The Daily Shot: 19-Sep-22

• The United States

• Canada

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Globval Developemnts

• Food for Thought

The United States

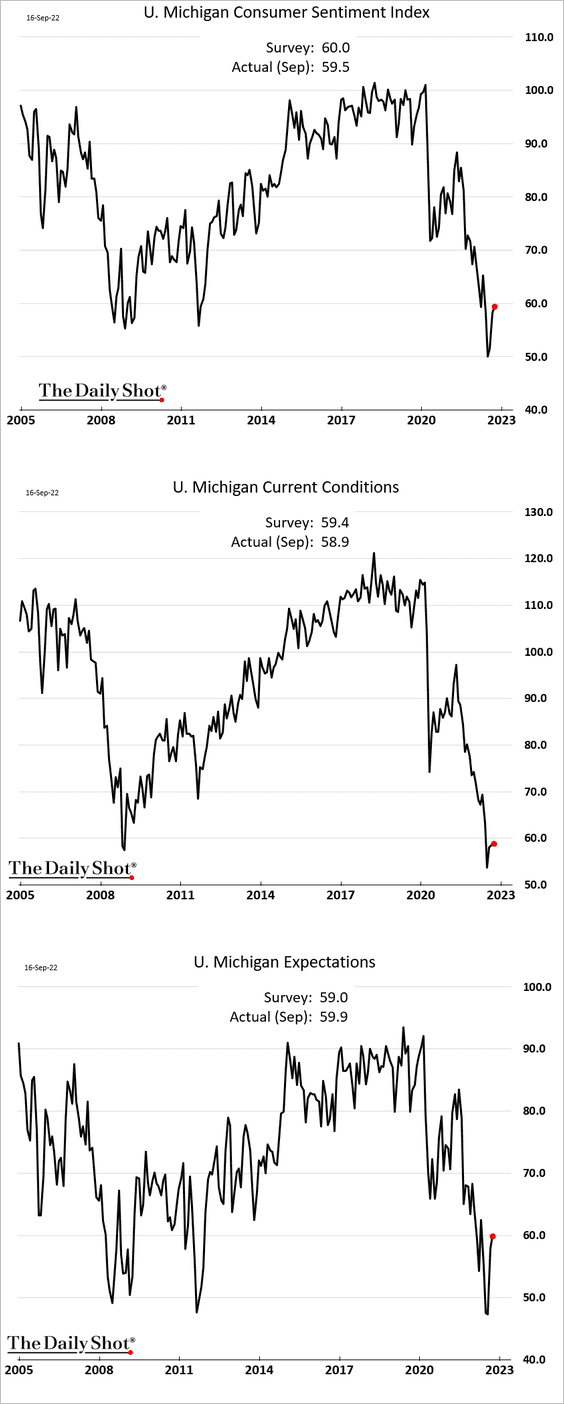

1. The U. Michigan consumer sentiment index edged higher this month as gasoline prices declined.

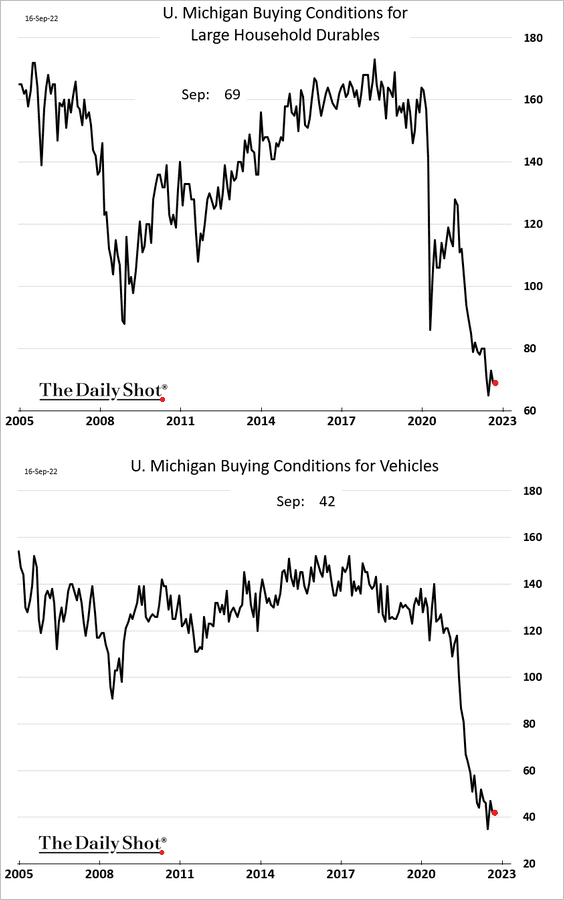

Buying conditions remain depressed.

——————–

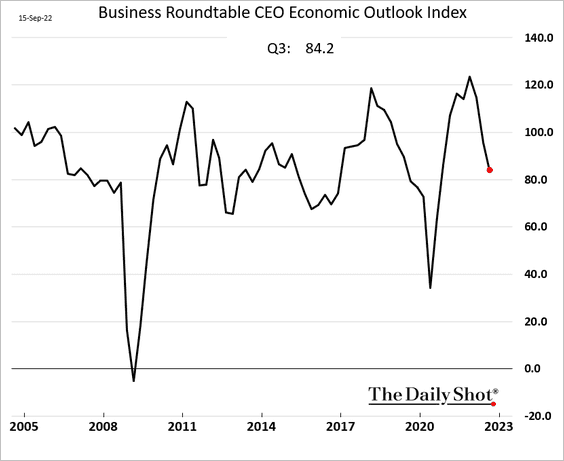

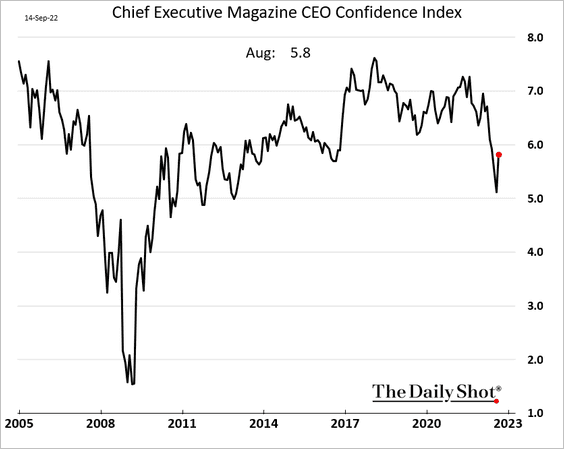

2. The Business Roundtable CEO sentiment survey is down this quarter.

But the CEO Magazine confidence index showed an improvement last month.

——————–

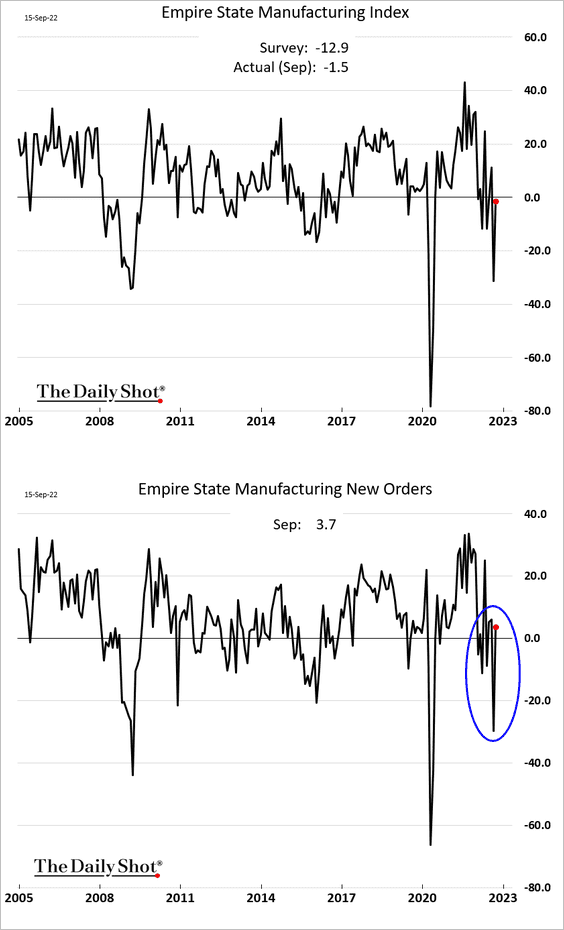

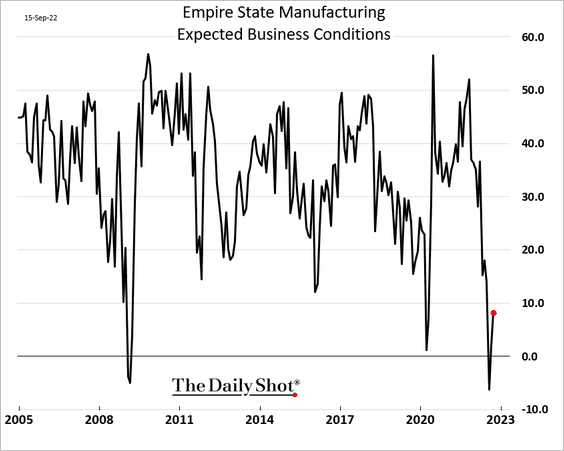

3. The NY Fed’s regional manufacturing index rebounded in September.

Expected business conditions are off the lows.

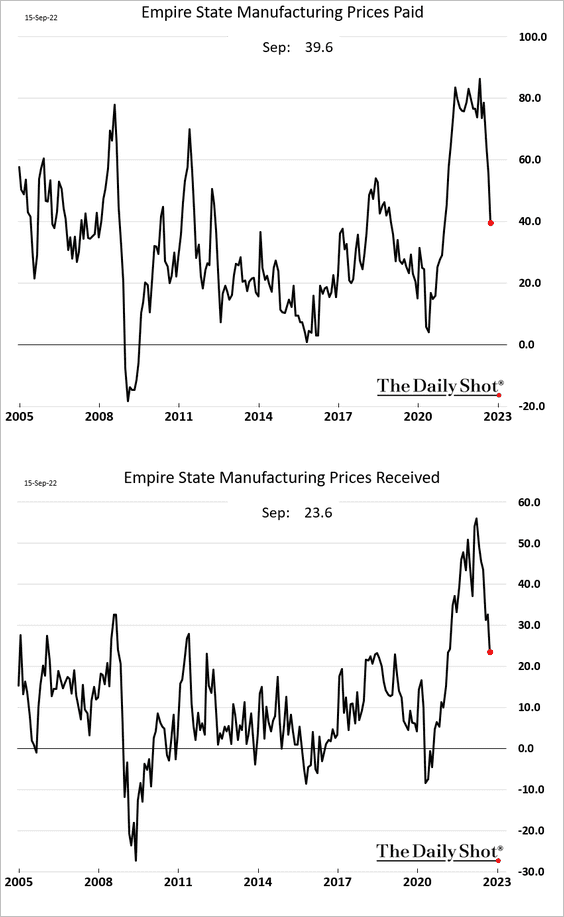

Price pressures are easing.

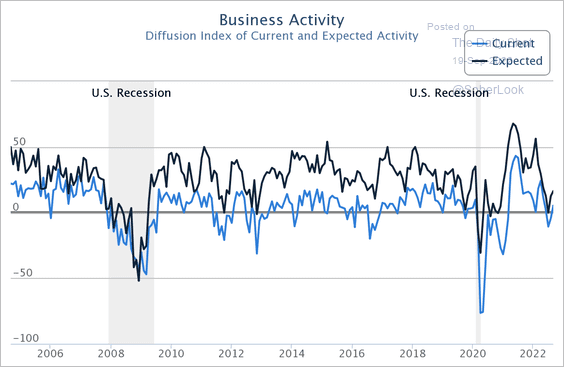

• The NY Fed’s service-sector index also showed a modest improvement.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

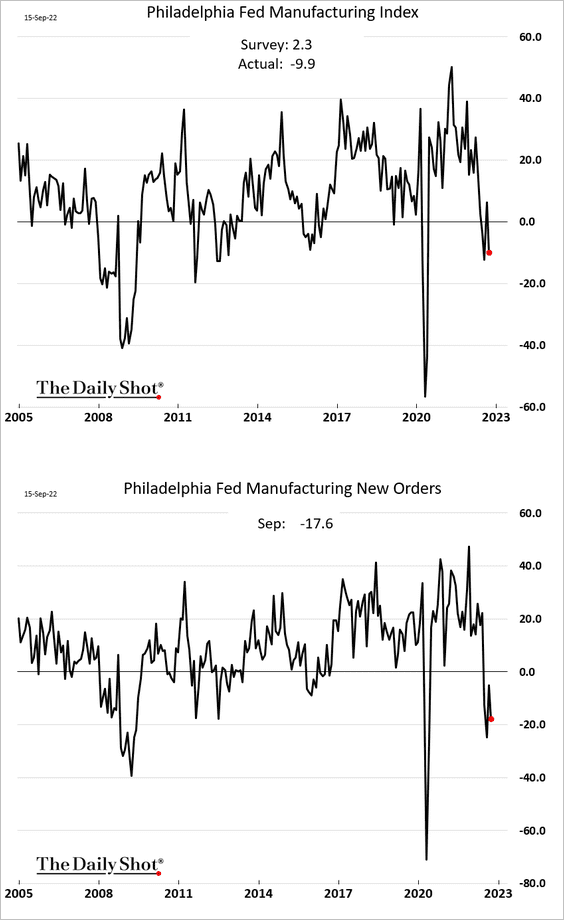

• On the other hand, the Philly Fed’s factory index declined.

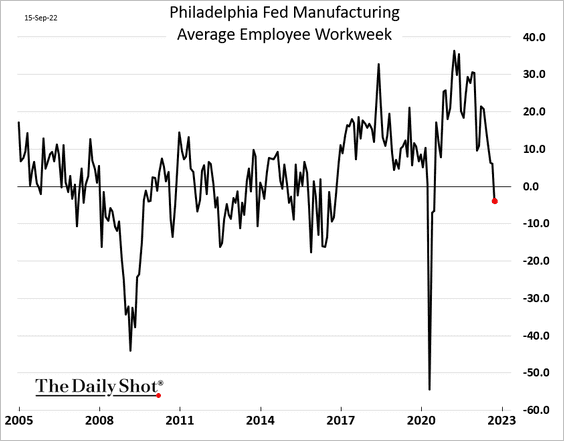

The average employee workweek indicator tumbled.

CapEx expectations are softer as well.

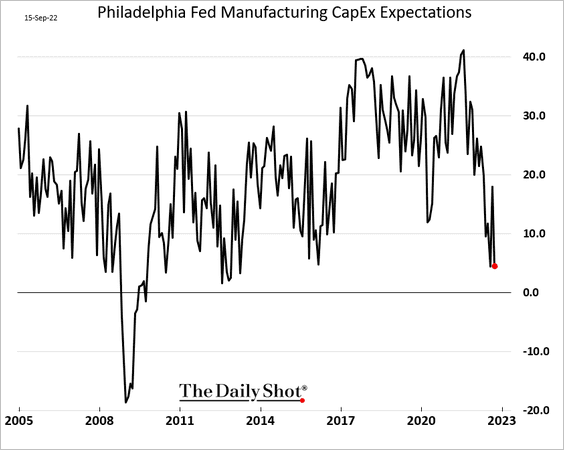

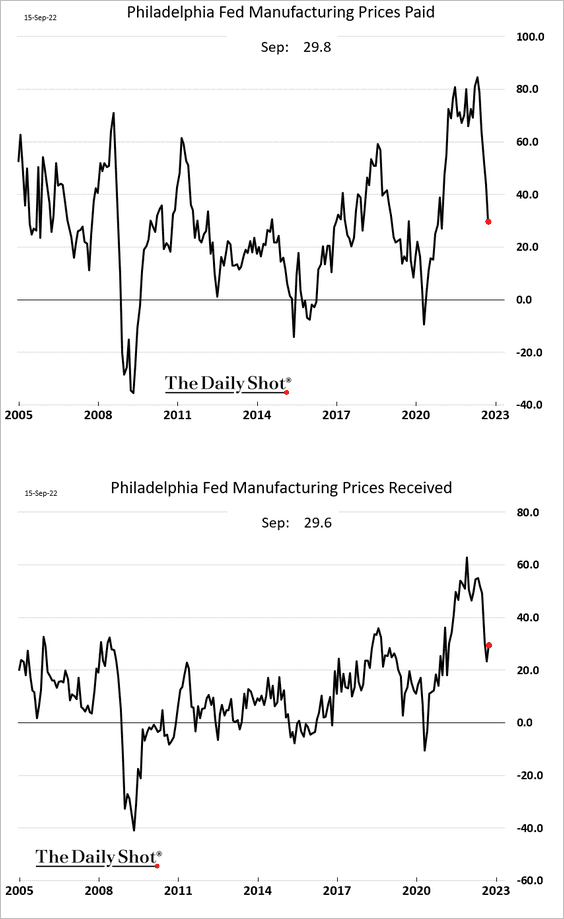

Supply pressures continue to ease.

– Prices:

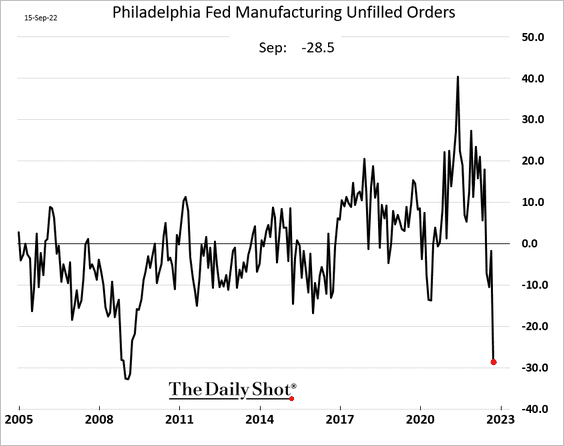

– Unfilled orders:

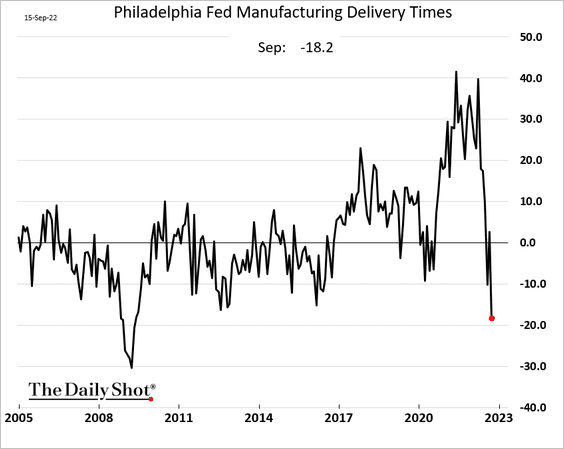

– Delivery times:

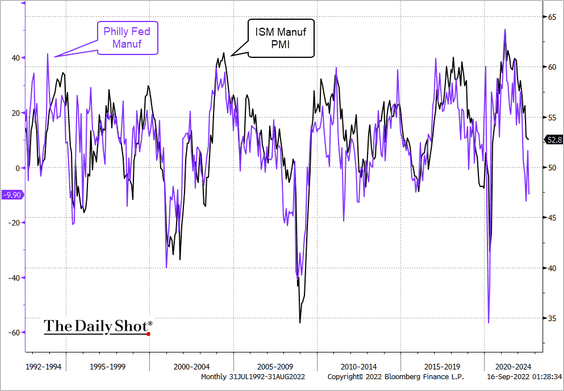

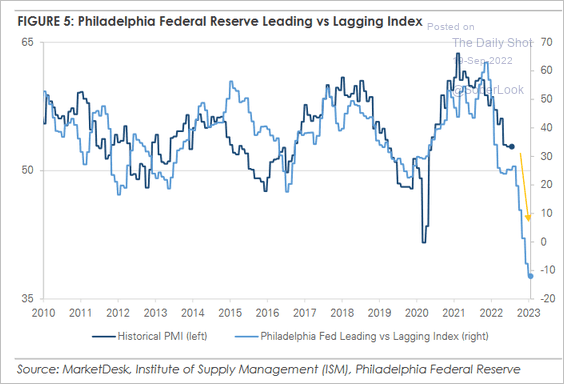

The Philly Fed’s index points to softer factory activity at the national level (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

4. Next, we have some updates on inflation.

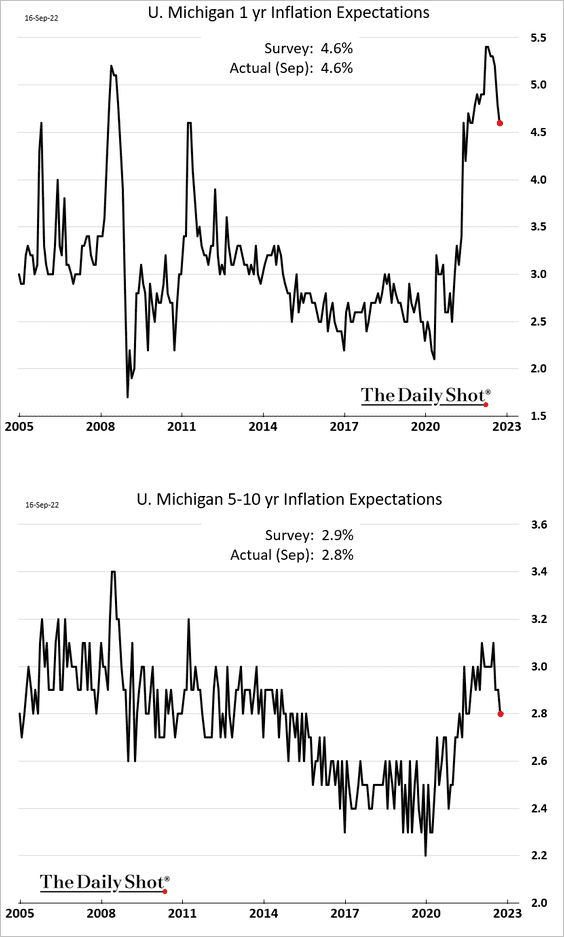

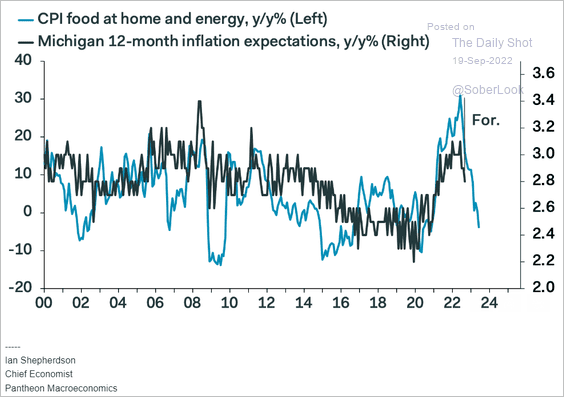

• The U. Michigan consumer inflation expectations continue to moderate.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

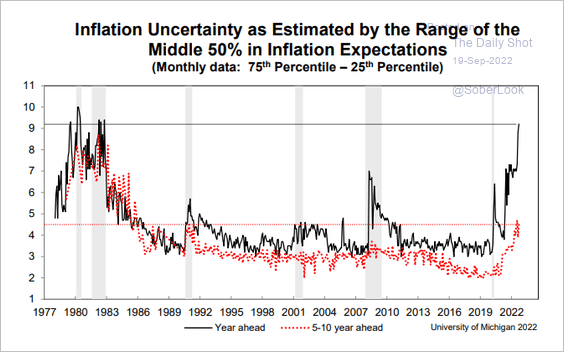

But inflation uncertainty keeps rising.

Source: @GregDaco

Source: @GregDaco

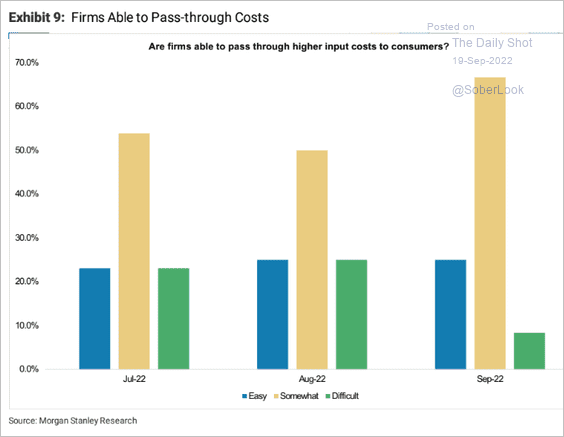

• Companies are still able to pass through higher costs (and some padding).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

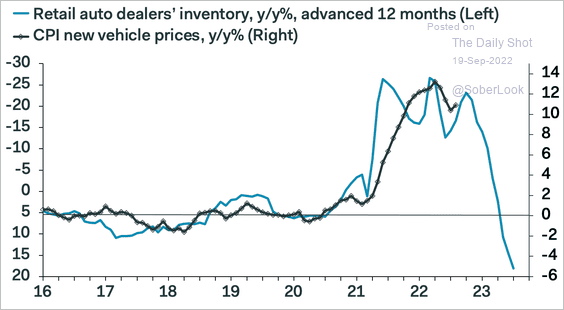

• Inflation on new cars should moderate as inventories and financing costs climb.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

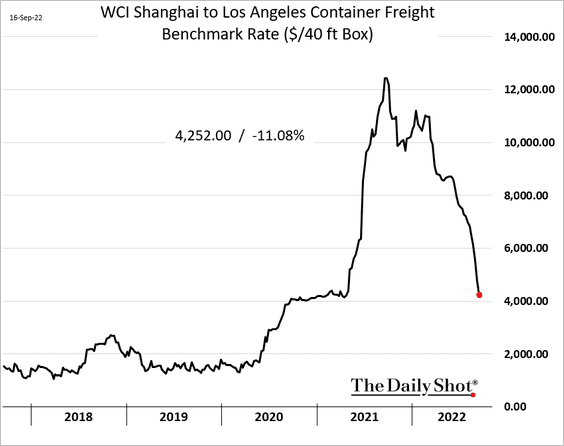

• Ocean freight shipping costs have been easing.

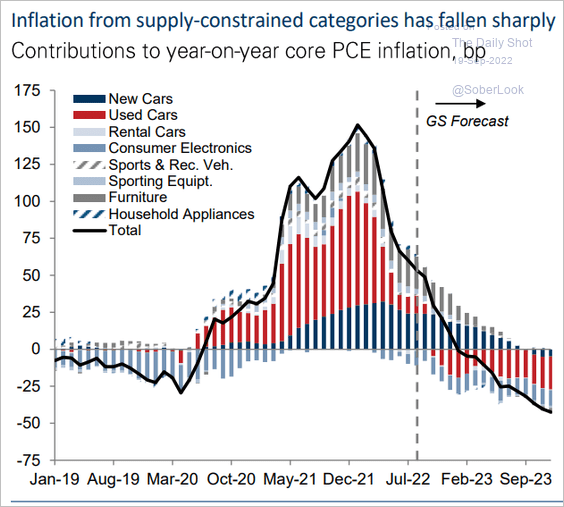

• Supply-constrained goods inflation continues to move lower.

Source: Goldman Sachs

Source: Goldman Sachs

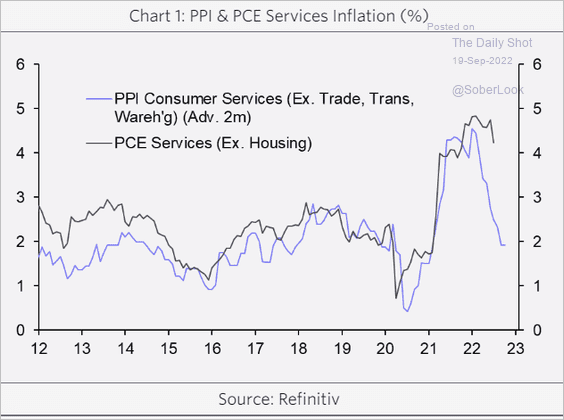

• Weaker demand should help ease inflationary pressures.

Source: Capital Economics

Source: Capital Economics

——————–

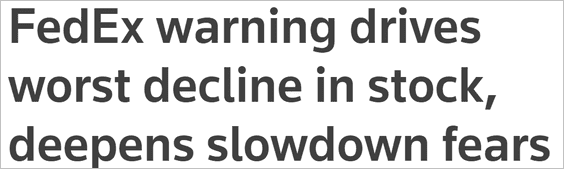

5. FedEx shares plummetted 21% on Friday. What does that tell us about the economy?

Source: Reuters Read full article

Source: Reuters Read full article

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

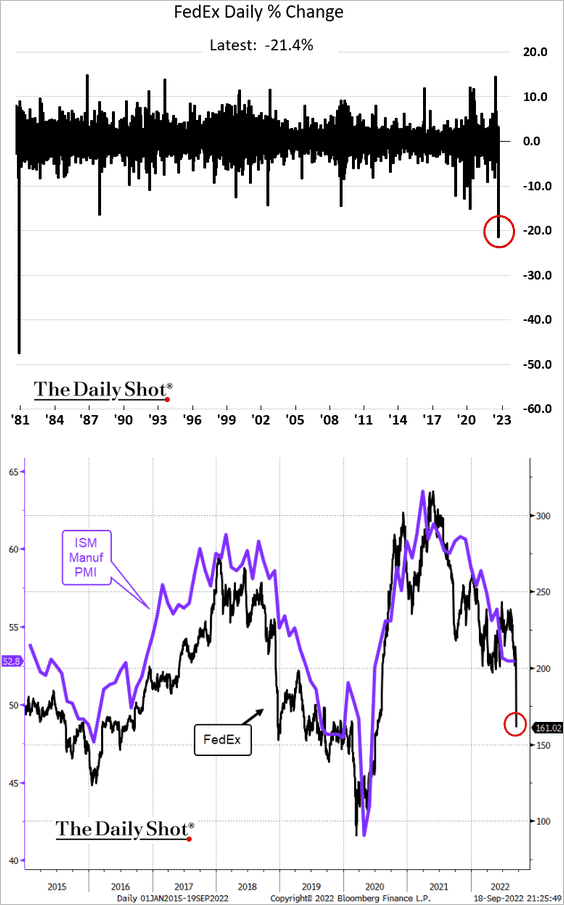

6. Household portfolios are down sharply this year.

Source: All Star Charts

Source: All Star Charts

Back to Index

Canada

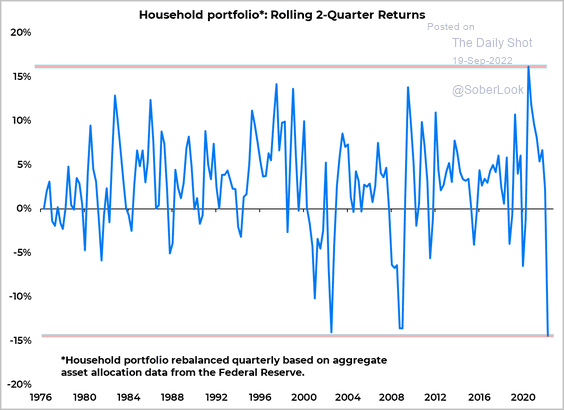

1. Housing starts remain well above pre-COVID levels.

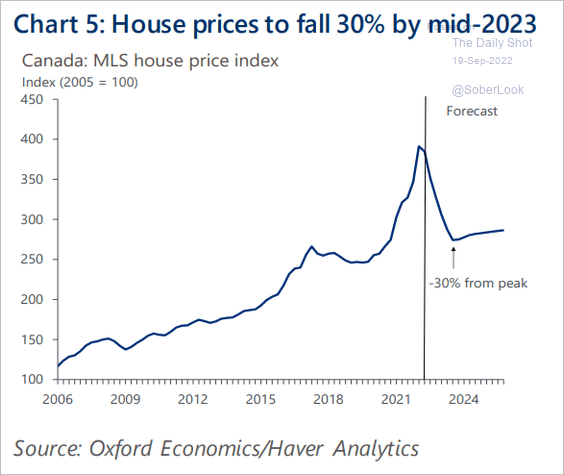

2. Oxford Economics sees a 30% decline in home prices from the peak.

Source: Oxford Economics

Source: Oxford Economics

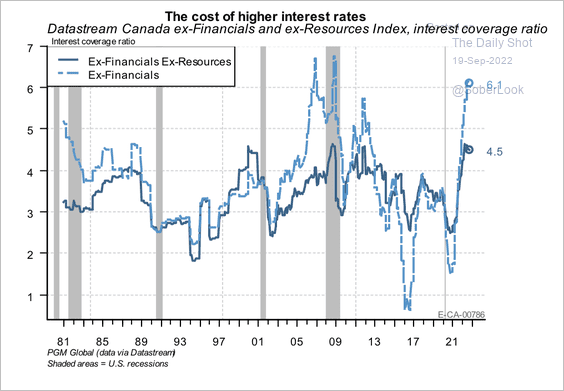

3. Corporate interest-coverage ratios are approaching all-time highs. However, the resource sector has not yet experienced the burden of higher interest rates because of high commodity prices, according to PGM Global.

Source: PGM Global

Source: PGM Global

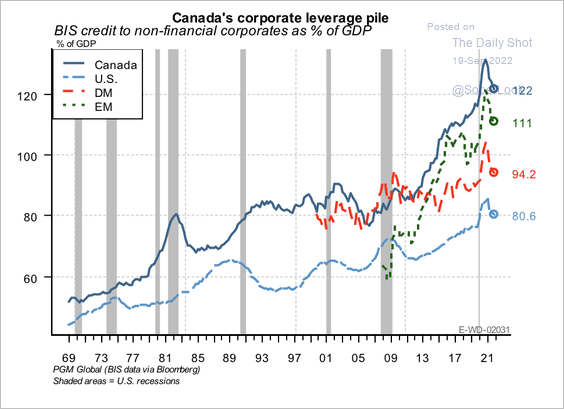

Canada’s corporate leverage is higher than in most other developed markets.

Source: PGM Global

Source: PGM Global

Back to Index

The United Kingdom

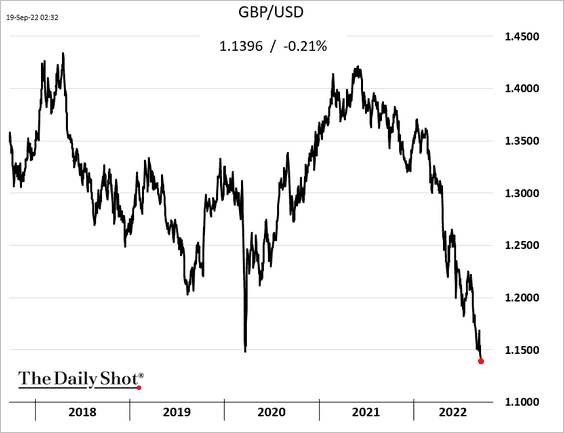

1. The pound continues to drift lower.

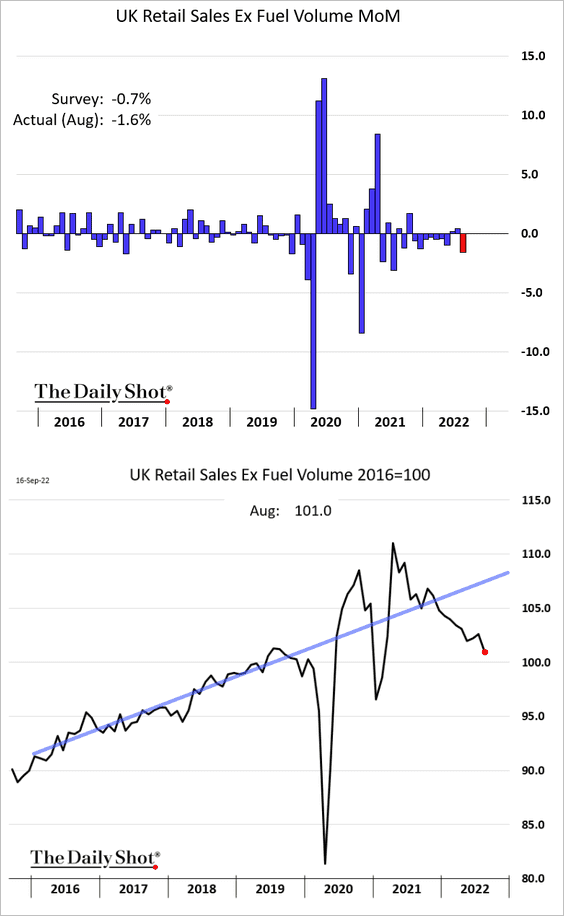

2. August retail sales surprised to the downside.

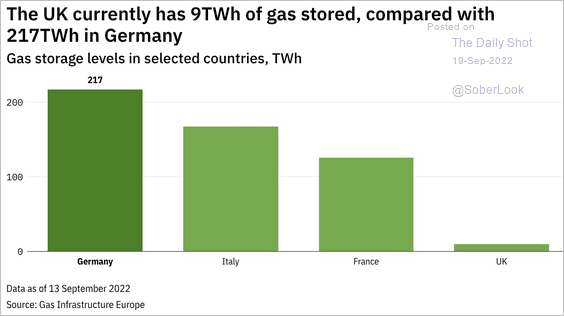

3. UK natural gas storage is very low compared to the EU.

Source: @janrosenow Read full article

Source: @janrosenow Read full article

Back to Index

Europe

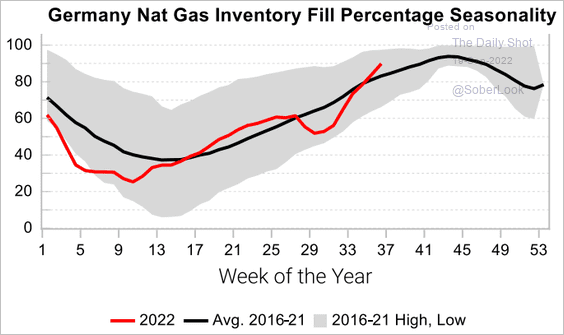

1. Germany’s natural gas inventories continue to climb.

Source: Variant Perception

Source: Variant Perception

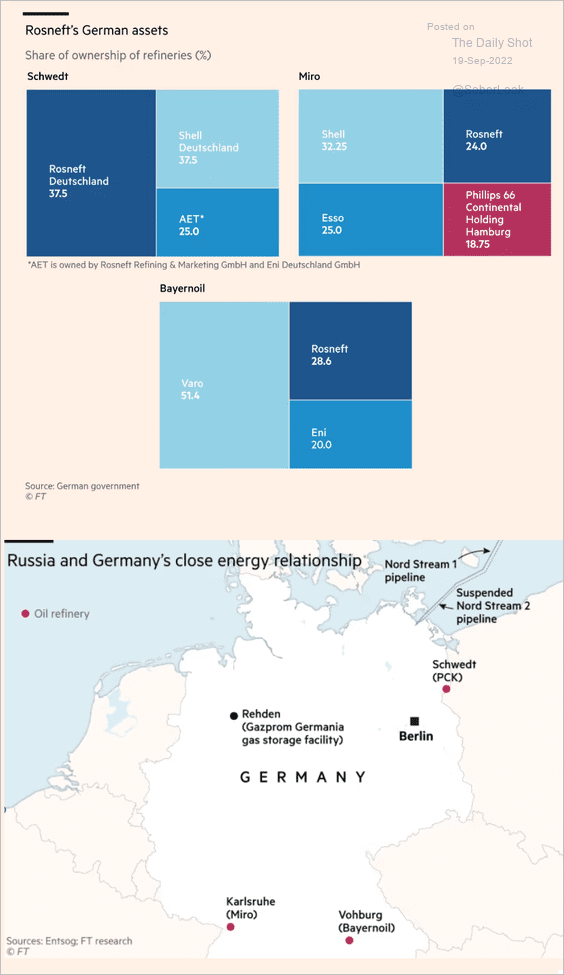

Germany took control of PCK Schwedt, a major Russian-owned oil refinery.

Source: @financialtimes Read full article Further reading

Source: @financialtimes Read full article Further reading

——————–

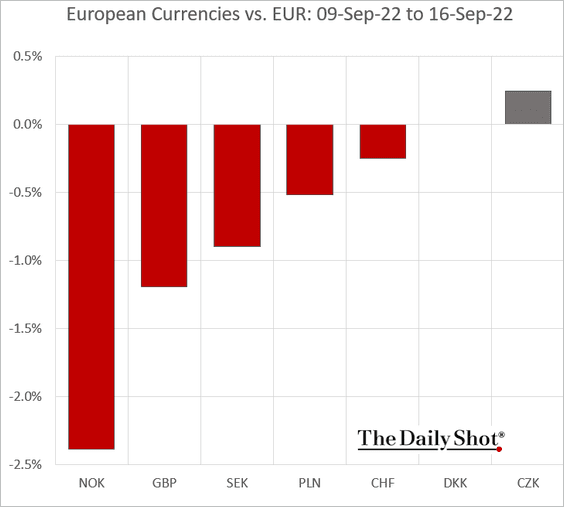

2. The Norwegian krone underperformed last week.

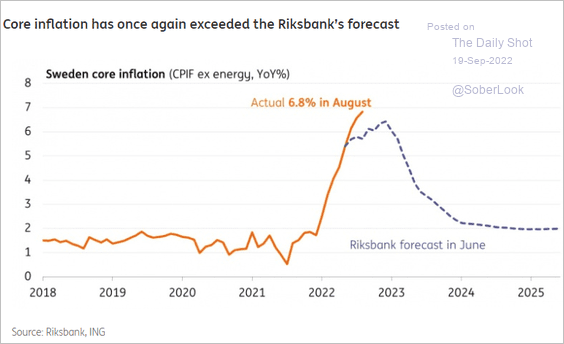

3. Sweden’s inflation continues to exceed Riksbank’s forecasts.

Source: ING

Source: ING

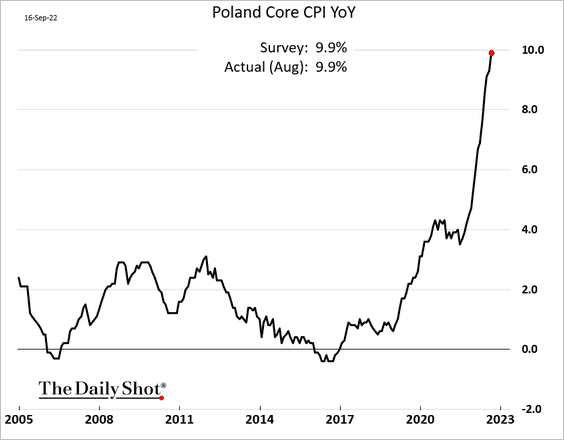

4. Poland’s core CPI is nearing 10%.

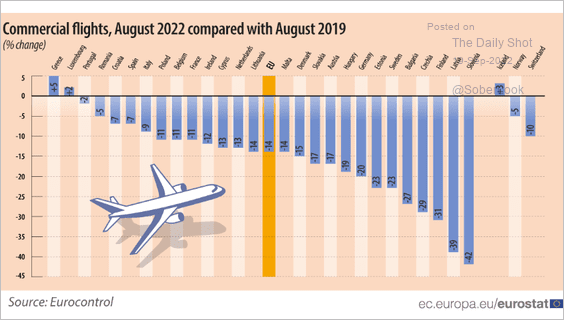

5. This chart shows EU commercial flights vs. pre-COVID levels.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

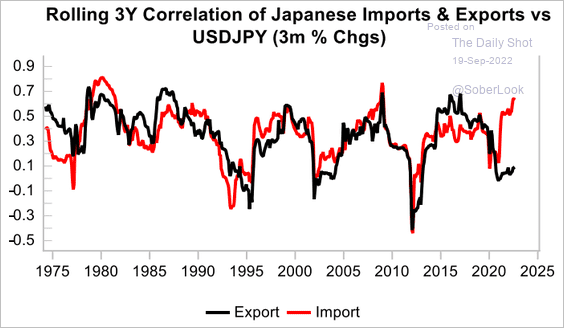

1. The yen’s weakness is boosting Japan’s energy import costs but is not helping much with exports.

Source: Variant Perception

Source: Variant Perception

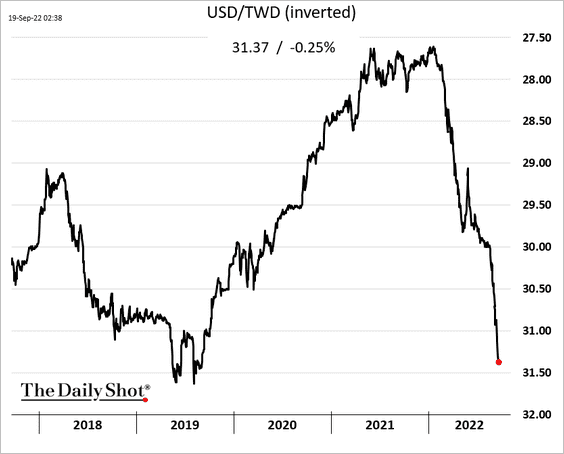

2. The Taiwan dollar continues to weaken vs. USD.

Back to Index

China

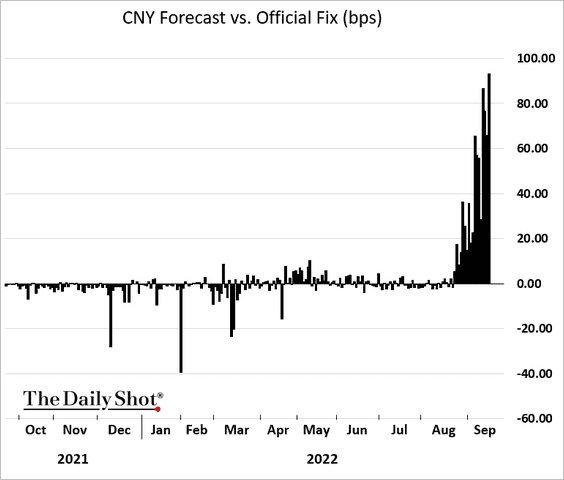

1. The PBoC is still attempting to strengthen the renminbi.

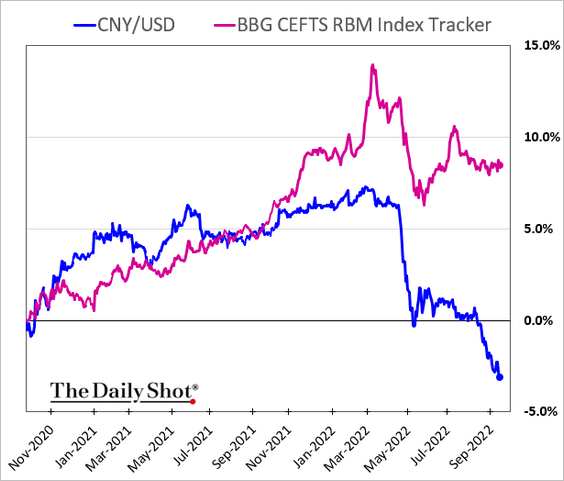

For now, the renminbi’s decline has been mostly against the dollar.

Source: Bloomberg

Source: Bloomberg

——————–

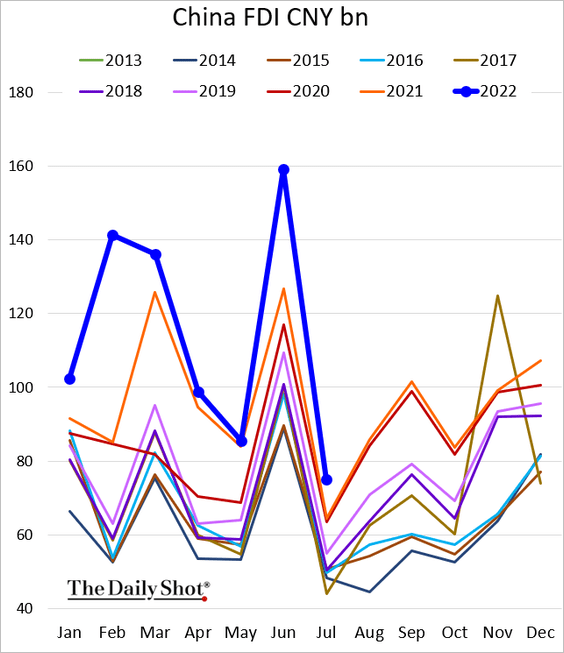

2. Foreign direct investment remains robust (a multi-year high for this time of the year).

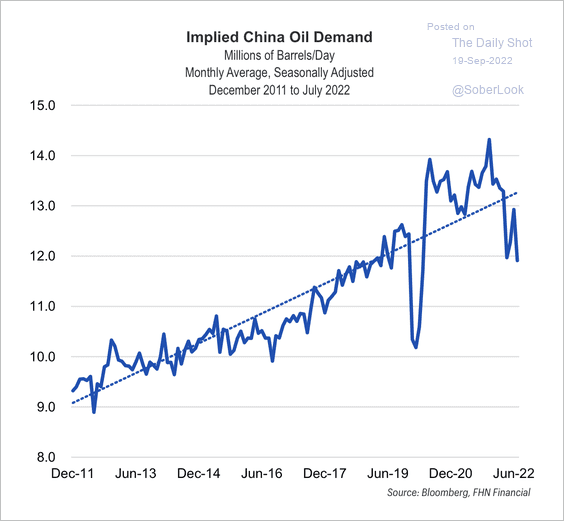

3. China’s oil demand has fallen below its long-term trend.

Source: FHN Financial

Source: FHN Financial

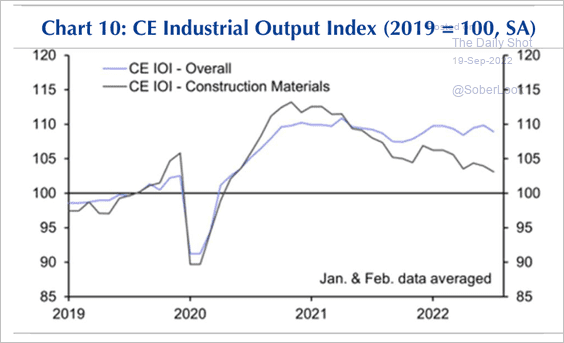

4. The output of building materials is still trending down.

Source: Capital Economics

Source: Capital Economics

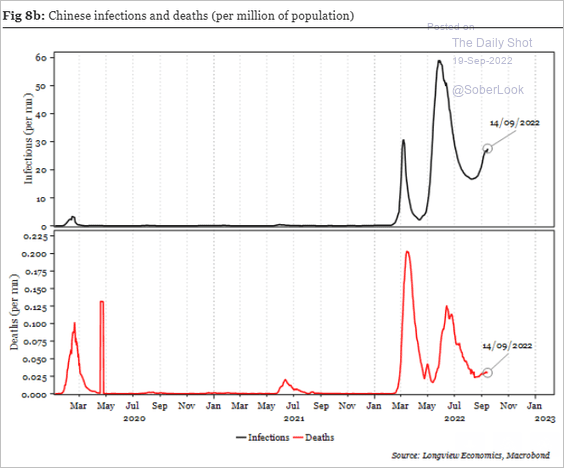

5. COVID remains a headwind for economic growth.

Source: Longview Economics

Source: Longview Economics

Back to Index

Emerging Markets

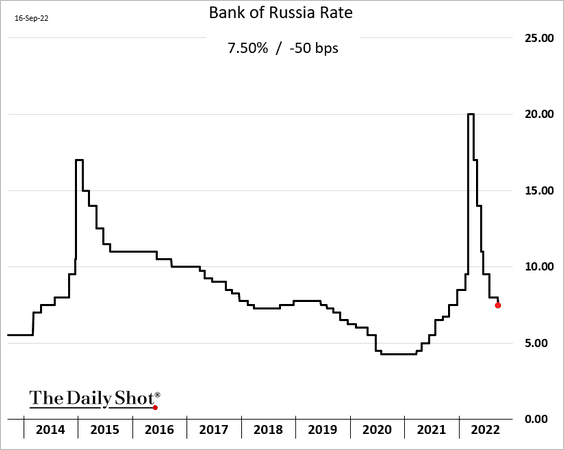

1. Russia’s central bank cut rates again.

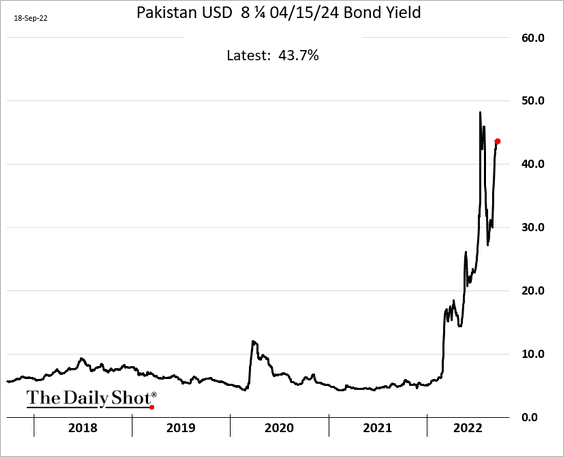

2. Pakistan will “absolutely not” default on its debt.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Bloomberg

Source: Bloomberg

——————–

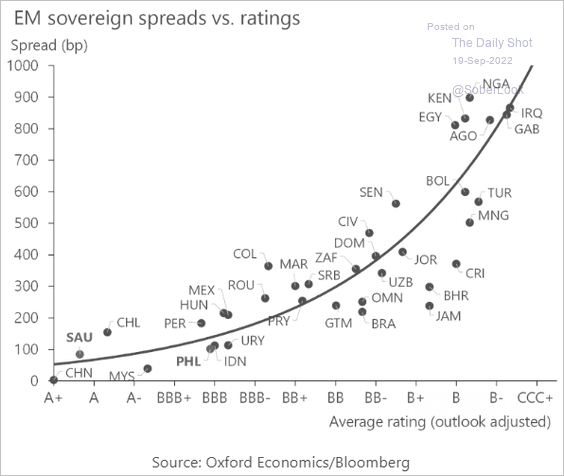

3. This chart shows EM sovereign spreads vs. ratings.

Source: Oxford Economics

Source: Oxford Economics

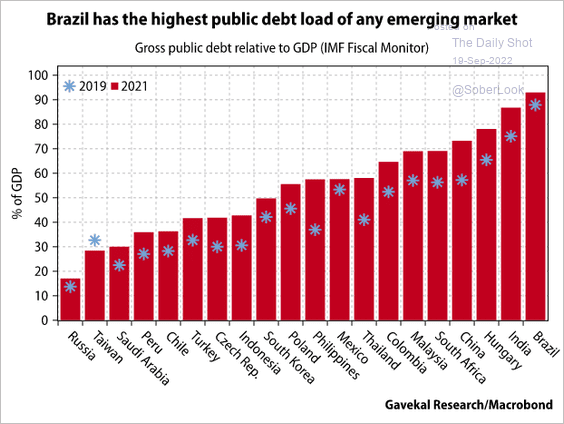

And here are the debt-to-GDP ratios.

Source: Gavekal Research

Source: Gavekal Research

——————–

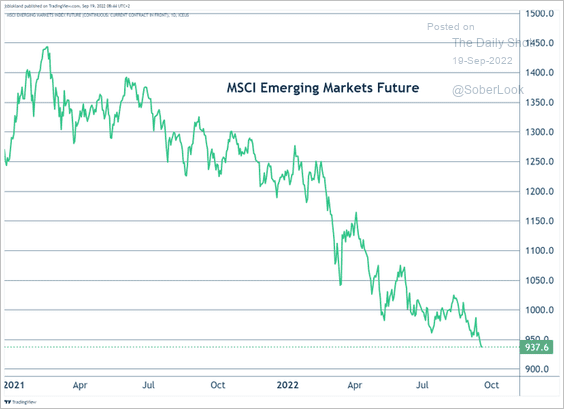

4. EM stocks remain under pressure.

Source: @true_insights_

Source: @true_insights_

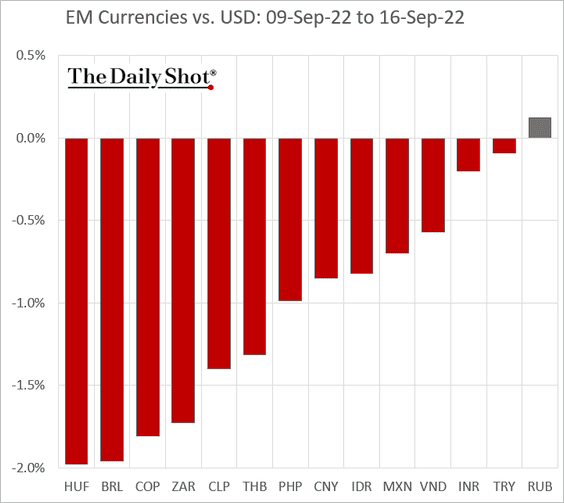

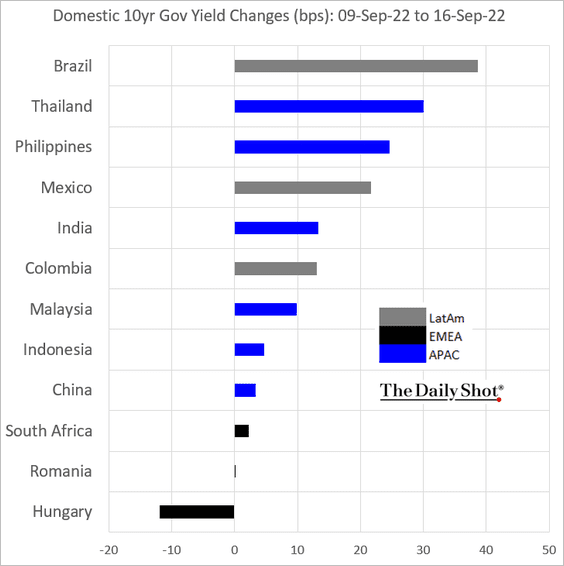

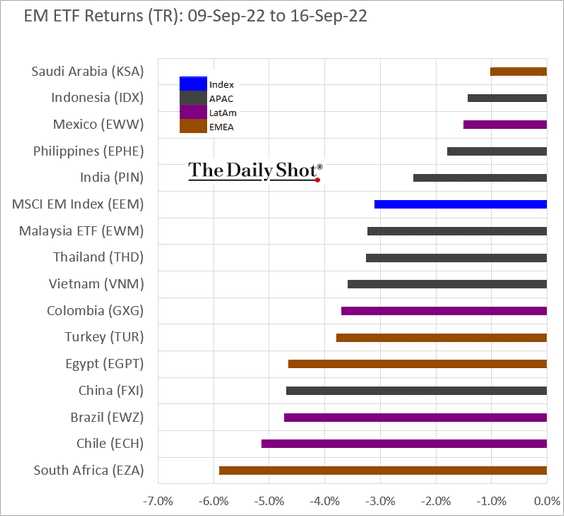

5. Next, we have some performance data from last week.

• Currencies:

• Bond yields:

• Equity ETFs:

Back to Index

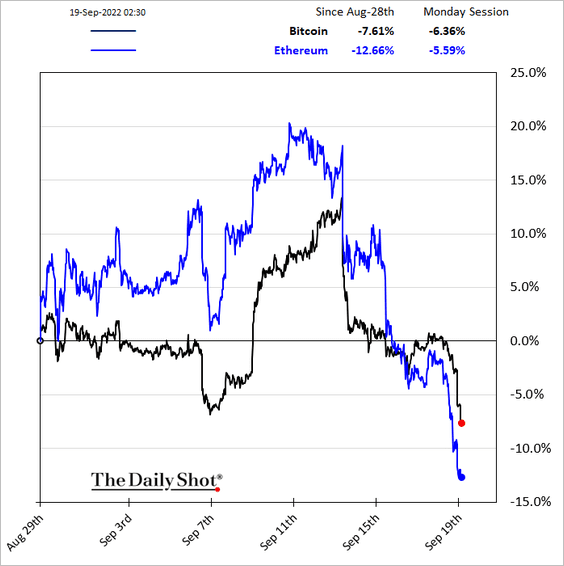

Cryptocurrency

1. Bitcoin is back below $19k as cryptos drop with stocks.

——————–

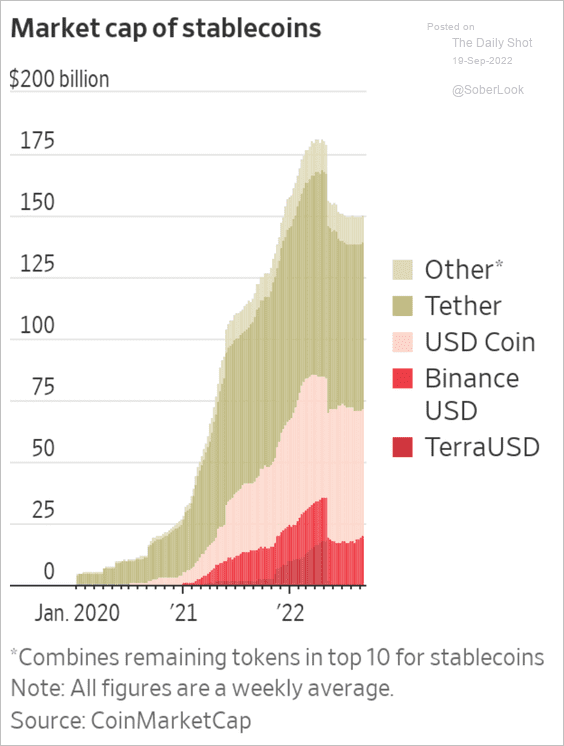

2. Here is the market cap of major stablecoins.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

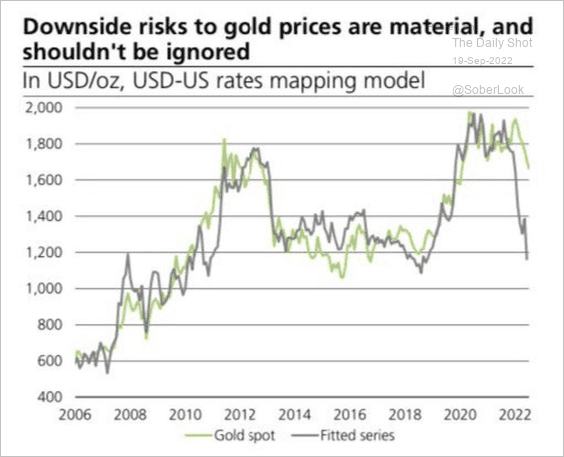

Commodities

1. The US dollar rally and surging real yields point to downside risks for gold.

Source: UBS; @MichaelAArouet

Source: UBS; @MichaelAArouet

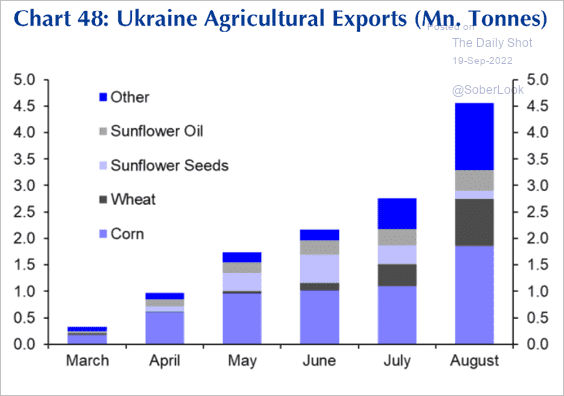

2. Will Putin shut off Ukrainian grain exports?

Source: Capital Economics

Source: Capital Economics

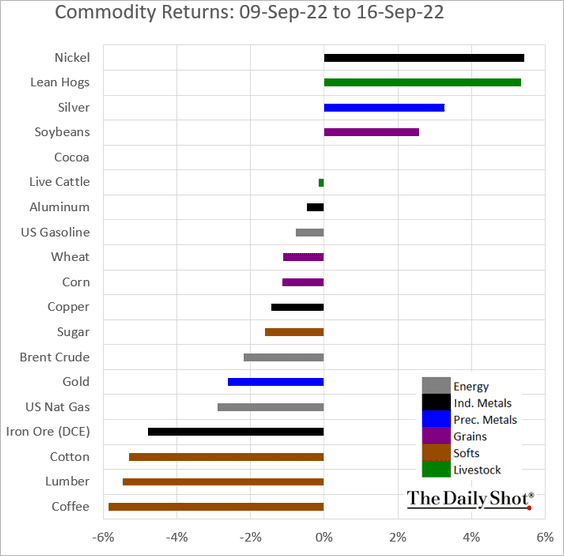

3. Here is last week’s performance across key commodity markets.

Back to Index

Energy

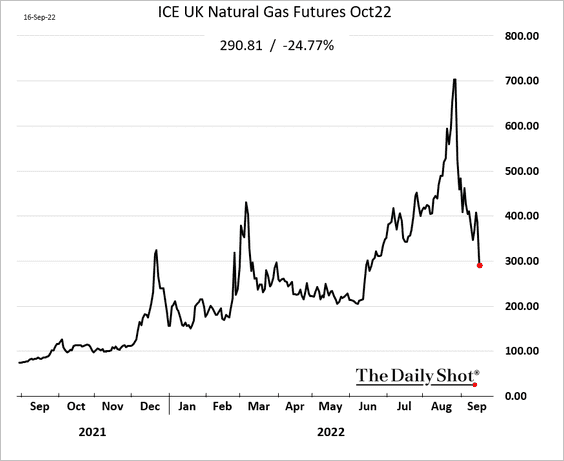

1. European natural gas futures continue to fall.

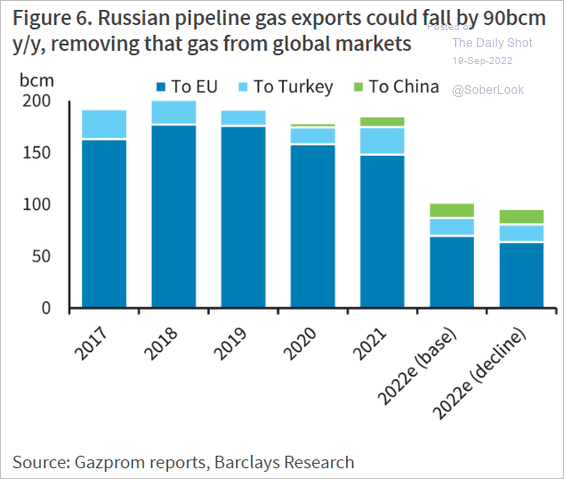

2. Here is a forecast for Russian natural gas sales from Barclays.

Source: Barclays Research

Source: Barclays Research

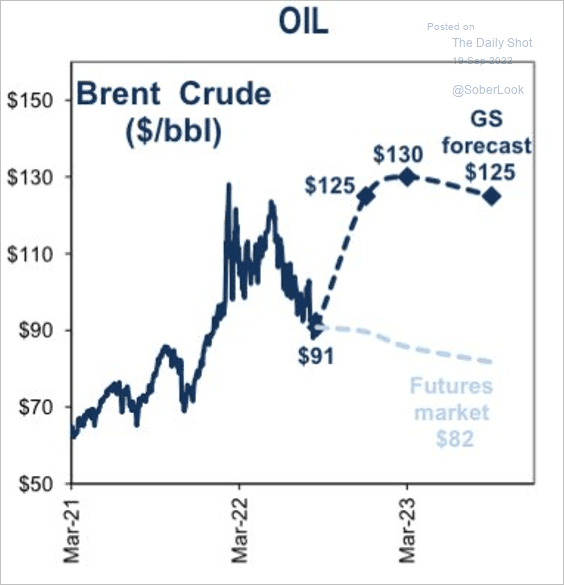

3. Goldman sees crude oil prices surging to $130/bbl next year.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

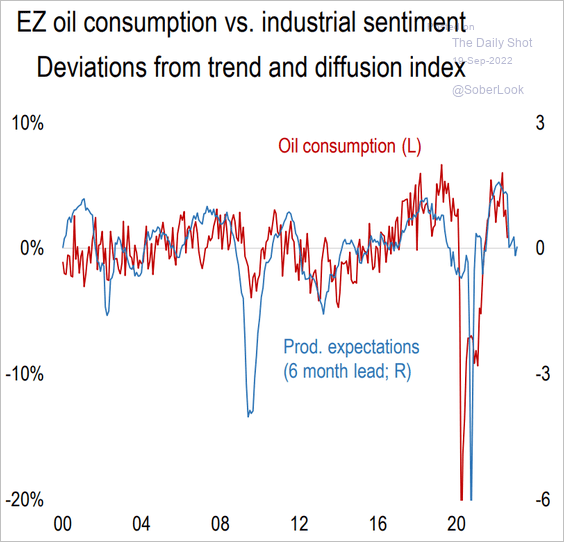

4. European oil demand will slow with industrial output.

Source: Numera Analytics

Source: Numera Analytics

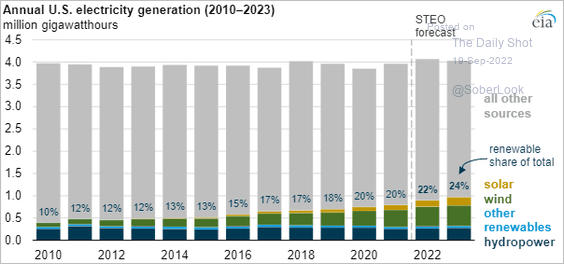

5. This chart shows US renewables electricity generation.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

Back to Index

Equities

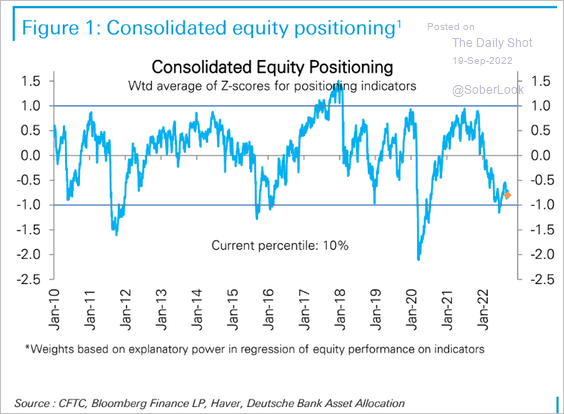

1. Let’s start with Deutsche Bank’s total positioning indicator.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

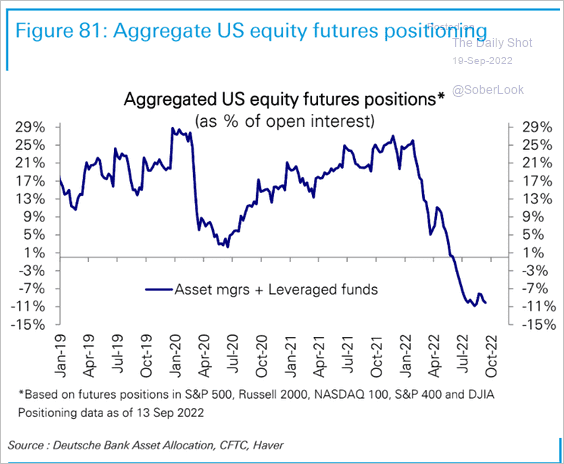

And here is the aggregate futures positioning.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

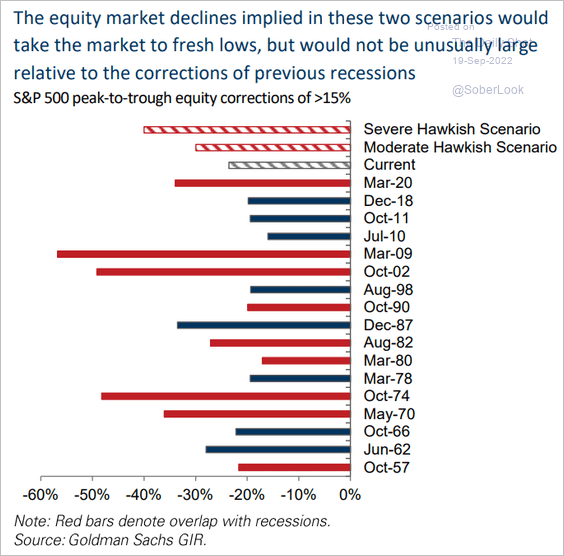

2. A more severe market decline would not be unusual in a recession scenario.

Source: Goldman Sachs

Source: Goldman Sachs

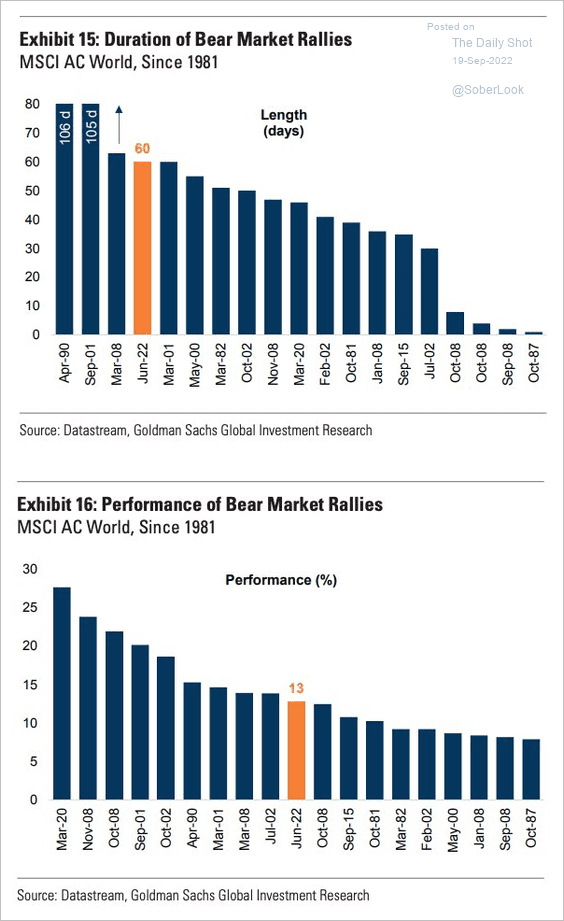

3. Here is a look at bear-market rallies.

Source: Goldman Sachs; @QCompounding

Source: Goldman Sachs; @QCompounding

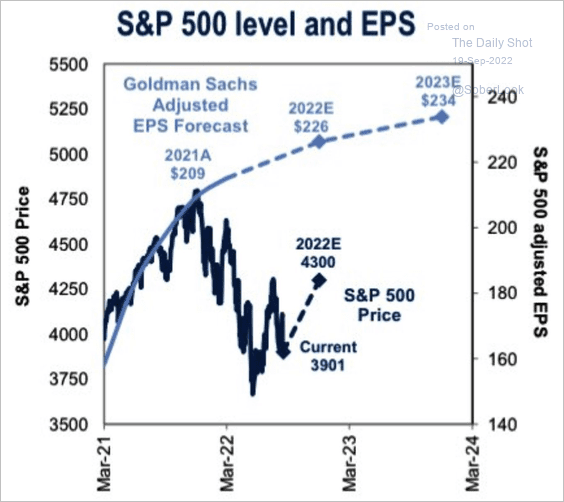

4. Goldman sees a market rebound by the end of the year.

Source: Goldman Sachs; @MichaelAArouet

Source: Goldman Sachs; @MichaelAArouet

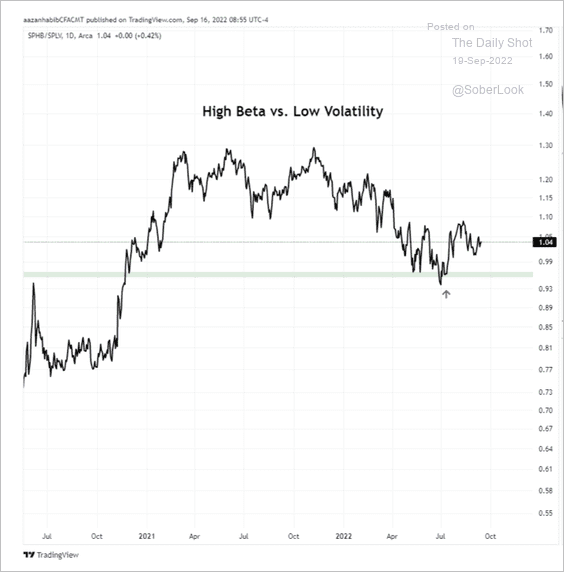

5. The Invesco S&P 500 High Beta ETF(SPHB) is holding support from its June low relative to the Low Volatility ETF (SPLV).

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

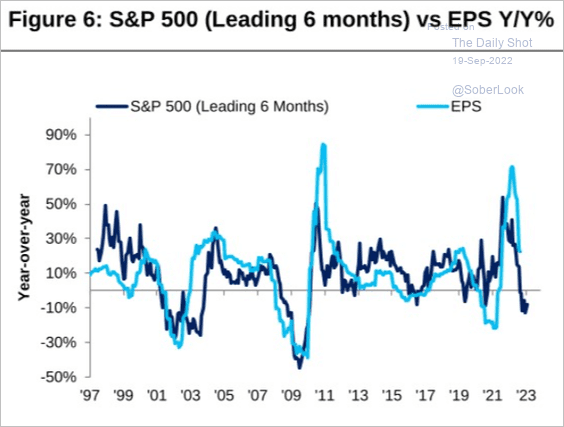

6. The market is pricing in further declines in earnings growth.

Source: Citi Private Bank

Source: Citi Private Bank

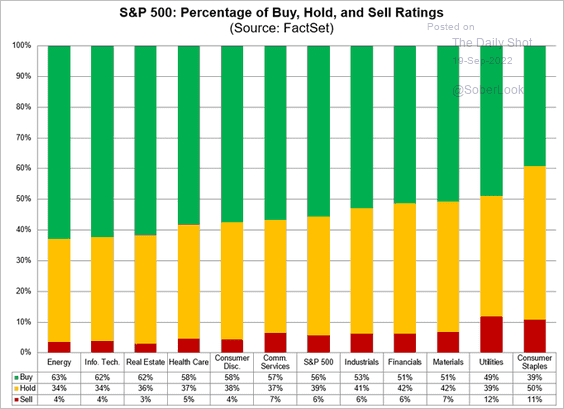

7. Here are the buy/sell ratings by sector.

Source: @FactSet Read full article

Source: @FactSet Read full article

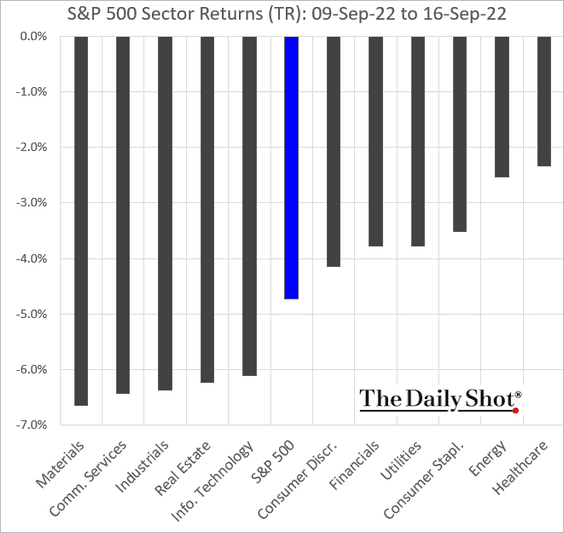

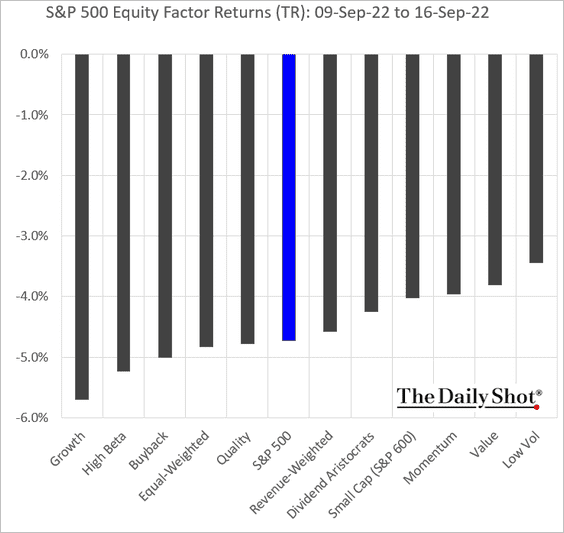

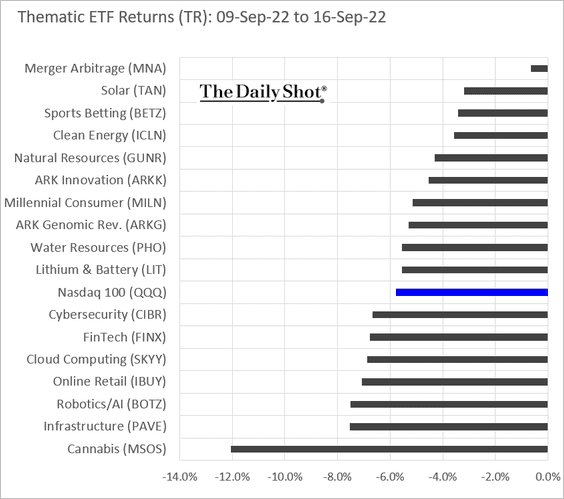

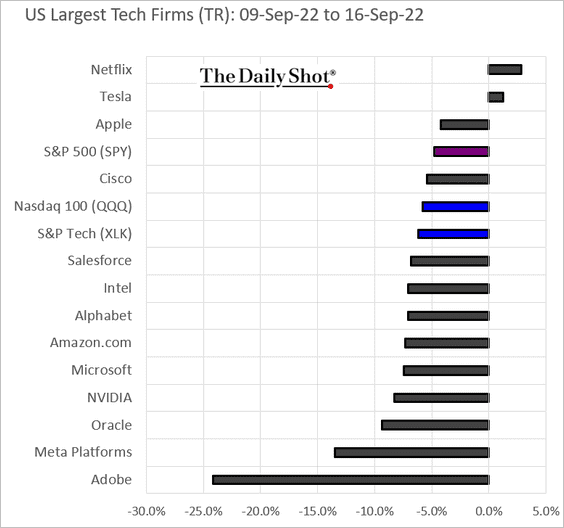

8. Next, we have last week’s performance data.

• Sectors:

• Equity factors:

• Thematic ETFs:

• Largest US tech firms:

——————–

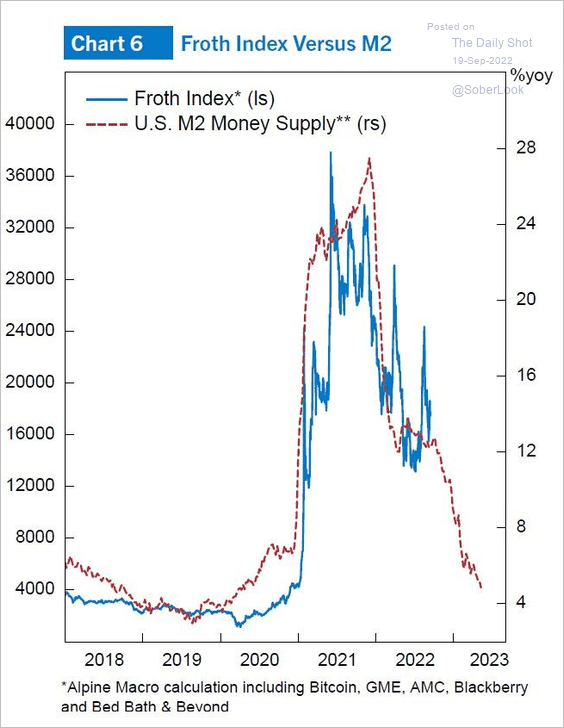

9. Tighter liquidity will be a headwind for speculative assets.

Source: Alpine Macro

Source: Alpine Macro

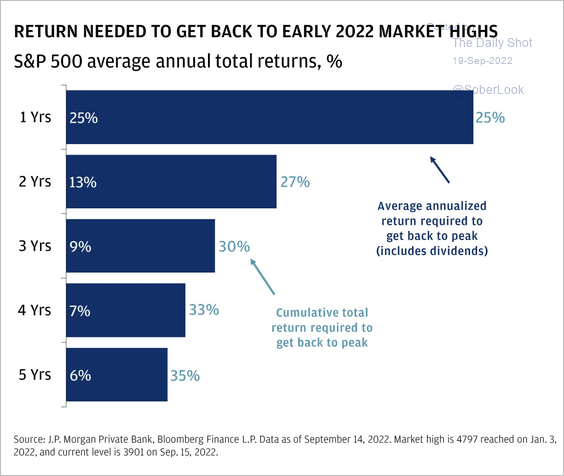

10. What returns are needed to get back to peak levels on the S&P 500?

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Credit

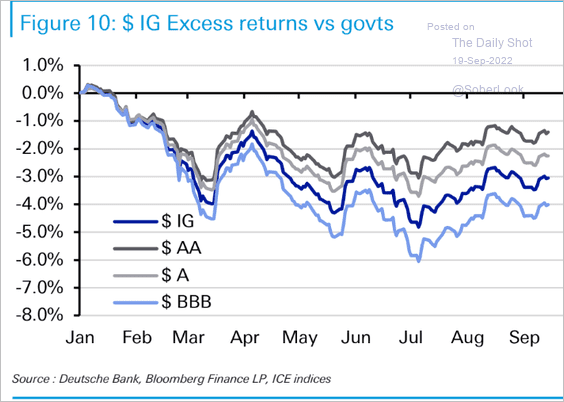

1. US investment-grade debt has been outperforming Treasuries, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

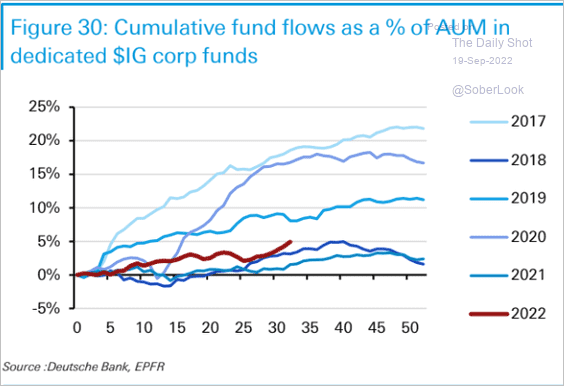

… amid fund inflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

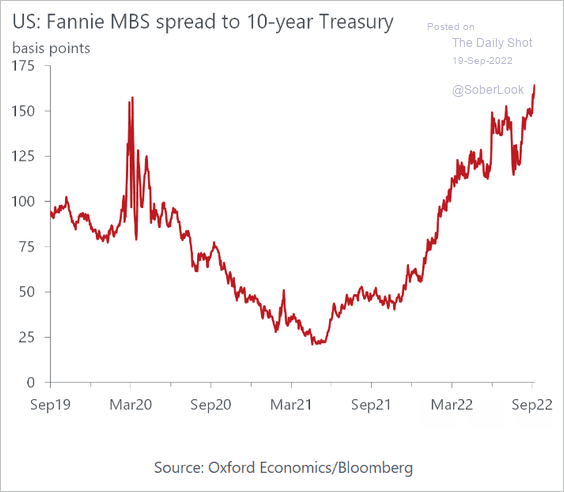

2. MBS spreads have been widening.

Source: Oxford Economics

Source: Oxford Economics

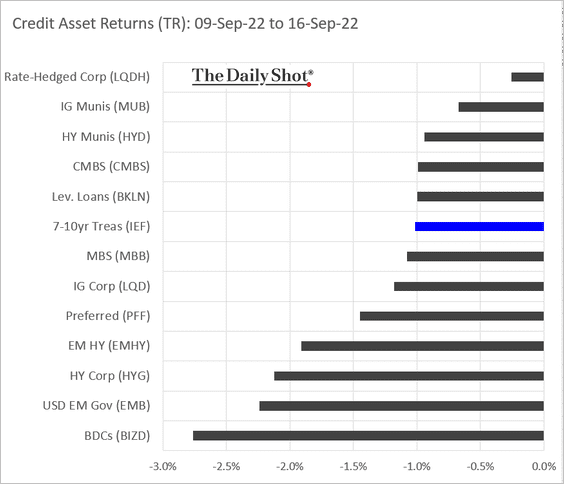

3. Here is last week’s performance by asset class.

Back to Index

Rates

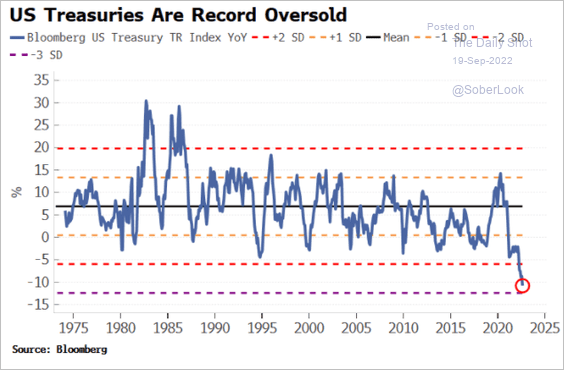

1. Speculative accounts have been boosting their bets against Treasuries.

Are Treasuries oversold?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

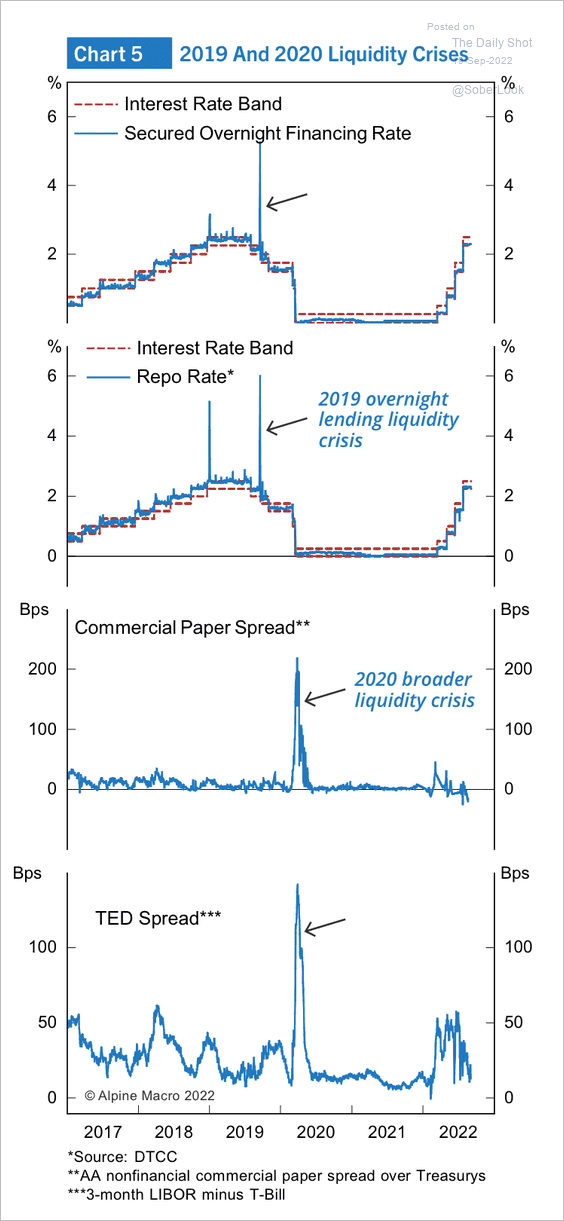

2. Liquidity is drying up, but conditions are not severe compared with 2020.

Source: Alpine Macro

Source: Alpine Macro

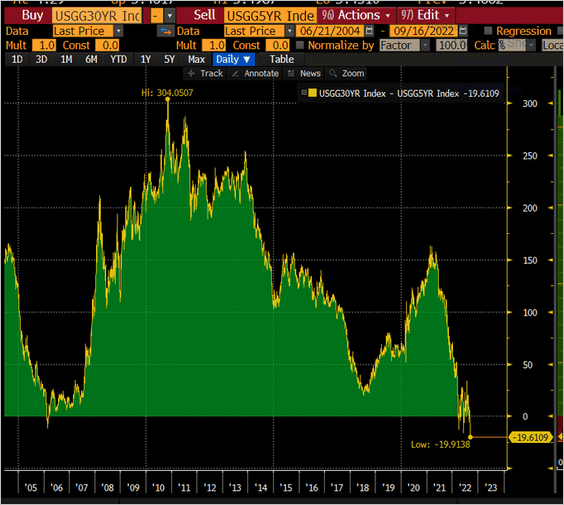

3. The Treasury curve continues to move deeper into inversion territory. Here is the 30yr – 5yr spread.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

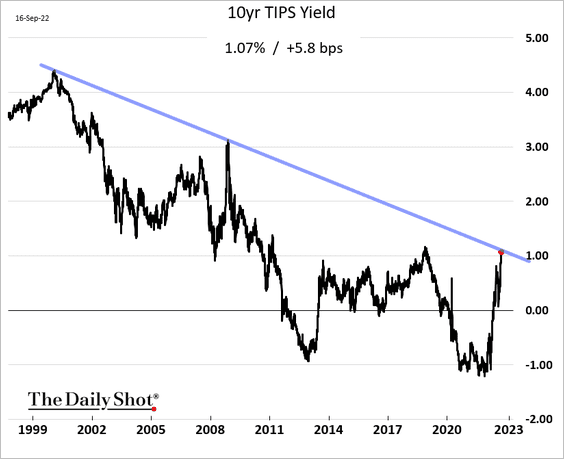

4. The 10-year TIPS yield (real rates) is above 1%.

h/t Evercore ISI Research

h/t Evercore ISI Research

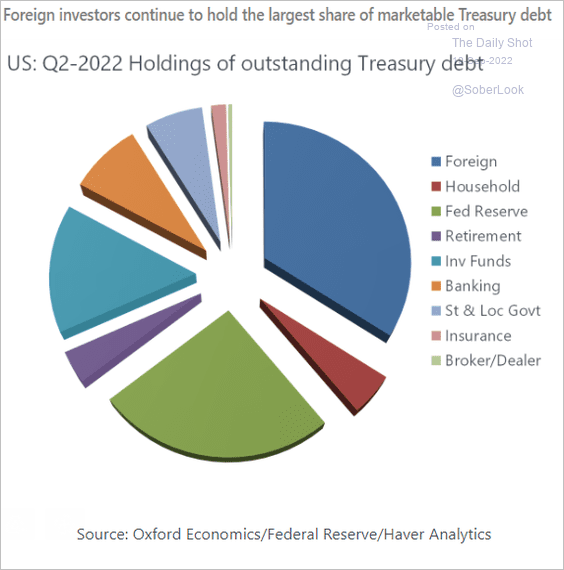

5. Who are the holders of Treasury securities?

Source: Oxford Economics

Source: Oxford Economics

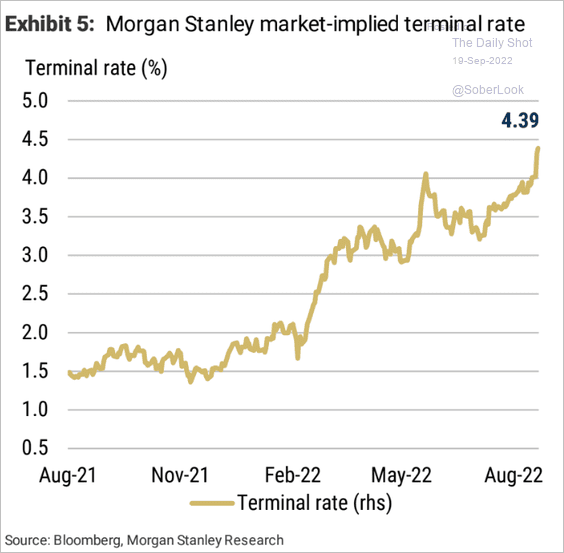

6. The market-implied terminal rate (maximum rate in the current Fed hiking cycle) continues to climb.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Globval Developemnts

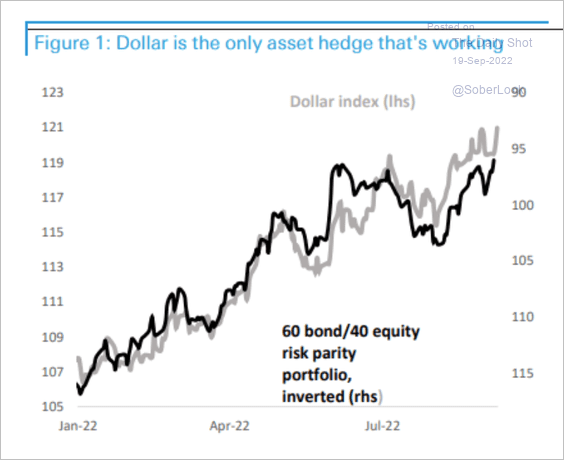

1. There has been a strong negative correlation between the dollar and a 60% equity/40% bond portfolio this year. The greenback has been a safe-haven asset.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

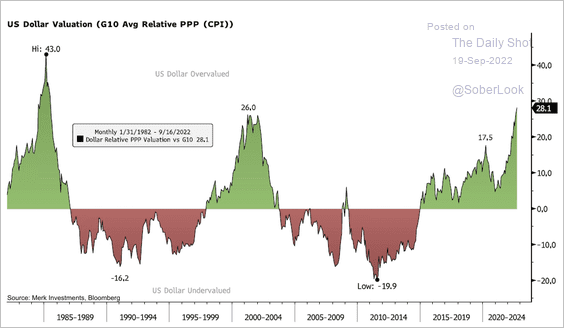

The US dollar is increasingly overvalued.

Source: @nicholastreece

Source: @nicholastreece

——————–

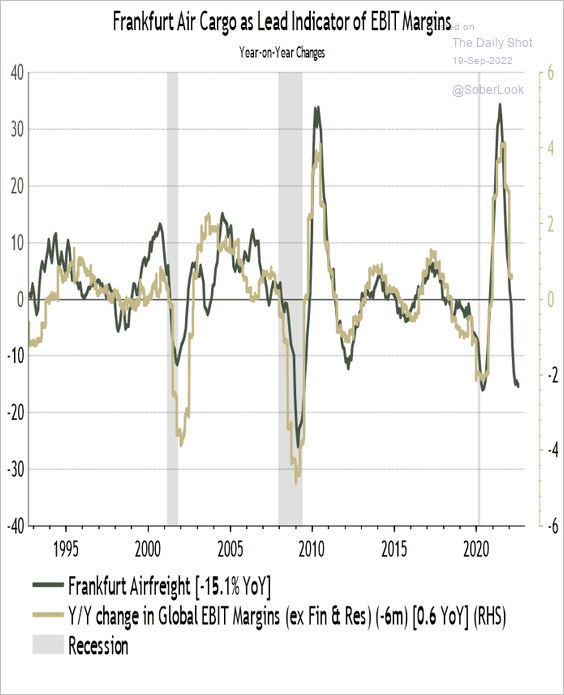

2. Frankfurt’s airfreight volume points to falling corporate margins.

Source: @IanRHarnett

Source: @IanRHarnett

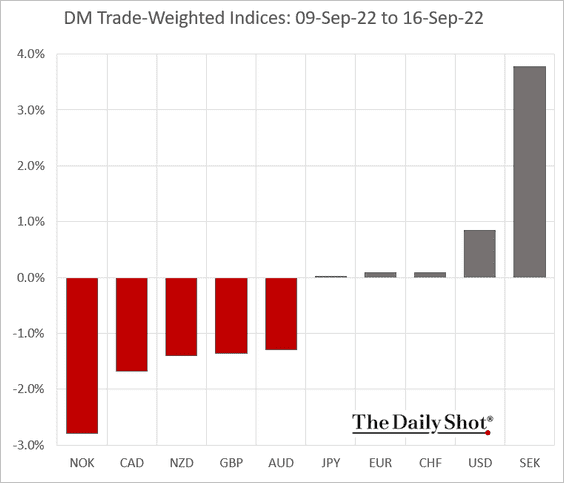

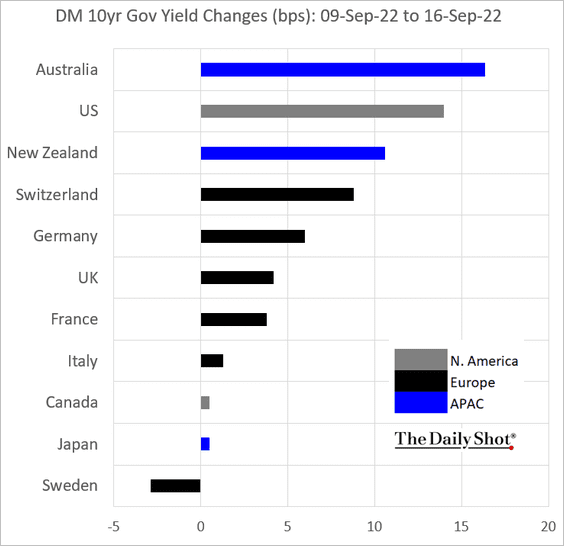

3. Next, we have some performance data from last week.

• Trade-weighted currency indices:

• DM sovereign yields:

——————–

Food for Thought

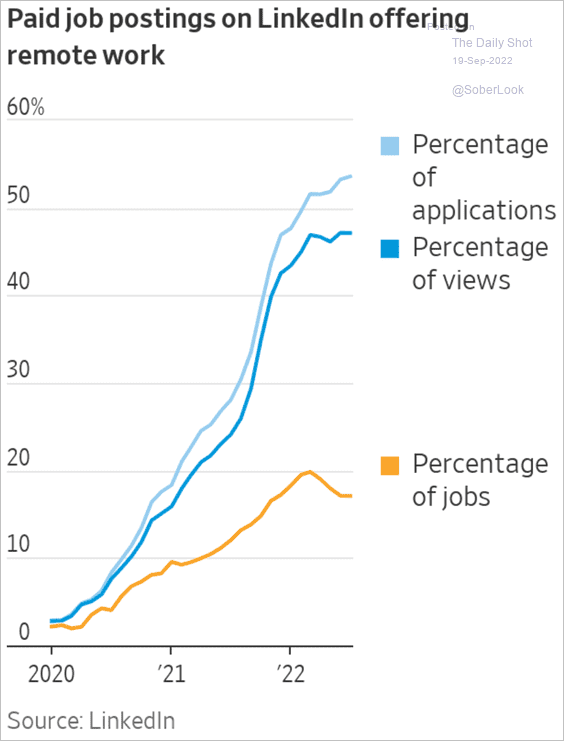

1. Remote work job applications and postings:

Source: @WSJ Read full article

Source: @WSJ Read full article

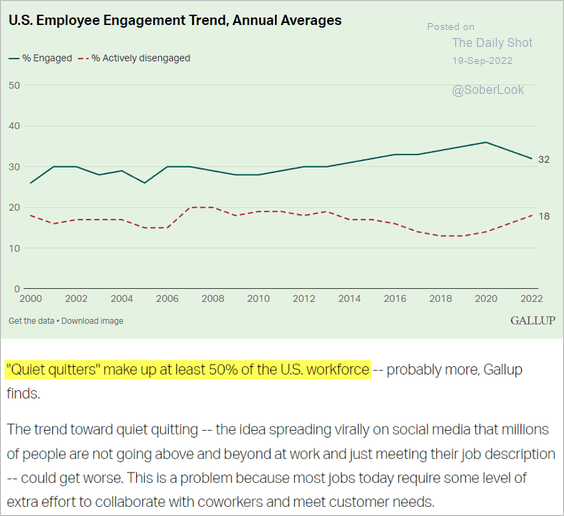

2. Employee engagement:

Source: Gallup Read full article

Source: Gallup Read full article

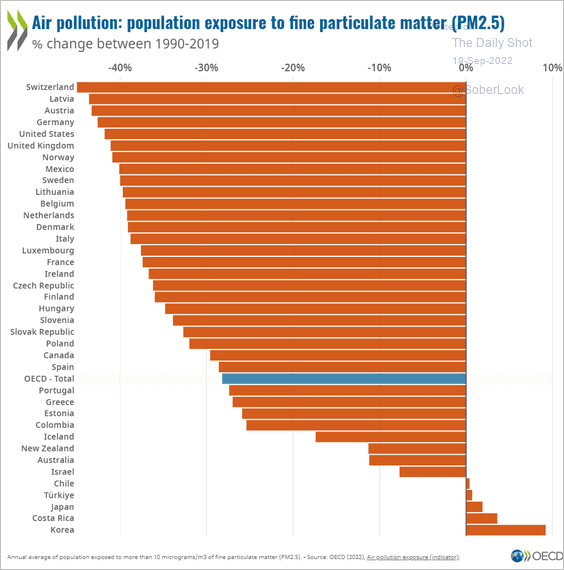

3. Declines in air pollution since 1990:

Source: @OECD Read full article

Source: @OECD Read full article

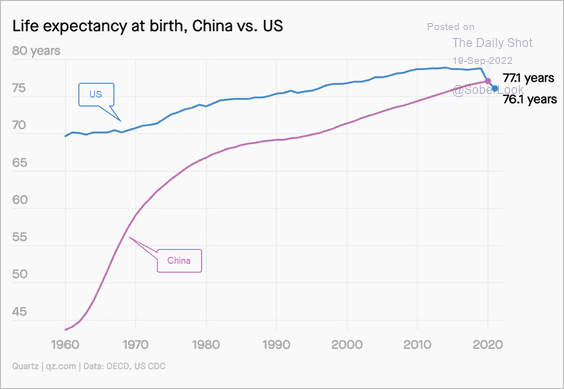

4. Life expectancy at birth:

Source: @ianbremmer

Source: @ianbremmer

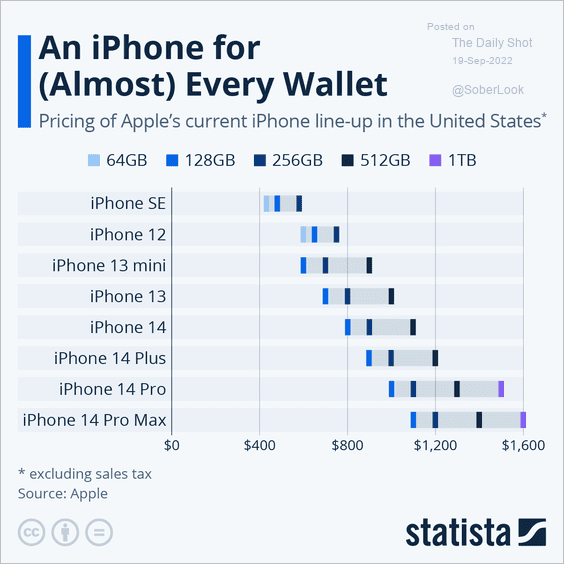

5. iPhone pricing:

Source: Statista

Source: Statista

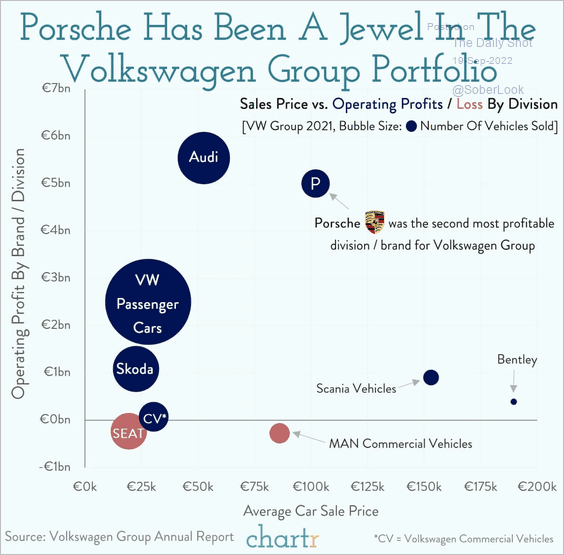

6. Volkswagen’s portfolio:

Source: @chartrdaily

Source: @chartrdaily

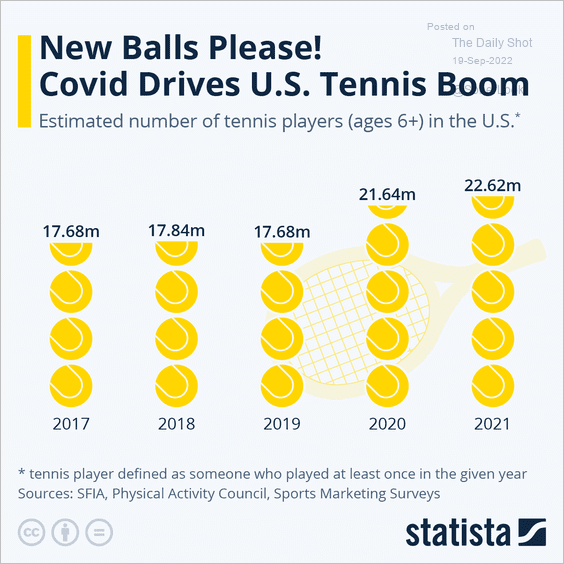

7. The US tennis boom:

Source: Statista

Source: Statista

——————–

Back to Index