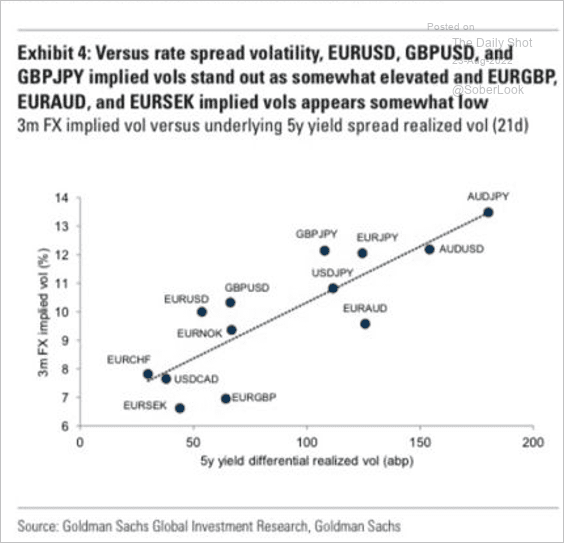

2. This scatterplot shows FX implied volatility vs. rate differentials’ realized vol.

Source: Goldman Sachs

Source: Goldman Sachs

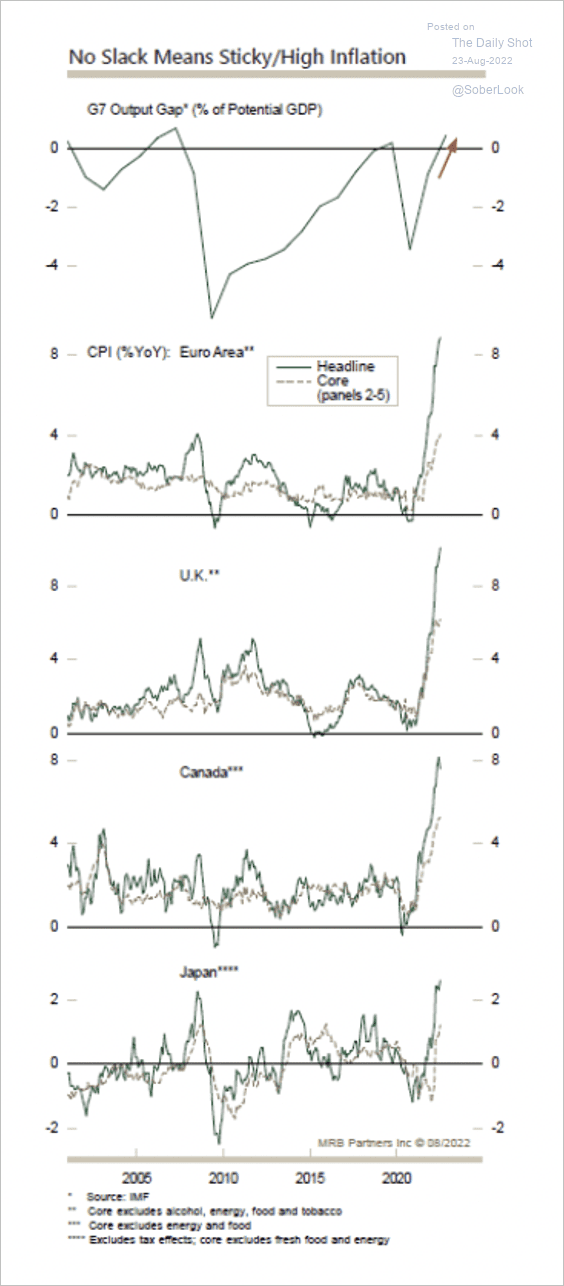

3. The output gap among G7 nations has significantly narrowed, which typically spurs inflation.

Source: MRB Partners

Source: MRB Partners

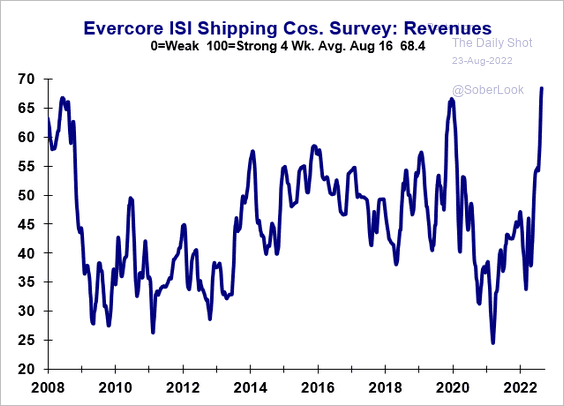

4. Shipping companies’ revenues have been surging, boosted by tanker activity.

Source: Evercore ISI Research

Source: Evercore ISI Research

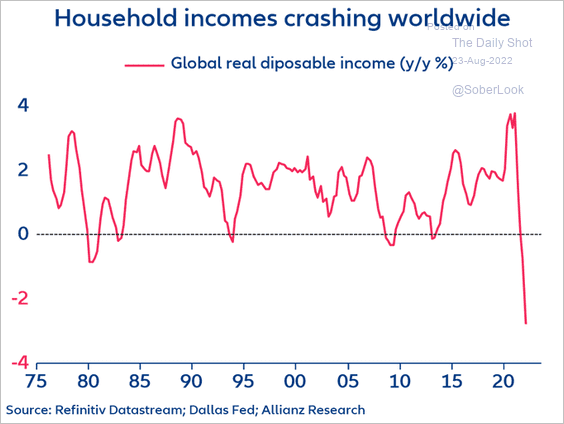

5. Households haven’t seen such a sharp decline in real incomes in decades.

Source: @PatrickKrizan

Source: @PatrickKrizan

——————–

Food for Thought

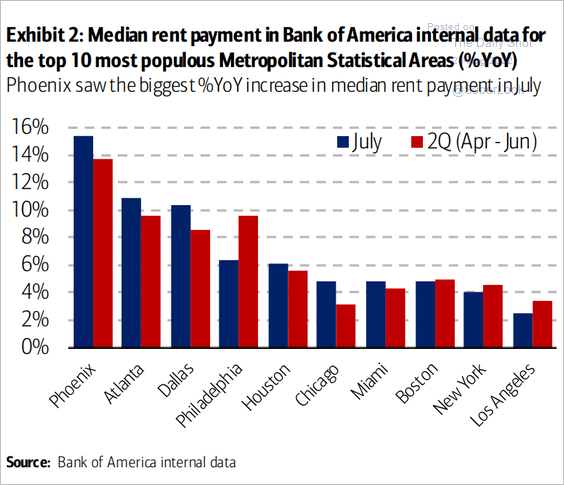

1. Year-over-year rent payment increases in the largest metro areas:

Source: Bank of America Institute

Source: Bank of America Institute

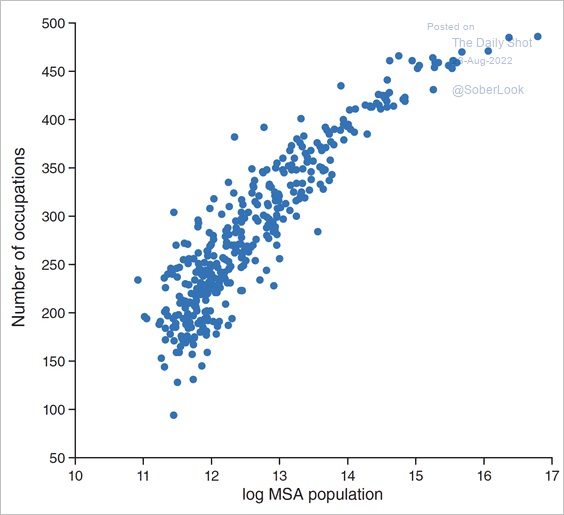

2. Number of occupations vs. US metropolitan area population:

Source: AEA Read full article

Source: AEA Read full article

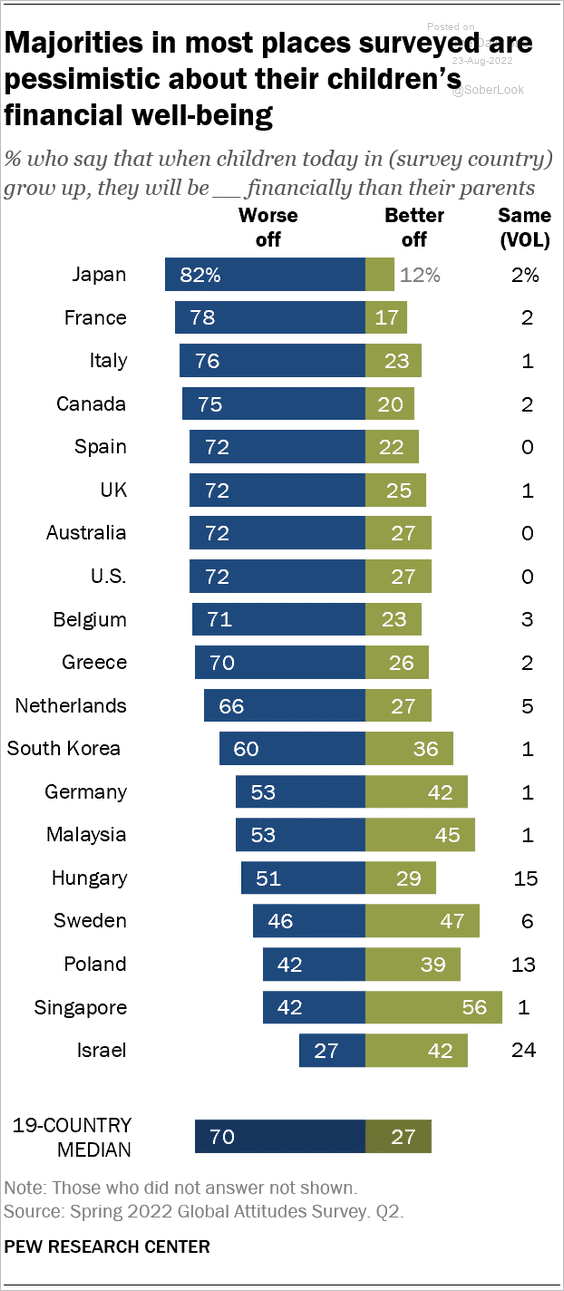

3. Views on the next generation’s financial well-being:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

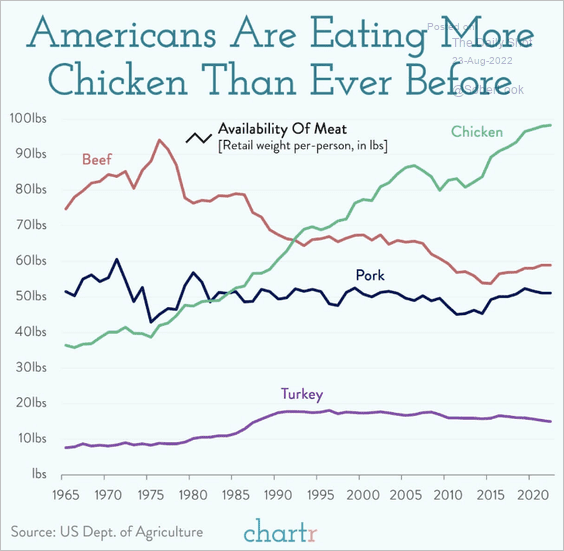

4. US meat consumption:

Source: @chartrdaily Read full article

Source: @chartrdaily Read full article

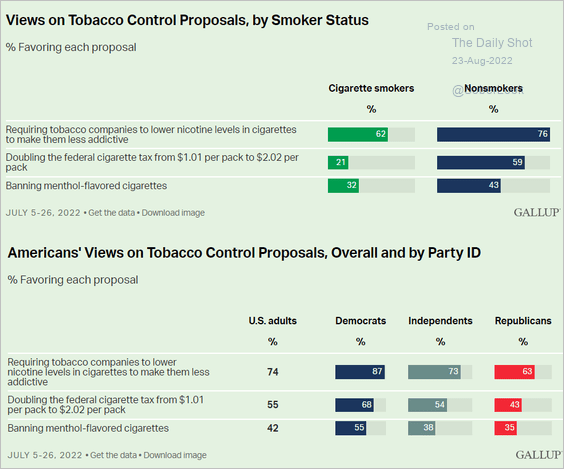

5. Views on tobacco control proposals:

Source: Gallup Read full article

Source: Gallup Read full article

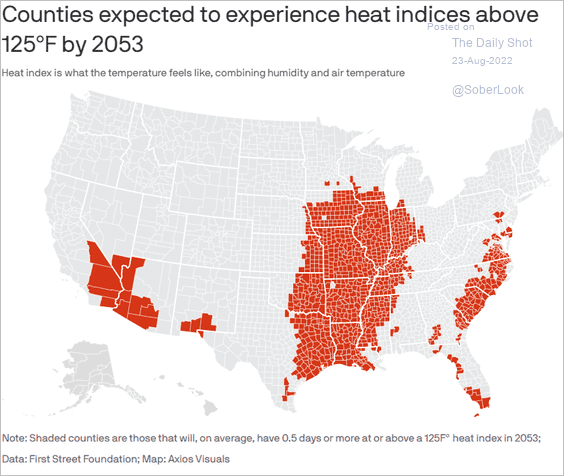

6. The Extreme Heat Belt:

Source: @axios Read full article

Source: @axios Read full article

7. The most detailed image of a human cell:

Source: Alfred Hendriks

Source: Alfred Hendriks

——————–

Back to Index