The Daily Shot: 04-Oct-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

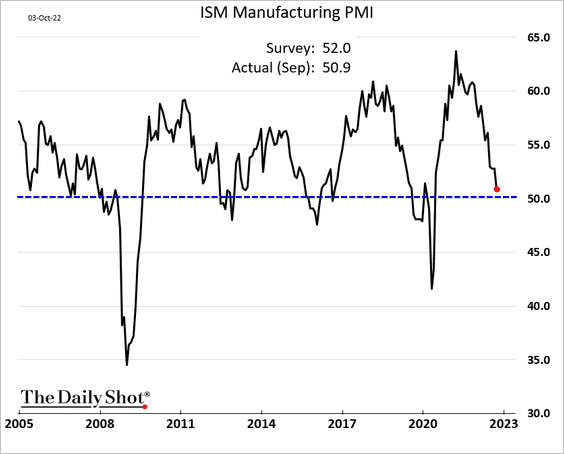

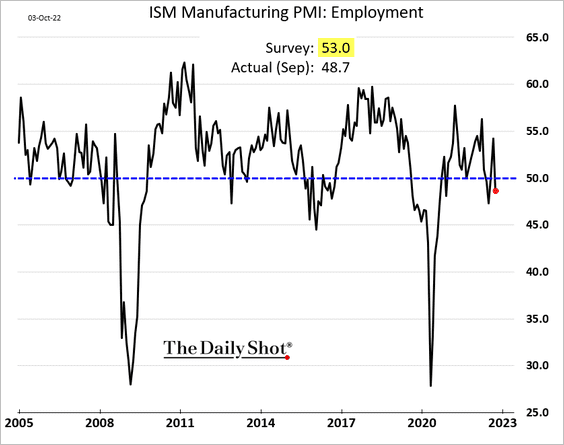

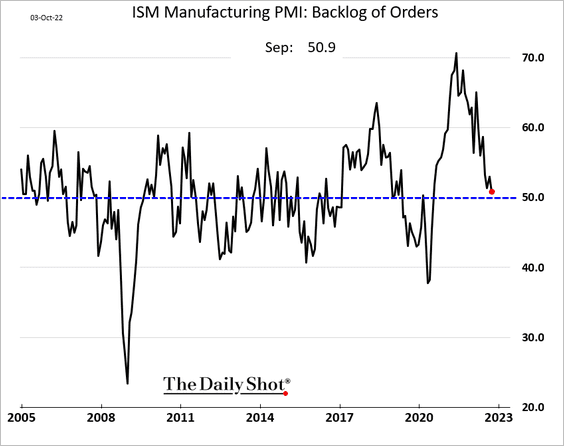

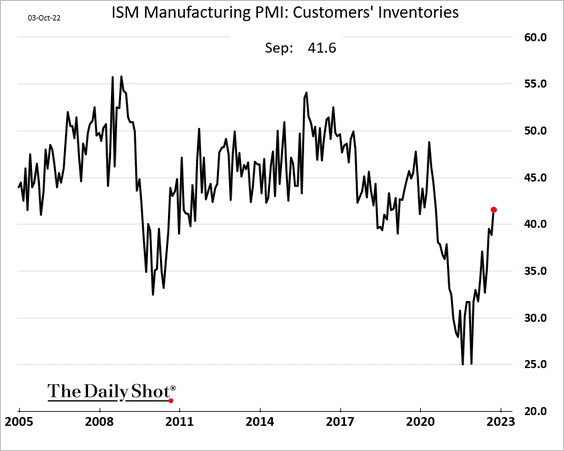

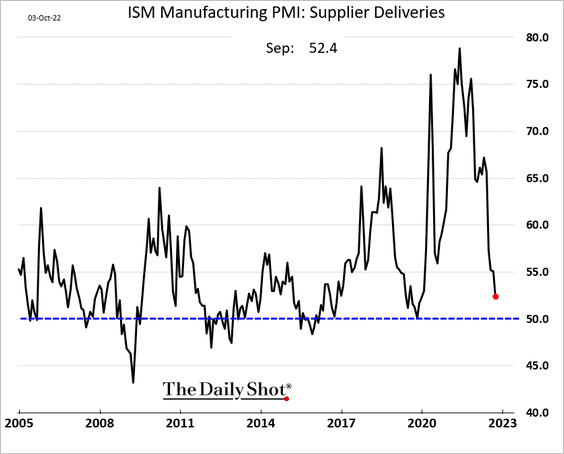

1. The ISM manufacturing PMI showed stalling growth in US factory activity.

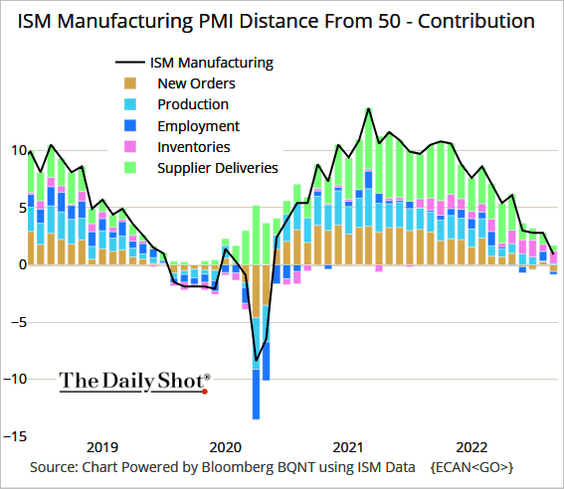

Orders and employment are now a drag on the PMI index.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

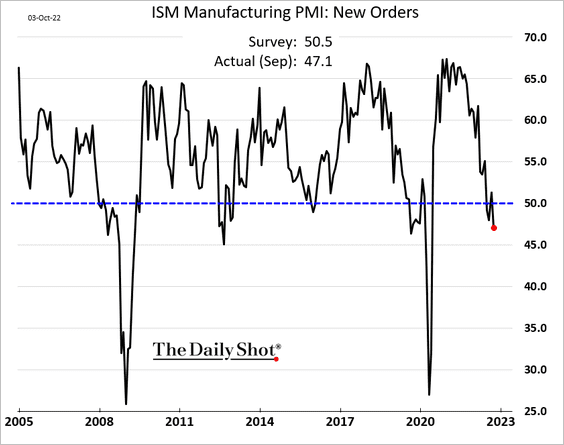

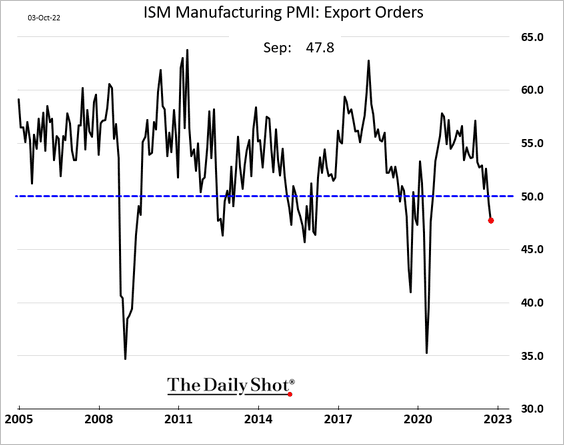

• New orders are shrinking (2 charts).

• Hiring has stopped.

• The backlog of orders is not growing.

• Customer inventories are rebounding.

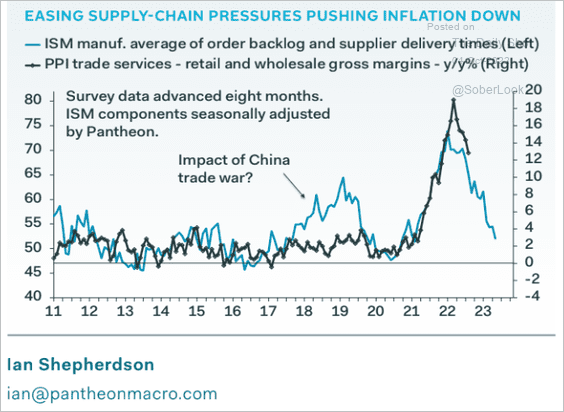

• Supply pressures continue to ease.

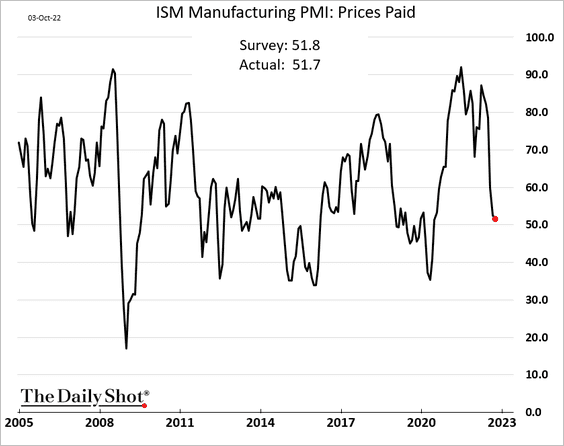

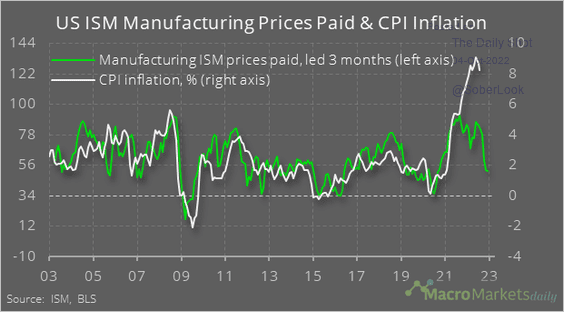

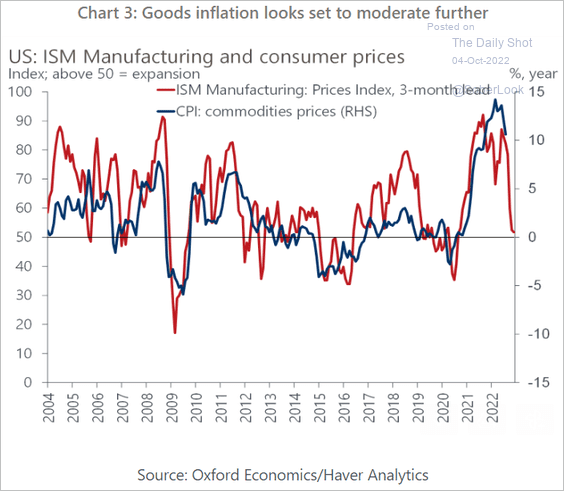

• Input price gains keep slowing, …

… which points to moderating inflation.

– The headline CPI vs. the ISM input price index:

Source: @macro_daily

Source: @macro_daily

– Goods CPI:

Source: Oxford Economics

Source: Oxford Economics

• The combination of faster supplier deliveries and shrinking order backlogs points to tighter corporate margins and lower PPI.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

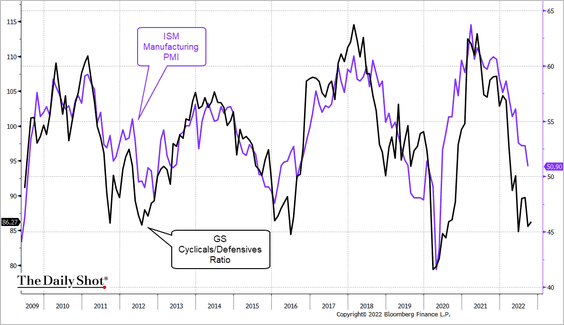

• The stock market suggests that we will see further declines in the ISM Manufacturing PMI. Here is the ratio of cyclical to defensive sectors vs. the ISM PMI.

——————–

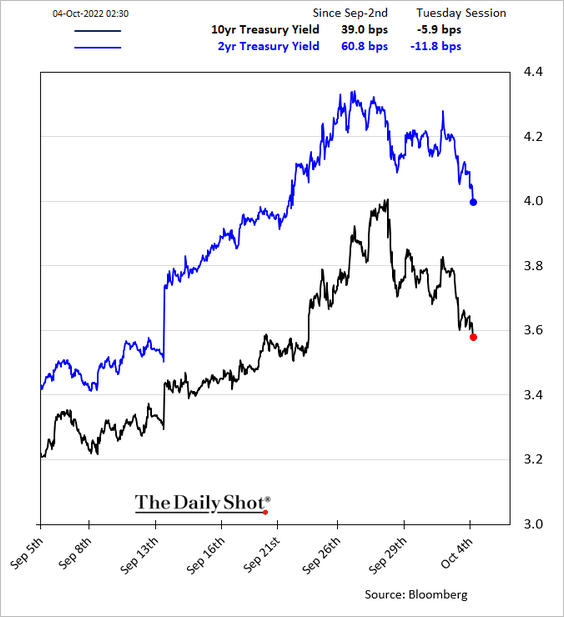

2. Treasury yields are moving lower.

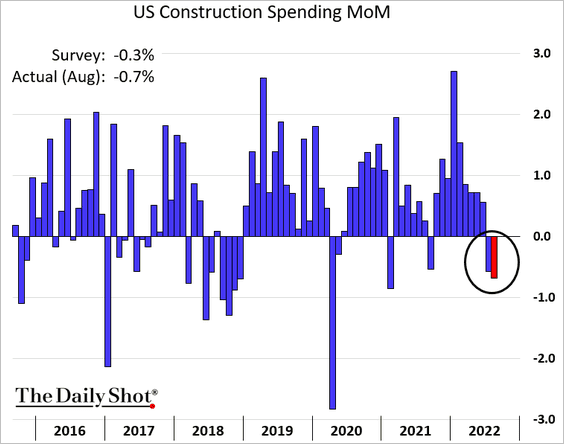

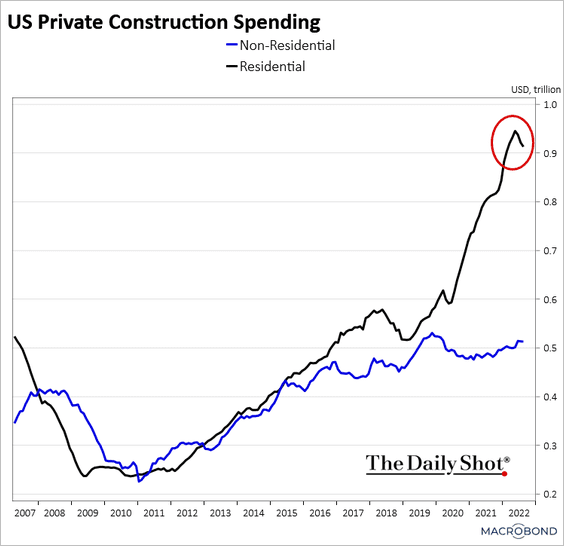

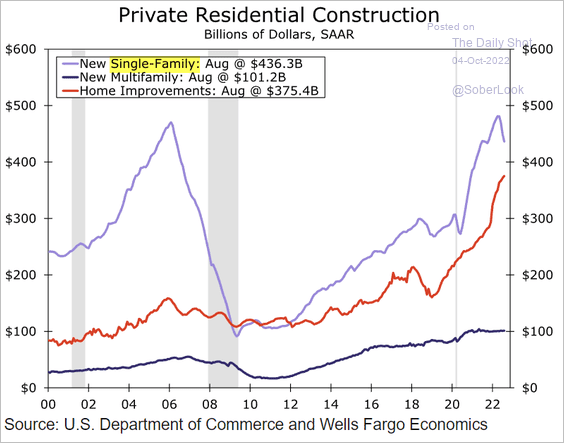

3. Construction spending declined again in August …

… driven by single-family housing (2 charts).

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

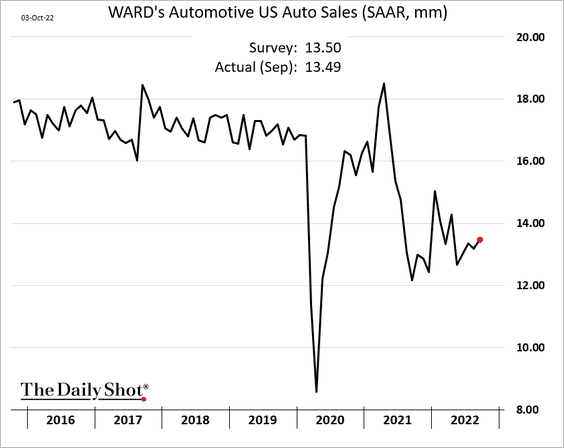

4. Auto sales edged higher in September.

GM sales picked up in Q3.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

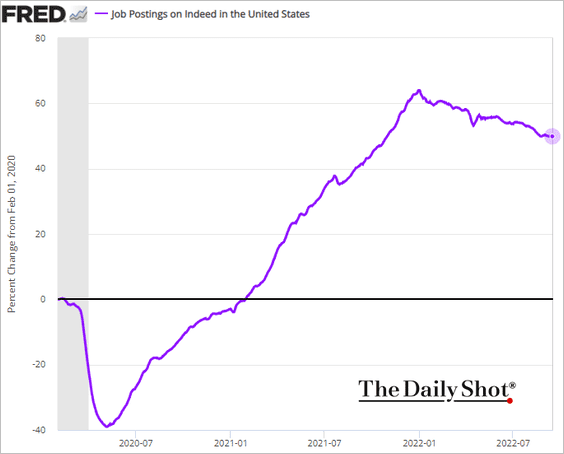

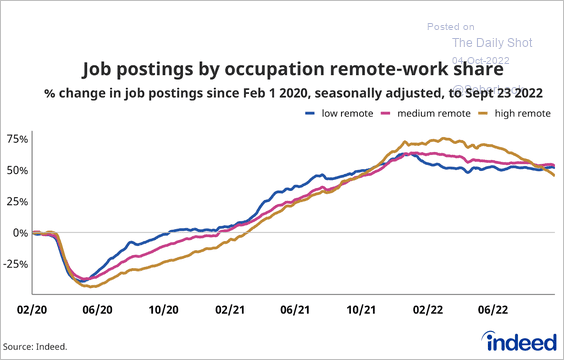

5. Job postings on Indeed continue to drift lower, but this rate of decline is not fast enough for the Fed. The goal is to get job openings to pre-COVID levels.

The decline in high-income postings has accelerated.

Source: @indeed

Source: @indeed

——————–

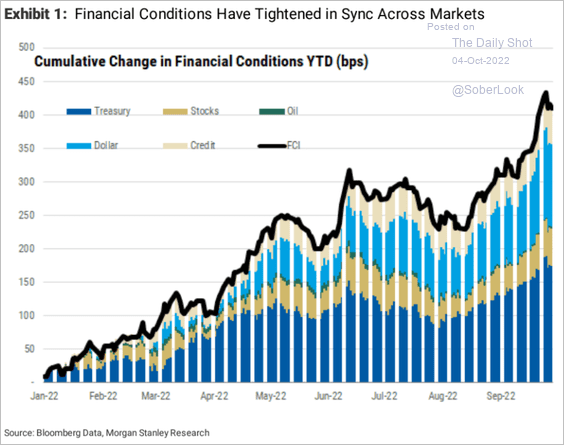

6. What are the drivers of tighter financial conditions?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

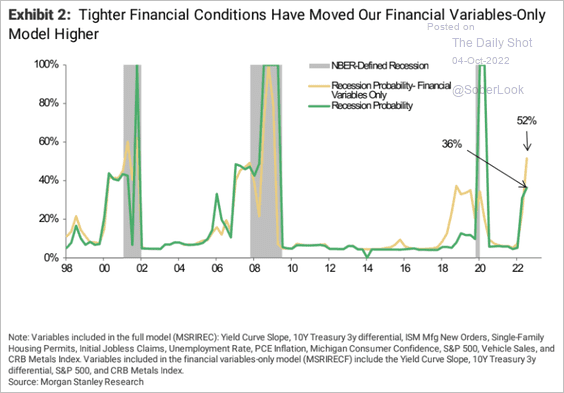

Will this tightening be enough to tip the economy into a recession? Here is a model from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Canada

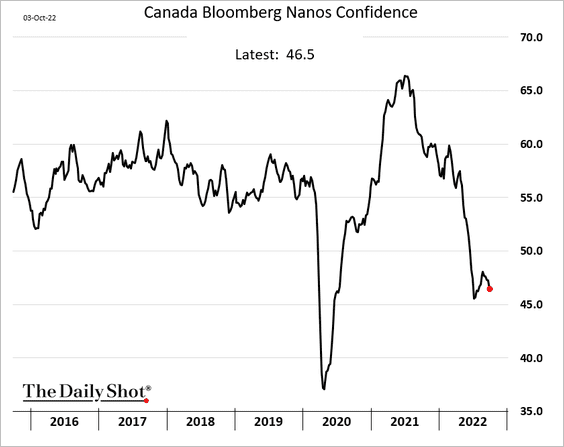

1. Consumer confidence remains depressed.

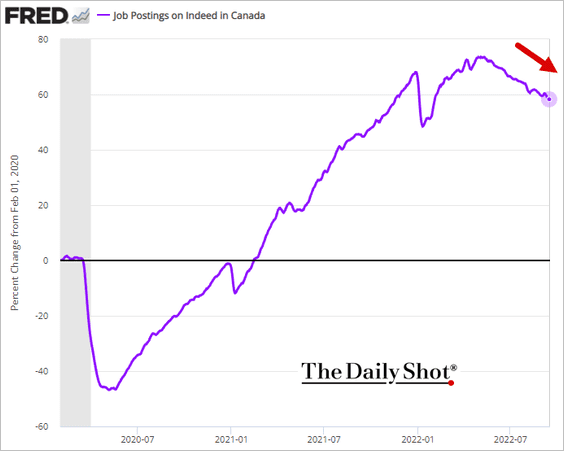

2. Job postings on Indeed continue to trend lower.

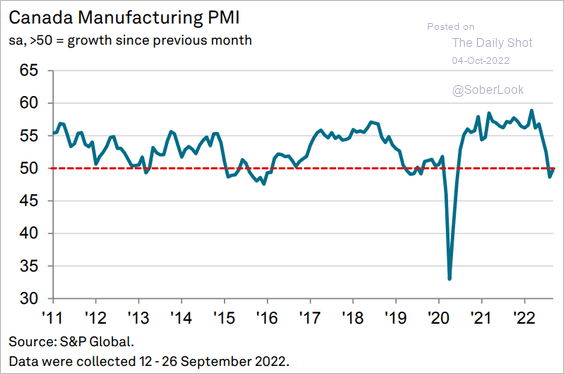

3. The PMI report shows no growth in factory activity.

Source: S&P Global PMI

Source: S&P Global PMI

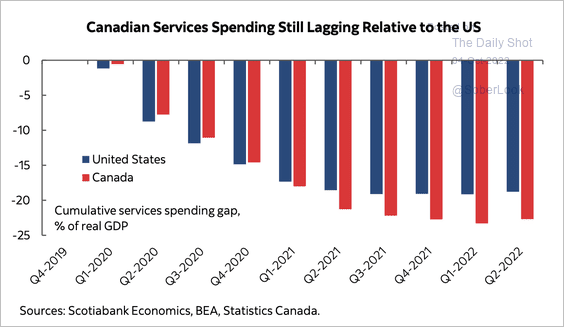

4. Canada’s pandemic-era slump in services spending has been deeper than in the US.

Source: Marc Ercolao; Scotiabank Economics

Source: Marc Ercolao; Scotiabank Economics

Back to Index

The United Kingdom

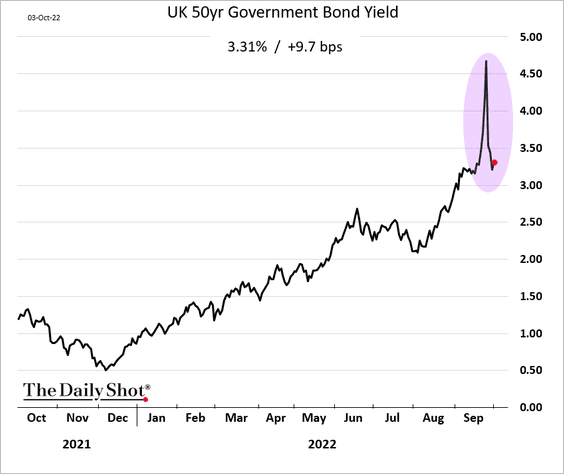

1. The volatility in long-term gilts has been extreme.

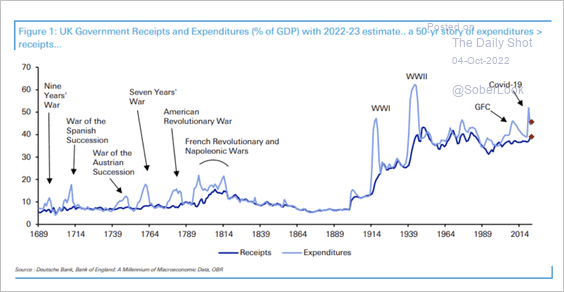

2. Here is a look at government spending and revenue throughout history.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The Eurozone

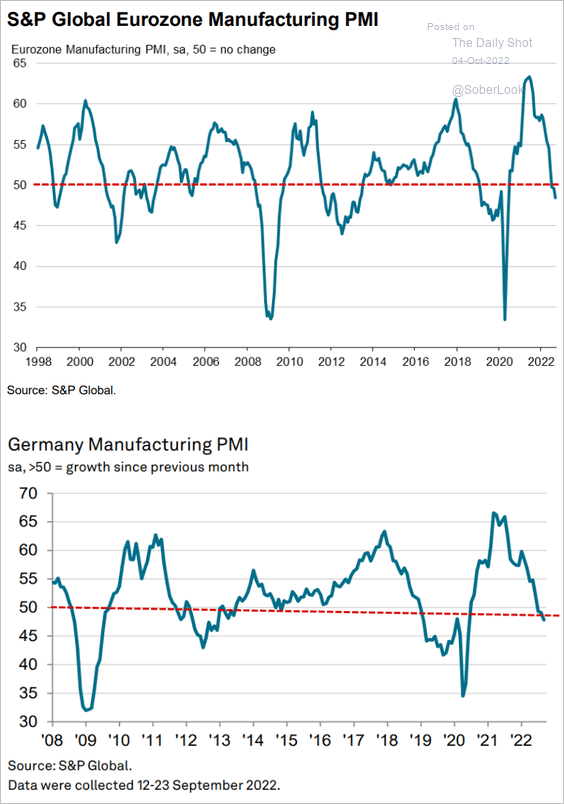

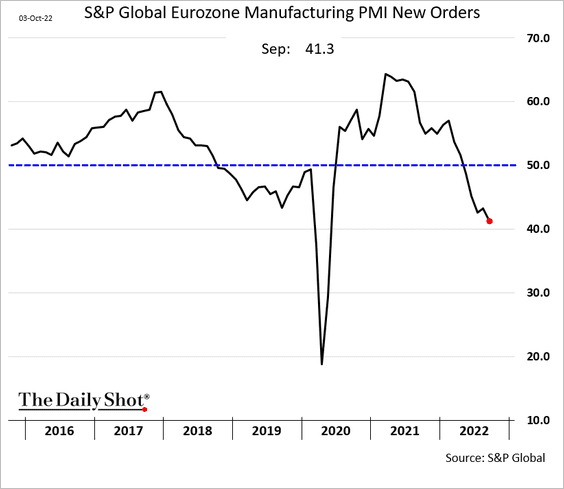

1. The September manufacturing PMI report points to a recession in the Eurozone …

Source: S&P Global PMI

Source: S&P Global PMI

… as manufacturing orders slump.

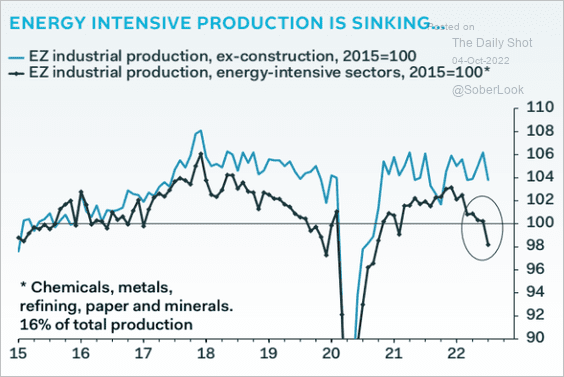

2. Energy-intensive sectors are in trouble.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

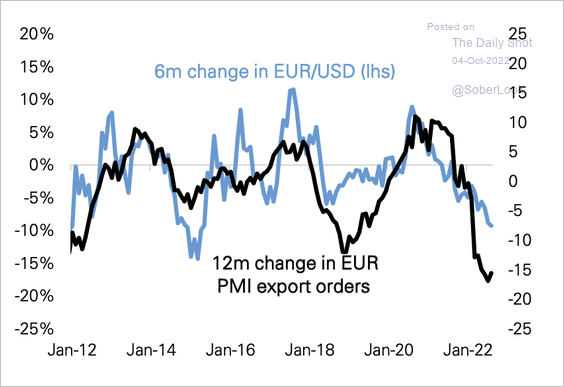

3. An inflection point in export order growth could eventually signal a rebound in EUR/USD.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

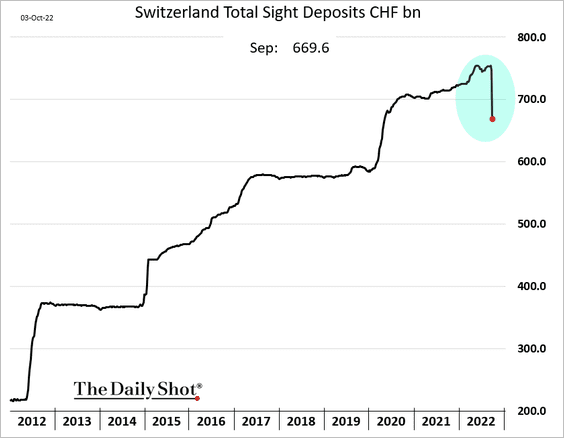

1. The Swiss central bank tightened monetary policy by sharply reducing liquidity last month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

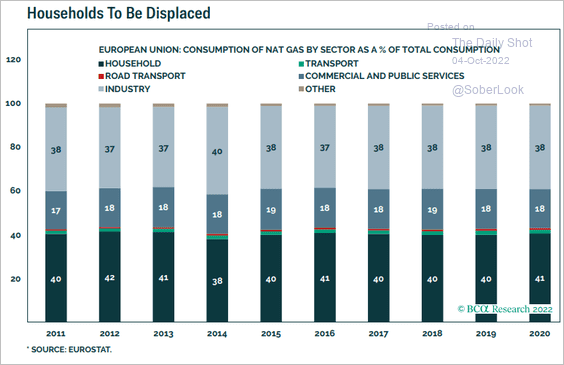

2. This chart shows natural gas consumption in the EU by sector.

Source: BCA Research

Source: BCA Research

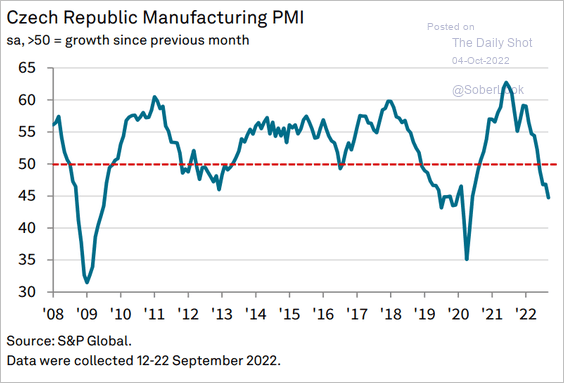

3. Czech Republic’s manufacturing sector is in a recession.

Source: S&P Global PMI

Source: S&P Global PMI

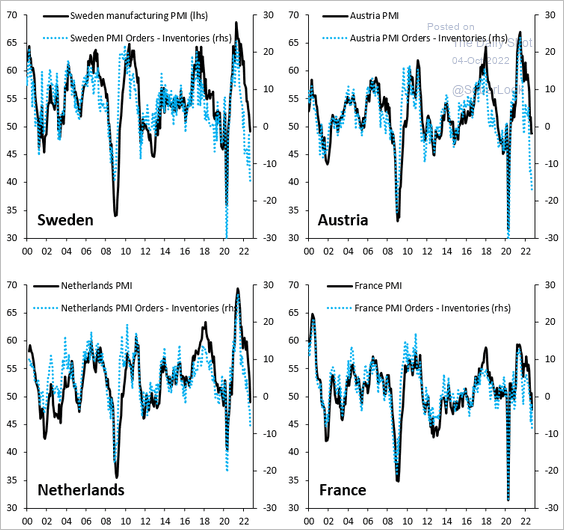

4. The spread between PMI indices of orders and inventories points to further economic pain in Europe.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

Back to Index

Japan

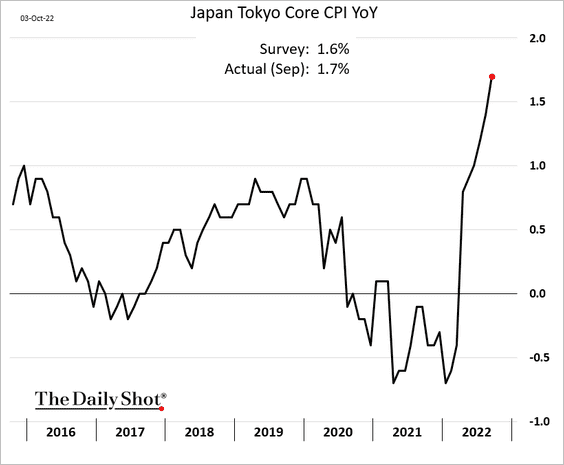

1. The Tokyo core CPI continued to climb in September.

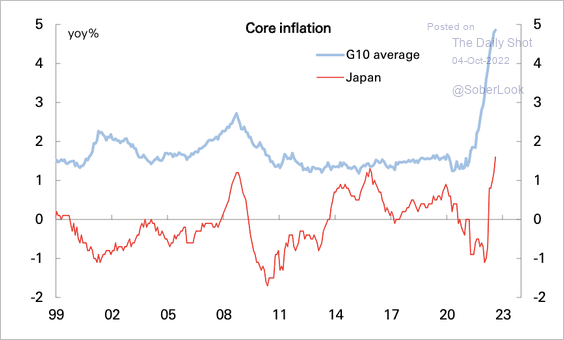

At the national level, inflation still lags behind peers markedly.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

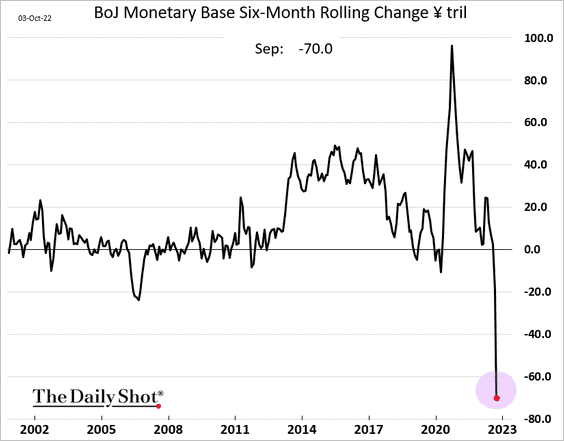

2. The BoJ has been conducting “stealth” tightening as the monetary base declines sharply.

Back to Index

Asia – Pacific

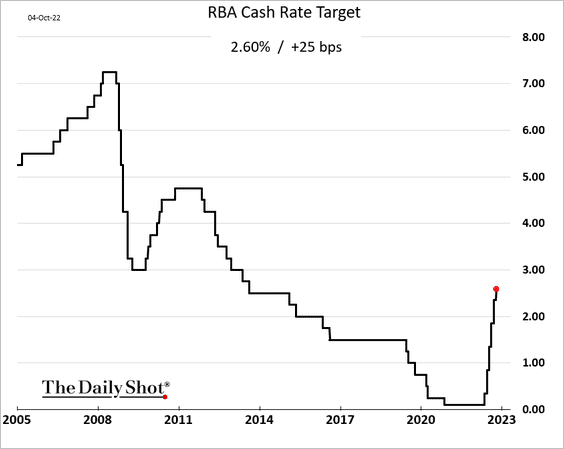

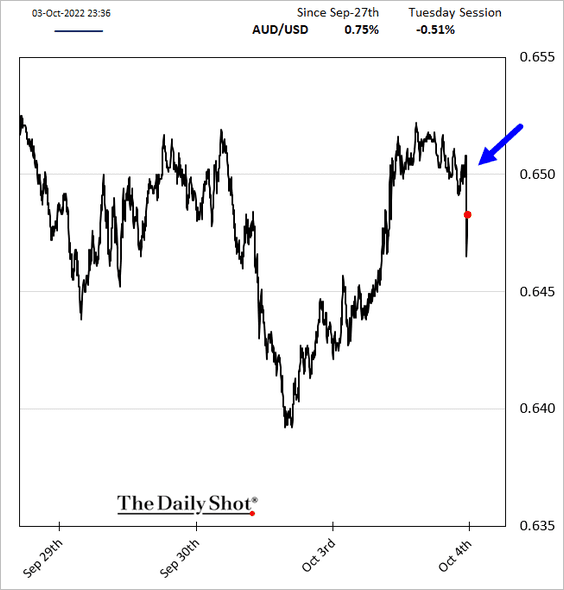

1. Let’s begin with Australia.

• The RBA surprised the markets with a lower-than-expected rate hike (25 bps rather than 50 bps).

The dovish shift sent the Aussie dollar lower, …

… while bonds rallied.

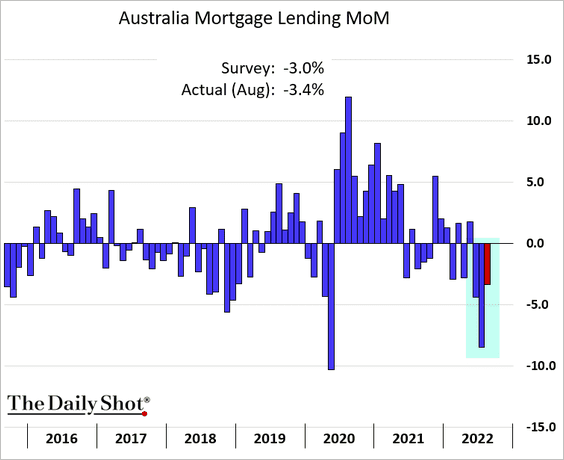

• Mortgage approvals were down again in August.

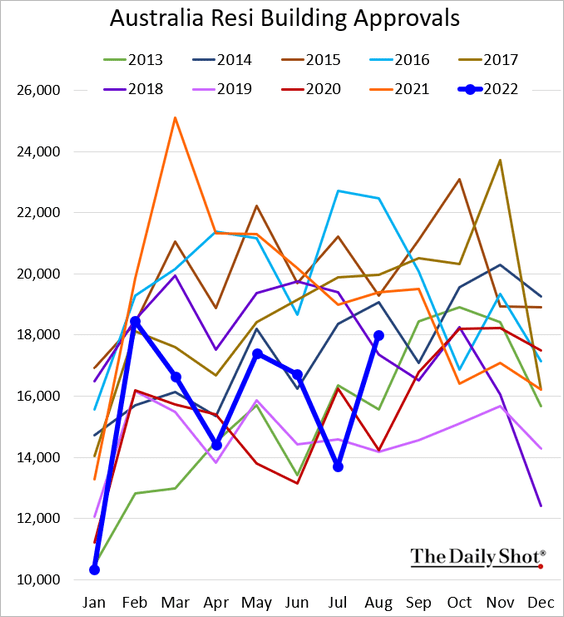

• Building approvals rebounded.

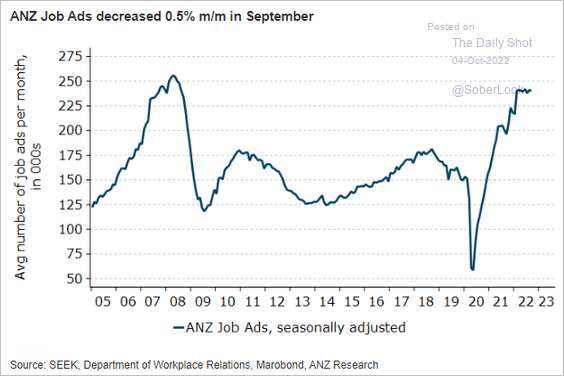

• The labor market remains tight.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

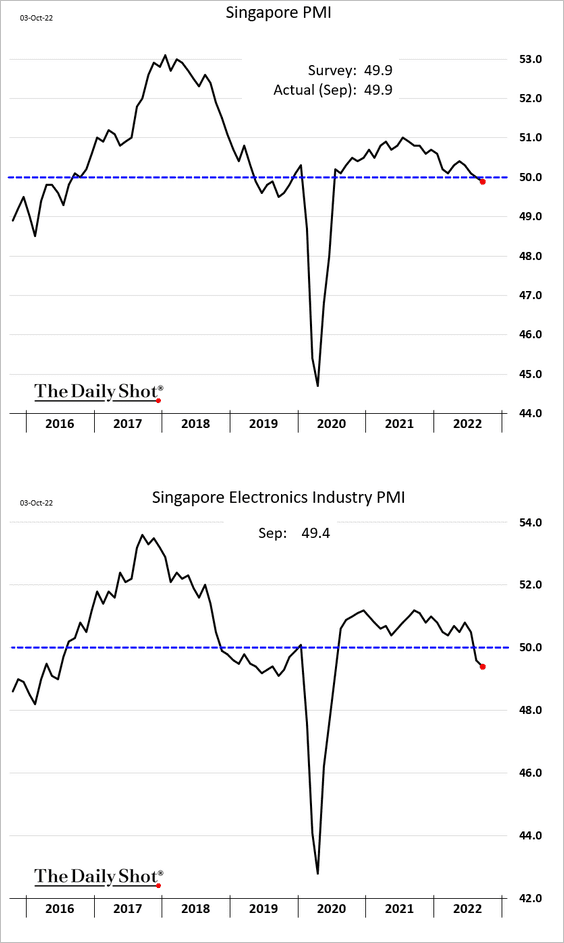

2. Singapore appears to be entering a recession.

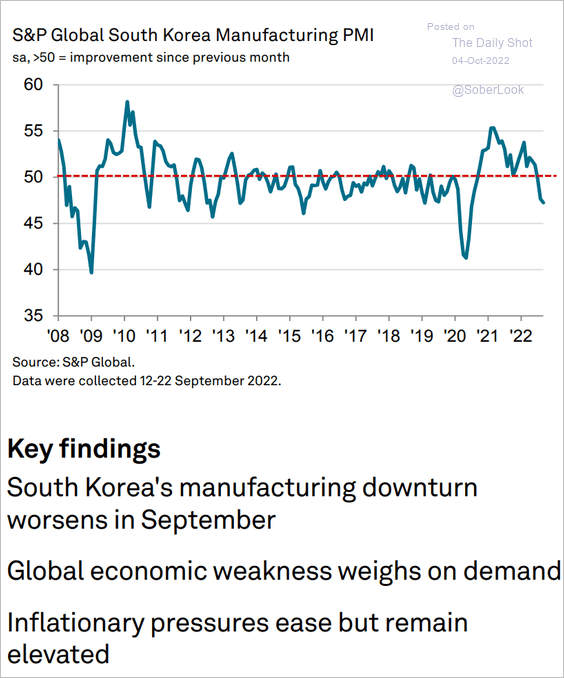

3. South Korea’s manufacturing contraction has accelerated.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

Emerging Markets

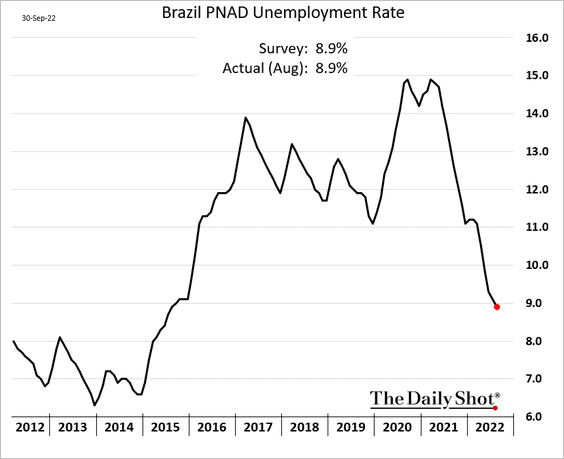

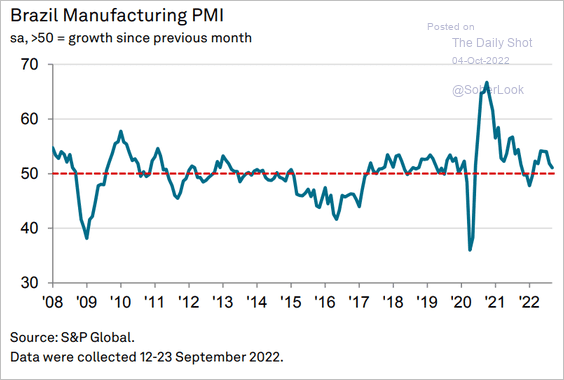

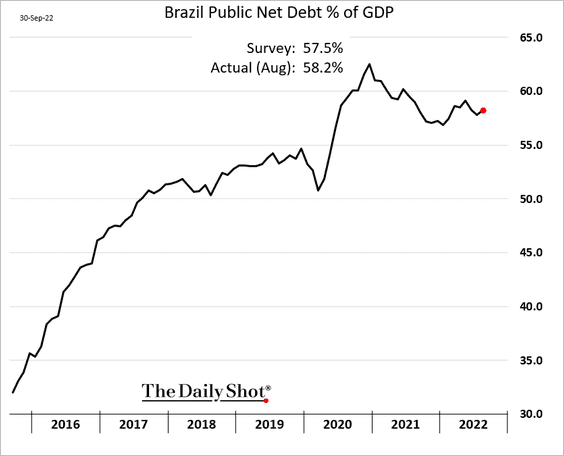

1. Let’s begin with Brazil.

• The unemployment rate keeps moving lower.

• Growth in factory activity has slowed.

Source: S&P Global PMI

Source: S&P Global PMI

• The debt-to-GDP ratio edged higher in August.

——————–

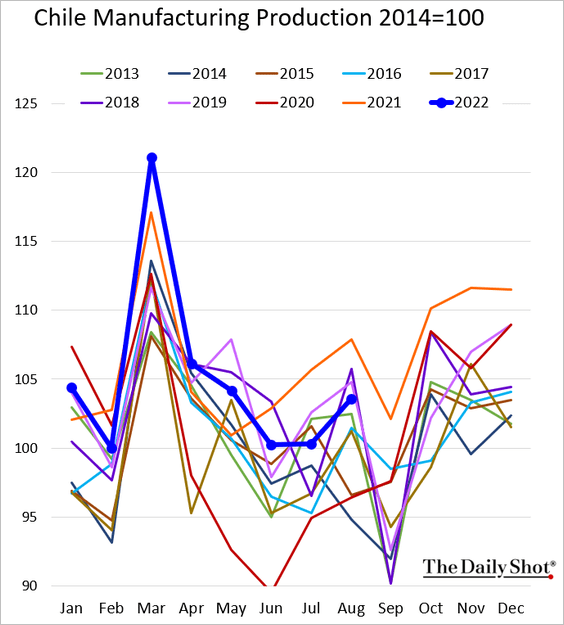

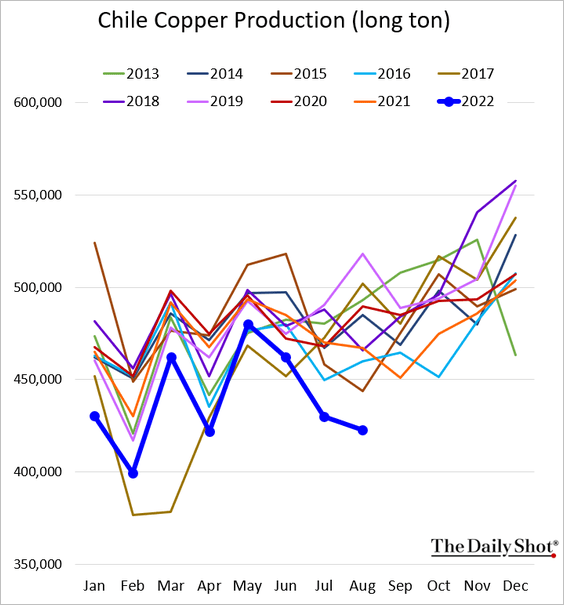

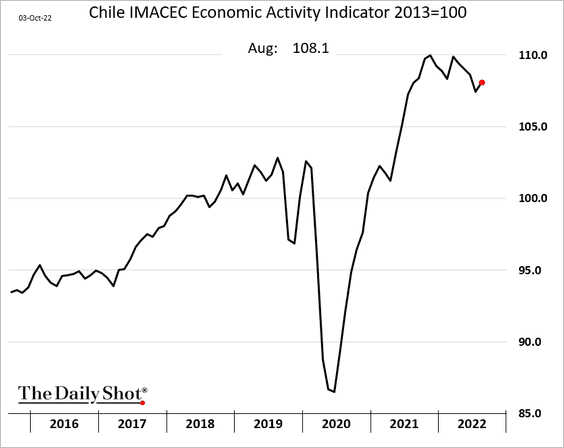

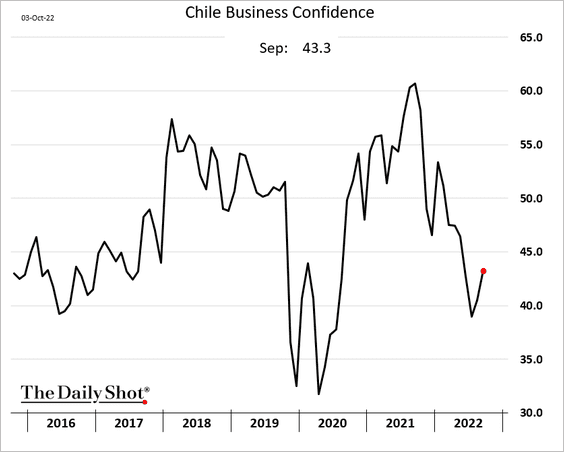

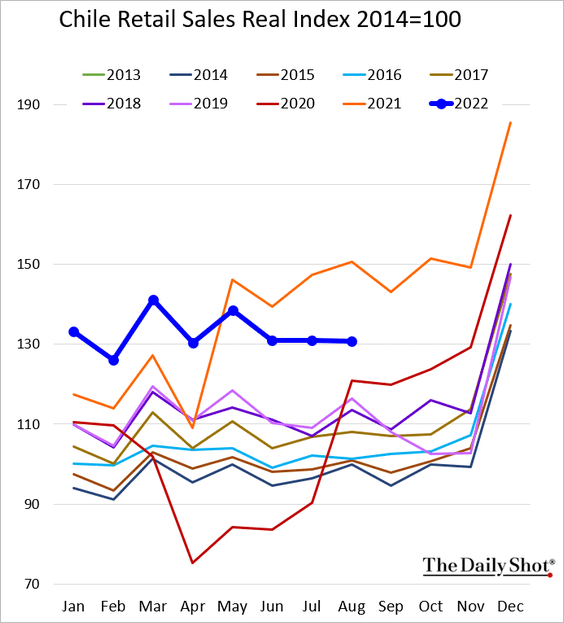

2. Next, we have some updates on Chile.

• Manufacturing output (some improvement from July):

• Copper production (a disaster):

• Economic activity (higher in August):

• Business confidence (an improvement in September):

• Retail sales (below last year’s level but holding up):

——————–

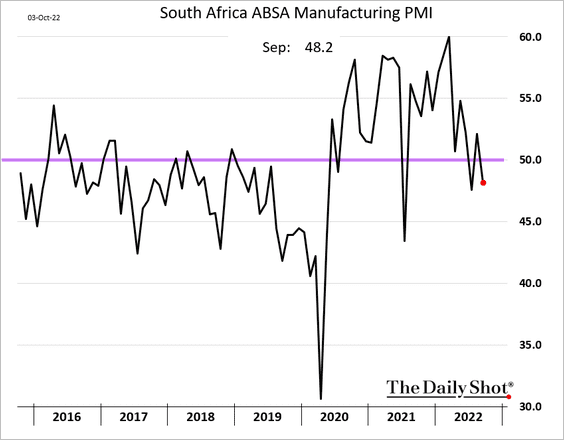

3. South Africa’s manufacturing is back in contraction territory.

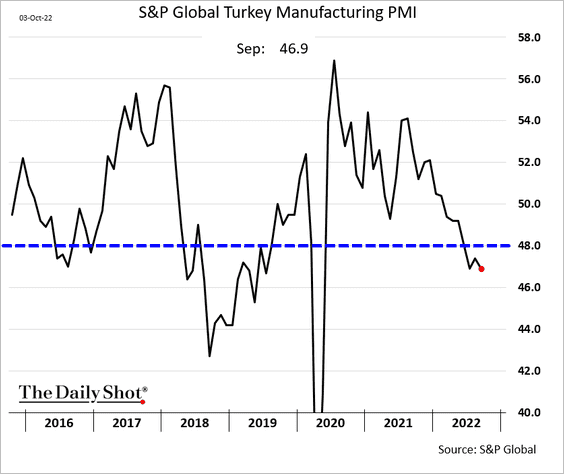

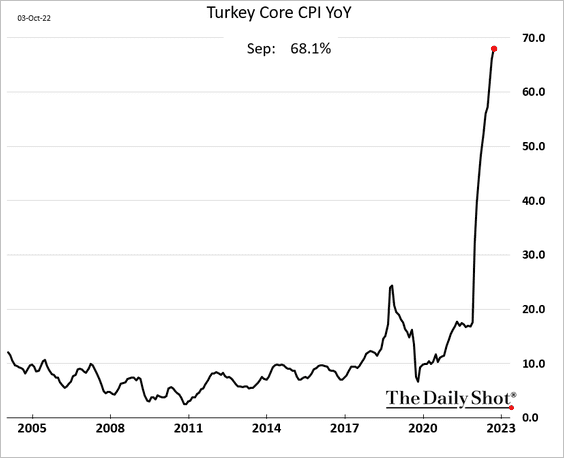

4. Turkey’s manufacturing decline accelerated last month.

The nation’s core CPI is now above 68%. Let’s cut rates some more and see what happens.

——————–

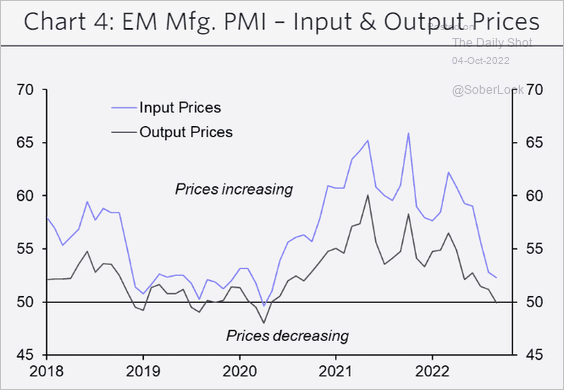

5. PMI data suggests that EM price pressures are receding.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

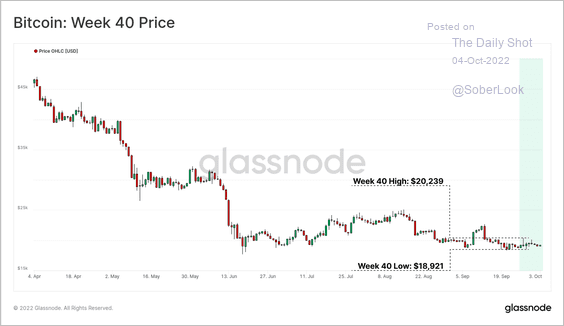

1. Bitcoin has traded in a tight range this summer.

Source: Glassnode Read full article

Source: Glassnode Read full article

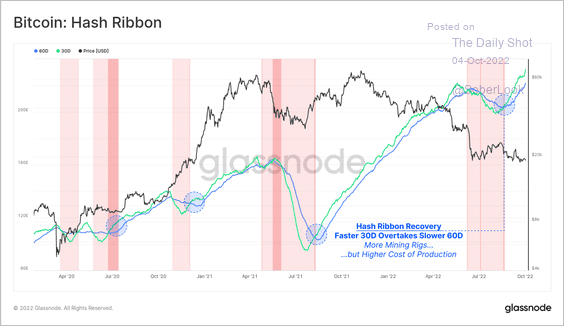

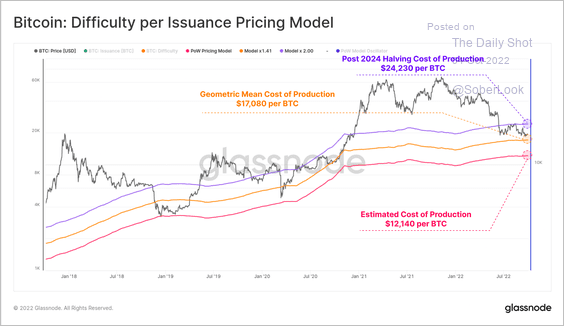

2. Bitcoin mining conditions are starting to improve as competition increases. So far, BTC’s price has not provided an incentive to miners this cycle.

Source: Glassnode Read full article

Source: Glassnode Read full article

Here are some estimated production costs for BTC mining operations.

Source: Glassnode Read full article

Source: Glassnode Read full article

——————–

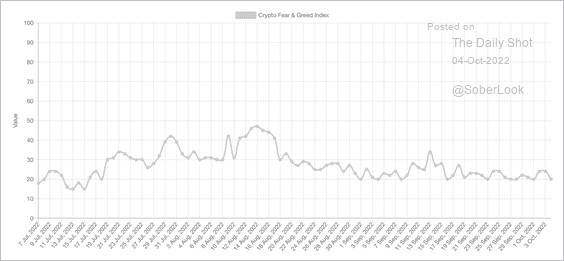

3. The Crypto Fear & Greed Index remains stuck in extreme fear mode.

Source: Alternative.me

Source: Alternative.me

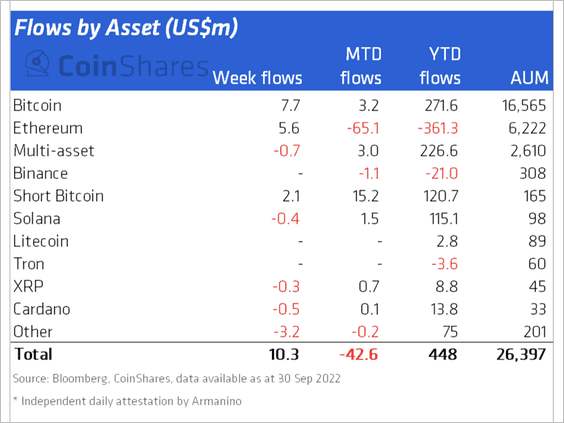

4. Crypto funds saw minor inflows last week led by Bitcoin and Ethereum-focused products.

Source: CoinShares Read full article

Source: CoinShares Read full article

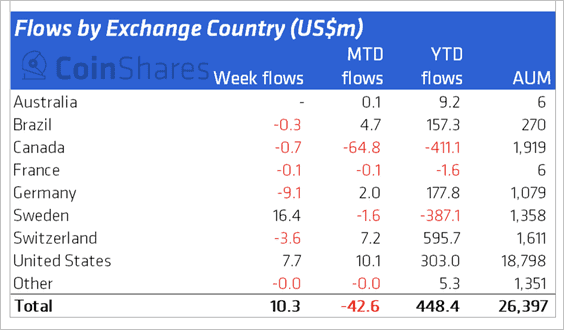

Switzerland and the US accounted for most fund inflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

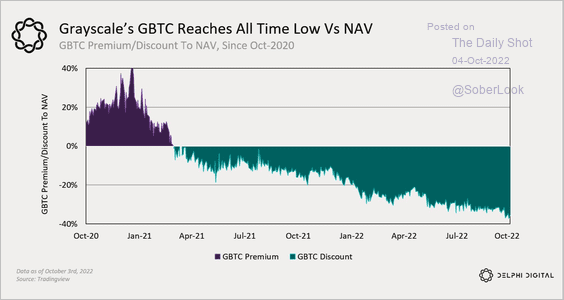

5. The Grayscale Bitcoin Trust’s (GBTC) discount to NAV reached an all-time low.

Source: @Delphi_Digital

Source: @Delphi_Digital

Back to Index

Commodities

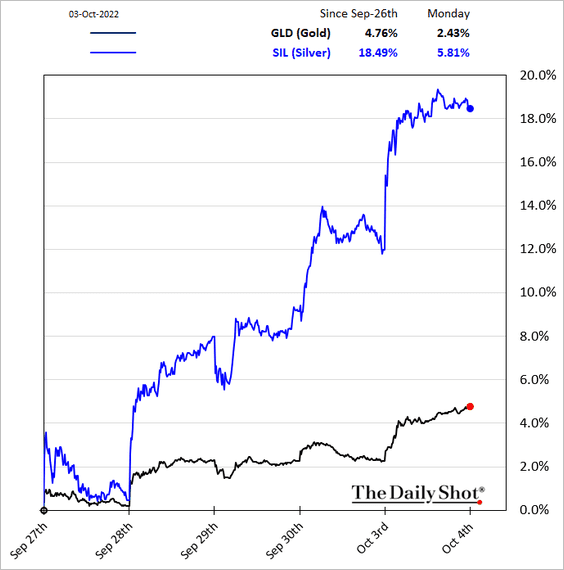

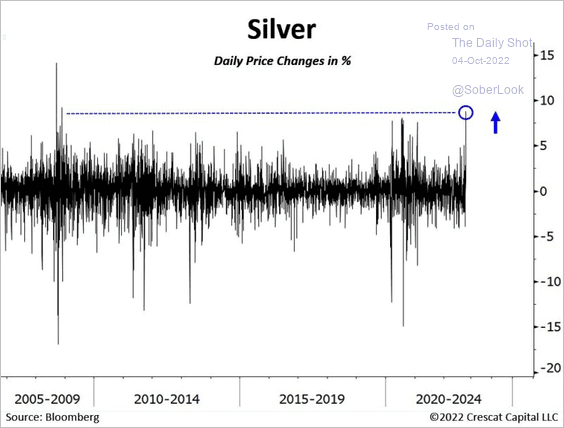

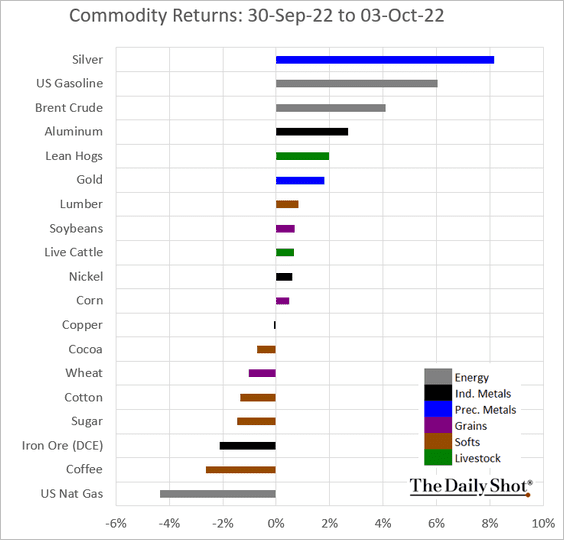

1. Precious metals jumped on Monday as the dollar and Treasury yields moved lower. Silver surged (3 charts).

Source: @TaviCosta

Source: @TaviCosta

——————–

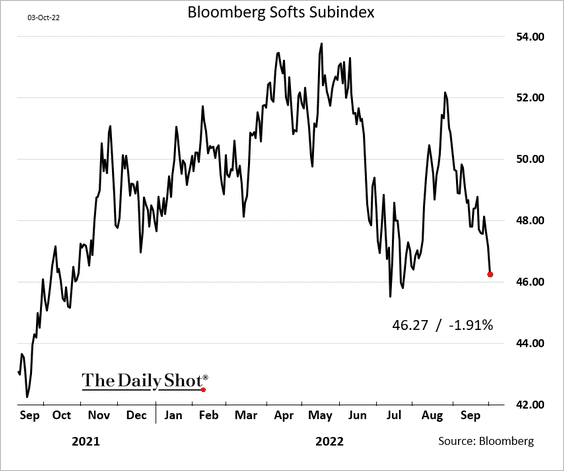

2. Softs are under pressure.

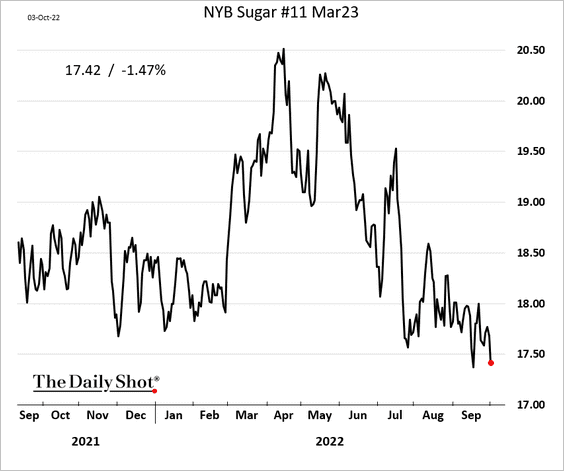

Here is sugar.

Back to Index

Energy

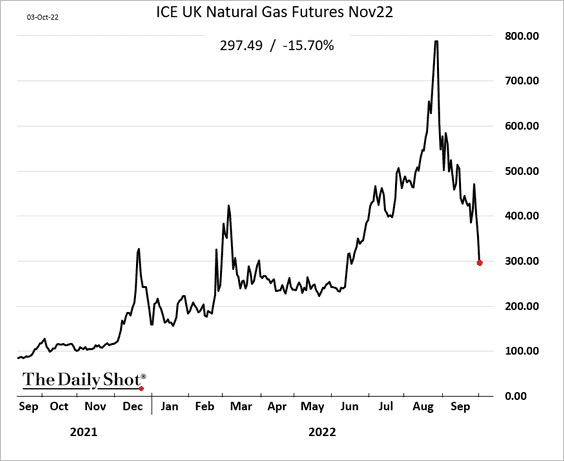

1. European natural gas prices keep falling despite Russia’s attempts to squeeze the market.

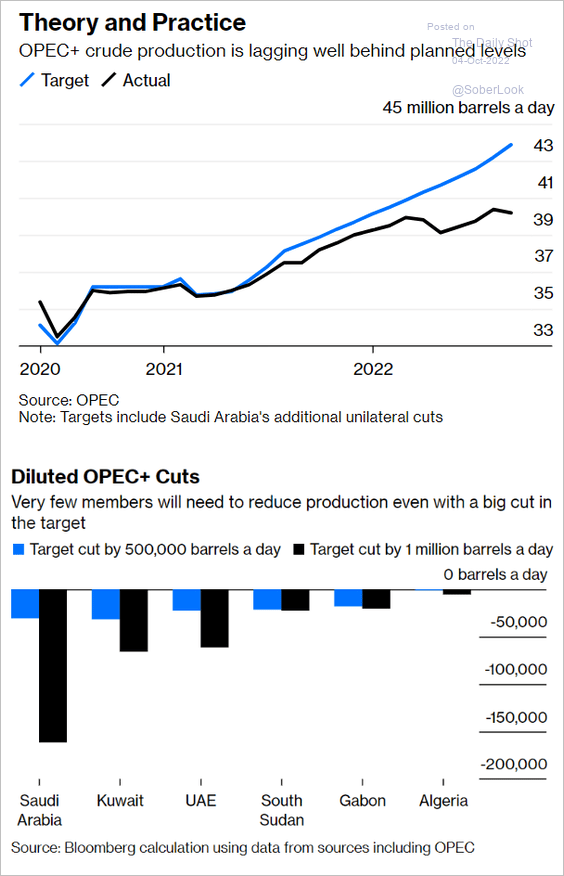

2. OPEC’s production has diverged sharply from targets.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Equities

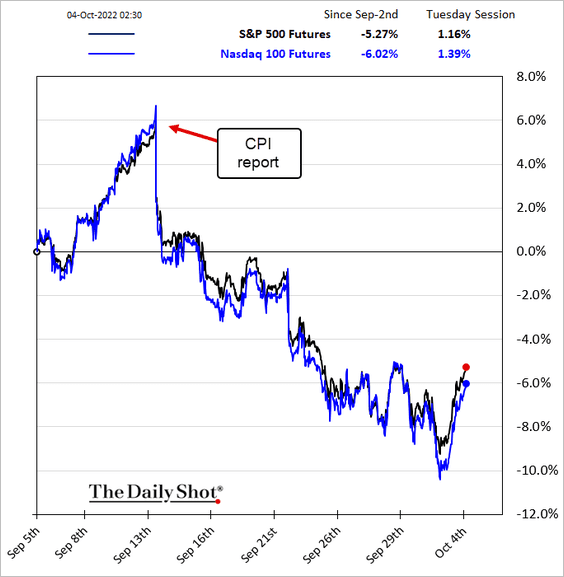

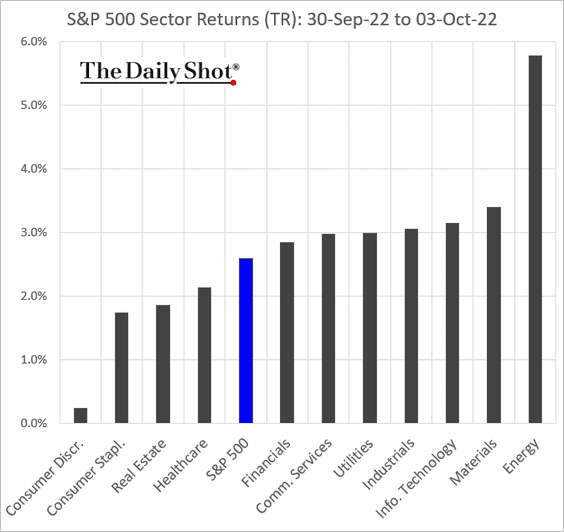

1. Stocks jumped as the dollar and Treasury yields moved lower. Hedge funds and institutions are short or massively underinvested.

The energy sector outperformed on Monday.

——————–

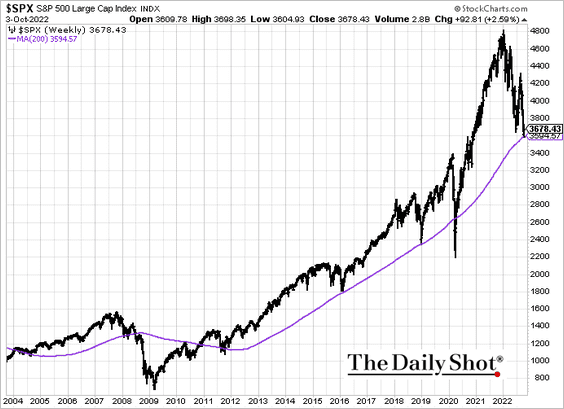

2. The S&P 500 held support at the 200-week moving average.

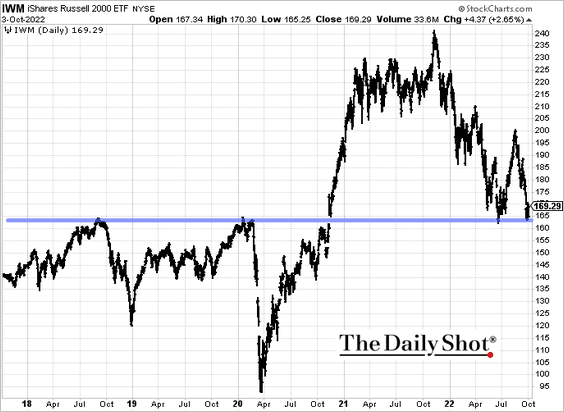

3. The Russell 2000 (IWM) has been testing support.

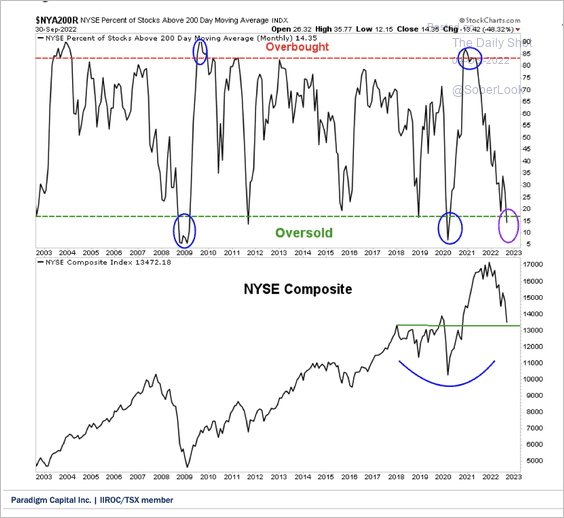

4. Last week, the percent of NYSE Composite stocks above their 200-day moving average reached the lowest level since the 2020 pandemic crash.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

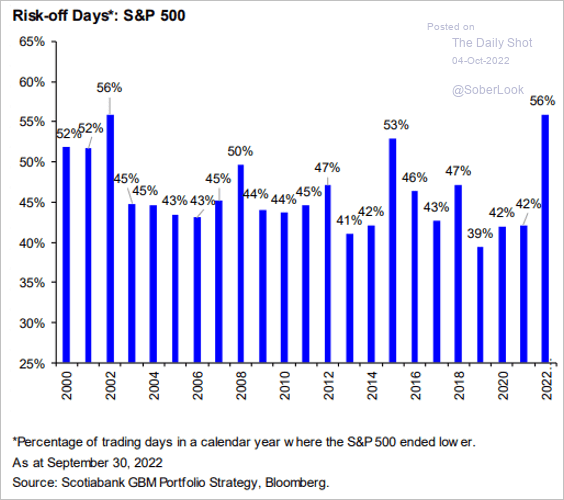

5. We’ve had a lot of risk-off days this year.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

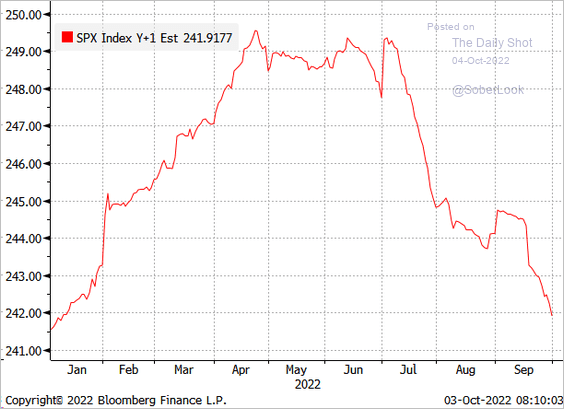

6. The S&P 500 2023 earnings estimates continue to decline.

Source: @MichaelMOTTCM

Source: @MichaelMOTTCM

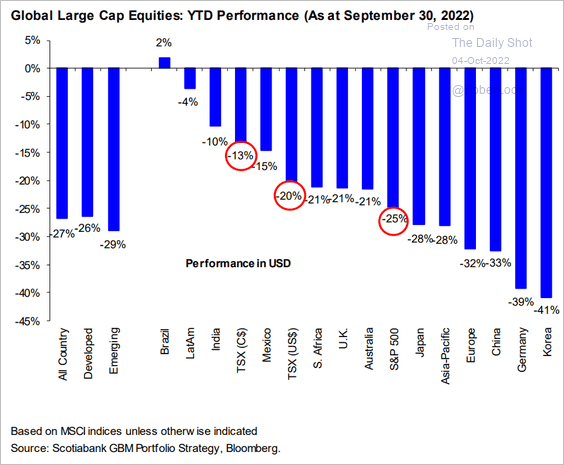

7. How did large-cap indices around the world perform last month?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

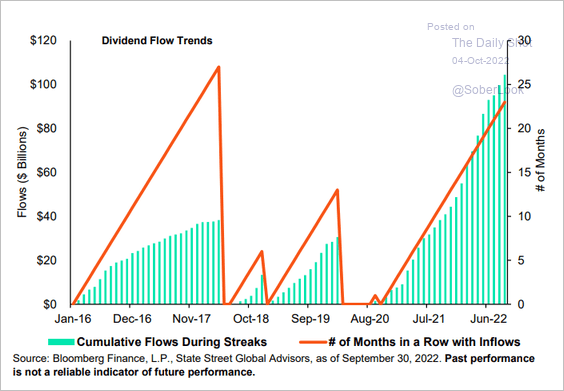

8. Dividend ETFs continue to see inflows.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

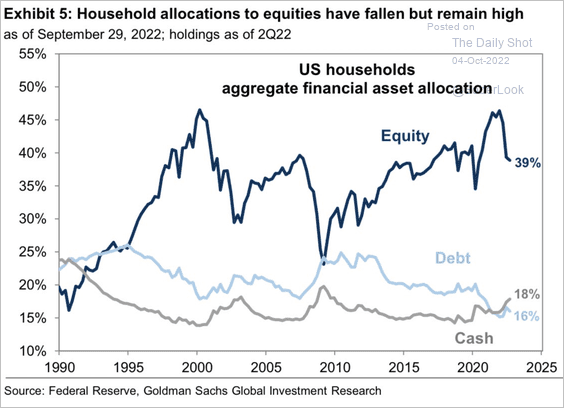

9. US households remain heavily exposed to stocks.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

Back to Index

Credit

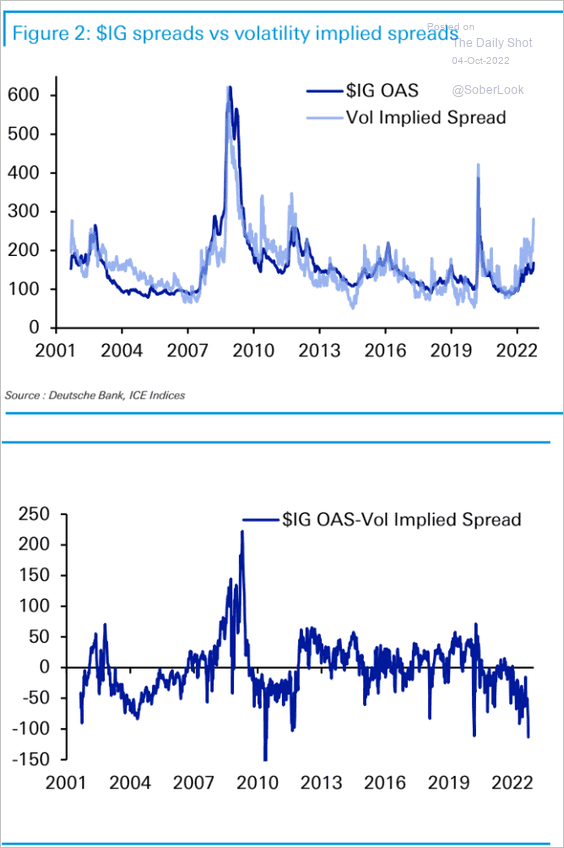

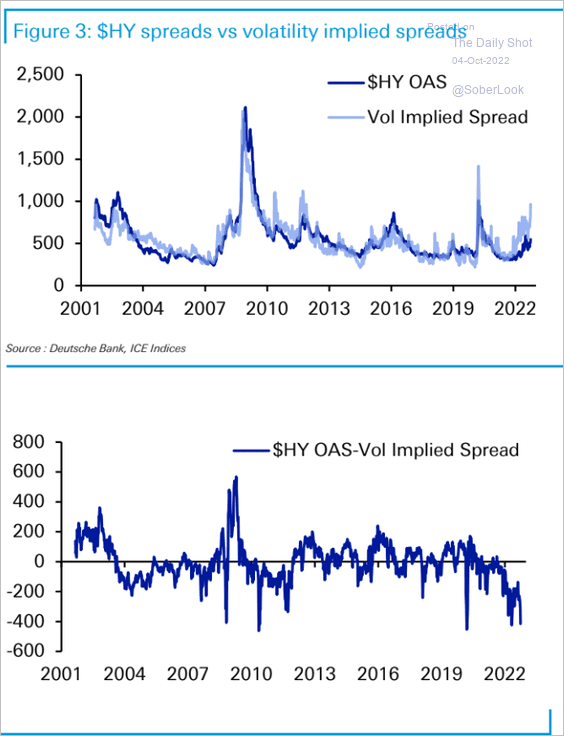

Increased market volatility suggests that corporate bond spreads should be wider.

• Investment grade:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• High yield:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Rates

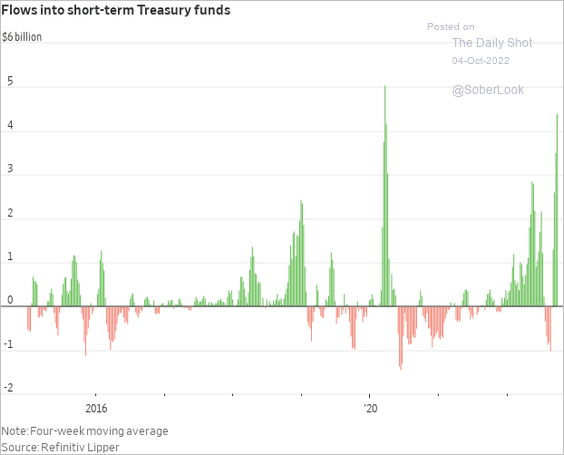

1. Flows into short-term Treasury funds surged in recent weeks.

Source: @WSJ Read full article

Source: @WSJ Read full article

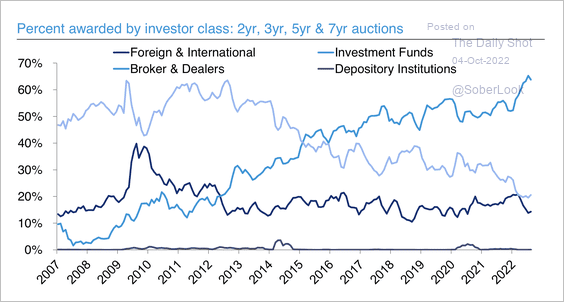

Investment fund demand for short and intermediate-term Treasuries at auction rose to new highs this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

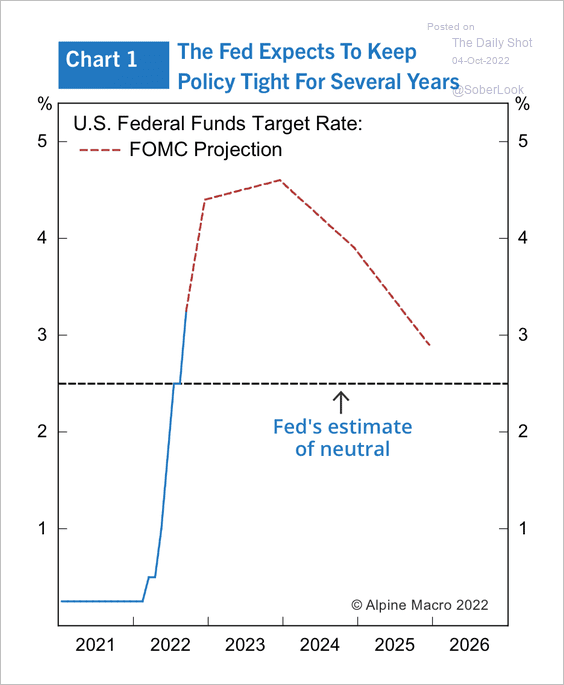

2. The fed funds rate is expected to peak at the end of 2023, according to Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Global Developments

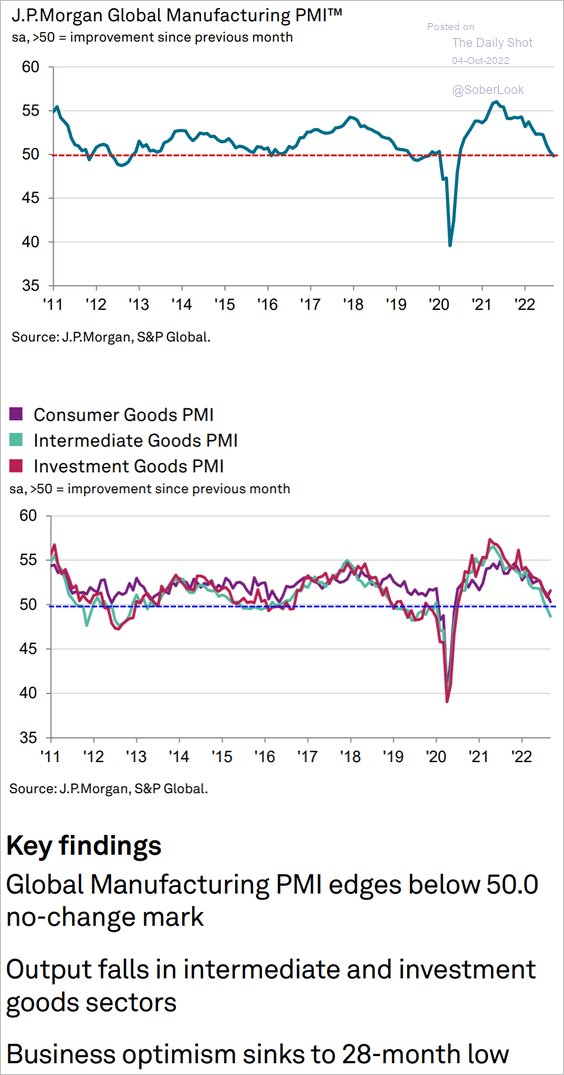

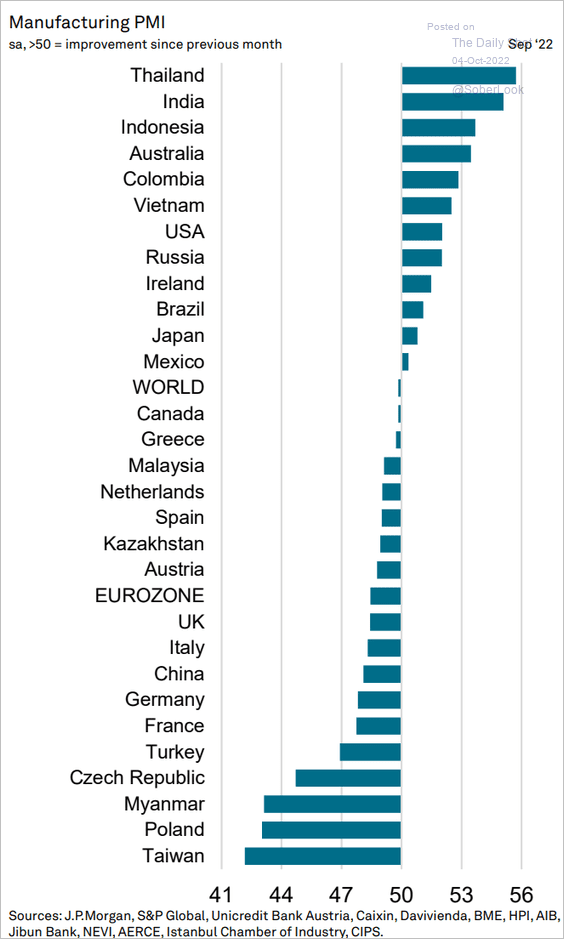

1. Global manufacturing growth has stalled.

Source: S&P Global PMI

Source: S&P Global PMI

Here are the PMI indicators by country (PMI < 50 means contraction).

Source: S&P Global PMI

Source: S&P Global PMI

——————–

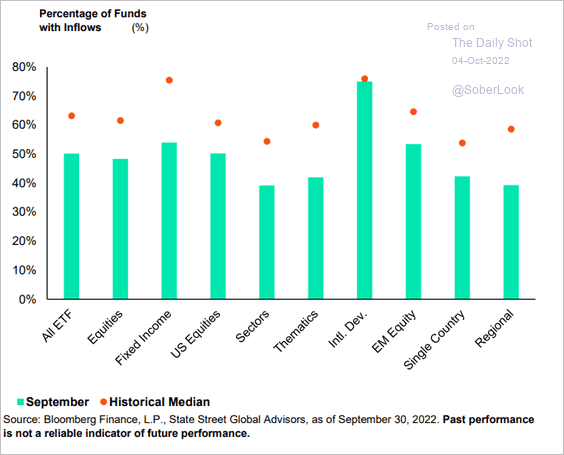

2. This chart shows the percentage of funds that saw inflows in September.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

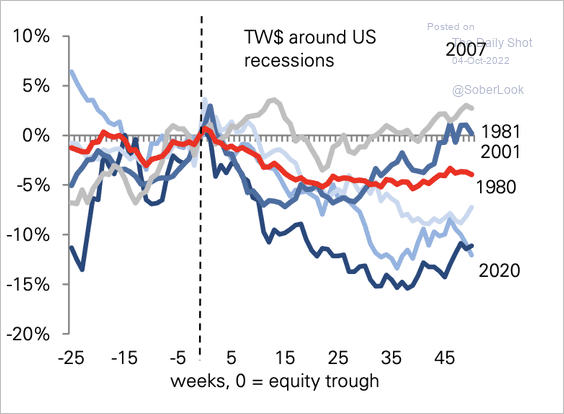

3. In previous recessions, the low in equities occurred alongside a peak in the dollar.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

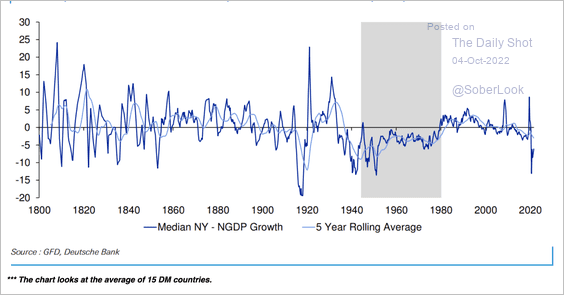

4. Nominal sovereign bond yields remained well below nominal GDP growth during the post-WWII deleveraging period, and debt funding is still relatively cheap today. Deutsche Bank expects yields to move closer to parity with GDP next year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

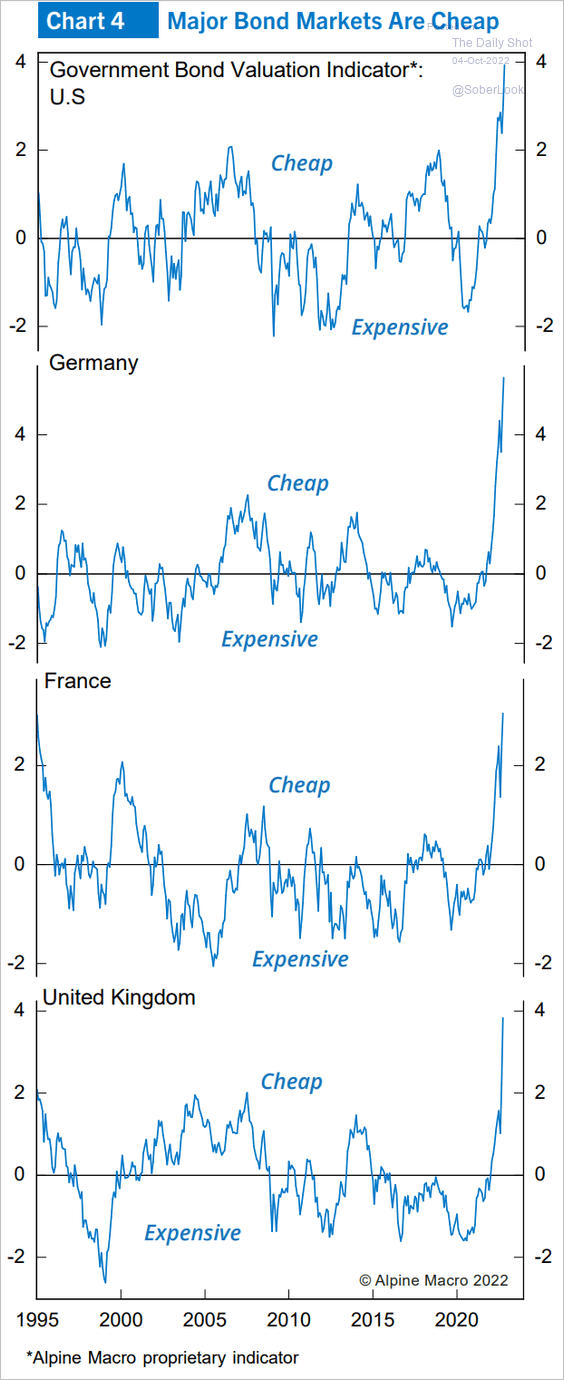

5. Government bonds look attractive.

Source: Alpine Macro

Source: Alpine Macro

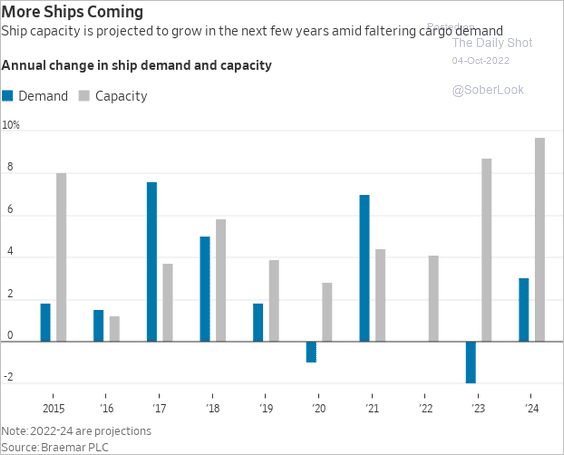

6. Will the cargo ship sector face overcapacity in the years ahead?

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

Food for Thought

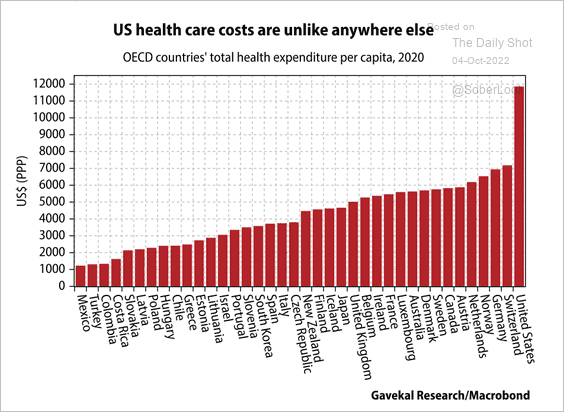

1. Health spending per capita:

Source: Gavekal Research

Source: Gavekal Research

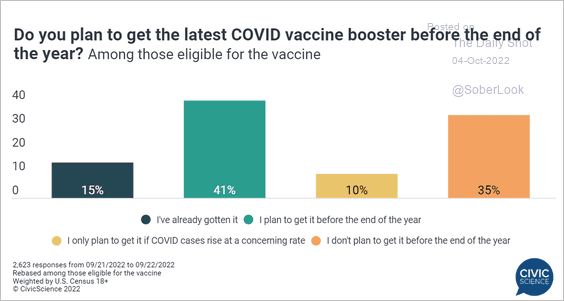

2. Getting the latest COVID booster:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

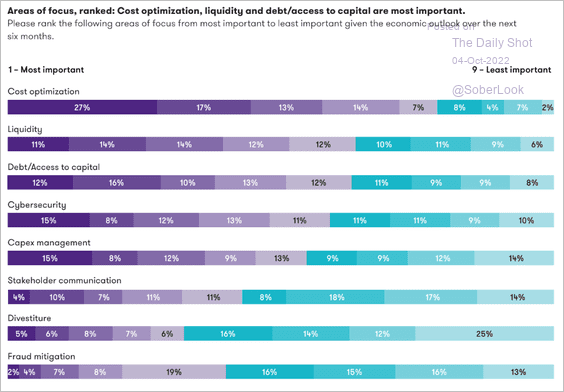

3. Corporate CFOs’ areas of focus:

Source: Grant Thornton Read full article

Source: Grant Thornton Read full article

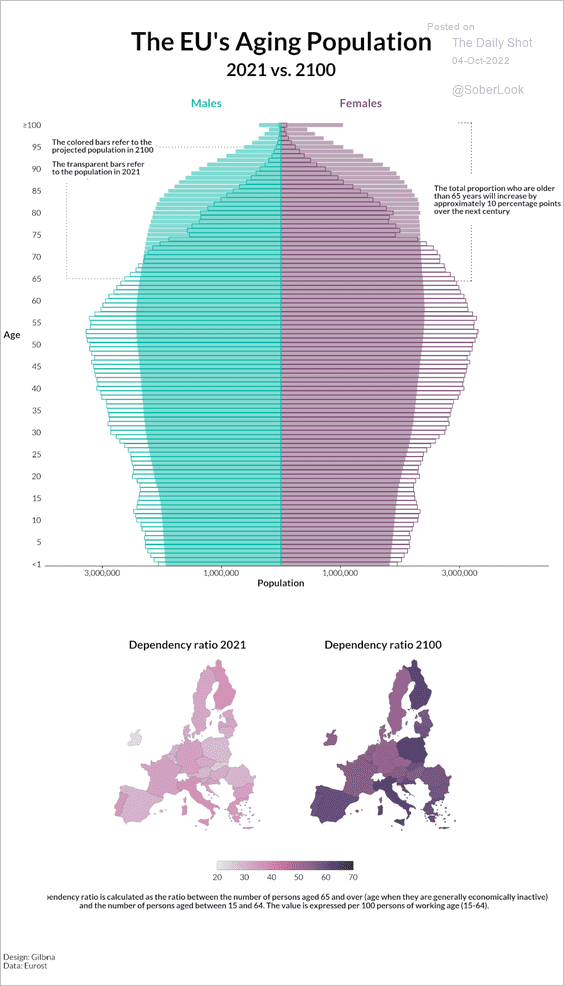

4. The EU’s aging population:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

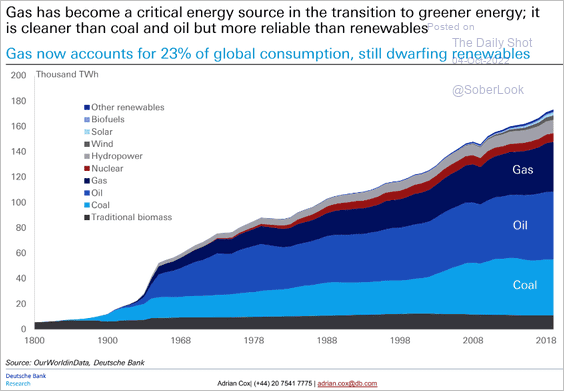

5. Increasing importance of natural gas in global energy consumption:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

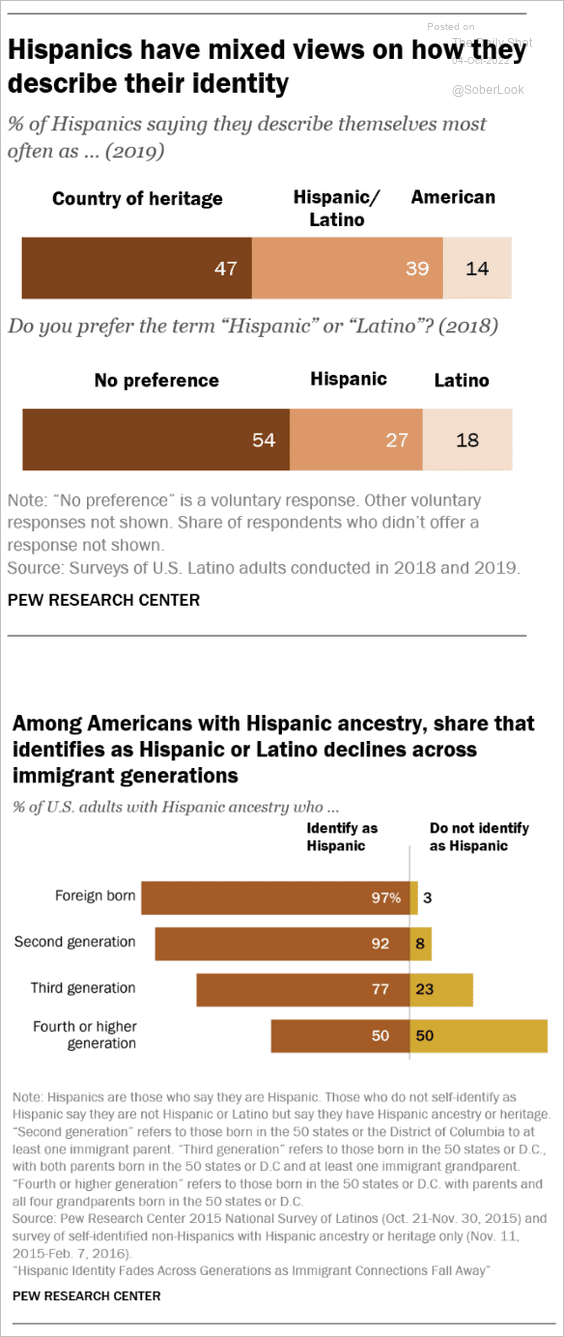

6. How Hispanic and Latino Americans describe their identity:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

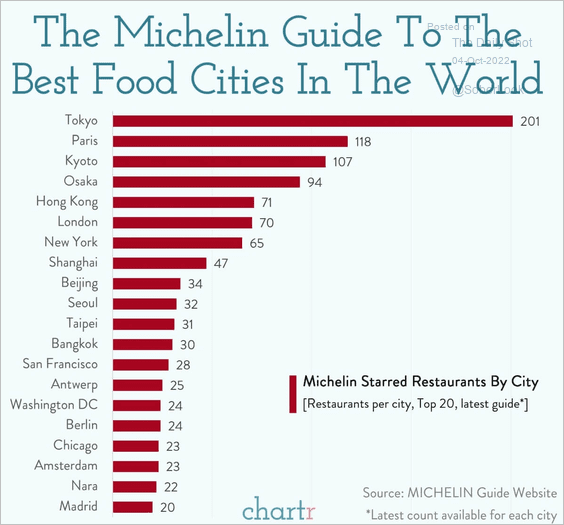

7. The best food cities:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index