The Daily Shot: 23-Sep-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

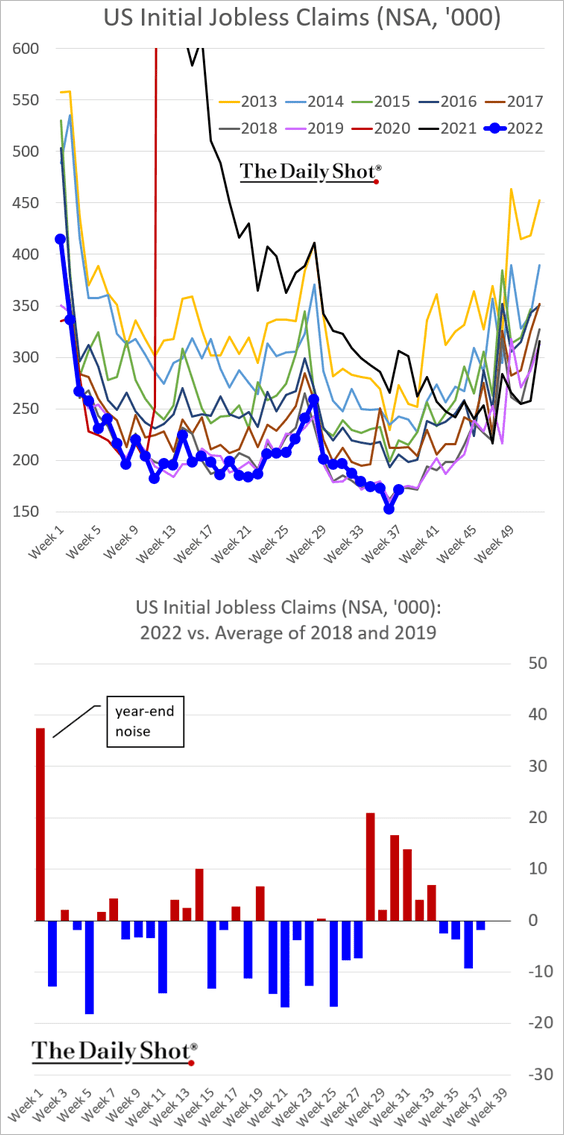

1. Let’s begin with the labor market.

• The jobless claims report shows no signs of easing demand for workers. Unemployment applications remain below pre-COVID levels.

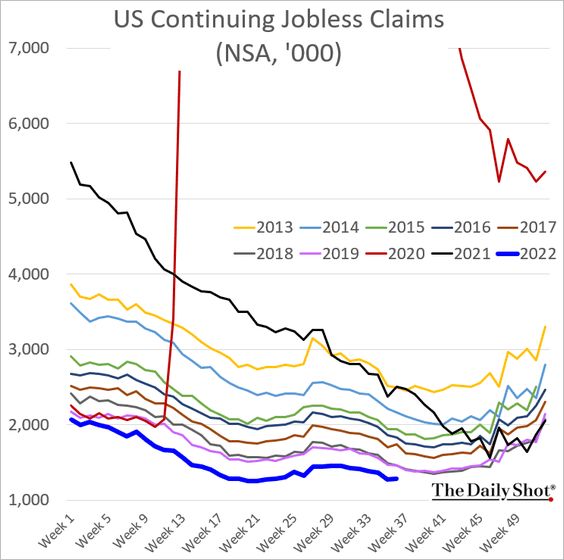

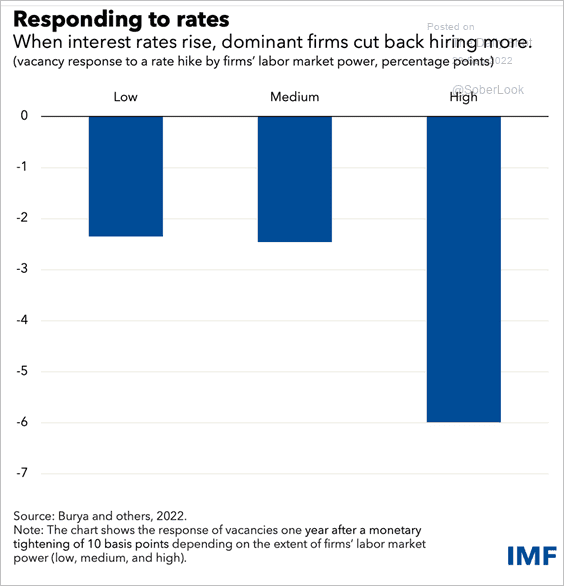

• Job losses are coming next year, according to BofA.

Source: BofA Global Research

Source: BofA Global Research

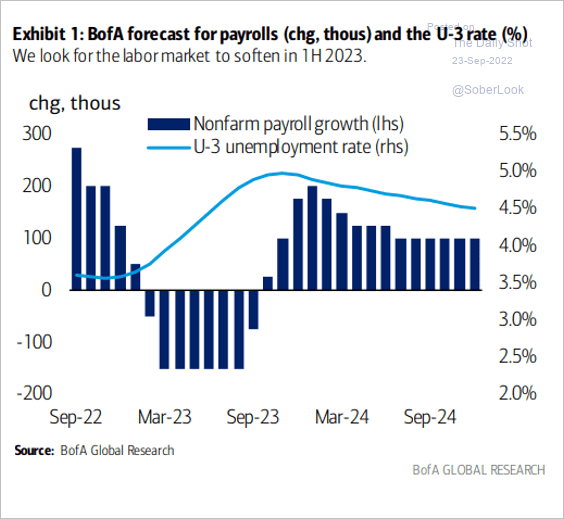

• Employment at dominant firms tends to be more impacted by rising interest rates.

Source: IMF Read full article

Source: IMF Read full article

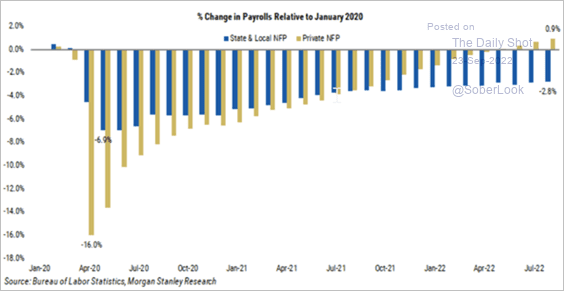

• While the private sector of the labor market has rebounded from the pandemic, state and local government job growth has lagged behind. If this trend continues, state and local payrolls will not reach the pre-pandemic peak until December 2025. A significant component of this trend is public school teachers, many of whom are not returning to work.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

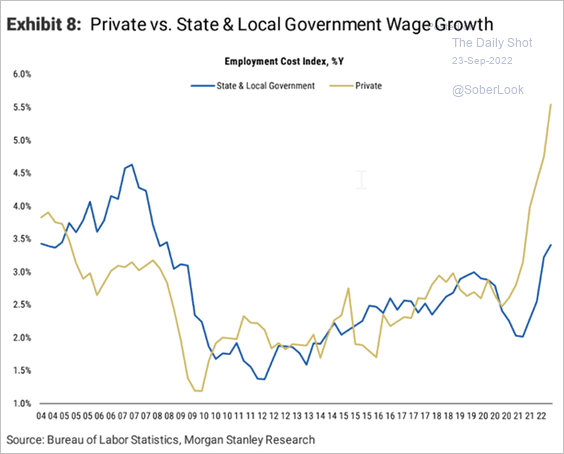

A key reason for lagging public-sector labor supply recovery is sluggish wage growth.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

2. Next, we have some updates on inflation.

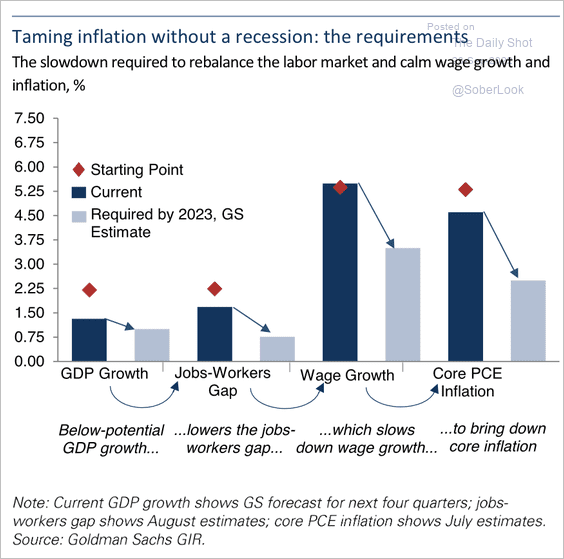

• A slowdown in economic growth and a significant decline in wage growth is needed to reduce inflation.

Source: Goldman Sachs

Source: Goldman Sachs

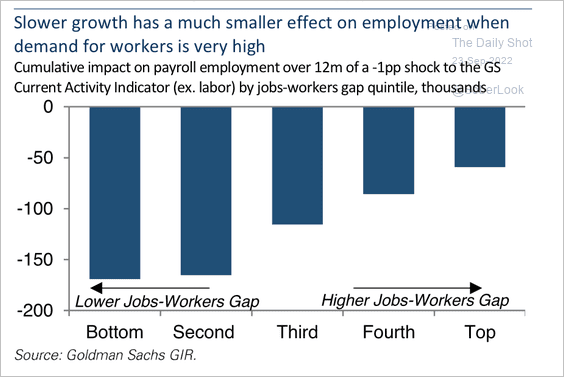

But a decline in wage growth is challenging when the demand for workers is high.

Source: Goldman Sachs

Source: Goldman Sachs

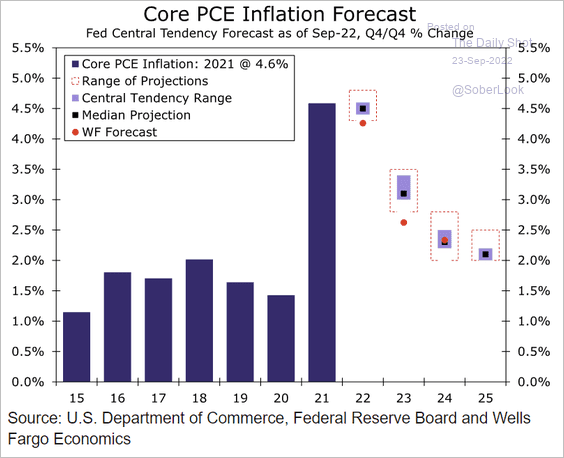

• Here is the core PCE inflation forecast from the FOMC and Wells Fargo.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

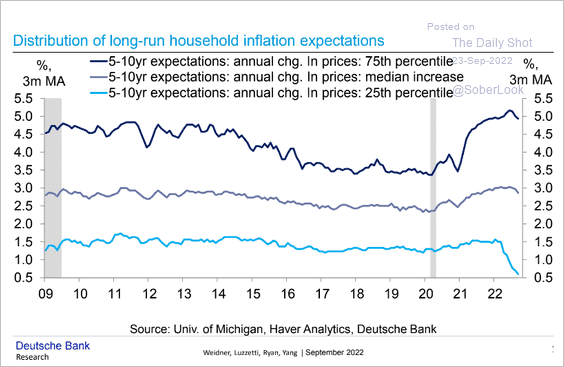

• This chart shows the distribution of longer-run consumer inflation expectations.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

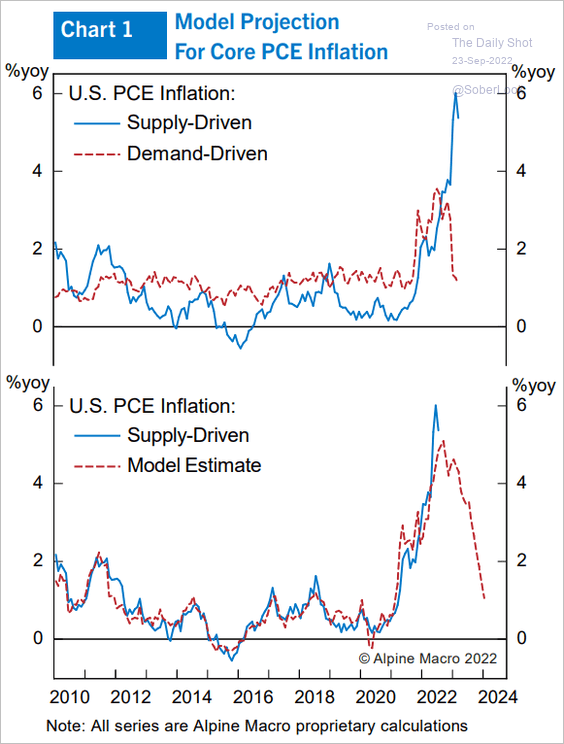

• Supply-driven inflation should be falling.

Source: Alpine Macro

Source: Alpine Macro

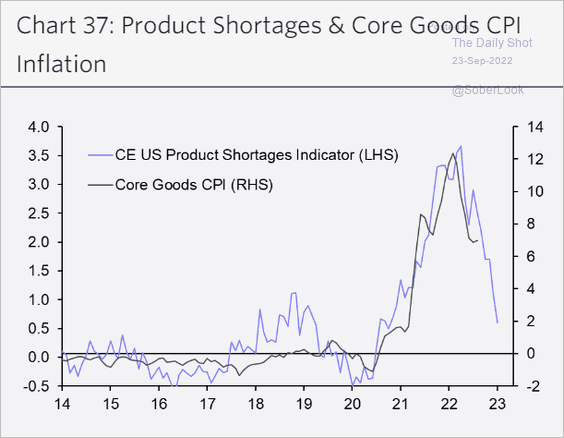

– Shortages are easing.

Source: Capital Economics

Source: Capital Economics

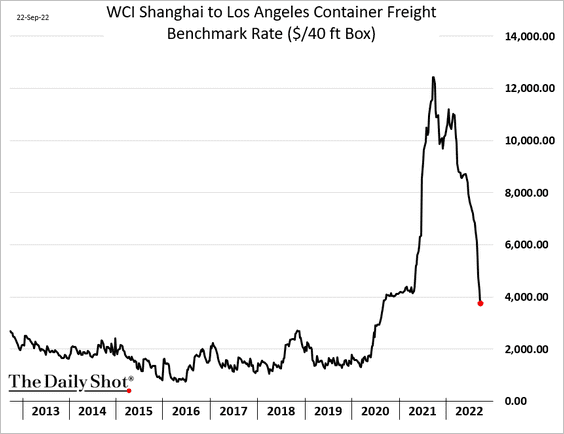

– International container shipping rates are tumbling.

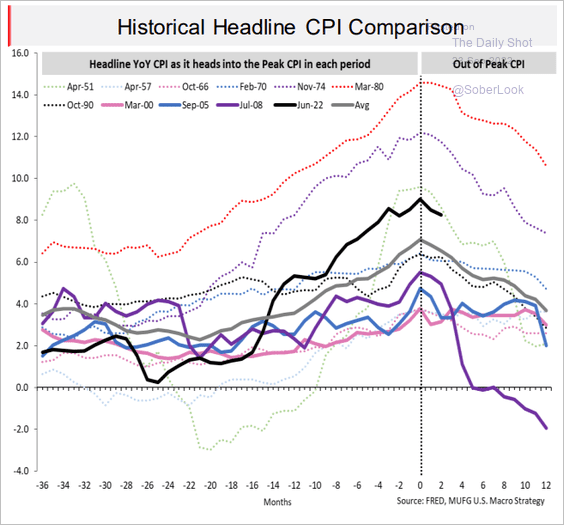

• Here is a look at previous inflation peaks.

Source: MUFG Securities

Source: MUFG Securities

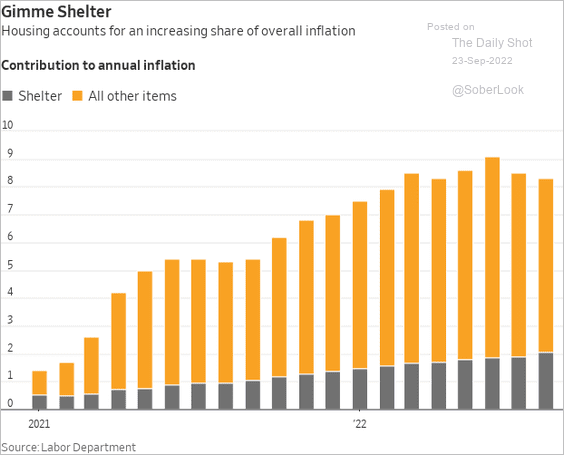

• Shelter is increasingly driving inflationary pressures.

Source: @WSJ Read full article

Source: @WSJ Read full article

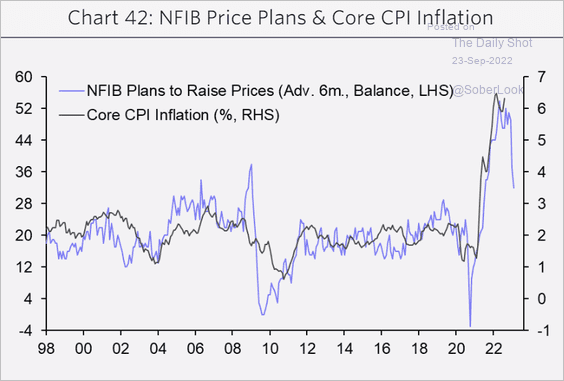

• Small business price intentions point to slower inflation ahead.

Source: Capital Economics

Source: Capital Economics

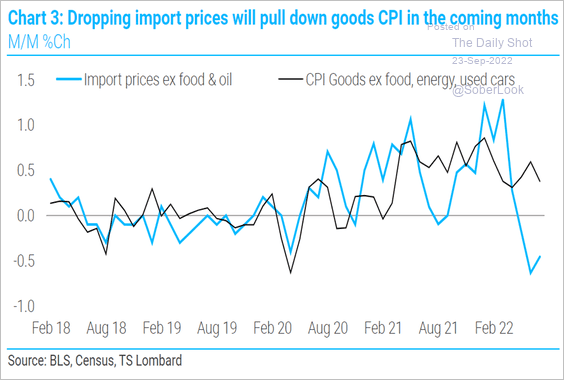

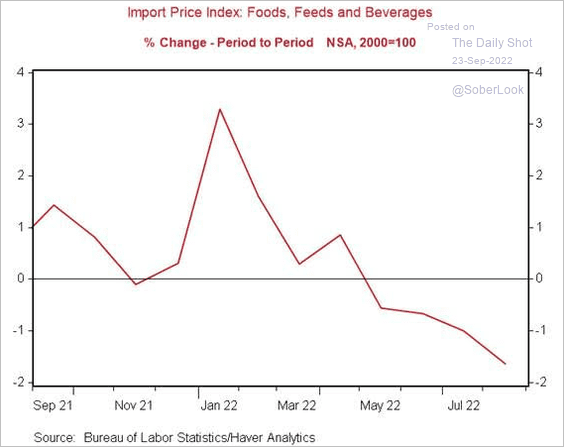

• The US dollar’s strength will keep a lid on import prices (2 charts).

Source: TS Lombard

Source: TS Lombard

Source: LPL Research

Source: LPL Research

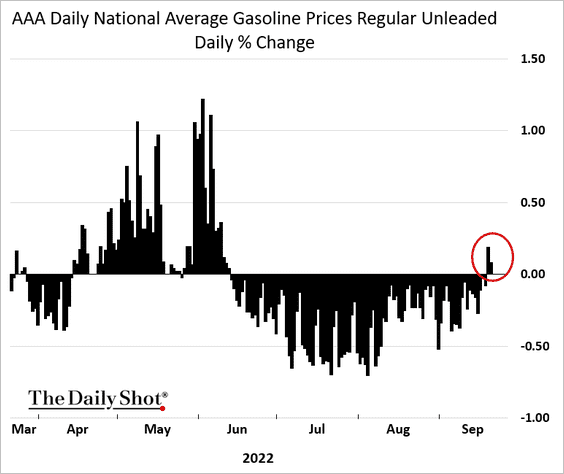

• Gasoline prices have stopped falling in recent days. What does this mean for consumer sentiment and inflation expectations?

——————–

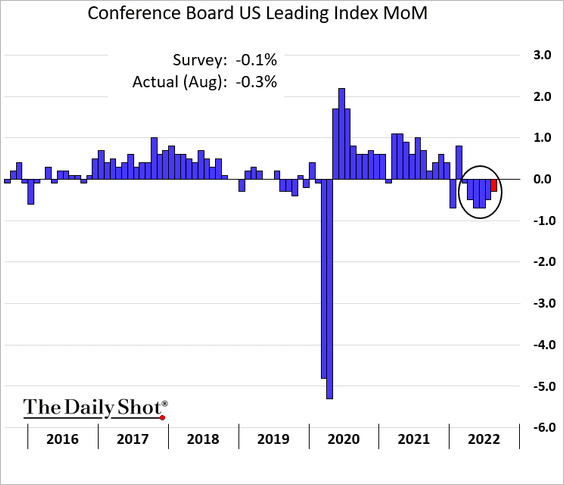

3. The US leading index has been down for six months in a row.

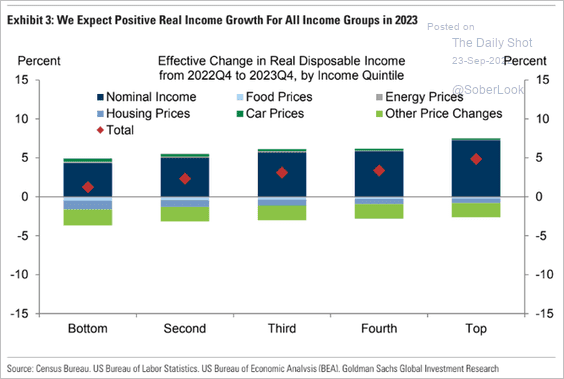

4. According to Goldman, real income growth will turn positive next year across all income groups as inflation moderates.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

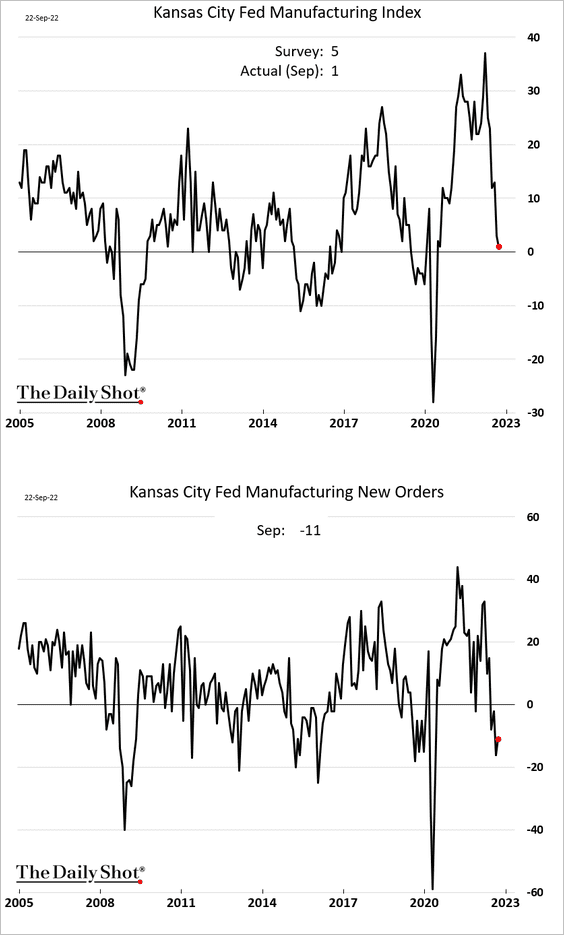

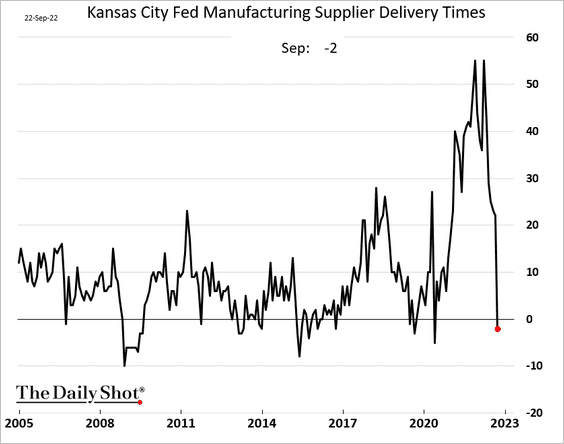

5. The Kansas City Fed’s regional manufacturing index declined again this month. Orders remain soft.

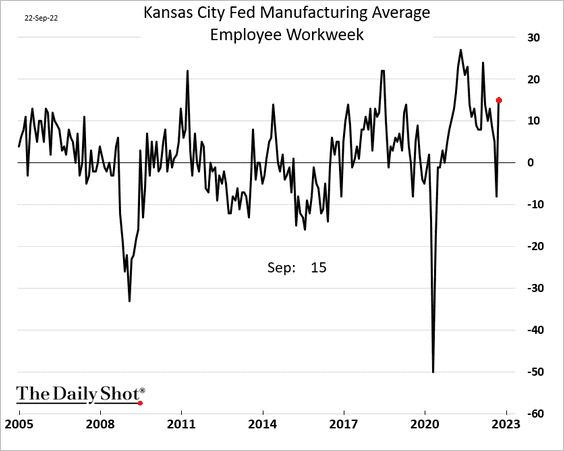

Workers have been busy again this month, …

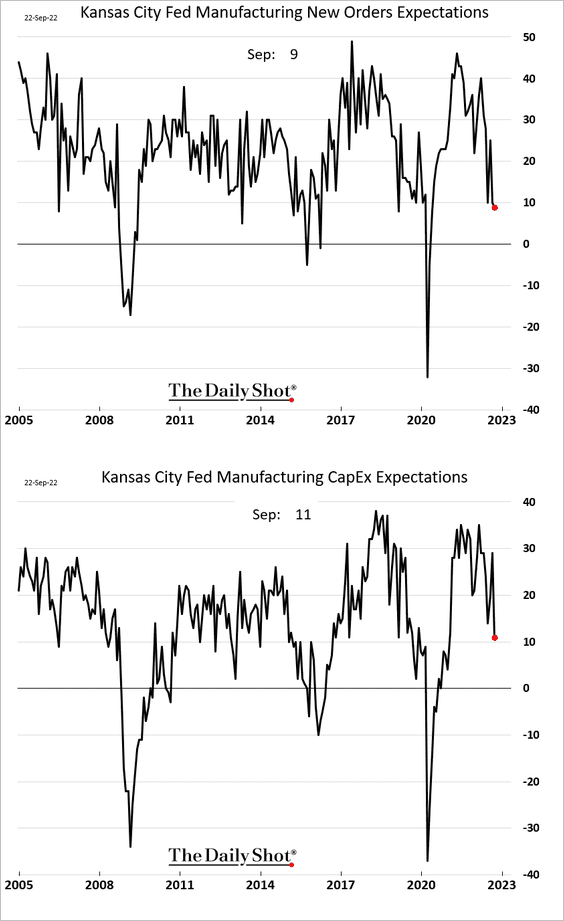

… but manufacturers are becoming less optimistic about the future.

Supply shortages are no longer there.

Back to Index

The United Kingdom

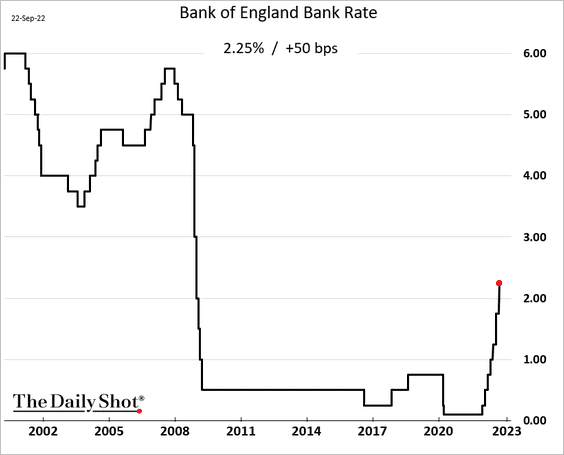

1. The BoE hiked rates by 50 bps, as expected.

Source: Reuters Read full article

Source: Reuters Read full article

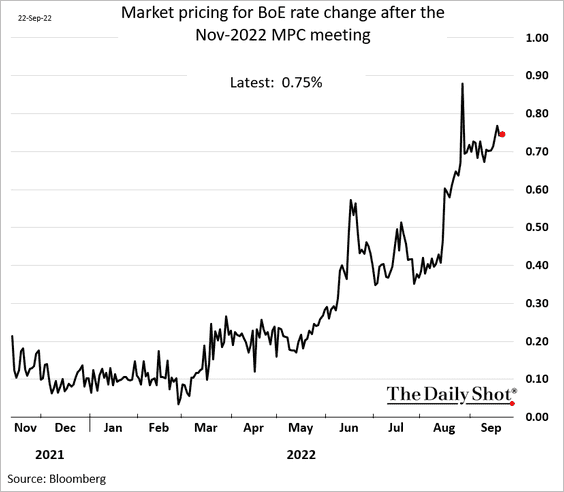

The market sees a 75 bps rate hike in November. That seems a bit aggressive as the UK’s economic growth stalls.

——————–

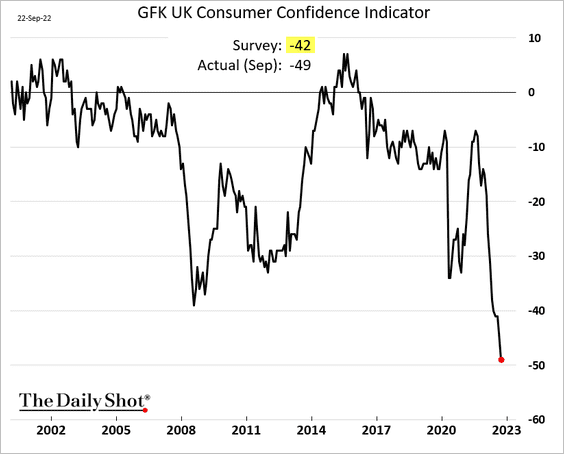

2. Consumer confidence hit a multi-decade low.

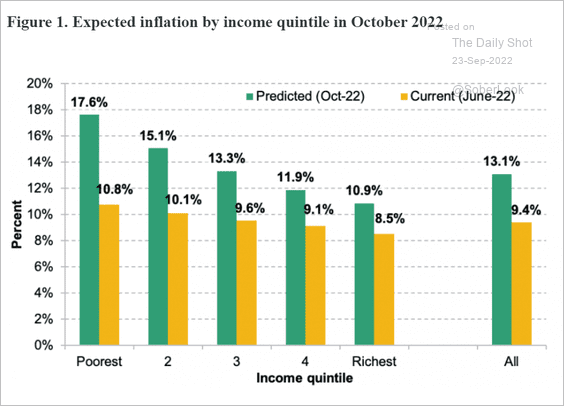

3. This chart shows households’ inflation expectations by income.

Source: IFS Read full article

Source: IFS Read full article

Back to Index

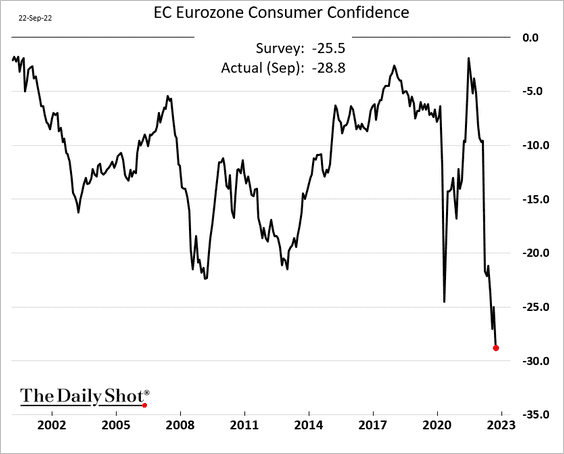

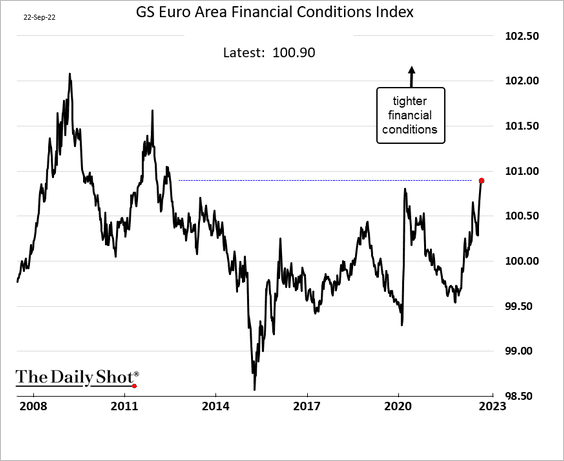

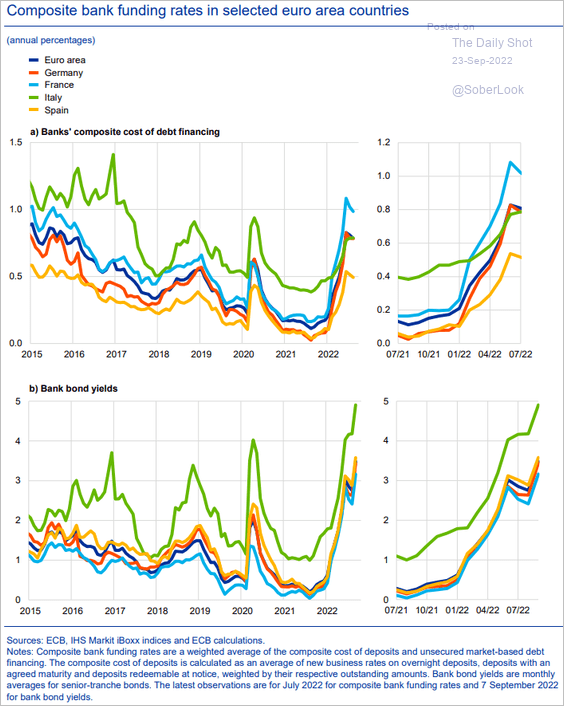

The Eurozone

1. Consumer confidence is at multi-decade lows.

2. Financial conditions are tightening.

3. Bank funding costs have risen sharply this year.

Source: ECB

Source: ECB

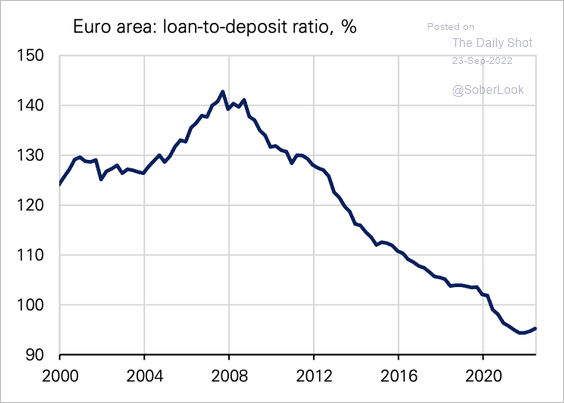

Will high banking system liquidity limit the pass-through of rate hikes to the real economy?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

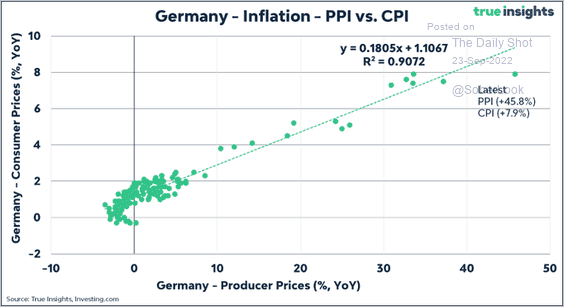

4. Germany’s massive PPI surge will show up in consumer inflation.

Source: @jsblokland

Source: @jsblokland

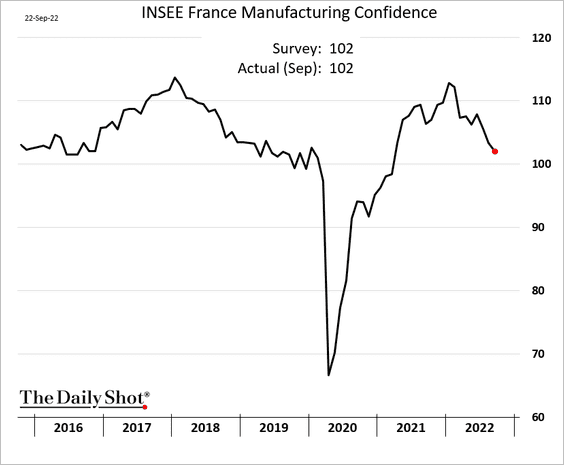

5. French manufacturing confidence is lower but has not crashed.

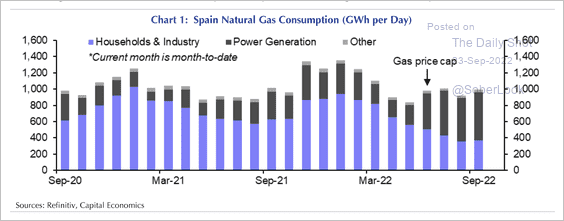

6. Spain’s household and industry gas consumption is declining. However, power-related gas demand remains elevated as price caps only benefit less efficient plants, giving them an advantage over more efficient ones, according to Capital Economics.

Source: Capital Economics

Source: Capital Economics

Back to Index

Europe

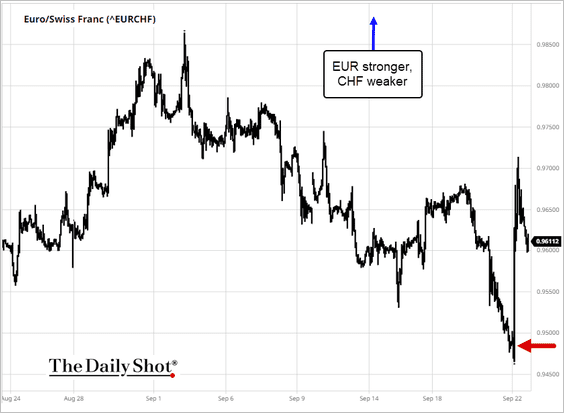

1. The Swiss central bank (SNB) hiked rates by 75 bps. The market was expecting 100 bps. The Swiss franc tumbled.

Source: barchart.com

Source: barchart.com

Source: Bloomberg Read full article

Source: Bloomberg Read full article

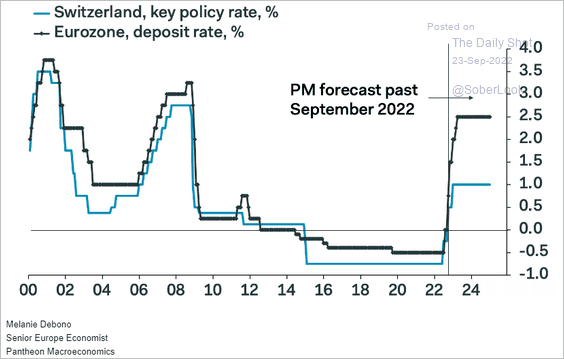

• How far will the SNB take its rate hikes? Here is a forecast from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

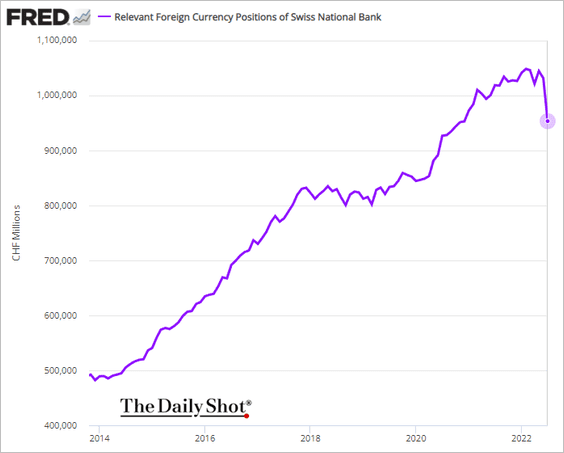

• The SNB has been cutting back on its massive FX reserves (which allowed the Swiss franc to rally).

——————–

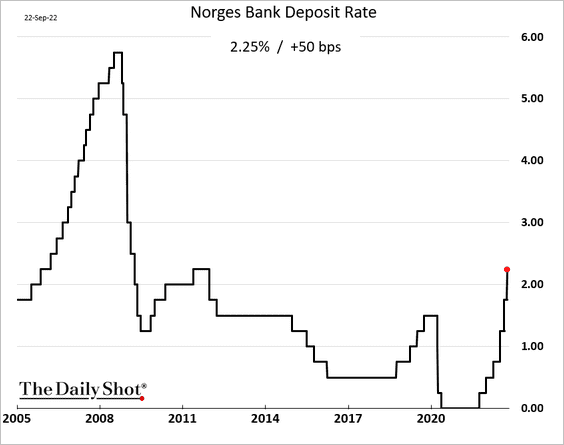

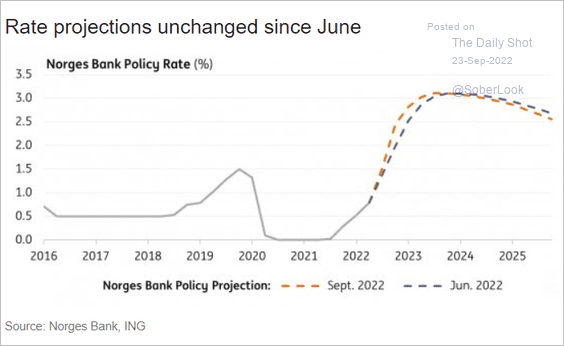

2. Norway’s central bank also hiked rates.

This chart shows market pricing for the rate trajectory.

Source: ING

Source: ING

——————–

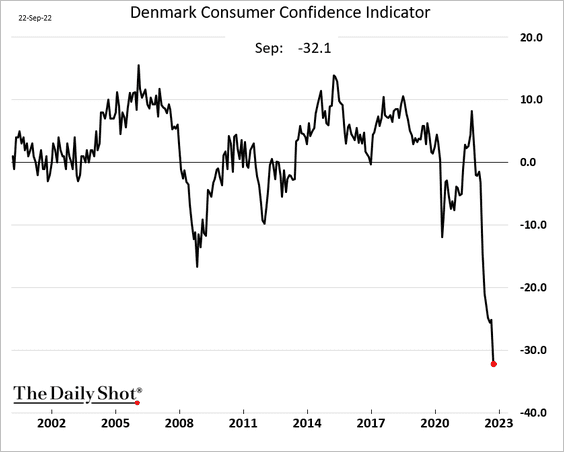

3. Denmark’s consumer sentiment is hitting extreme lows.

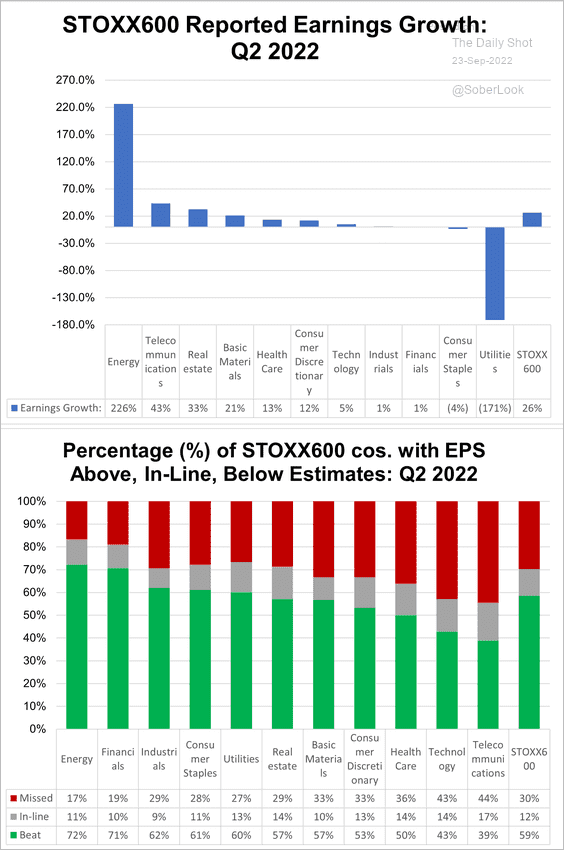

4. European corporate earnings growth has been robust.

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

Japan

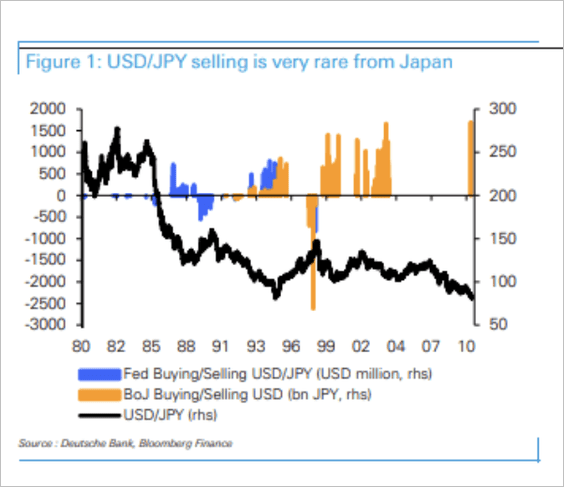

1. Japanese authorities intervened in the currency market on Thursday. It was the first time Japan had sold dollars since 1998. The yen jumped.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Japan has historically defended USD/JPY from below rather than above.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

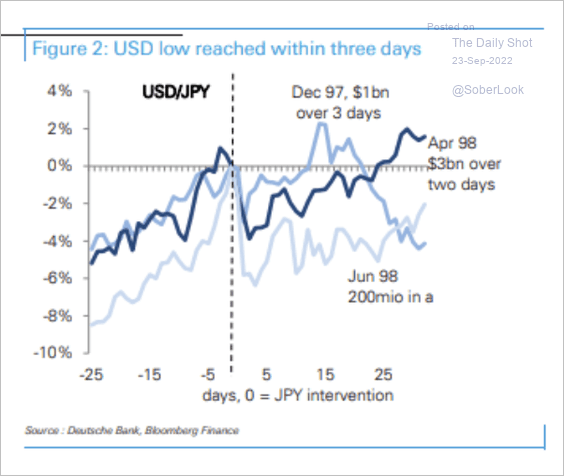

There was only one period of three sizable yen buying operations in the late 1990s, in which the dollar reached a low within three days.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

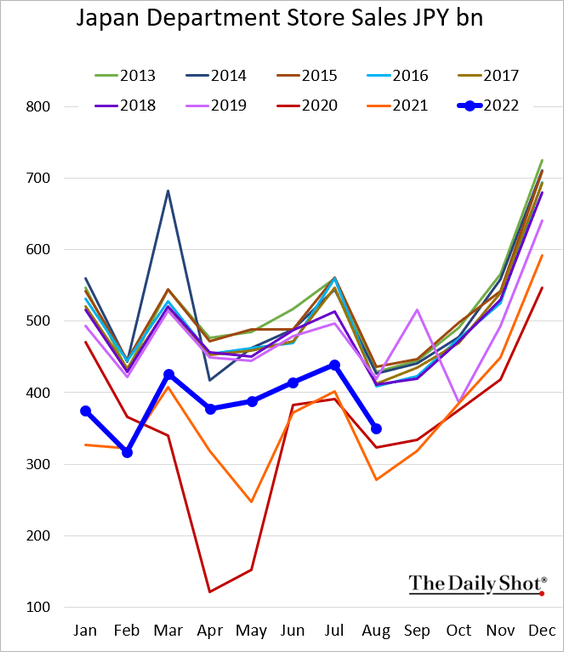

2. Department store sales remain well below pre-COVID levels.

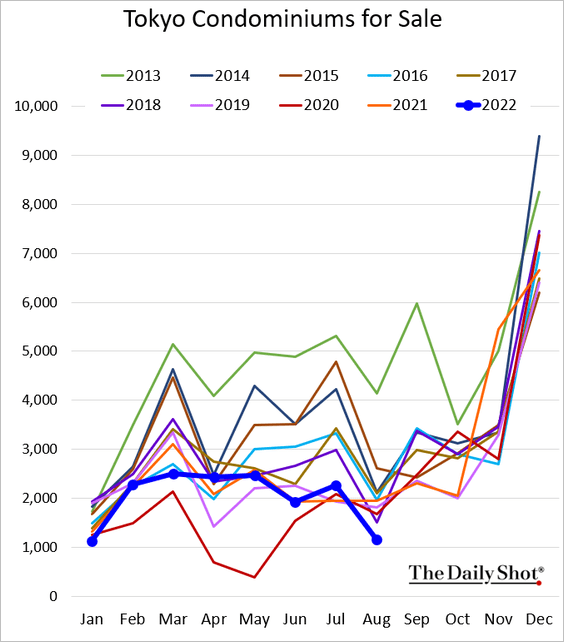

3. There aren’t a lot of condos for sale in Tokyo these days.

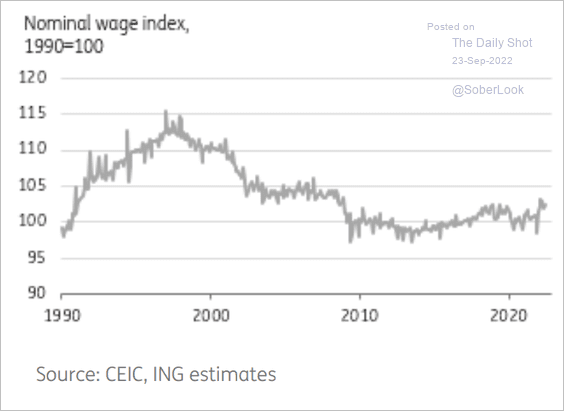

4. Nominal wages have been flat for years.

Source: ING

Source: ING

Back to Index

Asia – Pacific

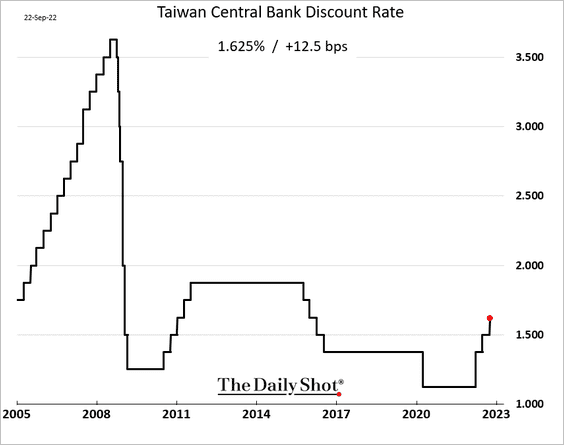

1. Taiwan’s central bank hiked rates, as expected.

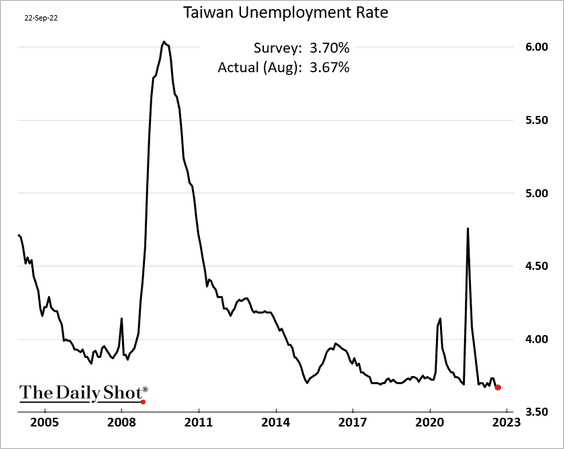

Taiwan’s unemployment rate remains low.

——————–

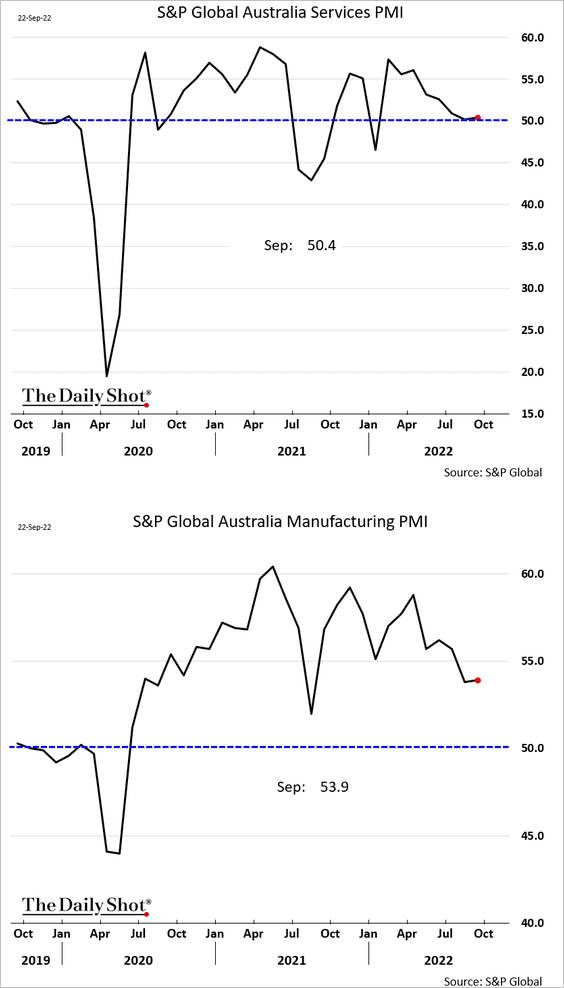

2. Australia’s business activity remains in growth mode. Manufacturing expansion is strong.

3. Singapore is now ranked as the world’s third financial center, bypassing Hong Kong.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

China

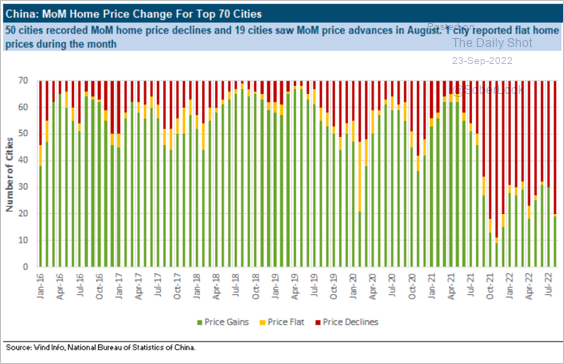

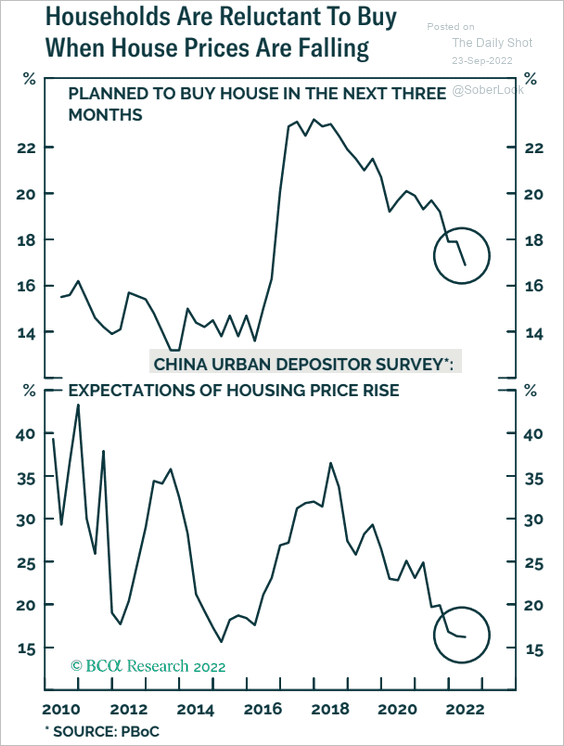

1. The housing market continues to struggle.

Source: CreditSights

Source: CreditSights

Households are reluctant to buy homes when prices are falling.

Source: BCA Research

Source: BCA Research

——————–

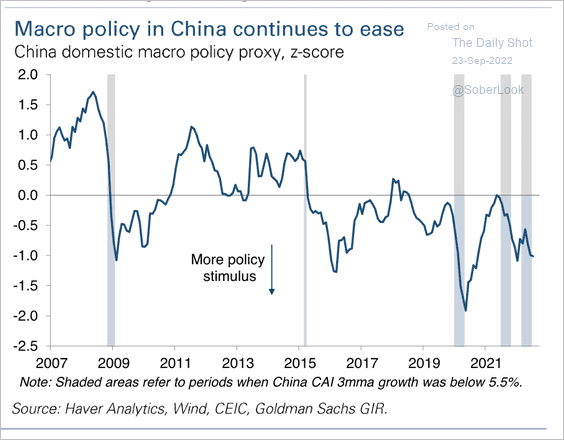

2. Macro policy remains stimulative, given headwinds from COVID-19 and weak property demand.

Source: Goldman Sachs

Source: Goldman Sachs

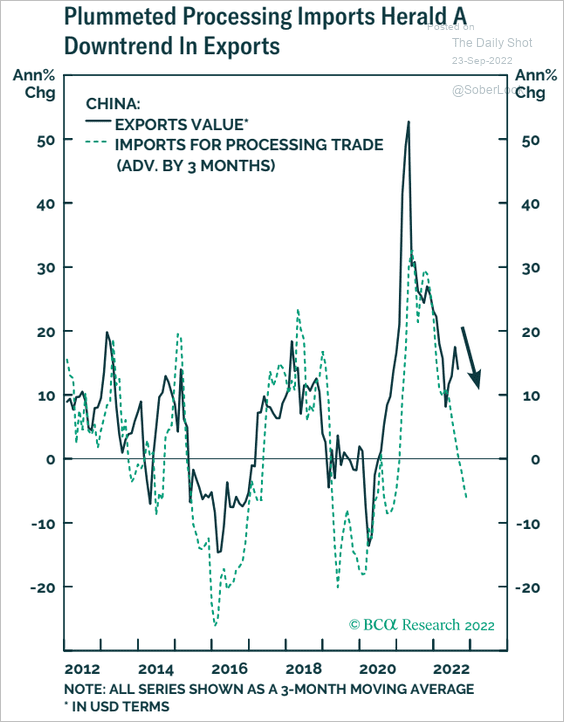

3. Exports are going lower.

Source: BCA Research

Source: BCA Research

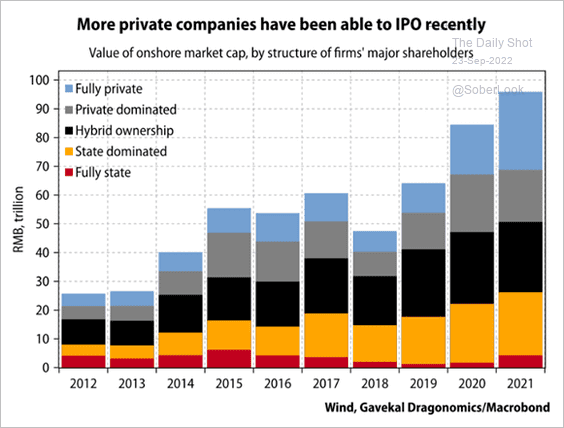

4. In 2021, fully privately-owned firms in China became the largest category of listed companies in terms of market cap following a surge of IPOs. For the past decade, firms with hybrid ownership (including a mix of state, private, shareholder, or other) were the largest category.

Source: Gavekal Research

Source: Gavekal Research

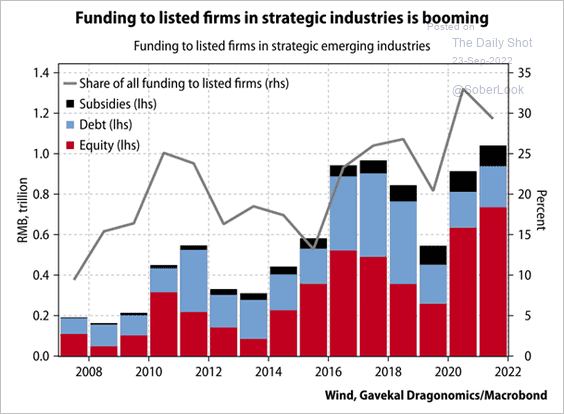

Chinese firms in “strategic emerging industries” (like technology, chemicals, and electronics) received funding of RMB 735bn from primary and secondary equity issuance by EOY 2021.

Source: Gavekal Research

Source: Gavekal Research

——————–

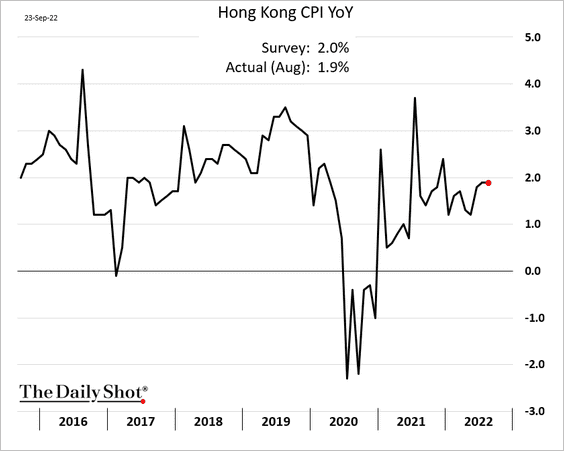

5. Hong Kong’s CPI is holding below 2%.

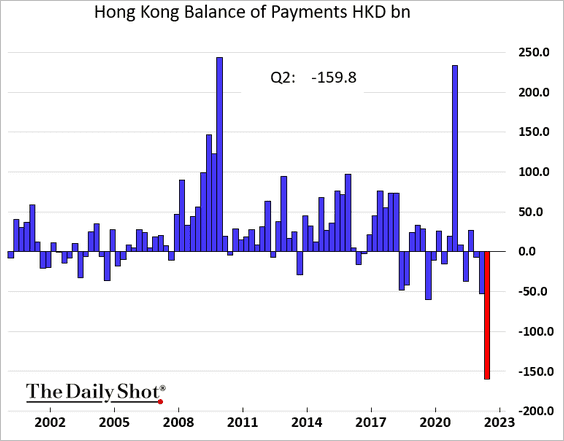

This chart shows Hong Kong’s balance of payments.

Back to Index

Emerging Markets

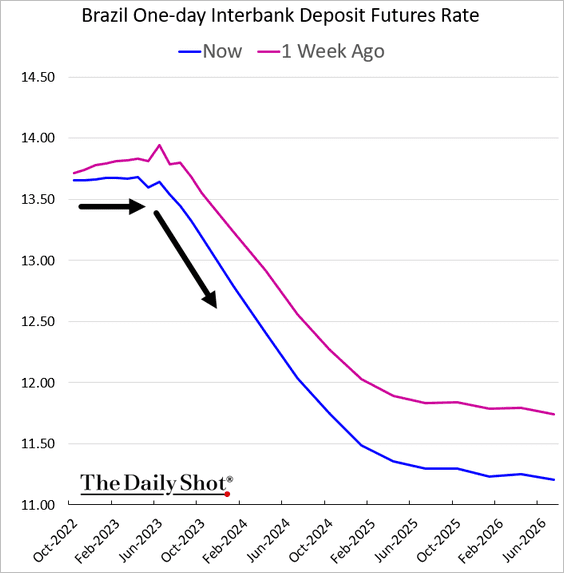

1. Brazil’s central bank is done with rate hikes, according to the markets.

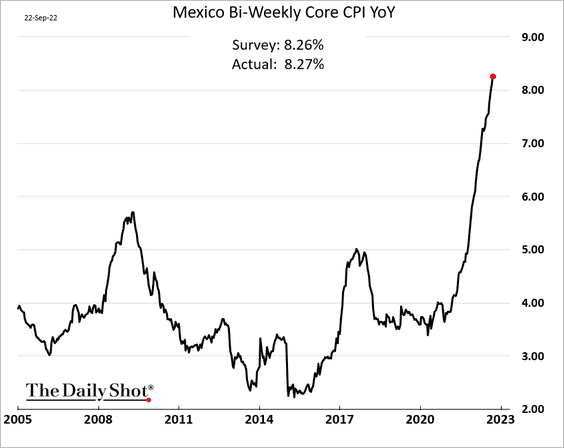

2. Mexico’s core inflation continues to surge.

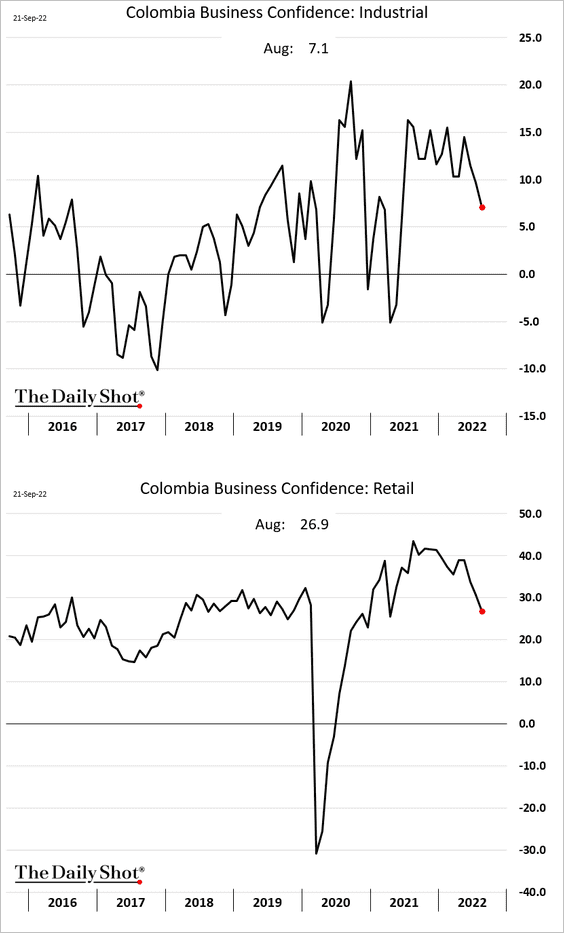

3. Colombia’s business confidence is rolling over.

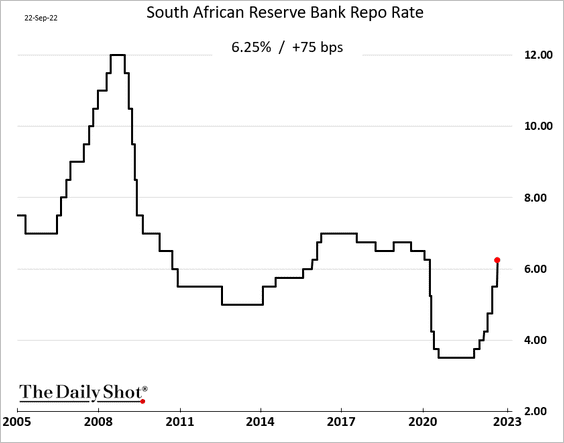

4. South Africa’s central bank delivered another jumbo rate hike.

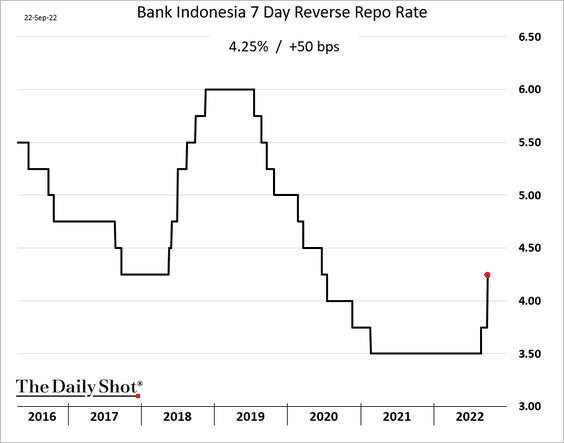

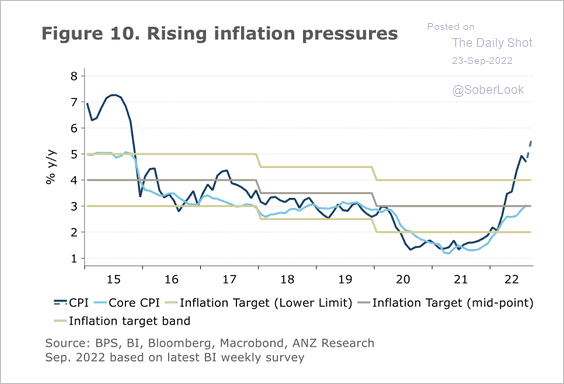

5. Indonesia’s central bank surprised with a 50 bps hike,…

… as inflation exceeds the target band.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

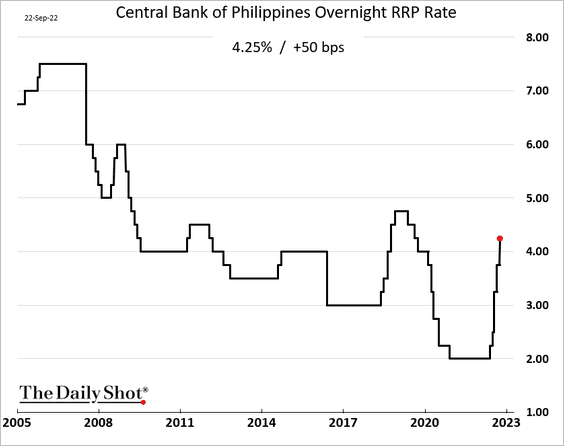

6. The Philippine central bank delivered another 50bps rate hike.

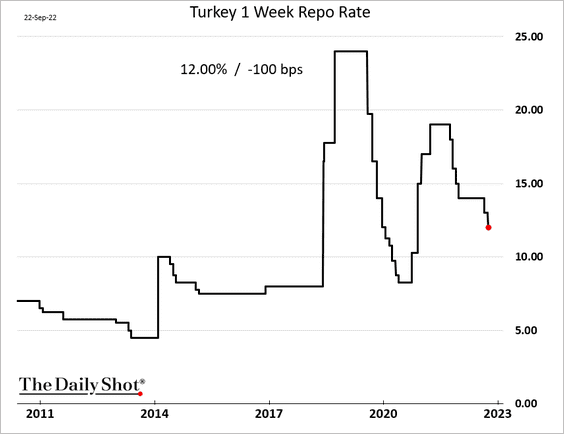

7. But Turkey’s central bank cut rates by 100 bps. Why not – the core inflation is only 66%.

Back to Index

Cryptocurrency

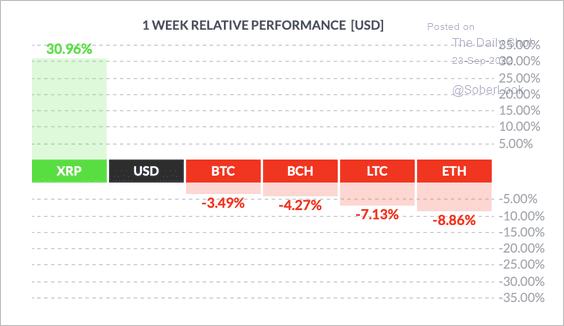

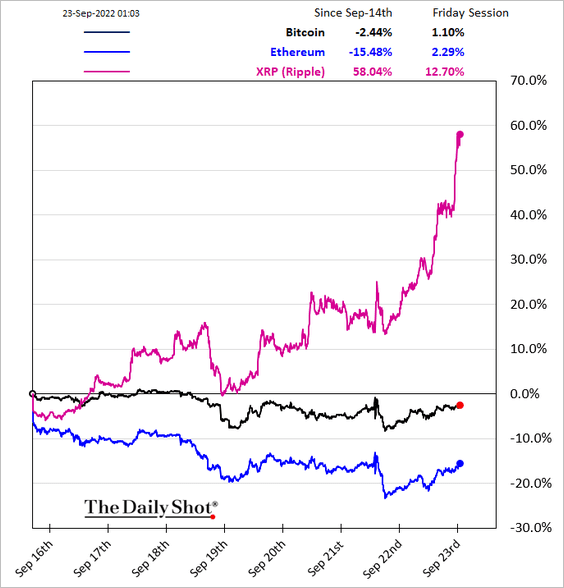

1. It’s been a tough week for cryptos, although XRP continues to outperform.

Source: FinViz

Source: FinViz

XRP has been stuck in a wide trading range since its peak in 2018. The cryptocurrency is not yet overbought but is approaching initial resistance.

——————–

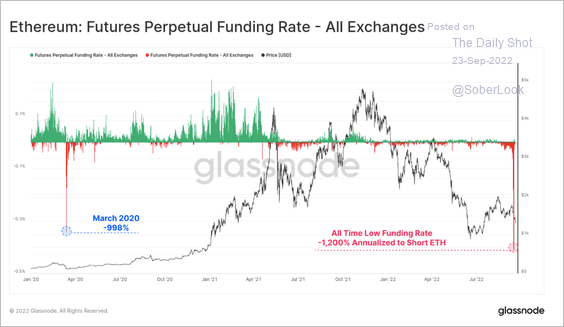

2. Funding rates (the cost to fund long or short positions in the ETH perpetual futures market) plunged last week, suggesting that most of the short-term speculation premium has dissipated, according to Glassnode.

Source: @glassnode

Source: @glassnode

3. US government departments published a series of reports in response to President Biden’s executive order on crypto, which he signed in March.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

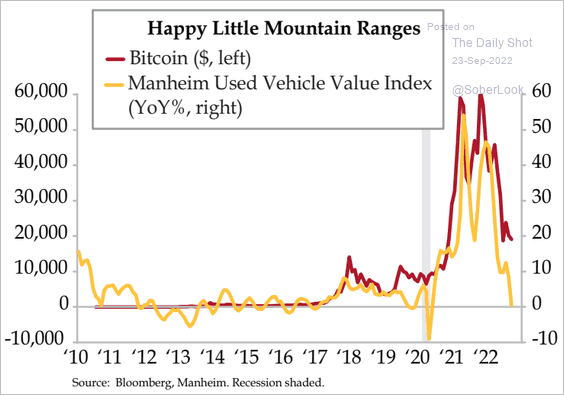

4. Can’t afford that car anymore, bro …

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Commodities

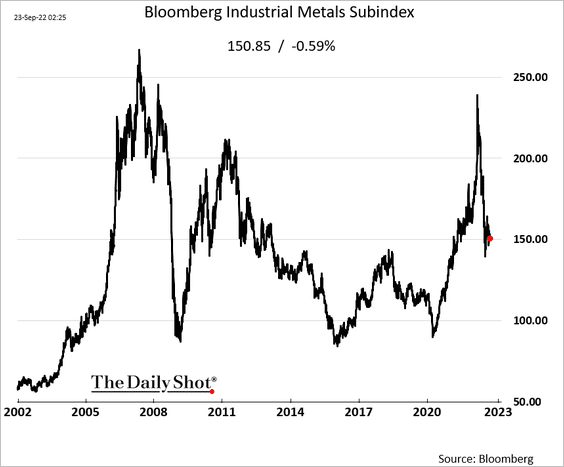

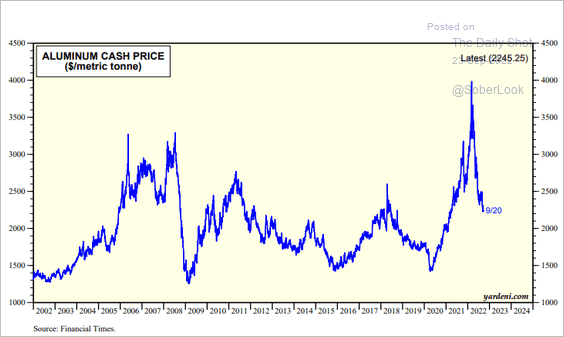

1. Industrial metals remain under pressure as the dollar surges.

Source: Yardeni Research

Source: Yardeni Research

——————–

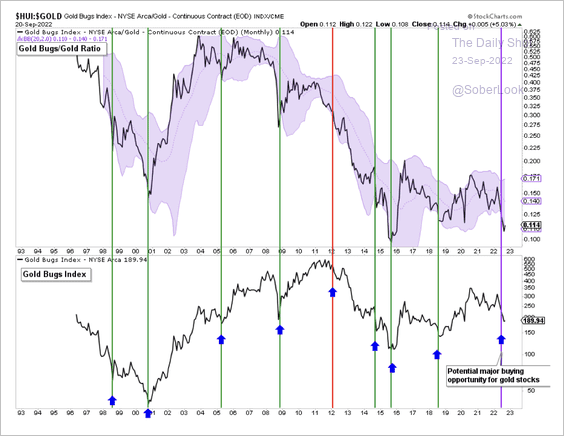

2. The gold equities/gold price ratio is testing support.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

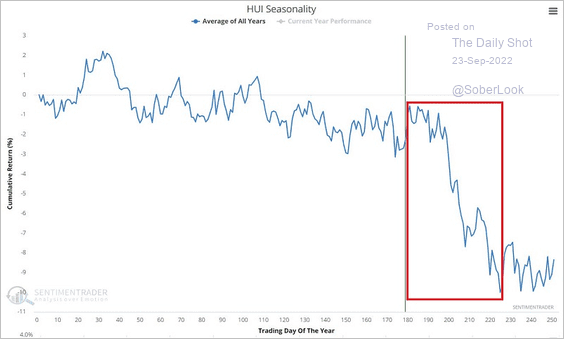

Gold stocks are entering a seasonally weak period.

Source: SentimenTrader

Source: SentimenTrader

——————–

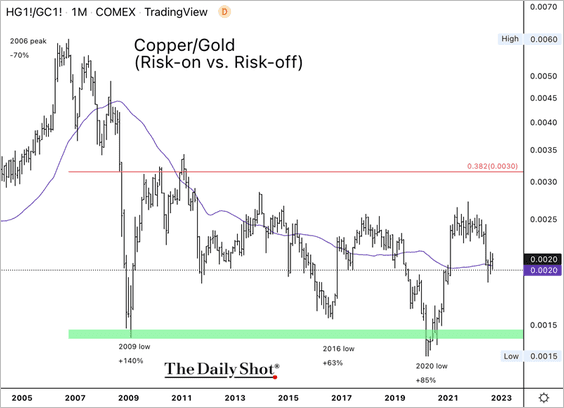

3. The copper/gold ratio is holding minor support but remains vulnerable to further downside.

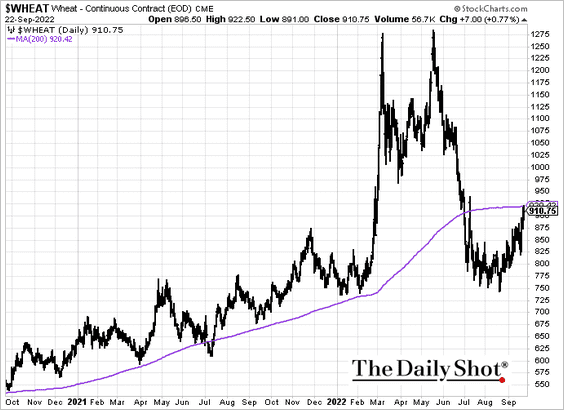

4. Wheat futures are testing resistance at the 200-day moving average.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

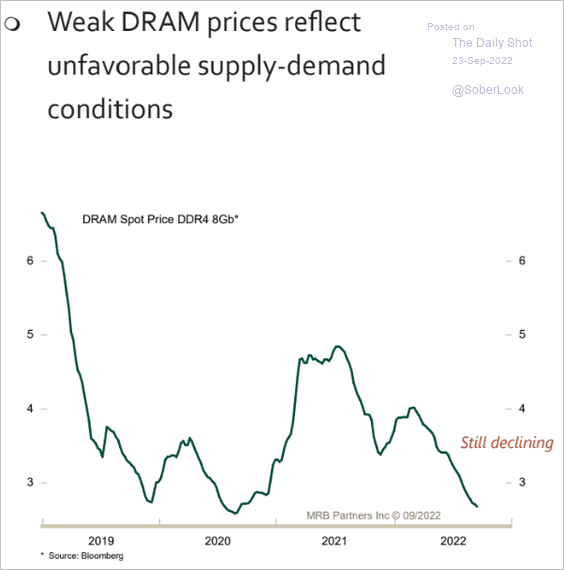

5. Memory chip prices have been moving lower.

Source: MRB Partners

Source: MRB Partners

Back to Index

Energy

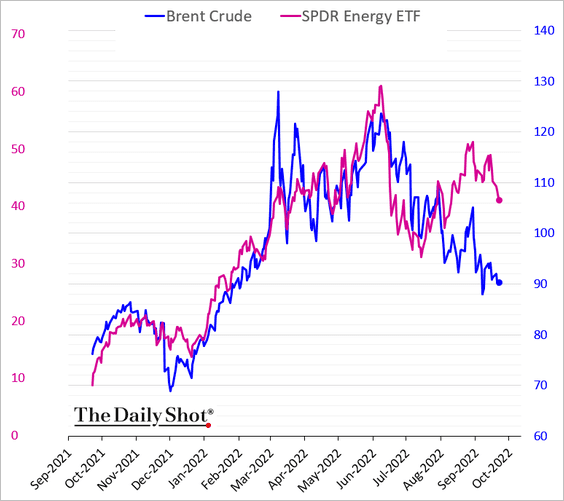

1. Are energy stocks catching up with oil prices?

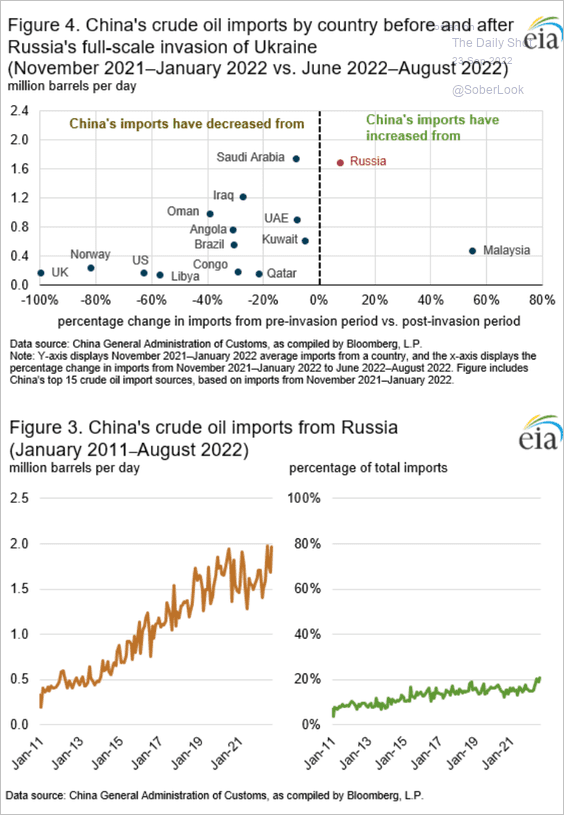

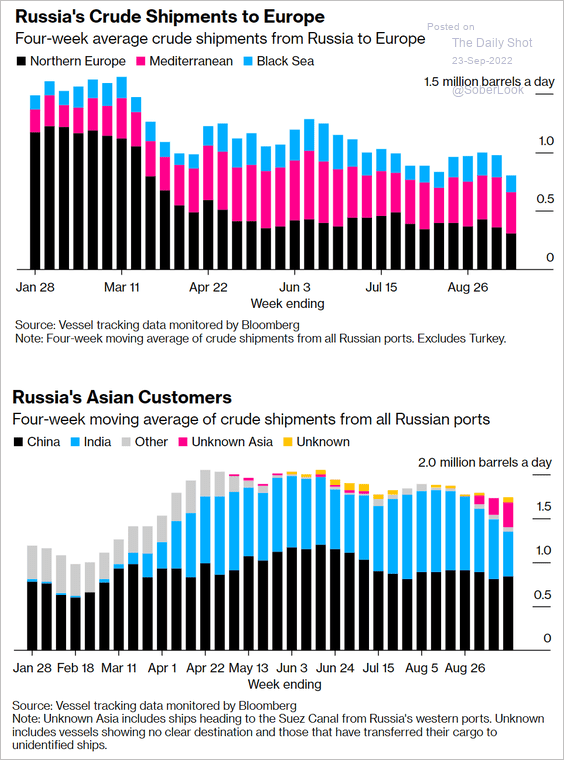

2. China has been shifting its oil purchases to Russia. Malaysia is also selling Russian oil to China.

Source: @EIAgov

Source: @EIAgov

3. These charts show Russia’s crude shipments to Europe and Asia.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Equities

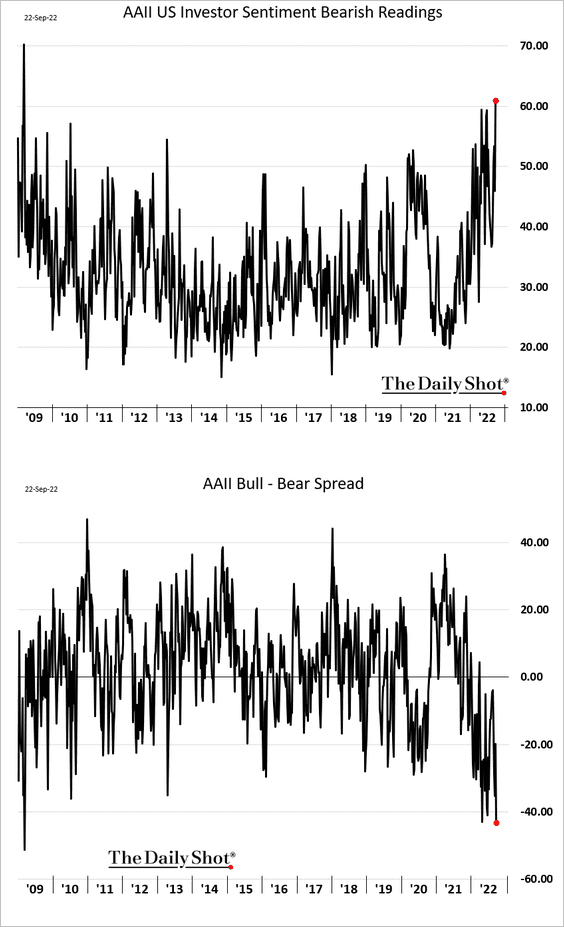

1. Investors are most bearish since the financial crisis.

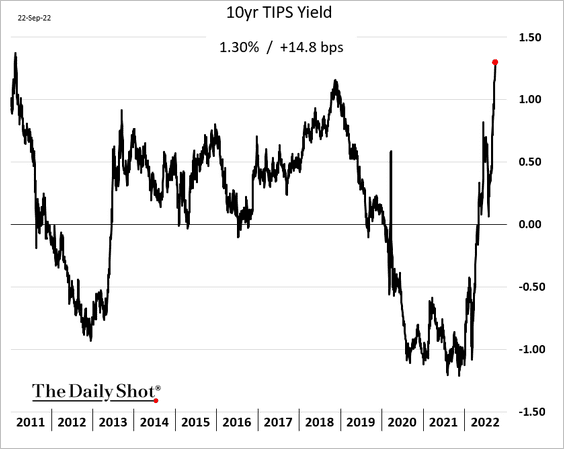

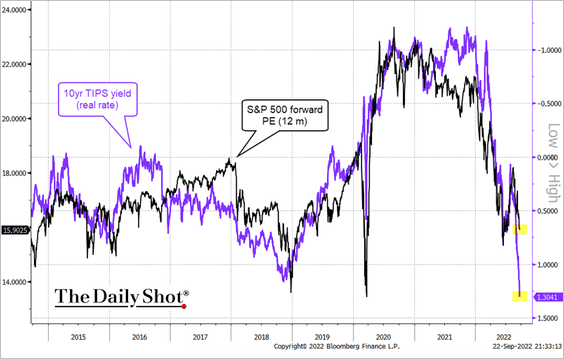

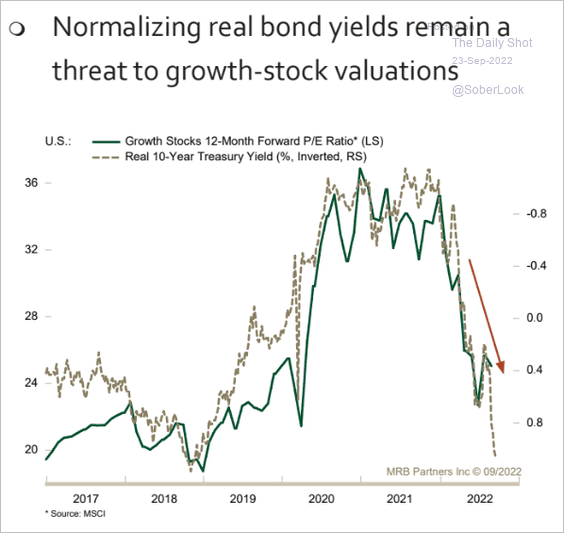

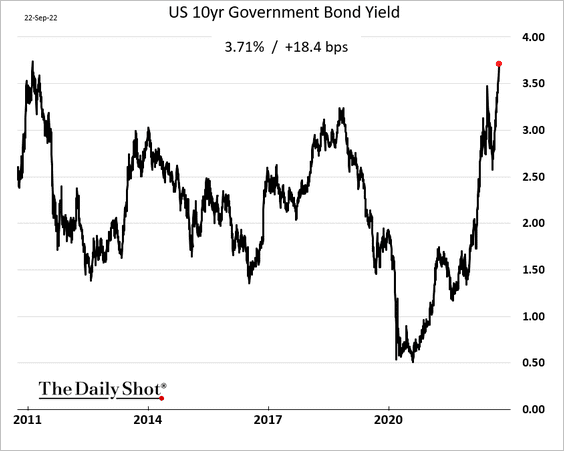

2. The US 10-year real yield hit the highest level since 2011, …

… which is putting downward pressure on valuations, …

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

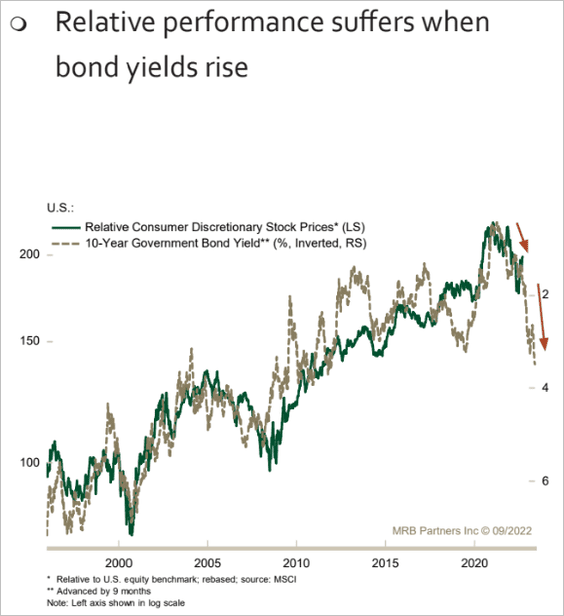

… especially in growth equities.

Source: MRB Partners

Source: MRB Partners

——————–

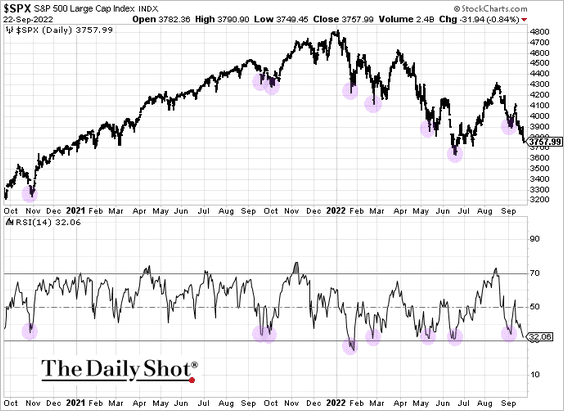

3. The S&P 500 is nearing oversold territory.

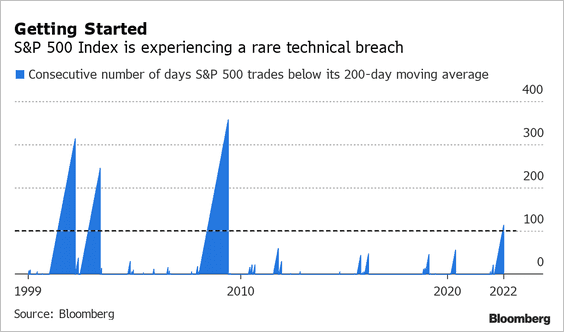

The number of days the S&P 500 has been below its 200-day moving average hit the highest level since the financial crisis.

Source: Jonathan Stubbs, @mikamsika, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: Jonathan Stubbs, @mikamsika, @TheTerminal, Bloomberg Finance L.P. Read full article

——————–

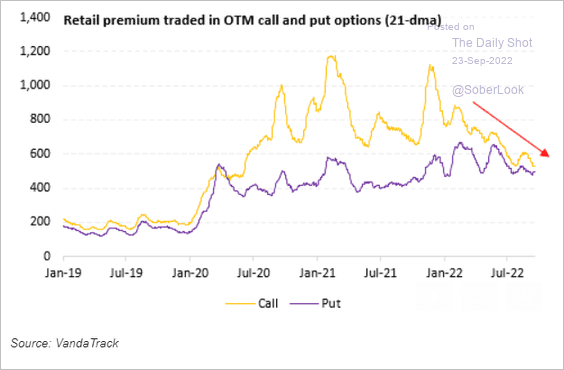

4. Retail call options trading has been slowing this year.

Source: Vanda Research

Source: Vanda Research

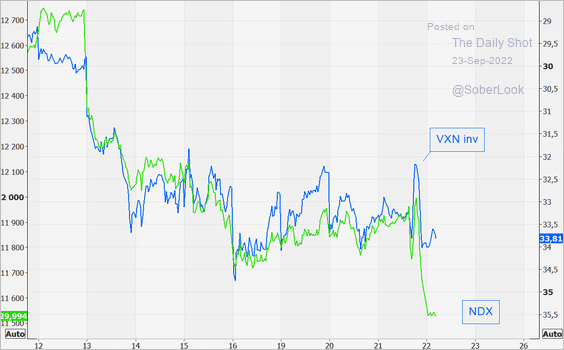

5. The Nasdaq 100 has decoupled from its implied volatility index (VXN). Demand for downside protection in indices remains relatively tepid.

Source: @themarketear

Source: @themarketear

6. Consumer discretionary shares may underperform further as yields surge.

7. The 2008 analogy is holding.

Source: @MichaelMOTTCM

Source: @MichaelMOTTCM

Back to Index

Rates

1. The 10yr Treasury yield keeps hitting multi-year highs. The selloff is looking “panicky.”

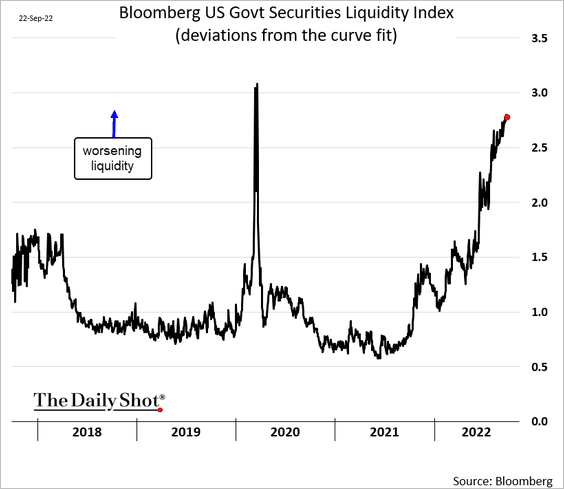

2. Treasury market liquidity continues to worsen.

h/t @jessefelder Further reading

h/t @jessefelder Further reading

——————–

Food for Thought

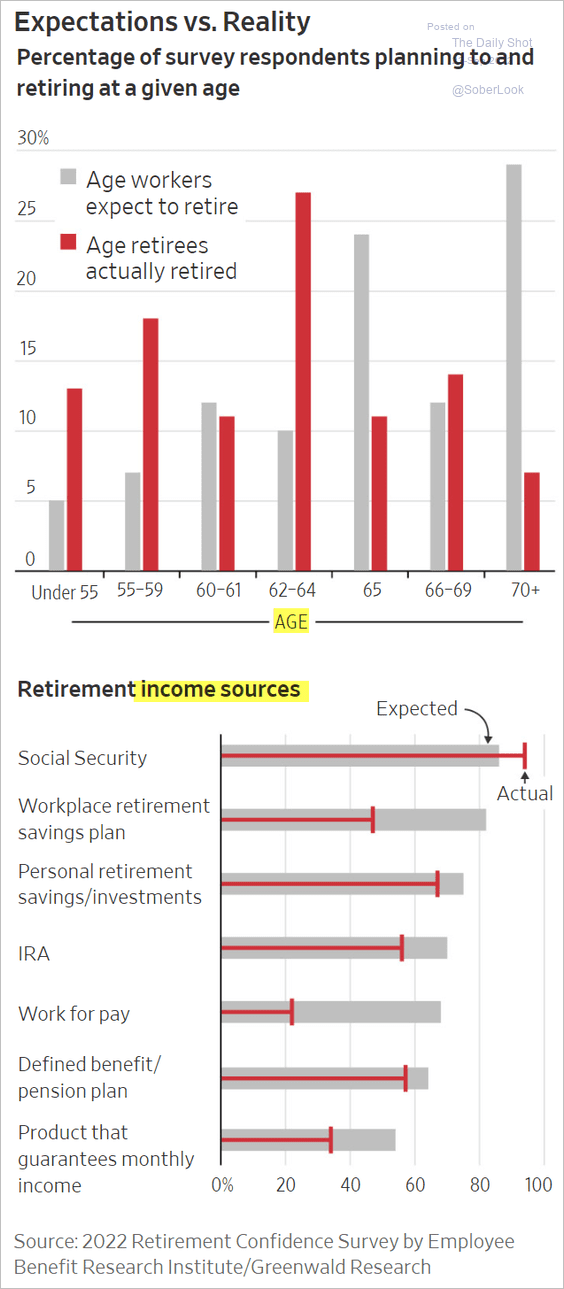

1. Retirees’ expectations vs. reality:

Source: @WSJ Read full article

Source: @WSJ Read full article

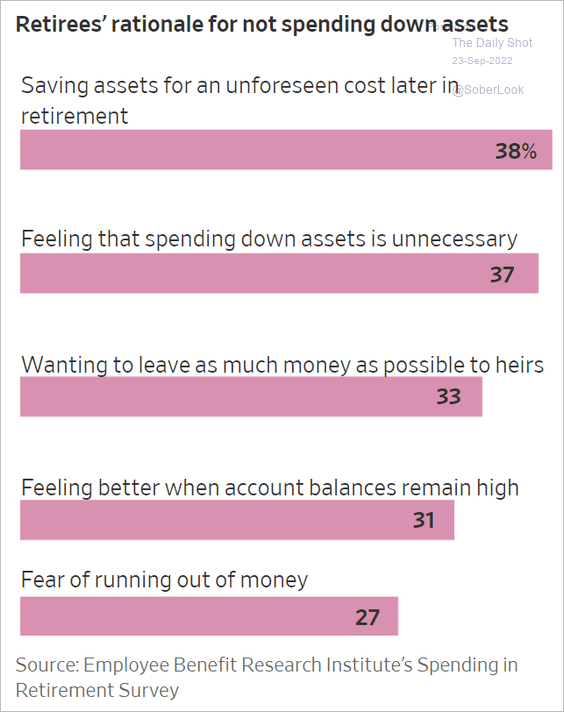

• Retirees’ rationale for not spending down assets:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

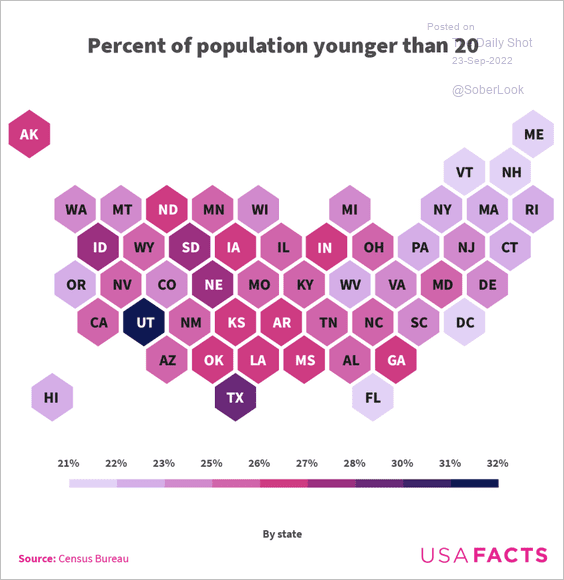

2. Share of the population aged 20 or less:

Source: USAFacts Read full article

Source: USAFacts Read full article

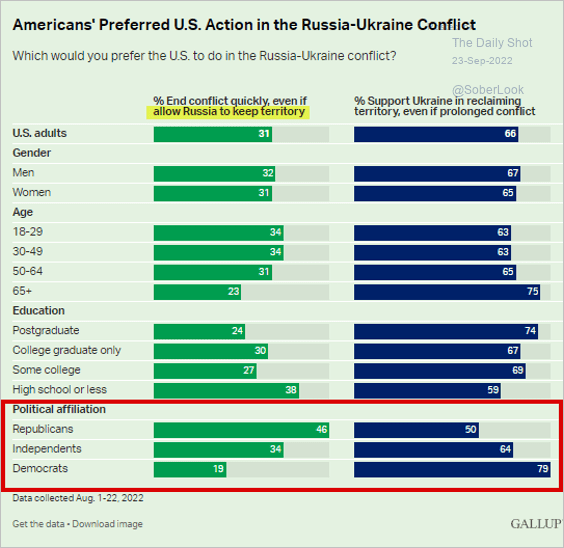

3. Preferred US action in the Russia-Ukraine conflict:

Source: Gallup Read full article

Source: Gallup Read full article

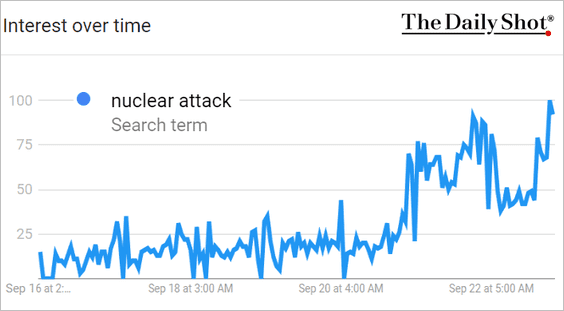

4. Google search frequency for “nuclear attack”:

Source: Google Trends

Source: Google Trends

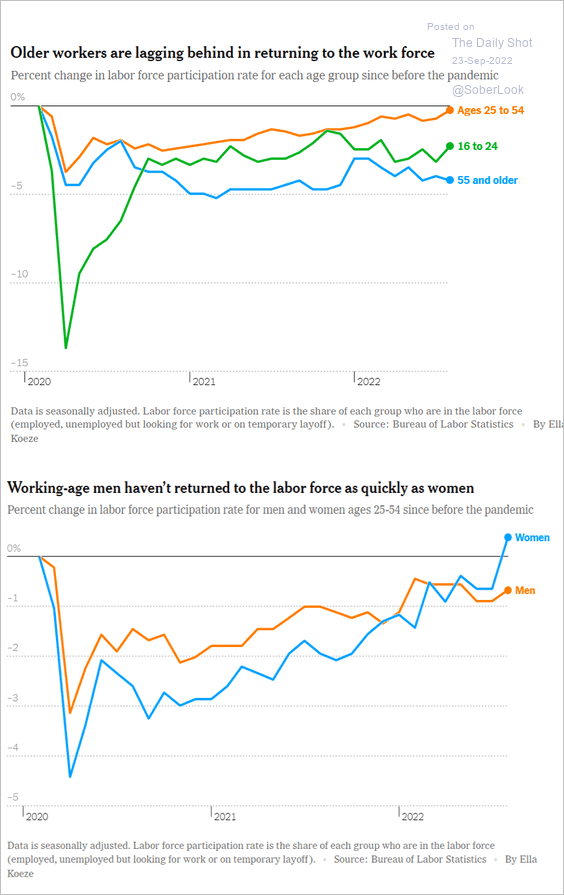

5. US labor force participation recovery (demographics):

Source: The New York Times Read full article

Source: The New York Times Read full article

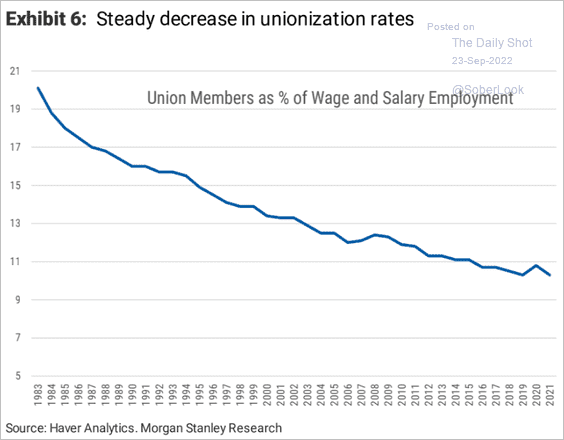

6. US union membership:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

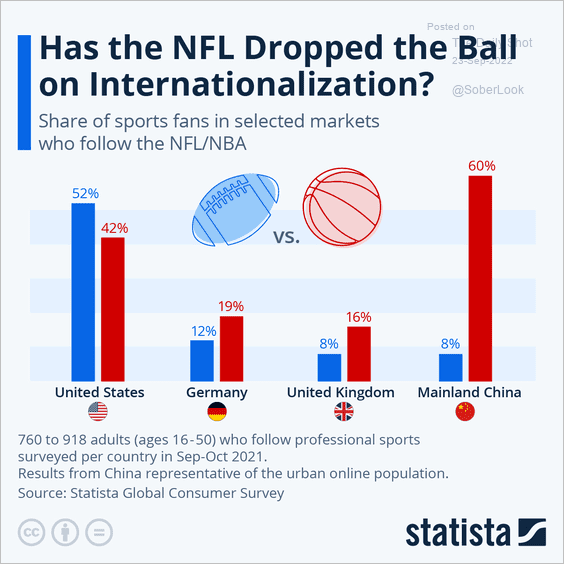

7. NFL vs. NBA sports fans internationally:

Source: Statista

Source: Statista

——————–

Have a great weekend!

Back to Index