The Daily Shot: 07-Oct-22

• Administrative Update

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

Administrative Update

As a reminder, The Daily Shot will not be published on Monday, October 10th.

Back to Index

The United States

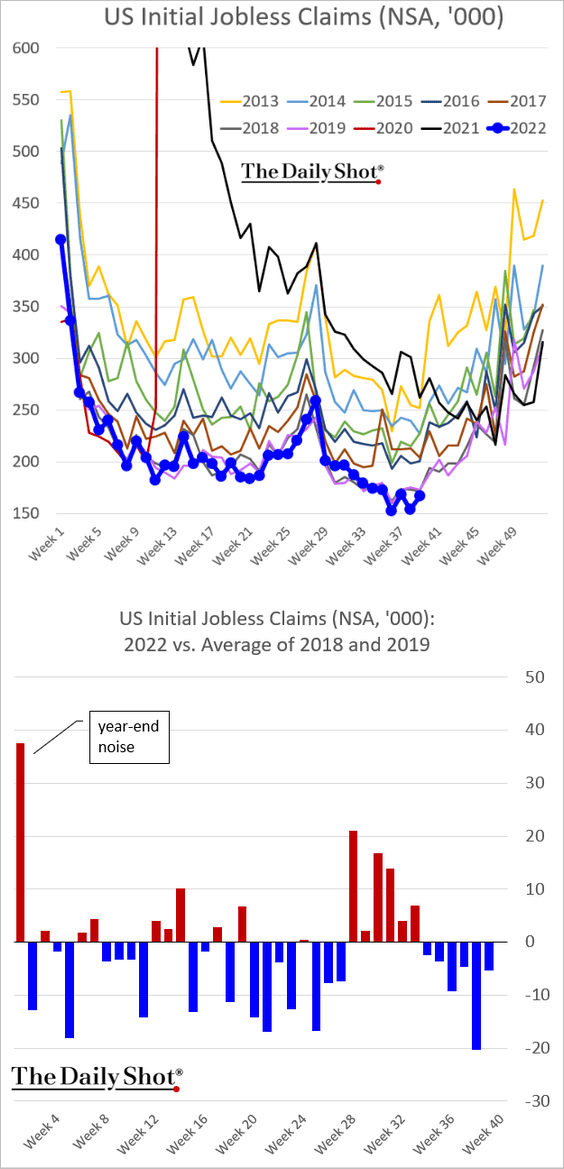

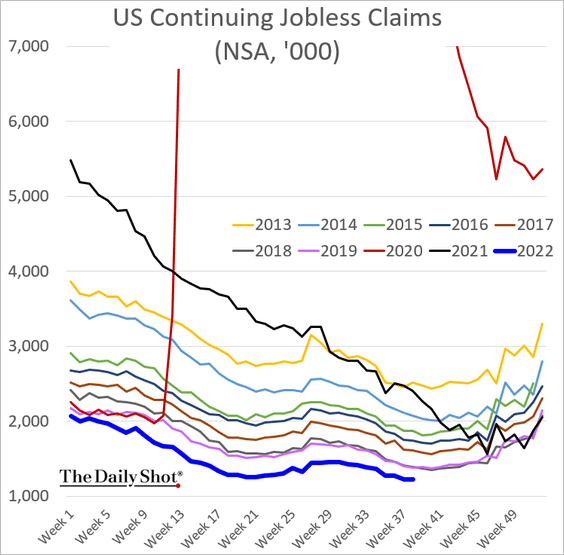

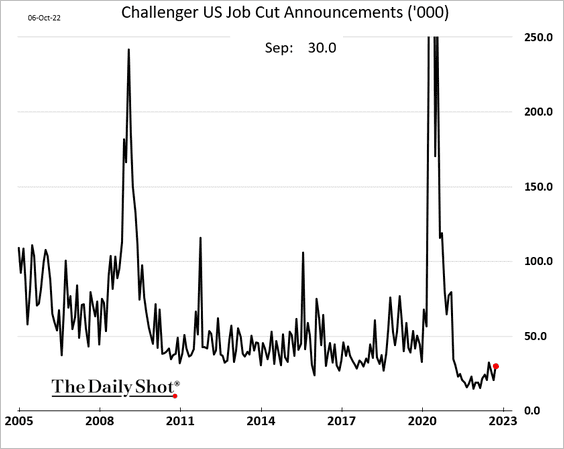

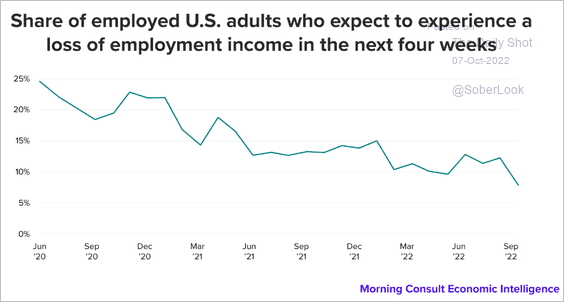

1. Let’s begin with the labor market.

• Jobless claims are holding below pre-COVID levels. The labor market remains tight.

• Job cuts increased this year but are still very low.

• Americans are not worried about employment income loss.

Source: Morning Consult

Source: Morning Consult

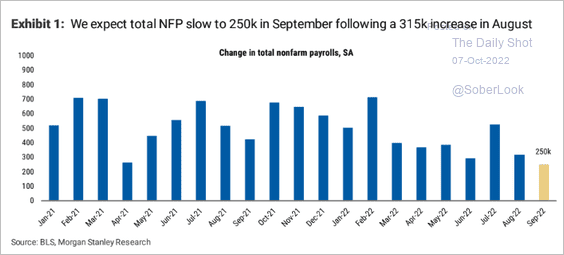

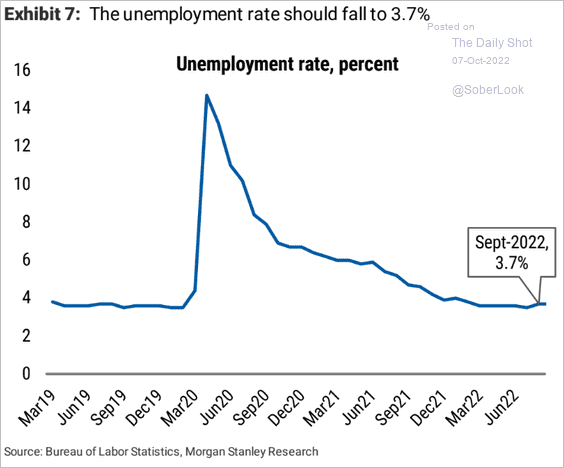

• Morgan Stanley sees 250k jobs created in September, with the unemployment rate holding at 3.7%.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Google search activity for “ask for raise” declined in recent weeks.

——————–

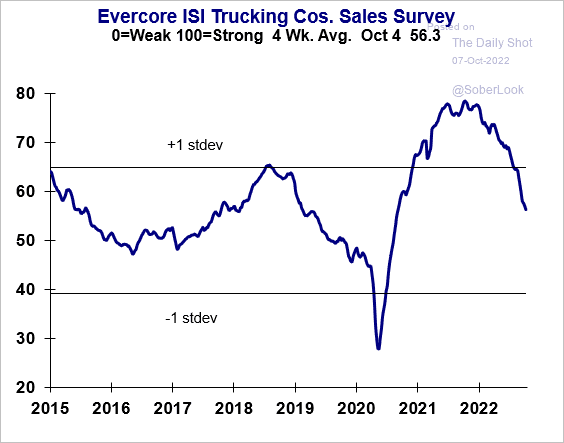

2. Trucking companies’ sales are slowing …

Source: Evercore ISI Research

Source: Evercore ISI Research

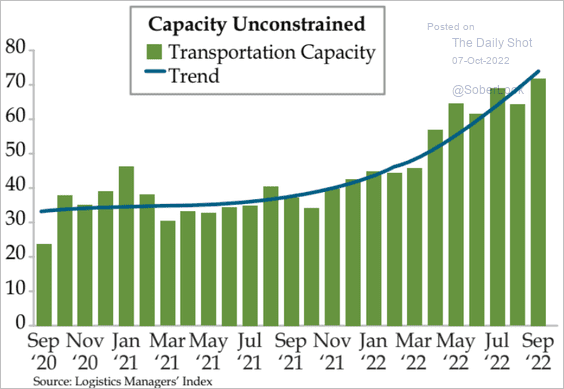

… amid substantial increases in transportation capacity this year.

Source: Quill Intelligence

Source: Quill Intelligence

——————–

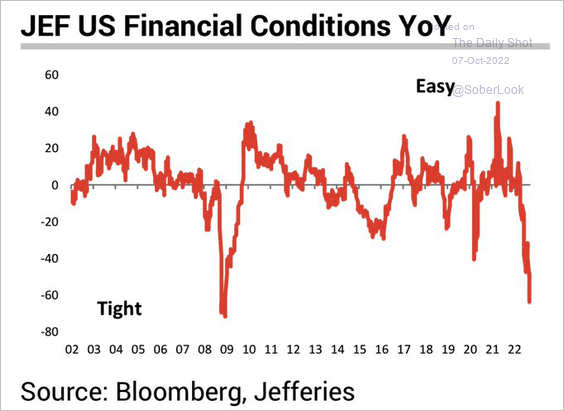

3. US financial conditions tightened dramatically this year.

Source: Jefferies; @WallStJesus

Source: Jefferies; @WallStJesus

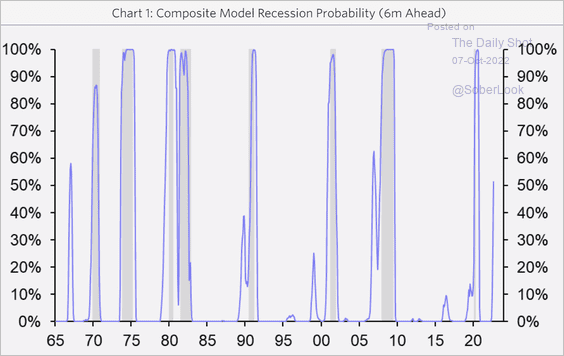

The probability of a recession in the next six months climbed above 50%, according to the Capital Economics model.

Source: Capital Economics

Source: Capital Economics

——————–

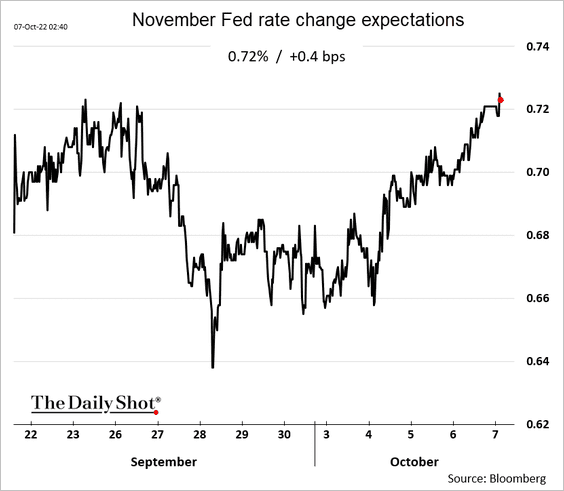

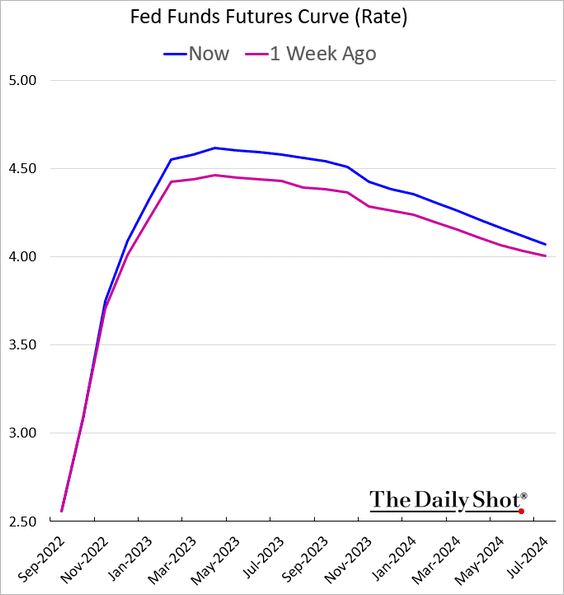

4. The market increasingly sees a 75 bps rate hike in November.

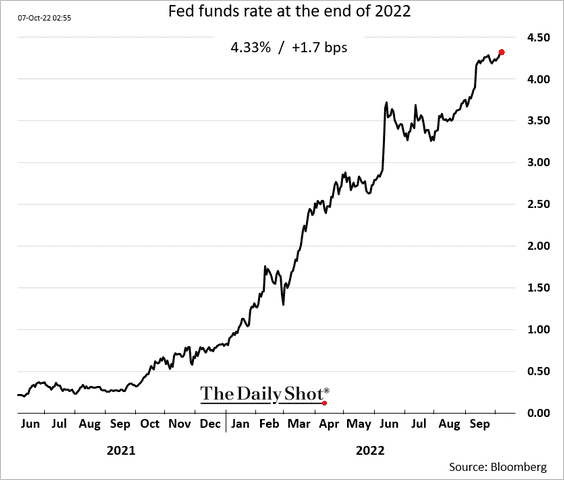

The Fed is now expected to take its benchmark rate to 4.3% by the end of the year.

The terminal rate is now around 4.6%. Here is the market pricing for the fed funds rate trajectory.

——————–

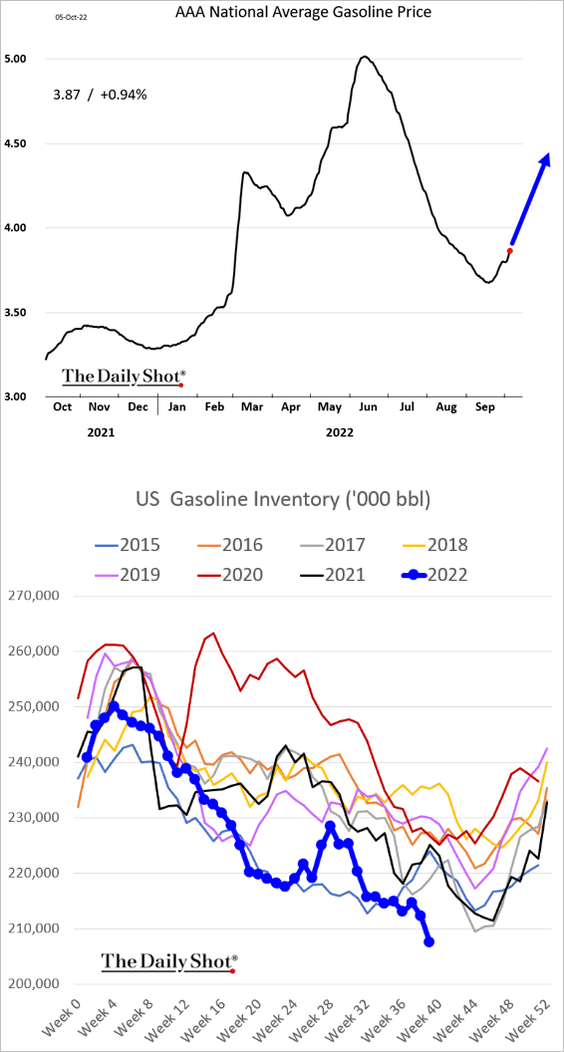

5. Gasoline prices are going higher as inventories tumble.

Back to Index

Canada

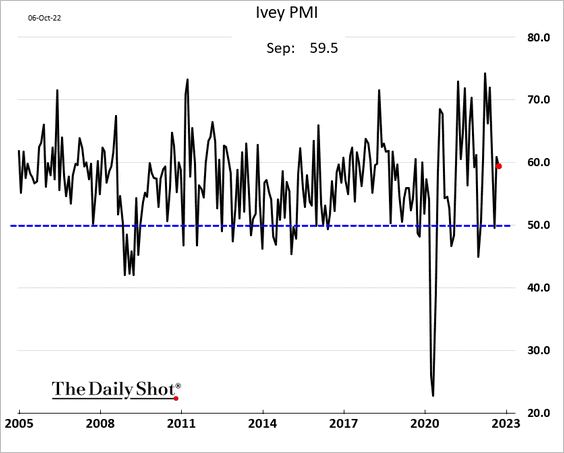

1. The Ivey PMI showed robust business activity last month.

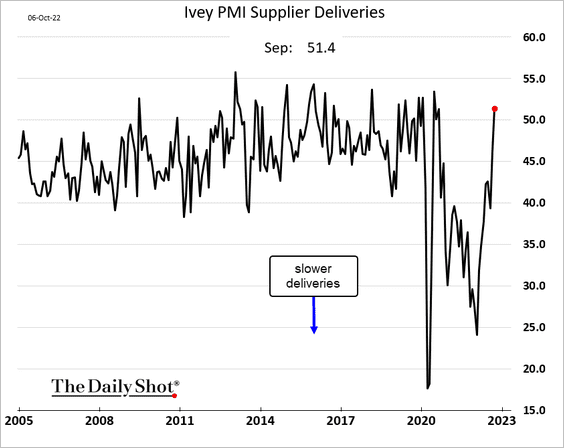

Supply bottlenecks have eased.

——————–

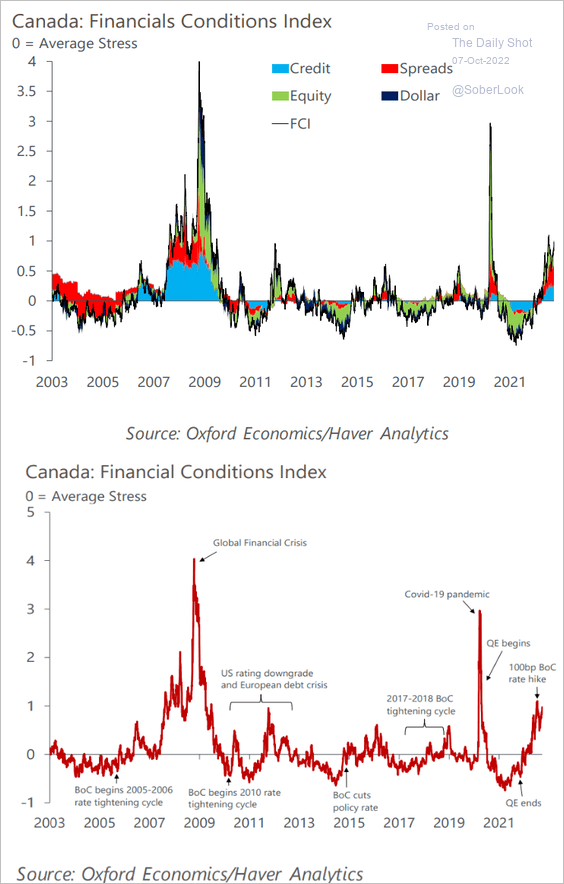

2. Financial conditions have been tightening.

Source: Oxford Economics

Source: Oxford Economics

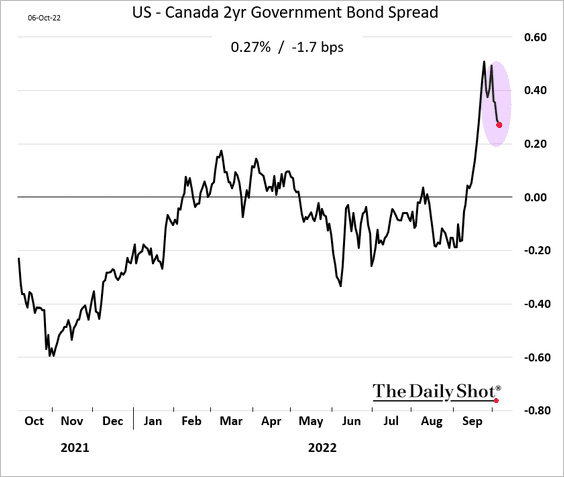

3. The US-Canada yield spreads are falling after the recent surge …

… as the BoC strikes a hawkish tone.

Source: The Globe and Mail Read full article

Source: The Globe and Mail Read full article

Back to Index

The United Kingdom

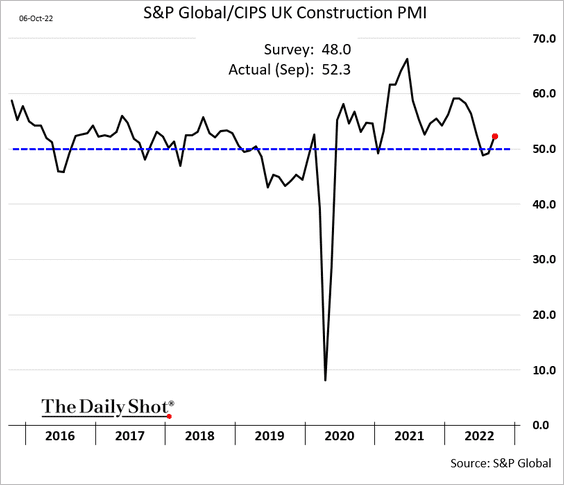

1. Construction activity unexpectedly grew last month.

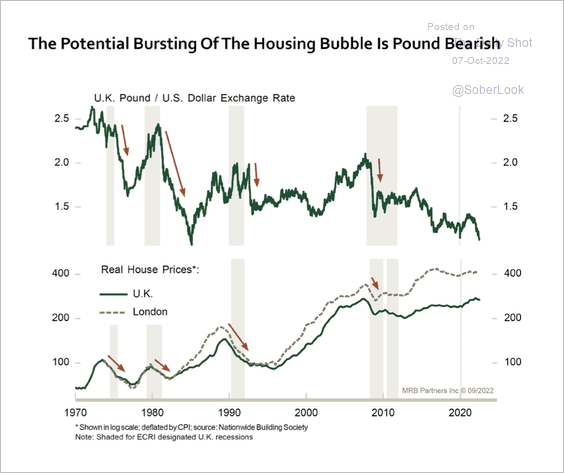

2. Selloffs in GBP/USD have typically occurred alongside a decline in real house prices.

Source: MRB Partners

Source: MRB Partners

Back to Index

The Eurozone

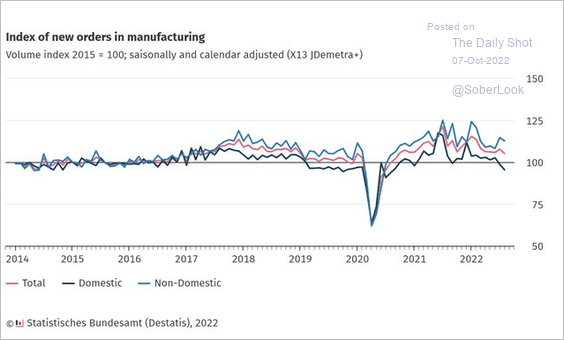

1. Let’s begin with Germany.

• Industrial production declined in August, but the manufacturing component (2nd panel) was roughly flat.

Domestic demand has been weakening.

Source: @destatis_news Read full article

Source: @destatis_news Read full article

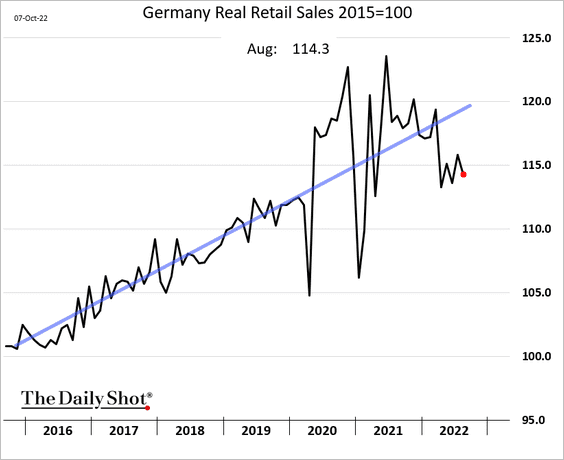

• Retail sales were softer in August.

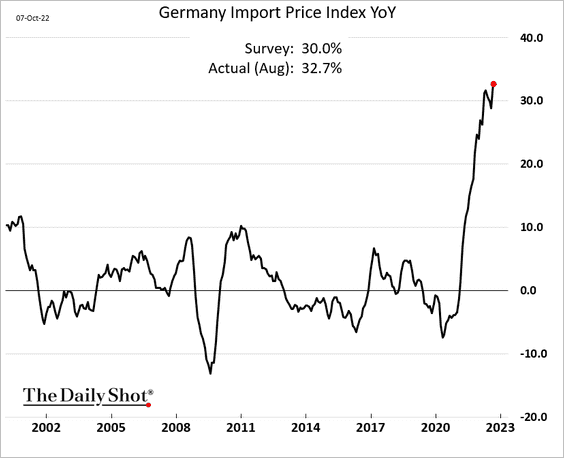

• Import prices have been surging.

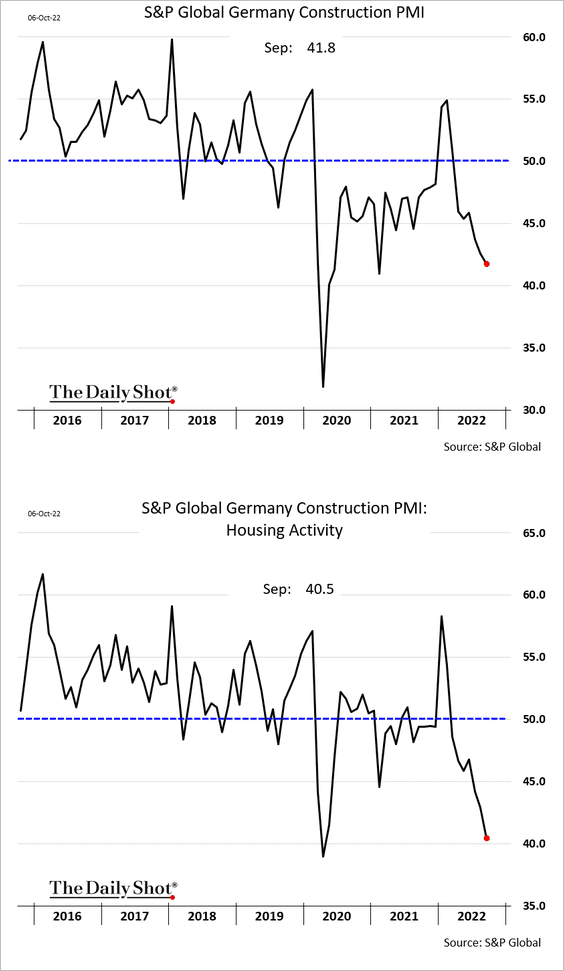

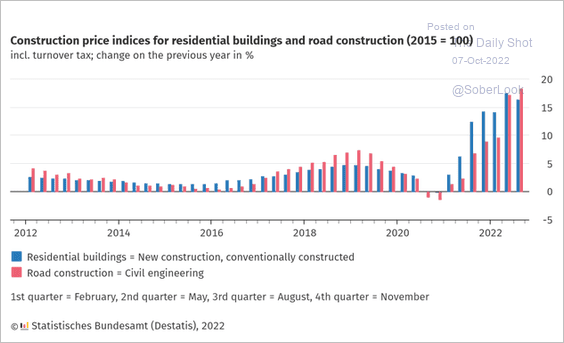

• The slump in construction activity worsened last month.

Gains in construction prices have been enormous.

Source: @destatis_news Read full article

Source: @destatis_news Read full article

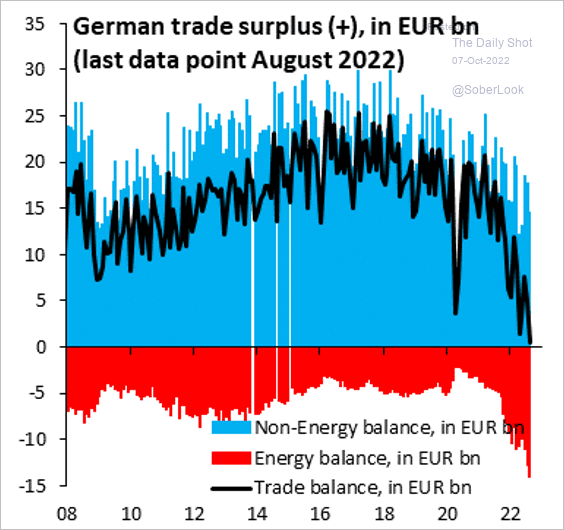

• Here is the breakdown of Germany’s trade balance.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

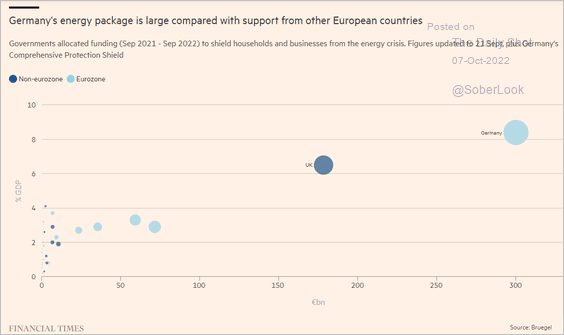

• Germany’s energy package is huge.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

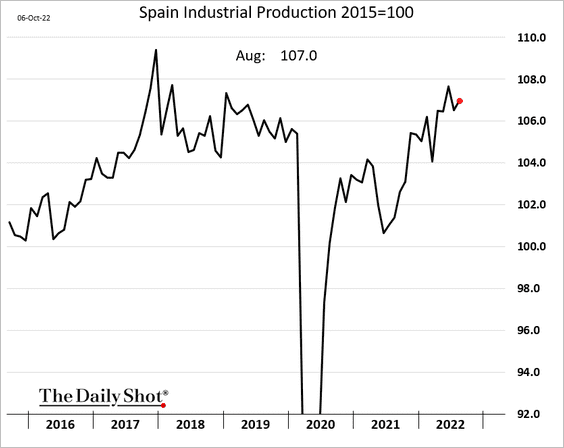

2. Spain’s industrial production increased in August.

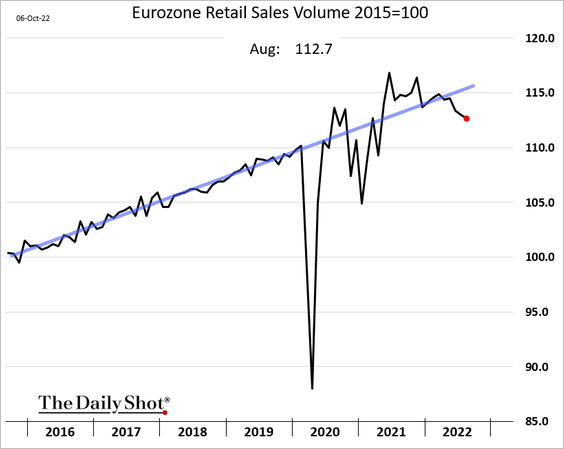

3. Euro-area retail sales declined again in August.

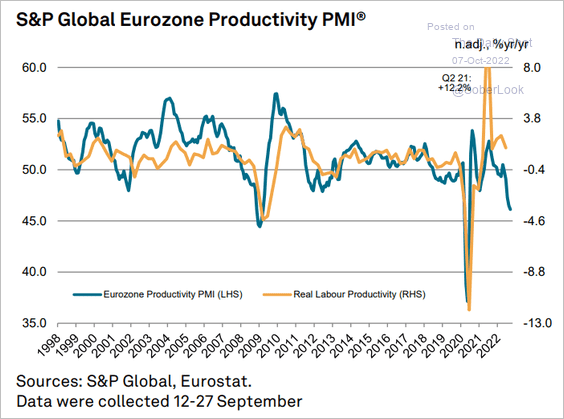

4. PMI data suggest that Eurozone productivity is falling.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

Europe

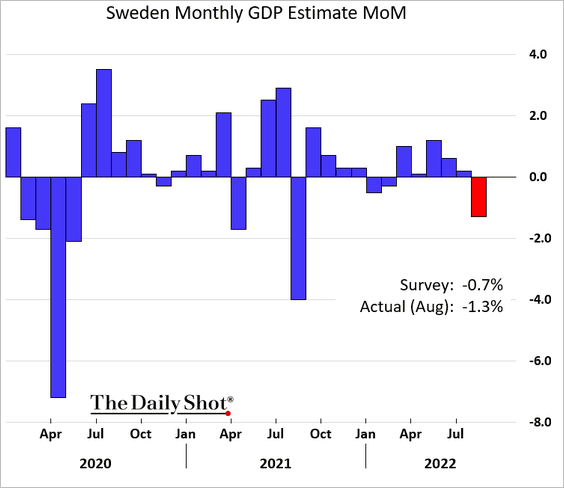

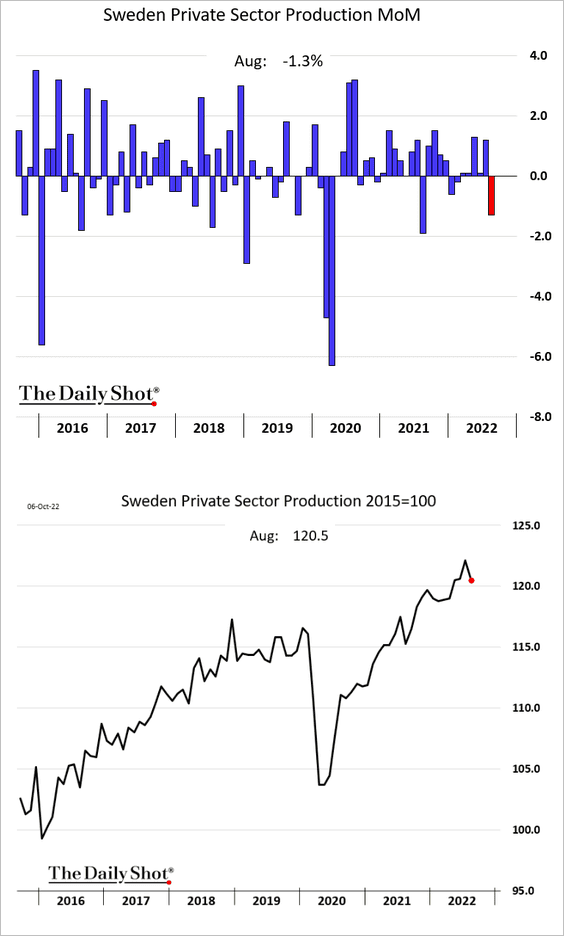

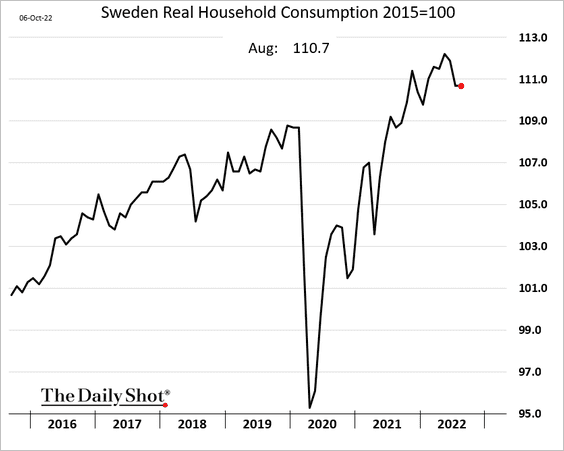

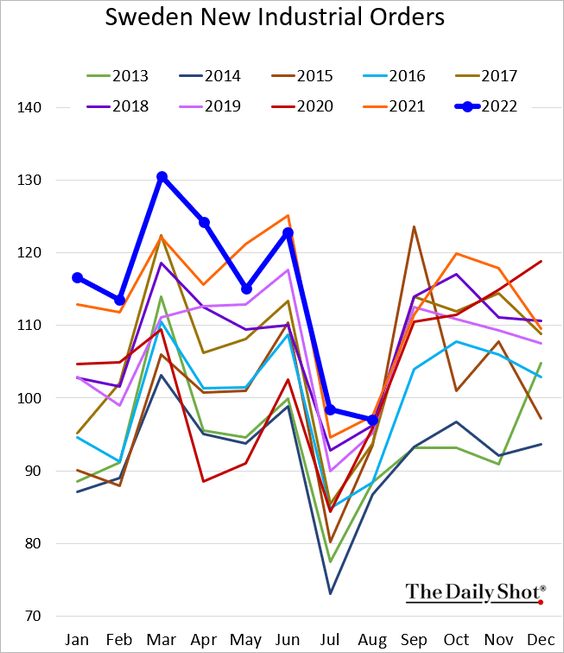

1. Sweden’s GDP slumped in August, …

… as business output declined.

• Household consumption held steady.

• Industrial orders were softer.

——————–

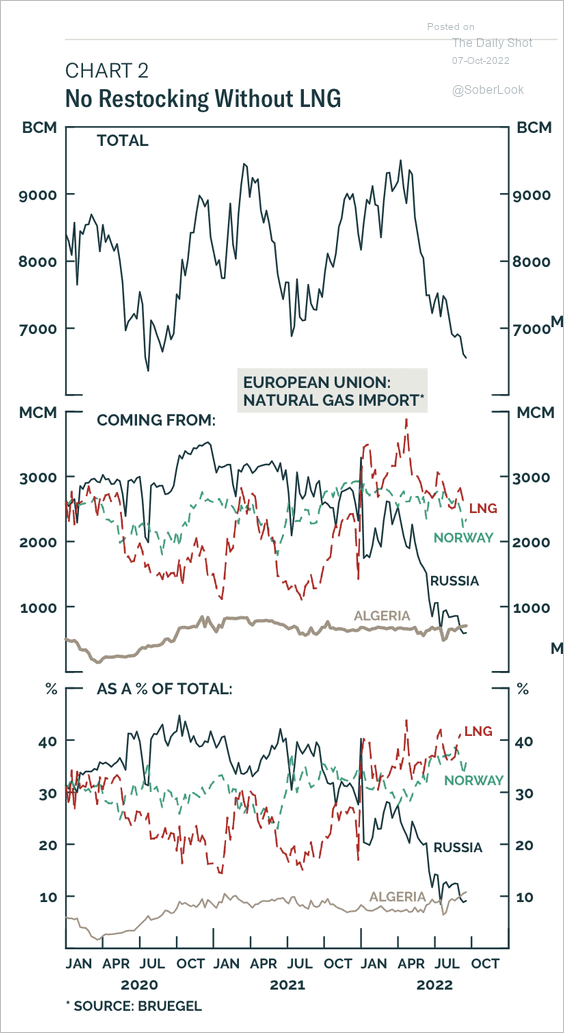

2. The absence of a summer dip in Norwegian gas exports and the surge in LNG inflows have partially replaced missing supply from Russia. That has helped Europe rapidly rebuild its natural gas inventories.

Source: BCA Research

Source: BCA Research

Back to Index

Asia – Pacific

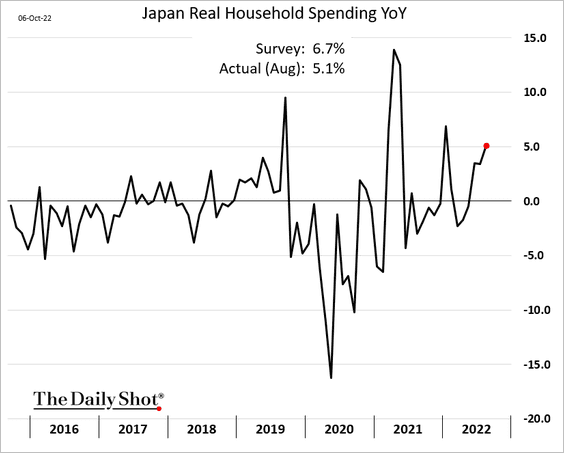

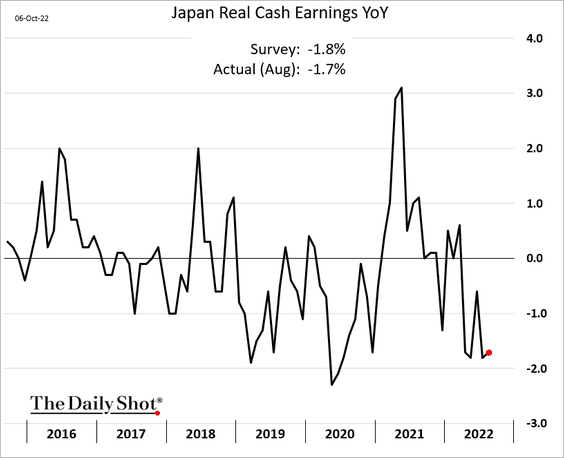

1. Japan’s household spending increased less than expected in August.

Real earnings remain negative.

——————–

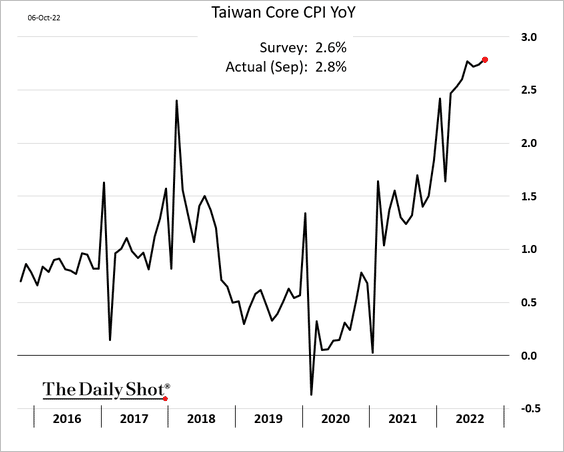

2. Taiwan’s inflation continues to climb, exceeding forecasts.

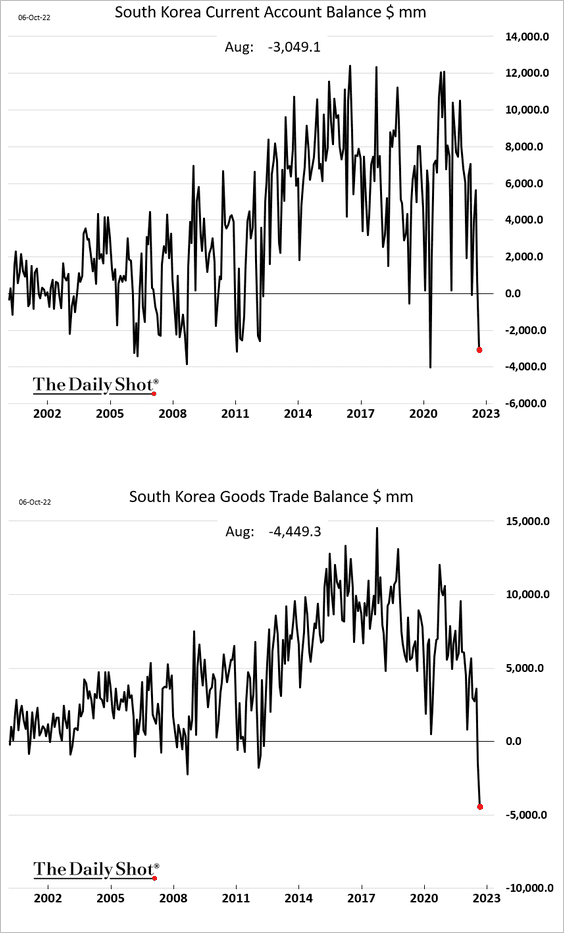

3. South Korea’s current account balance is back in deficit, driven by trade.

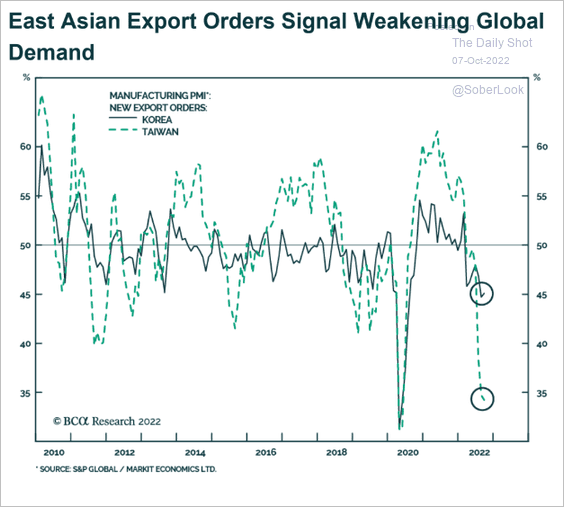

4. PMI reports show shrinking export orders in Taiwan and South Korea.

Source: BCA Research

Source: BCA Research

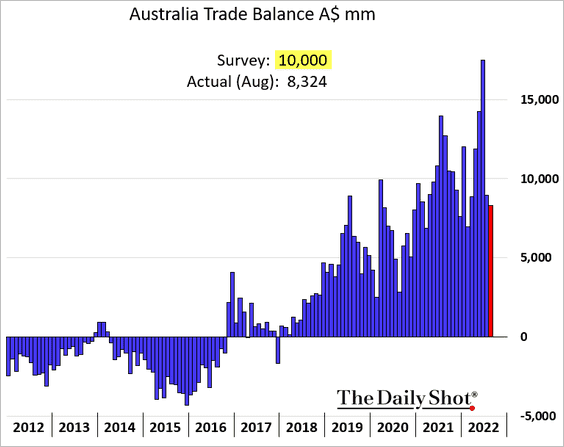

5. Australia’s trade surplus declined more than expected.

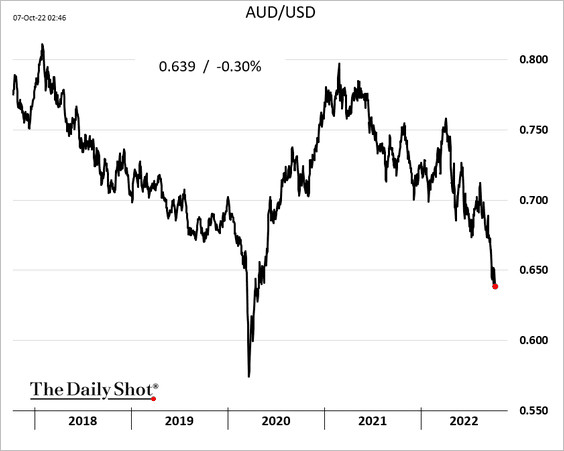

The Aussie dollar continues to fall vs. USD.

Back to Index

China

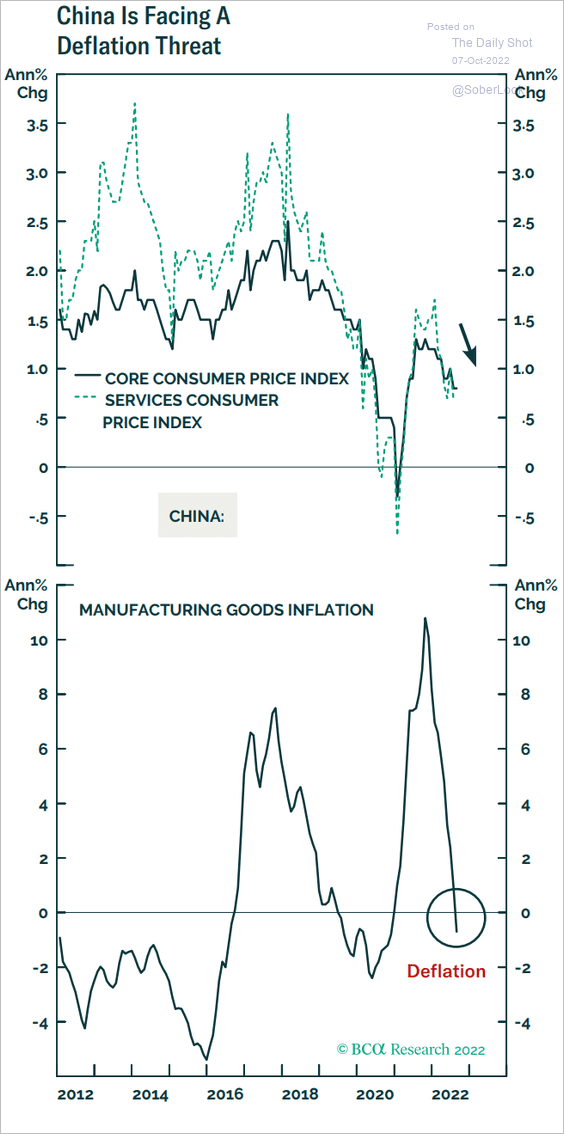

1. China is facing disinflationary pressures.

Source: BCA Research

Source: BCA Research

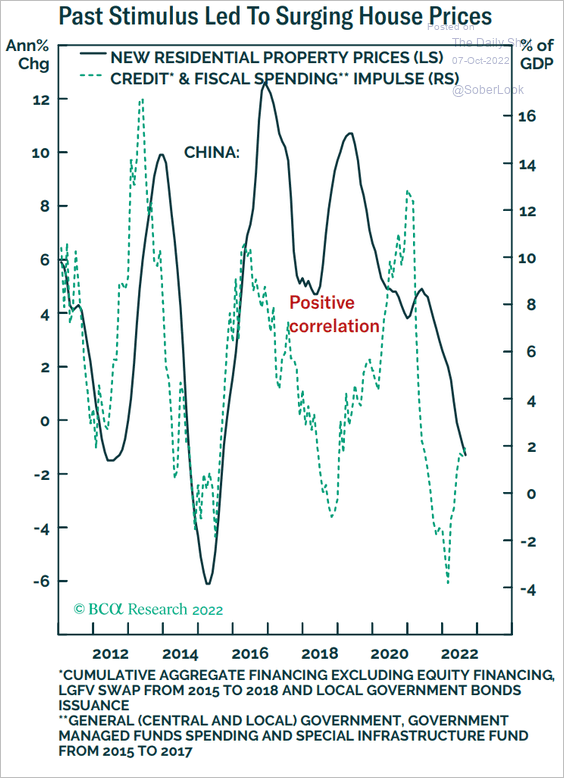

2. Will stimulus stabilize property prices?

Source: BCA Research

Source: BCA Research

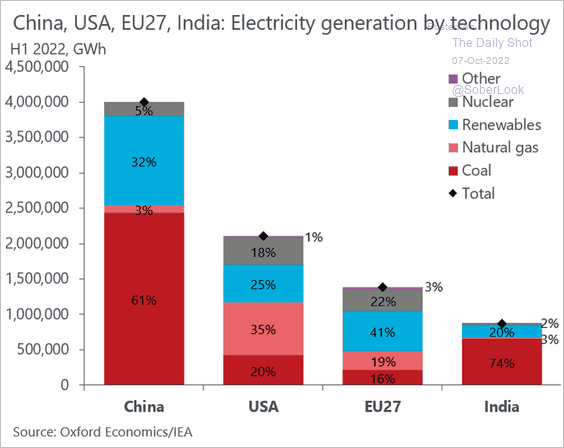

3. China’s coal consumption is massive.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Emerging Markets

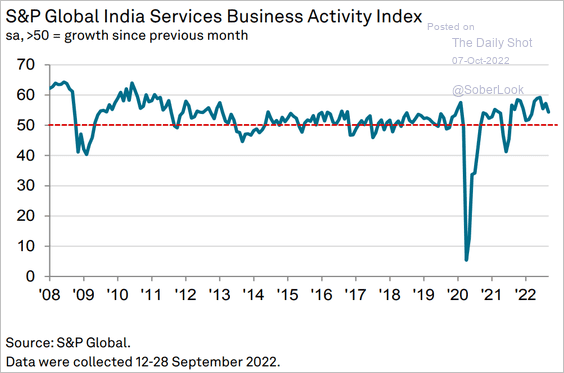

1. Growth in India’s service sector has been slowing.

Source: S&P Global PMI

Source: S&P Global PMI

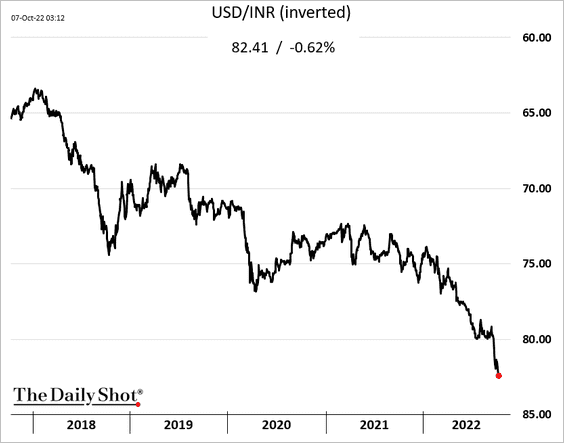

The rupee hit another record low vs. USD.

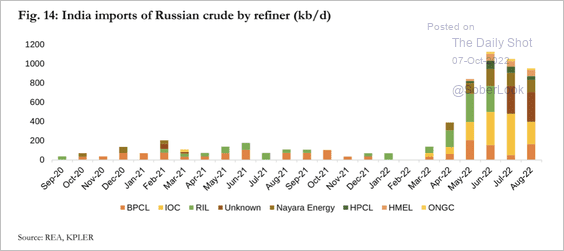

Separately, India has been a key beneficiary of discounted Russian oil.

Source: Renaissance Energy Advisors

Source: Renaissance Energy Advisors

——————–

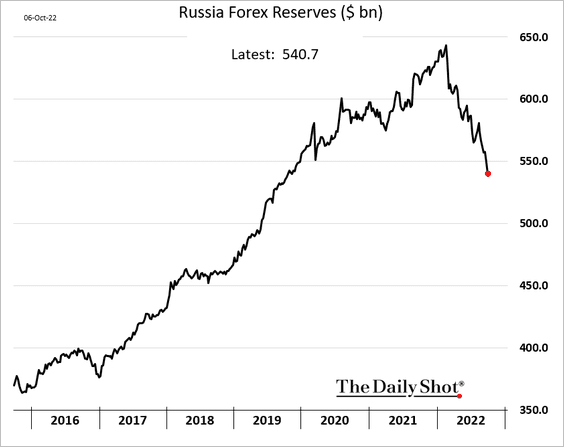

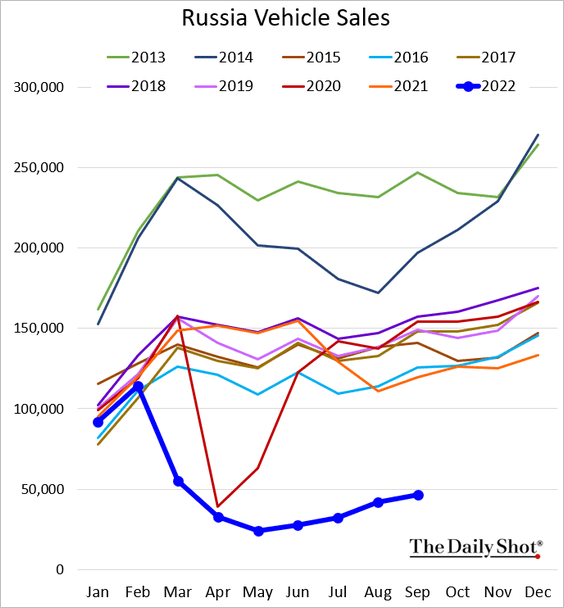

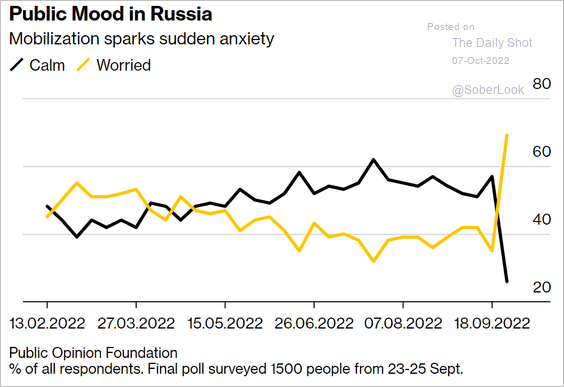

2. Next, we have some updates on Russia.

• FX reserves continue to move lower (in dollar terms).

• Vehicle sales remain depressed.

• Polls show some anxiety in Russia since the mobilization announcement.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

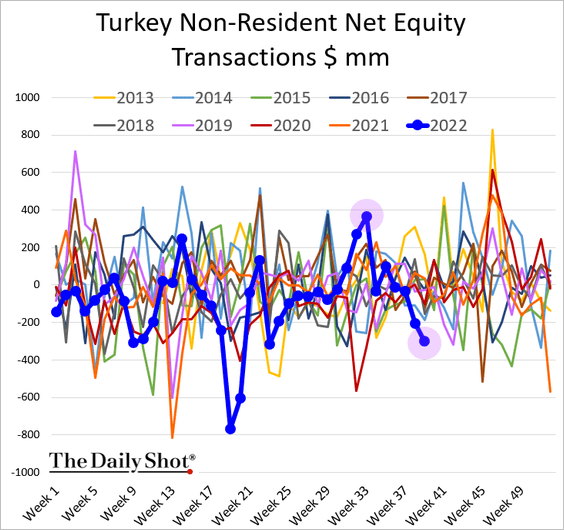

3. Foreigners are pulling out of Turkey’s stocks (after getting in a few weeks back).

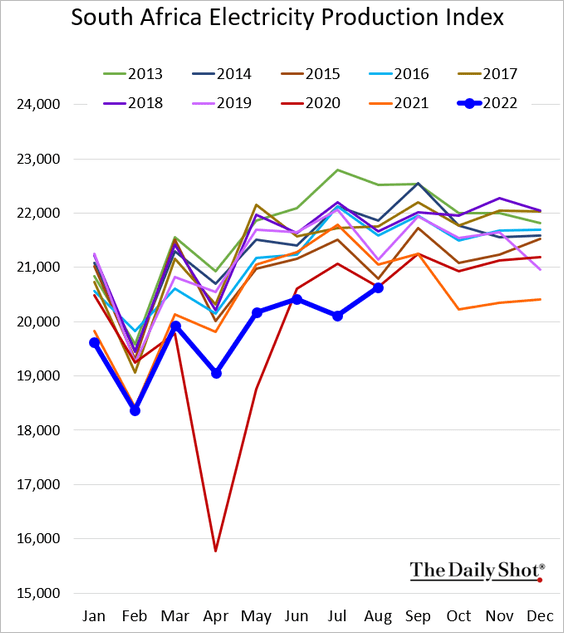

4. South Africa’s electricity production has been soft.

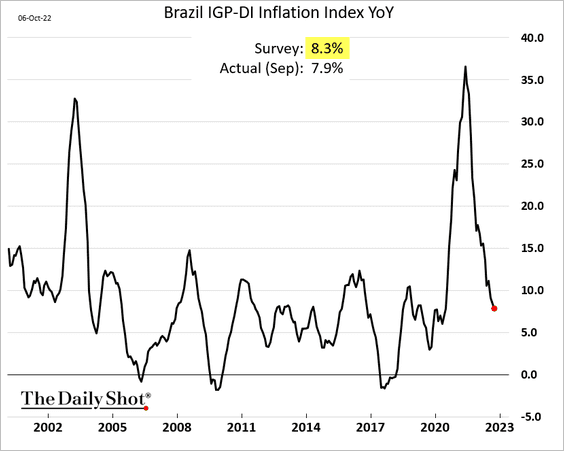

5. Brazil’s CPI continues to ease.

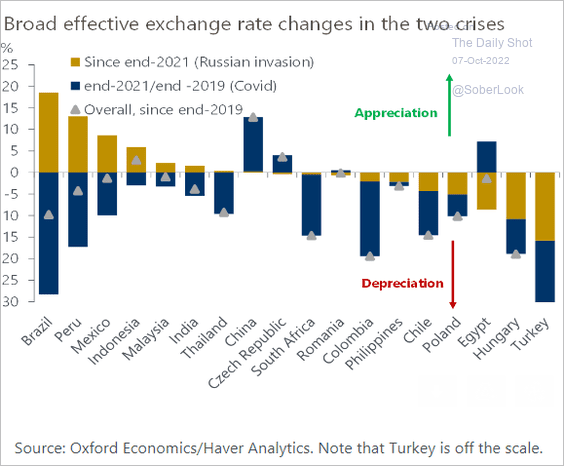

6. This chart shows the changes in effective exchange rates since the end of 2019.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Energy

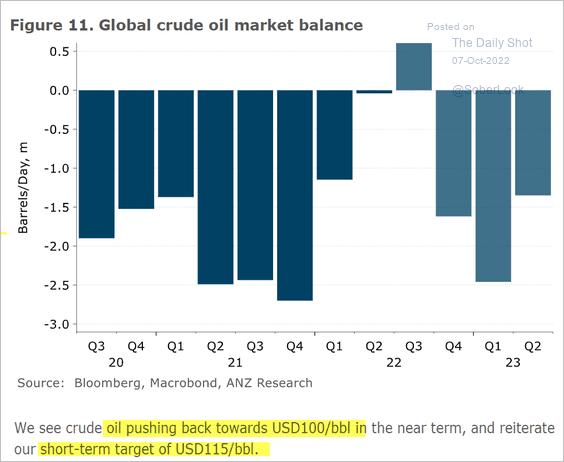

1. Here is a forecast for the global oil market balance from ANZ Research.

Source: @ANZ_Research

Source: @ANZ_Research

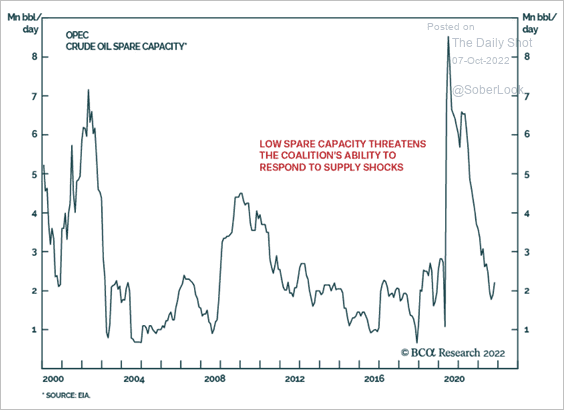

2. Here is OPEC’s spare capacity.

Source: BCA Research

Source: BCA Research

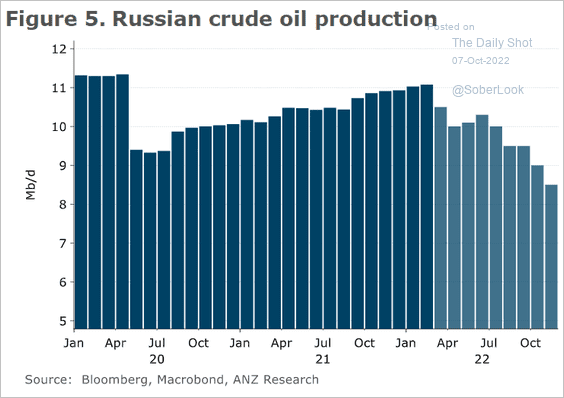

3. Russian crude oil production has been trending lower.

Source: @ANZ_Research

Source: @ANZ_Research

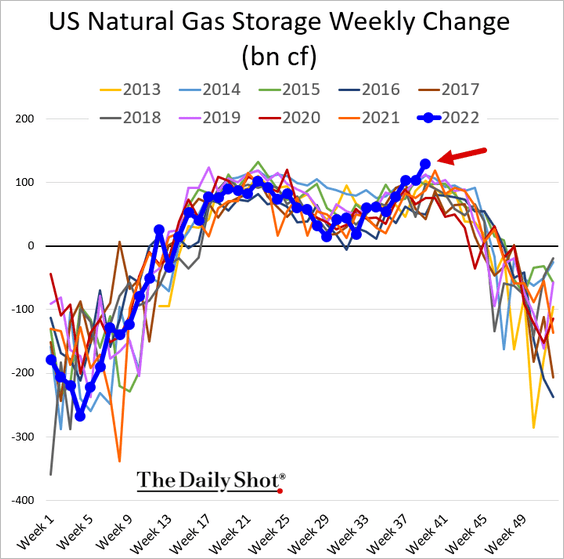

4. US natural gas storage injection surged in recent weeks.

Back to Index

Equities

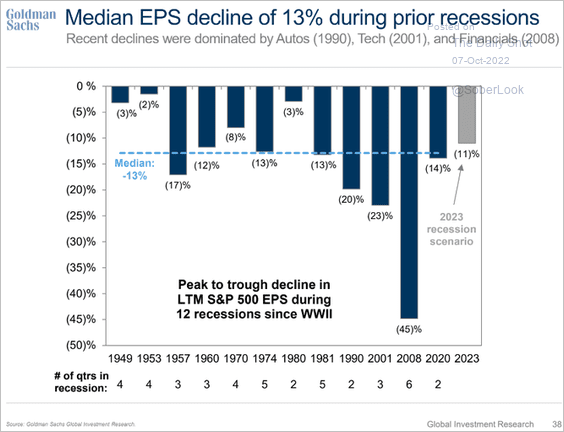

1. Corporate earnings have plenty of room to fall if the US enters a recession.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

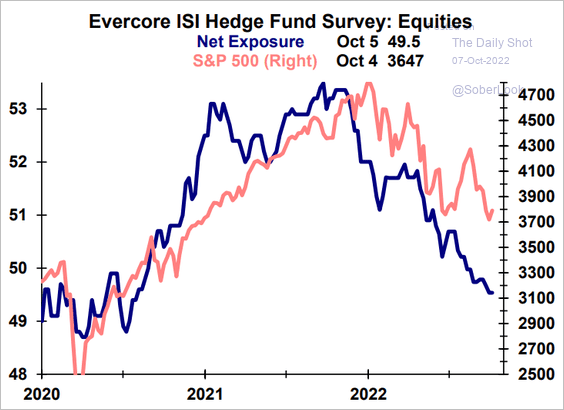

2. Hedge funds continue to reduce equity exposure, according to a survey from Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

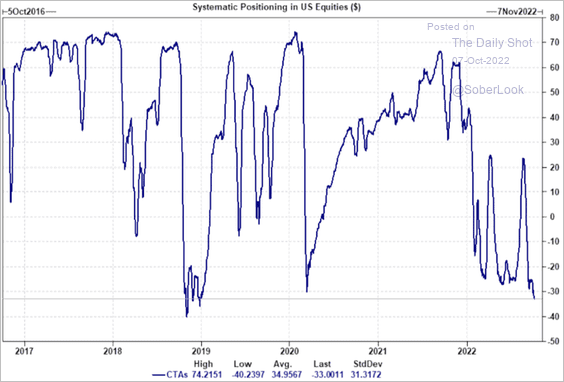

CTAs’ systematic positioning is very bearish.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

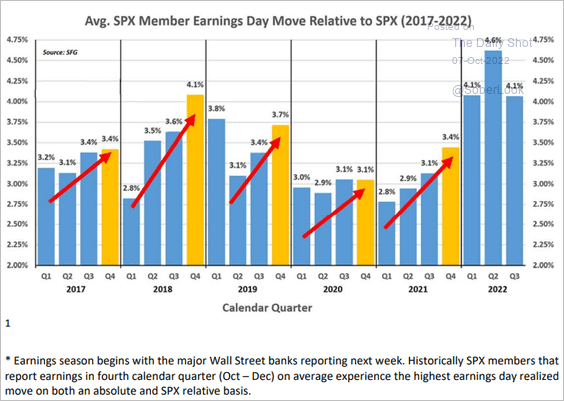

3. Q4 earnings-day moves tend to be higher than in other quarters.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

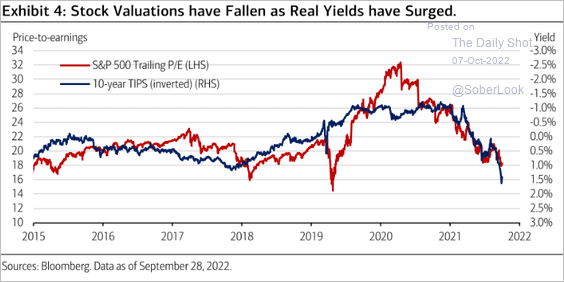

4. Real yields point to further declines in stock valuations.

Source: Merrill Lynch

Source: Merrill Lynch

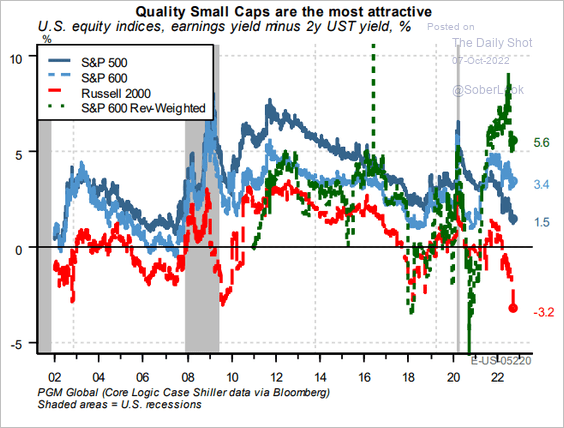

5. The revenue-weighted S&P 600 index (small caps) has the highest earnings yield relative to 2-year Treasuries.

Source: PGM Global

Source: PGM Global

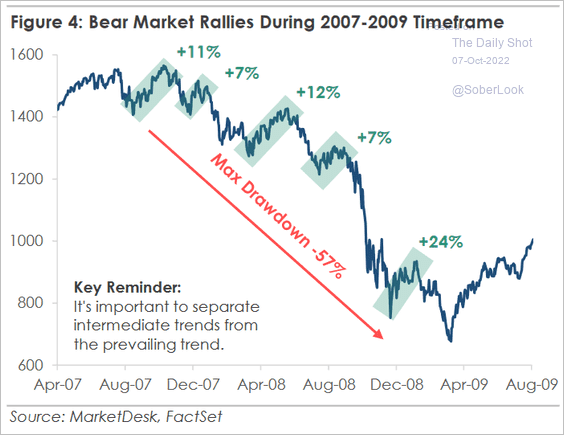

6. This chart shows the financial crisis bear market rallies.

Source: MarketDesk Research

Source: MarketDesk Research

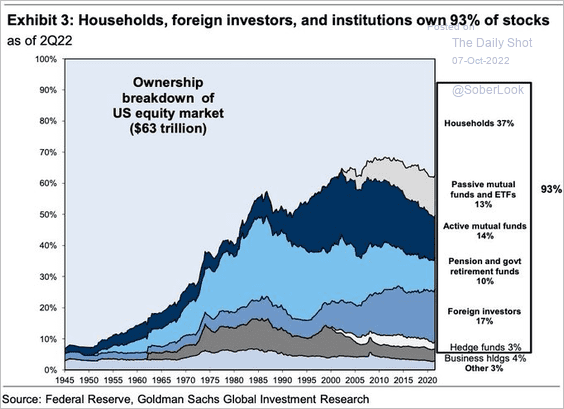

7. Who owns the US stock market?

Source: Goldman Sachs; @SamRo

Source: Goldman Sachs; @SamRo

Back to Index

Credit

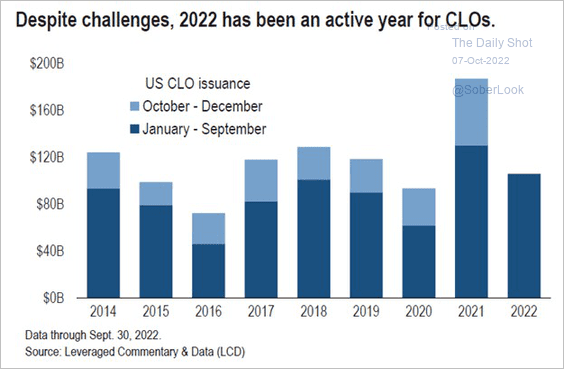

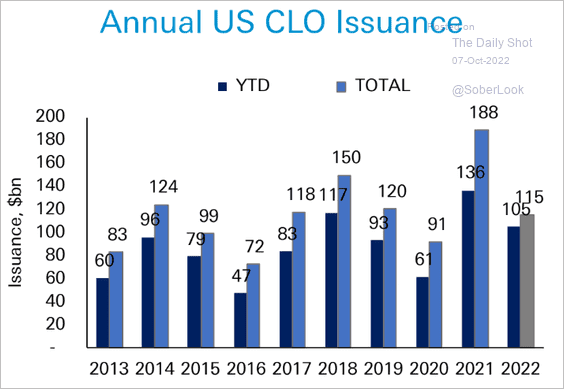

1. CLO issuance has been remarkably strong this year.

Source: @lcdnews

Source: @lcdnews

Here is a forecast for the full year from Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

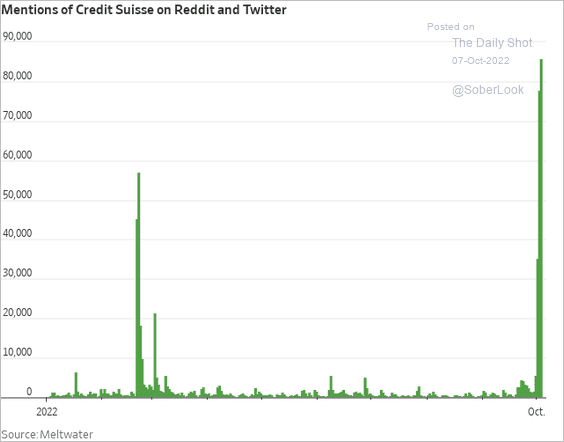

2. Chatter about Credit Suisse surged on social media.

Source: @WSJ Read full article

Source: @WSJ Read full article

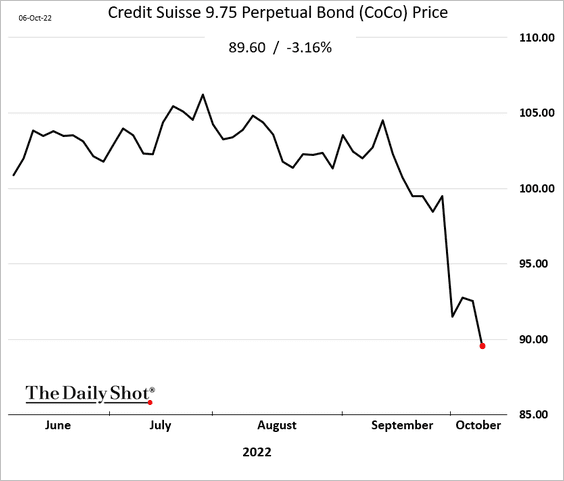

• The new (2022) CoCo bonds dipped below $90.

• CS is offering to buy back debt.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Rates

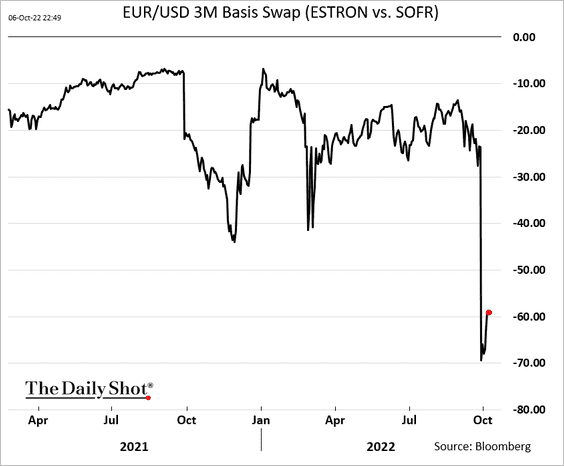

1. Basis swaps show concerns about year-end US dollar liquidity.

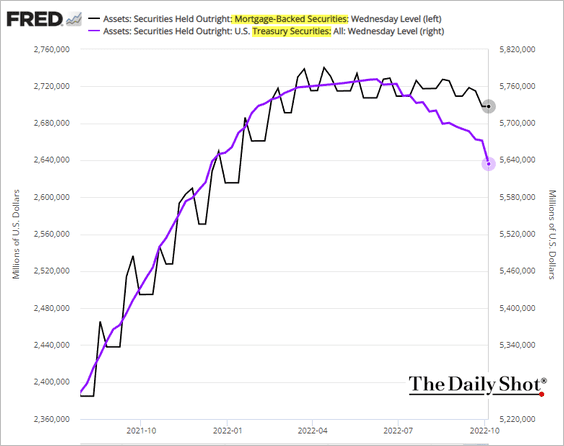

2. The Fed’s Treasury holdings declined sharply due to month-end bond redemptions.

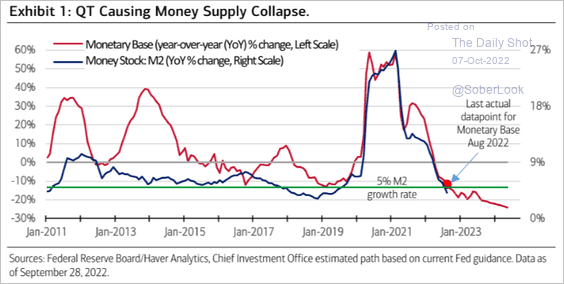

3. Liquidity continues to tighten.

Source: Merrill Lynch

Source: Merrill Lynch

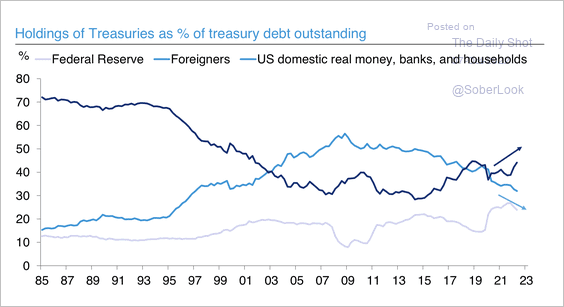

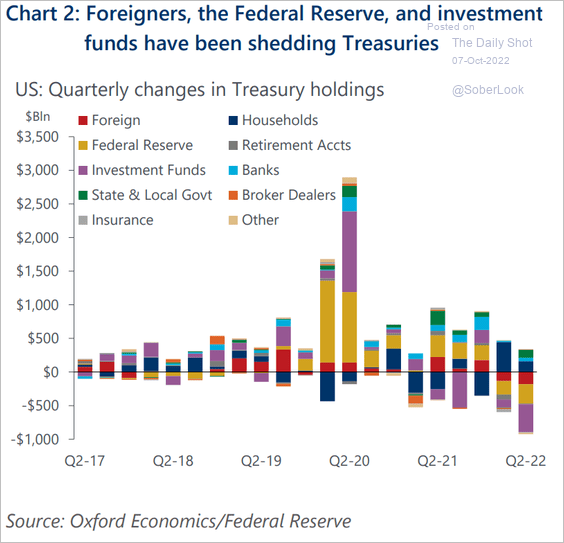

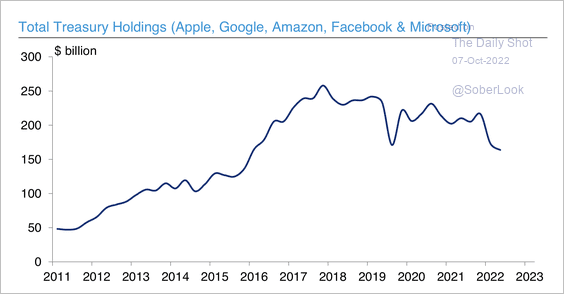

4. Foreign ownership of Treasuries continues to fall since peaking a decade ago.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Oxford Economics

Source: Oxford Economics

Large tech companies’ holdings of Treasuries have declined in recent quarters.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

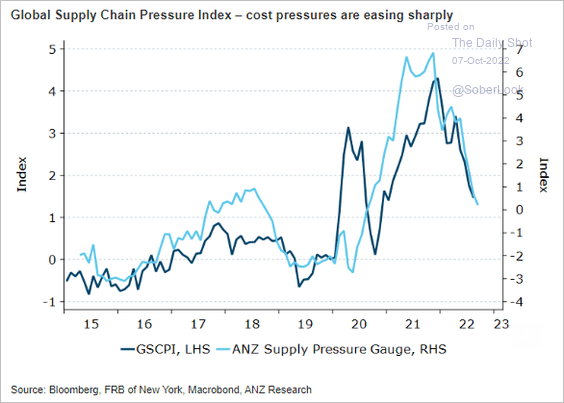

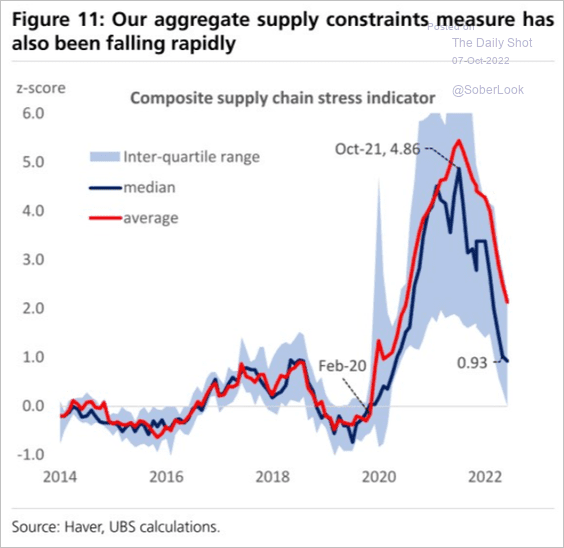

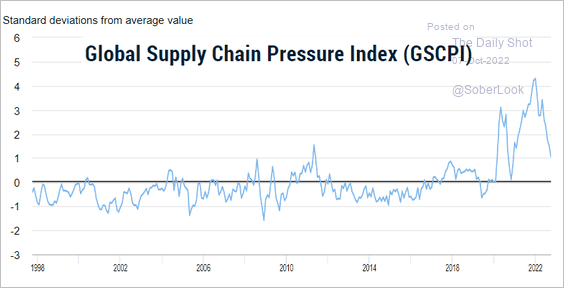

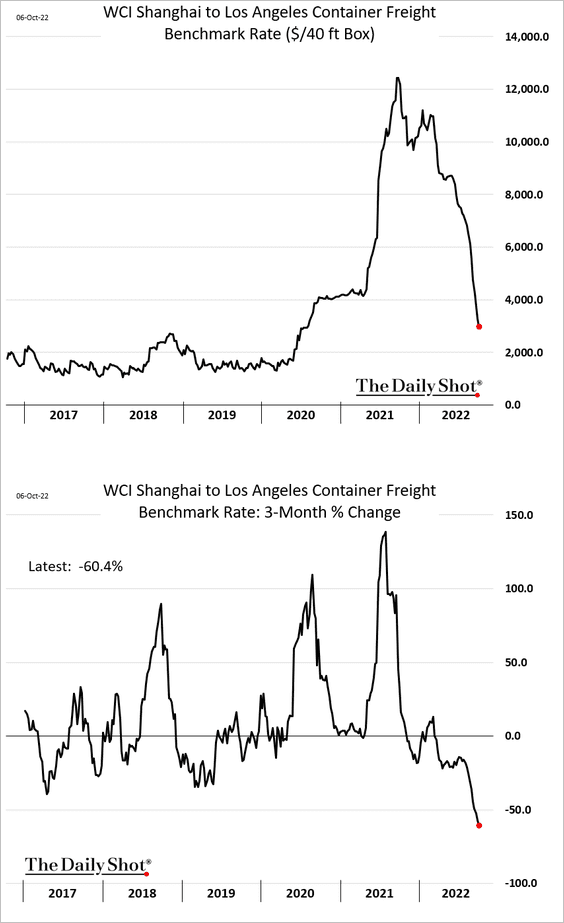

1. Supply chain pressures are easing as demand slumps (3 charts).

Source: @ANZ_Research

Source: @ANZ_Research

Source: UBS Research

Source: UBS Research

Source: Federal Reserve Bank of New York

Source: Federal Reserve Bank of New York

Container shipping costs are down sharply.

——————–

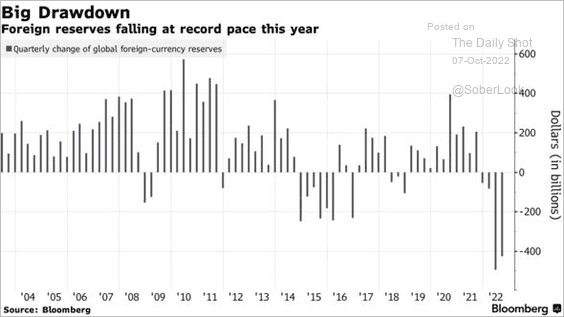

2. FX reserves (measured in dollars) saw substantial declines this year. The drop is due to the dollar’s strength (lowering non-USD reserves’ value) as well as nations spending dollars to defend their currencies.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

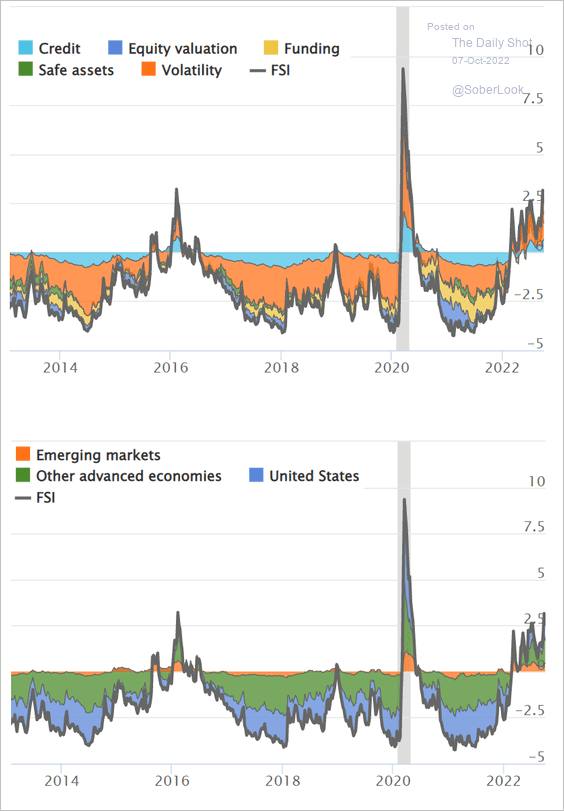

3. Financial stress has risen but is not extreme.

Source: OFR

Source: OFR

——————–

Food for Thought

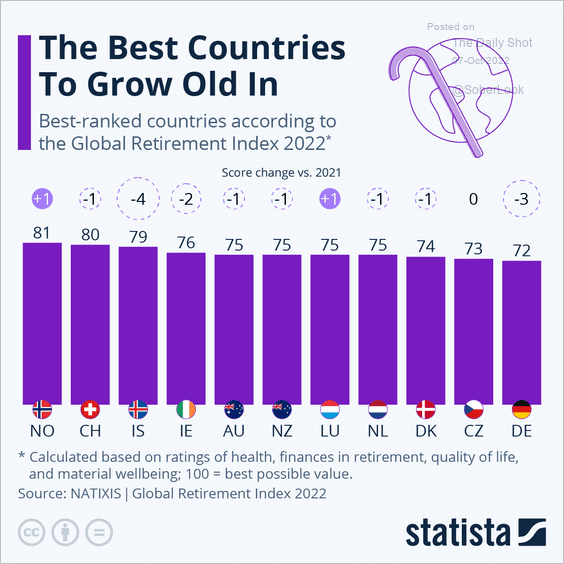

1. Global Retirement Index rankings:

Source: Statista

Source: Statista

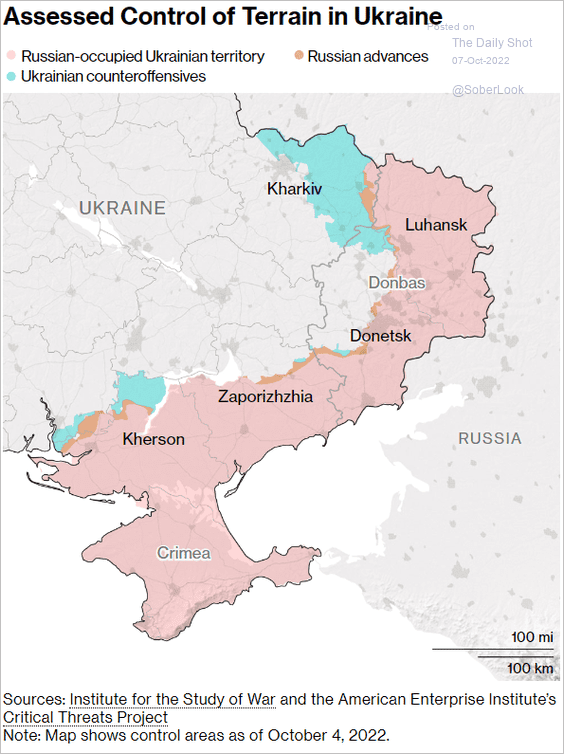

2. Control of Ukrainian territory:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

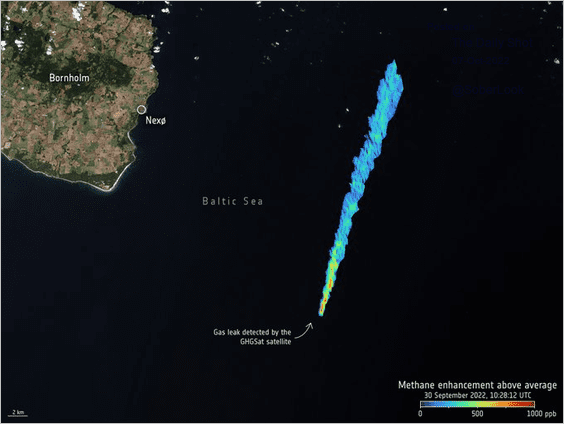

3. Methane from the sabotaged natural gas pipeline:

Source: @ESA_EO, @ghgsat

Source: @ESA_EO, @ghgsat

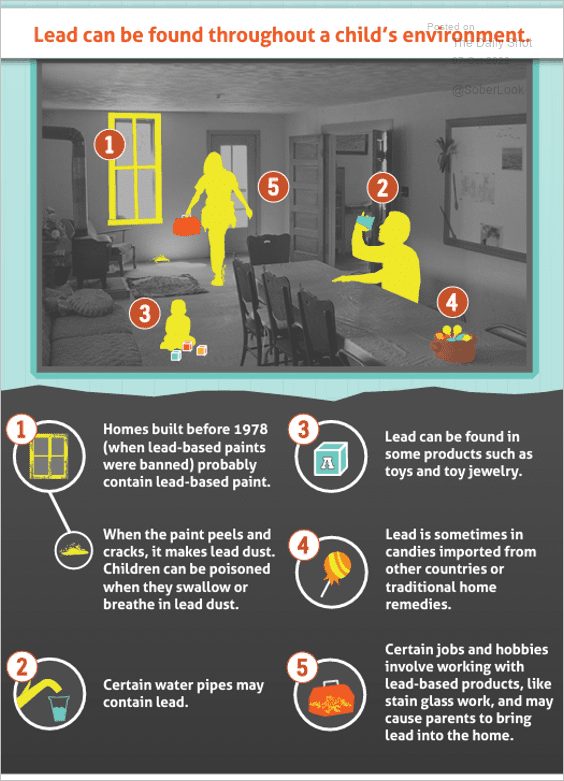

4. Sources of lead exposure:

Source: CDC Read full article

Source: CDC Read full article

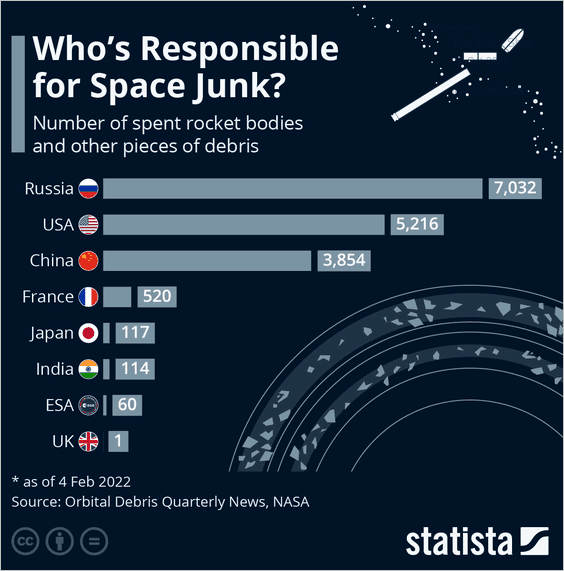

5. Sources of space junk:

Source: Statista

Source: Statista

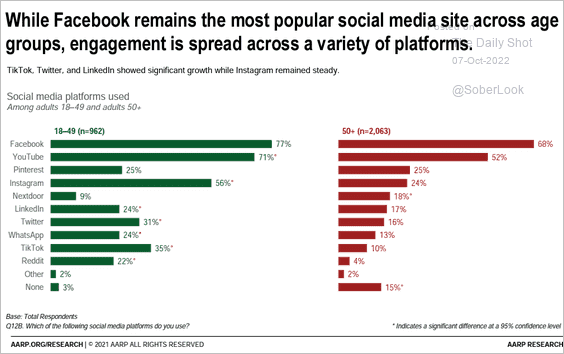

6. Social media use by age category:

Source: AARP Read full article

Source: AARP Read full article

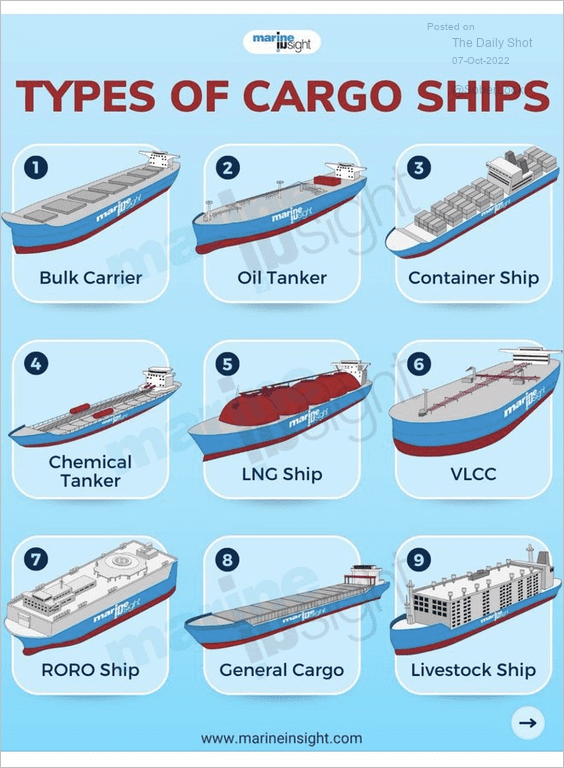

7. Types of cargo ships:

Source: @MarineInsight

Source: @MarineInsight

——————–

The next Daily Shot will be out on Tuesday, October 11th.

Have a great weekend!

Back to Index