The Daily Shot: 29-Sep-22

• The United Kingdom

• The United States

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United Kingdom

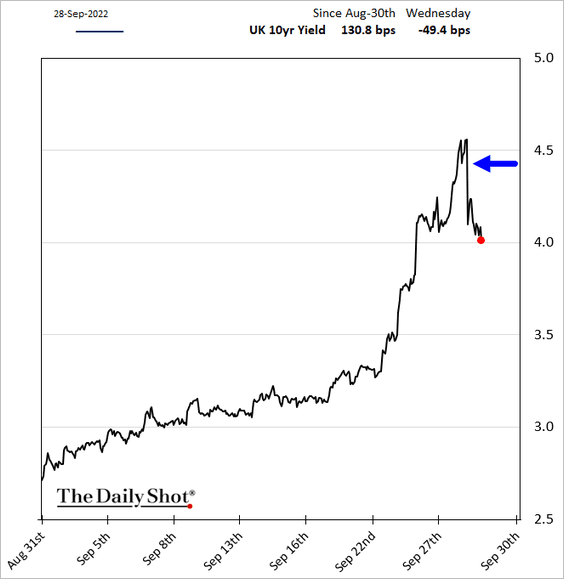

1. The BoE stepped in with bond purchases to stem the rout in gilts that was triggered by the new government’s fiscal stimulus.

Source: Reuters Read full article

Source: Reuters Read full article

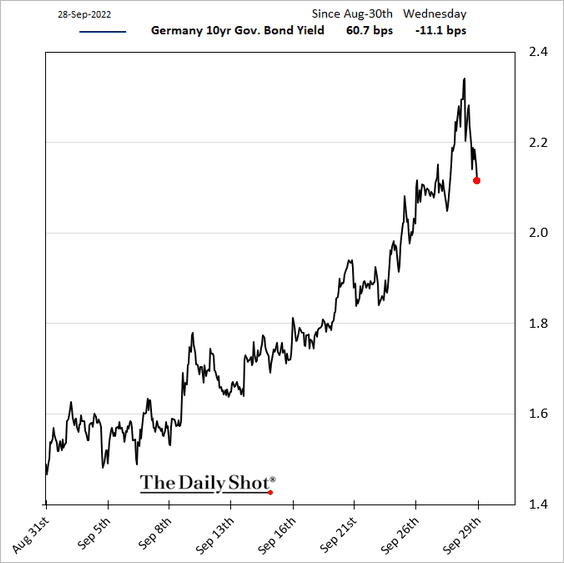

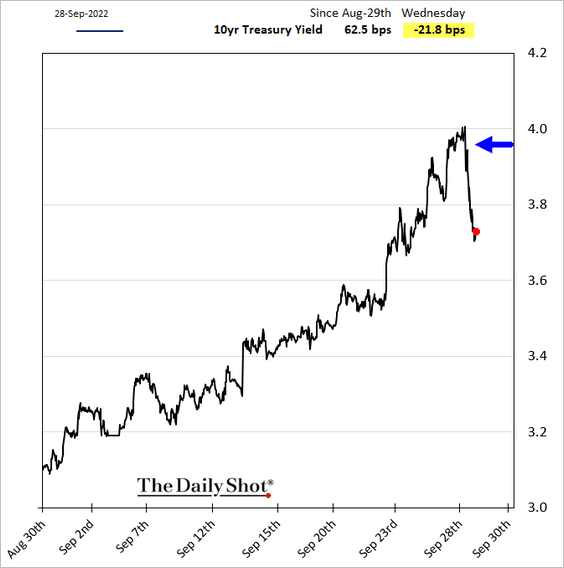

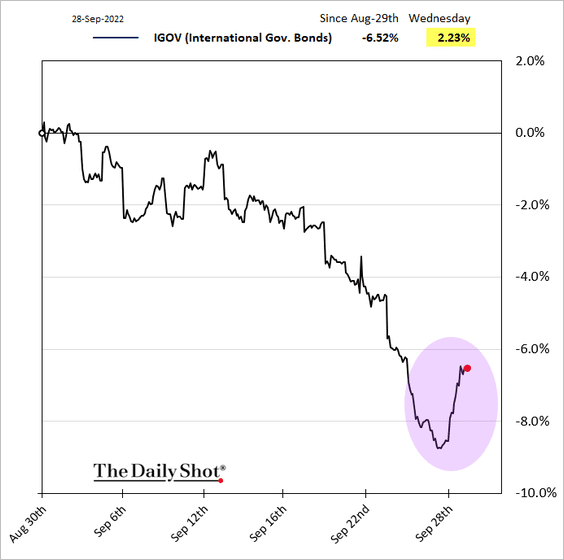

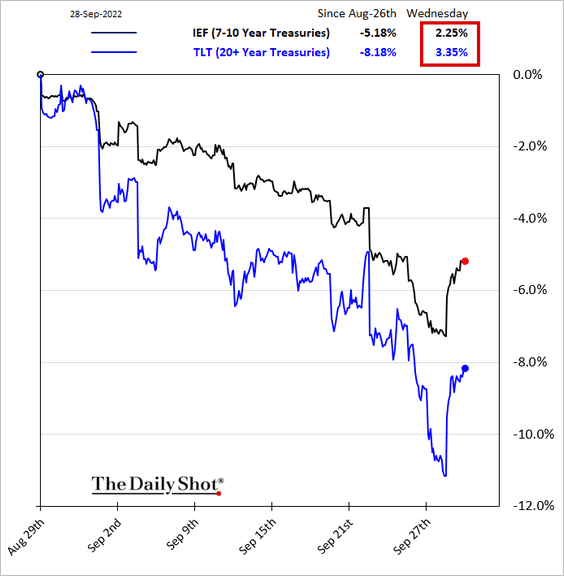

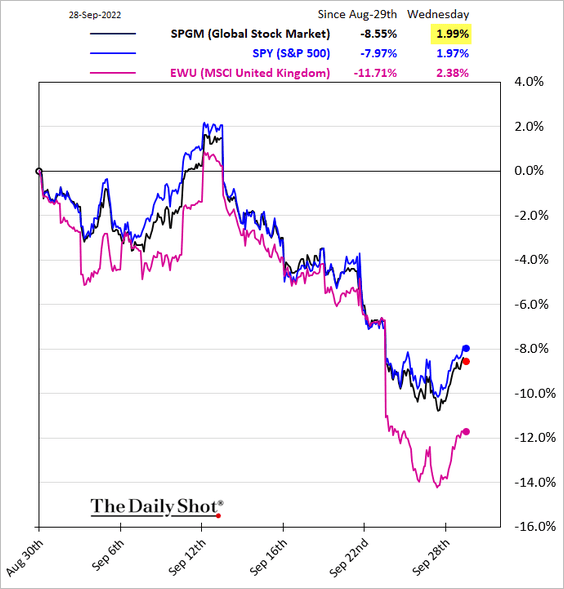

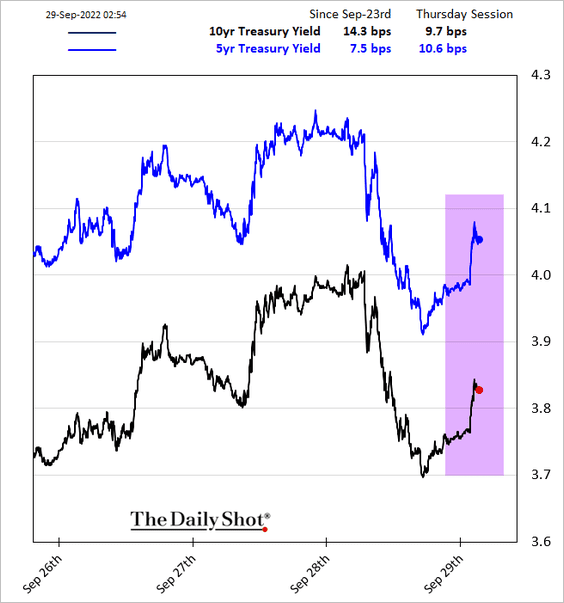

Global fixed-income and equity markets jumped amid short-covering.

• UK, German, and US yields:

• Global and US government bond ETFs:

• Global equities:

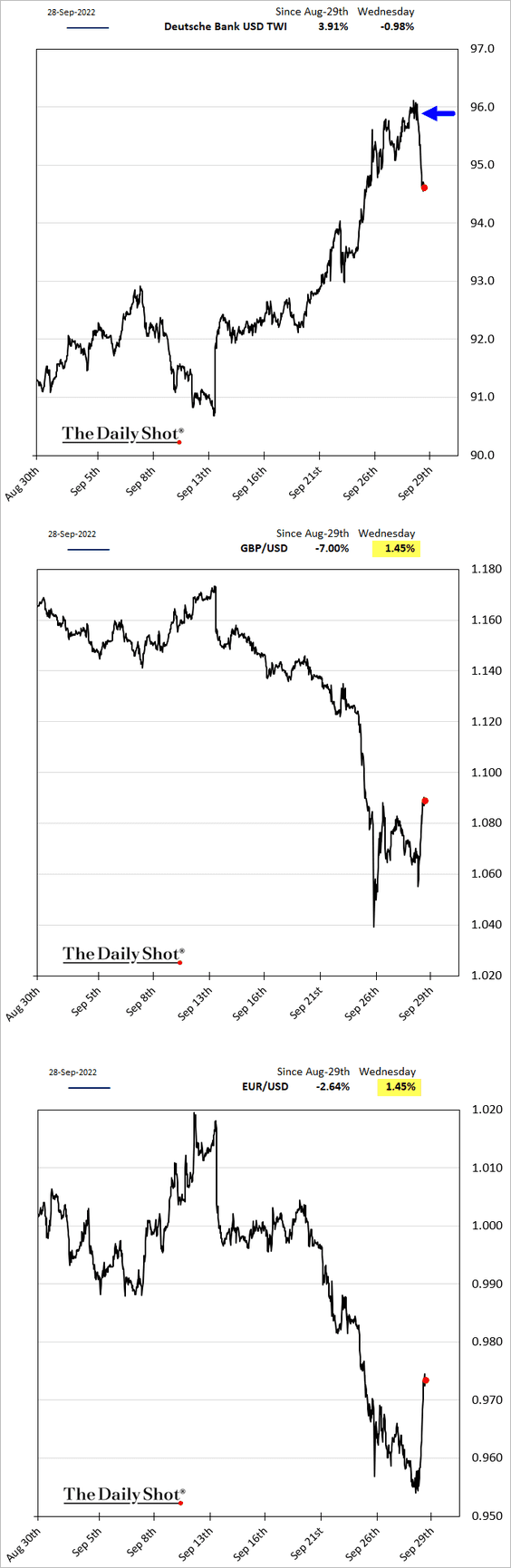

The dollar dipped.

——————–

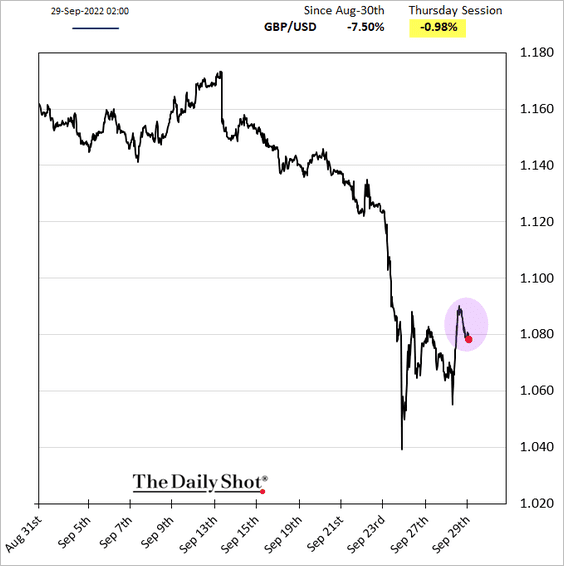

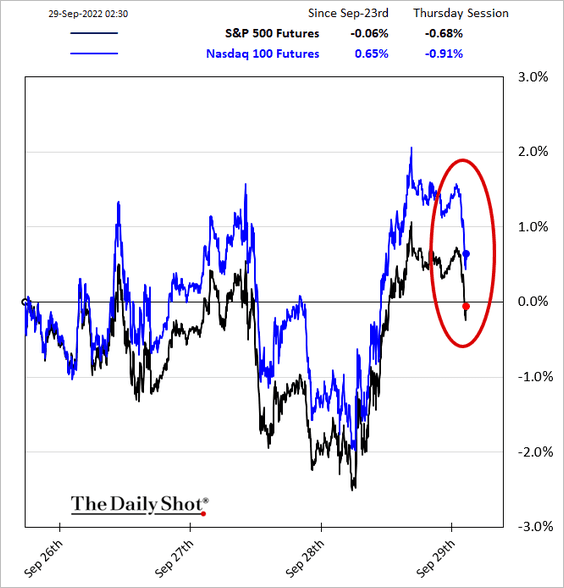

2. However, the party didn’t last very long.

• The pound is falling again.

• US stock futures and bonds are lower.

——————–

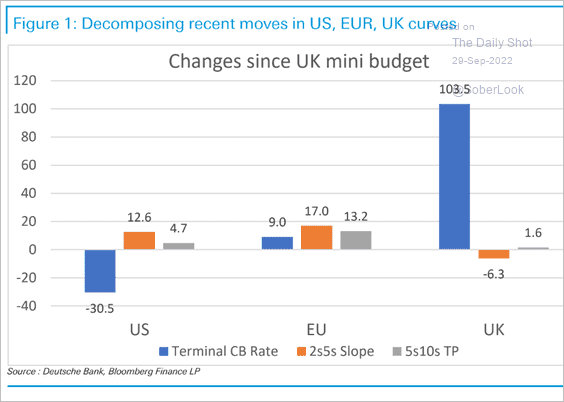

3. The BoE terminal rate (maximum expected rate in this cycle) surged after the budget announcement.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

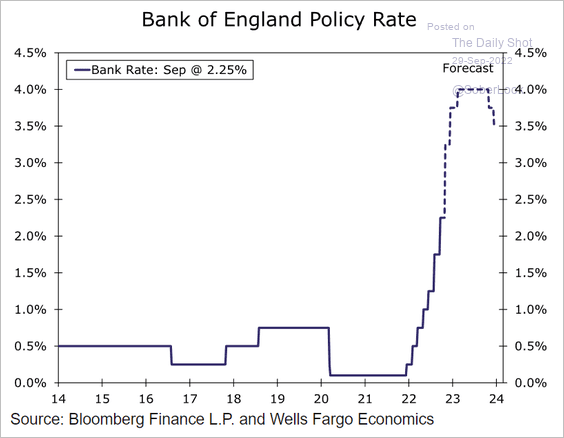

Wells Fargo doesn’t see the BoE rate rising above 4%.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

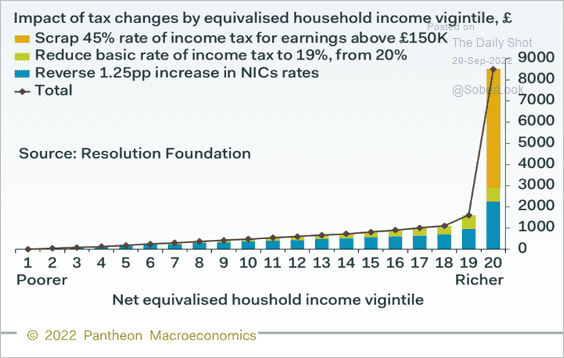

4. The new tax cuts don’t look great from a political perspective.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

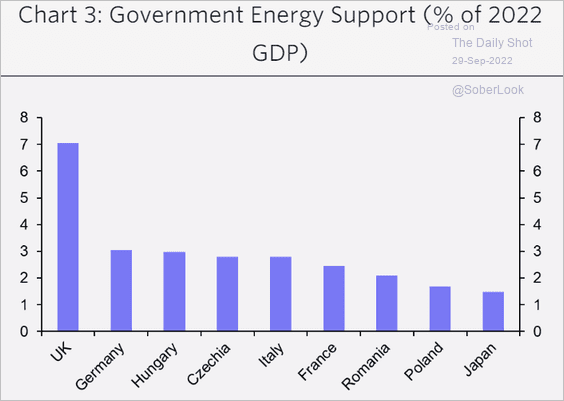

5. The UK government’s energy support is massive.

Source: Capital Economics

Source: Capital Economics

And it may not be enough.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The United States

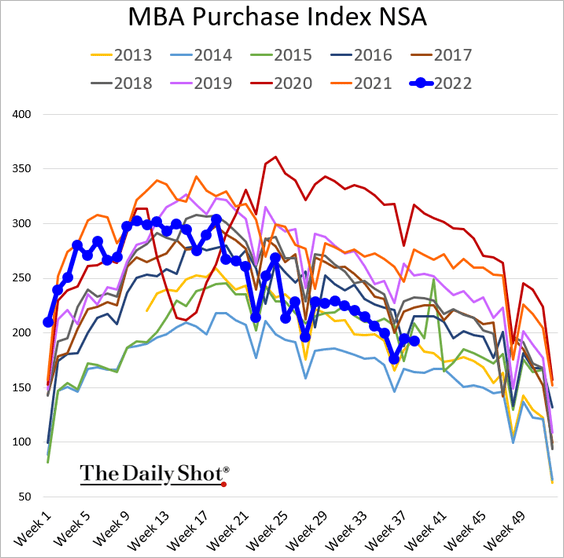

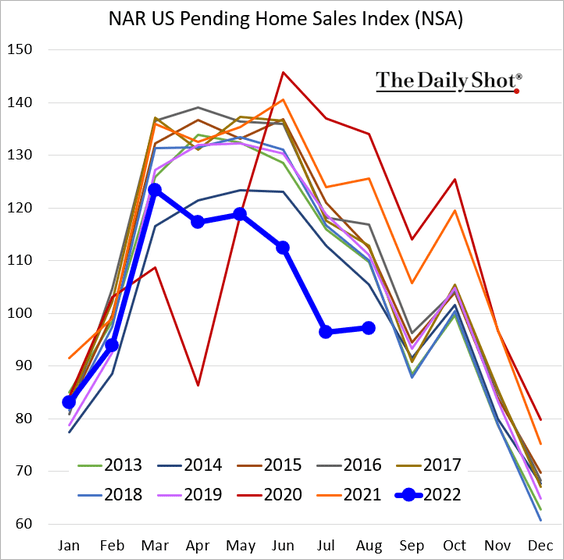

1. Once again, let’s start with the housing market.

• Mortgage applications are now following the 2013 trajectory.

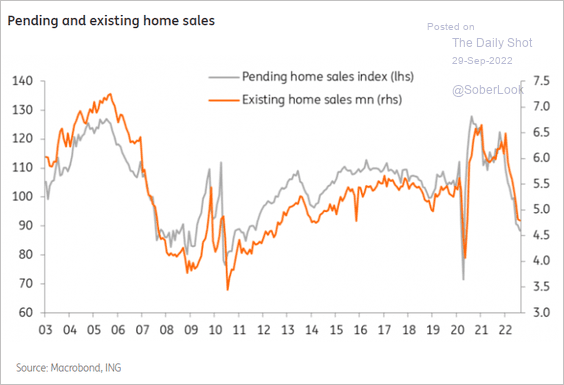

• Pending home sales were at multi-year lows in August, …

Source: MarketWatch Read full article

Source: MarketWatch Read full article

… pointing to further weakness in completed sales.

Source: ING

Source: ING

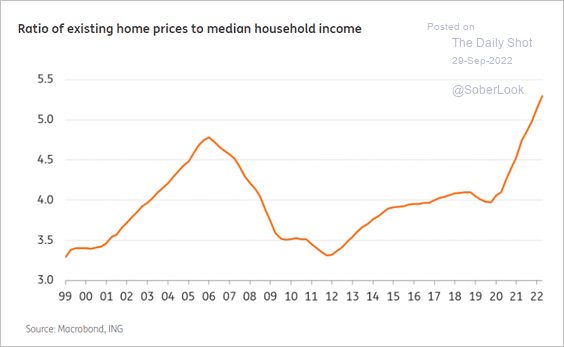

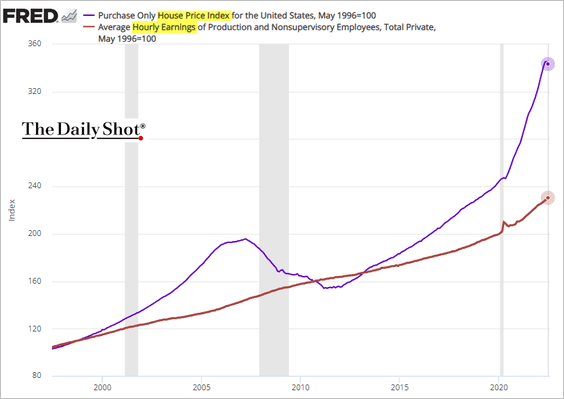

• Home prices are too high relative to incomes.

Source: ING

Source: ING

The gap has been widening for some time.

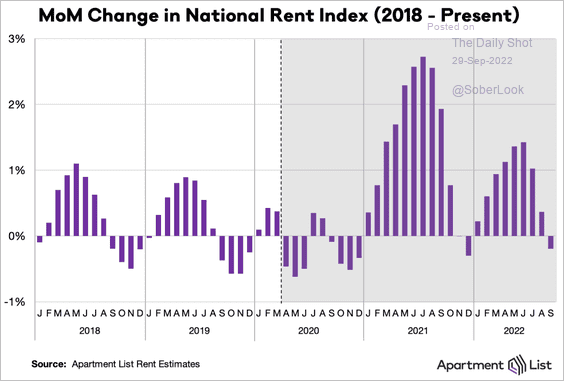

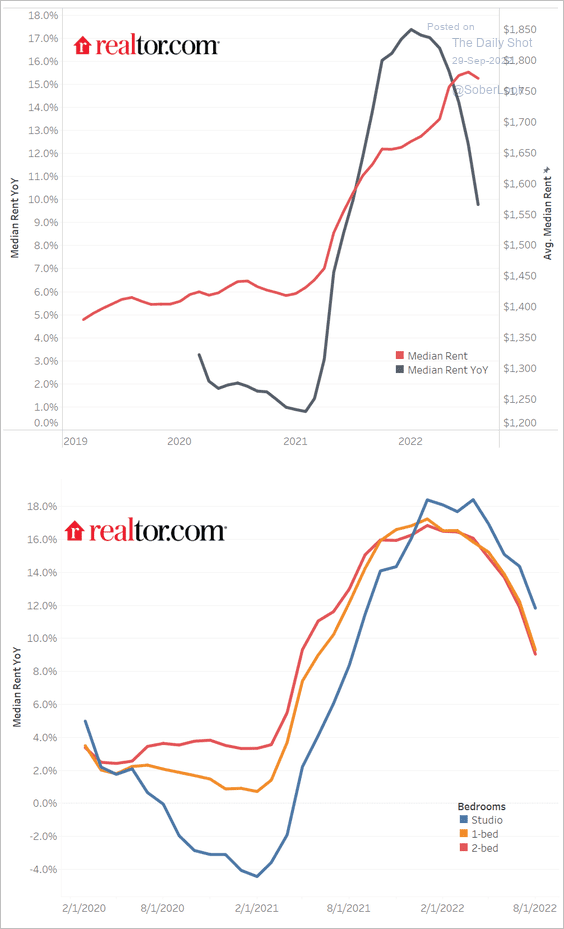

• Rent inflation shows signs of easing.

– Apartment List:

Source: Apartment List

Source: Apartment List

– Realtor.com:

Source: realtor.com

Source: realtor.com

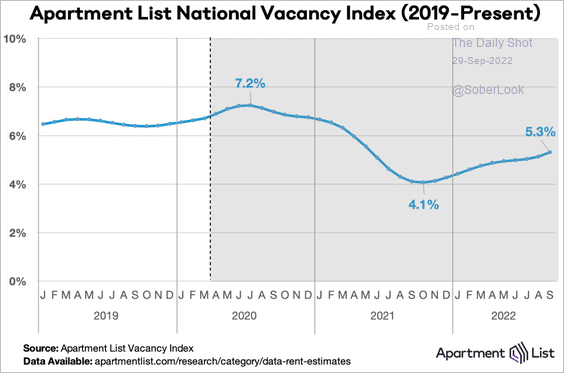

Rental vacancies have been moving higher.

Source: Apartment List

Source: Apartment List

——————–

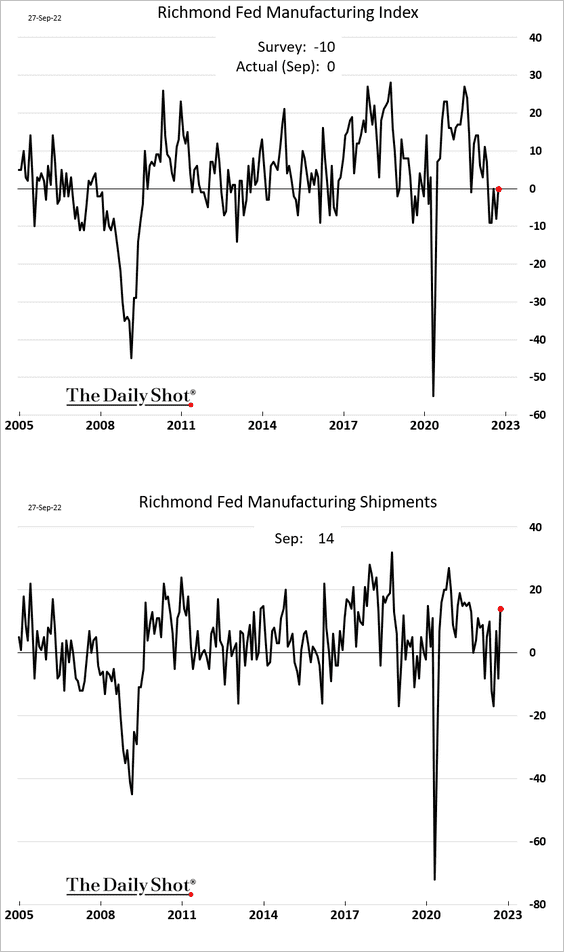

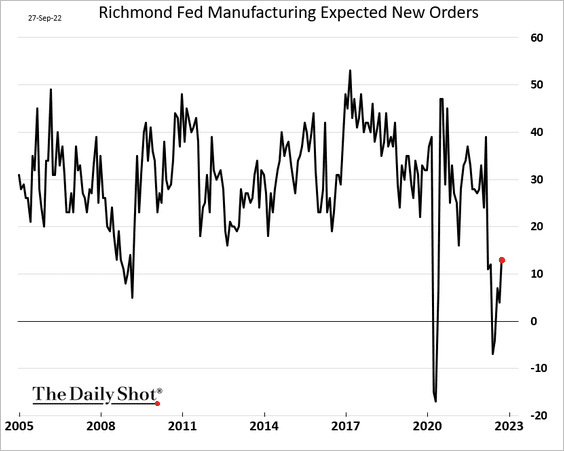

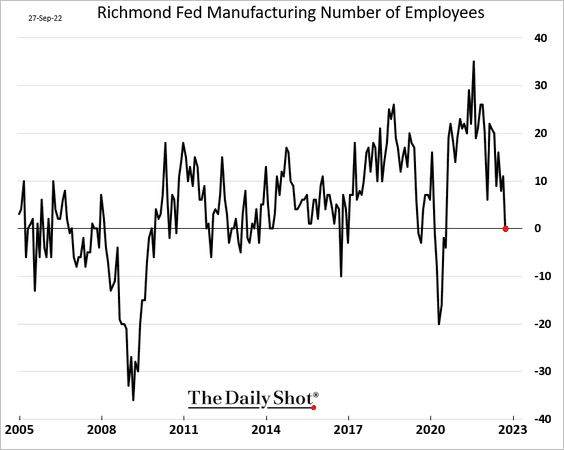

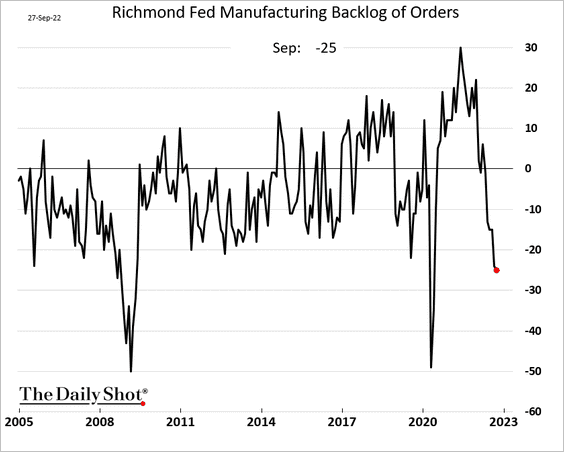

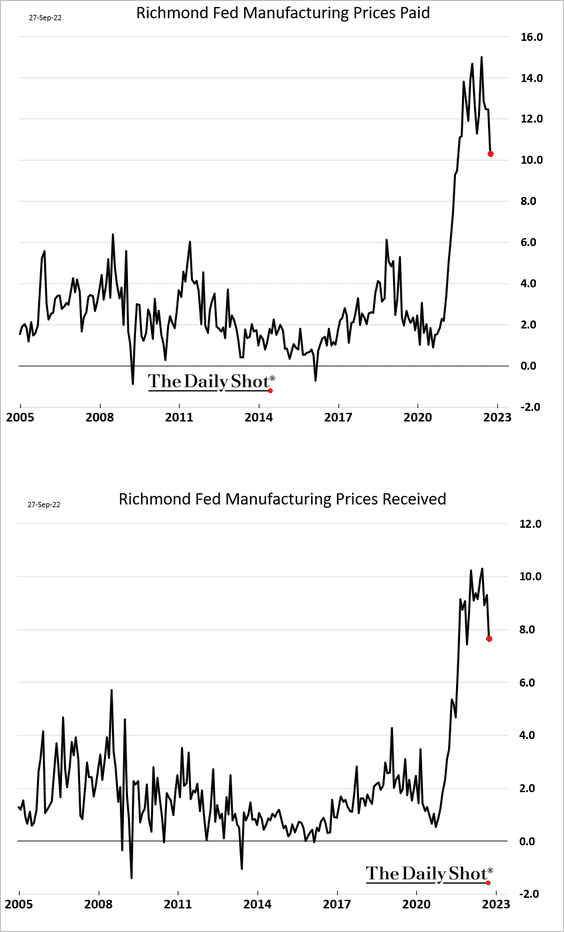

2. The Richmond Fed’s manufacturing index improved this month.

• There isn’t much hiring going on:

• Order backlog continues to fall.

• Price pressures persist.

——————–

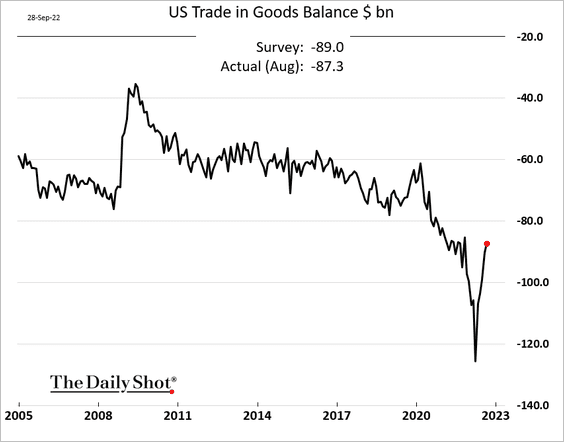

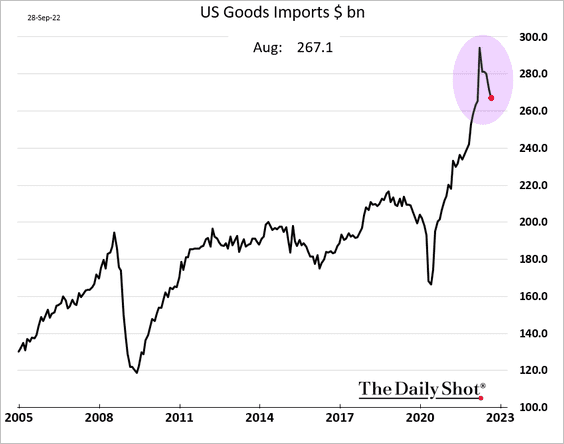

3. The trade balance continues to improve …

… as imports slow.

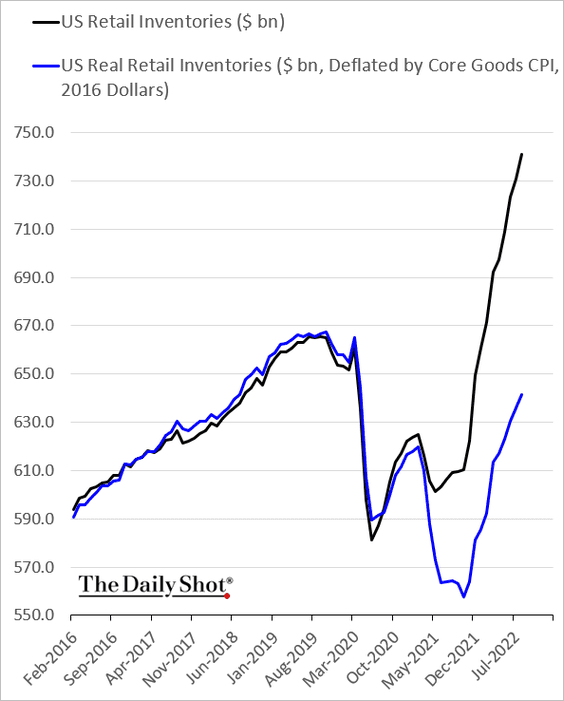

4. Inventories keep climbing.

Back to Index

The Eurozone

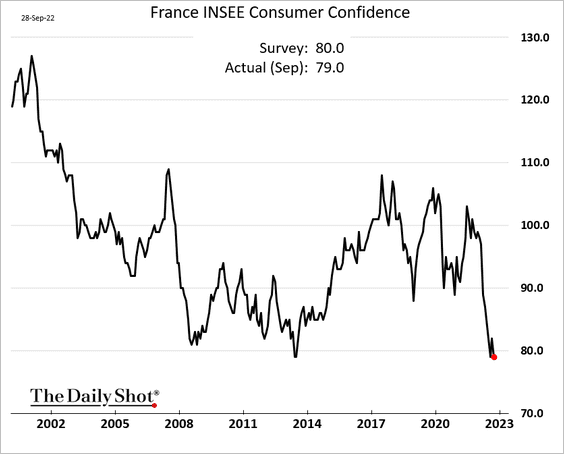

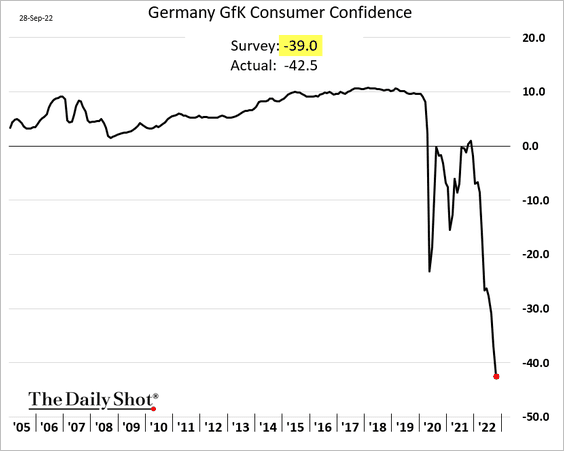

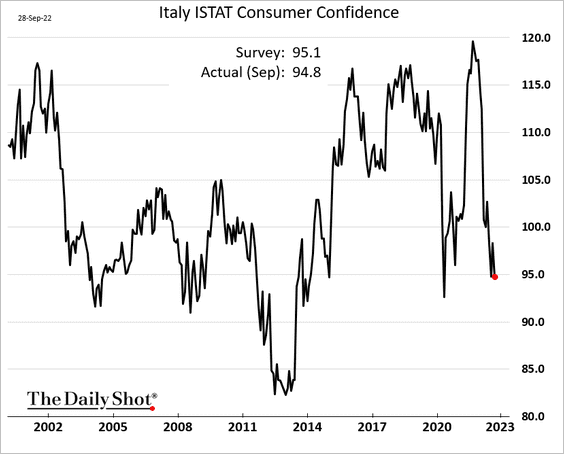

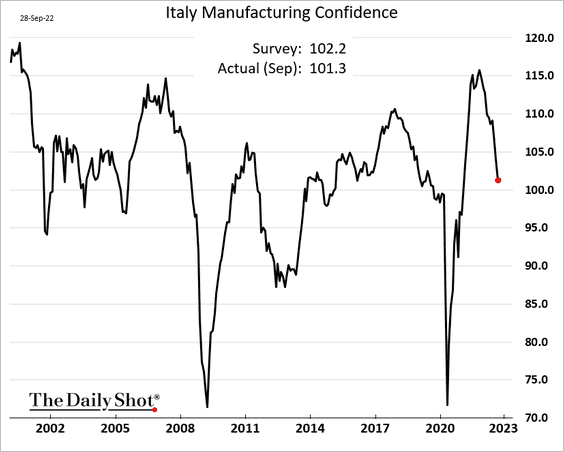

1. The slump in sentiment is worsening.

• French consumer confidence:

• German consumer confidence (extreme lows):

• Italian consumer confidence:

• Italian manufacturing confidence:

——————–

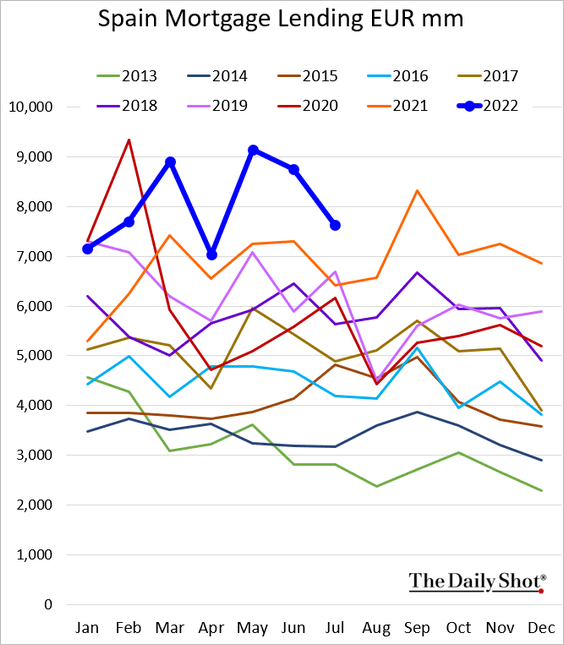

2. Spanish mortgage lending remains robust.

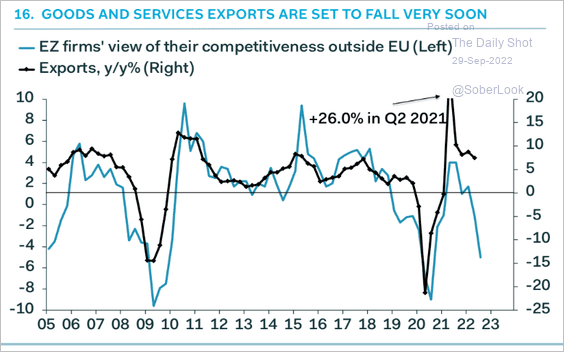

3. Euro-area exports are expected to deteriorate.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

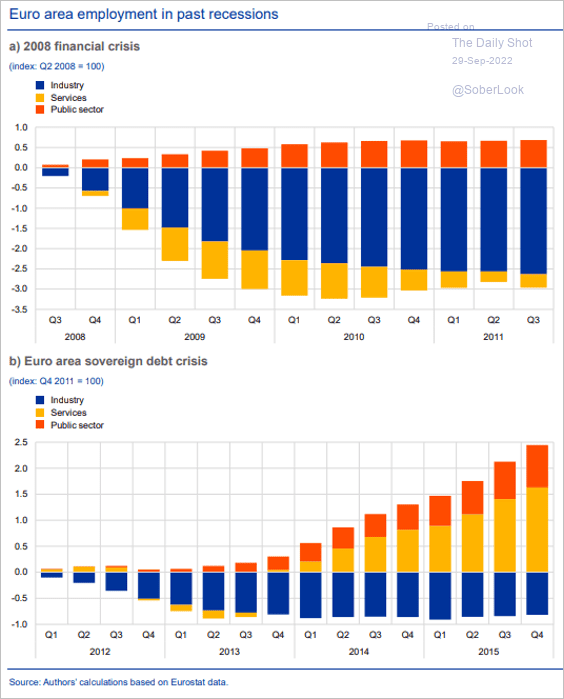

4. Here is a look at employment trends during the last two recessions.

Source: ECB

Source: ECB

Back to Index

Europe

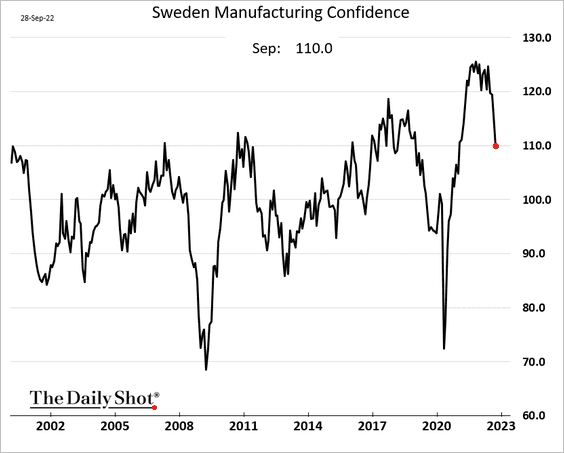

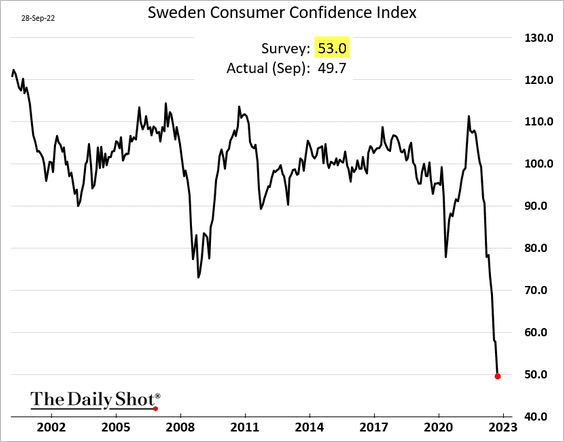

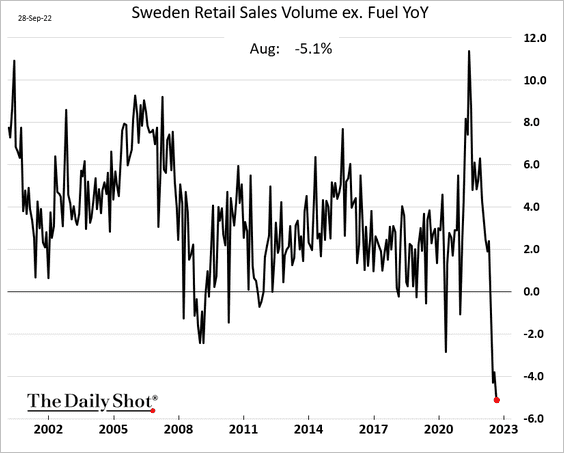

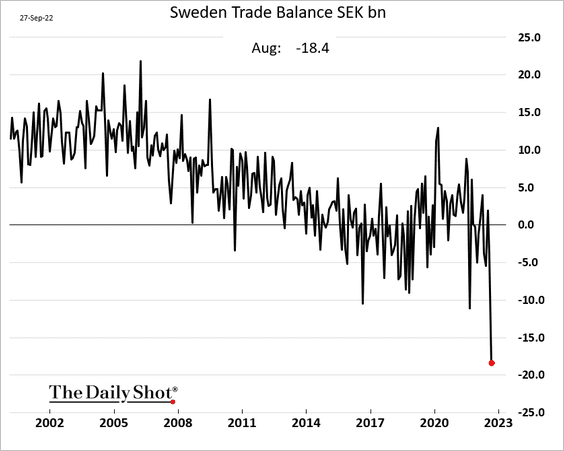

1. Let’s begin with Sweden.

• Manufacturing confidence has rolled over.

• Consumer confidence has collapsed.

• Retail sales were down sharply last month on a year-over-year basis.

• The trade deficit hit a new record.

——————–

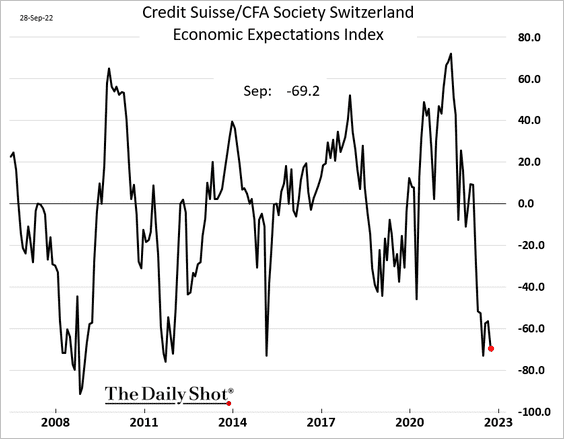

2. Swiss economic sentiment is near multi-year lows.

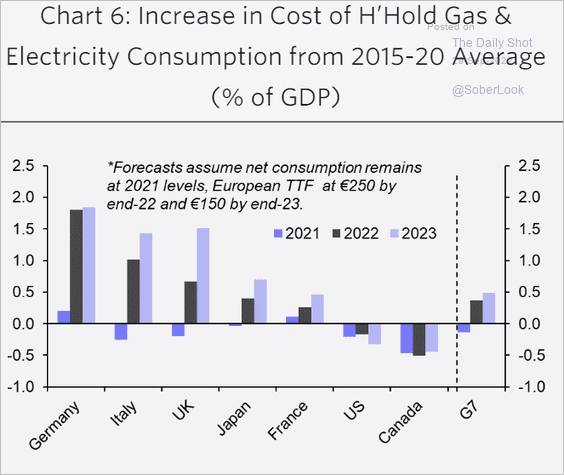

3. European households will face substantial energy cost hikes next year despite government support.

Source: Capital Economics

Source: Capital Economics

Back to Index

Japan

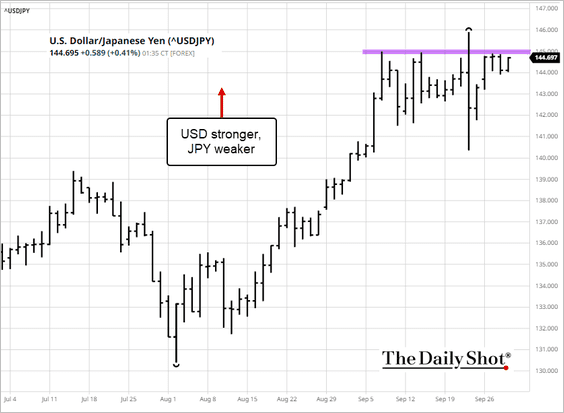

1. The market wants to take dollar-yen beyond 145.

Source: barchart.com

Source: barchart.com

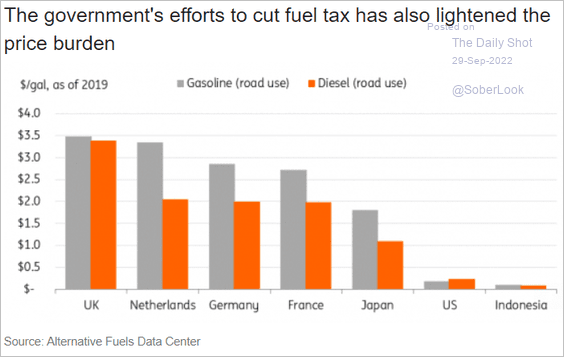

2. The government has been able to keep fuel costs at lower levels than what we see in Europe.

Source: ING

Source: ING

Back to Index

Asia – Pacific

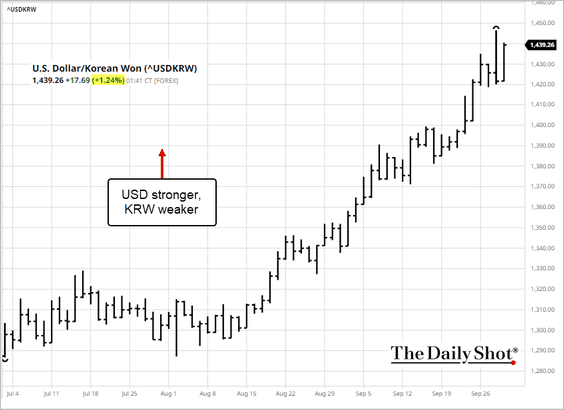

1. Asian currencies remain under pressure. Here is USD/KRW.

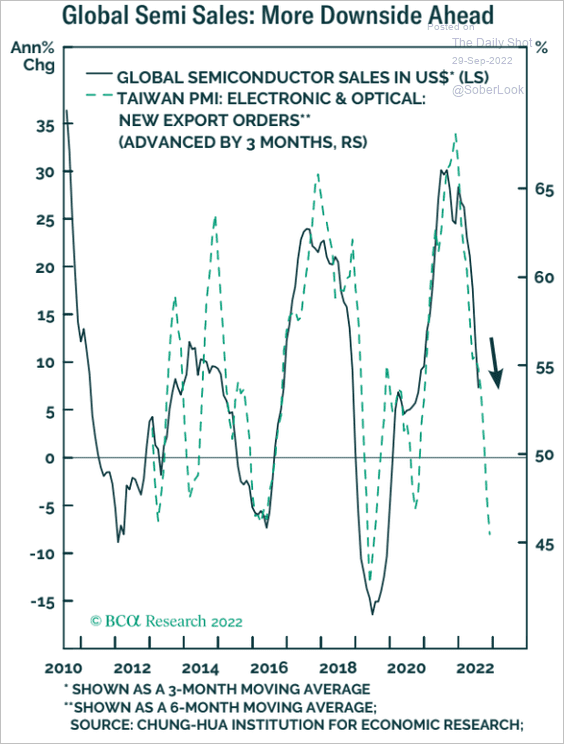

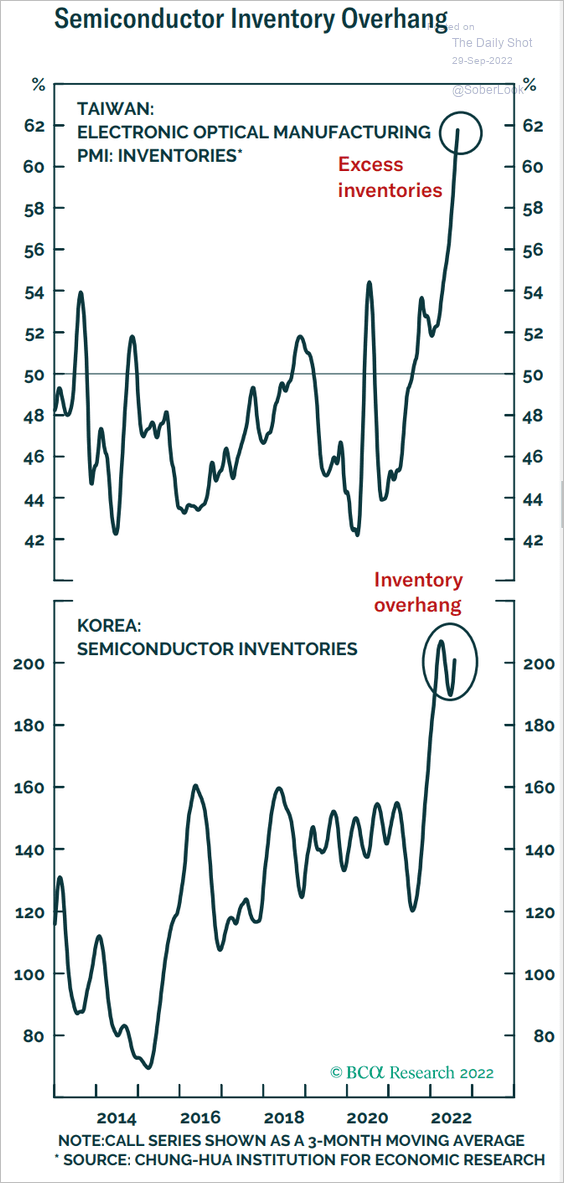

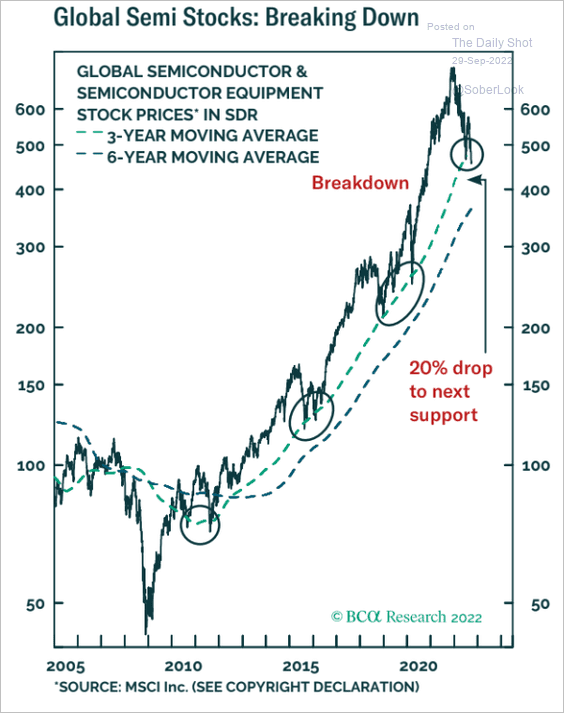

2. Semiconductor exporters face some headwinds (2 charts).

![]() Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

Source: BCA Research

Source: BCA Research

——————–

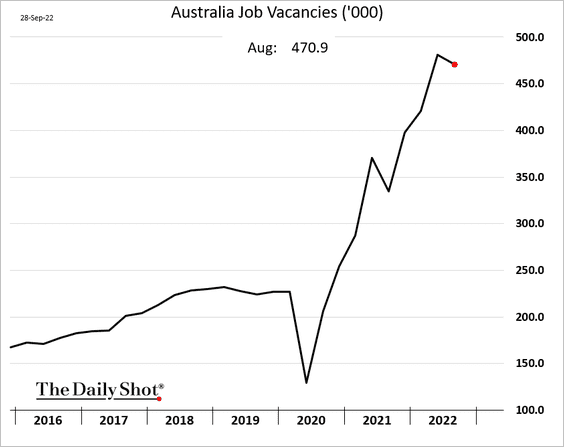

3. Australia’s job vacancies appear to have peaked over the summer.

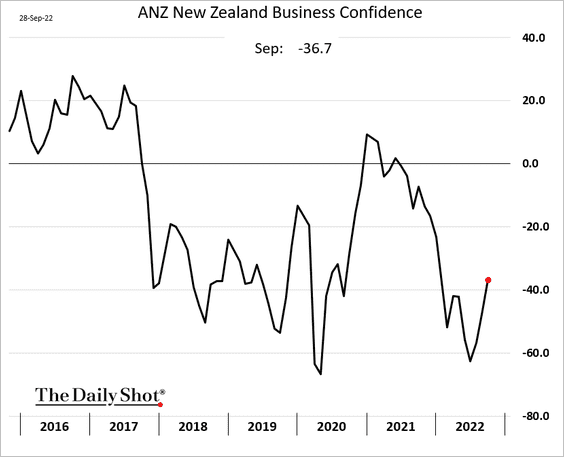

4. New Zealand’s business confidence improved again this month.

Back to Index

China

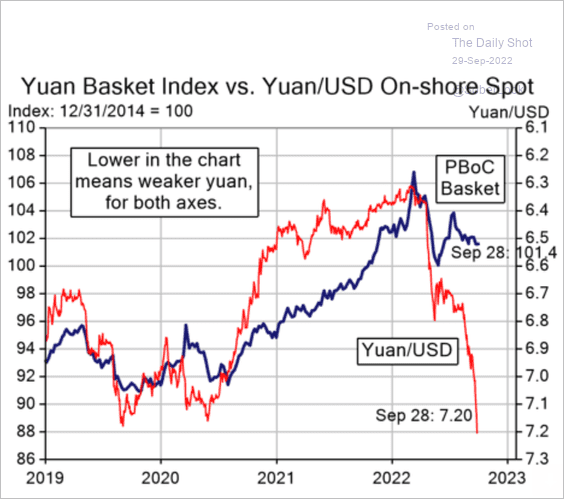

1. The RMB’s decline has been mostly against the dollar.

Source: Evercore ISI Research

Source: Evercore ISI Research

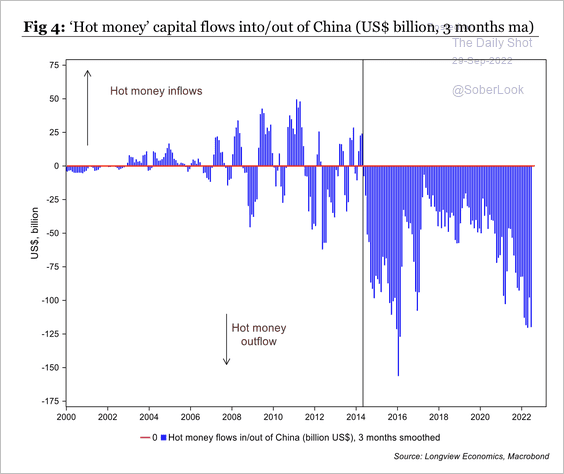

2. “Hot money” (capital flows not related to trade and likely speculative) continues to exit China at a similar pace to the yuan devaluation in 2015.

Source: Longview Economics

Source: Longview Economics

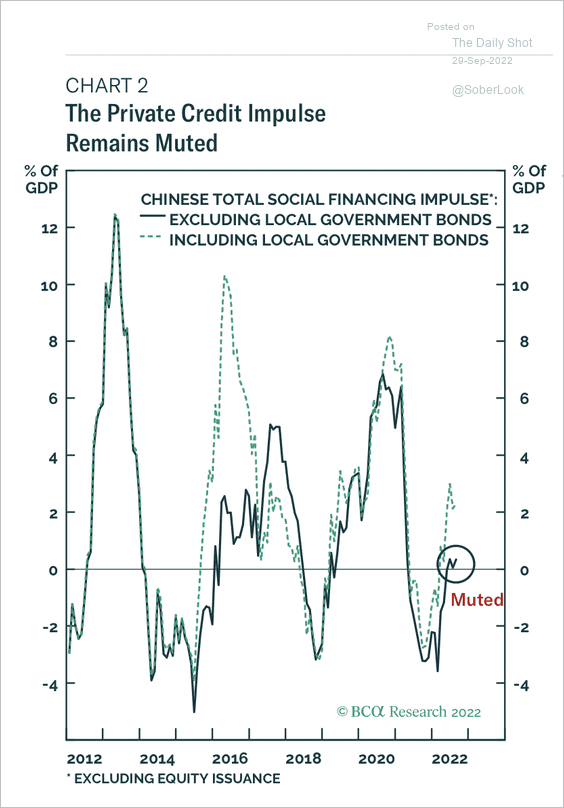

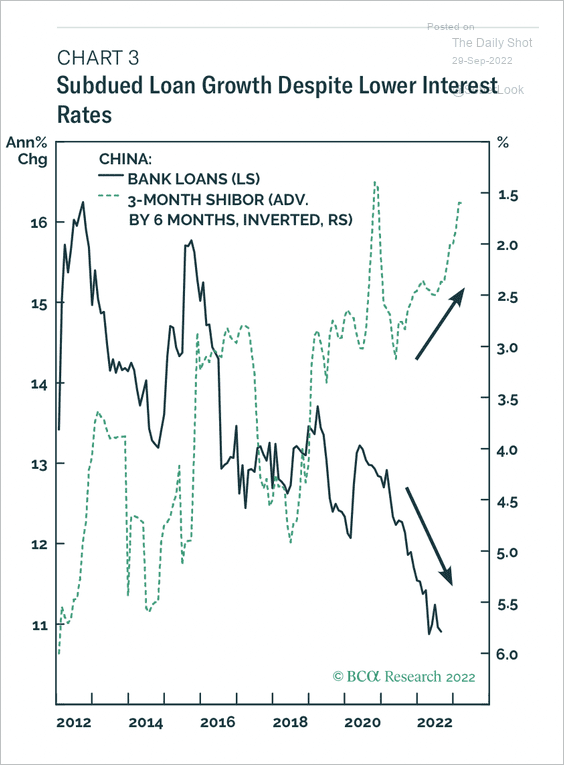

3. The private credit impulse remains muted …

Source: BCA Research

Source: BCA Research

… mostly because of declining loan growth and weak borrower demand.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

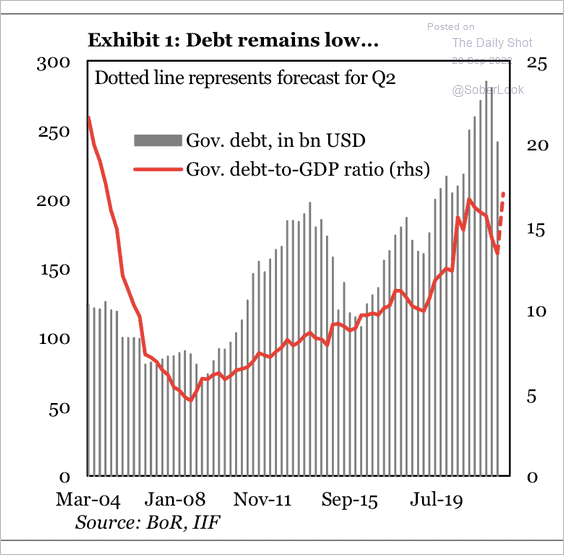

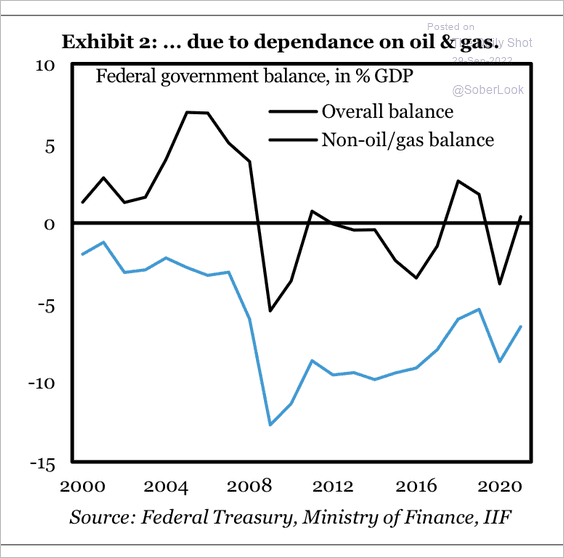

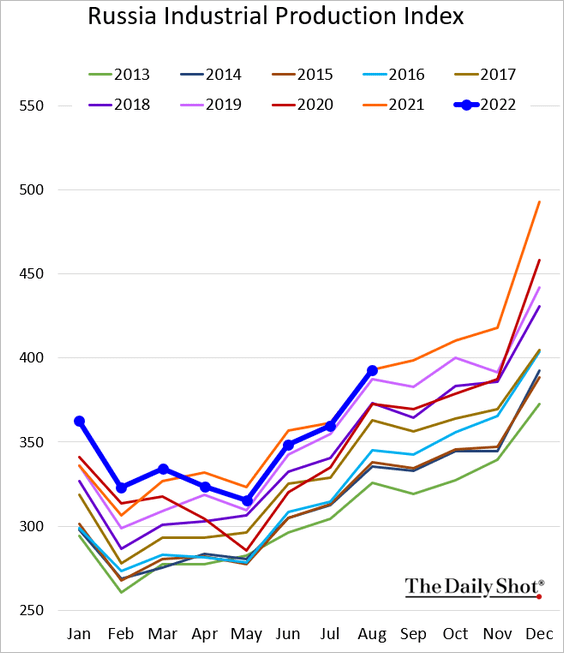

1. Let’s begin with some updates on Russia.

• Without oil and gas, Russia’s federal budget would have been in persistently large deficits over the past decade (2 charts).

Source: IIF

Source: IIF

Source: IIF

Source: IIF

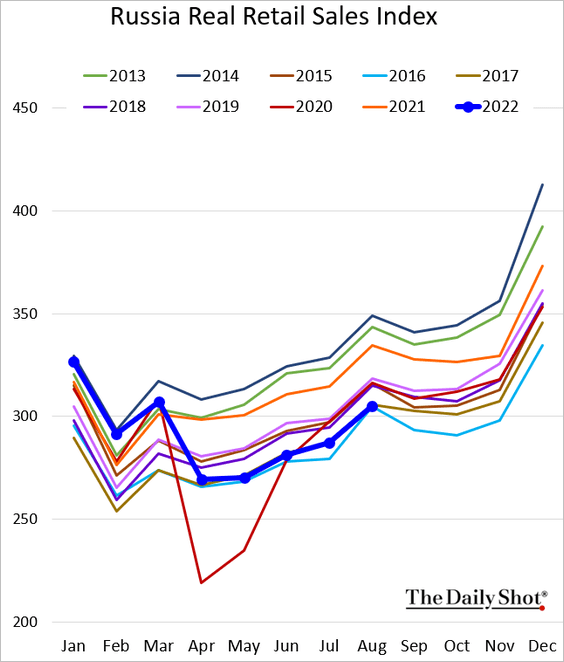

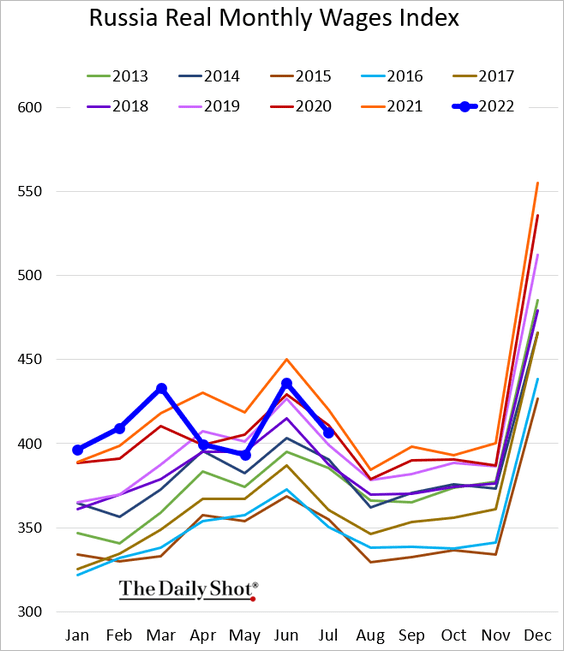

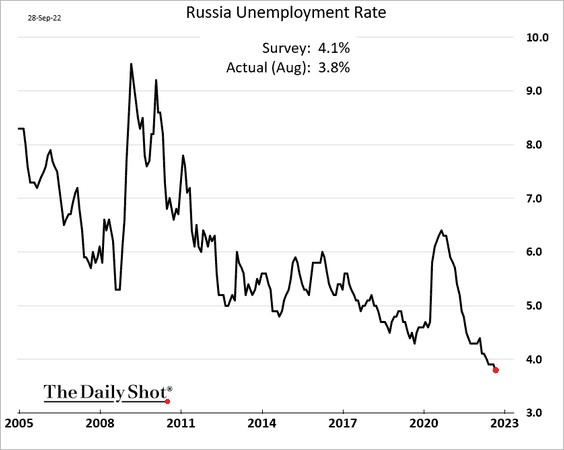

• The following indicators are from the Russian government and should be taken with a grain of salt.

– Industrial production:

– Retail sales:

– Real wages:

– The unemployment rate:

——————–

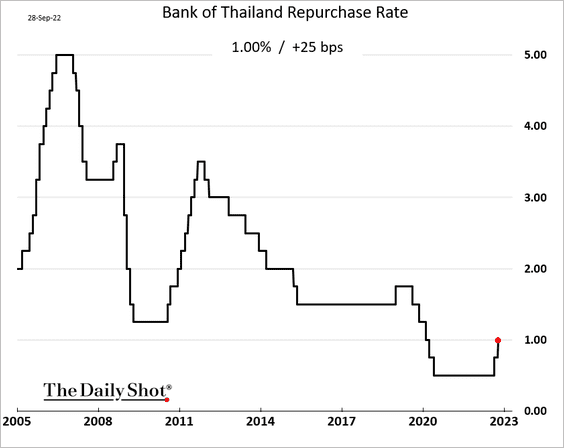

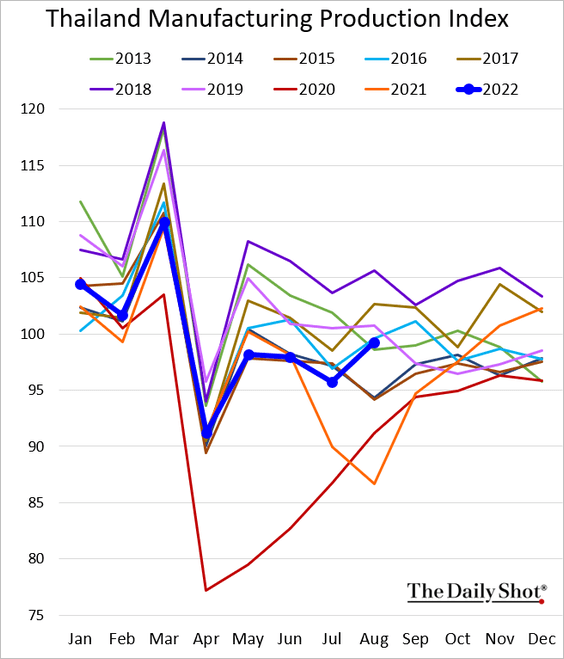

2. Thailand’s central bank hiked rates again.

Manufacturing activity is rebounding from the COVID slump.

——————–

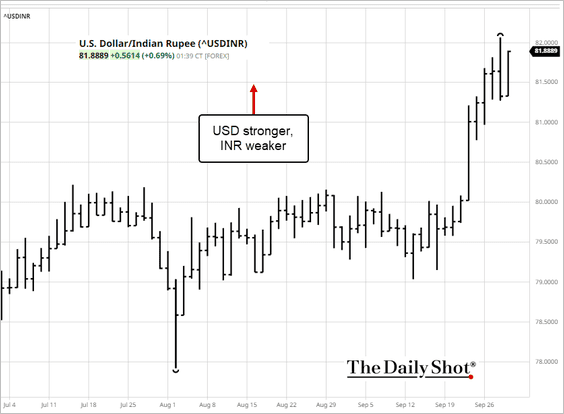

3. The Indian rupee is back near record lows vs. USD.

Source: barchart.com

Source: barchart.com

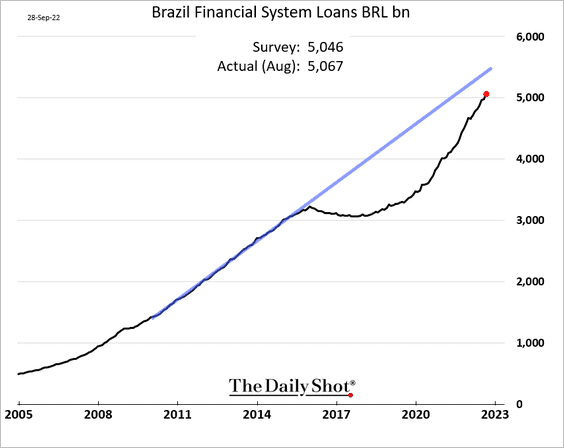

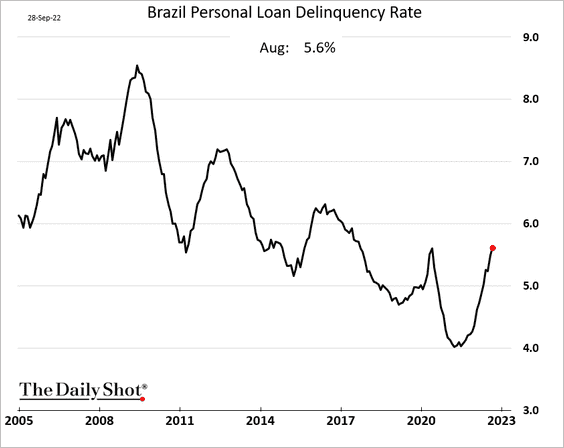

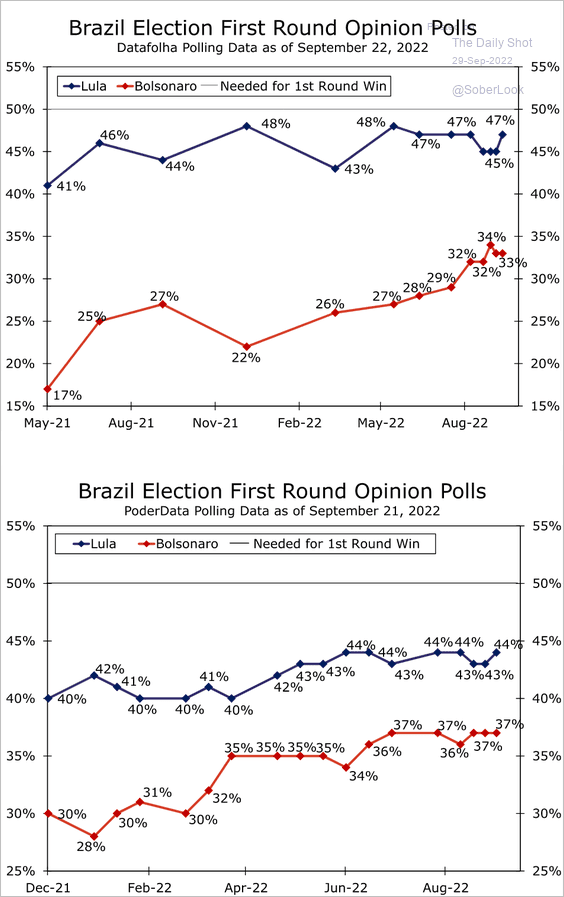

4. Here are some updates on Brazil.

• Loan growth:

• Personal loan defaults:

• The latest polls:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Cryptocurrency

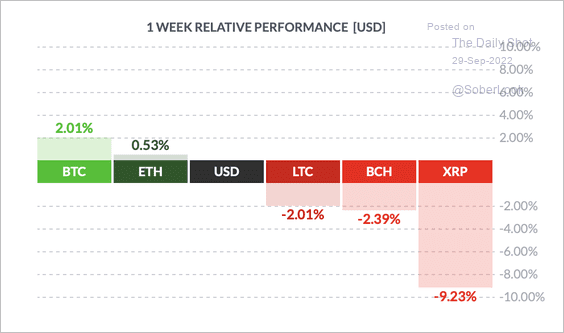

1. BTC has outperformed other large cryptos over the past week, while XRP underperformed.

Source: FinViz

Source: FinViz

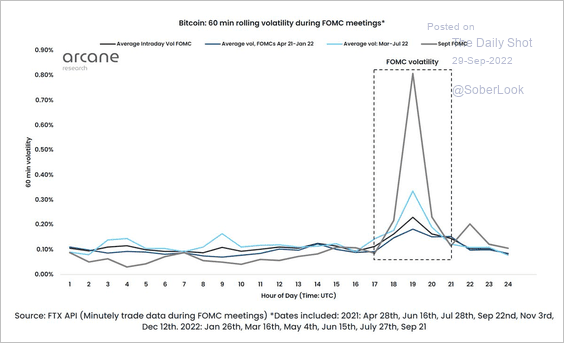

2. Bitcoin’s intraday volatility during last week’s FOMC meeting hit record highs.

Source: @ArcaneResearch

Source: @ArcaneResearch

Back to Index

Commodities

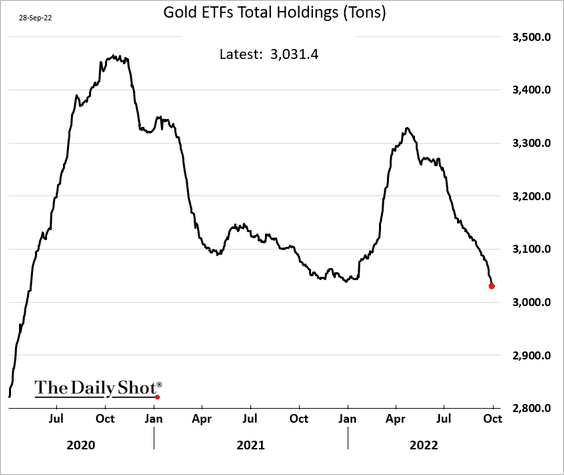

1. Gold ETF holdings are declining quickly.

h/t @Edspencive

h/t @Edspencive

2. Potash prices are off the highs but remain elevated.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Energy

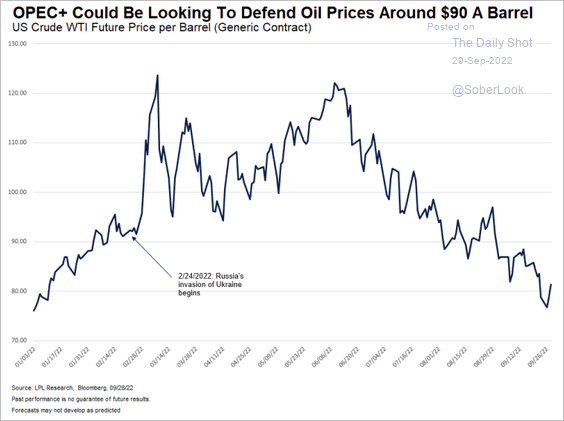

1. Will OPEC cut production?

Source: Reuters Read full article

Source: Reuters Read full article

Source: LPL Research, h/t @pav_chartbook Read full article

Source: LPL Research, h/t @pav_chartbook Read full article

——————–

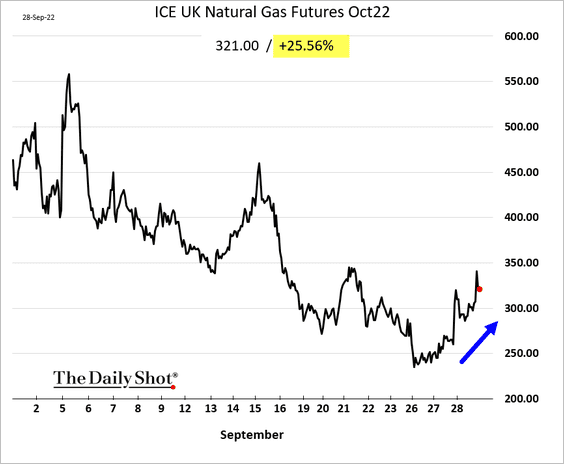

2. The gas pipeline sabotage sent European gas prices higher.

Source: Reuters Read full article

Source: Reuters Read full article

On a separate note, we received an email from what appears to be a credible source suggesting that Russian agents were responsible for both the Freeport LNG explosion and the gas pipeline explosions in the Baltic Sea. Presumably, the goal of this sabotage was to deprive Europe of natural gas flows before the winter heating season begins. The thinking in Moscow is that gas rationing would swing Europe’s public opinion against Western support for Ukraine.

——————–

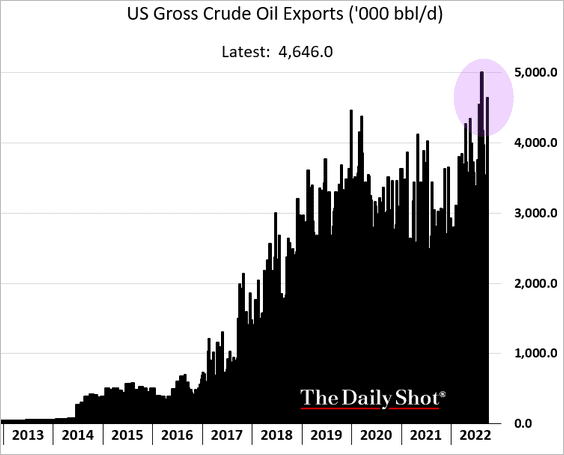

3. US oil exports remain near record highs.

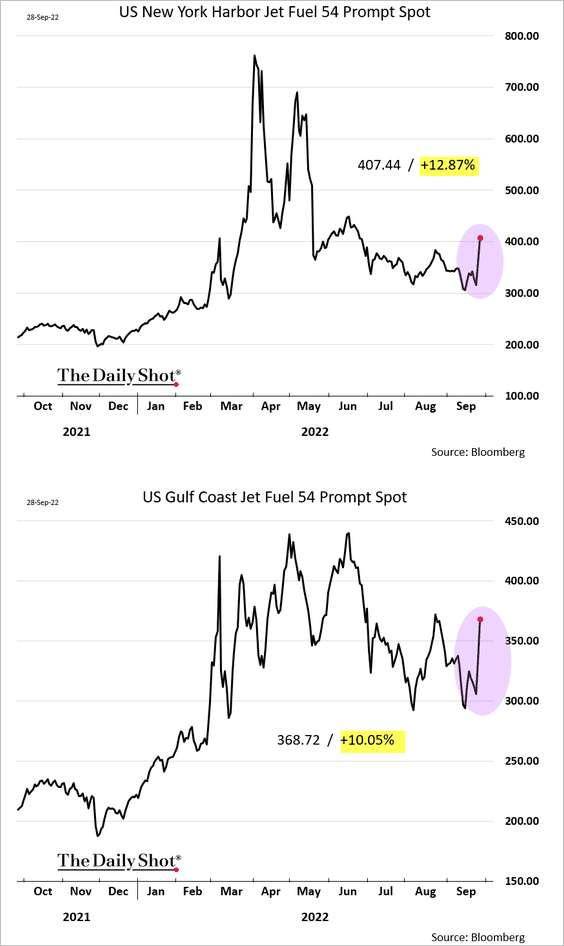

4. US jet fuel prices surged amid tight supplies.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Equities

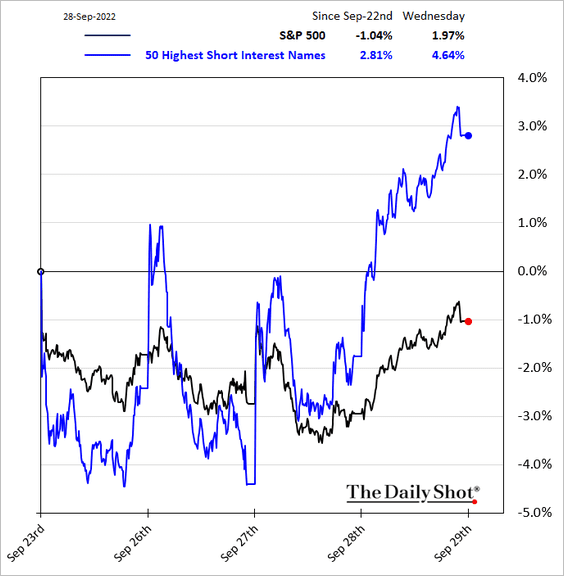

1. Stocks jumped after the BoE’s announcement (see the UK section). The rally was partially driven by short-covering.

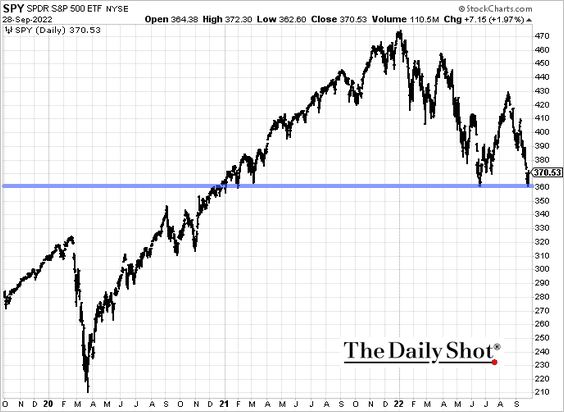

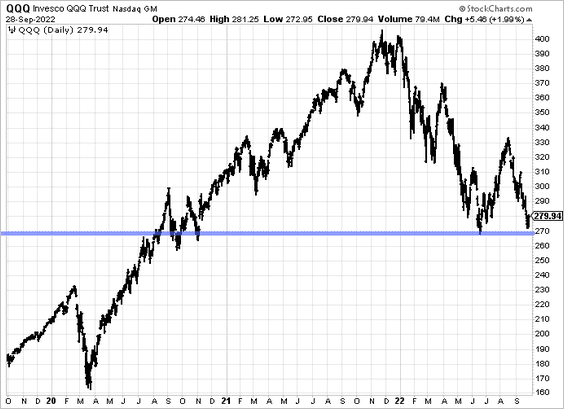

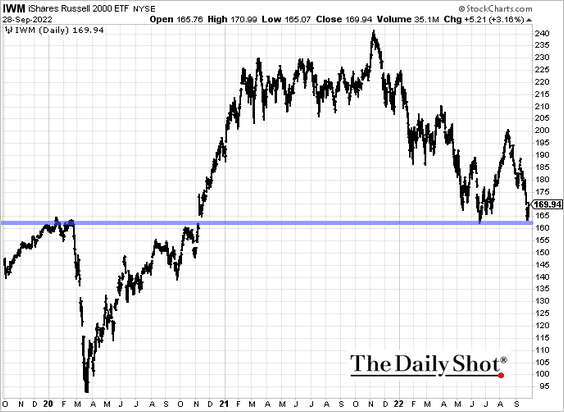

2. Support levels held (for now).

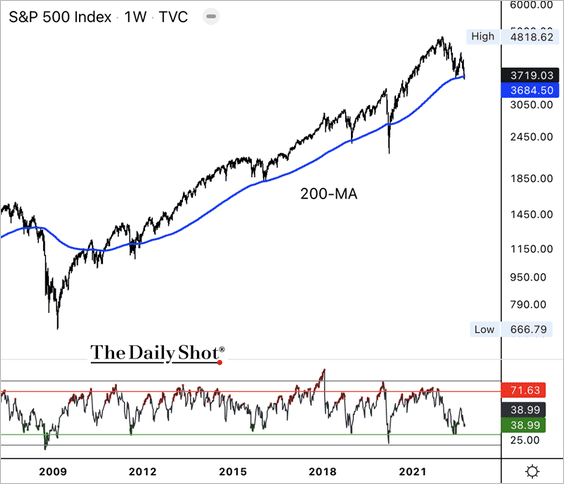

• S&P 500:

• Nasdaq 100:

• Russell 2000:

Will the S&P 500 hold support above its 200-week moving average? Unlike the July rally, the recent decline did not register an oversold reading on the weekly chart.

——————–

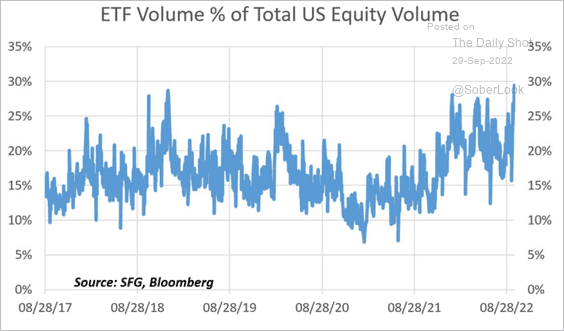

3. ETF trading as a share of total volume surged recently.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

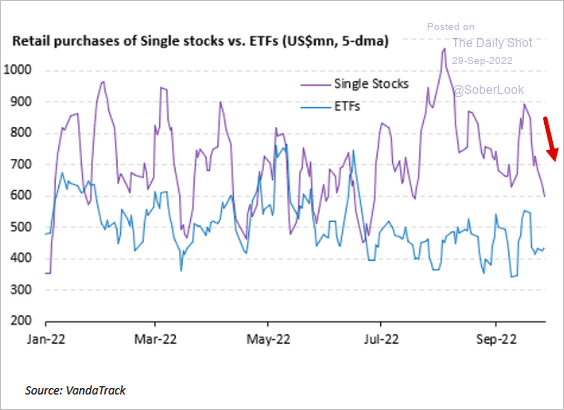

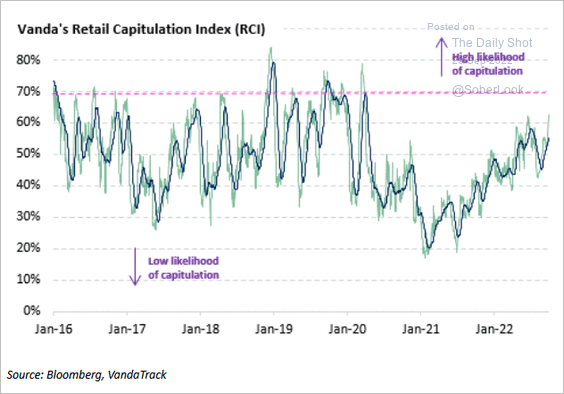

4. Retail buying has been slowing, …

Source: Vanda Research

Source: Vanda Research

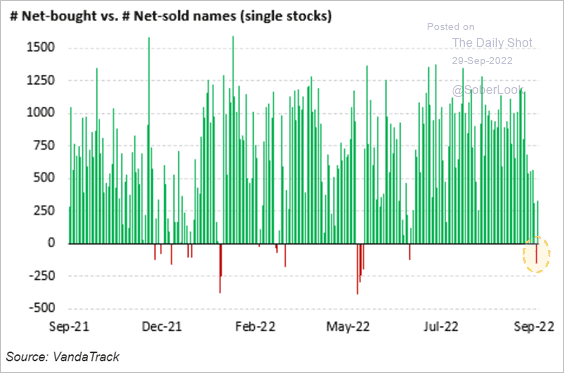

… with breadth weakening.

Source: Vanda Research

Source: Vanda Research

But there is no capitulation yet.

Source: Vanda Research

Source: Vanda Research

——————–

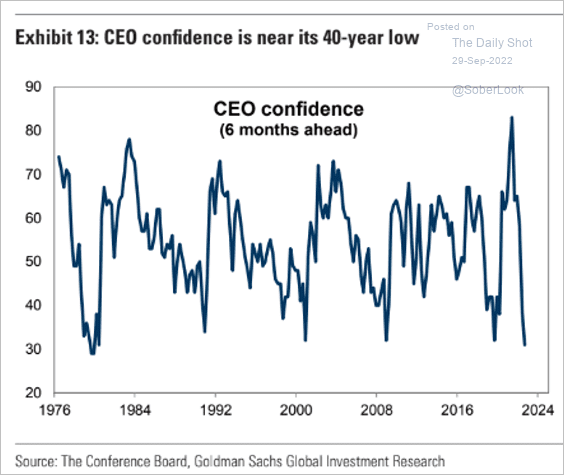

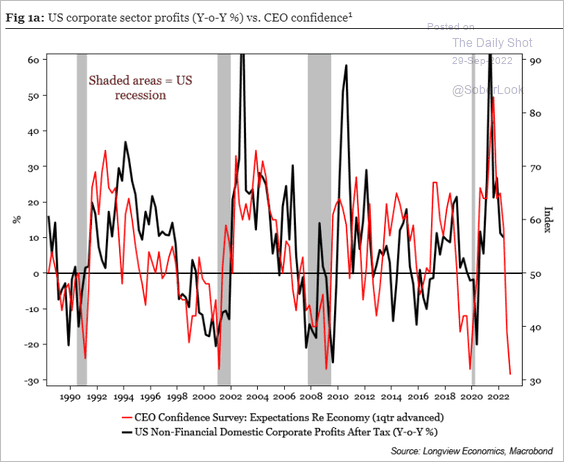

5. CEO confidence has deteriorated, …

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

… which doesn’t bode well for corporate profits.

Source: Longview Economics

Source: Longview Economics

——————–

6. More downside for semiconductor stocks? (2 charts)

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

——————–

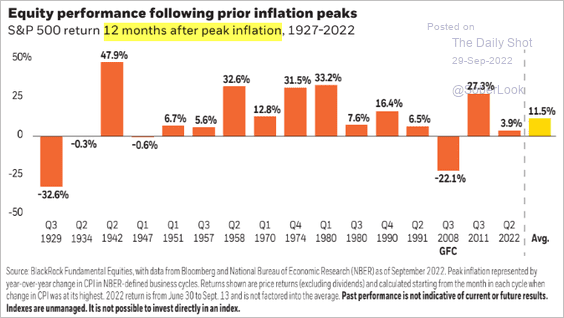

7. How do stocks perform following inflation peaks?

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

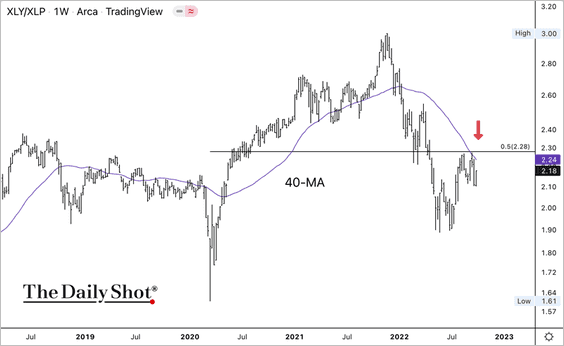

8. The price ratio of the Consumer Discretionary SPDR ETF (XLY) versus the Consumer Staples SPDR ETF (XLP) is rolling over.

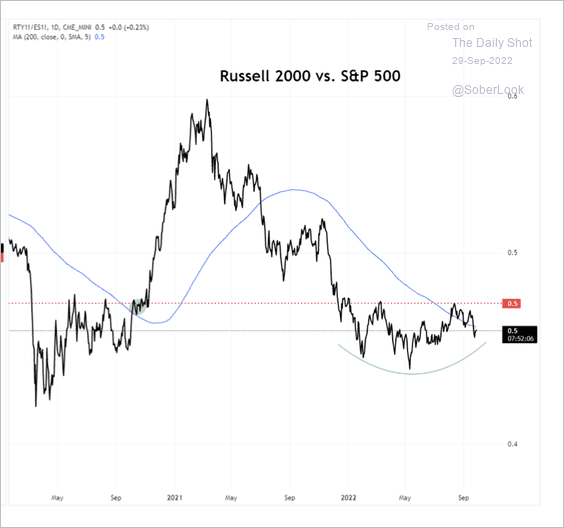

9. And the price ratio of the Russell 2,000 small-cap index versus the S&P 500 dipped below its 200-day moving average.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

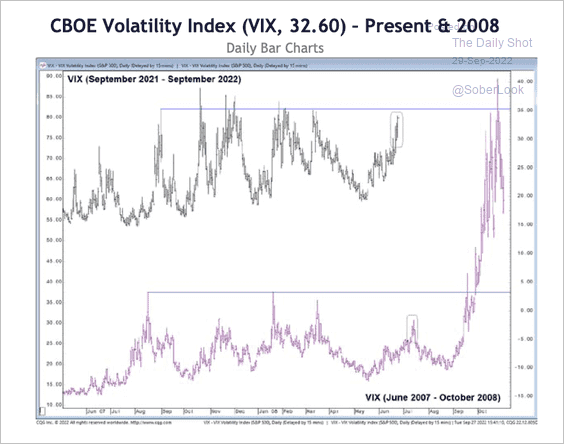

10. The VIX index declined from resistance yesterday. However, a breakout above 35 could lead to a more severe drawdown in the S&P 500, similar to 2008.

Source: @StocktonKatie

Source: @StocktonKatie

Back to Index

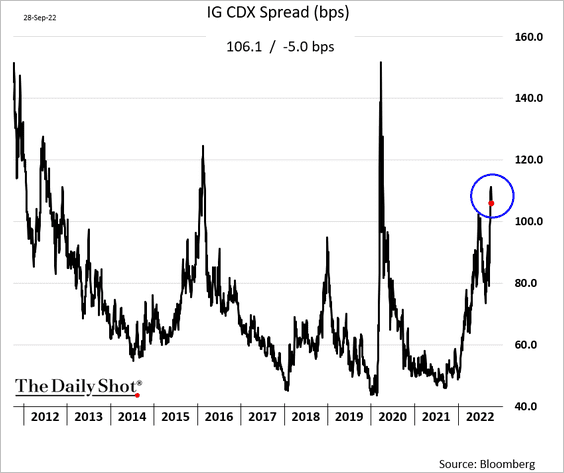

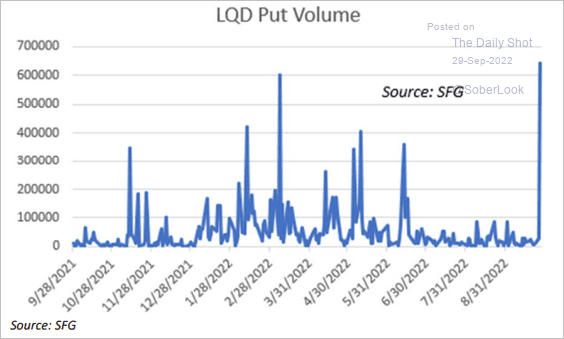

Credit

1. Investment-grade credit default swap spreads are off the highs but remain elevated.

Have we seen capitulation in investment-grade credit?

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

——————–

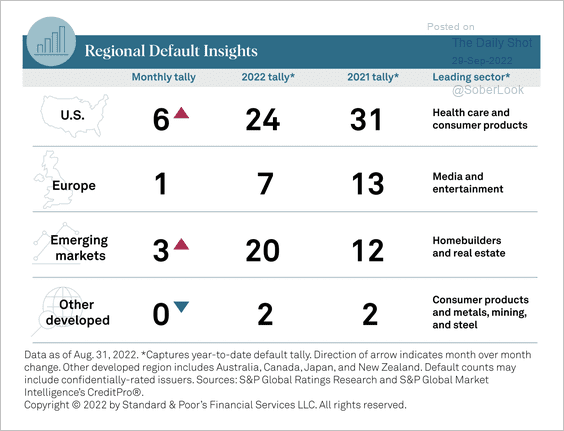

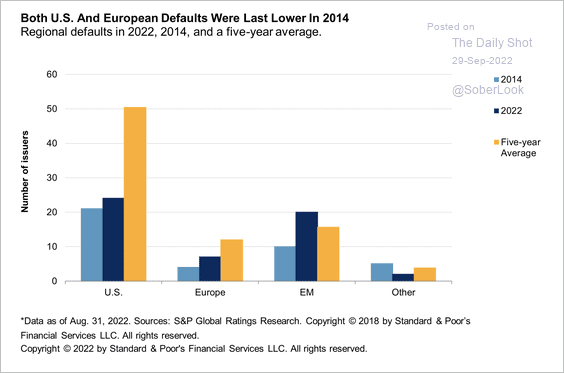

2. The global credit default tally continues to pick up, particularly in the US healthcare space, according to S&P Ratings.

Source: S&P Global Ratings

Source: S&P Global Ratings

Outside of emerging markets, defaults are still lower compared with their five-year average.

Source: S&P Global Ratings

Source: S&P Global Ratings

Back to Index

Global Developments

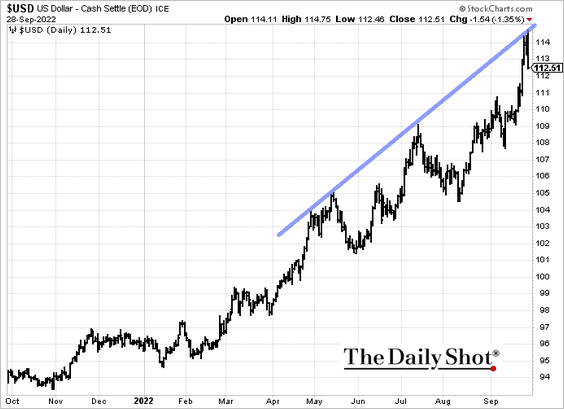

1. The US dollar (DXY index) held the uptrend resistance as the BoE intervened in the bond market.

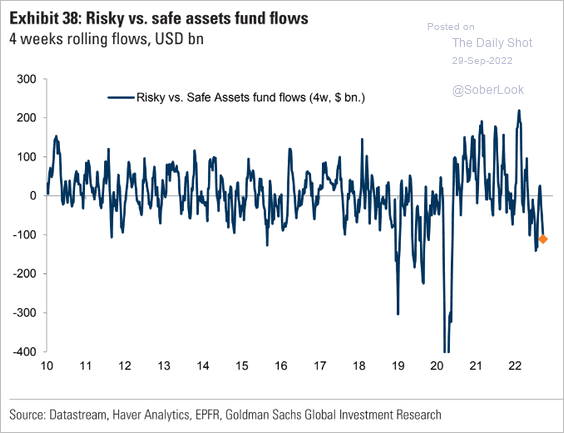

2. Risky vs. safe assets fund flows show sinking risk appetite.

Source: Goldman Sachs

Source: Goldman Sachs

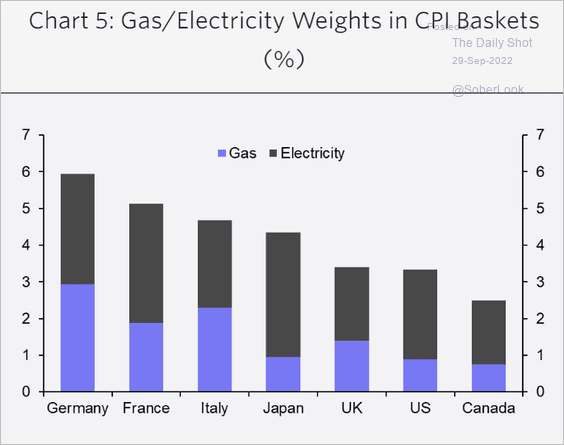

3. Finally, we have energy weights in each nation’s CPI index (from Capital Economics).

Source: Capital Economics

Source: Capital Economics

——————–

Food for Thought

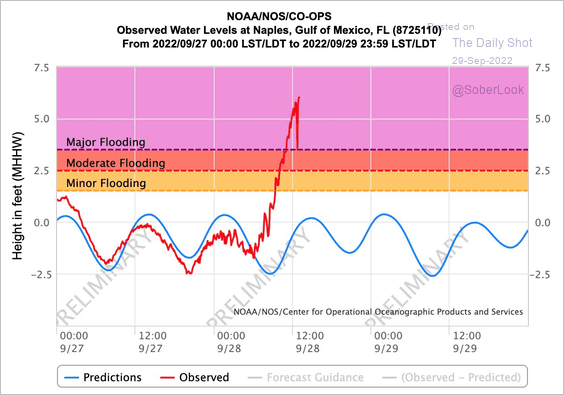

1. Flooding in Naples, Florida:

Source: @RARohde

Source: @RARohde

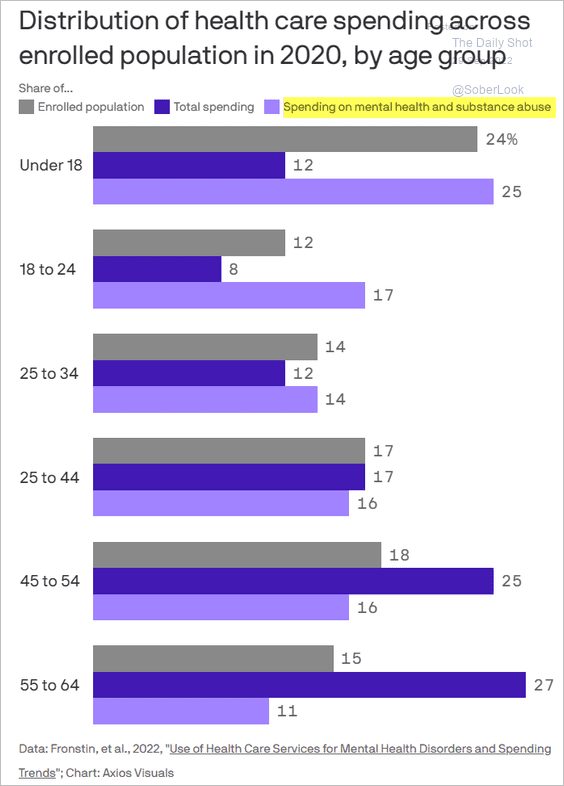

2. Mental health spending:

Source: @axios Read full article

Source: @axios Read full article

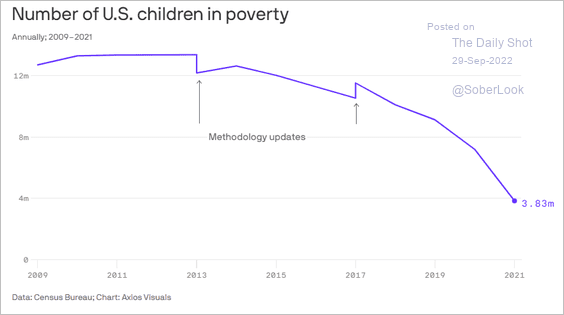

3. Number of US children in poverty:

Source: @axios Read full article

Source: @axios Read full article

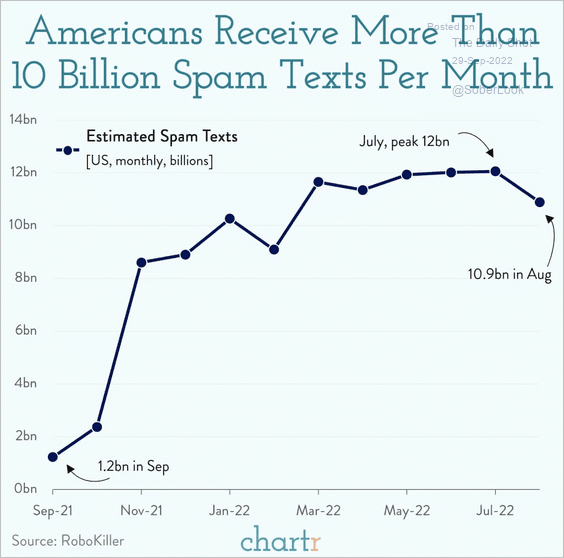

4. Spam texts:

Source: @chartrdaily

Source: @chartrdaily

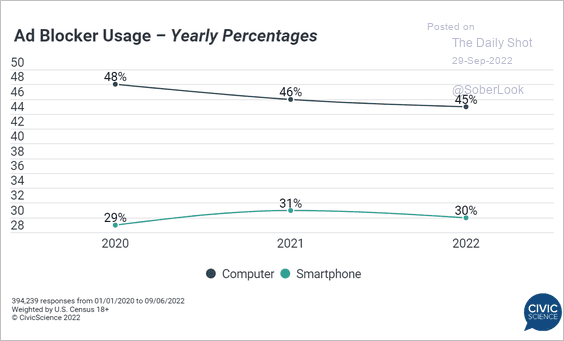

5. Ad blocker usage:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

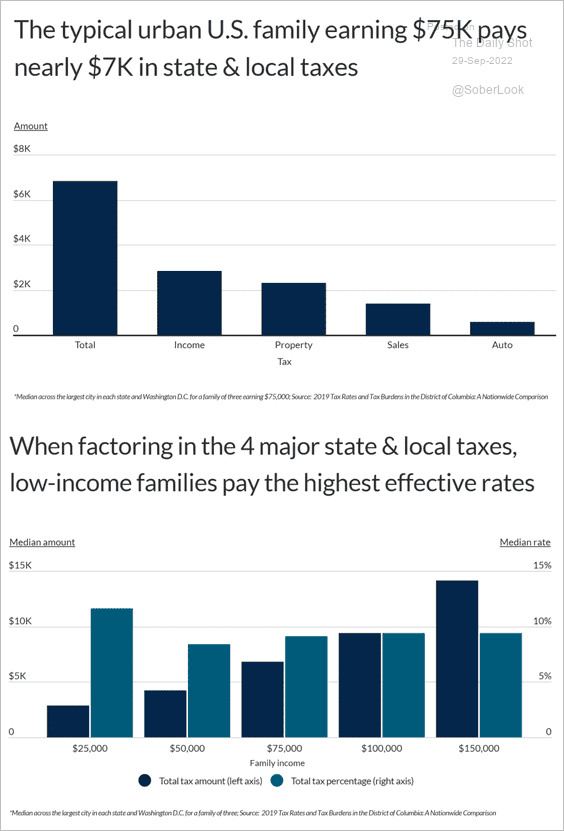

6. The impact of state and local taxes:

Source: Chamber of Commerce Read full article

Source: Chamber of Commerce Read full article

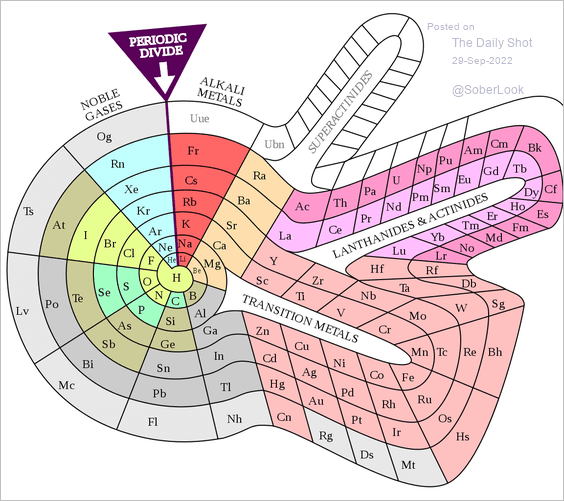

7. An alternative periodic table:

Source: Wikipedia Read full article

Source: Wikipedia Read full article

——————–

Back to Index