The Daily Shot: 05-Oct-22

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

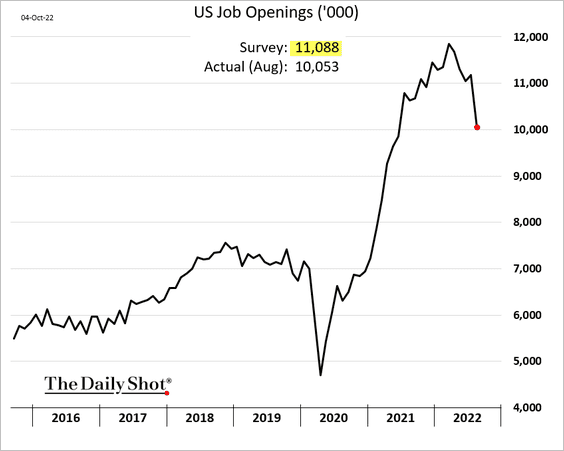

1. The August job openings report surprised to the downside, an indication that the labor market is finally starting to ease. From the Fed’s perspective, this is good news.

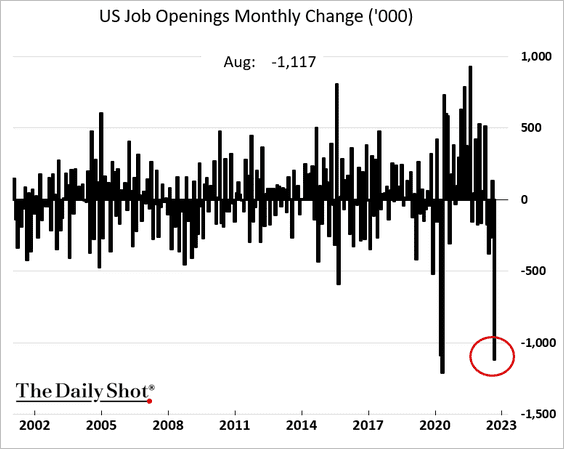

The monthly decline was substantial.

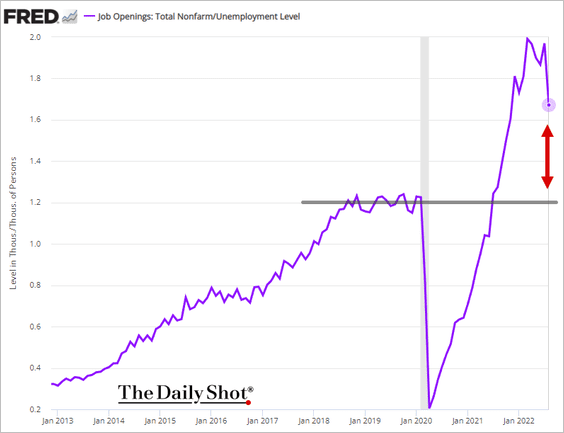

However, there is still a long way to go to bring the labor market balance to pre-COVID levels. Here is the number of openings per unemployed American.

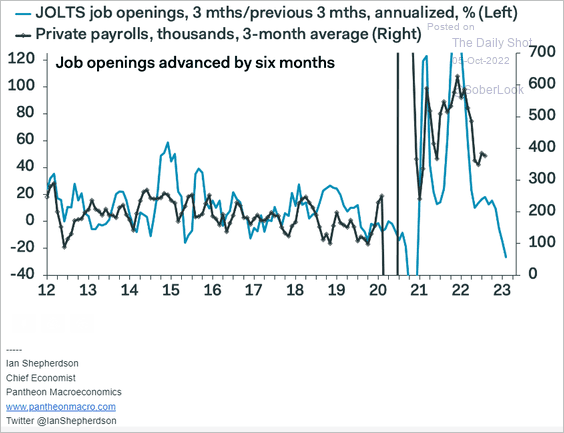

• Does the job openings report point to softer payroll gains ahead?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

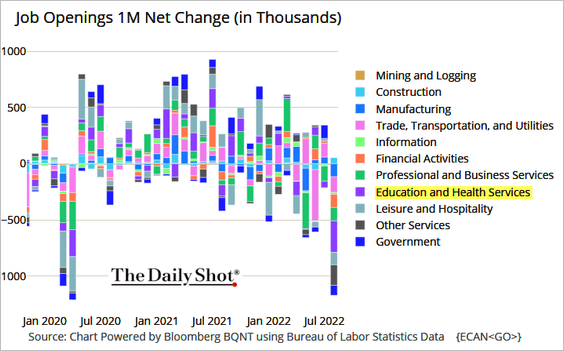

• The drivers of the dip in job openings were broad.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

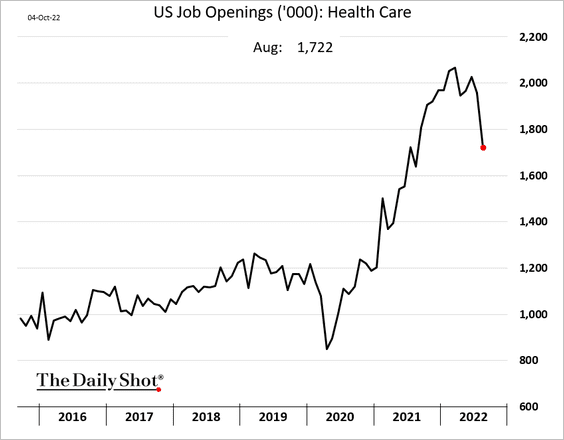

– Healthcare:

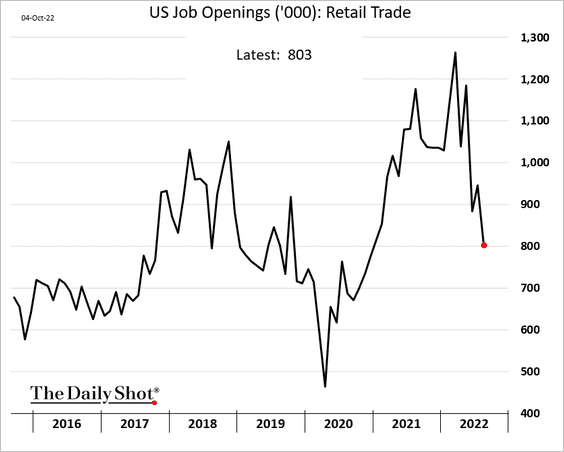

– Retail:

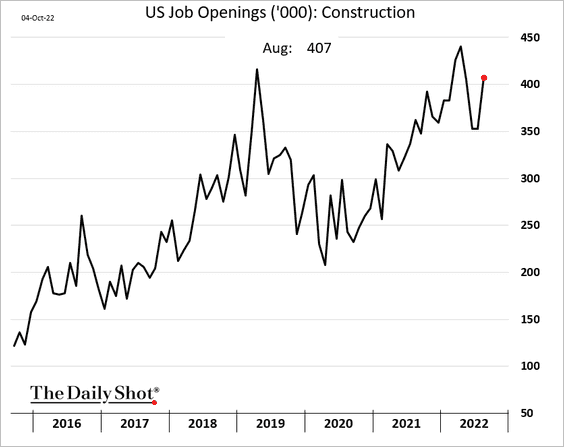

– Surprisingly, construction saw an increase in labor demand, which is unlikely to persist (2nd chart).

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

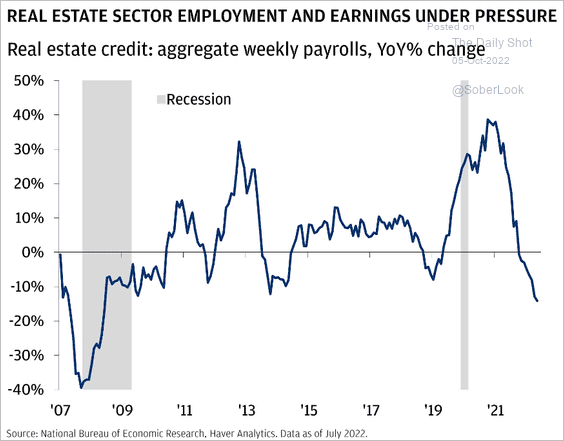

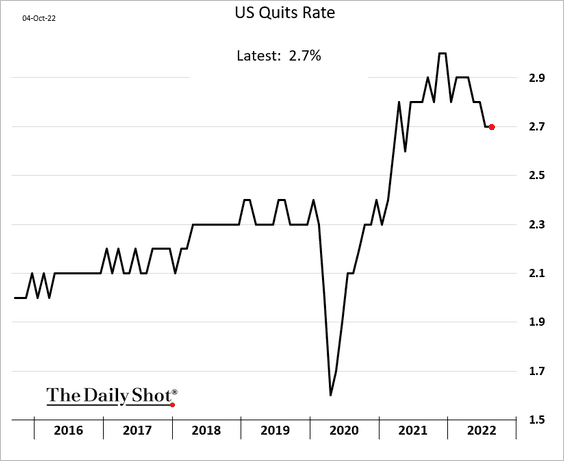

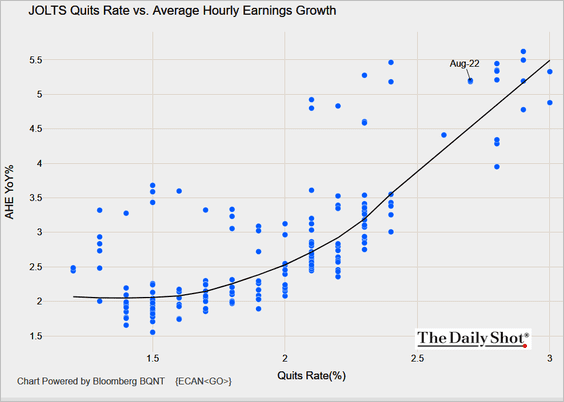

• The quits rate (voluntary resignations) held roughly steady in August.

– The quits rate needs to move lower in order for wage growth to moderate.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

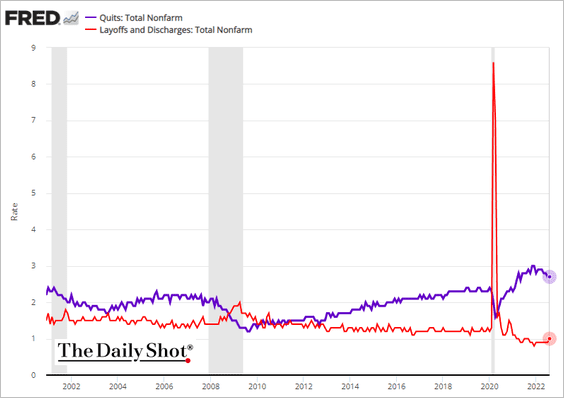

– This chart shows quits vs. layoffs.

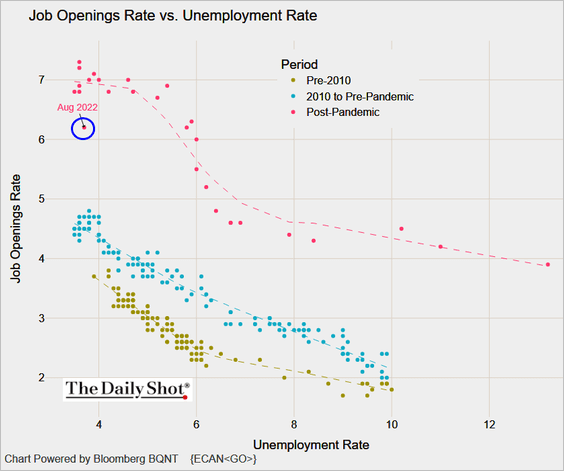

• Here is the Beveridge curve. The labor market is still out of balance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

2. Next, we have some updates on inflation.

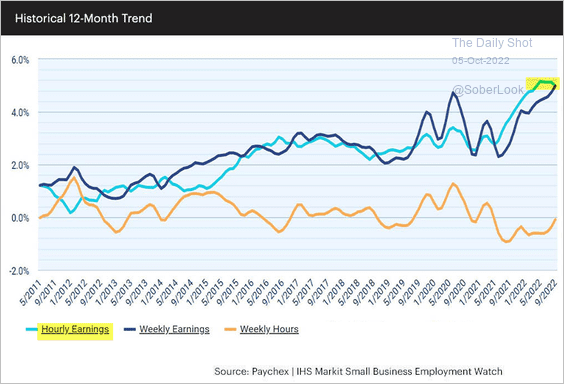

• Small business wage growth has leveled off.

Source: Paychex, IHS Markit

Source: Paychex, IHS Markit

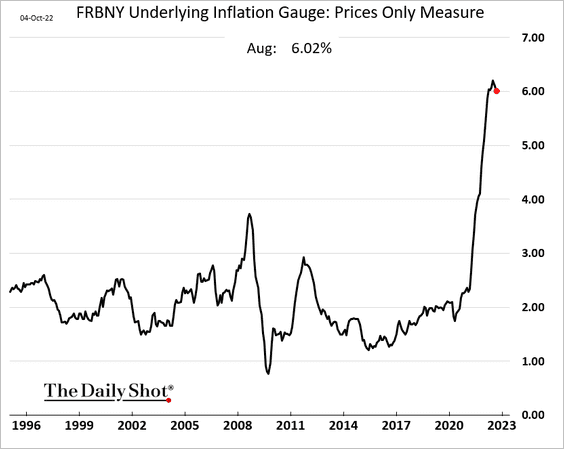

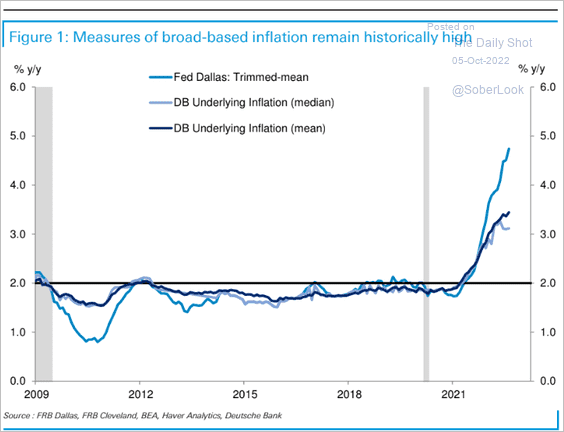

• Underlying inflation indicators are much too high (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

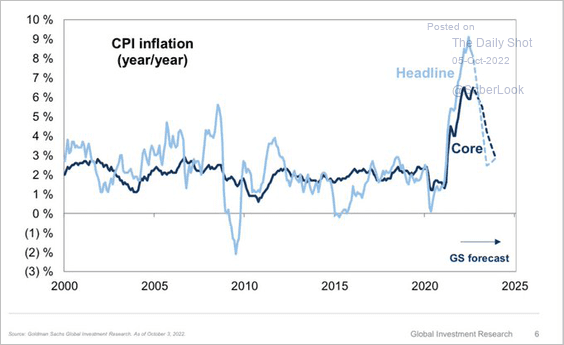

• Goldman is forecasting the core CPI to end the year at 6% and reach 2.9% by the end of 2023.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

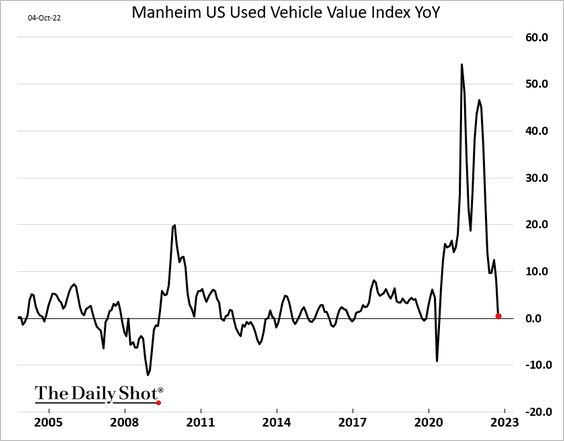

• Used car wholesale prices are back to last year’s levels.

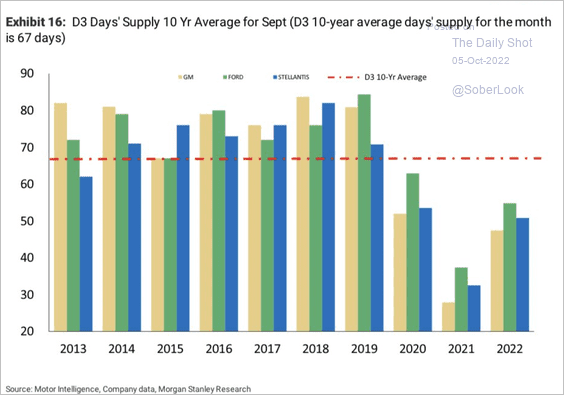

New car inventories are recovering.

Source: Morgan Stanley Research; @carlquintanilla

Source: Morgan Stanley Research; @carlquintanilla

——————–

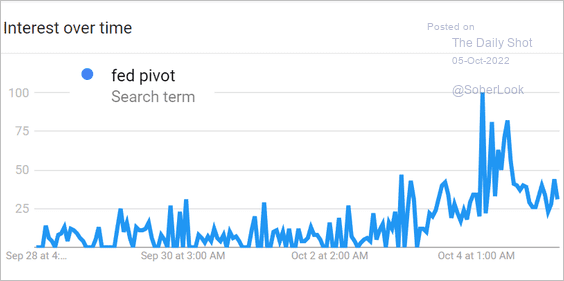

3. The “Fed pivot” talk is back. Wishful thinking?

Source: Reuters Read full article

Source: Reuters Read full article

Source: Google Trends

Source: Google Trends

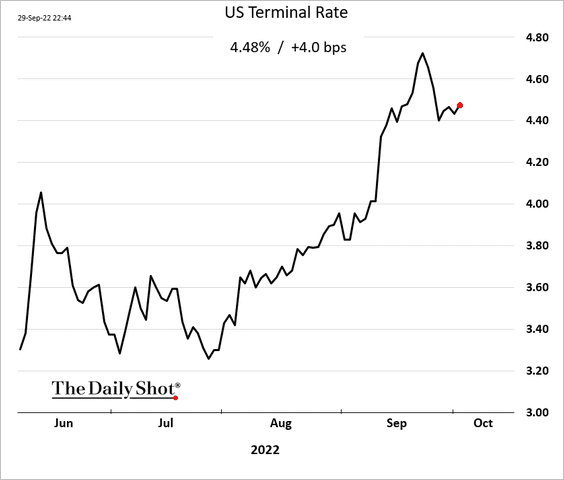

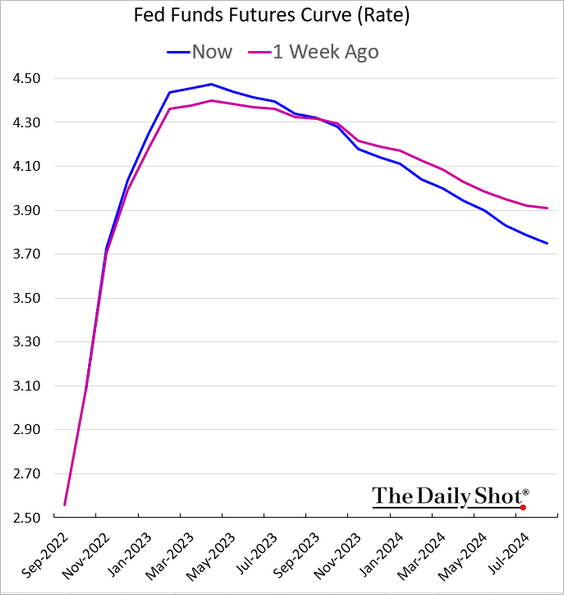

• The expected terminal rate is settling around 4.5%.

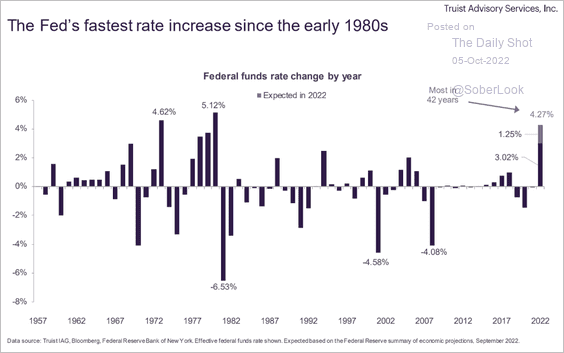

• This rate hike cycle has been unusual.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

The United Kingdom

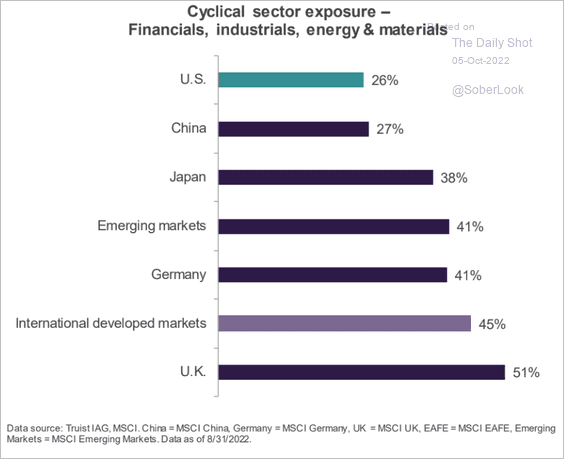

1. The UK stock market is heavily exposed to cyclicals.

Source: Truist Advisory Services

Source: Truist Advisory Services

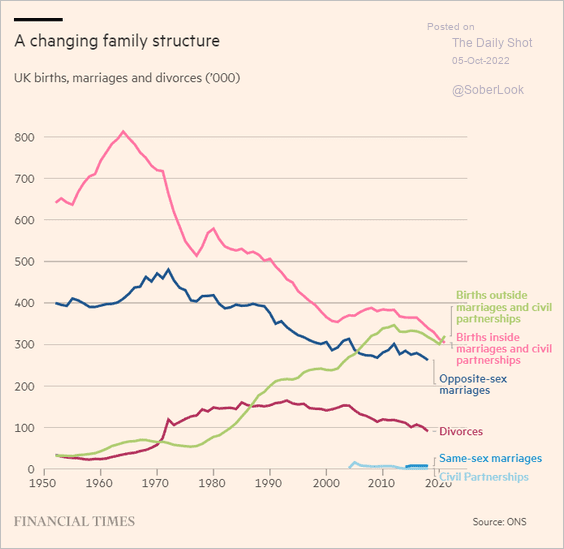

2. The family structure has been changing over the past few decades.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

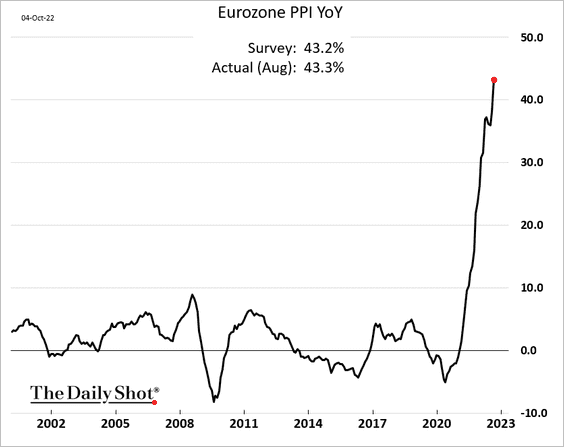

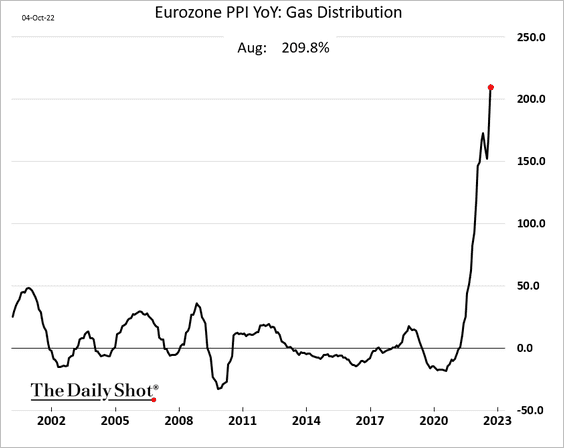

1. The euro-area PPI blasted past 40% in August …

… as energy/power costs soared.

——————–

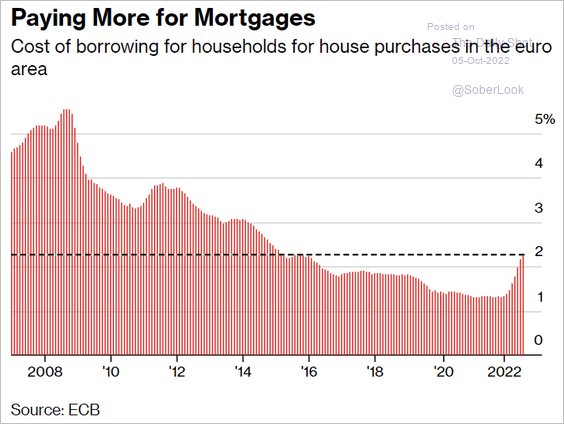

2. Mortgage rates have risen sharply.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

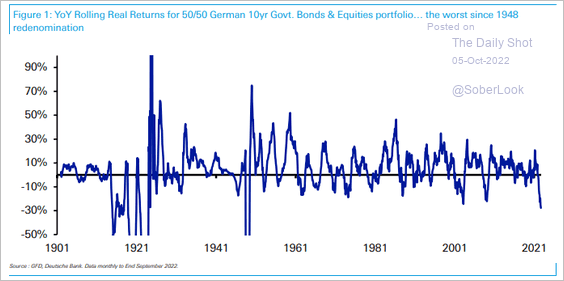

3. A German 50/50 bond/equity portfolio is down nearly 30% from its peak in real terms – the worst drawdown since 1948. A similar US portfolio is down roughly 25% from its peak, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Asia – Pacific

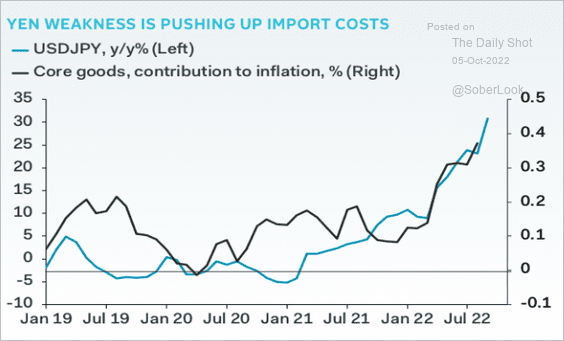

1. The yen’s weakness is pushing up inflation in Japan.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

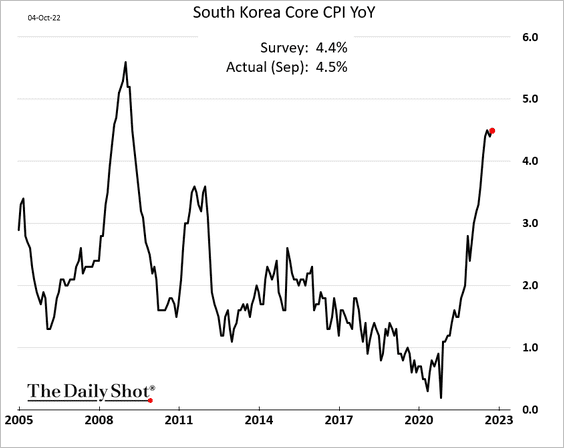

2. South Korea’s core inflation remains elevated.

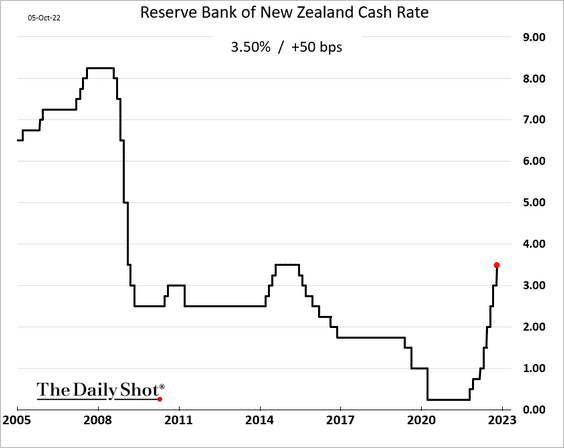

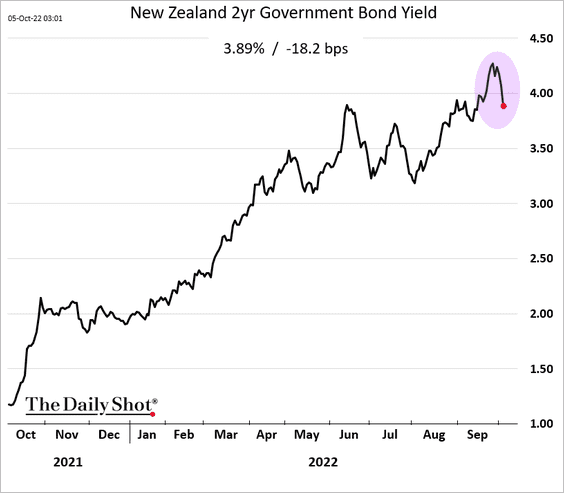

3. New Zealand’s central bank hiked rates by 50 bps.

Bond yields declined.

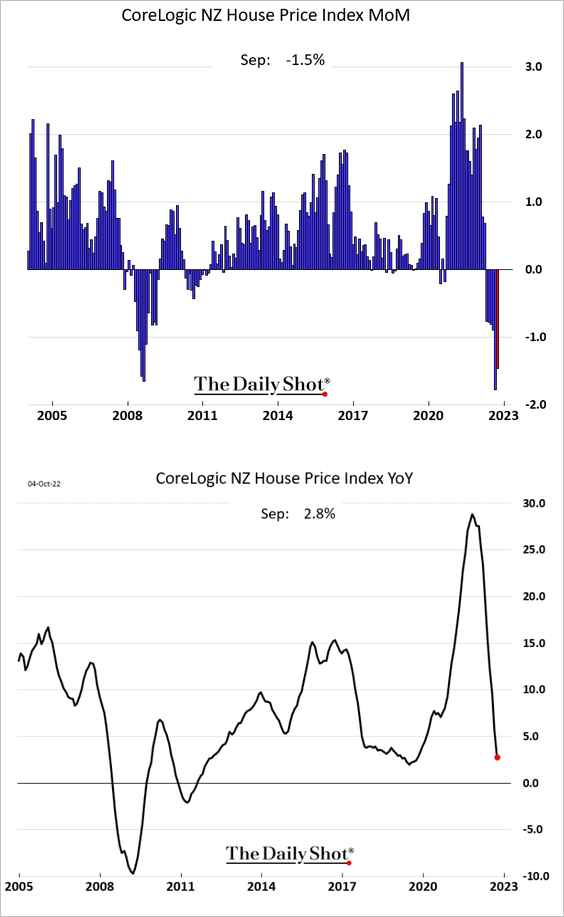

Separately, New Zealand’s home prices continue to fall.

——————–

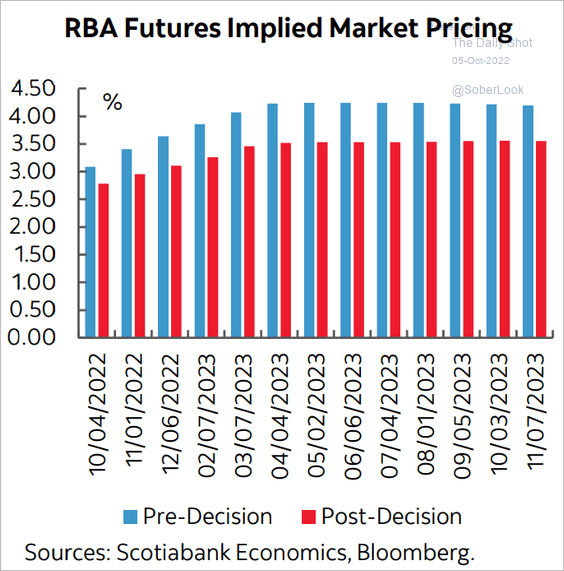

3. The market repriced the RBA rate expectations after the central bank’s dovish hike.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

China

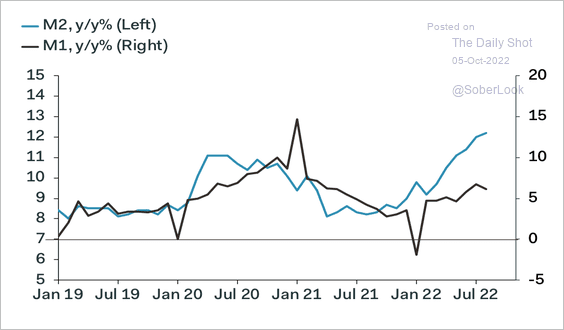

1. Money supply growth has been increasing.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

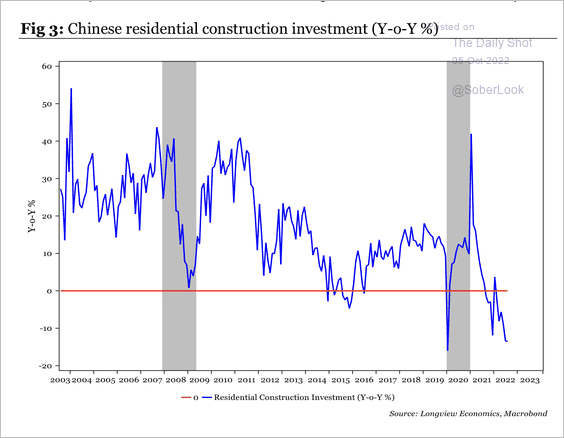

2. Residential construction investment remains depressed.

Source: Longview Economics

Source: Longview Economics

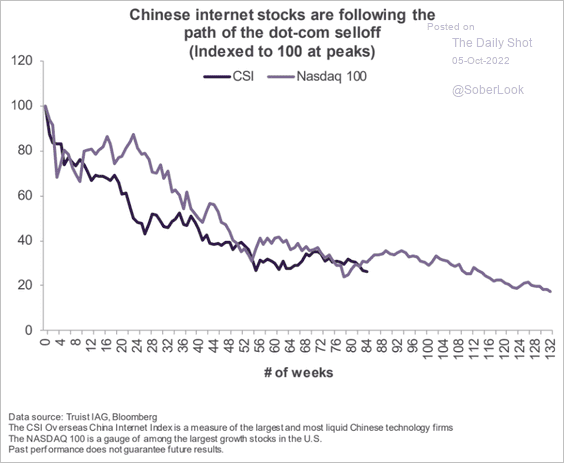

3. Internet stocks are following the dot-com analog.

Source: Truist Advisory Services

Source: Truist Advisory Services

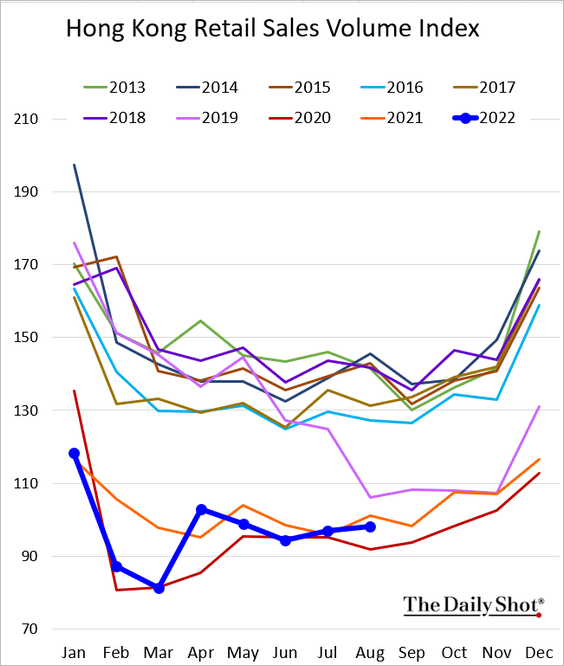

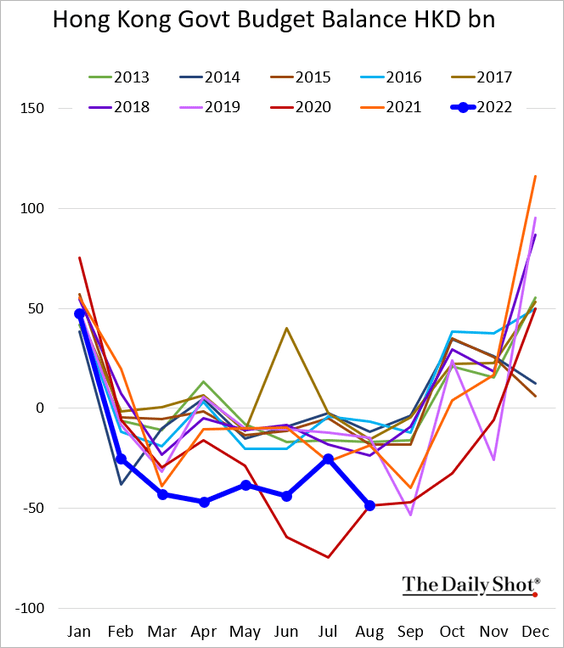

4. Hong Kong’s retail sales showed modest improvement recently.

Separately, Hong Kong’s government budget deteriorated to 2020 levels.

Back to Index

Emerging Markets

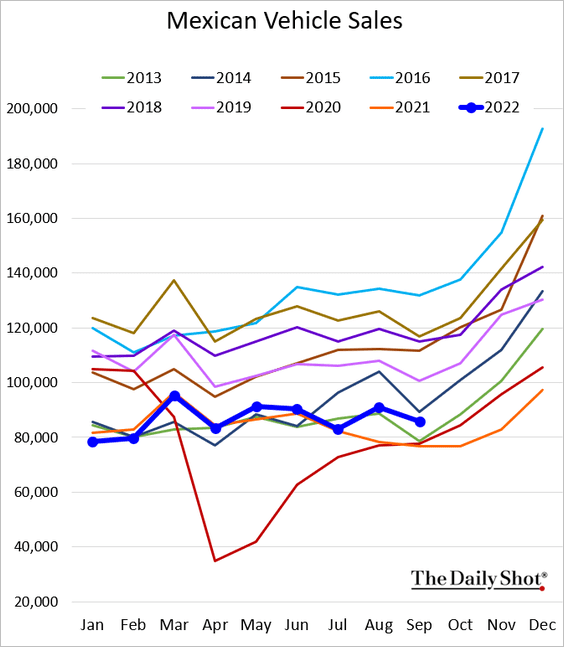

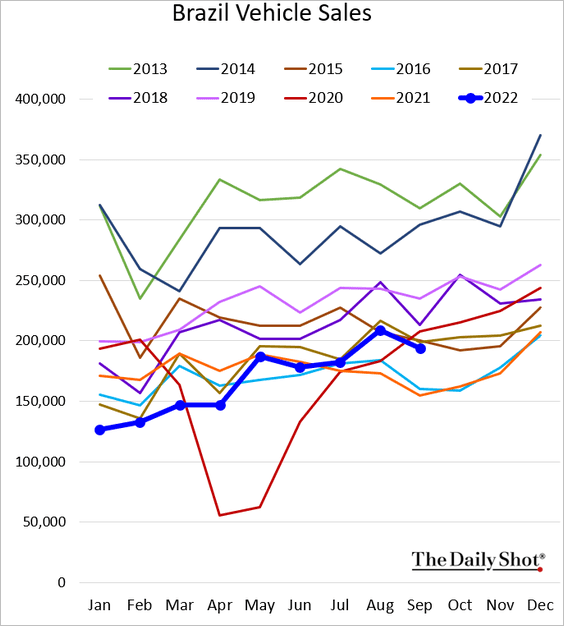

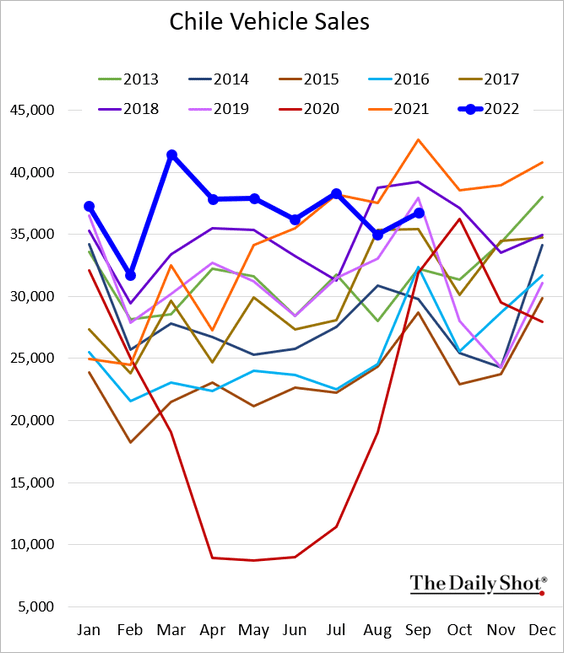

1. Let’s start with LatAm vehicle sales.

• Mexico (holding above 2021 levels):

• Brazil:

• Chile (now well below last year’s level):

——————–

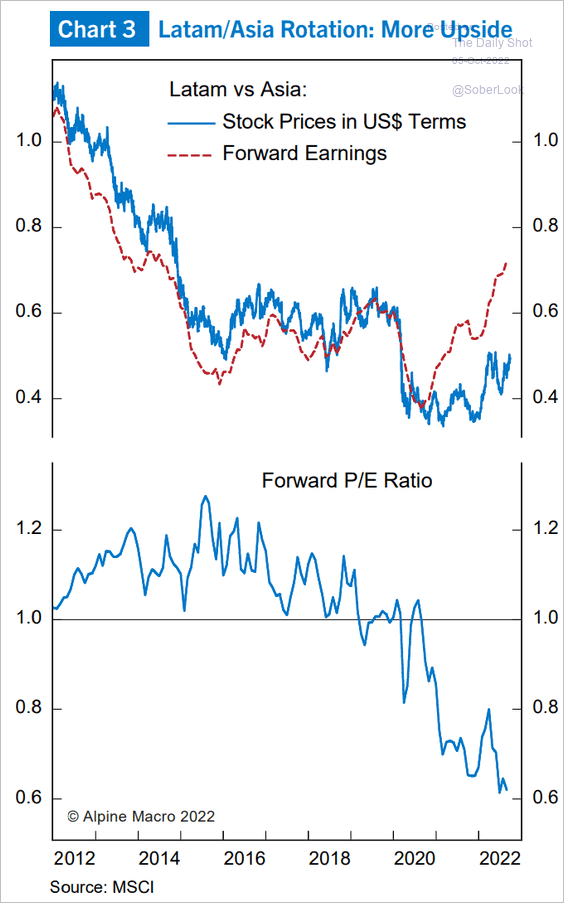

2. More Asia/LatAm rotation ahead?

Source: Alpine Macro

Source: Alpine Macro

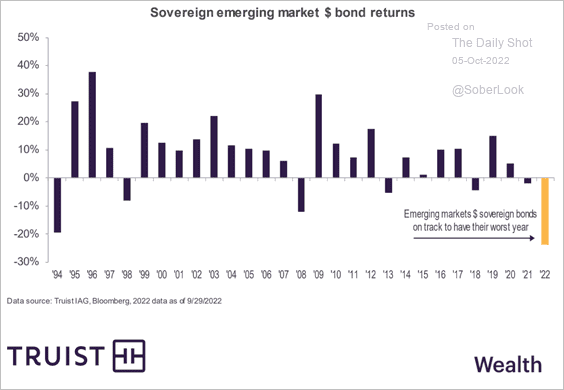

3. The selloff in sovereign debt has been extreme.

Source: Truist Advisory Services

Source: Truist Advisory Services

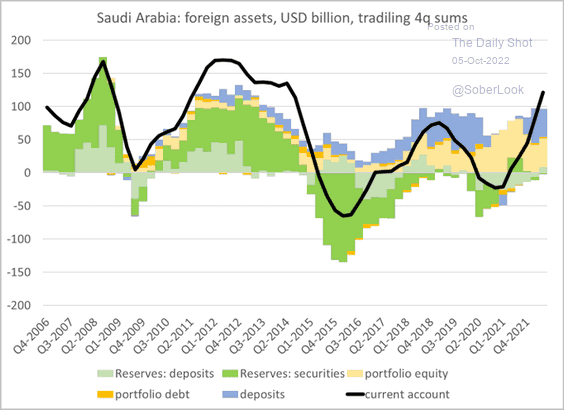

4. The Saudis are no longer buying bonds for their FX reserve account.

Source: @Brad_Setser

Source: @Brad_Setser

Back to Index

Cryptocurrency

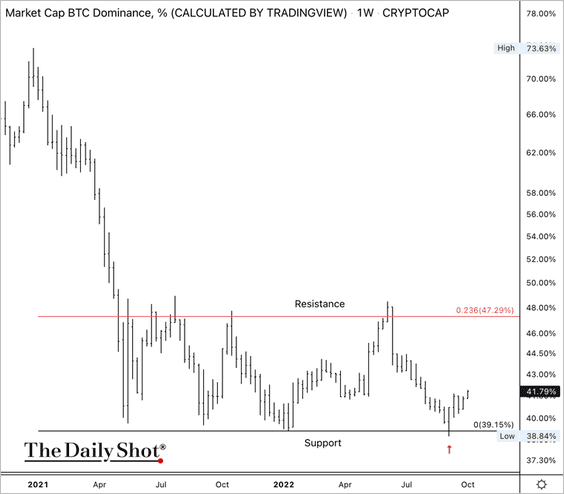

1. Bitcoin’s market cap relative to the total crypto market cap (dominance ratio) continues to hold support. A rise in the dominance ratio typically signals a lower appetite for risk among crypto traders.

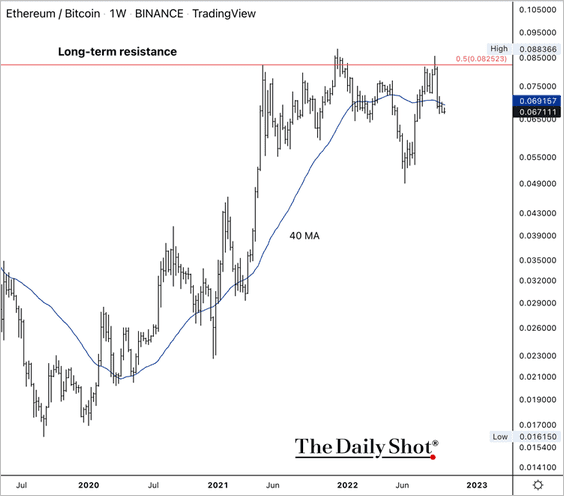

2. The ETH/BTC ratio failed to break above long-term resistance.

By the way, Fidelity has a new Ethereum index fund available to accredited investors.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

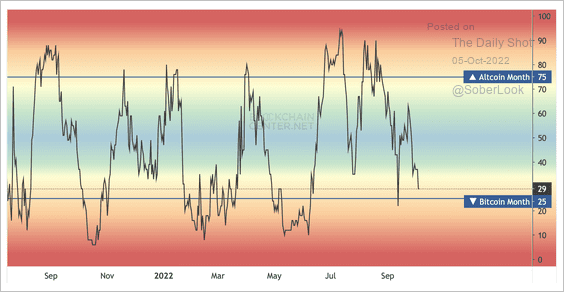

3. 29% of the top 50 altcoins have underperformed bitcoin over the past month.

Source: Blockchain Center

Source: Blockchain Center

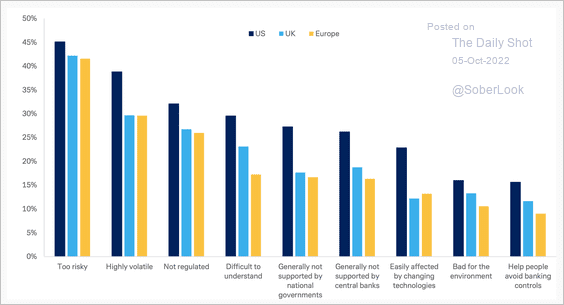

4. Risk, volatility, and regulation are the top concerns among investors, according to a survey by Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Commodities

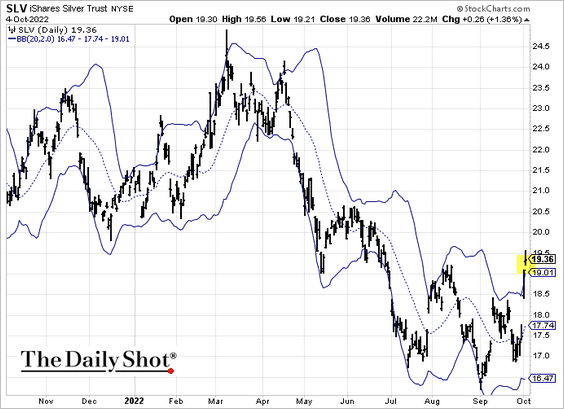

1. The rally in silver looks extended as the commodity climbs above the upper Bollinger band.

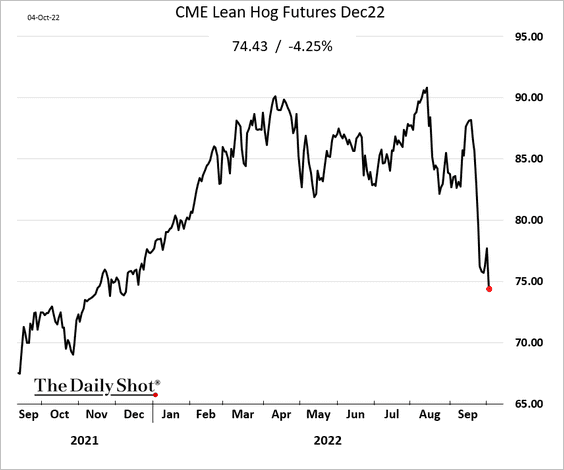

2. Chicago hog futures continue to fall amid softer demand from China.

Back to Index

Energy

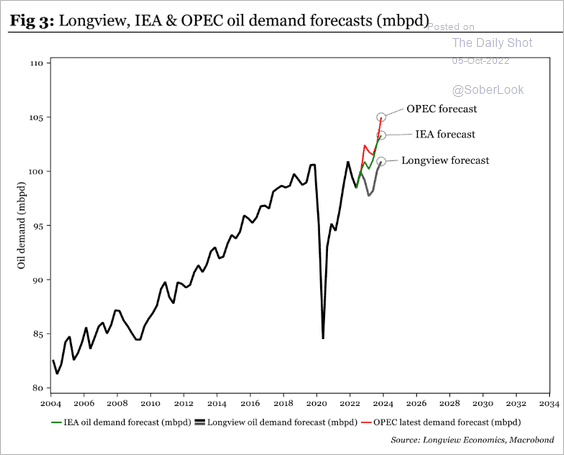

1. European natural gas is rapidly reversing the summer rally.

2. Longview Economics is skeptical about global oil demand as the world economy slumps.

Source: Longview Economics

Source: Longview Economics

Back to Index

Equities

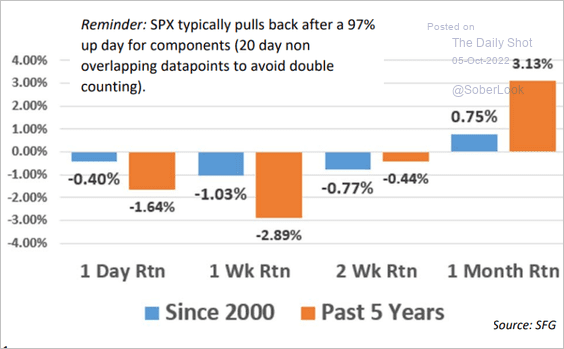

1. Stocks saw a broad rally on Tuesday, which usually indicates a pullback in the days ahead.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

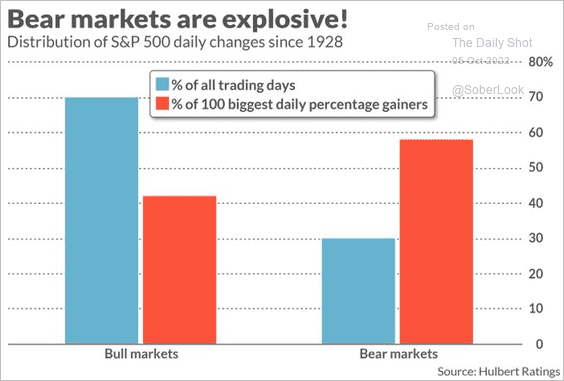

2. The biggest daily rallies are more common in bear markets.

Source: @jessefelder Read full article

Source: @jessefelder Read full article

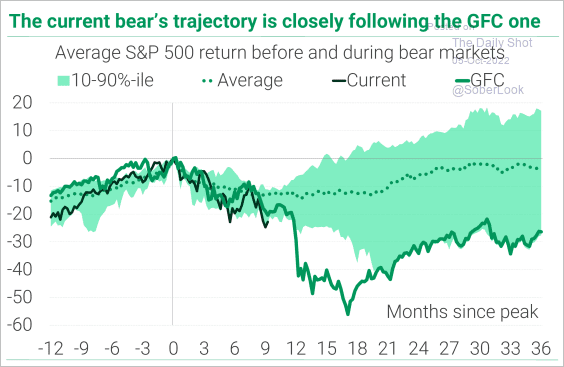

3. Here is the S&P 500 performance during bear markets.

Source: TS Lombard

Source: TS Lombard

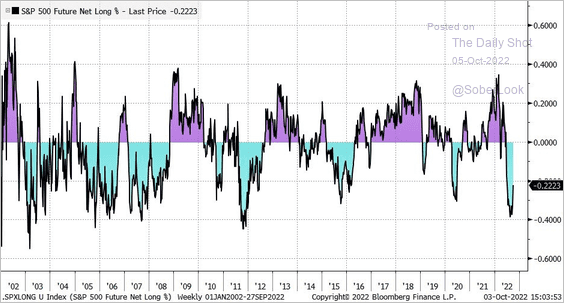

4. S&P 500 futures positioning has become slightly less short over the past two weeks.

Source: @LizYoungStrat

Source: @LizYoungStrat

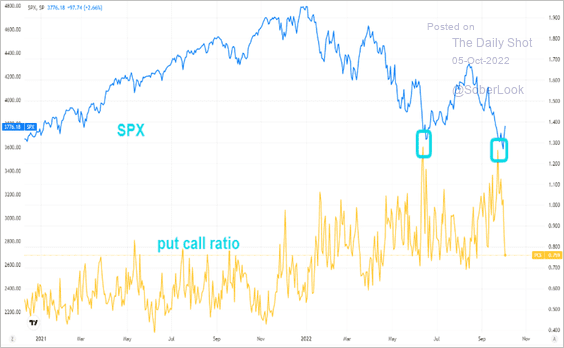

5. It’s been painful for the put-buying crowd over the past couple of days.

Source: @themarketear

Source: @themarketear

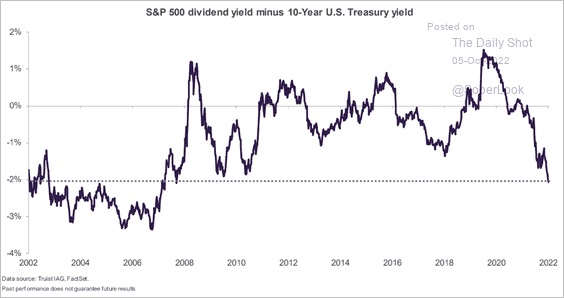

6. The S&P 500 dividend yield is low relative to Treasuries.

Source: Truist Advisory Services

Source: Truist Advisory Services

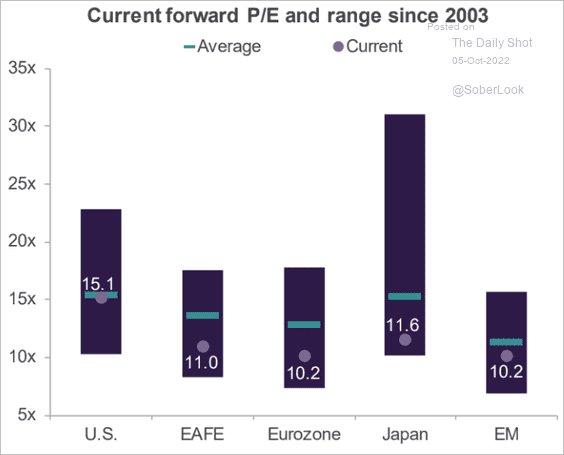

7. This chart shows global valuations and historical averages.

Source: Truist Advisory Services

Source: Truist Advisory Services

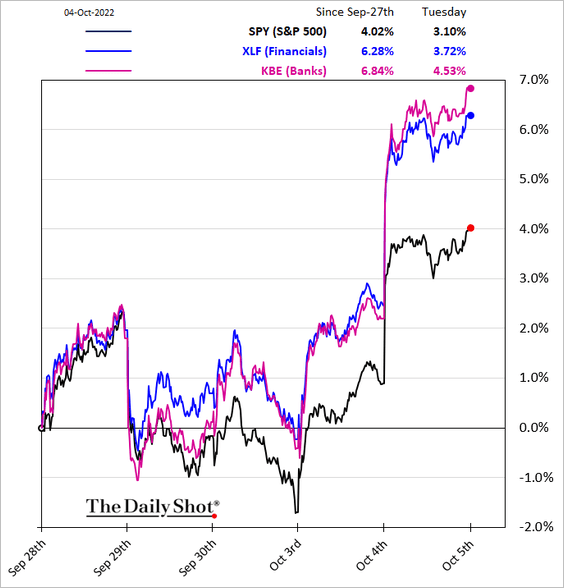

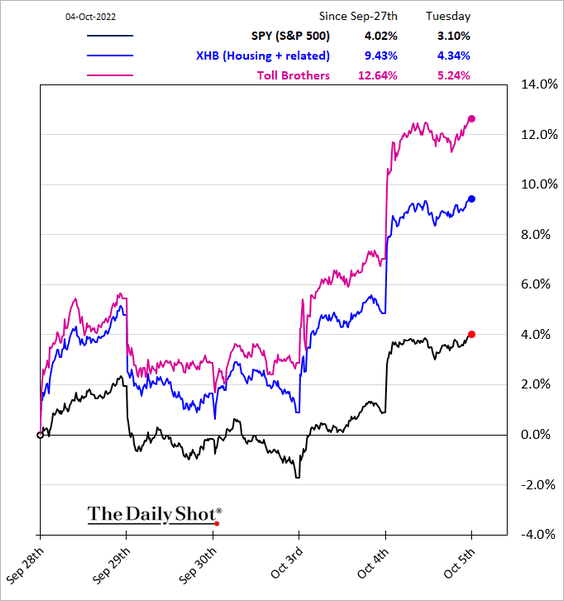

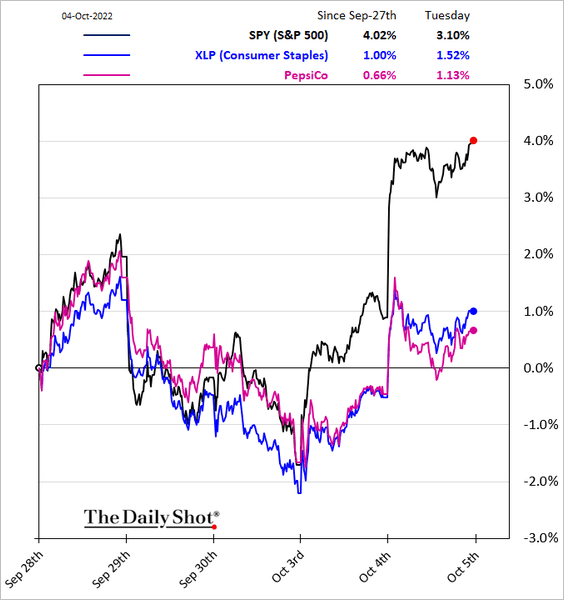

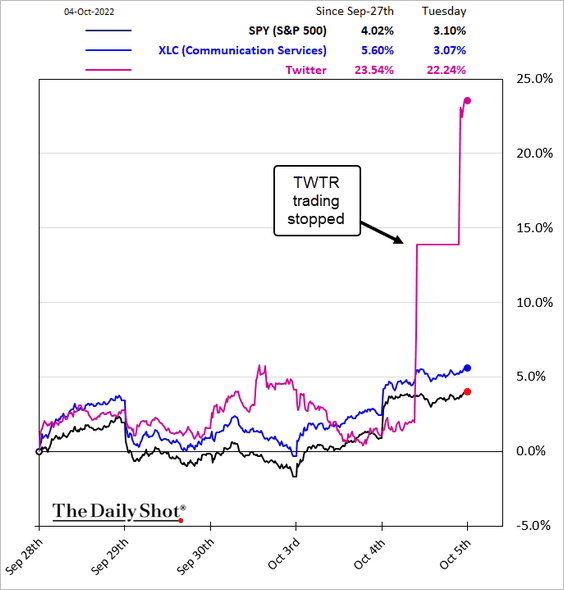

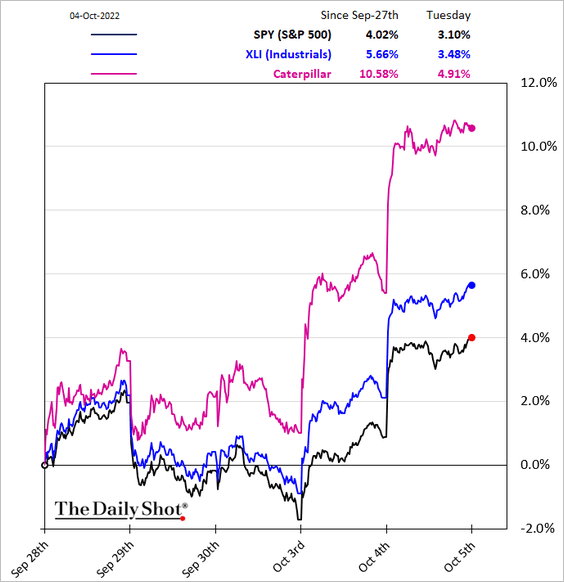

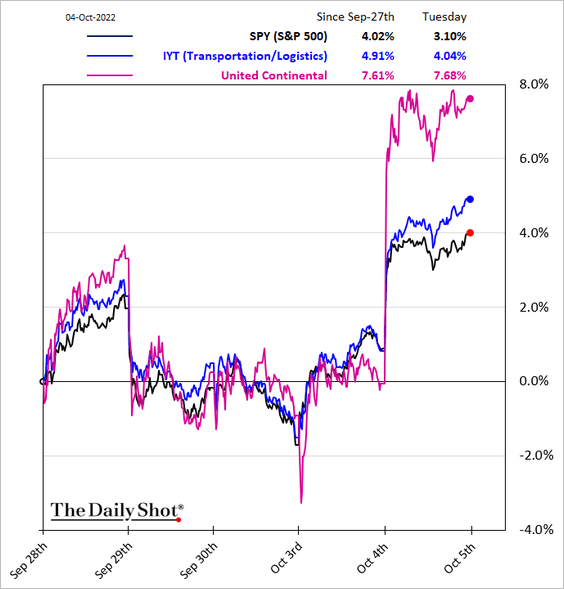

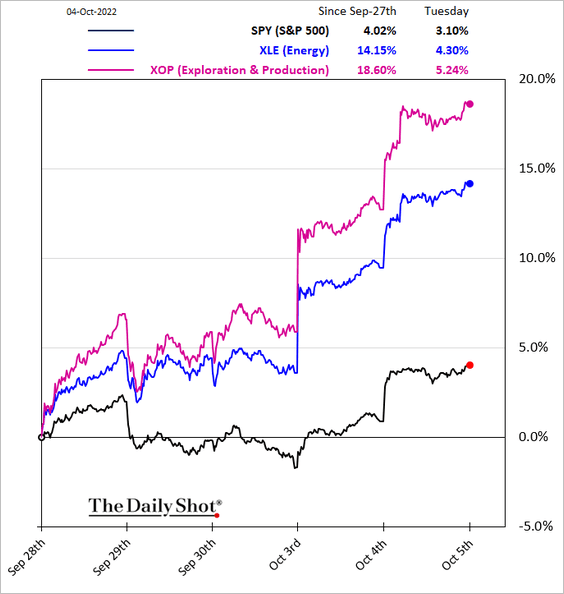

8. Next, we have some sector performance data over the past five business days.

• Financials:

• Housing:

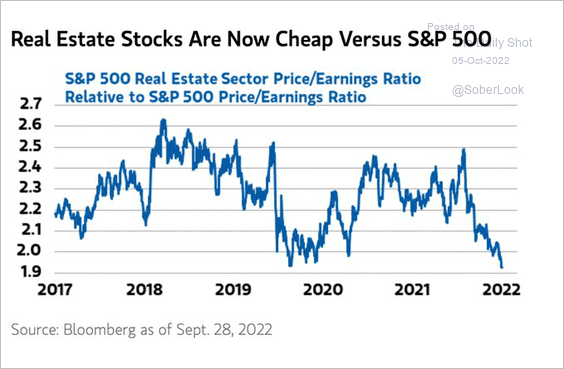

By the way, real estate sector valuations are very low relative to the S&P 500.

Source: @acemaxx, @MorganStanley

Source: @acemaxx, @MorganStanley

• Consumer Staples:

• Communication Services:

• Industrials:

• Transportation:

• Energy:

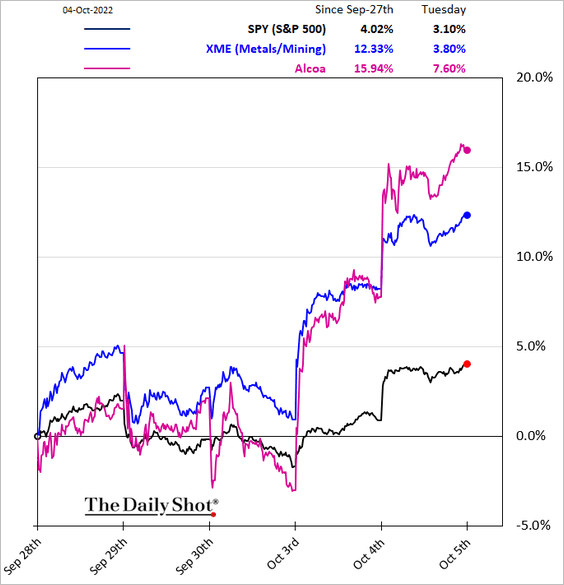

• Metals & Mining:

——————–

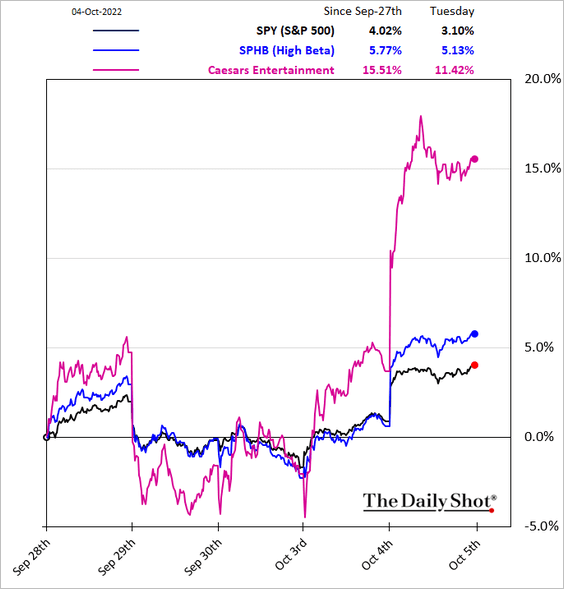

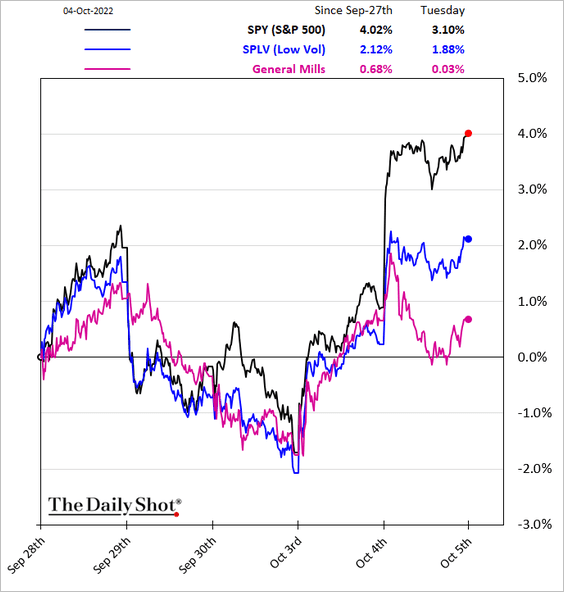

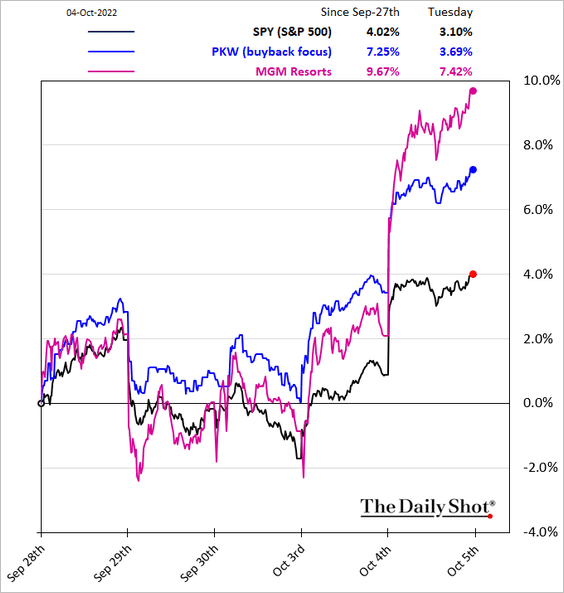

9. Now, let’s take a look at some equity factors:

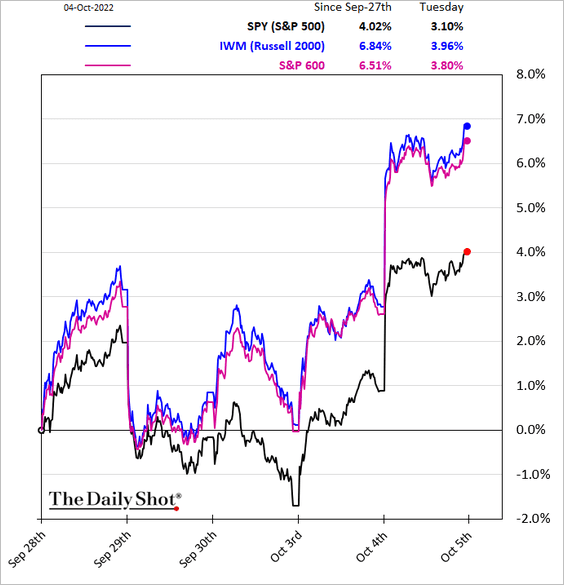

• Small caps:

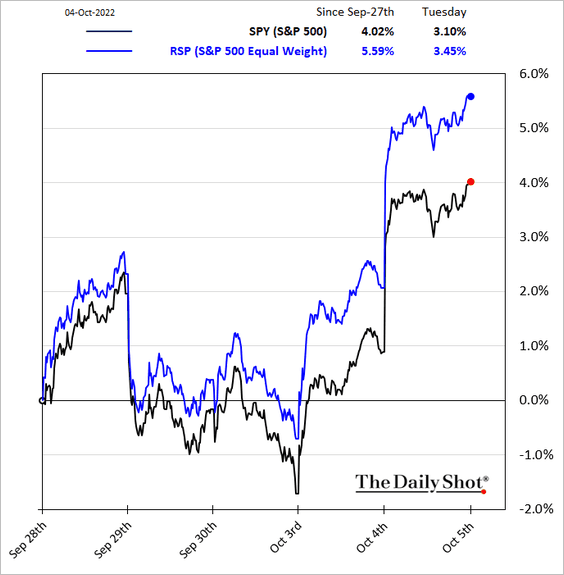

• Equal-weight S&P 500 (showing that the mega-caps have underperformed):

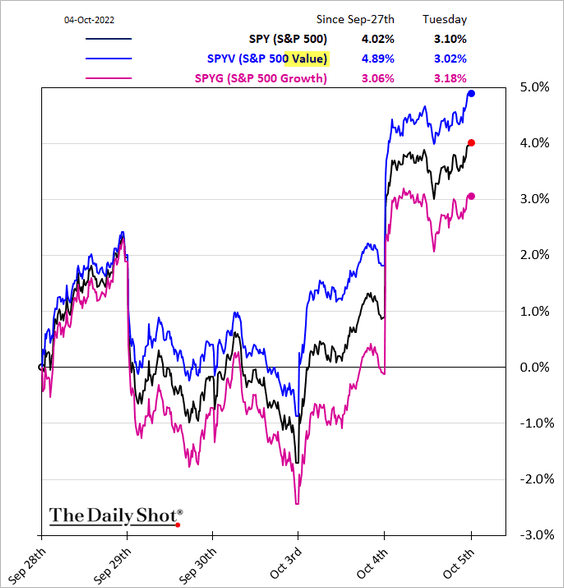

• Growth vs. Value (value has been outperforming):

• High Beta:

• Low Vol:

• Companies focused on share buybacks:

Back to Index

Credit

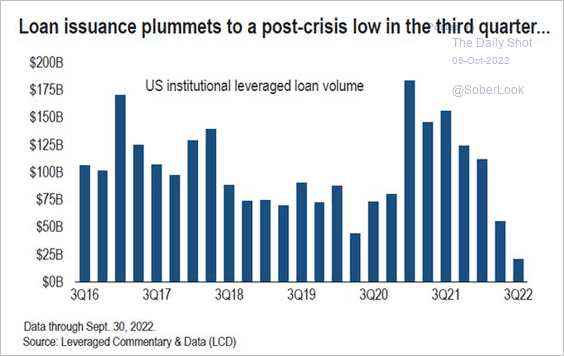

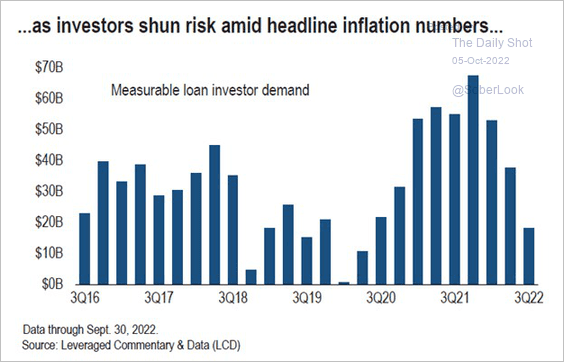

1. Leveraged loan issuance has deteriorated, …

Source: @lcdnews

Source: @lcdnews

… amid softer demand …

Source: @lcdnews

Source: @lcdnews

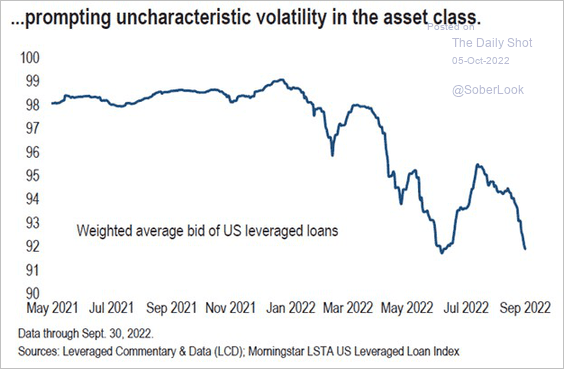

… and falling prices.

Source: @lcdnews

Source: @lcdnews

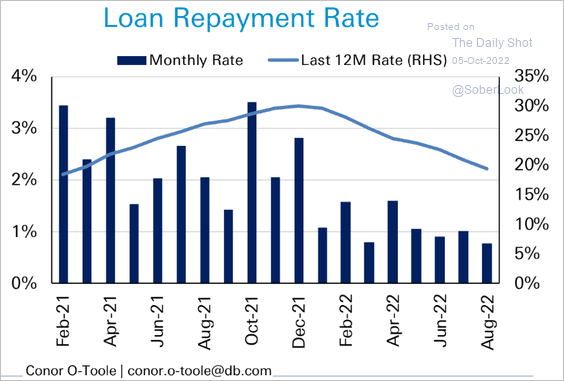

Leveraged loan repayments have slowed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

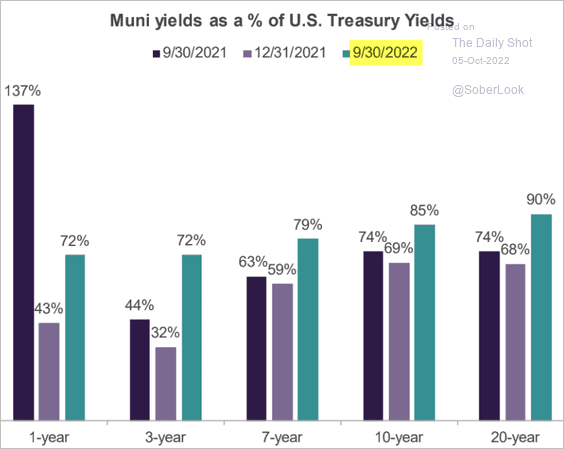

2. Munis look attractive relative to Treasuries.

Source: Truist Advisory Services

Source: Truist Advisory Services

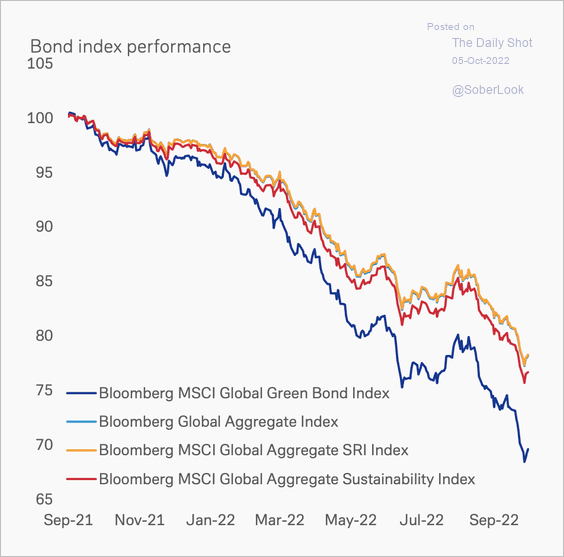

3. The Bloomberg MSCI Global Green Bond Index continues to underperform.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

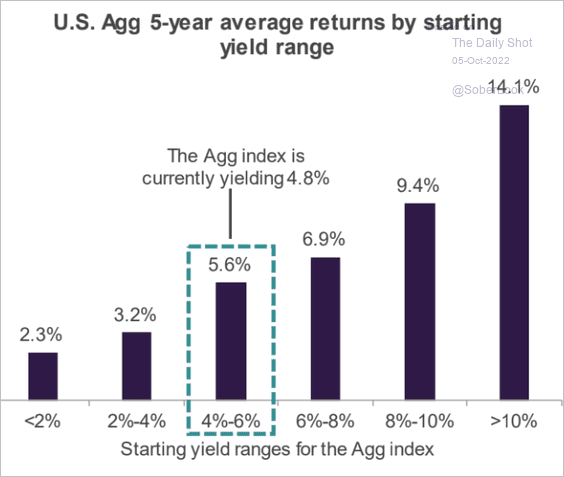

4. What kind of returns should we expect in fixed income over the next five years?

Source: Truist Advisory Services

Source: Truist Advisory Services

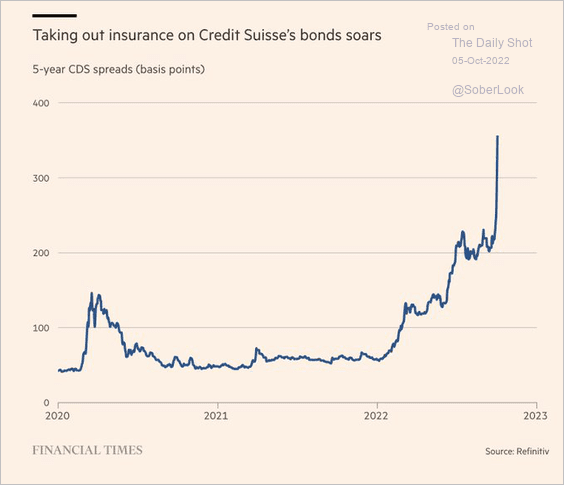

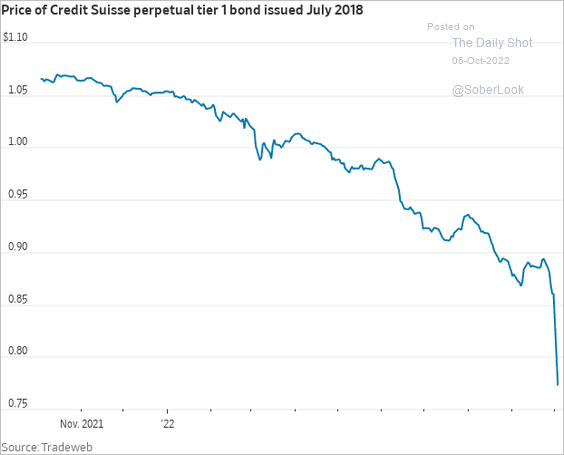

5. The Credit Suisse situation remains a concern.

• CDS spread:

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

• Perpetual bond price:

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Global Developments

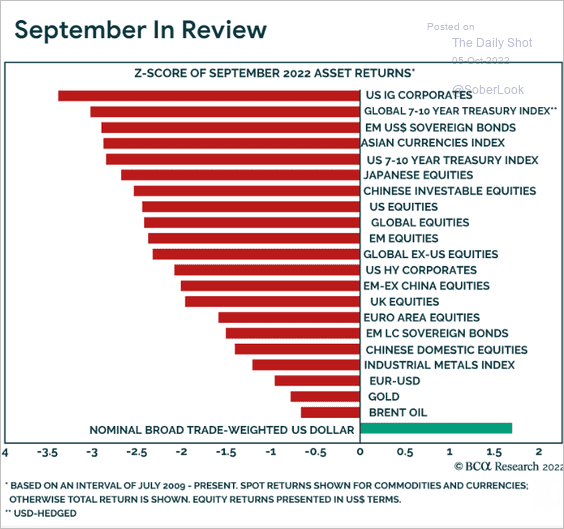

1. This chart shows the September performance by asset class (in standard deviations).

Source: BCA Research

Source: BCA Research

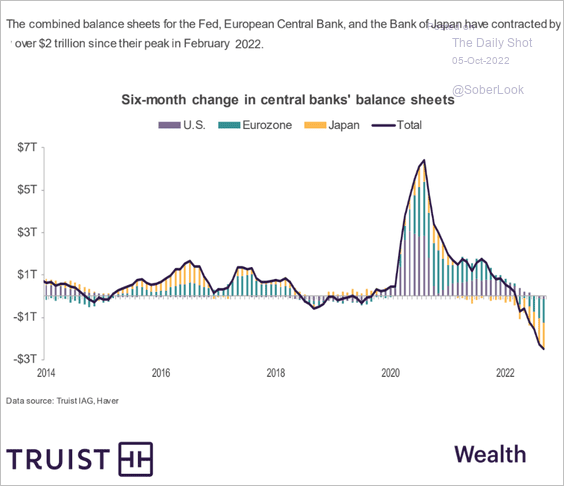

2. Central banks’ balance sheets continue to shrink:

Source: Truist Advisory Services

Source: Truist Advisory Services

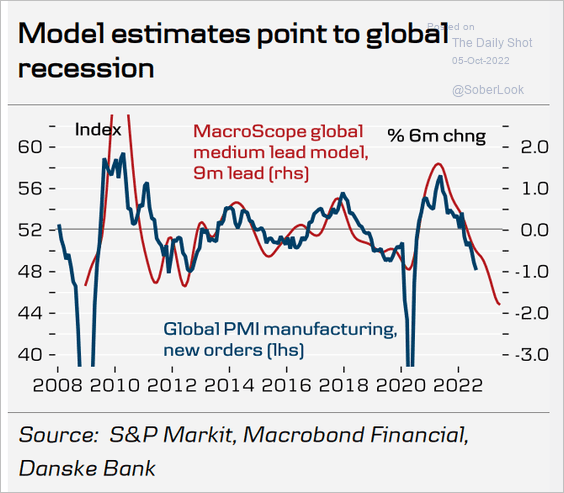

3. Leading indicators point to a global recession.

Source: Danske Bank

Source: Danske Bank

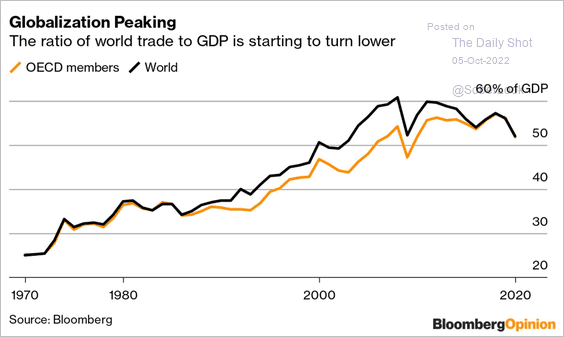

4. Globalization has peaked:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

Food for Thought

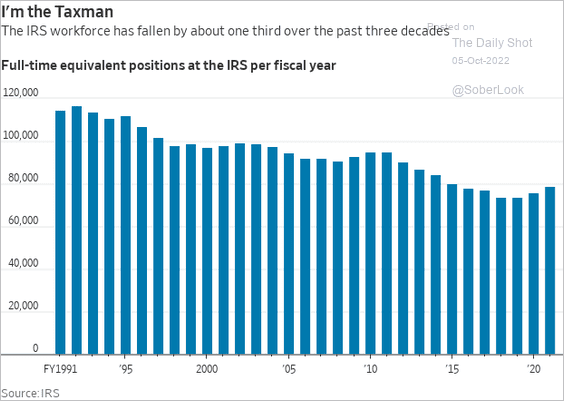

1. The IRS workforce:

Source: @WSJ Read full article

Source: @WSJ Read full article

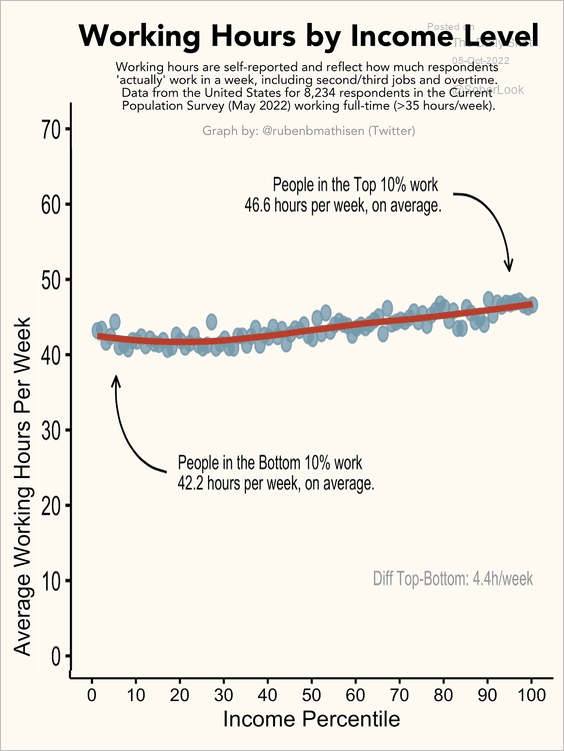

2. Working hours per week vs. income percentile:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

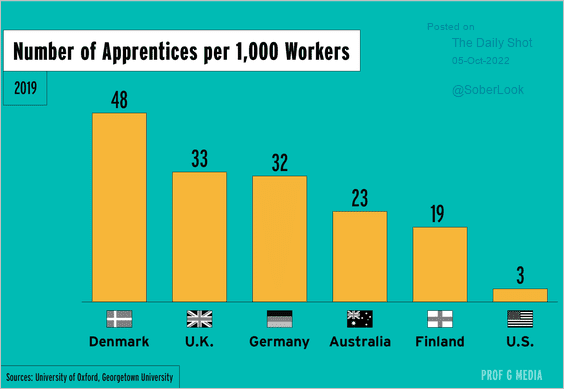

3. Apprenticeships in select countries:

Source: Scott Galloway Read full article

Source: Scott Galloway Read full article

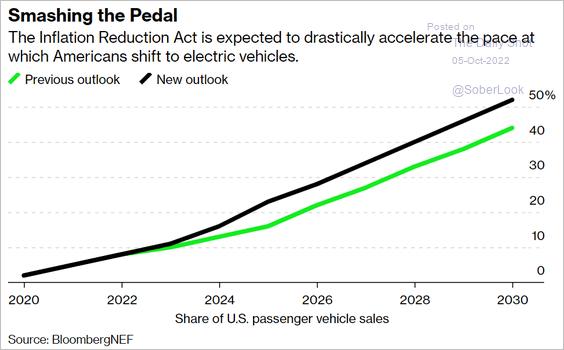

4. Projected EV sales:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

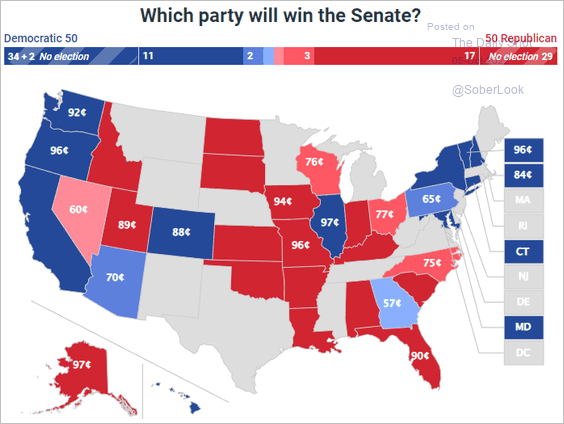

5. Betting markets’ probabilities for the 2022 US Senate races:

Source: @PredictIt

Source: @PredictIt

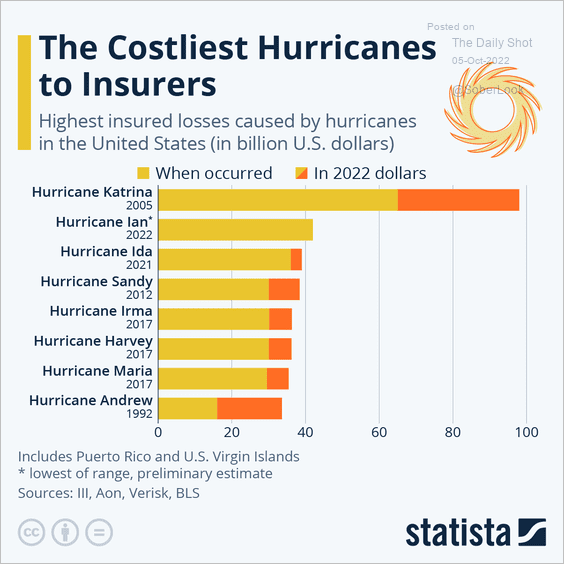

6. Costliest hurricanes:

Source: Statista

Source: Statista

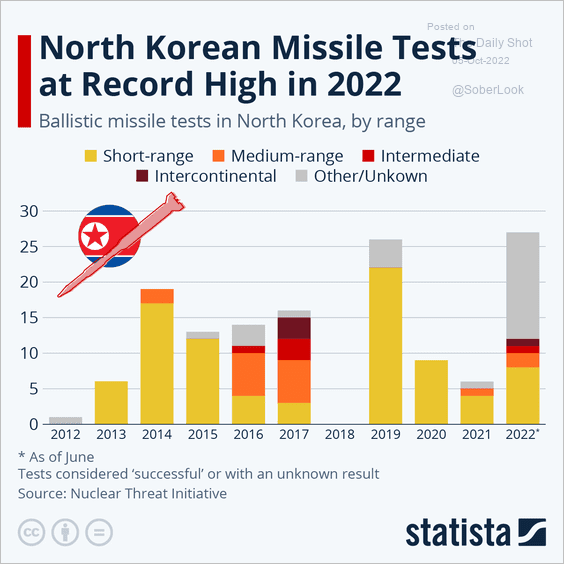

7. North Korea missile tests:

Source: Statista

Source: Statista

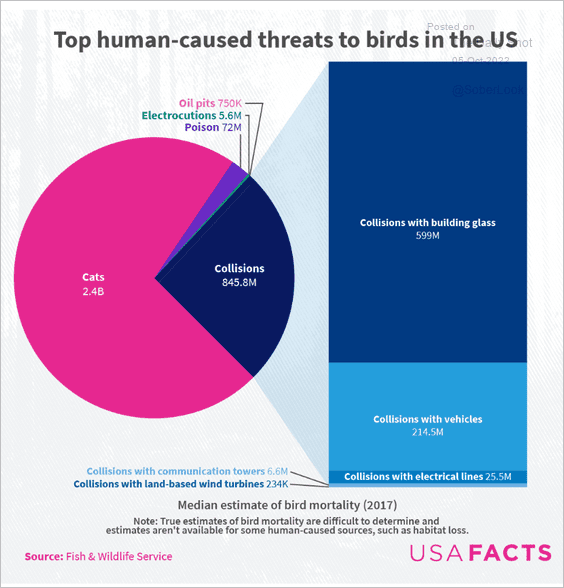

8. Human-caused threats to birds:

Source: USAFacts

Source: USAFacts

——————–

Back to Index