The Daily Shot: 09-Sep-22

• The United States

• The United Kingdom

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the labor market.

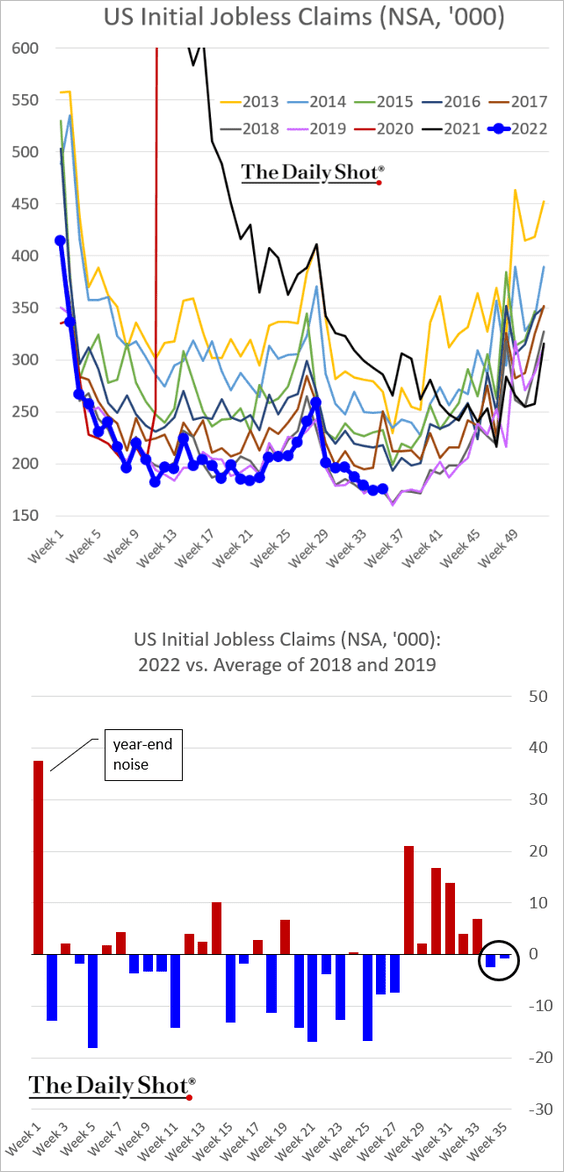

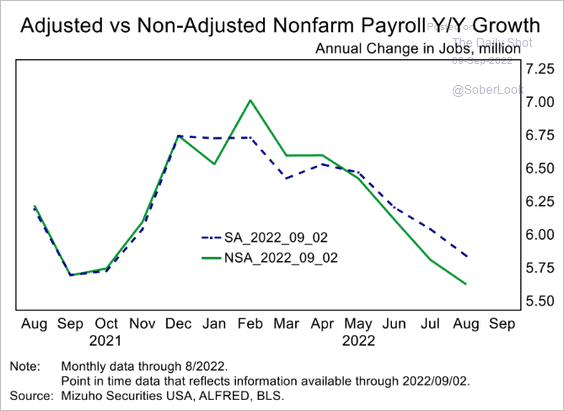

• Initial jobless claims dipped below their pre-pandemic levels again.

But continuing claims unexpectedly increased.

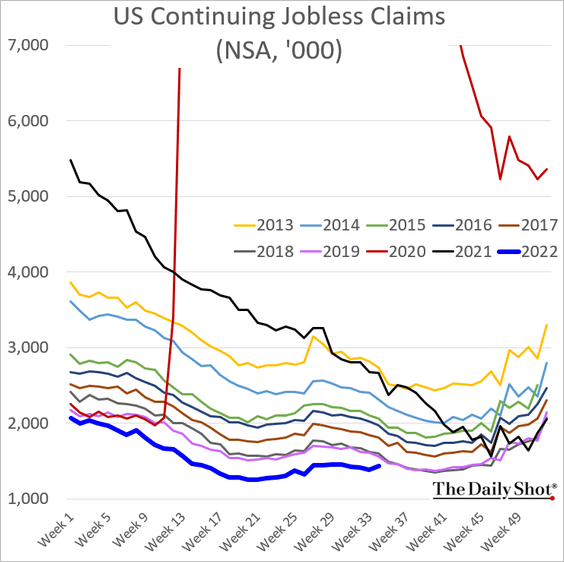

• Falling job vacancies point to higher unemployment ahead.

Source: BCA Research

Source: BCA Research

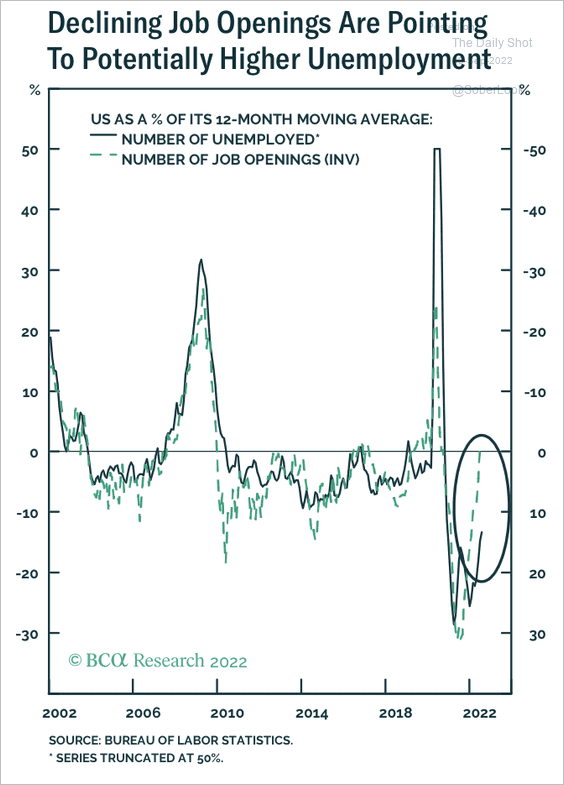

• The recent moderation in employment growth (year-over-year) has been steeper without the seasonal adjustments. Is the job market softer than the nonfarm payrolls report suggests?

Source: Mizuho Securities USA

Source: Mizuho Securities USA

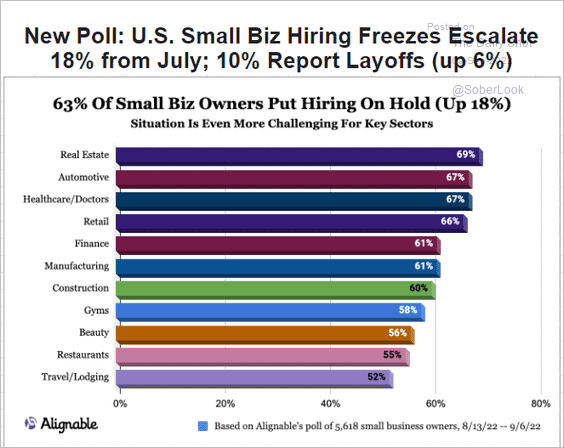

• Small businesses are reporting more hiring freezes.

Source: Alignable

Source: Alignable

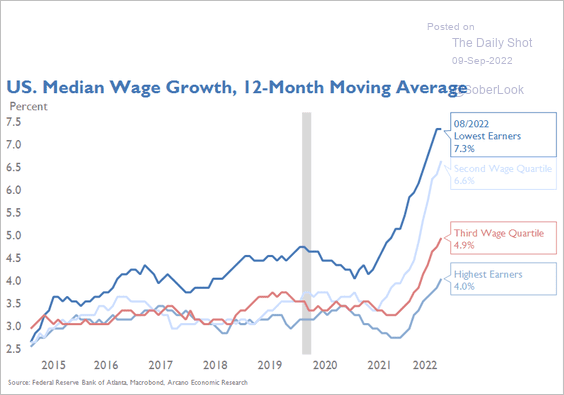

• Here is wage growth by wage category.

Source: Arcano Partners

Source: Arcano Partners

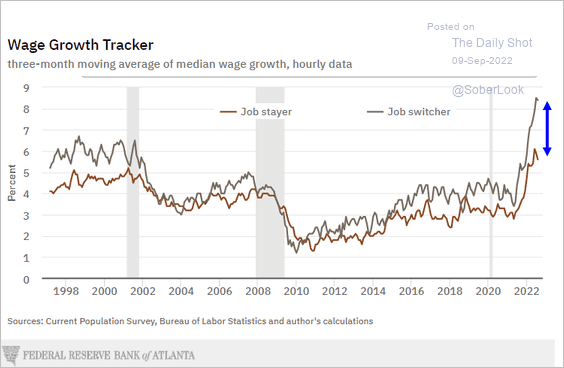

• Job hopping has never been this lucrative.

Source: @AtlantaFed

Source: @AtlantaFed

——————–

2. Fed officials are not backing off their hawkish stance.

Source: CNBC Read full article

Source: CNBC Read full article

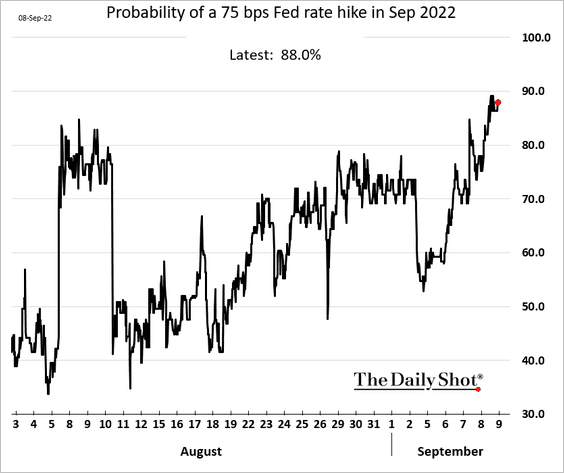

• A 75 bps rate hike this month is now nearly a certainty.

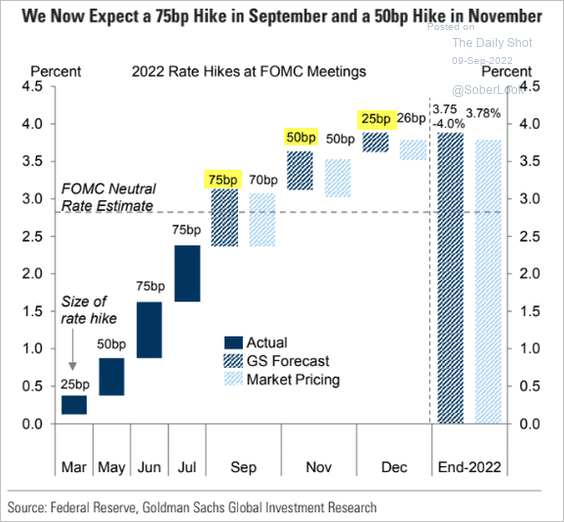

• What happens after that? According to Goldman, it’s 50 bps in November and 25 bps in December.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

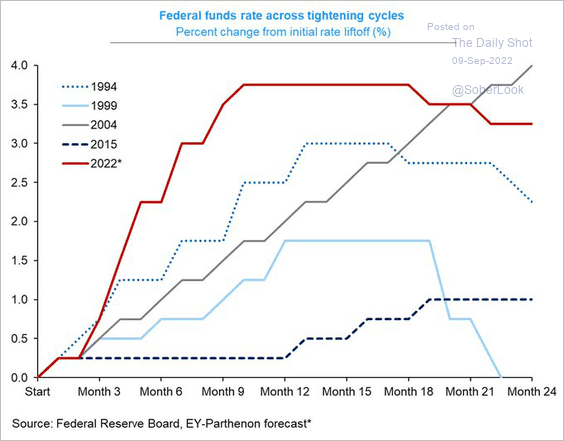

• Here is the Fed’s current rate trajectory compared to previous tightening cycles, according to EY-Parthenon.

Source: @GregDaco, @EY_US

Source: @GregDaco, @EY_US

——————–

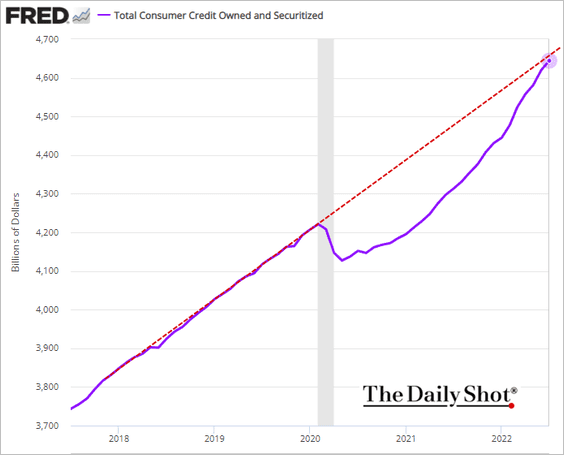

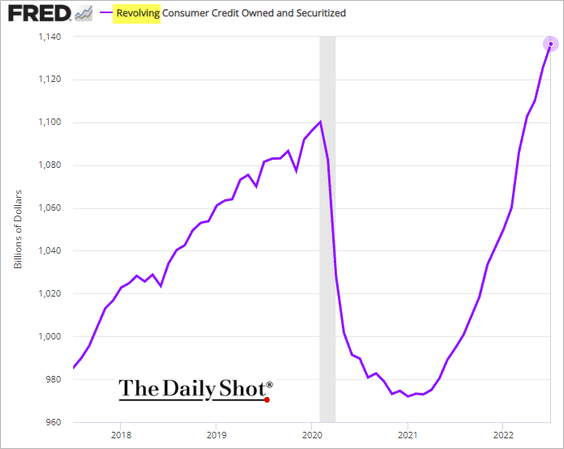

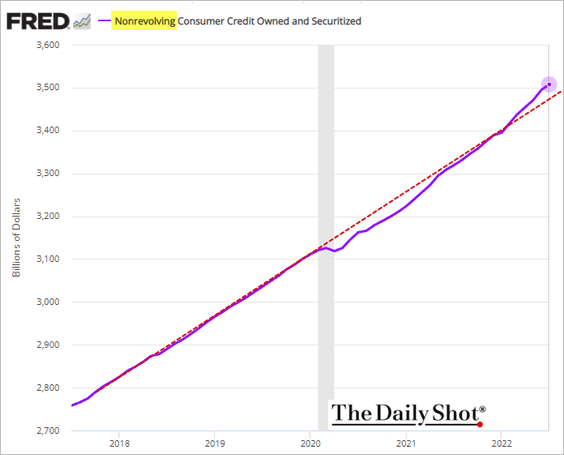

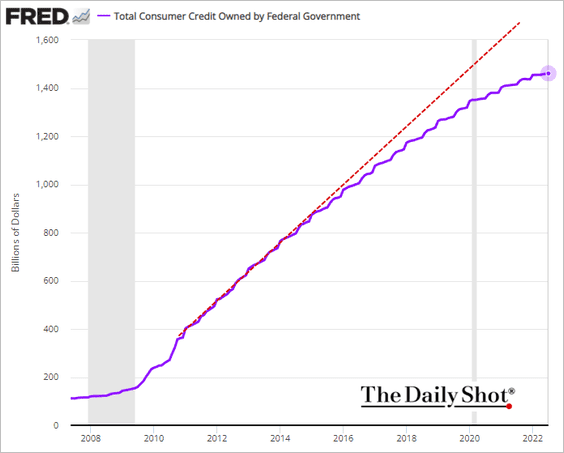

3. Consumer credit is nearing its pre-COVID trend.

• Credit card debt continues to climb.

• Non-revolving debt (auto loans and student debt) has been rising faster than the pre-pandemic trend.

• Growth in government-held student loans has been slowing.

——————–

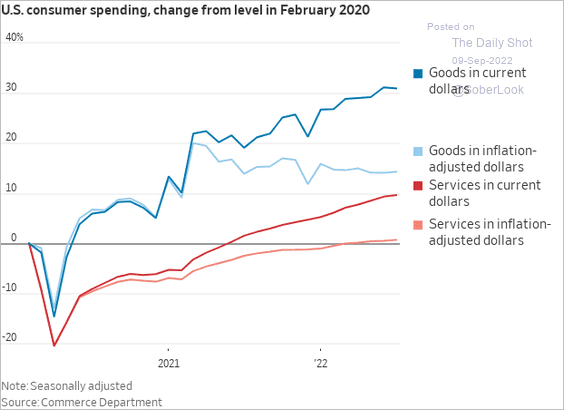

4. Goods spending remains well above services relative to pre-pandemic levels.

Source: @WSJ Read full article

Source: @WSJ Read full article

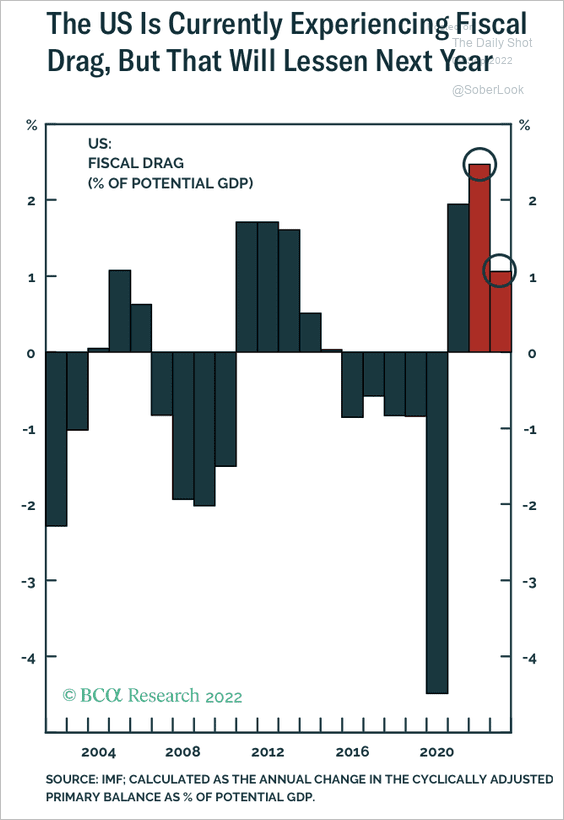

5. The current fiscal drag is expected to weaken next year.

Source: BCA Research

Source: BCA Research

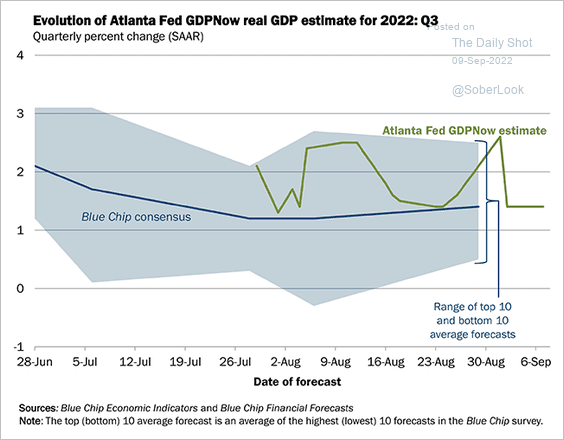

6. The Atlanta Fed’s GDPNow model has the Q3 GDP growth at 1.4% (roughly in line with sell-side economists).

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

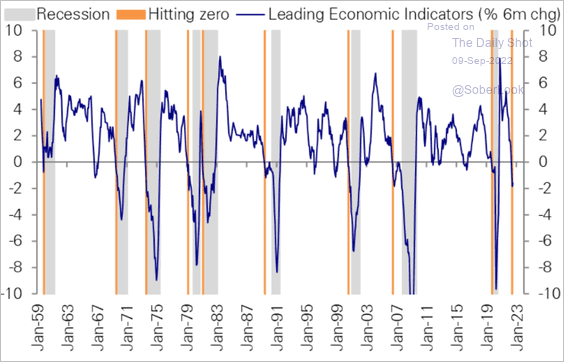

Recession risks remain elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

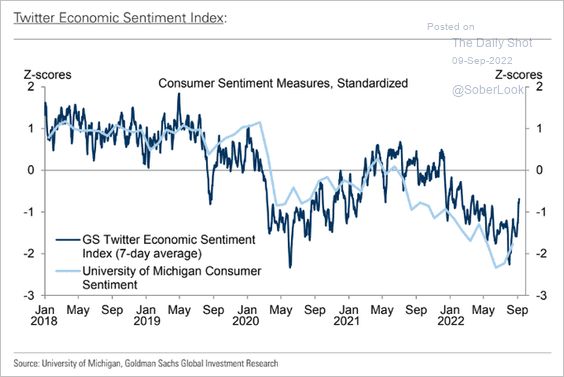

7. The GS Twitter Sentiment Index suggests that consumer sentiment is improving amid lower gasoline prices.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

Back to Index

The United Kingdom

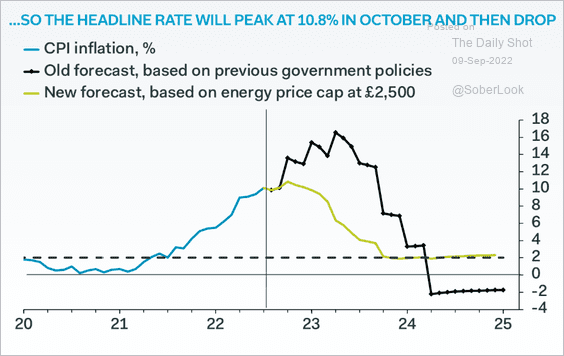

1. Here is what inflation may look like after the household energy bill cap.

• Pantheon Macroeconomics:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

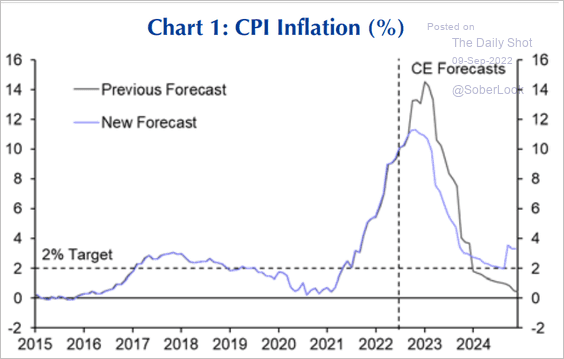

• Capital Economics:

Source: Capital Economics

Source: Capital Economics

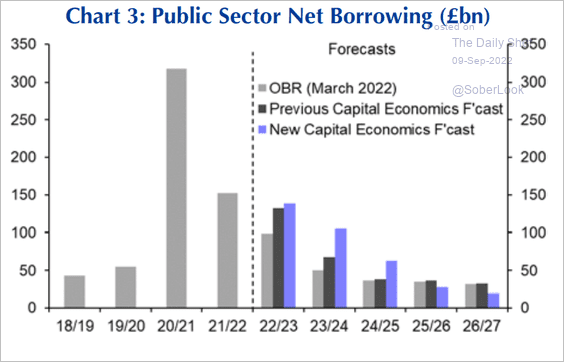

Government borrowing will rise substantially.

Source: Capital Economics

Source: Capital Economics

——————–

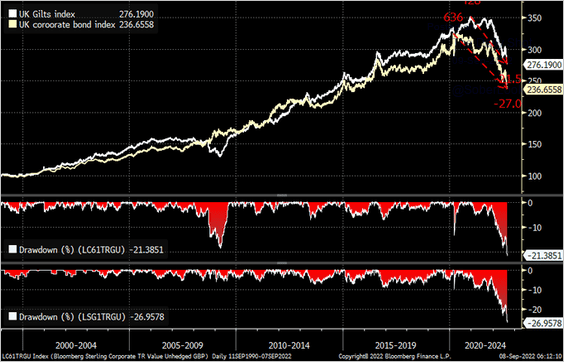

2. UK corporate and government debt has experienced an unprecedented drawdown.

Source: @Marcomadness2, @tomkeene, @lisaabramowicz1, @FerroTV

Source: @Marcomadness2, @tomkeene, @lisaabramowicz1, @FerroTV

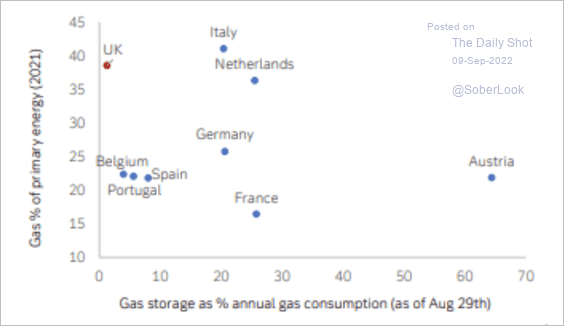

3. The UK is more reliant on gas versus regional peers, but the nation has very little storage.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

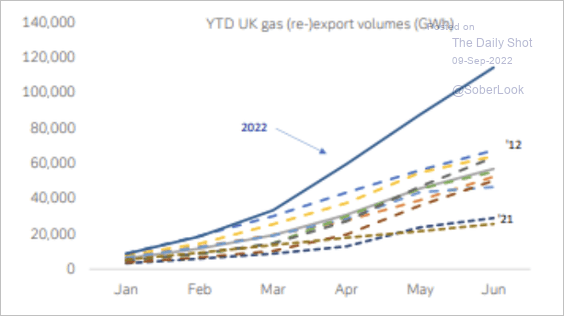

This is why the UK has been re-exporting gas in record amounts.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The Eurozone

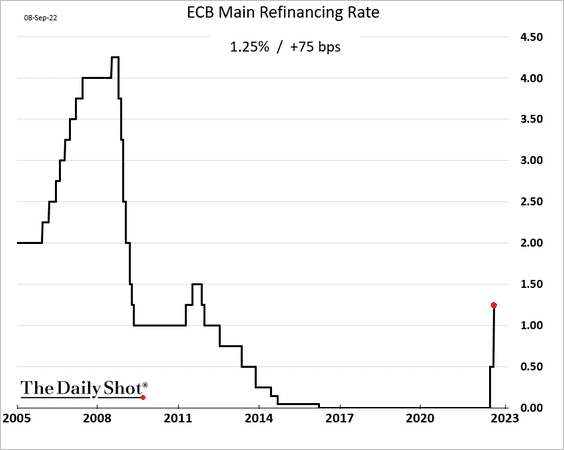

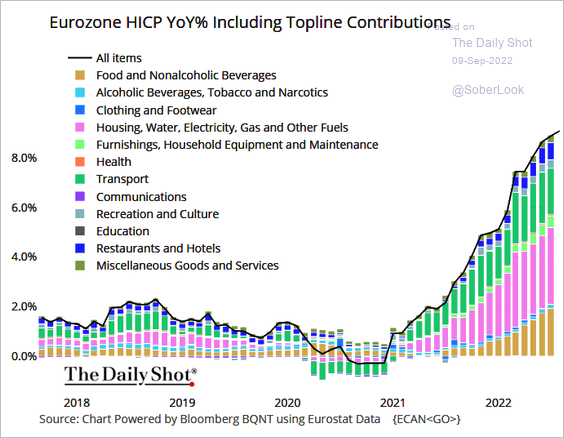

1. The ECB delivered an unprecedented 75 bps rate hike, …

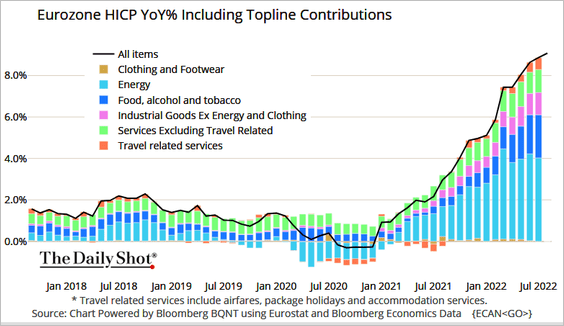

… as inflation surges (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

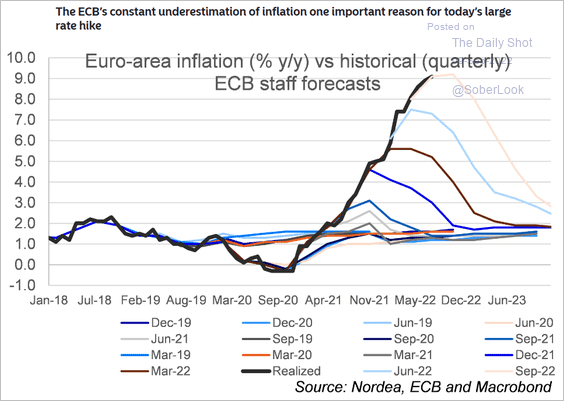

• The central bank boosted its CPI forecast – again.

Source: ECB

Source: ECB

Source: Nordea Markets

Source: Nordea Markets

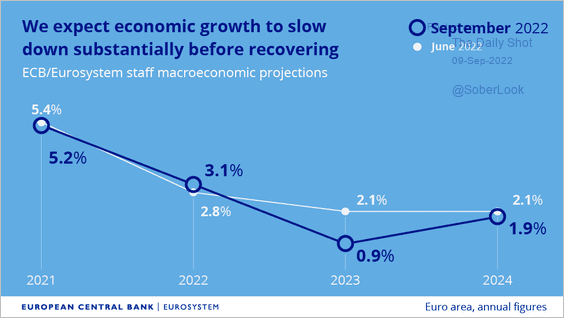

• The forecast for next year’s GDP growth was moved sharply lower.

Source: @ecb, @Lagarde

Source: @ecb, @Lagarde

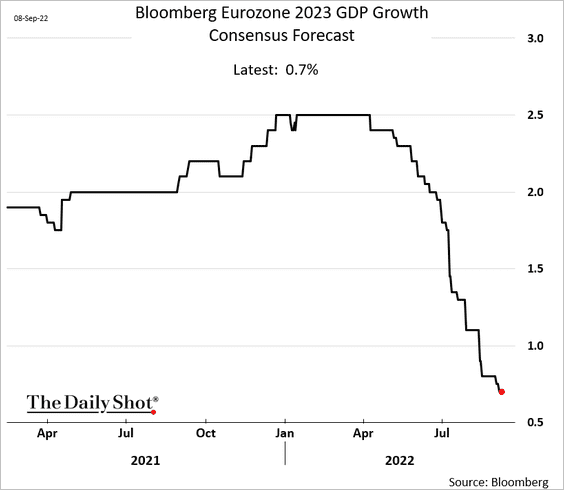

The ECB’s latest GDP projection is not too different from the consensus estimate.

——————–

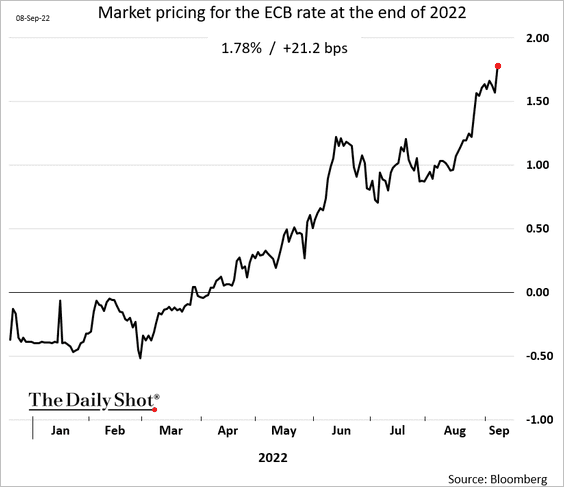

2. There are more rate hikes to come. The market now sees the ECB rate hitting 1.78% by the end of the year.

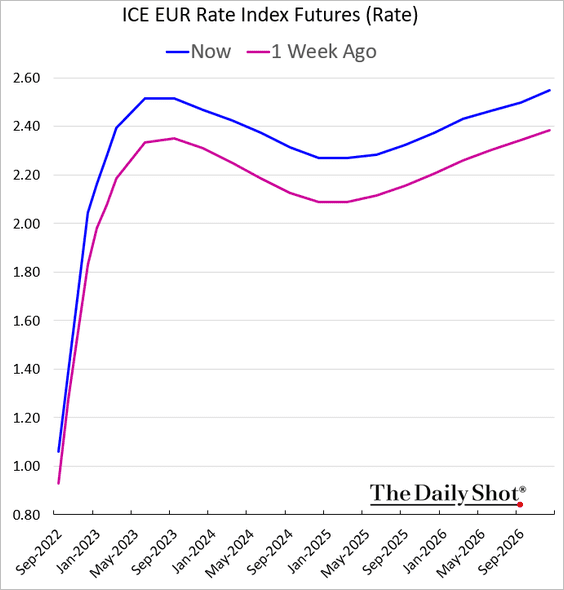

• Below is the expected rate trajectory.

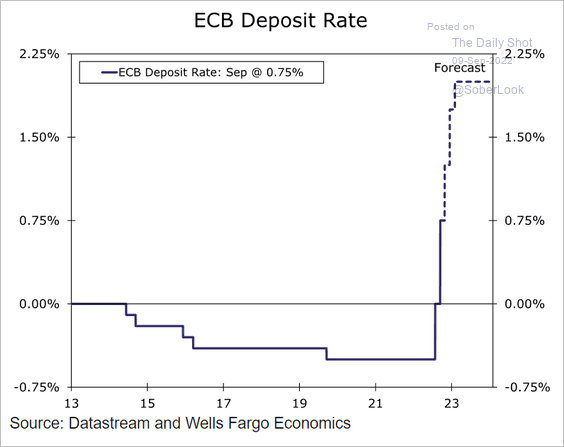

And here is a forecast from Wells Fargo.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

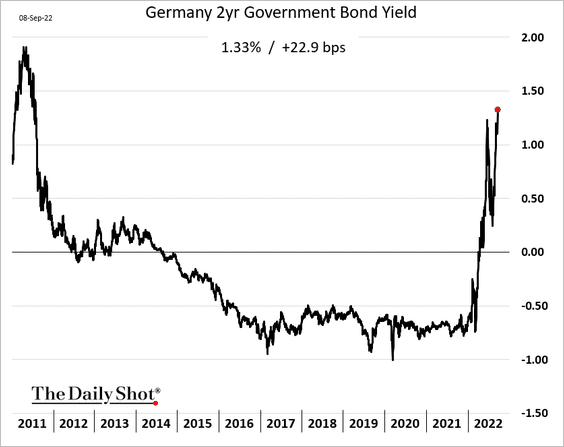

• The 2-year Bund yield rose to the highest level since 2011.

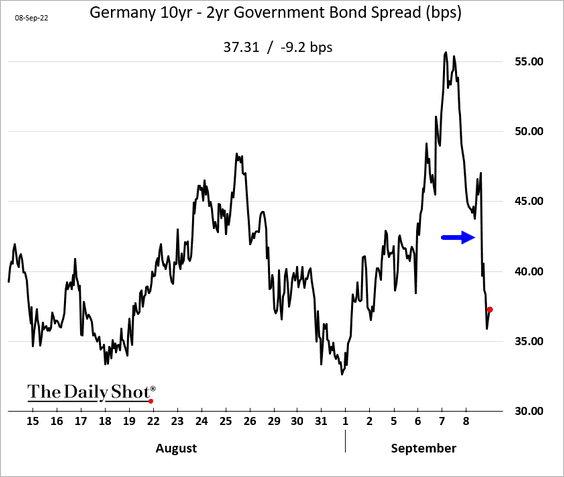

• The Bund curve flattened.

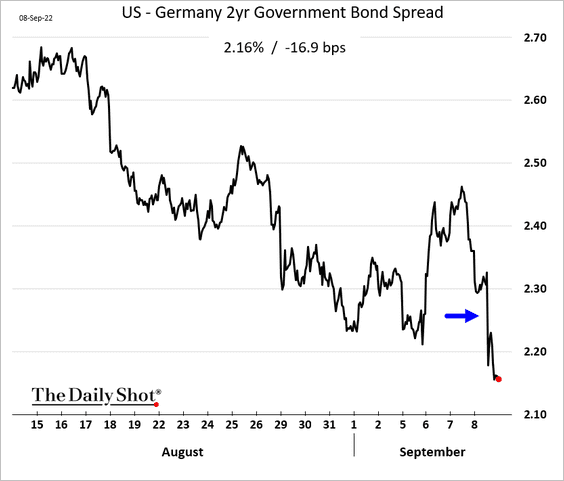

• The US – Germany 2-year yield spread moved lower.

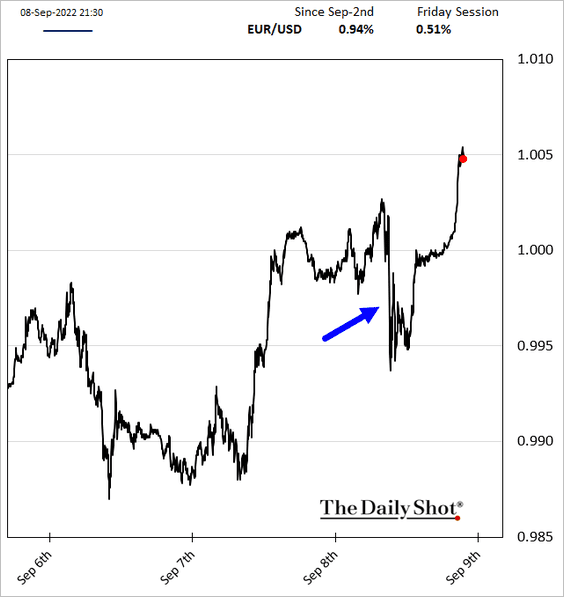

• The euro declined initially but then rebounded.

——————–

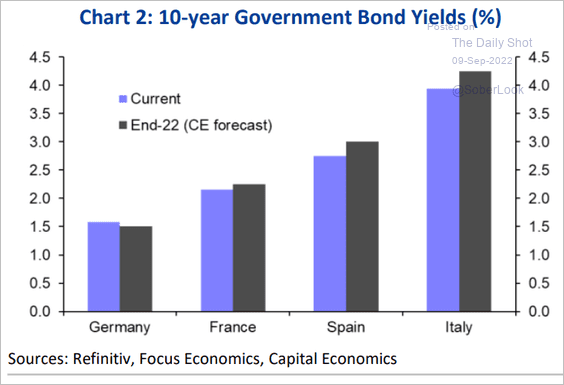

3. Outside of Germany, bond yields are headed higher, according to Capital Economics.

Source: Capital Economics

Source: Capital Economics

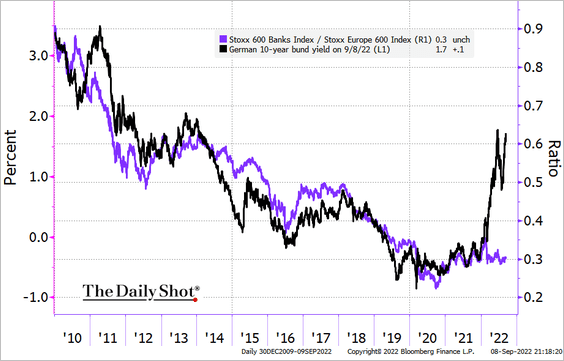

4. Shares of financials are not benefiting from higher rates.

Source: @mikamsika, @TheTerminal, Bloomberg Finance L.P.

Source: @mikamsika, @TheTerminal, Bloomberg Finance L.P.

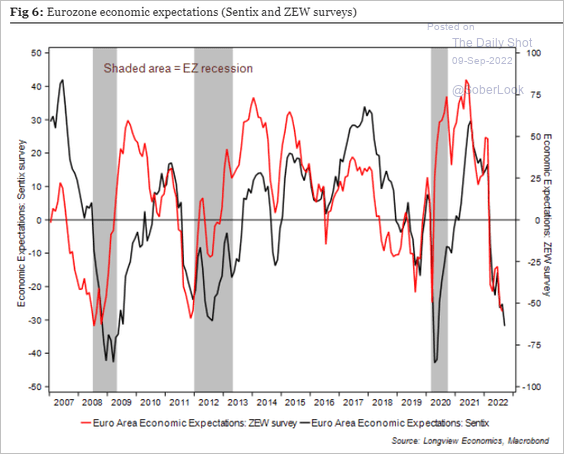

5. Economic sentiment indicators are in recession territory.

Source: Longview Economics

Source: Longview Economics

Back to Index

Japan

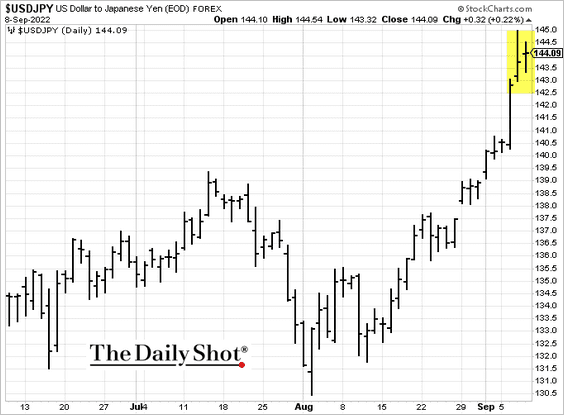

1. The yen’s decline paused, …

… as officials threatened to take action to stabilize the currency.

Source: Kyodo News Read full article

Source: Kyodo News Read full article

——————–

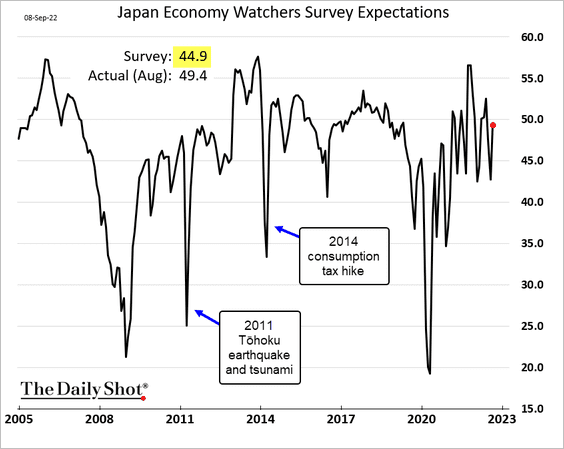

2. The Economy Watchers Expectations index surprised to the upside. The indicator has been volatile in the COVID era.

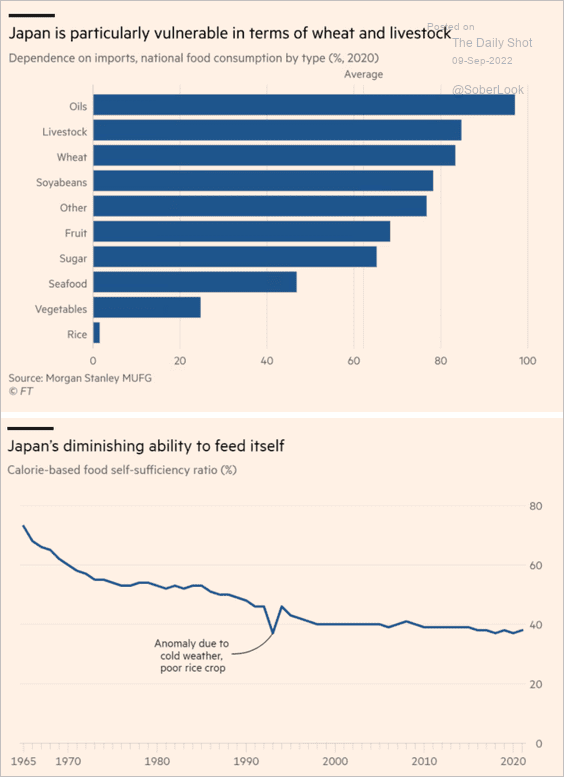

3. Japan is heavily dependent on food imports.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

China

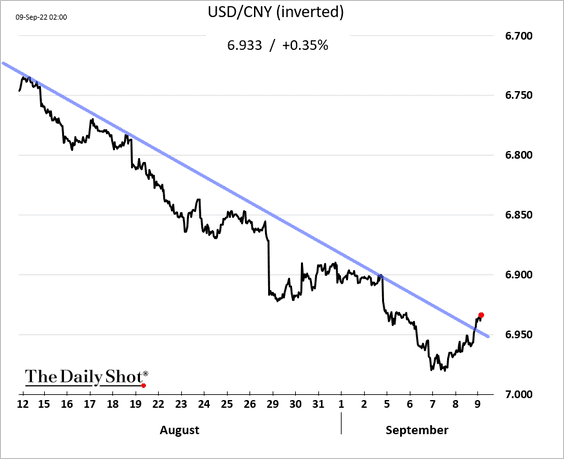

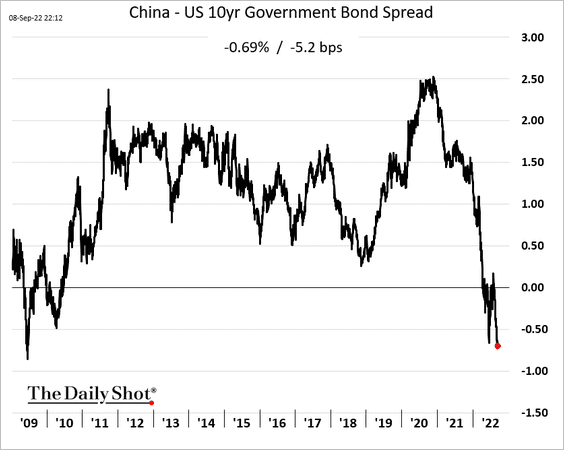

1. The renminbi finally stabilized as the dollar rally paused.

The China-US 10-year yield differential is at its lowest level in 13 years, which could add further pressure on the yuan.

——————–

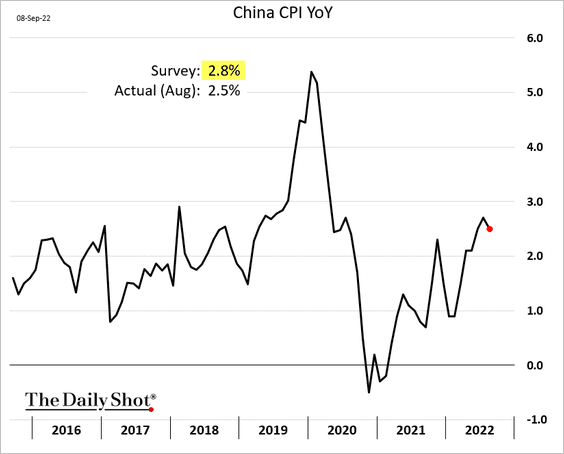

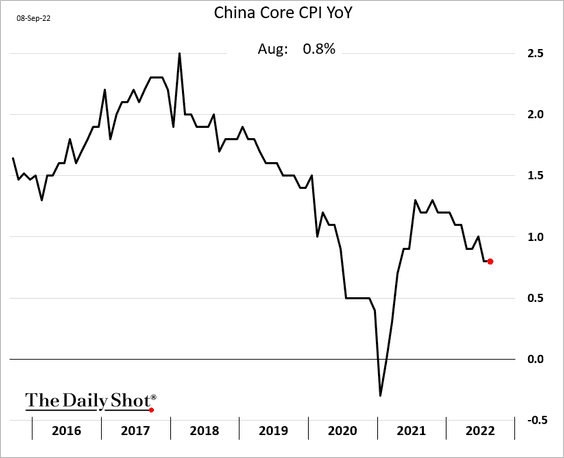

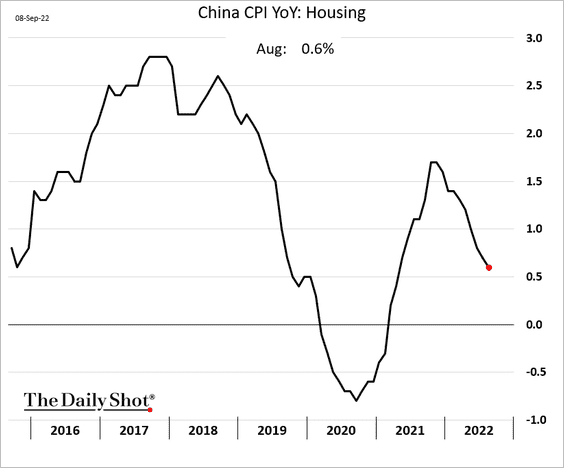

2. Inflation surprised to the downside.

The core CPI continues to trend lower.

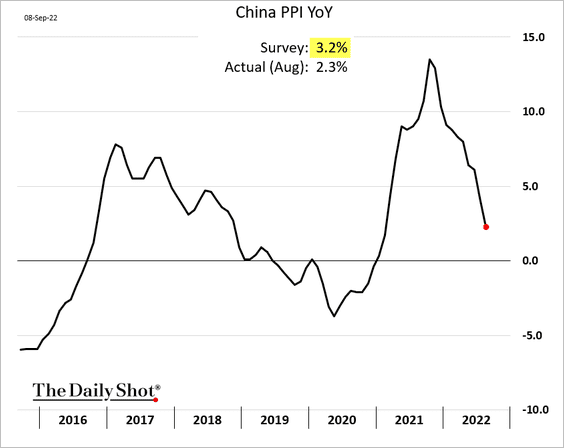

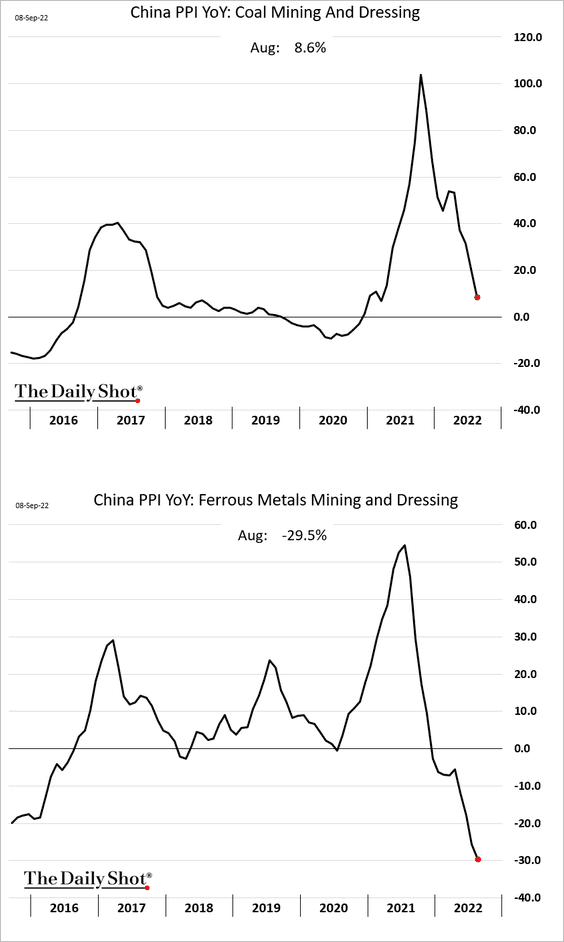

3. Gains in producer prices were also well below forecasts amid softer commodity prices. This trend is good news for central banks around the world (China is exporting disinflation).

——————–

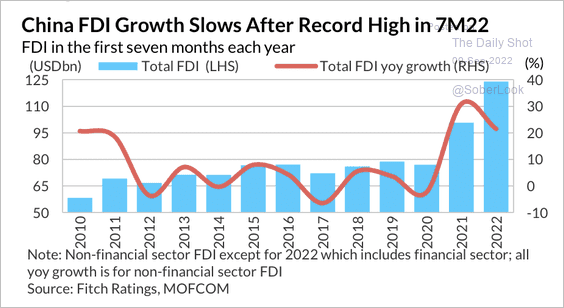

4. Foreign direct investment growth in non-financial sectors has slowed over the past few months.

Source: Fitch Ratings

Source: Fitch Ratings

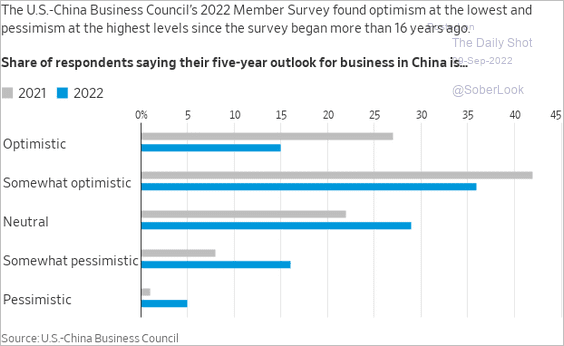

5. US businesses are less upbeat about China over the next five years.

Source: @WSJ Read full article

Source: @WSJ Read full article

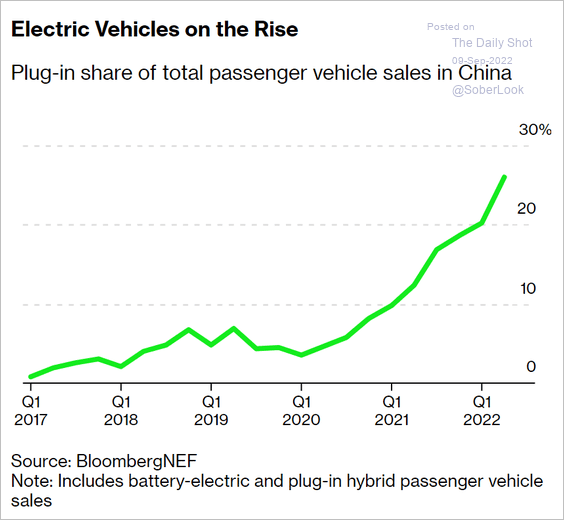

6. China is rapidly shifting to EVs.

Source: @colinmckerrache, @business Read full article

Source: @colinmckerrache, @business Read full article

Back to Index

Emerging Markets

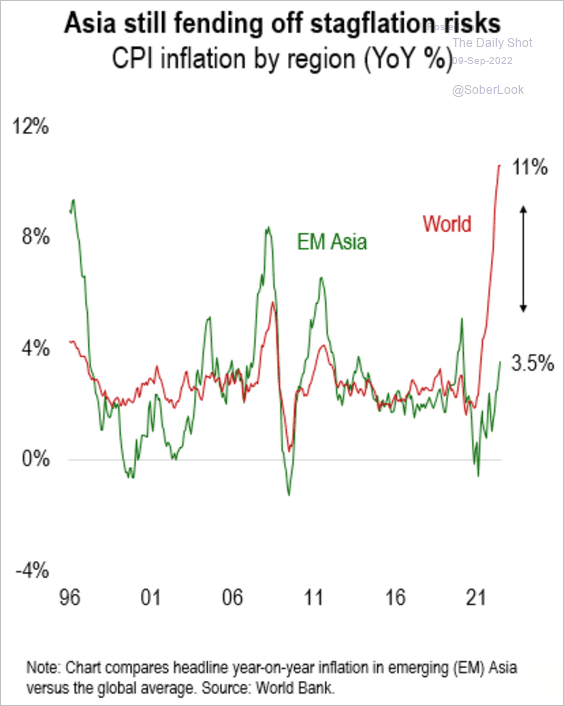

1. Inflation in EM Asia has been much lower than what we see globally.

Source: Numera Analytics

Source: Numera Analytics

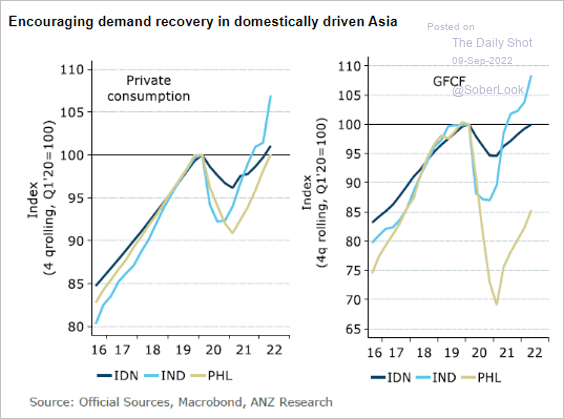

2. Indonesia’s economy has been outperforming.

Source: @ANZ_Research

Source: @ANZ_Research

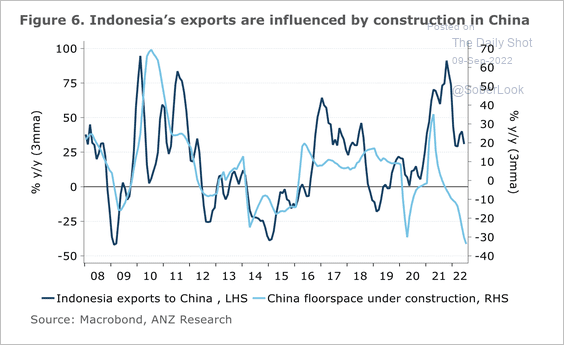

Indonesia’s exports to China have slowed because of weaker construction demand.

Source: @ANZ_Research

Source: @ANZ_Research

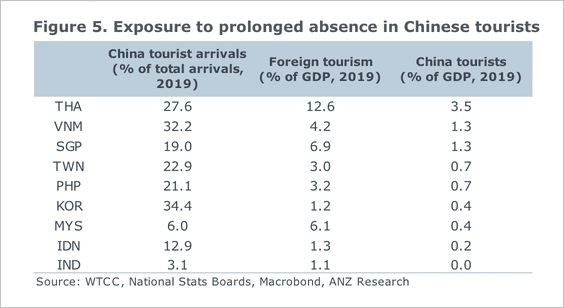

3. The absence of Chinese tourists could stall economic recoveries, particularly in Thailand, Vietnam, and Singapore.

Source: @ANZ_Research

Source: @ANZ_Research

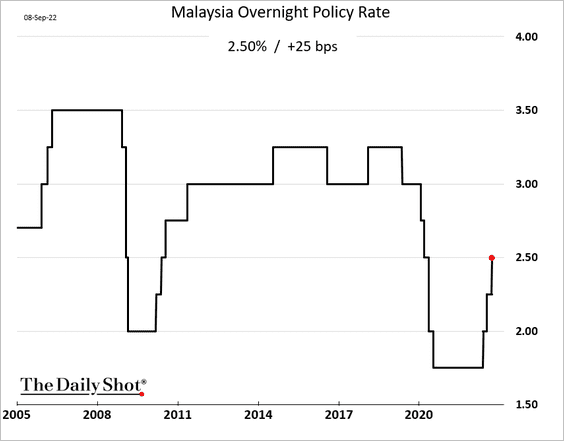

4. Malaysia’s central bank hiked rates again (still below pre-COVID levels).

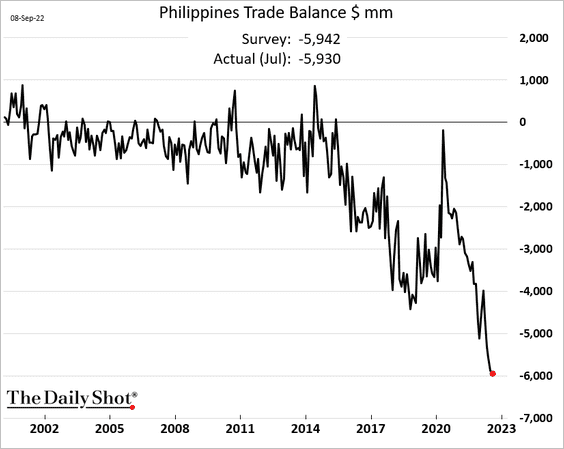

5. The Philippine trade deficit hit a record.

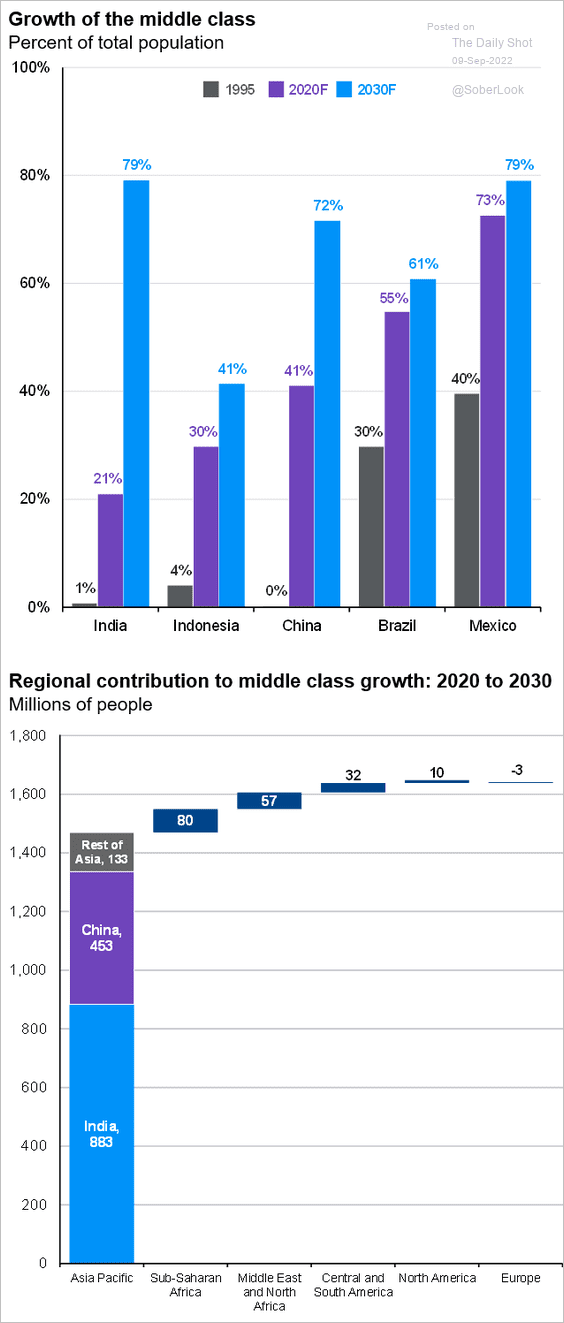

6. Next, we have some data on middle-class growth in emerging markets.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Cryptocurrency

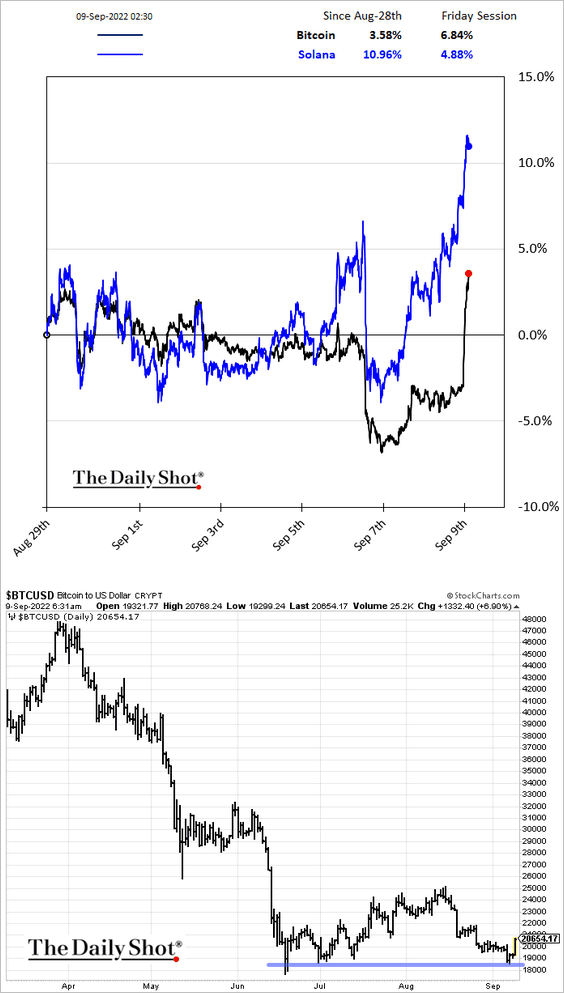

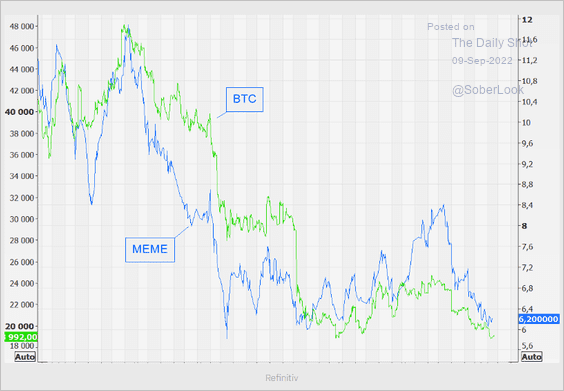

1. Cryptos are surging, with bitcoin back above 20k, as the dollar rally stalls.

2. Bitcoin remains a “hot money” asset.

Source: @themarketear

Source: @themarketear

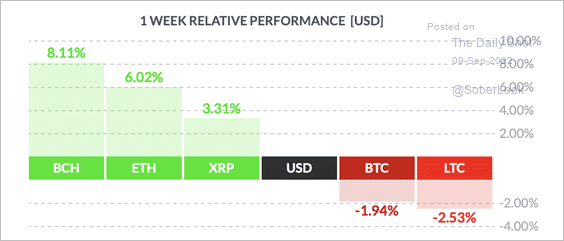

3. Bitcoin (BTC) and Litecoin (LTC) underperformed other top cryptos over the past week.

Source: FinViz

Source: FinViz

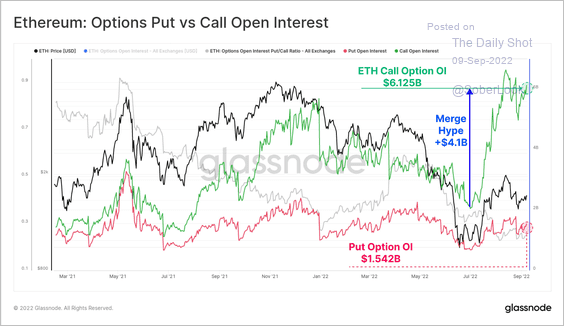

4. Ether (ETH) options open interest has surged over the past month, driven by excitement over “The Merge.”

Source: @glassnode

Source: @glassnode

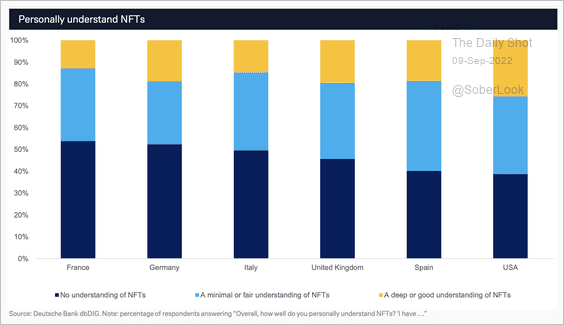

5. Less than one-third of respondents to a Deutsche Bank public survey have a good or deep understanding of NFTs.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

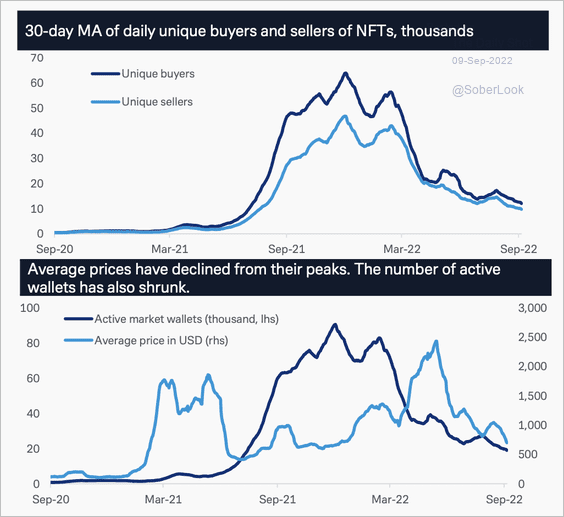

NFTs have seen a significant slowdown in activity.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Energy

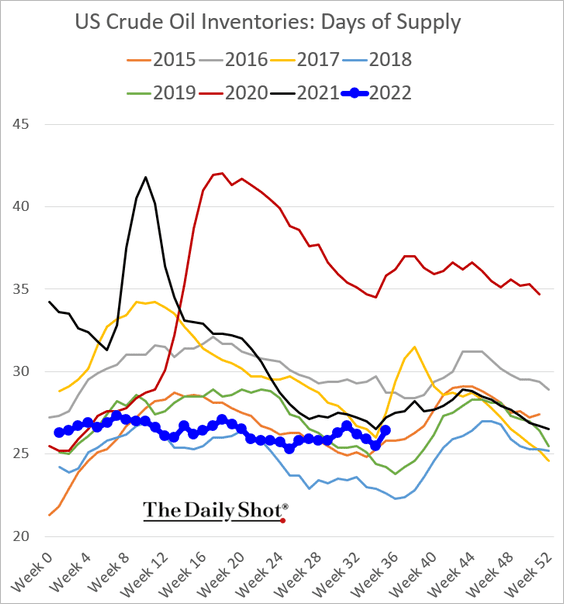

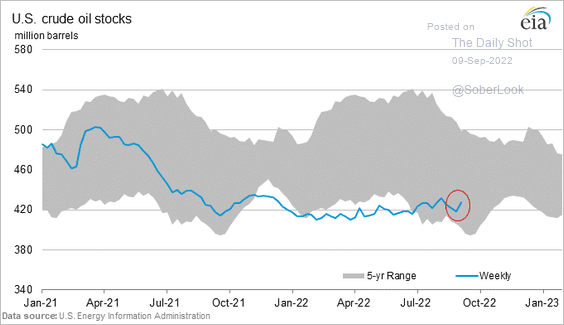

1. US oil inventories jumped last week.

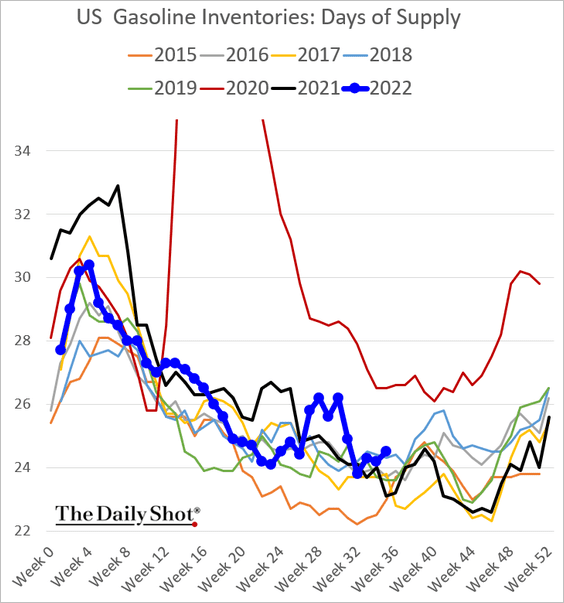

2. Gasoline inventories are now elevated when measured in days of supply.

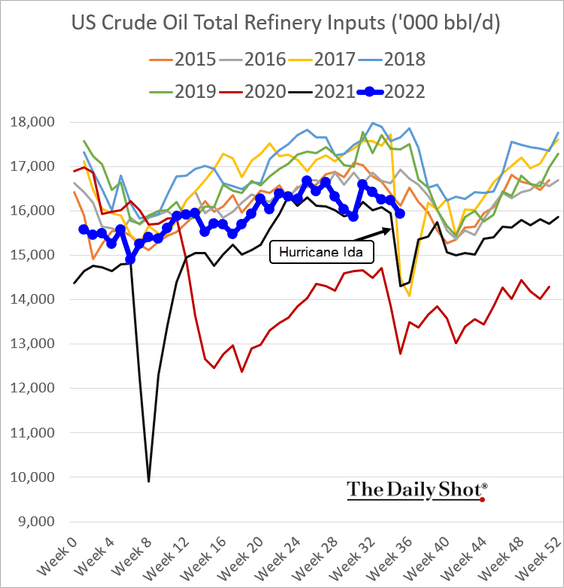

3. Refinery inputs remain soft for this time of the year.

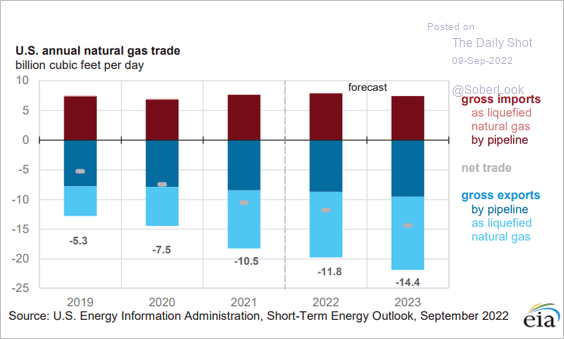

4. US Natural gas exports continue to grow.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

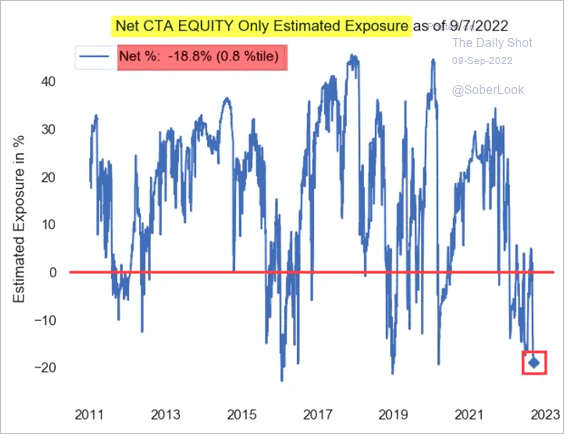

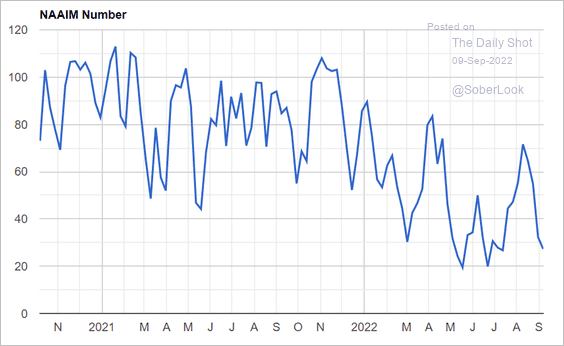

1. Sentiment remains depressed.

• CTA positioning:

Source: Nomura; @themarketear

Source: Nomura; @themarketear

• Investment managers:

Source: NAAIM; @pav_chartbook

Source: NAAIM; @pav_chartbook

——————–

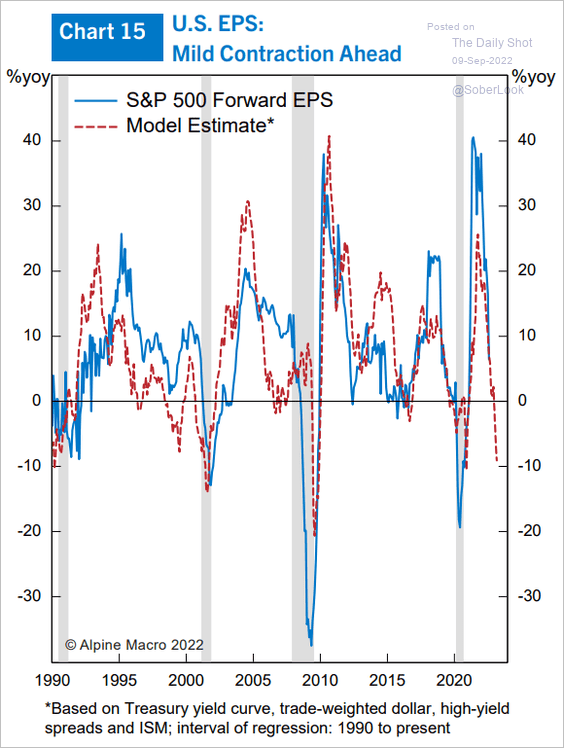

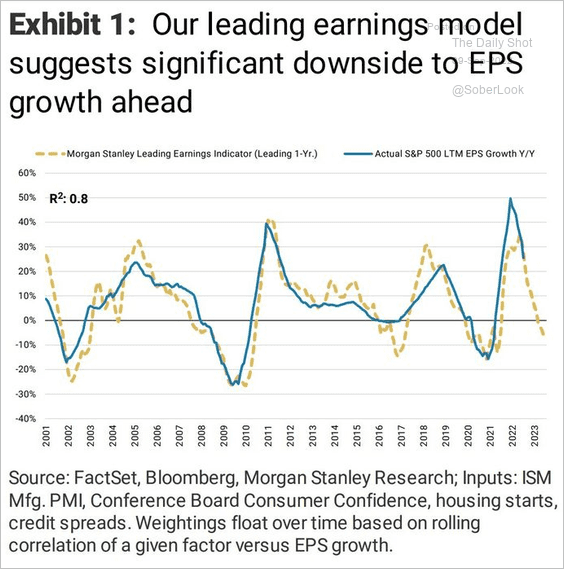

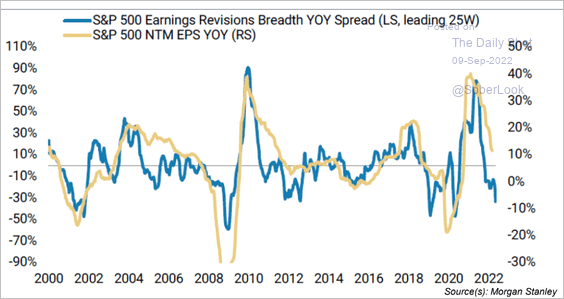

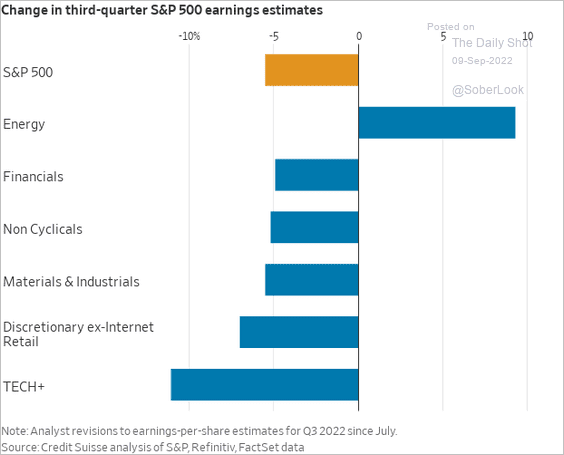

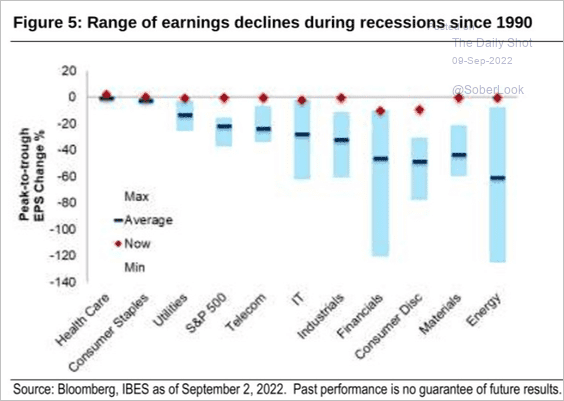

2. Analysts see an earnings recession ahead.

– Alpine Macro:

Source: Alpine Macro

Source: Alpine Macro

– Morgan Stanley:

Source: Morgan Stanley, MarketWatch Read full article

Source: Morgan Stanley, MarketWatch Read full article

• Earnings downgrades continue (2 charts).

Source: Morgan Stanley Research; III Capital Management

Source: Morgan Stanley Research; III Capital Management

Source: @WSJ Read full article

Source: @WSJ Read full article

• How much do earnings decline during recessions?

Source: Citi Private Bank

Source: Citi Private Bank

——————–

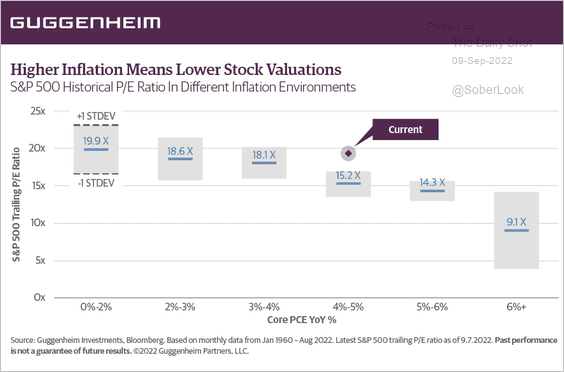

3. Given the current valuations and inflation levels, a 20% market drop in the months ahead is a possibility, according to Guggenheim Partners.

Source: @ScottMinerd

Source: @ScottMinerd

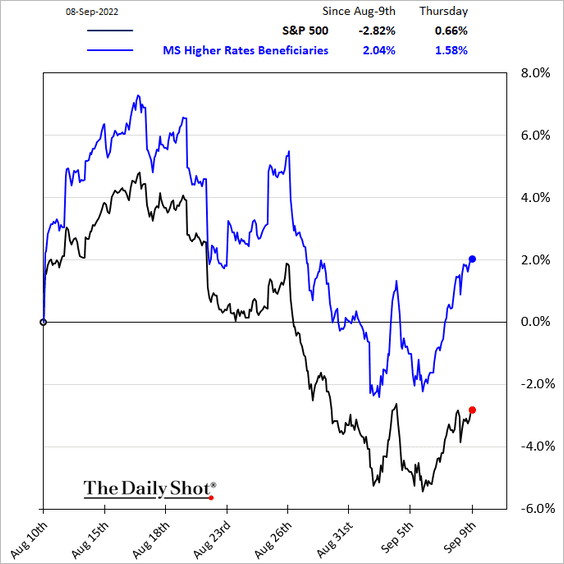

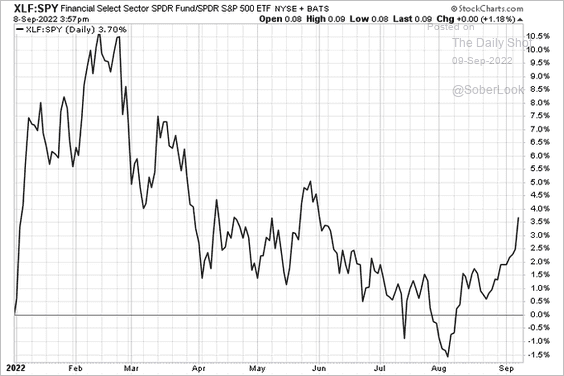

4. Companies that benefit from higher rates, such as financials, have been outperforming recently.

Source: @MikeZaccardi

Source: @MikeZaccardi

——————–

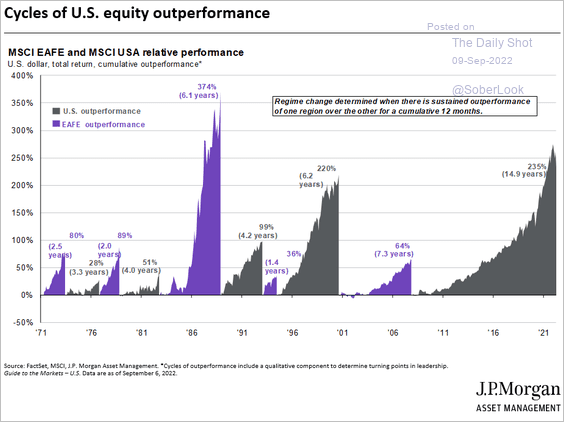

5. The current US market outperformance cycle (vs. the rest of the world) is nearing 15 years in length.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Credit

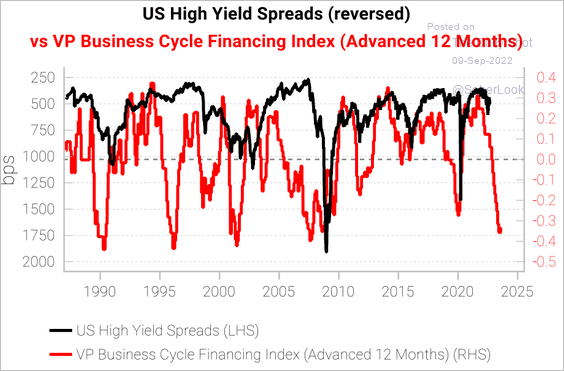

1. High-yield markets face some headwinds, according to VP Research.

Source: Variant Perception

Source: Variant Perception

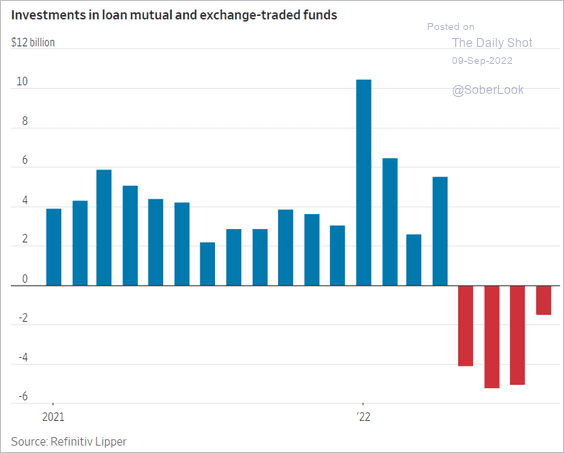

2. Leveraged loan fund outflows have been severe in recent months.

Source: @WSJ Read full article

Source: @WSJ Read full article

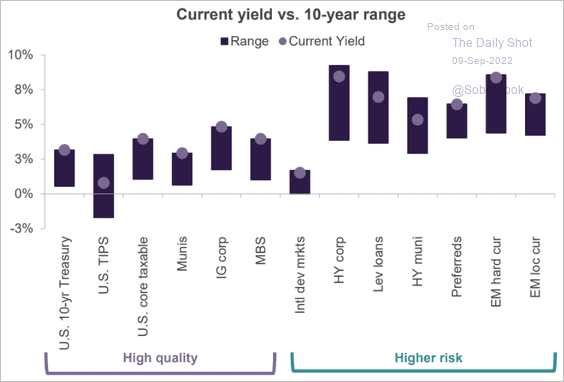

3. This chart shows fixed-income yields vs. the 10-year average.

Source: Truist Advisory Services

Source: Truist Advisory Services

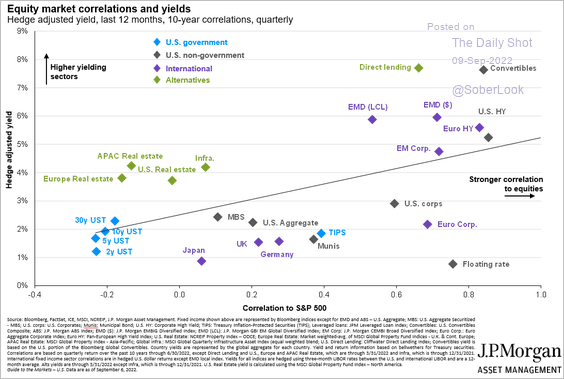

And this scatterplot shows asset-class yields vs. their correlation to the S&P 500.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Rates

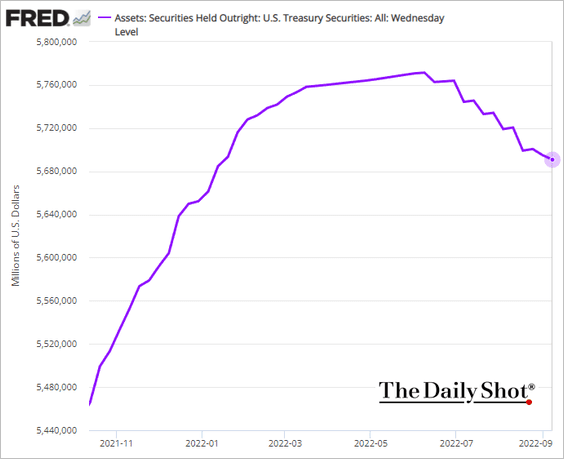

1. The Fed’s quantitative tightening will pick up momentum this month.

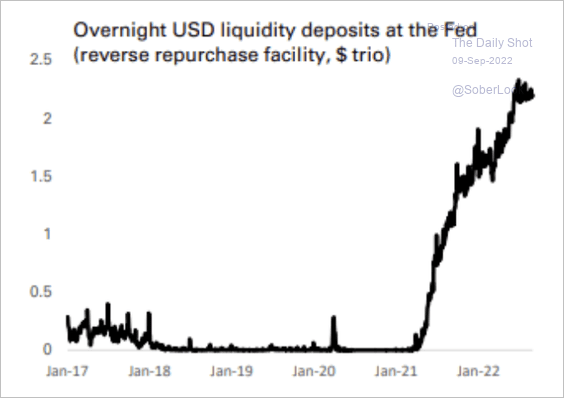

2. There has been a surge in demand for “safe” dollars via the Fed’s overnight reverse repurchase facility. This could lead to an even larger liquidity withdrawal from the system than the Fed’s QT alone, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

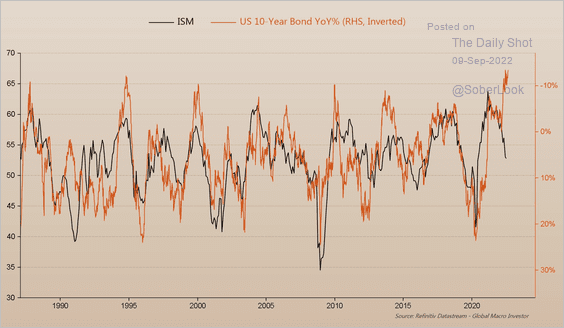

3. Slower economic growth points to lower Treasury yields ahead.

Source: @RaoulGMI

Source: @RaoulGMI

Back to Index

Global Developments

1. The dollar is extremely overvalued, similar to 1985.

Source: BCA Research

Source: BCA Research

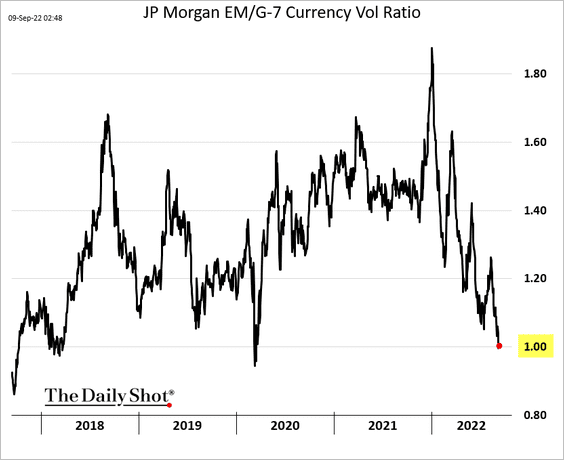

2. G-7 currencies are now as volatile as EM currencies (based on implied vol).

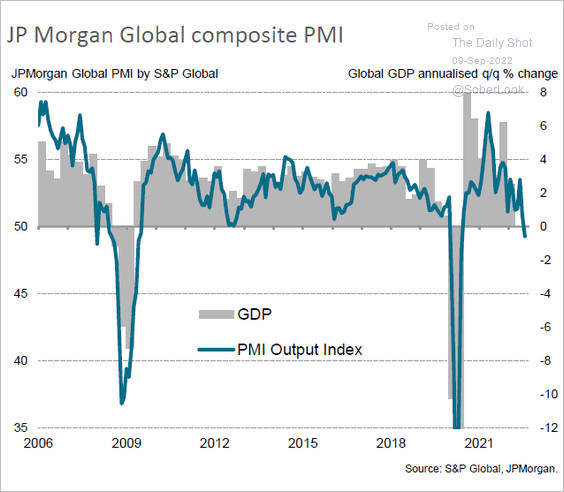

3. Global business activity is in contraction.

Source: @SPGlobalPMI

Source: @SPGlobalPMI

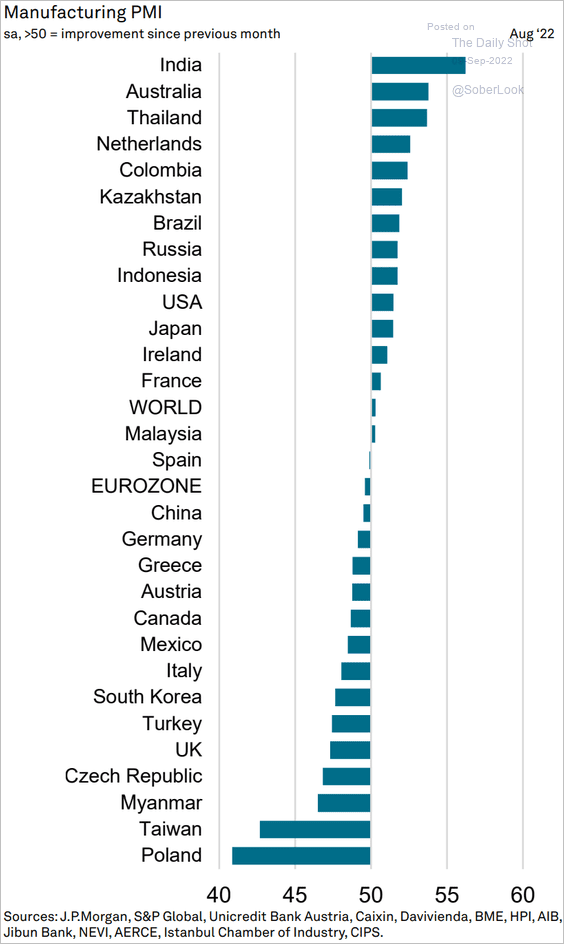

Key manufacturing hubs register deteriorating activity.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

Food for Thought

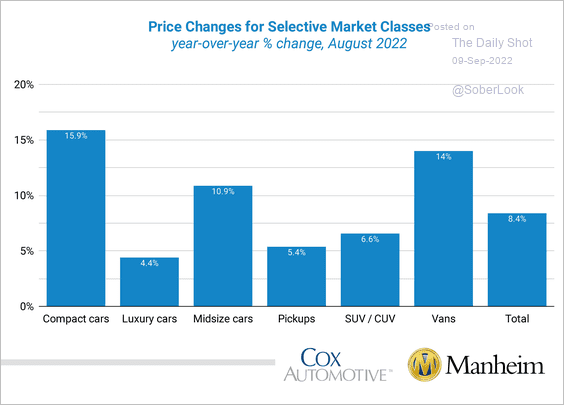

1. Used vehicle prices vs. 12 months ago:

Source: Manheim Read full article

Source: Manheim Read full article

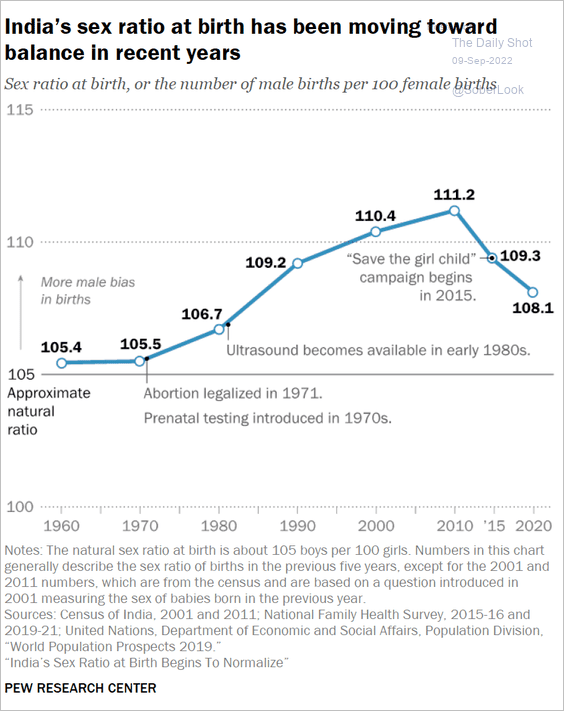

2. India’s sex ratio over time:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

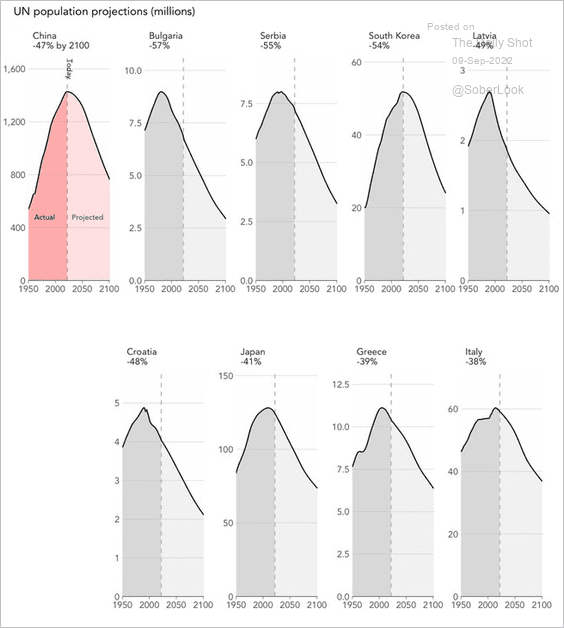

3. Population projections for select countries:

Source: @jburnmurdoch

Source: @jburnmurdoch

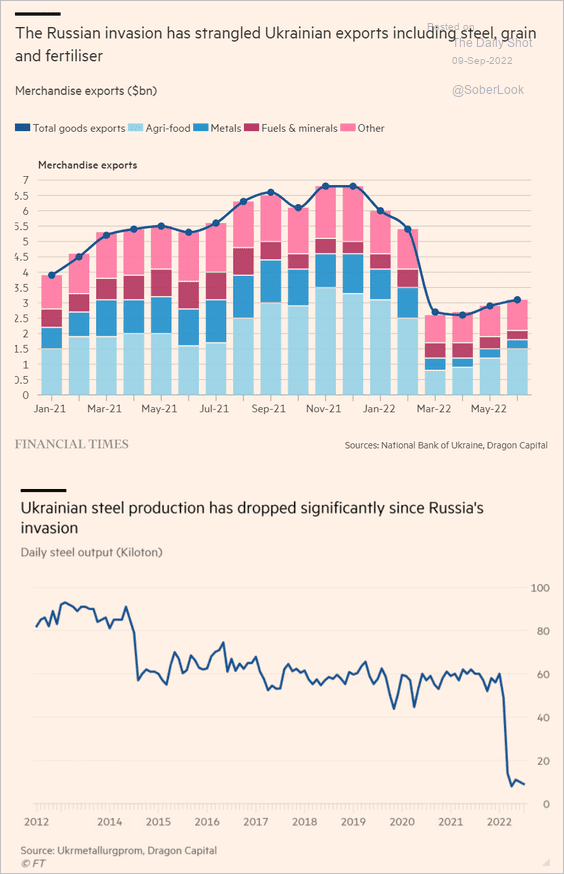

4. Ukrainian exports:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

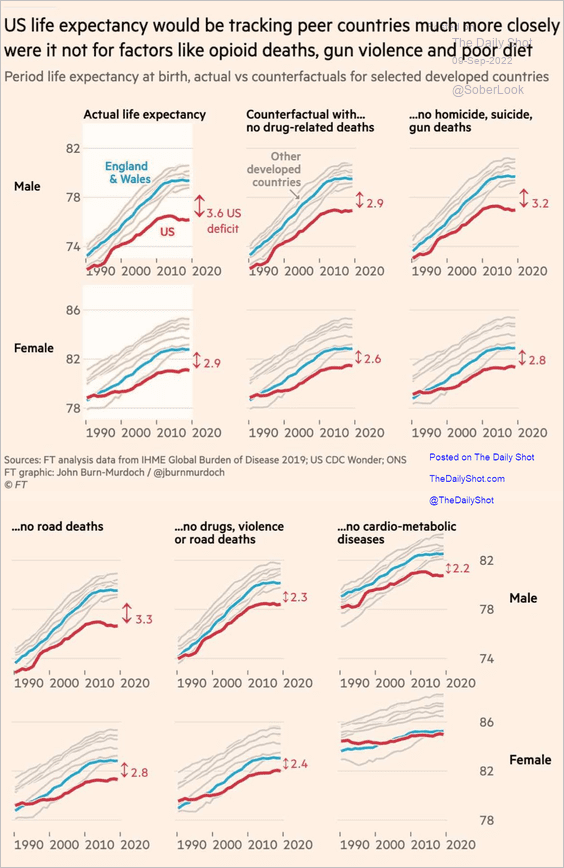

5. Drivers of US lagging life expectancy:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

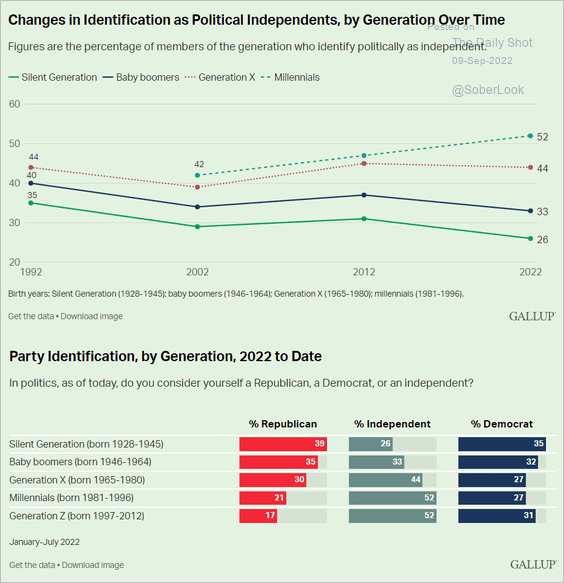

6. Going independent:

Source: Gallup Read full article

Source: Gallup Read full article

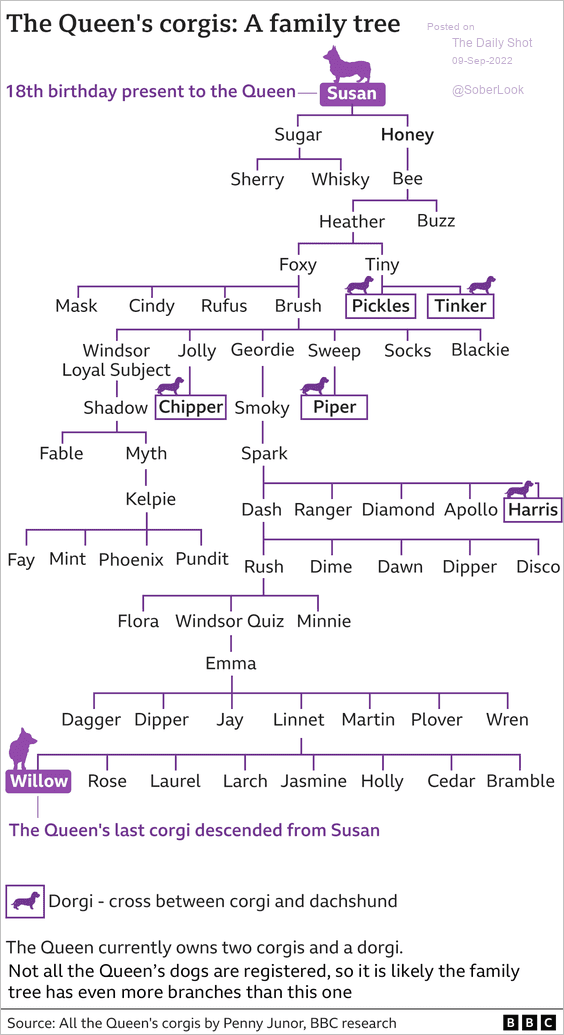

7. The queen’s corgis:

Source: BBC Read full article

Source: BBC Read full article

——————–

Have a great weekend!

Back to Index