The Daily Shot: 14-Sep-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

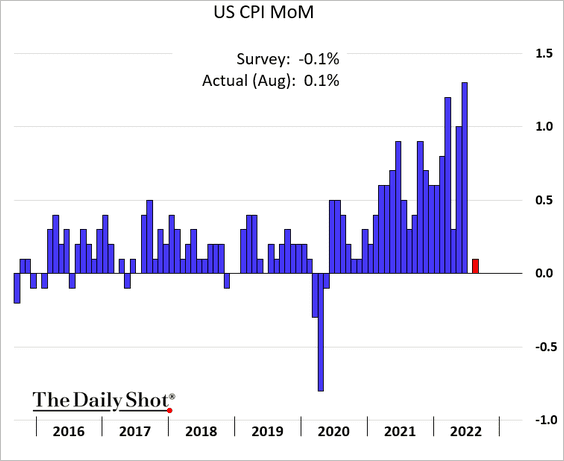

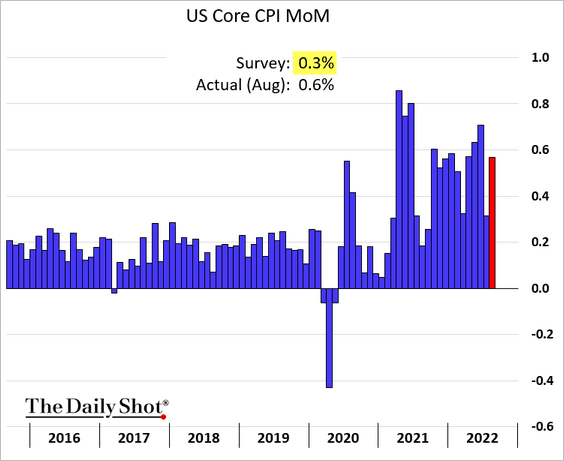

1. The CPI report was highly disappointing, with price gains exceeding estimates.

The core CPI month-over-month change was double the consensus expectations.

Below is the attribution.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

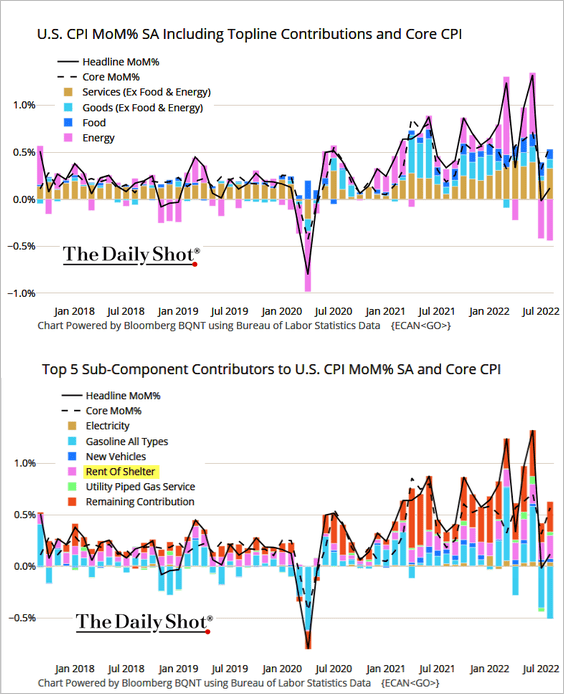

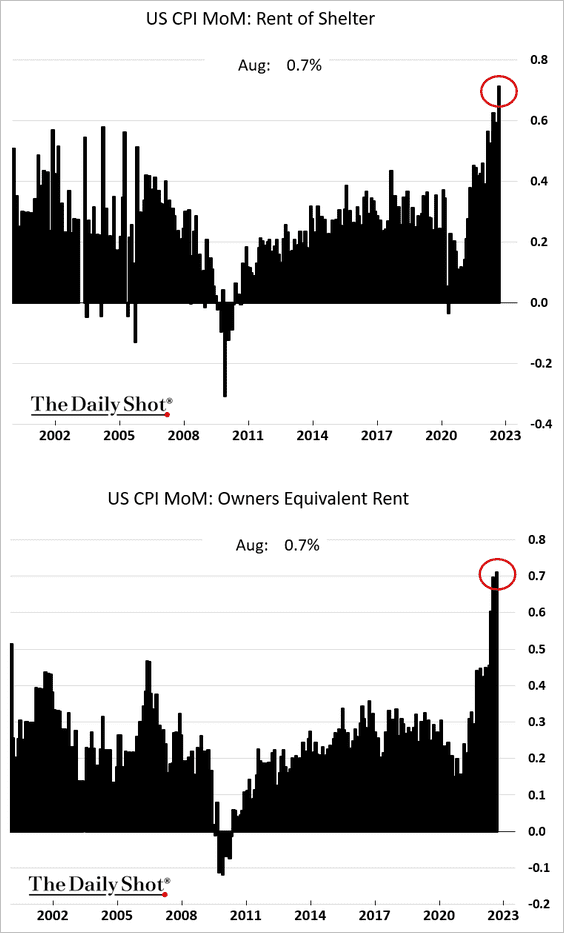

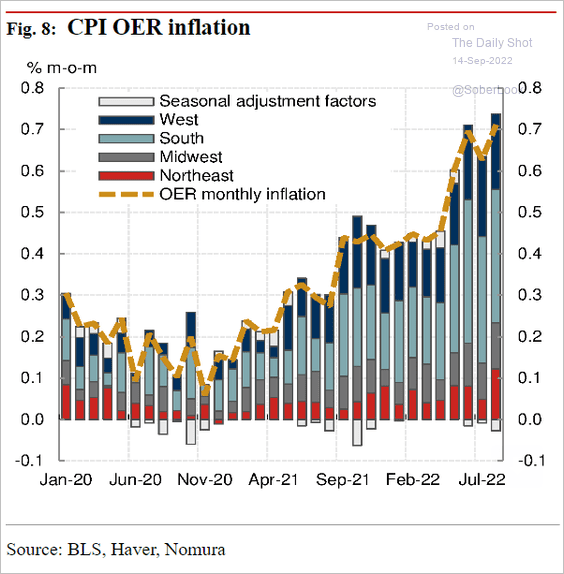

• Shelter inflation hit another multi-decade high.

Here is the regional breakdown of owners’ equivalent rent.

Source: Nomura Securities

Source: Nomura Securities

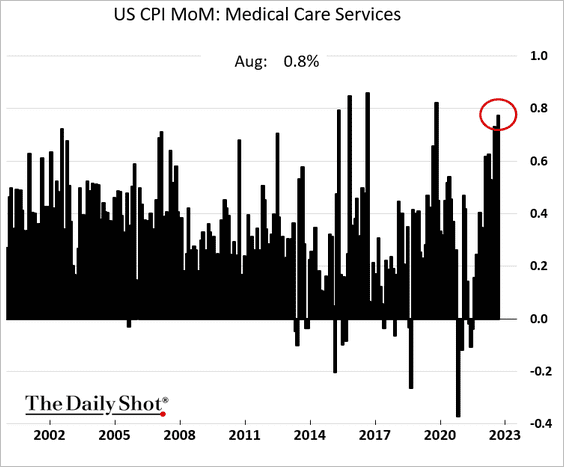

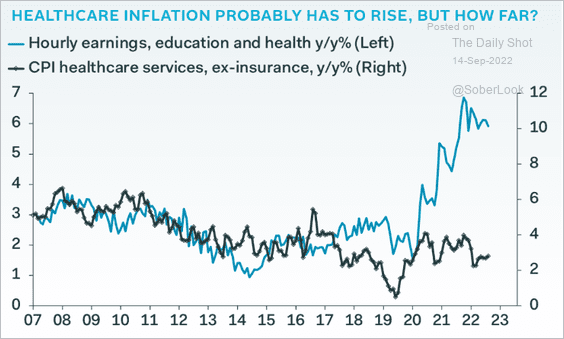

• Medical care services CPI jumped in August.

We could see medical care inflation rising further as labor costs surge.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: CNN Business Read full article

Source: CNN Business Read full article

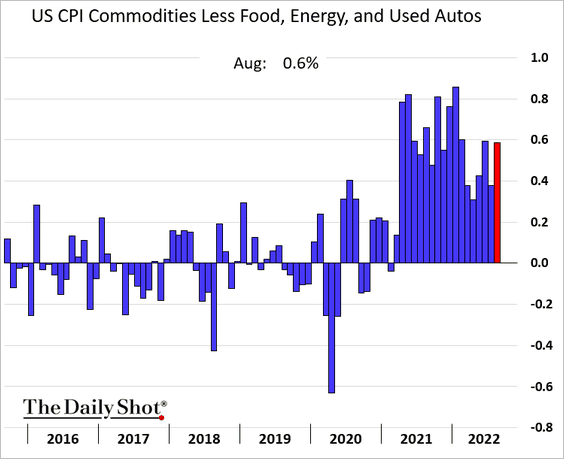

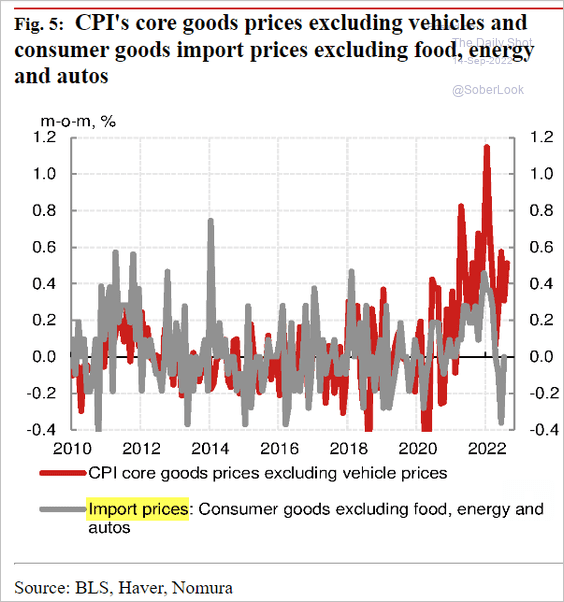

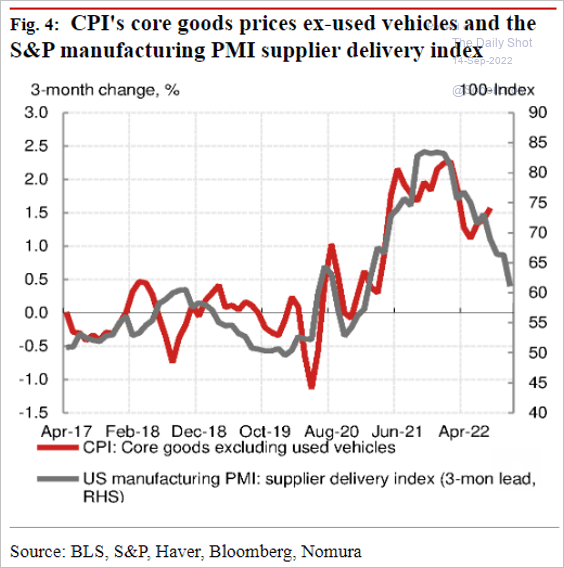

• Core goods prices showed a surprisingly strong gain.

Given lower import costs and easing supply stress (charts below), core goods inflation should ease. But demand appears to remain robust for now, allowing companies to keep boosting prices. The Fed will want to further soften demand by hiking rates more than expected.

Source: Nomura Securities

Source: Nomura Securities

Source: Nomura Securities

Source: Nomura Securities

• We will have more data on the CPI report tomorrow, including some forecasts.

——————–

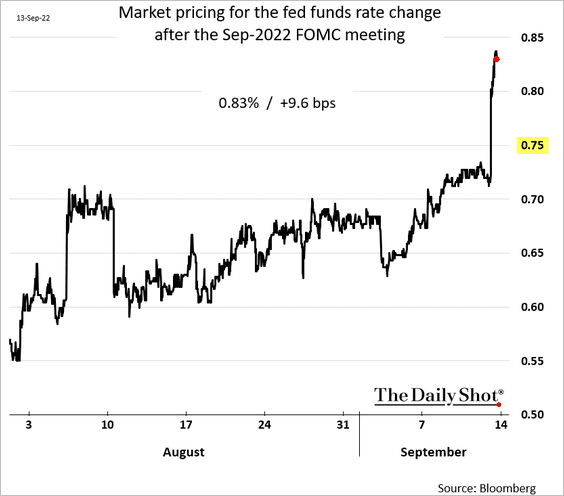

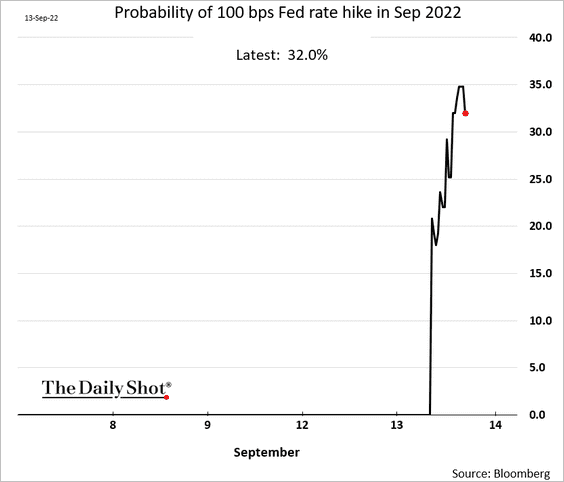

2. Markets reacted sharply to the CPI surprise, with hopes for rapidly slowing inflation dashed on Tuesday.

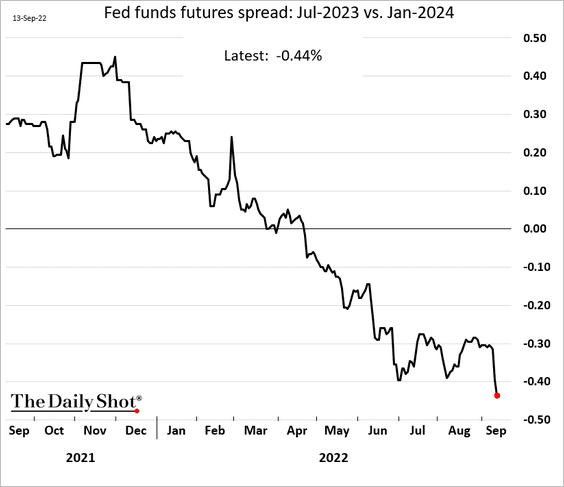

• The expected September rate increase rose above 75 bps, …

… as the market prices in some probability of a 100 bps hike.

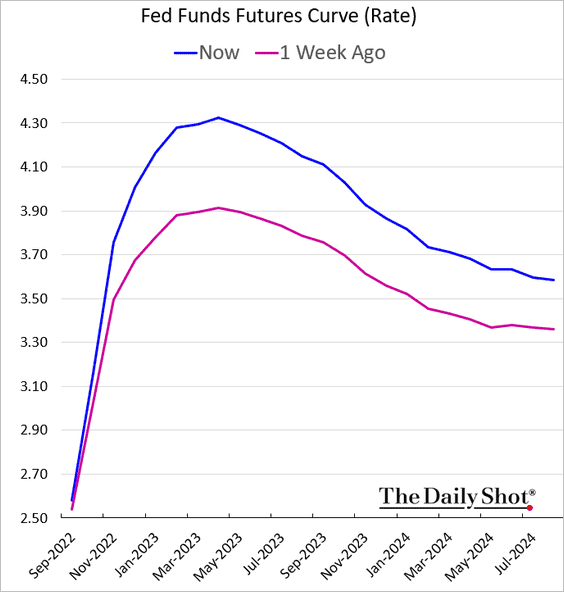

• The terminal rate jumped above 4.3%.

The market increasingly expects rate cuts in the second half of next year.

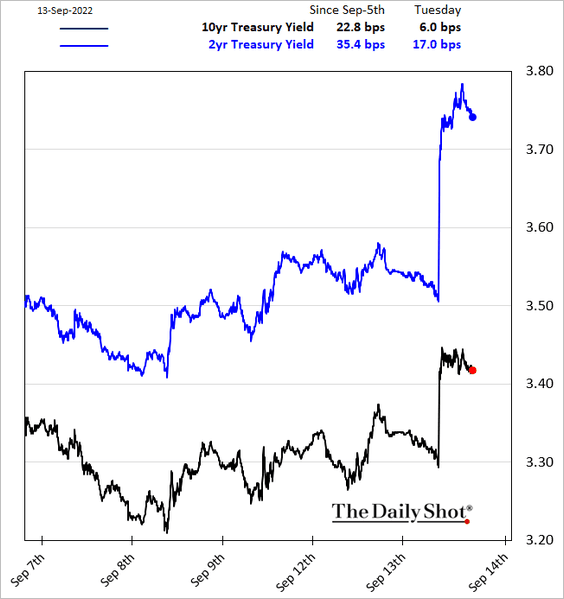

• Treasury yields climbed sharply, …

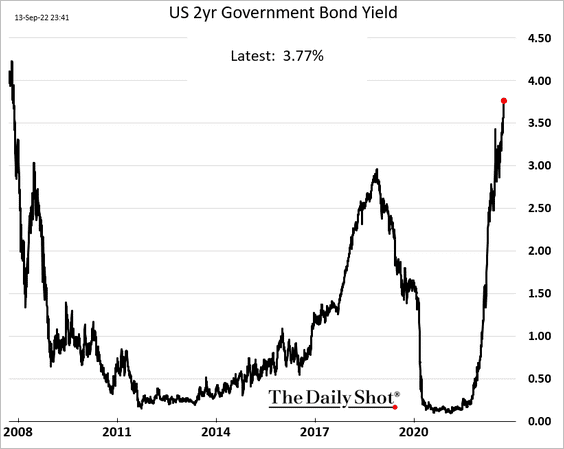

… with the 2-year rate approaching 4%.

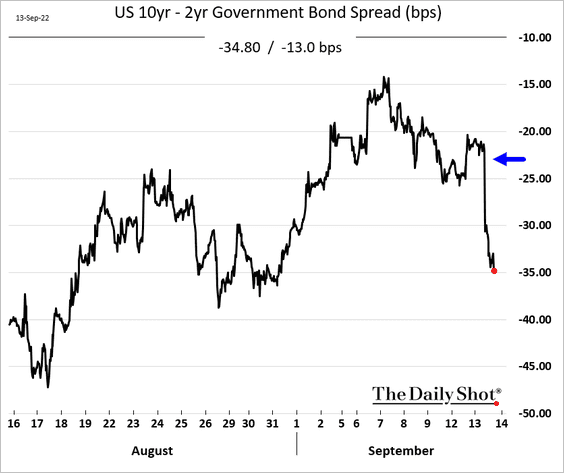

The yield curve inversion deepened.

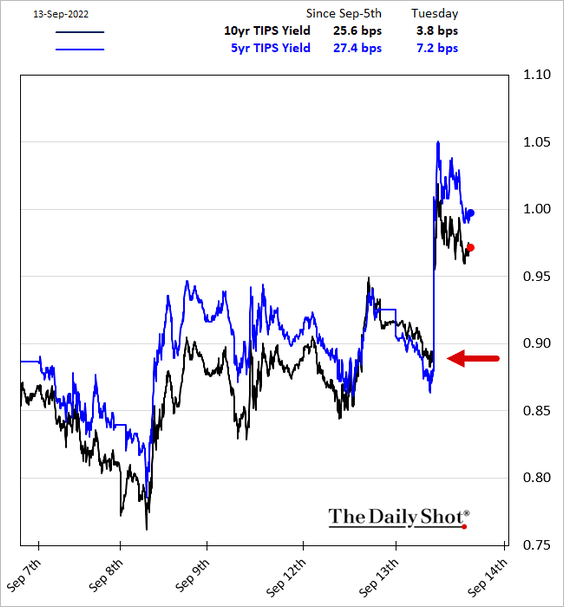

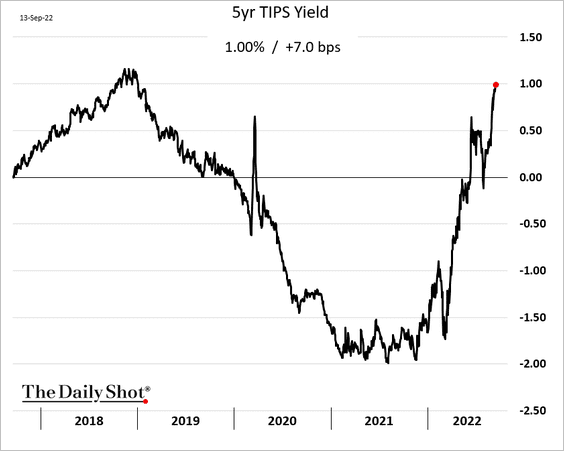

• Real yields also jumped, which tends to pressure growth stocks.

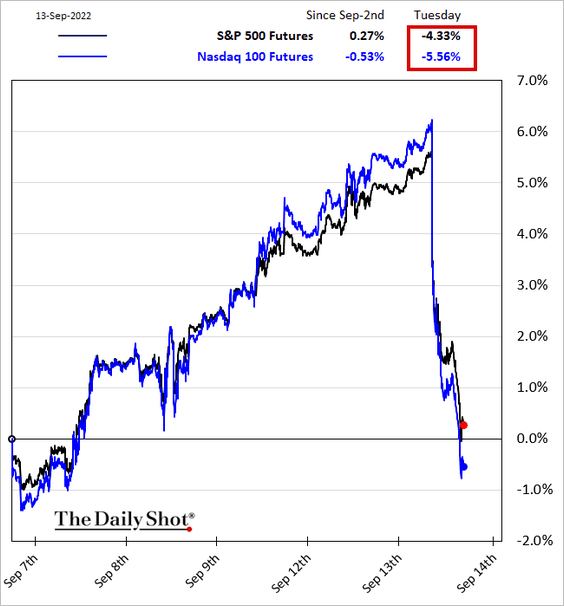

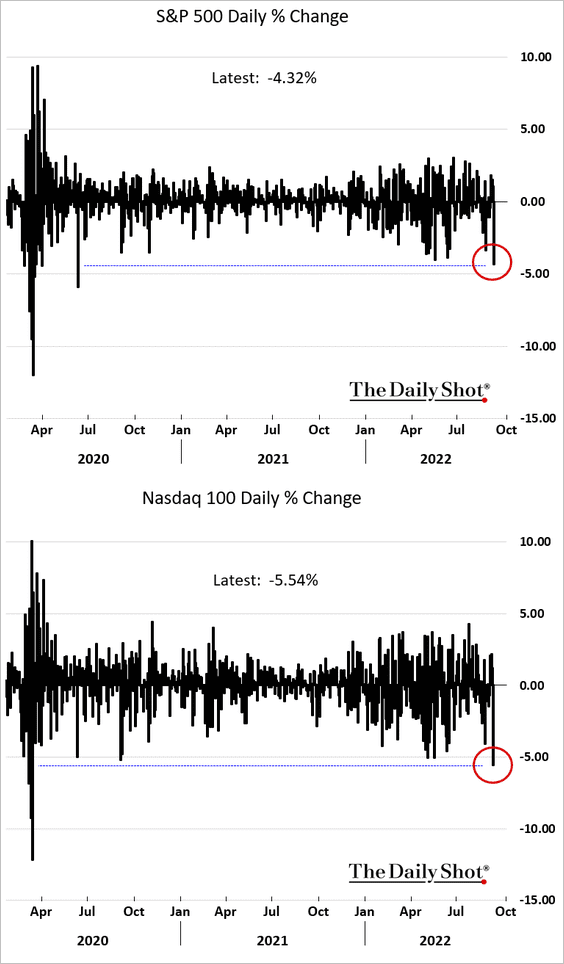

• Stocks saw the worst one-day rout since 2020.

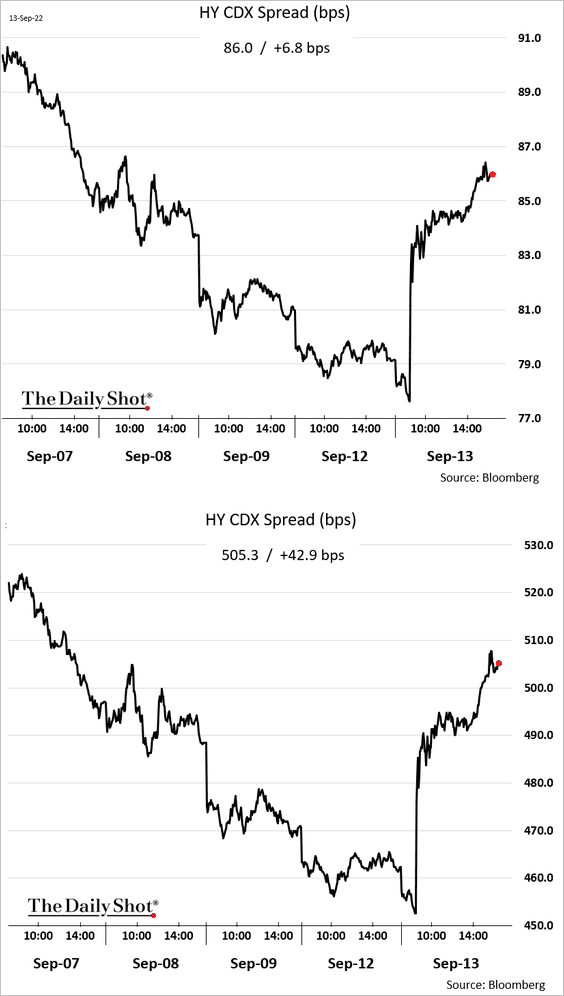

• Credit spreads widened.

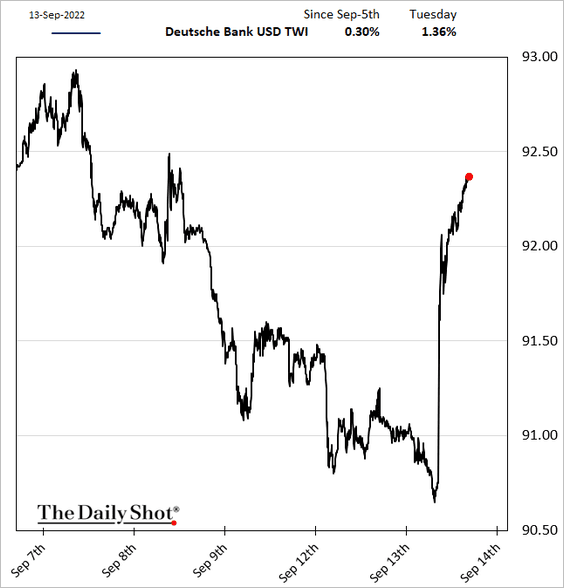

• The US dollar surged.

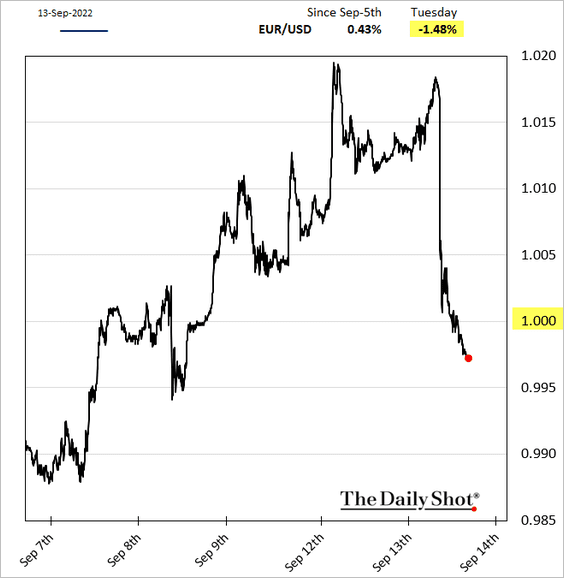

The euro dipped back below parity.

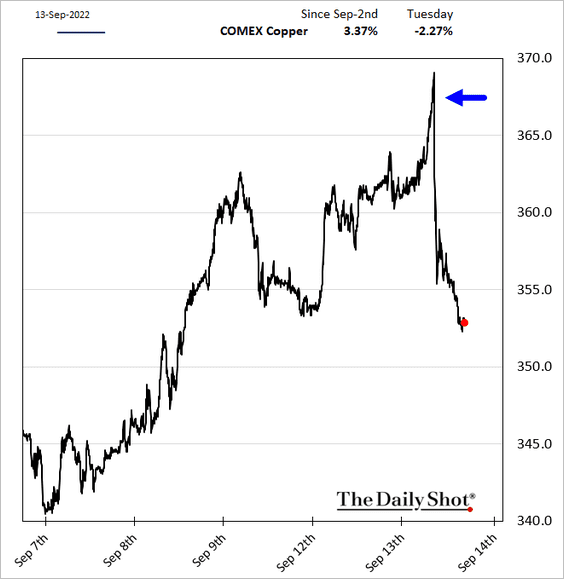

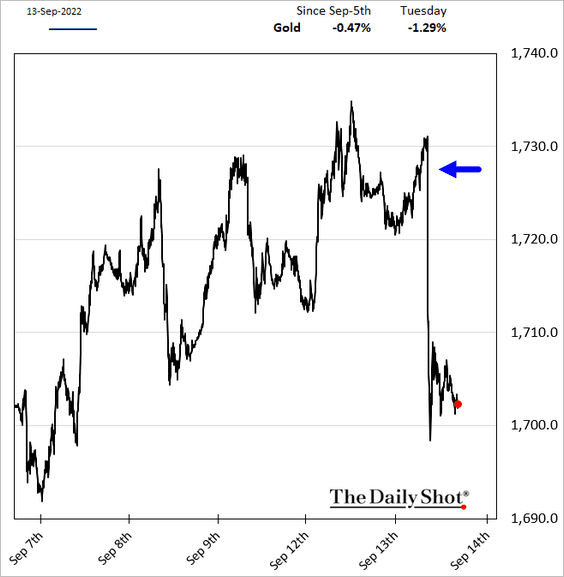

• Commodities came under pressure.

– Copper:

– Gold:

——————–

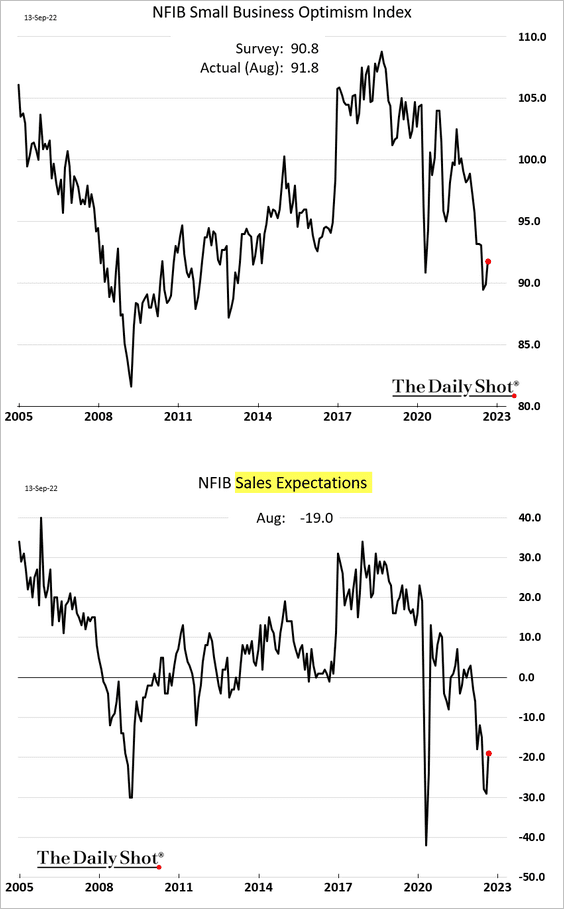

3. The NFIB small business sentiment index showed a modest improvement in August (more updates on this report tomorrow).

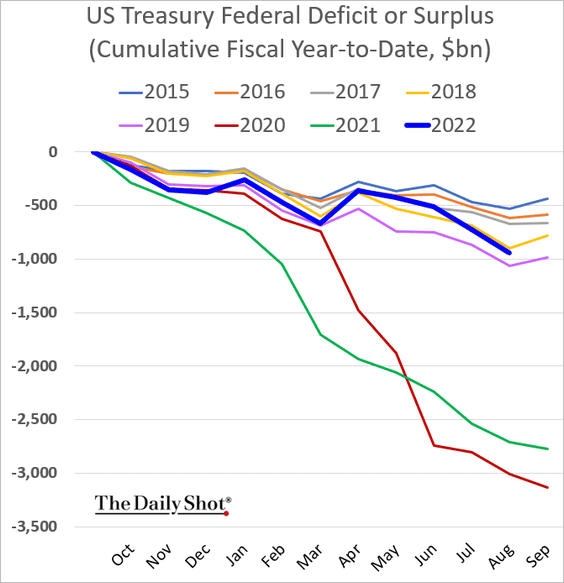

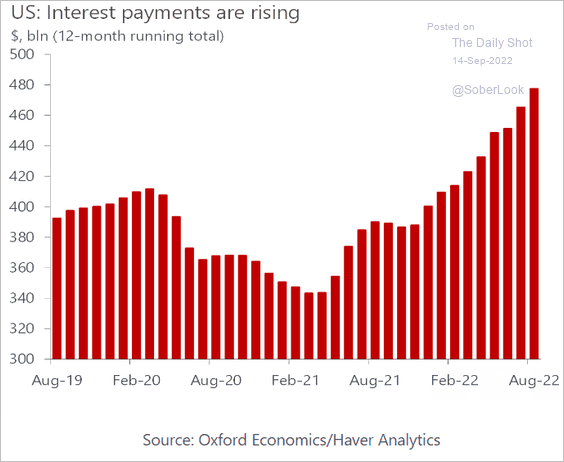

4. The federal budget deficit is back above 2018 levels.

Federal interest payments are rising rapidly as the Fed hikes rates.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Canada

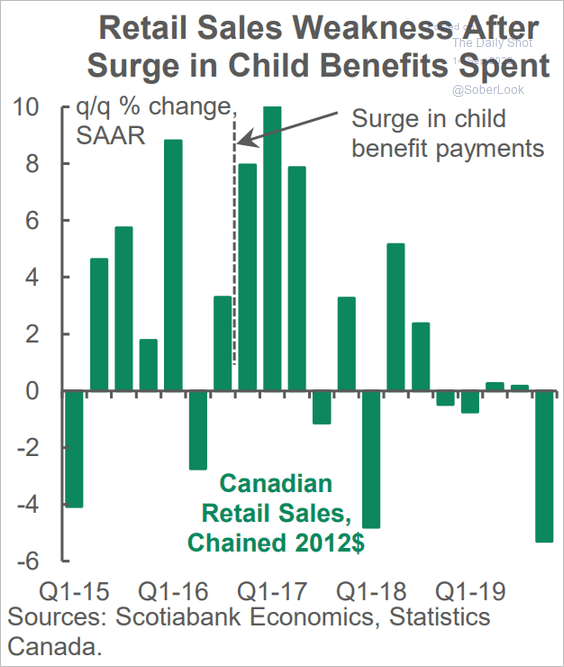

1. Retail sales declined sharply last quarter.

Source: Scotiabank Economics

Source: Scotiabank Economics

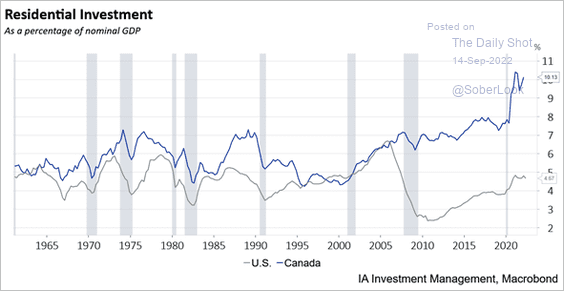

2. Canadian and US residential investment trends diverged after the US housing bubble started to deflate in 2006.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

Back to Index

The United Kingdom

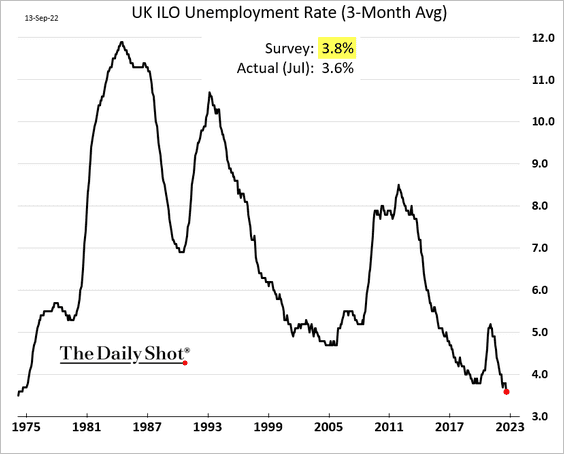

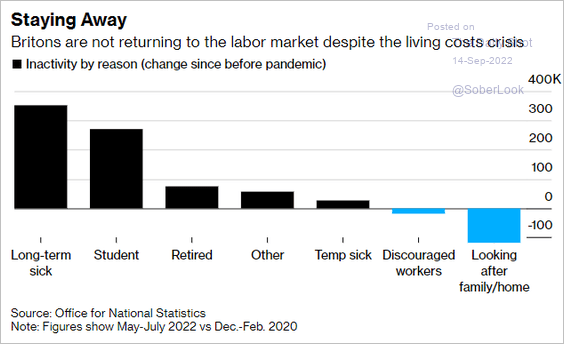

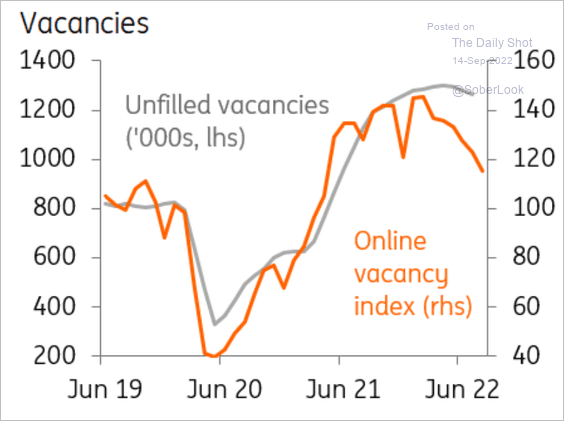

1. The labor market remains very tight as the unemployment rate hits the lowest level since 1974.

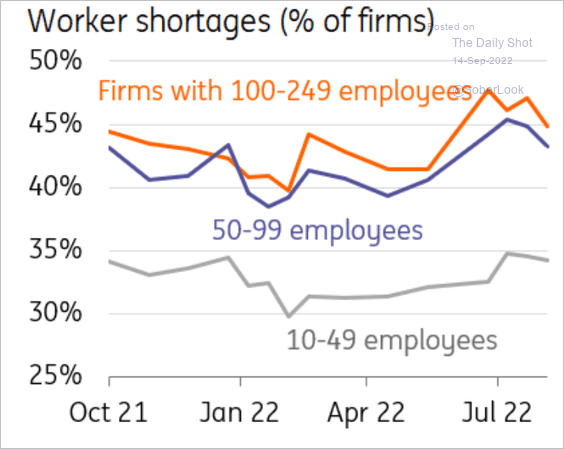

• Shortages persist.

Source: ING

Source: ING

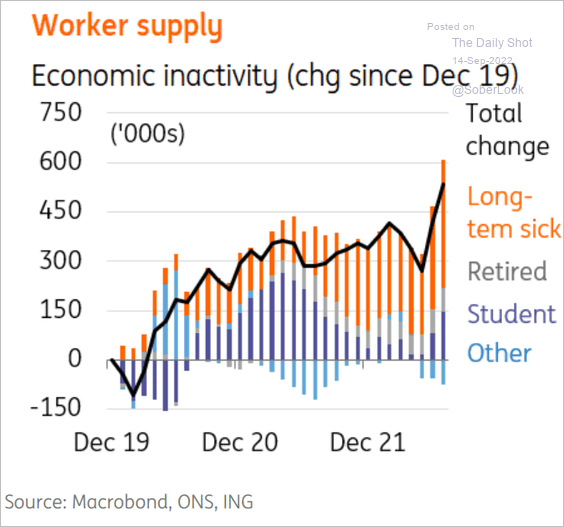

• More workers have been exiting the labor force due to illness (2 charts).

Source: ING

Source: ING

Source: Bloomberg Read full article

Source: Bloomberg Read full article

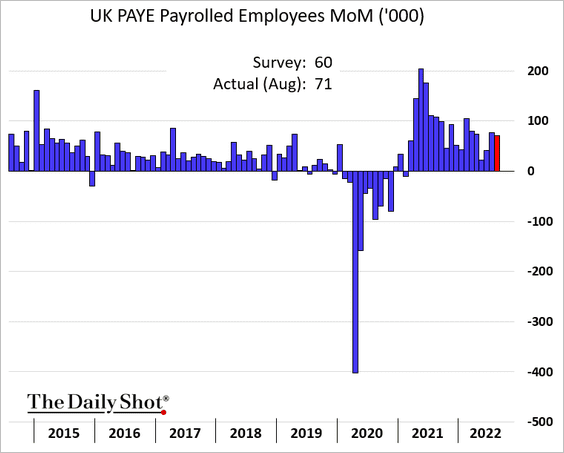

• Payrolls climbed in August.

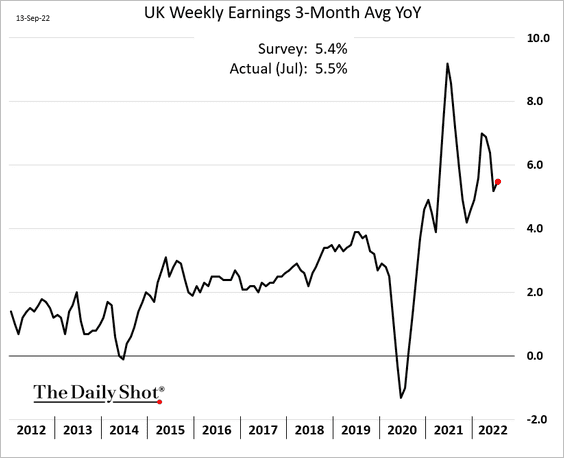

• Wage growth remains elevated.

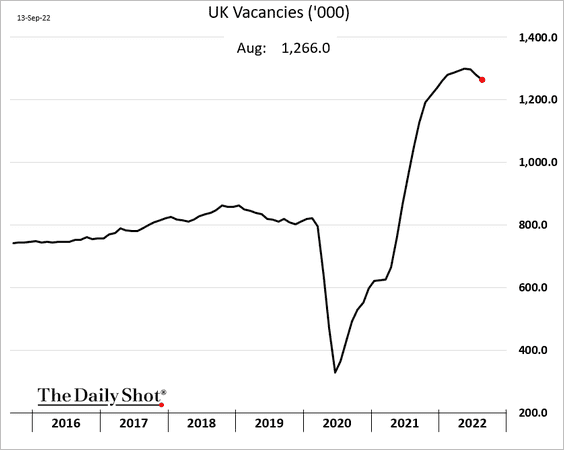

• Vacancies are starting to turn lower.

Source: ING

Source: ING

——————–

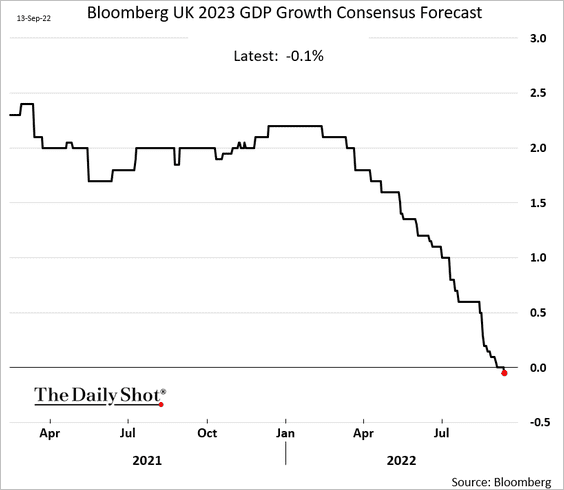

2. Economists now expect the UK GDP to contract next year.

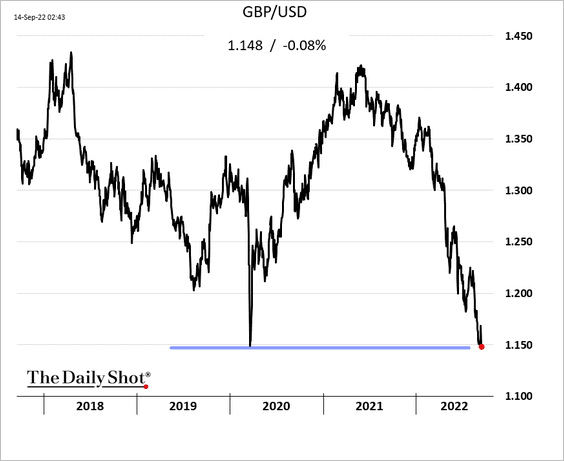

3. The pound is at the 2020 lows.

Back to Index

The Eurozone

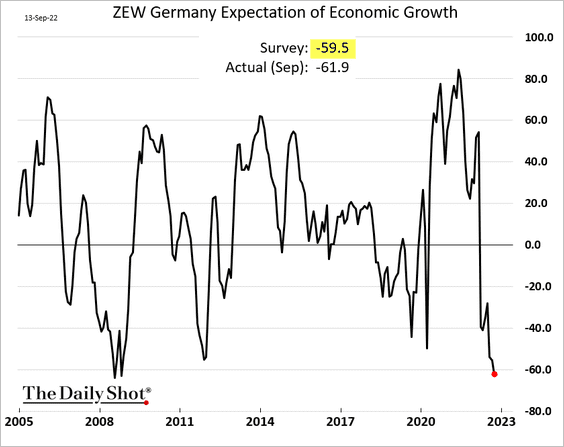

1. Germany’s ZEW expectations of economic growth are near the 2008 lows.

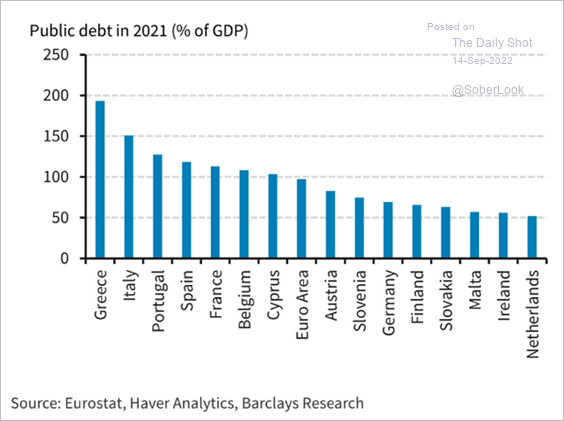

2. Euro-area public debt fell to 97% of GDP in 2021 from 99% of GDP in 2020. The European Commission forecasts public debt will decline to 93% of GDP in 2024. That goal might be challenging as recession looms.

Source: Barclays Research

Source: Barclays Research

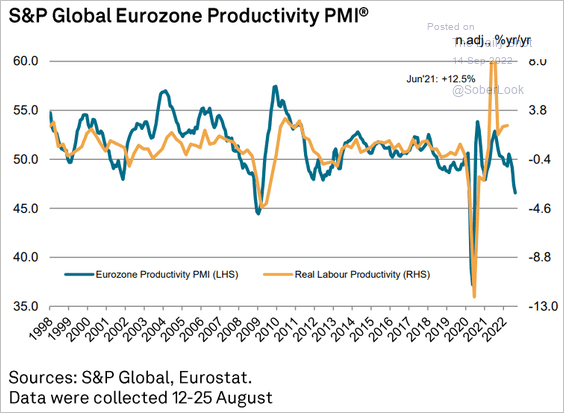

3. Productivity is deteriorating, according to the S&P Global PMI.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

Asia – Pacific

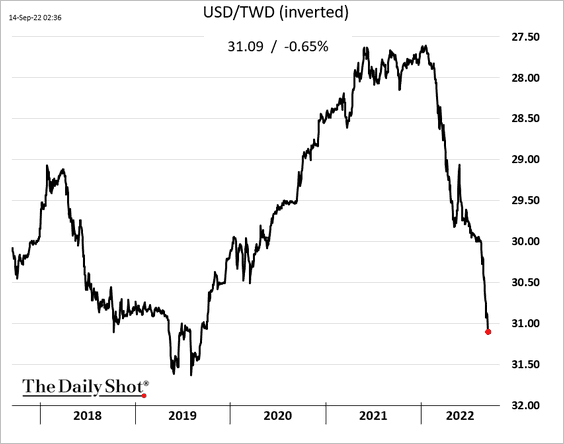

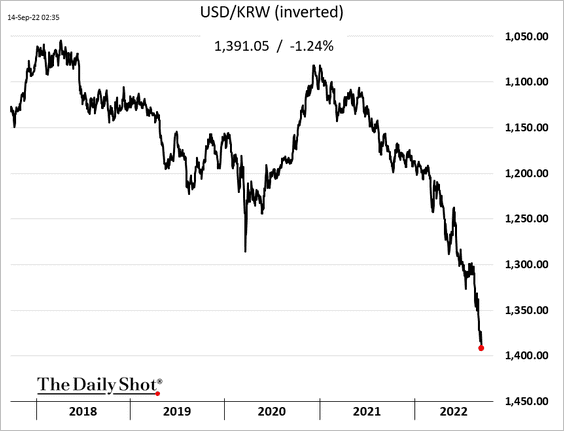

1. Asian currencies are under pressure.

• The Taiwan dollar:

• The South Korean won:

——————–

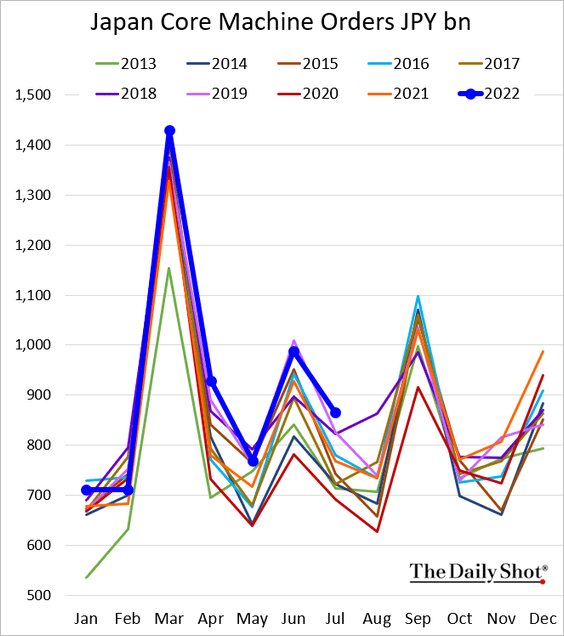

2. Japan’s machine orders point to robust business investment this quarter.

Back to Index

China

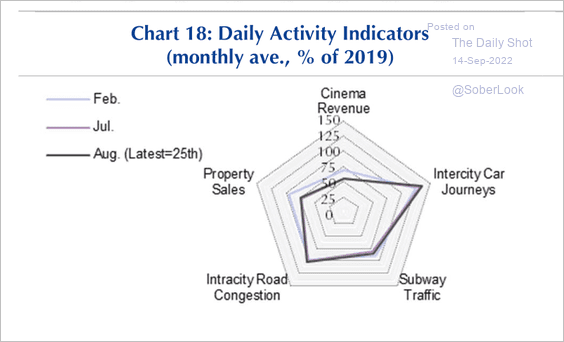

1. High-frequency data show most activities have returned to their February highs except property sales.

Source: Capital Economics

Source: Capital Economics

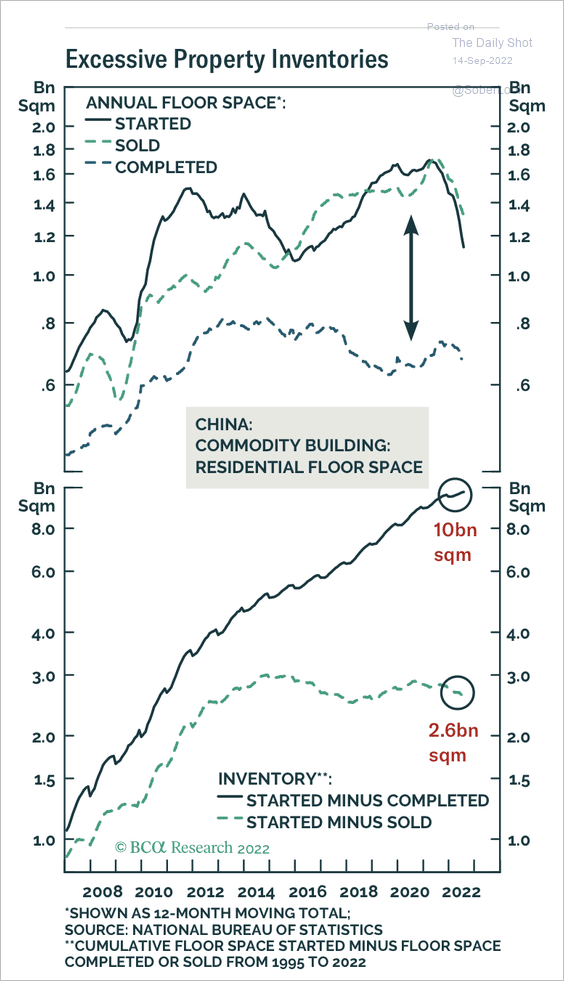

2. The property market has seen a surge in incomplete projects, which appears structural. This could make policy stimulus difficult to execute, according to BCA Research.

Source: BCA Research

Source: BCA Research

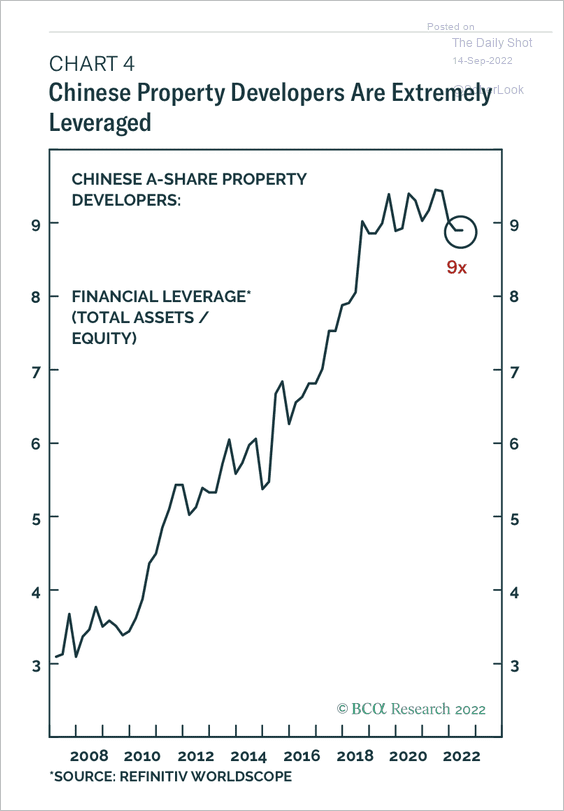

• Excessive leverage among property developers is a problem.

Source: BCA Research

Source: BCA Research

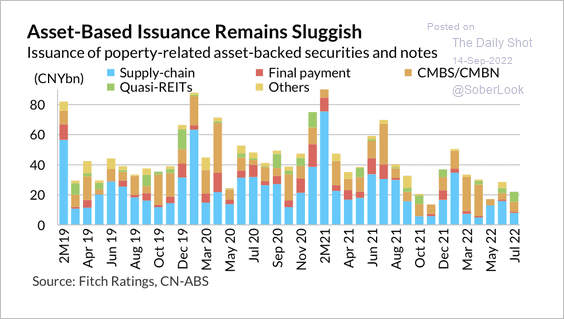

• Property developers’ asset-backed bond issuance remains sluggish.

Source: Fitch Ratings

Source: Fitch Ratings

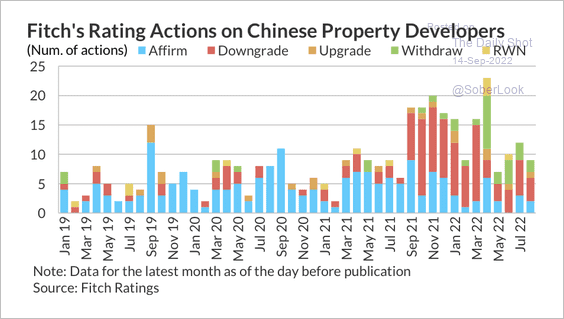

Fitch downgrades continue to outnumber upgrades among property developers.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

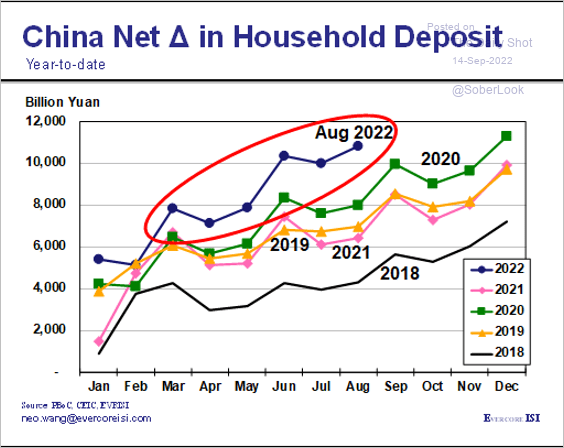

3. Household deposits continue to outpace previous years amid increased risk aversion.

Source: Evercore ISI Research

Source: Evercore ISI Research

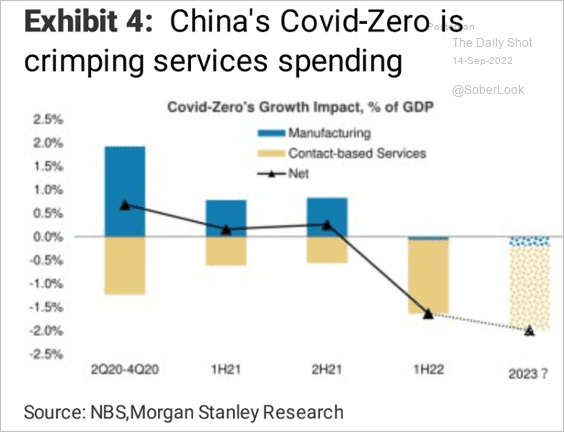

4. Service spending is down sharply.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

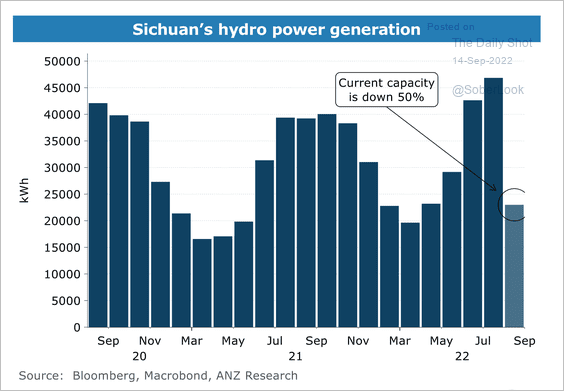

5. China’s hydropower has been curbed by drought conditions in western Sichuan. Coal-fired power could help bridge the gap, according to ANZ Research.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Emerging Markets

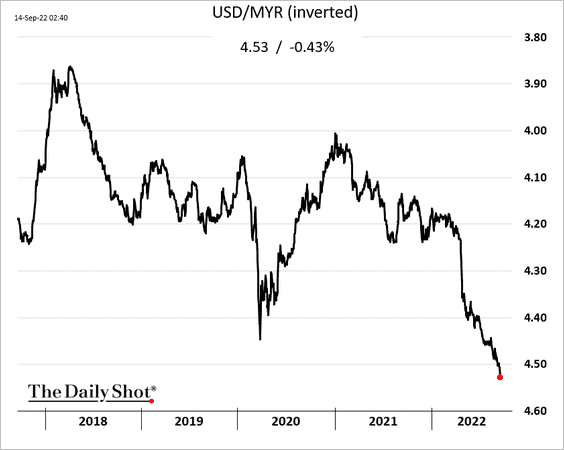

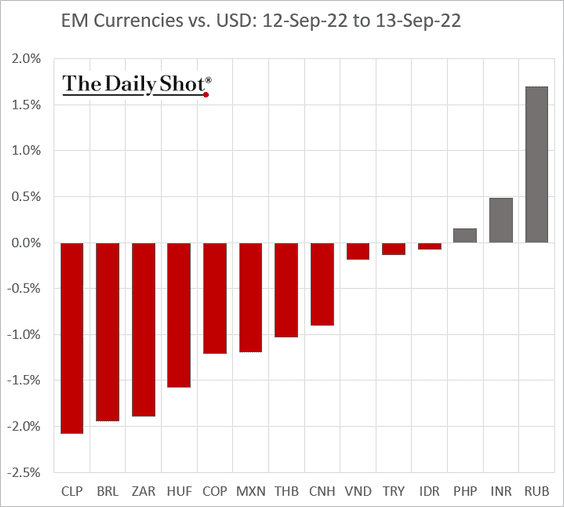

1. Asian currencies declined further after the US CPI shock. Here is the Malaysian ringgit.

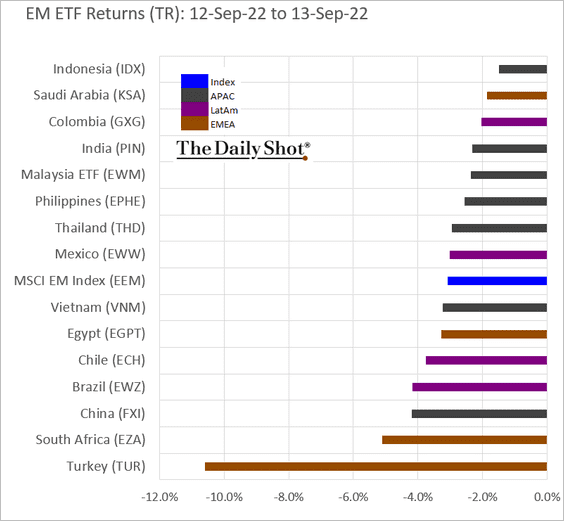

Here is the market response to the US CPI report.

• Currencies:

• Equity ETFs:

——————–

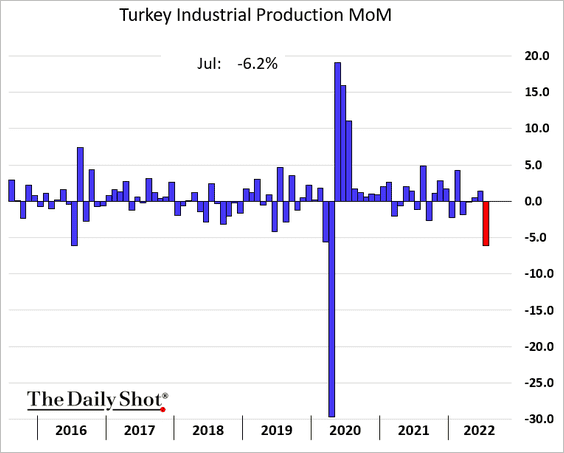

2. Turkey’s industrial production tumbled in July.

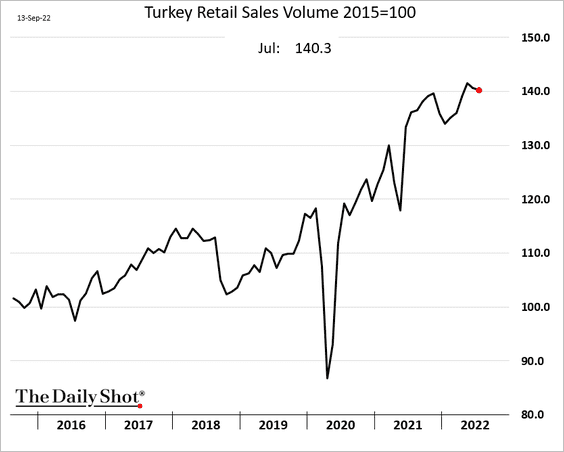

Retail sales are holding up.

——————–

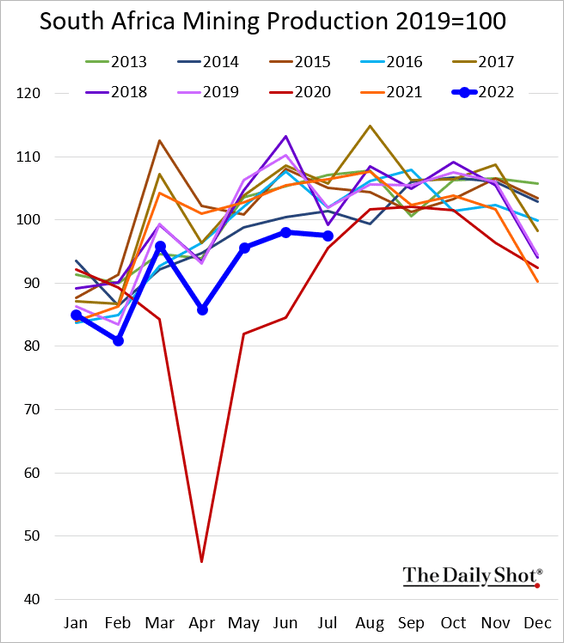

3. South Africa’s mining output held up better than expected in July but remained well below last year’s levels.

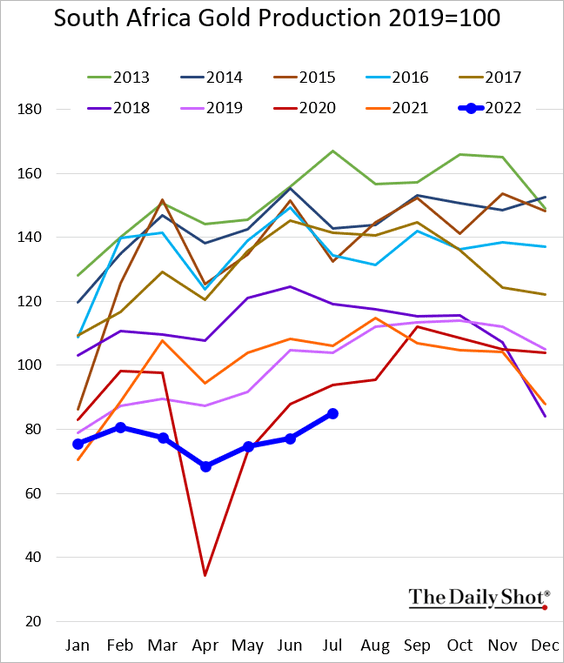

Here is gold production.

Back to Index

Cryptocurrency

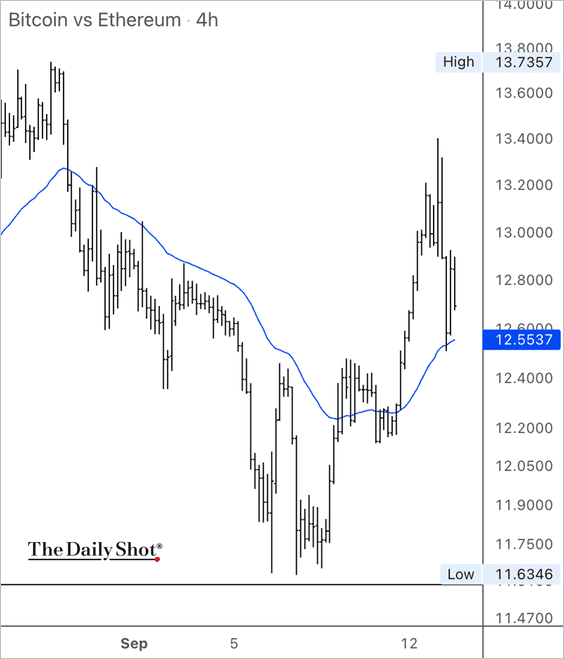

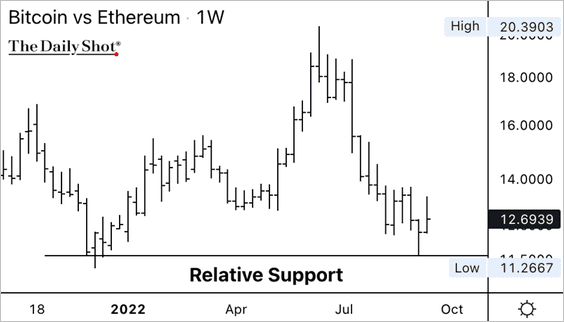

1. ETH outperformed BTC during yesterday’s sell-off …

… but the BTC/ETH price ratio continues to hold long-term support, suggesting risk-off conditions.

——————–

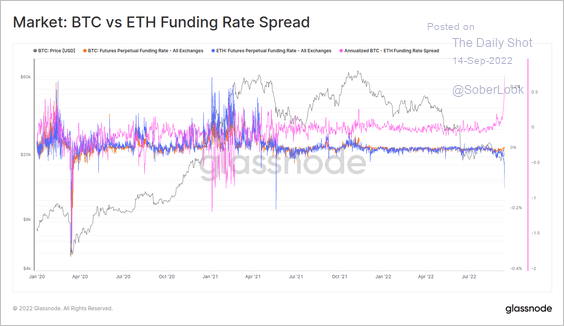

2. The spread between BTC and ETH perpetual futures funding rates is near an all-time high. This indicates traders heavily short ETH versus BTC, likely hedging for the upcoming “Merge,” according to Glassnode.

Source: @glassnode

Source: @glassnode

Back to Index

Commodities

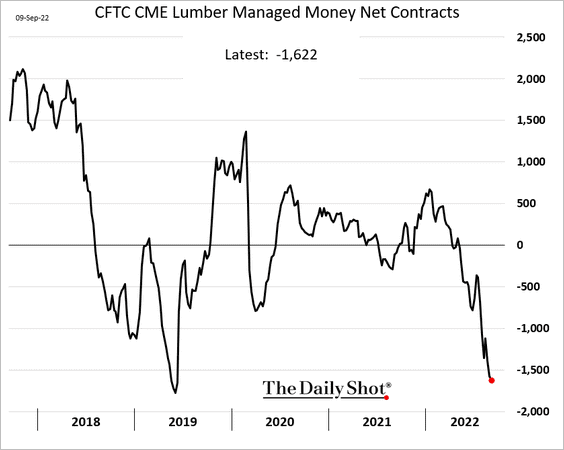

US lumber futures held support, …

… as speculative accounts remain extremely bearish.

Back to Index

Energy

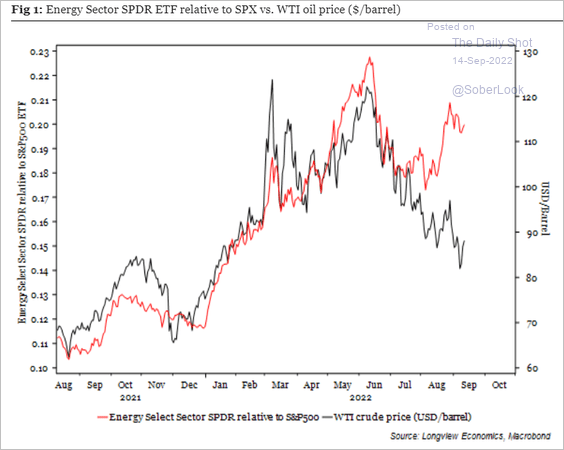

1. The relative performance of energy shares has been outpacing oil prices.

Source: Longview Economics

Source: Longview Economics

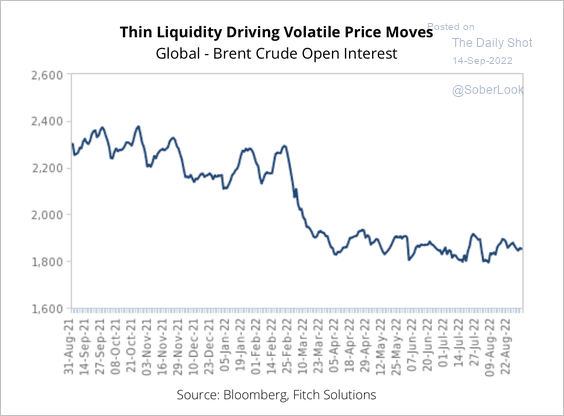

2. Low liquidity has been a key factor behind volatile price swings in Brent oil.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

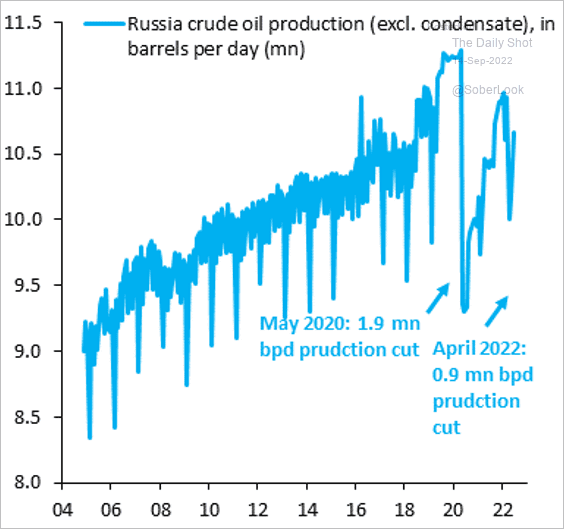

3. Russia’s oil output has not crashed as some analysts expected.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

Back to Index

Equities

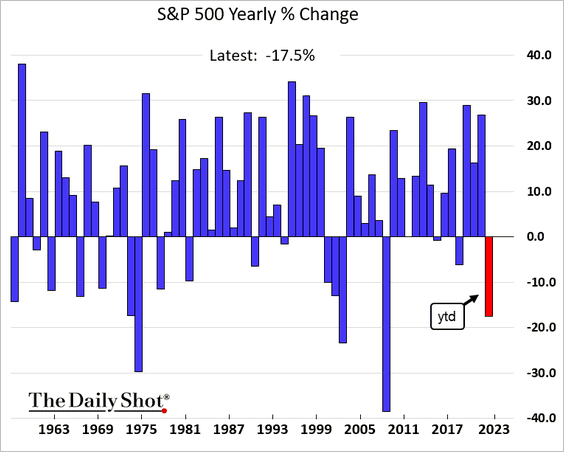

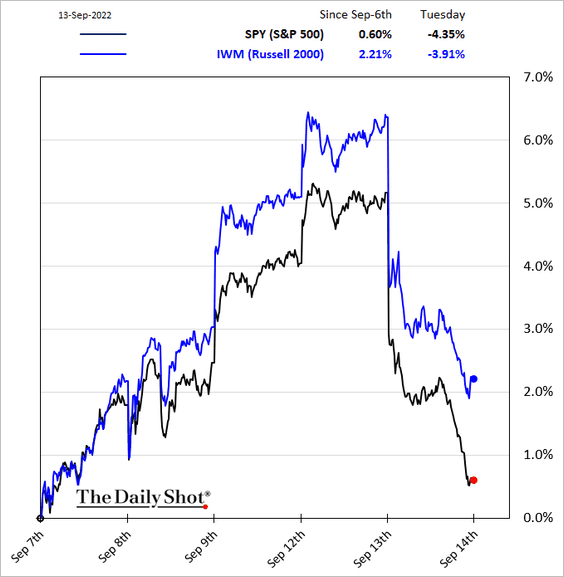

1. Tuesday’s market rout was the worst since 2020.

Here is the S&P 500 year-to-date decline compared to annual performance since the 1960s.

——————–

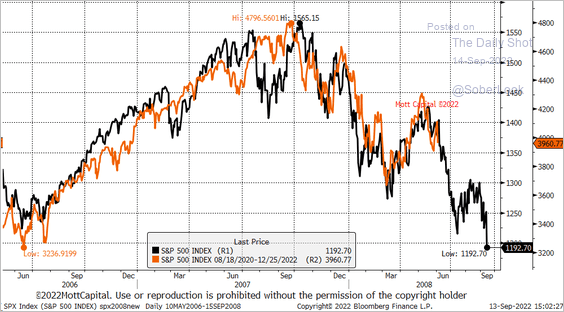

2. The 2008 analog remains in play.

Source: @MichaelMOTTCM

Source: @MichaelMOTTCM

3. The S&P 500 is back at support.

4. Rising real yields continue to pose significant downside risks for growth stocks.

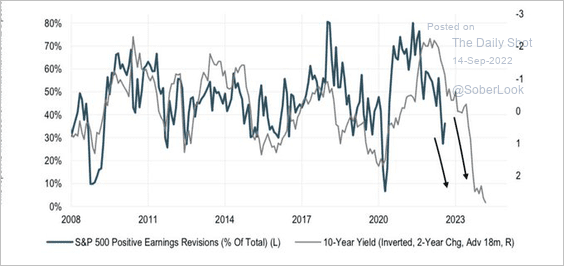

5. Higher rates are a headwind for earnings.

Source: @MichaelKantro

Source: @MichaelKantro

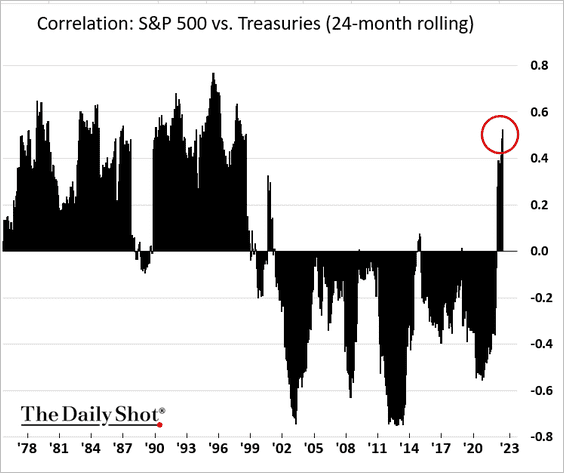

6. For two decades, Treasuries were an effective hedge for stocks – but no longer …

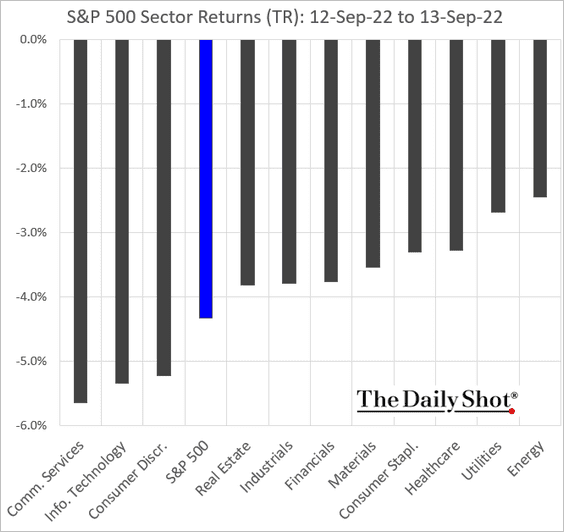

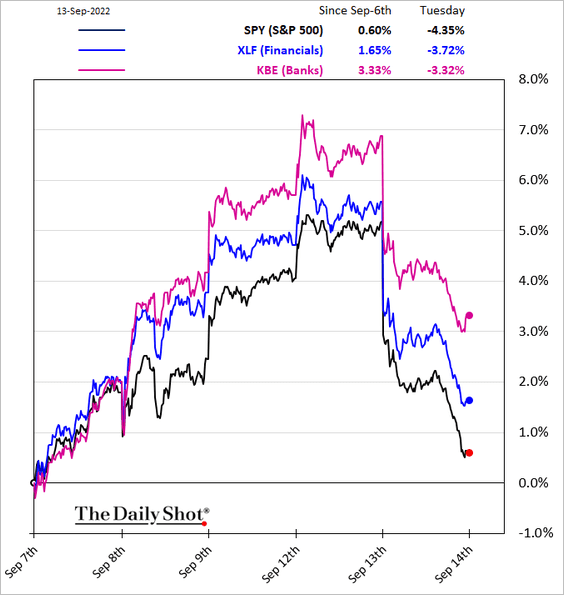

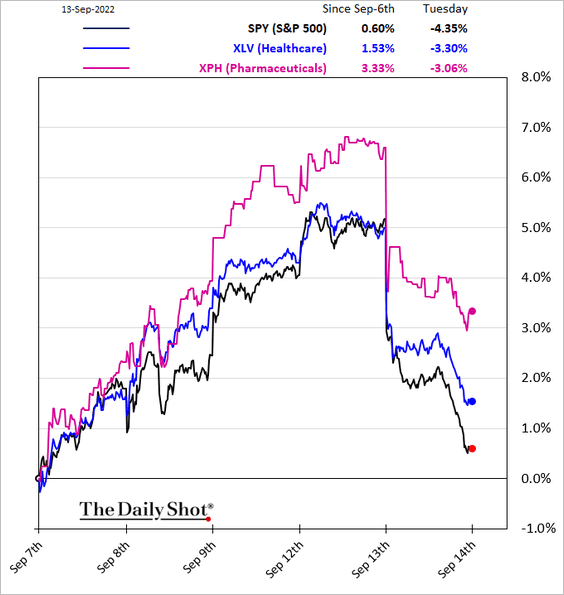

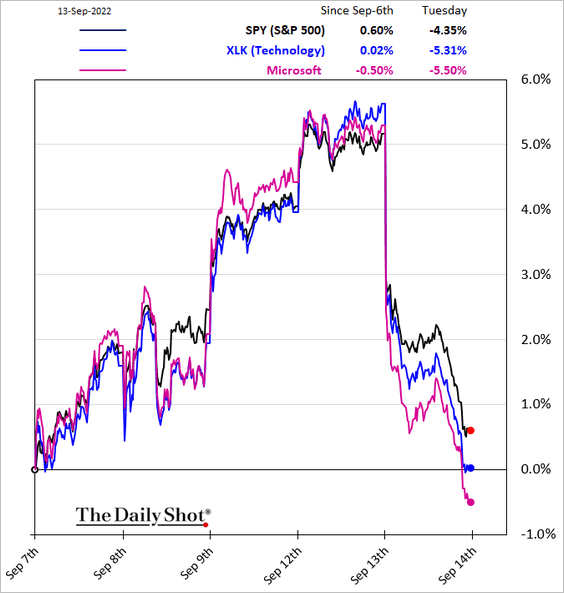

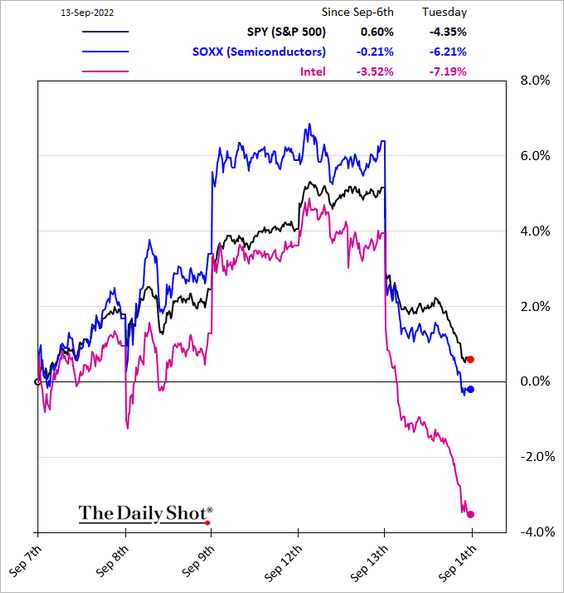

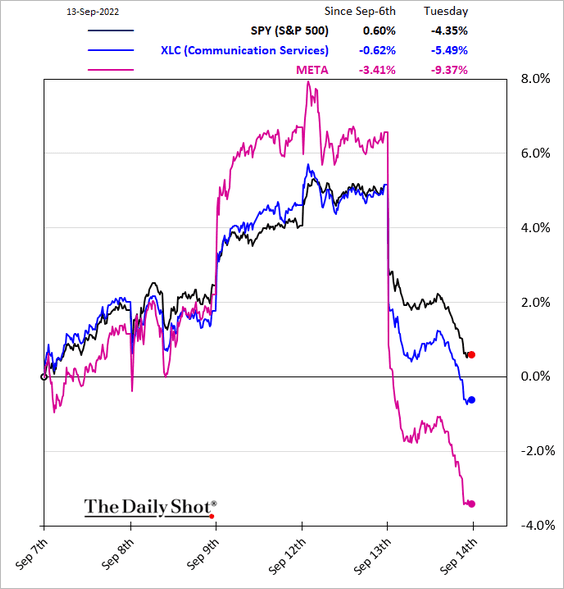

7. How did the US CPI shock impact different sectors on Tuesday?

Here is sector performance over the past five business days (for select sectors).

• Banks:

• Healthcare:

• Tech, semiconductors, and communication services:

——————–

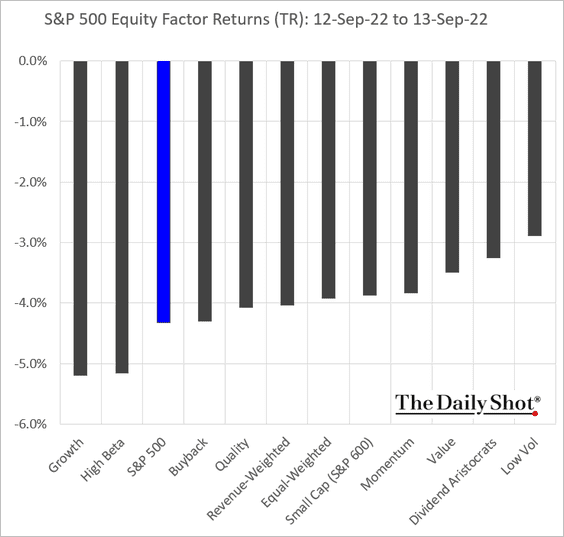

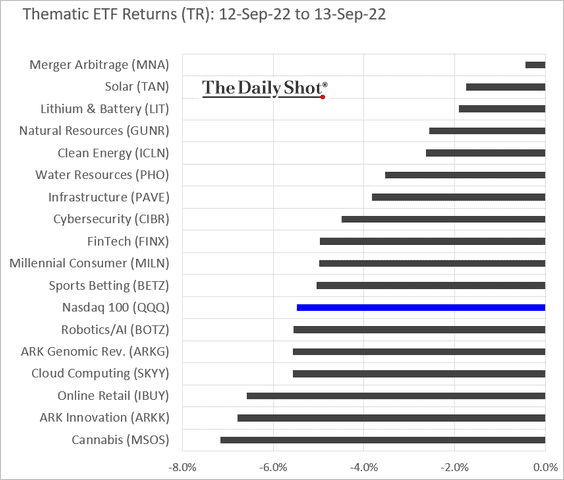

8. How did equity factors and thematic ETFs perform on Tuesday?

Small caps have been outperforming.

Back to Index

Credit

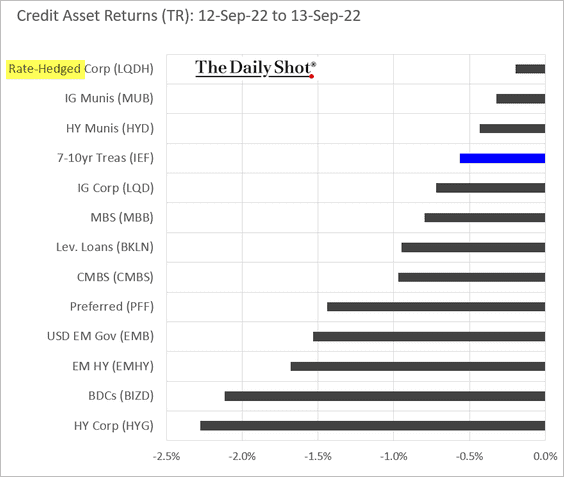

Tuesday’s selloff in credit was mostly driven by rising rates.

Back to Index

Rates

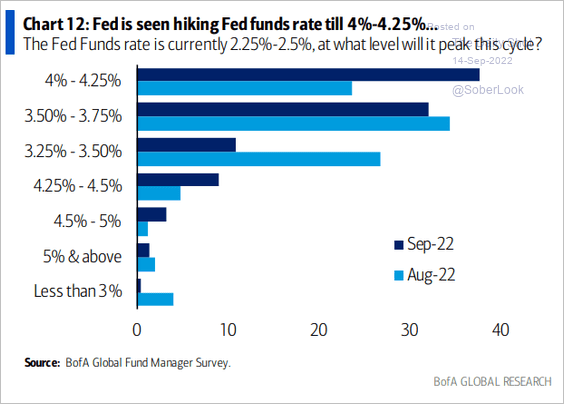

1. Where is the terminal rate? It’s above 4.3%, according to the fed funds futures market.

Source: BofA Global Research

Source: BofA Global Research

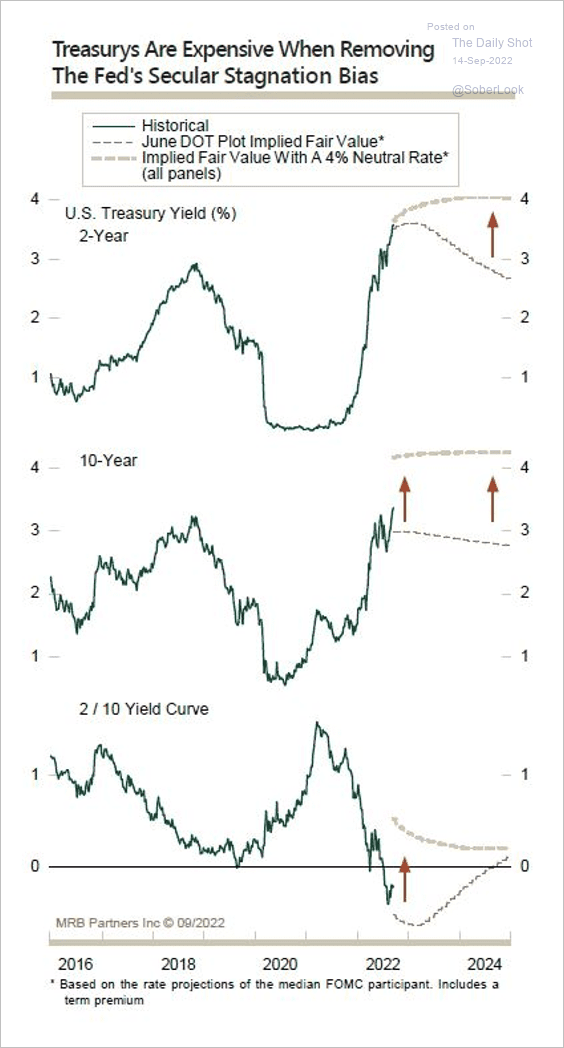

2. Could the neutral rate be at 4%? The path toward a 4% neutral policy rate could be an anchor for longer-dated Treasury yields, which explains the current inversion of the curve.

Source: MRB Partners

Source: MRB Partners

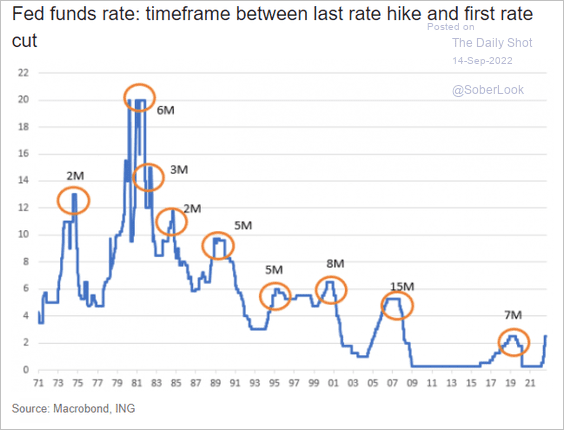

3. This chart shows the timing between the Fed’s last rate hike and first rate cut.

Source: ING

Source: ING

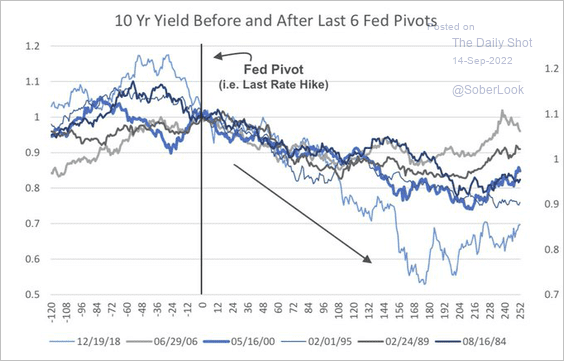

4. Treasury yields generally do not fall until the end of the Fed’s hiking cycle.

Source: @MichaelKantro

Source: @MichaelKantro

Back to Index

Global Developments

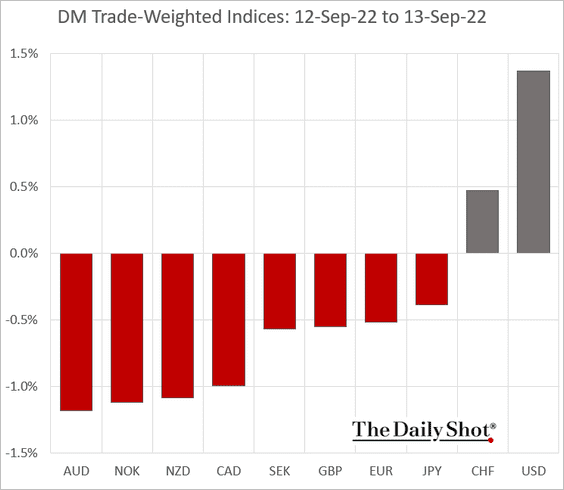

1. How did DM currencies respond to the US CPI surprise on Tuesday?

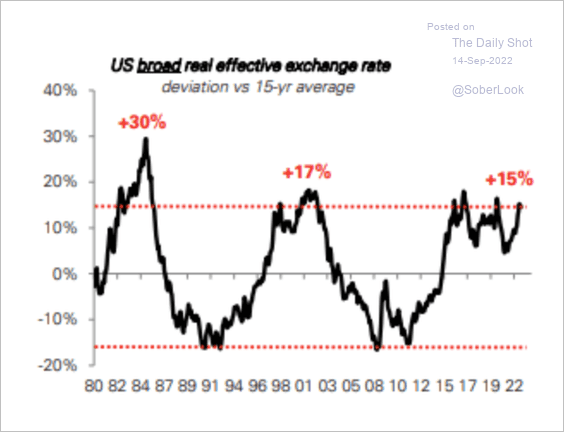

2. The dollar has deviated far above its 15-year average but is not yet extreme compared to the 1980s.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

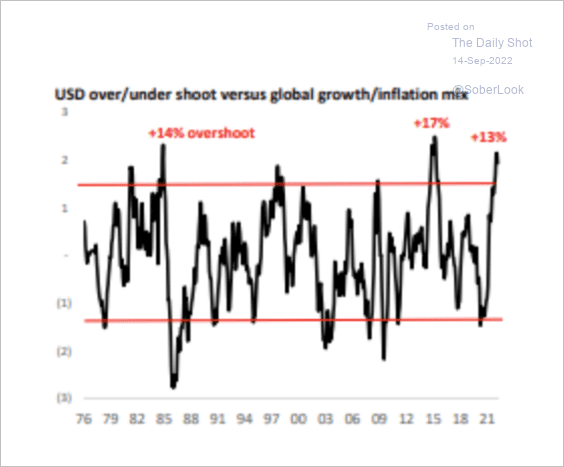

The surge in the dollar could reflect market expectations of a highly stagflationary outcome.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

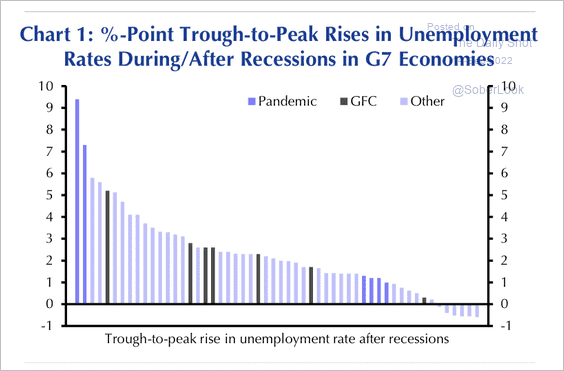

3. Unemployment rates almost always rise in recessions.

Source: Capital Economics

Source: Capital Economics

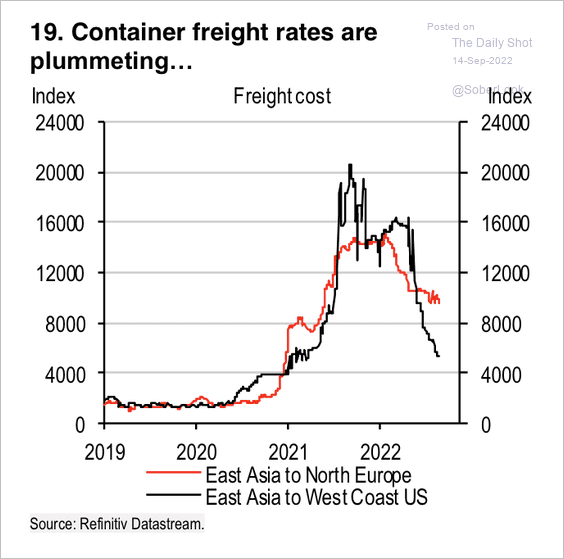

4. US shipping costs have fallen more sharply than in Europe.

Source: HSBC Global Research

Source: HSBC Global Research

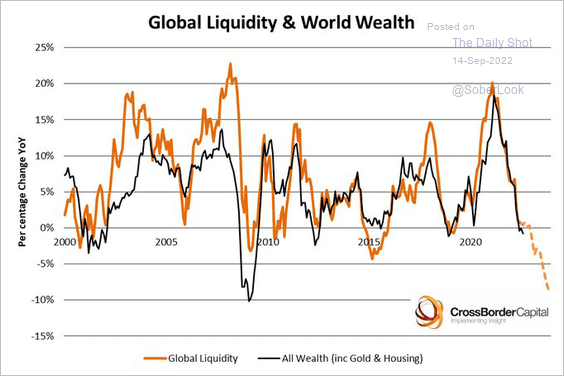

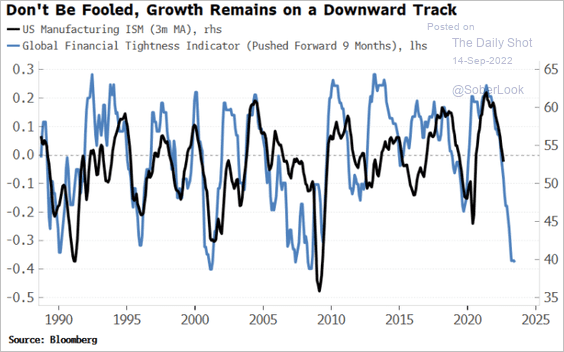

5. Tight liquidity is putting a squeeze on global wealth …

Source: @crossbordercap

Source: @crossbordercap

… and economic activity.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

Food for Thought

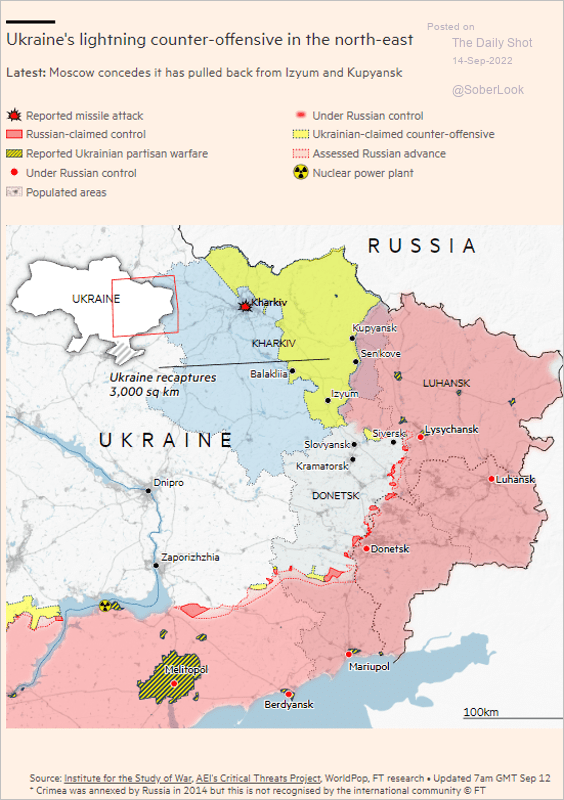

1. Ukraine’s counteroffensive:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

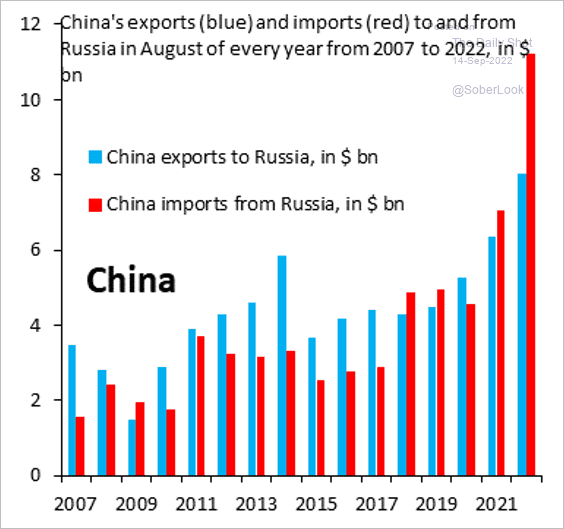

2. The China – Russia trade:

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

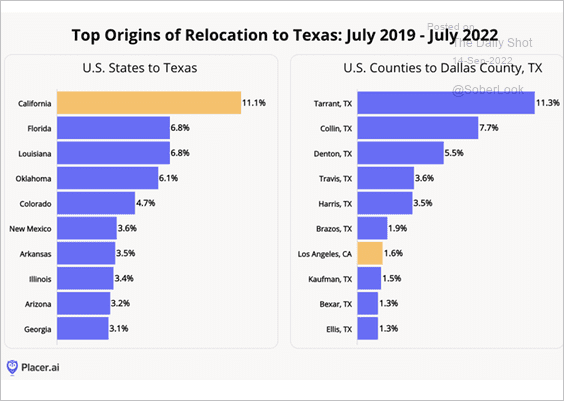

3. Relocations to Texas:

Source: Placer.ai

Source: Placer.ai

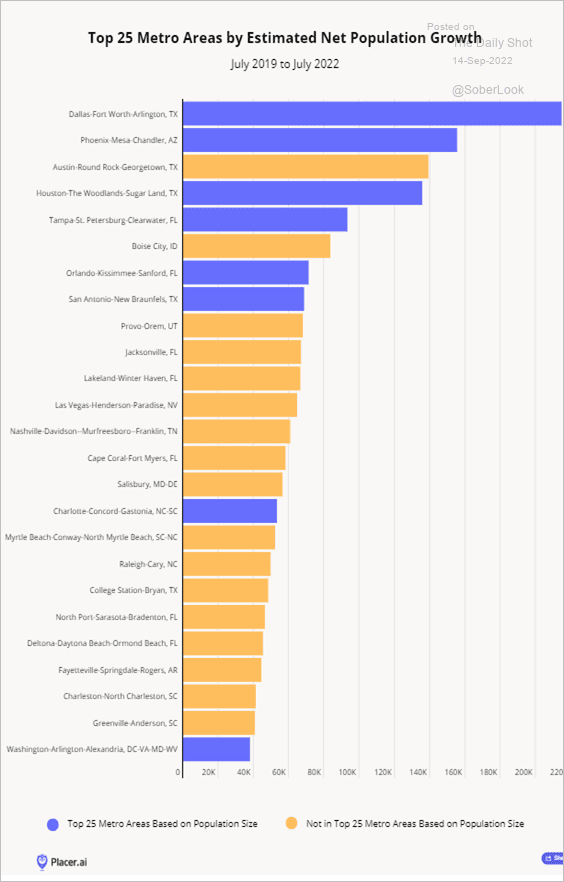

• Top metro areas by population growth:

Source: Placer.ai

Source: Placer.ai

——————–

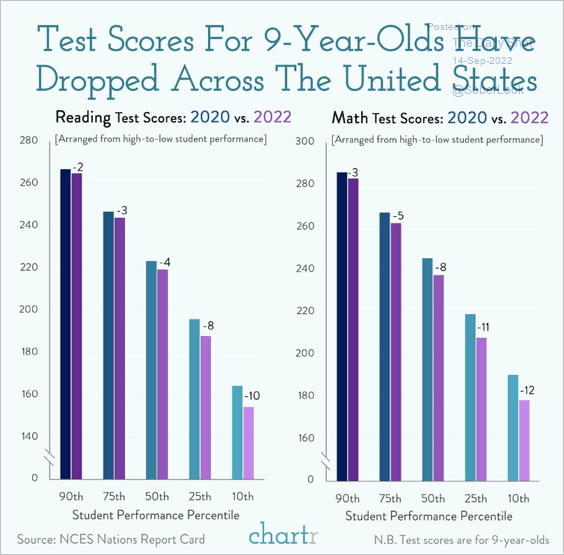

4. Test scores for 9-year-olds (2020 vs. 2022):

Source: Federal Reserve Bank of Atlanta Read full article

Source: Federal Reserve Bank of Atlanta Read full article

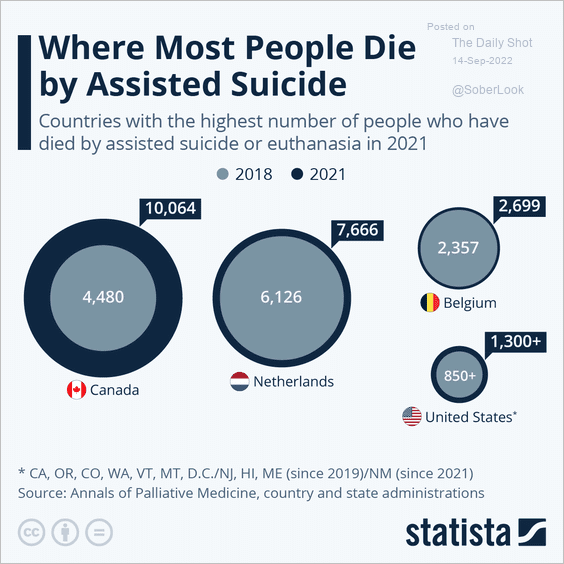

5. Assisted suicide deaths:

Source: Statista

Source: Statista

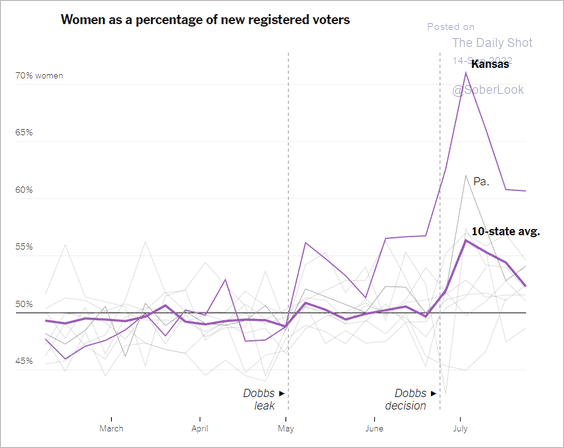

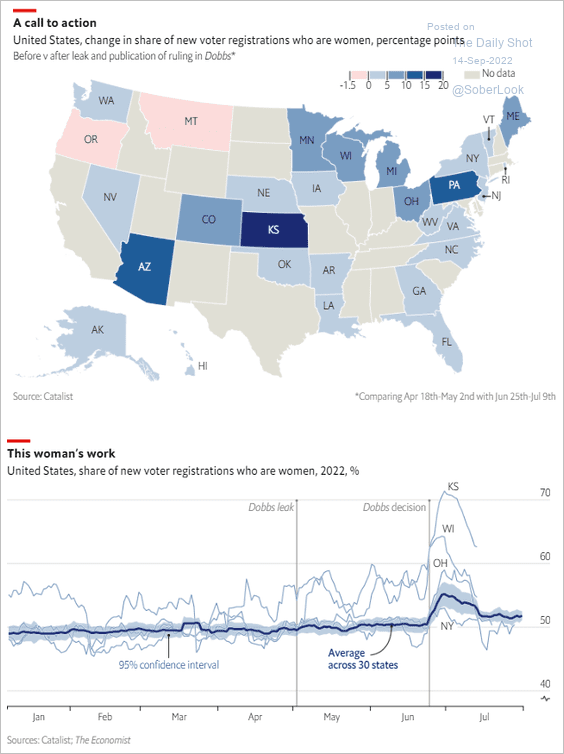

6. Women as a percentage of newly registered voters in the US:

Source: The New York Times Read full article

Source: The New York Times Read full article

Source: The Economist Read full article

Source: The Economist Read full article

——————–

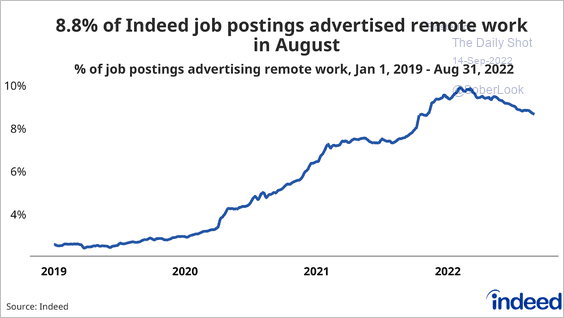

7. Remote work postings:

Source: @indeed

Source: @indeed

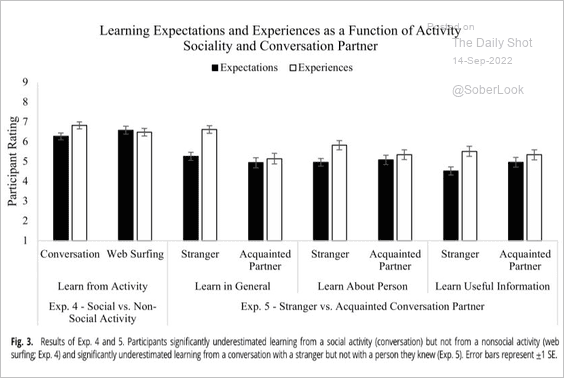

8. Learn by talking to strangers:

Source: @emollick Read full article

Source: @emollick Read full article

——————–

Back to Index