The Daily Shot: 07-Sep-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

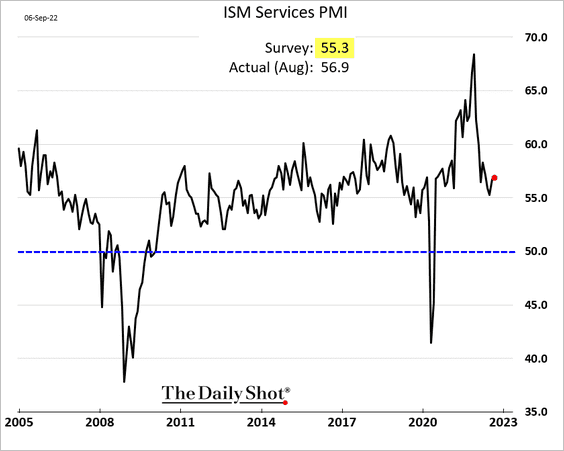

1. The ISM Services PMI topped forecasts, showing robust service-sector growth in the US.

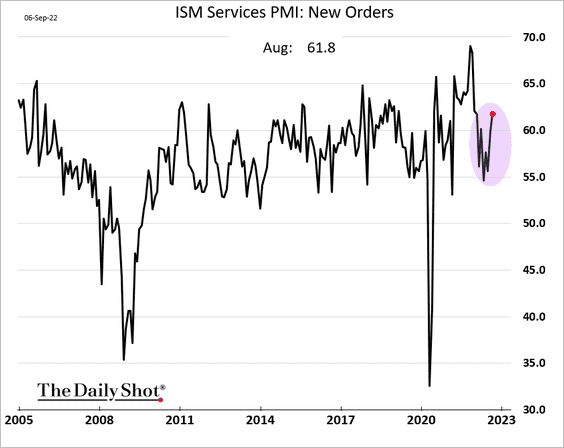

The index of new orders bounced.

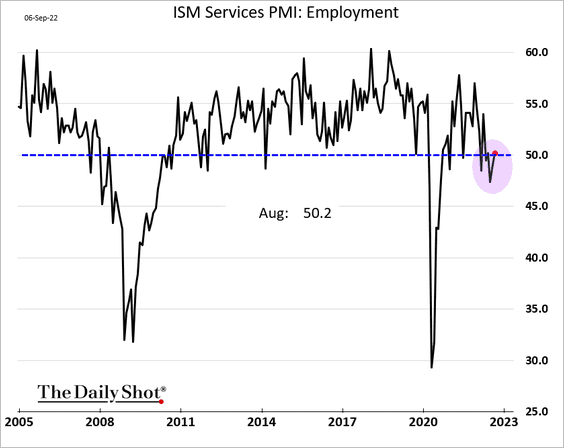

And employment returned to growth.

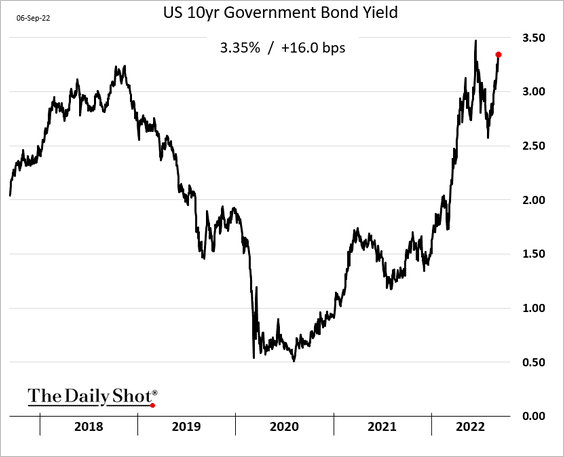

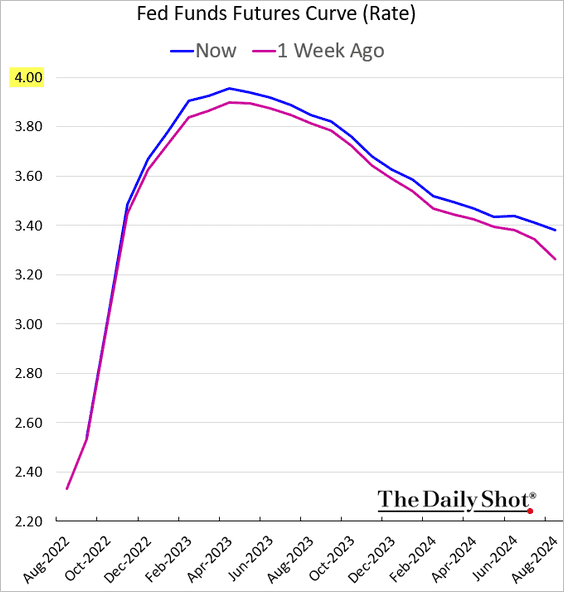

• With no signs of recession in services, Treasury yields jumped.

The peak of the expected fed funds rate trajectory (the terminal rate) is nearing 4%.

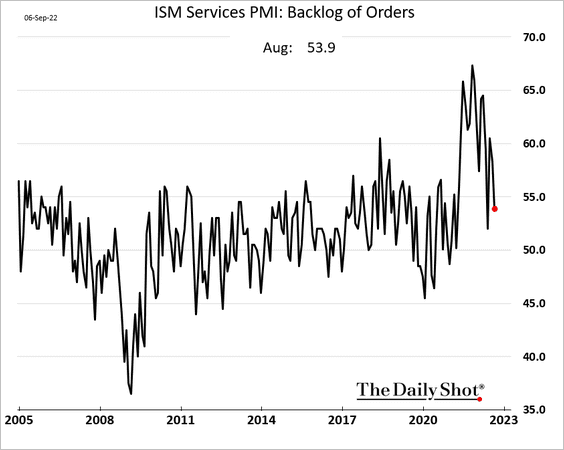

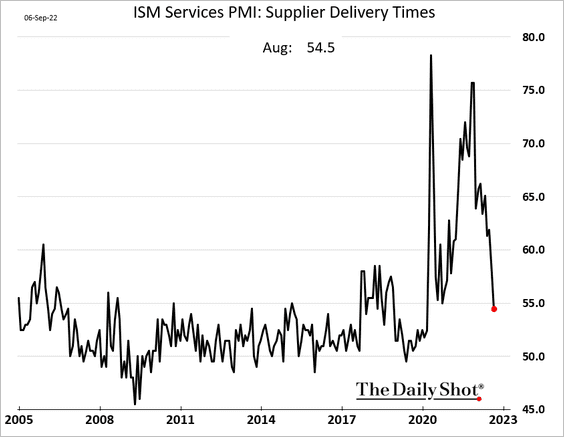

• Supply chain stress levels have been easing.

– Backlog of orders:

– Supplier delivery times:

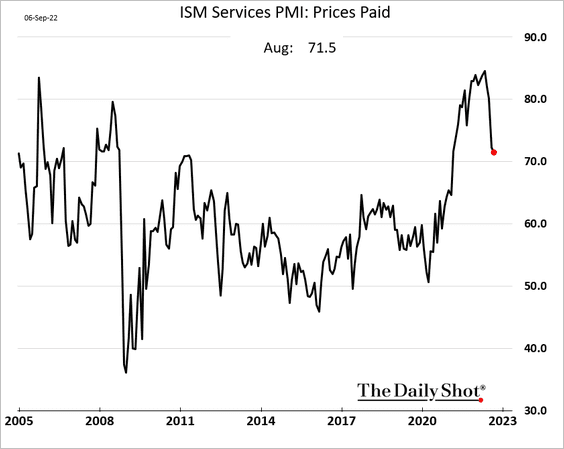

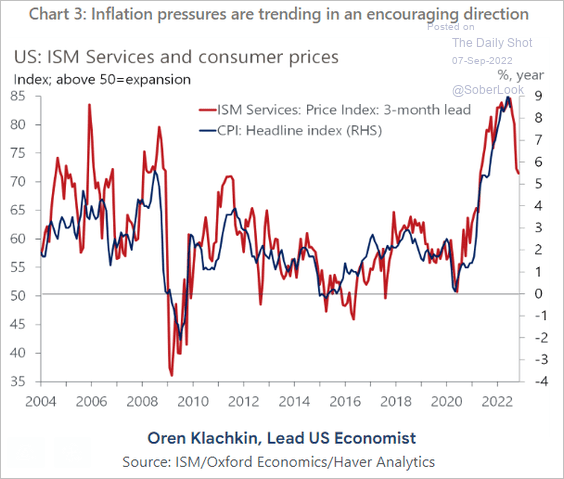

• Price pressures persist but are well off the highs, …

… which points to slower consumer inflation ahead.

Source: Oxford Economics

Source: Oxford Economics

——————–

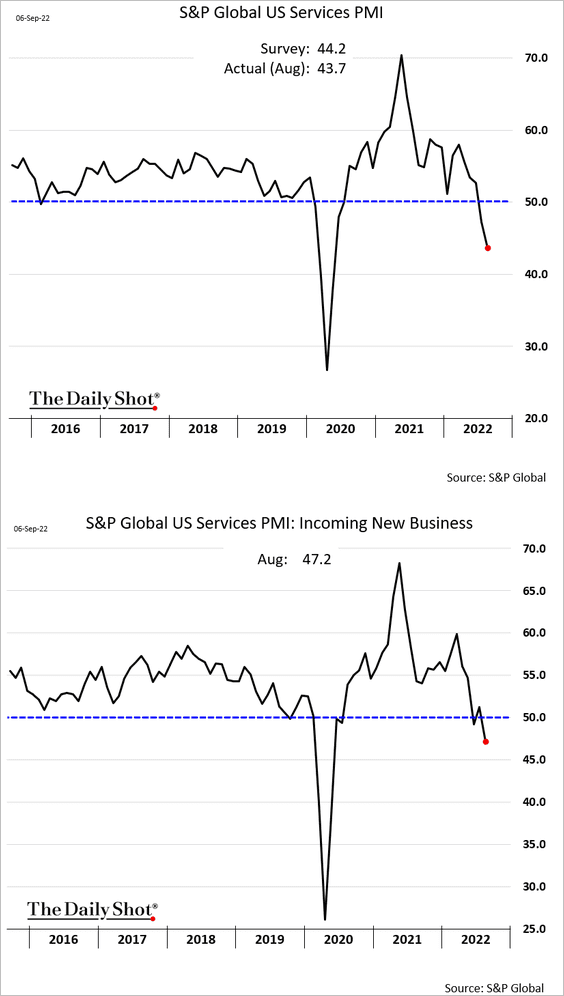

2. A similar PMI report from S&P Global paints a very different picture, suggesting that service-sector activity is contracting rapidly.

Source: @WSJ Read full article

Source: @WSJ Read full article

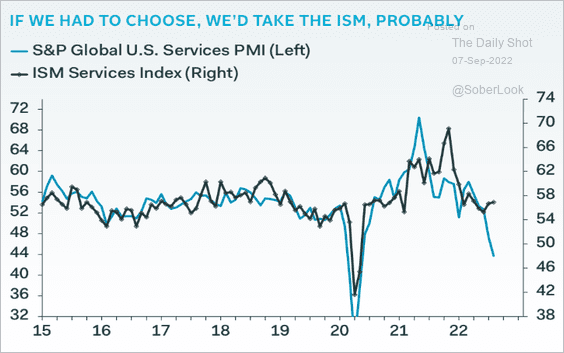

Which indicator is right?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

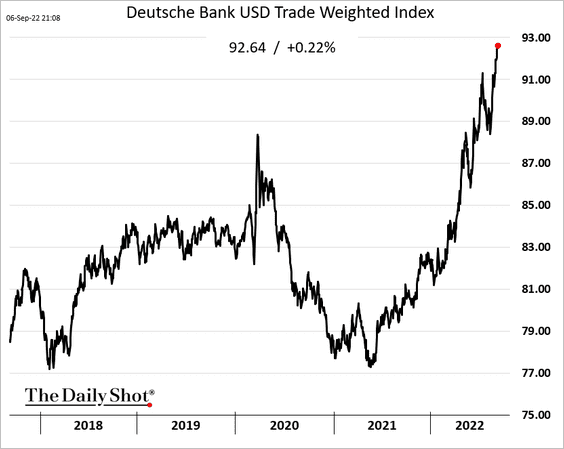

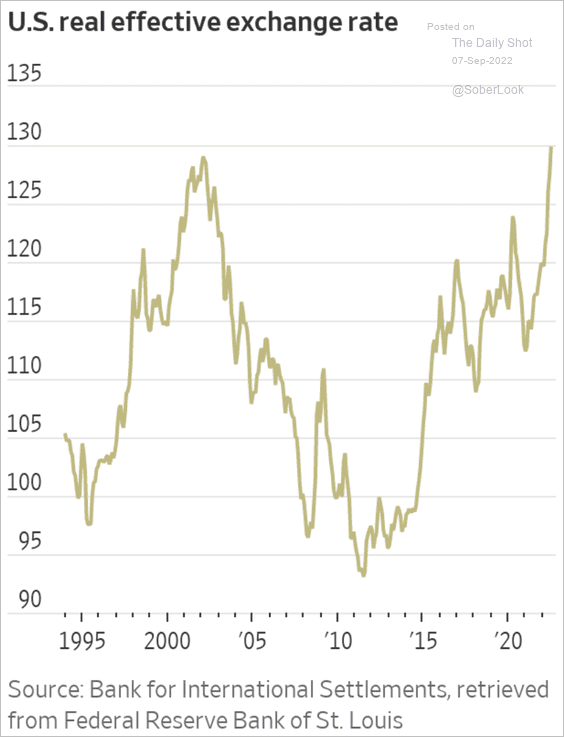

3. The US dollar continues to surge.

Here is the real effective exchange rate going back to 1994.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

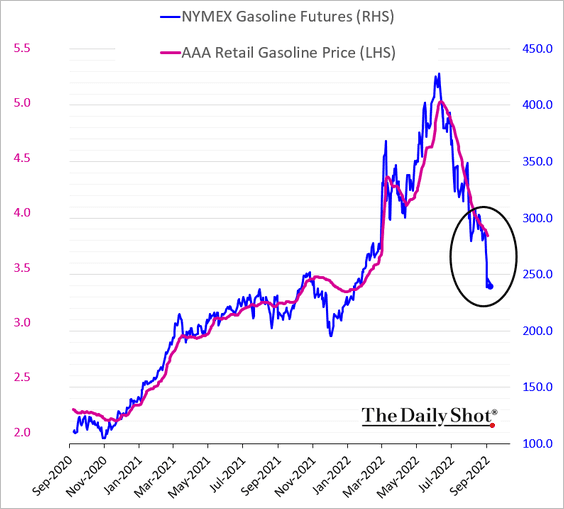

4. Gasoline futures point to lower prices at the pump.

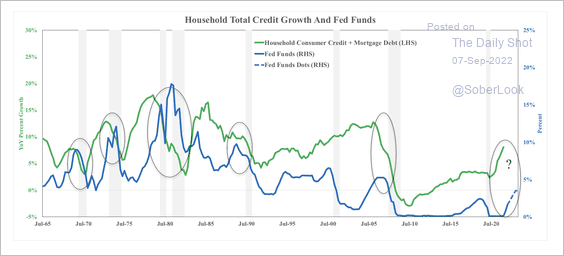

5. Next, we have some updates on household credit.

• Historically, rate hikes have occurred alongside a slowdown in household credit and mortgage debt, which preceded recessions.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

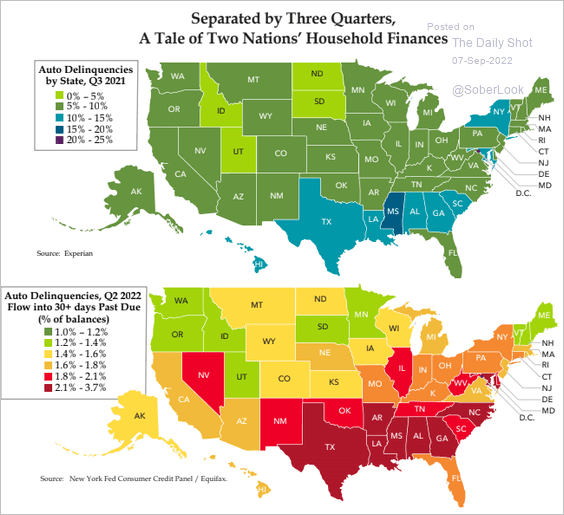

• Auto loan delinquencies have picked up this year.

Source: Quill Intelligence

Source: Quill Intelligence

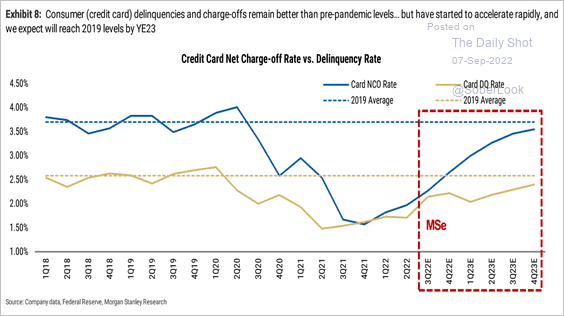

• Credit card delinquencies/charge-offs are expected to return to pre-COVID levels next year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

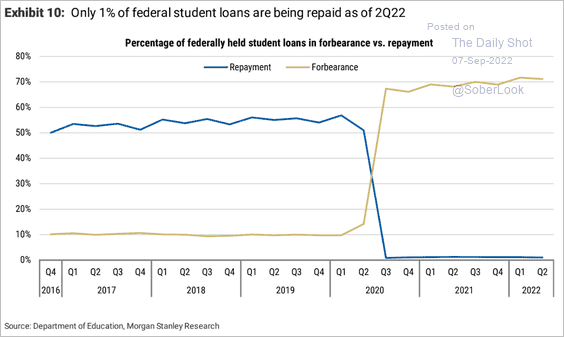

• The student loan gravy train stops in January of next year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

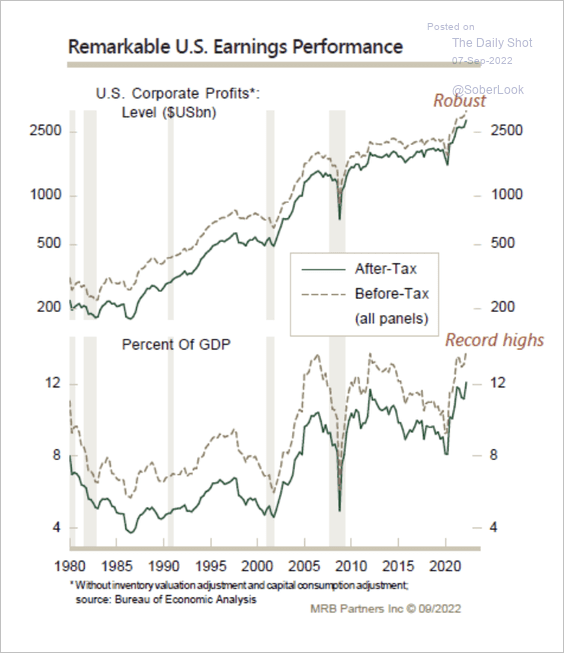

6. Corporate profits surged in the second quarter to an all-time high relative to GDP.

Source: MRB Partners

Source: MRB Partners

Back to Index

Canada

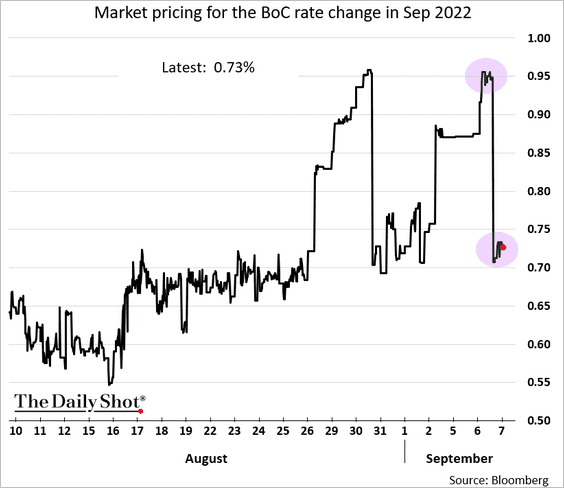

1. The market expects a 75 bps BoC rate hike due to weaker economic data (after oscillating between 100 bps and 75 bps).

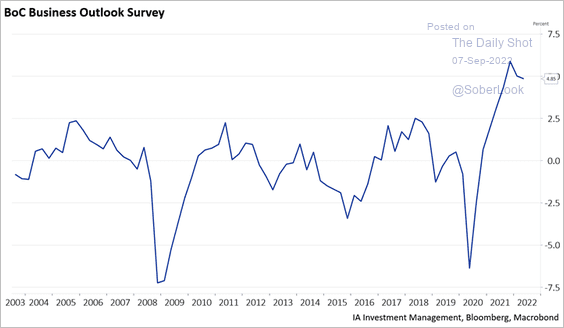

2. Business outlook has been strong but has probably deteriorated this quarter.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

Back to Index

The United Kingdom

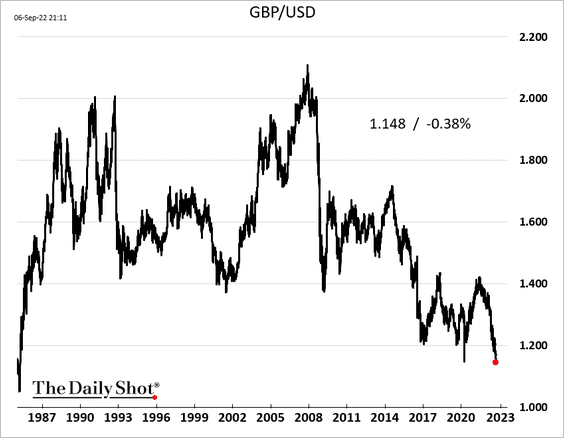

1. The pound hit the lowest level since 1985 vs. USD.

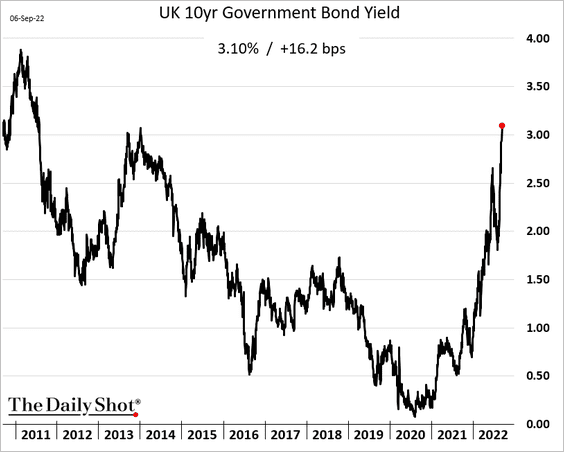

2. Gilt yields continue to surge.

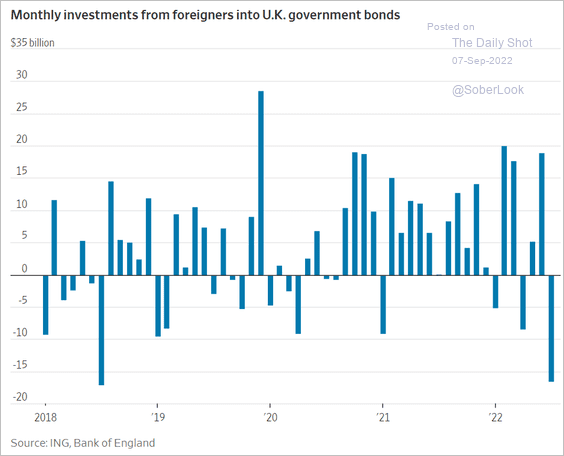

Foreigners dumped gilts last month.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

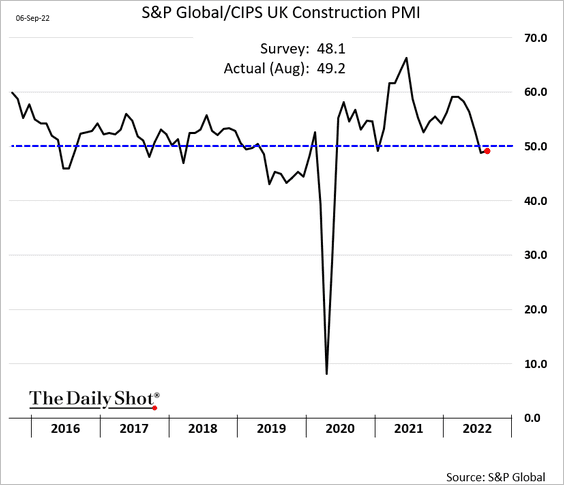

3. Construction activity remains sluggish.

4. A massive energy assistance package is coming. There are rumors it will hit £170 billion.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

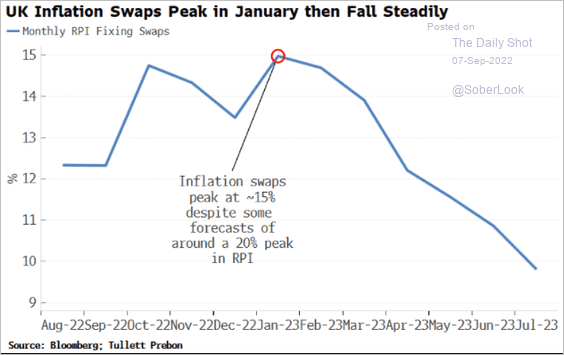

5. Inflation swaps suggest that the CPI will peak in January.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

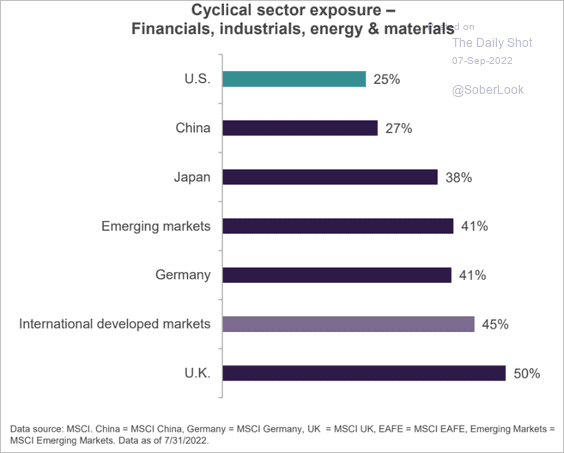

6. The UK stock market is heavily exposed to cyclicals.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

The Eurozone

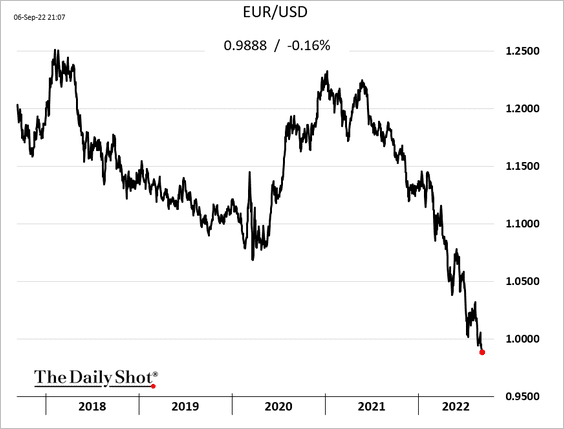

1. The euro continues to sink vs. USD.

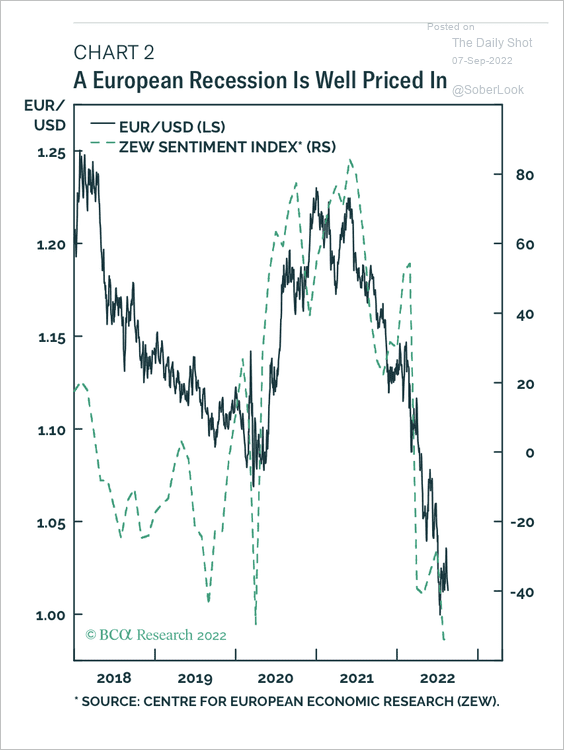

• EUR/USD’s decline has tracked the plunge in economic sentiment over the past year.

Source: BCA Research

Source: BCA Research

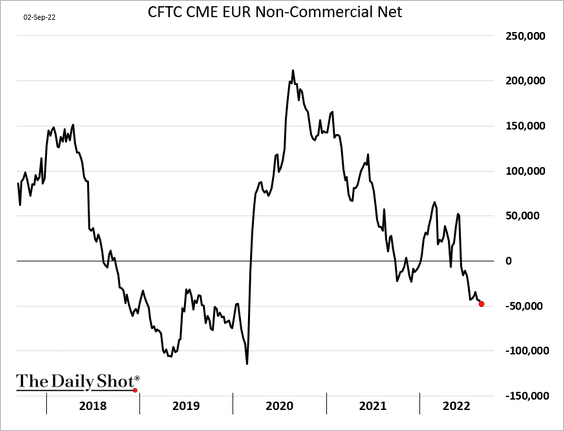

• Speculative accounts have been increasing their bets against the euro.

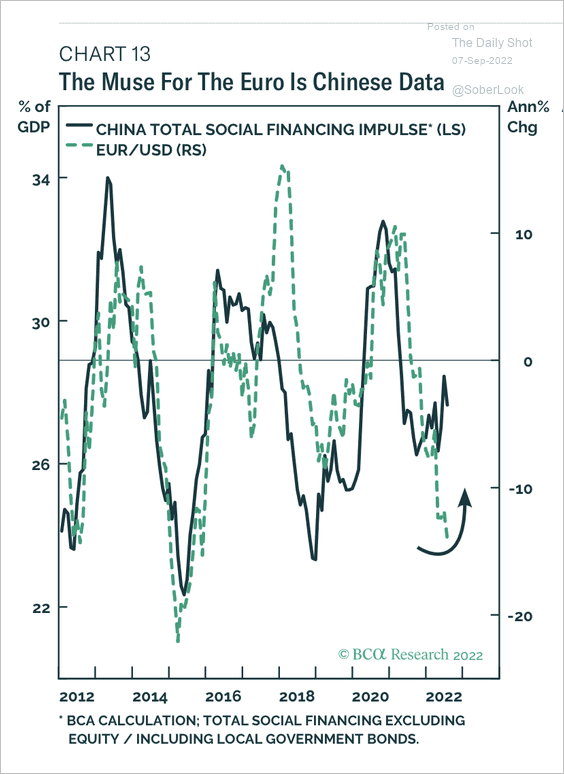

• A rebound in China’s credit impulse would be bullish for EUR/USD.

Source: BCA Research

Source: BCA Research

——————–

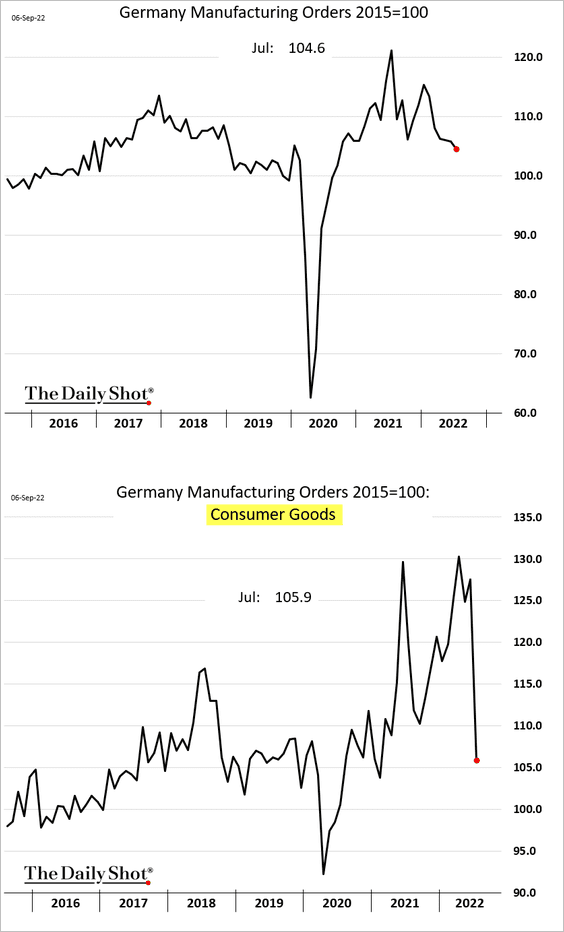

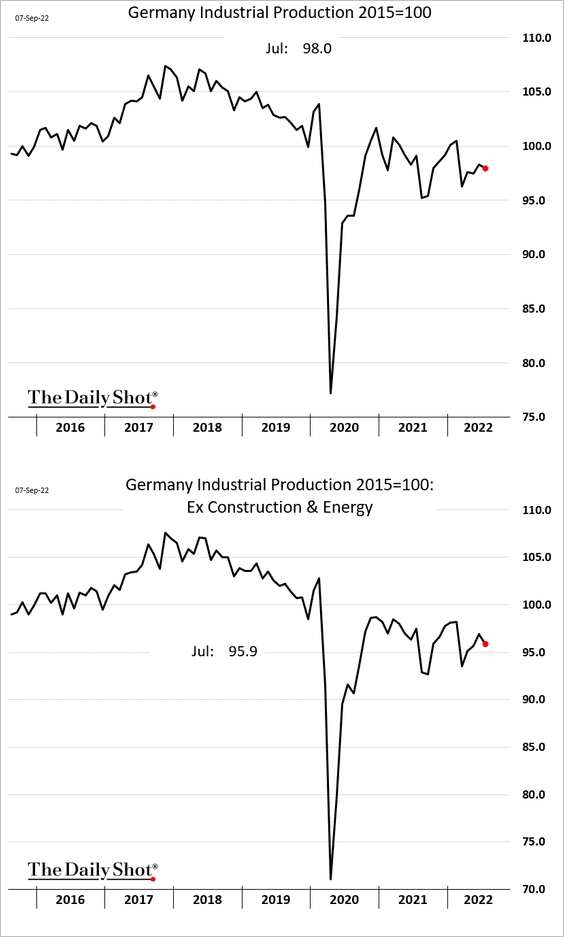

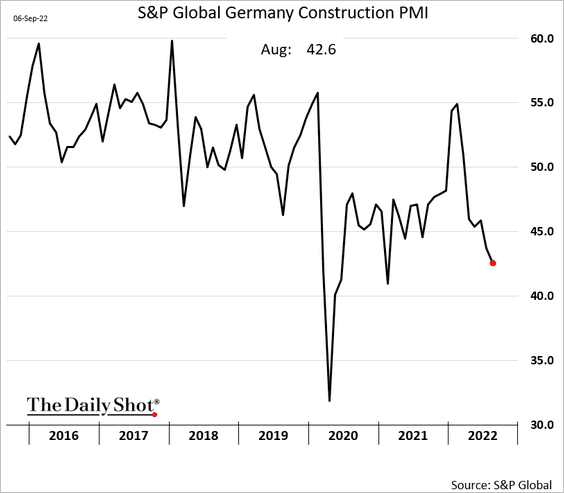

2. Next, we have some updates on Germany.

• Factory orders weakened further in July.

• The decline in industrial production was smaller than expected.

• Construction activity continues to soften.

——————–

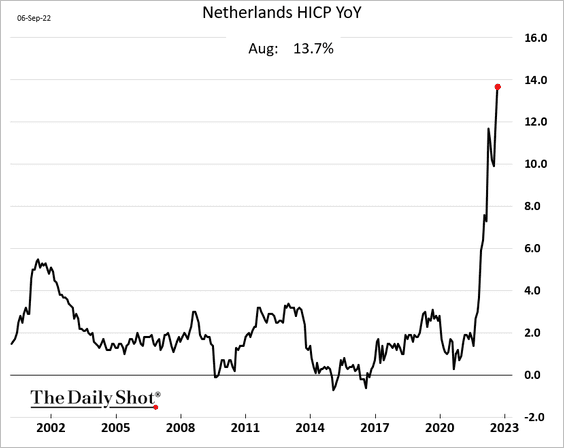

3. The Dutch CPI is nearing 14%.

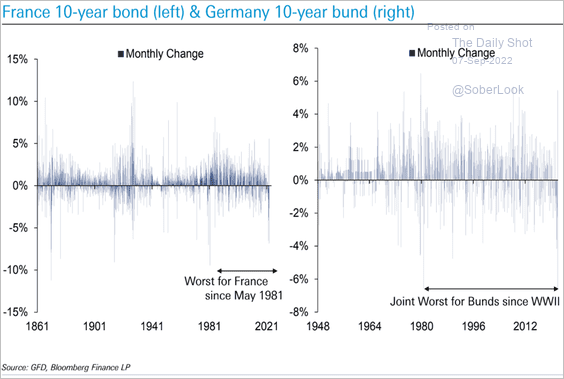

4. August was a challenging month for Eurozone debt.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

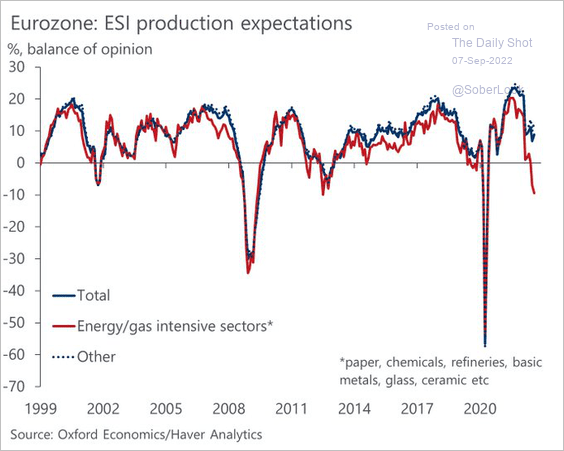

5. Energy-sensitive industries are in trouble.

Source: @OliverRakau

Source: @OliverRakau

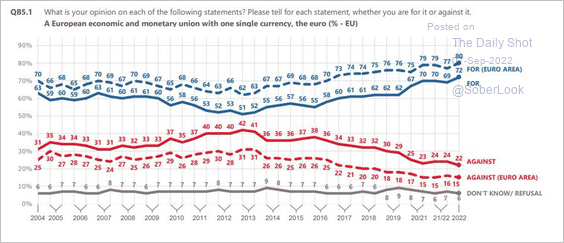

6. Support for the euro has been strengthening.

Source: @MxSba, @EurobarometerEU

Source: @MxSba, @EurobarometerEU

Back to Index

Asia – Pacific

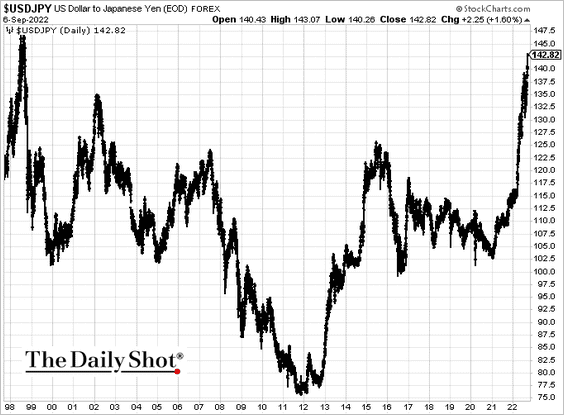

1. Dollar-yen continues to surge.

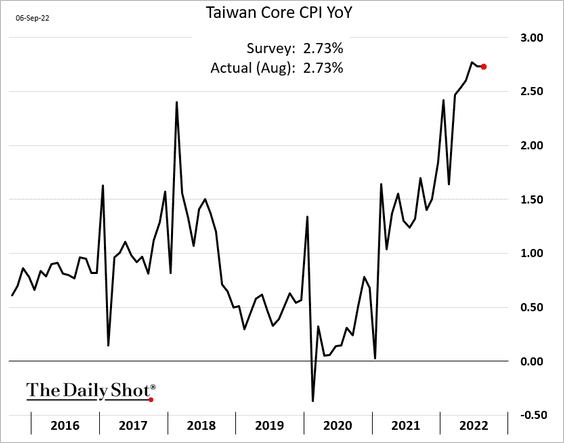

2. Taiwan’s core CPI was in line with expectations.

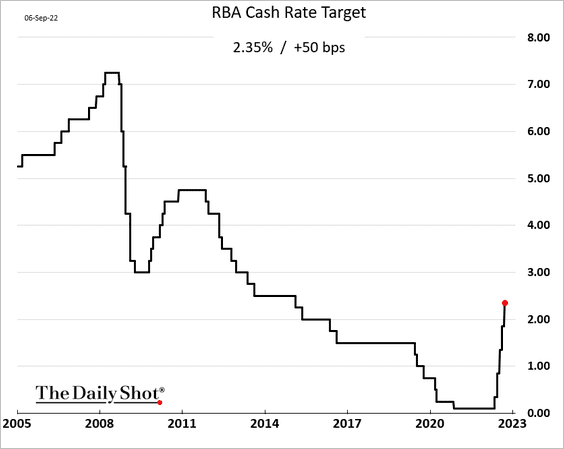

3. The RBA hiked rates by 50 bps again.

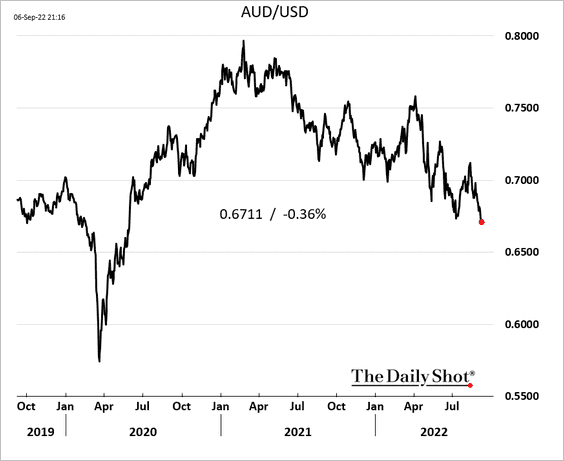

The Aussie dollar continues to drift lower vs. USD.

Back to Index

China

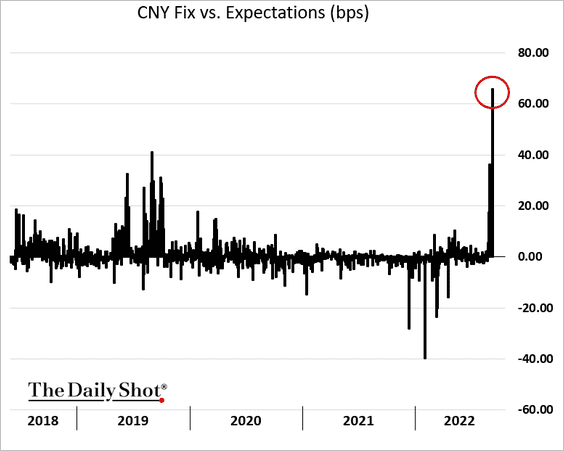

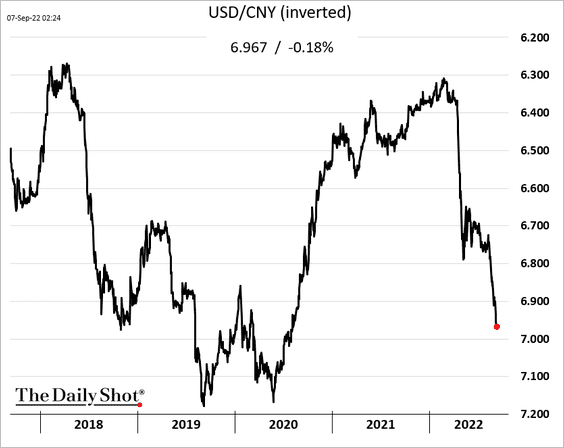

1. The PBoC is getting increasingly aggressive in its efforts to stabilize the renminbi. The spread between the latest exchange rate fix and market expectations hit a new high.

For now, the effort is not working.

——————–

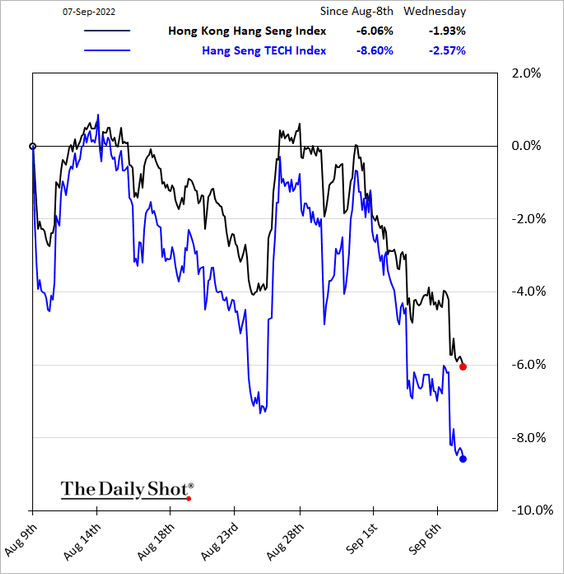

2. Stocks continue to decline in Hong Kong.

Tech shares are underperforming.

——————–

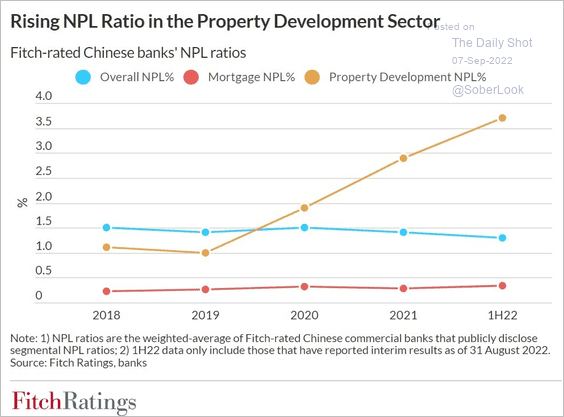

3. Property developers’ nonperforming loan share has been rising, …

Source: Fitch Ratings

Source: Fitch Ratings

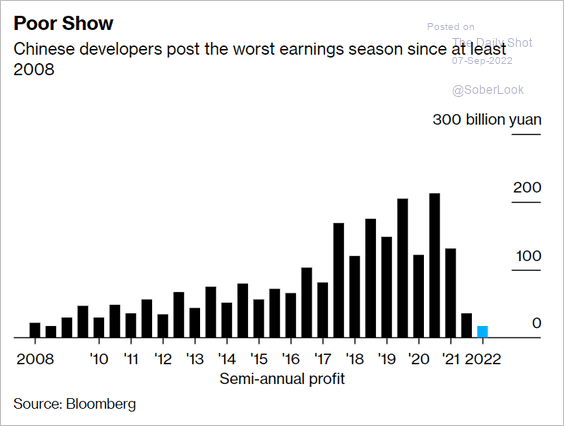

… and earnings are deteriorating.

Source: @johnchenghc, @markets Read full article

Source: @johnchenghc, @markets Read full article

——————–

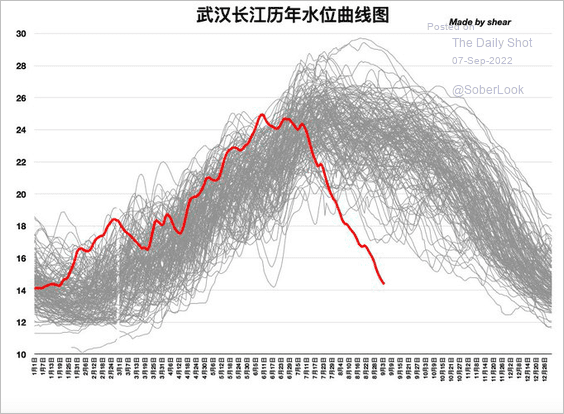

4. The water level of the Yangtze River in Wuhan hasn’t been this low in recent decades.

Source: @yangyubin1998, @Datawrapper

Source: @yangyubin1998, @Datawrapper

Back to Index

Emerging Markets

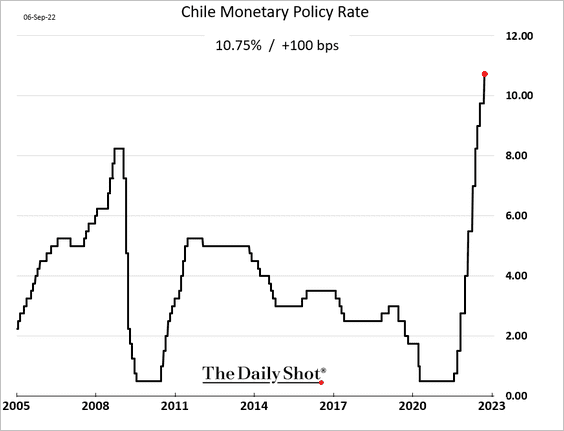

1. Chile’s central bank unexpectedly hiked rates by 100 bps.

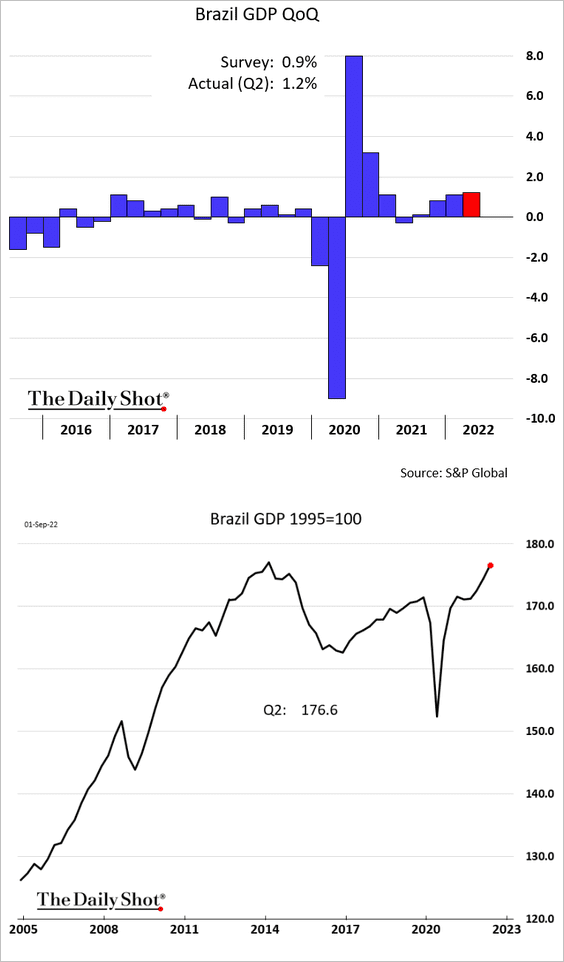

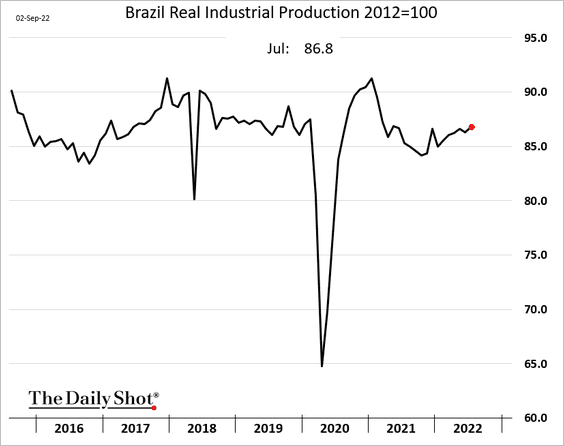

2. Next, we have some updates on Brazil.

• Q2 GDP growth (better than expected):

• Industrial production (improving):

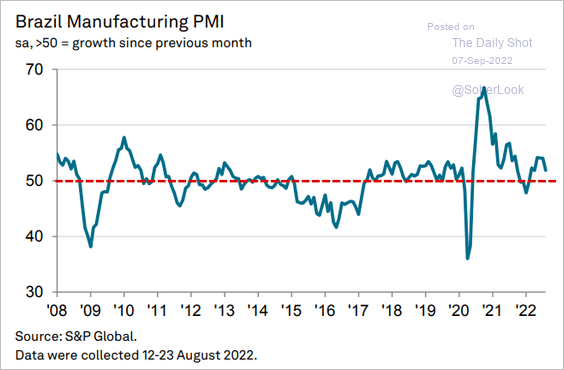

• Manufacturing PMI (still in growth mode):

Source: S&P Global PMI

Source: S&P Global PMI

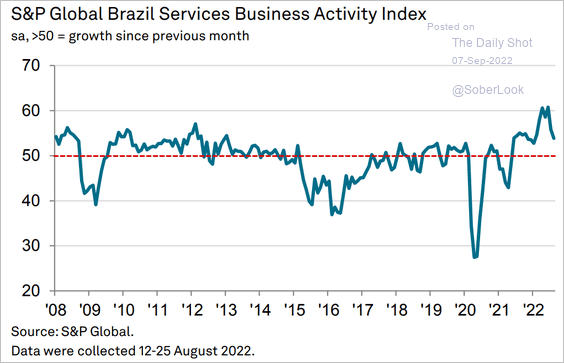

Services PMI:

Source: S&P Global PMI

Source: S&P Global PMI

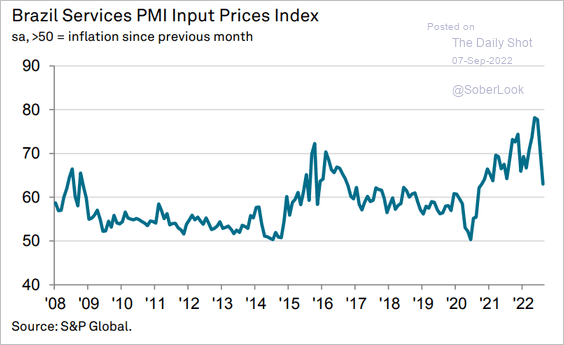

Price pressures are easing.

Source: S&P Global PMI

Source: S&P Global PMI

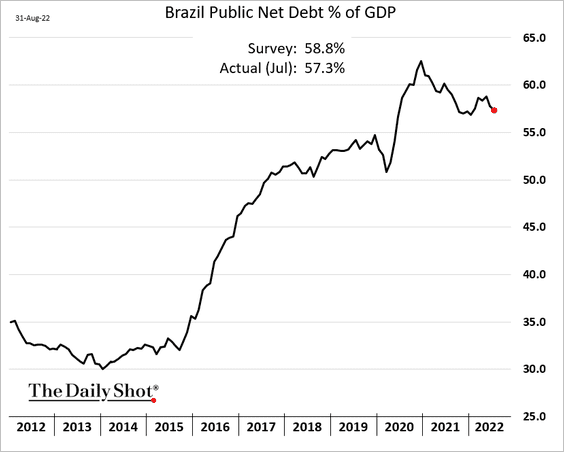

• Debt-to-GDP:

——————–

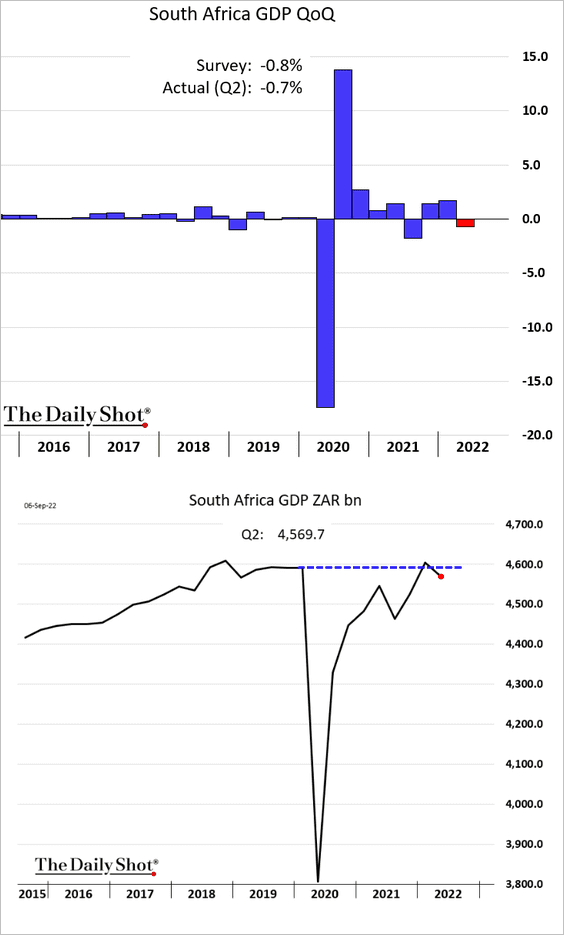

3. South Africa’s economy contracted last quarter.

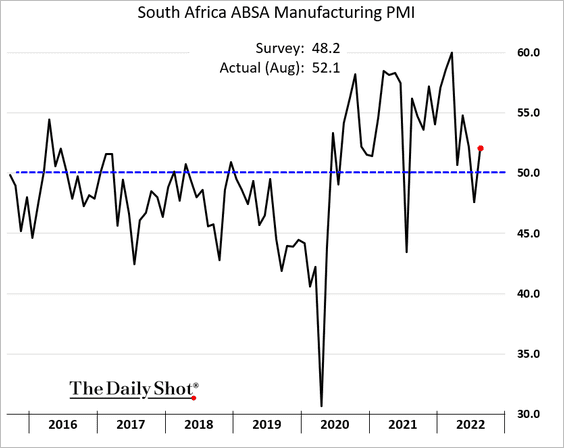

• Manufacturing unexpectedly returned to growth mode.

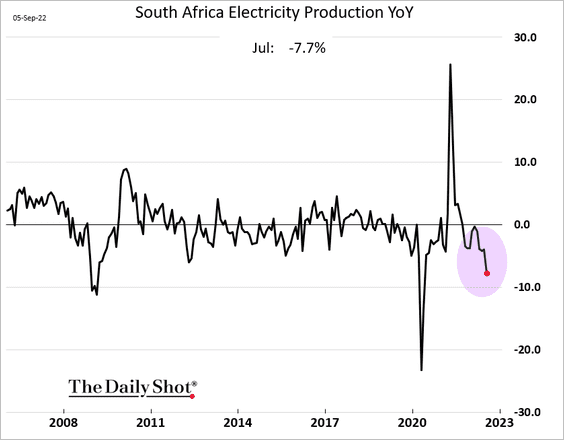

• Electricity output has been deteriorating.

——————–

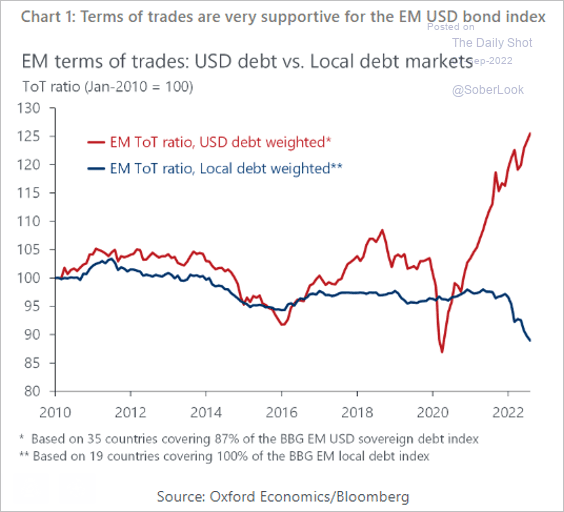

4. EM terms of trade support dollar-denominated debt.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Cryptocurrency

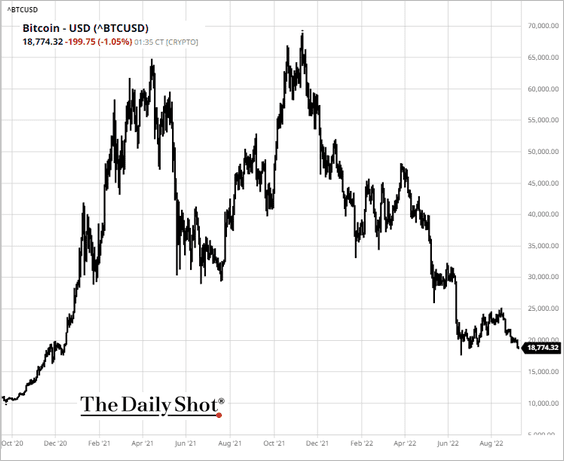

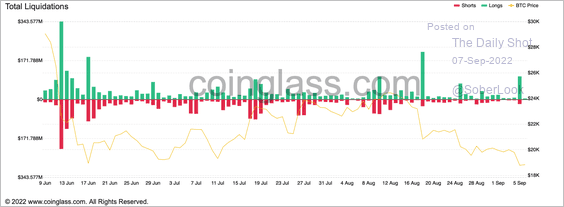

1. Bitcoin dipped below $19k.

Tuesday’s sell-off triggered a spike in long BTC liquidations – the highest since August 18.

Source: Coinglass

Source: Coinglass

——————–

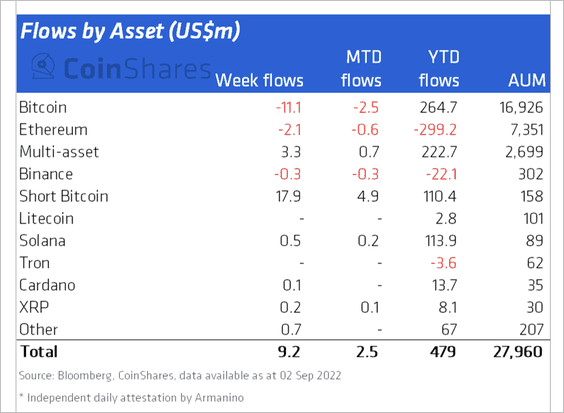

2. Crypto funds saw minor inflows last week, driven by record flows to short-bitcoin products.

Source: CoinShares Read full article

Source: CoinShares Read full article

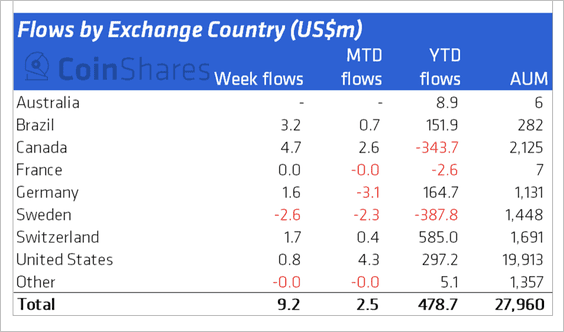

Crypto funds in Canada and Brazil accounted for a majority of inflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

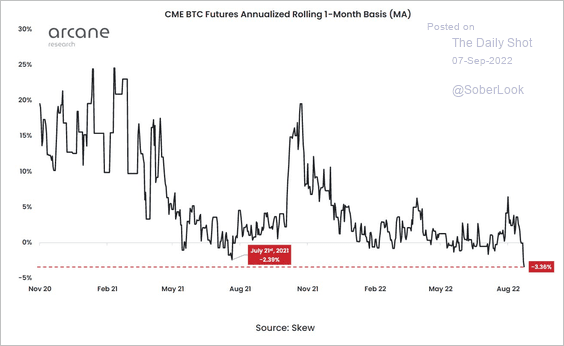

3. The front-month CME BTC futures contract is in steep backwardation, which previously occurred around a short squeeze in July of last year.

Source: @ArcaneResearch

Source: @ArcaneResearch

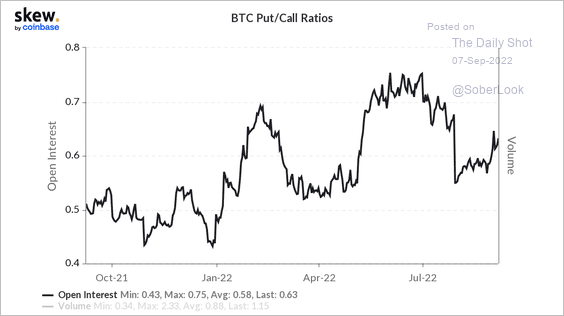

4. Bitcoin’s put/call ratio remains elevated.

Source: Skew

Source: Skew

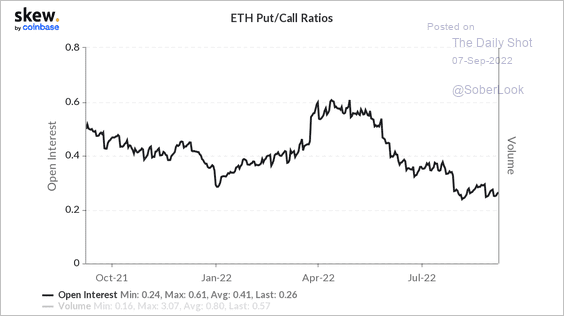

Ether’s put/call ratio is trending lower.

Source: Skew

Source: Skew

Back to Index

Commodities

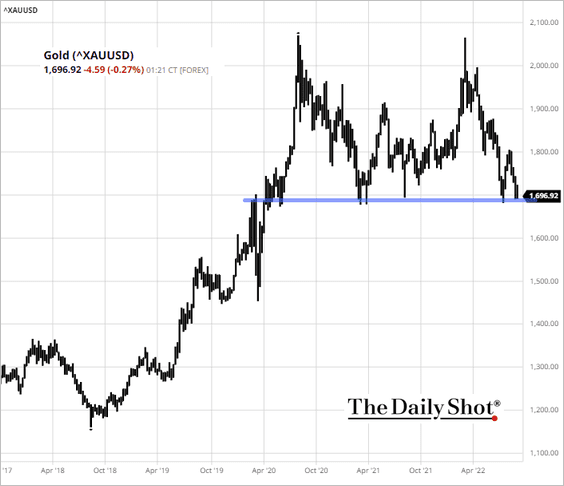

1. Gold is at support.

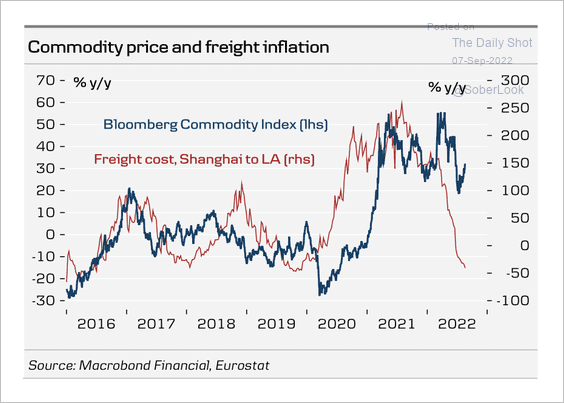

2. The decline in freight costs points to lower commodity prices.

Source: Danske Bank

Source: Danske Bank

Back to Index

Energy

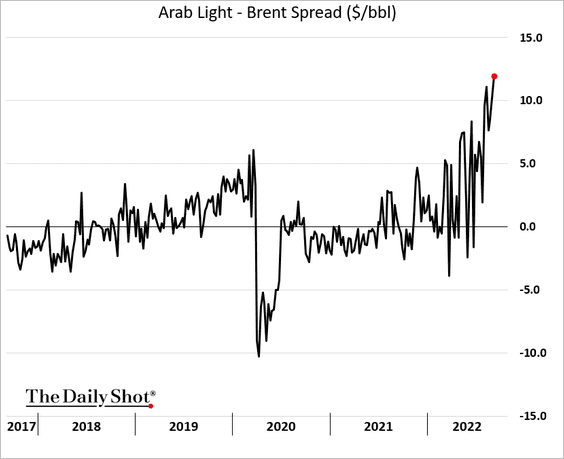

1. The Arab Light premium to Brent has been elevated.

Saudi Aramco was forced to cut prices.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

——————–

2. Could Russia face a domestic energy crunch?

Source: Markets Insider Read full article

Source: Markets Insider Read full article

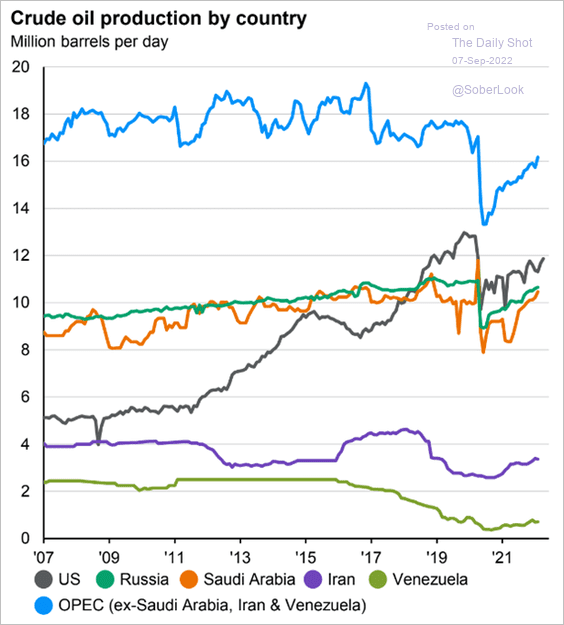

3. Here is crude oil production by country.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

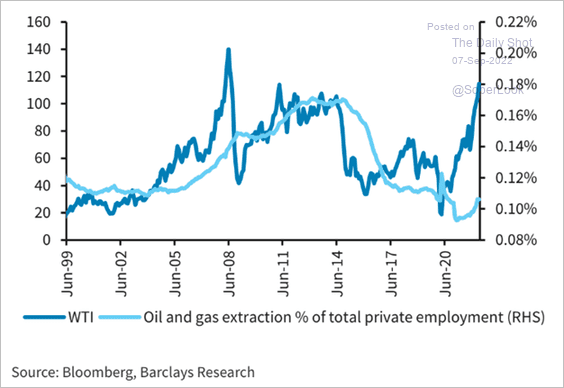

Workers have been slow to return to the US energy sector despite strong demand.

Source: Barclays Research

Source: Barclays Research

——————–

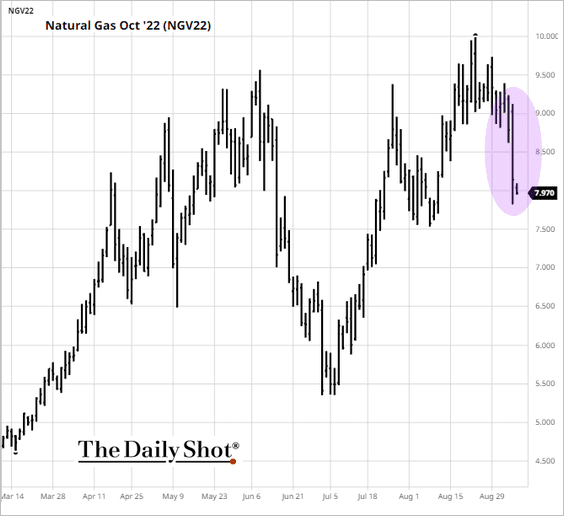

4. US natural gas futures took a hit.

Source: barchart.com

Source: barchart.com

Source: OilPrice.com Read full article

Source: OilPrice.com Read full article

——————–

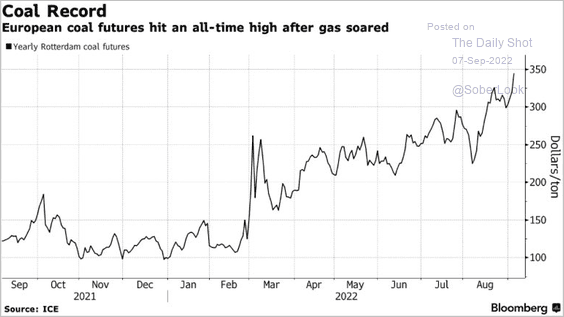

5. European coal prices continue to surge.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

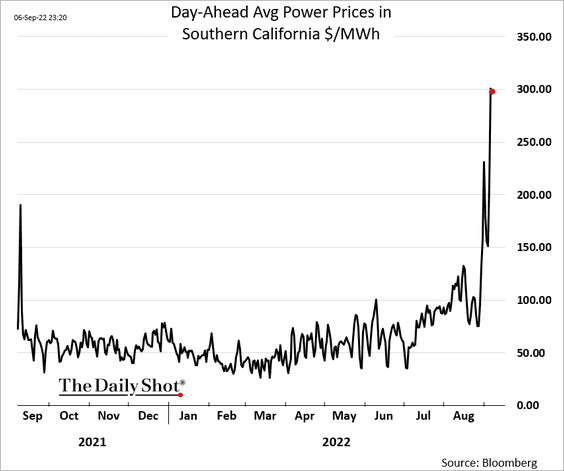

6. The heat wave keeps pressuring California’s power grid.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

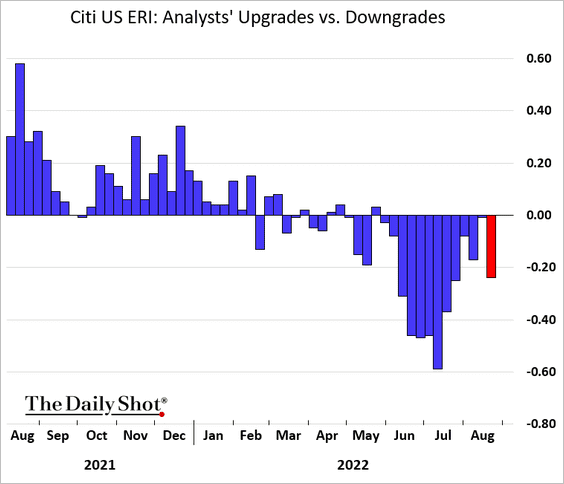

1. Analysts’ earnings downgrades have exceeded upgrades for 13 weeks in a row.

2. Rising real yields continue to pressure stocks.

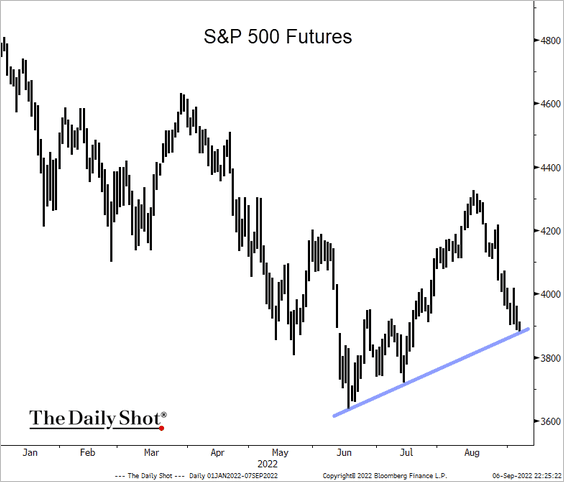

3. The S&P 500 futures are at support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

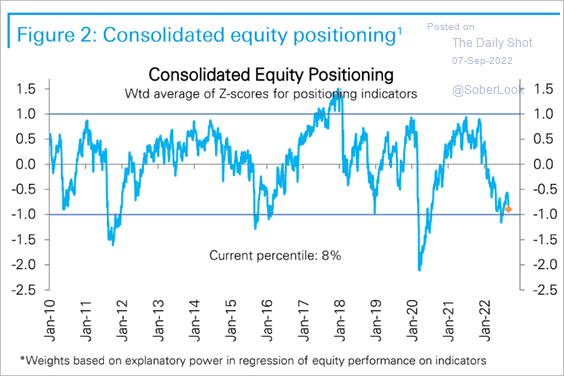

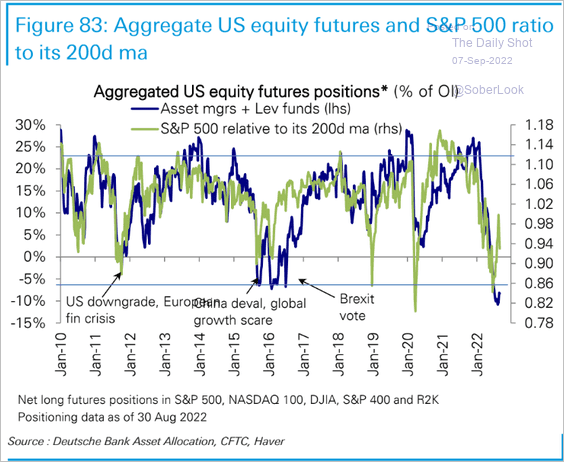

4. Deutsche Bank’s consolidated positioning indicator continues to show bearish sentiment.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Investors have been positioning for further market declines.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

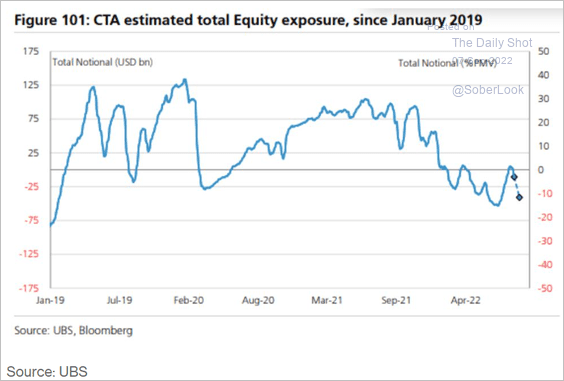

• Some analysts expect positioning to become even more bearish.

Source: UBS, Bloomberg Read full article

Source: UBS, Bloomberg Read full article

——————–

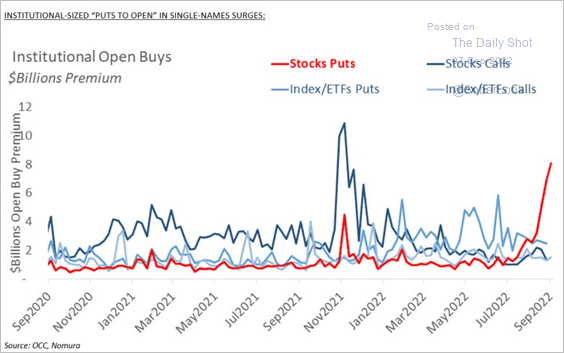

5. Institutional demand for put options has been surging.

Source: Nomura; @investor743

Source: Nomura; @investor743

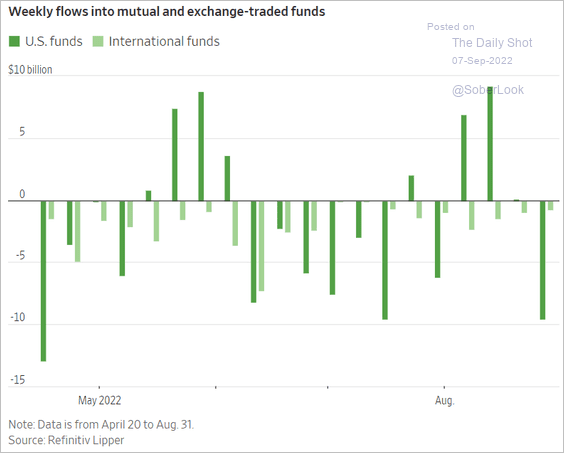

6. US equity funds saw substantial outflows last month.

Source: @WSJ Read full article

Source: @WSJ Read full article

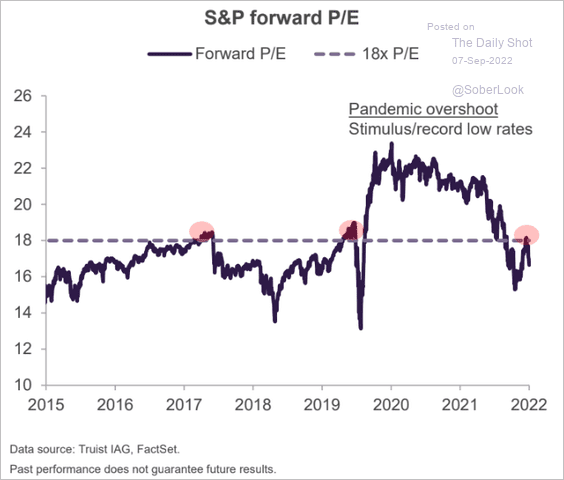

7. The S&P 500 hits resistance at around 18x forward P/E.

Source: Truist Advisory Services

Source: Truist Advisory Services

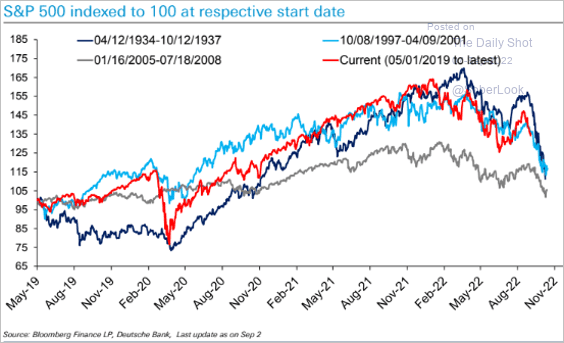

8. Should we pay attention to market trend analogies (2 charts)?

Source: @themarketear

Source: @themarketear

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

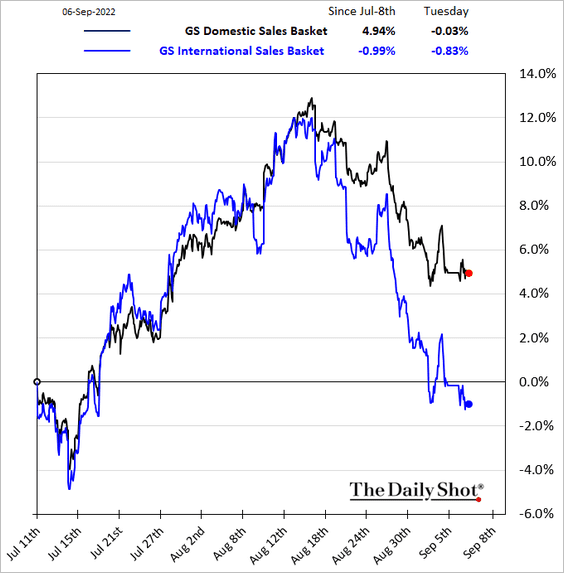

9. Companies with large international sales exposure have been underperforming as the US dollar surges.

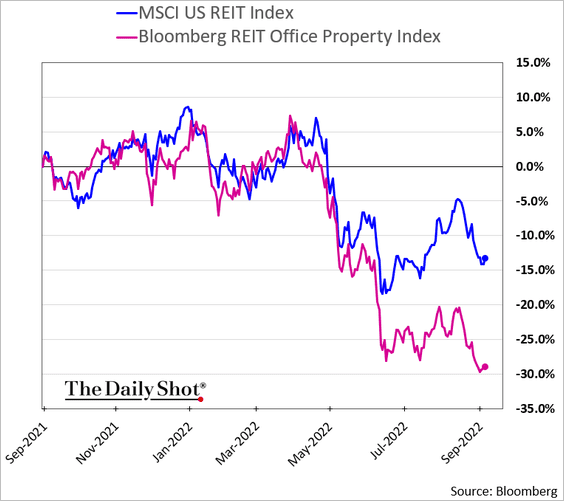

10. Office REITS are struggling despite employees returning to the office.

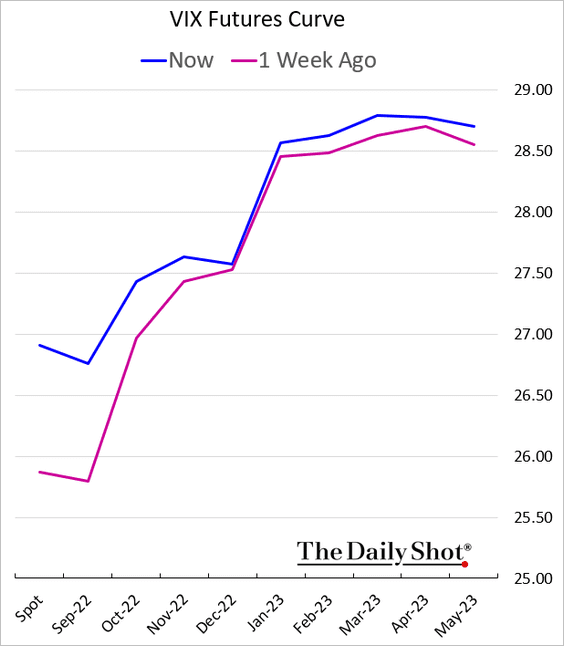

11. The VIX curve doesn’t signal significant stress in the market.

Back to Index

Rates

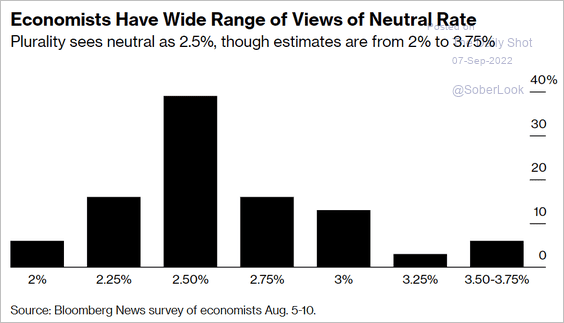

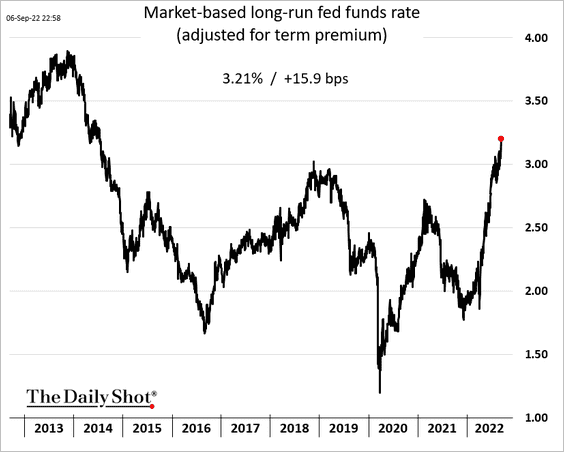

1. Where is the neutral rate?

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Market expectations for the neutral rate have been rising.

——————–

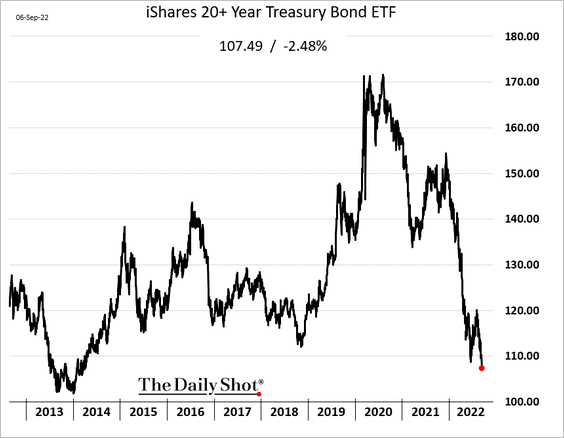

2. TLT (long-term Treasury ETF) hit the lowest level since the taper-tantrum.

——————–

Food for Thought

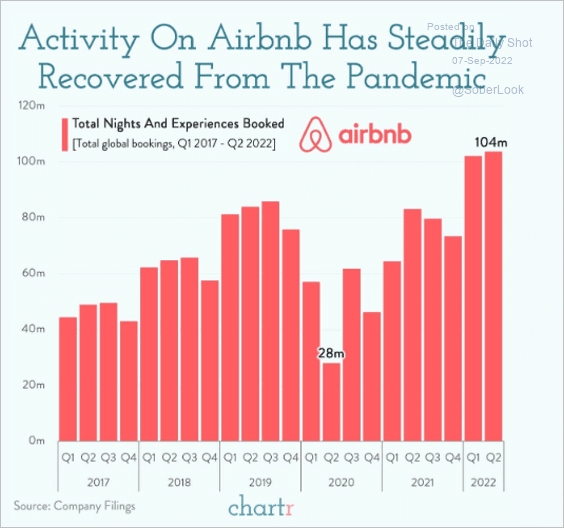

1. Airbnb recovery:

Source: @chartrdaily

Source: @chartrdaily

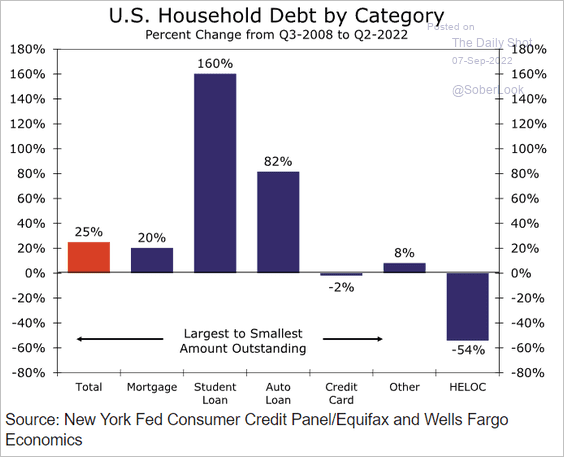

2. Household debt changes since 2008:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

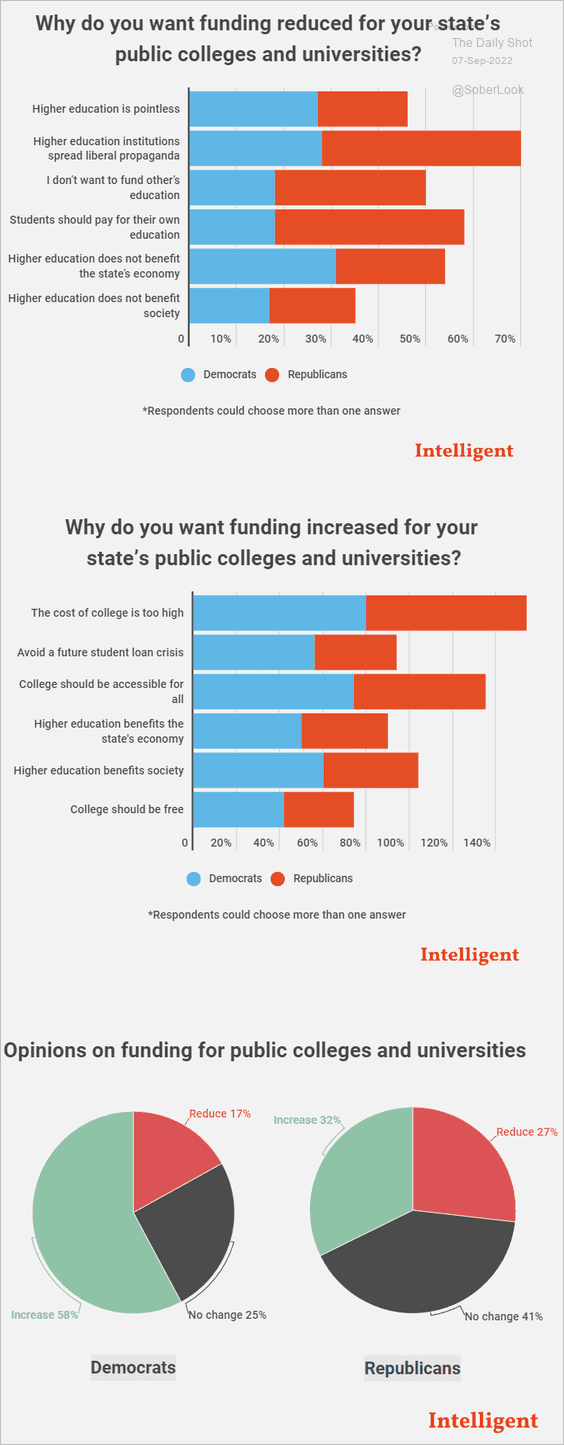

3. Reasons for increasing/decreasing funding for public colleges:

Source: Intelligent.com Read full article

Source: Intelligent.com Read full article

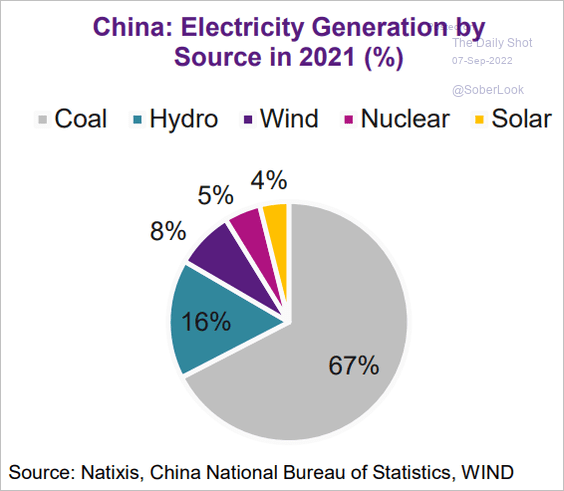

4. China’s electricity generation by source:

Source: Natixis

Source: Natixis

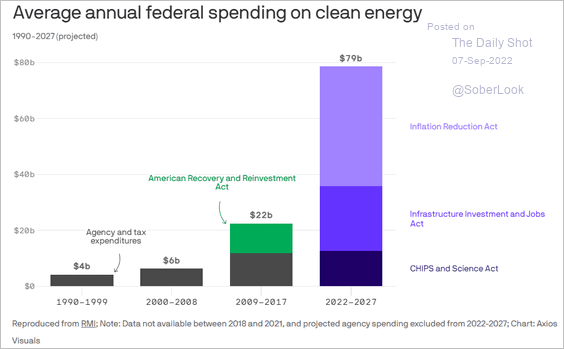

5. US federal spending on clean energy:

Source: @axios Read full article

Source: @axios Read full article

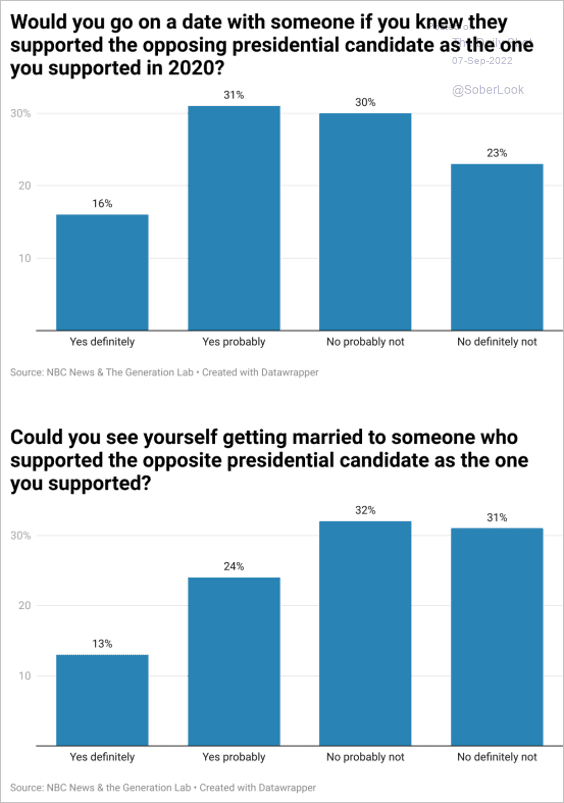

6. Dating or marrying someone who voted for the other presidential candidate:

Source: NBC News Read full article

Source: NBC News Read full article

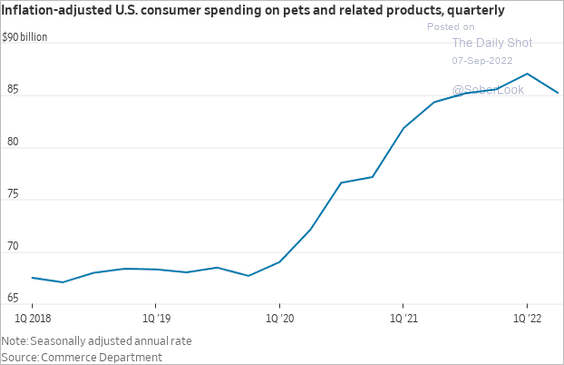

7. Spending on pets:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Back to Index