The Daily Shot: 21-Sep-22

• Global Developments

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Equities

• Rates

• Food for Thought

Global Developments

1. The recent Ukrainian territorial gains prompted Putin to escalate the conflict.

Source: Reuters Read full article

Source: Reuters Read full article

The euro dropped. Gold and oil prices are higher. Surprisingly, US stock futures are up.

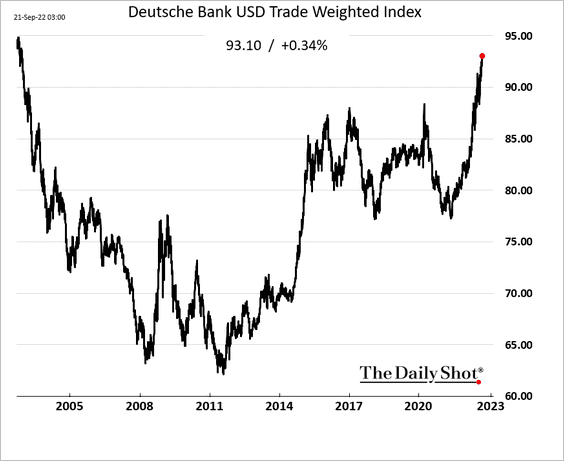

The US dollar (trade-weighted index) hit a two-decade high.

——————–

2. It’s a busy week of central bank meetings. Plenty of rate hikes coming up …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

3. Recession fears will dampen capital investment.

Source: Numera Analytics

Source: Numera Analytics

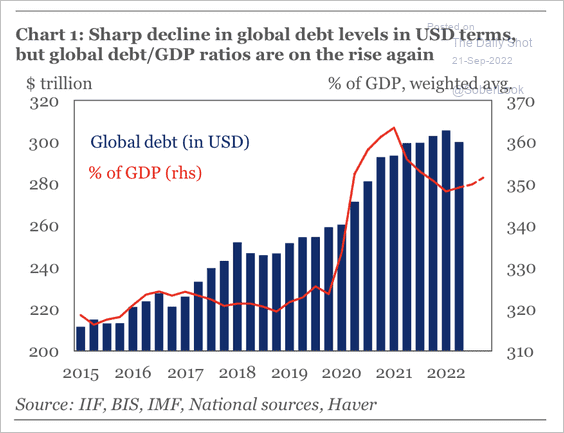

4. Global debt declined for the first time since 3Q 2018.

Source: IIF

Source: IIF

5. This chart shows the distribution of households’ financial assets in the largest economies.

Source: RIETI Read full article

Source: RIETI Read full article

Back to Index

The United States

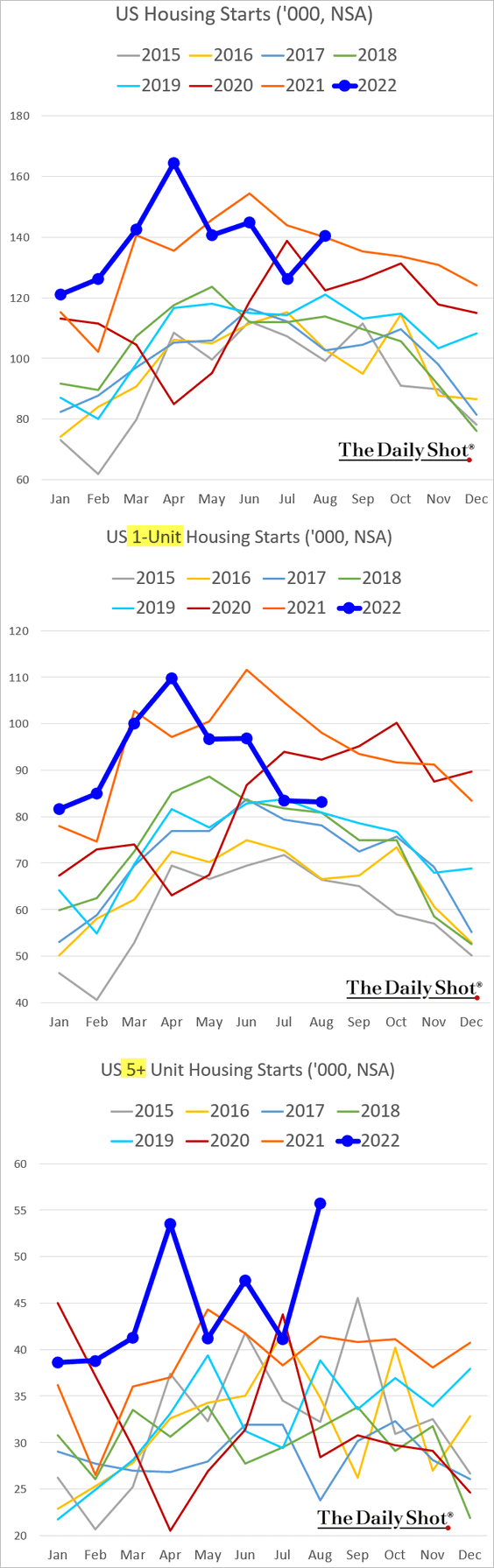

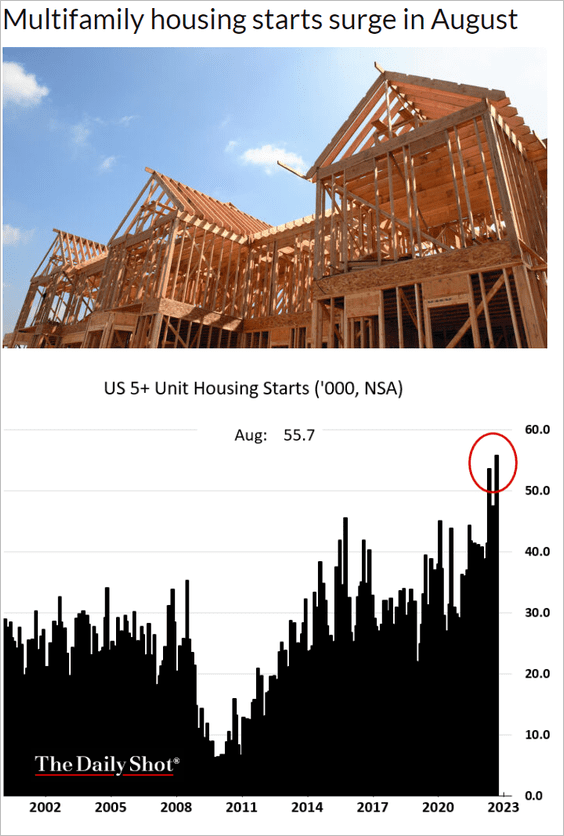

1. Housing starts were stronger than expected, boosted by a surge in multifamily construction.

Source: LBM Journal Read full article

Source: LBM Journal Read full article

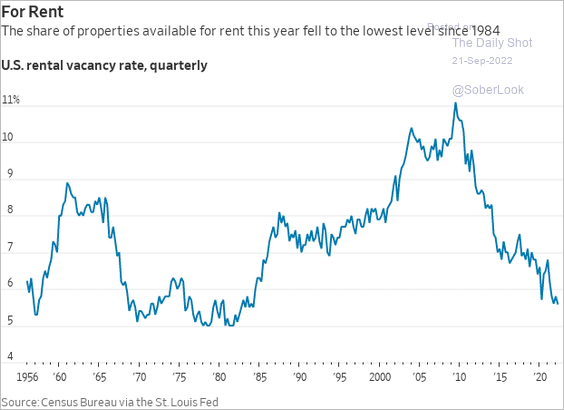

Ongoing declines in rental vacancy rates are supporting multifamily housing.

Source: @WSJ Read full article

Source: @WSJ Read full article

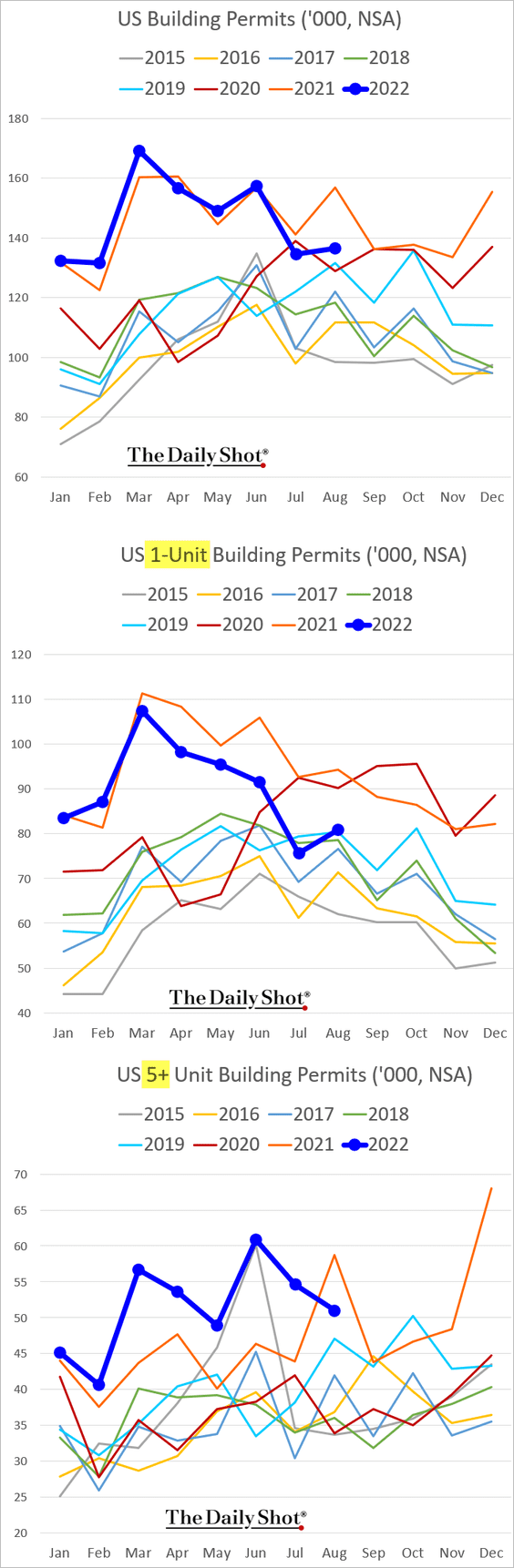

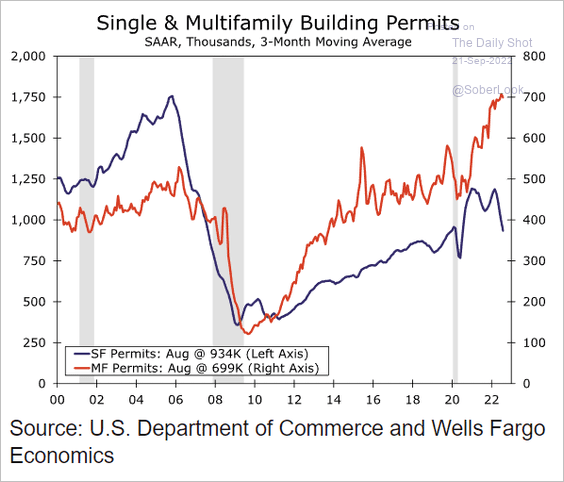

• Construction permits were more subdued.

Multifamily permits have been outpacing single-family housing.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

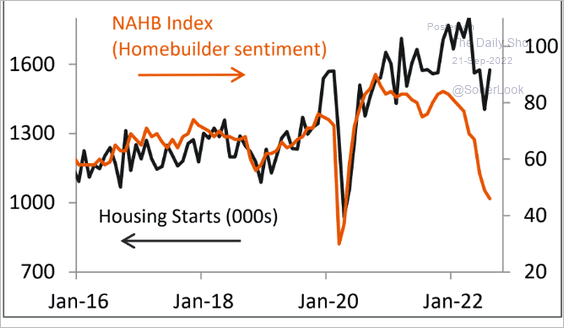

• There is trouble ahead for residential constriction.

Source: Piper Sandler

Source: Piper Sandler

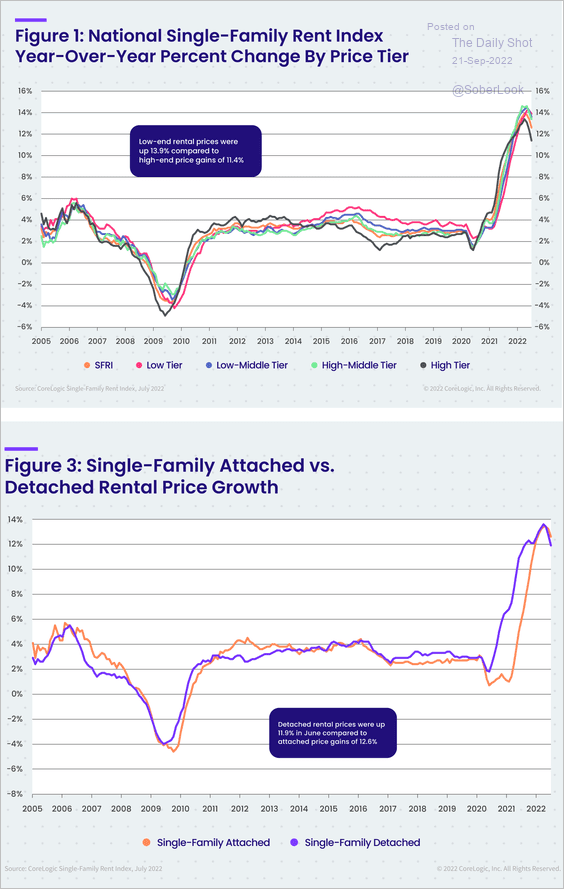

• Single-family rents have peaked.

Source: CoreLogic

Source: CoreLogic

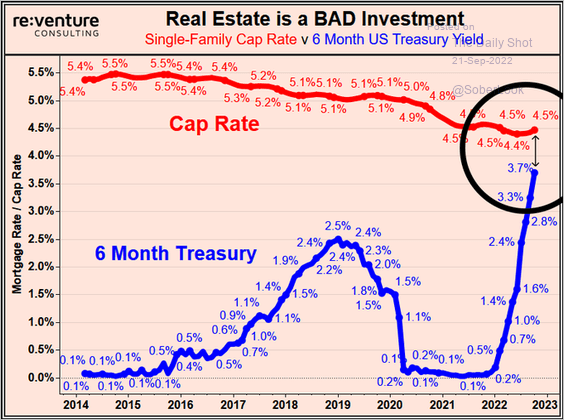

• Single-family cap rates are too low relative to Treasury yields. Property prices will have to come down to boost cap rates.

Source: @nickgerli1

Source: @nickgerli1

——————–

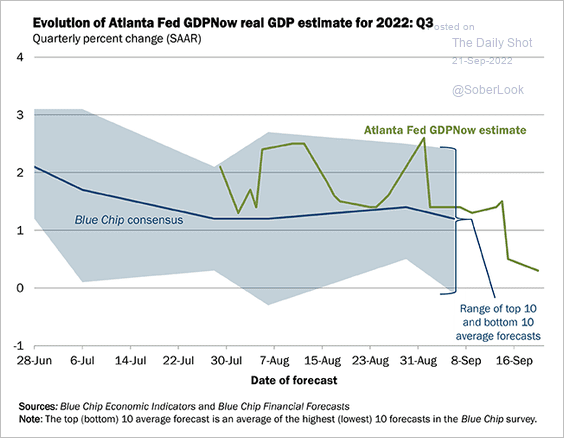

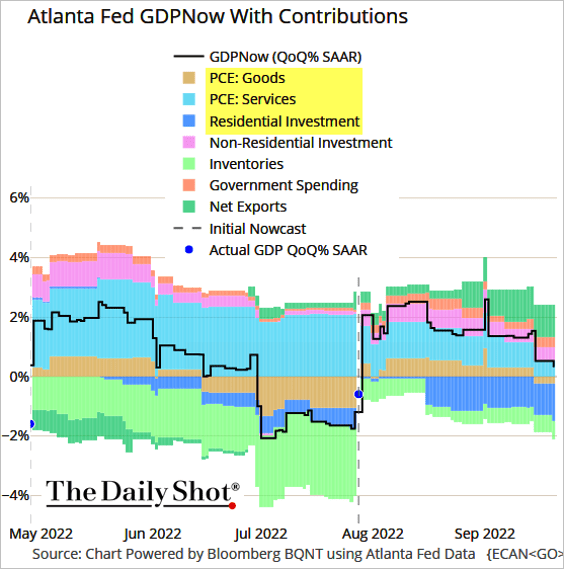

2. The GDPNow model now shows 0.3% GDP growth in the current quarter.

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

The weakness is driven by softer consumer spending and falling residential investment.

Source: Bloomberg

Source: Bloomberg

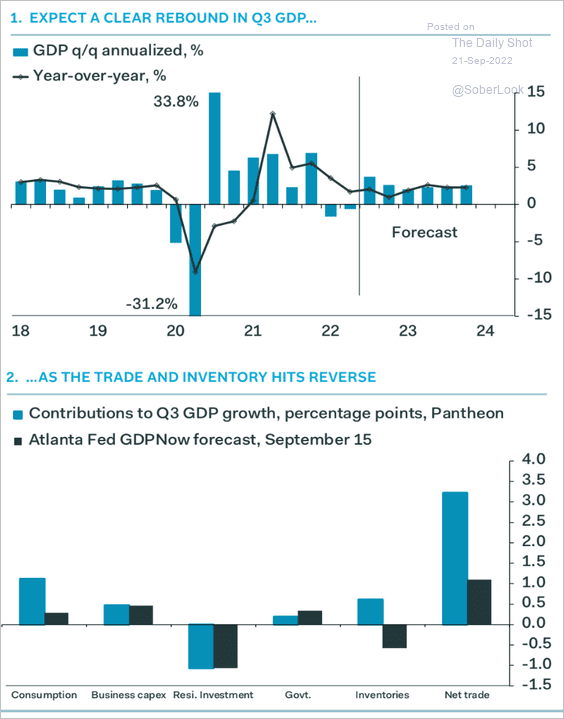

However, many economists are more optimistic about growth in the current quarter.

• Pantheon Macroeconomics sees firmer consumption and tumbling imports boosting growth.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

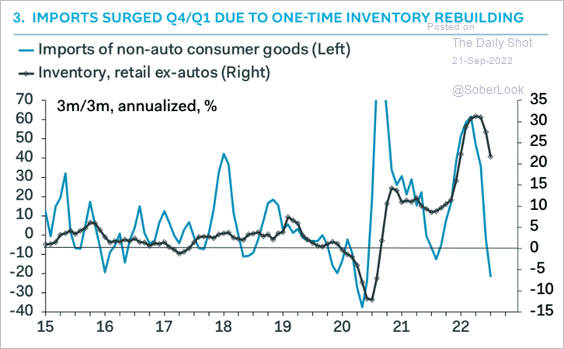

Imports are dropping as inventories recover.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

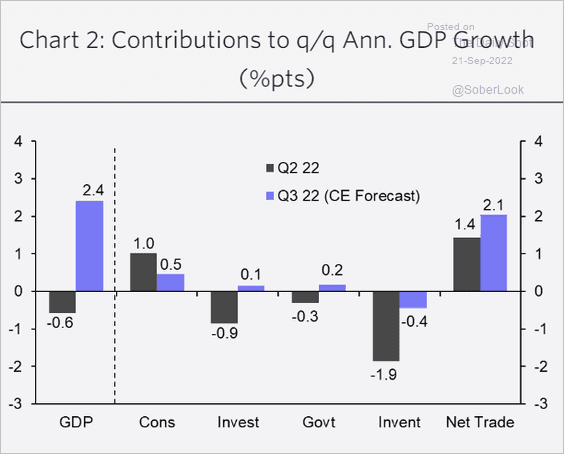

• Here is a forecast from Capital Economics.

Source: Capital Economics

Source: Capital Economics

——————–

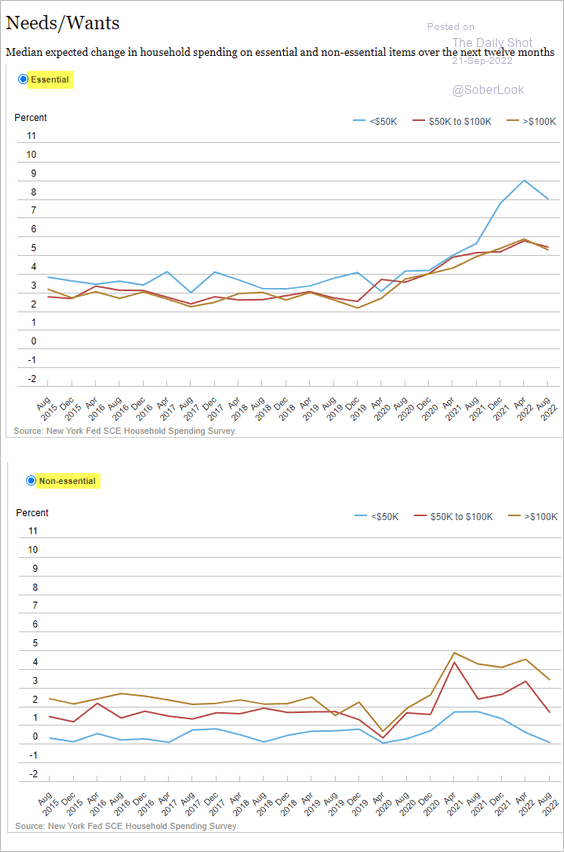

4. Consumers expect to cut spending on non-essential items.

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

5. US port congestion has shifted (in part) to the East Cast.

Source: ING

Source: ING

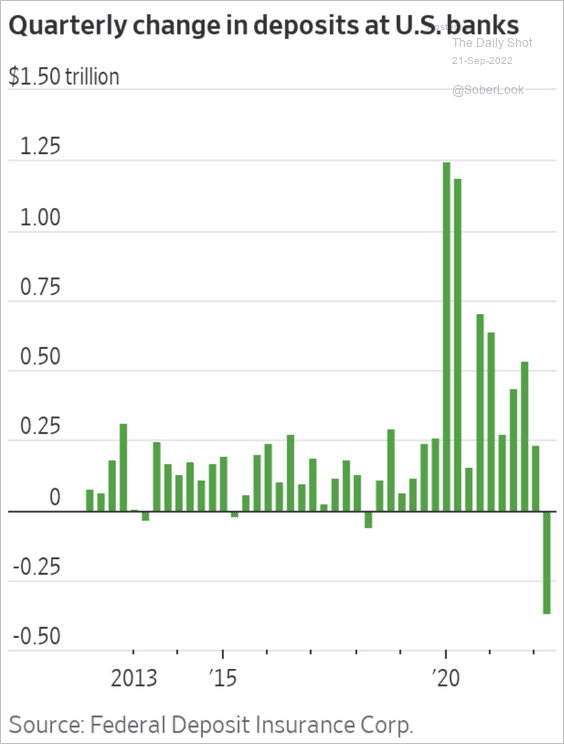

6. Bank deposits declined sharply last quarter.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

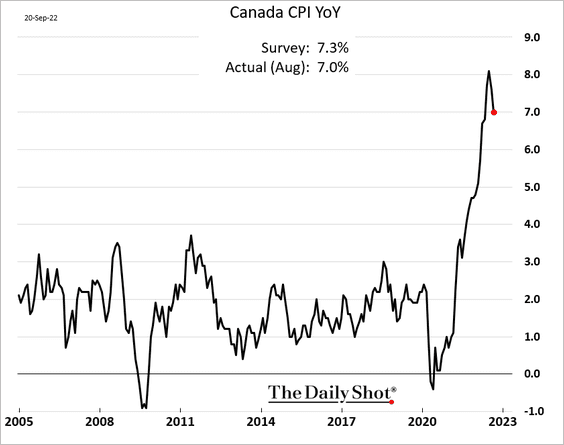

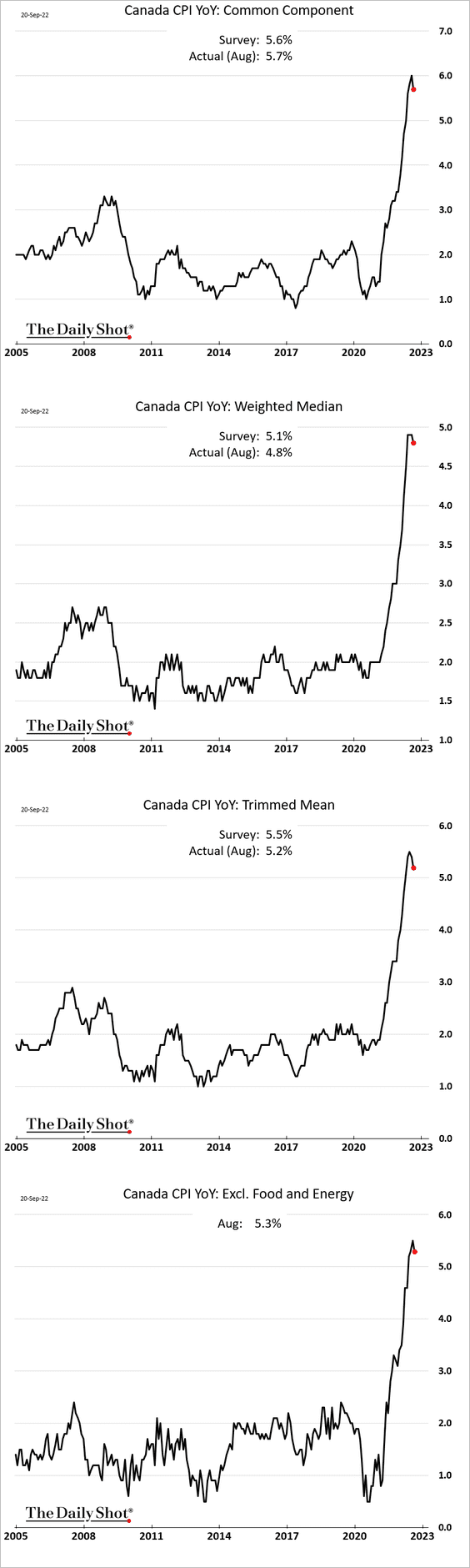

Canada

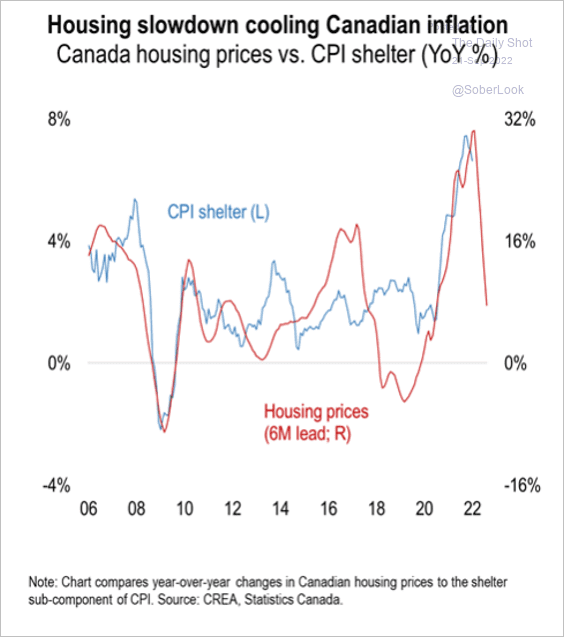

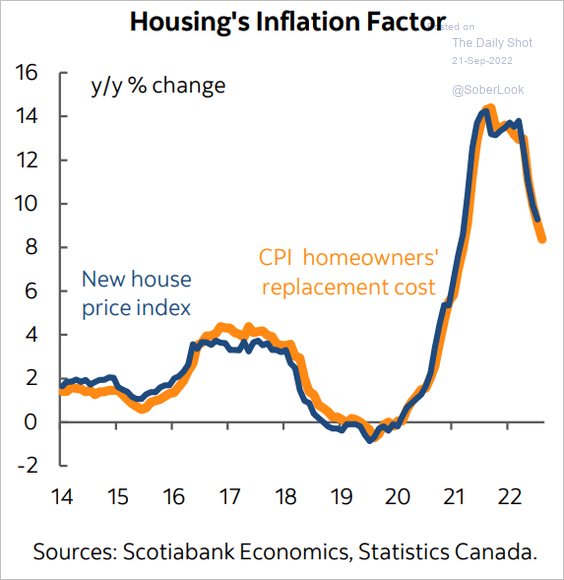

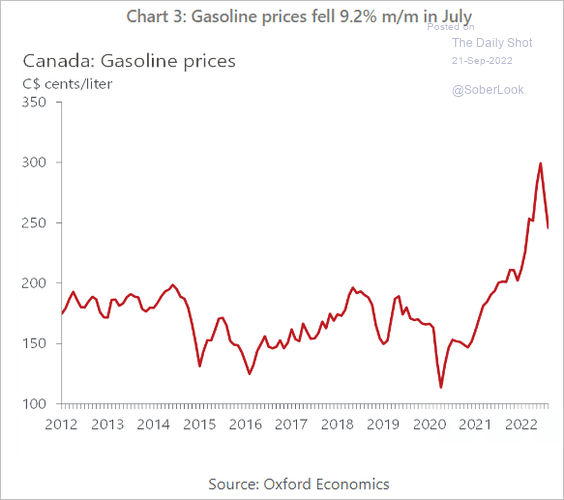

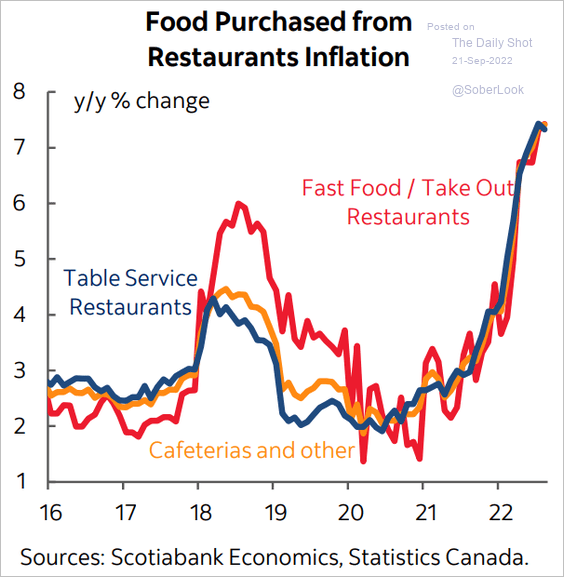

1. The CPI report was a bit softer than expected.

• Core inflation measures have peaked.

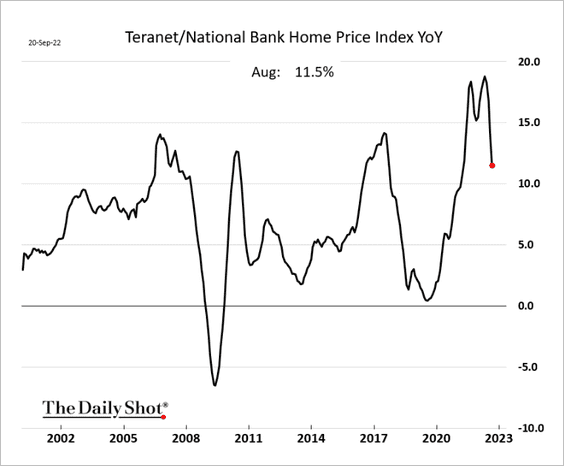

• The housing market is cooling, which is helping to ease inflationary pressures.

Source: Numera Analytics

Source: Numera Analytics

Source: Scotiabank Economics

Source: Scotiabank Economics

• Energy costs are also lower.

Source: Oxford Economics

Source: Oxford Economics

• But food inflation keeps surging.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

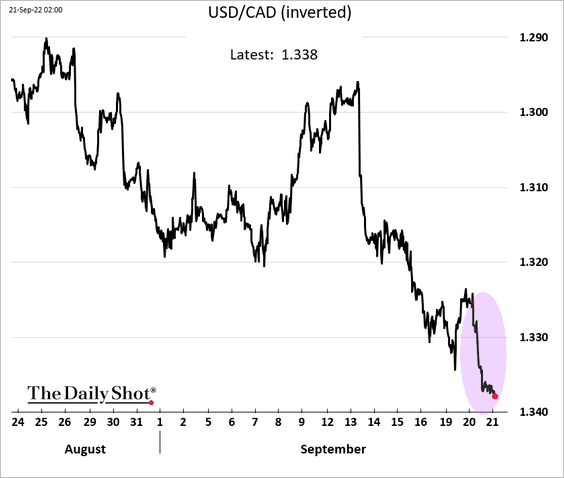

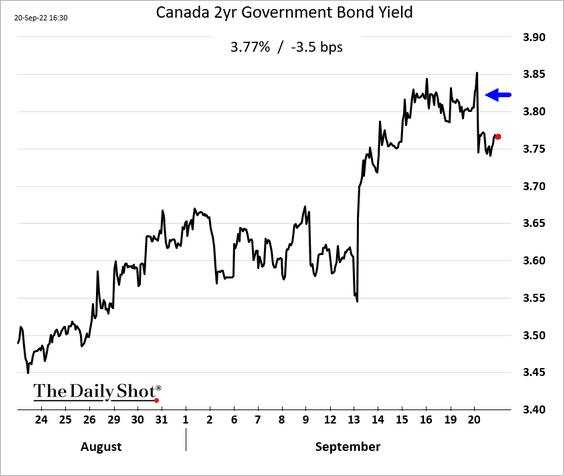

2. The Canadian dollar resumed its decline vs. USD after the CPI report.

Bond yields edged lower.

——————–

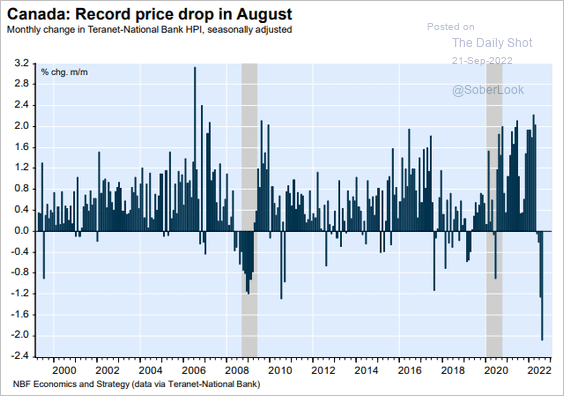

3. Home prices are falling quickly.

Source: @quinngreg

Source: @quinngreg

——————–

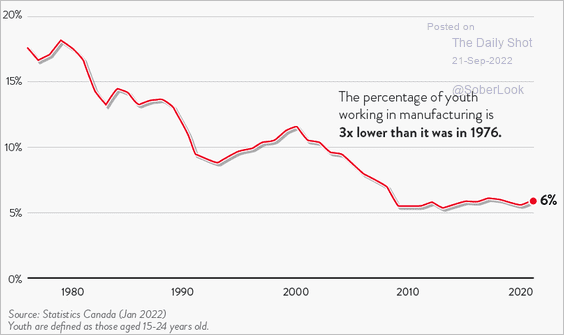

4. This chart shows the percentage of youth in Canada’s manufacturing sector.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

Back to Index

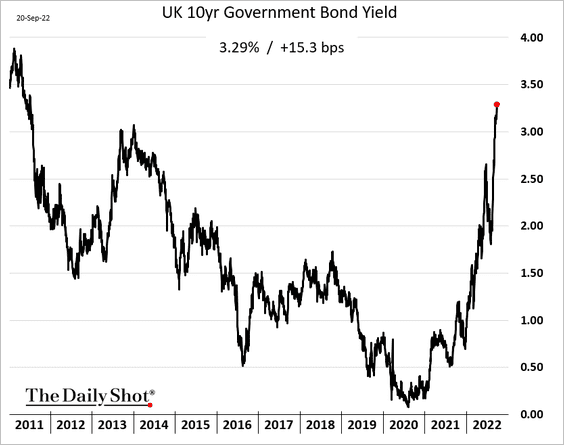

The United Kingdom

1. Gilt yields continue to surge.

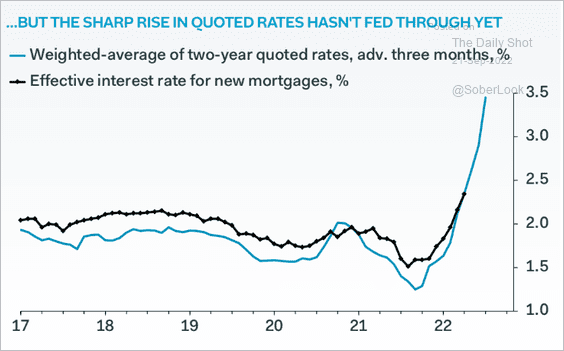

2. Mortgage pain is coming as loans reset at higher rates.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

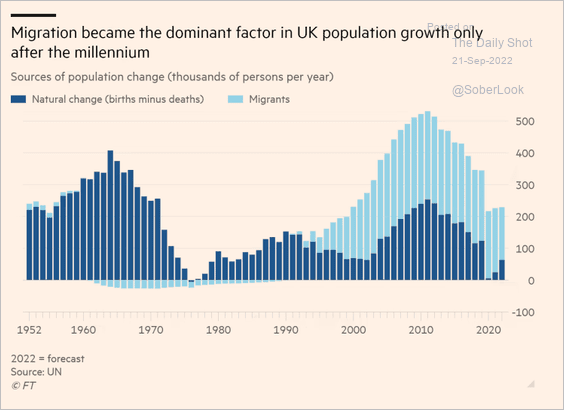

3. Migration has been driving the UK population growth.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

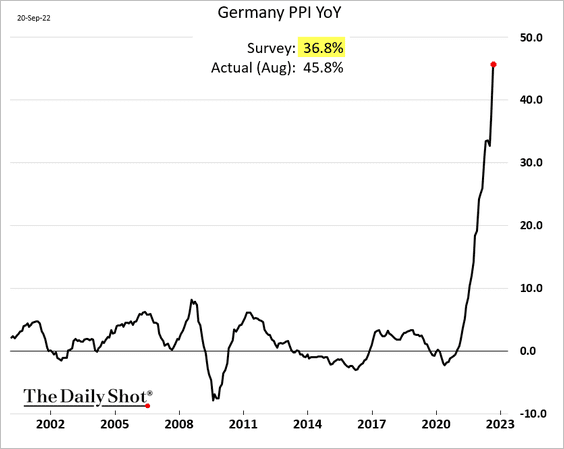

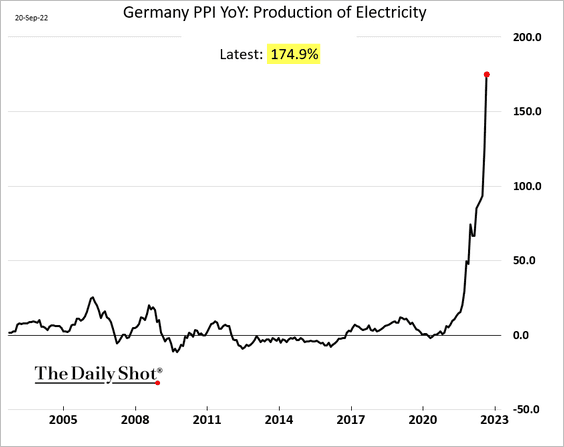

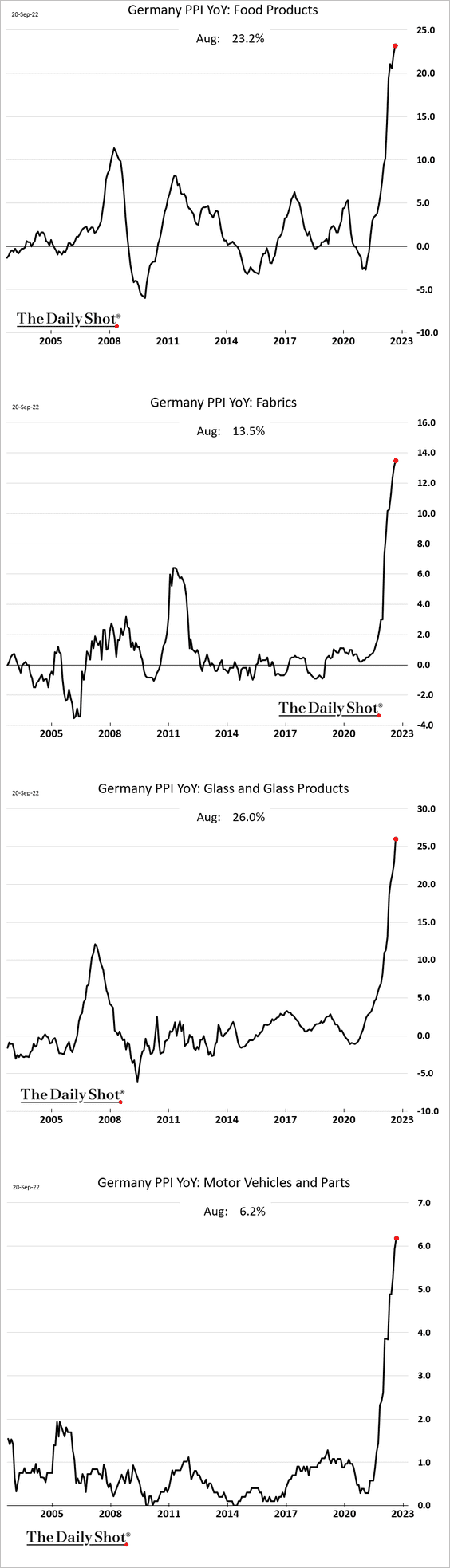

1. Germany’s producer price report was a shocker.

The surprise came from electricity prices, …

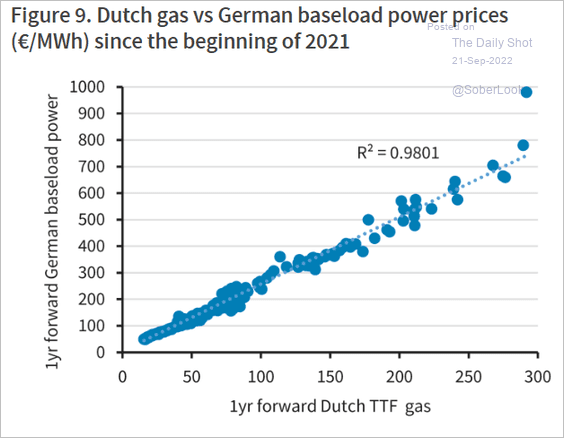

… driven by unprecedented gains in the cost of natural gas.

Source: Barclays Research

Source: Barclays Research

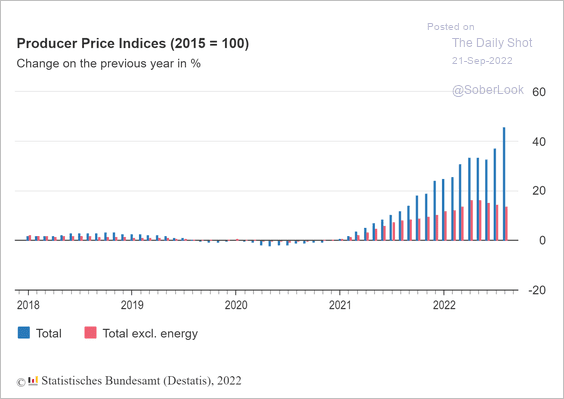

• The PPI excluding energy has been moderating.

Source: Destatis Read full article

Source: Destatis Read full article

But many non-energy PPI components keep rising on a year-over-year basis.

——————–

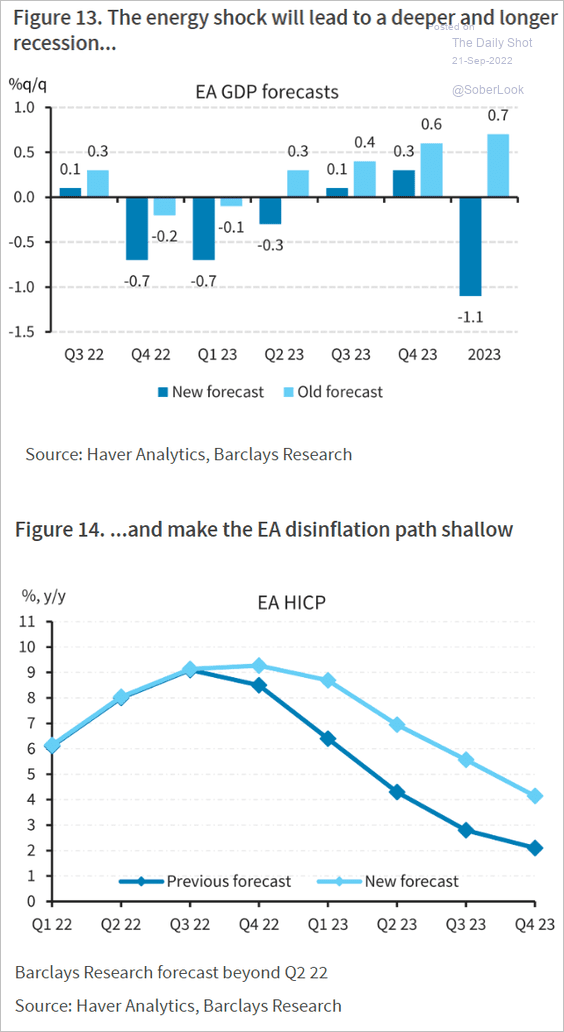

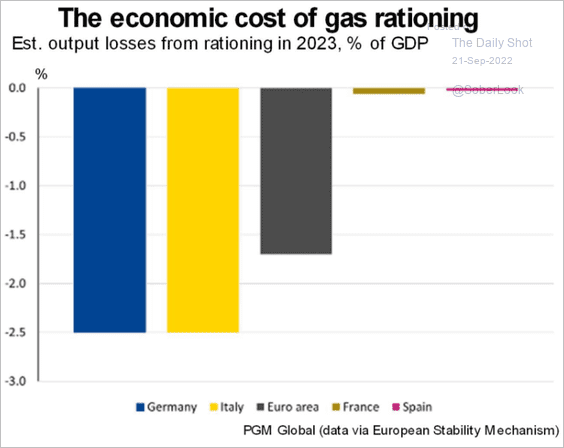

2. The energy shock will lead to stagflation.

Source: Barclays Research

Source: Barclays Research

Germany and Italy are more exposed (2 charts).

Source: Barclays Research

Source: Barclays Research

Source: PGM Global

Source: PGM Global

——————–

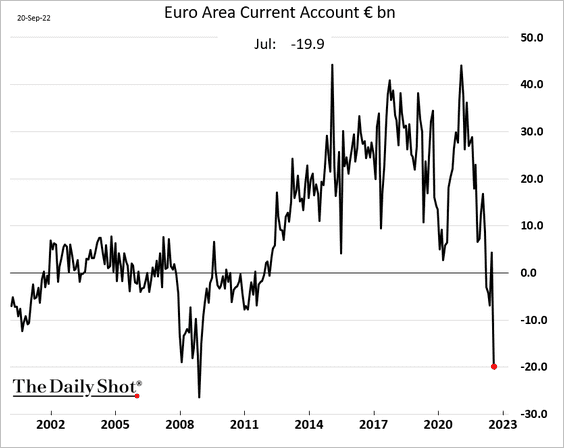

3. The Eurozone current account is deep in deficit territory, driven by the energy trade deficit.

Back to Index

Europe

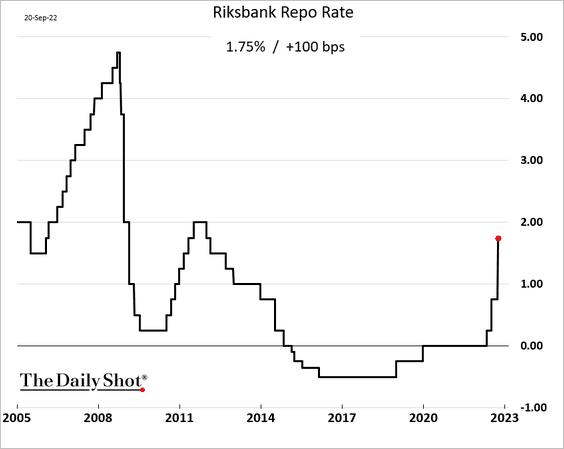

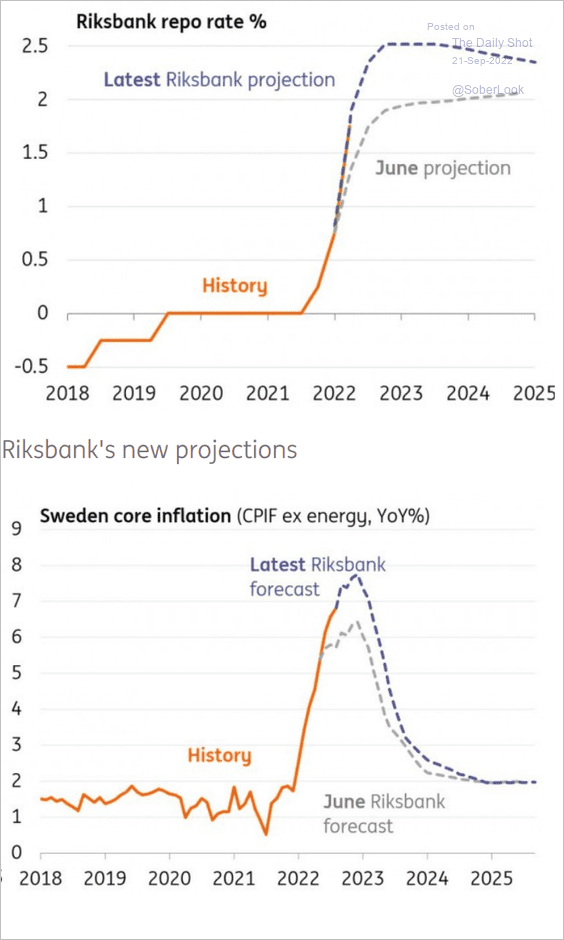

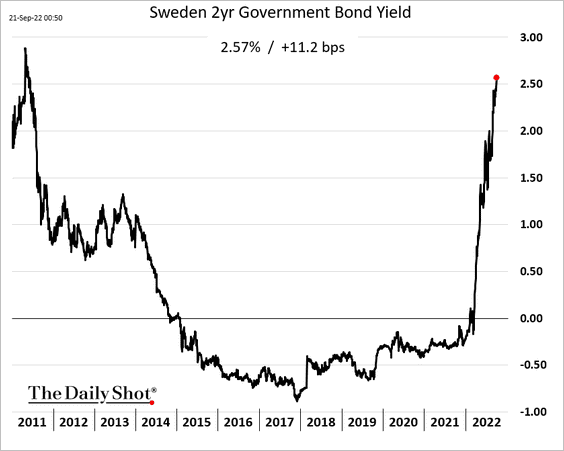

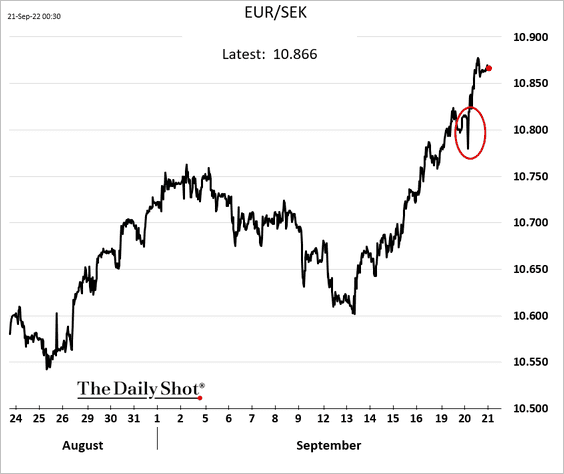

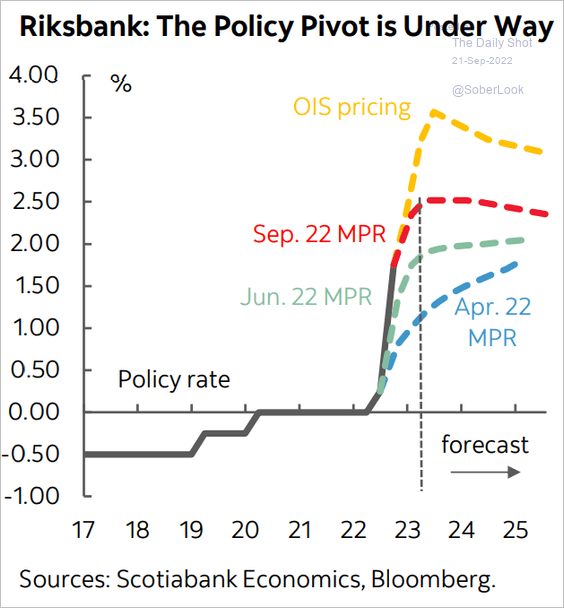

1. Sweden’s Riksbank shocked the markets with a 100 bps rate hike.

The central bank boosted its rate trajectory projection and the CPI forecast.

Source: ING

Source: ING

• Bond yields jumped.

But the krona continued to weaken (chart shows the euro gaining against the krona).

• The market has repriced rate expectations.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

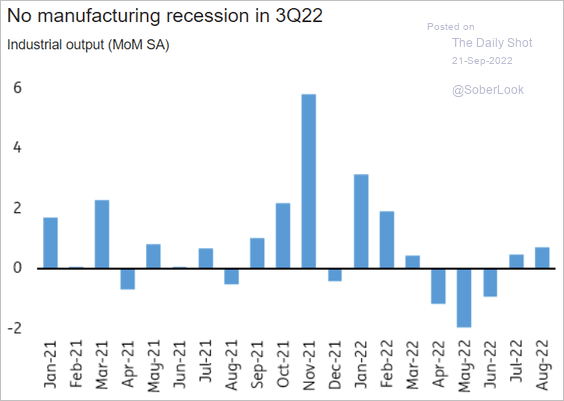

2. Poland’s industrial output is holding up.

Source: ING

Source: ING

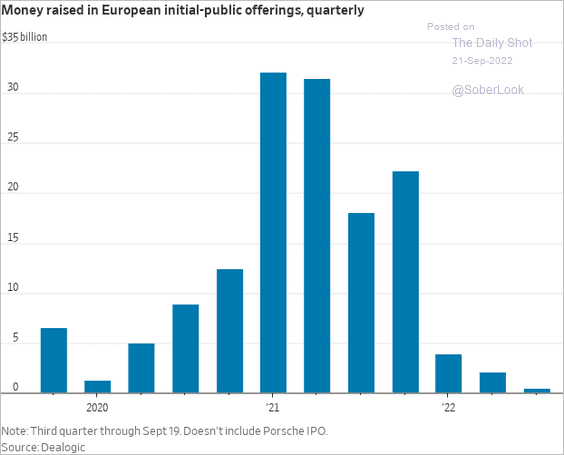

3. It’s been a tough year for Europe’s IPO market. Porsche’s IPO will be one of the largest European public listings in years.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Japan

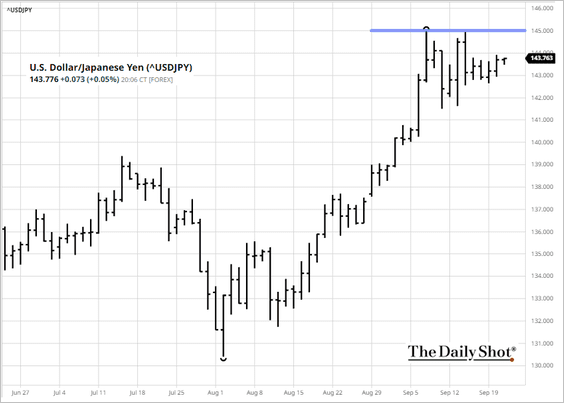

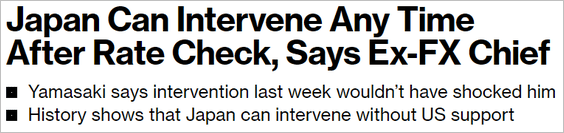

1. Is the dollar-yen at 145 Japan’s line in the sand?

Source: barchart.com

Source: barchart.com

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

2. The PPI – CPI divergence points to margin pressures for Japanese firms.

Source: ING

Source: ING

Back to Index

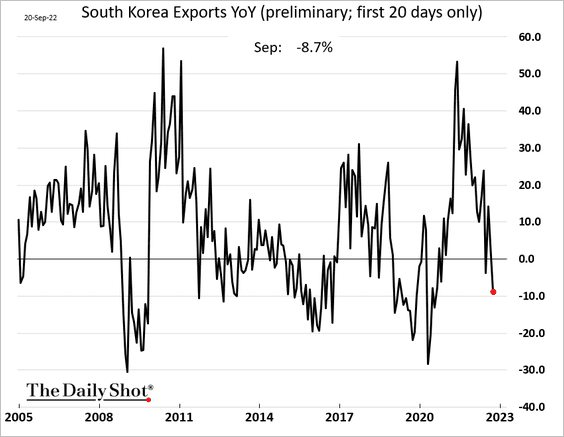

Asia – Pacific

1. South Korea’s exports have been slowing.

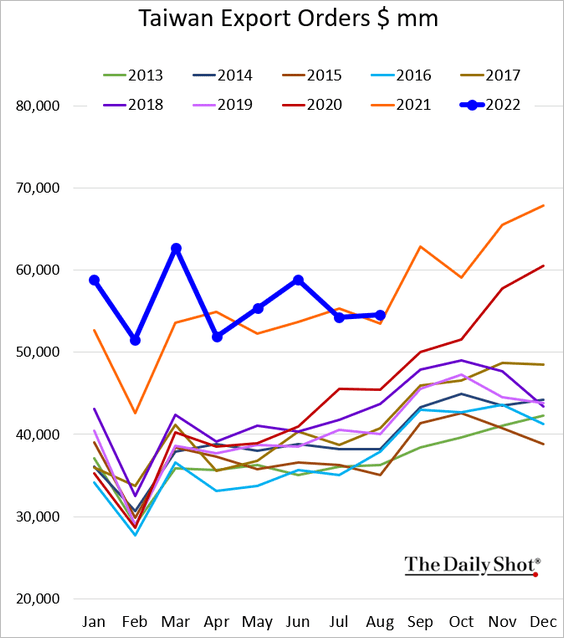

2. Taiwan’s export orders are holding at last year’s levels.

The Taiwan dollar continues to tumble vs. USD.

Back to Index

China

1. The renminbi remains under pressure despite the PBoC’s support.

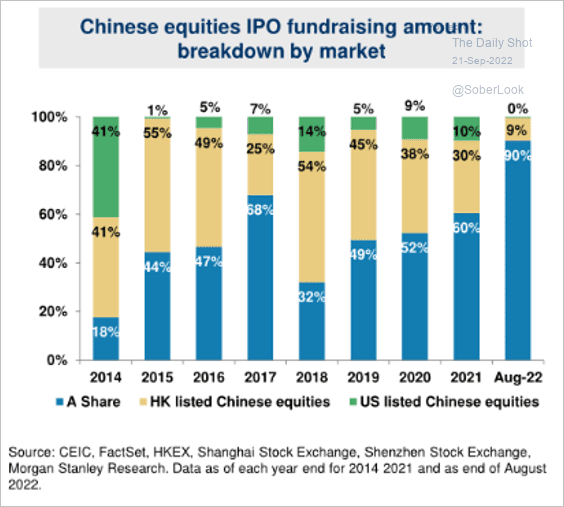

2. Chinese companies raised most of their IPO funds in mainland markets this year.

Source: Morgan Stanley Research; @SofiaHCBBG

Source: Morgan Stanley Research; @SofiaHCBBG

Back to Index

Emerging Markets

1. Russian stocks are down sharply as Putin escalates the conflict.

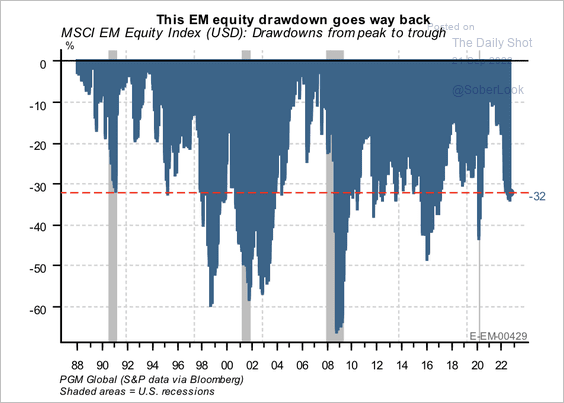

2. The current drawdown in the MSCI EM Equity Index is in line with its historical average.

Source: PGM Global

Source: PGM Global

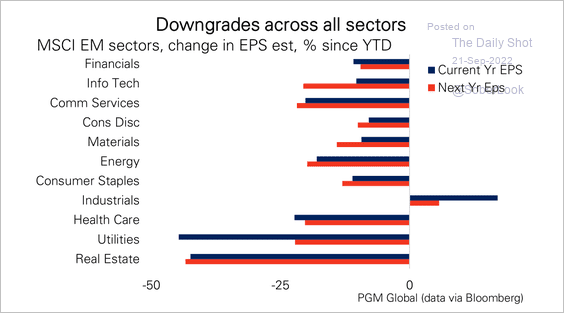

Negative earnings revisions are spread across value and growth sectors. Industrials is the only sector with positive earnings upgrades this year, driven by shipping and marine transport stocks, according to PGM Global.

Source: PGM Global

Source: PGM Global

——————–

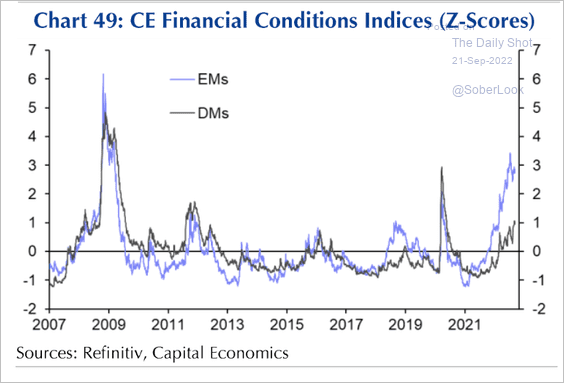

3. Financial conditions are tighter in emerging versus developed markets. That’s partly because many EM central banks raised rates earlier than advanced economies.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

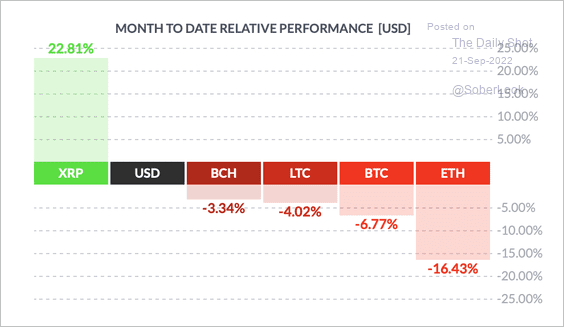

1. It’s been a tough month for cryptos so far, although XRP is outperforming (possibly related to a pump scam).

Source: FinViz

Source: FinViz

Source: CoinTelegraph Read full article

Source: CoinTelegraph Read full article

It is still unclear if XRP is a security, but we could find out soon.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

——————–

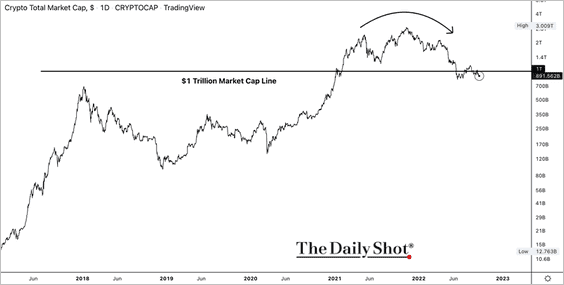

2. The total crypto market cap is back below $1 trillion.

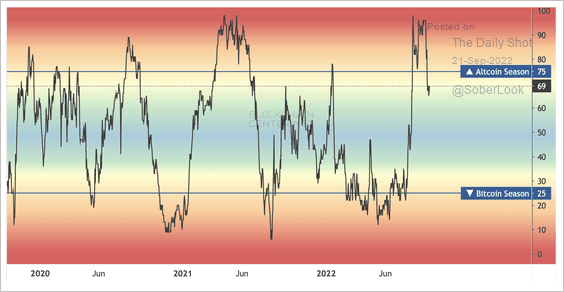

3. 69% of altcoins have outperformed bitcoin over the past three months. It is no longer “altcoin season.”

Source: Blockchain Center

Source: Blockchain Center

Back to Index

Equities

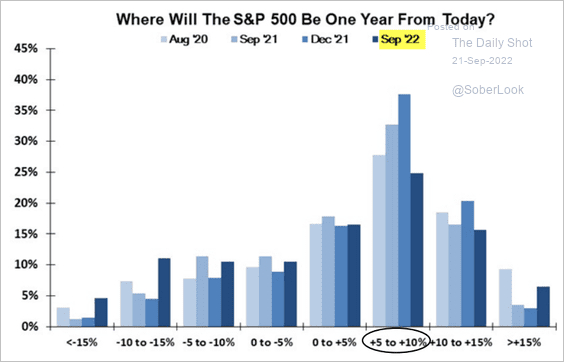

1. Where will the S&P 500 be a year from now? Here is a survey from Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

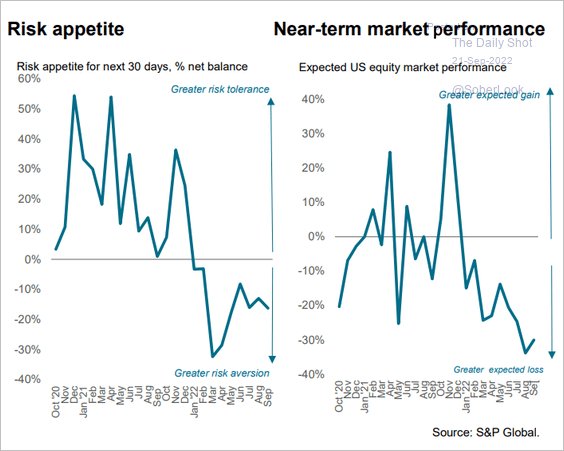

2. What are the key drivers of depressed investor sentiment?

Source: S&P Global PMI

Source: S&P Global PMI

Source: S&P Global PMI

Source: S&P Global PMI

——————–

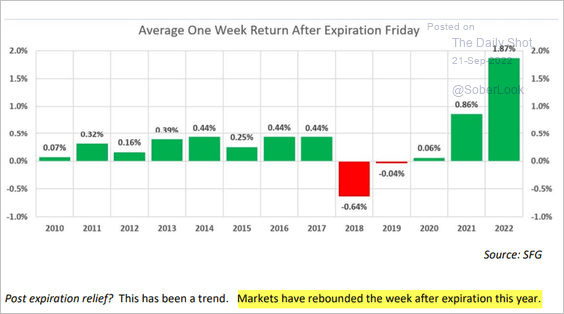

3. Will we get a post-expiration rebound?

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

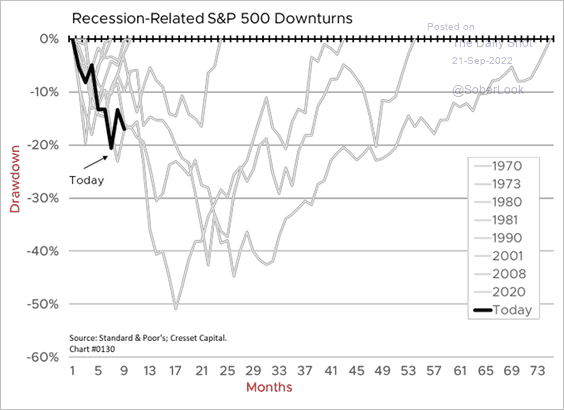

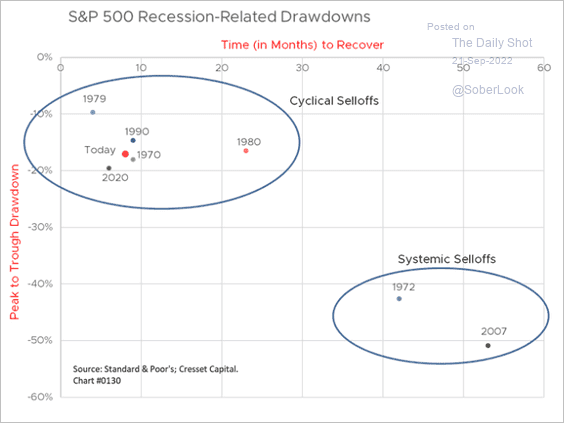

4. The current bear market is consistent with other recession-related drawdowns.

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

Are we in a cyclical selloff?

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

——————–

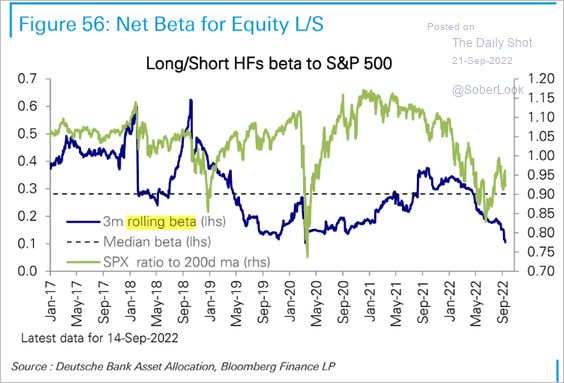

5. Long/short hedge funds continue to cut net exposure to stocks.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

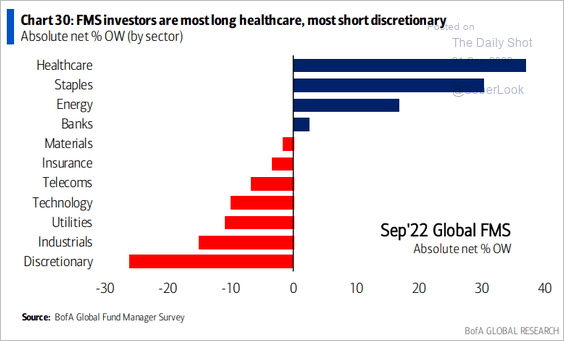

6. How are fund managers positioned across sectors?

Source: BofA Global Research

Source: BofA Global Research

7. The SOX semiconductor index is at support.

![]() h/t Evercore ISI Research

h/t Evercore ISI Research

8. Demand for out-of-the-money protection has been soft.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

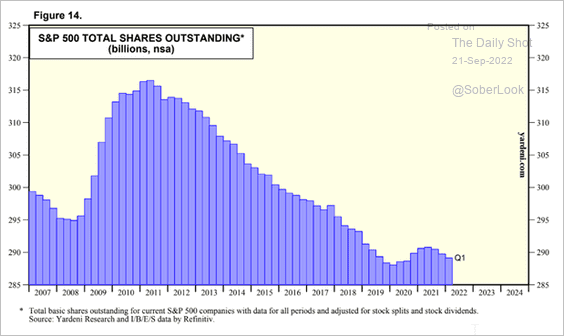

9. Stock buybacks have reduced the share count of the S&P 500 by about 9% over the last decade. Buybacks helped avoid share dilution that results from stock-based compensation.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

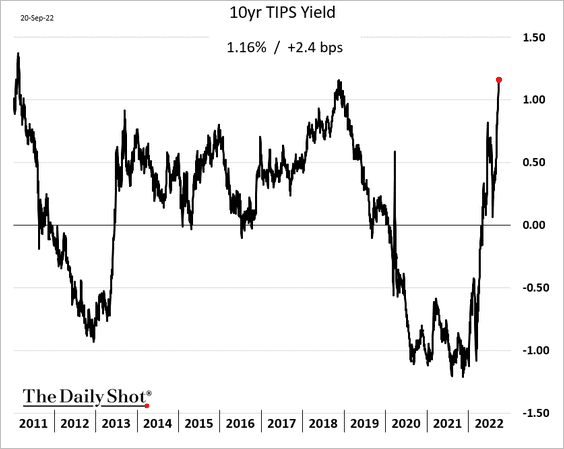

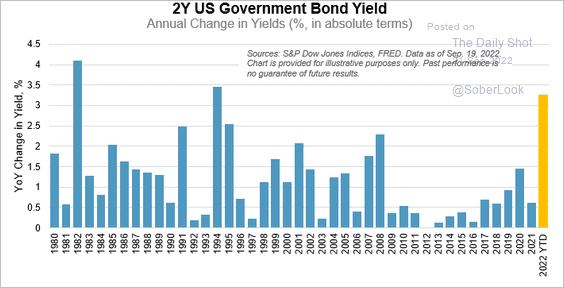

Rates

1. Real yields keep climbing.

2. It’s been decades since we’ve seen such a sharp increase in the 2-year Treasury yield.

Source: S&P Dow Jones Indices

Source: S&P Dow Jones Indices

——————–

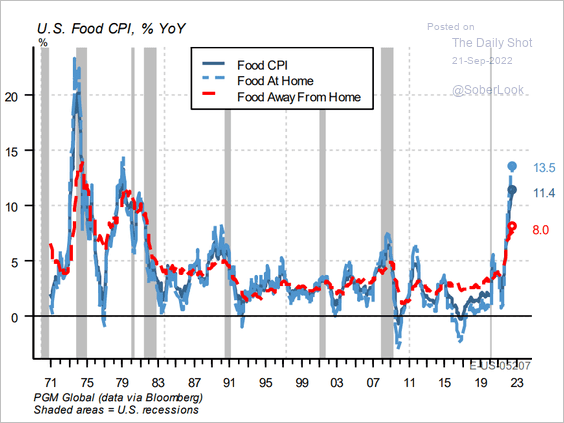

Food for Thought

1. Food inflation-at home and away from home:

Source: PGM Global

Source: PGM Global

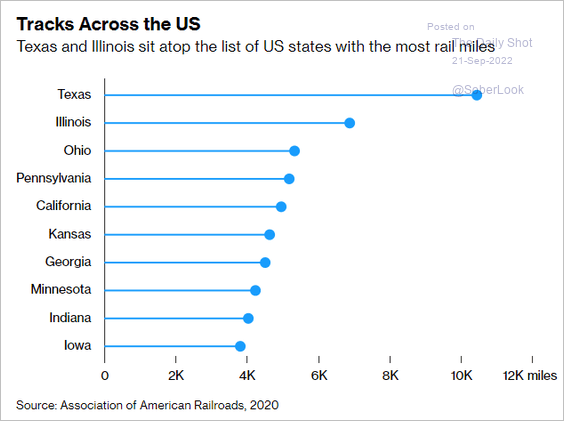

2. Rail miles by state:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

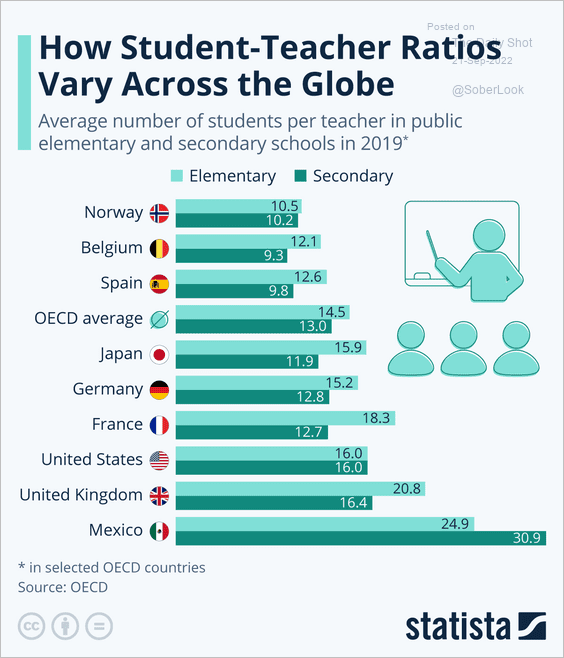

3. Student-teacher ratios:

Source: Statista

Source: Statista

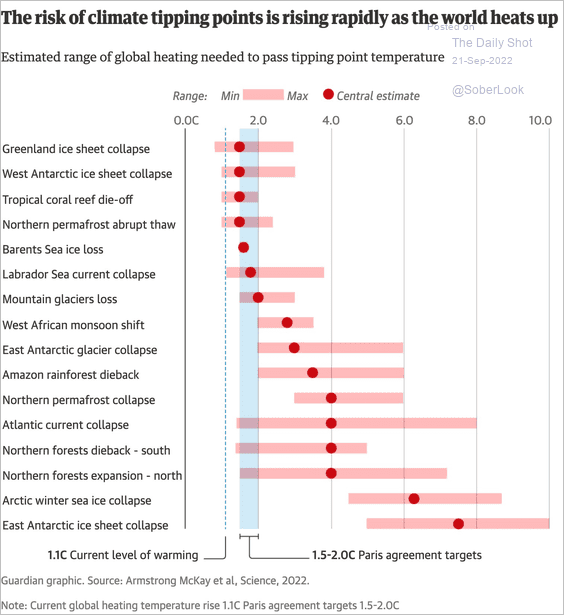

4. Climate tipping points:

Source: The Guardian Read full article

Source: The Guardian Read full article

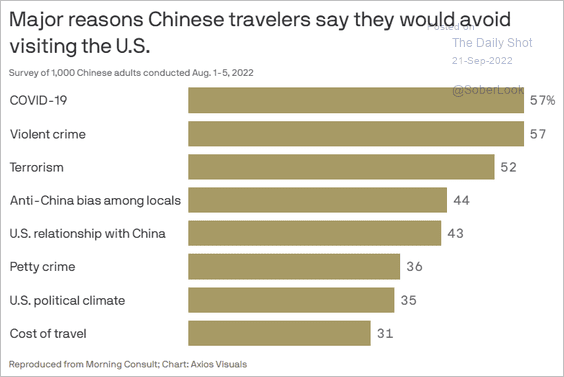

5. Chinese travelers avoiding the US:

Source: @axios Read full article

Source: @axios Read full article

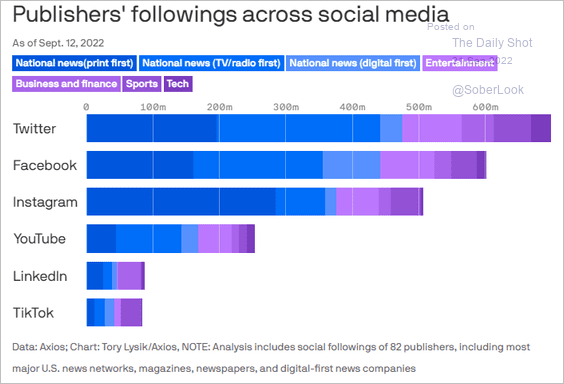

6. Publishers’ reach on social media:

Source: @axios Read full article

Source: @axios Read full article

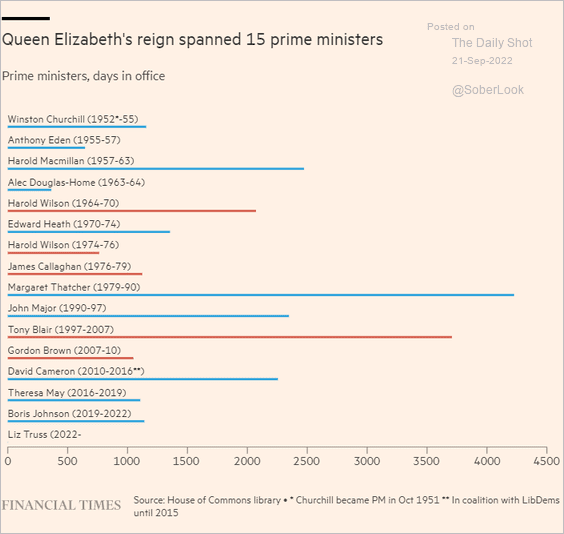

7. UK prime ministers during Queen Elizabeth’s reign:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

Back to Index