The Daily Shot: 12-Sep-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with some updates on inflation.

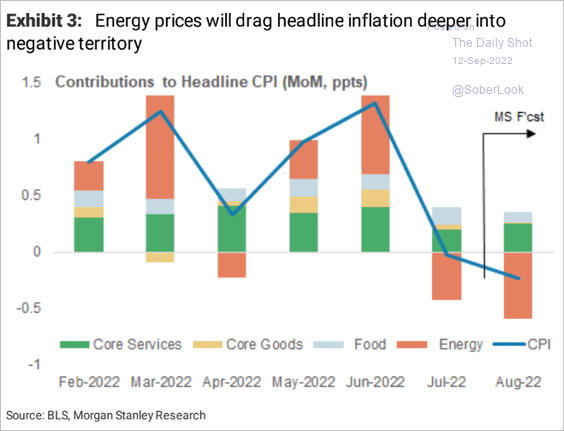

• Morgan Stanley is estimating a negative month-over-month CPI print for August due to lower fuel prices.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

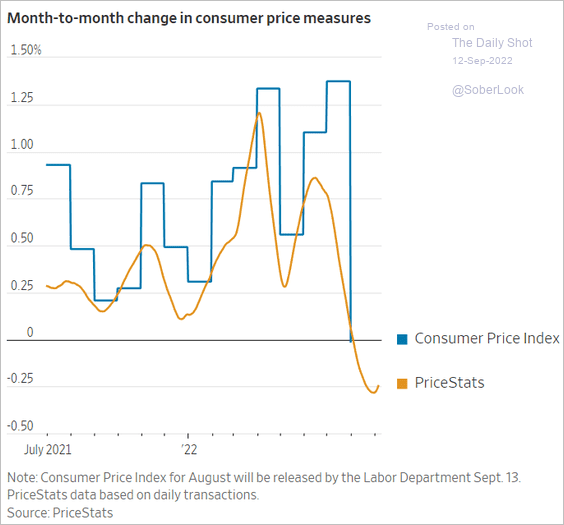

• High-frequency indicators also point to a decline in the CPI.

Source: @WSJ Read full article

Source: @WSJ Read full article

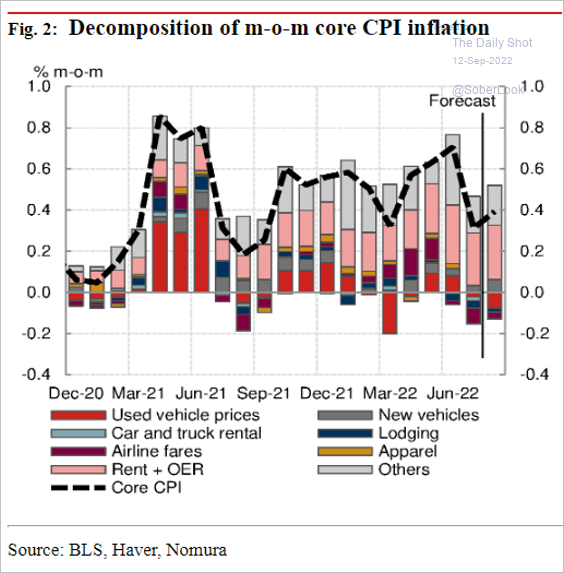

• But the core inflation remained elevated, according to Nomura (driven by housing).

Source: Nomura Securities

Source: Nomura Securities

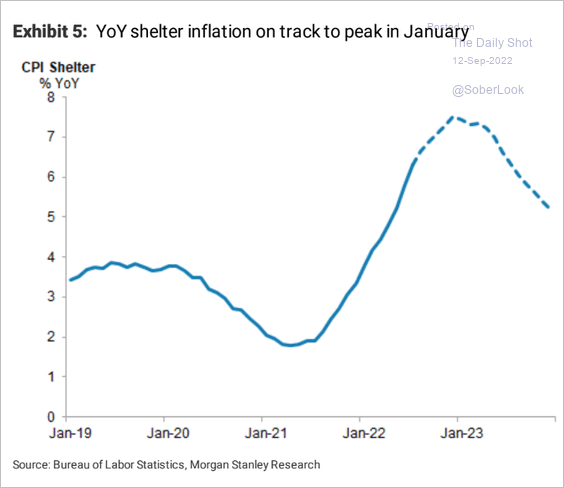

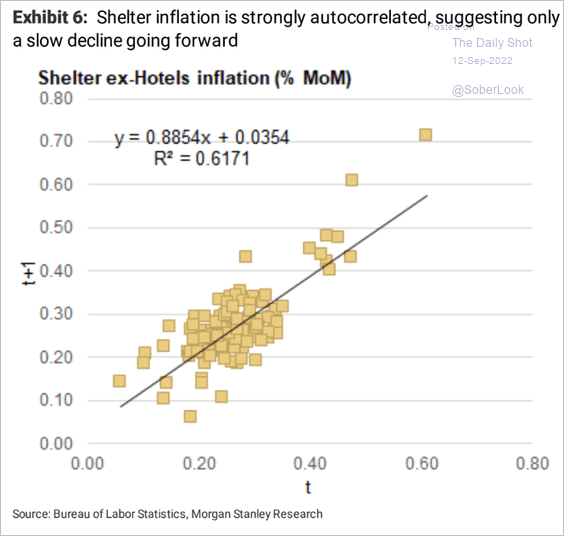

• Shelter inflation is not expected to peak until next year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Shelter CPI tends to be autocorrelated, which means that trend reversals are slow.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

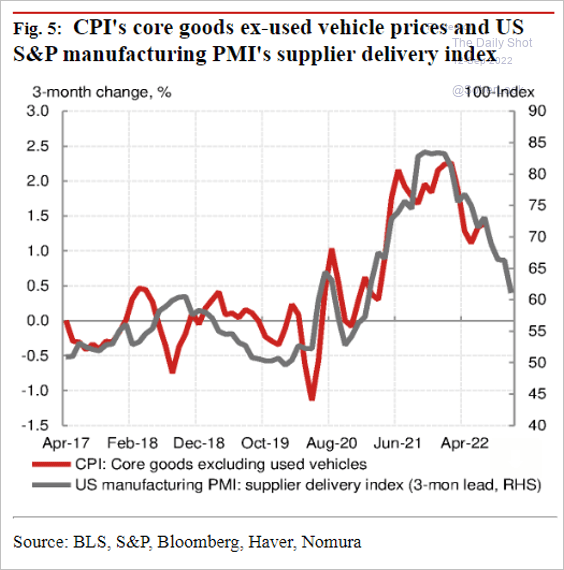

• Easing supply stress should soften core goods inflation.

Source: Nomura Securities

Source: Nomura Securities

• Market-based inflation expectations have been falling.

Source: @michaellachlan, @markets Read full article

Source: @michaellachlan, @markets Read full article

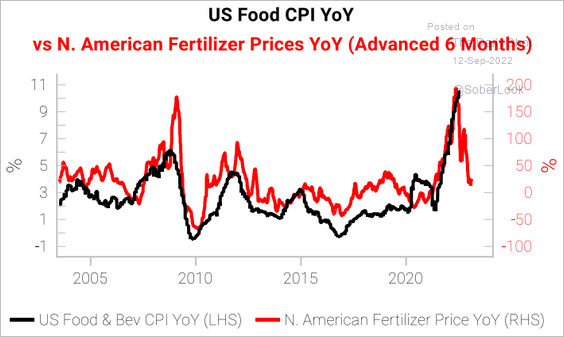

• Food inflation should begin to moderate.

Source: Variant Perception

Source: Variant Perception

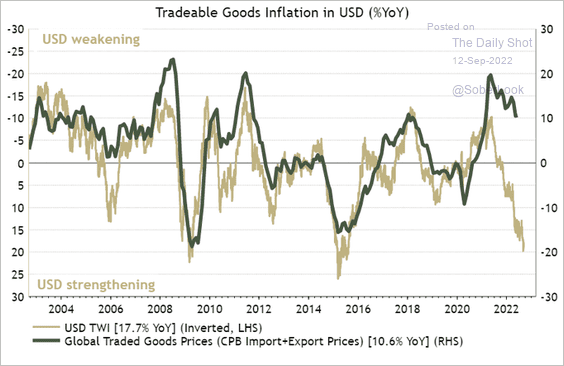

• US dollar gains should ease tradable goods inflation.

Source: @IanRHarnett

Source: @IanRHarnett

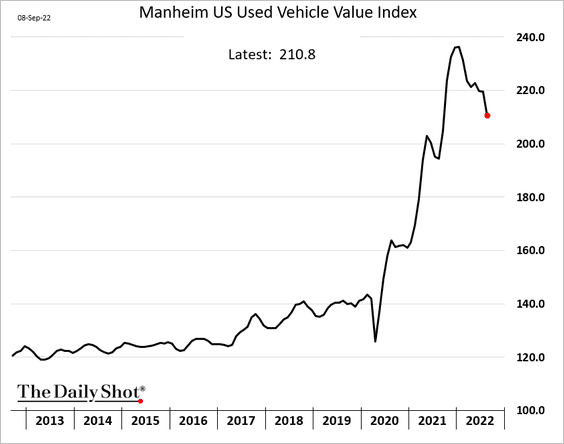

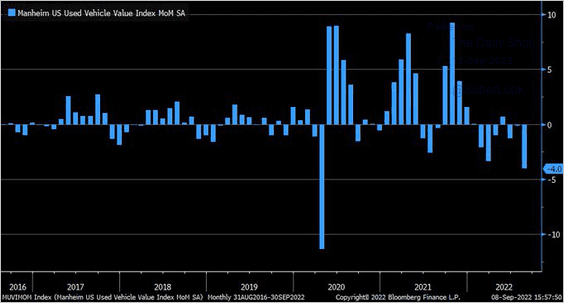

• Used vehicle prices have been declining (2 charts).

Source: @LizAnnSonders, @Manheim_US

Source: @LizAnnSonders, @Manheim_US

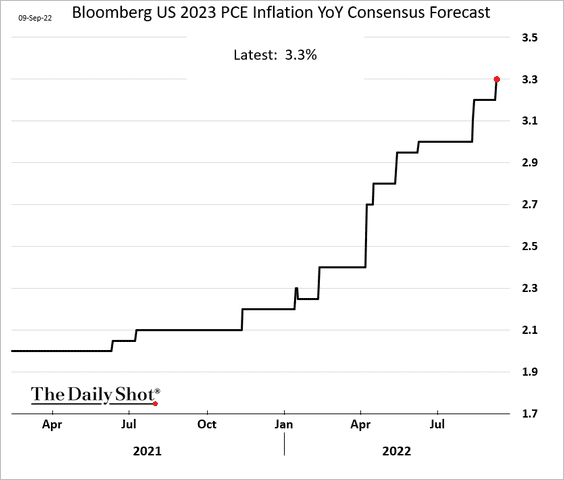

• Economists continue to boost their forecasts for PCE inflation in 2023.

——————–

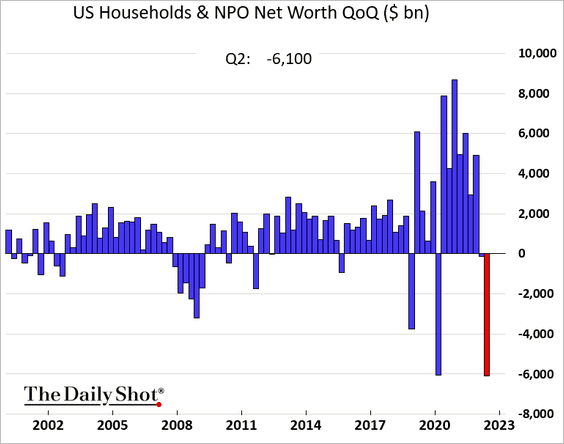

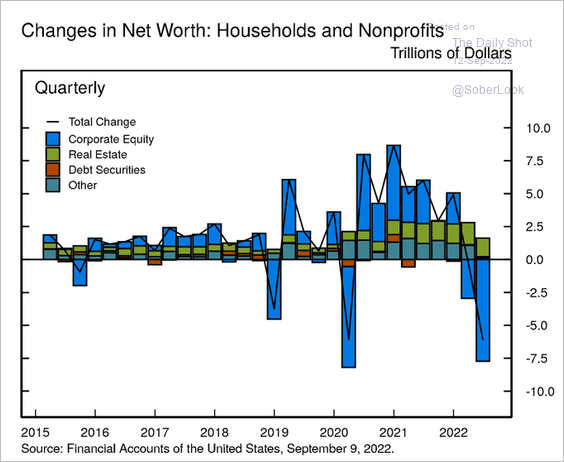

2. Household net worth tumbled last quarter as stocks slumped.

Source: @federalreserve Read full article

Source: @federalreserve Read full article

Source: Reuters Read full article

Source: Reuters Read full article

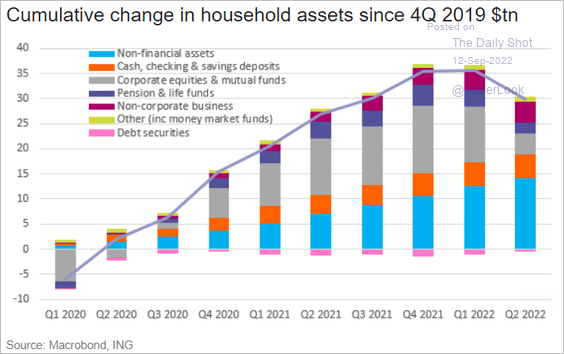

Here are the cumulative gains since the start of the pandemic.

Source: ING

Source: ING

——————–

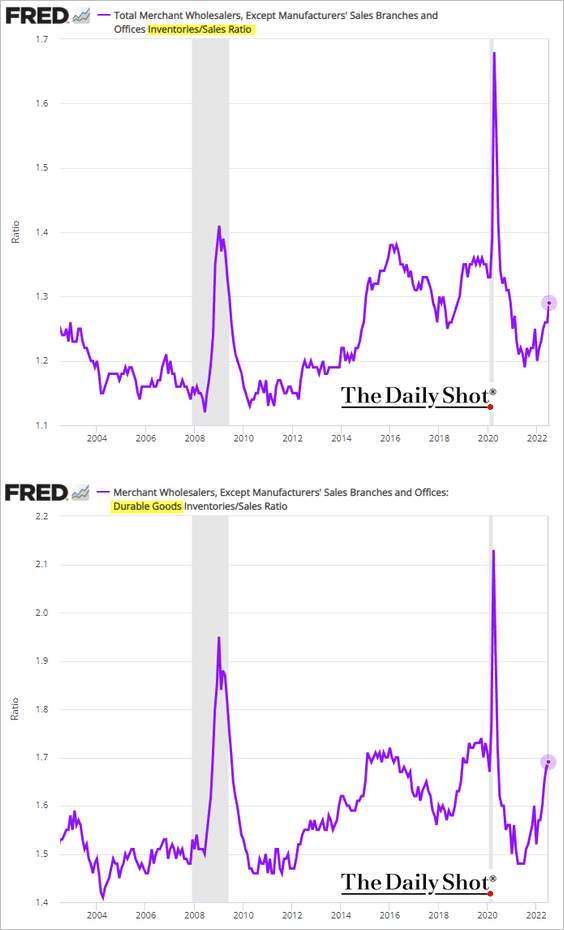

3. The inventories-to-sales ratio is rebounding, especially in durable goods.

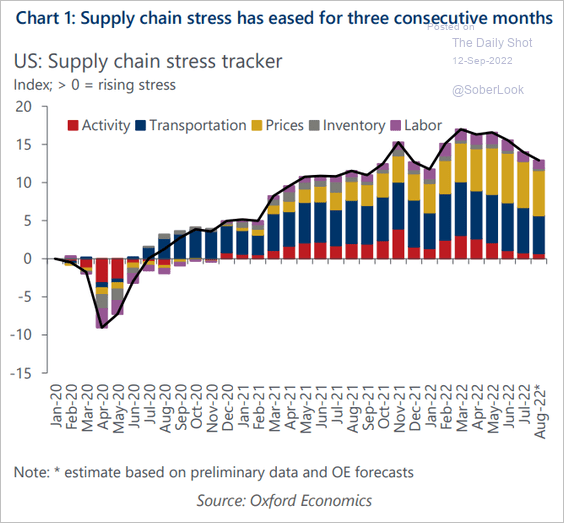

4. The Oxford Economics supply chain stress index continues to moderate.

Source: Oxford Economics

Source: Oxford Economics

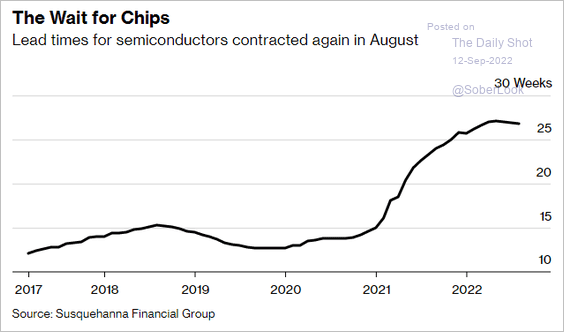

Semiconductor delivery times appear to have peaked but remain elevated.

Source: @ianmking, @technology Read full article

Source: @ianmking, @technology Read full article

——————–

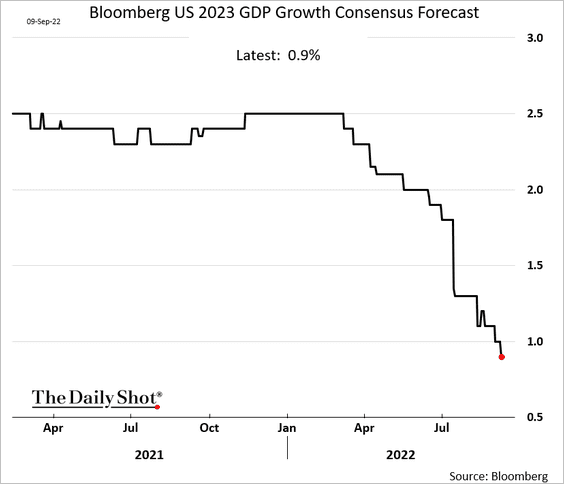

5. Next, we have some updates on economic growth.

• Economists now expect next year’s growth to dip below 1%.

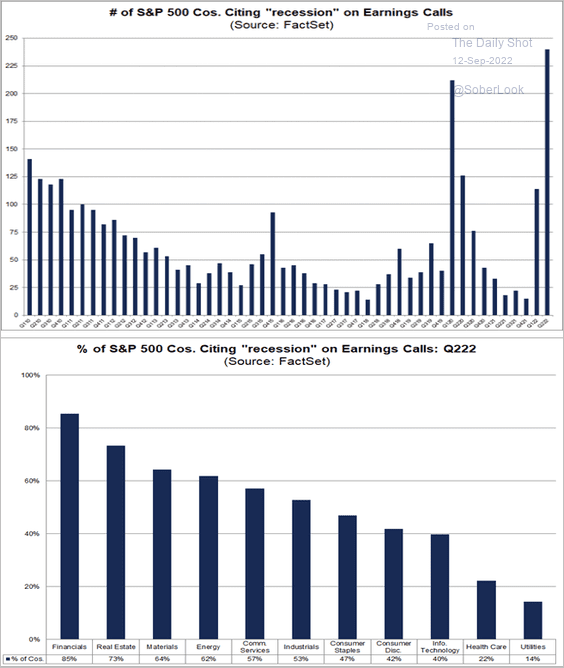

• Companies are increasingly mentioning “recession” on earnings calls.

Source: FactSet

Source: FactSet

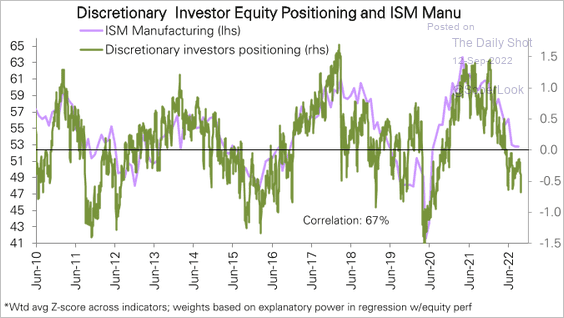

• Stock investors are positioning for a recession.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

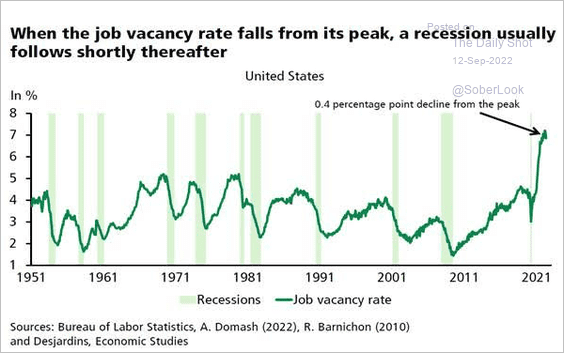

• Job openings tend to peak before recessions.

Source: Desjardins

Source: Desjardins

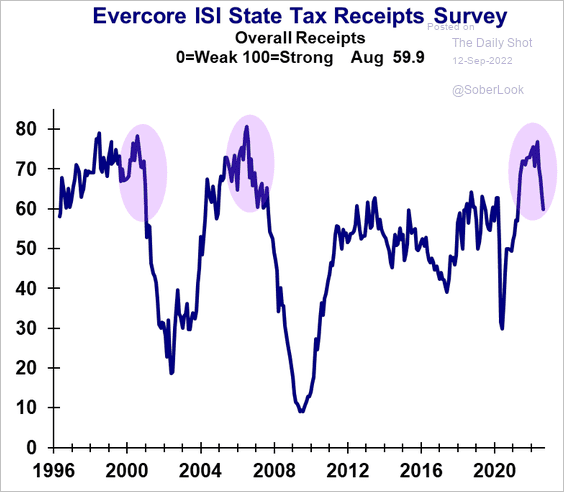

• State tax receipts are slowing.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

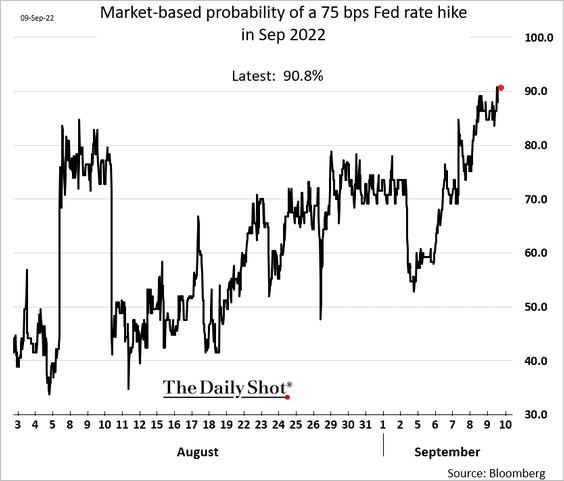

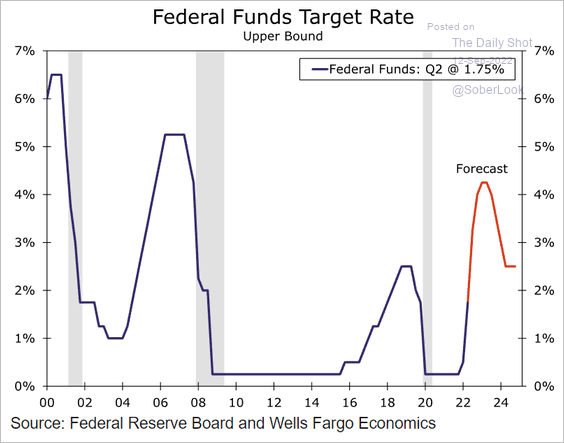

6. The markets are convinced that the Fed will lift rates by 75 bps this month.

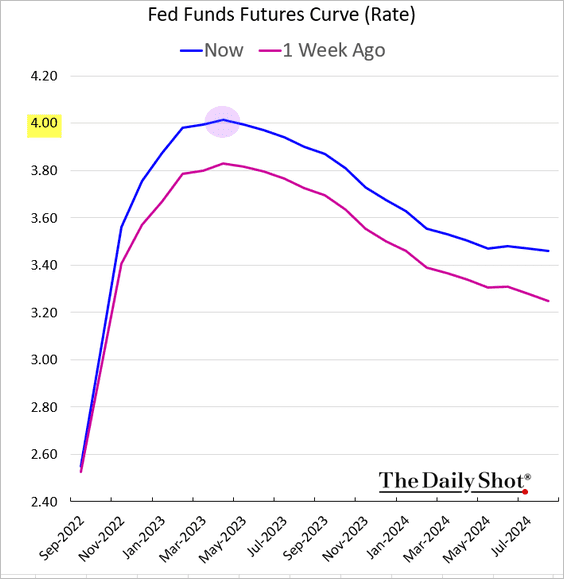

• Market pricing for the terminal rate is now above 4%.

Here is a forecast from Wells Fargo. Will the Fed be forced to cut rates in the second half of next year?

Source: Wells Fargo Securities

Source: Wells Fargo Securities

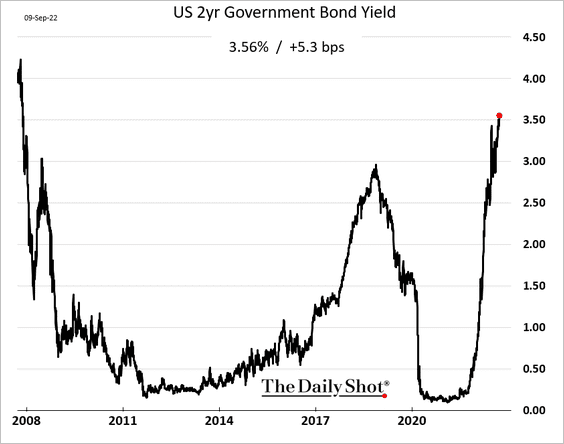

• The 2-year Treasury yield has risen above 3.5%.

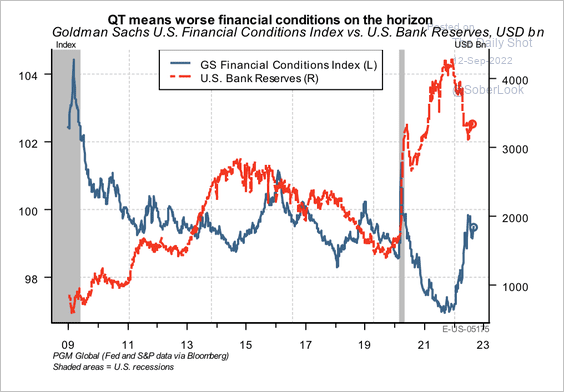

• Financial conditions could worsen as quantitative tightening accelerates.

Source: PGM Global

Source: PGM Global

Back to Index

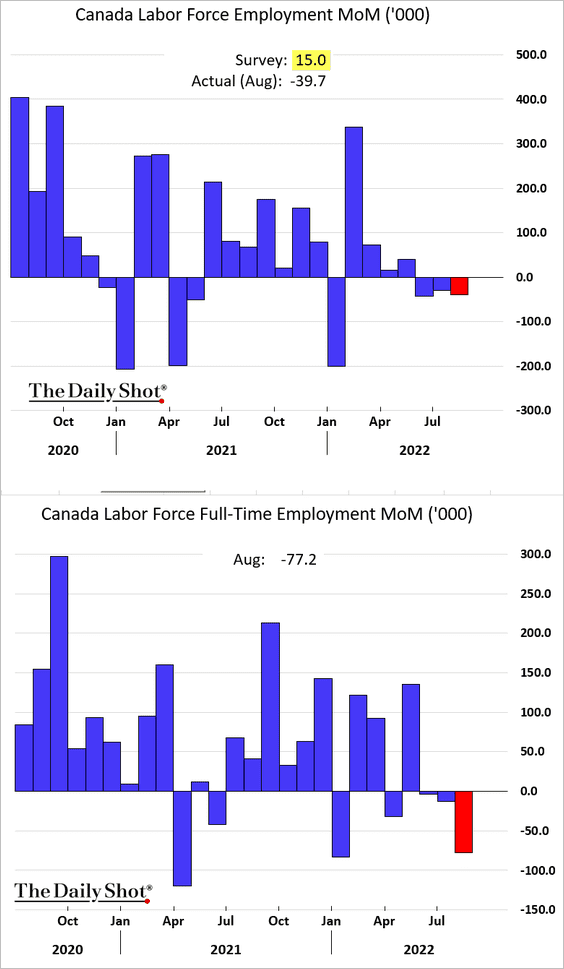

Canada

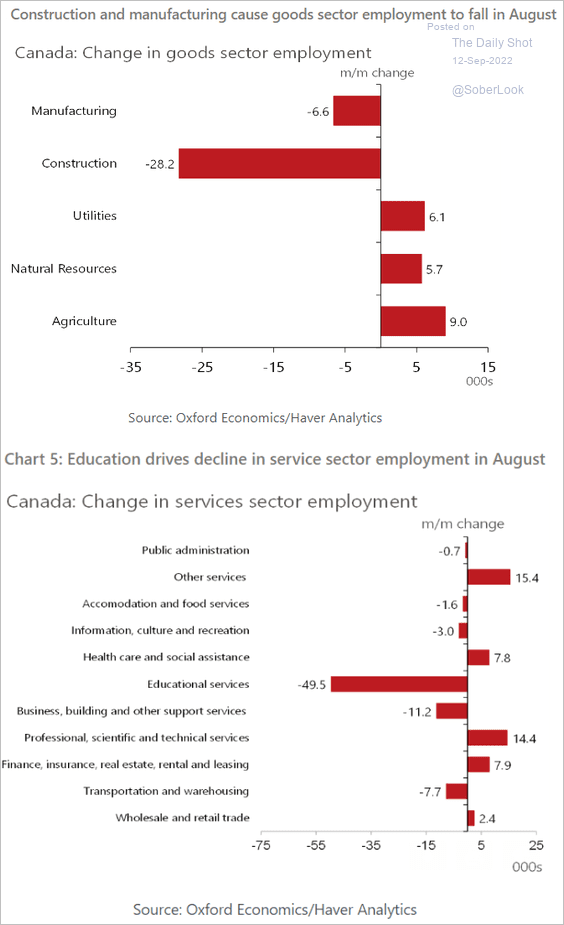

1. The employment report surprised to the downside. That’s three months of job losses in a row.

Construction and education drove last month’s employment losses.

Source: Oxford Economics

Source: Oxford Economics

• The unemployment rate jumped.

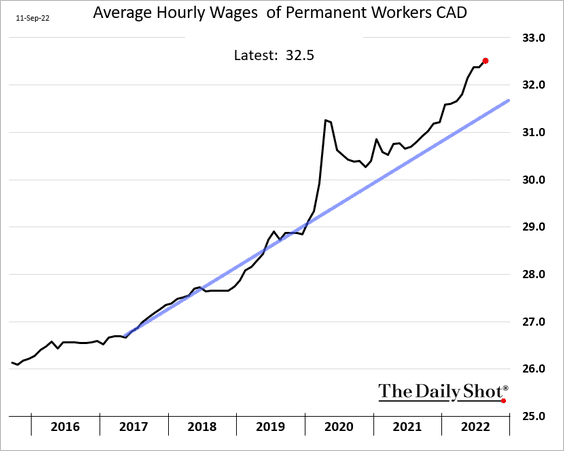

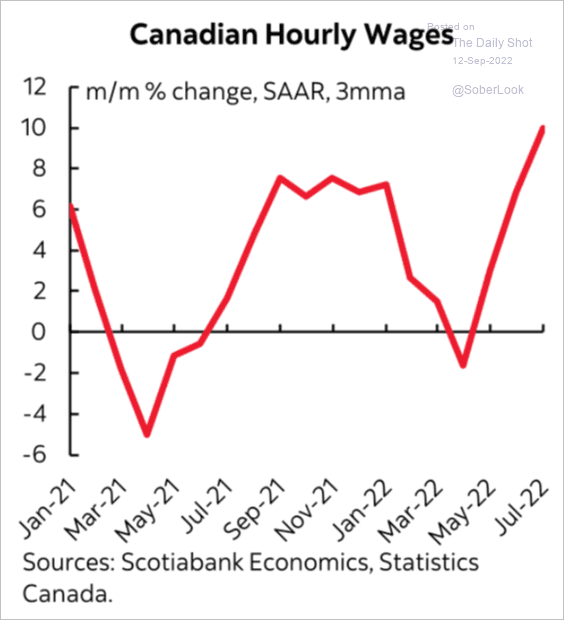

• Wage growth remains well above pre-COVID levels, which will be the BoC’s key focus.

Source: Scotiabank Economics

Source: Scotiabank Economics

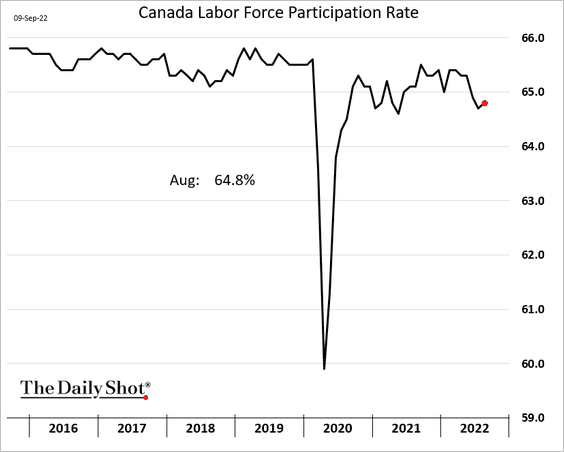

• The participation rate edged higher.

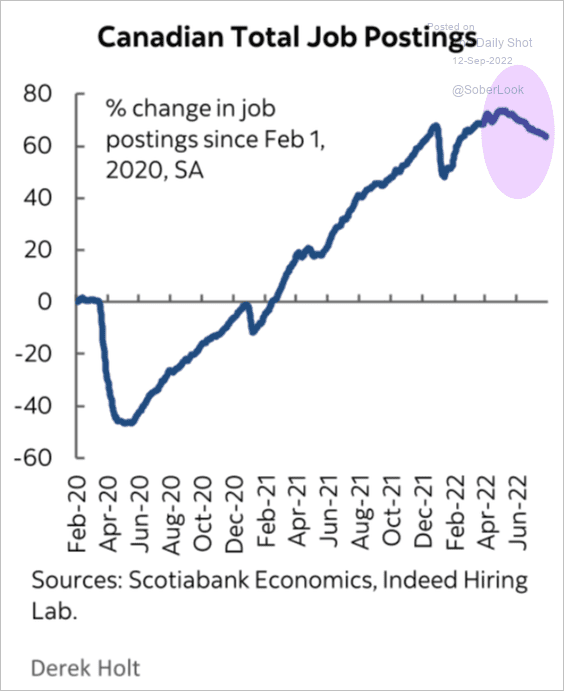

• Job postings are trending down.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

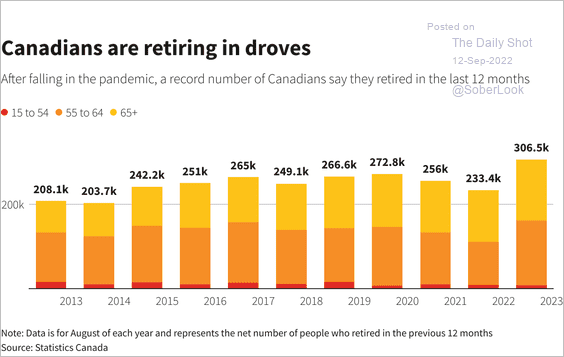

2. Retirements have accelerated

Source: Reuters Read full article

Source: Reuters Read full article

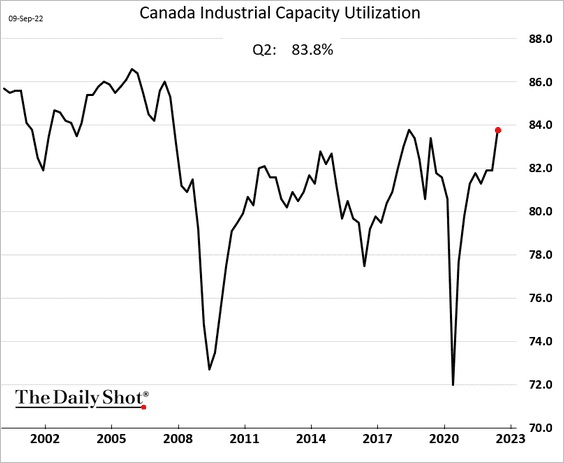

3. Capacity utilization surged in Q2 (but probably declined this quarter).

Back to Index

The United Kingdom

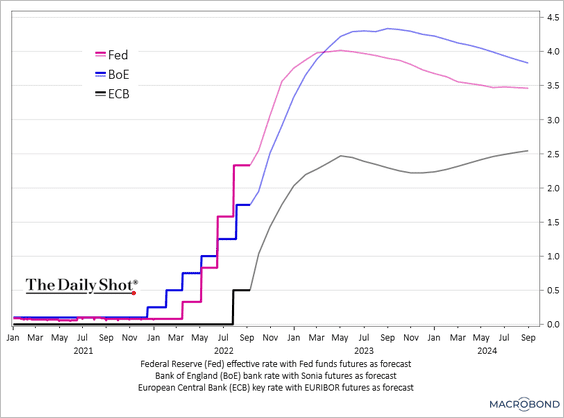

1. BoE rate hikes are expected to outpace the Fed’s tightening.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

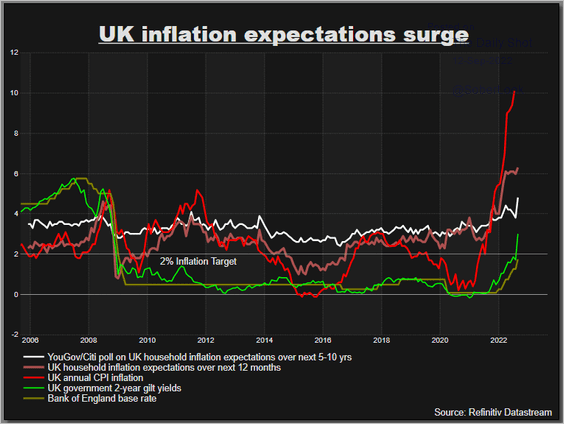

2. Inflation expectations have been rising.

Source: Reuters Read full article

Source: Reuters Read full article

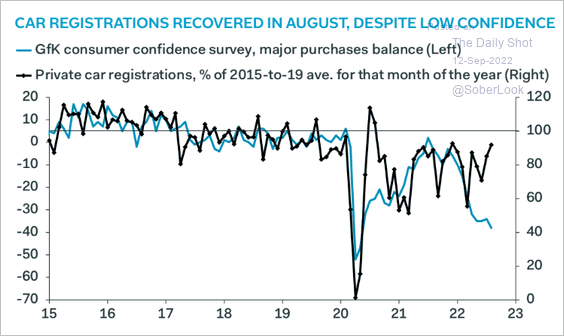

3. Car purchases have been holding up despite collapsing consumer sentiment.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

The Eurozone

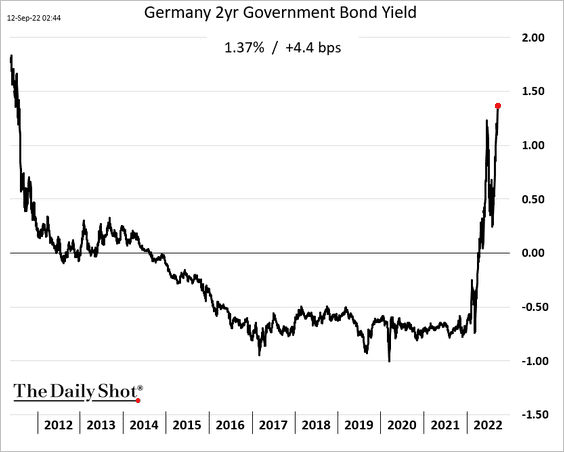

1. Market expectations for the ECB rate at the end of the year continue to climb.

Here is the 2-year Bund.

——————–

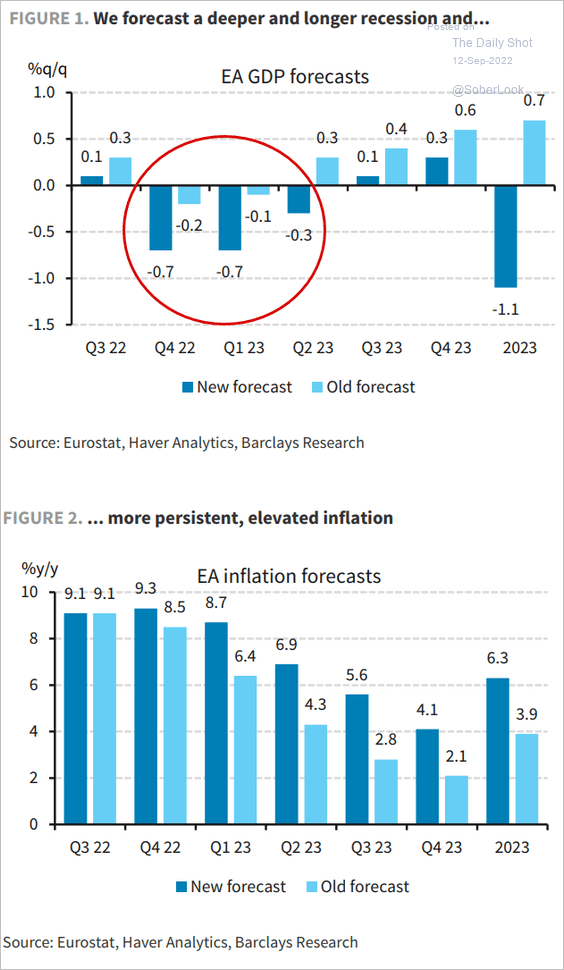

2. A deep recession is coming, according to Barclays.

Source: Barclays Research

Source: Barclays Research

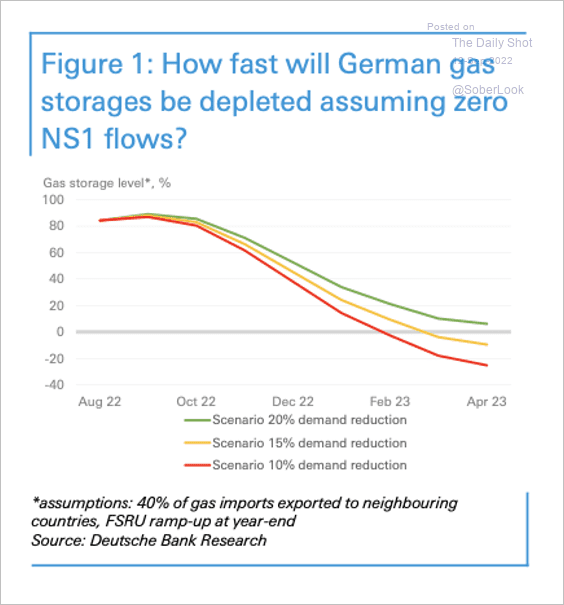

3. Even with a 20% demand reduction, Germany’s gas storage would be largely depleted at the end of the winter season, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

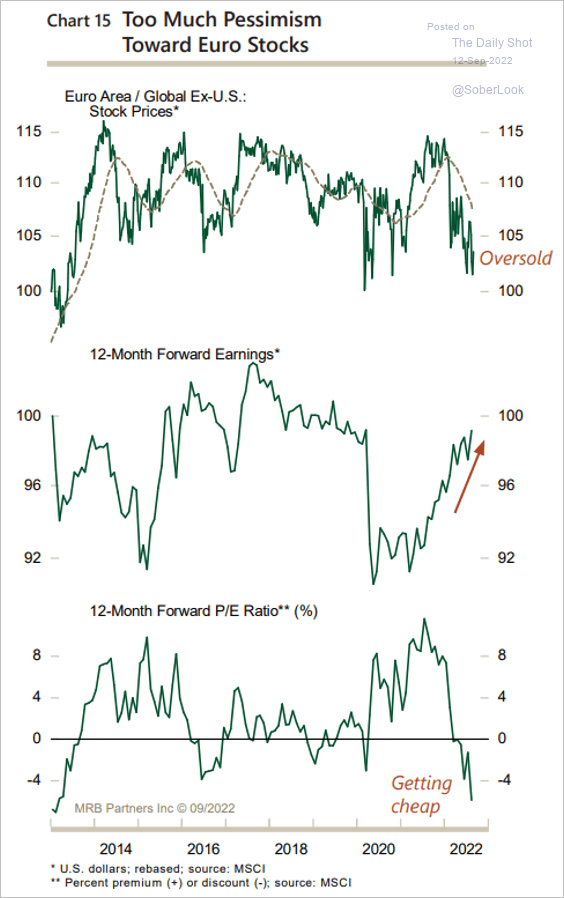

4. Are euro-area shares oversold?

Source: MRB Partners

Source: MRB Partners

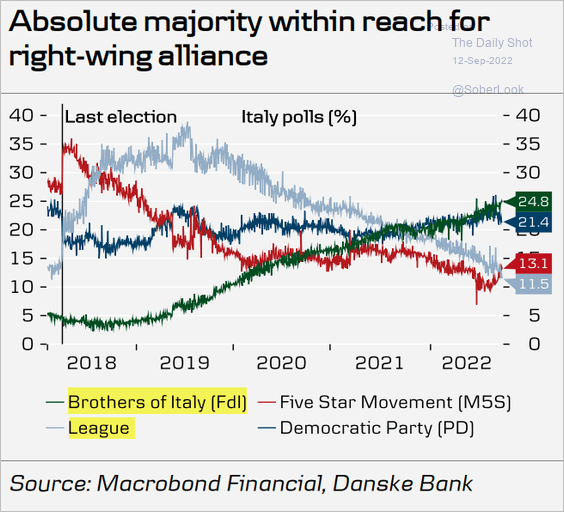

5. Italy’s right-wing parties could get an absolute majority.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Danske Bank

Source: Danske Bank

Back to Index

Europe

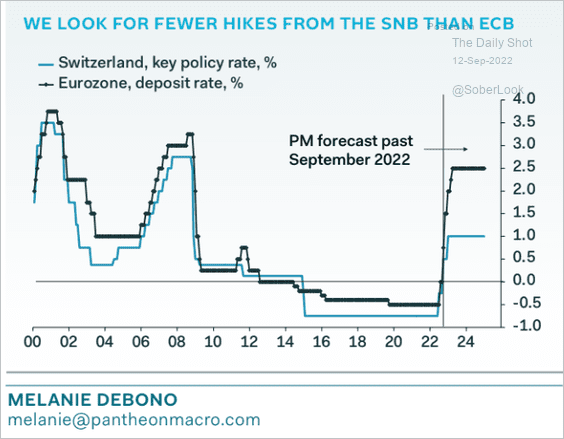

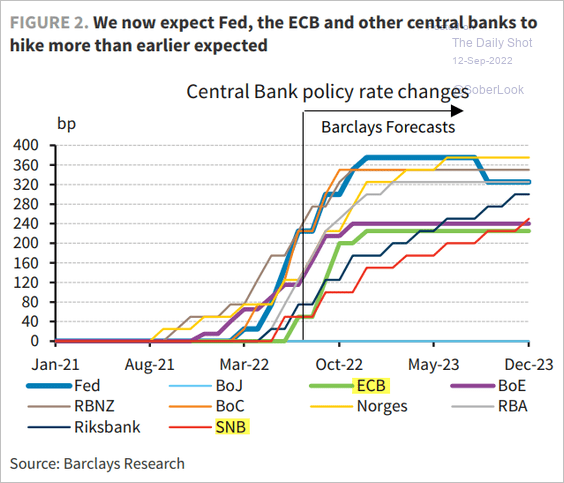

1. Will the SNB rate hikes lag the ECB?

• Pantheon Macroeconomics:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Barclays:

Source: Barclays Research

Source: Barclays Research

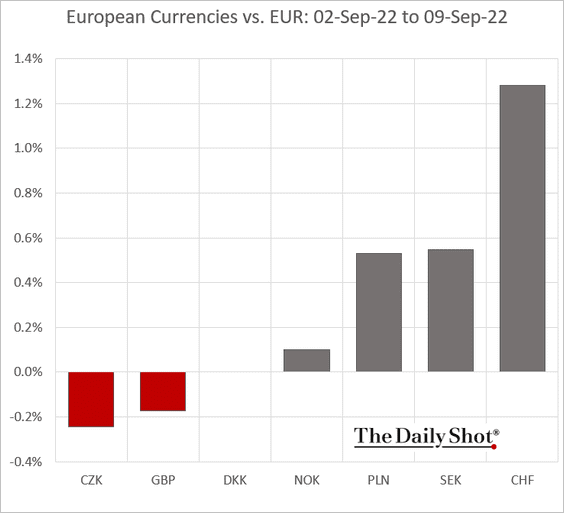

The Swiss franc outperformed other European currencies last week.

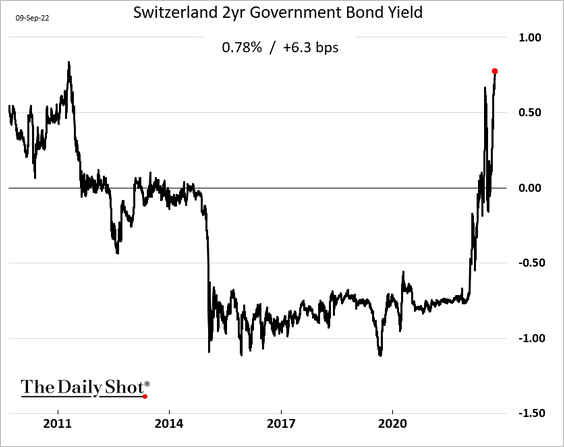

The 2-year yield hit the highest level in over a decade.

——————–

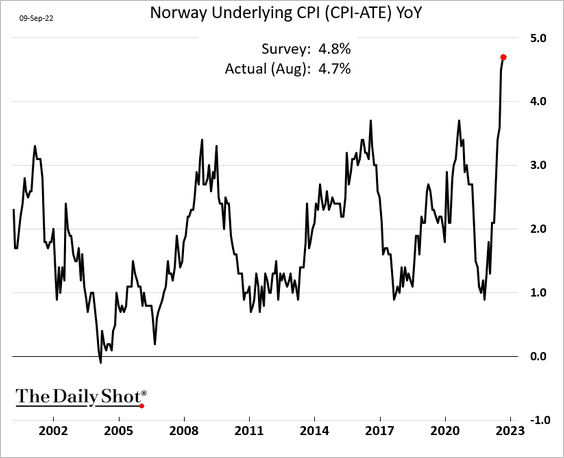

2. Norway’s underlying inflation continued to climb last month.

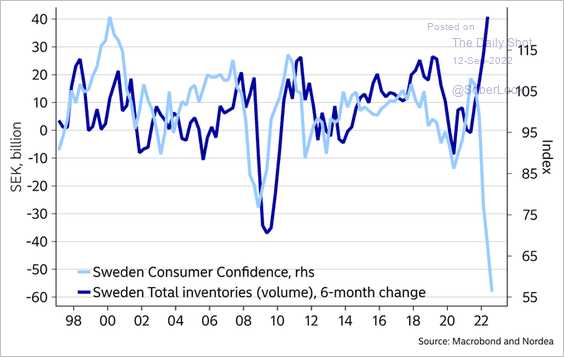

3. Sweden’s rising inventories and record-low consumer confidence is not a good mix.

Source: @MikaelSarwe

Source: @MikaelSarwe

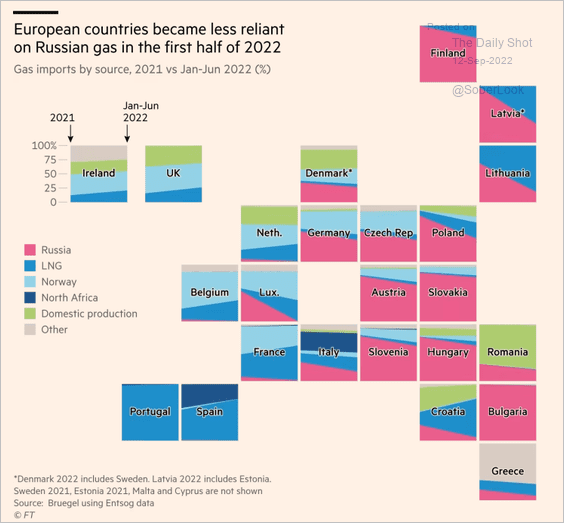

4. European countries reduced their reliance on Russian natural gas in the first half of the year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

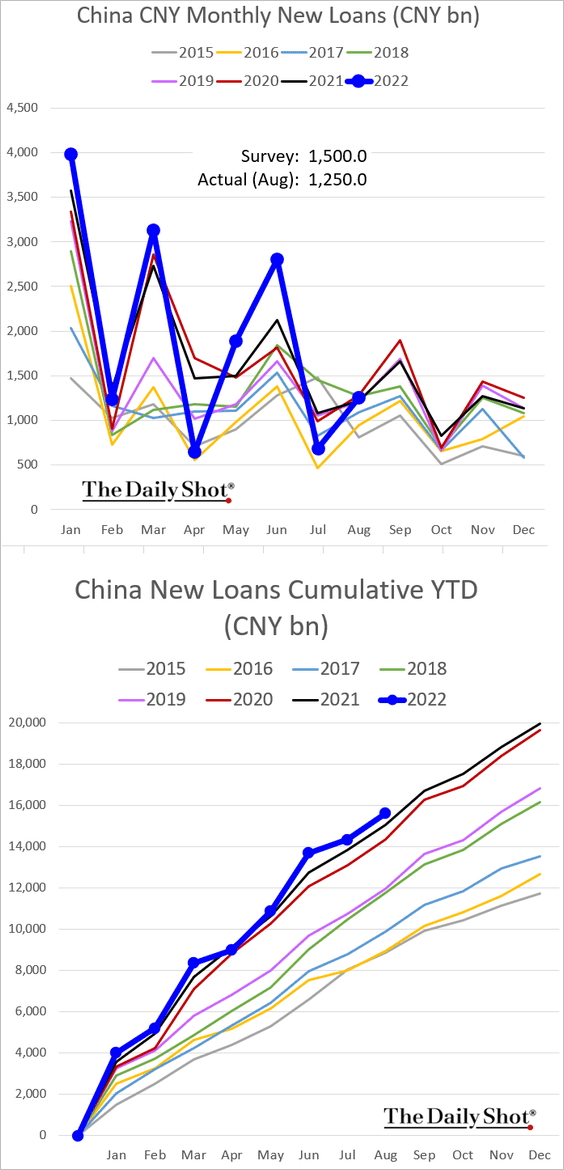

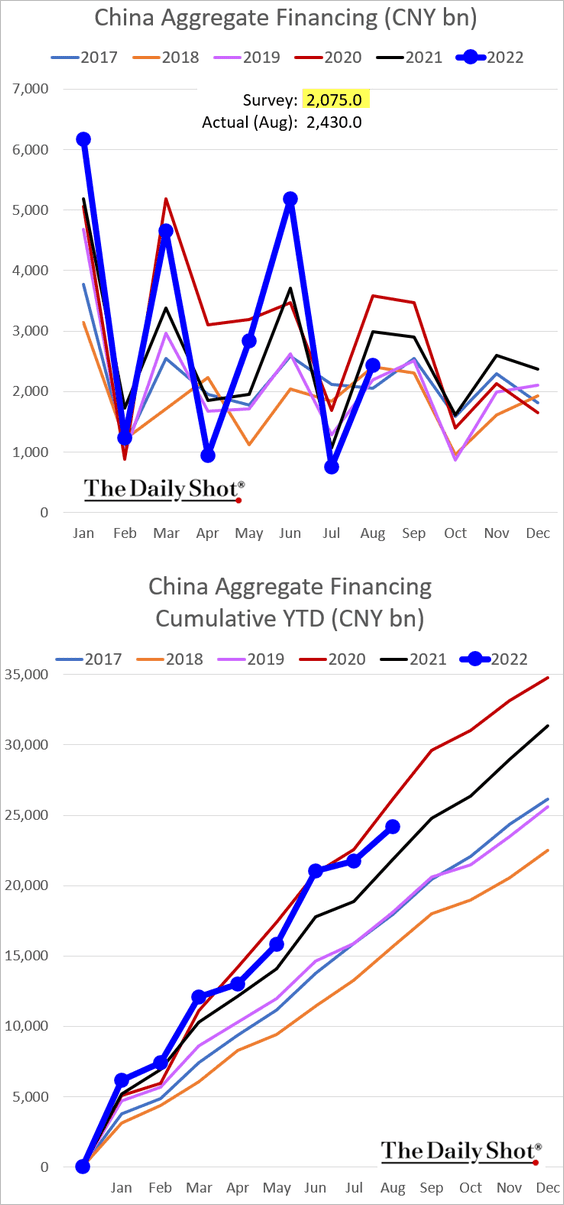

China

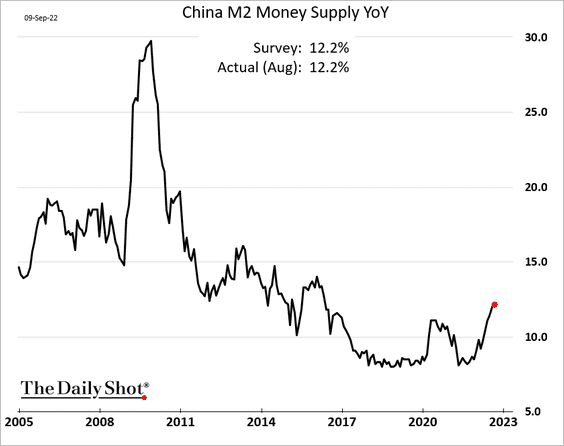

1. Bank loan growth was softer than expected last month.

But total credit surprised to the upside.

The money supply expansion continues to improve.

——————–

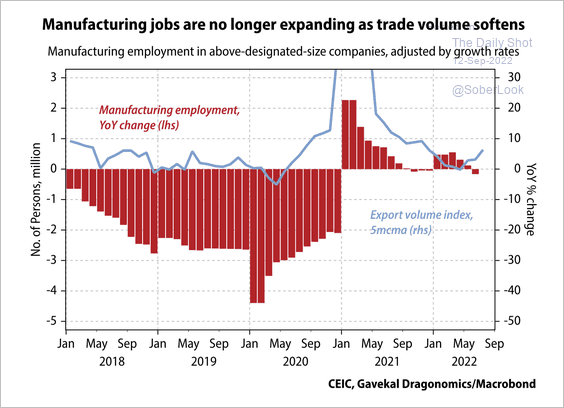

2. Manufacturing jobs were rising despite the pandemic but have recently started to lose steam.

Source: Gavekal Research

Source: Gavekal Research

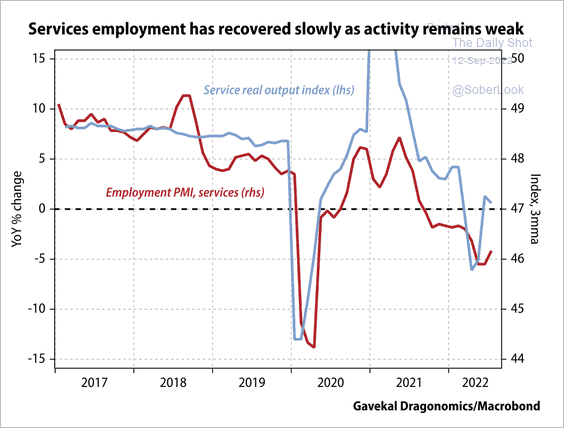

Hiring in the service sector has been weak, albeit with marginal improvement in recent months.

Source: Gavekal Research

Source: Gavekal Research

——————–

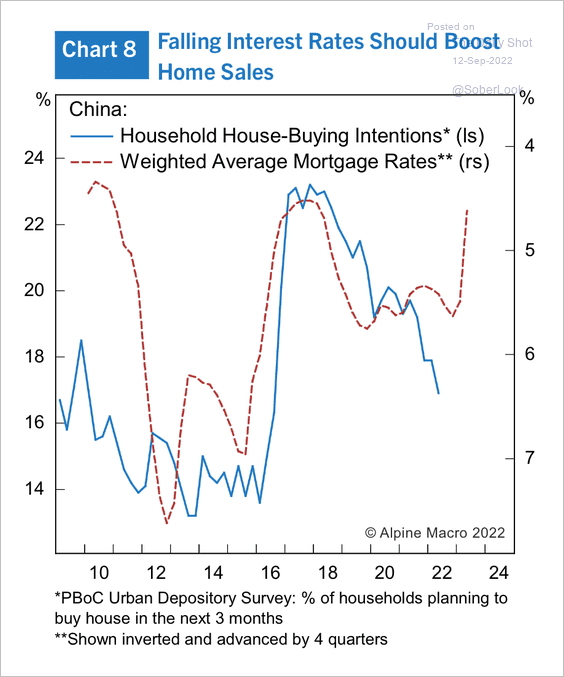

3. Home purchase intention could improve as mortgage rates decline.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Emerging Markets

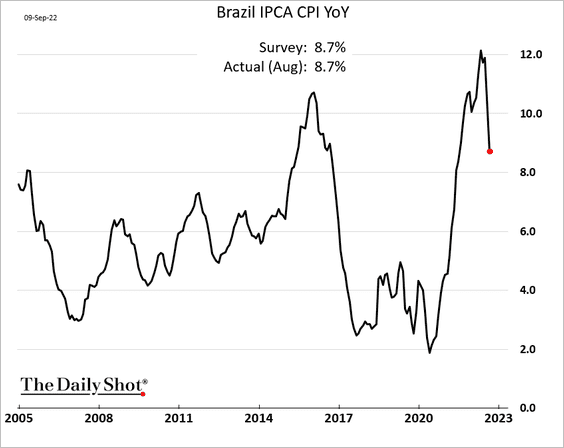

1. Brazil’s inflation has been moderating.

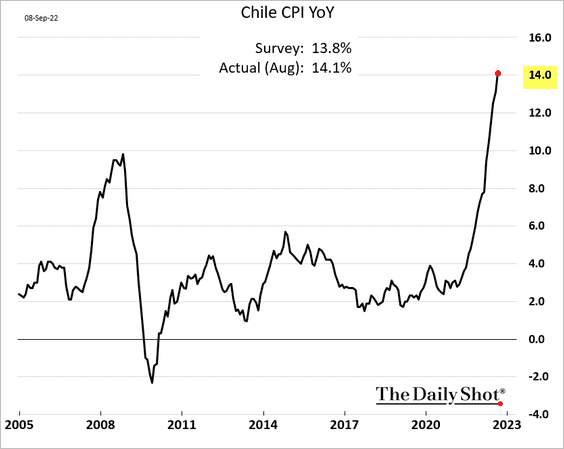

2. But Chile’s CPI climbed above 14%.

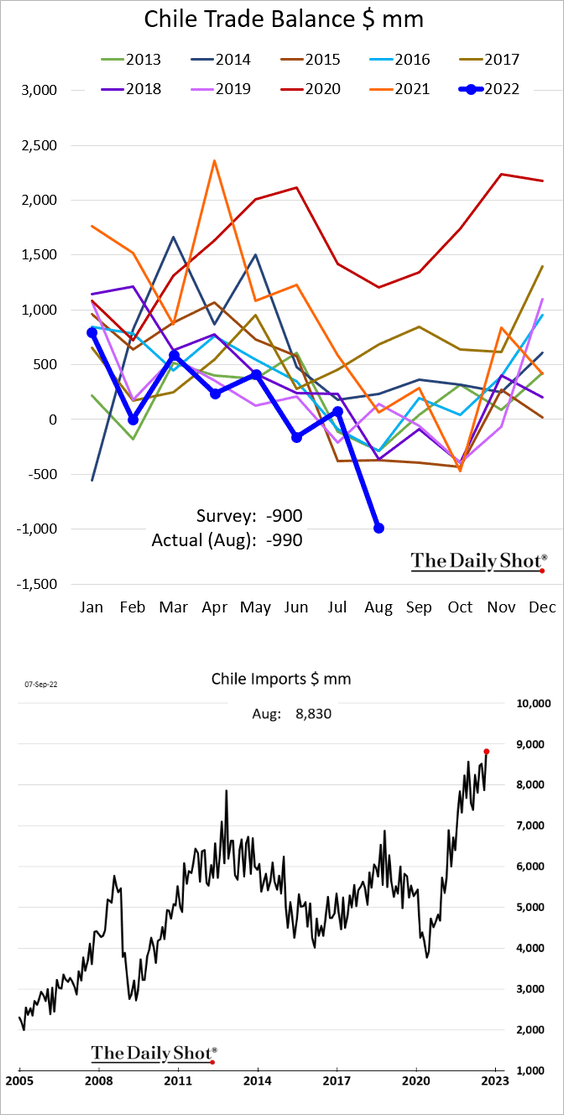

• Chile’s trade balance has been deteriorating as imports surge.

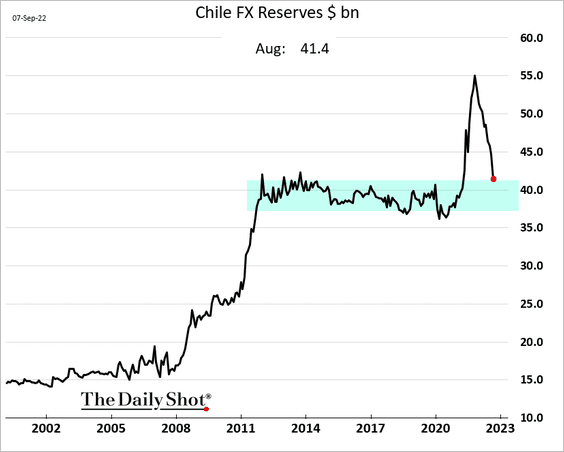

• FX reserves are rapidly returning to pre-COVID levels.

——————–

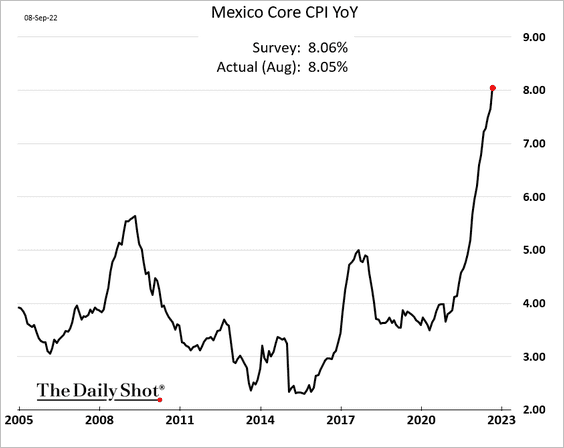

3. Mexico’s core CPI is above 8%.

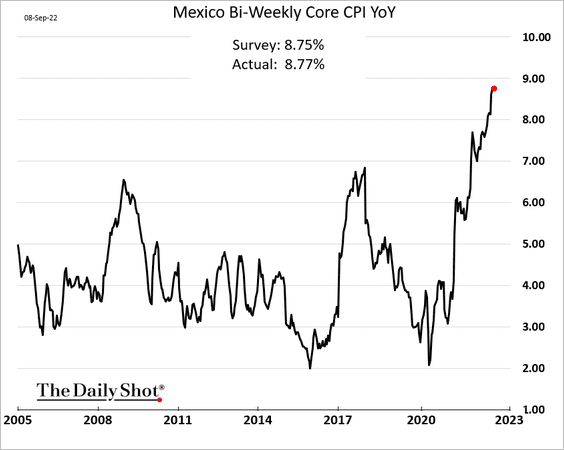

Here is the biweekly index.

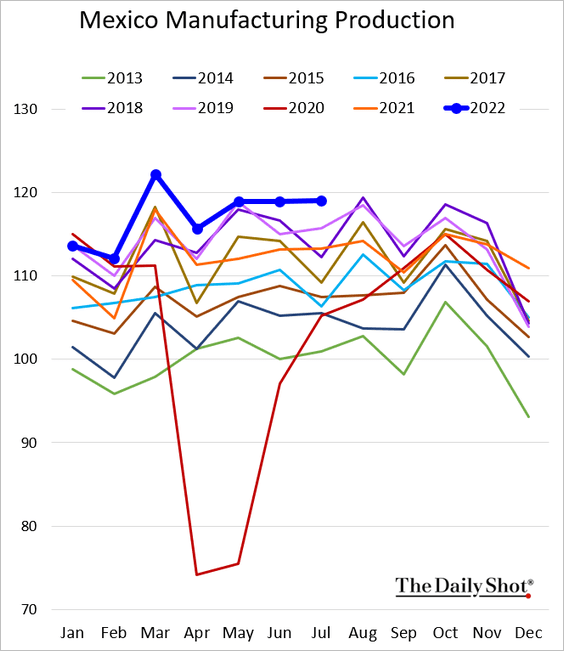

Separately, Mexico’s factory output remains robust.

——————–

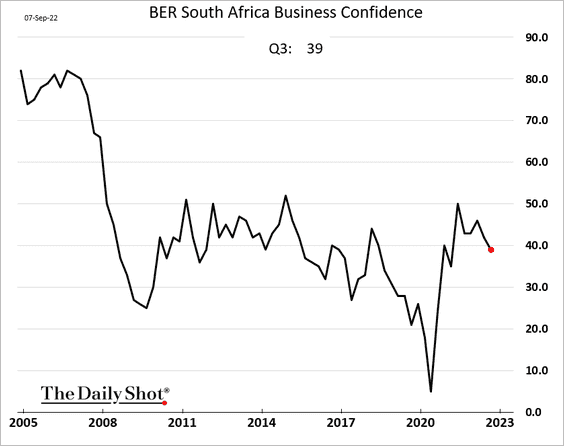

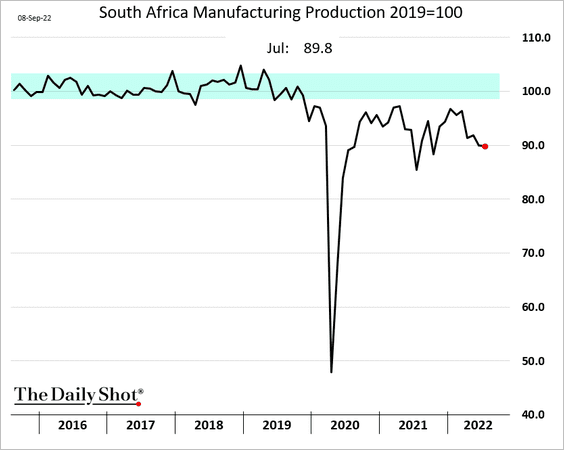

4. South Africa’s business confidence is rolling over.

Manufacturing output remains soft.

——————–

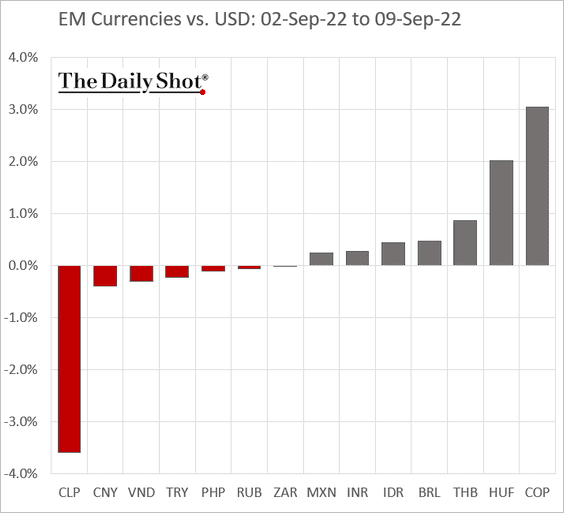

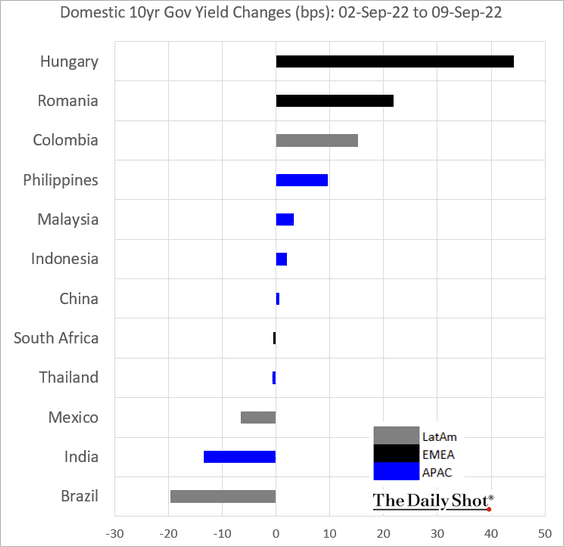

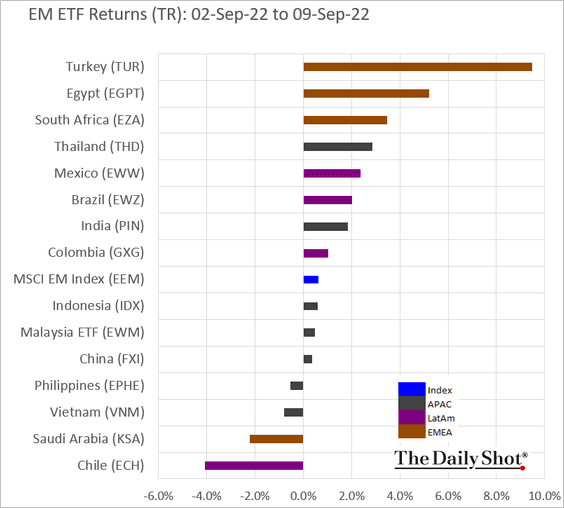

5. Next, we have some performance data from last week.

• Currencies:

• Domestic bond yields:

• Equity ETFs:

Back to Index

Commodities

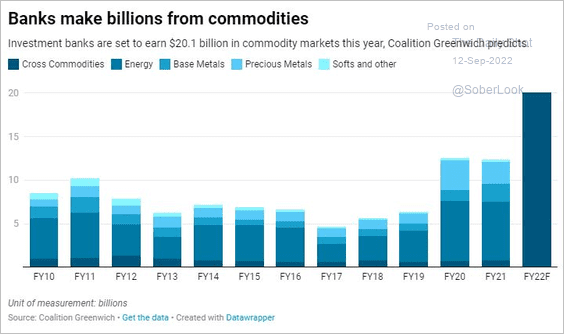

1. Commodity trading has been profitable for banks this year.

Source: Reuters Read full article

Source: Reuters Read full article

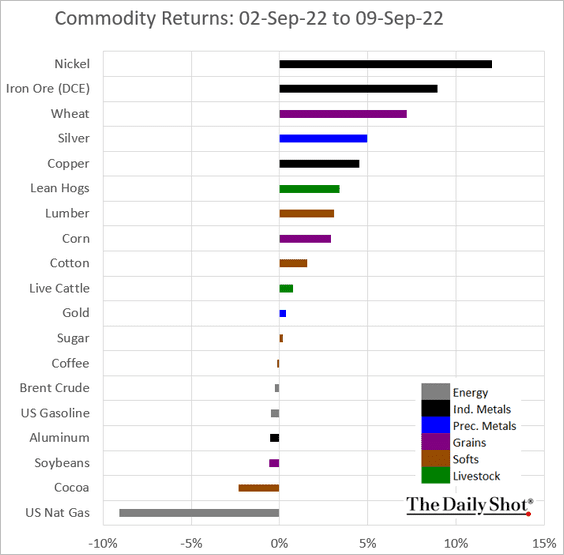

2. Here is last week’s performance across key commodity markets.

Back to Index

Energy

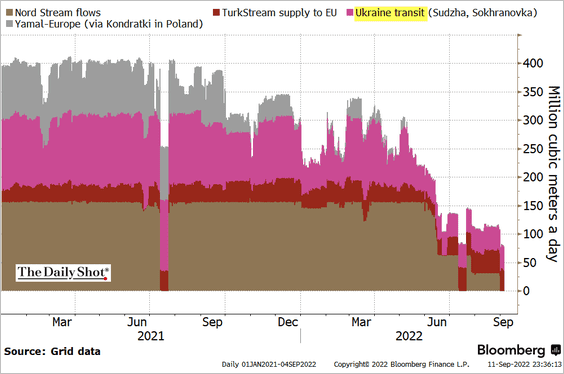

1. For now, Russian natural gas flows via Ukraine are holding, even as Nord Stream flows have been halted.

How long will this last?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

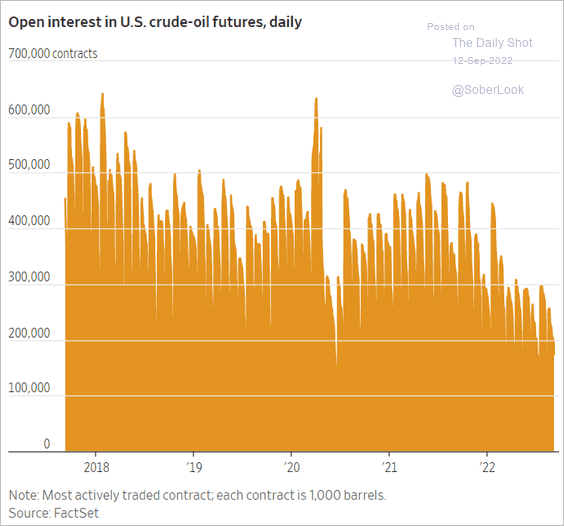

2. Open interest in US crude oil futures has been trending lower.

Source: @WSJ Read full article

Source: @WSJ Read full article

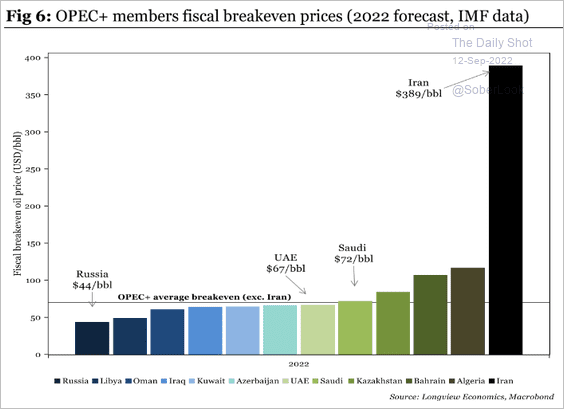

3. This chart shows the OPEC+ fiscal breakeven crude oil prices.

Source: Longview Economics

Source: Longview Economics

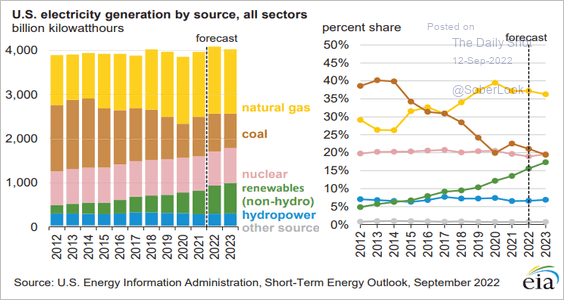

4. Finally, we have US electricity generation by source.

Source: @EIAgov

Source: @EIAgov

Back to Index

Equities

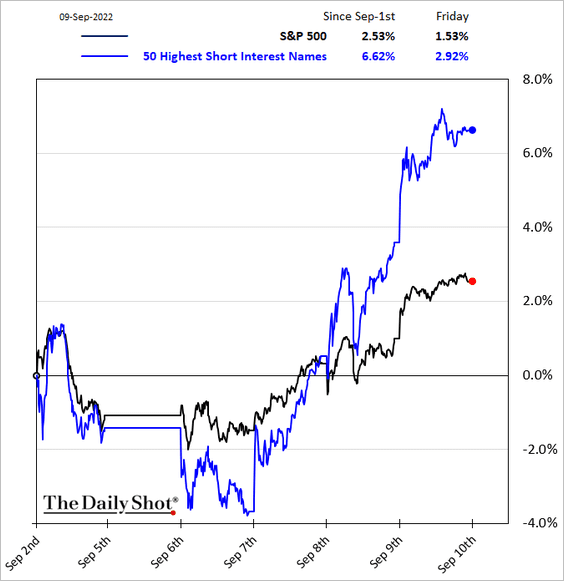

1. Short-covering gave stocks a boost last week.

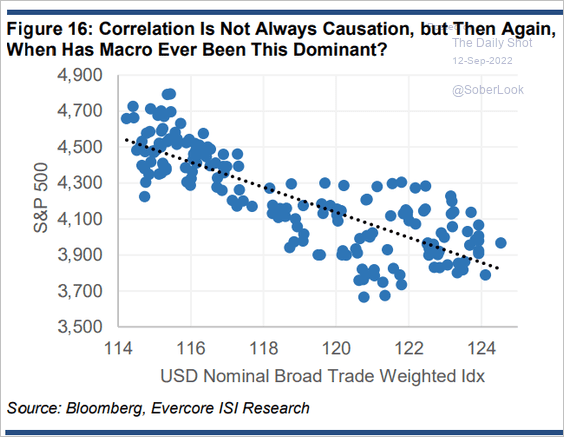

2. The stalling US dollar rally was also a tailwind for stocks.

Source: Evercore ISI Research

Source: Evercore ISI Research

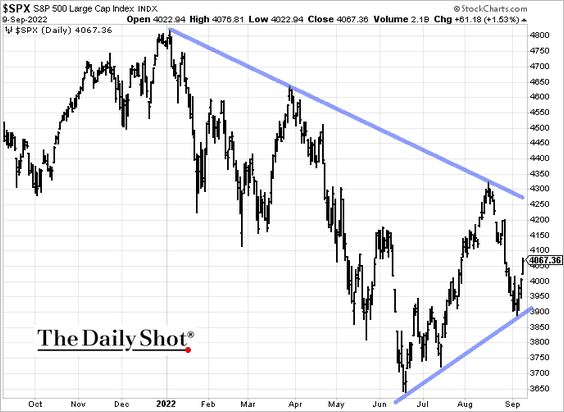

3. The S&P 500 is in a wedge pattern.

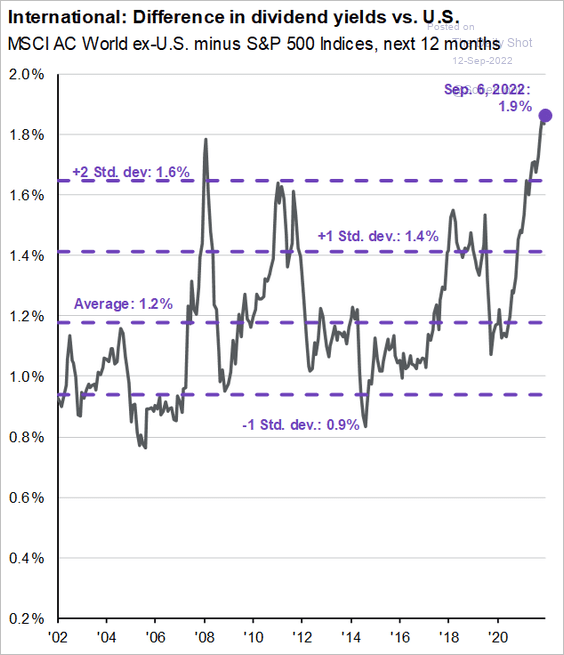

4. The S&P 500 dividend yield increasingly lags international peers.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

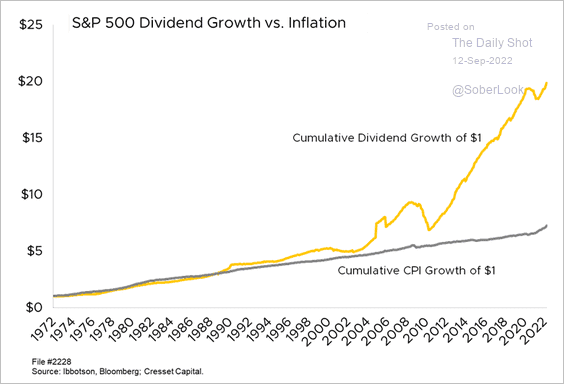

5. S&P 500 dividend growth has massively outpaced inflation since the financial crisis.

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

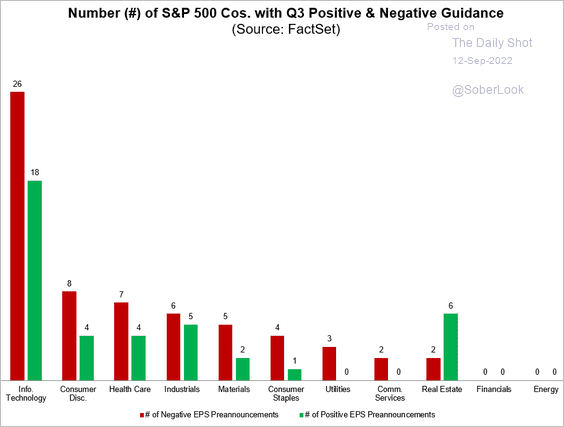

6. A majority of companies have been providing negative Q3 EPS guidance.

Source: @FactSet Read full article

Source: @FactSet Read full article

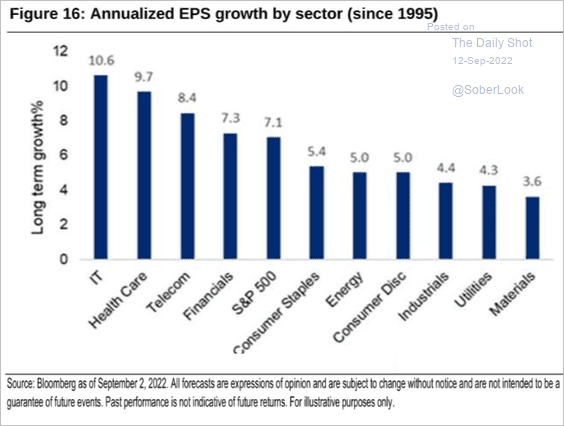

This chart shows EPS growth by sector since 1995.

Source: Citi Private Bank

Source: Citi Private Bank

——————–

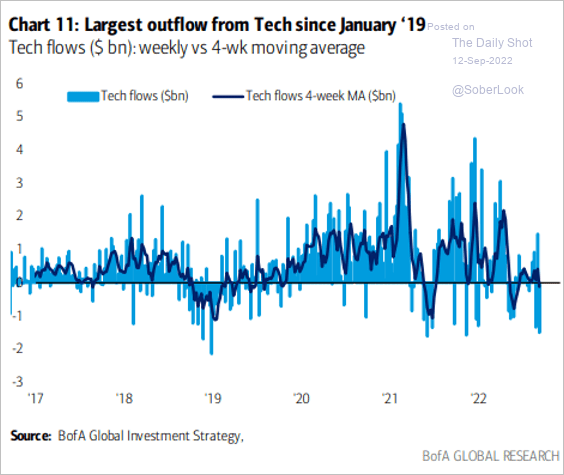

7. Tech outflows accelerated in recent weeks.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: BofA Global Research

Source: BofA Global Research

——————–

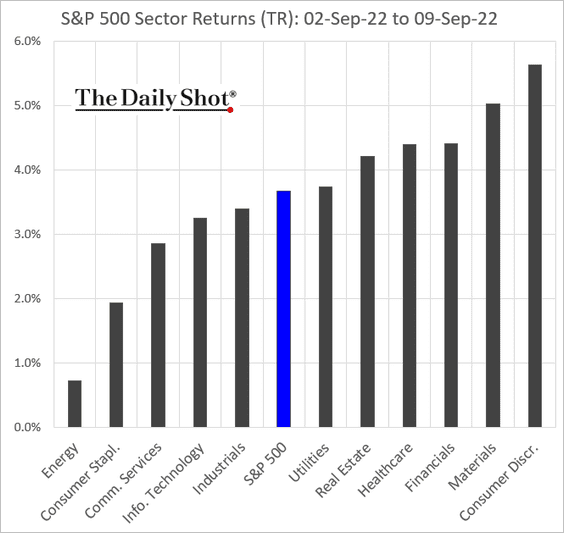

8. Next, we have some performance data from last week.

• Sectors:

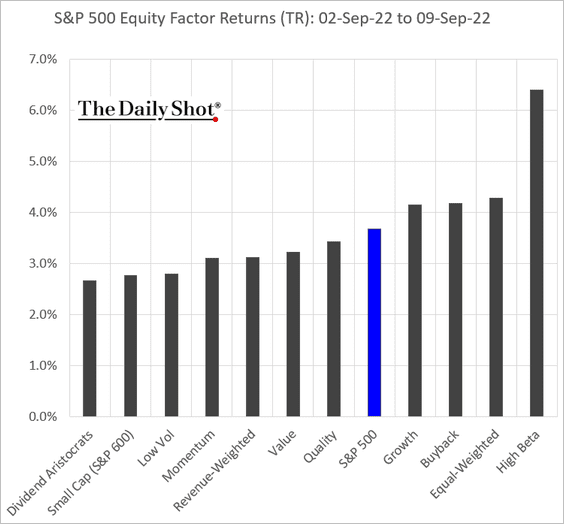

• Equity factors:

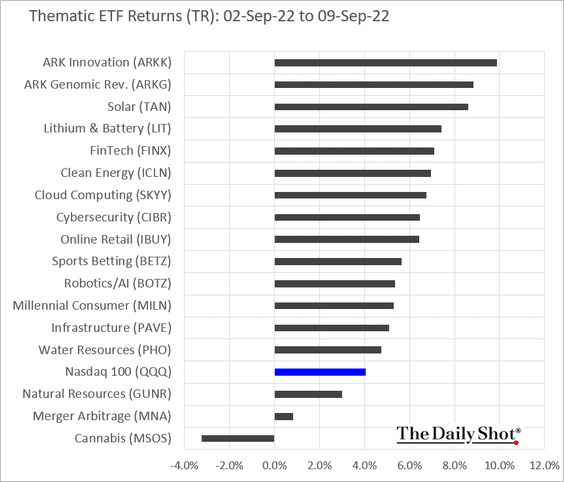

• Thematic ETFs:

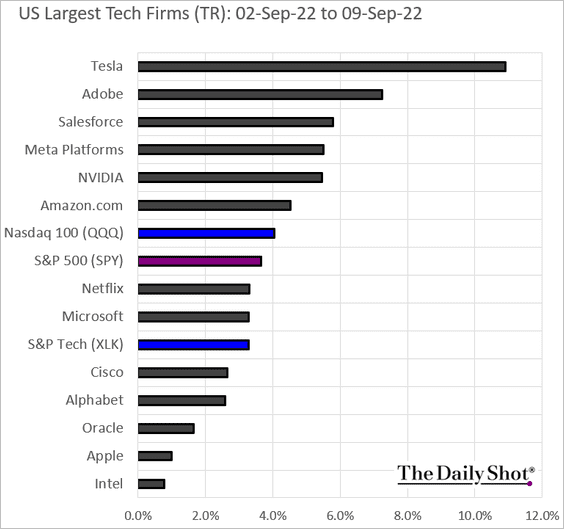

• Largest tech firms:

Back to Index

Credit

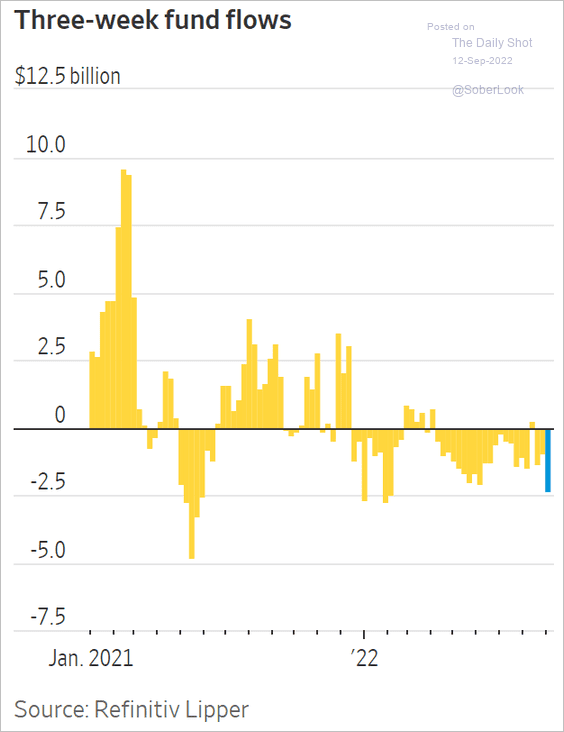

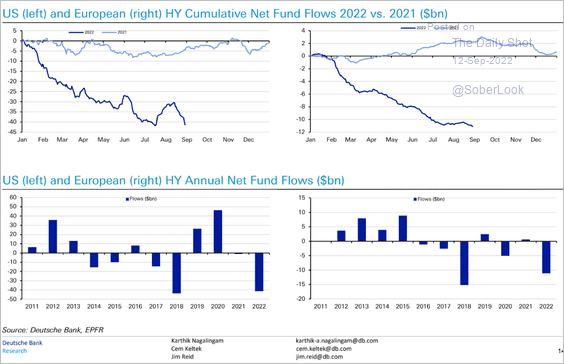

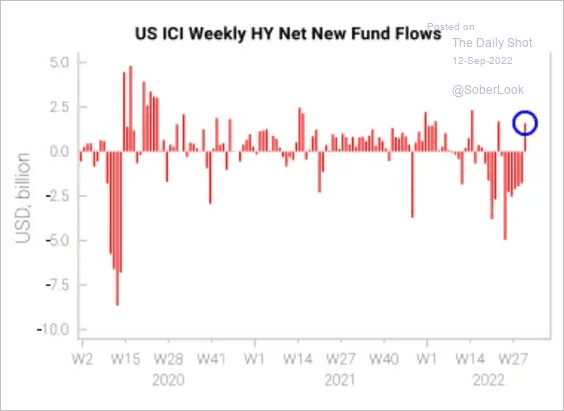

1. High-yield outflows have been extreme.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

But we finally got some inflows last week.

Source: Variant Perception

Source: Variant Perception

——————–

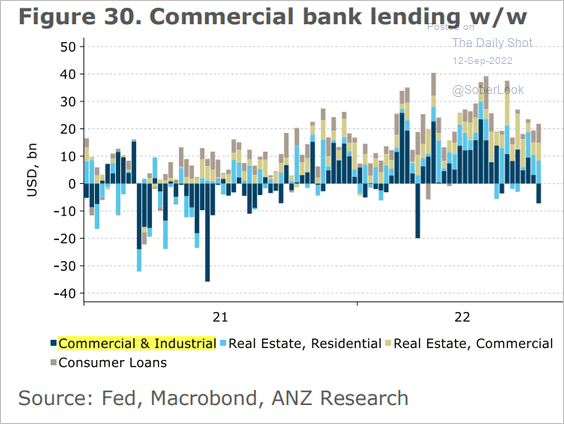

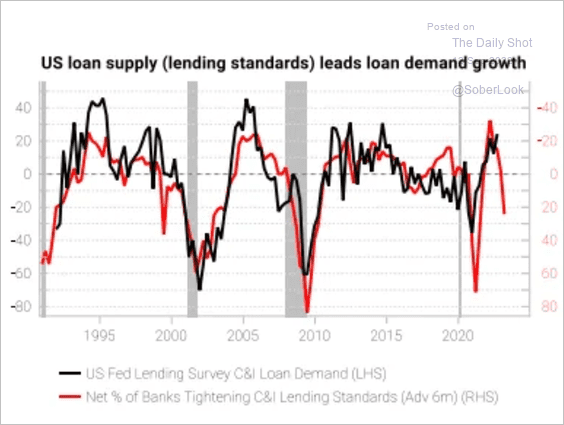

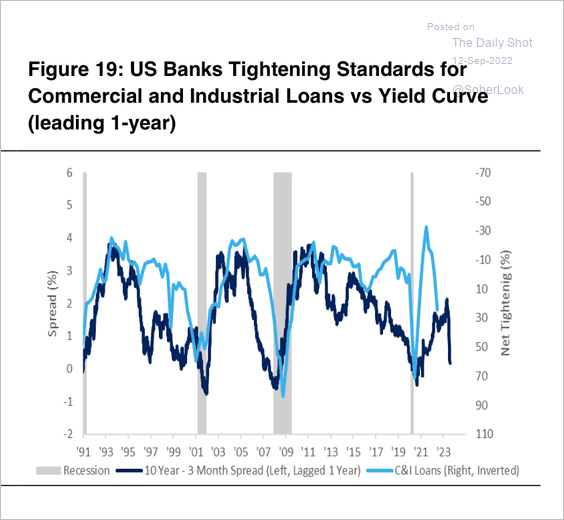

2. Business loan growth turned negative last week.

Source: @ANZ_Research

Source: @ANZ_Research

We could see further declines in the months ahead.

Source: Variant Perception

Source: Variant Perception

Source: Citi Private Bank

Source: Citi Private Bank

——————–

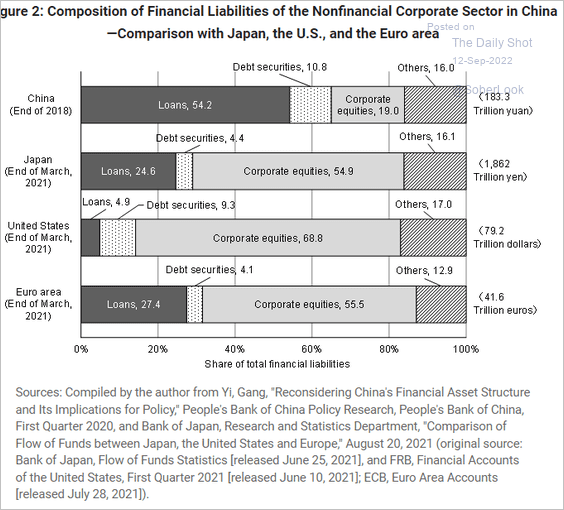

3. Here is the distribution of corporate sector liabilities in the largest economies.

Source: RIETI Read full article

Source: RIETI Read full article

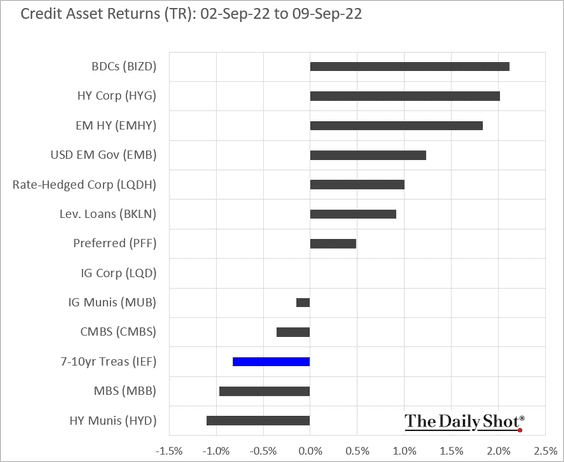

4. Finally, we have last week’s performance data by asset class.

Back to Index

Rates

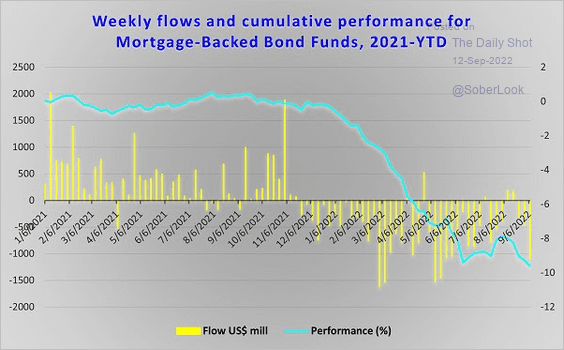

1. MBS funds saw significant outflows last week, continuing the trend we’ve seen much of the year.

Source: EPFR Global Navigator

Source: EPFR Global Navigator

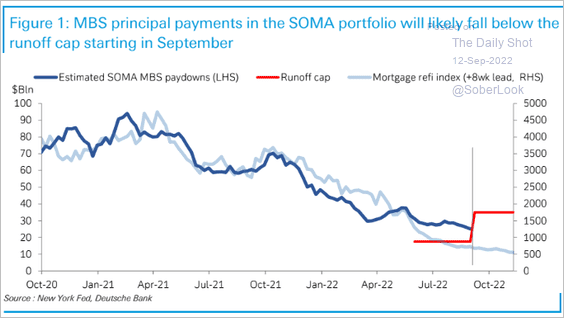

2. Mortgage refi activity has declined sharply. As a result, MBS debt on Fed’s balance sheet will take much longer to amortize, slowing QT.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

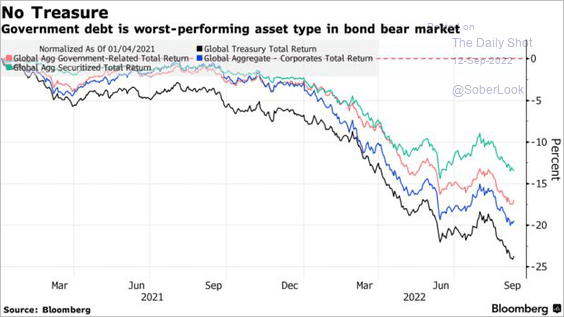

3. Global government bonds have underperformed other types of debt.

Source: @GarfieldR1966, @markets Read full article

Source: @GarfieldR1966, @markets Read full article

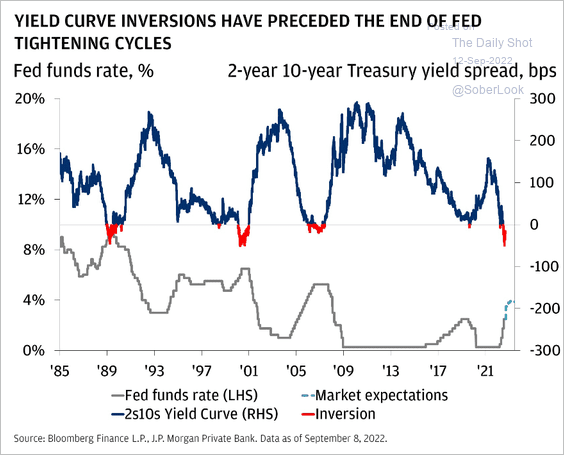

4. Yield curve inversions tend to precede the end of Fed tightening.

Source: JP Morgan Private Bank

Source: JP Morgan Private Bank

Back to Index

Global Developments

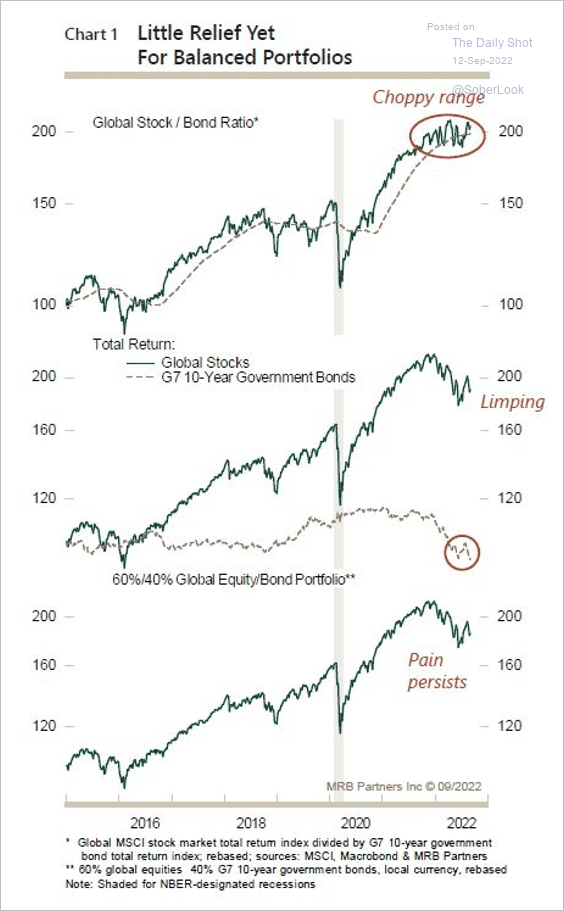

1. The global 60% equity/40% bond ratio remains challenged, especially given recent market swings.

Source: MRB Partners

Source: MRB Partners

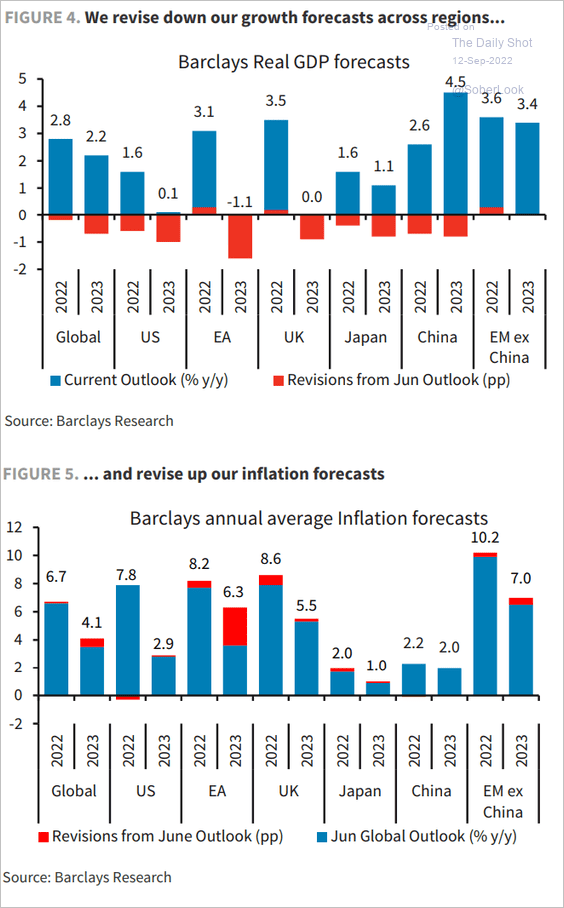

2. Barclays downgraded its global GDP growth estimate while boosting inflation forecasts.

Source: Barclays Research

Source: Barclays Research

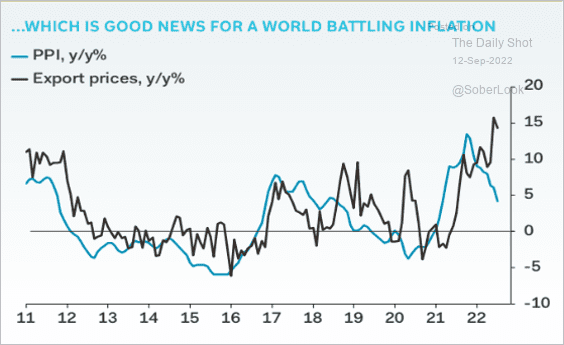

3. China’s tumbling PPI will help ease global price pressures.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

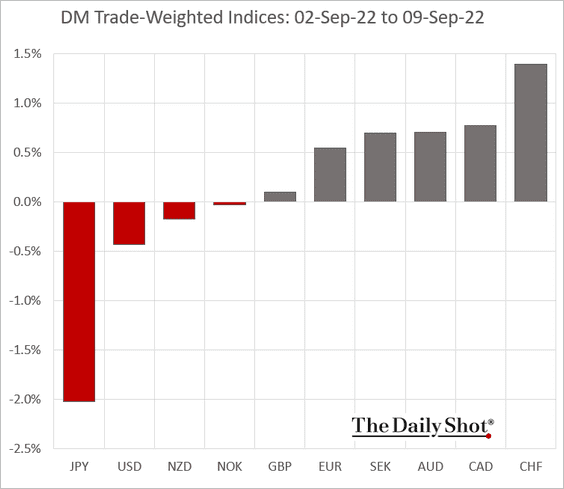

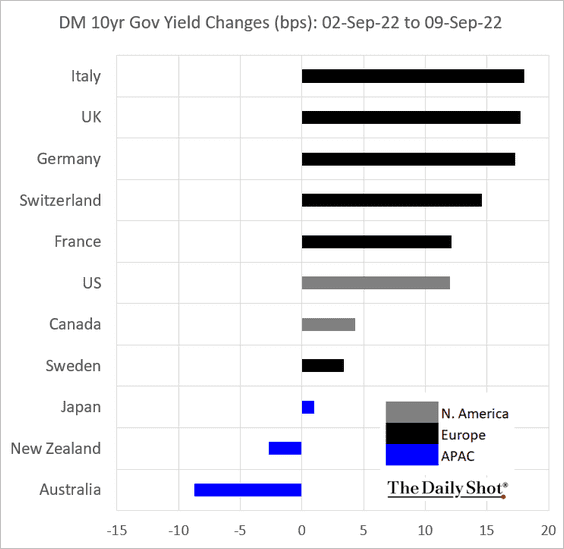

4. Next, we have some DM performance data from last week.

• Trade-weighted currency indices:

• Bond yields:

——————–

Food for Thought

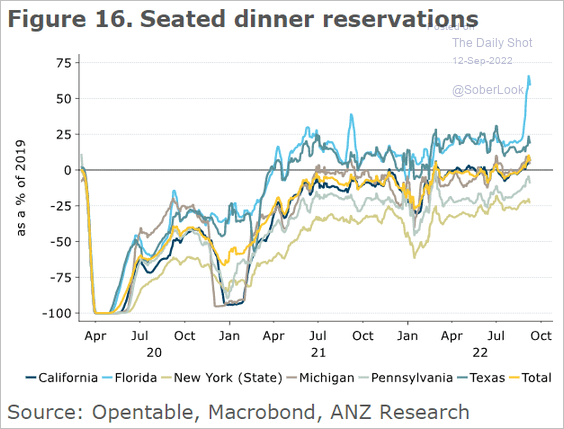

1. Restaurant reservations in select states:

Source: @ANZ_Research

Source: @ANZ_Research

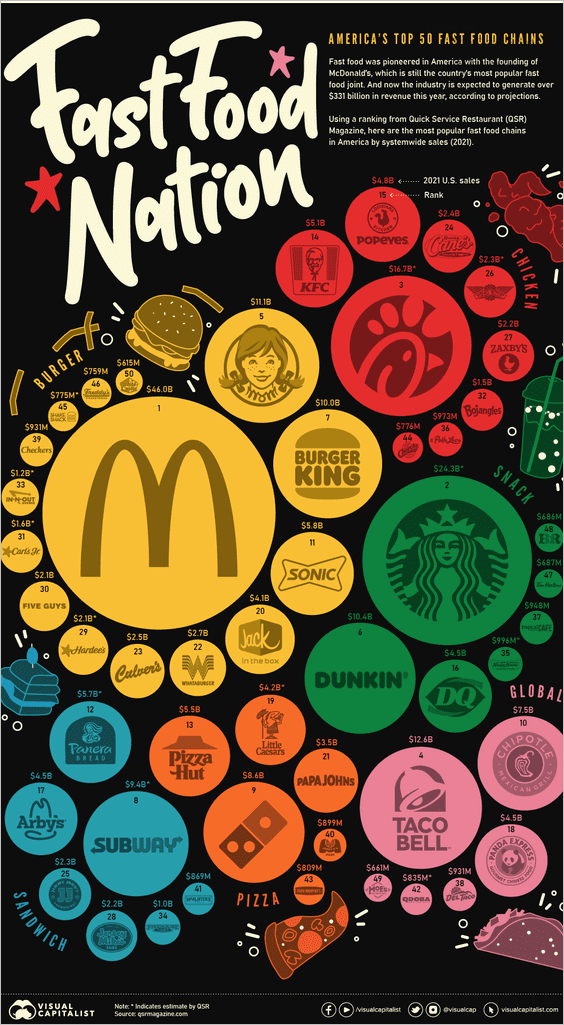

2. The most popular fast food brands:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

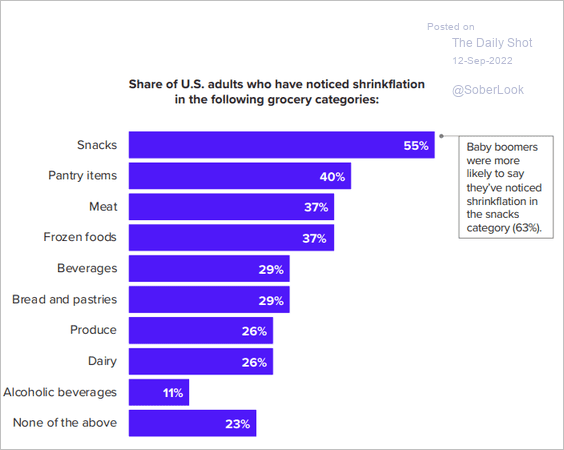

3. Shrinkflation:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

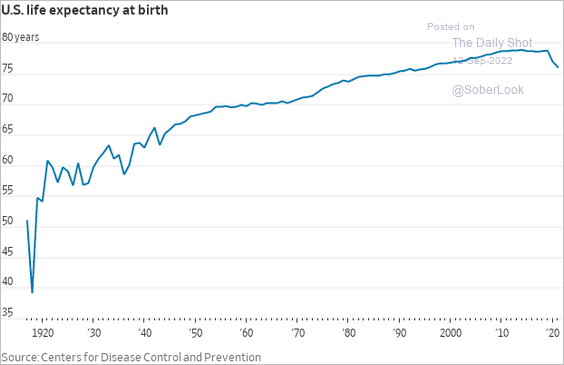

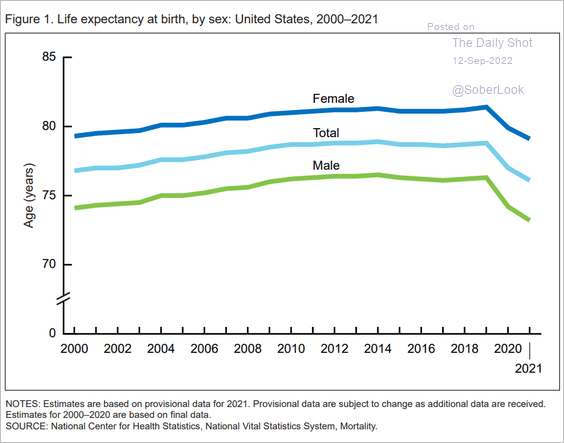

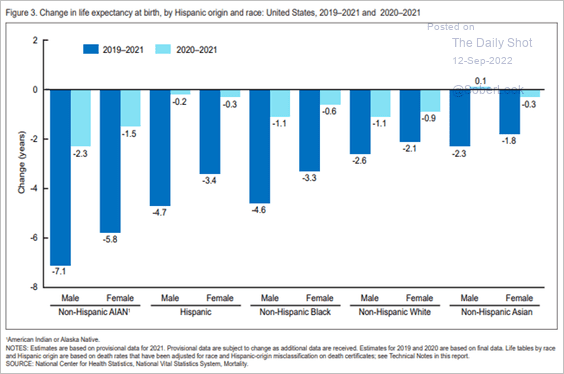

4. US life expectancy trends (3 charts):

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Centers for Disease Control and Prevention

Source: Centers for Disease Control and Prevention

Source: Centers for Disease Control and Prevention

Source: Centers for Disease Control and Prevention

——————–

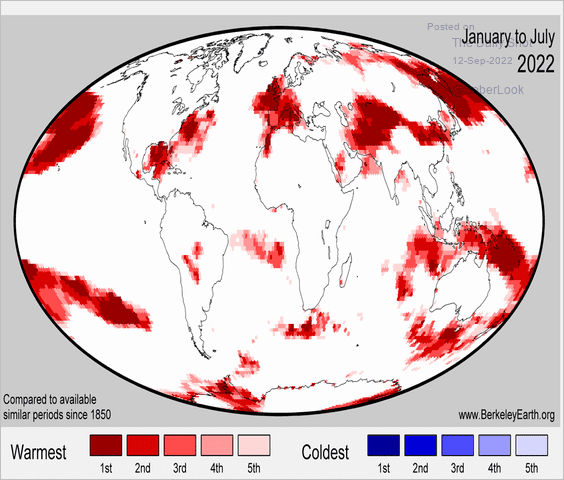

5. No areas of record cold in 2022:

Source: @ZLabe, @BerkeleyEarth Read full article

Source: @ZLabe, @BerkeleyEarth Read full article

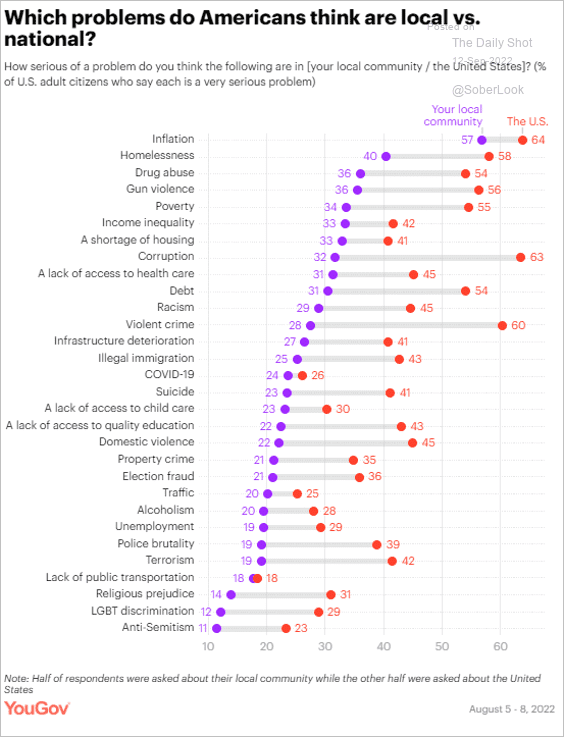

6. Local vs. national problems:

Source: YouGov Read full article

Source: YouGov Read full article

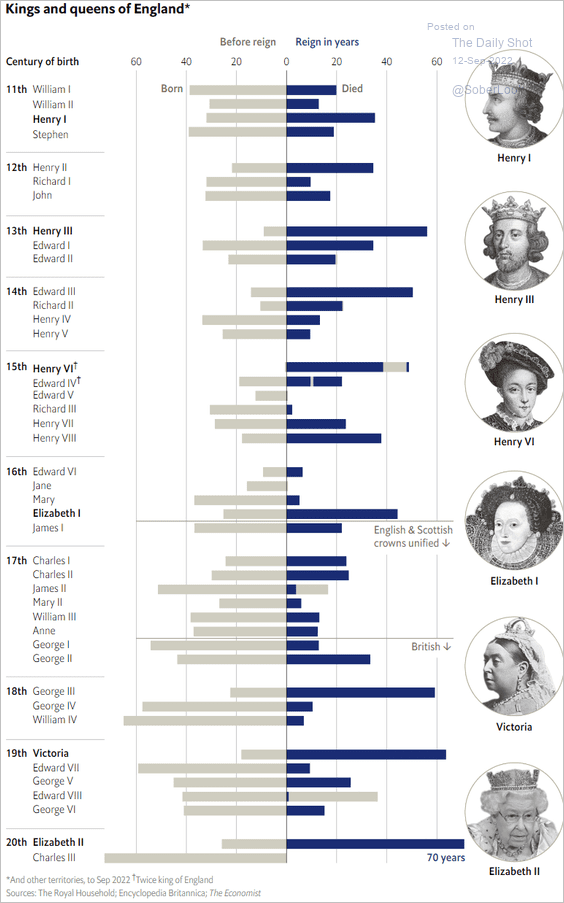

7. Kings and queens of England:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

Back to Index