The Daily Shot: 20-Sep-22

• The United States

• Canada

• The Eurozone

• Japan

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

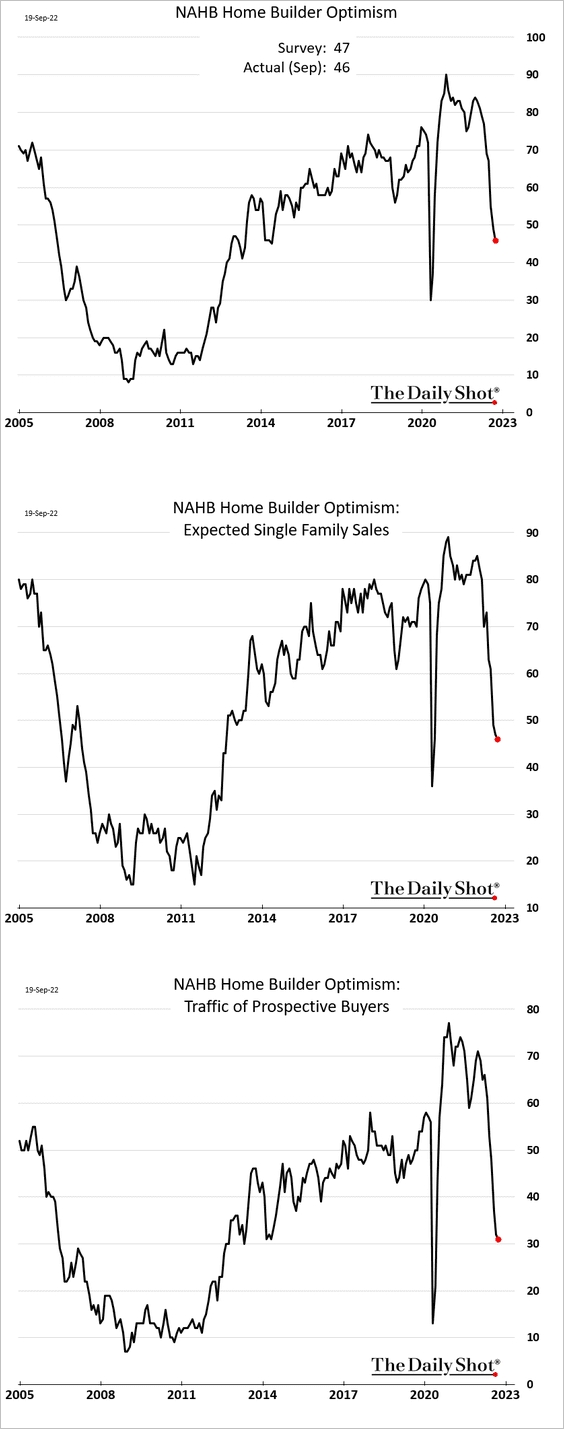

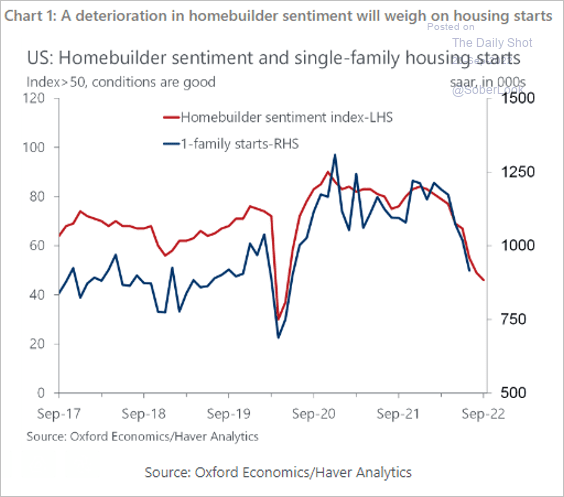

1. Let’s begin with the housing market.

• Homebuilder sentiment continues to deteriorate as demand weakens.

This trend doesn’t bode well for residential construction.

Source: Oxford Economics

Source: Oxford Economics

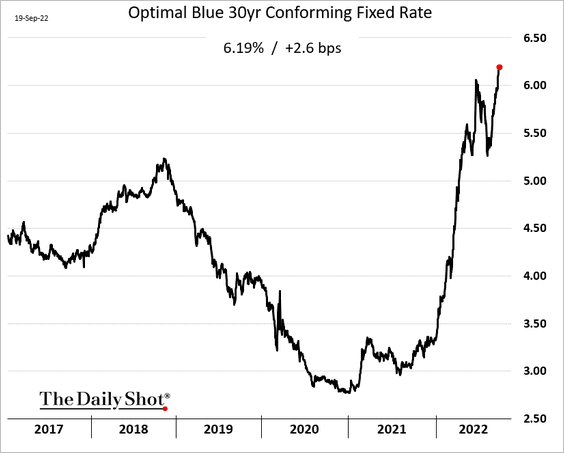

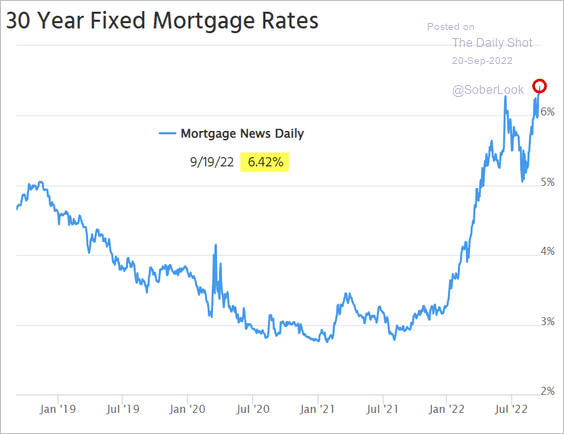

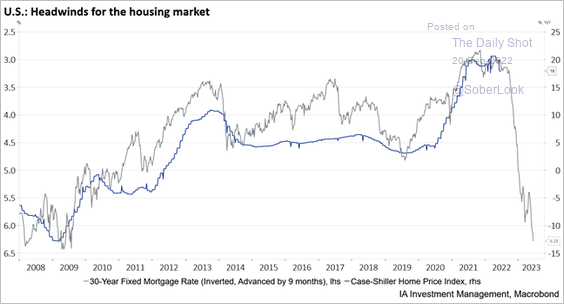

• Mortgage rates keep climbing with Treasury yields (2 charts) …

Source: Mortgage News Daily

Source: Mortgage News Daily

… putting pressure on home prices.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

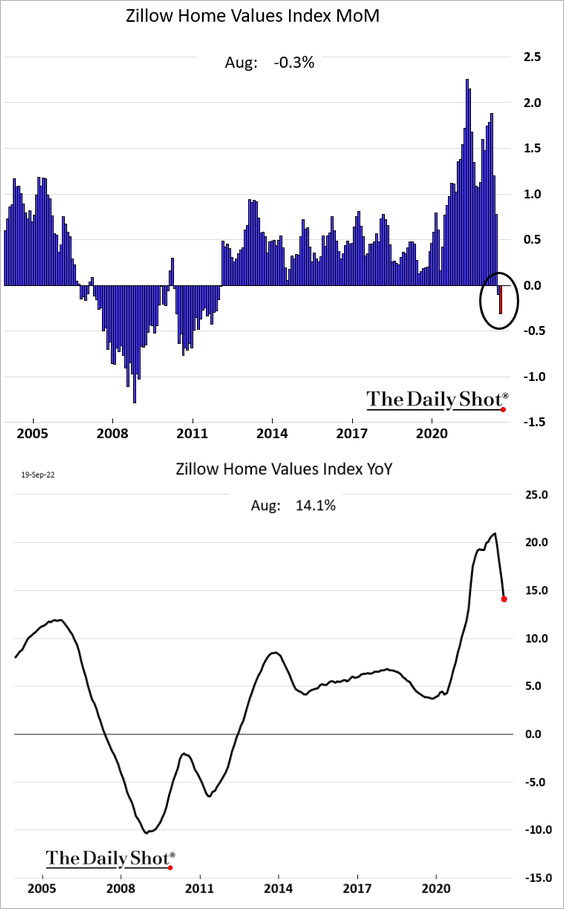

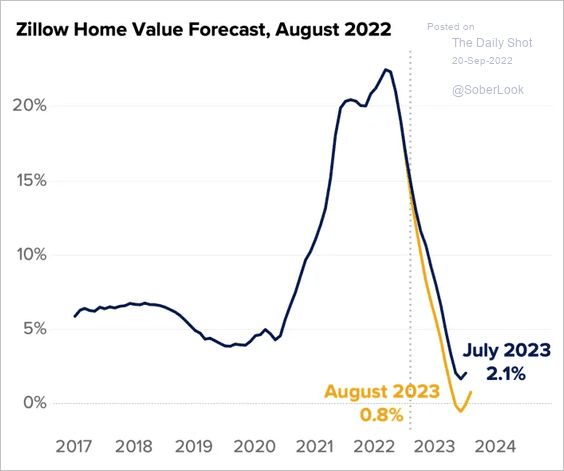

• Home prices are declining on a month-over-month basis for the first time in a decade.

Will we see home price appreciation dip into negative territory year-over-year?

Source: Zillow

Source: Zillow

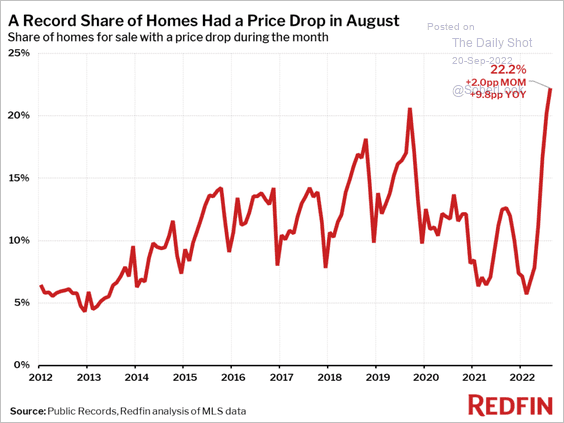

• Sellers are cutting prices.

Source: Redfin

Source: Redfin

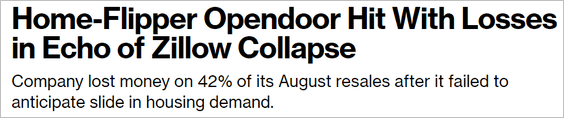

• Home-flipping is not profitable in this environment.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: YipitData

Source: YipitData

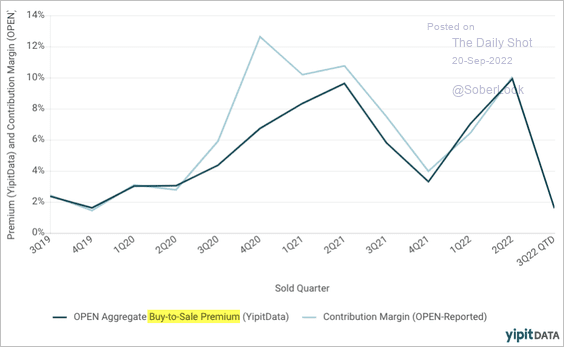

• New listings are declining, …

Source: Redfin

Source: Redfin

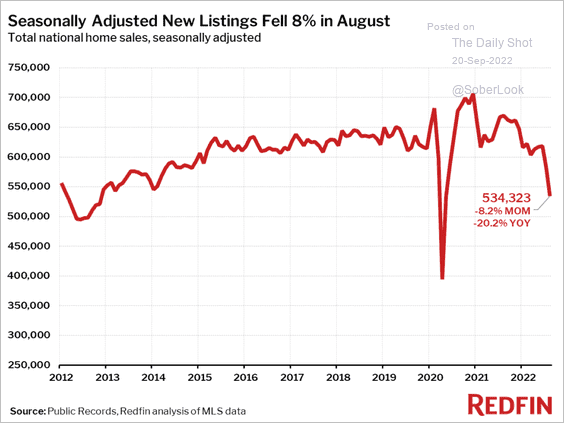

… but inventories of unsold homes are grinding higher (measured in months of supply).

Source: Redfin

Source: Redfin

——————–

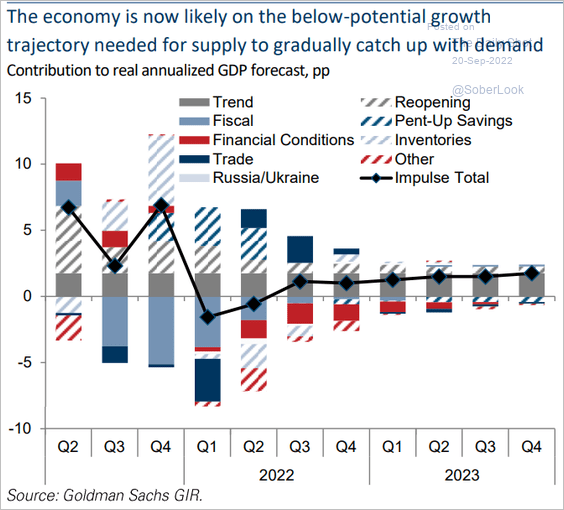

2. Next, we have some updates on economic growth.

• The economy is now expanding below potential, according to Goldman.

Source: Goldman Sachs

Source: Goldman Sachs

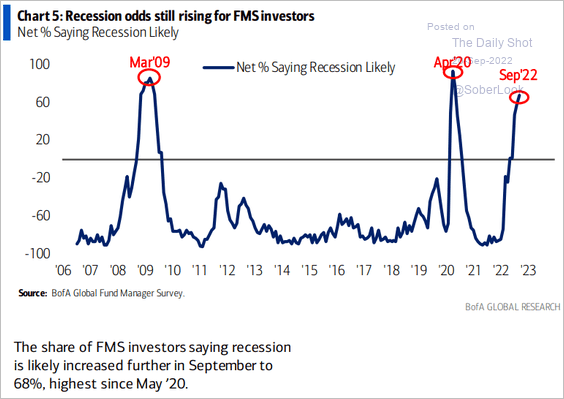

• The percentage of investors expecting a recession keeps climbing, according to a survey from BofA.

Source: BofA Global Research

Source: BofA Global Research

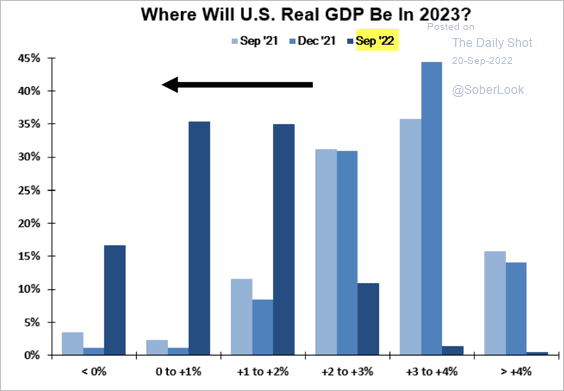

• Here is a survey from Evercore ISI on the 2023 GDP growth.

Source: Evercore ISI Research

Source: Evercore ISI Research

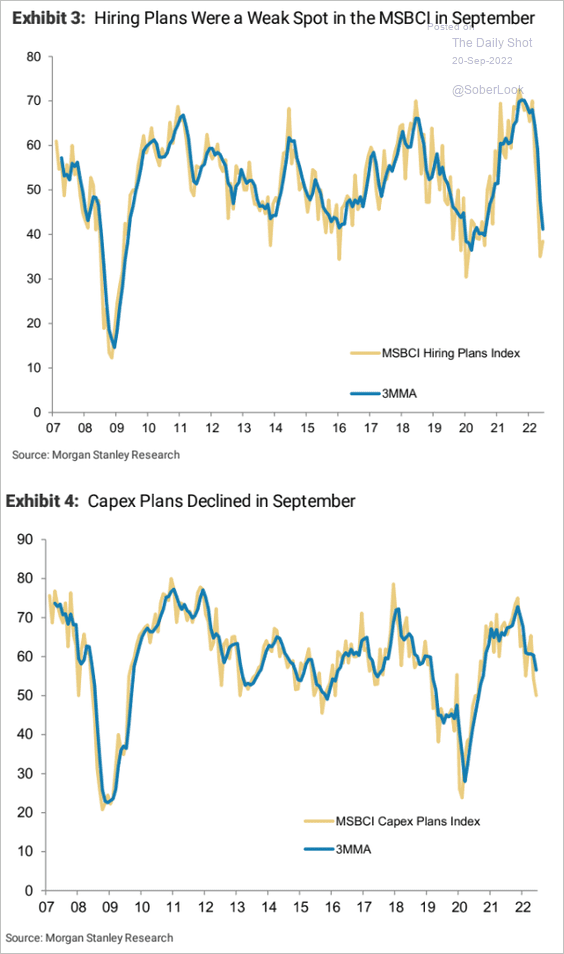

3. The Morgan Stanley Business Conditions Index shows slower CapEx and hiring plans.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

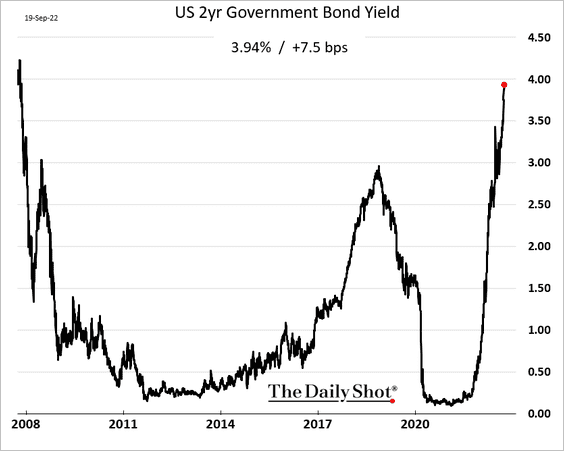

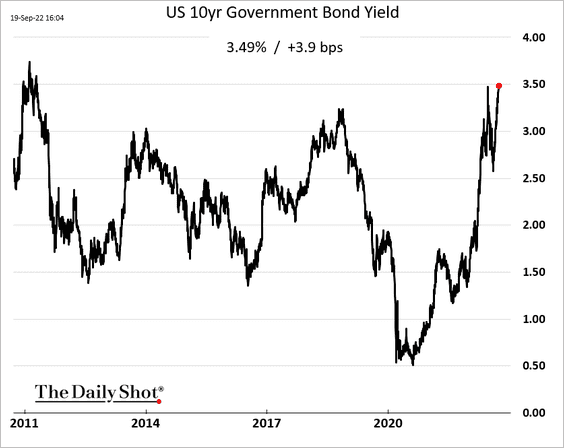

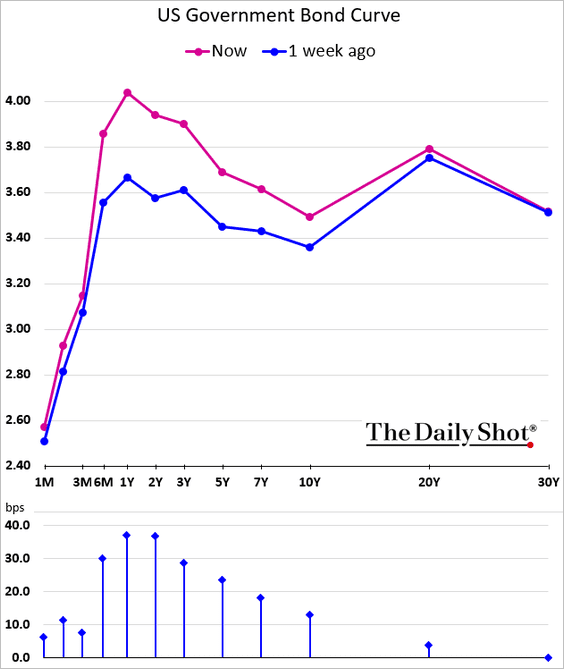

4. Treasury yields continue to surge.

• 2yr:

• 10yr:

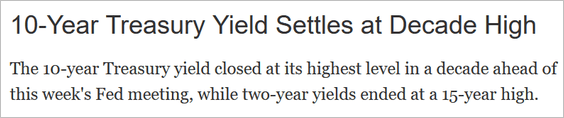

Source: @WSJ Read full article

Source: @WSJ Read full article

The curve is becoming more inverted.

——————–

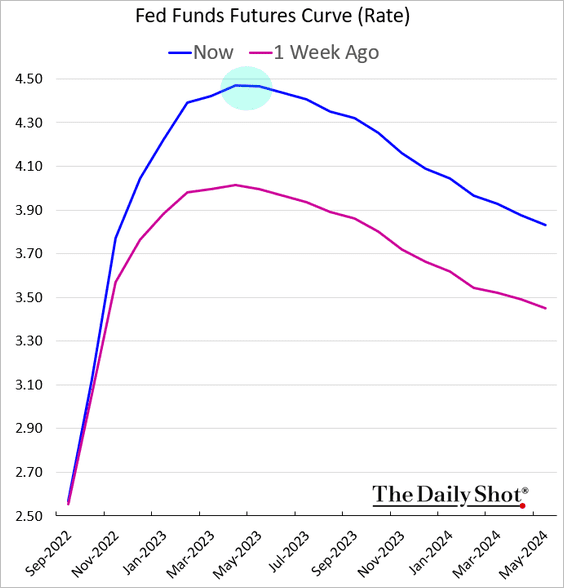

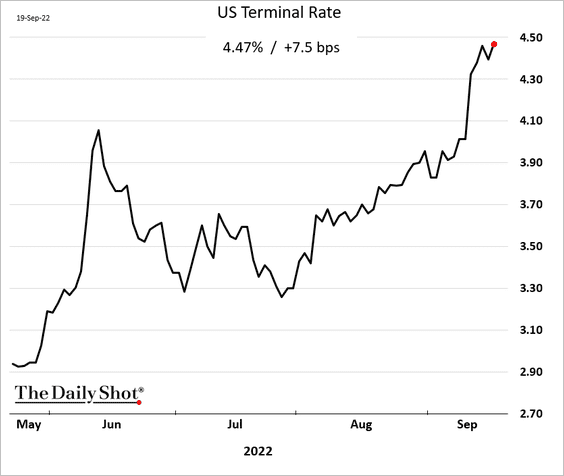

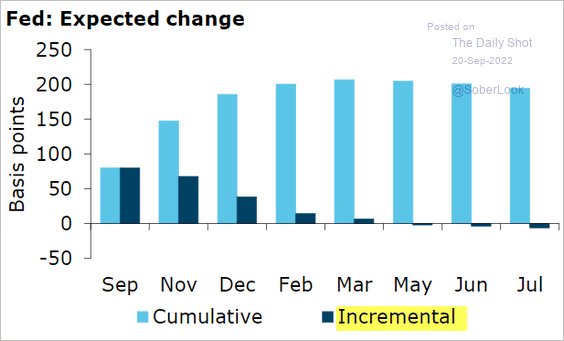

5. The market has repriced the fed funds rate trajectory by almost 50 bps in recent days.

• The terminal rate (the peak in the chart above) is nearing 4.5%.

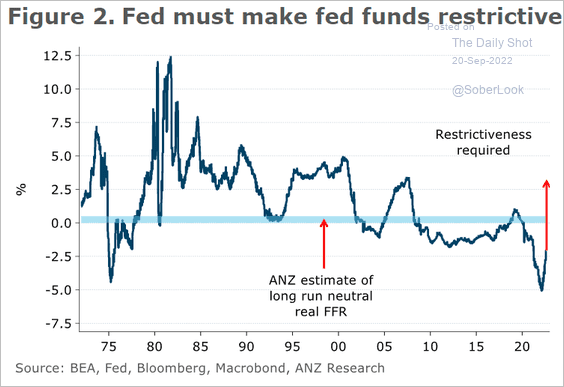

ANZ, Deutsche Bank, and several other research groups see the terminal rate closer to 5%, which is needed to kick rates into restrictive territory.

Source: @ANZ_Research

Source: @ANZ_Research

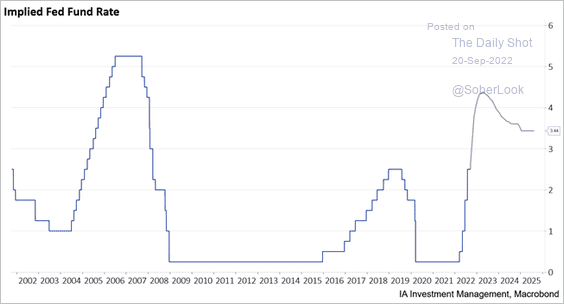

• Here is how the current market projection compares to previous rate hikes.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

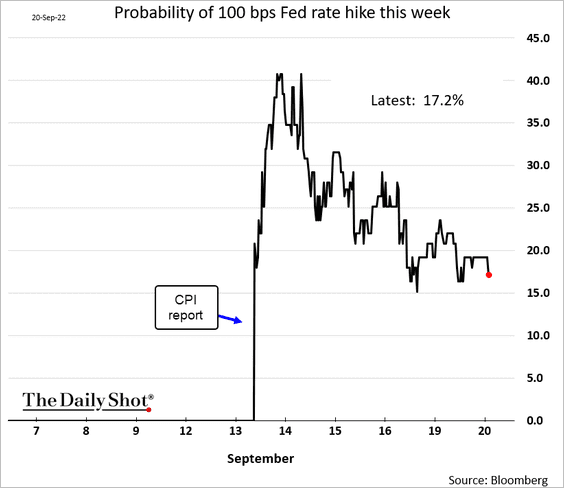

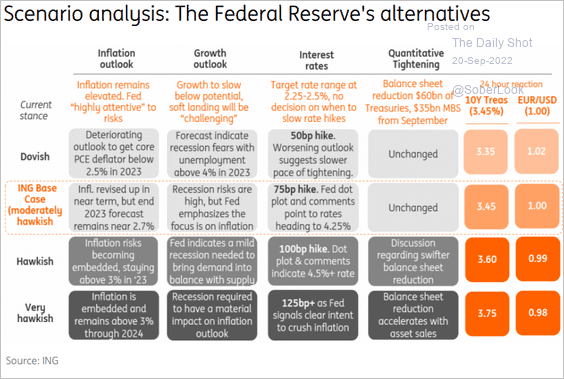

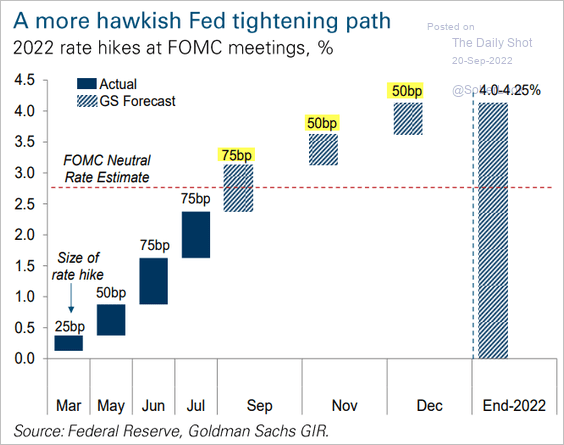

• What should we expect from the Fed this week and for the rest of the year?

– A 100 bps rate hike this week is not likely. While inflation has been sticky, inflation expectations have been moving lower.

– Below are some scenarios from ING.

Source: ING

Source: ING

– Goldman expects 75 bps this week, followed by two 50 bps hikes.

Source: Goldman Sachs

Source: Goldman Sachs

Here is the market expectation.

Source: @ANZ_Research

Source: @ANZ_Research

Back to Index

Canada

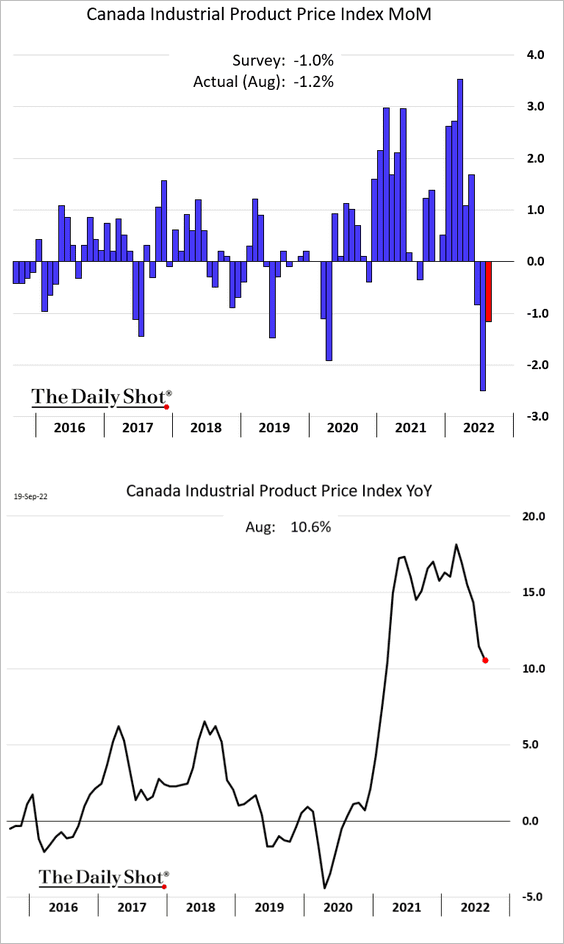

1. Industrial output prices have been declining.

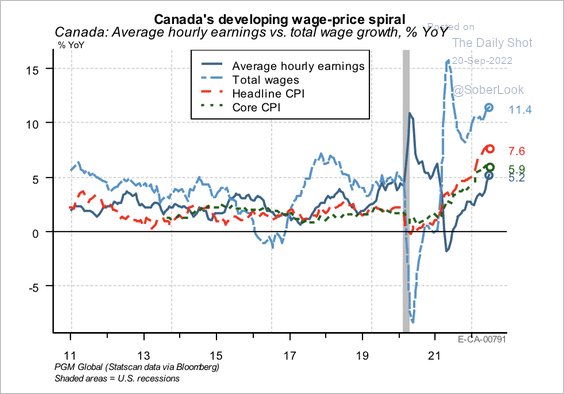

2. Strong wage growth has pressured the BoC to aggressively hike rates.

Source: PGM Global

Source: PGM Global

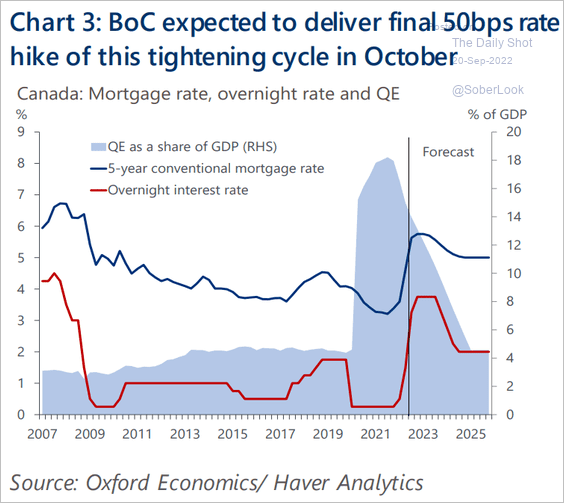

The last BoC rate hike is coming in October, according to Oxford Economics. But mortgage rates will stay elevated.

Source: Oxford Economics

Source: Oxford Economics

——————–

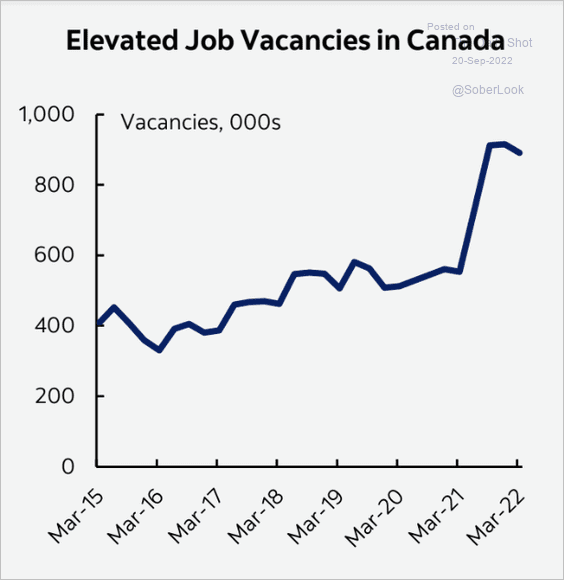

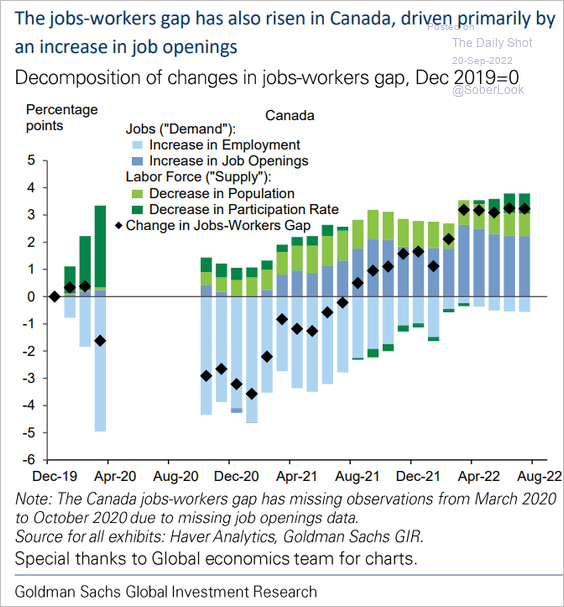

3. More than a million jobs remain vacant in Canada due to labor shortages, doubling the pre-pandemic level.

Source: Scotiabank Economics

Source: Scotiabank Economics

Here is the jobs-workers gap.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

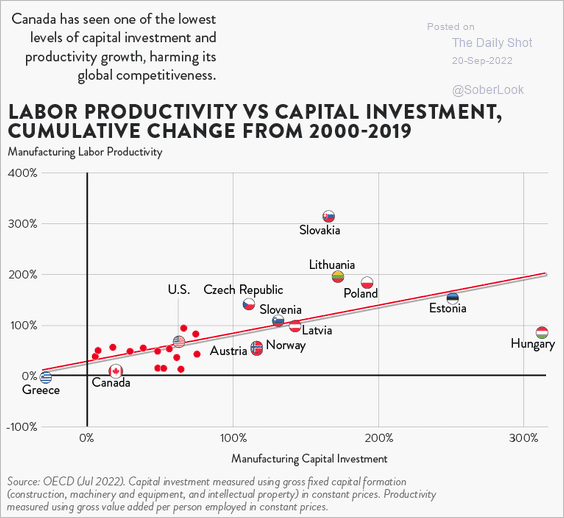

4. Canada’s capital investment and labor productivity growth are low relative to other industrialized nations.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

The Eurozone

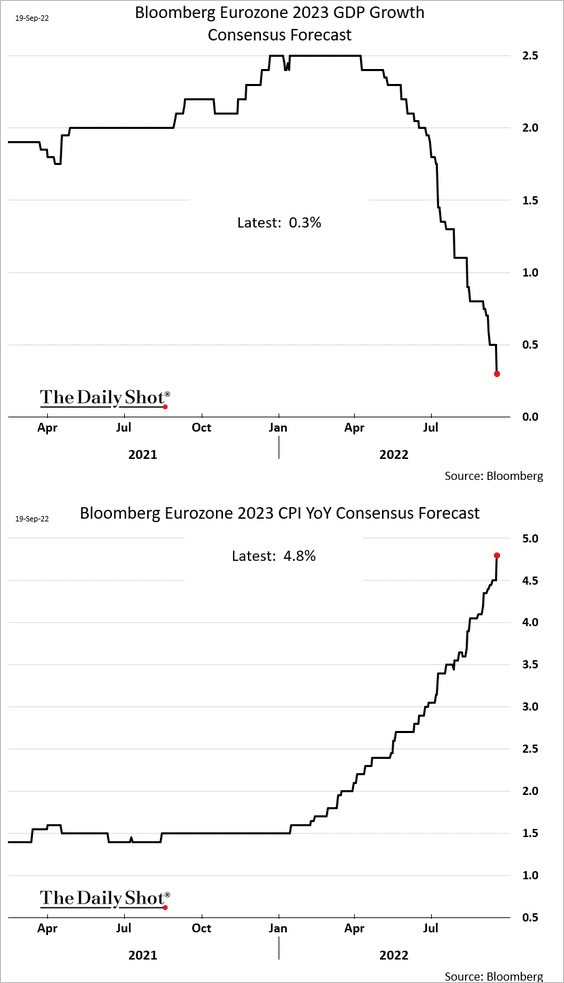

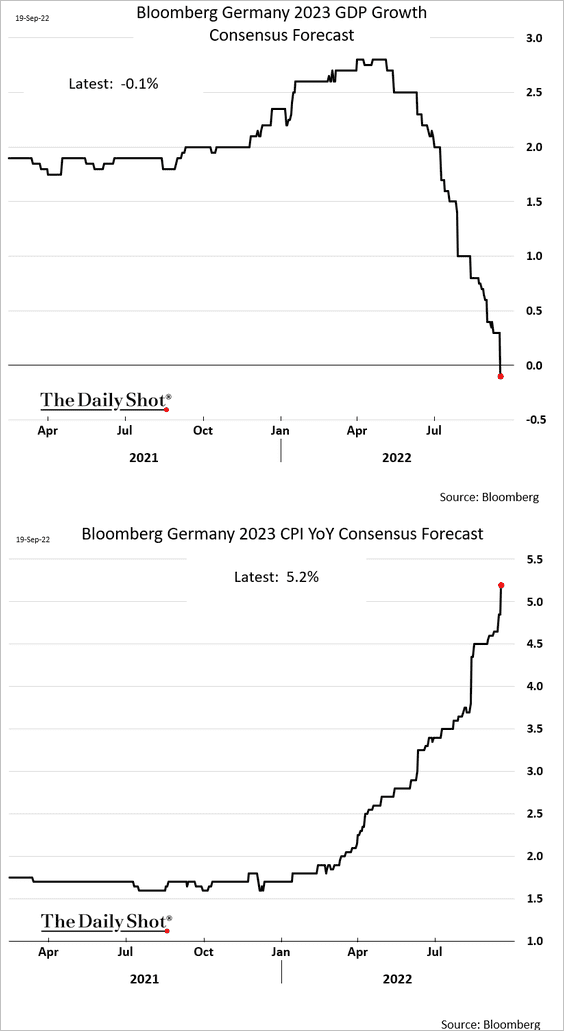

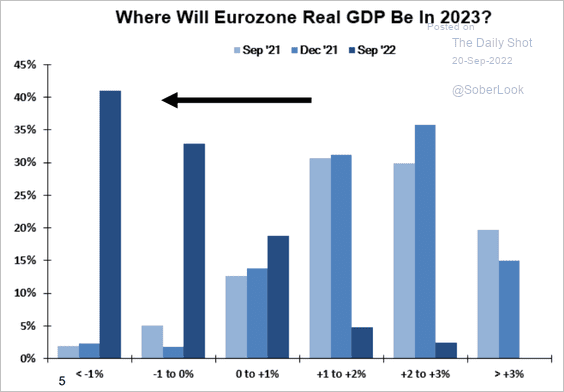

1. Economists increasingly see stagflation in the Eurozone. Below is the evolution of median forecasts.

• The euro area:

• Germany:

• Here is a survey from Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

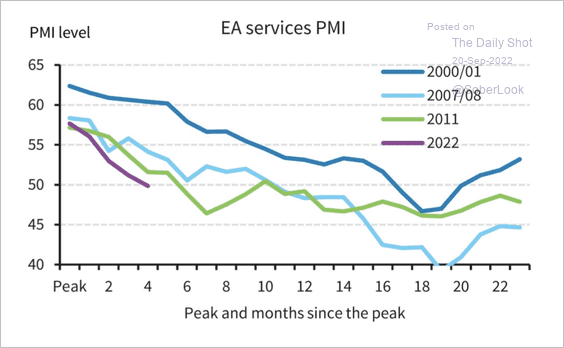

• Services PMI is declining at a pace consistent with past recessions.

Source: Barclays Research

Source: Barclays Research

——————–

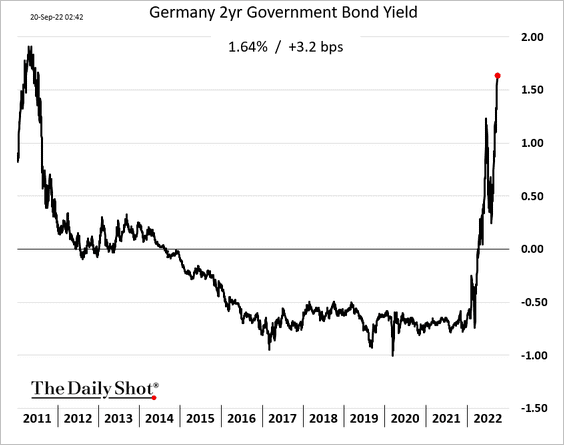

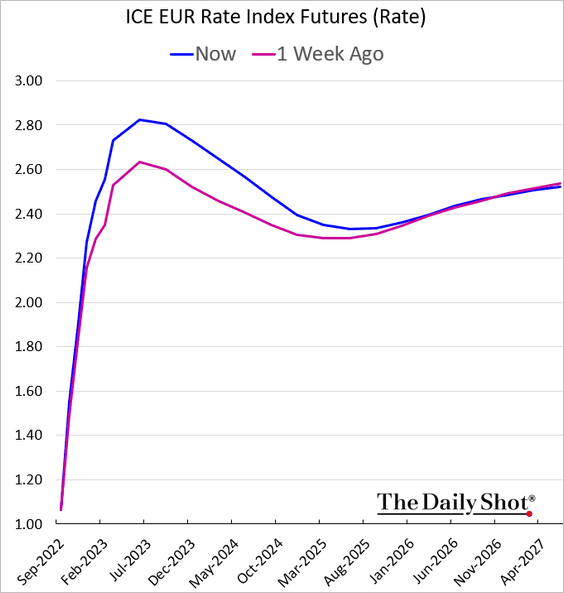

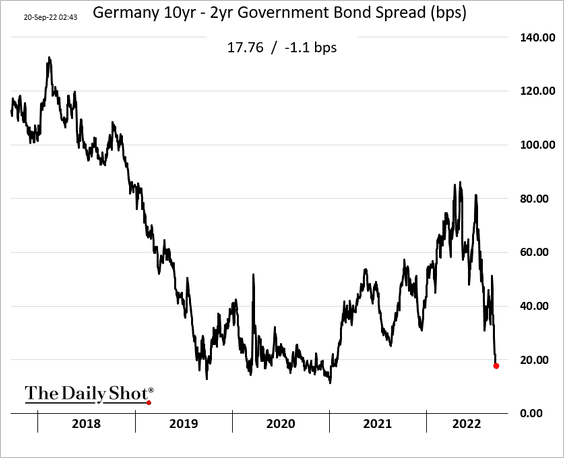

2. Germany’s 2-year yield continues to climb, …

… as the market reprices ECB rate hike expectations.

The Bund curve keeps getting flatter.

——————–

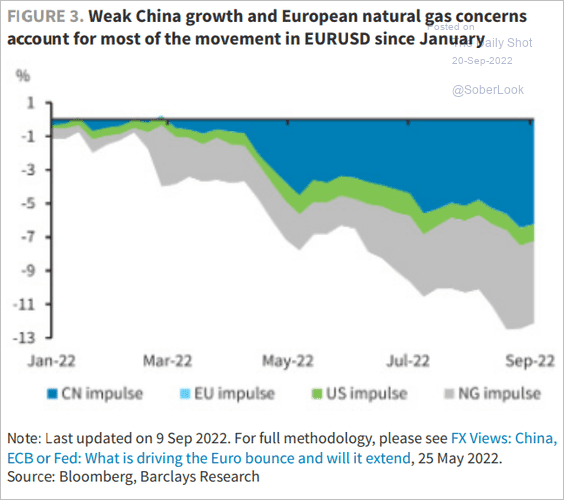

3. What are the drivers of the euro’s weakness this year?

Source: Barclays Research

Source: Barclays Research

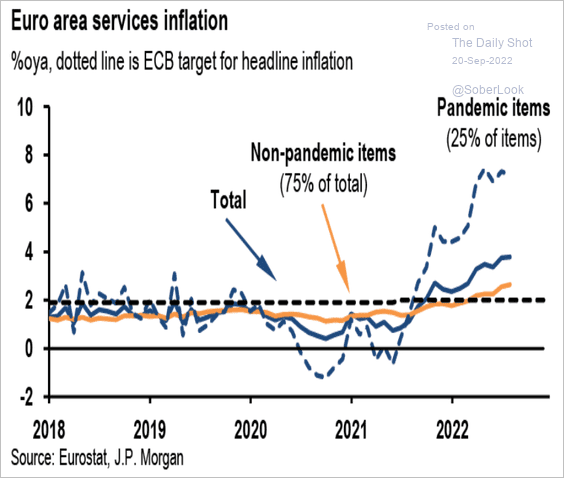

4. Inflation for “non-pandemic” items is now above the ECB’s target.

Source: JP Morgan Research; III Capital Management

Source: JP Morgan Research; III Capital Management

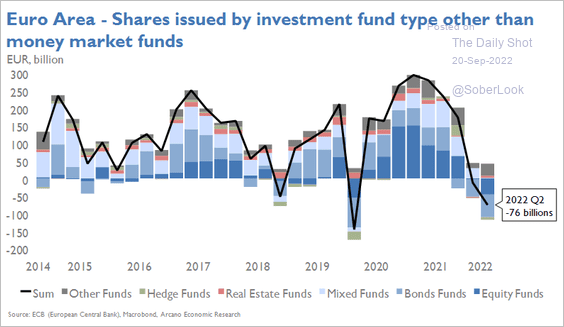

5. Euro-area investment funds’ redemptions have been outpacing share issuance.

Source: Arcano Economics

Source: Arcano Economics

Back to Index

Japan

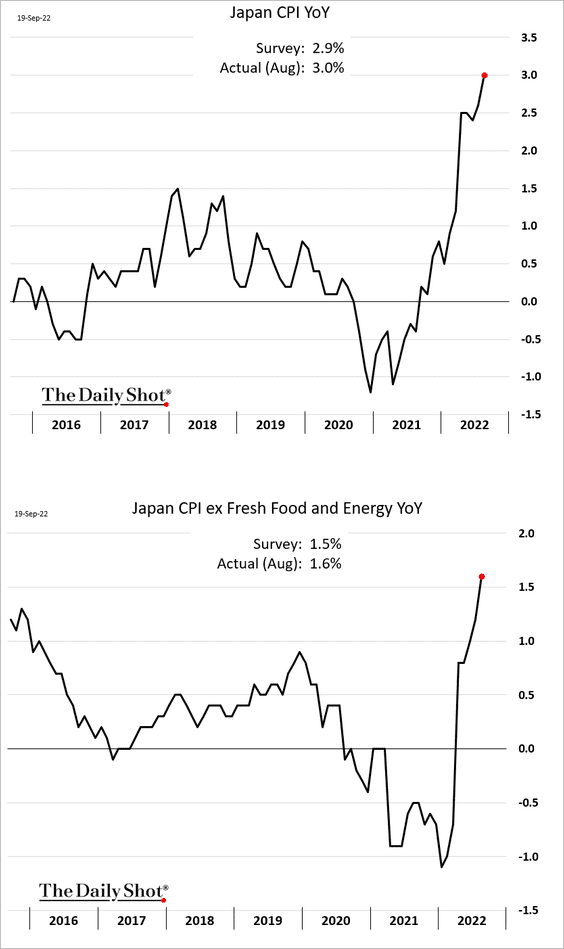

1. The headline inflation hit 3%.

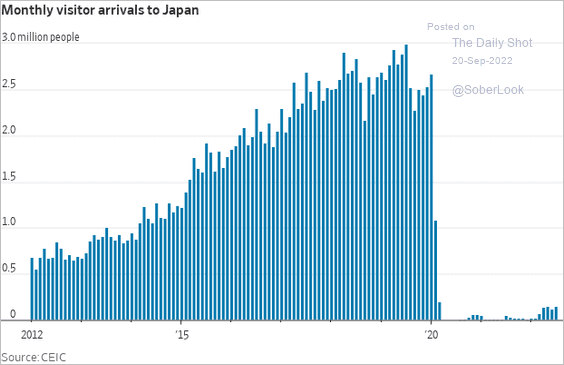

2. According to the WSJ, “Japan is set to join Southeast Asia and Australia in lifting most entry restrictions for international visitors.”

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

China

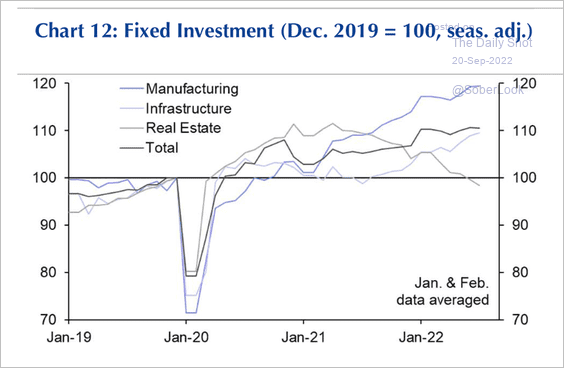

1. Investment in manufacturing and infrastructure have been resilient, but real estate investment continues to retreat.

Source: Capital Economics

Source: Capital Economics

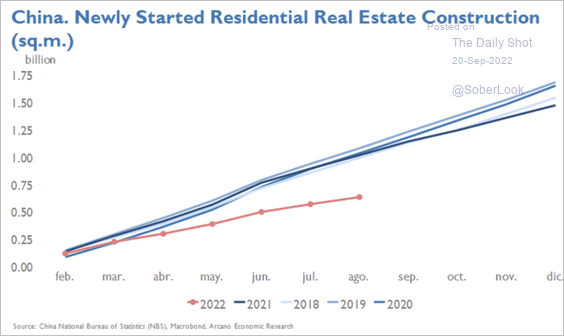

This chart shows newly-started construction.

Source: Arcano Economics

Source: Arcano Economics

——————–

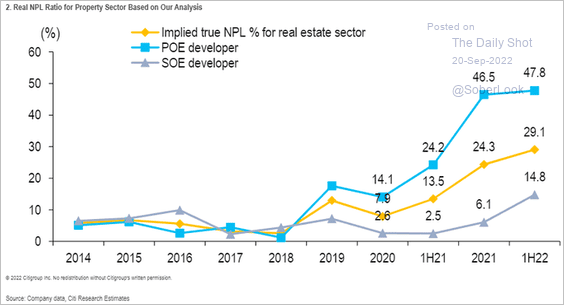

2. Non-performing loan balances in the property sector have risen substantially (SOE = state-owned enterprises; POE = private-owned enterprises).

Source: @SofiaHCBBG

Source: @SofiaHCBBG

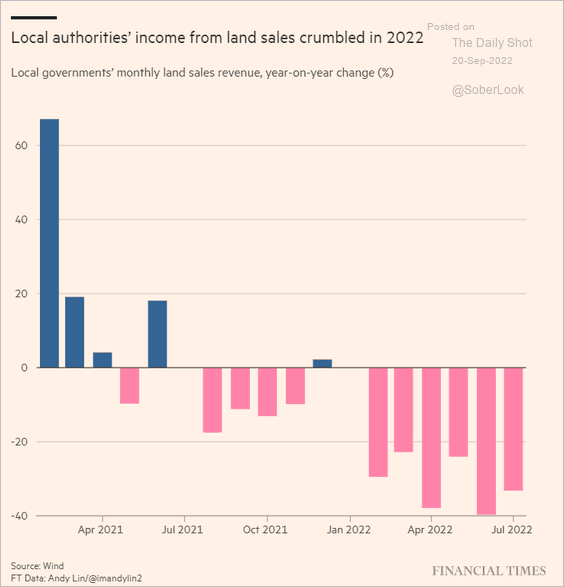

3. Reduced land sales are pressuring local governments’ budgets. According to the FT, “local government financing vehicles are rushing to buy vast quantities of land with borrowed funds.”

Source: @financialtimes Read full article

Source: @financialtimes Read full article

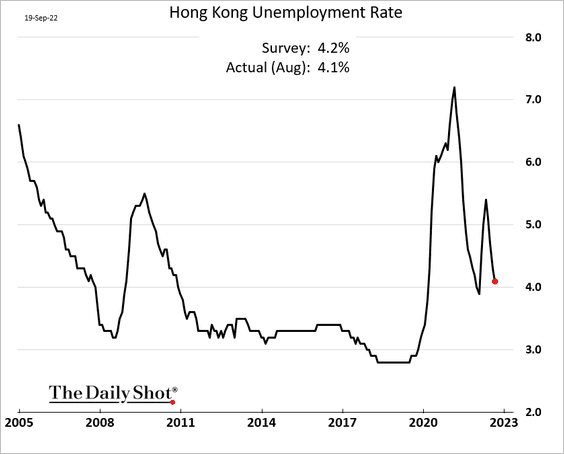

4. Hong Kong’s unemployment rate has been declining.

Back to Index

Emerging Markets

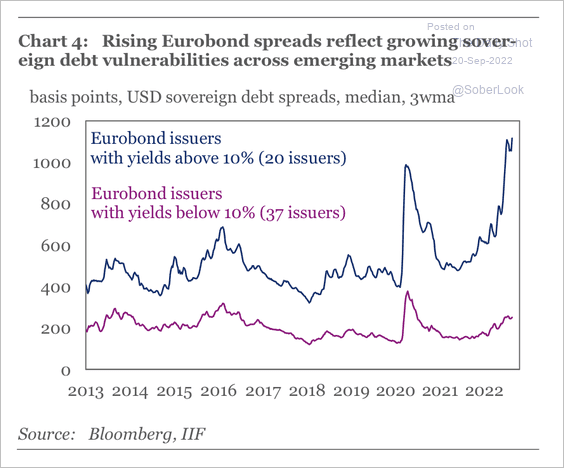

1. Sovereign bond spreads for high-yield borrowers have surpassed pandemic highs.

Source: IIF

Source: IIF

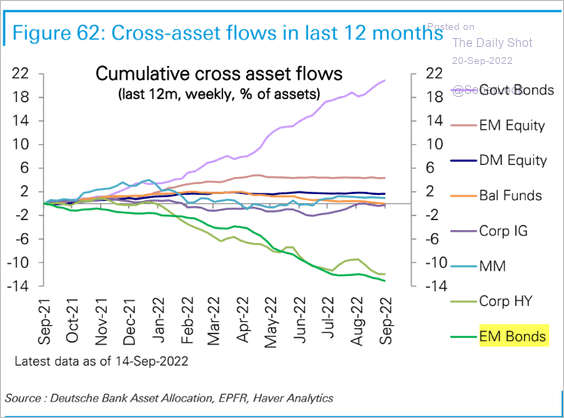

2. Bond funds continue to see outflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

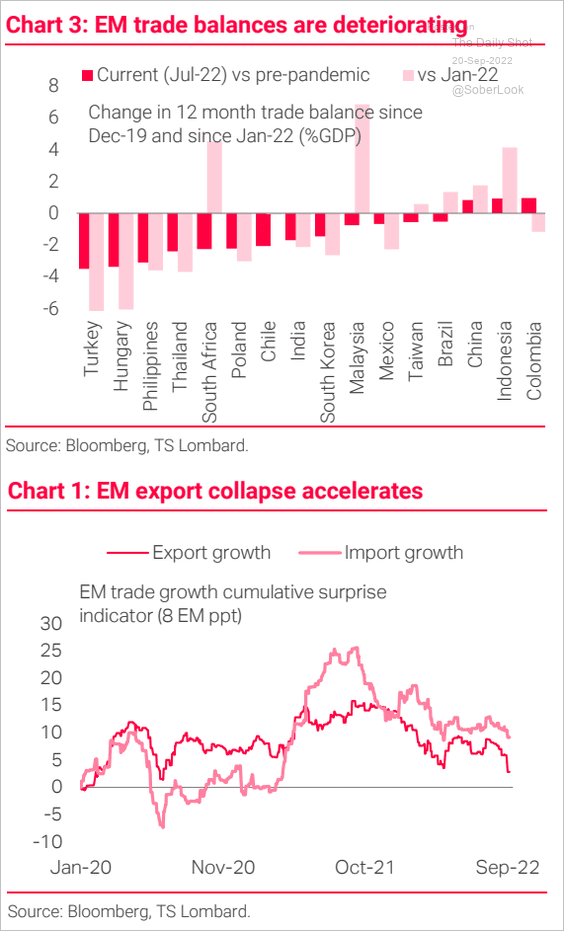

3. Trade balances have been deteriorating.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

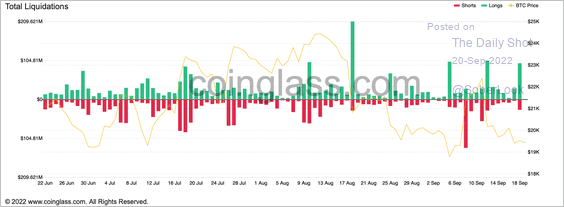

1. Recent bitcoin sell-offs have triggered spikes in long liquidations. The latest extreme was in August when BTC broke below $23K.

Source: Coinglass

Source: Coinglass

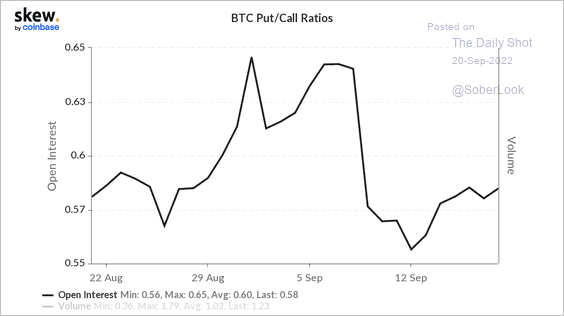

2. Bitcoin’s put/call ratio is ticking higher.

Source: Skew

Source: Skew

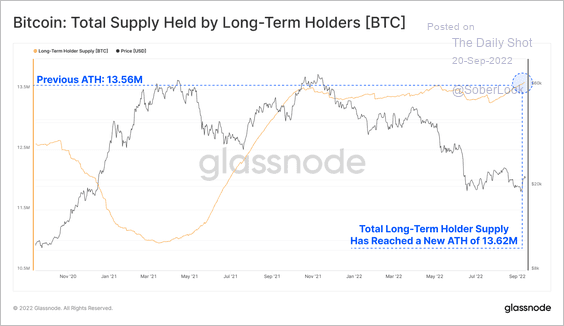

3. Total bitcoin supply held by long-term holders reached a new all-time high.

Source: @glassnode

Source: @glassnode

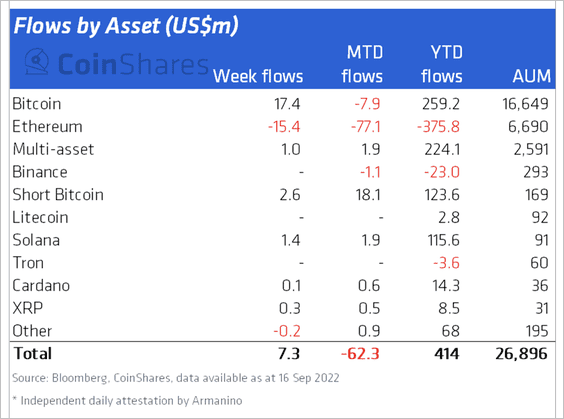

4. Crypto funds saw minor inflows last week, led by Bitcoin-focused products. However, Ethereum-focused products continued to see outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

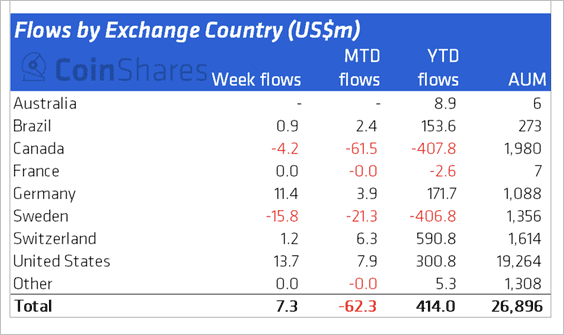

Inflows have been focused on the US and Germany, while Sweden and Canada experienced outflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

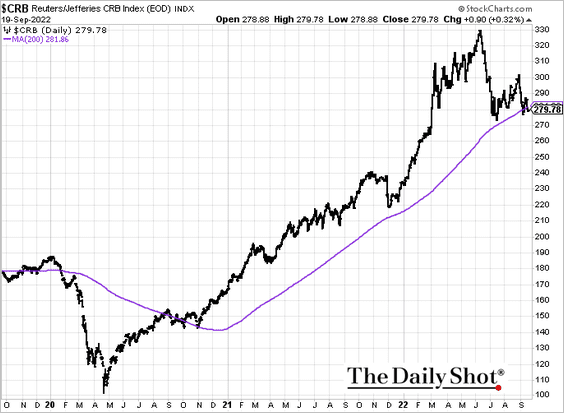

1. The CRB commodity index is testing support at the 200-day moving average.

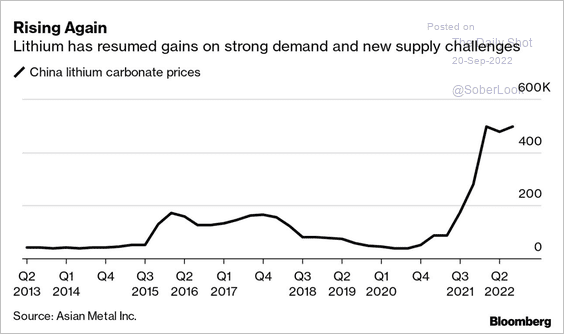

2. Lithium prices are climbing again.

Source: @annieLee23, @business Read full article

Source: @annieLee23, @business Read full article

Back to Index

Energy

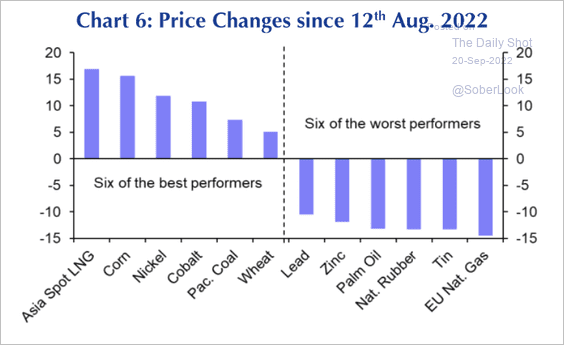

1. Asia spot LNG saw a large price rise last month ahead of the winter season.

Source: Capital Economics

Source: Capital Economics

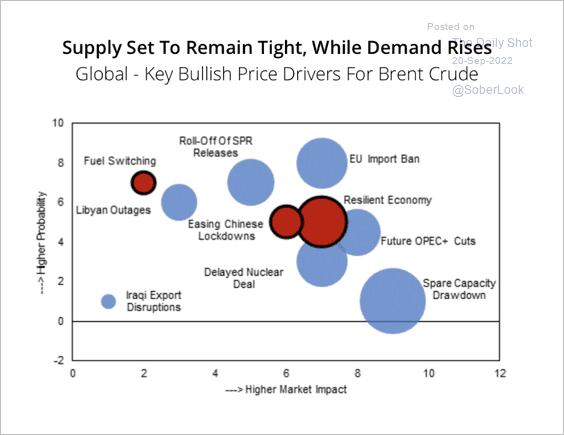

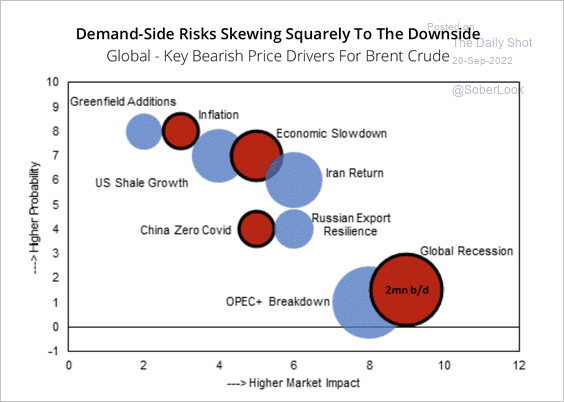

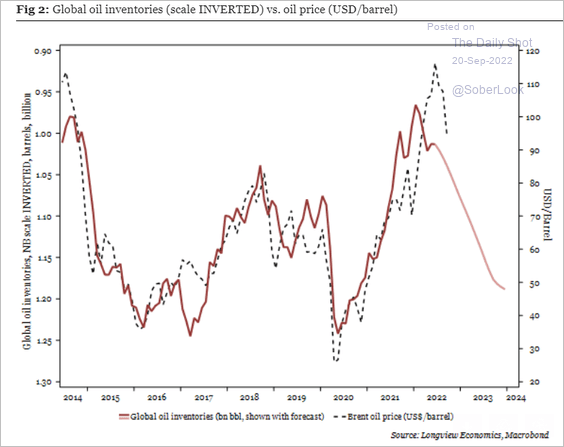

2. Here is a look at bullish and bearish drivers for Brent oil, according to Fitch. Blue dots denote supply side drivers, and red denotes demand (2 charts).

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Rising inventories could pressure prices.

Source: Longview Economics

Source: Longview Economics

Back to Index

Equities

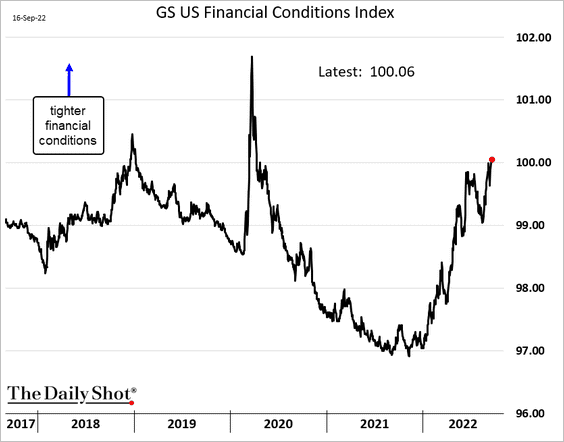

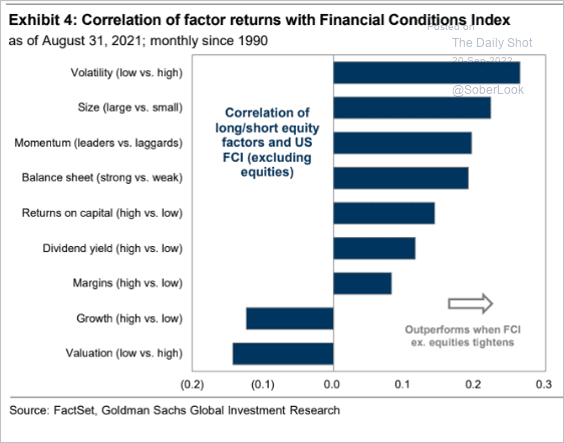

1. US financial conditions continue to tighten.

How correlated are equity factors to financial conditions?

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

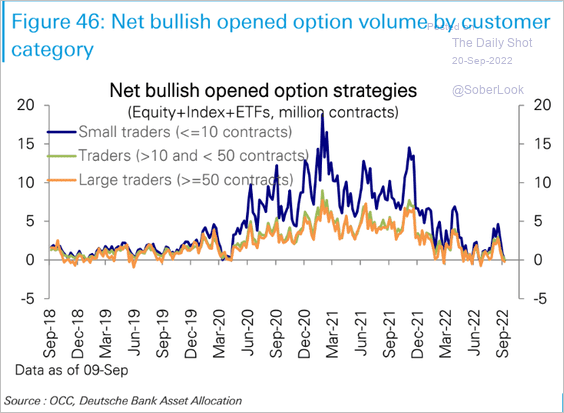

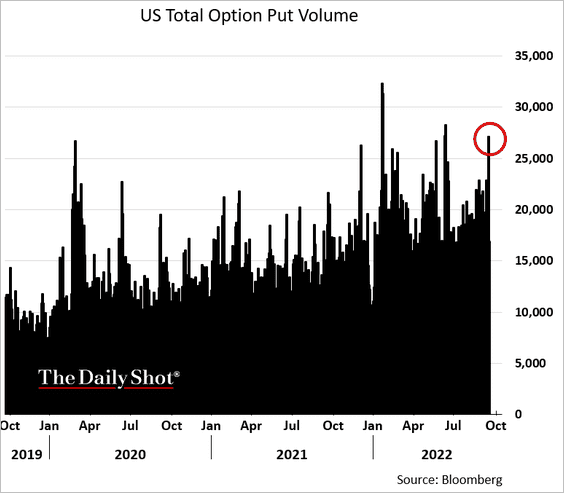

2. Bullish options bets remain low.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Put option volume jumped this week.

——————–

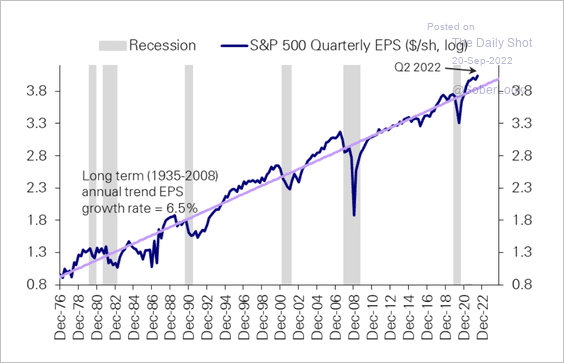

3. S&P 500 earnings are significantly above their long-term trend.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

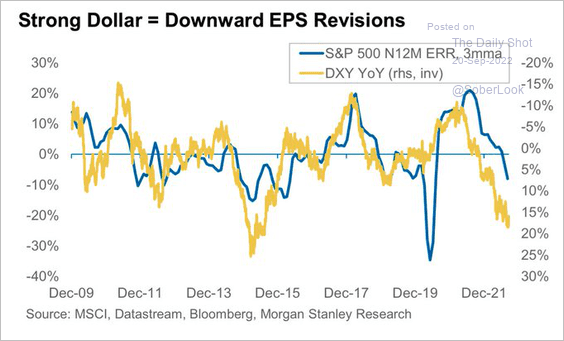

• A stronger US dollar points to more downward earnings revisions.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

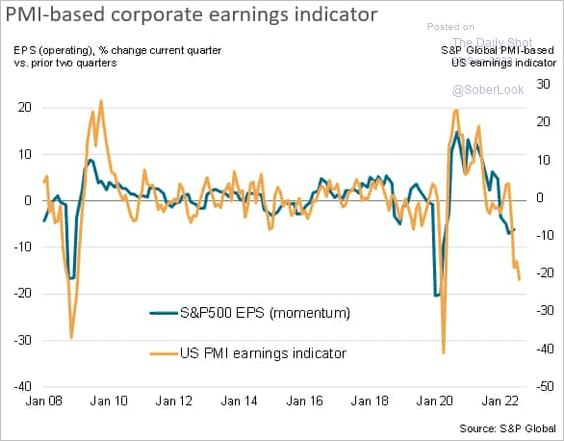

• The PMI-based earnings indicator from S&P Global also signals significant downgrades ahead.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

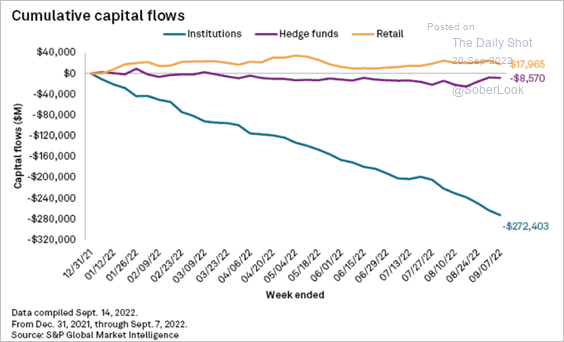

4. Institutions have been the primary sellers this year. According to S&P Global Market Intelligence, “In the five weeks ending Sept. 7, long-only investors sold $51.2 billion worth of equities …”

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

5. Investors prefer the US market relative to other regions.

Source: Evercore ISI Research

Source: Evercore ISI Research

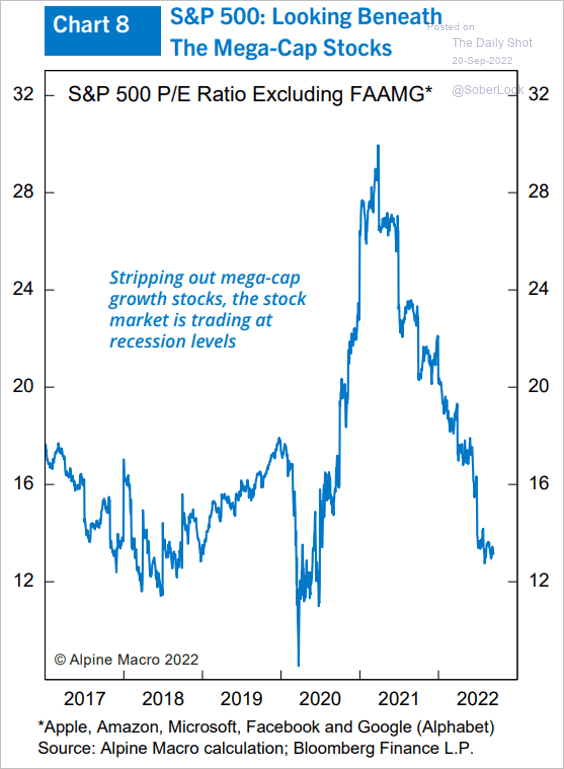

6. S&P 500 valuations look reasonable without the tech mega-caps.

Source: Alpine Macro

Source: Alpine Macro

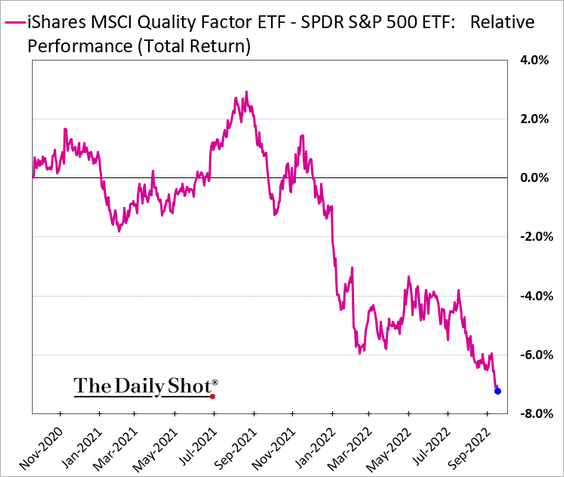

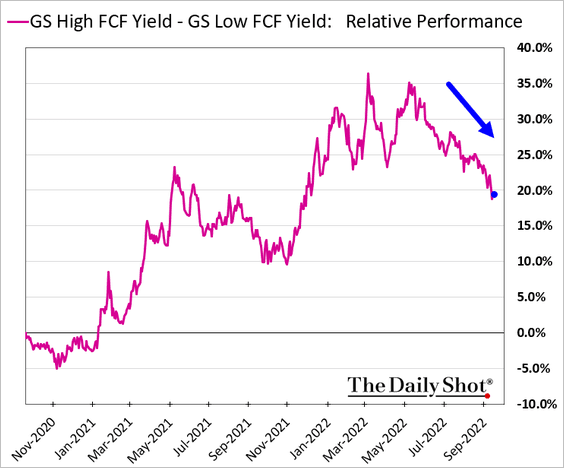

7. Quality names have been underperforming.

Here is the relative performance of companies with high vs. low free-cash-flow yields.

——————–

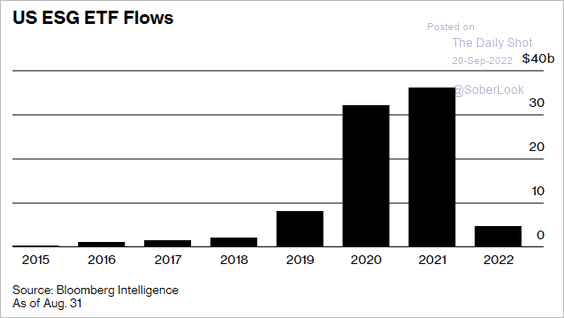

8. ESG ETF flows slowed sharply this year.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Credit

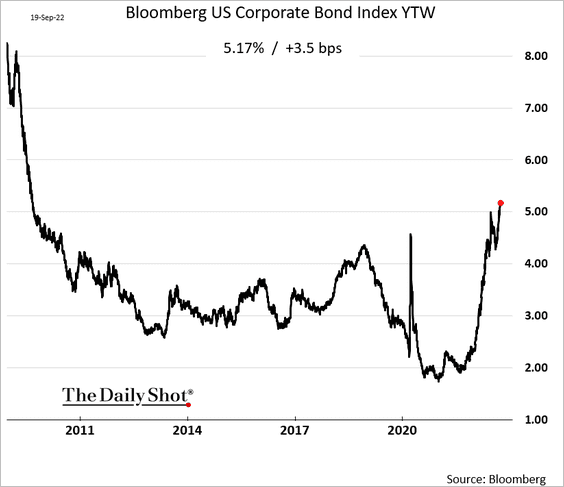

1. Investment-grade bond yields hit the highest level in years.

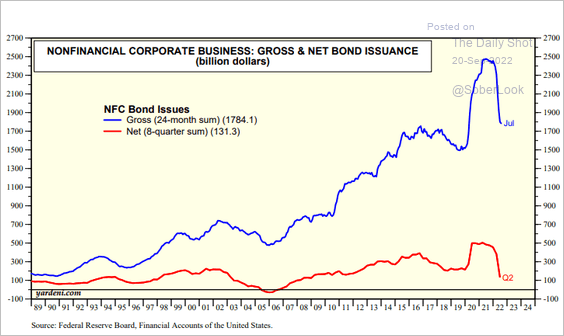

2. This chart shows US gross and net corporate bond issuance.

Source: Yardeni Research

Source: Yardeni Research

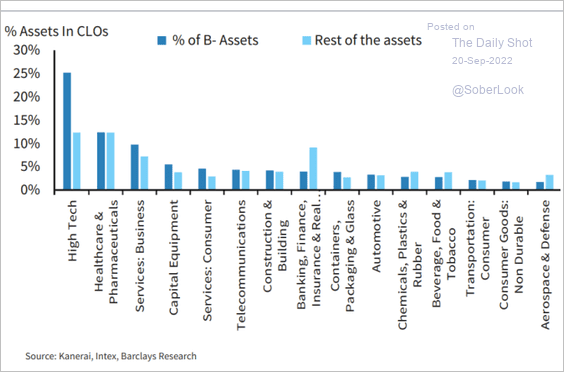

3. CLOs could see their CCC buckets “overflowing” if downgrades pick up.

Source: Barclays Research; III Capital Management

Source: Barclays Research; III Capital Management

Back to Index

Global Developments

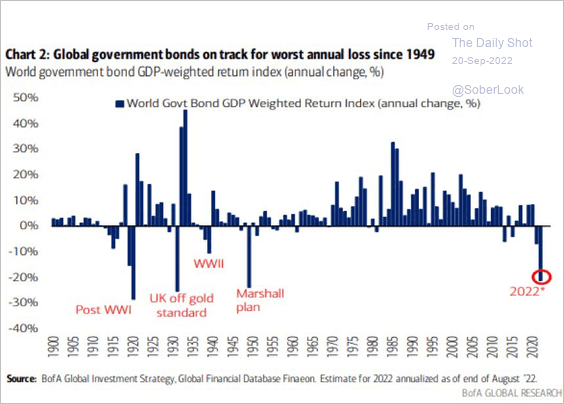

1. It’s been a rough year for government bonds.

Source: BofA Global Research

Source: BofA Global Research

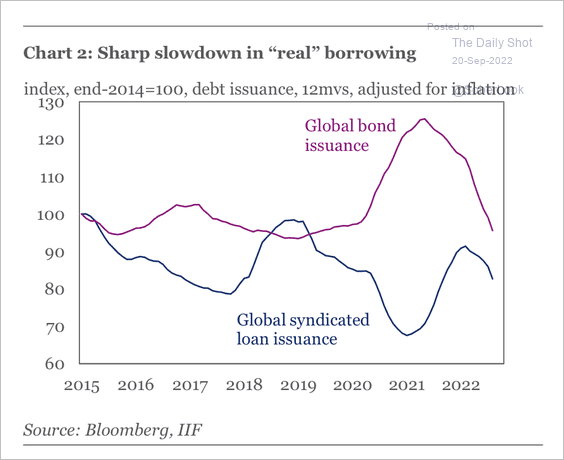

2. Bond issuance, when adjusted for inflation, is at multi-year lows. The rapid rise in borrowing costs and weak investor appetite have kept many issuers away from primary markets this year, according to IIF.

Source: IIF

Source: IIF

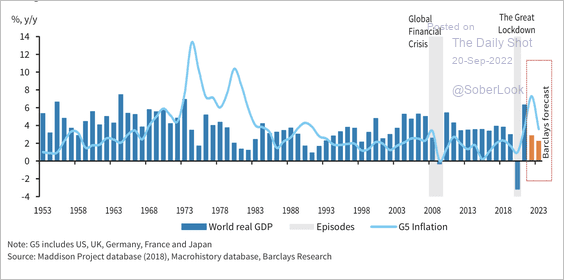

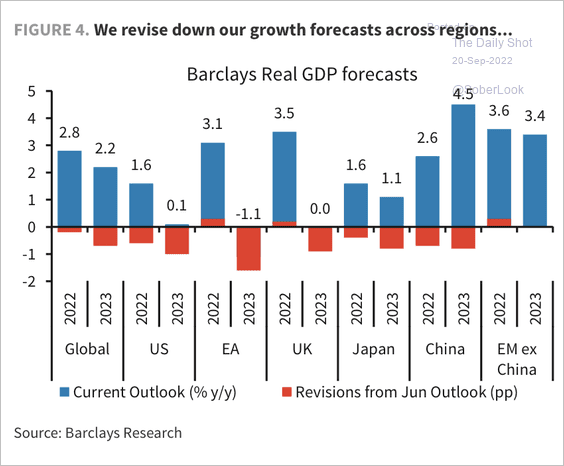

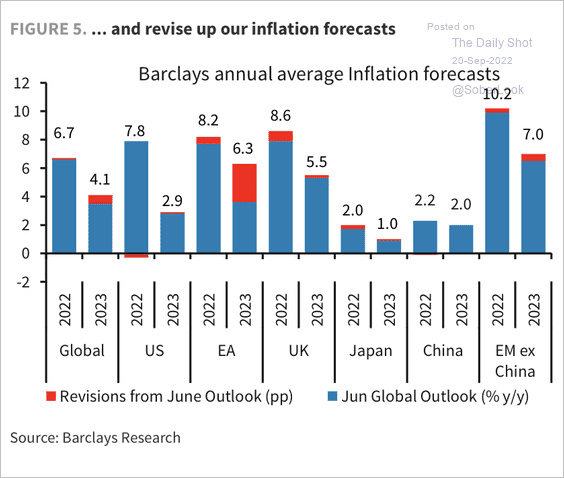

3. Barclays expects global growth to be among the lowest annual rates in the post-WW-II period next year. And elevated inflation could create more hardship (3 charts).

Source: Barclays Research

Source: Barclays Research

Source: Barclays Research

Source: Barclays Research

Source: Barclays Research

Source: Barclays Research

——————–

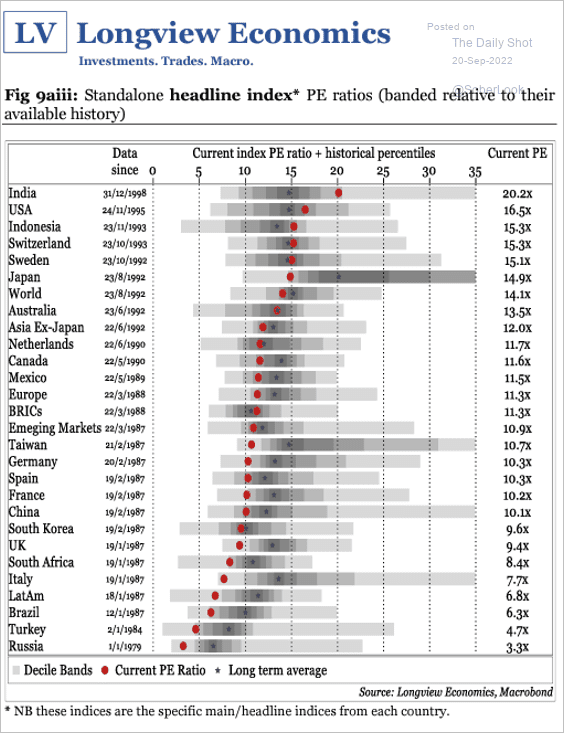

4. This chart shows PE ratios in select economies (compared to historical ranges).

Source: Longview Economics

Source: Longview Economics

——————–

Food for Thought

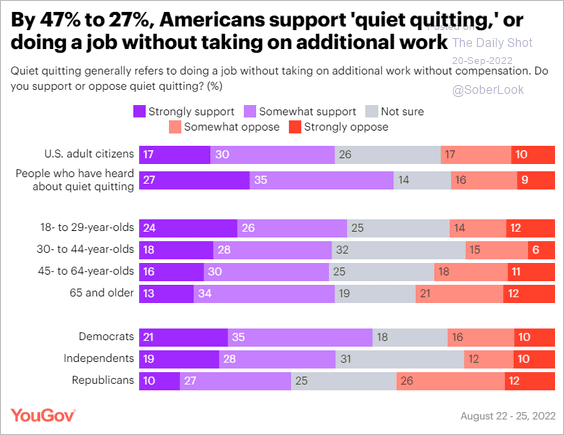

1. Views on “quiet quitting“:

Source: YouGov Read full article

Source: YouGov Read full article

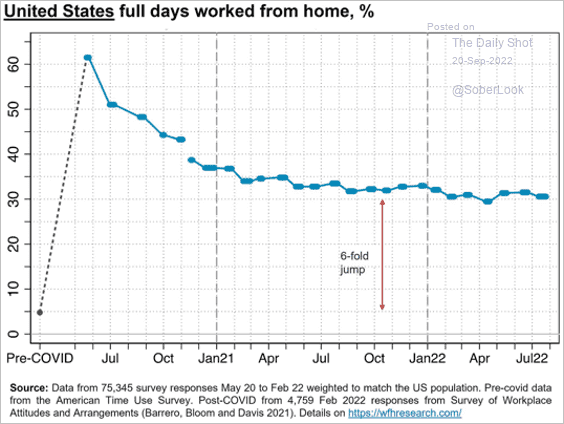

2. Telecommuting rates are holding at 30%.

Source: Bain & Company

Source: Bain & Company

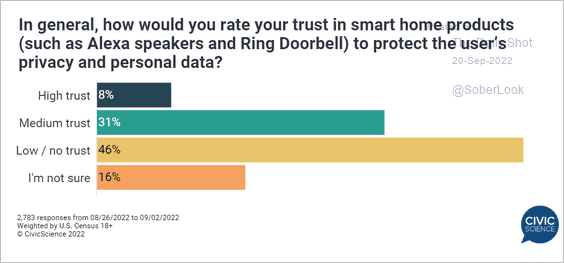

3. Home products protecting users’ privacy:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

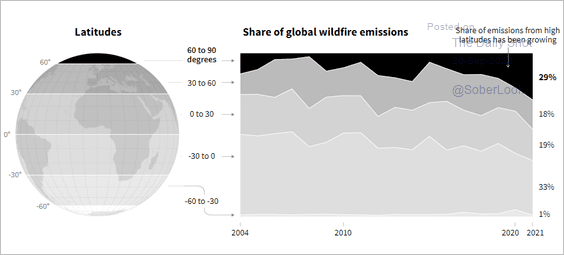

4. Wildfire emissions by latitude:

Source: Reuters Read full article

Source: Reuters Read full article

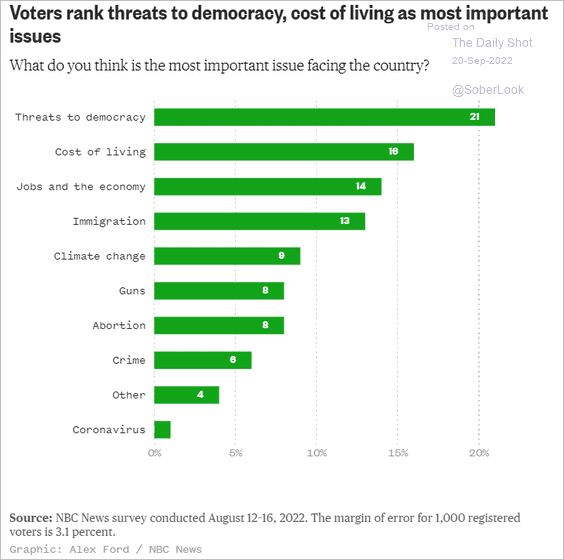

5. Most important issues facing the US:

Source: NBC News Read full article

Source: NBC News Read full article

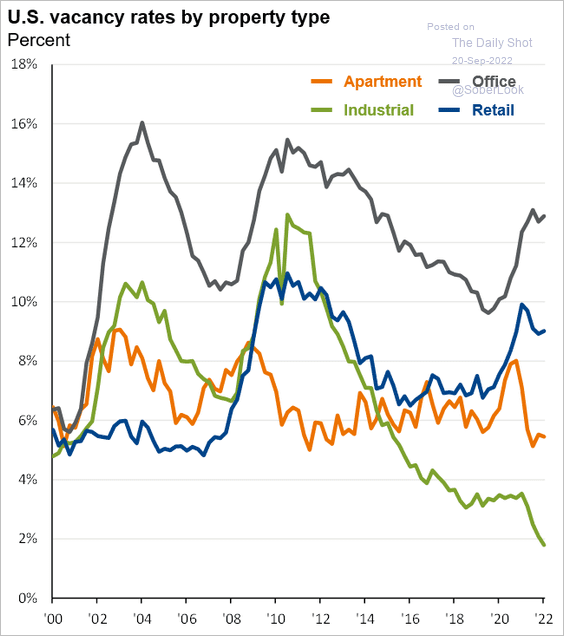

6. US vacancy rates by property type:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

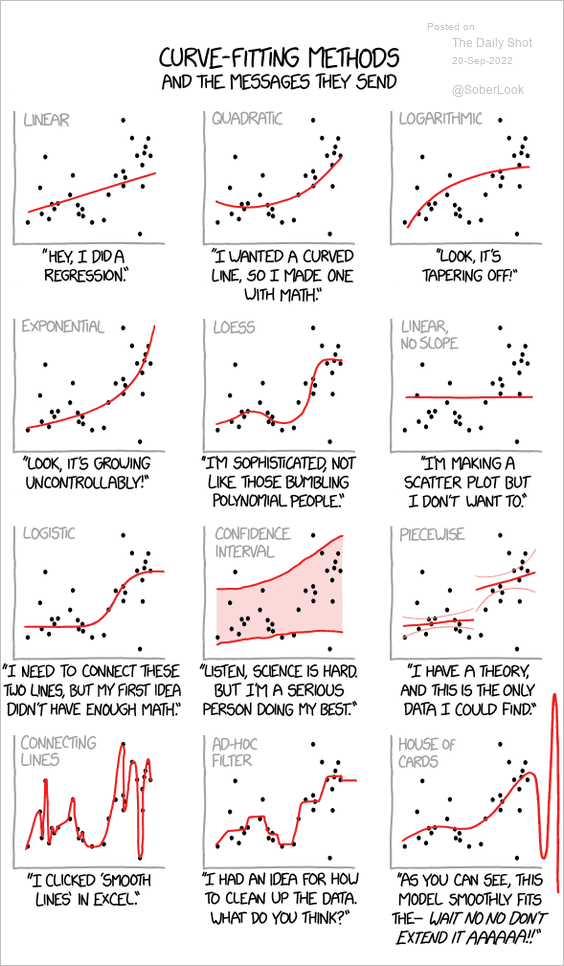

7. Curve-fitting methods:

Source: @dwhiginbotham

Source: @dwhiginbotham

——————–

Back to Index