The Daily Shot: 29-Aug-22

• Administrative Update

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Alternatives

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

As a reminder, The Daily Shot will not be published on Friday, September 2nd and Monday, September 5th.

Back to Index

The United States

In a succinct speech, Jerome Powell once again reminded the markets not to expect a “pivot” from the US central bank any time soon. His comments weren’t significantly different from what we saw in the FOMC minutes.

• The labor market is too tight.

The labor market is particularly strong, but it is clearly out of balance, with demand for workers substantially exceeding the supply of available workers.

• The Fed is focused on easing demand.

Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance.

• A recession won’t necessarily mean rate cuts.

… we must keep at it until the job is done. History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting.

• Expect economic pain.

While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

——————–

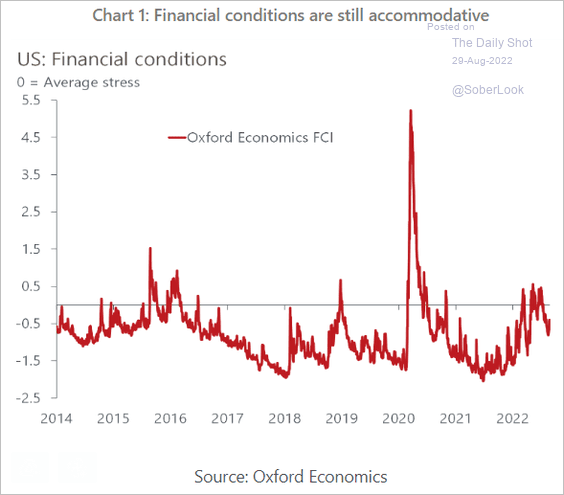

2. Financial conditions remain relatively accommodative, and the Fed would like to see more tightening (2 charts).

Source: Oxford Economics

Source: Oxford Economics

——————–

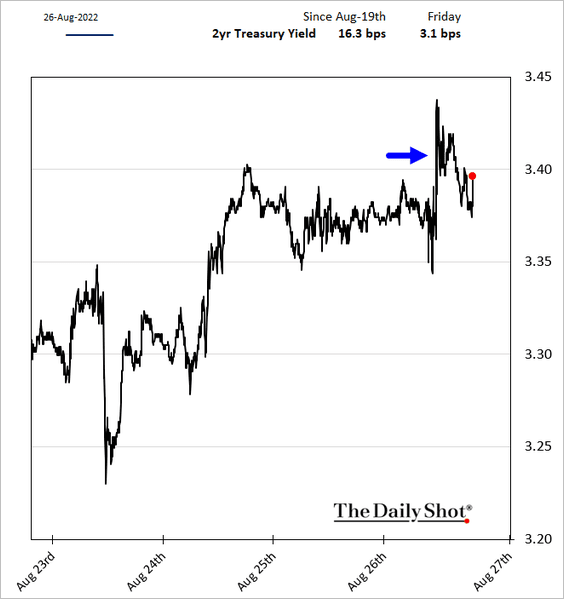

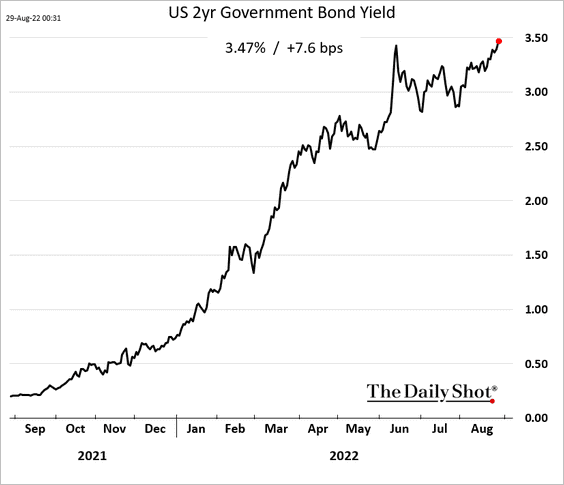

3. Short-term Treasury yields rose modestly on Friday but are climbing this morning. The 2-year yield is nearing 3.5%.

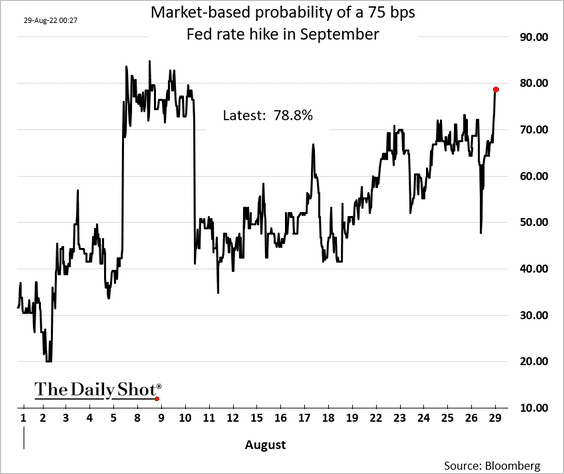

The probability of a 75 bps rate hike in September is nearing 80%.

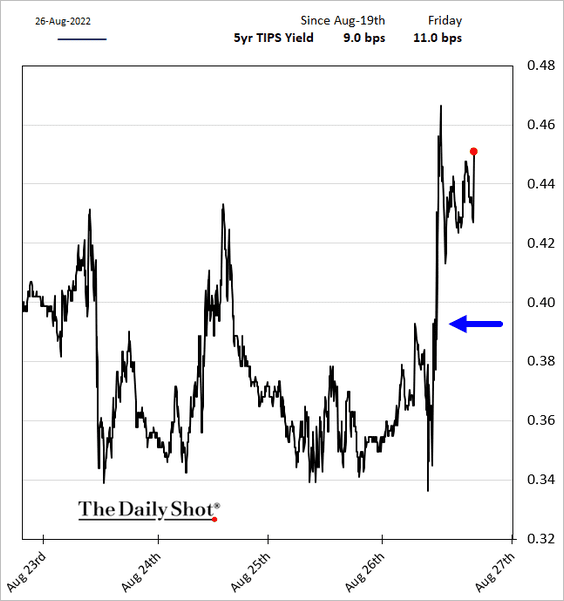

• Real yields jumped, …

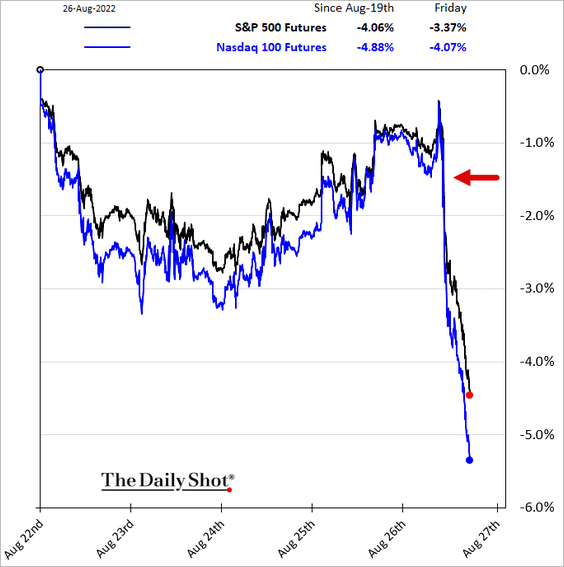

… putting downward pressure on stocks.

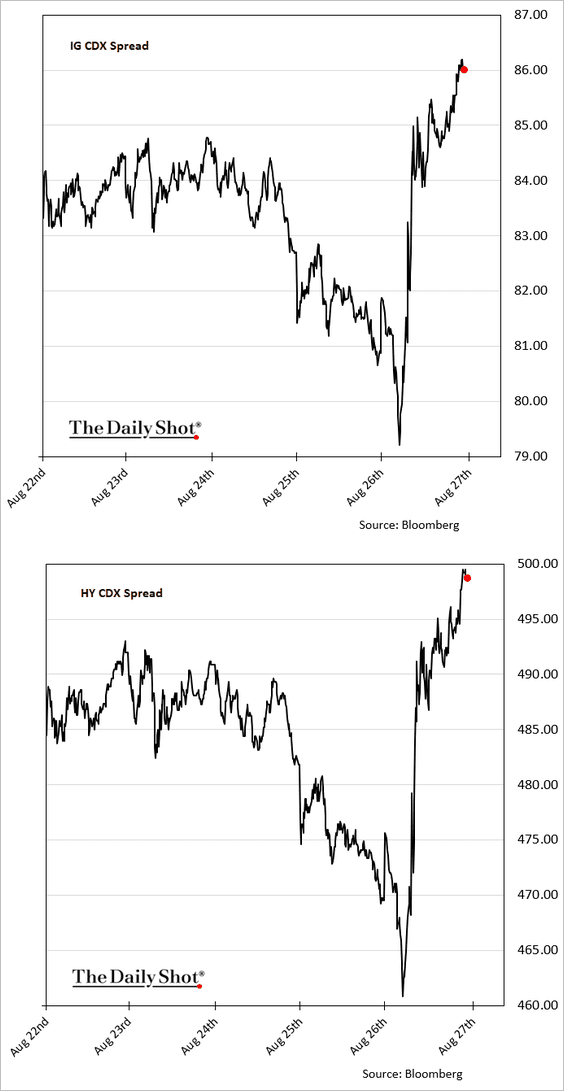

• Credit spreads widened.

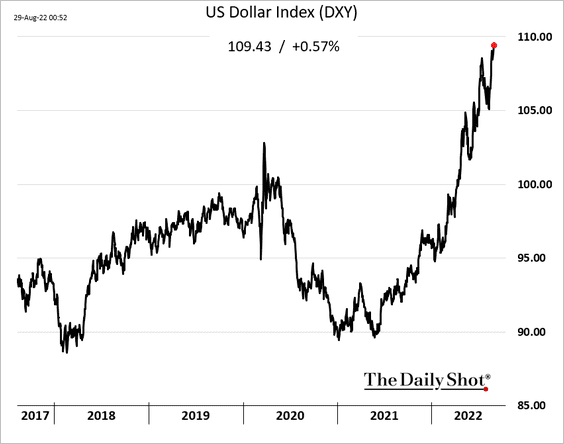

• The dollar is pushing higher.

——————–

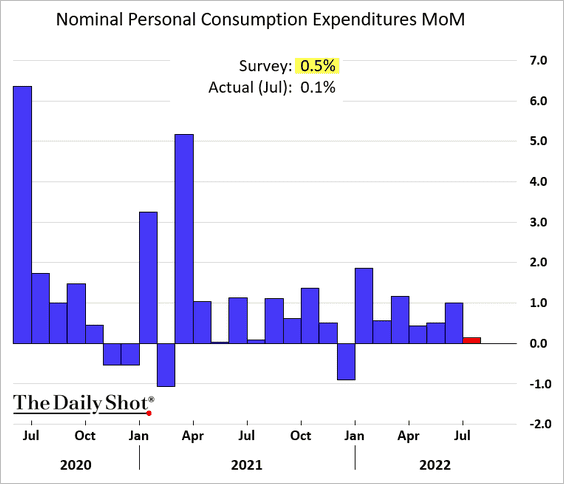

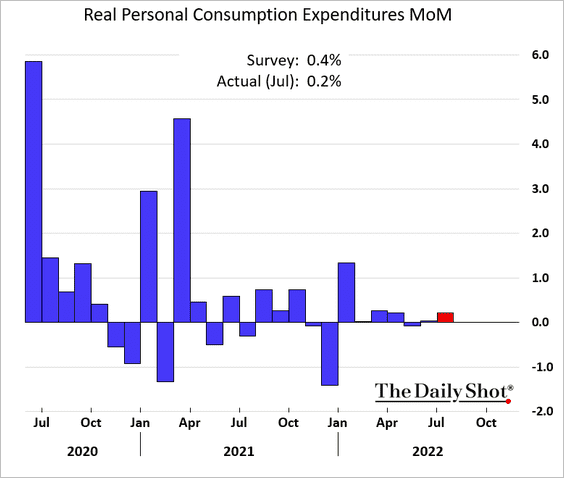

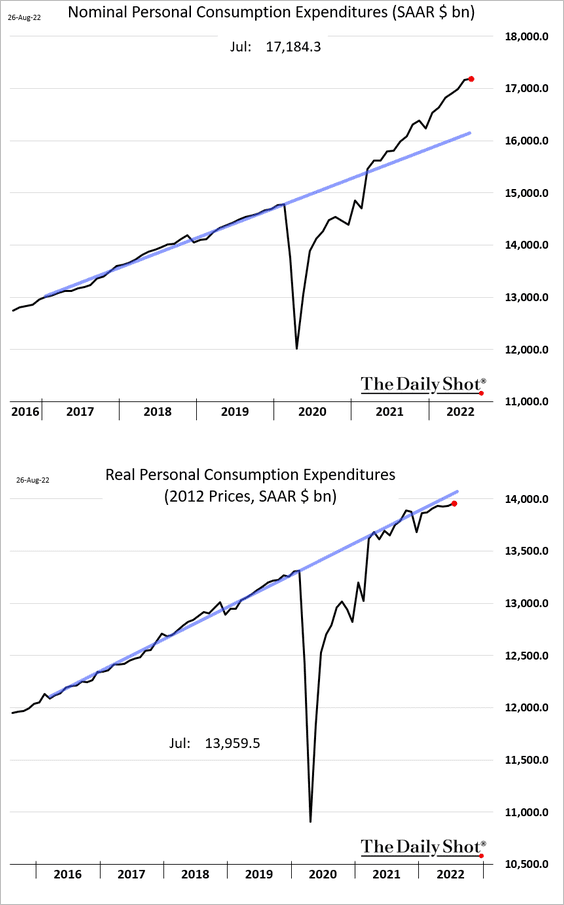

4. Consumer spending slowed in July but remained in growth mode.

Here are the trends.

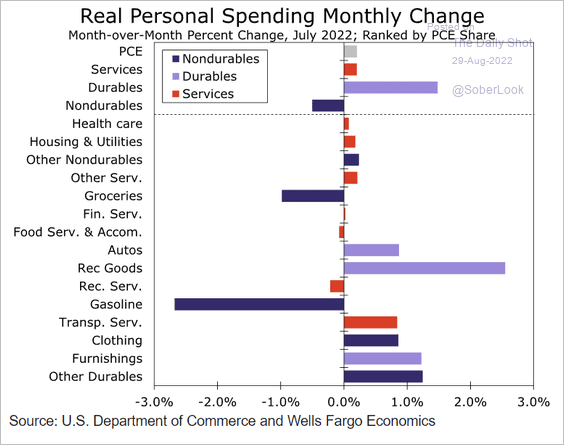

And this chart shows real spending by sector.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

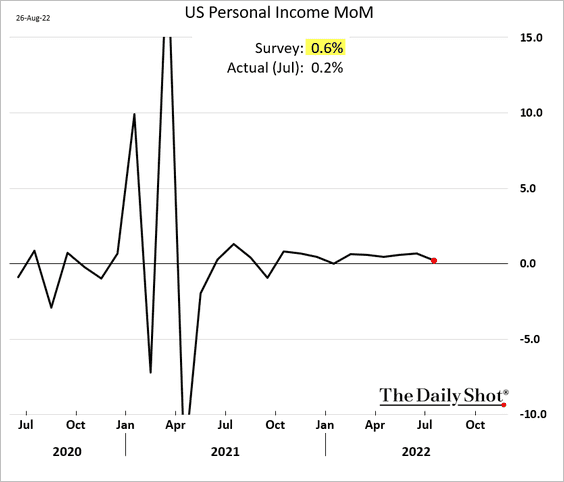

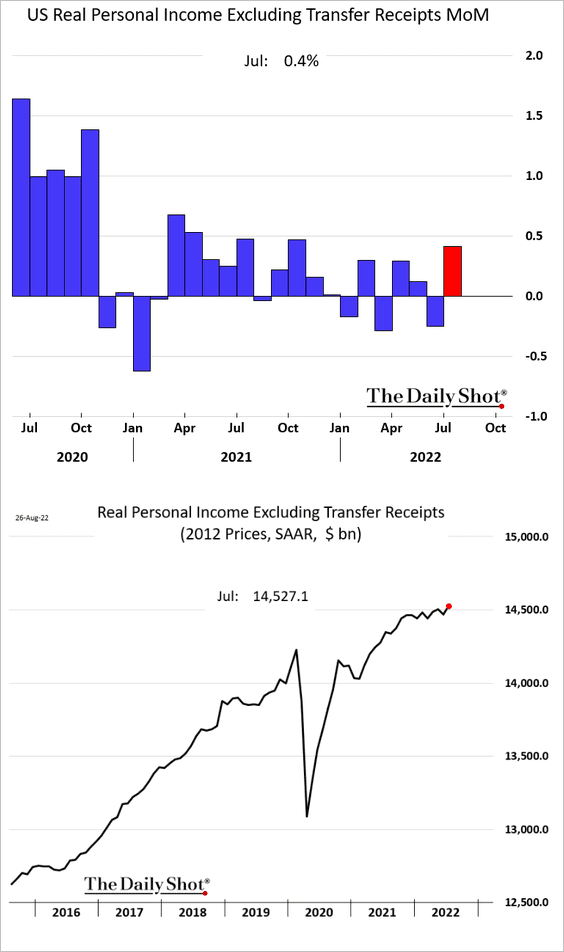

• Personal income growth slowed.

This chart shows real personal income in dollar terms.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

However, real income excluding government payments saw a healthy increase in July.

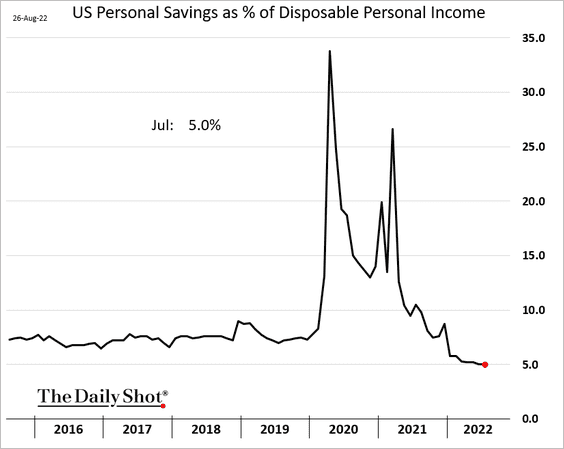

• Savings continue to slow.

——————–

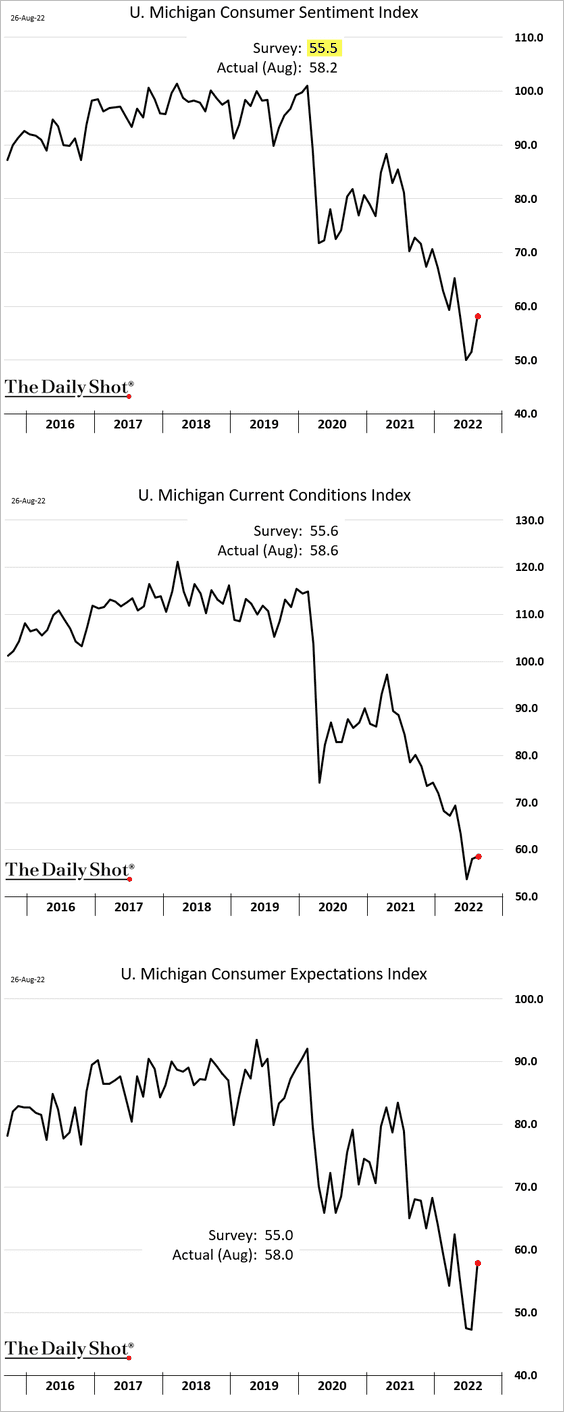

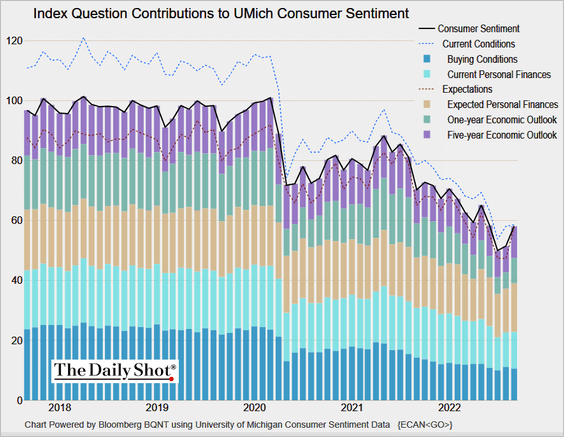

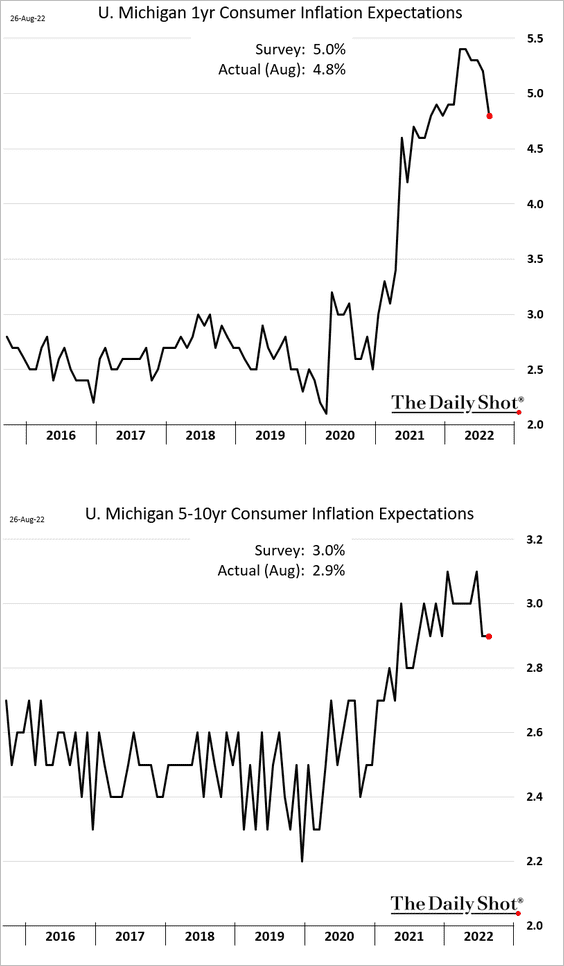

5. The U. Michigan consumer sentiment report showed an improvement in the latter part of August, …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

… as gasoline prices declined further.

Inflation expectations also edged lower. It’s worth noting that oil prices have been rising in recent days, which may push gasoline prices up.

——————–

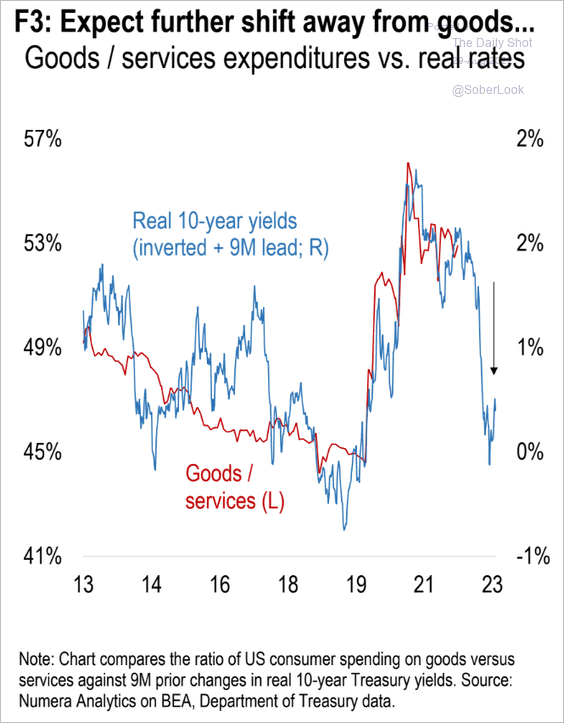

6. Will consumers continue to shift from goods to services?

Source: Numera Analytics

Source: Numera Analytics

Back to Index

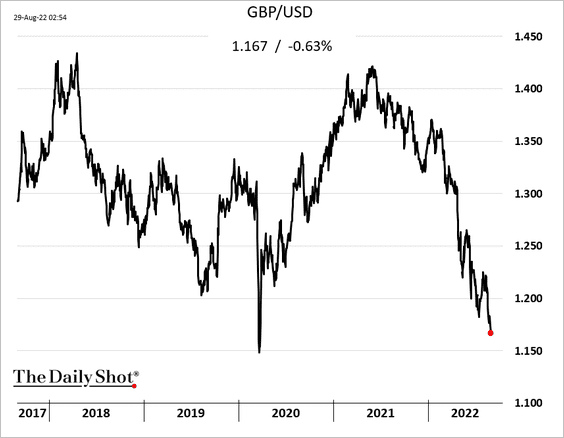

The United Kingdom

1. The pound is nearing 2020 lows against the dollar.

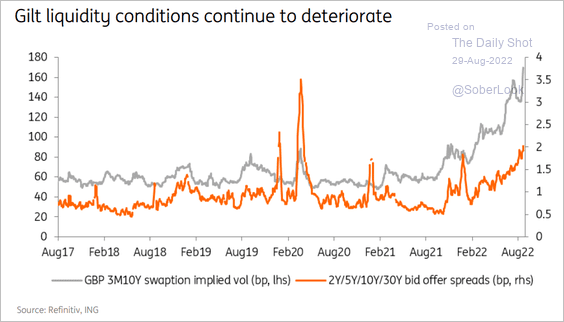

2. Gilt volatility has been rising while liquidity worsens.

Source: ING

Source: ING

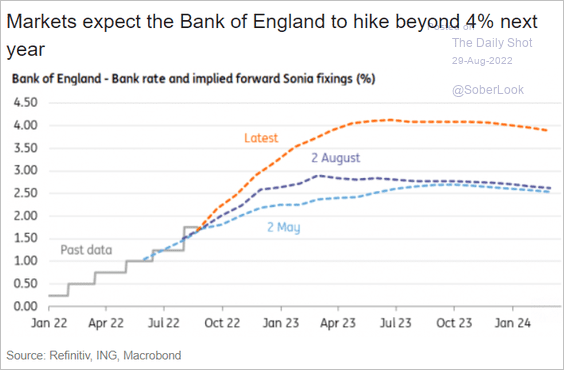

3. The market continues to adjust the BoE rate trajectory higher.

Source: ING

Source: ING

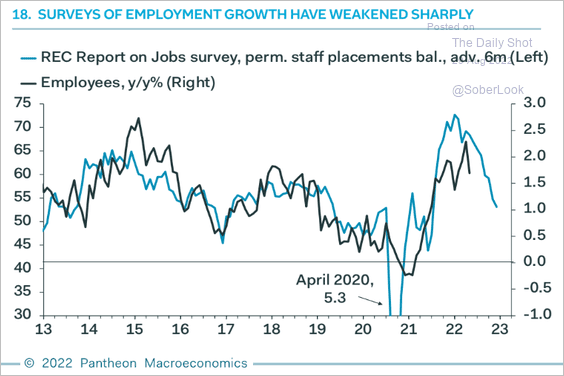

4. Employment growth is slowing.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

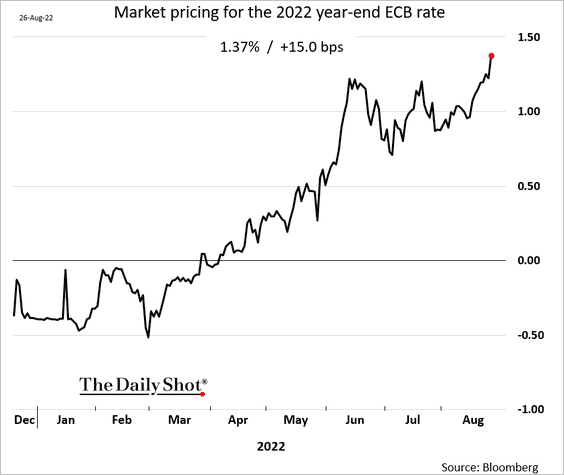

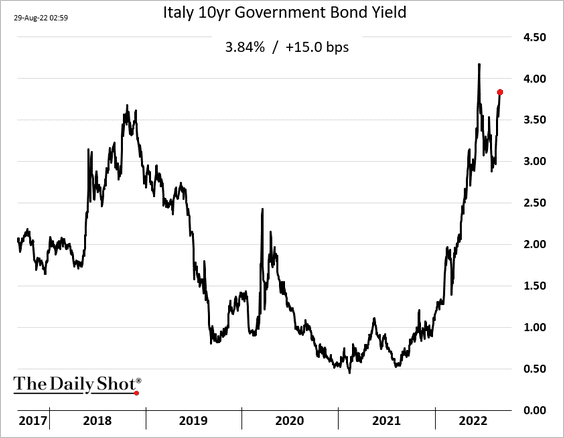

1. ECB officials struck a hawkish tone at Jackson Hole.

Source: Reuters Read full article

Source: Reuters Read full article

Market expectations for the ECB rate at the end of the year hit a new high.

Bond yields are climbing.

——————–

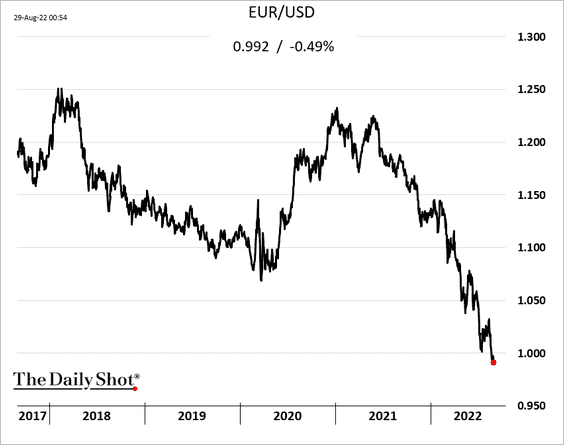

2. The euro continues to sink vs. USD.

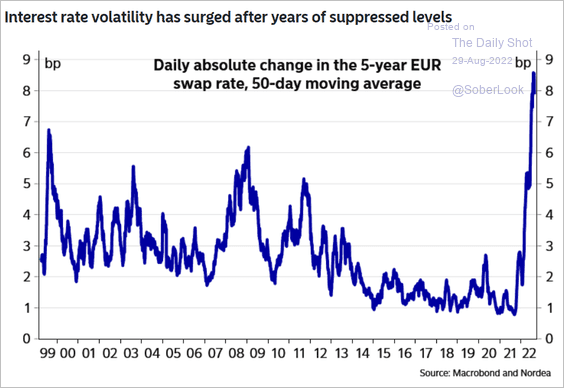

3. Volatility in euro rate markets is holding at extreme levels.

Source: Nordea Markets

Source: Nordea Markets

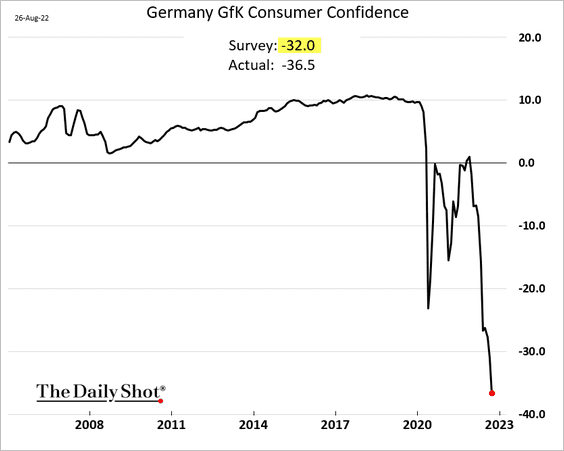

4. Germany’s consumer sentiment hit a new low.

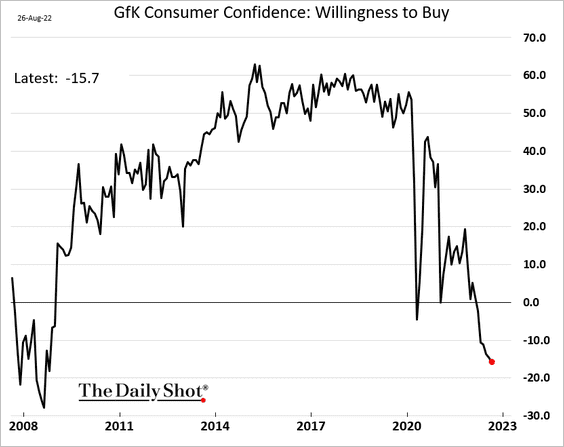

Here is the “willingness to buy” component.

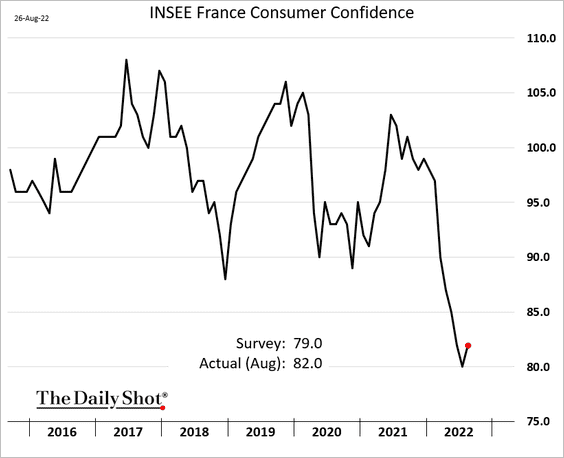

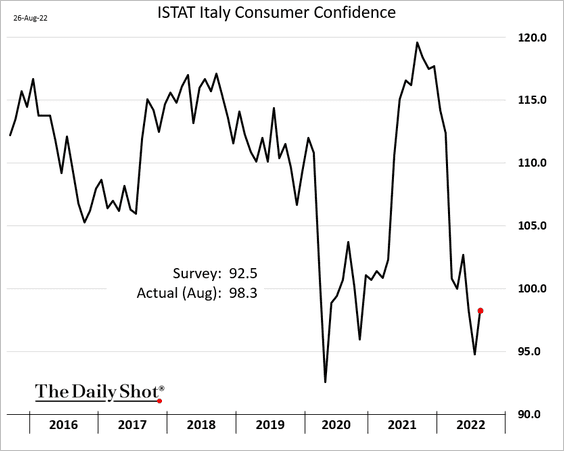

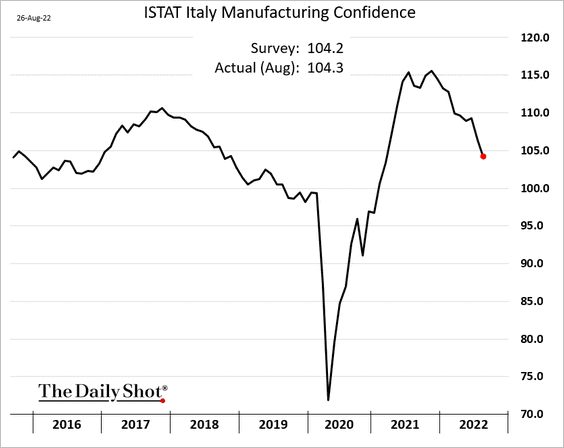

French and Italian consumer sentiment indicators edged higher in August.

Italian manufacturing confidence is trending lower.

——————–

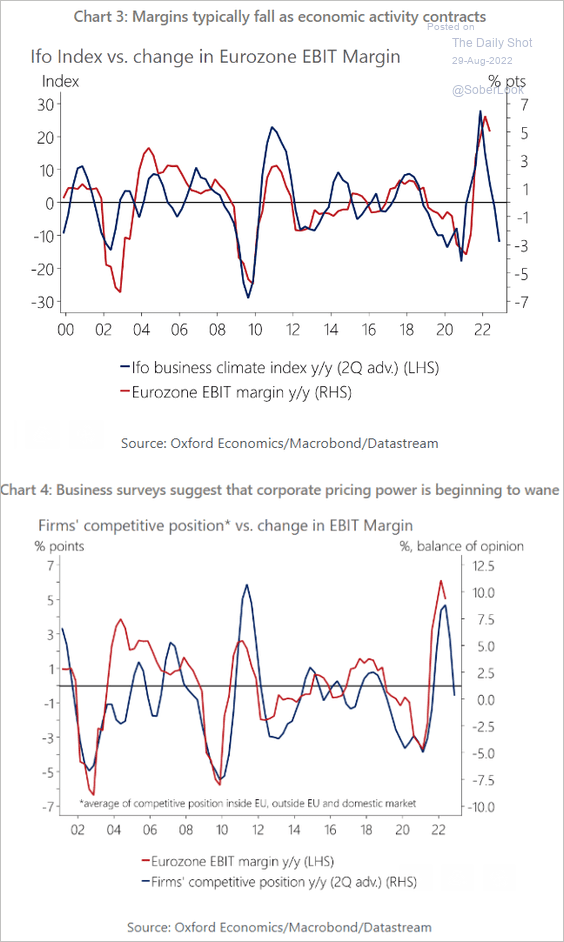

5. Corporate margins are under pressure.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Europe

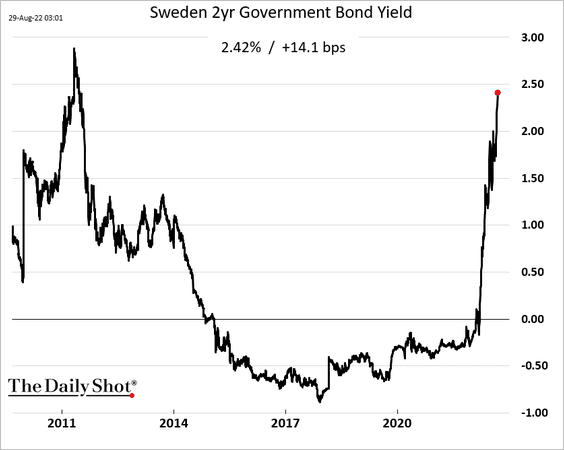

1. Sweden’s bond yields continue to surge.

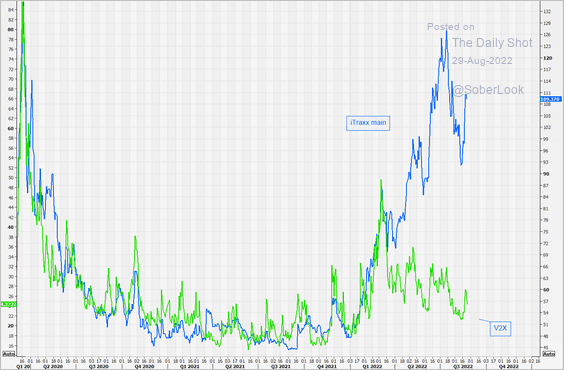

2. Credit has diverged from equity vol.

Source: @themarketear

Source: @themarketear

Back to Index

Asia – Pacific

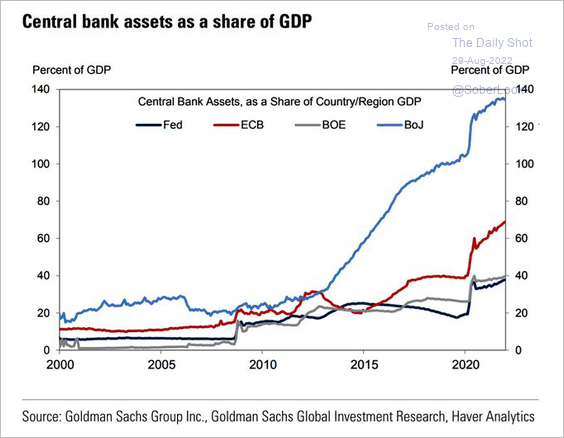

1. The BoJ’s balance sheet size stands out.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

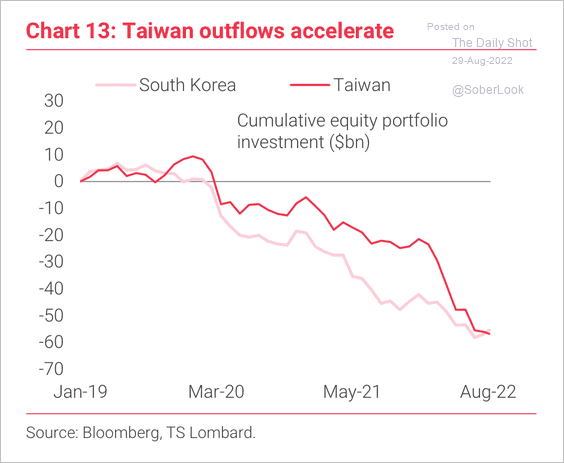

2. Taiwan and South Korea equity outflows have accelerated.

Source: TS Lombard

Source: TS Lombard

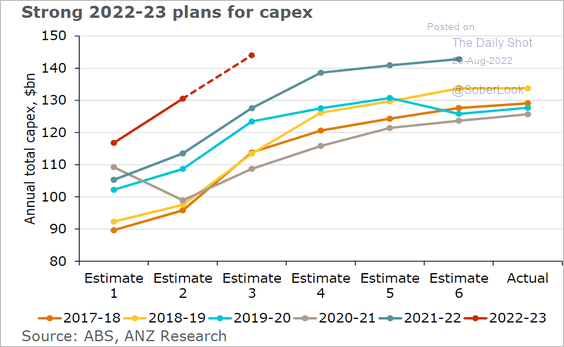

3. Australia’s business investment expectations remain strong.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

China

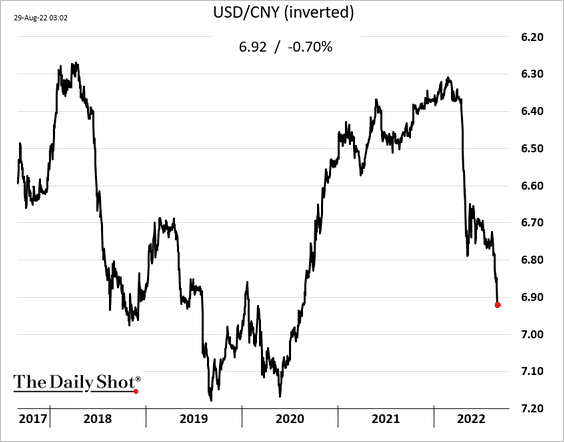

1. The renminbi continues to sink vs. USD.

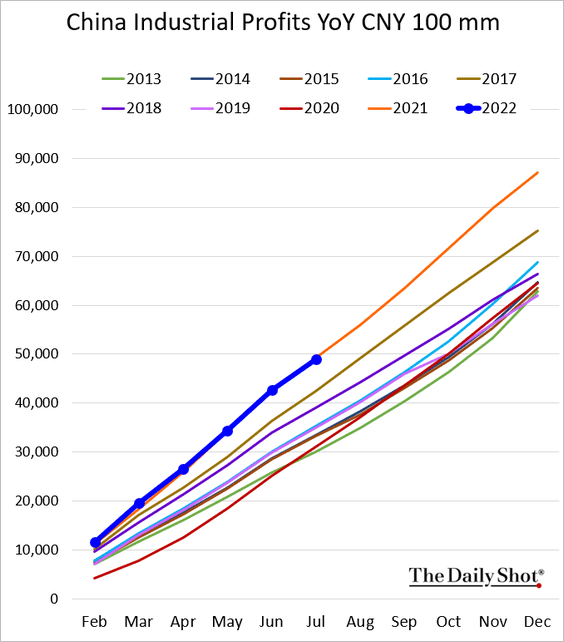

2. Industrial profits are holding at last year’s level.

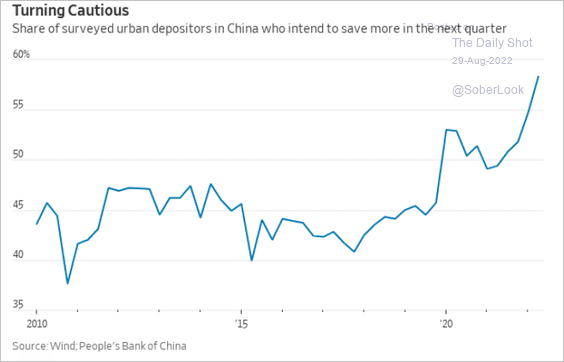

3. Households are increasingly focused on saving.

Source: @WSJ Read full article

Source: @WSJ Read full article

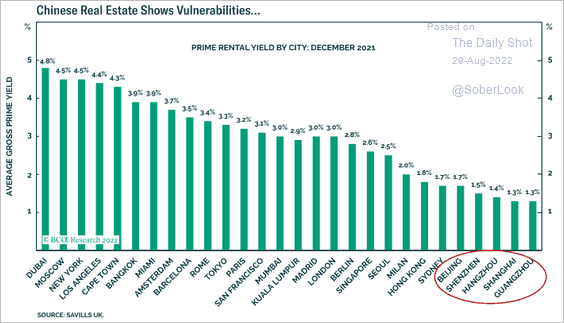

4. Rental property yields are low relative to other parts of the world.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

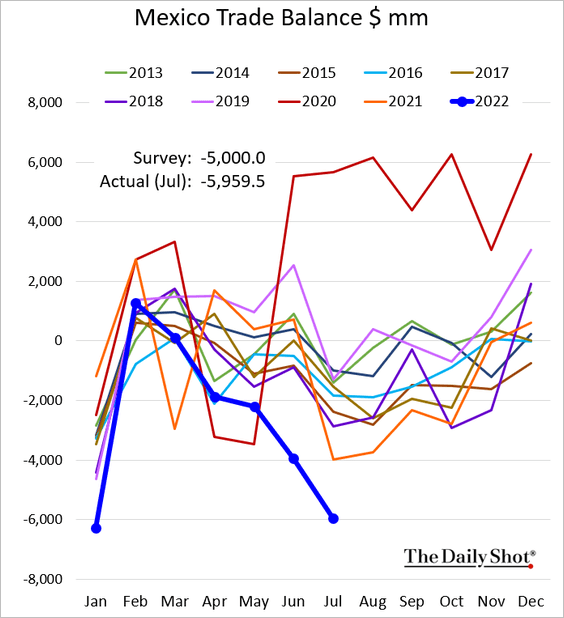

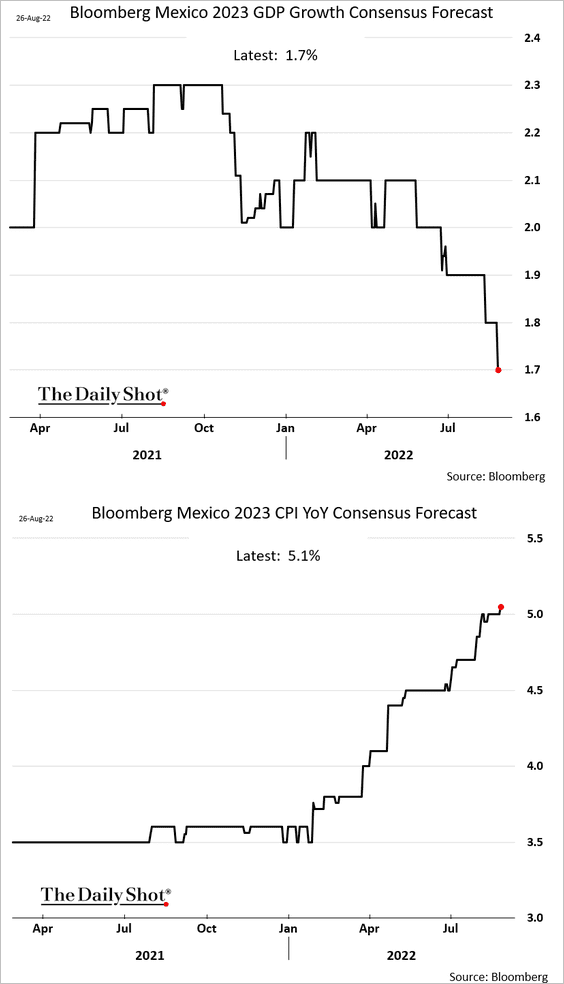

1. Mexico’s trade balance has been deteriorating.

Economists continue to downgrade their forecasts for Mexico’s economic growth next year while raising inflation projections.

——————–

2. Economists are also projecting a deeper recession for Russia next year.

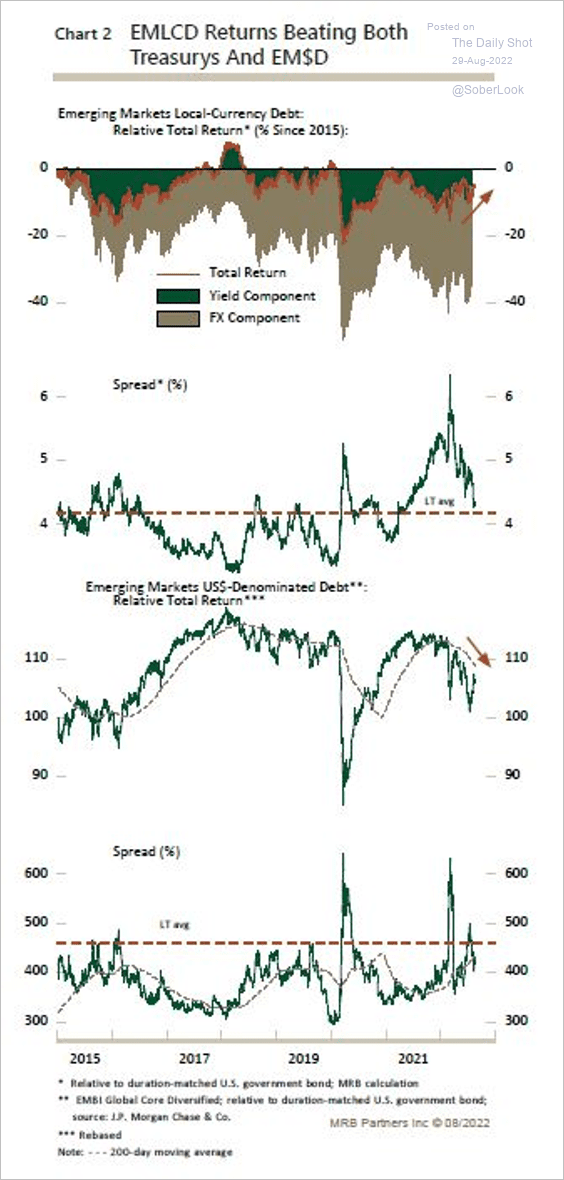

3. MRB Partners expects EM local-currency debt to outperform as EM central banks have room to pause their interest rate hiking cycles earlier than DM peers.

Source: MRB Partners

Source: MRB Partners

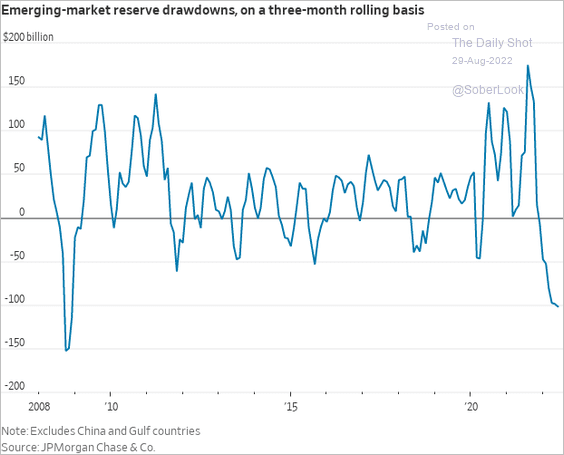

4. EM F/X reserves have declined sharply in recent months.

Source: @WSJ Read full article

Source: @WSJ Read full article

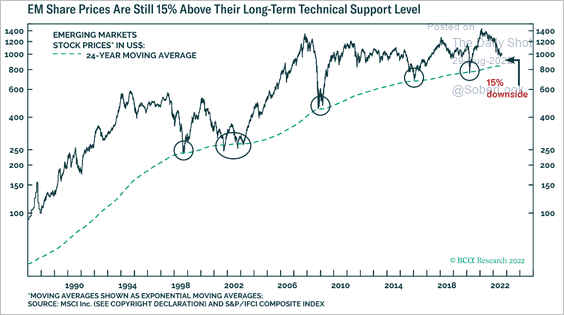

5. EM equities are about 15% above long-term support.

Source: BCA Research

Source: BCA Research

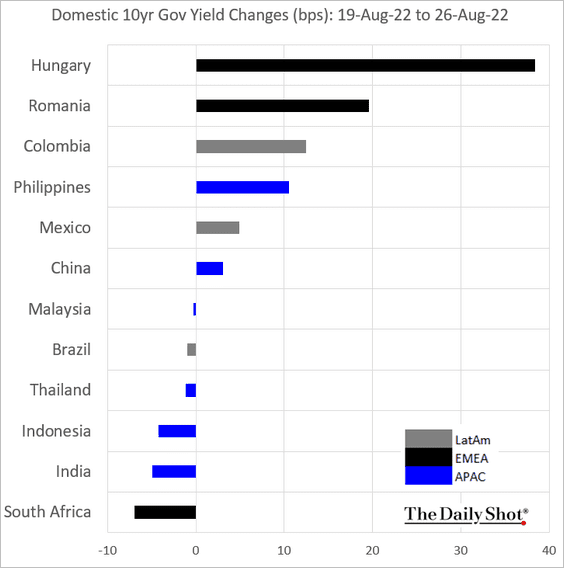

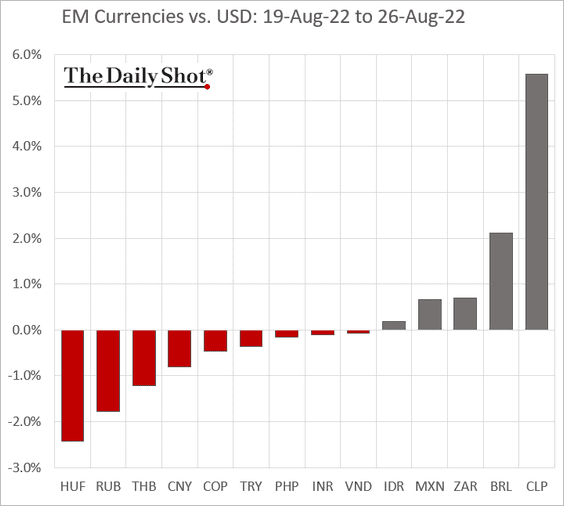

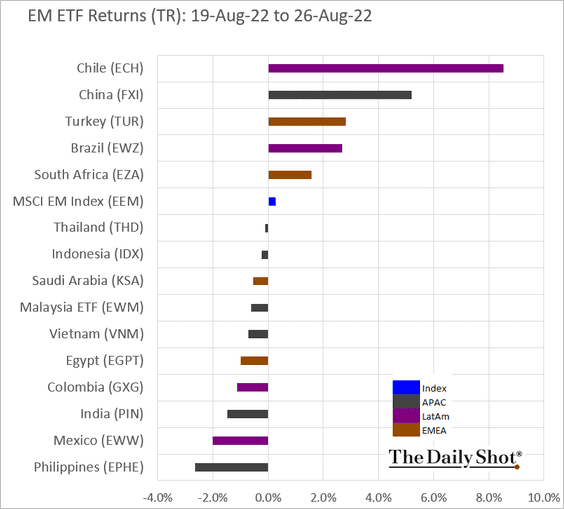

6. Next, we have some performance data from last week.

• Domestic bond yields:

• Currencies:

• Equity ETFs:

Back to Index

Cryptocurrency

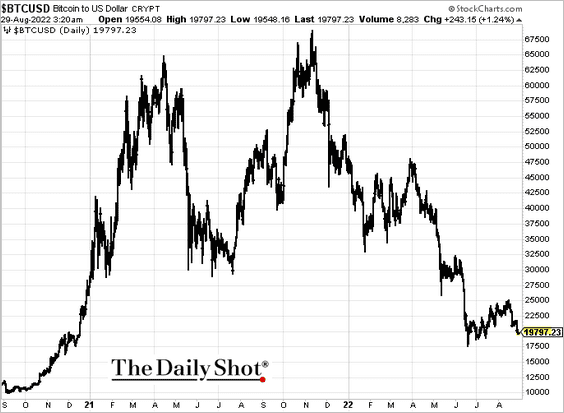

1. Cryptos are down sharply over the weekend (after Jackson Hole), with bitcoin dipping below $20k.

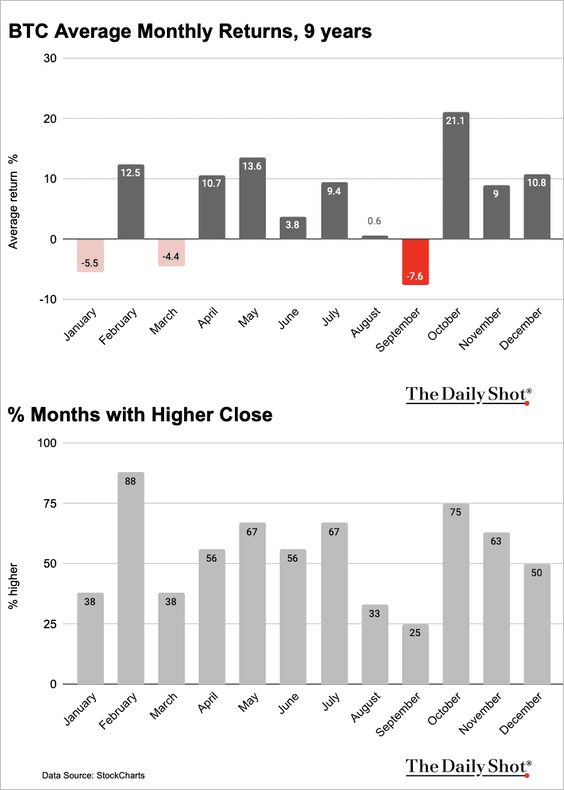

2. Similar to equities, bitcoin typically struggles in September.

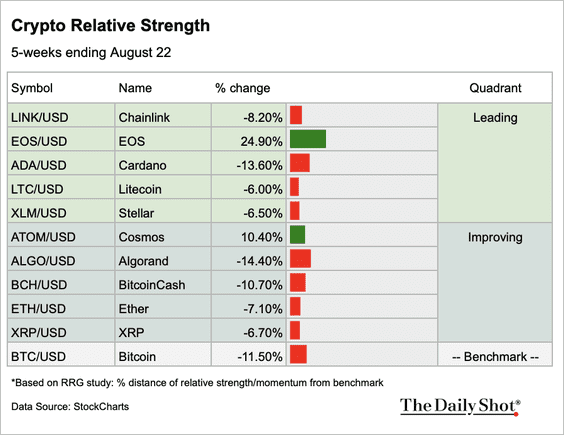

3. This table compares price momentum between top cryptos and bitcoin, ranked by relative strength. Although most altcoins are leading, their outperformance has weakened during the latest sell-off.

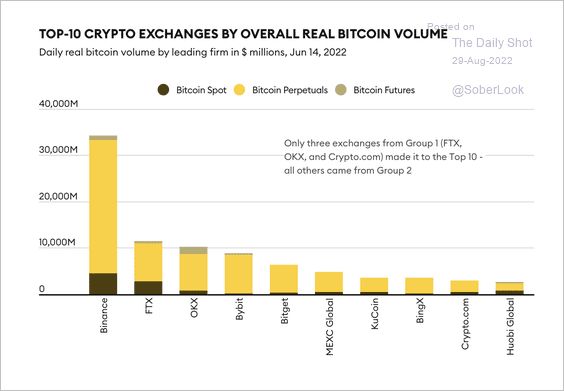

4. Here are the top crypto exchanges by real bitcoin volume.

Source: Forbes Read full article

Source: Forbes Read full article

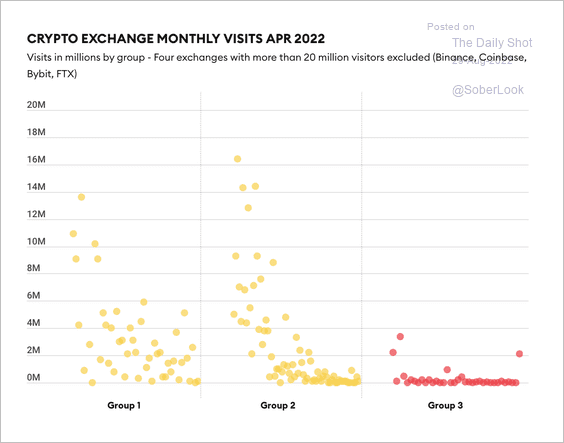

However, there is a large discrepancy between self-reported trading volume and website traffic. Among other factors, Forbes concluded that more than half of all bitcoin transactions are fake.

Source: Forbes Read full article

Source: Forbes Read full article

Back to Index

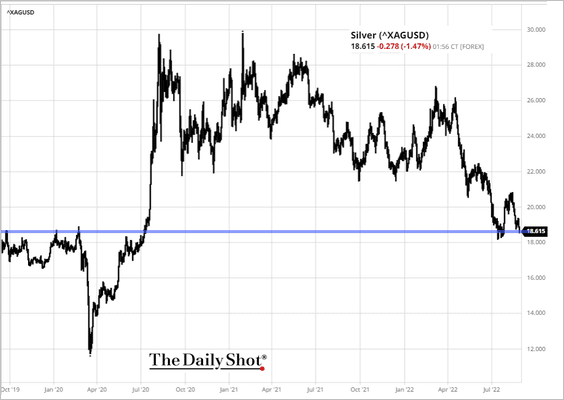

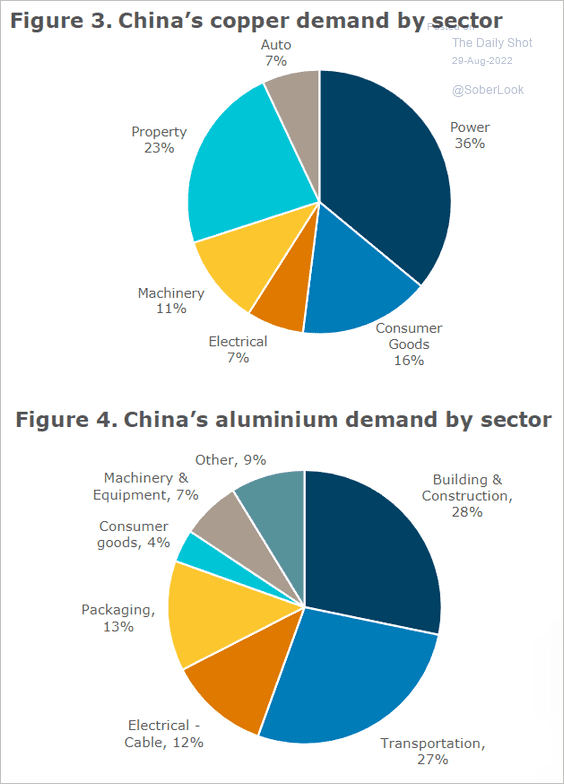

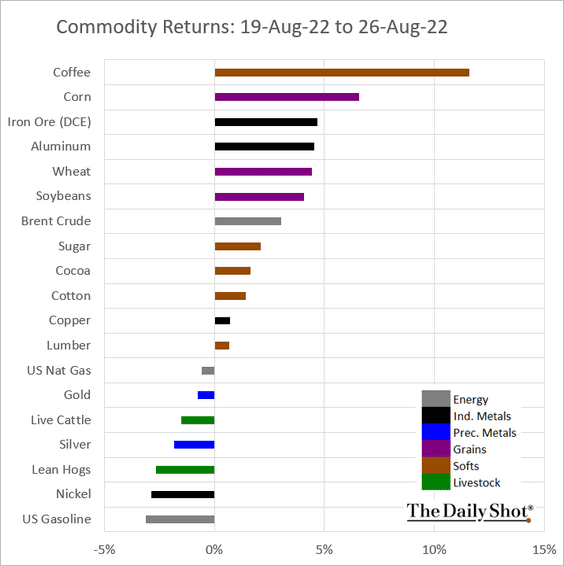

Commodities

1. Precious metals are under pressure from higher bond yields and a stronger dollar. Here is silver.

Source: barchart.com

Source: barchart.com

2. This chart shows China’s copper and aluminum demand by sector.

Source: @ANZ_Research

Source: @ANZ_Research

3. Here is last week’s performance across key commodity markets.

Back to Index

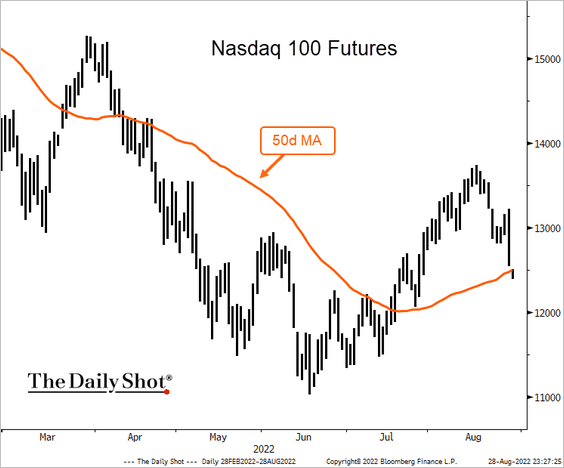

Equities

1. Rising real yields are a headwind for growth stocks.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

2. The Nasdaq 100 futures are testing support at the 50-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

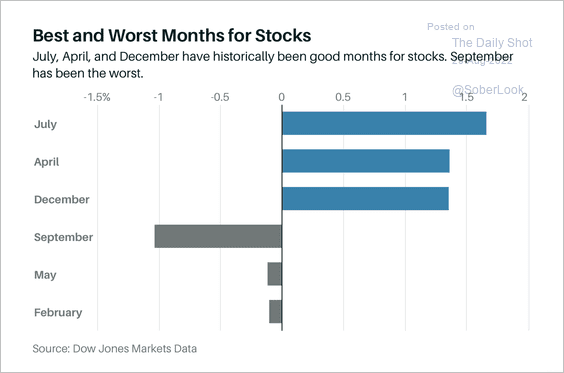

3. Historically, September has been the worst month for stocks. But the sell-off has already begun.

Source: Barron’s Read full article

Source: Barron’s Read full article

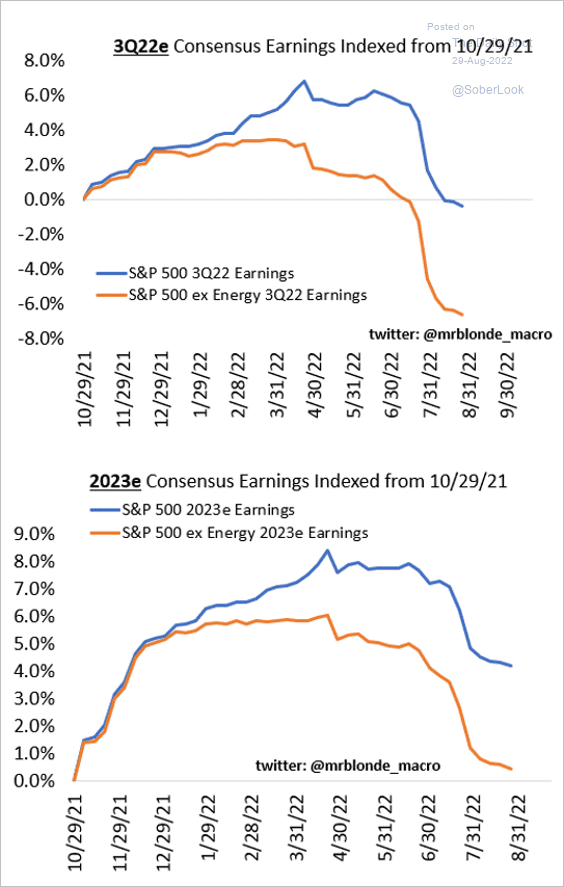

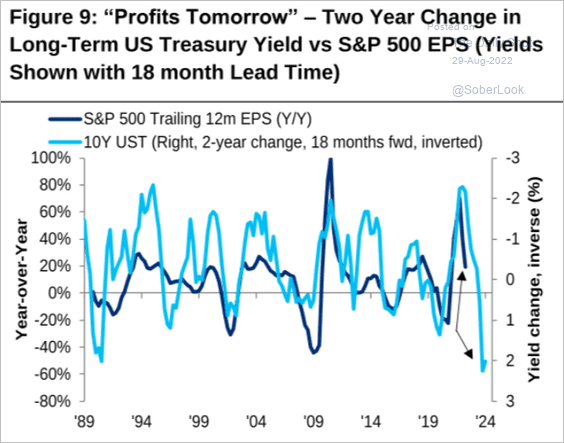

4. Earnings projections continue to trend lower.

Source: @MrBlonde_macro

Source: @MrBlonde_macro

And elevated Treasury yields point to further weakness.

Source: Citi Private Bank

Source: Citi Private Bank

——————–

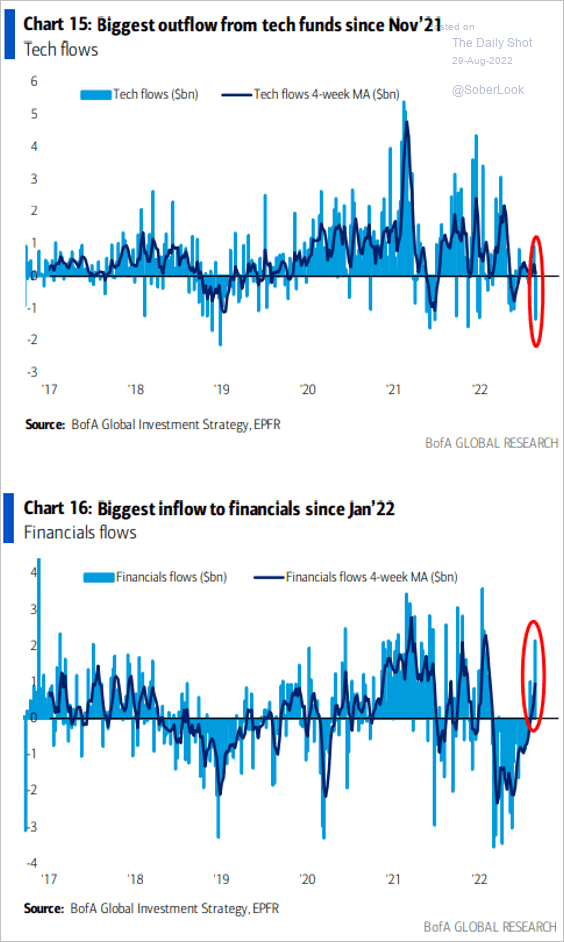

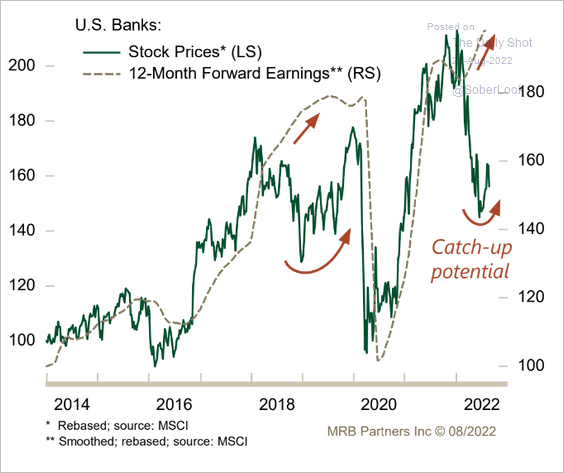

5. Tech funds saw substantial outflows while financials are finally registering inflows.

Source: BofA Global Research

Source: BofA Global Research

Banks could outperform, boosted by widening interest margins.

Source: MRB Partners

Source: MRB Partners

——————–

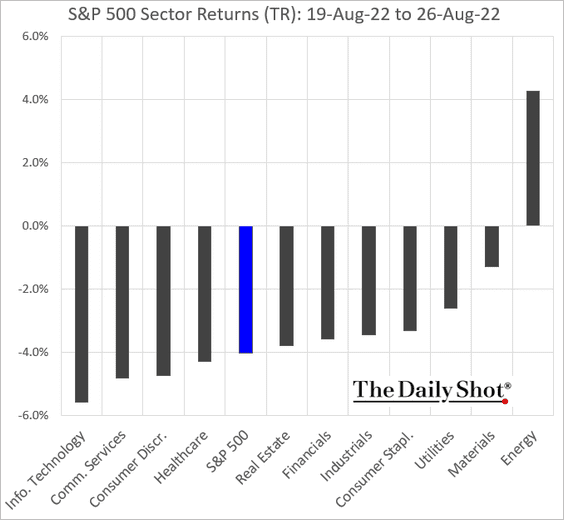

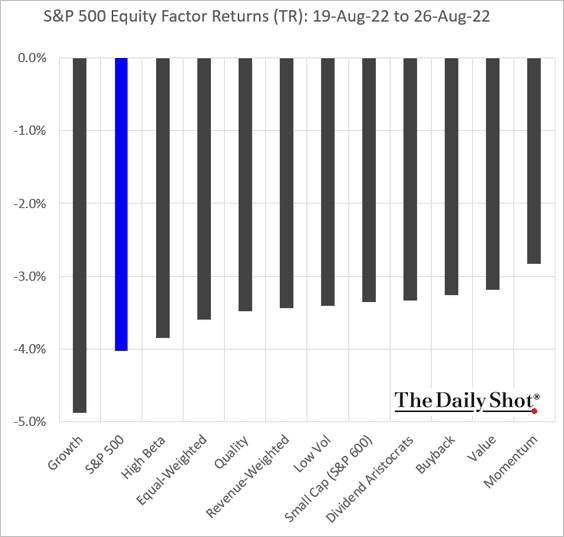

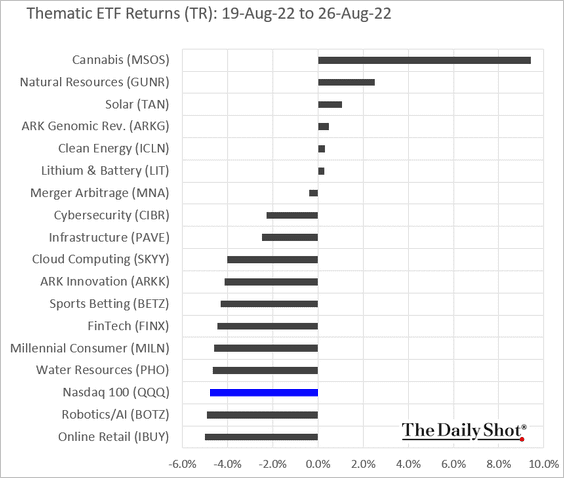

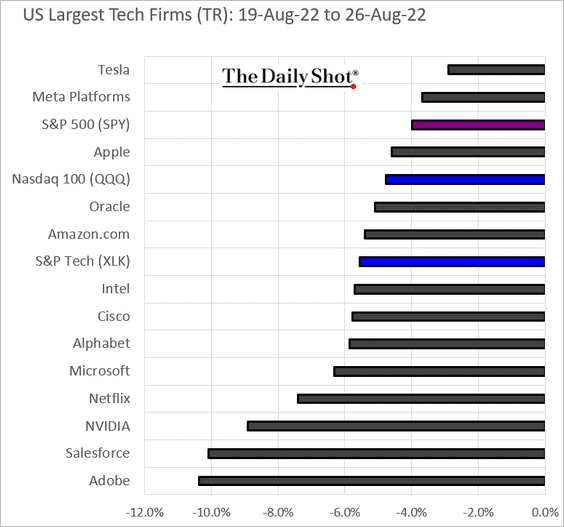

6. Next, we have some performance data from last week.

• Sectors:

• Equity factors:

• Thematic ETFs:

• Largest US tech firms:

Back to Index

Alternatives

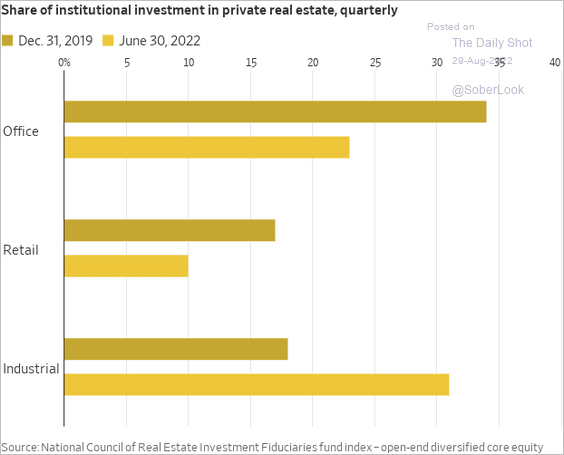

1. Institutional investors in commercial real estate have been cutting back on office and retail properties but increasing industrial real estate holdings.

Source: @WSJ Read full article

Source: @WSJ Read full article

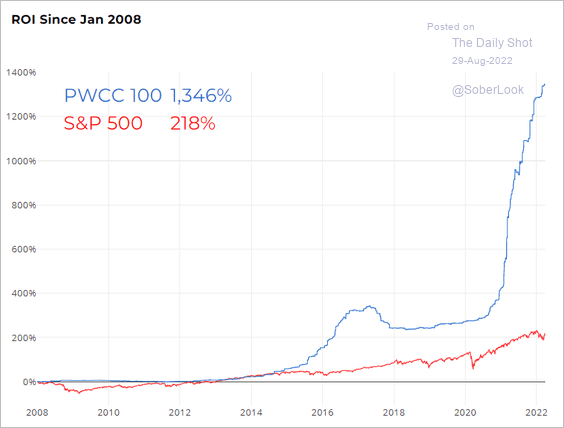

2. Trading card prices have exploded to the upside.

Source: PWCC

Source: PWCC

Source: AP News Read full article

Source: AP News Read full article

Back to Index

Credit

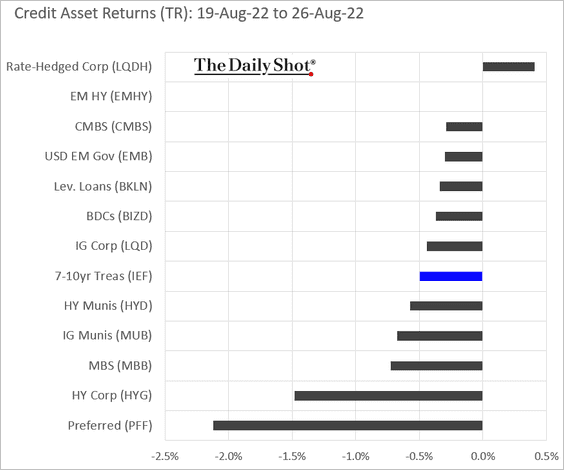

Here is last week’s performance by asset class.

Back to Index

Rates

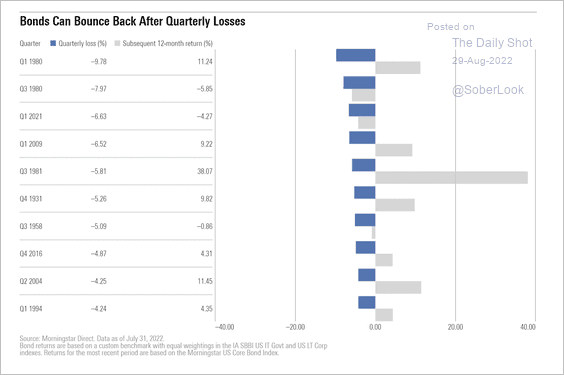

1. Bonds have typically bounced back after a quarterly loss.

Source: Morningstar Direct Read full article

Source: Morningstar Direct Read full article

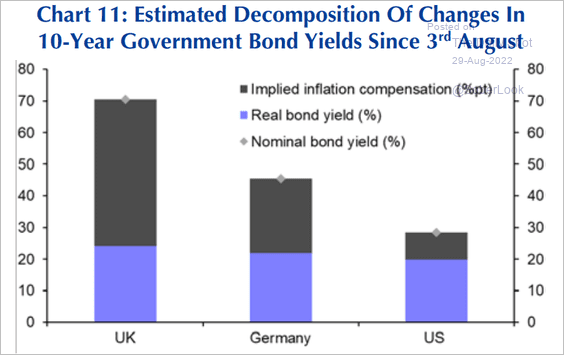

2. Here is the attribution of yield changes since August 3rd.

Source: Capital Economics

Source: Capital Economics

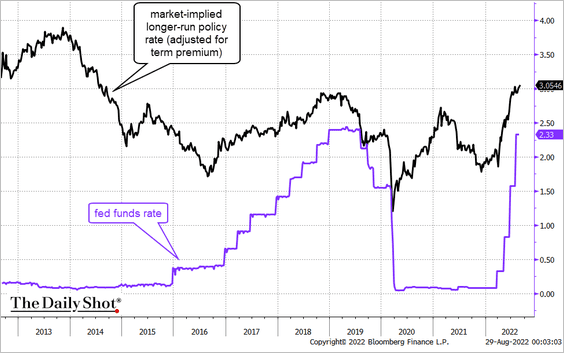

3. The market sees another 70 bps of Fed rate hikes to go before reaching the “neutral” policy stance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Global Developments

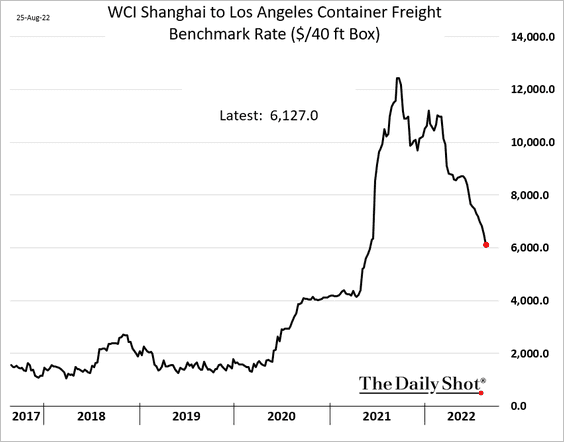

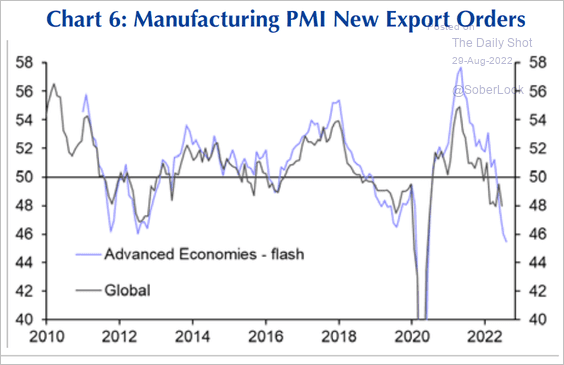

1. Container shipping costs continue to fall …

… with export orders.

Source: Capital Economics

Source: Capital Economics

——————–

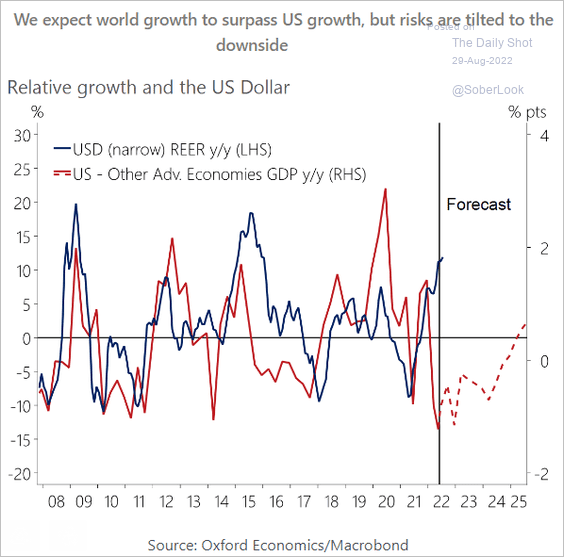

2. US economic underperformance poses a downside risk for the dollar.

Source: Oxford Economics

Source: Oxford Economics

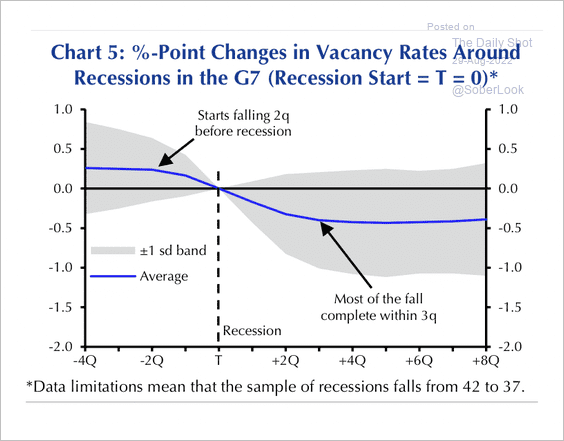

3. Job vacancies begin to fall up to six months before the onset of a recession, on average, and have stopped falling three quarters after.

Source: Capital Economics

Source: Capital Economics

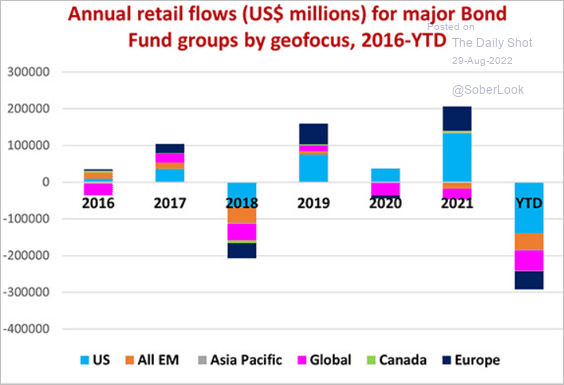

4. Retail investors have pulled a substantial amount of capital out of bond funds this year.

Source: EPFR Global Navigator

Source: EPFR Global Navigator

5. Finally, we have some performance data from last week.

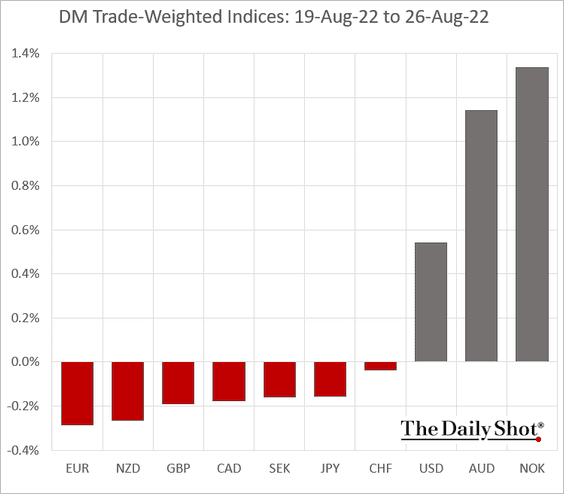

• Trade-weighted currency indices:

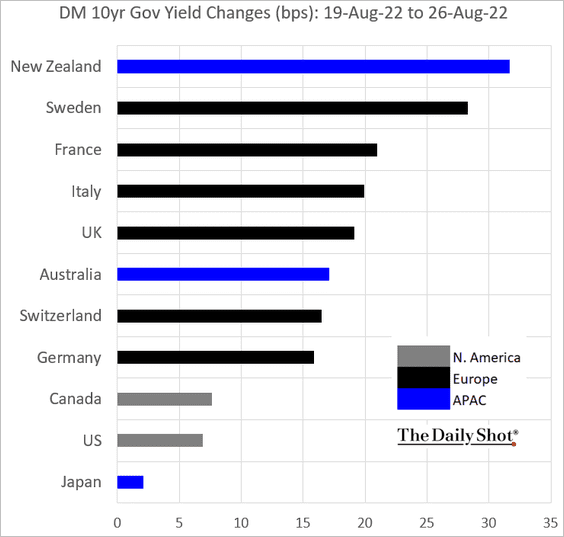

• Bond yields:

——————–

Food for Thought

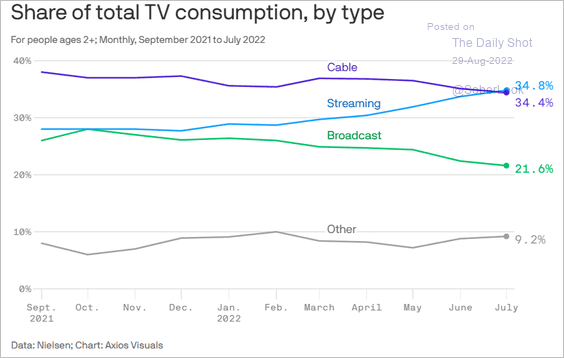

1. TV consumption by type:

Source: @axios Read full article

Source: @axios Read full article

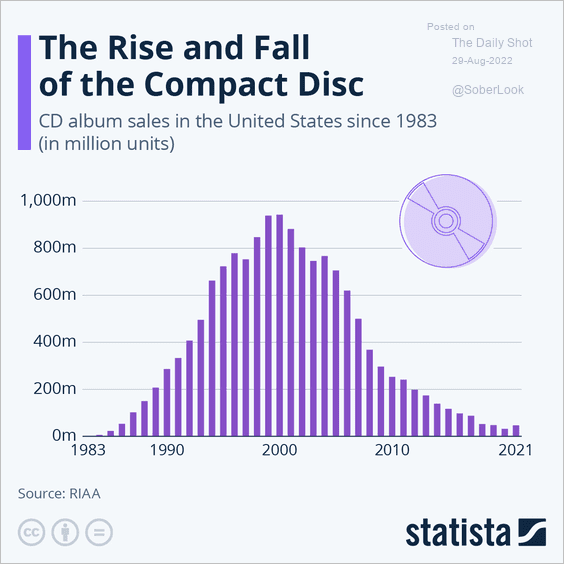

2. CD album sales:

Source: Statista

Source: Statista

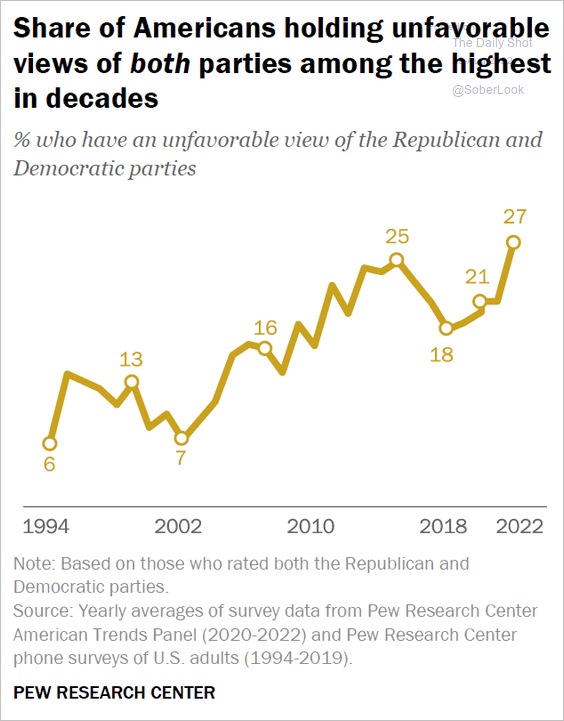

3. Unfavorable views of the Republican and Democratic parties:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

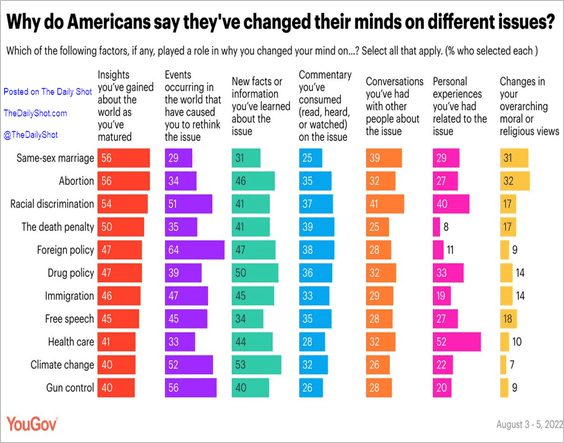

4. Reasons for shifting views on different issues:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

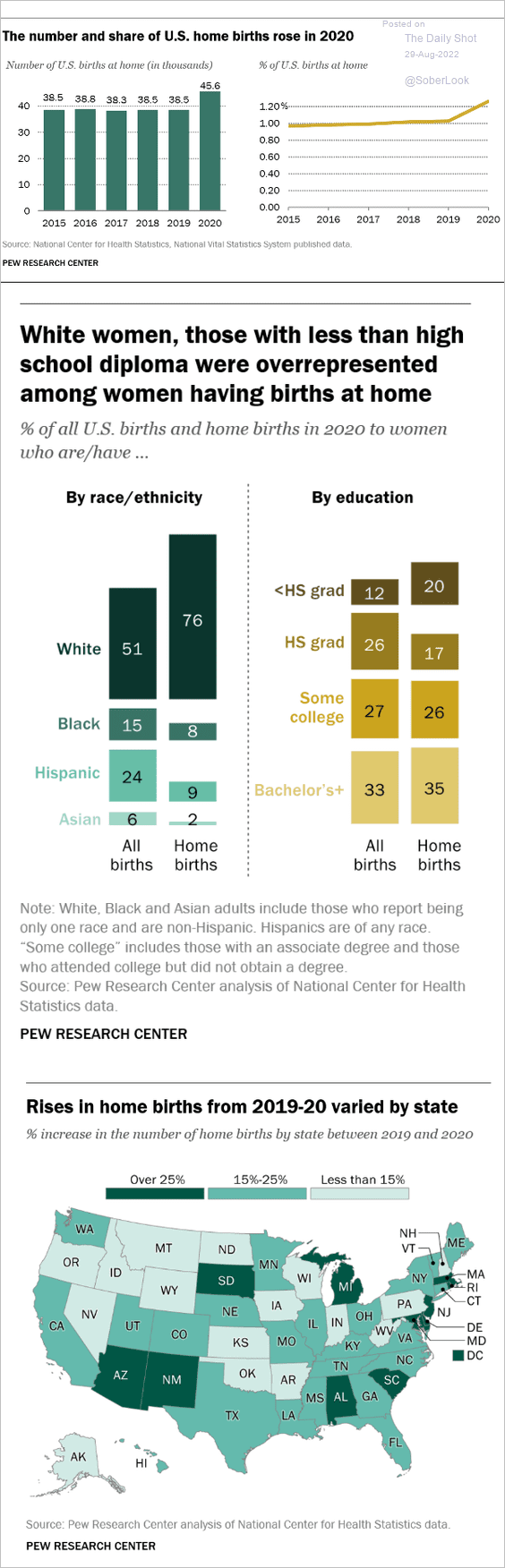

5. Home births:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

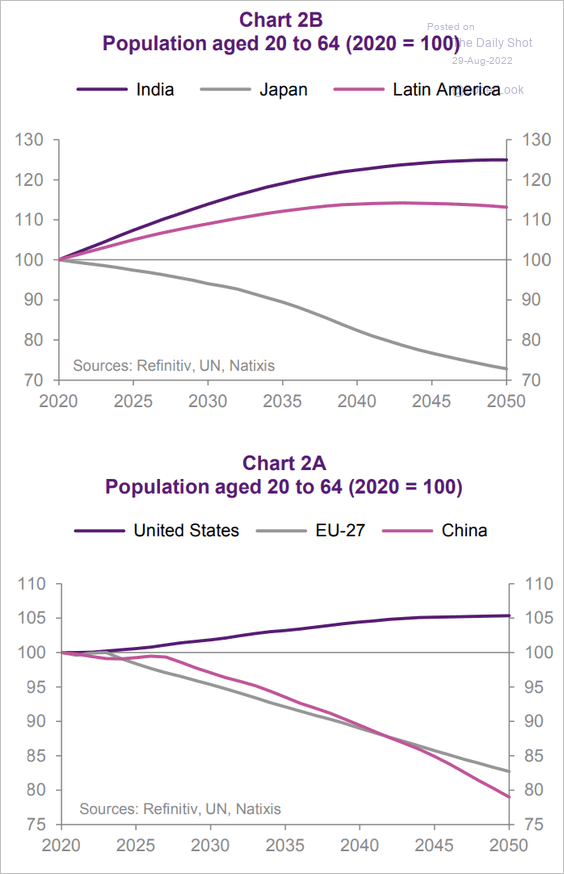

6. Working-age population projections in select economies:

Source: Natixis

Source: Natixis

7. Drought-related discoveries:

Source: Statista

Source: Statista

——————–

Back to Index